The Daily Shot: 12-Jul-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

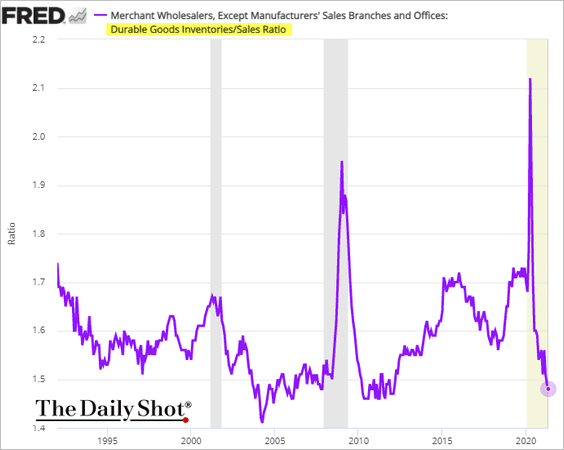

1. The durable goods inventories-to-sales ratio (at the wholesale level) continues to move lower amid supply constraints.

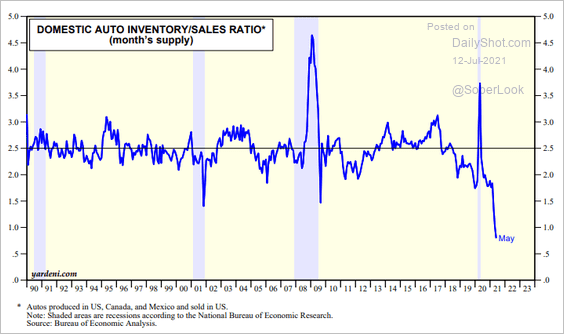

Automobile inventories have been exceptionally tight.

Source: Yardeni Research

Source: Yardeni Research

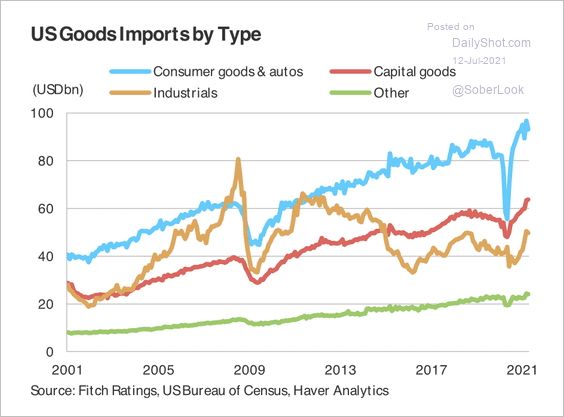

Supply chain pressures are likely a result of higher than expected consumer goods spending relative to pre-pandemic levels, according to Fitch.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

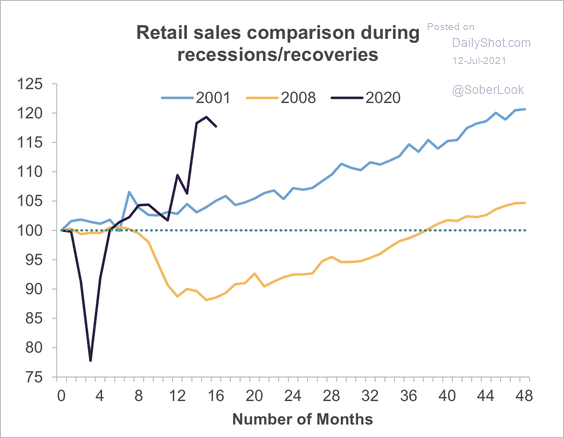

2. The recovery in retail sales has been faster than in previous post-recession environments.

Source: Truist Advisory Services

Source: Truist Advisory Services

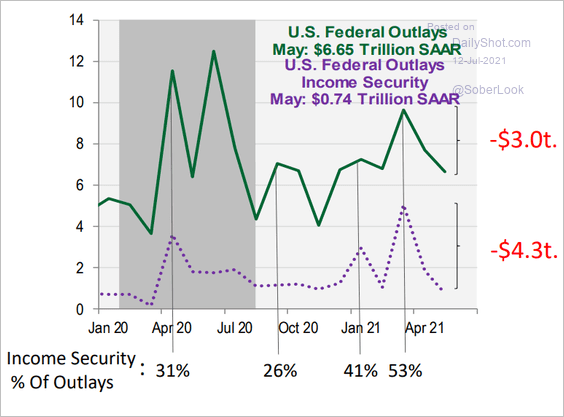

3. The “fiscal cliff” is already here as federal outlays moderate.

Source: Cornerstone Macro

Source: Cornerstone Macro

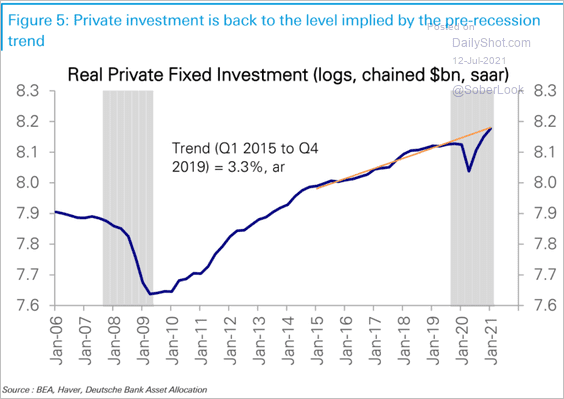

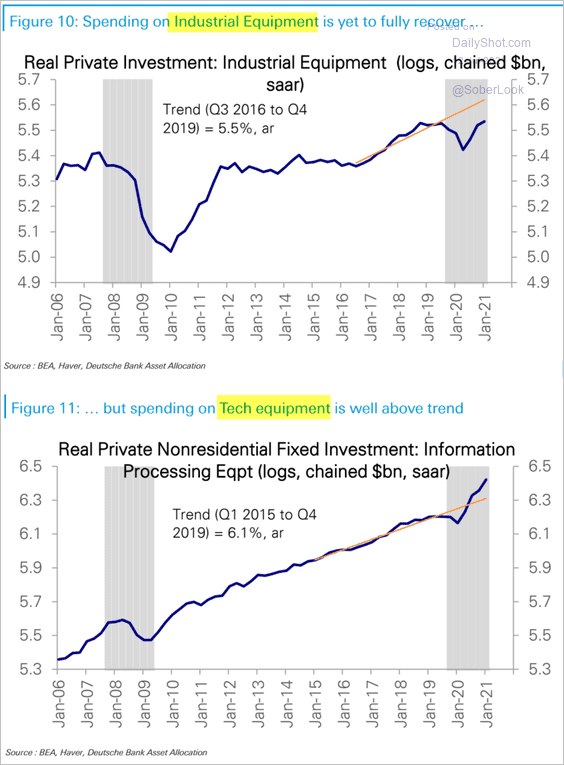

4. Private investment is back to its pre-COVID trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But the recovery has been uneven, with industrial equipment lagging.

Source: Deutsche Bank Research Read full article

Source: Deutsche Bank Research Read full article

——————–

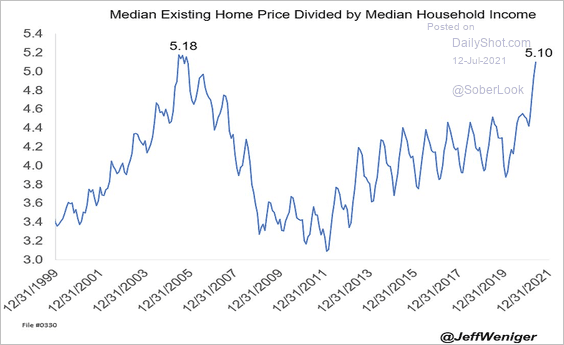

5. The ratio of home prices to household income is nearing the housing bubble peak.

Source: @JeffWeniger

Source: @JeffWeniger

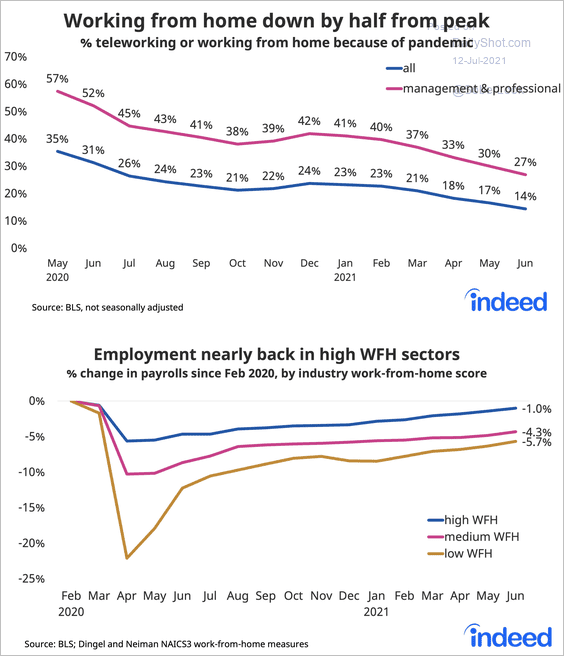

6. The percentage of Americans working from home is down by half since the 2020 peak. Employment in sectors with high work-from-home ratios has almost fully recovered.

Source: @JedKolko

Source: @JedKolko

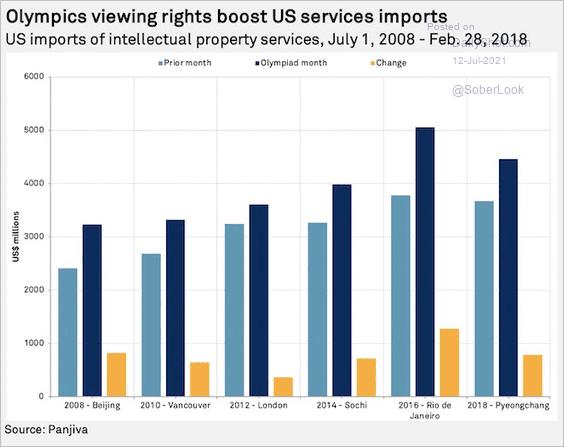

7. Olympics viewing rights significantly raise US service imports.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

8. Next, we have some updates on inflation.

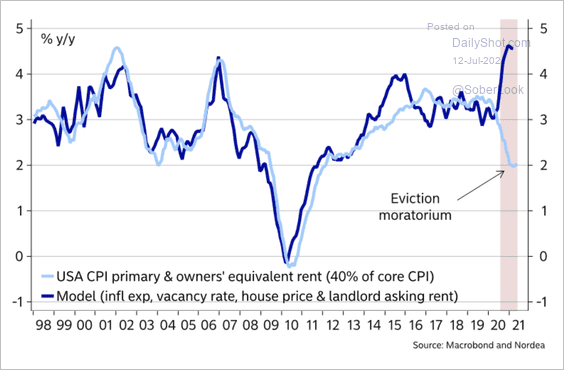

• Will we see a sharp rise in rent inflation once the eviction moratorium ends?

Source: Nordea Markets

Source: Nordea Markets

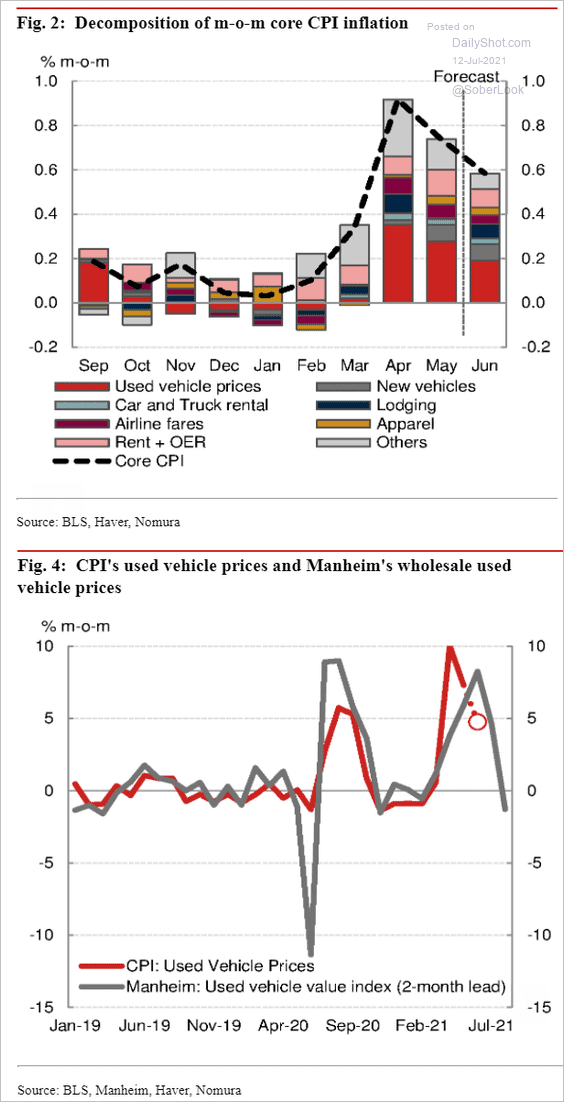

• Nomura expects slower month-over-month core CPI gain in June as used vehicle prices peak.

Source: Nomura Securities

Source: Nomura Securities

Back to Index

Canada

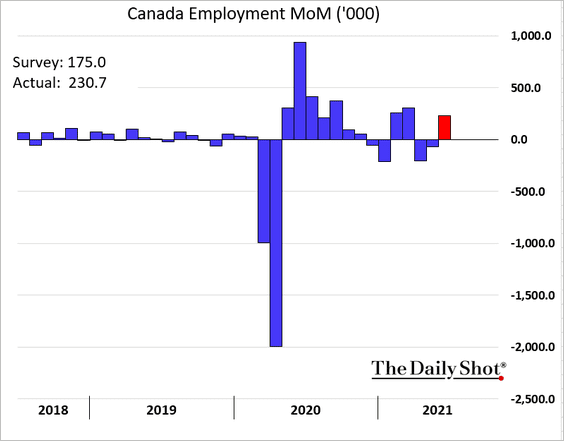

1. The June employment report surprised to the upside.

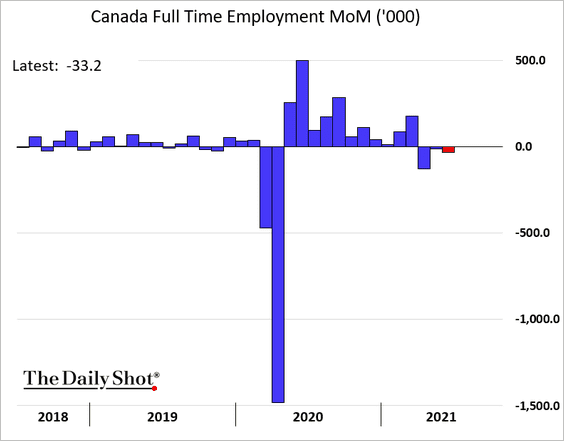

However, full-time employment declined.

