The Daily Shot: 21-Sep-21

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• The United States

• Canada

• The Eurozone

• Food for Thought

China

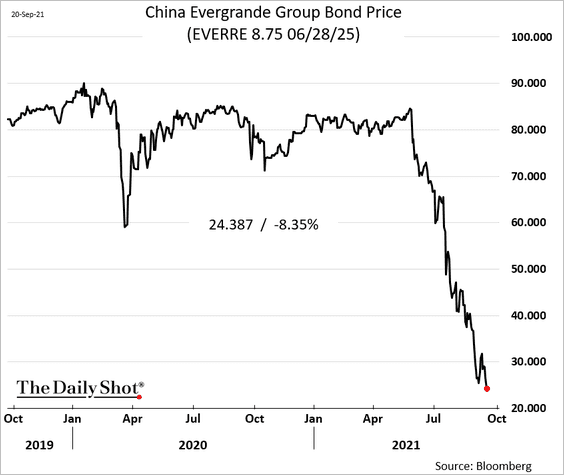

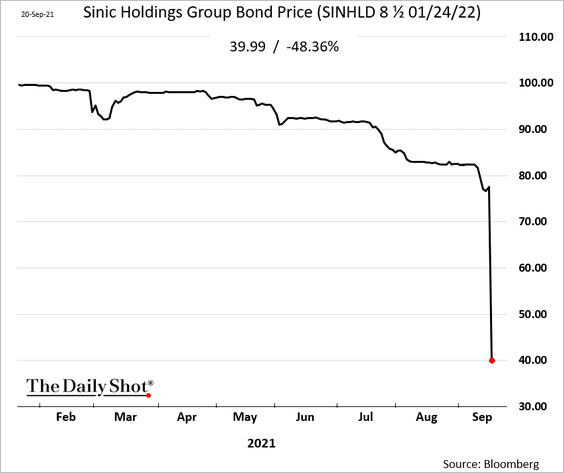

1. Debt of leveraged property companies remains under pressure.

• Evergrande:

• Sinic Holdings:

However, analysts doubt that the property debt crunch is China’s “Lehman moment.”

Source: Barclays Research

Source: Barclays Research

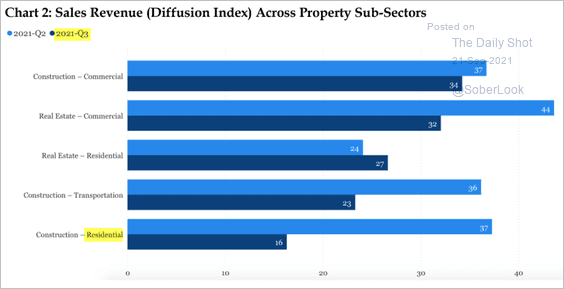

Yes, residential property sales have been struggling this quarter.

Source: China Beige Book

Source: China Beige Book

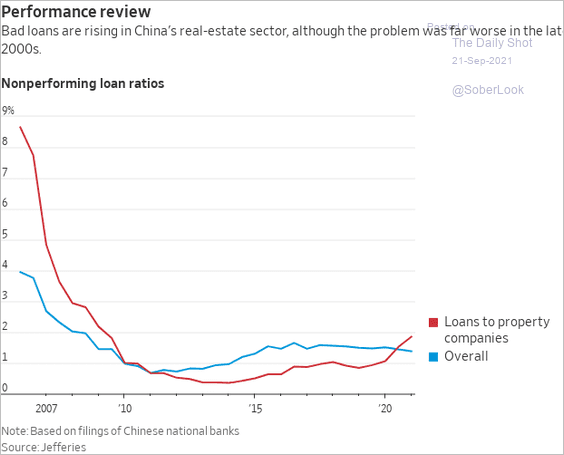

And banks see an increase in bad property loans.

Source: @WSJ Read full article

Source: @WSJ Read full article

But these trends will not freeze the nation’s credit flows or send the economy into a recession. Some of these property developers will be restructured, with bond investors taking a hit. The impact on the banking system will be limited.

——————–

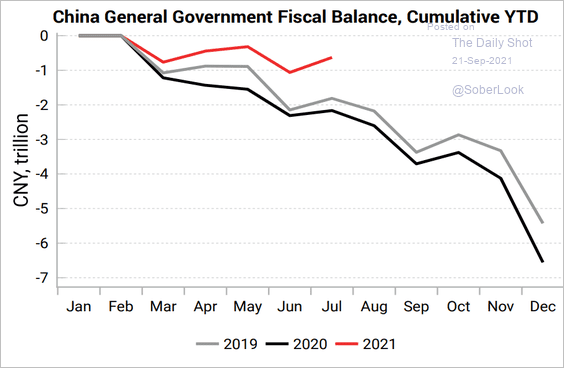

2. China’s economy has been moderating due to trends not directly related to property markets. One reason is the slowdown in fiscal stimulus this year.

Source: Variant Perception

Source: Variant Perception

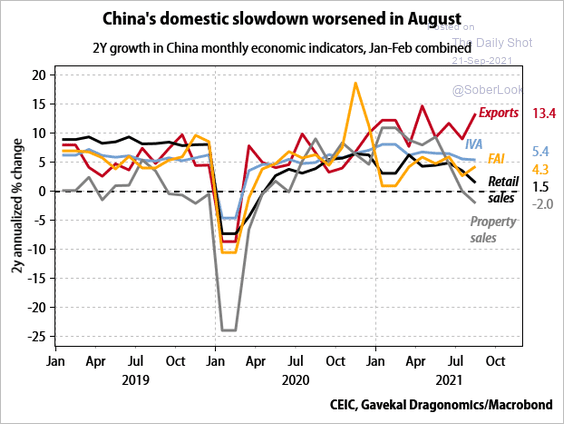

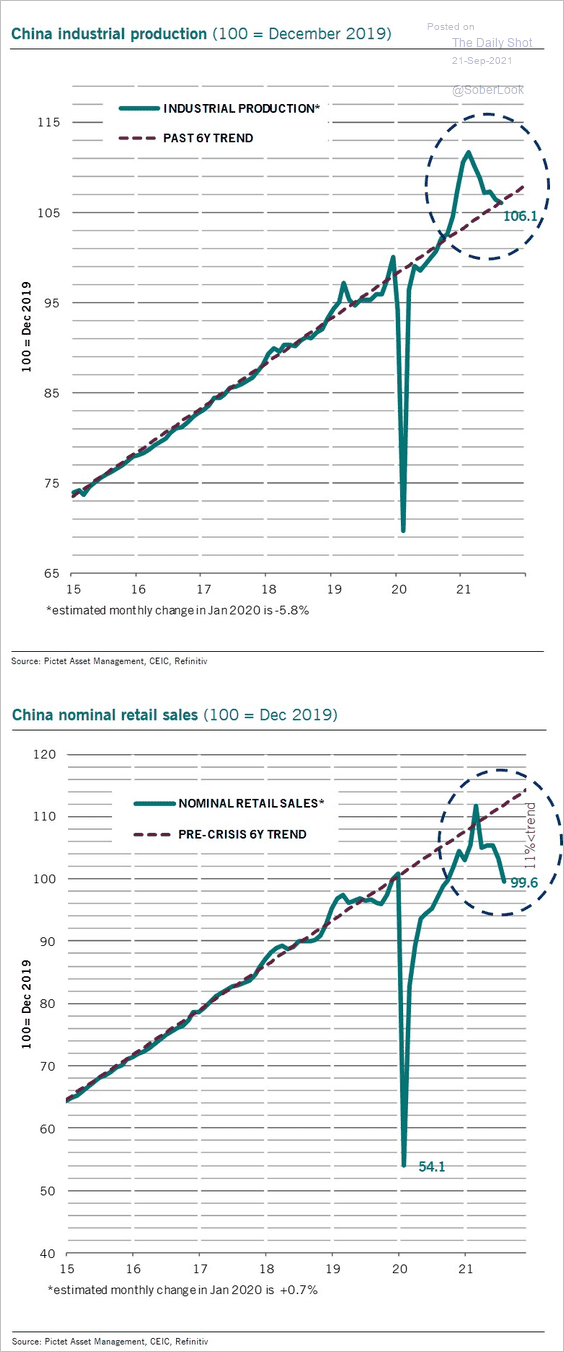

Industrial production and retail sales growth have both weakened.

Source: Gavekal Research

Source: Gavekal Research

Source: @PkZweifel

Source: @PkZweifel

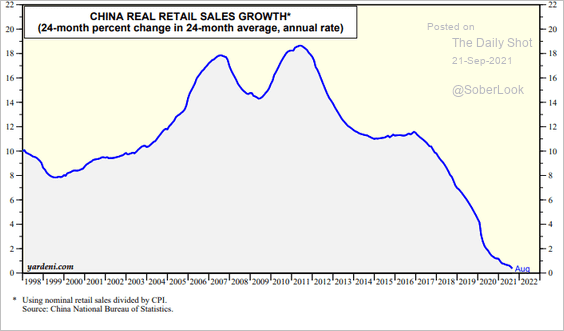

Growth in real retail sales has been slowing for years.

