The Daily Shot: 11-Aug-21

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

Administrative Update

Please note that most Apple devices such as iPhones and iPads disable the table of contents links in The Daily Shot. To avoid having to scroll, click the “View in your browser” link at the beginning of the newsletter, which makes the navigational links operational.

At the end of each section, there is a “back to index” link, which gets you to your next section in two clicks.

Other technical information about The Daily Shot is available here.

Back to Index

The United States

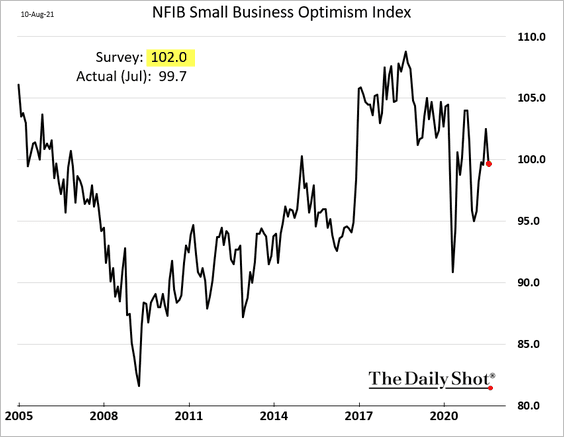

1. The NFIB small business sentiment index was weaker than expected last month.

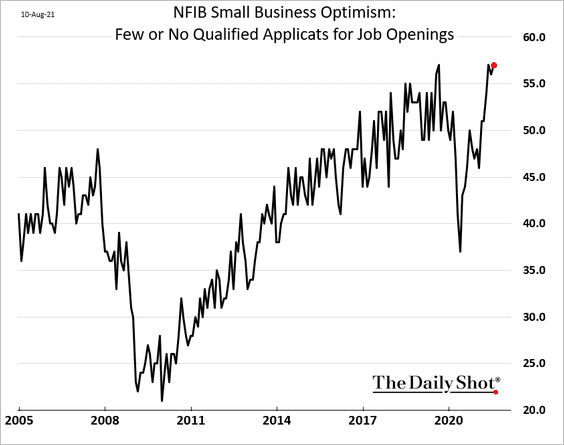

As we saw last week, small firms continue to struggle with labor shortages (see chart). Companies increasingly report challenges attracting qualified workers.

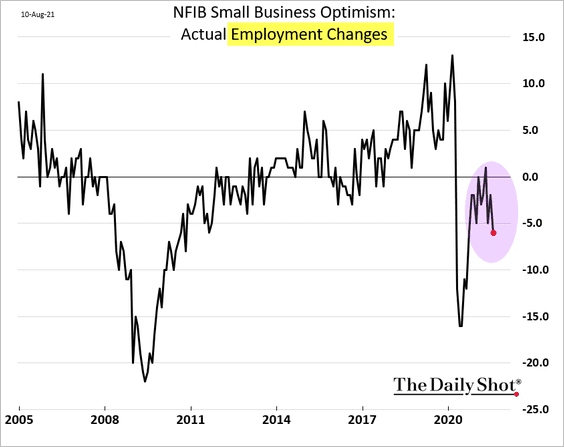

The rebound in small business hiring has stalled.

Companies are boosting wages to keep/attract workers (see chart).

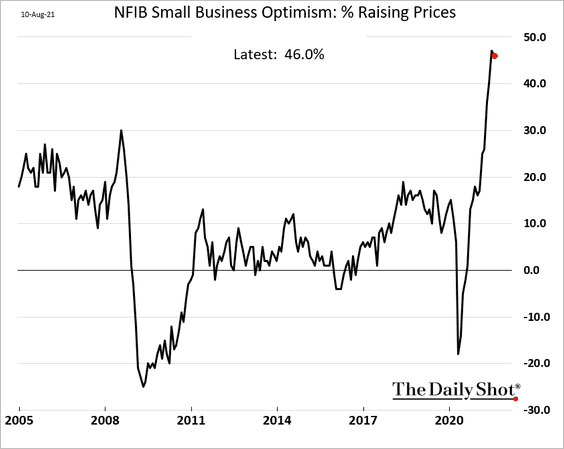

• The percentage of firms raising prices appears to have peaked but remains near the highs.

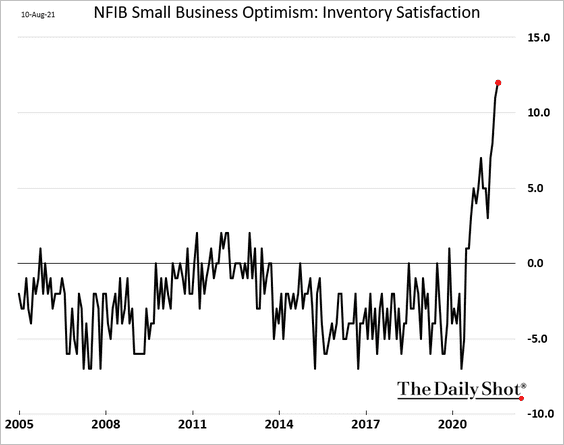

• A record percentage of companies view current inventory levels as “too low” amid persistent supply-chain challenges.

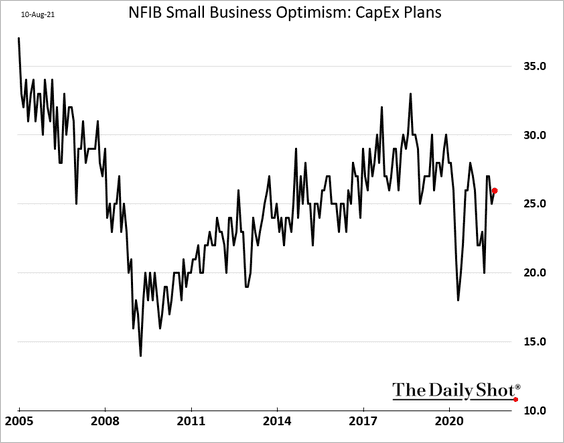

• CapEx expectations have been trending lower.

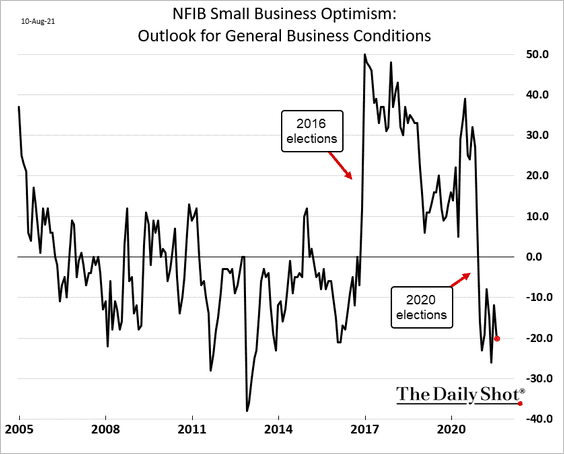

• Small business outlook remains tethered to politics.

——————–

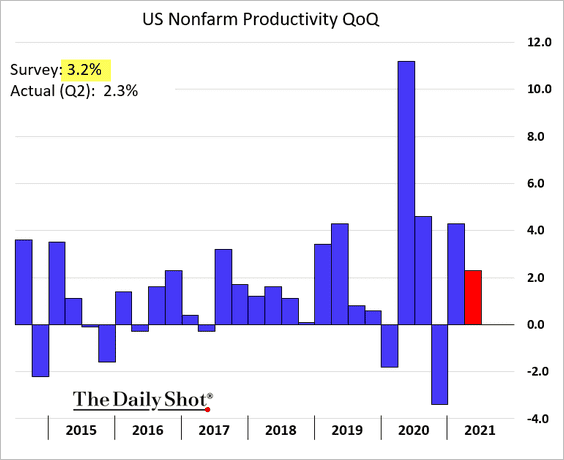

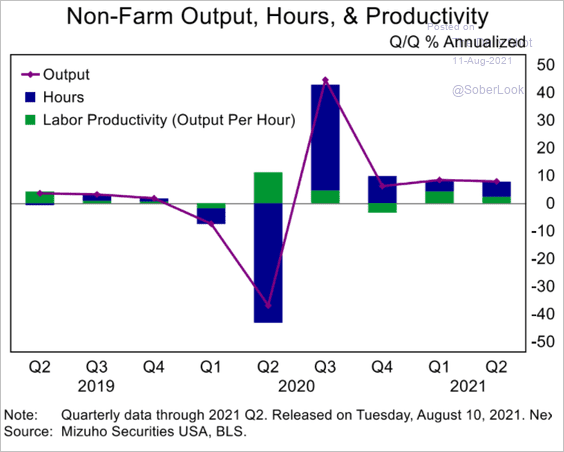

2. US productivity gains were lower than expected in Q2.

Output growth was driven more by hours worked than productivity increases.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

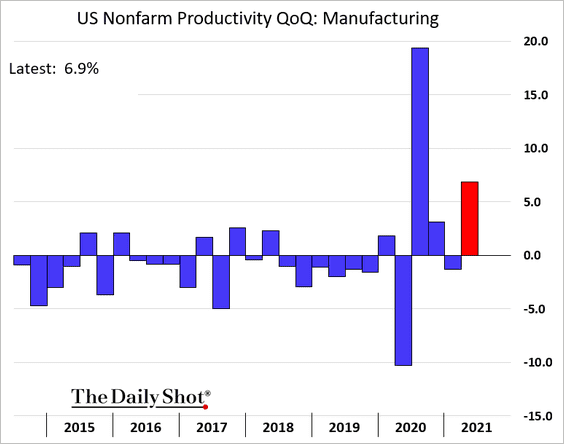

But manufacturing saw substantial improvements.

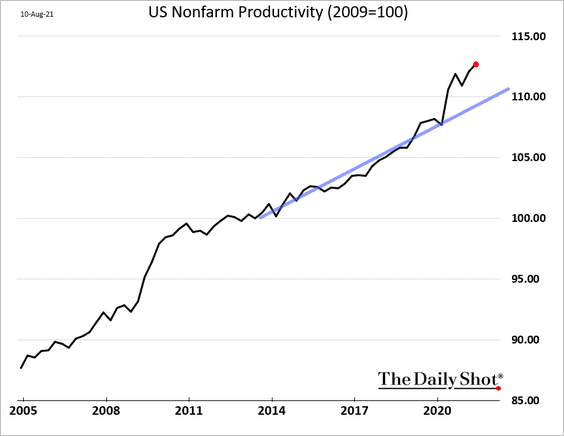

• The overall productivity growth remains above the pre-COVID trend.

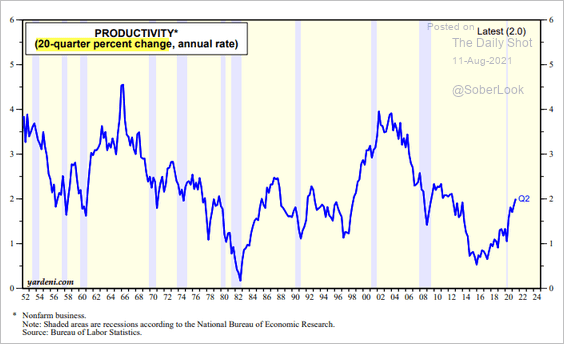

• This chart shows productivity gains over 20-quarter periods.

