The Daily Shot: 10-Aug-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Global Developments

• Food for Thought

The United States

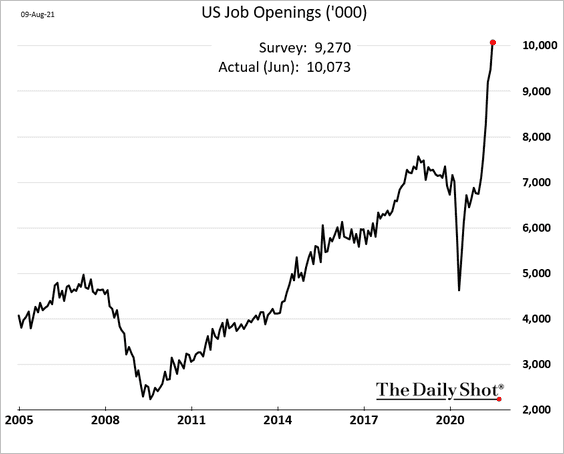

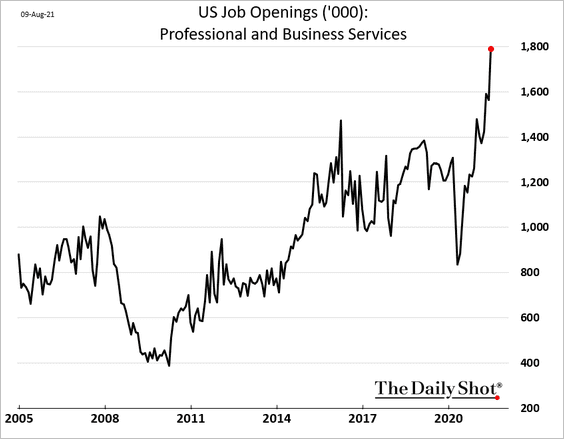

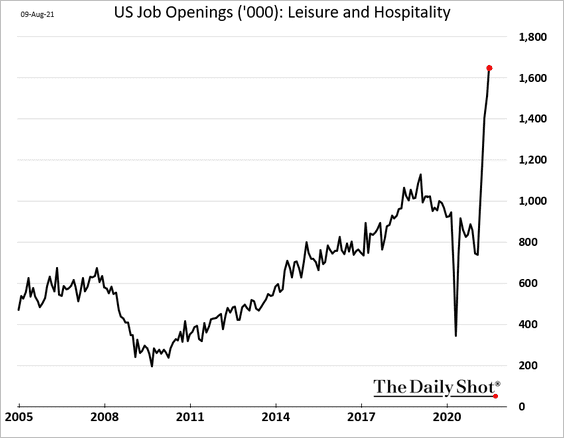

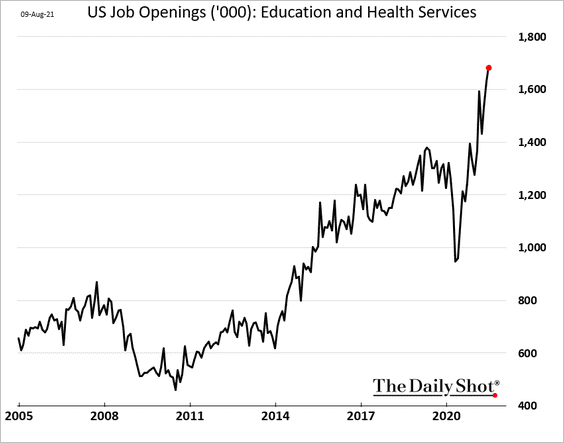

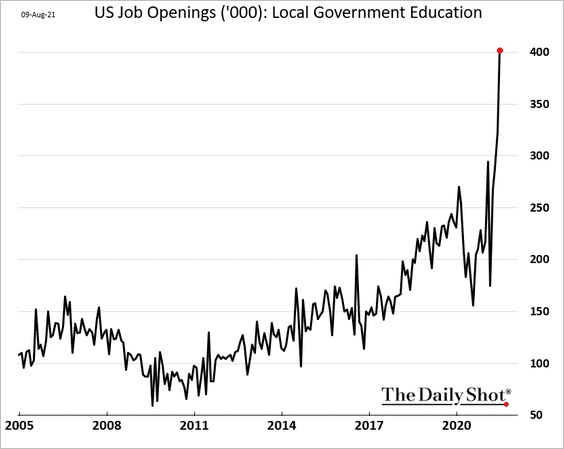

1. Job openings hit another record in June, with the May figures revised higher. The demand for labor in the US is unprecedented.

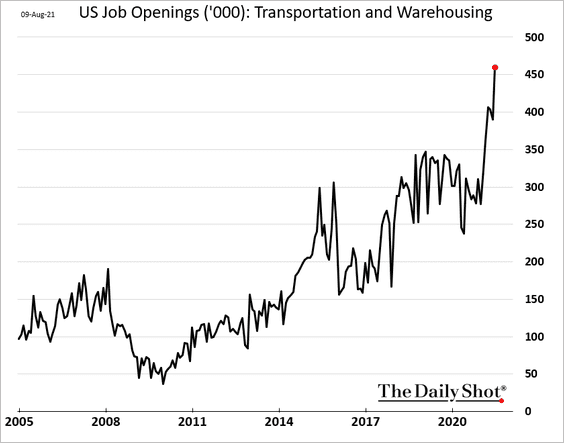

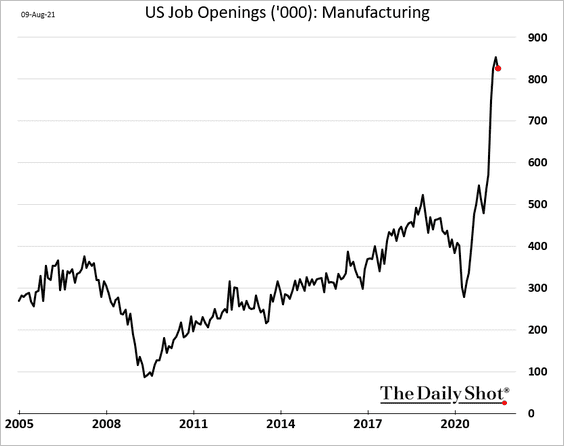

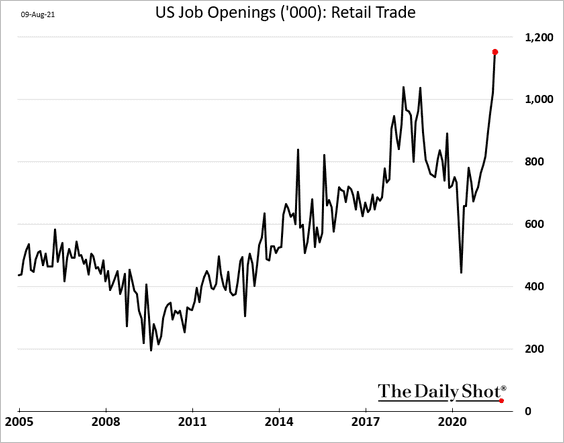

Vacancies have been surging broadly, with most sectors hitting record highs.

– Demand for drivers and warehouse workers:

– Manufacturing:

– Retail:

– Professional services:

– Hotels and restaurants:

– Healthcare:

– Public school teachers:

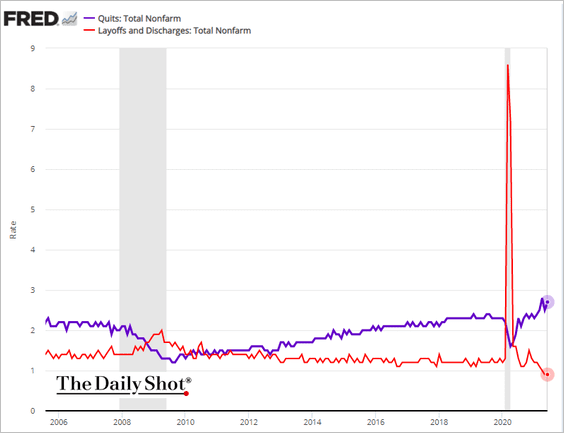

• Layoffs are near the lows, and voluntary resignations (quits) are near the highs.

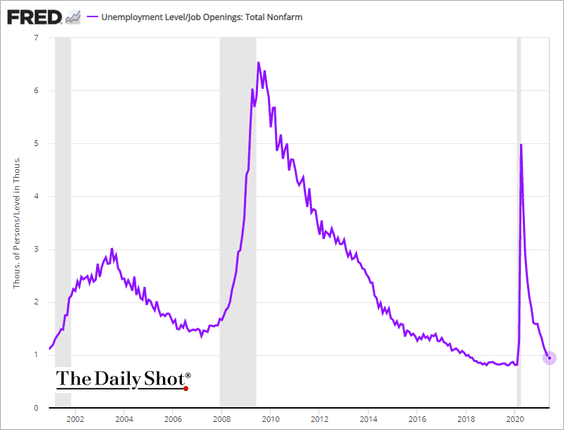

• The ratio of unemployed to job openings is back below one.

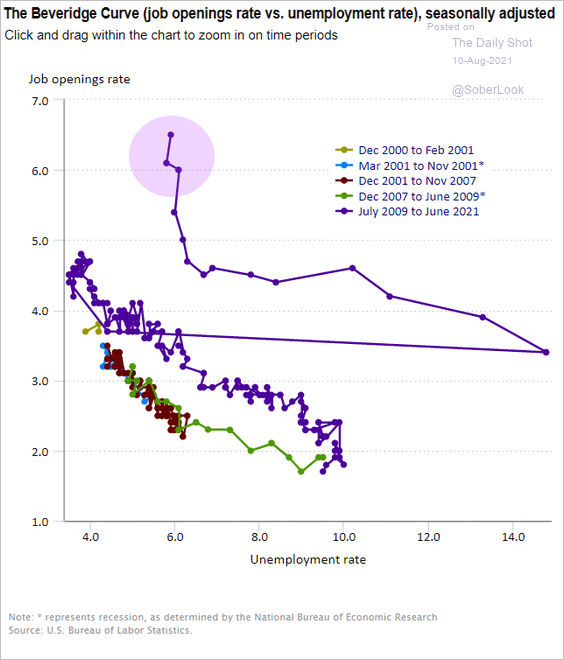

• The Beveridge curve illustrates just how tight the labor market has become. While businesses should see some relief as workers return, labor shortages could persist for some time (low immigration, years of weak population growth, and high retirement rates).

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

——————–

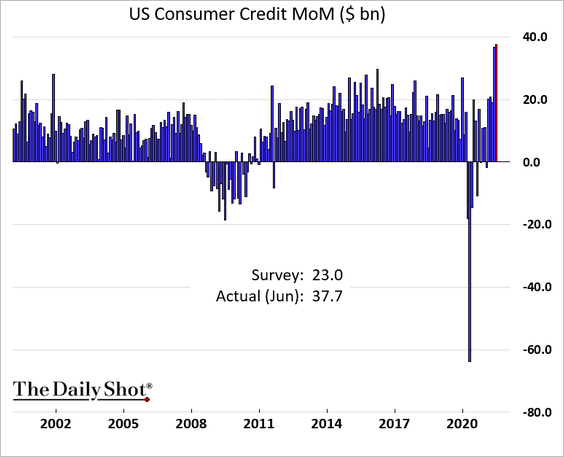

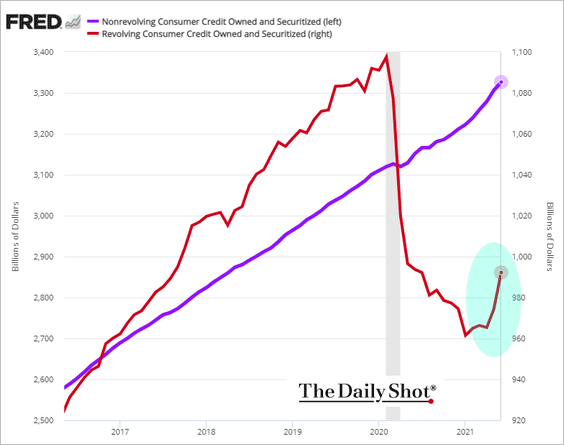

2. Next, we have some updates on household credit.

• Consumer credit jumped by most on record in June, …

… as Americans tapped their credit cards (revolving credit).

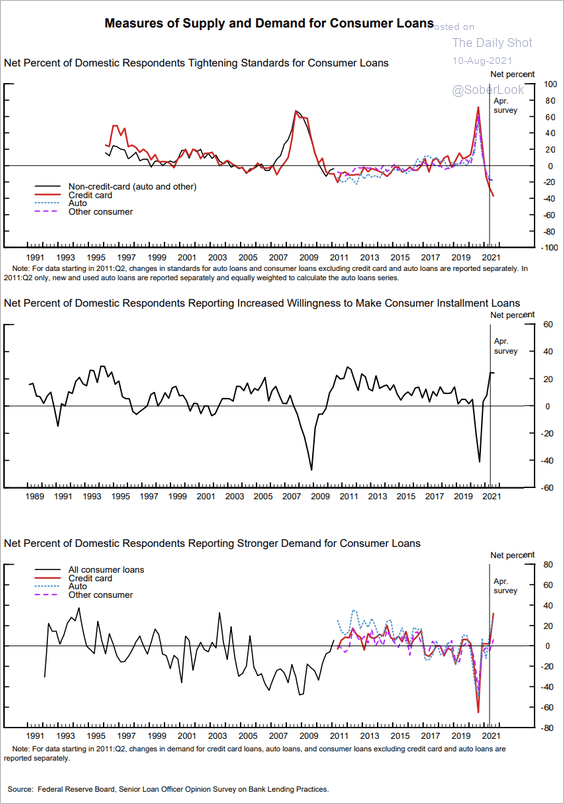

• Banks have been increasingly accommodative (easing underwriting standards) as demand for credit card borrowing picks up.

