The Daily Shot: 19-Aug-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

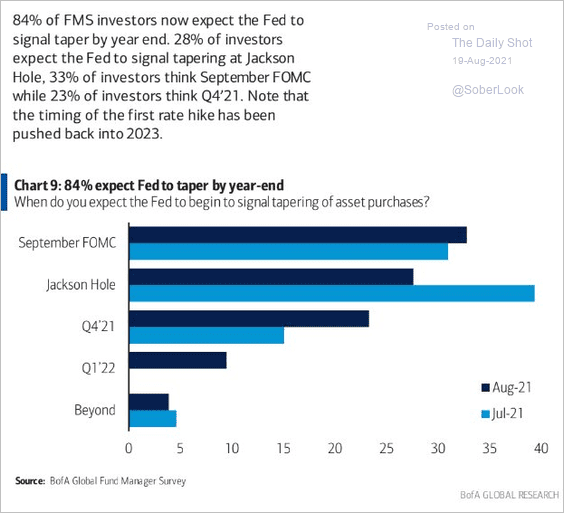

1. The Fed minutes showed increasing disagreements about the timing and the pace of tapering securities purchases. How close is the labor market to what the central bank officials called “substantial further progress”? Several FOMC members want to see a couple of additional employment reports, but it appears that the Fed may be ready to begin taper in the fourth quarter.

FOMC: – Most participants judged that the Committee’s standard of “substantial further progress” toward the maximum-employment goal had not yet been met. At the same time, most participants remarked that this standard had been achieved with respect to the price-stability goal. A few participants noted, however, that the transitory nature of this year’s rise in inflation, as well as the recent declines in longer-term yields and in market-based measures of inflation compensation, cast doubt on the degree of progress that had been made toward the price-stability goal since December. Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year because they saw the Committee’s “substantial further progress” criterion as satisfied with respect to the price-stability goal and as close to being satisfied with respect to the maximum-employment goal. Various participants commented that economic and financial conditions would likely warrant a reduction in coming months. Several others indicated, however, that a reduction in the pace of asset purchases was more likely to become appropriate early next year because they saw prevailing conditions in the labor market as not being close to meeting the Committee’s “substantial further progress” standard or because of uncertainty about the degree of progress toward the price-stability goal. Participants agreed that the Committee would provide advance notice before making changes to its balance sheet policy.

When will the Fed announce taper? Here is BofA’s survey of fund managers.

Source: BofA Global Research; @Saburgs

Source: BofA Global Research; @Saburgs

——————–

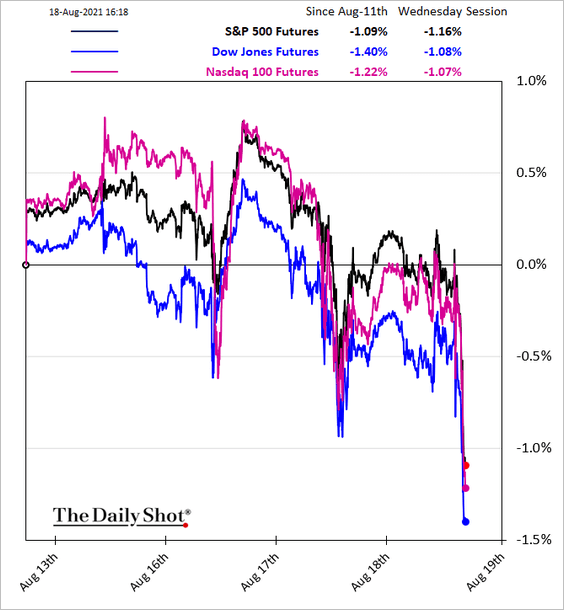

2. The stock market sold off in response to the Fed minutes.

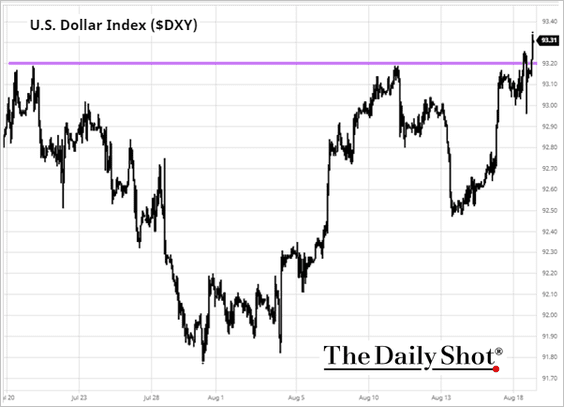

The dollar advanced.

Source: barchart.com

Source: barchart.com

——————–

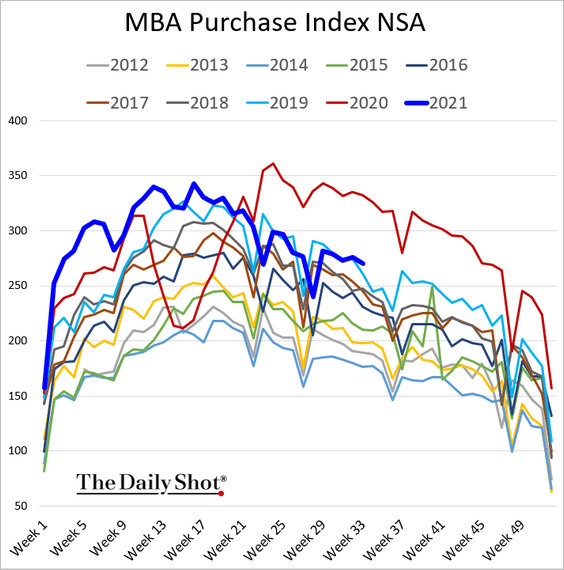

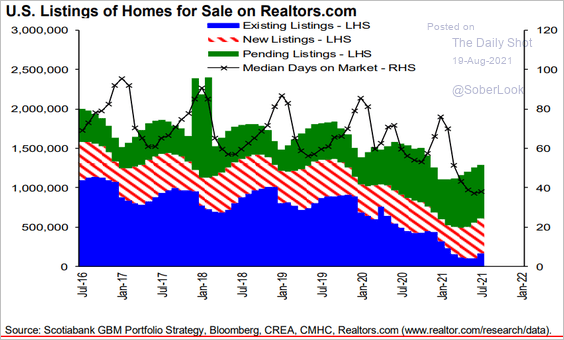

3. Next, we have some updates on the housing market.

• Mortgage applications remain robust (near 2019 levels).

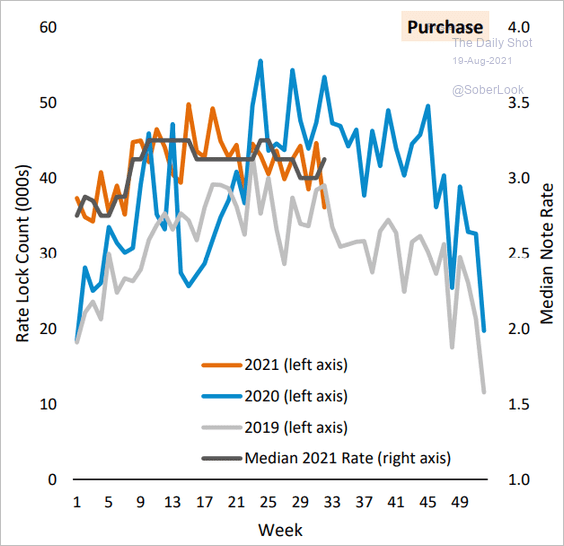

Rate locks declined.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

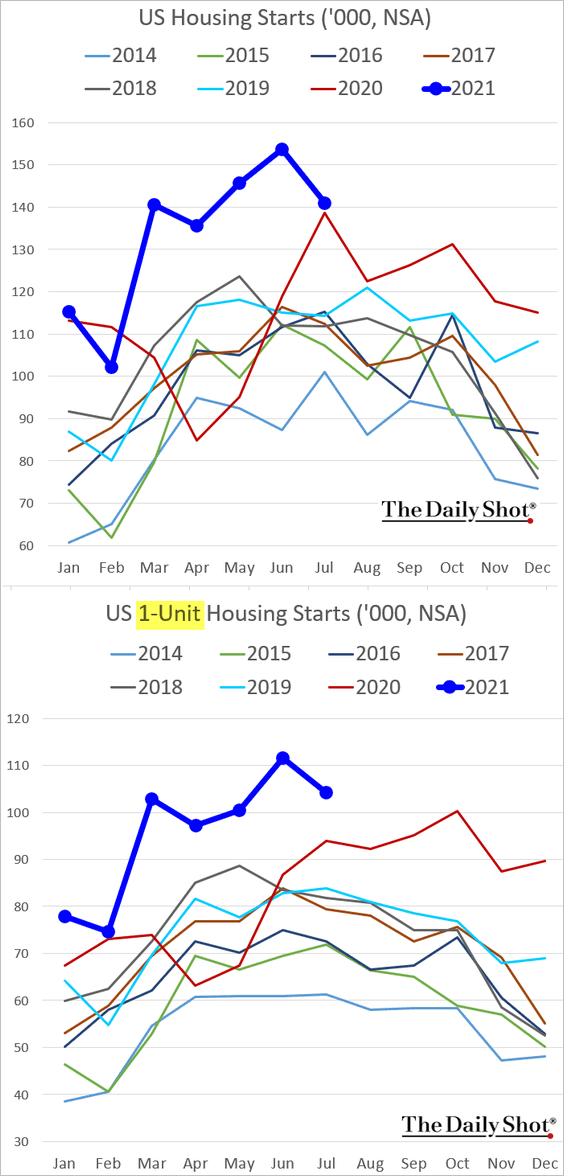

• July housing starts came in below market expectations. Nonetheless, residential construction activity remains at multi-year highs for this time of the year.

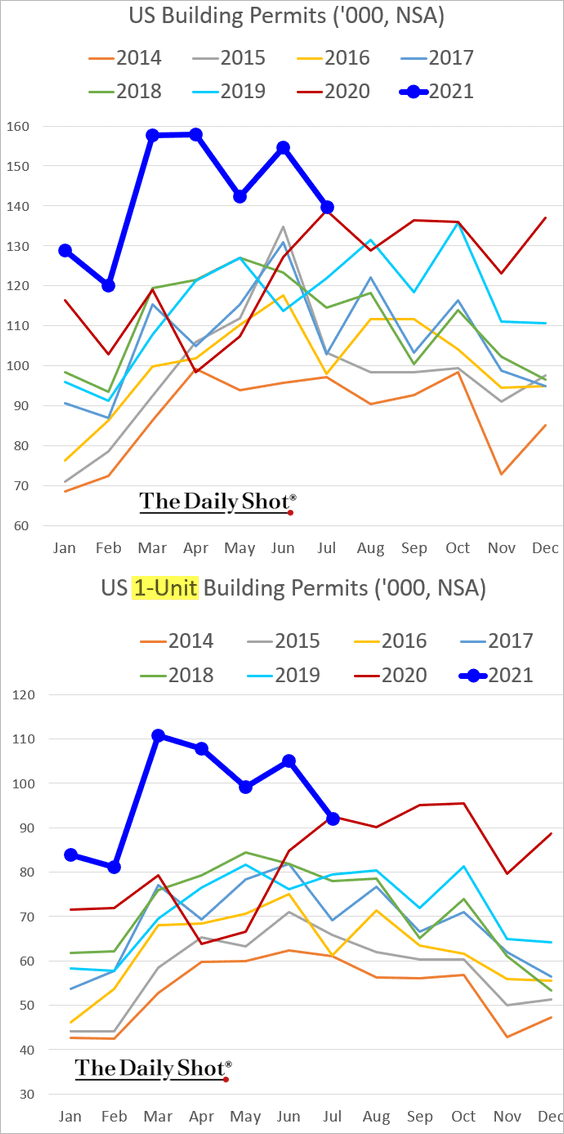

Building permits were roughly in line with forecasts.

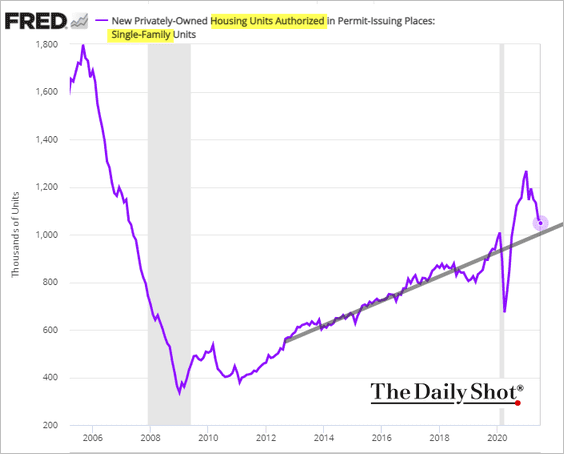

Single-family permits are approaching the pre-COVID trend.

