The Daily Shot: 20-Sep-21

• Equities

• Credit

• Energy

• Commodities

• Rates

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• Europe

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

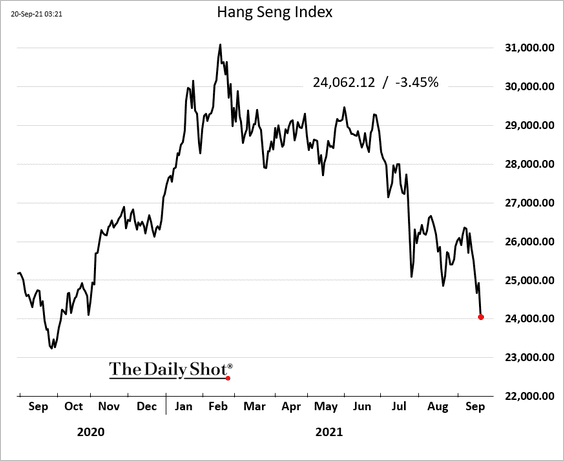

1. Global sentiment is decidedly in risk-off mode, partly driven by credit developments in China. The Hang Seng Index is down 3.5%.

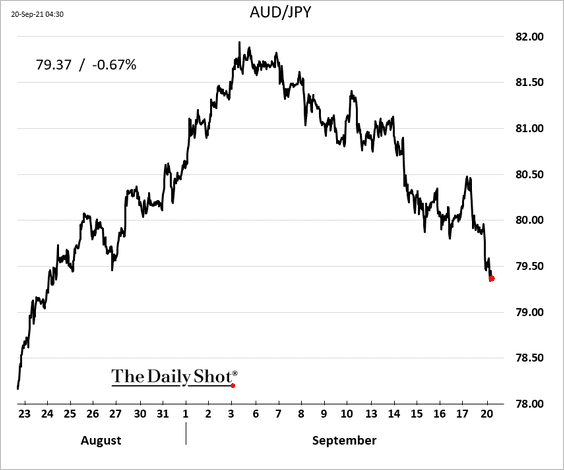

Aussie-yen, a proxy for global risk appetite, has been falling.

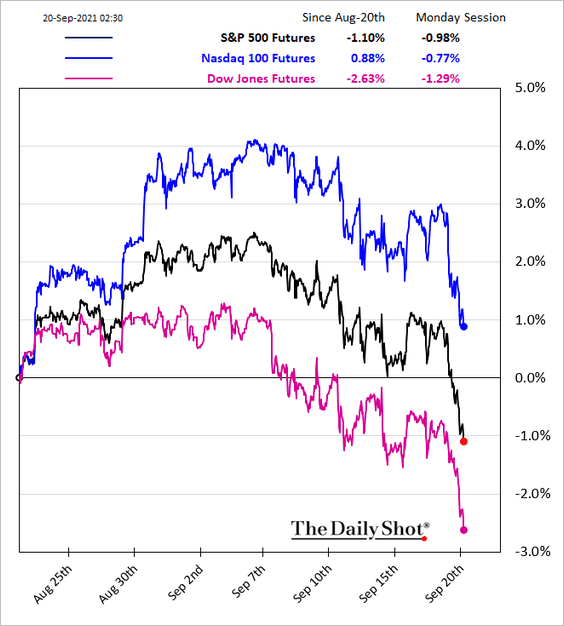

US futures are heavy this morning, …

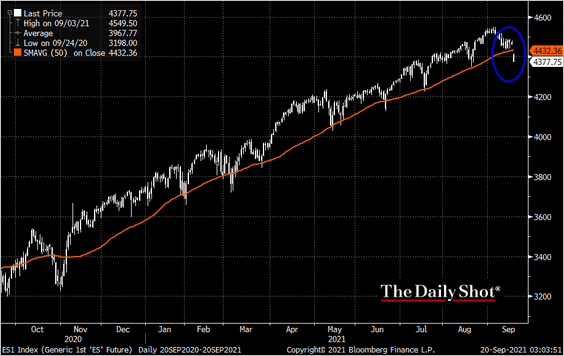

… with the active S&P 500 contract dipping well below the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

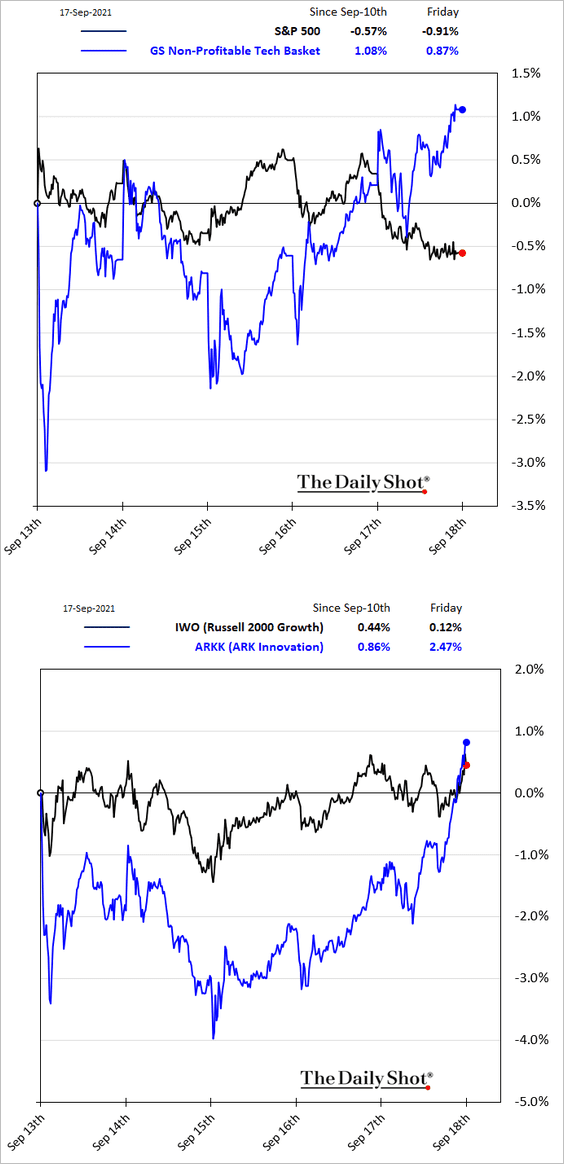

2. The Reddit crowd bid up speculative tech companies last week. It’s not going to be pretty on the way down.

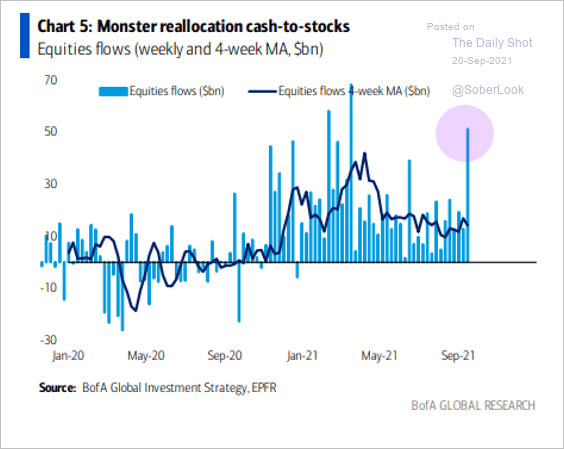

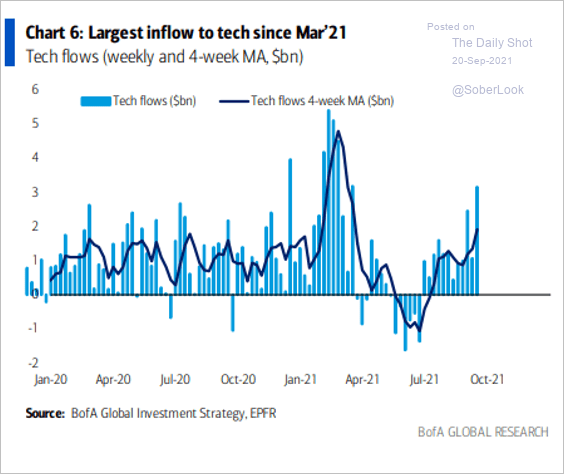

3. Equity inflows have been impressive.

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

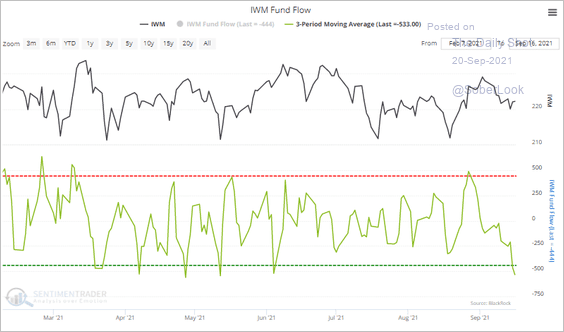

However, the iShares Russell 2,000 small-cap ETF (IWM) saw its second-largest outflow since February last week.

