The Daily Shot: 07-Jul-21

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

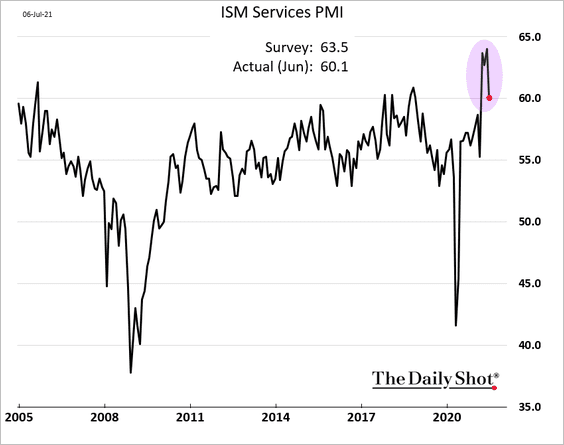

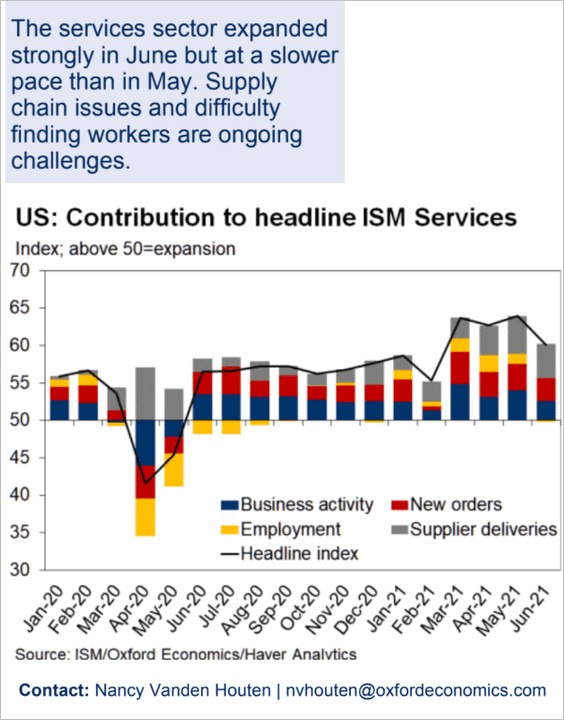

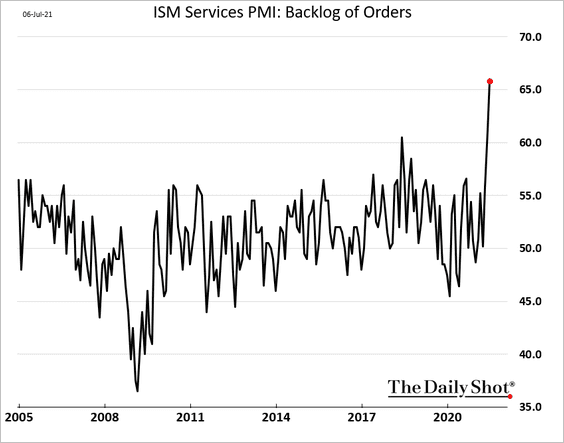

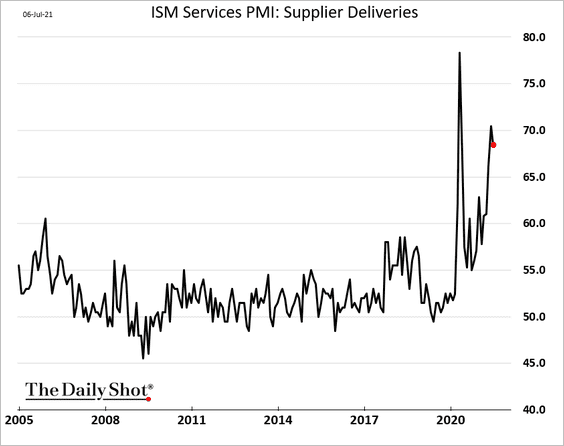

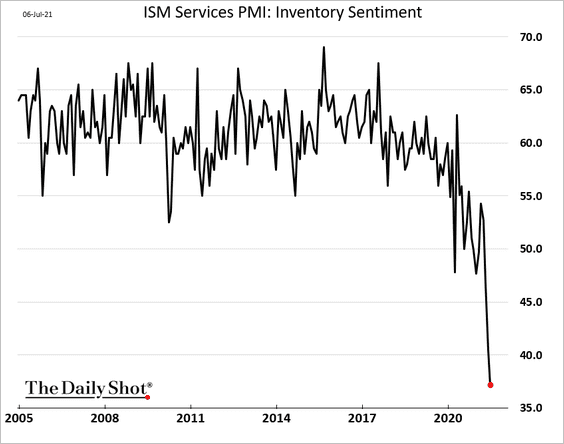

1. The ISM Services PMI came off the highs, surprising to the downside. To be sure, US service sector activity continued to expand at a healthy pace in June, but growth was slower than in May.

Source: Oxford Economics

Source: Oxford Economics

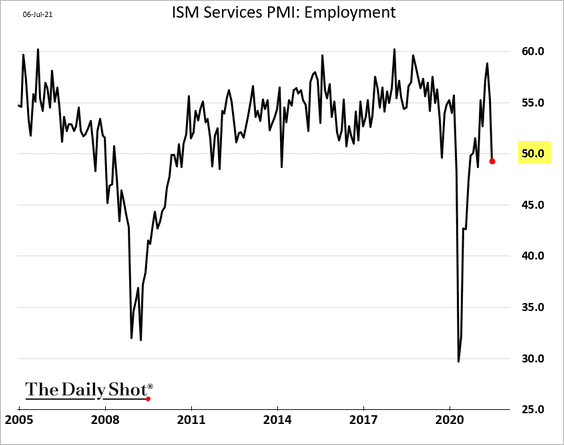

• The employment index dipped into contraction territory (PMI < 50).

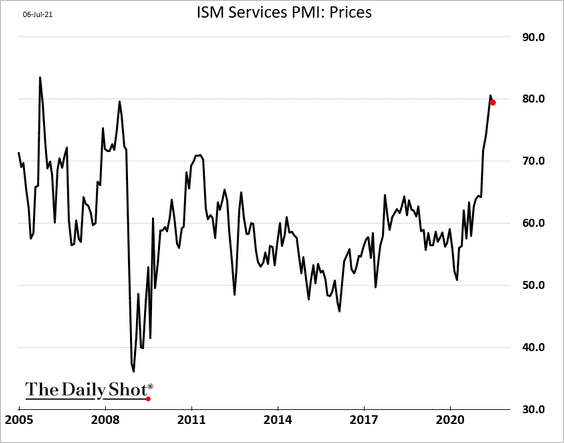

• Prices continued to climb, but a touch slower.

• Service firms, particularly retailers, are struggling to fill orders, …

… amid supply bottlenecks (slow deliveries) …

… and extraordinarily tight inventories.

——————–

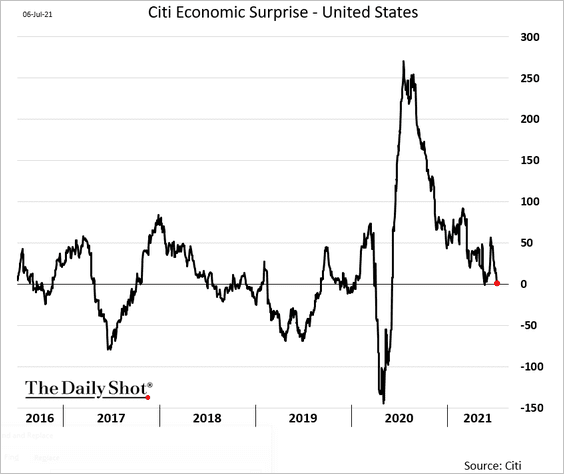

2. The Citi Economic Surprise Index is back near zero due to the ISM data miss.

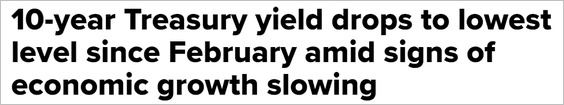

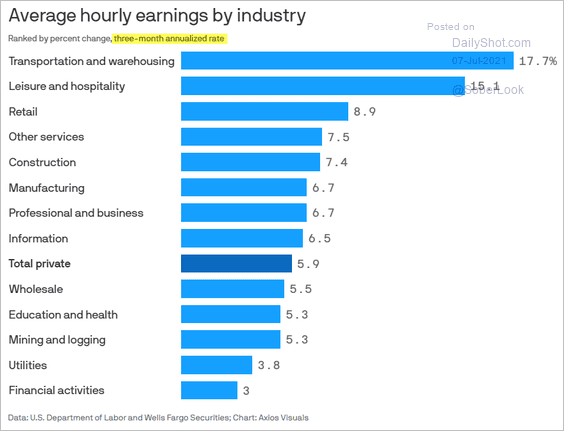

3. Treasury yields tumbled, and the curve flattened. Bond yields around the world followed (see the rates section). It wasn’t entirely clear just how much of the Treasury rally and the downshift in risk sentiment on Tuesday was due to the disappointing ISM report.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

