The Daily Shot: 27-Sep-21

• Equities

• Credit

• Rates

• Energy

• Commodities

• Cryptocurrencies

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

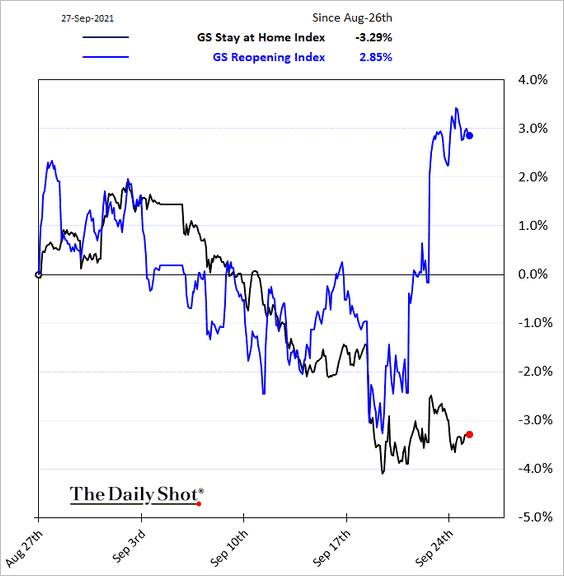

1. Goldman’s “reopening” index massively outperformed “stay at home” stocks last week.

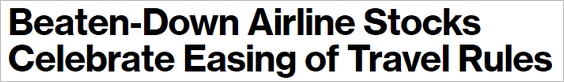

Airlines got a boost from easing travel rules.

Source: @business Read full article

Source: @business Read full article

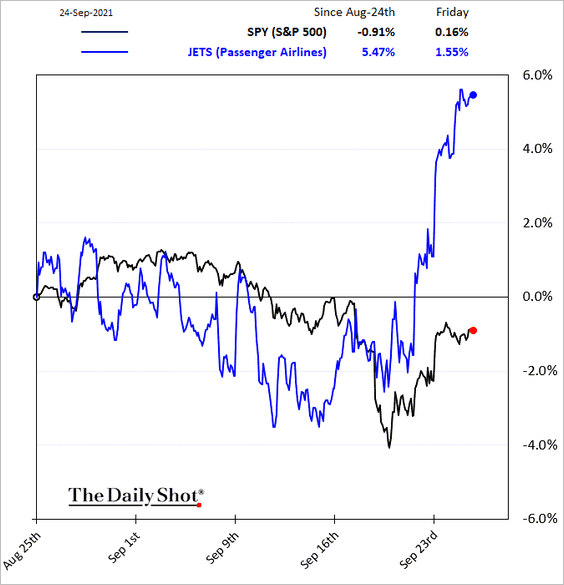

But it wasn’t just about airlines.

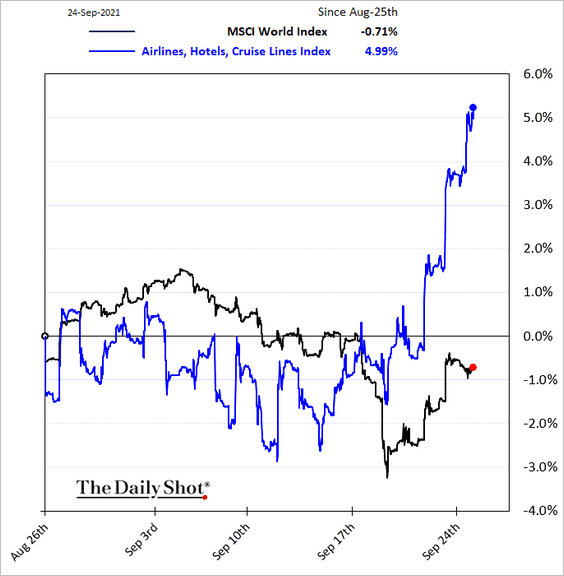

The trend was global, with the Solactive Airlines, Hotels & Cruise Lines Index surging.

——————–

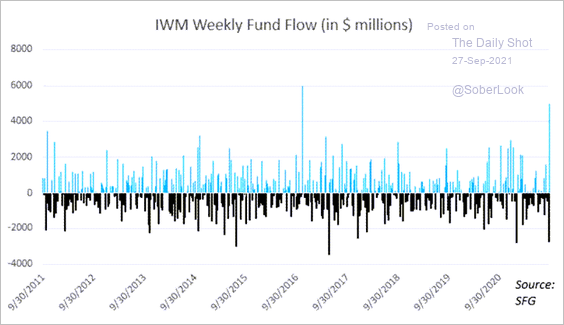

2. Small-cap flows reversed last week. The chart shows flows into IWM (Russell 2000 ETF).

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

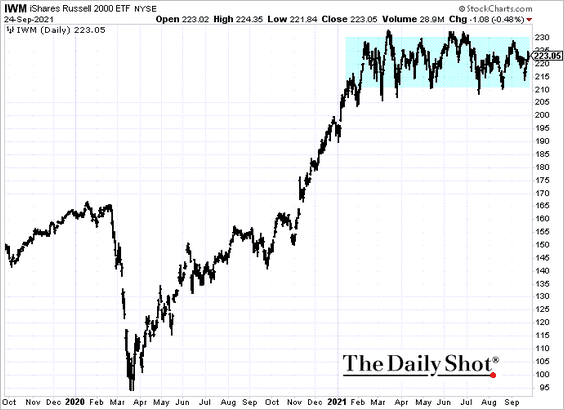

The Russell 2000 index remains range-bound.

——————–

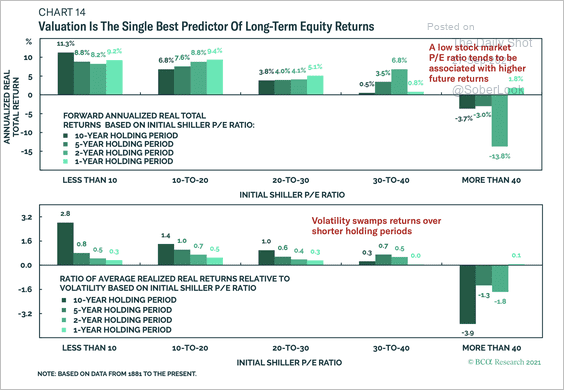

3. Starting valuations are good at predicting long-term global stock returns, but short-term volatility tends to dominate, with returns driven by the business cycle.

Source: BCA Research

Source: BCA Research

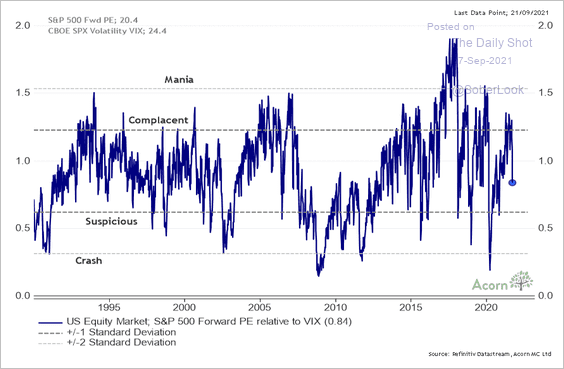

4. The ratio of S&P 500 forward P/E to VIX suggests that investors are not overly enthusiastic.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

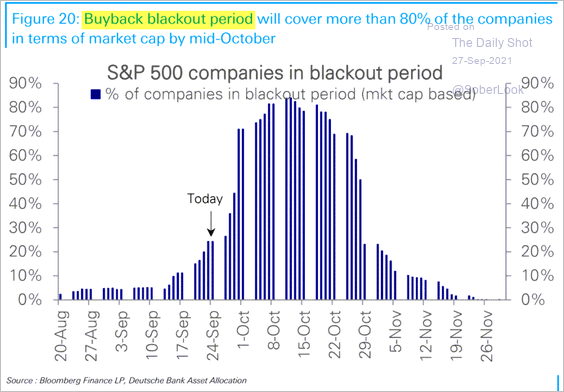

5. The buyback blackout period is coming up.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

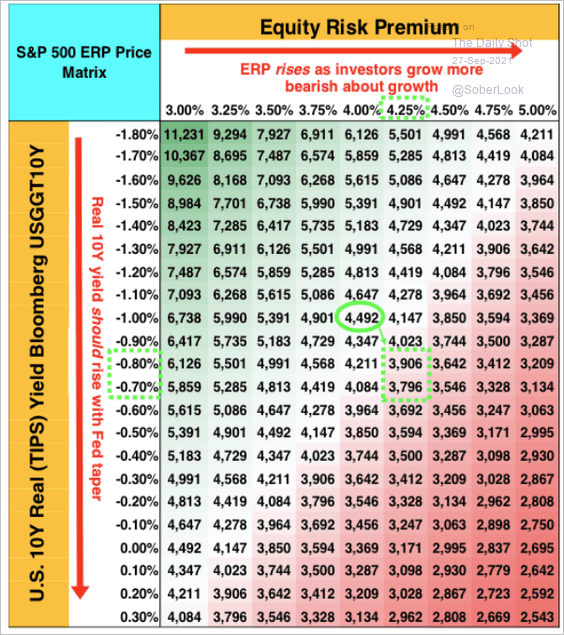

6. Stifel estimates a 10%-15% correction in the S&P 500 in Q4, given the rise in real yields and the equity risk premium.

Source: Stifel

Source: Stifel

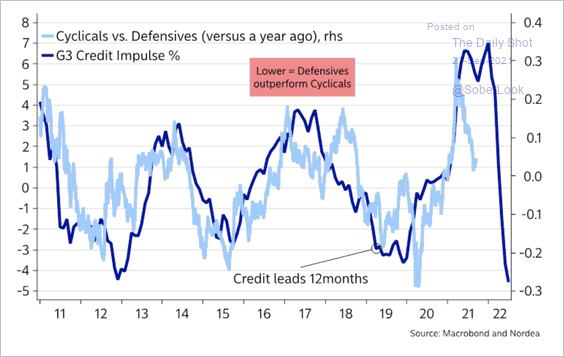

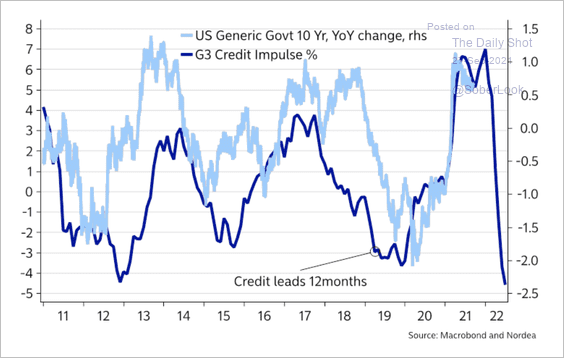

7. A weaker credit impulse typically benefits defensives relative to cyclicals.

Source: Nordea Markets

Source: Nordea Markets

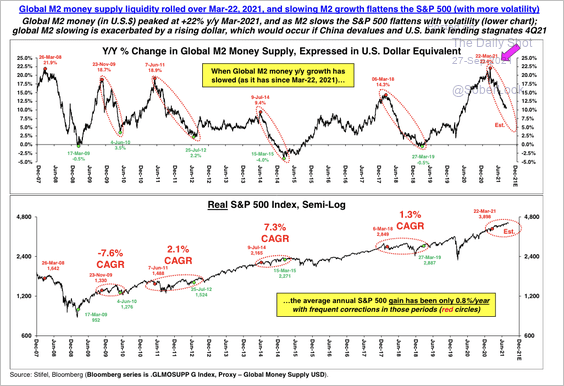

Slowing M2 money supply growth often leads to a soft patch in US equities.

