The Daily Shot: 22-Sep-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• China

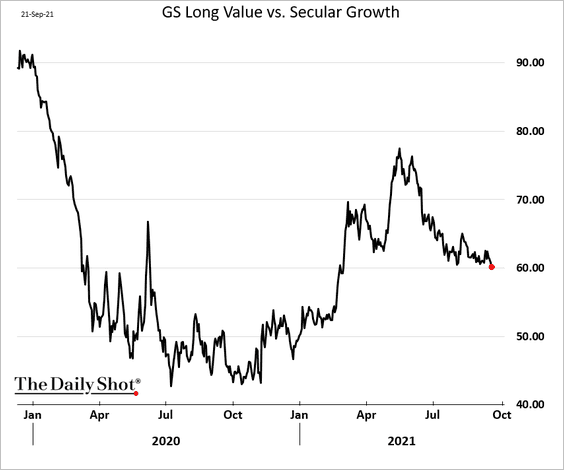

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

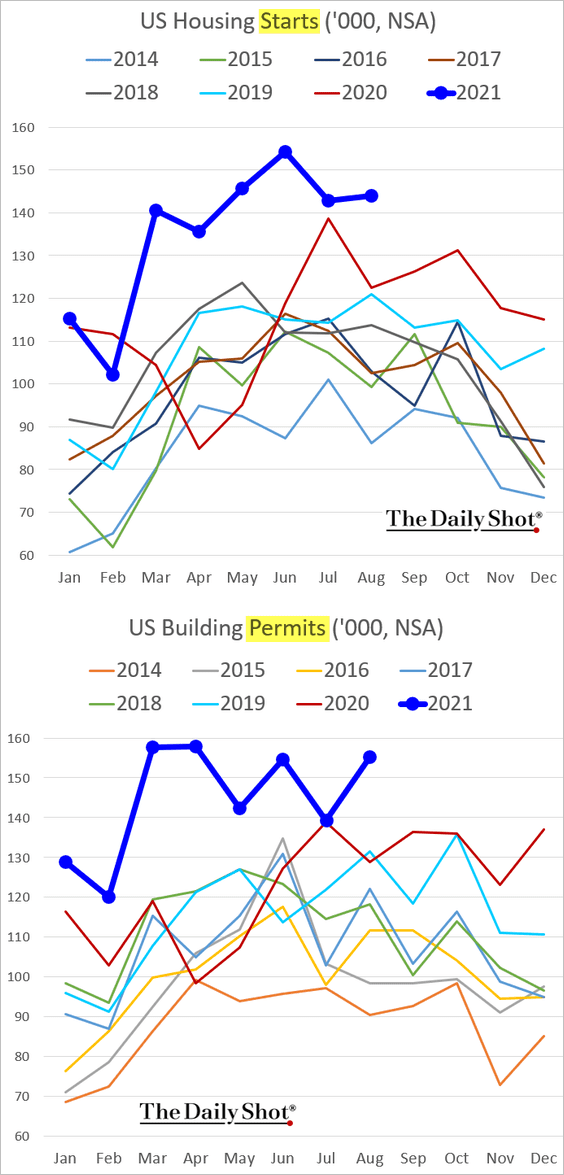

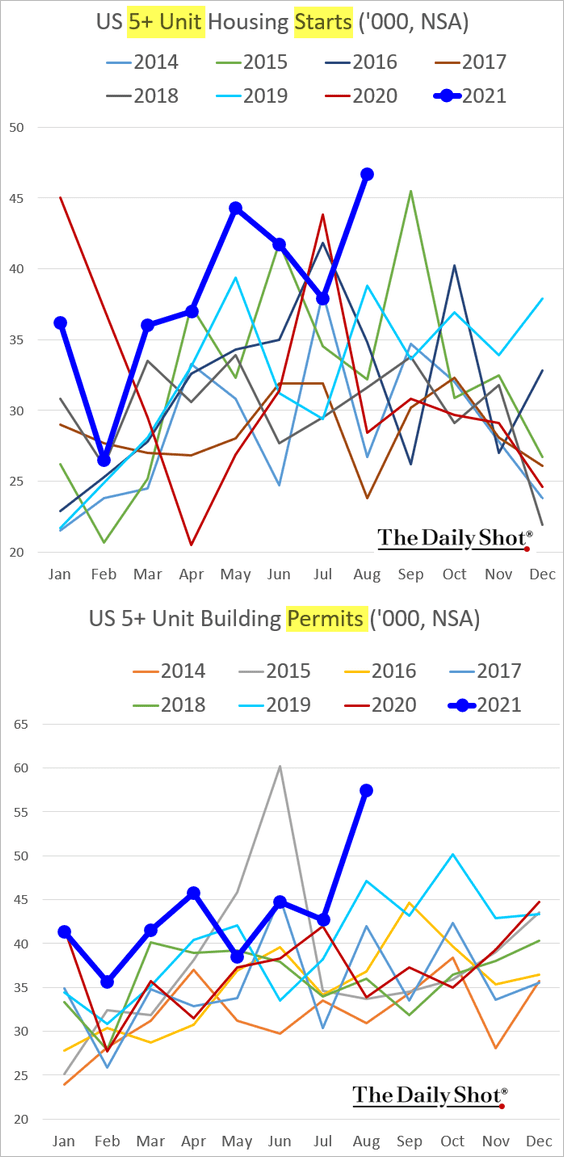

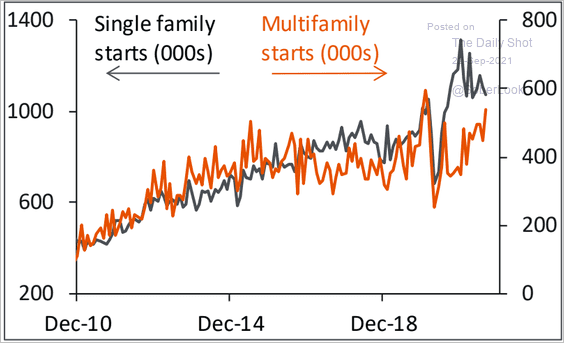

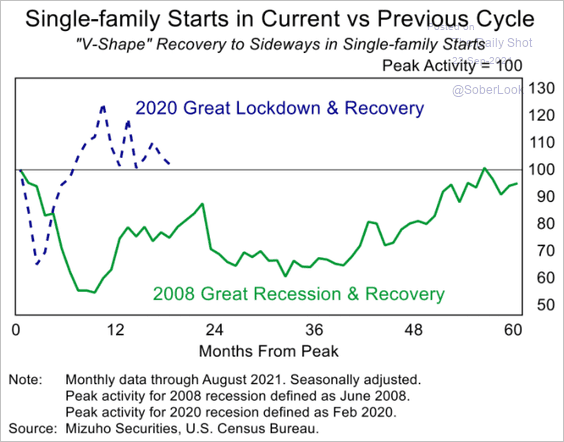

1. Let’s begin with the housing market.

• Last month’s housing starts and construction permits were stronger than expected.

– The gains were driven by multi-family (apartment) construction.

– Here are the seasonally-adjusted trends.

Source: Piper Sandler

Source: Piper Sandler

– Single-family construction activity is back near pre-COVID levels.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

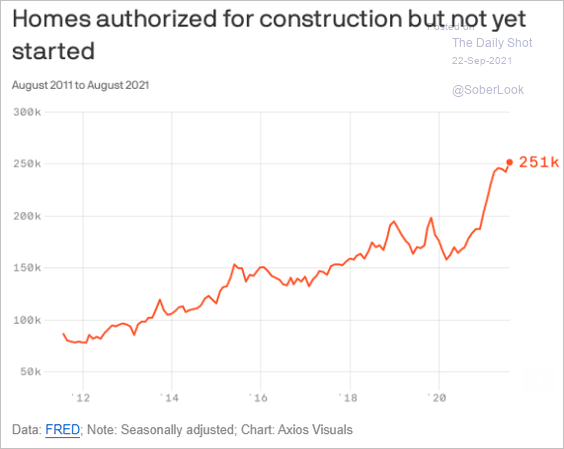

• Authorized residential construction projects that haven’t been started yet reached a multi-year high. Builders are plagued by supply chain bottlenecks.

Source: @axios

Source: @axios

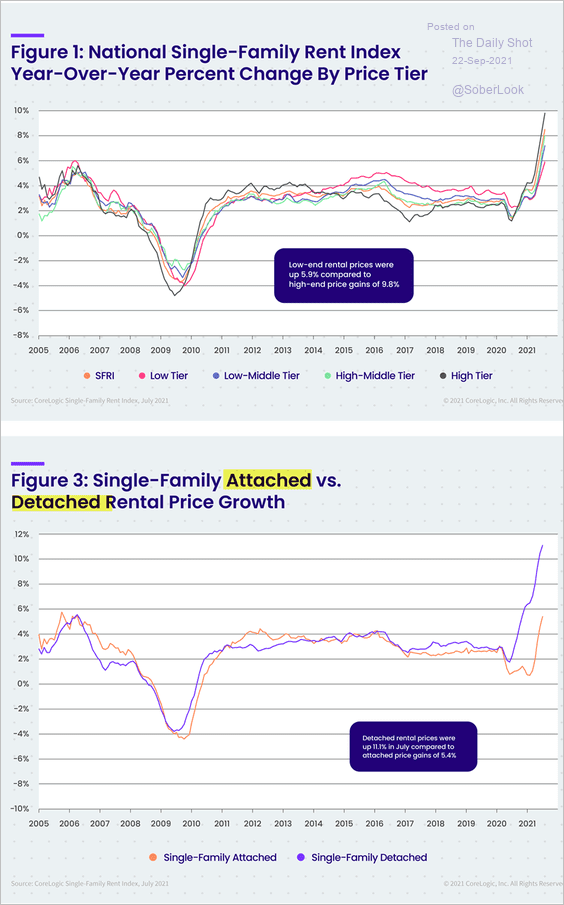

• Single-family housing rents continue to surge, with detached units outpacing attached homes.

