The Daily Shot: 01-Jul-21

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

1. Please note that the next Daily Shot will be published on Monday, July 5th.

2. Please see this summary for information on updating your account status (for example, if you don’t want your subscription to renew automatically).

Back to Index

The United States

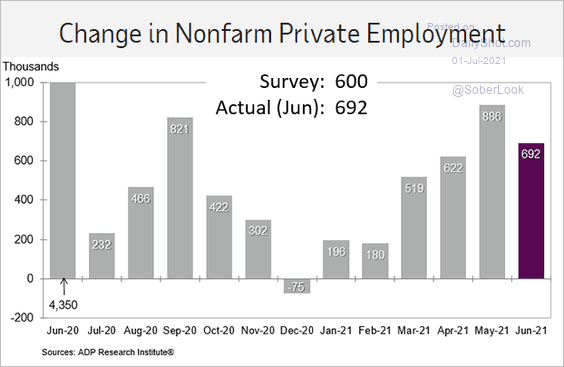

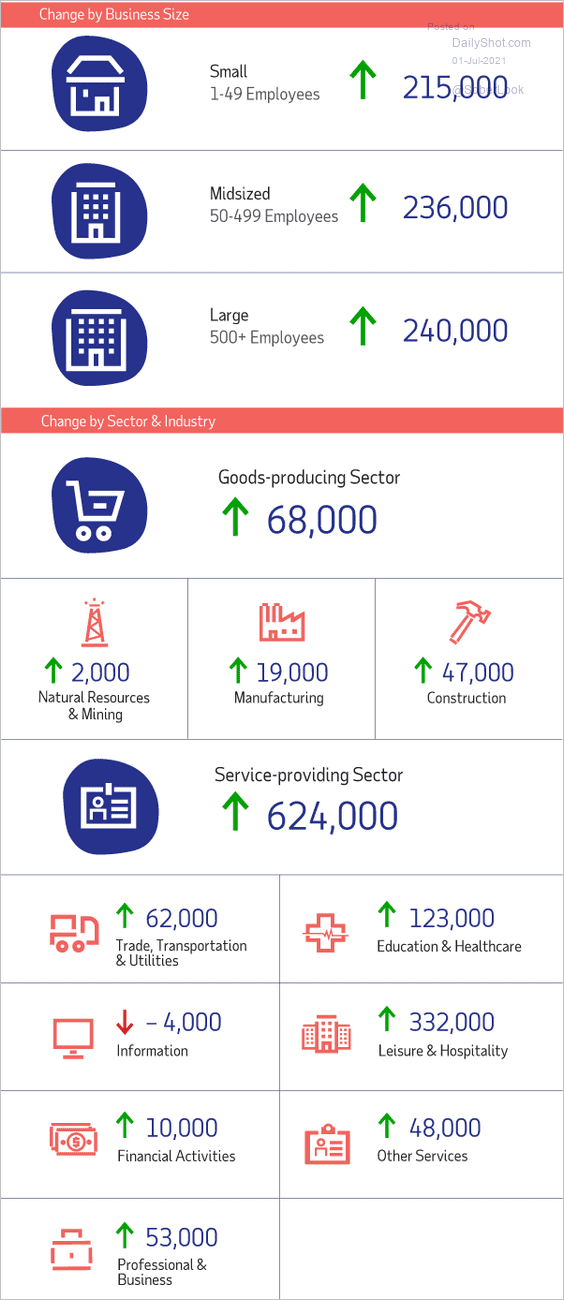

1. The ADP report showed strong gains in private payrolls in June, topping forecasts.

Source: ADP Research Institute

Source: ADP Research Institute

Employment gains were broad, with Leisure and Hospitality picking up 332k jobs.

Source: ADP Research Institute

Source: ADP Research Institute

——————–

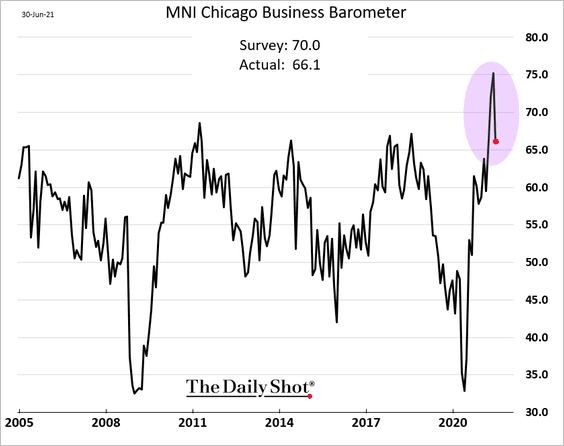

2. The Chicago PMI pulled back from the May highs. The report indicated that input price gains sped up in June, and hiring slowed.

Regional surveys point to a strong ISM Manufacturing report at the national level (10 AM this morning).

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

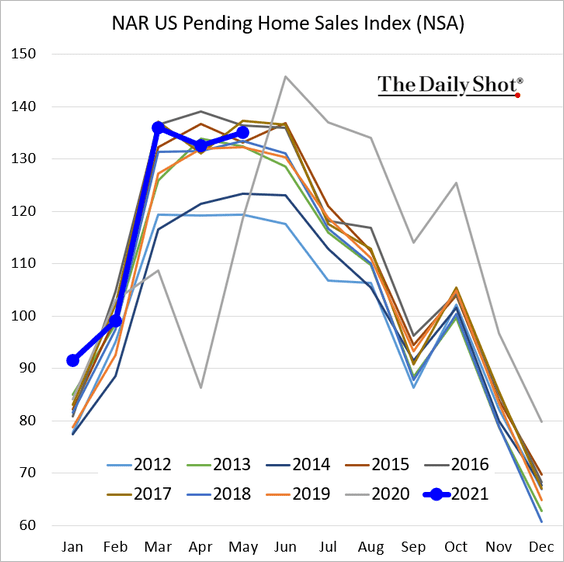

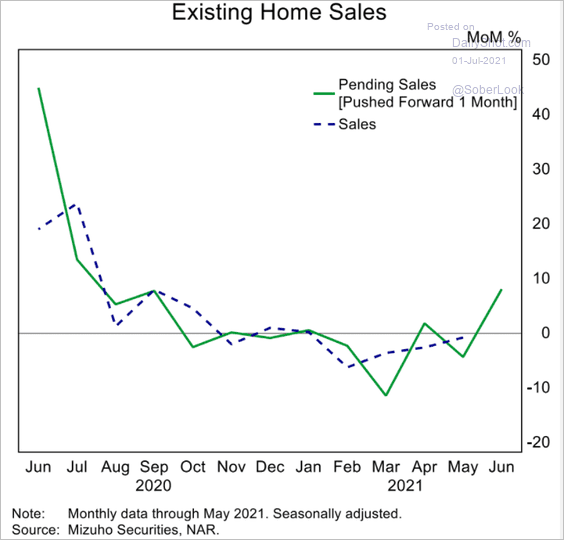

3. Pending home sales surprised to the upside. Despite sharp price increases, housing demand remains robust.

We are likely to see a jump in existing home sales in June.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

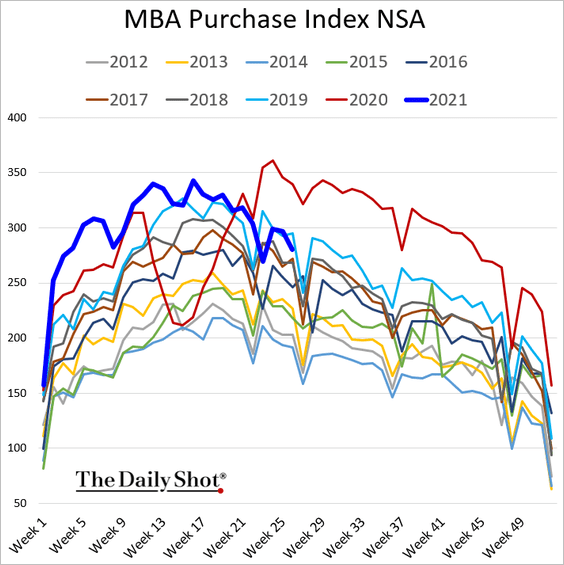

However, mortgage applications are now running below 2019 levels.

——————–

4. Here are a couple of updates on inflation.

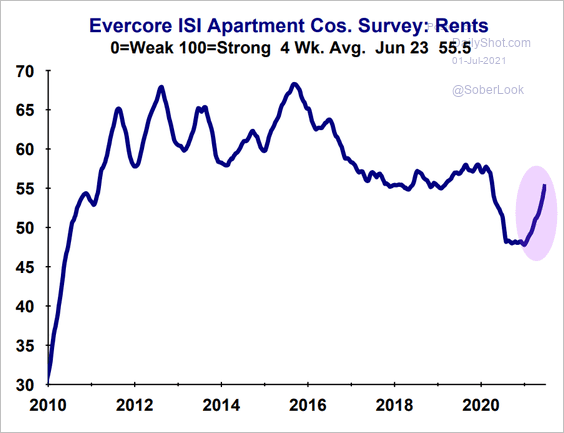

• The Evercore ISI Apartment Survey shows rents rebounding quickly. We should see this recovery boosting the core CPI in the months ahead.

Source: Evercore ISI

Source: Evercore ISI

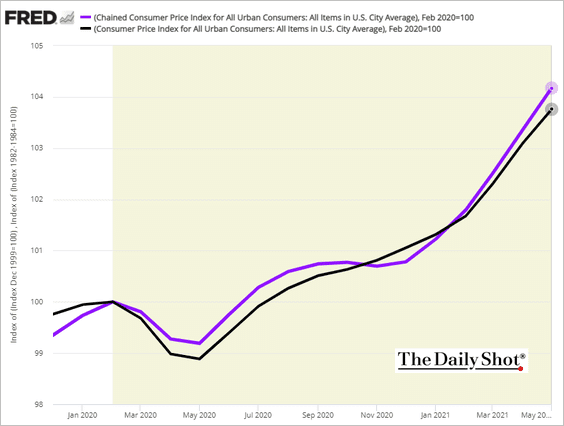

• The chained CPI index outperformed the official inflation measure since the start of the pandemic because it takes into account changing spending patterns.

Further reading

Further reading

——————–

5. Next, let’s take a look at some trends in the labor markets.

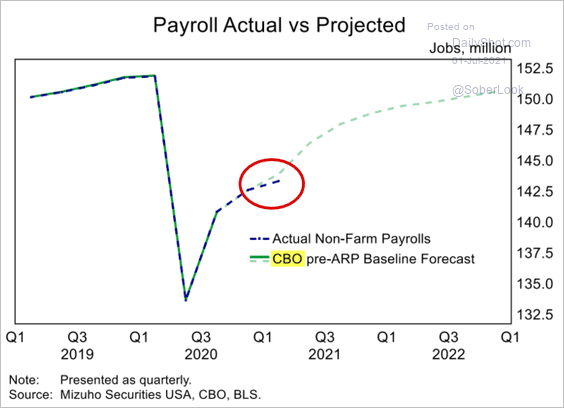

• The CBO expected Americans who are out of work to get jobs faster than they have been.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

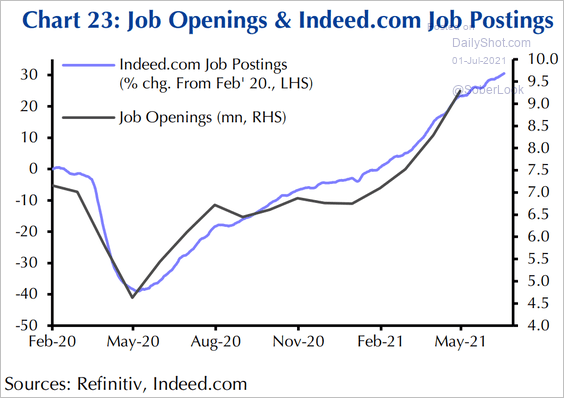

And there are plenty of jobs.

Source: Capital Economics

Source: Capital Economics

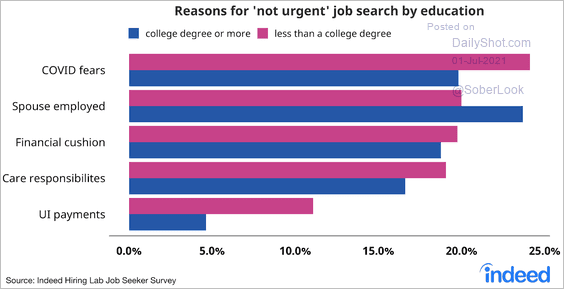

So what are the reasons?

