The Daily Shot: 23-Jul-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

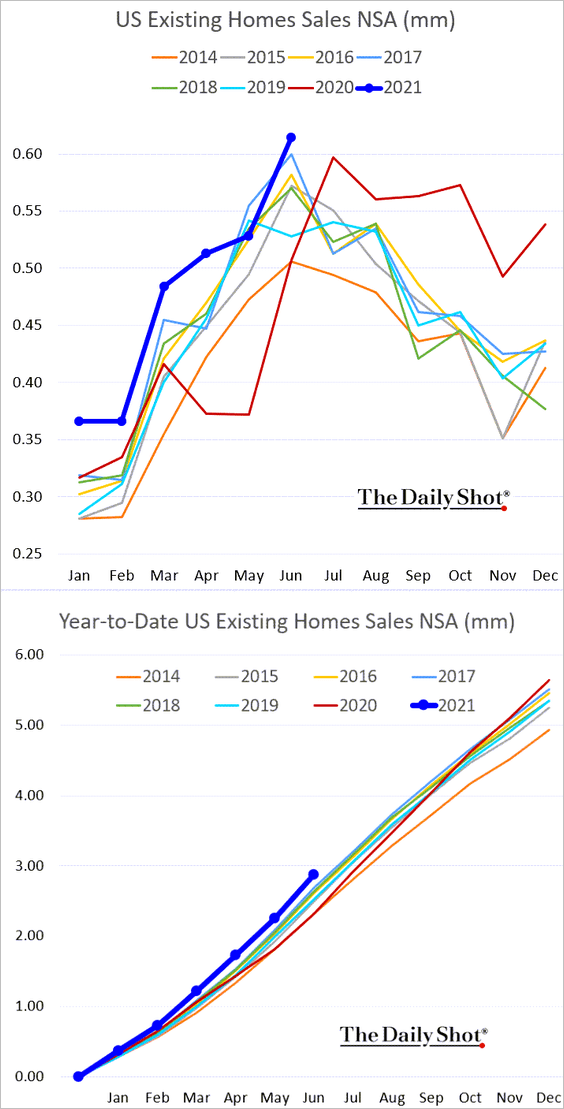

1. Let’s begin with the housing market.

• Existing home sales hit a multi-year high last month but were still below forecasts.

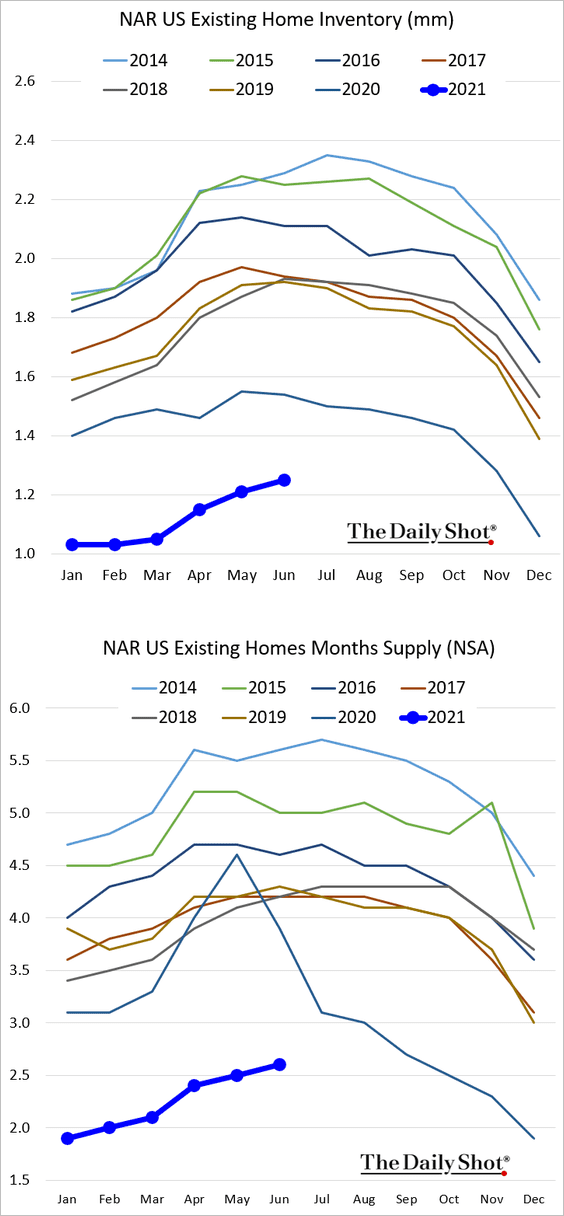

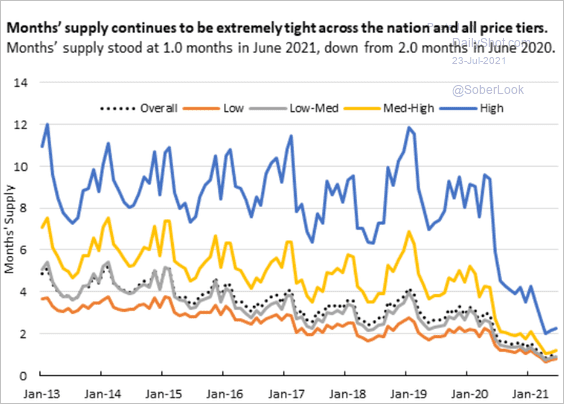

• Inventories remain exceptionally low for this time of the year.

This chart shows inventories by price tier.

Source: AEI Housing Center

Source: AEI Housing Center

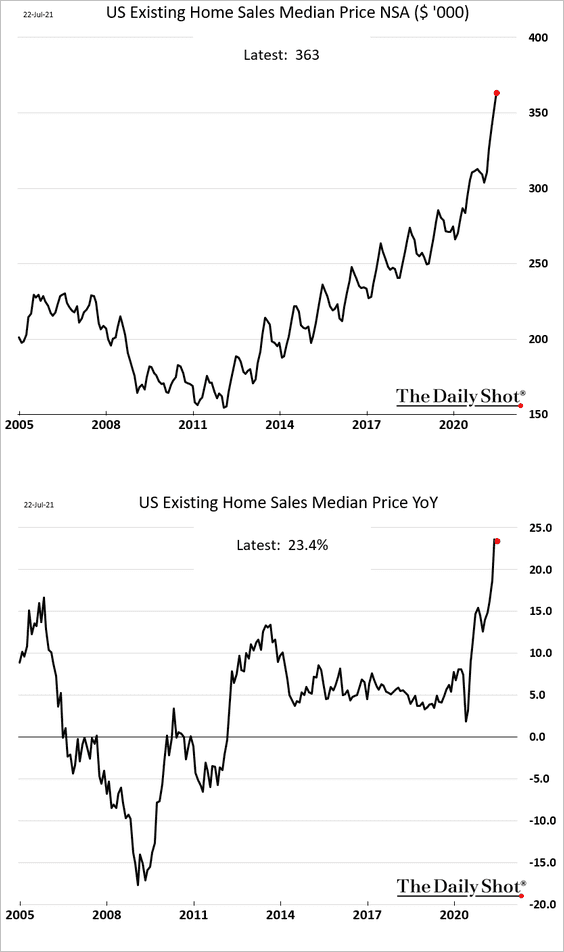

• The median price of sold existing homes hit $363k, a new high.

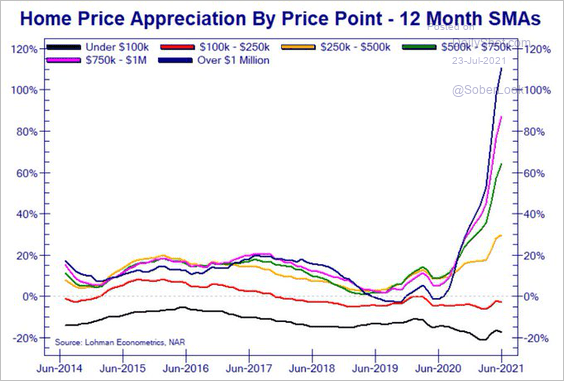

– Here is the breakdown by price point.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

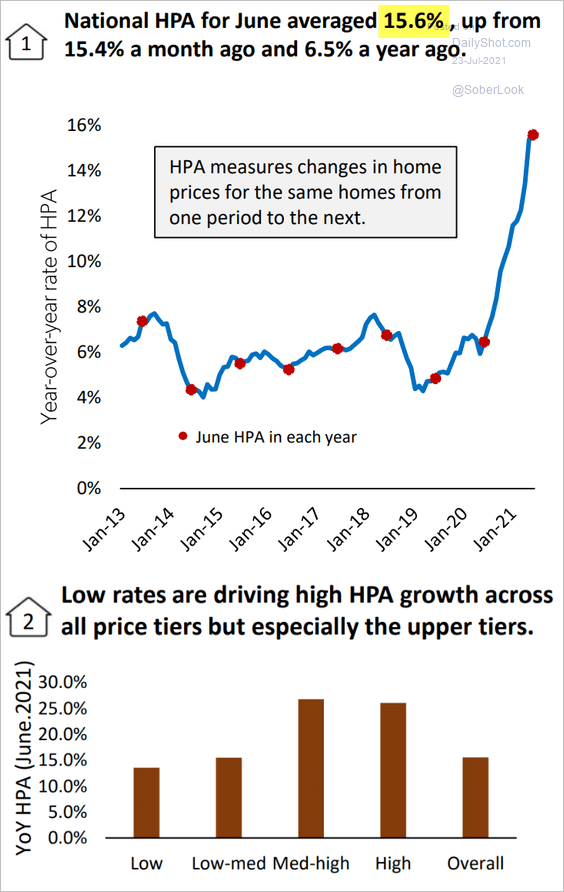

– The AEI Housing Center shows substantial year-over-year gains across all price tiers.

Source: AEI Housing Center

Source: AEI Housing Center

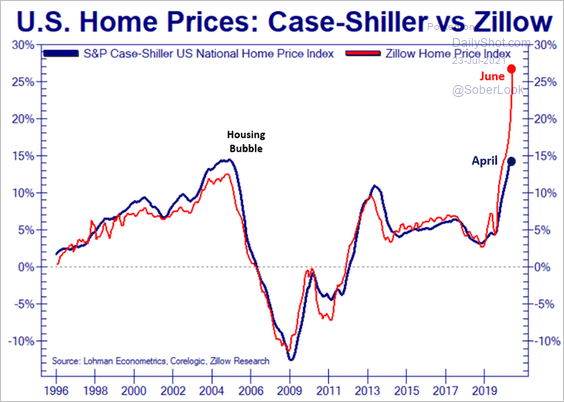

– Will we see the widely-followed Case-Shiller housing index exceed 25% in June?

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

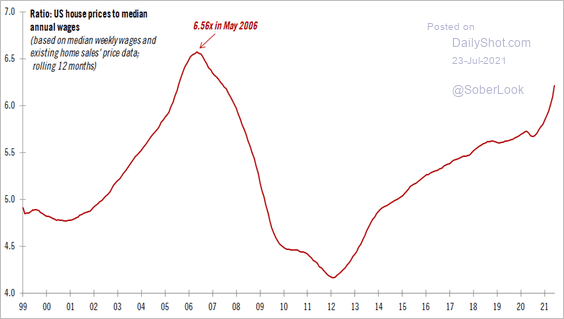

– This chart shows the ratio of home prices to annual wages.

