The Daily Shot: 25-Aug-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

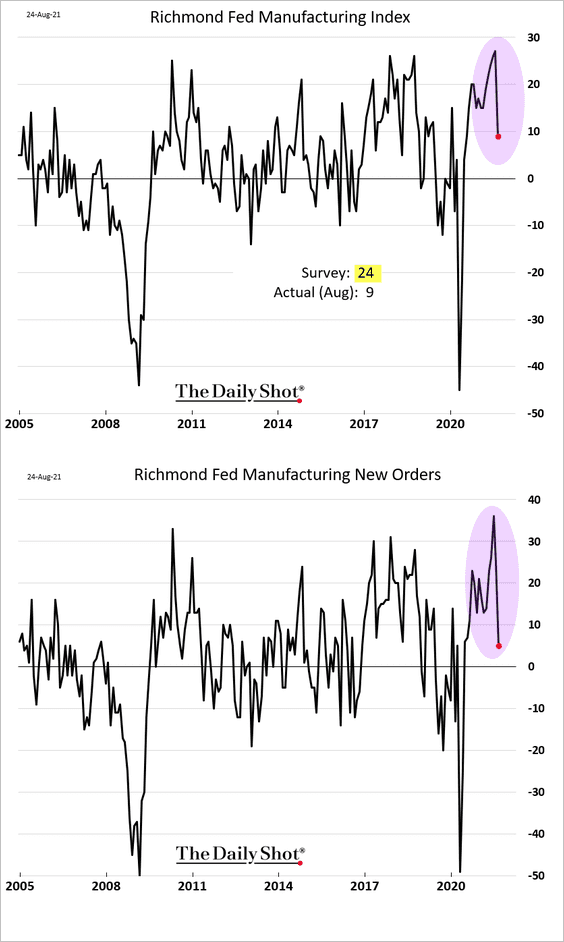

1. The Richmond Fed’s manufacturing index tumbled in August as order growth slowed. The map below shows the Richmond Fed’s district.

Source: Wikimedia

Source: Wikimedia

• Order backlog is easing.

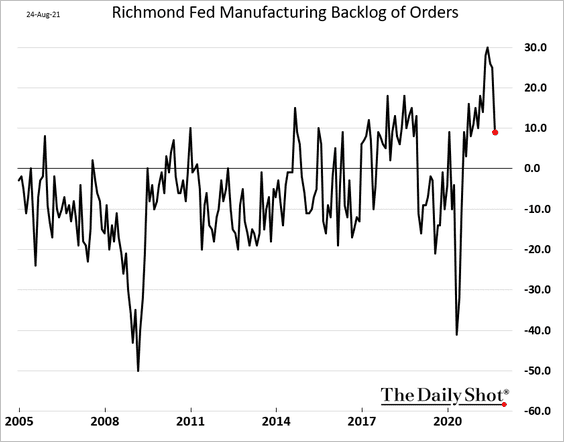

• Factories continue to boost wages at an accelerated pace.

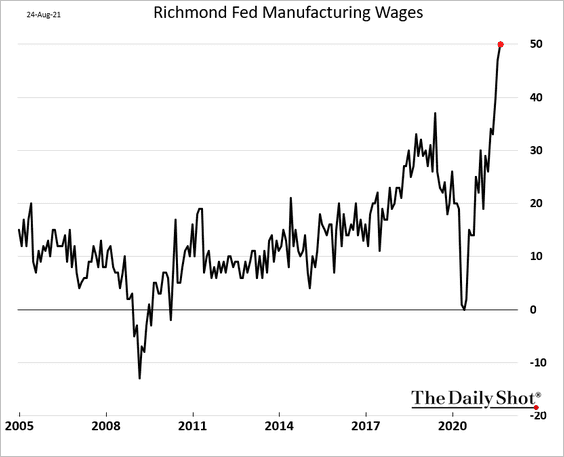

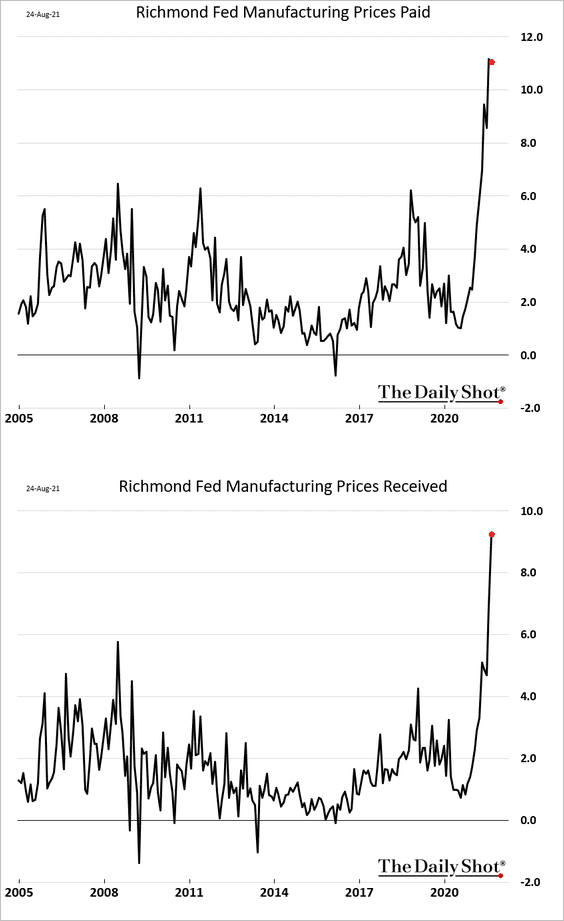

• Price pressures persist, with companies passing on some of the increased costs to their clients.

——————–

2. China’s manufacturing growth tends to lead the US, with the PMI index pointing to further moderation in US factory activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

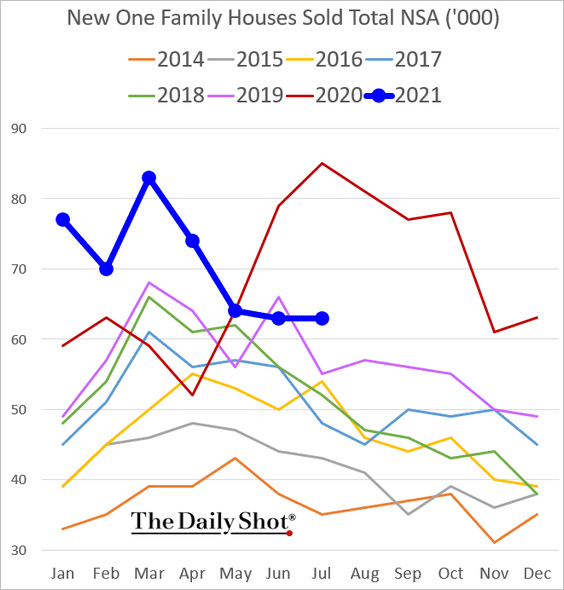

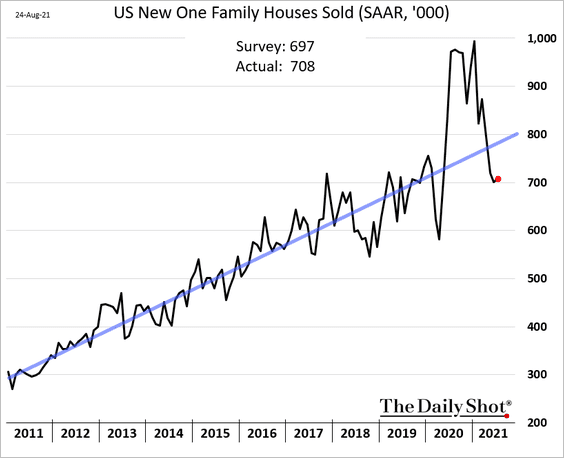

3. New home sales are back above 2019 levels.

• Sales are below trend on a seasonally adjusted basis.

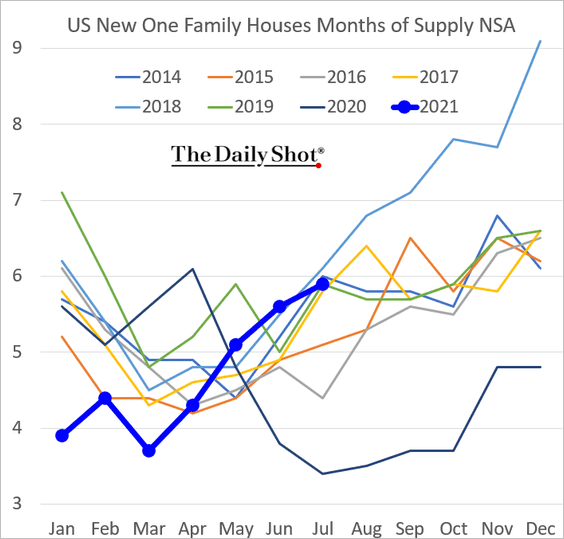

• Inventories of new homes have been rising.

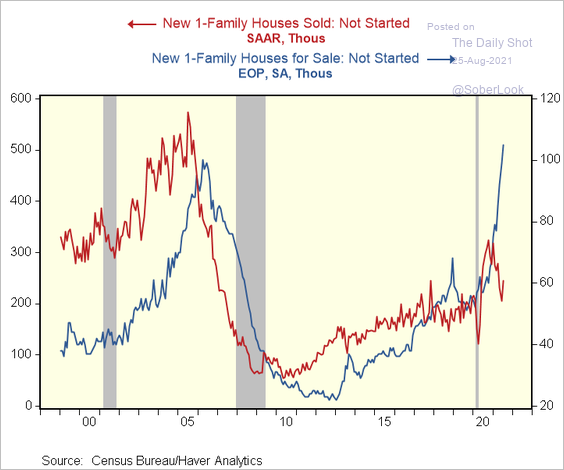

• This chart shows sold and for sale houses that have not been started yet (builders pre-selling).

Source: @RenMacLLC

Source: @RenMacLLC

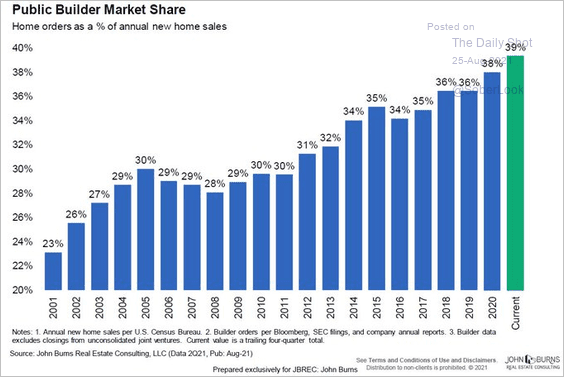

• By the way, the large, publicly-traded homebuilders increasingly control the nation’s residential construction market.

Source: @JBREC

Source: @JBREC

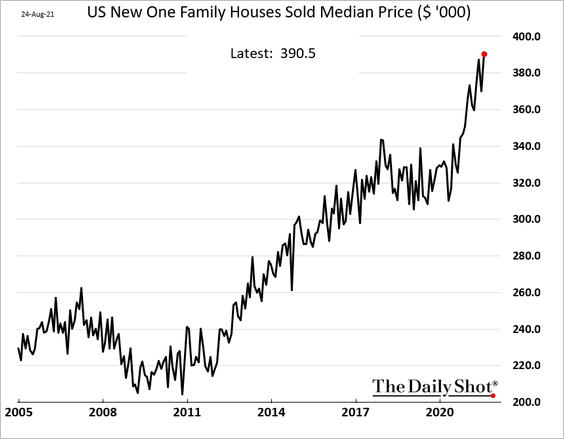

• The median price of a new home is approaching $400k.

