The Daily Shot: 21-Jul-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

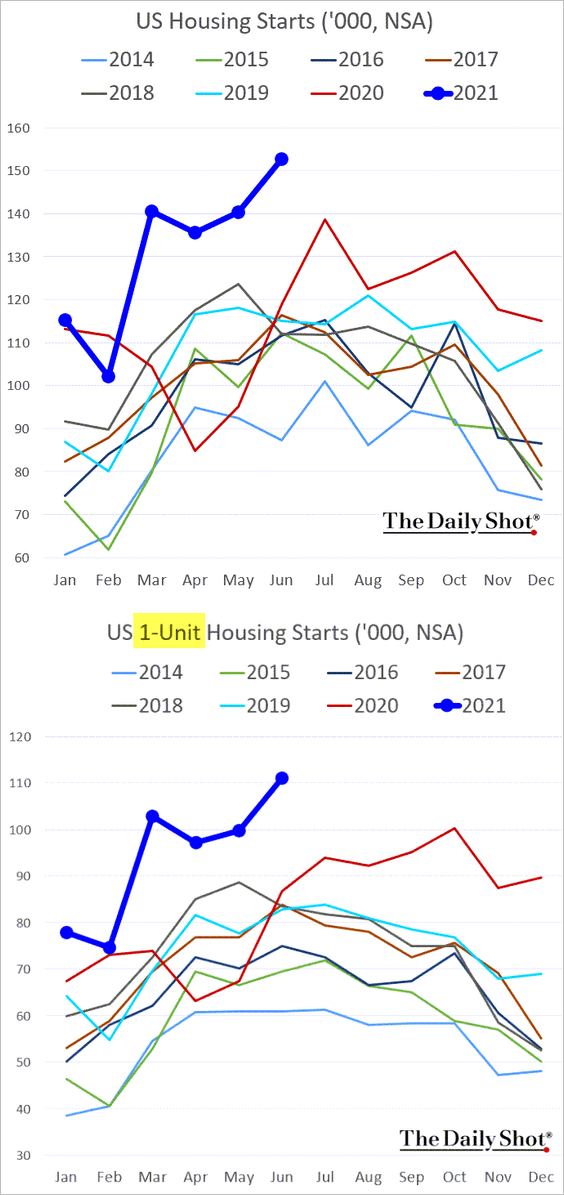

1. Residential construction remains robust, with housing starts hitting multi-year highs.

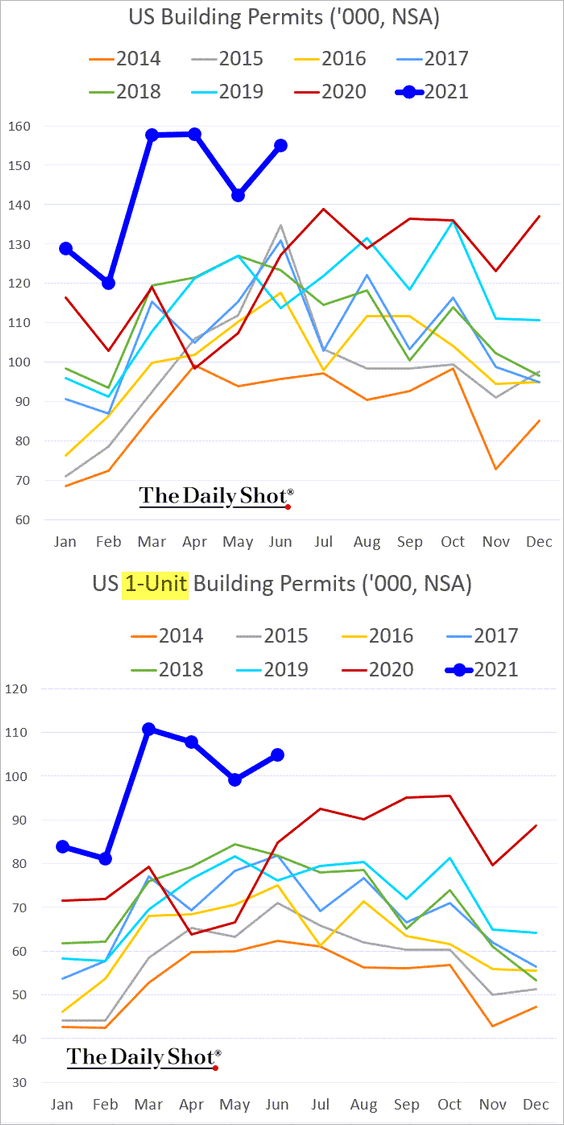

Building permits were a bit less vigorous than the market expected but still quite strong.

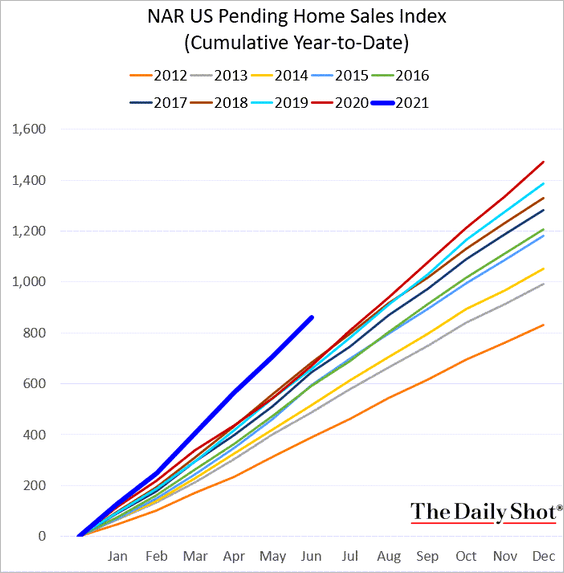

Just to put construction permits into perspective, here is the cumulative year-to-date chart.

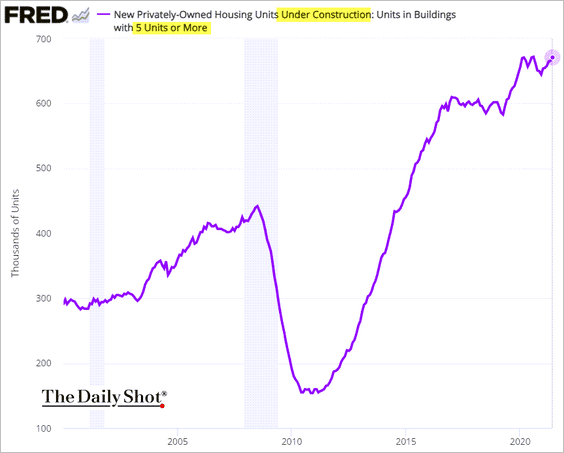

Below are a couple of other residential construction trends.

• There is still quite a bit of multi-family construction in the pipeline (apartments).

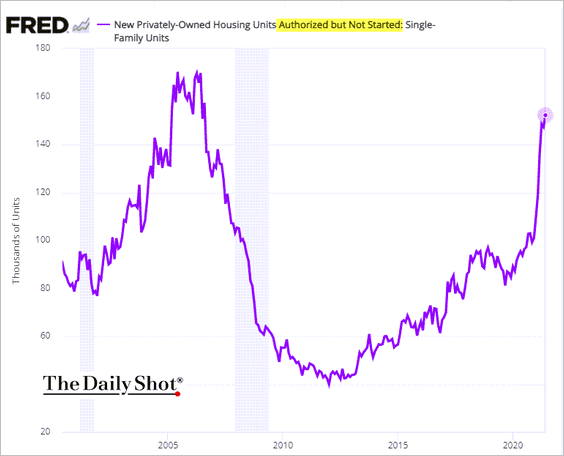

• The backlog of authorized but not started single-family units keeps climbing. Builders are struggling to keep up.

——————–

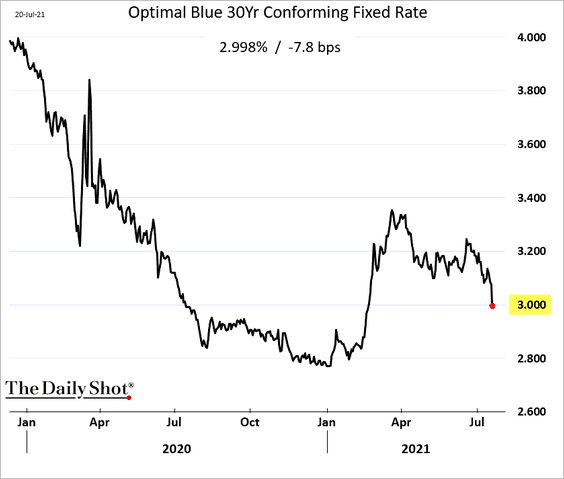

2. The 30yr mortgage rate dipped below 3% as Treasury yields tumbled.

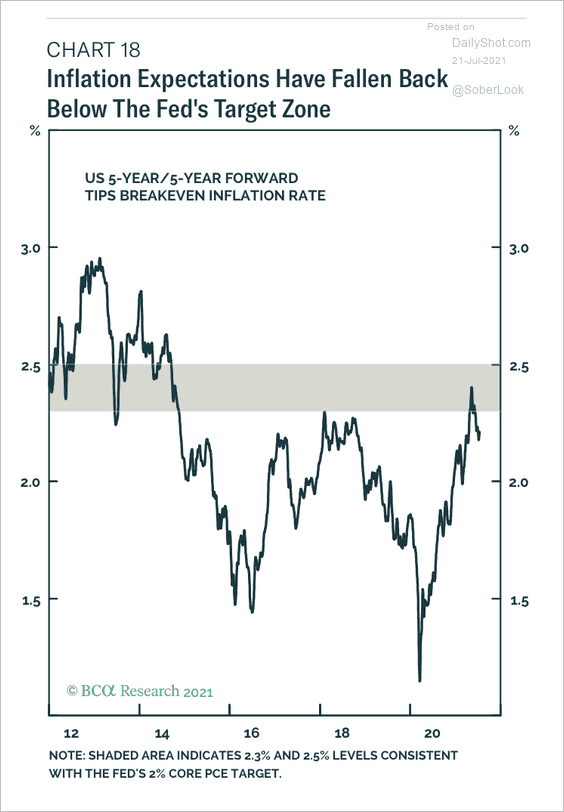

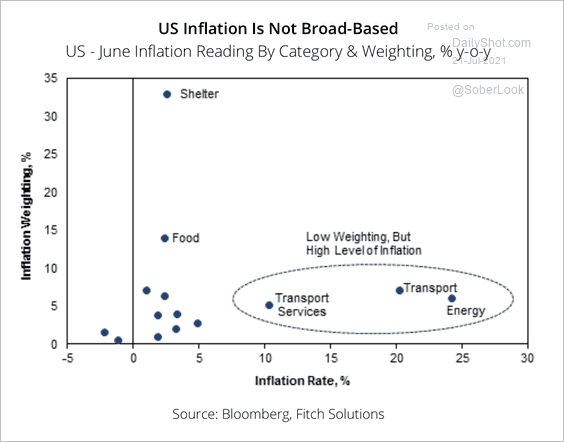

3. Longer-dated market-based inflation expectations have been moderating, …

Source: BCA Research

Source: BCA Research

… as the market accepts the “transient” theme.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

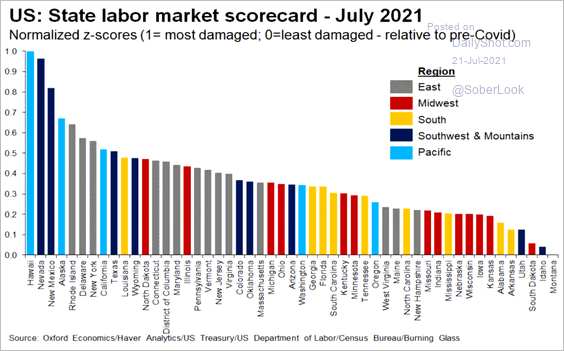

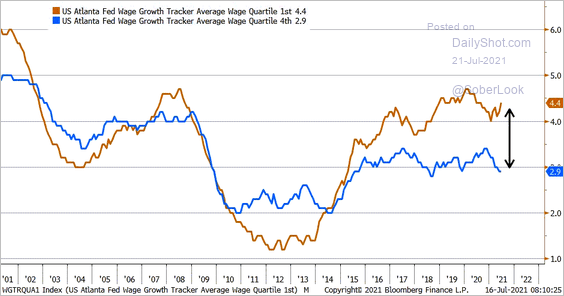

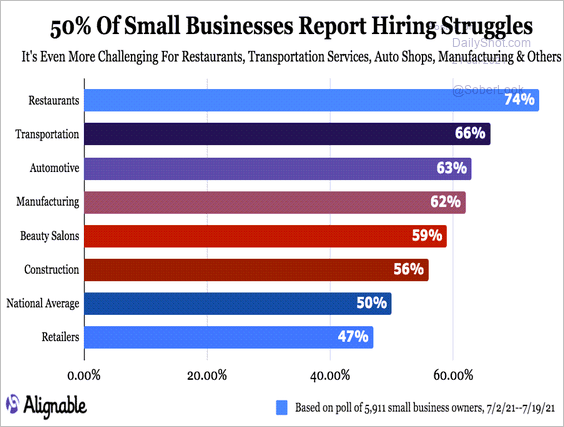

4. Next, we have some updates on the labor market.

• The most damaged state labor markets:

