The Daily Shot: 18-Oct-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

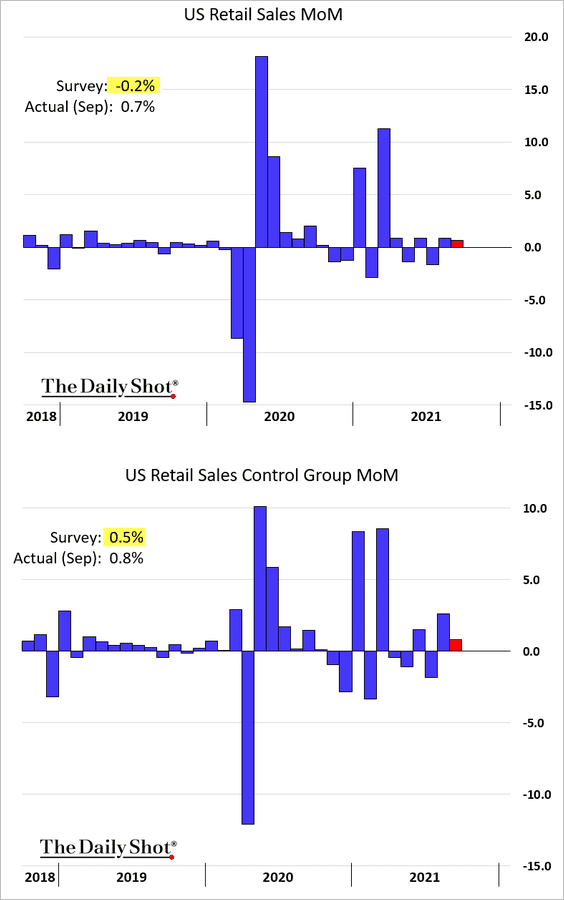

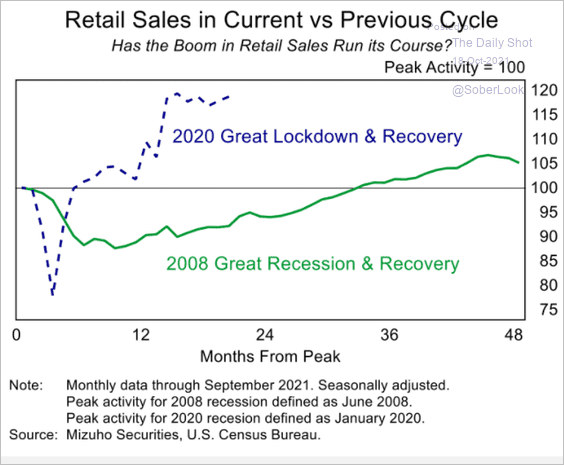

1. September retail sales surprised to the upside. US consumers complain about high prices but keep spending.

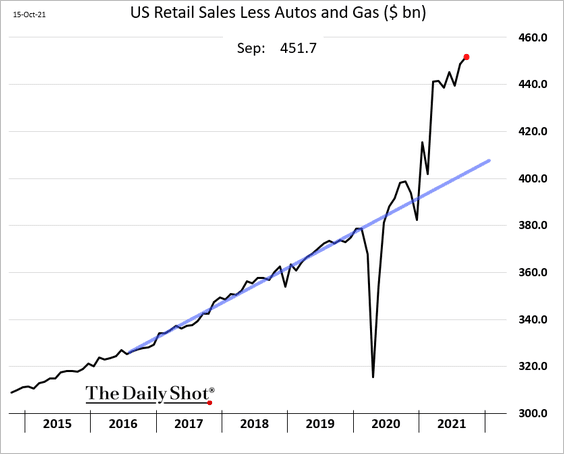

Excluding autos and gas, the dollar amount of retail sales hit another record high.

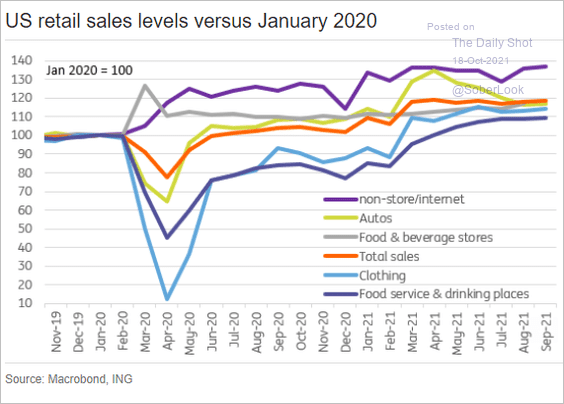

Here are the trends by sector.

Source: ING

Source: ING

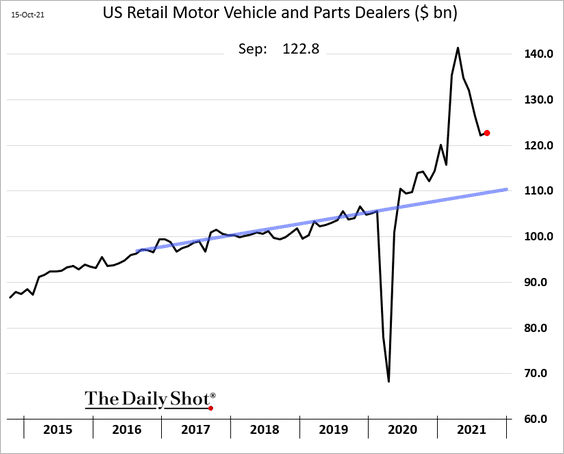

Spending on automobiles increased in September after months of declines from the peak (still well above pre-COVID levels).

This chart compares the current trajectory of retail sales with the post-2008 recovery.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

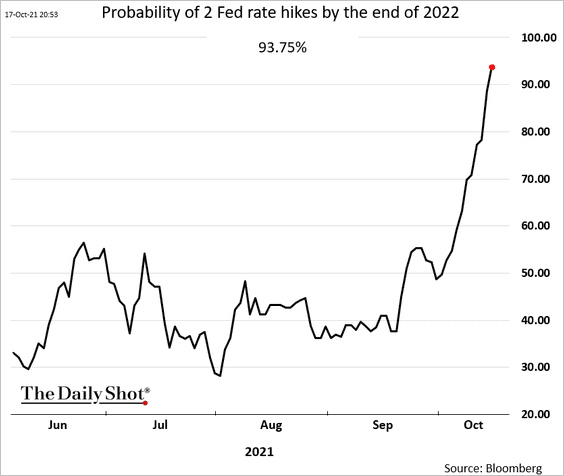

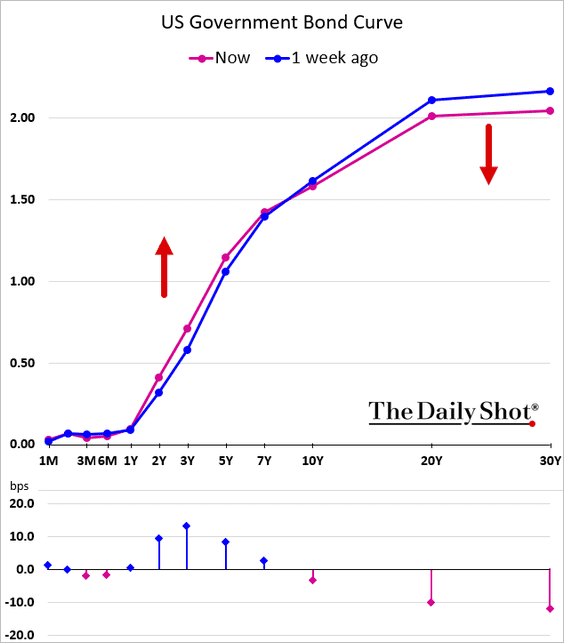

2. Global inflationary trends (combined with robust US consumption) are causing the market to reevaluate the Fed’s actions over the next few years.

• The market is increasingly convinced that the Fed will be forced to hike twice next year.

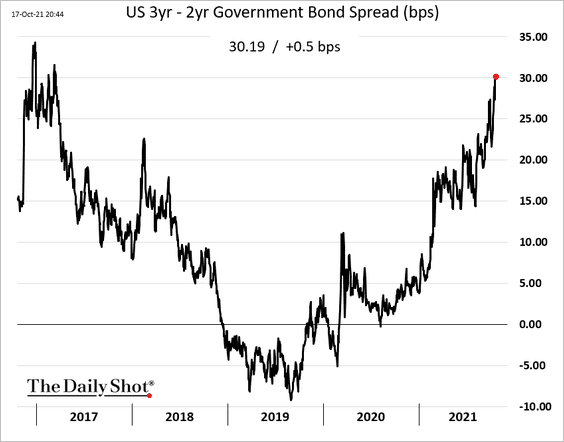

• Moreover, the market sees the central bank becoming more aggressive over the next few years as inflation becomes tougher to tame. The front end of the Treasury curve is steepening.

h/t @lisaabramowicz1

h/t @lisaabramowicz1

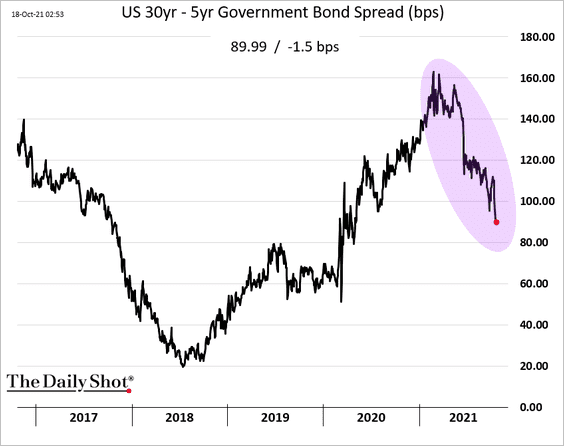

• On the other hand, the longer end of the Treasury curve is flattening.

The market sees a more hawkish Fed slowing the economy as it fights inflation.

——————–

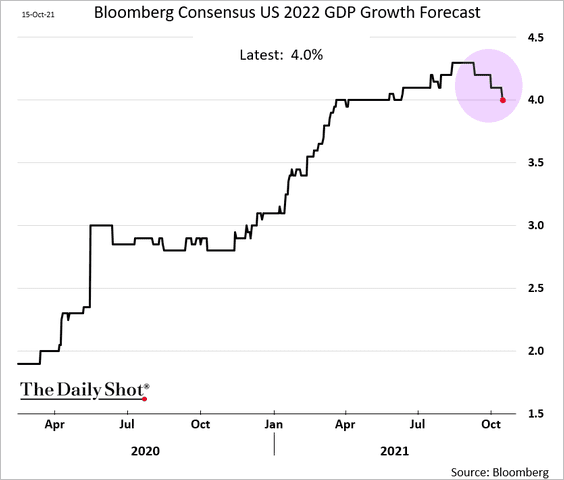

3. Economists are downgrading next year’s US GDP growth forecasts.

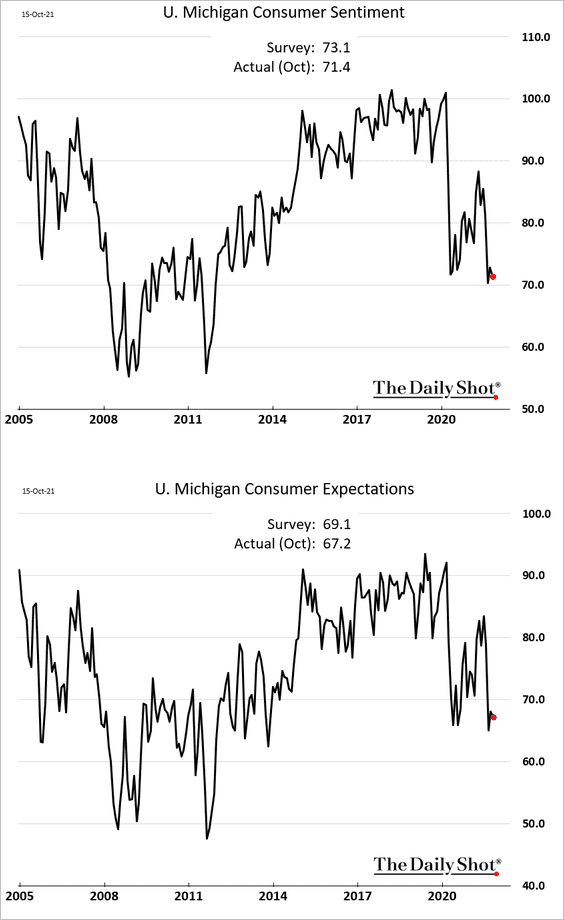

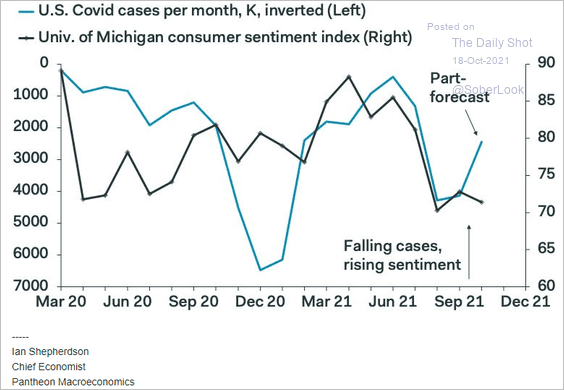

4. The October U Michigan consumer sentiment report was softer than the market was expecting.

Analysts expected an improvement as the COVID situation eases.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

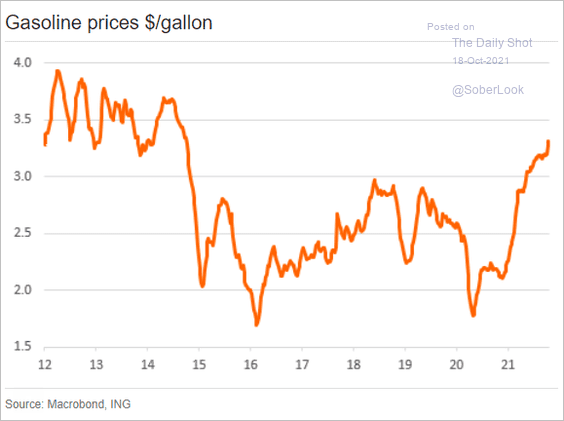

But rising prices, especially on gasoline, have been a drag on consumer confidence.

