The Daily Shot: 13-Oct-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

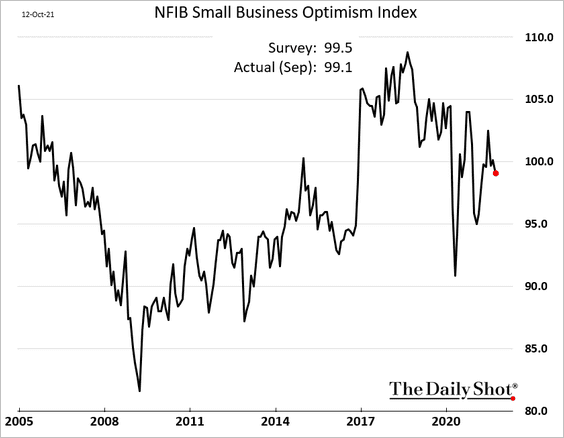

1. The NFIB small business sentiment index ticked lower in September.

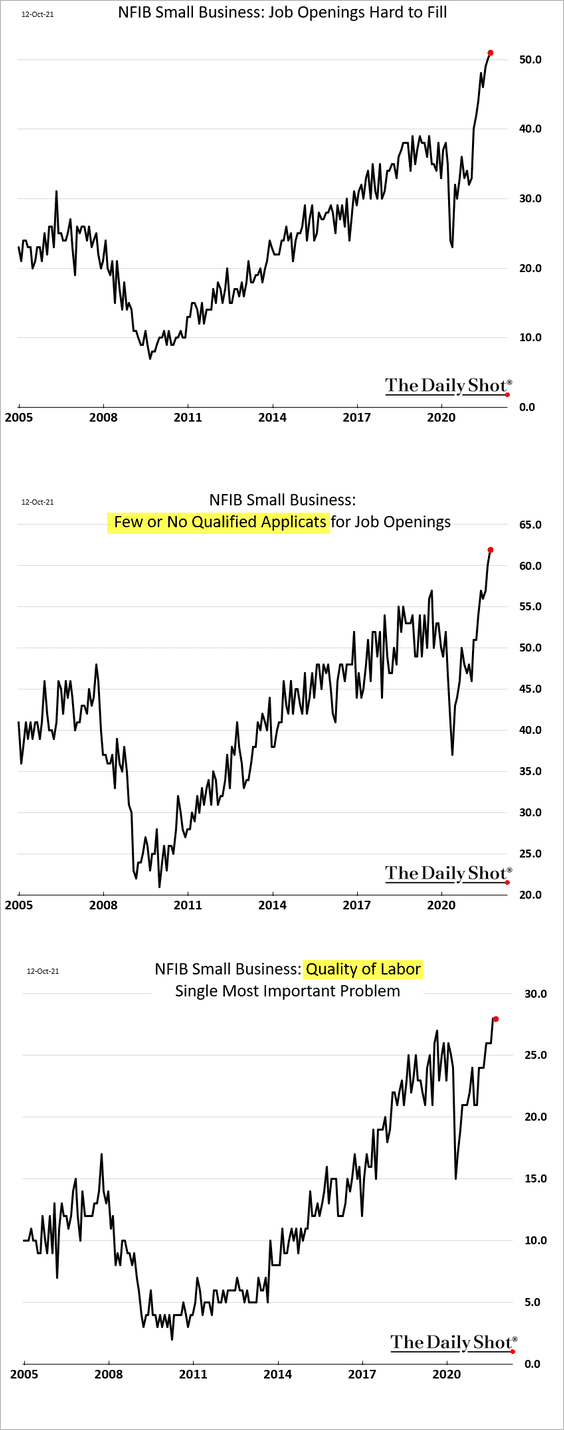

• Labor shortages became even more acute last month.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

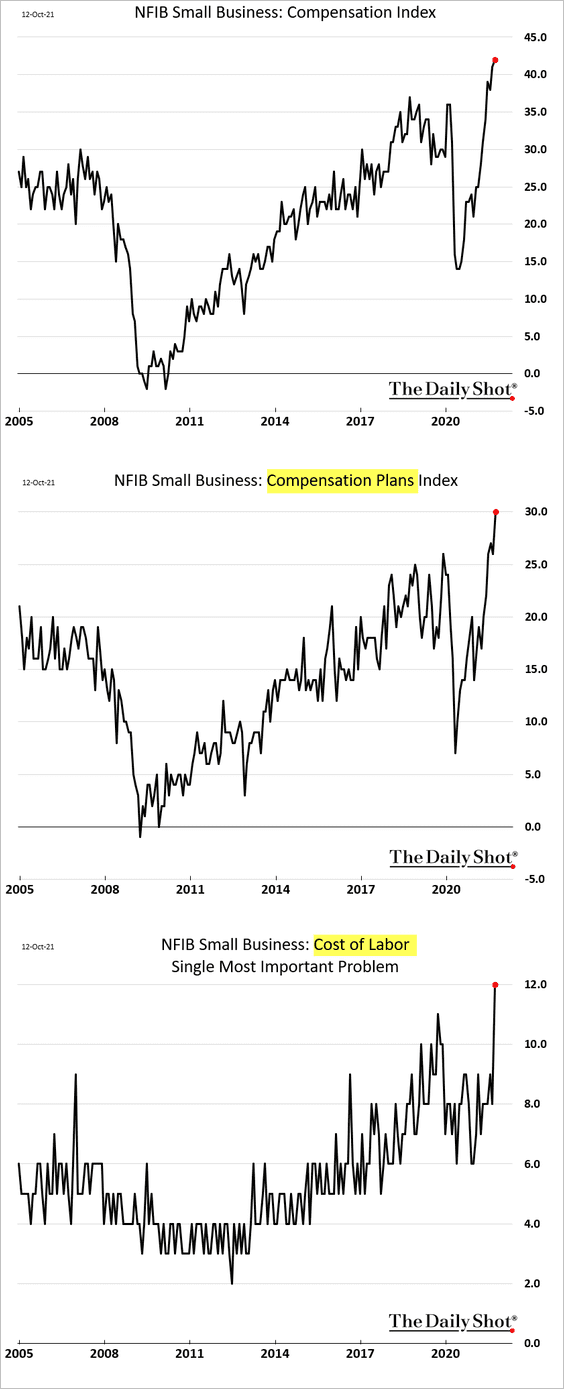

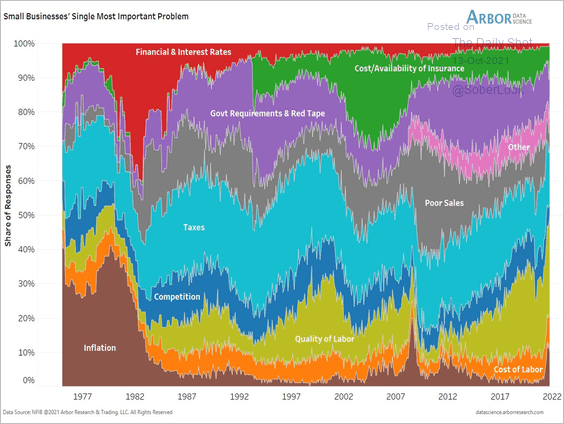

• A record share of businesses are boosting wages and plan to keep doing so in the months ahead. The cost of labor is becoming more of a problem.

Source: @benbreitholtz

Source: @benbreitholtz

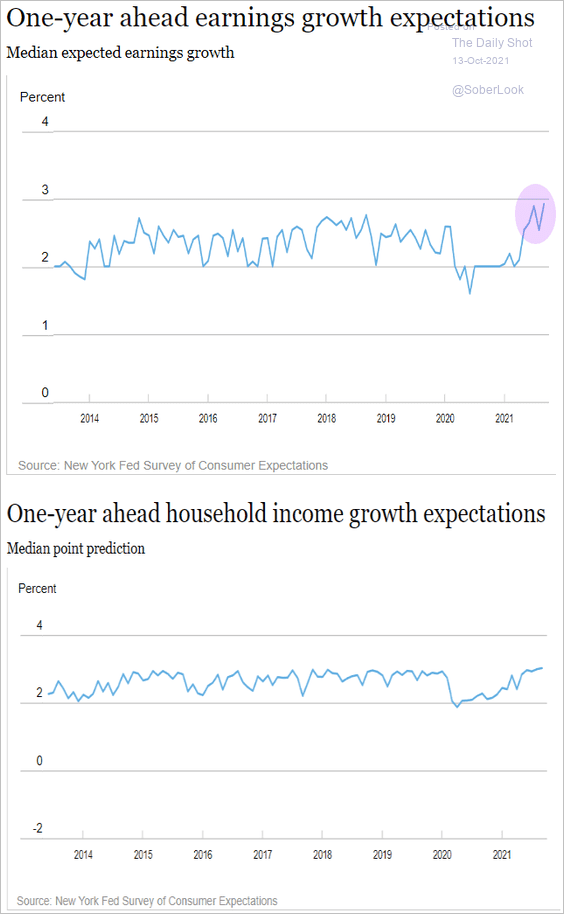

By the way, households also expect to see higher wages, according to the NY Fed’s national consumer survey.

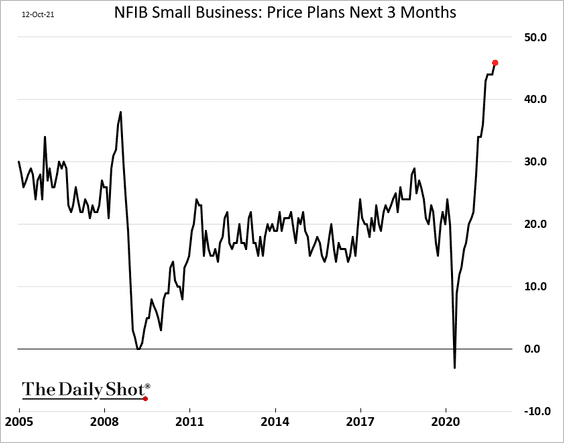

• The percentage of firms planning to raise prices keeps climbing.

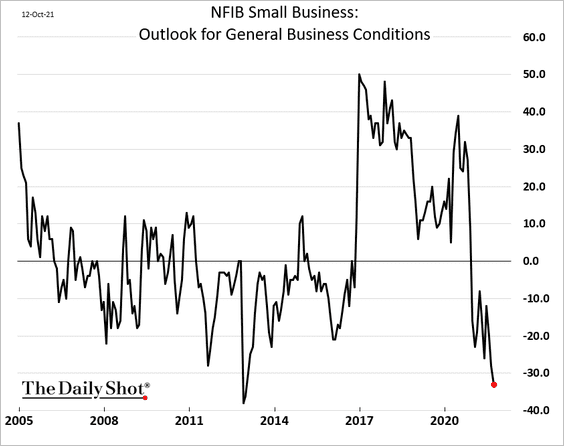

• Business outlook continues to deteriorate.

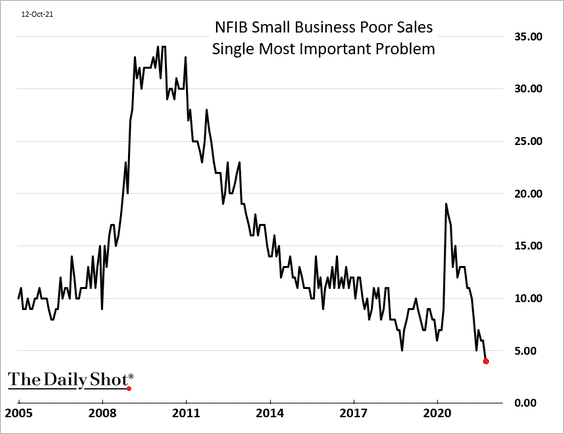

And it’s not about poor sales.

——————–

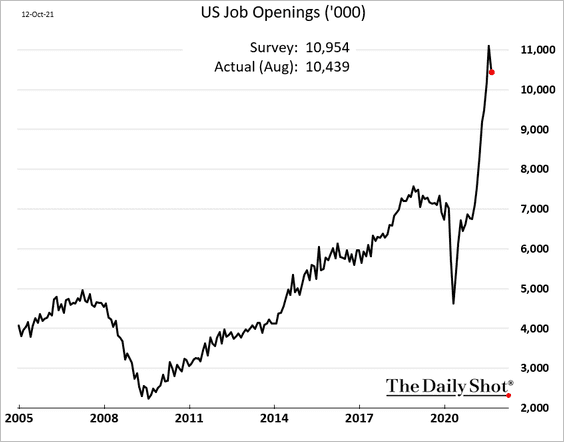

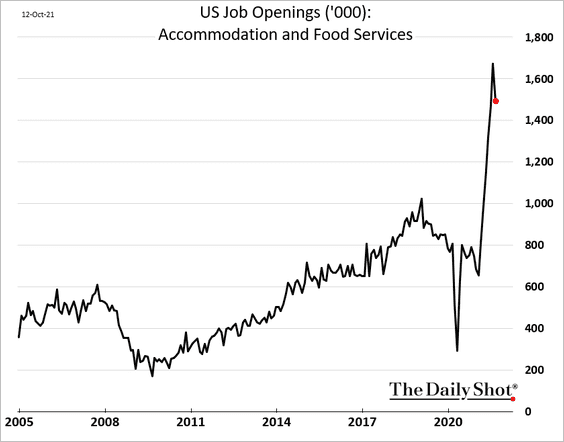

2. US job openings came off the highs in August as the pandemic strengthened.

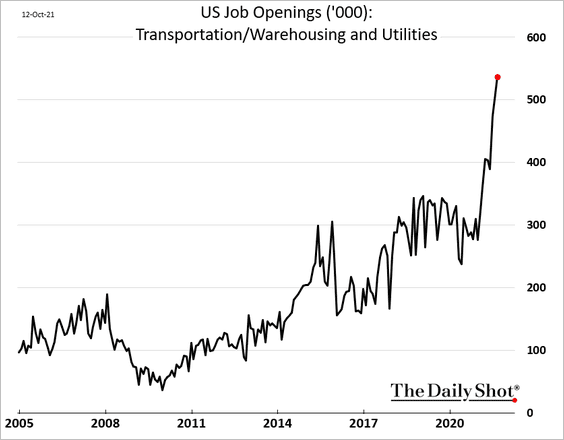

• But demand for workers in logistics (transportation & warehousing) continues to surge.