Source: Oxford Economics

Source: Oxford Economics

• The upper vs. lower quartile wage growth divergence:

Source: @LizAnnSonders, @AtlantaFed

Source: @LizAnnSonders, @AtlantaFed

• Sectors experiencing most labor shortages:

Source: Alignable

Source: Alignable

——————–

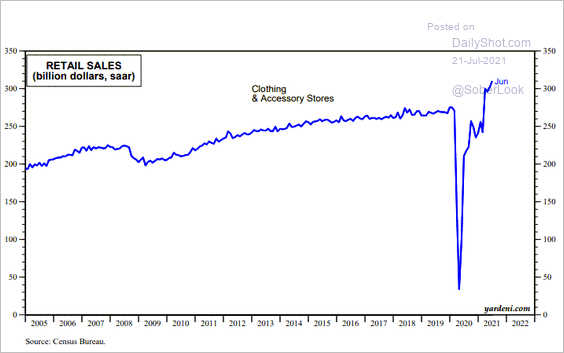

5. Spending at clothing stores surged well above pre-COVID levels.

Source: Yardeni Research

Source: Yardeni Research

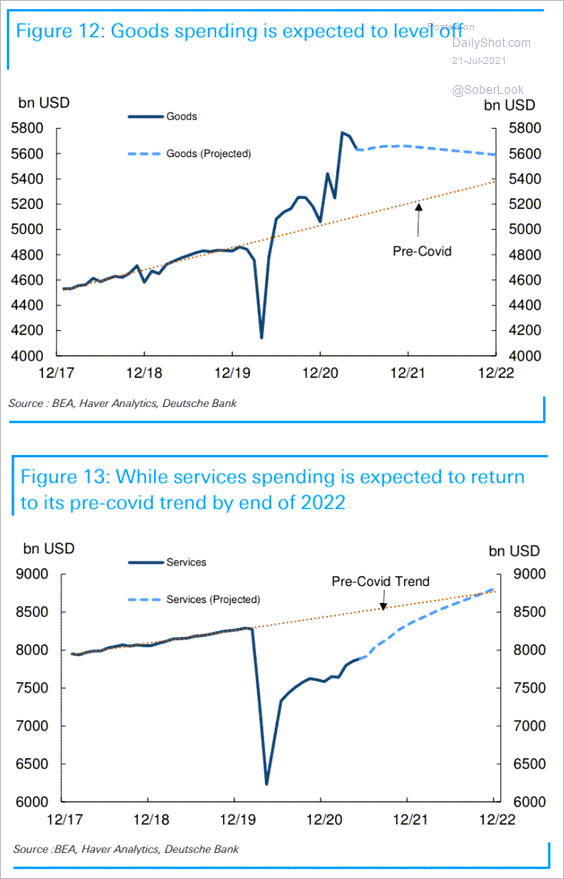

But goods spending is expected to level off as services rebound.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

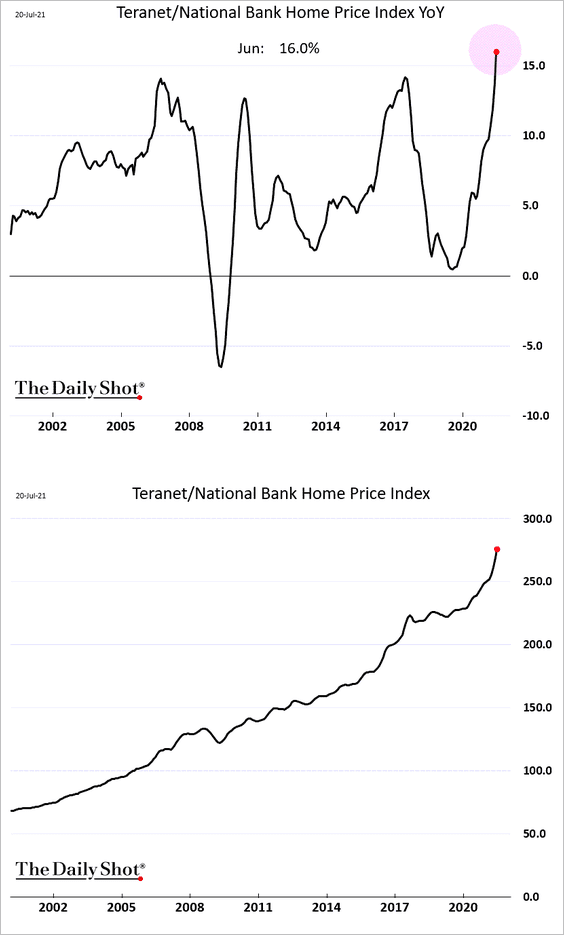

1. Home price appreciation hit the highest level in at least two decades.

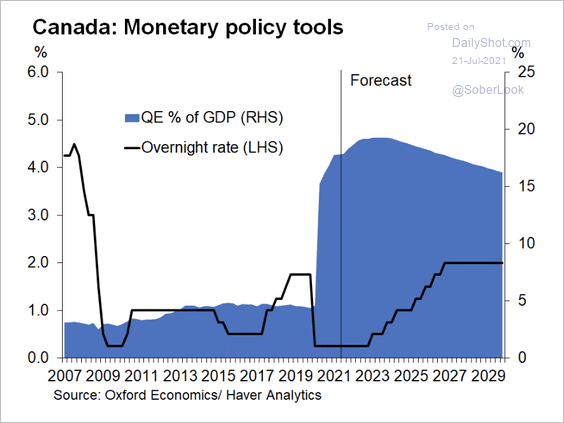

2. The BoC will likely further taper QE this year but will hold off on hiking rates until early 2023, according to Oxford Economics. Will the housing market trend (above) prompt the central bank to accelerate tightening?

Source: Oxford Economics

Source: Oxford Economics

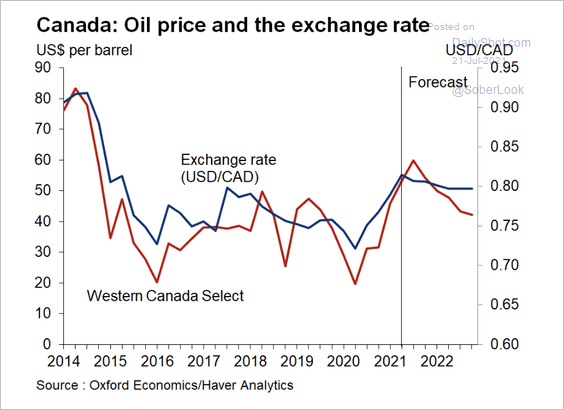

3. A downturn in oil prices could weigh on the loonie.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

1. The pound has been rolling over vs. USD (also weaker against EUR).

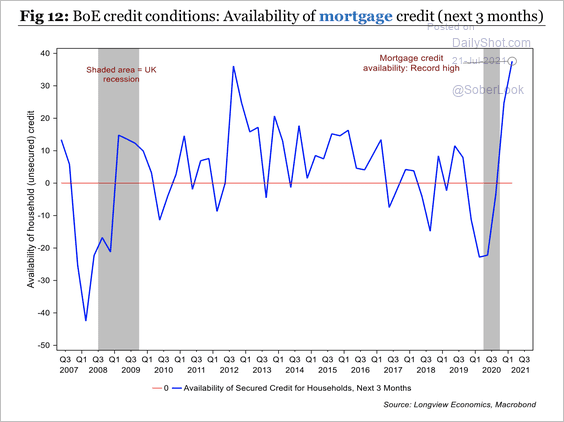

2. Mortgage credit availability is at a record high.

Source: Longview Economics

Source: Longview Economics

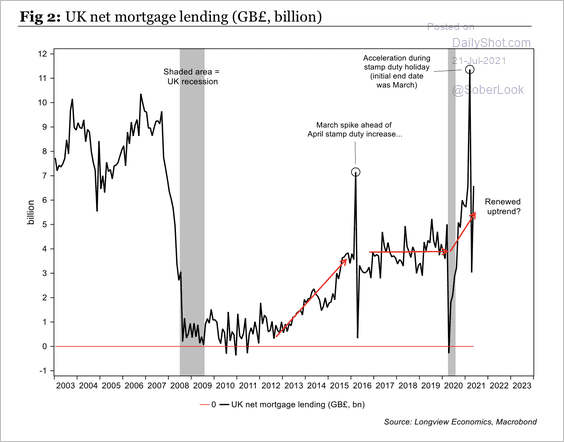

Could we see a renewed uptrend in mortgage lending?

Source: Longview Economics

Source: Longview Economics

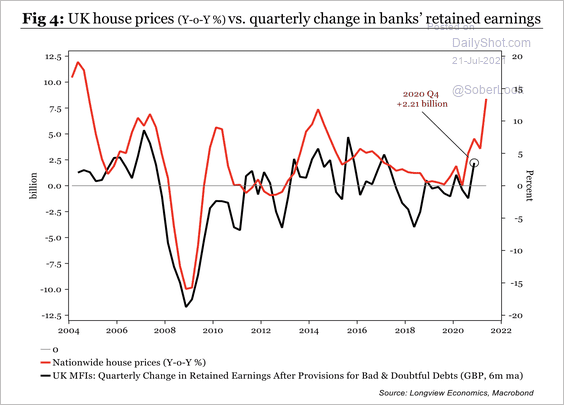

Rising housing prices along with banks’ increased capacity to extend credit could lead to growth in lenders’ retained earnings, according to Longview Economics.

Source: Longview Economics

Source: Longview Economics

——————–

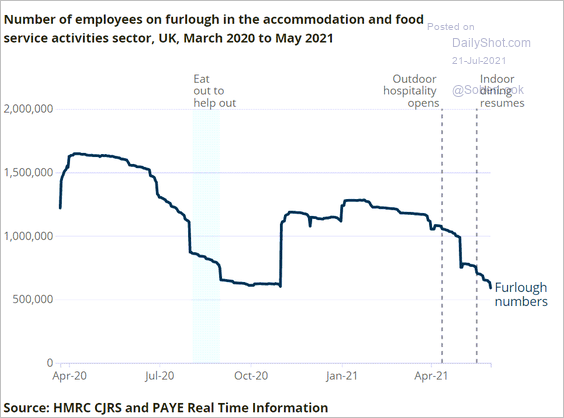

3. This chart shows the number of furloughed workers in accommodation and food services.

Source: ONS Read full article

Source: ONS Read full article

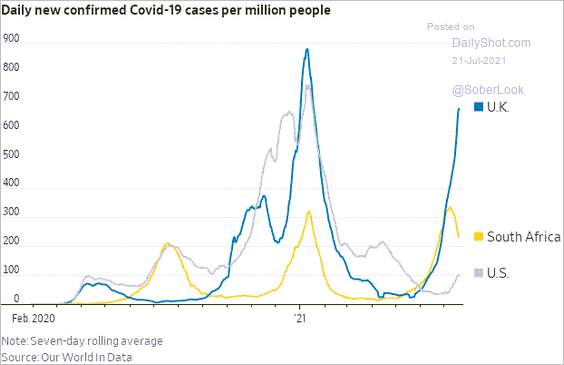

4. New COVID cases keep climbing.

Source: @jeffsparshott

Source: @jeffsparshott

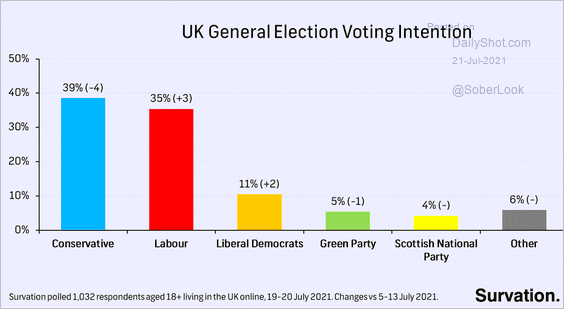

5. Next, we have a couple of updates on UK politics.

• Voting intentions:

Source: @Survation Read full article

Source: @Survation Read full article

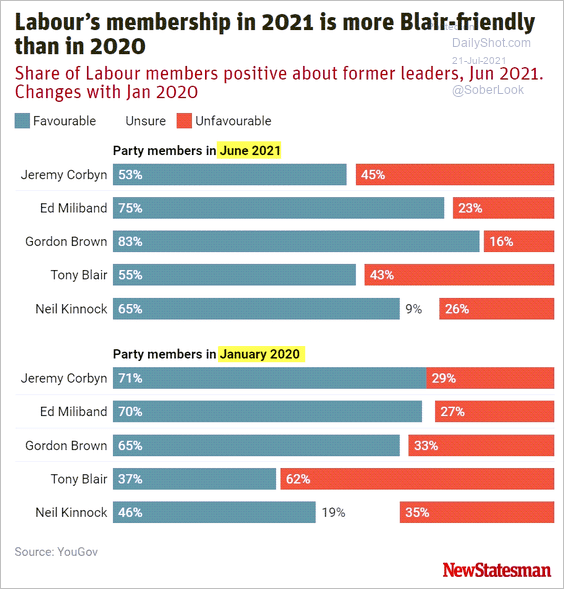

• Labour members’ views on former leaders:

Source: @BritainElects, @YouGov, @bnhwalker Read full article

Source: @BritainElects, @YouGov, @bnhwalker Read full article

Back to Index

The Eurozone

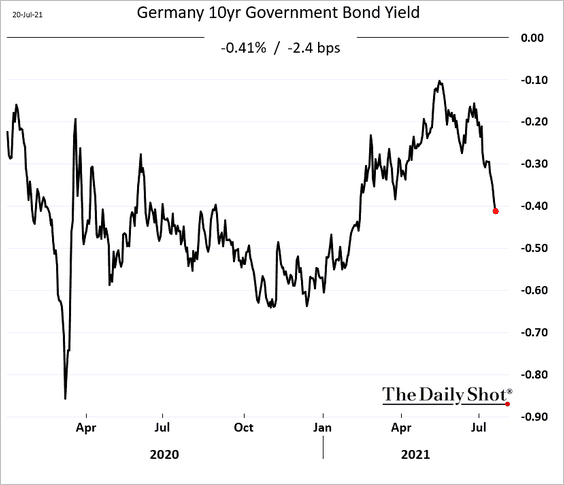

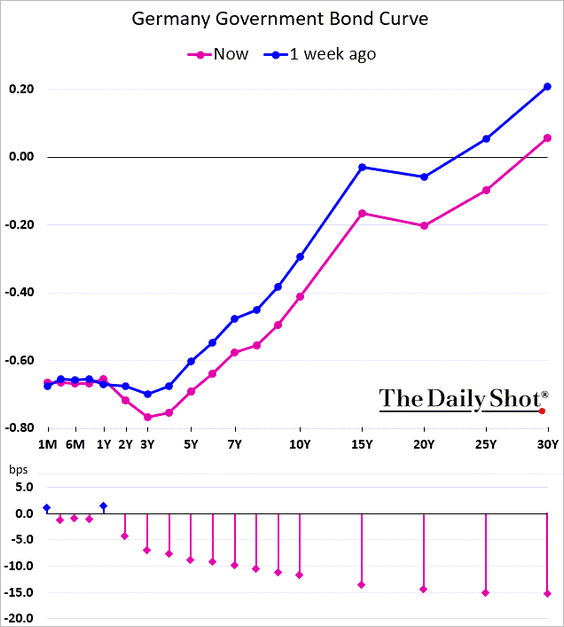

1. Bund yields continue to sink, …

… as the curve flattens.

——————–

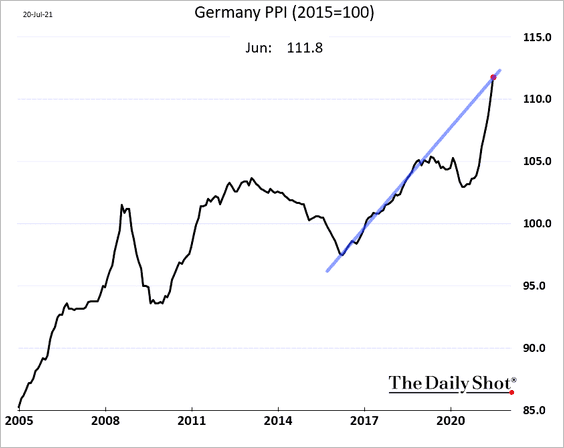

2. Germany’s producer prices are back at the pre-COVID trend.

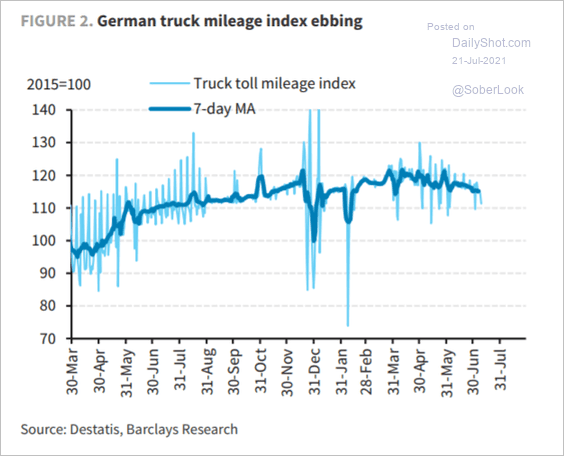

Separately, the truck mileage index is ebbing.

Source: Barclays Research

Source: Barclays Research

——————–

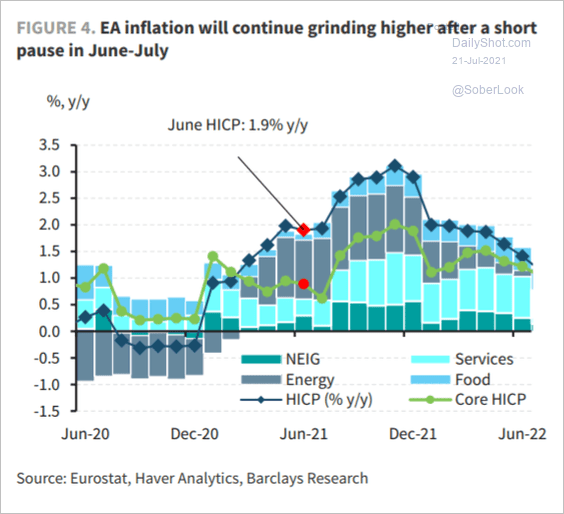

3. Euro-area consumer inflation is expected to swell in the months ahead.

Source: Barclays Research

Source: Barclays Research

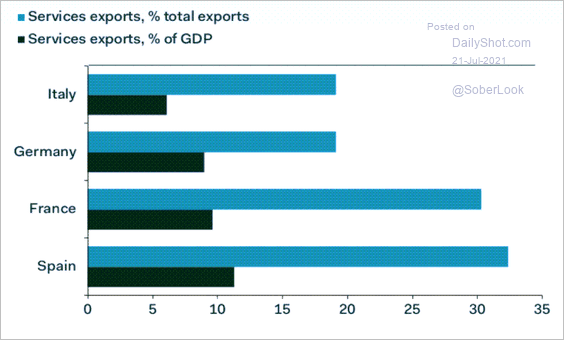

4. This chart shows the relative importance of service exports by country.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

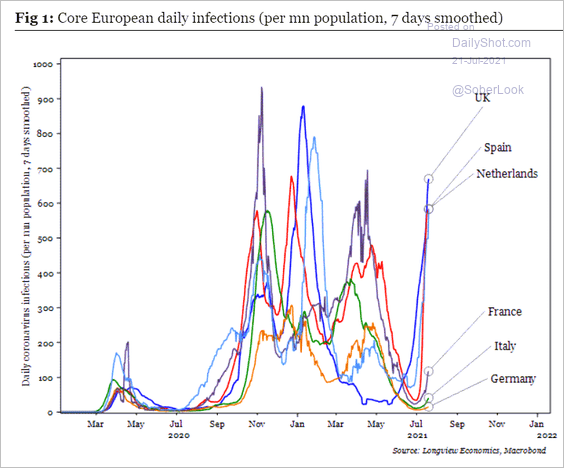

5. Next, we have a couple of updates on the pandemic.

• COVID cases (with the UK thrown in for comparison):

Source: Longview Economics

Source: Longview Economics

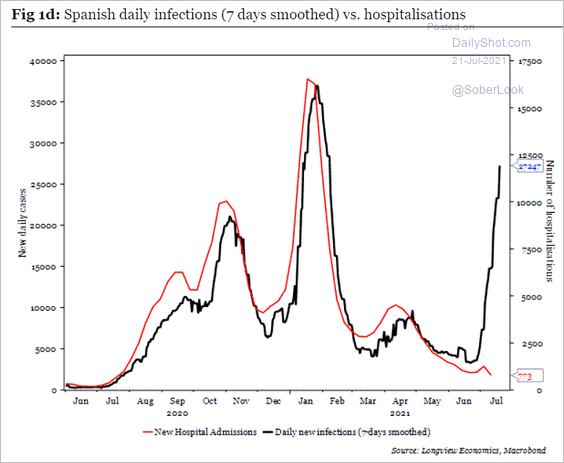

• Spain’s new cases vs. hospitalizations (vaccine effectiveness):

Source: Longview Economics

Source: Longview Economics

Back to Index

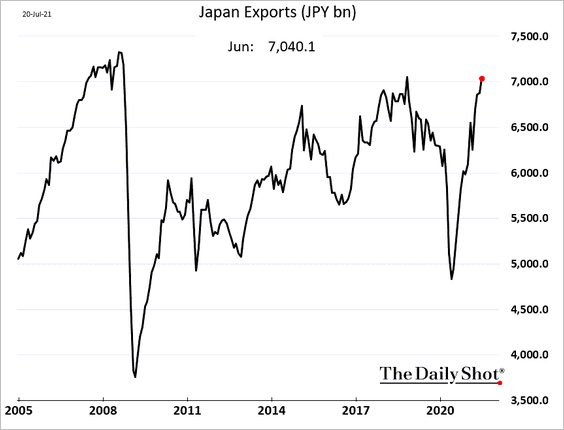

Japan

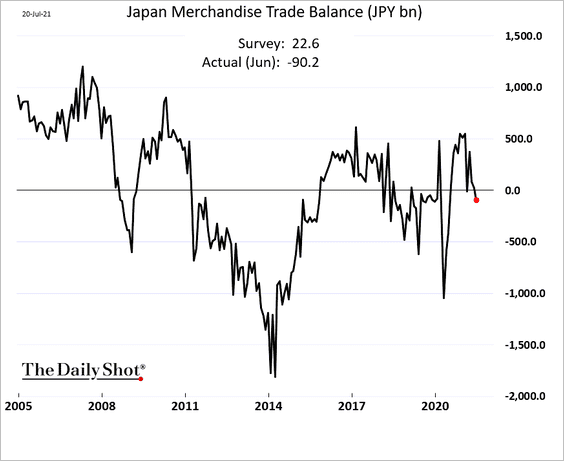

1. Exports continue to climb.

But Japan’s trade balance unexpectedly swung into deficit.

