The Daily Shot: 12-Oct-21

• Administrative Update

• China

• Asia – Pacific

• Japan

• The Eurozone

• Europe

• The United kingdom

• The United States

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

For iPhone/iPad users: The Daily Shot navigation links (skipping to different sections) work with Apple’s recently released iOS 15 operating system.

Back to Index

China

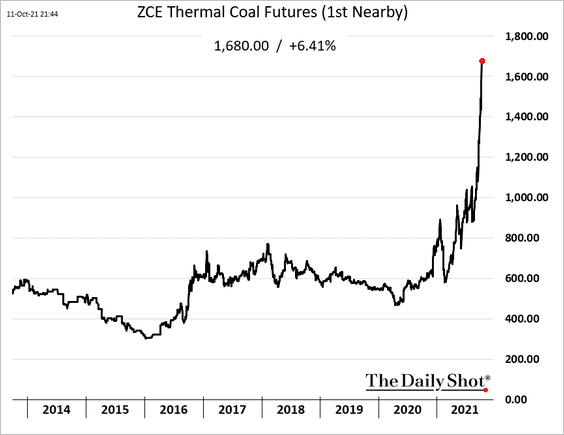

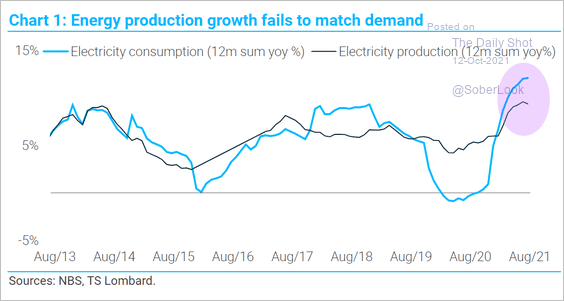

1. Thermal coal prices hit a new high today amid falling inventories and strong demand for electricity.

Source: TS Lombard

Source: TS Lombard

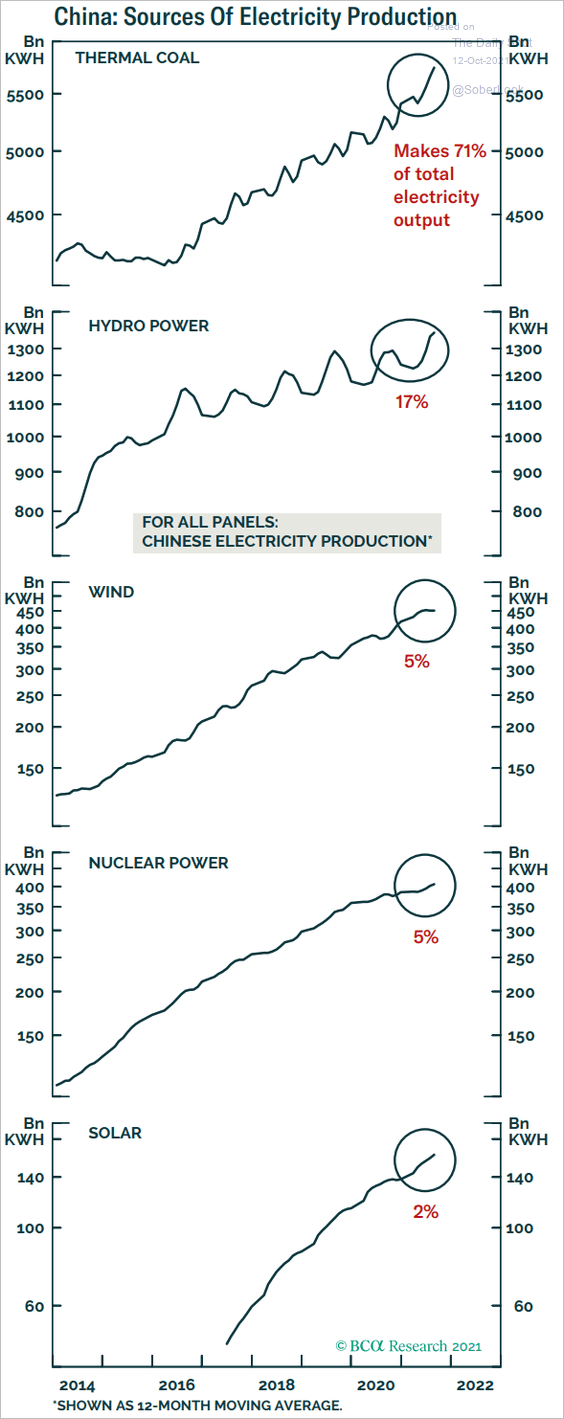

• Coal usage for power production surged this year.

Source: BCA Research

Source: BCA Research

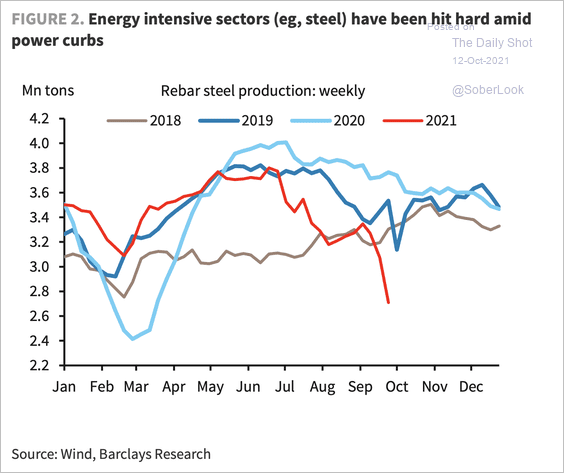

• Steel output has slumped partly due to energy scarcity.

Source: Barclays Research

Source: Barclays Research

——————–

2. Next, let’s revisit the property sector.

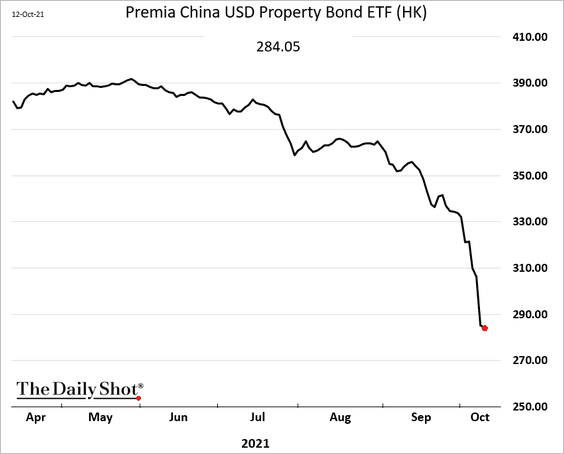

• Investors continue to dump property bonds.

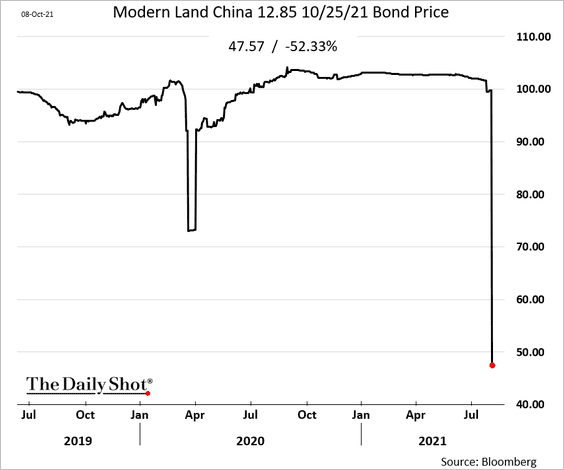

• Modern Land’s bond maturing this month gave up half of its value after the firm sought to delay repayment.

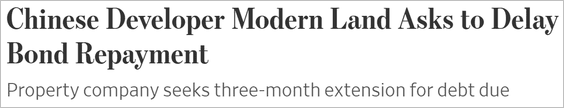

Source: @WSJ Read full article

Source: @WSJ Read full article

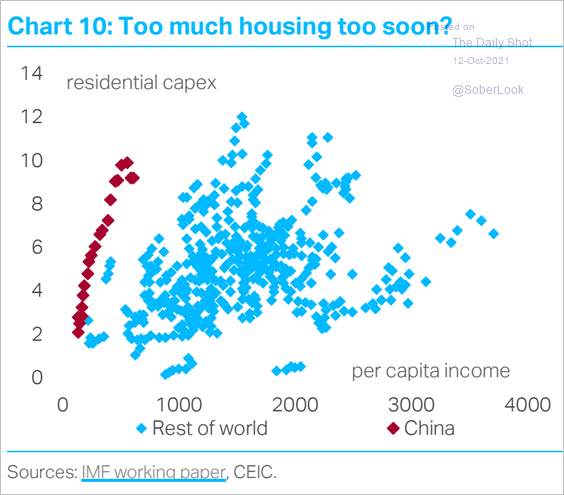

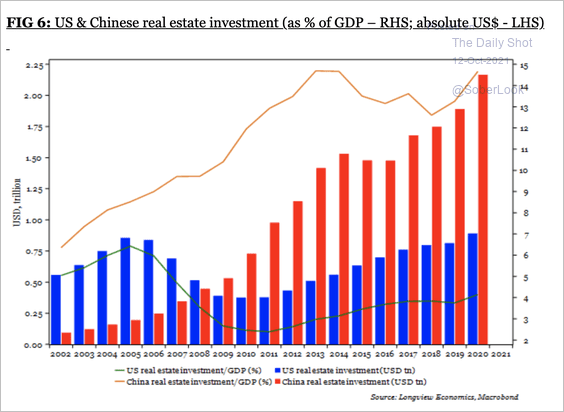

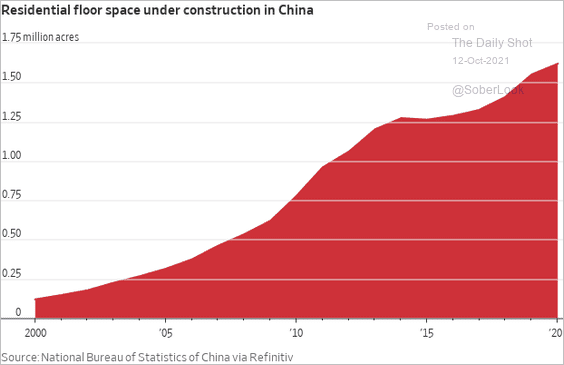

• Residential investment growth has been too fast (3 charts).

Source: TS Lombard

Source: TS Lombard

Source: Longview Economics

Source: Longview Economics

Source: @WSJ Read full article

Source: @WSJ Read full article

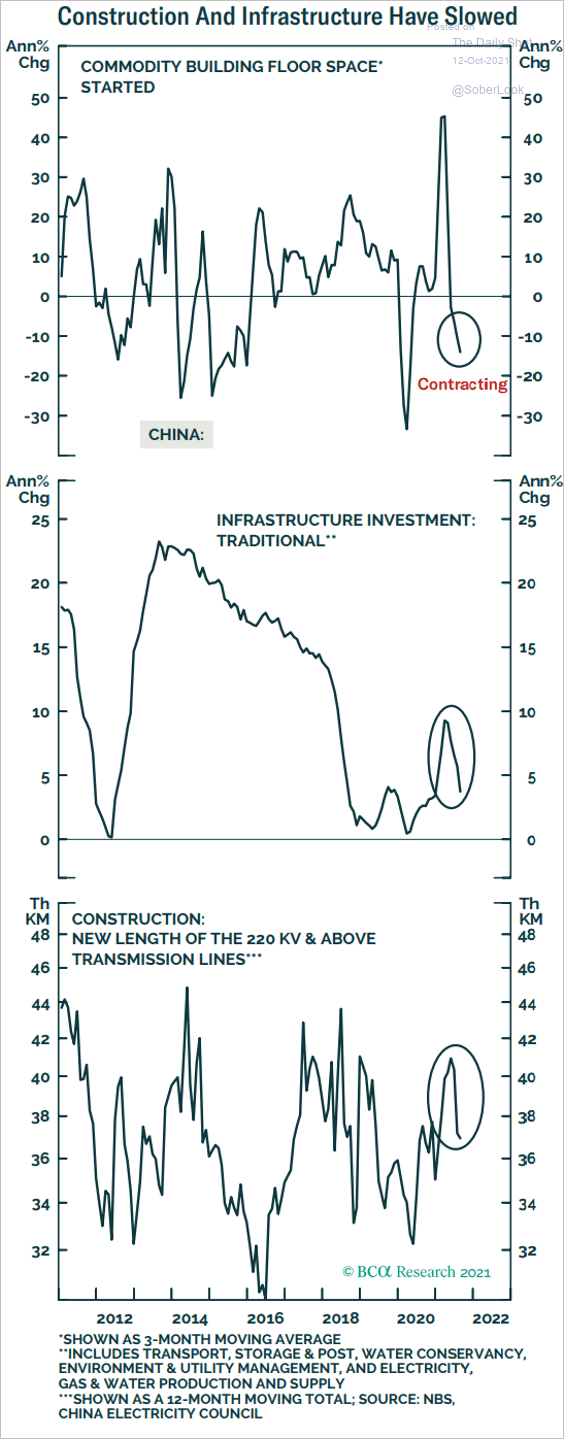

But construction and infrastructure activity slowed recently.

Source: BCA Research

Source: BCA Research

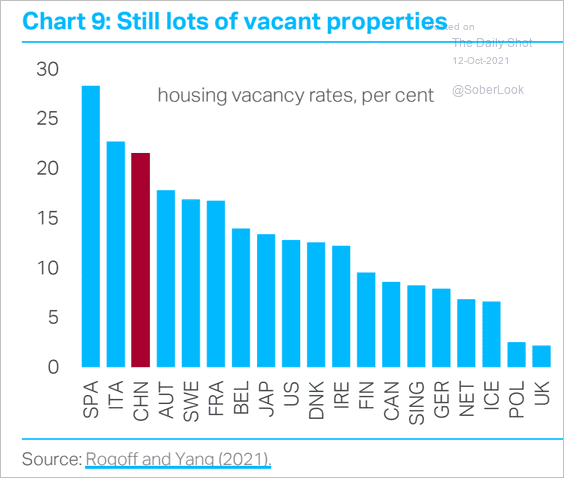

• The percentage of vacant properties is relatively high.

