The Daily Shot: 28-Jun-21

• The United States

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

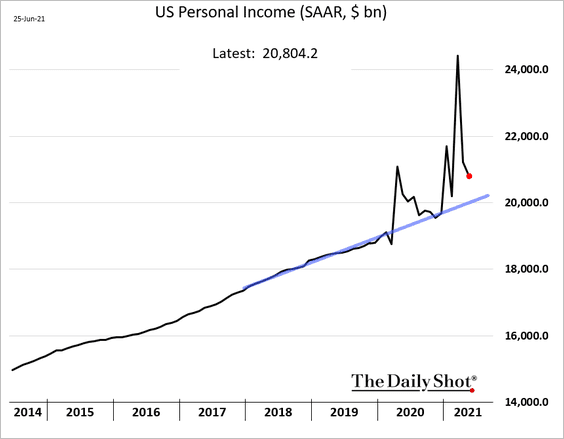

1. Personal income eased in May but remained above the pre-COVID trend.

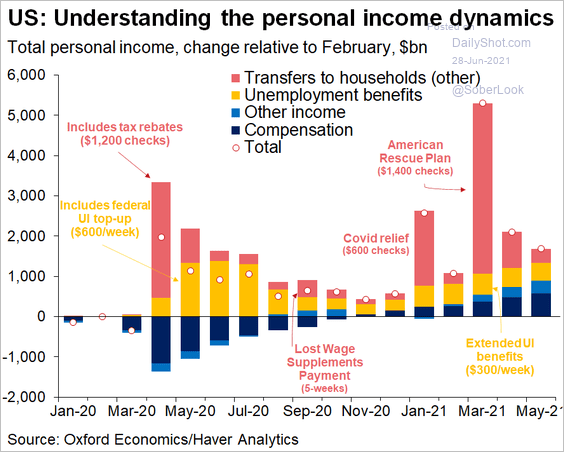

This chart shows the drivers of personal income changes since February 2020.

Source: @GregDaco

Source: @GregDaco

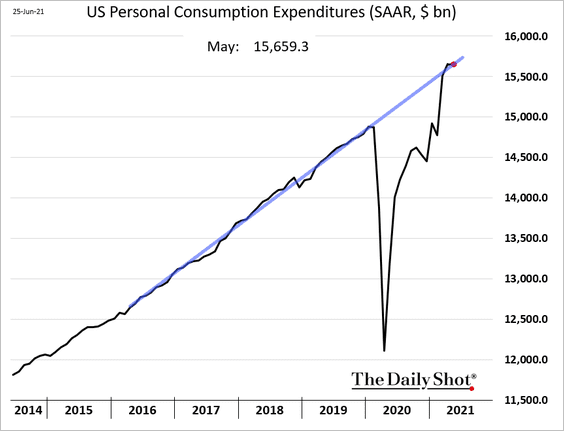

• Consumer spending has returned to its pre-pandemic trend.

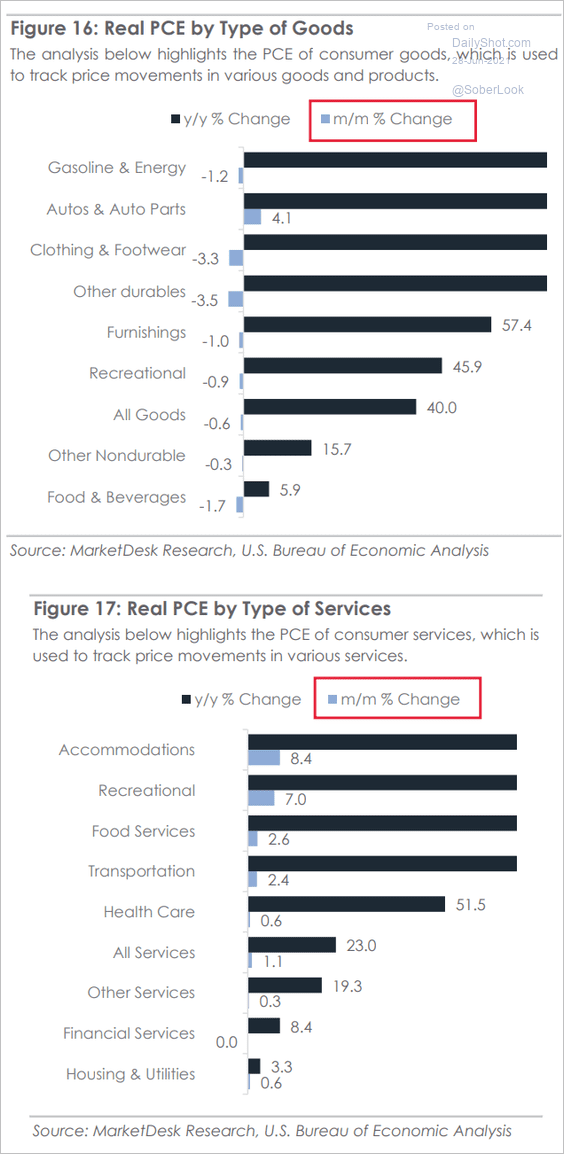

Here is the breakdown of spending changes by sector.

Source: MarketDesk Research

Source: MarketDesk Research

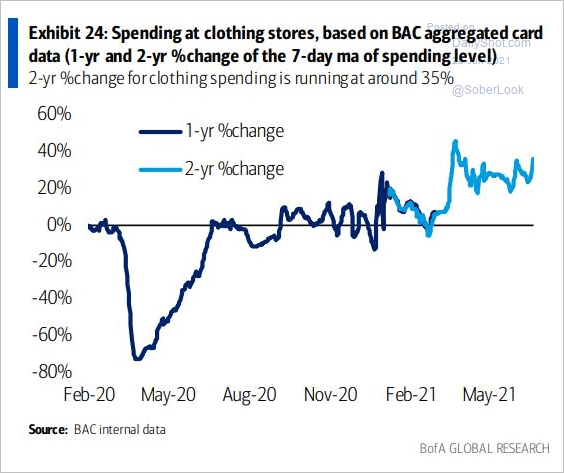

By the way, spending on clothing is now running well above 2019 levels, according to BofA’s card data.

Source: BofA Global Research; @TheStalwart

Source: BofA Global Research; @TheStalwart

——————–

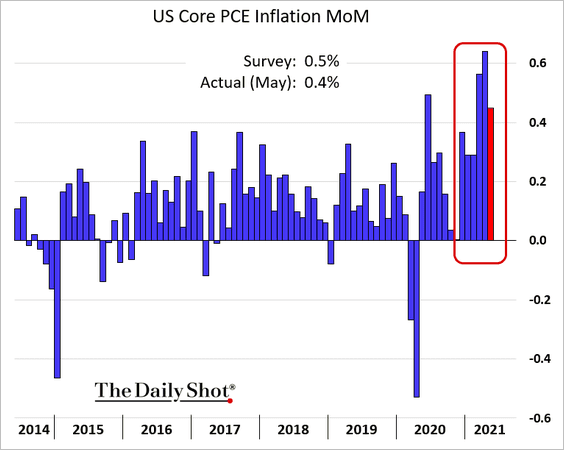

2. The May PCE inflation report was roughly in line with consensus.

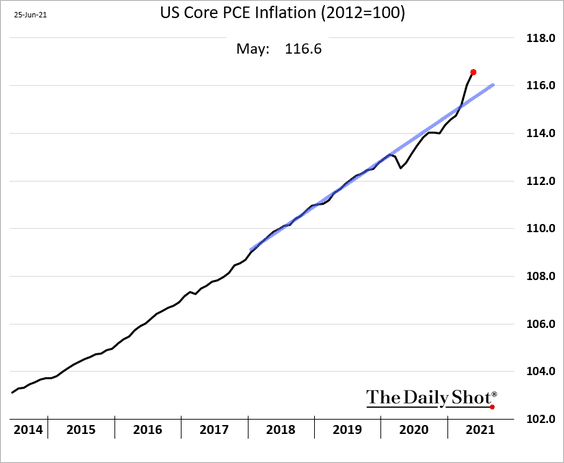

• The core inflation price index is now firmly above the pre-COVID trend.

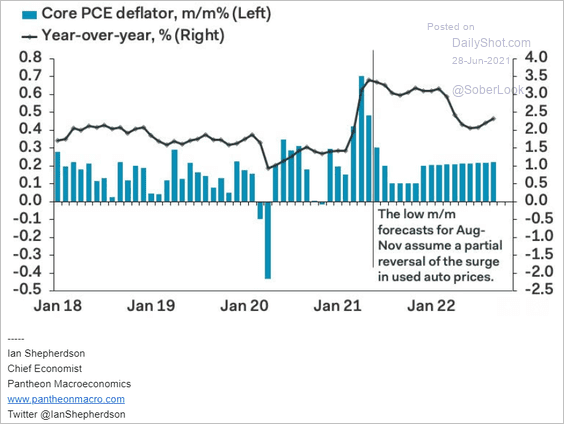

• Pantheon Macroeconomics expects the core PCE inflation to moderate in the months ahead as used car prices pull back from the highs.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

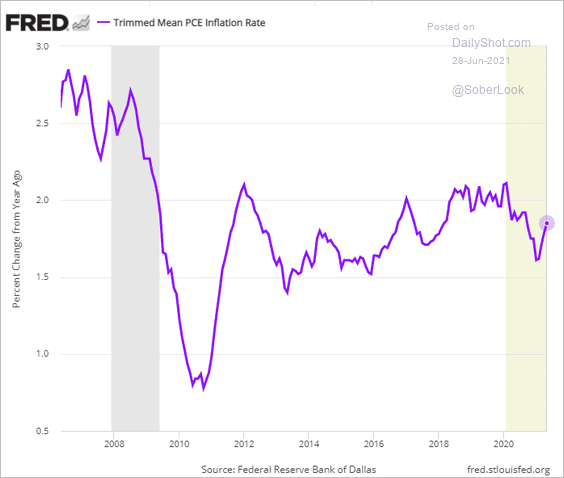

• The closely watched trimmed mean PCE inflation measure (from the Dallas Fed) remains relatively subdued.