Source: SentimenTrader

Source: SentimenTrader

——————–

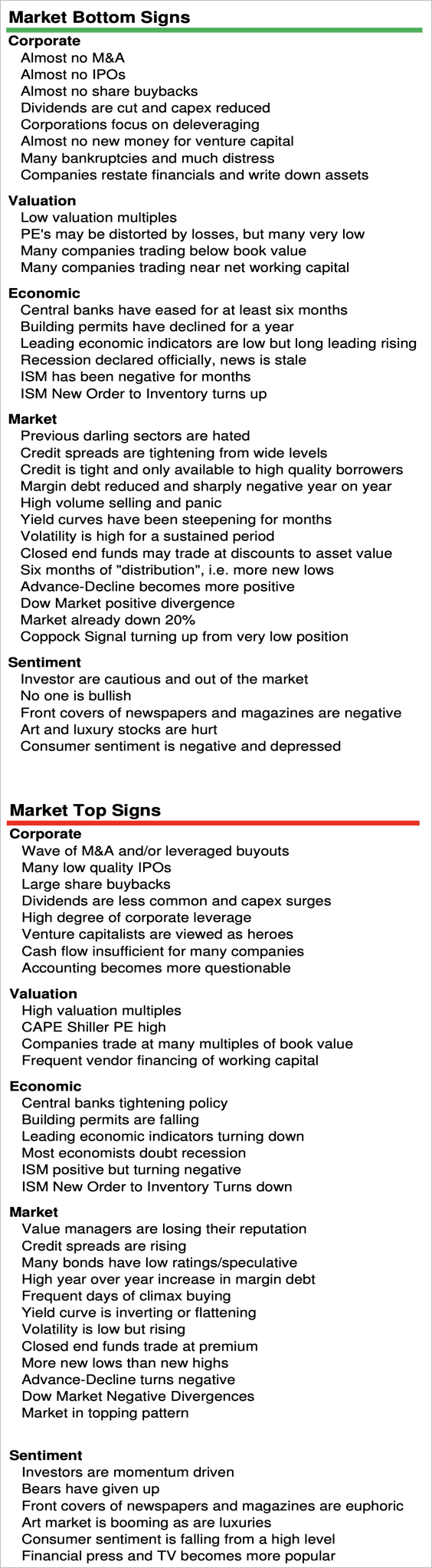

4. Variant Perception’s market tops and bottoms checklist is flashing signs of a top.

Source: Variant Perception

Source: Variant Perception

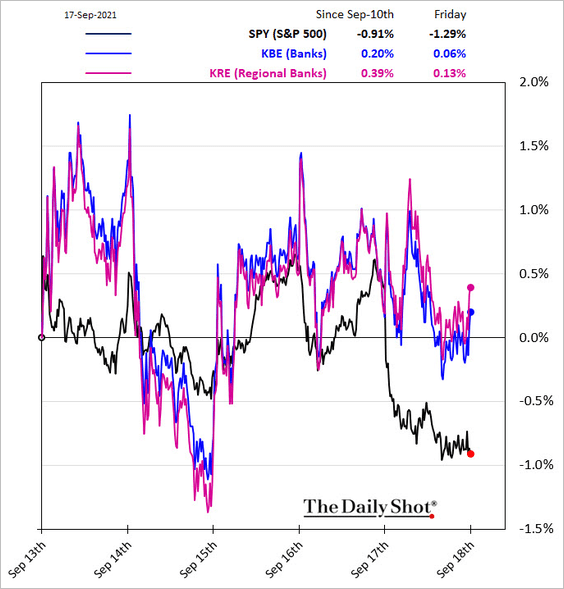

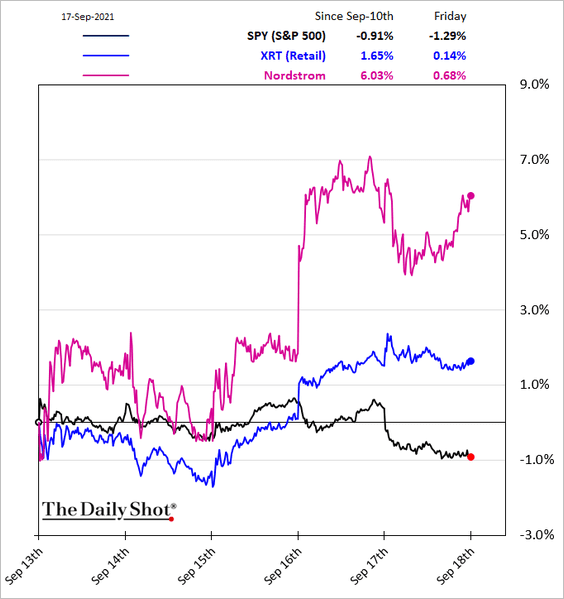

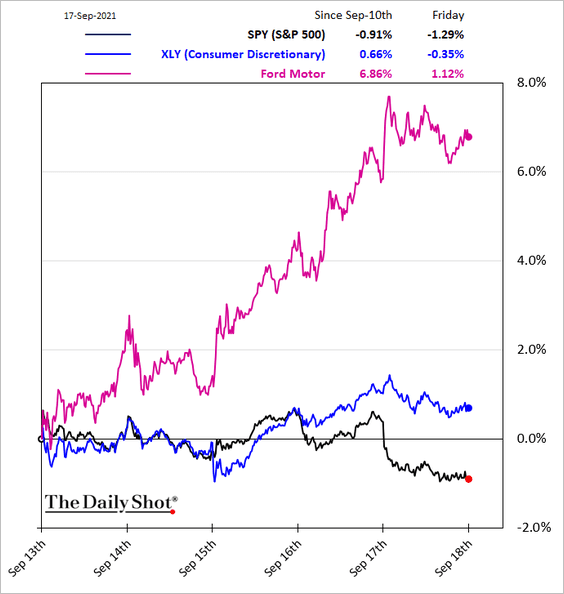

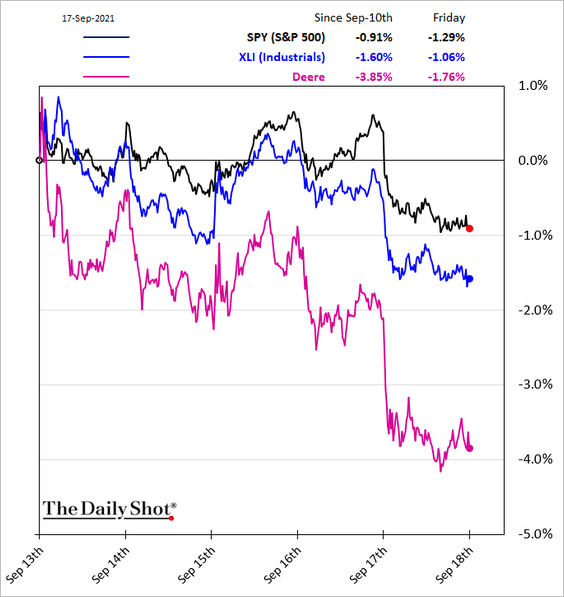

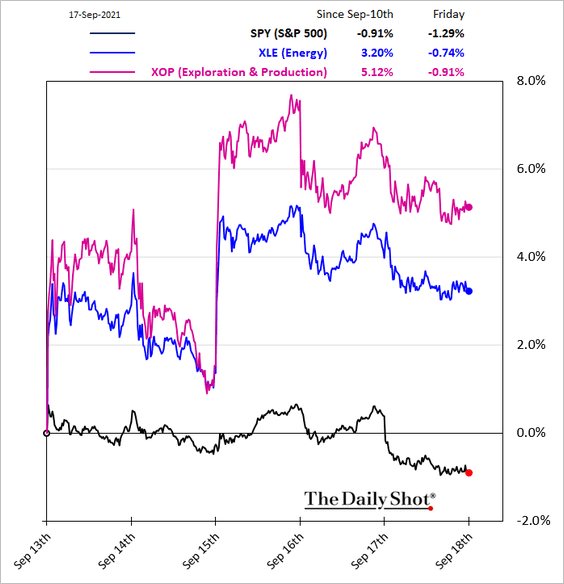

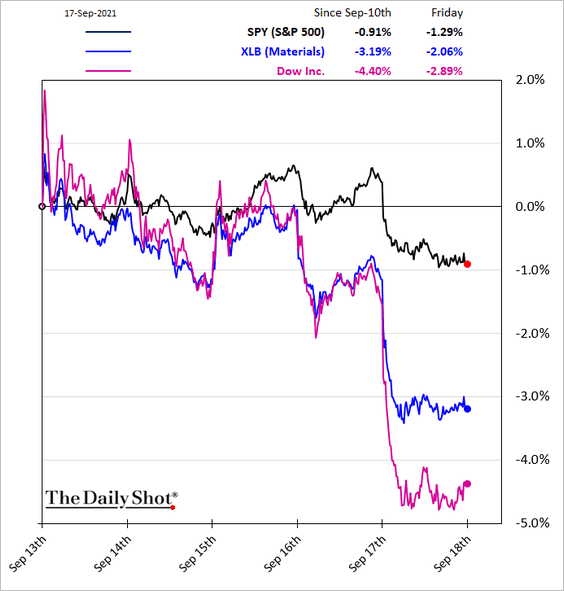

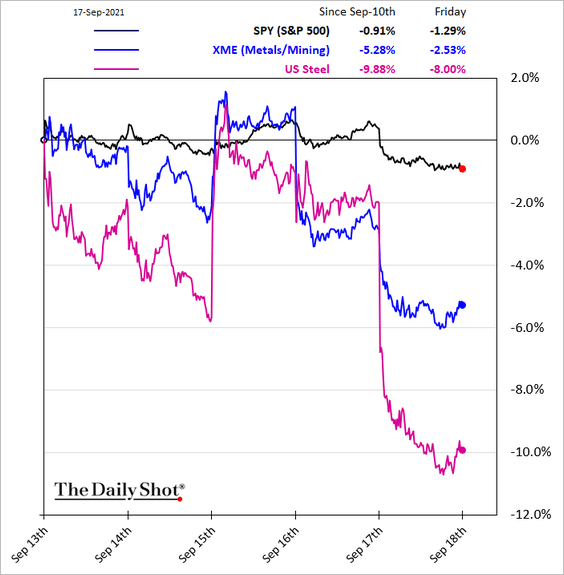

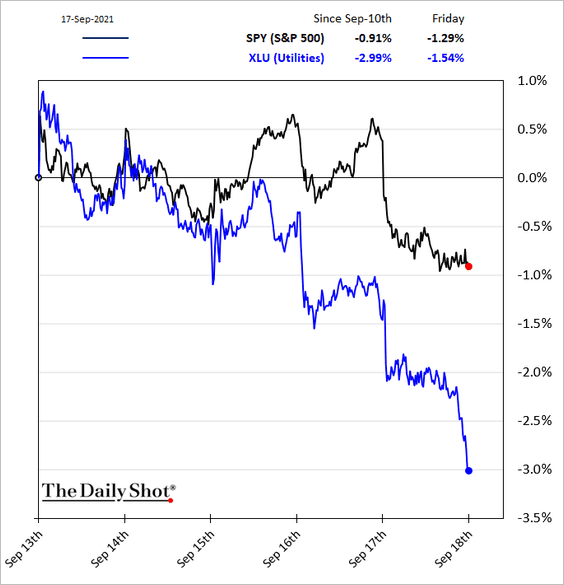

5. Next, we have last week’s sector moves.

• Banks:

• Consumer stocks (2 charts):

• Industrials:

• Energy:

• Materials and Metals & Mining:

• Utilities:

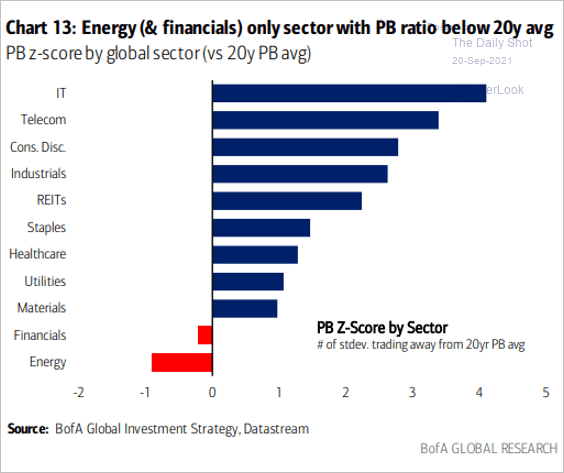

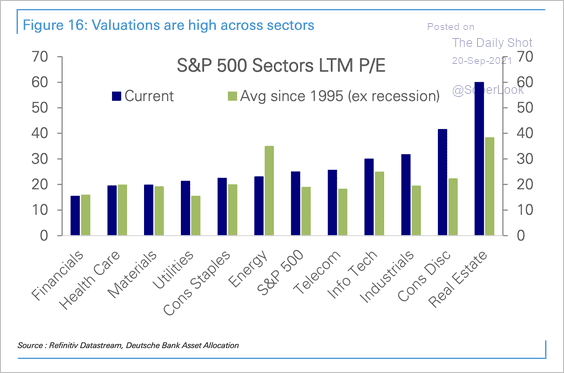

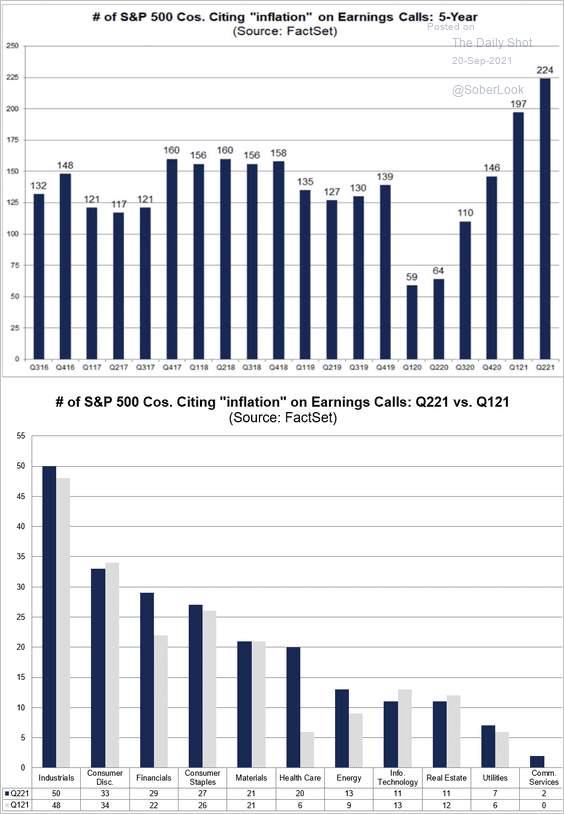

6. Here are some additional sector trends.

• Price-to-book ratio (z-scores):

Source: BofA Global Research

Source: BofA Global Research

• Trailing P/E ratios:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Companies citing “inflation” on earnings calls, by sector:

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

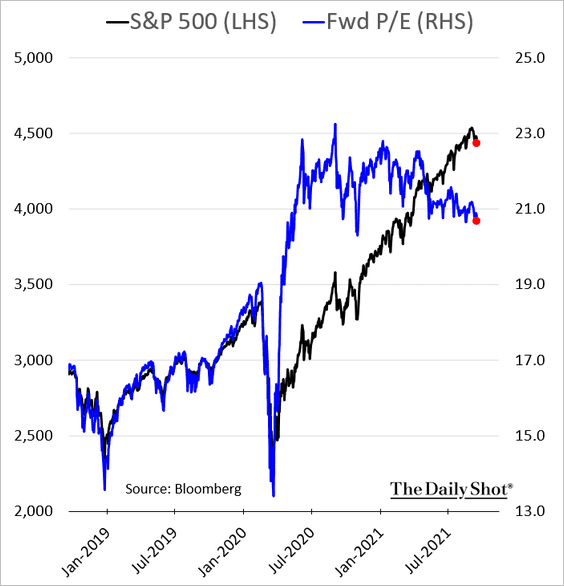

7. Forward P/E ratios have been drifting lower.

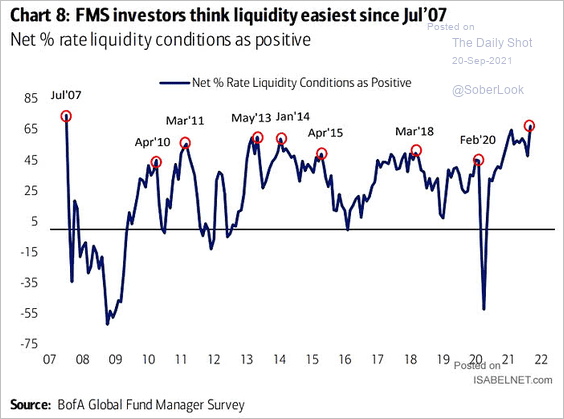

The S&P 600 (small-cap) forward P/E ratio is down sharply.

——————–

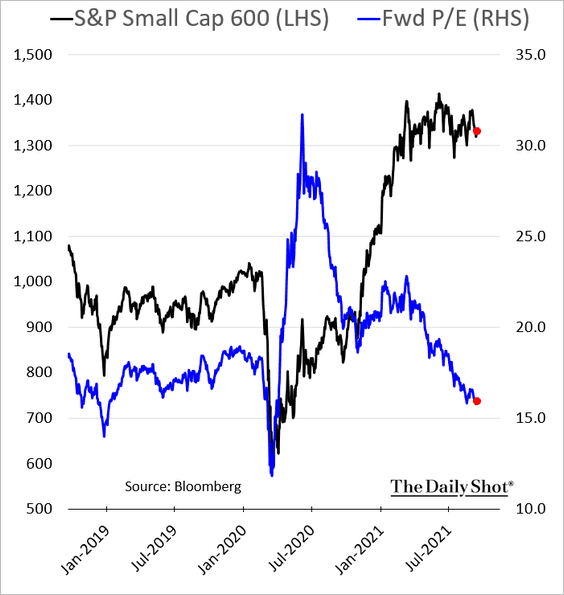

8. Small caps tend to be more vulnerable to wage inflation.

Source: Goldman Sachs

Source: Goldman Sachs

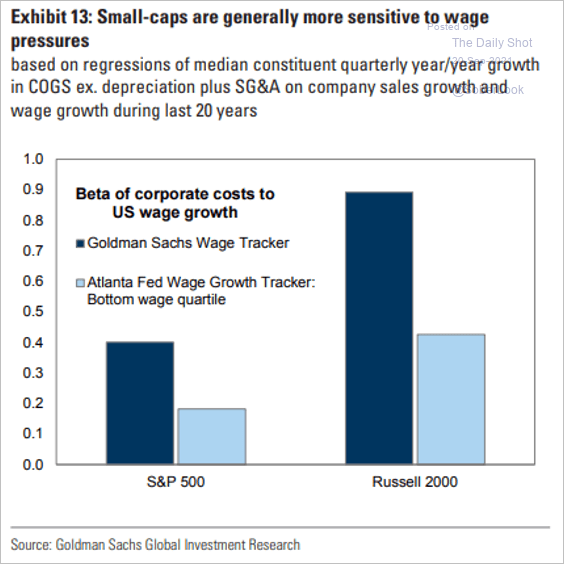

9. Liquidity conditions have been exceptionally supportive, according to fund managers.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