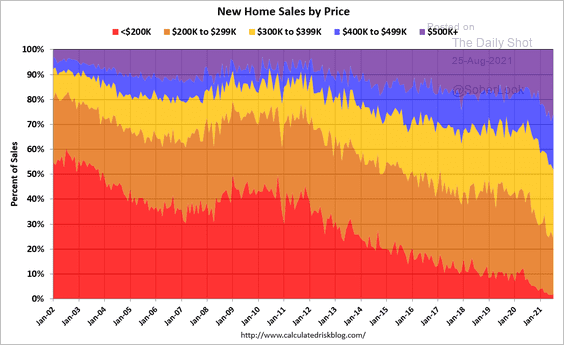

Here is the distribution of new home sales by price range.

Source: @calculatedrisk Read full article

Source: @calculatedrisk Read full article

——————–

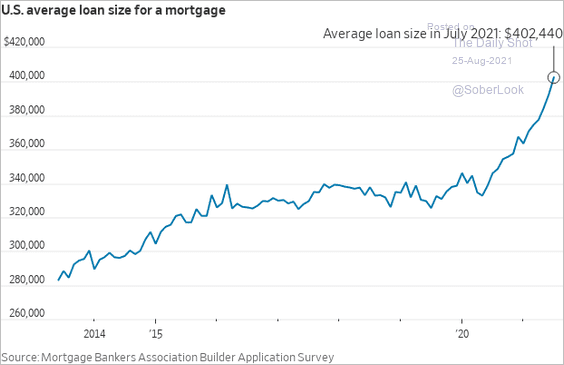

4. The average size of a mortgage in the US is now above $400k.

Source: @WSJ Read full article

Source: @WSJ Read full article

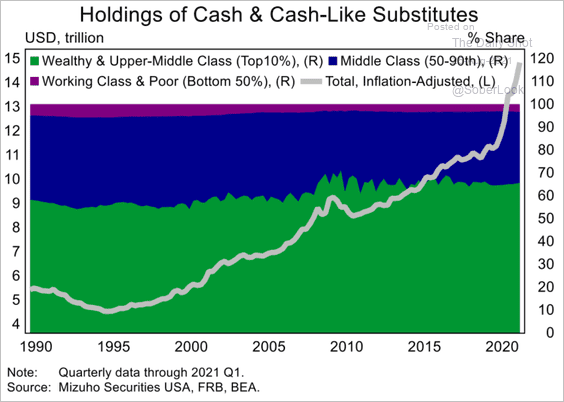

5. This chart shows the distribution and growth of household cash balances.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

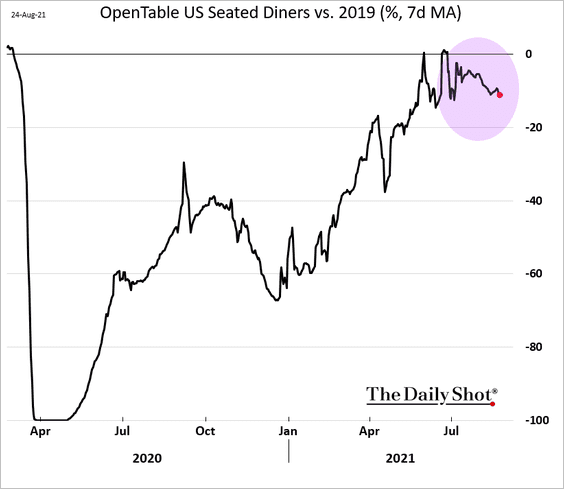

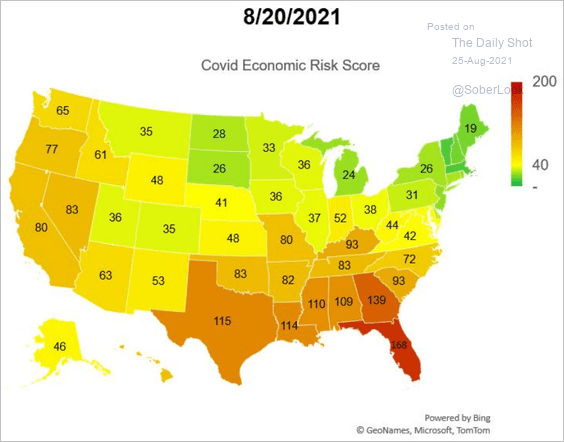

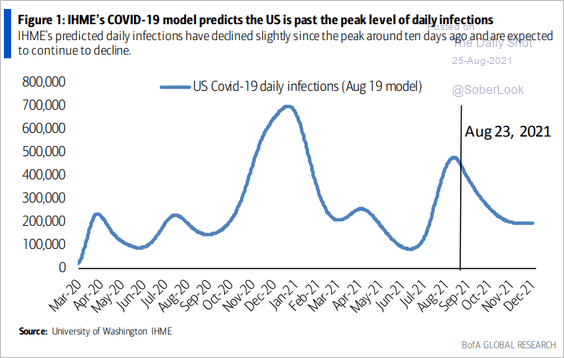

6. Next, we have some high-frequency data.

• Seated diners at US restaurants:

• COVID-related economic risk score by state:

Source: Cornerstone Macro

Source: Cornerstone Macro

• The U. Washington COVID model (infections peaking):

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

7. Finally, here are some updates on the US monetary policy.

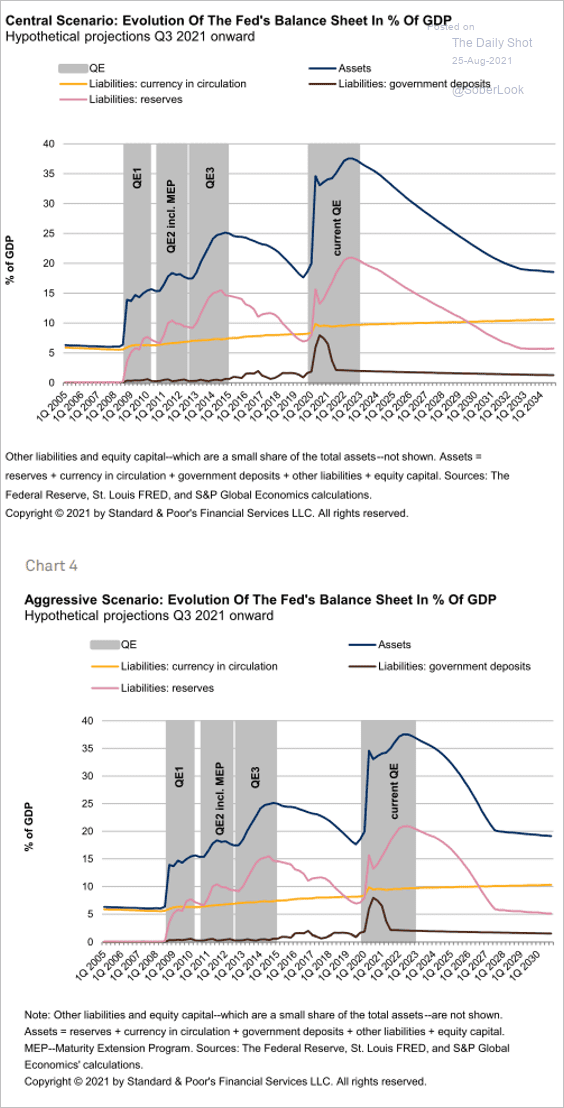

• Two scenarios for the Fed’s balance sheet as a percentage of GDP (from S&P Global Ratings):

Source: S&P Global Ratings

Source: S&P Global Ratings

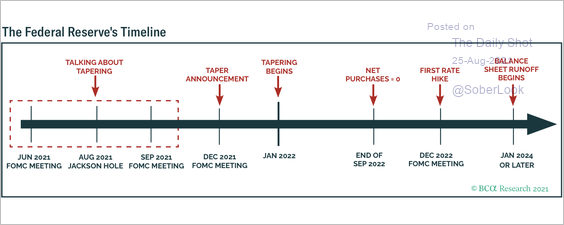

• An estimated timeline of Fed policy changes, according to BCA Research:

Source: BCA Research

Source: BCA Research

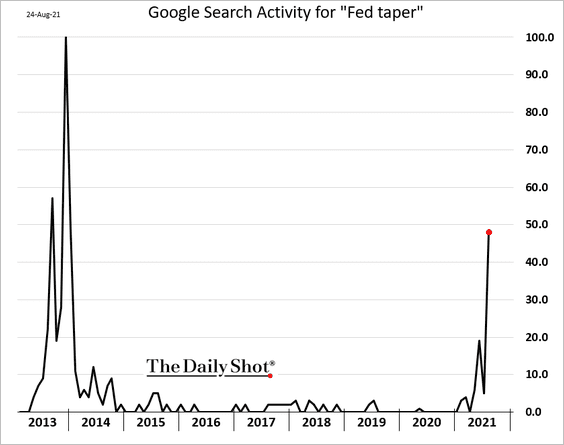

• Online search activity for “Fed taper”:

Back to Index

The United Kingdom

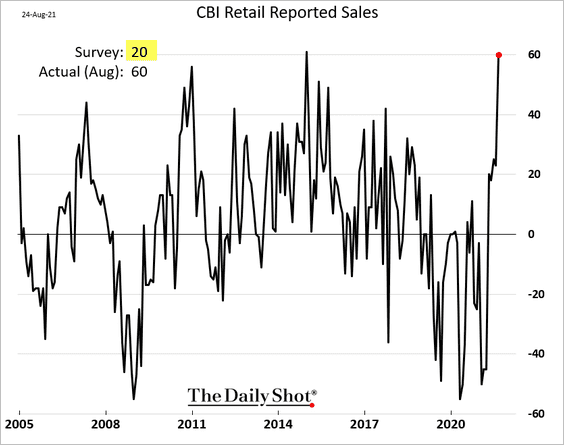

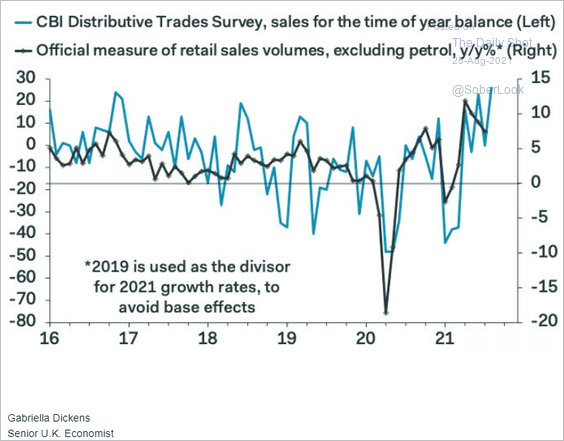

The CBI report showed retail sales surging in August, with the headline figure well above consensus.