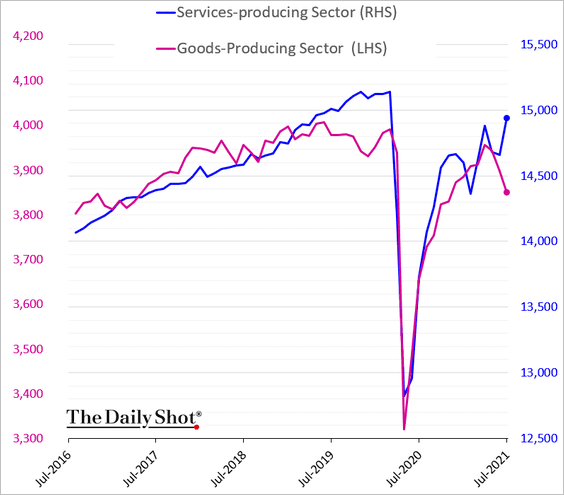

• Recent employment gains have been dominated by services.

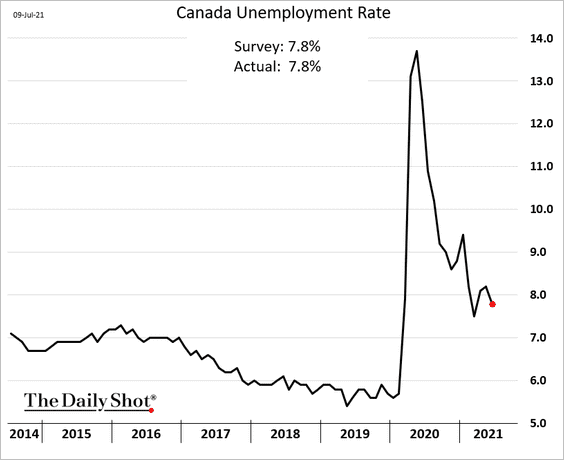

• The unemployment rate was in line with forecasts.

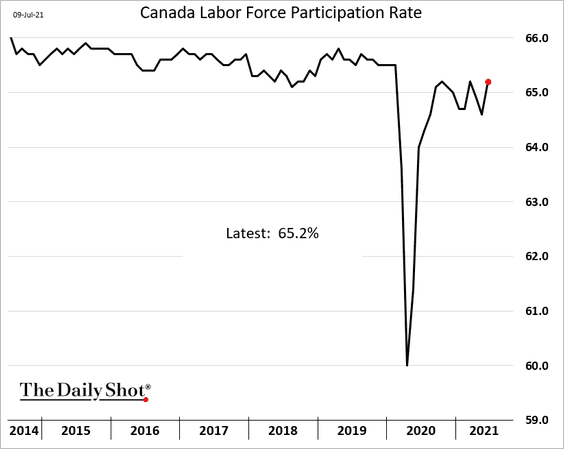

• Labor force participation ticked higher in June.

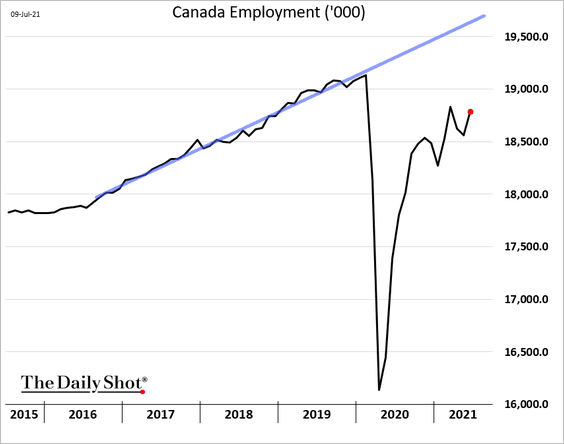

• It will be a while before employment returns to its pre-COVID trend.

——————–

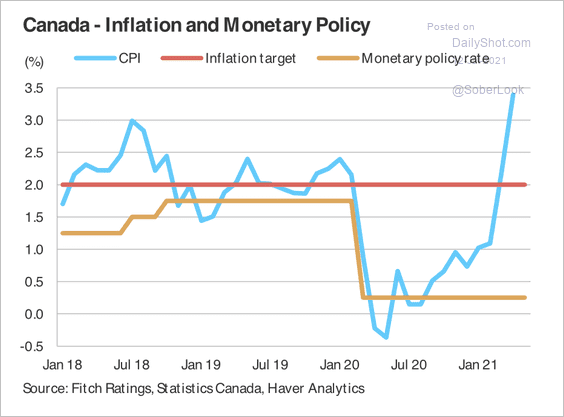

2. Fitch expects the Bank of Canada to raise rates during the second half of this year, driven by above-target inflation and a buoyant housing market.

Source: Fitch Ratings

Source: Fitch Ratings

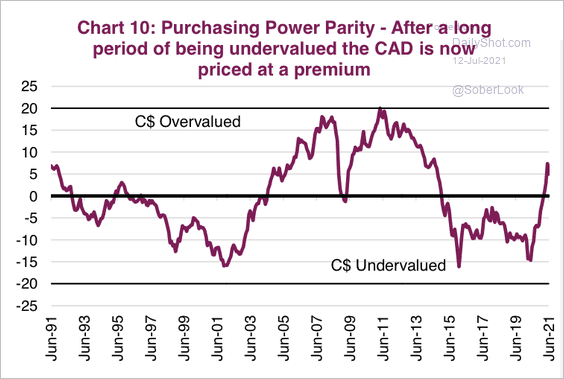

3. The Canadian dollar is priced at a premium but is not yet overvalued, according to Richardson GMP.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

Back to Index

The United Kingdom

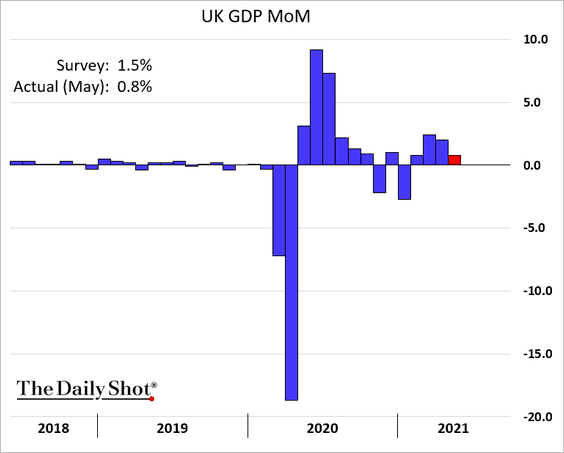

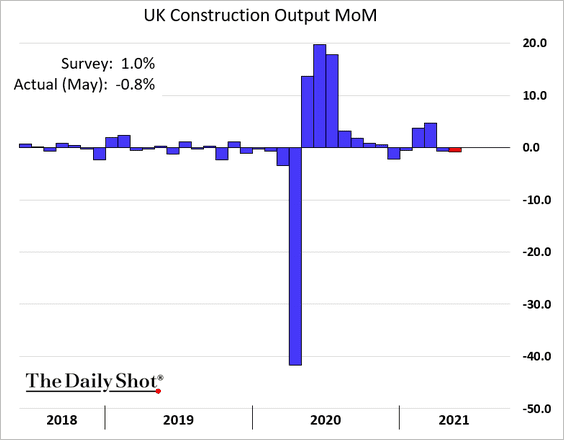

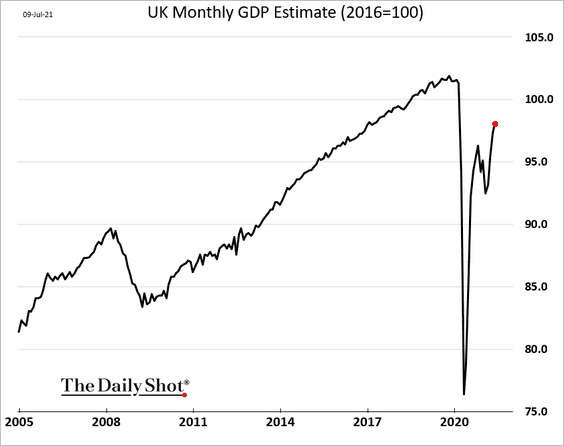

1. The May GDP estimate surprised to the downside.

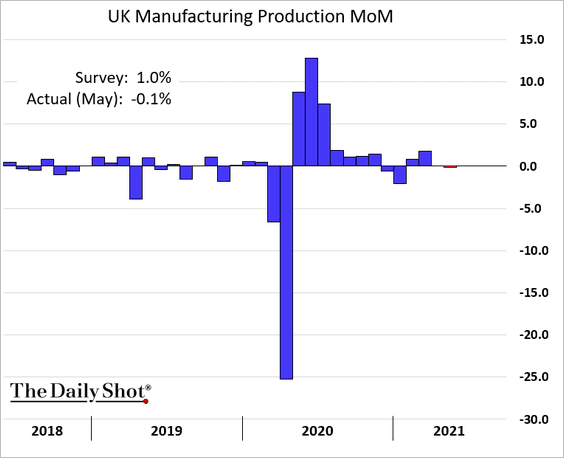

• Manufacturing and construction output unexpectedly declined.

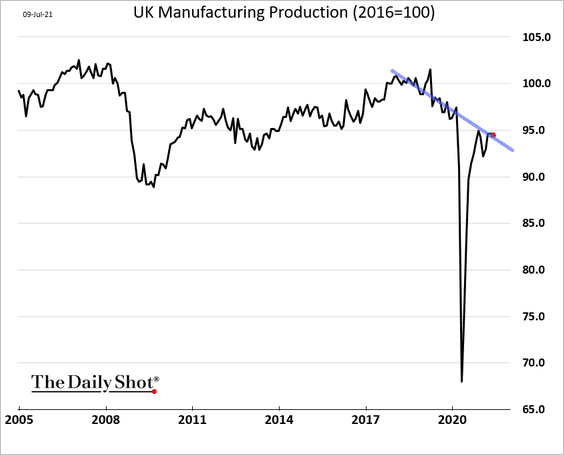

• Factory output remains on its downward trend.

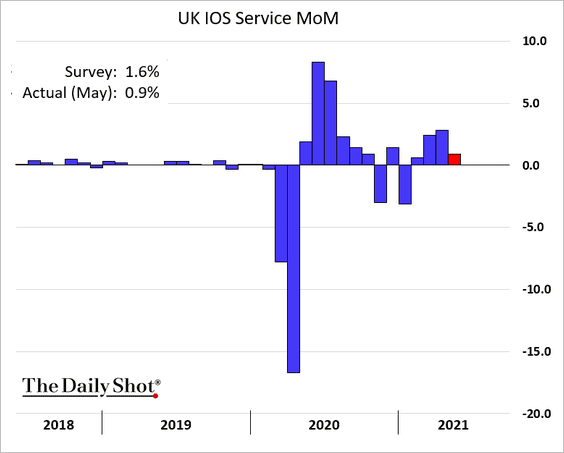

• Service-sector expansion was below estimates.

• Here is the monthly GDP index.

——————–

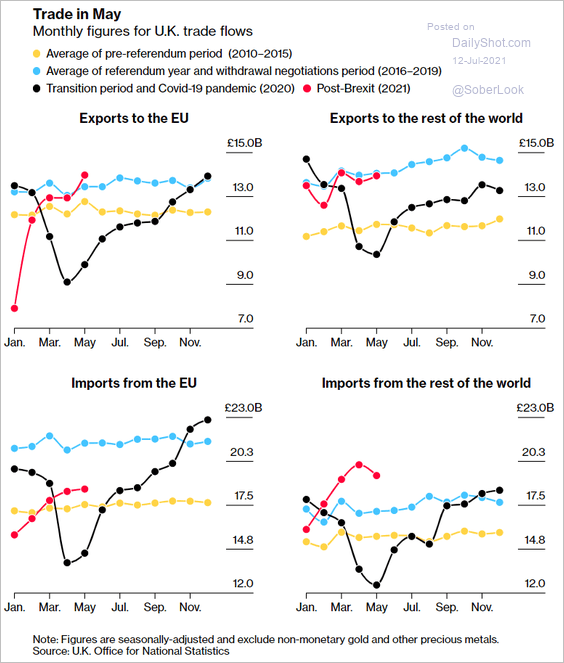

2. Trade with the EU continues to improve.

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

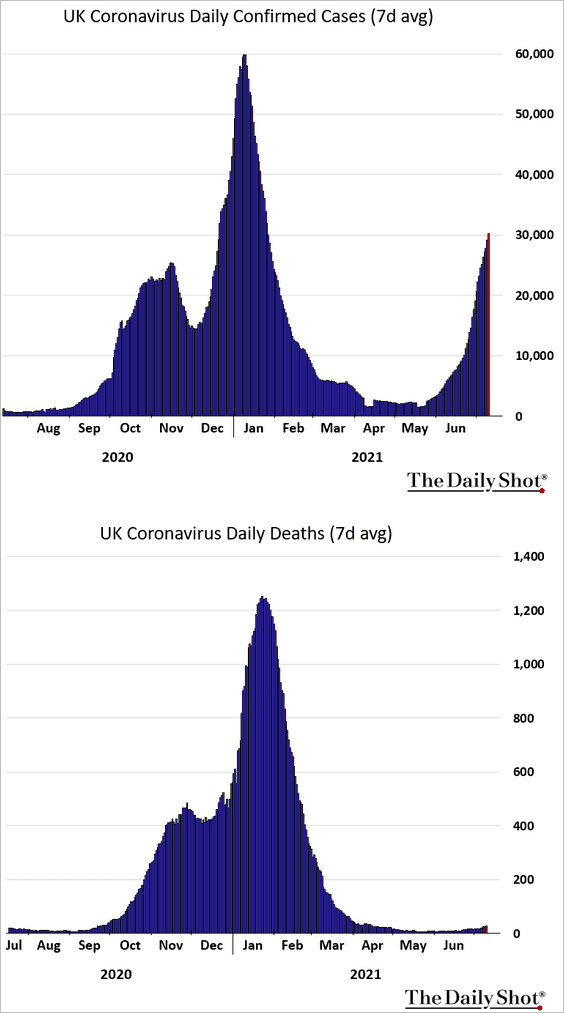

3. The number of COVID-related deaths remains low even as new cases spike.

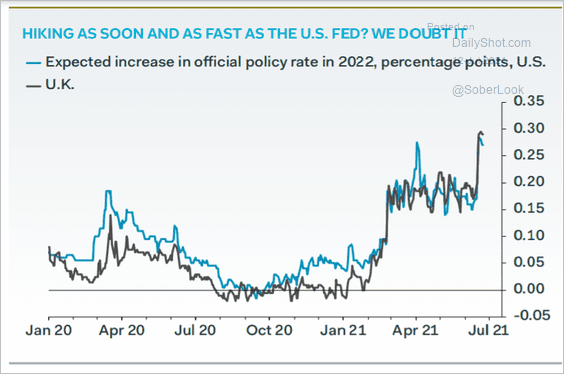

4. The market expects the BoE to hike in line with the Fed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

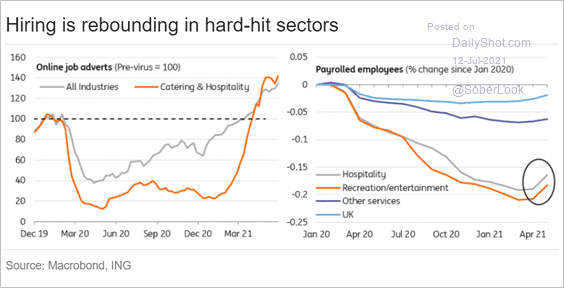

5. Hiring in hard-hit sectors is rebounding.

Source: ING

Source: ING

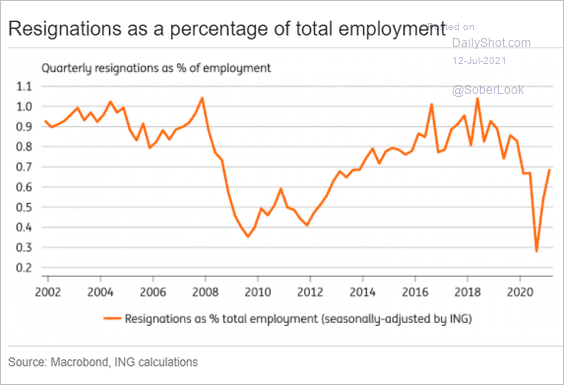

• Voluntary resignations are up.

