The Daily Shot: 29-Sep-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

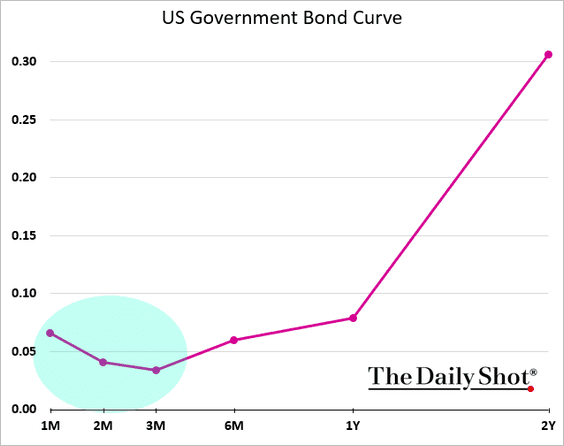

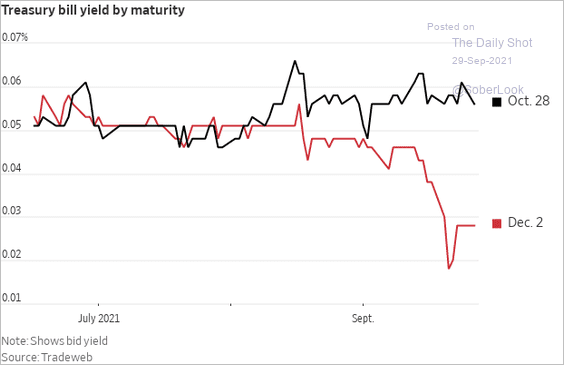

1. The risk of a technical default remains priced into the Treasury curve, which is inverted at the short end.

Bills maturing next month (the expected X-Date) are trading at a discount. Longer-dated bills are yielding less because the market expects the situation to be resolved by then.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

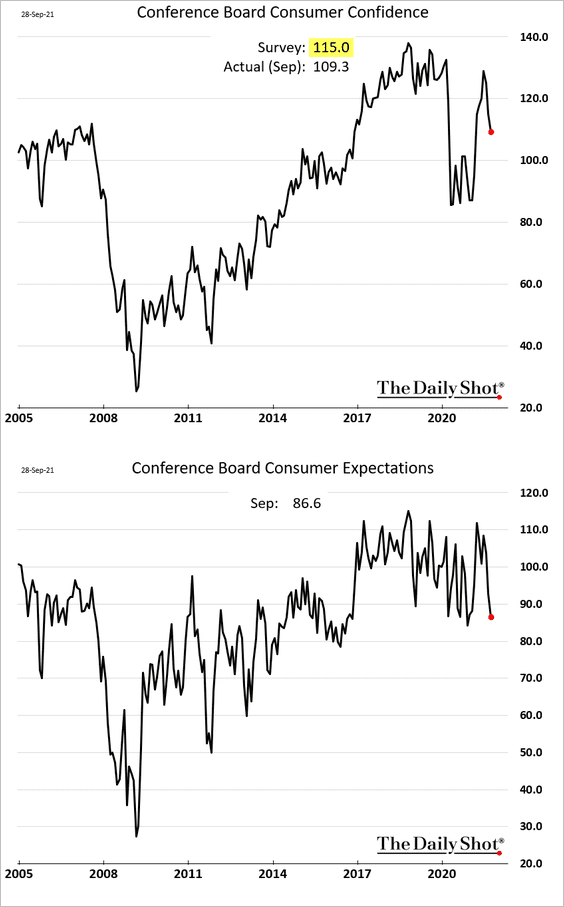

2. The Conference Board’s consumer confidence index surprised to the downside. Analysts blame it on the Delta variant – in which case we should see an improvement soon.

Source: Reuters Read full article

Source: Reuters Read full article

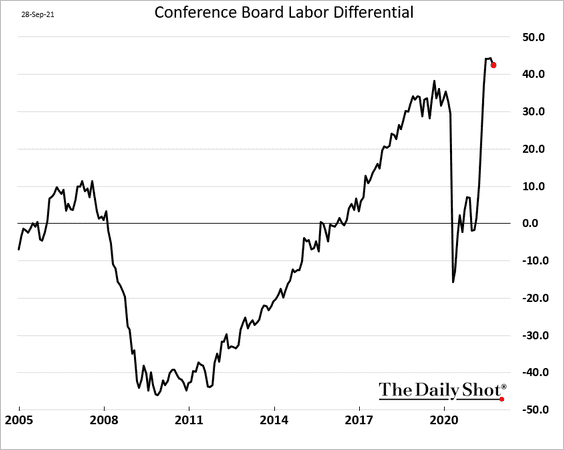

The labor differential (“jobs plentiful” – “jobs hard to get”) remains elevated, pointing to robust hiring activity.

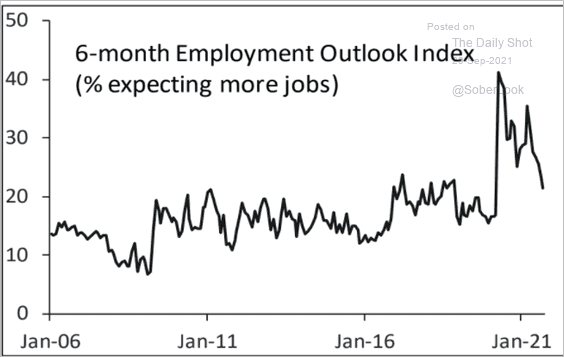

However, consumers are less certain about jobs going forward.

Source: Piper Sandler

Source: Piper Sandler

——————–

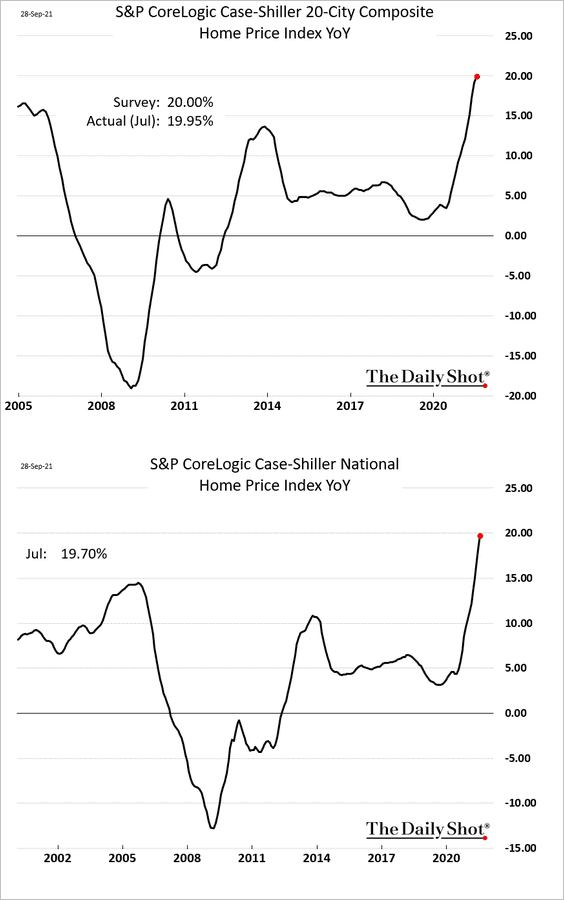

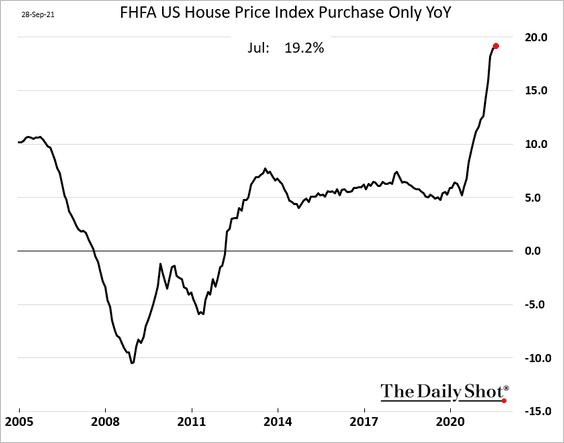

3. Home price appreciation approached 20% in July.

Here is the housing price index from FHFA.

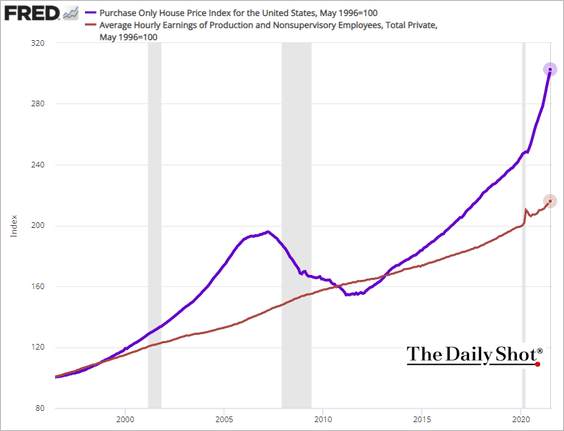

The divergence between home prices and wages is nearing extremes, making the housing market more vulnerable to higher mortgage rates.

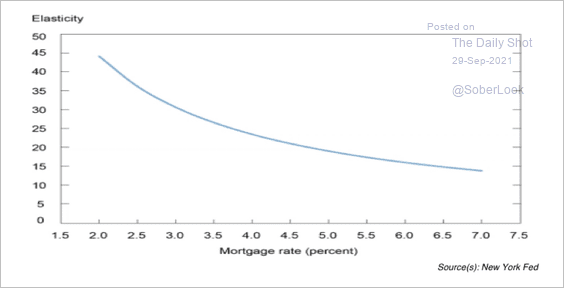

Moreover, housing prices are more sensitive to interest rate changes at lower rates.

Source: III Capital Management

Source: III Capital Management

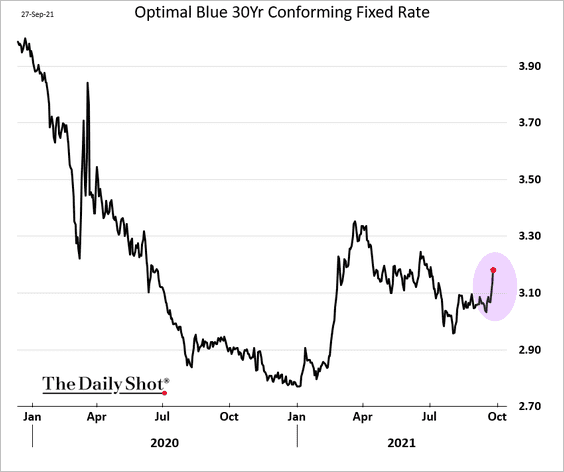

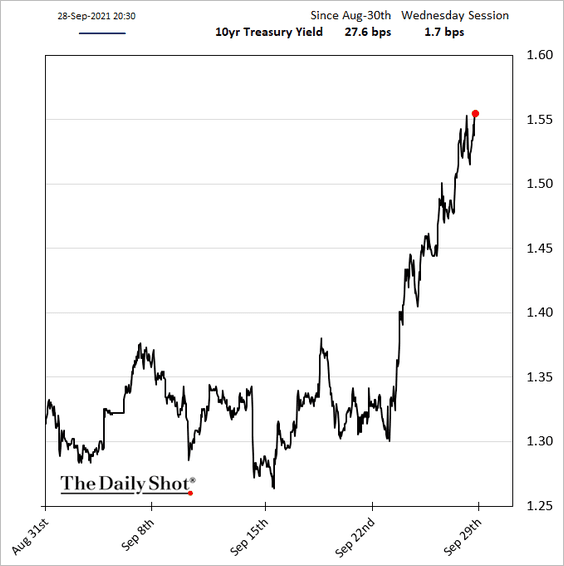

By the way, mortgage rates increased this week as Treasury yields climbed.