Source: ING

Source: ING

——————–

5. Next, we have some updates on inflation.

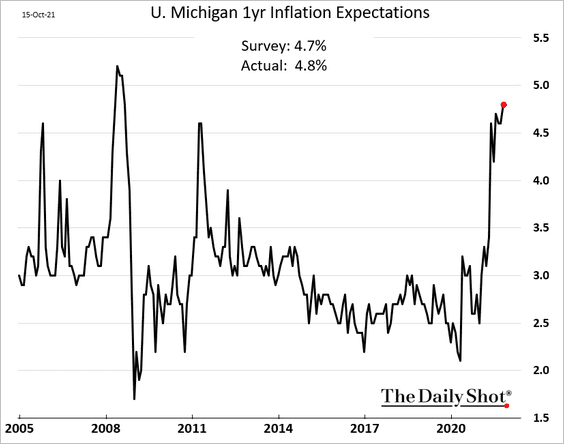

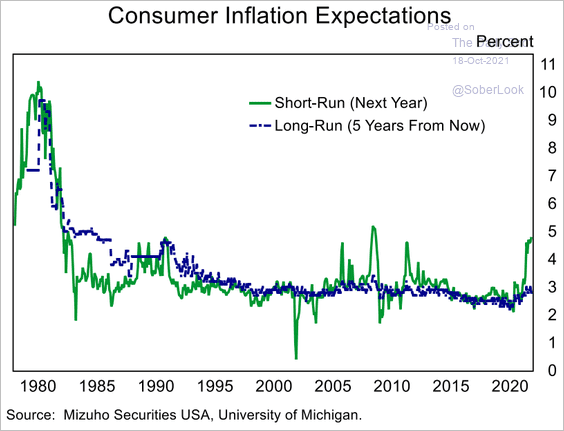

• Short-term consumer inflation expectations keep climbing.

But longer-term expectations seem to be “well-anchored.”

Source: Mizuho Securities USA

Source: Mizuho Securities USA

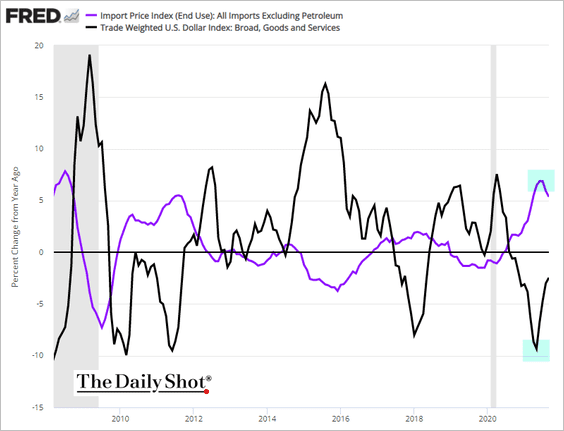

• Import price inflation has peaked for now as the dollar rebounded.

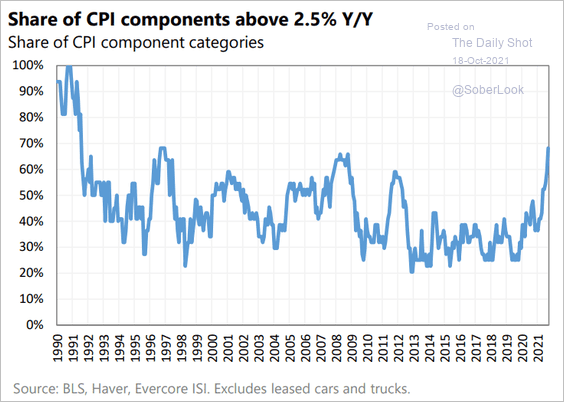

• Here is the share of CPI components that are above 2.5% on a year-over-year basis (inflation breadth).

Source: Evercore ISI

Source: Evercore ISI

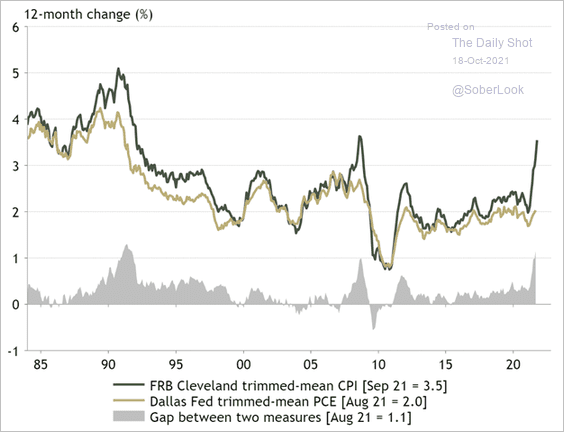

• The trimmed-mean CPI has diverged from the trimmed-mean PCE inflation measure.

Source: @DomWh1te

Source: @DomWh1te

——————–

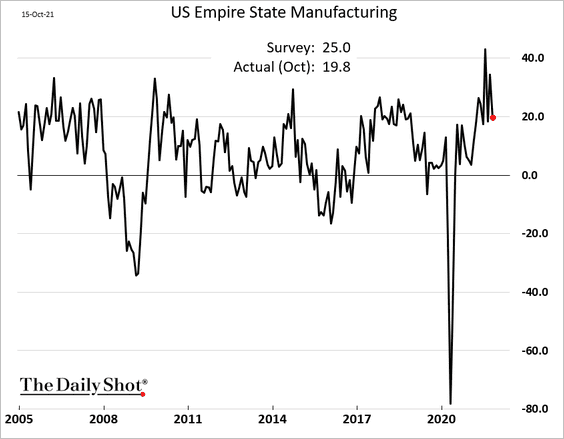

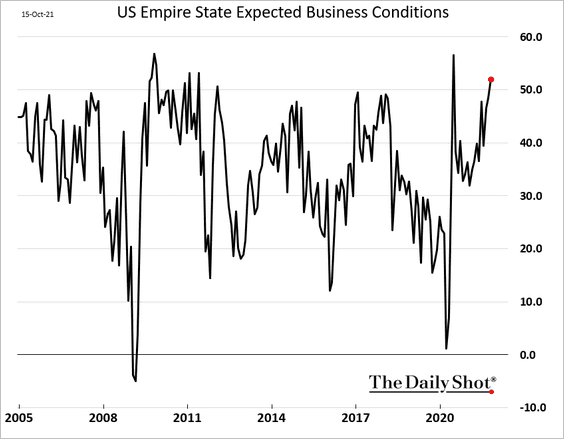

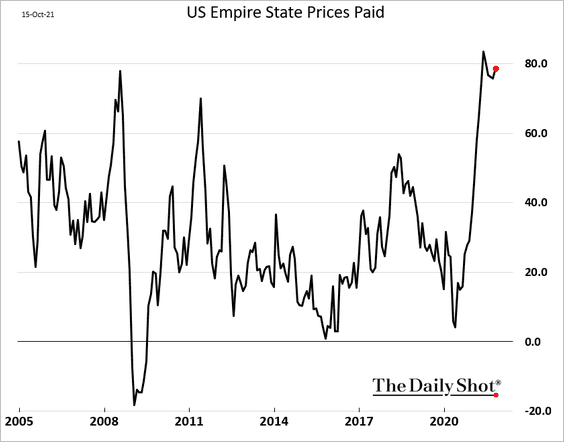

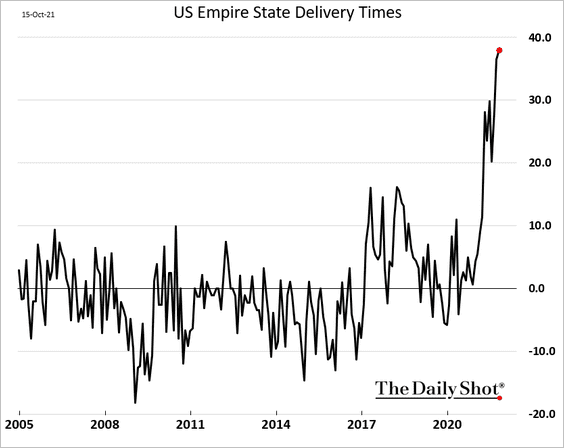

6. The Empire Manufacturing report from the NY Fed (the first regional report of the month) showed some moderation in factory activity.

But manufacturers remain upbeat about the future.

• Price pressures …

… and supply chain bottlenecks persist.