Source: CoreLogic

Source: CoreLogic

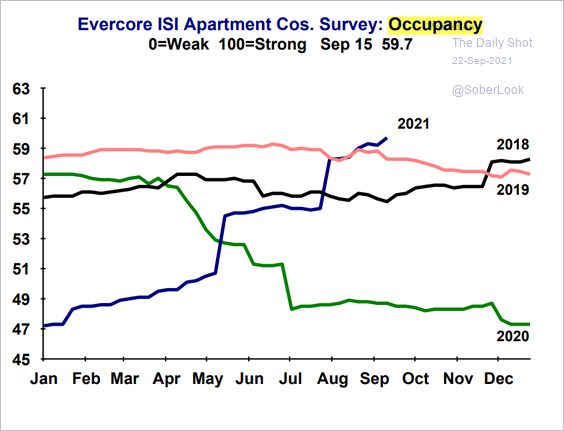

• Apartment occupancy continues to improve (chart shows Evercore’s occupancy indicator).

Source: Evercore ISI

Source: Evercore ISI

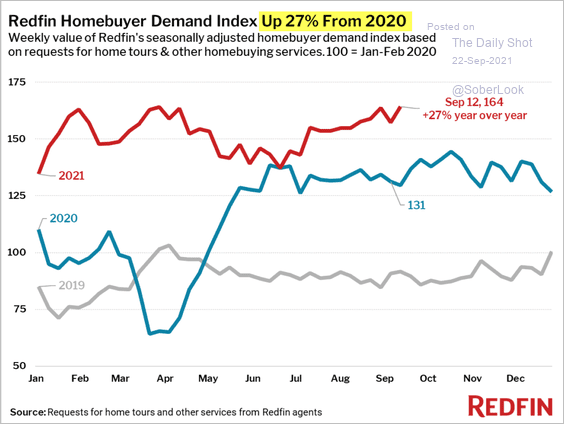

• Despite some recent talk of a pause in the housing market, high-frequency data from Redfin shows demand near multi-year highs.

Source: @Redfin

Source: @Redfin

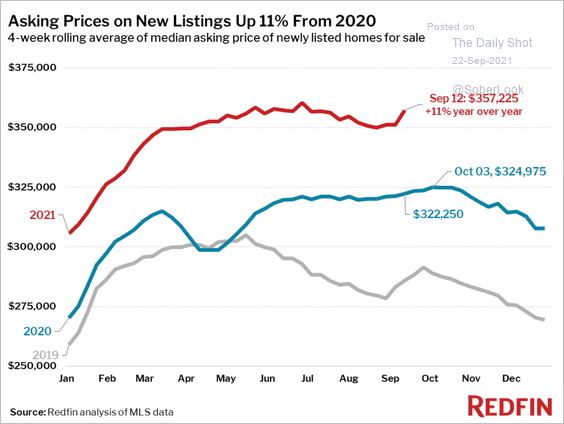

And asking prices remain elevated.

Source: @Redfin

Source: @Redfin

——————–

2. Next, we have some updates on the monetary policy.

• When will QE taper start? When will it end?

Source: Cornerstone Macro

Source: Cornerstone Macro

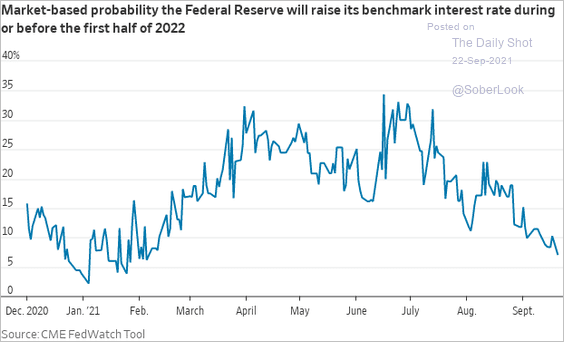

• Based on market pricing, a rate hike in the first half of next year is increasingly unlikely.

Source: @WSJ Read full article

Source: @WSJ Read full article

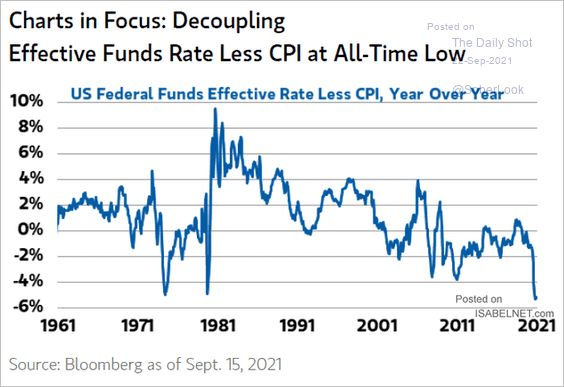

• The real fed funds rate points to extreme policy accommodation.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

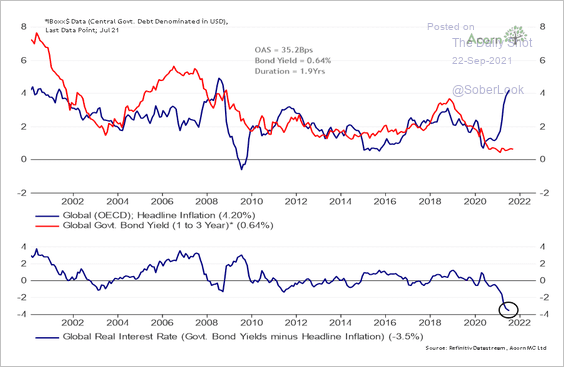

It’s a global trend.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

——————–

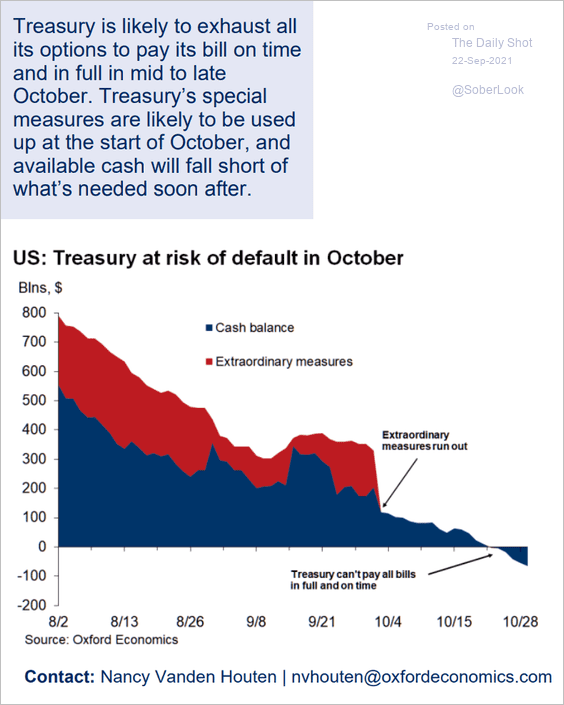

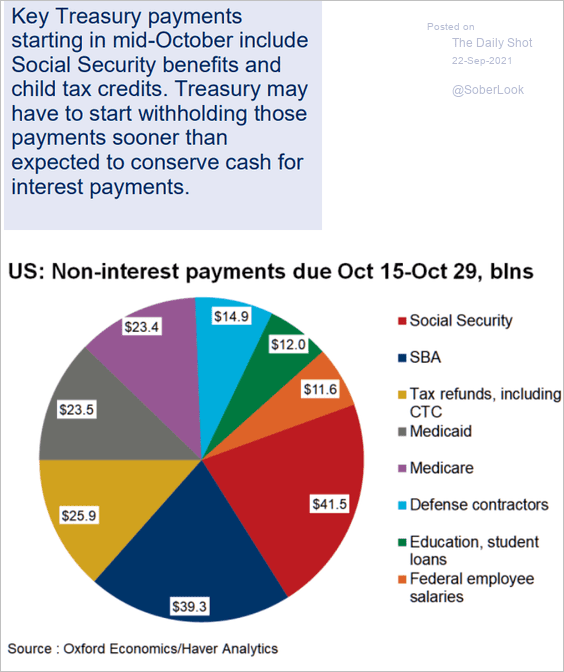

3. The X-date is coming next month. Democrats have the ability to lift the debt ceiling unilaterally through the reconciliation process, but the optics of raising the limit by $3.5 trillion may pose challenges for some politicians.

Source: Oxford Economics

Source: Oxford Economics

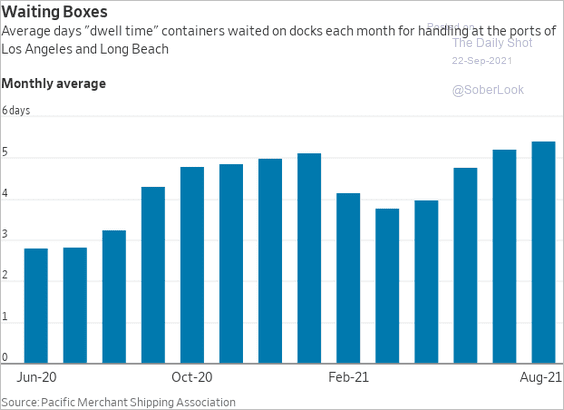

4. Import container wait times keep climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

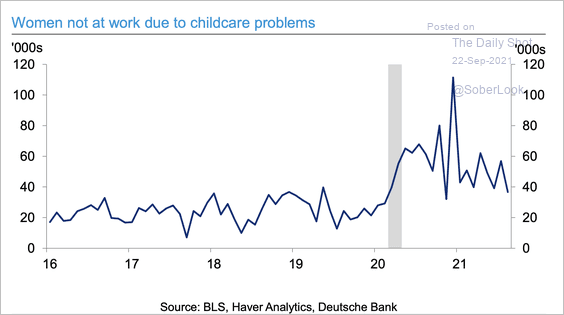

5. Childcare has been a big issue during the pandemic and continues to keep many women out of the labor force.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