——————–

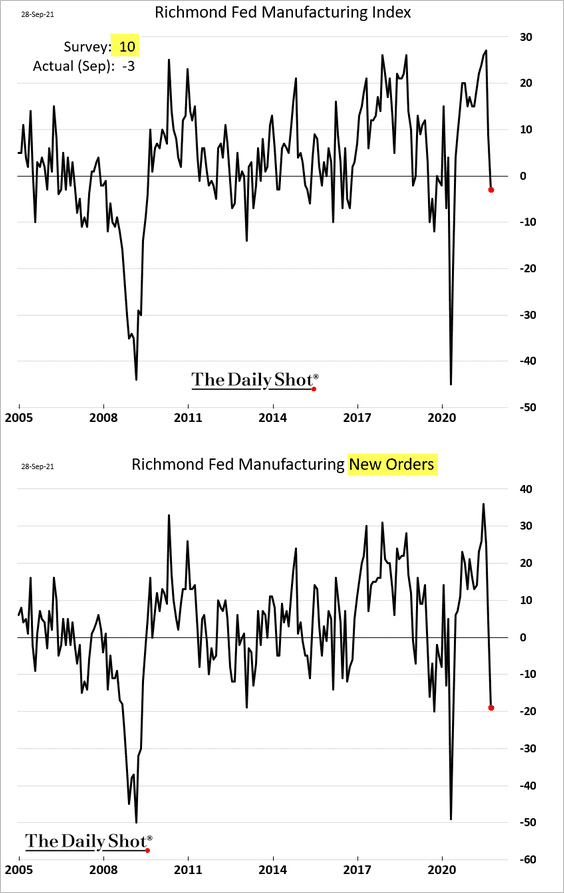

4. The Richmond Fed’s manufacturing index slumped this month.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

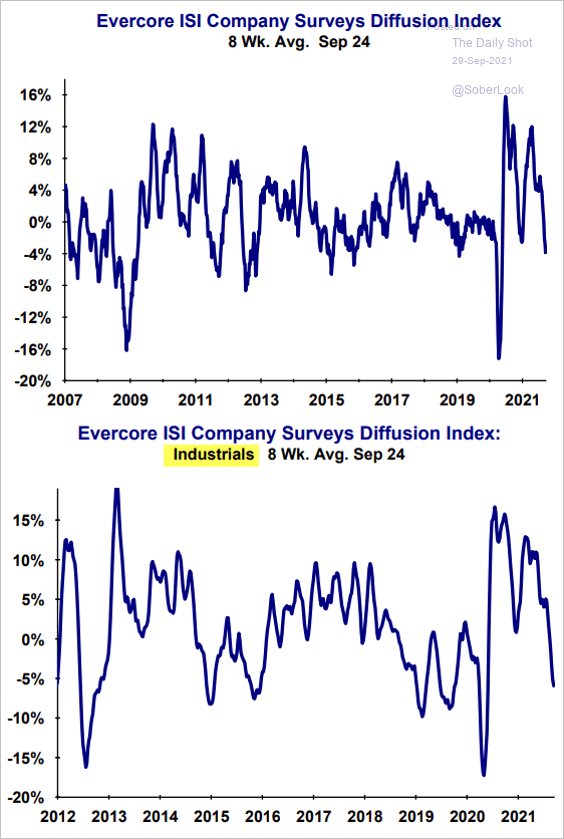

Related to the trend above, the Evercore ISI business survey diffusion index shows softening activity for industrial firms.

Source: Evercore ISI

Source: Evercore ISI

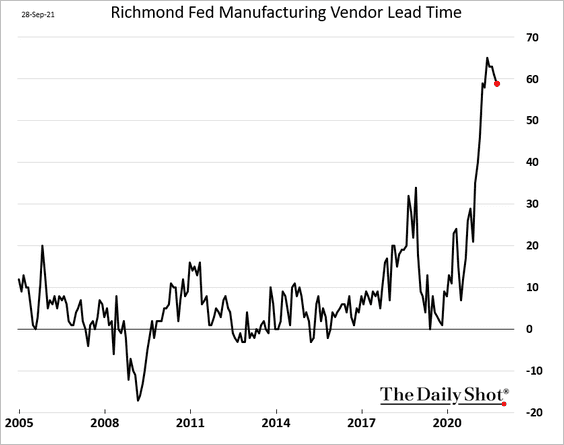

Supply bottlenecks remain extreme, but the index of vendor lead times appears to have peaked.

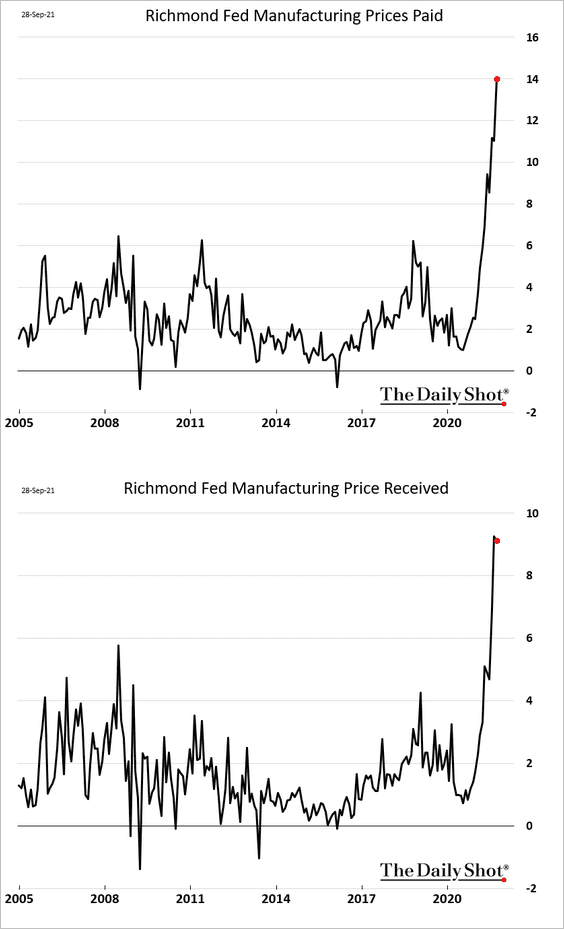

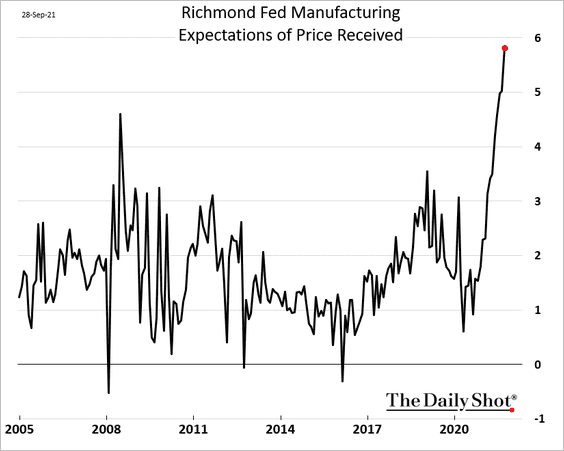

Price pressures have been getting worse.

And factories expect to keep hiking prices in the months ahead.

——————–

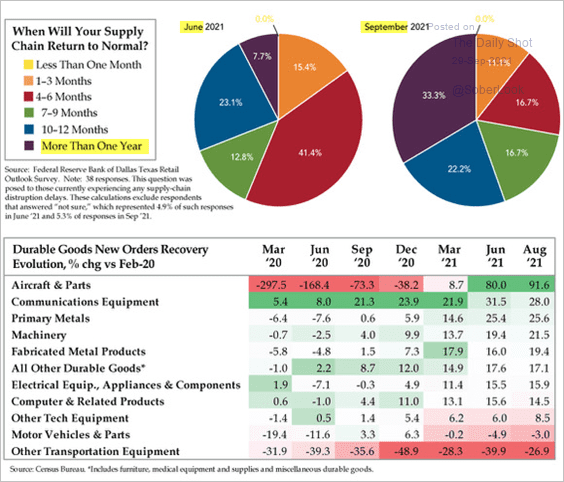

5. Companies now see supply chain issues as persisting for some time.

Source: The Daily Feather

Source: The Daily Feather

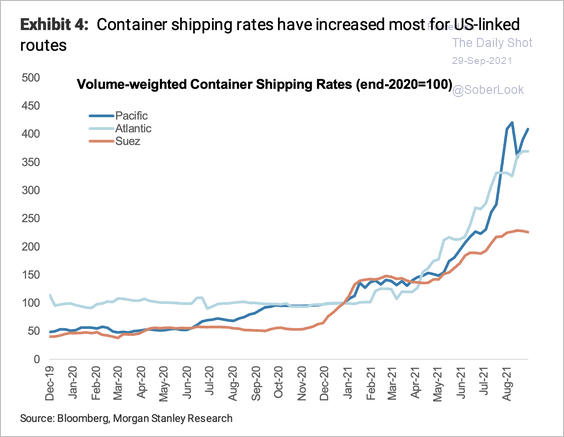

Shipping to the US has experienced far higher rates than other routes.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

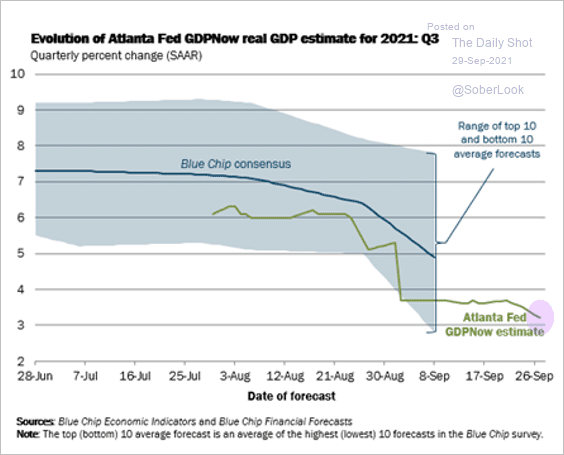

6. The Atlanta Fed’s GDPNow model forecast for Q3 GDP growth continues to move lower.

Source: Atlanta Fed

Source: Atlanta Fed

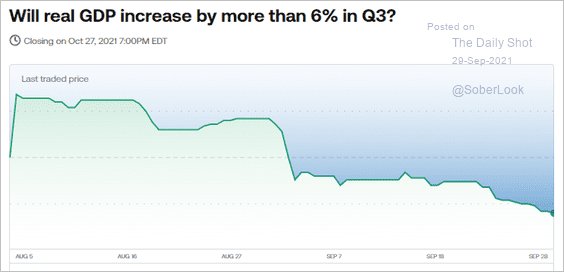

We also see this trend in the betting markets.

Source: Kalshi

Source: Kalshi

——————–

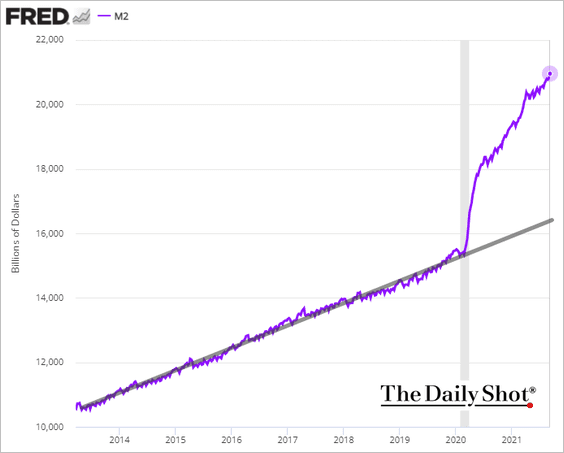

7. The M2 money supply shows plenty of “excess” liquidity in the economy (about $4.5 trillion above the pre-COVID trend).