——————–

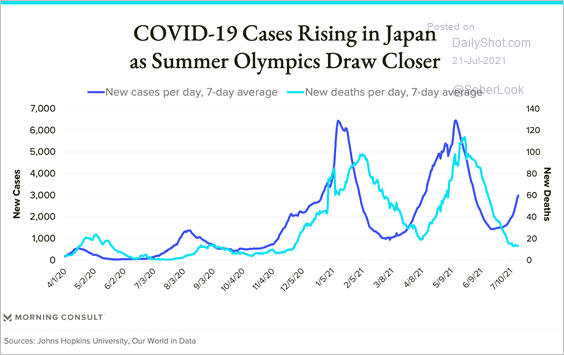

2. COVID cases are climbing, but the death rate remains low.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

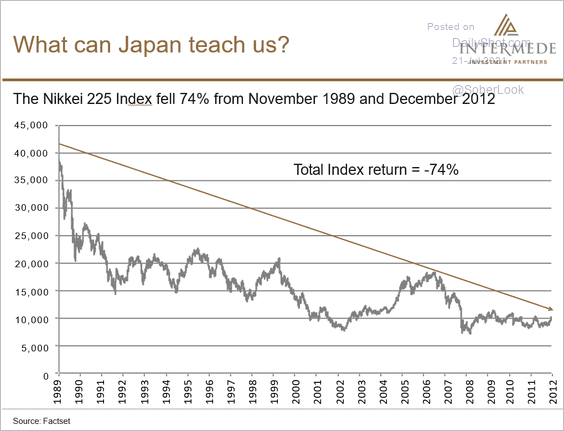

3. Between 1989 and the end of 2012, the Nikkei lost 74%, with only 19 stocks ending in positive territory.

Source: Mia Kwok, Livewire Markets Read full article

Source: Mia Kwok, Livewire Markets Read full article

Back to Index

Asia – Pacific

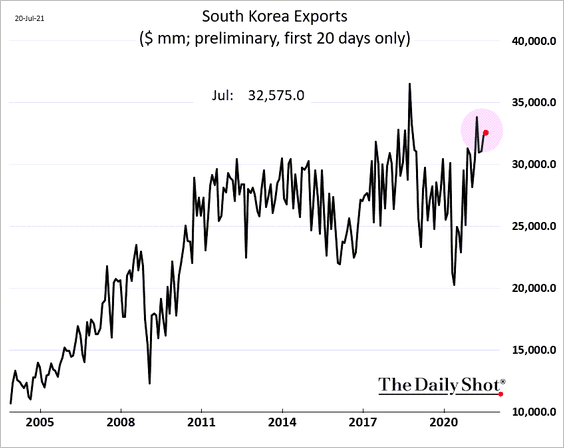

1. South Korea’s exports remain robust.

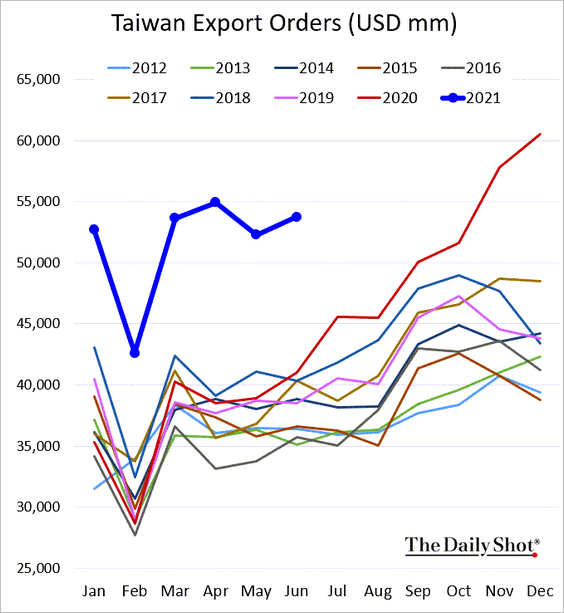

2. Taiwan’s export orders are hitting record highs for this time of the year.

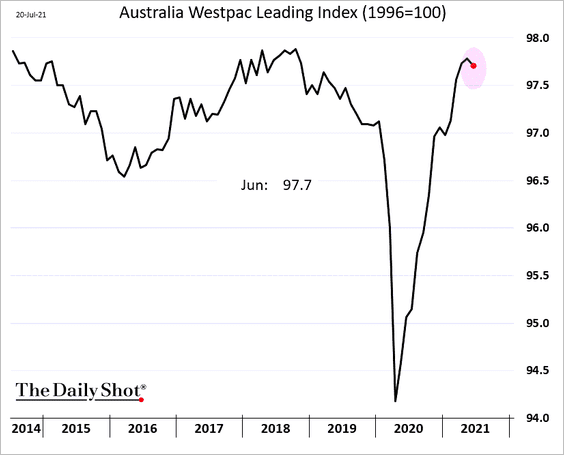

3. Australia’s leading index turned lower in June.

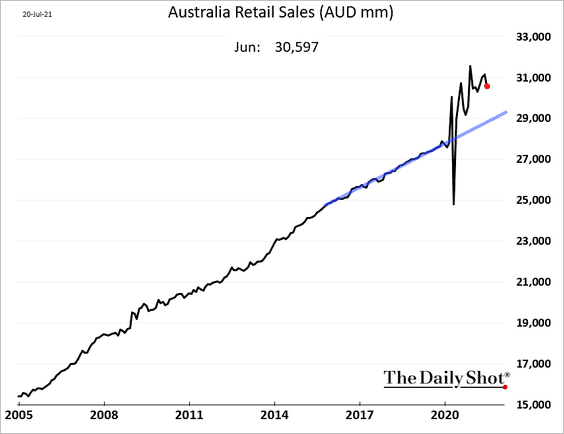

Retail sales declined more than expected but remained well above the pre-COVID trend.

Back to Index

China

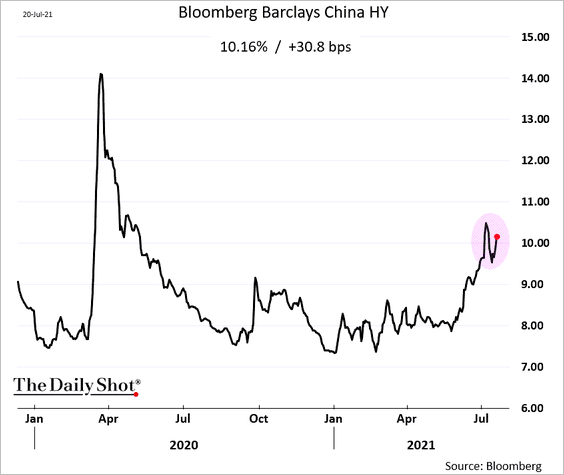

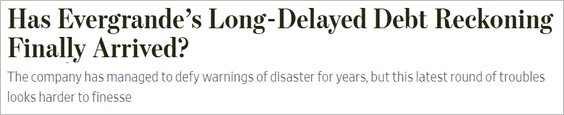

1. Dollar-denominated lower-rated bond yields remain elevated, pressured by leveraged names such as Evergrande.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

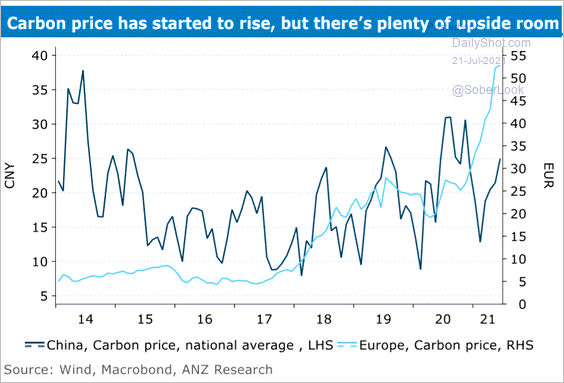

2. China’s carbon credit prices could see further gains.

Source: ANZ Research

Source: ANZ Research

Back to Index

Emerging Markets

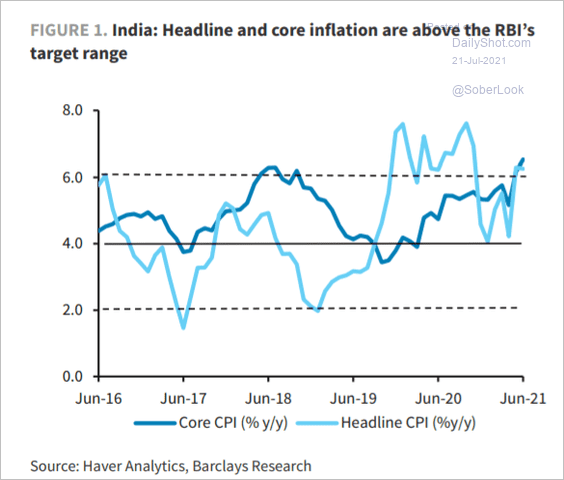

1. India’s inflation has been holding above the RBI’s target range.

Source: Barclays Research

Source: Barclays Research

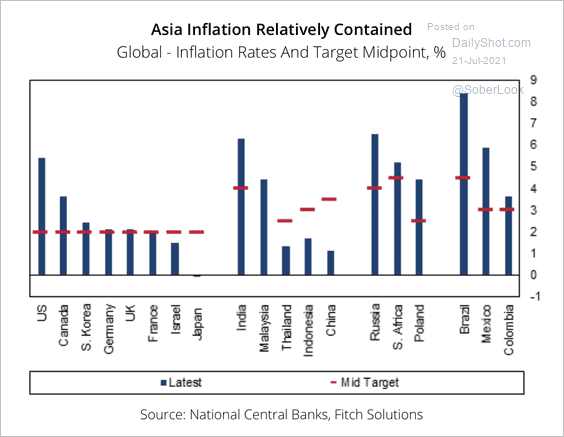

2. Inflation in EM Asia countries appears relatively tame. Fitch Solutions expects inflation rates to recede through the second half of this year, which should dampen some headwinds from currency depreciation.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

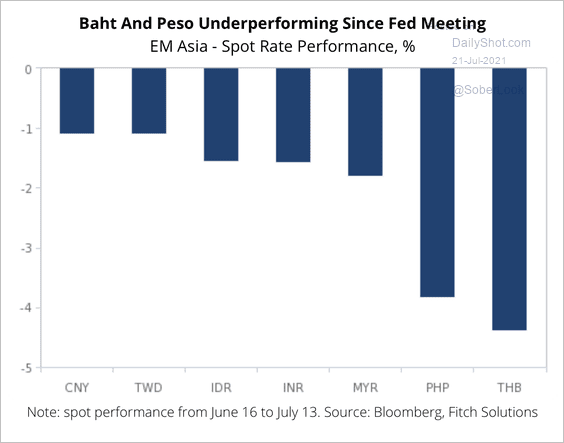

3. The Thai baht and Philippine peso have underperformed since the June Fed meeting.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

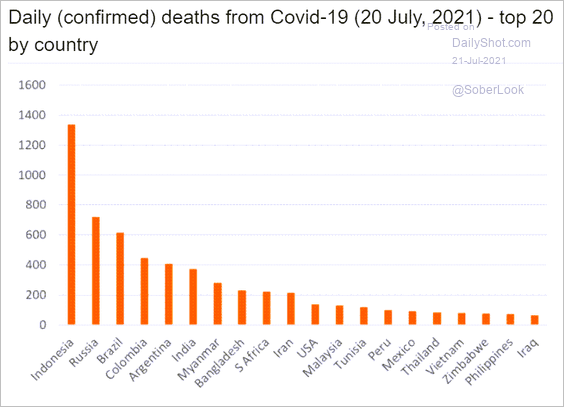

4. This chart shows daily confirmed deaths from COVID by country.

Source: ING

Source: ING

Back to Index

Cryptocurrency

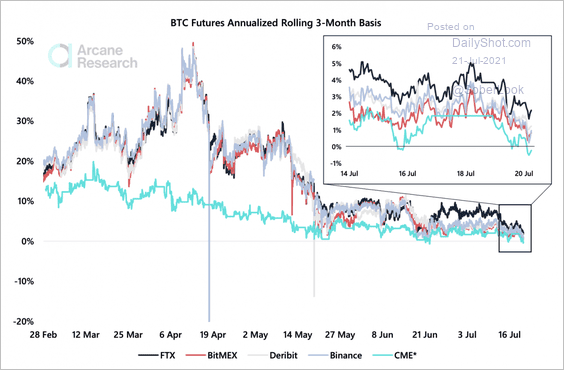

1. Bitcoin CME futures have shifted into backwardation as traders are no longer willing to pay a premium for their exposure.