Source: ESM Read full article

Source: ESM Read full article

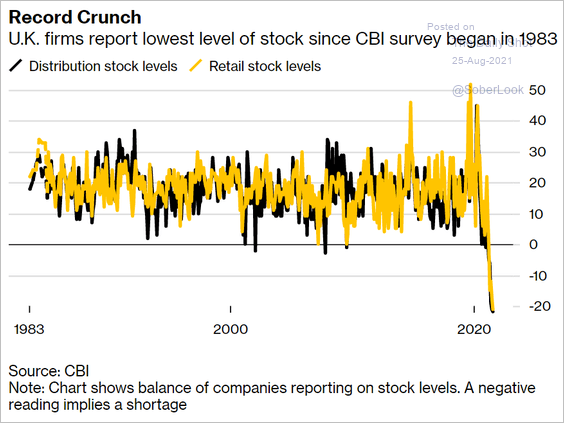

• Inventories are at their lowest levels in decades.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• We should see a pop in the official retail sales index.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

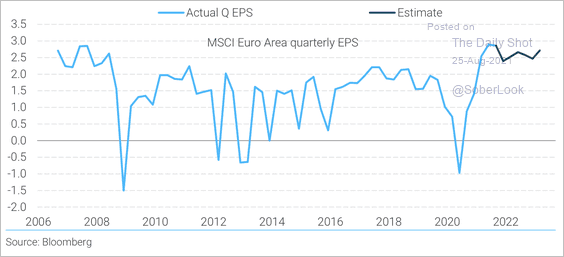

1. Consensus earnings forecasts are broadly flat over the next six quarters (at elevated levels).

Source: TS Lombard

Source: TS Lombard

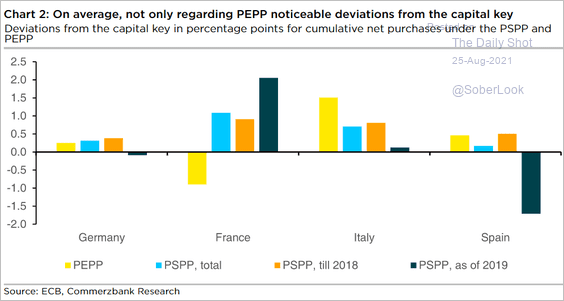

2. The ECB has been deviating from the capital keys proportions when purchasing securities.

Source: Commerzbank Research

Source: Commerzbank Research

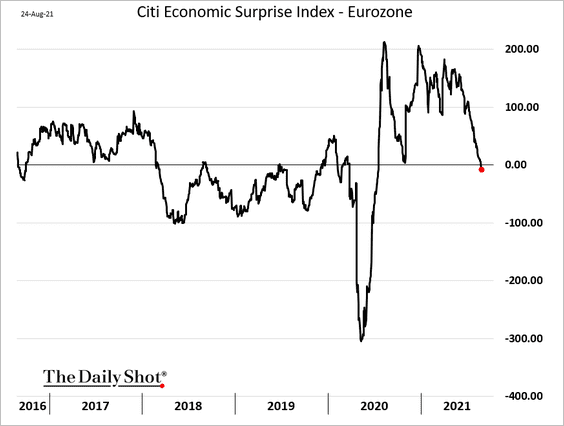

3. The Citi Economic Surprise Index continues to sink.

Source: Citi

Source: Citi

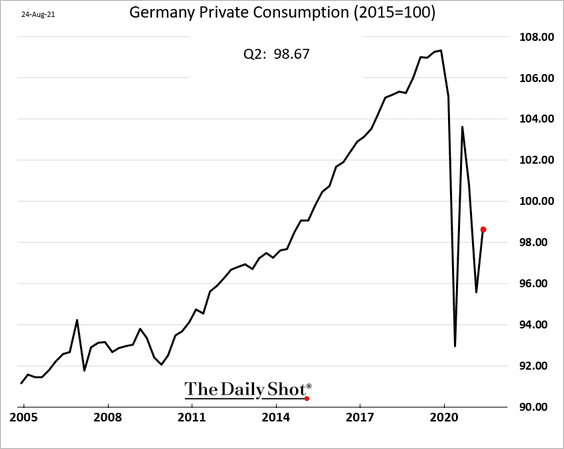

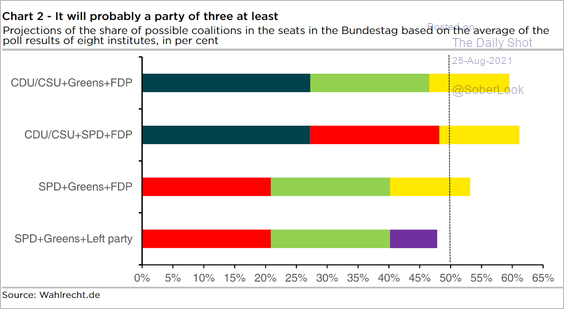

4. Next, we have a couple of updates on Germany.

• The recovery in private consumption has a long way to go.

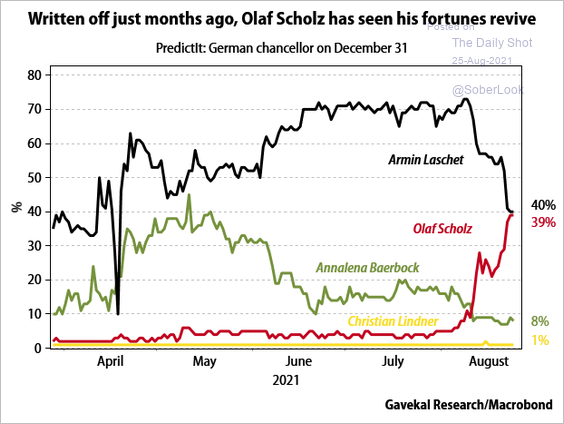

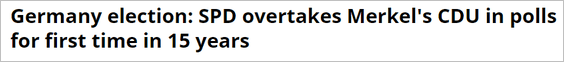

• The betting markets now show roughly equal odds of a CDU/CSU vs. SPD victory.

Source: Gavekal Research

Source: Gavekal Research

Source: Euronews Read full article

Source: Euronews Read full article

Here are some possible coalitions based on the latest polls.

Source: Commerzbank Research

Source: Commerzbank Research

Back to Index

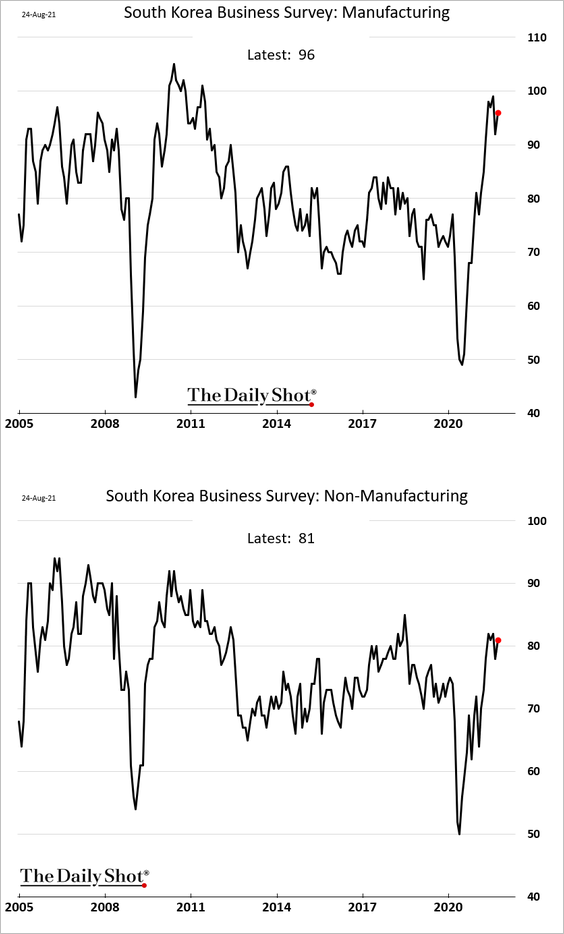

Asia – Pacific

1. South Korea’s business surveys remain resilient.

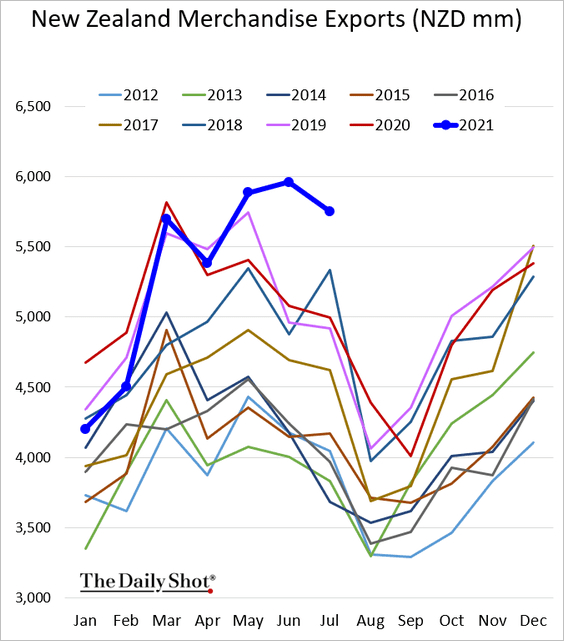

2. New Zealand’s exports are still at record levels for this time of the year.

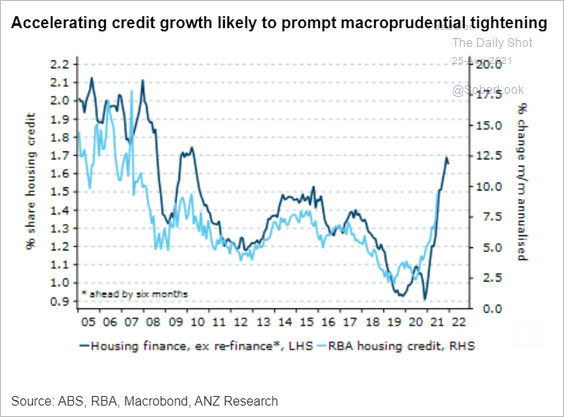

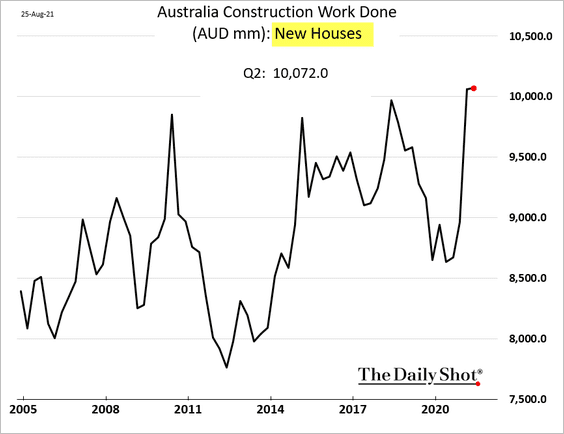

3. Australia’s housing credit growth has been unusually strong.

Source: ANZ Research

Source: ANZ Research

However, residential construction was almost unchanged last quarter.

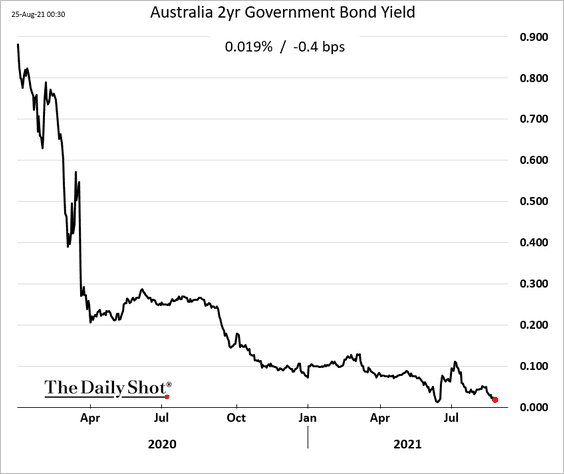

Australia’s 2yr yield is nearing zero again amid lockdowns.