Source: Yardeni Research

Source: Yardeni Research

——————–

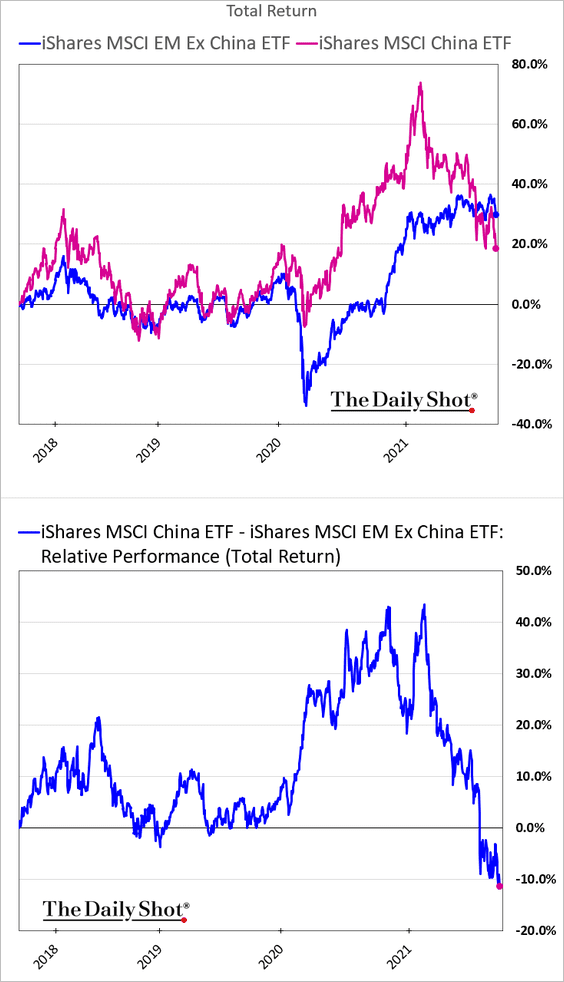

3. China’s stocks have been underperforming other EM shares.

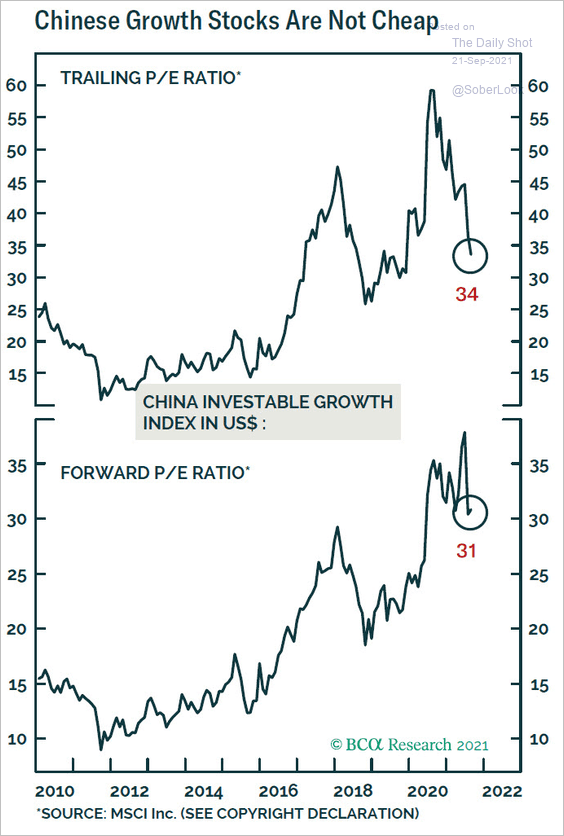

And yet, China’s growth stocks are not cheap.

Source: BCA Research

Source: BCA Research

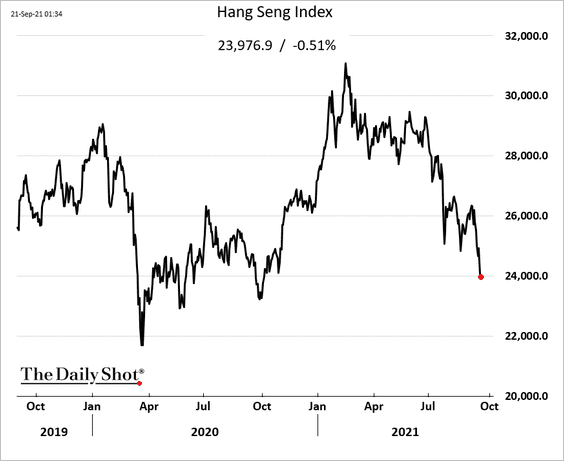

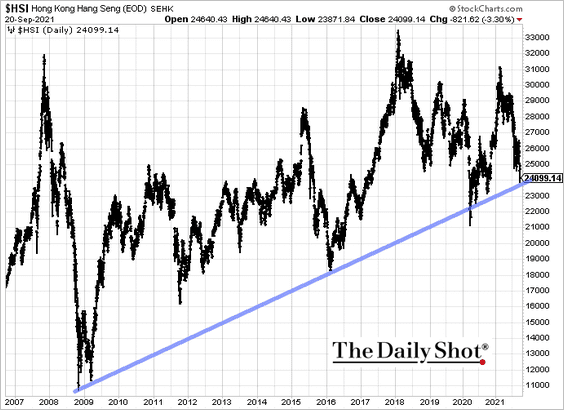

• The Hang Seng Index is down again today, although the property index appears to have stabilized.

The Hang Seng is testing long-term support.

h/t @IshikaMookerjee Read full article

h/t @IshikaMookerjee Read full article

——————–

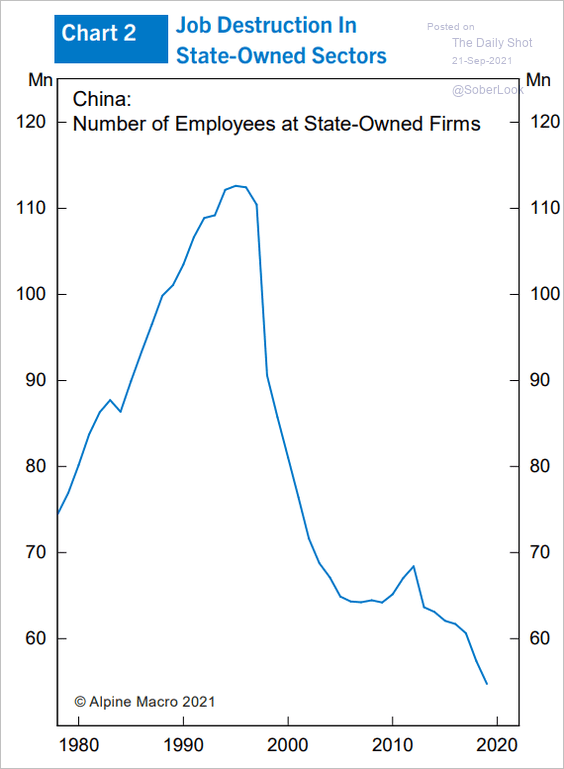

4. Employment at state-owned firms has been falling for a couple of decades.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

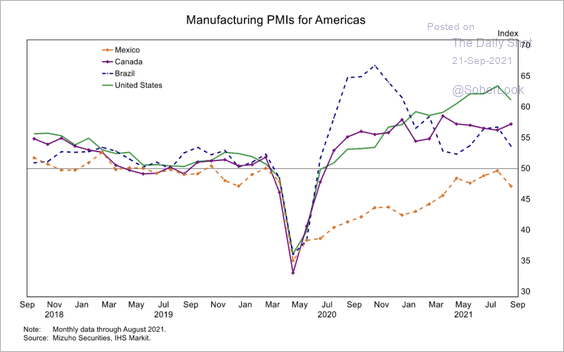

1. Mexico’s manufacturing activity has lagged behind regional peers.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

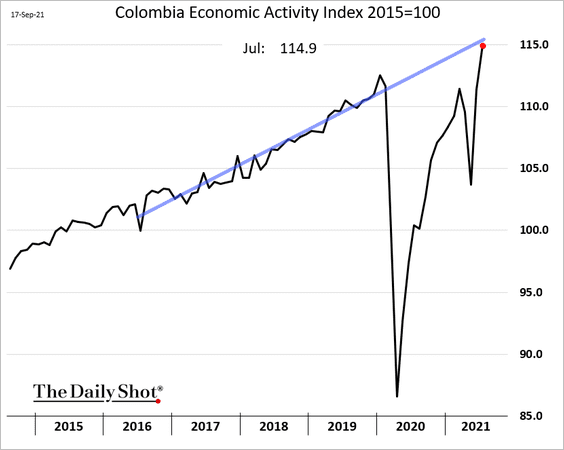

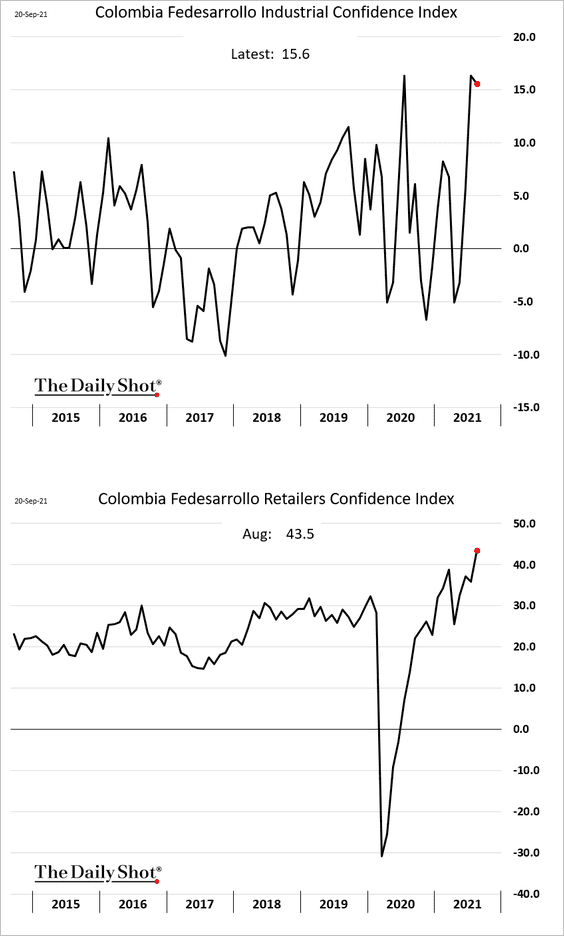

2. Colombia’s economy is back at the pre-COVID trend.

Business sentiment has been strong.

——————–

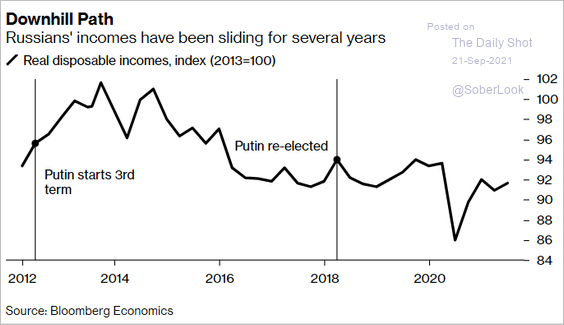

3. Russian households’ real disposable incomes have not recovered from the 2014/15 oil market crash (which sent the ruble tumbling).