Source: Arcane Research

Source: Arcane Research

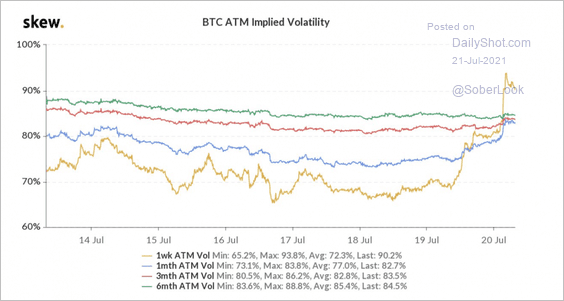

2. Bitcoin’s short-term implied volatility spiked as the price dipped below $30K.

Source: Skew

Source: Skew

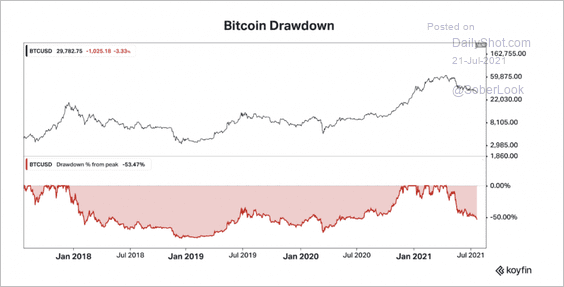

3. Bitcoin’s drawdown is about halfway through the previous bear market in 2018.

Source: Koyfin Read full article

Source: Koyfin Read full article

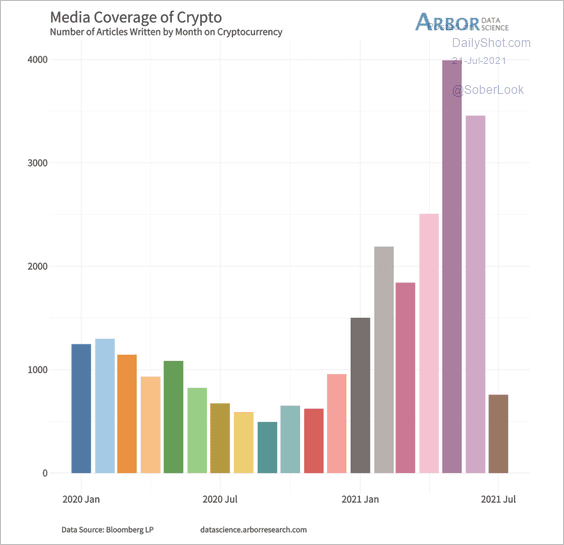

4. Crypto media coverage is off to a slow start this month.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

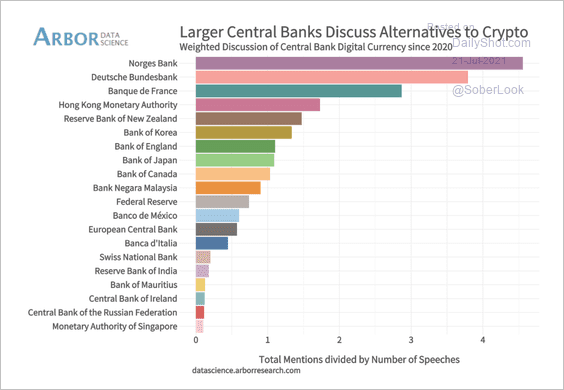

5. Which central banks are discussing alternatives to crypto?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

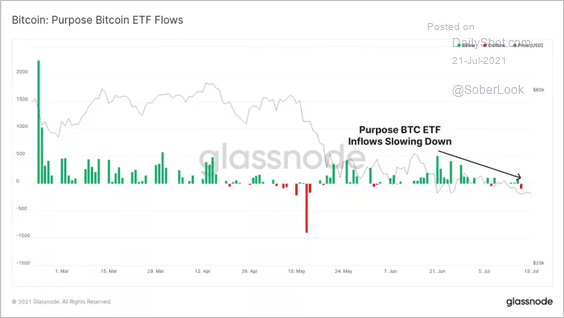

6. The Canada-based Purpose ETF (first Bitcoin ETF in North America) has seen a slowdown in net inflows in recent days.

Source: Glassnode

Source: Glassnode

7. The US Senate is set to investigate crypto’s use in ransomware.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

8. FTX raised $900 million in a new funding round that closed Tuesday, valuing the crypto exchange at $18 billion.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

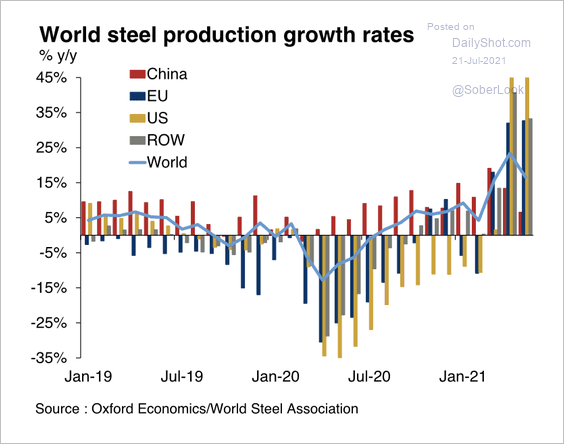

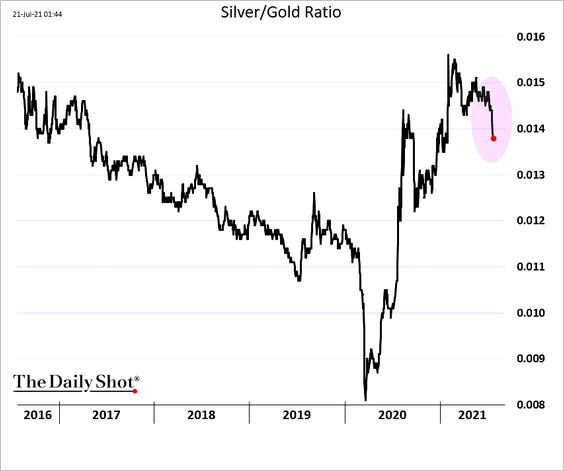

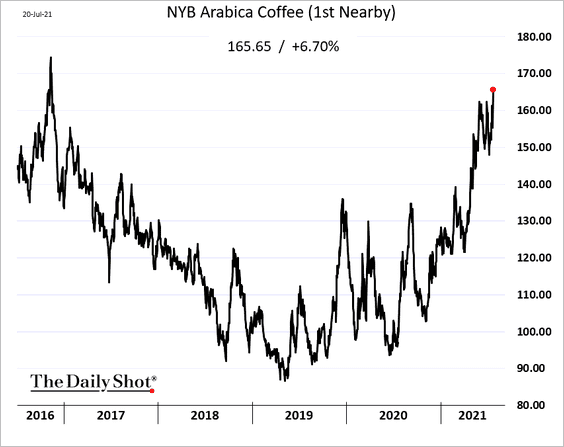

Commodities

1. Global steel production is picking up.

Source: Oxford Economics

Source: Oxford Economics

2. The silver-to-gold ratio is rolling over.

3. Coffee prices hit a multi-year high due to weather conditions in Brazil.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

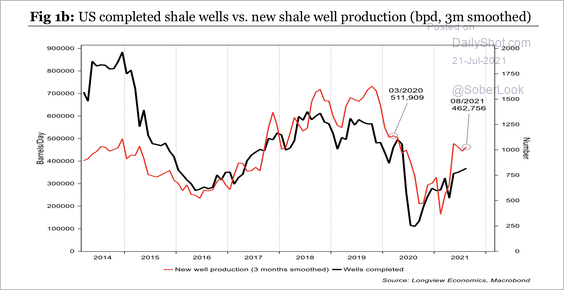

Energy

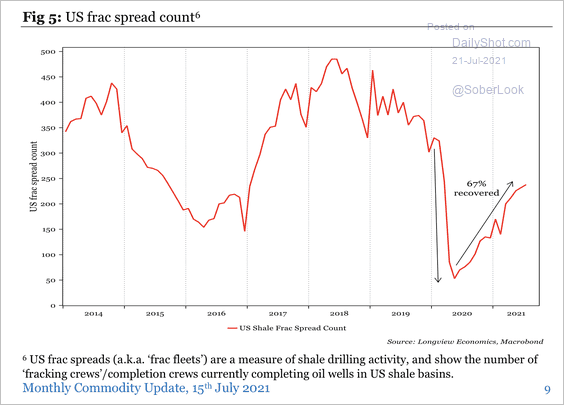

1. US shale well production is recovering just below pre-pandemic levels (2 charts).

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

——————–

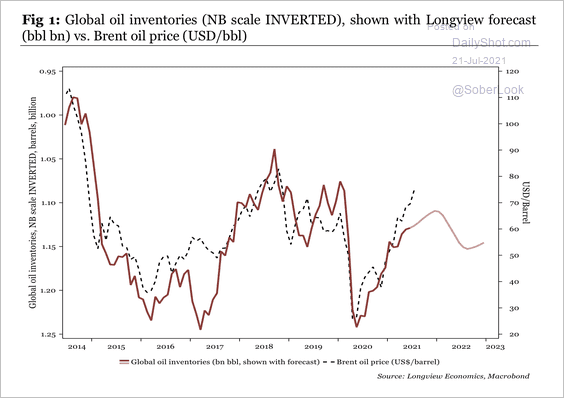

2. Longview forecasts rising global oil inventories, which could weigh on oil prices.

Source: Longview Economics

Source: Longview Economics

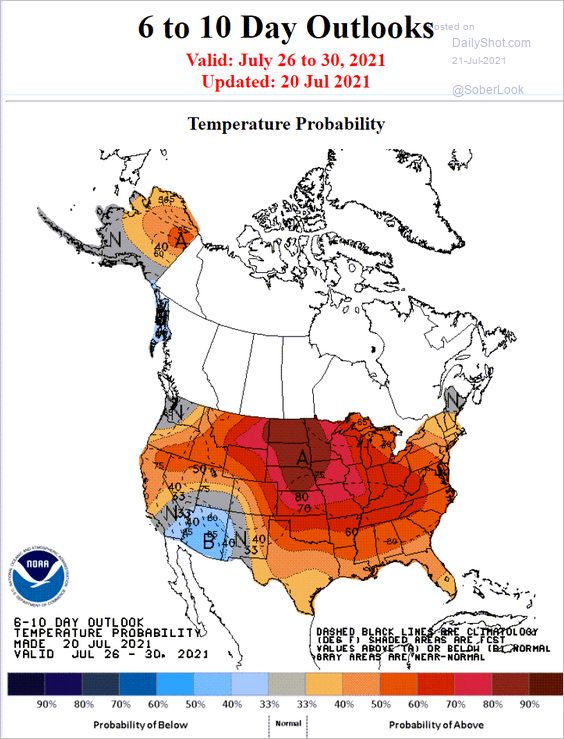

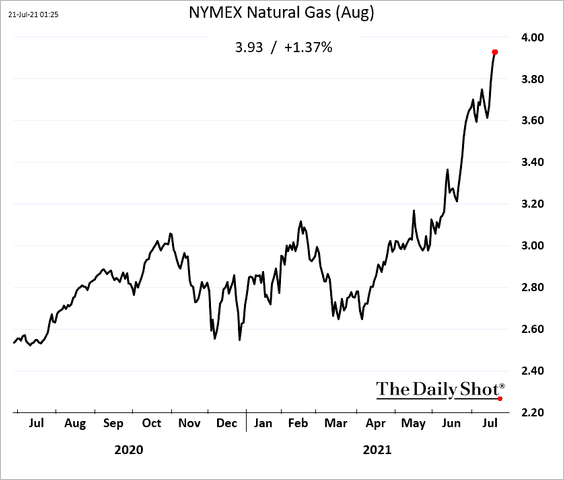

3. US natural gas prices are surging as temperatures rise.

Source: NOAA

Source: NOAA

——————–

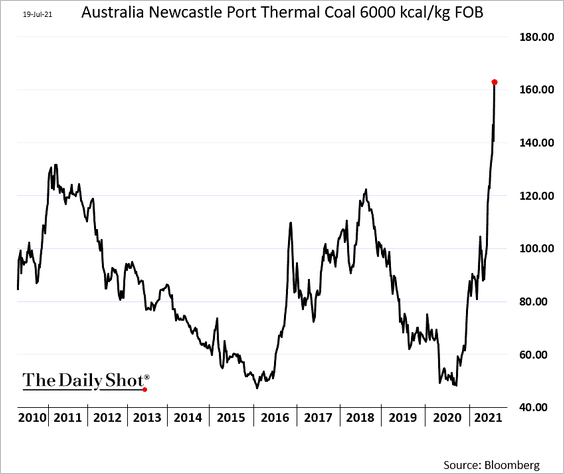

4. The Newcastle thermal coal price has surged this year. (Newcastle is the world’s largest coal export port based in Australia.)

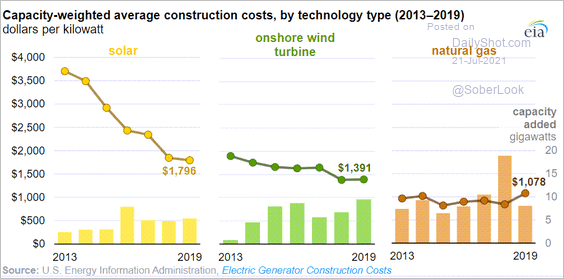

5. US construction costs for solar power generation continue to fall.

Source: EIA Read full article

Source: EIA Read full article

Back to Index

Equities

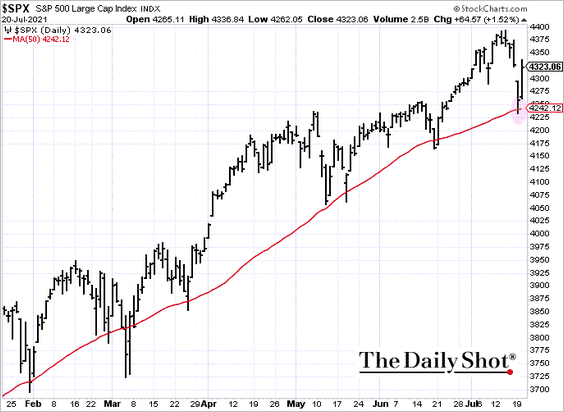

1. The S&P 500 bounced off the 50-day moving average as dip buyers moved in.

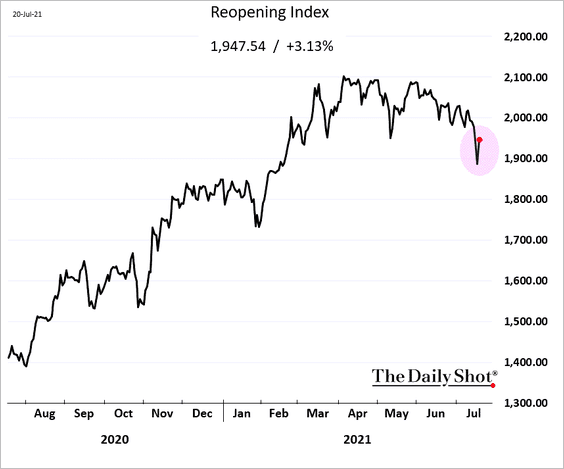

• “Reopening” stocks bounced from recent lows.