Source: Stifel

Source: Stifel

——————–

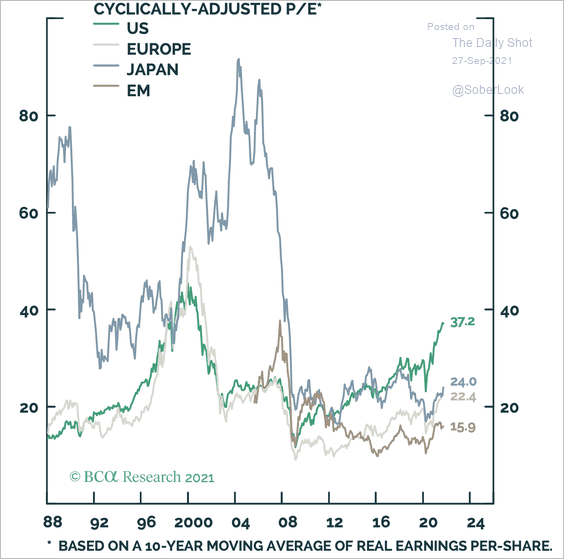

8. US Stocks are substantially more expensive than global peers.

Source: BCA Research

Source: BCA Research

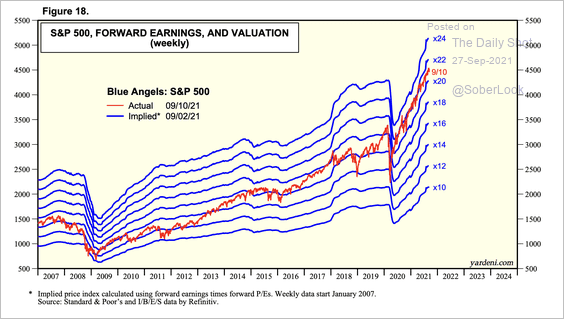

9. The next chart shows the S&P 500 price implied by various earnings multiples (over time).

Source: Yardeni Research

Source: Yardeni Research

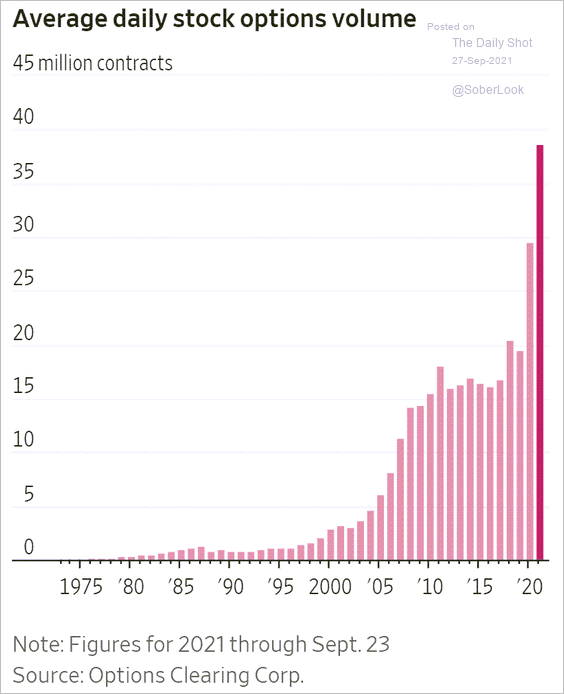

10. This year’s stock options volume has been unprecedented.

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

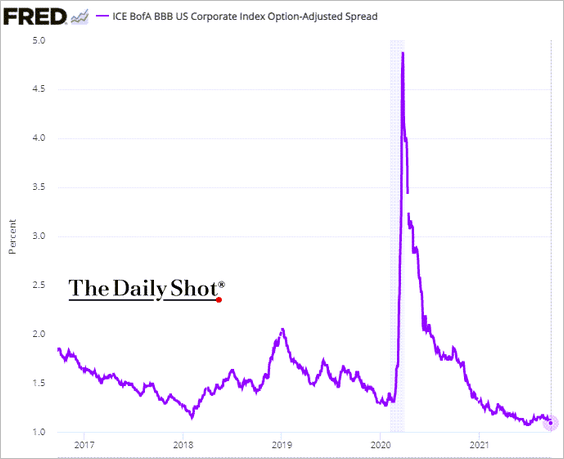

1. BBB corporate bond spreads are nearing multi-year lows.

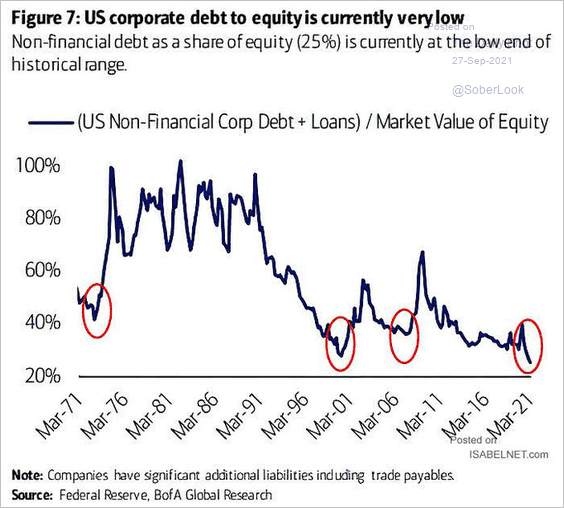

2. The US corporate debt-to-equity ratio is extraordinarily low (as the stock market continues to rally).

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

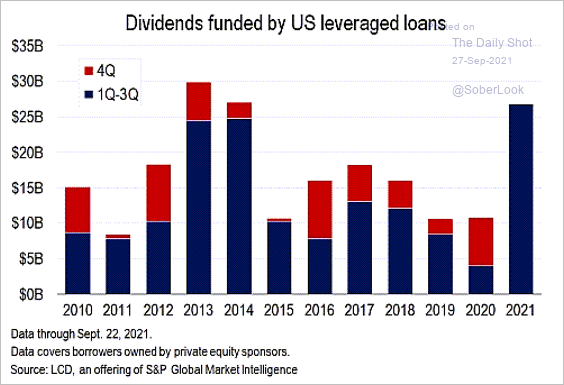

3. Funding dividends with leveraged loans has been popular this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

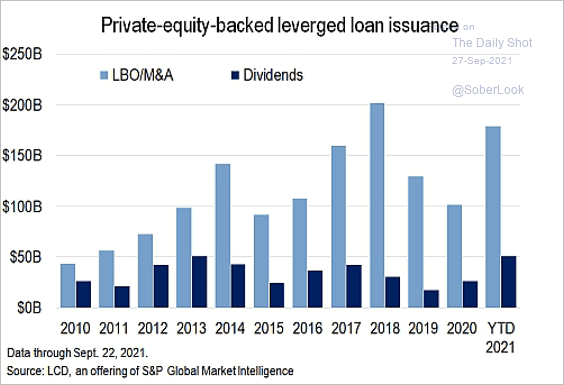

Here is how loan proceeds were deployed by private equity firms.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

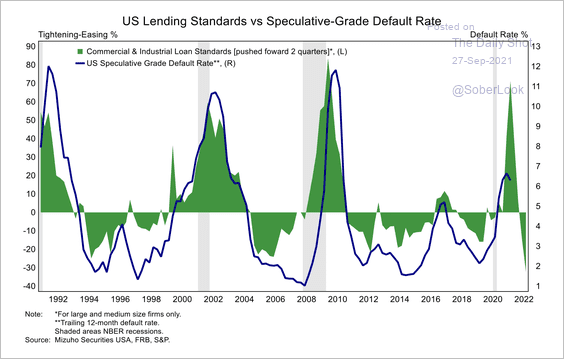

4. Easier lending standards point to a lower speculative-grade default rate.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

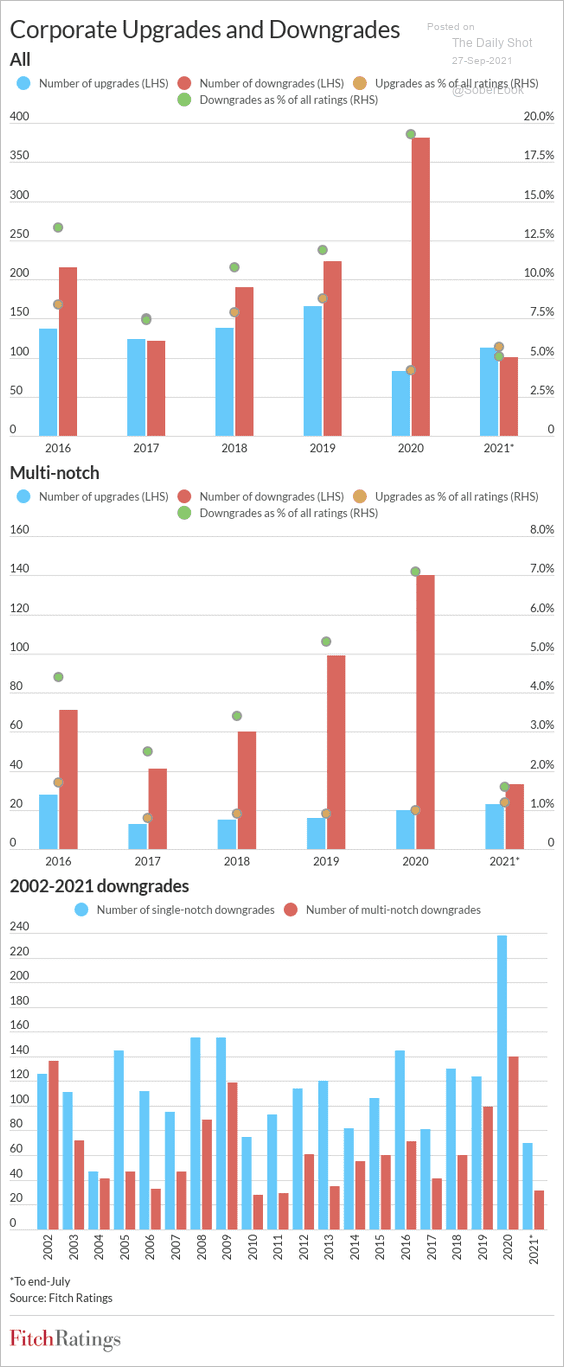

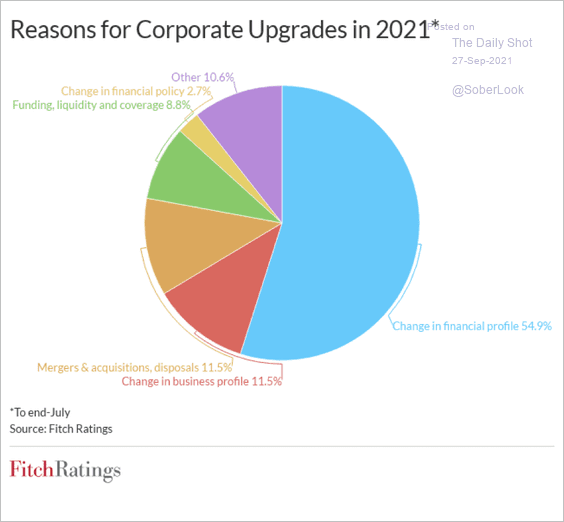

5. After a tumultuous 2020, corporate credit has seen far fewer downgrades so far this year (2 charts).

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

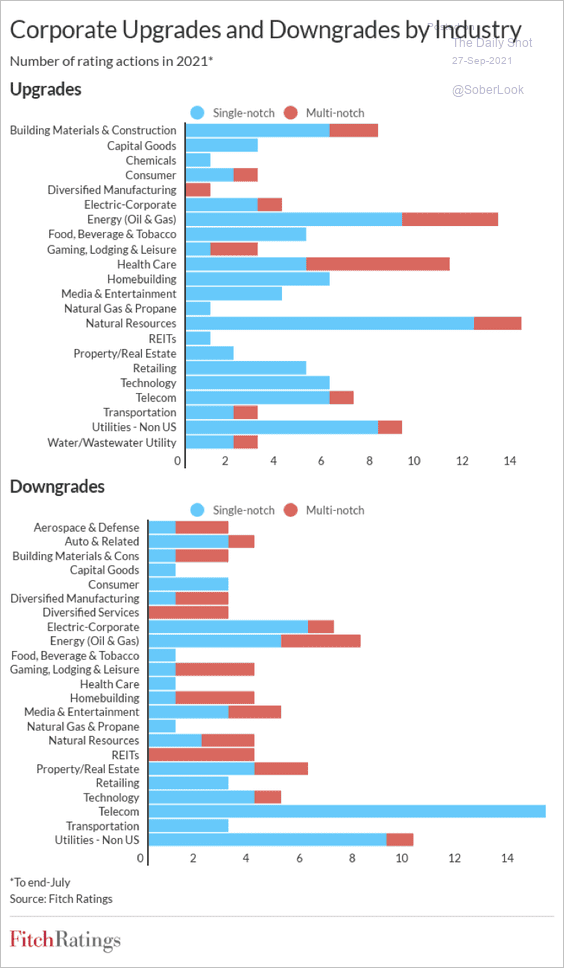

Telecoms and utilities have seen the greatest number of downgrades this year, while healthcare and natural resource credits have improved.

Source: Fitch Ratings

Source: Fitch Ratings

Rates

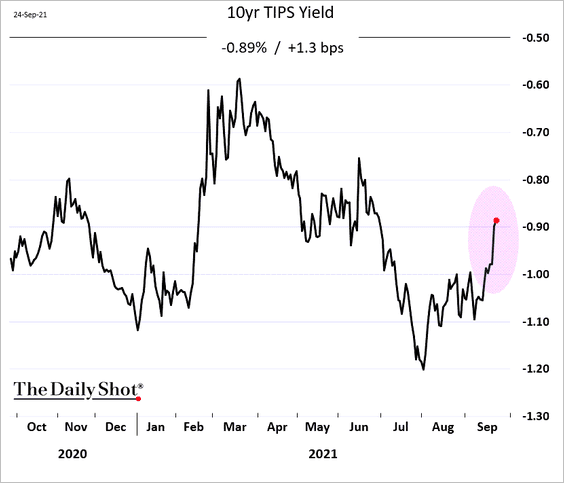

1. TIPS yields (implied real rates) have climbed in recent days (which tends to be a negative for growth stocks).

2. Will the declining credit impulse lead to lower bond yields again?

Source: Nordea Markets

Source: Nordea Markets

Energy

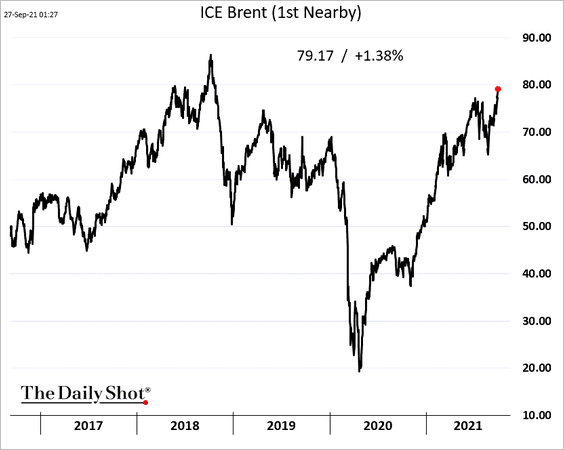

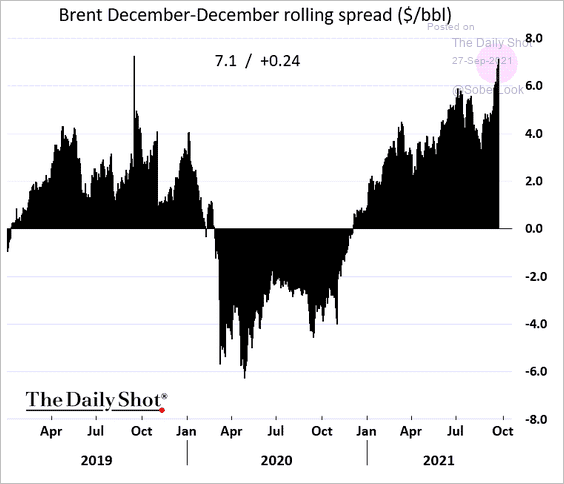

1. Brent is trading above $79/bbl.

The one-year backwardation hit a two-year high.