– COVID concerns, savings, other sources of income, childcare …

Source: Indeed Read full article

Source: Indeed Read full article

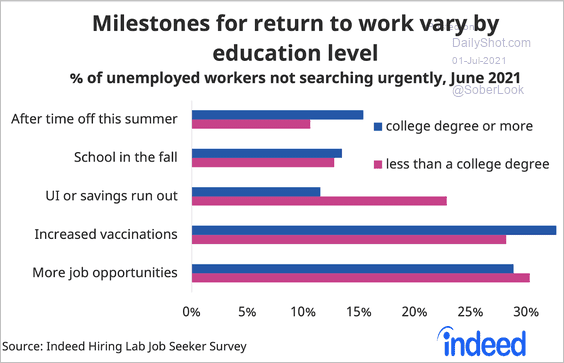

– Milestones to return to work:

Source: Indeed Read full article

Source: Indeed Read full article

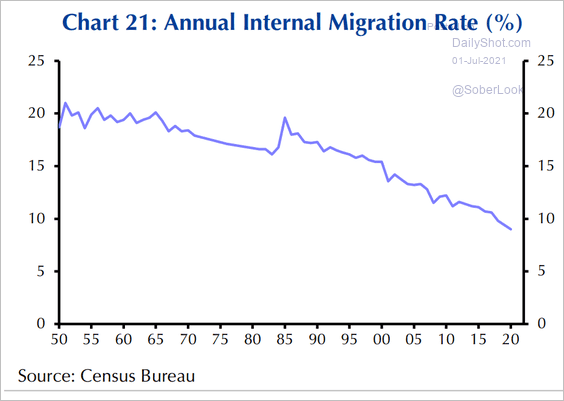

– Reduced mobility (not willing/able to move for a job):

Source: Capital Economics

Source: Capital Economics

– Much higher retirement rates:

Source: Capital Economics

Source: Capital Economics

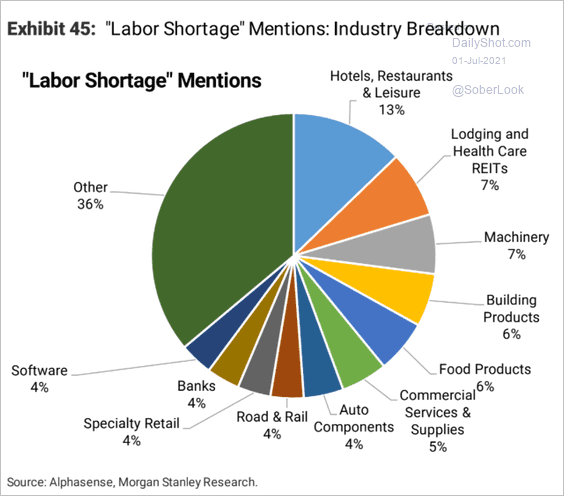

• Here is the breakdown of labor shortages by sector.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

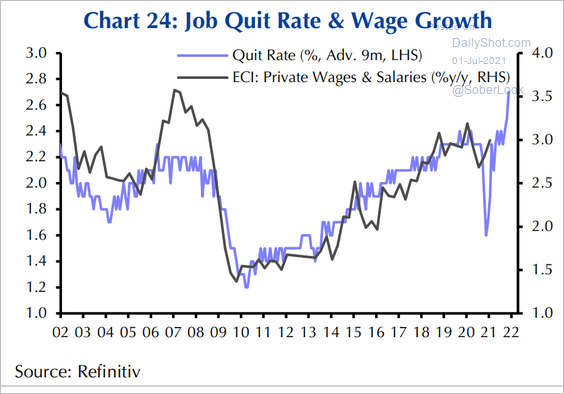

• The quit rate points to rapid increases in wage growth.

Source: Capital Economics

Source: Capital Economics

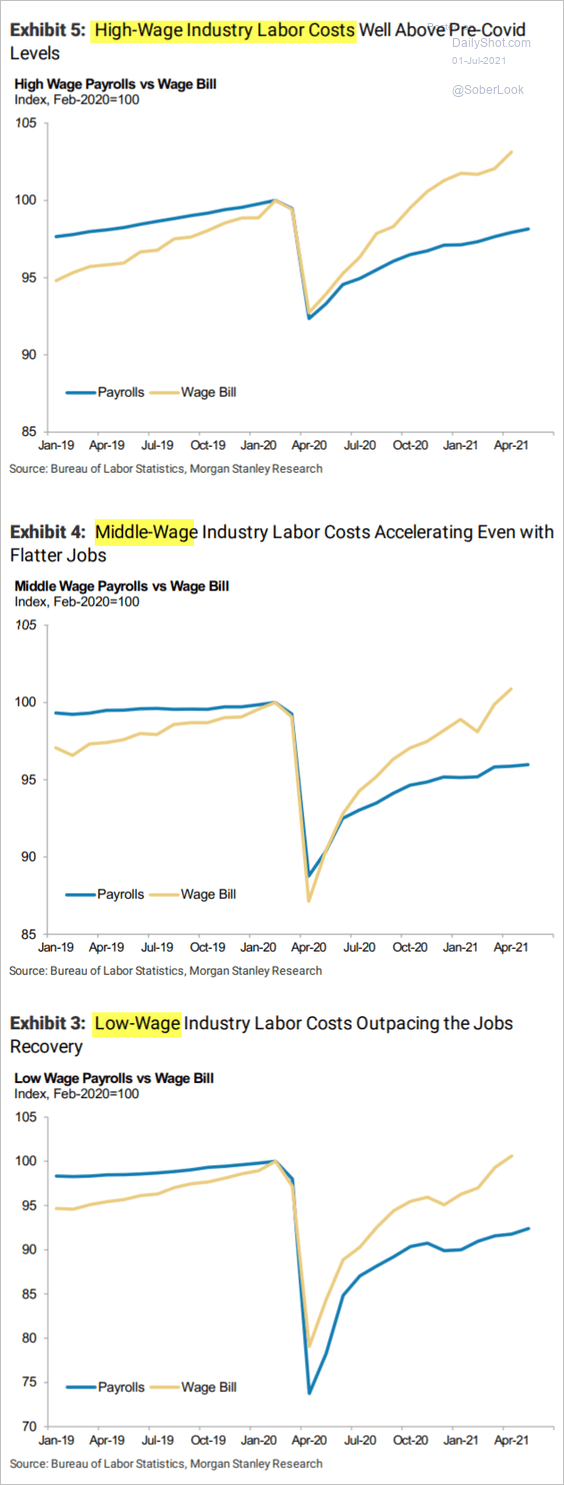

• These charts show the rebound in labor costs by wage category.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

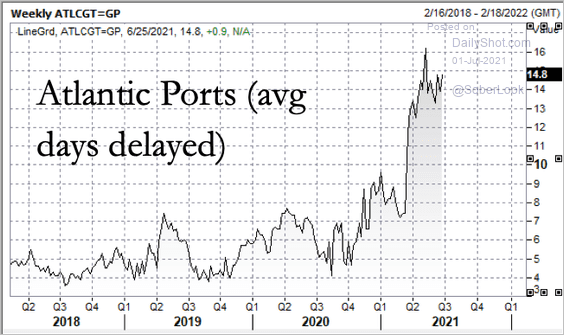

6. US West Coast port delays persist.

Source: @StockBoardAsset

Source: @StockBoardAsset

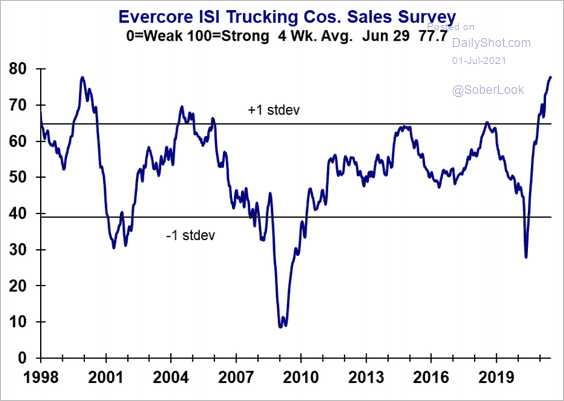

Trucking companies haven’t seen such strong sales growth in over two decades, according to Evercore ISI.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Canada

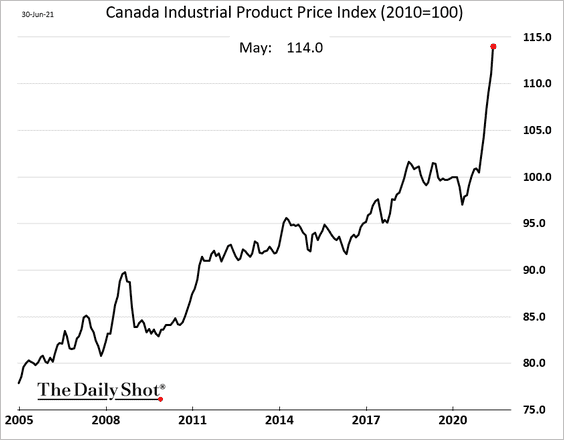

1. Industrial producer prices are soaring.

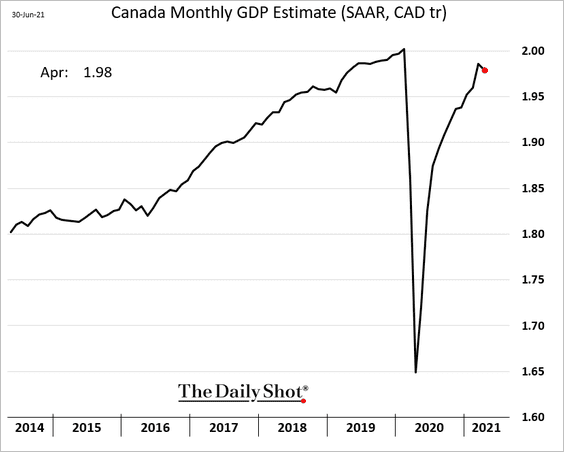

2. The April GDP decline was smaller than expected.

——————–

The United Kingdom

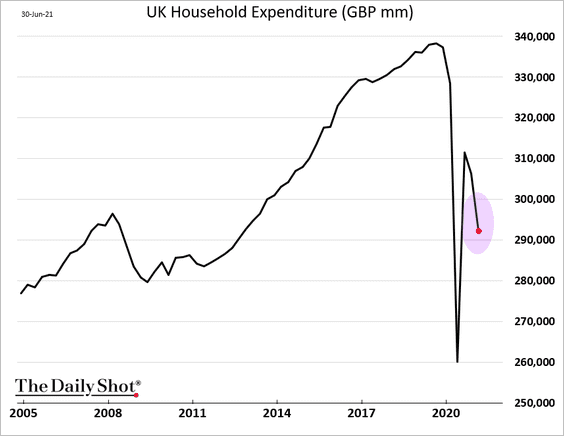

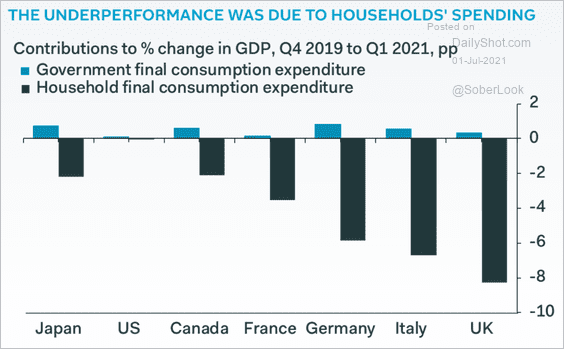

1. The Q1 decline in household spending was more severe than the earlier estimate.

The massive drop in household spending since the start of the pandemic was the reason the UK GDP underperformed (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

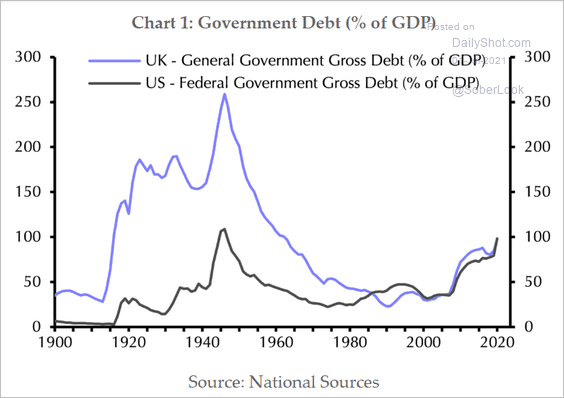

2. The UK and US debt-to-GDP ratios have converged again.

Source: Capital Economics

Source: Capital Economics

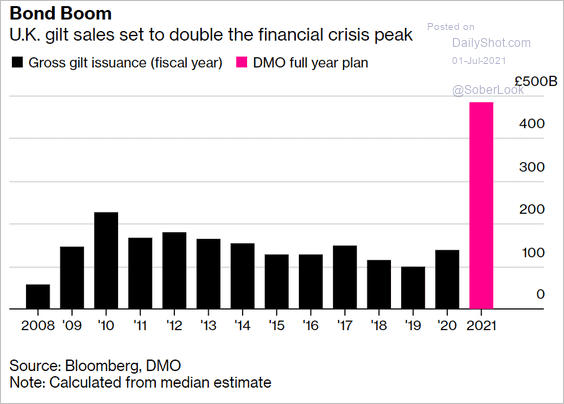

3. Gilt sales this year will double the post-crisis peak in 2010.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

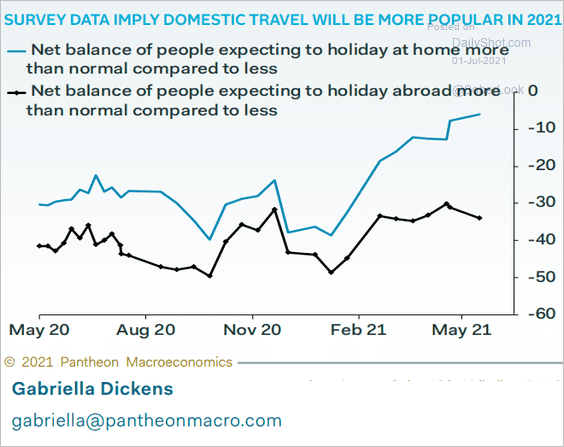

4. Domestic travel is rebounding, but trips abroad remain well below pre-COVID levels.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