Back to Index

Canada

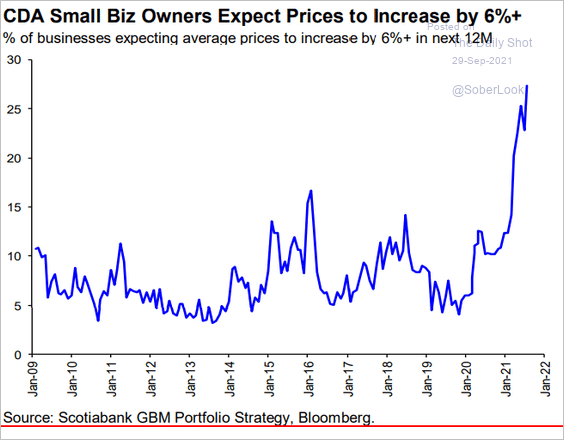

1. Increasingly, small businesses expect to boost prices by 6% or more.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

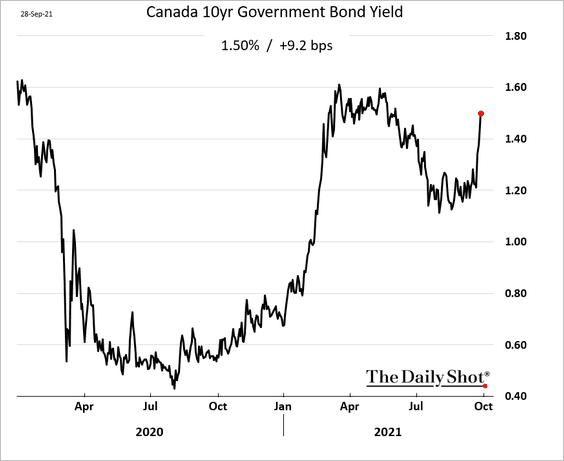

2. Bond yields have been climbing.

Back to Index

The United Kingdom

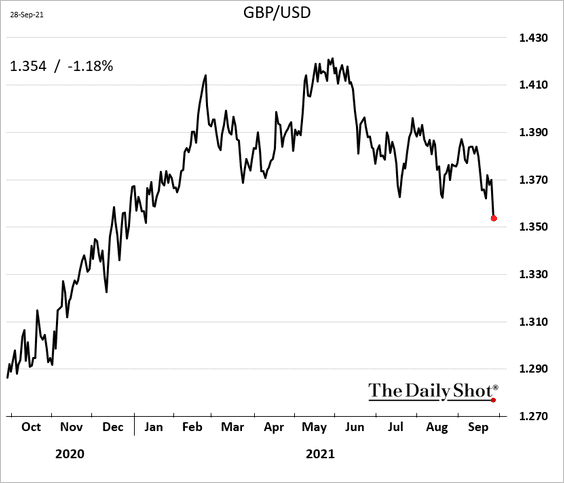

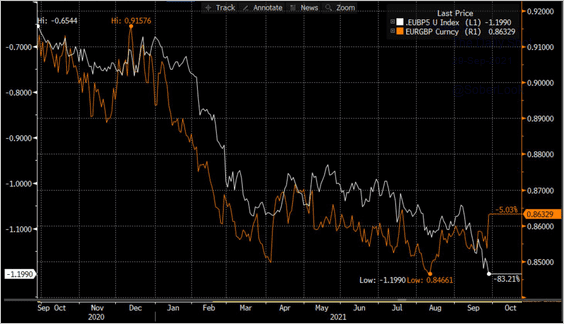

1. The pound sold off on Tuesday.

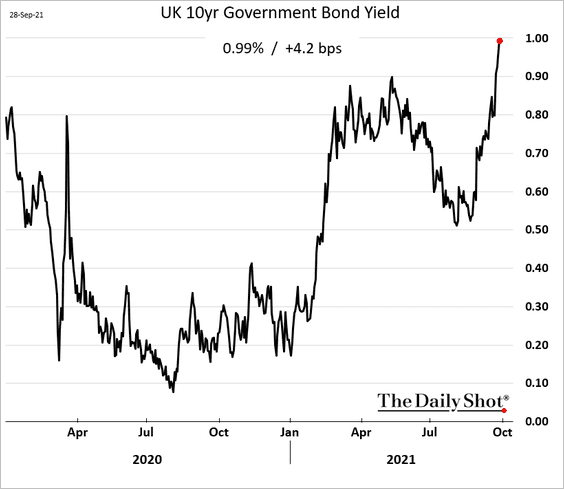

• Gilt yields keep moving higher.

Will higher rate differentials with the Eurozone (white line) put downward pressure on EUR/GBP?

Source: @jnordvig

Source: @jnordvig

——————–

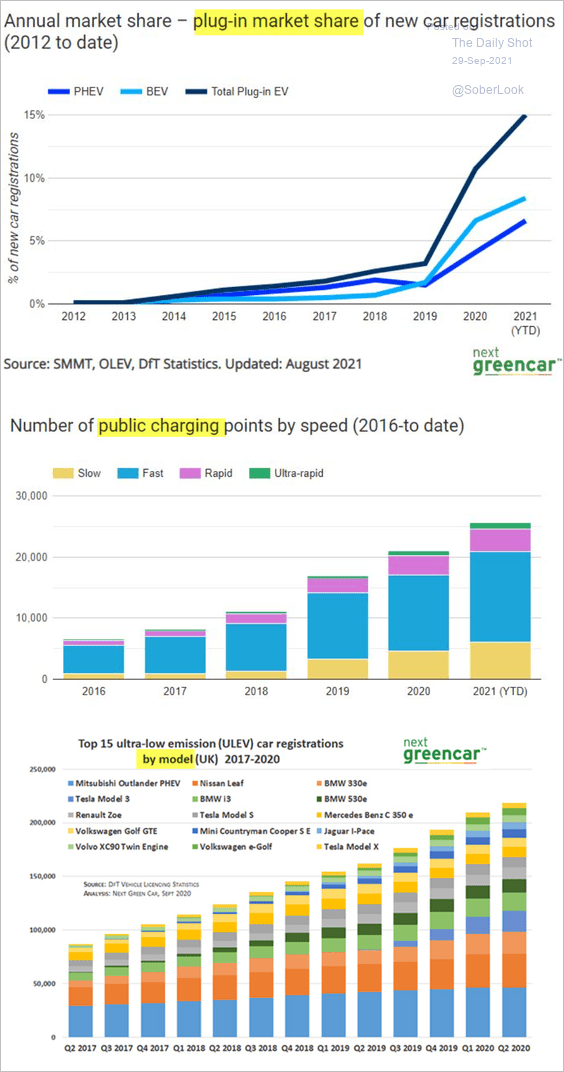

2. Next, we have some EV trends in the UK.

Source: Next Green Car Read full article

Source: Next Green Car Read full article

Back to Index

The Eurozone

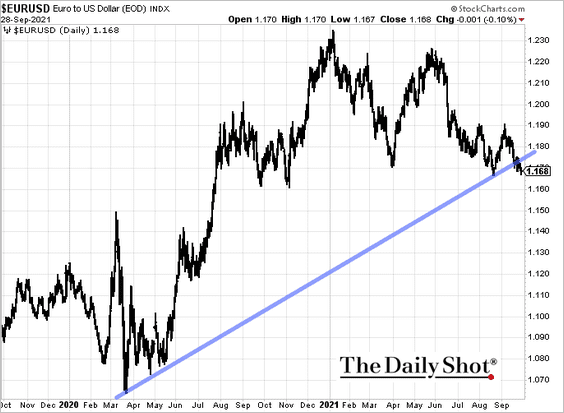

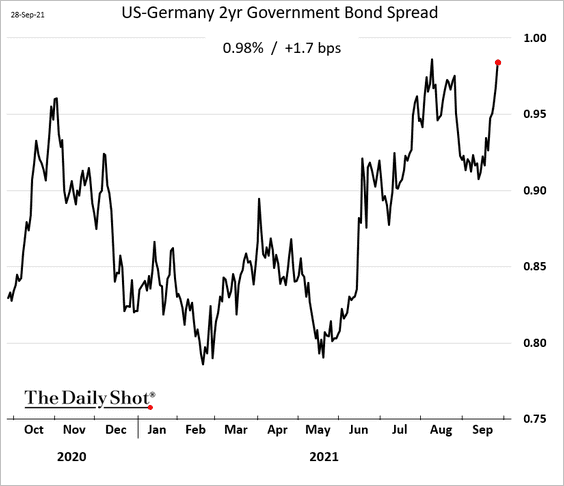

1. The euro is trading near 2021 lows.

The rate differentials with the US are a drag on the euro.

——————–

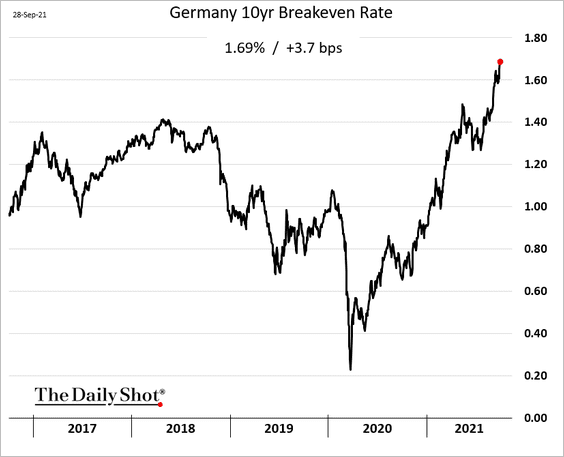

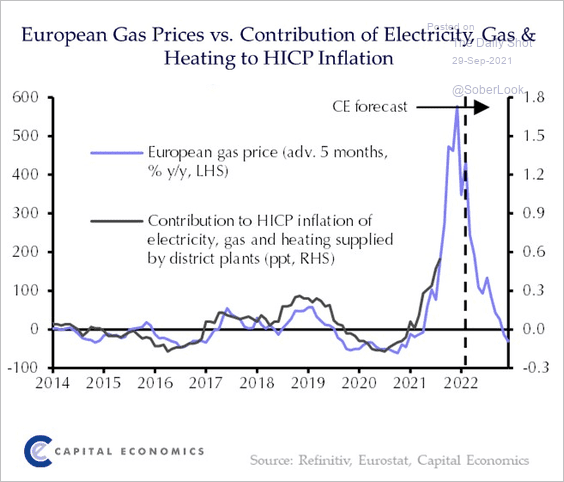

2. Euro-area market-based inflation expectations continue to climb.

Capital Economics expects surging natural gas prices to bring the headline CPI to 4% this year.

Source: @CapEconEurope Read full article

Source: @CapEconEurope Read full article

——————–

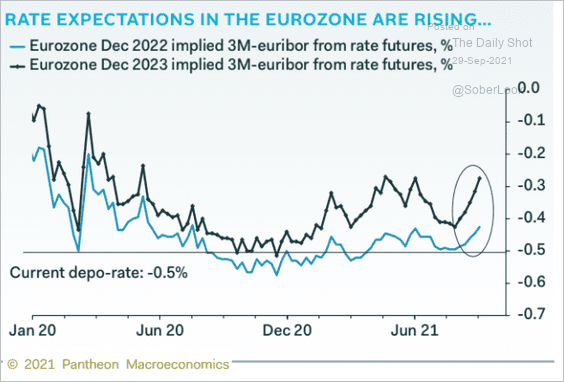

3. Short-term rates implied by the futures market have been moving higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

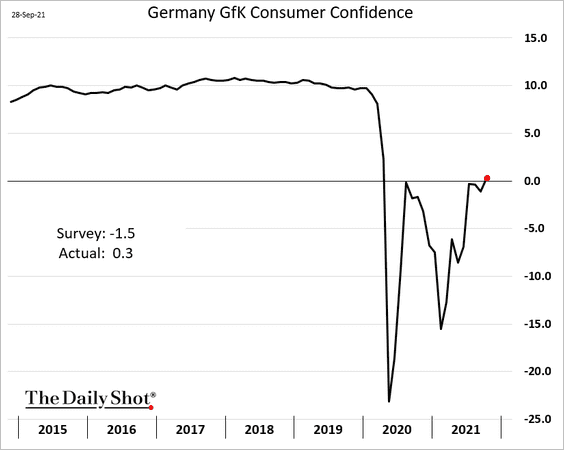

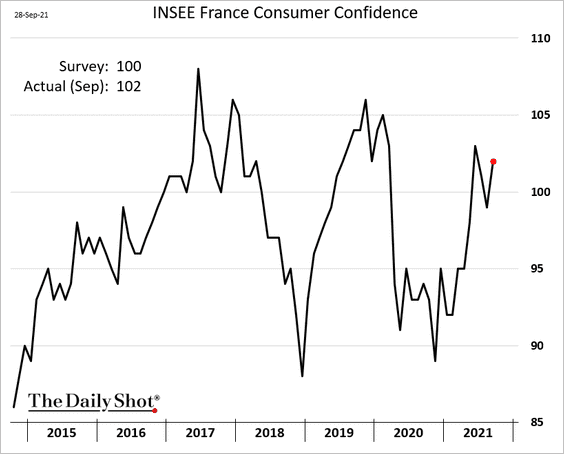

4. Consumer confidence improved this month.

• Germany:

• France:

——————–

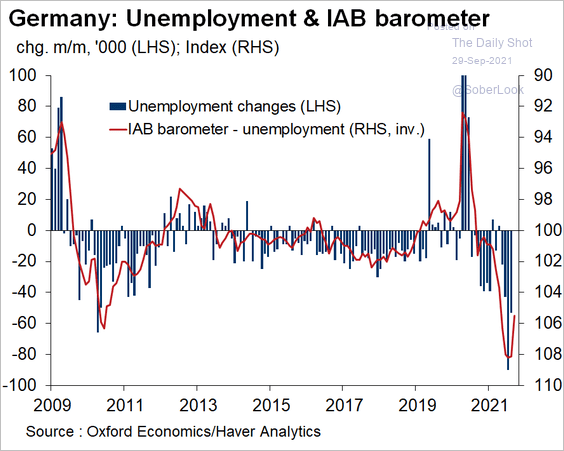

5. Germany’s labor market continues to strengthen (chart shows falling unemployment).

Source: @OliverRakau

Source: @OliverRakau

Back to Index

Europe

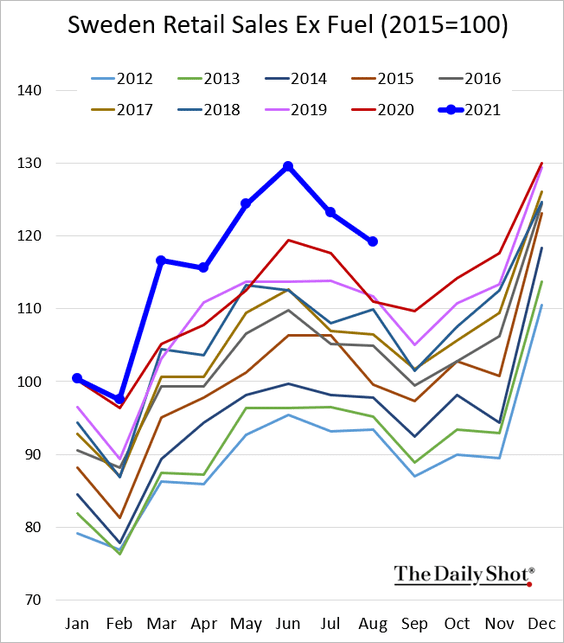

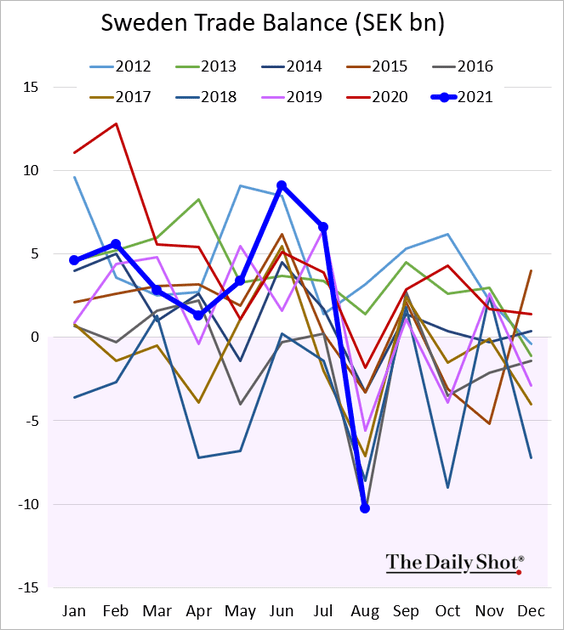

1. Sweden’s retail sales remain strong.

The trade deficit was worse than expected last month due to supply-chain issues.

——————–

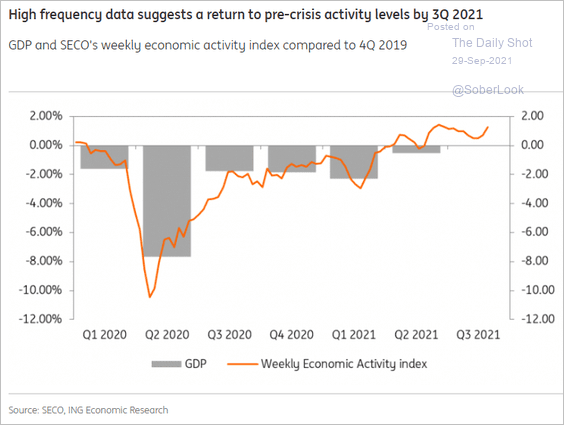

2. Swiss economic activity continues to show improvement.

Source: ING

Source: ING

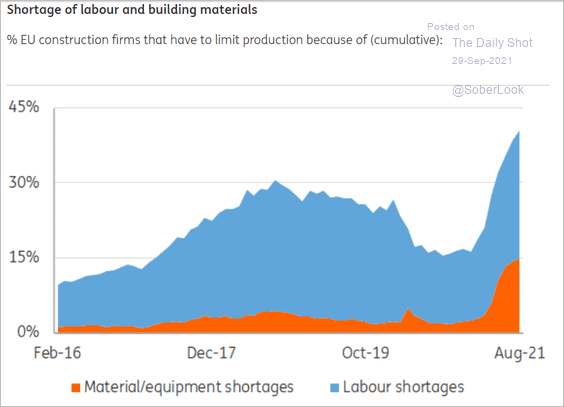

3. EU construction firms are increasingly facing material/equipment and labor shortages.

Source: ING

Source: ING

Back to Index

China

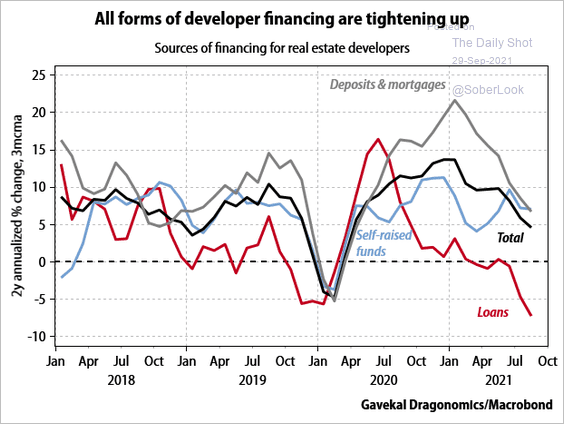

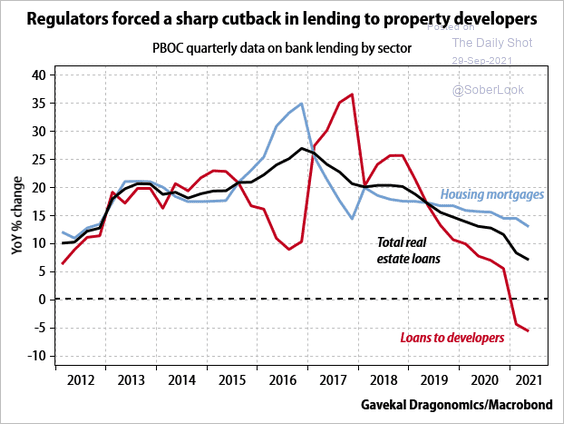

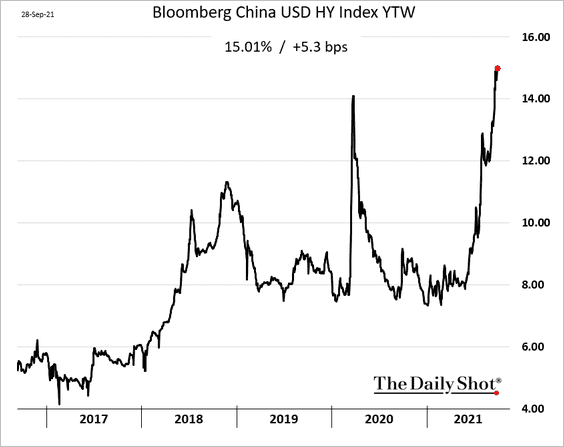

1. Financing for developers has been tightening (2 charts).

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

And costs of bond financing for leveraged companies keep climbing.

——————–

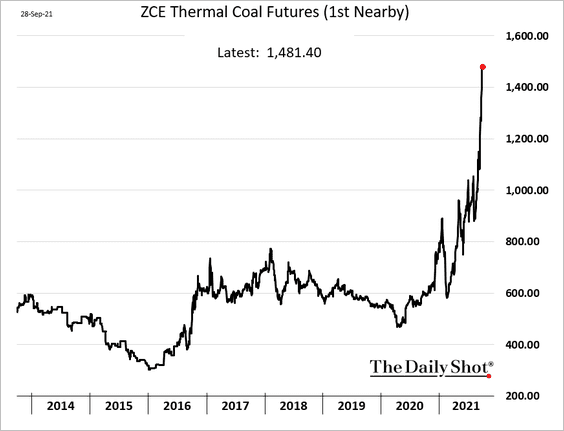

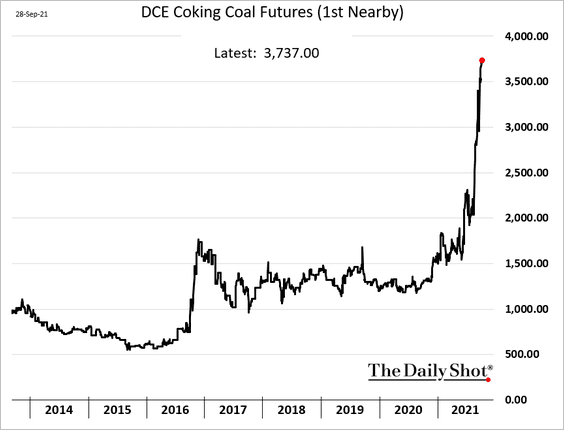

2. Coal prices continue to surge, which will put pressure on industrial activity.

——————–

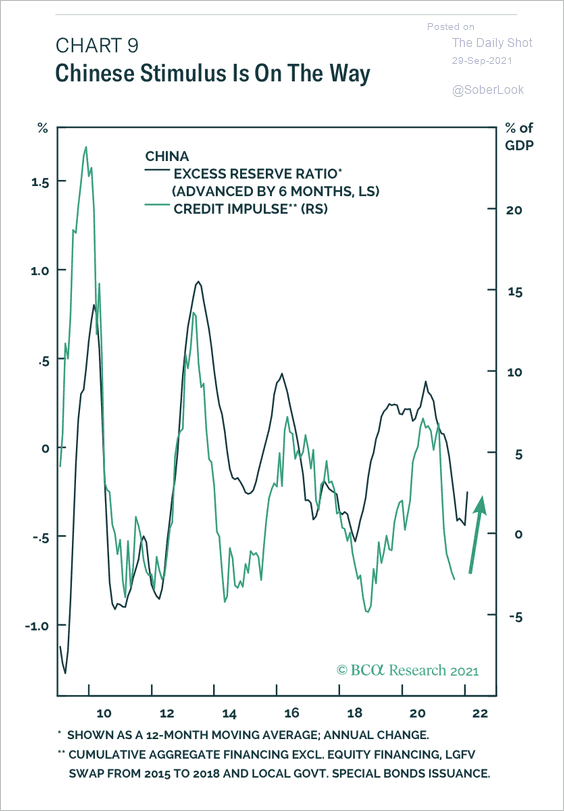

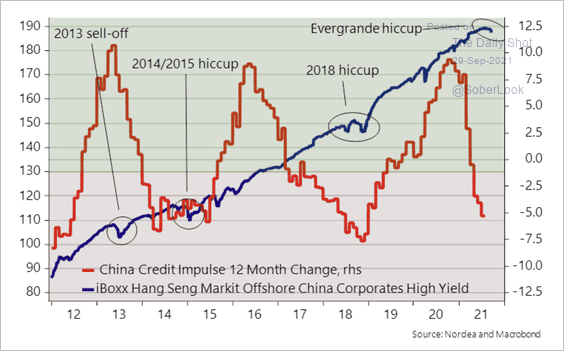

3. Historically, cuts in the reserve requirement have preceded credit growth.

Source: BCA Research

Source: BCA Research

There has been a downturn in China every 36 months, and usually authorities step in to boost liquidity.