h/t Grant Smith

h/t Grant Smith

——————–

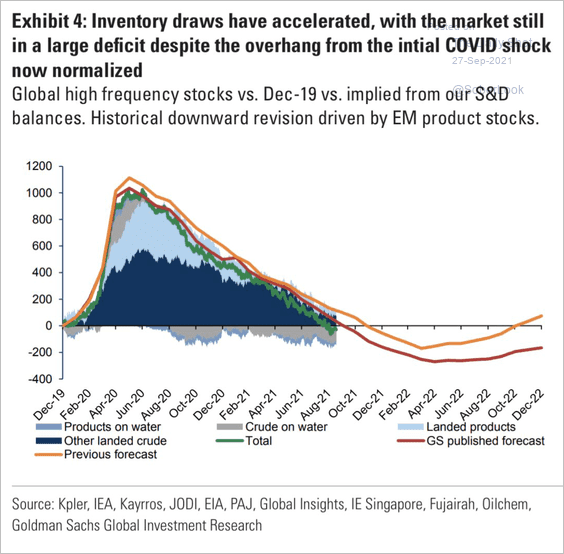

2. Goldman expects further acceleration in global inventory draws.

Source: Goldman Sachs; @HFI_Research

Source: Goldman Sachs; @HFI_Research

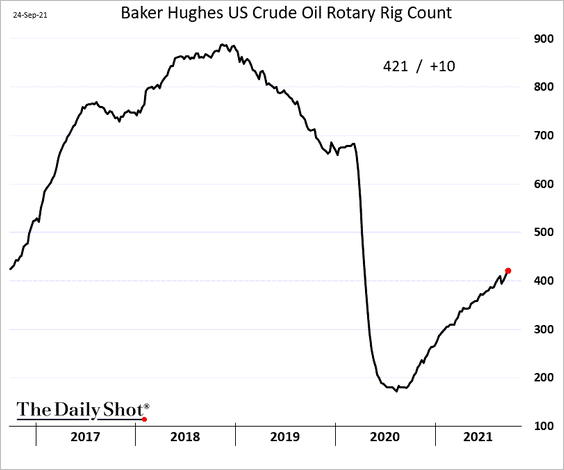

3. The US rig count is picking up momentum.

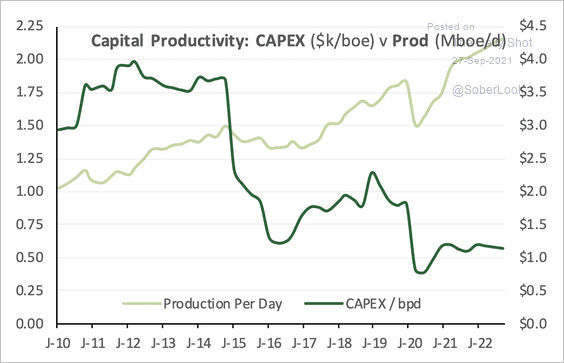

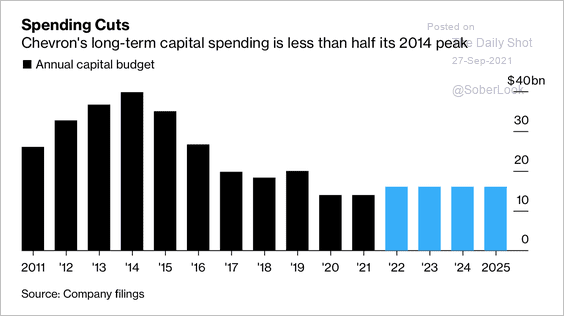

4. US Oil & Gas producers have maintained capital discipline established during the Covid crisis.

Source: Cornerstone Macro

Source: Cornerstone Macro

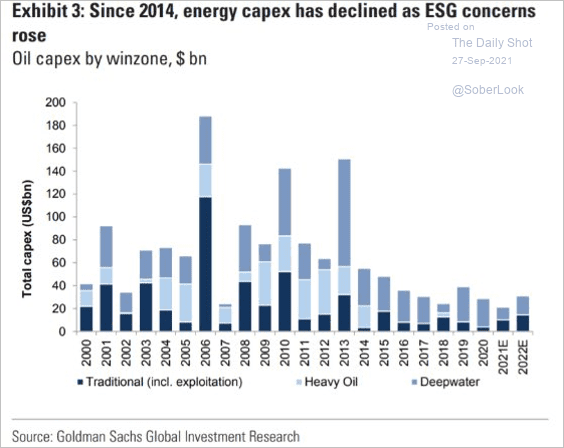

ESG concerns also contributed to depressed CapEx.

Source: Goldman Sachs; @TeddyVallee

Source: Goldman Sachs; @TeddyVallee

CapEx at many firms is expected to remain subdued, which will further tighten energy markets and boost prices.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

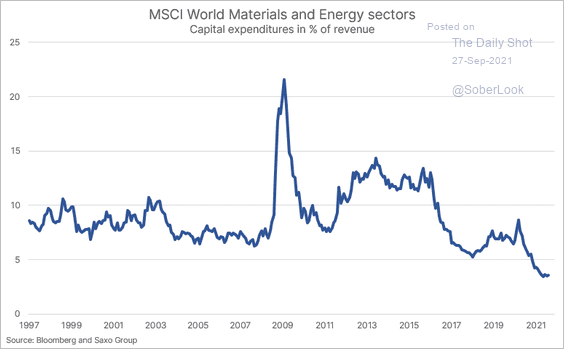

Other commodities are experiencing similar trends.

Source: @petergarnry

Source: @petergarnry

Commodities

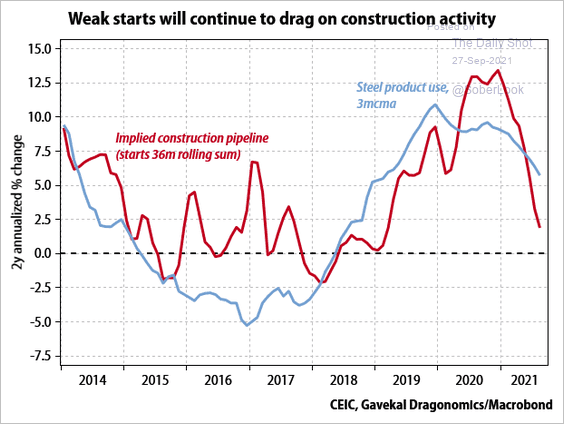

1. Will softer construction activity in China put downward pressure on steel demand?

Source: Gavekal Research

Source: Gavekal Research

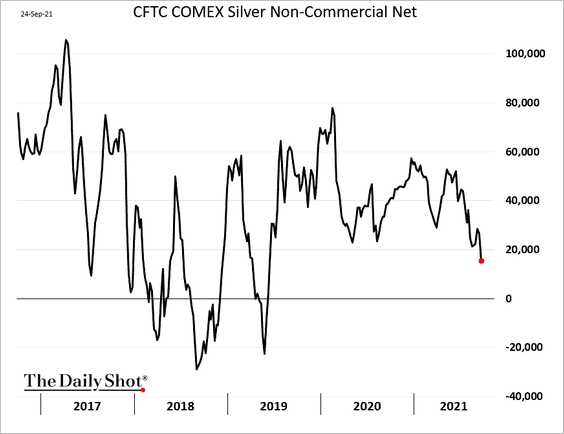

2. Speculative accounts are trimming their bets on silver.

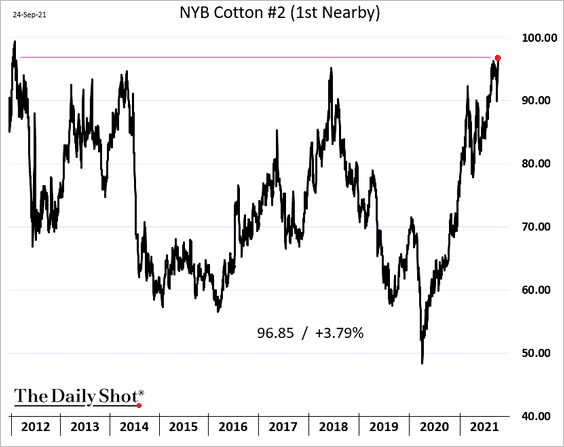

3. US cotton futures hit the highest level in nearly a decade amid strong export demand.

Cotton futures in China are also surging.

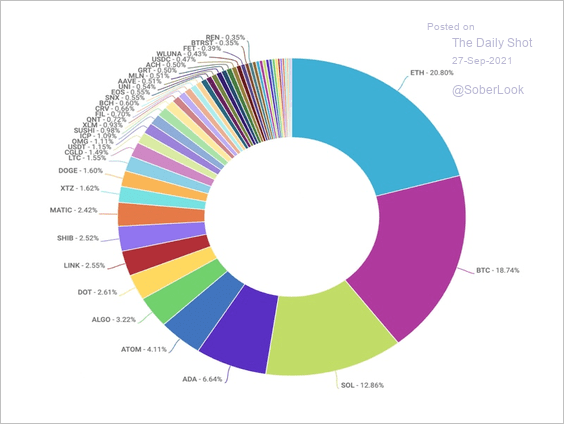

Cryptocurrencies

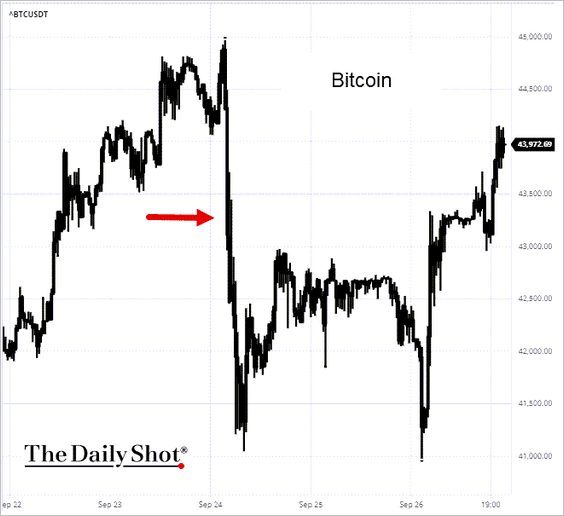

1. Beijing decided to make all crypto transactions illegal.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Cryptos took a hit at first but are now rebounding.

Source: barchart.com

Source: barchart.com

——————–

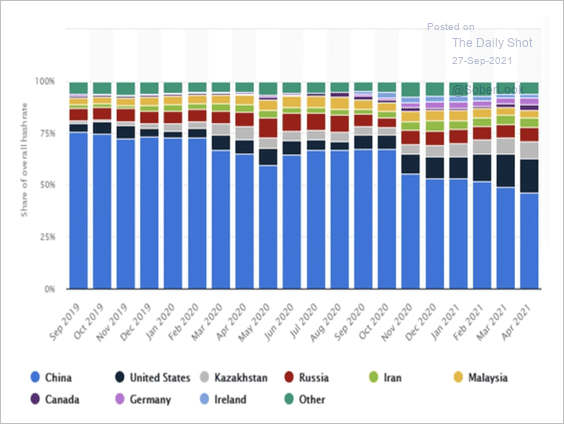

2. The chart below shows crypto miner migration out of China in the months leading up to the latest ban.

Source: FundStrat Read full article

Source: FundStrat Read full article

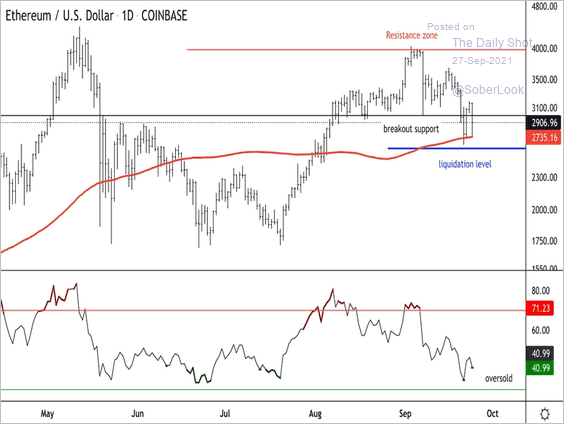

3. Ether is holding support above its 100-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

ETH trading volumes outpaced BTC on the Coinbase exchange last week.

Source: Coinbase

Source: Coinbase

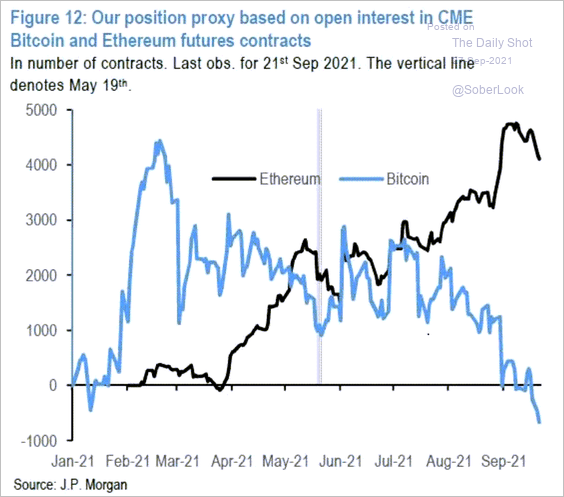

Futures bets on ETH have been climbing, while bitcoin positioning has shifted to net short.

