The Daily Shot: 15-Jul-21

• Administrative Update

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

Administrative Update

If you received the WSJ discount last year, please note that your subscription will automatically renew for another year at $135. If you would like to cancel your subscription or change account information, please see the account management page.

As a reminder, we do not offer refunds.

Back to Index

The United States

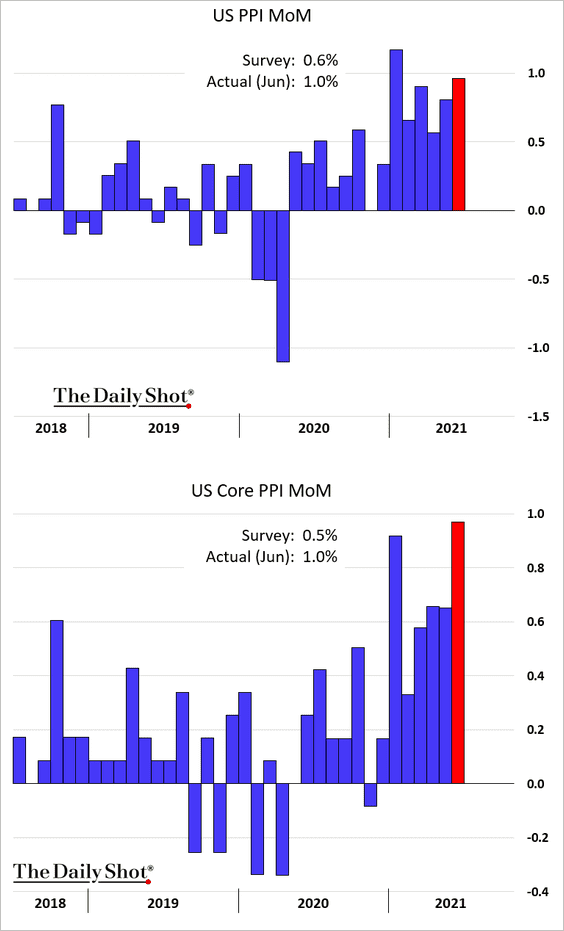

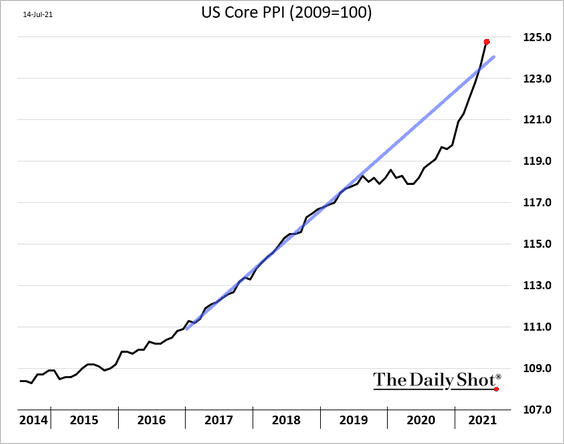

1. The June producer price report topped forecasts, with the core PPI monthly gain hitting a multi-year high.

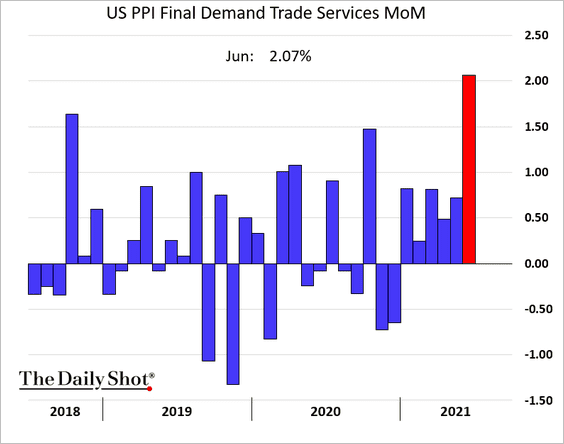

Part of the strength in the core PPI came from “trade services,” which represents business markups. US companies are gaining pricing power.

——————–

2. Next, let’s continue with the CPI report data.

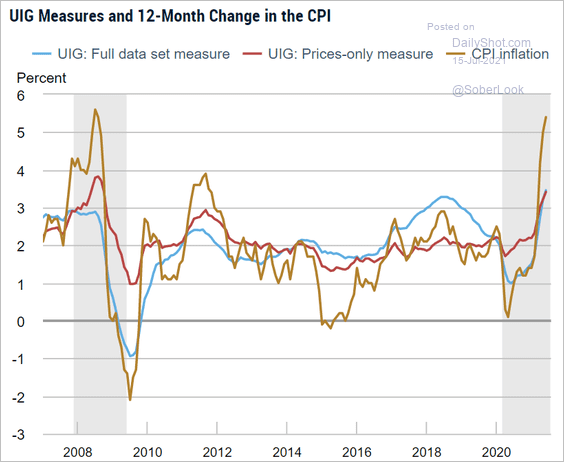

• On a year-over-year basis, some alternative inflation measures didn’t show the same spike (or the drop in 2020) as the core CPI.

– The NY Fed’s UIG index:

Source: NY Fed

Source: NY Fed

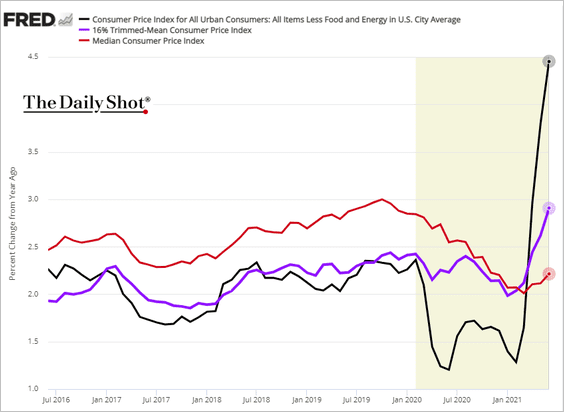

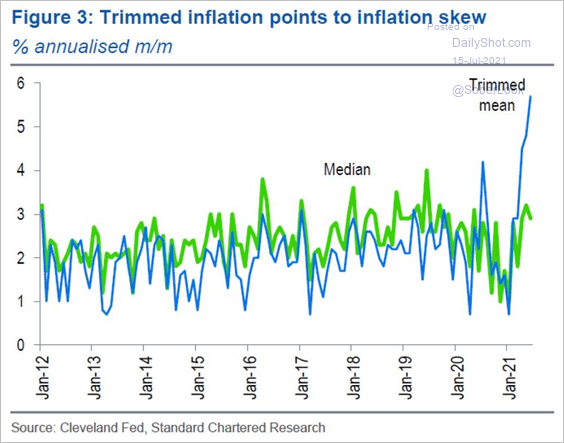

– Trimmed-mean and median CPI:

The divergence between the trimmed-mean and median measures points to inflation “skew.”

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

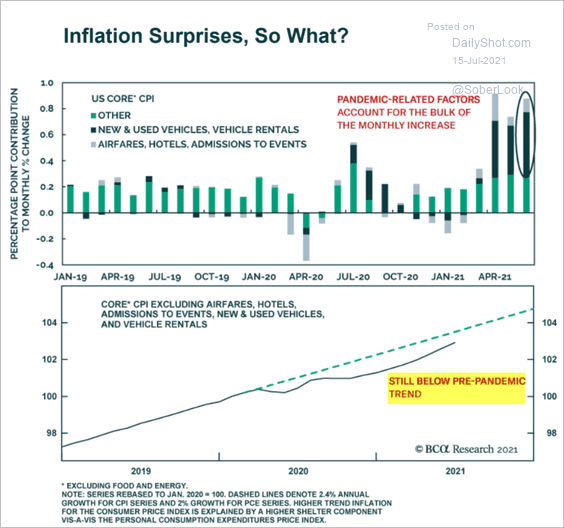

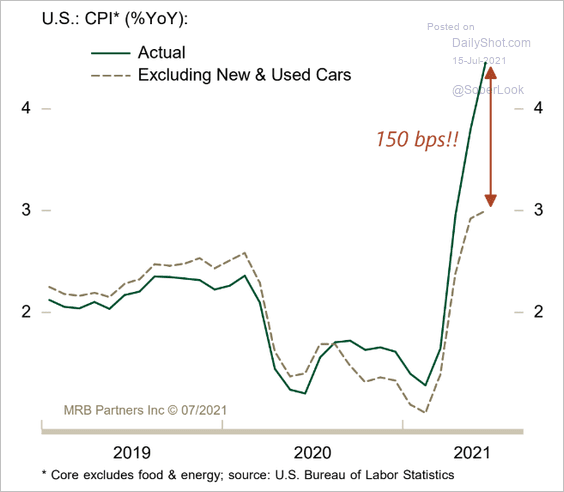

• Without the vehicle (chip-related) and reopening-related CPI components, inflation is still below the pre-COVID trend.

Source: BCA Research

Source: BCA Research

Source: MRB Partners

Source: MRB Partners

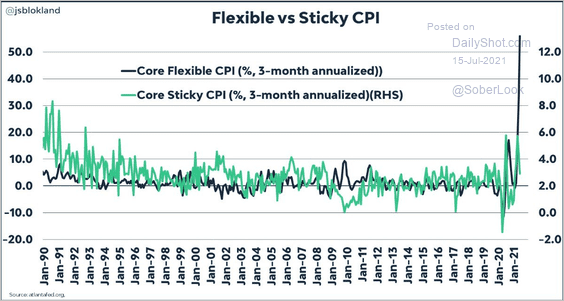

That’s why Flexible CPI is massively outperforming Sticky CPI, supporting the Fed’s “transient” thesis for now. The situation may change if rent/OER inflation quickens more than expected.

Source: @jsblokland

Source: @jsblokland

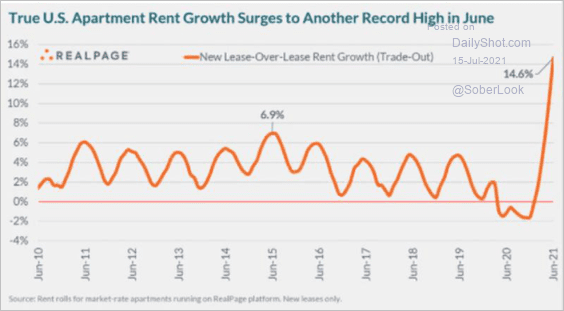

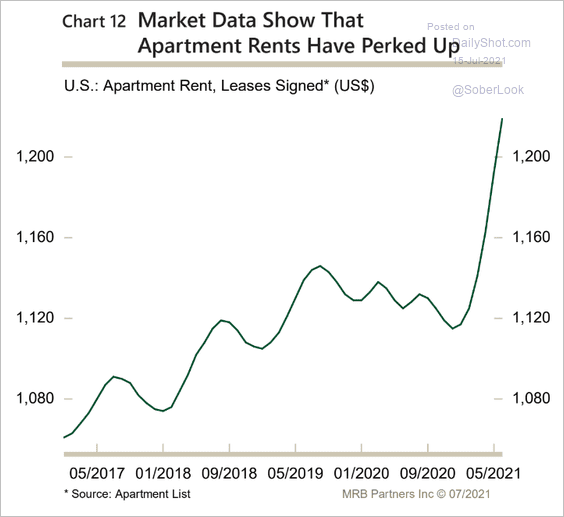

• And there are signs that rent inflation could accelerate (2 charts).

