The Daily Shot: 19-Oct-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrencies

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

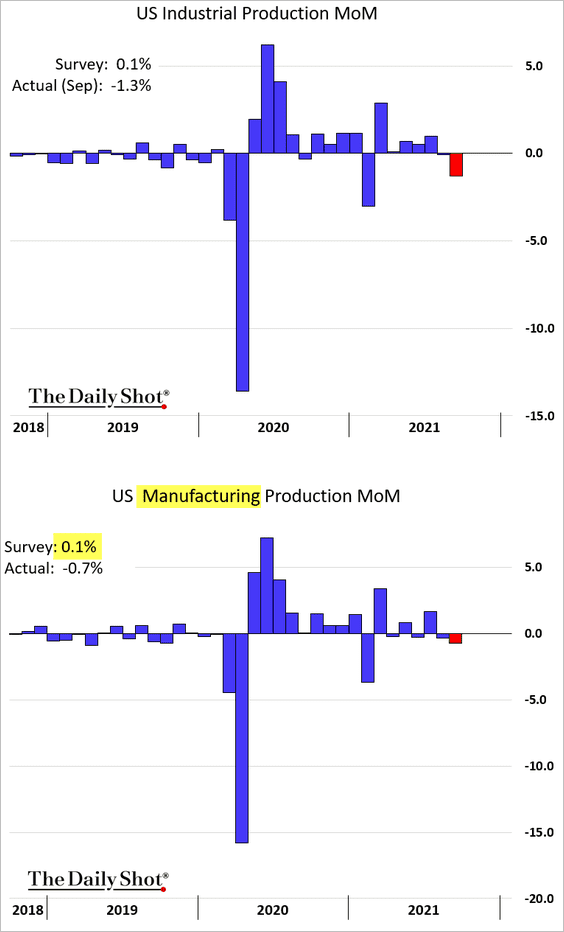

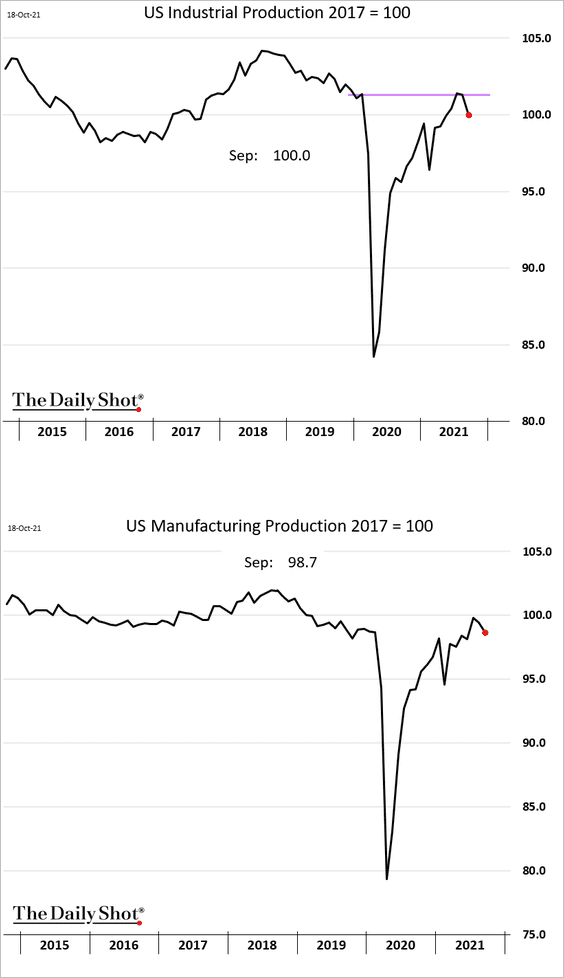

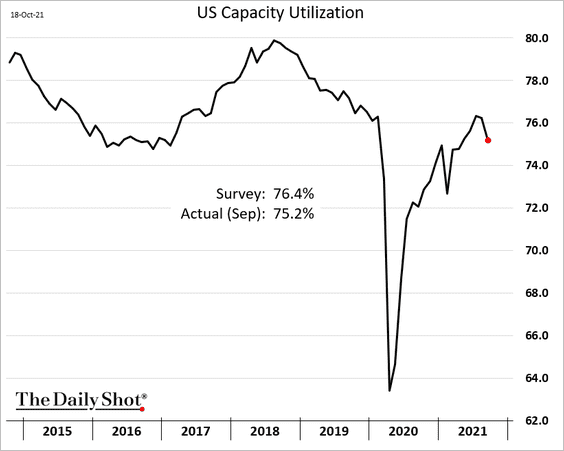

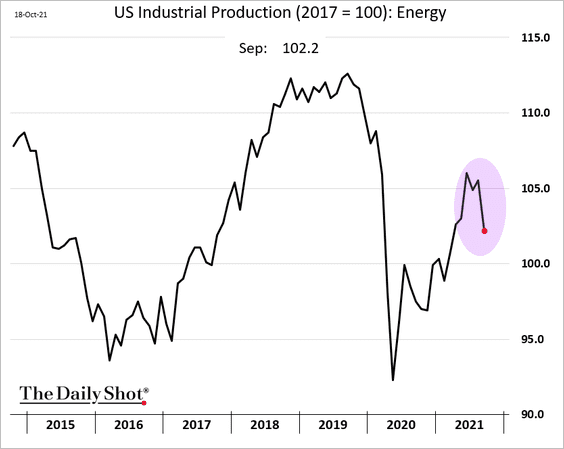

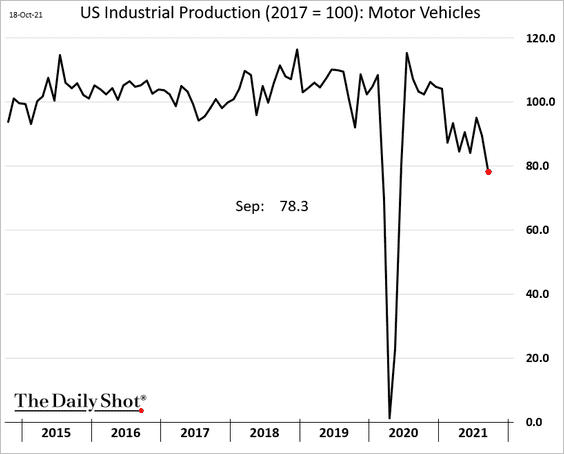

1. Industrial production surprised to the downside, with supply shortages and the impact of Hurricane Ida weighing on output.

Source: Reuters Read full article

Source: Reuters Read full article

• The industrial production index is now well below pre-COVID levels.

• Energy output was soft as the post-hurricane recovery took longer than expected.

• Automobile production tumbled.

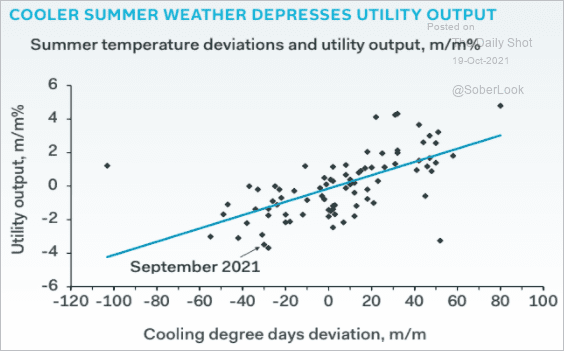

• Cooler summer weather depressed utility output, becoming a drag on industrial production.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