Source: TS Lombard

Source: TS Lombard

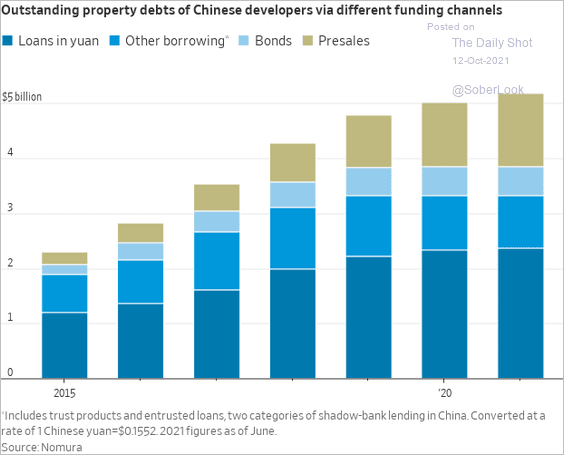

• Here are the sources of funding for real estate developers.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

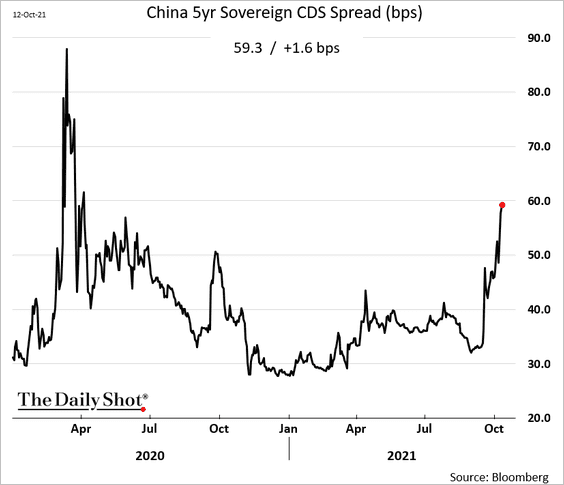

3. China’s sovereign CDS spread remains elevated.

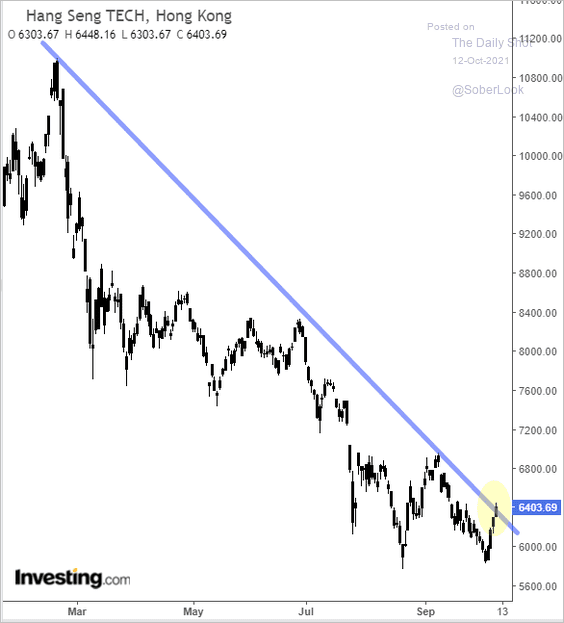

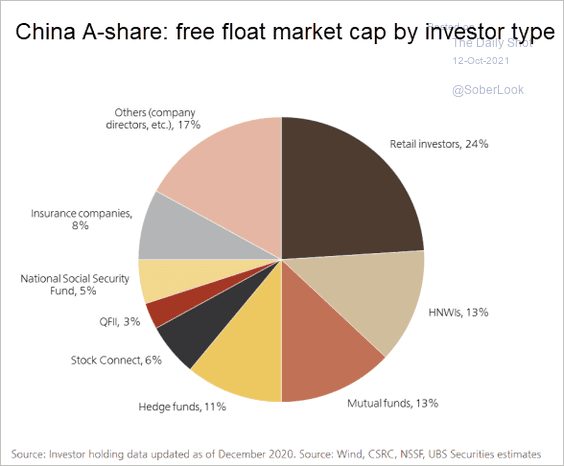

4. Here are some updates on the equity market.

• Tech shares in Hong Kong (testing resistance):

• A-share free float by investor type:

Source: UBS Asset Management

Source: UBS Asset Management

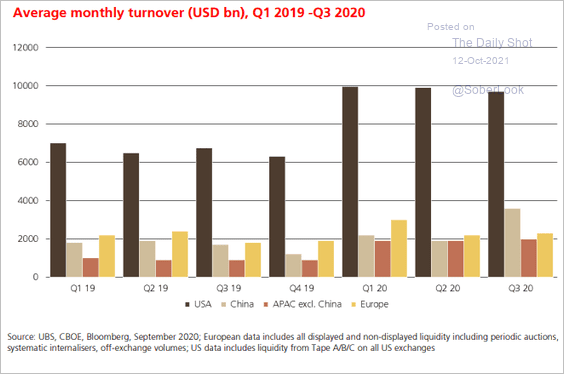

• A-share turnover by quarter:

Source: UBS Asset Management

Source: UBS Asset Management

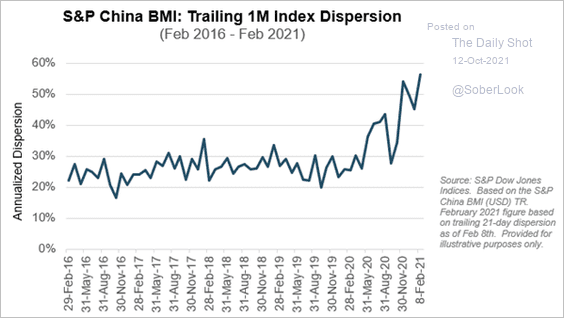

• Equity return dispersion (tech and property shares down sharply, other sectors more stable):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

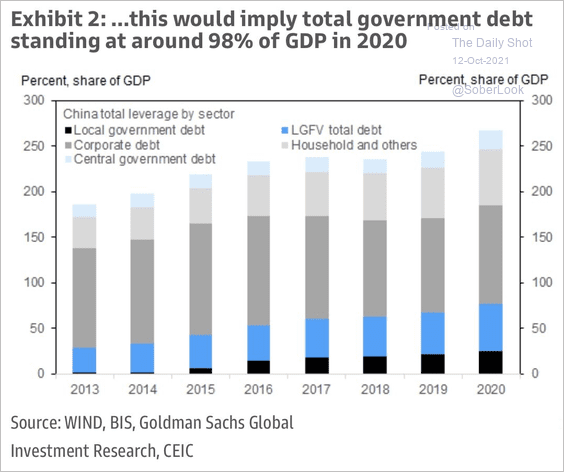

5. Here is the total debt-to-GDP trend by sector.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Asia – Pacific

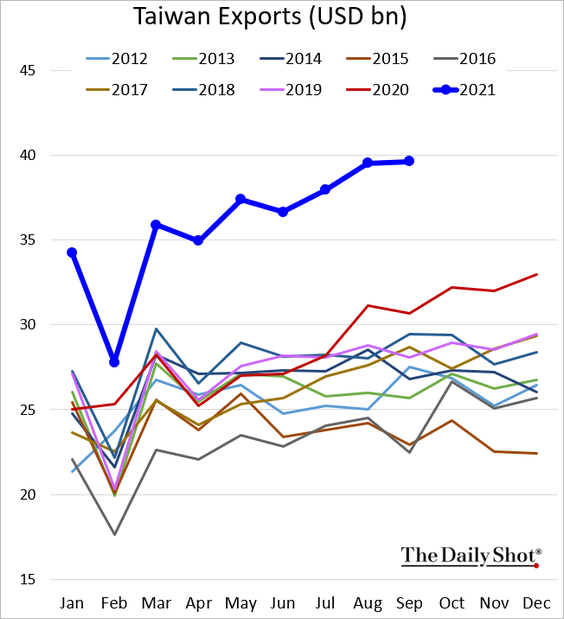

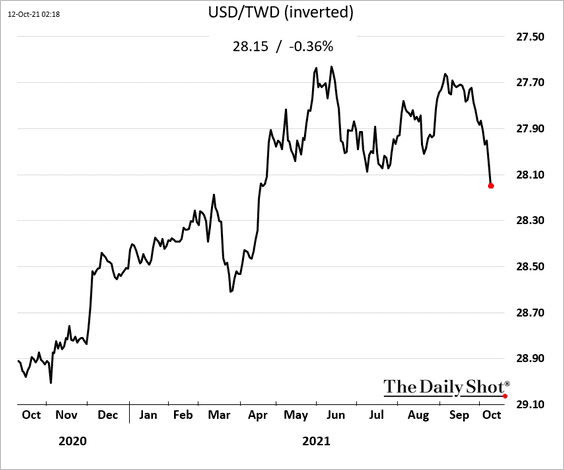

1. Taiwan’s exports hit another record high.

The Taiwan dollar is rolling over.

——————–

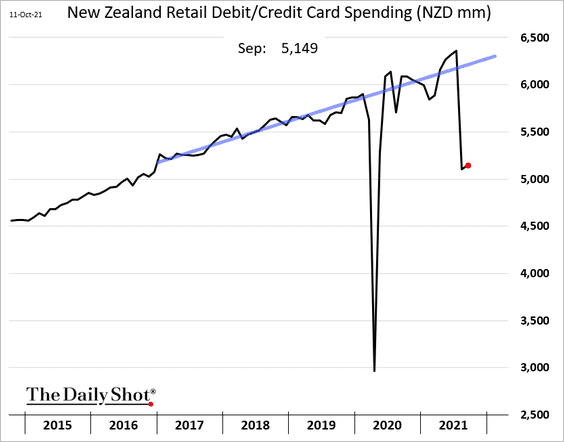

2. Retail card spending in New Zealand remains depressed.

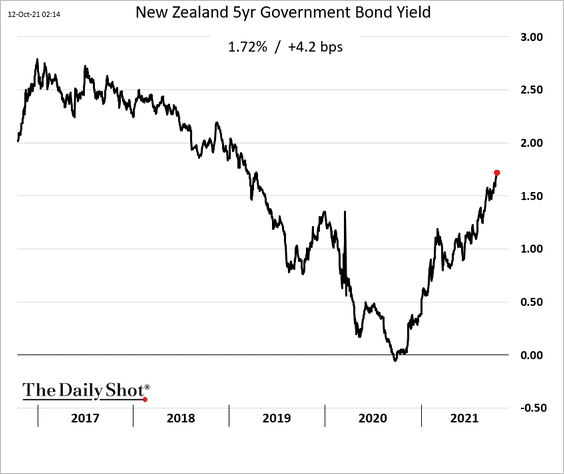

New Zealand’s bond yields continue to climb.

——————–

3. Next, we have some updates on Australia.

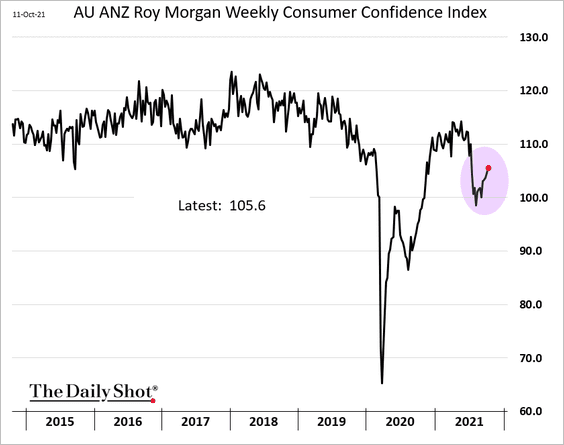

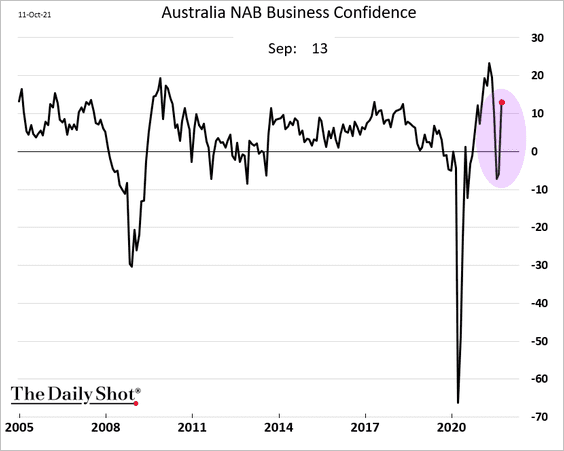

• Consumer and business confidence indicators are rebounding.

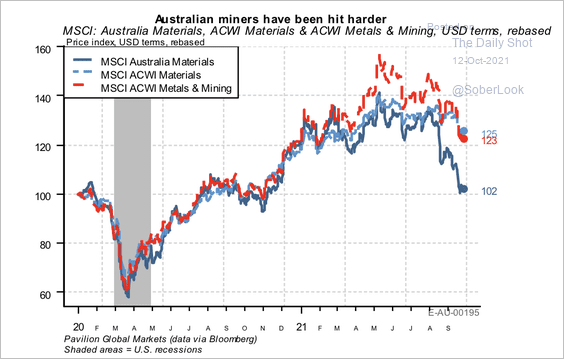

• Aussie mining stocks significantly underperformed their global counterparts this year …

Source: Pavilion Global Markets

Source: Pavilion Global Markets

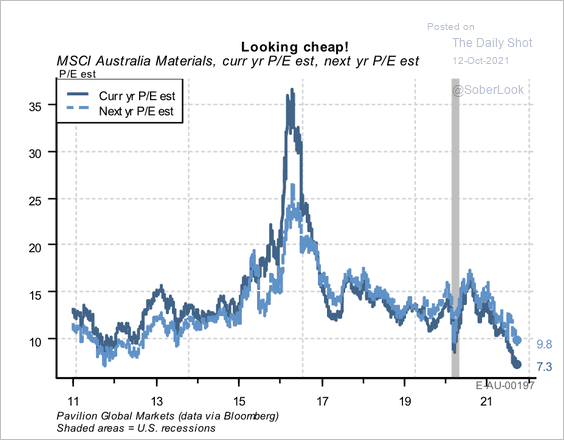

… pushing valuations to the lowest levels in about a decade.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

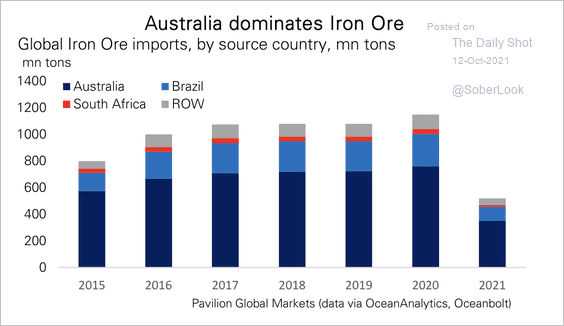

Australia dominates the global iron ore supply. Slowing demand from China does not help.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Back to Index

Japan

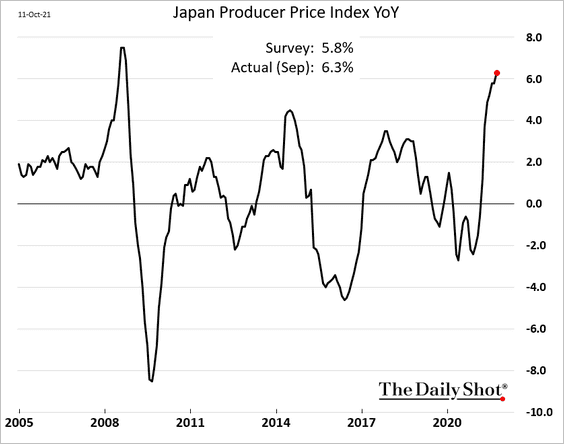

1. Producer prices increased more than expected last month. With consumer inflation remaining depressed, the PPI spike could put pressure on margins in some sectors.

