The Daily Shot: 24-Aug-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

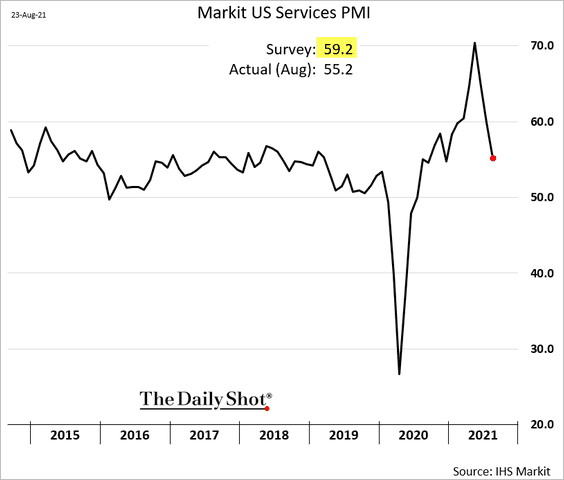

1. The Markit PMI report showed some pullback in business activity growth this month. The deceleration was particularly sharp in services as COVID cases climbed.

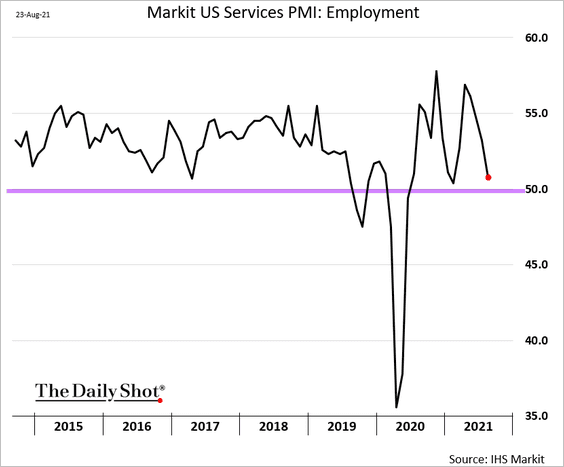

Service hiring slowed.

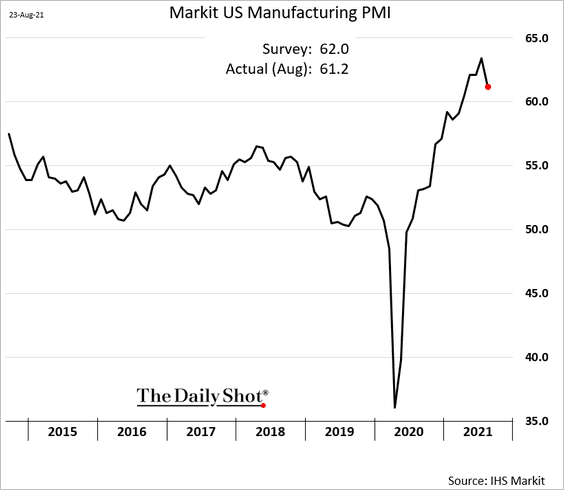

While off the highs, growth in factory activity remains robust.

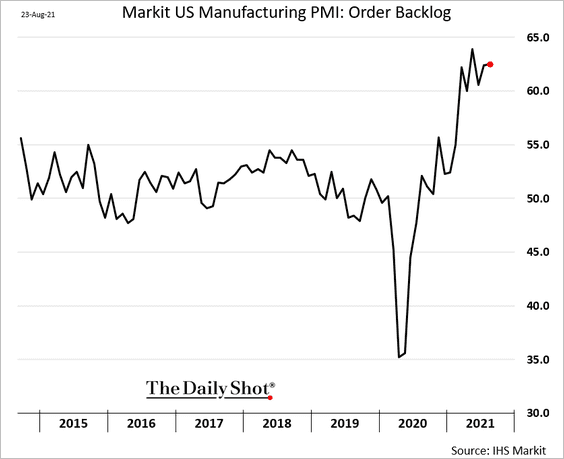

Supply-chain challenges are still acute.

• Order backlog:

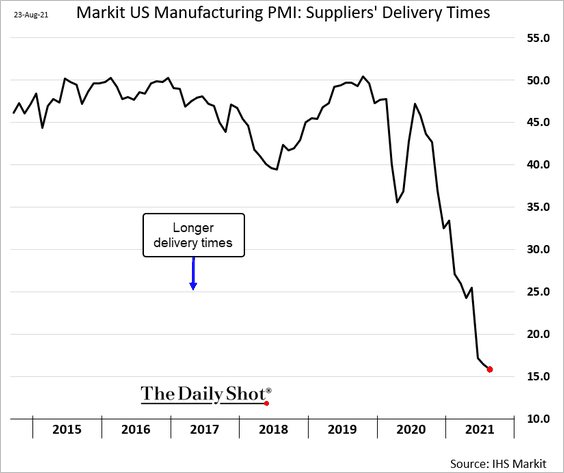

• Supplier delays:

Price pressures in manufacturing are hitting extreme levels, but companies are passing some of the cost increases to clients.

——————–

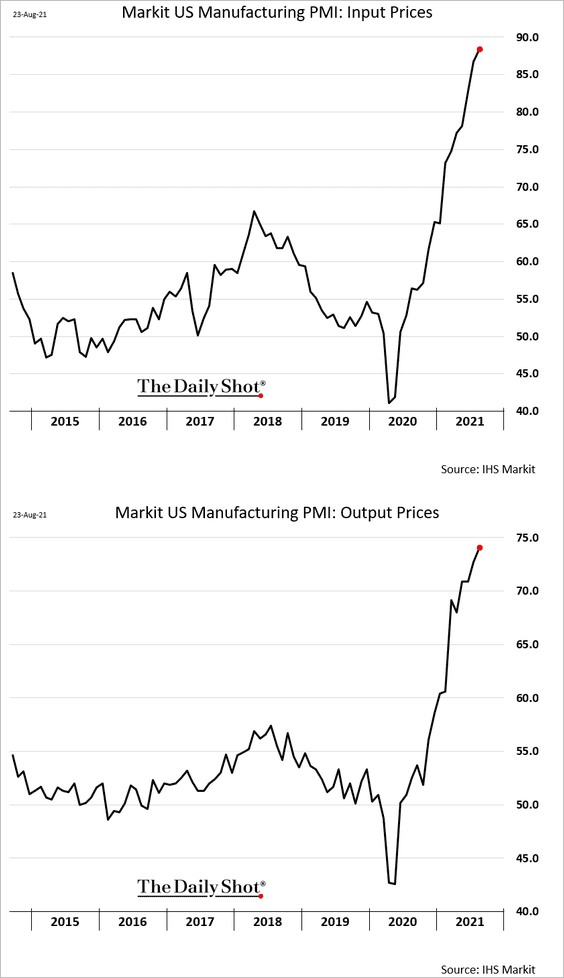

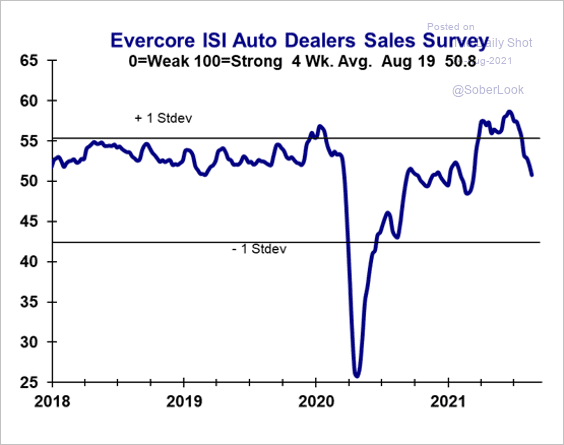

2. The World Economics SMI report also showed business growth slowing a bit.

Source: World Economics

Source: World Economics

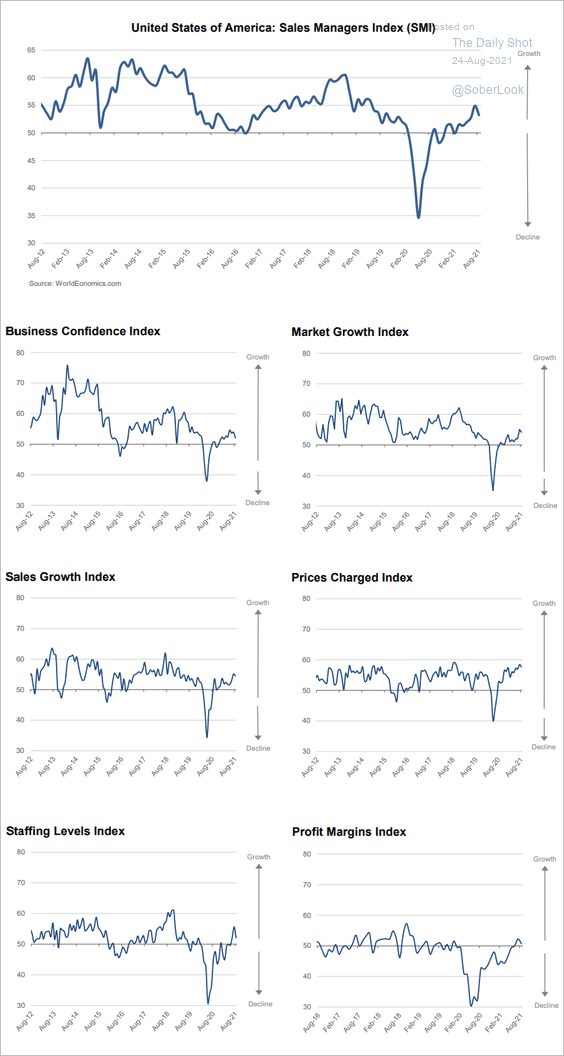

3. Auto dealers continue to report lower sales due to supply shortages.

Source: Evercore ISI

Source: Evercore ISI

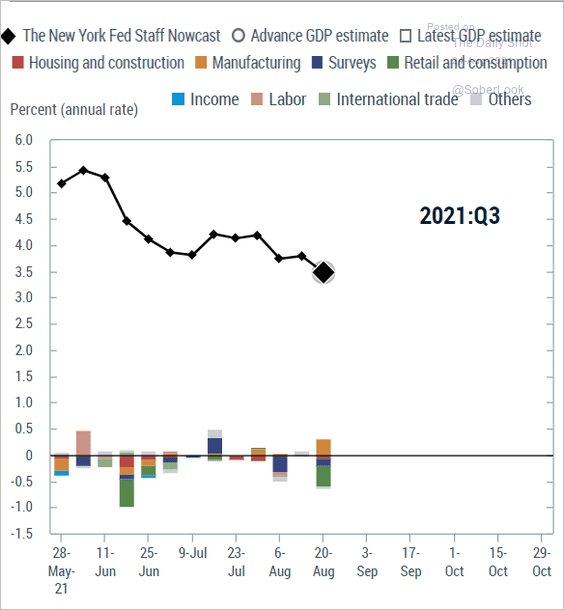

4. The NY Fed’s Nowcast model forecast for Q3 GDP growth continues to trend lower.

Source: NY Fed

Source: NY Fed

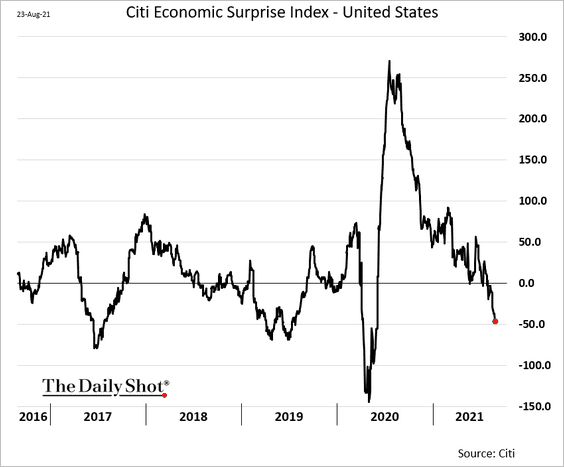

5. The Citi Economic Surprise Index keeps declining.

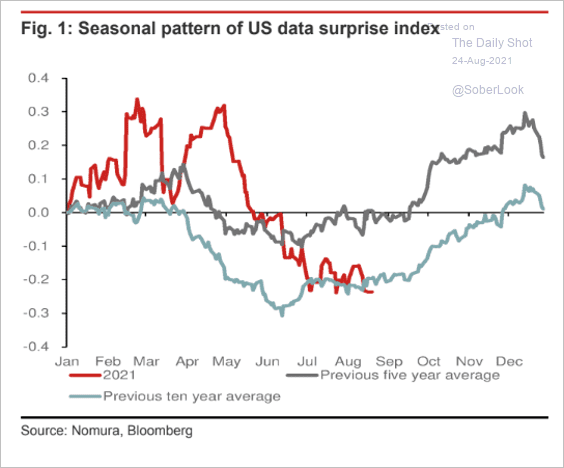

US data surprise indices tend to be seasonal. Will we see a rebound?

Source: Nomura; @Saburgs

Source: Nomura; @Saburgs

——————–

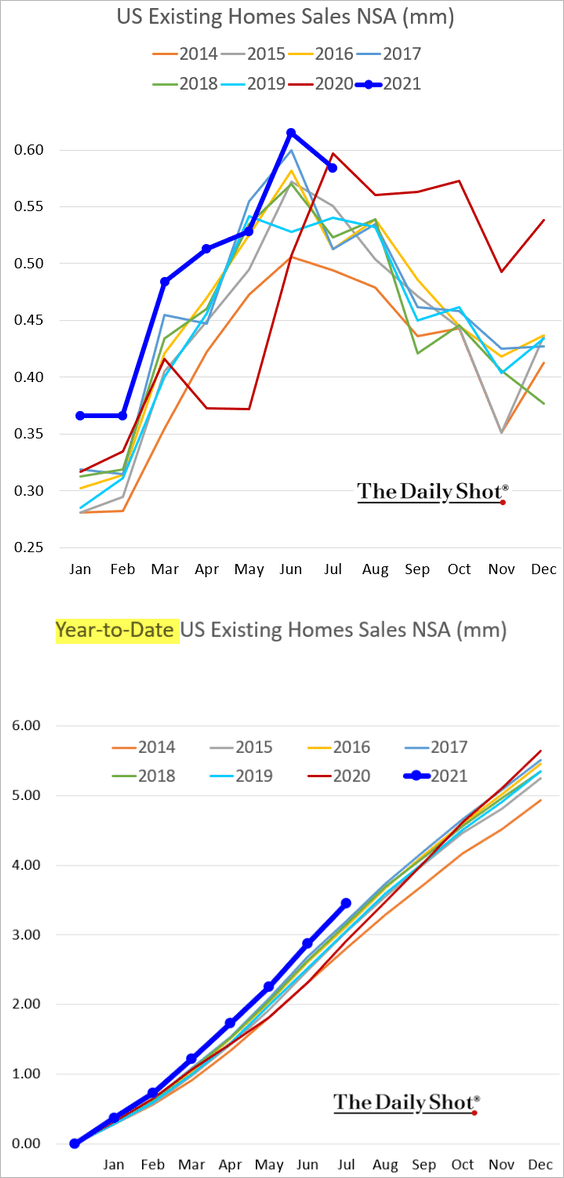

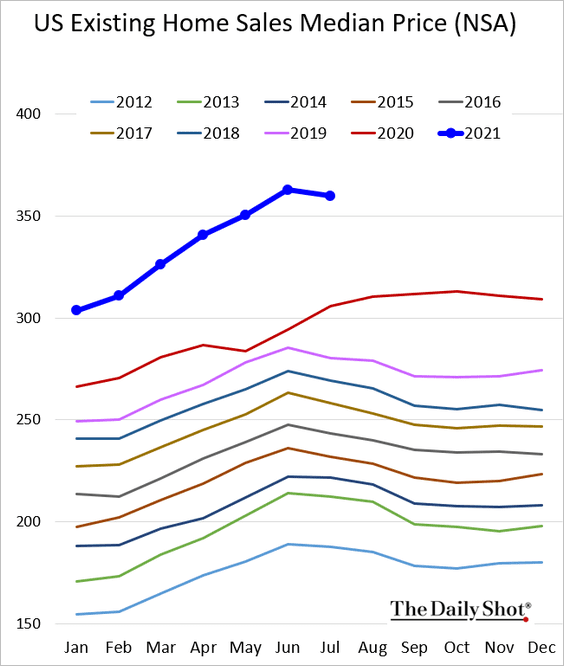

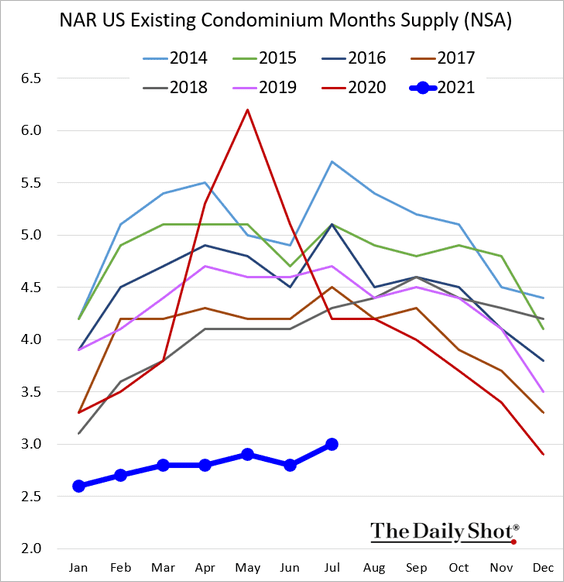

6. Existing home sales remain exceptionally strong, dipping just below the 2020 summer craze in July.

The median price held at record levels for this time of the year.