——————–

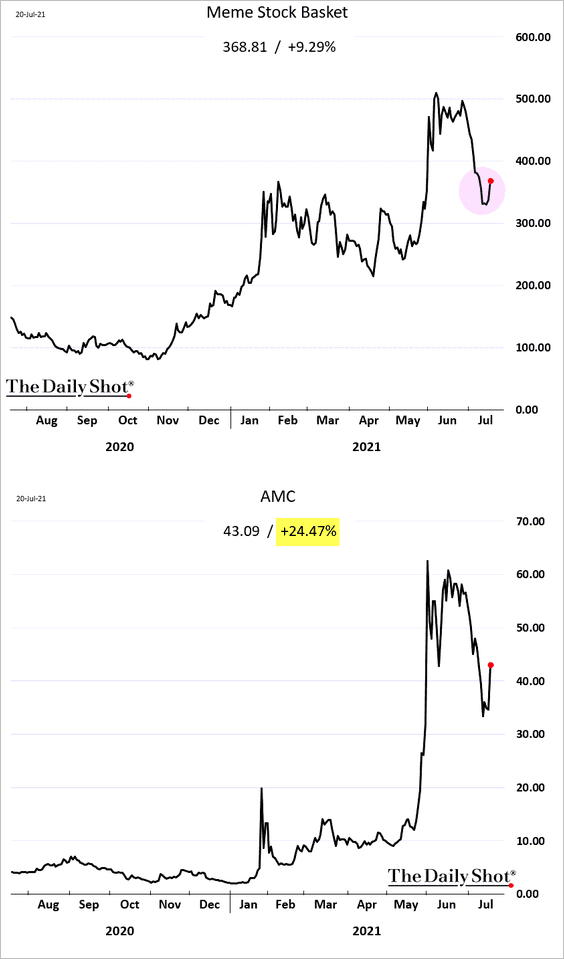

2. The Reddit crowd jumped back into some of their favorite stocks.

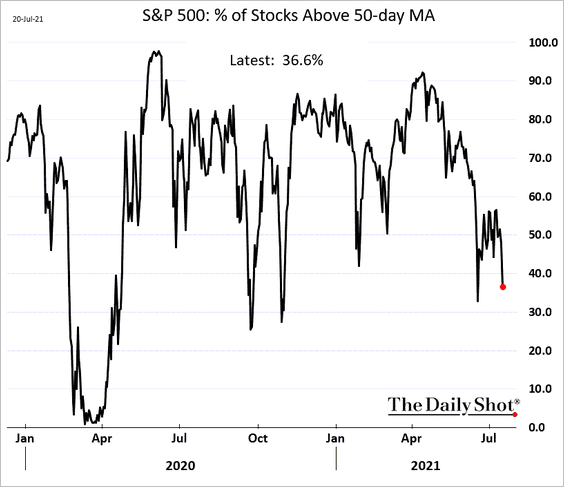

3. Market breadth has been relatively weak.

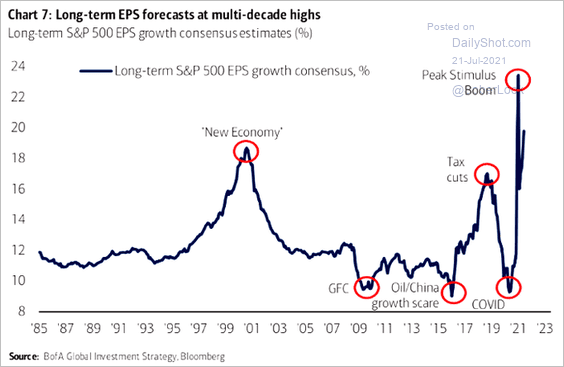

4. Long-term S&P 500 EPS growth expectations remain unusually optimistic.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

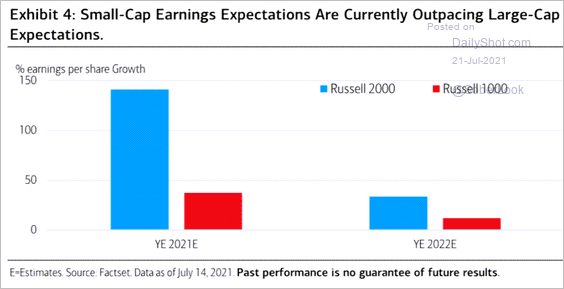

5. Small-cap earnings expectations have been outpacing large caps.

Source: BofA Global Research

Source: BofA Global Research

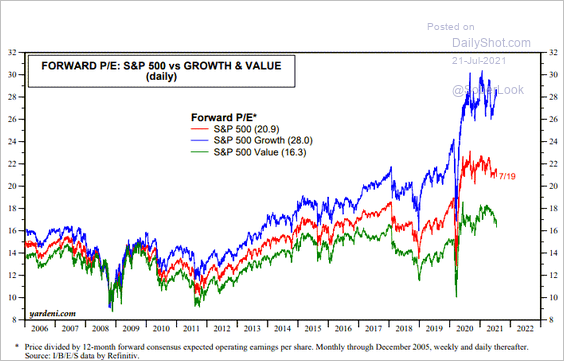

6. This chart shows forward P/E ratios for growth and value stocks.

Source: Yardeni Research

Source: Yardeni Research

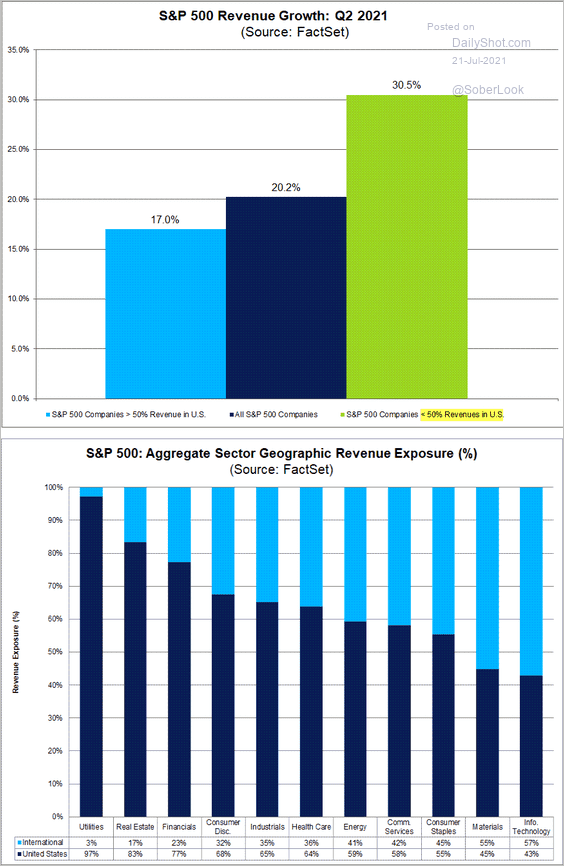

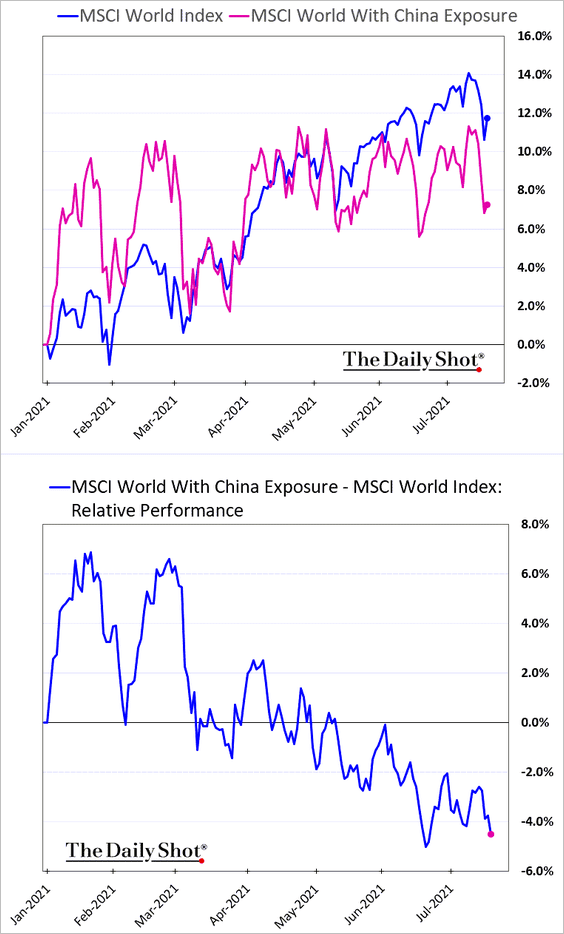

7. Global exposure has been helpful for revenue growth in Q2.

Source: @FactSet Read full article

Source: @FactSet Read full article

But China sales exposure has been a negative for companies’ stock performance year-to-date.

——————–

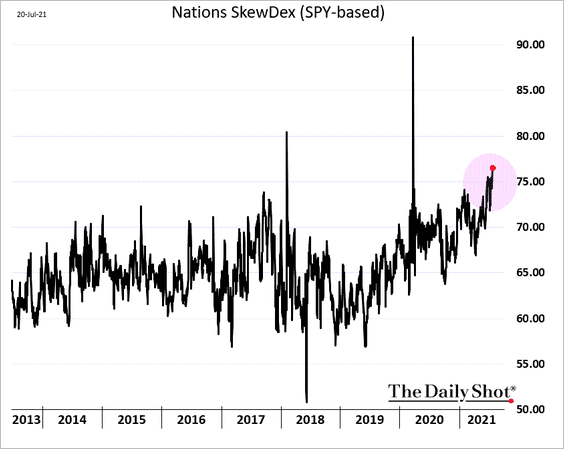

8. SPY (S&P 500 ETF) skew (downside vs. upside vol) continues to climb, pointing to demand for downside protection.

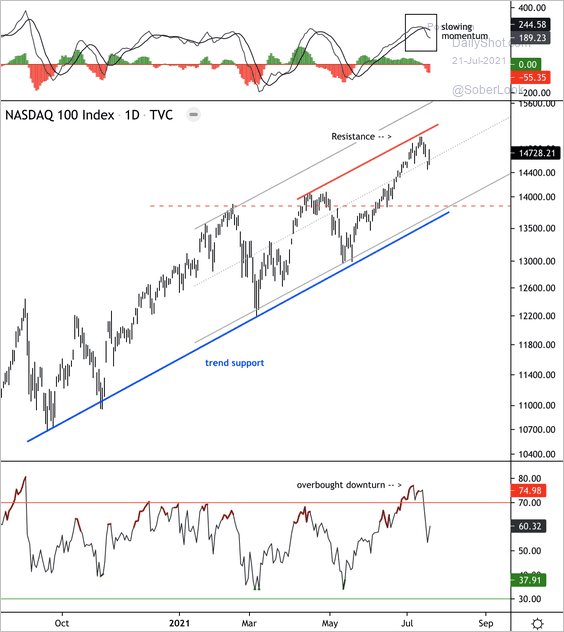

9. Next, we have some technical charts.

• The Nasdaq 100 appears overbought at resistance.

Source: Dantes Outlook

Source: Dantes Outlook

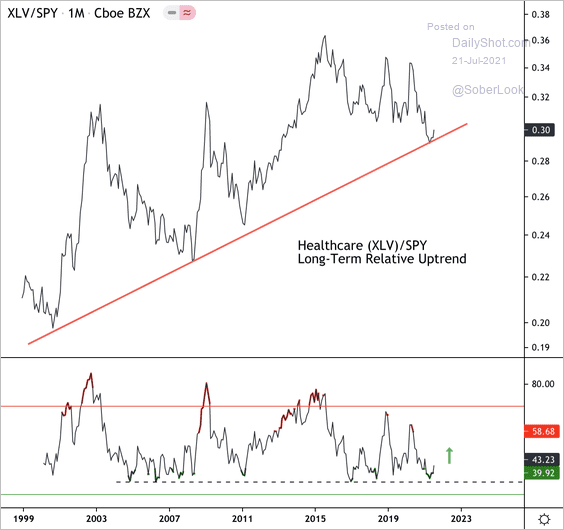

• The SPDR Healthcare ETF (XLV) is testing long-term support relative to the S&P 500.