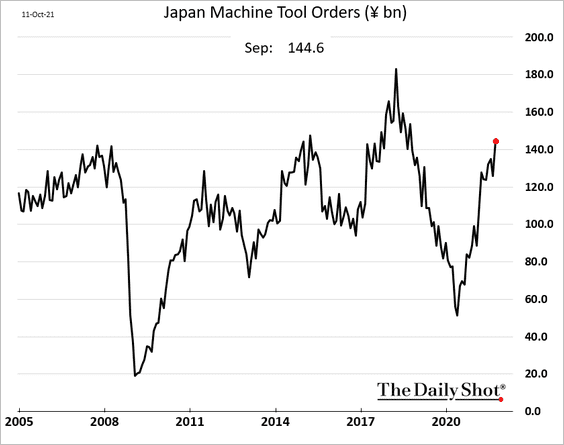

2. Machine tool orders rose sharply last month.

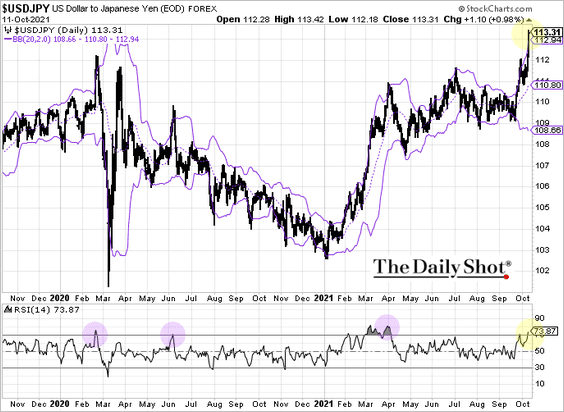

3. Technicals suggest that the dollar is overbought vs. the yen.

h/t Cormac Mullen

h/t Cormac Mullen

Back to Index

The Eurozone

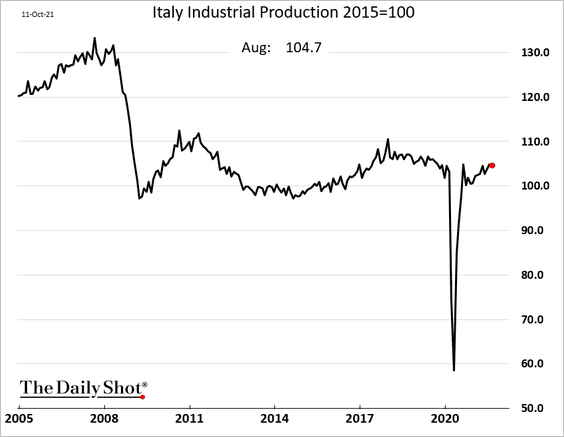

1. Italian industrial production is holding near pre-COVID levels.

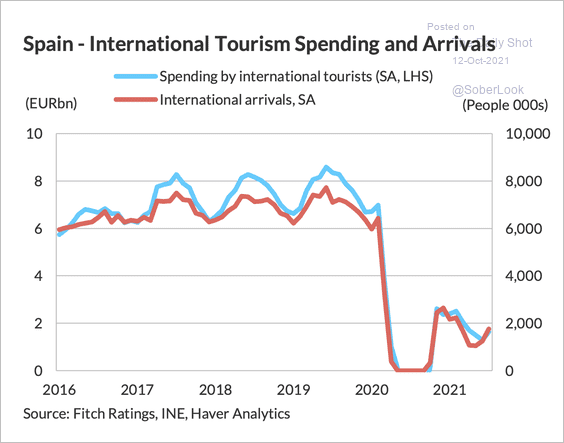

2. Spanish tourism recovery has been painfully slow.

Source: Fitch Ratings

Source: Fitch Ratings

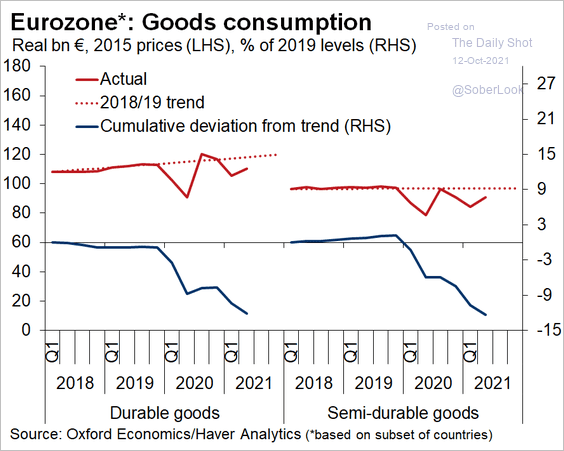

3. This chart shows goods consumption relative to the pre-COVID trend.

Source: @OliverRakau

Source: @OliverRakau

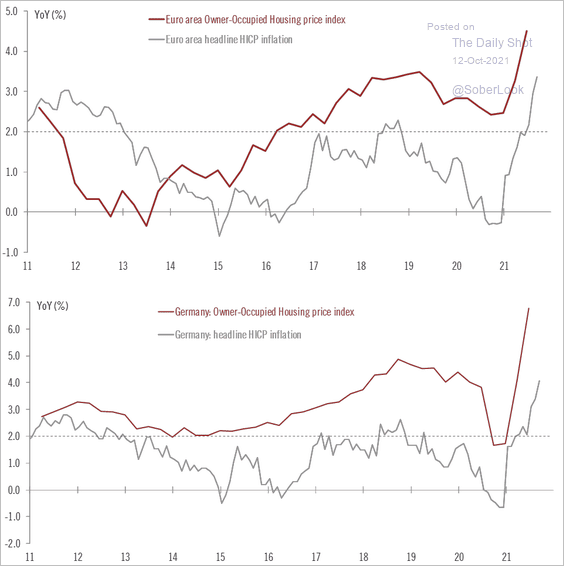

4. Home price appreciation spiked in Germany.

Source: @fwred

Source: @fwred

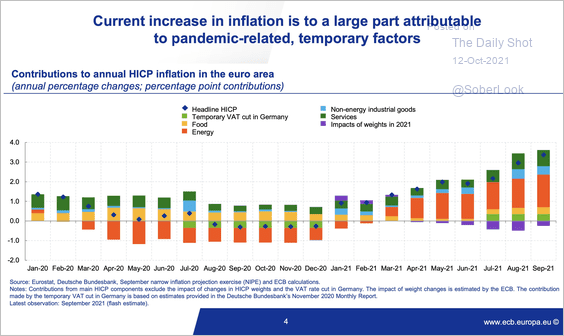

5. Here are the drivers of the Eurozone’s CPI.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

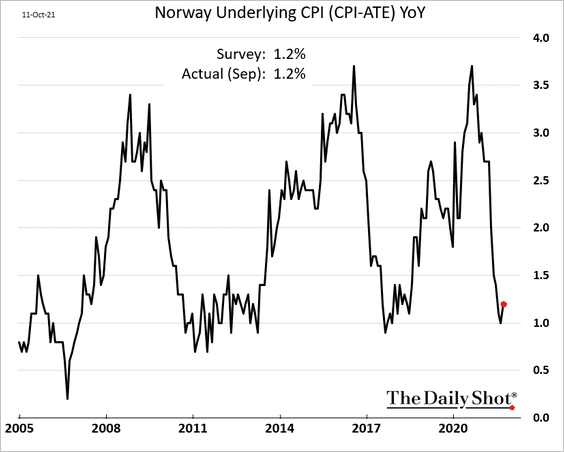

1. Norway’s CPI remains tepid.

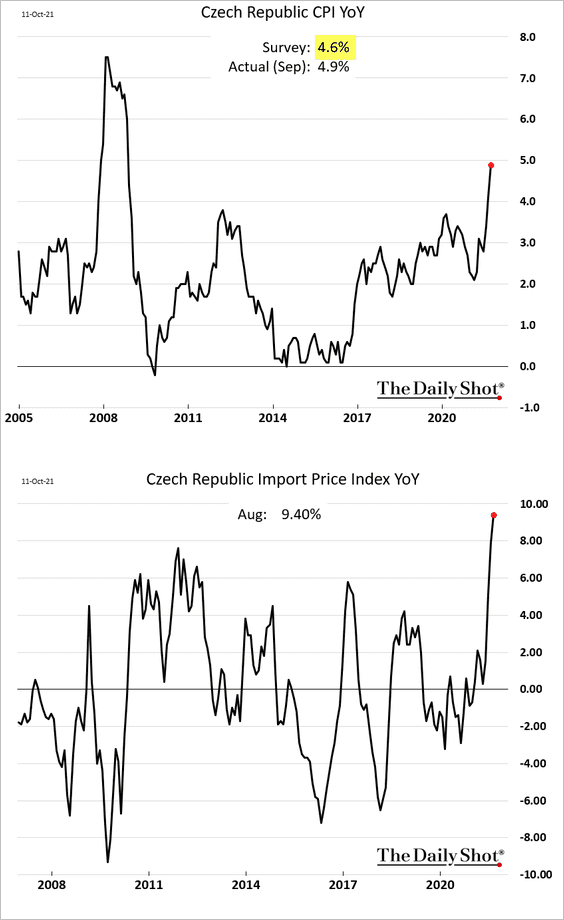

2. Czech inflation surprised to the upside.

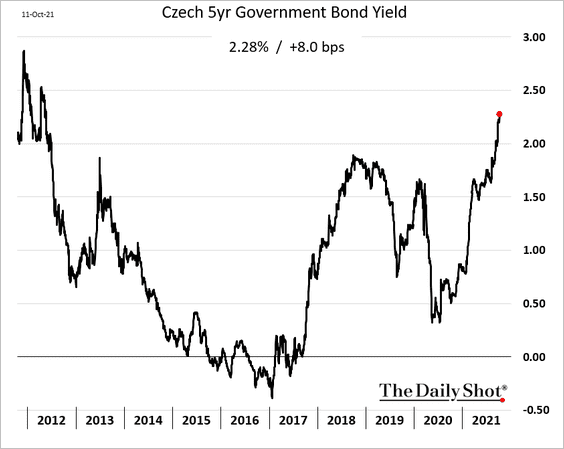

Bond yields are surging.