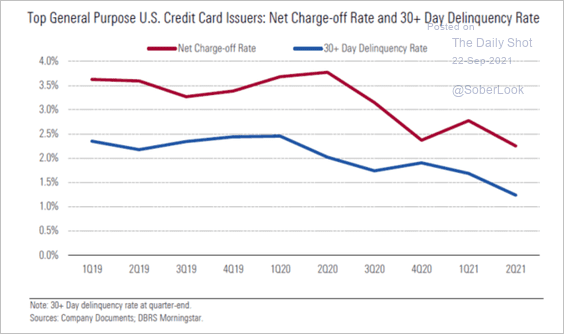

6. The 30+ day delinquency rate for credit cards is at a multi-year low.

Source: DBRS Morningstar

Source: DBRS Morningstar

Back to Index

Canada

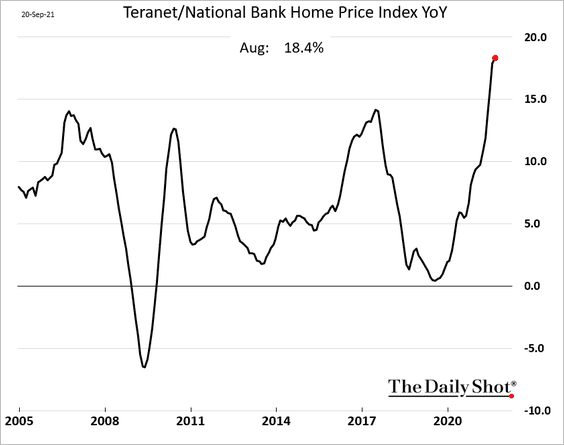

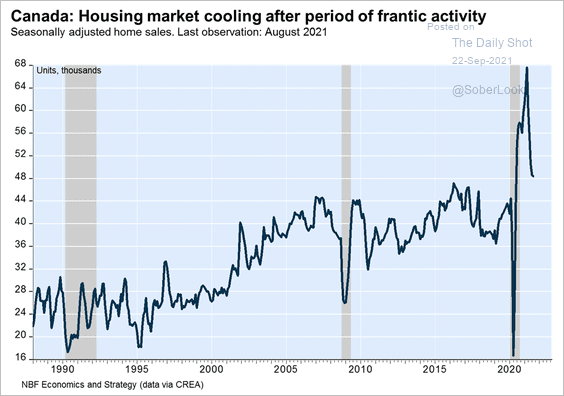

1. Home price appreciation is now above 18%.

But home sales have been cooling.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

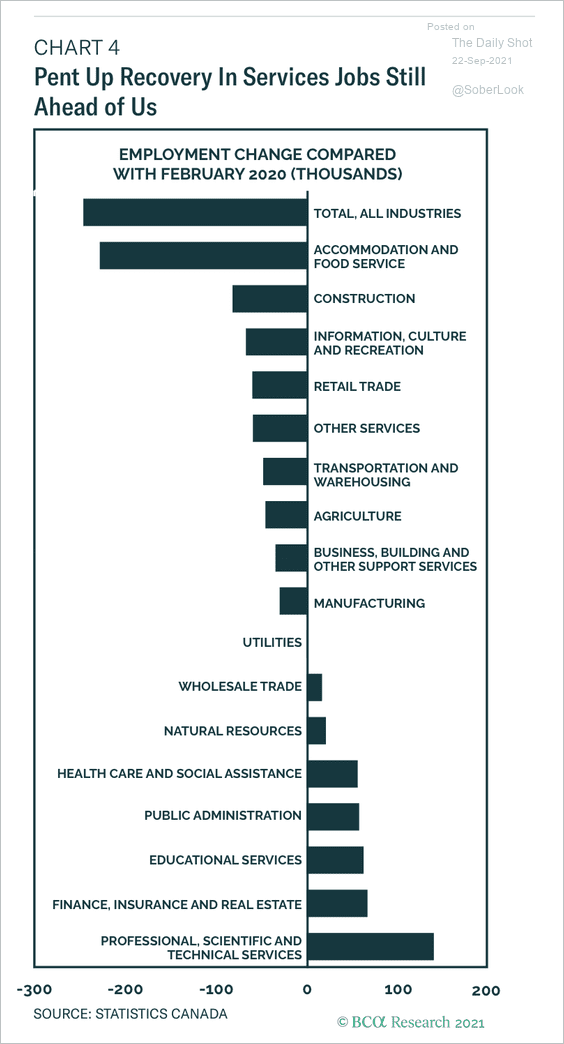

2. Service-sector job recovery has some ways to go.

Source: BCA Research

Source: BCA Research

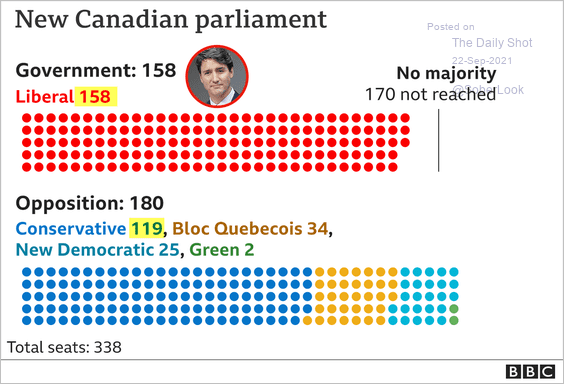

3. Meet the new parliament …

Source: BBC Read full article

Source: BBC Read full article

…. the same as the old parliament (from 2019)? Was the election worth it?

Source: The Guardian

Source: The Guardian

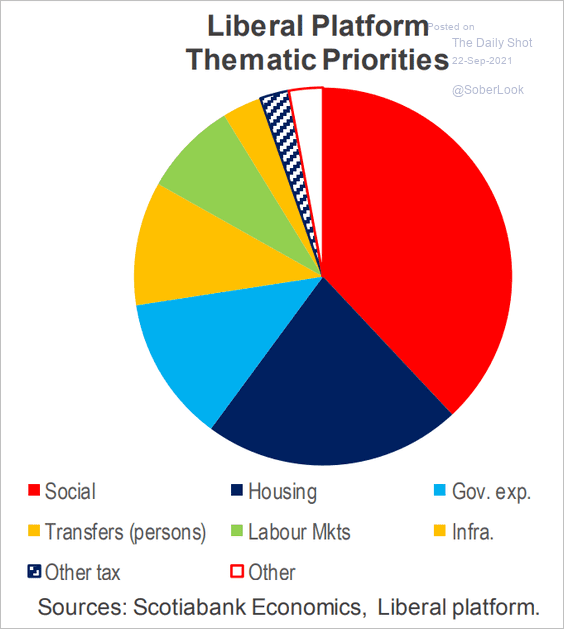

4. Here are the Liberal Party’s thematic priorities.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

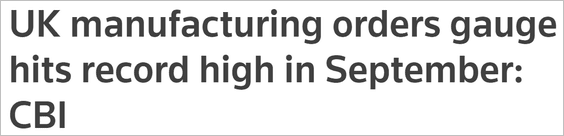

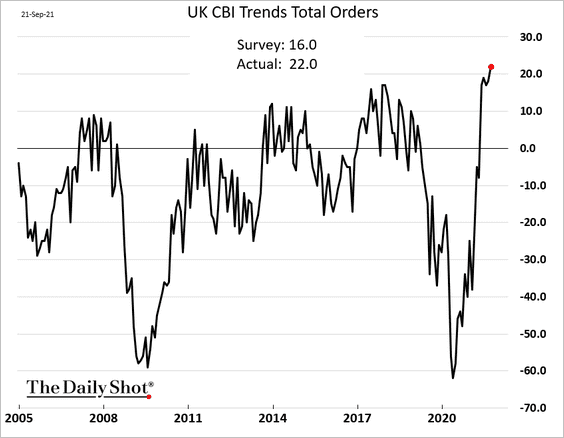

1. The CBI industrial orders index hit a record high this month.

Source: Reuters Read full article

Source: Reuters Read full article

Will industrial production follow?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

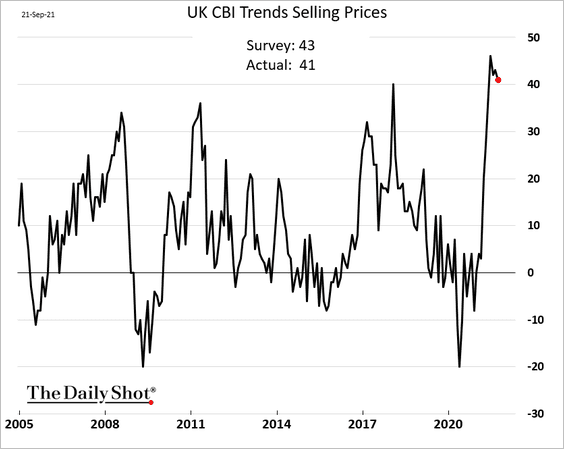

The index of selling prices remains near extremes but appears to have peaked.

