The Daily Shot: 09-Jul-21

• Rates

• Credit

• Equities

• Energy

• Emerging Markets

• China

• The Eurozone

• The United States

• Global Developments

• Food for Thought

Rates

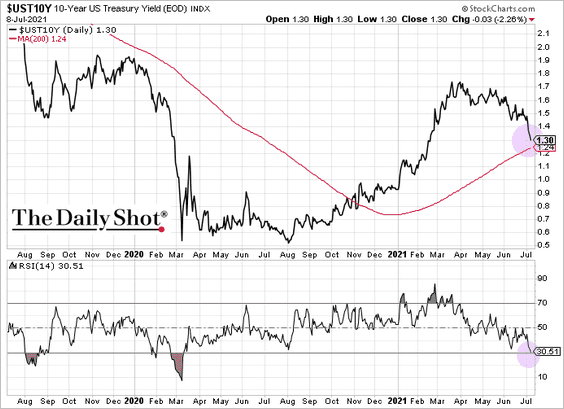

1. The 10-year Treasury yield is nearing support at the 200-day moving average, with technicals suggesting that the bond rally is becoming stretched.

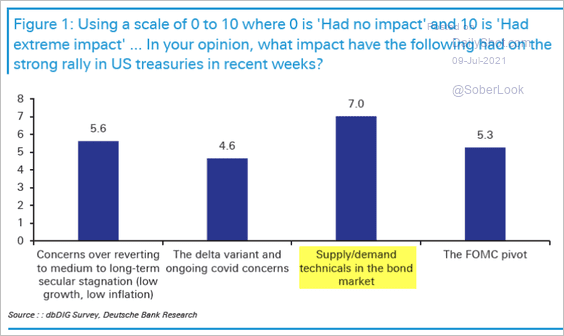

What drove this rapid drop in yields? Many analysts have pointed to supply/demand technical factors as the key reason.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

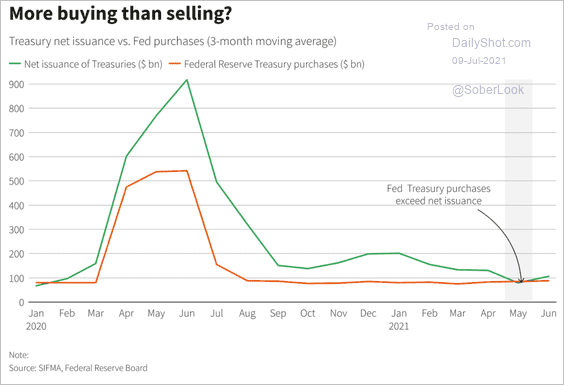

The US Treasury has been issuing less debt as it taps its cash holdings (see chart). The Fed has been mopping up all the new issuance, tightening the supply and sending yields lower.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

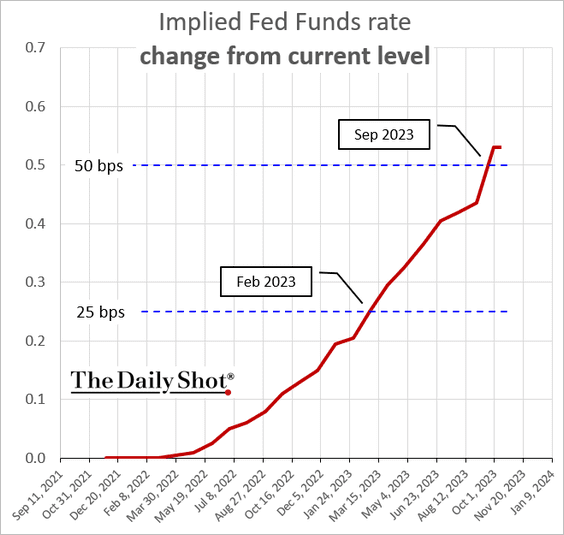

2. The first Fed rate hike is now fully priced in for February of 2023 (vs. November of 2022 a few days ago).

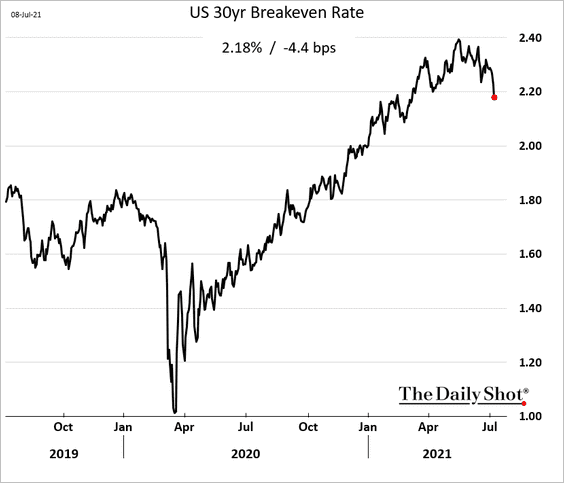

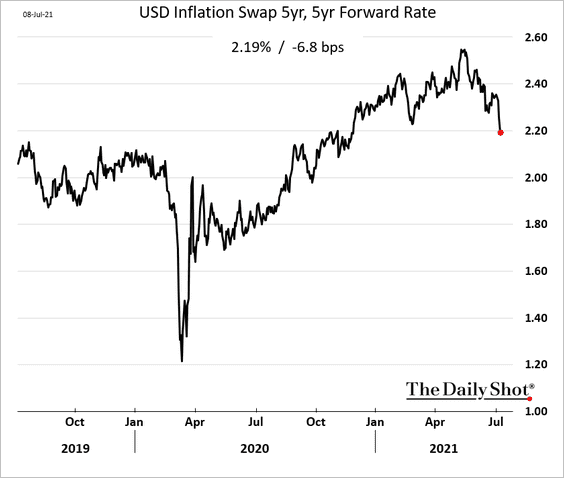

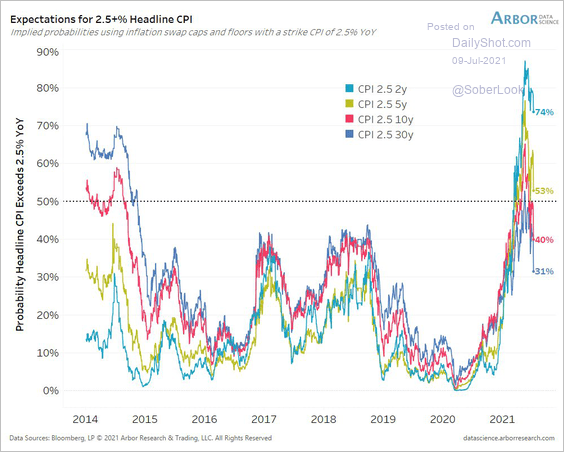

3. Long-term inflation expectations have been moderating.

• 30yr breakeven rate:

• 5yr inflation swap, 5 years forward:

• Inflation options markets:

Source: @benbreitholtz

Source: @benbreitholtz

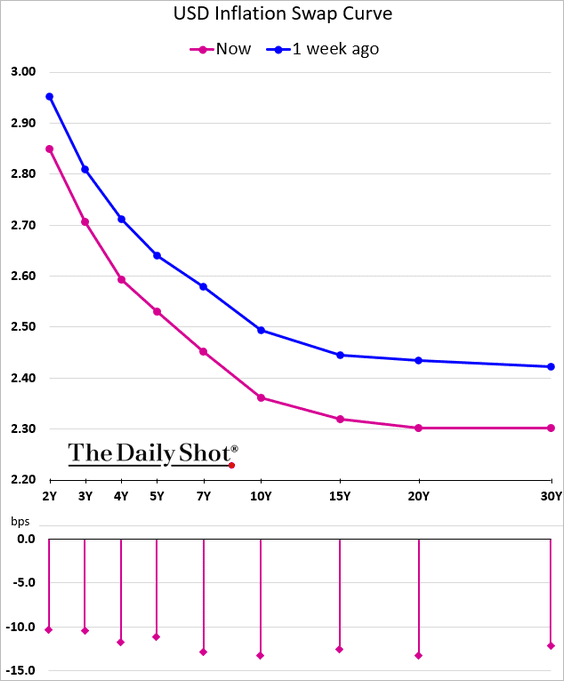

The inflation swap curve has become more inverted (inflation expected to moderate over the long run).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