Source: ING

Source: ING

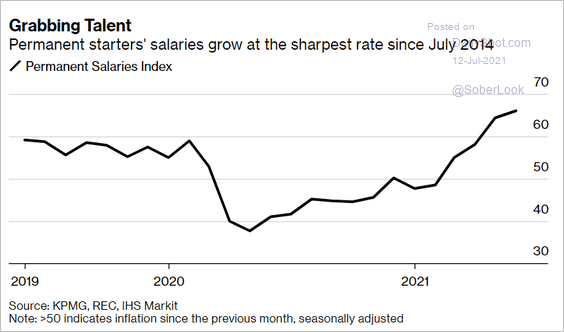

• Salaries of newly-hired workers have been on the rise.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

The Eurozone

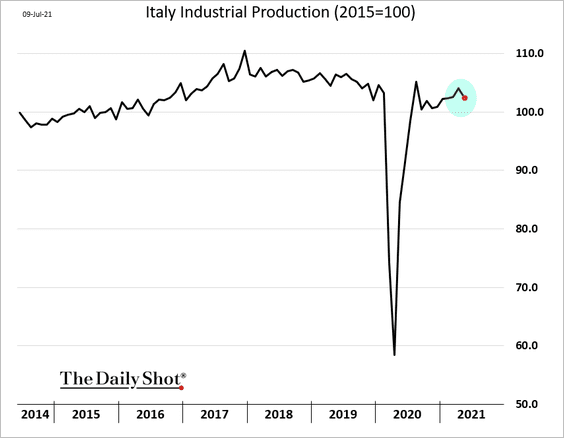

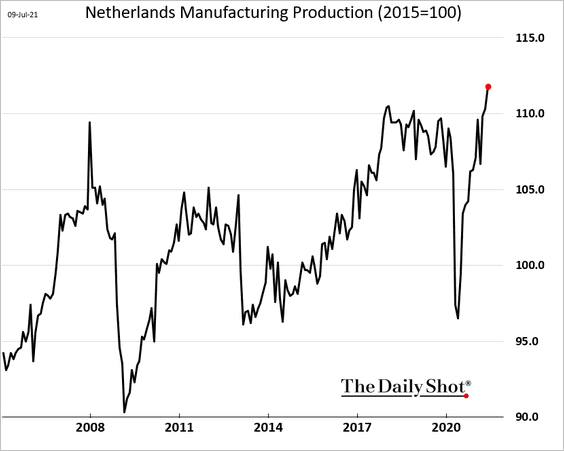

1. Italian industrial production unexpectedly declined in May.

But Dutch factory output is surging.

——————–

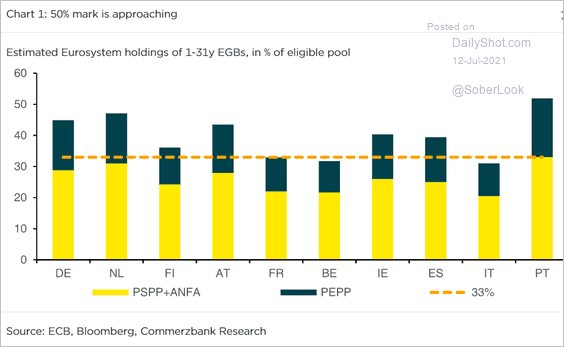

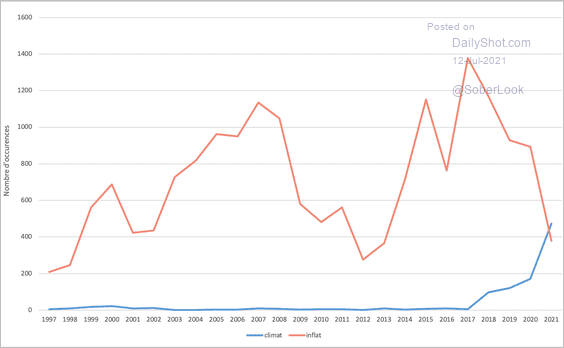

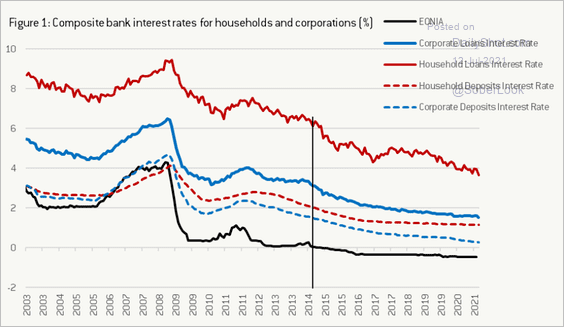

2. Next, we have some updates on monetary policy.

• The ECB’s bond holdings as a percentage of eligible pool:

Source: Commerzbank Research

Source: Commerzbank Research

• The ECB’s mentions of climate vs. inflation.

Source: @adam_tooze, @deyris_j

Source: @adam_tooze, @deyris_j

• Policy transmission took a few years:

Source: Bruegel Read full article

Source: Bruegel Read full article

——————–

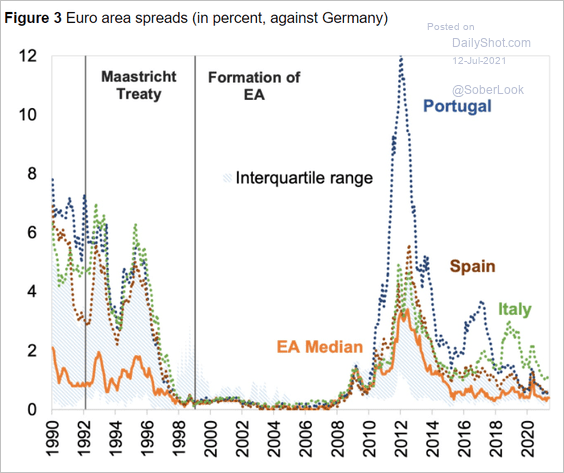

3. Here is a long-term chart of bond spreads in select economies.

Source: VOX EU Read full article

Source: VOX EU Read full article

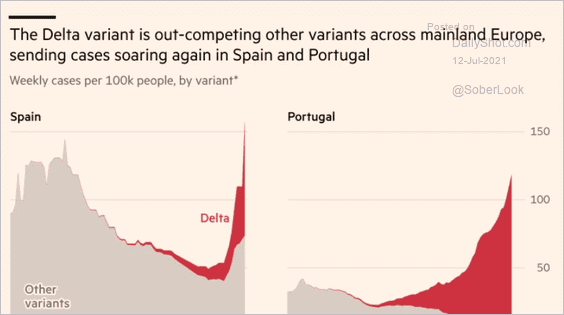

4. The Delta variant now dominates new cases across Europe.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

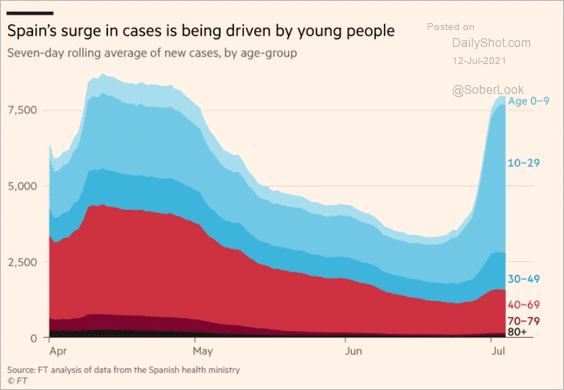

The spike in new cases in Spain is driven by young people.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

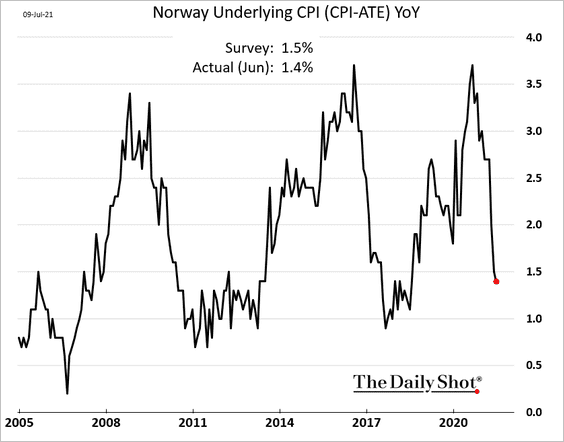

1. Norway’s inflation continues to moderate.

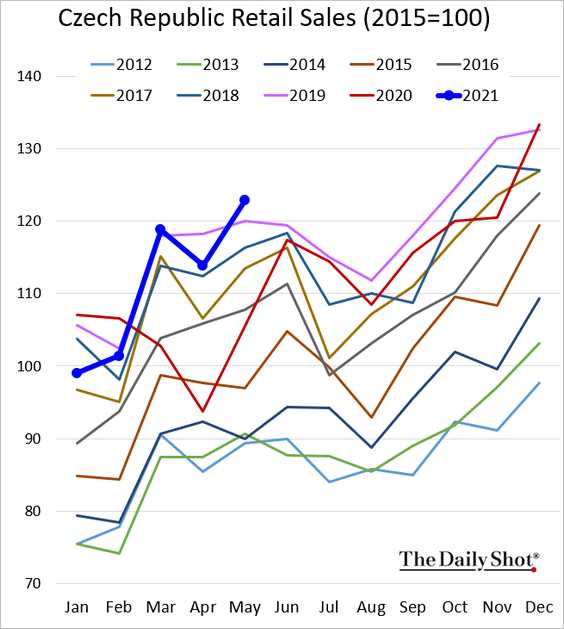

2. Czech retail sales are now well above pre-COVID levels.

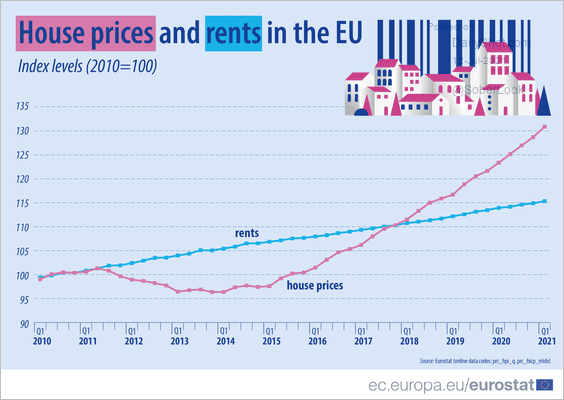

3. Home prices have been outpacing rents across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

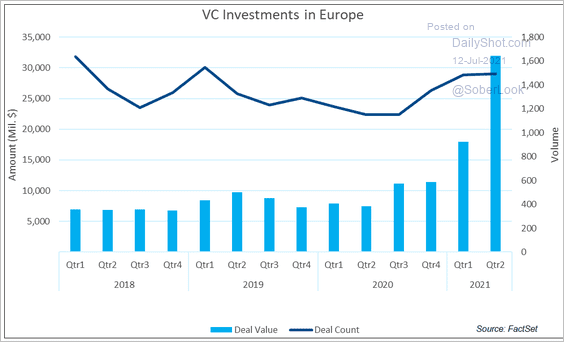

4. VC investments in Europe have surged.

Source: @FactSet

Source: @FactSet

Back to Index

Asia – Pacific

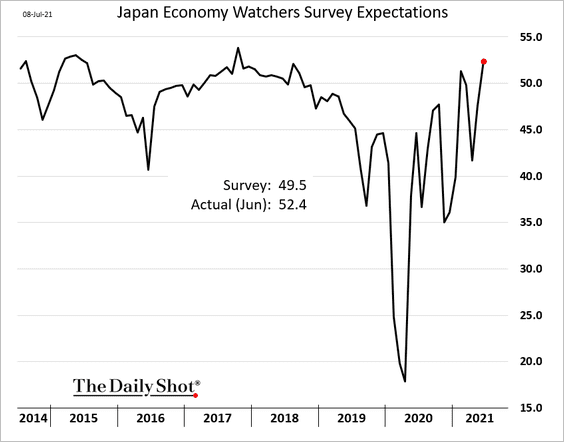

1. Japan’s Economy Watchers Expectations index hit the highest level since 2017, topping forecasts.

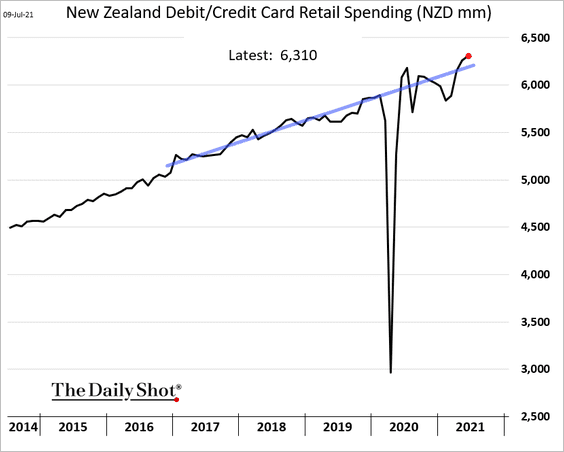

2. New Zealand’s retail card spending is now above its pre-COVID trend.

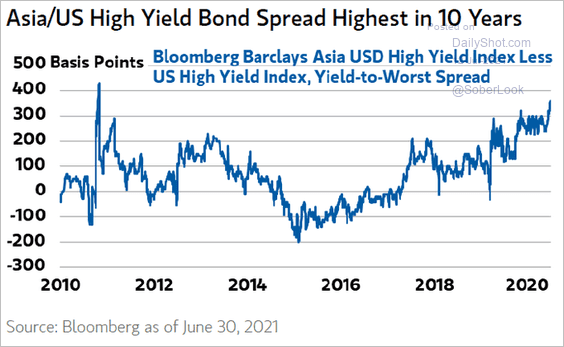

3. Asian USD-denominated high-yield bonds have been underperforming their US counterparts.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