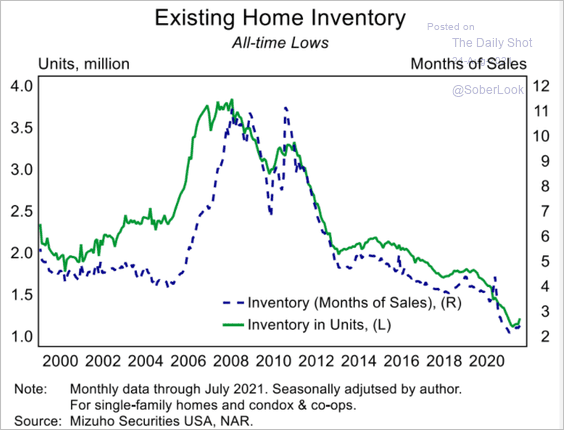

Inventories remain near all-time lows.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

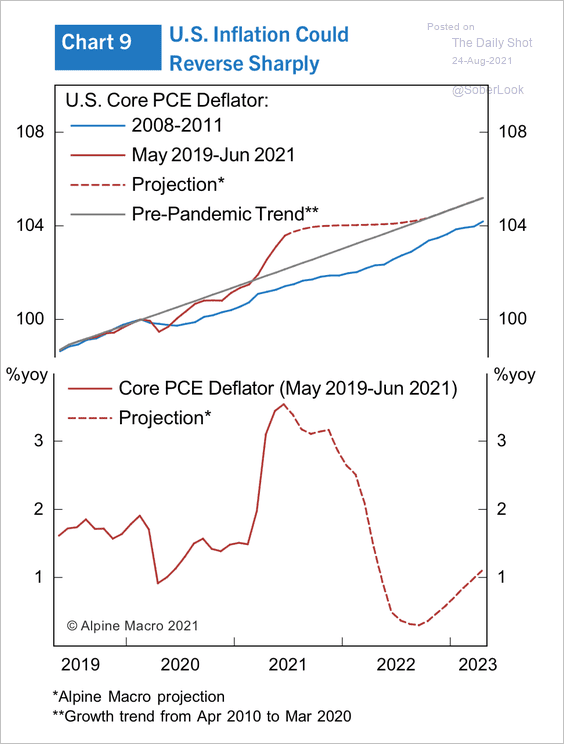

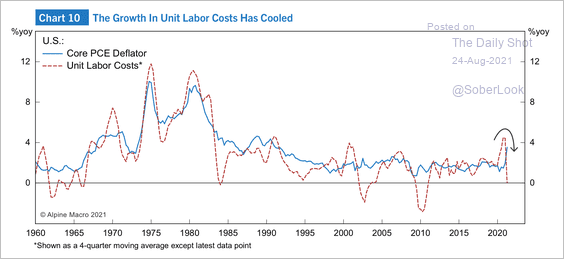

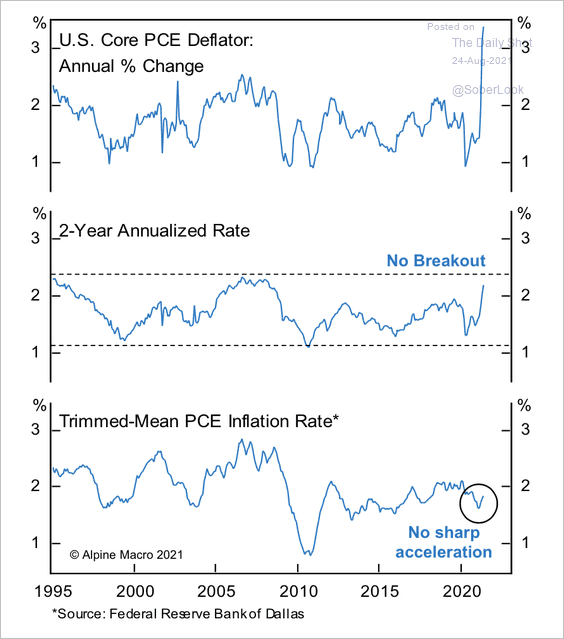

7. Here are some updates on inflation.

• Next year’s inflation figures will be calculated off the elevated base effects of this year, which could lead to a sharp drop-off in measured (year-over-year) inflation, according to Alpine Macro (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

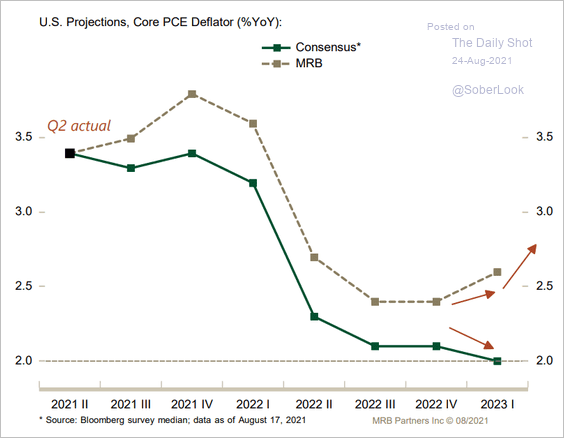

• The core PCE inflation will revert to 2%, according to Bloomberg’s survey of economists. Not everyone agrees. Here is a forecast from MRB.

Source: MRB Partners

Source: MRB Partners

• There has not been a sharp acceleration in the trimmed-mean CPI yet.

Source: Alpine Macro

Source: Alpine Macro

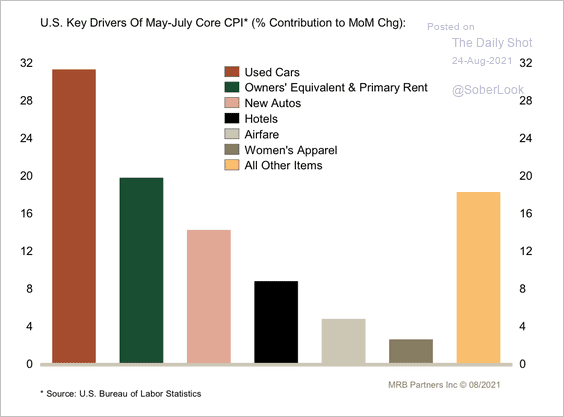

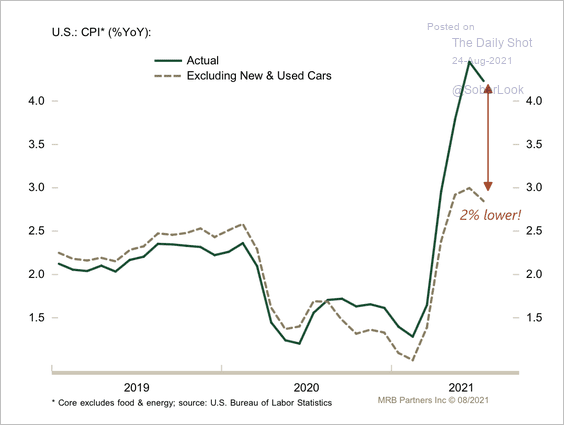

• Used car prices had an outsize contribution to May-July inflation prints (2 charts).

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

Source: MRB Partners

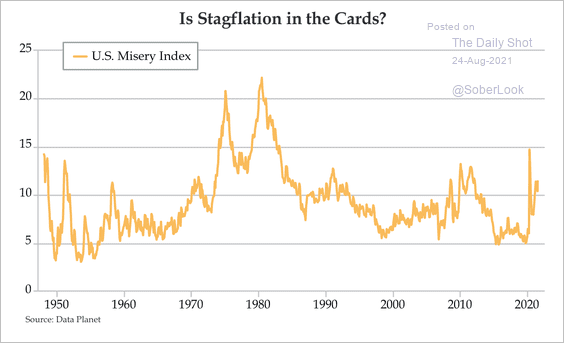

• Higher inflation has raised the US misery index, even as employment improves.

Source: Quill Intelligence

Source: Quill Intelligence

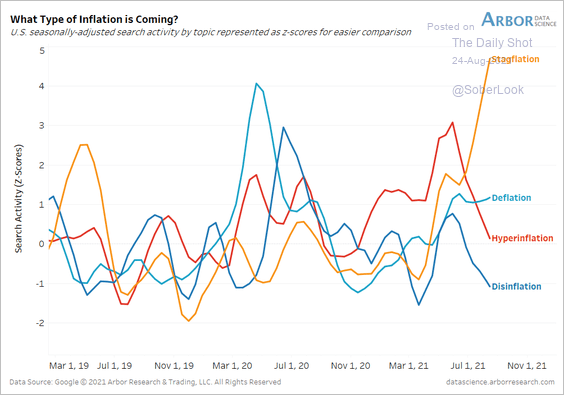

• Online search for “stagflation” is surging.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

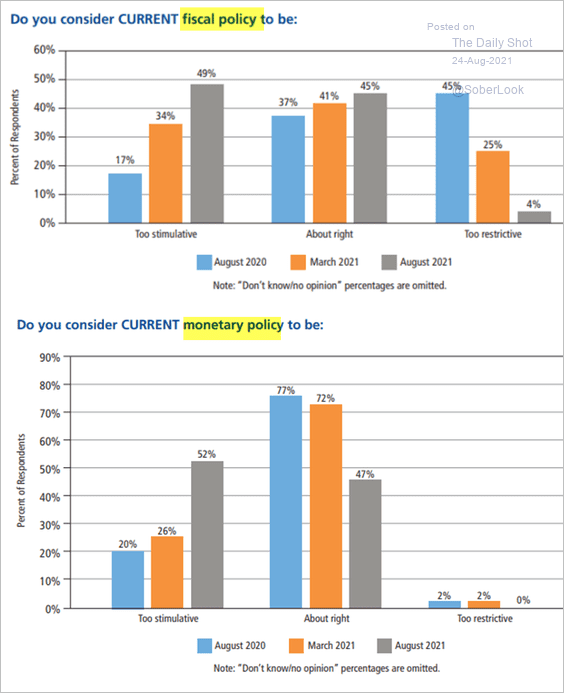

8. Economists and financial analysts increasingly see US monetary and fiscal policies as too stimulative.

Source: @GregDaco, @business_econ

Source: @GregDaco, @business_econ

Back to Index

Canada

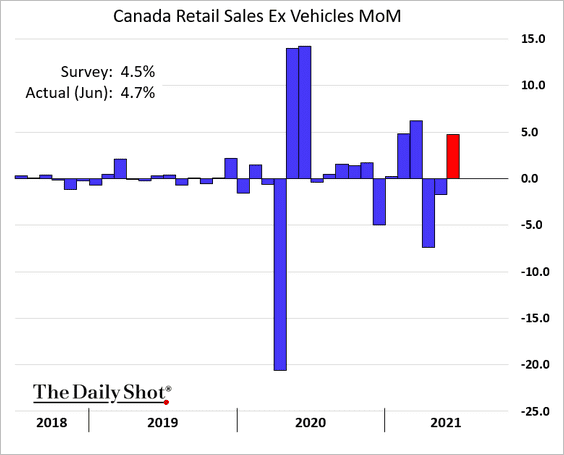

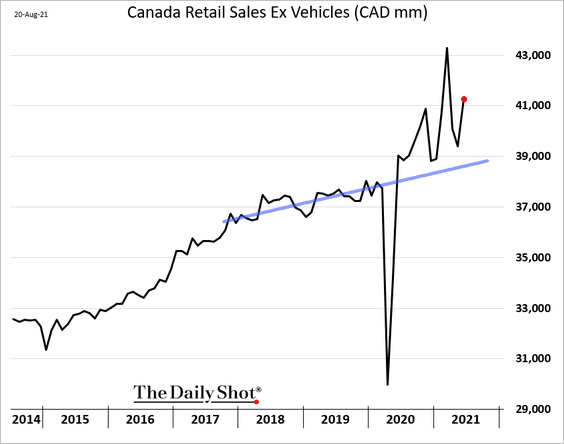

1. Retail sales rebounded in June.

——————–

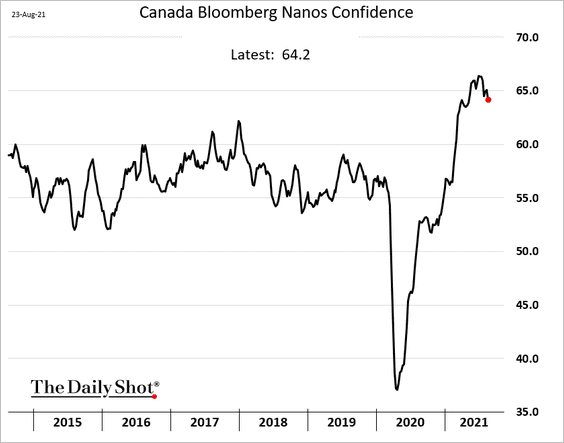

2. Consumer sentiment appears to be rolling over.

Back to Index

The United Kingdom

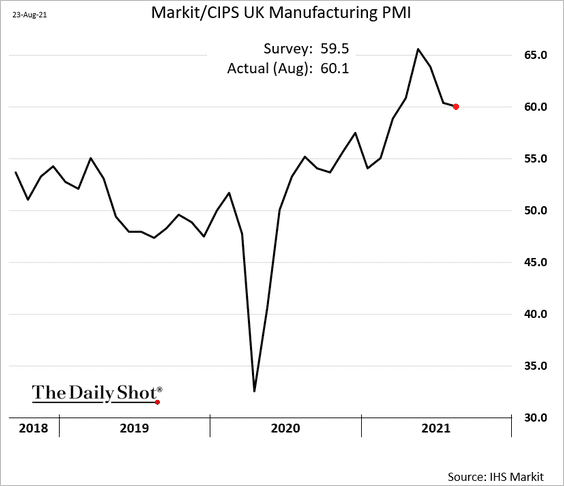

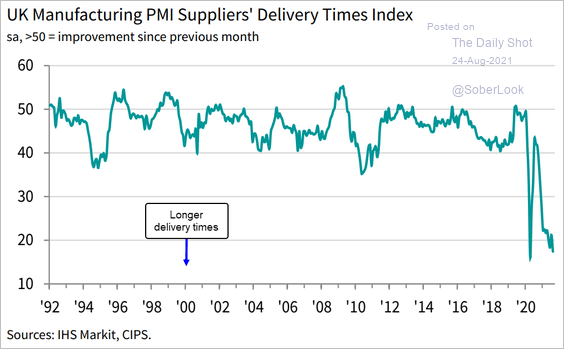

1. Manufacturing growth remains solid.

But factories are struggling with supplier delays.