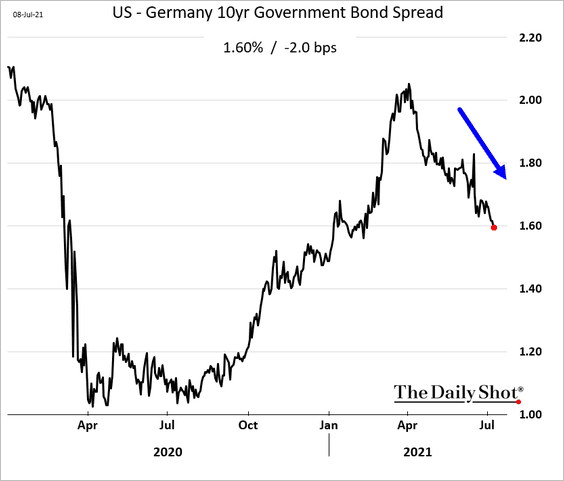

4. The spread between Treasuries and Bunds has been tightening.

Back to Index

Credit

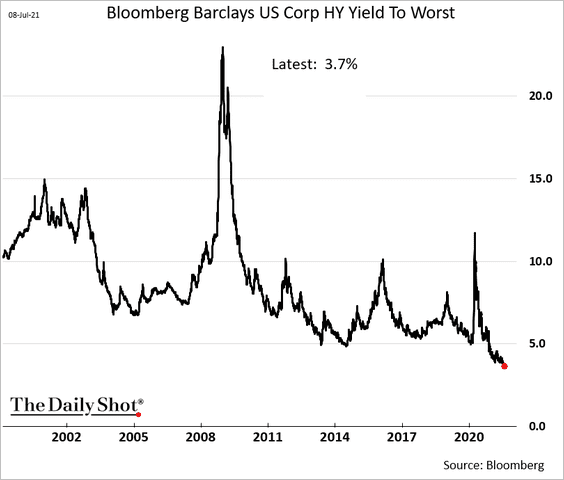

1. An average US high-yield bond now yields 3.7%.

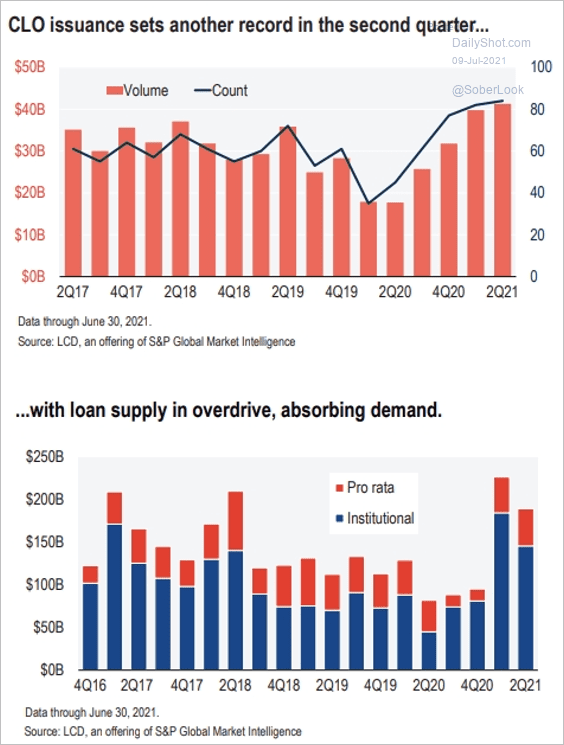

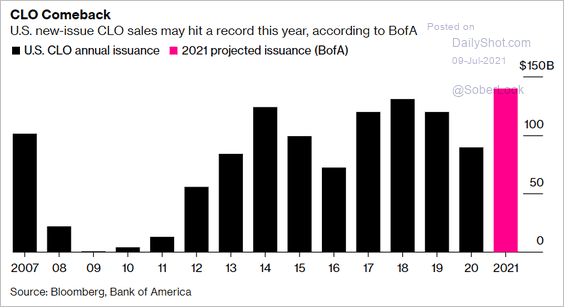

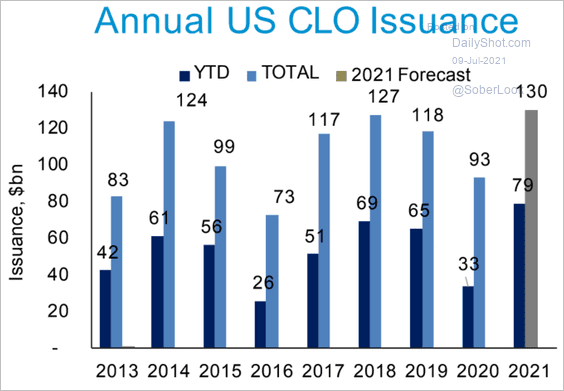

2. US CLO activity has been exceptionally robust, easily absorbing all the new supply of leveraged loans.

Source: @lcdnews

Source: @lcdnews

Below are a couple of forecasts for the full year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

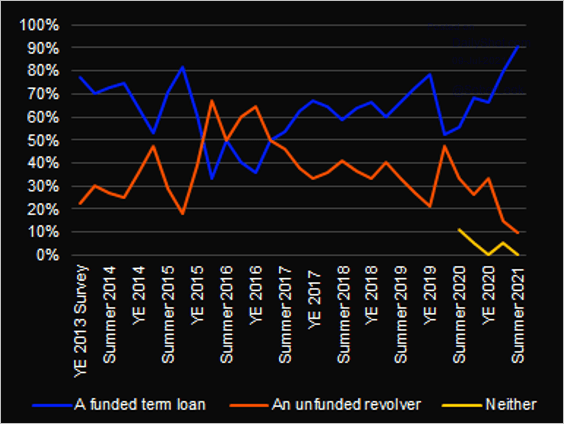

3. The pandemic caused companies to tap their revolving facilities (as revenues dried up), resulting in more funded exposure than banks (and other credit providers) expected. Lenders now just want term loans.

Source: @LPCLoans

Source: @LPCLoans

Back to Index

Equities

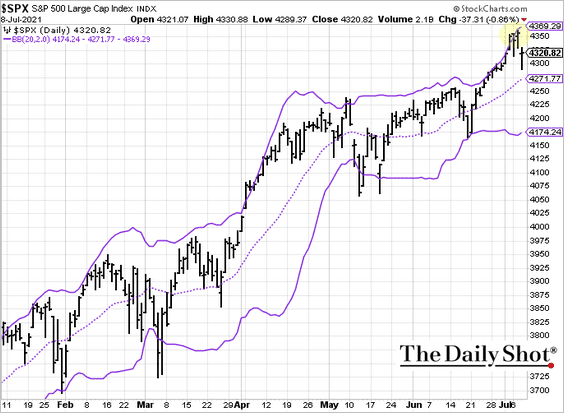

1. The S&P 500 held resistance at the upper Bollinger band.

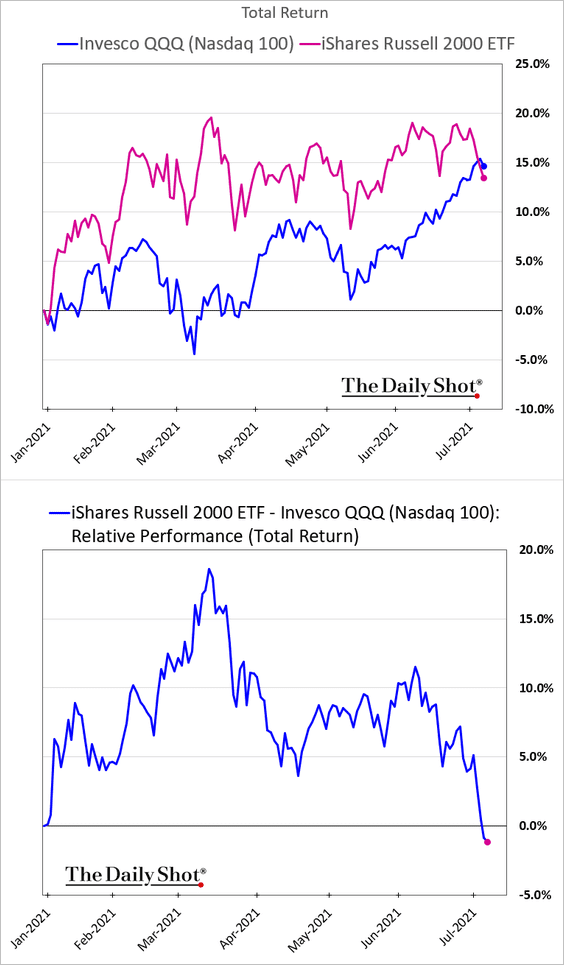

2. The Russell 2000 is now underperforming the Nasdaq 100 year-to-date.

The iShares Russell 2000 ETF tested support on Thursday.