——————–

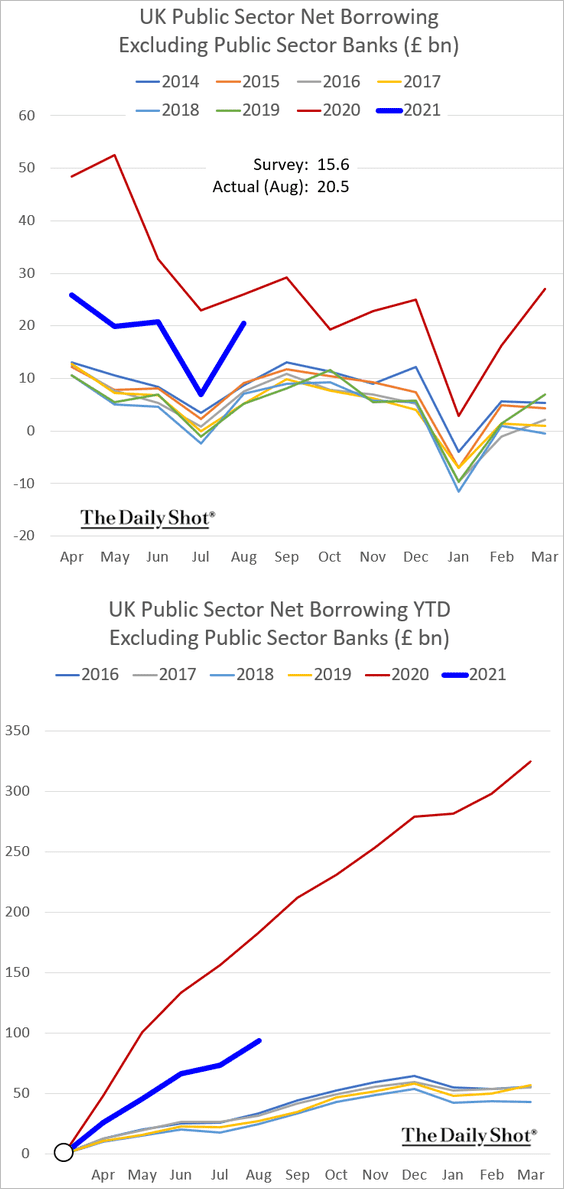

2. The government borrowed more in August than economists expected.

But the trend remains below the government’s forecasts.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

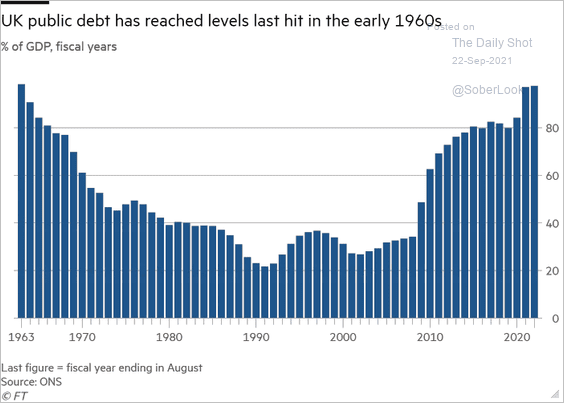

The debt-to-GDP ratio is at a multi-decade high.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

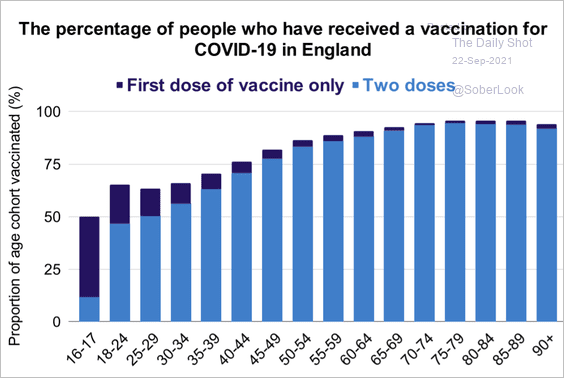

3. This chart shows the UK’s vaccinated population percentages by age.

Source: UK Government Read full article

Source: UK Government Read full article

Back to Index

The Eurozone

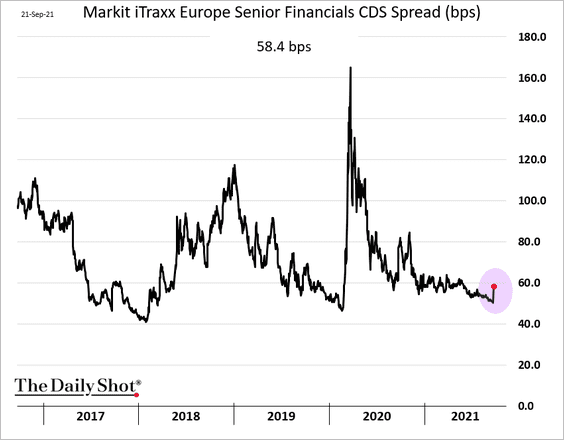

1. The recent market volatility had a limited impact on bank credit spreads.

Source: Bloomberg

Source: Bloomberg

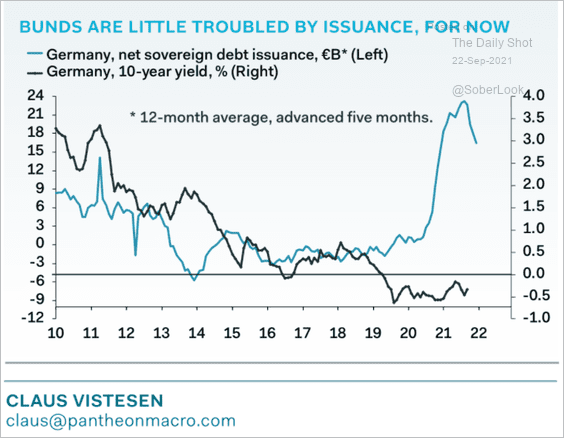

2. A significant increase in Bund issuance had no impact on yields.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

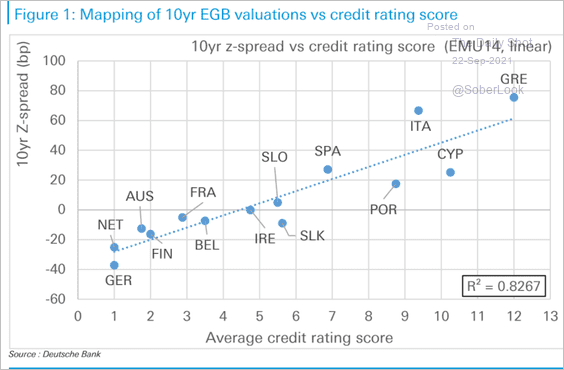

This scatterplot shows government bond spreads vs. credit ratings.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

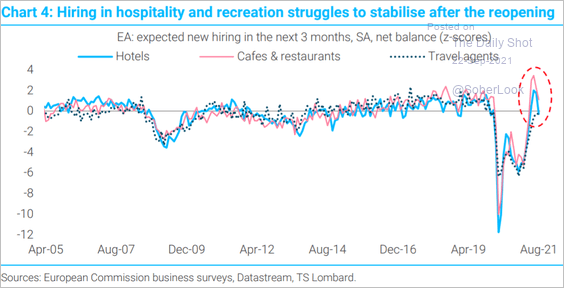

3. The “reopening” sector hiring rebound was not sustained.

Source: TS Lombard

Source: TS Lombard

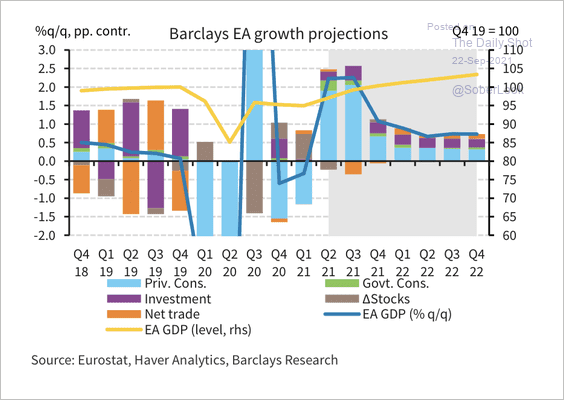

4. Barclays expects economic activity to return to pre-crisis levels next quarter, in line with the ECB.

Source: Barclays Research

Source: Barclays Research

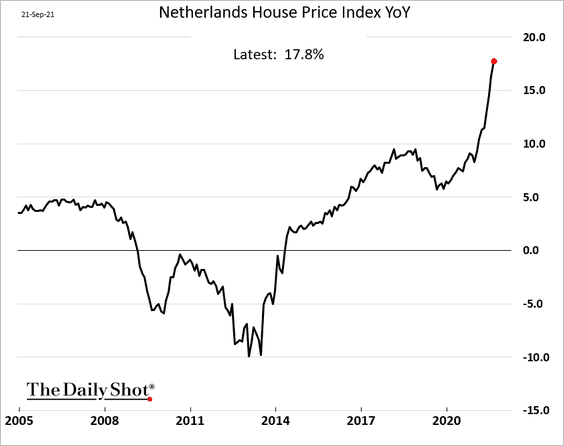

5. Home price gains in the Netherlands continue to accelerate.

Back to Index

China

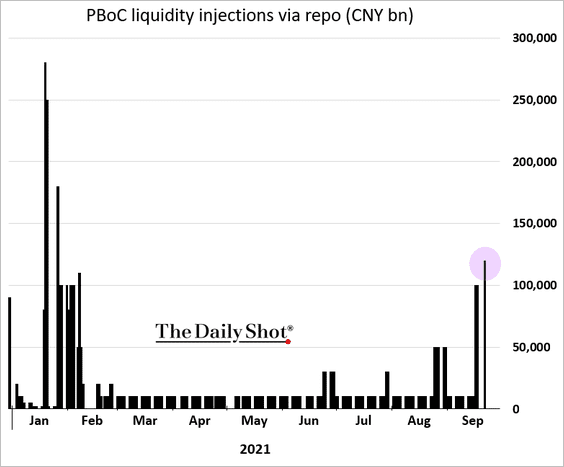

1. The PBoC injected more liquidity into the financial system.

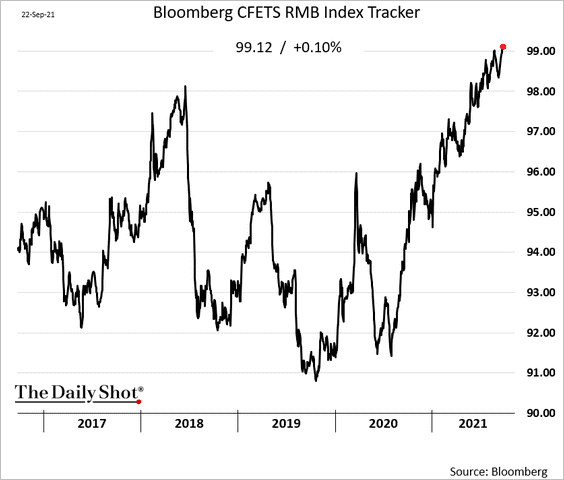

2. One of the headaches for China’s policymakers is the continued yuan strength (chart shows RMB vs. a basket of key currencies). This trend can have a substantial drag on economic growth.