Source: IHS Markit

Source: IHS Markit

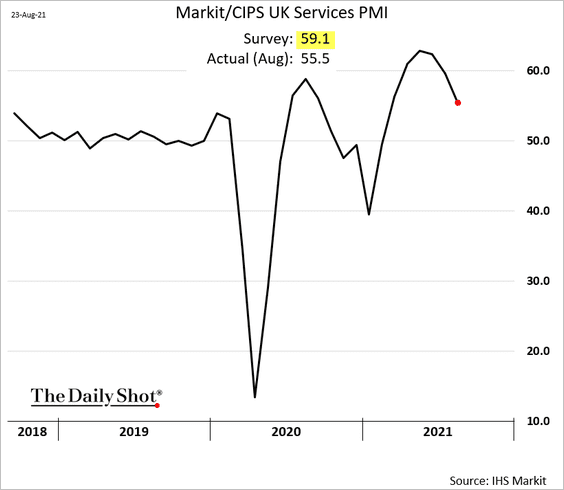

• Service-sector growth slowed more than expected.

Businesses are concerned about staffing shortages.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

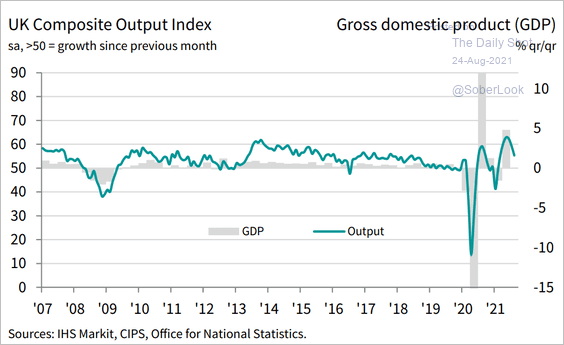

• Here is the composite PMI index.

Source: IHS Markit

Source: IHS Markit

——————–

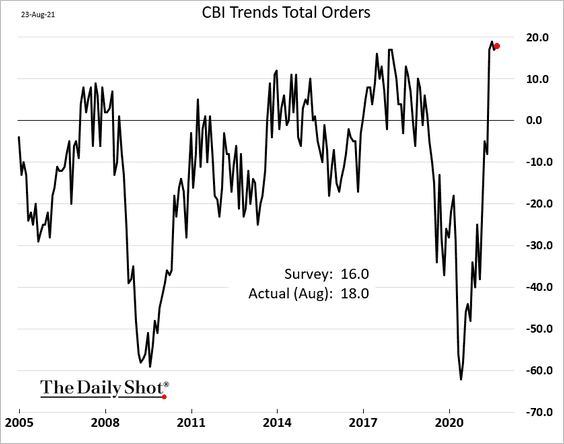

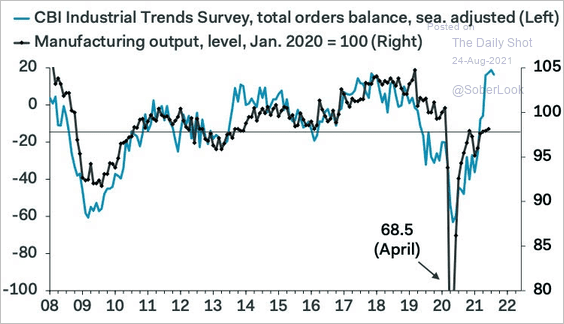

2. According to the latest CBI report, industrial orders are still unusually strong, …

… pointing to further gains in factory output.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

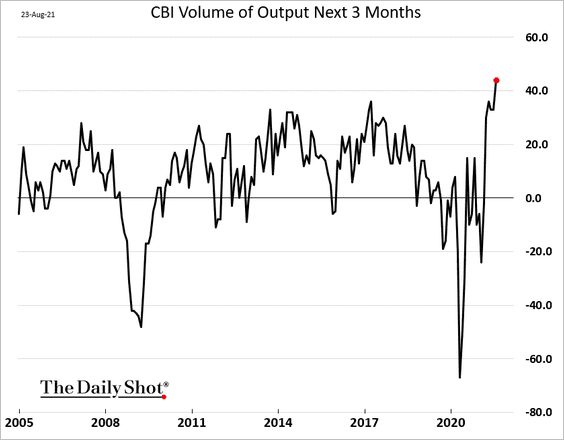

• Companies see output surging in the months ahead.

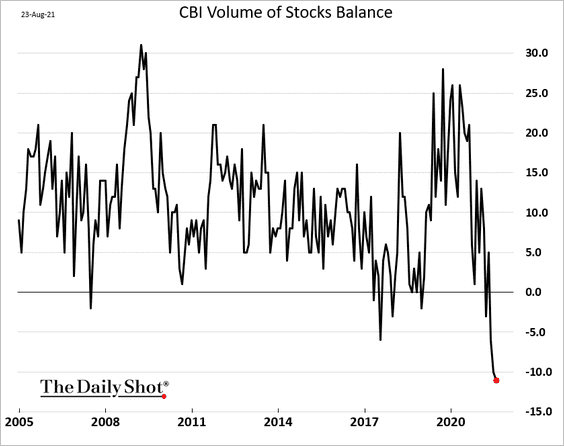

• Inventories tumbled in recent months.

Source: Reuters Read full article

Source: Reuters Read full article

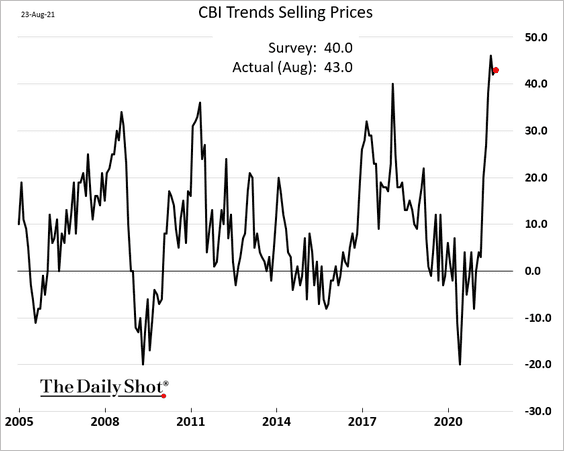

• Companies are boosting prices.

——————–

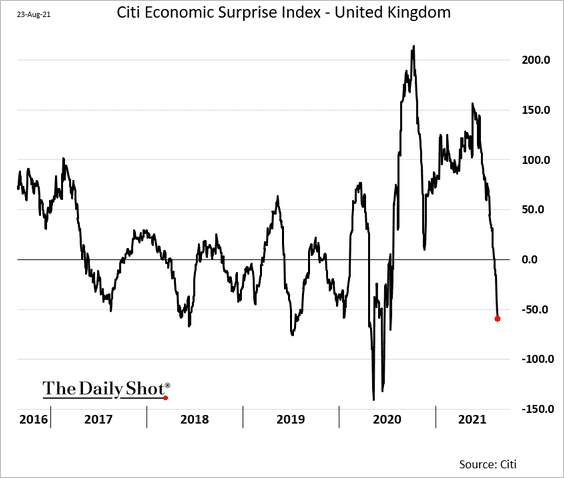

3. Here is the Citi Economic Surprise Index.

Back to Index

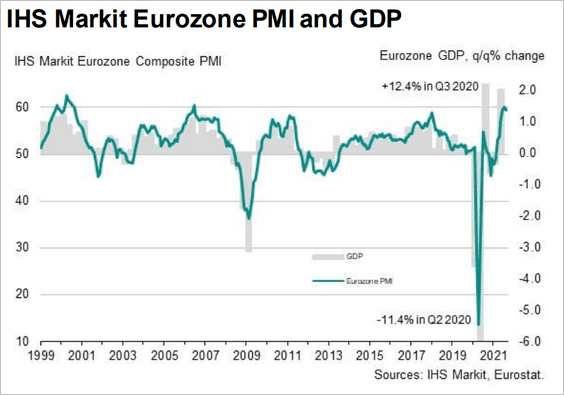

The Eurozone

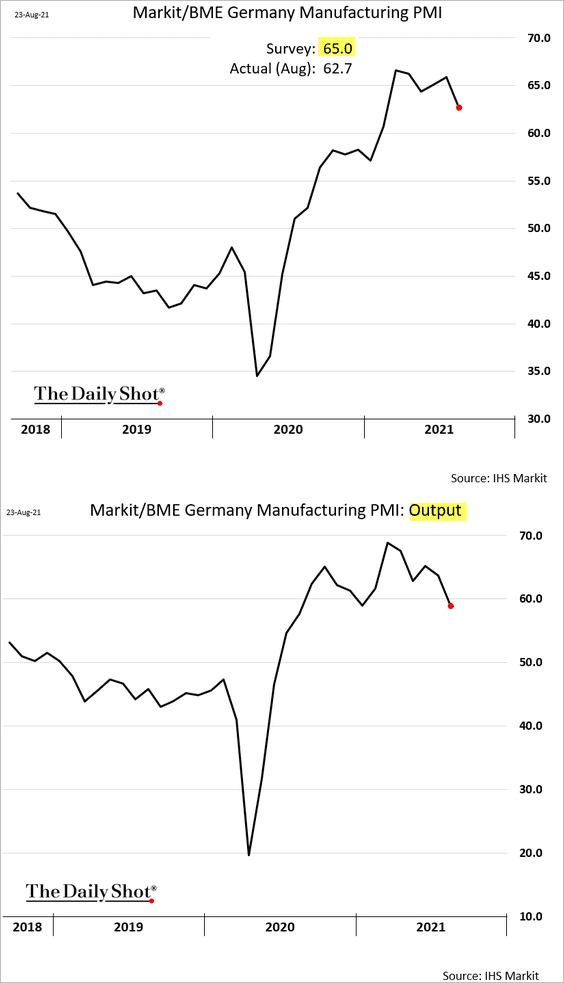

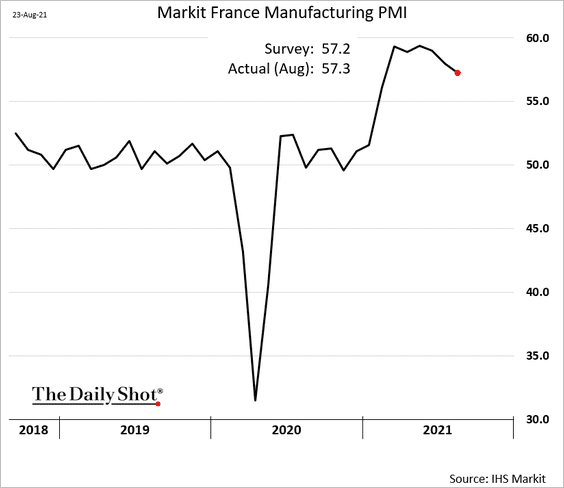

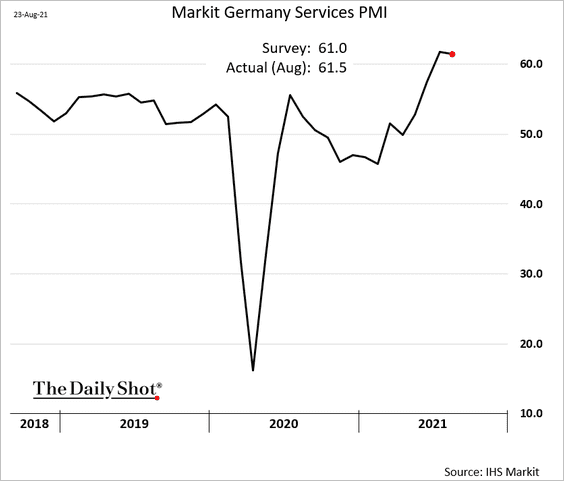

1. The August PMI report showed ongoing strength in business activity across the single-currency bloc. Germany’s manufacturing output decelerated somewhat due to supply shortages.

French manufacturing remains robust.

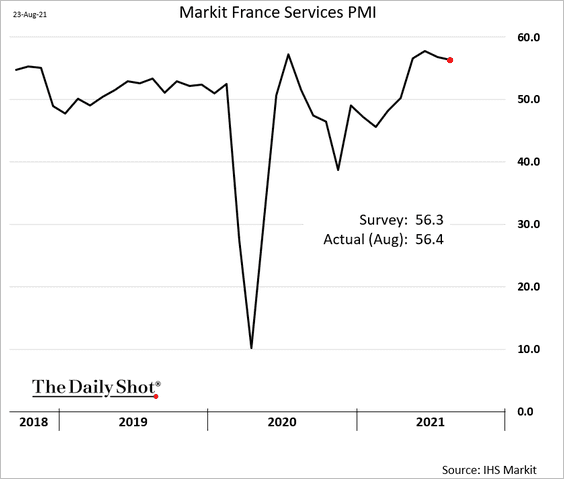

• Service-sector growth held up well in August.

– France:

– Germany:

• Here is the compostie PMI.

——————–

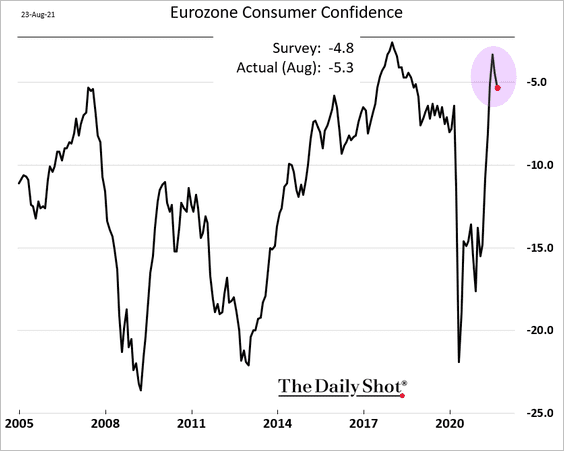

2. Euro-area consumer confidence is off the highs but remains above pre-pandemic levels.

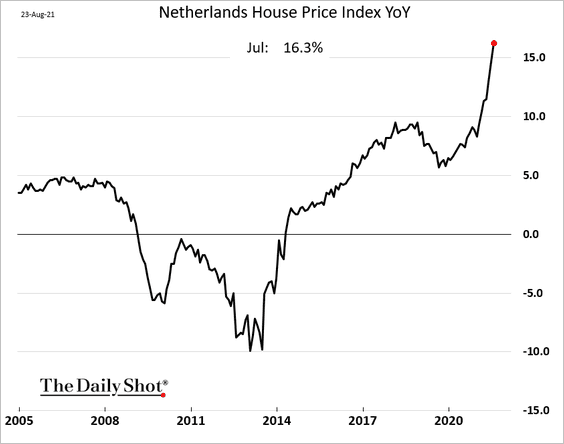

3. Dutch housing prices continue to surge.

Back to Index

Japan

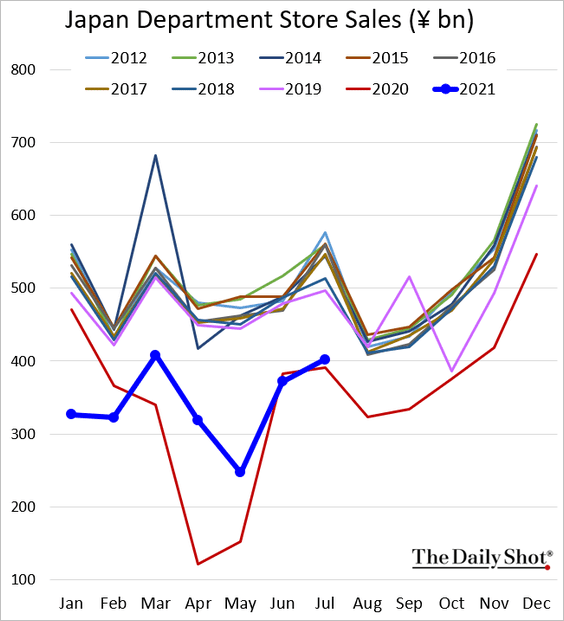

1. Department store sales are only slightly above 2020 levels.

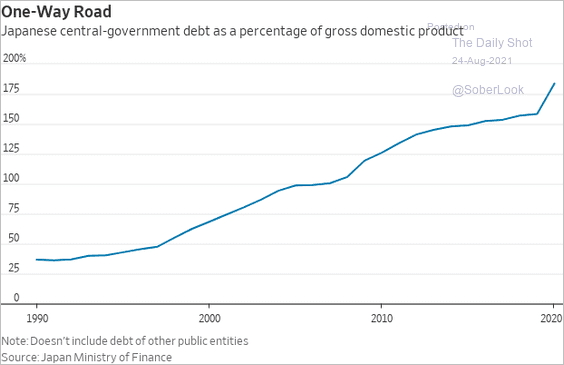

2. The debt-to-GDP ratio is approaching 200% – well above other advanced economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