3. Here are some additional updates on inflation.

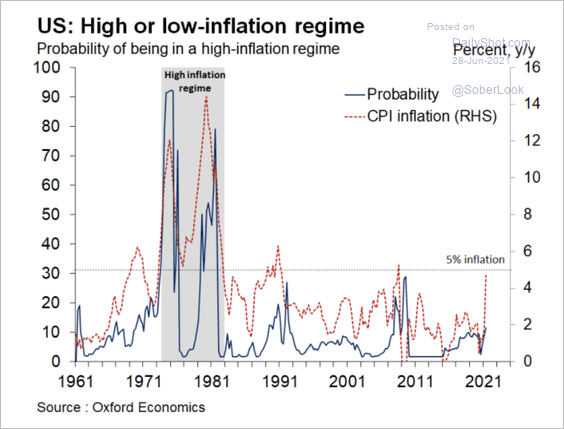

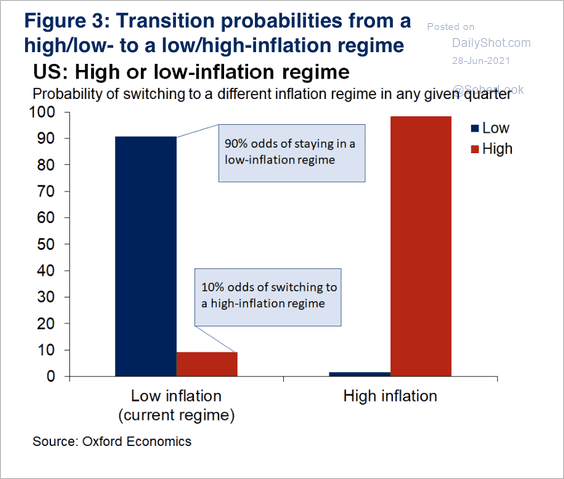

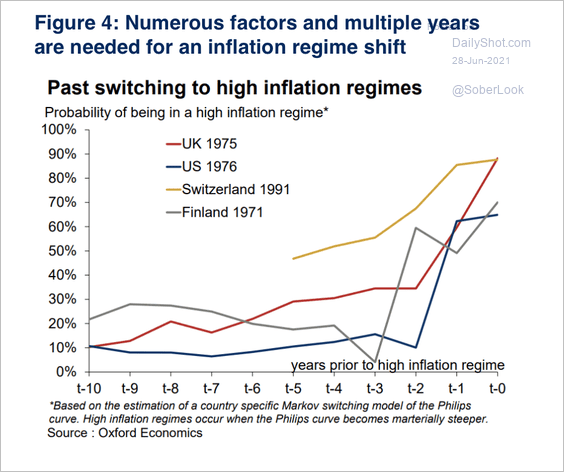

• Odds of a high inflation regime similar to the 1970s remain low, according to Oxford Economics (3 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

——————–

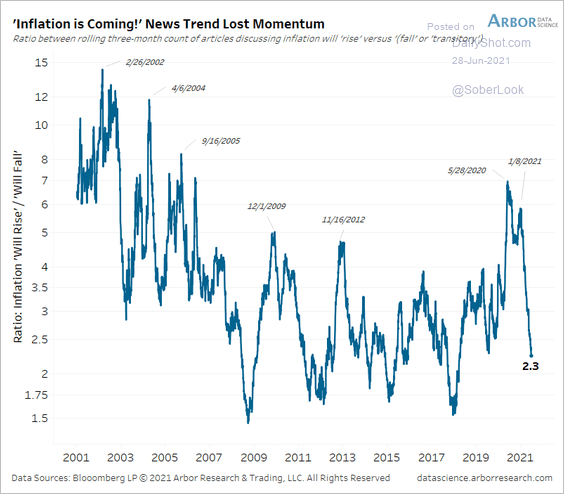

• The number of news articles mentioning higher inflation has been moderating.

Source: @benbreitholtz

Source: @benbreitholtz

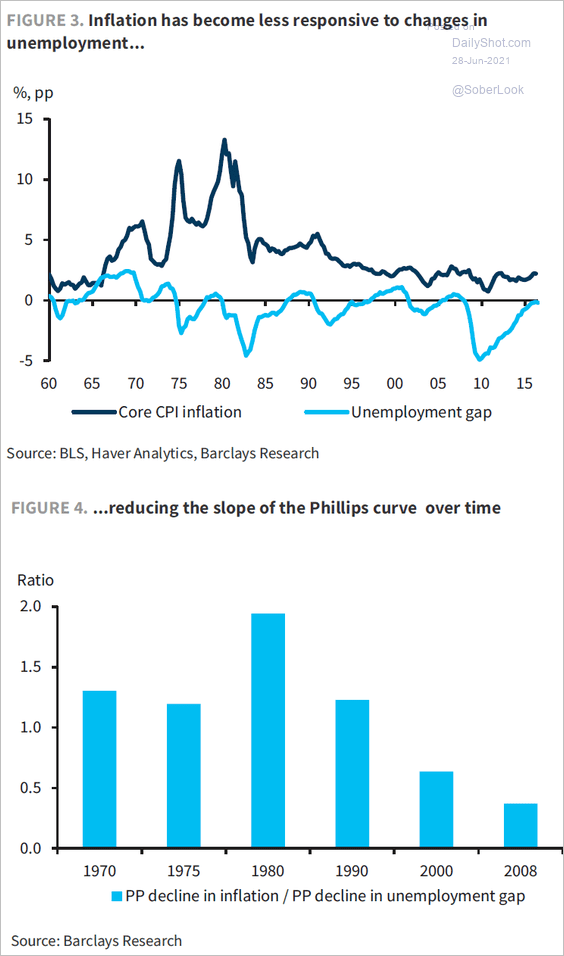

• Inflation has been less responsive to changes in employment.

Source: Barclays Research

Source: Barclays Research

——————–

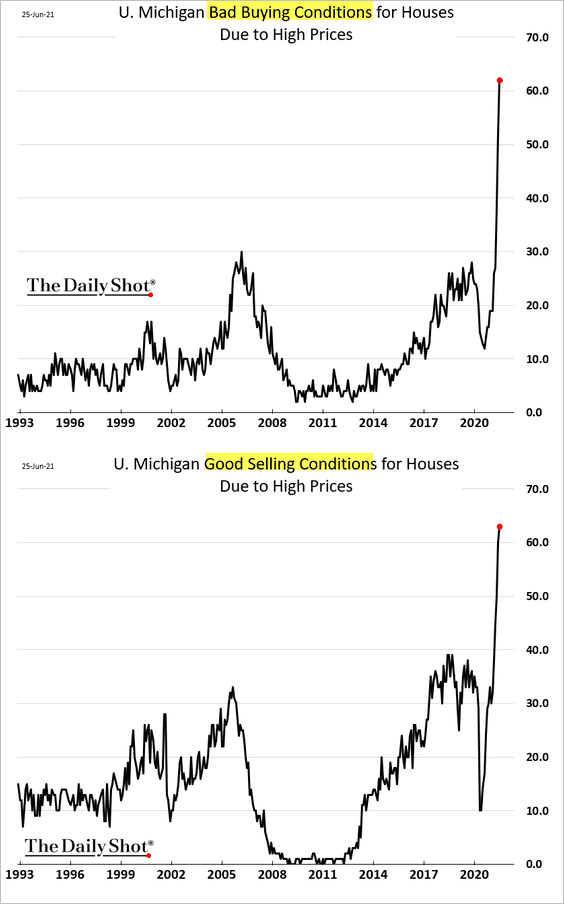

4. Finally, the charts below show how consumers feel about buying and selling a home in response to surging prices.

h/t @Not_Jim_Cramer

h/t @Not_Jim_Cramer

Back to Index

The Eurozone

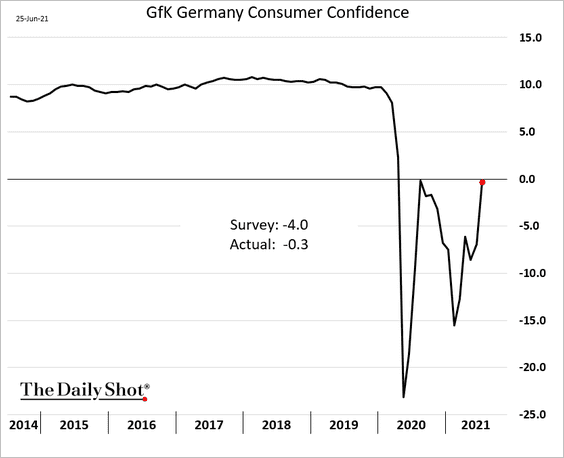

1. Let’s begin with Germany.

• Consumer confidence rebounded sharply in June.

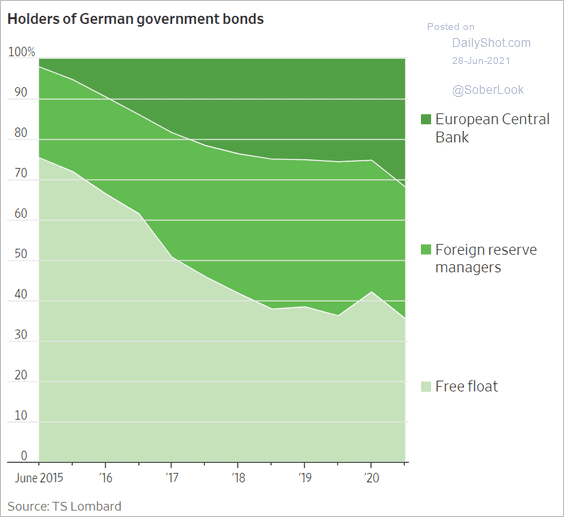

• Who owns German government debt?

Source: @WSJ Read full article

Source: @WSJ Read full article

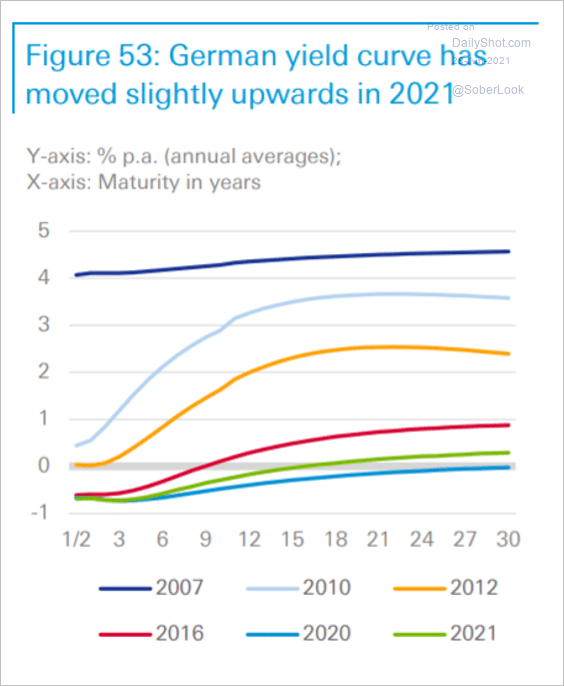

• Here is the evolution of Germany’s yield curve.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

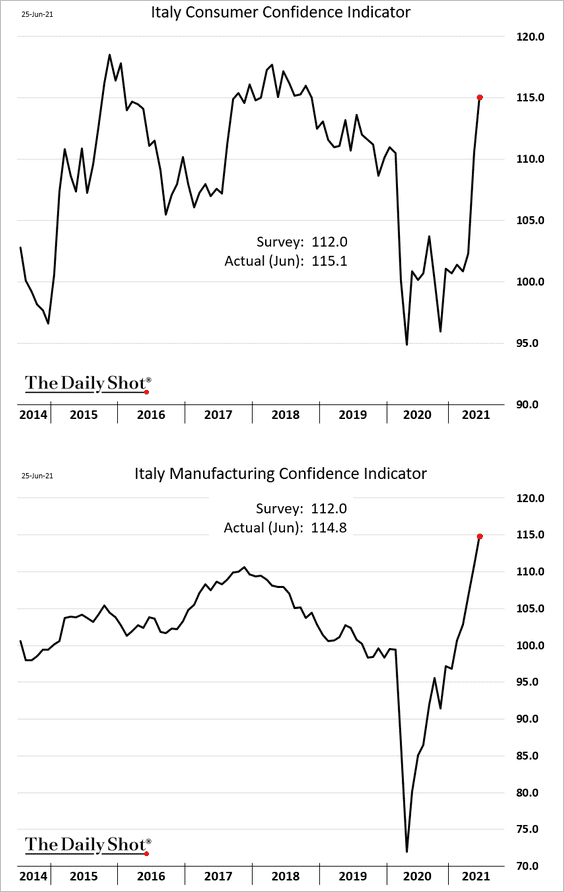

2. Italian sentiment indicators are surging.

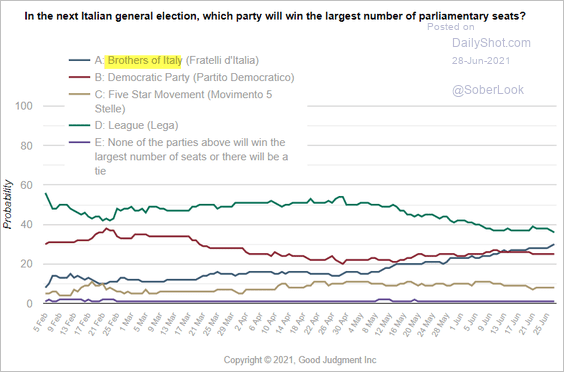

Separately, more superforecasters are predicting the Brothers of Italy winning the largest number of parliamentary seats in the next election.