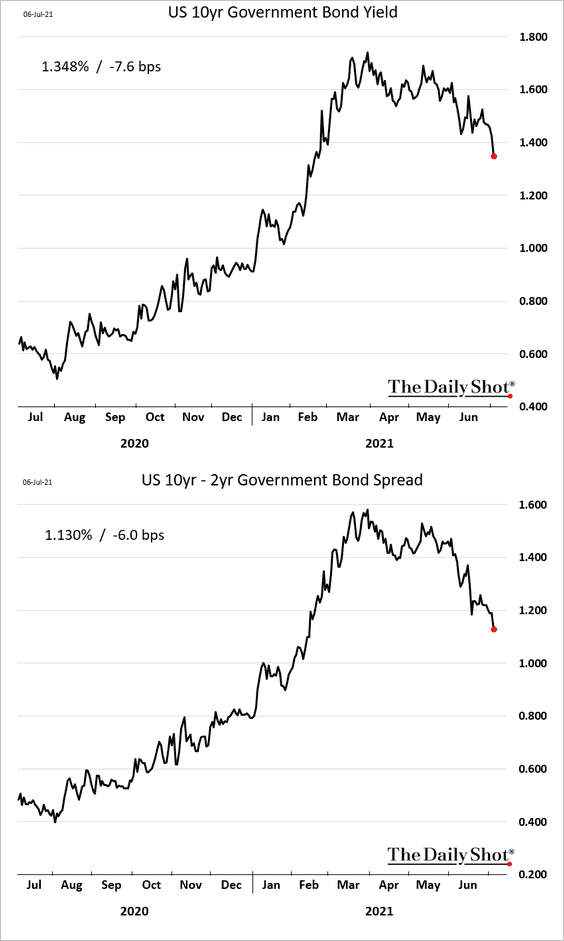

4. Given the urgent demand for labor in many areas, more workers should be coming off unemployment.

Source: @PIIE Read full article

Source: @PIIE Read full article

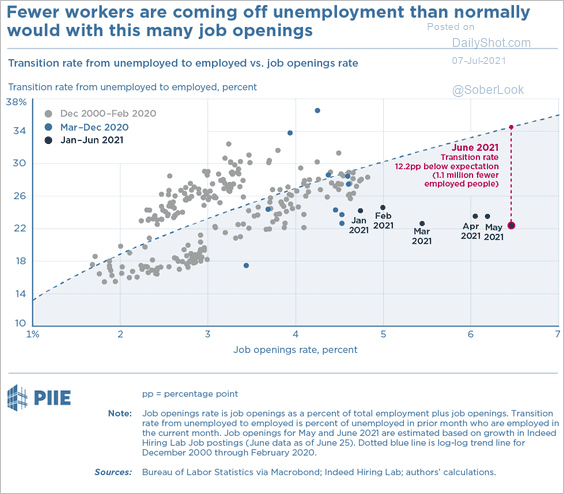

5. The following chart shows the change in wages by industry over the past three months.

Source: @axios Read full article

Source: @axios Read full article

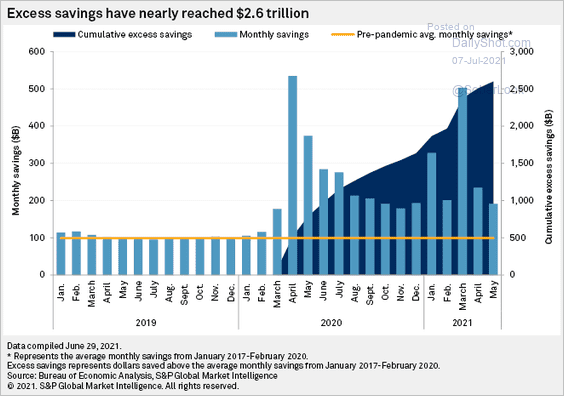

6. Excess household savings are nearing $2.6 trillion.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

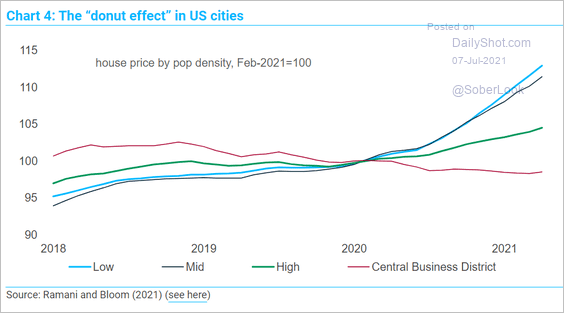

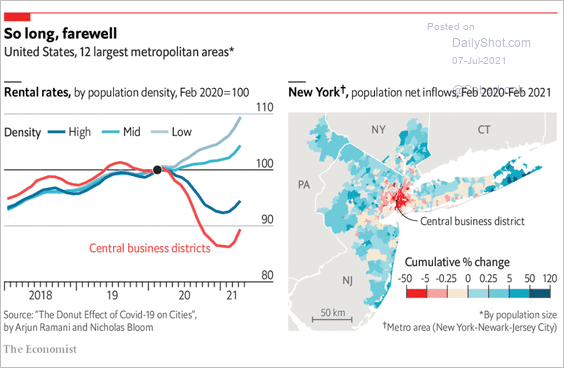

7. Property price trends continue to show the “donut effect” as housing demand shifts toward suburban areas (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: The Economist Read full article

Source: The Economist Read full article

——————–

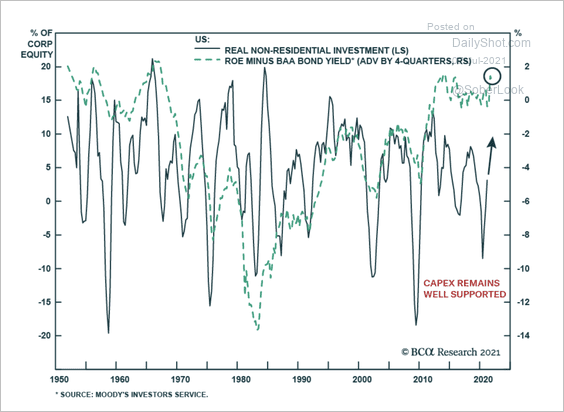

8. The gap between the return on capital and the cost of capital is incentivizing businesses to invest (see Morgan Stanley’s CapEx expectations chart).

Source: BCA Research

Source: BCA Research

Back to Index

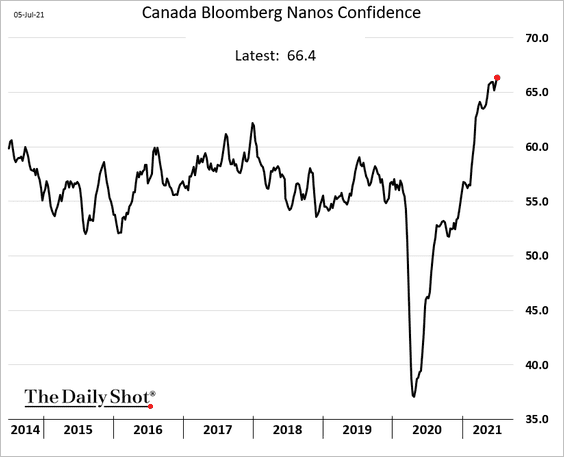

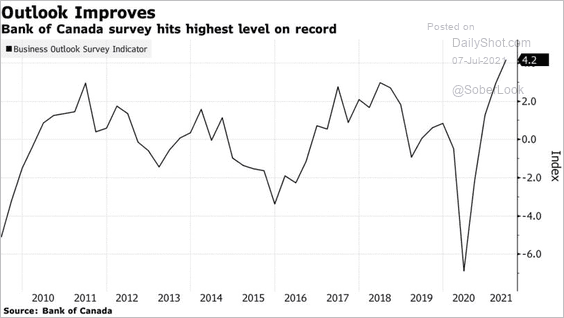

Canada

Consumer and business confidence indicators are hitting multi-year highs.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

The Eurozone

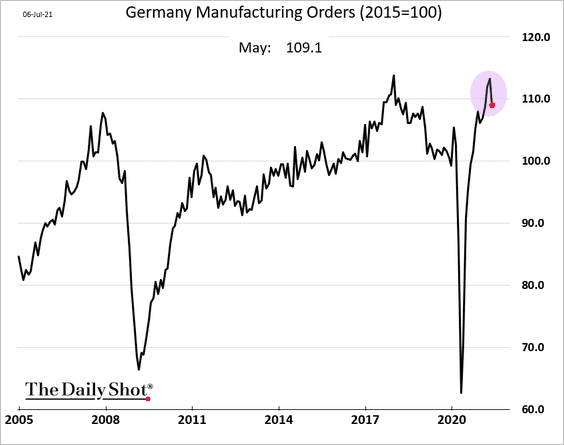

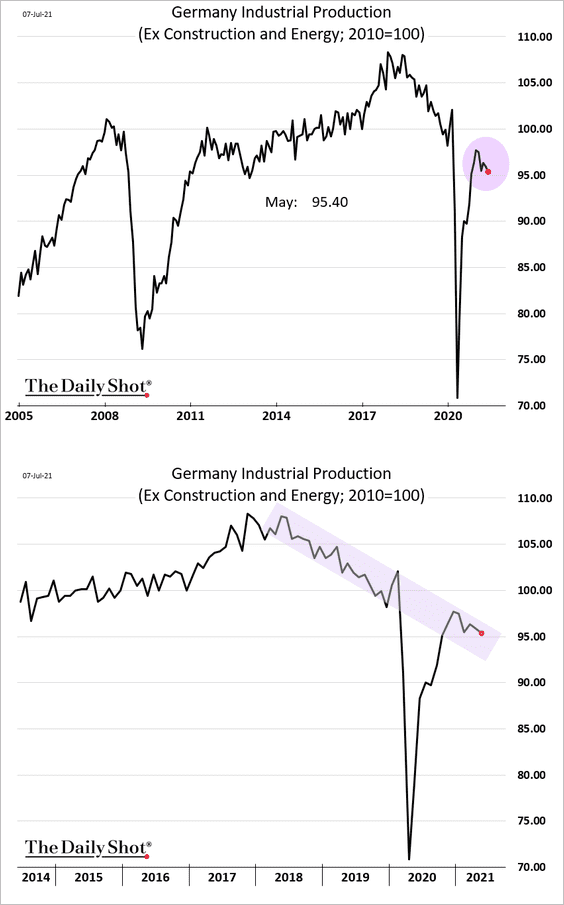

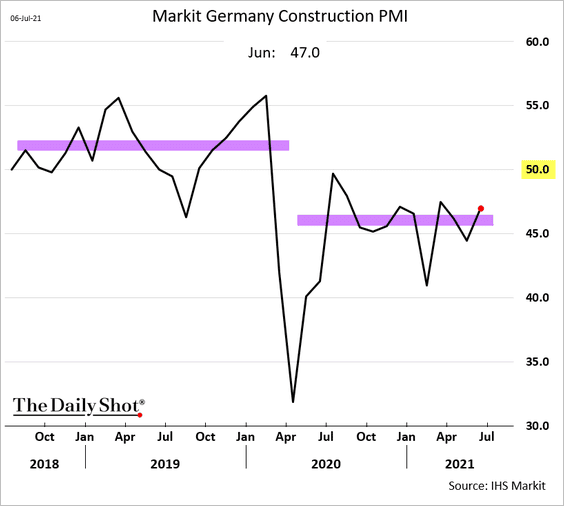

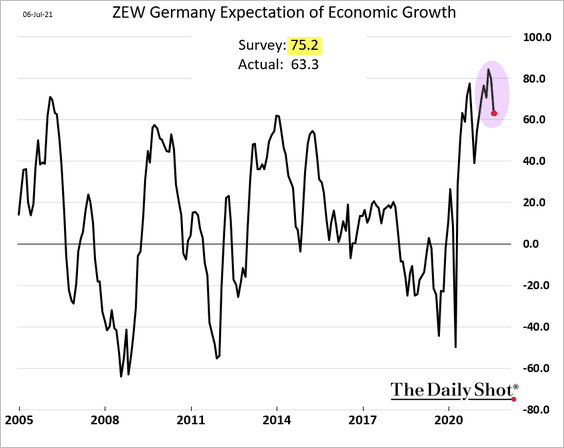

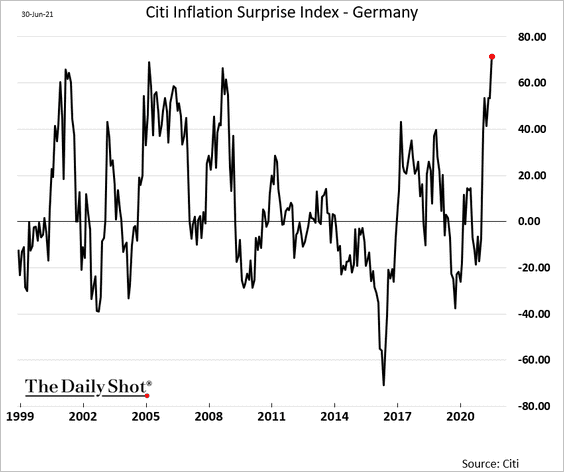

1. Let’s begin with Germany.

• Manufacturing orders unexpectedly declined in May.

And industrial production continued to shrink. While some attribute this weakness to supply-chain problems, it’s worth noting that the downtrend started in 2018 (2nd chart).

• Construction activity continues to shrink (PMI < 50).

• The ZEW expectations index surprised to the downside.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• The Citi Inflation Surprise Index hit a record high.