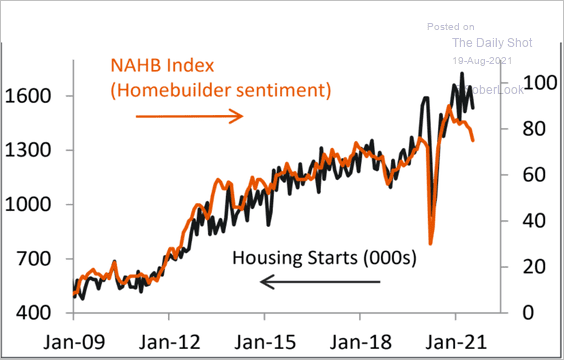

• Homebuilder sentiment suggests that housing starts could moderate further.

Source: Piper Sandler

Source: Piper Sandler

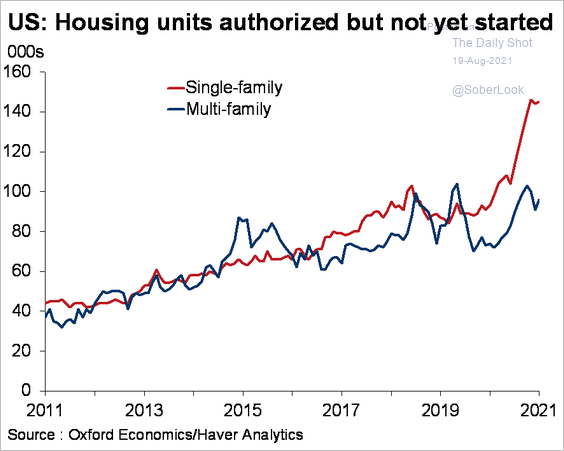

• Single-family units authorized but not yet started remain elevated.

Source: Oxford Economics

Source: Oxford Economics

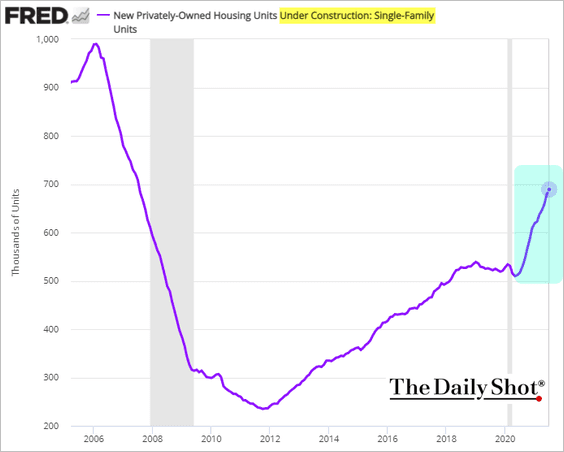

• The inventory of houses under construction continues to climb.

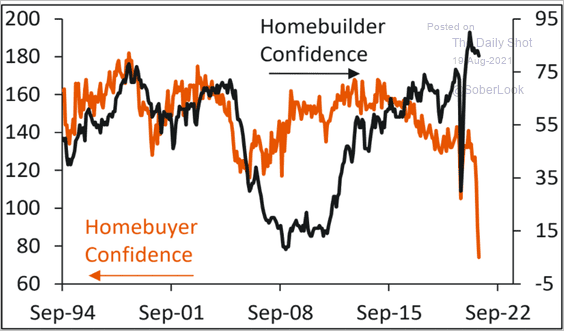

• There is a disconnect between homebuilder and homebuyer confidence.

Source: Piper Sandler

Source: Piper Sandler

• Existing housing inventories remain depressed.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

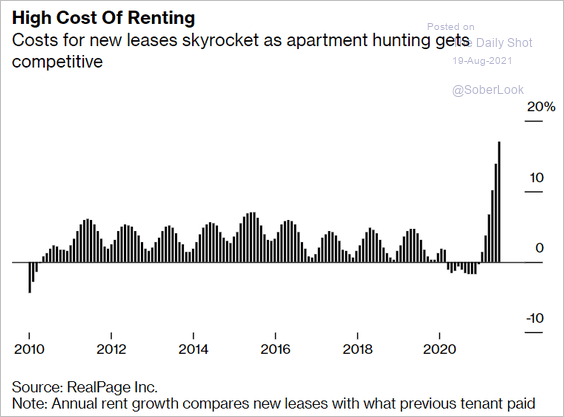

• Yesterday, we saw single-family (houses) rent increases quickening (chart). Apartment rents are surging as well.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

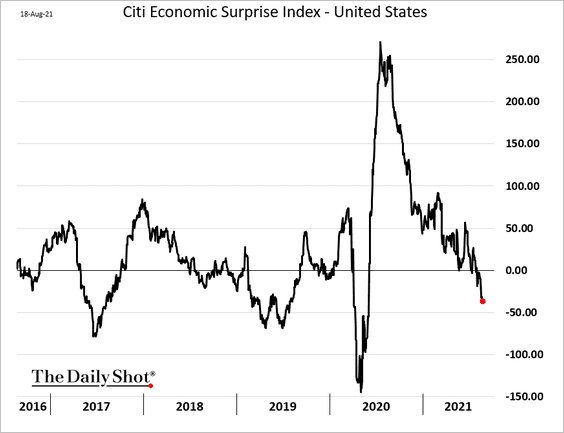

4. The Citi Economic Surprise Index continues to trend lower.

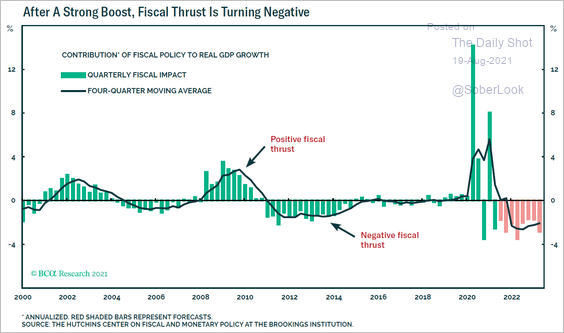

5. The fiscal thrust is turning negative.

Source: BCA Research

Source: BCA Research

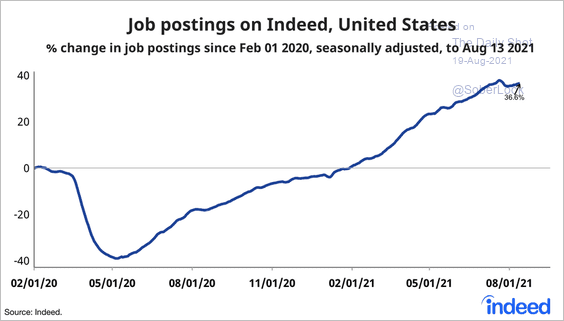

6. Job postings on Indeed are no longer rising but remain well above pre-COVID levels.

Source: @JedKolko, @indeed Read full article

Source: @JedKolko, @indeed Read full article

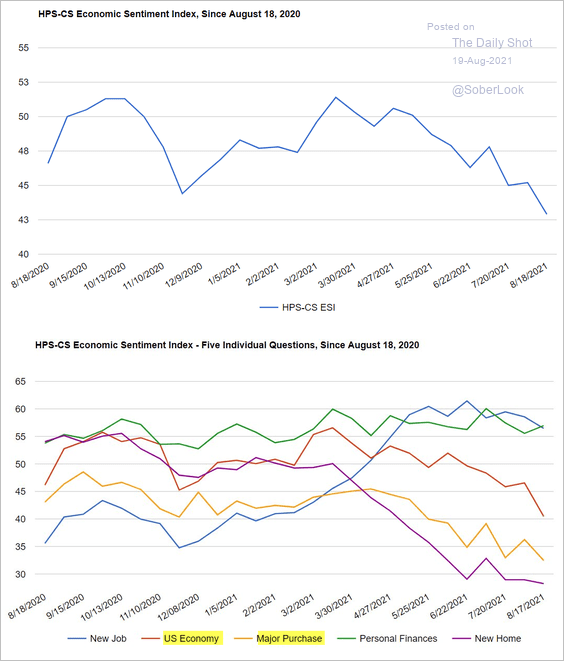

7. The HPS-CS consumer sentiment index confirmed the weakness we saw in the U. Michigan report.

Source: @HPS_CS Read full article

Source: @HPS_CS Read full article

Back to Index

Canada

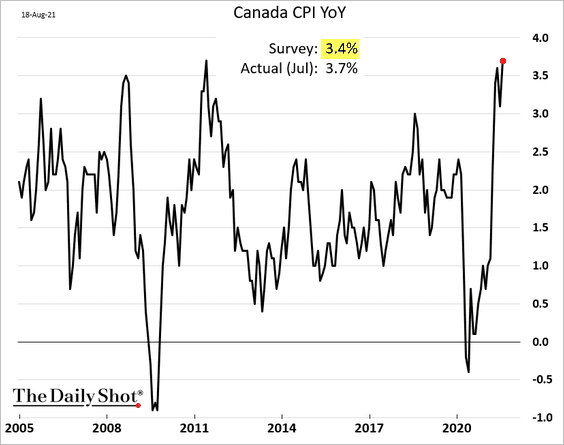

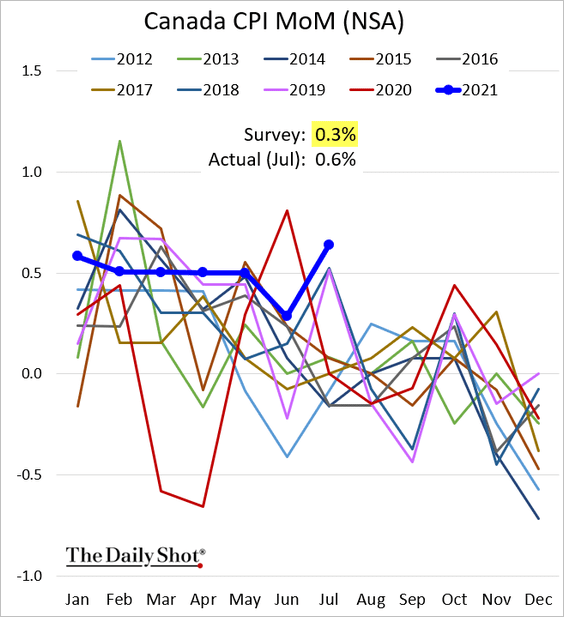

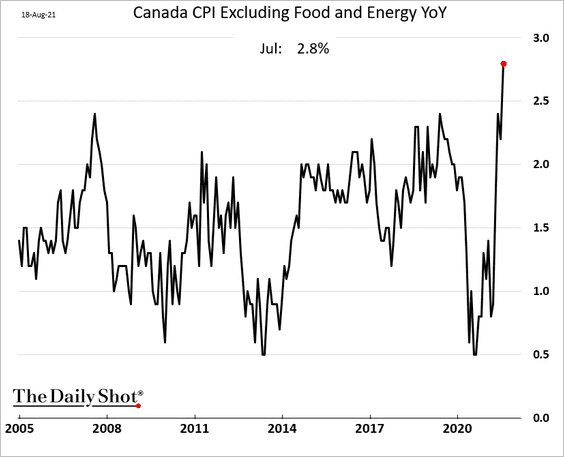

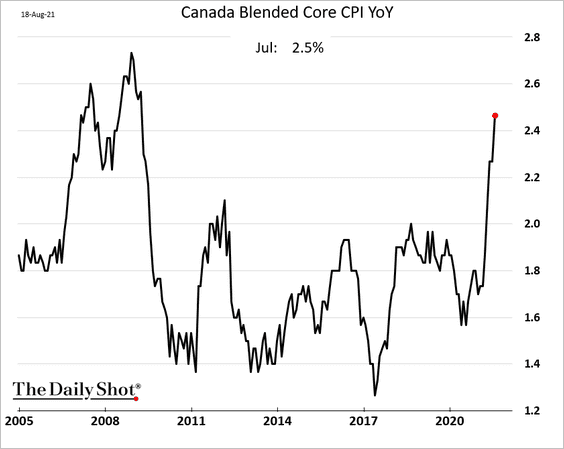

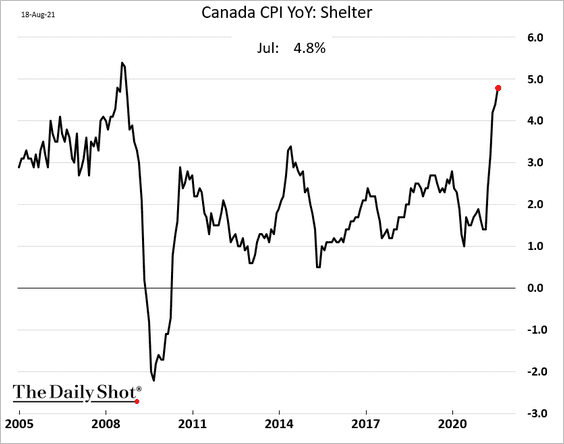

1. The CPI report was stronger than expected, boosted by shelter.

• Month-over-month gains in the CPI:

• CPI ex. food and energy:

• The blended core CPI:

• Shelter inflation:

Source: Better Dwelling Read full article

Source: Better Dwelling Read full article

——————–

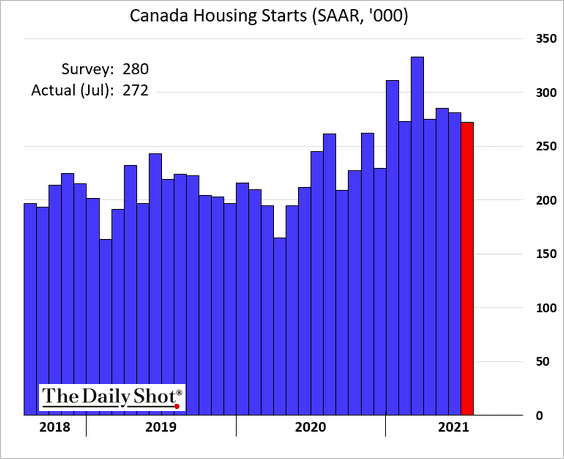

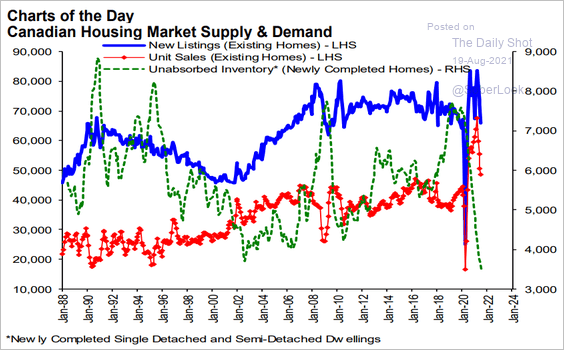

2. Housing starts remained robust in July.

This chart shows the housing market supply & demand dynamics.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

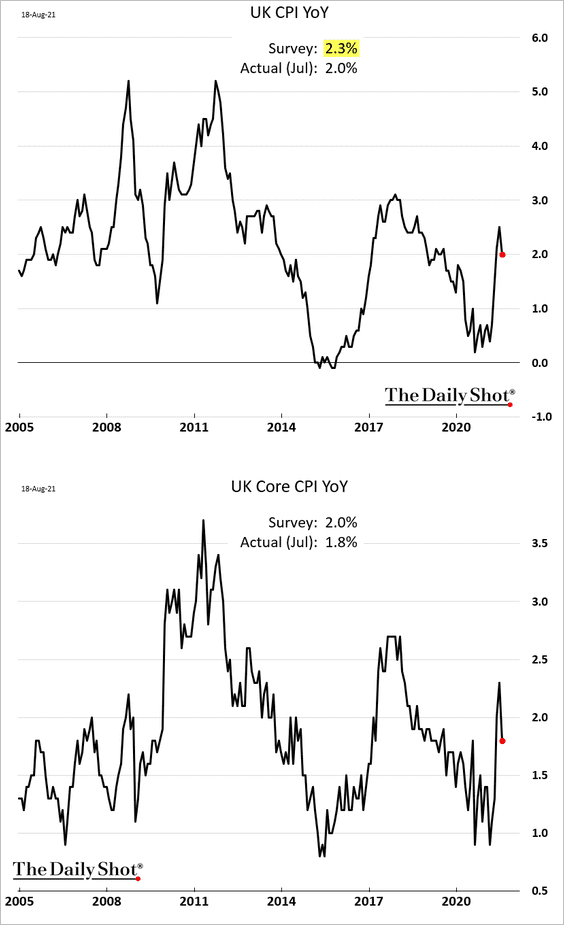

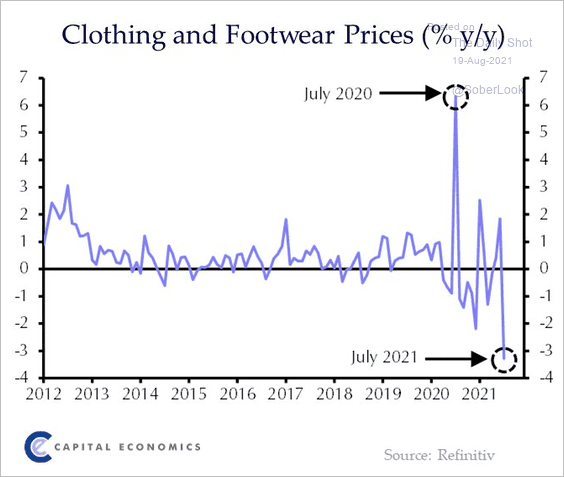

1. The CPI report surprised to the downside. Apparel inflation has been moderating.

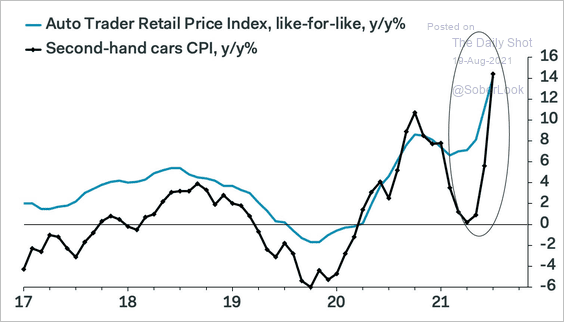

Used car inflation has caught up with AutoTrader’s data, and according to Pantheon Macroeconomics, there isn’t much room for further gains.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

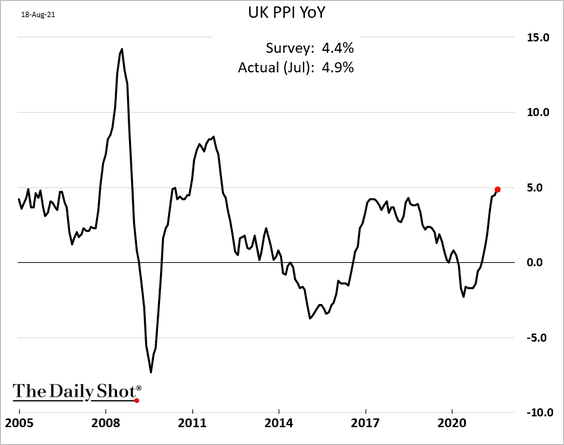

2. Producer price gains were stronger than expected.

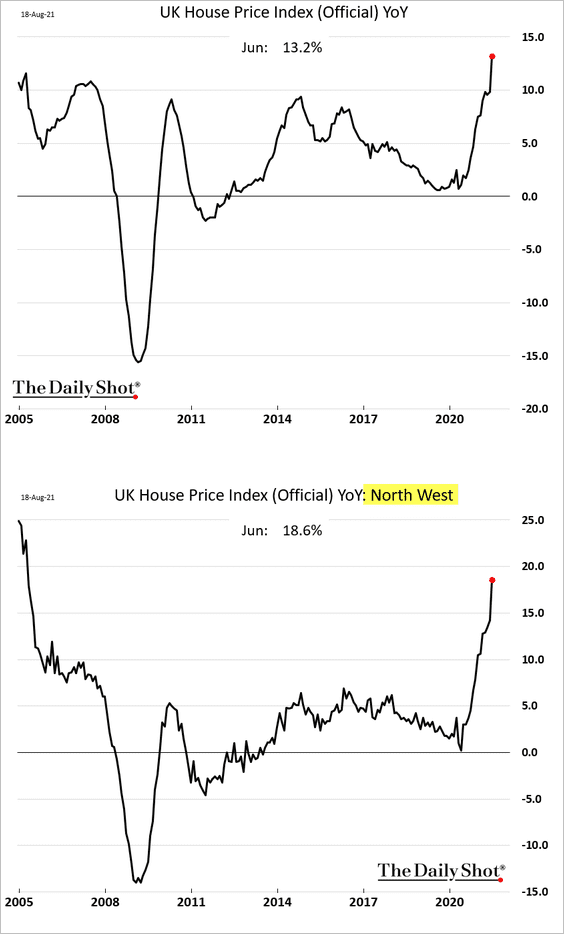

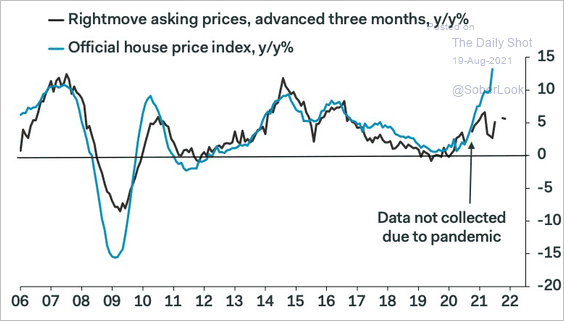

3. The official report on home prices showed housing appreciation hitting multi-year highs.

However, the Rightmove index points to a pullback in price gains.

Source: @G_Dickens11

Source: @G_Dickens11

Back to Index

The Eurozone

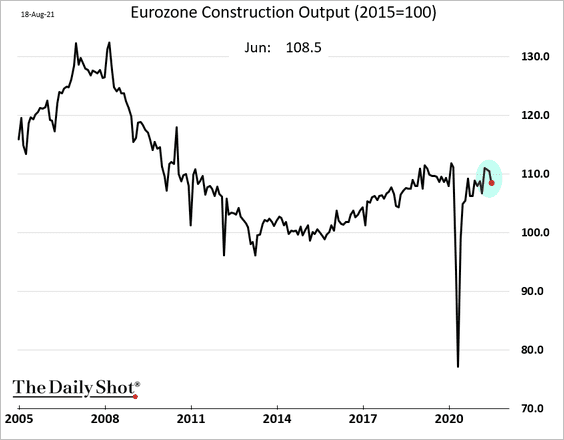

1. Construction output declined in June.

2. Global supply bottlenecks haven’t impacted goods inflation dramatically.

Source: @CapEconEurope Read full article

Source: @CapEconEurope Read full article

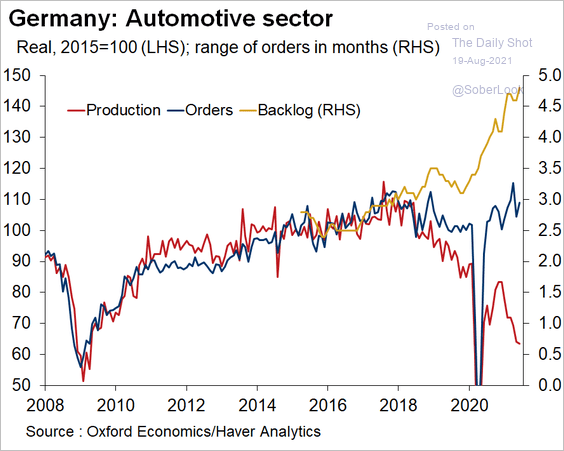

3. According to Oxford Economics, the German auto industry now has about five months’ worth of production to catch up on as backlogs balloon due to semiconductor shortages.