Back to Index

Canada

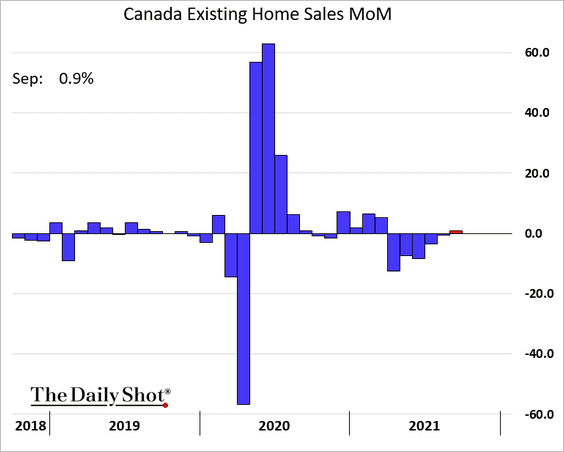

1. After five months of declines, existing-home sales ticked higher in September.

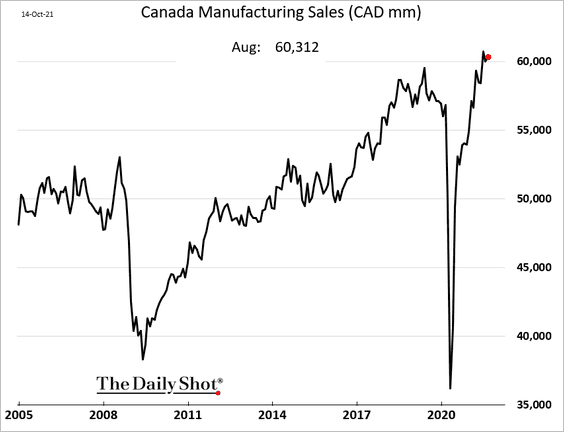

2. Manufacturing sales remain robust.

Back to Index

The United Kingdom

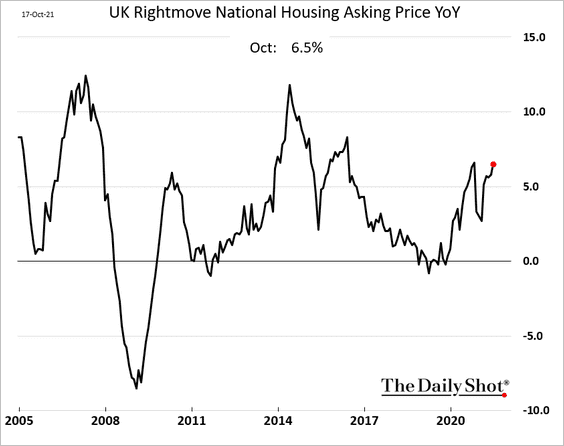

1. Home price appreciation is holding up well, according to the Rightmove asking price index.

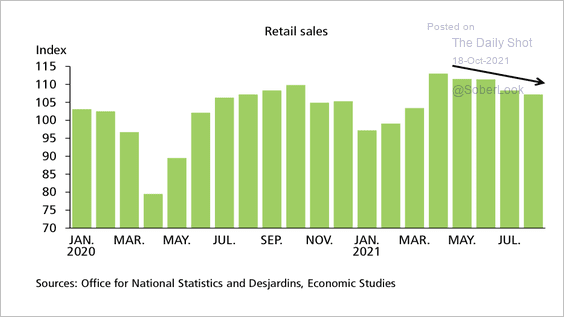

2. Retail sales have moderated over the past few months.

Source: Desjardins

Source: Desjardins

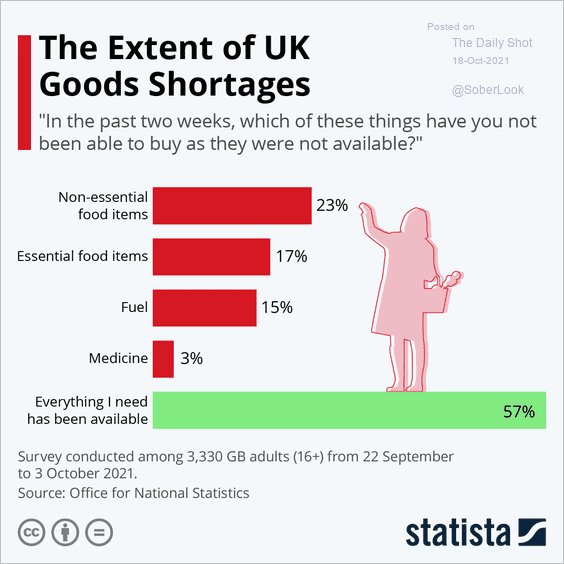

3. Some consumers are experiencing shortages of food items.

Source: Statista

Source: Statista

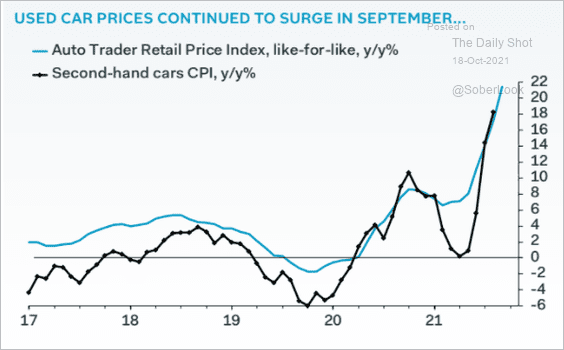

4. Used car prices continue to surge.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

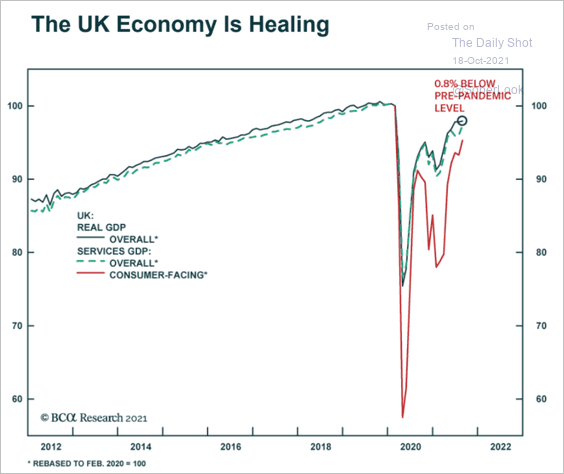

5. Consumer-facing services have been recovering.

Source: BCA Research

Source: BCA Research

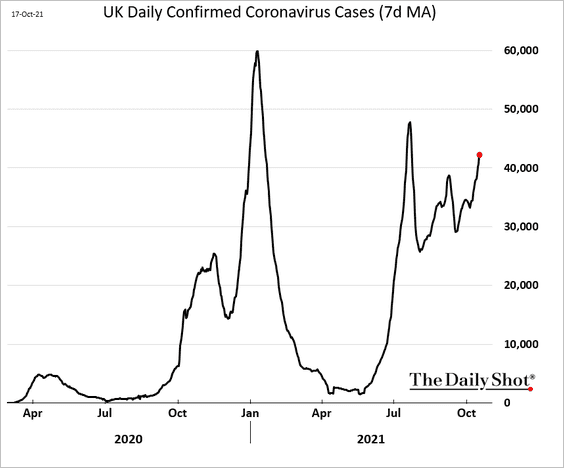

However, the COVID situation appears to be worsening again.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The Eurozone

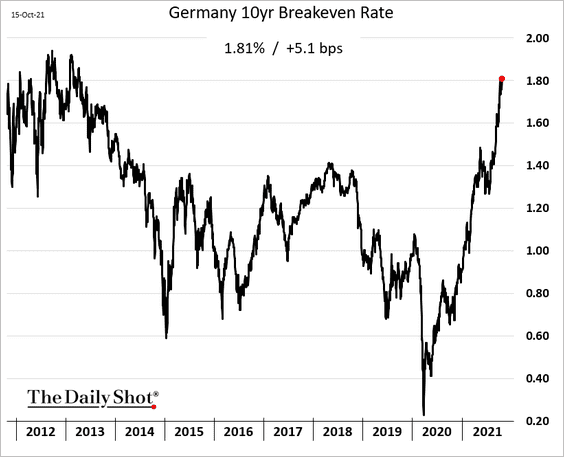

1. Market-based inflation expectations continue to climb.

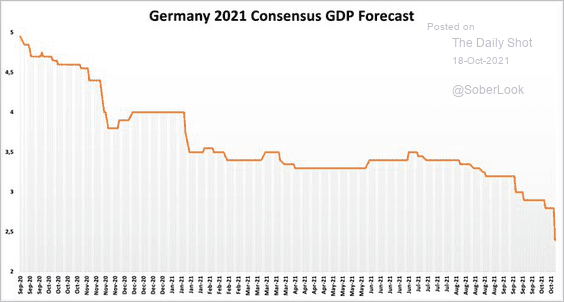

2. Economists have been downgrading Germany’s 2021 growth forecasts.

Source: @Schuldensuehner Read full article

Source: @Schuldensuehner Read full article

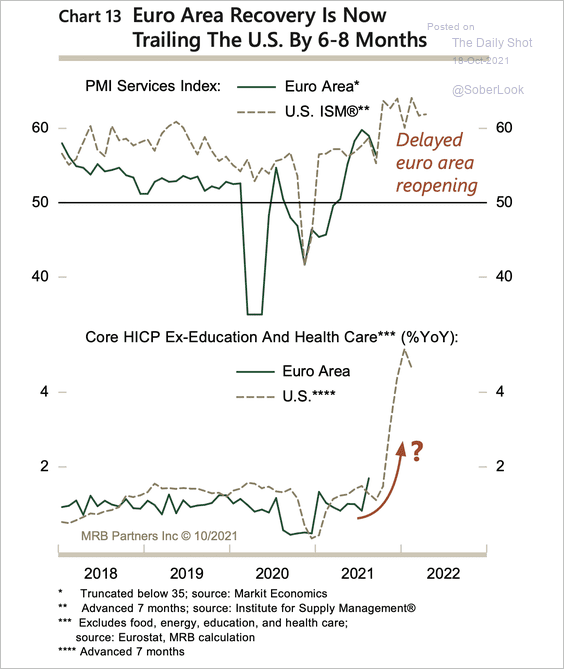

3. Slower reopening in Europe has meant the service sector is now 6-8 months behind the US. As growth picks up, inflation is likely to follow.