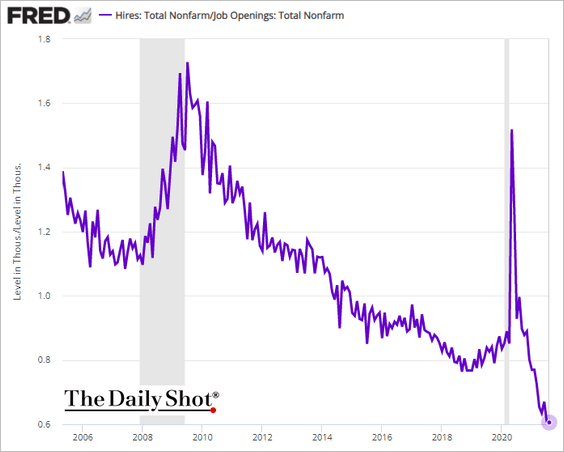

• The hires-to-openings ratio remains at record lows.

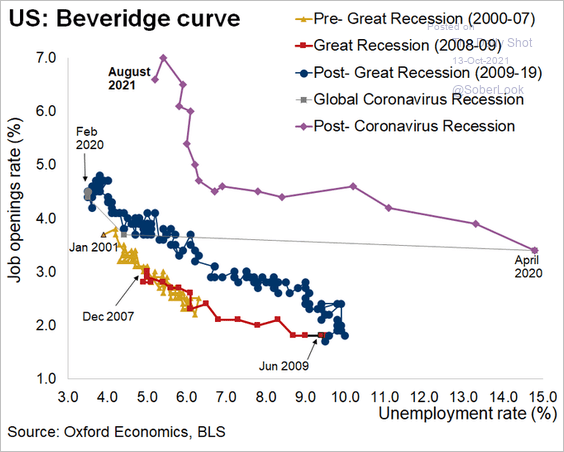

Here is the Beveridge curve.

Source: @GregDaco

Source: @GregDaco

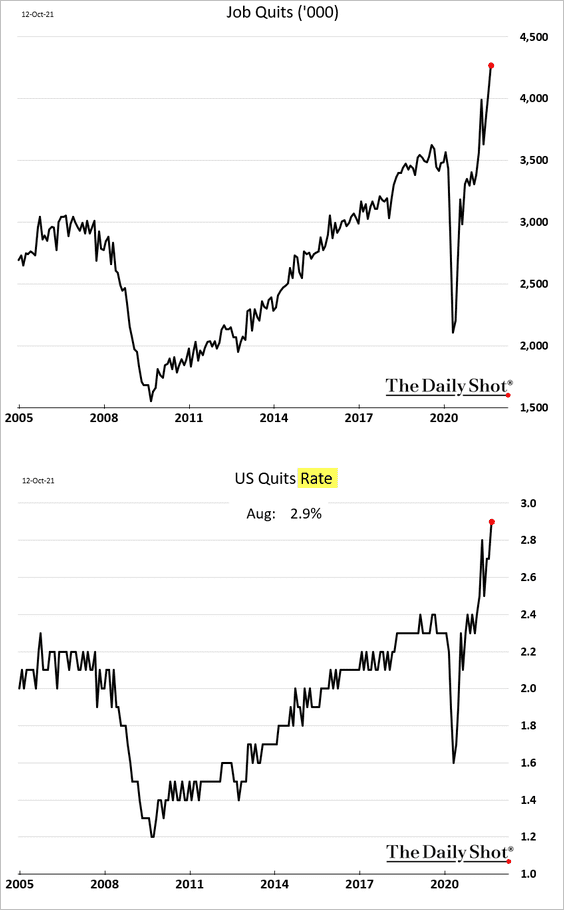

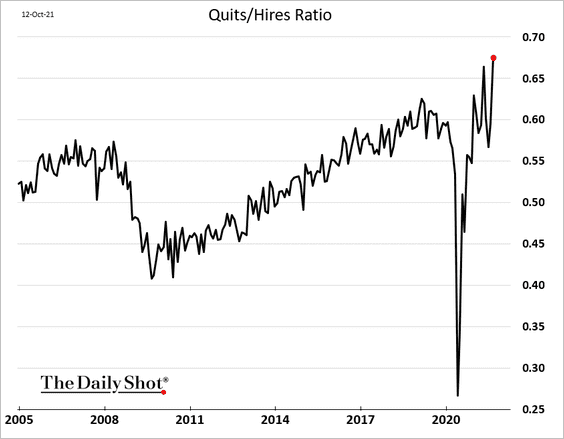

• Americans are quitting their jobs at a record pace. The quits rate and the absolute number of voluntary resignations hit a record high.

Here is the quits-to-hires ratio – an indication of a tightening labor market.

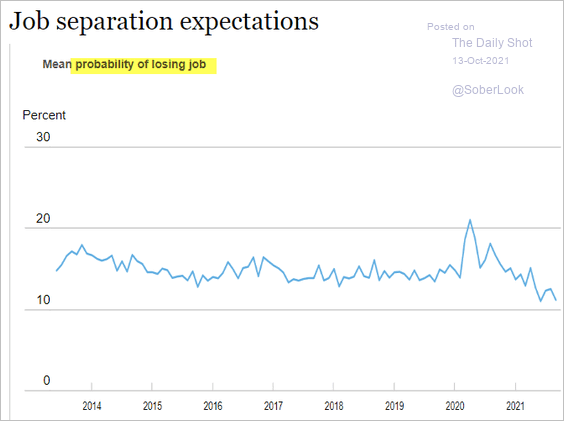

Separately, the NY Fed’s national survey shows that fewer Americans are worried about losing their job.

——————–

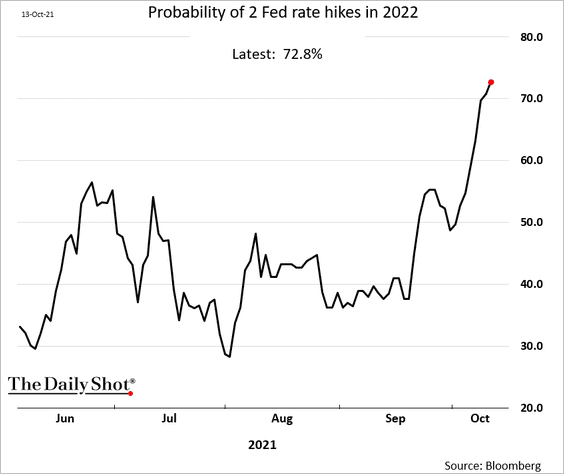

3. Tight labor markets and indications of higher wage inflation further boosted expectations for the pace of Fed rate hikes. The market now sees a 70%+ probability of two hikes next year.

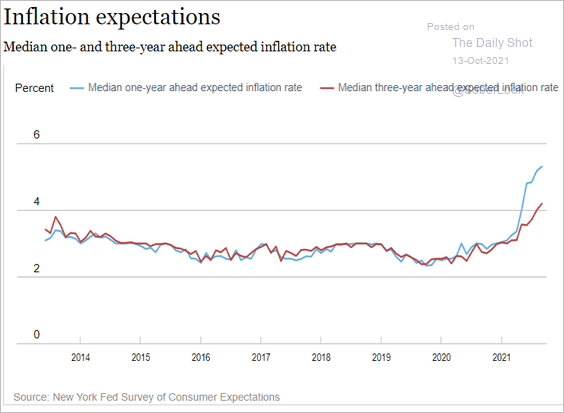

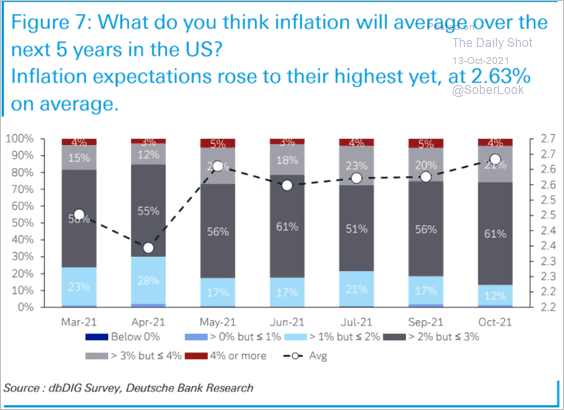

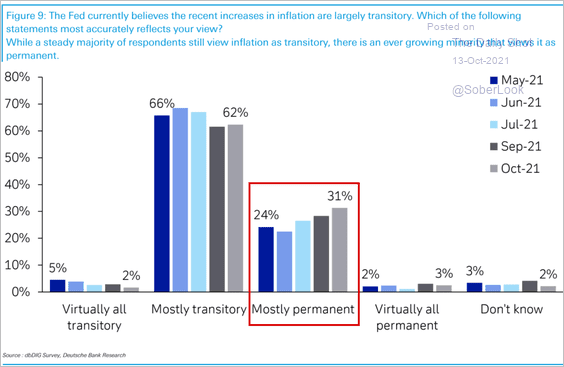

4. Next, we have some updates on inflation.

• Households’ inflation expectations continue to climb.

• Market professionals have been boosting their inflation expectations as well, according to a survey from Deutsche Bank (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

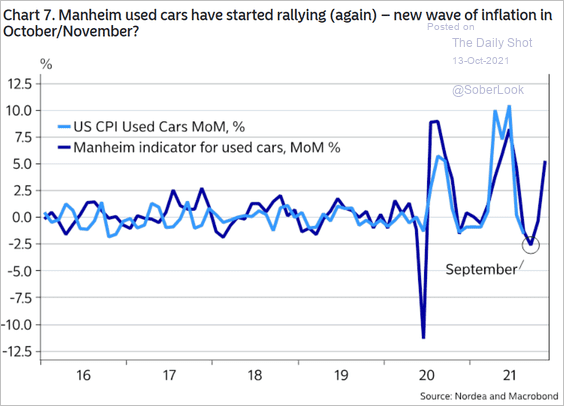

• Based on wholesale prices, used-car CPI will climb in the months ahead.

Source: Nordea Markets

Source: Nordea Markets

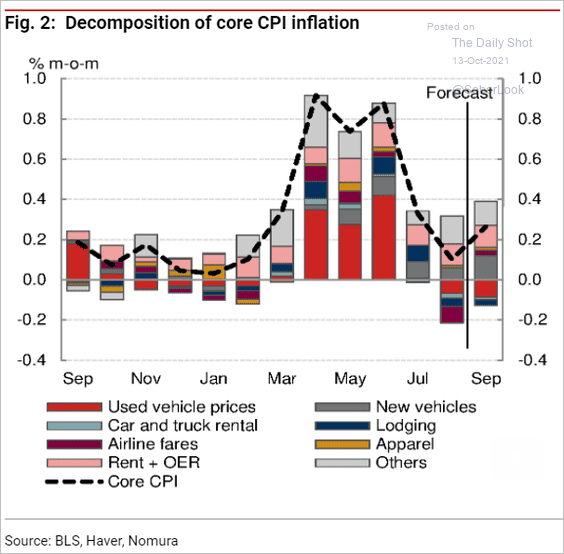

• Here is Nomura’s core CPI estimate for September (the used car price spike will come later).

Source: Nomura Securities

Source: Nomura Securities

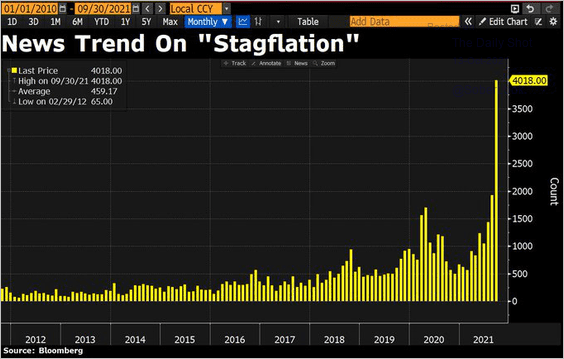

• There is plenty of talk about stagflation these days.