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

Source: MRB Partners

Source: MRB Partners

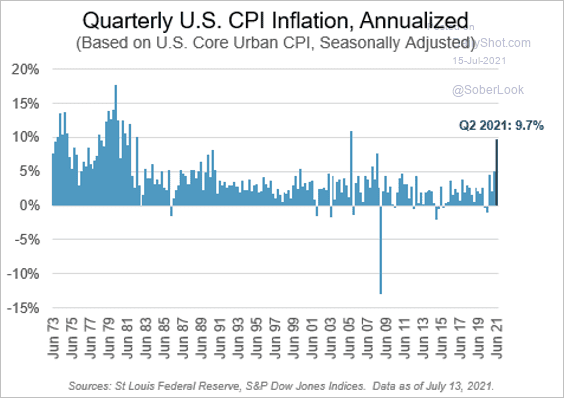

• The quarterly core CPI jump has been impressive.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

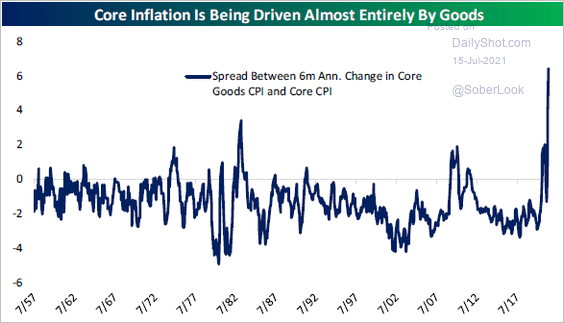

• Goods inflation dominates the recent increase in the core CPI.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

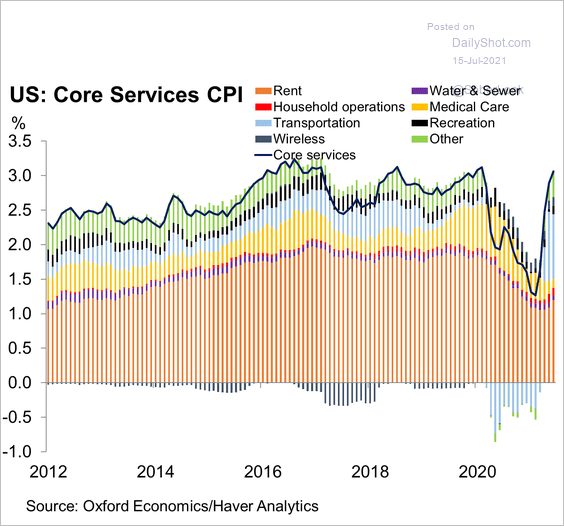

• Here is the core services CPI decomposition.

Source: Oxford Economics

Source: Oxford Economics

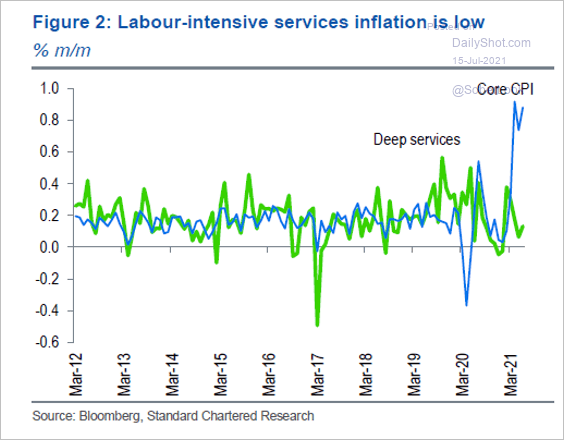

• Labor-sensitive services inflation has been “well behaved.”

Source: @StanChart, @tracyalloway

Source: @StanChart, @tracyalloway

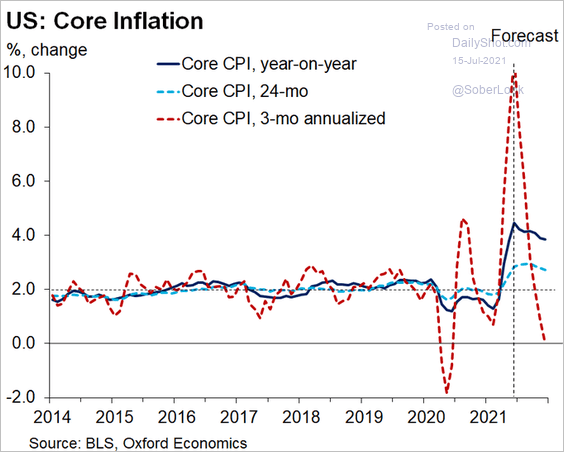

• Has the core CPI peaked?

Source: @GregDaco

Source: @GregDaco

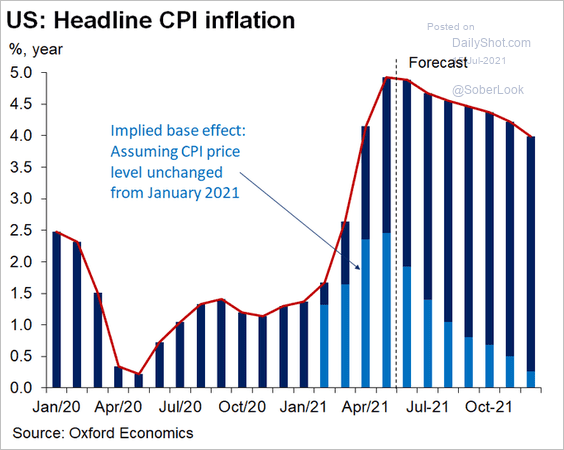

• Base effects should begin to dissipate.

Source: @GregDaco

Source: @GregDaco

——————–

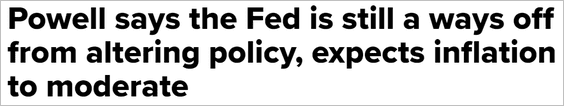

3. Powell’s comments eased markets’ concerns after the CPI surprise.

Source: CNBC Read full article

Source: CNBC Read full article

Bond yields and the dollar declined.

——————–

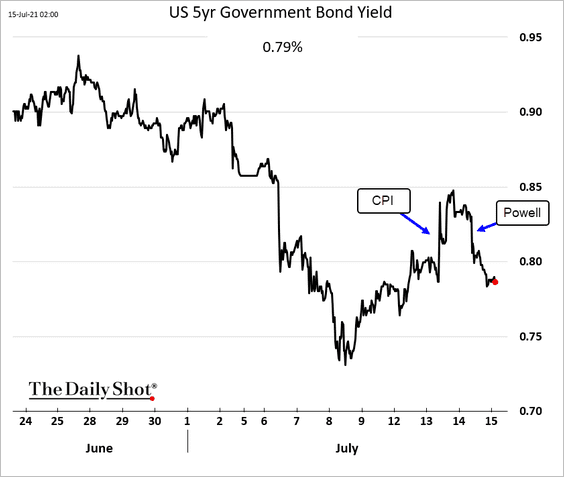

4. Next, we have some updates on the housing market.

• Mortgage applications remain soft relative to last year’s levels.

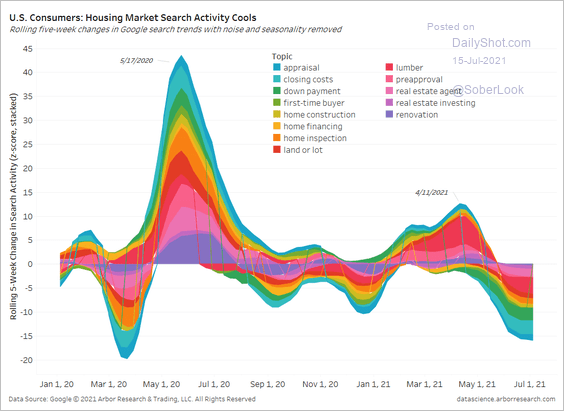

• Housing-related online search activity has slowed.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

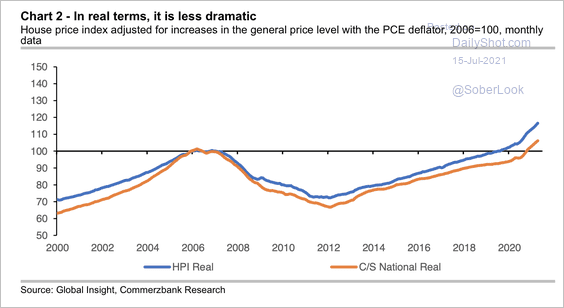

• In real terms, housing prices are just under 17% higher than 2006 (housing bubble) levels, according to Commerzbank.

Source: Commerzbank Research

Source: Commerzbank Research

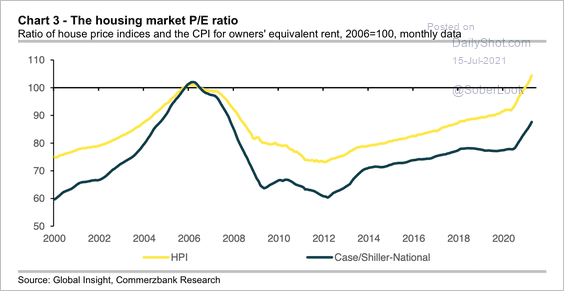

• By some measures, housing valuations are still below the 2006 peak.

Source: Commerzbank Research

Source: Commerzbank Research

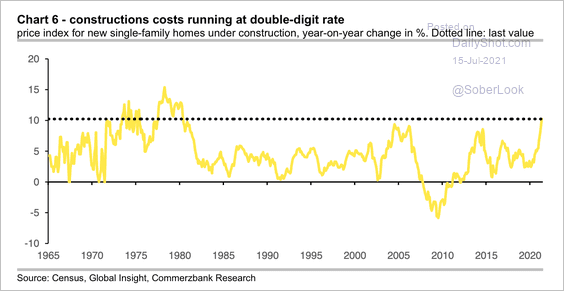

• The rising costs of building materials have contributed to higher house prices.

Source: Commerzbank Research

Source: Commerzbank Research

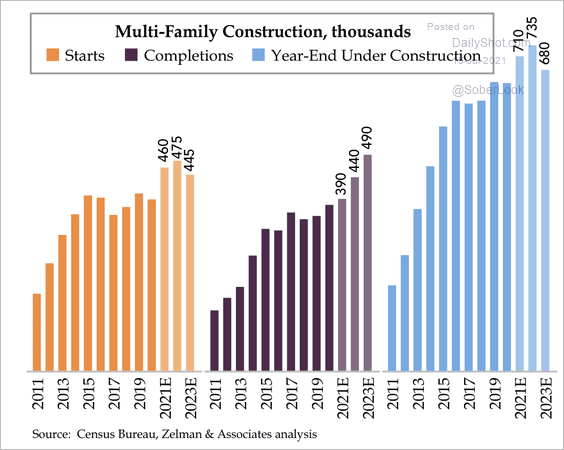

• Multi-family construction is expected to rise over the next few years.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

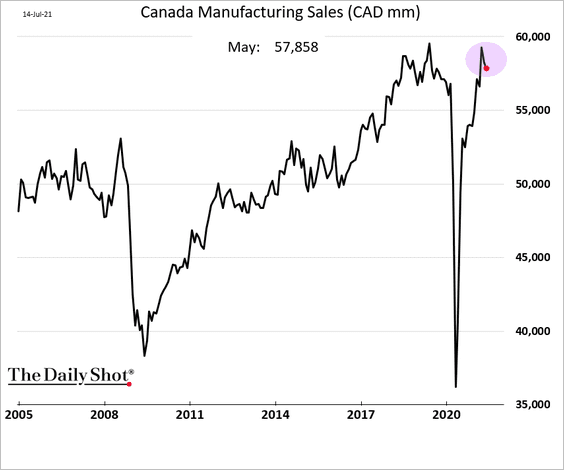

Canada

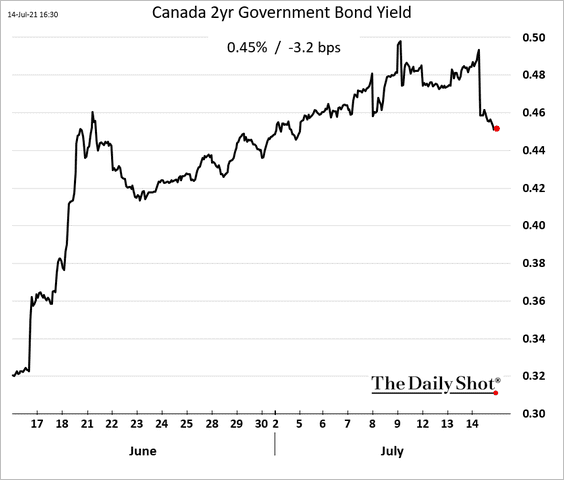

1. Canada’s central bank upgraded its inflation forecast and tapered QE.

Source: @markets Read full article

Source: @markets Read full article

The market wasn’t impressed. Some were expecting a more hawkish outcome. Bond yields edged lower.