Source: @markets Read full article

Source: @markets Read full article

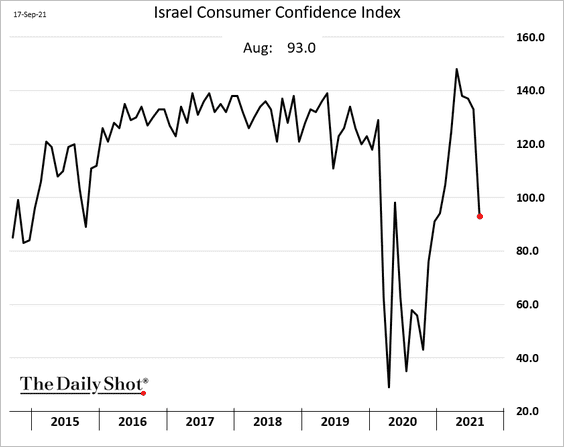

4. Israel’s consumer sentiment has been deteriorating as COVID cases surge.

5. Inflation expectations in Turkey keep grinding higher.

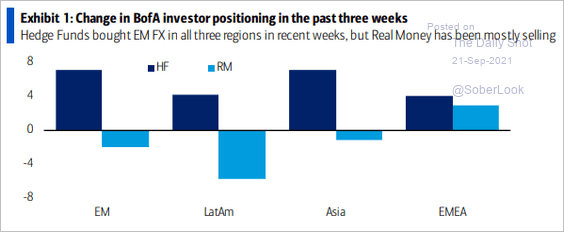

6. Hedge funds have been buying EM currencies in recent weeks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

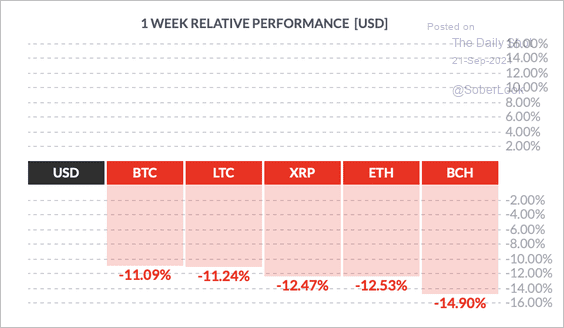

1. Cryptocurrencies are in the red over the past week, although bitcoin is outperforming.

Source: FinViz

Source: FinViz

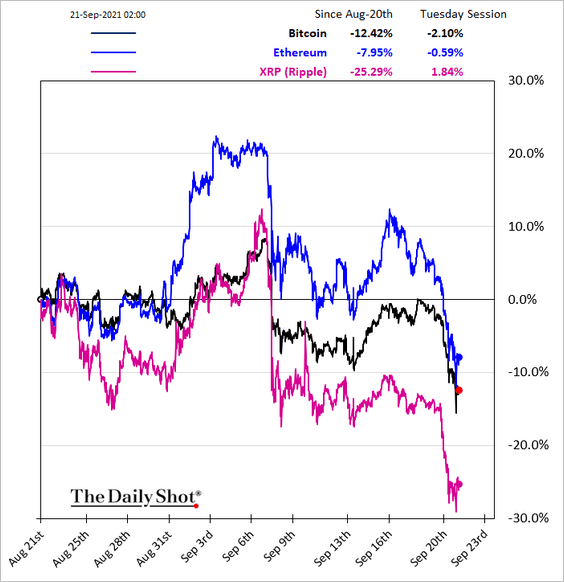

• Here is the relative performance over the past month.

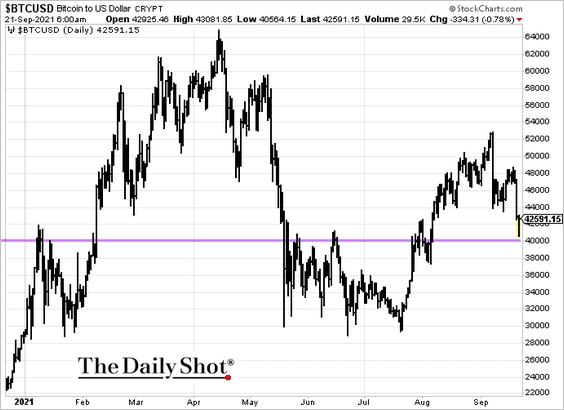

• Bitcoin held support at $40k.

——————–

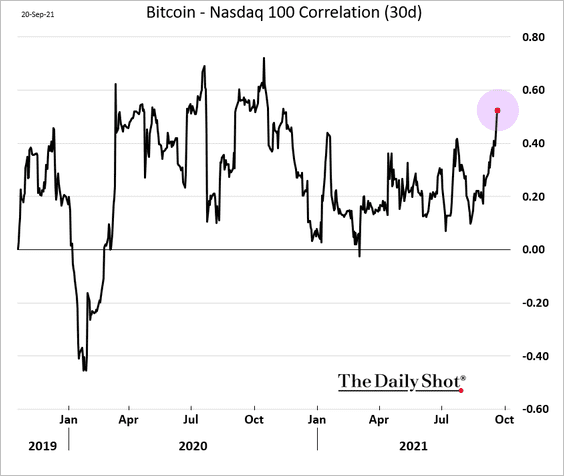

2. Using cryptos to diversify risk-asset portfolios proved ineffective in the latest selloff.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Bitcoin-equity correlations jumped.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

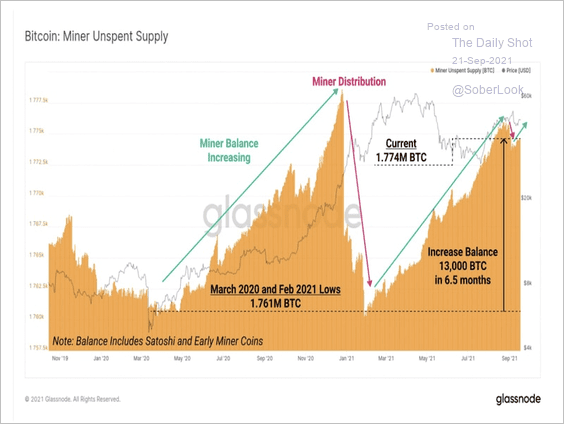

3. Bitcoin miners have been in accumulation mode over the past six months.

Source: Glassnode

Source: Glassnode

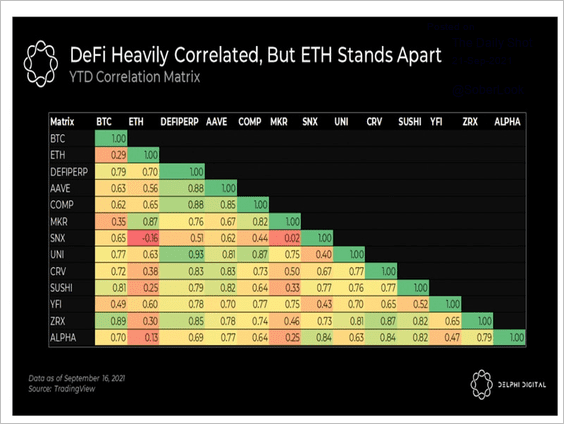

4. DeFi tokens are fairly correlated with each other, but the correlation with ETH is relatively weak.

Source: Delphi Digital Read full article

Source: Delphi Digital Read full article

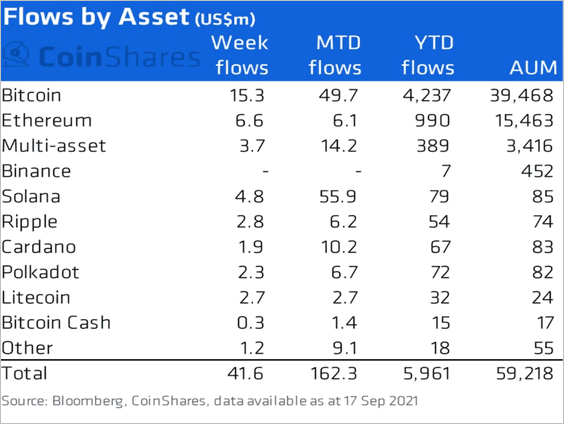

5. Digital asset investment products registered their fifth consecutive week of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