Source: Federal Reserve Board

Source: Federal Reserve Board

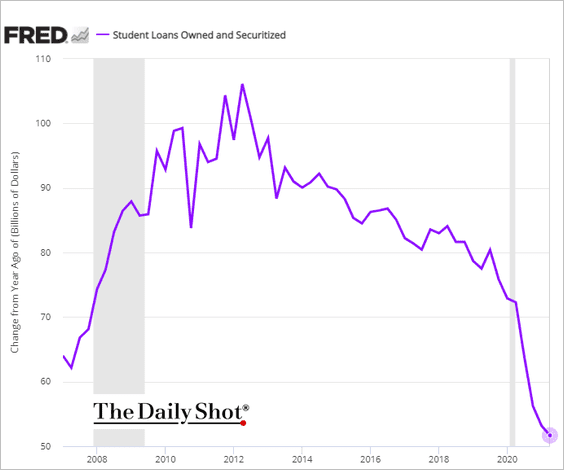

• Student debt growth continues to slow.

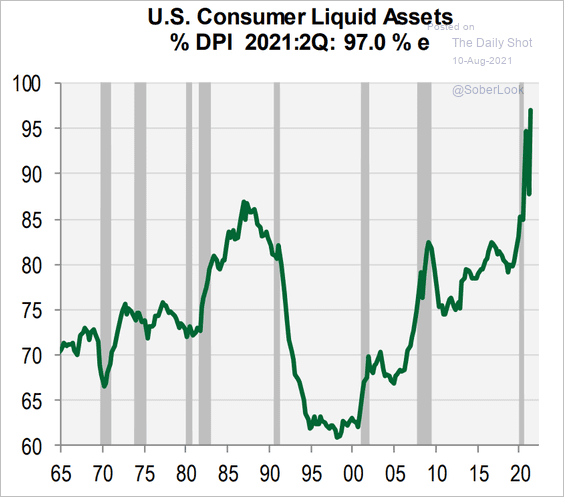

• Households’ liquid assets as a percentage of disposable personal income are at record highs.

Source: Cornerstone Macro

Source: Cornerstone Macro

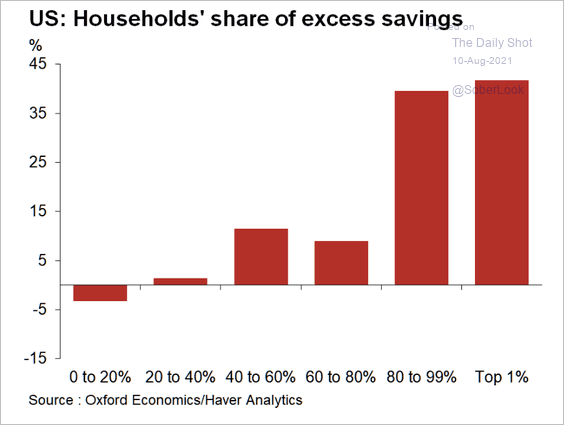

Here is the distribution of excess savings.

Source: Oxford Economics

Source: Oxford Economics

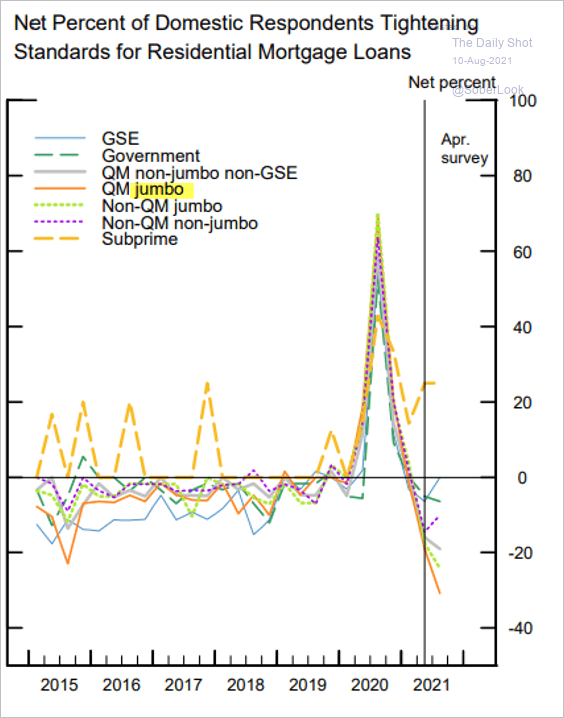

• Banks have been easing lending standards on jumbo mortgages amid strong demand.

Source: Federal Reserve Board

Source: Federal Reserve Board

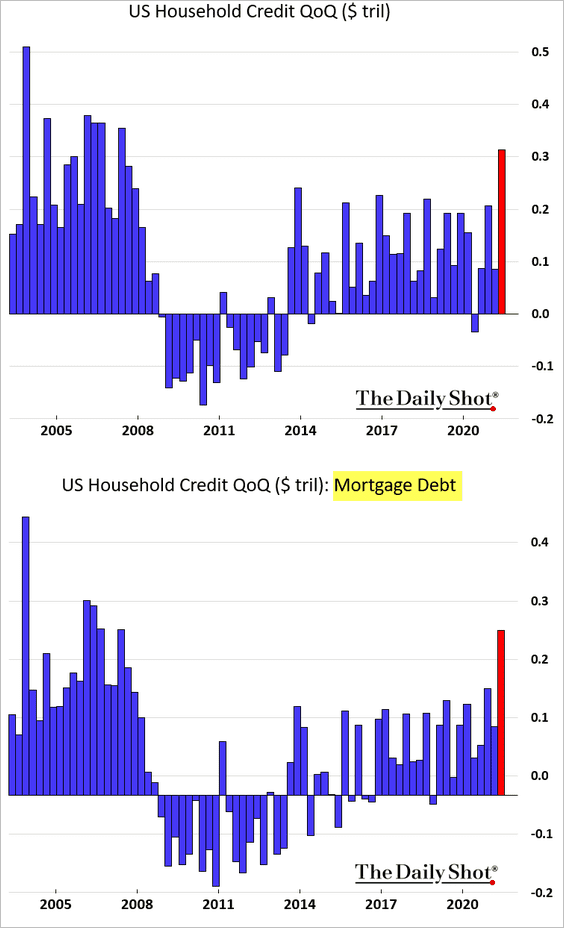

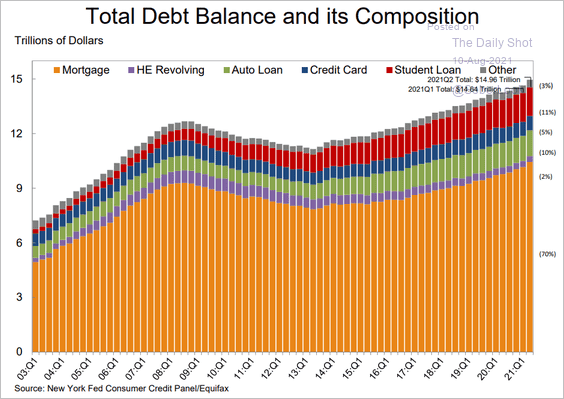

• The overall household credit rose sharply in the second quarter, driven by mortgages.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

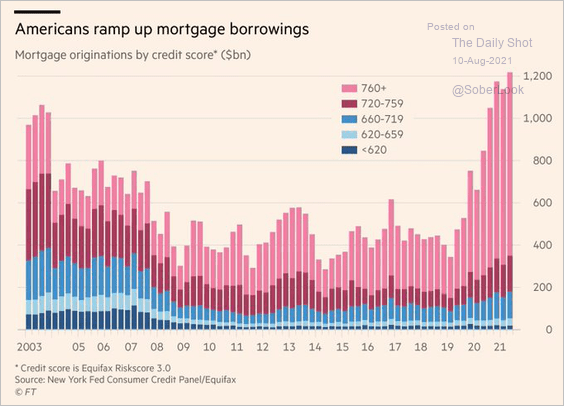

• Mortgage financing remains dominated by top-credit-score borrowers.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

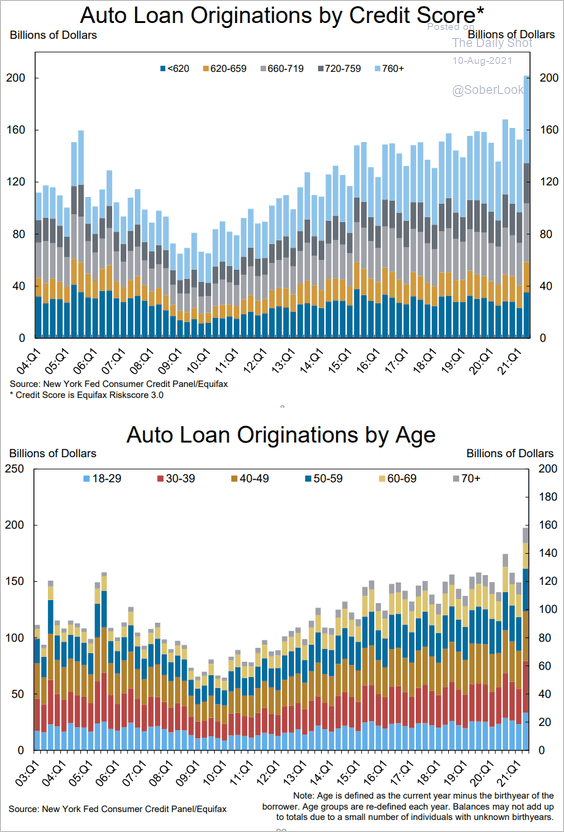

• These charts show auto loan originations by borrowers’ credit score and age.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

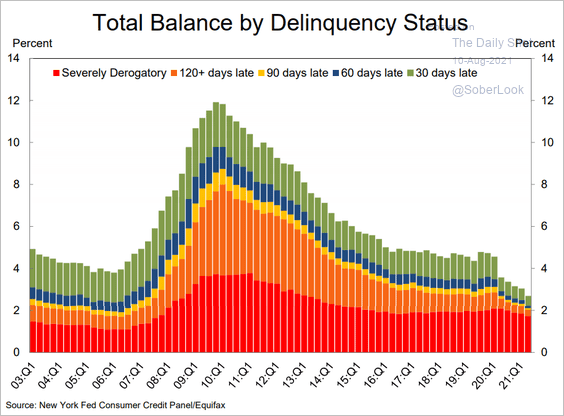

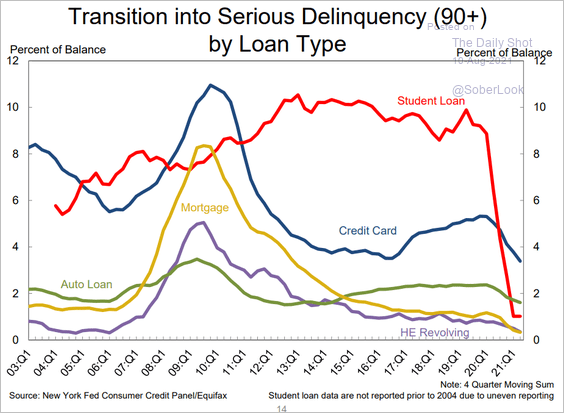

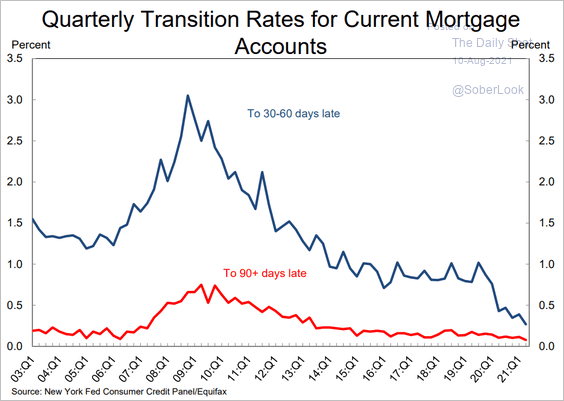

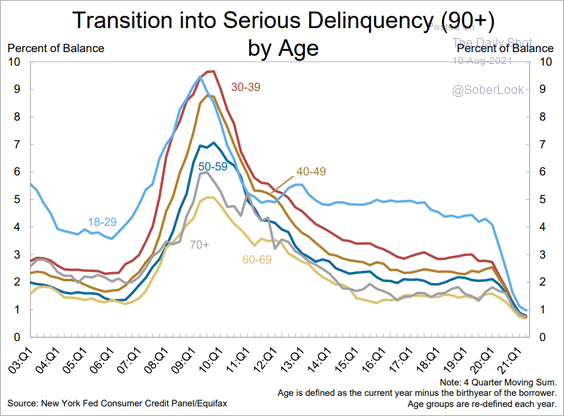

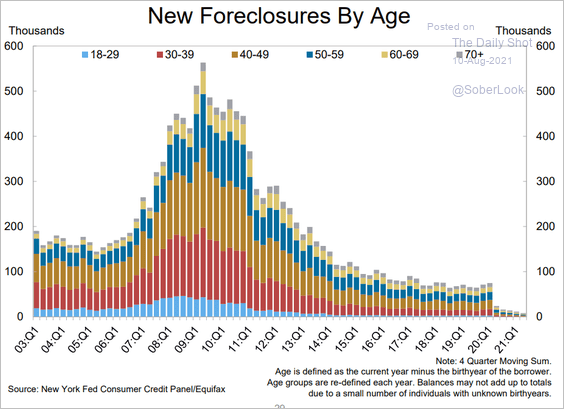

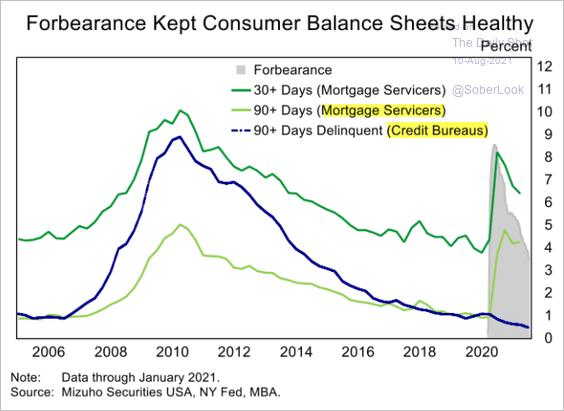

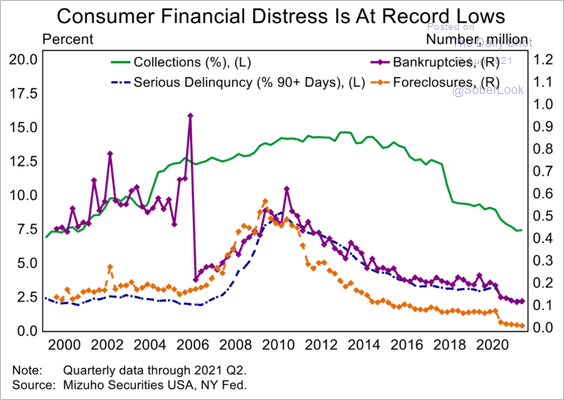

• Next, we have some updates on households’ financial distress.