——————–

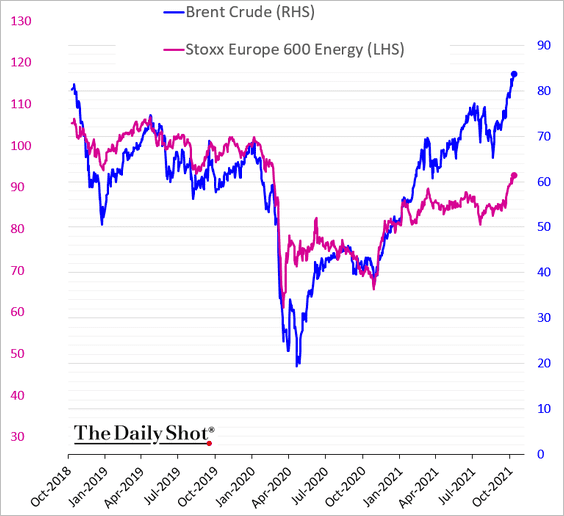

3. Energy stocks continue to underperform oil.

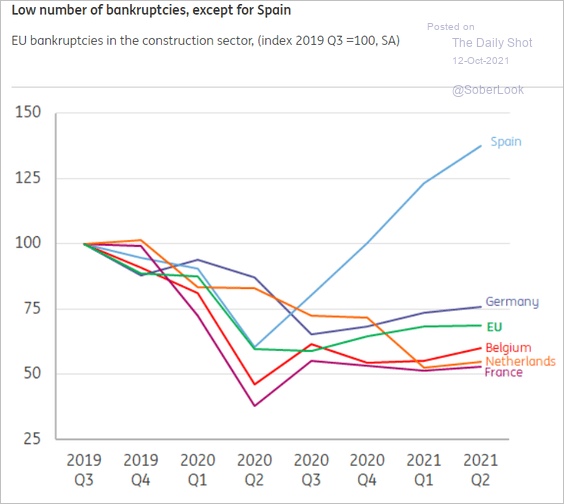

4. This chart shows the evolution of bankruptcies in the construction sector since the start of the pandemic.

Source: ING

Source: ING

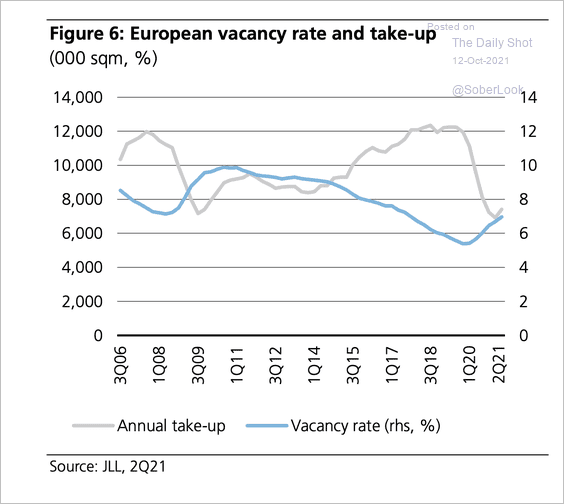

5. European office vacancy and take-up rates have hardly recovered.

Source: UBS Asset Management

Source: UBS Asset Management

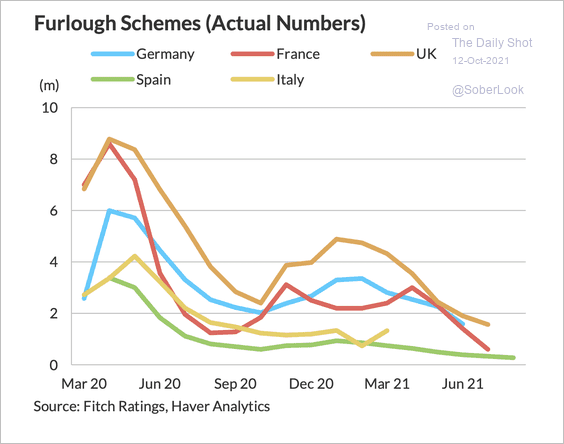

6. Furlough schemes around Europe are winding down.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

The United kingdom

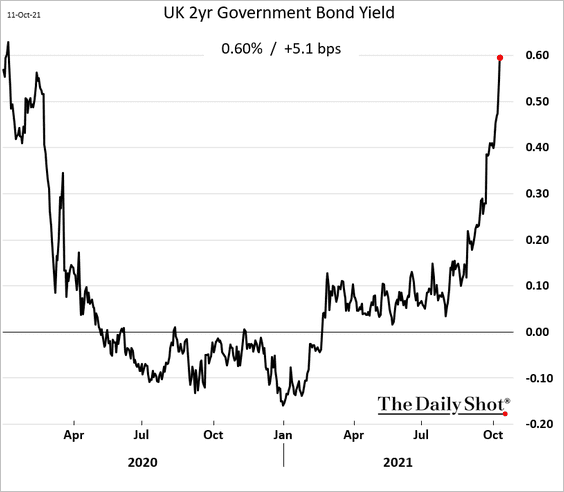

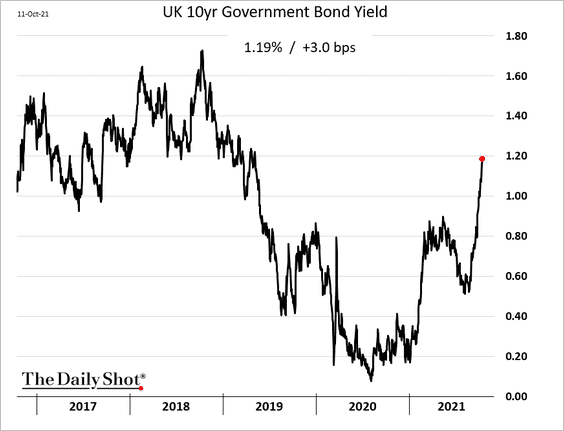

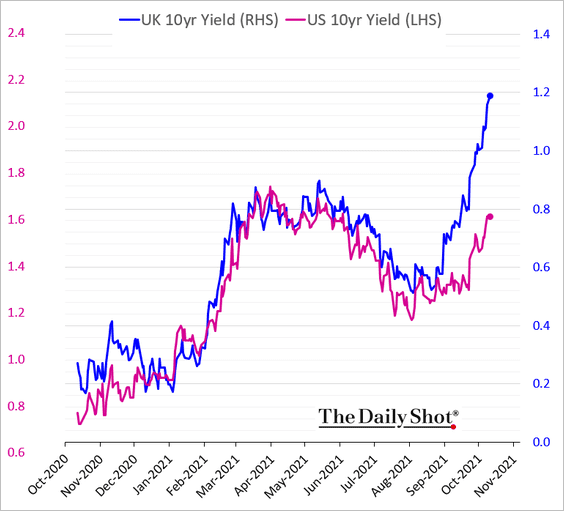

1. Gilt yields continue to surge, …

… outpacing the US.

——————–

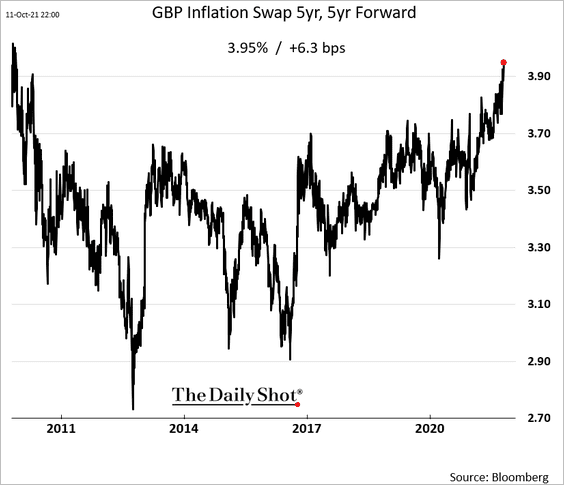

2. Long-term inflation expectations hit the highest level in over a decade.

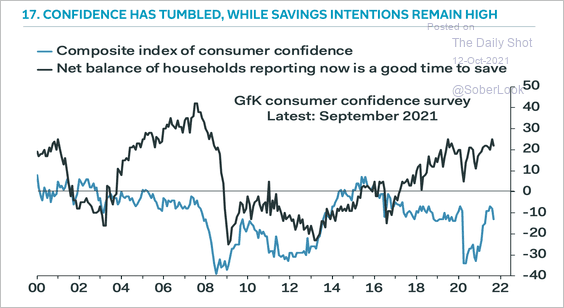

3. The UK has been facing soft consumer confidence and a rising desire to save.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

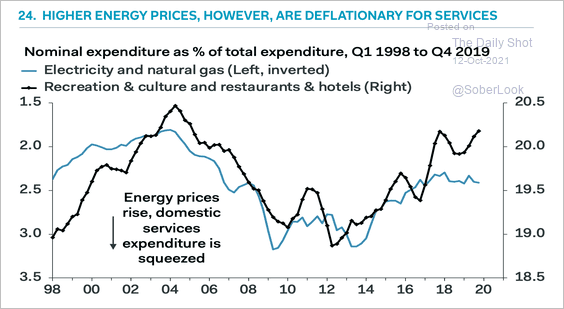

4. Higher energy prices in the UK are about to hit spending on domestic leisure activities

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

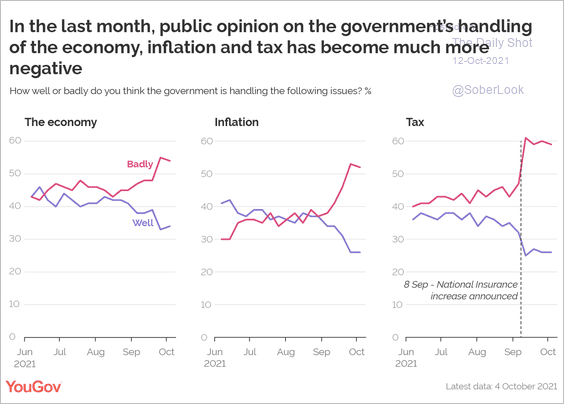

5. Public opinion on the government’s handling of the economy, inflation, and taxes has shifted.

Source: @YouGov Read full article

Source: @YouGov Read full article

Back to Index

The United States

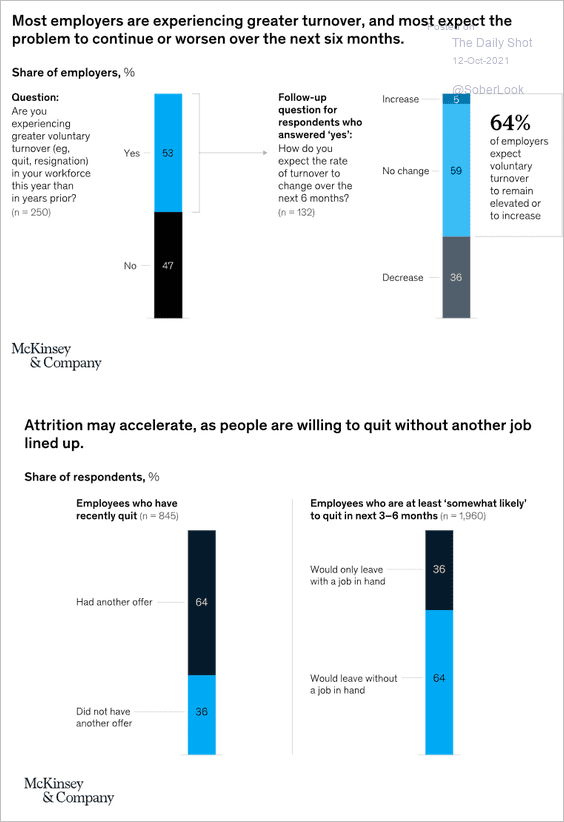

1. Let’s begin with the labor market.

• Employment turnover is rising.

Source: @McKinsey Read full article

Source: @McKinsey Read full article

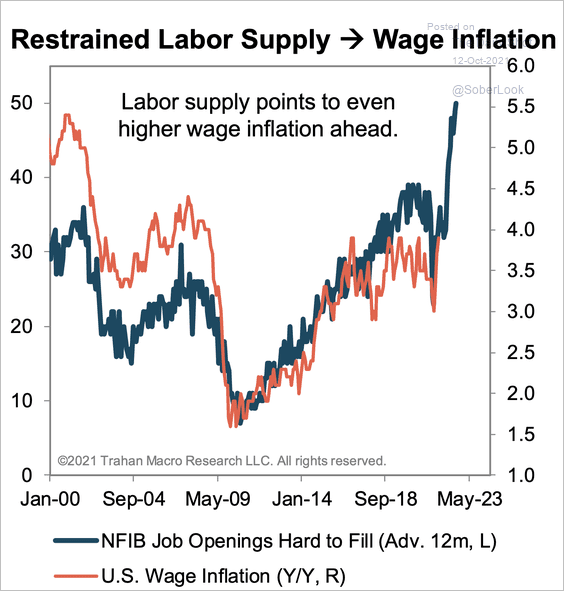

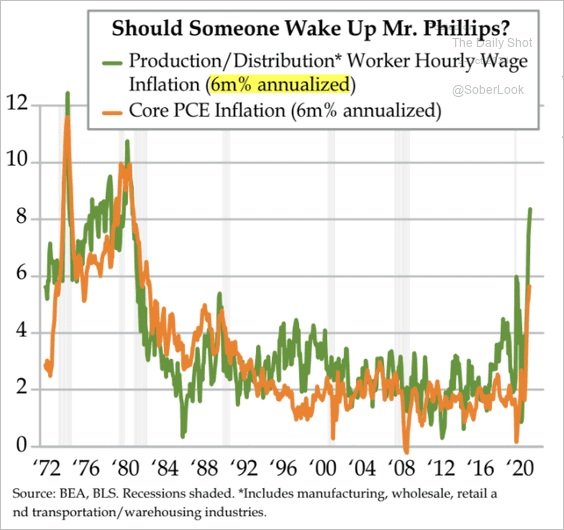

• The tight labor market will further boost wage inflation, …

Source: Trahan Macro Research

Source: Trahan Macro Research

… which is likely to feed through to consumer inflation.

Source: The Daily Feather

Source: The Daily Feather

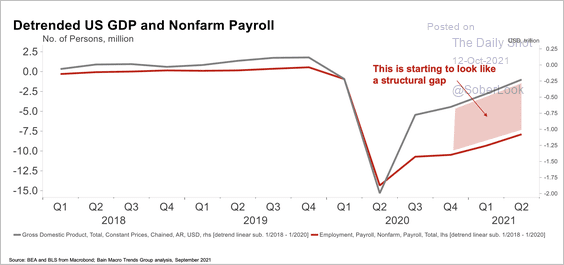

• As the US economy recovered, mainly due to a surge in the higher-productivity goods sectors, a gap has opened up between the number of people employed and GDP. The key question now is whether this gap is structural or will close.

Source: Bain & Company

Source: Bain & Company

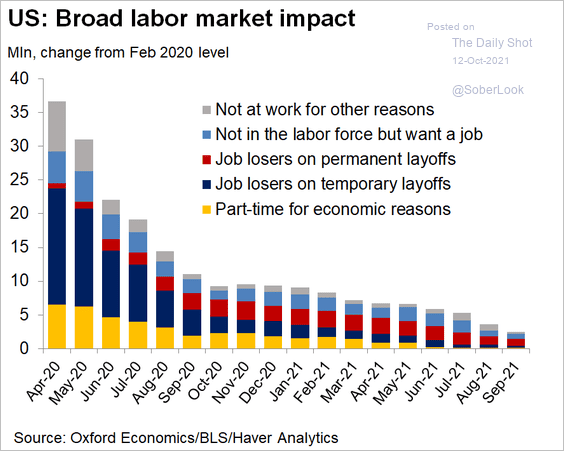

• This chart shows the broad unemployment/underemployment trend since the start of the pandemic.

Source: @GregDaco

Source: @GregDaco

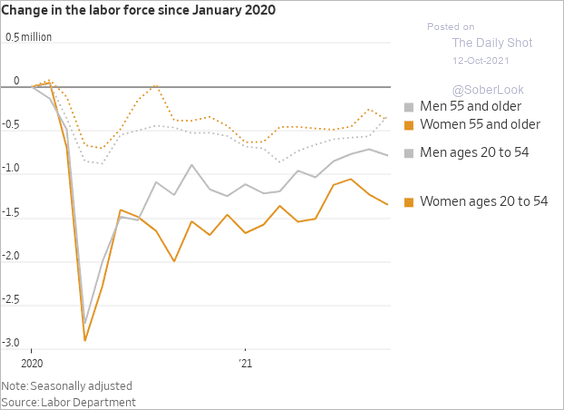

• Here are the labor force participation demographic trends.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

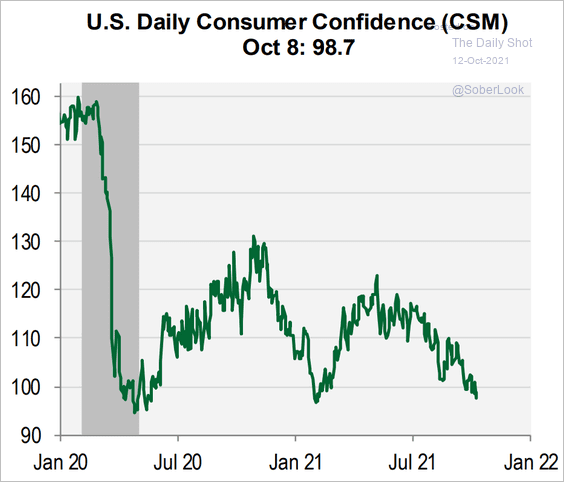

2. Cornerstone Macro’s consumer confidence tracker shows further deterioration, …

Source: Cornerstone Macro

Source: Cornerstone Macro

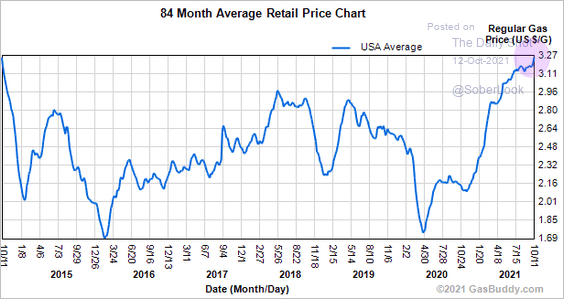

… as retail gasoline prices hit the highest level since 2014.