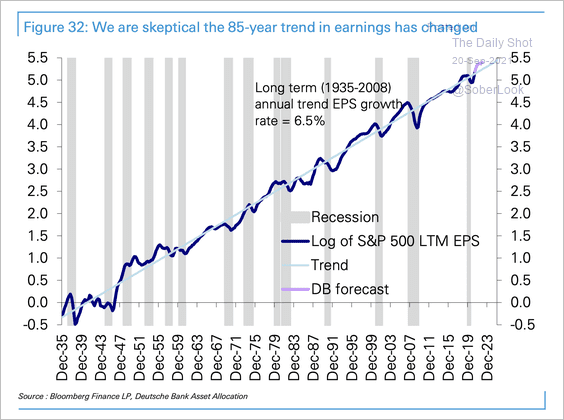

10. S&P 500 earnings have grown at 6.5% per year since 1935.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

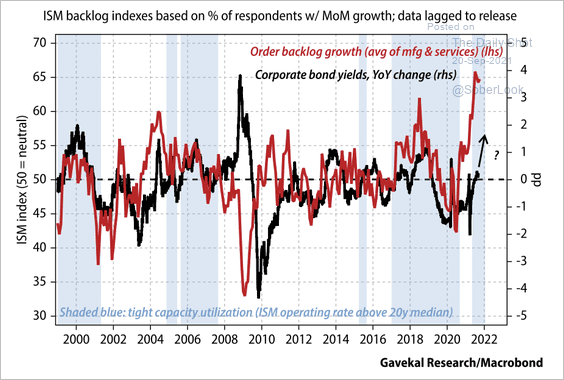

1. Resolving bottlenecks could require more capital, which could lead to an increase in corporate bond yields, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

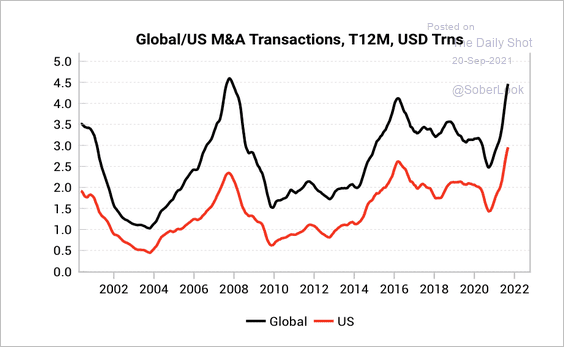

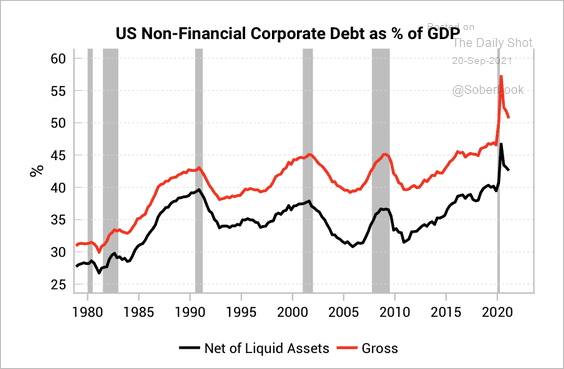

2. M&A transaction volumes have surged over the past year, boosting debt levels. Corporate debt as a percent of GDP remains far above highs seen in previous cycles (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Back to Index

Energy

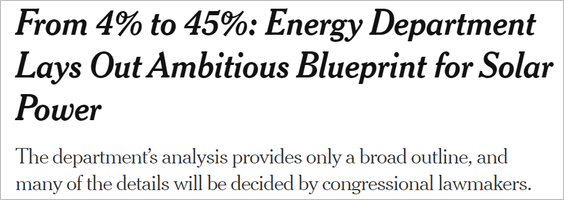

1. Clean energy shares rallied last week.

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

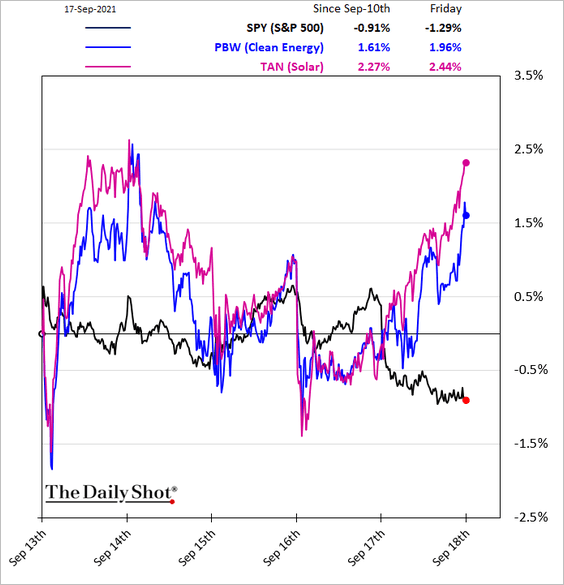

2. The US rig count bounced from the Ida-driven dip but still lags oil prices.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

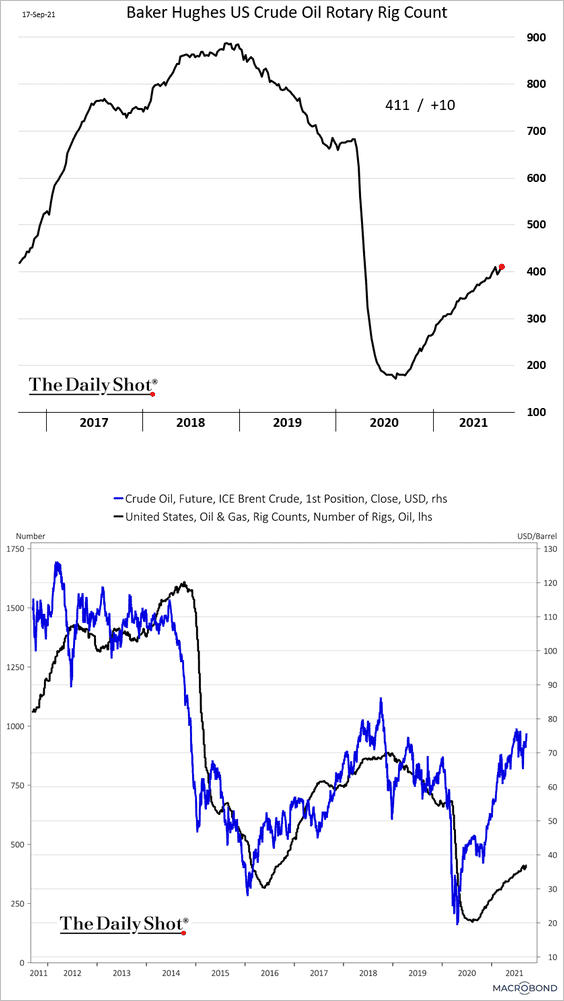

3. Oil price momentum declined from max positive levels over the past month.

Source: Deutsche Bank Research Read full article

Source: Deutsche Bank Research Read full article

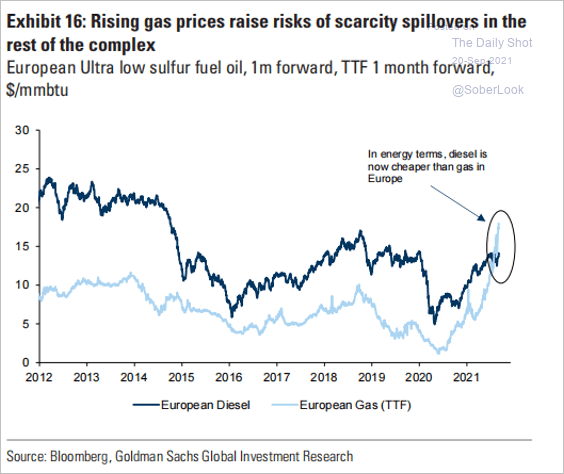

4. Will the surge in natural gas prices boost other energy sectors in Europe?

Source: @chigrl

Source: @chigrl

Back to Index

Commodities

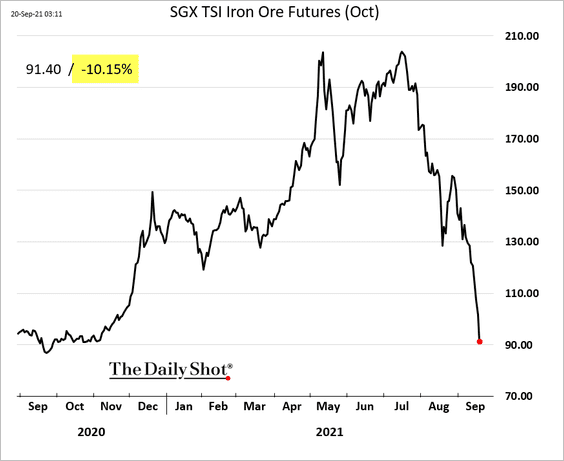

1. Iron ore is down 10% today in Singapore.

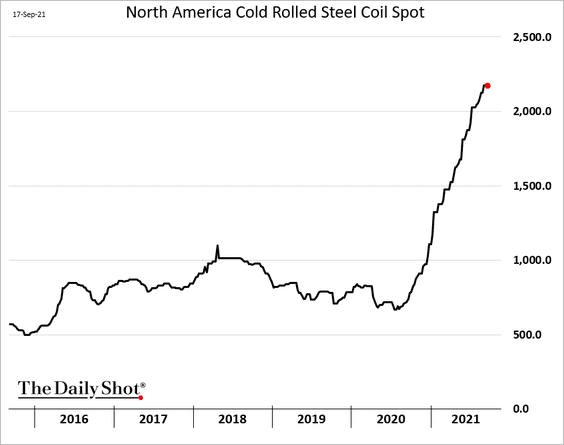

Are North American steel prices about to peak?

——————–

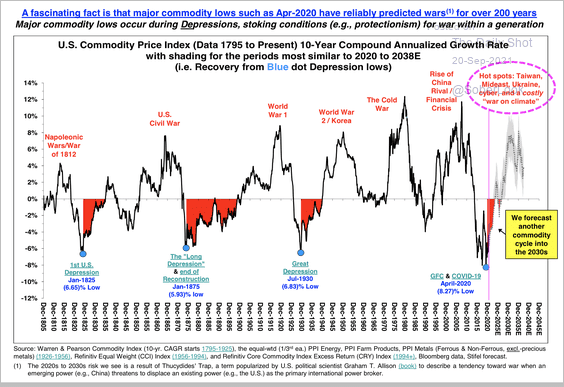

2. Previously, sharp moves in commodity prices occurred during times of war/crisis.

Source: Stifel

Source: Stifel

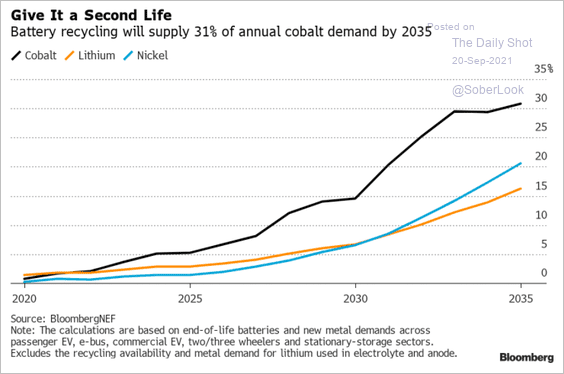

3. Battery recycling is expected to supply almost a third of cobalt needs by 2035.

Source: @kd_ampofo, @BloombergNEF, @SMI_UQ Read full article

Source: @kd_ampofo, @BloombergNEF, @SMI_UQ Read full article

Back to Index

Rates

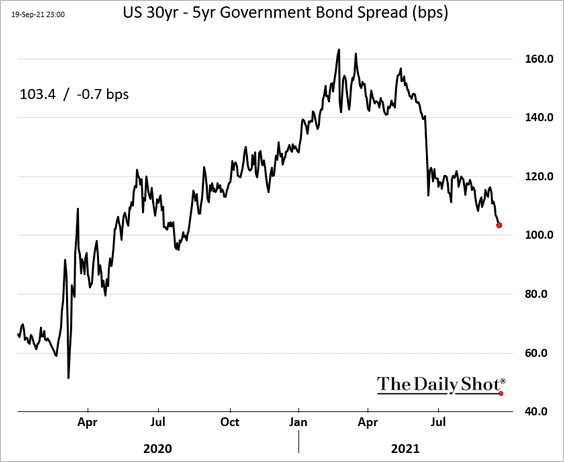

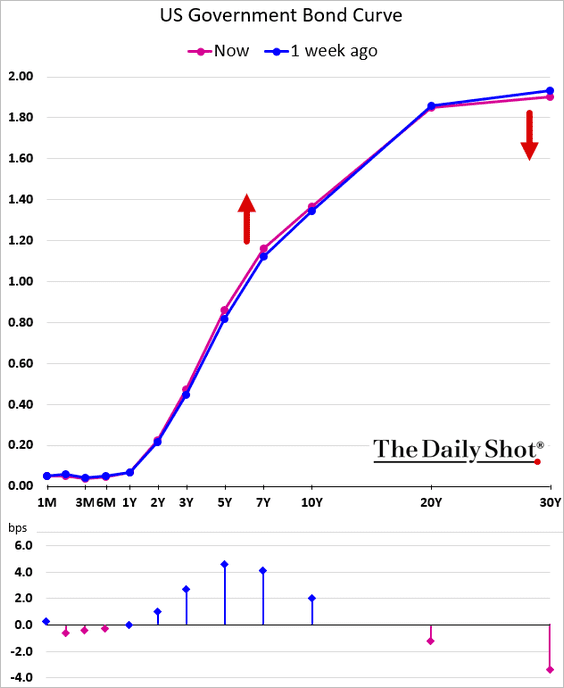

1. The long end of the Treasury curve continues to flatten.

——————–

2. Primary dealers expect a pop in Treasury yields by the end of the year.

Source: @markets Read full article

Source: @markets Read full article

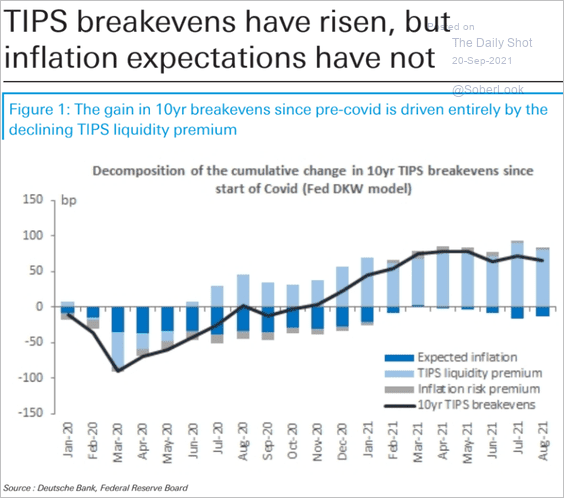

3. Despite the massive demand for TIPS this year, inflation expectations have been relatively flat.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Cryptocurrency