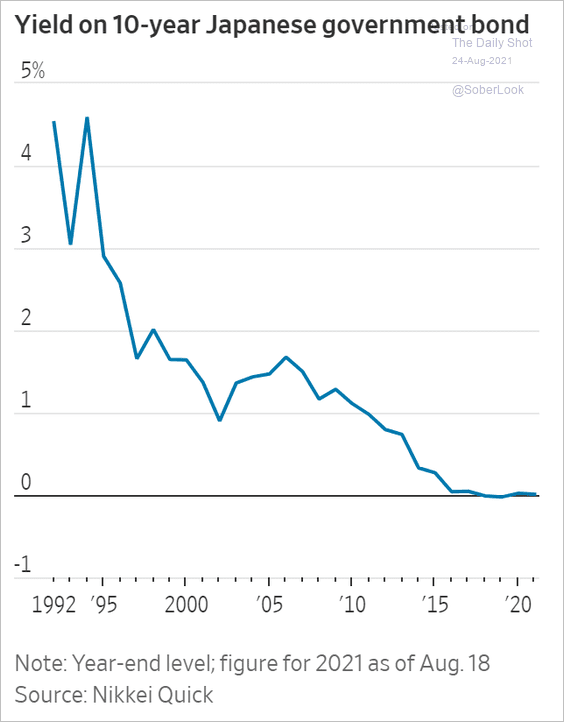

And yet, debt yields remain at zero, held down by the BoJ. But inflation is still well below the central bank’s target. These trends are providing plenty of ammunition for the MMT crowd.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia – Pacific

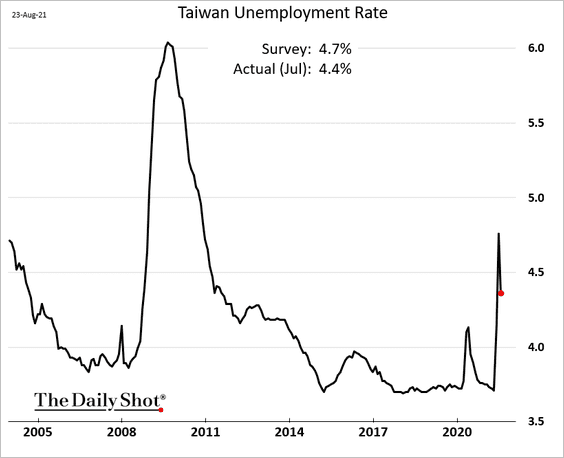

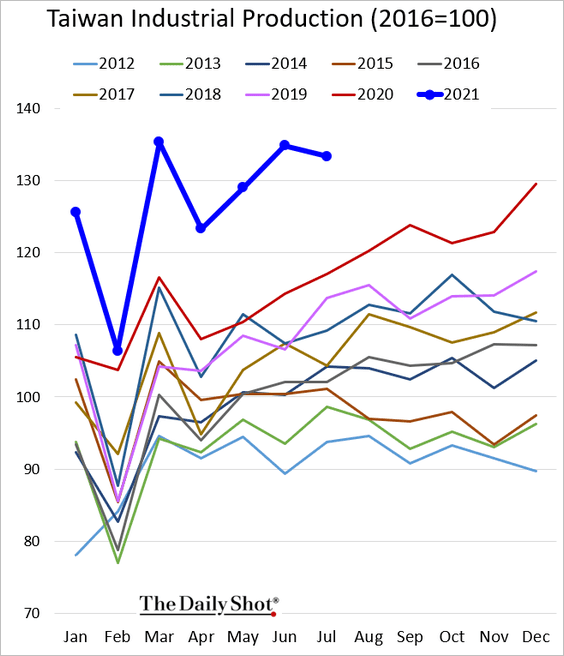

1. Taiwan’s unemployment rate declined last month.

Industrial production was a bit softer than expected.

——————–

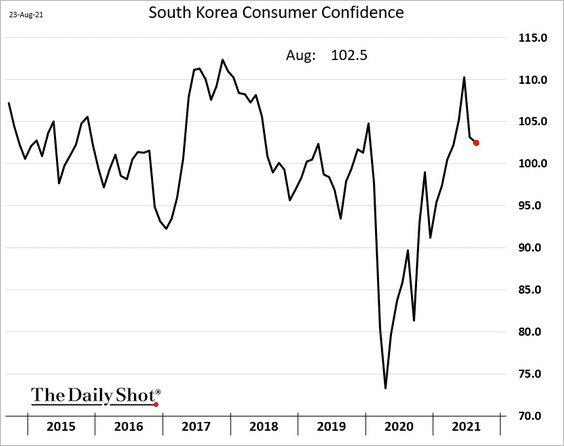

2. South Korea’s consumer confidence has been resilient despite the pandemic surge.

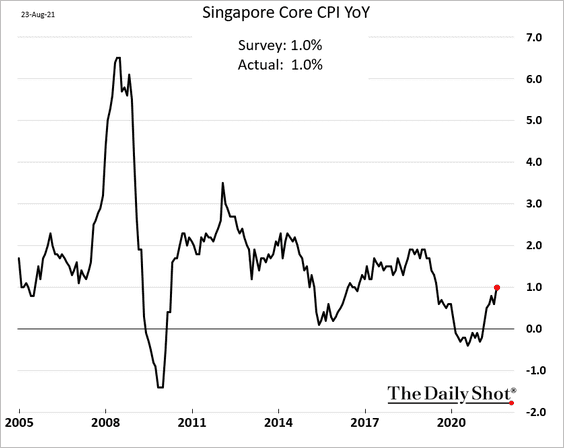

3. Singapore’s CPI is back at 1%.

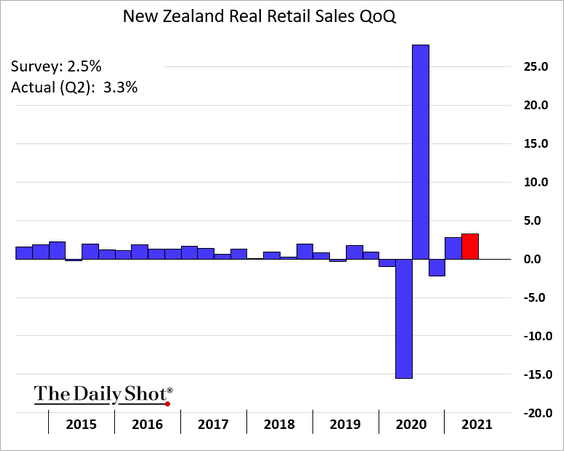

4. New Zealand’s Q2 retail sales topped economists’ forecasts.

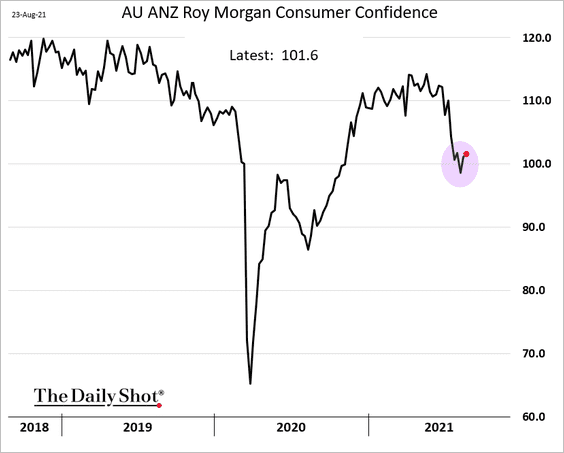

5. Australia’s consumer confidence appears to have bottomed.

Back to Index

China

1. Evergrande shares remain under pressure.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

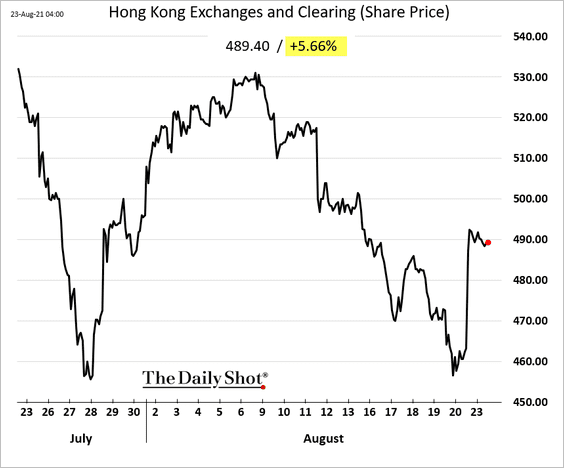

2. Hong Kong Exchanges and Clearing shares are up sharply with the planned launch of China A share futures.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

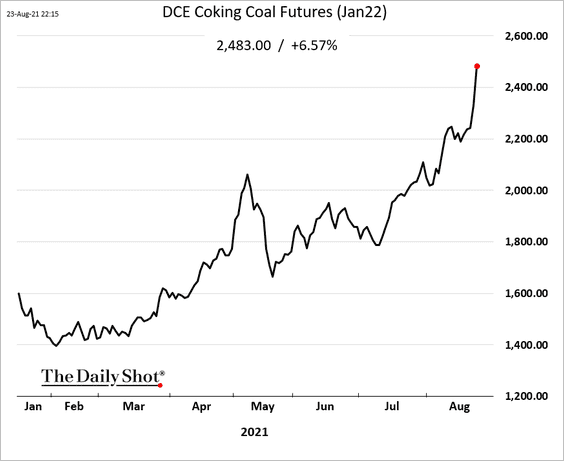

3. Coal prices continue to surge after Mongolian imports were shut off.

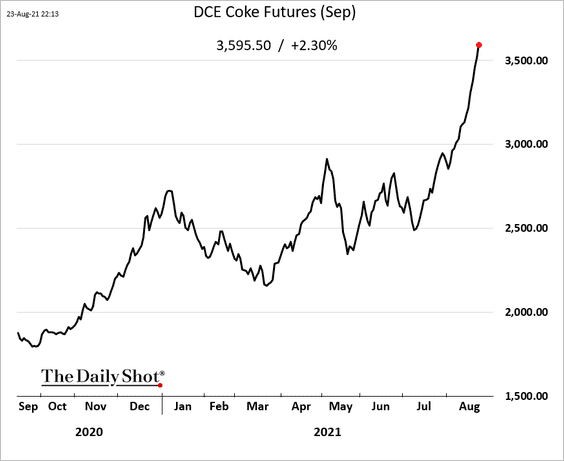

Metallurgical coke prices keep climbing.

——————–

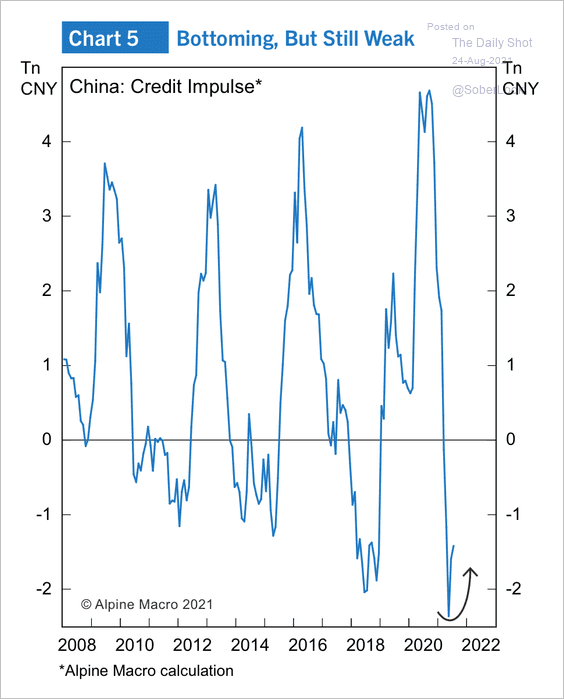

4. China’s credit impulse is stabilizing.

Source: Alpine Macro

Source: Alpine Macro

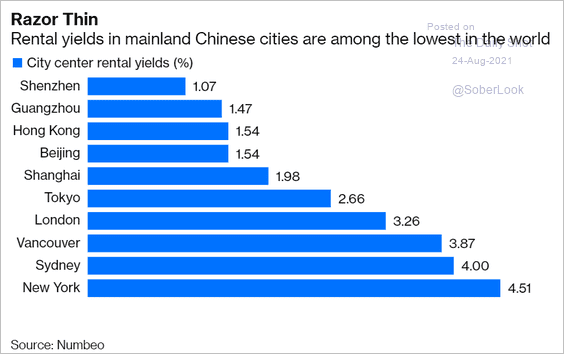

5. Rental yields are some of the lowest in the world due to elevated property prices.

Source: @bopinion Read full article

Source: @bopinion Read full article

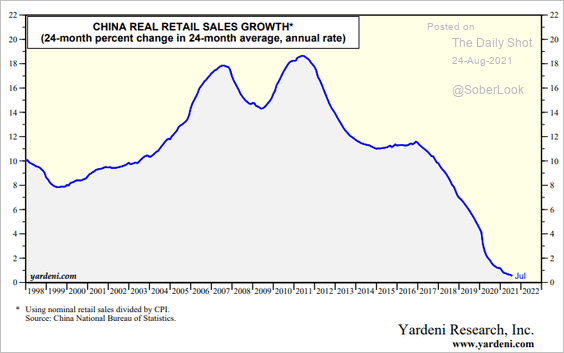

6. This chart shows China’s real retail sales growth.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Emerging Markets

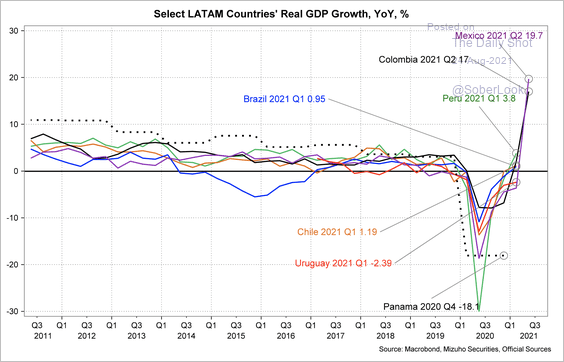

1. Let’s begin with Latin America.

• Growth is rebounding sharply from Q2 of last year, led by Mexico and Columbia.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

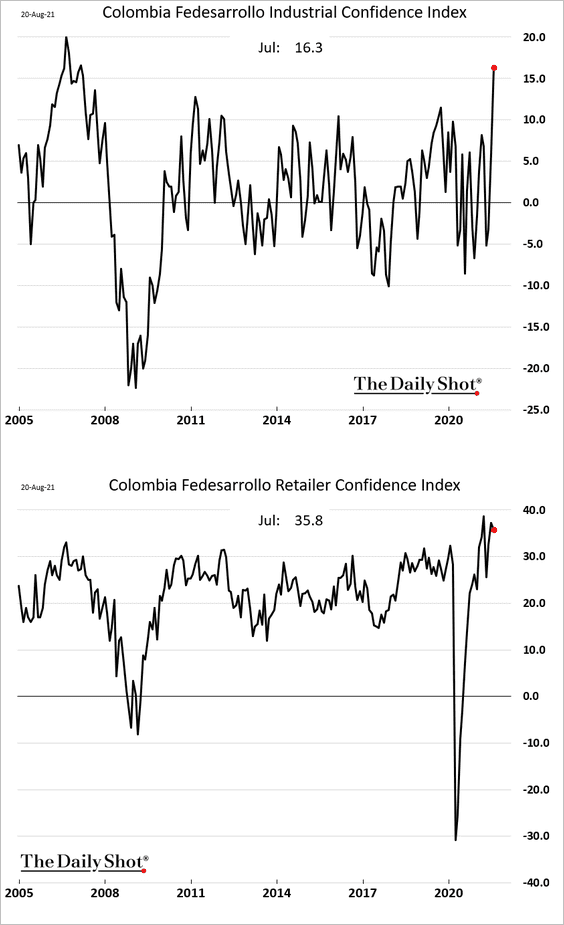

– Here is Colombia’s business confidence.