Back to Index

China

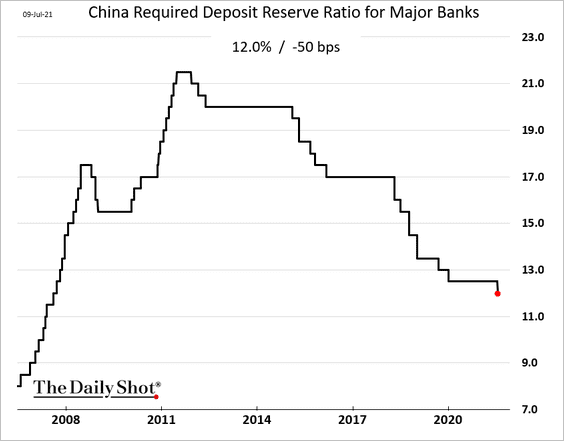

1. The PBoC cut the reserve requirement rate.

Source: Reuters Read full article

Source: Reuters Read full article

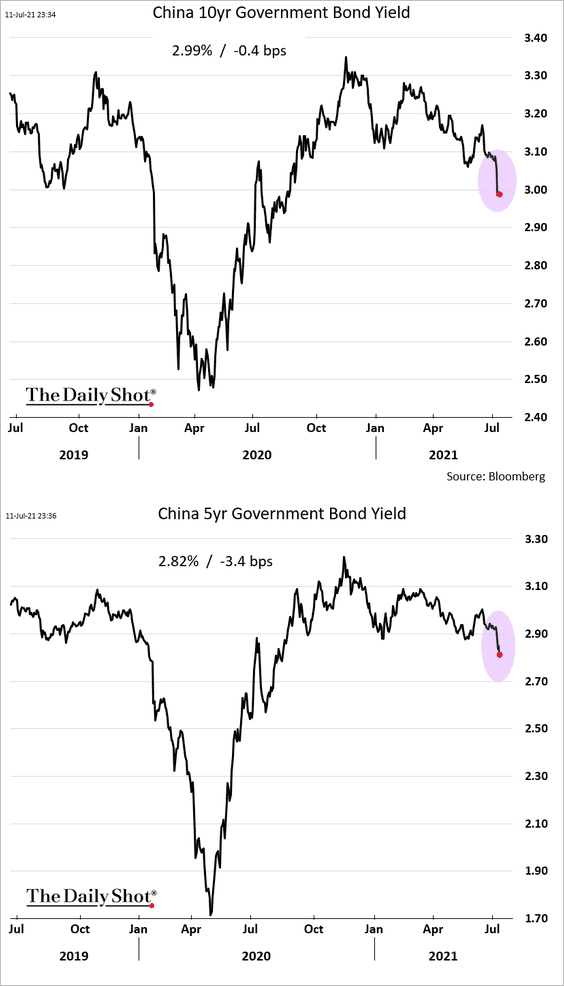

• Bond yields declined.

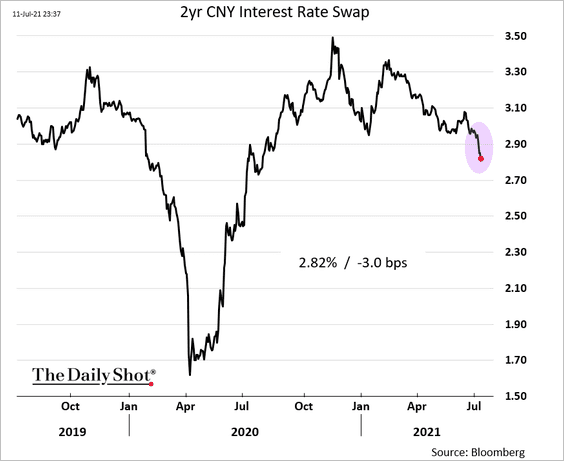

Short-term rates were lower as well.

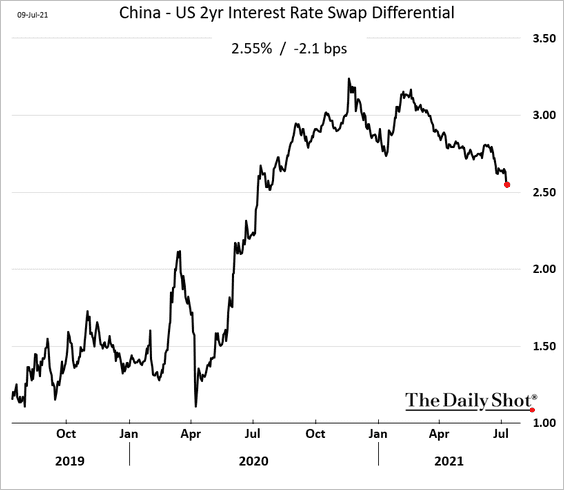

The two-year rate swap differential with the US is moving lower.

——————–

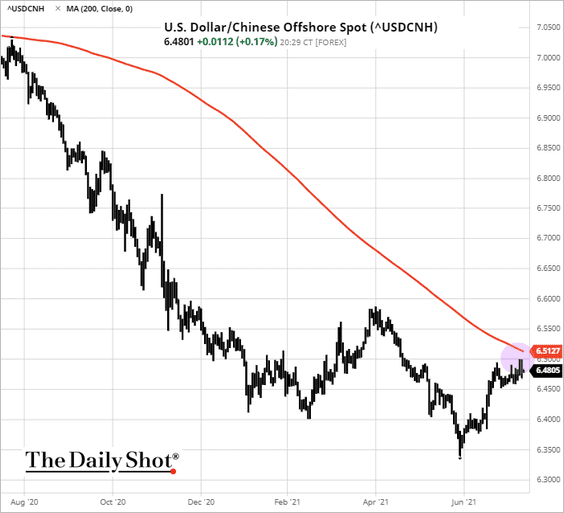

2. USD/CNH (US dollar – offshore yuan) may test resistance at the 200-day moving average (weaker yuan, stronger US dollar).

Source: barchart.com, h/t Tian Chen

Source: barchart.com, h/t Tian Chen

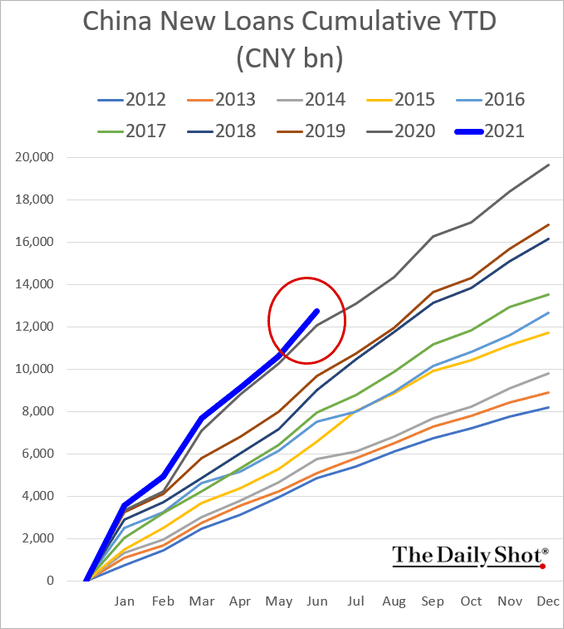

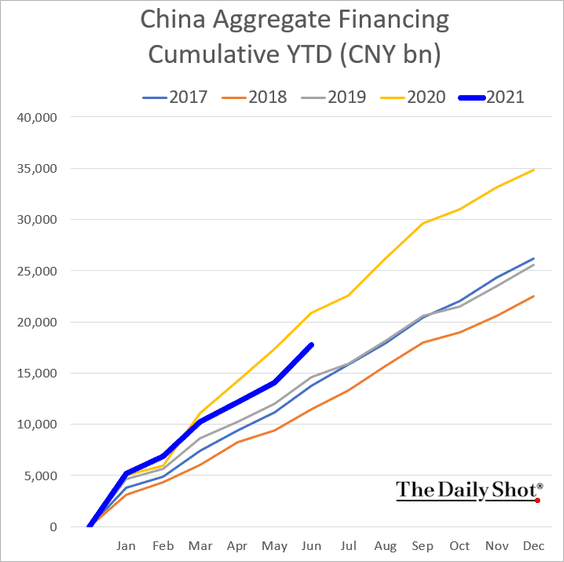

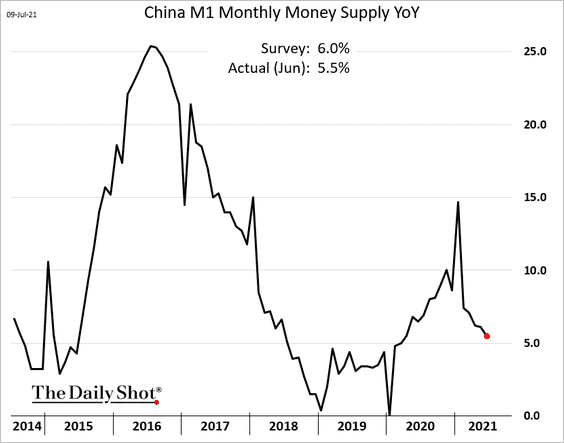

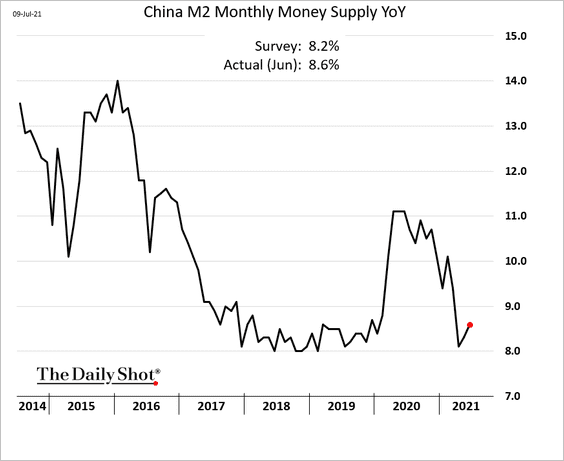

3. Last month’s loan growth exceeded forecasts.

Money supply indicators were mixed.

——————–

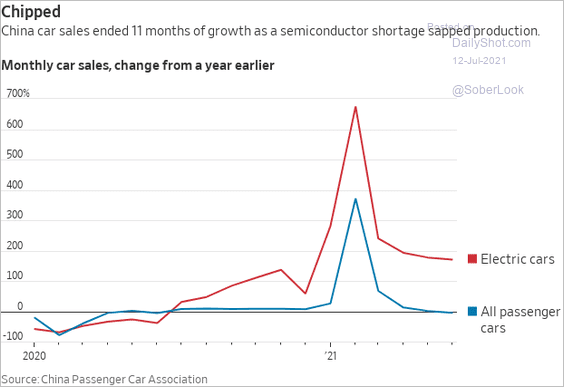

4. Growth in car sales is back in negative territory.

Source: @WSJ Read full article

Source: @WSJ Read full article

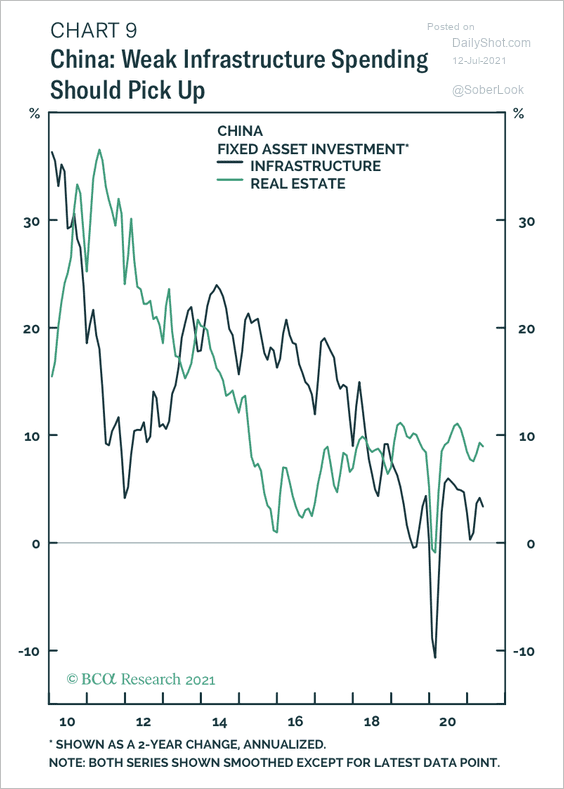

5. Proceeds from local government bond issuance should benefit infrastructure spending, according to BCA Research.

Source: BCA Research

Source: BCA Research

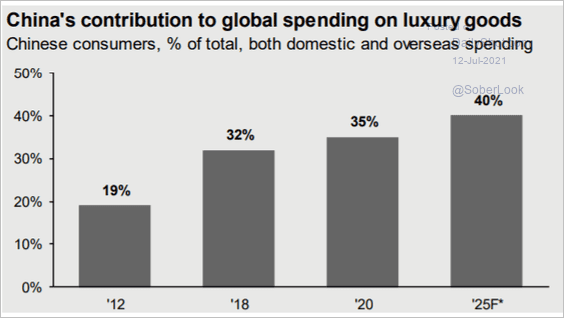

6. China increasingly dominates global spending on luxury goods.

Source: @JPMorganAM

Source: @JPMorganAM

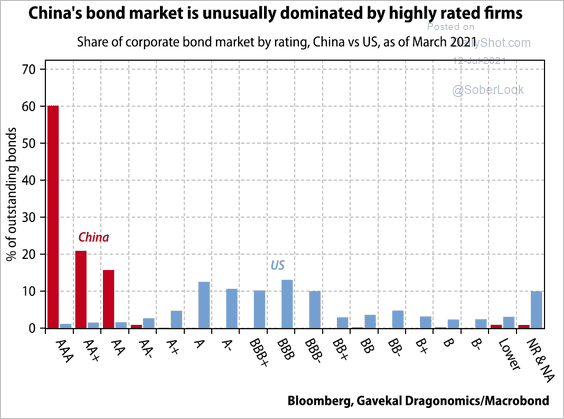

7. Here is the distribution of China’s bond market by rating.

Source: Gavekal Research

Source: Gavekal Research

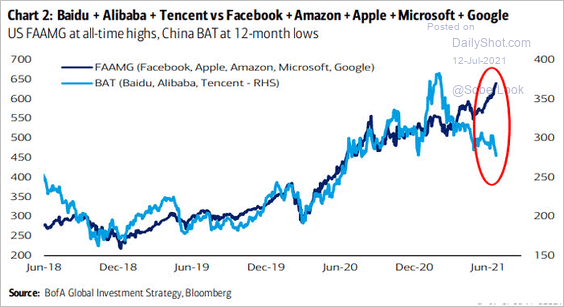

8. China’s mega-caps have been underperforming US peers as Beijing cracks down on the tech industry.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