Source: Nordea Markets

Source: Nordea Markets

——————–

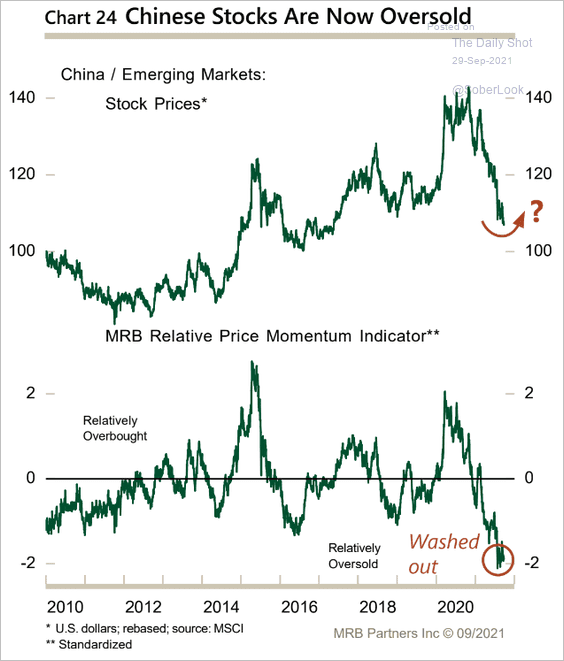

4. Are China’s stocks oversold?

Source: MRB Partners

Source: MRB Partners

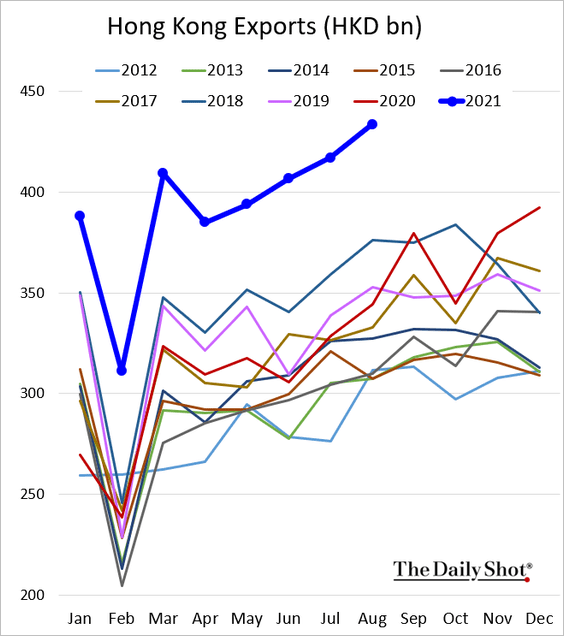

5. Hong Kong’s exports hit a record high.

Back to Index

Emerging Markets

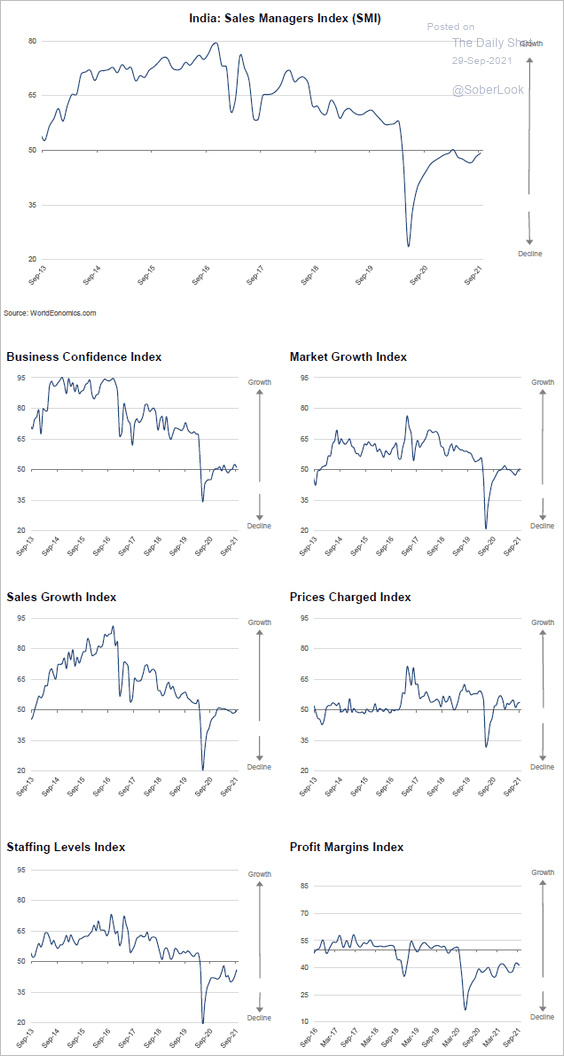

1. The World Economics SMI shows the COVID-driven recession in India’s business activity easing this month.

Source: World Economics

Source: World Economics

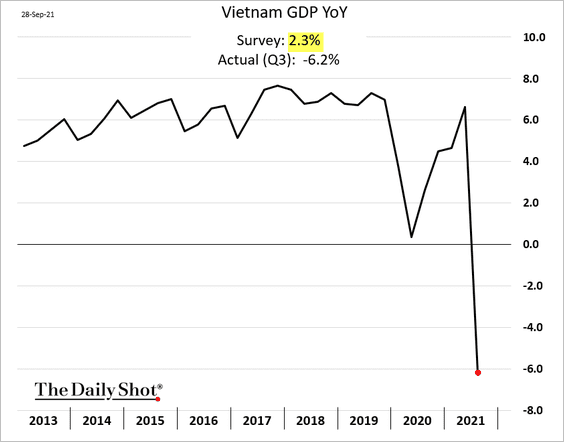

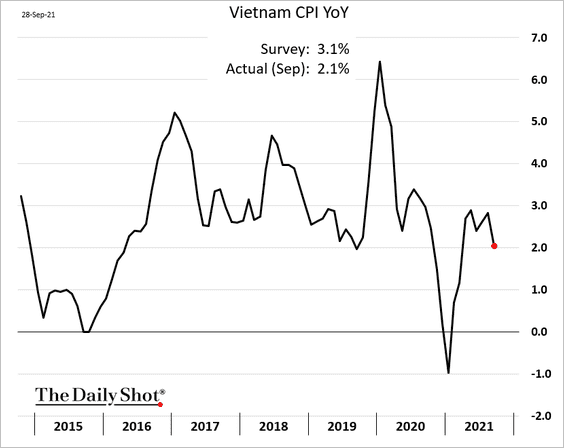

3. Vietnam’s GDP unexpectedly plummetted in Q3, as the pandemic took its toll.

Inflation moderated this month.

——————–

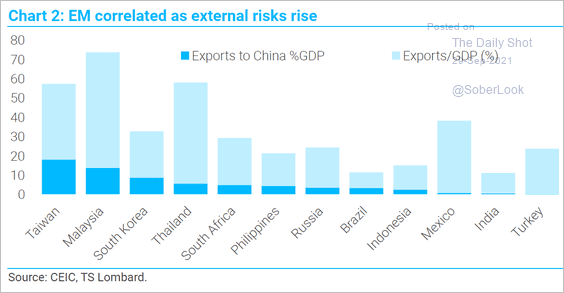

4. Which countries are most vulnerable to a slowdown in China?

Source: TS Lombard

Source: TS Lombard

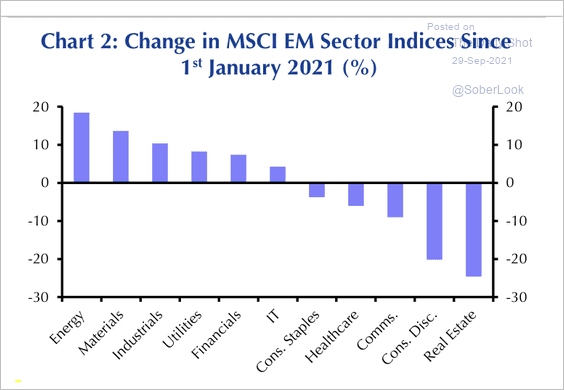

5. EM energy and material stocks performed well this year, while real estate and consumer stocks lagged.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

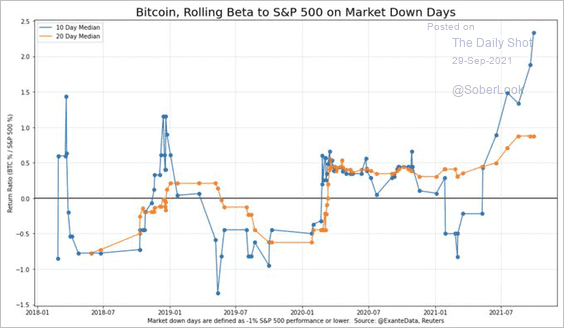

1. Bitcoin’s beta to the S&P 500 has been rising.

Source: @ExanteData

Source: @ExanteData

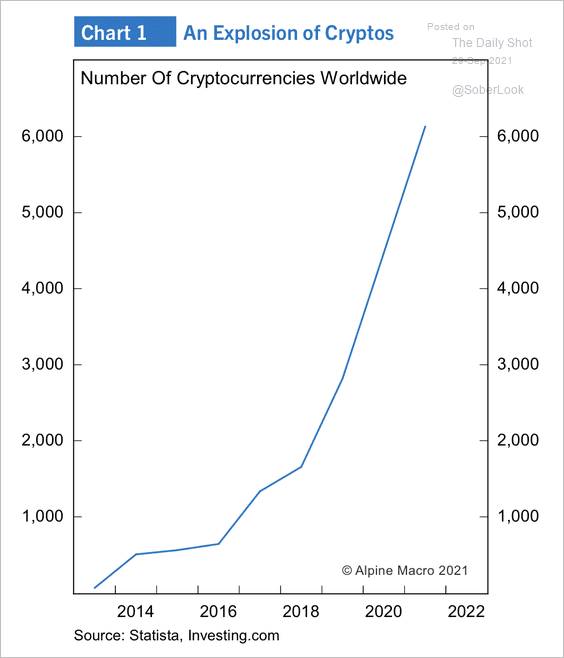

2. There are roughly 6,000 cryptos worldwide.

Source: Alpine Macro

Source: Alpine Macro

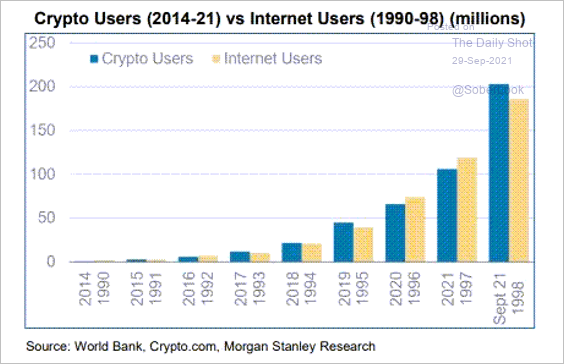

3. This chart compares crypto user growth to internet users in the 1990s.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Energy

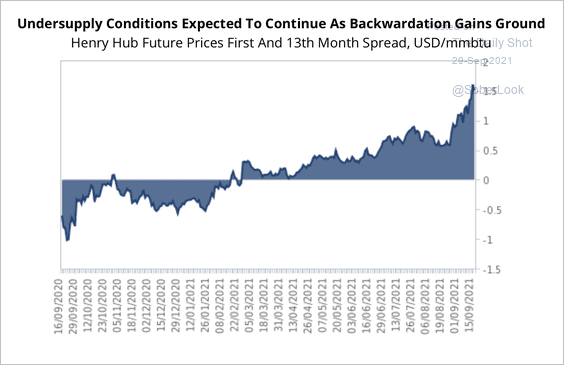

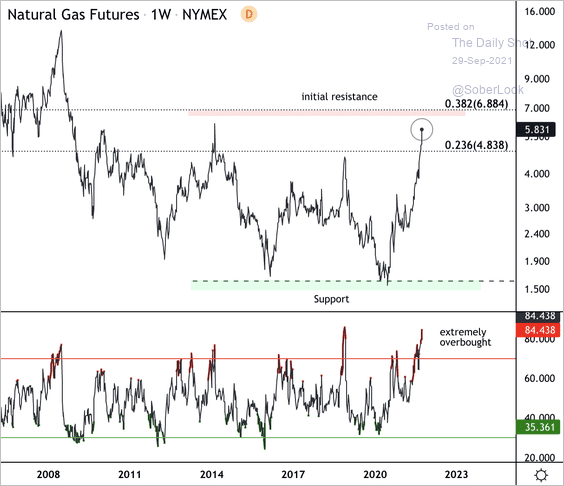

1. Futures prices for Henry Hub natural gas indicate continued undersupply expectations for the next year. Will producers respond to elevated prices?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

The front-month natural gas futures contract is extremely overbought near resistance.