Source: @DavidInglesTV

Source: @DavidInglesTV

——————–

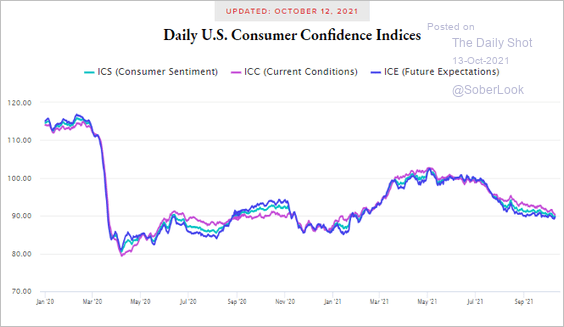

5. Morning Consult’s high-frequency consumer confidence indicator keeps trending lower.

Source: Morning Consult

Source: Morning Consult

Back to Index

Canada

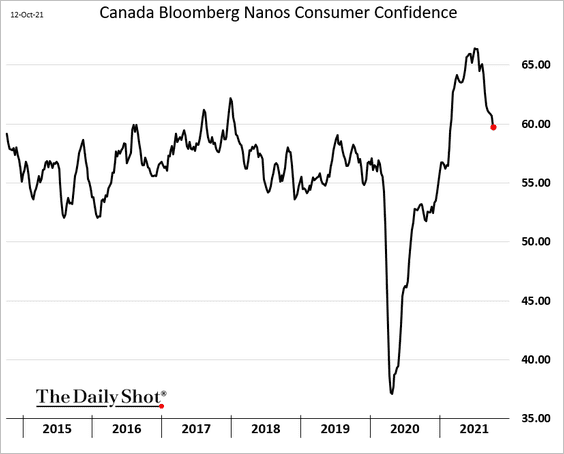

1. Consumer confidence continues to moderate.

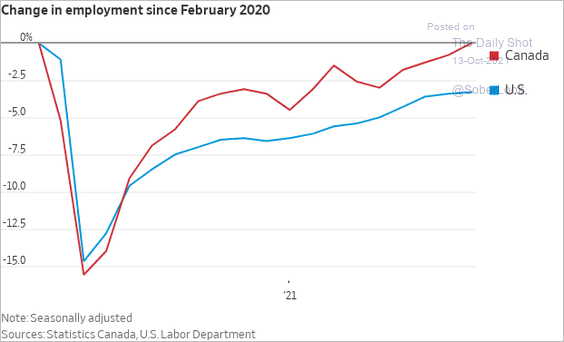

2. Canada’s labor market recovery has been outpacing the US.

Source: @WSJ Read full article

Source: @WSJ Read full article

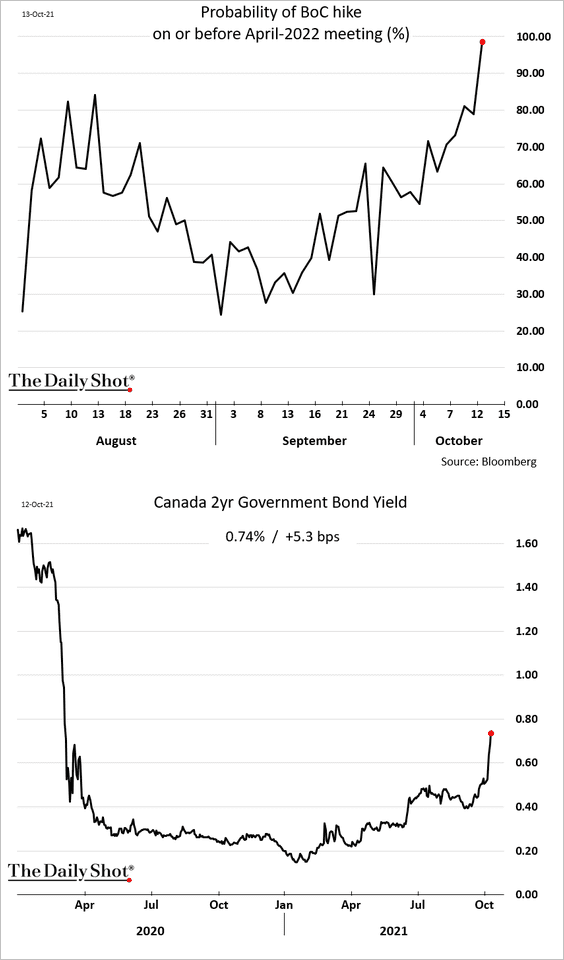

3. The market is now certain that the BoC will hike rates on or before April.

Back to Index

The United Kingdom

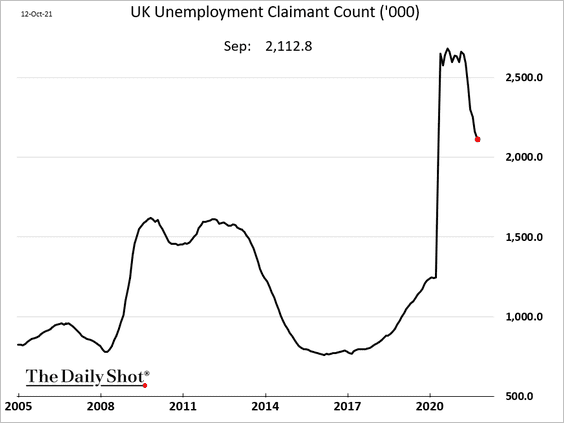

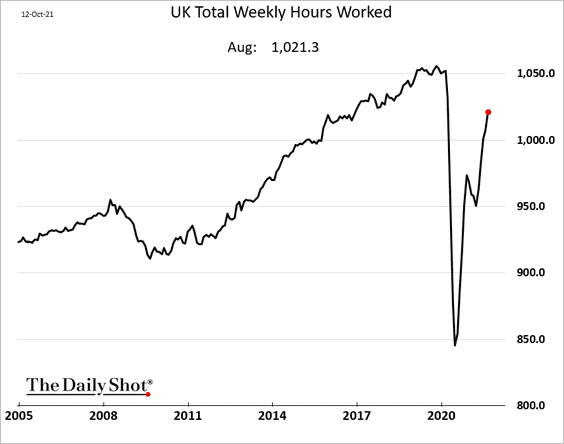

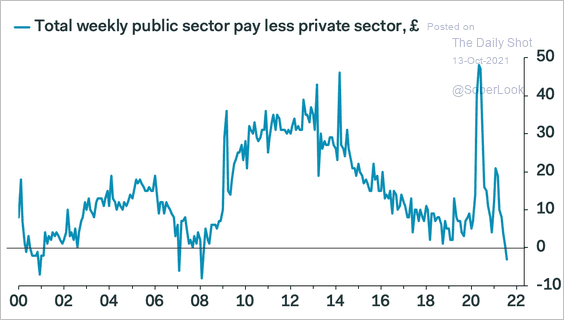

1. The labor market continues to recover.

• The number of people on unemployment:

• Weekly hours:

• Private sector wages were above the public sector for the first time since 2008.

Source: @samueltombs

Source: @samueltombs

——————–

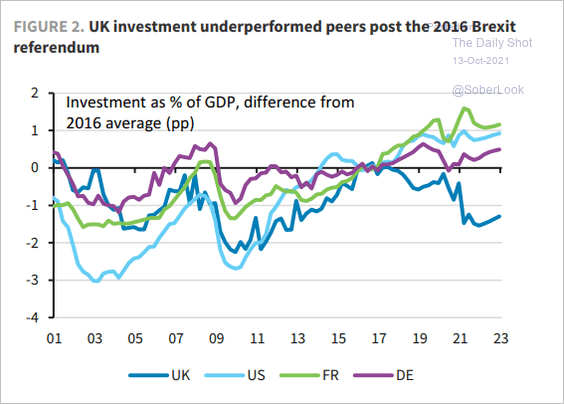

2. Business investment in the UK has been lagging.

Source: Barclays Research

Source: Barclays Research

Back to Index

The Eurozone

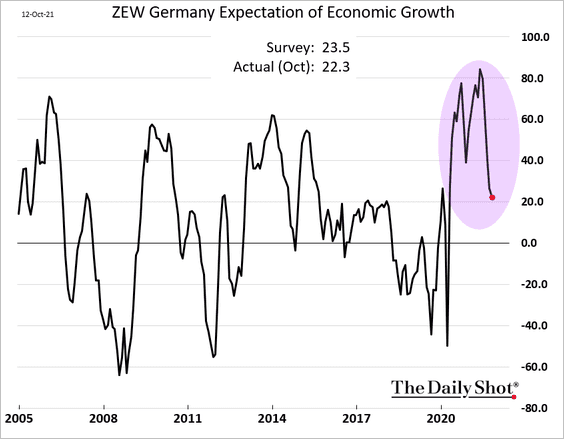

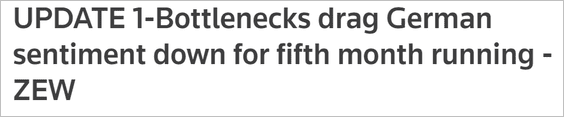

1. Germany’s ZEW economic expectations indicator deteriorated further this month.

Source: Reuters Read full article

Source: Reuters Read full article

• German wholesale inflation has been accelerating.

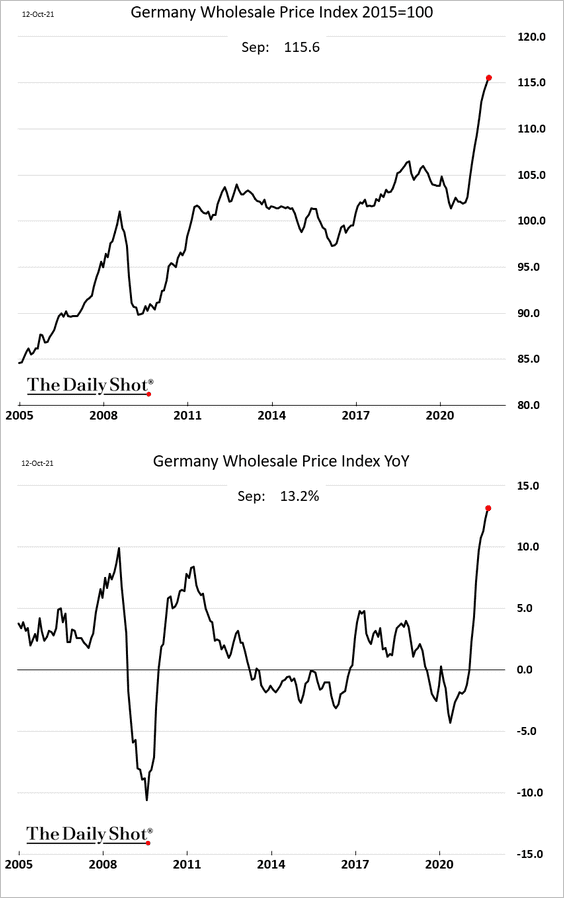

• Bund yields are climbing.

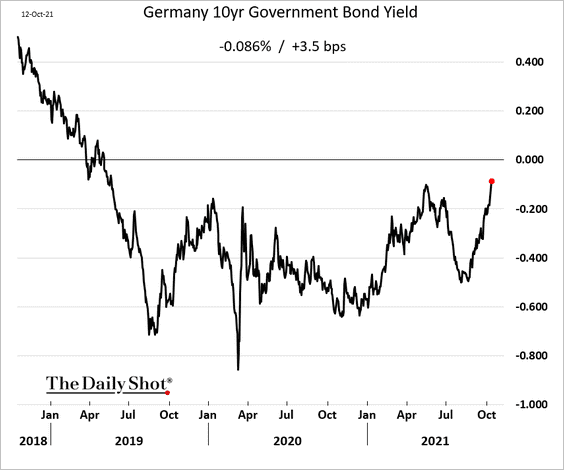

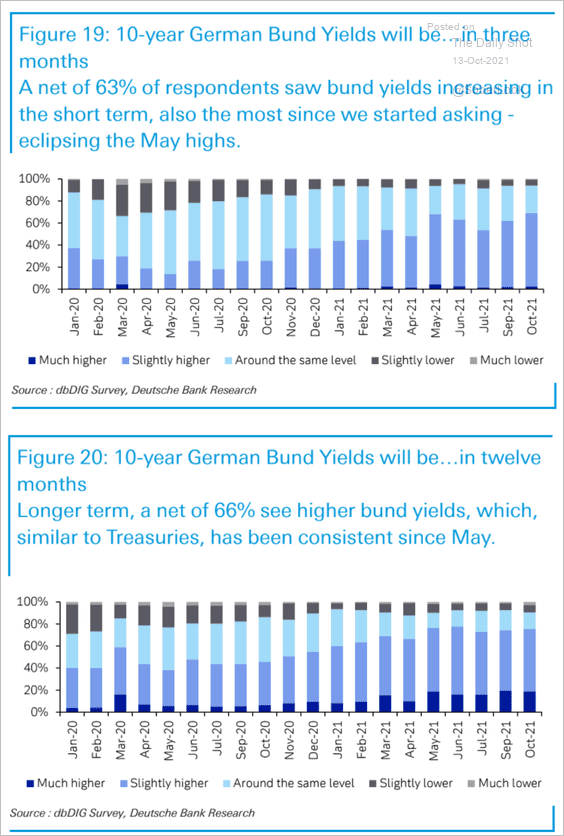

And market professionals expect further gains ahead.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