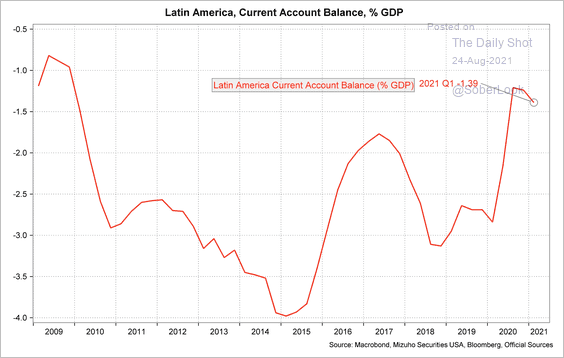

– The region’s current account deficit narrowed sharply last year.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

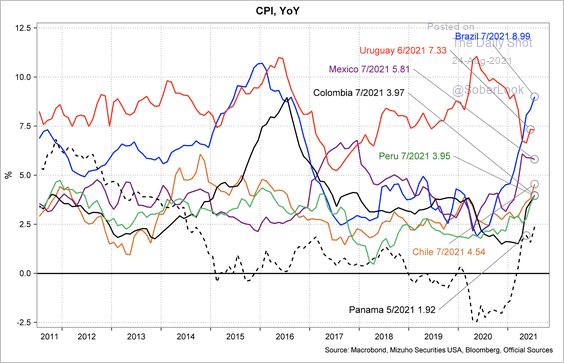

– Inflation has accelerated in Brazil and Mexico, while it remains relatively stable in other countries.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

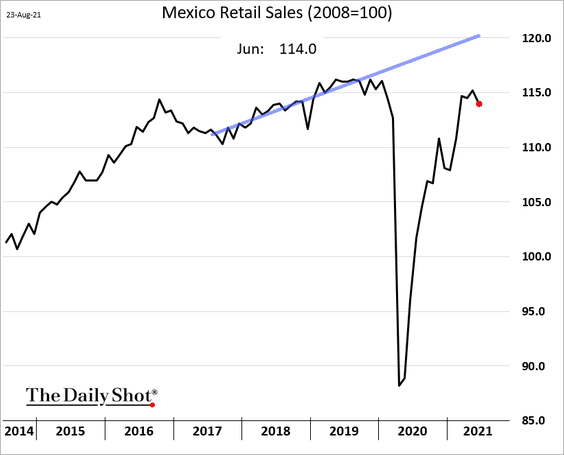

– Mexican retail sales declined in June.

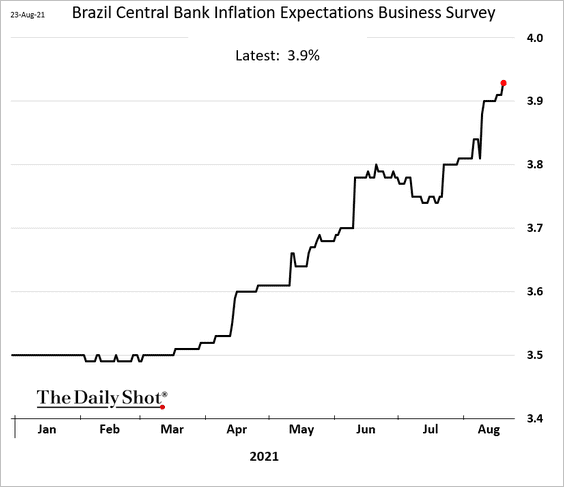

– Brazil’s inflation expectations keep climbing despite the central bank’s aggressive rate hikes (and further rate increase expectations).

h/t @brandimarte

h/t @brandimarte

——————–

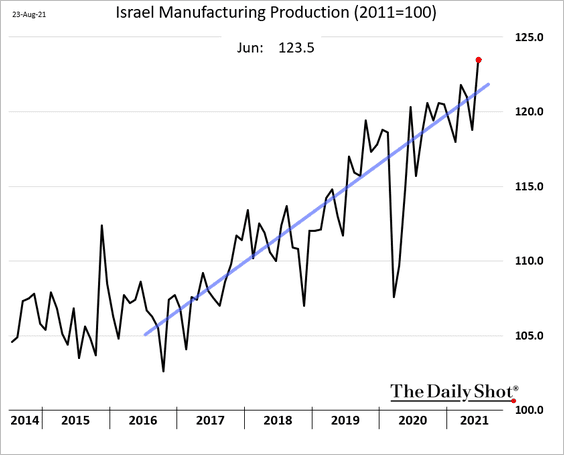

2. Israel’s manufacturing sector barely felt the pandemic downturn.

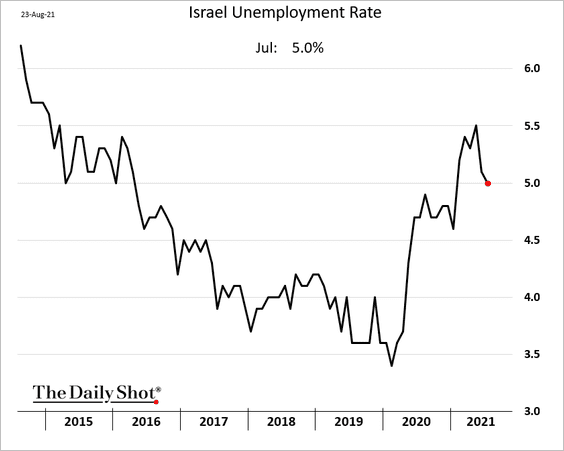

The unemployment rate is starting to moderate.

——————–

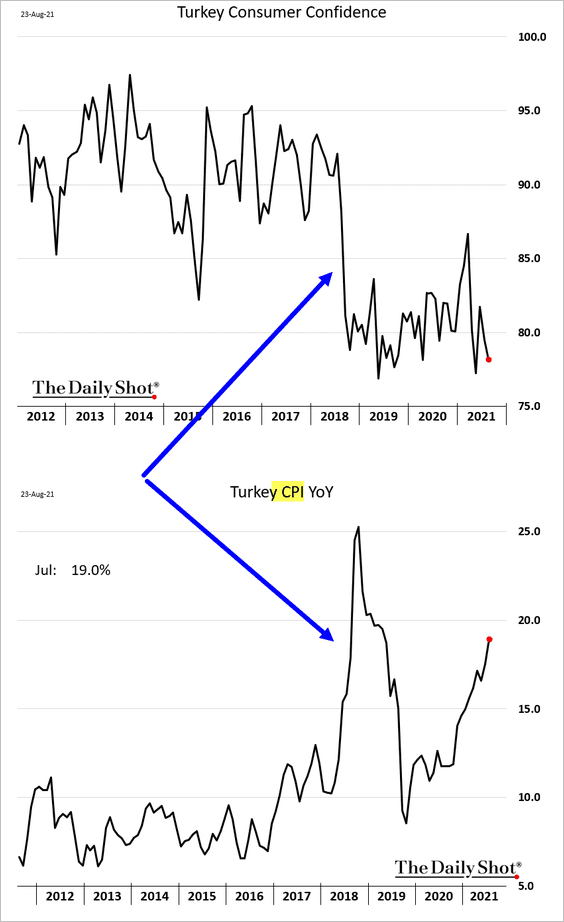

3. Turkey’s consumer confidence never recovered from the 2018 currency crisis.

Back to Index

Cryptocurrency

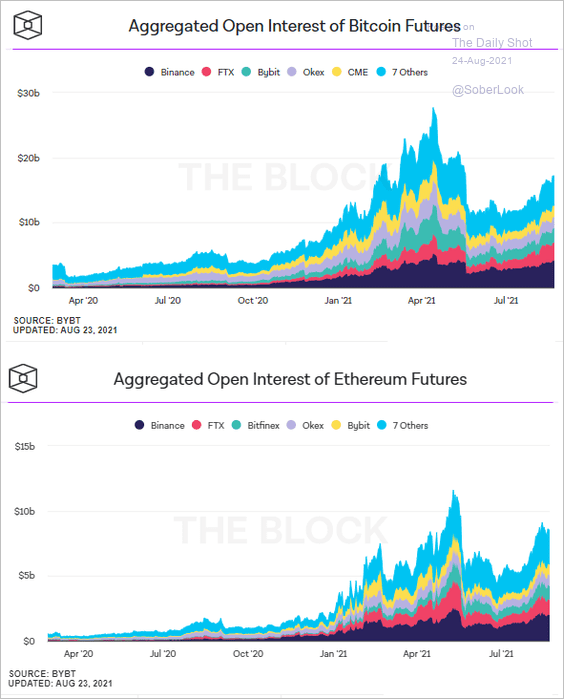

1. Crypto futures volume is recovering.

Source: The Block

Source: The Block

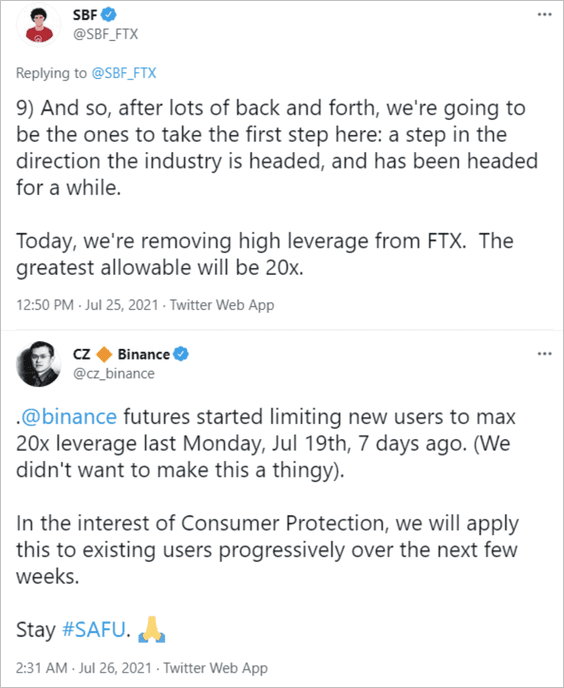

But exchanges have started limiting the amount of available leverage.

Source: Enigma Securities

Source: Enigma Securities

——————–

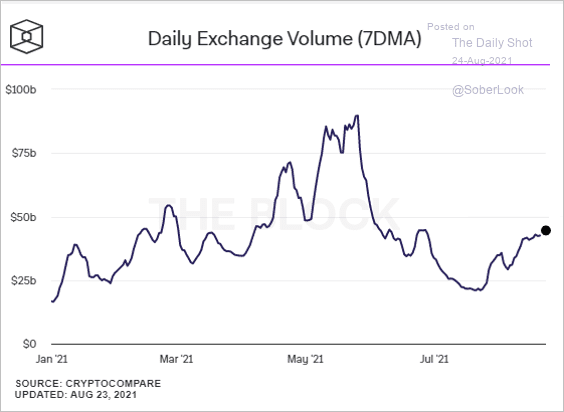

2. Spot volumes are still well below the May/June peak.

Source: The Block

Source: The Block

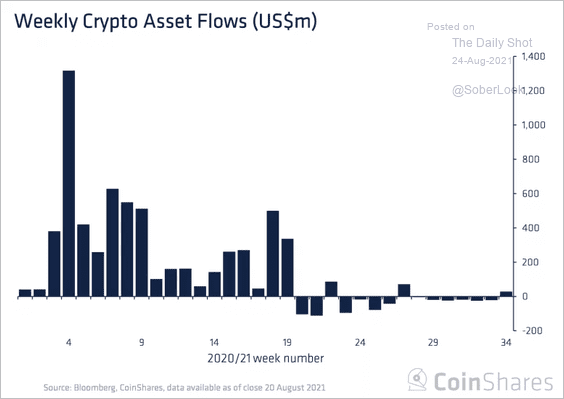

3. Digital asset funds saw $21 million in net inflows last week, reversing six consecutive weeks of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