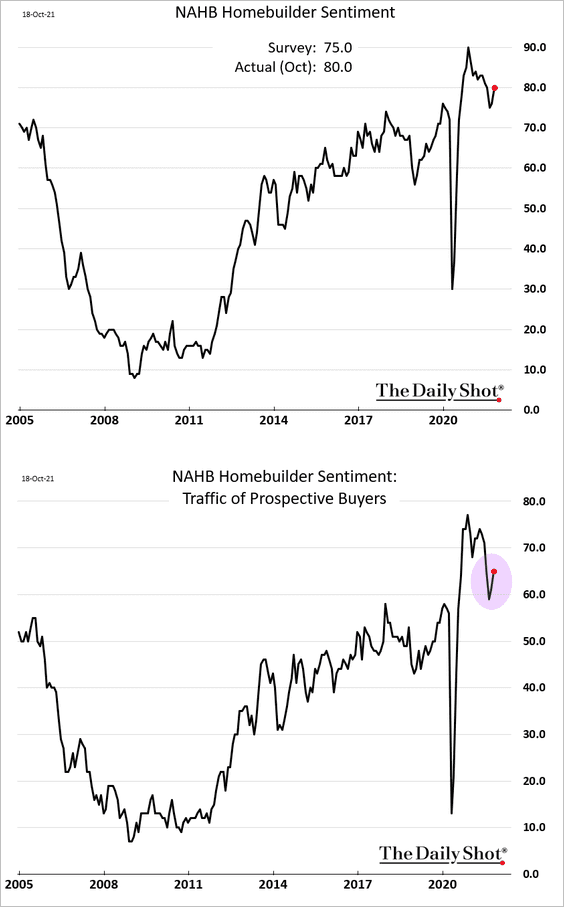

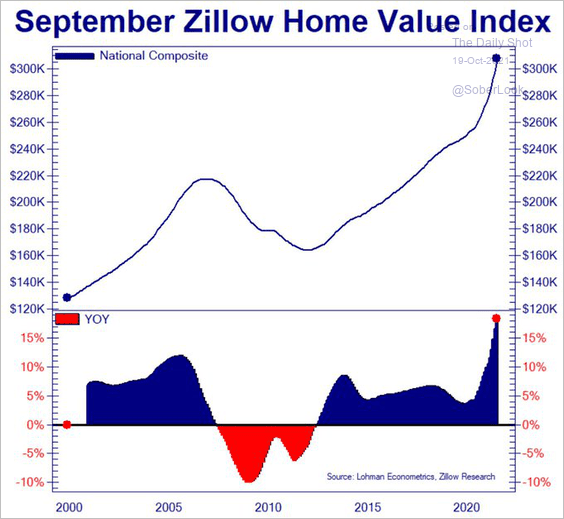

2. Here are a couple of updates on the housing market.

• Homebuilder sentiment jumped this month as buyers returned.

• Year-over-year gains in Zillow’s home price index hit a record high last month.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