Source: Dantes Outlook

Source: Dantes Outlook

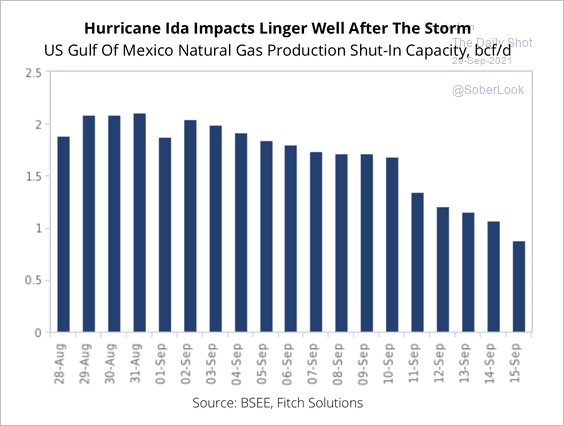

2. US natural gas production in the Gulf remains shut-in after Hurricane Ida. Fitch expects the bulk of output to be restored by the end of the month. However, if outages in upstream output continue, we could see more upside pressure on prices.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

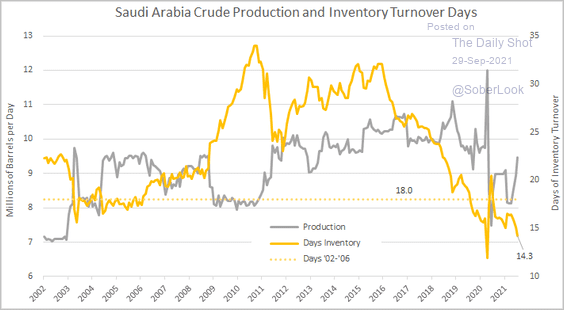

3. Saudi oil inventories are nearing multi-year lows.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Back to Index

Equities

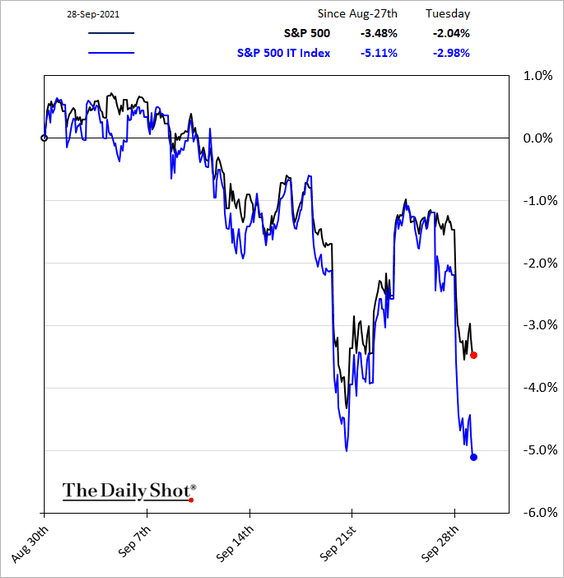

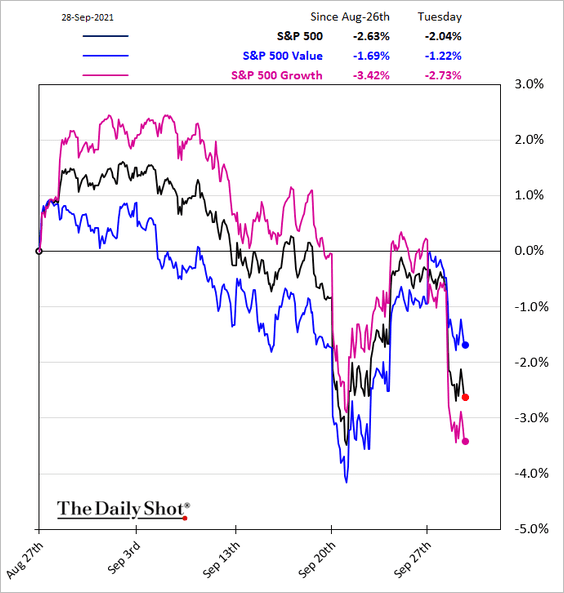

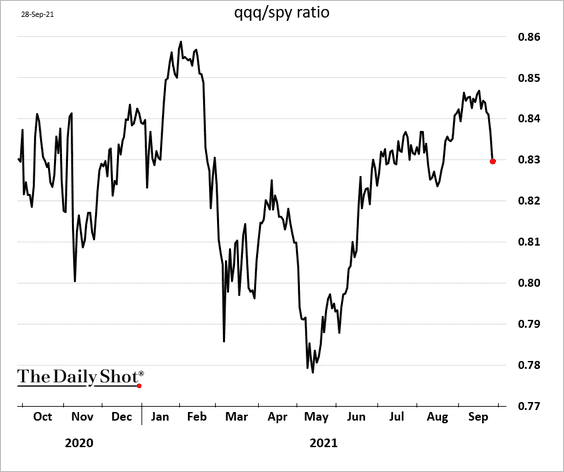

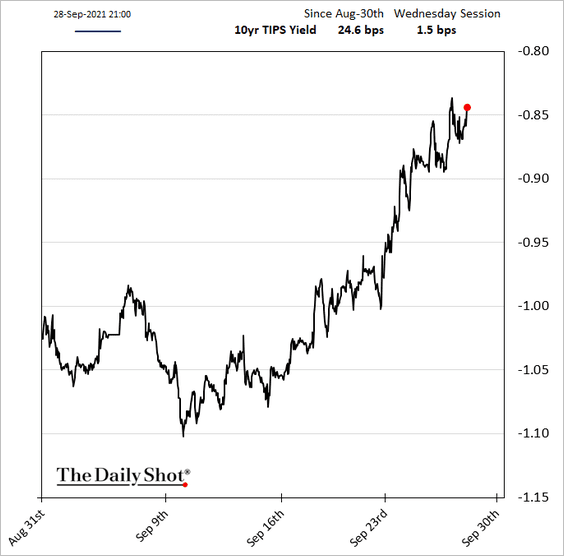

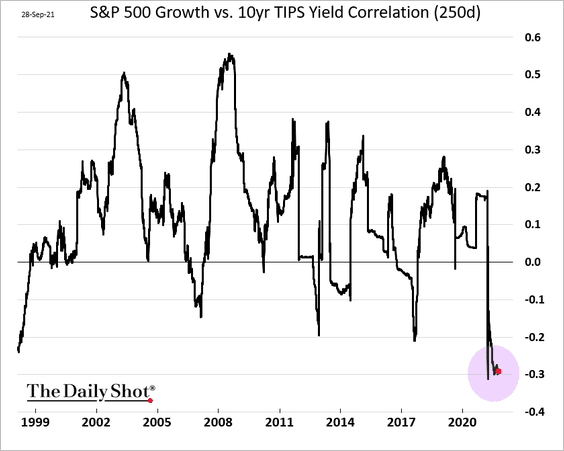

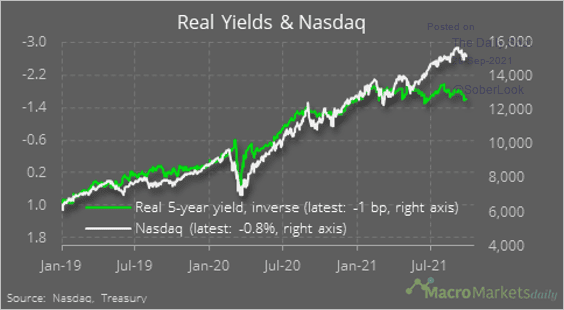

1. Rising bond yields …

… pressured stocks on Tuesday, with growth stocks underperforming (3 charts).

• Growth shares are particularly vulnerable to real rates (TIPS yields).

• More pain ahead?

Source: @macro_daily

Source: @macro_daily

——————–

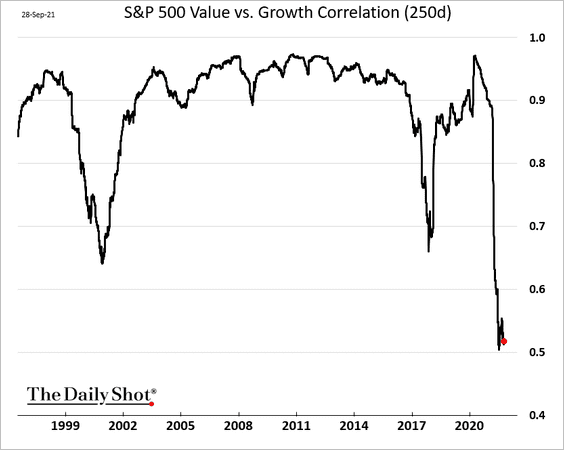

2. The correlation between growth and value stocks remains near multi-year lows.

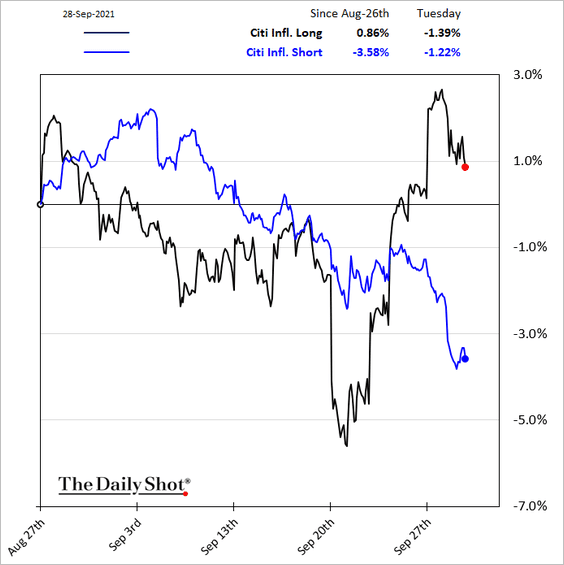

3. Stocks that respond positively to higher inflation have been outperforming.

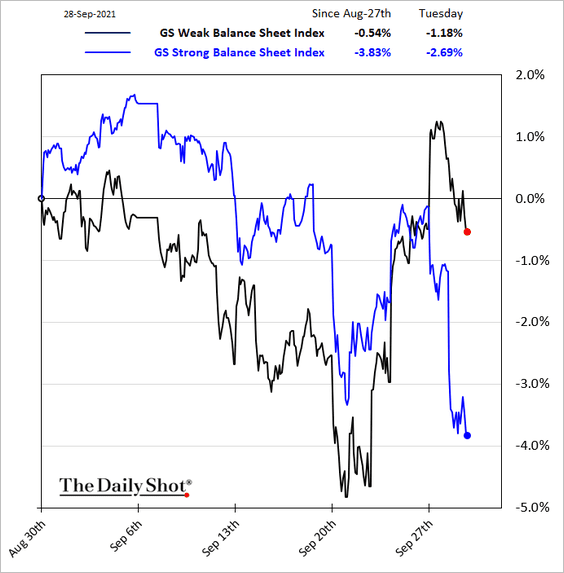

Related to the above, companies with weak balance sheets also outperformed.