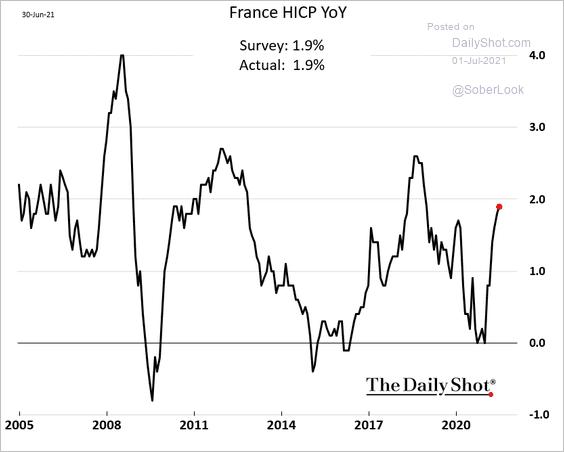

The Eurozone

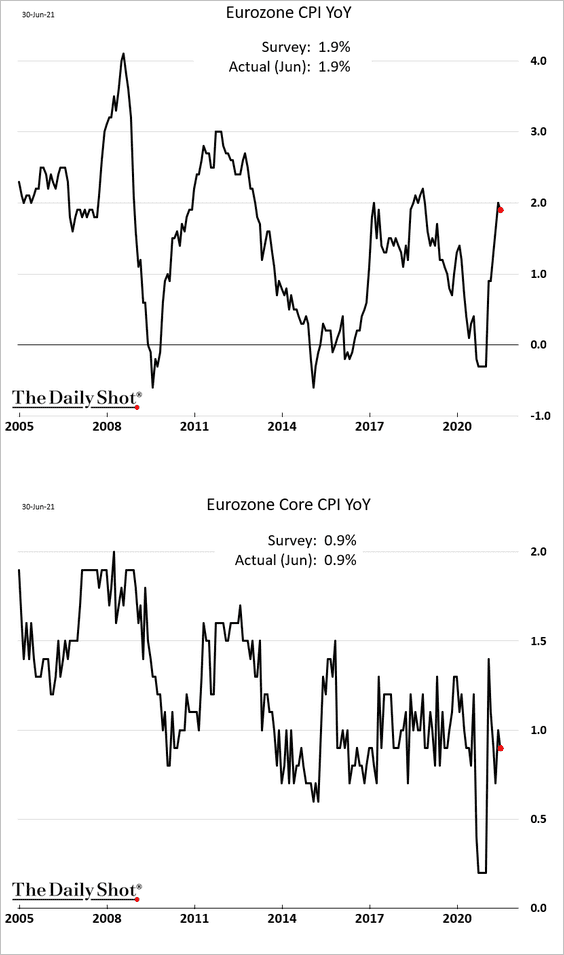

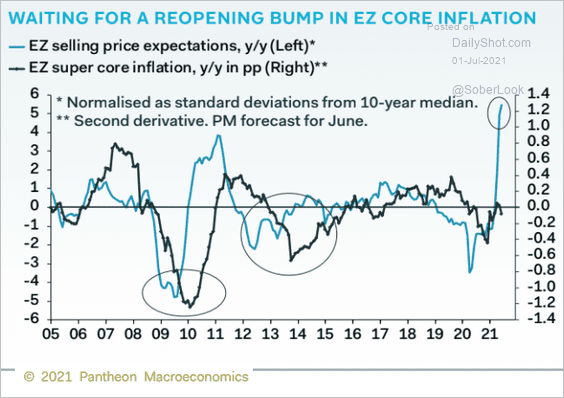

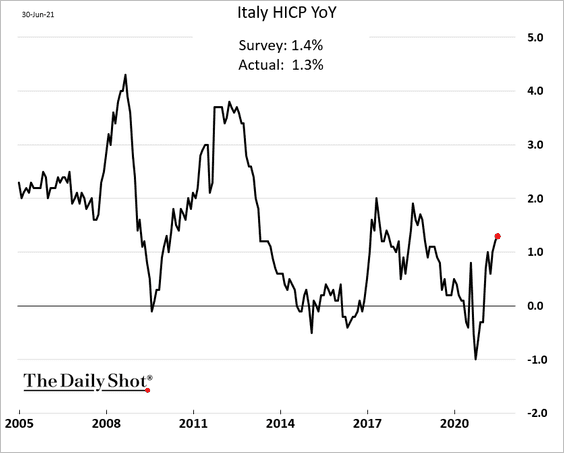

1. The CPI dipped below 2%, and the core CPI is back below 1%.

But we should see gains in core inflation in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Here are the CPI trends for Italy and France.

——————–

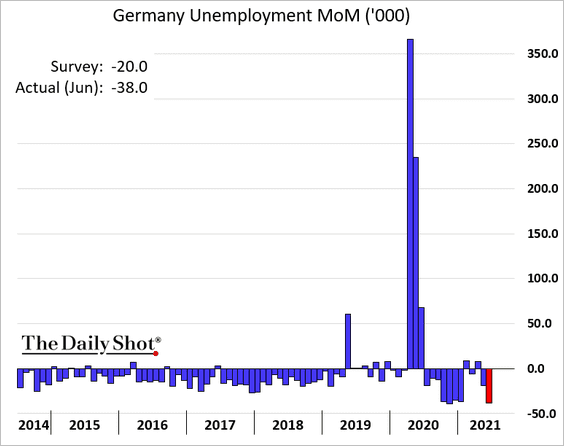

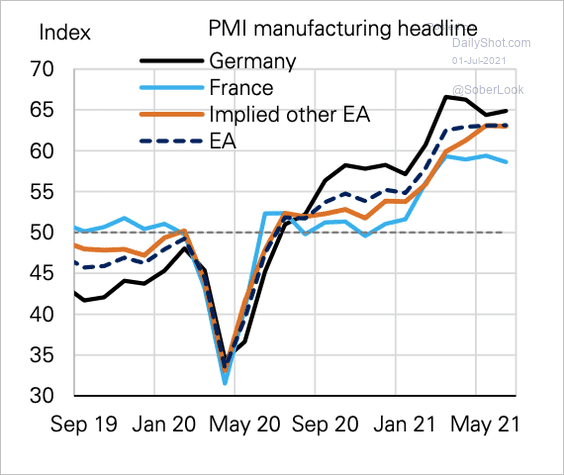

2. Germany’s labor market is rapidly recovering.

Separately, Germany’s manufacturing PMI has been outperforming its peers over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

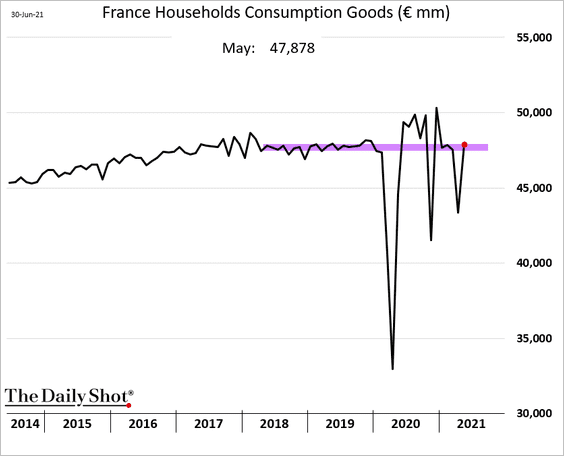

3. French consumer spending is back at pre-COVID levels.

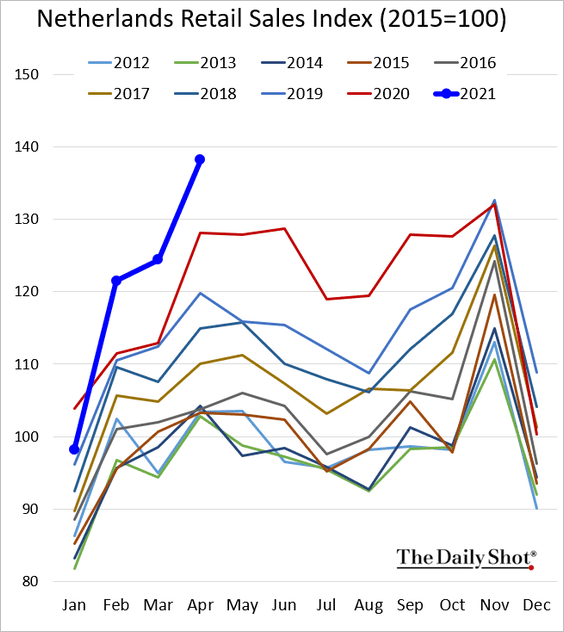

4. Dutch retail sales are surging.

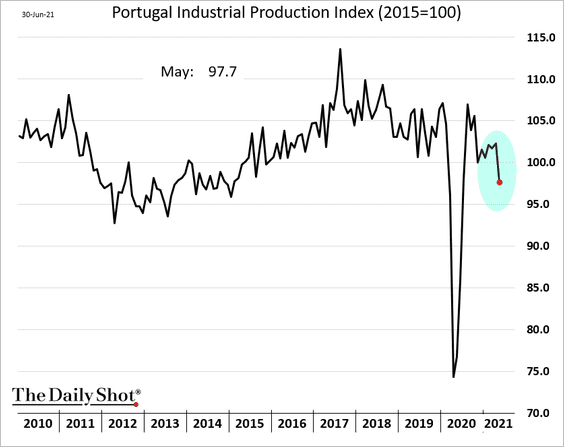

5. Portugal’s industrial production tumbled in May.

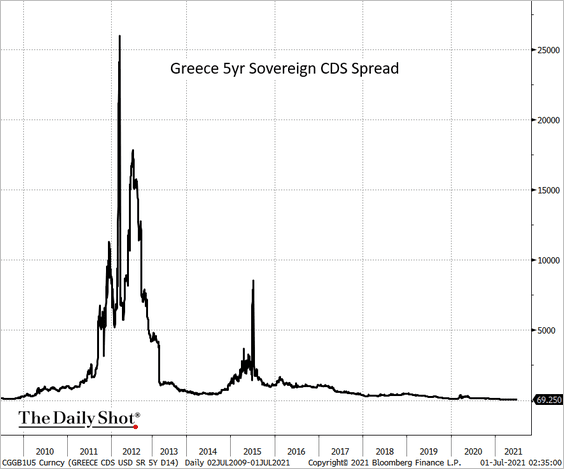

6. Greek sovereign credit default swap spreads hit a new low.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

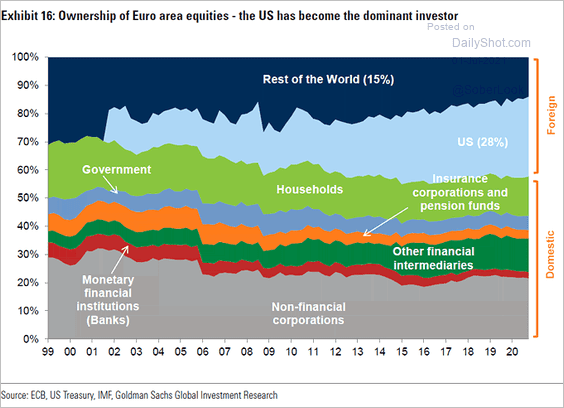

7. Who owns euro-area equities?

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Back to Index

Japan

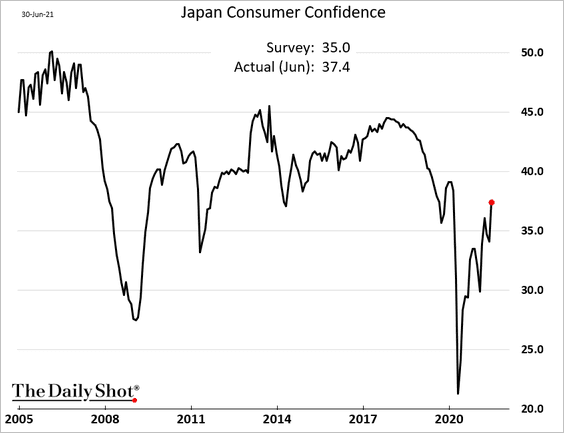

1. Consumer confidence is recovering.

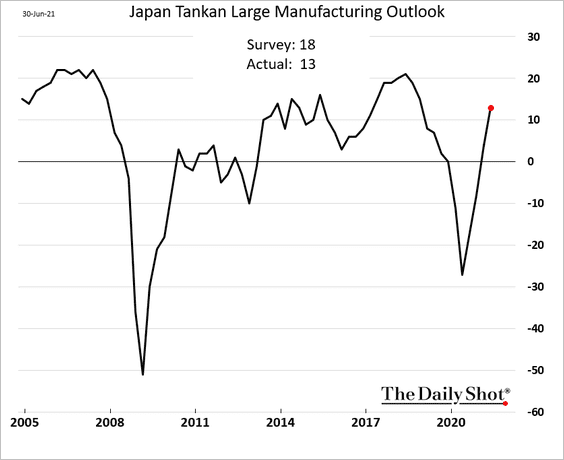

2. The Q2 Tankan business surveys came in below market expectations.

• Manufacturing:

• Non-manufacturing:

——————–

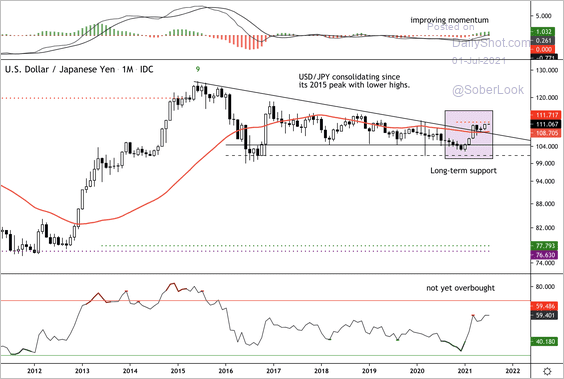

3. USD/JPY is attempting to break above a five-year downtrend.

Source: Dantes Outlook

Source: Dantes Outlook

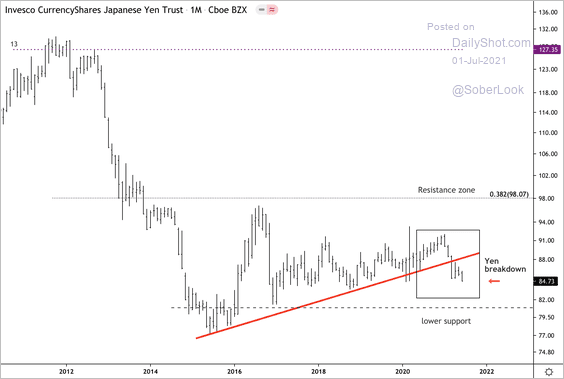

The Invesco Japanese Yen ETF (FXY) is breaking down.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