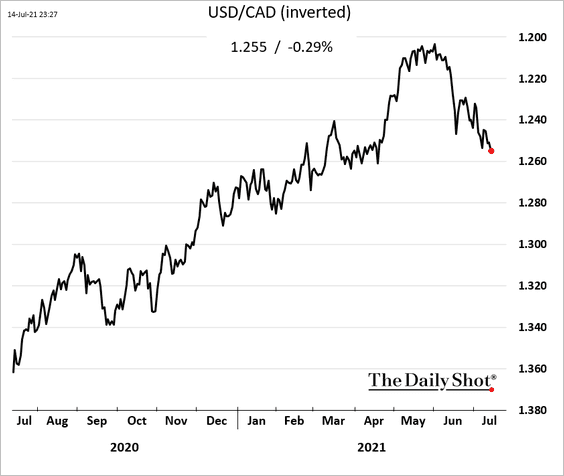

The loonie continues to trend down vs. USD.

——————–

2. Manufacturing sales declined in May but were still above pre-COVID levels.

3. The Oxford Economics Recovery Tracker has fully “recovered.”

![]() Source: Oxford Economics

Source: Oxford Economics

Back to Index

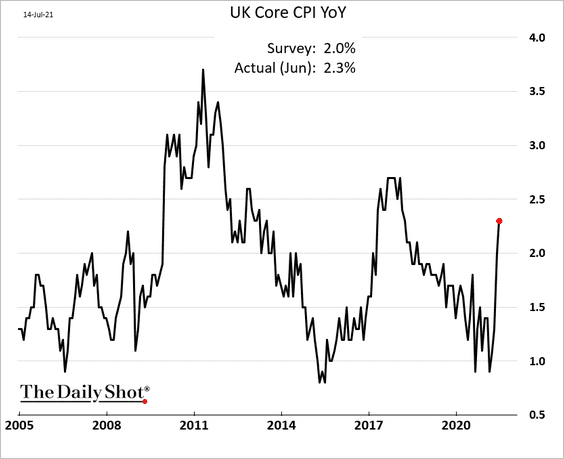

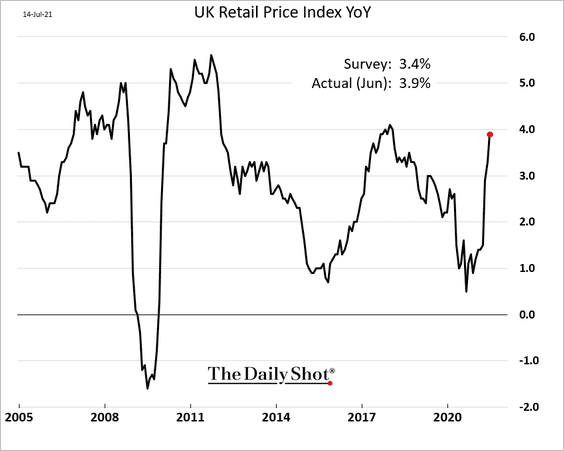

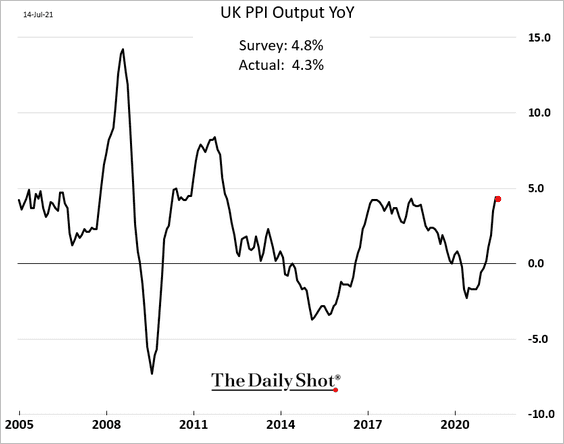

The United Kingdom

1. The June inflation report topped economists’ forecasts.

Here is the retail price index.

But the PPI appears to have peaked.

——————–

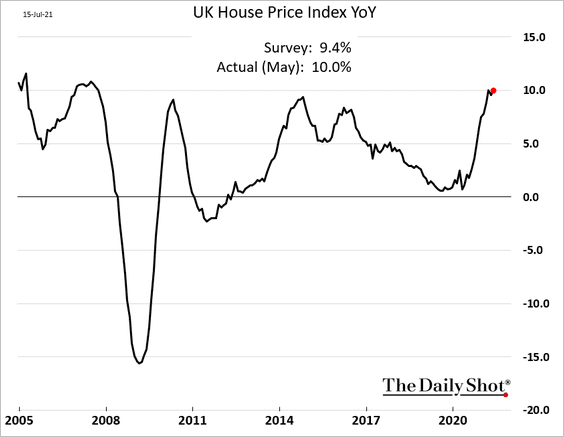

2. The official home price appreciation index is back at 10%.

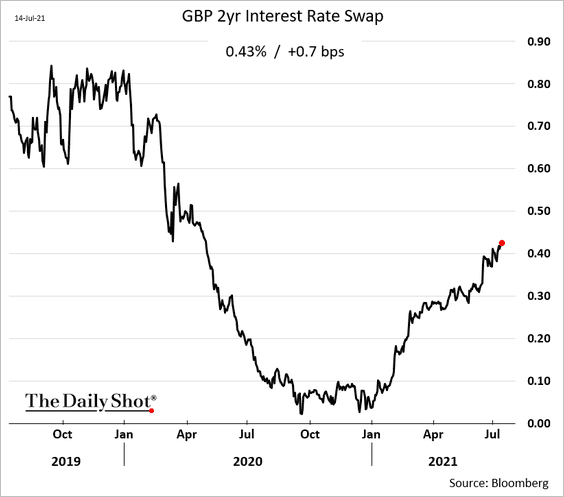

3. Short-term interest rate swap rates keep grinding higher.

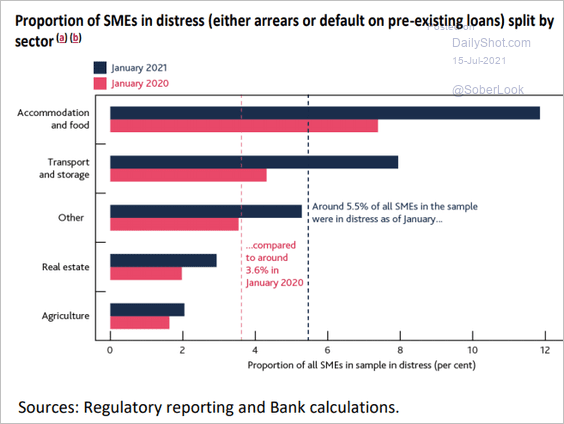

4. In January, many small firms were in distress. How much has the situation improved since then?

Source: BoE Read full article

Source: BoE Read full article

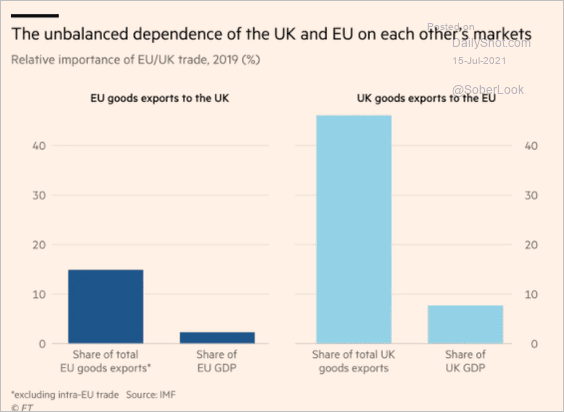

5. Here is the relative importance of the UK-EU trade.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

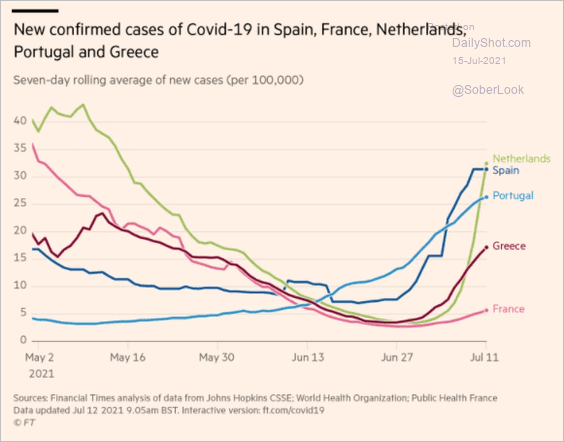

1. The Netherlands is back on top of the COVID wave.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

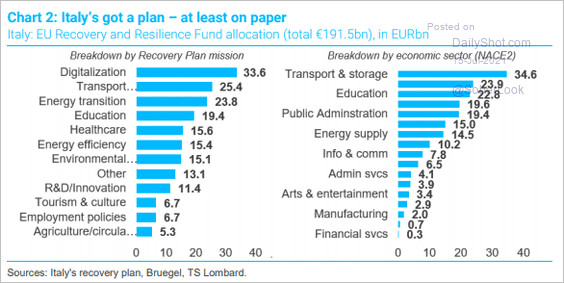

2. According to TS Lombard,

Italy’s recovery plan is designed to mitigate the legacy of underinvestment in digital and transport infrastructure, in education/R&D and in employment policies and to keep up with developments in energy transition/efficiency and electric mobility.