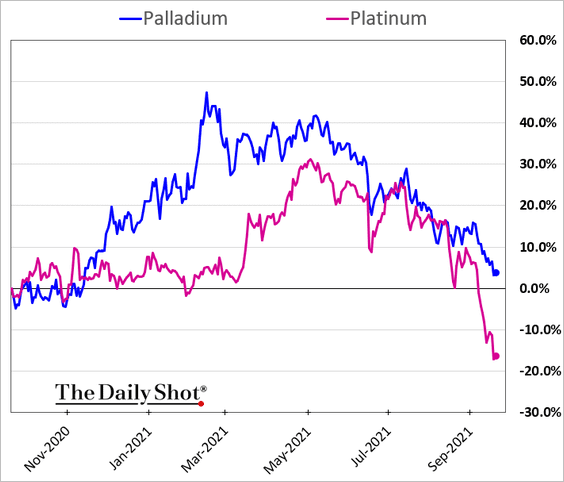

1. Platinum is down sharply in recent weeks.

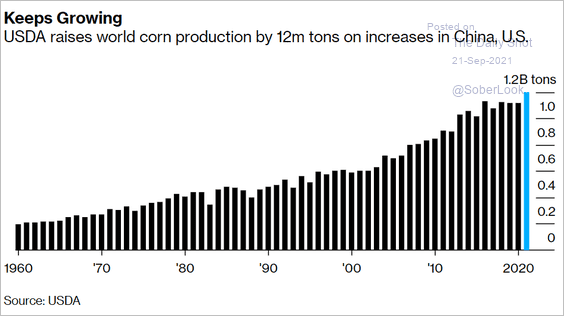

2. Global corn production is expected to hit a record high this year.

Source: @markets Read full article

Source: @markets Read full article

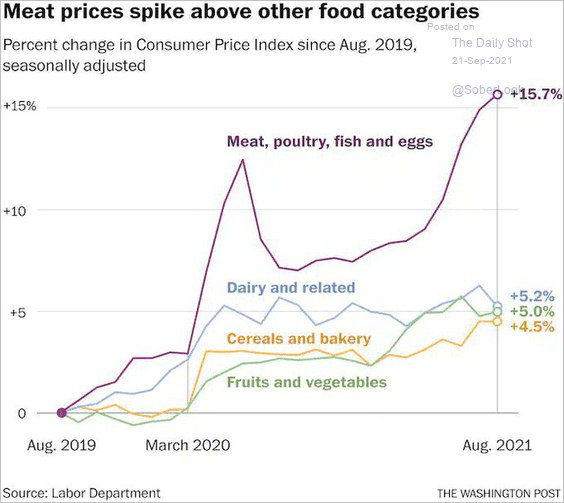

3. Meat prices have outpaced other food categories.

Source: @abhabhattarai Read full article

Source: @abhabhattarai Read full article

4. PVC costs have been surging.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Energy

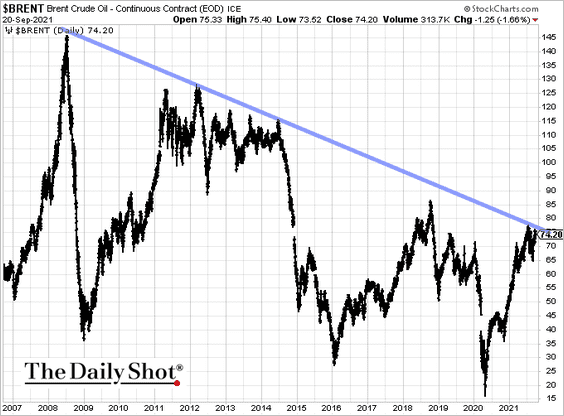

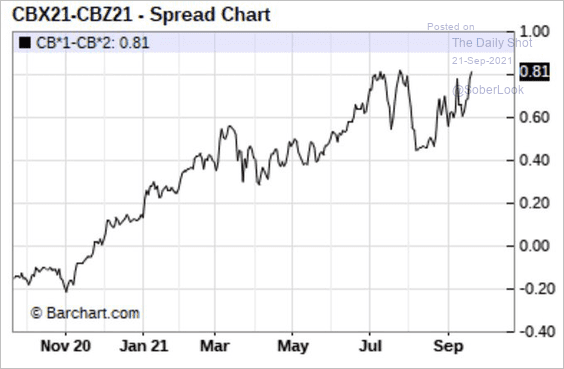

1. Brent held long-term resistance as equities sold off.

Despite a pullback in prices, Brent backwardation (inverted curve) held up well – an indication of tightness in the market.

Source: @HFI_Research

Source: @HFI_Research

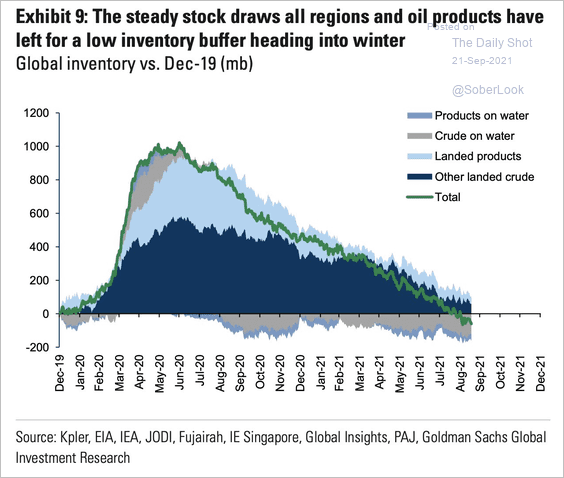

Global inventories of crude oil and products are now below pre-COVID levels.

Source: Goldman Sachs; @HFI_Research

Source: Goldman Sachs; @HFI_Research

——————–

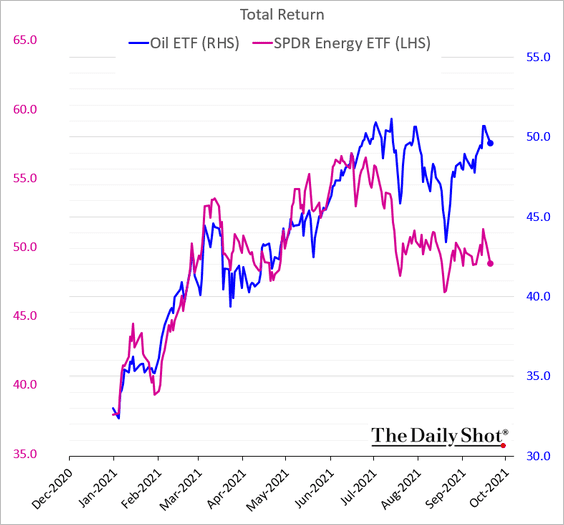

2. Energy shares continue to underperform oil.

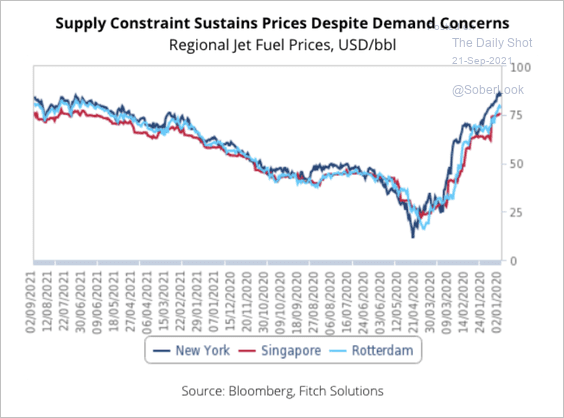

3. Jet fuel prices have mostly recovered from last year’s lows.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

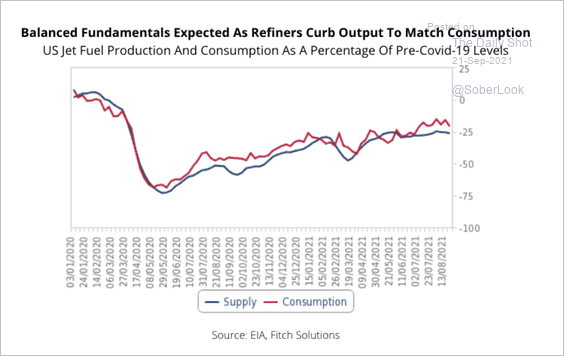

However, jet fuel production (and consumption) is still well below pre-pandemic levels.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

4. European natural gas prices continue to surge to new records.

Back to Index

Equities

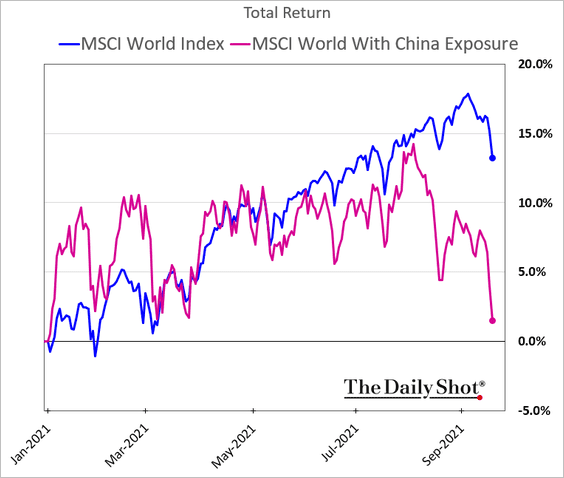

1. There are plenty of risks to consider for US stock investors. China’s property developers are not one of them. The sector’s credit crunch should have a moderate impact on China’s growth. Economic expansion has been slowing for other reasons (see the China section).

Yes, companies with substantial sales in China will likely see slower earnings growth.

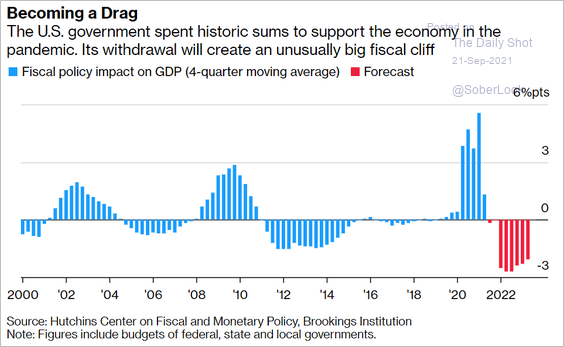

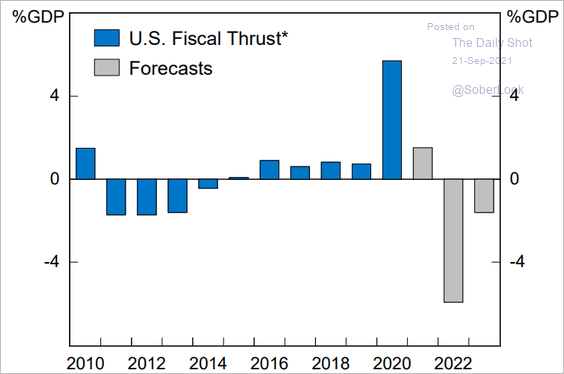

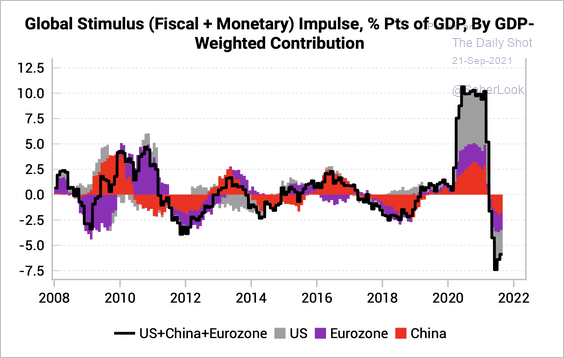

But it’s the US and global fiscal drag that is more likely to impact profits (3 charts).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Alpine Macro

Source: Alpine Macro

Source: Variant Perception

Source: Variant Perception

Other US domestic issues also pose risks, including tech regulation and a potential surprise from the Fed (perhaps due to more persistent inflation). Here are a couple of additional concerns.