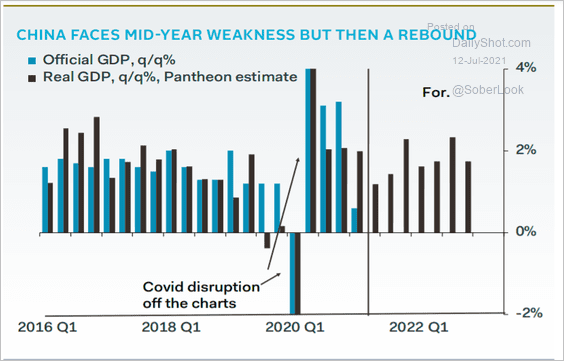

9. Pantheon Macroeconomics expects China’s GDP growth to rebound in Q4.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

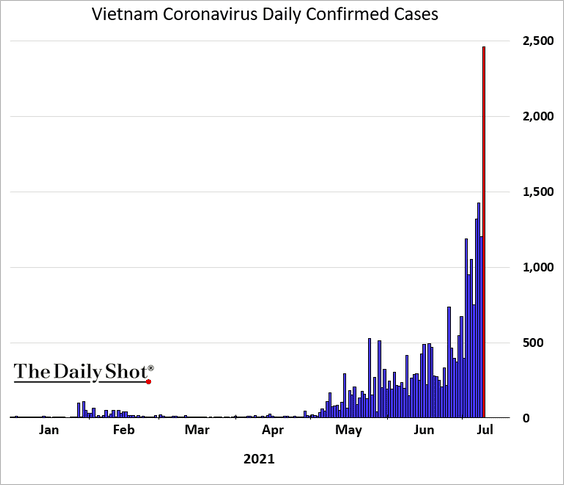

1. COVID cases in Vietnam rose sharply at the end of last week.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

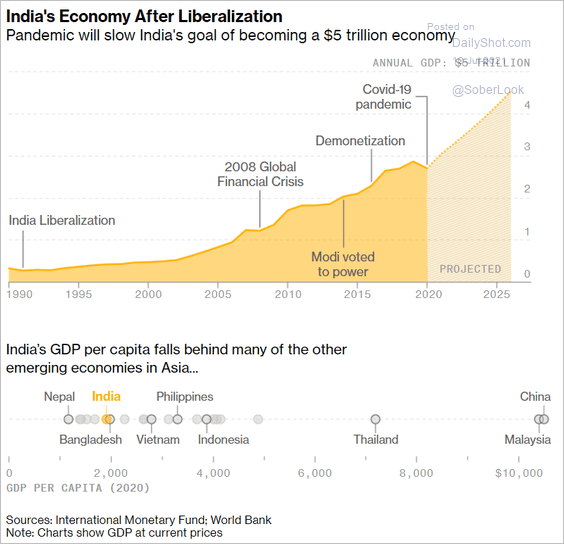

2. When will India reach its goal of becoming a five trillion dollar economy?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

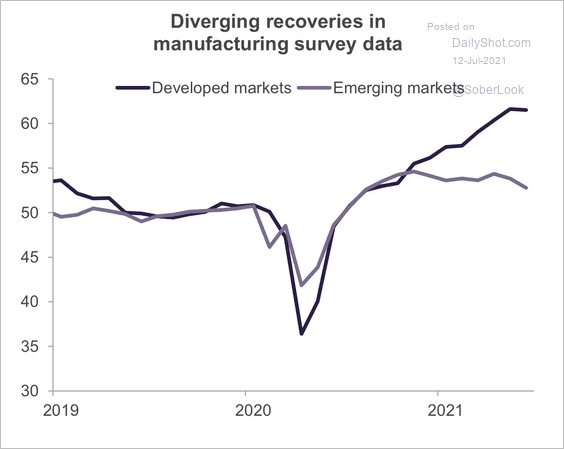

3. EM countries have lagged the manufacturing recovery in developed markets.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Cryptocurrency

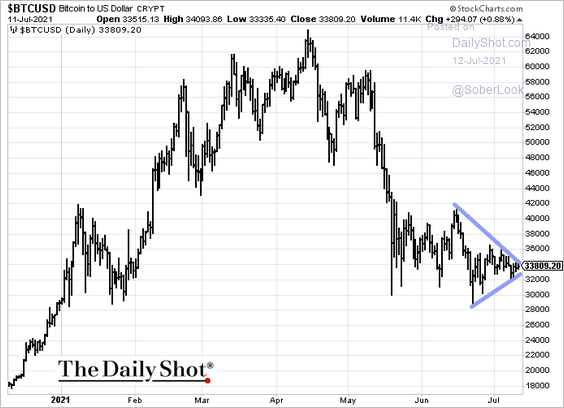

1. Bitcoin’s volatility has moderated recently.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

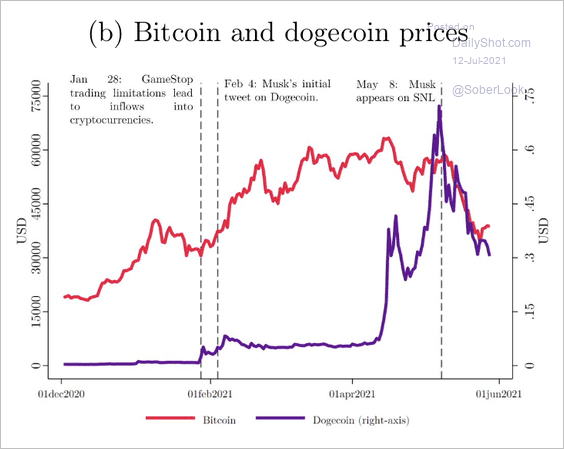

2. This chart shows the series of events that occurred before the crypto top in May.

Source: BIS

Source: BIS

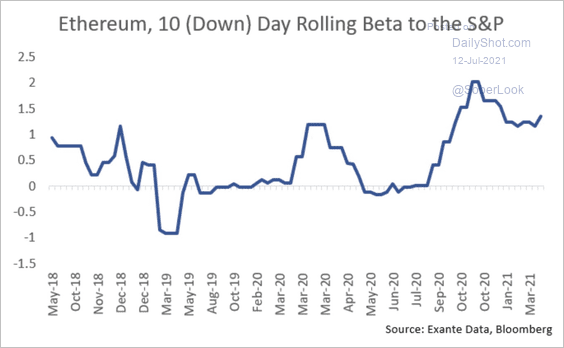

3. Ethereum’s beta to the S&P 500 remains elevated.

Source: @jnordvig

Source: @jnordvig

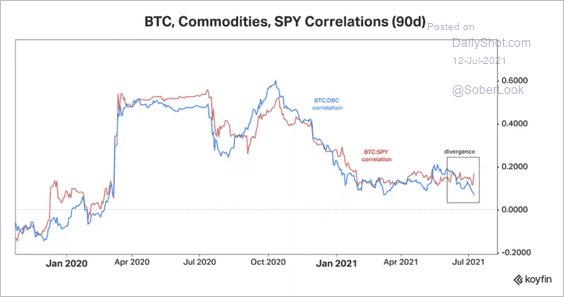

Bitcoin’s correlation with the S&P 500 is starting to rise, while the correlation with commodities continues to fall.