– Total delinquencies:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

– Thanks, Uncle Sam!

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

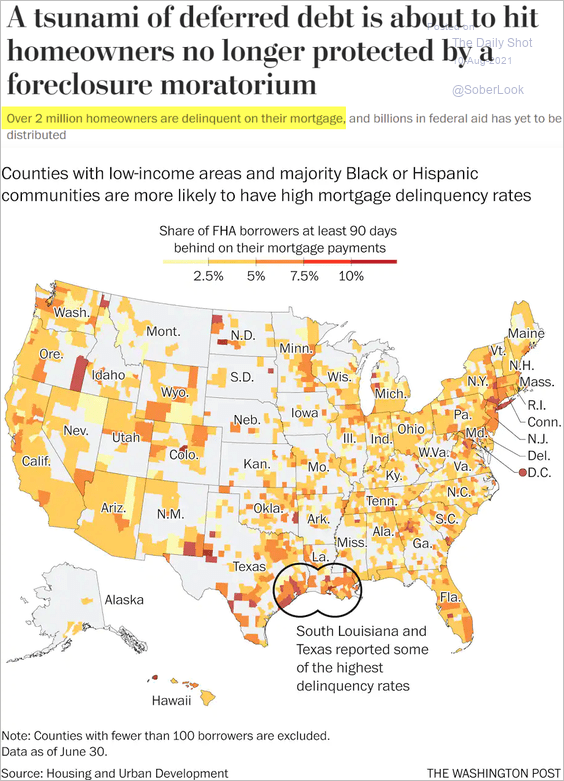

– Mortgage delinquencies and foreclosures (3 charts) …

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

… helped by forbearance programs:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

– Consumer financial distress is at record lows.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

– What happens when support ends?

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

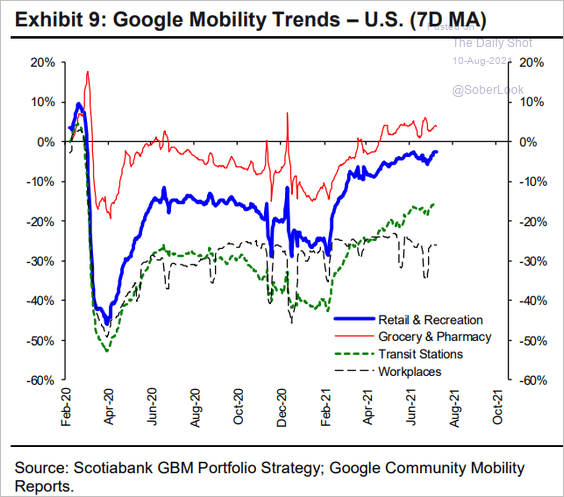

3. Mobility continues to improve …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

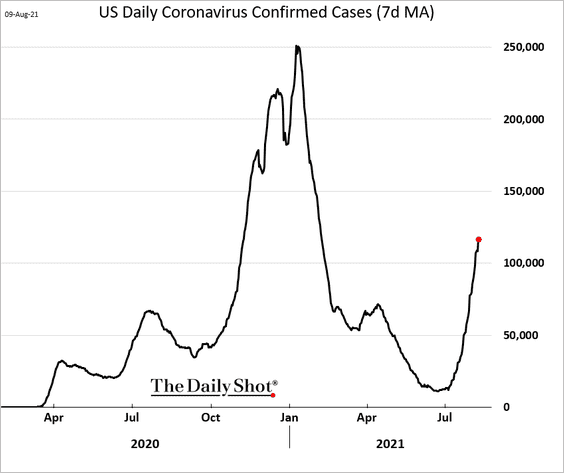

… despite rising COVID cases.

Back to Index

The United Kingdom

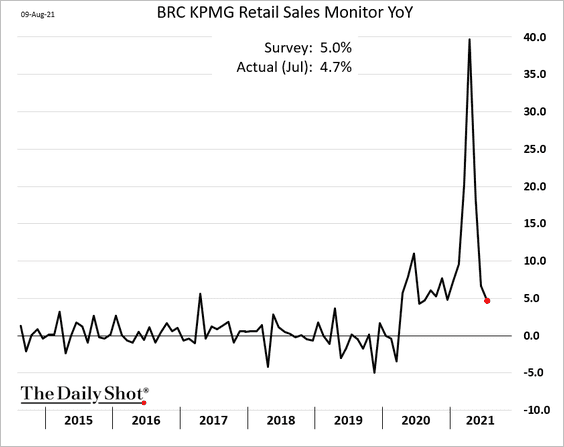

1. Retail sales growth moderated last month, according to BRC.

Source: The Independent Read full article

Source: The Independent Read full article

——————–

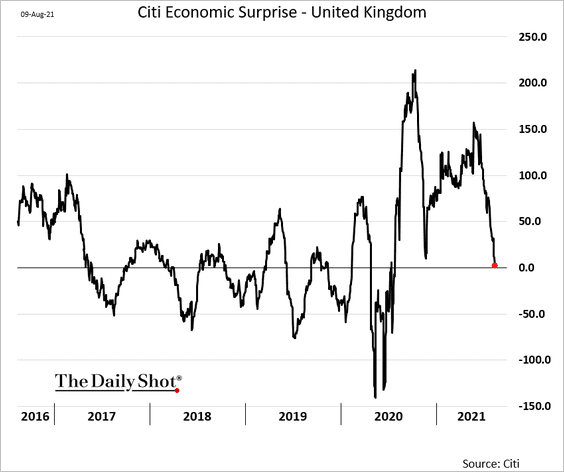

2. The Citi Economic Surprise Index continues to sink.

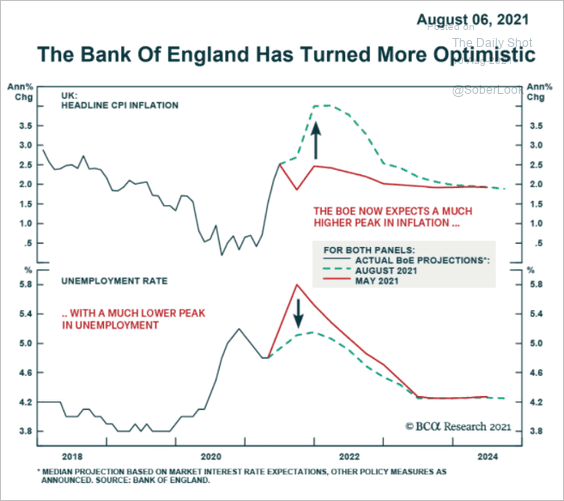

3. As we saw last week, the BoE boosted its forecast for near-term inflation. The central bank also lowered its projections for unemployment.

Source: BCA Research

Source: BCA Research

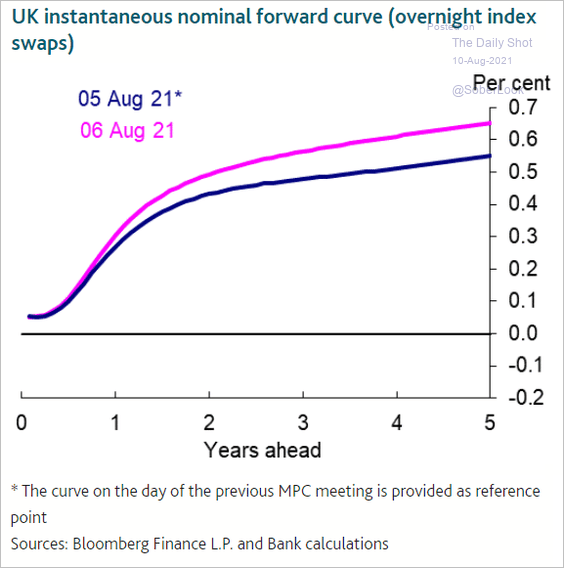

In response, markets priced in faster rate hikes (chart shows market expectations for the overnight rate).