Source: @hmeisler

Source: @hmeisler

——————–

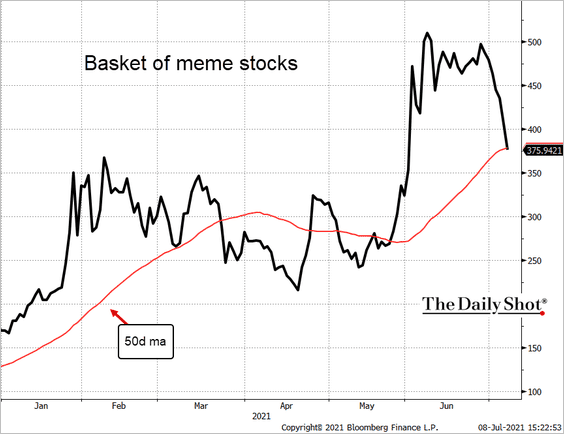

3. Meme stocks are in bear-market territory.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

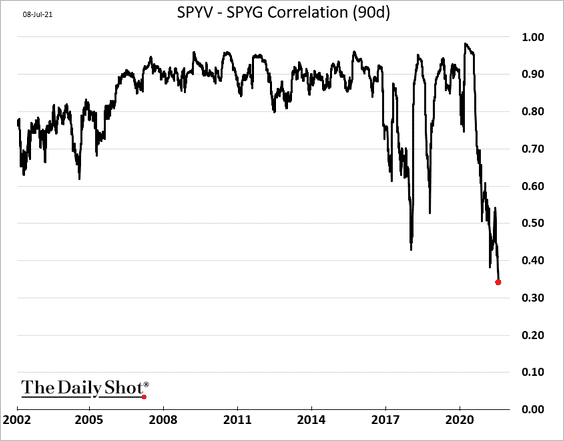

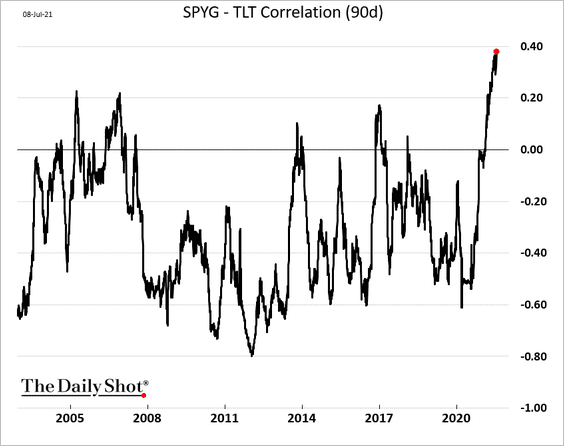

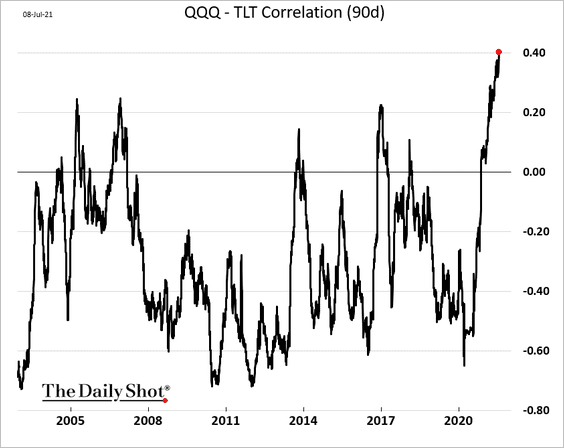

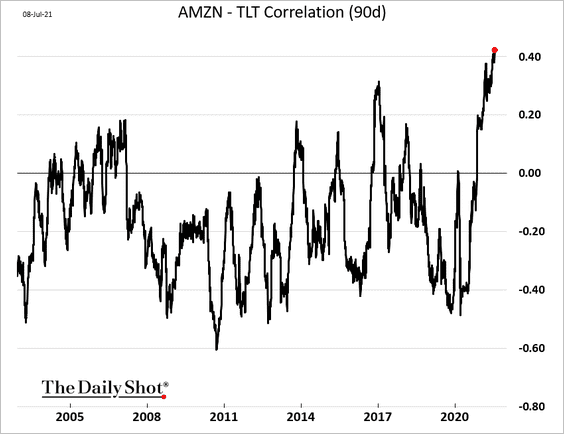

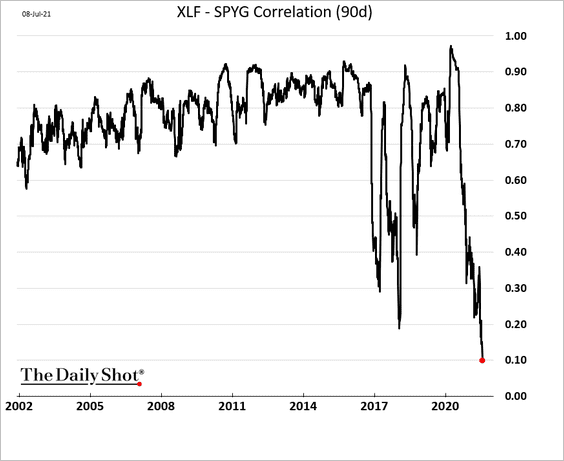

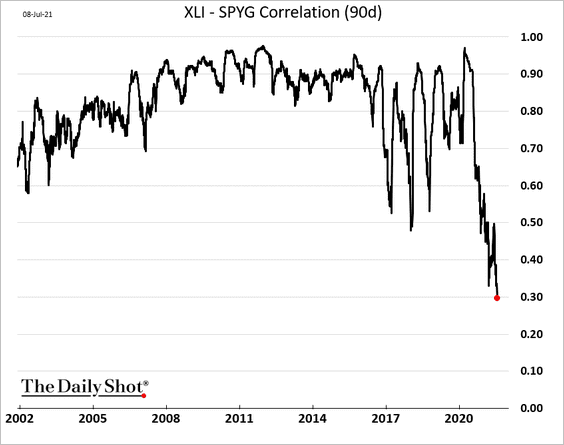

4. Why is the correlation between growth and value hitting extreme lows?

The trend is driven by the growth factor’s increasing correlation with Treasuries (TLT = iShares 20+ Year Treasury ETF).

In particular, it’s the growth mega-caps that have become highly correlated with bonds (QQQ = Nasdaq 100).

But many value stocks are not correlated to bonds. In fact, banks are inversely correlated with Treasuries (positively correlated with Treasury yields). As a result, these sectors have become less correlated with growth stocks.

• Financials:

• Industrials:

Back to Index

Energy

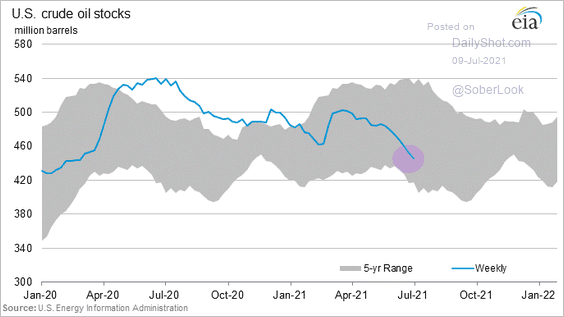

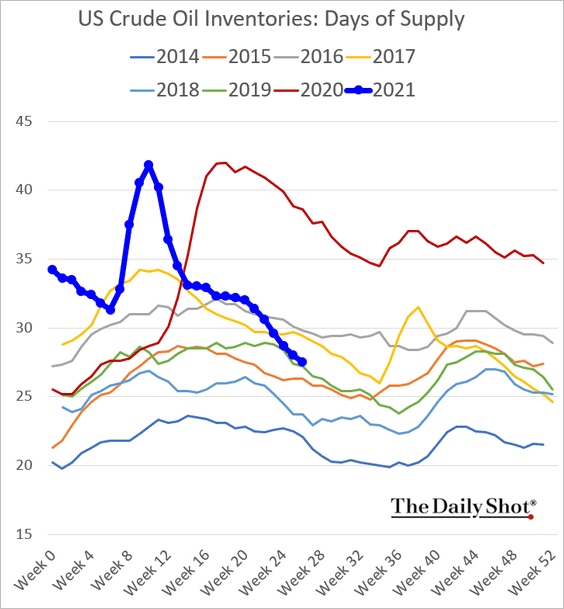

1. US crude oil inventories continue to shrink, supporting oil prices.

• Days of supply:

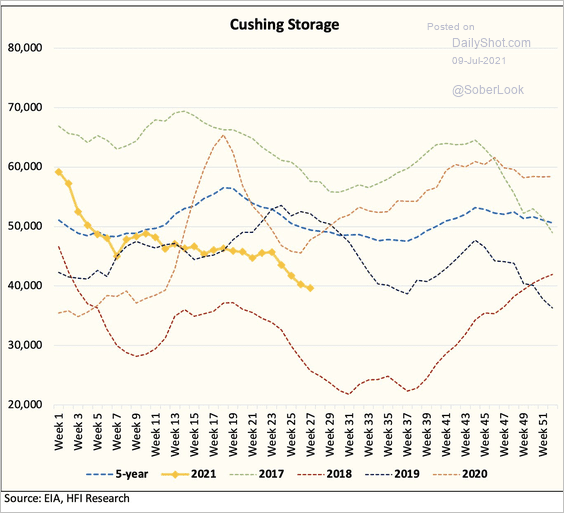

• Inventories at Cushing, OK (NYMEX WTI settlement hub):

Source: @HFI_Research

Source: @HFI_Research

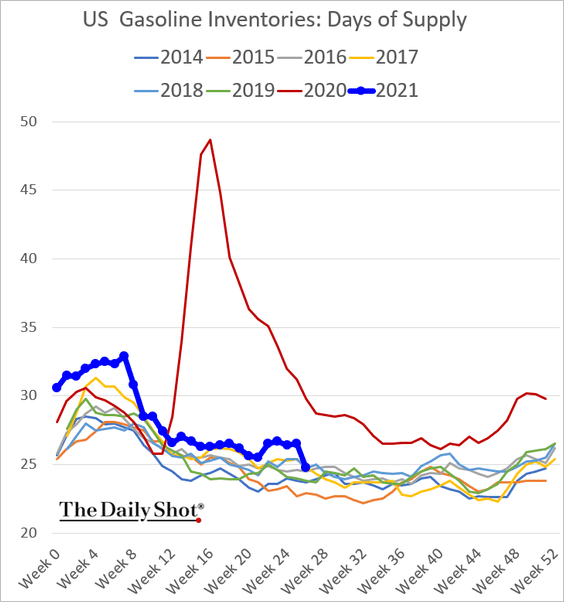

Gasoline inventories also declined.

——————–

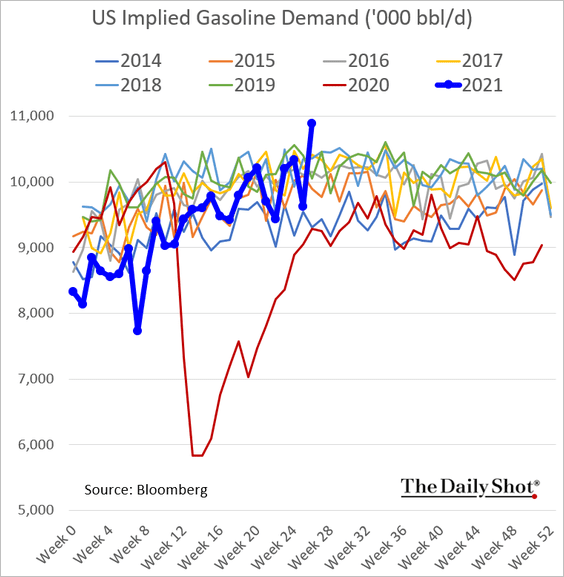

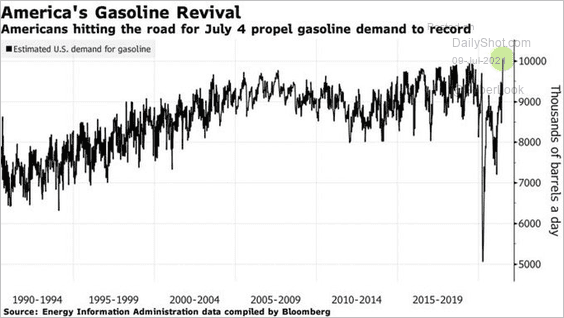

2. US gasoline demand scored a record high as Americans hit the road (going into the July 4th weekend).

Source: @Lynnmdoan Read full article

Source: @Lynnmdoan Read full article

——————–

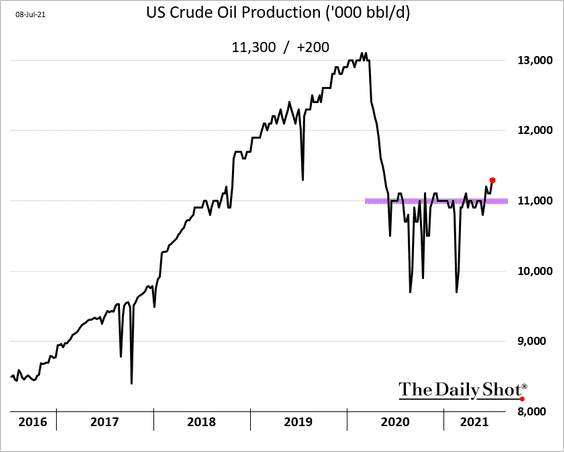

3. US crude oil production, which has been capped at 11 million barrels per day, is breaking higher.

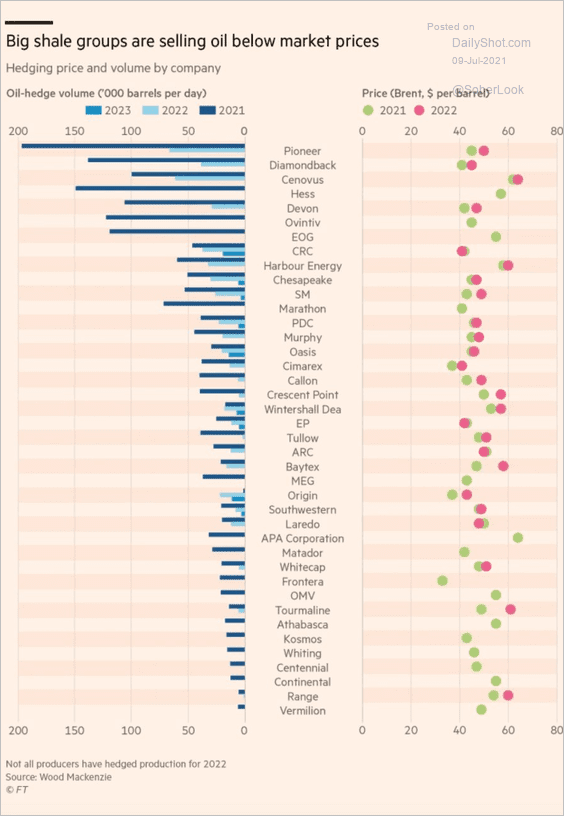

4. Many shale firms hedged their output and are now selling crude oil well below spot prices (hedges offsetting price gains).