Source: @TCosterg Read full article

Source: @TCosterg Read full article

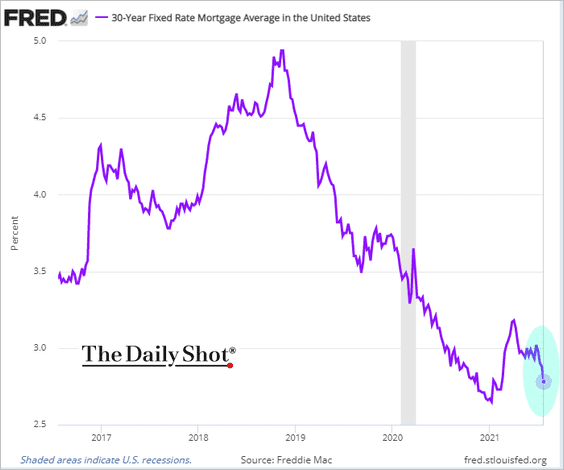

• The 30yr mortgage rate is now firmly below 3%.

——————–

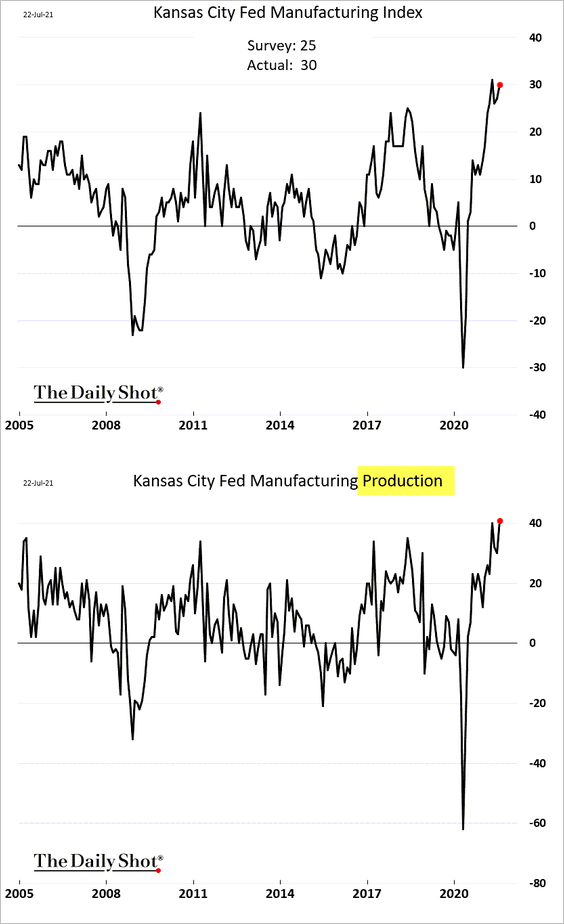

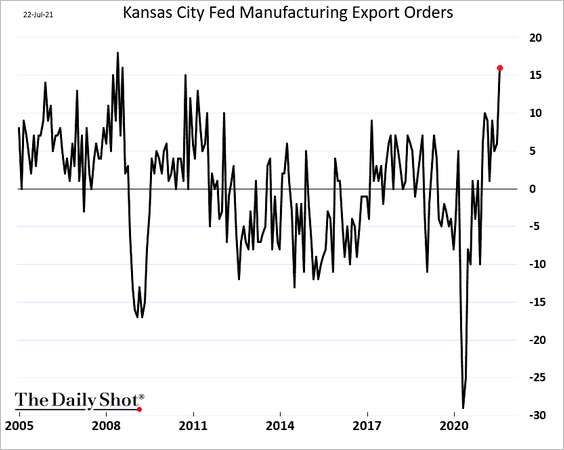

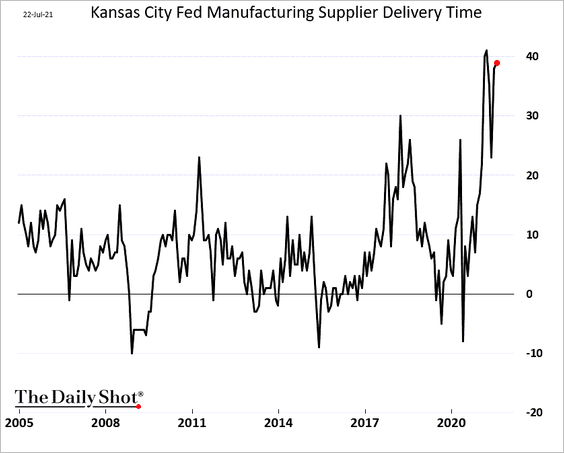

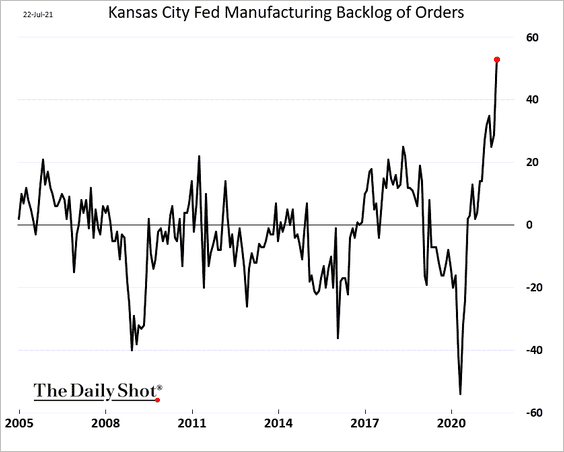

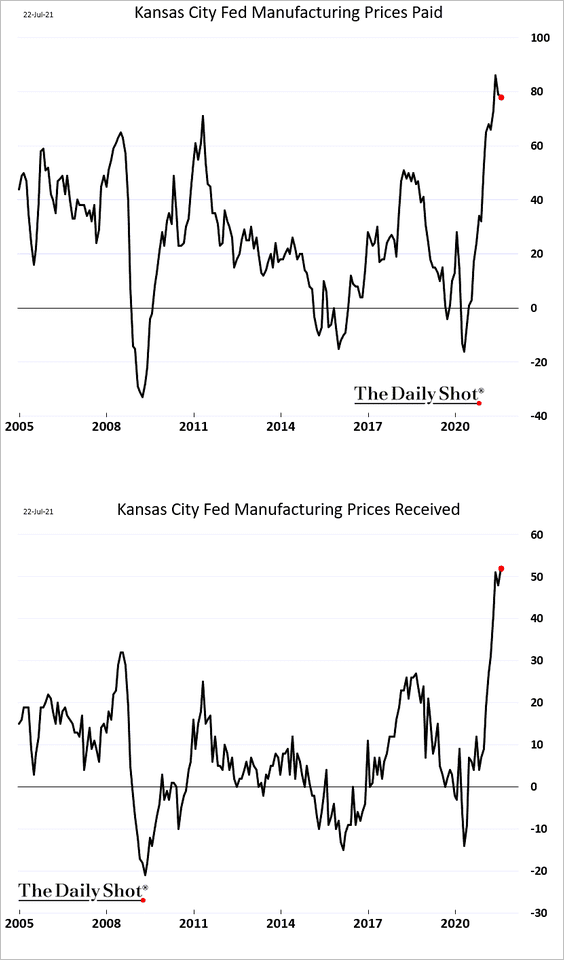

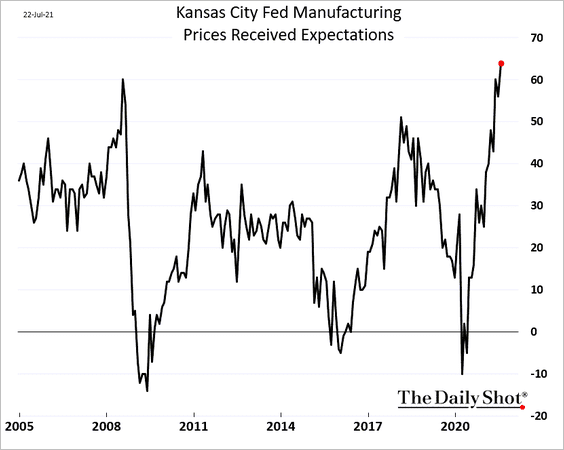

2. The Kansas City manufacturing index was firmer than expected in July.

• More companies are reporting increased export orders.

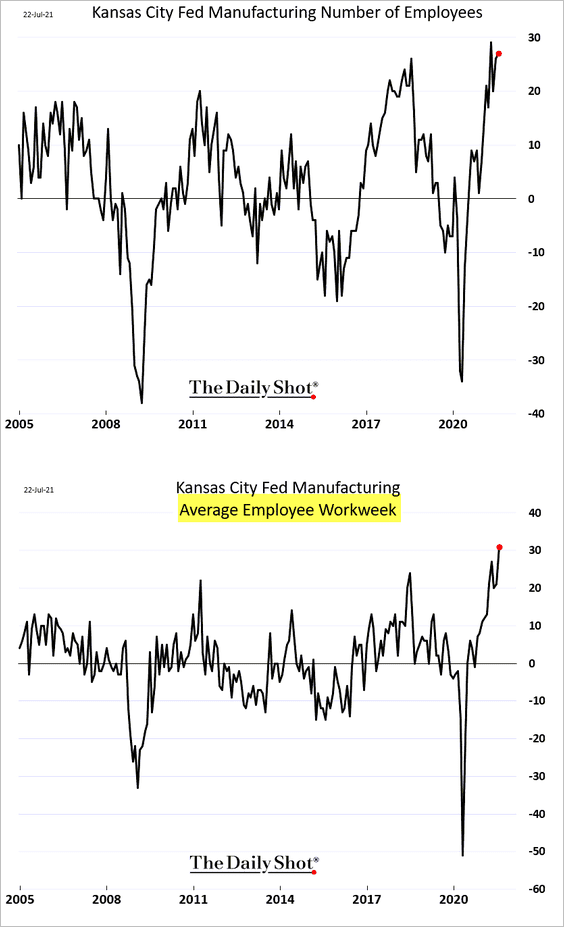

• Employment metrics are remarkably strong.

• Supplier bottlenecks remain acute.

– Delivery times:

– Order backlog:

• Price pressures persist.

And a record percentage of manufacturers expect to boost prices in the near future.

——————–

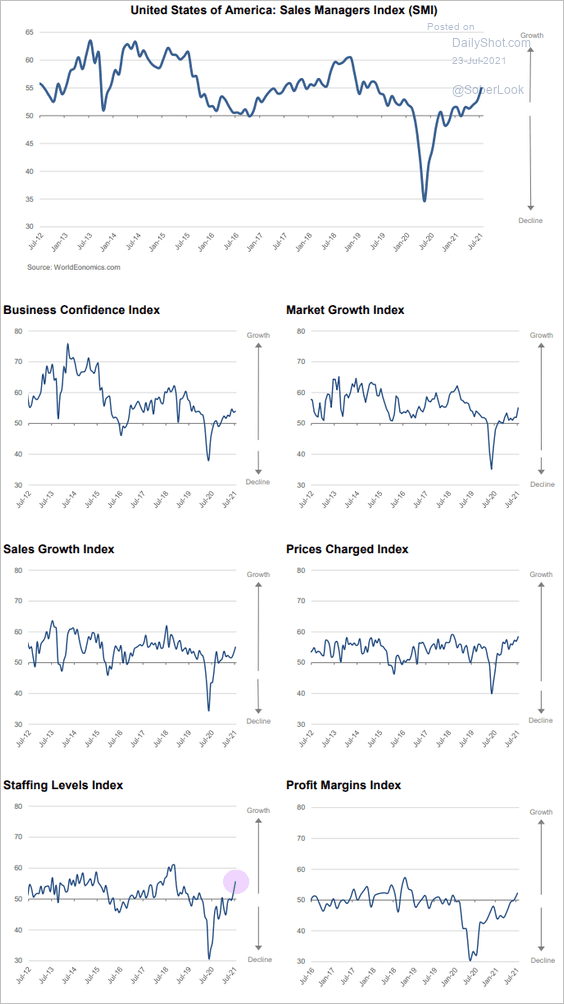

3. At the national level, the World Economics SMI report shows further improvements in business activity this month. Hiring has accelerated.