Source: GasBuddy

Source: GasBuddy

——————–

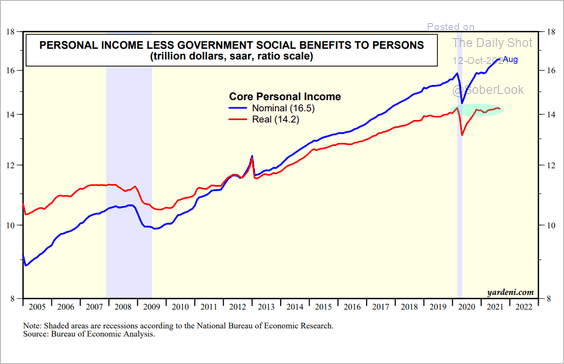

3. Real incomes, excluding government support, have been flat since the start of the pandemic.

Source: Yardeni Research

Source: Yardeni Research

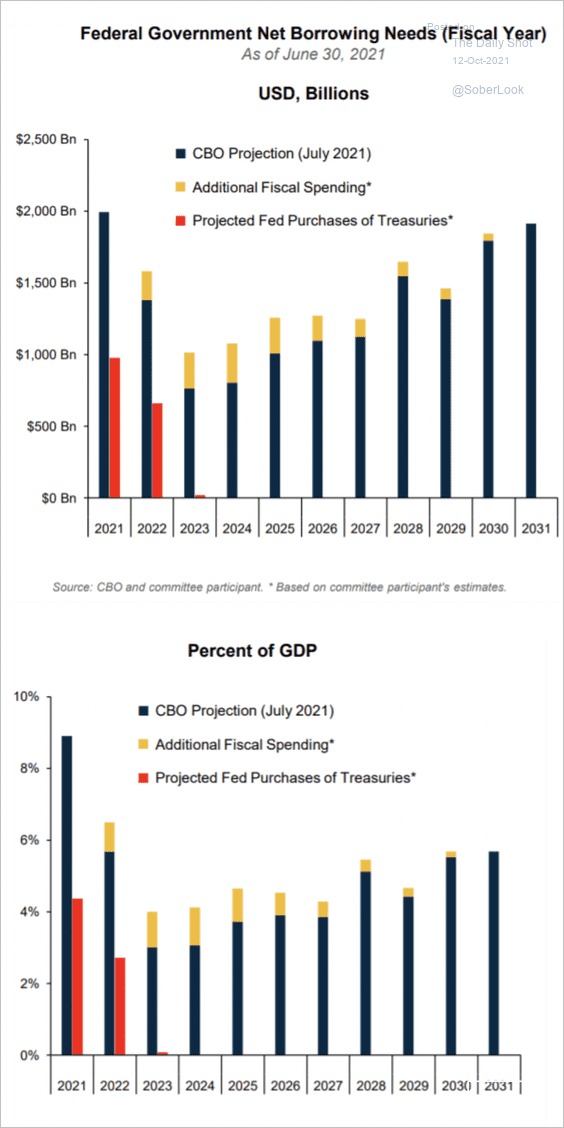

4. This chart shows projections for the US Treasury’s net borrowing needs and the Fed’s purchases of Treasuries.

Source: Reuters Read full article

Source: Reuters Read full article

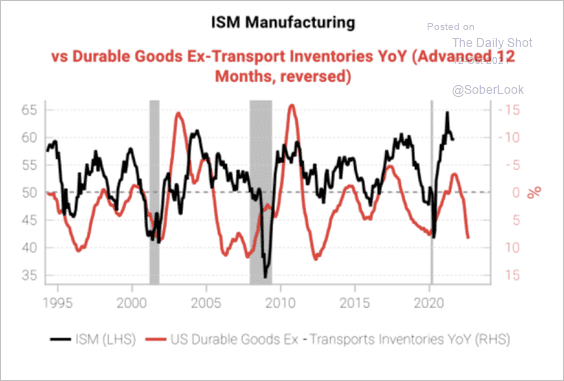

5. The recent decline in durable goods inventory growth points to slowing manufacturing activity ahead.

Source: Variant Perception

Source: Variant Perception

Back to Index

Emerging Markets

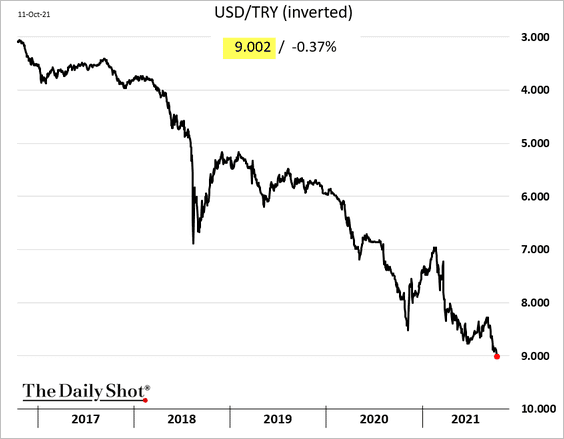

1. The Turkish lira hit a record low.

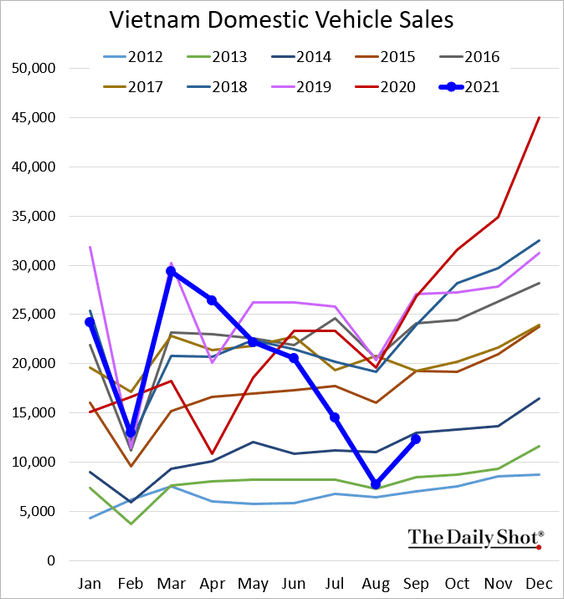

2. Vietnam’s domestic car sales improved last month but remain soft.

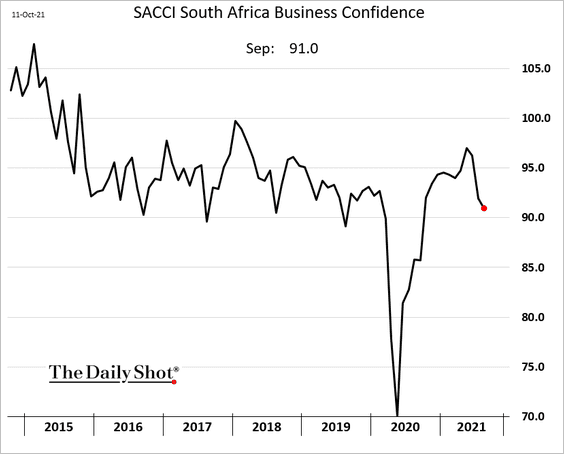

3. South Africa’s business confidence is now well below pre-COVID levels.

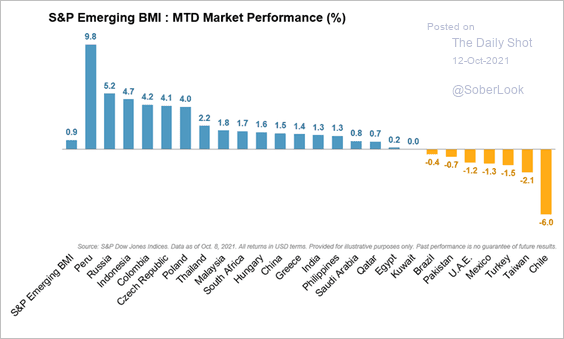

4. Next, we have the month-to-date equity returns.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

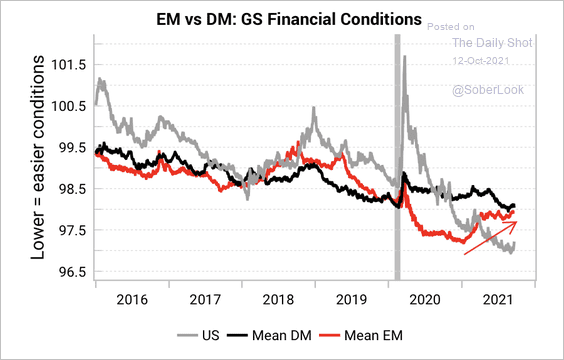

5. Financial conditions have tightened over the past year, especially relative to developed markets, …

Source: Variant Perception

Source: Variant Perception

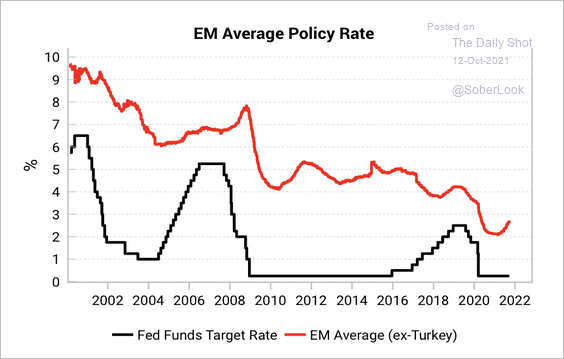

… which is partly due to EM central bank rate hikes in response to rising inflation.

Source: Variant Perception

Source: Variant Perception

Back to Index

Cryptocurrency

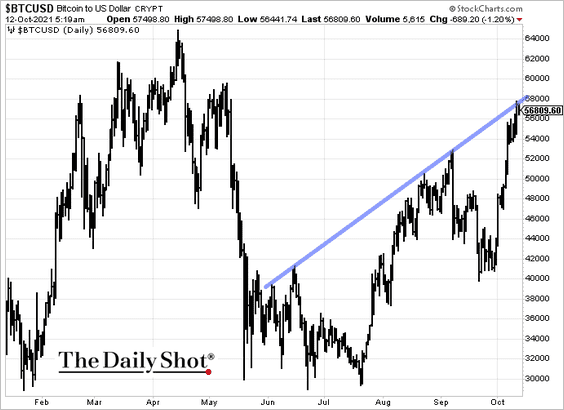

1. Bitcoin is at resistance.

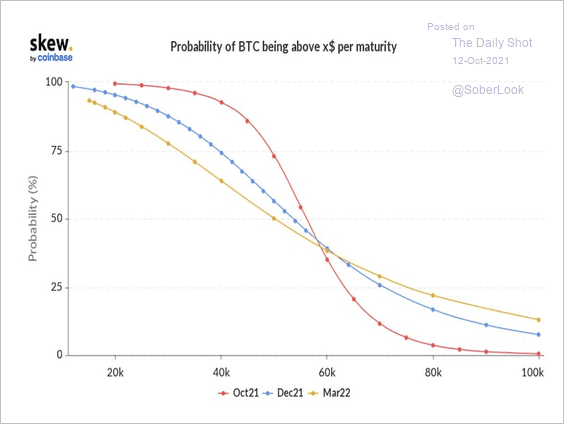

2. The options market is placing a 20% probability of bitcoin ending the month at a new all-time high above $65K.

Source: Skew Read full article

Source: Skew Read full article

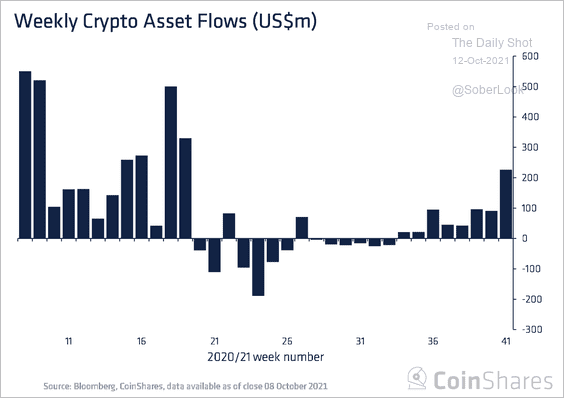

3. Crypto-focused investment products saw eight straight weeks of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

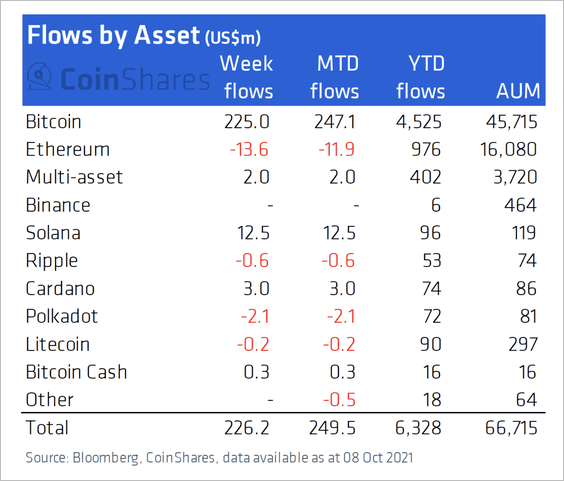

Bitcoin products accounted for the majority of inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

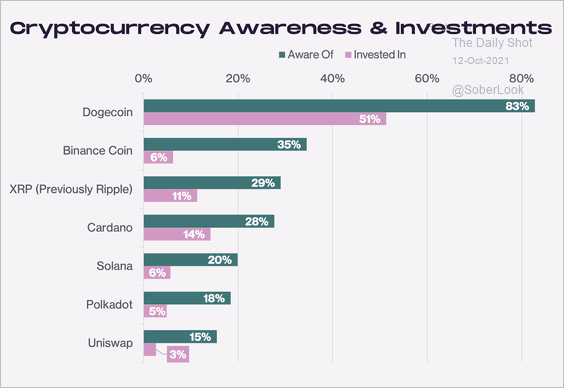

4. Next, we have some data on crypto awareness.

Source: Cardify Read full article

Source: Cardify Read full article

Back to Index

Commodities

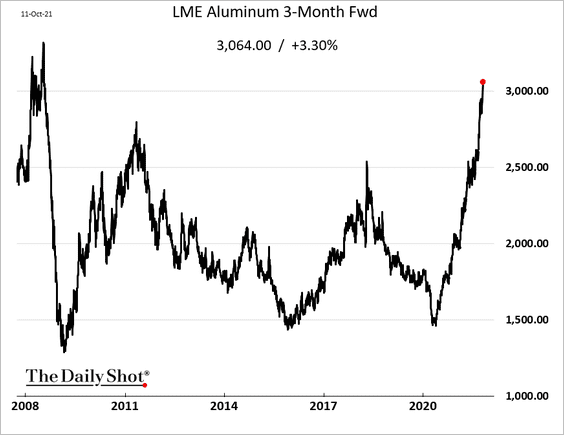

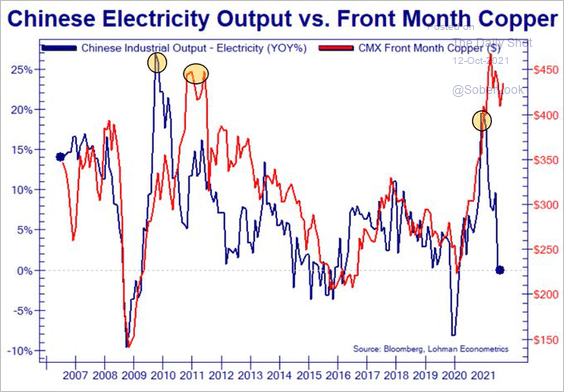

1. Aluminum prices are surging, boosted by the spike in energy costs.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

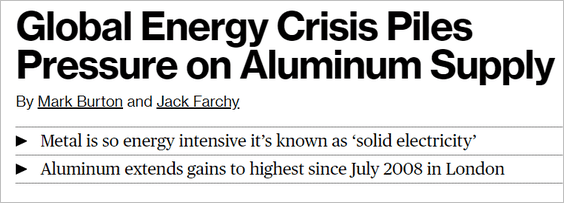

2. Chinese housing starts historically correlated well with commodity prices, and the recent reading points to commodity declines are ahead.

