The Daily Shot: 16-Aug-21

• The United States

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

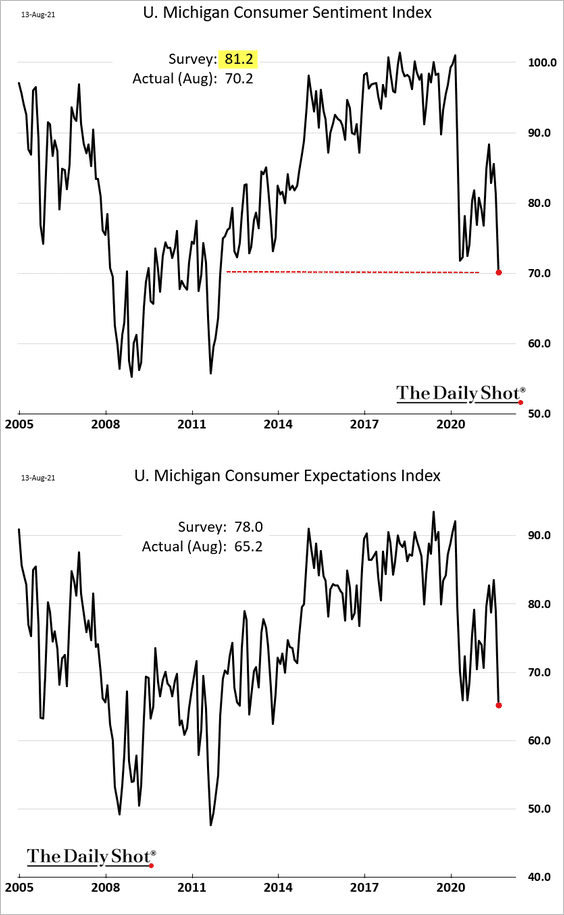

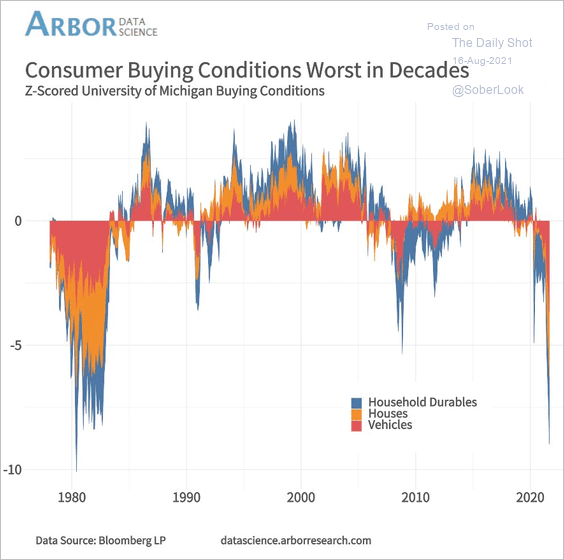

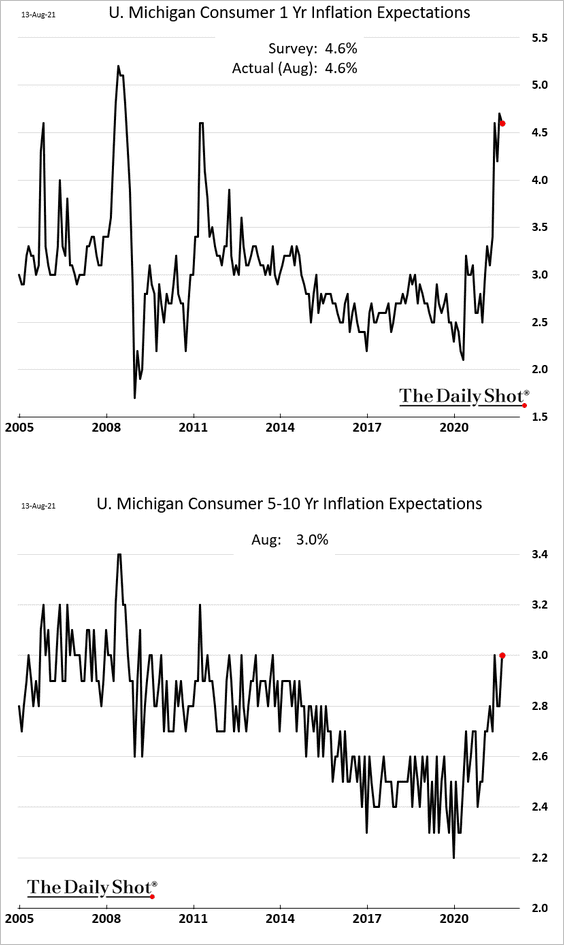

1. The U. Michigan’s consumer sentiment report was a shocker, with the composite index hitting the lowest level in a decade. Increased concerns about the resurgent pandemic and sharp price gains have taken a toll on household confidence.

Source: Reuters Read full article

Source: Reuters Read full article

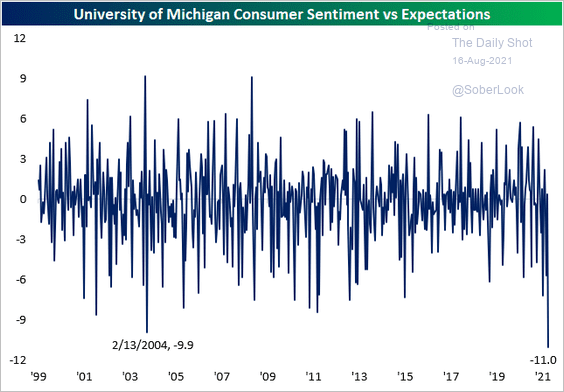

• It was the worst negative surprise on record.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

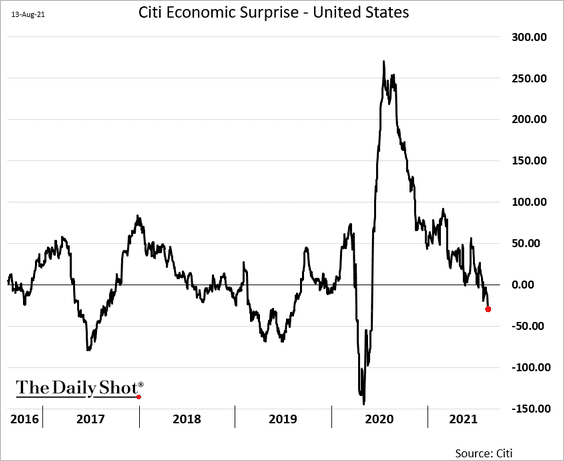

The Citi Economic Surprise Index declined further.

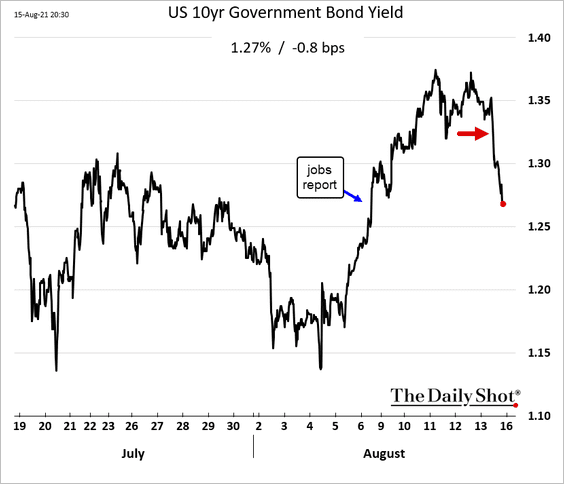

• Treasury yields and the dollar slumped in response to the U. Michigan report.

Further reading

Further reading

• Households’ expectations of personal finances deteriorated sharply.

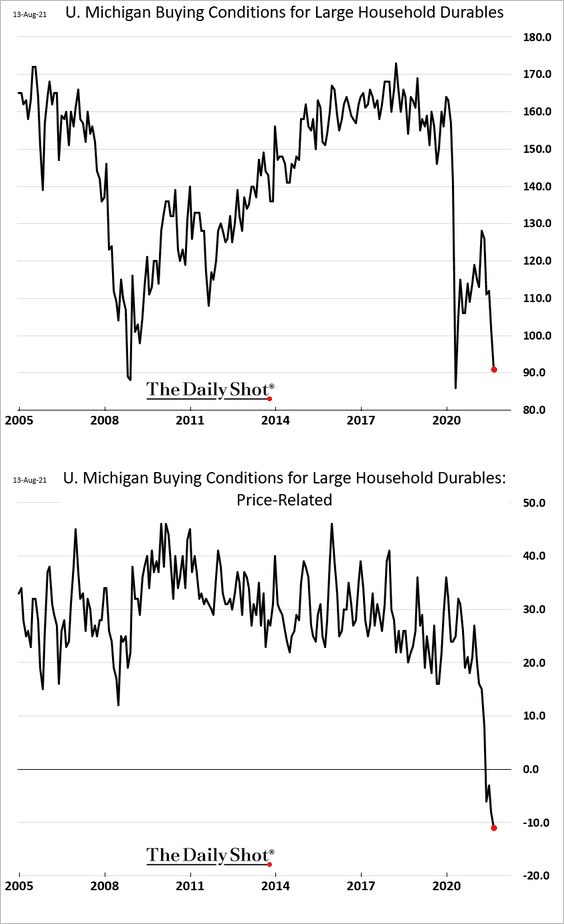

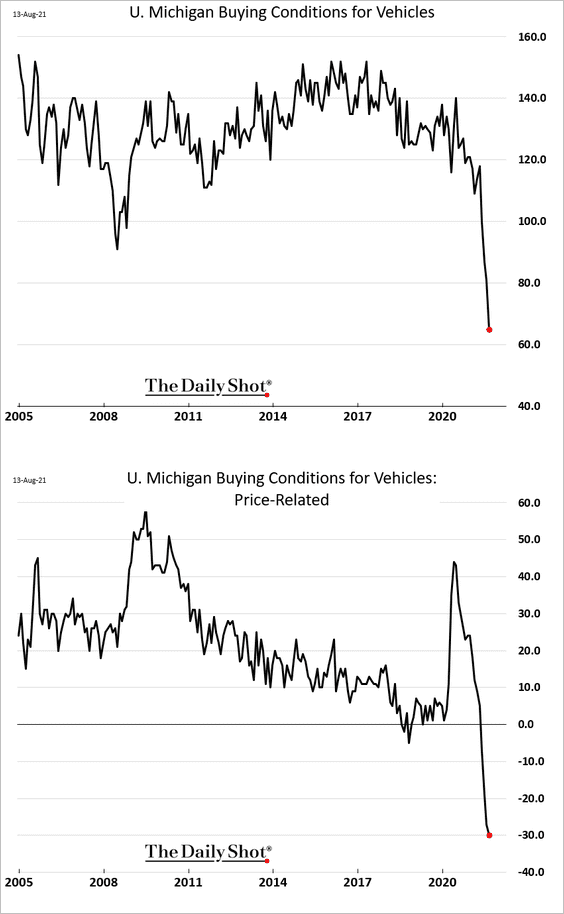

• Buying conditions for household durables and vehicles deteriorated further, driven by concerns about rising prices.

Source: @DataArbor

Source: @DataArbor

——————–

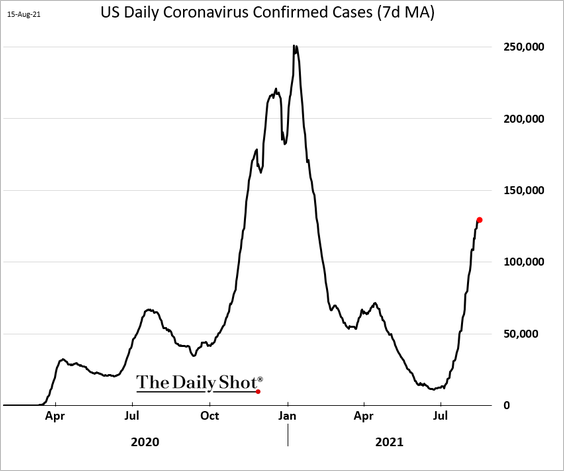

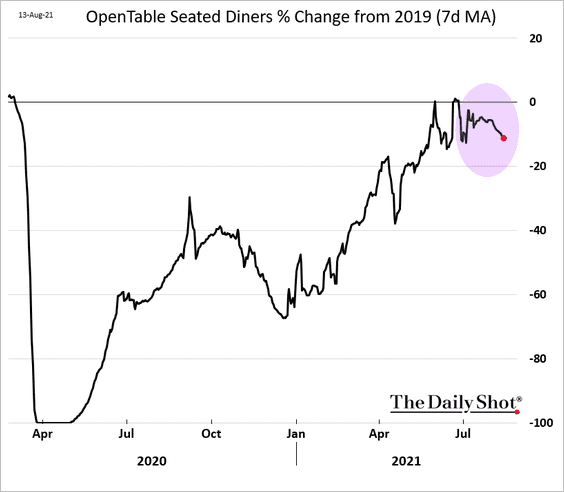

2. In addition to the U. Michigan report, the COVID situation …

Source: Reuters Read full article

Source: Reuters Read full article

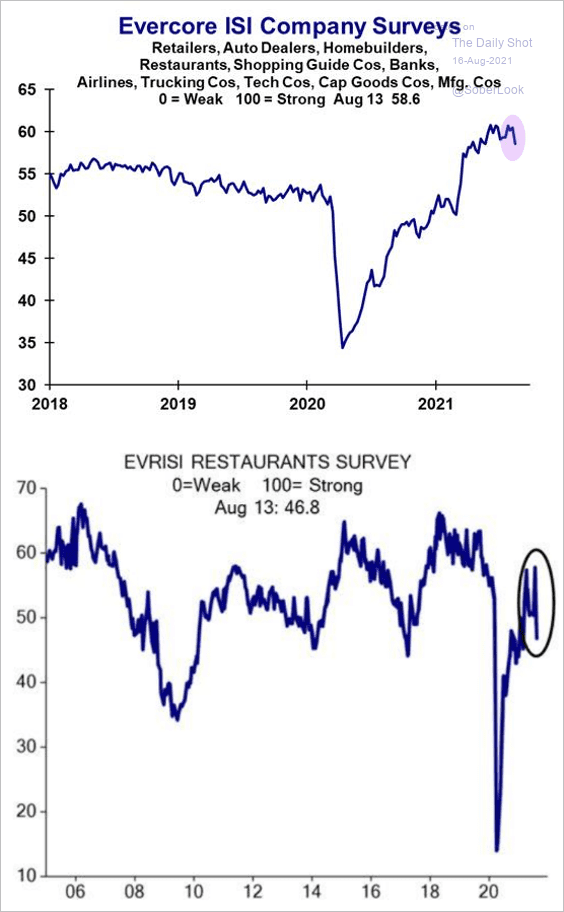

… is starting to show up in other high-frequency data.