Source: World Economics Read full article

Source: World Economics Read full article

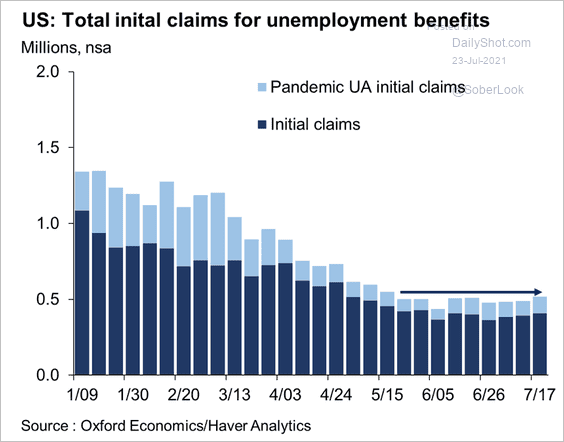

4. Initial jobless claims remain stubbornly high relative to pre-pandemic levels.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

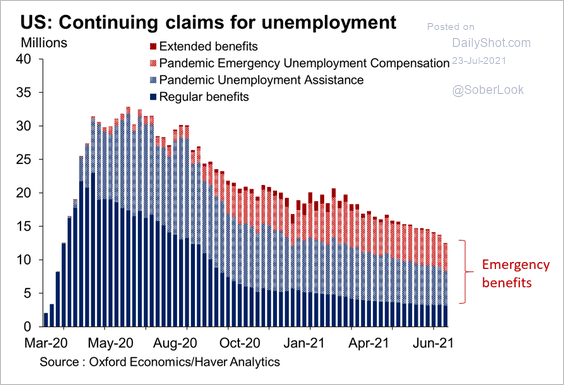

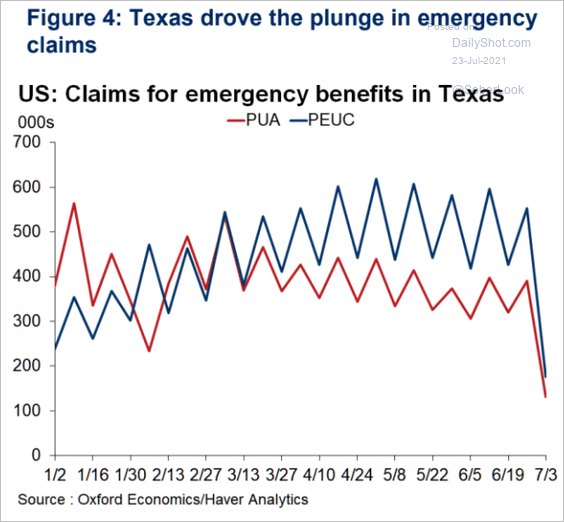

Continuing claims are moving lower. We should see sharp declines ahead as states’ cancellations of emergency benefits are incorporated in the data.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

Source: Oxford Economics

Source: Oxford Economics

——————–

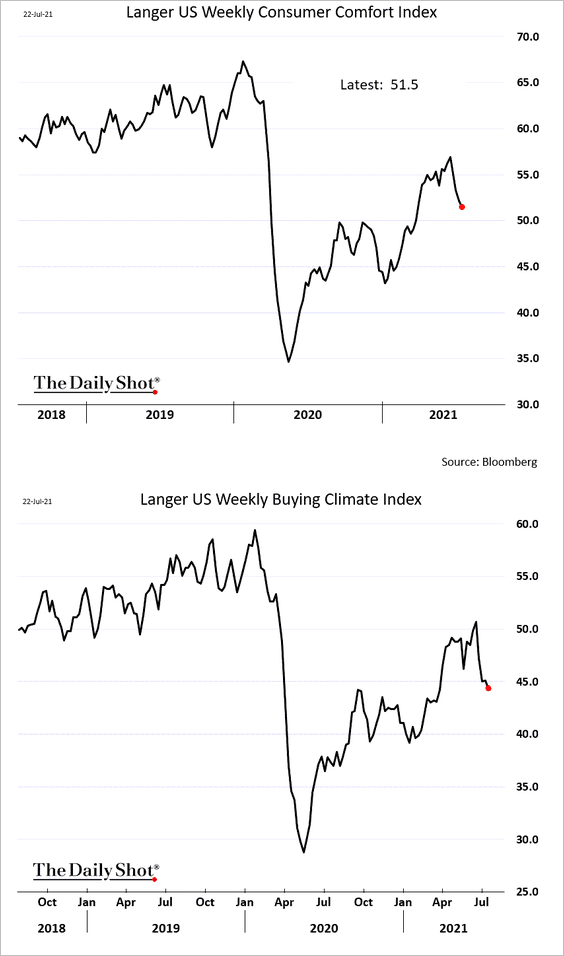

5. As we saw yesterday, consumer sentiment has deteriorated lately.

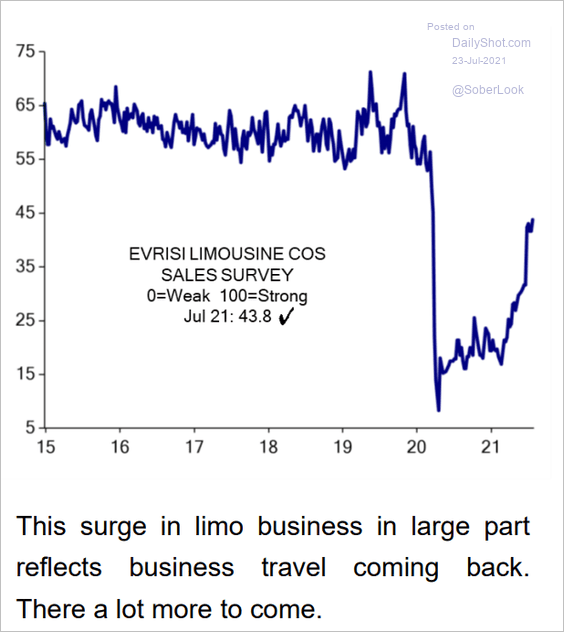

6. Business travel is recovering.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

The United Kingdom

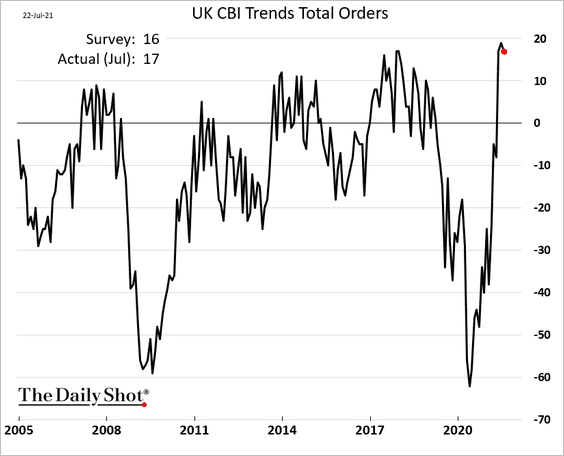

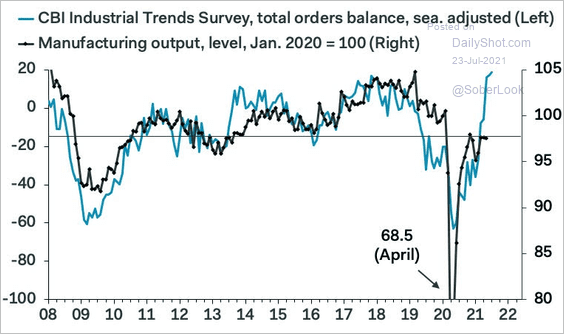

The CBI Trends report showed continuing strength in industrial orders.

Source: Reuters Read full article

Source: Reuters Read full article

We should see substantial gains in manufacturing output in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

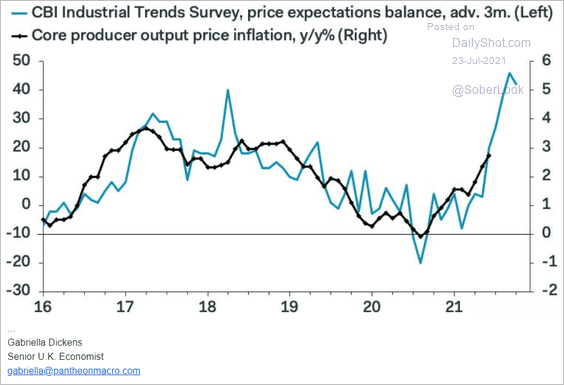

Producer price inflation will accelerate, according to the CBI report.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

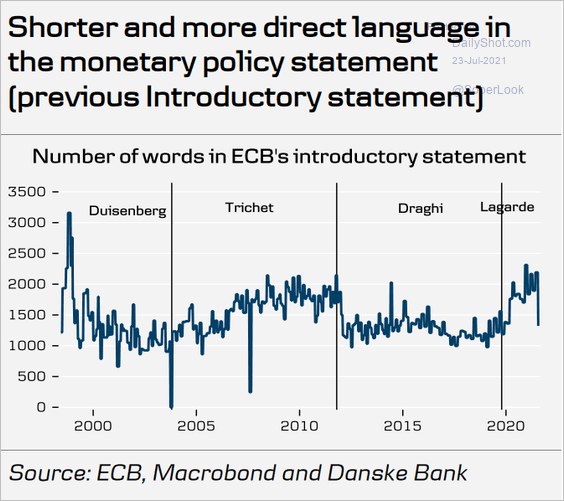

1. The ECB slightly adjusted its forward guidance based on the new strategy. The central bank is now even more dovish, with tapering unlikely to be announced this quarter.

Source: CNBC Read full article

Source: CNBC Read full article

The statement language was shorter and more direct.

Source: Danske Bank

Source: Danske Bank

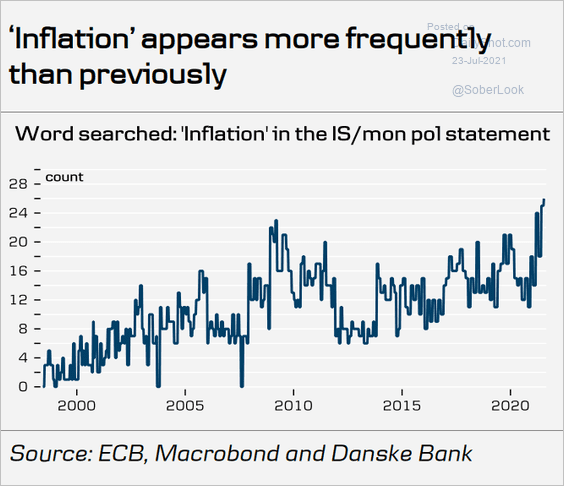

The word “inflation” appeared more frequently.

Source: Danske Bank

Source: Danske Bank

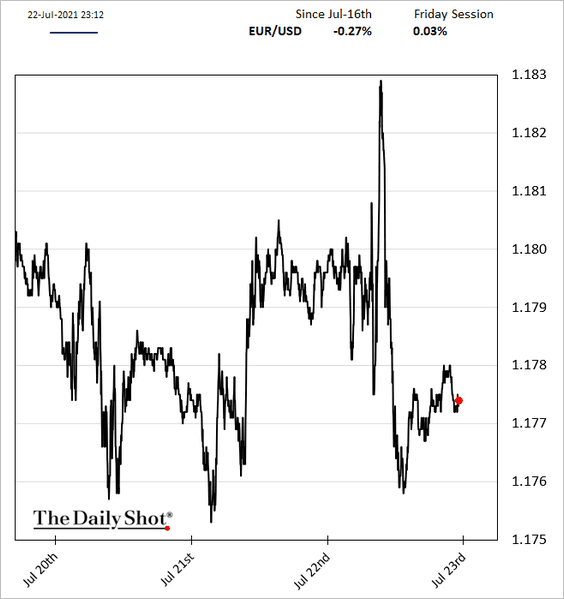

The euro jumped at first (partially due to the language change) but retreated shortly after.