Source: @OliverRakau

Source: @OliverRakau

Back to Index

Europe

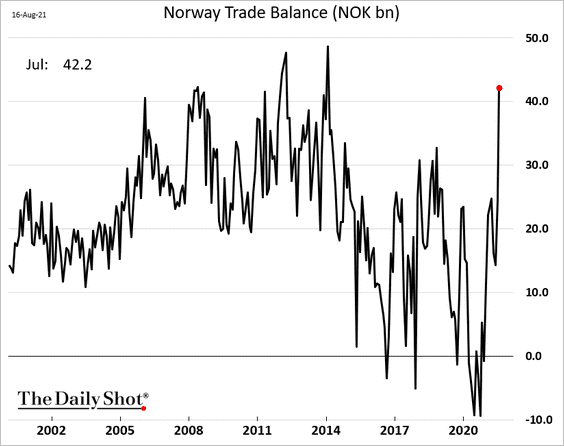

1. Norway’s trade surplus surged last month amid higher energy prices.

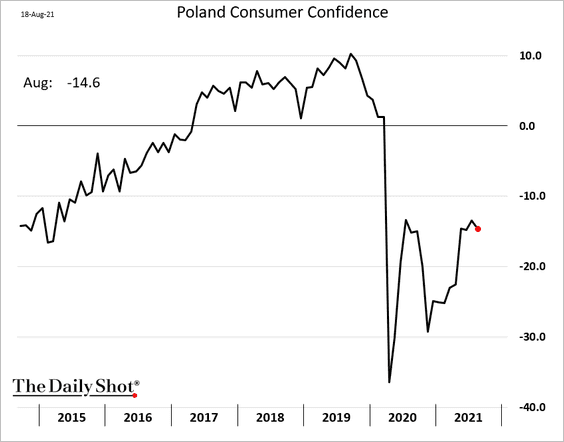

2. Poland’s consumer sentiment remains depressed.

Back to Index

Asia – Pacific

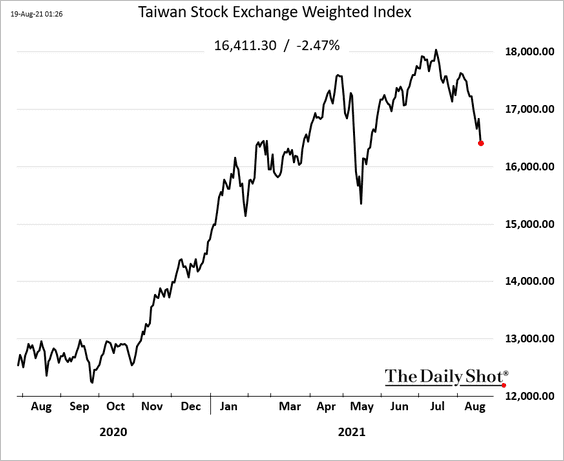

1. Taiwan’s stocks are rolling over.

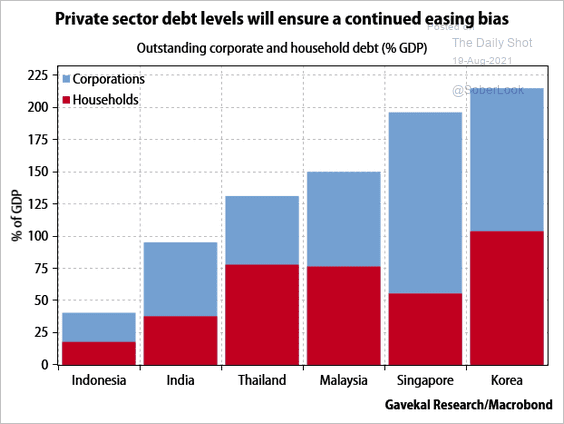

2. This chart shows private-sector debt levels.

Source: Gavekal Research

Source: Gavekal Research

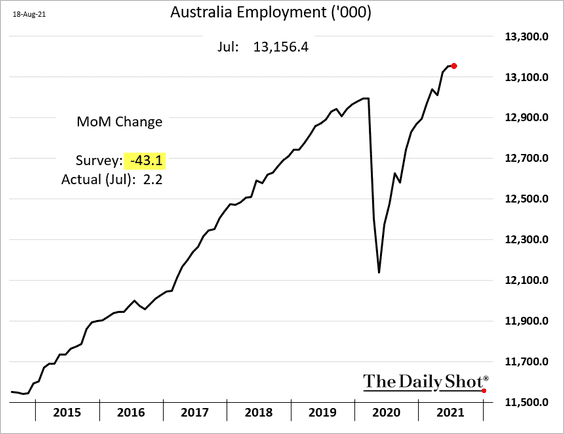

3. Australia’s employment report topped economists’ forecasts – again. The report showed modest job gains (a loss was expected). The lockdowns will likely have a bigger impact on the August report.

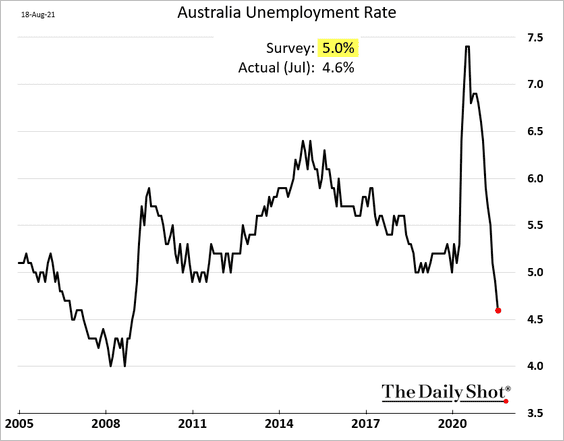

The unemployment rate dipped below 5% for the first time since 2008.

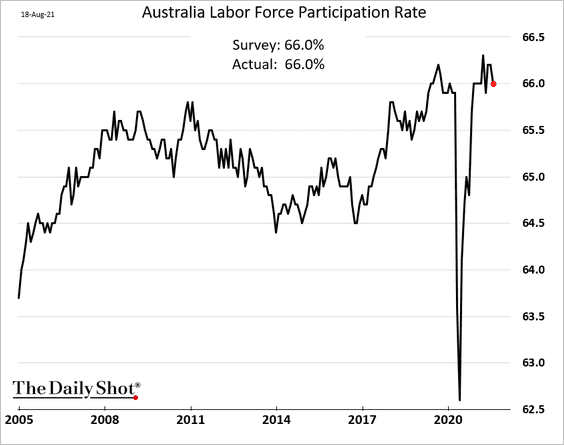

Labor force participation was in line with expectations.

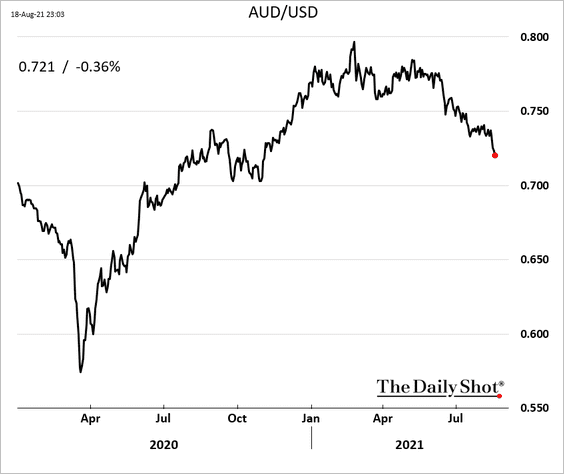

Nonetheless, the Aussie dollar remains under pressure as commodity prices slump.

<+>

Back to Index

China

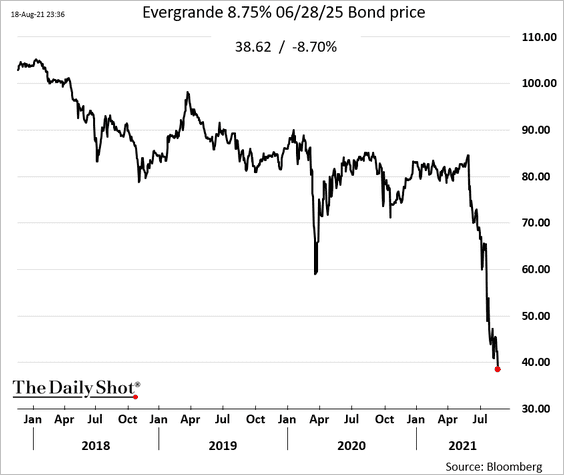

1. Evergrande’s bonds continue to tumble as the market prepares for restructuring. The dollar bonds will probably have a lower recovery rate than those denominated in CNY.

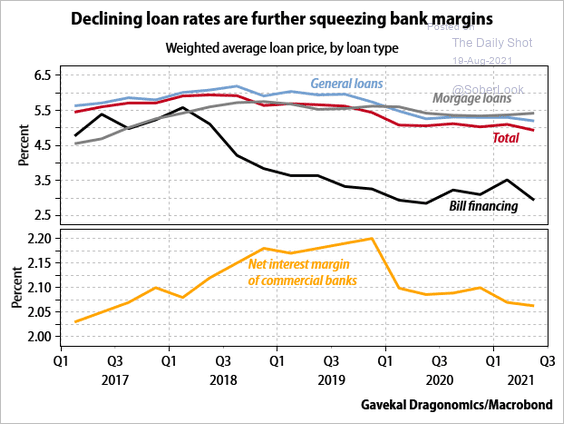

2. Bank margins have been trending lower.

Source: Gavekal Research

Source: Gavekal Research

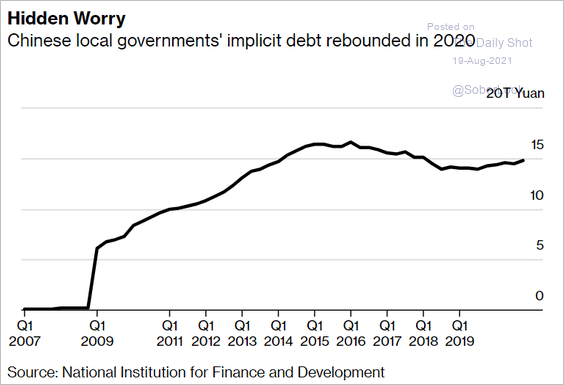

3. This chart shows local governments’ off-balance-sheet debt. Beijing is now focused on getting this debt under control.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

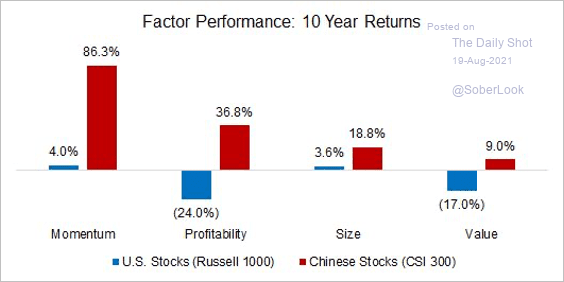

4. The momentum factor has outperformed over the past decade, especially relative to the US.

Source: FactorResearch

Source: FactorResearch

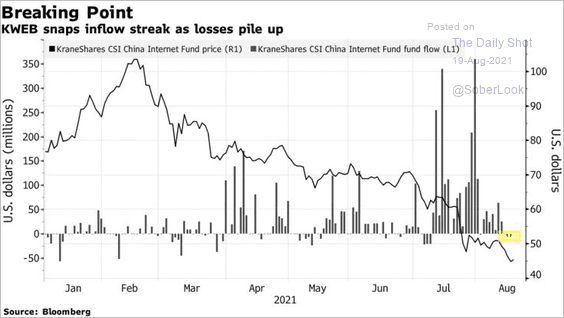

5. Flows into the KraneShares China Internet ETF have turned negative (dip-buying capitulation?).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

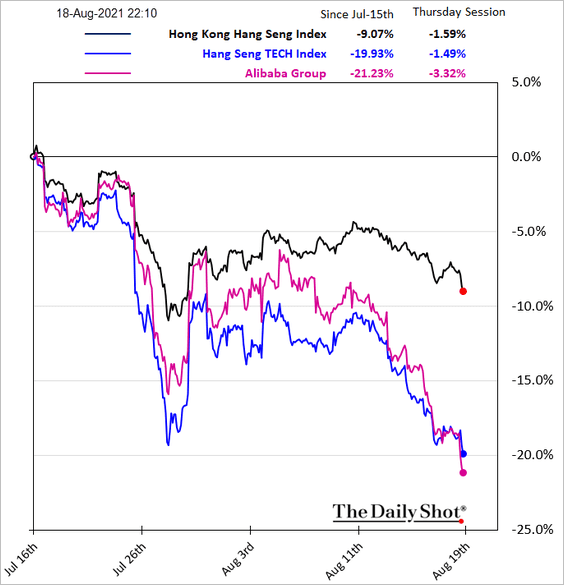

6. Stocks are heavy in Hong Kong today.

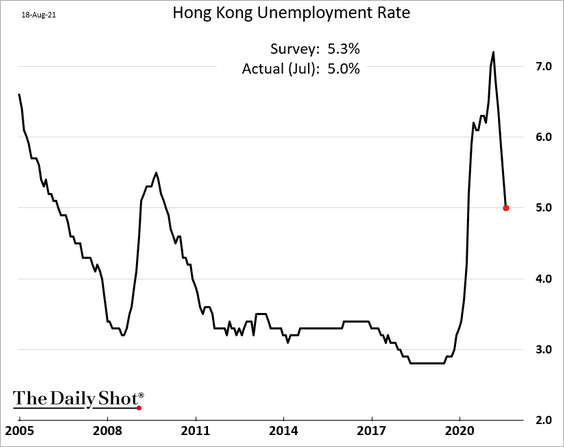

7. Hong Kong’s unemployment rate is falling.

Back to Index

Emerging Markets

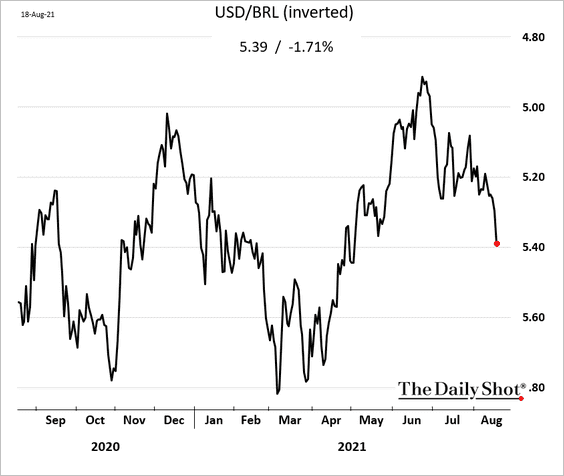

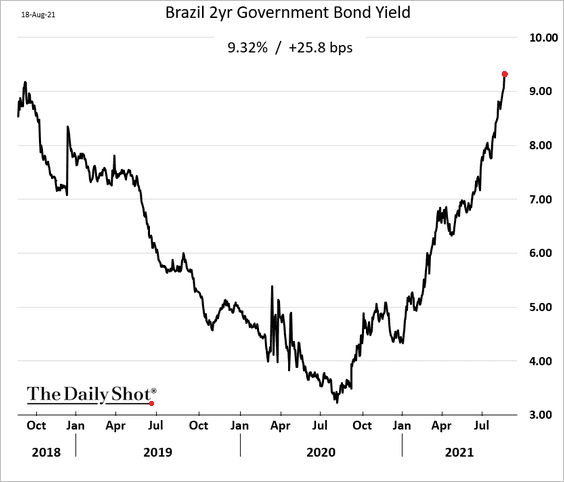

1. Brazil’s bonds and the currency are under pressure.

• The real:

• The 2yr yield:

• The yield curve:

——————–

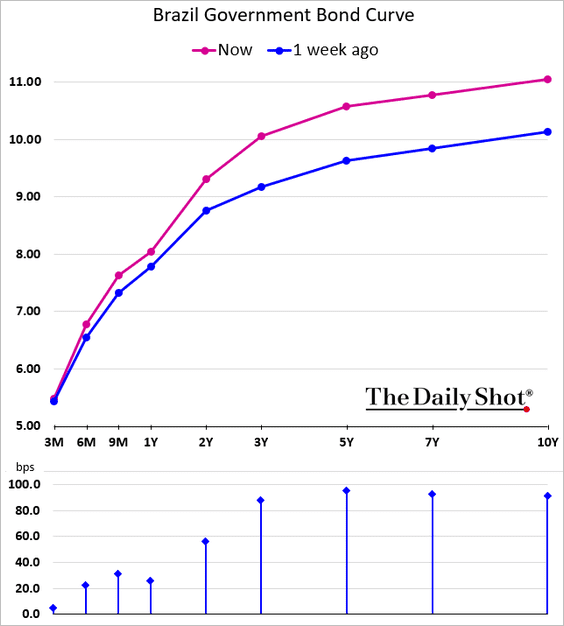

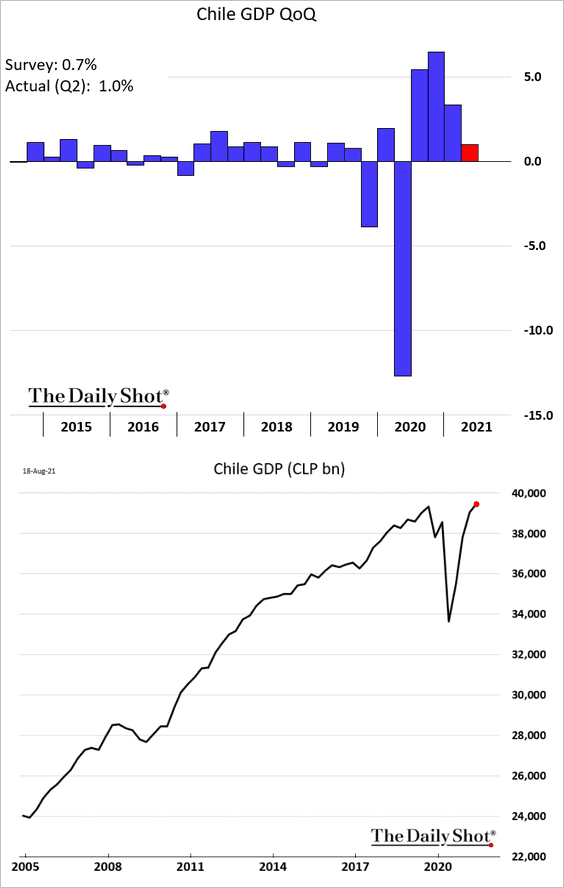

2. Chile’s GDP report was a bit stronger than expected.

3. Next, we have some updates on South Africa.

• The core CPI (below forecasts):

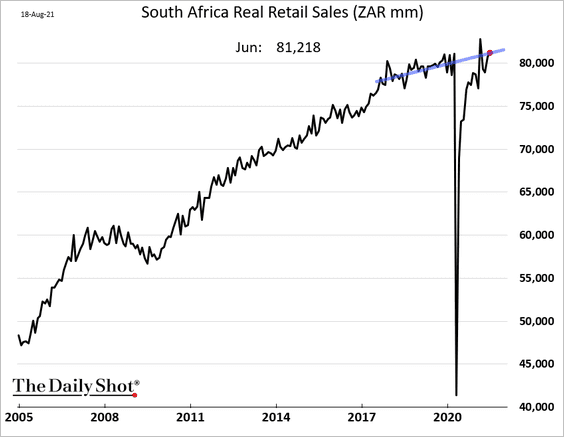

• Retail sales (back to the pre-COVID trend):

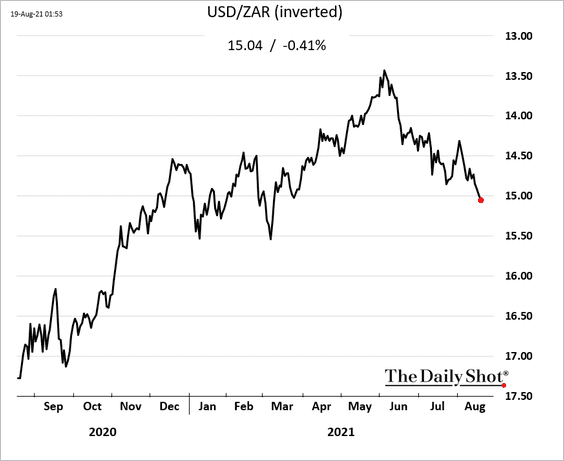

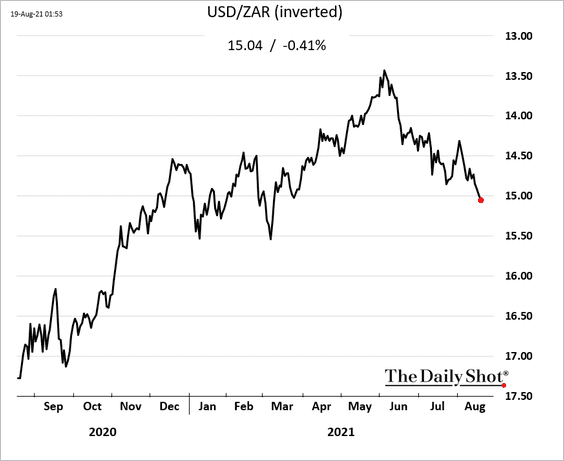

• The rand (weaker):

——————–

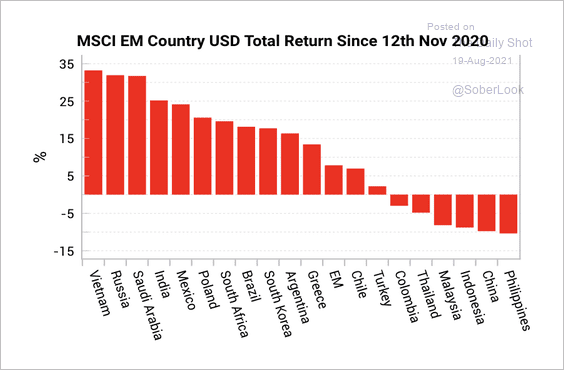

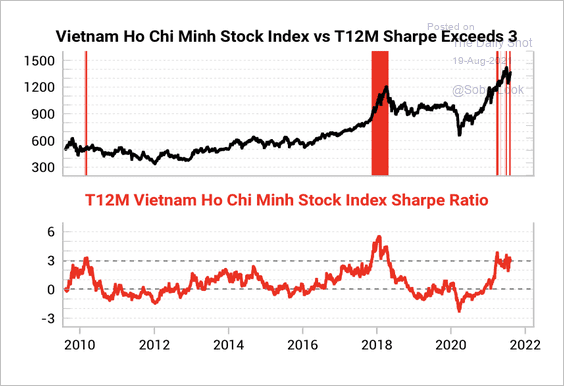

4. Vietnam and Russia have been among the best equity performers in dollar terms since November 2020.

Source: Variant Perception

Source: Variant Perception

The Sharpe ratio for the Vietnam stock index is near 2018 highs, which preceded a downturn.

Source: Variant Perception

Source: Variant Perception

——————–

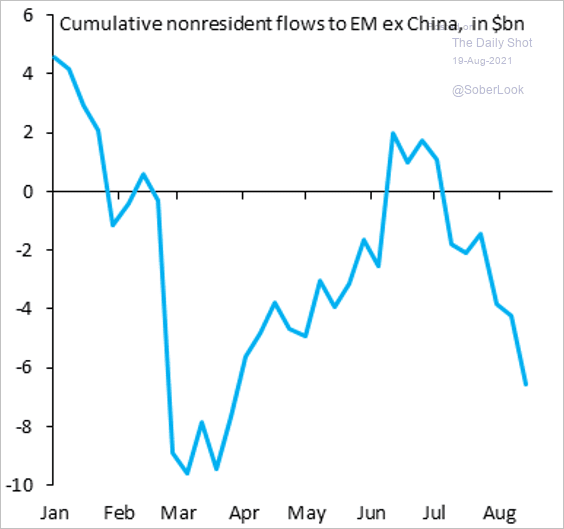

5. EM fund outflows appear to be accelerating.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

Back to Index

Cryptocurrency

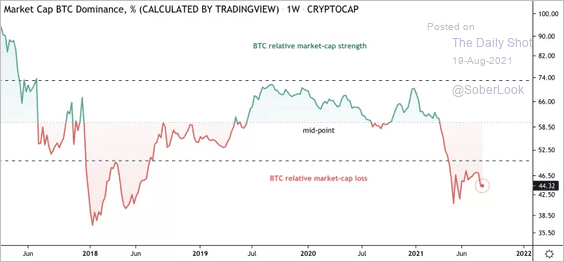

1. The market dominance of bitcoin, or the largest cryptocurrency’s value as a share of the overall market, declined to 44% over the past week. Altcoins such as ether, XRP, and Cardano took the lead.

Source: CoinDesk

Source: CoinDesk

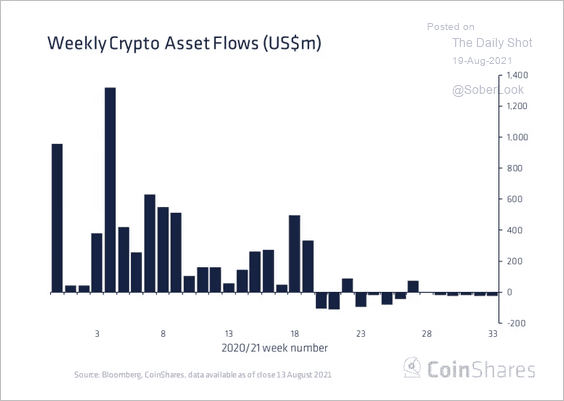

2. Digital-asset funds saw the sixth consecutive week of outflows despite the crypto rally.

Source: CoinShares

Source: CoinShares

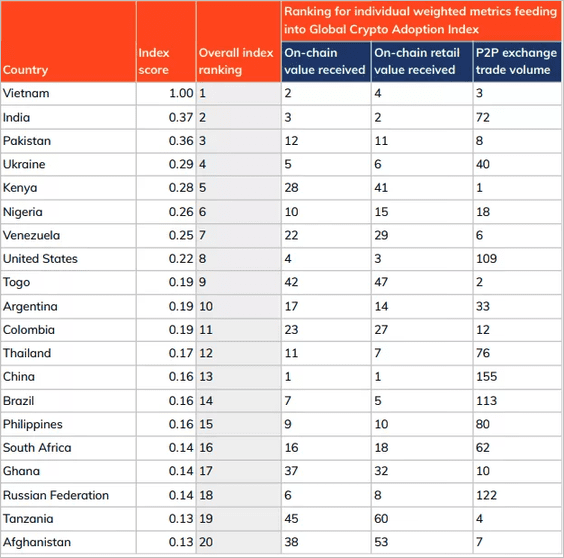

3. Which countries rank high in terms of crypto adoption?

Source: Chainalysis Read full article

Source: Chainalysis Read full article

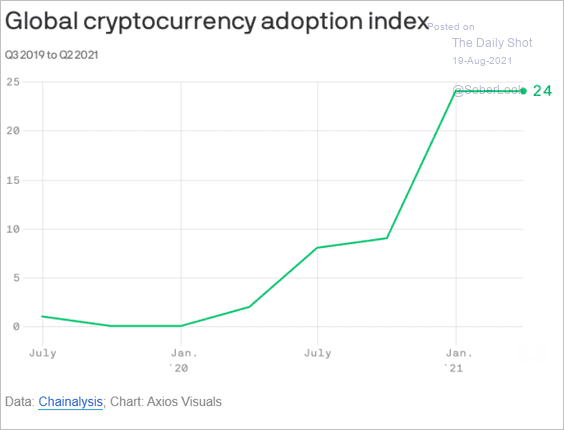

This chart shows the global crypto adoption index.