Source: Good Judgment

Source: Good Judgment

——————–

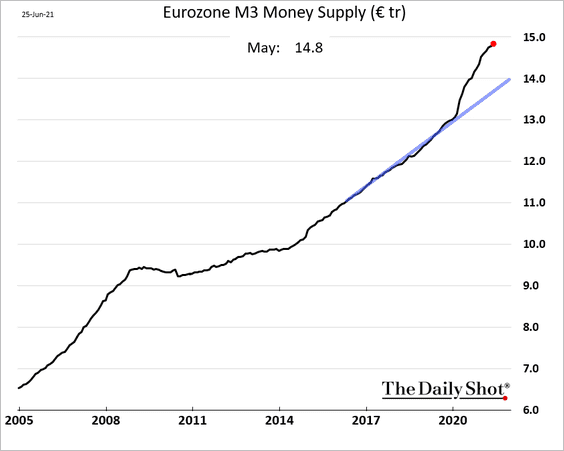

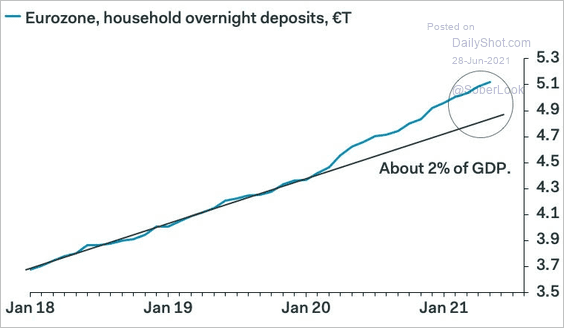

3. The Eurozone’s broad money supply remains well above its pre-COVID trend.

Household “excess” savings are substantial and rising.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Japan