——————–

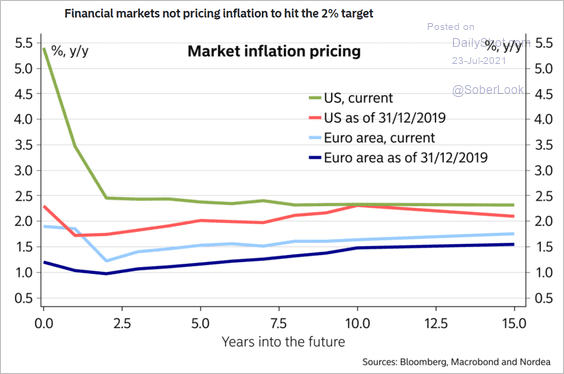

2. Unlike in the US, the market expects the Eurozone’s inflation to remain below 2% for years to come.

Source: Nordea Markets

Source: Nordea Markets

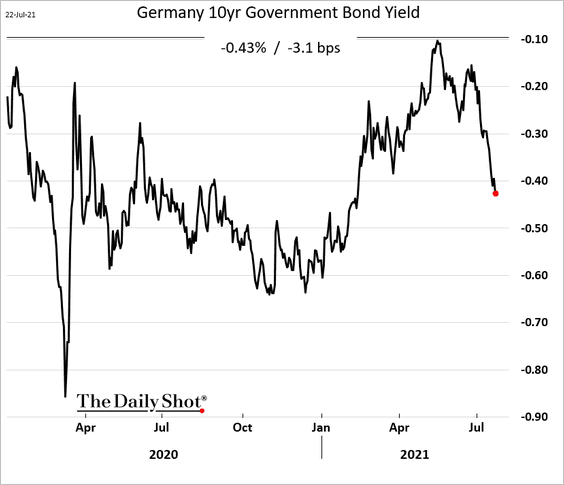

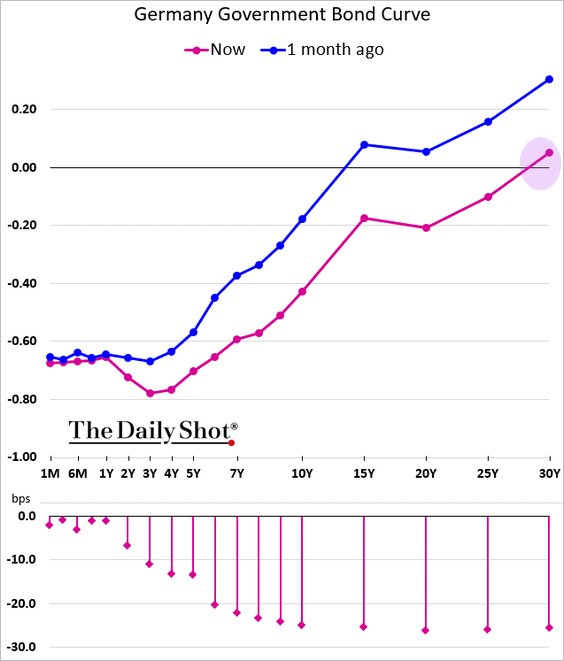

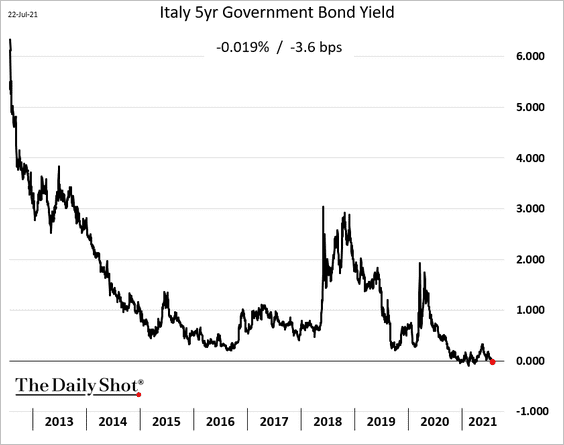

3. Bund yields resumed their decline as the curve flattens. The whole curve may become negative shortly.

The Italian 5-year bond yield is back in negative territory.

——————–

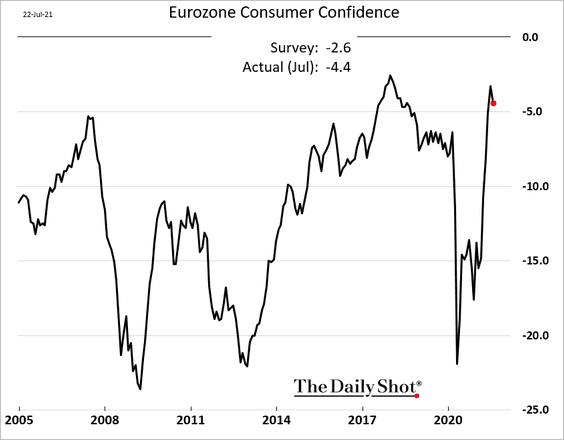

4. Euro-area consumer sentiment unexpectedly declined this month.

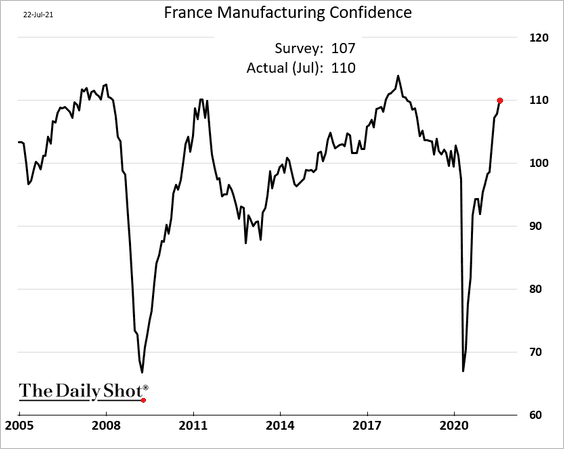

5. French manufacturing confidence surprised to the upside.

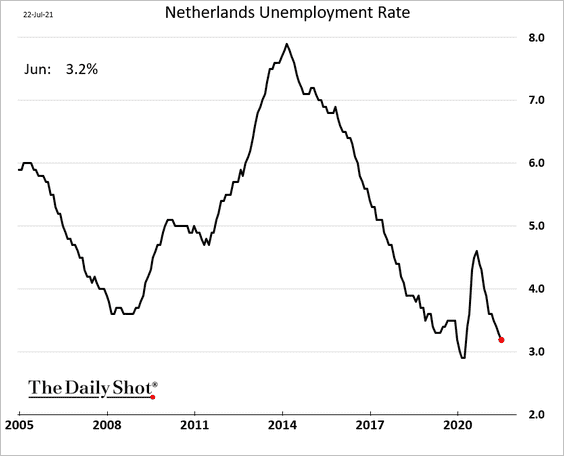

6. Dutch unemployment is approaching pre-COVID levels.

Back to Index

Asia – Pacific

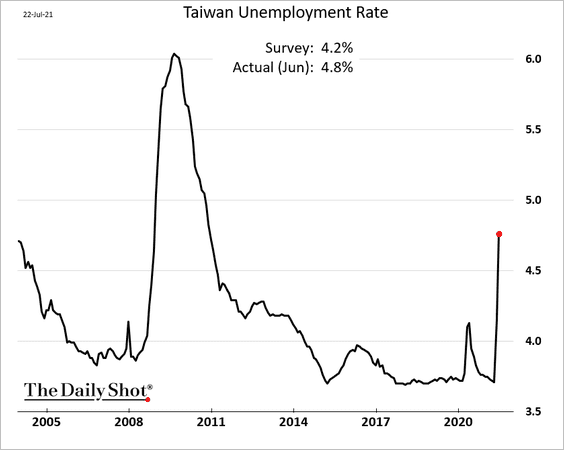

1. Taiwan’s unemployment rate has been surging.

Source: Taiwan News Read full article

Source: Taiwan News Read full article

——————–

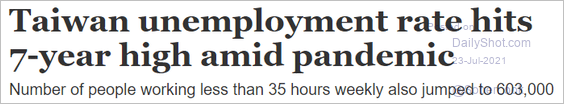

2. Australia’s manufacturing growth moderated this month.

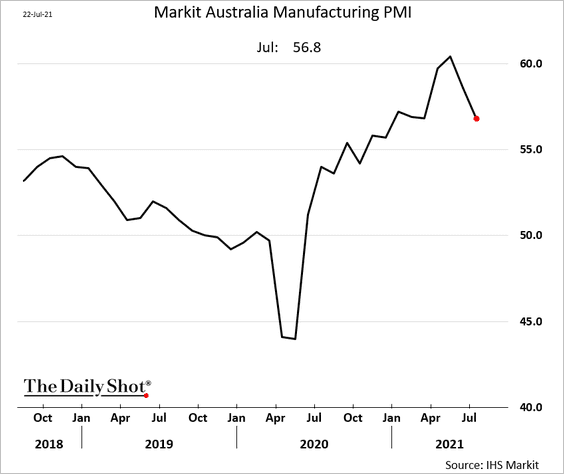

Service-sector activity contracted sharply (PMI < 50) amid lockdowns.

Back to Index

China

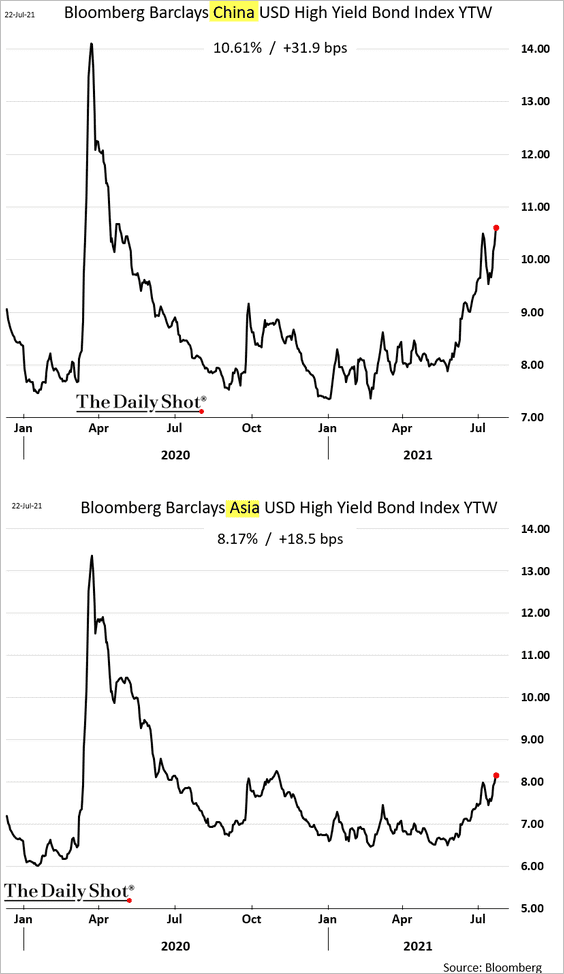

1. The Evergrande situation is pressuring regional high-yield indices (charts show index yields).

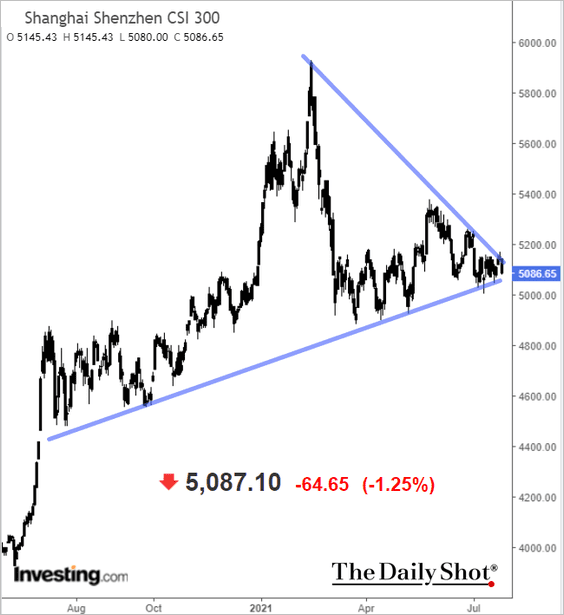

2. The Shanghai Shenzhen CSI benchmark index is in a wedge pattern. More penalties on DiDi and Evergrande risks pulled the market lower this morning.