——————–

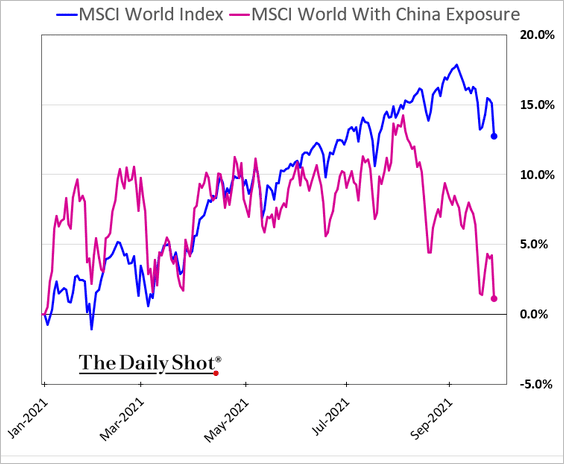

4. Companies with substantial sales in China continue to struggle.

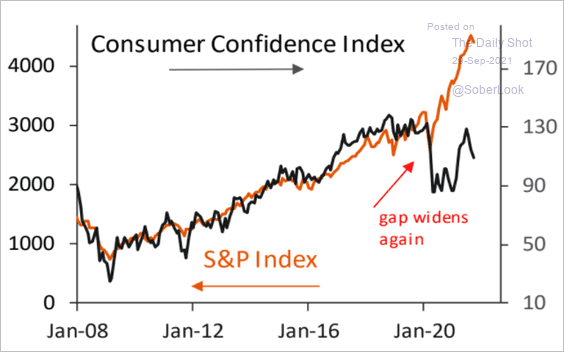

5. Stock prices have diverged from consumer confidence.

Source: Piper Sandler

Source: Piper Sandler

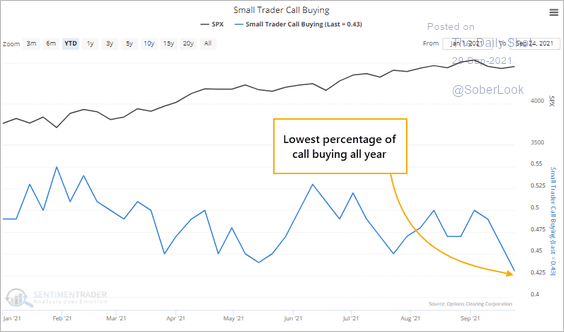

6. Last week, only 43% of small option trader volume was attributed to speculative call positions. That’s the lowest concentration of outright bullish bets so far this year.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Rates

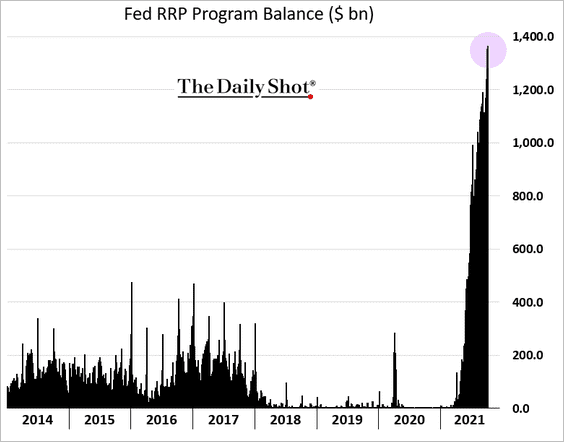

1. The Fed’s RRP facility balance hit a record high as the US Treasury’s withdrawal of cash from the Fed floods the market with liquidity.

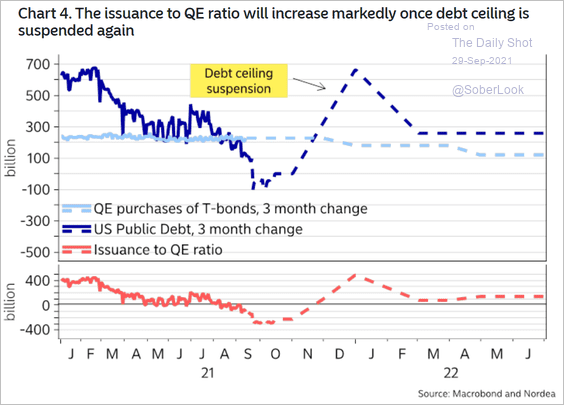

2. The ratio of the US Treasury’s debt issuance vs. the Fed’s QE purchases (red line) will rebound after the debt ceiling is lifted.

Source: Nordea Markets

Source: Nordea Markets

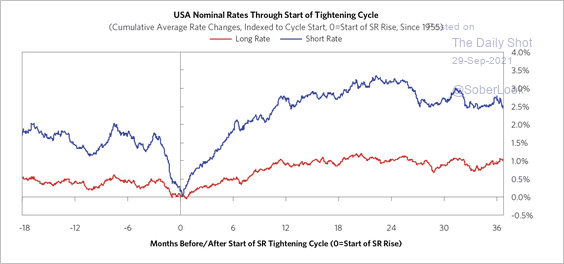

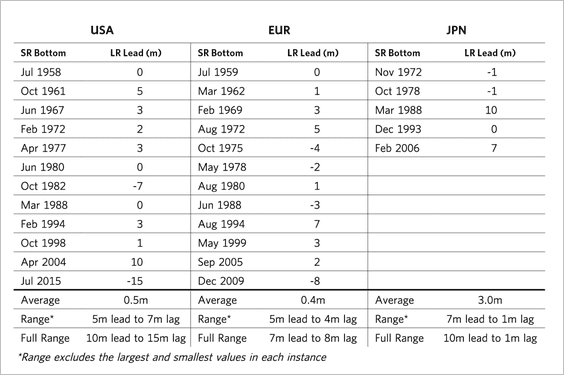

3. On average, bond yields led the move in short-term rates by less than a month.

Source: Bridgewater Associates Read full article

Source: Bridgewater Associates Read full article

In fact, the bond market has hardly ever led a rise in short-term rates by more than a few months (negative numbers indicate a lag).

Source: Bridgewater Associates Read full article

Source: Bridgewater Associates Read full article

——————–

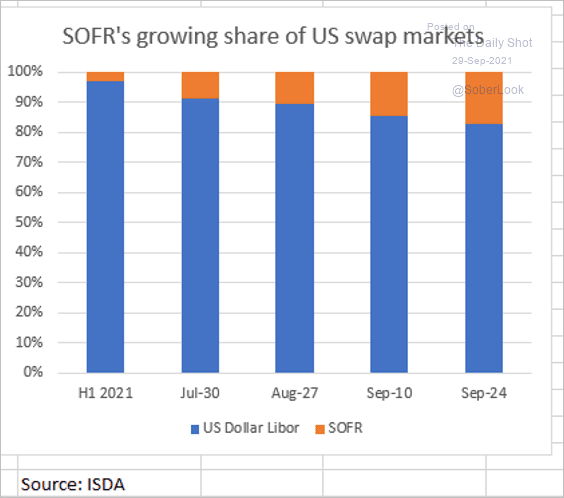

4. SOFR (LIBOR replacement) is making some inroads in the USD swaps market.

Source: @Chris_Whittall

Source: @Chris_Whittall

Back to Index

Global Developments

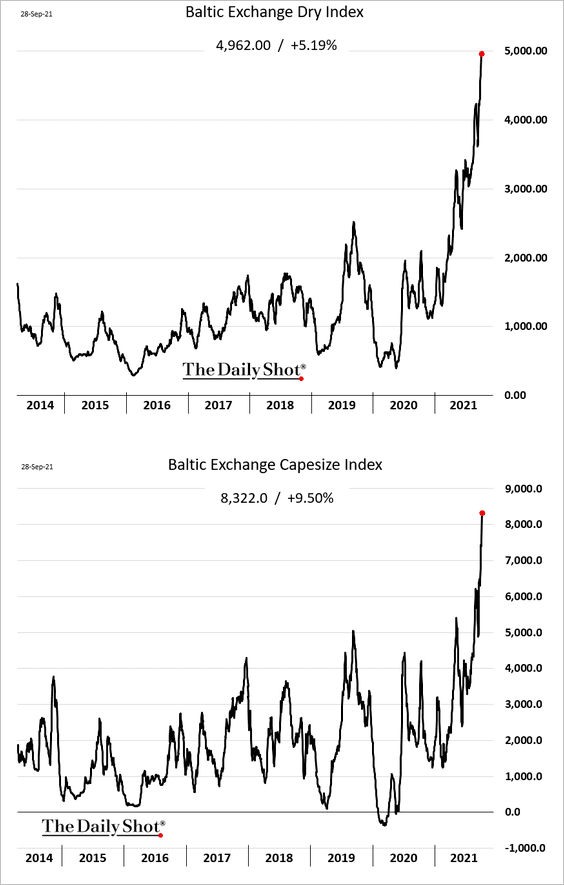

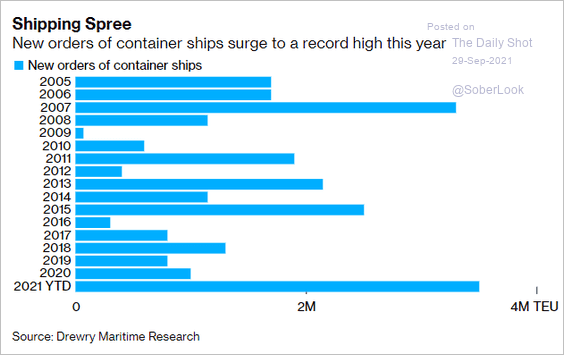

1. Shipping costs continue to surge.

• Containers from China:

• Dry bulk costs:

Shipping orders already hit a record high.

Source: @markets Read full article

Source: @markets Read full article

——————–

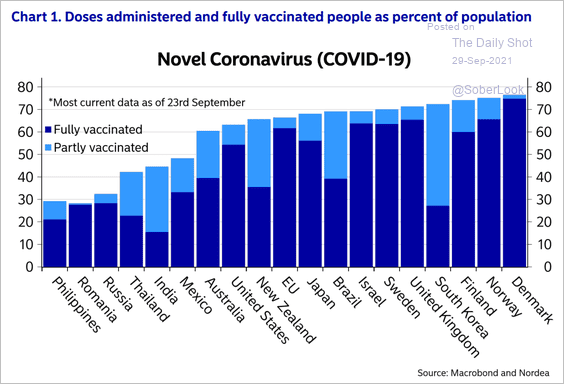

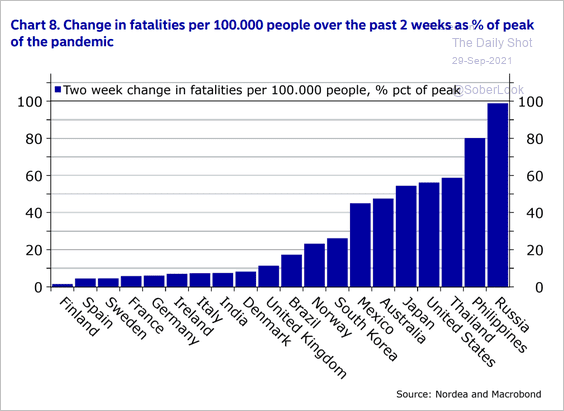

2. Next, we have a couple of updates on the pandemic.

• Vaccinated population share:

Source: Nordea Markets

Source: Nordea Markets

• Fatalities:

Source: Nordea Markets

Source: Nordea Markets

——————–

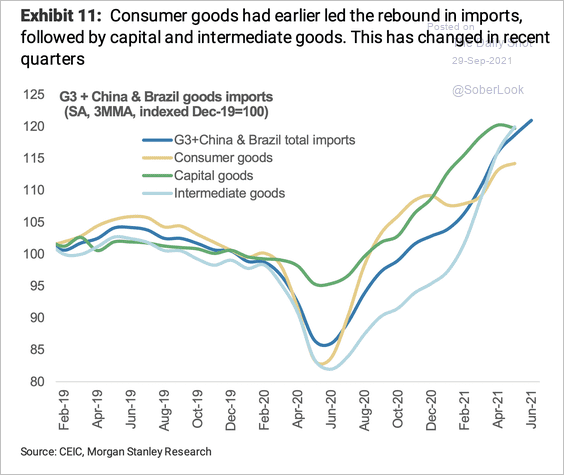

3. Globally, imports of capital and intermediate goods are now taking the baton over from consumer goods.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