Source: TS Lombard

Source: TS Lombard

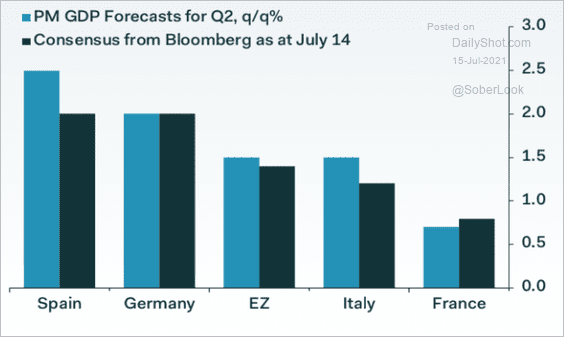

3. According to Pantheon Macroeconomics, Spain’s economy outperformed the Eurozone peers in Q2.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

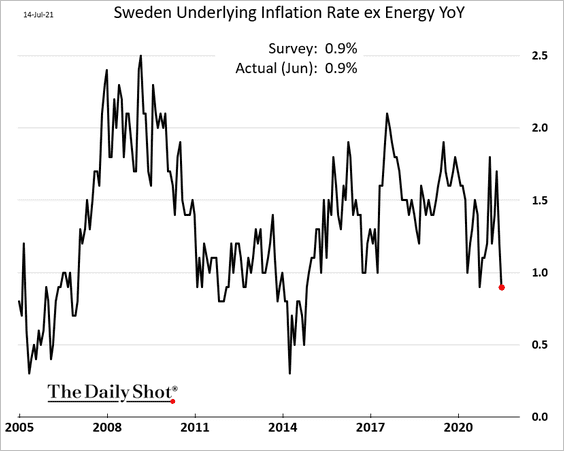

4. Sweden’s underlying inflation is back below 1%.

Back to Index

Asia – Pacific

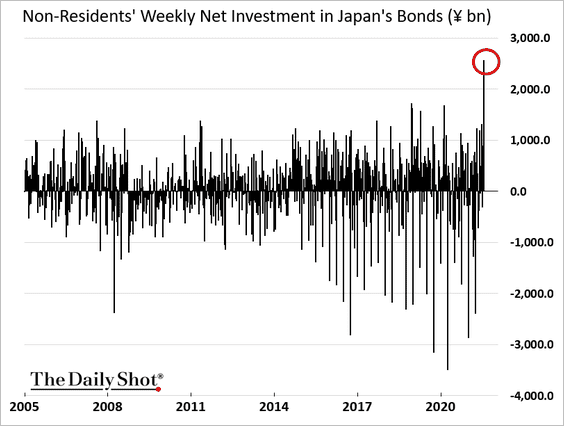

1. Foreigners bought Japanese bonds last week – a lot of bonds.

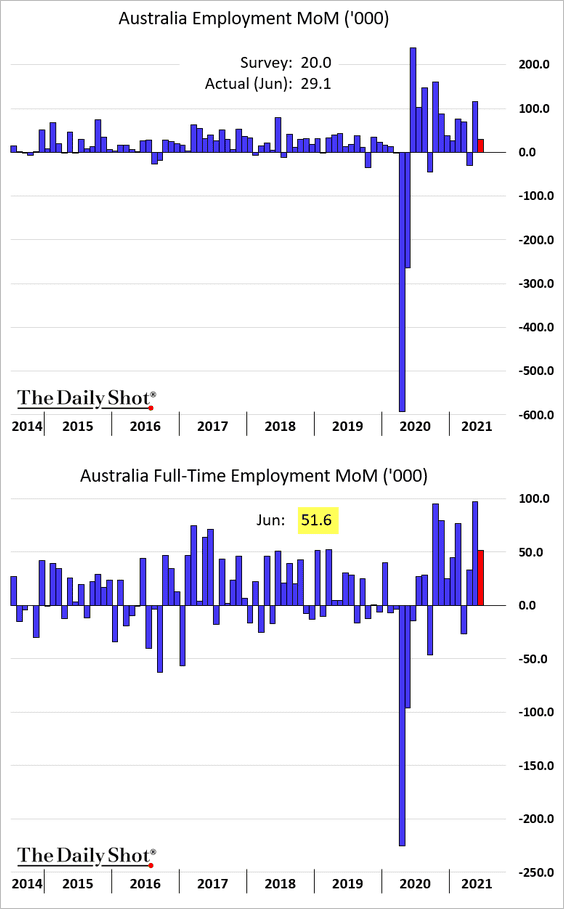

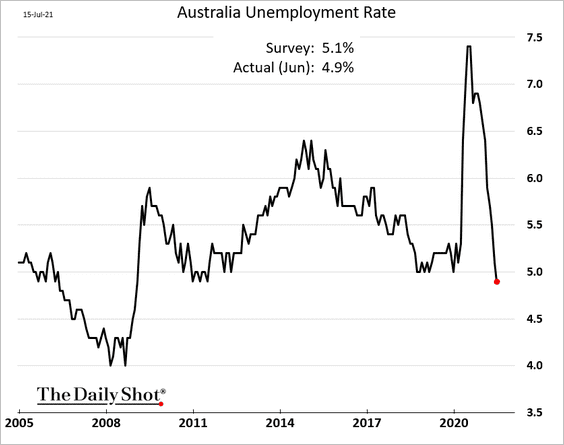

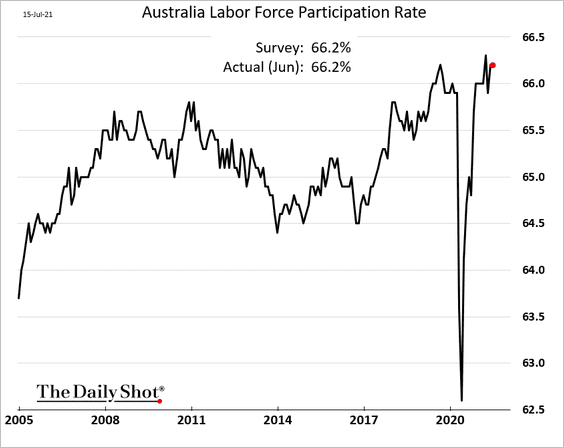

2. Australia’s employment report surprised to the upside again.

• The unemployment rate dipped below 5%.

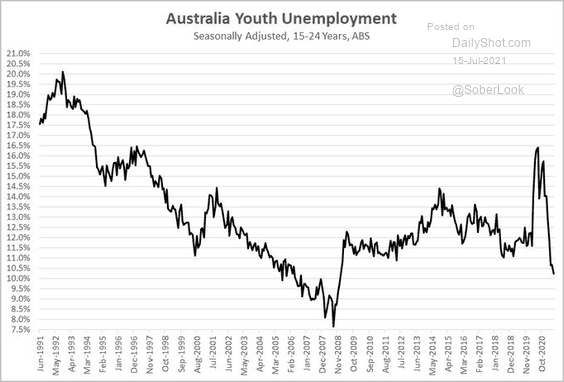

Here is youth unemployment.

Source: @Scutty

Source: @Scutty

• The participation rate held steady.

Back to Index

China

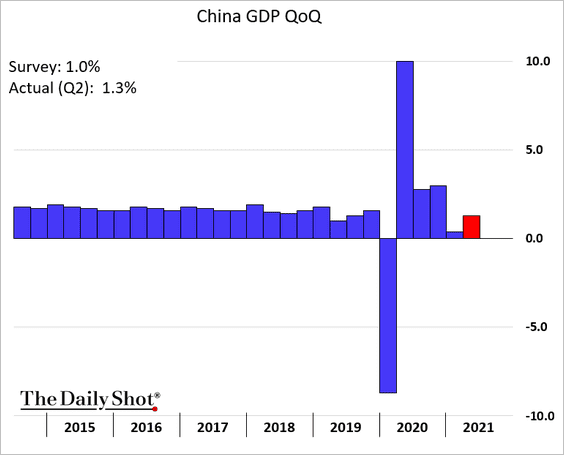

1. The Q2 GDP growth rebounded, exceeding forecasts (although some are questioning the accuracy of this report).

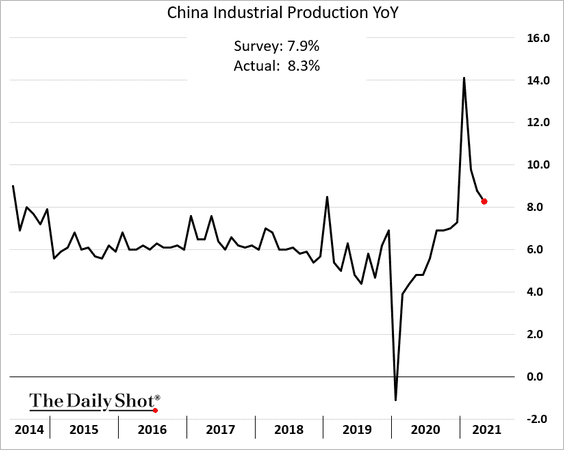

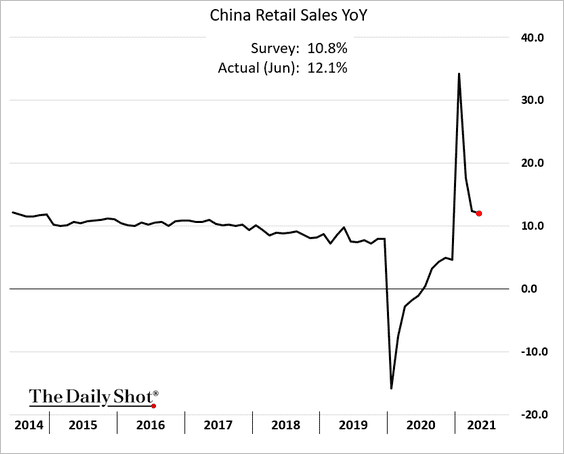

2. June industrial production and retail sales also topped expectations.

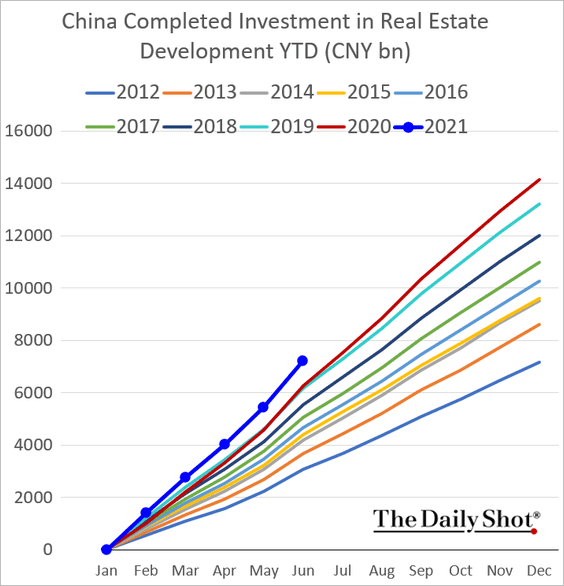

Property investment remains robust.

——————–

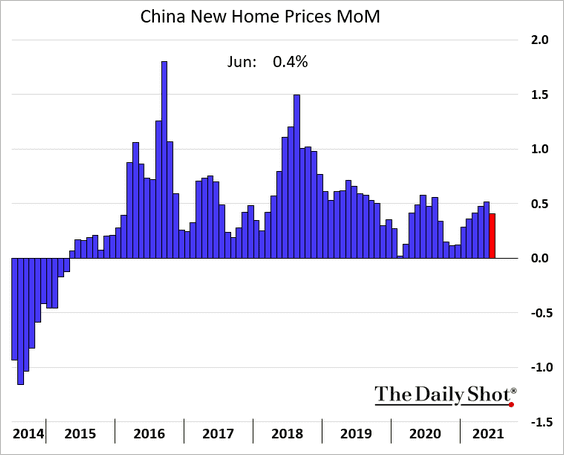

3. Home price appreciation moderated last month.

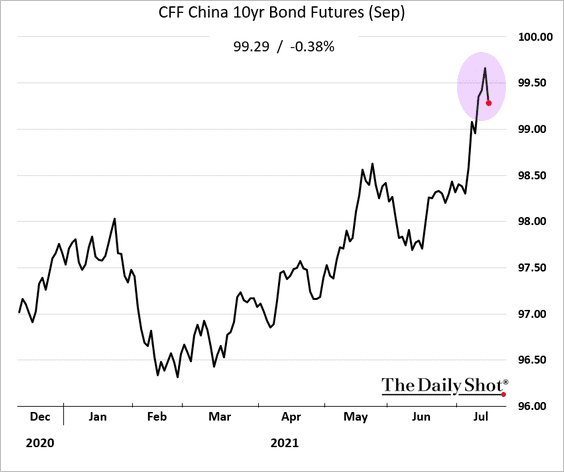

4. The PBoC is signaling that it’s not easing after the RRR cut.

Source: @markets Read full article

Source: @markets Read full article

Bond prices declined.