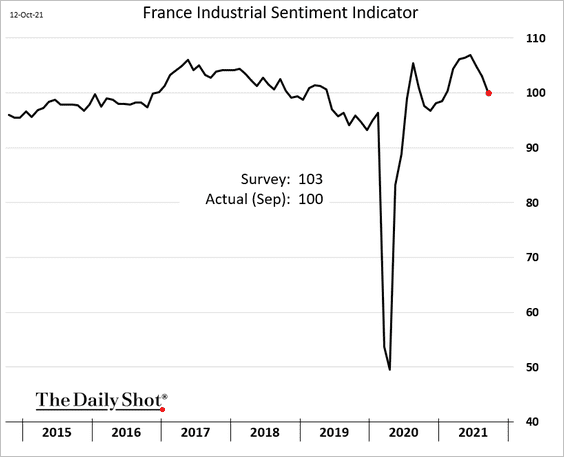

2. French industrial sentiment has been moderating.

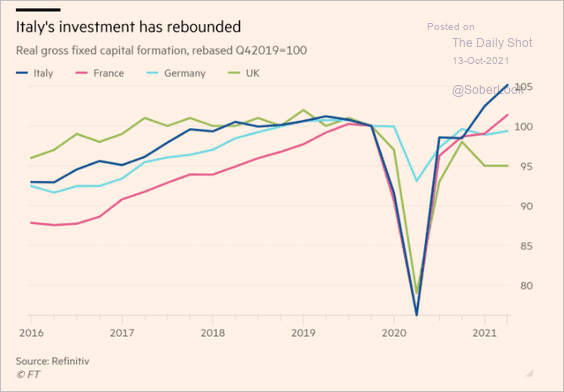

3. Italian business investment has been outpacing European peers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

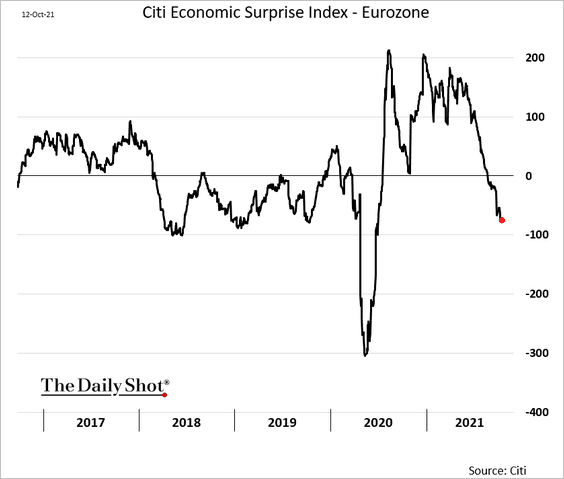

4. The Citi Economic Surprise Index keeps drifting lower.

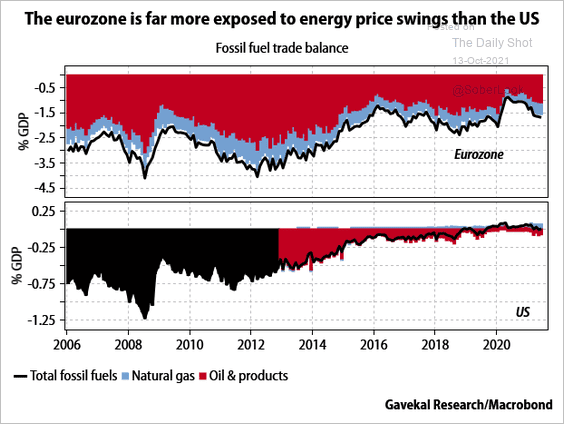

5. The Eurozone’s economy is more exposed to higher energy prices than the US.

Source: Gavekal Research

Source: Gavekal Research

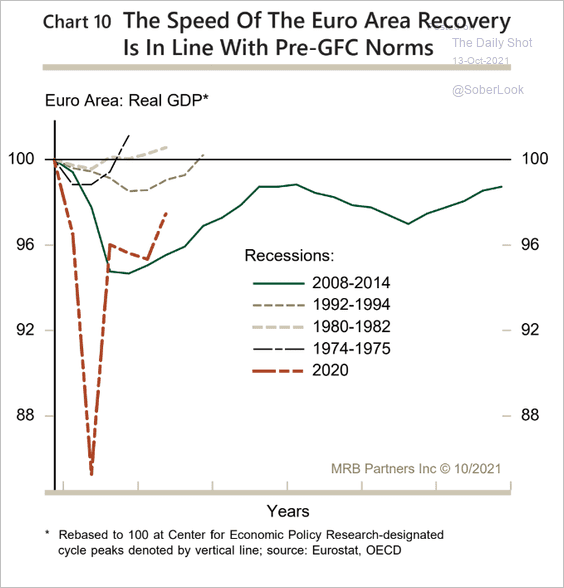

6. This chart compares the current euro-area recovery to previous downturns.

Source: MRB Partners

Source: MRB Partners

Back to Index

Europe

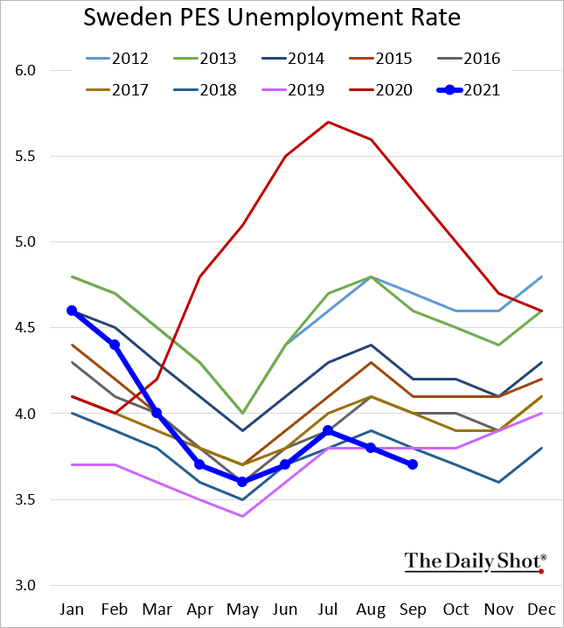

1. Sweden’s unemployment rate hit the lowest level in years (for this time of the year).

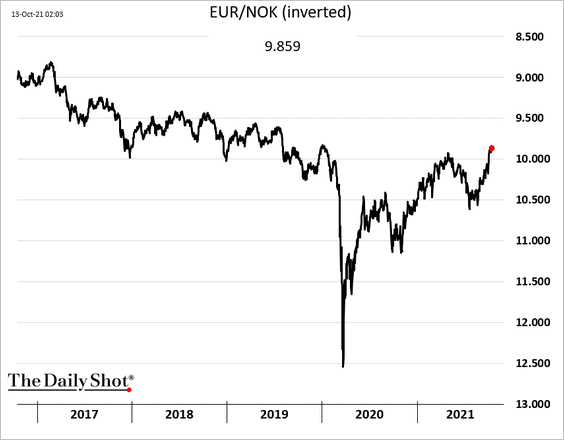

2. The Norwegian krone has been strengthening as oil prices surge.

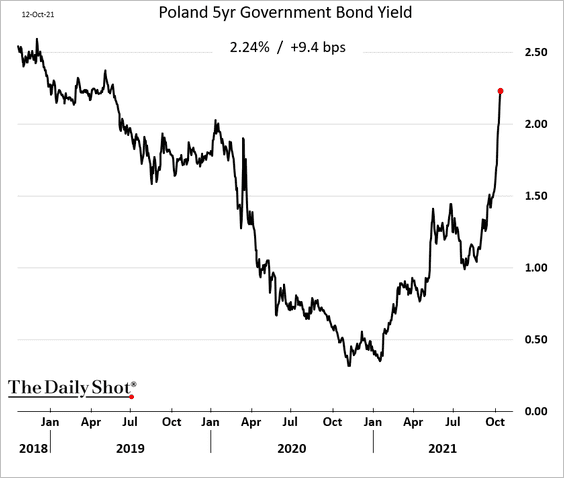

3. Poland’s bond yields are soaring.

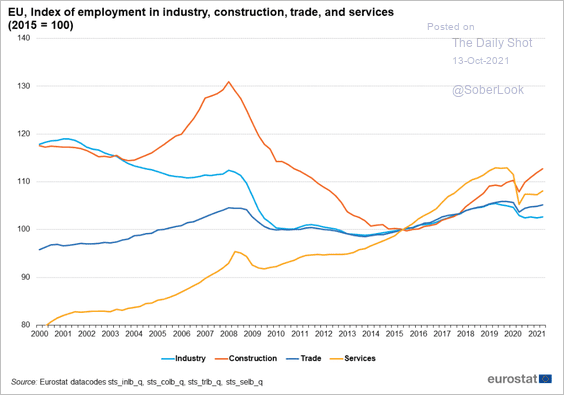

4. This chart shows EU employment by sector over the past two decades.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

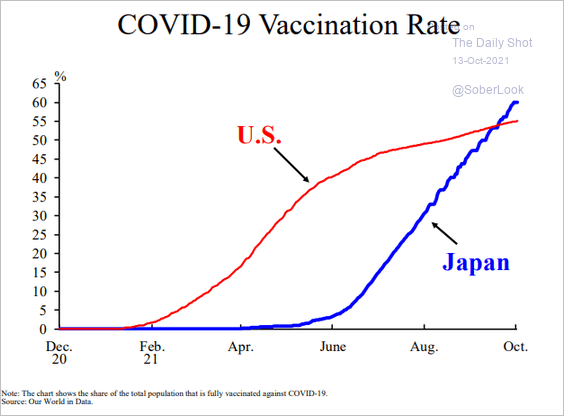

1. Japan’s vaccination rate has been outpacing the US.

Source: BIS Read full article

Source: BIS Read full article

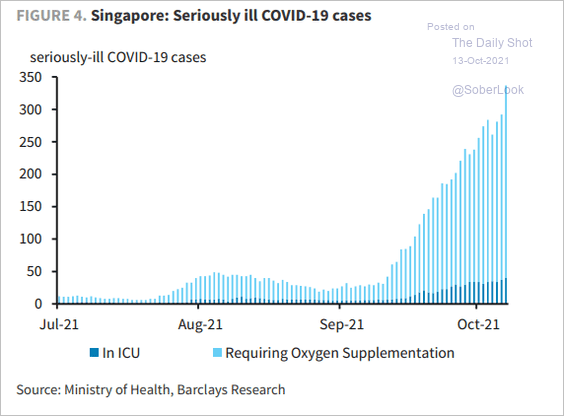

2. Singapore’s number of seriously ill COVID patients has been climbing.

Source: Barclays Research

Source: Barclays Research

Back to Index

China

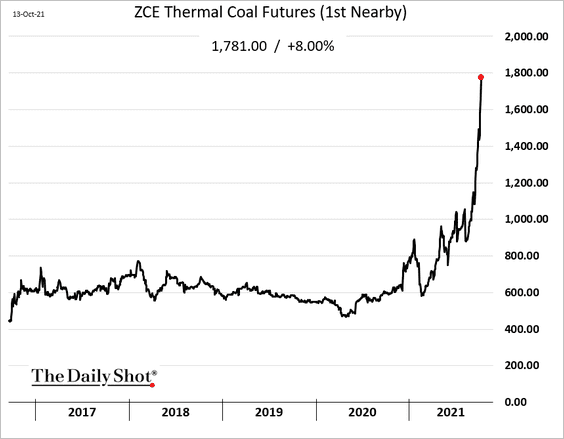

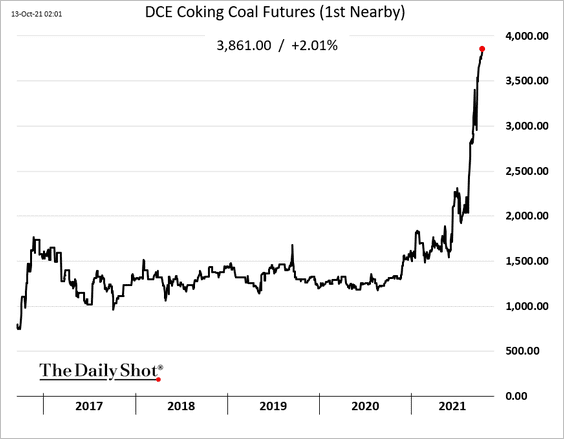

1. Thermal coal prices continue to surge.

Metallurgical coal is also hitting new highs.

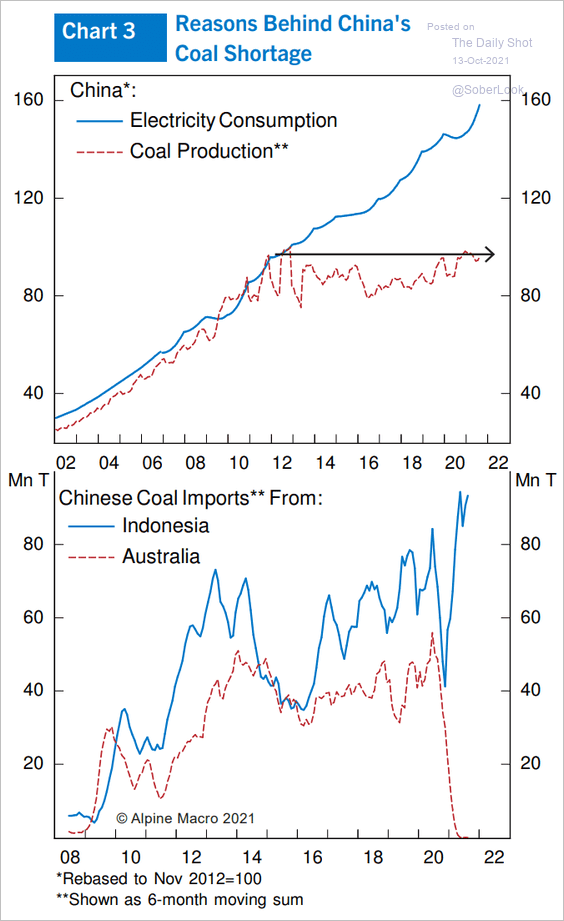

Weak domestic production and the loss of imports from Australia have contributed to low coal inventories. The Delta spike also reduced imports from Mongolia.