Source: BoE

Source: BoE

——————–

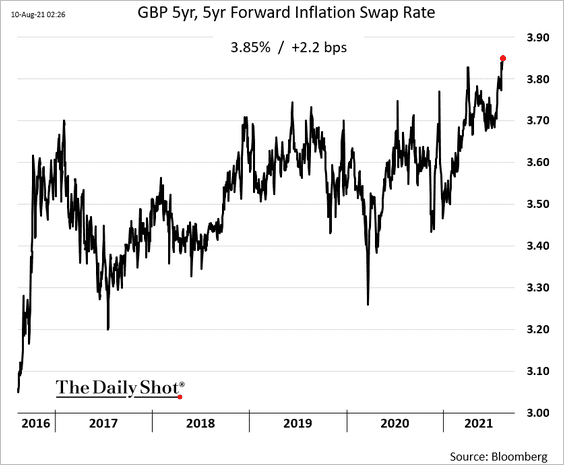

4. Long-term market-based inflation expectations continue to grind higher.

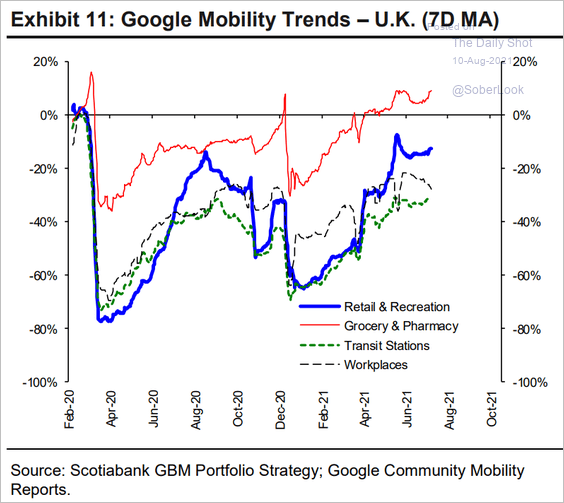

5. Mobility recovery has stalled.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

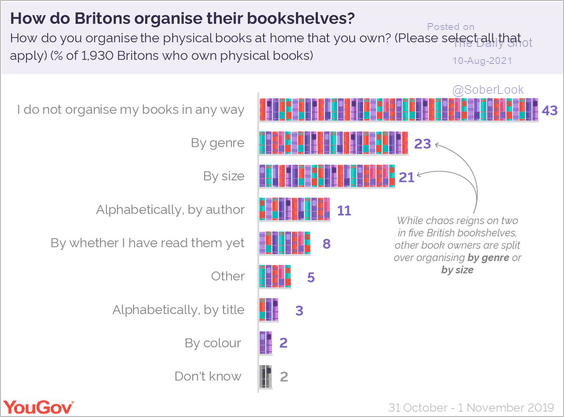

6. On a lighter note, here is how Britons organize their books.

Source: @YouGov, @IvanTheK

Source: @YouGov, @IvanTheK

Back to Index

The Eurozone

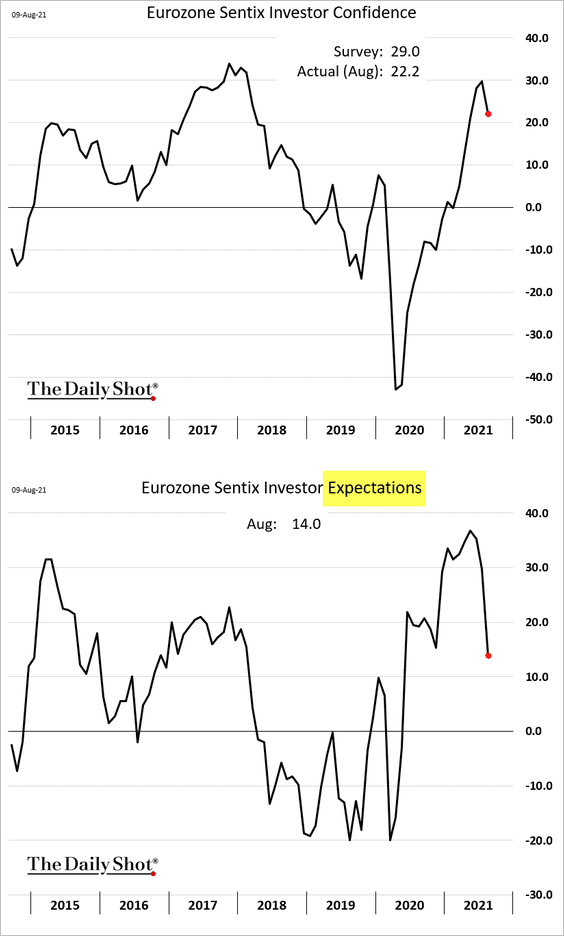

1. Investor confidence took a hit amid pandemic concerns.

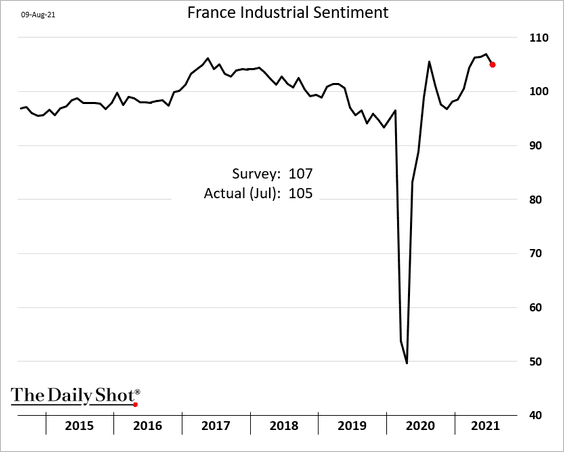

2. French industrial sentiment appears to have peaked.

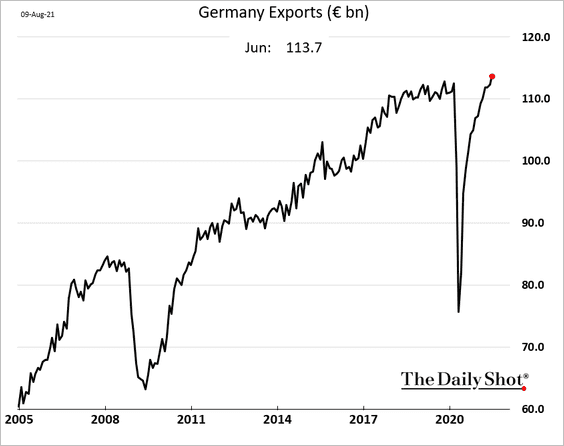

3. German exports hit a record high.

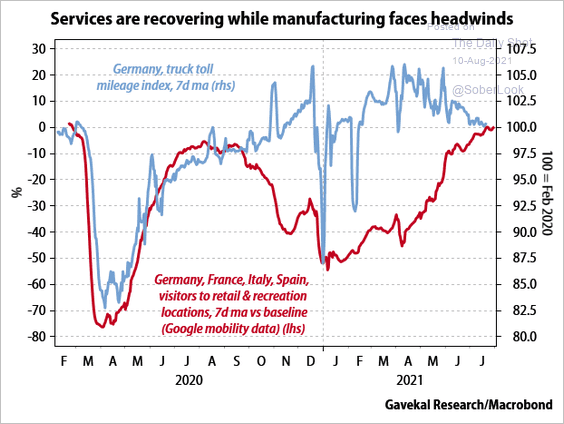

4. Services have been recovering this summer as manufacturing activity moderates.

Source: Gavekal Research

Source: Gavekal Research

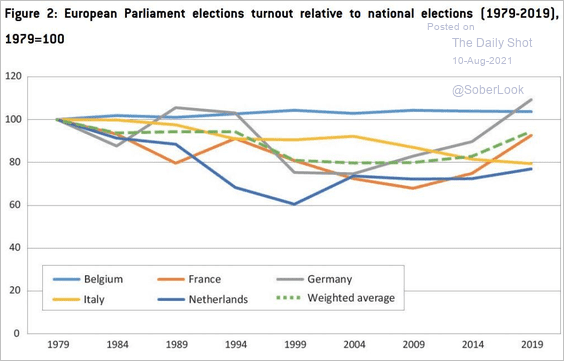

5. This chart shows European Parliament election turnout relative to national elections.

Source: @Bruegel_org, @FrancescoPapad1, @enricobergamini, @manumourlon, @porcarorama Read full article

Source: @Bruegel_org, @FrancescoPapad1, @enricobergamini, @manumourlon, @porcarorama Read full article

Back to Index

Asia – Pacific

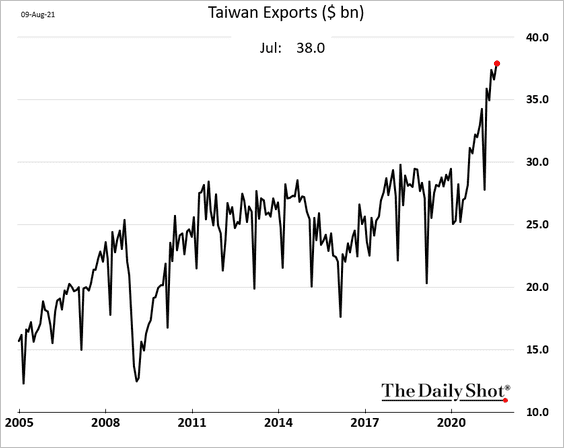

1. Taiwan’s exports have been soaring.

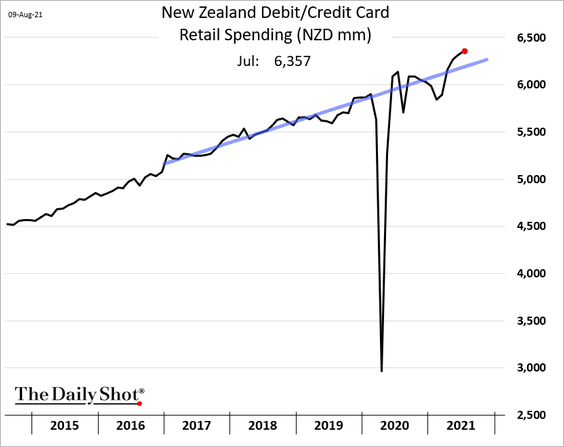

2. New Zealand’s retail card spending is now above the pre-COVID trend.

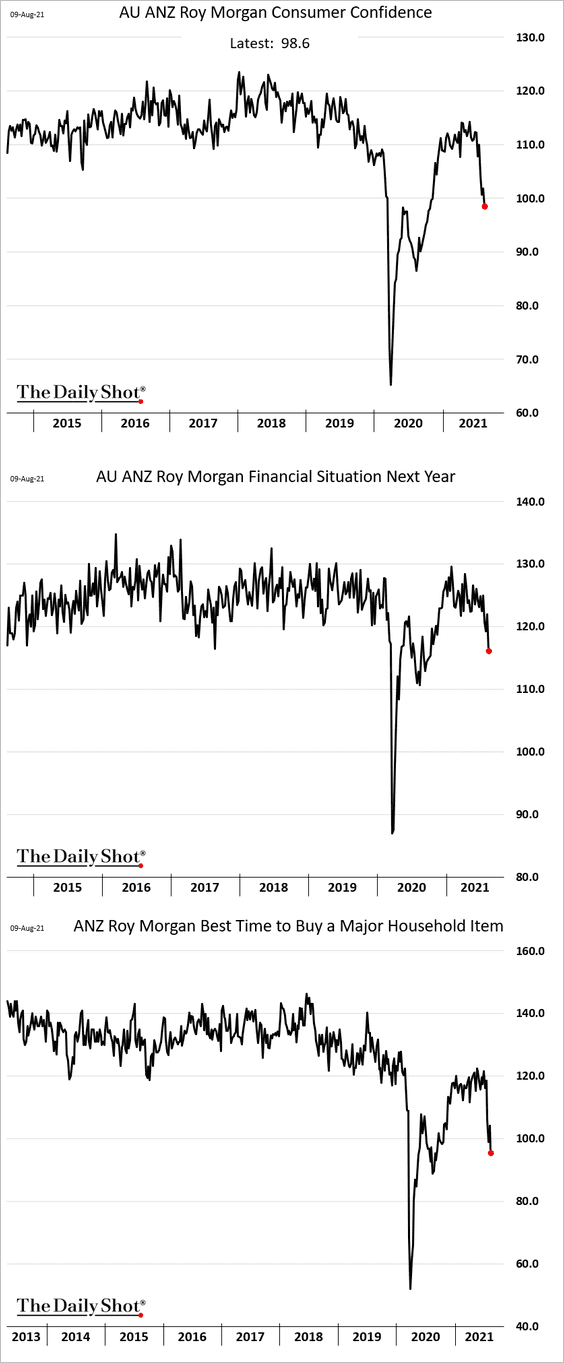

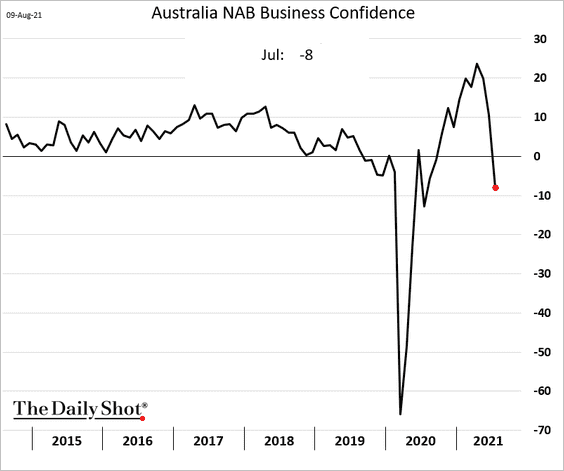

3. Australia’s consumer and business sentiment has been plunging due to the COVID situation.

• Consumer confidence:

• Business confidence:

Back to Index

China

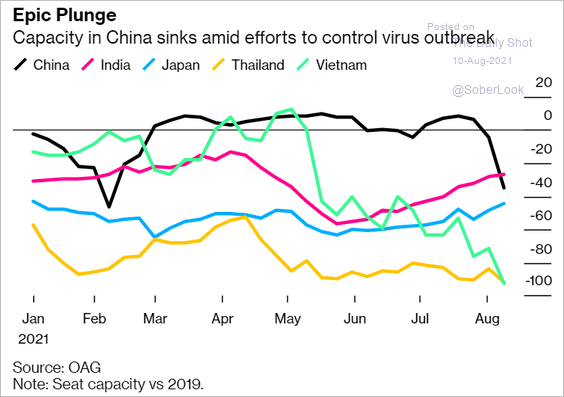

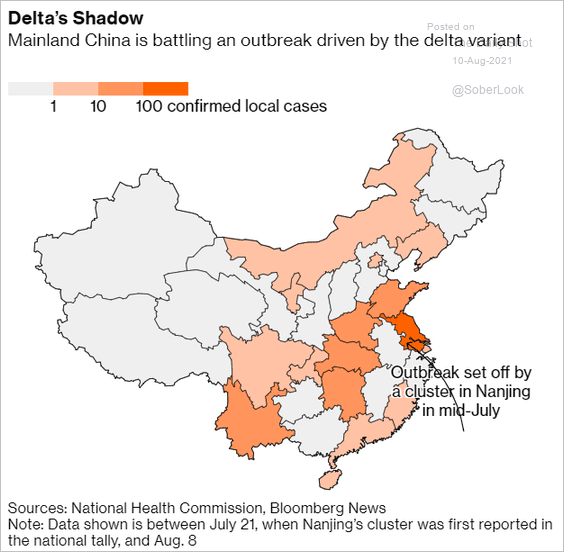

1. Air travel is down sharply …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

… amid concerns about the outbreak.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

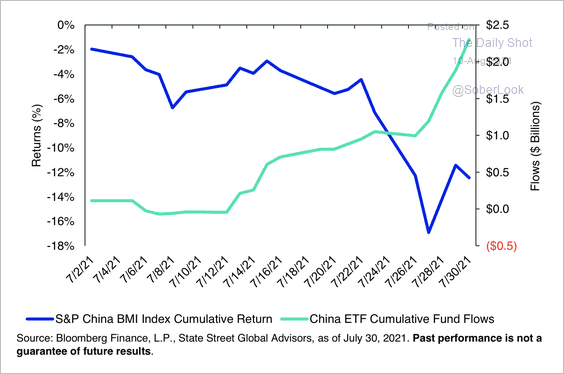

2. Fund inflows accelerated even as stocks came under pressure.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Back to Index

Emerging Markets

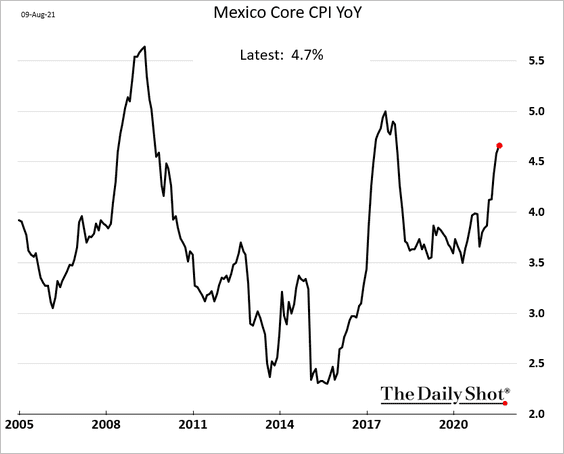

1. Mexico’s core inflation continues to rise.

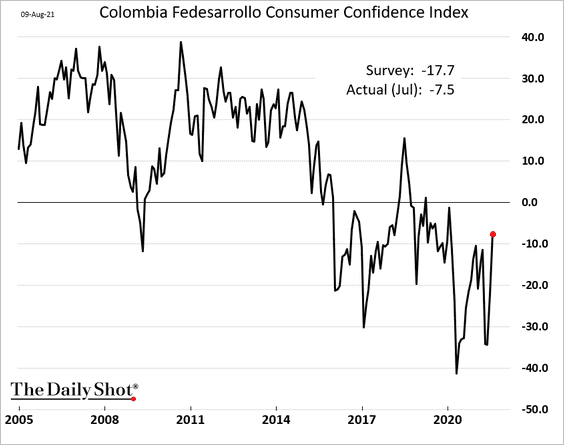

2. Colombia’s consumer confidence rebounded more than expected.

3. Here are some updates on Chile.

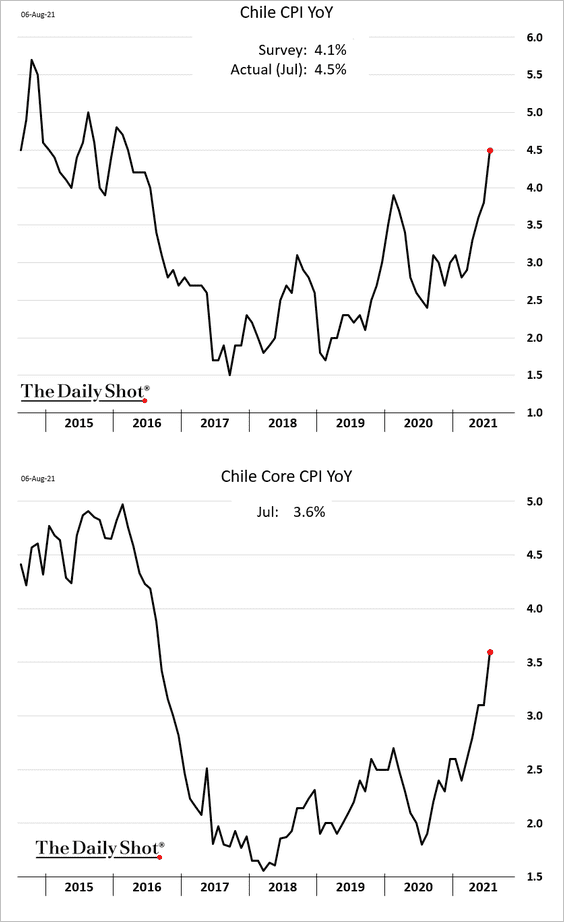

• Inflation topped forecasts last month.