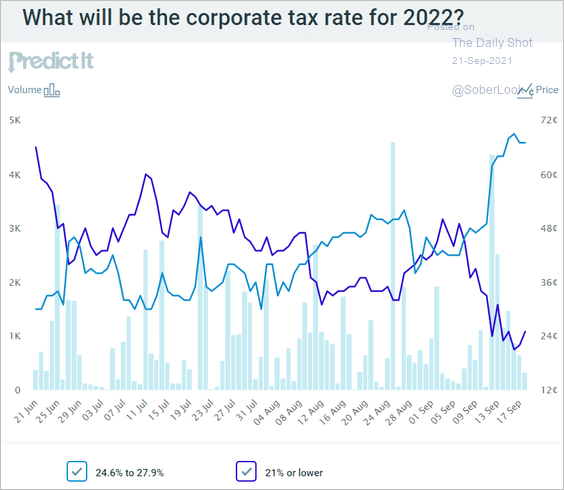

• Corporate and capital gains tax hikes:

Source: @PredictIt

Source: @PredictIt

• The debt ceiling:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

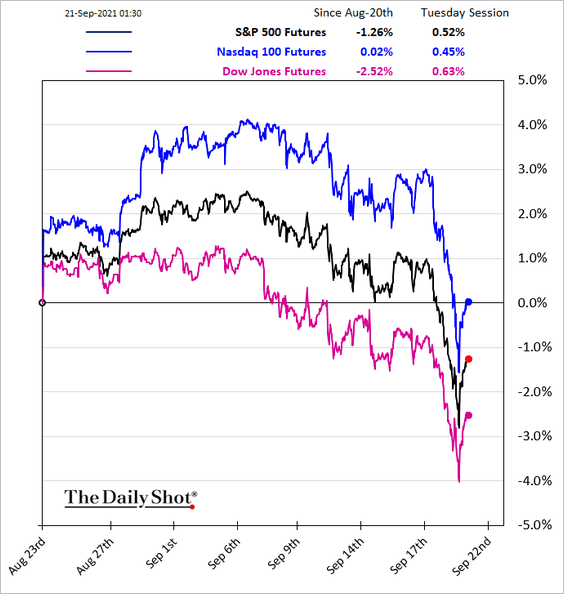

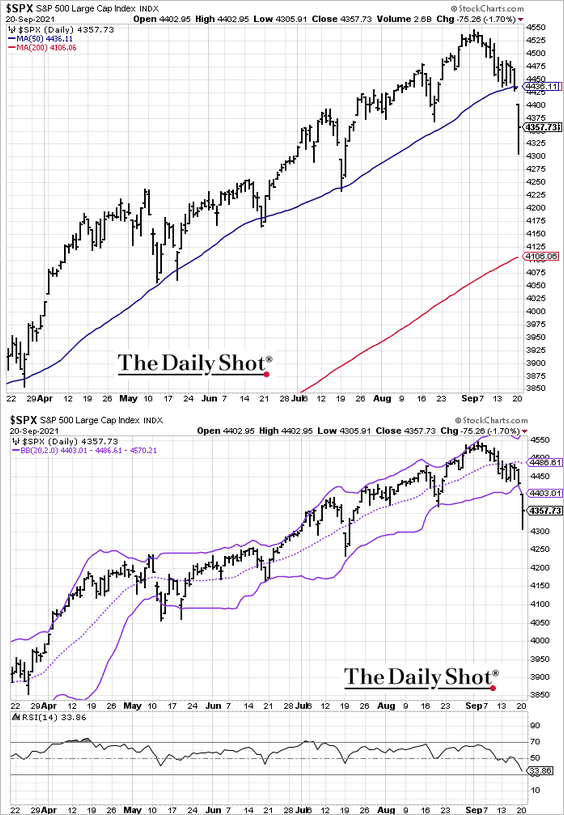

2. US stocks have stabilized after a sharp selloff.

From a technical perspective, the S&P 500 broke through the 50-day moving average and the lower Bollinger band. According to Cormac Mullen of Bloomberg, the next key support level would be the 200-day moving average.

——————–

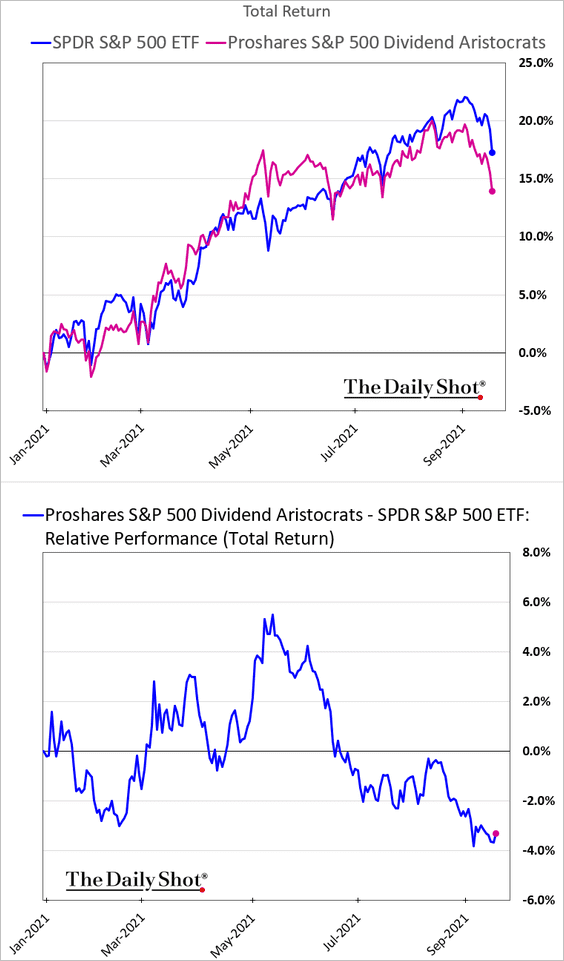

3. High-dividend/dividend growth stocks have been underperforming.

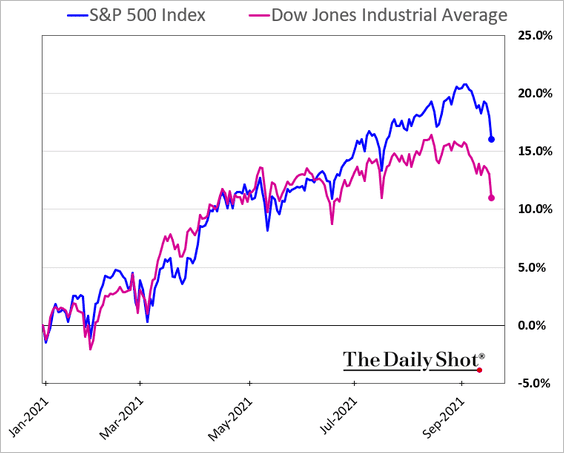

• The Dow has sharply underperformed the S&P 500.