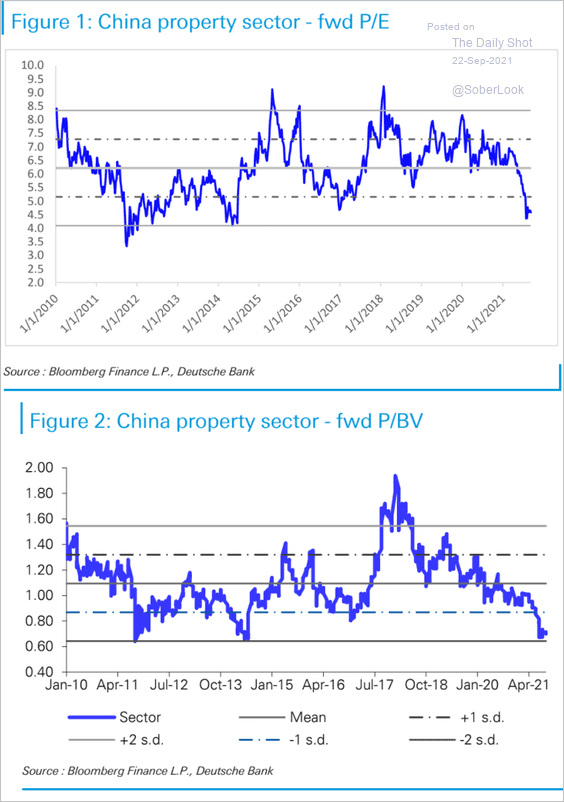

3. Property sector valuations are near extreme lows (charts show forward price-to-earnings and price-to-book ratios).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

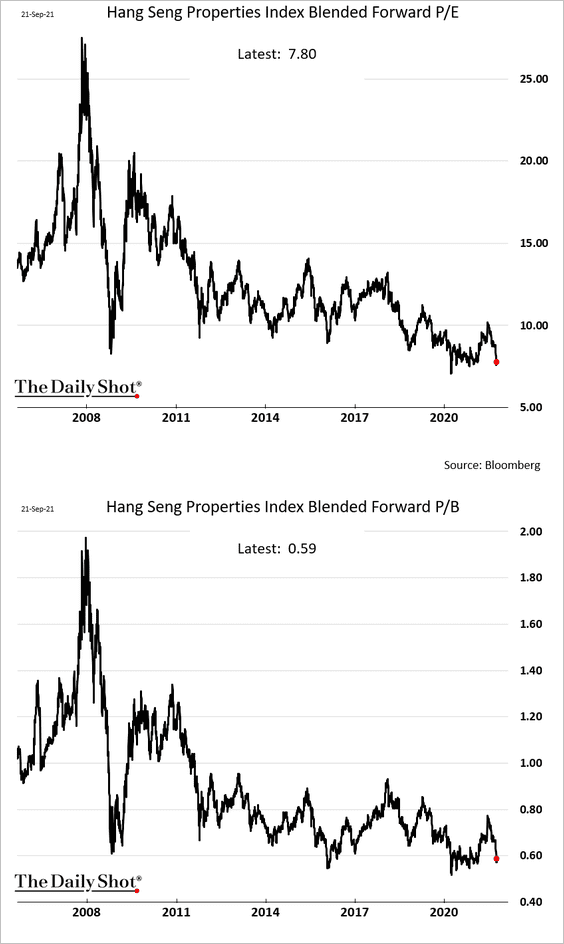

• Hong-Kong-listed firms:

——————–

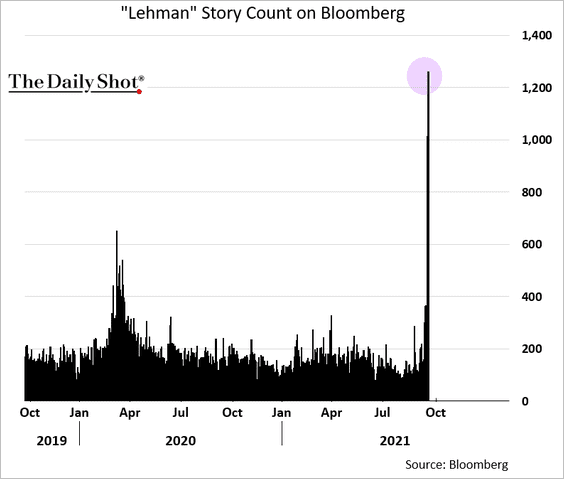

4. Stories mentioning “Lehman” (in reference to Evergrande) spiked recently.

h/t @daniburgz

h/t @daniburgz

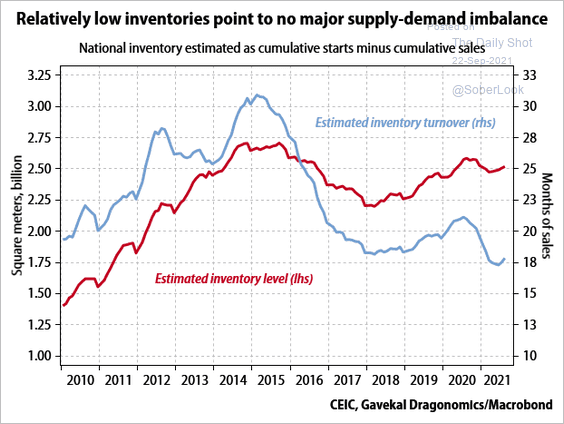

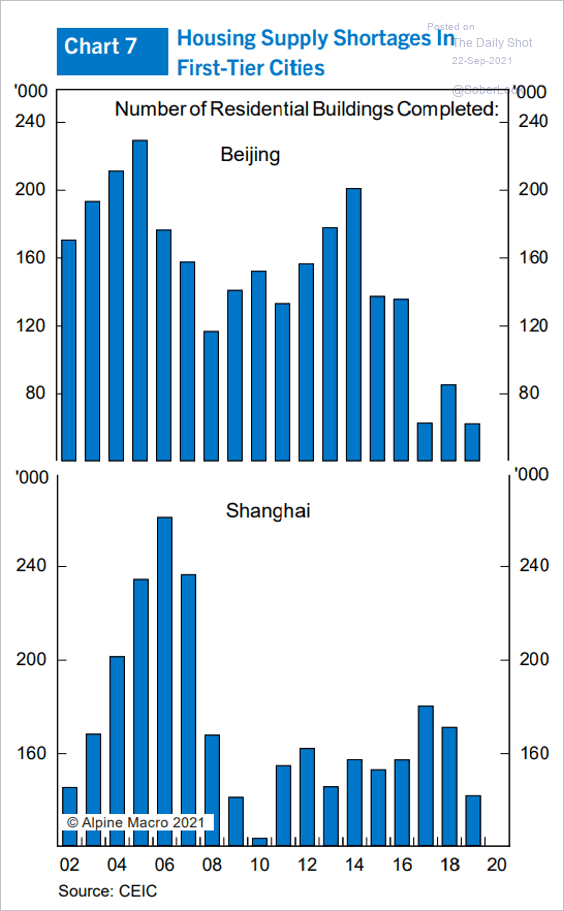

5. China’s housing market is not oversupplied (2 charts).

Source: Gavekal Research

Source: Gavekal Research

Source: Alpine Macro

Source: Alpine Macro

——————–

6. There is no rebound in Macau’s visitor numbers.

Back to Index

Emerging Markets

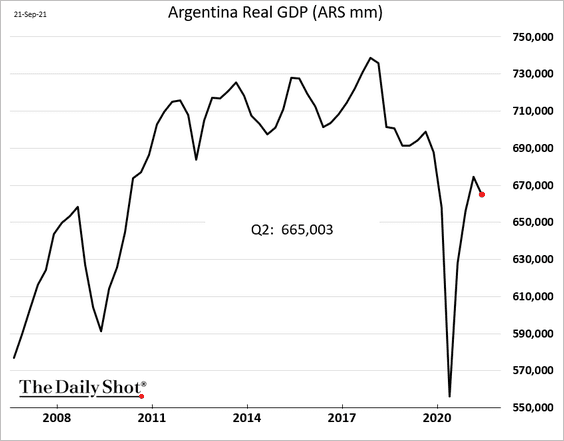

1. Argentina’s GDP slumped in the second quarter.

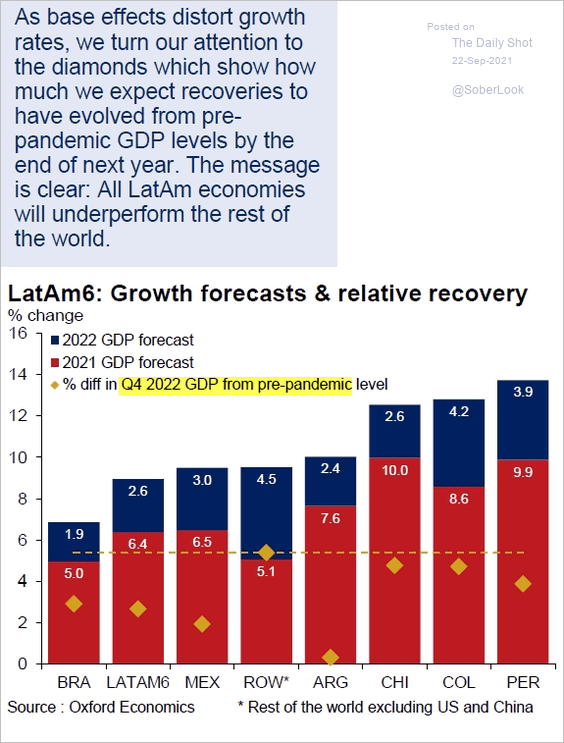

2. This chart shows the Oxford Economics forecast for LatAm GDP growth through the end of next year.

Source: @OxfordEconomics Read full article

Source: @OxfordEconomics Read full article

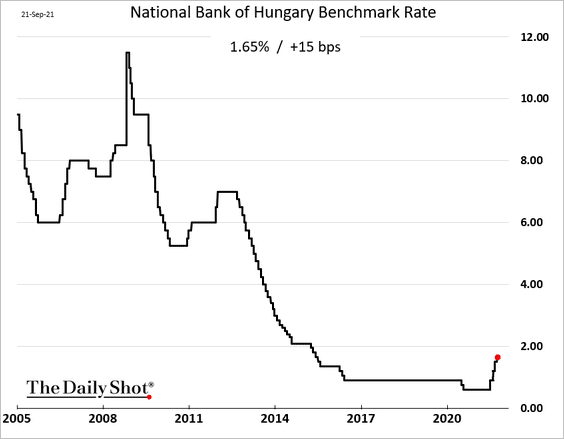

3. Hungary’s central bank hiked rates by 15 bps (25 bps was expected). These types of indecisive moves tend to confuse the market.