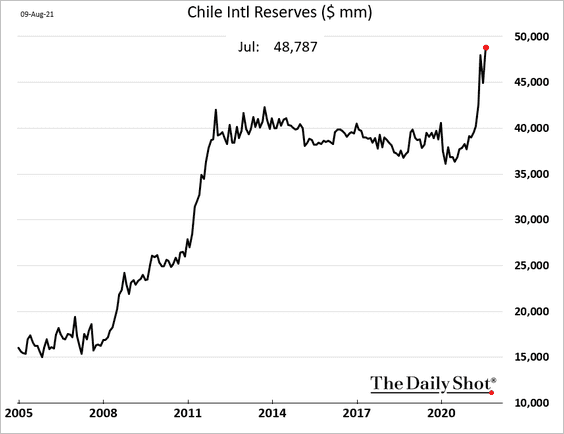

• F/X reserves hit a record high, …

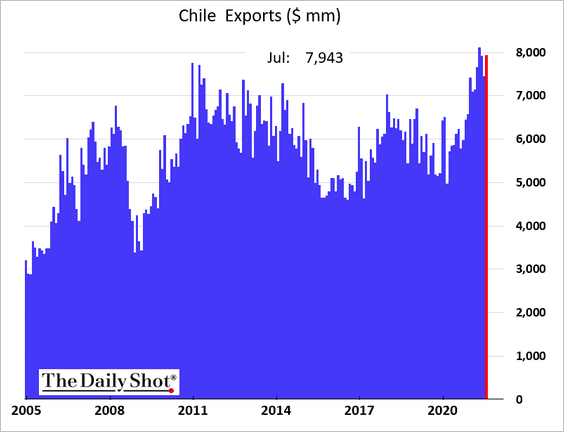

… boosted by robust exports.

——————–

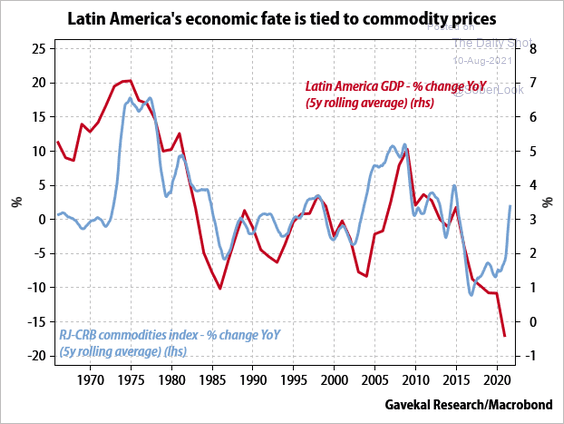

4. Higher commodity prices should support LatAm growth.

Source: Gavekal Research

Source: Gavekal Research

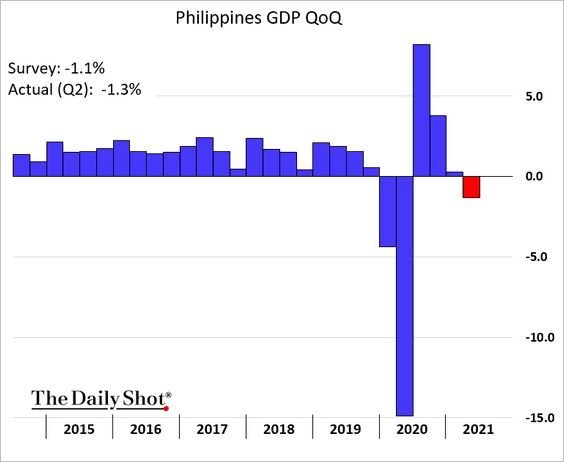

5. The Philippine economy contracted more than expected last quarter.

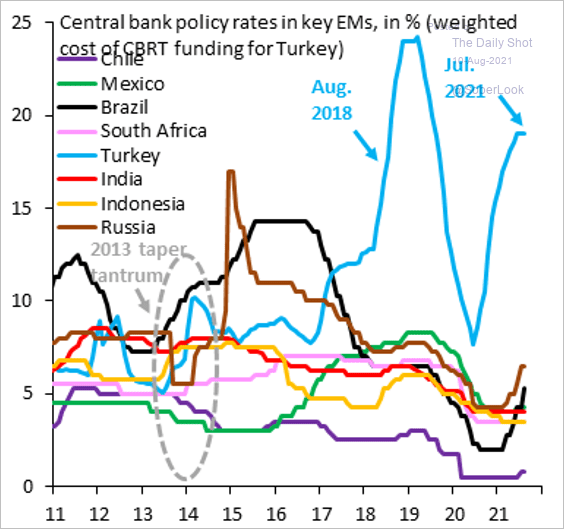

6. EM policy rates will continue to climb.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

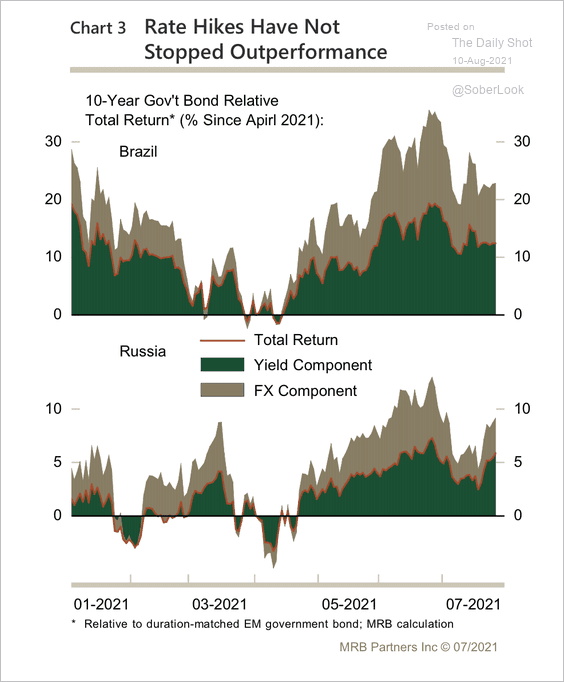

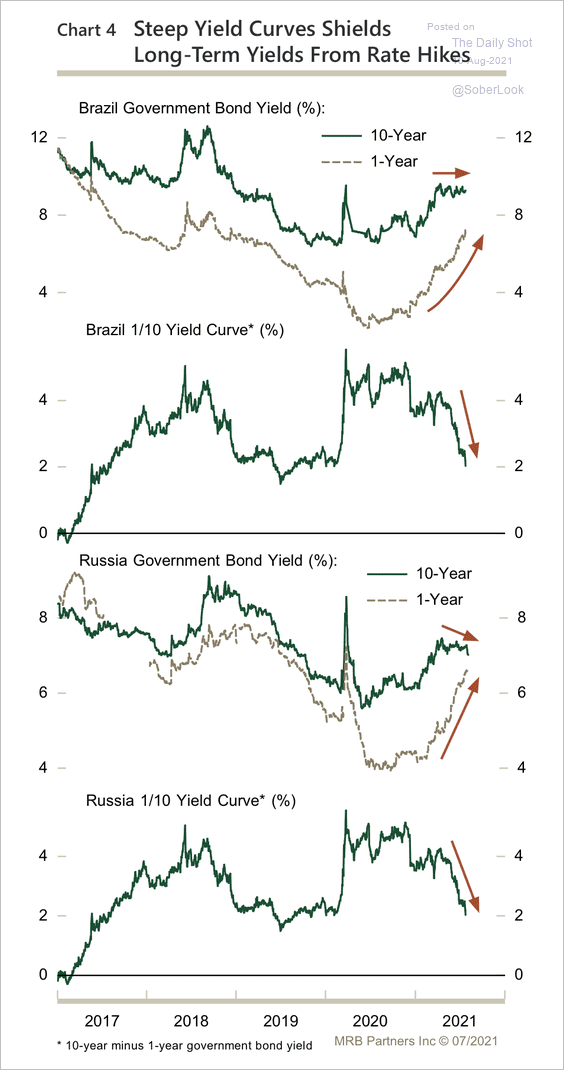

7. Brazil and Russia’s government bonds have significantly outperformed their EM counterparts over the past few months …

Source: MRB Partners

Source: MRB Partners

… largely due to relatively steep yield curves in both countries.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

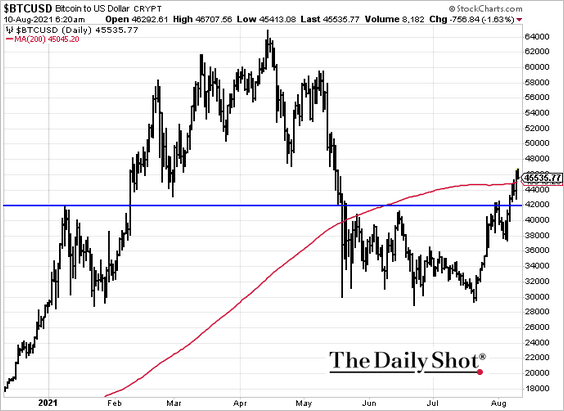

1. Bitcoin broke above the 200-day moving average, which typically precedes further upside.

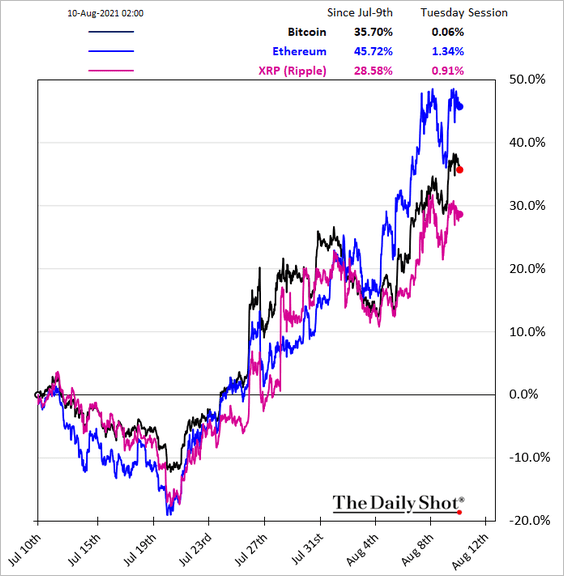

2. It’s been a good couple of weeks for crypto markets.

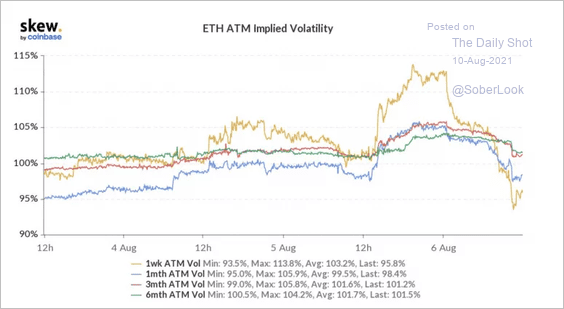

3. Ether’s implied volatility dropped sharply last week as the cryptocurrency rallied nearly 30%.

Source: @skewdotcom

Source: @skewdotcom

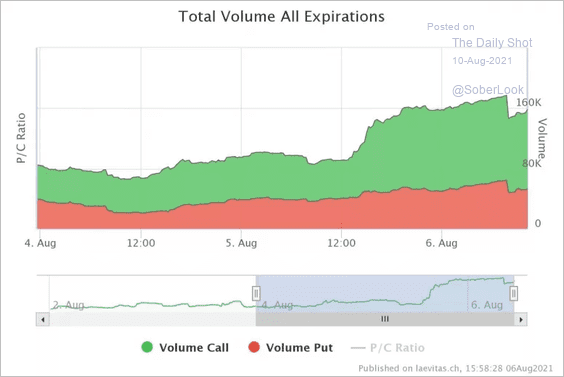

The bulk of Ethereum options activity has been concentrated in the higher strike, longer duration calls.