Source: MRB Partners

Source: MRB Partners

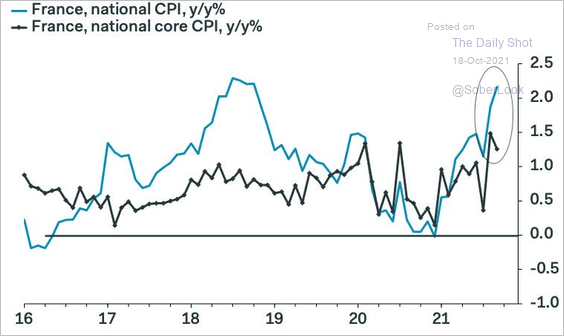

4. Core inflation appears to have cooled in France.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

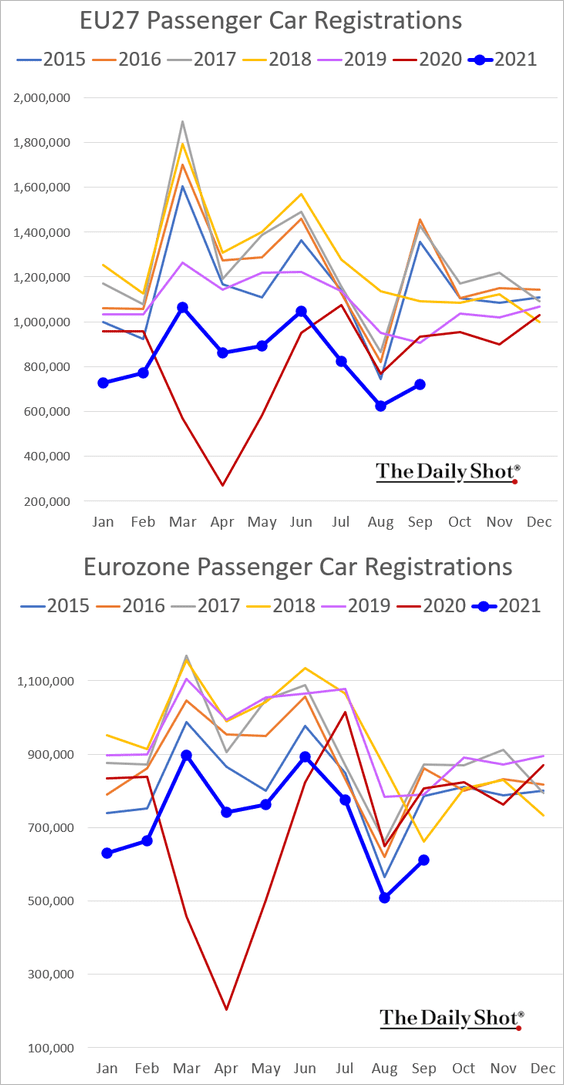

5. New car registrations continue to run at multi-year lows in the EU and the Eurozone.

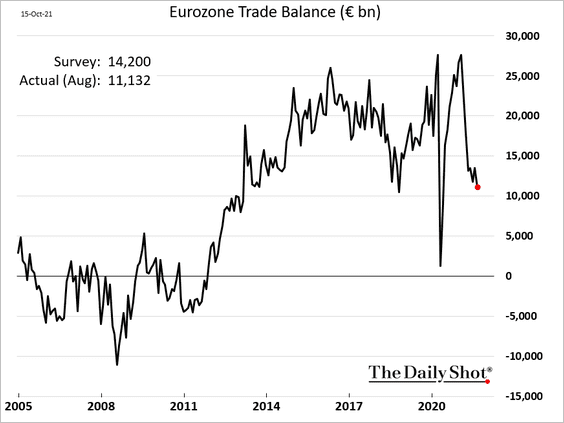

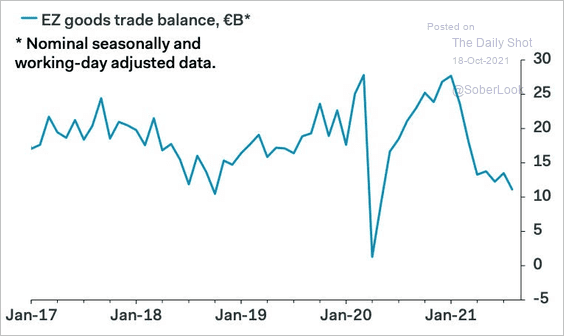

6. The Eurozone’s trade surplus surprised to the downside.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

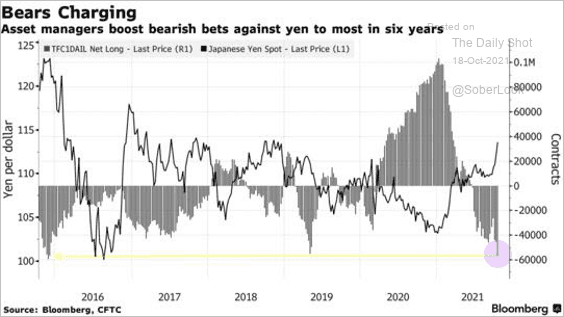

1. Traders have been boosting their bets against the yen.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

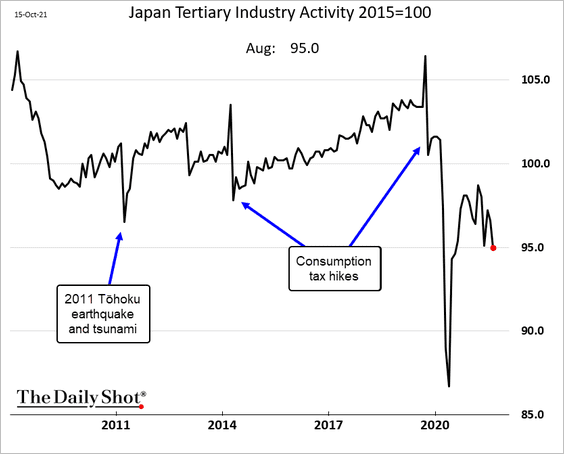

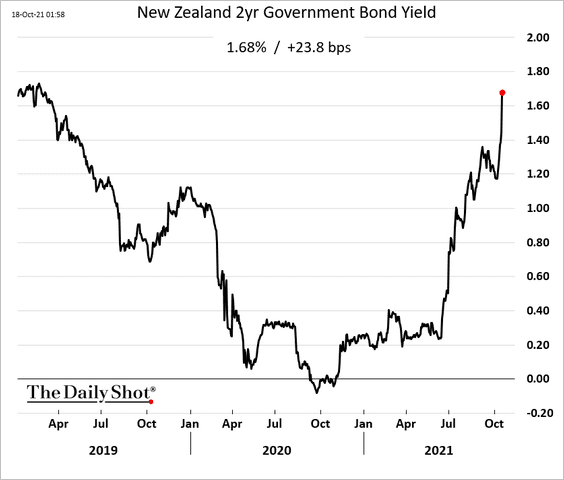

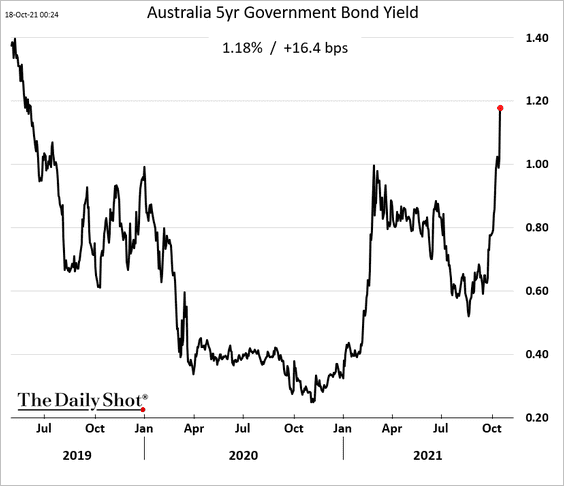

2. Japan’s service sector activity hit the lowest level since 2020 in August.

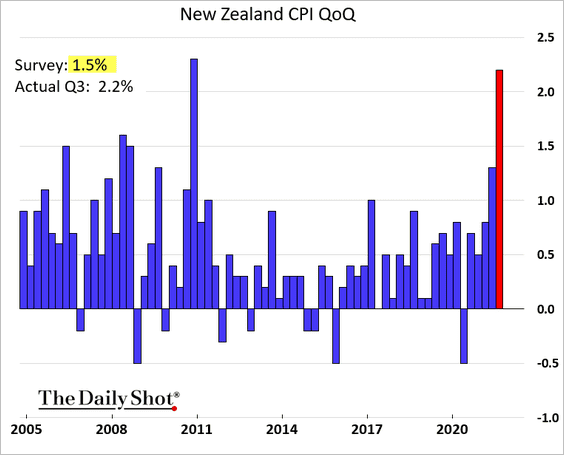

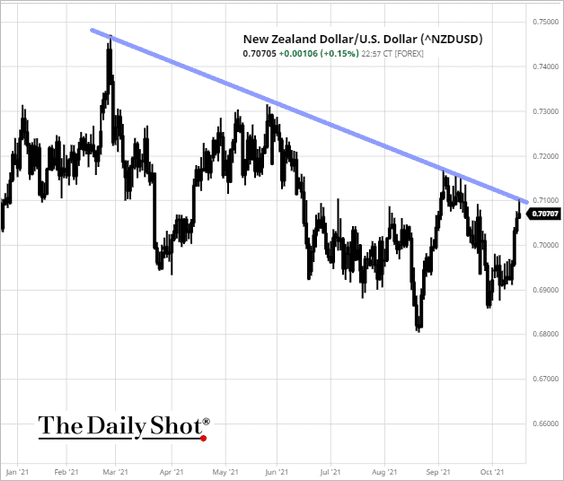

3. New Zealand’s CPI surprised to the upside, which reverberated across global fixed-income markets.

• The Kiwi dollar is testing resistance.

Source: barchart.com

Source: barchart.com

• New Zealand’s service-sector PMI rebounded from the lows but remains in contraction territory.

Back to Index

China

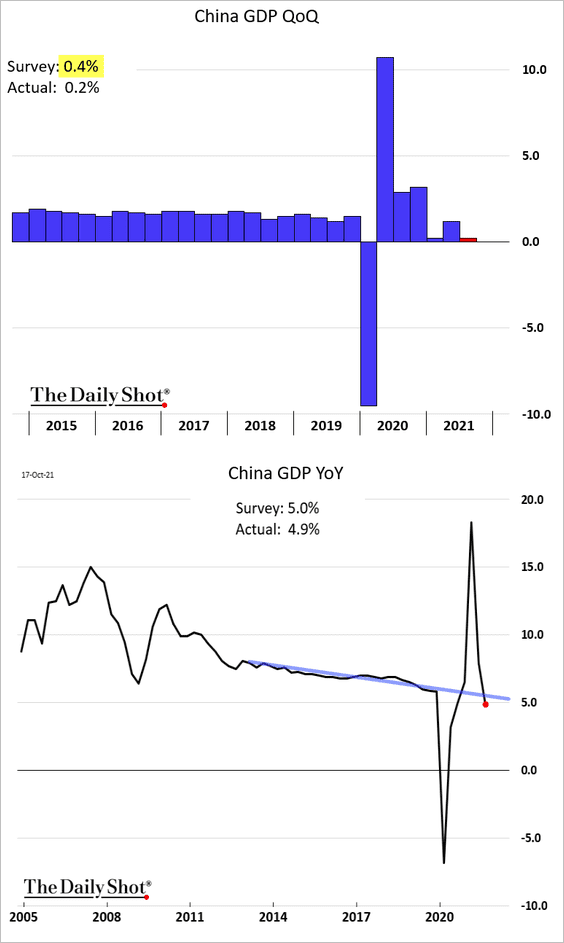

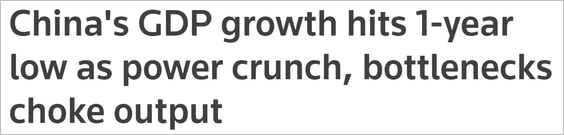

1. China’s economy slowed last quarter, with the GDP report coming in below forecasts.

Source: Reuters Read full article

Source: Reuters Read full article

BCA Research expects GDP growth to rebound in Q4.

Source: BCA Research

Source: BCA Research

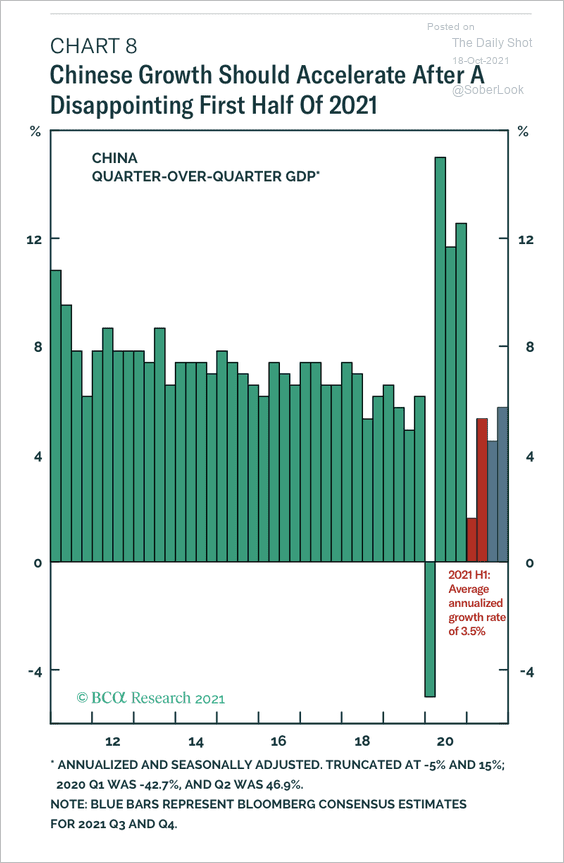

• Retail sales improved in September.

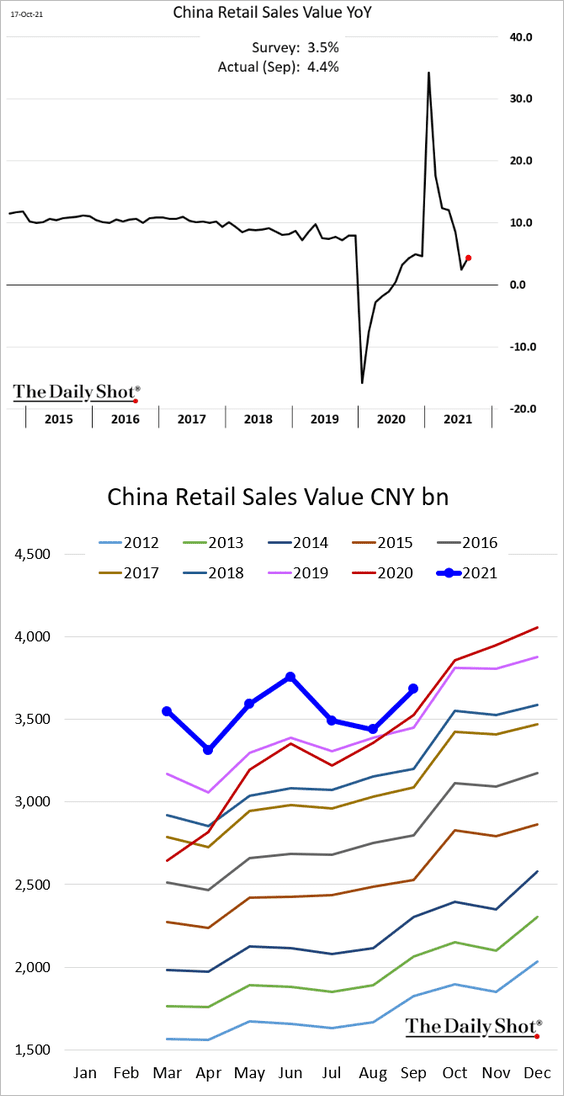

• But industrial production slowed further.

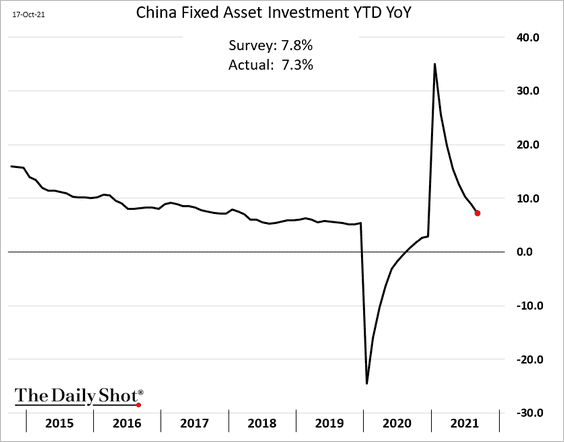

• Fixed asset investment was below expectations.

——————–

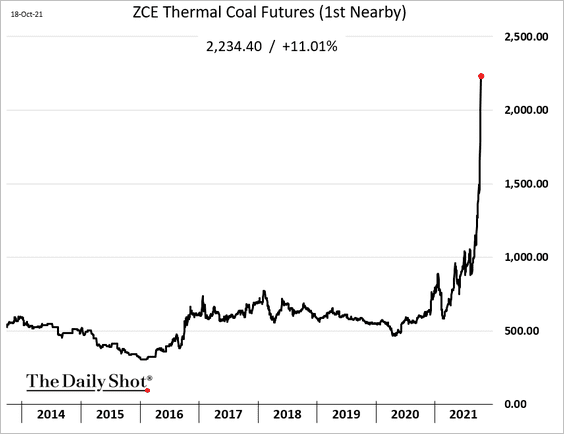

2. We had another double-digit gain in thermal coal prices today as the energy crisis worsens.

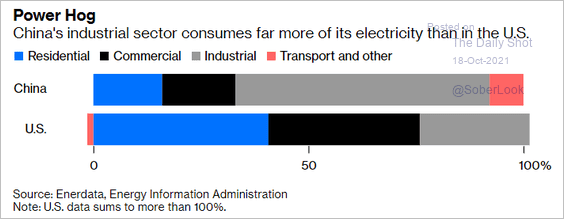

• China’s industrial sector consumes a much larger share of electricity than in the US.