Source: JP Morgan; Charles-Henry Monchau

Source: JP Morgan; Charles-Henry Monchau

——————–

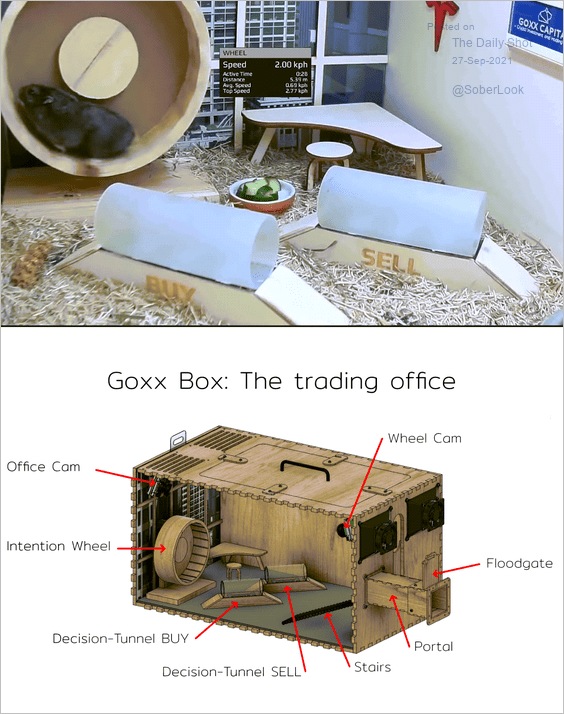

4. Can a hamster make money trading crypto? You bet.

Source: NPR Read full article

Source: NPR Read full article

Source: @mrgoxx

Source: @mrgoxx

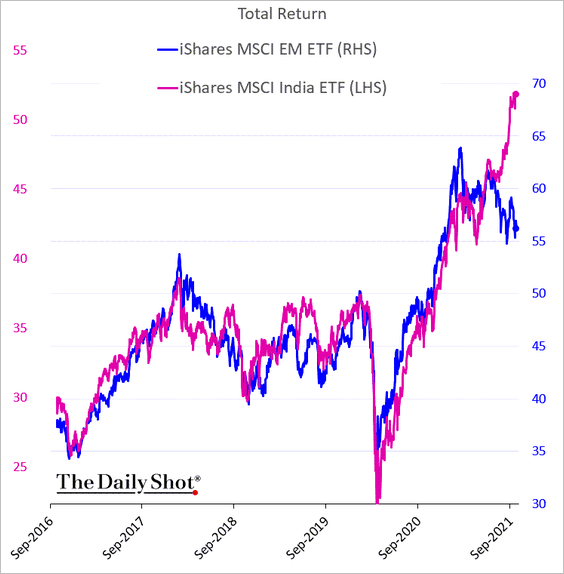

Emerging Markets

1. Indian stocks continue to outperform (at the expense of China).

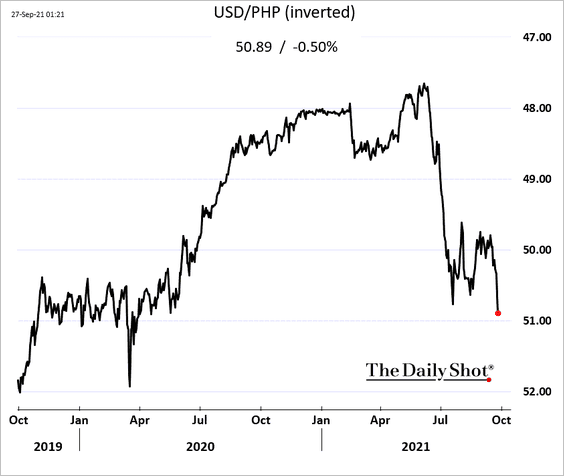

2. The Philippine peso hit the lowest level since April of last year.

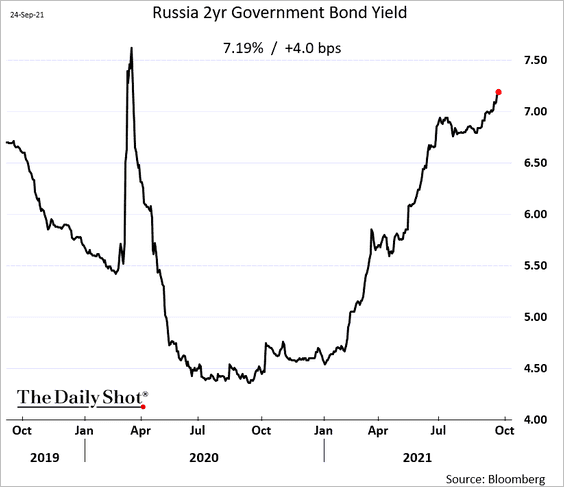

3. Russian bond yields continue to climb.

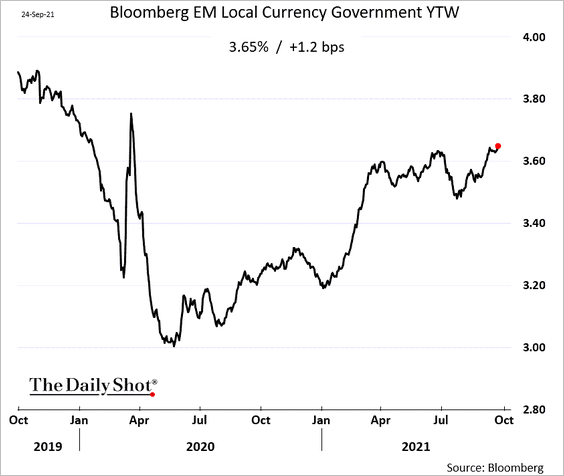

Government bond yields have been grinding higher across emerging markets.

——————–

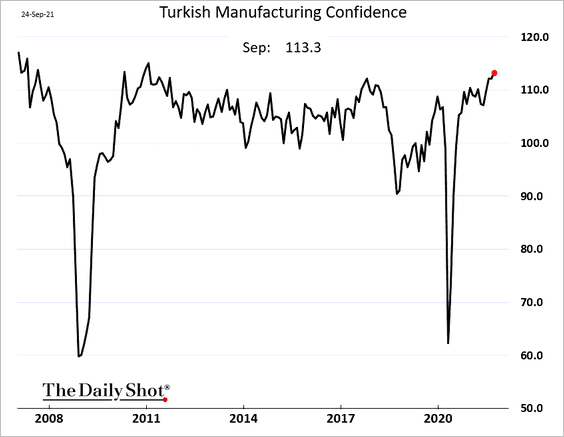

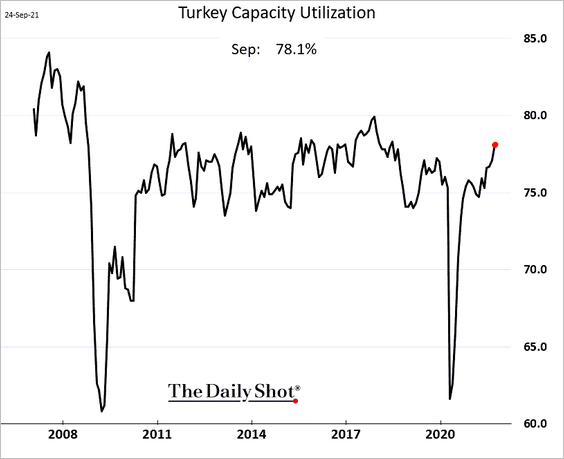

4. Turkey’s manufacturing confidence is at multi-year highs.

Capacity utilization is climbing.

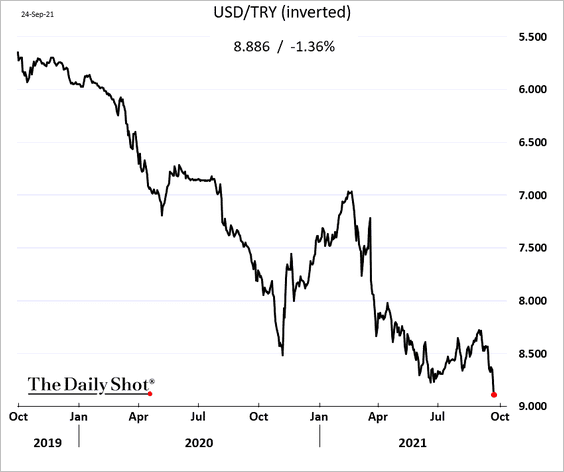

The lira remains under pressure.

——————–

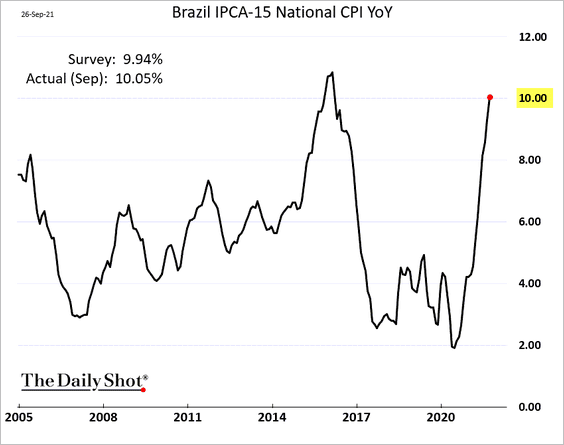

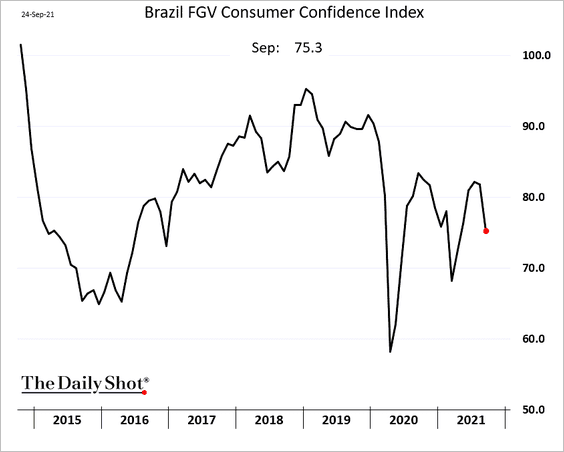

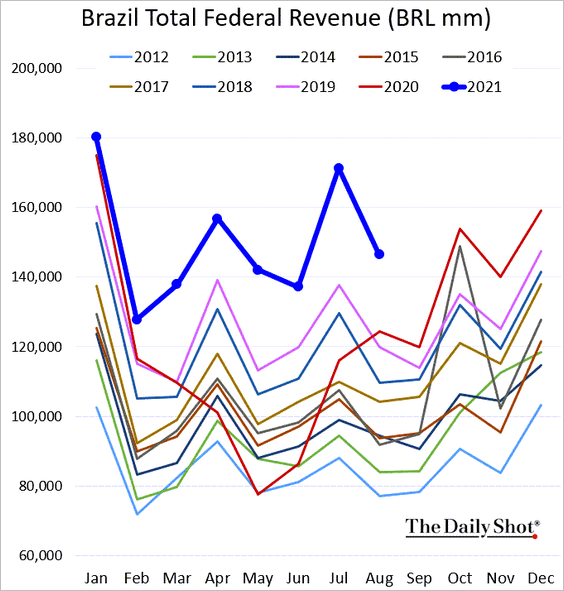

5. Next, we have some updates on Brazil.

• Inflation hit double digits.

• Consumer confidence weakened this month.

• Tax collections remain robust.

China

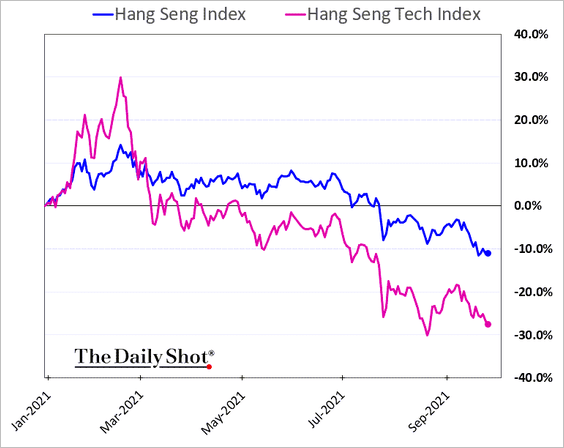

1. Tech stocks continue to underperform in Hong Kong.

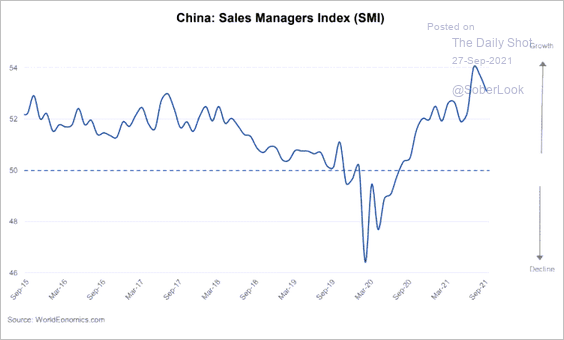

2. The World Economics all-sector SMI shows robust growth in business activity.

Source: World Economics

Source: World Economics

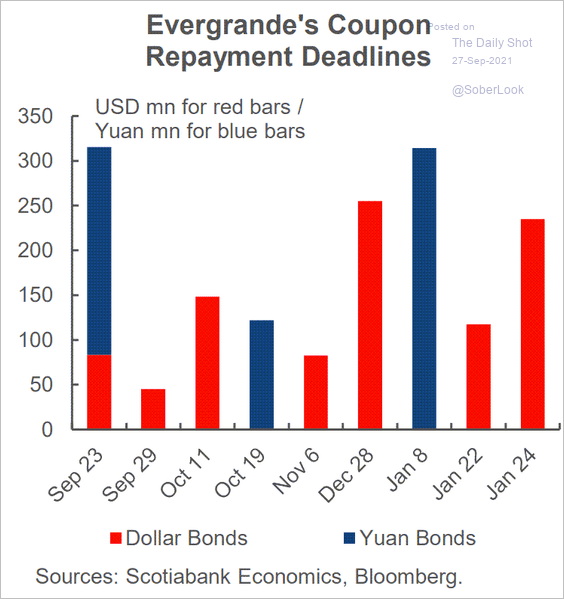

3. Evergrande missed its coupon payment.

Source: The Guardian Read full article

Source: The Guardian Read full article

Here is the coupon payment schedule.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