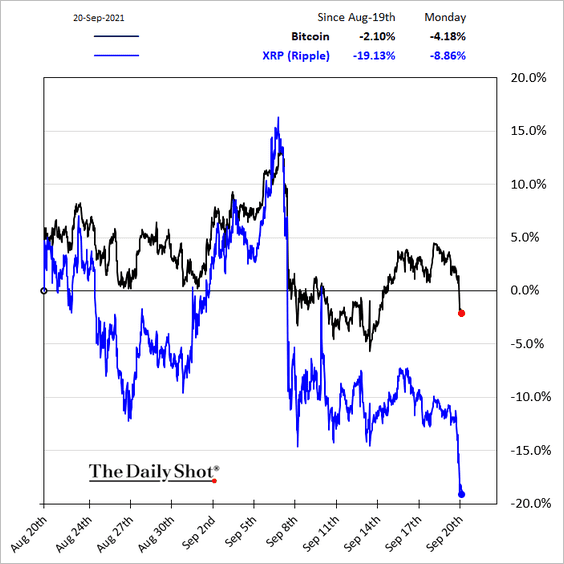

1. Cryptos are under pressure as risk appetite dims. XRP is down 9% today.

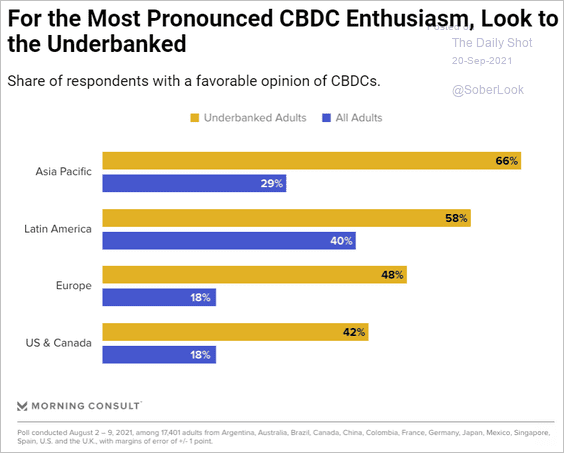

2. Underbanked households show the most interest in central bank digital currencies.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

Emerging Markets

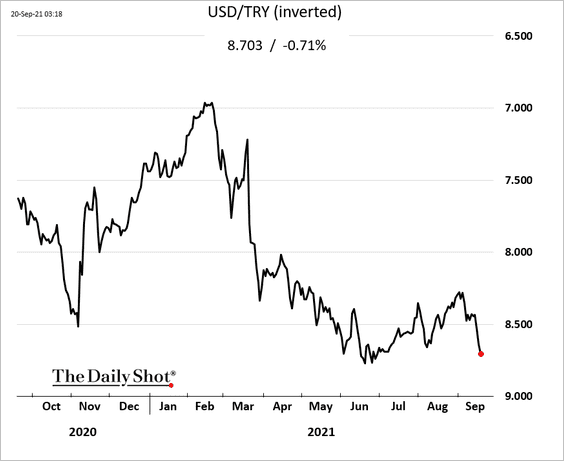

1. EM currencies started the week on a softer note. Here is the Turkish lira.

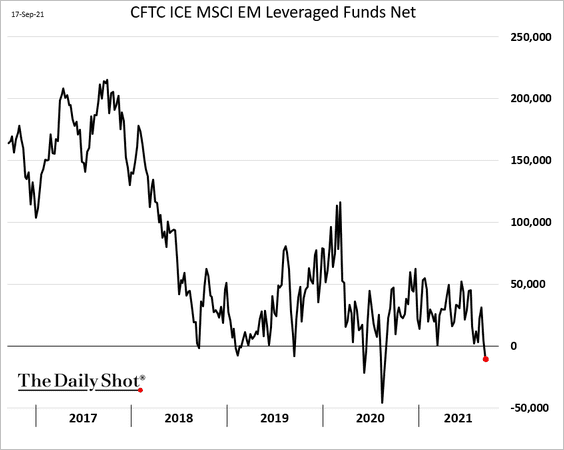

2. Hedge funds have soured on EM equities, with net futures positioning turning negative.

3. Next, we have some updates on India.

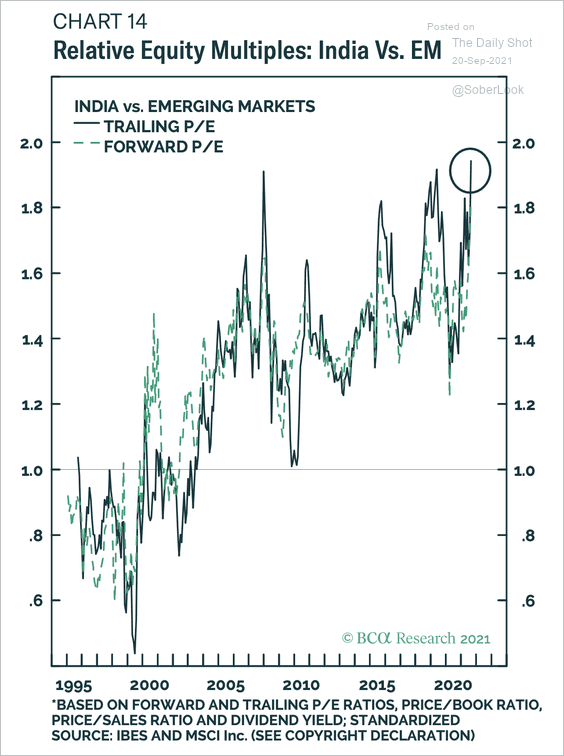

• Indian stocks trade at almost double the multiples of the rest of the emerging markets. In part, this is due to stronger earnings growth, lower volatility, and (according to some analysts) better prospects.

Source: BCA Research

Source: BCA Research

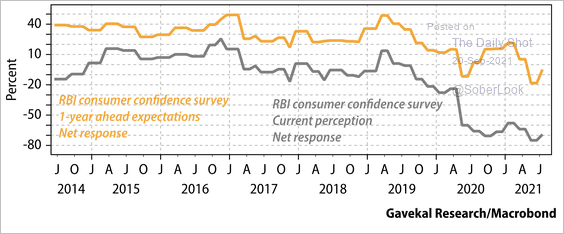

• Indian consumer confidence remains depressed, although expectations did not decline as much as current conditions.

Source: Gavekal Research

Source: Gavekal Research

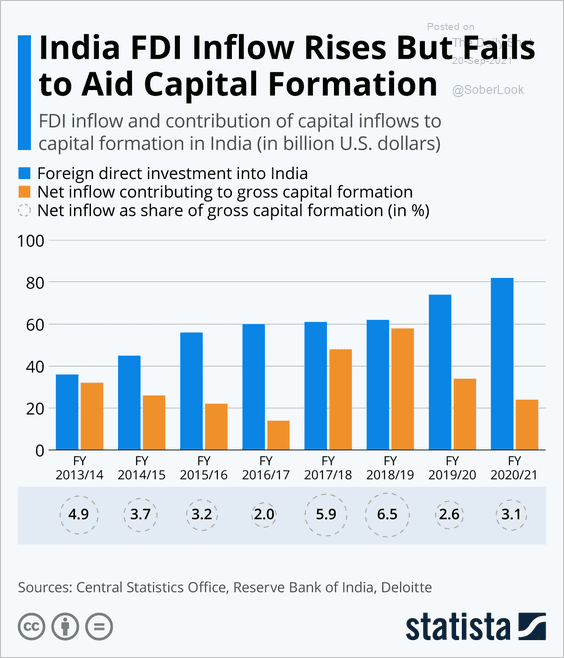

• Foreign direct investment has been climbing, but business spending hasn’t followed.

Source: Statista

Source: Statista

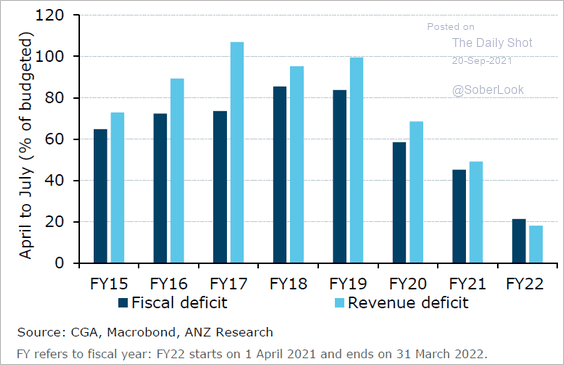

• India’s fiscal situation is improving.

Source: ANZ Research

Source: ANZ Research

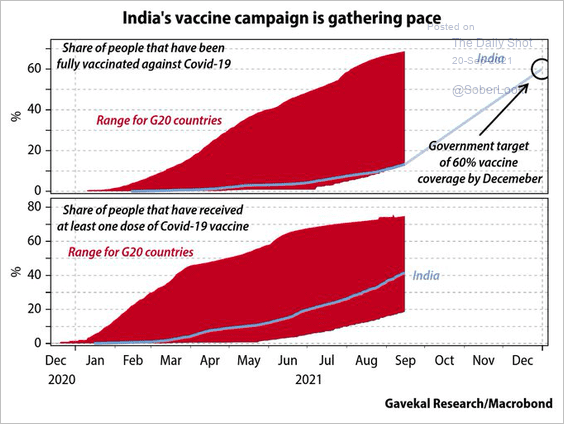

• Vaccinations have been gathering pace.

Source: @Gavekal

Source: @Gavekal

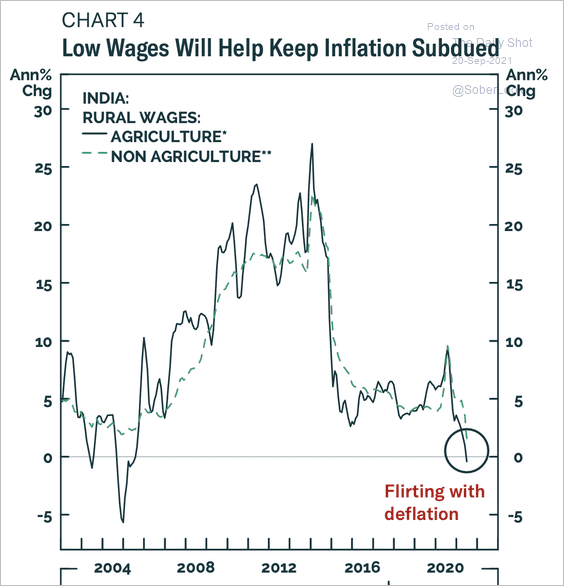

• Indian rural wage growth is close to zero, restraining inflation.

Source: BCA Research

Source: BCA Research

Back to Index

China

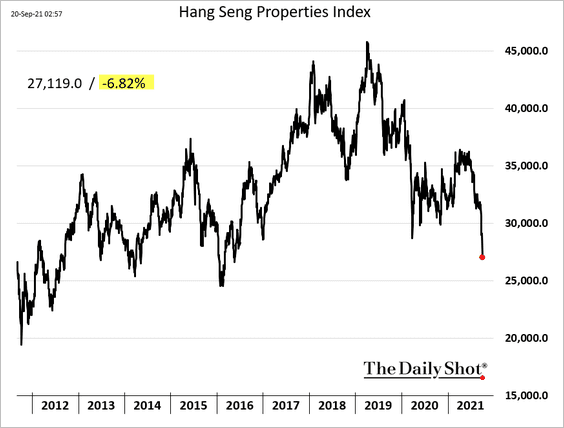

1. The Hang Seng Properties Index is down 6.8% on Monday, …

… with Evergande leading the way.

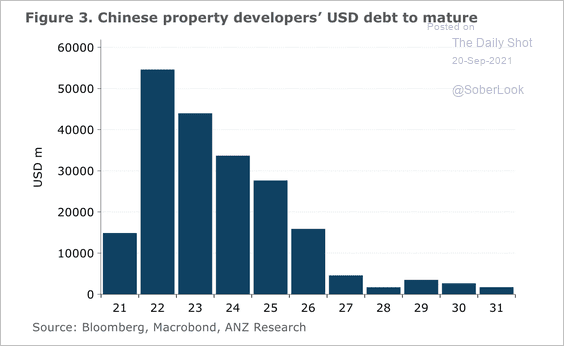

• Lower-rated bond yields continue to push higher. As much as $55 billion of property developers’ debt will mature next year, followed by another $44 billion in 2023.

Source: ANZ Research

Source: ANZ Research

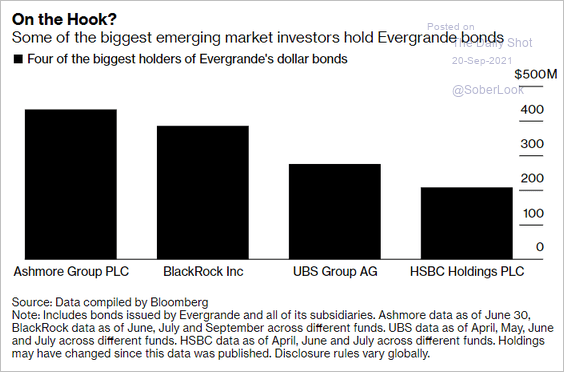

• Who are the largest holders of Evergrande bonds?

Source: @markets Read full article

Source: @markets Read full article

——————–

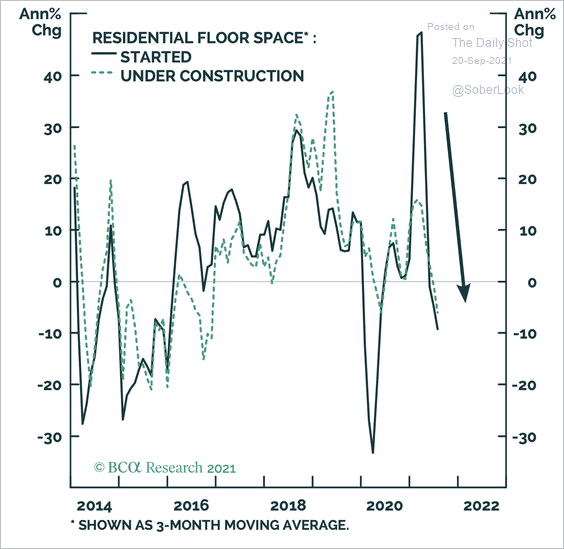

2. Regulation since the start of the year has started to cool the Chinese real estate market.

Source: BCA Research

Source: BCA Research

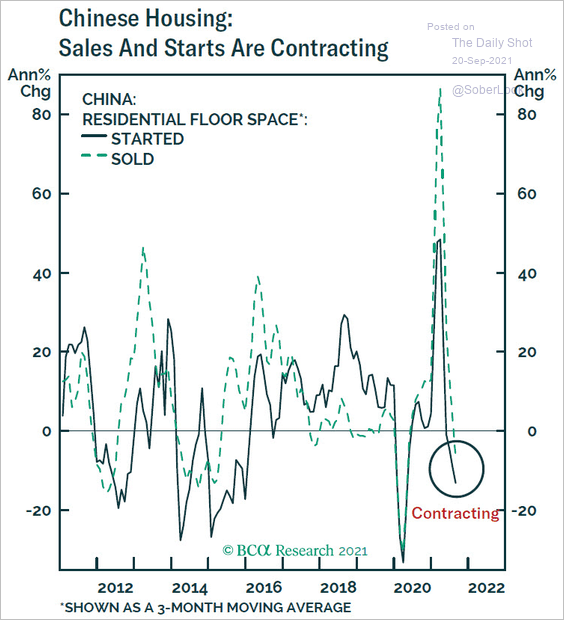

• Housing starts and new home sales have been soft.