Source: Yardeni Research

Source: Yardeni Research

——————–

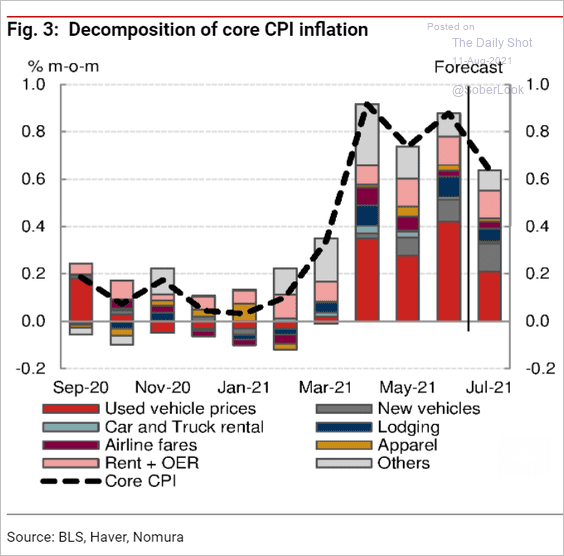

3. Next, we have some updates on inflation.

• Nomura expects to see lower core CPI gains in July.

Source: Nomura Securities

Source: Nomura Securities

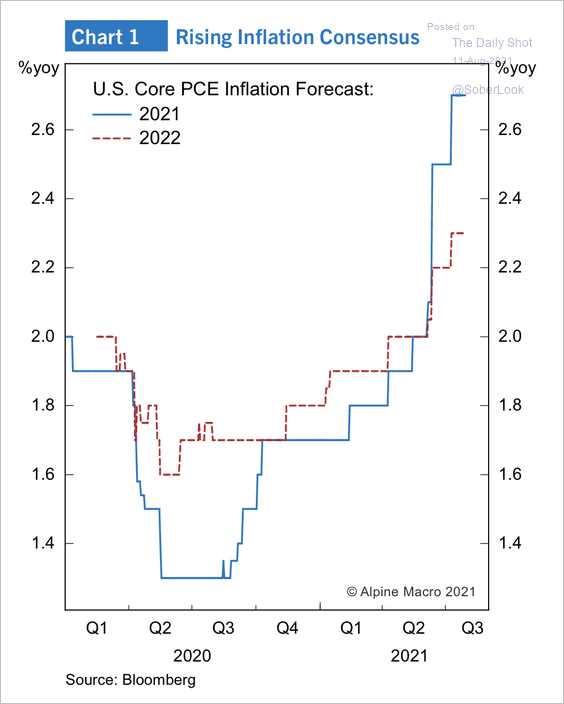

• Consensus forecasts for inflation continue to revise upward.

Source: Alpine Macro

Source: Alpine Macro

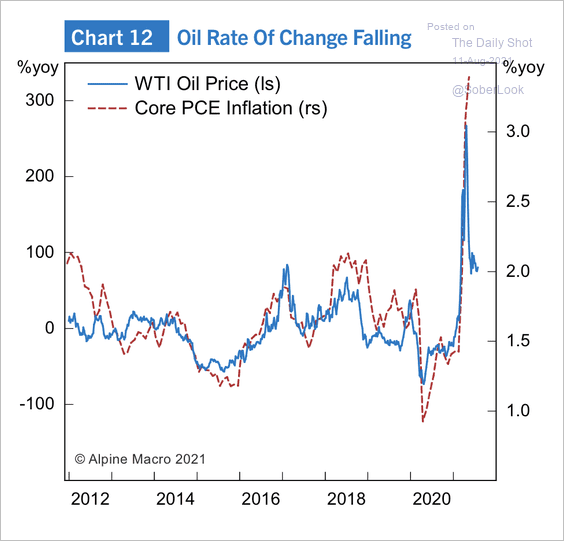

• The slowing oil price rate of change points to a decline in core PCE inflation.

Source: Alpine Macro

Source: Alpine Macro

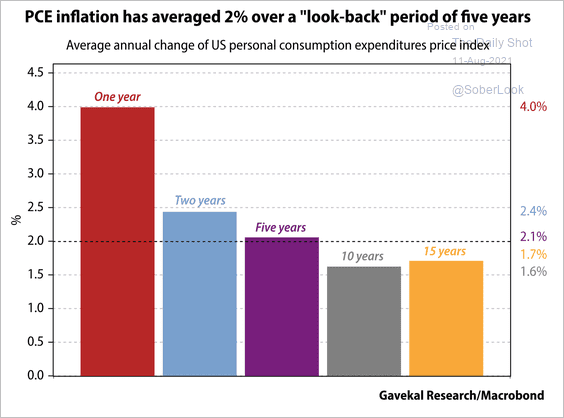

• PCE inflation has averaged 2% over a look-back period of five years.

Source: Gavekal Research

Source: Gavekal Research

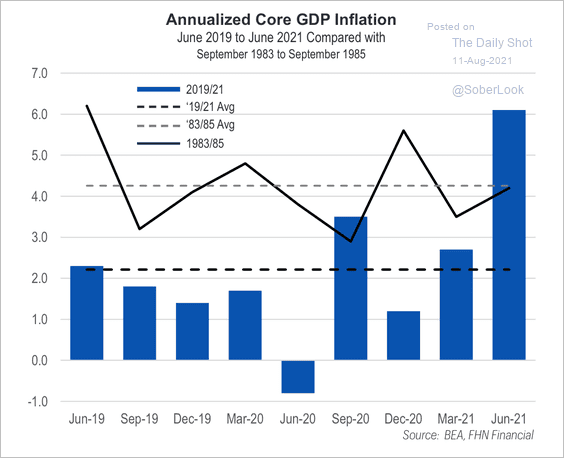

• Unlike previous years, the most recent inflation spike is against the backdrop of a long period of low inflation.

Source: FHN Financial

Source: FHN Financial

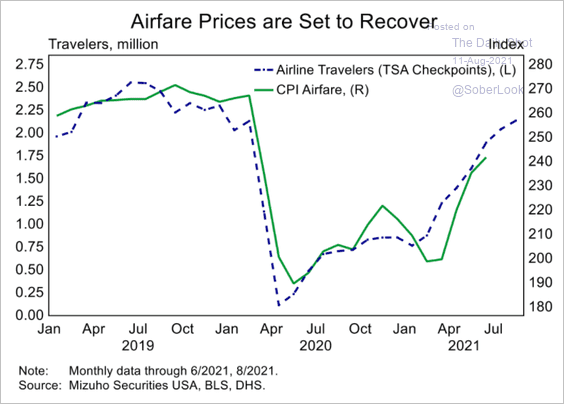

• Airfare CPI is recovering.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

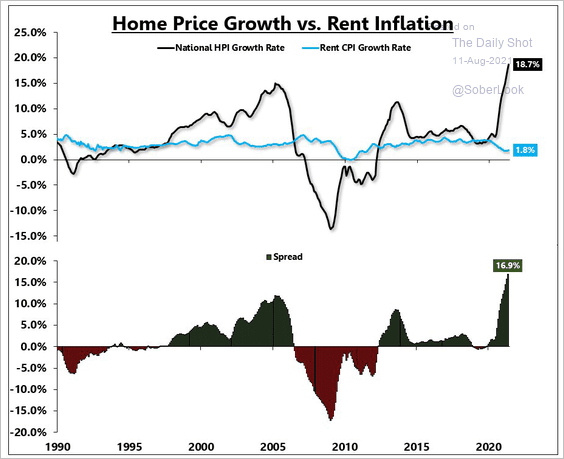

• This chart shows rent inflation vs. home price appreciation.

Source: @EPBResearch

Source: @EPBResearch

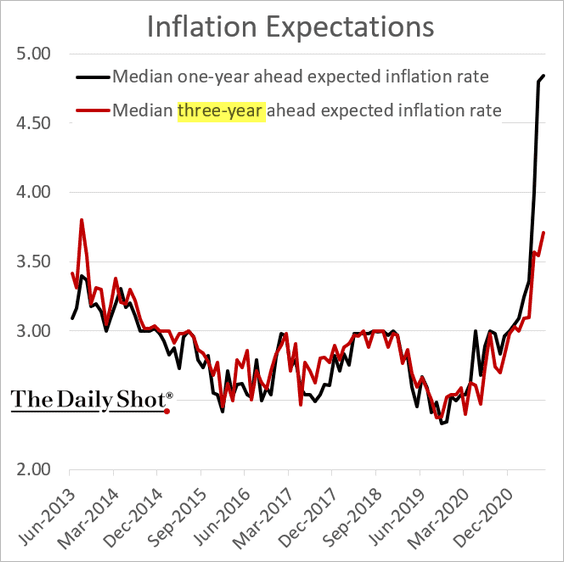

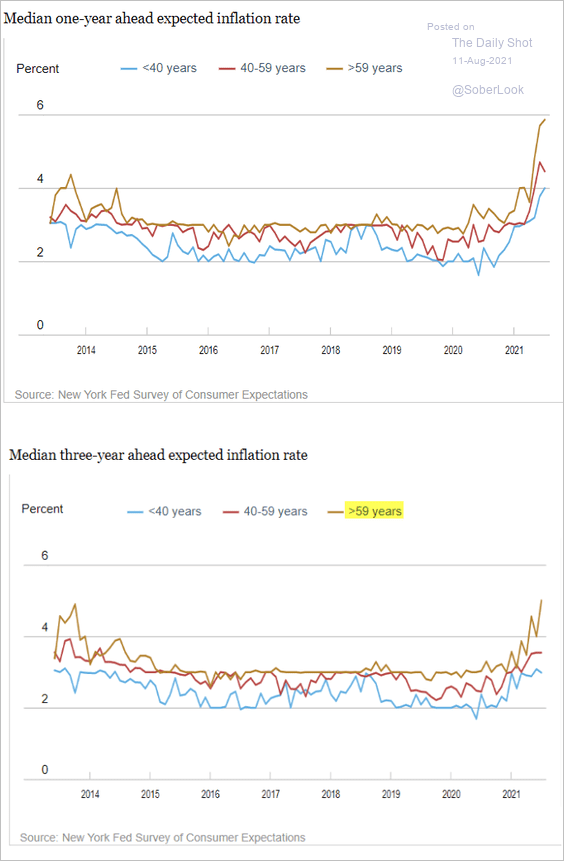

• The NY Fed’s national consumer survey points to rising inflation expectations. The ongoing increases in the three-year expected inflation rate suggest that consumers are not convinced of the “transient inflation” narrative.

Source: NY Fed

Source: NY Fed

Older Americans are particularly concerned about inflation.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

——————–

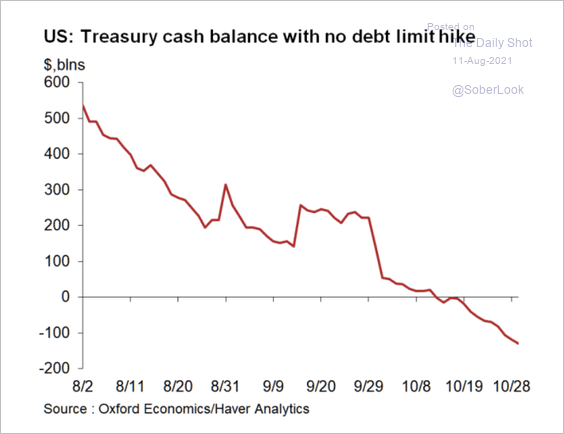

3. The Treasury could run short of the liquidity needed to meet all obligations in the first half of October.

Source: Oxford Economics

Source: Oxford Economics

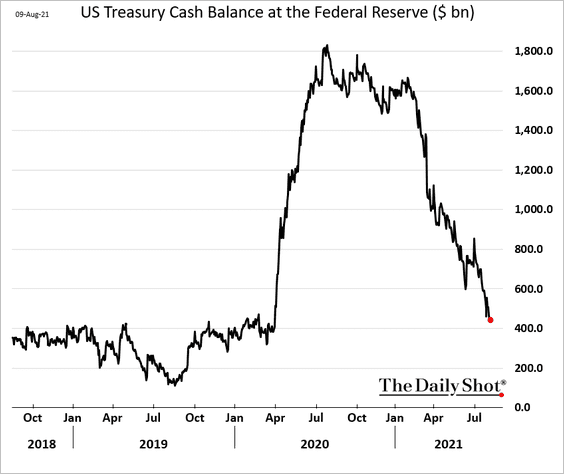

Cash balances at the Fed continue to shrink.