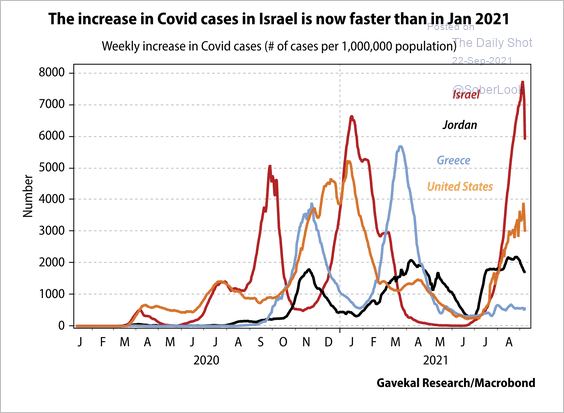

4. Herd immunity via vaccination hasn’t worked well in Israel, with new cases surpassing previous peaks.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Cryptocurrency

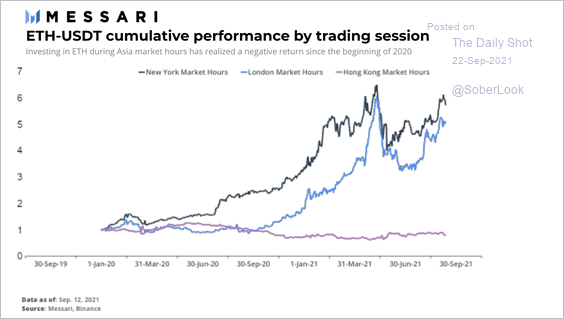

1. ETH tends to perform best during the New York and London market hours relative to Hong Kong hours.

Source: Messari

Source: Messari

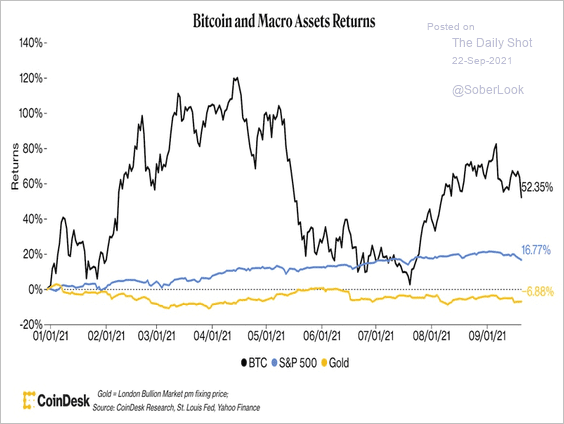

2. Bitcoin has outperformed the S&P 500 and gold year-to-date, although its correlation with equities has increased over the past few months.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

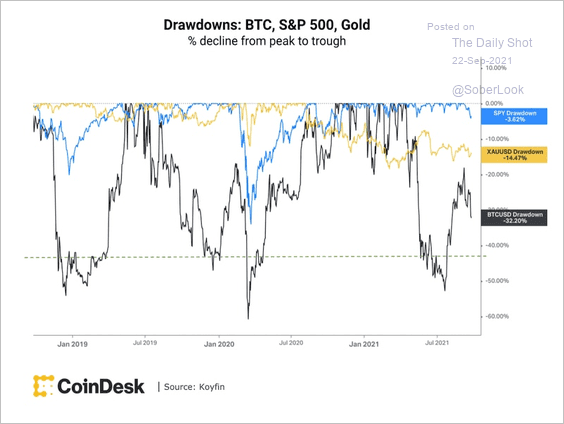

3. This chart shows bitcoin’s sharp drawdowns versus the S&P 500 and gold.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

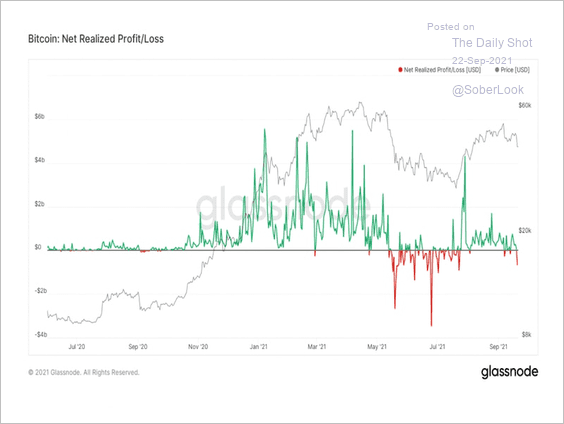

4. The realized net loss of all moved BTC over time is the largest since June 25 when bitcoin was trading around $31,600, according to blockchain data.

Source: @glassnode

Source: @glassnode

5. SEC Chairman Gary Gensler had some tough words for stablecoins.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

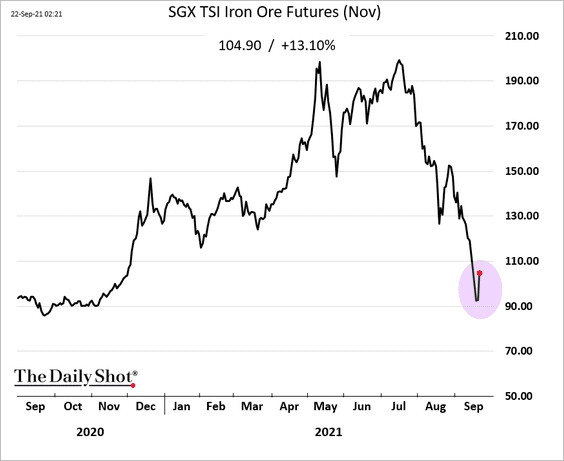

1. Iron ore futures found support.

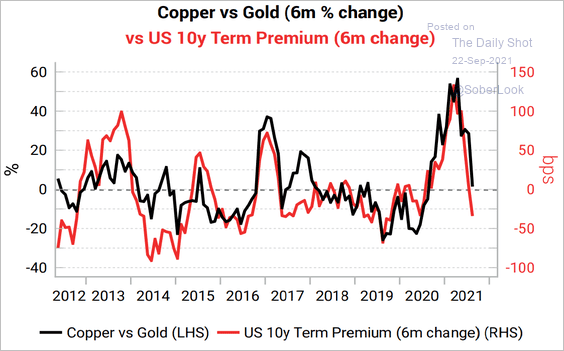

2. The copper-to-gold ratio movements tend to be correlated with the 10yr Treasury term premium.

Source: Variant Perception

Source: Variant Perception

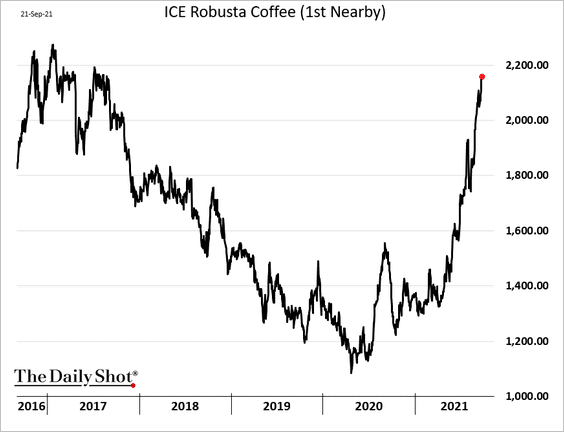

3. Robusta coffee futures have been surging.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Energy

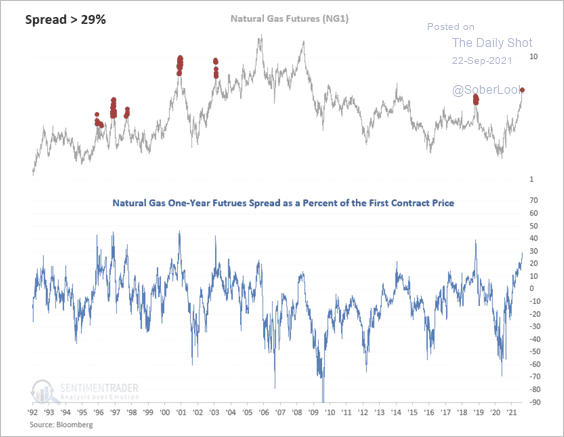

1. The NYMEX natural gas one-year futures spread as a percent of the first contract price is nearing a peak, which typically precedes a pullback in price.