Source: @axios Read full article

Source: @axios Read full article

——————–

4. This looks sustainable …

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

Commodities

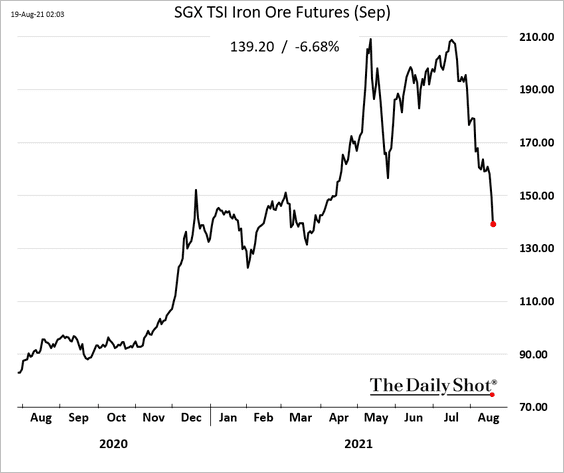

1. Iron ore futures are plummetting.

Source: @markets Read full article

Source: @markets Read full article

——————–

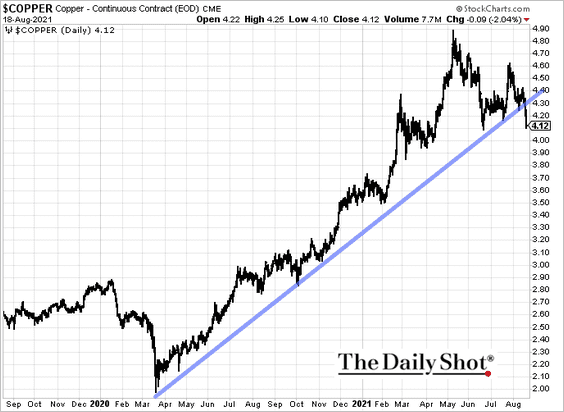

2. Copper broke below the uptrend support.

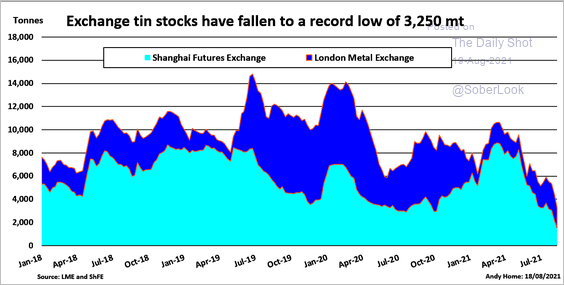

3. Tin inventories on exchanges are at multi-year lows.

Source: Reuters; @AndyHomeMetals Read full article

Source: Reuters; @AndyHomeMetals Read full article

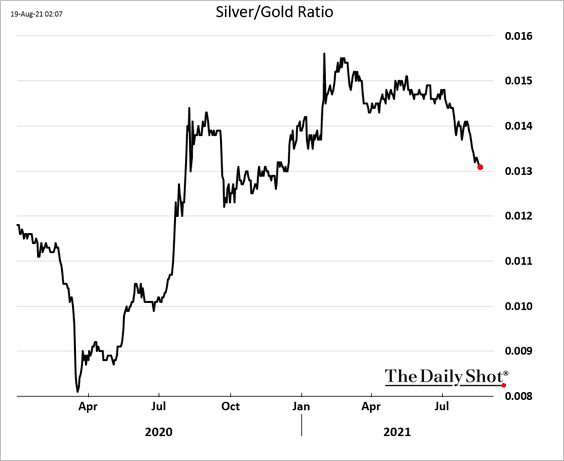

4. The silver-to-gold ratio keeps moving lower.

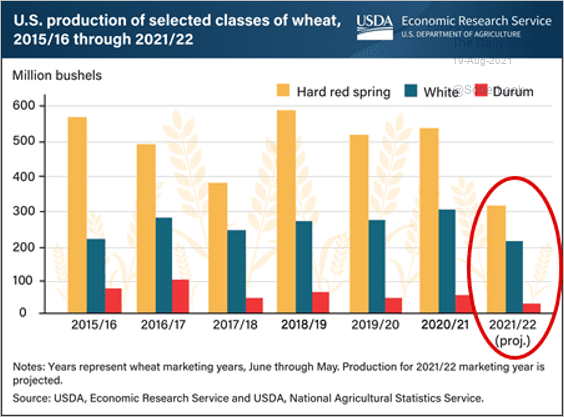

5. Drought dampened production and export prospects for key US wheat classes, according to the USDA.

Source: @USDA_ERS Read full article

Source: @USDA_ERS Read full article

Back to Index

Energy

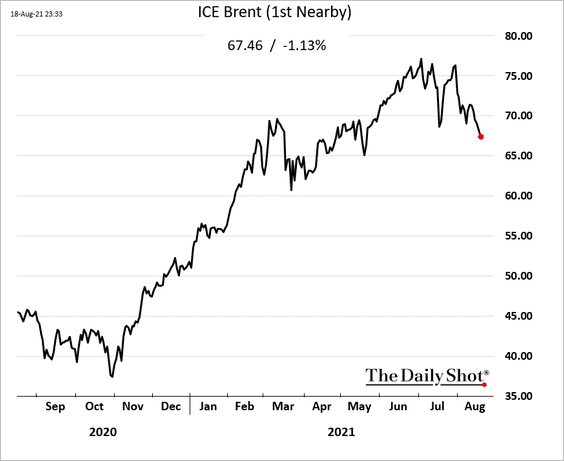

1. Crude oil prices continue to weaken.

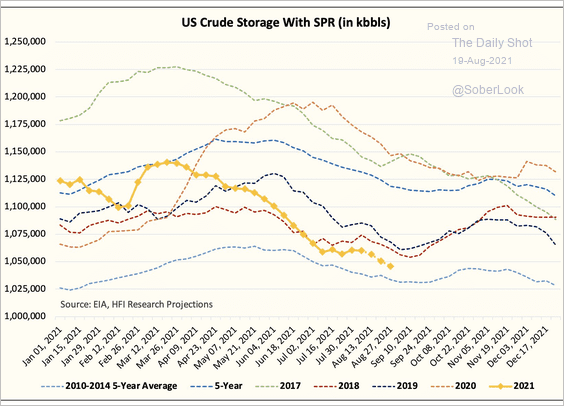

2. US crude oil in storage (with the Strategic Petroleum Reserve) is moving lower.

Source: @HFI_Research

Source: @HFI_Research

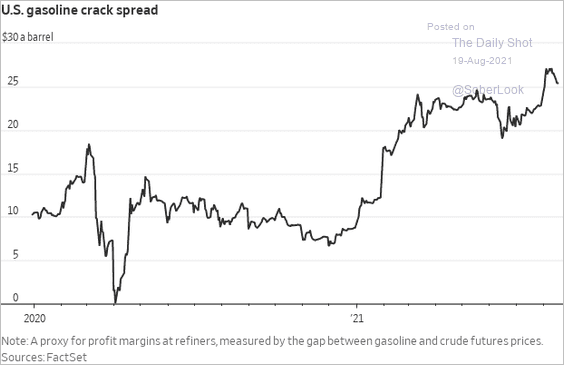

3. Gasoline crack spreads have risen this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

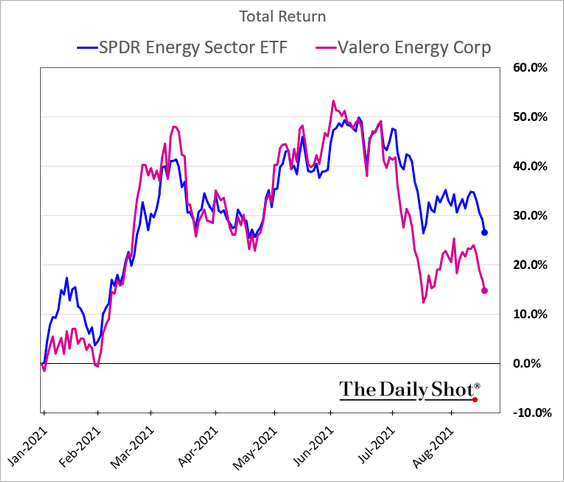

But refinery businesses have underperformed due to environmental regulation concerns.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

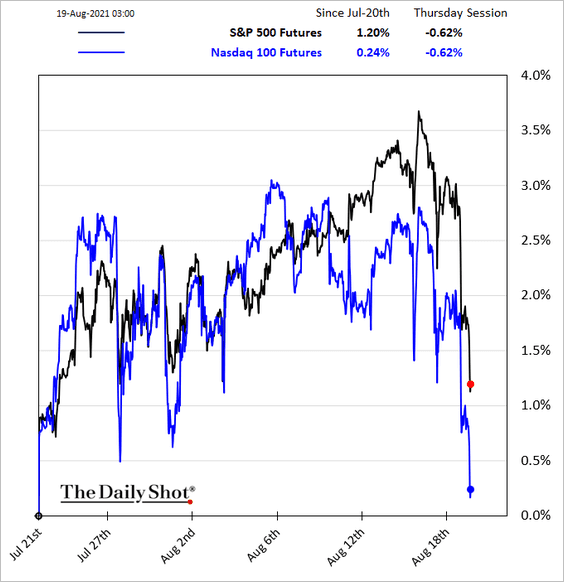

1. Stock futures are heavy this morning after the FOMC minutes (see the US section).

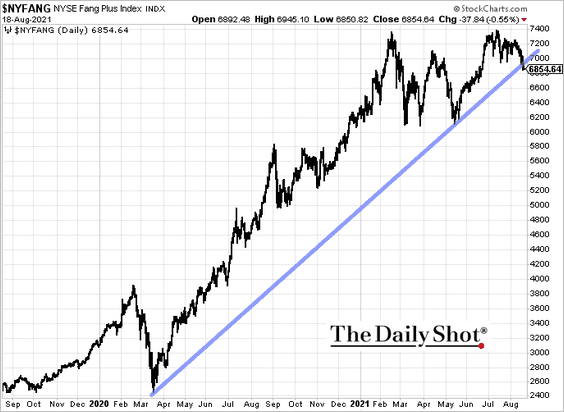

2. The FANG+ stocks are testing support.

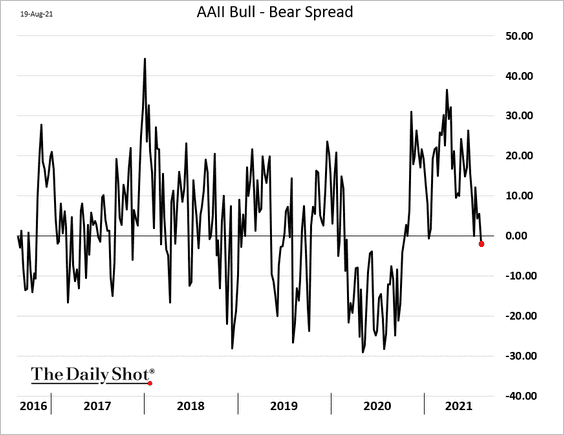

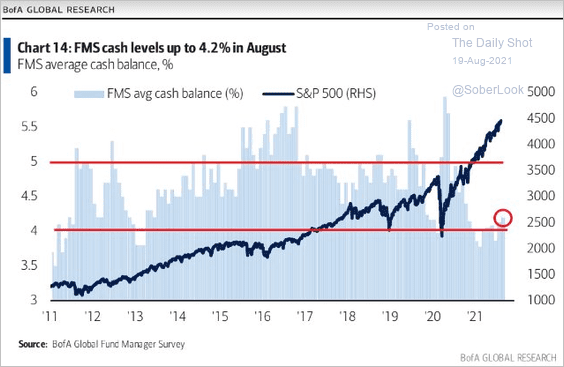

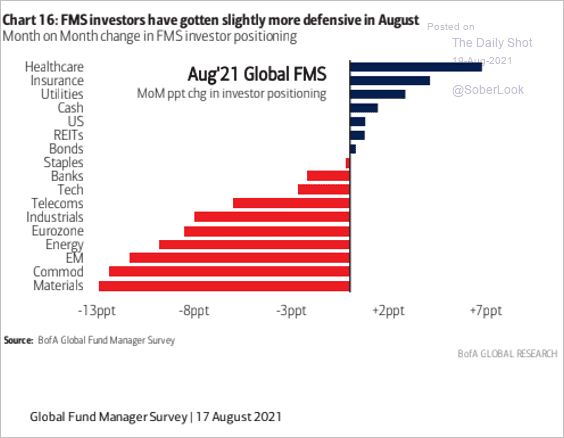

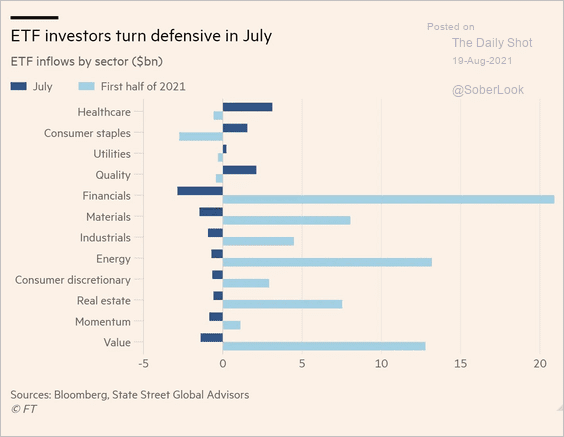

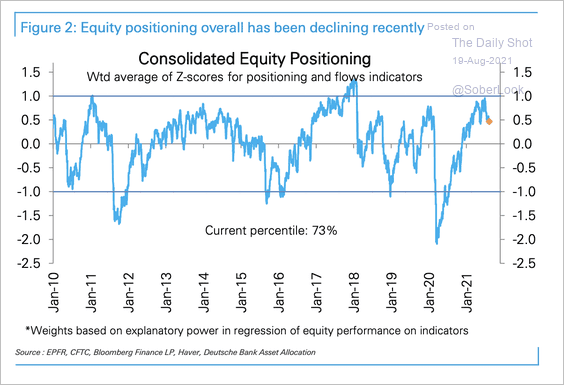

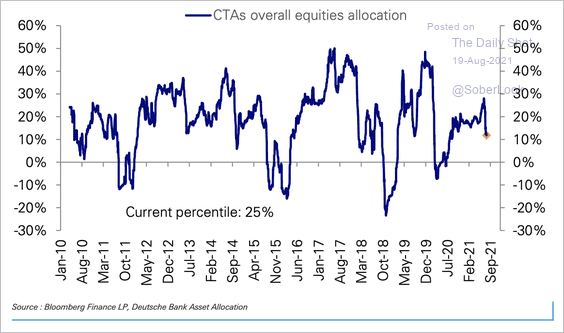

3. Investor sentiment has been turning more cautious.

• AAII bull/bear spread:

• An increase in fund managers’ cash balances:

Source: BofA Global Research; @Saburgs

Source: BofA Global Research; @Saburgs

• Defensive positioning by fund managers:

Source: BofA Global Research; @Saburgs

Source: BofA Global Research; @Saburgs

• Defensive positioning by ETF investors:

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

• Consolidated equity positioning:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• CTA positioning:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

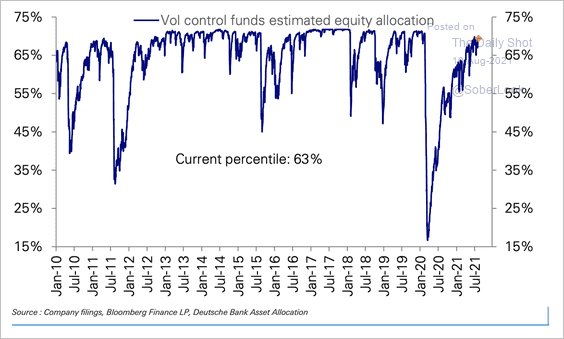

However, vol control funds have continued to raise equity exposure back to the top of their historical range.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

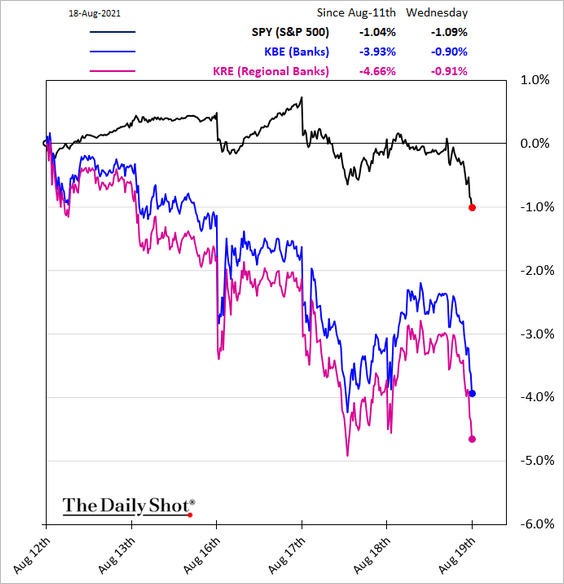

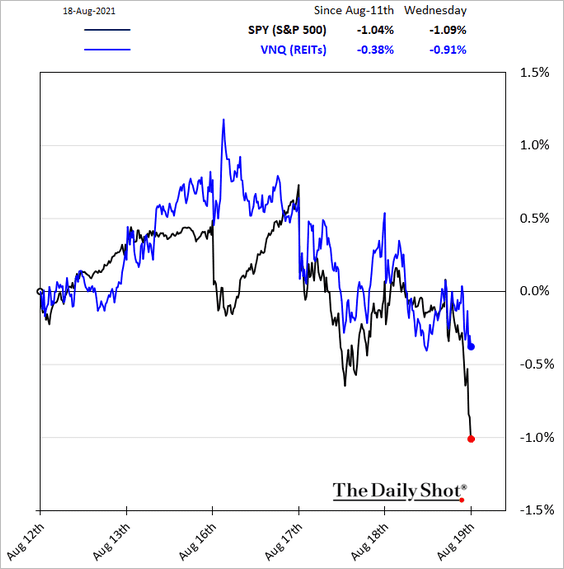

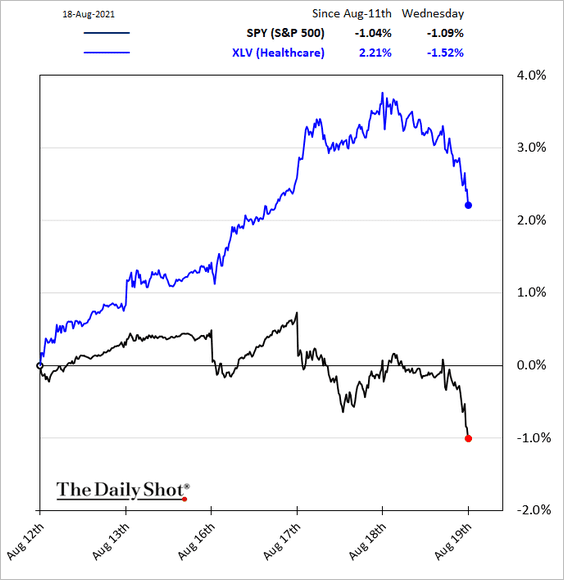

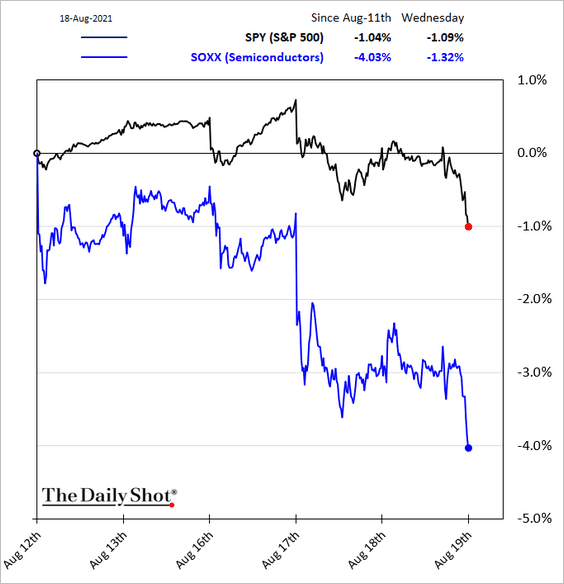

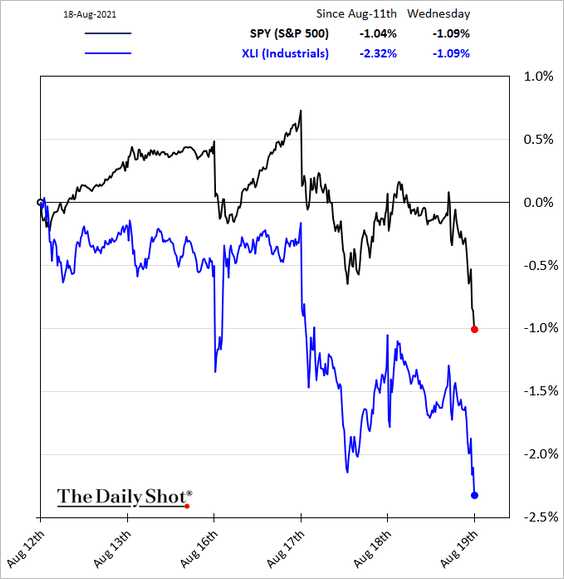

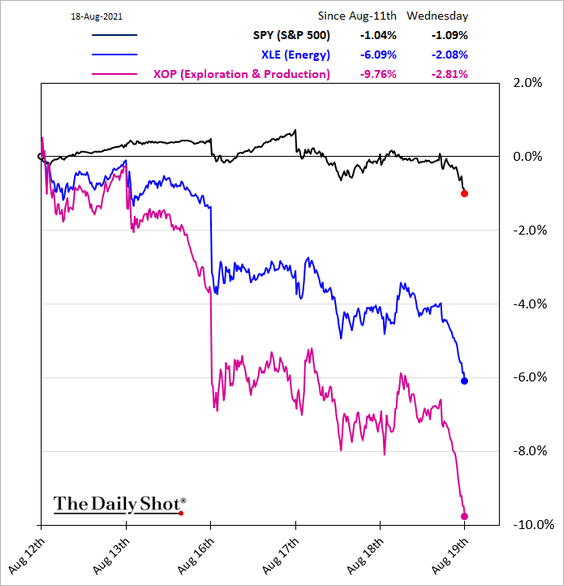

4. Next, we have some sector updates.

• Banks:

• REITs:

• Healthcare:

• Semiconductors:

• Industrials:

• Energy:

——————–

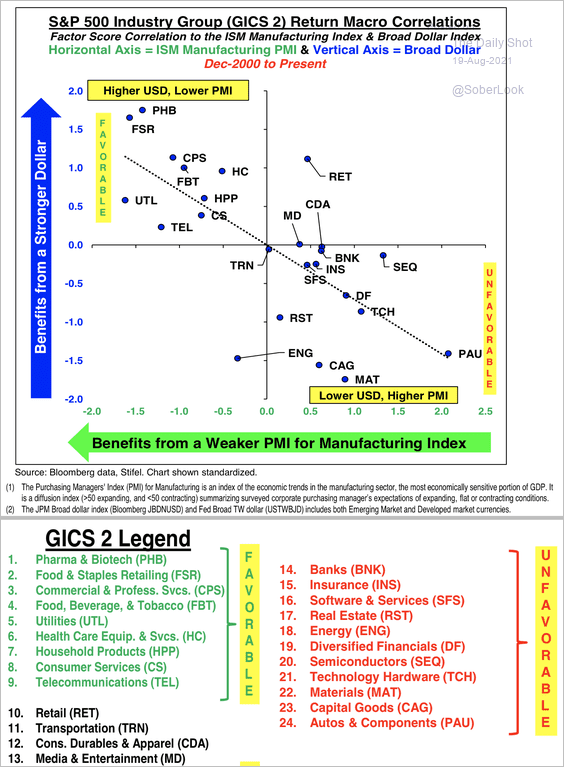

5. Stifel expects the US manufacturing PMI to weaken and the dollar to strengthen, which could benefit defensive sectors.