Source: Laevitas Read full article

Source: Laevitas Read full article

——————–

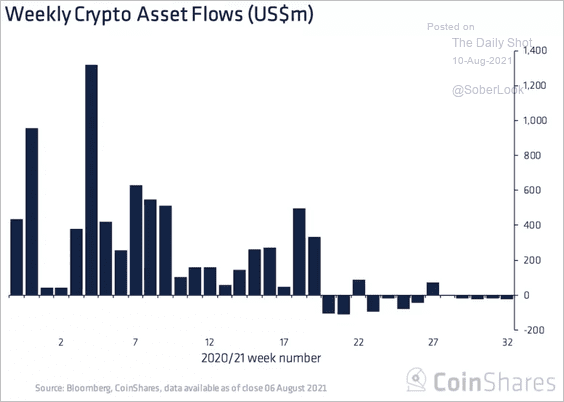

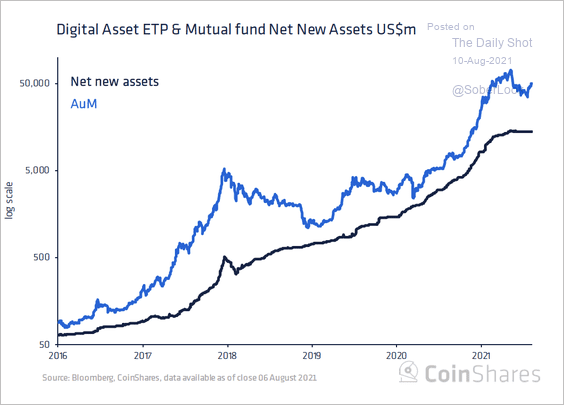

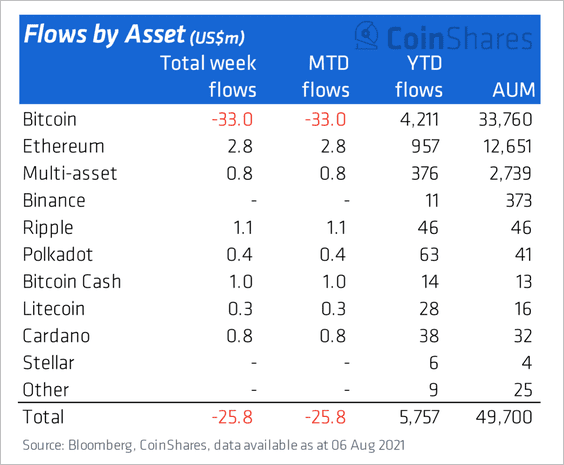

3. Digital asset funds saw outflows for the fifth straight week, although assets under management hit the highest level since mid-May (2 charts).

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares

Source: CoinShares

Bitcoin funds continued to bear the brunt of outflows last week.

Source: CoinShares

Source: CoinShares

——————–

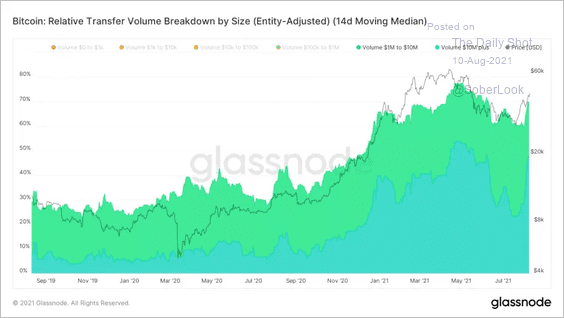

4. Bitcoin’s transaction volume with values of at least $1 million has risen 10% since the beginning of August and accounts for nearly 70% of the total value transferred. This suggests large investors have fueled the recent bitcoin rally

Source: Glassnode Read full article

Source: Glassnode Read full article

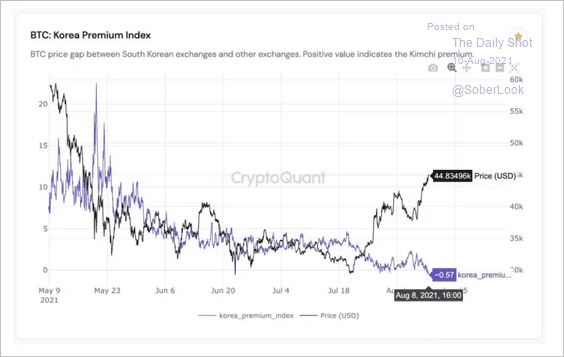

5. The “kimchi premium” has flipped to a discount, which reflects a substantial decline in South Korean trading activity relative to other regions.

Source: CryptoQuant

Source: CryptoQuant

Back to Index

Commodities

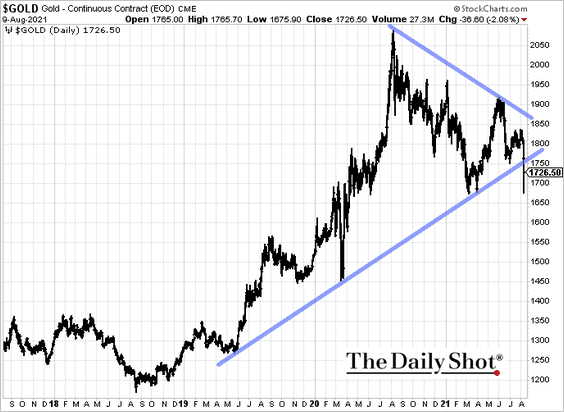

1. Gold technicals haven’t been great.

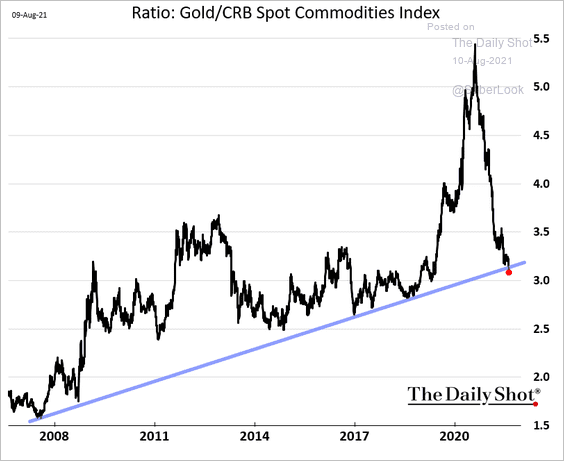

Here is gold relative to the CRB Commodities Index

h/t Cornerstone Macro

h/t Cornerstone Macro

——————–

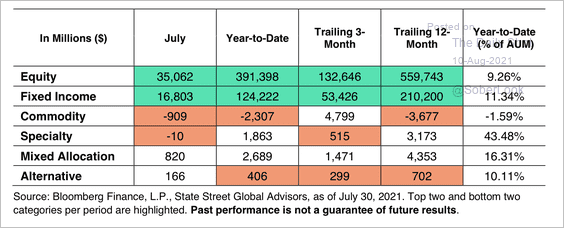

2. While equities and fixed income ETFs had inflows in July, commodity funds had outflows as investors reduced gold-related exposures, according to State Street.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

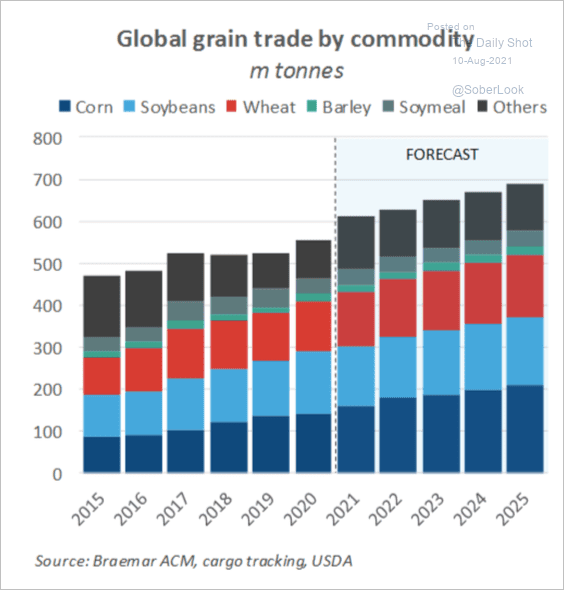

3. Global grain trade volumes are expected to rise over the next few years.

Source: Breakwave Advisors Read full article

Source: Breakwave Advisors Read full article

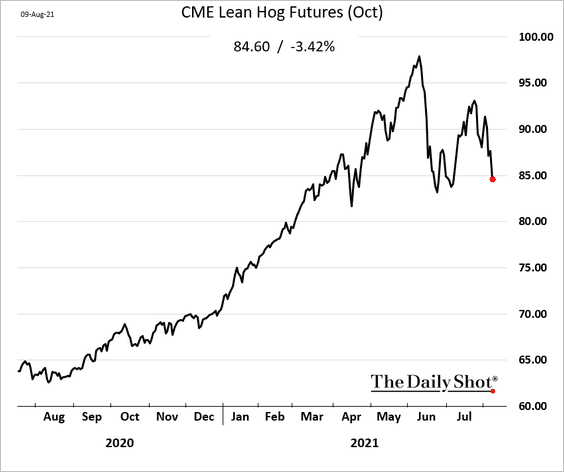

4. Chicago hog futures are rolling over.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

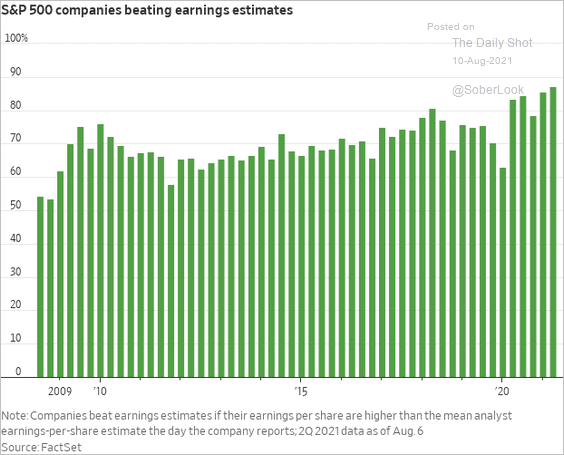

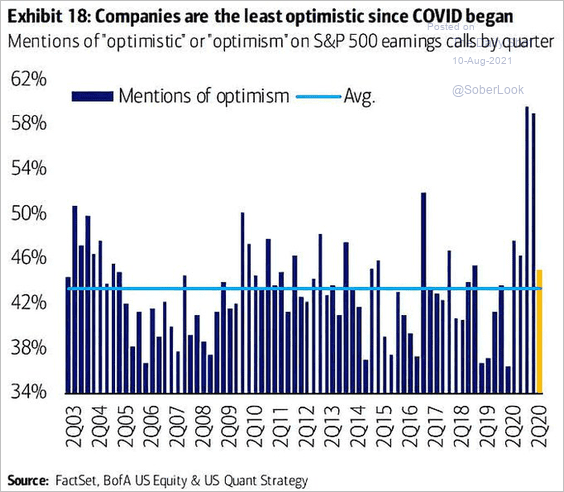

1. A record number of firms are beating earnings estimates.

Source: @WSJ Read full article

Source: @WSJ Read full article

But outlook has become less optimistic.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

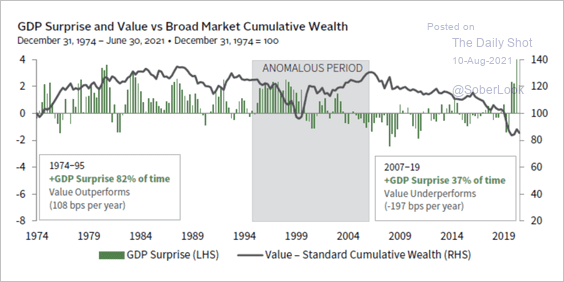

2. Value stock performance is heavily dependent on economic growth.

Source: Cambridge Associates Read full article

Source: Cambridge Associates Read full article

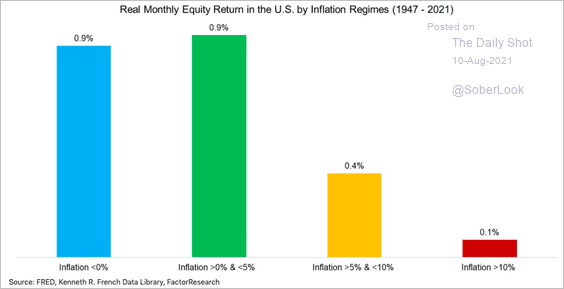

3. This chart shows real monthly equity returns during different inflation regimes.

Source: FactorResearch

Source: FactorResearch

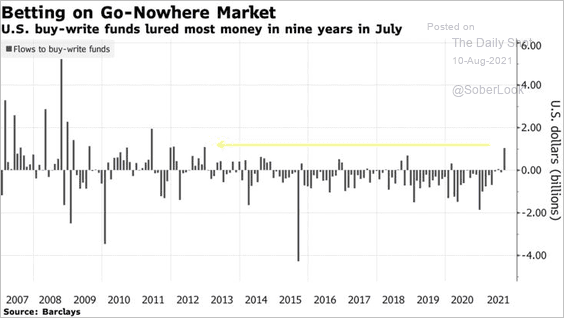

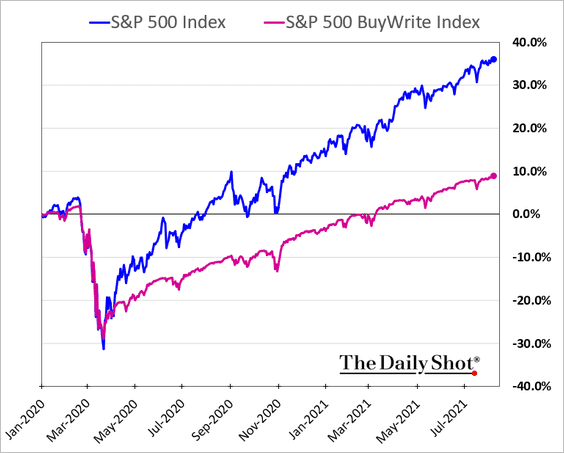

4. Buy-write funds finally got some inflows.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

These strategies tend to underperform even on a risk-adjusted basis (a similar drawdown but limited upside).