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

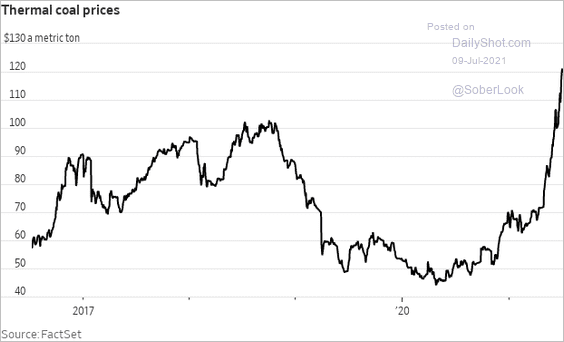

5. Coal prices have been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

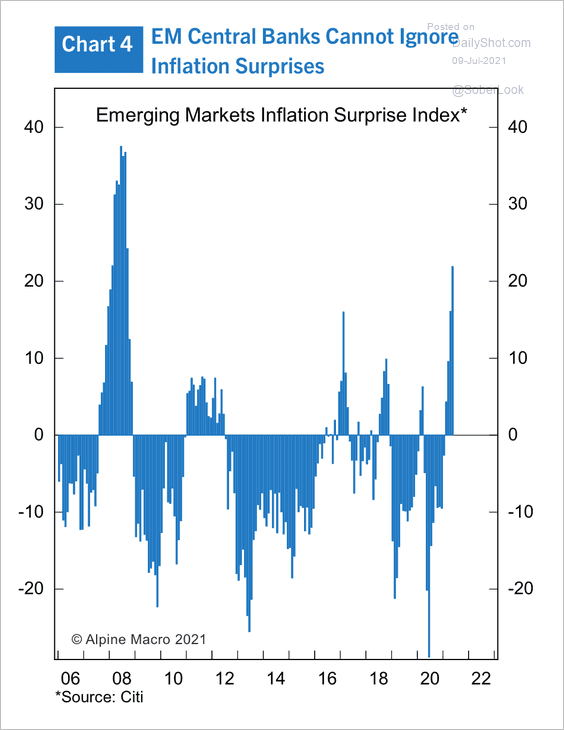

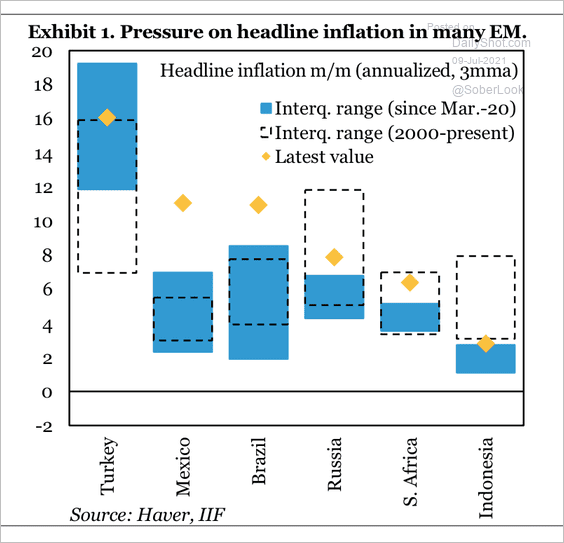

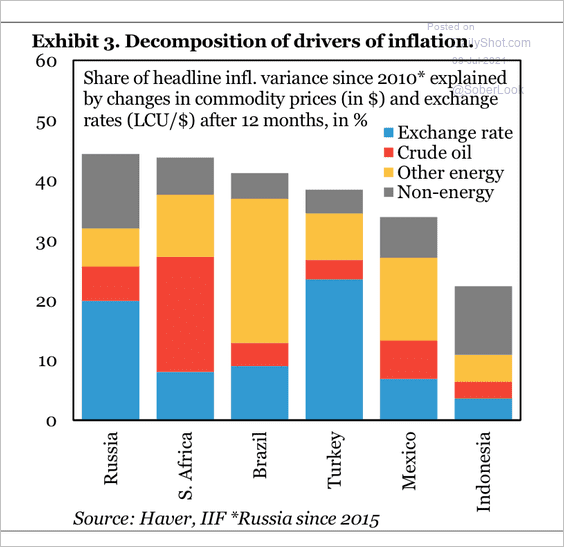

1. Rising inflation has caused many EM central banks to raise rates this year (3 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