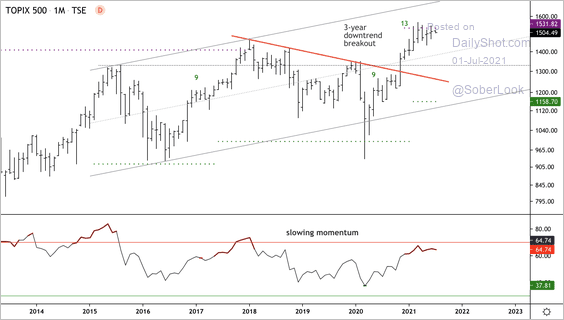

4. The Topix 500 Index appears overbought with slowing upside momentum.

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

Asia – Pacific

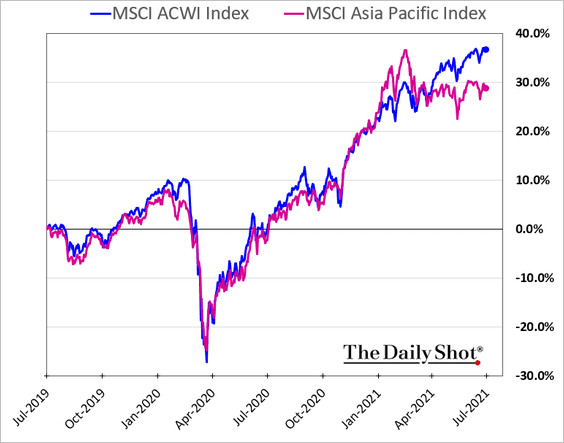

1. Asian stocks have been underperforming global peers.

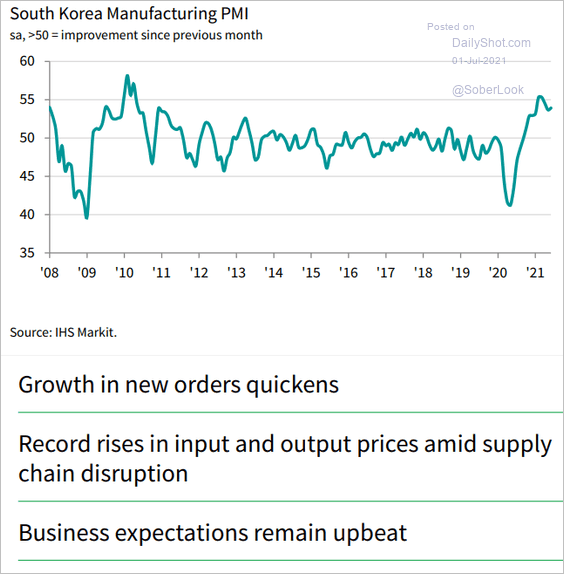

2. South Korea’s manufacturing PMI continues to show robust growth.

Source: IHS Markit

Source: IHS Markit

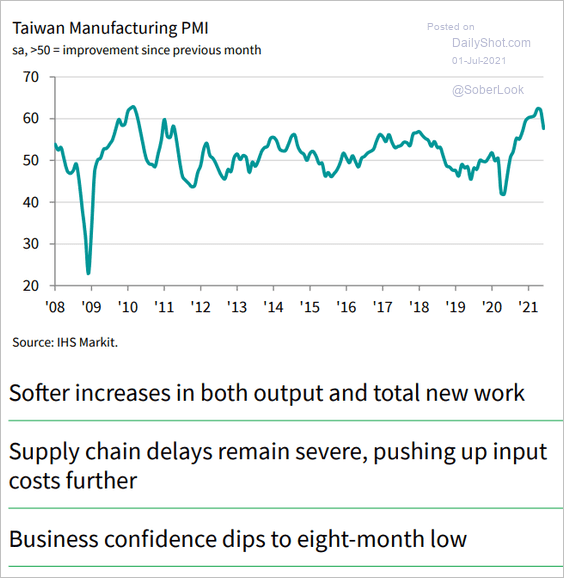

3. Taiwan’s June PMI is off the peak but remains strong.

Source: IHS Markit

Source: IHS Markit

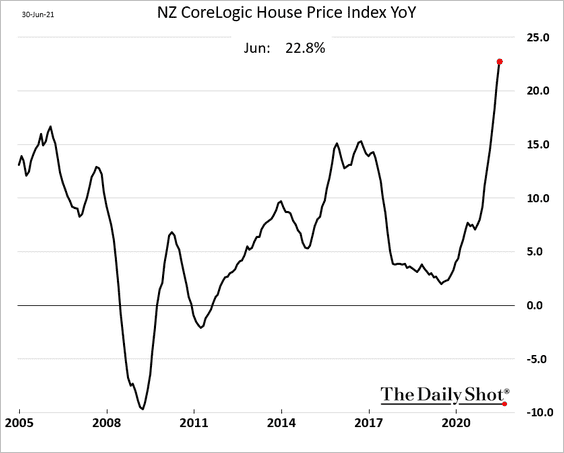

4. New Zealand’s housing bubble has been spectacular. The RBNZ needs to act soon.

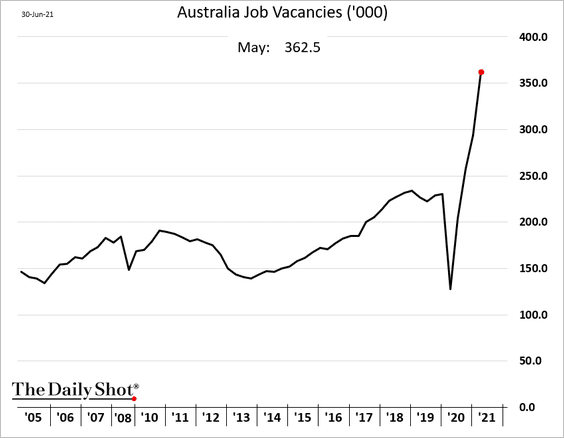

5. Australia’s job vacancies are surging.

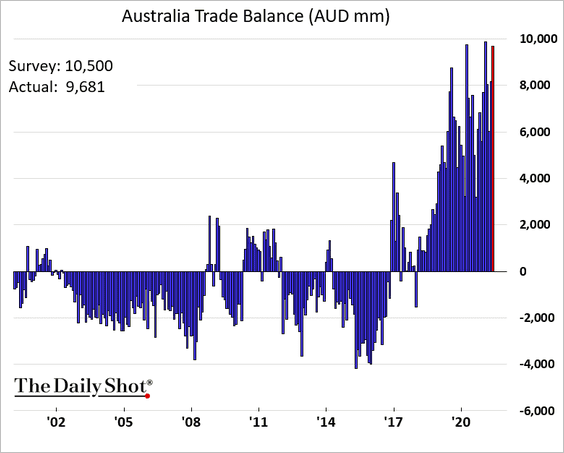

The nation’s trade surplus is near record highs.

Back to Index

China

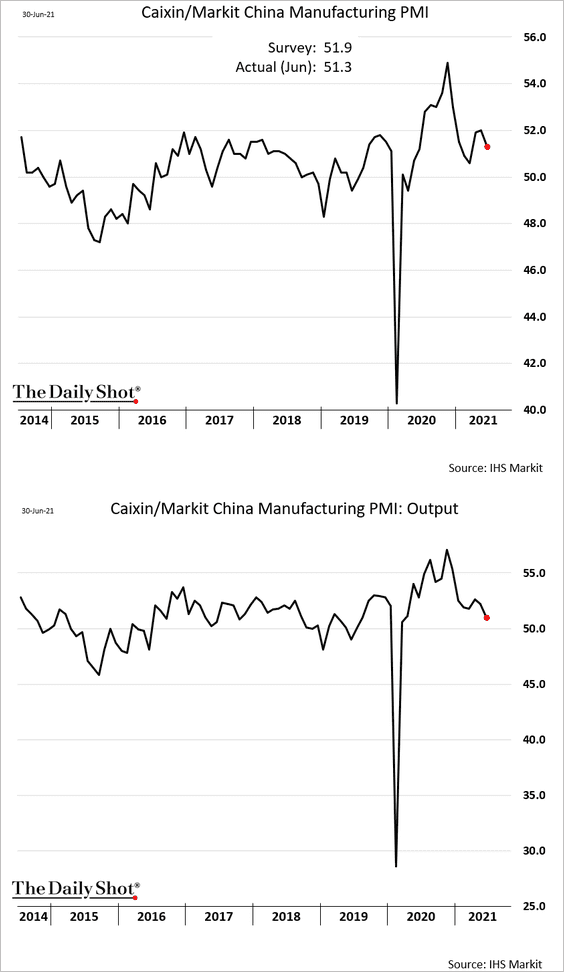

1. The Markit manufacturing PMI was softer than expected as production growth slowed.

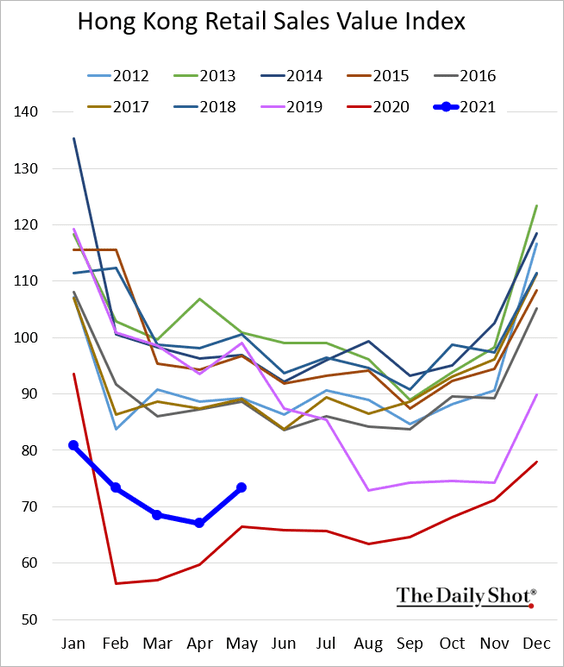

2. Hong Kong’s retail sales remain weak.

Back to Index

Emerging Markets

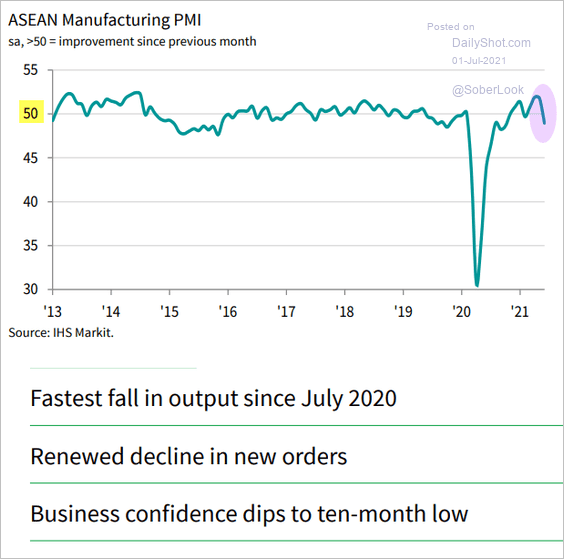

1. Houston, we have a problem. The ASEAN manufacturing PMI is back in contraction territory as the pandemic takes its toll.

Source: IHS Markit

Source: IHS Markit

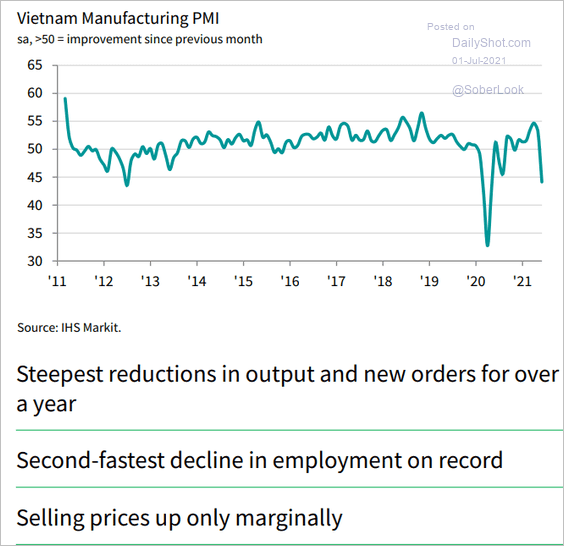

Vietnam’s factory activity tumbled in June.

Source: IHS Markit

Source: IHS Markit

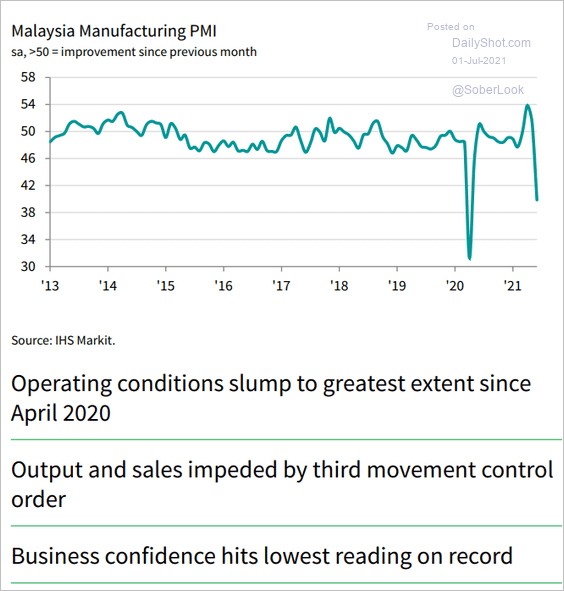

Malaysia’s manufacturing took a massive hit.

Source: IHS Markit

Source: IHS Markit

Below are some additional PMI trends.

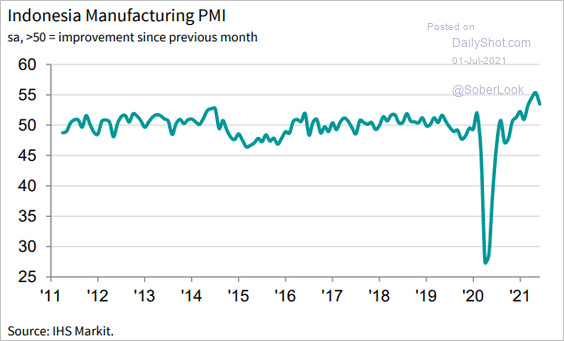

• Indonesia (still growing):

Source: IHS Markit

Source: IHS Markit

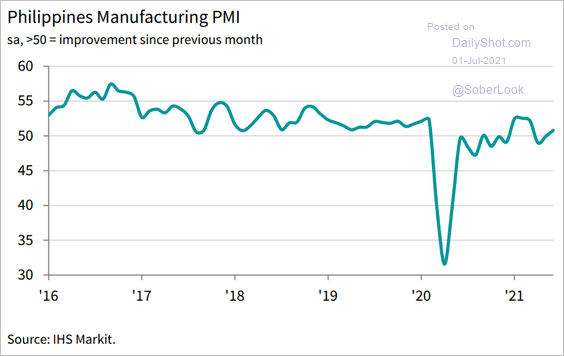

• The Philippines (slight growth):

Source: IHS Markit

Source: IHS Markit

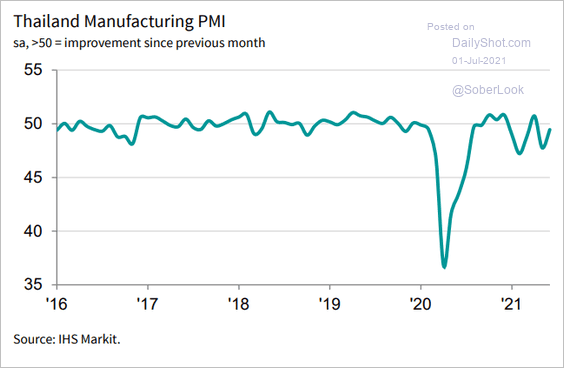

• Thailand (slower contraction):