Source: Koyfin Read full article

Source: Koyfin Read full article

——————–

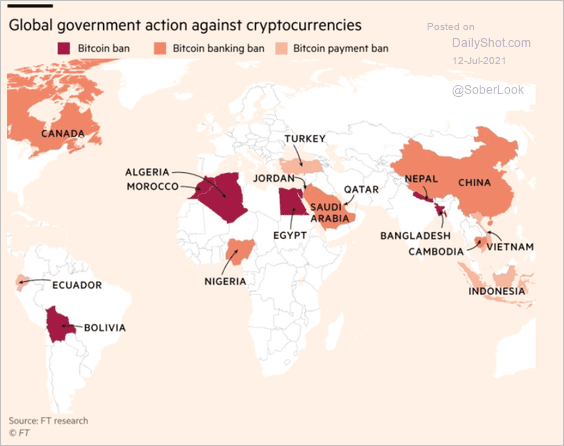

4. Which governments have taken action against cryptocurrencies?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

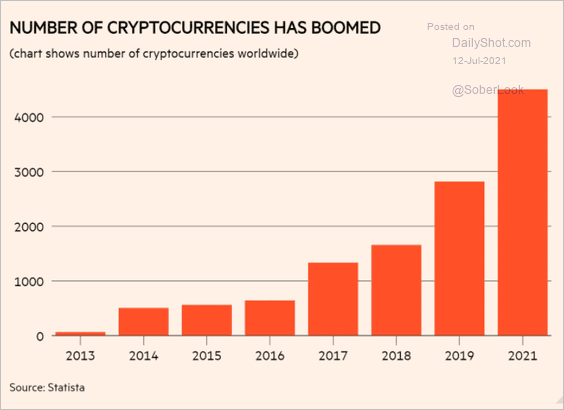

5. The number of cryptos is exploding (low barrier to entry).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

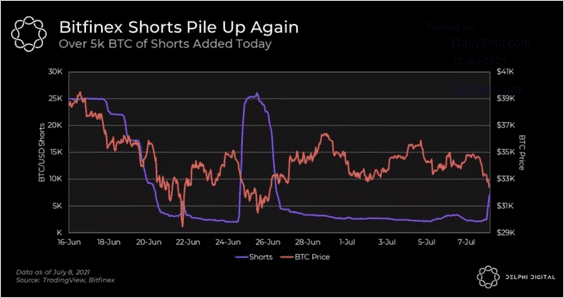

6. Short positions on the Bitfinex exchange spiked last week.

Source: Delphi Digital Read full article

Source: Delphi Digital Read full article

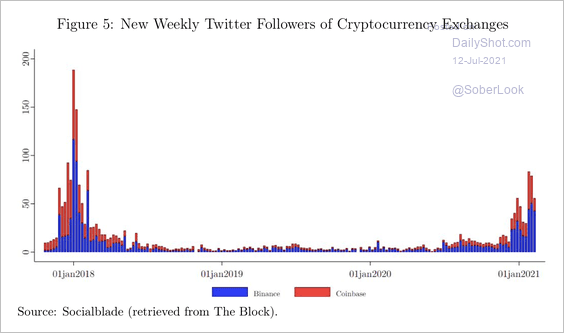

7. New weekly Twitter followers of crypto exchanges have risen this year but remain below 2018 levels.

Source: BIS

Source: BIS

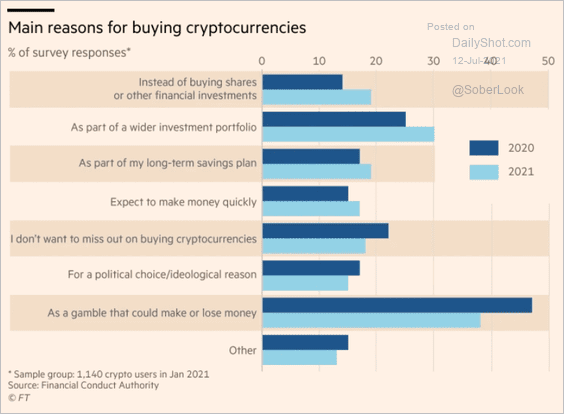

8. What are the main reasons for buying cryptos?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Commodities

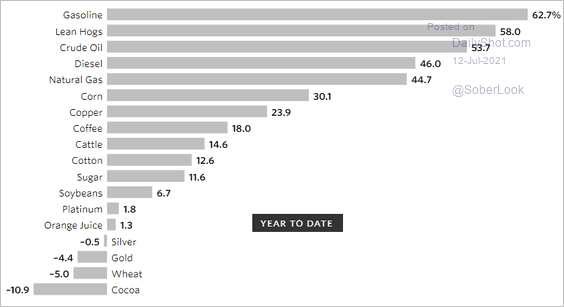

1. This chart shows the year-to-date performance for key commodity markets.

Source: @WSJ Read full article

Source: @WSJ Read full article

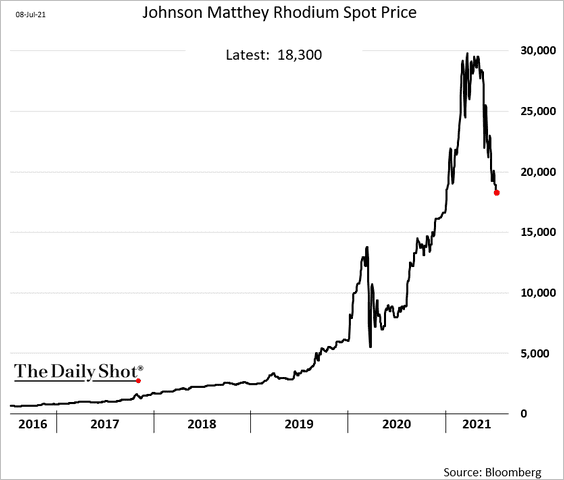

2. Rhodium prices tumbled from the peak in recent weeks.

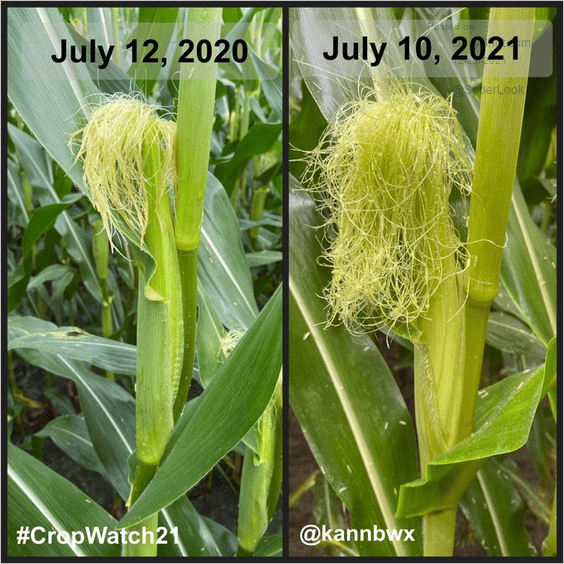

3. US corn crops look good this year (these photos are from SE Illinois).

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

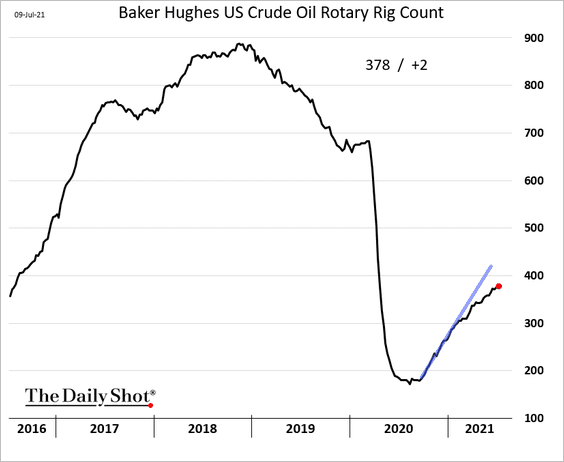

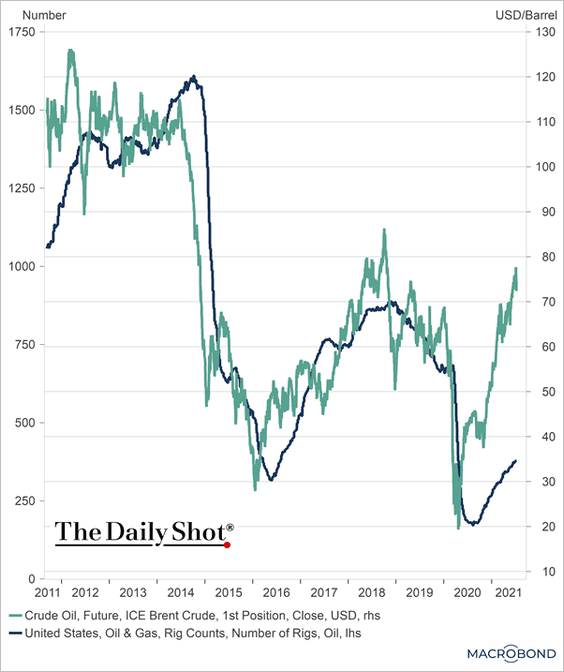

1. The recovery in the number of US oil rigs has been slowing, …

… lagging oil prices.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

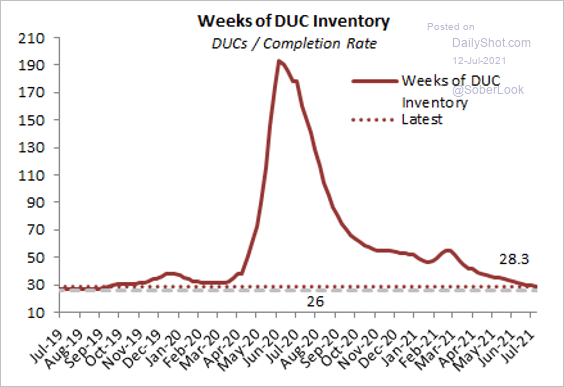

The excess inventory of drilled but uncompleted (DUC) wells has been exhausted. Operators will need to accelerate drilling to stabilize DUC levels.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

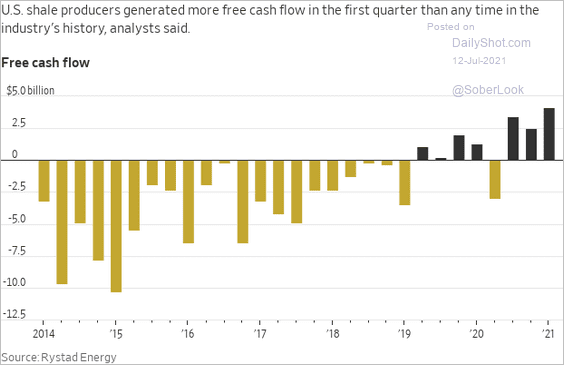

2. Shale companies’ free cash flow is at multi-year highs.

Source: @WSJ Read full article

Source: @WSJ Read full article

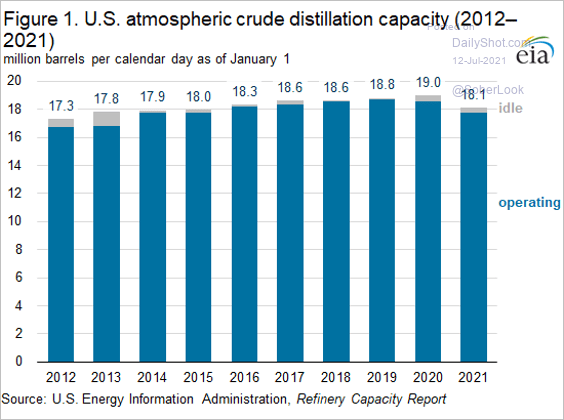

3. US refining capacity declined this year.

Source: @EIAgov

Source: @EIAgov

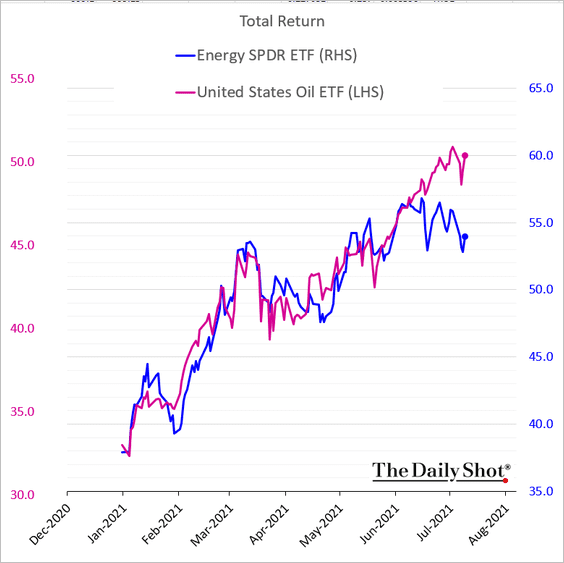

4. Energy companies’ shares are not participating in the crude oil rally.

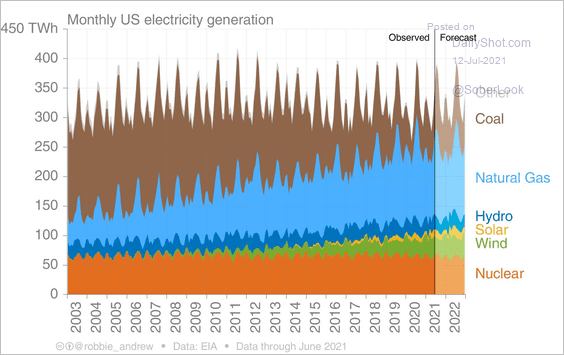

5. This chart shows US electricity generation by source.

Source: @robbie_andrew

Source: @robbie_andrew

Back to Index

Equities

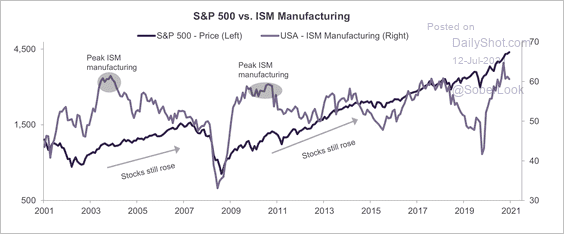

1. Peak economic momentum does not necessarily mean a peak in stock prices.

Source: Truist Advisory Services

Source: Truist Advisory Services

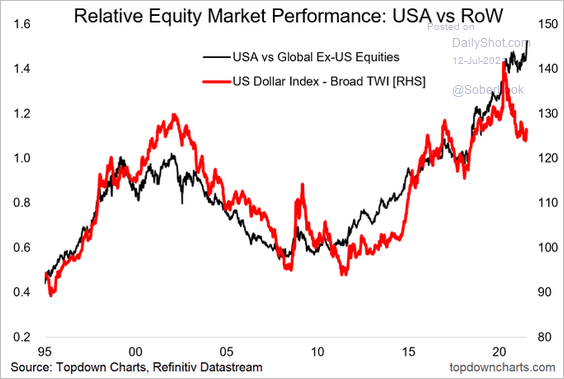

2. US equity outperformance vs. the rest of the world (RoW) has diverged from the US dollar index.

Source: @Callum_Thomas, @topdowncharts Read full article

Source: @Callum_Thomas, @topdowncharts Read full article

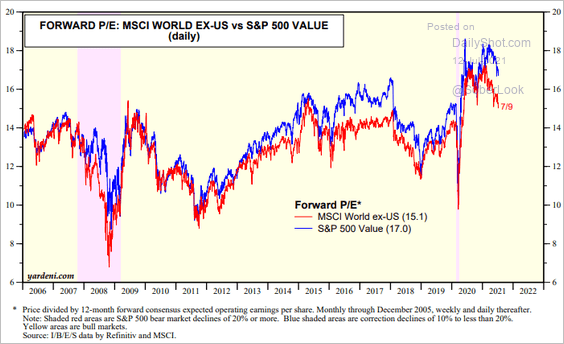

US stocks trade at a substantial premium vs. the rest of the world.

Source: Yardeni Research

Source: Yardeni Research

——————–

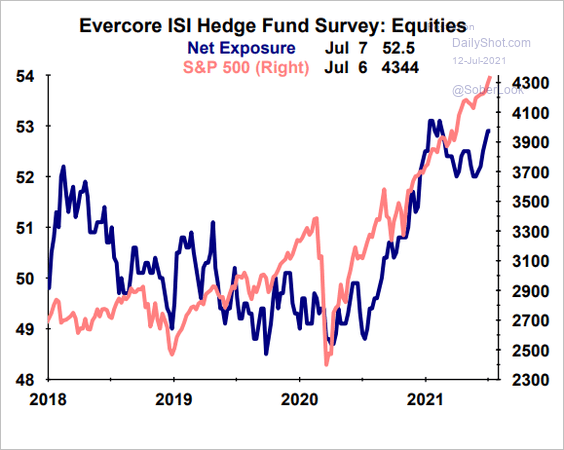

3. Hedge funds’ leverage remains elevated.

Source: Evercore ISI

Source: Evercore ISI

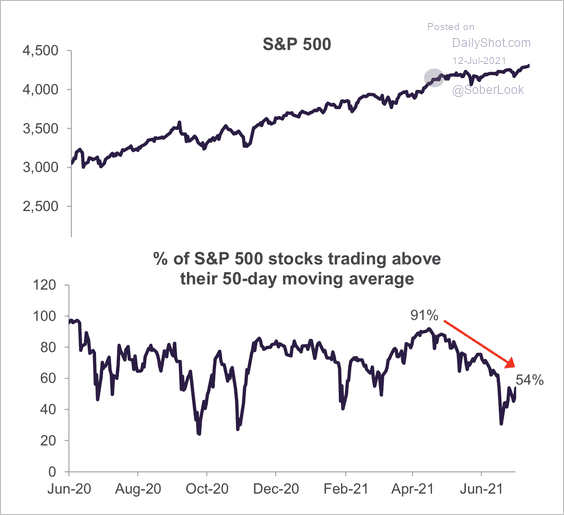

4. Individual stock participation has weakened as the market makes new highs.

Source: Truist Advisory Services

Source: Truist Advisory Services

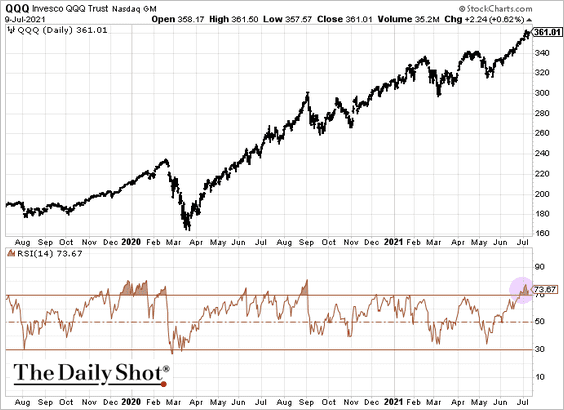

5. Technicals show that the Nasdaq 100 rally is stretched.

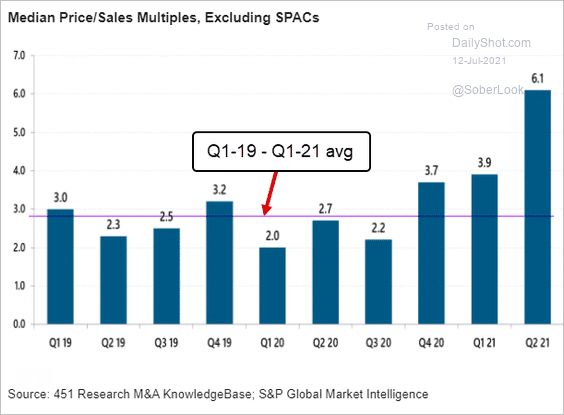

6. The Q2 tech M&A activity was more than double the recent average.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

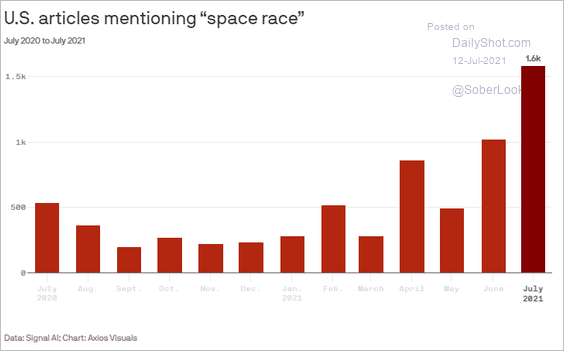

7. There has been a great deal of interest in space tourism.

• News stories:

Source: @axios Read full article

Source: @axios Read full article

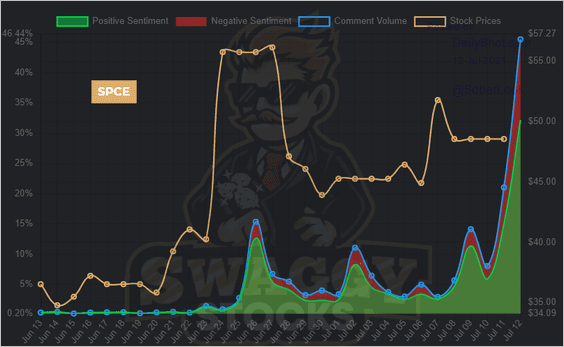

• Virgin Galactic sentiment on Reddit:

Source: SwaggyStocks

Source: SwaggyStocks

Back to Index

Credit

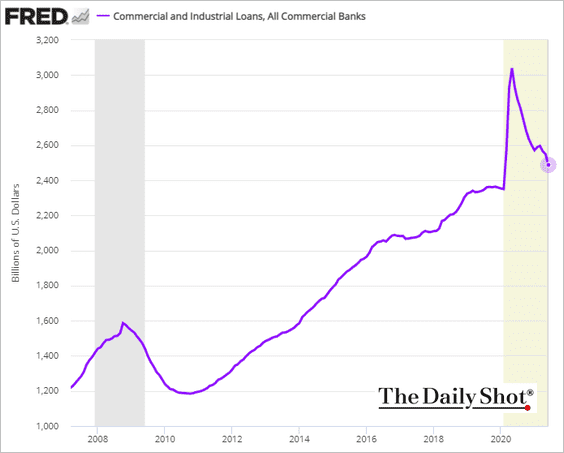

1. Business loan balances continue to moderate.

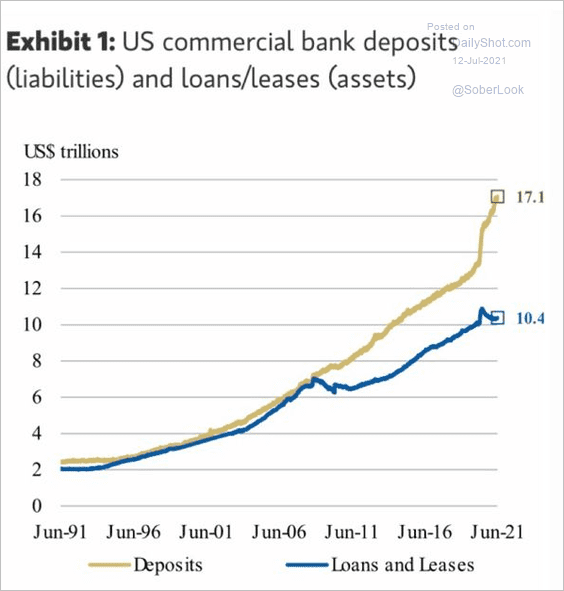

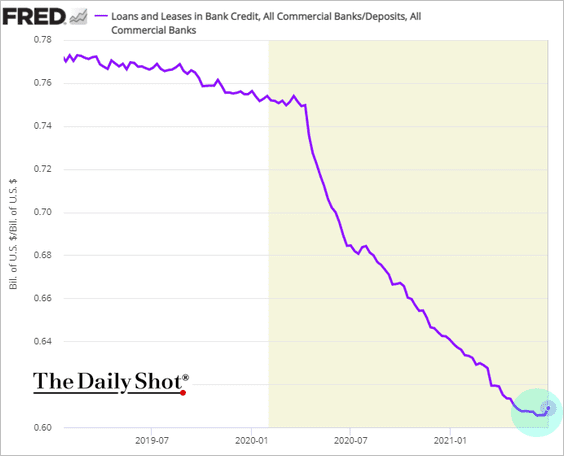

2. The loan-to-deposit ratio collapsed after the Fed launched its QE program last year.

Source: Morgan Stanley Research, h/t James W.