——————–

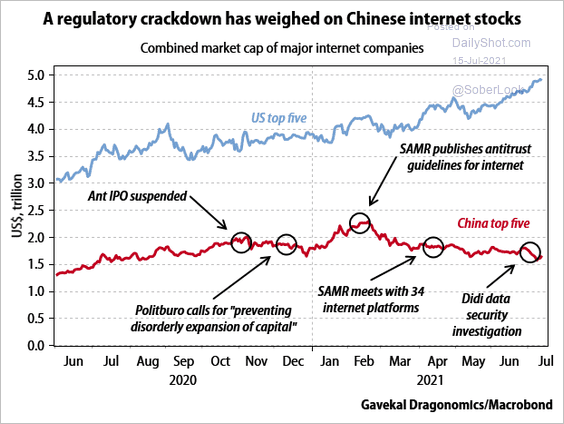

5. Here is the history of Bejing’s crackdown on tech.

Source: Gavekal Research

Source: Gavekal Research

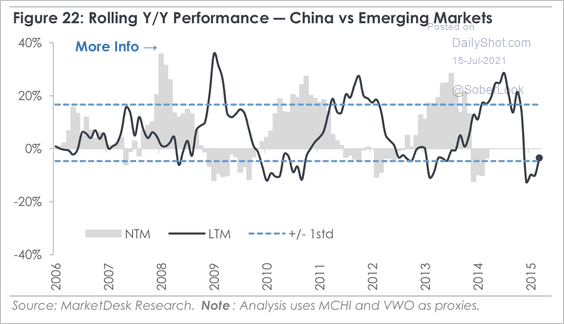

6. The year-over-year performance gap between China and the rest of EM appears stretched.

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Emerging Markets

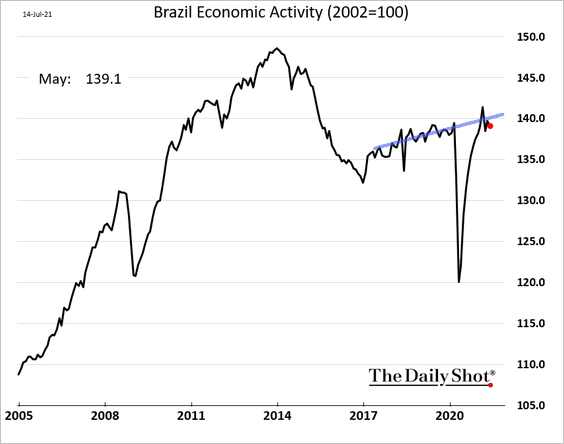

1. Brazil’s economic activity is slightly below the pre-COVID trend.

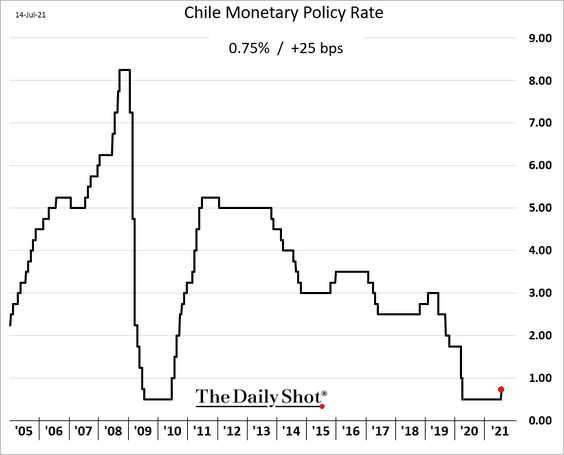

2. Chile’s central bank hiked rates (as expected).

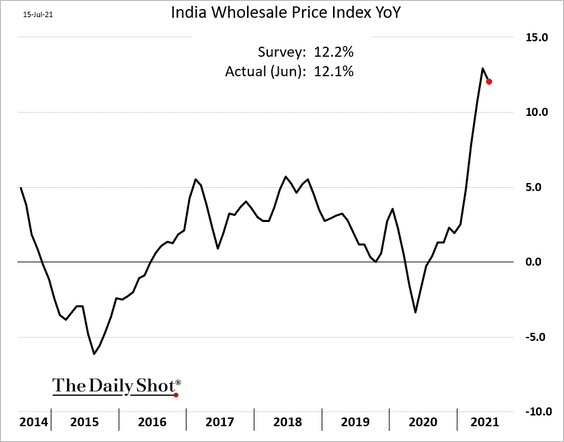

3. India’s wholesale inflation appears to be peaking.

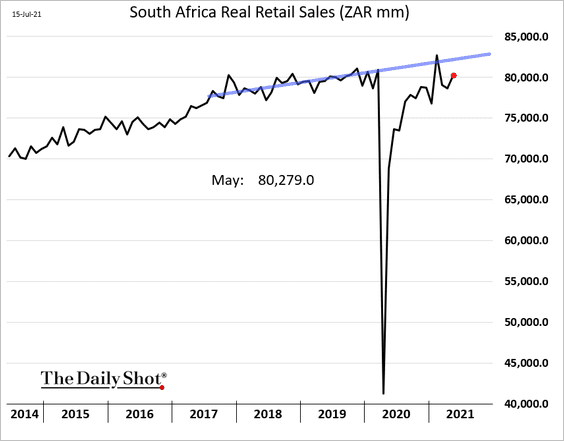

4. South Africa’s retail sales improved in May but remained below the pre-COVID trend.

Back to Index

Commodities

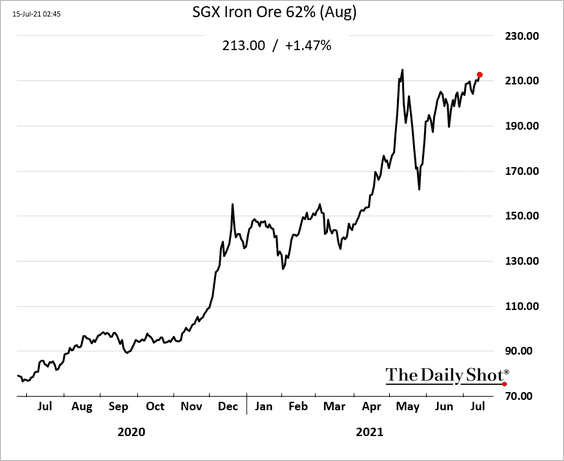

1. Iron ore futures are approaching multi-year highs reached in May.

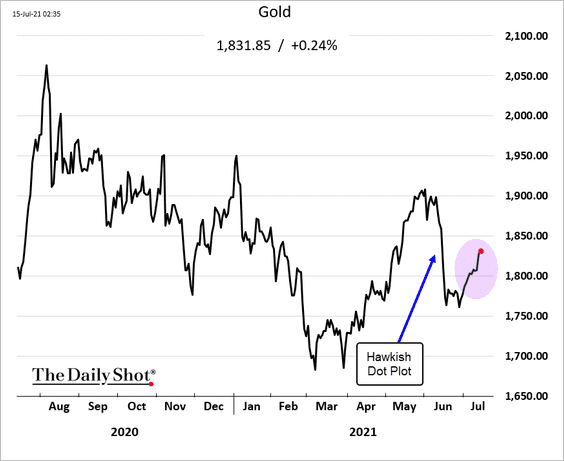

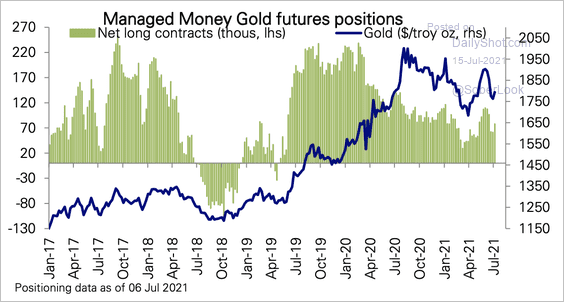

2. The price of gold is recovering.

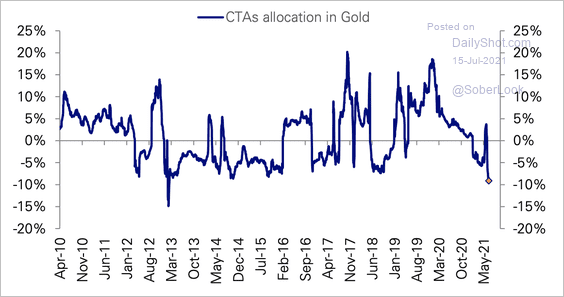

CTAs’ short positioning in gold is near an extreme, largely due to the precious metal’s downtrend since August 2020.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Gold net-long futures positioning continues to decline from extreme levels in 2019.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

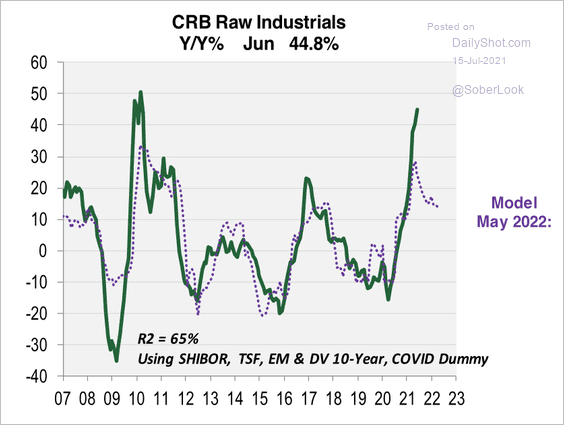

3. Cornerstone Macro expects a decline in the CRB Raw Industrials Index next year as monetary and fiscal stimulus fades.

Source: Cornerstone Macro

Source: Cornerstone Macro

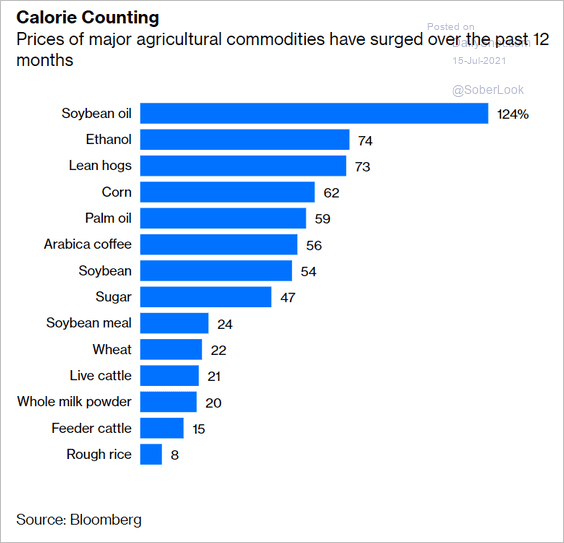

4. It’s been an impressive run for agricultural commodities.

Source: @davidfickling, @ClaraDFMarques, @andymukherjee70, @AdamMinter, @bopinion Read full article

Source: @davidfickling, @ClaraDFMarques, @andymukherjee70, @AdamMinter, @bopinion Read full article

Back to Index

Energy

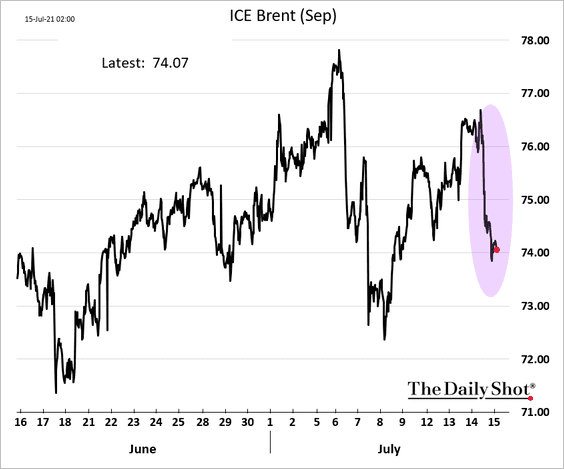

1. OPEC appears to have reached a deal with UAE.

Source: @WSJ Read full article

Source: @WSJ Read full article

Crude oil futures dropped.