Source: IHS Markit

Source: IHS Markit

——————–

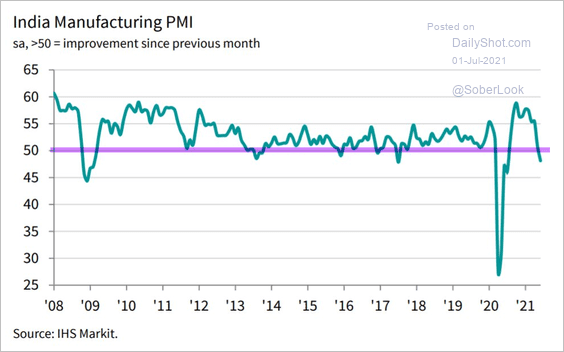

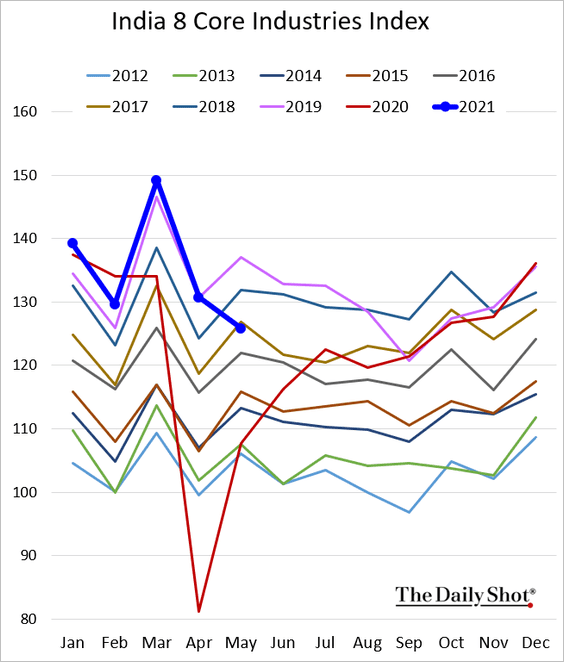

2. India’s manufacturing activity shrunk in June.

Source: IHS Markit

Source: IHS Markit

The core industries’ output tumbled in May.

——————–

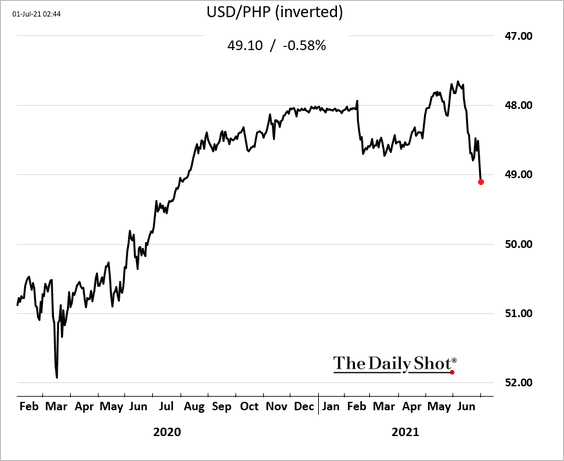

3. The Philippine peso is under pressure.

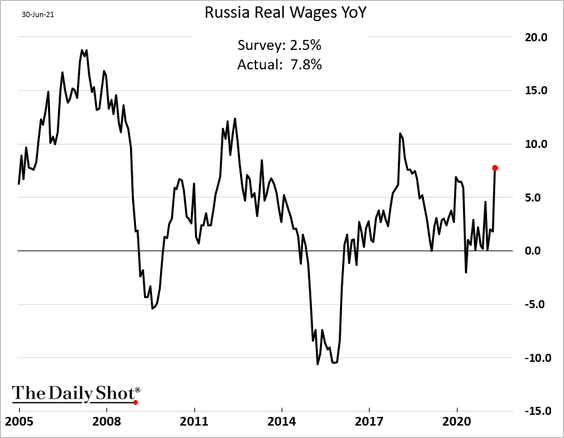

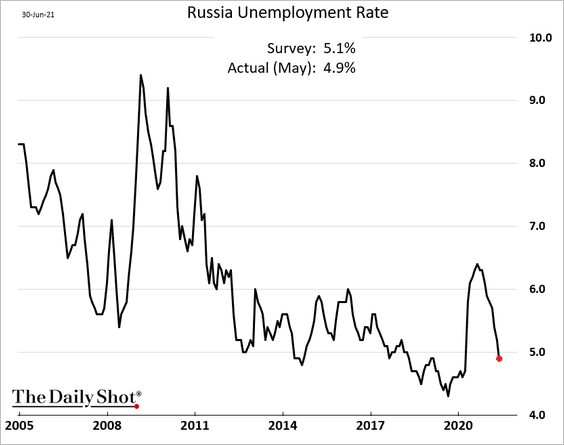

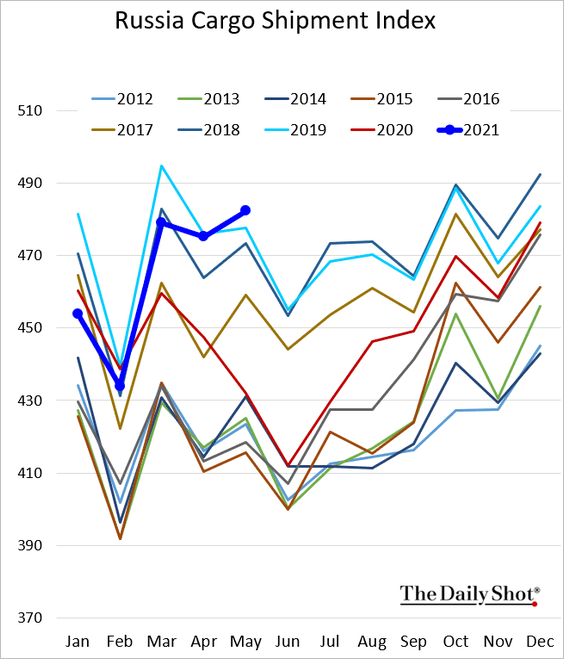

4. Russia’s economy is rebounding.

• Wages:

• Unemployment:

• Cargo shipments:

——————–

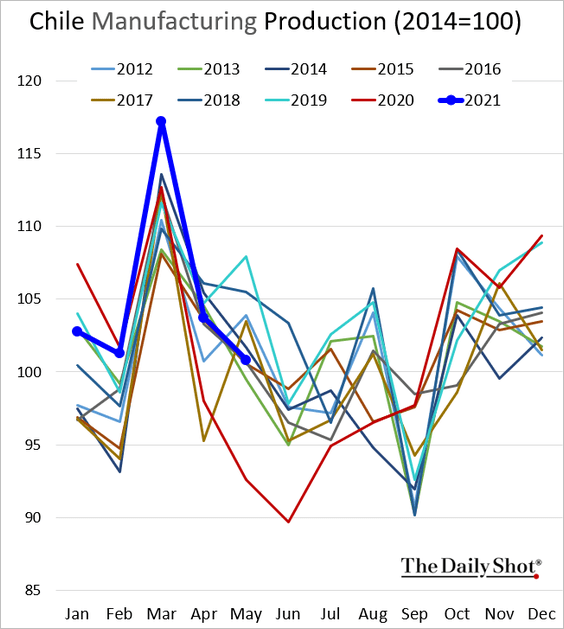

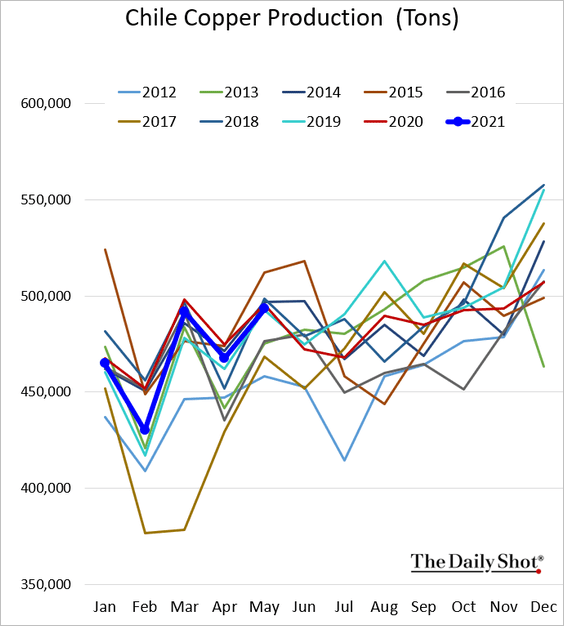

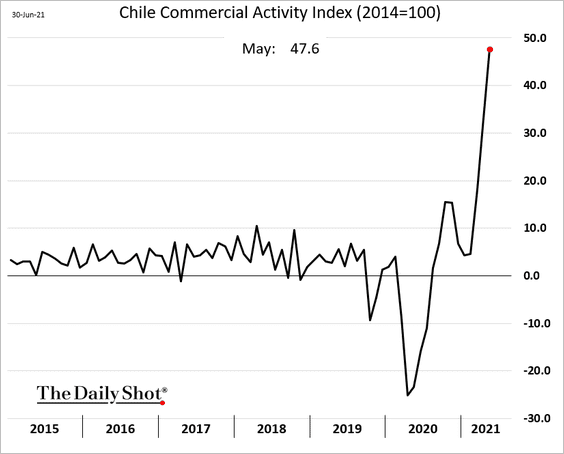

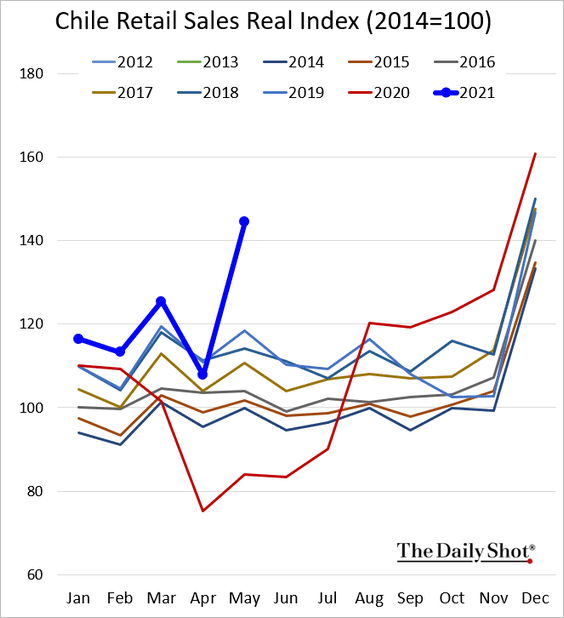

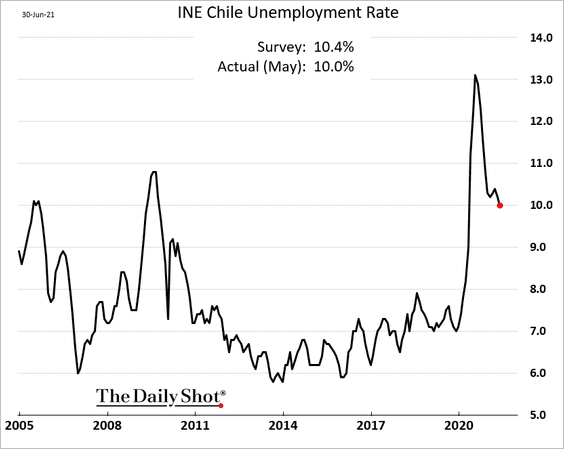

5. Finally, we have some updates on Chile.

• May manufacturing production (well below pre-COVID levels):

• Copper output (similar to last year’s level):

• Business activity (surging):

• Retail sales (surging):

• The unemployment rate:

Back to Index

Cryptocurrency

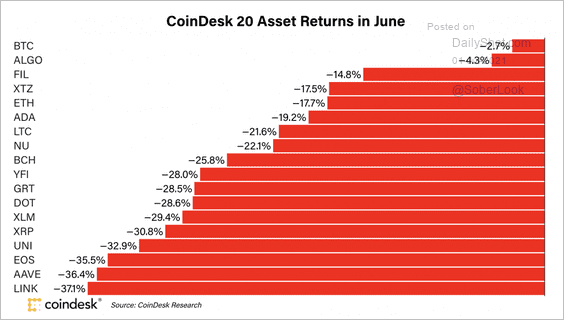

1. Despite a negative month, Bitcoin outperformed other large market-cap cryptocurrencies in June.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

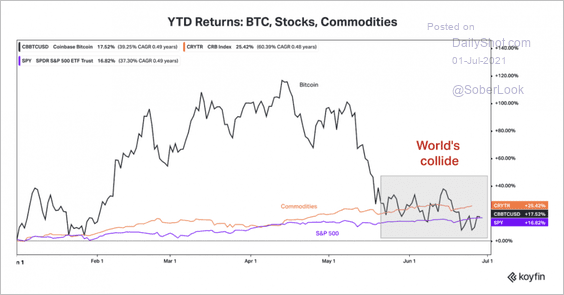

2. Bitcoin’s year-to-date return is beating the S&P 500 but trailing the Thomson Reuters Core Commodity Index.

Source: Koyfin

Source: Koyfin

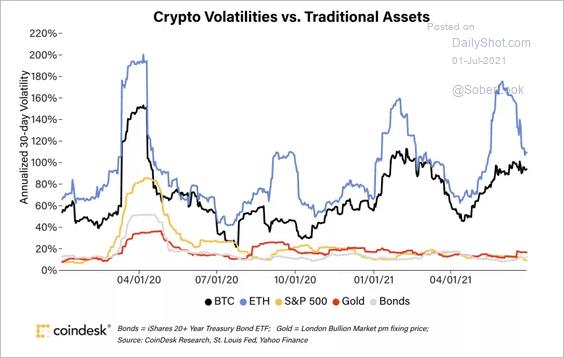

3. While Bitcoin and Ethereum experienced extreme volatile swings over the past month, traditional markets have remained relatively calm.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