Back to Index

China

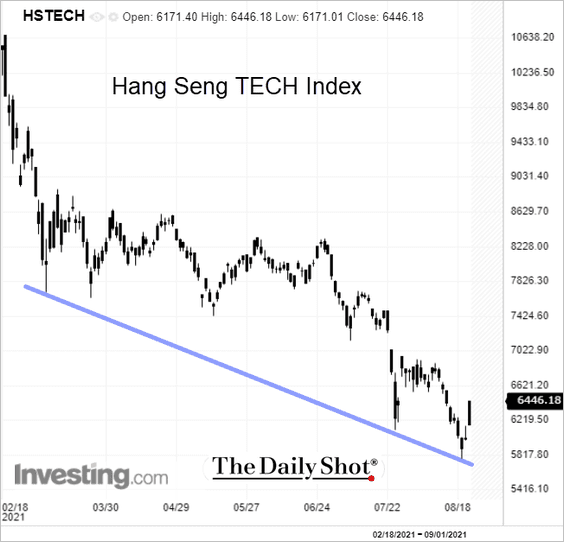

1. Tech stocks bounced from support in Hong Kong.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

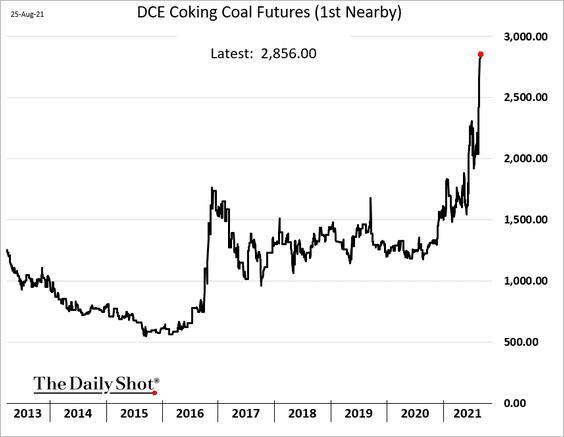

2. Coal prices continue to surge.

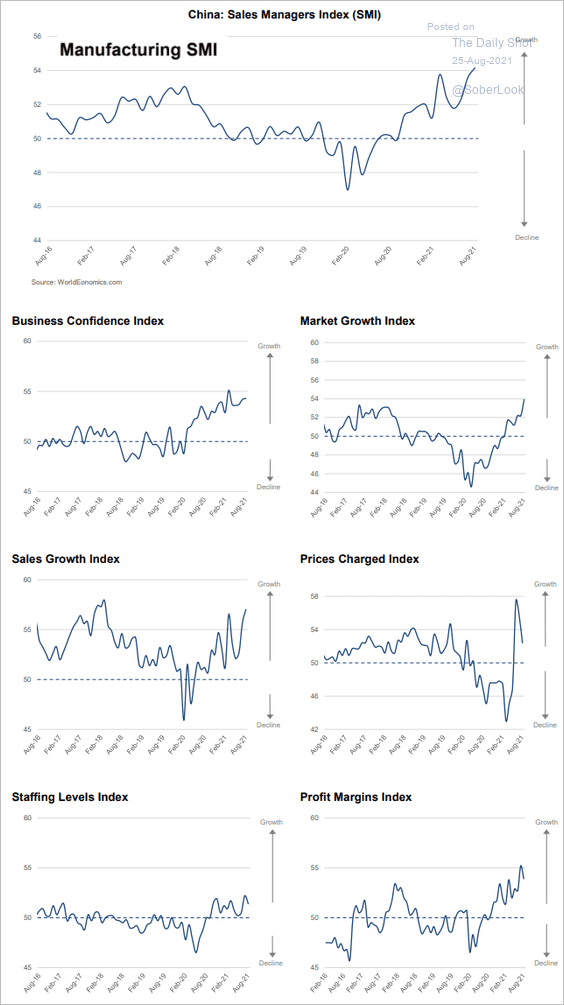

3. The World Economics SMI report shows surprisingly robust factory activity this month.

Source: World Economics

Source: World Economics

Service-sector growth is holding up as well.

Source: World Economics

Source: World Economics

——————–

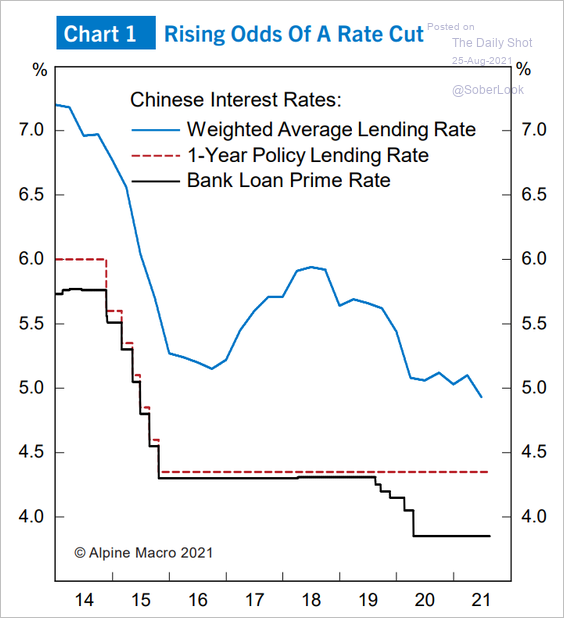

4. Will we see a rate cut from the PBoC in the coming months?

Source: Alpine Macro

Source: Alpine Macro

5. Labor costs continue to climb, outpacing Mexico and Vietnam.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

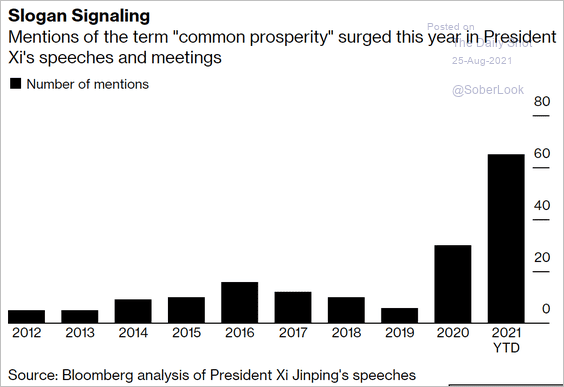

6. Beijing is increasingly concerned about China’s growing inequality.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

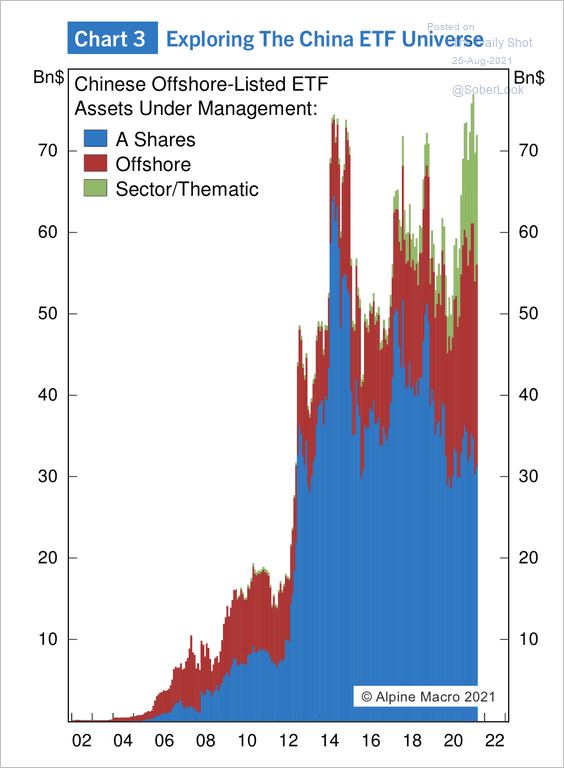

7. Assets under management of ETFs tracking sectors and themes have significantly risen over the past year, while other ETFs tracking the broad onshore/offshore indices have remained relatively flat over the same period.

Source: Alpine Macro

Source: Alpine Macro

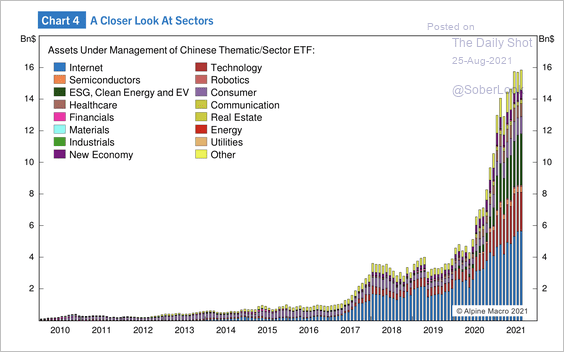

Thematic ETFs exposed to internet, tech, ESG, and electric vehicle names have attracted fresh capital.