Source: @davidfickling, @bopinion Read full article

Source: @davidfickling, @bopinion Read full article

• China is trying to lock in more LNG imports.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. Next, we have some updates on China’s markets.

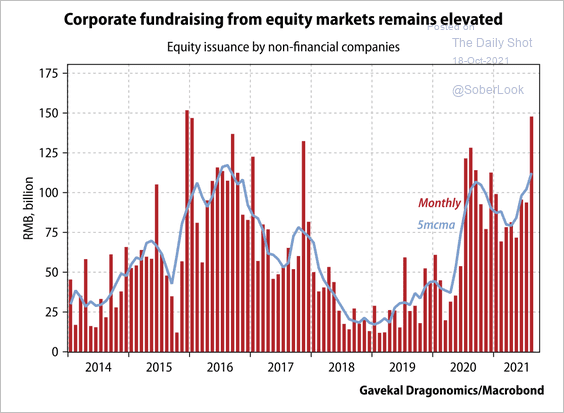

• Equity fundraising is at the highest level since 2016.

Source: Gavekal Research

Source: Gavekal Research

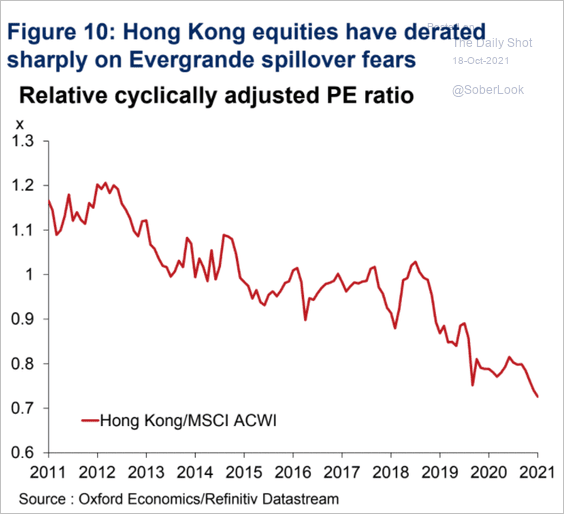

• Hong Kong’s stocks are cheap relative to global peers.

Source: Oxford Economics

Source: Oxford Economics

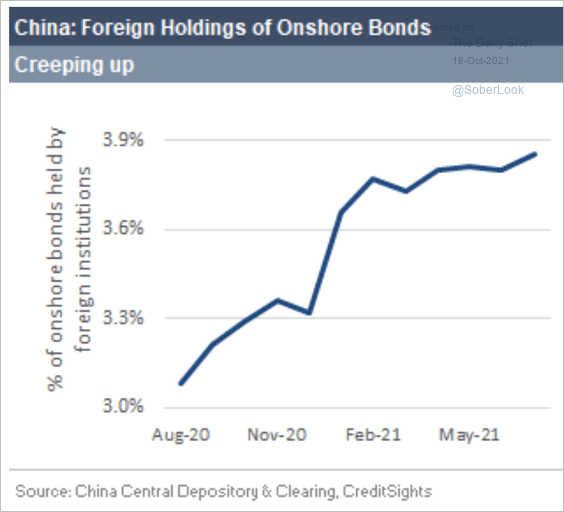

• Foreign holdings of onshore bonds have been climbing.

Source: CreditSights

Source: CreditSights

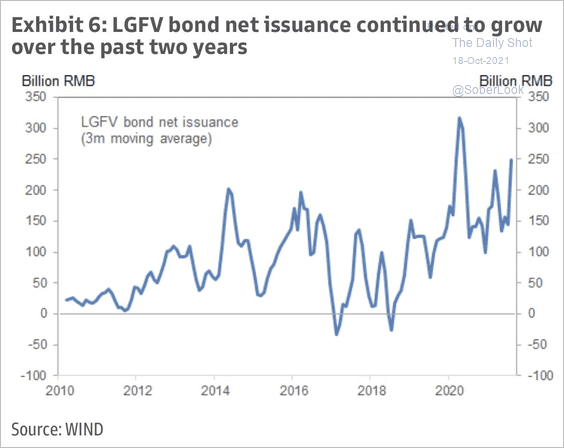

• Local government debt issuance (via LGFVs) remains elevated.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Emerging Markets

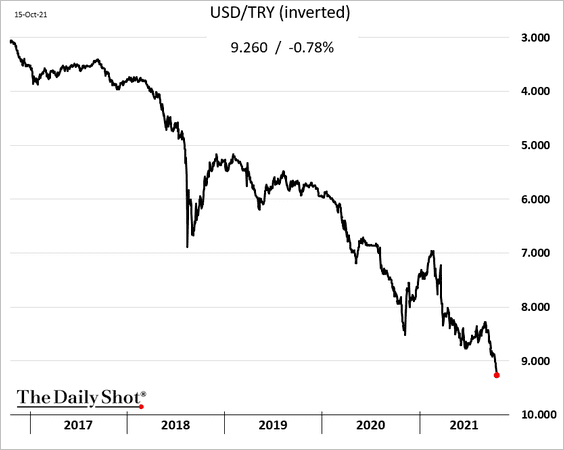

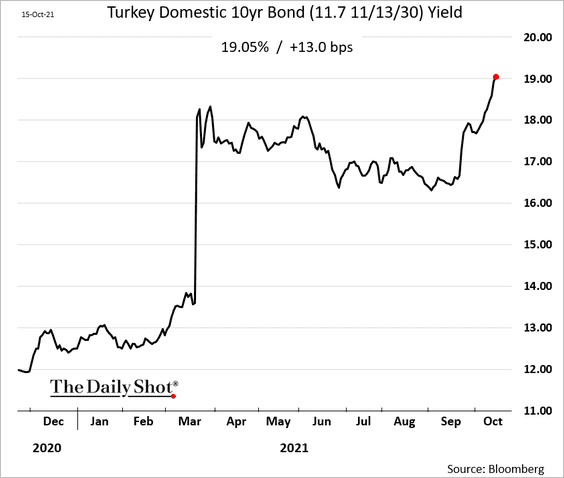

1. The Turkish lira remains under pressure.

And local-currency bonds have also sold off.

——————–

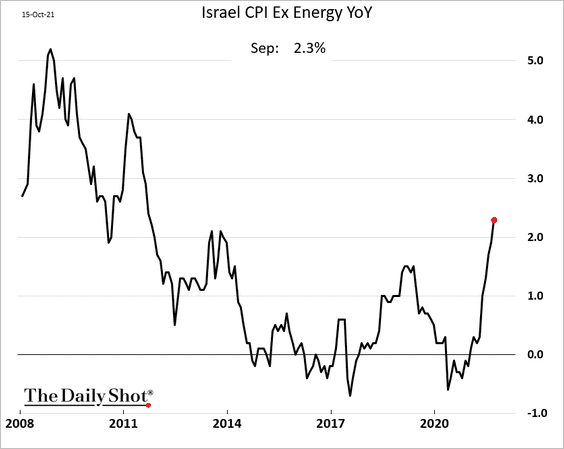

2. Israel’s inflation is hitting multi-year highs.

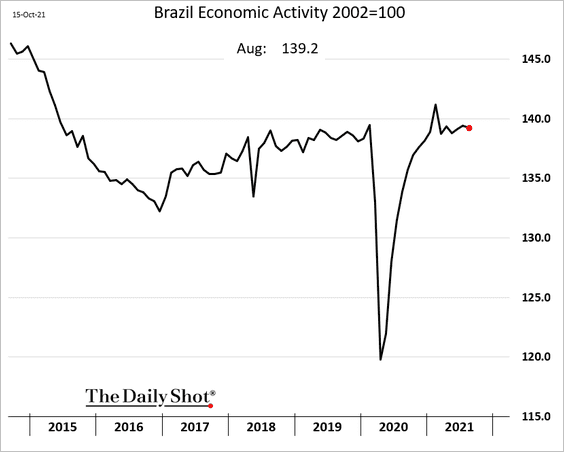

3. Brazil’s economic activity is holding at pre-COVID levels.

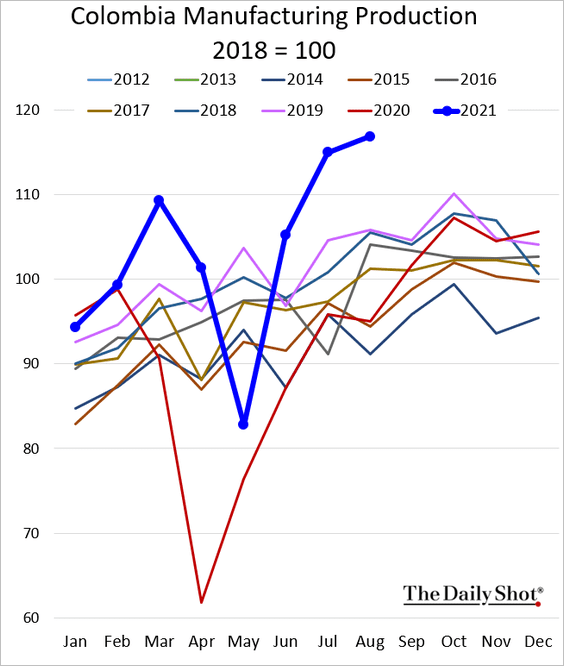

4. Colombia’s manufacturing output hit a record high.

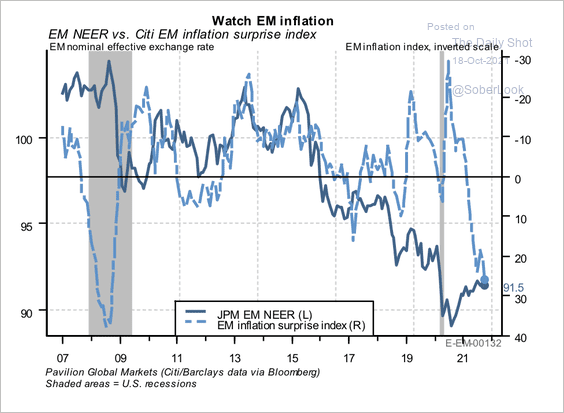

5. EM inflation is starting to surprise higher.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Back to Index

Cryptocurrency

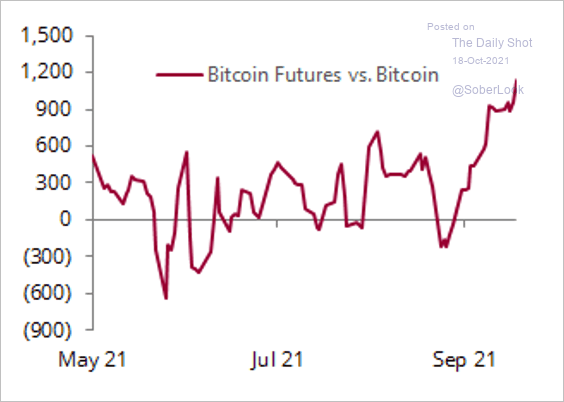

1. It’s official. The SEC approved the first futures-based bitcoin ETF.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

• Bitcoin blasted past $62k.

• And the futures-spot spread has blown out.

Source: @Marcomadness2

Source: @Marcomadness2

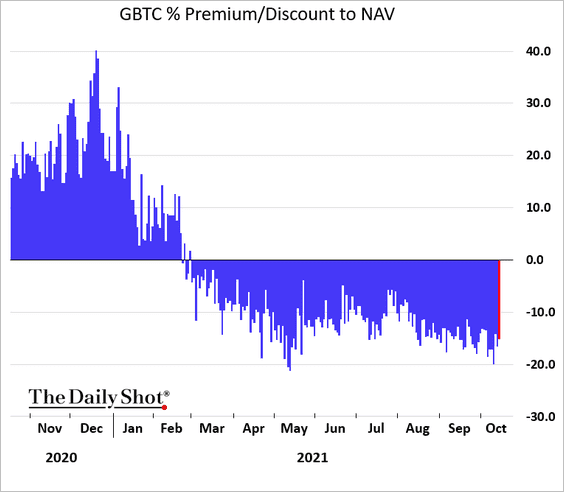

2. Grayscale is planning to convert its bitcoin trust product (GBTC) into a spot bitcoin ETF.

Source: CNBC Read full article

Source: CNBC Read full article

GBTC has traded at a discount to NAV for most of the year, and the conversion would (in theory) remove the discount.