Source: Stifel

Source: Stifel

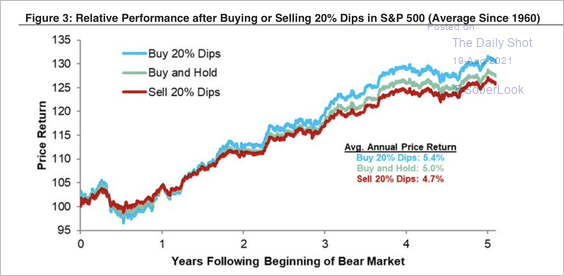

6. On average, buying the dip has worked over the long term.

Source: Citi Private Bank

Source: Citi Private Bank

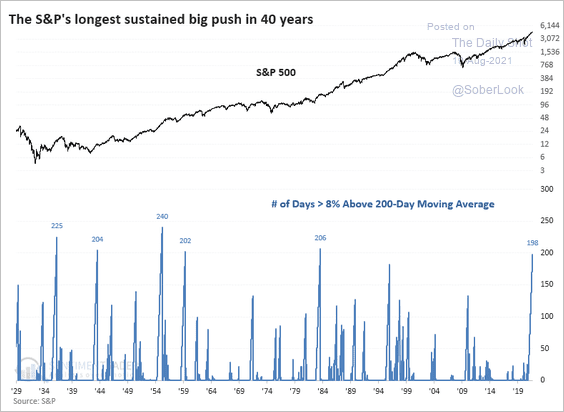

7. The S&P 500 had the longest sustained push in 40 years.

Source: @RitholtzWealth, @abnormalreturns Read full article

Source: @RitholtzWealth, @abnormalreturns Read full article

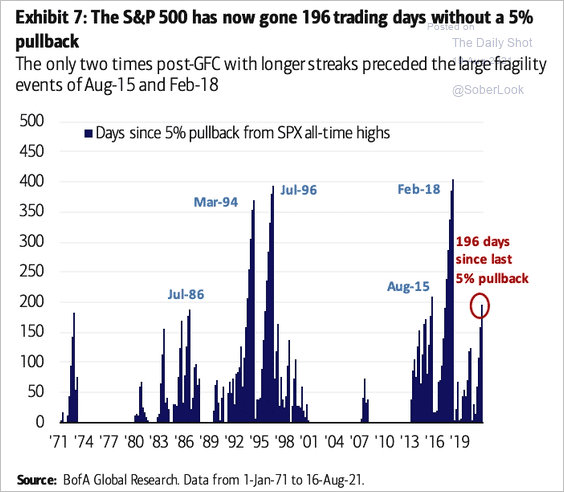

It’s been a while since the last 5% pullback. It’s time.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

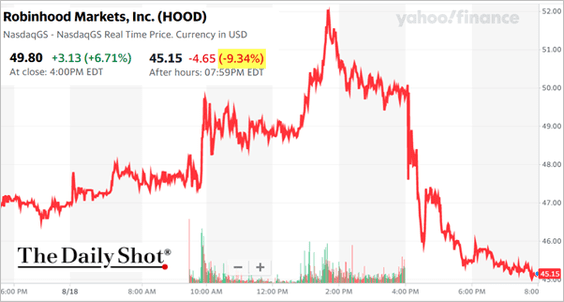

8. Is the Reddit crowd losing interest in meme stocks?

Source: Yahoo Finance

Source: Yahoo Finance

Back to Index

Rates

1. The Fed’s Bullard is becoming concerned about the central bank being behind the curve.

Source: Reuters Read full article

Source: Reuters Read full article

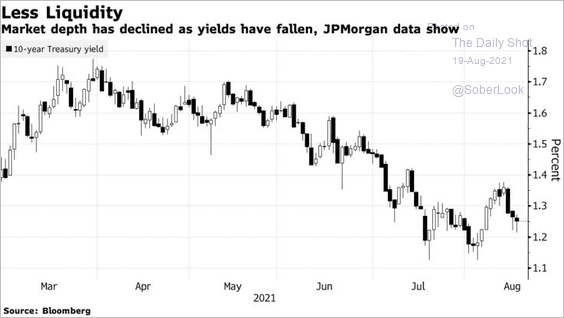

2. Treasury market liquidity deteriorated this year.

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

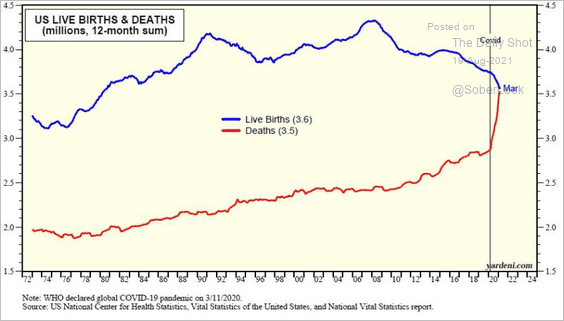

1. US births and deaths:

Source: Yardeni Research

Source: Yardeni Research

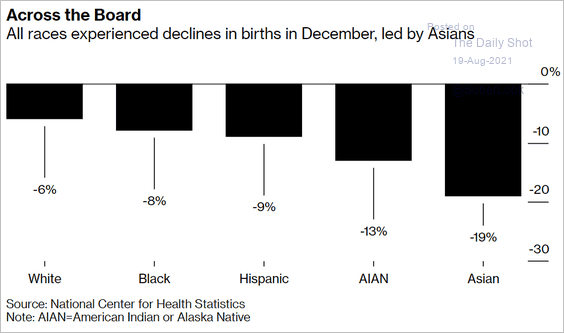

2. US birth rates by race (Dec 2021 vs. Dec 2020):

Source: @business Read full article

Source: @business Read full article

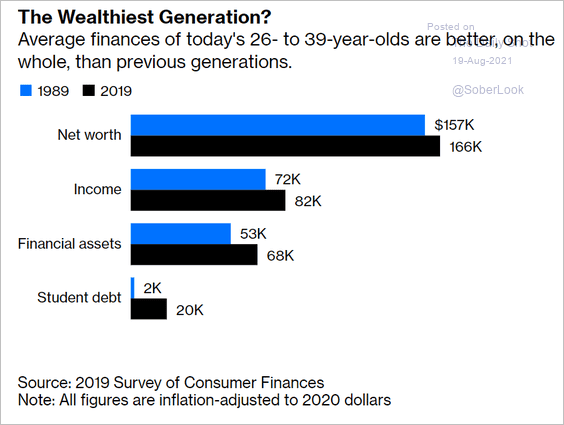

3. Struggling Millennials? It’s a myth.

Source: @allisonschrager, @bopinion Read full article

Source: @allisonschrager, @bopinion Read full article

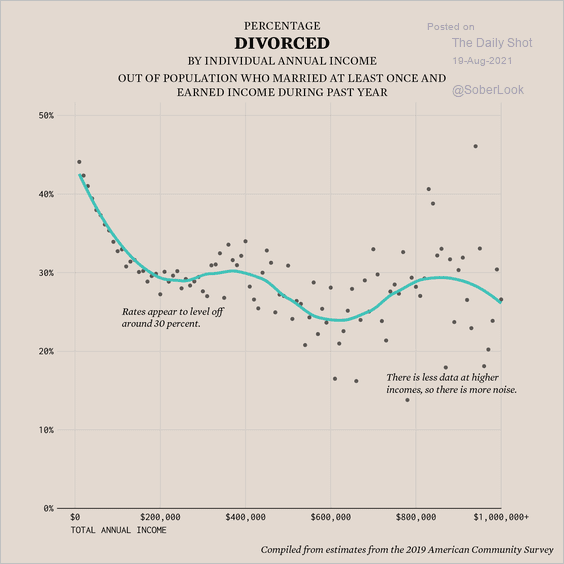

4. Divorce rates by income:

Source: FlowingData Read full article

Source: FlowingData Read full article

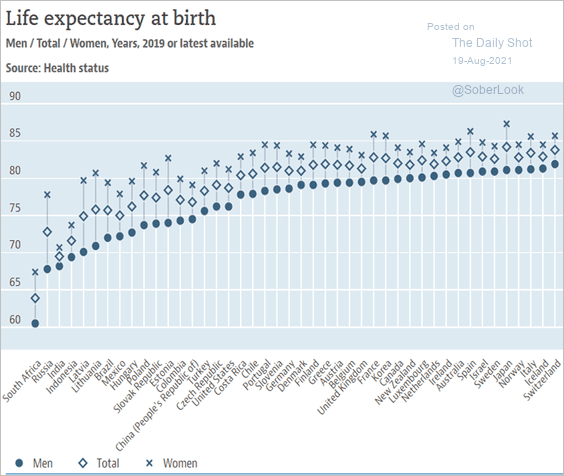

5. Life expectancy, by country:

Source: OECD

Source: OECD

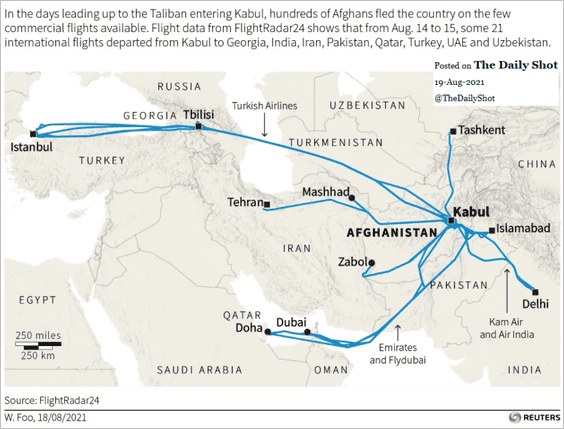

6. Fleeing Afghanistan:

Source: @Reuters Read full article

Source: @Reuters Read full article

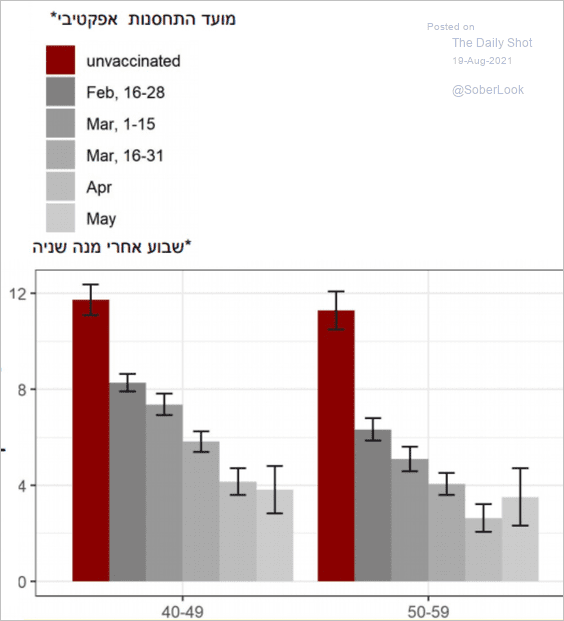

7. The decay of COVID vaccine efficacy over time (Israel data):

Source: @segal_eran

Source: @segal_eran

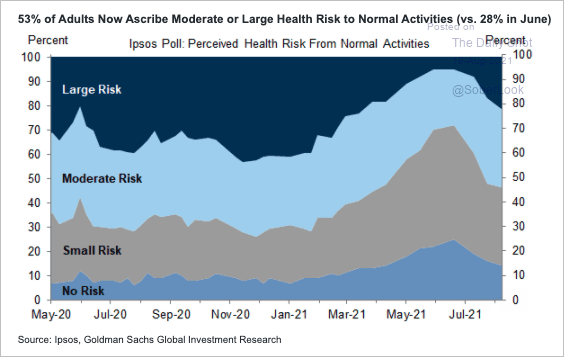

8. Perceived health risk from normal activities:

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

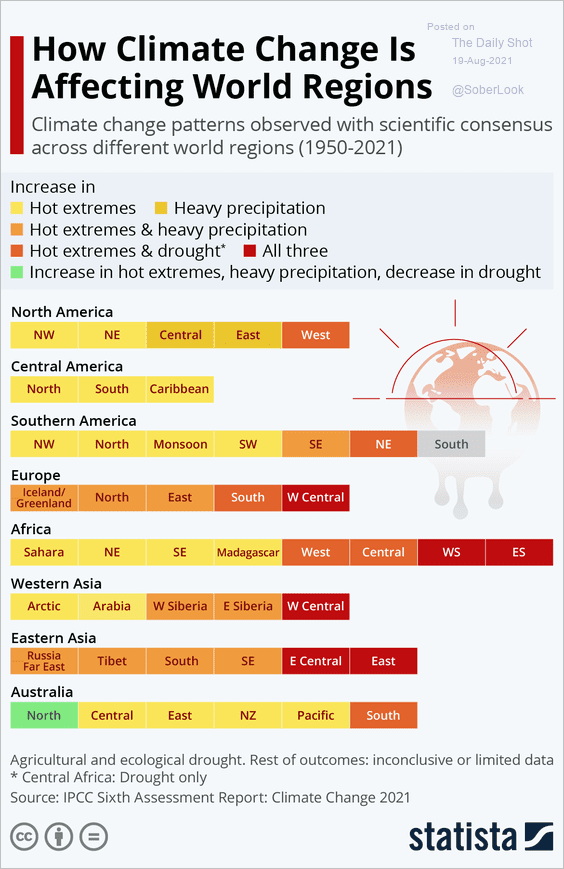

9. The global impact of climate change:

Source: Statista

Source: Statista

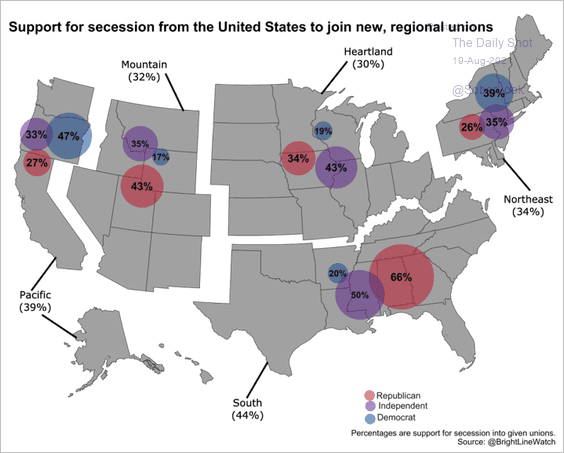

10. Support for secession from the US:

Source: @leedrutman

Source: @leedrutman

11. As seen in a Vegas parking lot:

h/t Carley Garner

h/t Carley Garner

——————–

Back to Index