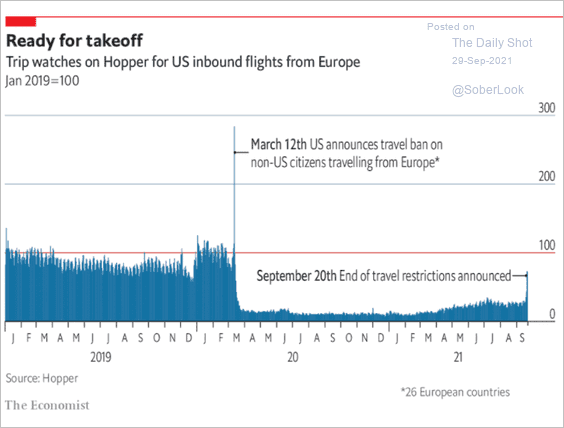

1. US inbound flights from Europe:

Source: The Economist Read full article

Source: The Economist Read full article

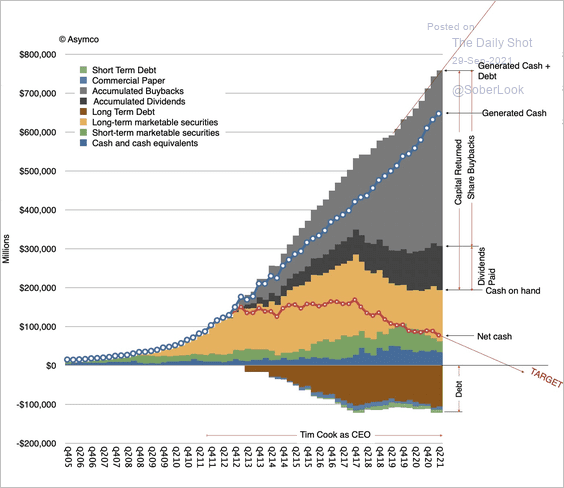

2. Apple’s balance sheet over time:

Source: @asymco

Source: @asymco

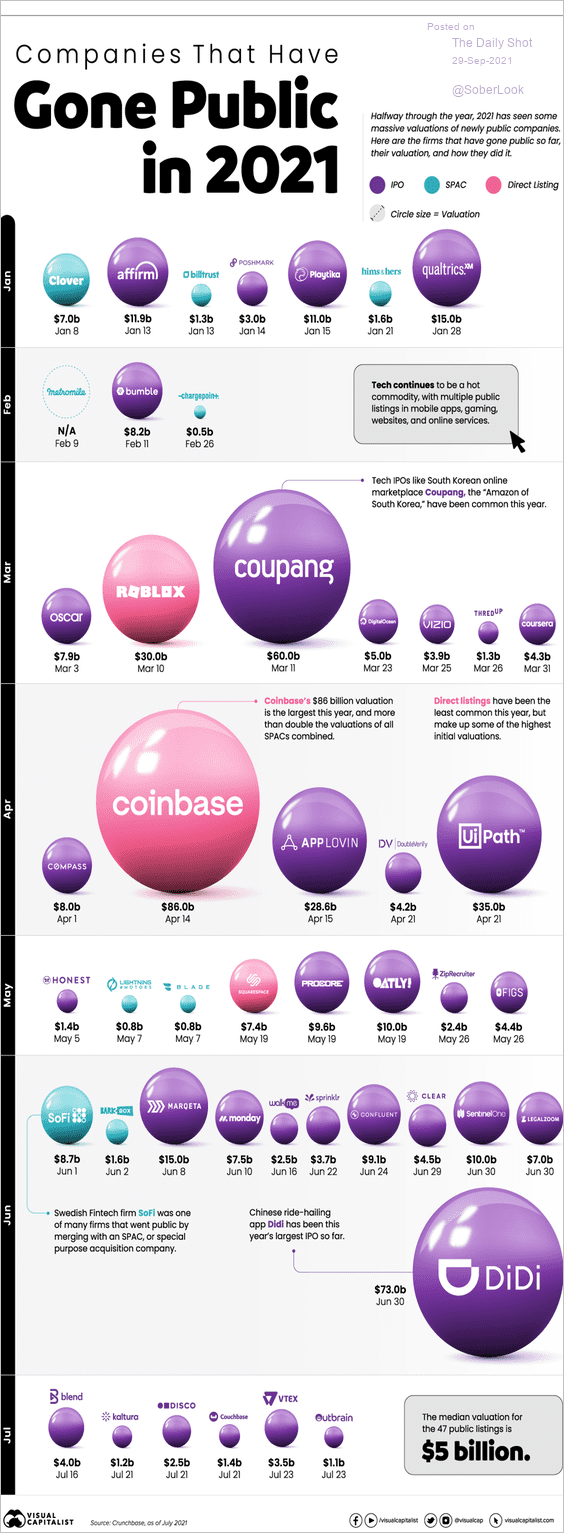

3. Companies that have gone public in 2021:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

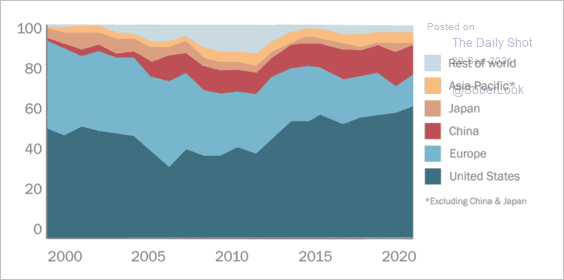

4. Locations of the world’s largest 100 companies by market capitalization:

Source: Center for Data Innovation Read full article

Source: Center for Data Innovation Read full article

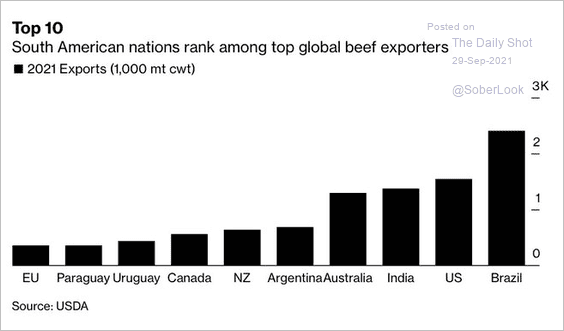

5. Largest beef exporters:

Source: @FarmPolicy, Bloomberg Read full article

Source: @FarmPolicy, Bloomberg Read full article

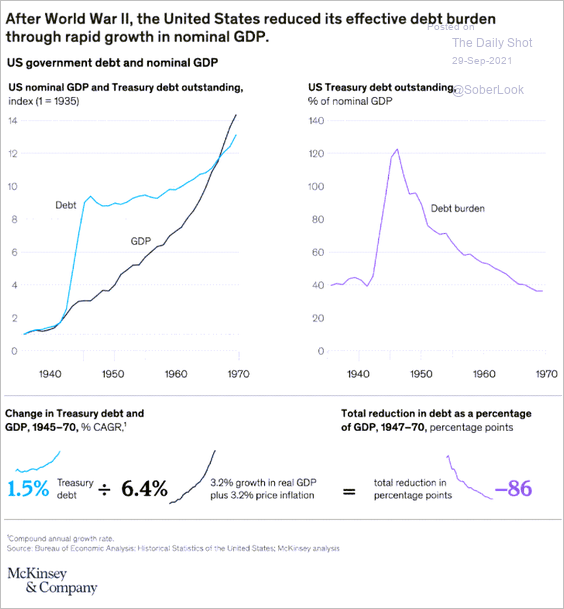

6. US post-WWII debt burden:

Source: McKinsey Read full article

Source: McKinsey Read full article

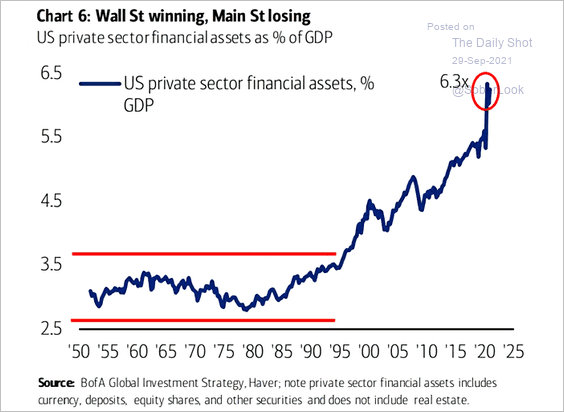

7. US private-sector financial assets as a percent of GDP:

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

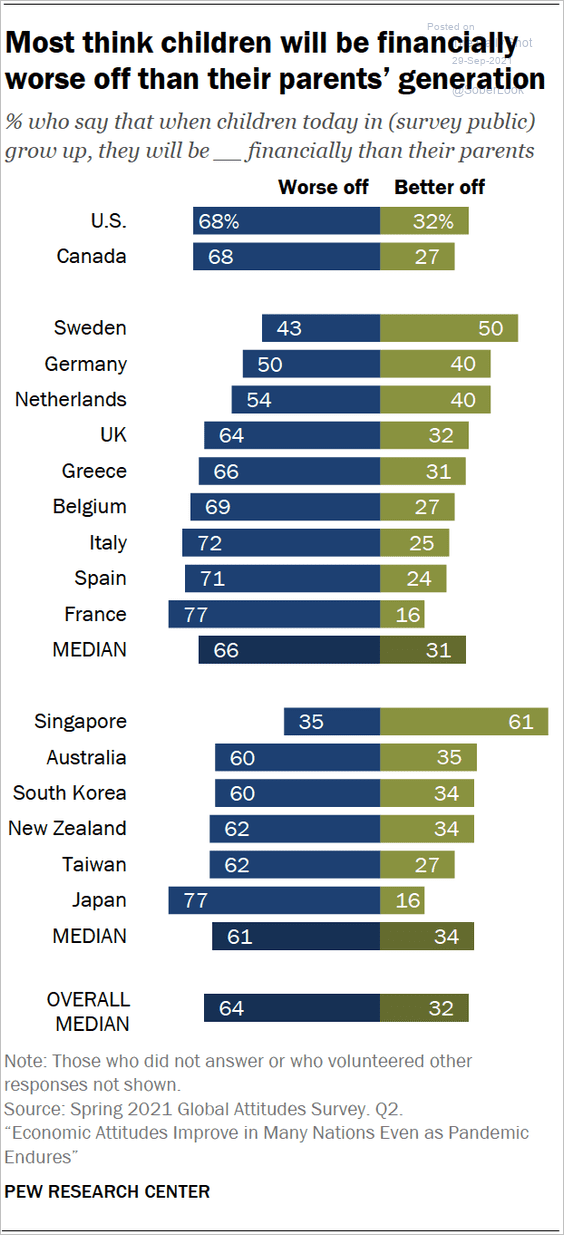

8. Will children be financially worse off than their parents’ generation?

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

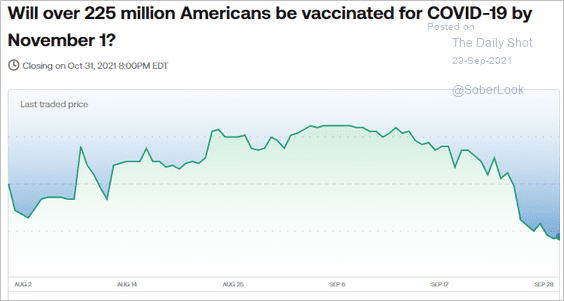

9. Will over 225 million Americans be vaccinated by November 1st? The chart shows betting market odds.

Source: Kalshi

Source: Kalshi

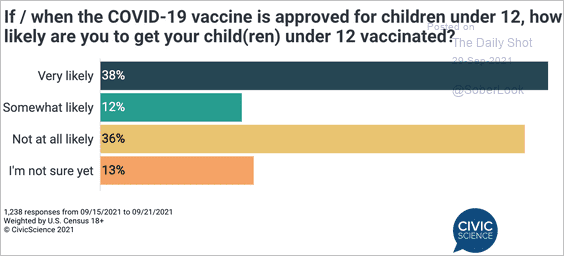

10. Vaccinating children under 12:

Source: @CivicScience

Source: @CivicScience

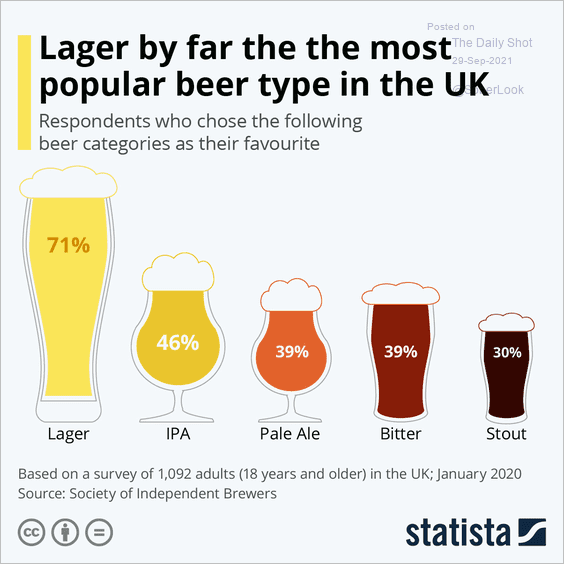

11. Most popular types of beer in the UK:

Source: Statista

Source: Statista

——————–

Back to Index