——————–

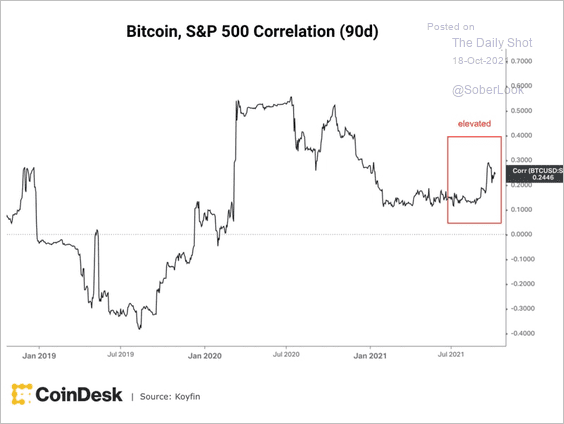

3. The recent rise in bitcoin’s price coincided with stabilization in equity markets, keeping the correlation between BTC and the S&P 500 elevated.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

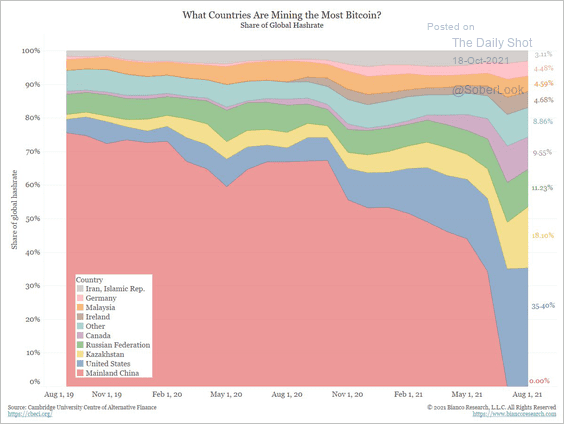

4. This chart shows the shift of bitcoin mining out of China.

Source: @biancoresearch

Source: @biancoresearch

Back to Index

Commodities

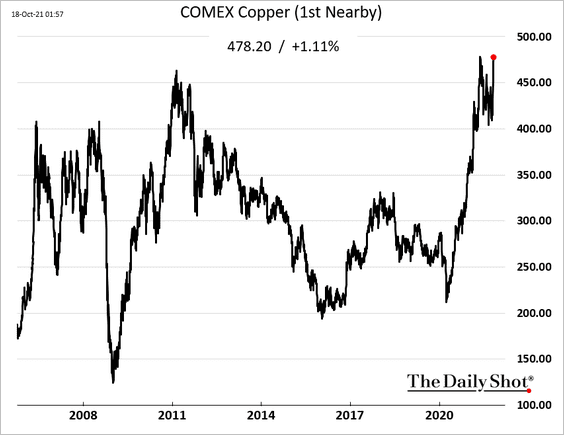

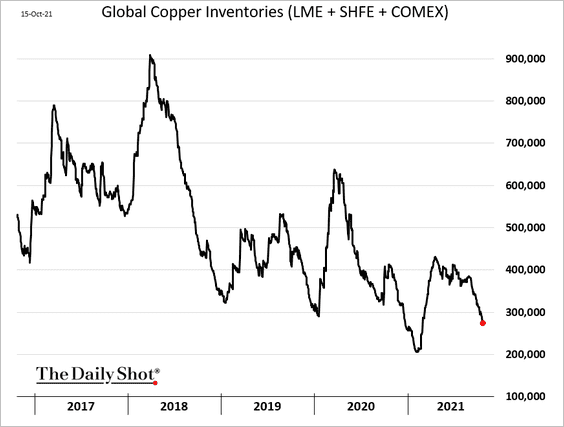

1. Copper is trading near the highs, …

… as inventories tighten.

——————–

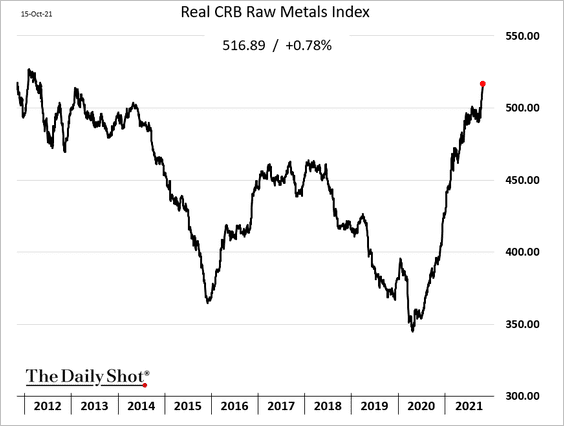

2. The CRB raw industrial metals index is near a decade high even when adjusted for inflation (the nominal index hit a record high).

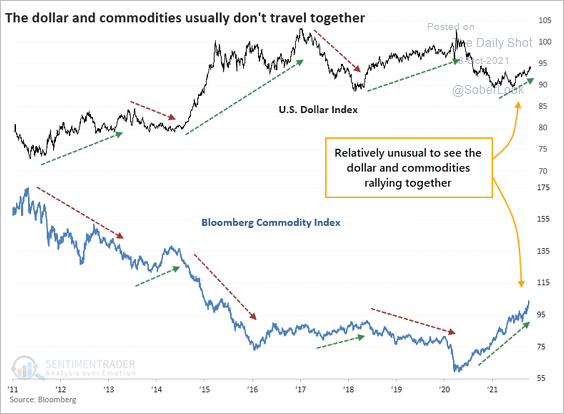

3. The simultaneous rally in commodities and the US dollar is not sustainable.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Energy

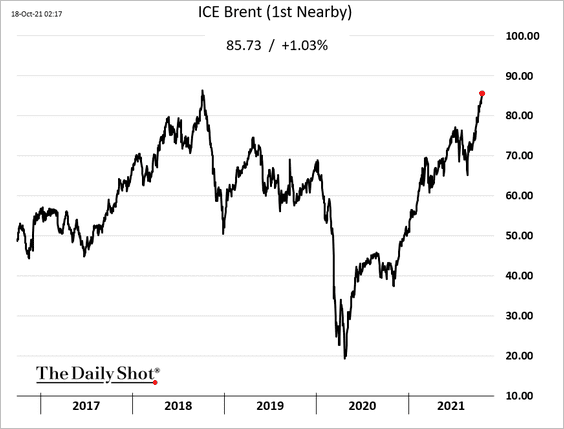

1. Crude oil continues to climb, …

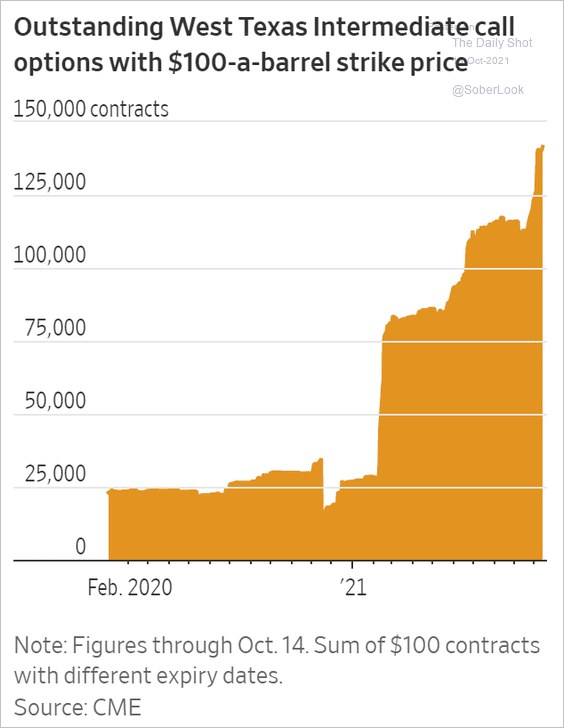

… with options traders increasingly betting on $100/bbl oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

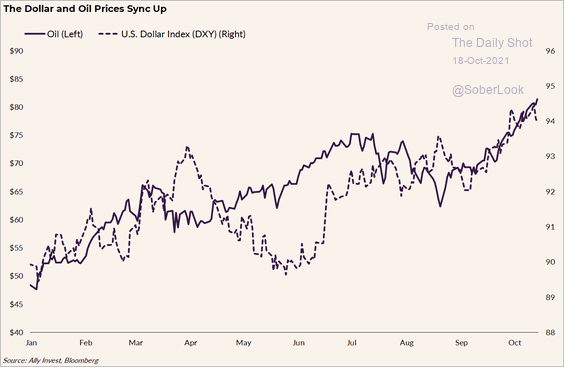

But a stronger US dollar could stall the rally in oil.