Source: Alpine Macro

Source: Alpine Macro

——————–

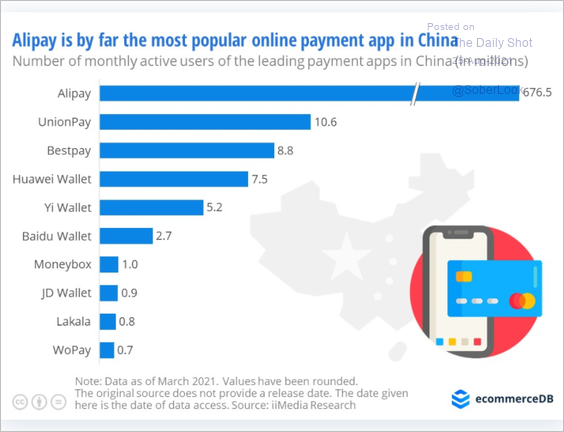

8. This chart shows active users on Cina’s payment platforms.

Source: ecommerceDB.com Read full article

Source: ecommerceDB.com Read full article

Back to Index

Emerging Markets

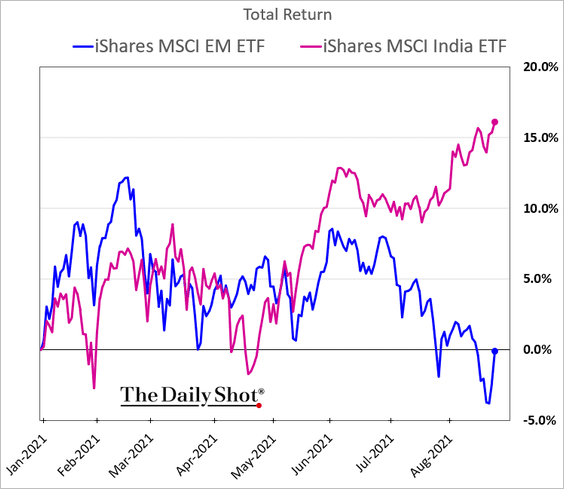

1. Indian equities have been outperforming as investors rotated out of China-sensitive economies.

3. Over a third of South Africa’s workers are unemployed.

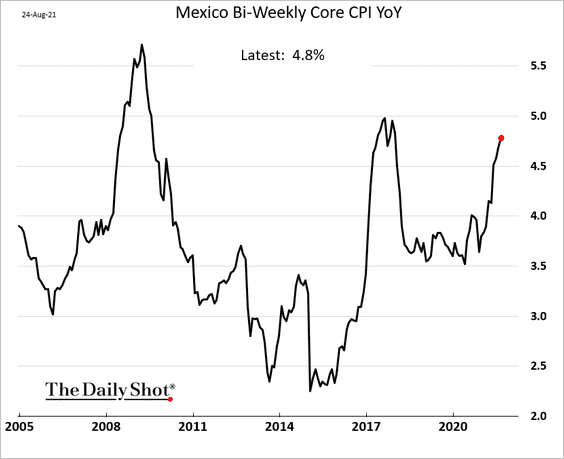

4. Mexican core inflation is approaching 5%.

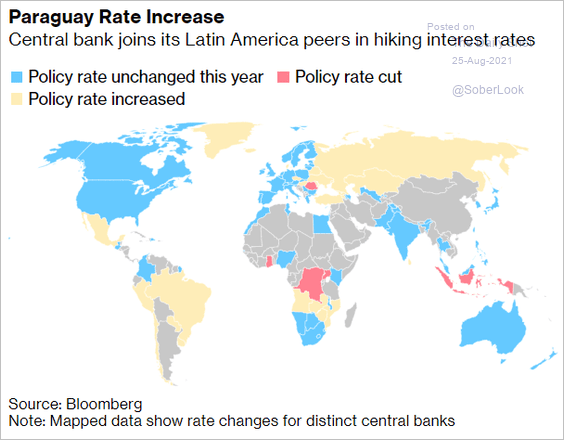

5. More countries are turning yellow on the map below.

Source: @markets Read full article

Source: @markets Read full article

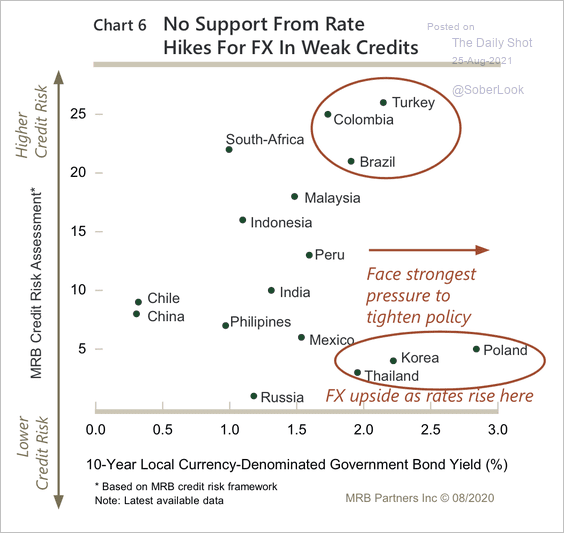

6. This scatterplot shows MRB’s credit risk score vs. each country’s 10yr bond yield.

Source: MRB Partners

Source: MRB Partners

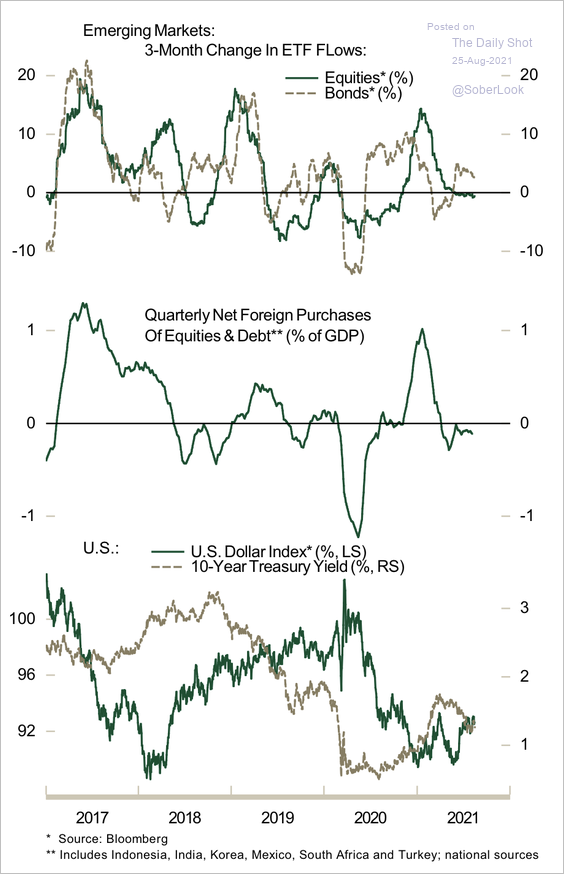

7. EM bond inflows increased this year while equity inflows have dried up, partly explained by movements in the dollar.

Source: MRB Partners

Source: MRB Partners

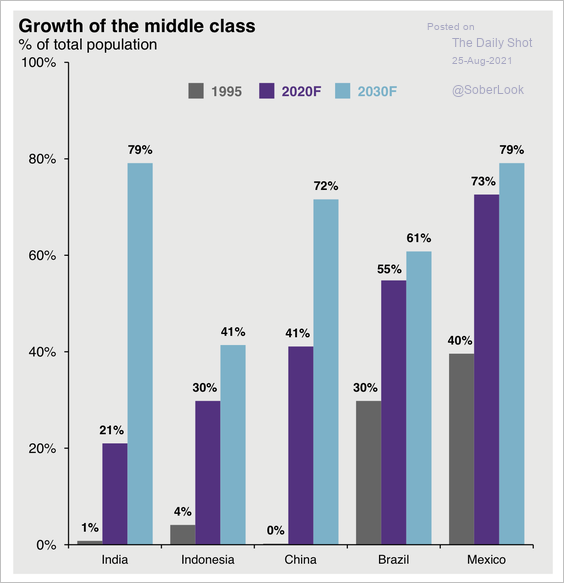

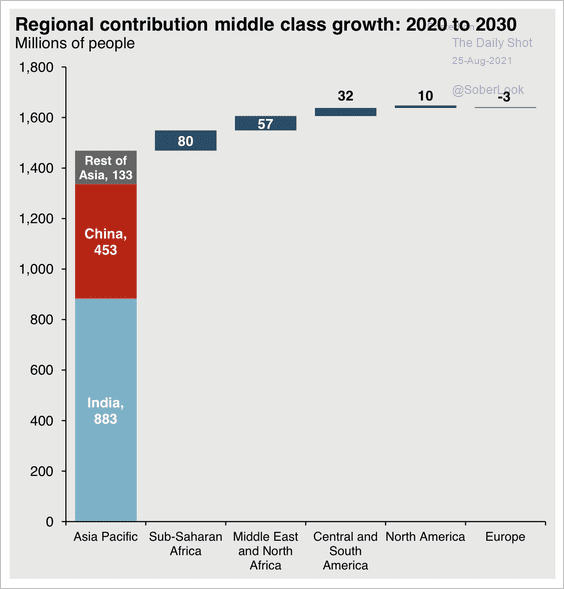

8. The middle class is expected to grow rapidly across EM, dominated by India and China (2 charts).

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Cryptocurrency

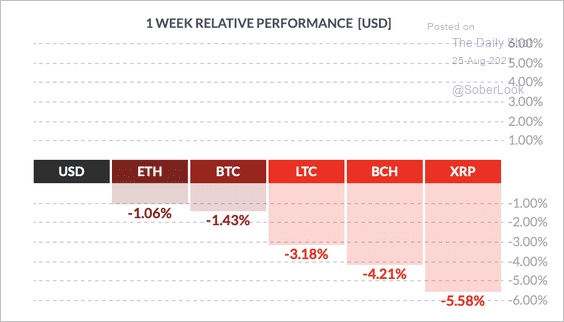

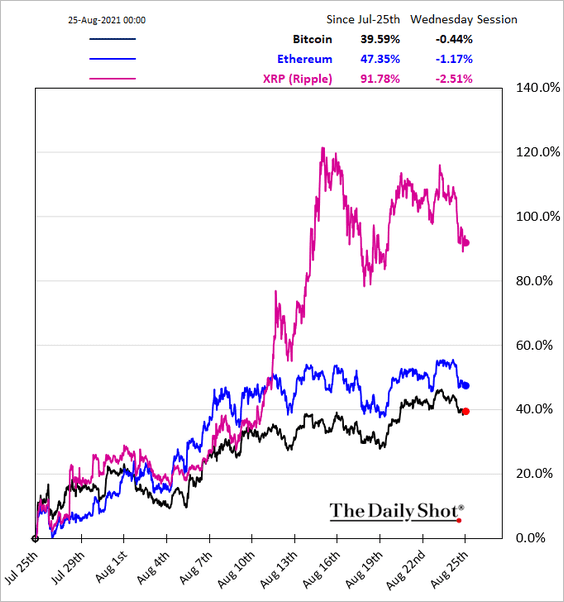

1. Cryptocurrencies are in pullback mode after a strong rally over the past month.

Source: FinViz

Source: FinViz

——————–

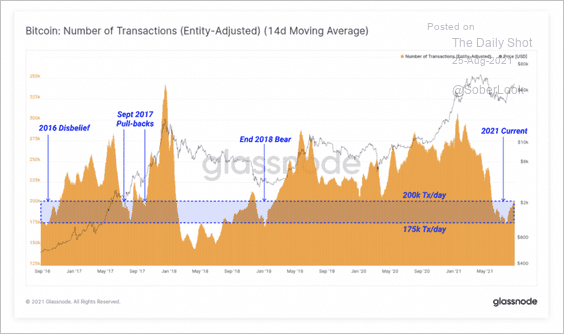

2. Bitcoin’s blockchain transaction counts are at historically low levels despite the recent price rally.

Source: Glassnode

Source: Glassnode

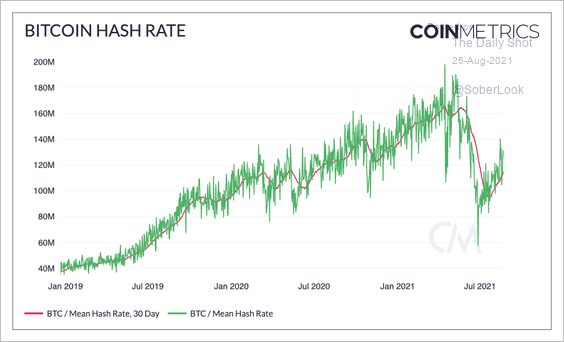

3. Bitcoin’s hashrate has been recovering from a local bottom in late June.

Source: Coin Metrics

Source: Coin Metrics

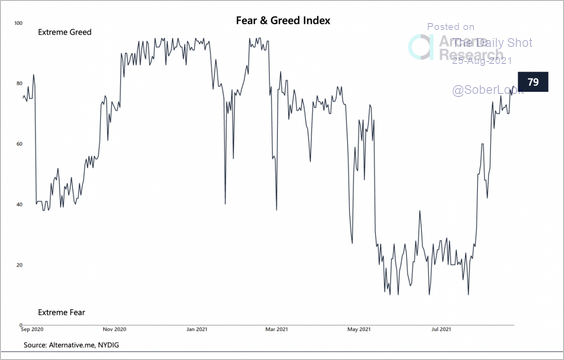

4. The crypto Fear & Greed Index is approaching “extreme greed” territory.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

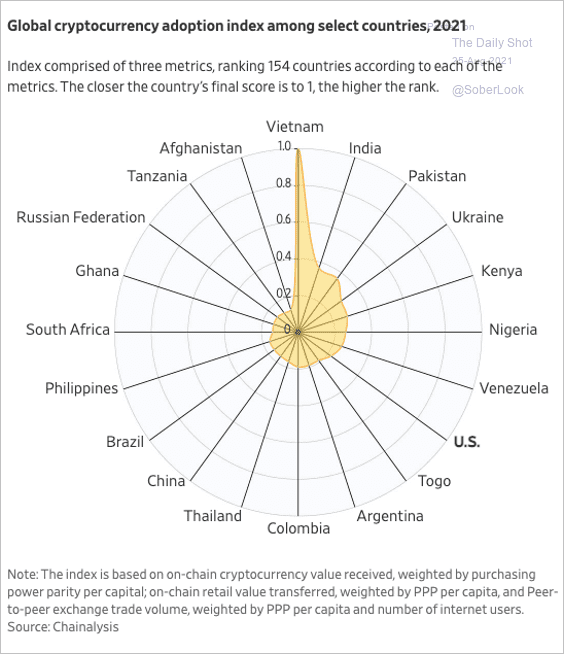

5. This spider chart illustrates the level of cryptocurrency adoption around the world.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