——————–

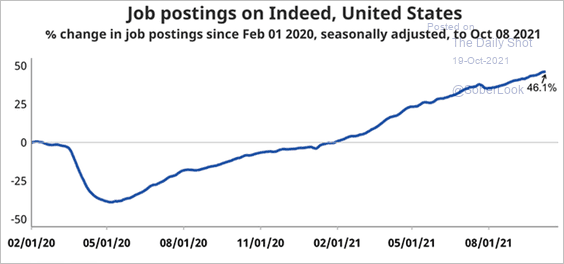

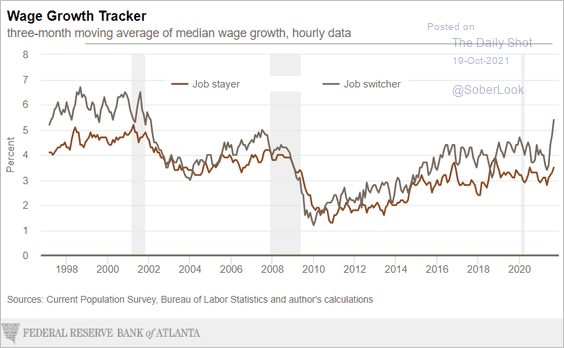

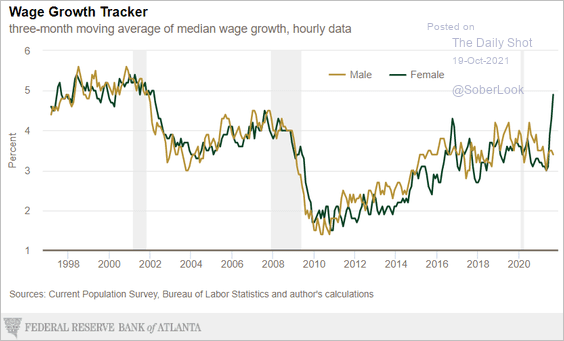

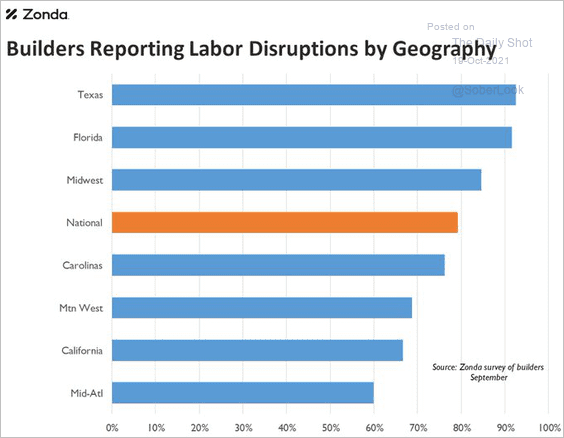

3. Next, we have some data on the labor market.

• Job openings on Indeed continue to climb.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Job-hopping has been lucrative lately.

Source: Atlanta Fed

Source: Atlanta Fed

• US women see much faster wage growth this year.

Source: Atlanta Fed

Source: Atlanta Fed

• Construction firms are facing severe labor shortages.

Source: @AliWolfEcon

Source: @AliWolfEcon

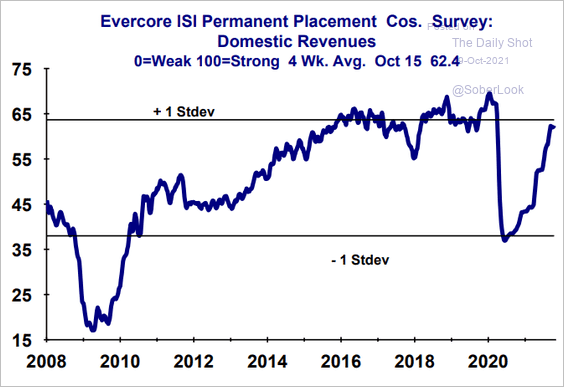

• Head hunters’ revenues have been rebounding.

Source: Evercore ISI

Source: Evercore ISI

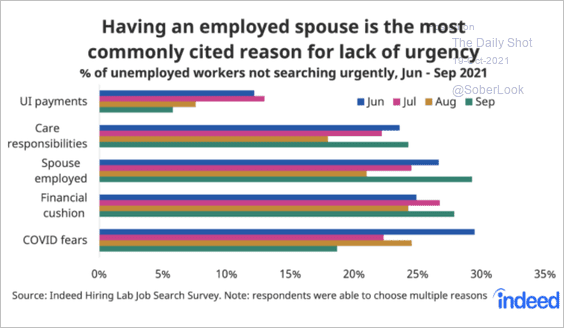

• Here are the reasons for the lack of urgency in returning to work.

Source: @GregDaco, @nick_bunker, @indeed Read full article

Source: @GregDaco, @nick_bunker, @indeed Read full article

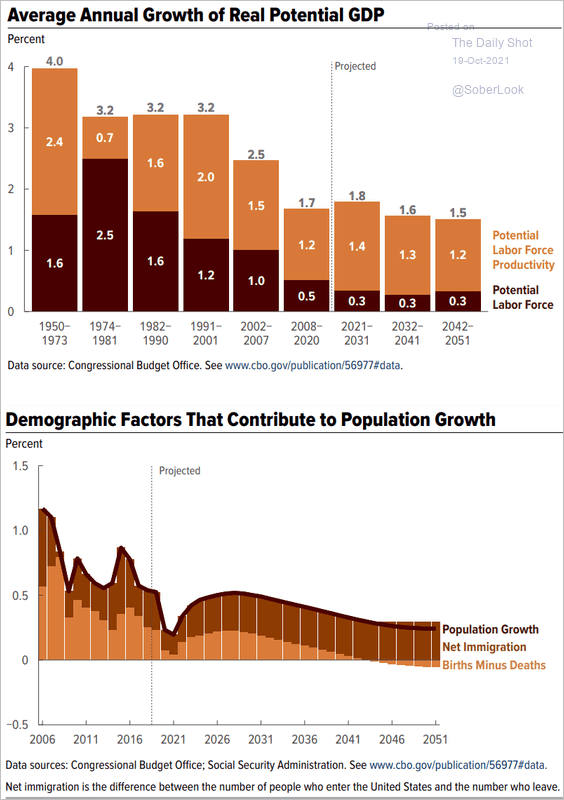

• Weak labor force growth will limit US economic expansion.