• OpenTable seated diners:

• The Evercore ISI business survey:

Source: Evercore ISI

Source: Evercore ISI

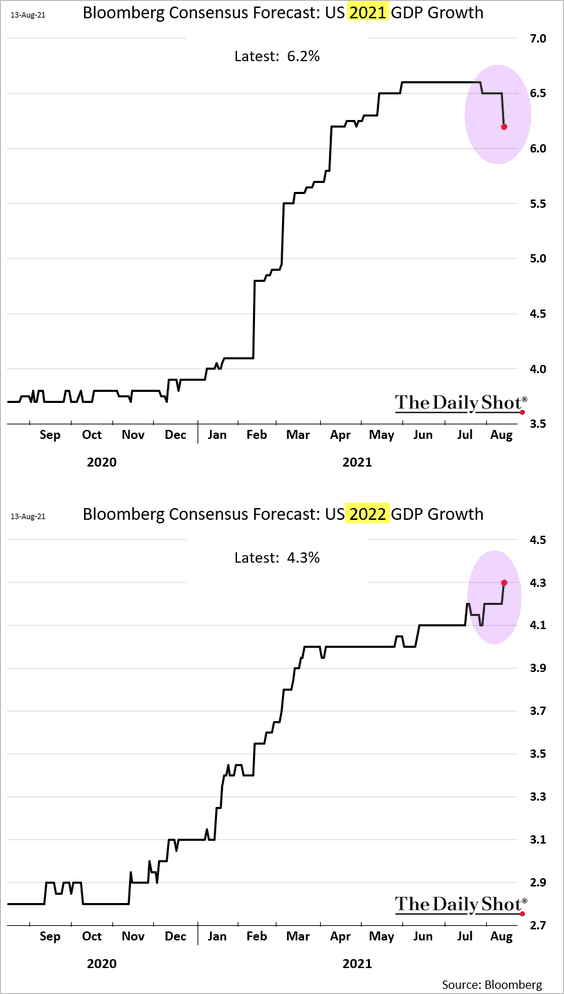

Economists are downgrading their 2021 GDP estimates, with growth pushed into 2022.

——————–

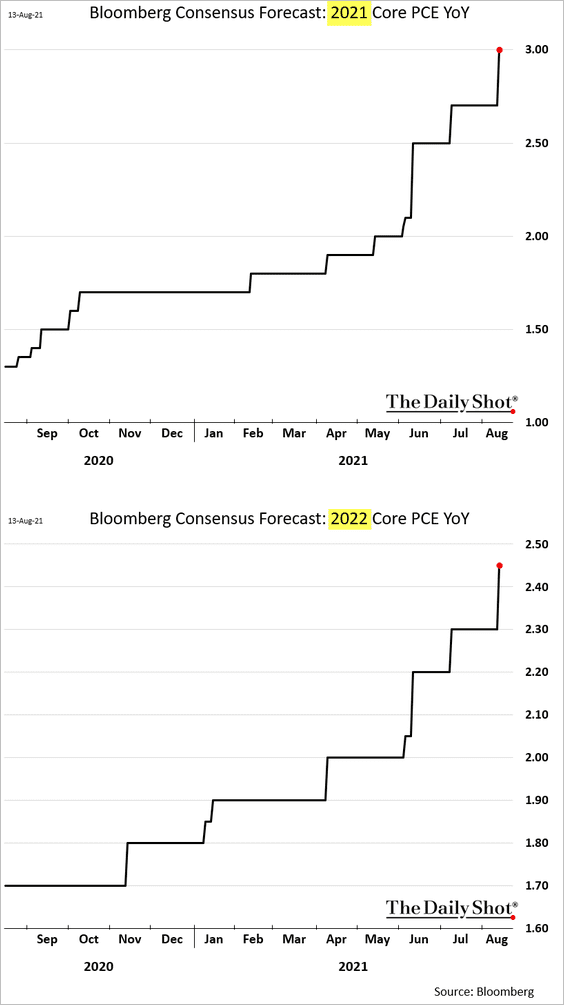

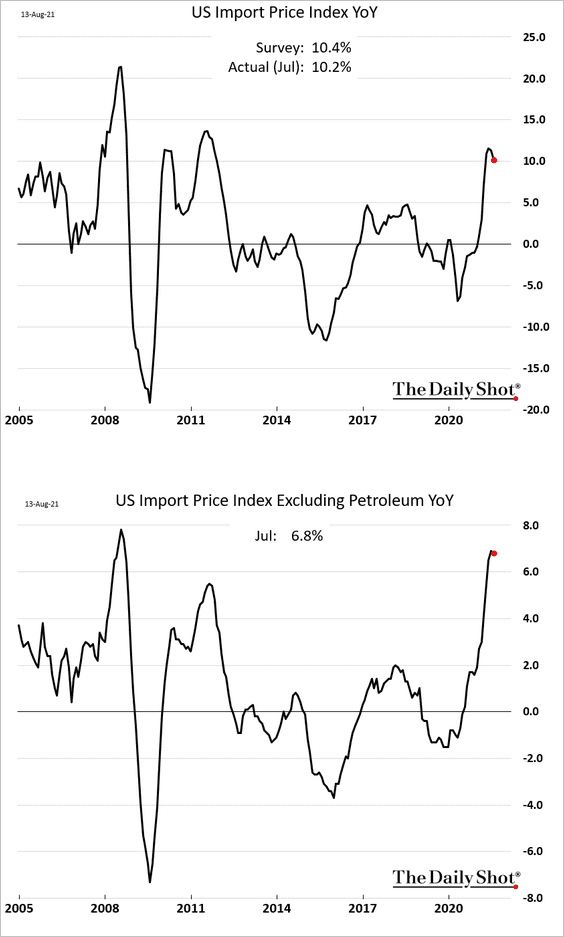

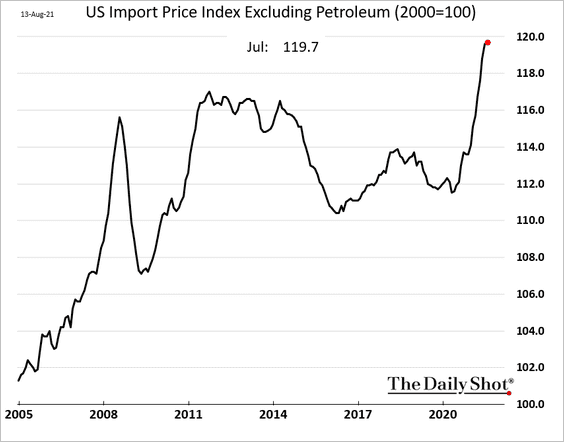

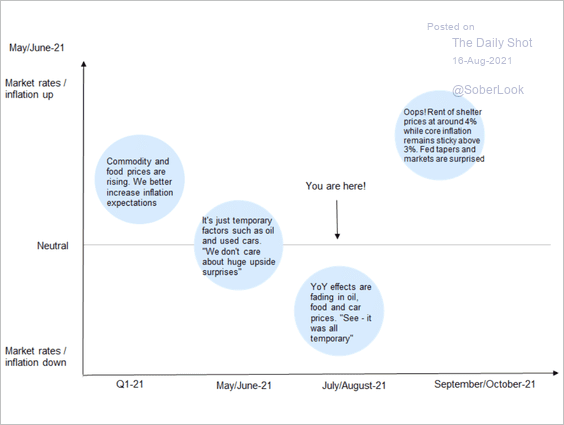

3. Next, we have some updates on inflation.

• Consumer inflation expectations remain elevated.

• Economists continue to boost their inflation forecasts.

Source: @markets Read full article

Source: @markets Read full article

• Gains in import prices appear to be peaking.

Here the import price index.

• Nordea expects inflationary pressures to fade before a spike of rent-of-shelter prices forces the Fed to taper later this year.

Source: Nordea Markets

Source: Nordea Markets

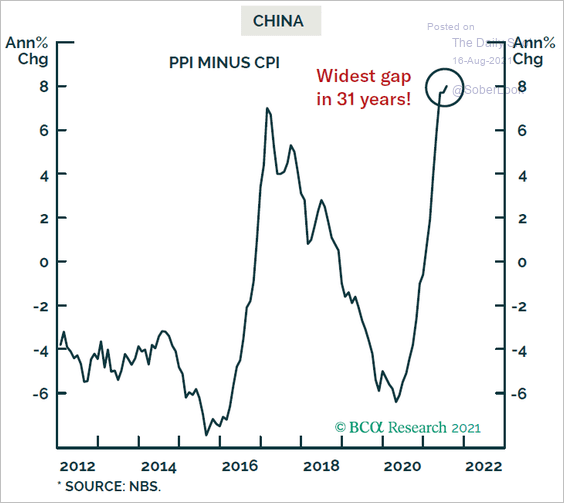

• Producer price increases have been outpacing consumer prices, potentially creating margin pressures in some sectors.

——————–

4. The bipartisan infrastructure legislation is not expected to have a material impact on the deficit.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

The Eurozone

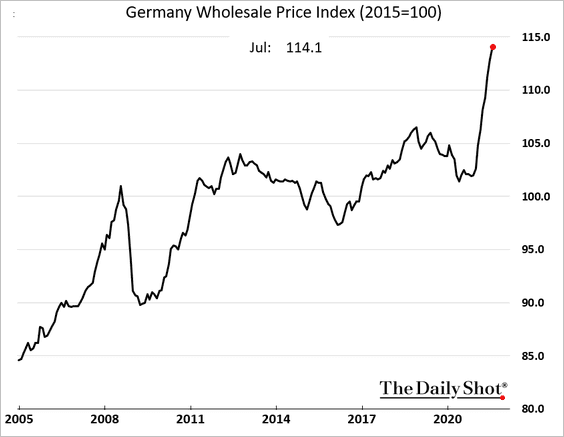

1. German wholesale prices continue to surge.

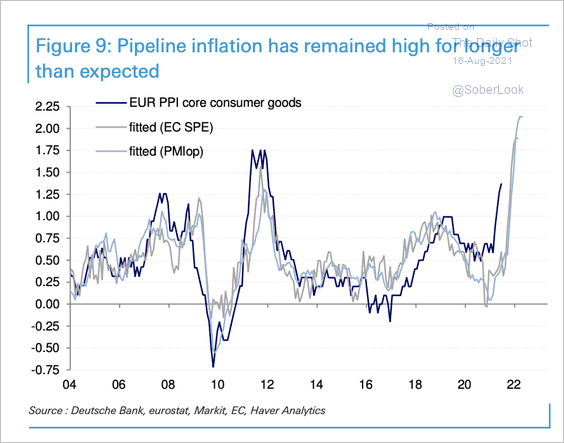

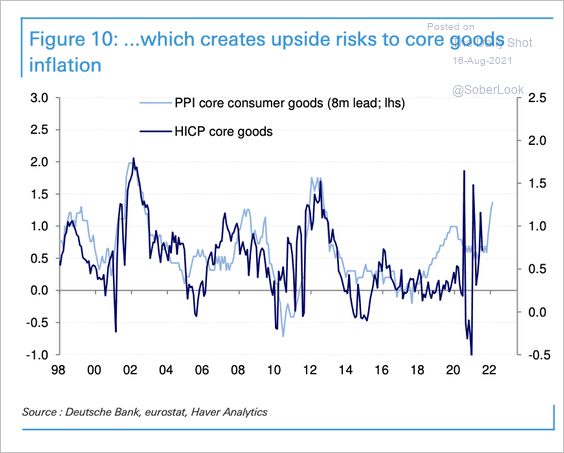

2. Euro-area underlying inflation is rising longer than expected, which suggests further upside to core goods inflation, according to Deutsche Bank (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