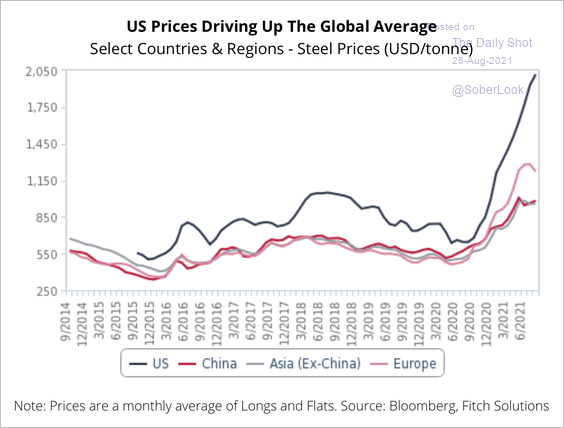

1. Fitch Solutions expects global steel prices to weaken.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

US steel prices have surged more than Asia and Europe over the past year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

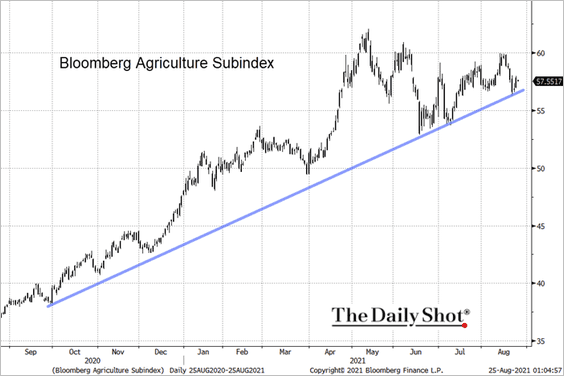

2. Bloomberg’s agriculture index is at support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

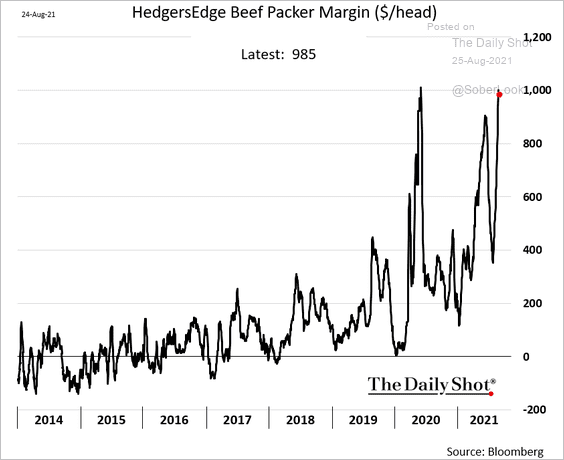

3. US beef packers are enjoying near-record margins.

h/t @mhirtz

h/t @mhirtz

Back to Index

Energy

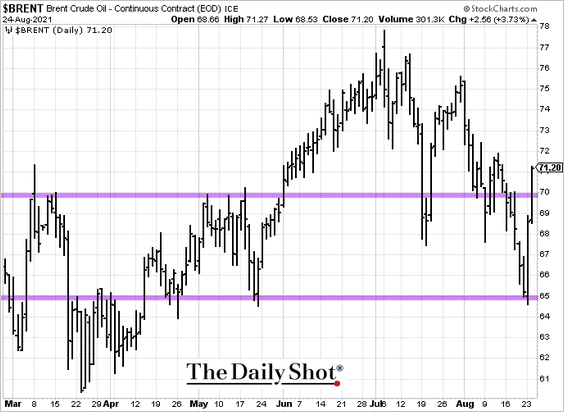

1. Brent is back above $70/bbl.

2. Backwardation is rebounding. Here is the Brent Oct-Nov futures spread.

Source: @HFI_Research

Source: @HFI_Research

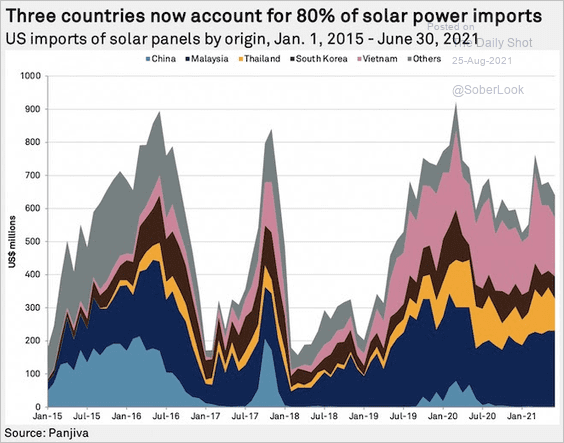

3. Next, we have US solar panel imports by country of origin.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Equities

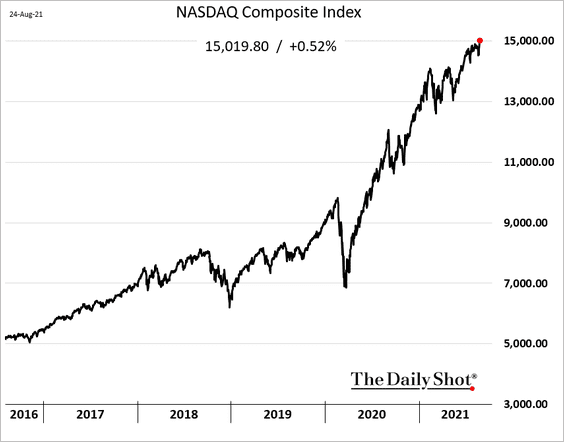

1. US indices hit record highs, with the Nasdaq Composite breaching 15k.

2. The correlation between stocks and bonds has been declining. This reversal points to growth fears rather than concerns about a hawkish Fed.

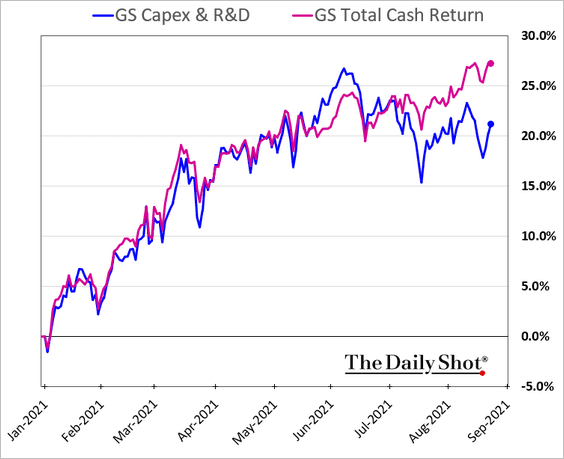

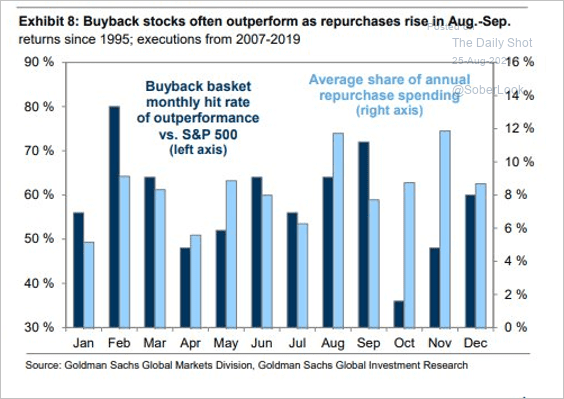

3. The market has been rewarding companies focused on dividends and share buybacks rather than those investing in their business.

According to Goldman, buyback stocks outperform when repurchases increase.

Source: Goldman Sachs; @Saburgs

Source: Goldman Sachs; @Saburgs

——————–

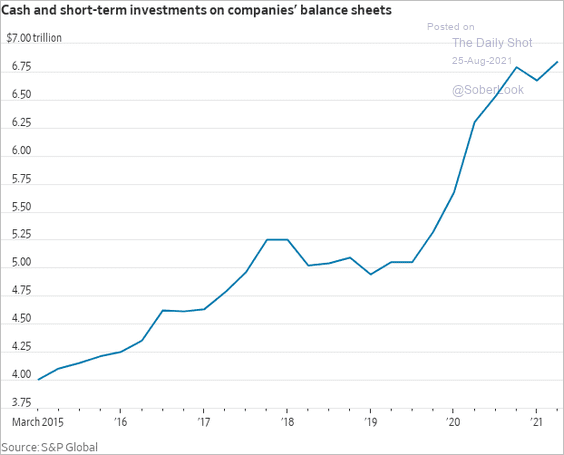

4. Corporate cash holdings hit a new high this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

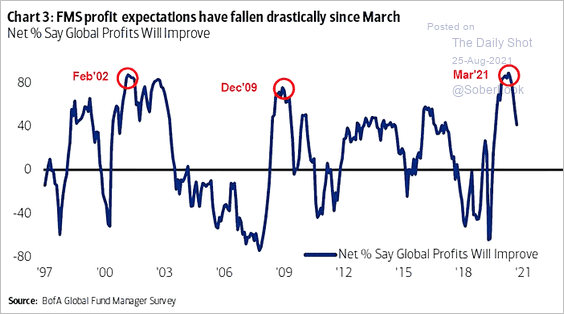

5. Fund managers’ expectations of global corporate profits have been declining since March.

Source: BofA Global Research; @Saburgs

Source: BofA Global Research; @Saburgs

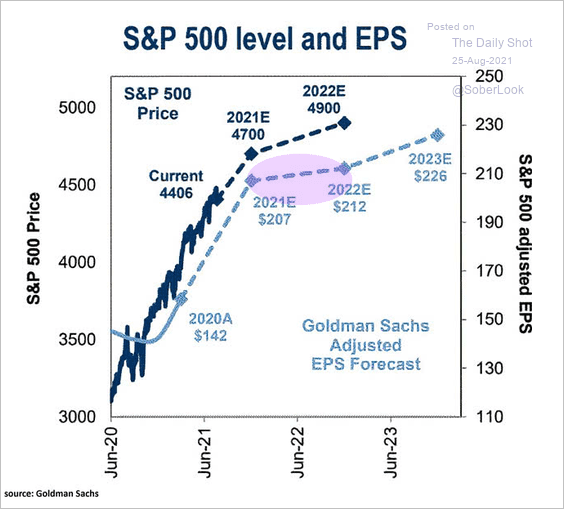

Goldman sees the S&P 500 EPS growth stalling next year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

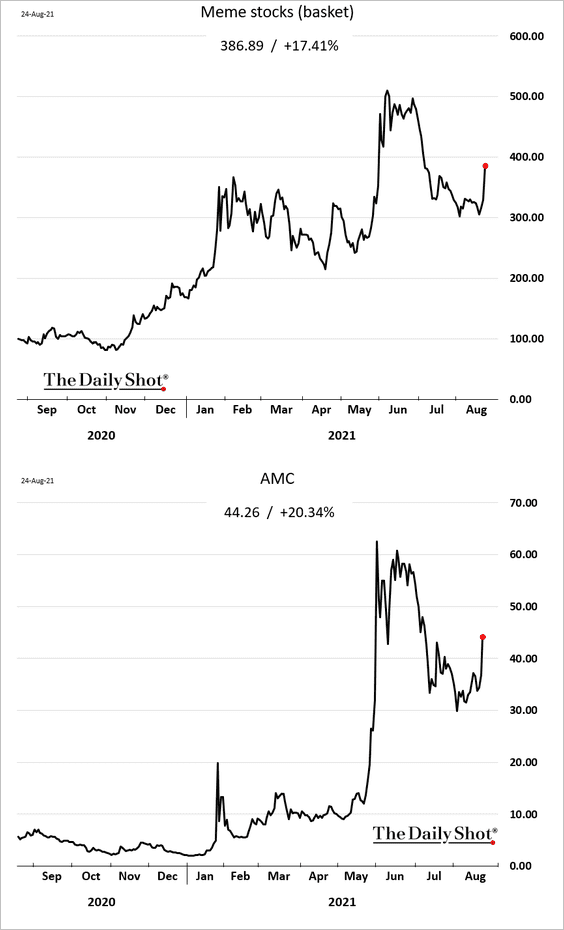

6. Meme stocks woke up this week.

7. Next, we have some updates on volatility (from Morgan Stanley).

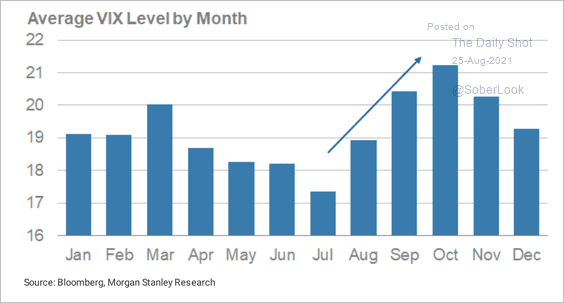

• Volatility tends to pick up into September.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