Source: CBO

Source: CBO

——————–

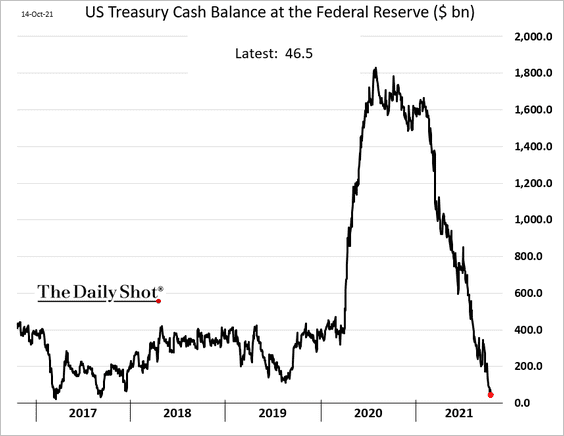

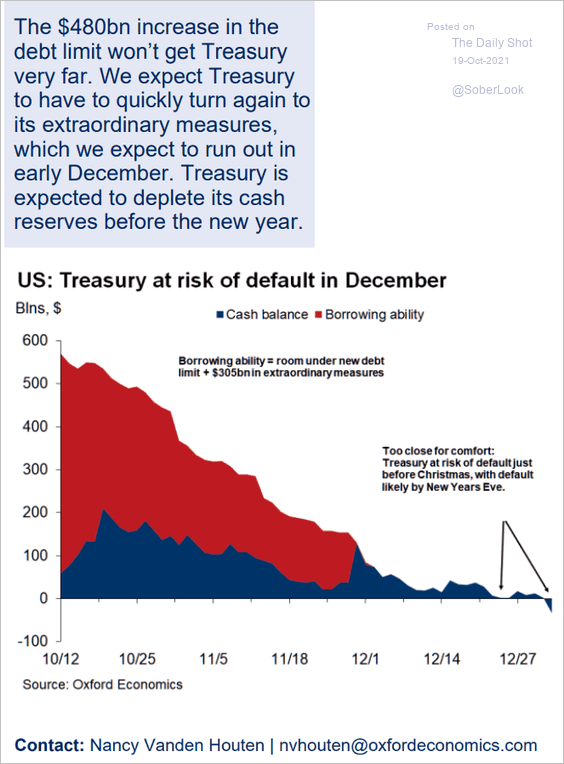

4. The US Treasury’s cash balances became dangerously low in the debt ceiling impasse.

We are going to revisit this issue later this year.

Source: Oxford Economics

Source: Oxford Economics

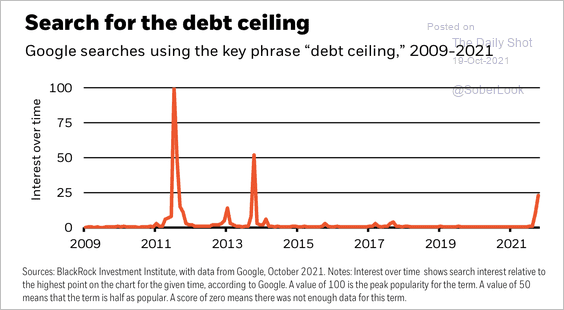

Google searches for “debt ceiling” have been low relative to prior events.