——————–

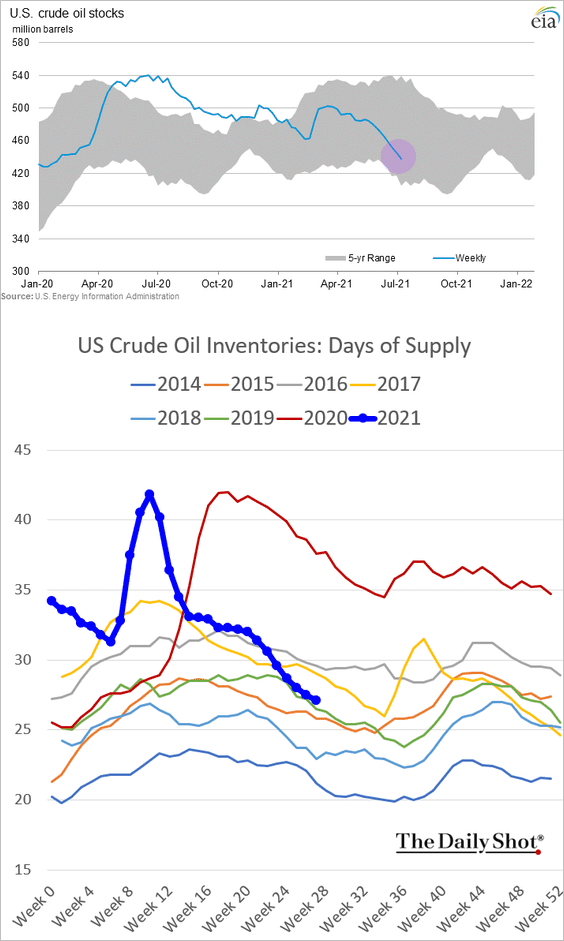

2. US crude oil inventories continue to shrink, with last week’s drawdown exceeding forecasts again. The “days of supply” measure is running just above 2019 levels.

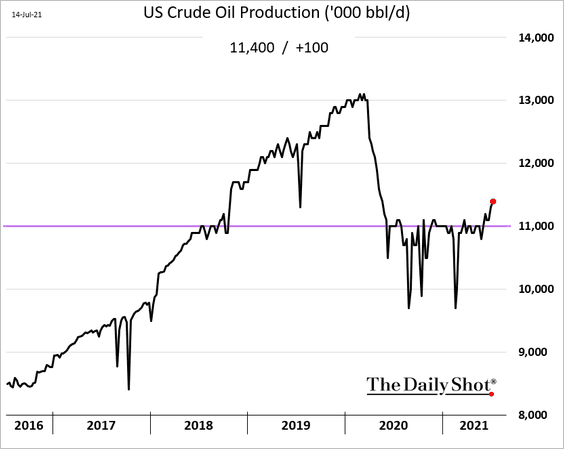

3. US crude oil production continues to rebound.

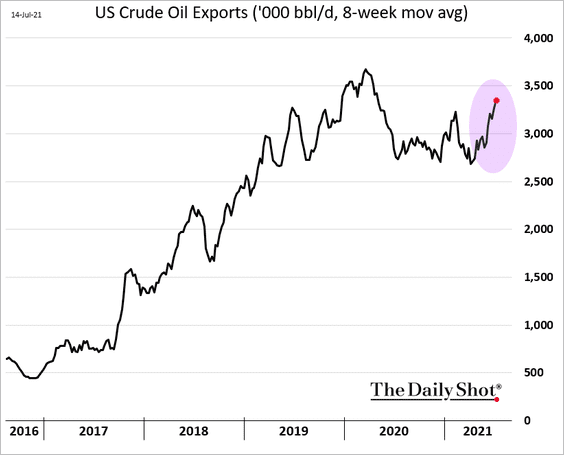

• Gross exports are trending higher as well.

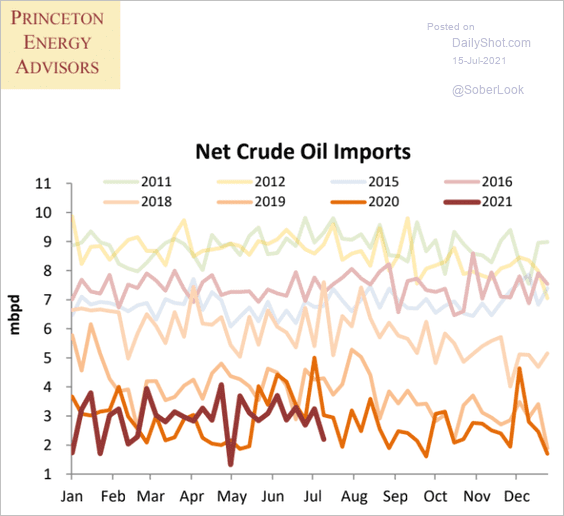

Net imports are the lowest in years (for this time of the year).

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

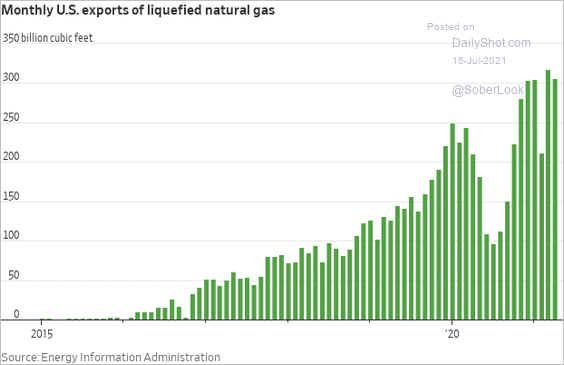

4. This chart shows US LNG exports.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

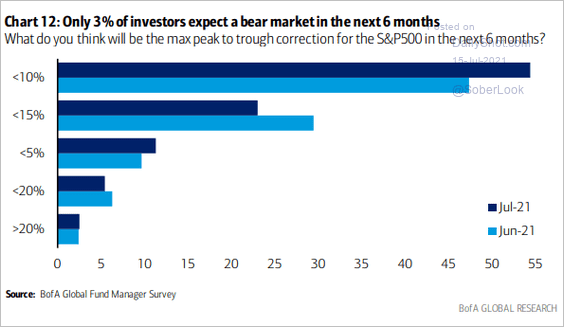

1. Fund managers are not concerned about a near-term bear market.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

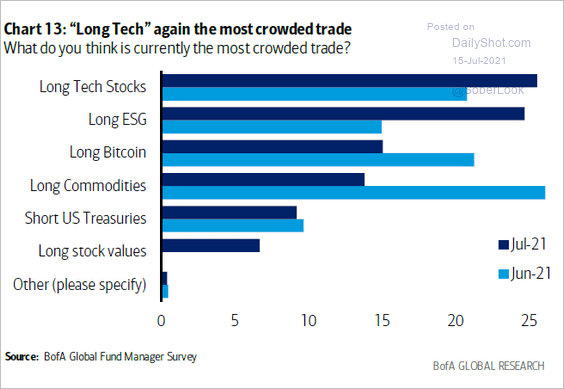

2. “Long tech” is once again the most crowded trade, according to the BofA Fund Manager Survey.

Source: BofA Global Research; @PippaStevens13

Source: BofA Global Research; @PippaStevens13

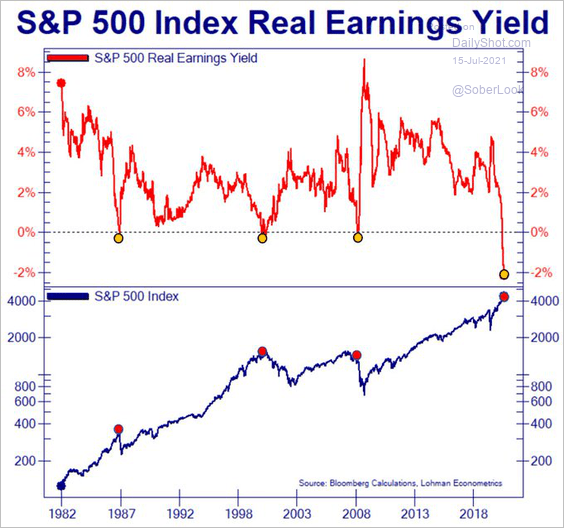

3. Based on the headline CPI, the real S&P 500 earnings yield doesn’t look very attractive.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

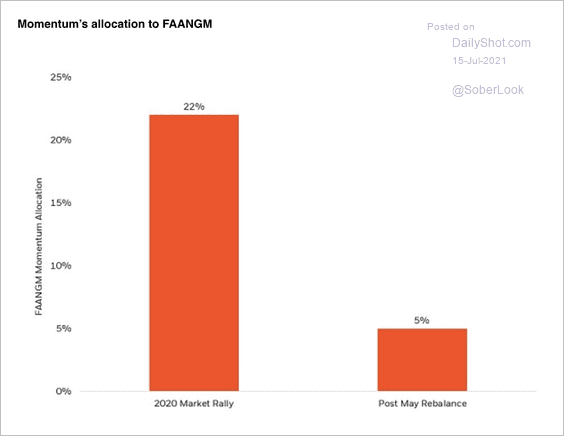

4. The iShares MSCI US Momentum factor held an average 22% weight to FAANGM names during last year’s market rally. The only FAANGM company it still holds is Google at an approximate 5% weight, according to BlackRock.

Source: BlackRock

Source: BlackRock

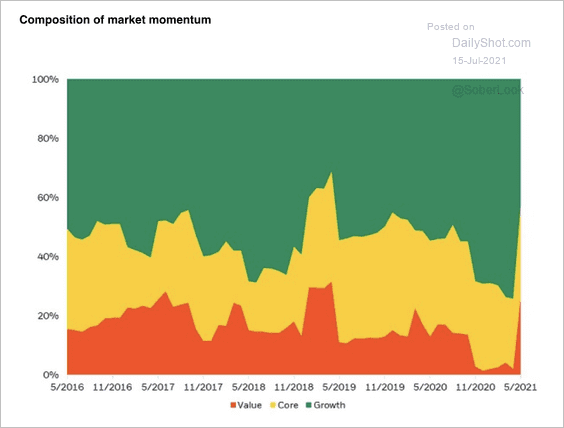

• As value advanced this year, market momentum has moved away from growth.