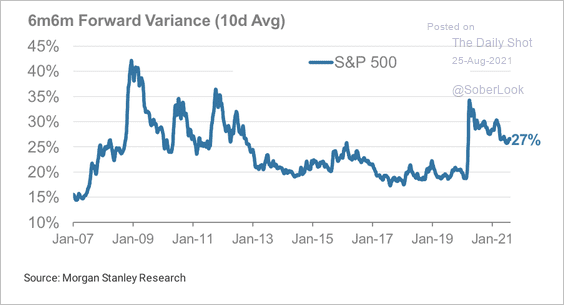

• The S&P 500 forward vols are still above average.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

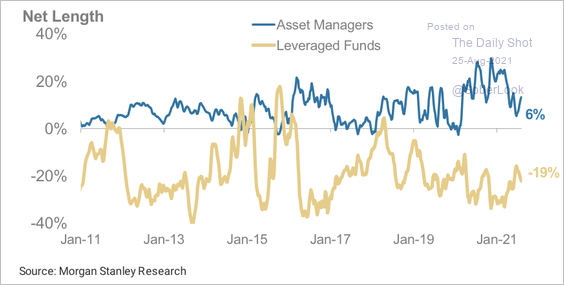

• Asset managers have trimmed their net-long VIX positions.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

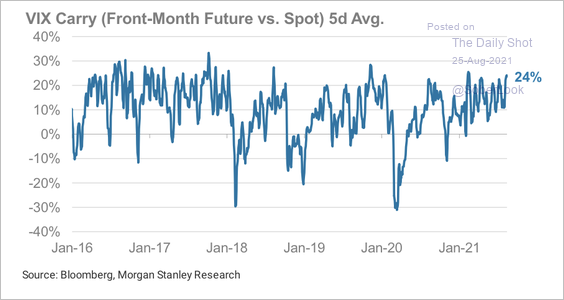

• For now, VIX carry remains strong (elevated contango).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Demand for out-of-the-money VIX calls has been growing as traders use VIX options to hedge against a downturn in stocks.

Source: @markets, h/t @WallStJesus Read full article

Source: @markets, h/t @WallStJesus Read full article

Back to Index

Alternatives

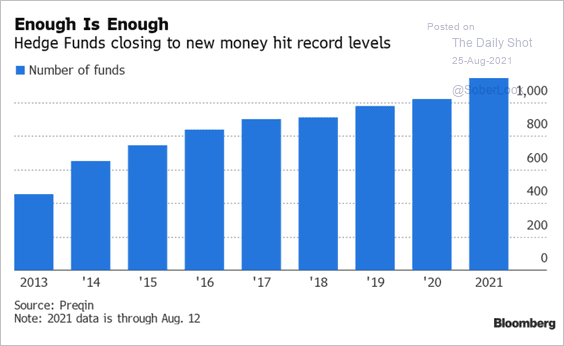

1. Hedge funds are increasingly rejecting new money as they try to manage redemption risks.

Source: @business Read full article

Source: @business Read full article

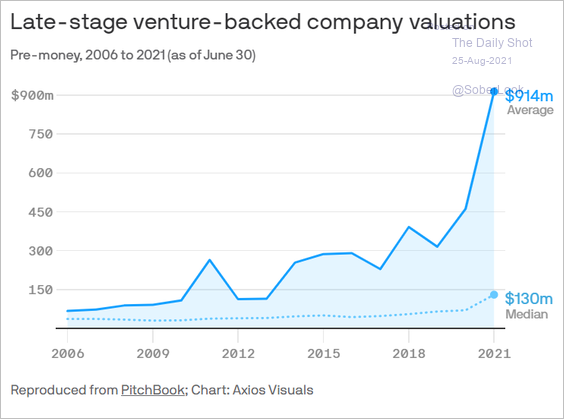

2. VC-backed company valuations are surging.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Credit

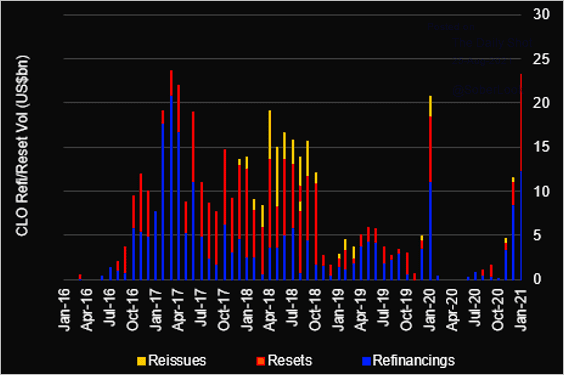

1. CLO repricings surged recently due to strong demand from investors.

Source: @LPCLoans

Source: @LPCLoans

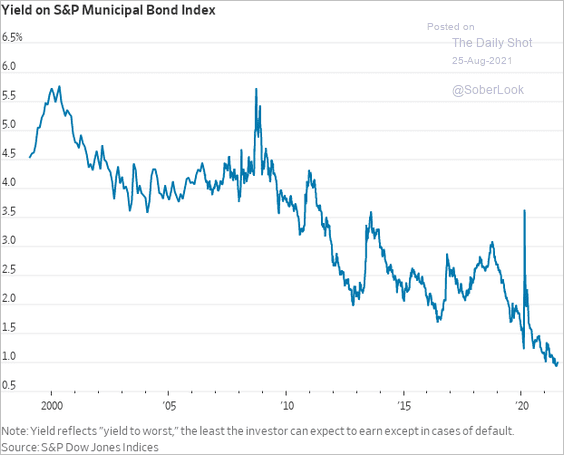

2. Muni yields continue to trend lower amid concerns about higher tax rates ahead.

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Private-label MBS activity is still a shadow of the levels we saw before the financial crisis, but demand has been growing.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

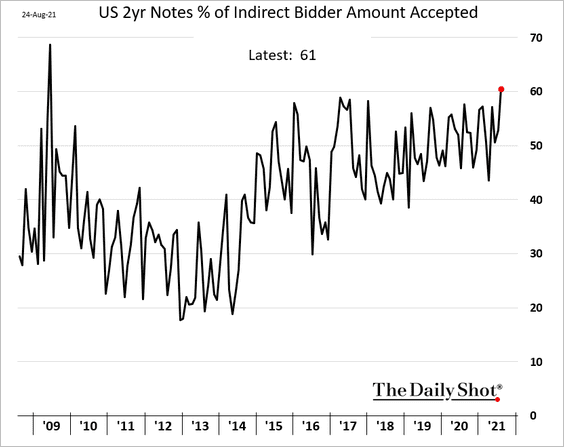

1. Demand for short-term Treasuries has been strong as US dollar money markets are flooded with liquidity.

Source: TheStreet Read full article

Source: TheStreet Read full article

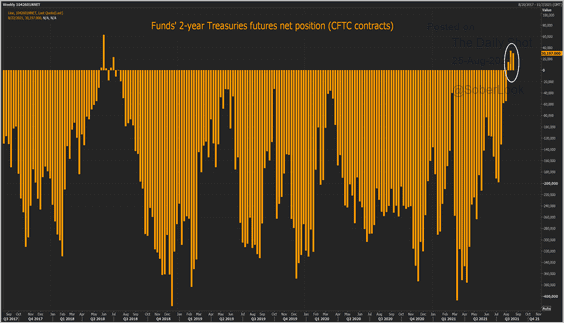

Speculative accounts remain net-long the 2yr note futures.

Source: @ReutersJamie Read full article

Source: @ReutersJamie Read full article

——————–

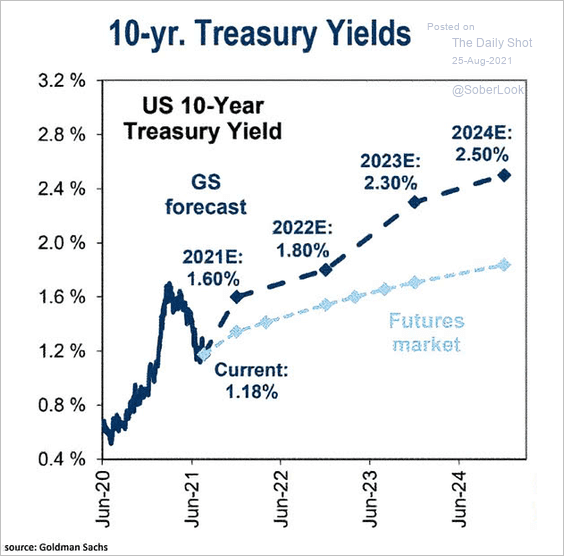

2. Goldman sees higher Treasury yields than is currently priced into the market.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