——————–

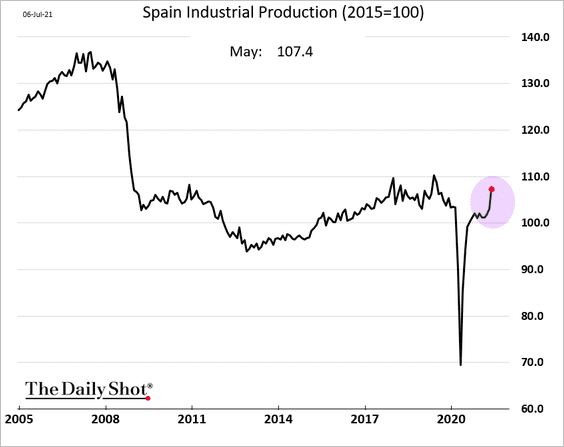

2. Spain’s industrial production is now well above pre-COVID levels.

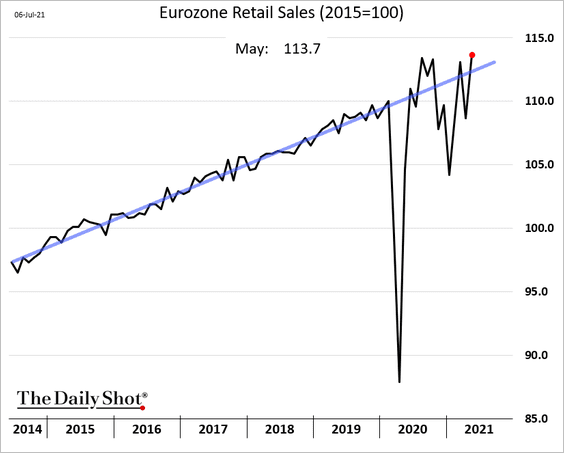

3. Euro-area retail sales were back above trend in May.

Source: IHS Markit

Source: IHS Markit

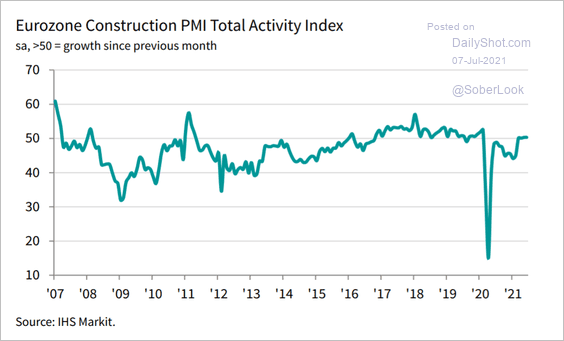

4. Construction activity at the Eurozone level is stable but not growing (PMI = 50).

Source: ANZ Research

Source: ANZ Research

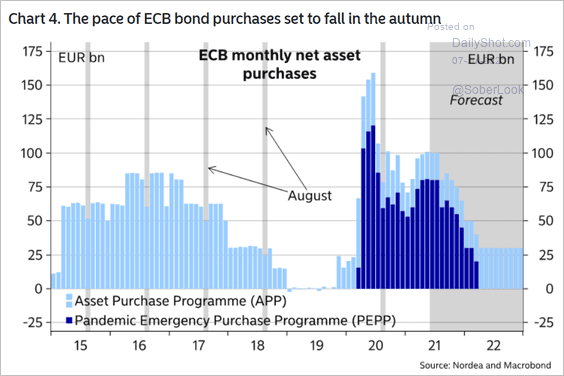

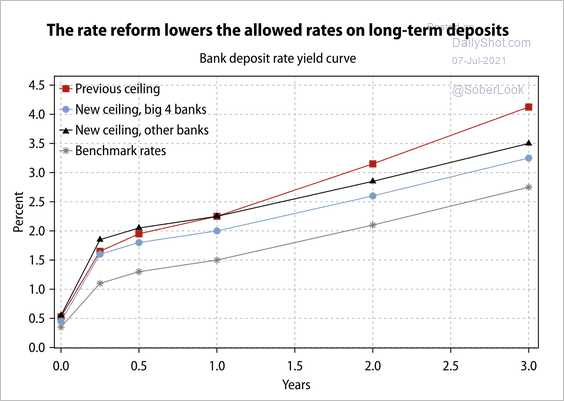

5. The ECB will begin tapering later this year.

Source: Nordea Markets

Source: Nordea Markets

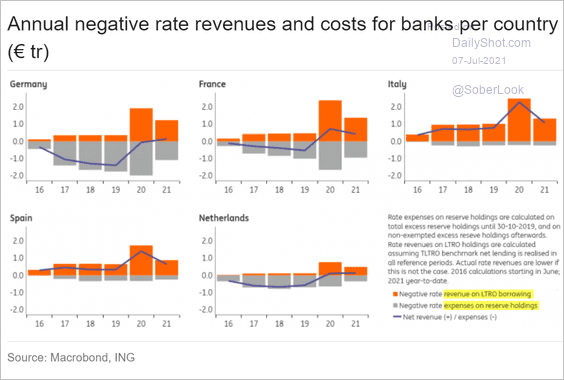

6. The TLTRO program (attractive ECB financing for banks) more than offset the cost of negative rates on excess reserves.

Source: ING

Source: ING

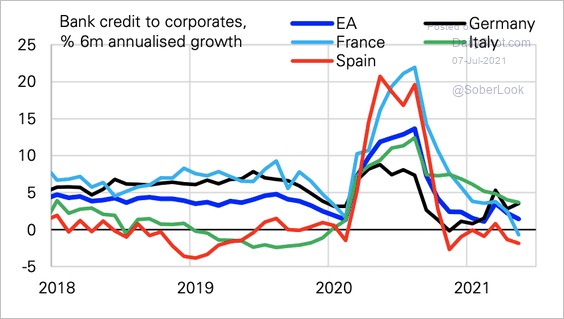

7. Negative corporate loan flows (declines in business loan balances) have been concentrated in France and Spain.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

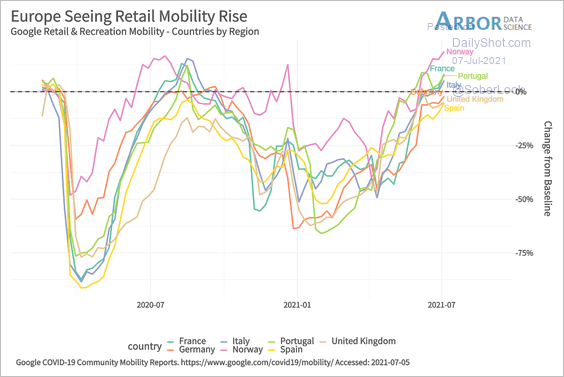

1. Online search data point to a strong rebound in retail and recreation mobility.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

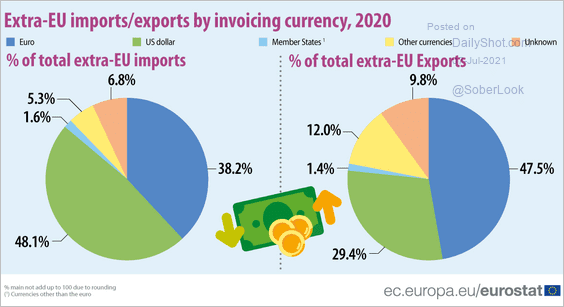

2. Which invoicing currencies are most commonly used for EU imports and exports?

Source: Eurostat Read full article

Source: Eurostat Read full article

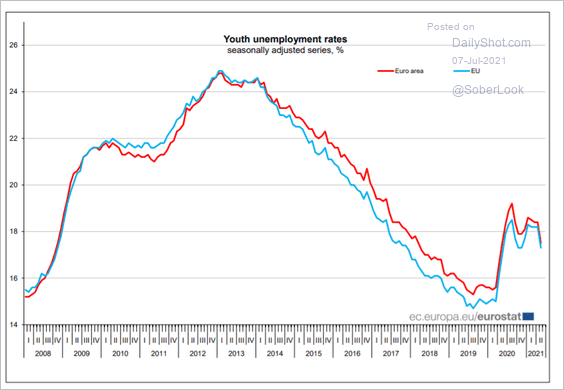

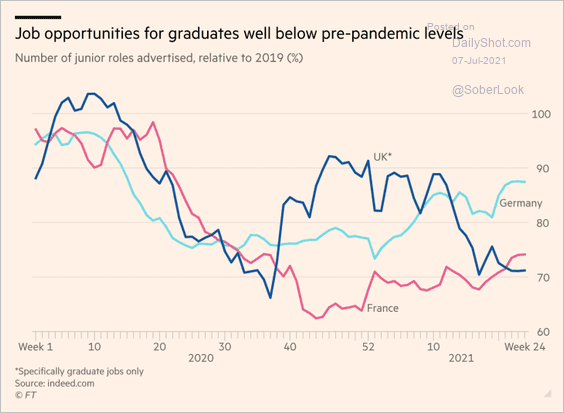

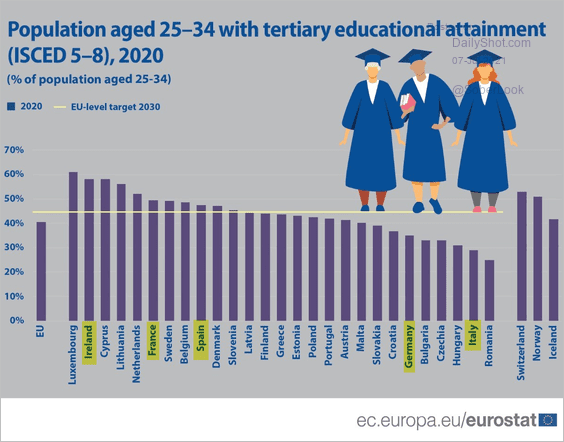

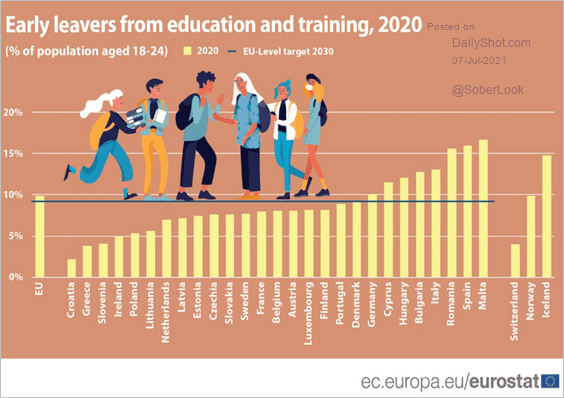

3. Next, we have some data on Western Europe’s younger population.

• Youth unemployment in the EU:

Source: Eurostat Read full article

Source: Eurostat Read full article

• Opportunities for new graduates:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Millenials with tertiary educational attainment:

Source: Eurostat Read full article

Source: Eurostat Read full article

• According to Eurostat, “In 2020, 9.9 % of 18-24-year-olds in the EU had completed at most a lower secondary education and were not in further education or training.”