Source: BCA Research

Source: BCA Research

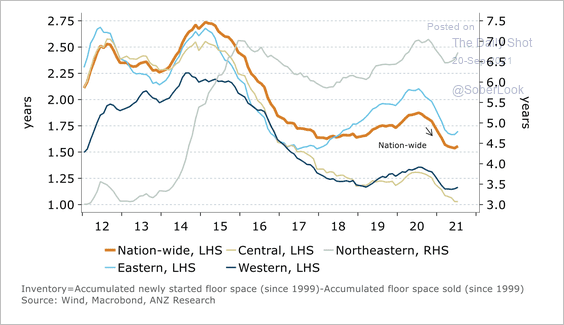

• Property inventory levels are lower than in the previous cycle.

Source: ANZ Research

Source: ANZ Research

——————–

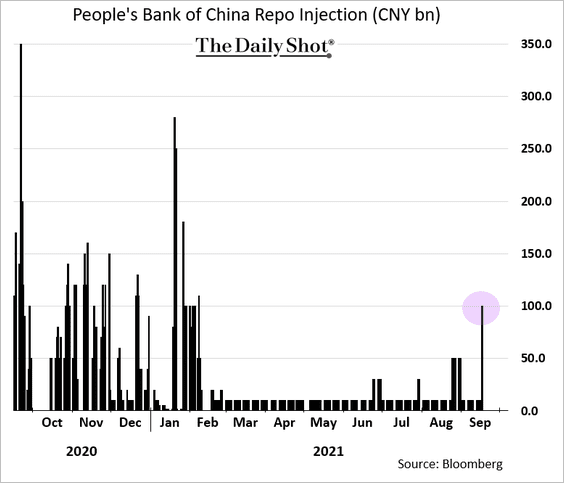

3. The PBoC injected liquidity into the banking system in response to signs of credit stress.

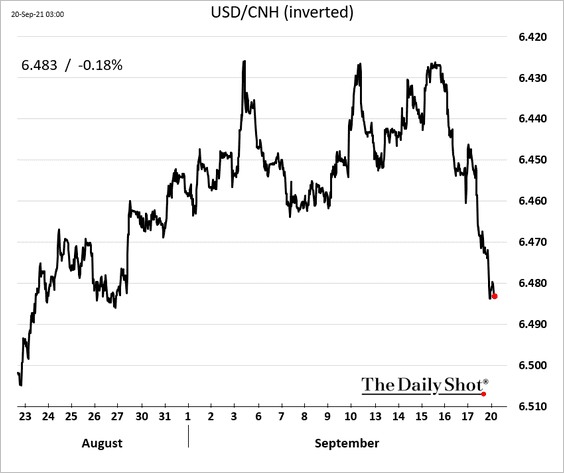

3. The renminbi is softer amid outflows.

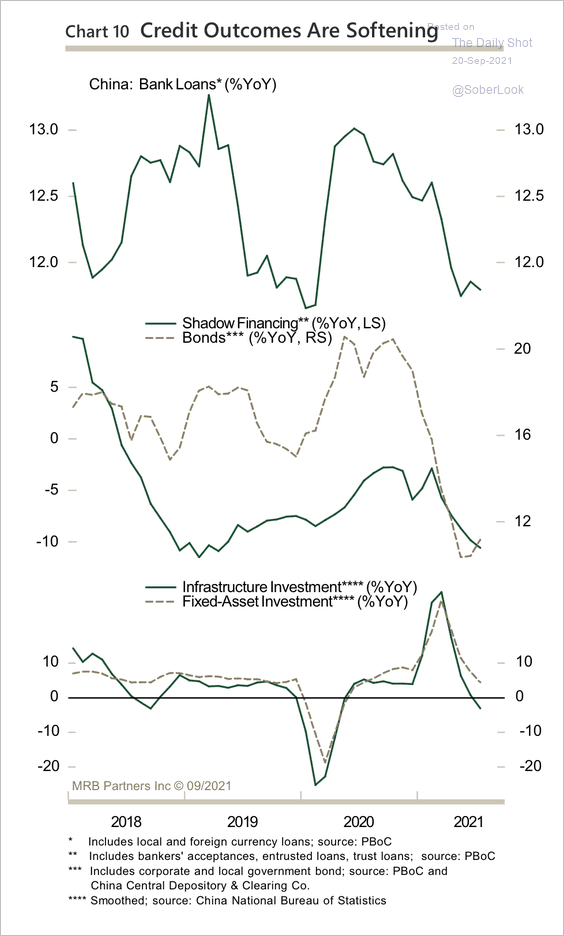

4. The decline in China’s credit impulse has led to a reduction in fixed-asset investment this year.

Source: MRB Partners

Source: MRB Partners

Back to Index

Asia – Pacific

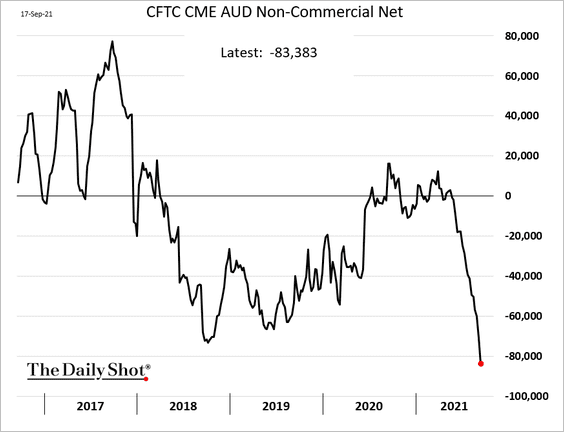

1. Speculative accounts continue to boost their bets against the Aussie dollar.

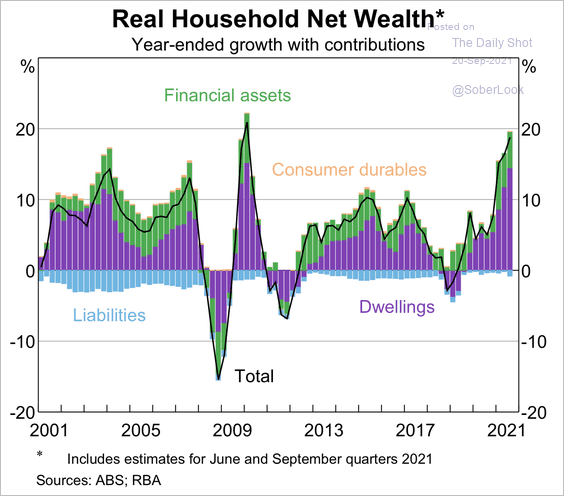

2. Growth in Australia’s household wealth accelerated this year.

Source: BIS Read full article

Source: BIS Read full article

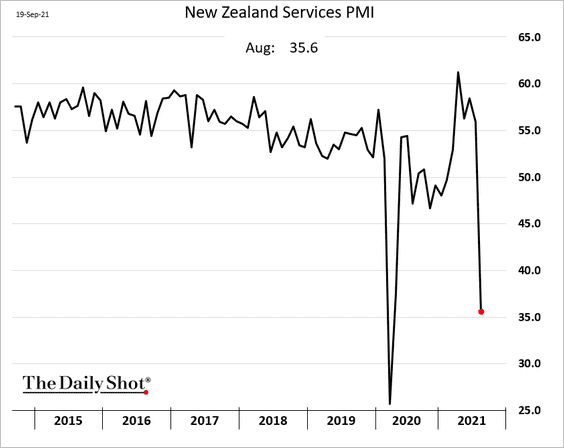

3. New Zealand’s service activity tumbled last month (second-lowest level for this index) due to the national lockdown.

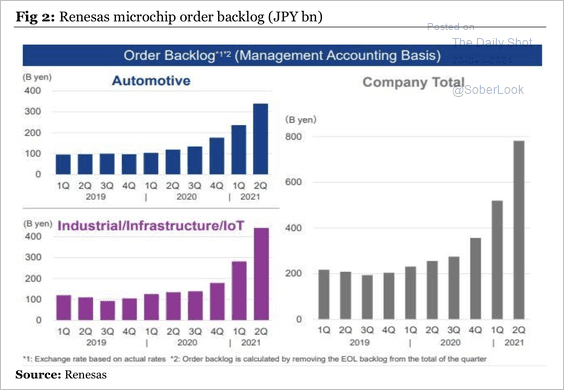

4. The global order backlog of microchips from Renesas, a large Japanese semiconductor supplier whose microchip plant set on fire in March, is now four times greater than it was before the pandemic.

Source: Renseas; Longview Economics

Source: Renseas; Longview Economics

Back to Index

The Eurozone

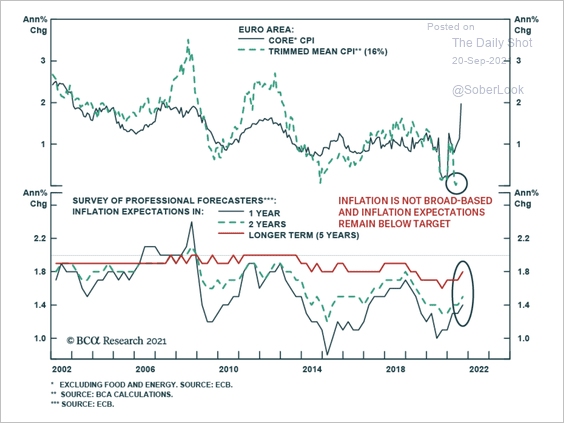

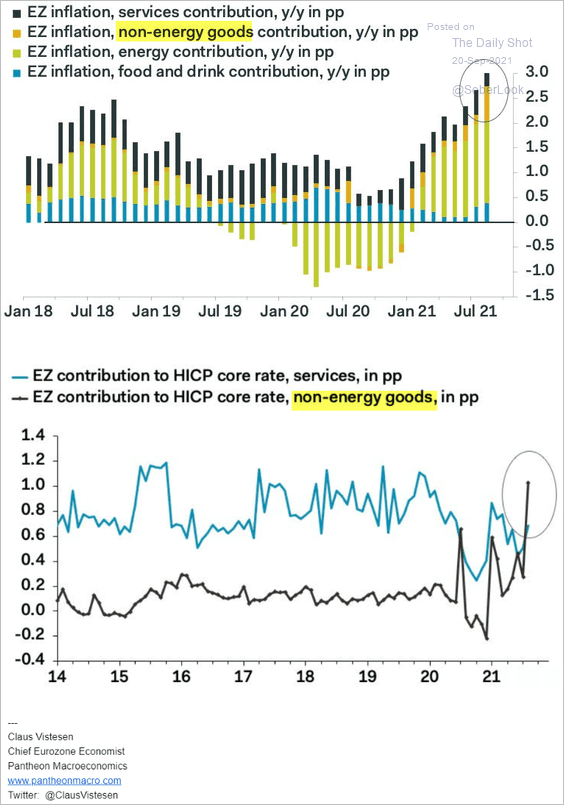

1. The pickup in euro area inflation has not been broad-based.

Source: BCA Research

Source: BCA Research

Non-energy goods prices rose sharply last month, pushing the core CPI higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

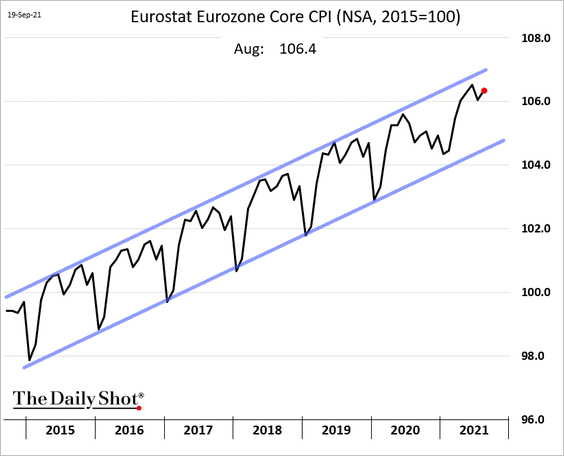

Nonetheless, the core CPI index remains range-bound.