Source: SentimenTrader

Source: SentimenTrader

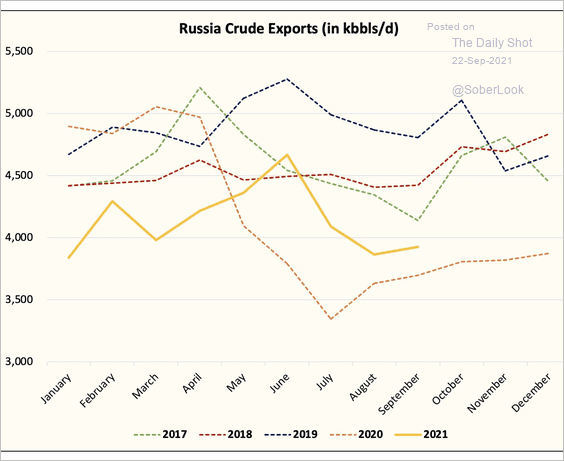

2. Russia’s oil exports have been relatively soft.

Source: @HFI_Research

Source: @HFI_Research

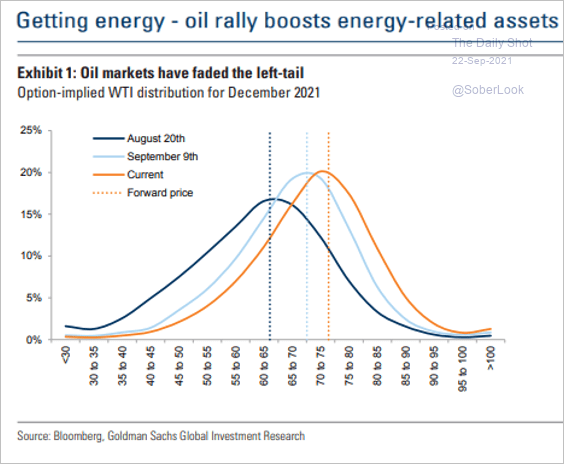

3. This chart shows the options market-based probability distribution for WTI prices in December.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Equities

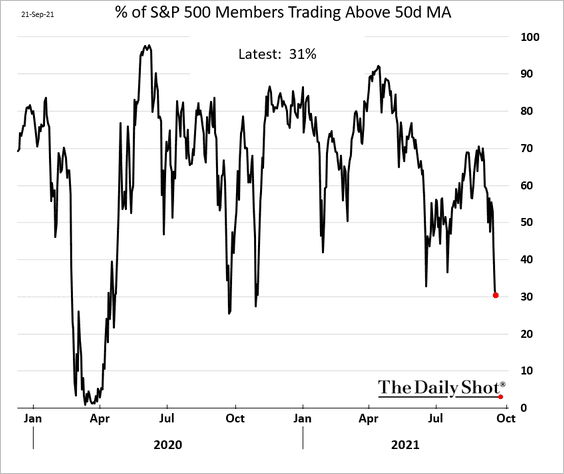

1. Only 31% of S&P 500 members now trade above their 50-day moving average.

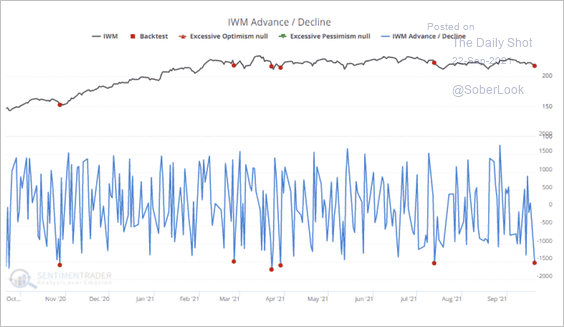

2. Nearly 1,600 more stocks in the Russell 2,000 small-cap index declined than advanced on Monday. This is only the sixth time in the past year when selling pressure was so overwhelming.

Source: SentimenTrader

Source: SentimenTrader

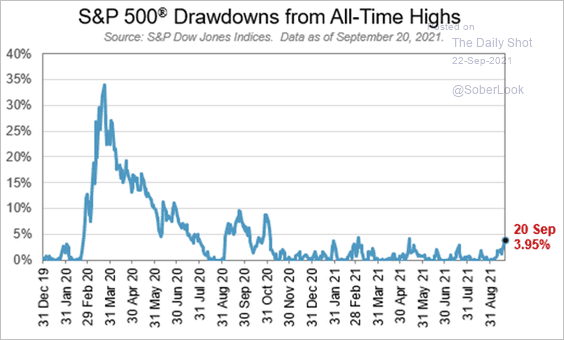

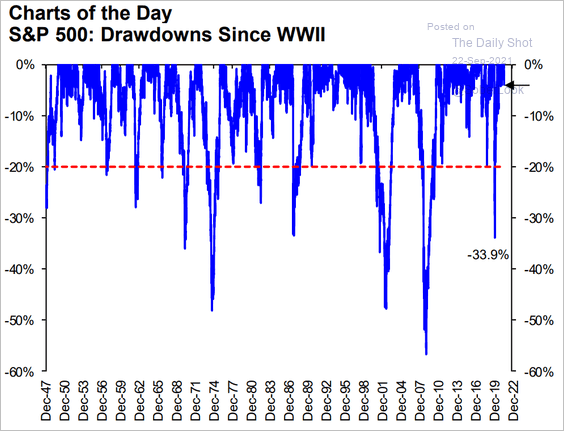

3. The latest drawdown has been relatively modest (2 charts).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

4. The Fear & Greed index is near the lows for the year (a bullish sign).

Source: CNN Business

Source: CNN Business

5. Companies with weak balance sheets have been underperforming since June.

6. Related to the trend above, value stocks have been underperforming growth.

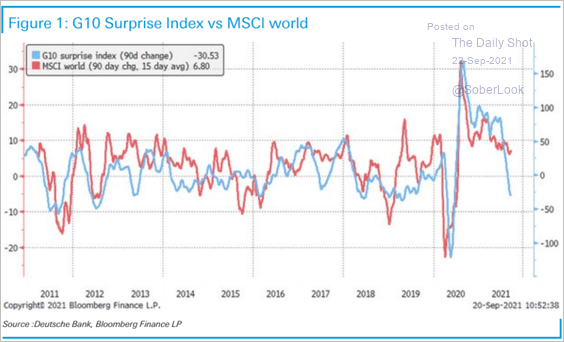

7. Is the slowing momentum in global economic growth going to pull share prices lower?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

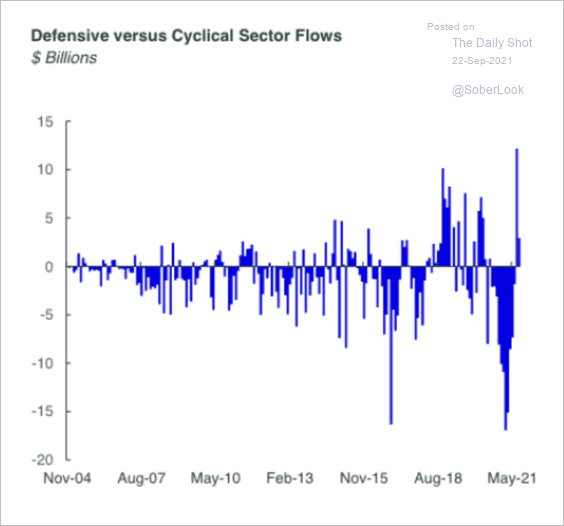

8. Defensive sectors are seeing net inflows versus cyclical sectors.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

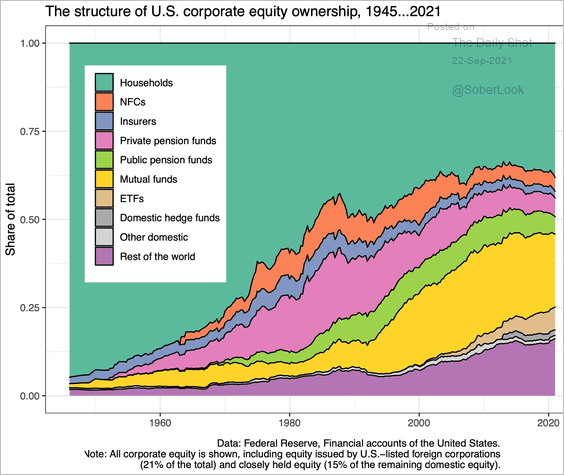

9. This chart shows US stock ownership distribution over time.

Source: @BJMbraun

Source: @BJMbraun

Back to Index

Global Developments

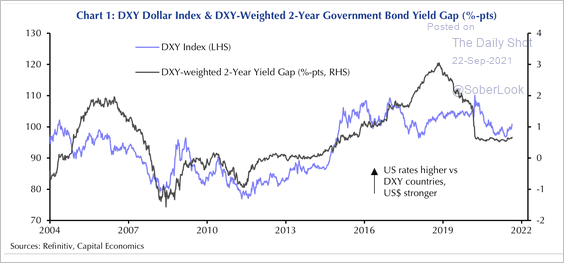

1. Capital Economics expects interest rate differentials to provide further support for the dollar, especially against the euro, yen, and renminbi.

Source: Capital Economics

Source: Capital Economics

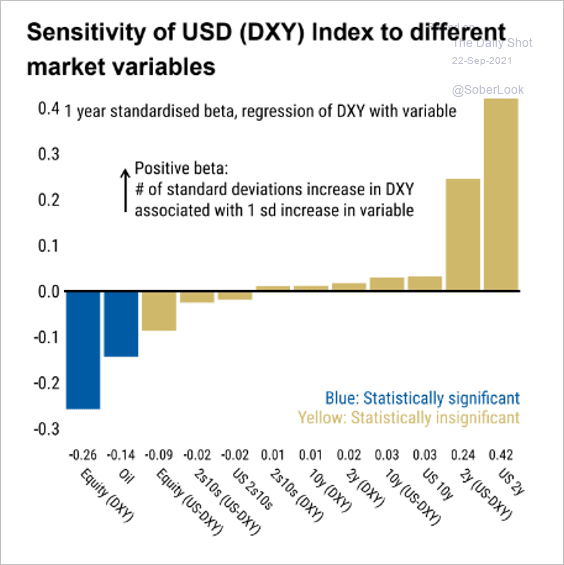

2. Here is the US dollar’s sensitivity to different market variables.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

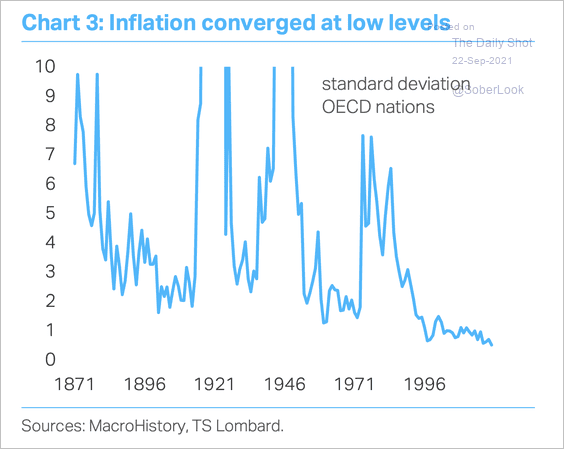

3. Inflation rates around the world have generally converged in the last few decades.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