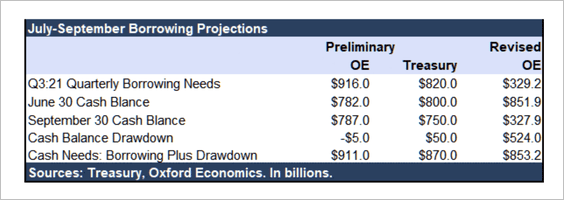

Here is a look at the estimated Treasury borrowing needs for the July-September quarter, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

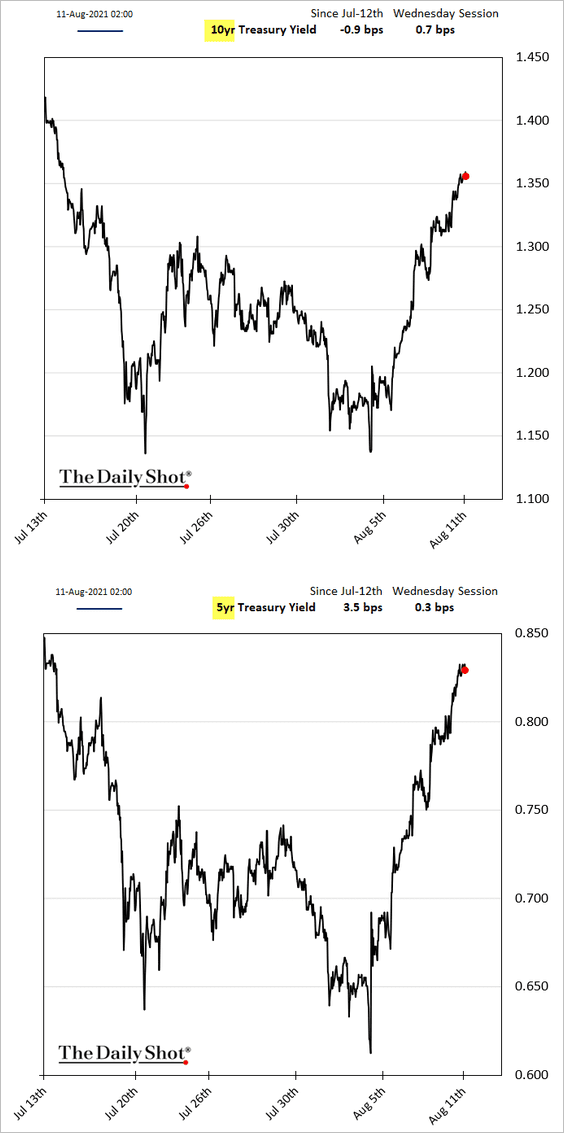

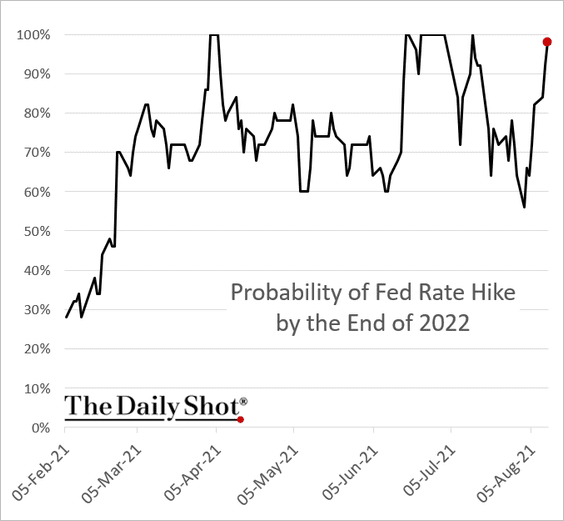

4. Treasury yields continue to climb.

A Fed rate hike next year is once again fully priced into the market.

——————–

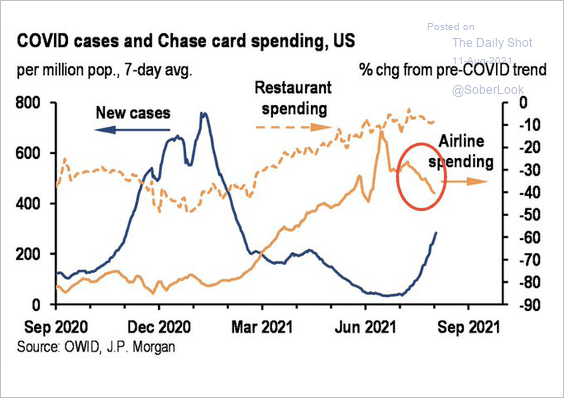

5. Card spending is moderating as the COVID situation worsens.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

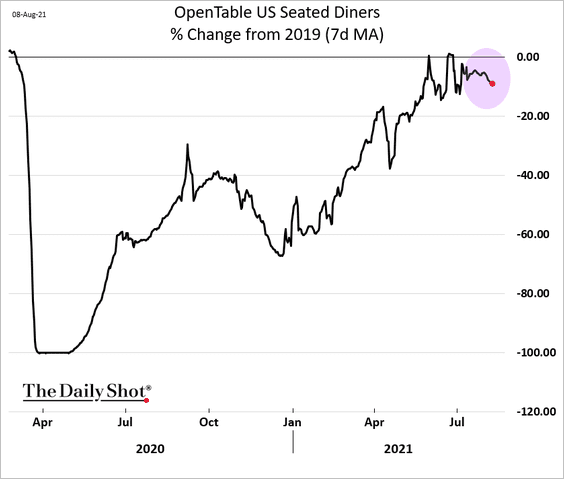

The OpenTable index seems to have peaked as well.

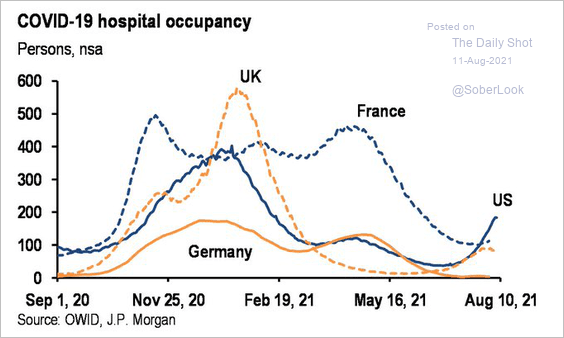

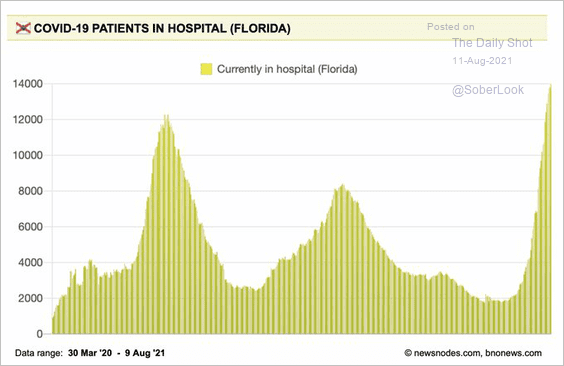

Hospitalizations have been rising.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

Source: @EricTopol

Source: @EricTopol

Back to Index

The United Kingdom

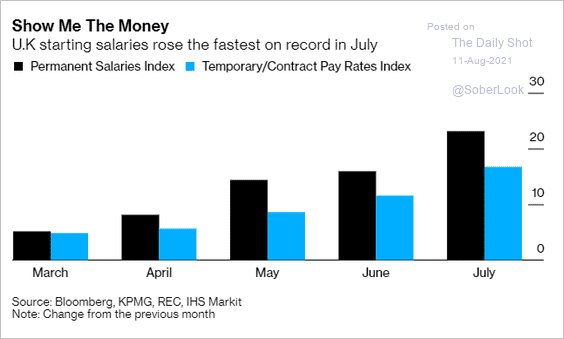

1. Wages are growing rapidly, …

Source: @Quicktake Read full article

Source: @Quicktake Read full article

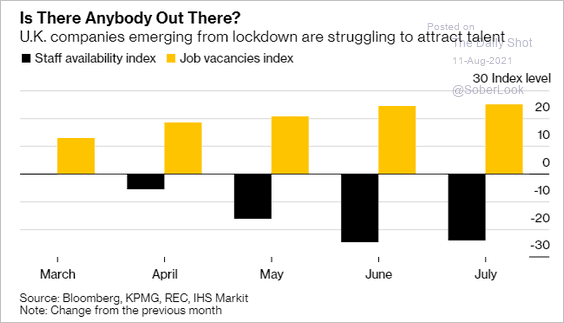

… amid labor shortages.

Source: @Quicktake Read full article

Source: @Quicktake Read full article

——————–

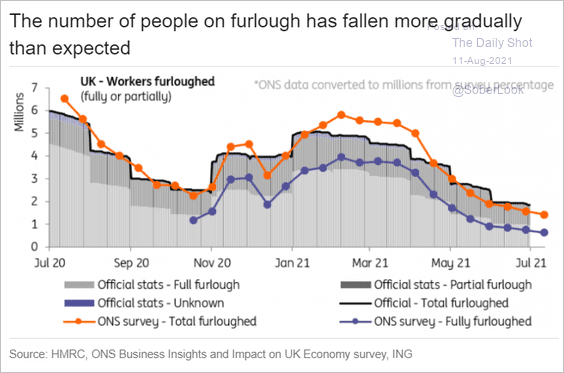

2. Furloughs have been declining slower than expected.

Source: ING

Source: ING

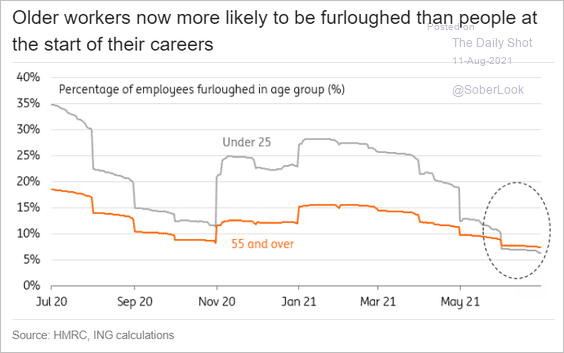

There are now more older furloughed workers than younger ones.

Source: ING

Source: ING

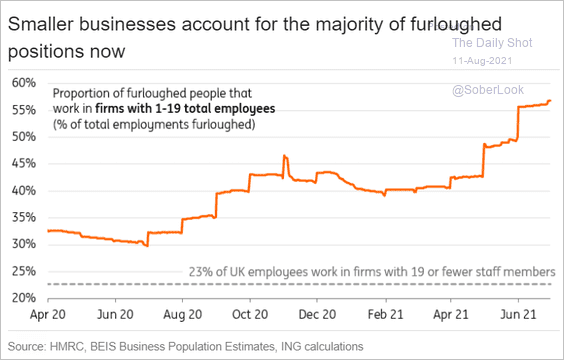

Furloughs are increasingly dominated by small firms.