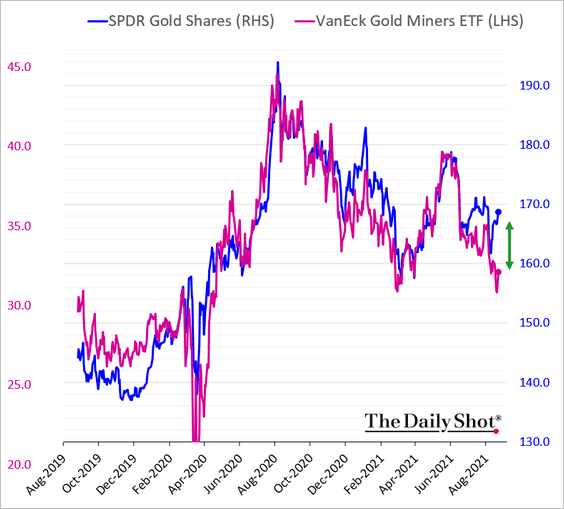

1. Shares of gold miners have decoupled from gold prices.

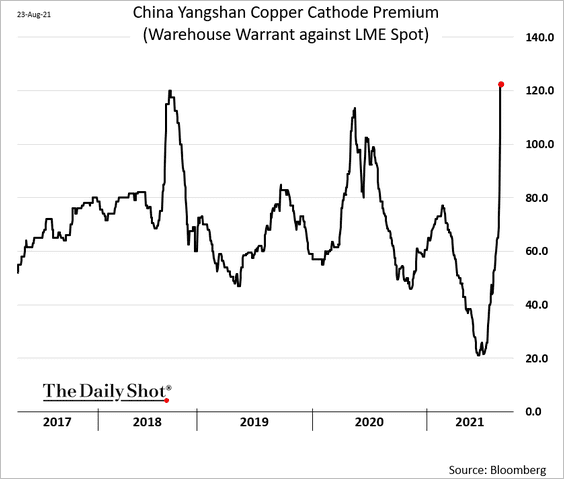

2. Chinese importers are paying a hefty premium for copper amid domestic supply bottlenecks (chart units = $/ton).

h/t @mburtonmetals

h/t @mburtonmetals

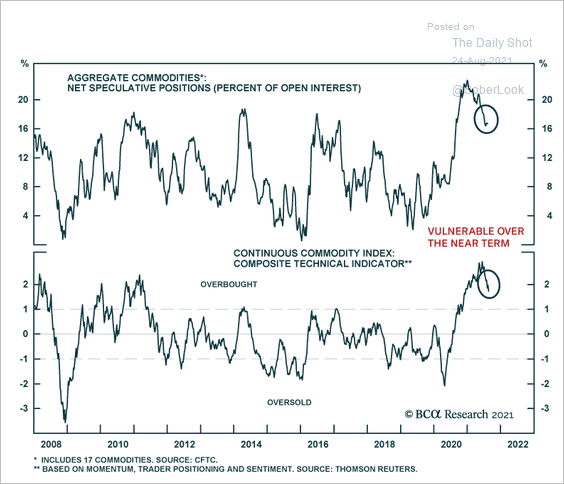

3. Commodity market technicals remain stretched.

Source: BCA Research

Source: BCA Research

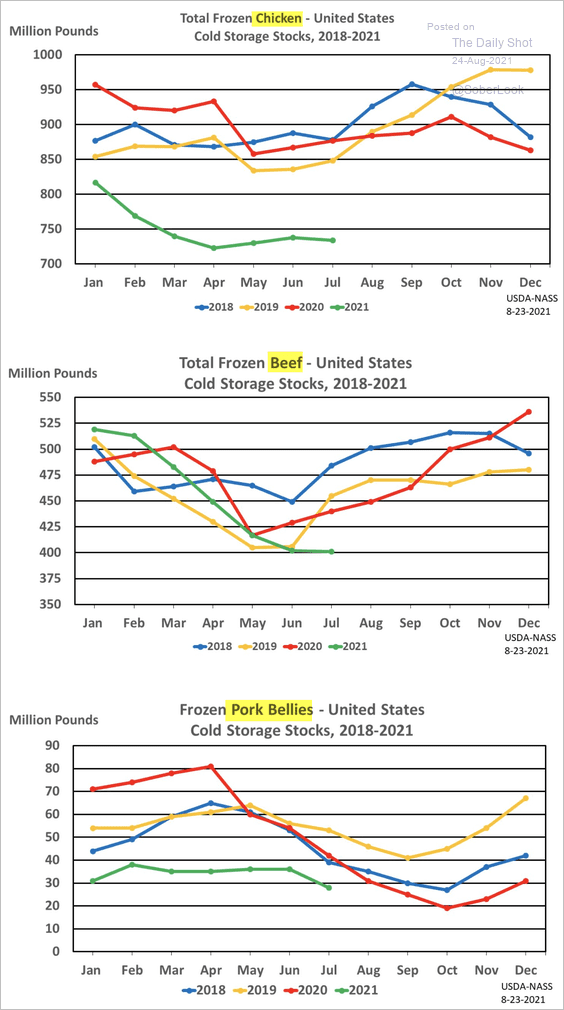

4. US meat inventories are at multi-year lows.

Source: @FarmPolicy, @usda_nass Read full article

Source: @FarmPolicy, @usda_nass Read full article

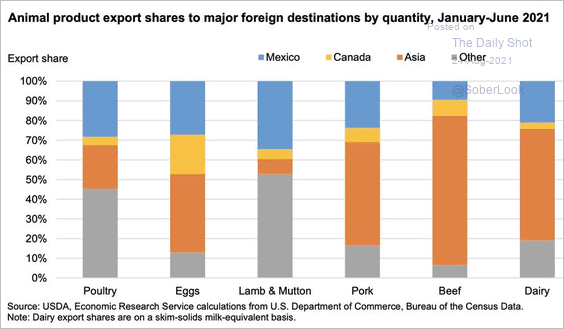

This chart shows the regional distribution of US animal product exports.

Source: @FarmPolicy, @USDA_ERS Read full article

Source: @FarmPolicy, @USDA_ERS Read full article

Back to Index

Energy

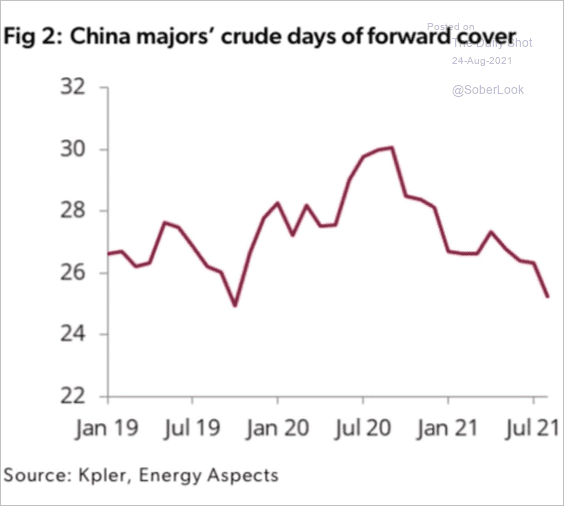

1. China’s oil inventories have been tightening.

Source: @HFI_Research

Source: @HFI_Research

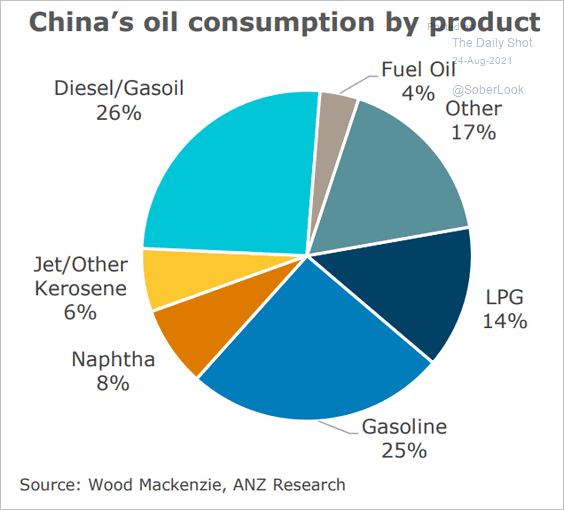

Here is China’s oil consumption by product.

Source: ANZ Research

Source: ANZ Research

——————–

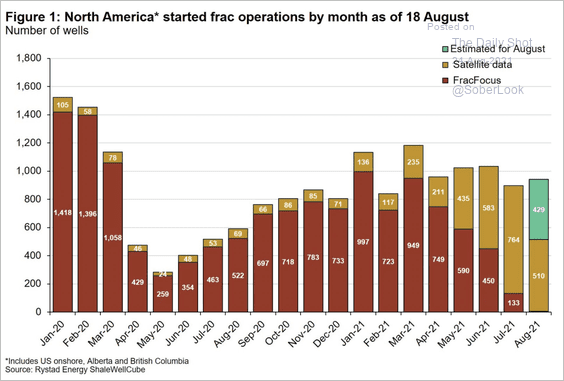

2. There hasn’t been much growth in US fracking operations.

Source: Rystad Energy; @HFI_Research

Source: Rystad Energy; @HFI_Research

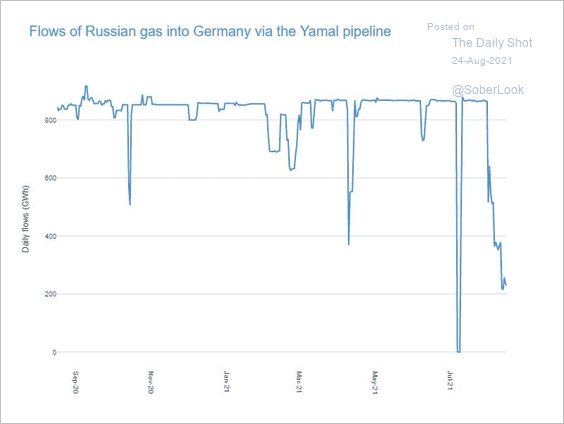

3. Gas supplies from Russia to Germany sharply declined over the past month.

Source: Investec

Source: Investec

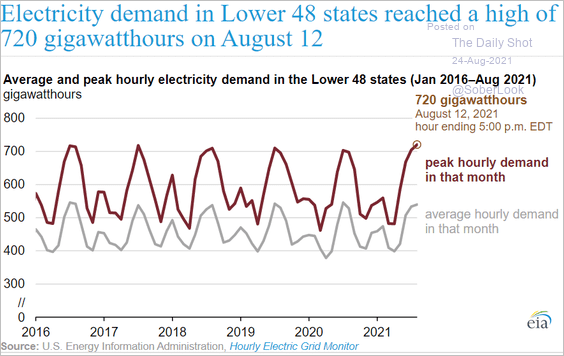

4. US electricity demand spiked this month.

Source: EIA Read full article

Source: EIA Read full article

Back to Index

Equities

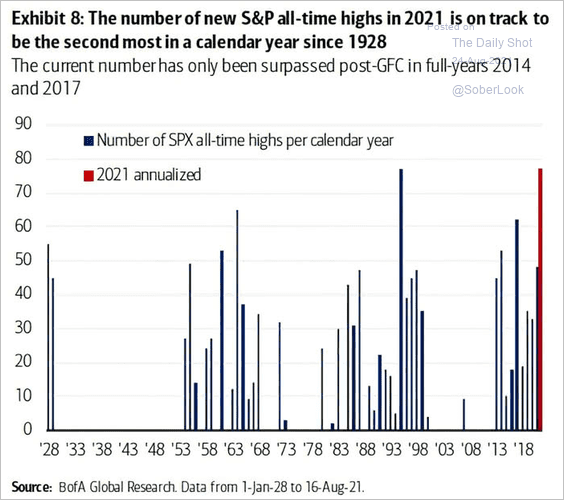

1. The S&P 500 continues to hit all-time highs.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

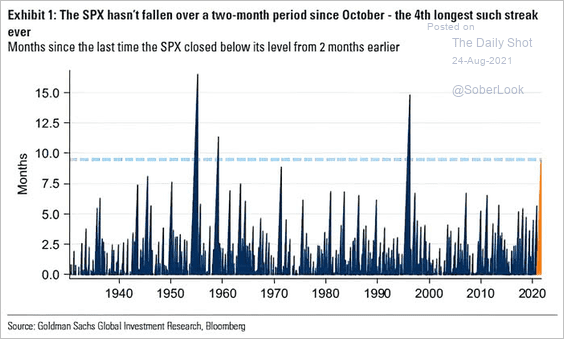

The index hasn’t fallen over a two-month period since October.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