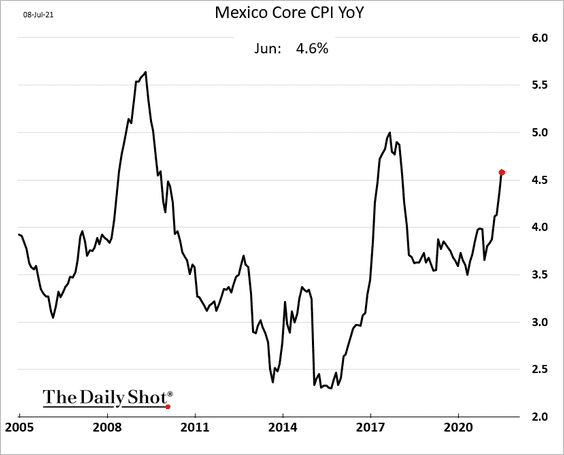

2. Mexican core CPI continues to climb. More rate hikes are on the way.

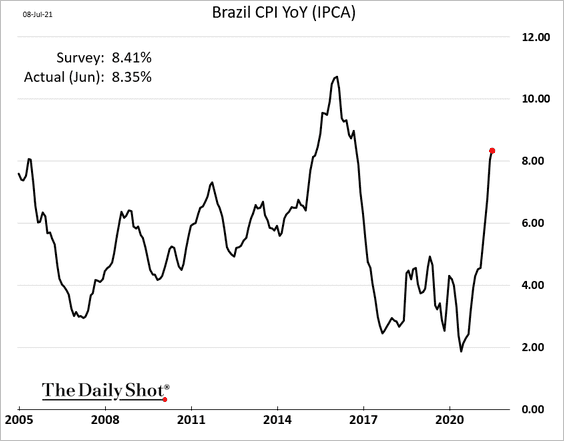

3. Brazil’s inflation is also rising.

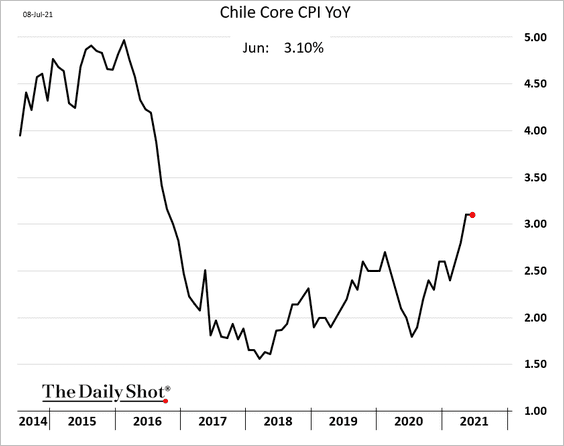

4. Chile’s CPI held steady last month.

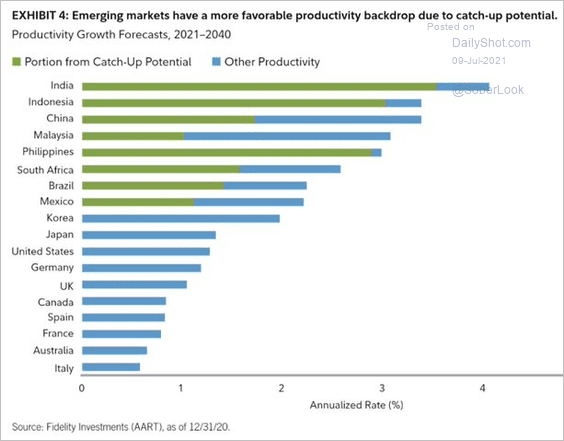

5. EM productivity is set to grow sharply over the next couple of decades.

Source: @Callum_Thomas

Source: @Callum_Thomas

Back to Index

China

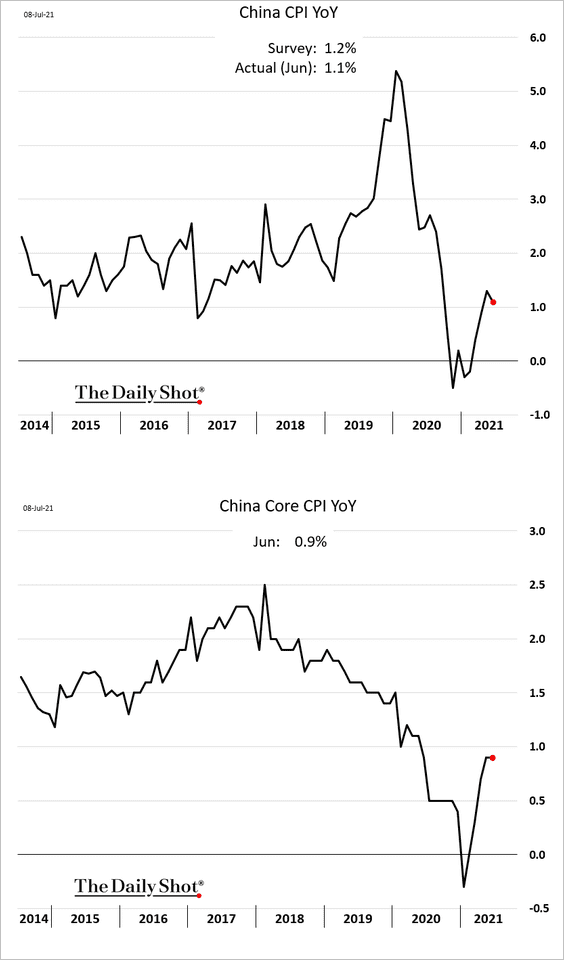

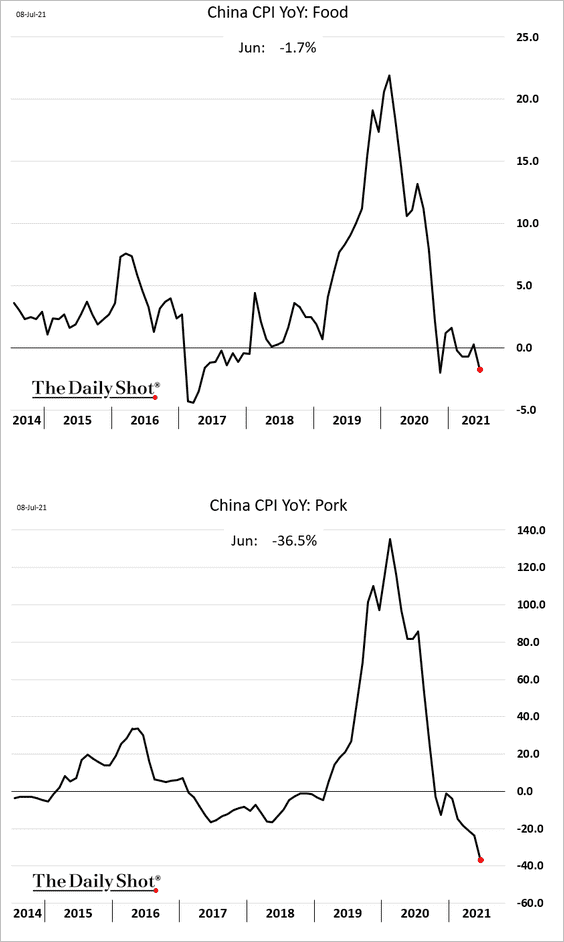

1. The headline CPI ticked lower even as core inflation held steady.

Falling pork prices pushed the headline CPI down.

——————–

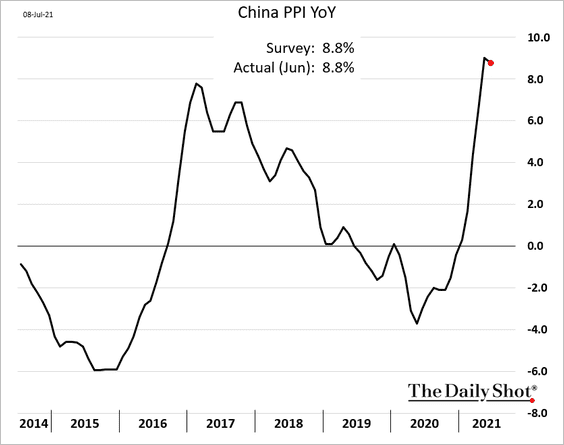

2. The PPI also ticked lower.

3. With consumer inflation under control and business activity moderating, the PBoC is considering some targeted easing. The central bank may cut reserve requirements for some banks.

Source: Reuters Read full article

Source: Reuters Read full article

Source: CNBC Read full article

Source: CNBC Read full article

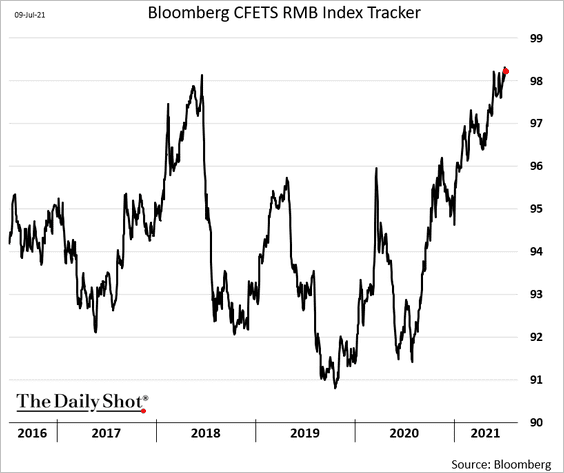

The renminbi’s strength relative to a basket of currencies could also be making the PBoC uneasy.

——————–

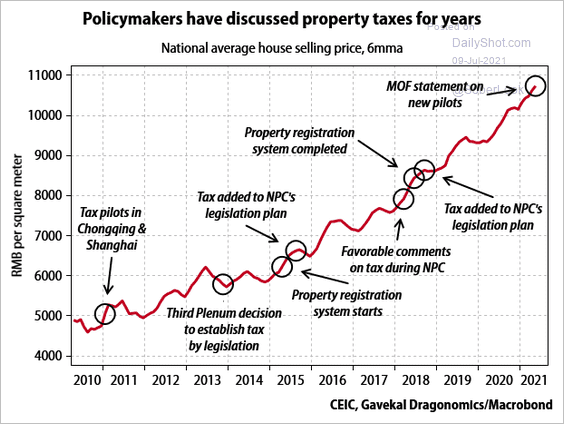

4. Will Beijing impose a property tax?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

The Eurozone

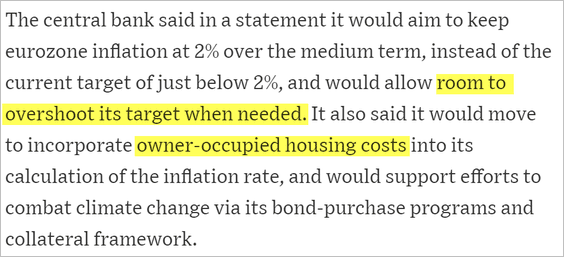

1. The ECB tweaked its policy approach after an extensive review. Here is a summary.

Source: @WSJ Read full article Further reading

Source: @WSJ Read full article Further reading

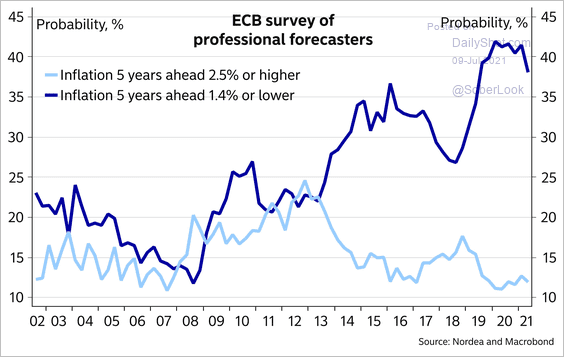

2. Forecasters don’t see inflationary pressures ahead.

Source: @JanVonGerich Read full article

Source: @JanVonGerich Read full article

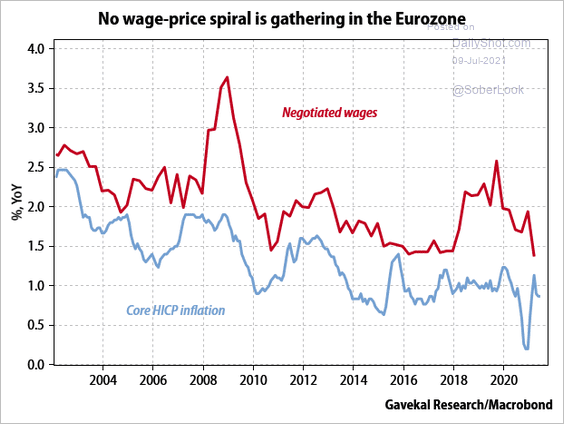

Wage growth has not been a concern.

Source: Gavekal Research

Source: Gavekal Research

——————–

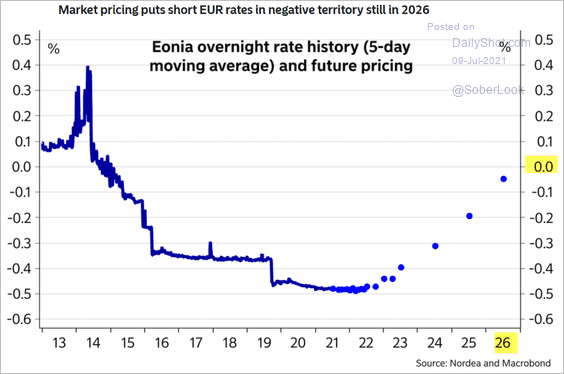

3. Based on market pricing, negative rates will be around for years.

Source: Nordea Markets

Source: Nordea Markets

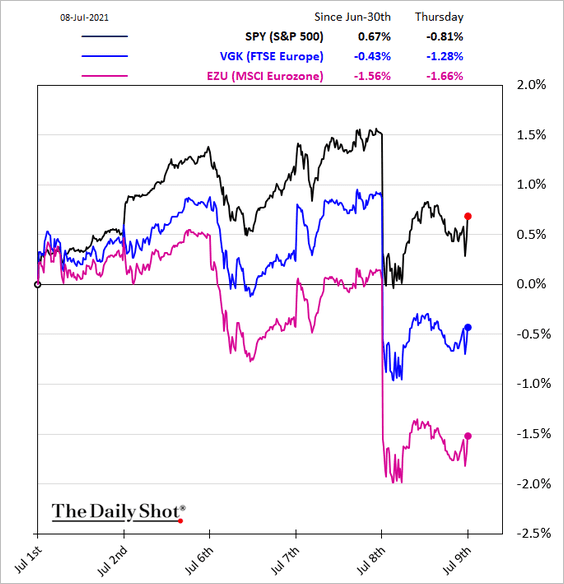

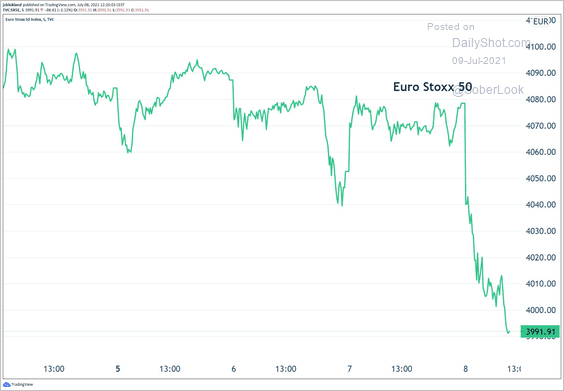

4. Stocks took a hit on Thursday, but the market has stabilized today.

Source: @jsblokland

Source: @jsblokland

——————–

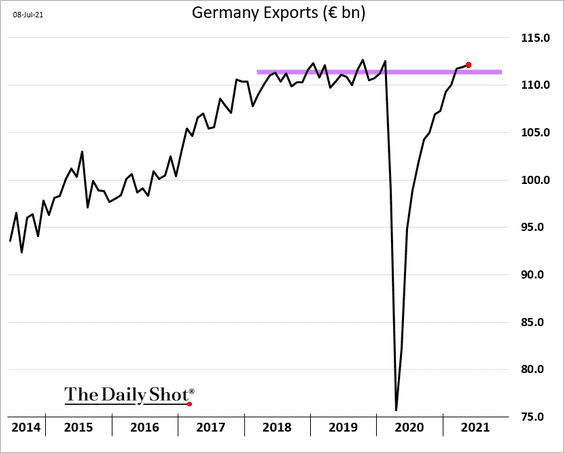

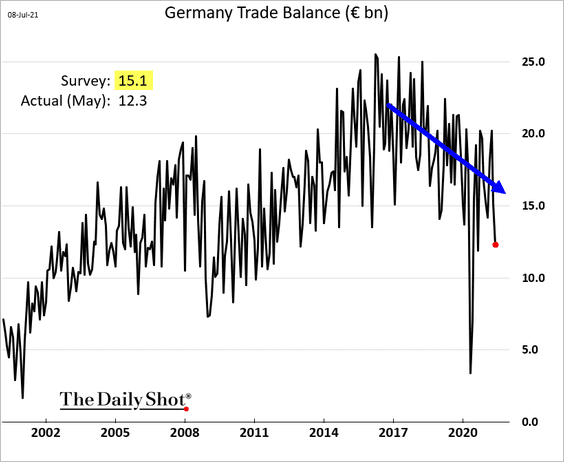

5. German exports have fully recovered.

The trade surplus continues to trend lower.