Source: Fitch Ratings

Source: Fitch Ratings

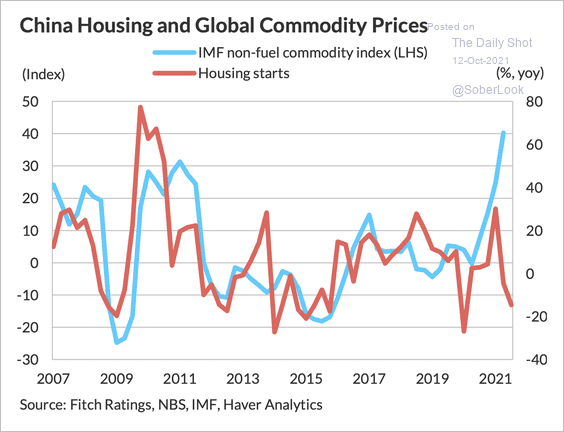

3. Here is copper vs. China’s electricity output.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

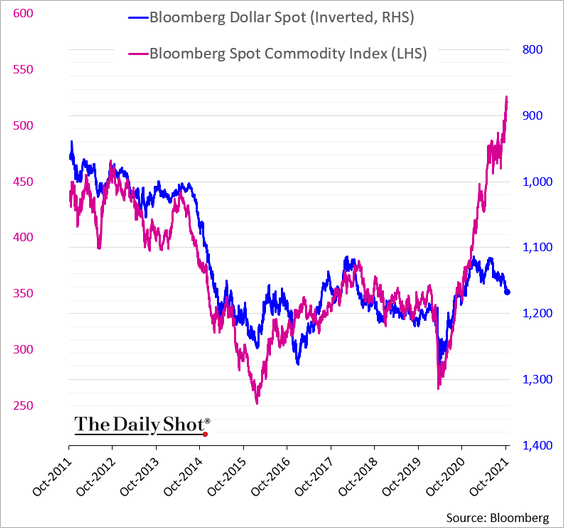

4. The recent US dollar gains could weigh on commodity prices.

h/t @ISABELNET_SA

h/t @ISABELNET_SA

Back to Index

Energy

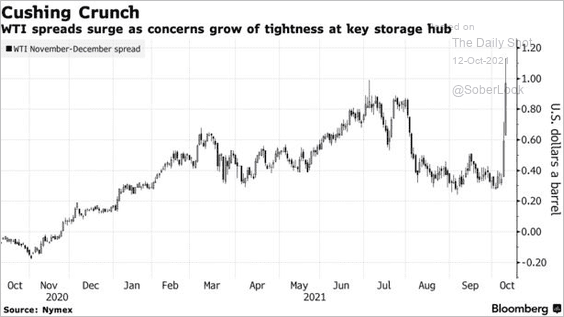

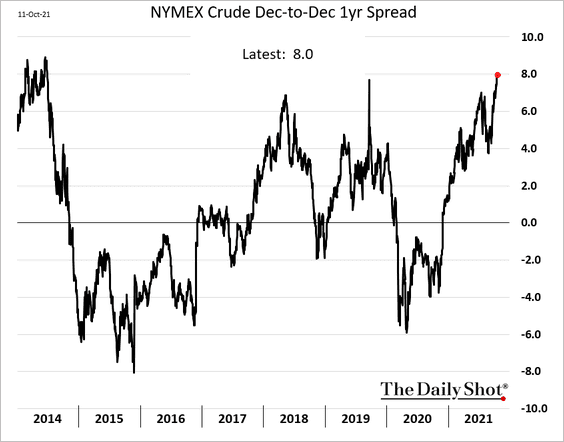

1. The US oil curve continues to move deeper into backwardation, pointing to tight supplies (2 charts).

• Nov-Dec spread:

Source: @business Read full article

Source: @business Read full article

• December-to-December (1yr) rolling spread:

h/t @jessicaisummers

h/t @jessicaisummers

——————–

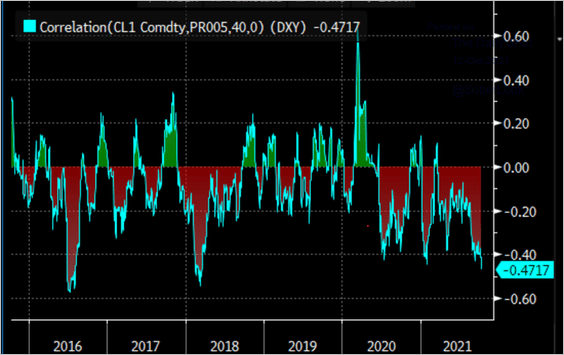

2. Further gains in the US dollar could slow the rally in oil.

Source: @Marcomadness2

Source: @Marcomadness2

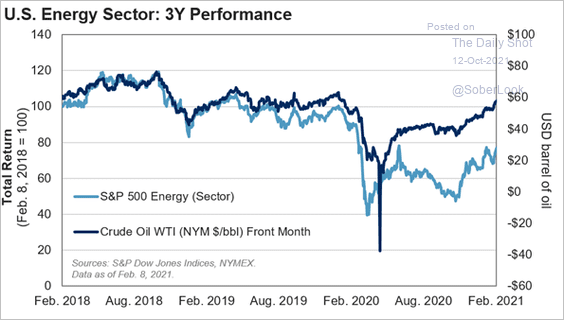

3. US energy shares continue to underperform oil.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

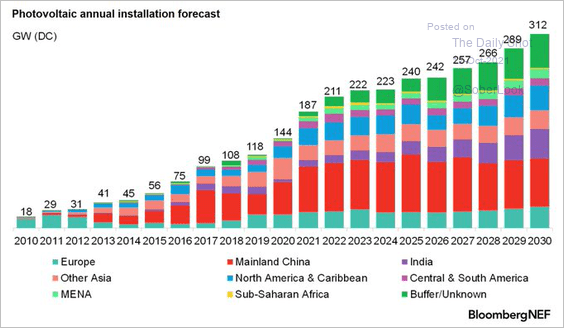

4. Next, we have some updates on renewables.

• Solar installations:

Source: @NatBullard

Source: @NatBullard

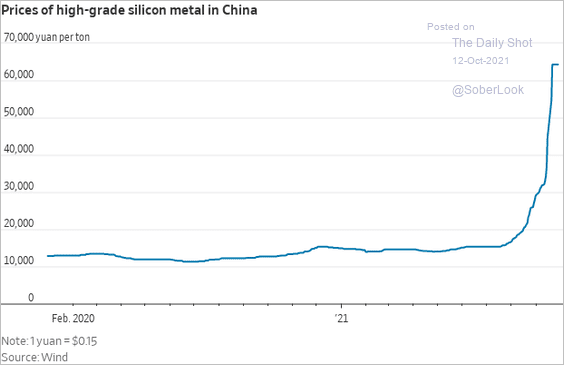

• Rising costs in solar panel production:

Source: @WSJ Read full article

Source: @WSJ Read full article

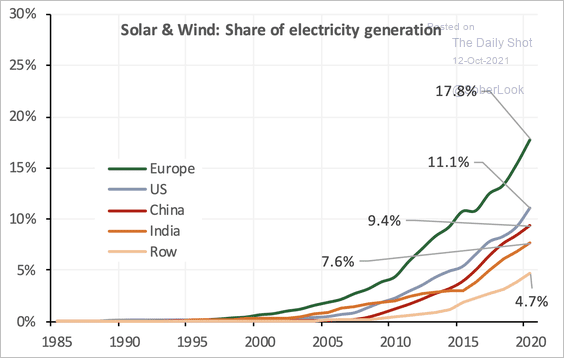

• Solar and wind penetration of electricity generation around the world:

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Equities

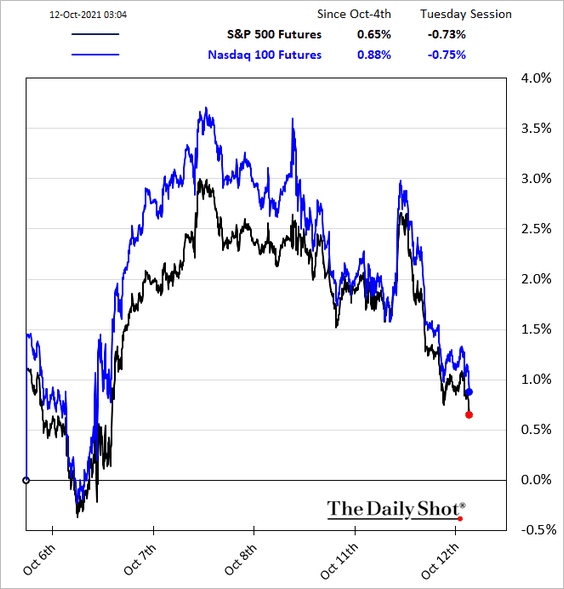

1. Stocks are softer this morning, …

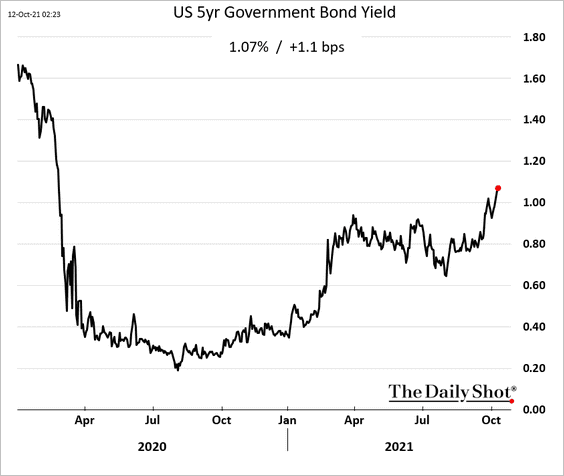

… as bond yields grind higher.

——————–

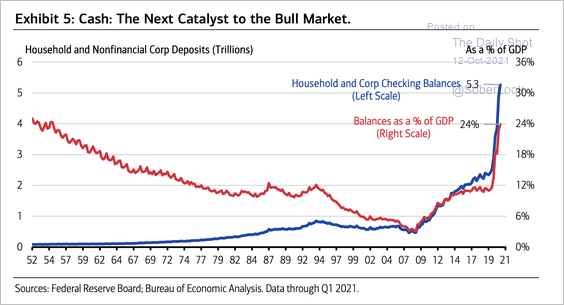

2. The amount of liquidity held by US corporates and households, both on an absolute and relative basis, has never been higher, which should be a tailwind for stocks.

Source: Merill Lynch , BofA Global Research

Source: Merill Lynch , BofA Global Research

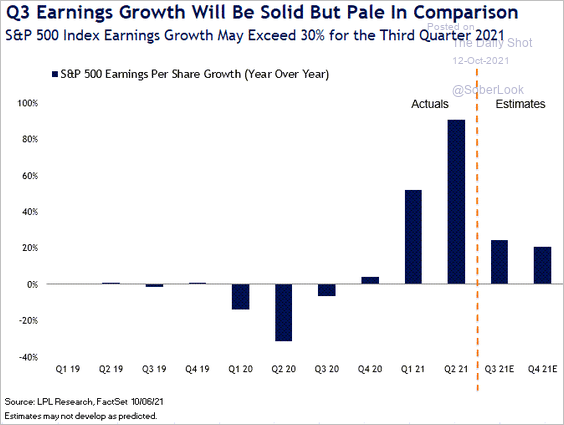

3. Earnings growth will moderate as comps become more challenging.

Source: LPL Research

Source: LPL Research

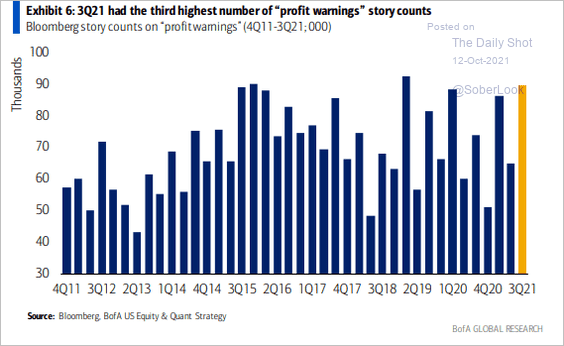

4. Profit warnings picked up last quarter.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

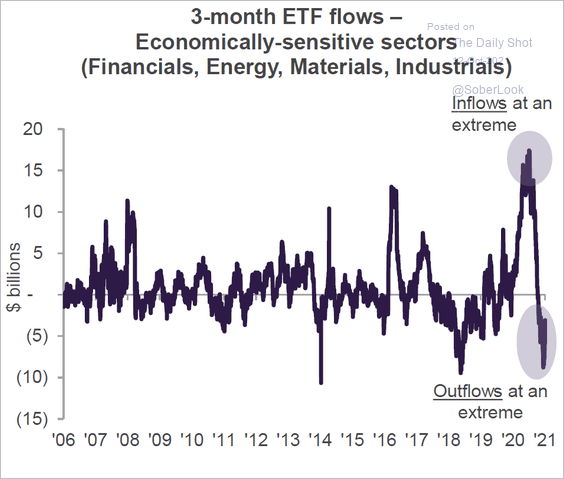

5. The last three months have seen extreme outflows from economically sensitive sectors, suggesting expectations have reset.