Source: ING

Source: ING

——————–

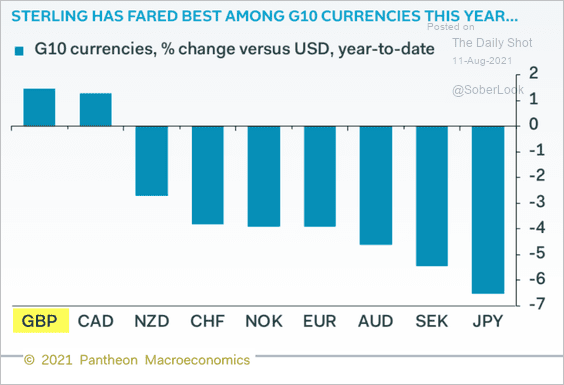

3. The pound has outperformed other G10 currencies vs. the dollar.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

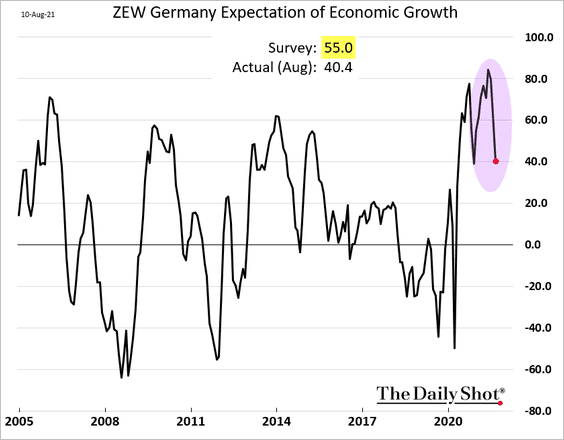

1. Germany’s ZEW index of growth expectations declined sharply (similar to Sentix – see chart).

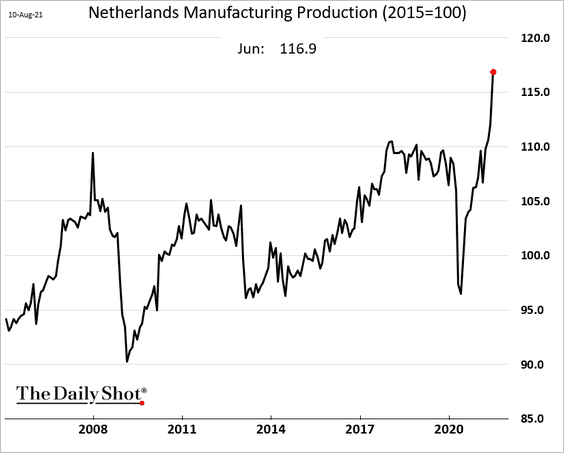

2. Dutch manufacturing output is surging (in contrast to Germany – see chart).

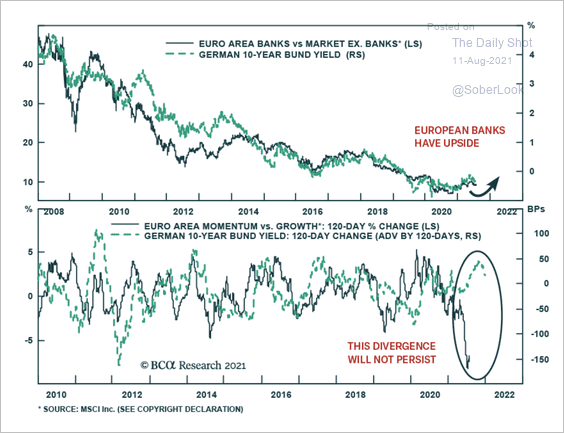

3. Will a rebound in Bund yields cause European banks to outperform?

Source: BCA Research

Source: BCA Research

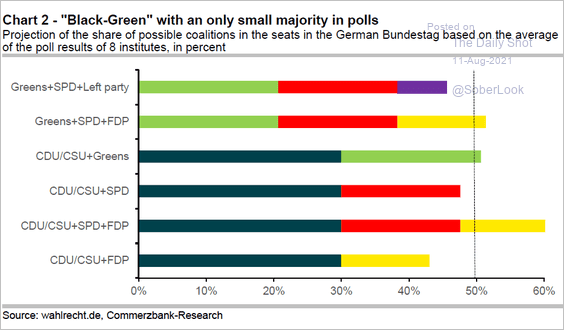

4. Here are some possible post-election coalitions in Germany, based on the latest polls.

Source: Commerzbank Research

Source: Commerzbank Research

Back to Index

Europe

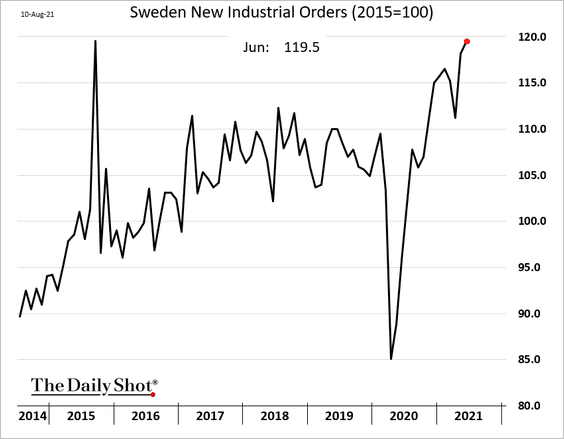

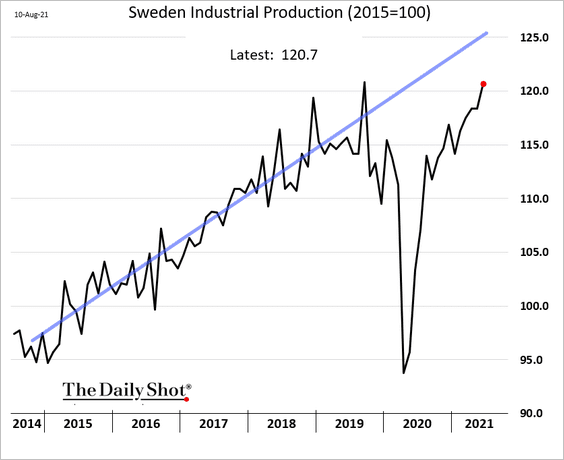

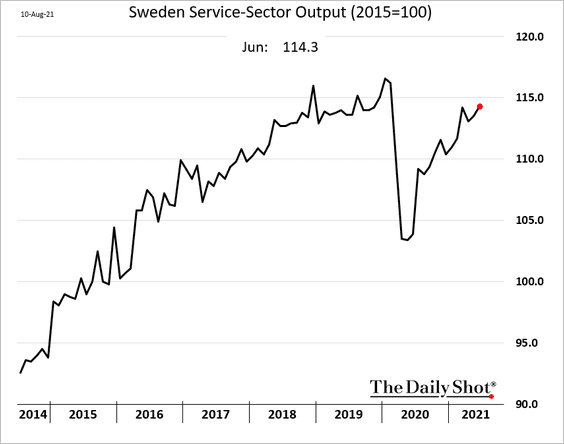

1. Let’s begin with Sweden, where economic growth remains robust.

• Industrial orders:

• Industrial production:

• Service-sector output:

• Household consumption (still below pre-COVID levels):

——————–

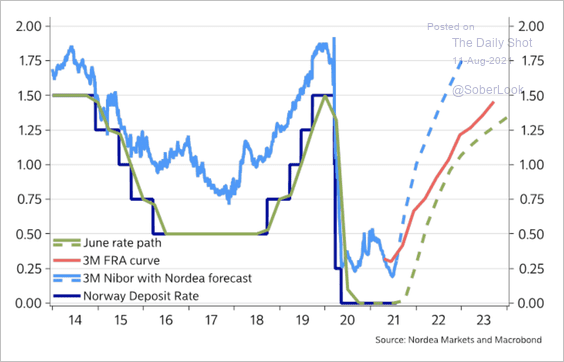

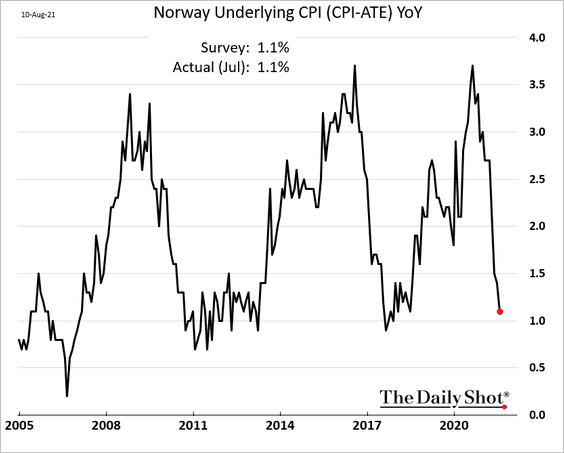

2. Markets are starting to doubt the Norges Bank’s rate path.

Source: Nordea Markets

Source: Nordea Markets

Norway’s inflation is dropping quickly.

——————–

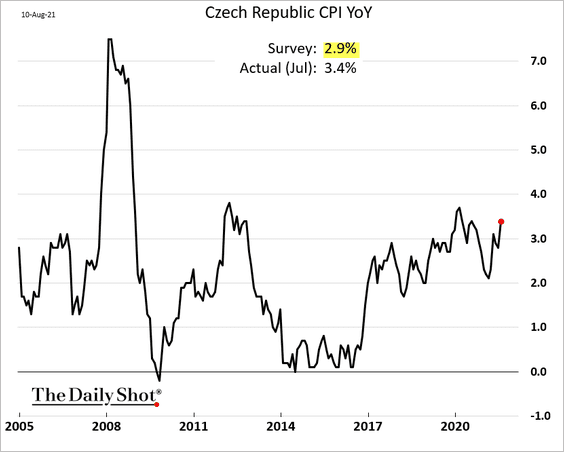

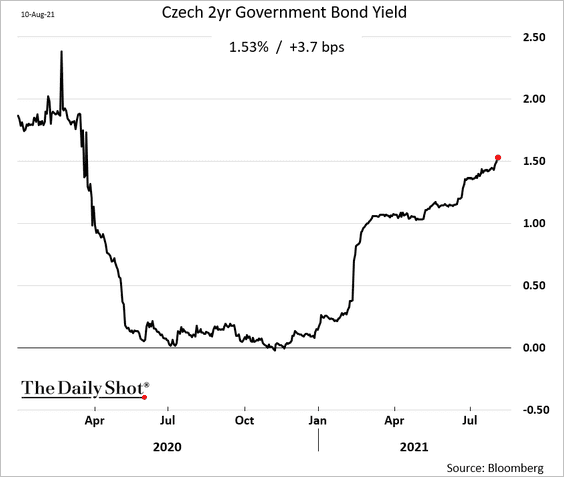

3. Czech inflation surprised to the upside.

Bond yields are pricing in more rate hikes.