——————–

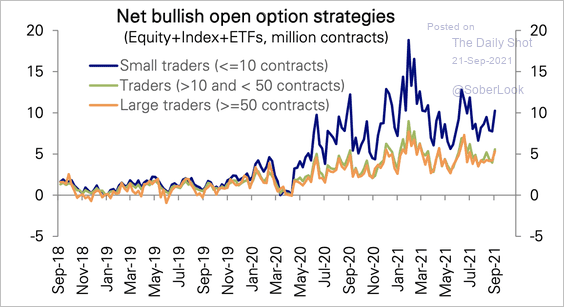

4. Retail trader activity peaked early this year but remains elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

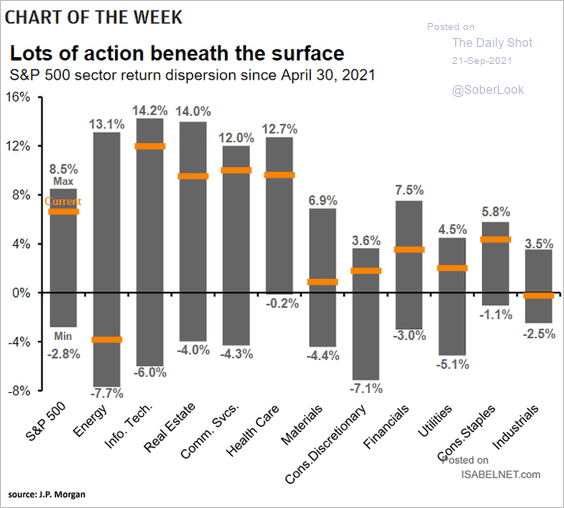

5. This chart shows sector return dispersion since the end of April.

Source: @ISABELNET_SA, @JPMorganAM

Source: @ISABELNET_SA, @JPMorganAM

6. The relative performance of small caps has been tracking the changes in the US Treasury term premium.

Source: Variant Perception

Source: Variant Perception

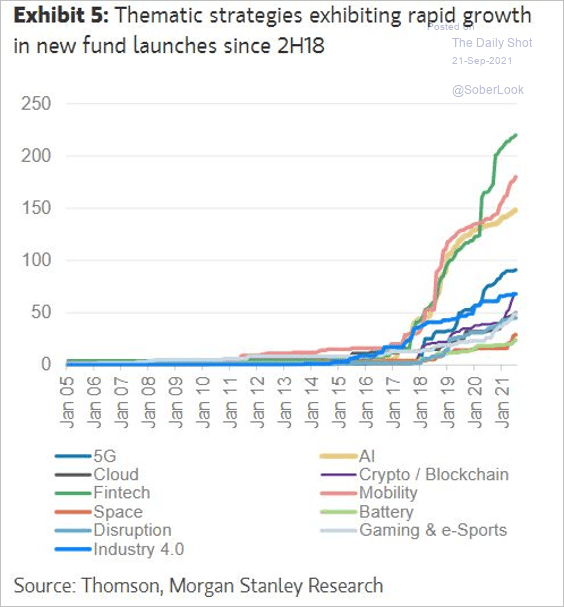

7. Thematic fund launches have surged in recent years.

Source: Morgan Stanley Research; @Callum_Thomas

Source: Morgan Stanley Research; @Callum_Thomas

Back to Index

Credit

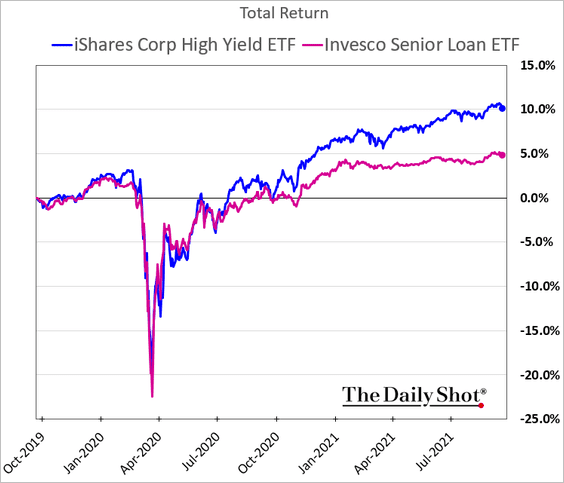

1. Leveraged loans saw a similar drawdown to high-yield bonds last year but a much more limited upside since then.

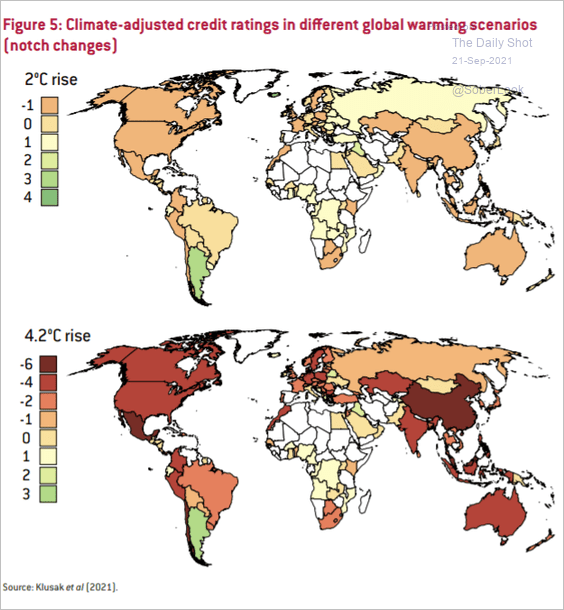

2. This map shows the potential impact of climate change on sovereign credit ratings.

Source: Bruegel Read full article

Source: Bruegel Read full article

Back to Index

Rates

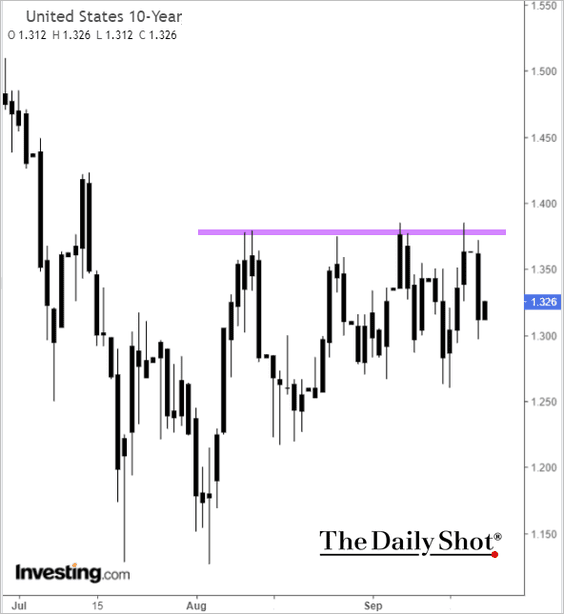

1. The 10yr Treasury yield has been holding resistance near 1.38%.

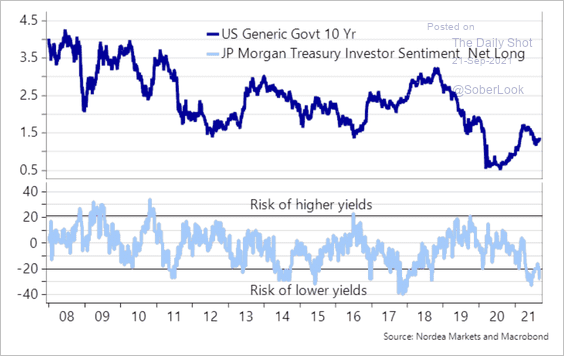

2. Net-short investor positioning in Treasuries appears stretched.

Source: Nordea Markets

Source: Nordea Markets

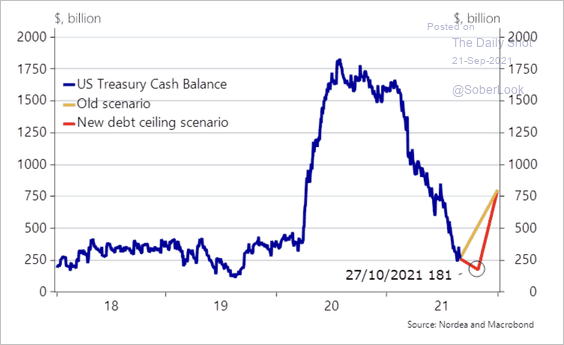

3. The US Treasury will withdraw a substantial amount of dollar liquidity later this year (by parking cash at the Fed) once it can sell debt again.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

The United States

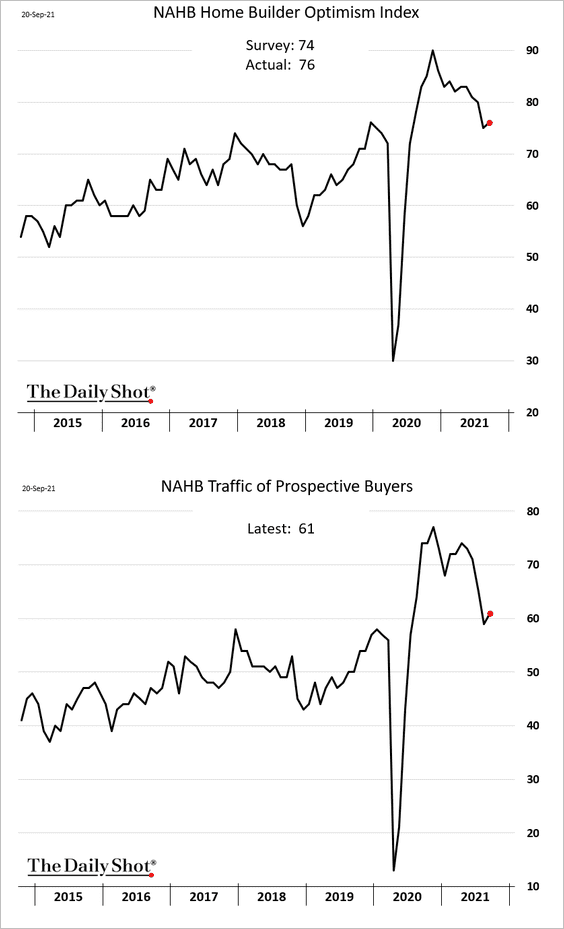

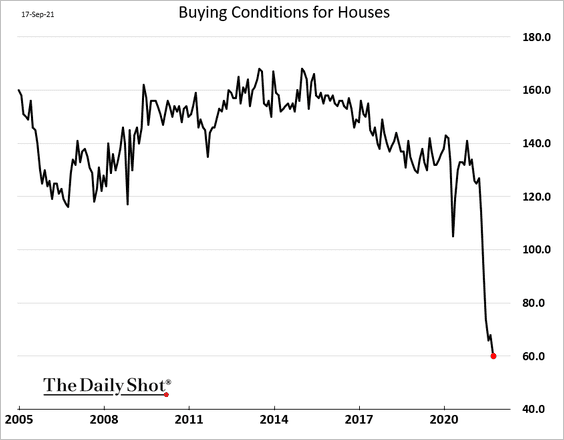

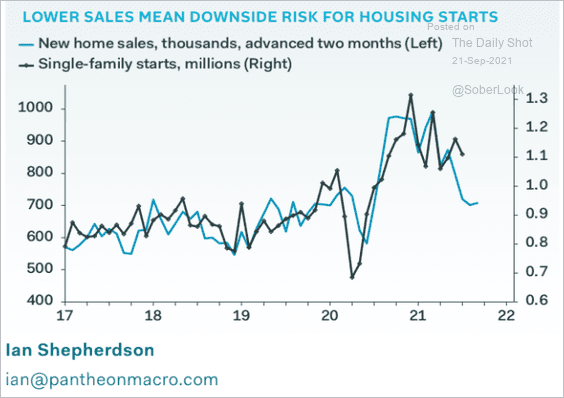

1. Let’s begin with the housing market.

• Homebuilder optimism ticked higher.

• Consumers’ views on buying conditions for homes continue to deteriorate, according to the latest U. Michigan survey.

• Housing starts face downside risks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

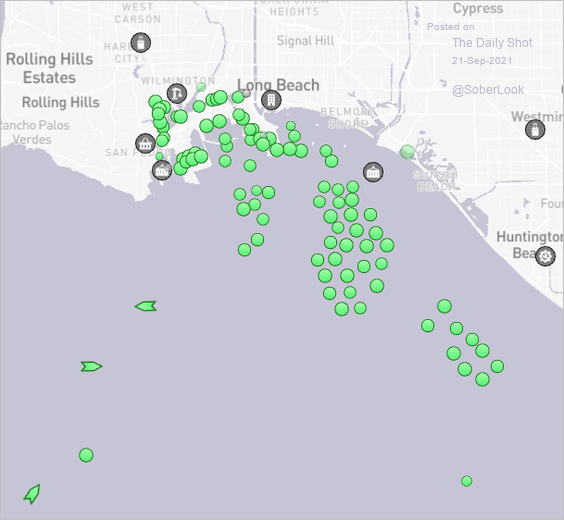

2. There are now 72 container ships waiting to unload at the port of LA/Long Beach, a new high.

Source: MarineTraffic

Source: MarineTraffic

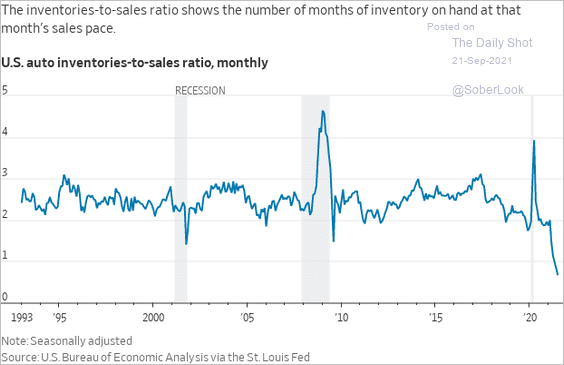

• The sales-to-inventories ratio for automobiles continues to fall.

Source: @WSJ Read full article

Source: @WSJ Read full article

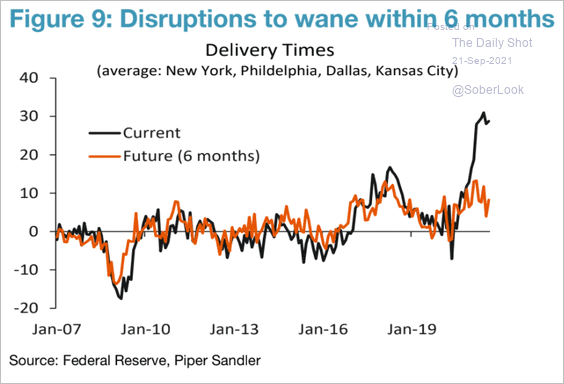

• Manufacturers expect disruptions to ease within the next six months.