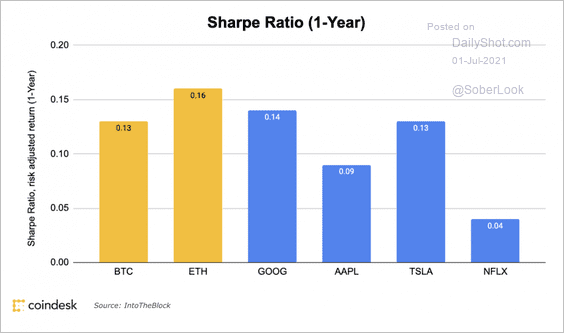

But over the past year, Bitcoin’s and Ethereum’s risk-adjusted performance was similar to popular US stocks.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

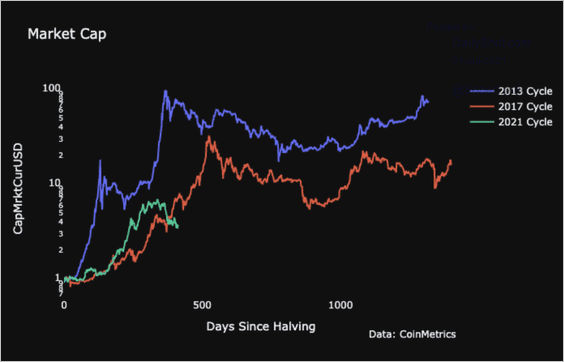

4. The current Bitcoin bull cycle has decoupled from the 2013 and 2017 cycles.

Source: Coin Metrics

Source: Coin Metrics

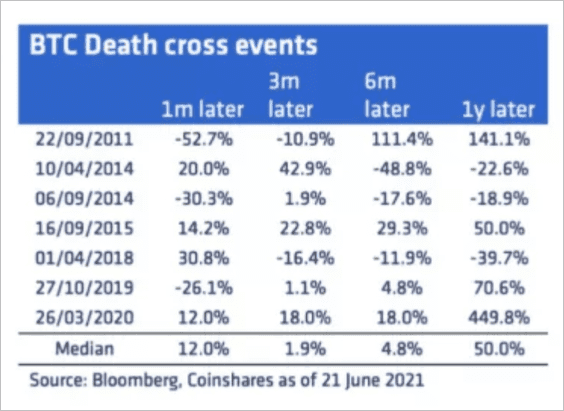

5. Bitcoin returns following a “death cross” event can vary and tend to be low to negative.

Source: @CoinSharesCo

Source: @CoinSharesCo

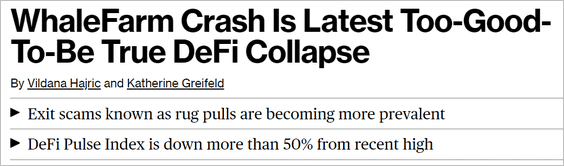

6. We continue to see shocks in the DeFi world.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

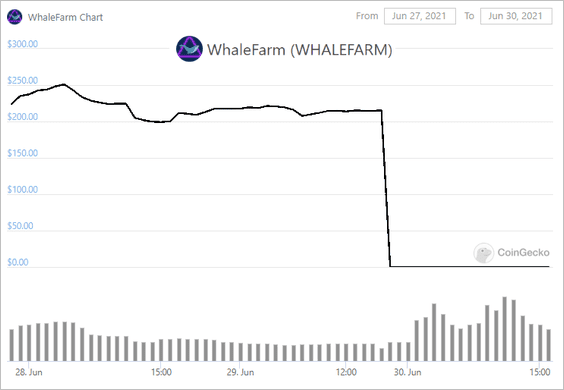

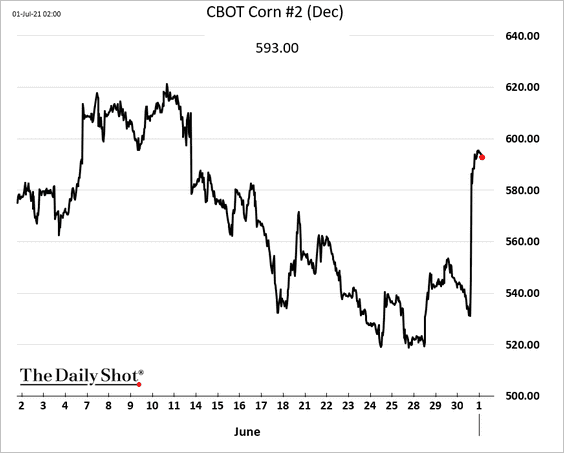

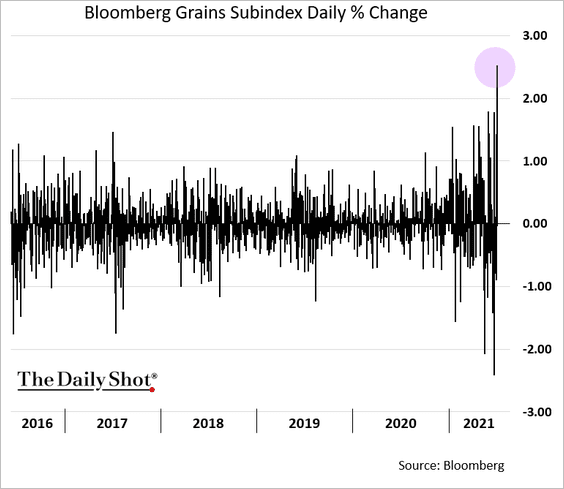

1. Corn futures hit limit-up after US plantings data fell short of market expectations.

Soybeans surged as well.

Bloomberg’s grains index hasn’t had a day like this in years.