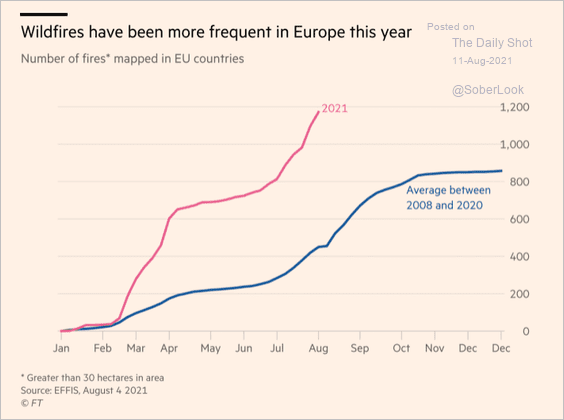

4. Wildfires have been more frequent this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia – Pacific

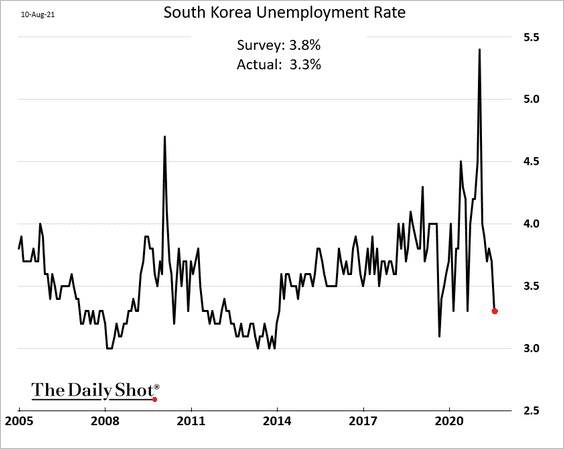

1. South Korean unemployment rate continues to drop.

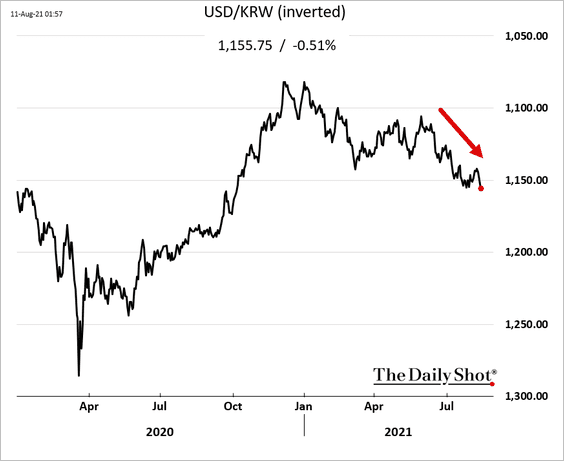

The won is trending lower amid elevated COVID cases.

——————–

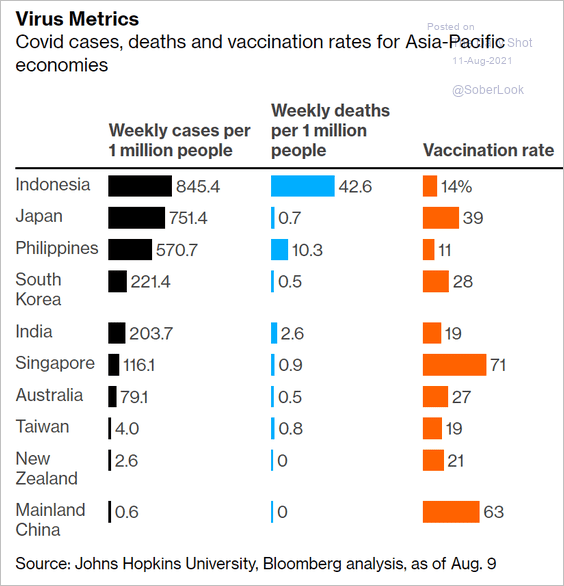

2. Here is an overview of the COVID situation in Asia.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

China

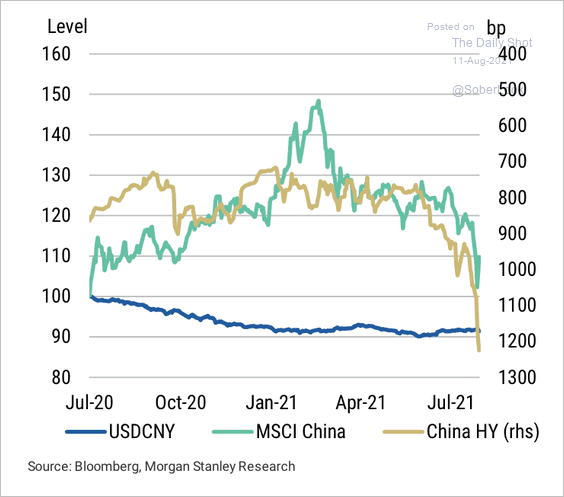

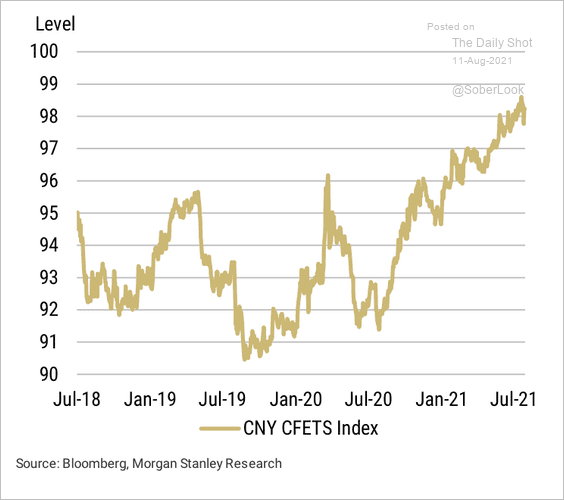

1. USD/CNY has been relatively stable despite volatility in equities and credit.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

The trade-weighted renminbi remains strong.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

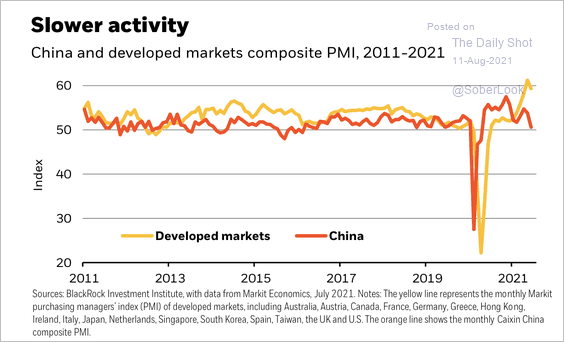

2. China’s composite PMI has diverged from developed markets this year.

Source: BlackRock

Source: BlackRock

3. Beijing has been highly supportive of the domestic semiconductor industry.

![]() Source: @adam_tooze, @WSJ Read full article

Source: @adam_tooze, @WSJ Read full article

Back to Index

Emerging Markets

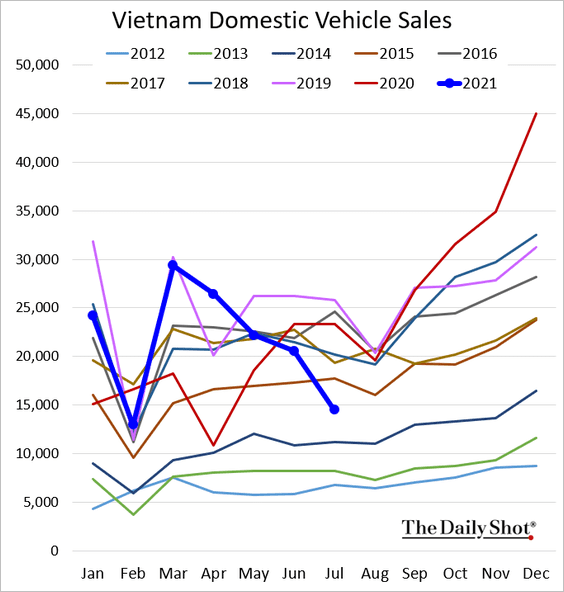

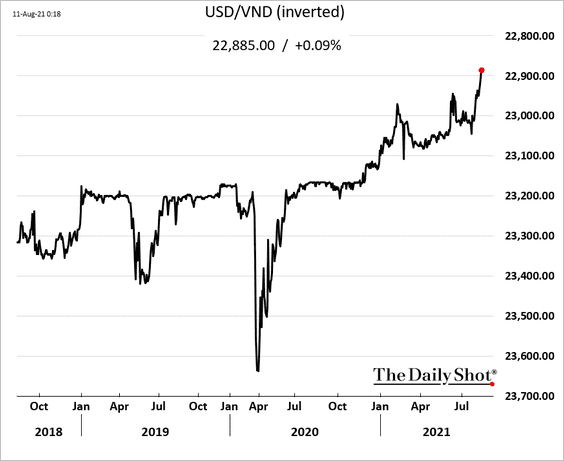

1. Vietnam’s vehicle sales are tumbling.

The Vietnamese dong has been allowed to appreciate after the agreement with the US to improve “exchange-rate flexibility.”