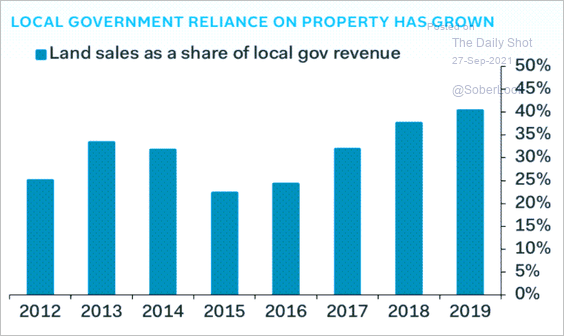

4. Local governments have been relying heavily on land sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

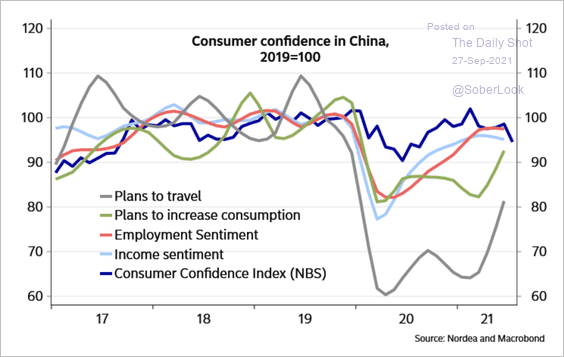

5. Chinese consumer confidence across various categories has not yet recovered fully to 2019 levels.

Source: Nordea Markets

Source: Nordea Markets

Asia – Pacific

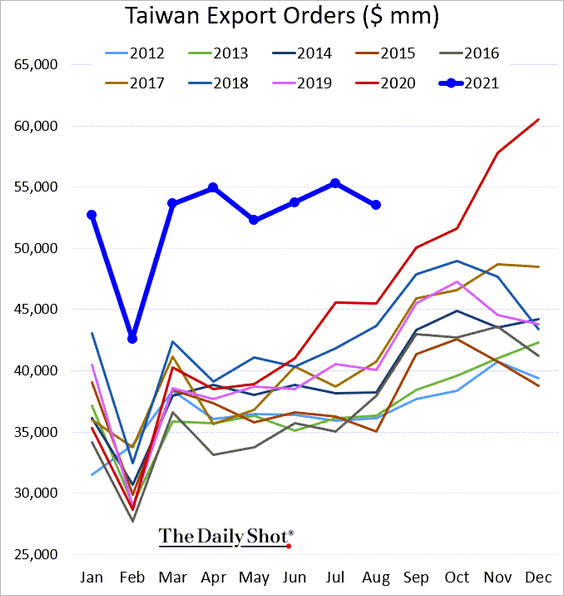

1. Taiwan’s export orders were disappointing.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

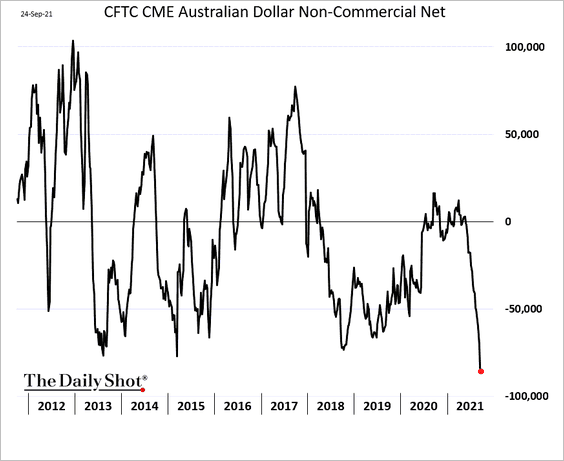

2. Speculators further boosted their bets against the Aussie dollar.

Japan

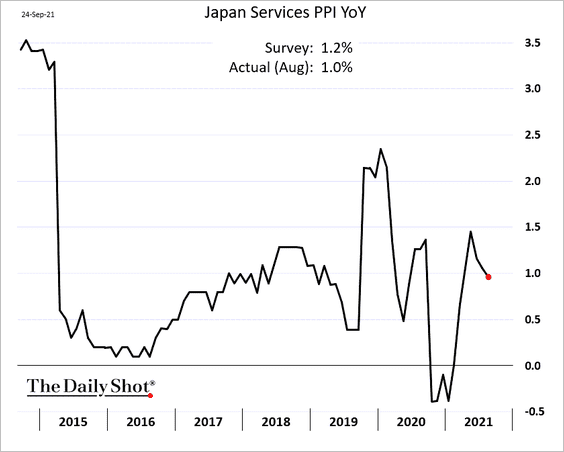

1. Service-sector PPI surprised to the downside.

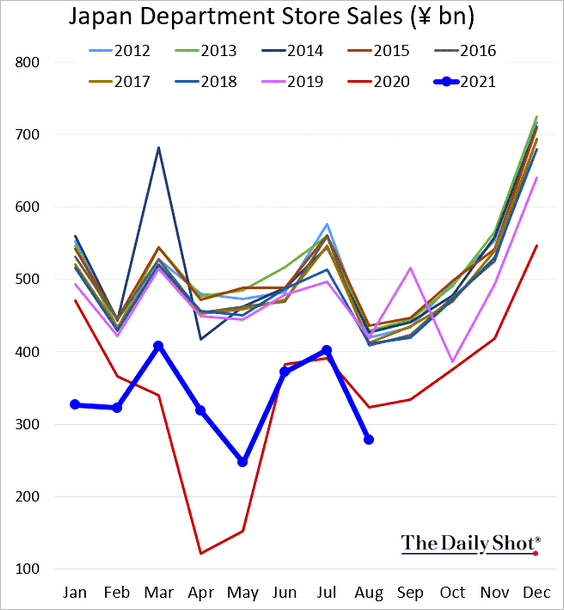

2. Department store sales have been worse than in 2020 (for this time of the year).

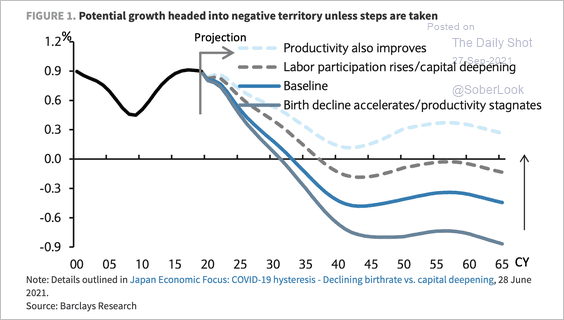

3. Japanese policymakers need to find ways to fight the negative long-term growth dynamics.

Source: Barclays Research

Source: Barclays Research

The Eurozone

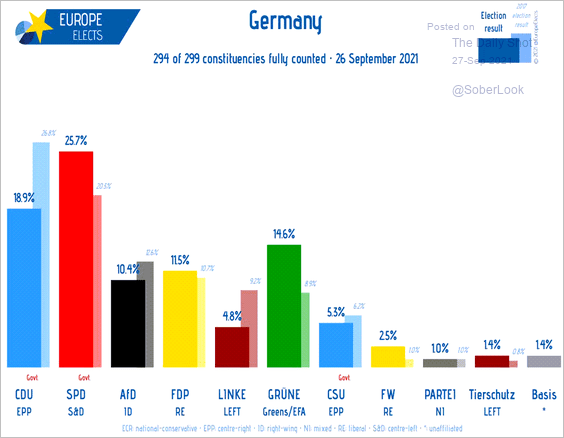

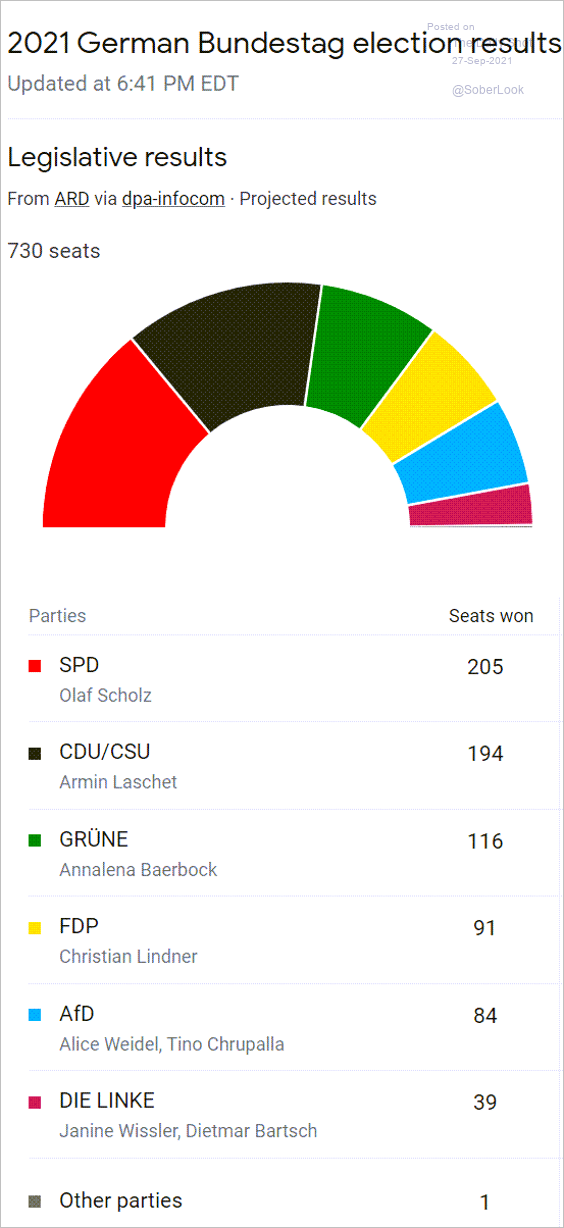

1. Let’s begin with Germany.

• SPD edged out CDU/CSU in the national elections (25.7% vs. 24.2% as of the latest count). It’s an end of an era.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @EuropeElects, @DecisionDeskHQ Read full article

Source: @EuropeElects, @DecisionDeskHQ Read full article

Source: Google

Source: Google

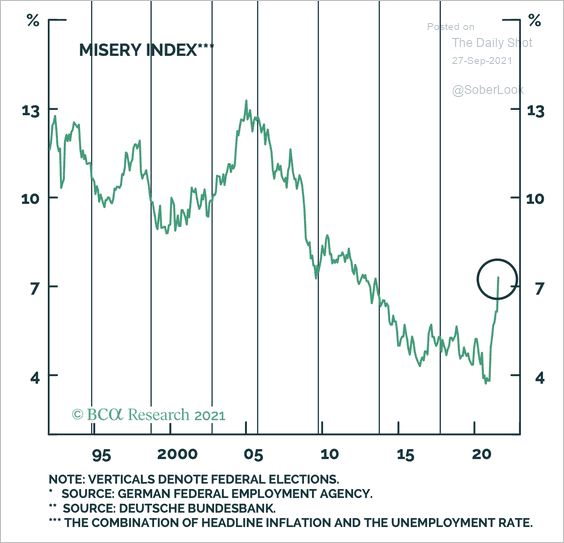

– Germany’s Misery Index (unemployment rate + inflation rate) could help explain the shift in voter preferences.

Source: BCA Research

Source: BCA Research

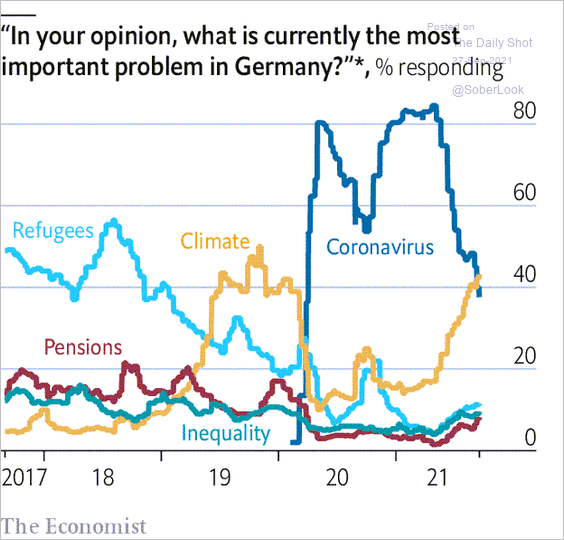

Increased focus on climate change also contributed.

Source: The Economist Read full article

Source: The Economist Read full article

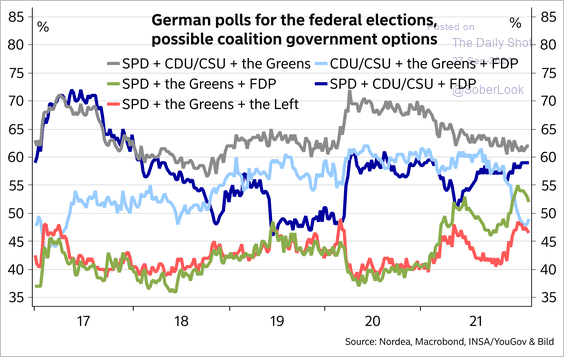

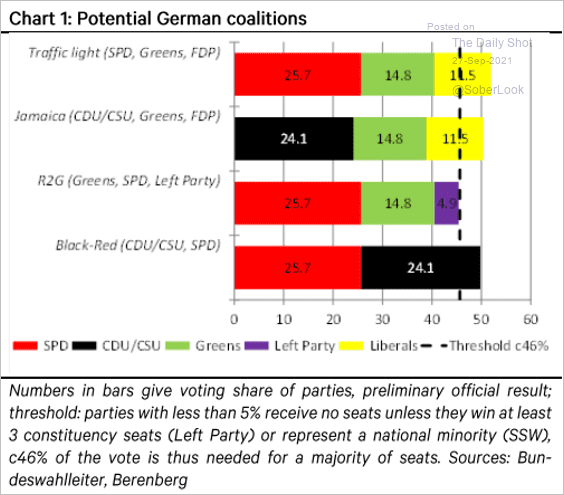

– Here are the possible coalitions.