Source: Alpine Macro

Source: Alpine Macro

——————–

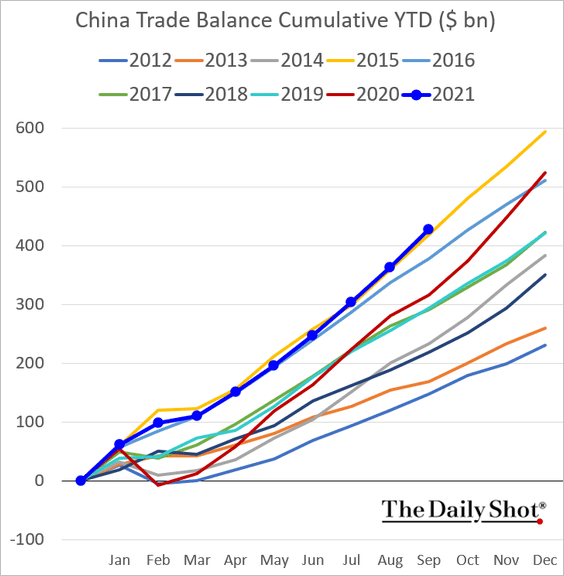

2. The trade surplus hit a new high for this time of the year (YTD).

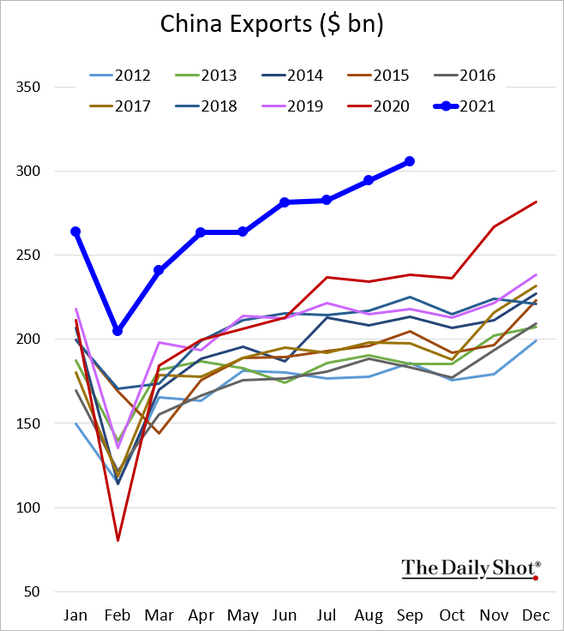

Exports are at record highs.

——————–

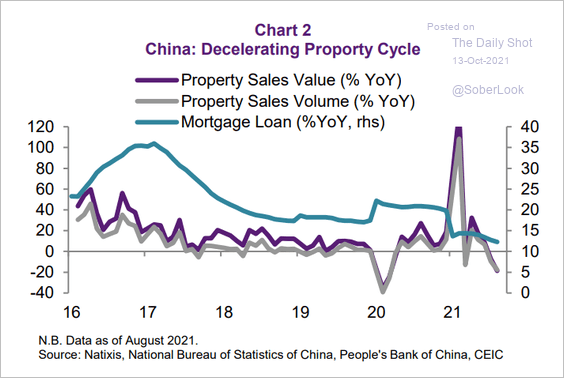

3. The property sector has been decelerating for some time.

Source: Natixis

Source: Natixis

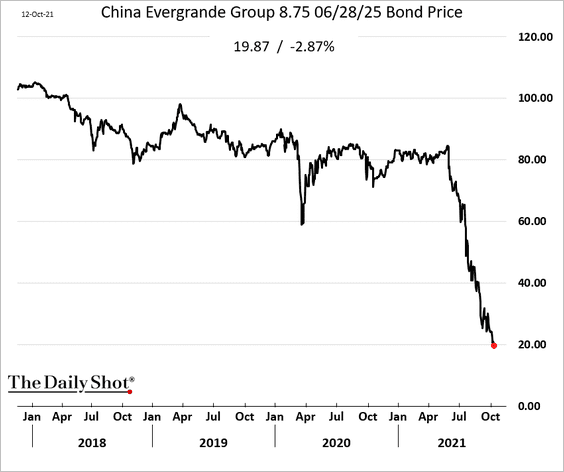

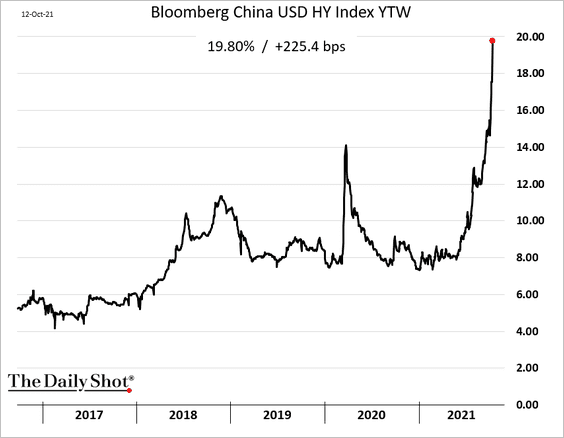

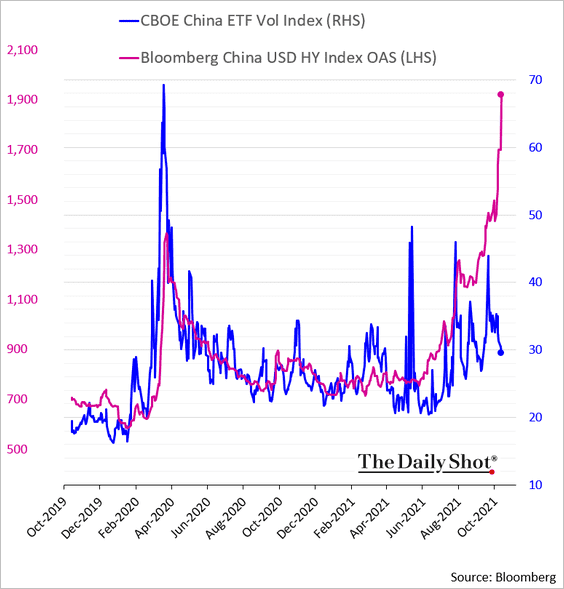

The credit situation remains precarious.

• Evergrande’s bond price:

• The HY index yield (approaching 20%):

• As we mentioned previously, the blowout in bond spreads could boost equity volatility.

Back to Index

Emerging Markets

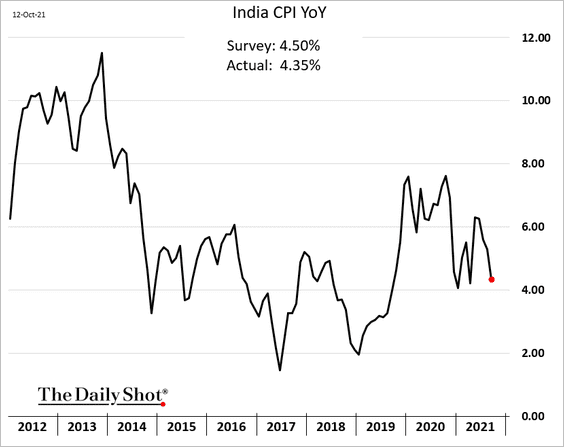

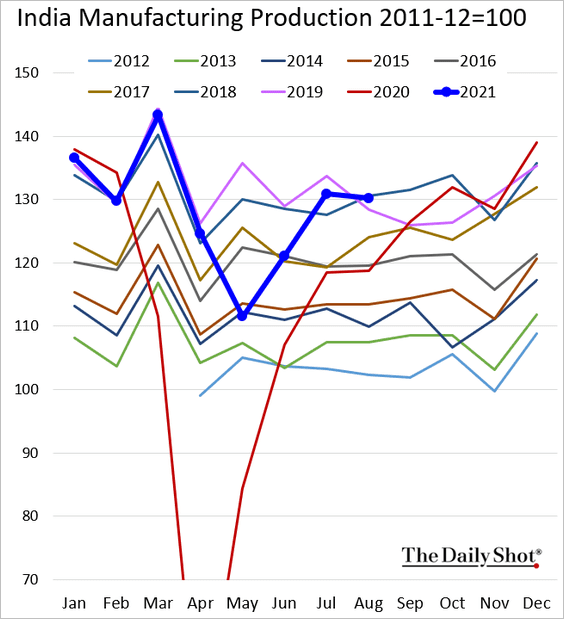

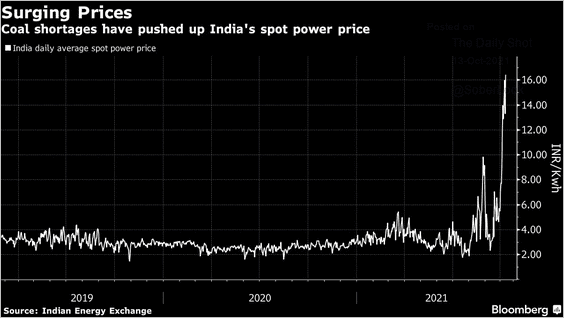

1. Let’s begin with India.

• Inflation has been moderating.

• Industrial production is back above 2019 levels.

• Electricity prices surged recently.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

——————–

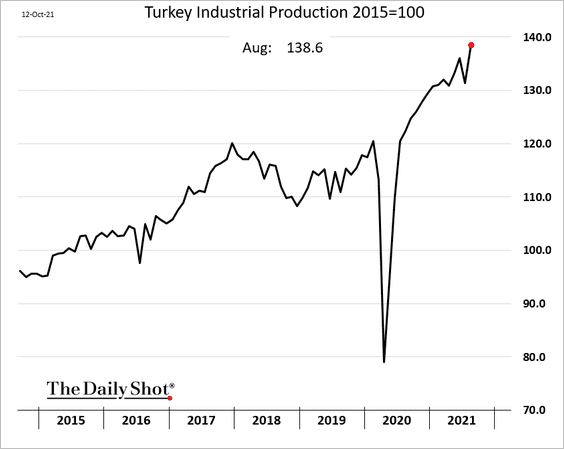

2. Turkey’s industrial production continues to rise.

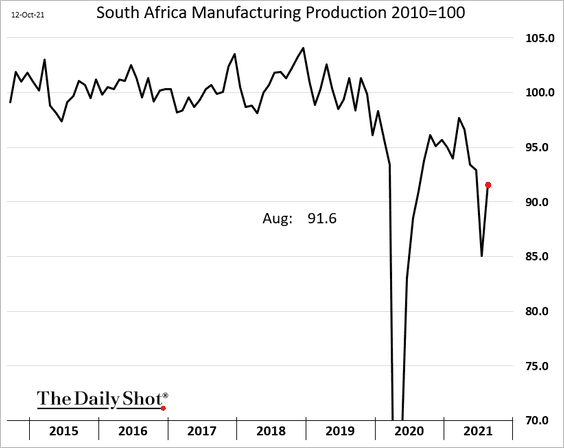

3. South Africa’s manufacturing output rebounded in August.

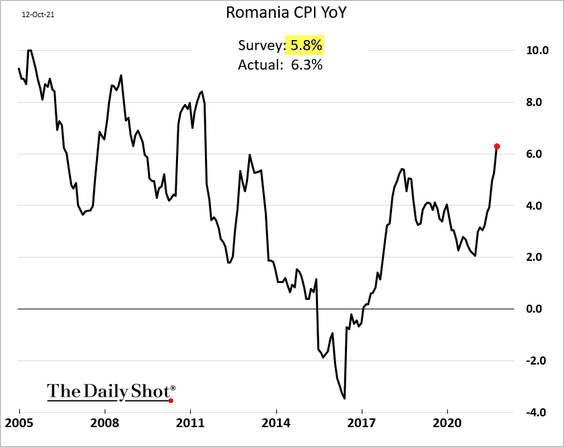

4. Romania’s inflation surprised to the upside.

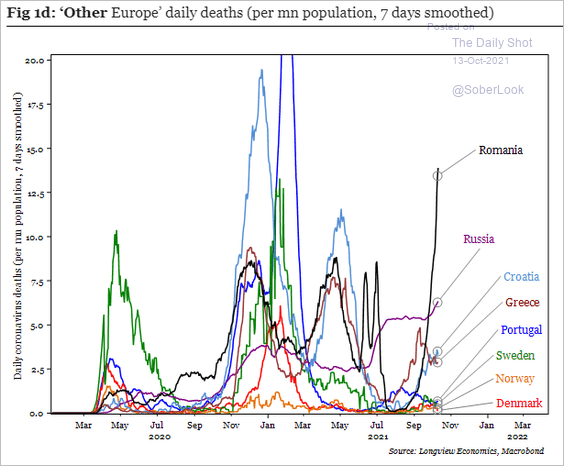

Separately, COVID cases in Romania have accelerated.