Source: Lindsey Bell, Ally Invest

Source: Lindsey Bell, Ally Invest

——————–

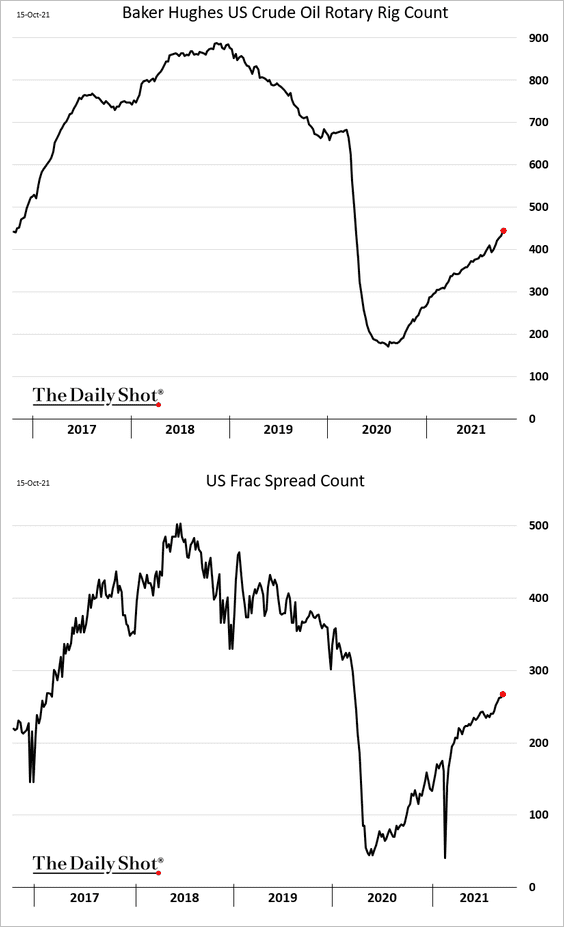

2. US fracking activity continues to rebound.

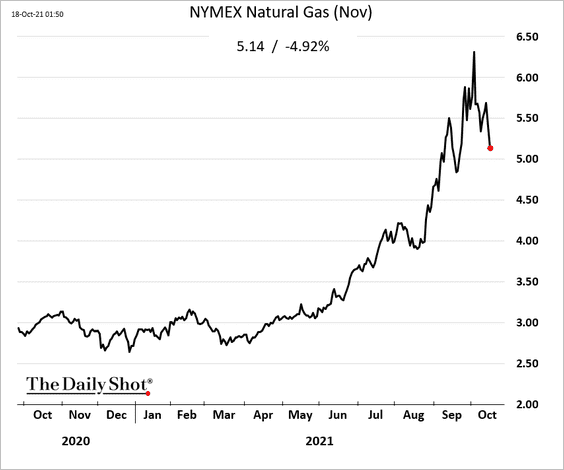

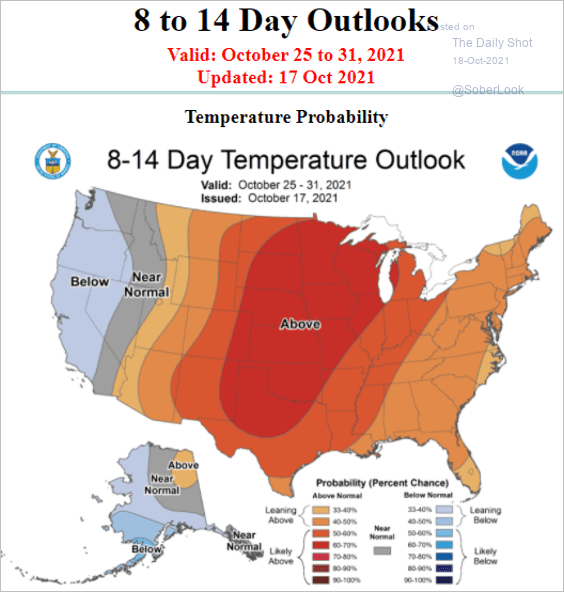

3. US natural gas prices are rolling over amid warm weather.

Source: NOAA

Source: NOAA

Back to Index

Equities

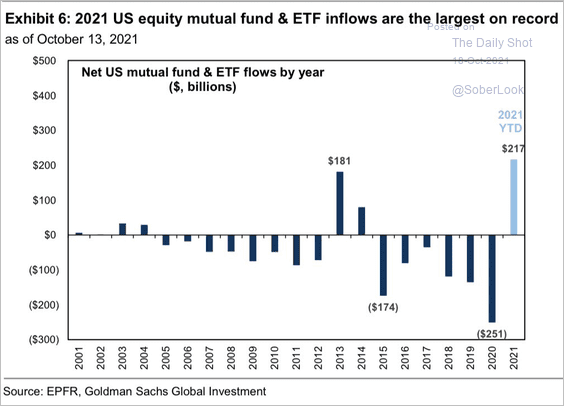

1. This year’s flows into US equities hit a record high.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

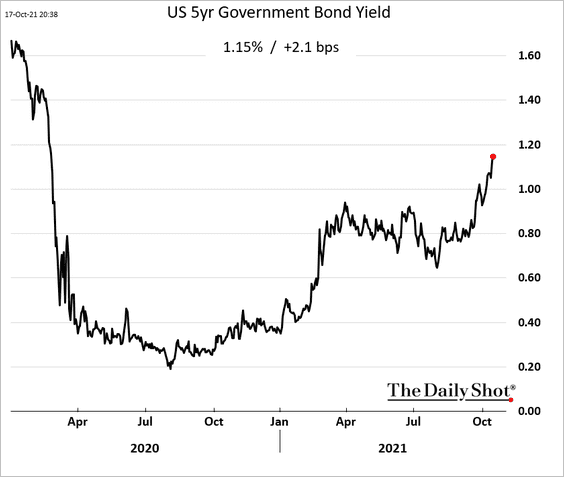

2. Will rising bond yields stall the stock market rally?

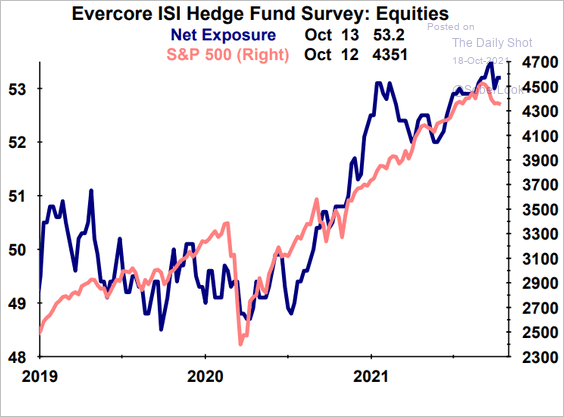

3. Hedge funds’ equity exposure remains elevated.

Source: Evercore ISI

Source: Evercore ISI

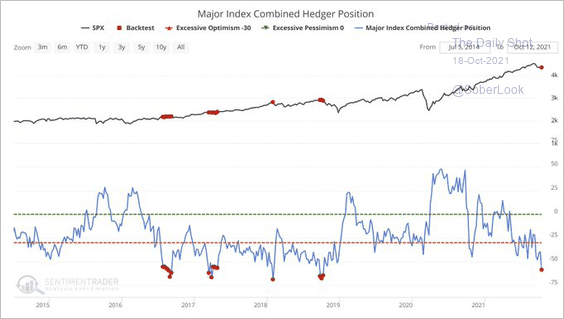

• Commercial hedgers are now net short index futures.

Source: SentimenTrader

Source: SentimenTrader

——————–

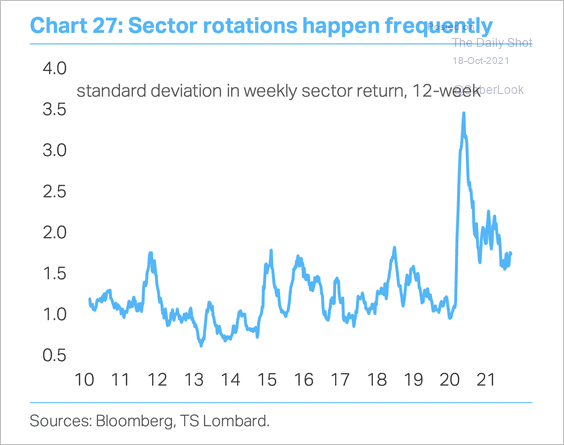

4. The pandemic ushered in a period of extreme sectoral rotation in global stocks that persists in 2021.

Source: TS Lombard

Source: TS Lombard

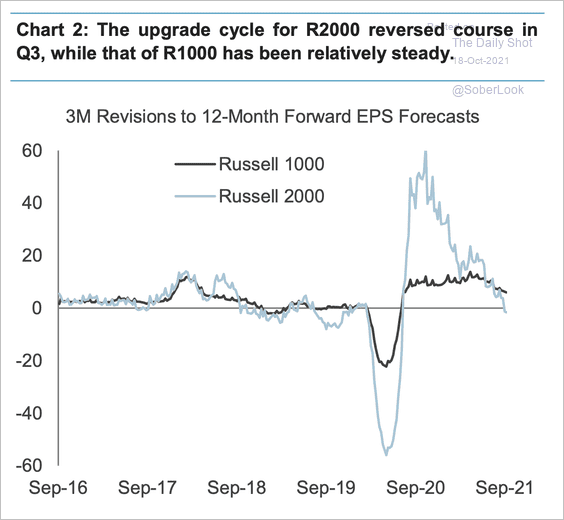

5. The Russell 2000 earnings revisions have reversed while those of the Russell 1000 (large caps) are relatively stable.

Source: FTSE Russell

Source: FTSE Russell

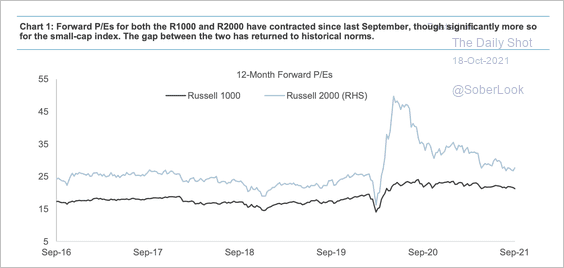

Valuations of small-cap stocks are back to their historical premium to large-cap stocks (Russell 1000) as the pandemic recovery progresses.

Source: FTSE Russell

Source: FTSE Russell

——————–

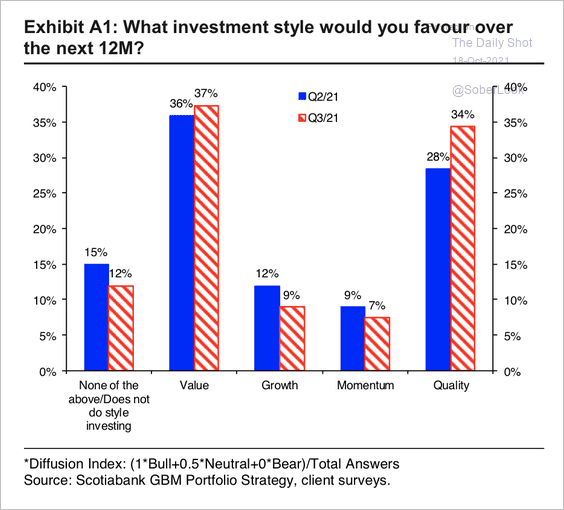

6. Most institutional investors favor quality and value factors over the next 12 months, according to a Scotiabank survey.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

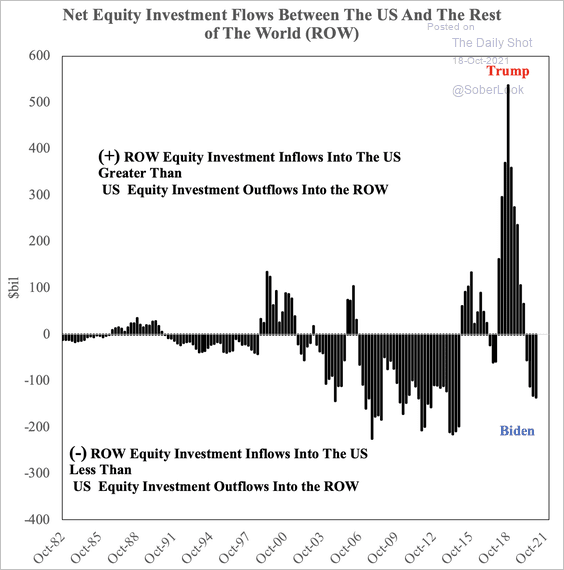

7. Proposals to raise taxes could push equity flows out of the US.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Back to Index

Credit

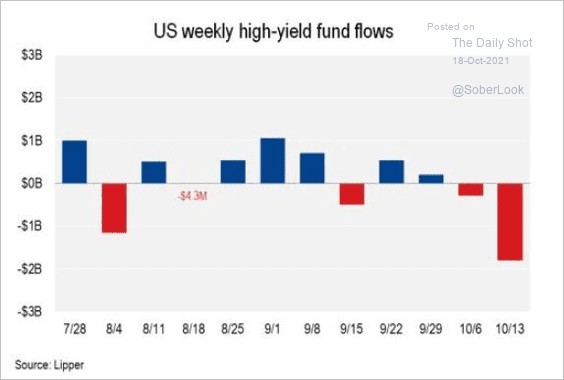

1. HY funds saw some outflows in recent days.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

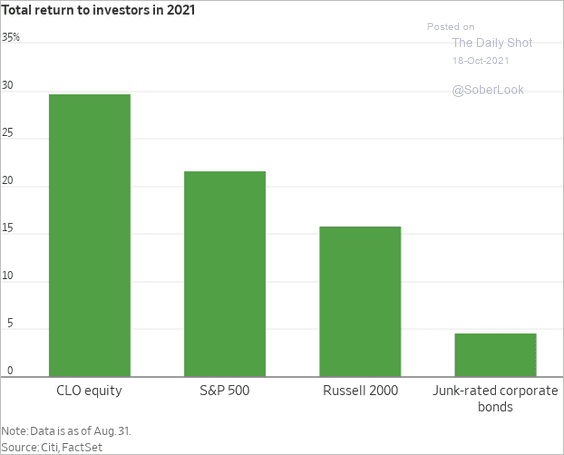

2. CLO equity (unrated tranches) performed well this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

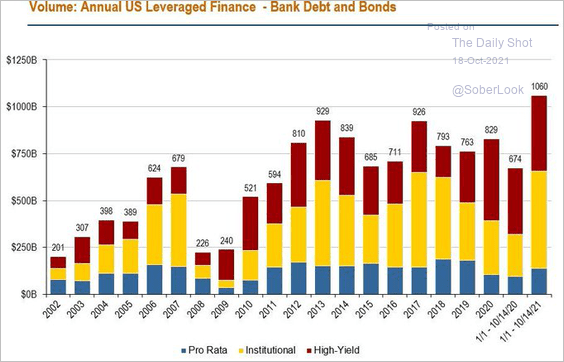

3. Year-to-date US leveraged finance issuance exceeds $1 trillion.

Source: @lcdnews

Source: @lcdnews

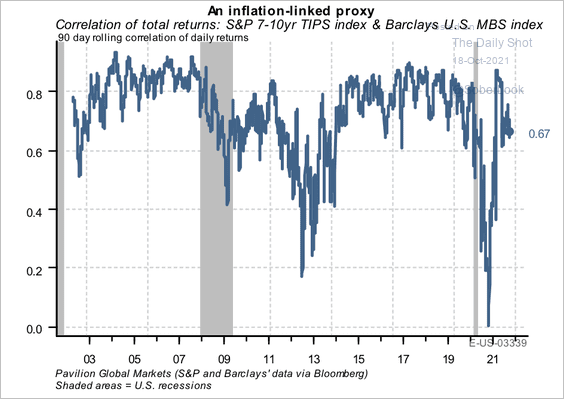

4. The correlation between TIPS (inflation protection) and mortgage-backed securities (MBS) tends to be strong.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Back to Index