Source: Eurostat

Source: Eurostat

Back to Index

Asia – Pacific

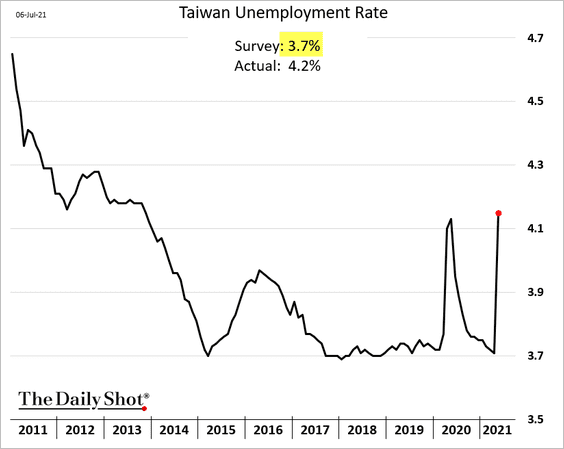

1. Taiwan’s unemployment rate surged in May.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

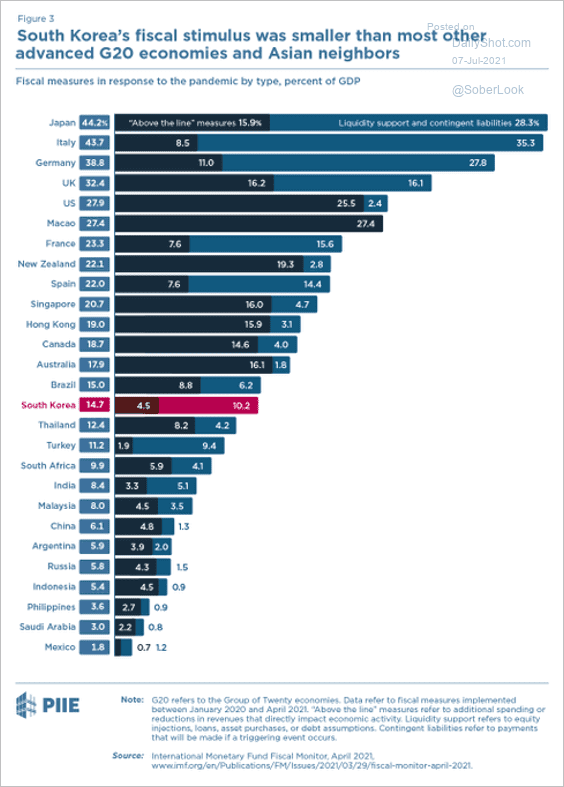

2. South Korea’s fiscal stimulus was smaller than what we saw in other economies.

Source: @PIIE, @jfkirkegaard Read full article

Source: @PIIE, @jfkirkegaard Read full article

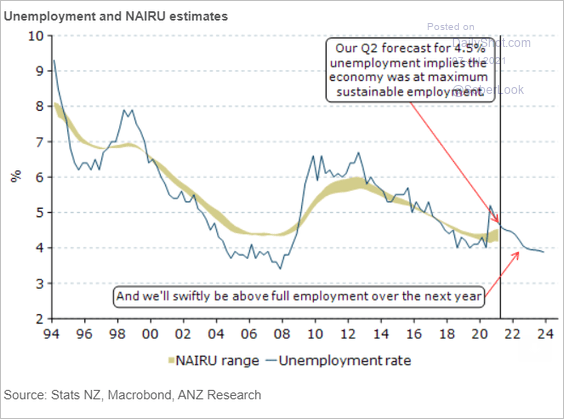

3. New Zealand is approaching full employment. Rate hikes are coming this year.

Source: ANZ Research

Source: ANZ Research

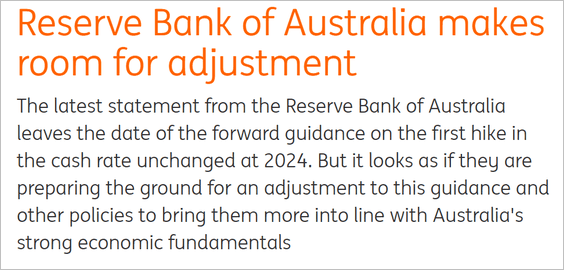

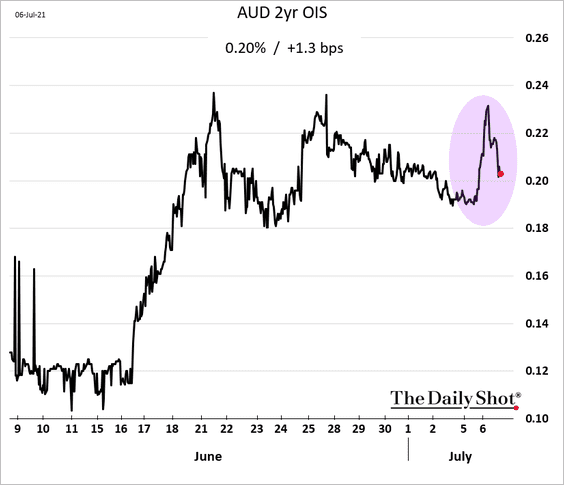

4. The RBA has set the stage for removing some accommodation.

Source: ING Read full article

Source: ING Read full article

But the market wasn’t impressed. The increase in yields was short-lived.

Back to Index

China

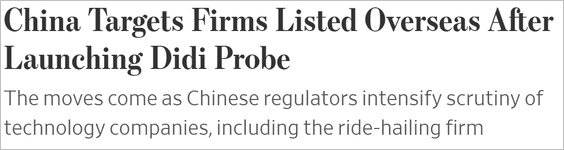

1. Beijing’s aggressive stance on DiDi may sap demand for China’s equity listings abroad.

Source: @WSJ Read full article

Source: @WSJ Read full article

Recently-listed US shares of Chinese companies took a hit.

——————–

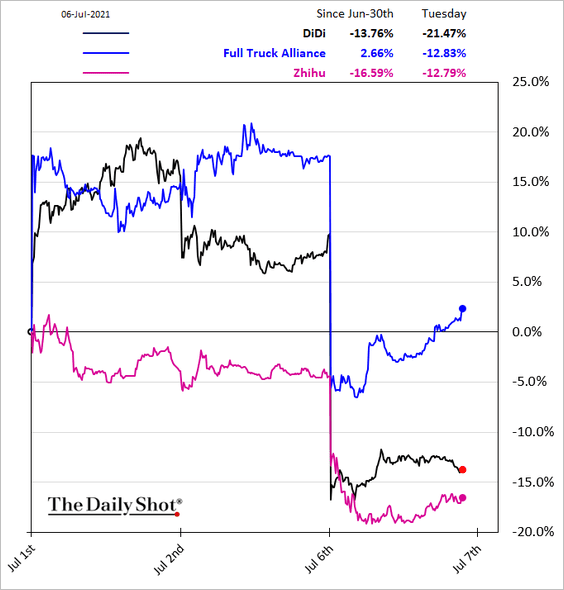

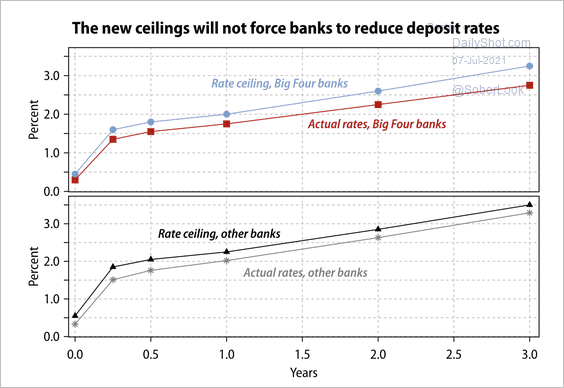

2. Banks are revising the ceilings on rates offered to depositors.

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

——————–

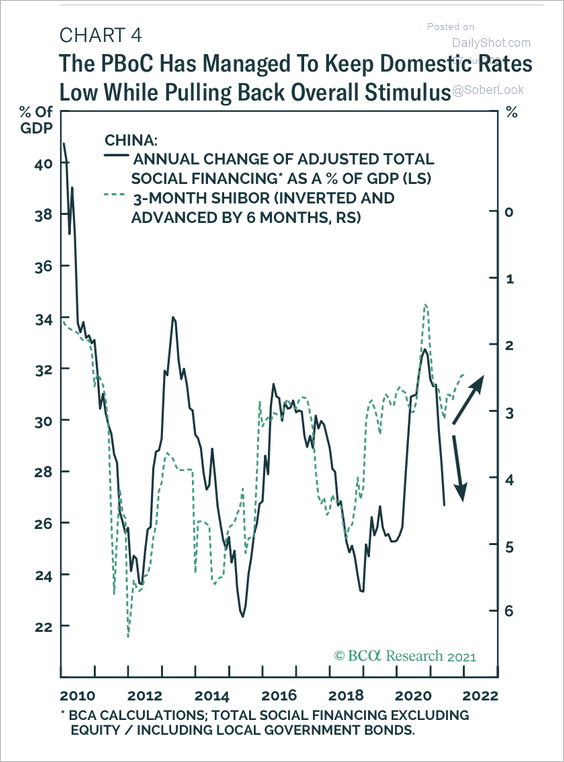

3. Domestic rates remain low despite the pullback in stimulus.

Source: BCA Research

Source: BCA Research

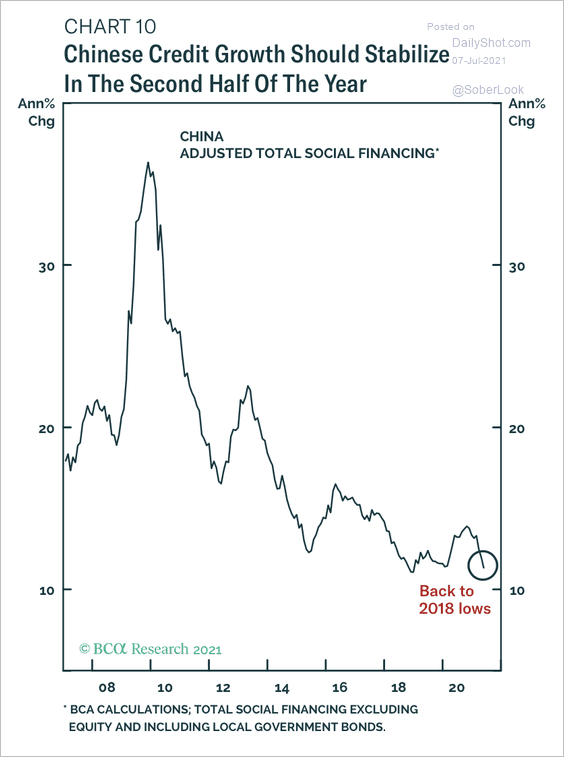

4. BCA Research expects credit growth to stabilize later this year.

Source: BCA Research

Source: BCA Research

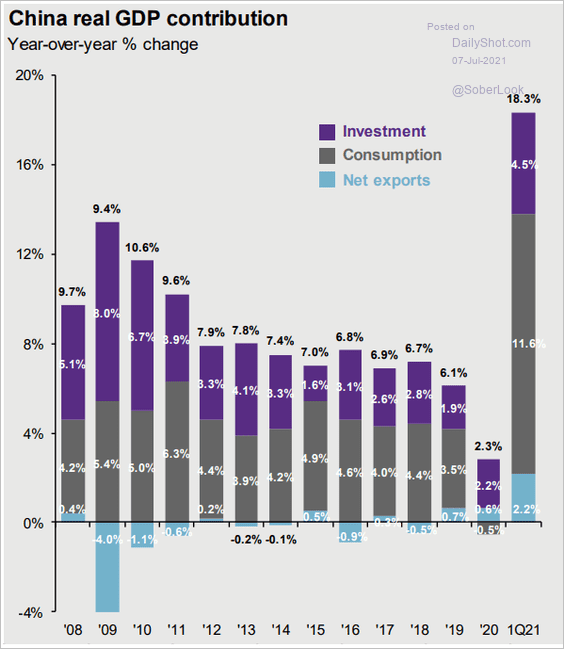

5. This chart shows the contributions to China’s GDP growth.

Source: @JPMorganAM

Source: @JPMorganAM

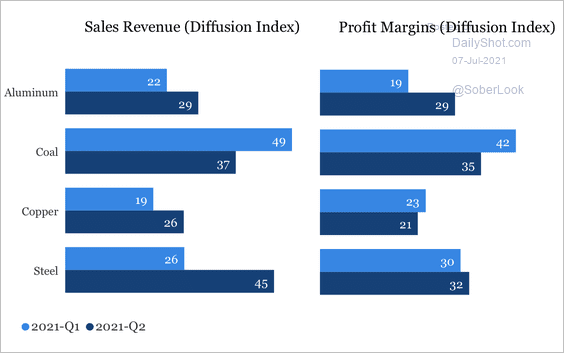

6. Steel producer earnings grew over the past quarter while coal weakened.

Source: China Beige Book

Source: China Beige Book

Back to Index

Emerging Markets

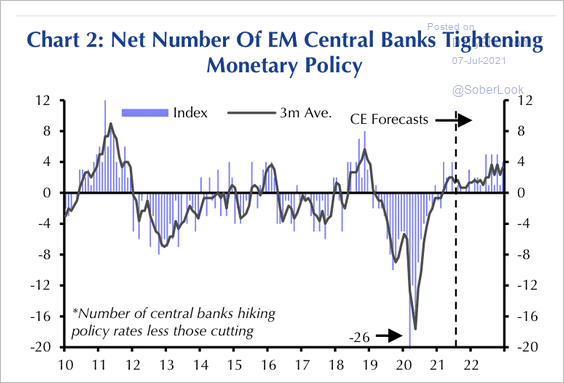

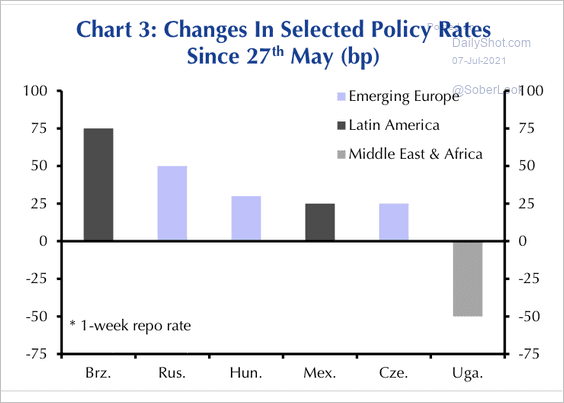

1. Many EM central banks are starting to raise rates (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

——————–

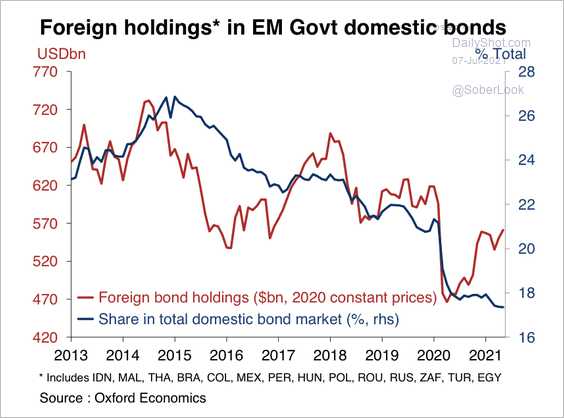

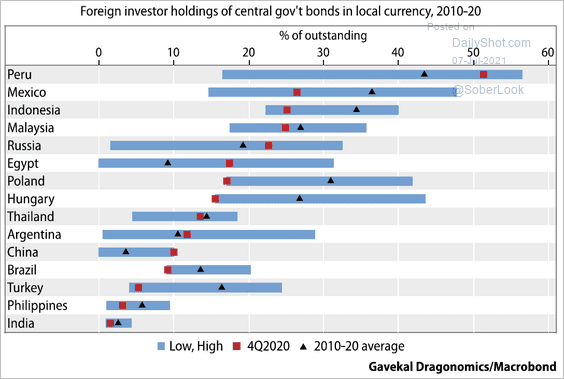

2. Foreign exposure to EM bonds has risen over the past year. However, foreign investors’ share in local EM bond markets has been declining since 2015. This is mainly due to EM countries issuing debt at a faster pace than foreign investors are willing/able to absorb, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

• This chart shows foreign investors’ holdings of local government bonds.