Source: Dantes Outlook

Source: Dantes Outlook

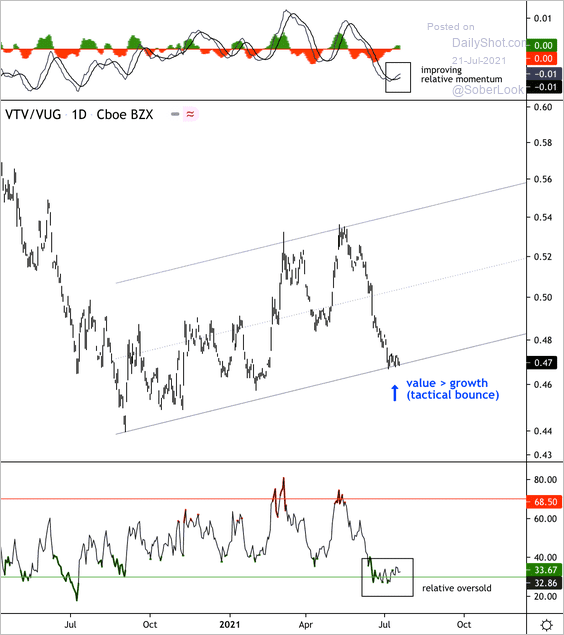

• The Vanguard Value ETF (VTV) is testing support relative to the Vanguard Growth ETF (VUG).

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

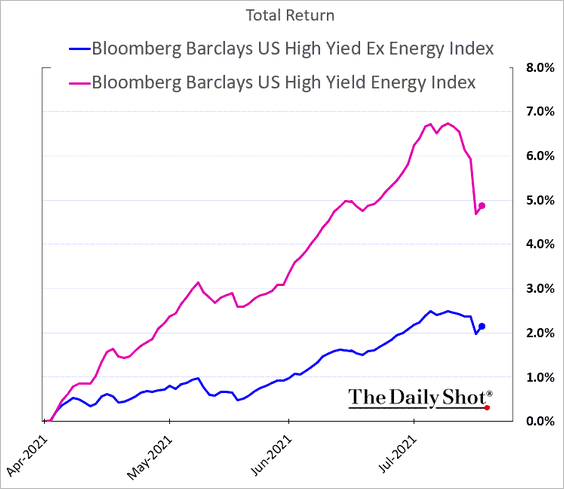

Credit

1. Energy-sector high-yield bonds took a hit as oil prices dropped.

h/t @jackpitcher20

h/t @jackpitcher20

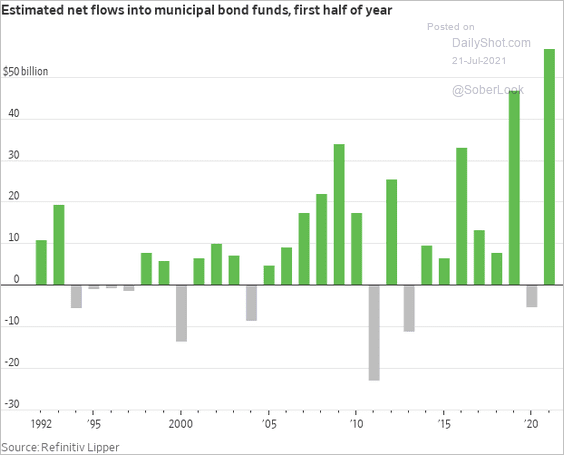

2. Muni fund inflows surged in the first half of the year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

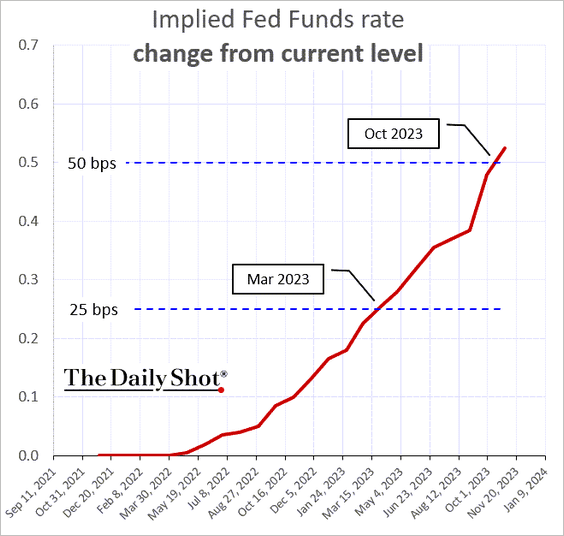

1. Expectations for the first Fed rate hike have shifted to March of 2023.

Source: @TheTerminal, Bloomberg Finance L.P. Read full article

Source: @TheTerminal, Bloomberg Finance L.P. Read full article

——————–

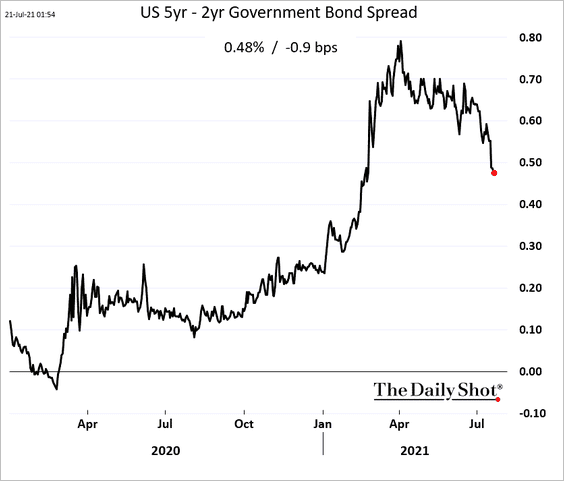

2. The Treasury curve keeps flattening at the short end.

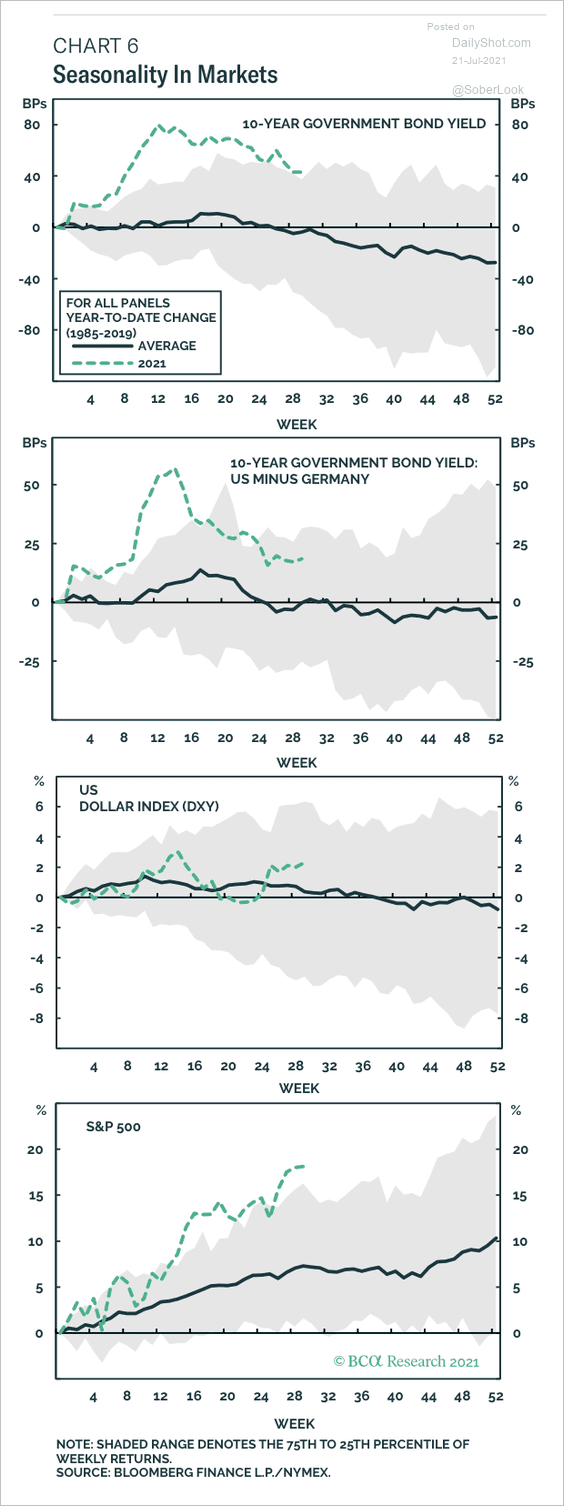

3. Global government bond yields are entering a seasonally weak period.

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

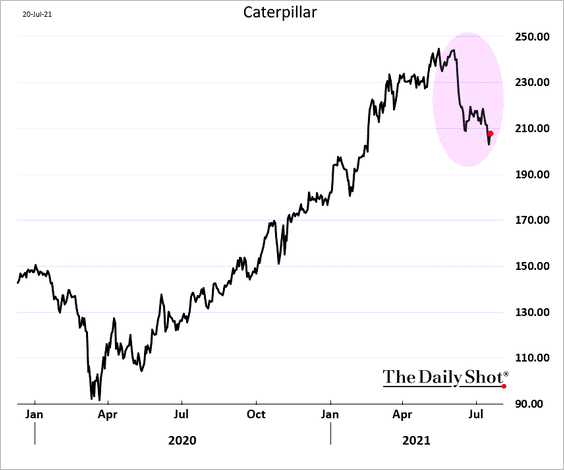

1. Caterpillar’s stock points to a pause in reflation bets.

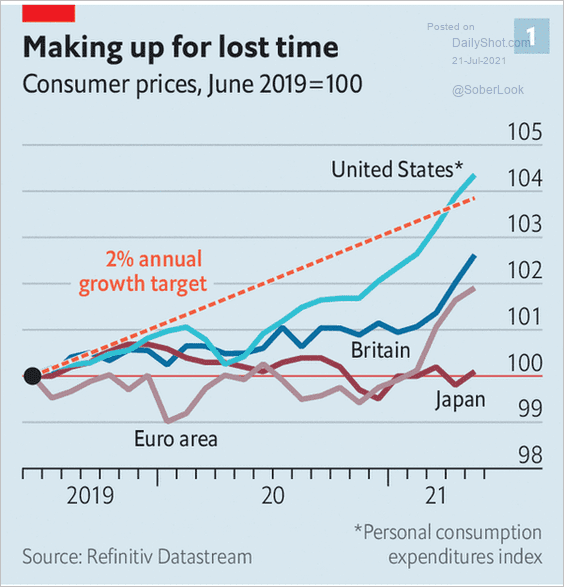

2. Here is a comparison of inflation trends in advanced economies.

Source: The Economist Read full article

Source: The Economist Read full article

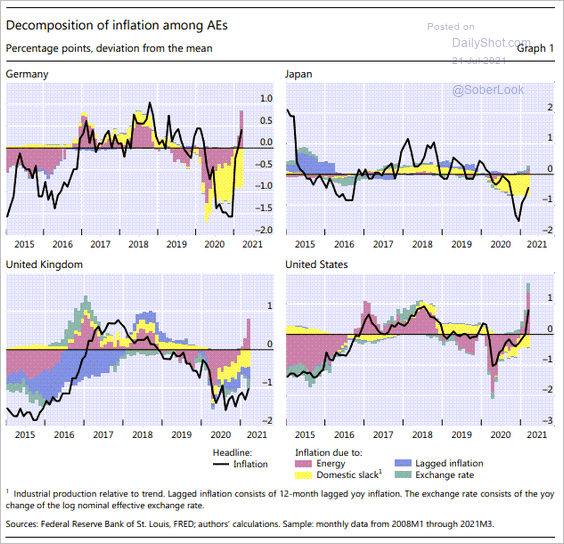

And this chart provides the decomposition of the year-over-year inflation changes.