Back to Index

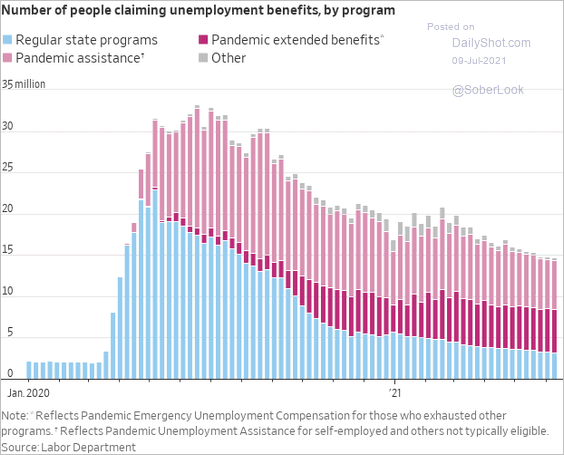

The United States

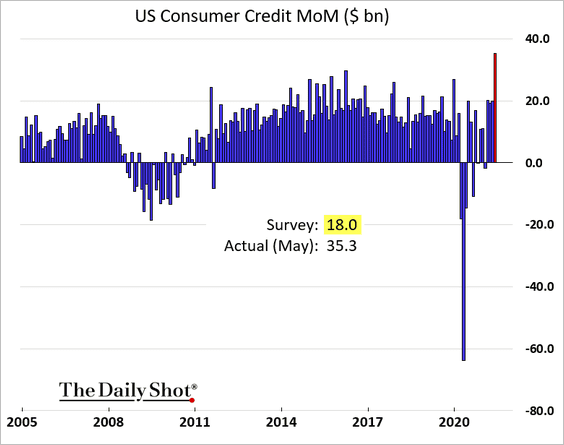

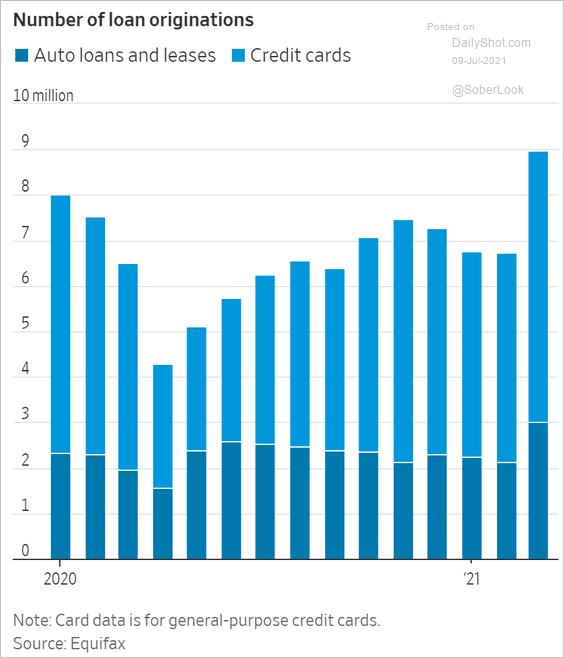

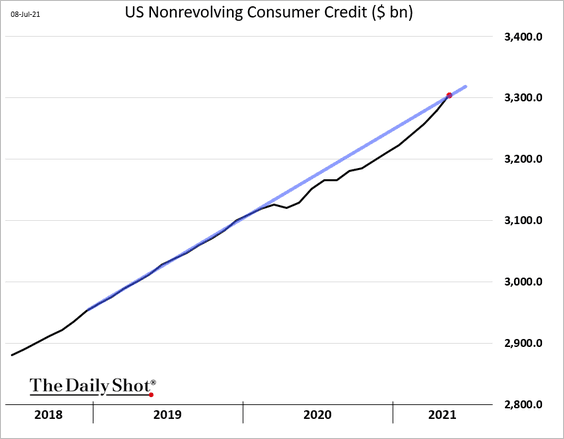

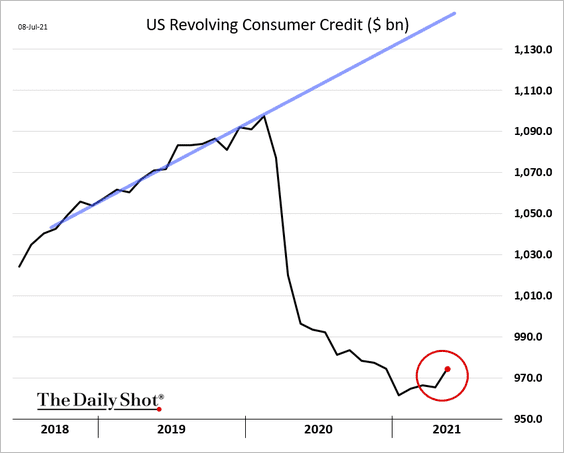

1. The May increase in consumer credit was the highest on record as Americans tapped their credit cards. Auto debt has been growing as well.

Source: @WSJ Read full article

Source: @WSJ Read full article

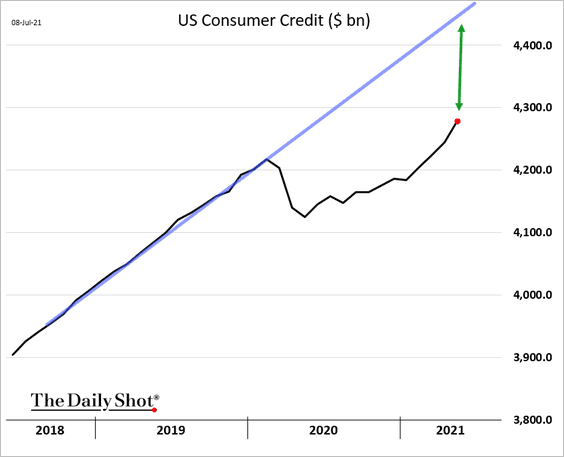

• The overall consumer credit remains well below the pre-COVID trend.

Nonrevolving credit (auto loans and student debt) is back to its pre-pandemic trend.

But credit card debt declined massively last year. The May increase isn’t too dramatic when we look at the total dollar amounts.

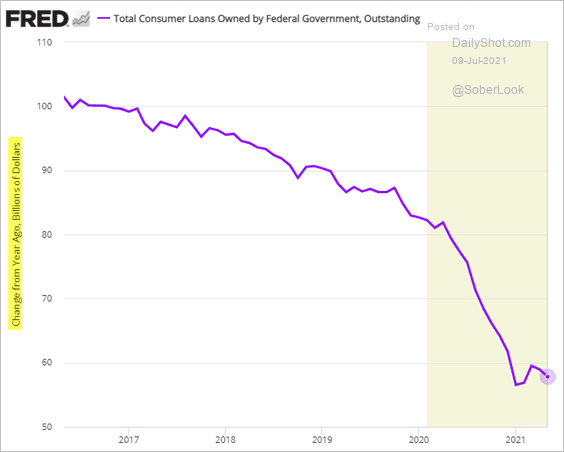

• Growth in student debt remains well below pre-pandemic levels.

——————–

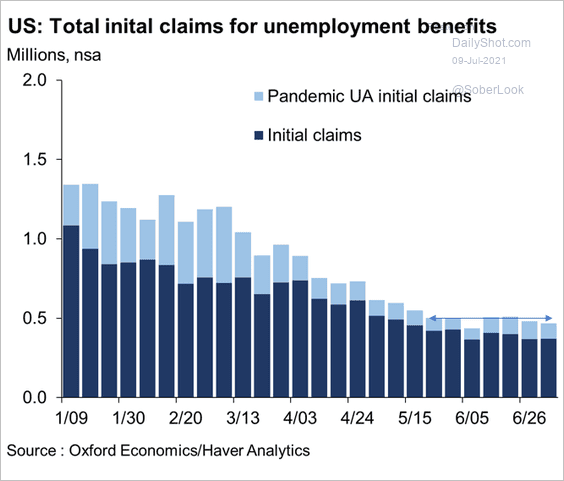

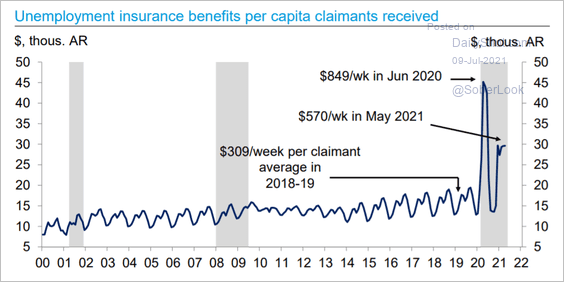

2. Initial jobless claims have leveled off since May.

Source: @GregDaco

Source: @GregDaco

Continuing claims keep trending lower.