——————–

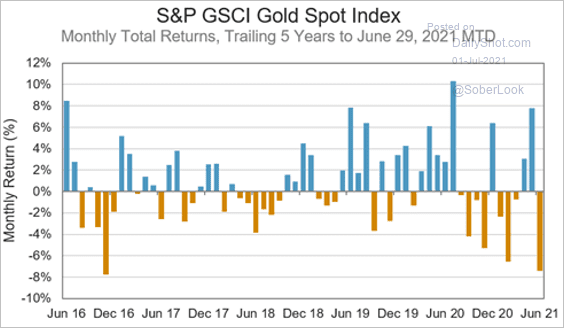

2. June was a tough month for gold due to the Fed’s hawkish shift.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

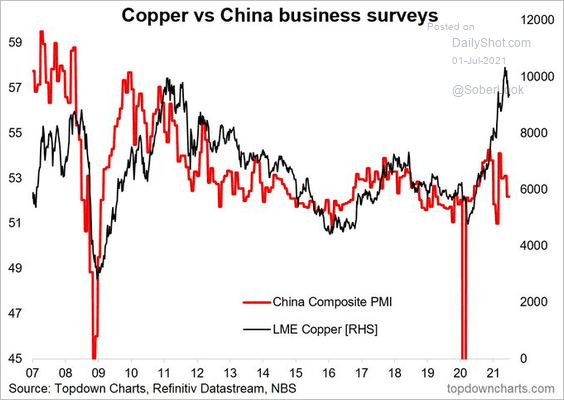

3. China’s soft PMI readings don’t bode well for copper.

Source: @topdowncharts

Source: @topdowncharts

Back to Index

Energy

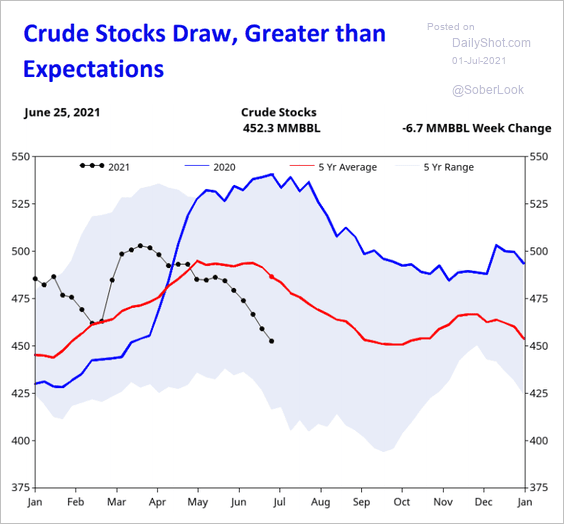

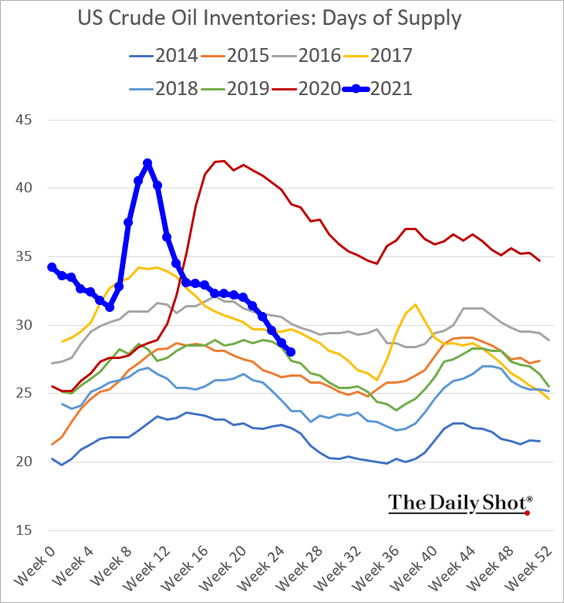

1. US crude oil inventories continue to shrink.

Source: Fundamental Analytics

Source: Fundamental Analytics

——————–

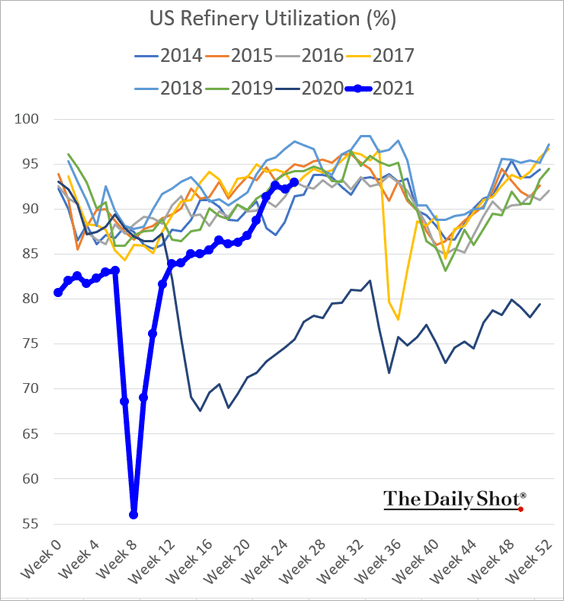

2. Refinery utilization is trending higher.

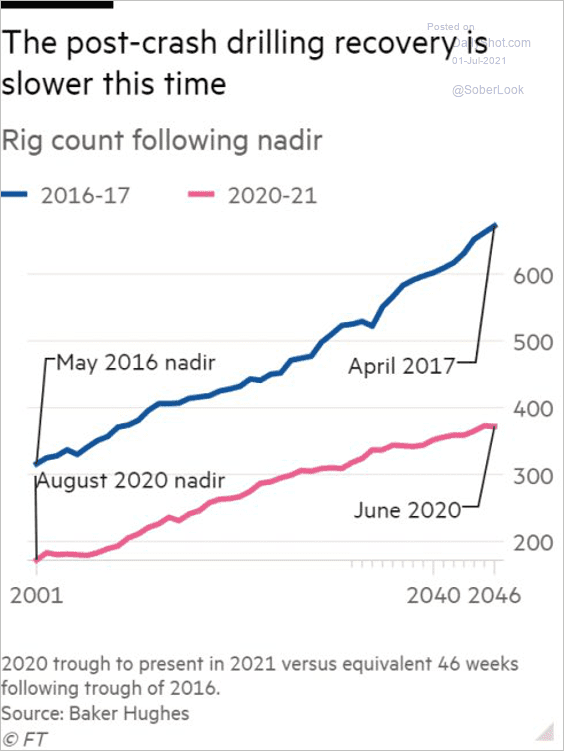

3. US drilling recovery has been slower than in 2016/17.

Source: @DiMartinoBooth, @jessefelder Read full article

Source: @DiMartinoBooth, @jessefelder Read full article

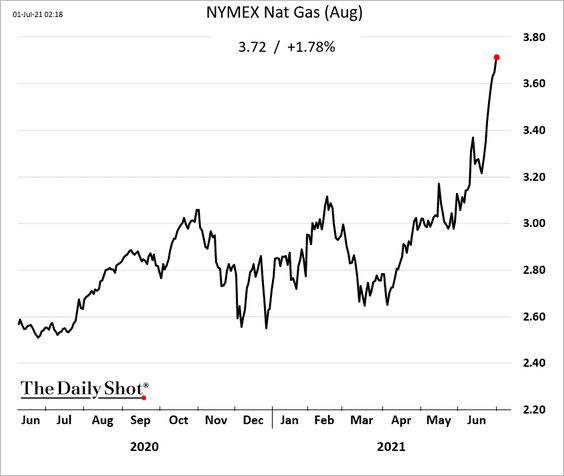

4. Natural gas futures continue to surge.

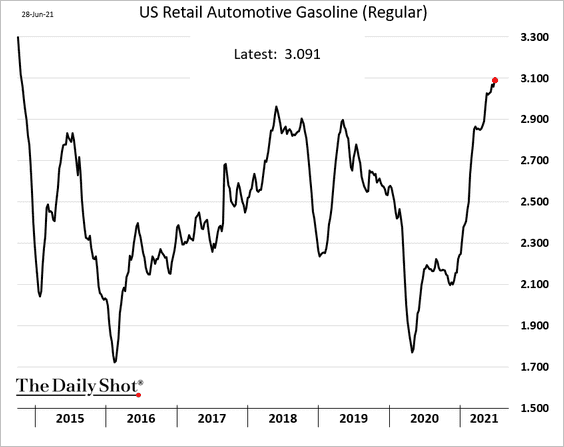

5. US retail gasoline prices hit the highest level since 2014 ahead of the July 4th holiday.

Back to Index

Equities

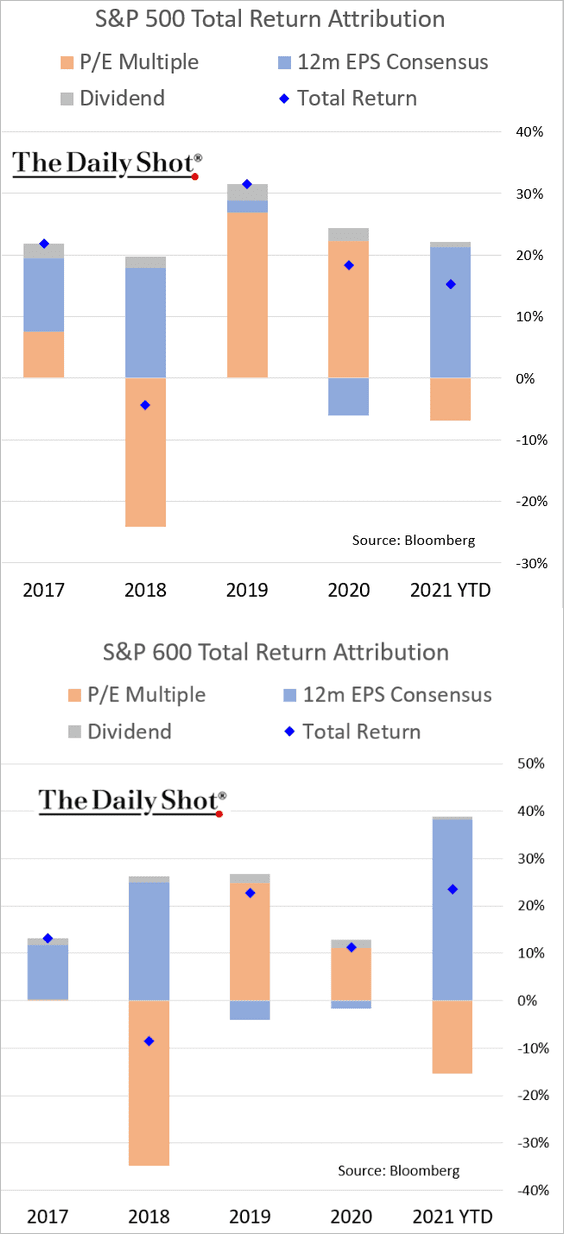

1. Earnings expectations continue to drive stock gains this year.

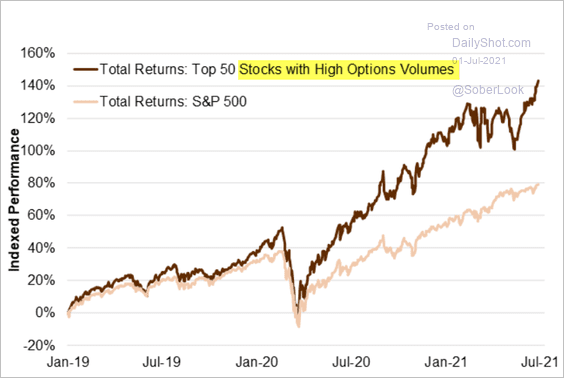

2. Stocks with high options volume keep outperforming.

Source: Goldman Sachs, @themarketear

Source: Goldman Sachs, @themarketear

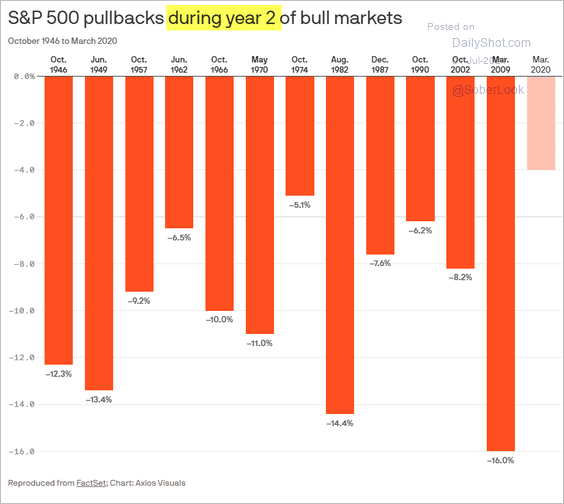

3. Pullbacks during the second year of bull markets can be severe.

Source: @axios Read full article

Source: @axios Read full article

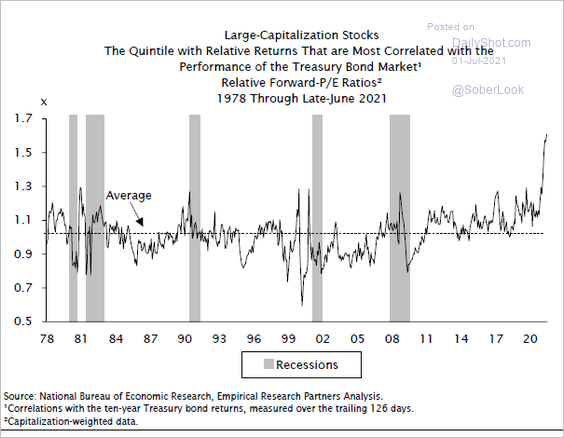

4. Stocks most correlated with Treasuries are the most expensive.

Source: @RBAdvisors

Source: @RBAdvisors

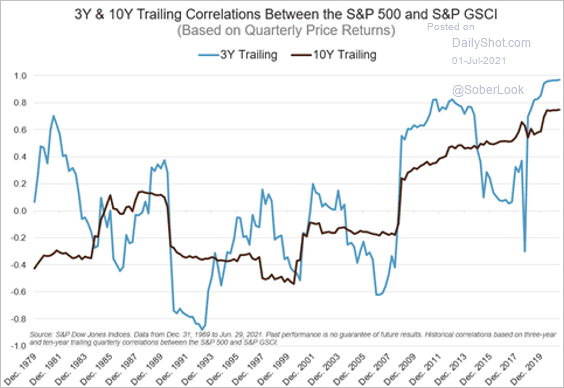

5. Here is the correlation between commodities and stocks.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

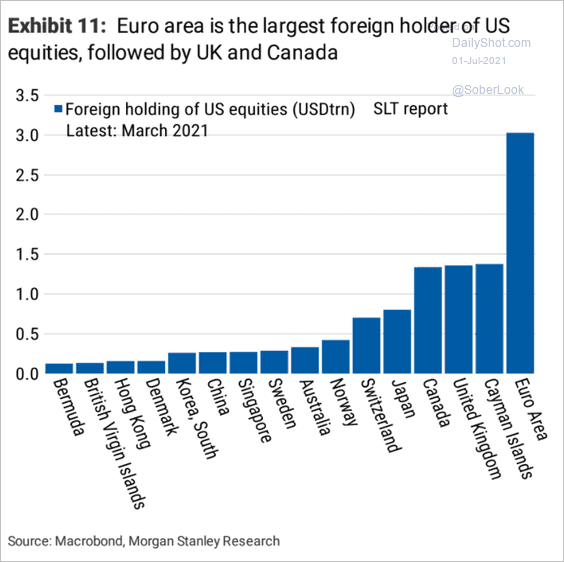

6. The Eurozone is the largest foreign holder of US stocks.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

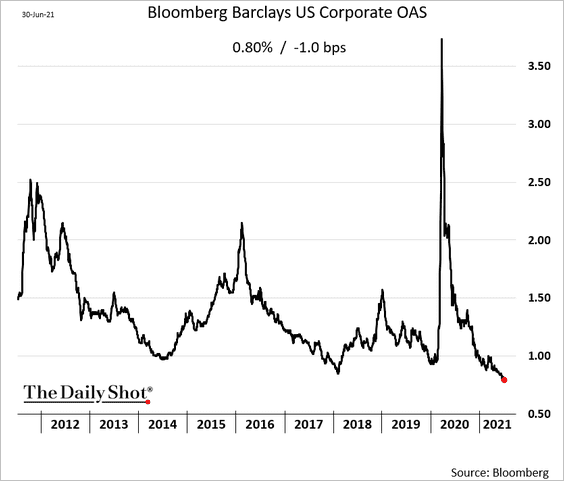

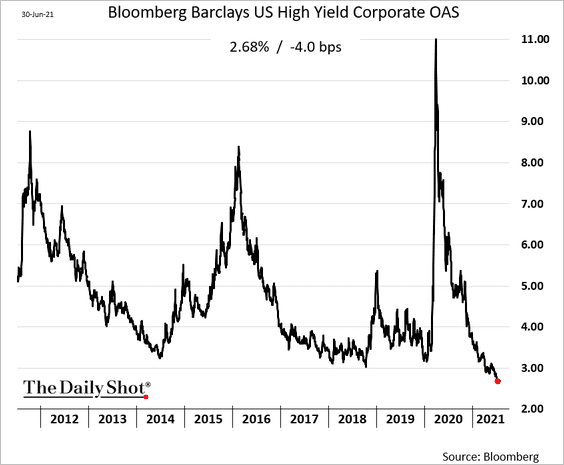

Credit

1. US credit spreads keep hitting new lows.

• Investment-grade:

• High-yield:

——————–

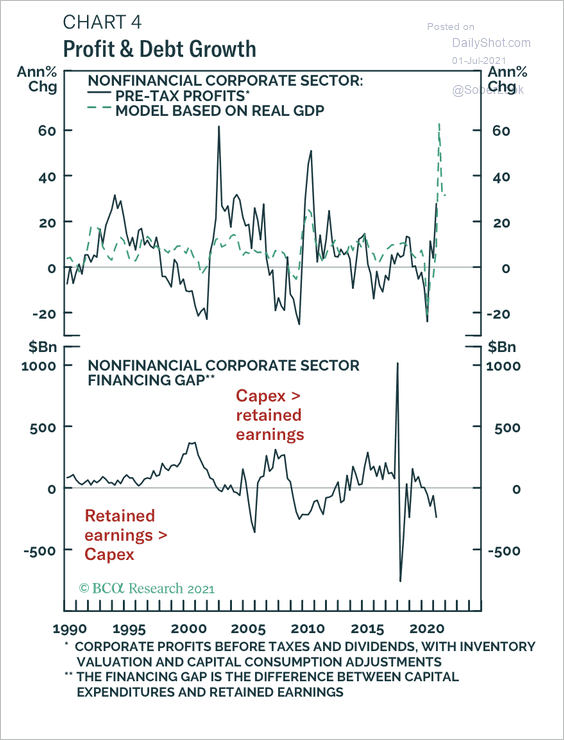

2. The nonfinancial corporate sector financing gap has been negative in each of the past four quarters. This means that retained earnings have exceeded capital expenditures. And as a result, BCA Research expects corporate debt growth to slow going forward as firms have built up excess capital that can be deployed in place of debt.

Source: BCA Research

Source: BCA Research

Back to Index

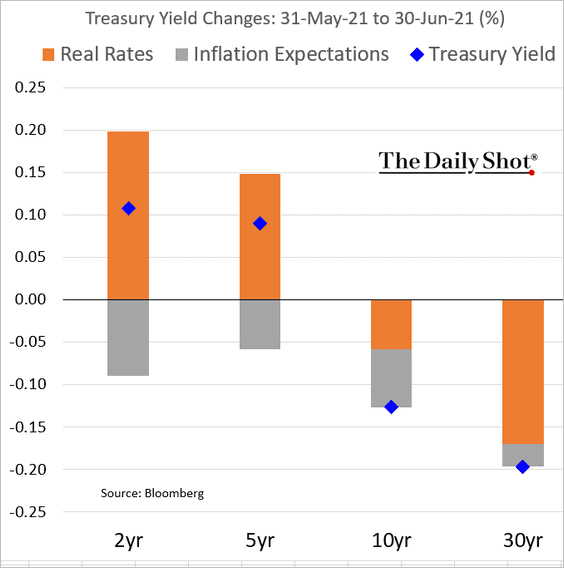

Rates

1. Here is the attribution of Treasury yield changes in June.

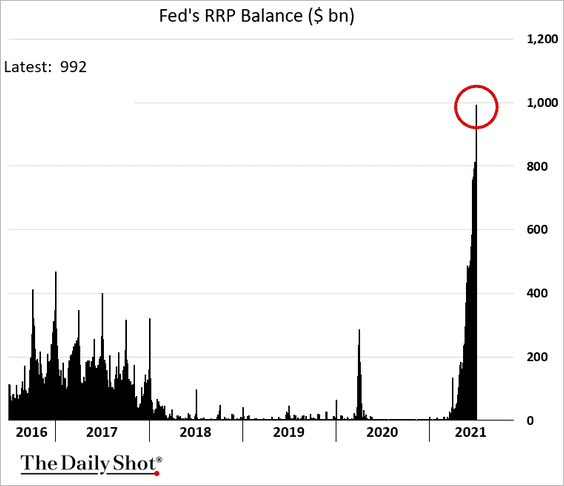

2. The Fed’s RRP is approaching $1 trillion, allowing the central bank to drain some liquidity.

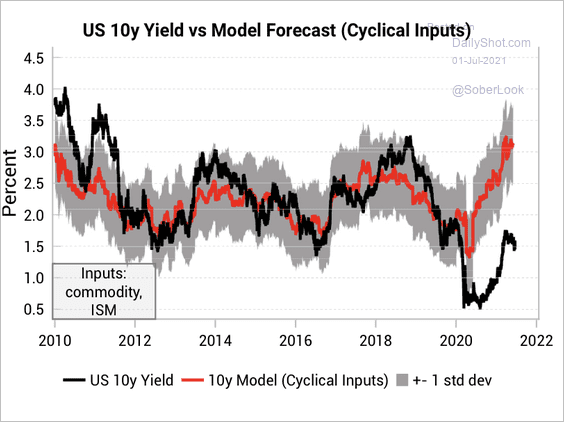

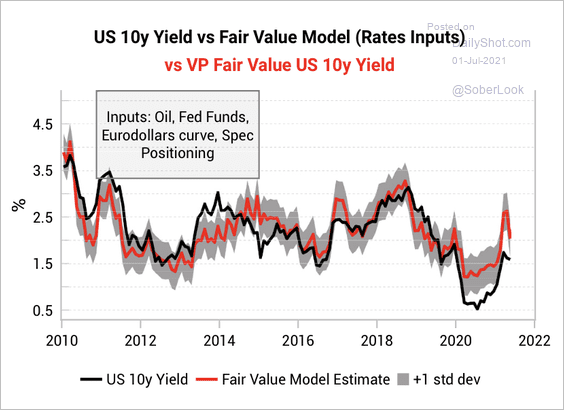

3. The 10-year Treasury yield is much lower than forecasts based on cyclical inputs such as ISM and commodity prices, according to Variant Perception (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

——————–

4. Fed officials are becoming uneasy with the recent surge in home prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