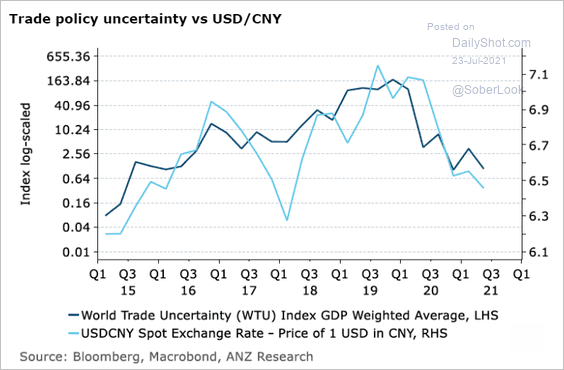

3. Lower trade policy uncertainty has been a positive for the renminbi.

Source: ANZ Research

Source: ANZ Research

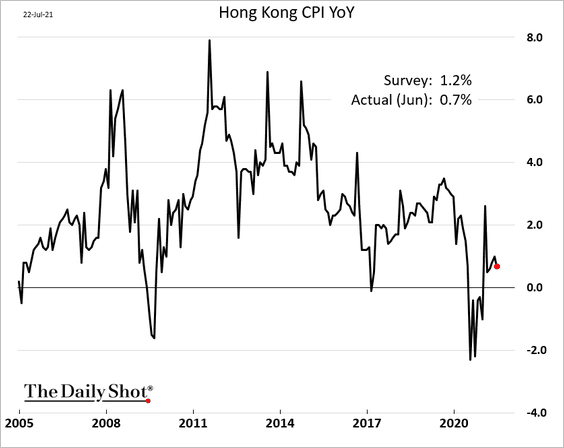

4. Hong Kong’s inflation remains subdued.

Back to Index

Emerging Markets

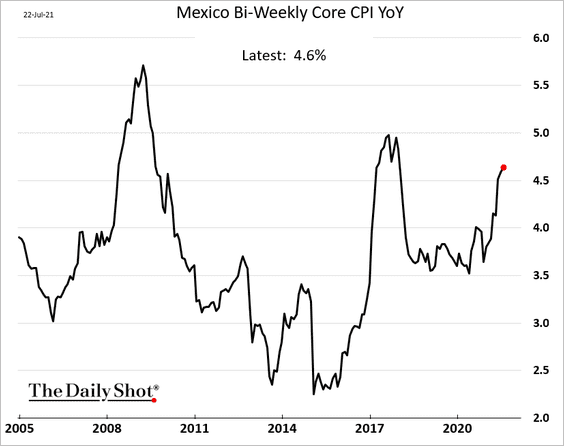

1. Mexico’s core inflation continues to grind higher.

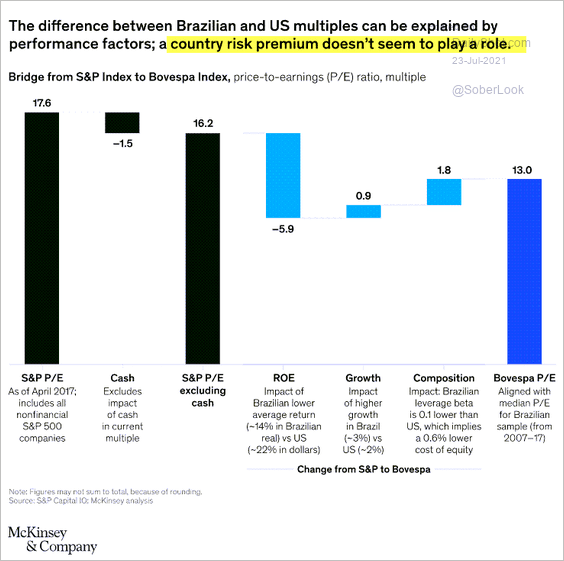

2. Country risk premium doesn’t seem to play a role in Brazil’s stock market valuation.

Source: McKinsey Read full article

Source: McKinsey Read full article

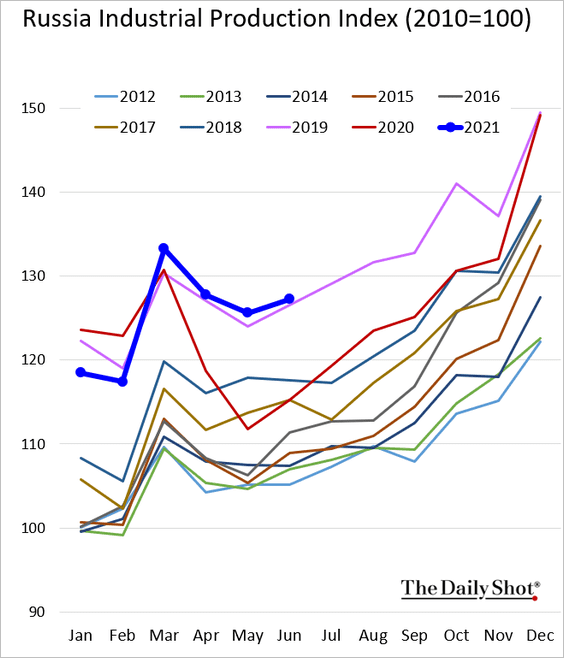

3. Russia’s industrial production is running in line with the 2019 levels.

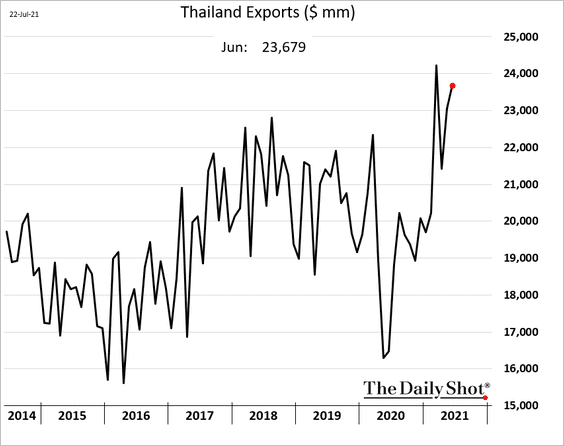

4. Thai exports are approaching record highs.

Back to Index

Cryptocurrency

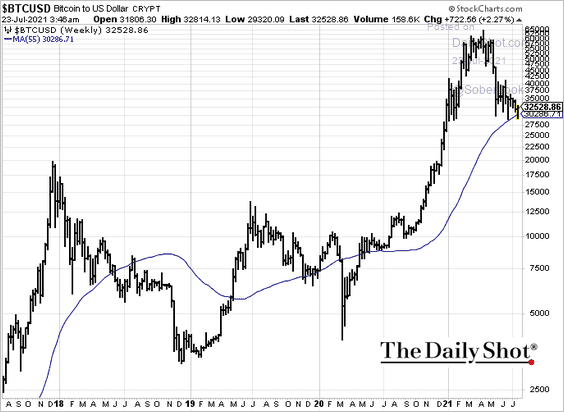

1. Bitcoin held support at the 55-week moving average.

h/t @ericlamTO

h/t @ericlamTO

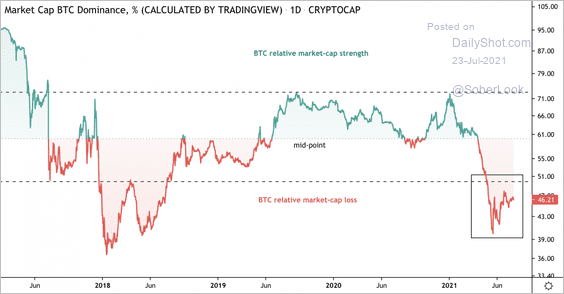

2. Bitcoin’s dominance ratio, which measures its market cap relative to the total market cap of major cryptocurrencies, is stabilizing around 46%.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

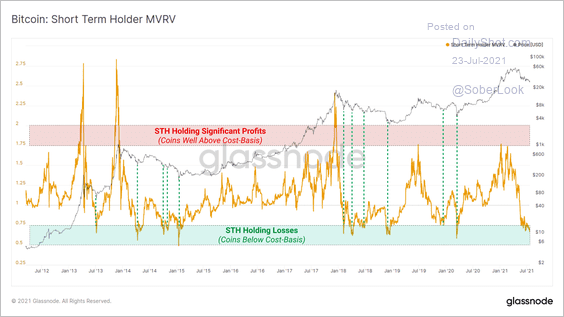

3. Short-term holders who were underwater (holding Bitcoin significantly below the acquisition cost) have been in capitulation mode.

Source: @glassnode

Source: @glassnode

4. ETH/BTC has been consolidating over the past two months. Will we see a breakout?

Source: Dantes Outlook

Source: Dantes Outlook

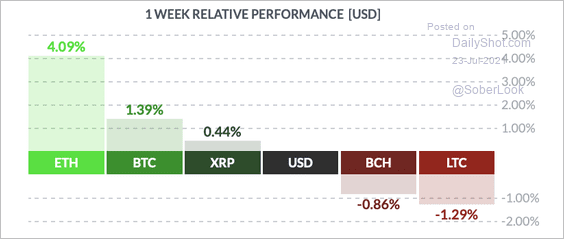

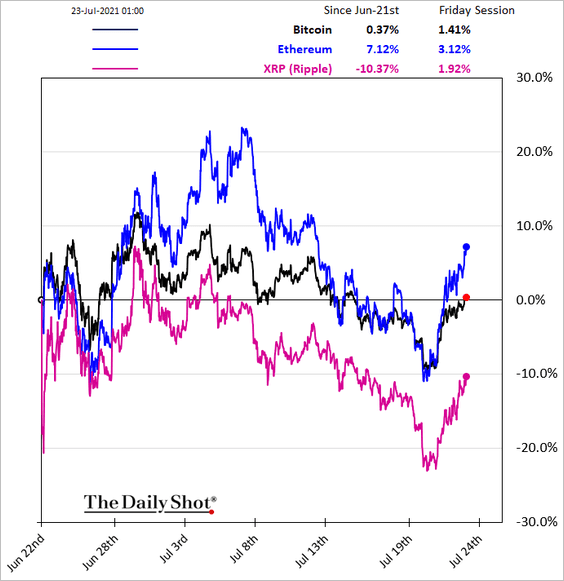

By the way, ether (ETH) has been outperforming major cryptocurrencies over the past week.