Source: @WSJ Read full article

Source: @WSJ Read full article

Unemployment insurance benefits per capita remain elevated, which should support spending.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

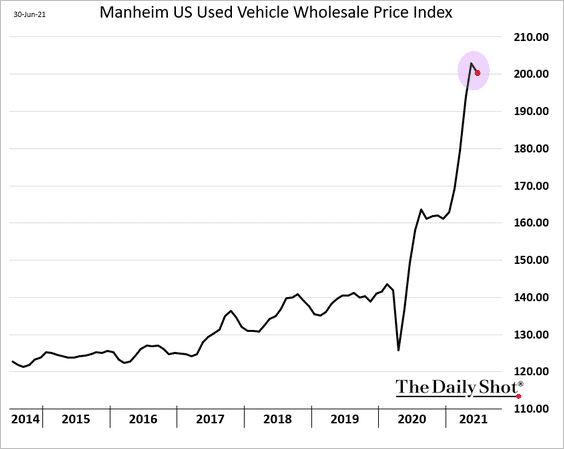

3. Used car prices remain near all-time highs, but the wholesale index appears to have peaked.

Back to Index

Global Developments

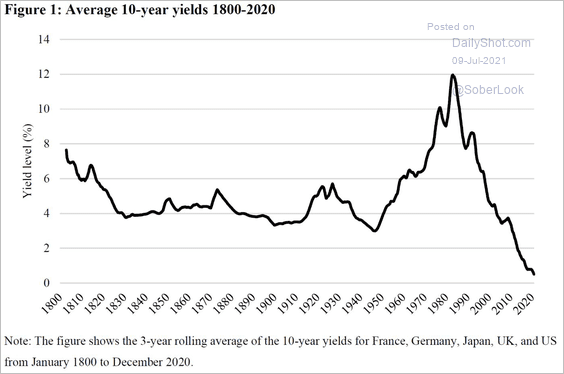

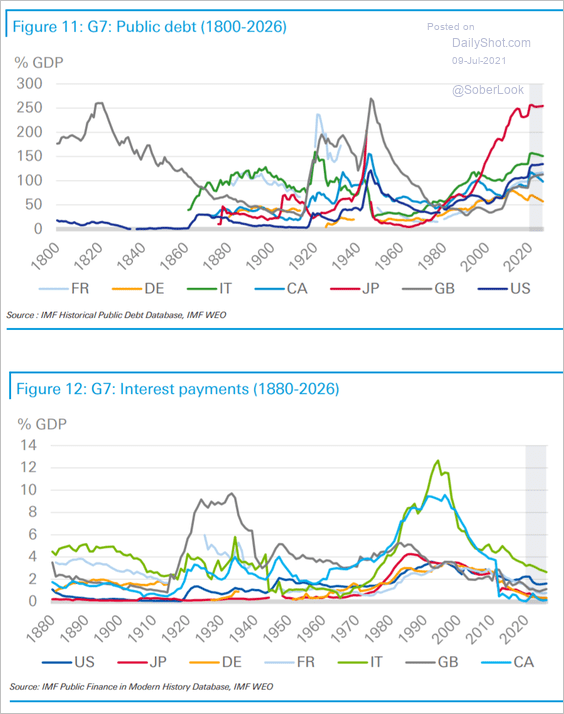

1. Let’s take a look at bond yields and public debt/interest payments going back to 1800.

Source: @jessefelder, @johnauthers Read full article

Source: @jessefelder, @johnauthers Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