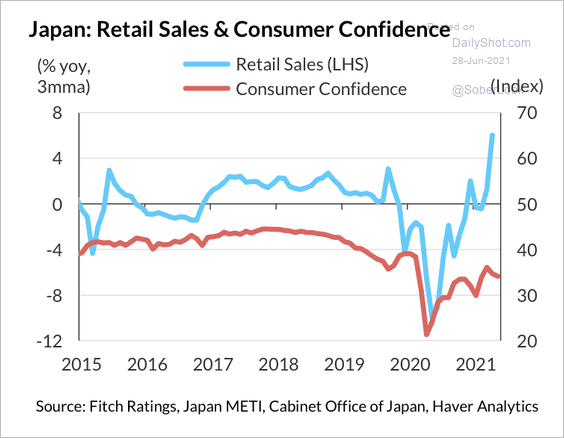

1. Consumer confidence has not caught up with the sharp rise in retail sales.

Source: Fitch Ratings

Source: Fitch Ratings

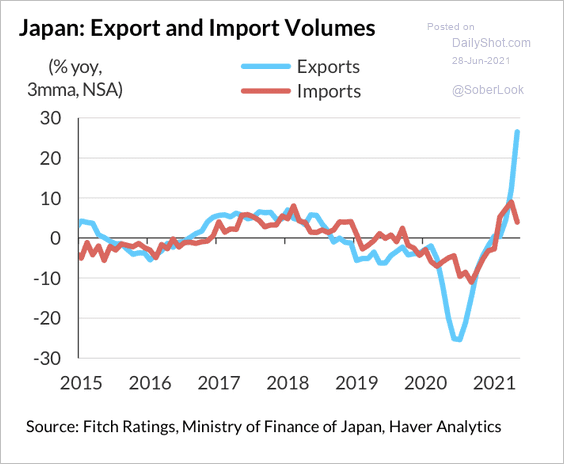

2. Export volumes have surged over the past year.

Source: Fitch Ratings

Source: Fitch Ratings

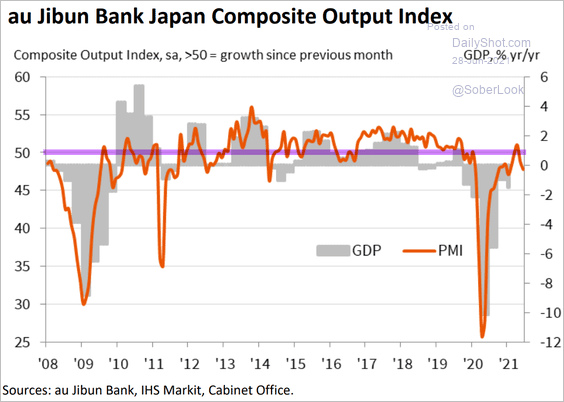

3. The Markit composite PMI index shows that the overall business activity is contracting (PMI < 50).

Source: IHS Markit

Source: IHS Markit

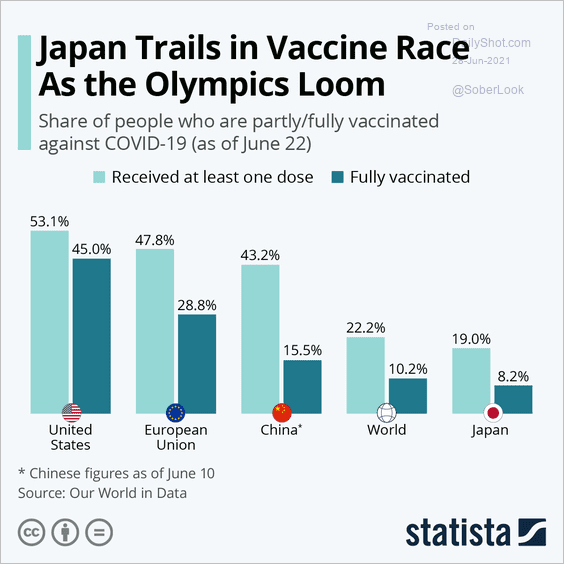

4. Japan’s vaccination program is lagging other economies.

Source: Statista

Source: Statista

Back to Index

China

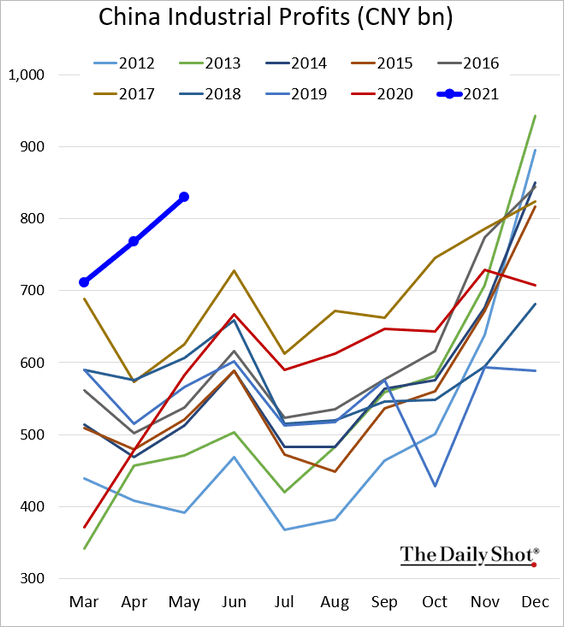

1. Industrial profits remained robust in May.

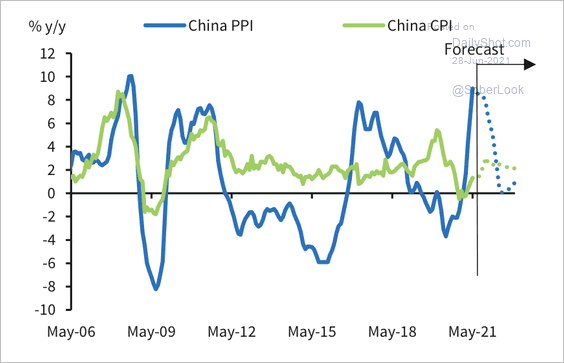

2. Barclays sees limited pass-through from surging PPI into CPI.

Source: Barclays Research

Source: Barclays Research

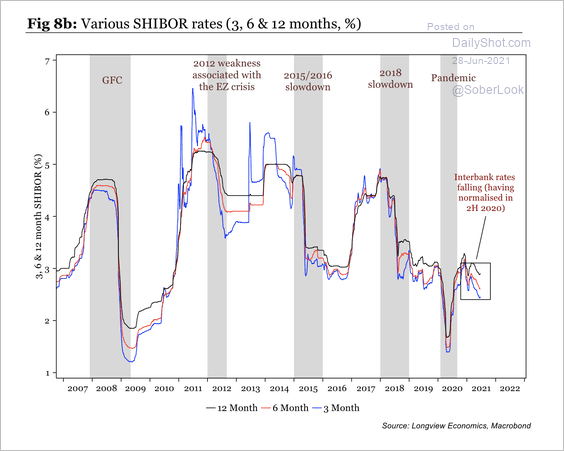

3. Interbank rates have been trending down since the pandemic shock last year.

Source: Longview Economics

Source: Longview Economics

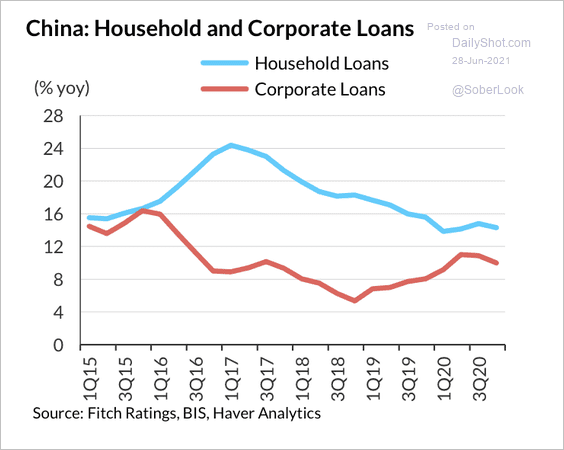

4. Loan growth has trended lower over the past few years.

Source: Fitch Ratings

Source: Fitch Ratings

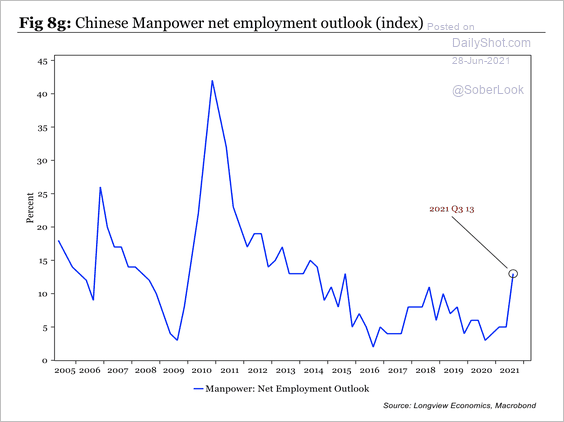

5. The employment outlook has improved sharply.

Source: Longview Economics

Source: Longview Economics

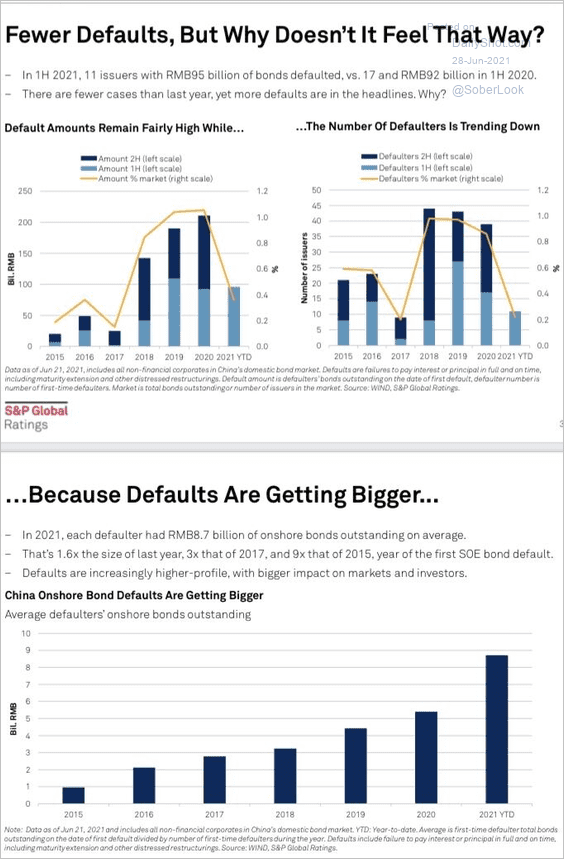

6. Next, we have some data on China’s domestic debt defaults.

Source: Charles Chang, S&P Global Read full article

Source: Charles Chang, S&P Global Read full article

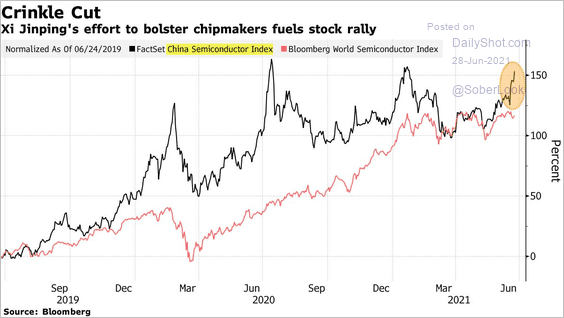

7. Semiconductor stocks have been rallying amid Beijing’s support for the sector.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

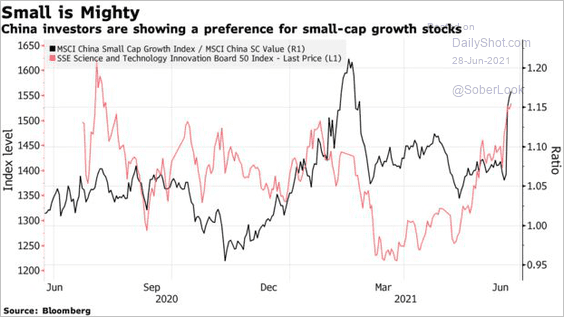

8. Small-cap growth stocks have been popular lately.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Emerging Markets

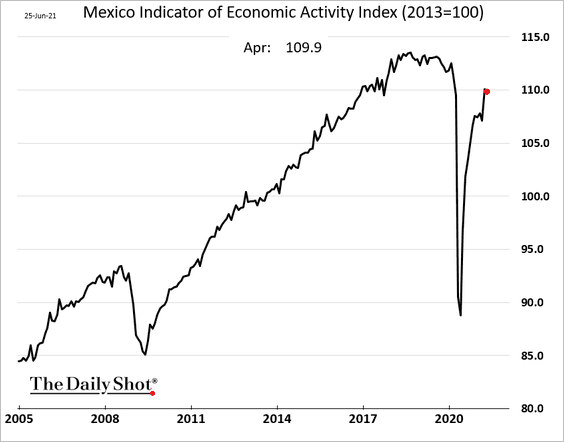

1. Mexico’s economic recovery stalled in April.

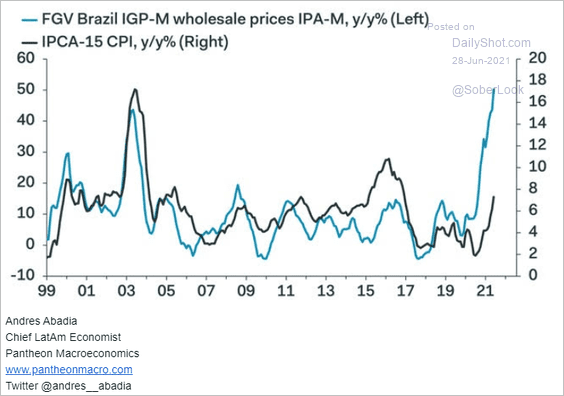

2. Signs point to further gains in Brazil’s consumer inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

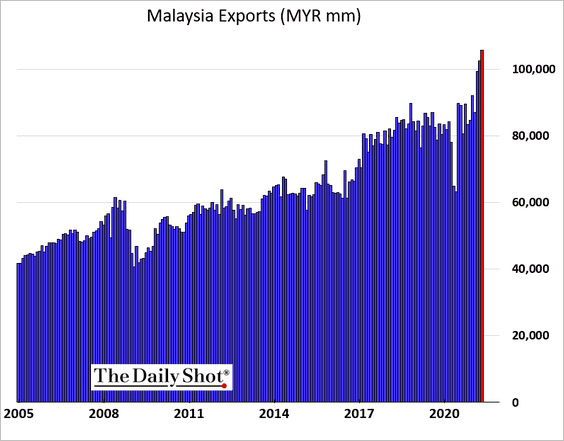

3. Malaysia’s exports hit a record high.

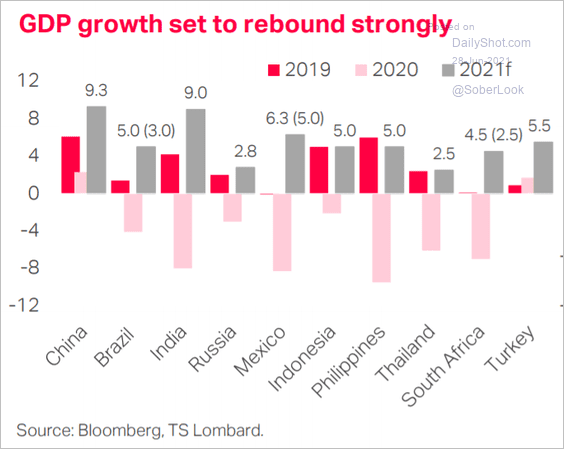

4. EM economies should see strong growth this year.

Source: TS Lombard

Source: TS Lombard

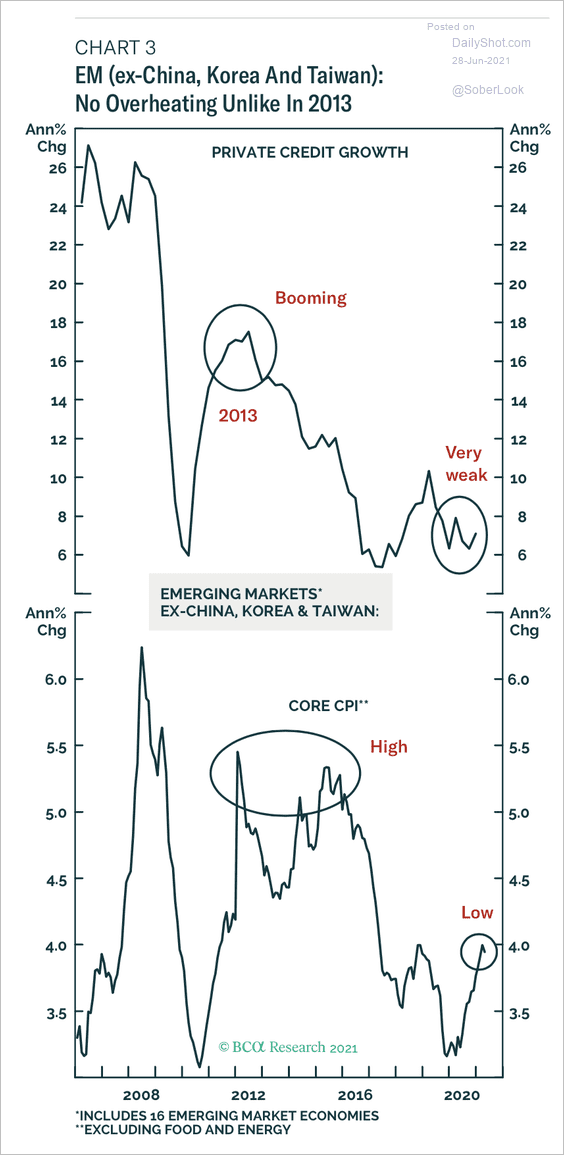

5. Most EM economies do not face excess credit and high inflation last seen during the 2013 taper tantrum.

Source: BCA Research

Source: BCA Research

Back to Index

Cryptocurrency

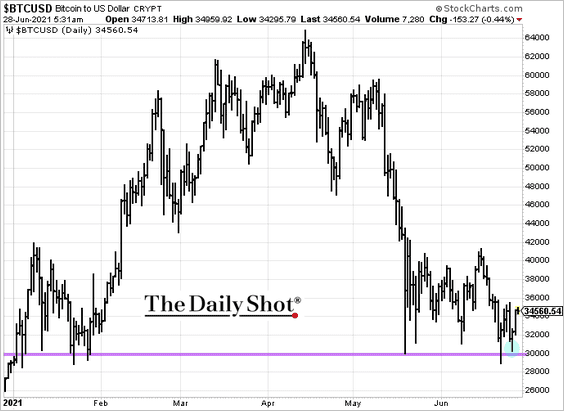

1. Bitcoin had another volatile weekend, once again testing support at $30k.

The regulatory news from the UK didn’t help.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

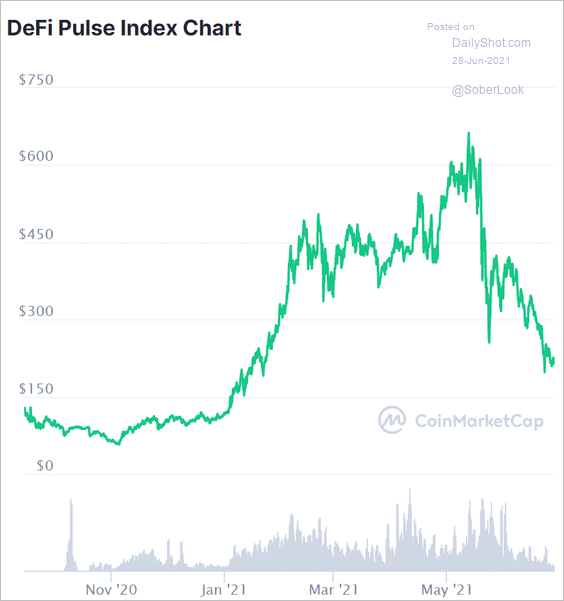

2. DeFi tokes remain under pressure.

Source: CoinMarketCap

Source: CoinMarketCap

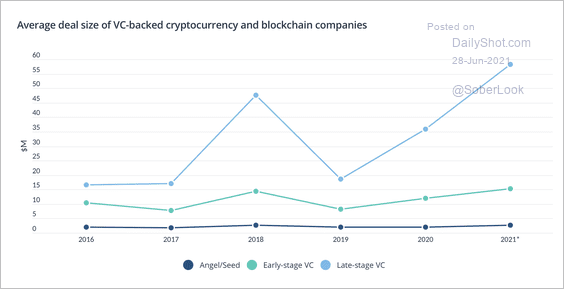

3. The average deal size for late-stage crypto/blockchain venture capital transactions has sharply increased over the past two years.