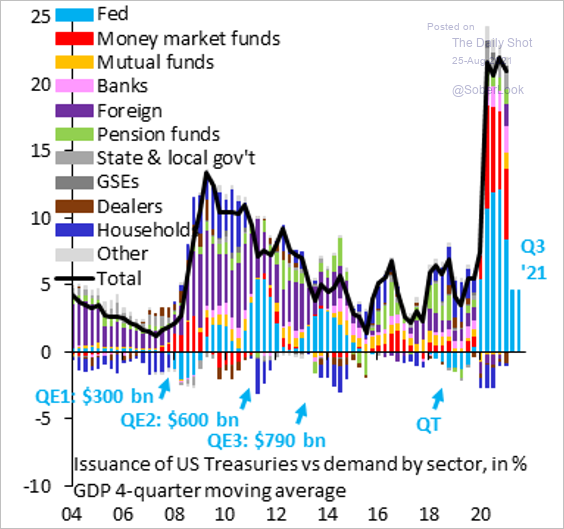

3. This chart shows Treasury issuance vs. demand.

Source: @ReutersJamie, @pdacosta, @Lavorgnanomics, @RobinBrooksIIF

Source: @ReutersJamie, @pdacosta, @Lavorgnanomics, @RobinBrooksIIF

Back to Index

Global Developments

1. Advanced economies’ business activity trends (PMIs) have diverged.

Source: BCA Research

Source: BCA Research

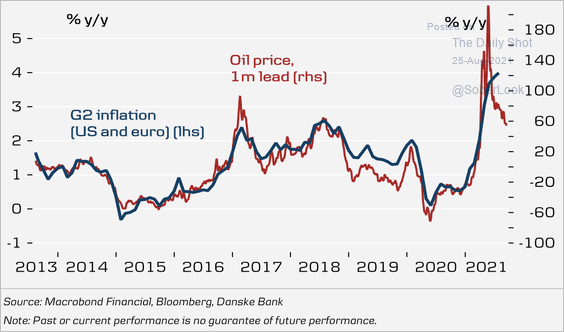

2. The year-over-year impact of oil prices on inflation has peaked.

Source: Danske Bank

Source: Danske Bank

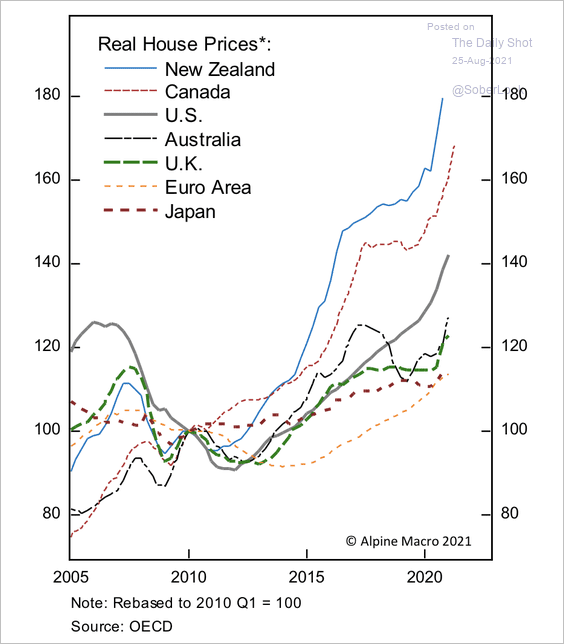

3. House prices are soaring across the globe.

Source: Alpine Macro

Source: Alpine Macro

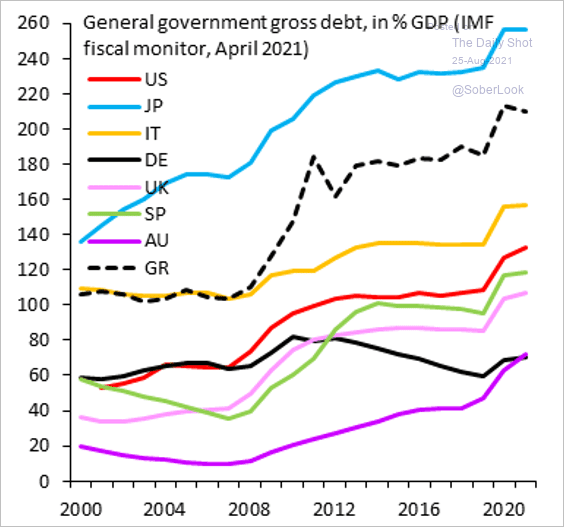

4. Finally, we have debt-to-GDP ratios (gross debt) in advanced economies.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

Food for Thought

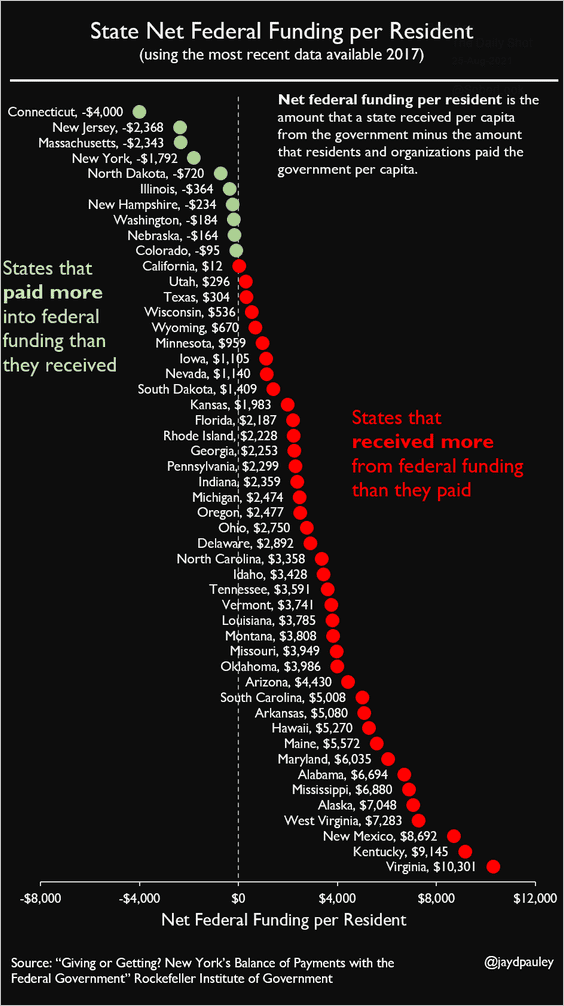

1. Net federal funding per resident, by state:

Source: @jaydpauley

Source: @jaydpauley

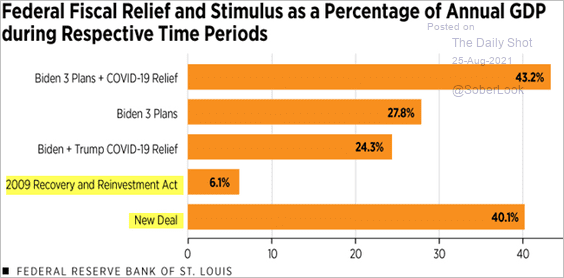

2. The recent US fiscal interventions compared to the New Deal:

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

3. Spending on new roads vs. road repair:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

4. Cash used in retail transactions:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

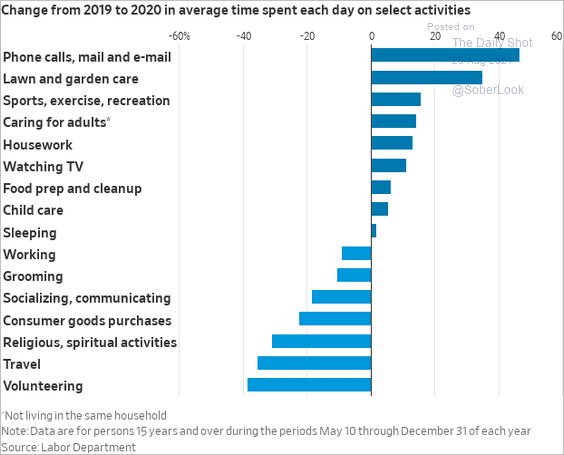

5. Time spent on select activities in 2020 vs. 2019:

Source: @WSJ Read full article

Source: @WSJ Read full article

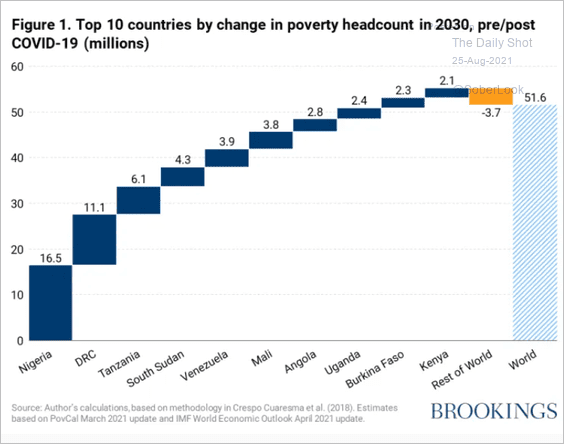

6. Top 10 countries by changes in poverty headcount:

Source: Brookings Read full article

Source: Brookings Read full article

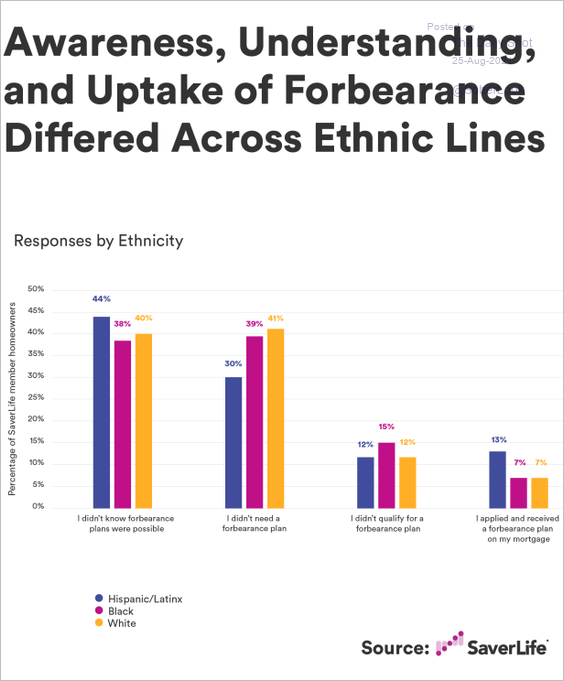

7. The uptake of mortgage forbearance plans in the US:

Source: Brookings Read full article

Source: Brookings Read full article

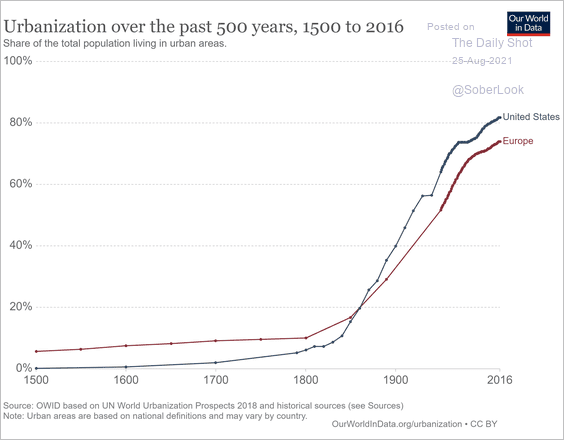

8. Urbanization over the past 500 years:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

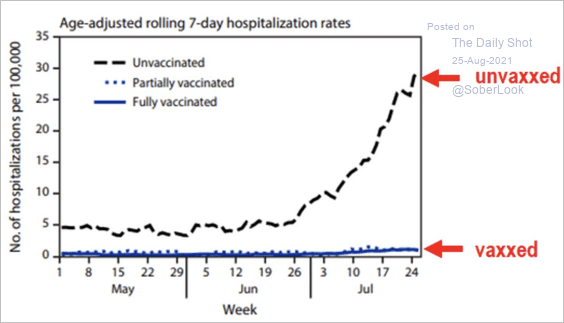

9. Vaccinated vs. unvaccinated hospitalization rates:

Source: @carlquintanilla, @CDCgov, @fundstrat Read full article

Source: @carlquintanilla, @CDCgov, @fundstrat Read full article

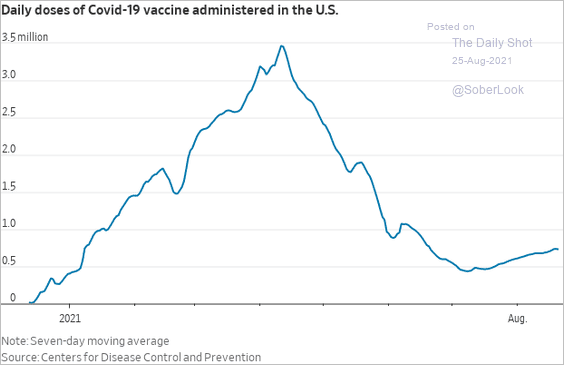

10. US daily COVID vaccinations:

Source: @WSJ Read full article

Source: @WSJ Read full article

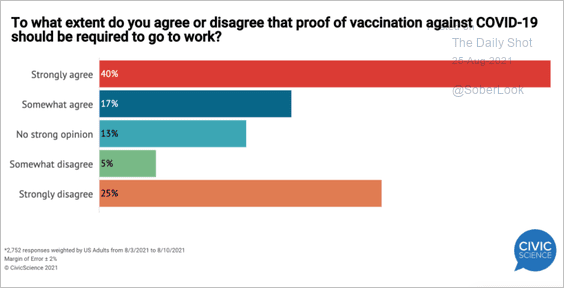

11. Support for vaccination requirements in the workplace:

Source: @CivicScience

Source: @CivicScience

12. Top choices to host Jeopardy:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Back to Index