——————–

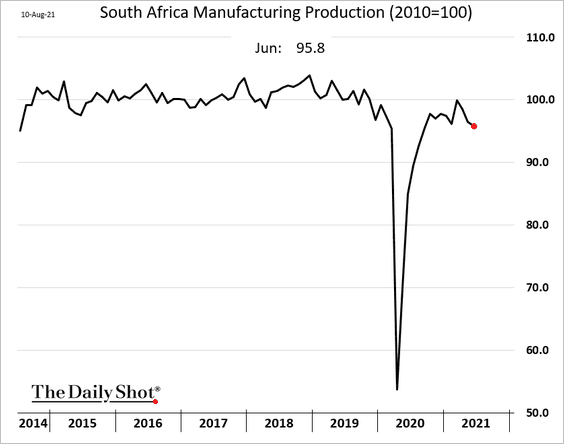

2. South Africa’s factory output has been weakening.

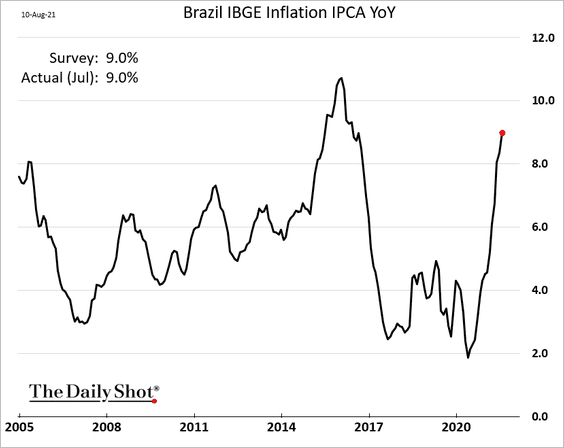

3. Brazil’s inflation continues to accelerate.

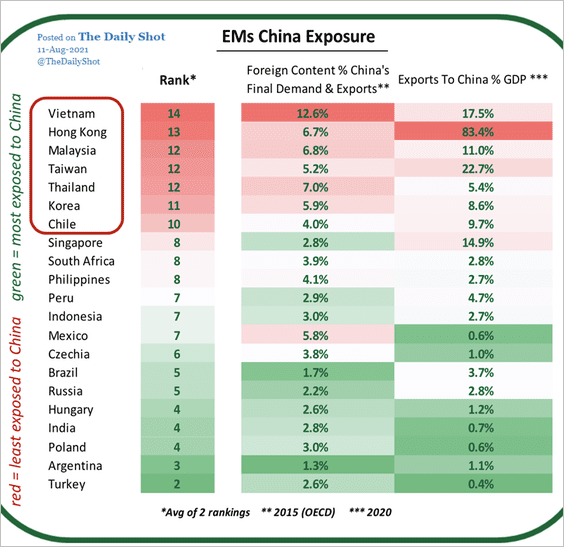

4. Which countries are most exposed to China?

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Cryptocurrency

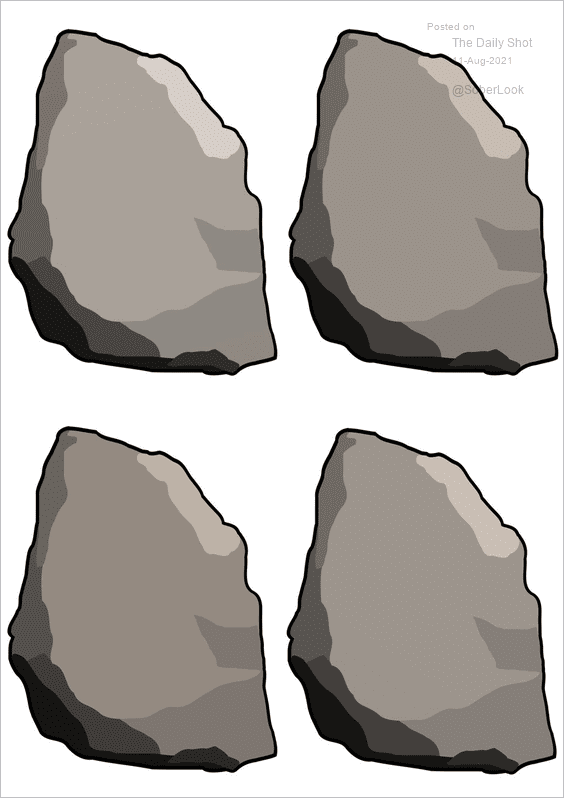

1. Digital (NFT) rocks are trading in the range of $110k – $160k (see story).

Source: @etherrockprice

Source: @etherrockprice

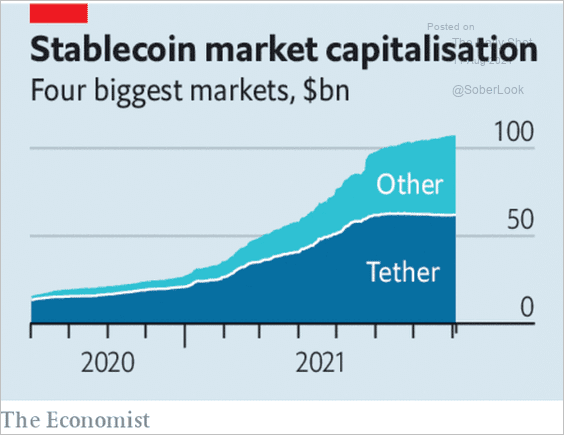

2. This chart shows stablecoin market capitalization.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Commodities

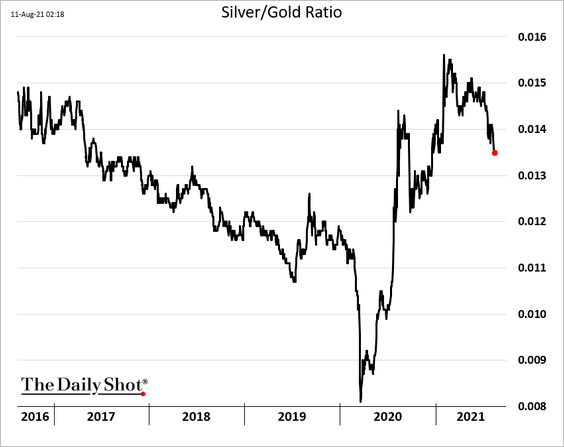

1. The silver-to-gold ratio has rolled over.

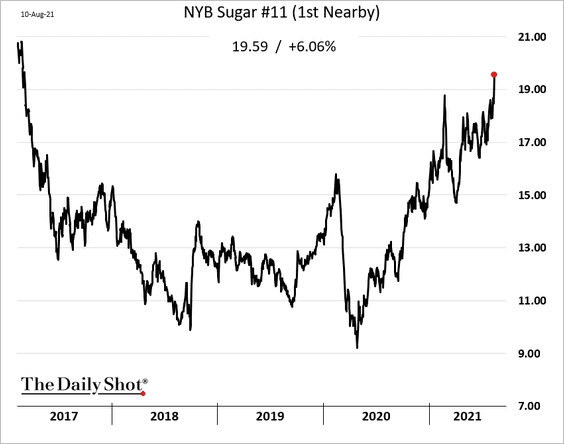

2. Sugar futures are surging.

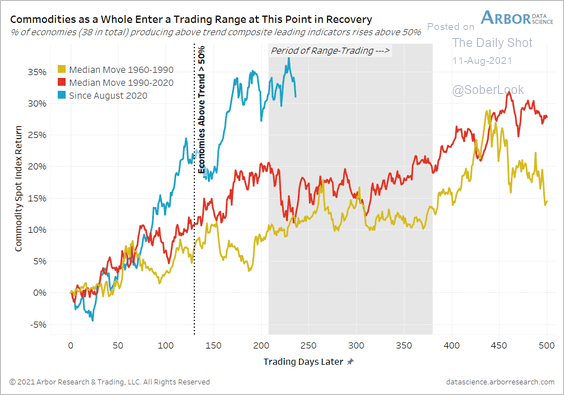

3. Based on historical patterns, commodities should enter a trading range.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Energy

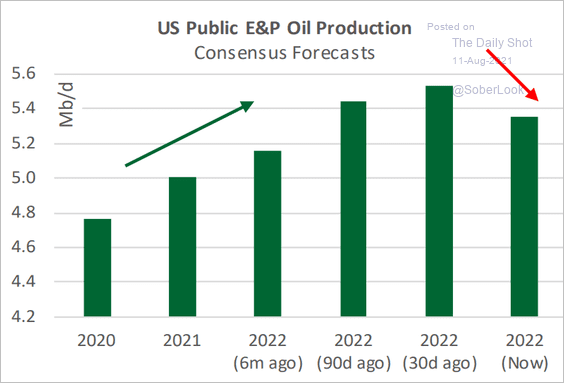

1. Forecasters are less upbeat on US oil production next year.

Source: Cornerstone Macro

Source: Cornerstone Macro

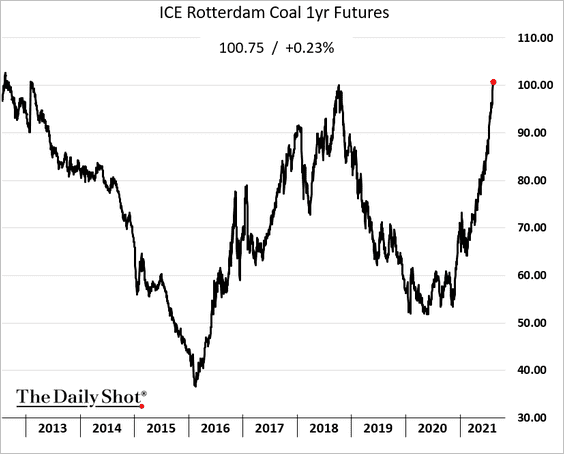

2. European coal prices are at multi-year highs due to high electricity demand (heatwave).

Back to Index

Equities

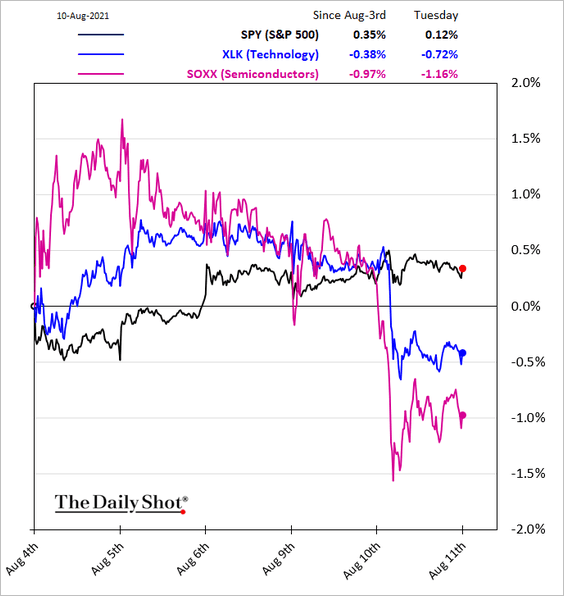

1. Tech stocks were weaker on Tuesday.

Source: BNN Bloomberg Read full article

Source: BNN Bloomberg Read full article

——————–

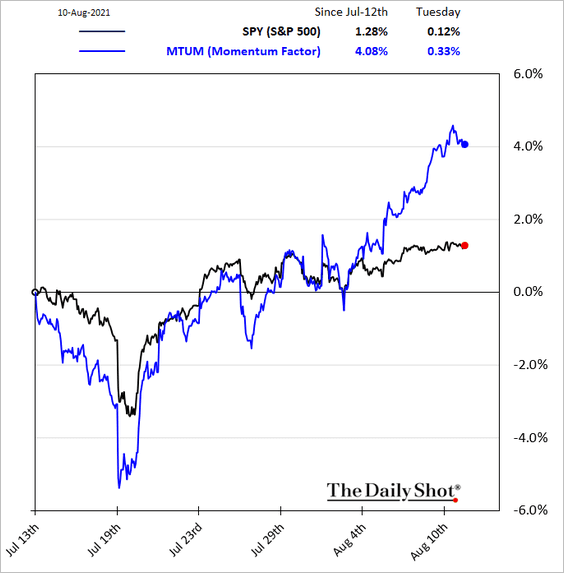

2. The momentum factor has been outperforming in recent days.

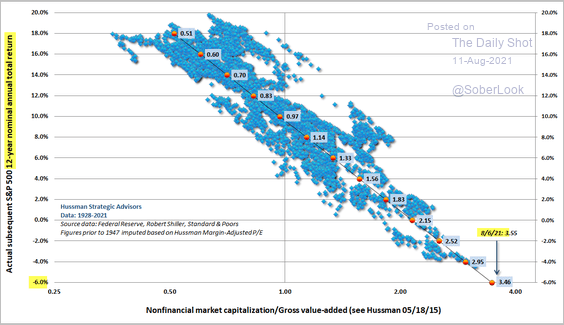

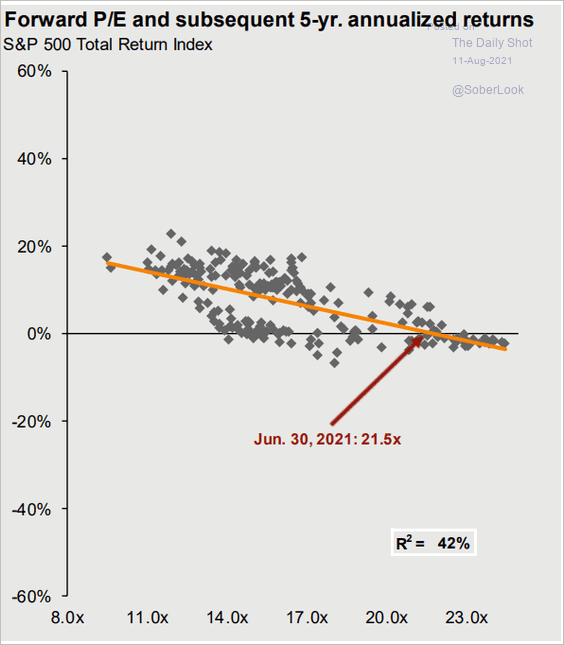

3. Valuation measures continue to indicate poor returns over longer periods.

• Market cap to gross value added ratio:

Source: @jessefelder, @hussmanjp Read full article

Source: @jessefelder, @hussmanjp Read full article

• Forward PE ratio:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

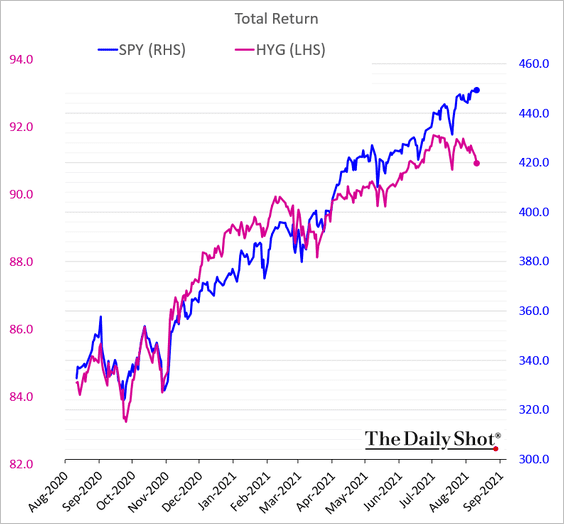

4. High-yield bonds (HYG) have diverged from stocks (SPY).

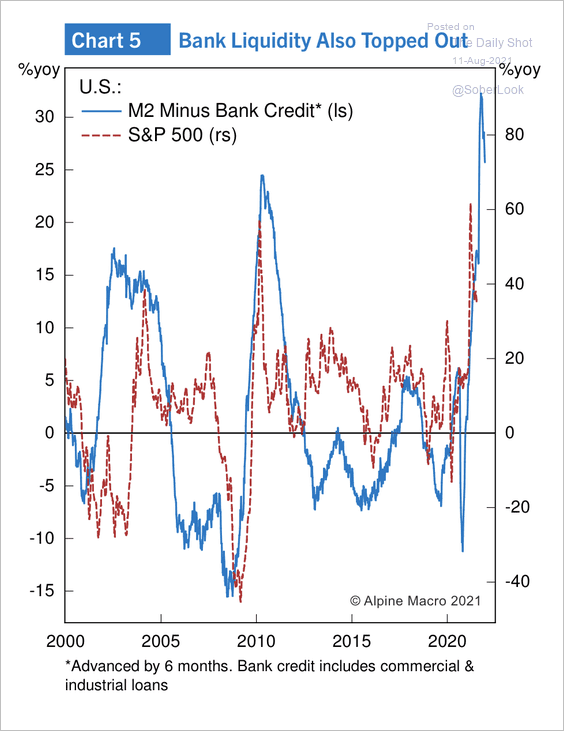

5. The decline in bank liquidity points to lower stock prices.

Source: Alpine Macro

Source: Alpine Macro

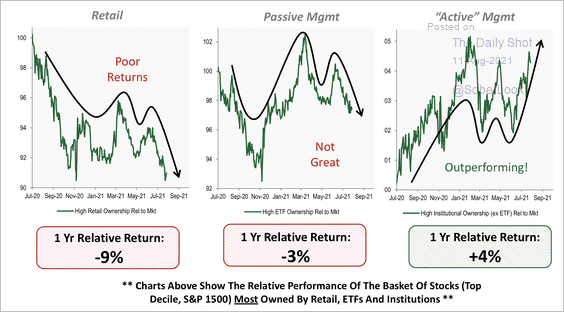

6. Active managers have been picking better stocks than retail investors and passive managers, according to Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

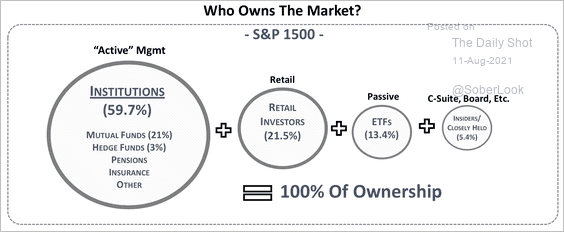

Institutions (active managers) own a majority of the S&P 500 stocks.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

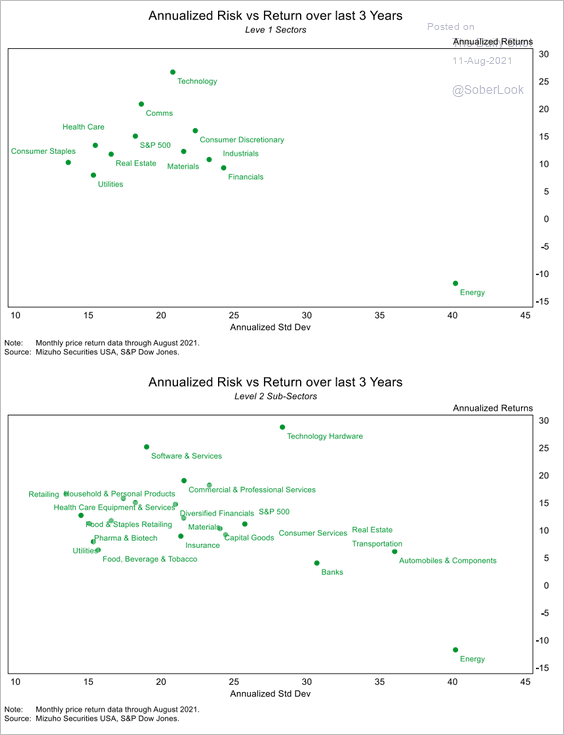

7. Here is the S&P 500 risk/return profile by sector and subsector.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

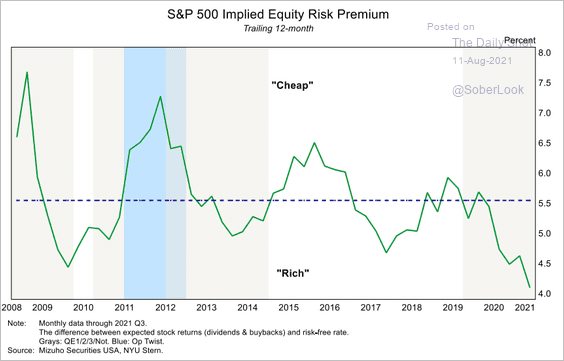

8. Equity risk premium continues to sink.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

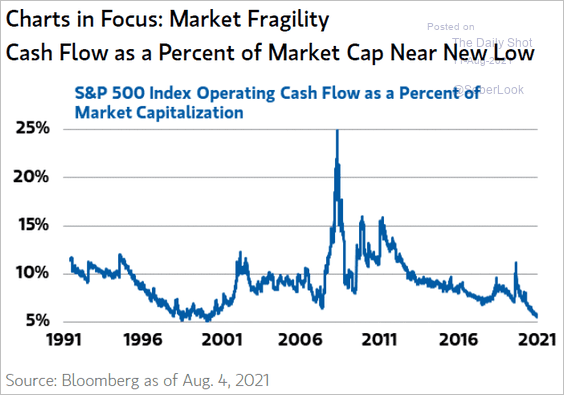

9. This chart shows operating cash flow as a percentage of the market cap.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

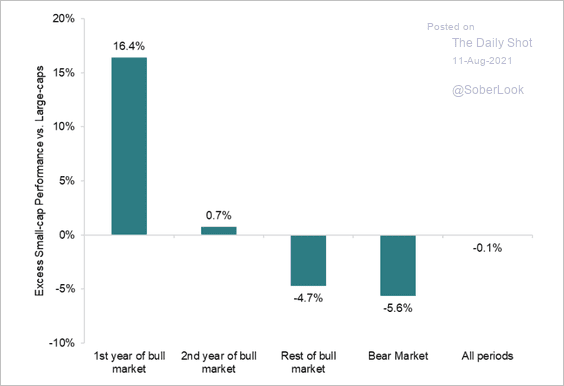

10. Small-caps perform best during the first year of a bull market.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Credit

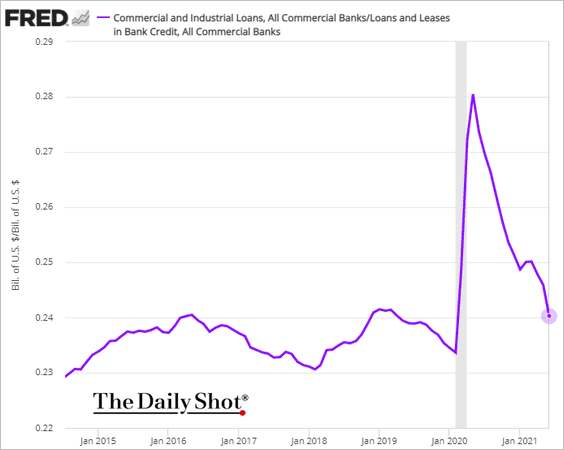

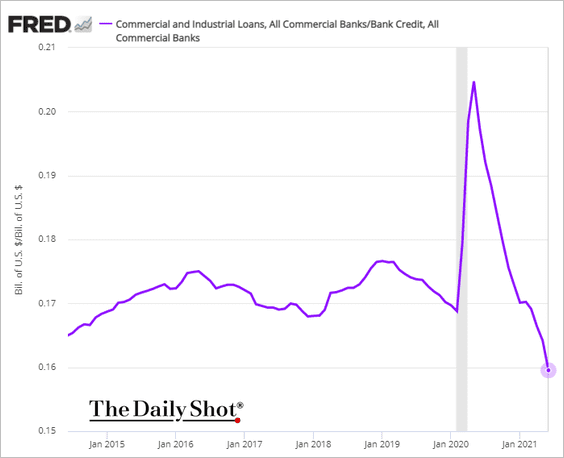

1. US business loan balances have been falling.

• Business loans as a share of total bank loans:

• Business loans as a share of bank credit (includes securities):