——————–

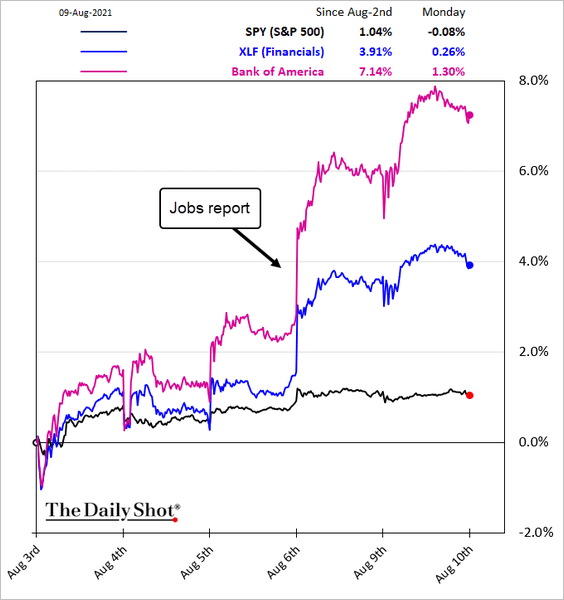

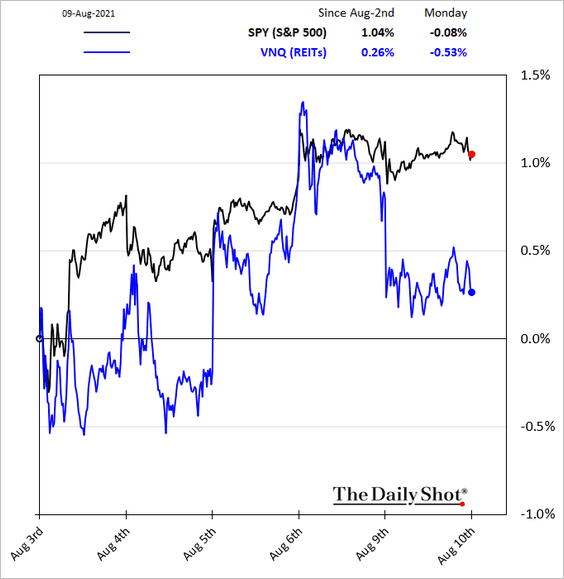

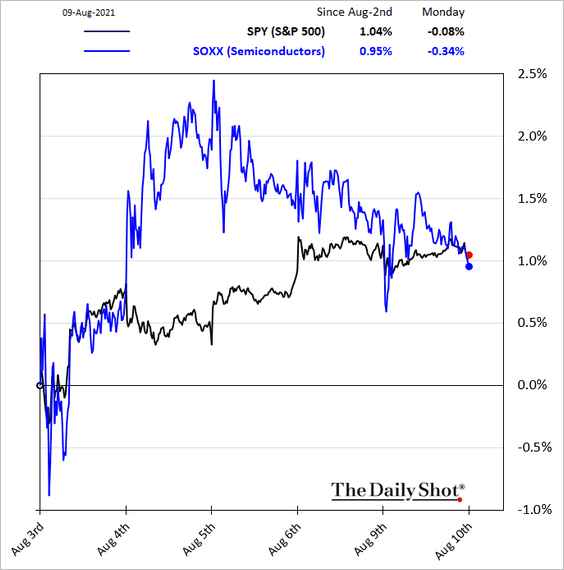

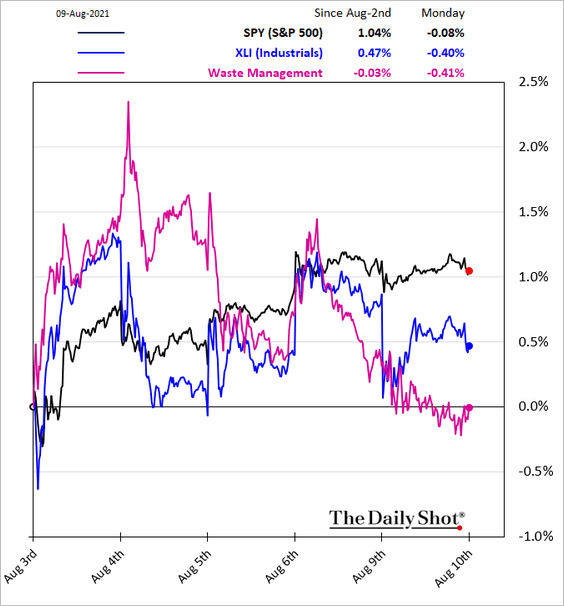

5. Next, we have some sector performance updates.

• Financials:

• REITs:

• Semicoductors:

• Industrials:

——————–

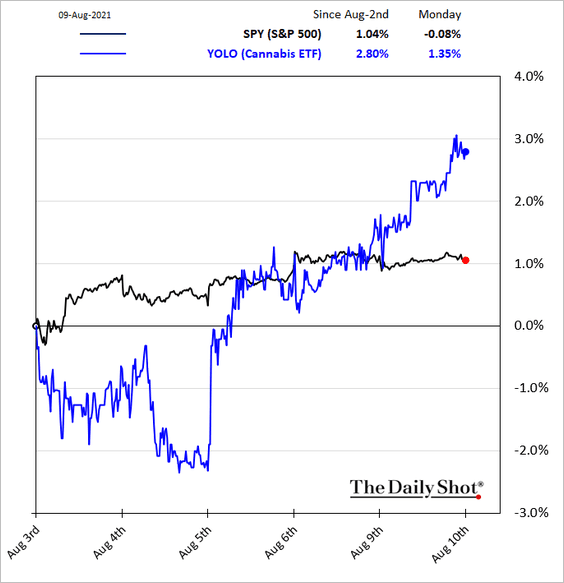

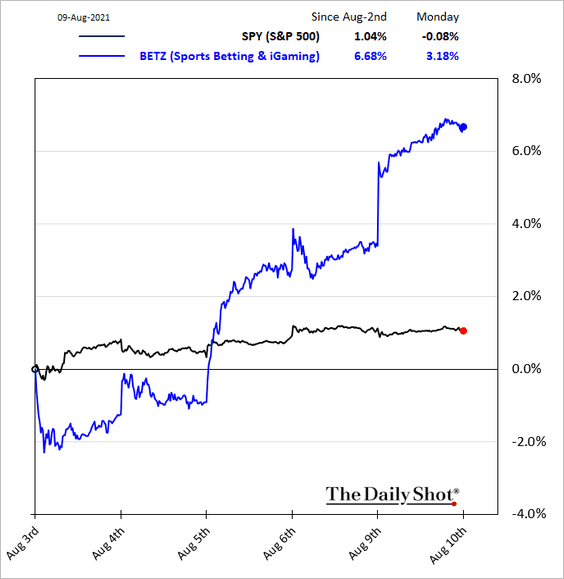

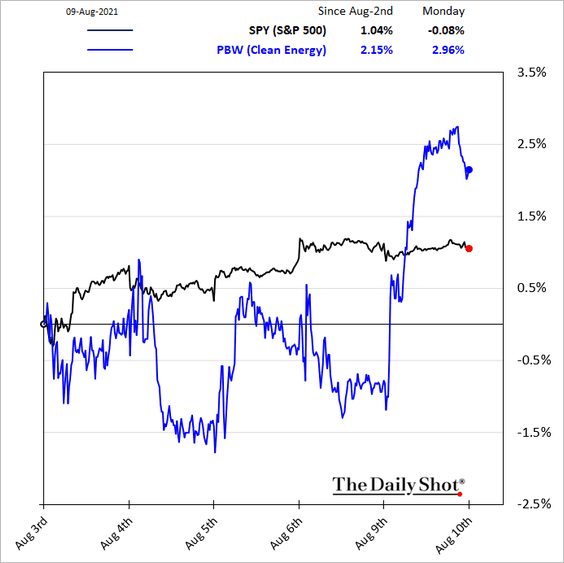

6. Here are some thematic portfolios popular with retail investors.

• Cannabis:

• Sports betting:

• Clean energy:

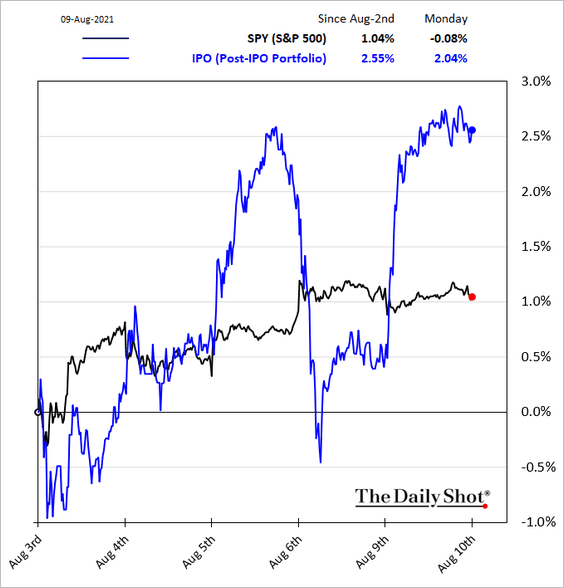

• Post-IPO shares:

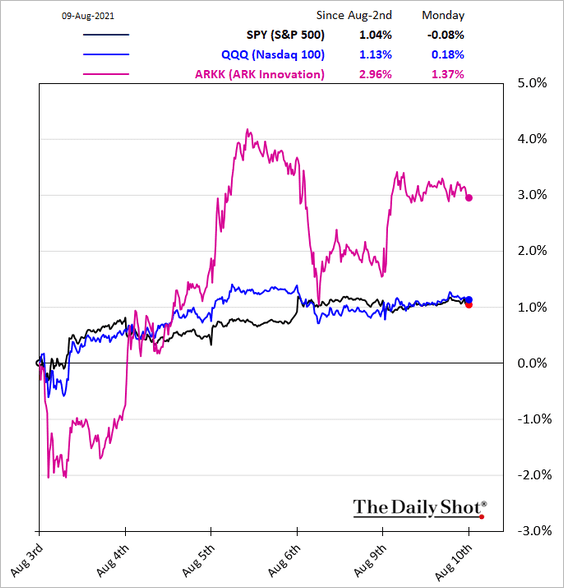

• ARK Innovation …

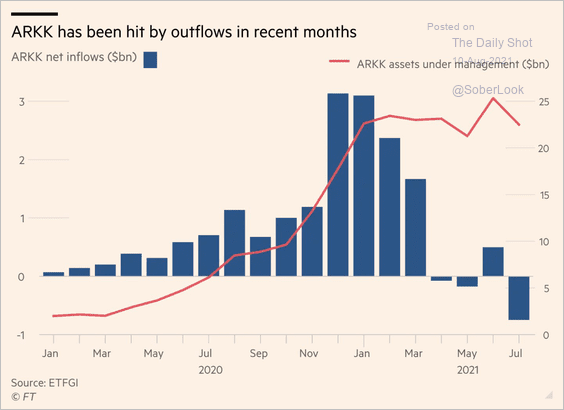

… after sharp outflows last month.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

——————–

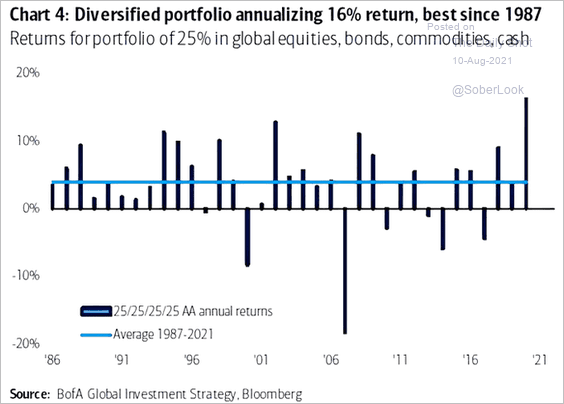

7. The 25/25/25/25 portfolio has performed well this year.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Back to Index

Global Developments

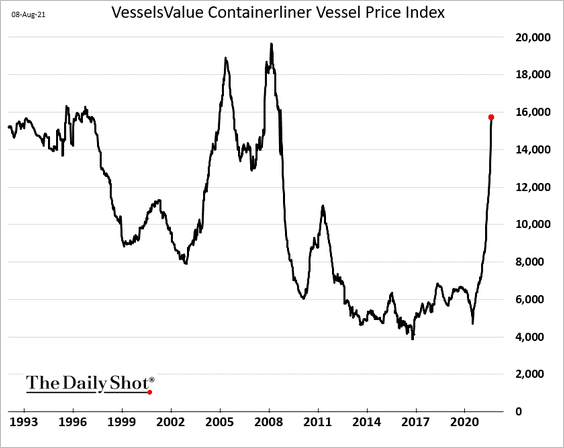

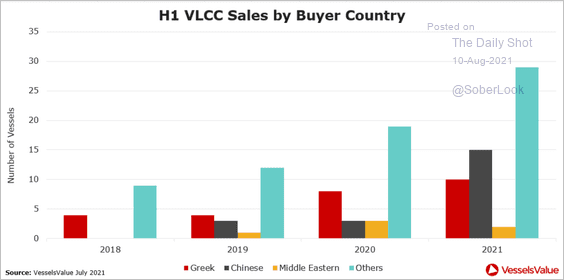

1. Vessel prices have been surging.

Source: VesselsValue

Source: VesselsValue

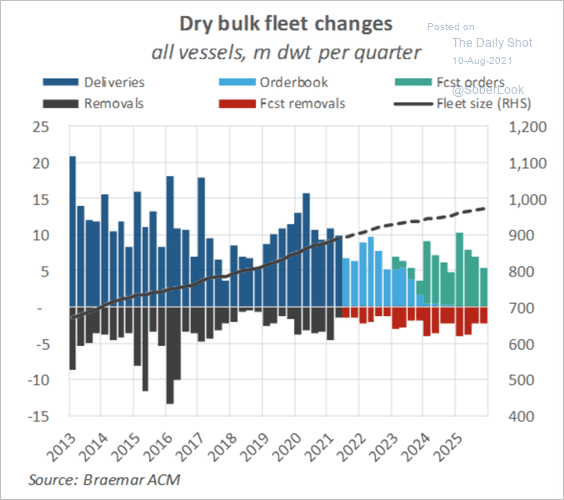

But dry bulk fleet growth is expected to slow, driven by an extremely limited order book.