Source: FinViz

Source: FinViz

——————–

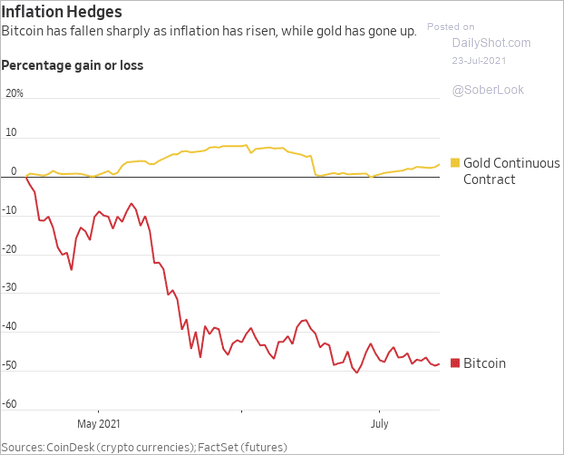

5. Bitcoin is not an effective hedge against inflation.

Source: @WSJ Read full article

Source: @WSJ Read full article

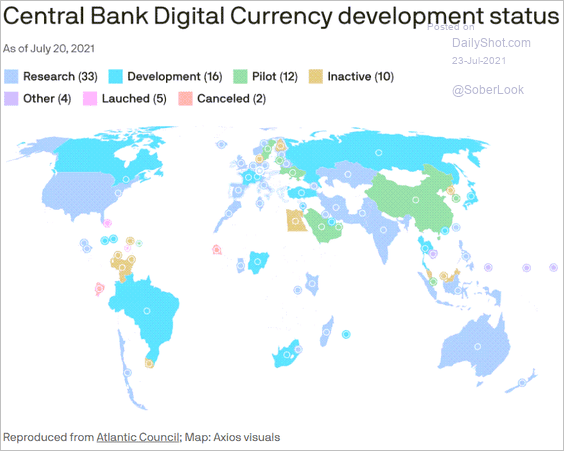

6. Which central banks are considering a digital currency?

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Commodities

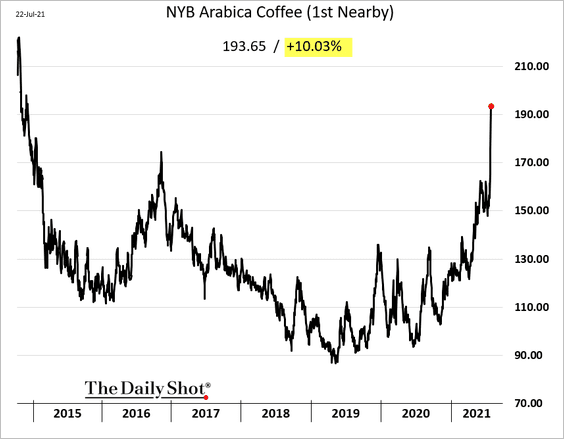

1. Coffee futures soared in response to the situation in Brazil

Source: Reuters Read full article

Source: Reuters Read full article

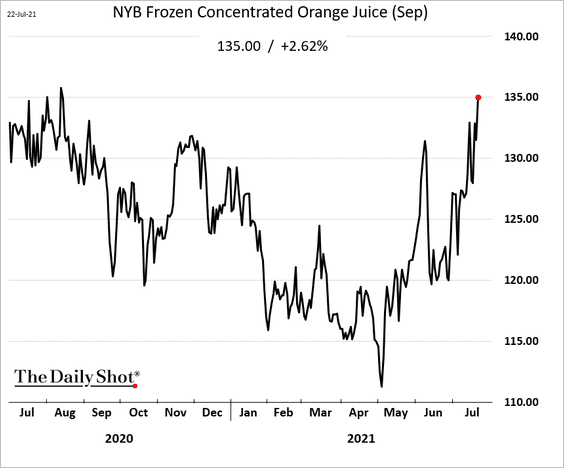

Orange juice futures are higher as well.

——————–

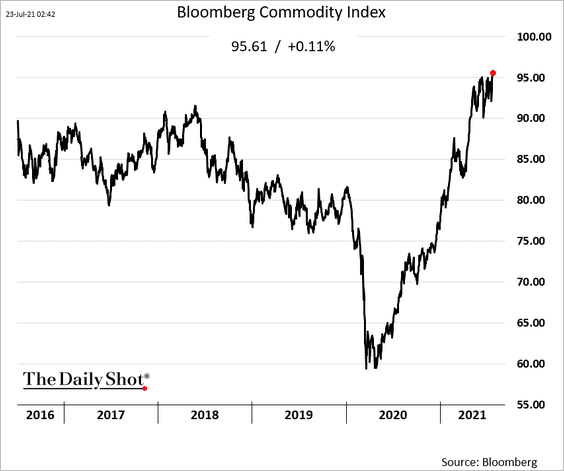

2. Bloomberg’s broad commodity index hit a multi-year high.

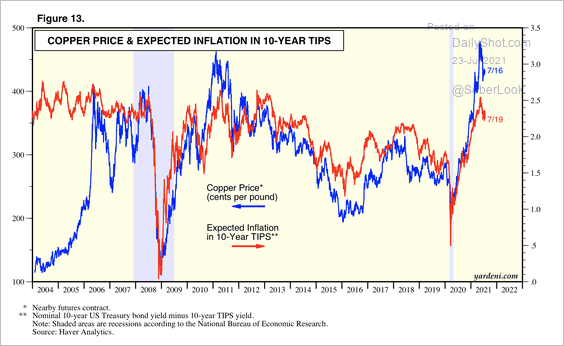

3. Copper has pulled back along with inflation expectations.

Source: Yardeni Research

Source: Yardeni Research

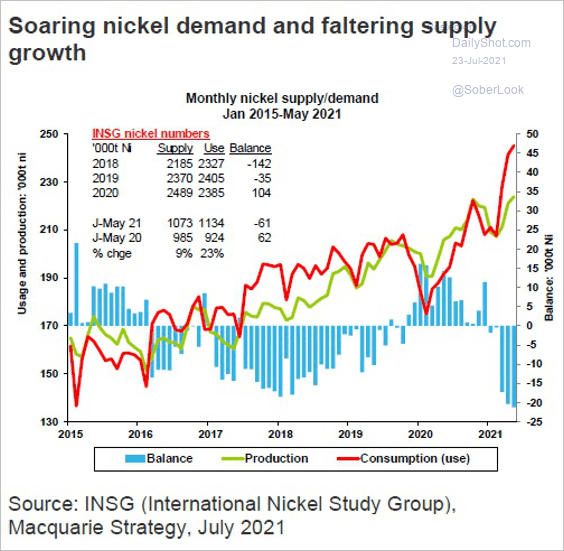

4. The nickel market is in deficit.

Source: Macquarie; @Scutty

Source: Macquarie; @Scutty

Back to Index

Energy

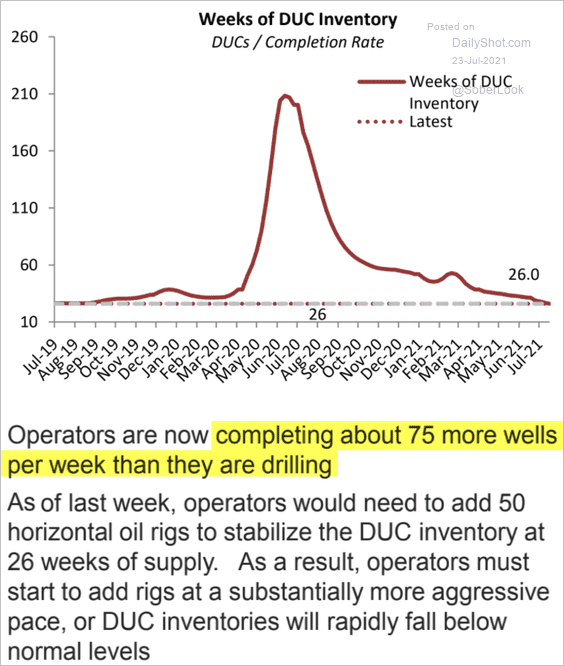

1. US frackers are not drilling enough to stabilize the number of drilled but uncompleted (DUC) wells.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

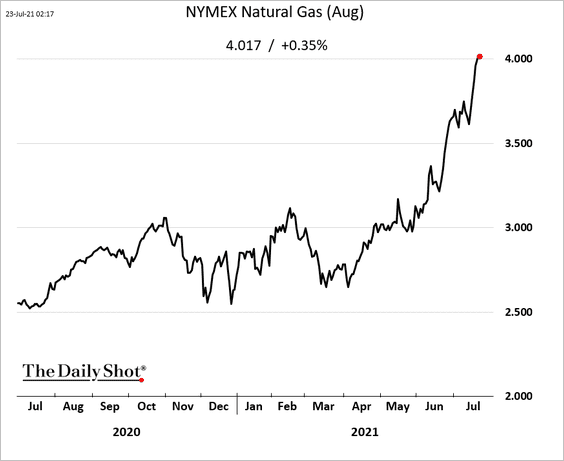

2. The active NYMEX natural gas contract is above $4.0/mmbtu.

Back to Index

Equities

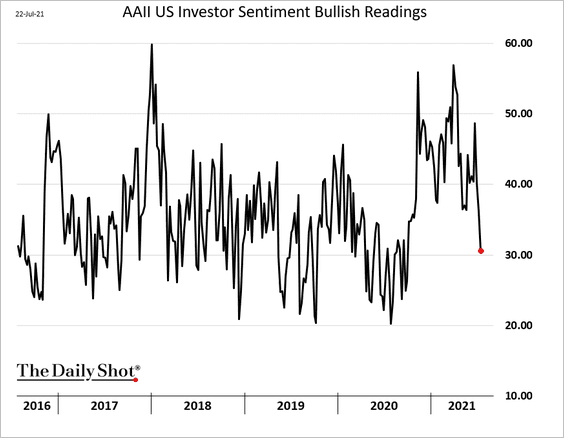

1. The percentage of bullish investors declined sharply this week.

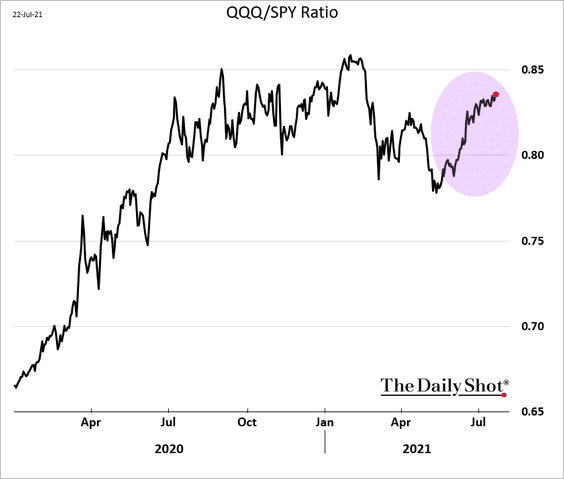

2. Large growth stocks continue to lead the rally. Here is the ratio of the Nasdaq 100 ETF to the S&P 500 ETF.

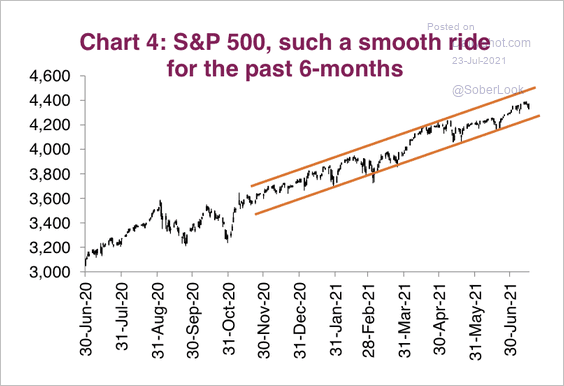

3. The S&P 500 has been in a solid up channel over the past six months.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