Global Developments

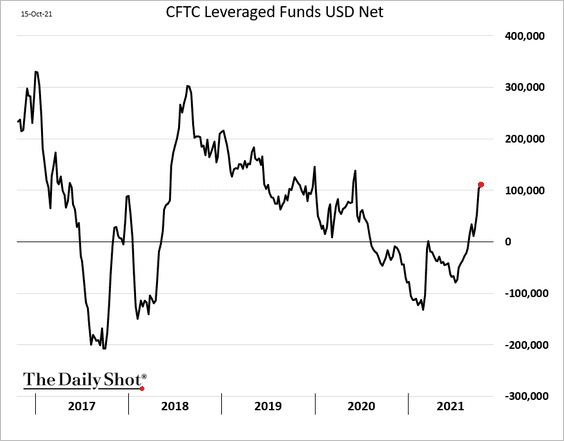

1. Hedge funds continue to boost their bets on the US dollar.

2. Wage growth remains elevated across OECD economies.

Source: Oxford Economics

Source: Oxford Economics

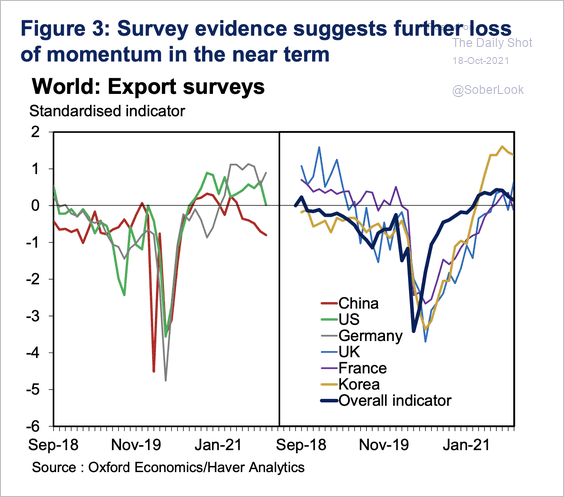

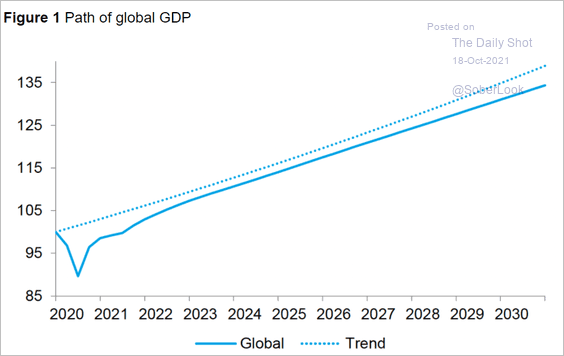

3. The pandemic permanently scarred global economic growth.

Source: VOX EU Read full article

Source: VOX EU Read full article

——————–

Food for Thought

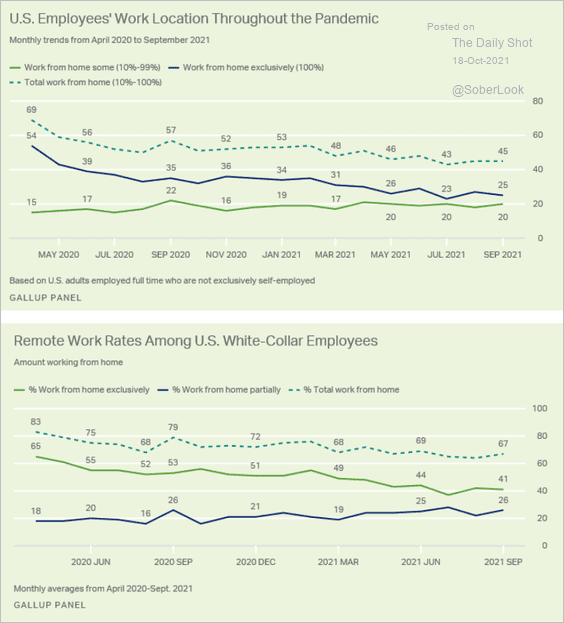

1. Still working from home:

Source: Gallup Read full article

Source: Gallup Read full article

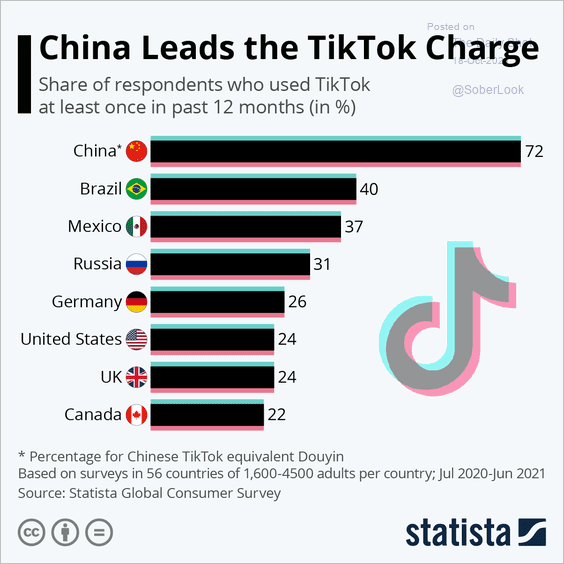

2. Using TikTok:

Source: Statista

Source: Statista

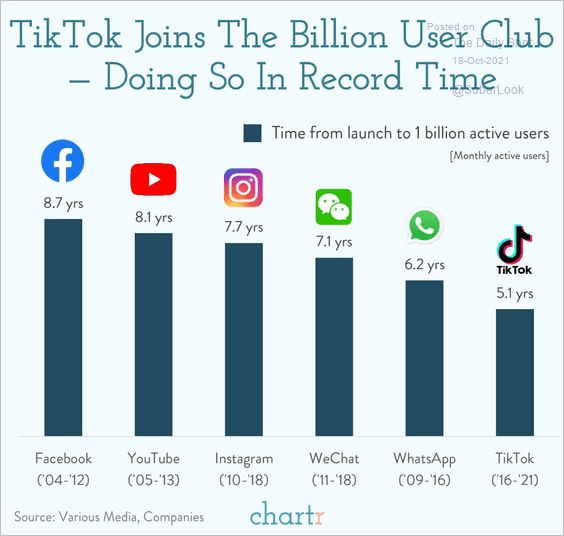

3. Time it took to reach one billion users:

Source: @chartrdaily

Source: @chartrdaily

4. Semiconductor use in cars:

![]() Source: @technology Read full article

Source: @technology Read full article

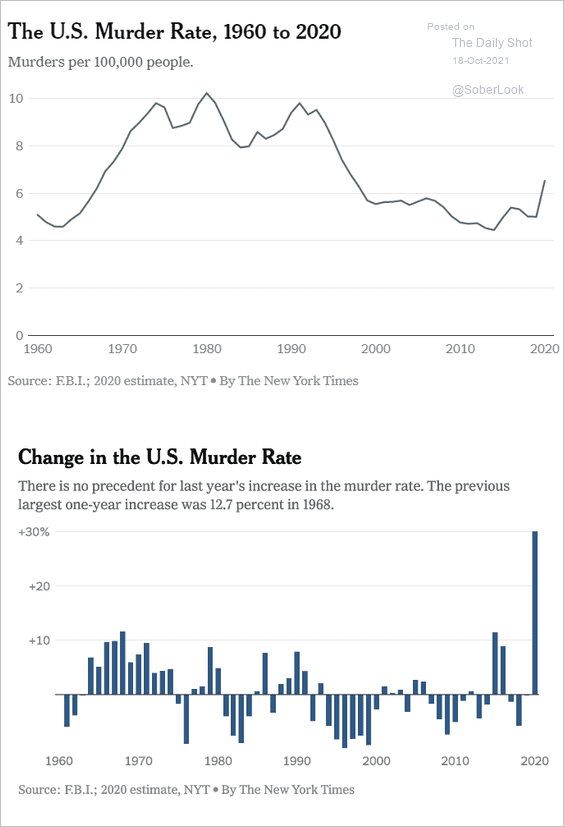

5. US murder rate:

Source: The New York Times Read full article

Source: The New York Times Read full article

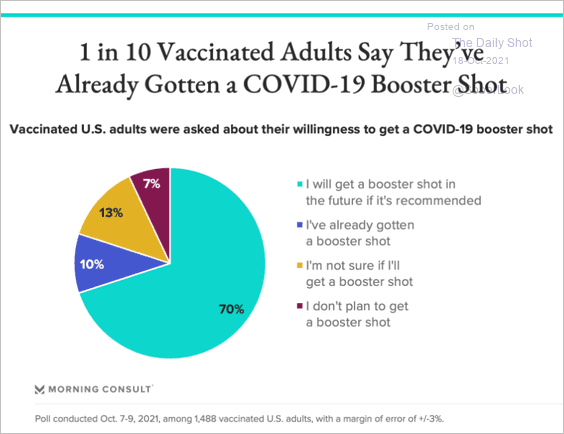

6. Getting a booster shot:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

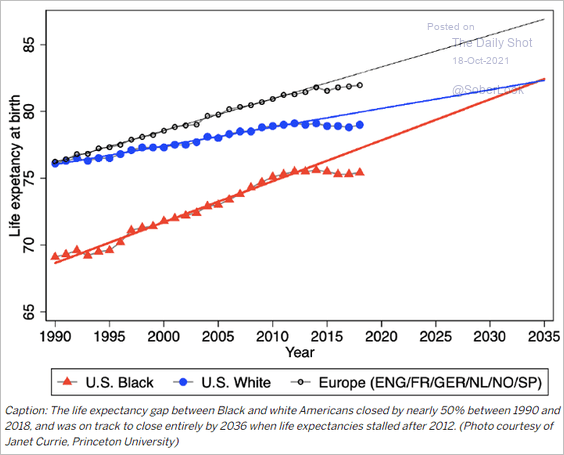

7. Life expectancy trends:

Source: Princeton School of Public and International Affairs

Source: Princeton School of Public and International Affairs

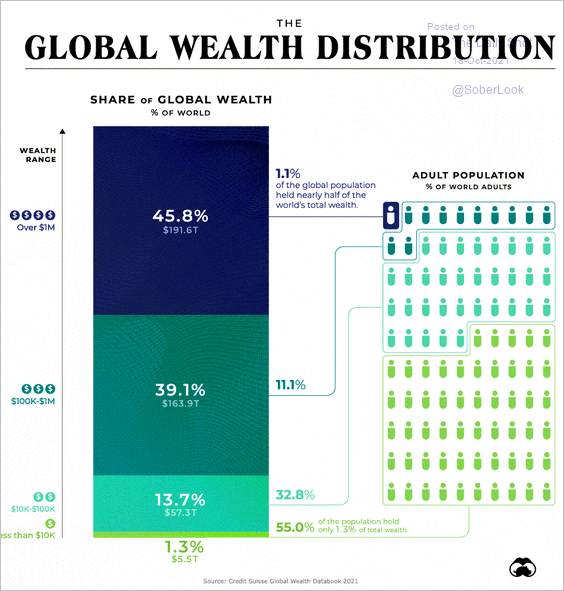

8. The global wealth distribution:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

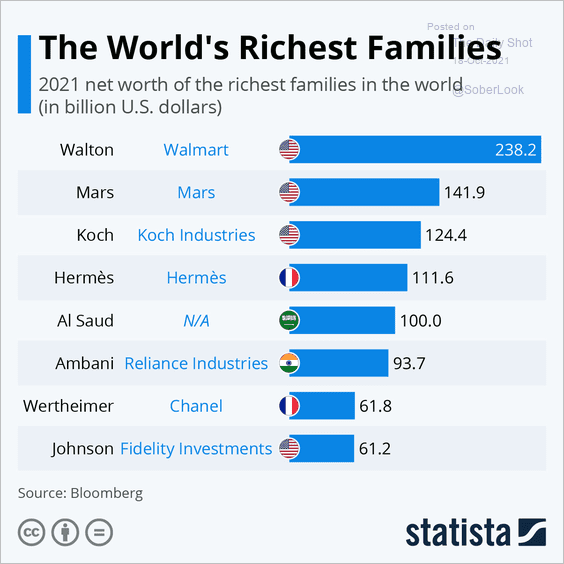

9. The world’s wealthiest families:

Source: Statista

Source: Statista

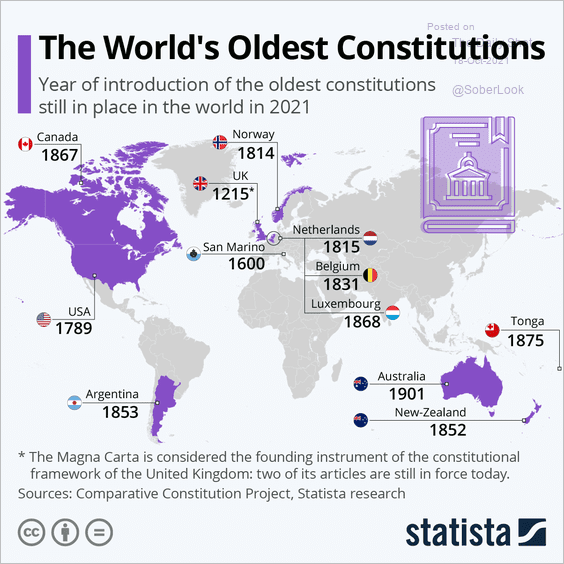

10. The oldest constitutions still in place:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index