Source: Gavekal Research

Source: Gavekal Research

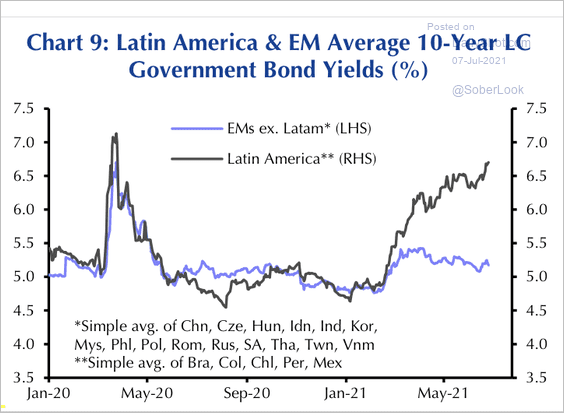

• Political risks have pushed up local-currency bond yields across Latin America.

Source: Capital Economics

Source: Capital Economics

——————–

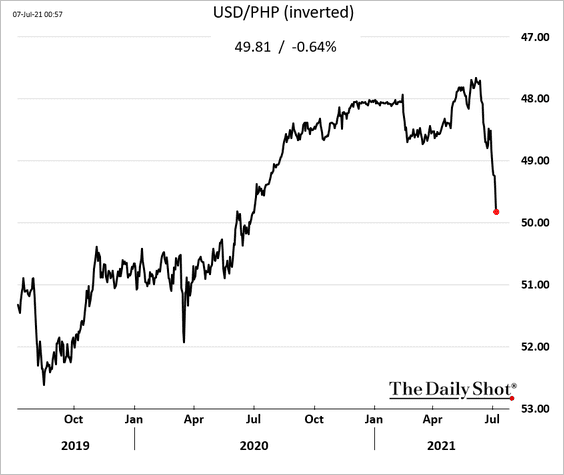

3. The Philippine peso continues to weaken, dragged lower (in part) by elevated oil prices.

Back to Index

Cryptocurrency

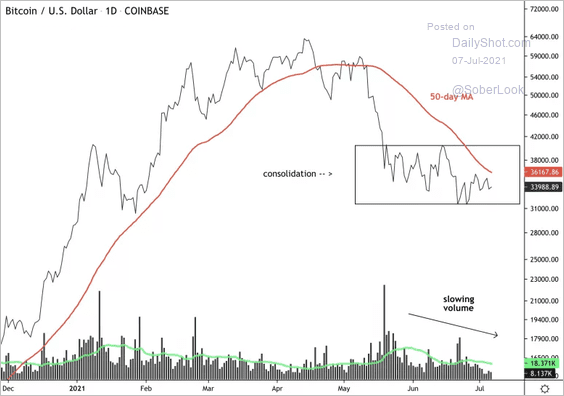

1. Bitcoin faces resistance at the 50-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

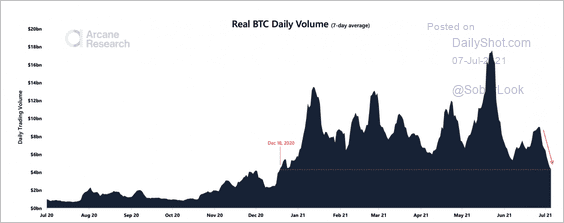

2. Bitcoin trading volume dropped significantly over the past week as price remains stuck in a range between $30,000 and $40,000.

Source: Arcane Research

Source: Arcane Research

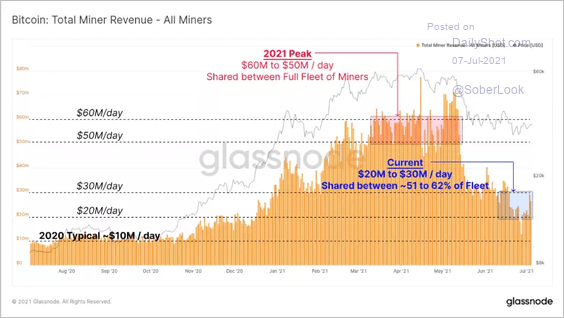

3. Bitcoin miner revenue is starting to recover.

Source: Glassnode

Source: Glassnode

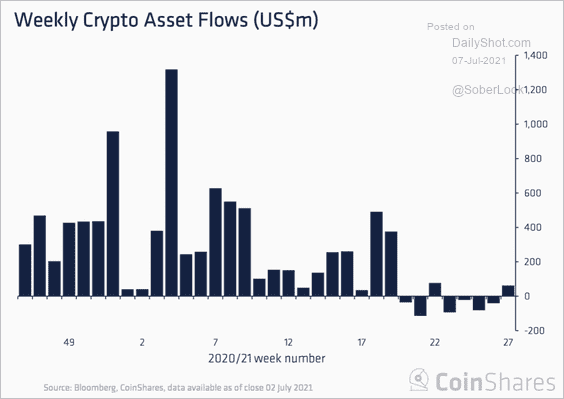

4. Digital asset investment funds attracted net capital inflows last week after four consecutive weeks of redemptions.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

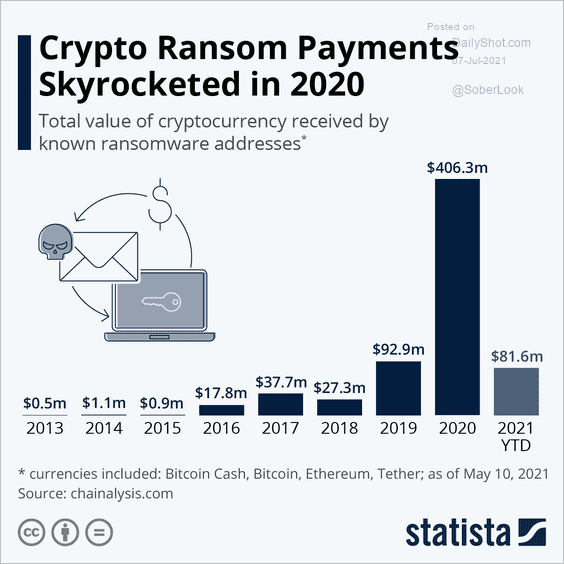

5. Rising crypto ransom payments increase reputational risks for the market.

Source: Statista

Source: Statista

Back to Index

Commodities

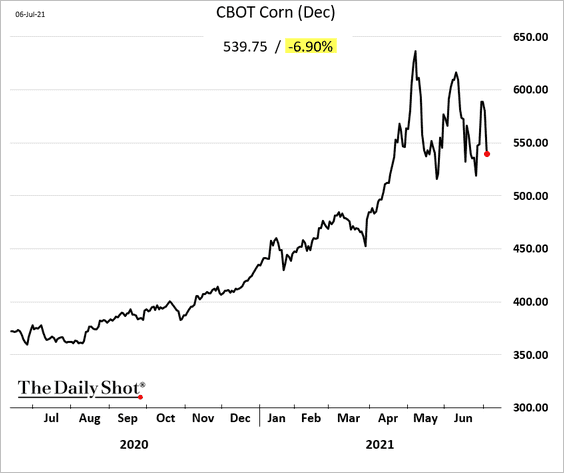

1. US grains tumbled on Tuesday, with rains expected to ease drought in many parts of the country. There are also concerns that China’s buying spree will moderate. As the chart below shows, corn and other grans have been whipsawed since May.

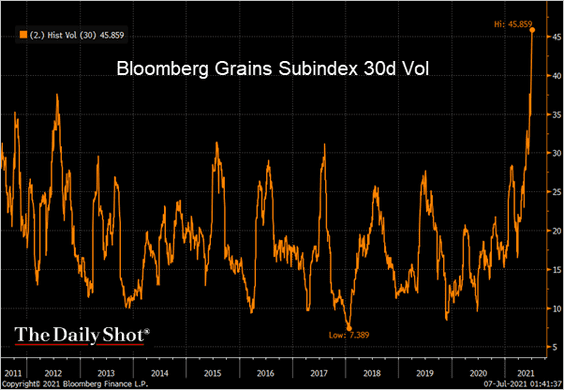

Volatility in US grains has reached multi-year highs.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

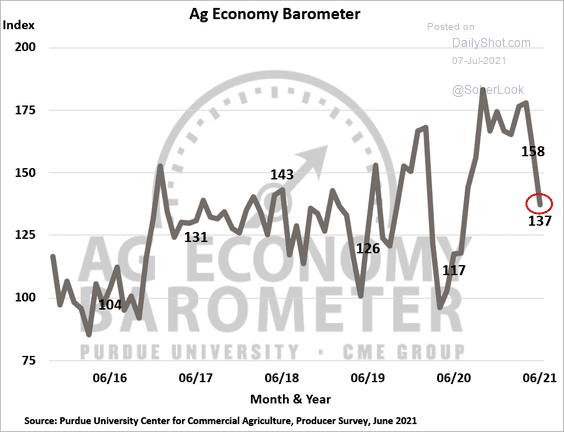

2. This volatility is making farmers uneasy as sentiment tumbles. Part of the decline is also due to US politics.

Source: Purdue University/CME Group Ag Economy Barometer

Source: Purdue University/CME Group Ag Economy Barometer

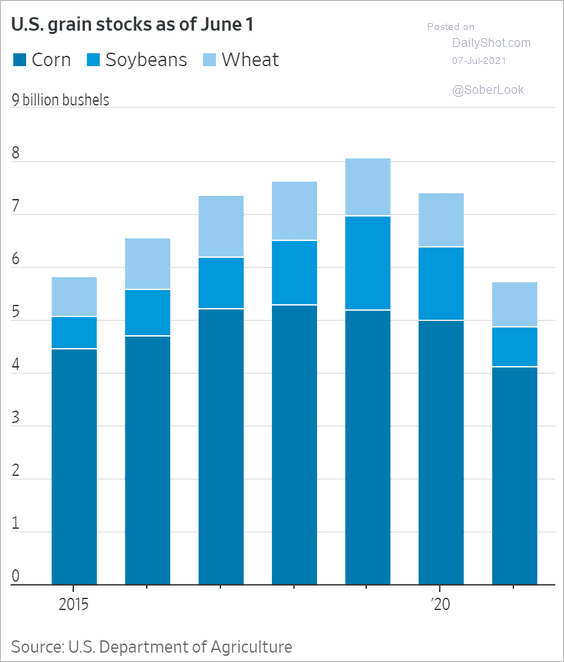

3. US grain inventories have been trending lower.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

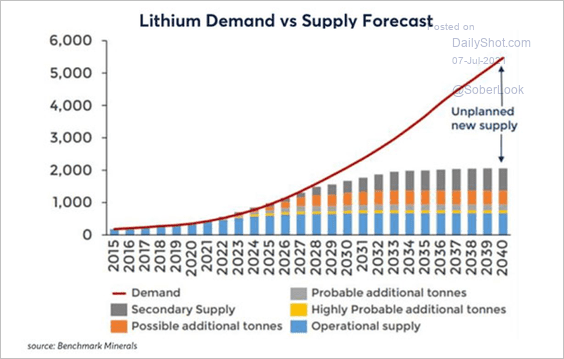

4. This chart illustrates the looming lithium market deficit.

Source: Institutional Investor Read full article

Source: Institutional Investor Read full article

Back to Index

Energy

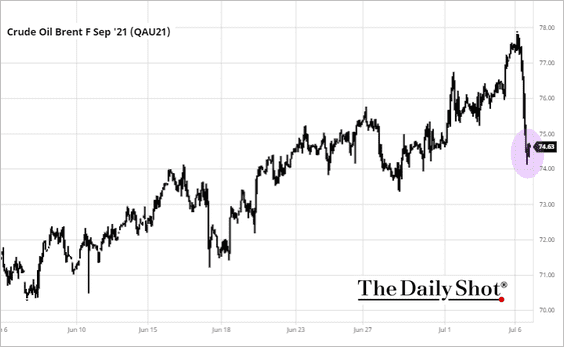

1. The US involvement in OPEC’s spat improves the chances of a deal to boost production. Crude oil tumbled.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: barchart.com