Source: @BIS_org Read full article

Source: @BIS_org Read full article

——————–

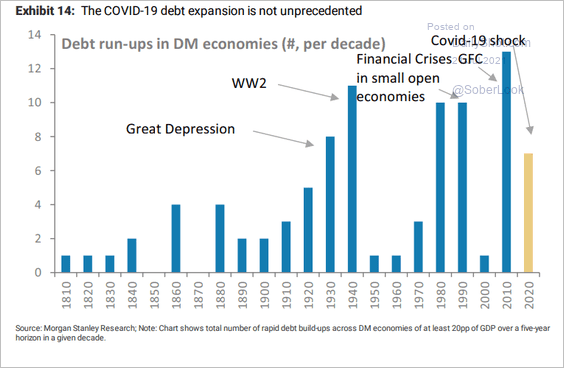

3. The COVID debt run-up in advanced economies is not unprecedented.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

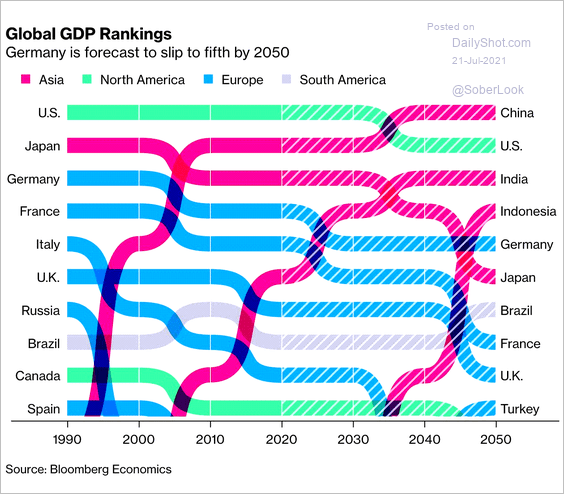

4. This chart shows historical and projected GDP rankings.

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

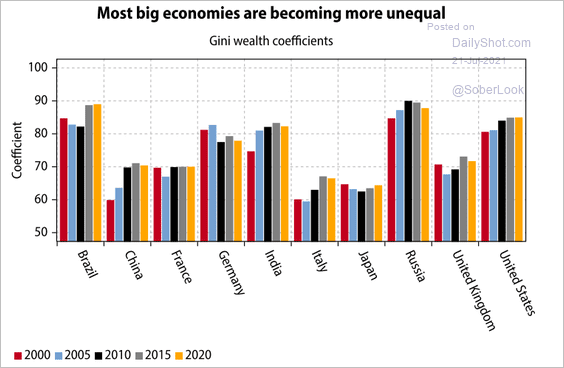

5. Inequality has risen in most big economies.

Source: Gavekal Research

Source: Gavekal Research

——————–

Food for Thought

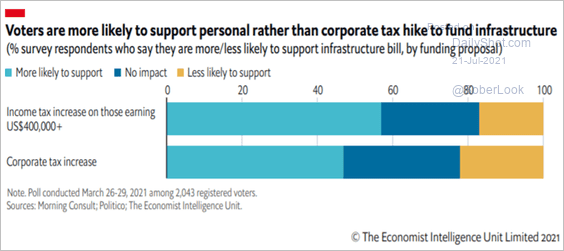

1. Supporting personal vs. corporate tax hikes:

Source: The Economist Read full article

Source: The Economist Read full article

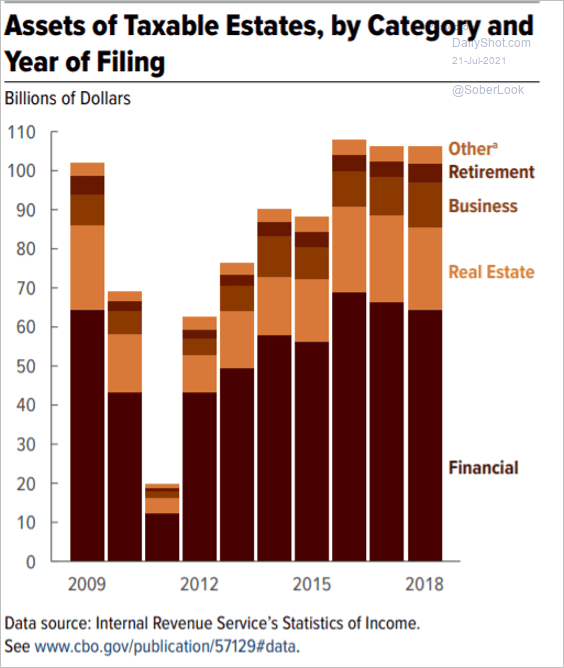

2. Assets of taxable estates:

Source: CBO Read full article

Source: CBO Read full article

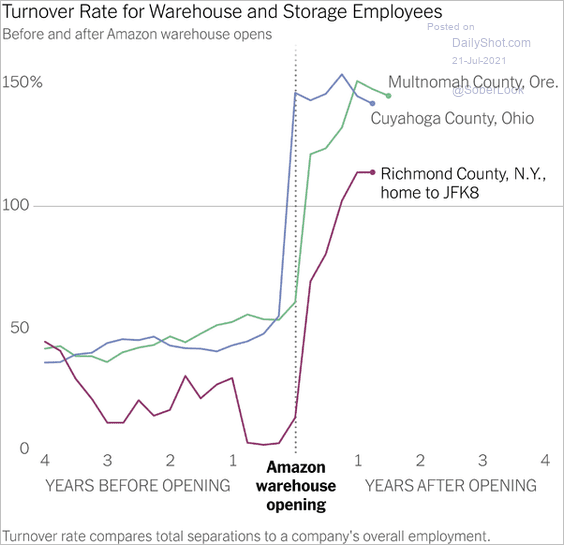

3. Warehouse employee turnover:

Source: The New York Times Read full article

Source: The New York Times Read full article

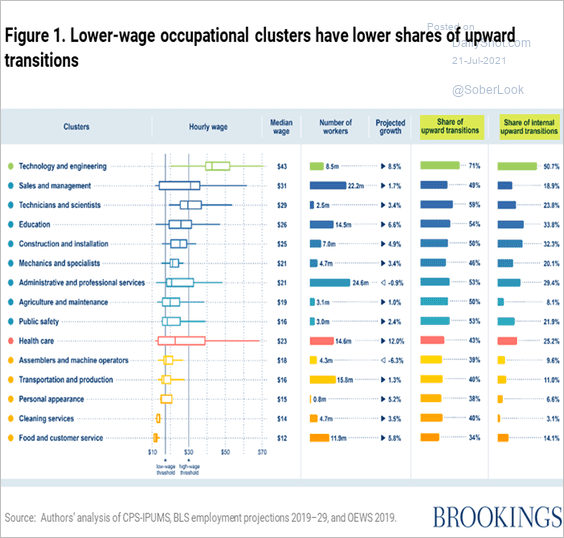

4. Upward mobility by occupation:

Source: Brookings Read full article

Source: Brookings Read full article

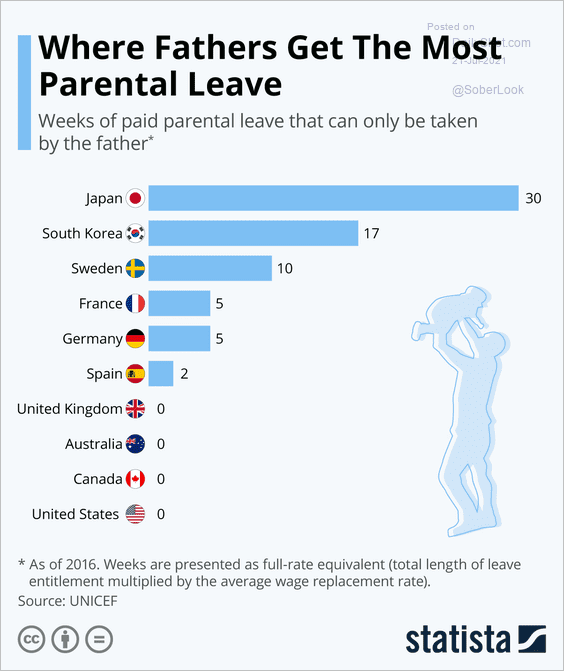

5. Parental leave:

Source: Statista

Source: Statista

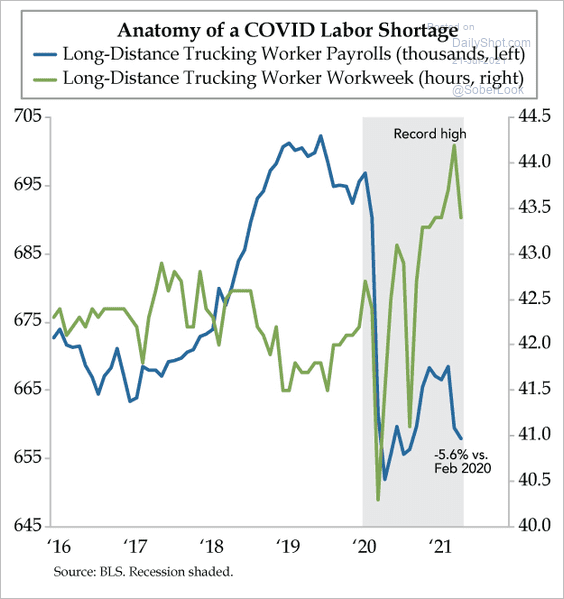

6. Fewer truckers are working longer hours:

Source: The Daily Feather

Source: The Daily Feather

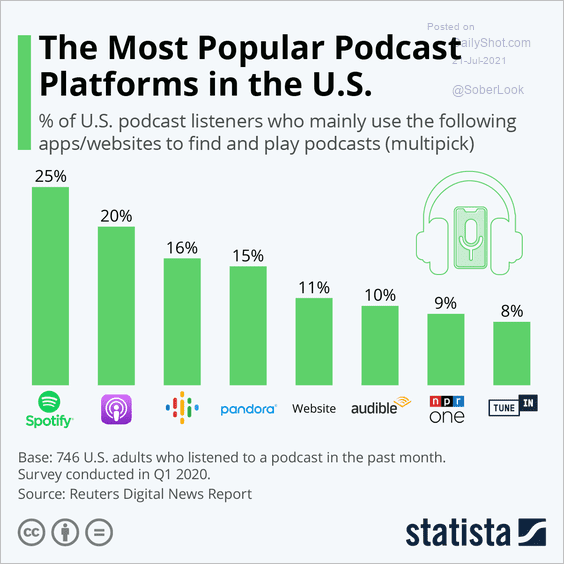

7. Popular podcast platforms:

Source: Statista

Source: Statista

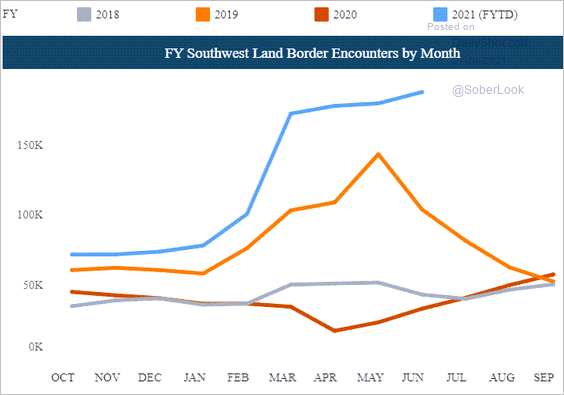

8. US southwest border apprehensions:

Source: CBP Further reading

Source: CBP Further reading

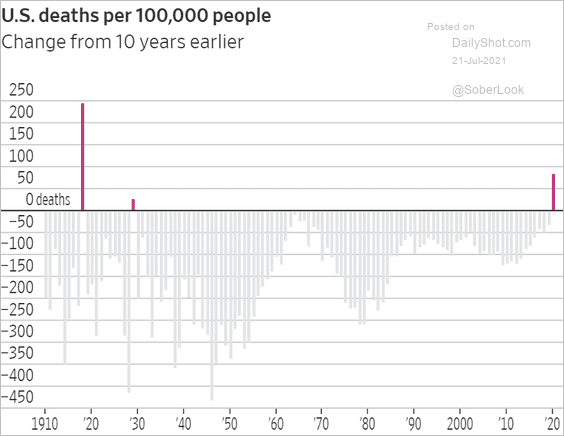

9. Decade-over-decade changes in US deaths from infections:

Source: @WSJ Read full article

Source: @WSJ Read full article

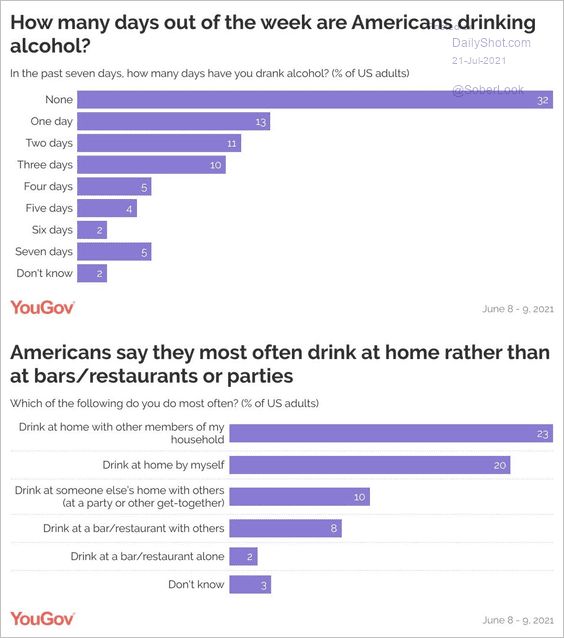

10. US alcohol consumption:

Source: @YouGovAmerica

Source: @YouGovAmerica

——————–

Back to Index