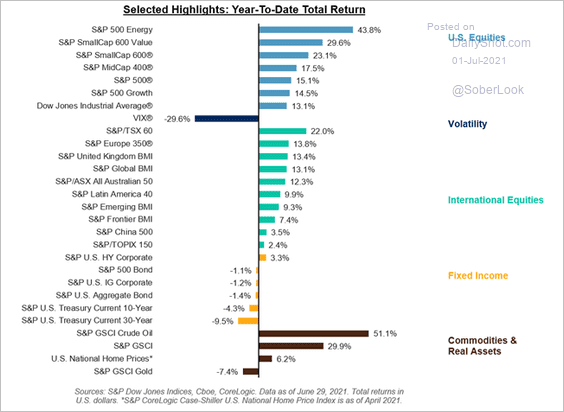

1. Below are the year-to-date returns across various asset classes.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

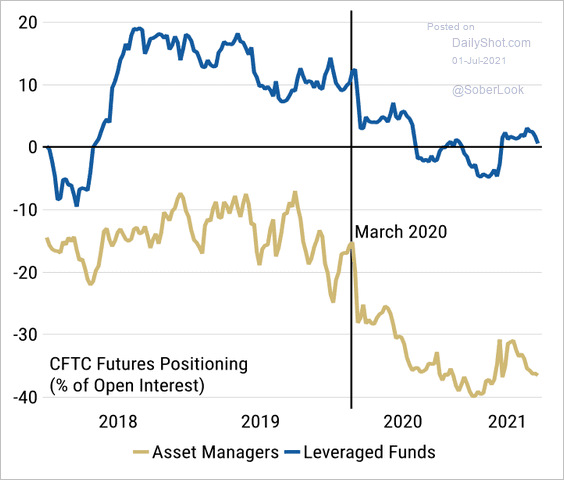

2. Asset managers remain net-short the dollar despite the recent rebound.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

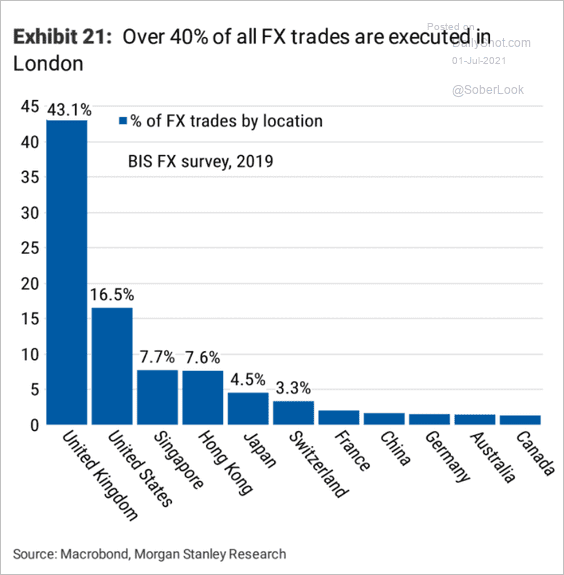

3. London is still the center of F/X trading.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

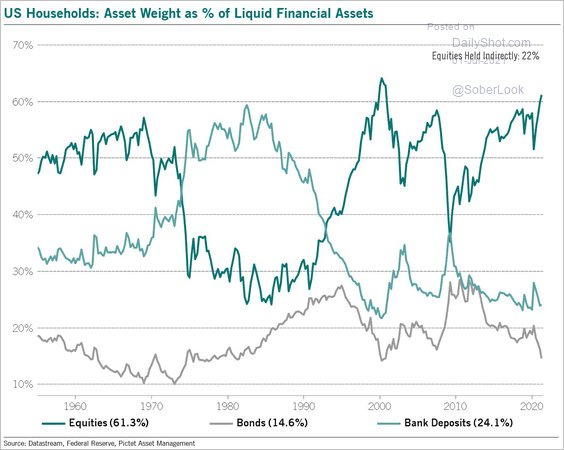

1. US households’ liquid assets:

Source: @BittelJulien

Source: @BittelJulien

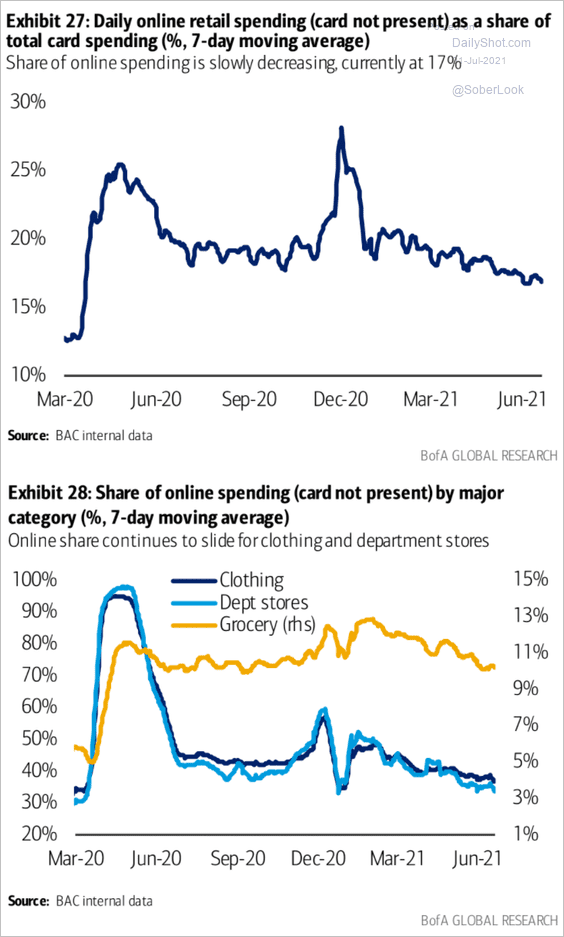

2. Credit/debit card spending online:

Source: BofA Global Research

Source: BofA Global Research

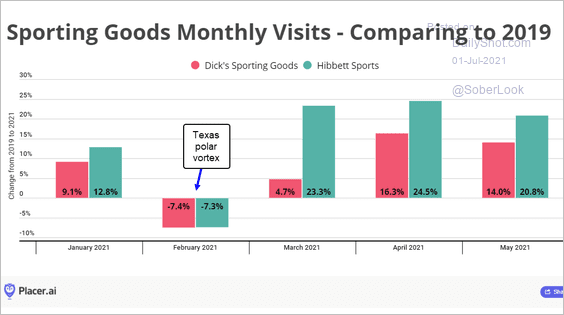

3. Sporting goods stores monthly visits:

Source: Placer.ai Read full article

Source: Placer.ai Read full article

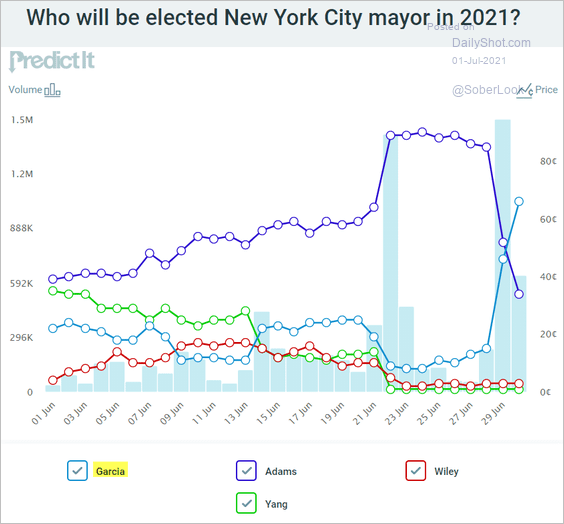

4. New York City mayoral election odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

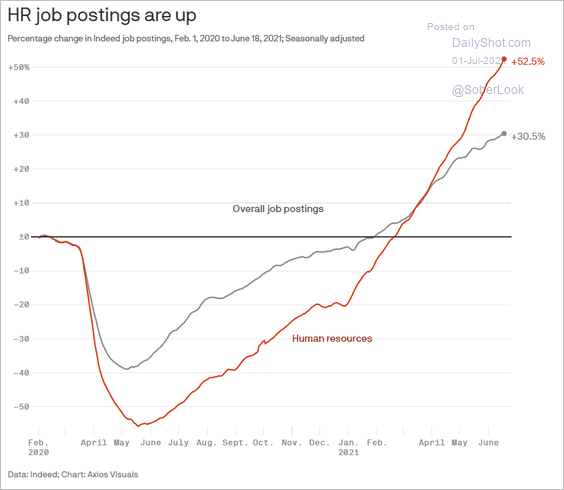

5. Demand for HR staff:

Source: @axios

Source: @axios

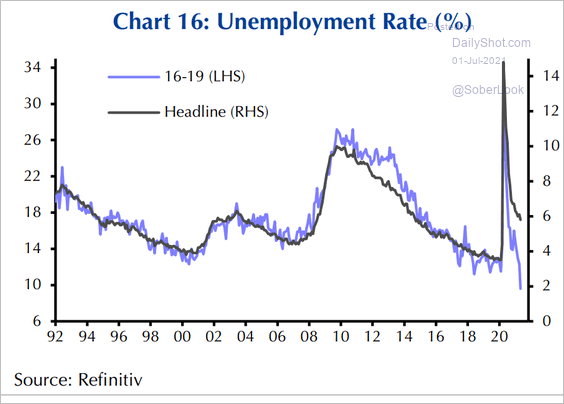

6. US teen unemployment:

Source: Capital Economics

Source: Capital Economics

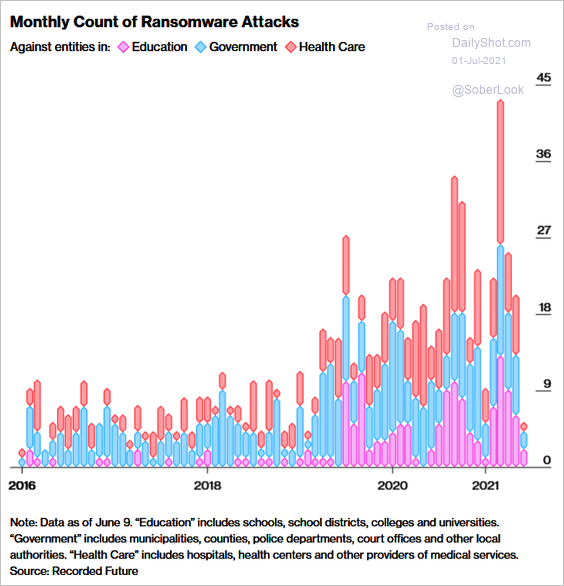

7. Ransomware attacks:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

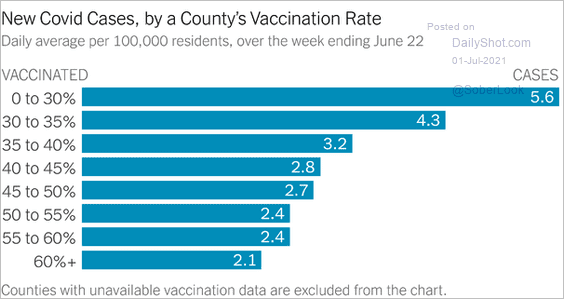

8. New COVID cases vs. vaccination rates:

Source: @DLeonhardt

Source: @DLeonhardt

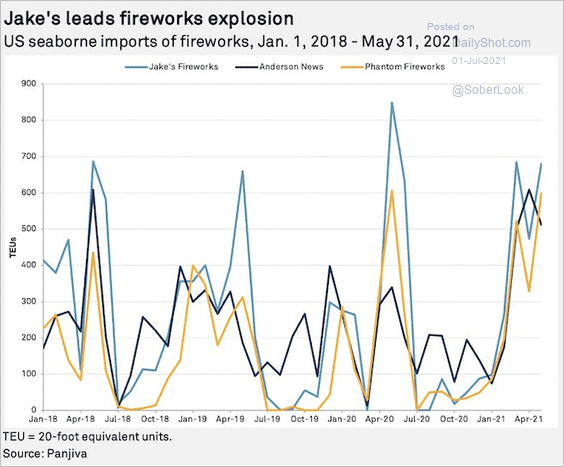

9. US seaborne imports of fireworks:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

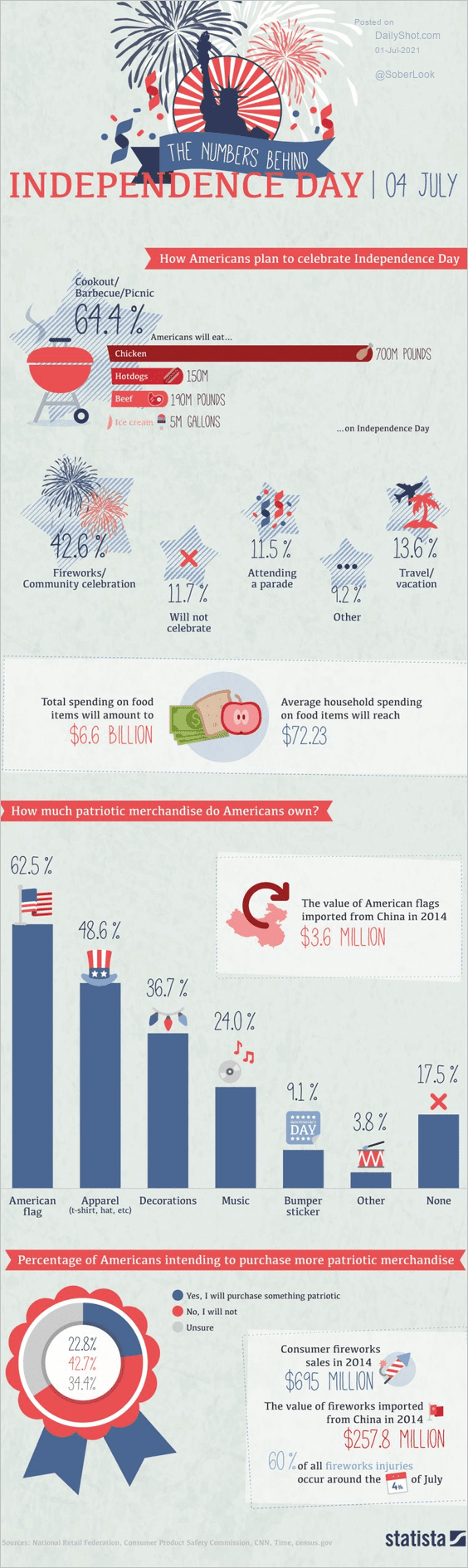

• Celebrating Independence Day:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index