——————–

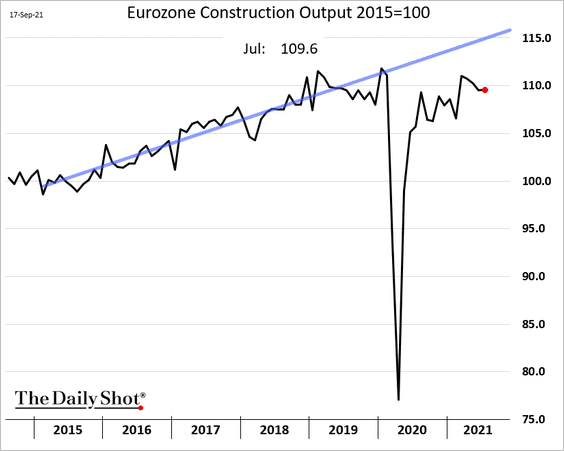

2. Construction output is at pre-COVID levels but well below the trend.

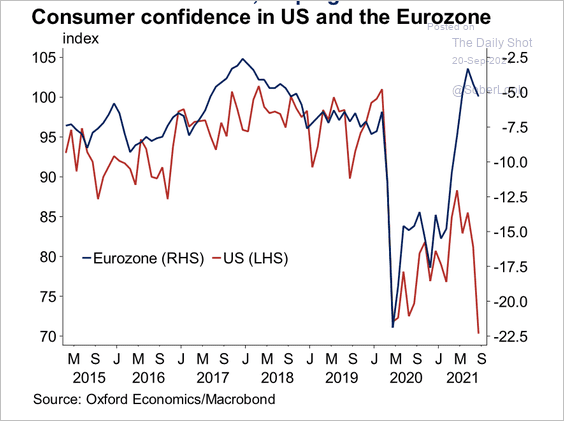

3. Eurozone consumer confidence remains firm relative to the US.

Source: Oxford Economics

Source: Oxford Economics

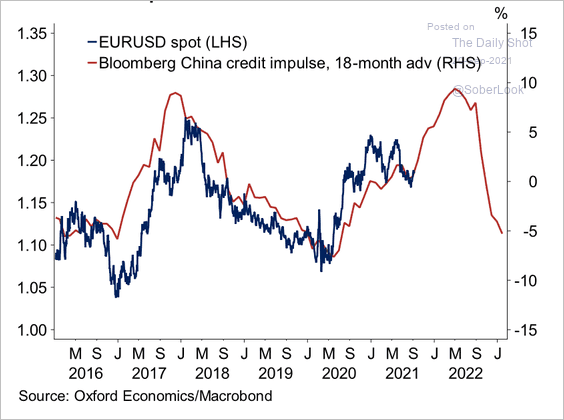

4. There could be further upside for EUR/USD due to lagged effects from China’s credit impulse, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

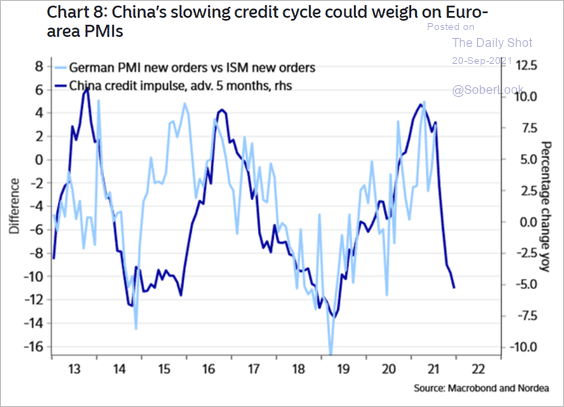

5. But China’s credit impulse could be a drag on German factory orders.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Europe

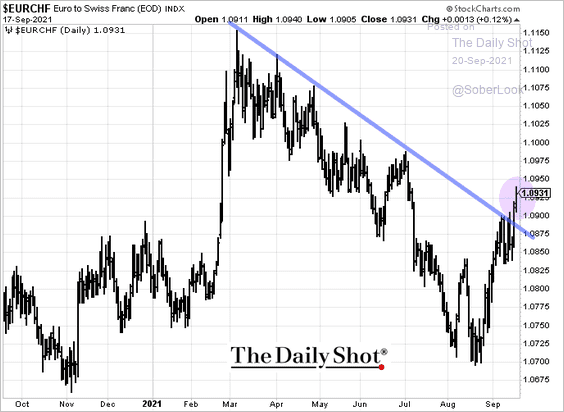

1. EUR/CHF broke above short-term resistance.

h/t @vkaramanis_fx

h/t @vkaramanis_fx

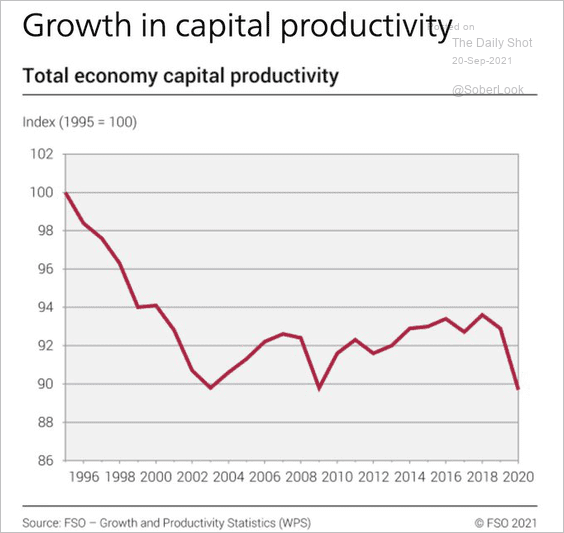

Separately, the Swiss capital productivity growth has been soft.

Source: @acemaxx, @StatSchweiz Read full article

Source: @acemaxx, @StatSchweiz Read full article

——————–

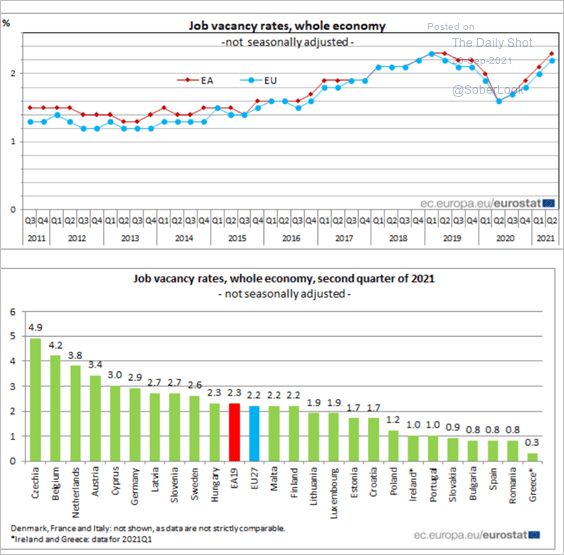

2. This chart shows job vacancies in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

The United Kingdom

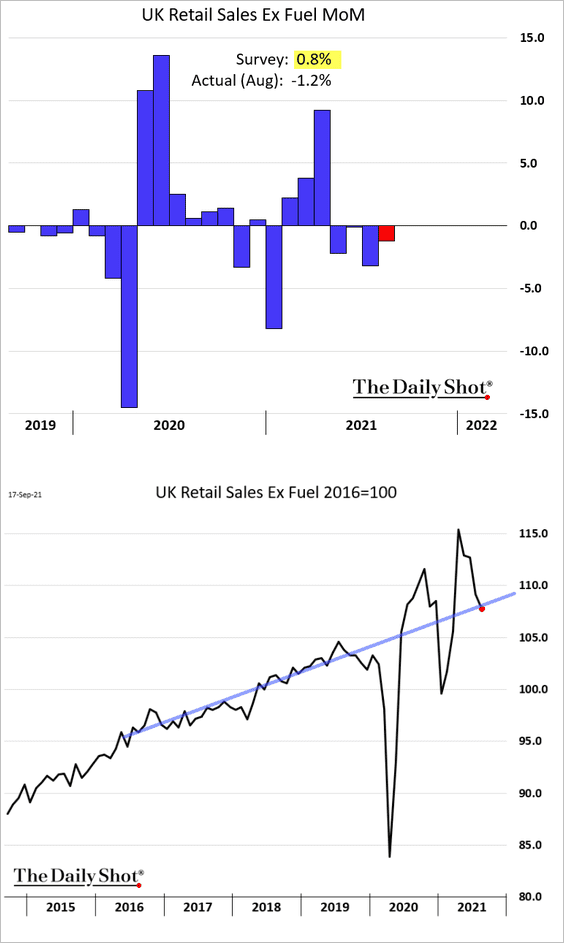

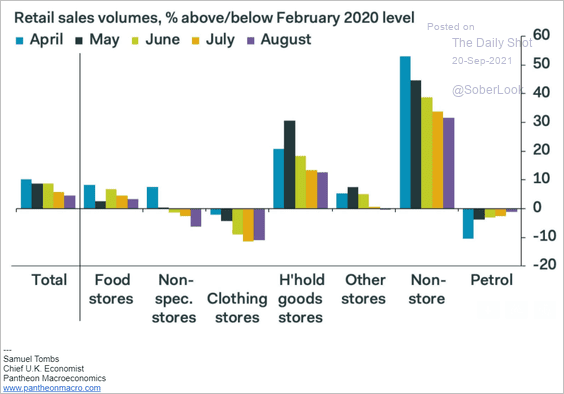

1. Retail sales unexpectedly declined last month,

Here is the breakdown by sector.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

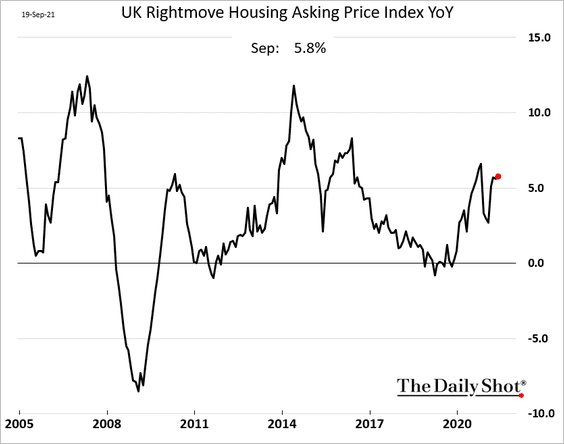

2. Growth in asking prices for residential property held below 6% this month.

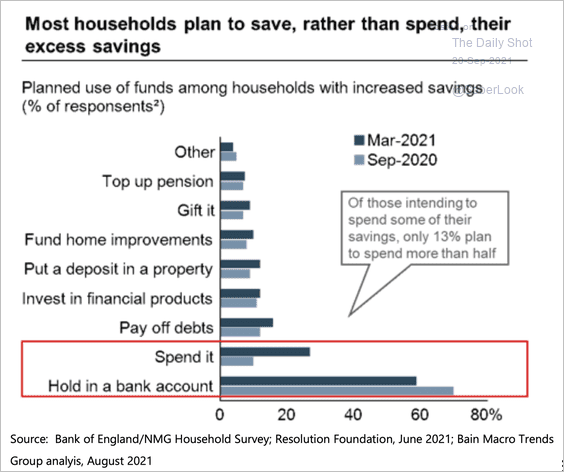

3. Consumers in the UK intend to save their excess savings, partly because most have accrued to higher-income households.

Source: Bain & Company

Source: Bain & Company

Back to Index

Canada

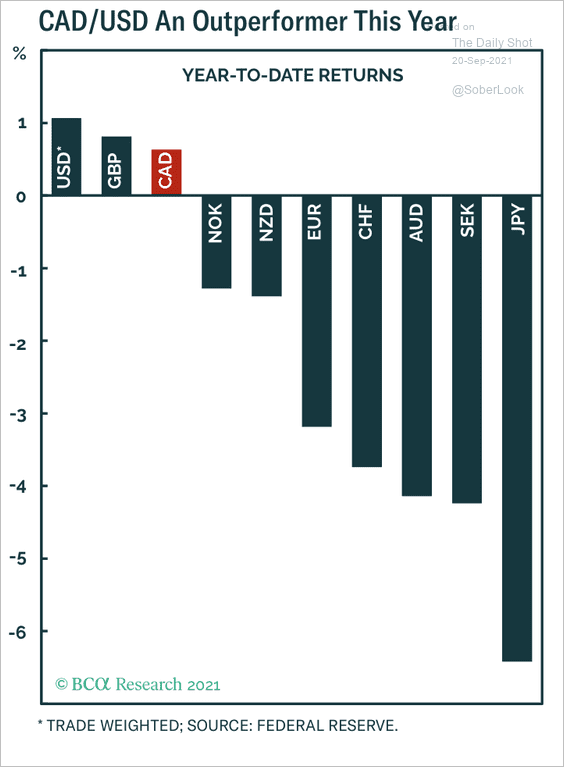

1. The Canadian dollar has performed well year-to-date.

Source: BCA Research

Source: BCA Research

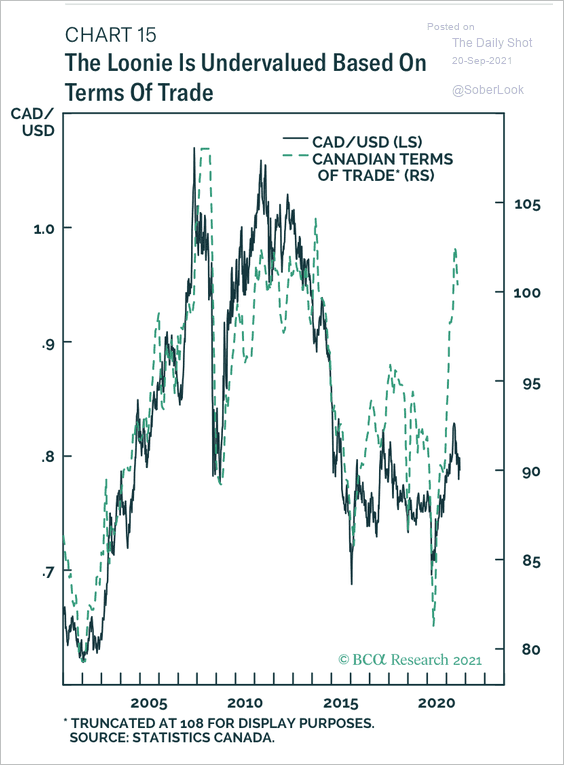

Improving terms of trade bode well for the loonie.