3. The French unemployment rate held at 8% in Q2.

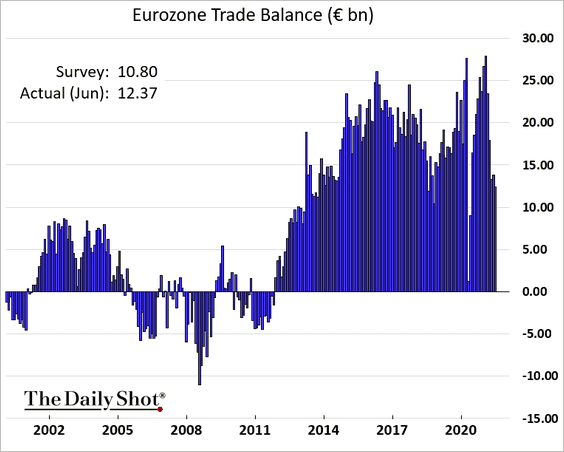

4. The Eurozone’s June trade surplus surprised to the upside, and the May figure was revised higher.

Back to Index

Europe

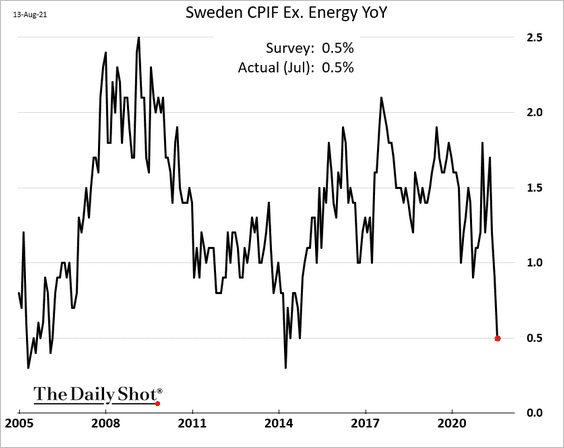

1. Sweden’s underlying inflation is back at 0.5%.

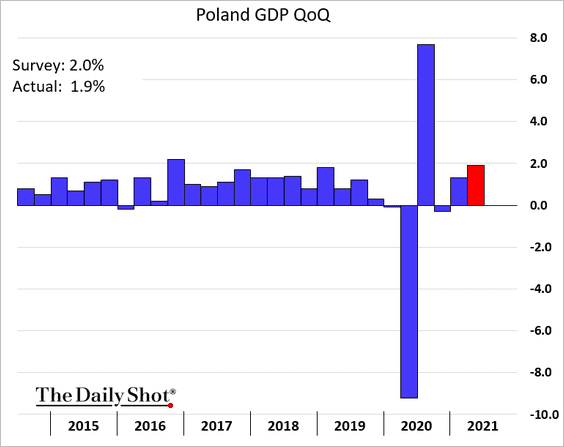

2. Poland’s GDP growth strengthened last quarter, …

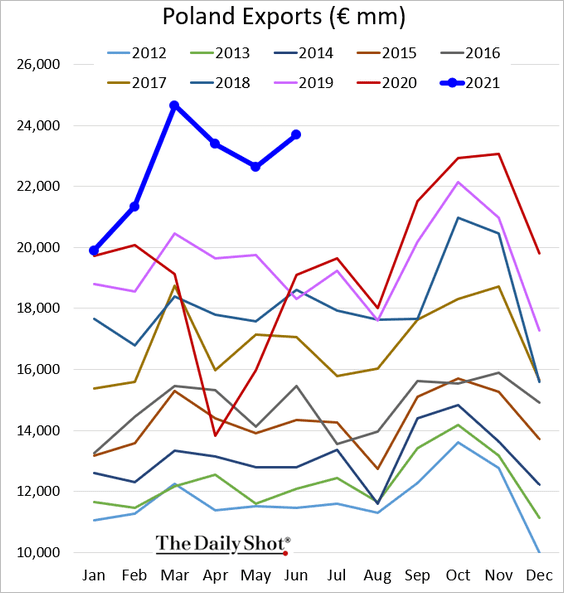

… as exports hit record highs (for this time of the year).

——————–

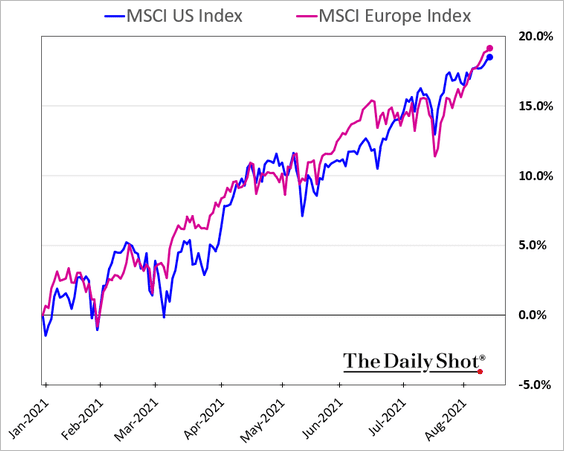

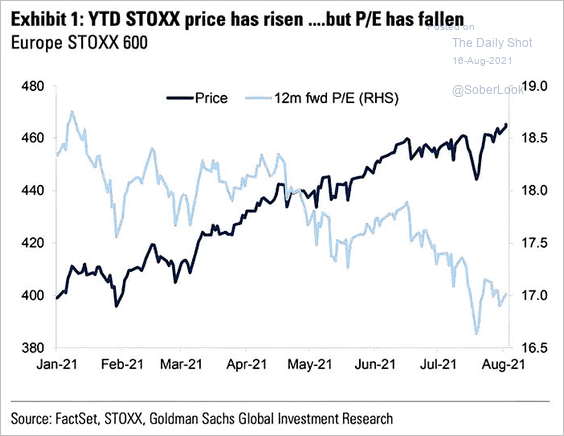

3. The MSCI Europe index has outperformed the US equivalent year-to-date.

European equity valuations continue to improve.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

4. This map shows average wholesale electricity prices across Europe.

Source: @fbeirao

Source: @fbeirao

Back to Index

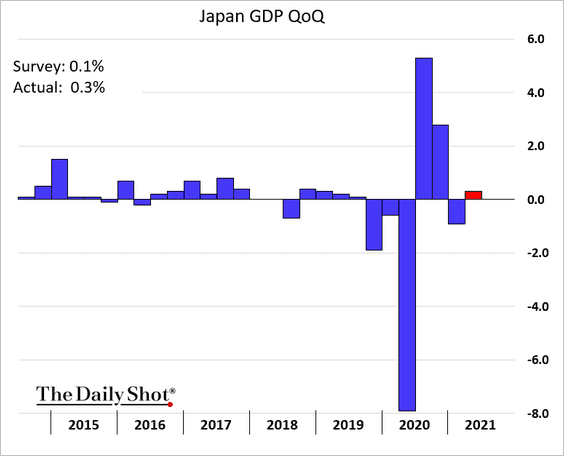

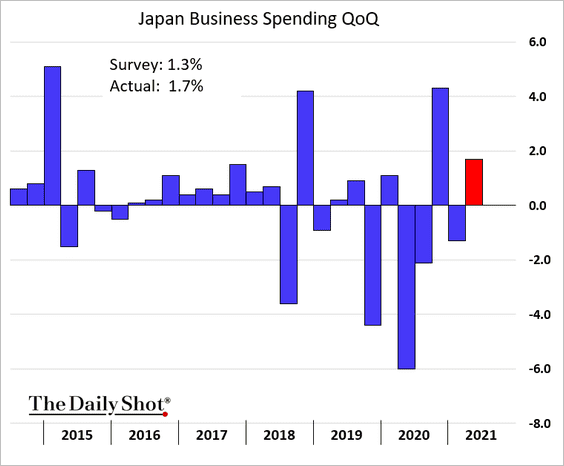

Japan

1. The Q2 GDP growth was a bit stronger than expected.

Private consumption and business investment surprised to the upside.

——————–

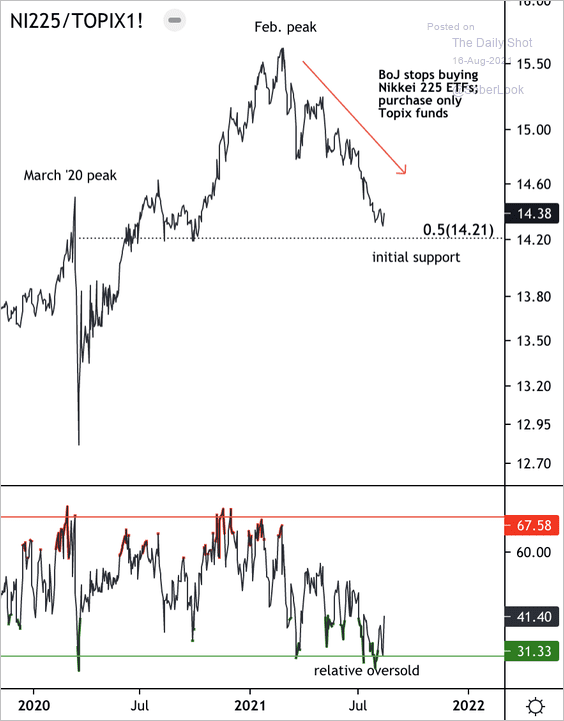

2. The Nikkei 225 Index is testing minor support relative to the Topix Index. The Nikkei/Topix ratio reversed a long-term uptrend around March after the BoJ ended its decade-long buying of Nikkei ETFs.

Source: Dantes Outlook

Source: Dantes Outlook

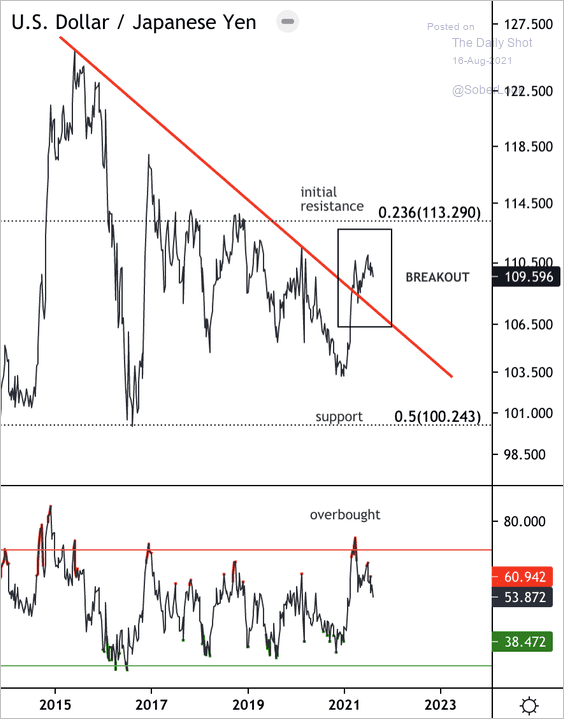

3. USD/JPY broke out of a 5-year downtrend with resistance around 113.

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

Asia – Pacific

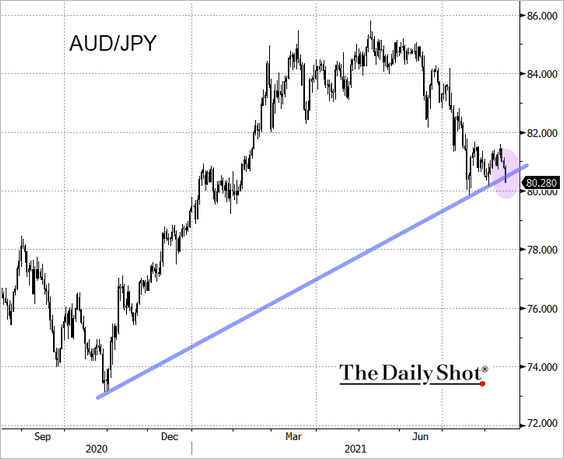

1. Aussie-yen us testing support as global sentiment shifts to risk-off amid pandemic concerns. The situation in Afghanistan is also contributing to a cautious mood.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