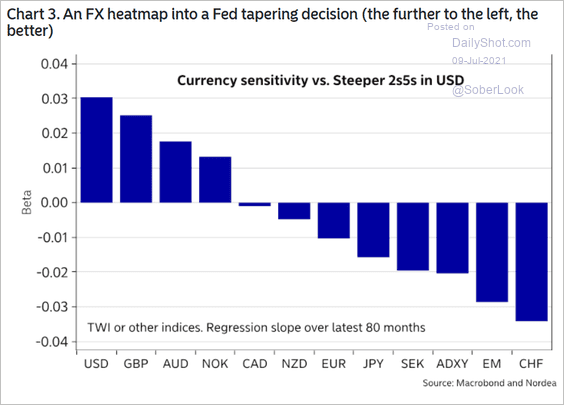

2. How will different currencies respond to a steepening US yield curve?

Source: Nordea Markets

Source: Nordea Markets

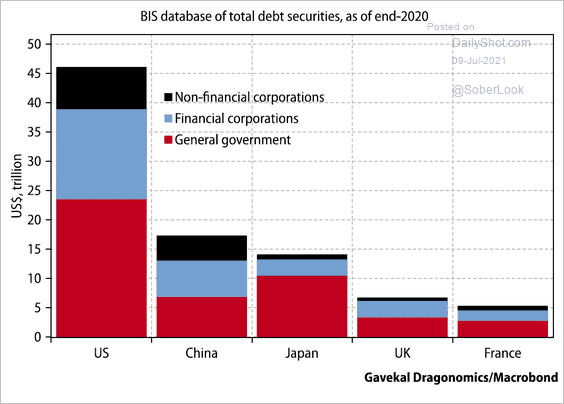

3. Here are the components of some of the largest debt markets.

Source: Gavekal Research

Source: Gavekal Research

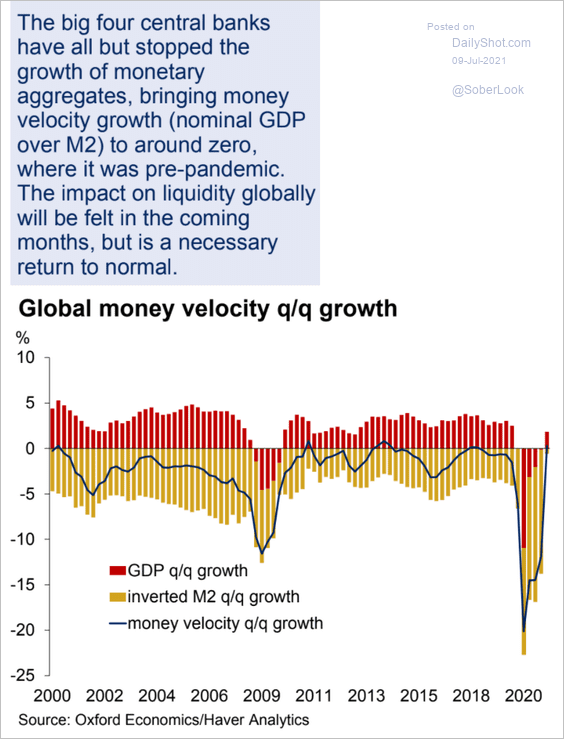

4. Money velocity is rebounding (slower money supply growth, stronger GDP).

Source: Oxford Economics

Source: Oxford Economics

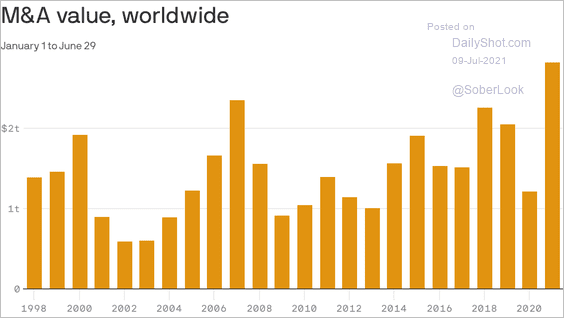

5. M&A activity has been surging.

Source: @axios Read full article

Source: @axios Read full article

——————–

Food for Thought

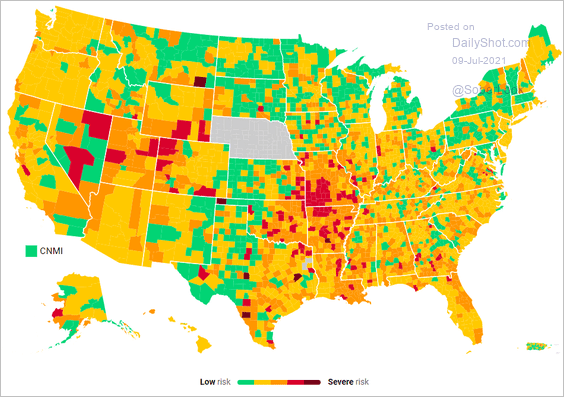

1. COVID risk by county:

Source: The Act Now Coalition

Source: The Act Now Coalition

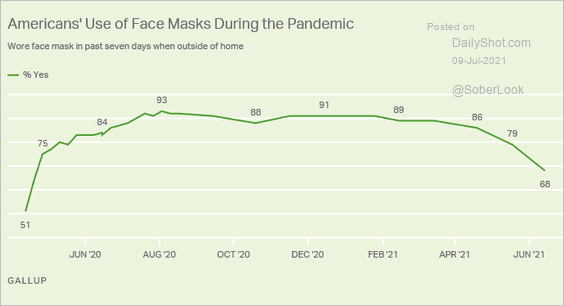

2. Mask usage in the US:

Source: Gallup Read full article

Source: Gallup Read full article

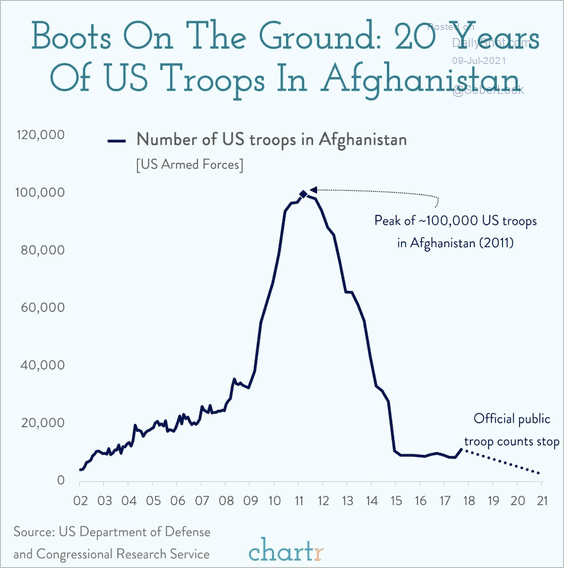

3. US troops in Afghanistan:

Source: @chartrdaily

Source: @chartrdaily

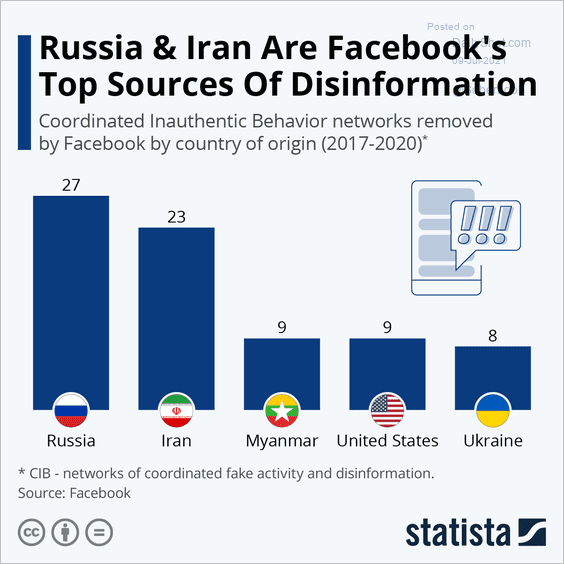

4. Top sources of disinformation on Facebook:

Source: Statista

Source: Statista

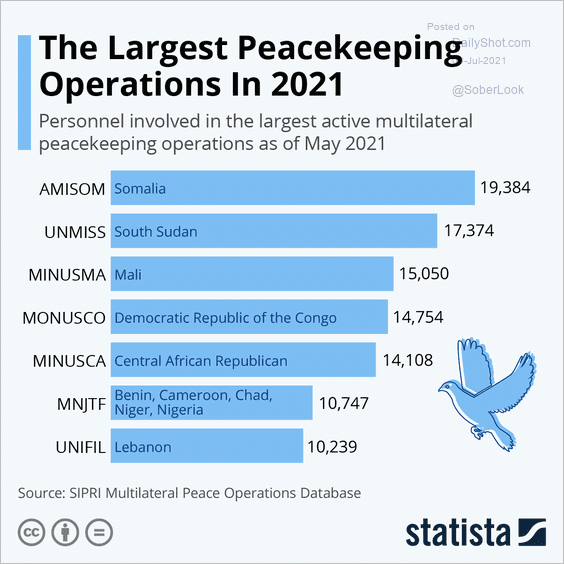

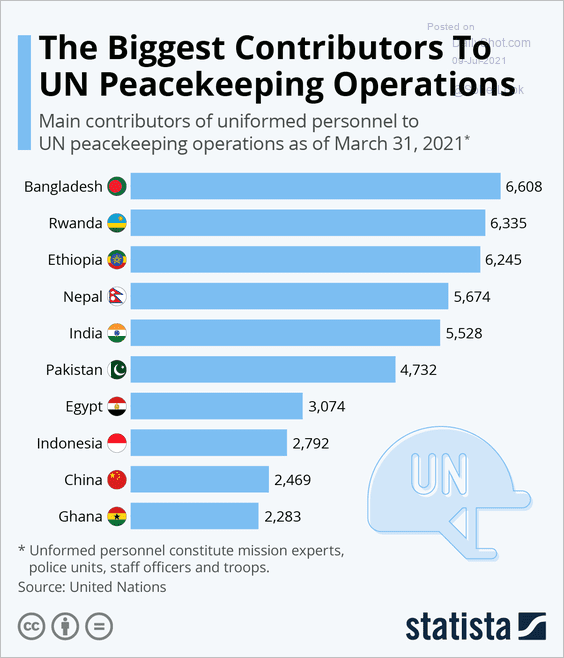

5. Peacekeeping operations (2 charts):

Source: Statista

Source: Statista

Source: Statista

Source: Statista

——————–

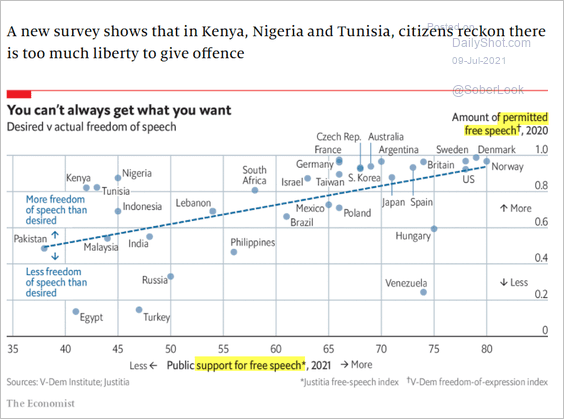

6. Freedom of speech vs. support for free speech:

Source: The Economist Read full article

Source: The Economist Read full article

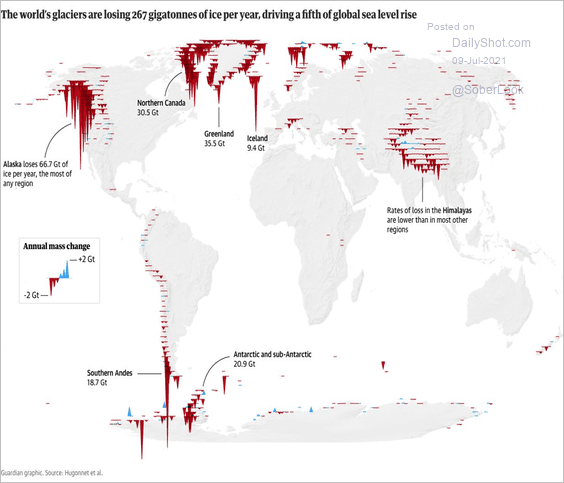

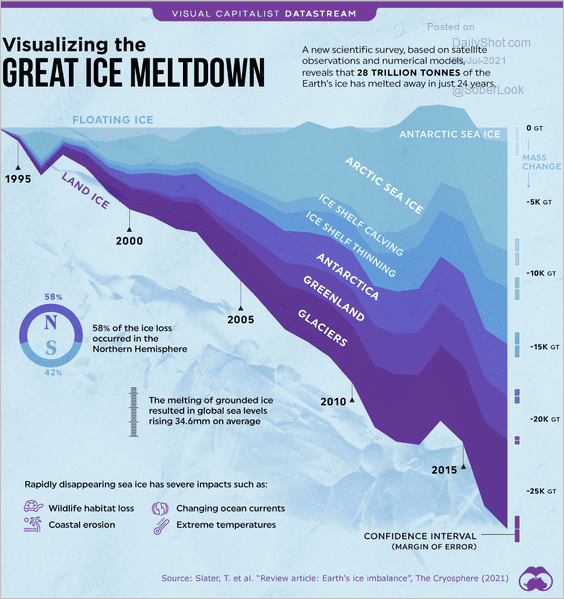

7. Melting glaciers (2 chats):

Source: @niko_tinius Read full article

Source: @niko_tinius Read full article

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

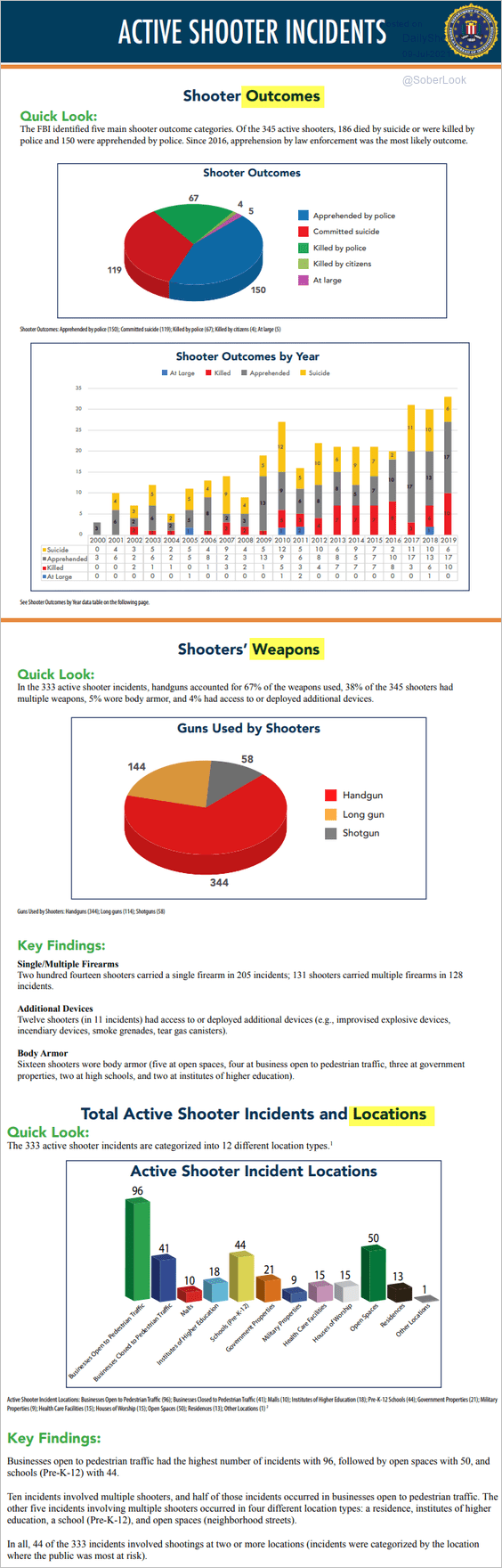

8. Data on US active shooter incidents:

Source: FBI

Source: FBI

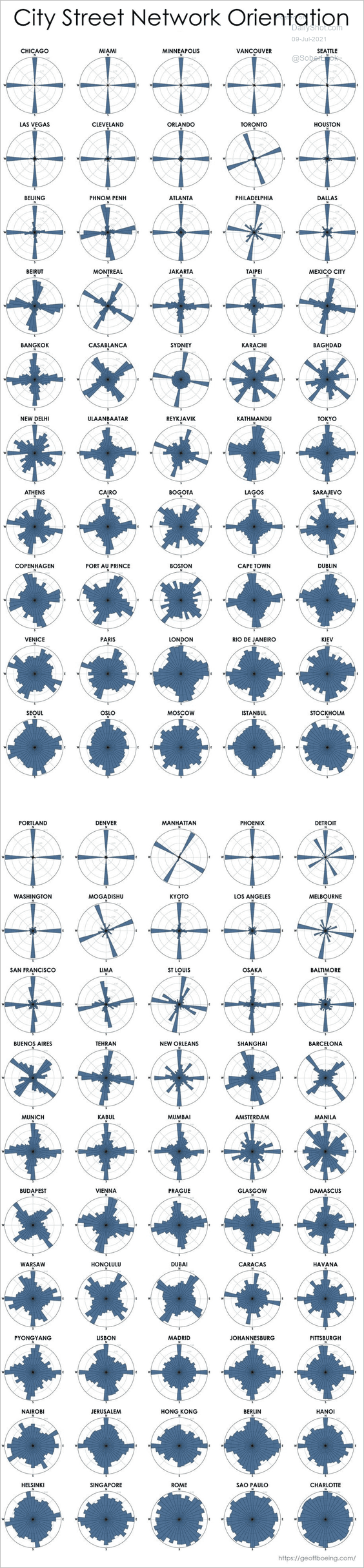

9. City street network orientation:

Source: @emollick Read full article

Source: @emollick Read full article

——————–

Have a great weekend!

Back to Index