Source: Breakwave Advisors Read full article

Source: Breakwave Advisors Read full article

——————–

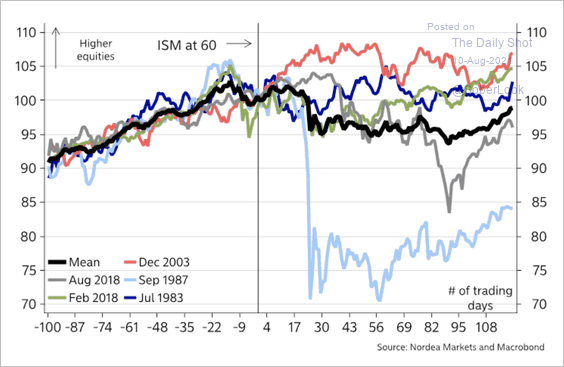

2. Typically, risk assets trade sideways/down after the ISM PMI peaks.

Source: Nordea Markets

Source: Nordea Markets

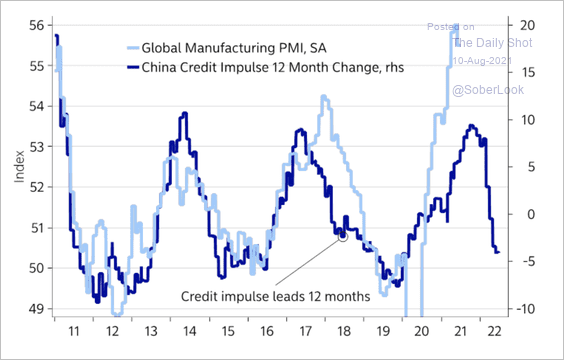

3. The decline in China’s credit impulse suggests global manufacturing PMIs have peaked.

Source: Nordea Markets

Source: Nordea Markets

——————–

Food for Thought

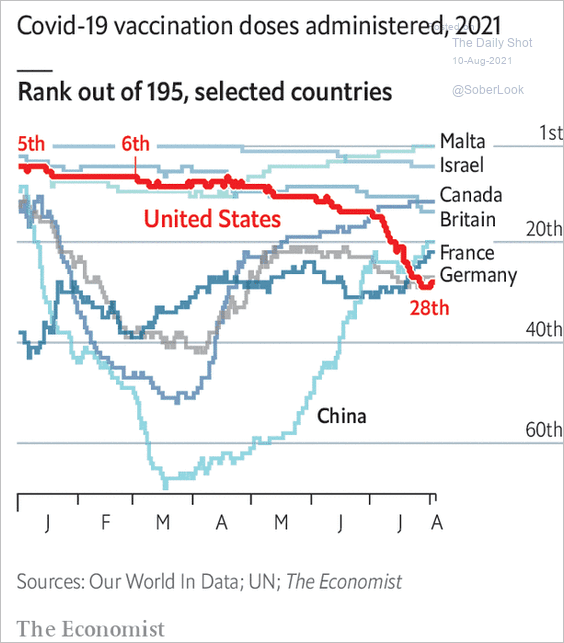

1. Vaccination progress rankings:

Source: The Economist Read full article

Source: The Economist Read full article

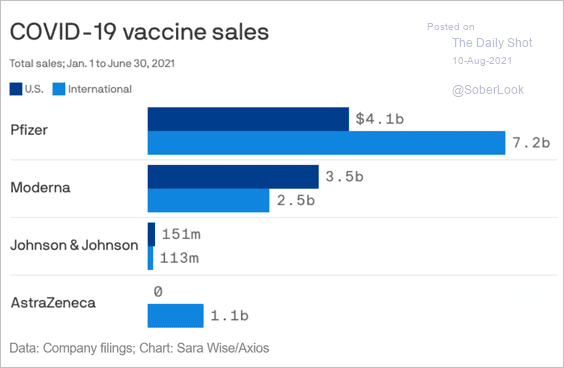

2. Vaccine sales:

Source: @axios Read full article

Source: @axios Read full article

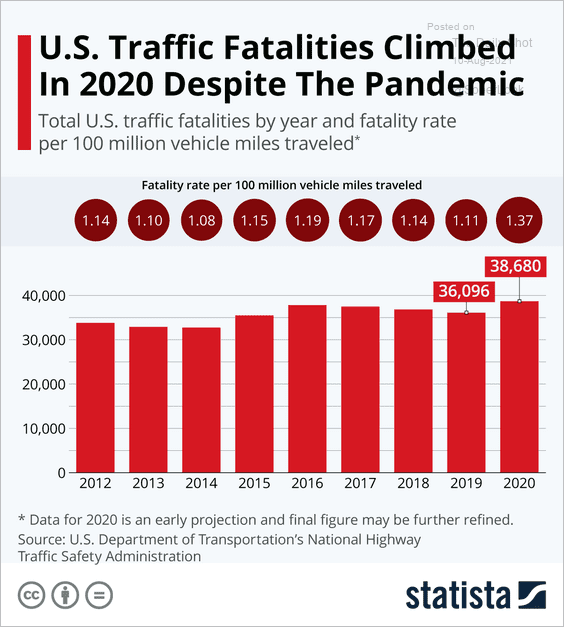

3. Traffic fatalities:

Source: Statista Read full article

Source: Statista Read full article

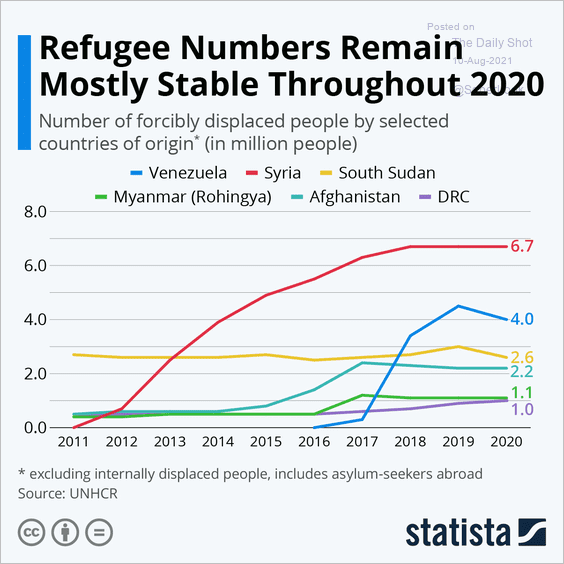

4. Refugee numbers:

Source: Statista

Source: Statista

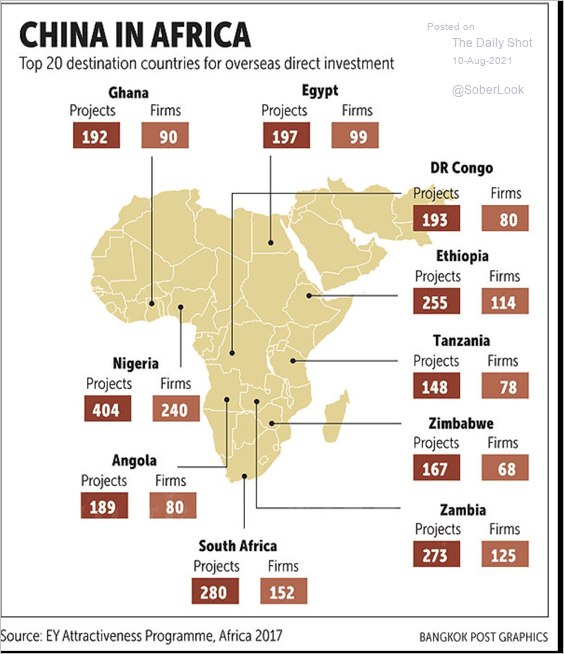

5. China’s presence in Africa:

Source: EY; @SamRamani2

Source: EY; @SamRamani2

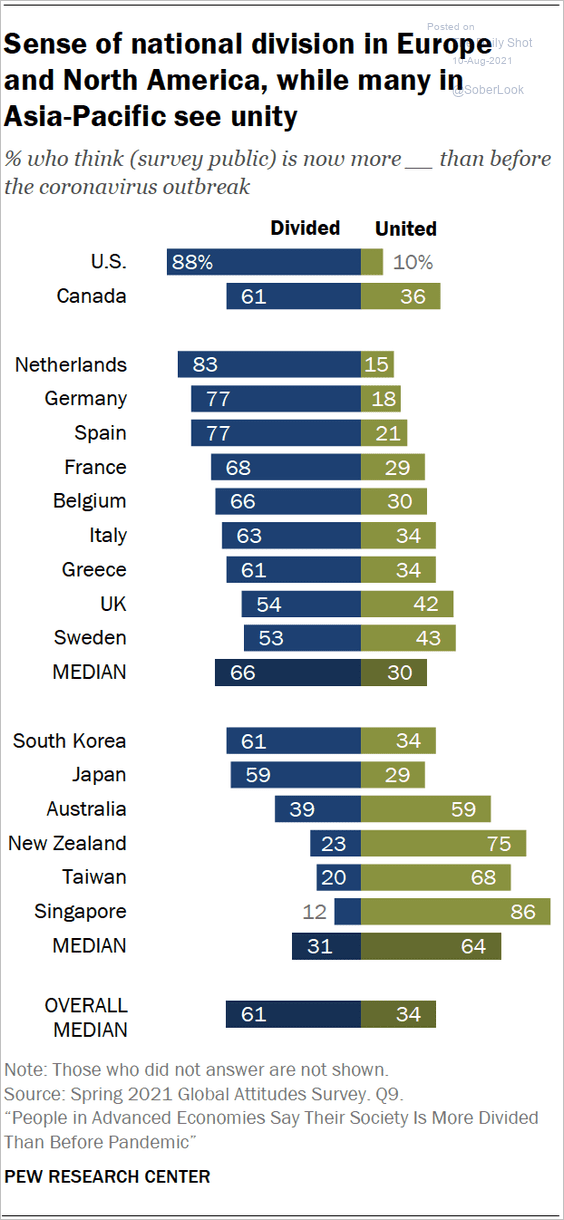

6. Which countries are more divided now than before COVID?

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

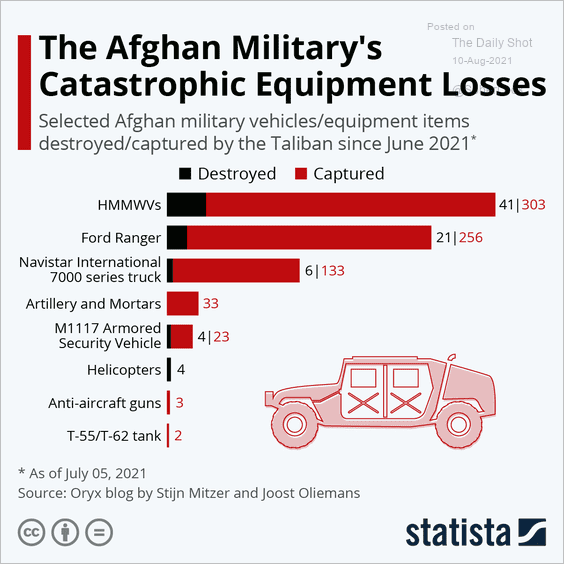

7. Afghan equipment “losses”:

Source: Statista

Source: Statista

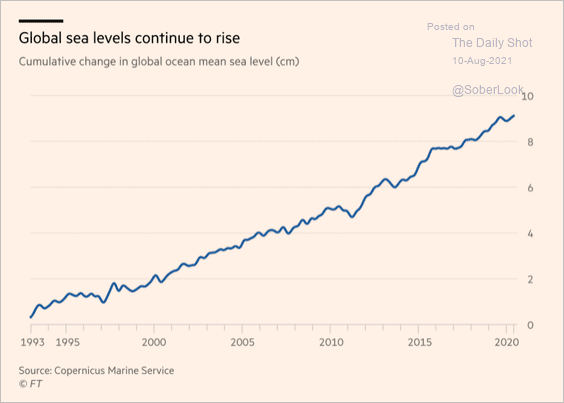

8. Global sea levels:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

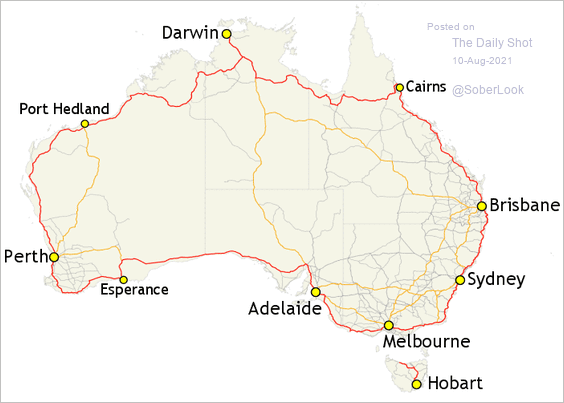

9. The longest national highway in the world:

Source: @TheBigDataStats Read full article

Source: @TheBigDataStats Read full article

——————–

Back to Index