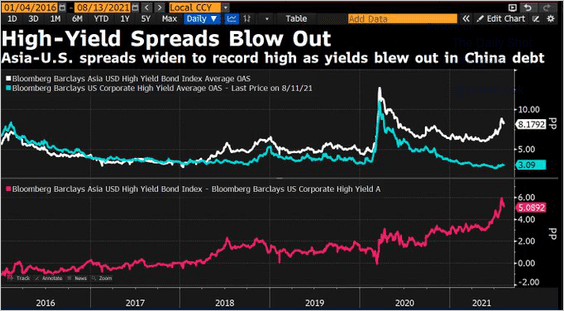

2. Asian HY spreads to the US have blown out.

Source: @DavidInglesTV

Source: @DavidInglesTV

Back to Index

China

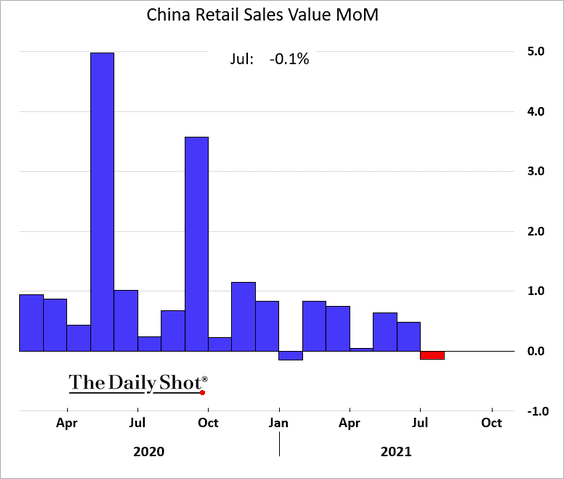

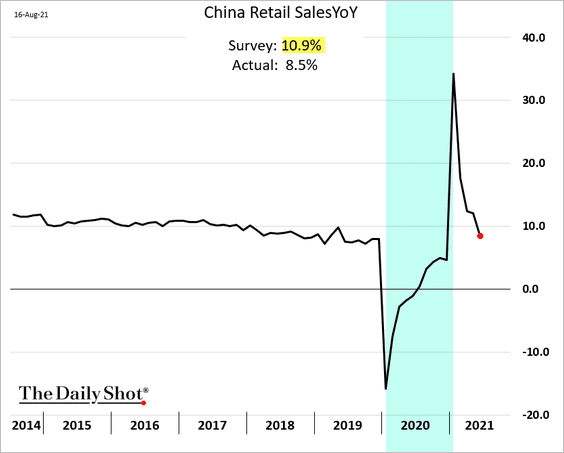

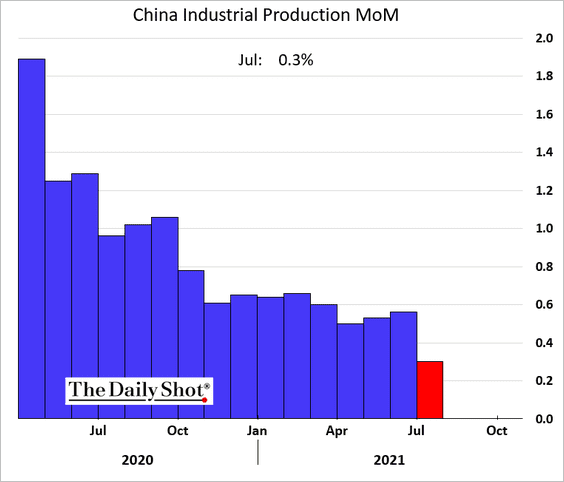

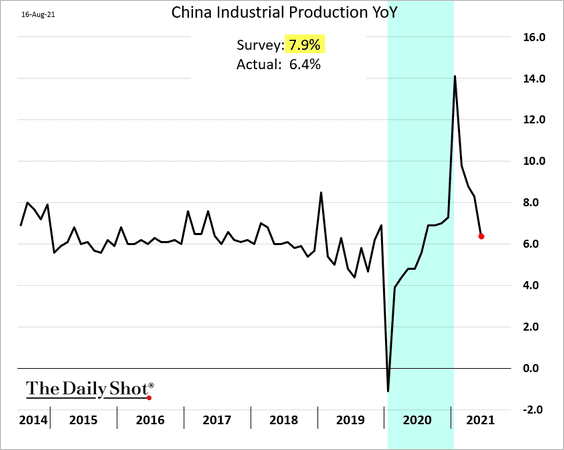

1. The July data surprised to the downside, pointing to an ongoing economic slowdown.

• Retail sales unexpectedly declined last month.

• Growth in industrial production continues to trend lower.

——————–

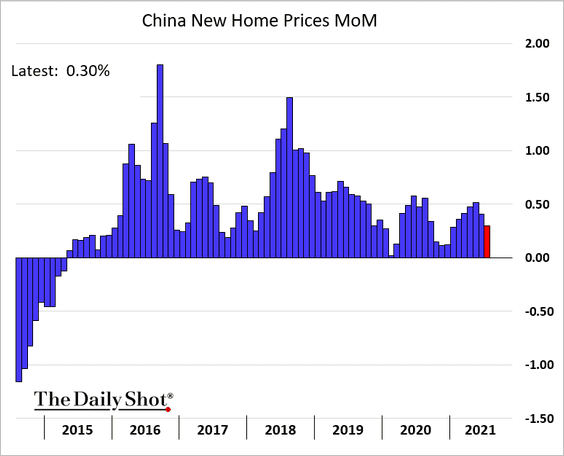

2. Home price appreciation slowed.

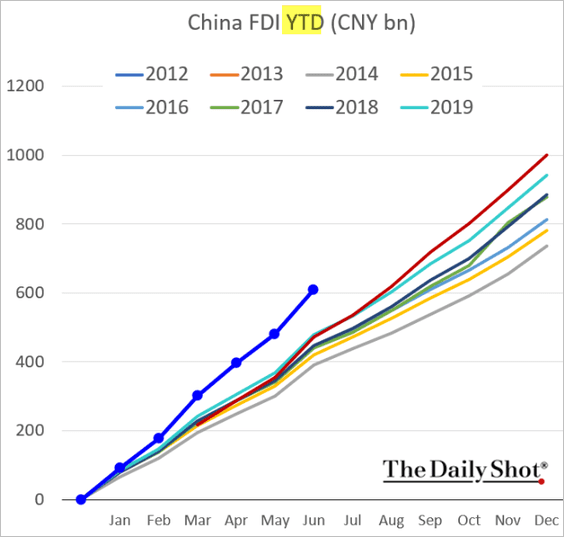

3. Foreign direct investment remains robust.

4. The PPI-CPI gap has blown out, which could pressure corporate margins.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

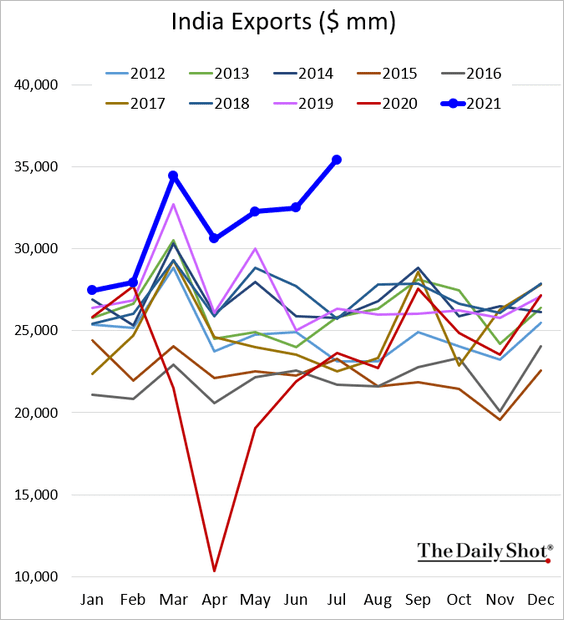

1. India’s exports hit a record high last month.

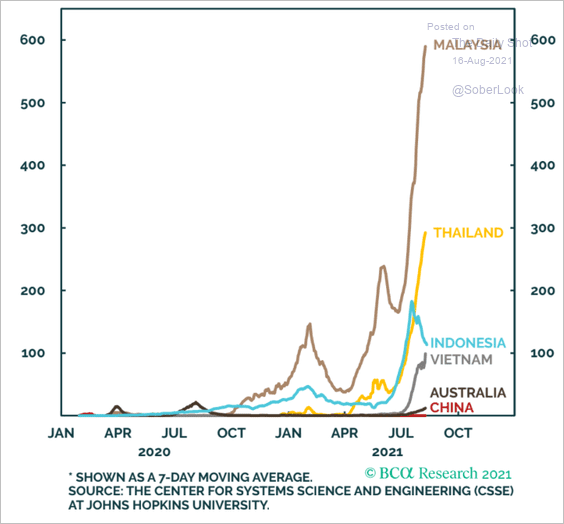

2. Malaysia, Thailand, and Vietnam continue to see higher COVID cases.

Source: BCA Research

Source: BCA Research

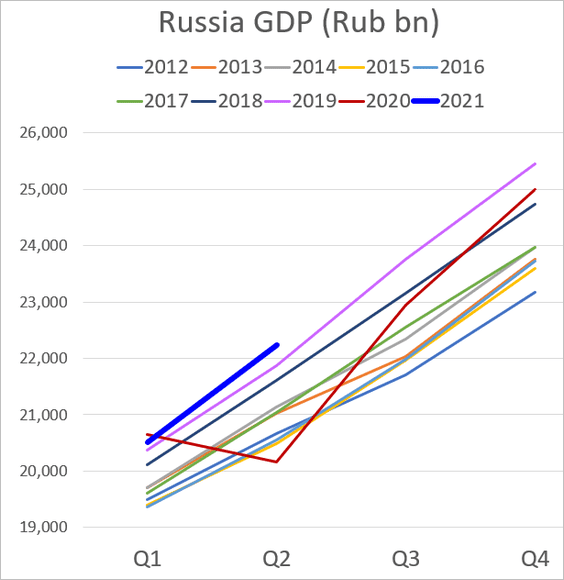

3. Russia’s economic growth remains anemic, with the Q2 GDP rising 1.7% vs. the second quarter of 2019.

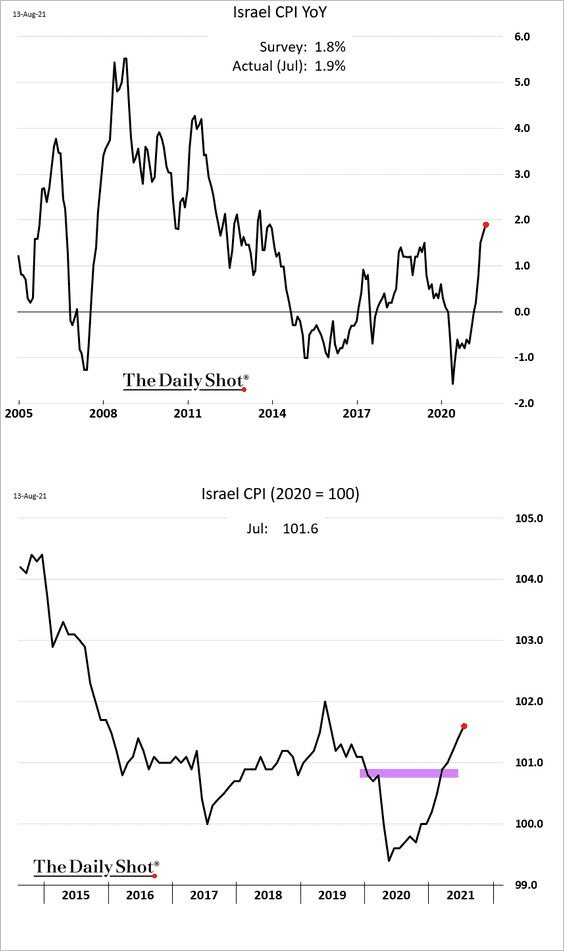

4. Israel’s inflation was modestly stronger than expected as prices rise above pre-COVID levels.

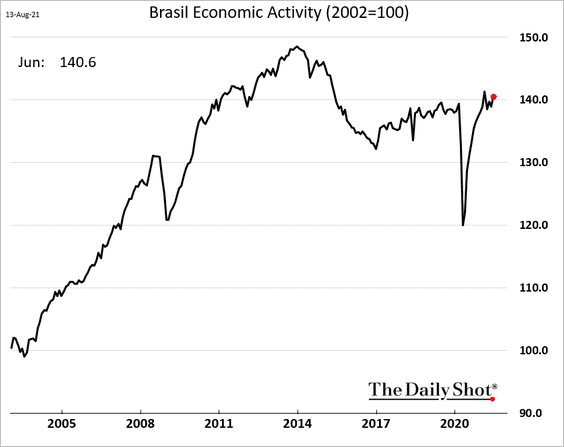

5. Brazil’s economic activity increased in June, holding above pre-COVID levels.

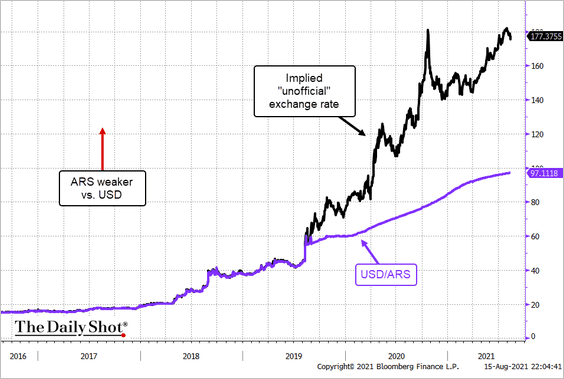

6. Argentina’s unofficial exchange rate continues to diverge from the official one. Will the government accelerate the peso’s depreciation?