Source: Longview Economics

Source: Longview Economics

——————–

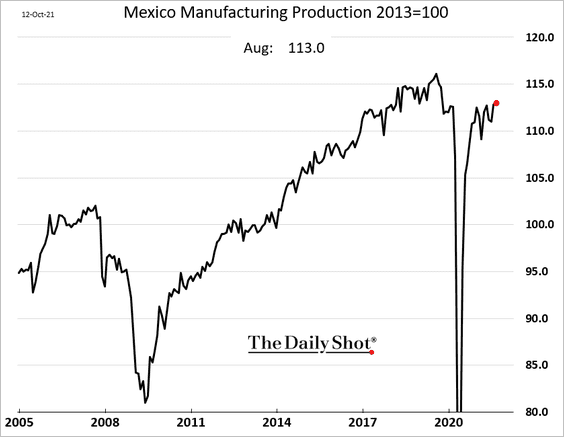

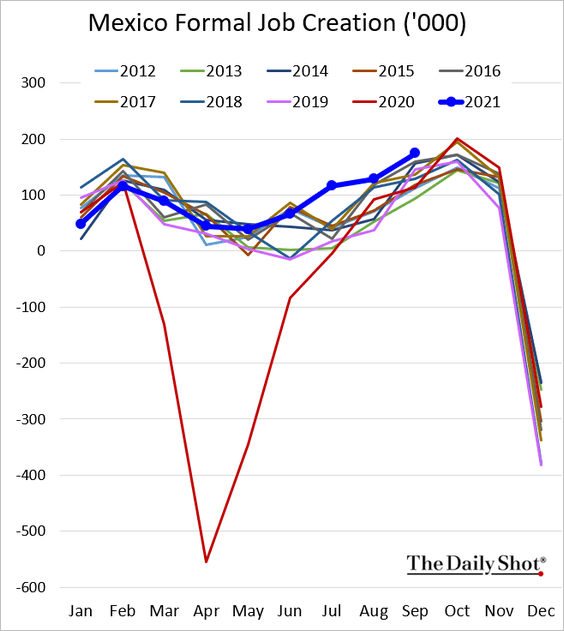

5. Mexico’s manufacturing output surprised to the upside.

Formal job creation remains strong.

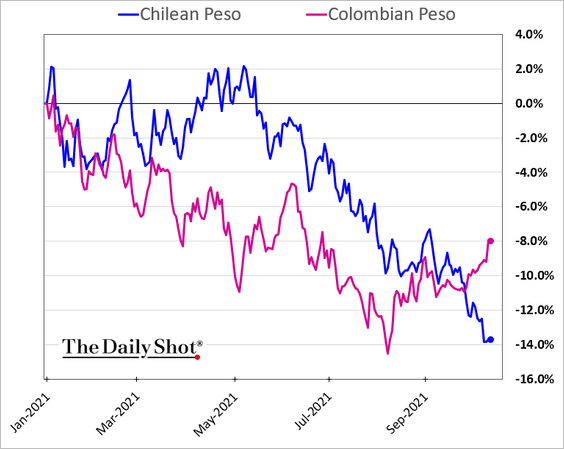

6. The Colombian peso has been outperforming as oil prices surge (vs. USD).

——————–

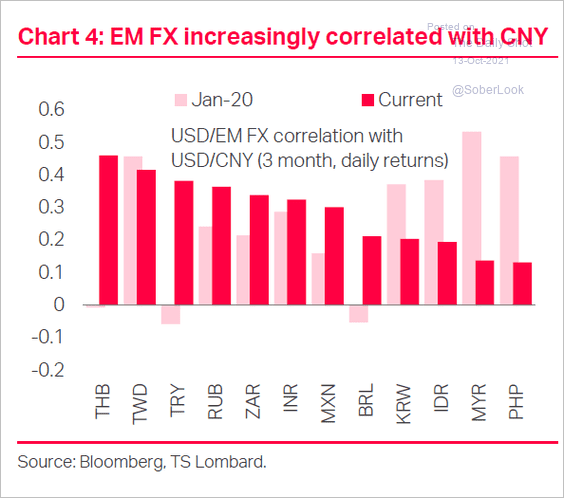

7. How correlated are EM currencies to the renminbi?

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

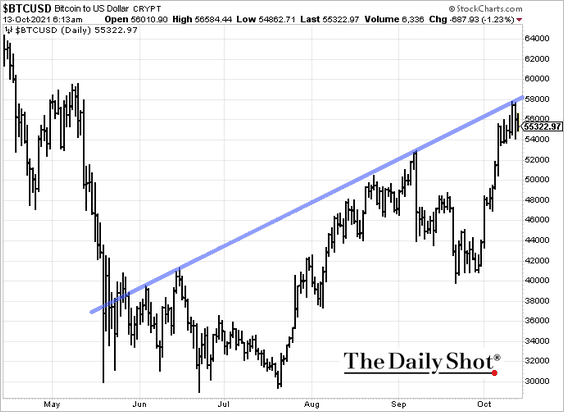

1. Bitcoin held short-term resistance.

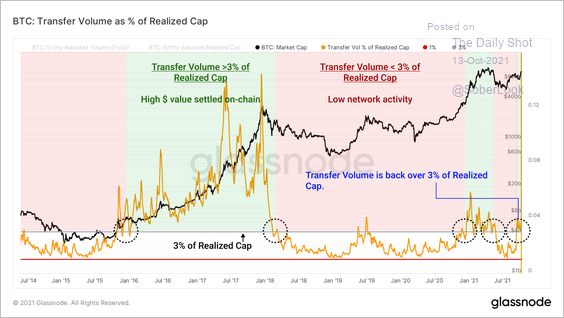

2. Bitcoin’s transfer volume as a percentage of its realized market cap is rising, which typically marks the beginning of a bullish phase, according to blockchain data.

Source: Glassnode Read full article

Source: Glassnode Read full article

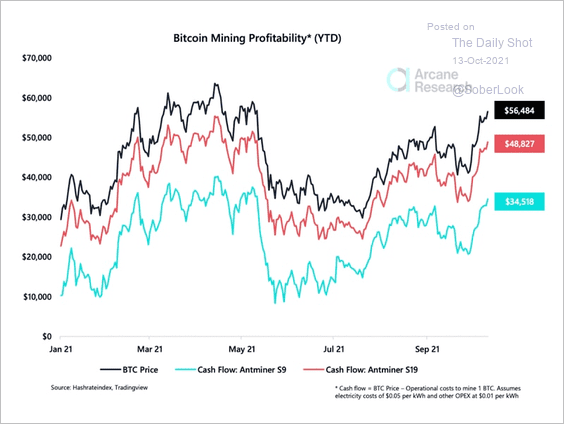

3. Bitcoin mining profitability accelerated during the first few days of October.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

4. Jamie Dimon says bitcoin is worthless

Source: Reuters Read full article

Source: Reuters Read full article

And the IMF warned of significant risk regarding the adoption of crypto as legal tender.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

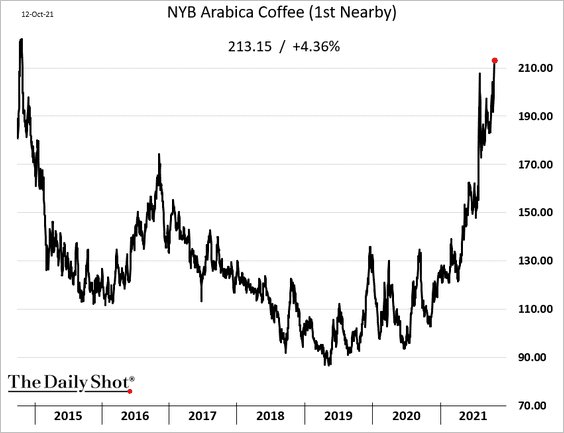

1. Coffee prices are hitting multi-year highs.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

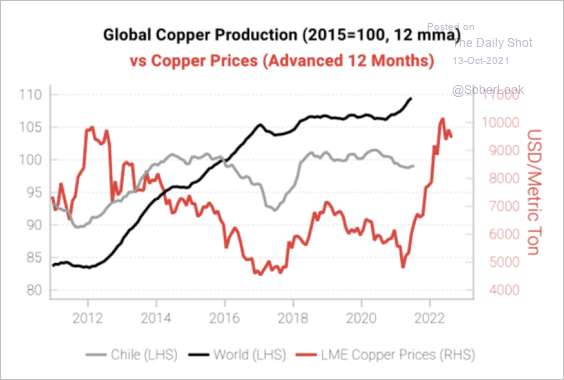

2. Global copper production has not reacted strongly to the recent price surge.

Source: Variant Perception

Source: Variant Perception

Back to Index

Energy

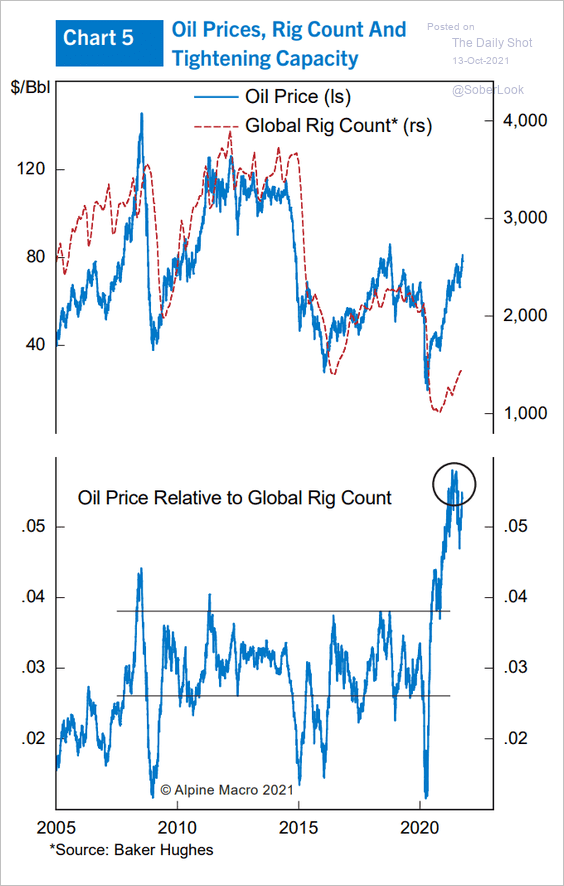

1. The gap between oil prices and the global rig count has blown out.

Source: Alpine Macro

Source: Alpine Macro

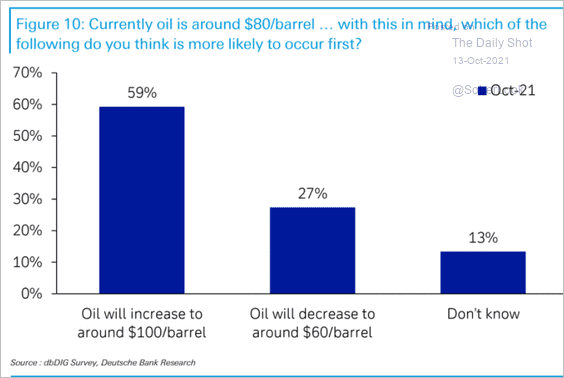

2. $100/bbl or $60/bbl?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

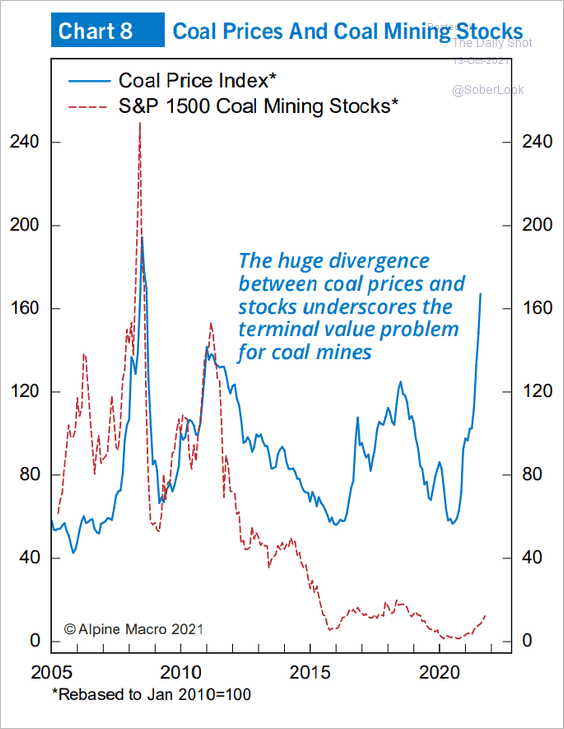

3. Coal mining stocks have been lagging coal prices.

Source: Alpine Macro

Source: Alpine Macro

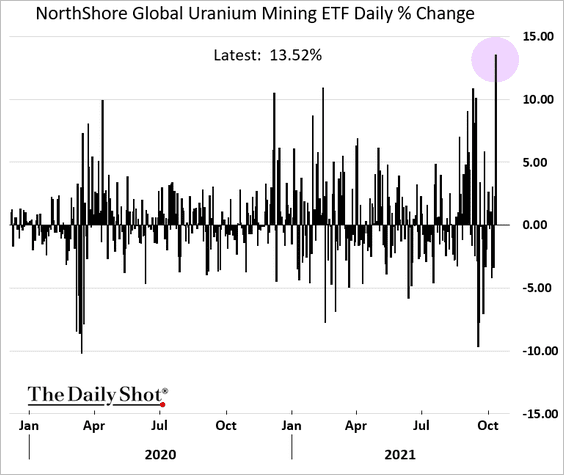

4. The uranium mining ETF spiked 13% on Tuesday.

Back to Index

Equities

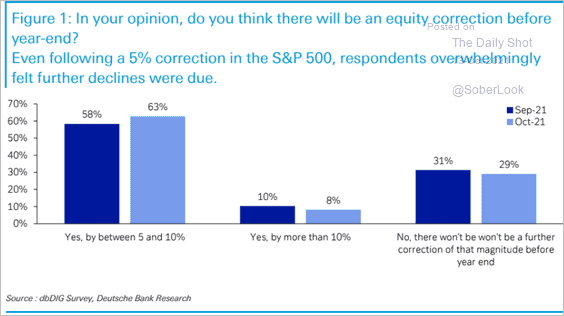

1. Market professionals see an additional 5-10% decline in the S&P 500 before the year-end (according to a Deutsche Bank survey).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