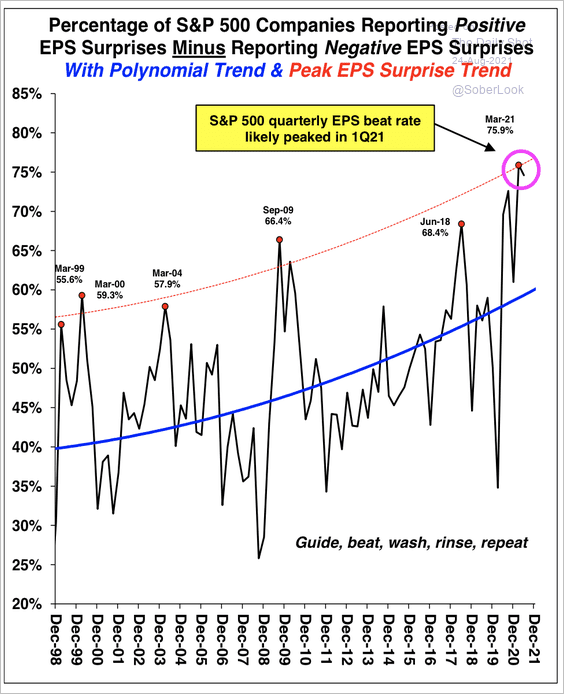

2. Are positive earnings surprises nearing a peak?

Source: Stifel

Source: Stifel

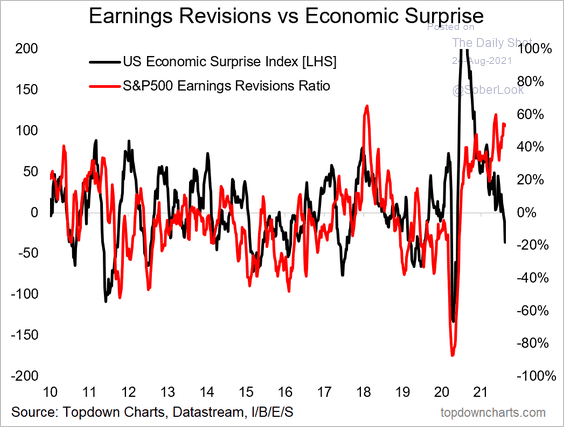

3. Earnings revisions have diverged from the Citi Economic Surprise Index.

Source: @topdowncharts

Source: @topdowncharts

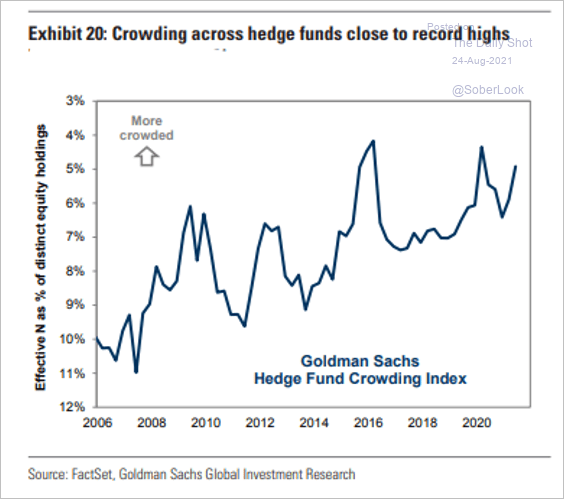

4. Hedge fund bets are increasingly crowded.

Source: Goldman Sachs; @Saburgs

Source: Goldman Sachs; @Saburgs

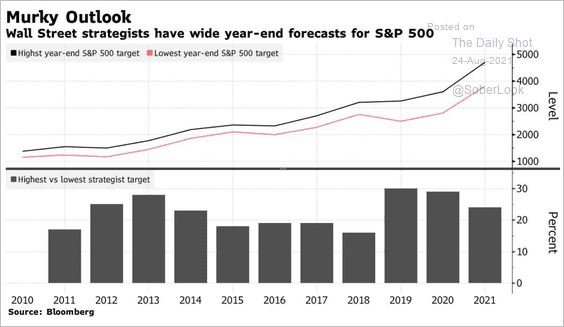

5. Analysts’ S&P 500 forecast dispersion has widened in recent years.

Source: @markets Read full article

Source: @markets Read full article

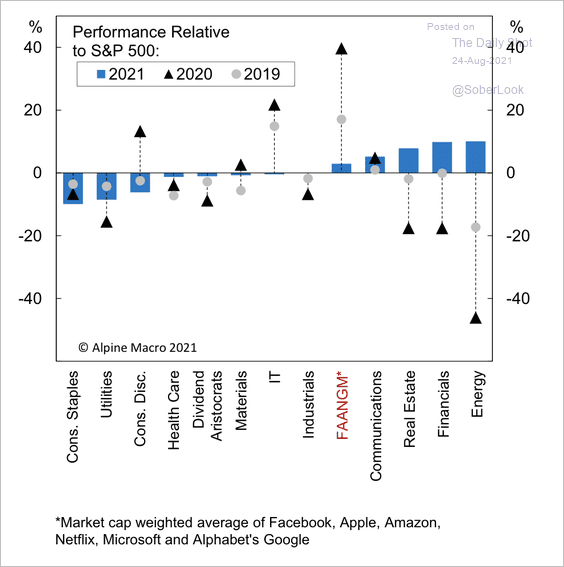

6. FAANGM stocks have risen for a third consecutive year.

Source: Alpine Macro

Source: Alpine Macro

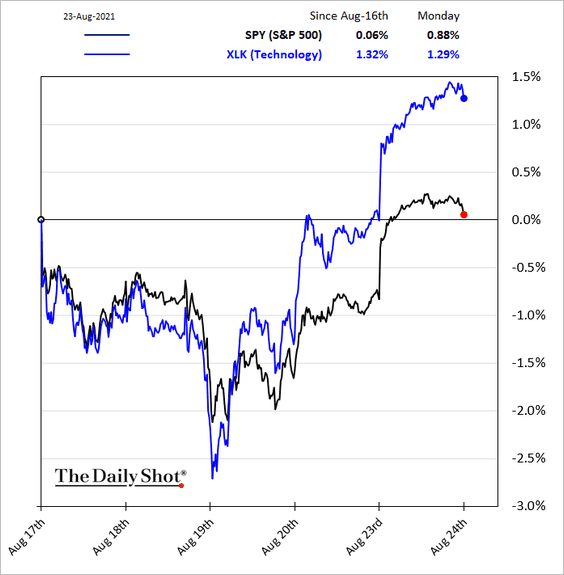

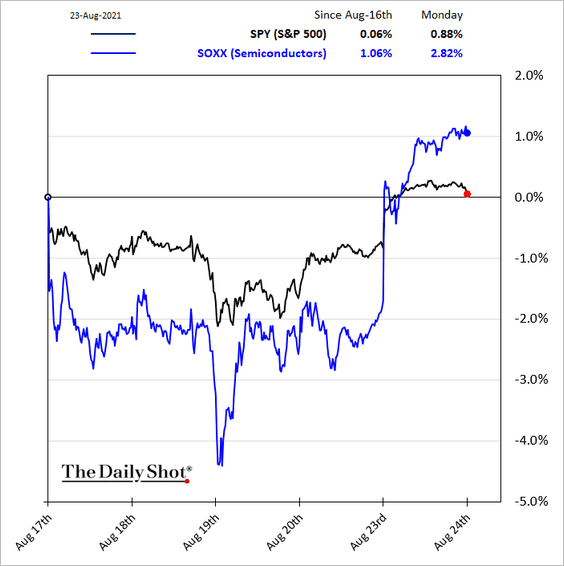

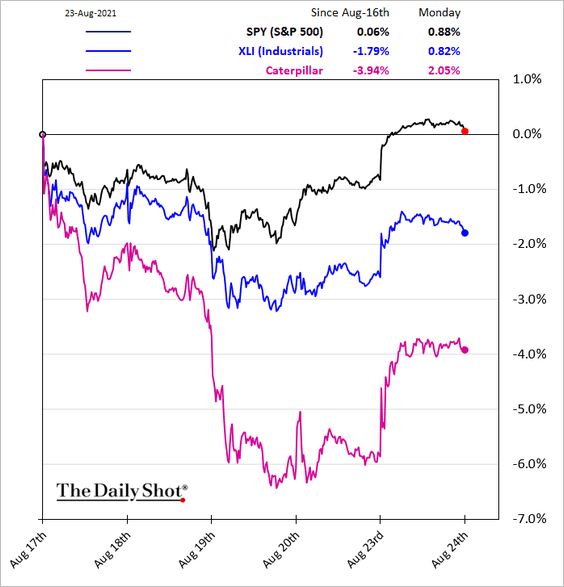

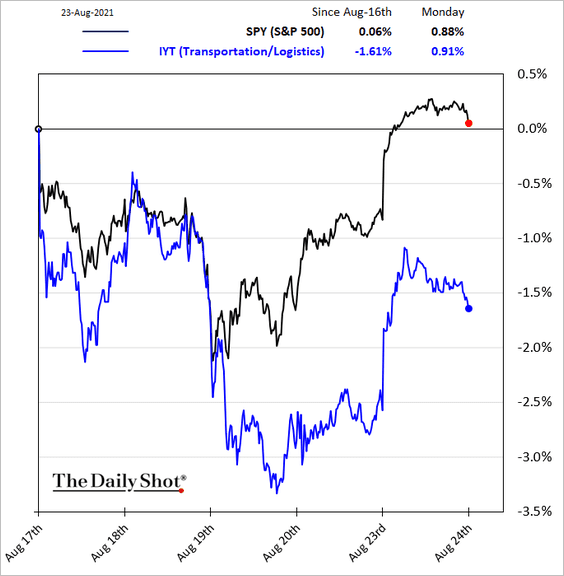

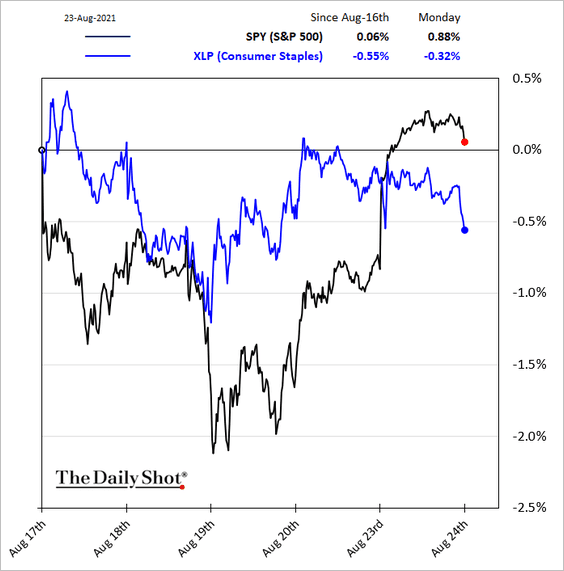

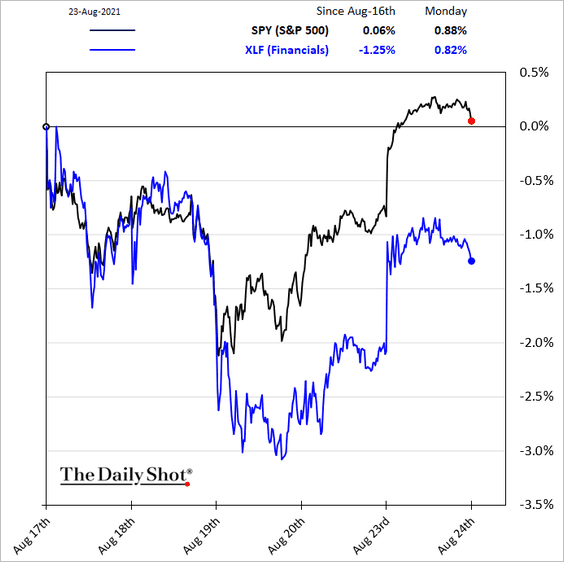

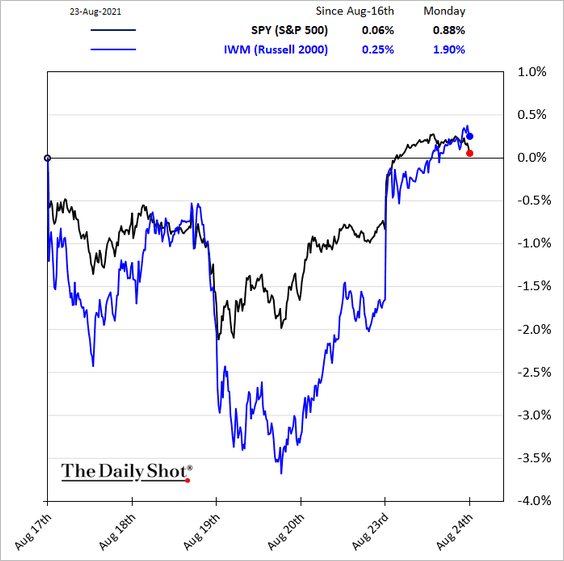

7. Next, we have some sector performance charts (last five business days).

• Tech and semiconductors:

• Industrials:

• Transportation:

• Consumer staples:

• Financials:

——————–

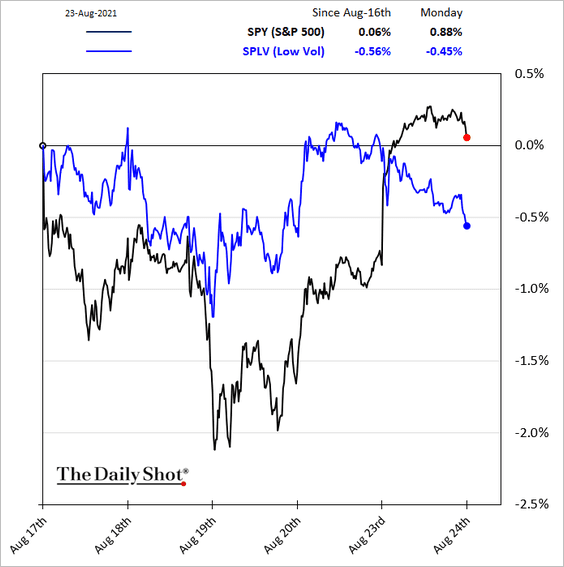

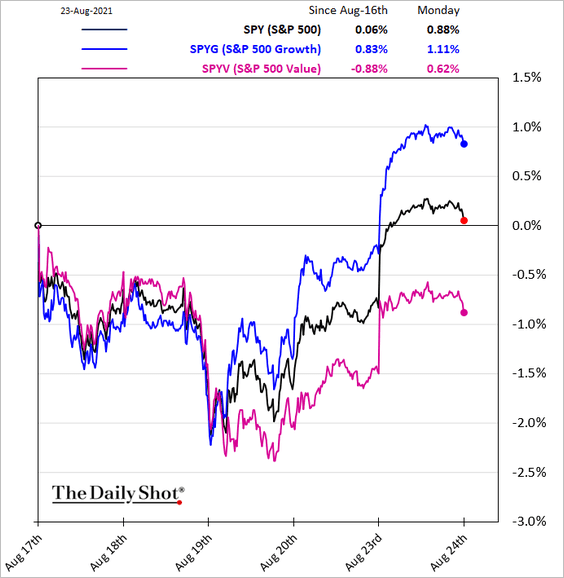

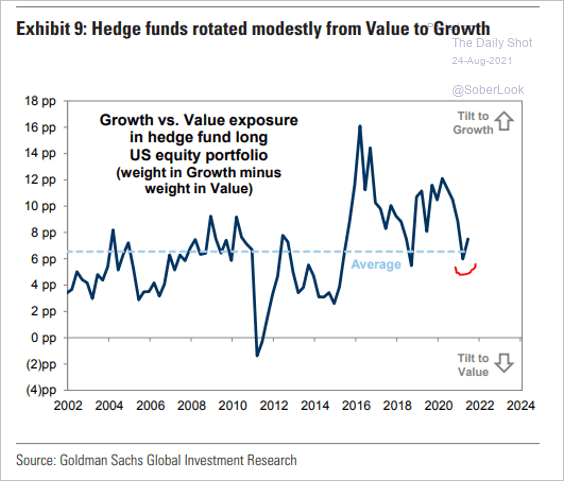

8. Below are some equity factor trends.

• Small caps (sharp rebound):

• Low-vol:

• Growth vs. value:

Source: Goldman Sachs; @Saburgs

Source: Goldman Sachs; @Saburgs

——————–

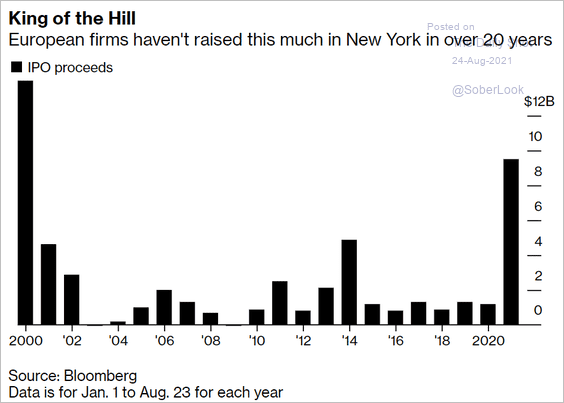

9. European firms have been raising quite a bit of capital in New York.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

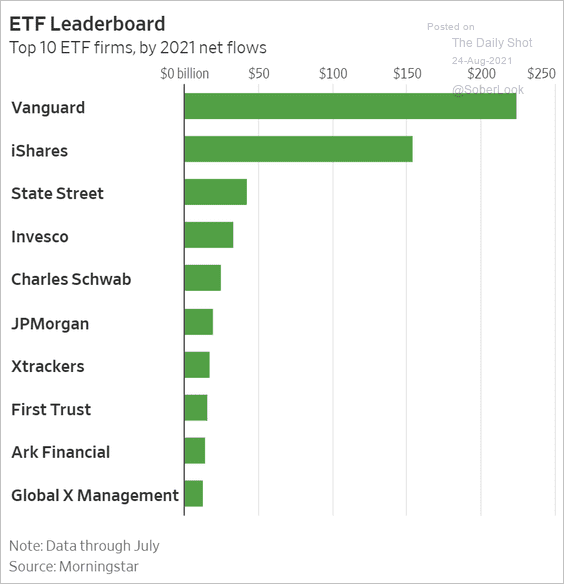

10. Finally, we have the top ten ETF firms.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

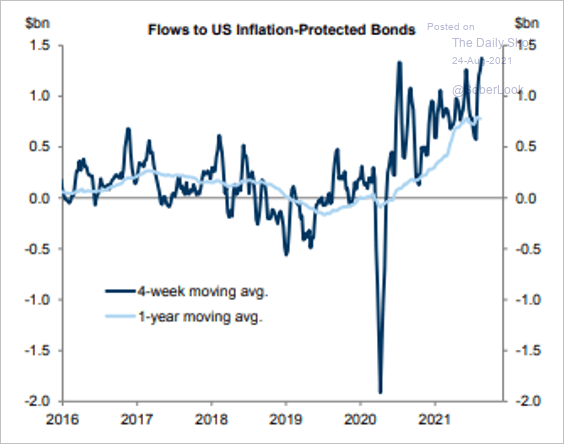

1. Fund flows into TIPS have been remarkable, …

Source: Goldman Sachs; @Saburgs

Source: Goldman Sachs; @Saburgs

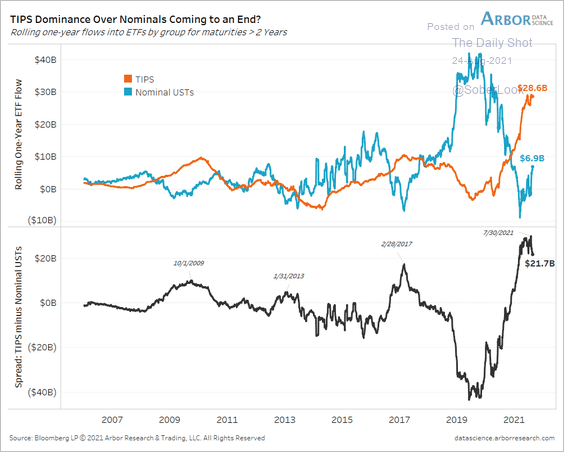

… massively outpacing flows into “nominal” Treasuries.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

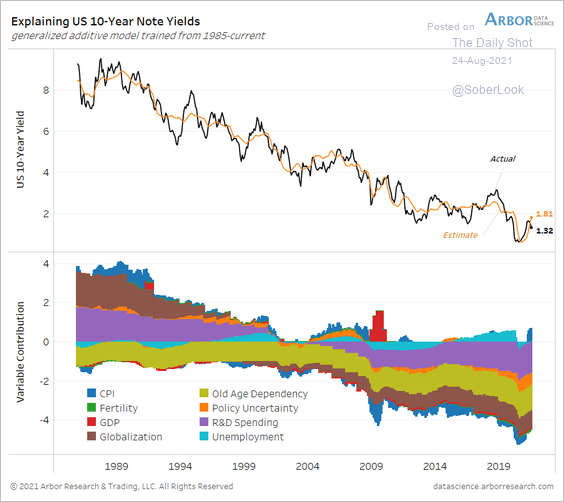

2. This chart shows the Arbor Data Science attribution of the 10yr Treasury yield changes over the past three decades.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

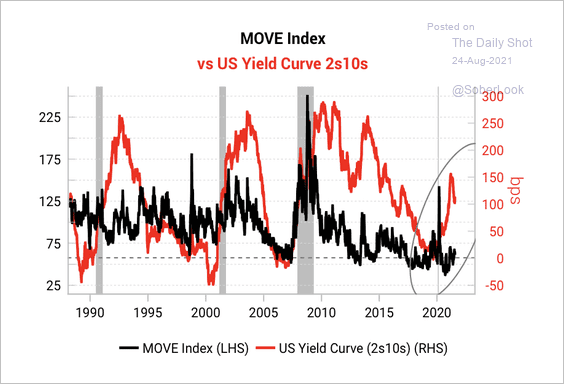

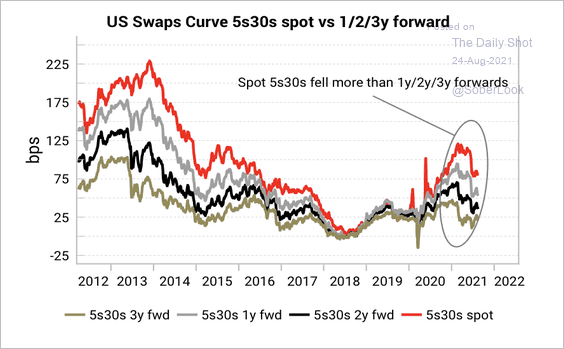

3. Fixed income volatility is low relative to the shape of the yield curve.

Source: Variant Perception

Source: Variant Perception

The divergence between spot and forward rates is still elevated, which has not been accompanied by higher fixed-income volatility.