Source: barchart.com

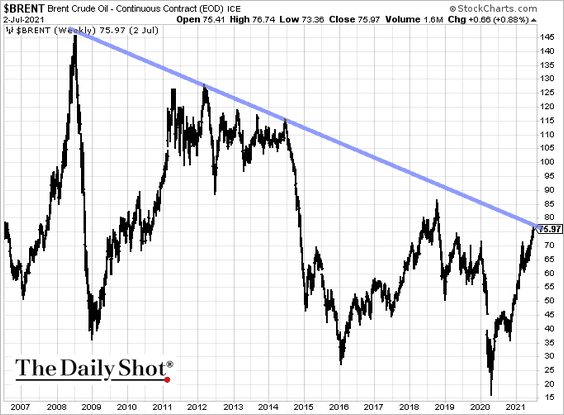

By the way, Brent crude is at a long-term downtrend resistance.

h/t @AkshayChinchal4

h/t @AkshayChinchal4

——————–

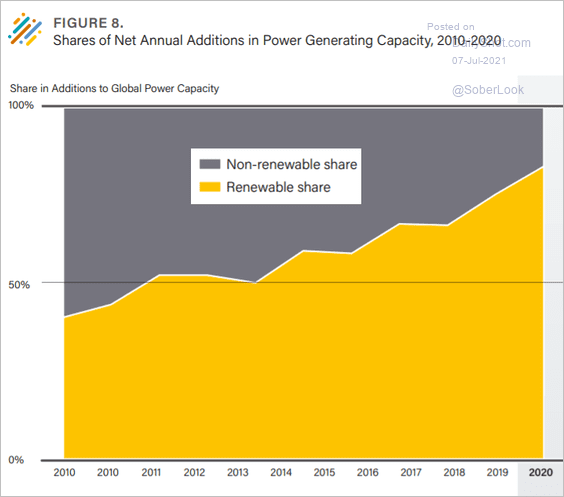

2. Renewables’ share of net new power generating capacity keeps climbing.

Source: REN21 Read full article

Source: REN21 Read full article

Back to Index

Equities

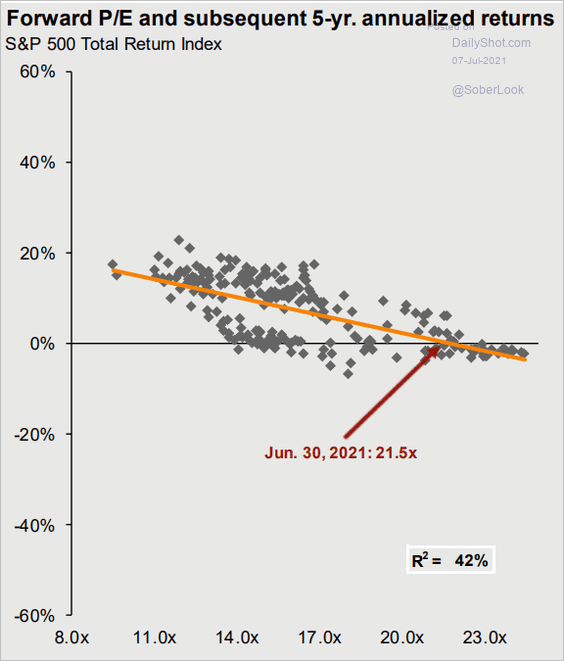

1. Current valuations don’t bode well for longer-term returns.

Source: @JPMorganAM

Source: @JPMorganAM

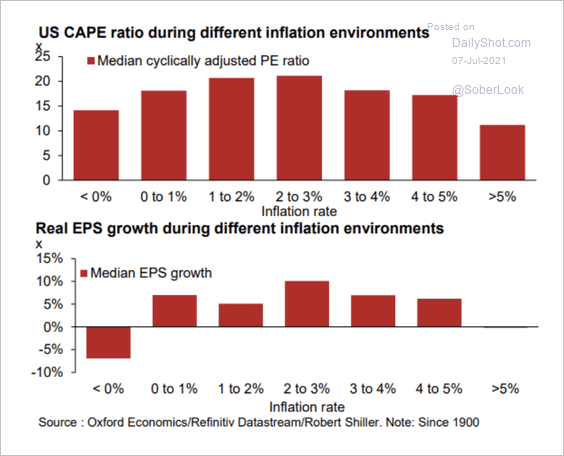

2. Equity multiples could start to decline if inflation expectations remain elevated.

Source: Oxford Economics

Source: Oxford Economics

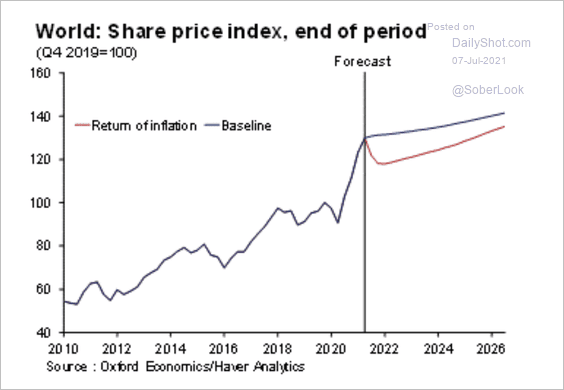

In an inflation scenario, world equity prices are 10% lower than Oxford Economics’ baseline forecast.

Source: Oxford Economics

Source: Oxford Economics

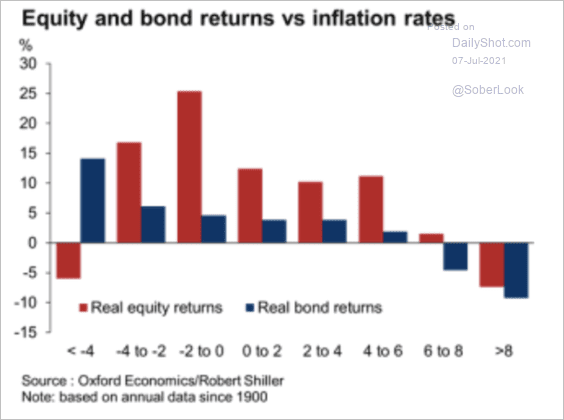

Equities are more resistant to an inflation spurt than bonds.

Source: Oxford Economics

Source: Oxford Economics

——————–

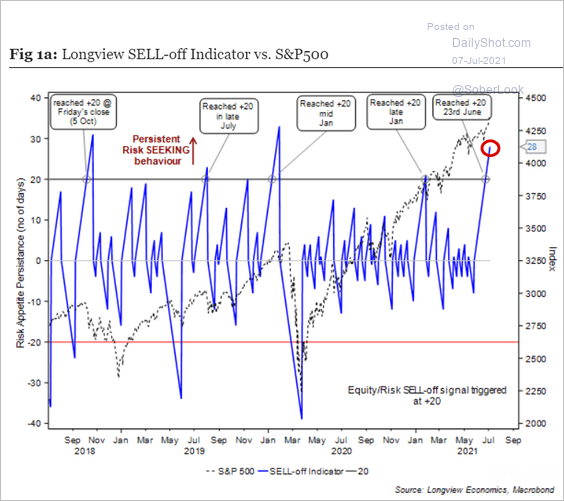

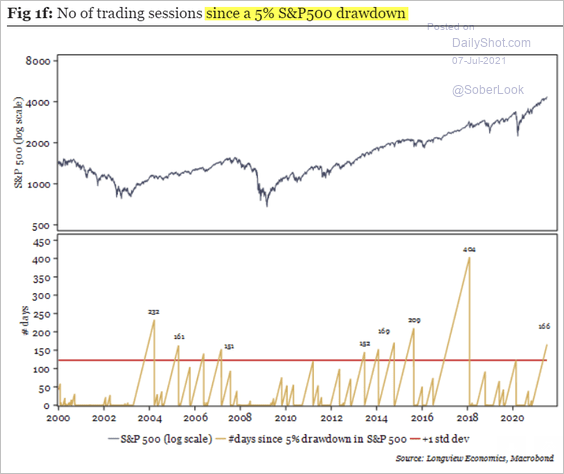

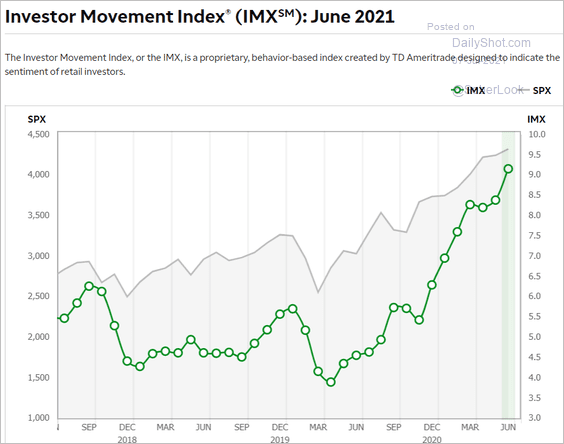

3. We continue to see signs of exuberance in the market.

• The Longview Economics risk appetite indicator:

Source: Longview Economics

Source: Longview Economics

• Trading sessions since a 5% drawdown:

Source: Longview Economics

Source: Longview Economics

• The TD Ameritrade retail investor positioning index (record high):

Source: @TDAmeritrade

Source: @TDAmeritrade

——————–

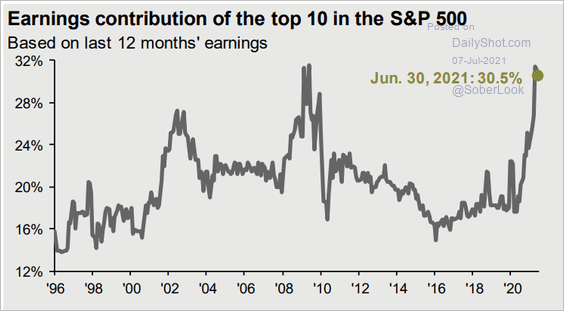

4. Earnings contribution of the top ten stocks in the S&P 500 are still near record highs.

Source: @JPMorganAM

Source: @JPMorganAM

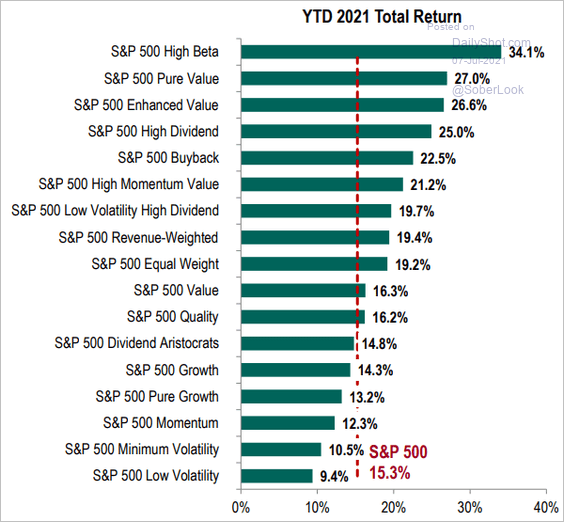

5. This chart shows equity factor/style year-to-date returns.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

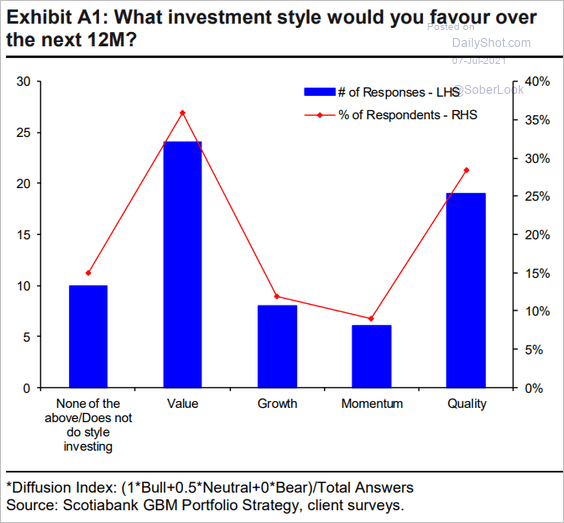

Which factors will outperform over the next 12 months?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