Source: @TheTerminal, Bloomberg Finance L.P., h/t @RobinBrooksIIF

Source: @TheTerminal, Bloomberg Finance L.P., h/t @RobinBrooksIIF

Back to Index

Cryptocurrency

1. Bitcoin is holding above the 200-day moving average.

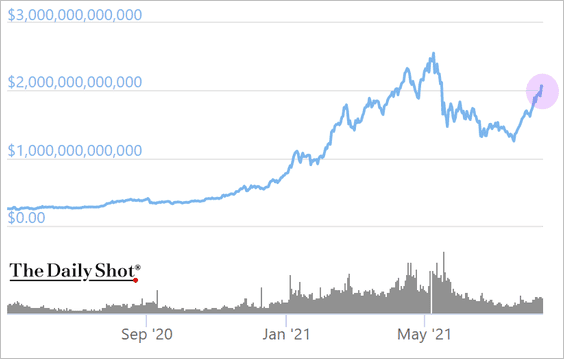

2. The total crypto market value is back above $2 trillion.

Source: @markets Read full article

Source: @markets Read full article

Source: CoinGecko

Source: CoinGecko

——————–

3. A majority of Investopedia readers have reduced their crypto holdings along with other speculative activities over the past month.

Source: Investopedia Read full article

Source: Investopedia Read full article

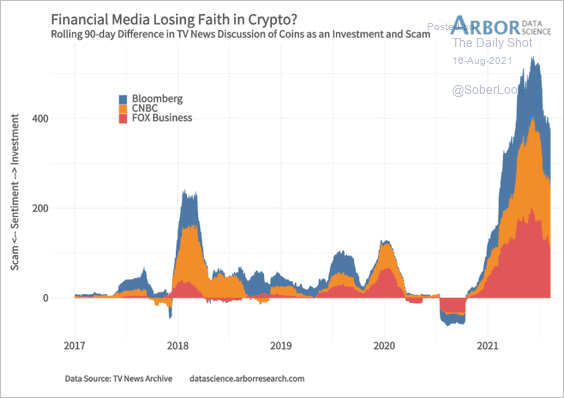

4. Media coverage of crypto markets has been slowing.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Commodities

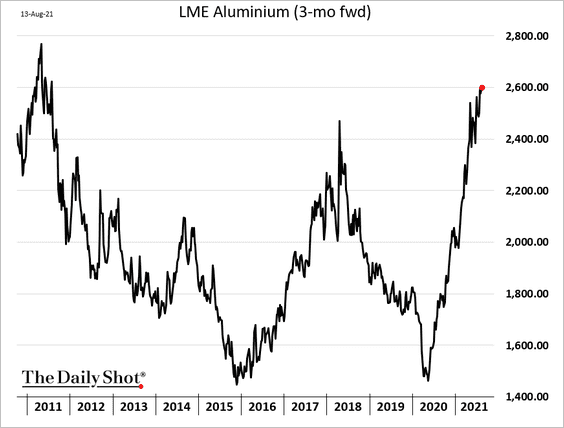

1. Aluminum is trding near the highest level in a decade.

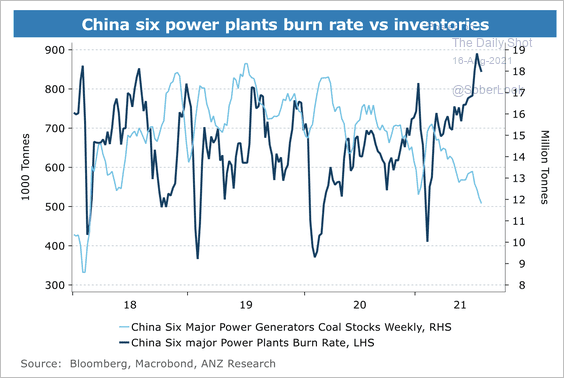

2. China’s coal industry faces strict import restrictions and constrained domestic production.

Source: ANZ Research

Source: ANZ Research

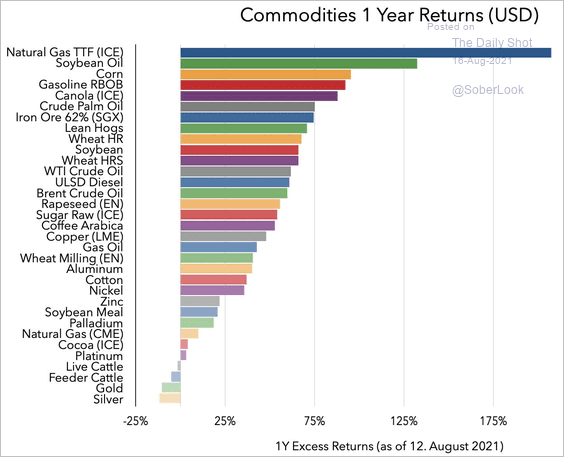

3. Here is a look at 1-year excess returns across major commodities relative to the Bloomberg Commodity Total Return Index.

Source: Christian Gerlach

Source: Christian Gerlach

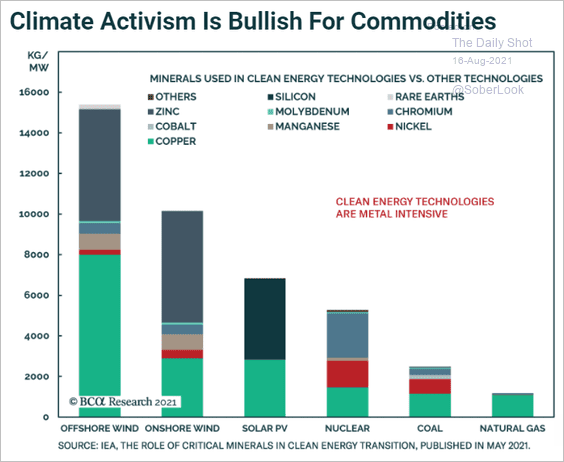

4. The shift from fossil fuels will support a number of commodity markets.

Source: BCA Research

Source: BCA Research

Back to Index

Energy

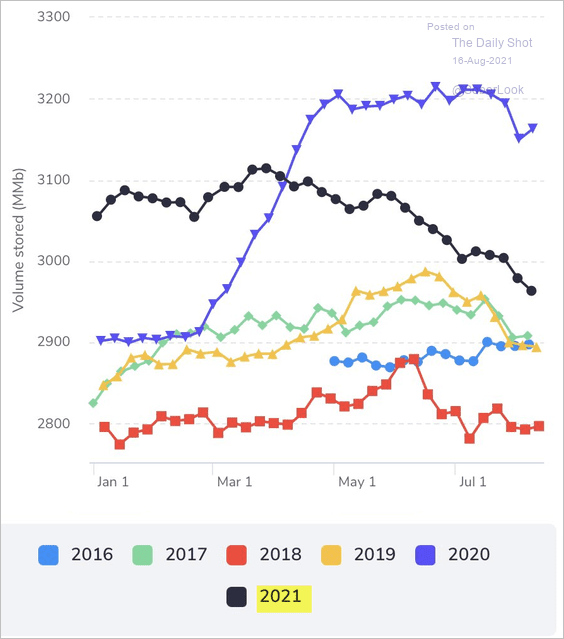

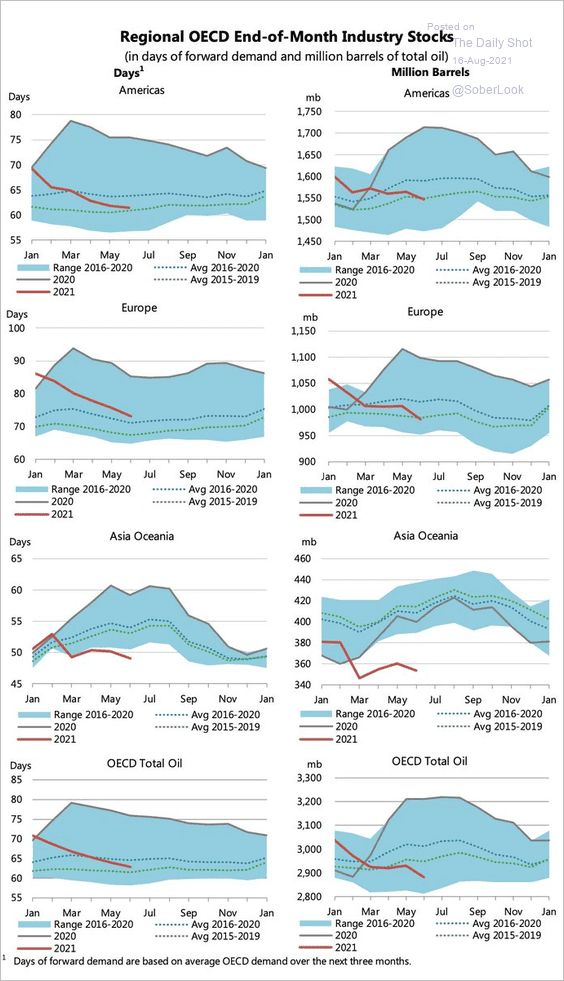

1. Global stockpiles of crude oil continue to trend lower.

Source: @BurggrabenH

Source: @BurggrabenH

Source: @HFI_Research

Source: @HFI_Research

——————–

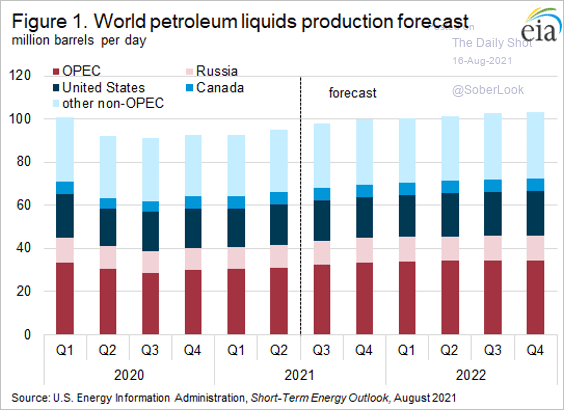

2. Here is the US government’s forecast for petroleum liquids production.

Source: EIA

Source: EIA

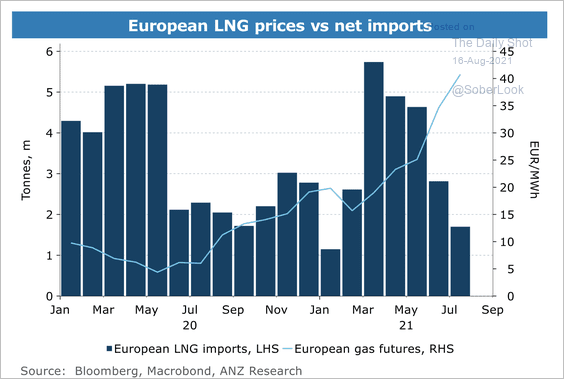

3. Severe tightness in LNG supply is keeping European imports low, which contributes to surging gas prices.

Source: ANZ Research

Source: ANZ Research

Back to Index

Equities

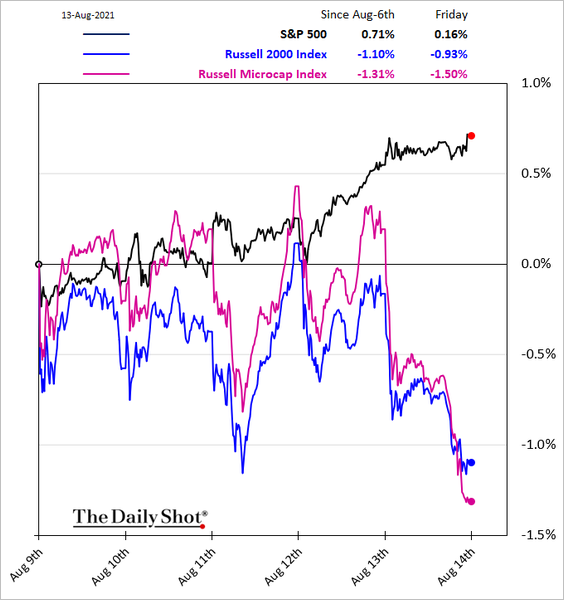

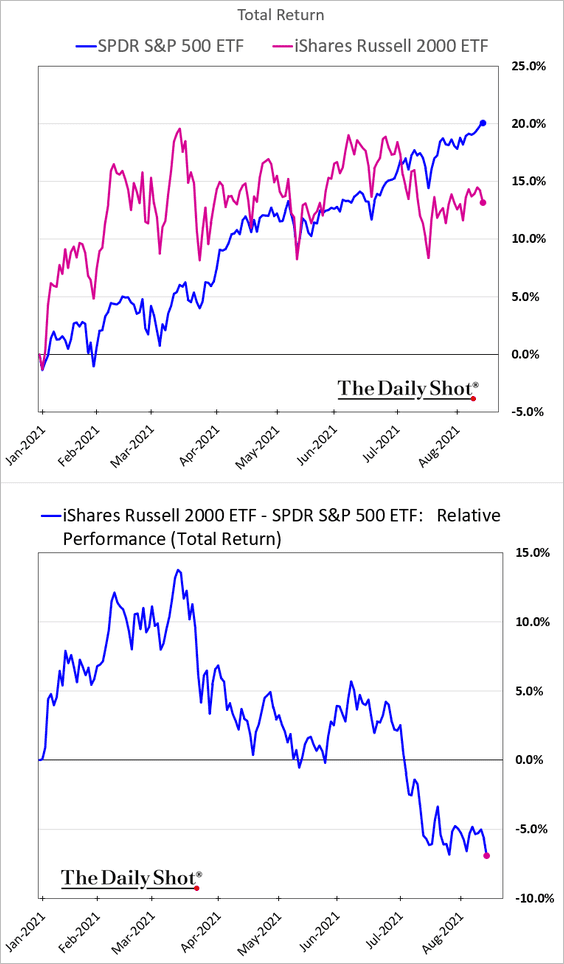

1. Small caps underperformed sharply last week.

Here is the year-to-date relative performance.