Source: Piper Sandler

Source: Piper Sandler

——————–

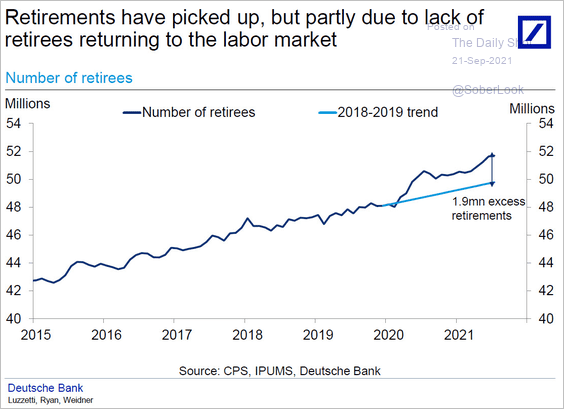

3. There are almost two million more retirees than would be expected based on the pre-COVID trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

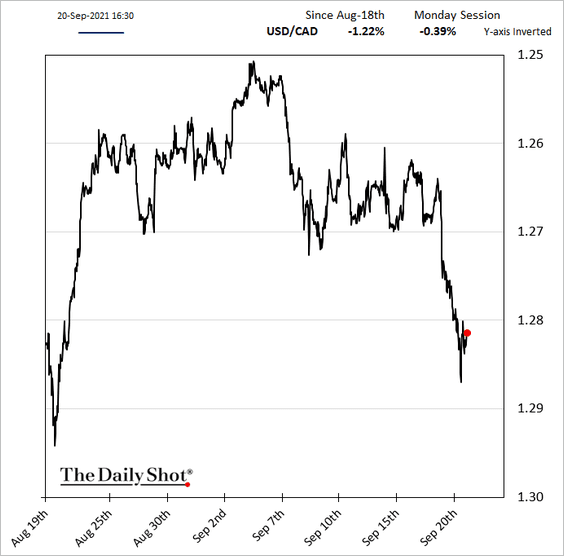

1. The loonie took a hit on Monday.

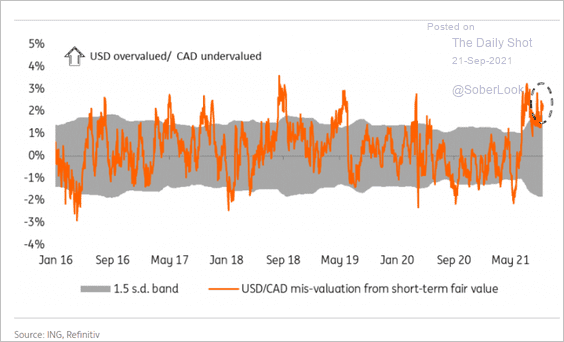

The currency appears to be undervalued relative to USD.