Source: PitchBook Read full article

Source: PitchBook Read full article

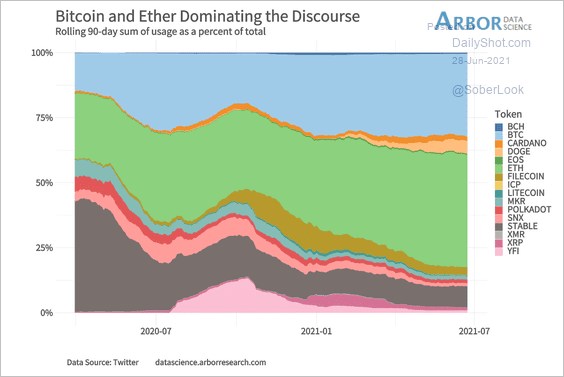

4. Bitcoin and Ethereum dominate the discourse on Twitter.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

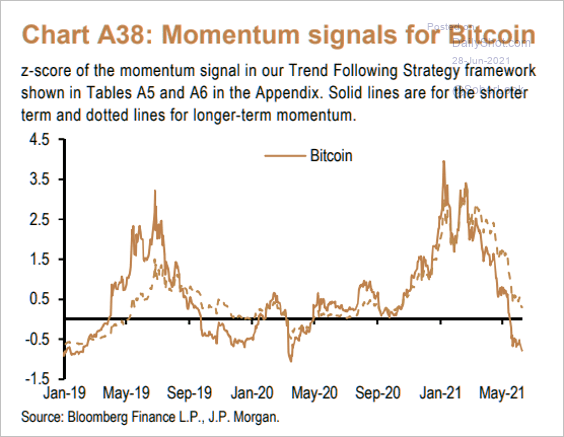

5. This chart shows JP Morgan’s momentum index for Bitcoin.

Source: JP Morgan; @themarketear

Source: JP Morgan; @themarketear

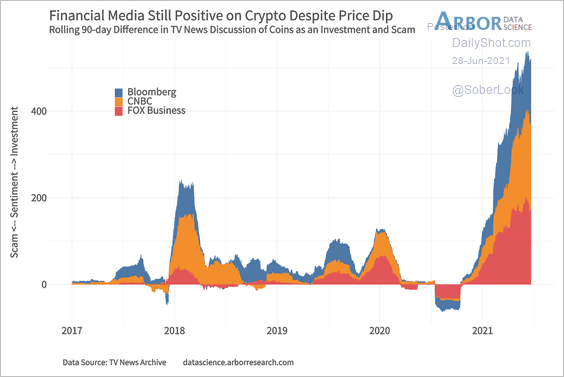

6. Media coverage of crypto markets remains positive.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

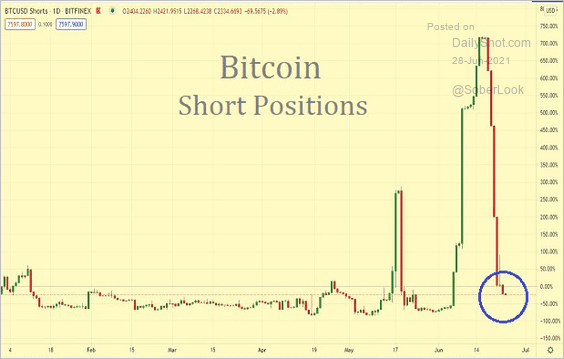

7. Bitcoin short interest has tumbled.

Source: @RMKOutFront

Source: @RMKOutFront

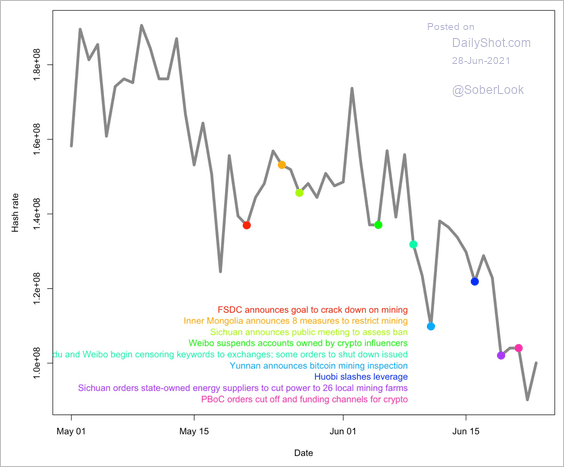

8. This chart shows the Bitcoin hash rate mapped against recent Chinese regulatory actions.

Source: @takenstheoreum

Source: @takenstheoreum

Back to Index

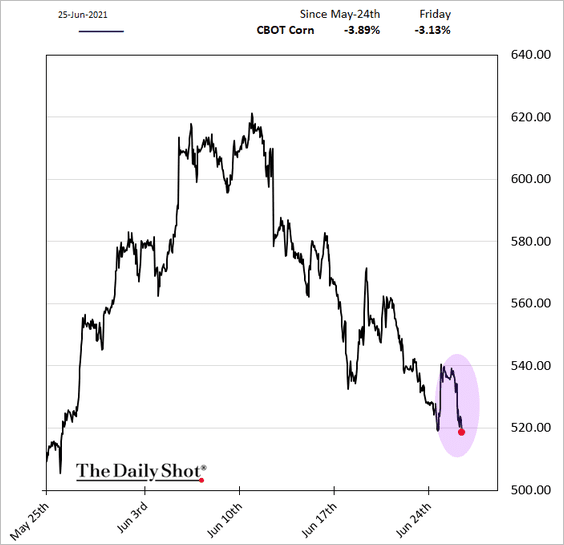

Commodities

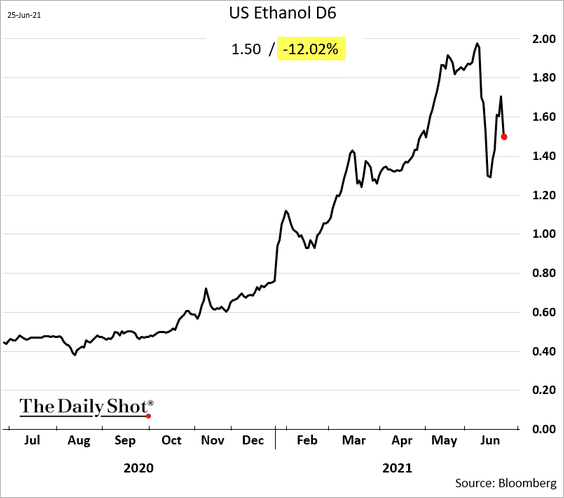

The US Supreme Court dealt a blow to the ethanol industry.

Source: Forbes Read full article

Source: Forbes Read full article

Corn and ethanol prices retreated.

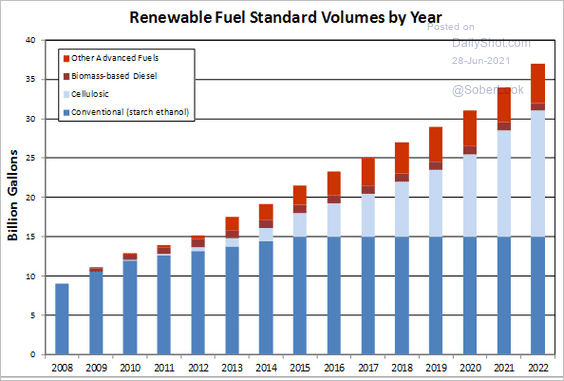

By the way, here is the renewable fuel standard by year.

Source: US Department of Energy Read full article

Source: US Department of Energy Read full article

Back to Index

Energy

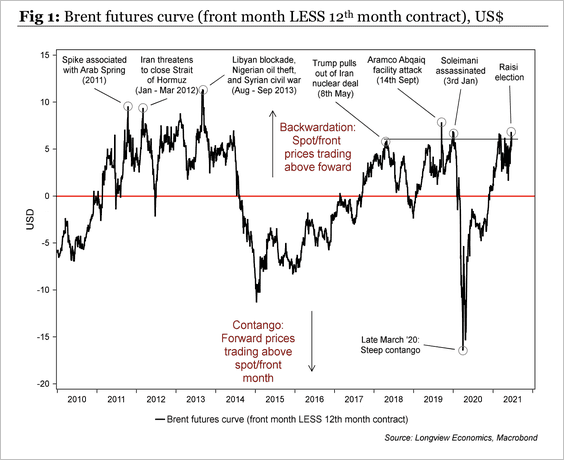

1. As we saw last week, the Brent futures curve has moved into deep backwardation.

Source: Longview Economics

Source: Longview Economics

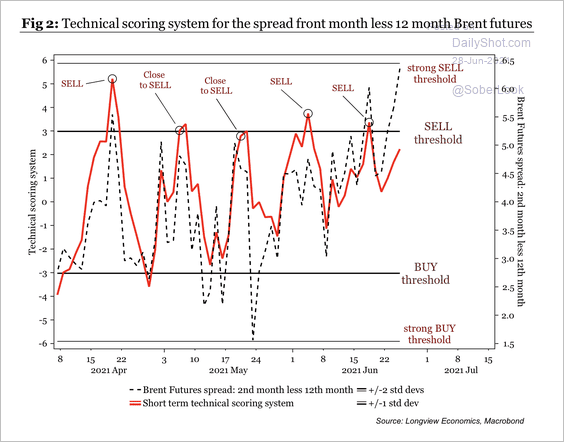

Technicals suggest the Brent futures backwardation should reverse in the near-term.