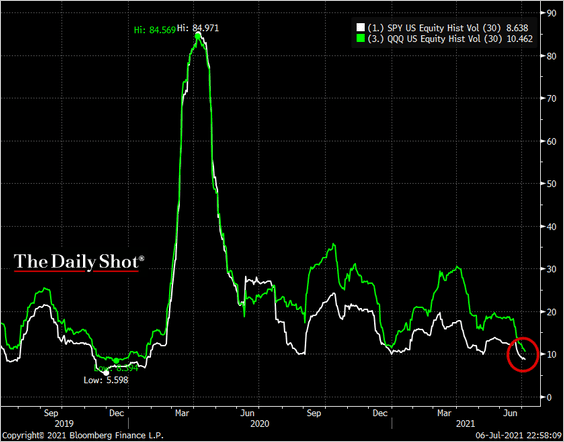

6. The gap between S&P 500 and Nasdaq 100 volatility measures has been tightening.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

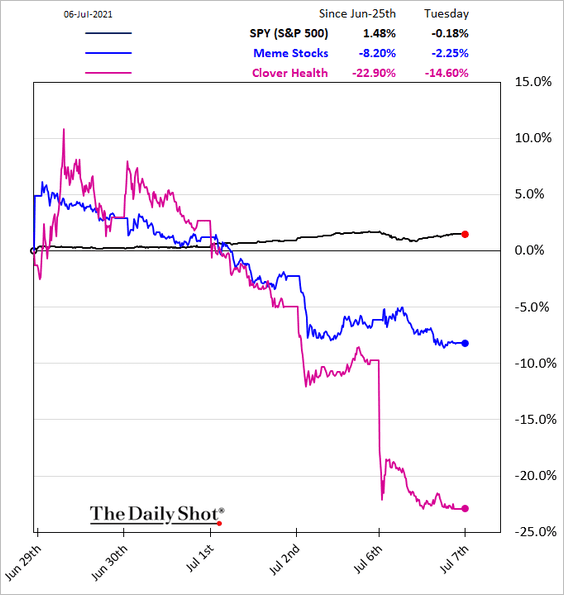

7. Meme stocks continue to struggle, which could be a positive for crypto.

Back to Index

Rates

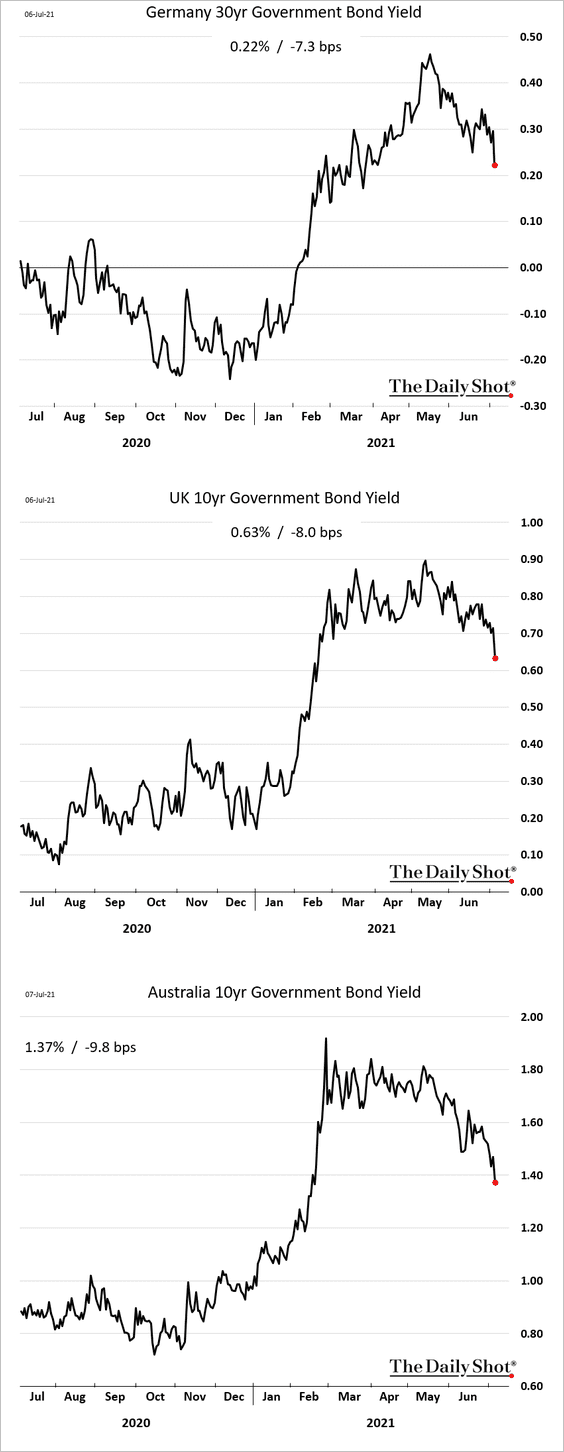

1. Global yields dipped on Tuesday with Treasuries.

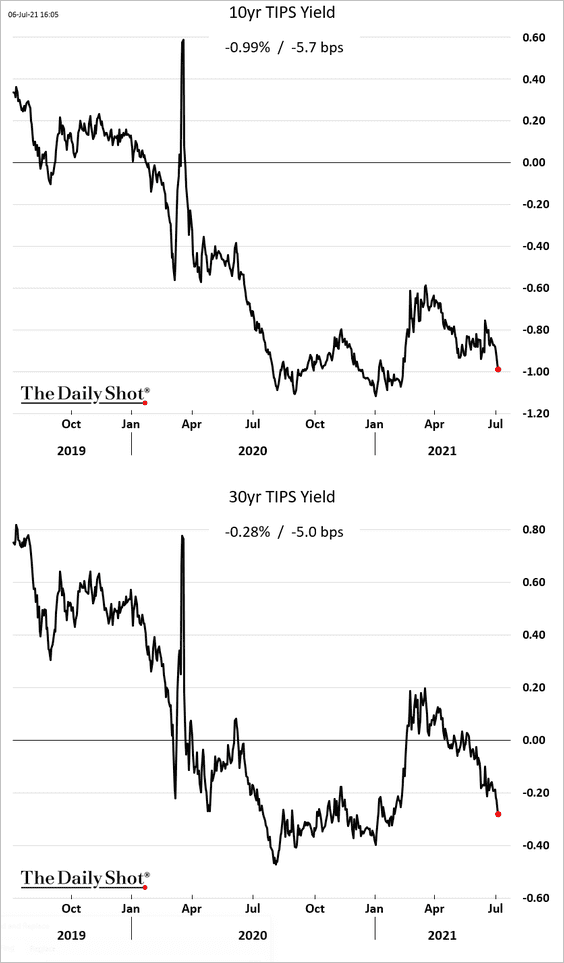

2. US inflation-linked Treasury yields (real rates) declined as well.

Back to Index

Global Developments

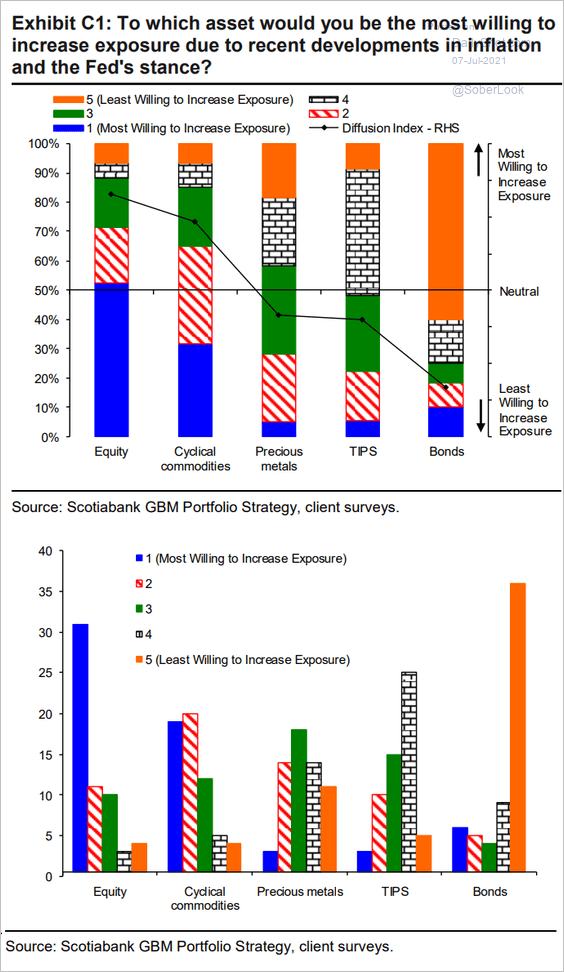

1. How will investors change allocations in response to higher inflation and a more hawkish Fed?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

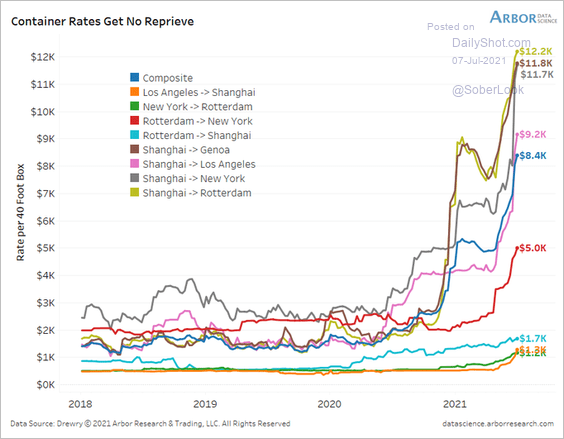

2. Container shipping costs continue to surge.

Source: @benbreitholtz

Source: @benbreitholtz

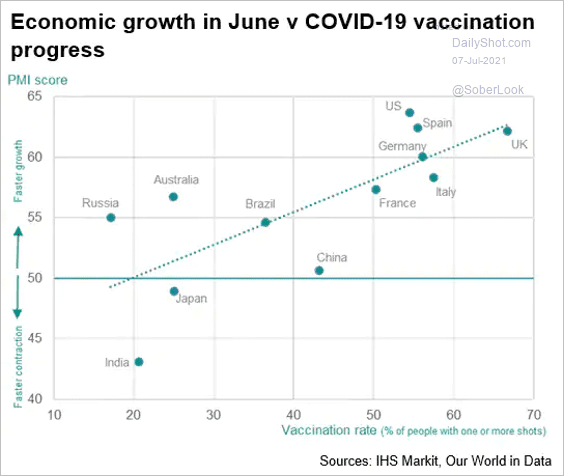

3. This scatterplot shows business activity (PMIs) vs. vaccination rates.

Source: IHS Markit

Source: IHS Markit

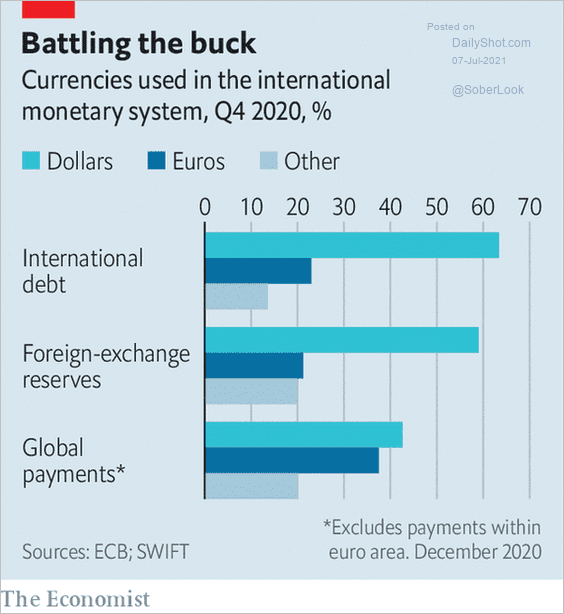

4. The chart below shows currencies used in the international monetary system.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Food for Thought