Source: ING

Source: ING

——————–

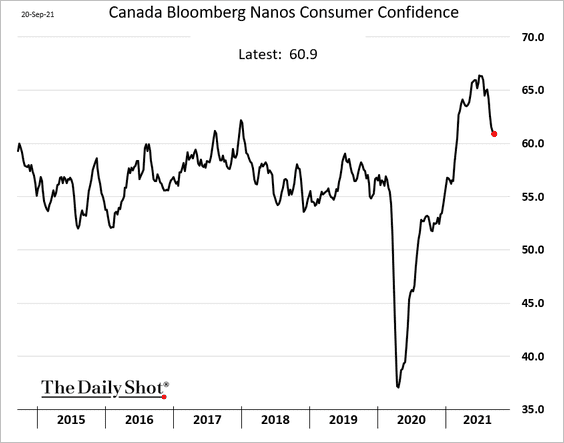

2. Consumer confidence continues to retreat.

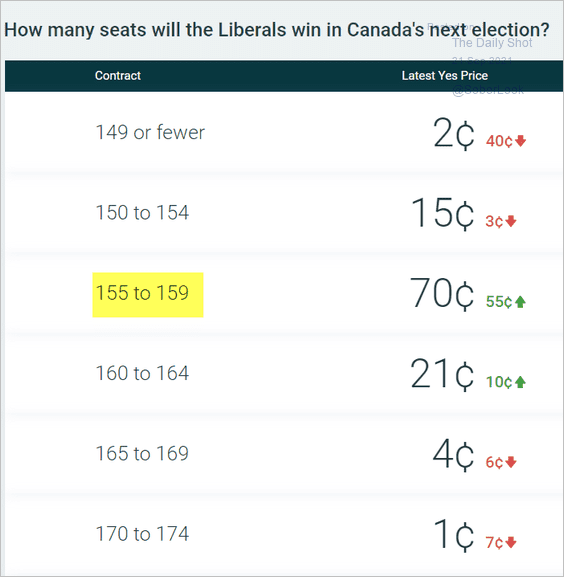

3. How many seats did the Liberals win (according to the betting markets)?

Source: @PredictIt

Source: @PredictIt

Back to Index

The Eurozone

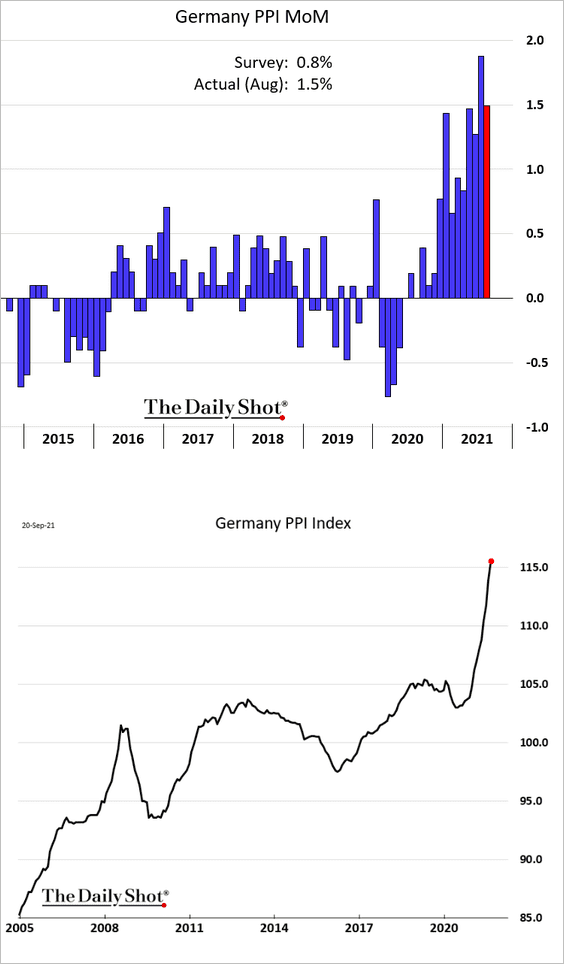

1. Germany’s producer prices continue to surge.

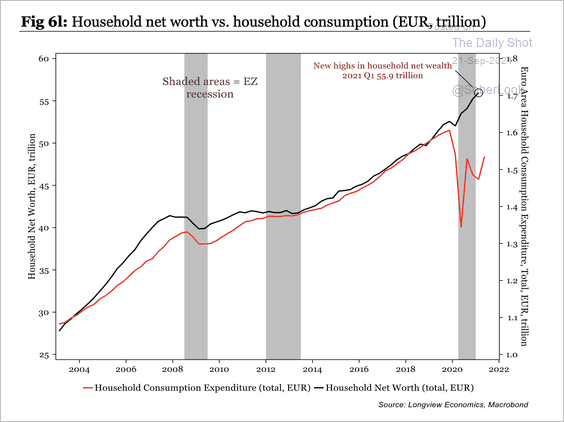

2. Consumption in the Eurozone tends to follow household net worth, implying further upside.

Source: Longview Economics

Source: Longview Economics

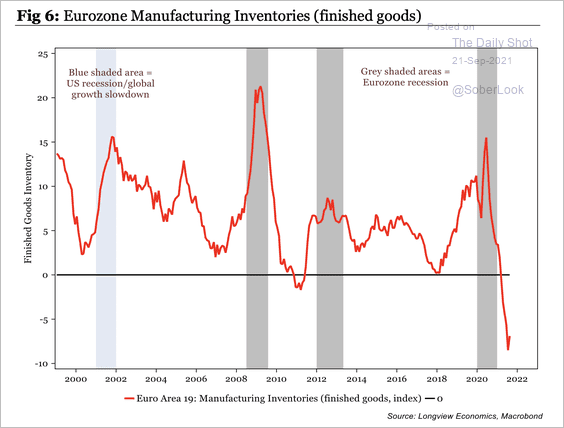

3. Inventories are at unprecedented levels in the euro area.

Source: Longview Economics

Source: Longview Economics

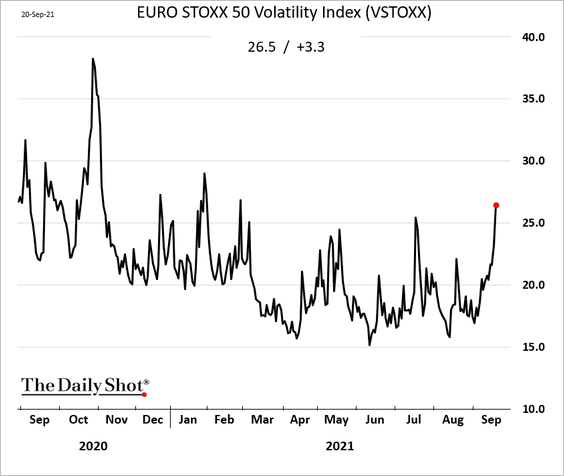

4. Equity implied volatility rose sharply on Monday.

——————–

Food for Thought

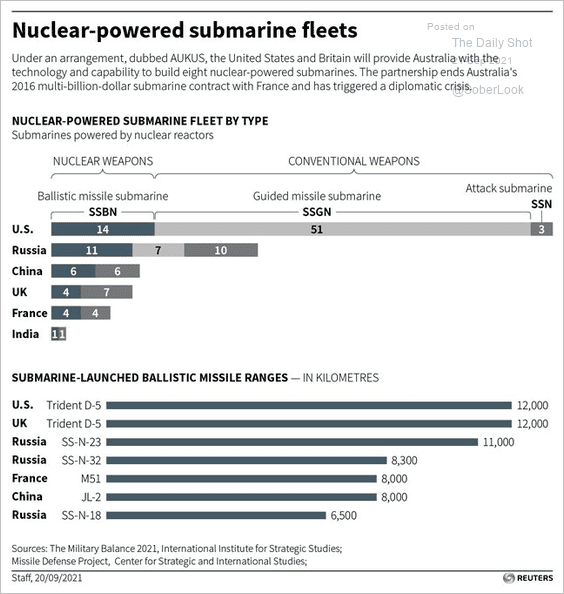

1. Nuclear-powered submarine fleets:

Source: @divyachowdhury, @ReutersGMF Read full article

Source: @divyachowdhury, @ReutersGMF Read full article

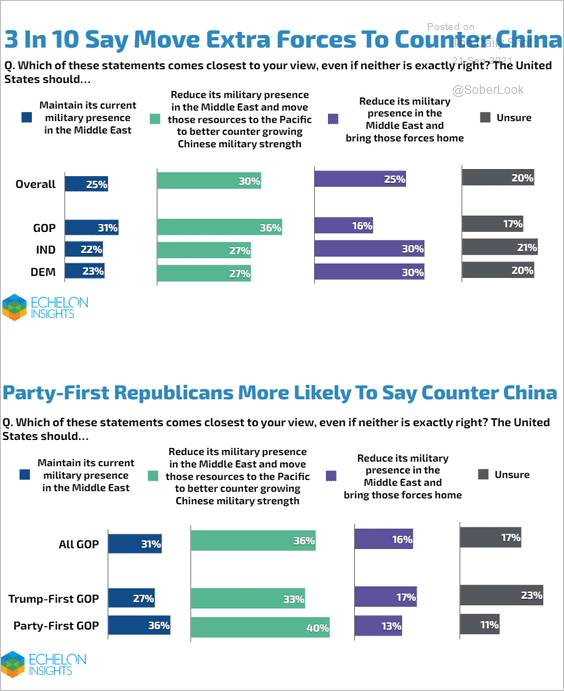

2. Americans’ views on moving extra forces from the Middle East to counter China:

Source: Echelon Insights

Source: Echelon Insights

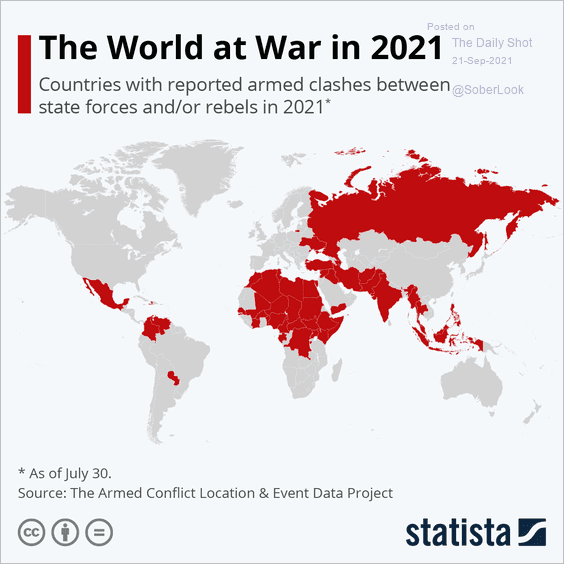

3. Armed conflicts in 2021:

Source: Statista

Source: Statista

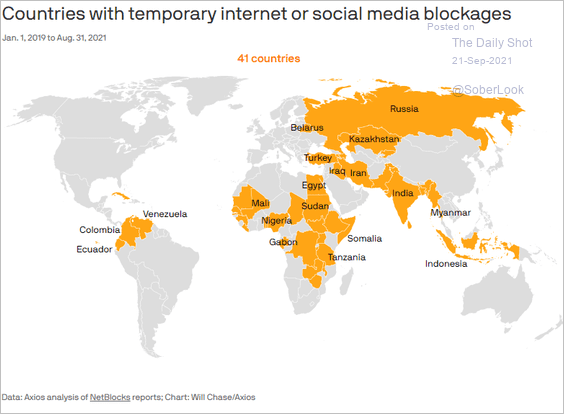

4. Countries with temporary internet or social media blockages:

Source: @axios Read full article

Source: @axios Read full article

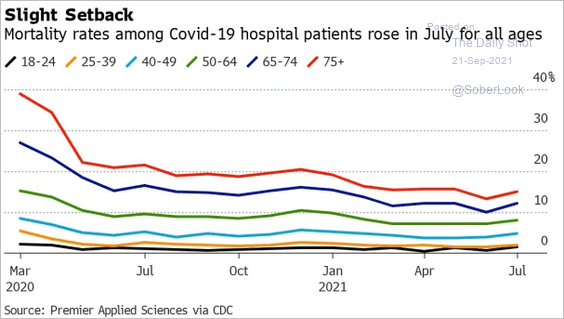

5. Mortality rates among COVID hospital patients:

Source: BNN Bloomberg Read full article

Source: BNN Bloomberg Read full article

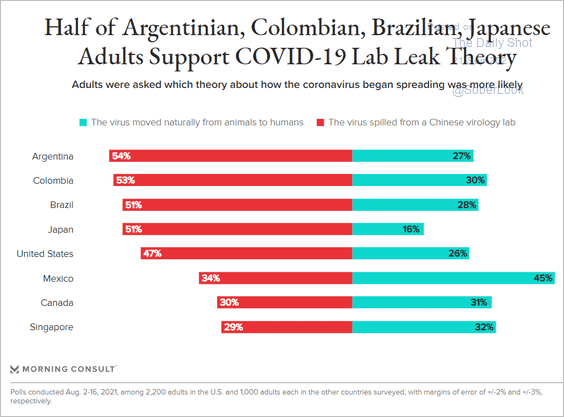

6. Belief in the lab leak theory:

Source: Morning Consult

Source: Morning Consult

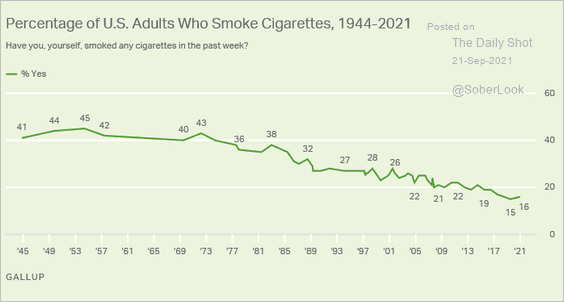

7. Cigarette smoking in the US:

Source: Gallup Read full article

Source: Gallup Read full article

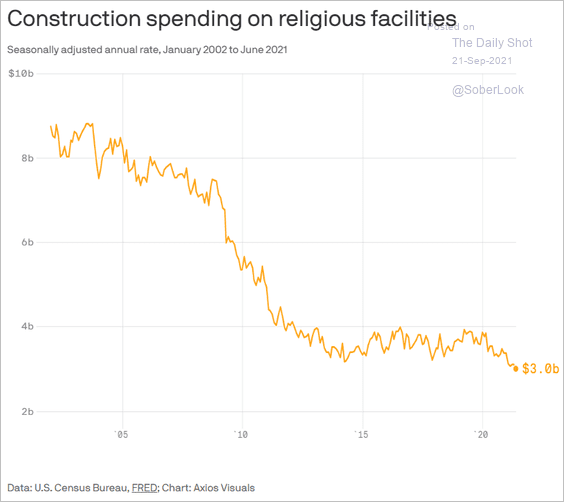

8. Construction spending on religious facilities:

Source: @axios Read full article

Source: @axios Read full article

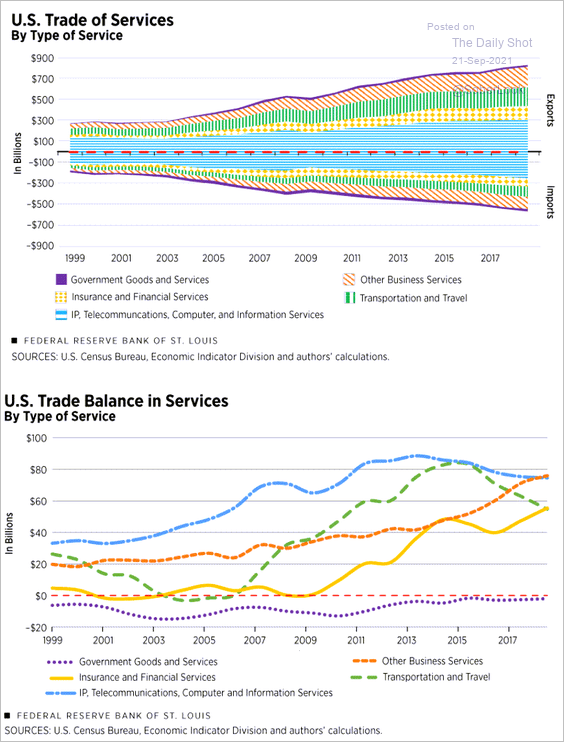

9. US international trade in services:

Source: Federal Reserve Bank of St. Louis Read full article

Source: Federal Reserve Bank of St. Louis Read full article

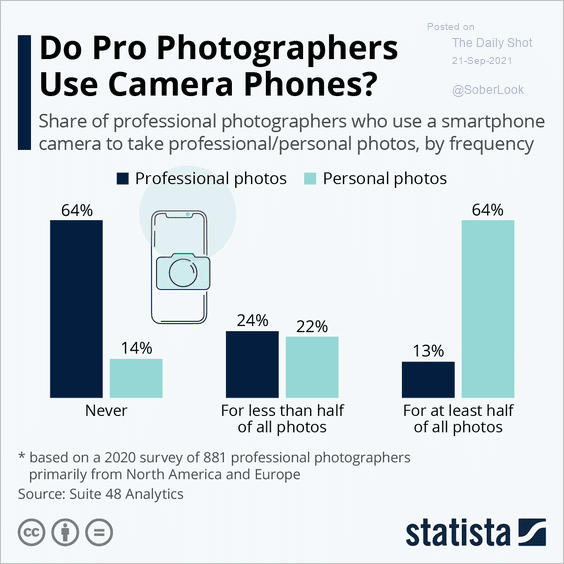

10. Professional photographers using camera phones:

Source: Statista

Source: Statista

11. All the dice in the figure below are perfect squares.

Source: BrainDen.com

Source: BrainDen.com

——————–

Back to Index