Source: BCA Research

Source: BCA Research

——————–

2. Here is an updated election poll tracker.

![]() Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United States

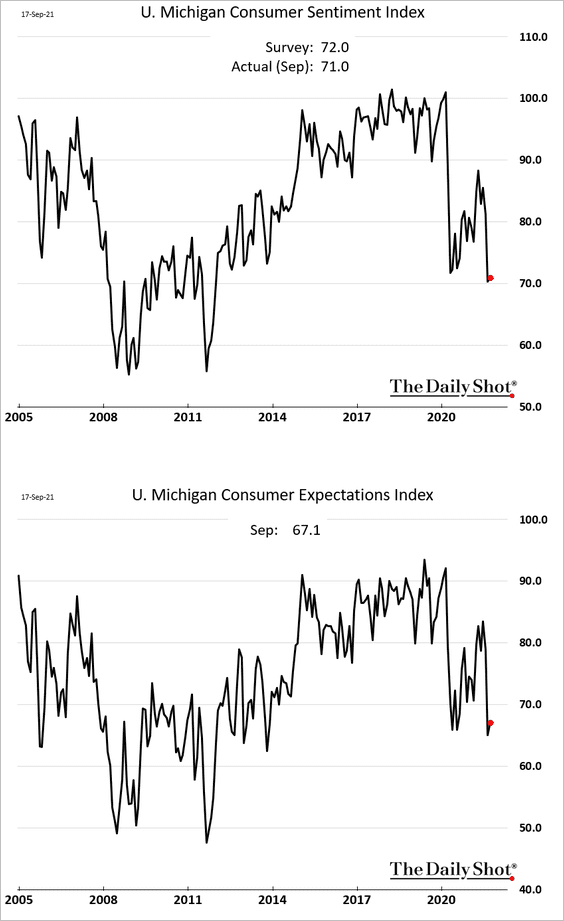

1. The U. Michigan consumer sentiment index was almost unchanged this month.

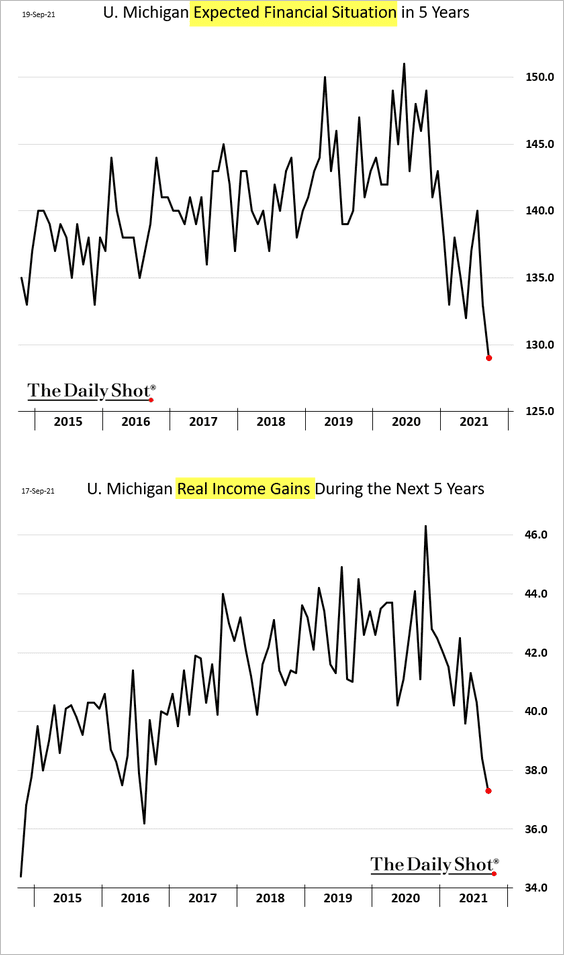

• Longer-term financial situation expectations continue to fall.

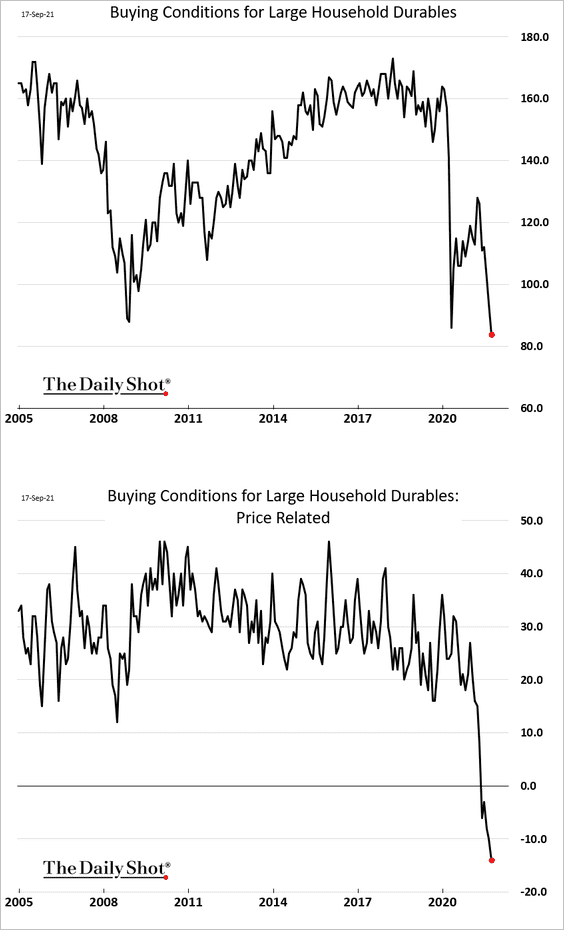

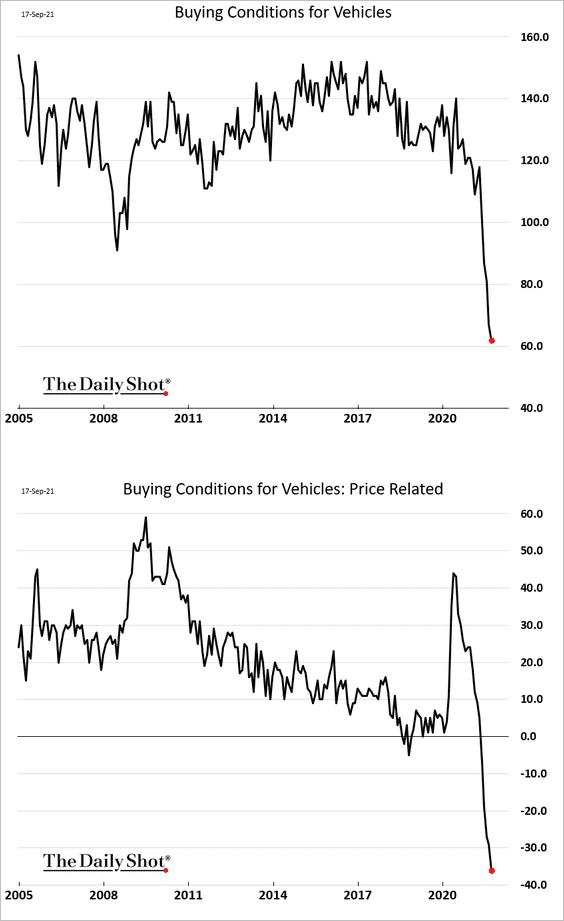

• Buying conditions for durable goods keep deteriorating, driven by higher prices. It should be noted that despite the complaints about prices, US consumers keep spending.

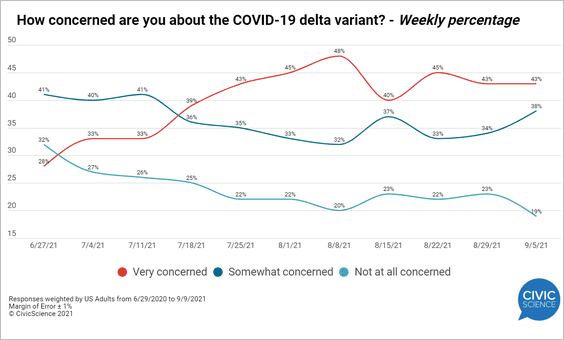

Separately, COVID concerns remain elevated.

——————–

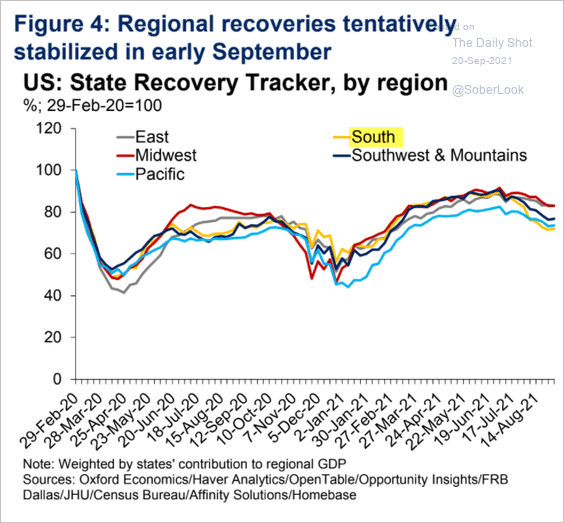

2. This chart shows the Oxford Economics Recovery Tracker by region.

Source: Oxford Economics

Source: Oxford Economics

——————–

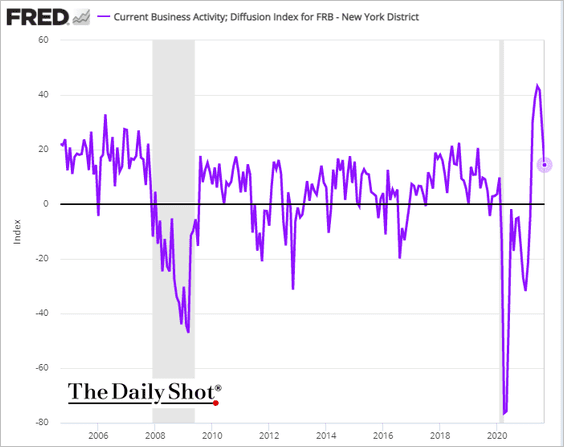

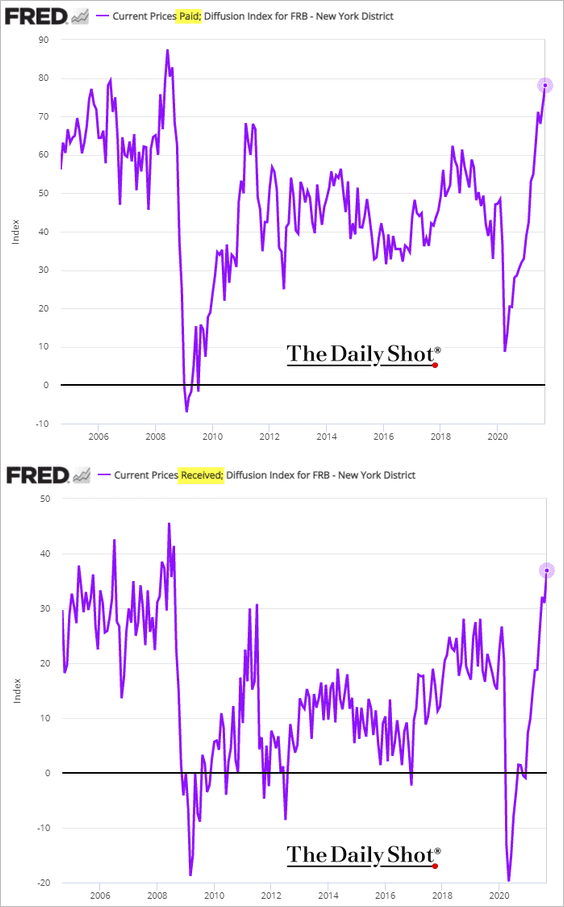

3. The NY Fed’s regional services index showed slower growth this month.

Price pressures continue to mount.

——————–

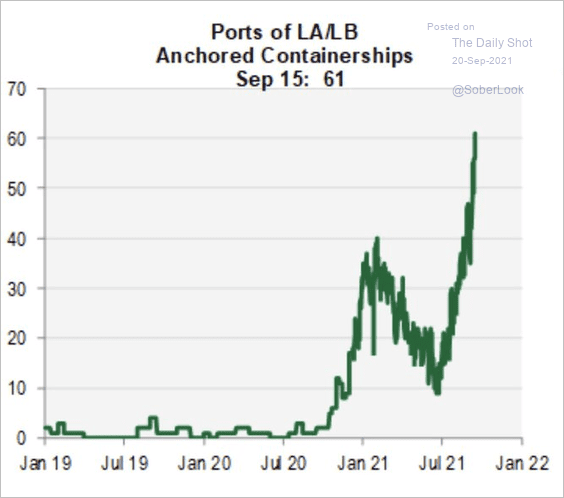

4. The West Coast port congestion is at extreme levels as businesses try to rebuild inventories ahead of the holiday shopping season.

Source: @MichaelKantro, @NancyRLazar1

Source: @MichaelKantro, @NancyRLazar1

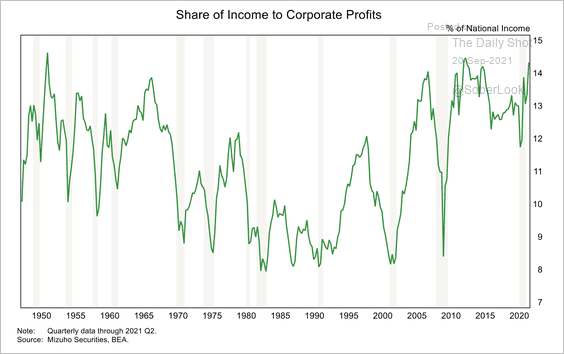

5. The corporate share of national income is rising again.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Global Developments