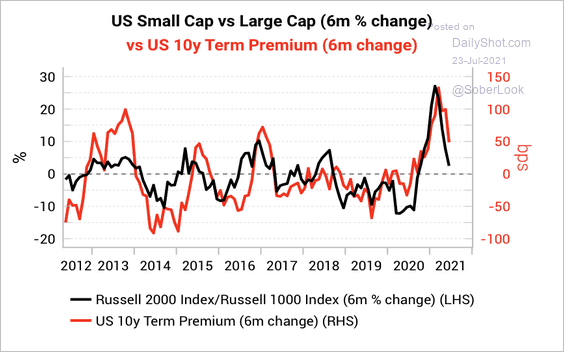

4. Small-caps began to underperform large-caps as the 10-year term premium declined.

Source: Variant Perception

Source: Variant Perception

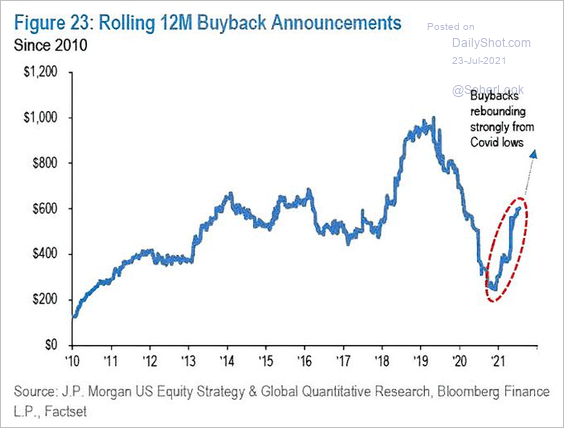

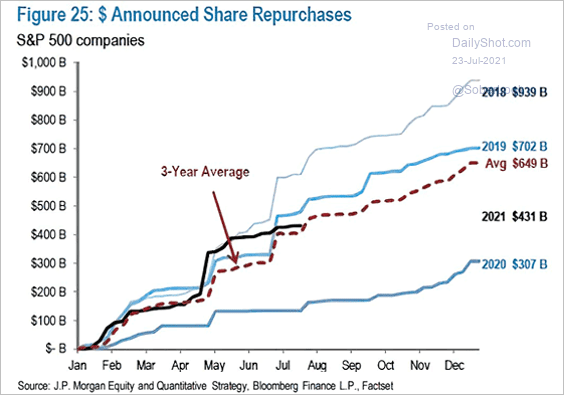

5. Buyback activity has been recovering this year.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @JPMorganAM

Source: @ISABELNET_SA, @JPMorganAM

——————–

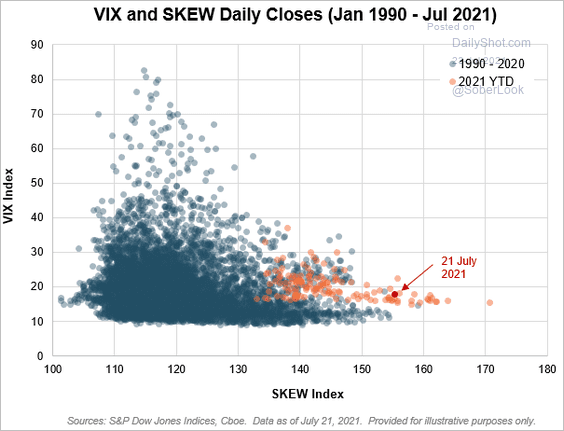

6. Despite lower implied vol, skew remains elevated as investors hedge against “tail risk.”

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Rates

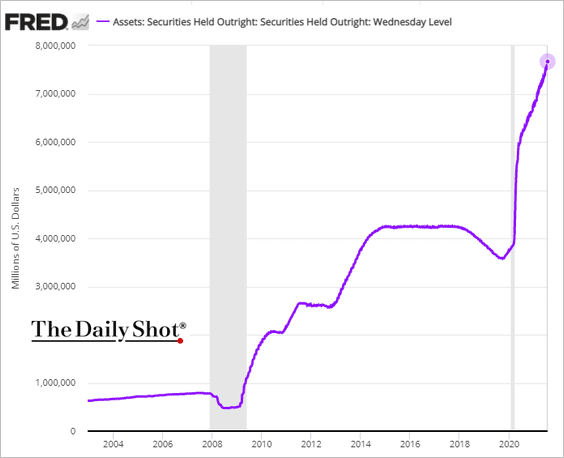

1. The Fed’s securities holdings are approaching $8 trillion.

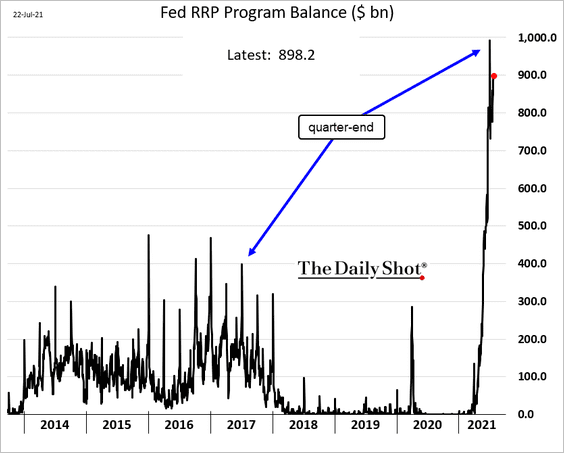

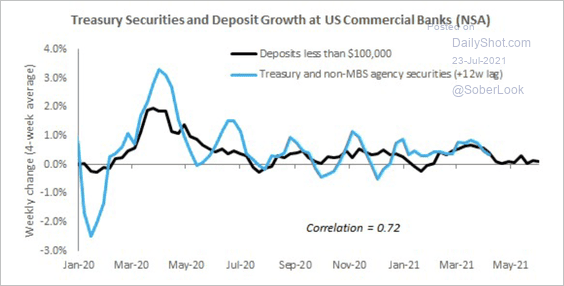

2. The Fed’s reverse repo balances are approaching $900 billion, allowing the central bank to limit liquidity growth in the financial system.

3. Deposit growth at US banks has slowed substantially, suggesting that bank buying of Treasuries could decline in the coming weeks, according to Deutsche Bank. This could result in higher yields.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

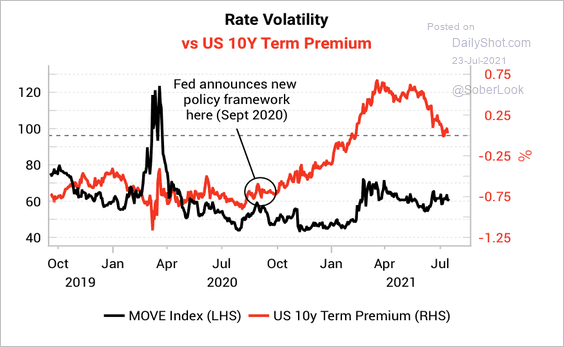

4. The 10-year term premium is back near zero, along with relatively low volatility.

Source: Variant Perception

Source: Variant Perception

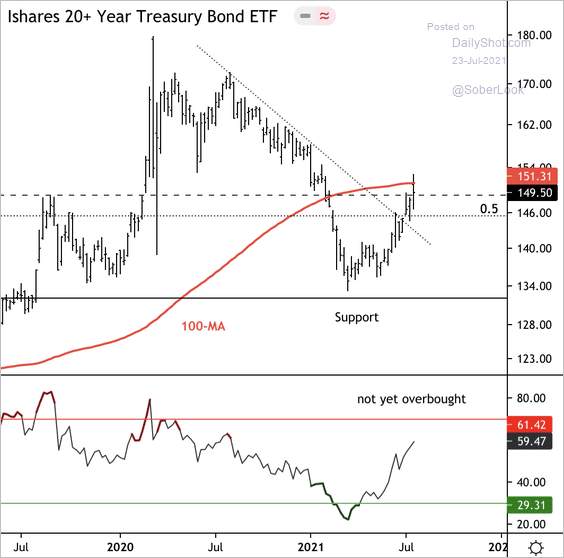

5. The iShares 20+ Year Treasury ETF (TLT) has broken above a year-long downtrend.

Source: Dantes Outlook

Source: Dantes Outlook

6. Treasury yields are tracking previous mid-cycle slowdowns, defined by decelerating industrial production growth.

![]() Source: Deutsche Bank Research

Source: Deutsche Bank Research

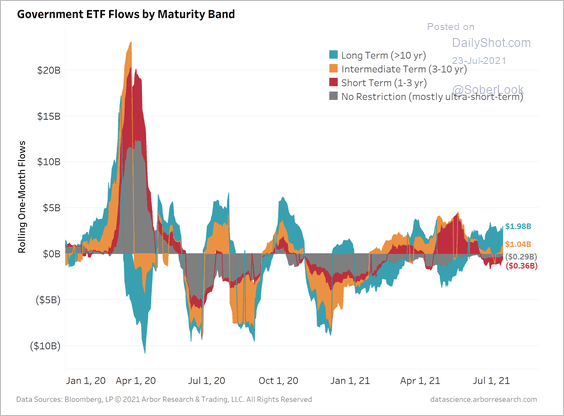

7. Investors have been buying intermediate-term and long-term Treasury ETFs over the past month.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