——————–

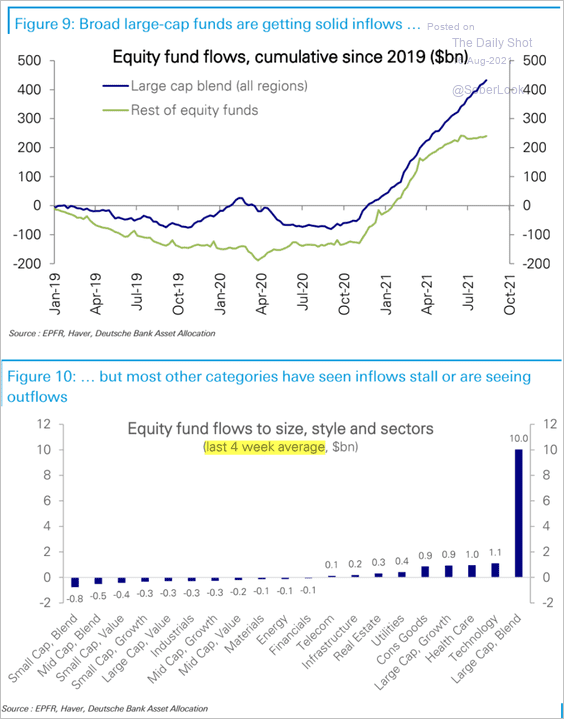

2. Large-cap funds have been dominating fund inflows recently.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

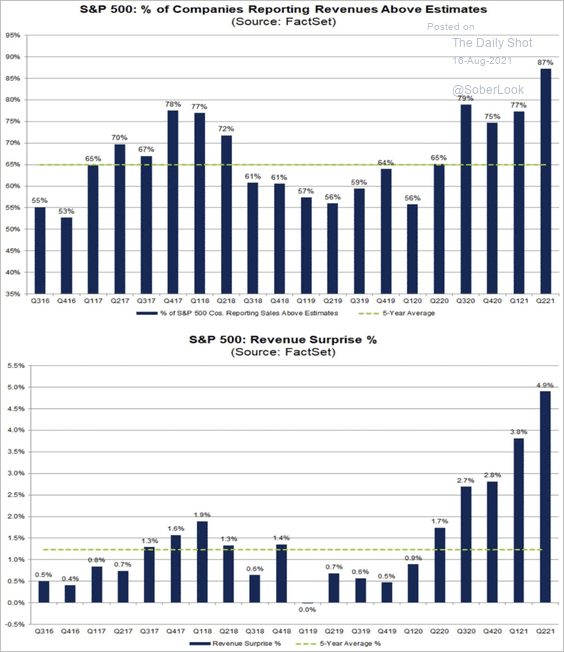

3. S&P 500 revenue surprises are hitting new records.

Source: @FactSet Read full article

Source: @FactSet Read full article

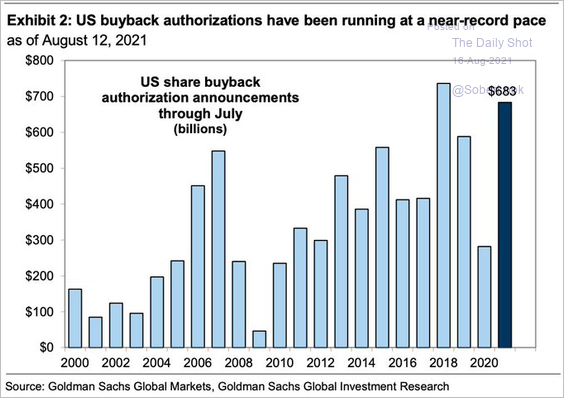

4. Share buyback activity is running at a near-record pace.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

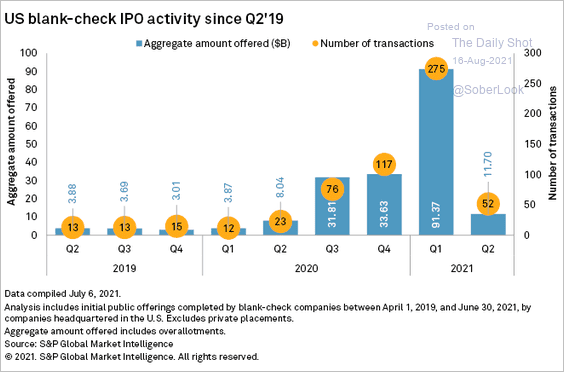

5. SPAC issuance cooled in the second quarter.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

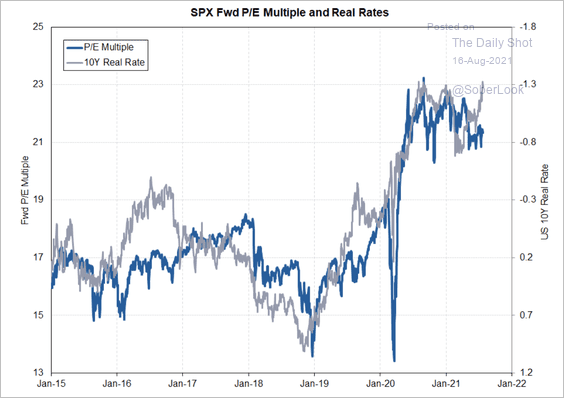

6. The decline in the 10-year Treasury real yield contributed to a higher S&P 500 price-to-earnings ratio.

Source: III Capital Management

Source: III Capital Management

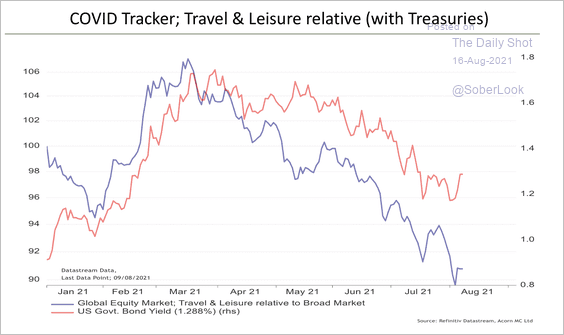

7. The underperformance of travel and leisure stocks has coincided with a decline in Treasury yields over the past few months.

Source: Acorn Macro Consulting

Source: Acorn Macro Consulting

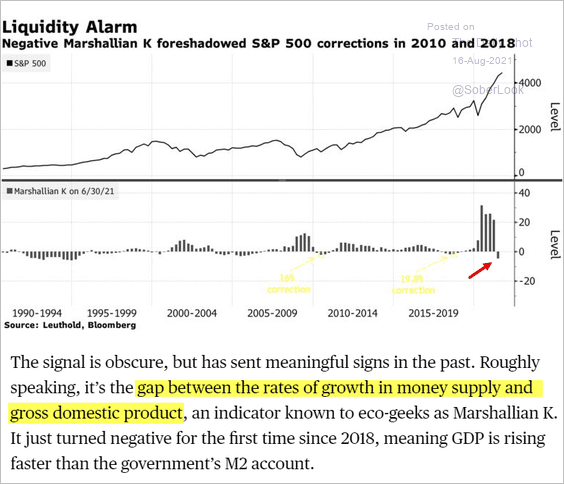

8. Should investors be concerned about a negative Marshallian K?

Source: @markets Read full article

Source: @markets Read full article

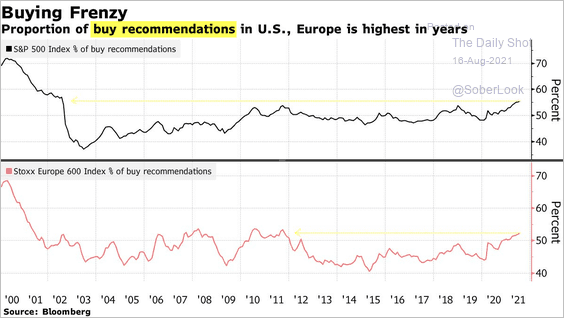

9. Equity analysts haven’t been this optimistic in years.

Source: @markets Read full article

Source: @markets Read full article

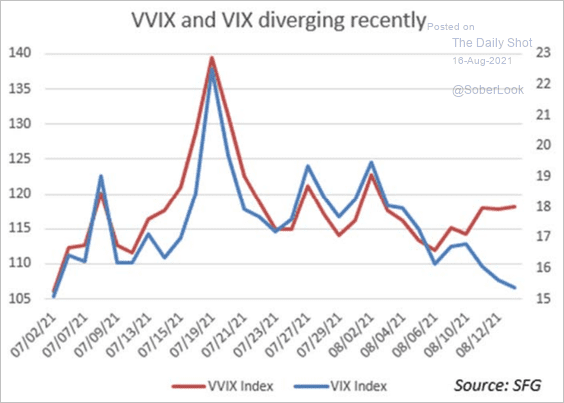

10. VVIX (vol of vol) has diverged from VIX. Traders are buying call options on VIX as a hedge against a market downturn.

Source: Chris.L.Murphy

Source: Chris.L.Murphy

Back to Index

Alternatives

1. Here is a look at alternative investment performance between 1999 and 2018.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

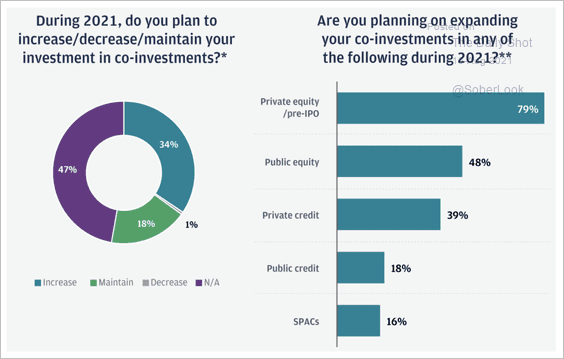

2. Roughly one-third of investors plan to increase their exposure to co-investments this year, according to a survey by JPMorgan.

Source: JP Morgan, h/t Zoetrope of Finance

Source: JP Morgan, h/t Zoetrope of Finance

3. GP-led secondary transaction volumes have increased over the past few years.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

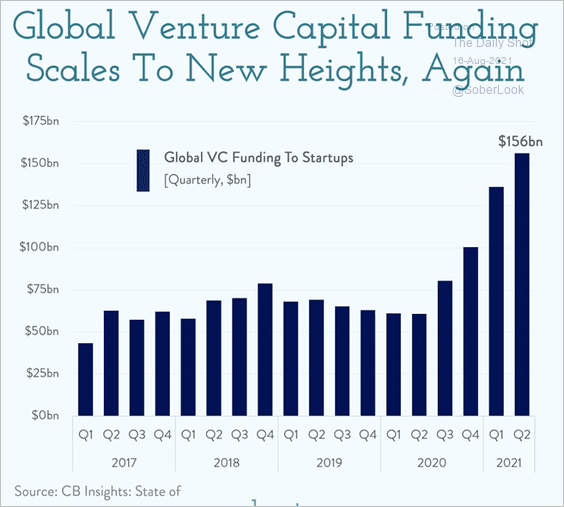

4. VC funding hit a new record last quarter.

Source: @chartrdaily

Source: @chartrdaily

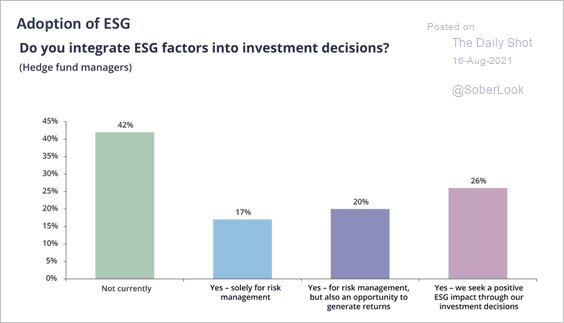

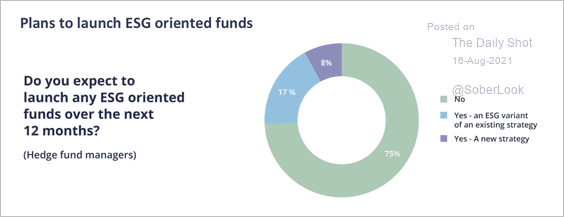

5. Nearly half of hedge fund managers surveyed by AIMA do not factor ESG into their investment decisions…

Source: AIMA, h/t Zoetrope of Finance Read full article

Source: AIMA, h/t Zoetrope of Finance Read full article

…and most have no plans to launch ESG oriented funds over the next 12 months.