——————–

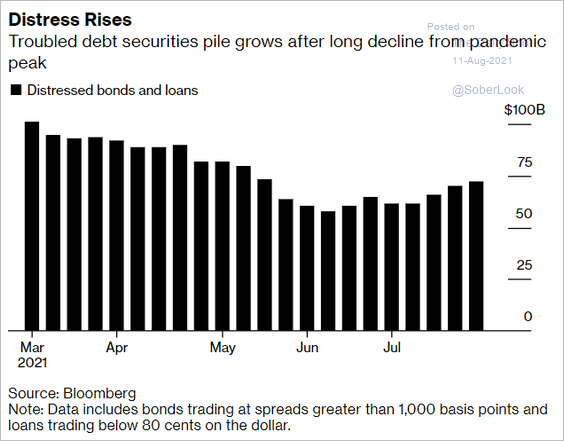

2. Distressed debt has risen in recent weeks.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Food for Thought

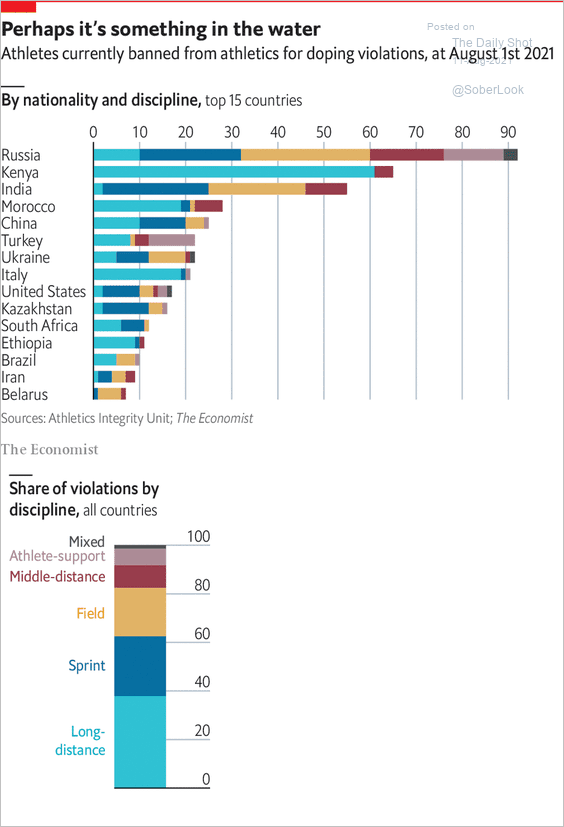

1. Athletics “doping contest”:

Source: The Economist Read full article

Source: The Economist Read full article

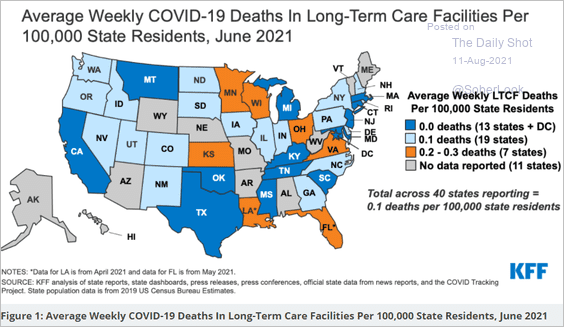

2. COVID deaths in long-term care facilities

Source: KFF

Source: KFF

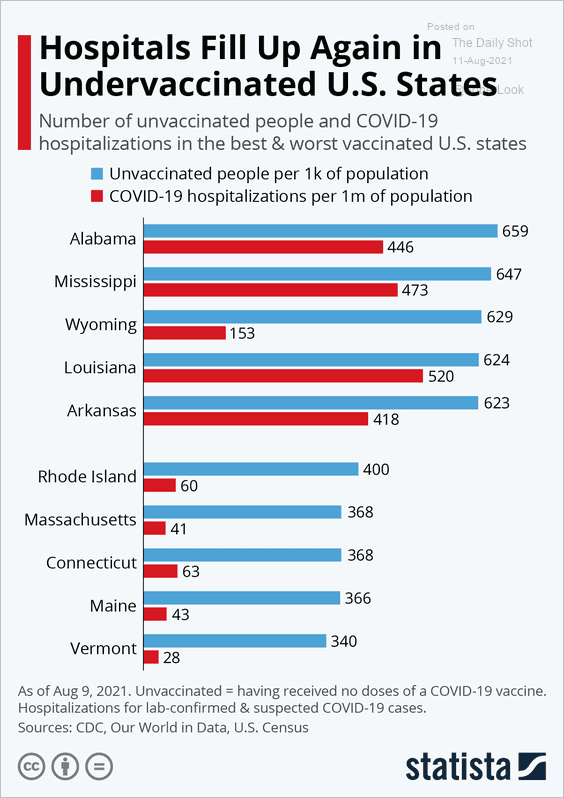

3. US COVID hospitalizations:

Source: Statista

Source: Statista

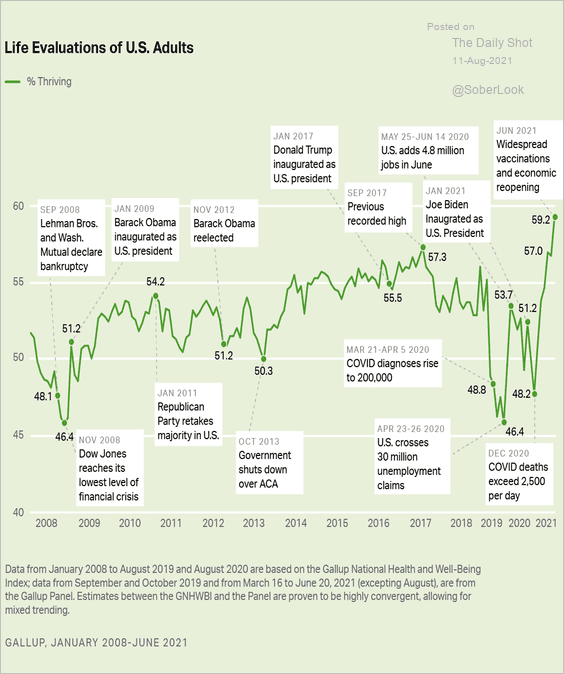

4. Americans’ life ratings:

Source: Gallup Read full article

Source: Gallup Read full article

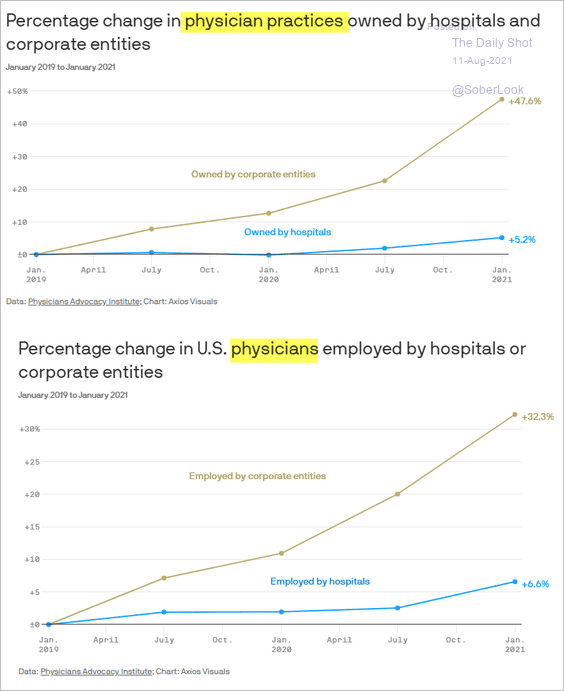

5. Acquisitions of doctor practices during the pandemic:

Source: @axios Read full article

Source: @axios Read full article

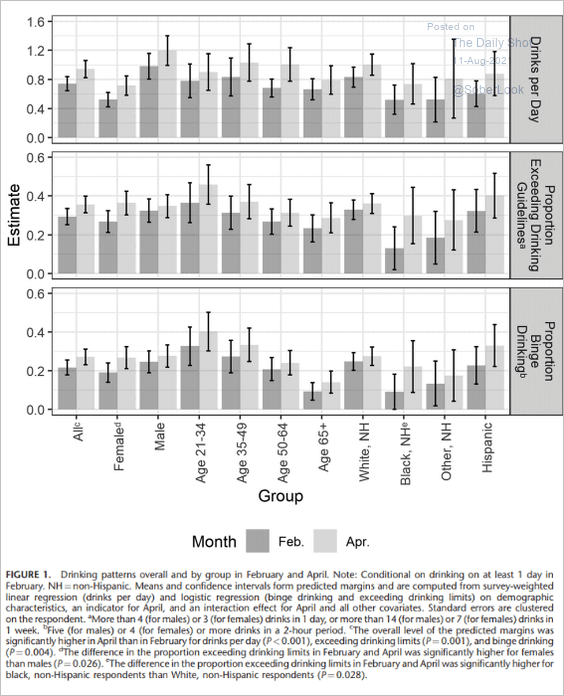

6. Drinking during lockdowns:

Source: American Society of Addiction Medicine Read full article

Source: American Society of Addiction Medicine Read full article

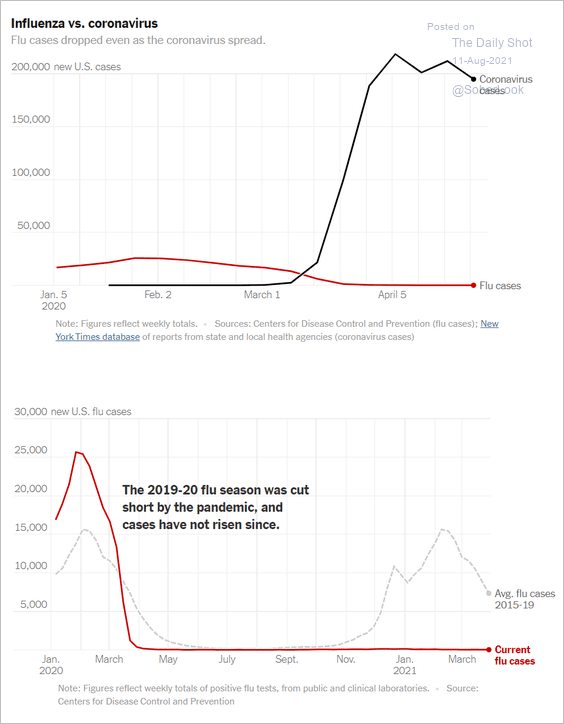

7. The flu vanishing during COVID:

Source: The New York Times Read full article

Source: The New York Times Read full article

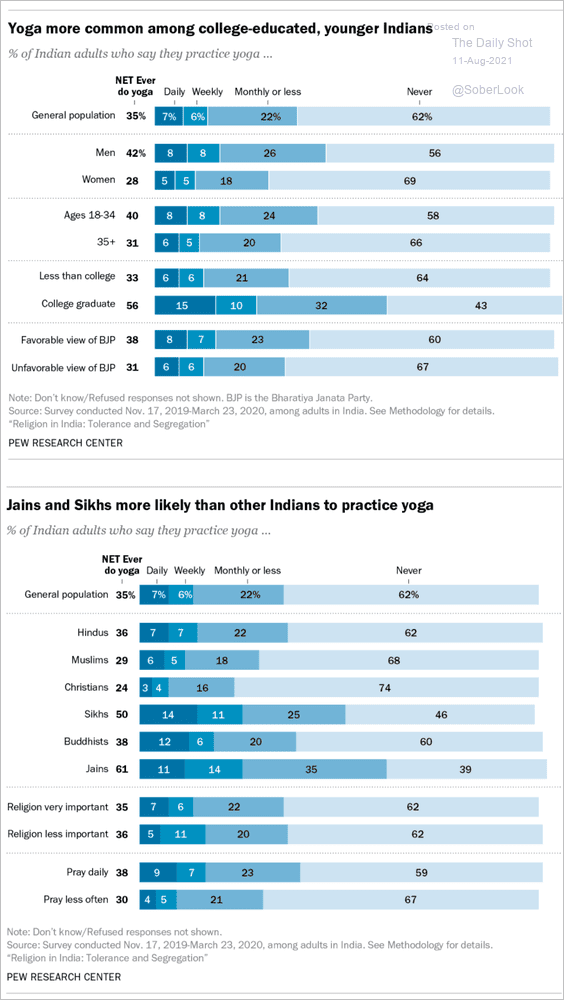

8. Practicing yoga:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

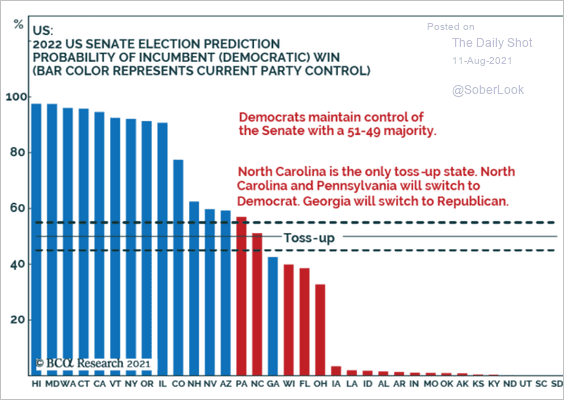

9. Senate midterm election forecast from BCA Research:

Source: BCA Research

Source: BCA Research

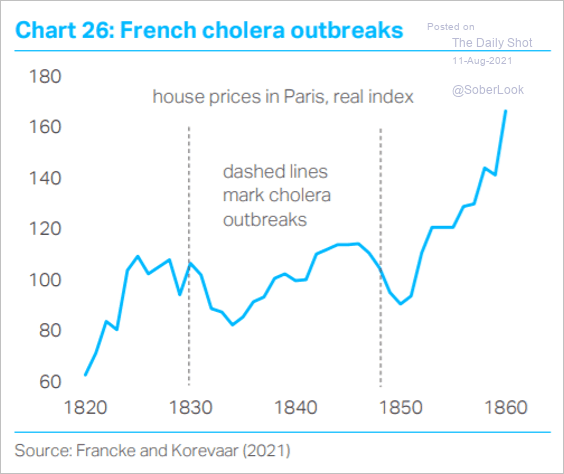

10. French cholera outbreaks and home price appreciation in the 1800s:

Source: TS Lombard

Source: TS Lombard

——————–

Back to Index