Source: BlackRock

Source: BlackRock

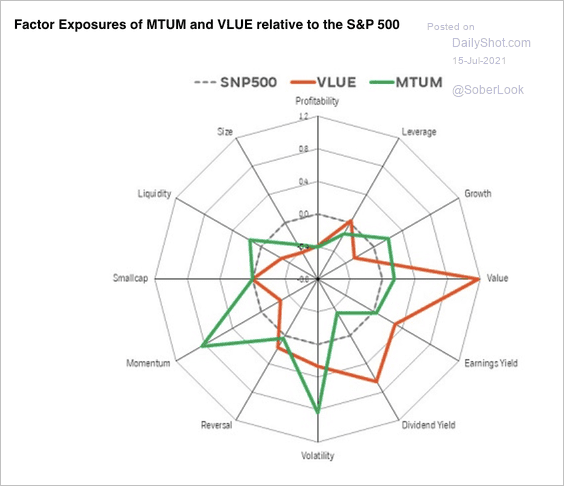

• Both momentum and value factors have some overlap, but largely maintain their potential diversifying benefits.

Source: BlackRock

Source: BlackRock

——————–

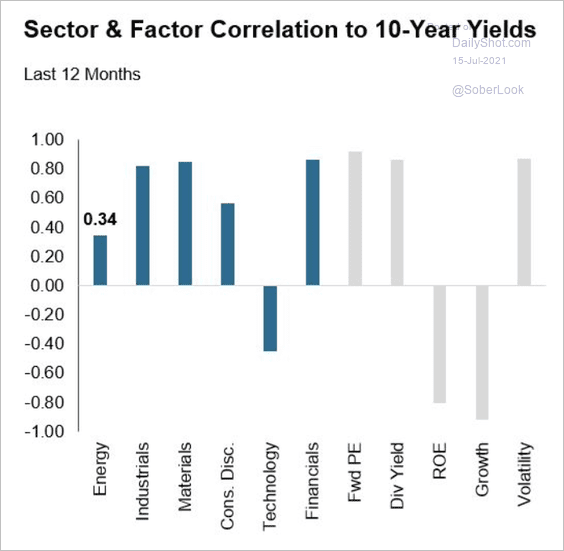

5. Tech and growth stocks have been negatively correlated with the 10-year Treasury yield over the past year.

Source: Denise Chisholm

Source: Denise Chisholm

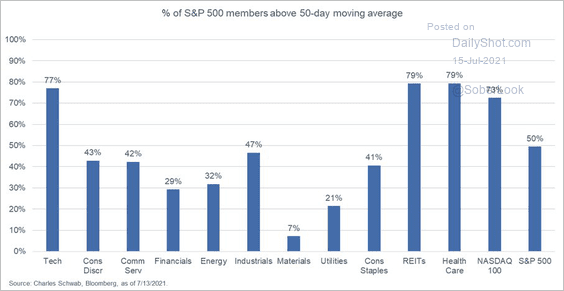

6. What percentage of each sector’s members trade above their 50-day moving average?

Source: @LizAnnSonders

Source: @LizAnnSonders

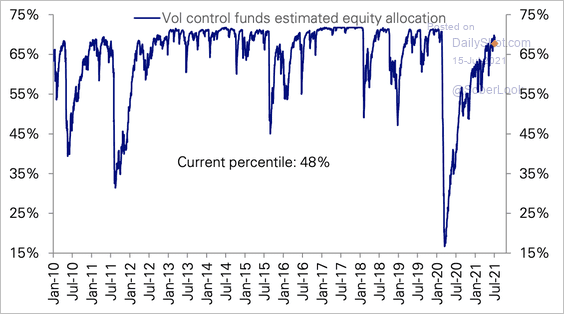

7. Receding volatility has prompted increased equity allocations from vol control funds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

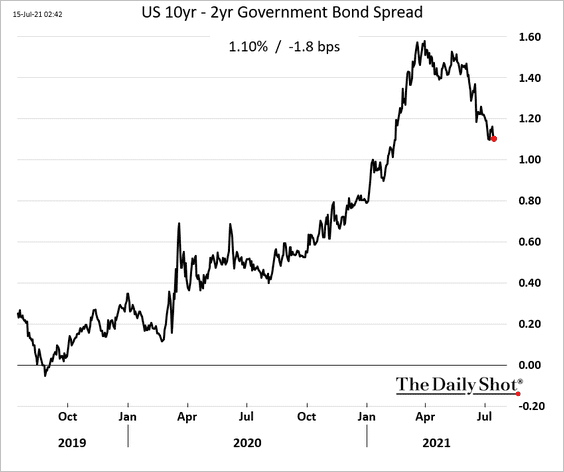

1. The Treasury curve continues to flatten.

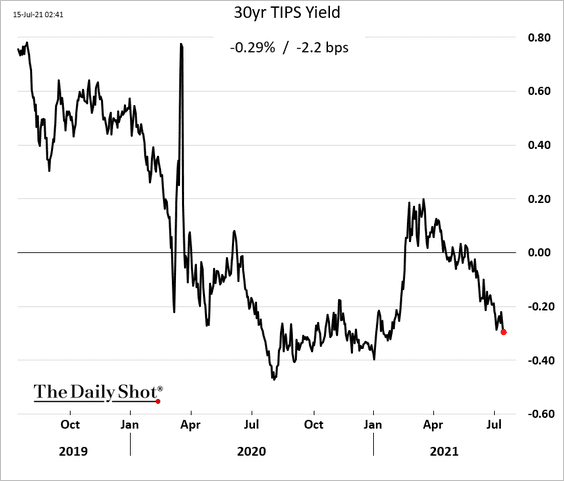

2. Longer-dated TIPS yields (implied real rates) are moving deeper into negative territory.

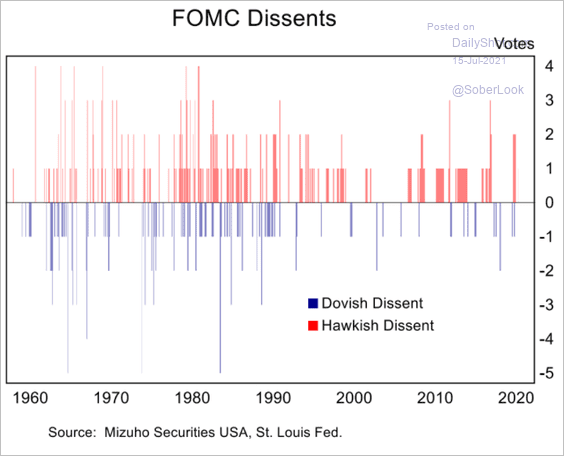

3. Here is the history of FOMC dissents.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

4. Based on history, Treasury yields are far too low given the growth in core CPI.

Source: Mitch Bollinger

Source: Mitch Bollinger

Back to Index

Global Developments

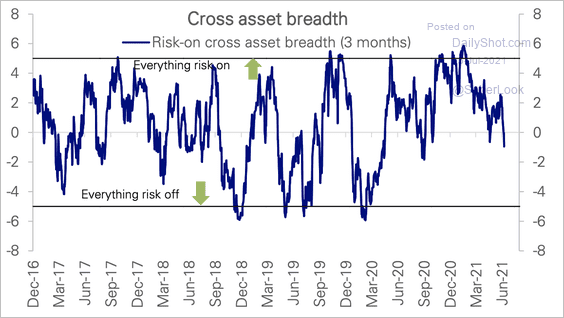

1. Deutsche Bank’s cross-asset breadth measure dipped into negative territory, which indicates less upside participation of risk-on assets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

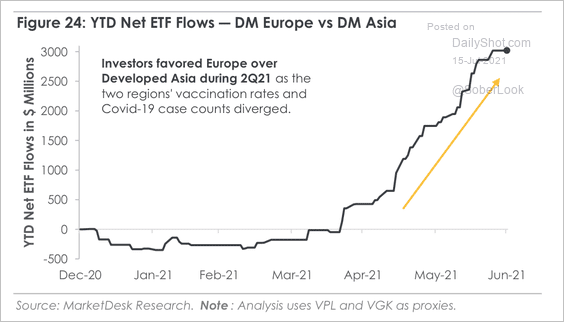

2. Developed market ETF flows have favored Europe over Asia over the past quarter.

Source: MarketDesk Research

Source: MarketDesk Research

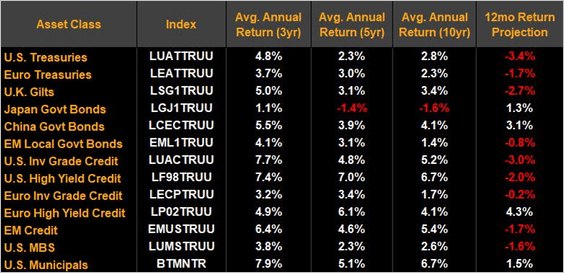

3. A majority of global fixed income asset classes are expected to deliver full-year losses over the next 12 months, according to Bloomberg Intelligence. European high yield bonds, Chinese government bonds, US municipals, and Japanese government bonds have positive expected returns through June 2022.

Source: Damian Sassower; Bloomberg Intelligence

Source: Damian Sassower; Bloomberg Intelligence

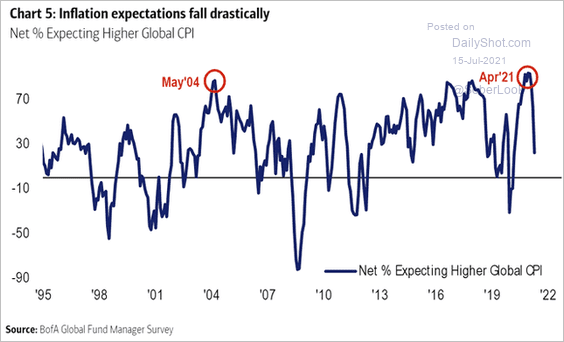

4. Fund managers’ inflation expectations have peaked, according to BofA’s survey.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