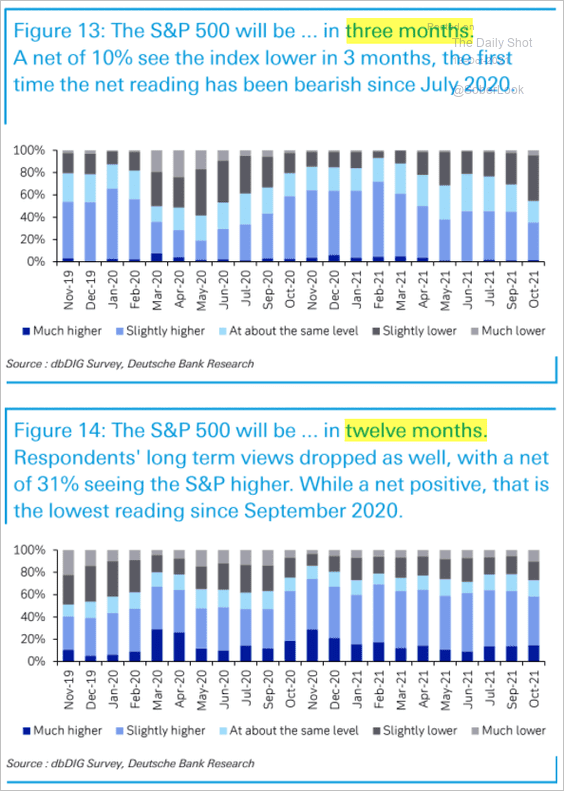

Where will the market be in three and twelve months?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

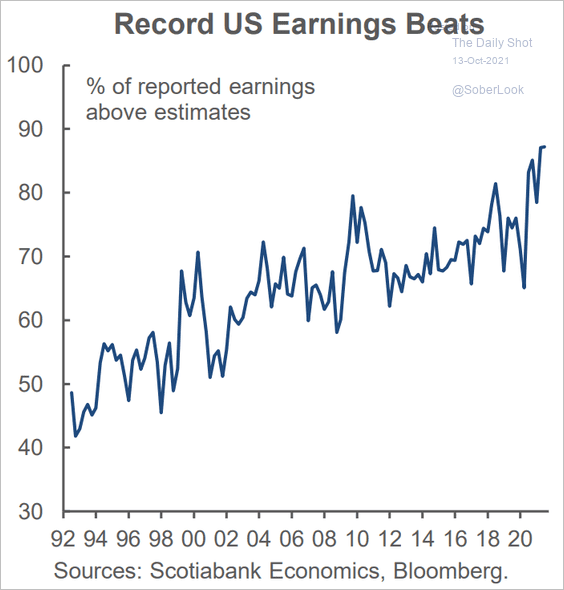

2. US earnings beats have probably peaked.

Source: Scotiabank Economics

Source: Scotiabank Economics

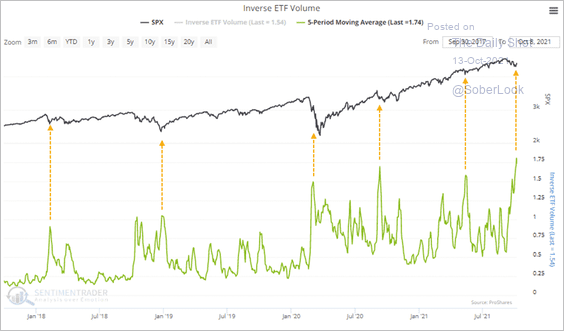

3. Over the past week, volume in inverse ETFs accounted for 1.75% of total NYSE volume – a record high.

Source: SentimenTrader

Source: SentimenTrader

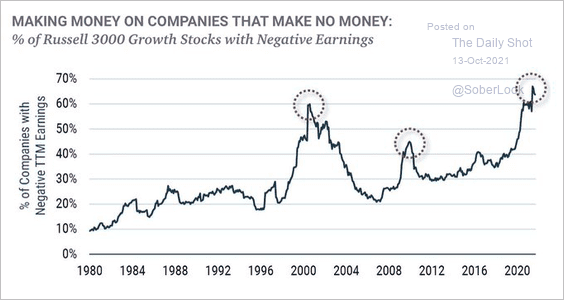

4. There are a lot of unprofitable growth stocks.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

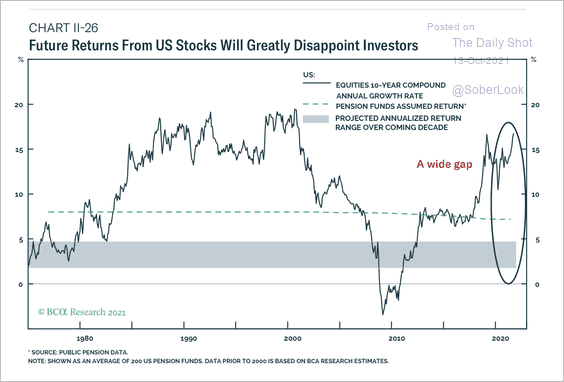

5. Equity returns over the next decade could fall far short of expectations.

Source: BCA Research

Source: BCA Research

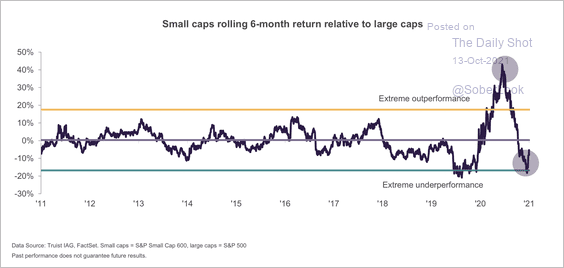

6. The recent underperformance of small caps appears to have bottomed.

Source: Truist Advisory Services

Source: Truist Advisory Services

7. Semiconductor stocks are at the 200-day moving average.

Source: @markets Read full article

Source: @markets Read full article

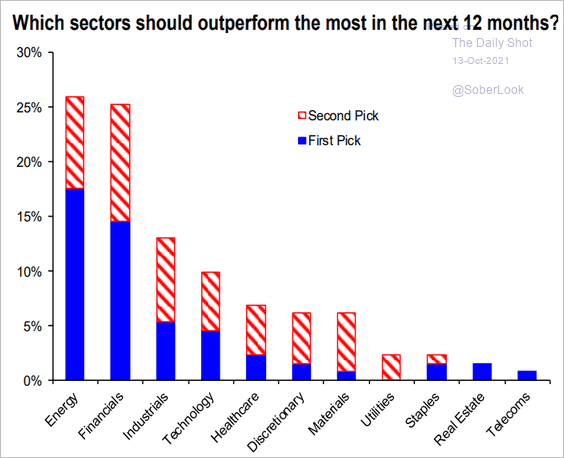

8. Which sectors will outperform over the next 12 months?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

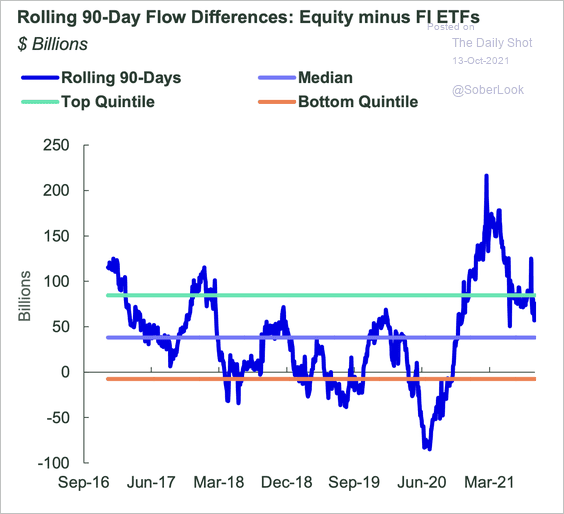

9. The differential between stock and bond ETF flows has compressed but remains above the median.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Back to Index

Rates

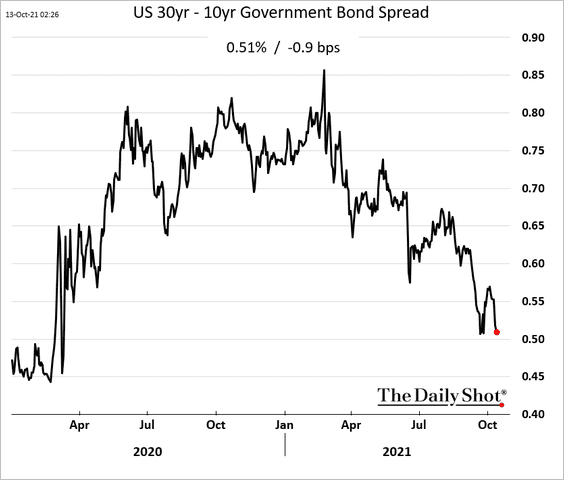

1. The longer end of the Treasury curve has been flattening.

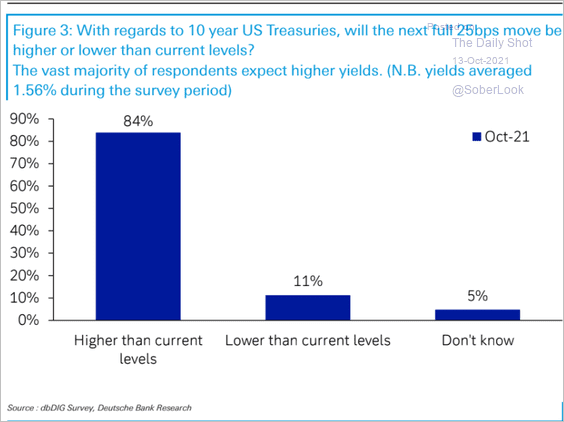

2. The next 20bps move on the 10yr yield will be higher.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

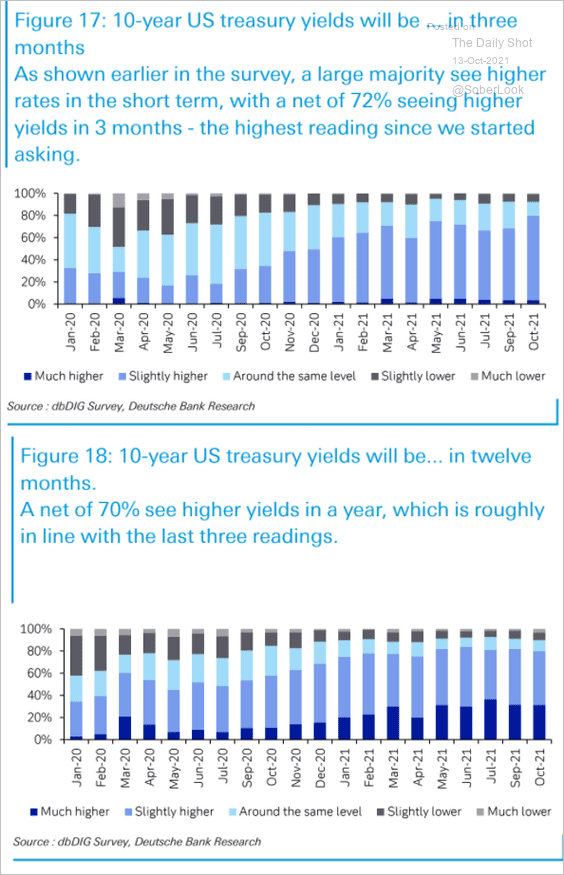

Where will yields be in three months? Twelve months?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

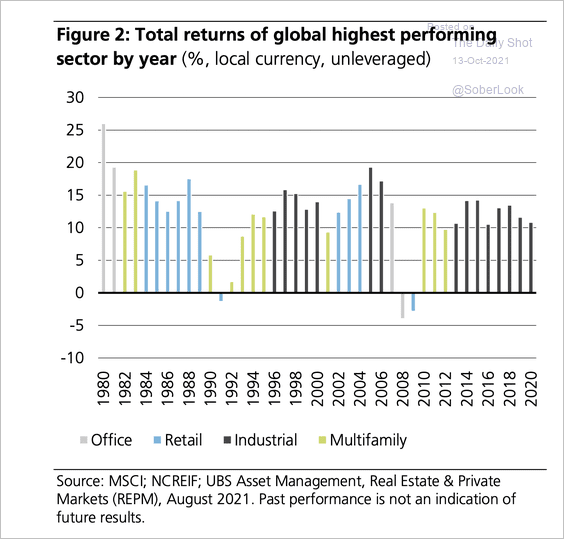

1. 2020 saw the 8th straight year of outperformance by the industrial property sector, marking it the longest run of outperformance by any real estate sector since records began.