Source: Variant Perception

Source: Variant Perception

Back to Index

Global Developments

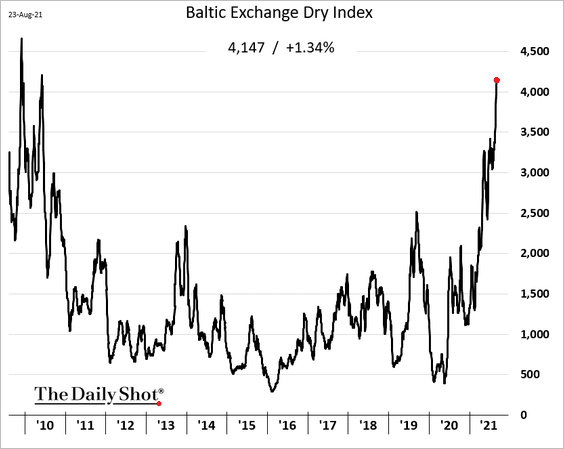

1. Dry bulk shipping costs continue to surge.

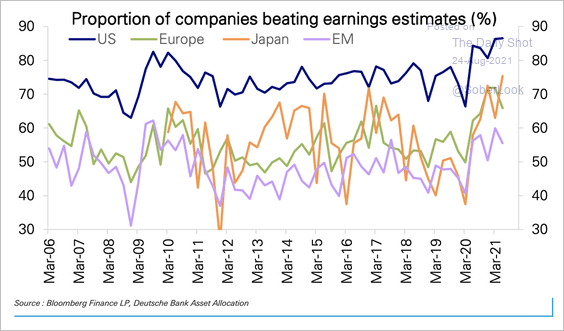

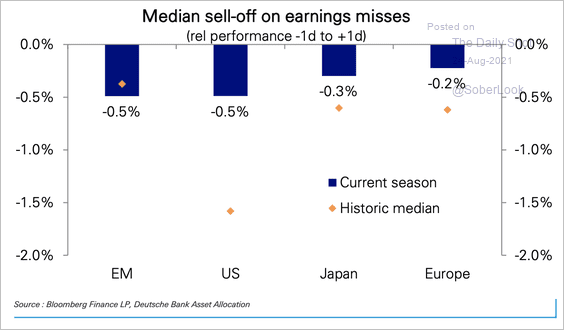

2. The proportion of companies with earnings beats are highest in the US and Japan, while Europe and EM have slowed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Companies that missed earnings estimates have not underperformed as severely as in the past.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

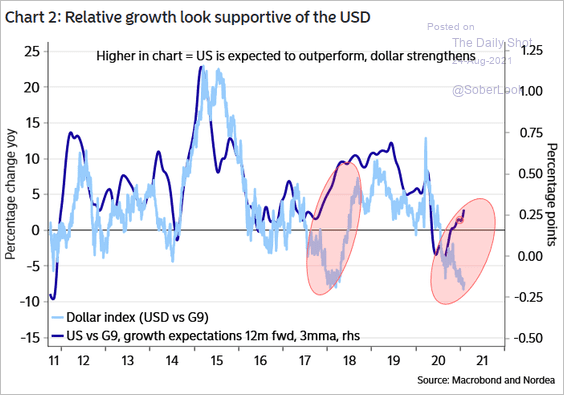

3. US vs. G9 growth expectation differentials point to a stronger US dollar ahead.

Source: @enlundm

Source: @enlundm

——————–

Food for Thought

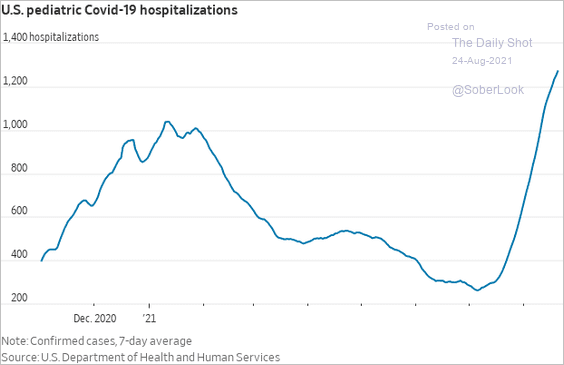

1. US pediatric COVID hospitalizations:

Source: @WSJ Read full article

Source: @WSJ Read full article

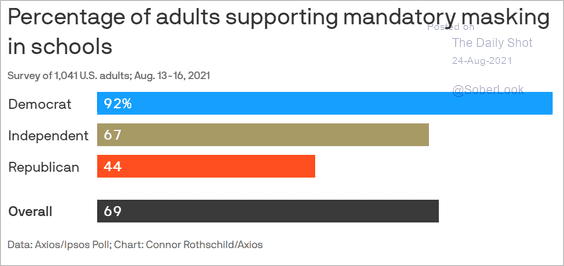

2. Support for mandatory masking in schools:

Source: @axios Read full article

Source: @axios Read full article

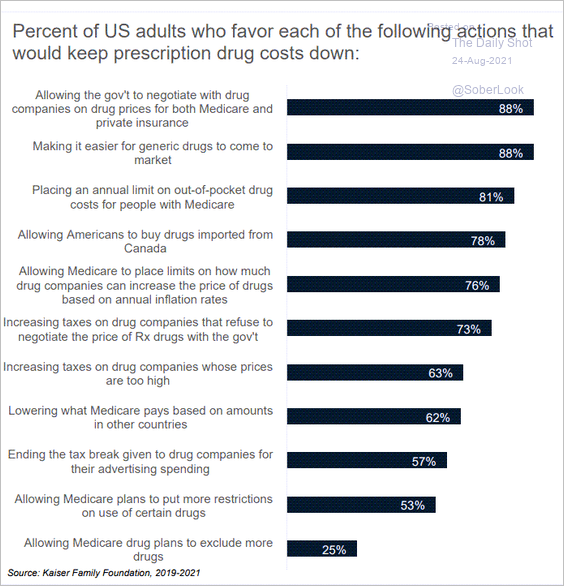

3. Support for potential actions to keep prescription drug costs down:

Source: Evercore ISI

Source: Evercore ISI

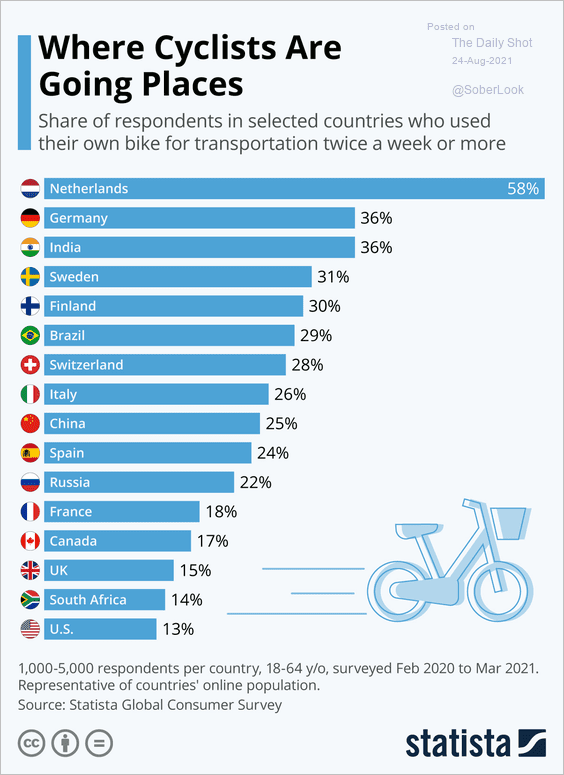

4. Frequent use of bicycles for transportation purposes:

Source: Statista

Source: Statista

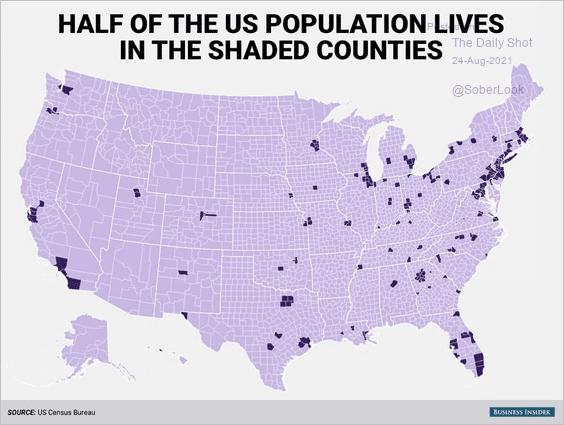

5. Most populous counties making up half of the US population:

Source: Business Insider Read full article

Source: Business Insider Read full article

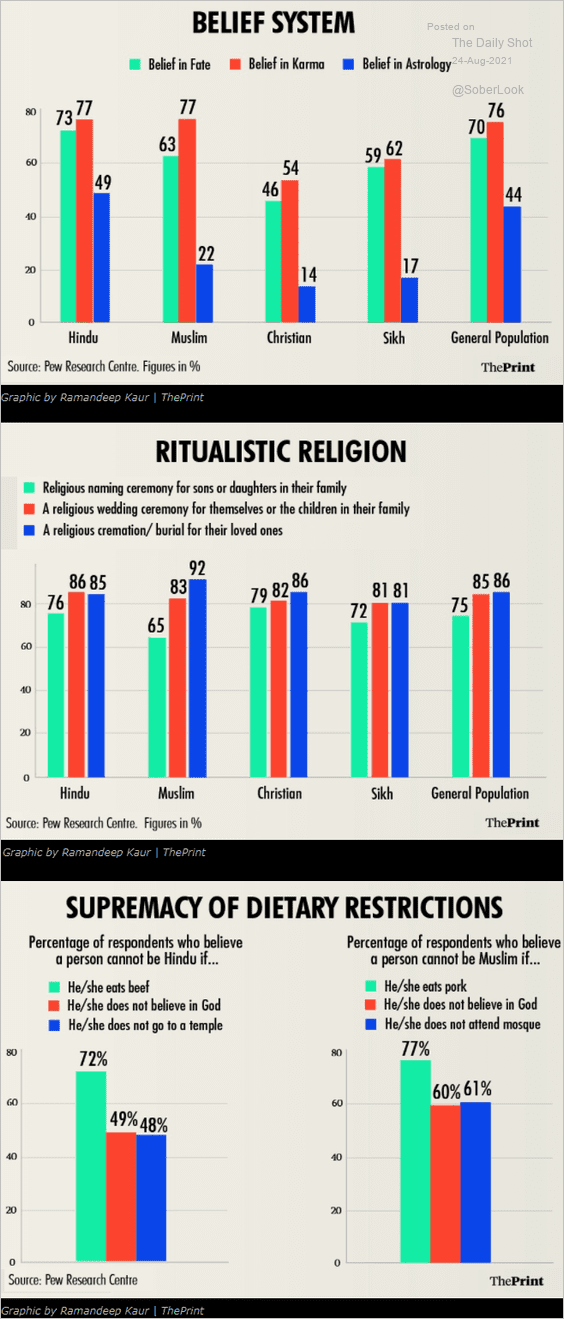

6. Dominant features of contemporary religion in India:

Source: ThePrint Read full article

Source: ThePrint Read full article

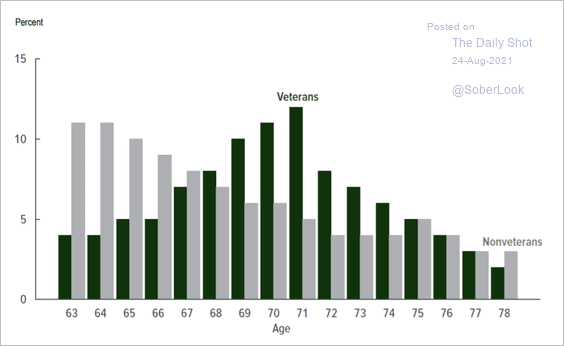

7. Age distribution of Vietnam veterans:

Source: CBO Read full article

Source: CBO Read full article

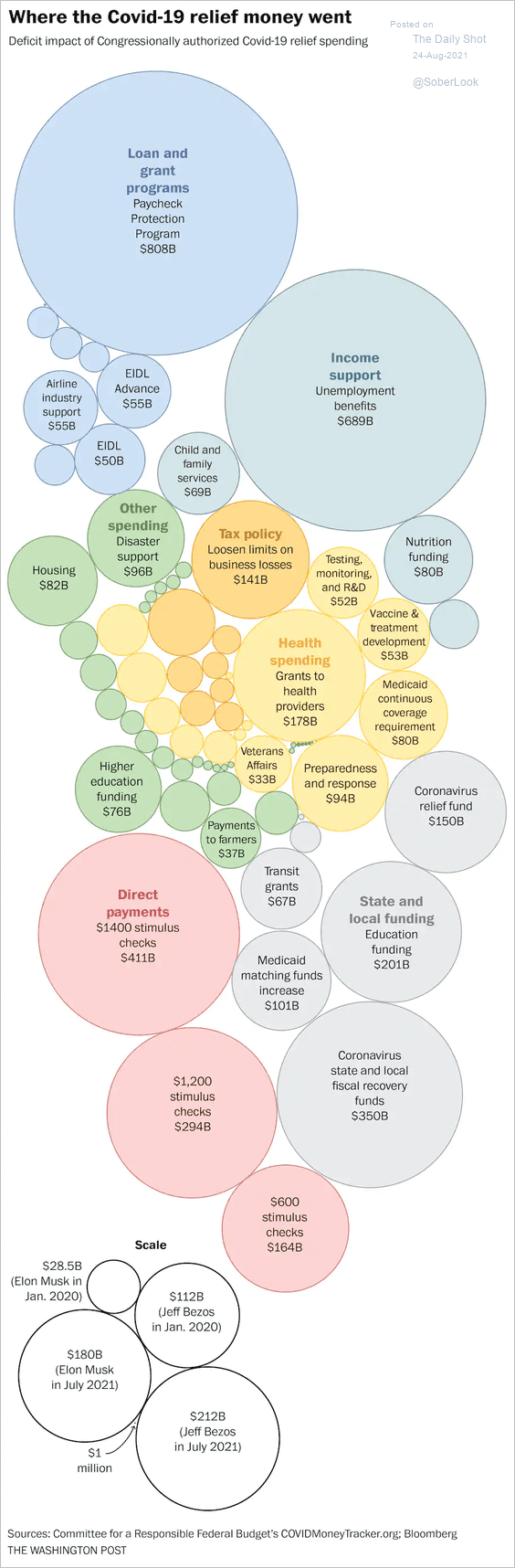

8. Where US COVID relief funds went:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

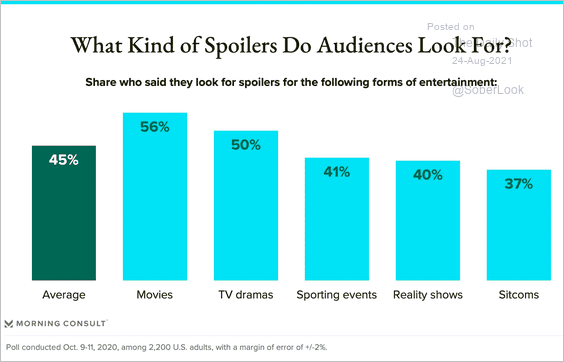

9. Looking for spoilers:

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

——————–

Back to Index