Source: Longview Economics

Source: Longview Economics

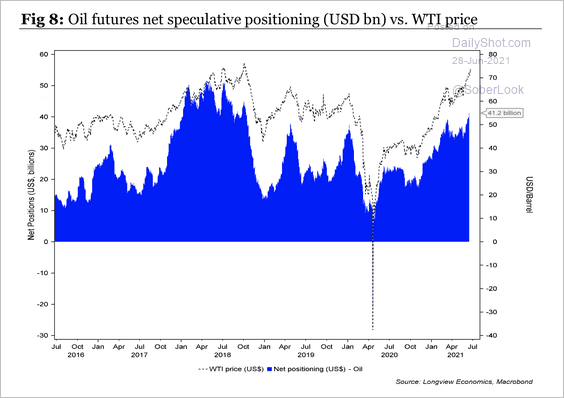

2. Net-long speculative positioning in WTI crude oil futures appears stretched.

Source: Longview Economics

Source: Longview Economics

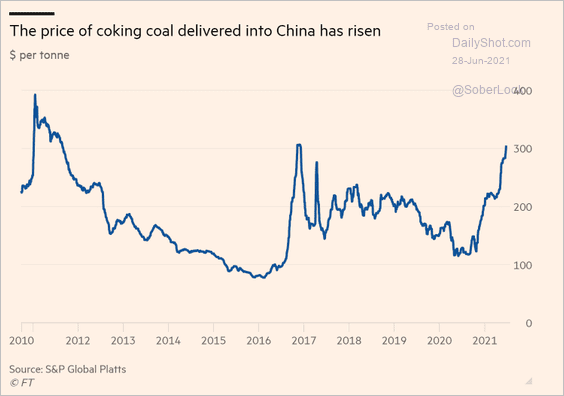

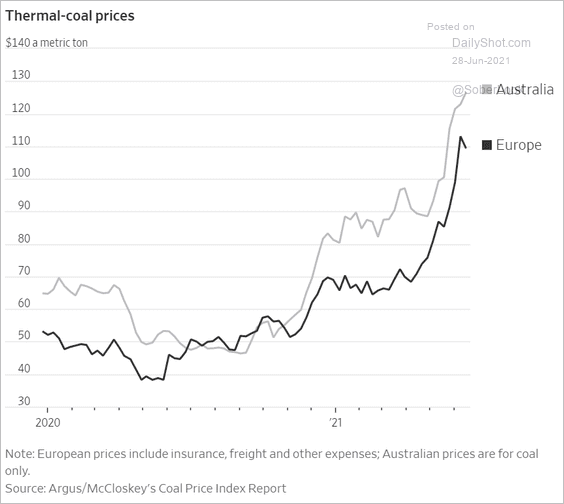

3. Global coal prices continue to climb.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

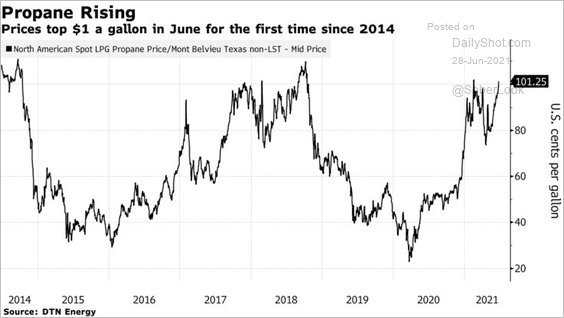

4. US propane prices have been rising.

Source: @markets Read full article

Source: @markets Read full article

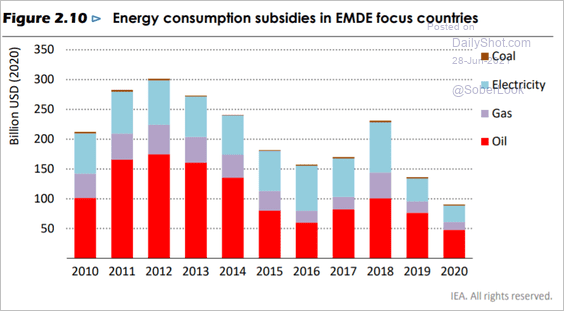

5. Global energy subsidies seem to be trending lower.

Source: IEA

Source: IEA

Back to Index

Equities

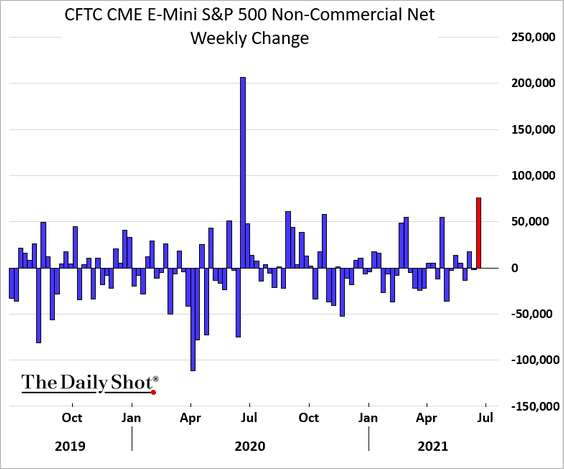

1. Speculative accounts boosted their bets on S&P 500 futures last week.

h/t Cormac Mullen

h/t Cormac Mullen

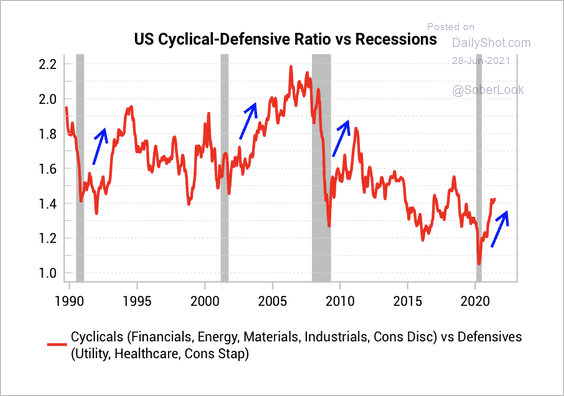

2. Cyclical stocks have been outperforming defensives, which is typical following a recession.

Source: Variant Perception

Source: Variant Perception

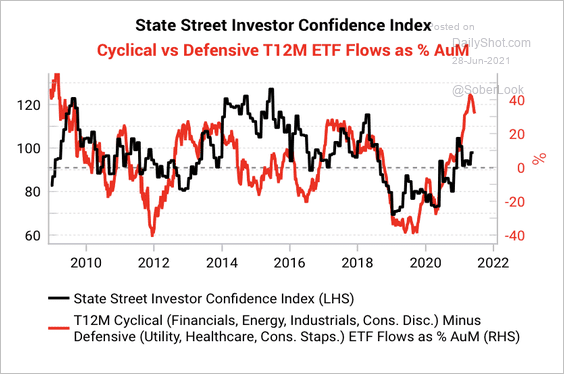

Flows into cyclical ETFs surged as investor confidence recovered.

Source: Variant Perception

Source: Variant Perception

——————–

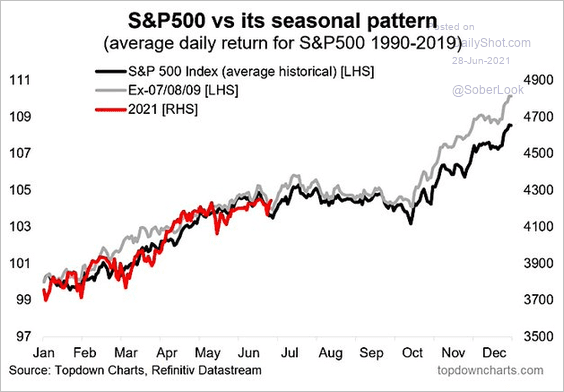

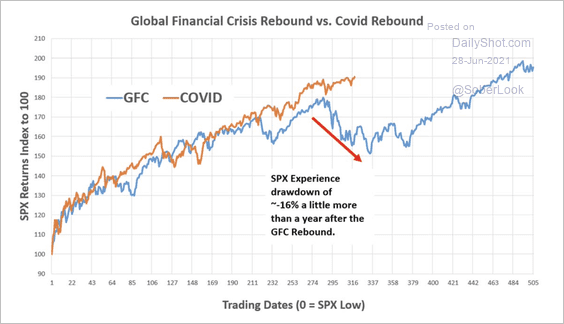

3. The S&P 500 seasonal pattern suggests that we will see further gains in Q4 after a pause.

Source: @Callum_Thomas, @topdowncharts

Source: @Callum_Thomas, @topdowncharts

However, the market could experience a drawdown of as much as 16% based on the post-financial crisis parallel.

Source: Chris Murphy; Susquehanna Derivative Strategy

Source: Chris Murphy; Susquehanna Derivative Strategy

——————–

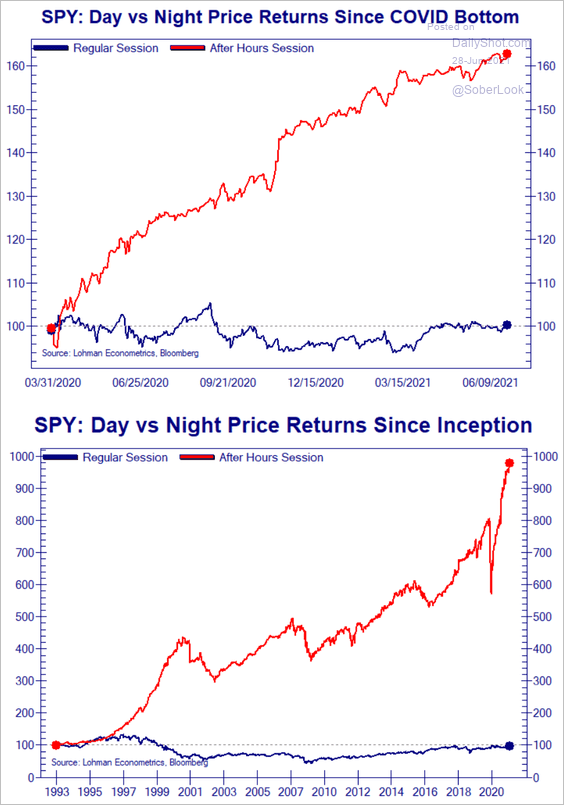

4. Most of the gains in the SPDR S&P 500 ETF have been in the after-hours sessions.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

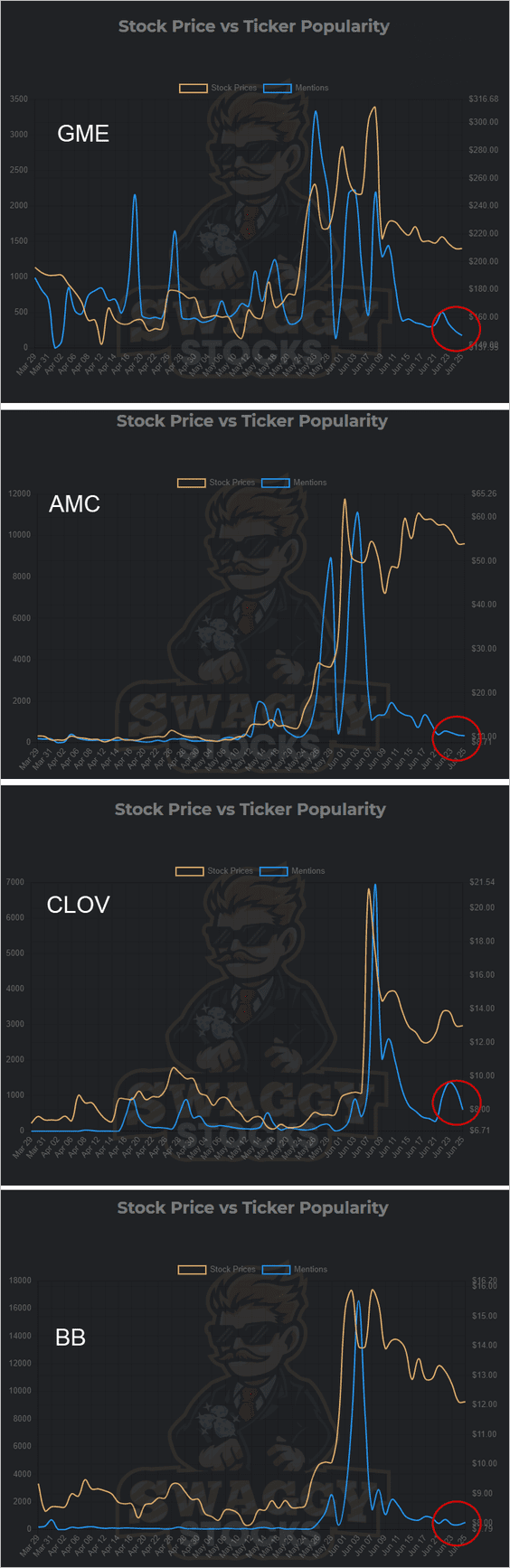

5. The Reddit crowd’s interest in some of the most popular meme stocks has waned.

Source: SwaggyStocks

Source: SwaggyStocks

Short sellers worry about the Reddit crowd’s next target, which has resulted in falling short interest across the US equity market.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