Source: UBS Asset Management

Source: UBS Asset Management

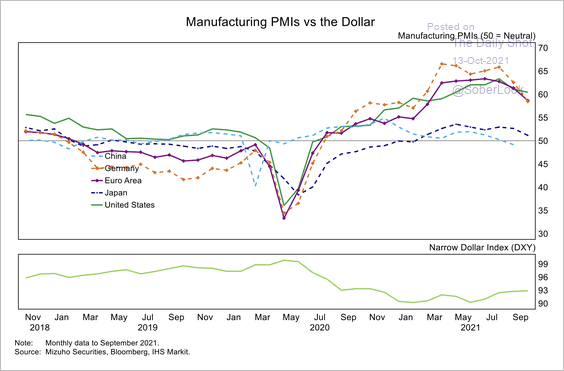

2. Manufacturing PMIs have weakened as the dollar strengthened.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

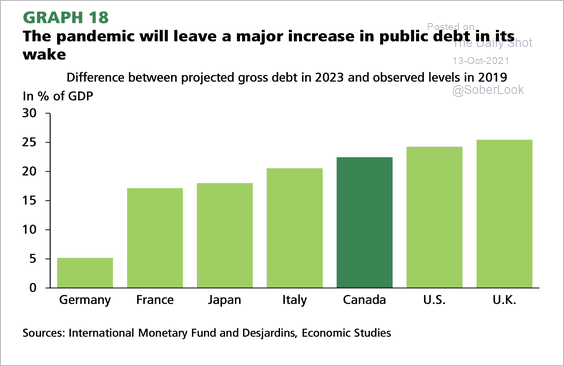

3. Covid has led to a massive increase in public debt in the developed world.

Source: Desjardins

Source: Desjardins

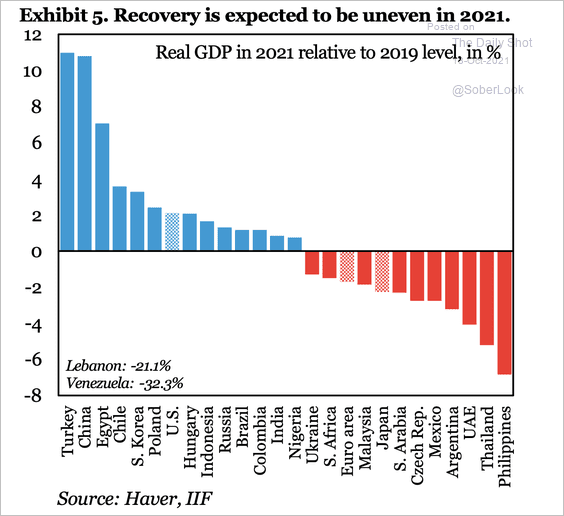

4. Recovery growth rates in 2021 are very uneven around the world.

Source: IIF

Source: IIF

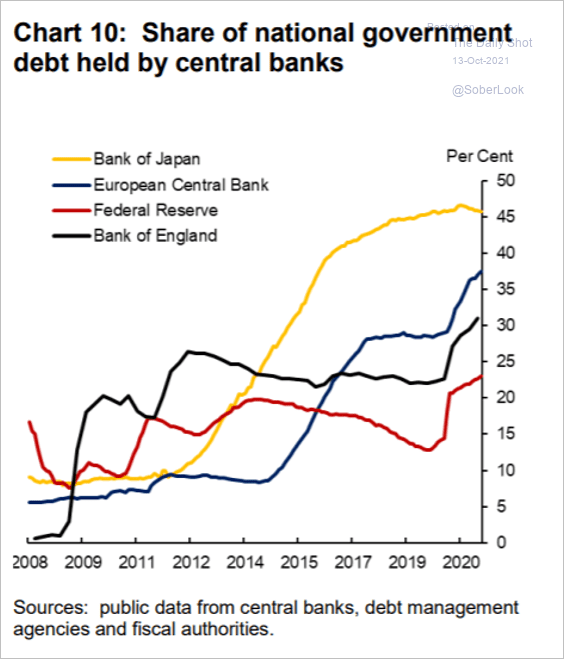

5. Finally, here is the share of government debt held by central banks.

Source: BIS Read full article

Source: BIS Read full article

——————–

Food for Thought

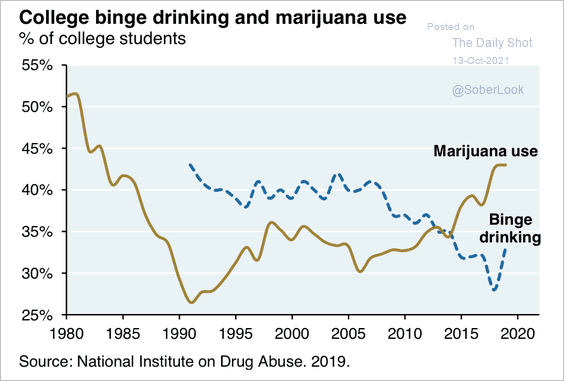

1. Binge drinking and marijuana use at US colleges:

Source: Michael Cembalest; J.P. Morgan Asset Management

Source: Michael Cembalest; J.P. Morgan Asset Management

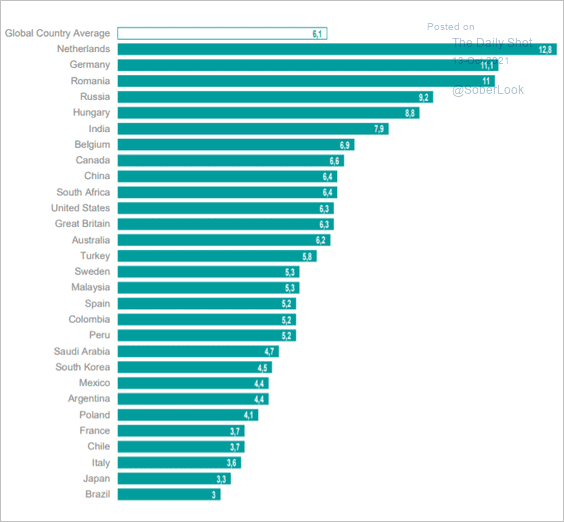

2. The number of hours of physical exercise per week (globally):

Source: Ipsos

Source: Ipsos

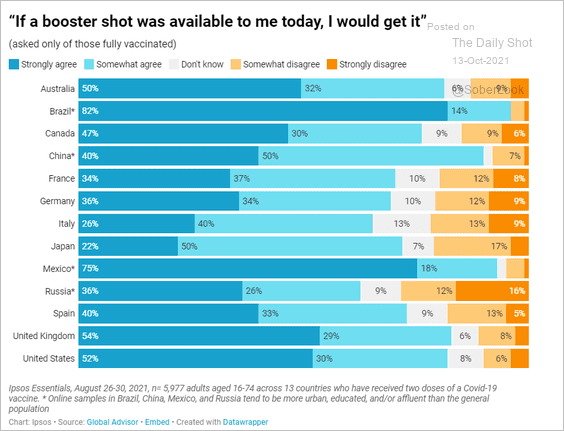

3. Views on getting a booster shot among those who are fully vaccinated:

Source: Ipsos Read full article

Source: Ipsos Read full article

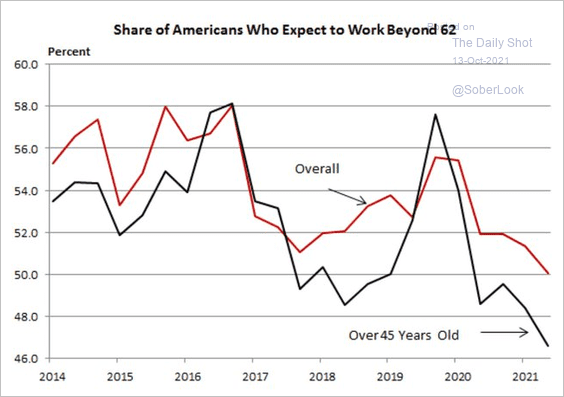

4. Americans’ plans for retirement:

Source: @SamRo, @OxfordEconomics Read full article

Source: @SamRo, @OxfordEconomics Read full article

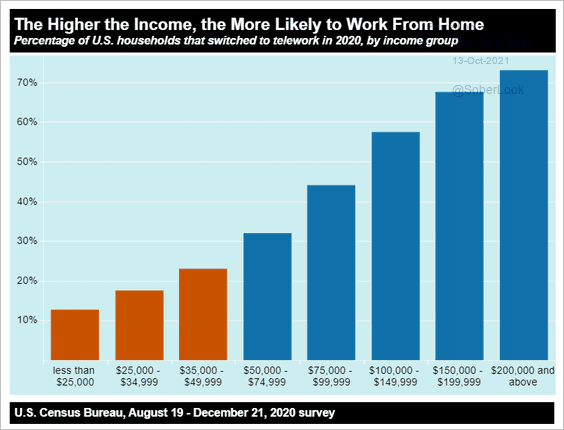

5. Telework by income group in 2020:

Source: Institute for Policy Studies Read full article

Source: Institute for Policy Studies Read full article

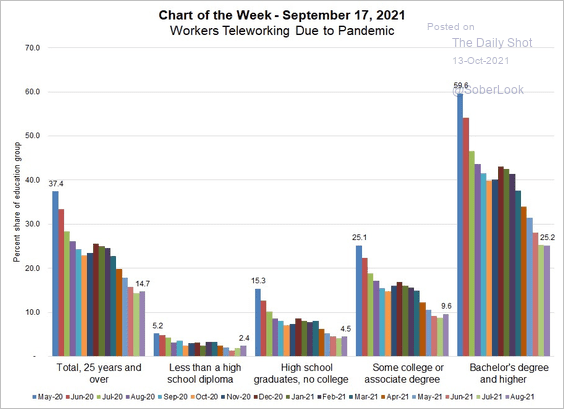

• Telework by educational attainment:

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

——————–

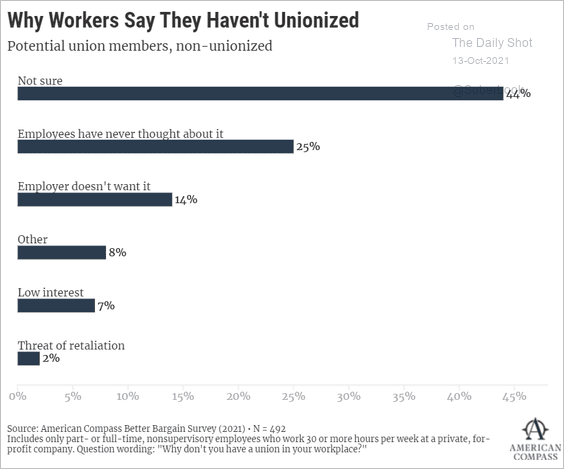

6. Why workers haven’t unionized:

Source: @AmerCompass

Source: @AmerCompass

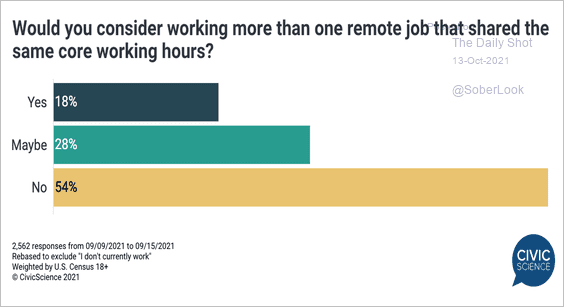

7. Working multiple remote jobs:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

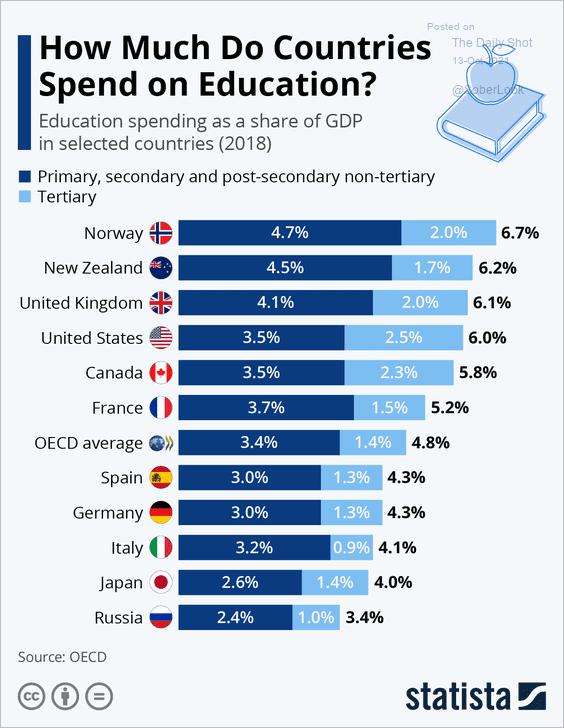

8. Education spending as a share of GDP:

Source: Statista

Source: Statista

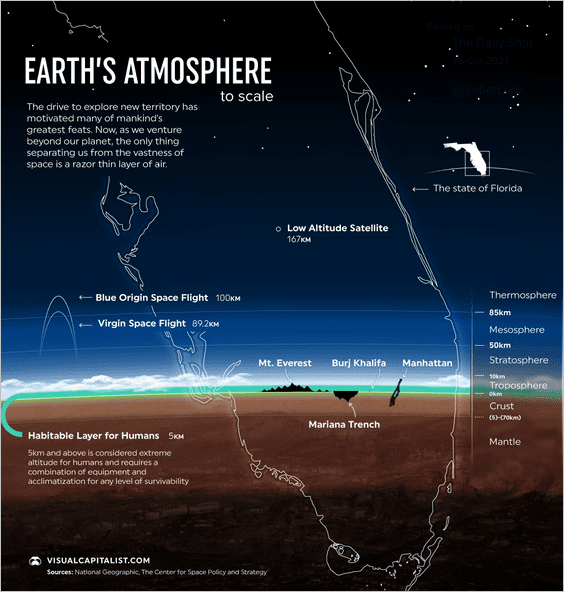

9. Earth’s atmosphere in perspective:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index