Source: Truist Advisory Services

Source: Truist Advisory Services

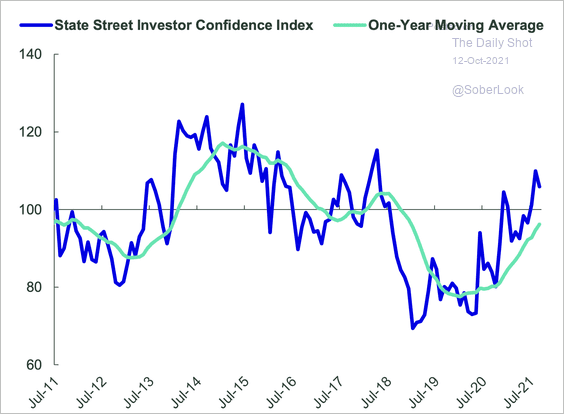

6. Despite a dip in September, institutional investor confidence is still near three-year highs.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

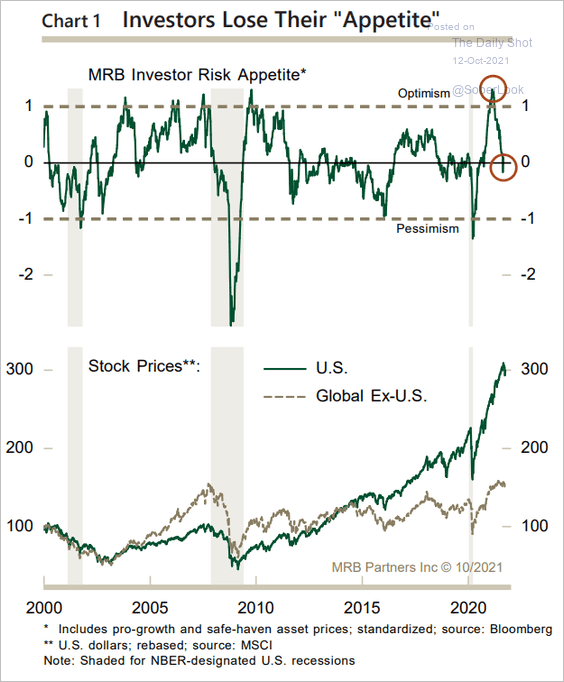

6. Investor risk appetite has been moderating.

Source: MRB Partners

Source: MRB Partners

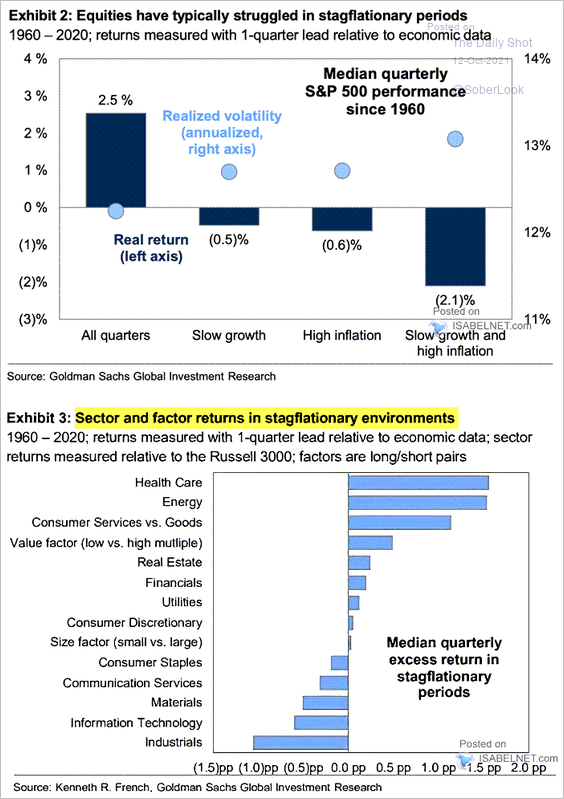

7. How do stocks perform in stagflationary environments?

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

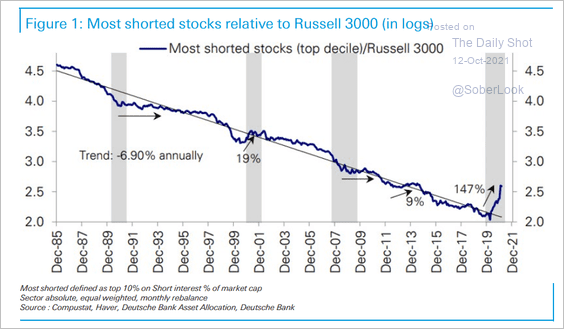

8. Most-shorted stocks broke the downward trend as the Reddit crowd pounced. Shorting equities, an essential part of a healthy market, has become nearly untenable.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

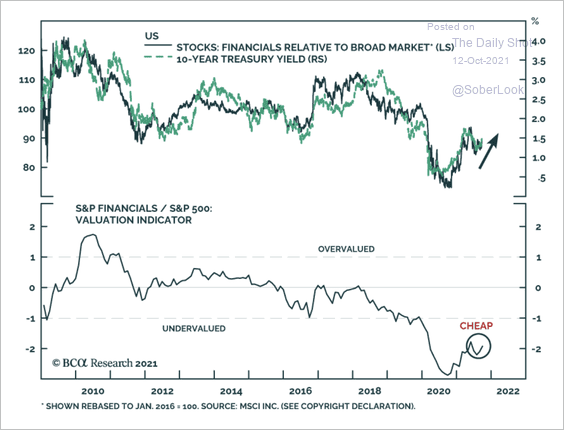

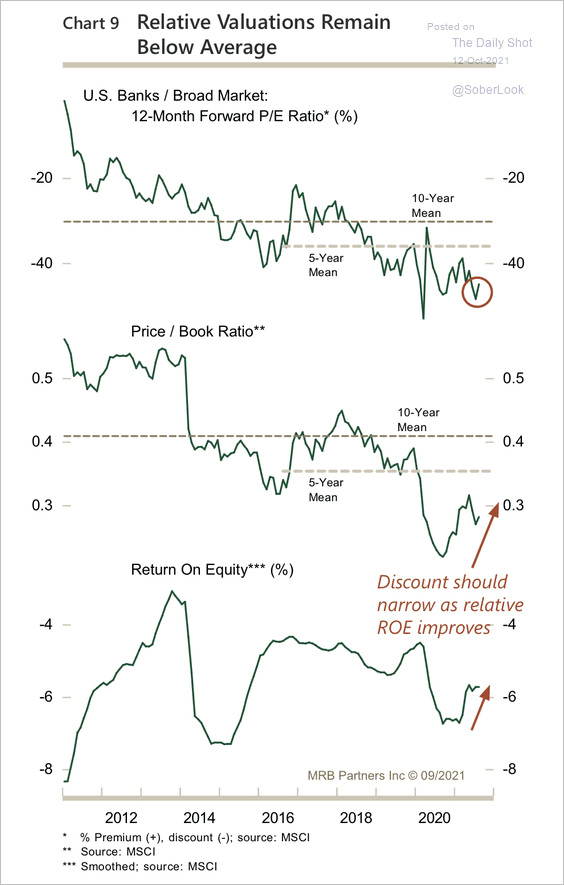

9. Financials still appear undervalued relative to the broader market (2 charts).

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

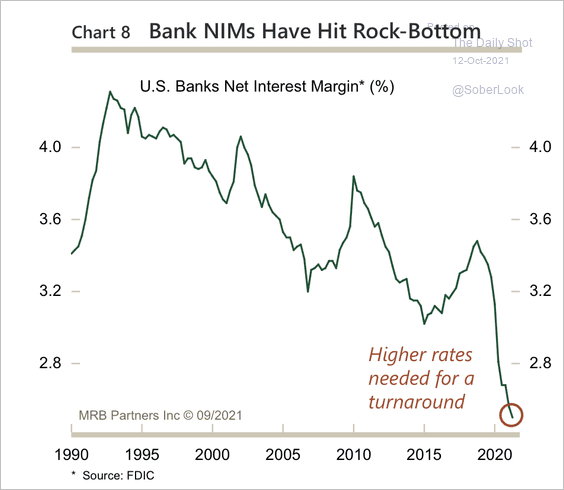

Have banks’ net-interest margins reached a bottom?

Source: BCA Research

Source: BCA Research

——————–

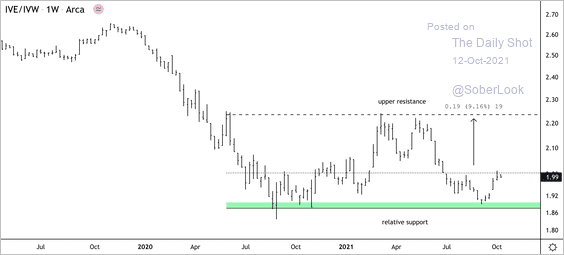

10. The iShares large-cap value ETF (IVE) is holding support relative to the iShares large-cap growth ETF (IVW).

Source: Dantes Outlook

Source: Dantes Outlook

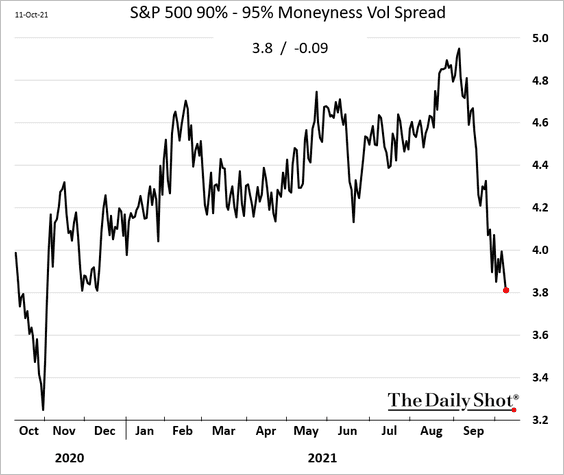

11. Option skew continues to trend lower as demand for out-of-the-money puts moderates.

h/t @danny_kirsch

h/t @danny_kirsch

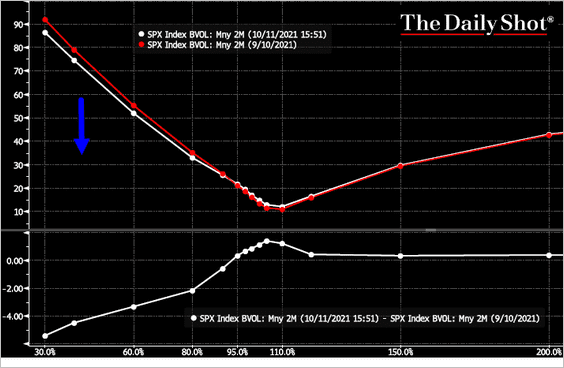

Here are the changes in the S&P 500 volatility curve by strike percentage (skew).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

1. S&P Global’s bankruptcy tracker shows slowing US defaults.

![]() Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

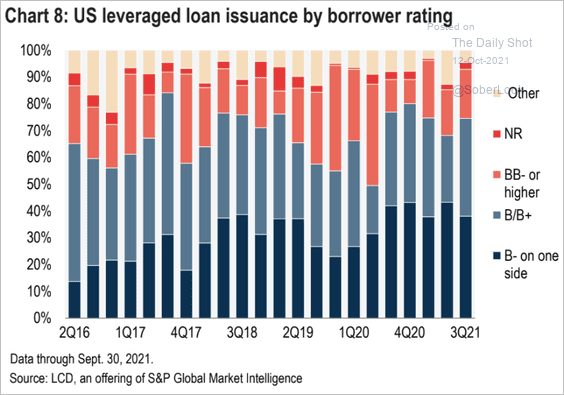

2. Next, we have leveraged loan issuance by rating, …

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

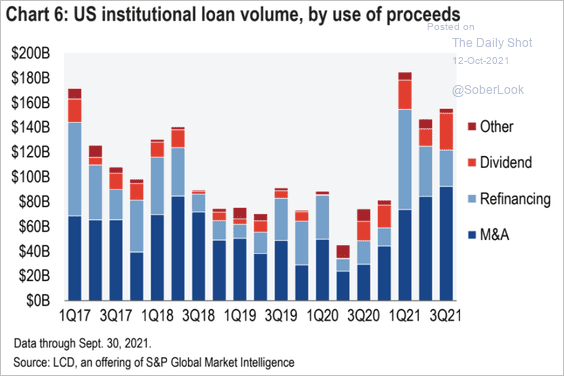

… and use of proceeds.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Rates

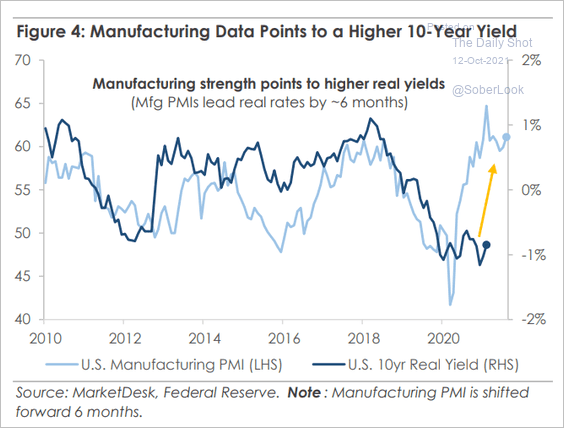

1. Higher real yields ahead?

Source: MarketDesk Research

Source: MarketDesk Research

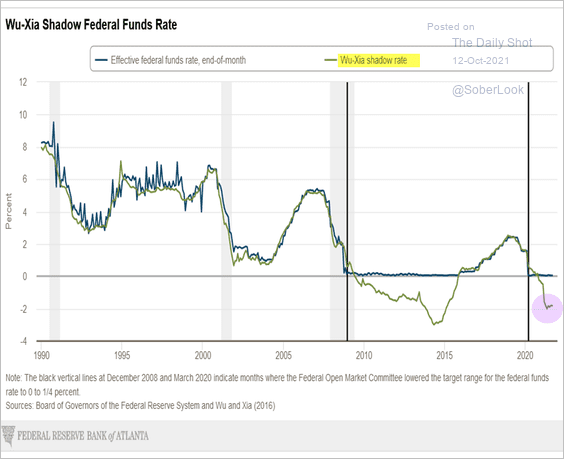

2. The US shadow rate shows an extraordinary level of policy accommodation.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

Back to Index

Global Developments

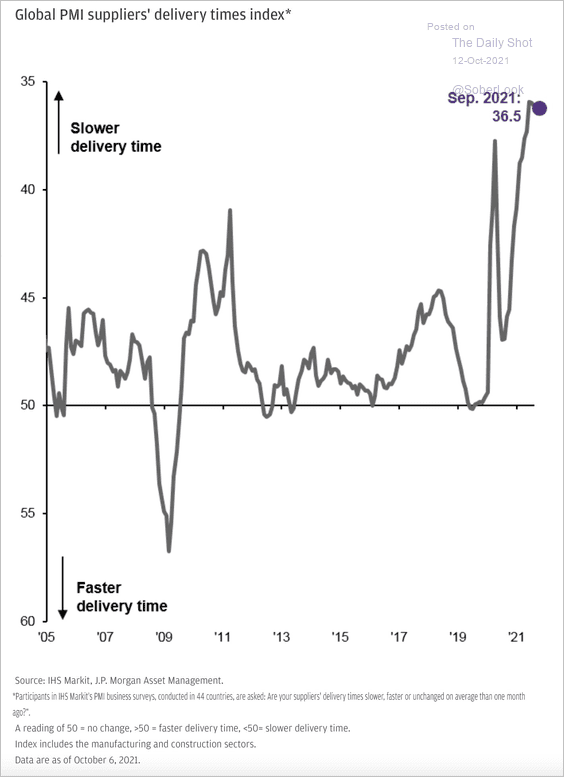

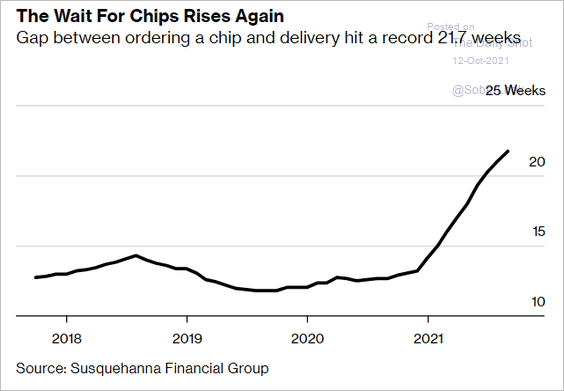

1. Global supply chain bottlenecks persist.

Source: @tomfishburne Read full article

Source: @tomfishburne Read full article

• Supplier deliveries:

Source: @acemaxx, @JPMorganAM

Source: @acemaxx, @JPMorganAM

• Semiconductor delays:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

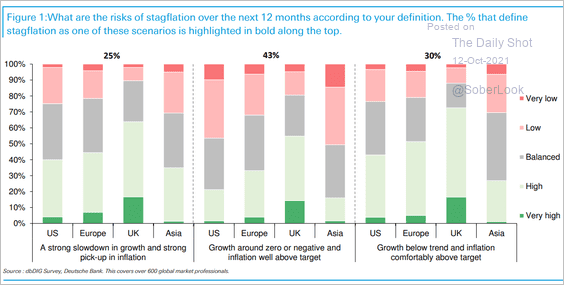

2. What are the risks of stagflation over the coming year?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

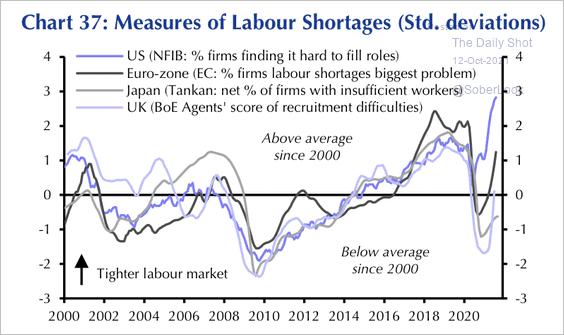

3. Labor markets are increasingly tight, especially in the US and the Eurozone.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

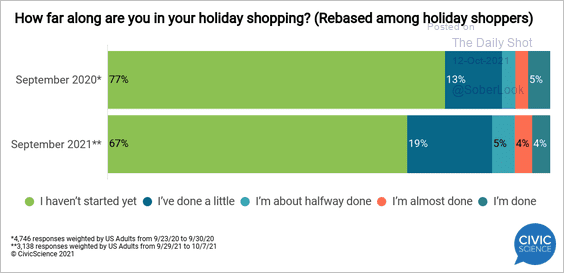

1. Early holiday shopping:

Source: @CivicScience

Source: @CivicScience

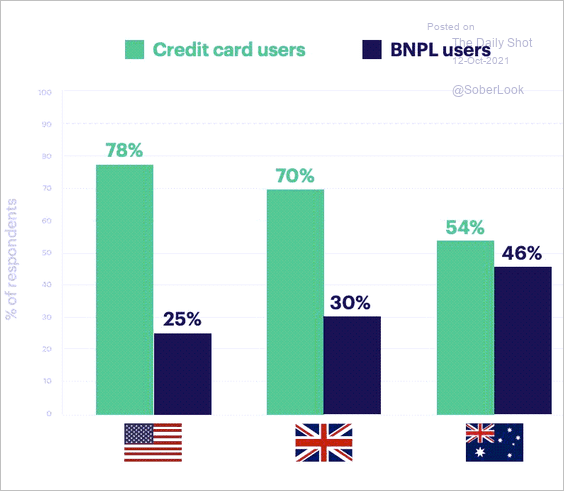

2. “Buy now pay later” (BNPL) users:

Source: @alantsen Read full article

Source: @alantsen Read full article

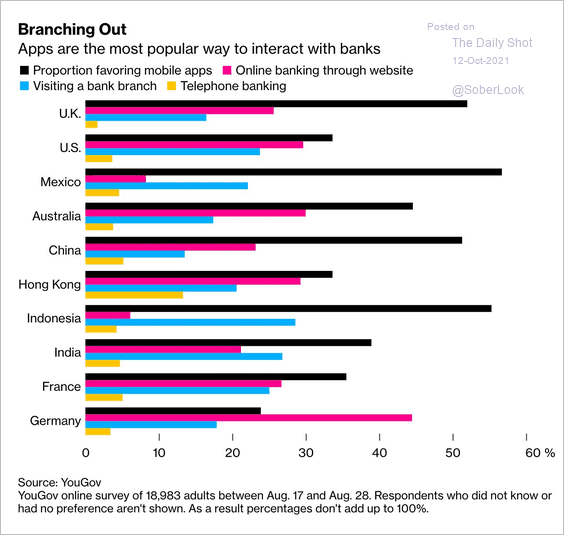

3. Interacting with banks:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

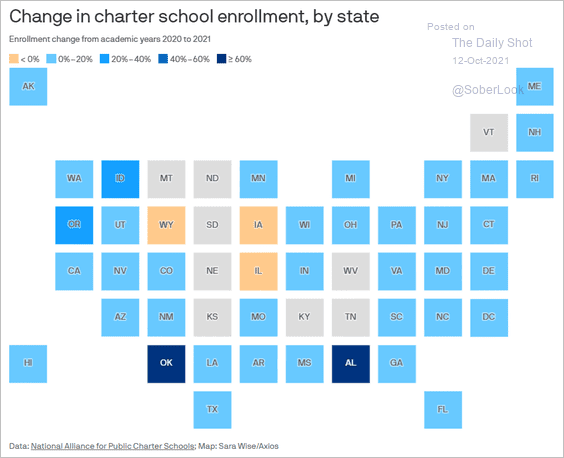

4. Growth in charter school enrollment:

Source: @axios Read full article

Source: @axios Read full article

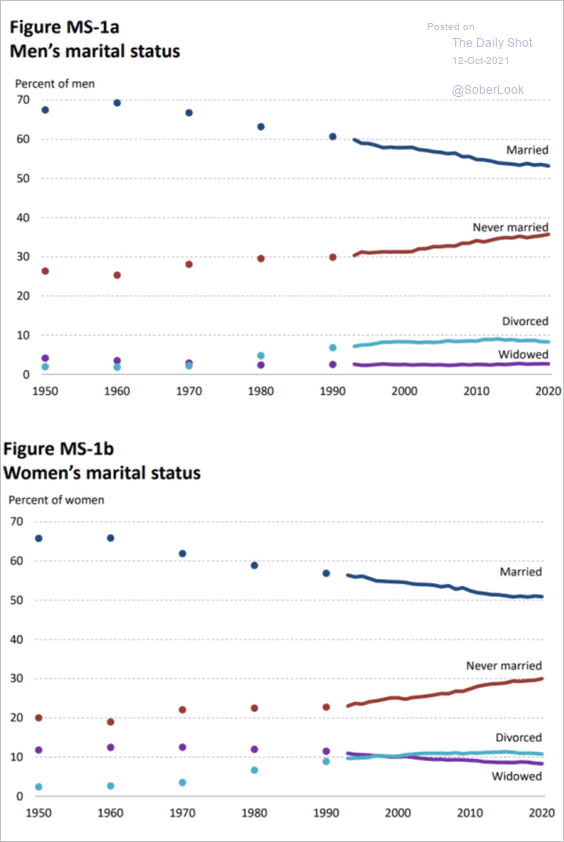

5. Nearly half of US adults are unmarried:

Source: @HTLasVegas, @rcgeconomics Read full article

Source: @HTLasVegas, @rcgeconomics Read full article

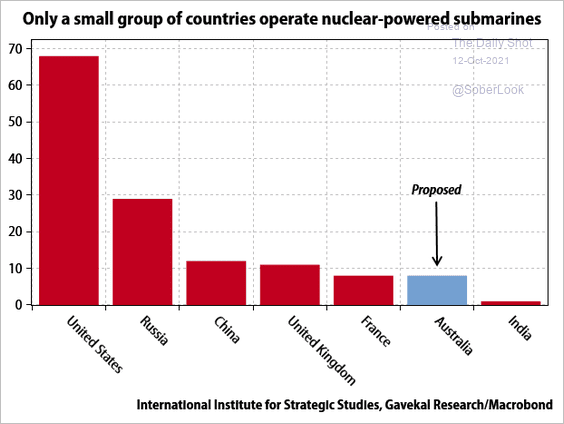

6. Nuclear submarine fleets:

Source: Gavekal Research

Source: Gavekal Research

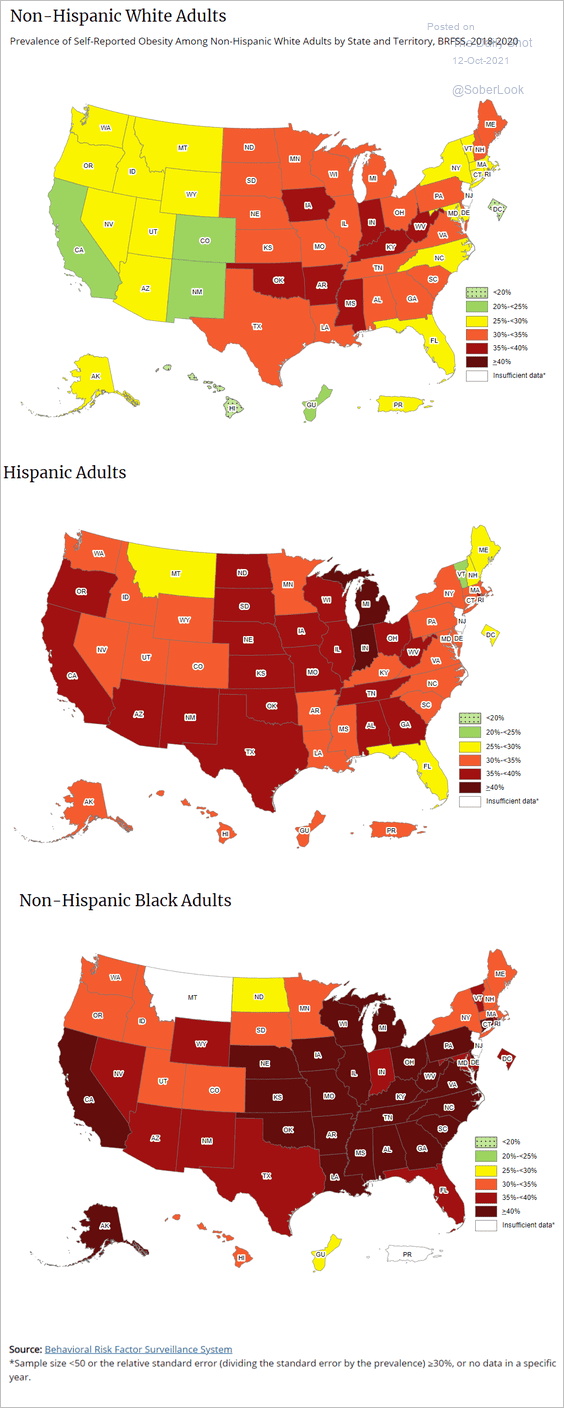

7. Adult obesity prevalence by state:

Source: CDC

Source: CDC

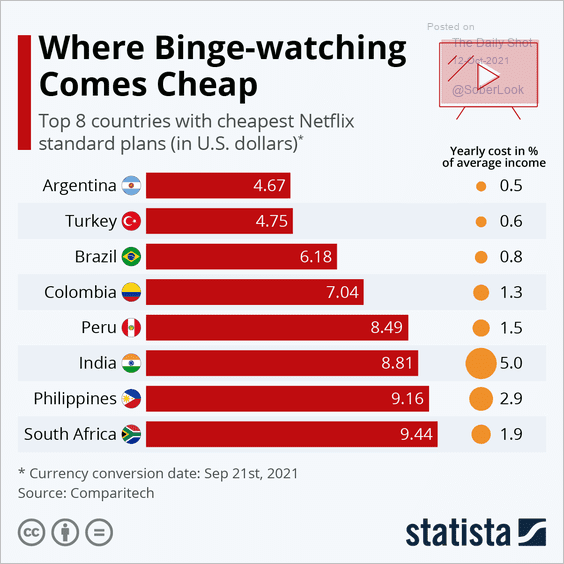

8. Cheapest Netflix standard plans:

Source: Statista

Source: Statista

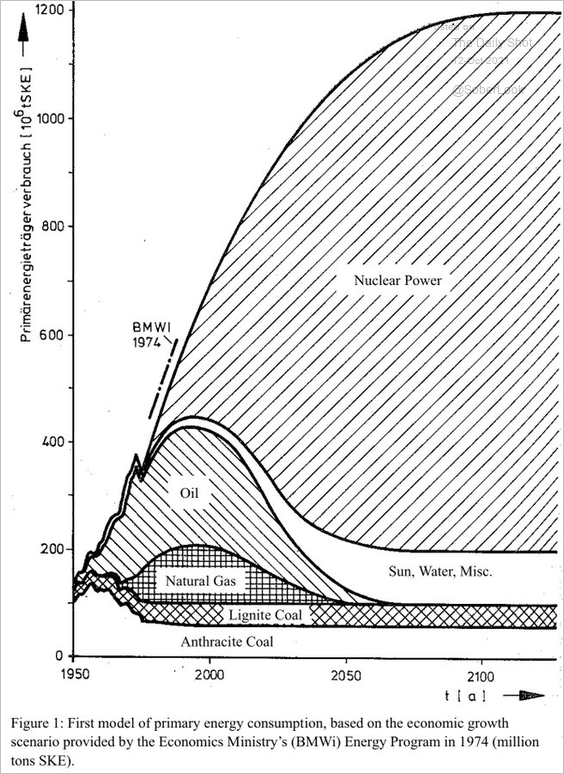

9. A mid-1970s German forecast for energy sources of the future:

Source: @Stephen83802580

Source: @Stephen83802580

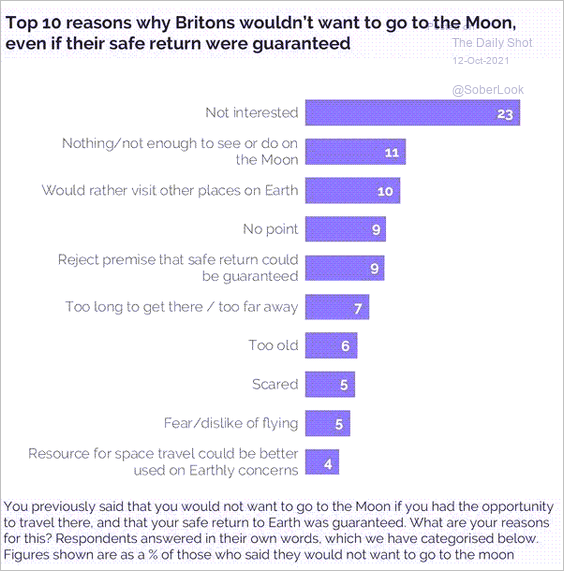

10. Reasons why Britons (individuals) would not want to go to the Moon:

Source: @RupertMyers Read full article

Source: @RupertMyers Read full article

——————–

Back to Index