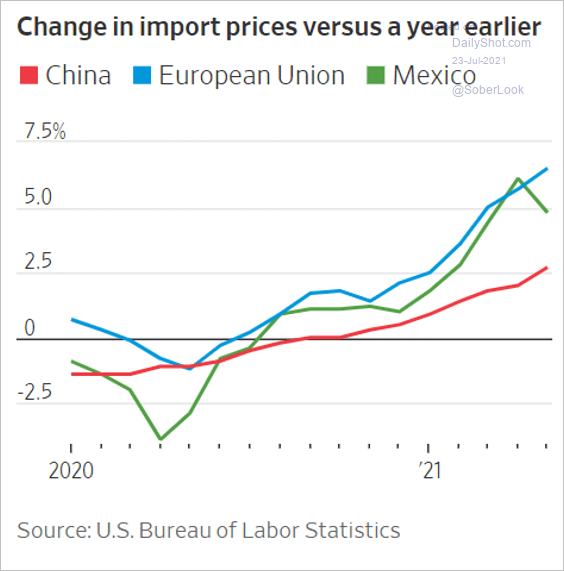

1. Rising US import prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

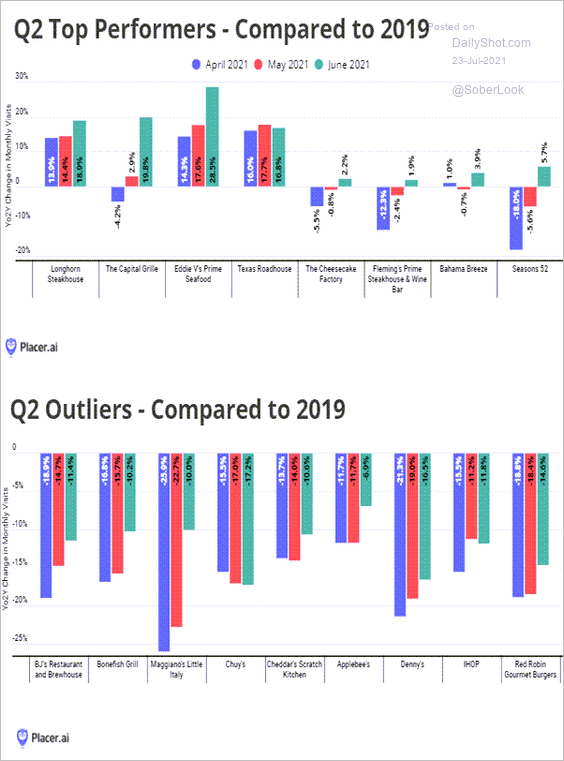

2. US casual dining winners and losers:

Source: Placer.ai

Source: Placer.ai

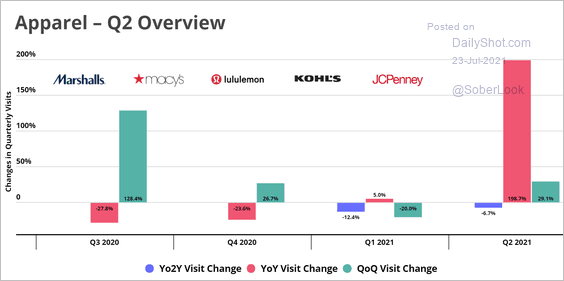

3. Apparel store visits (still below 2019 levels but not by much):

Source: Placer.ai

Source: Placer.ai

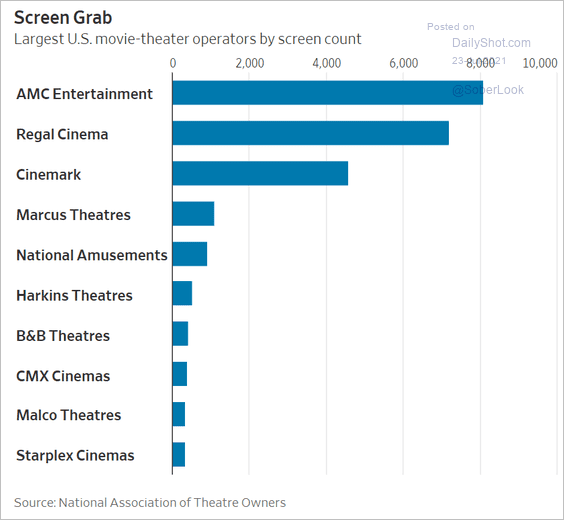

4. Largest US movie-theater operators:

Source: @WSJ Read full article

Source: @WSJ Read full article

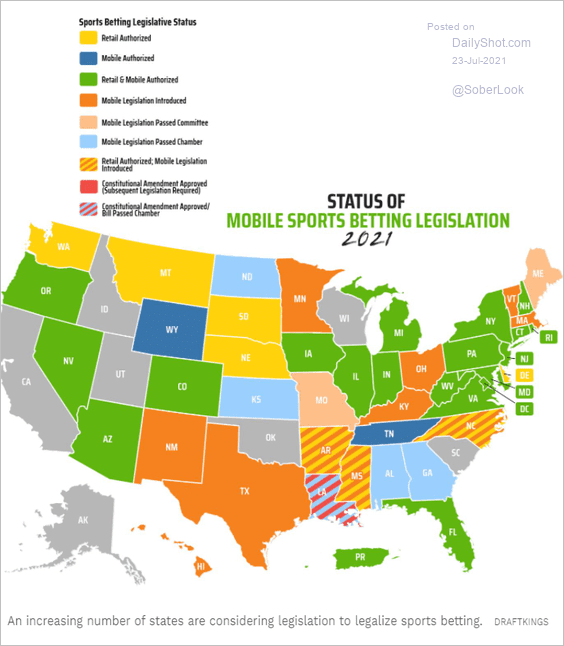

5. Sports betting legislation status:

Source: Forbes Read full article

Source: Forbes Read full article

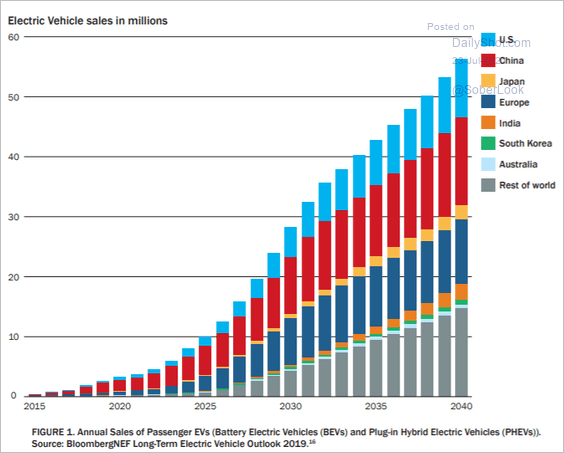

6. Projected EV sales:

Source: US Department of Energy Read full article

Source: US Department of Energy Read full article

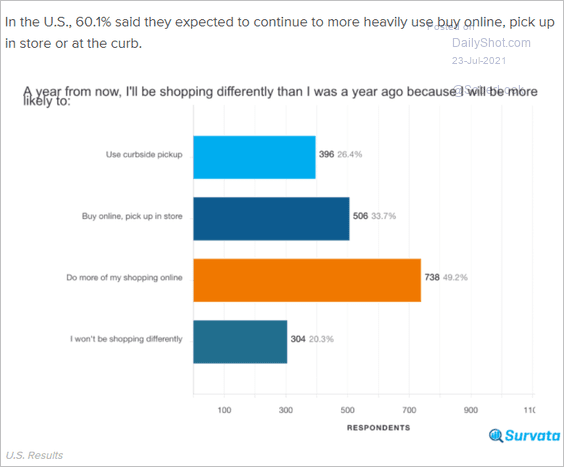

7. Shopping differently going forward:

Source: Signifyd Read full article

Source: Signifyd Read full article

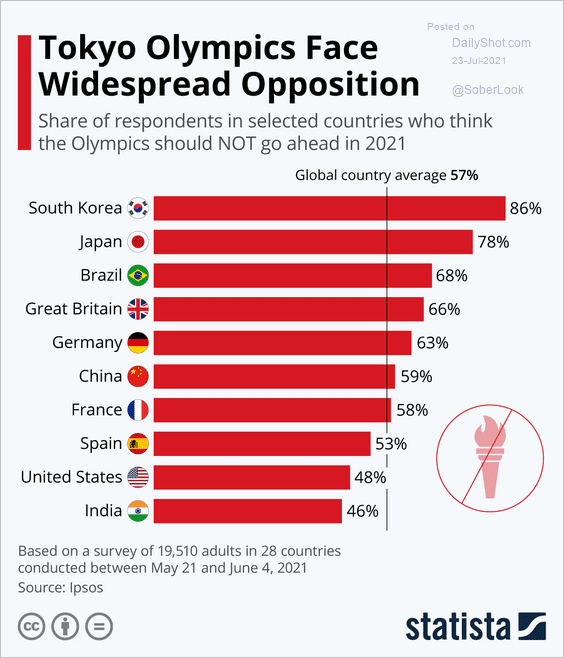

8. Opposition to Tokyo Olympics:

Source: Statista

Source: Statista

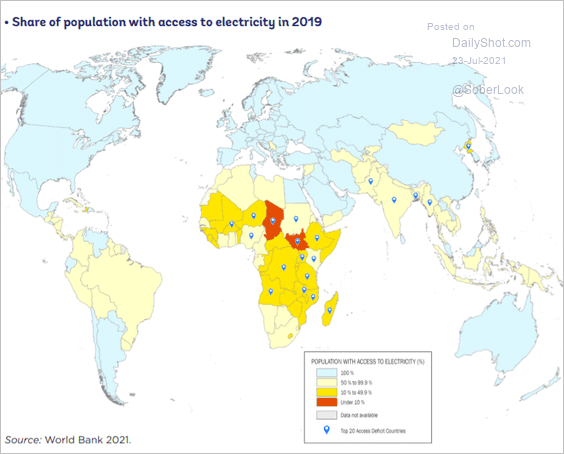

9. Access to electricity:

Source: The Energy Progress Report Read full article

Source: The Energy Progress Report Read full article

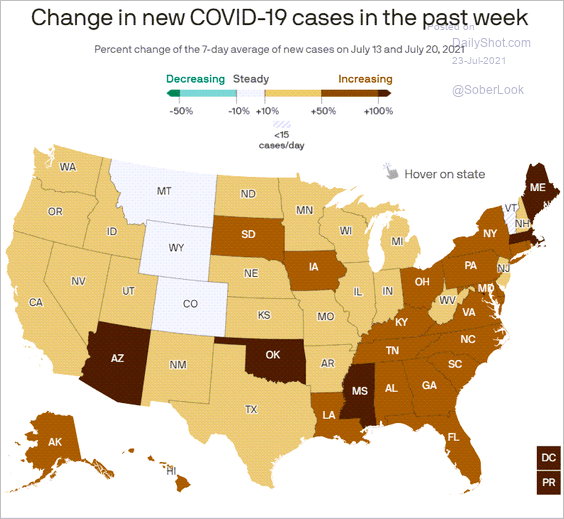

10. US COVID cases:

Source: @axios Read full article

Source: @axios Read full article

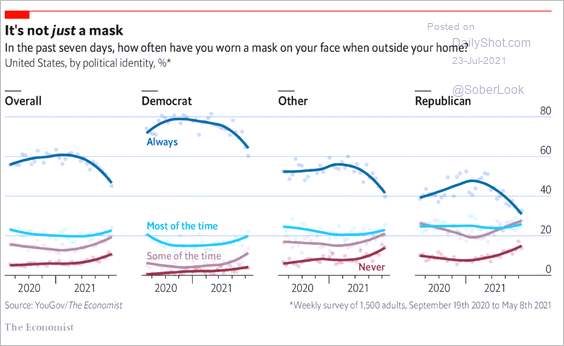

11. Wearing a mask:

Source: The Economist Read full article

Source: The Economist Read full article

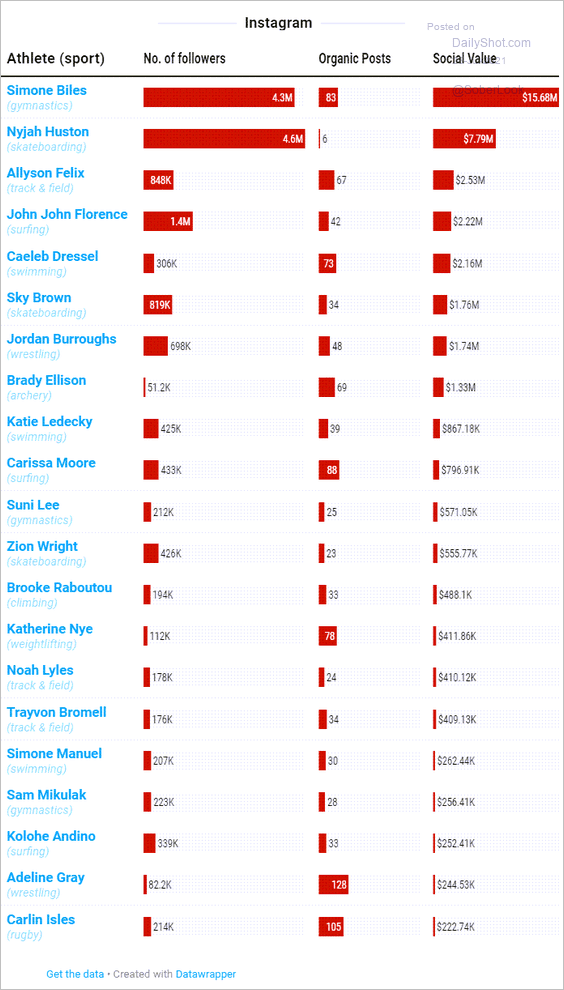

12. Popular Olympians in 2021:

Source: Sports Business Journal Read full article

Source: Sports Business Journal Read full article

——————–

Have a great weekend!

Back to Index