Source: AIMA, h/t Zoetrope of Finance Read full article

Source: AIMA, h/t Zoetrope of Finance Read full article

——————–

6. Global hedge funds’ assets under management have grown steadily.

Source: BofA Global Research, h/t Zoetrope of Finance

Source: BofA Global Research, h/t Zoetrope of Finance

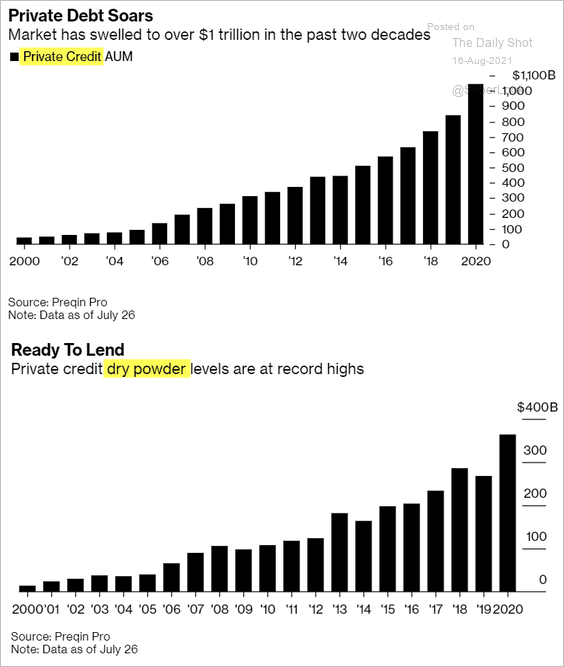

7. Private credit funds’ assets and dry powder have been surging in recent years.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Credit

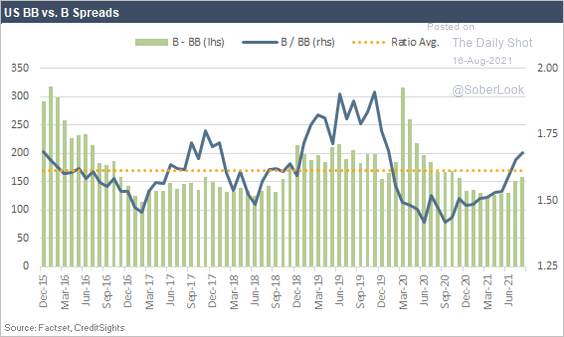

1. The ratio of B-rated and BB-rated bond spreads has turned higher, as some caution returns into the credit markets.

Source: CreditSights

Source: CreditSights

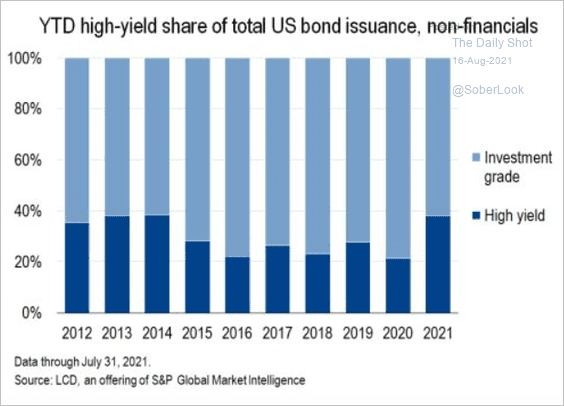

2. The high-yield share of US corporate bond issuance hit a multi-year high this year.

Source: @lcdnews, @JakemaLewis Read full article

Source: @lcdnews, @JakemaLewis Read full article

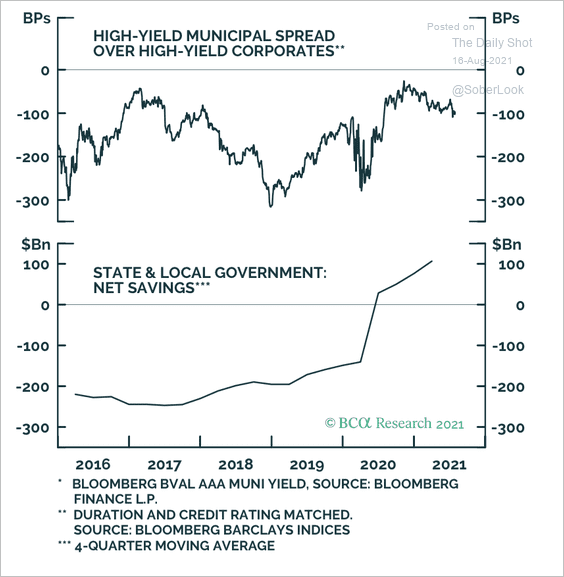

3. High-yield muni spreads declined relative to high-yield corporates as state and local government net savings turned positive.

Source: BCA Research

Source: BCA Research

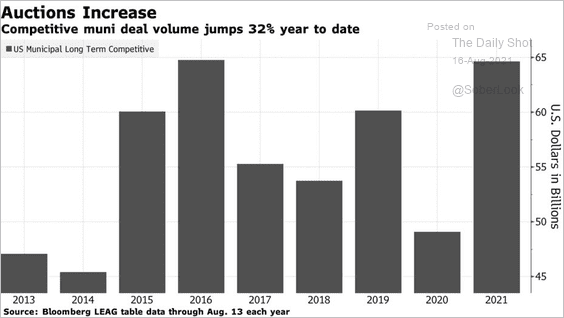

4. More muni debt has been sold through competitive auctions this year amid strong investor demand.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

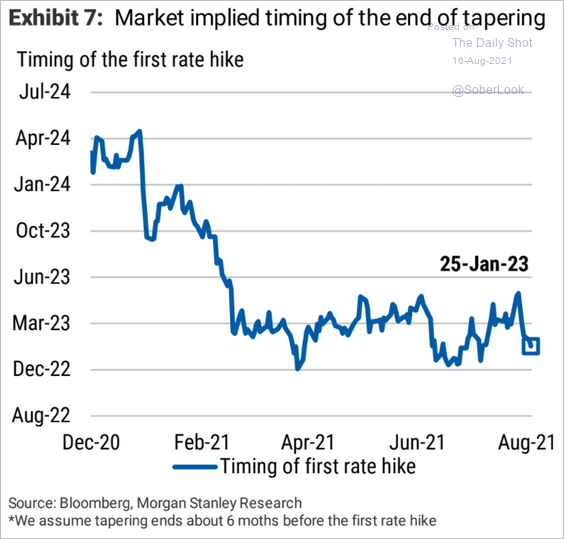

1. Markets expect the Fed’s taper to be completed at the beginning of 2023.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

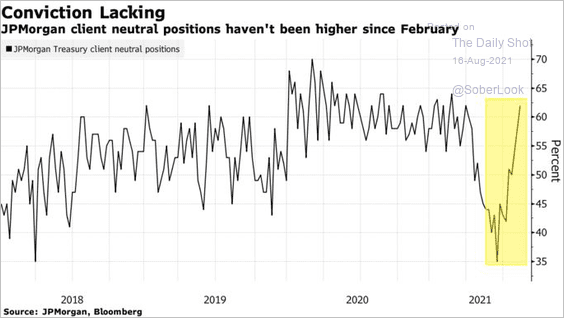

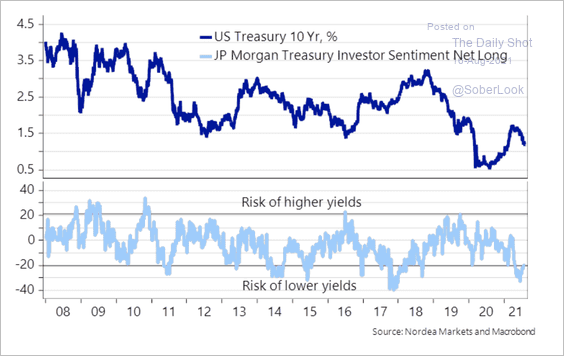

2. JP Morgan’s clients are increasingly neutral on Treasuries.

Source: @markets Read full article

Source: @markets Read full article

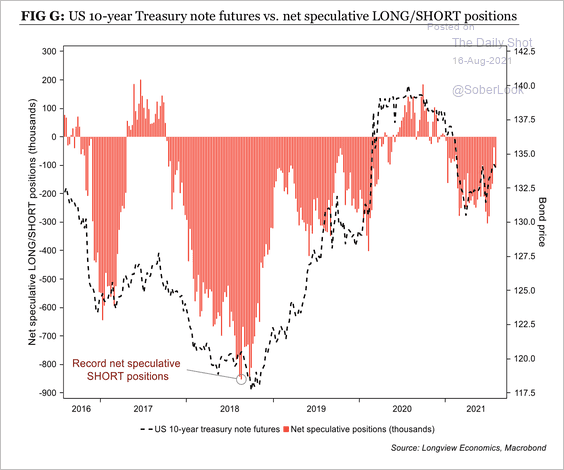

3. Treasury positioning is still net short despite the recent squeeze (2 charts).

Source: Nordea Markets

Source: Nordea Markets

Source: Longview Economics

Source: Longview Economics

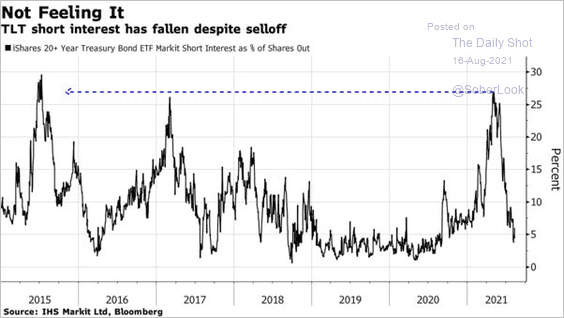

4. This chart shows short interest in the iShares 20+ Year Treasury ETF (TLT).

Source: @markets Read full article

Source: @markets Read full article

——————–

5. Treasury issuance has been almost fully absorbed by QE over the past 90 days, and will likely continue, according to Nordea.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Global Developments

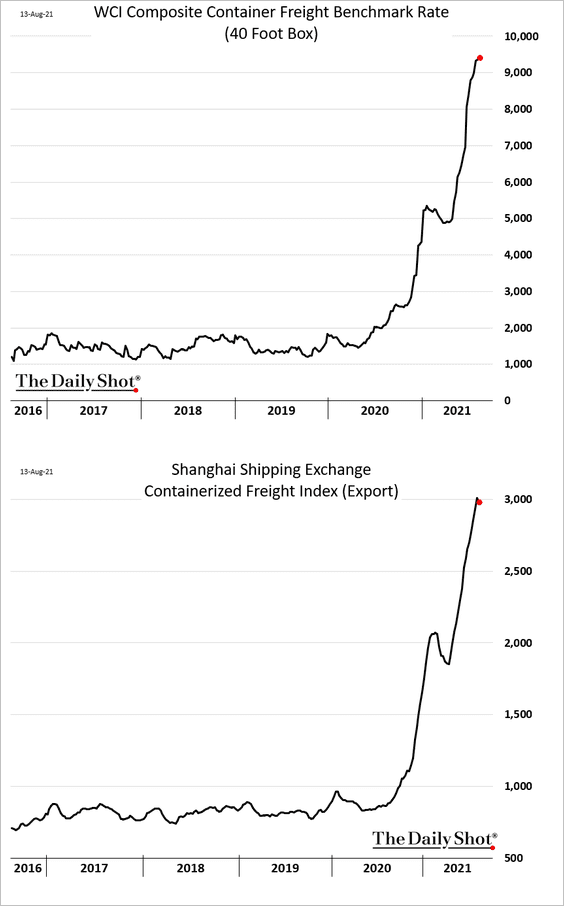

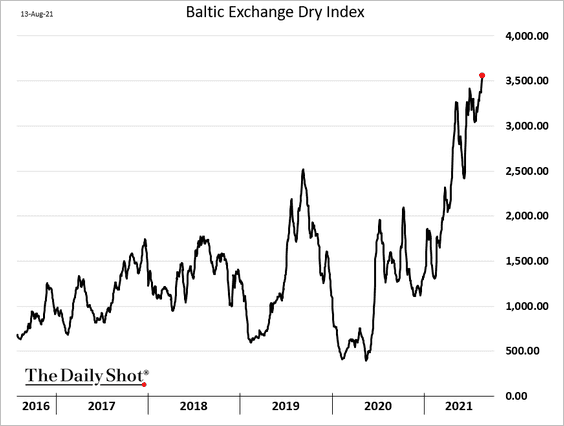

1. Gains in container rates appear to be slowing.

But dry bulk shipping costs hit a multi-year high last week.