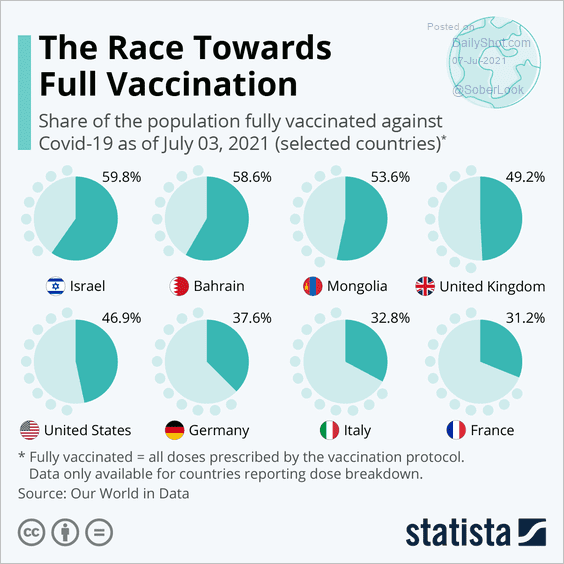

1. Share of the population fully vaccinated against COVID:

Source: Statista

Source: Statista

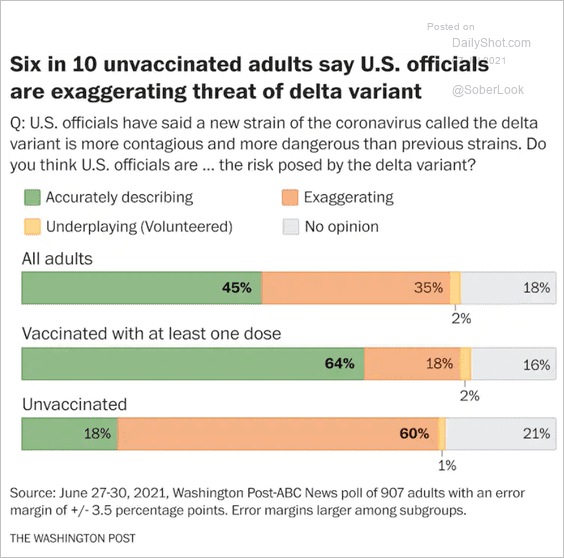

2. US views on the Delta variant:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

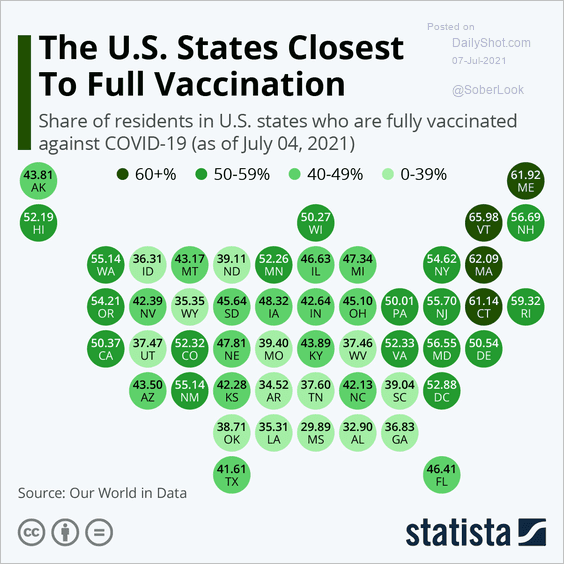

3. Vaccination rates by state:

Source: Statista

Source: Statista

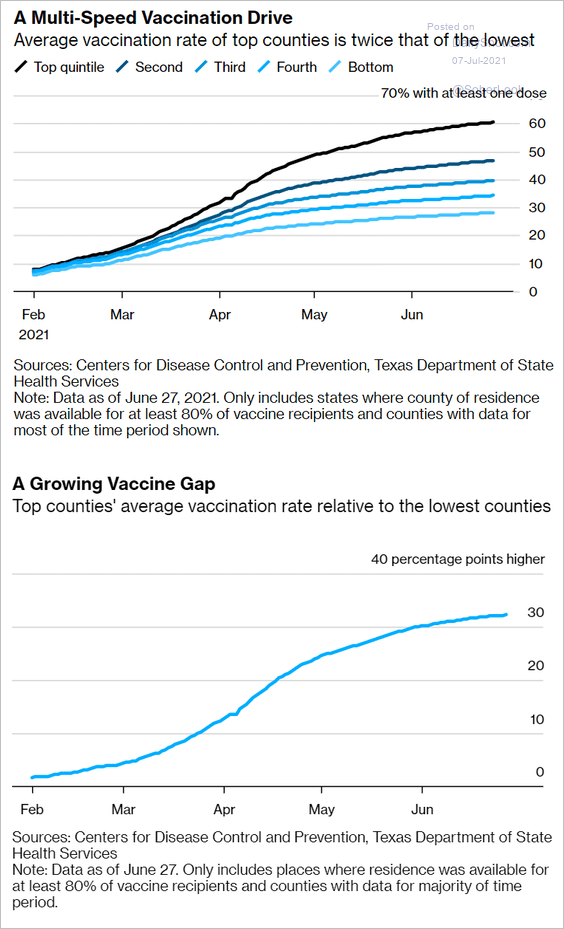

4. Uneven vaccination progress in the US:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

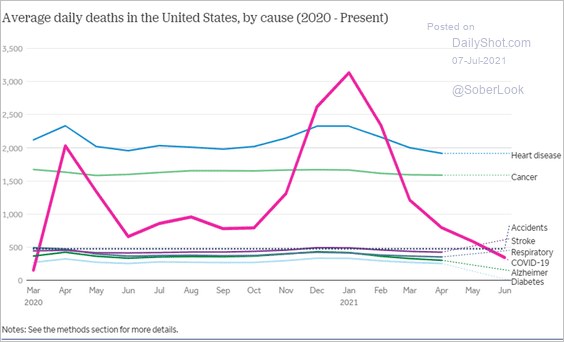

5. US daily deaths by cause:

Source: Peterson-KFF Read full article

Source: Peterson-KFF Read full article

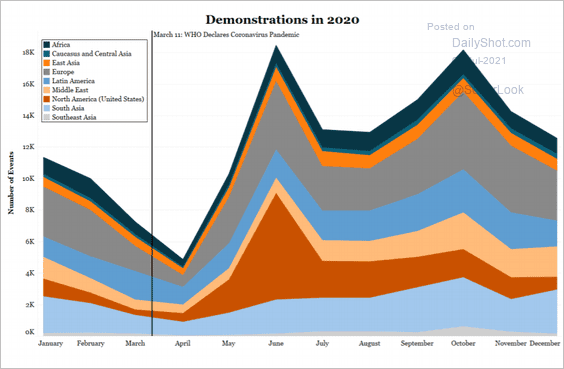

6. Demonstrations in 2020:

Source: ACLED Read full article

Source: ACLED Read full article

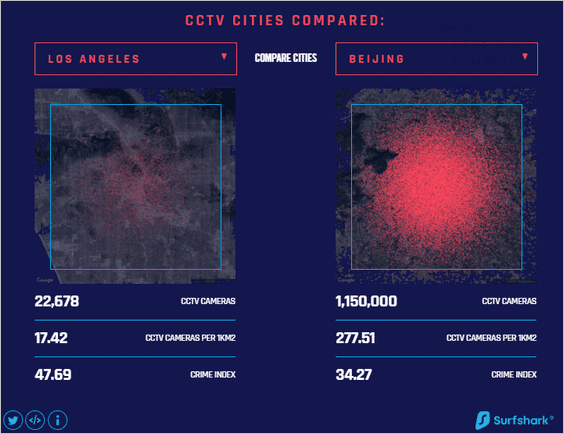

7. CCTV cameras in LA and Beijing:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

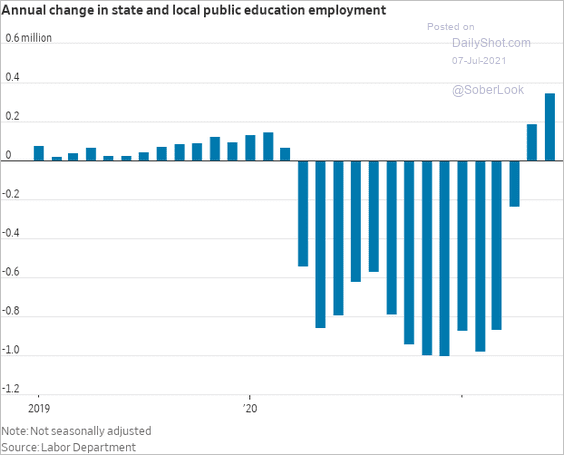

8. US local public education employment:

Source: @WSJ Read full article

Source: @WSJ Read full article

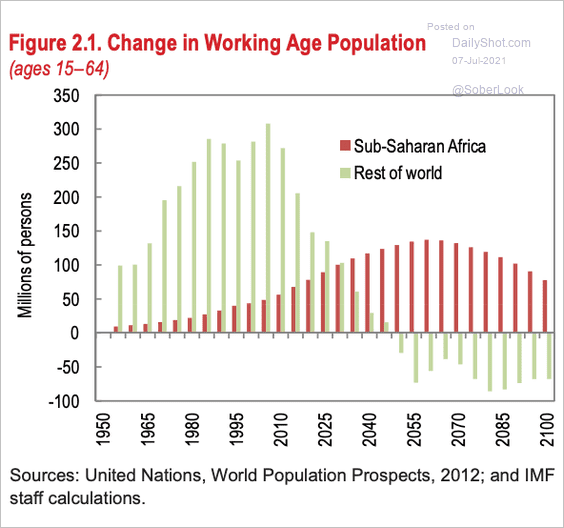

9. Sub-Saharan Africa working-age population:

Source: IMF, @adam_tooze Read full article

Source: IMF, @adam_tooze Read full article

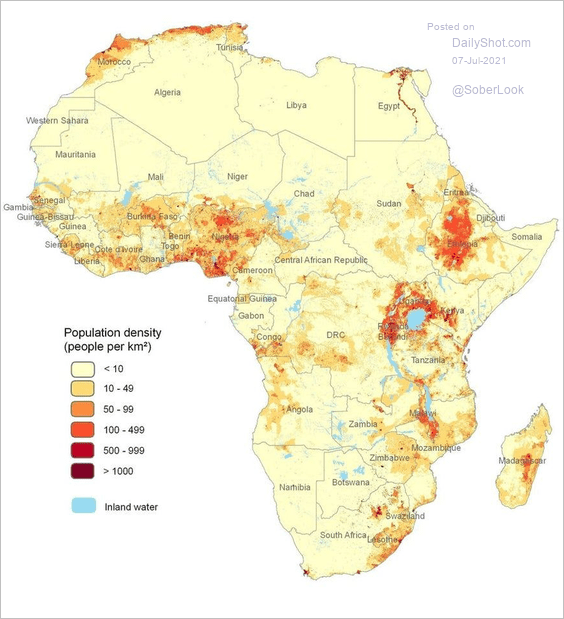

10. Population density across the African continent:

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

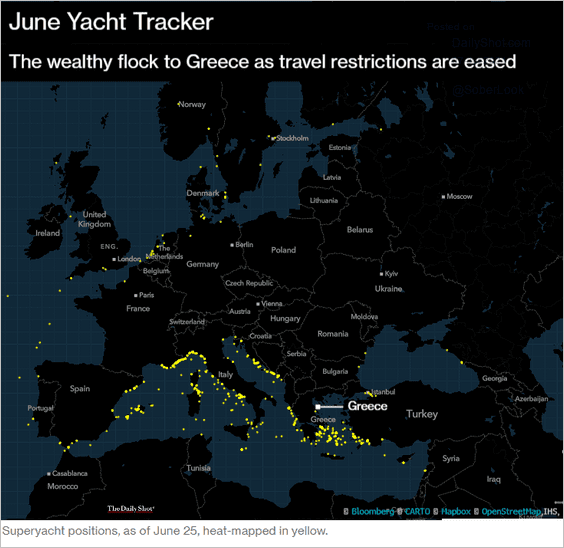

11. Superyachts flocking to Greece:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

Back to Index