Source: Nordea Markets

Source: Nordea Markets

Source: @Berenberg_Econ Read full article

Source: @Berenberg_Econ Read full article

——————–

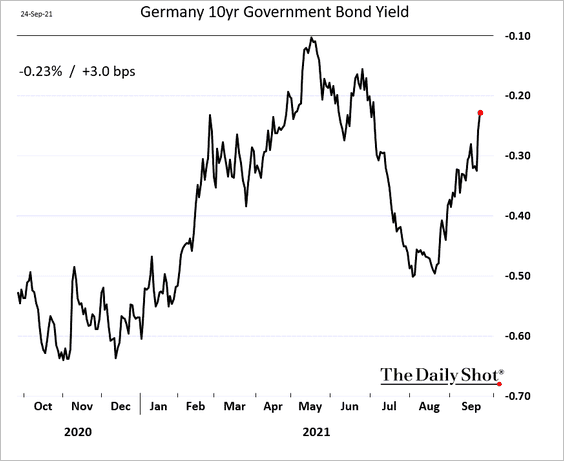

• Bund yields rose sharply last week.

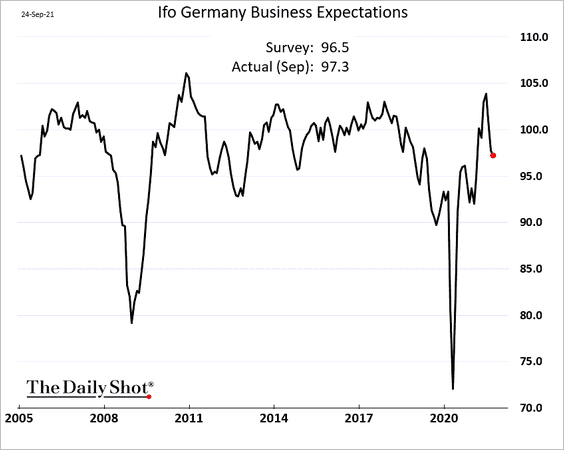

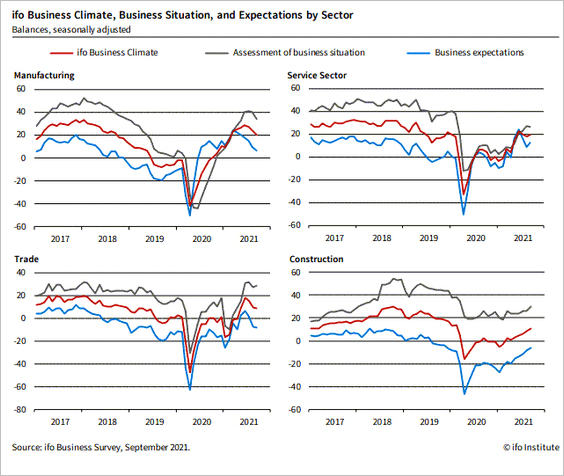

• The Ifo indicator shows some loss of momentum in business activity, although the decline has been lower than expected.

Source: ifo Institute

Source: ifo Institute

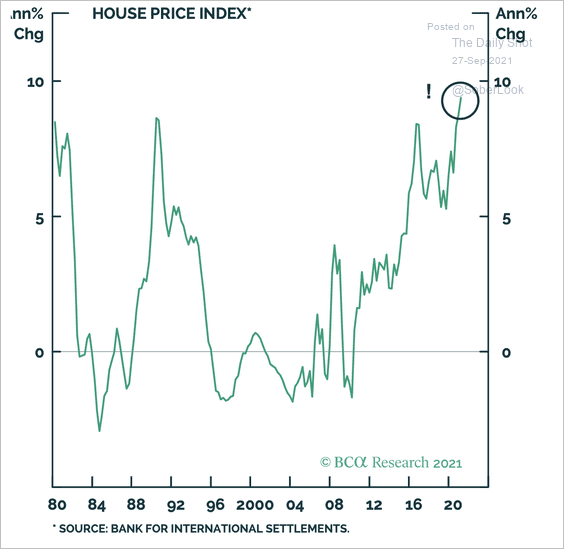

• German house prices have been rising at a blistering rate.

Source: BCA Research

Source: BCA Research

——————–

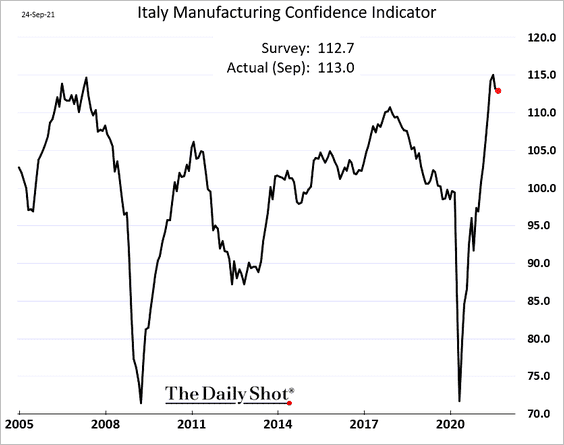

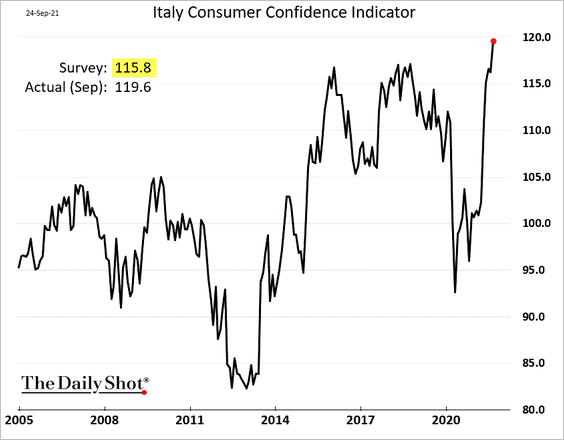

2. Italian sentiment indicators remain robust.

• Manufacturing sentiment:

• Consumer confidence (multi-year high):

——————–

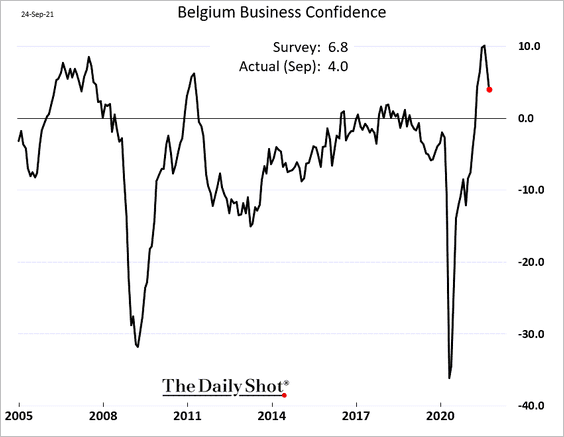

3. Belgian business confidence shows some loss of momentum.

The United Kingdom

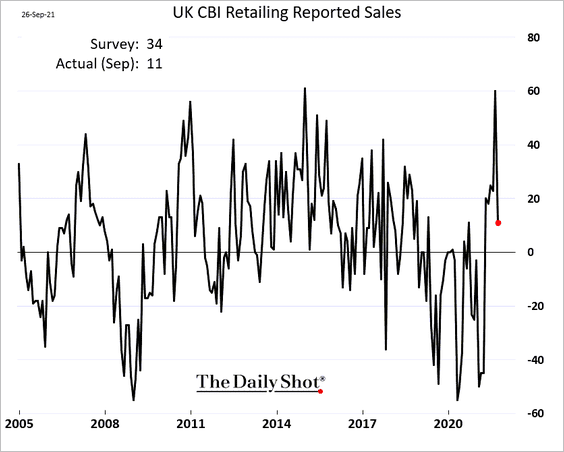

1. Retail sales slumped this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

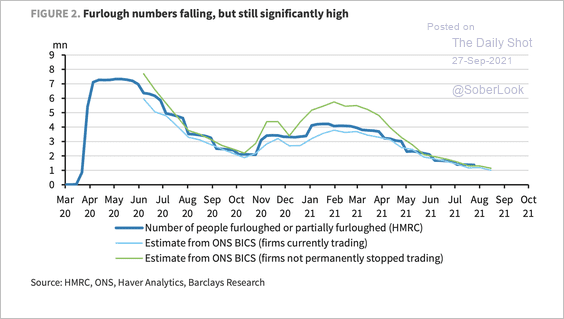

2. Despite it being the first month firms have had to contribute to furloughed wages, the number of furloughed workers stopped declining in July.

Source: Barclays Research

Source: Barclays Research

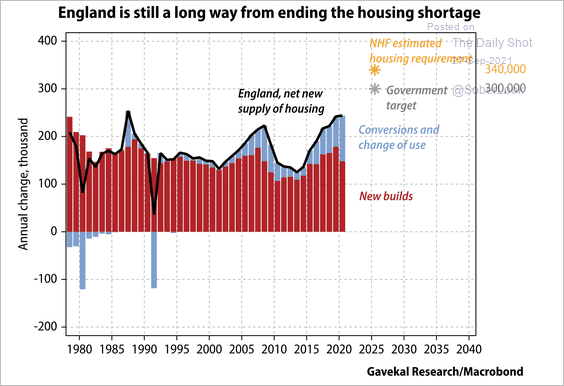

3. Although the recent year shows the best supply situation since the early 1970s, the housing market in England continues to be chronically undersupplied.

Source: Gavekal Research

Source: Gavekal Research

Canada

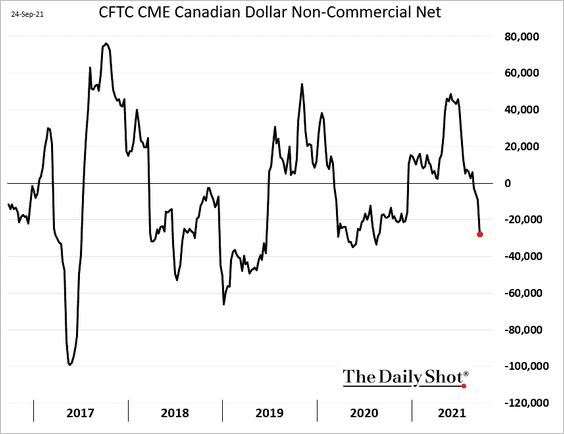

1. Hedge funds have soured on the Canadian dollar.

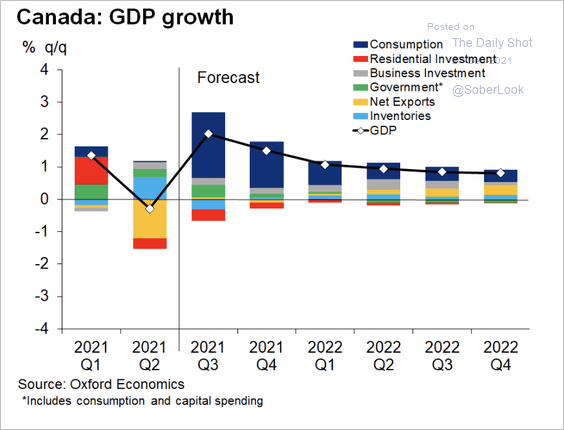

2. Consumption and government spending are expected to be the primary drivers of economic growth.

Source: Oxford Economics

Source: Oxford Economics

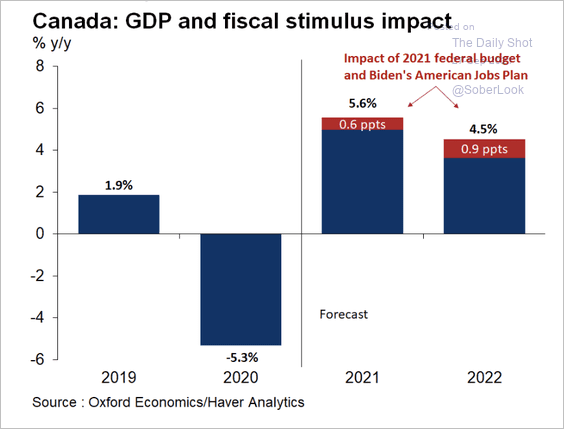

Fiscal stimulus will support GDP growth next year.