——————–

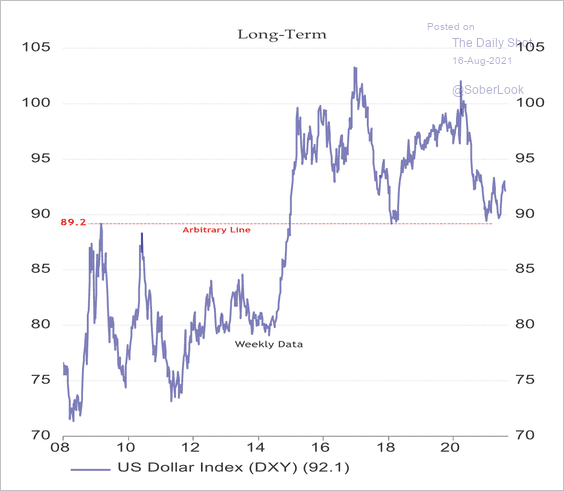

2. The dollar is holding long-term support.

Source: Acorn Macro Consulting

Source: Acorn Macro Consulting

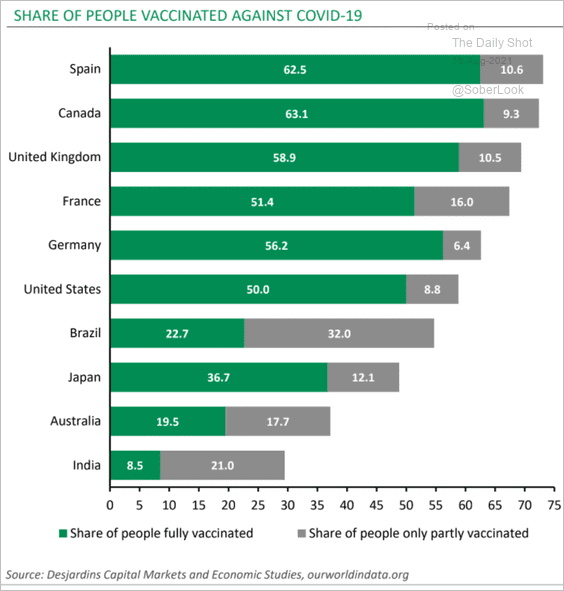

3. What percentage of each country’s population is vaccinated?

Source: Desjardins

Source: Desjardins

——————–

Back to Index

Food for Thought

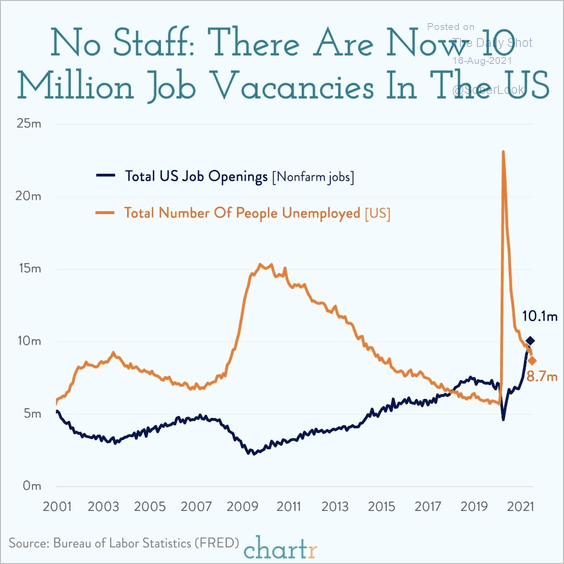

1. US job vacancies vs. the number of people unemployed:

Source: @chartrdaily

Source: @chartrdaily

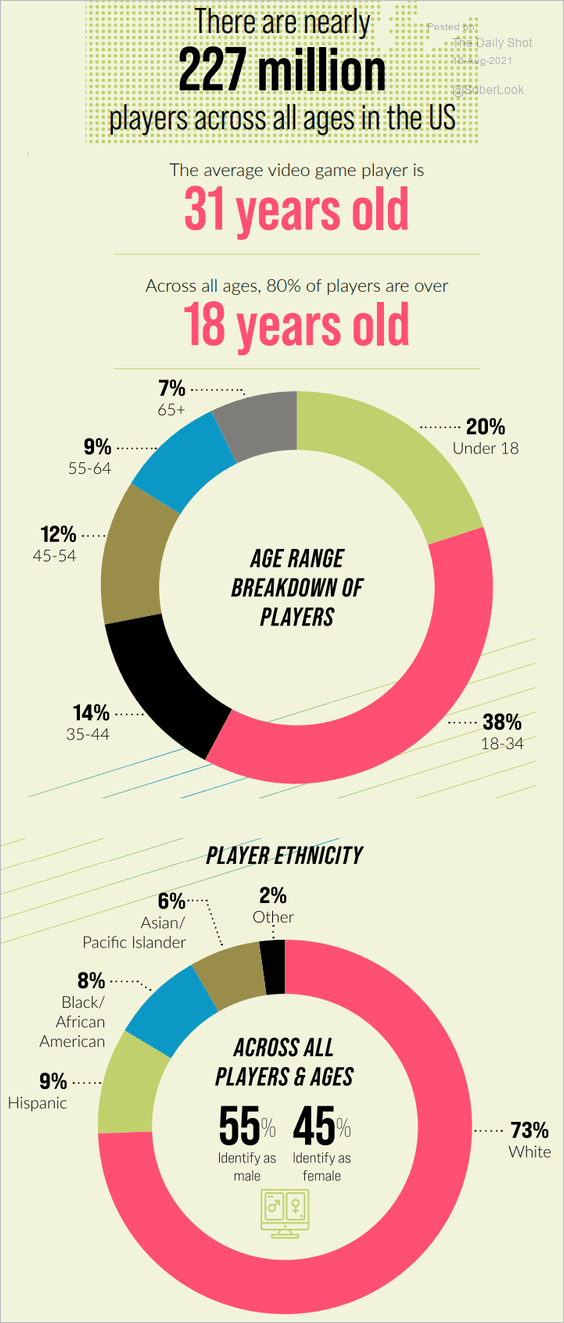

2. Video game player demographics:

Source: ESA Read full article

Source: ESA Read full article

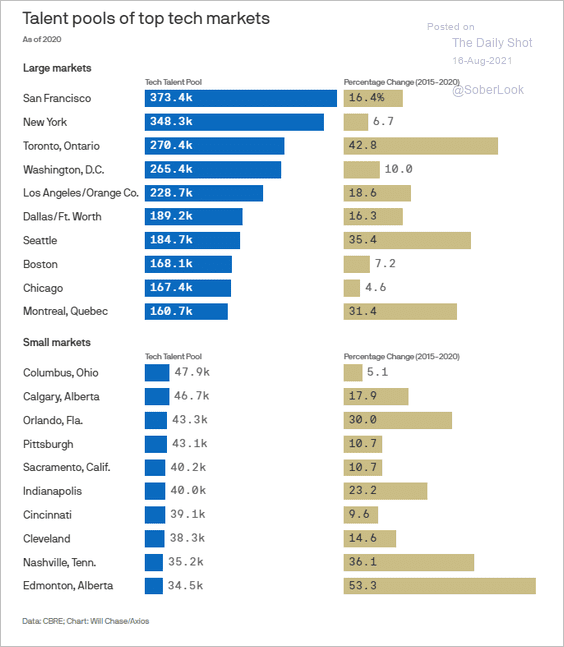

3. Talent pools of top tech markets:

Source: @axios Read full article

Source: @axios Read full article

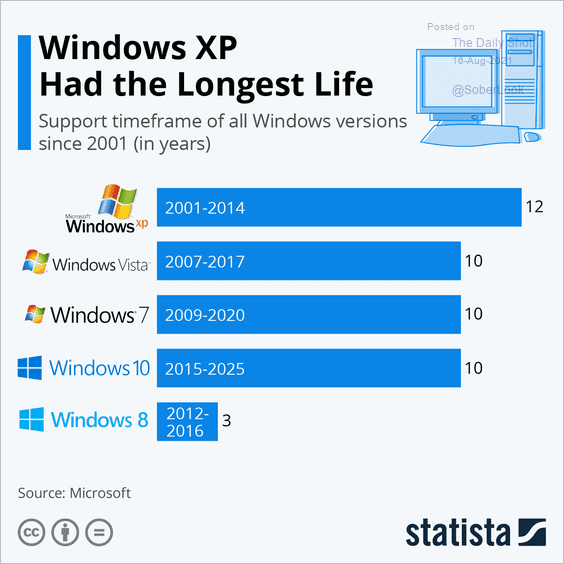

4. Support timeframes for Windows versions:

Source: Statista

Source: Statista

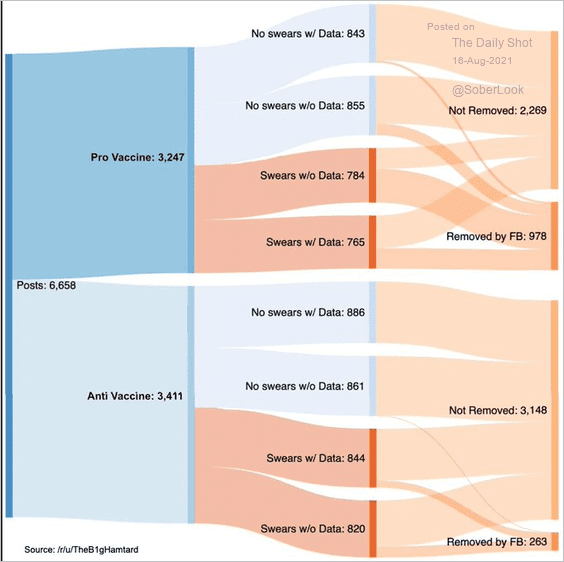

5. 200 fake Facebook accounts were created as part of an experiment. Half were posting pro-vaccine items, half were anti-vax. The chart shows how many were reported and removed by Facebook.

Source: @pkedrosky, u/TheB1gHamtard Read full article

Source: @pkedrosky, u/TheB1gHamtard Read full article

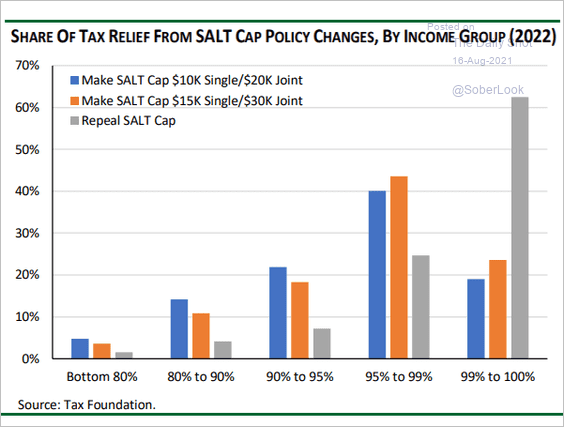

6. Share of tax relief from SALT cap policy changes:

Source: Cornerstone Macro

Source: Cornerstone Macro

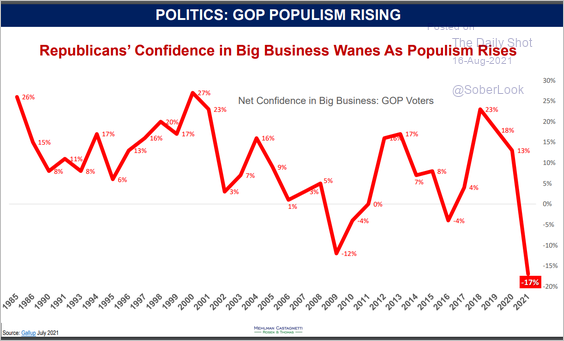

7. Republicans’ confidence in big business:

Source: Mehlman Castagnetti Rosen & Thomas Read full article

Source: Mehlman Castagnetti Rosen & Thomas Read full article

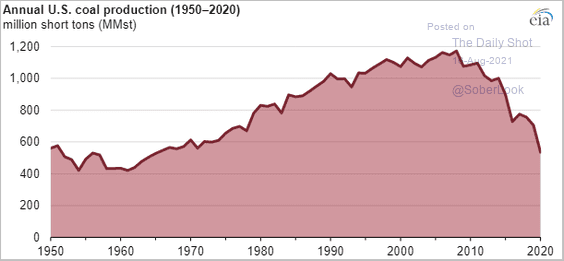

8. US coal production:

Source: @EIAgov Read full article

Source: @EIAgov Read full article

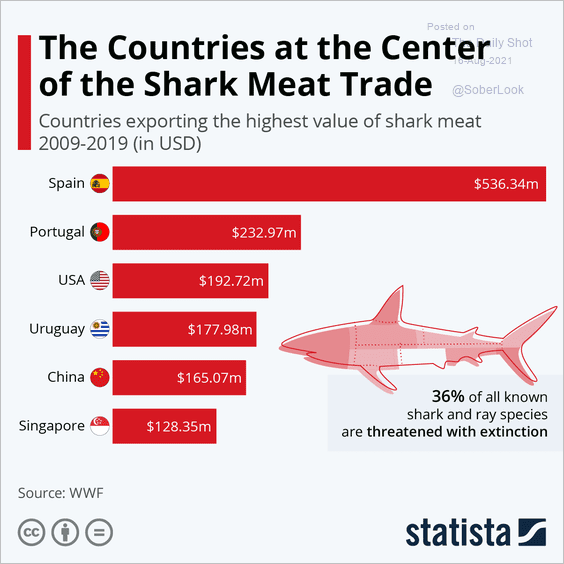

9. Shark meat exports:

Source: Statista

Source: Statista

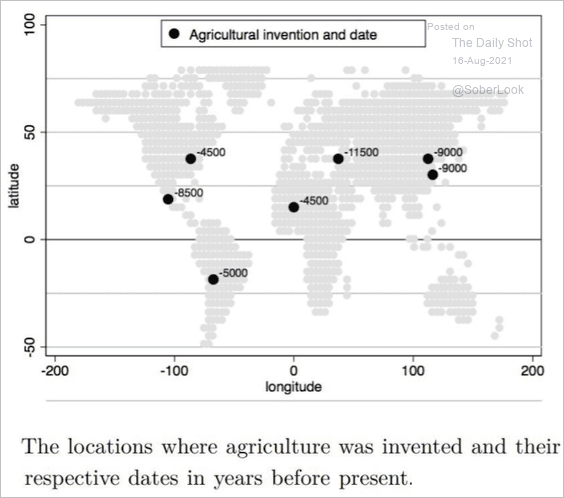

10. Centers of origin of agriculture:

Source: Andrea Matranga Read full article

Source: Andrea Matranga Read full article

——————–

Back to Index