Source: Morgan Stanley Research, h/t James W.

But it appears to have bottomed in recent weeks.

——————–

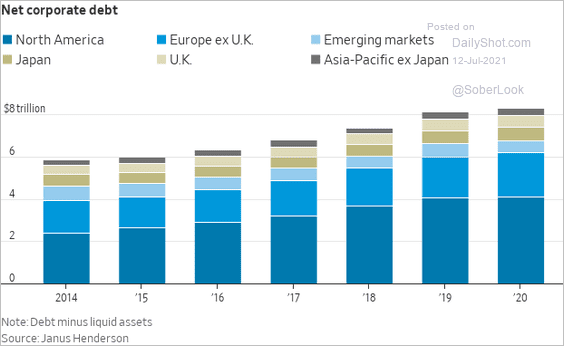

3. Here is the composition of global corporate debt by region.

Source: @WSJ Read full article

Source: @WSJ Read full article

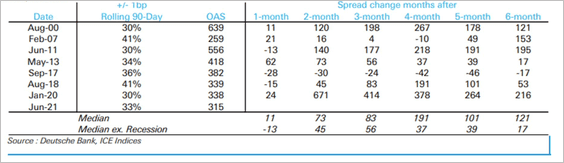

4. Periods of low volatility in high-yield debt typically result in wider spreads within 3-6 months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

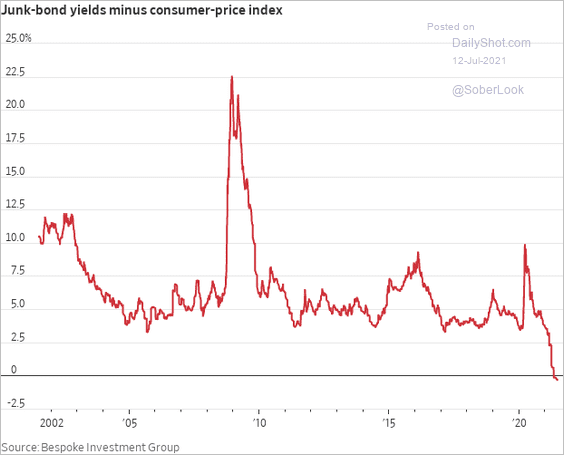

5. The spread between US high-yield bonds and the CPI is now negative.

Source: @WSJ Read full article

Source: @WSJ Read full article

6. US corporate leverage has been moderating (as earnings rebound) but remains elevated.

Source: CreditSights

Source: CreditSights

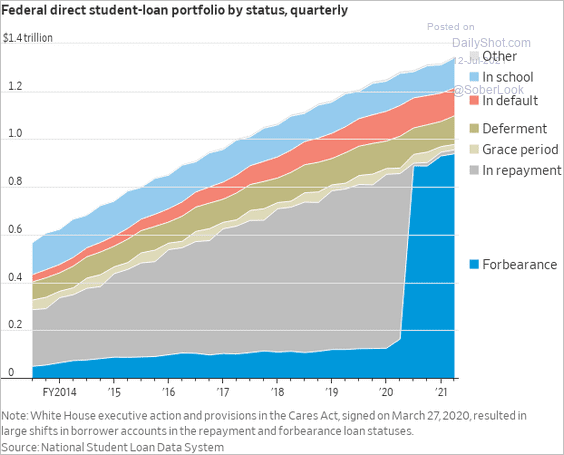

7. Here is the status of US student debt over time.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

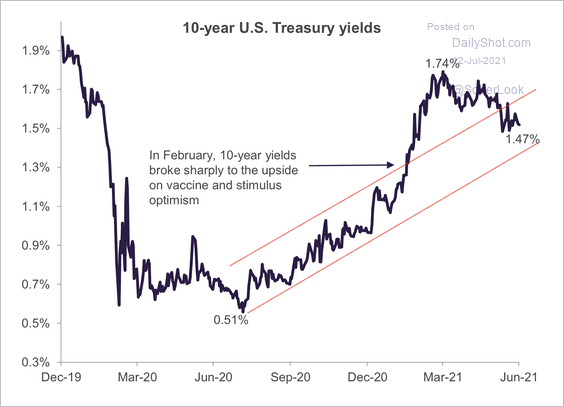

1. The 10-year Treasury yield has returned to its long-term trend channel. Will it hold support?

Source: Truist Advisory Services

Source: Truist Advisory Services

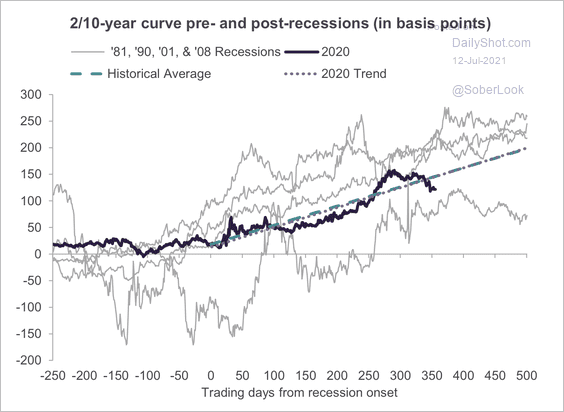

2. The recent steepening trend is below the historical post-recession average.

Source: Truist Advisory Services

Source: Truist Advisory Services

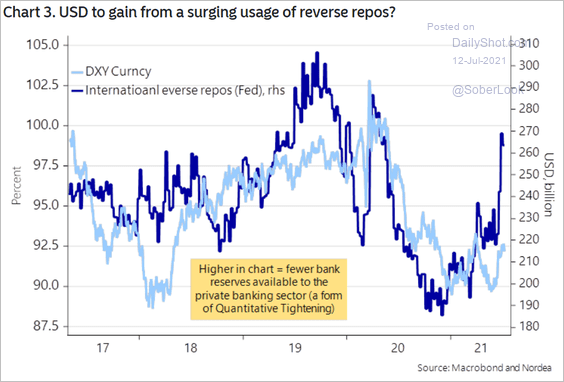

3. The massive uptake of the Fed’s RRP program has drained a substantial amount of liquidity, which should be a positive for the US dollar.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Global Developments