Source: Oxford Economics

Source: Oxford Economics

The United States

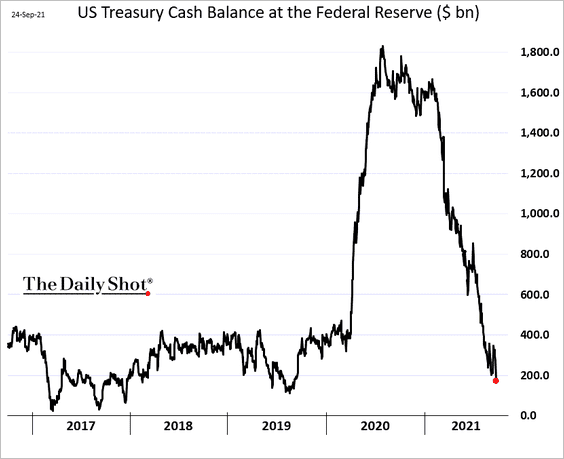

1. The clock is ticking on the debt ceiling deadline as the US Treasury’s cash balance dips below $200 bn.

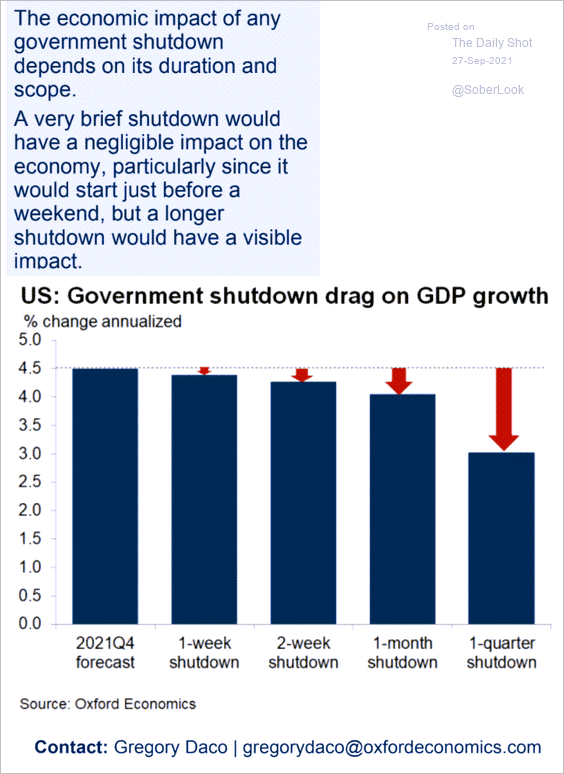

2. What will be the economic impact of a government shutdown?

Source: Oxford Economics

Source: Oxford Economics

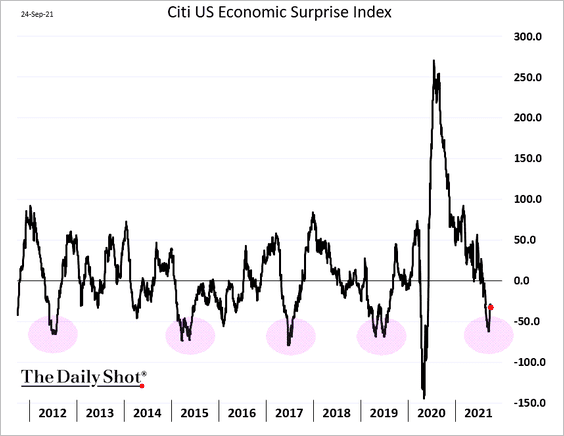

3. Have we seen a bottom in the Citi Economic Surprise Index?

h/t Truist Advisory Services

h/t Truist Advisory Services

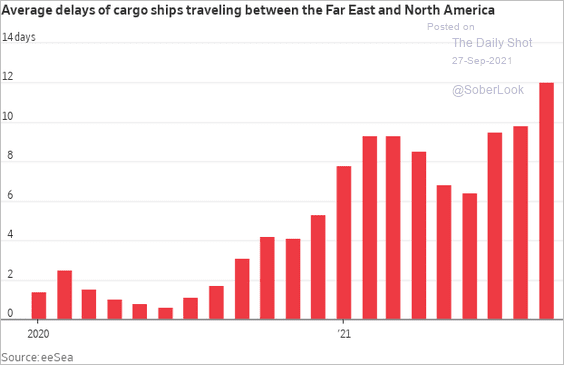

4. Cargo delays remain acute.

Source: @WSJ Read full article

Source: @WSJ Read full article

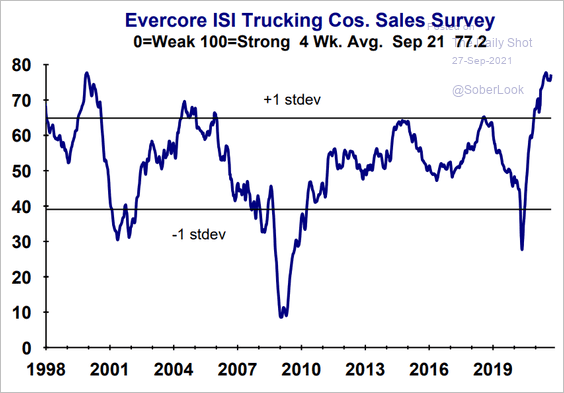

And trucking companies are doing well.

Source: Evercore ISI

Source: Evercore ISI

——————–

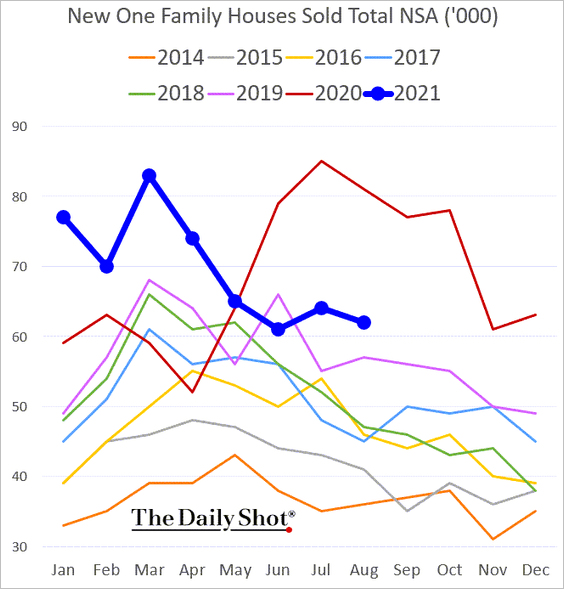

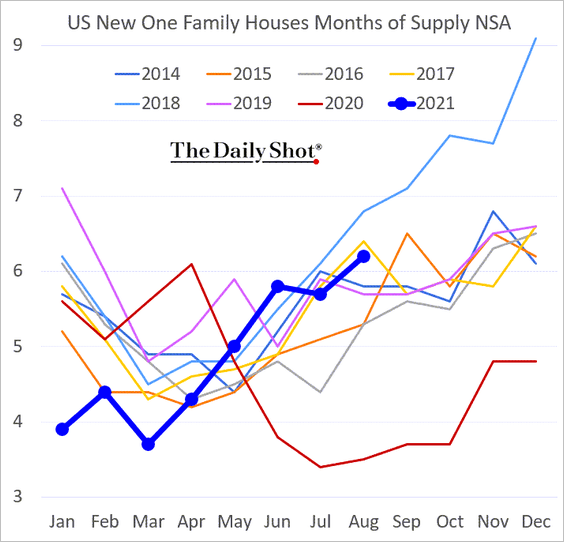

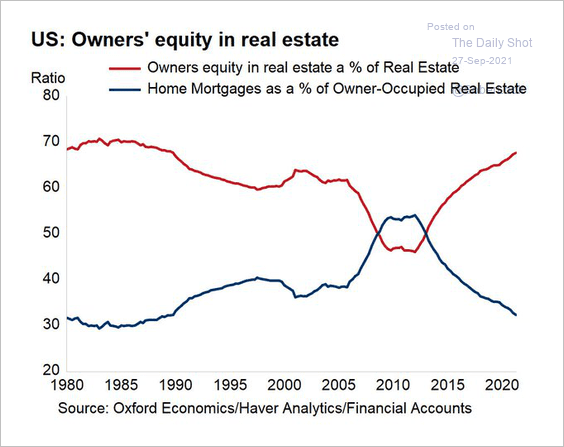

5. Next, we have some updates on housing.

• New home sales remain above 2019 levels.

Inventories have risen in line with seasonal patterns.

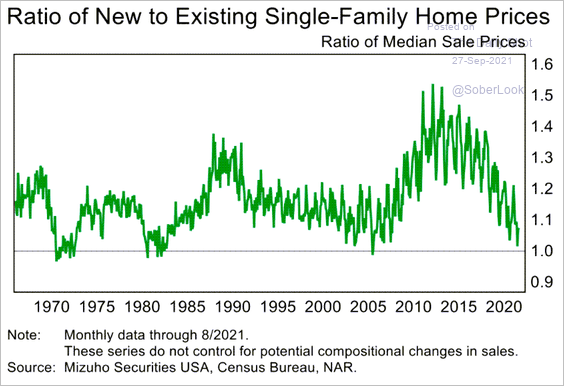

• The ratio of new to existing home prices remains near one.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

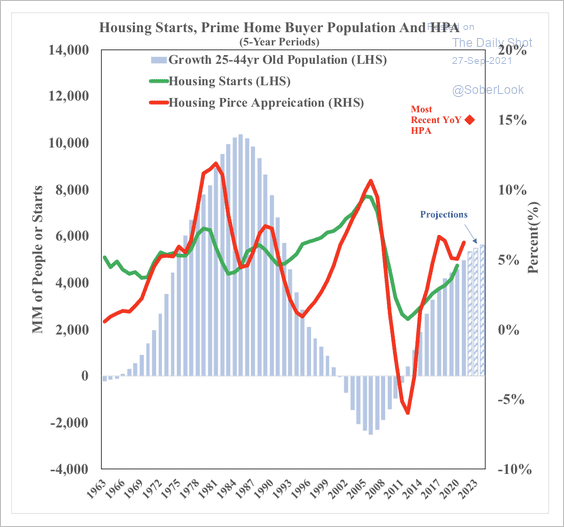

• Similar to the 1970s, demographics have increased housing demand.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

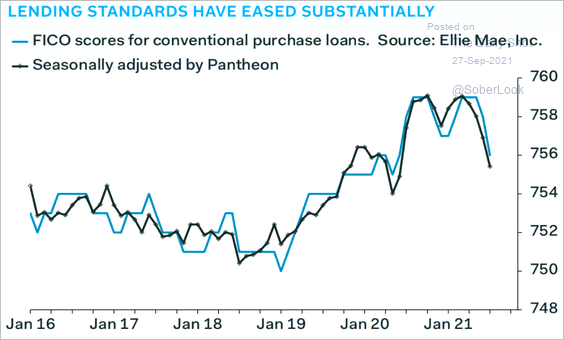

• Mortgage lending standards have been easing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Owners’ equity in real estate is at a multi-decade high.

Source: @GregDaco

Source: @GregDaco

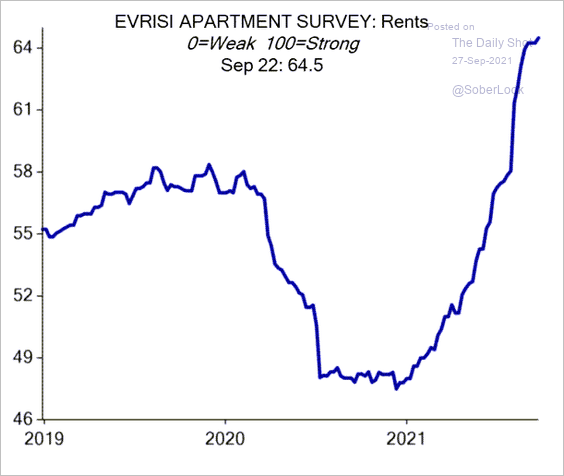

• More apartment owners report rent increases:

Source: Evercore ISI

Source: Evercore ISI

——————–

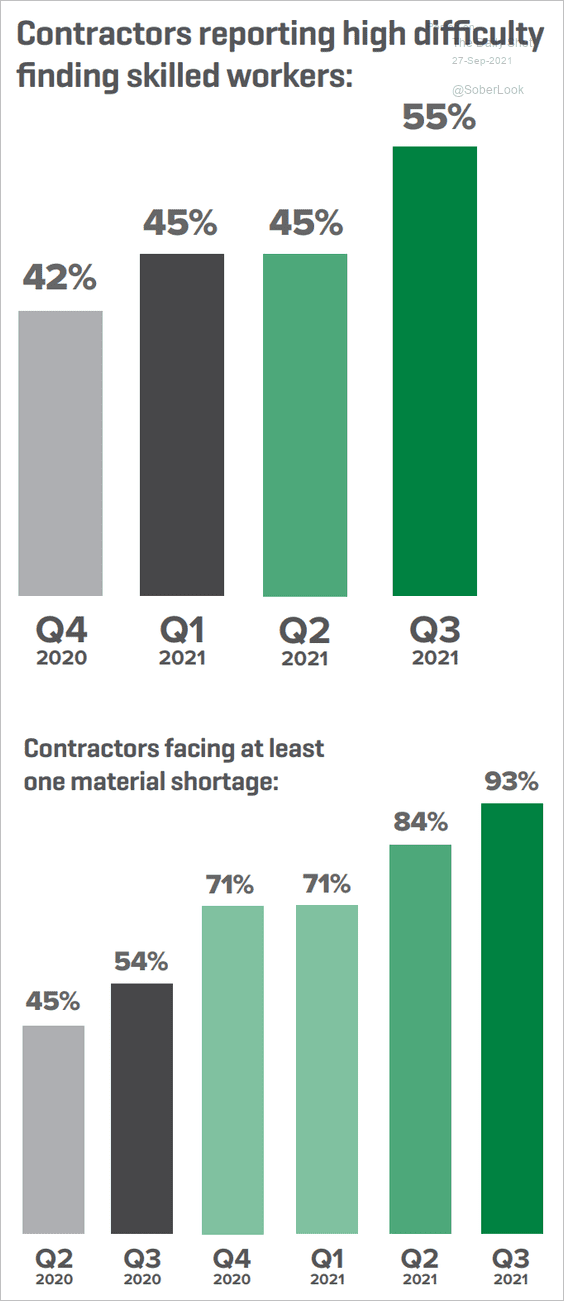

6. Commercial real estate construction firms increasingly face shortages of labor and supplies.

Source: US Chamber of Commerce Commercial Construction Index

Source: US Chamber of Commerce Commercial Construction Index

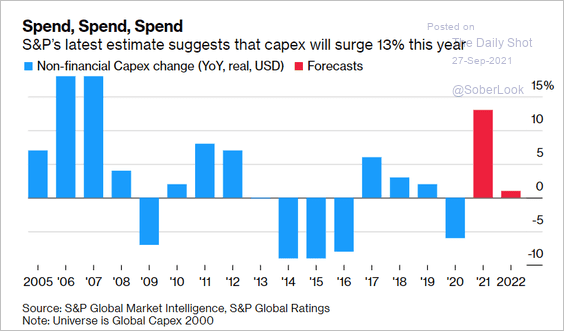

7. Estimates suggest that CapEx surged this year.

Source: @business Read full article

Source: @business Read full article

Global Developments

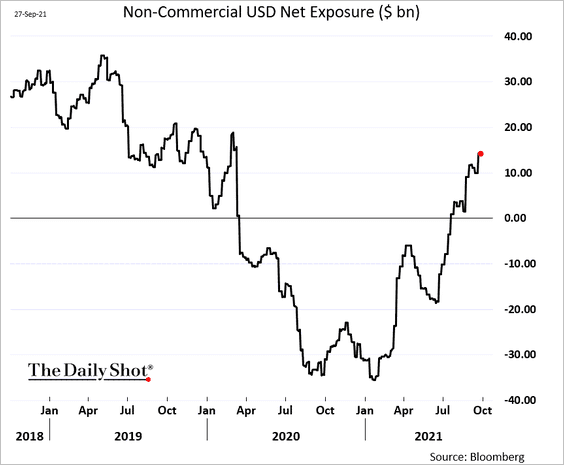

1. Speculative accounts continue to boost their exposure to the US dollar.

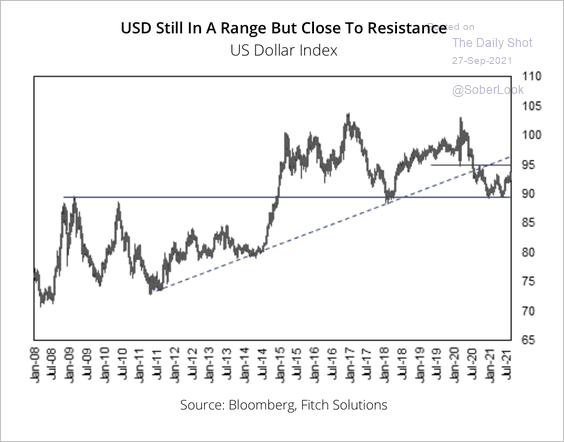

2. The dollar is still stuck in a range after breaking below a decade-long uptrend. Will resistance around 95 hold?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

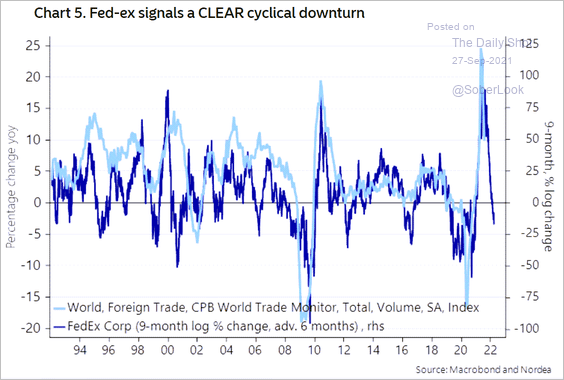

3. The FedEx selloff points to a downturn in global trade.

Source: Nordea Markets

Source: Nordea Markets

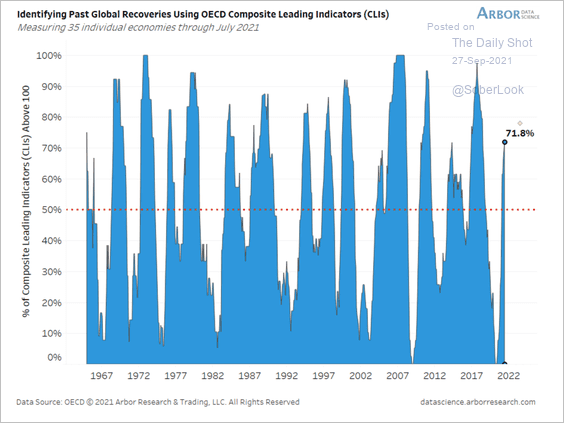

4. Roughly 70% of OECD countries are growing above trend.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

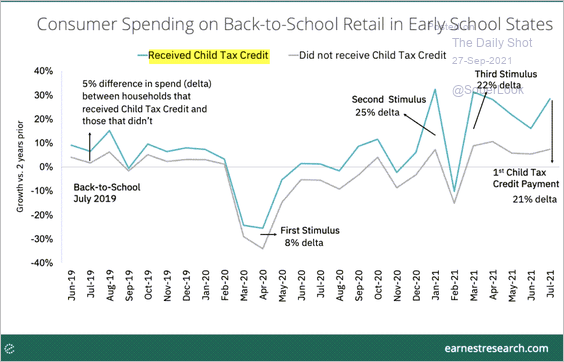

1. Back to school sales:

Source: Earnest Read full article

Source: Earnest Read full article

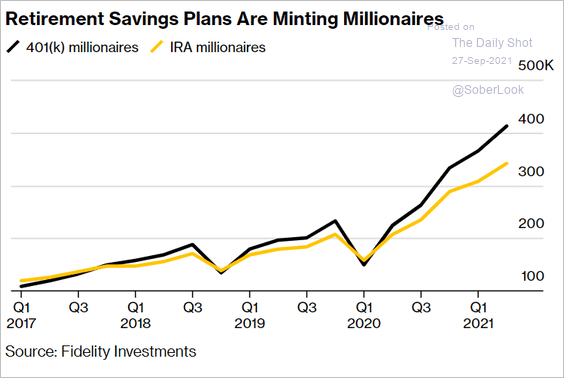

2. 401k and IRA accounts with $1 million or more:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

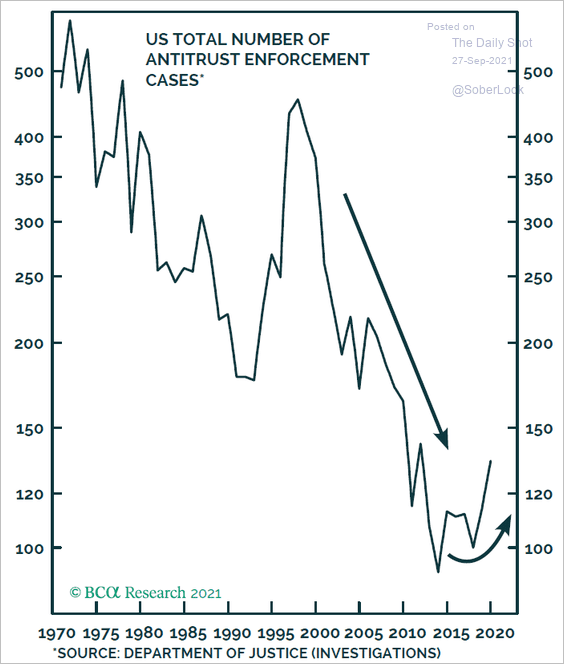

3. US antitrust enforcement:

Source: BCA Research

Source: BCA Research

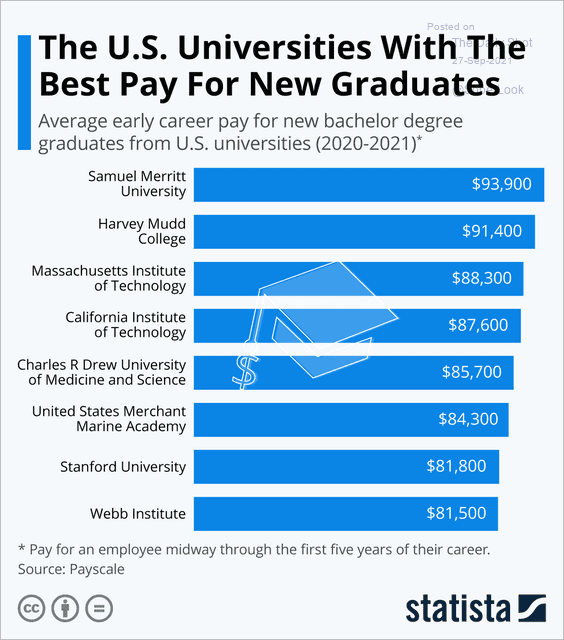

4. Universities with the best pay for new graduates:

Source: Statista

Source: Statista

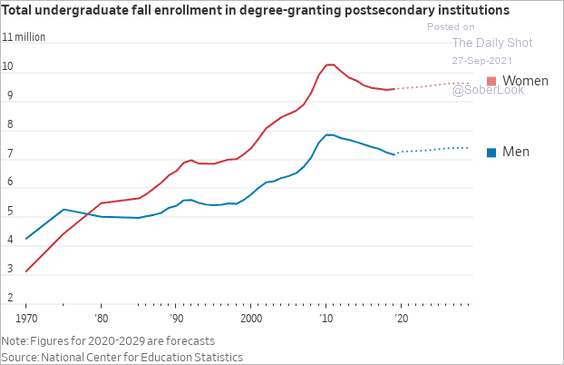

5. US undergraduate enrollment:

Source: @WSJ Read full article

Source: @WSJ Read full article

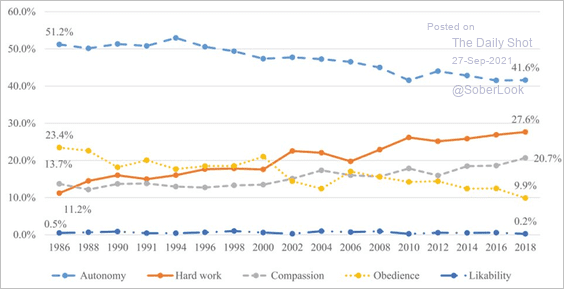

6. What values parents hope to instill in their children:

Source: @JonathanMijs, @Soc_Forum Read full article

Source: @JonathanMijs, @Soc_Forum Read full article

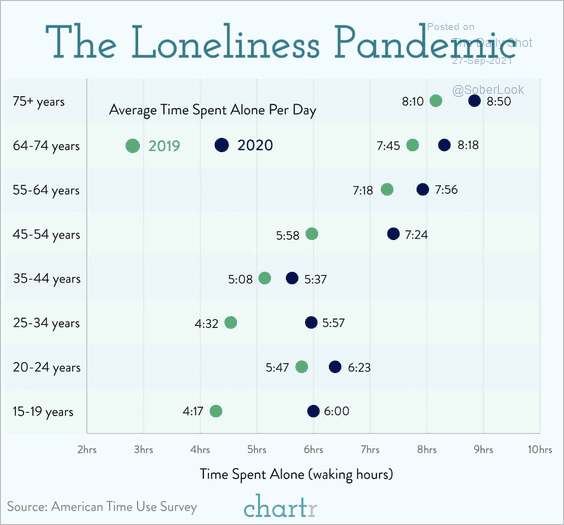

7. Time spent alone:

Source: @chartrdaily

Source: @chartrdaily

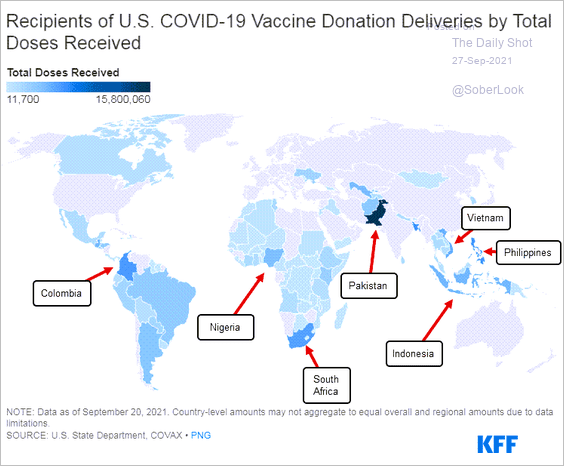

8. Recipients of US COIVD vaccine donations:

Source: KFF Read full article

Source: KFF Read full article

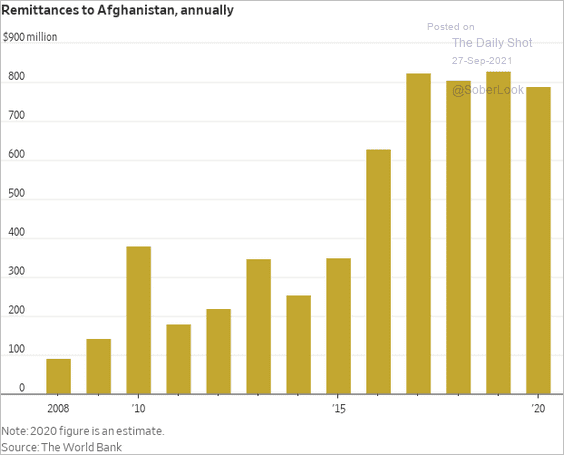

9. Remittances to Afghanistan:

Source: @WSJ Read full article

Source: @WSJ Read full article

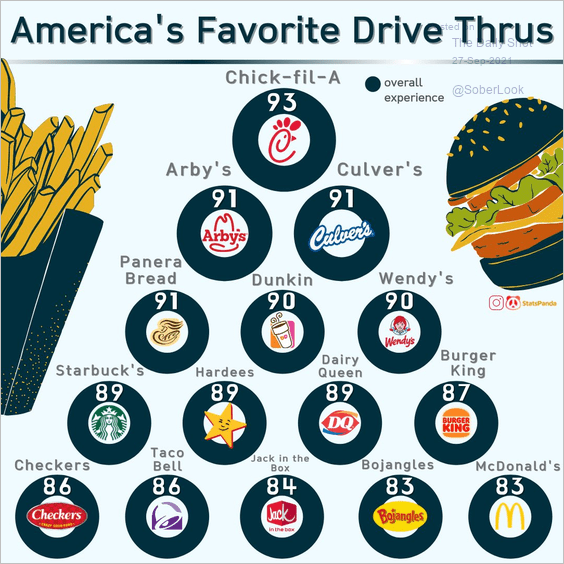

10. Drive-thru rankings:

Source: @statspanda1

Source: @statspanda1

——————–