1. Which payments will be held up first if the US debt ceiling is not raised?

Source: Oxford Economics

Source: Oxford Economics

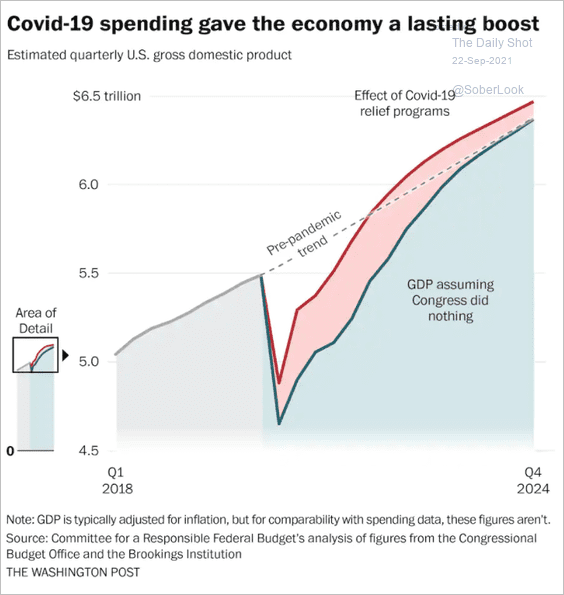

2. The impact of COVID relief programs on US GDP:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

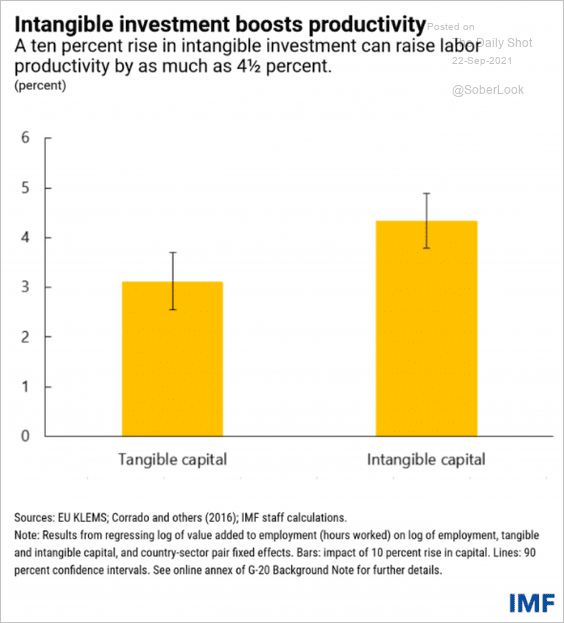

3. Intangible capital investments’ impact on productivity:

Source: IMF Read full article

Source: IMF Read full article

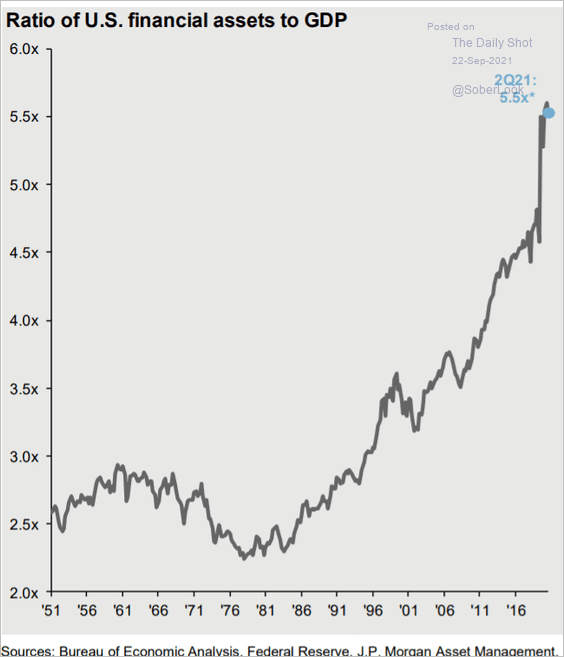

4. US financial assets relative to GDP:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

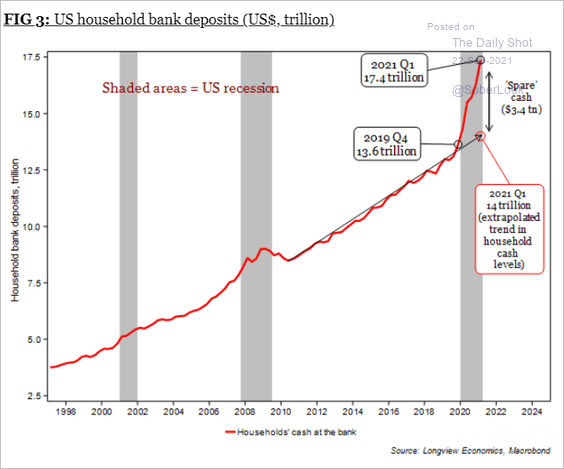

5. US household cash deposits:

Source: Longview Economics

Source: Longview Economics

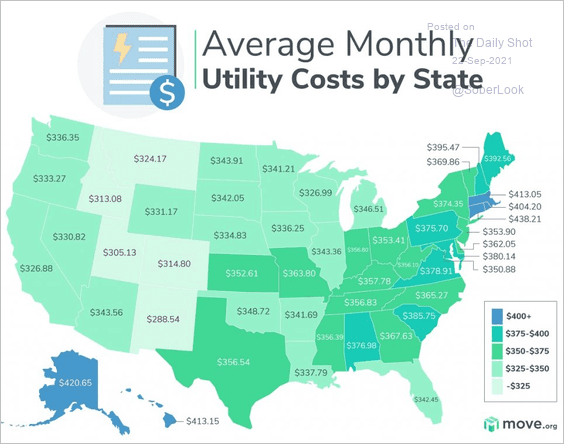

6. Utility costs by state:

Source: Move.org; h/t @HTLasVegas, @rcgeconomics

Source: Move.org; h/t @HTLasVegas, @rcgeconomics

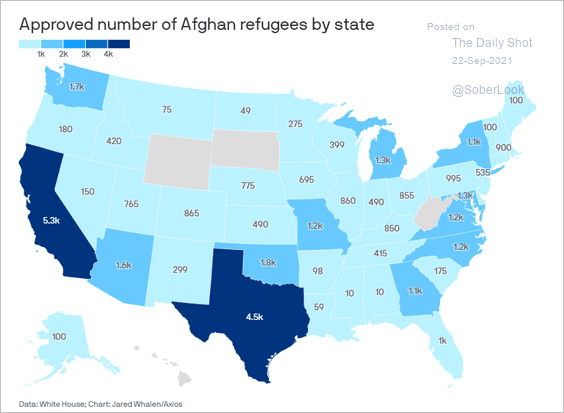

7. Approved number of Afghan refugees:

Source: @axios Read full article

Source: @axios Read full article

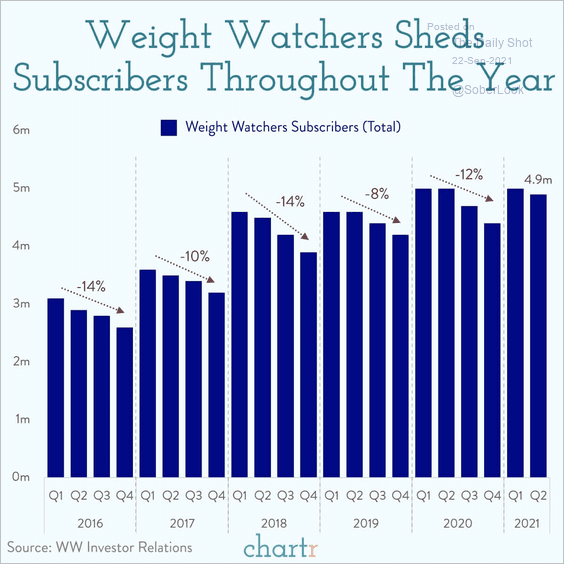

8. Weight Watchers subscribers over time:

Source: @chartrdaily

Source: @chartrdaily

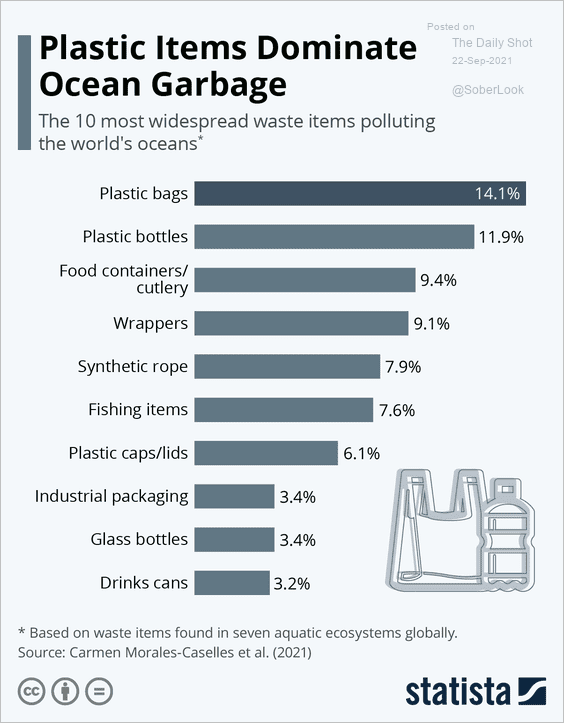

9. Plastic in the ocean:

Source: Statista

Source: Statista

10. Professionally-graded sports trading card prices vs. the S&P 500, since 2008:

Source: PWCC, h/t III Capital Management

Source: PWCC, h/t III Capital Management

——————–

Back to Index