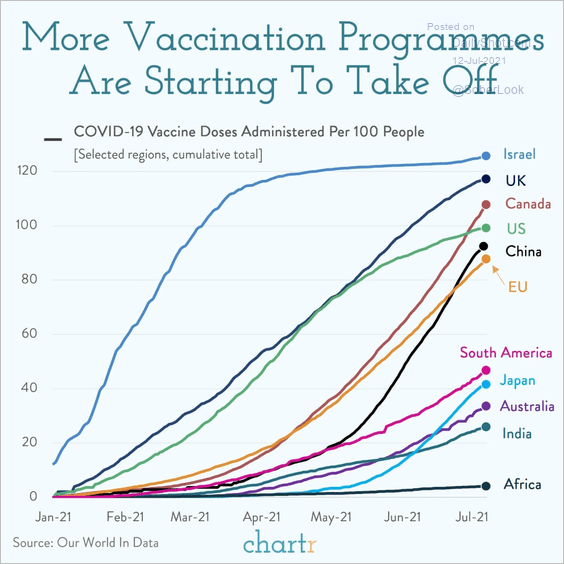

1. Let’s start with vaccination trends.

Source: @chartrdaily

Source: @chartrdaily

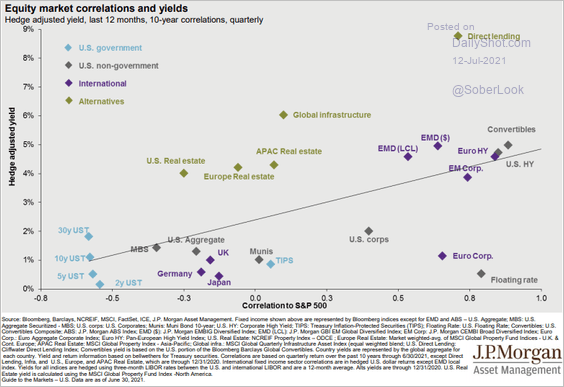

2. This scatterplot shows fixed-income yields vs. correlations to the S&P 500.

Source: @JPMorganAM

Source: @JPMorganAM

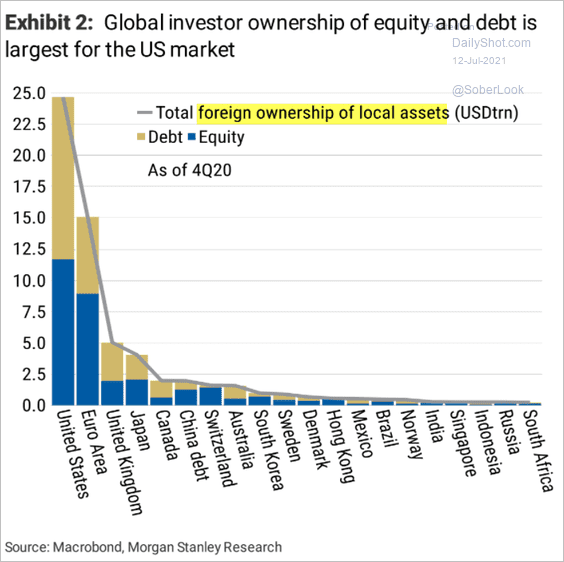

3. The chart below shows foreign ownership of local assets.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

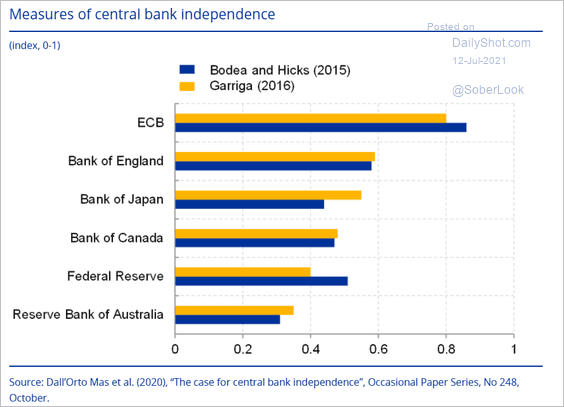

4. How independent are the central banks in advanced economies?

Source: ECB Read full article

Source: ECB Read full article

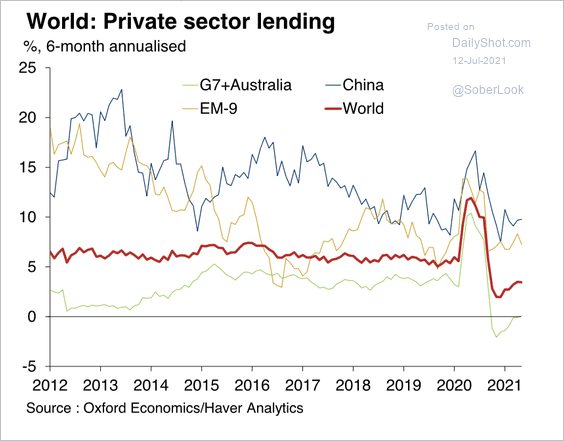

5. Private credit growth has declined sharply over the past year.

Source: Oxford Economics

Source: Oxford Economics

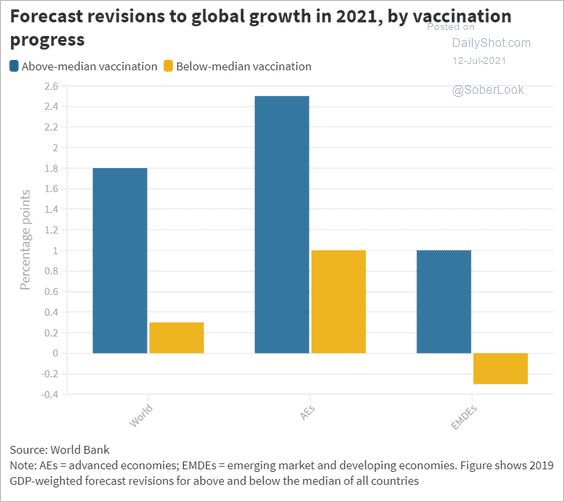

6. Economies of countries with low vaccination rates are underperforming this year.

Source: World Bank Group

Source: World Bank Group

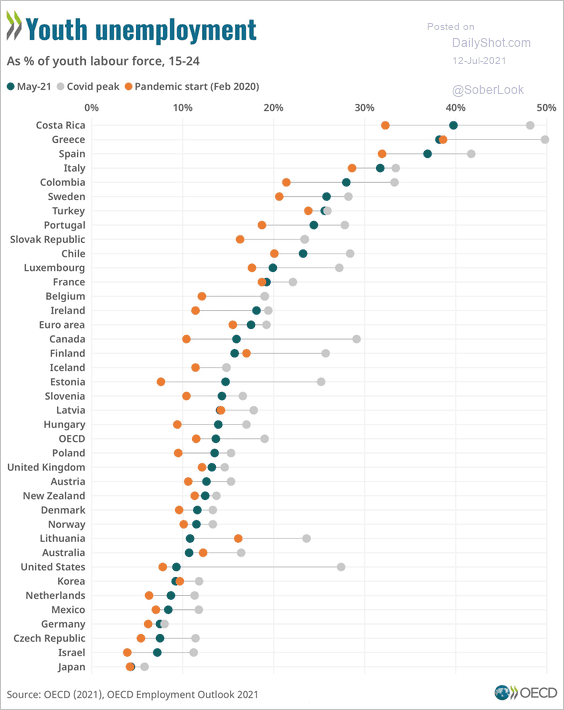

7. Finally, we have youth unemployment across OECD economies.

Source: @OECD Read full article

Source: @OECD Read full article

——————–

Food for Thought

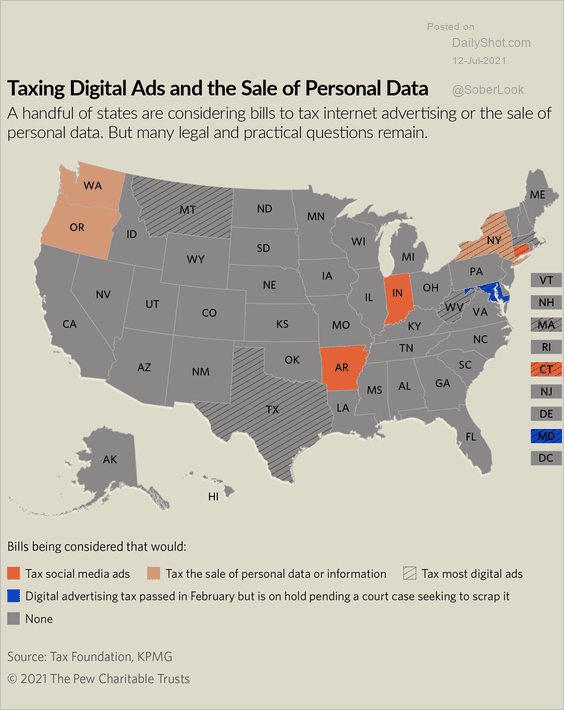

1. Taxing digital ads and the sale of personal data:

Source: The Pew Charitable Trusts Read full article

Source: The Pew Charitable Trusts Read full article

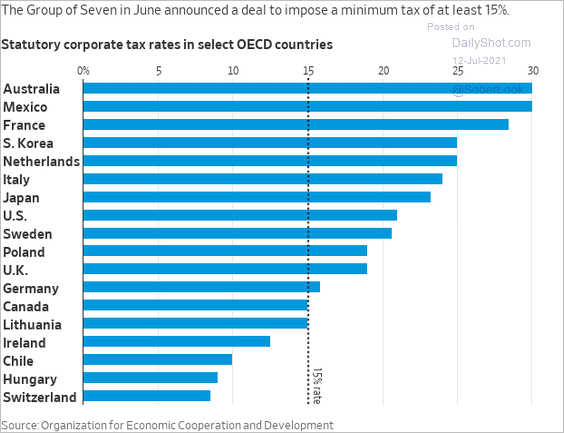

2. Corporate tax rates in select economies:

Source: @WSJ Read full article

Source: @WSJ Read full article

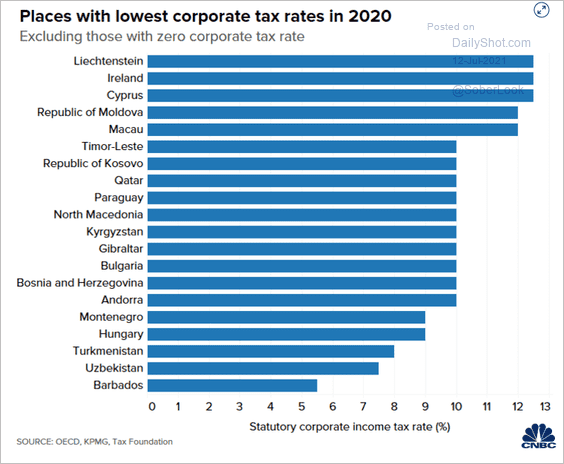

• Countries with the lowest corporate tax rates:

Source: CNBC Read full article

Source: CNBC Read full article

——————–

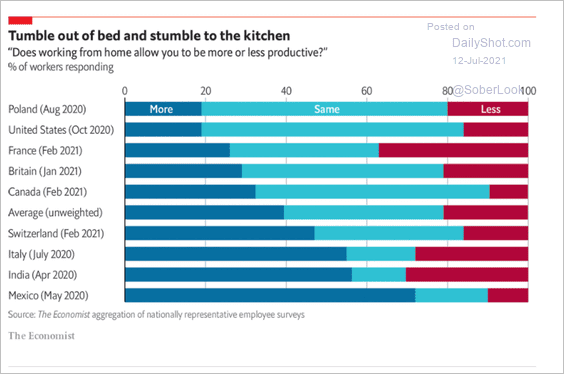

3. Productivity assessment of working from home:

Source: The Economist Read full article

Source: The Economist Read full article

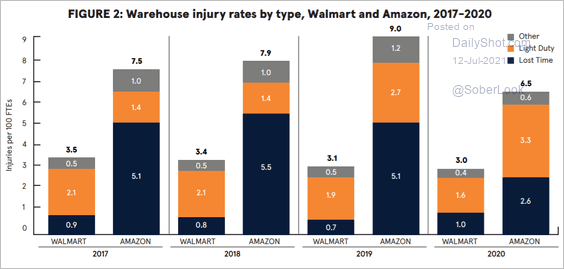

4. Warehouse injury rates for Walmart and Amazon:

Source: Strategic Organizing Center Read full article

Source: Strategic Organizing Center Read full article

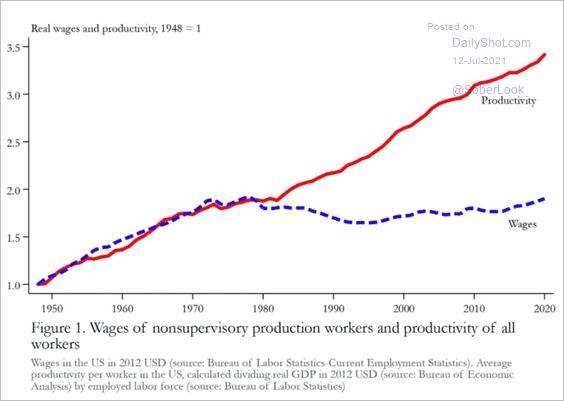

5. Wages and productivity:

Source: ProMarket Read full article

Source: ProMarket Read full article

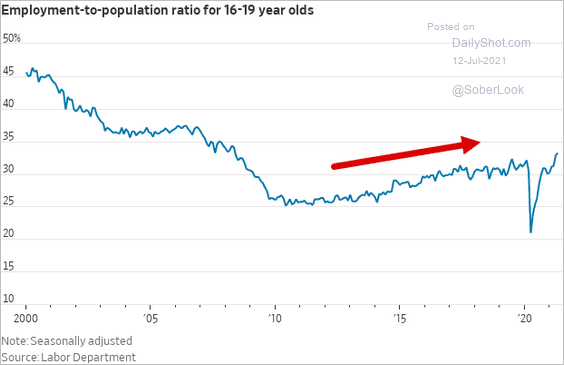

6. US teen employment-to-population ratio:

Source: @WSJ Read full article

Source: @WSJ Read full article

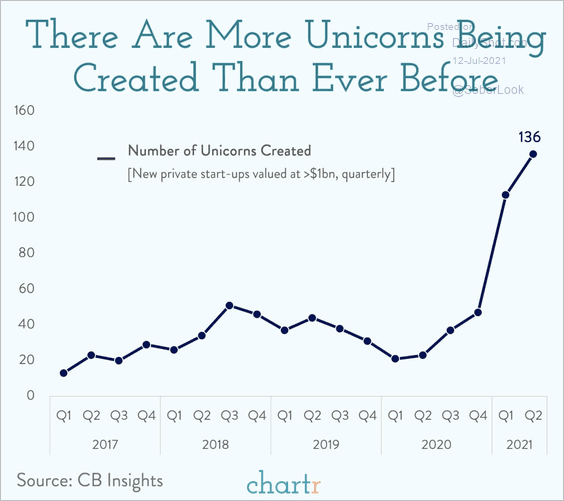

7. Unicorn creation:

Source: @chartrdaily

Source: @chartrdaily

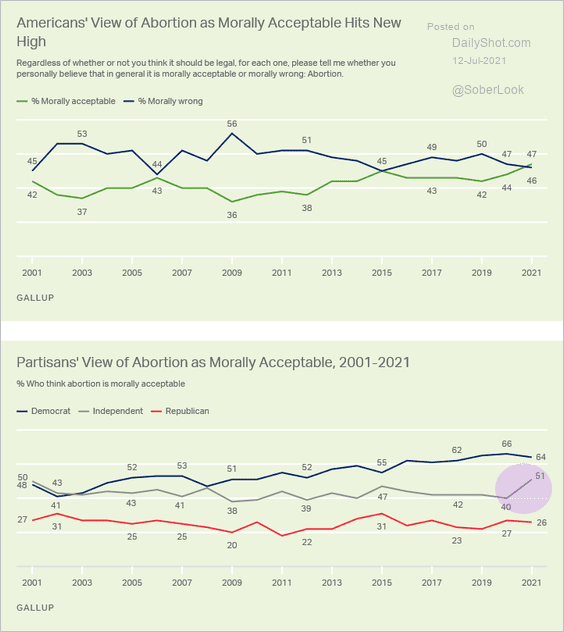

8. Views on abortion:

Source: Gallup Read full article

Source: Gallup Read full article

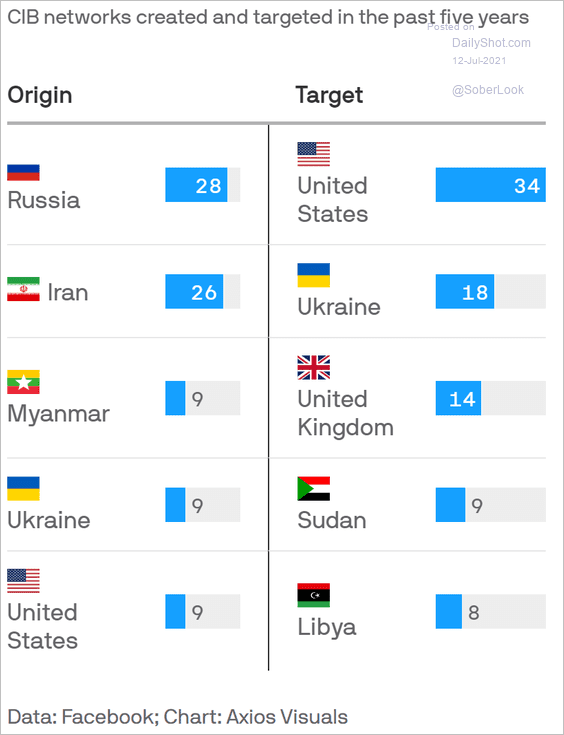

9. Sources and targets of disinformation campaigns on Facebook:

Source: @axios Read full article

Source: @axios Read full article

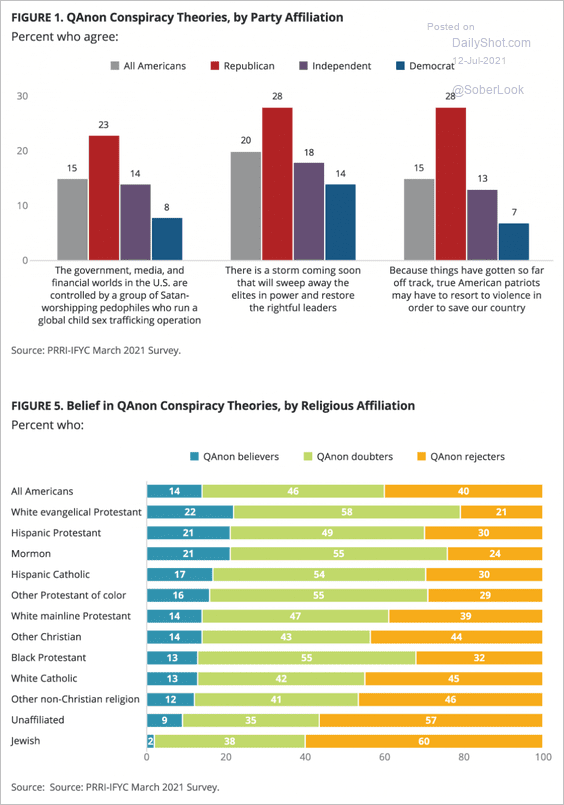

10. QAnon followers by party and religious affiliation:

Source: PRRI Read full article

Source: PRRI Read full article

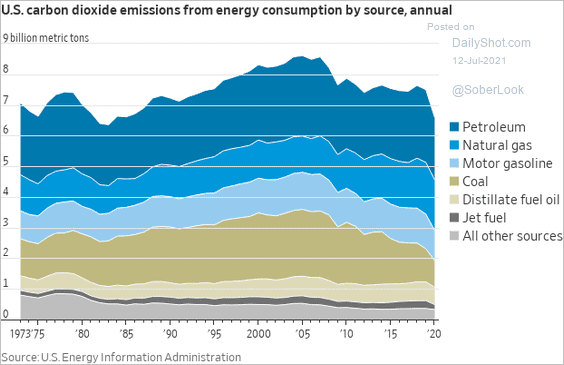

11. US CO2 emissions from energy consumption:

Source: @WSJ Read full article

Source: @WSJ Read full article

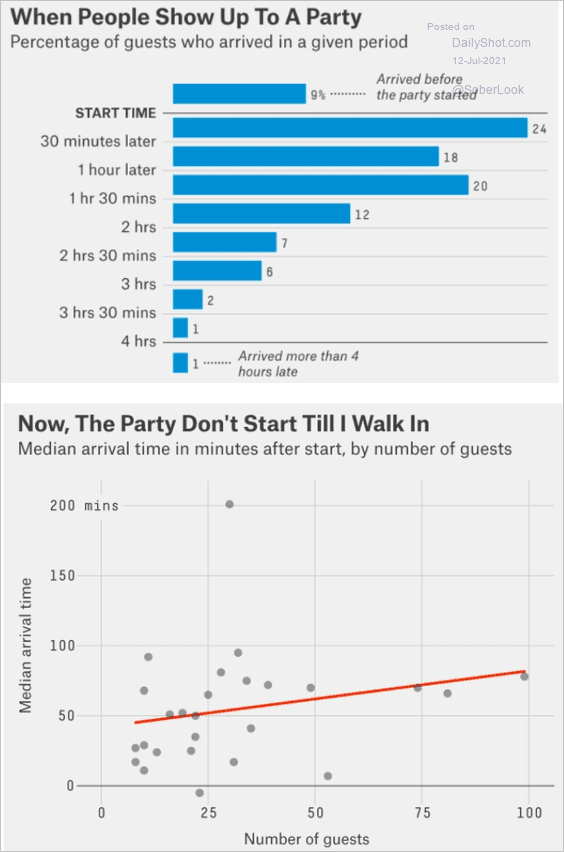

12. Showing up fashionably late to a party:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

——————–

Back to Index