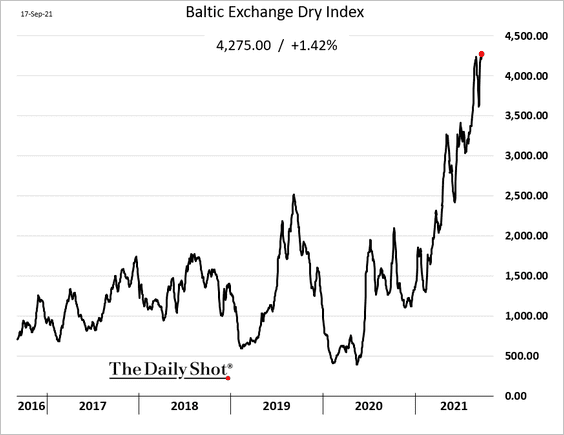

1. Dry bulk shipping costs keep grinding higher, even as iron ore prices tumble.

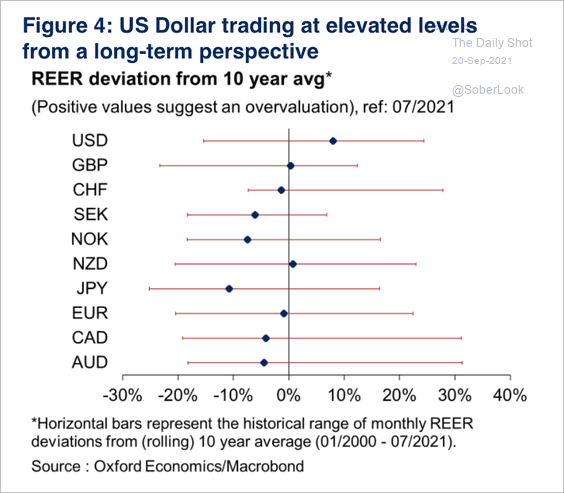

2. Oxford Economics expects the dollar to weaken into 2022.

Source: Oxford Economics

Source: Oxford Economics

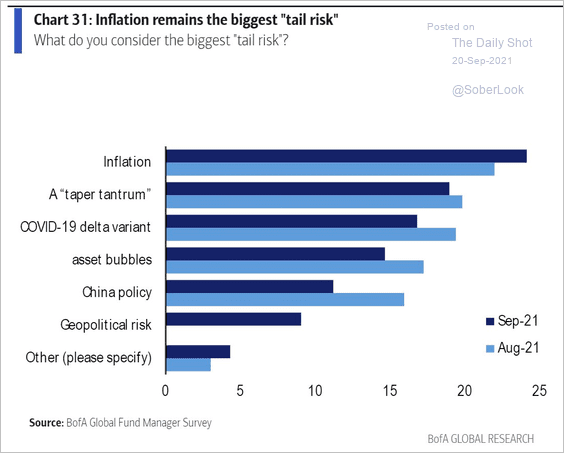

3. Fund managers still see inflation as the biggest tail risk.

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

——————–

Food for Thought

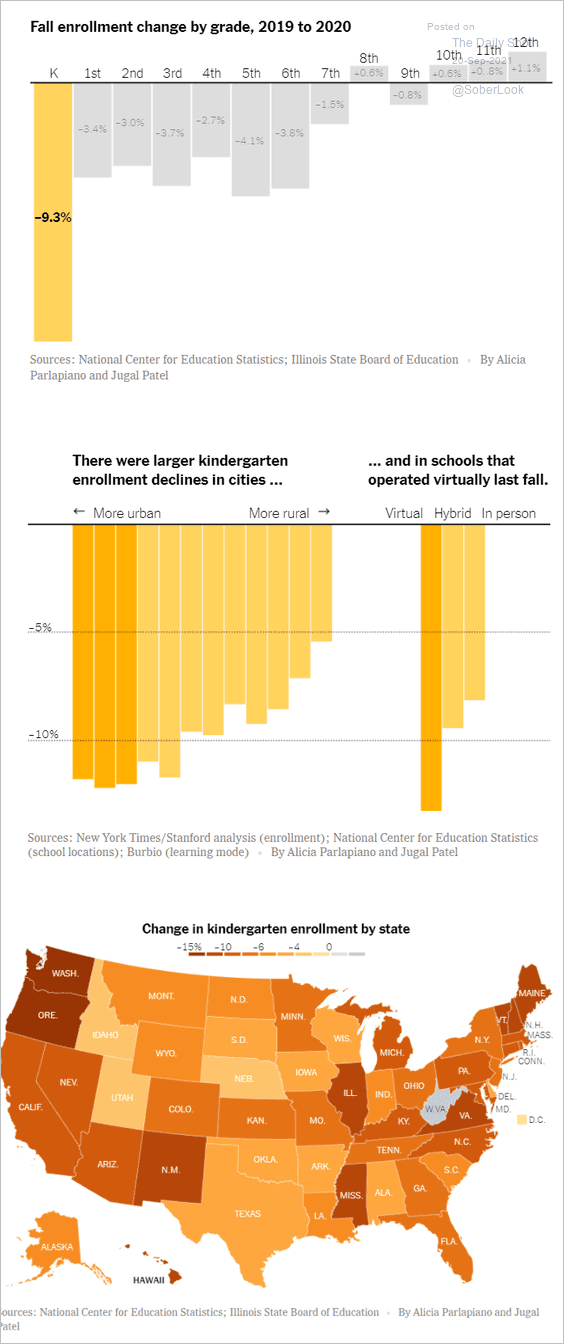

1. Declines in kindergarten enrollment in 2020:

Source: The New York Times Read full article

Source: The New York Times Read full article

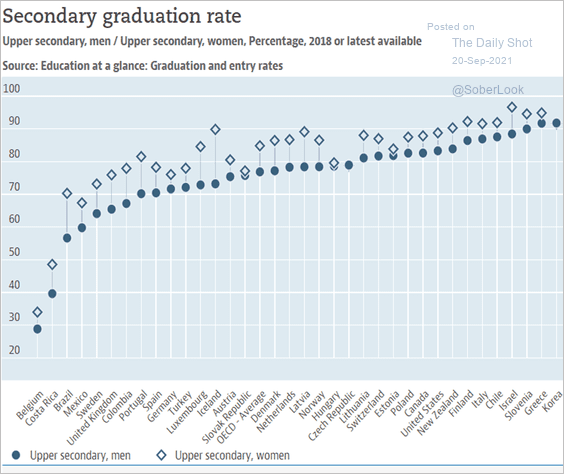

2. Graduation rates around the world:

Source: OECD

Source: OECD

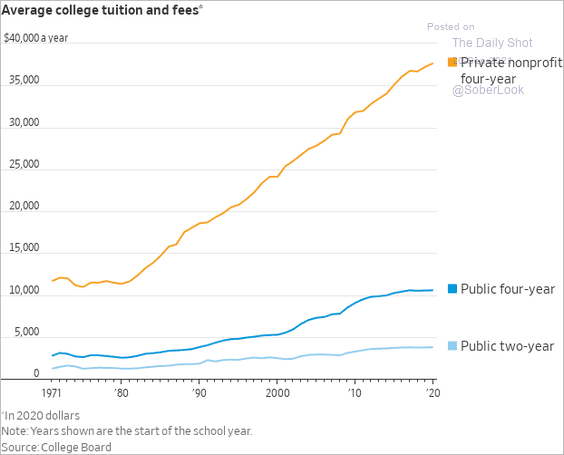

3. US college tuition and fees:

Source: @WSJ Read full article

Source: @WSJ Read full article

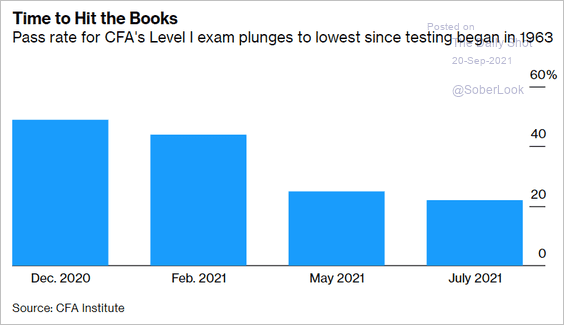

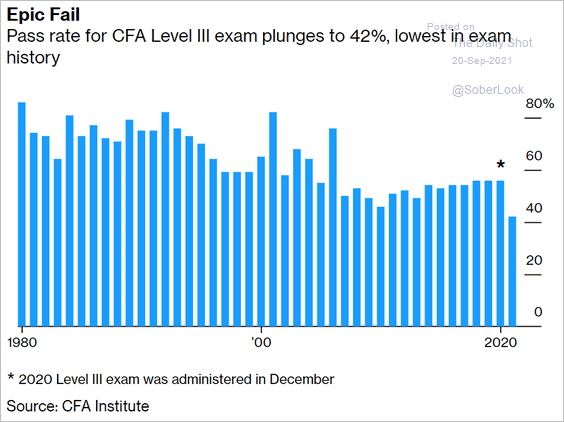

4. The CFA exam pass rate:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

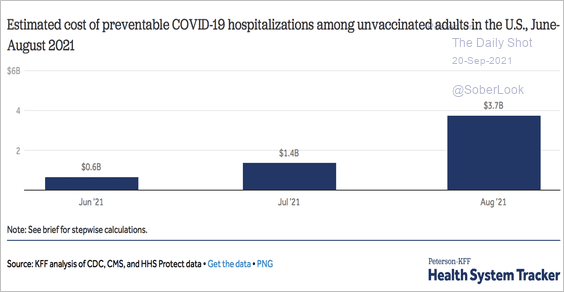

5. The cost of COVID hospitalizations (unvaccinated adults):

Source: @cynthiaccox, @KFF Read full article

Source: @cynthiaccox, @KFF Read full article

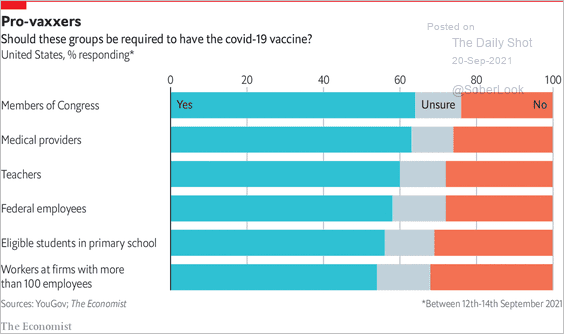

6. Views on vaccination requirements:

Source: The Economist Read full article

Source: The Economist Read full article

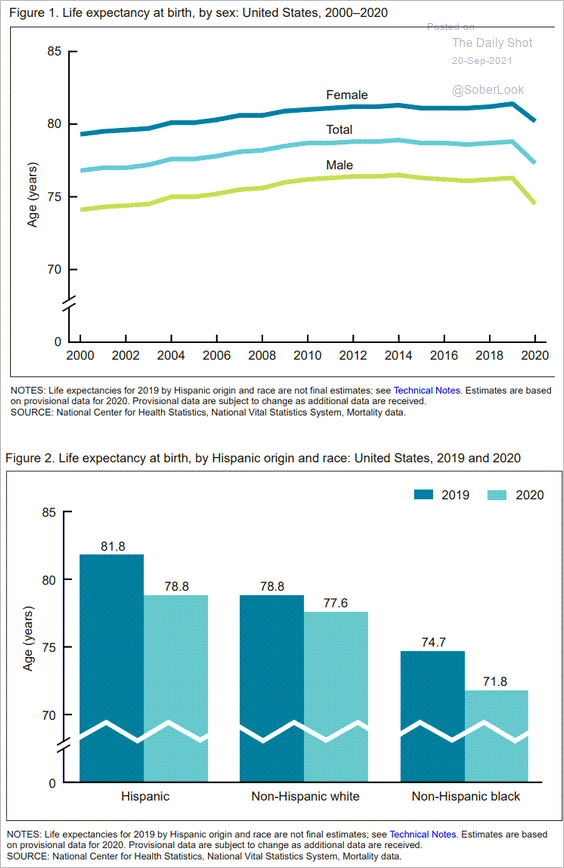

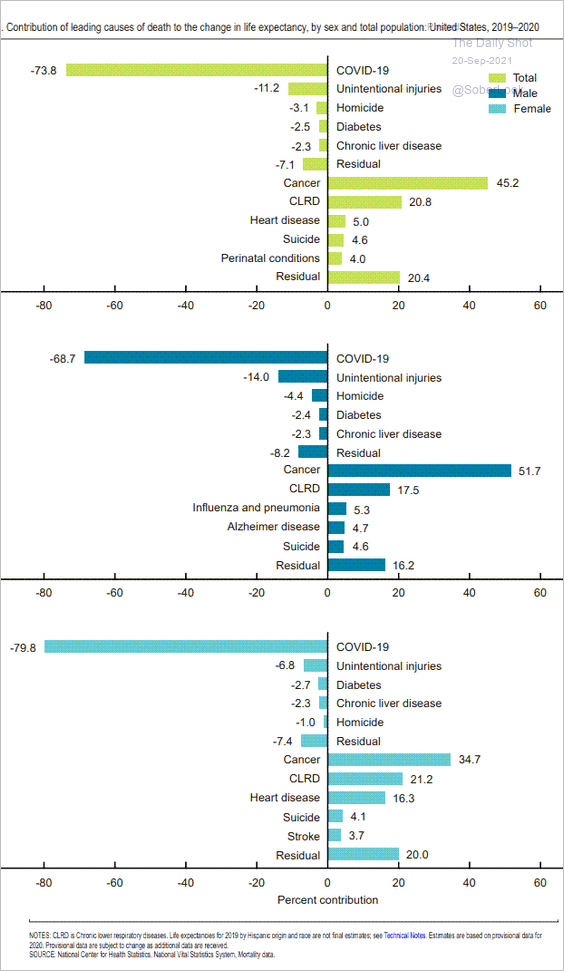

7. The decline in US life expectancy:

Source: CDC

Source: CDC

Source: CDC

Source: CDC

——————–

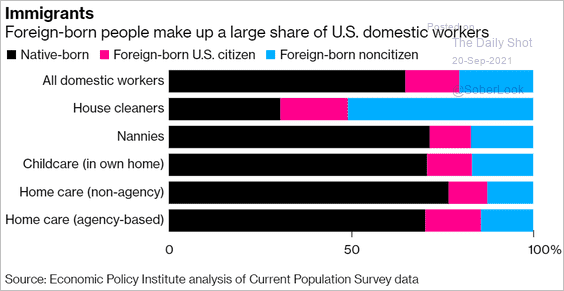

8. US domestic workers:

Source: @bbgequality Read full article

Source: @bbgequality Read full article

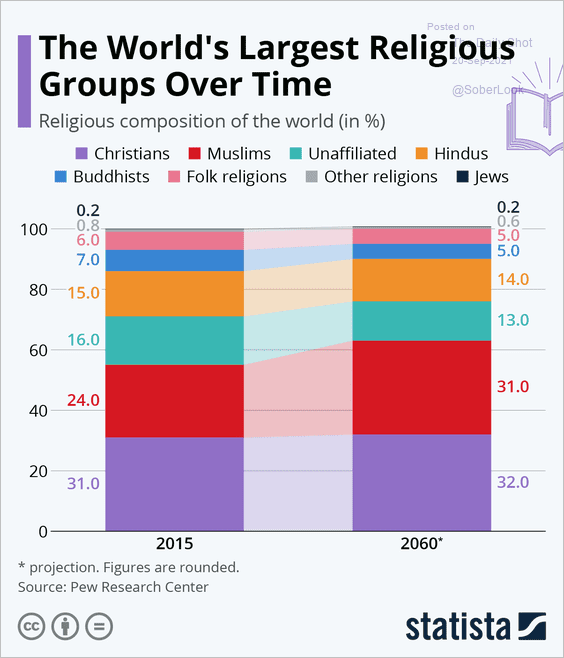

9. Religious composition of the world over time:

Source: Statista

Source: Statista

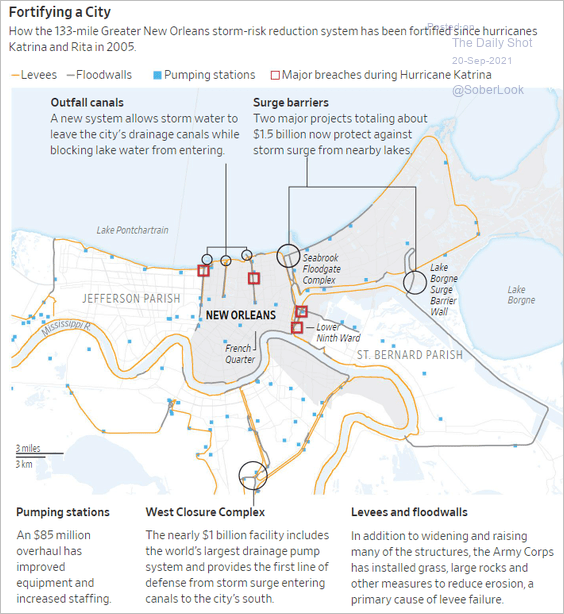

10. The New Orleans storm system:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index