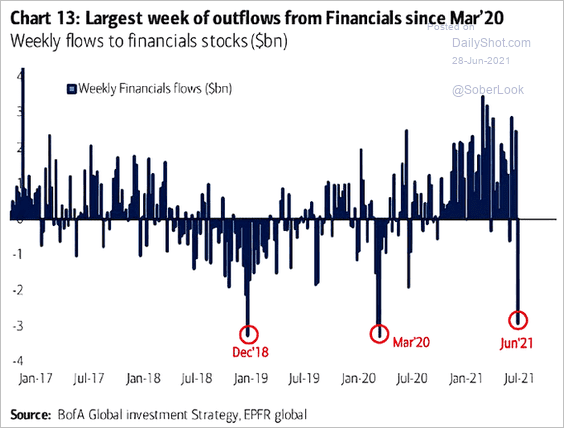

6. Financials saw outflows recently.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

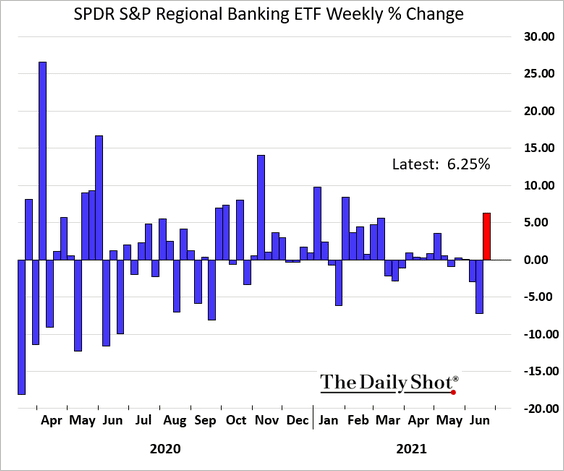

But the Fed’s stress test results sent bank shares sharply higher last week.

——————–

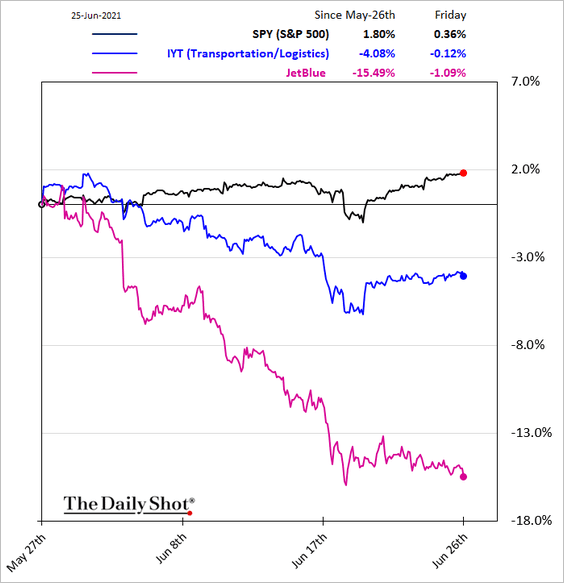

7. Transport stocks have been underperforming, which some view as a bearish sign for the market.

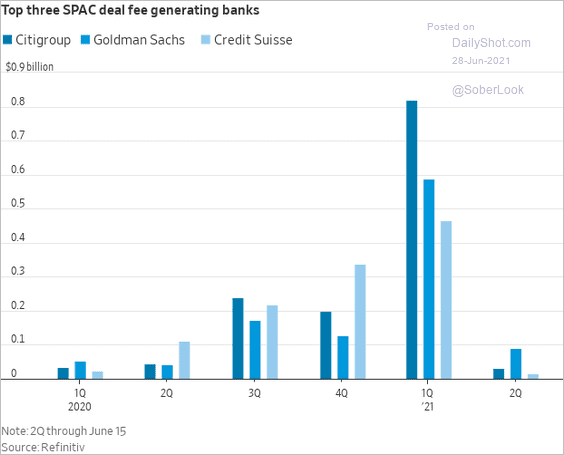

8. SPAC deal fees are drying up.

Source: @WSJ Read full article

Source: @WSJ Read full article

9. The CBOE skew index continues to hit new highs, pointing to robust demand for downside protection.

Back to Index

Rates

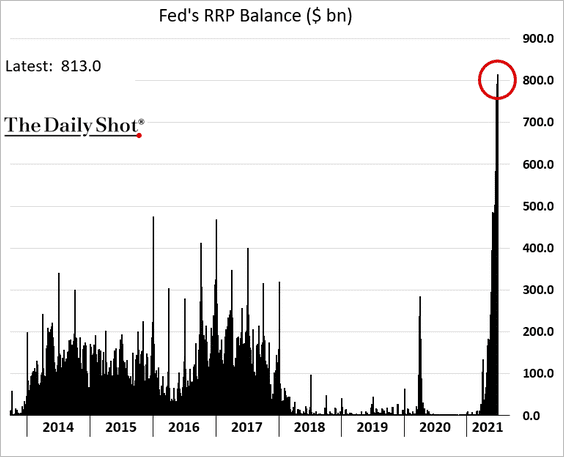

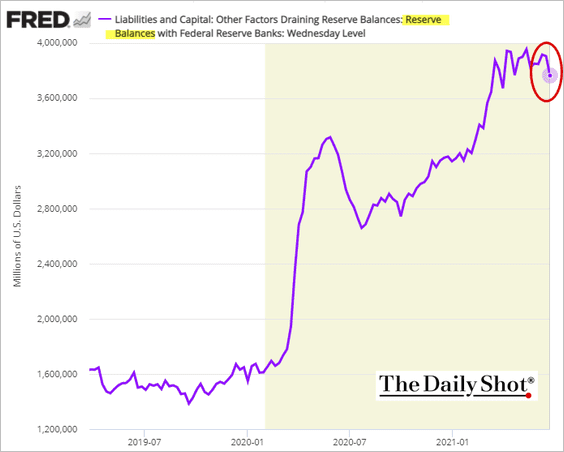

1. The massive rise in the Fed’s RRP balance …

… drained some reserves from the banking system (which was the Fed’s goal).

——————–

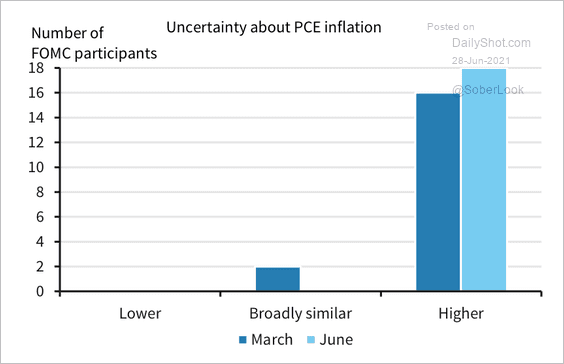

2. FOMC participants see higher uncertainty in their outlook for PCE inflation, …

Source: Barclays Research

Source: Barclays Research

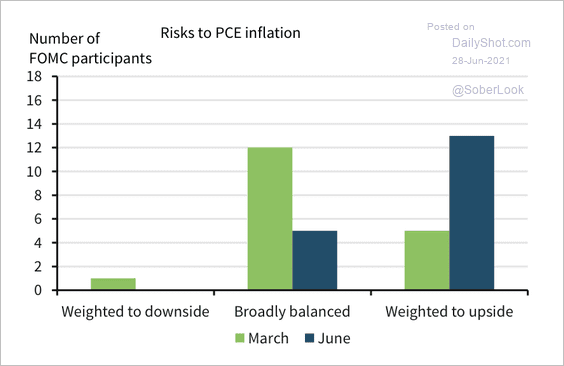

… with risks to their forecast skewed to the upside.

Source: Barclays Research

Source: Barclays Research

——————–

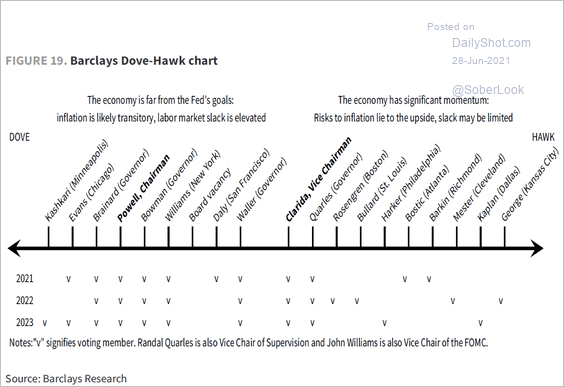

3. Here is the FOMC dove-hawk spectrum.

Source: Barclays Research

Source: Barclays Research

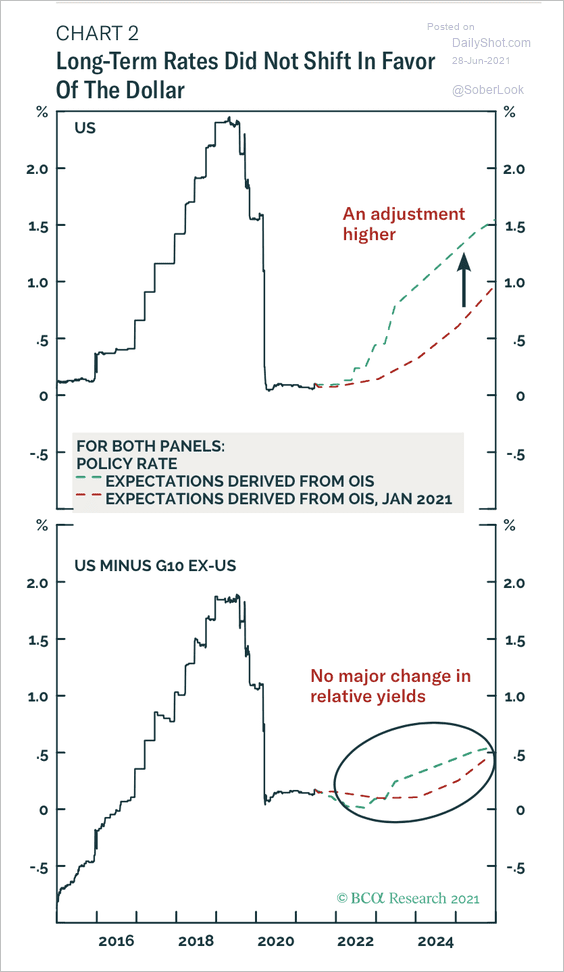

4. Markets expect the Fed to raise rates by 34 basis points in 2022 and an additional 51 basis points in 2023. On the surface, this explains the recent dollar rally, but rate expectations between the US and the rest of the world were largely unchanged as real rates moved higher across the G10, according to BCA Research.