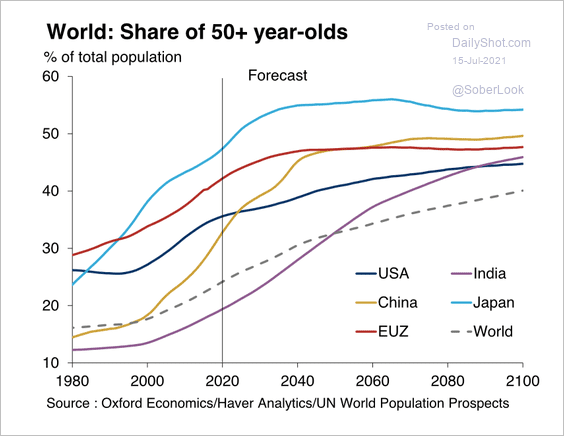

5. How rapidly is the world aging?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Food for Thought

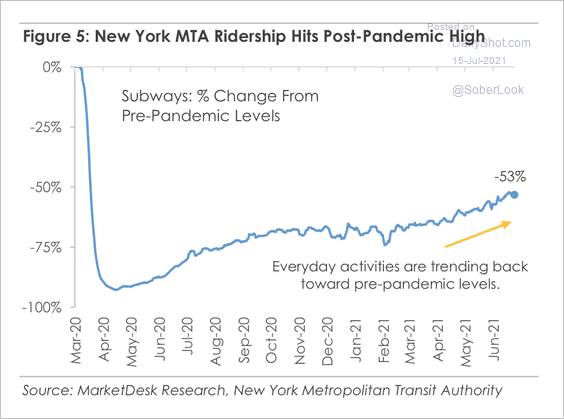

1. NYC subway ridership:

Source: MarketDesk Research

Source: MarketDesk Research

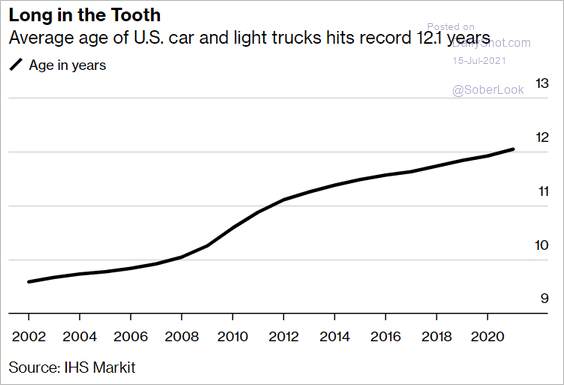

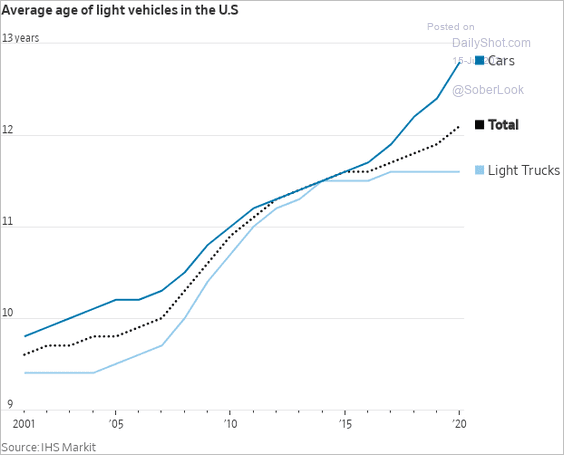

2. The average age of US cars and trucks:

Source: @business Read full article

Source: @business Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

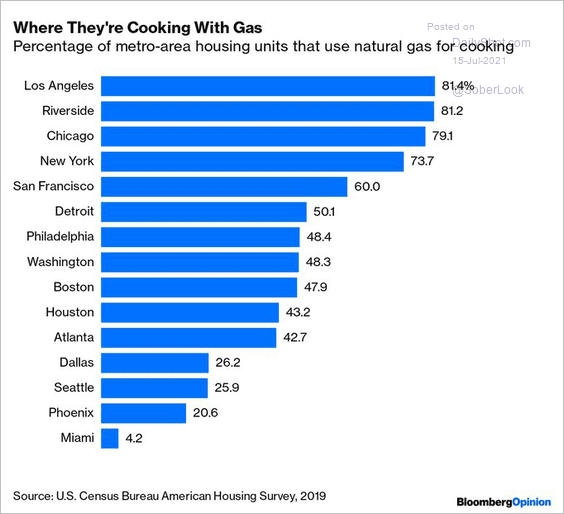

3. Cooking with natural gas:

Source: @foxjust Read full article

Source: @foxjust Read full article

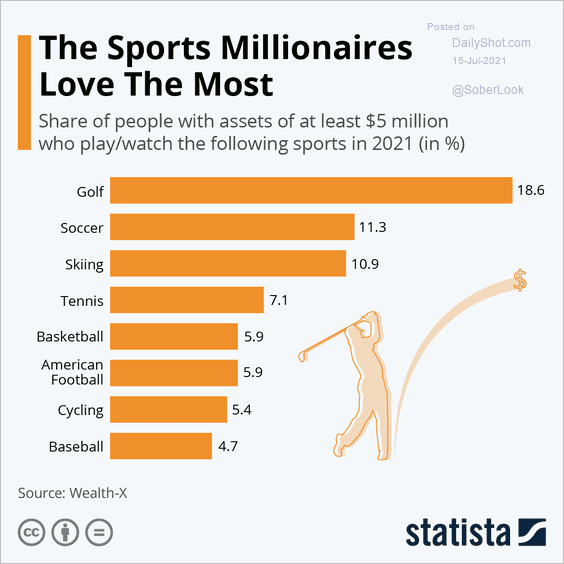

4. The sports that millionaires like:

Source: Statista

Source: Statista

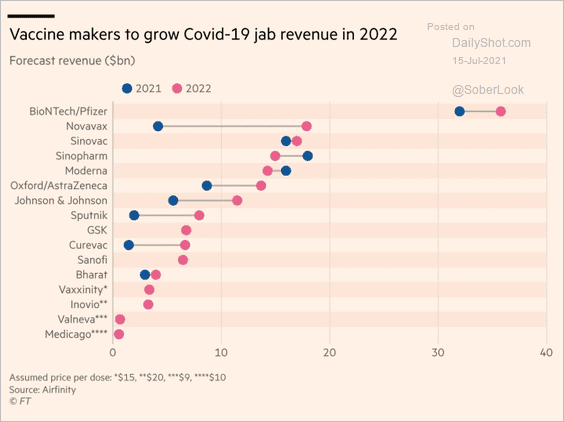

5. Vaccine makers’ revenues:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

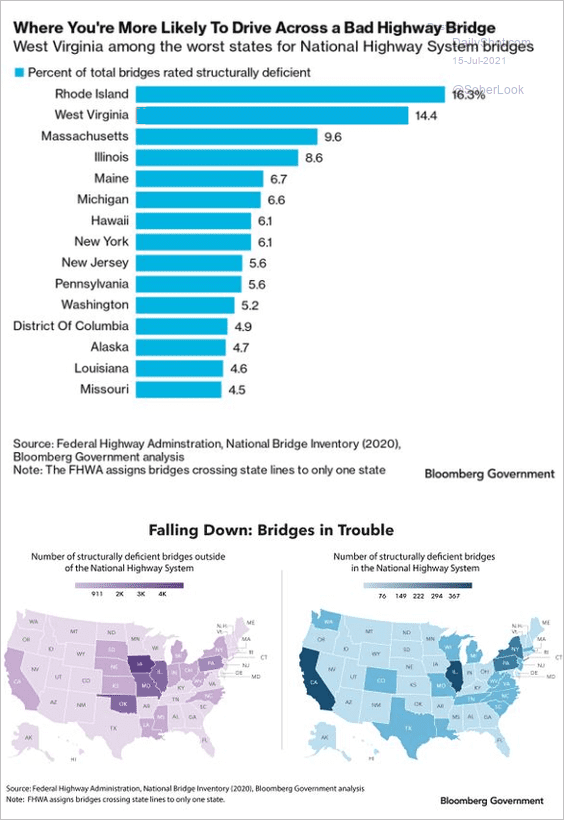

6. Bad highway bridges:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

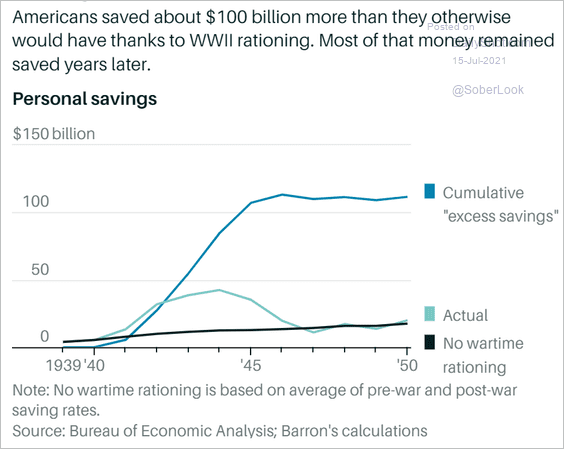

7. Personal savings during and after WWII rationing:

Source: Barron’s Read full article

Source: Barron’s Read full article

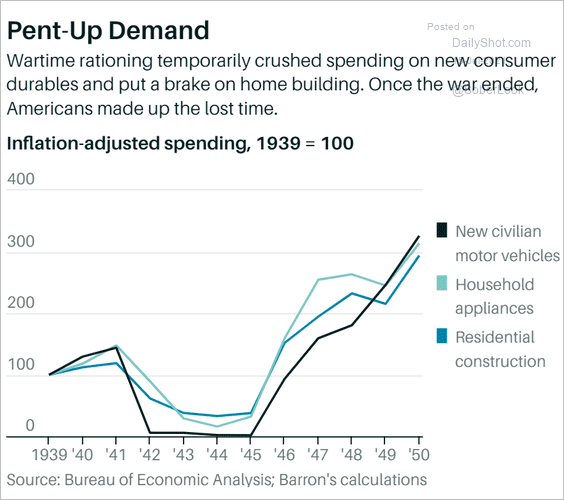

• Personal spending during and after WWII rationing:

Source: Barron’s Read full article

Source: Barron’s Read full article

——————–

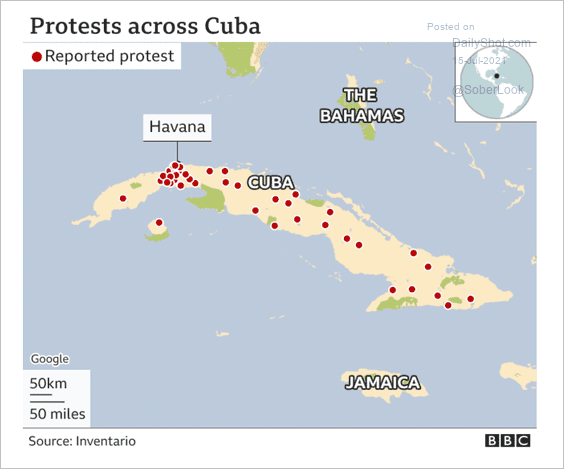

8. Protests across Cuba:

Source: BBC Read full article

Source: BBC Read full article

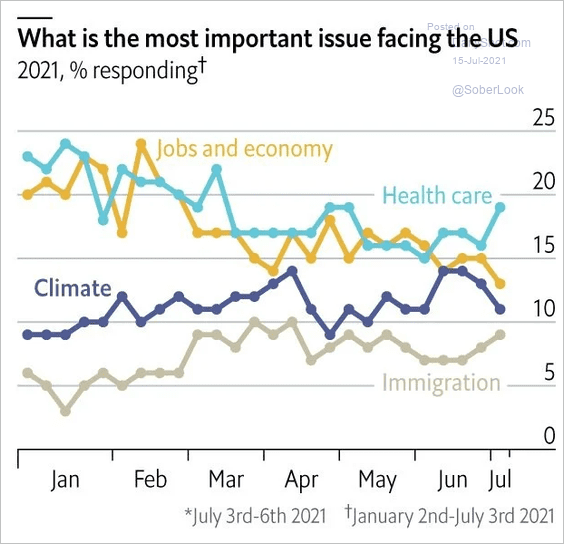

9. Most important issues facing the US:

Source: The Economist Read full article

Source: The Economist Read full article

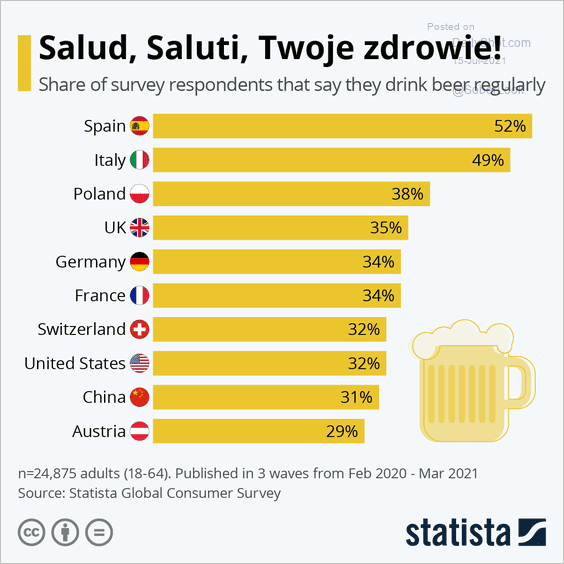

10. Who is drinking beer regularly?

Source: Statista

Source: Statista

——————–

Back to Index