Source: BCA Research

Source: BCA Research

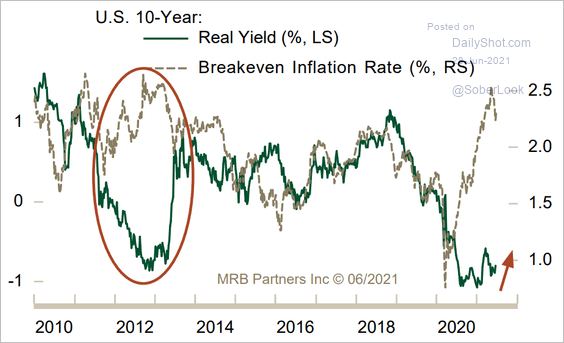

5. The divergence between real yields and inflation expectations during the 2013 taper tantrum didn’t last long. Is it different this time?

Source: MRB Partners

Source: MRB Partners

——————–

Food for Thought

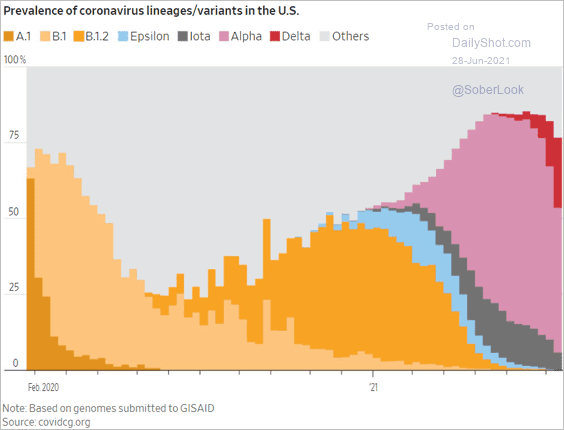

1. The prevalence of COVID variants:

Source: @WSJ Read full article

Source: @WSJ Read full article

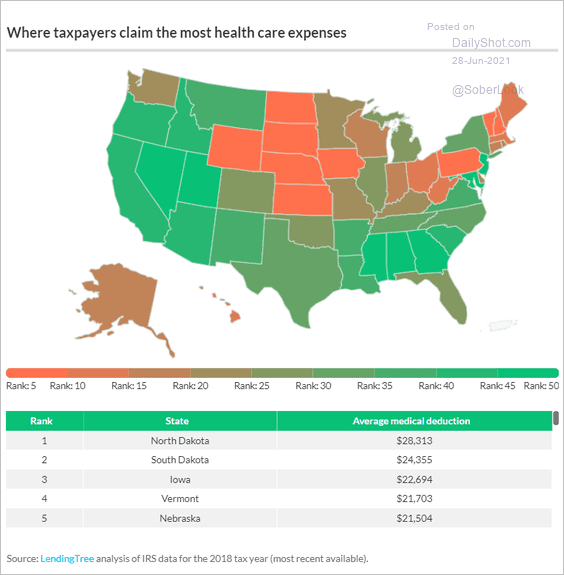

2. Where US taxpayers claim the most healthcare expenses:

Source: LendingTree Read full article

Source: LendingTree Read full article

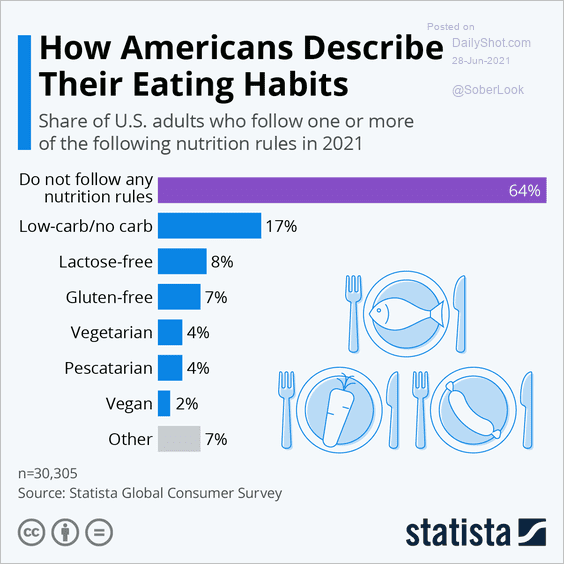

3. American diets:

Source: Statista

Source: Statista

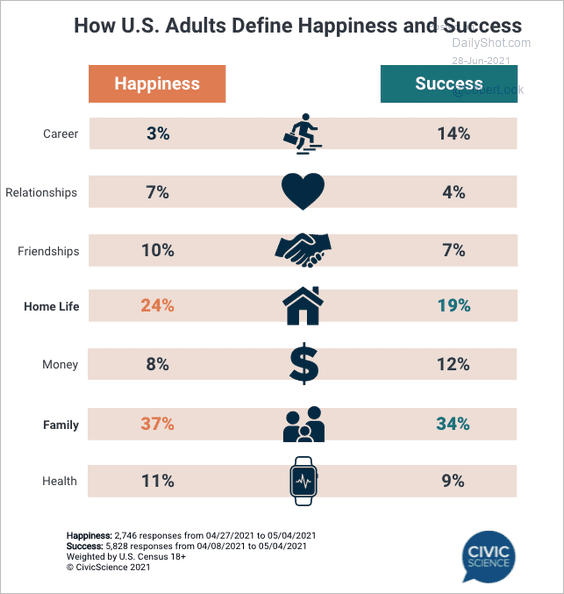

4. Defining happiness and success:

Source: CivicScience Read full article

Source: CivicScience Read full article

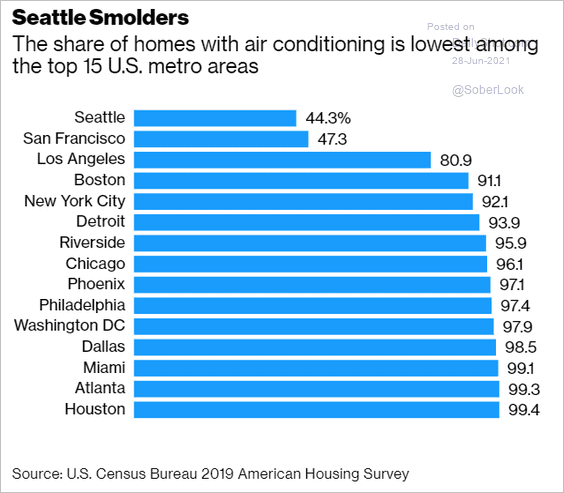

5. The share of homes with air conditioning:

Source: @business Read full article

Source: @business Read full article

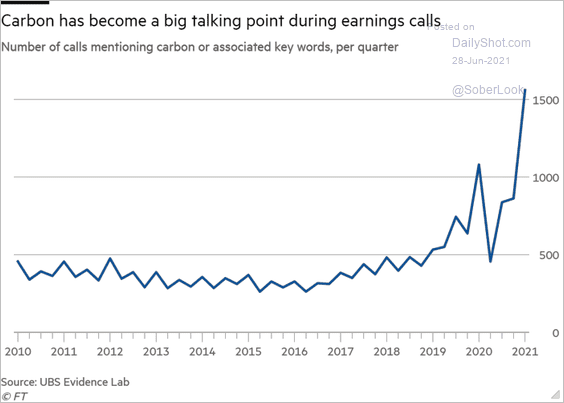

6. Companies discussing carbon on earnings calls:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

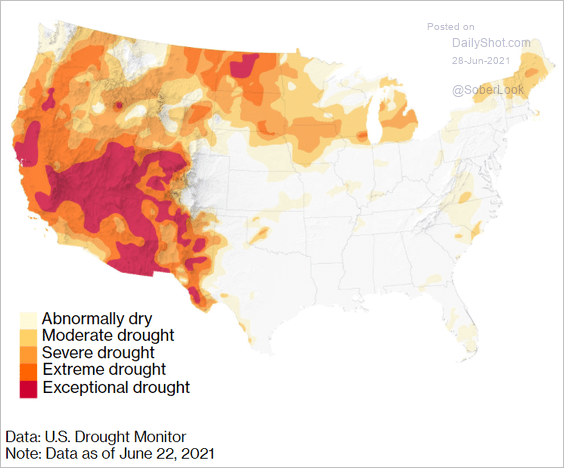

7. Updated US drought map:

Source: @business Read full article

Source: @business Read full article

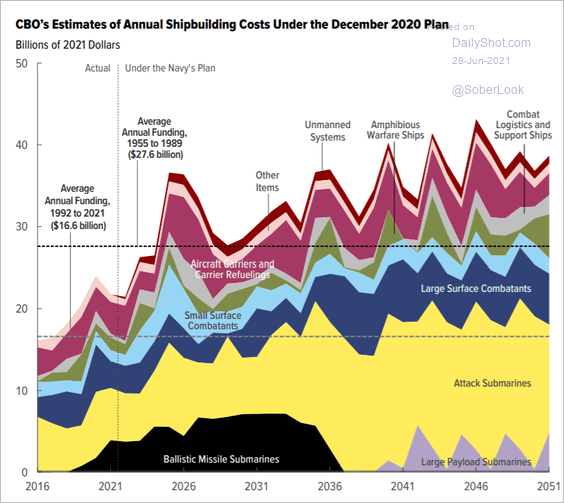

8. The US Navy’s spending plans …

Source: CBO Read full article

Source: CBO Read full article

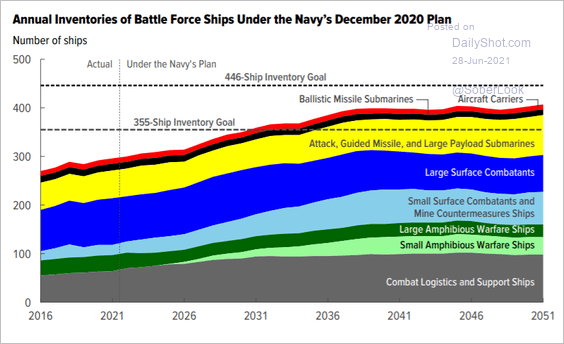

… and ship inventory goals:

Source: CBO Read full article

Source: CBO Read full article

——————–

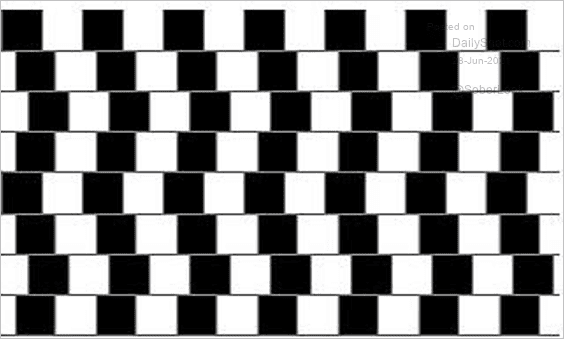

9. These lines are straight and parallel.

Source: BrainDen.com

Source: BrainDen.com

——————–

Back to Index