Source: BlackRock

Source: BlackRock

——————–

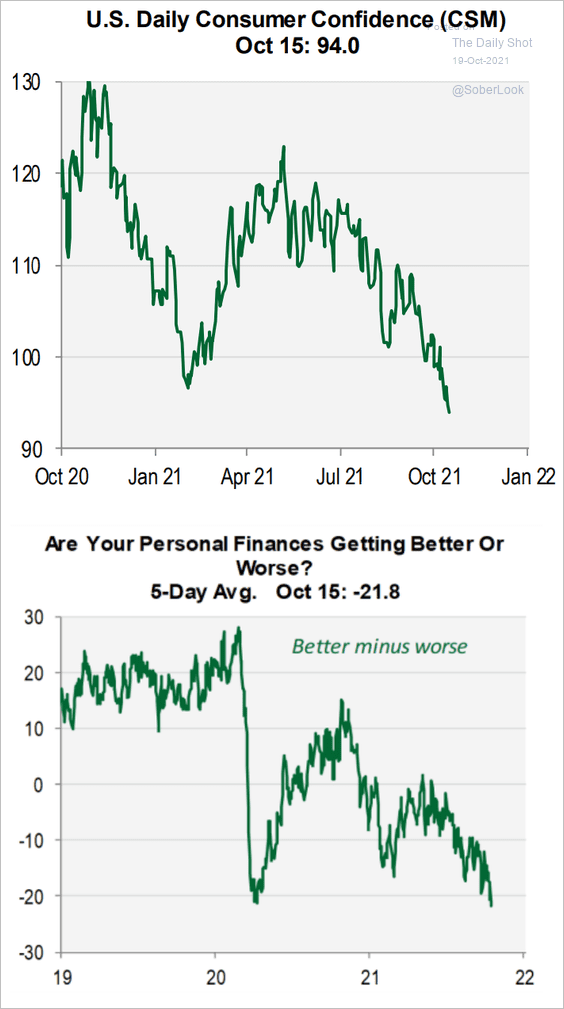

5. Just as we saw in the U. Michigan report, other indicators point to a deterioration in consumer sentiment.

• Cornerstone Macro’ high-frequency indicator:

Source: Cornerstone Macro

Source: Cornerstone Macro

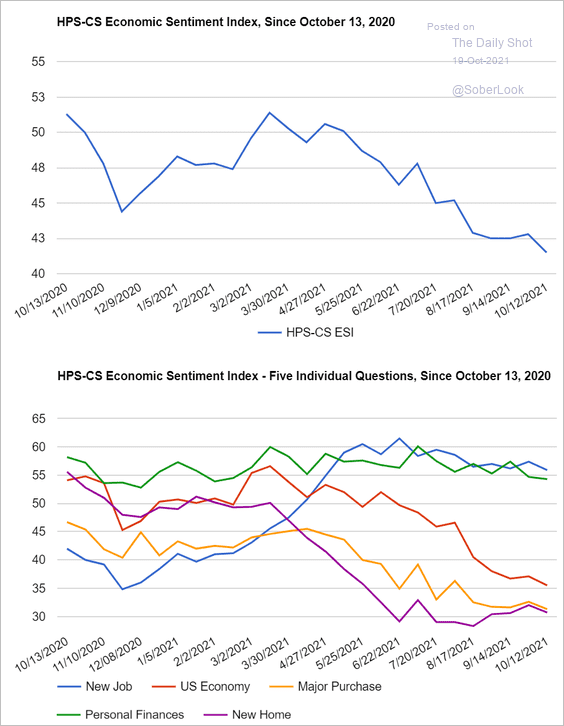

• The HPS-CS Sentiment Index:

Source: ESI Read full article

Source: ESI Read full article

Back to Index

Canada

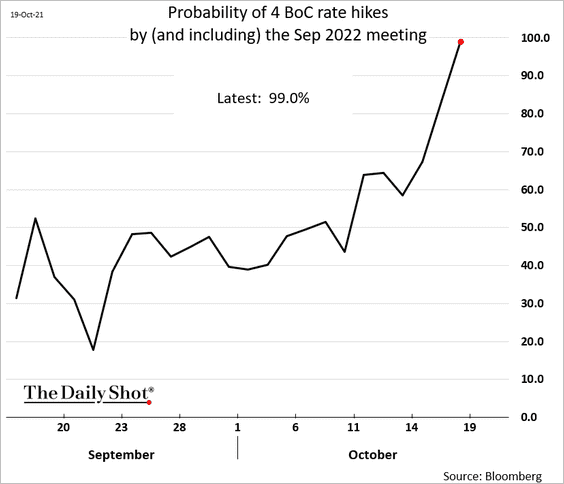

1. Four BoC rate hikes by the end of Q3 of next year? The market is convinced.

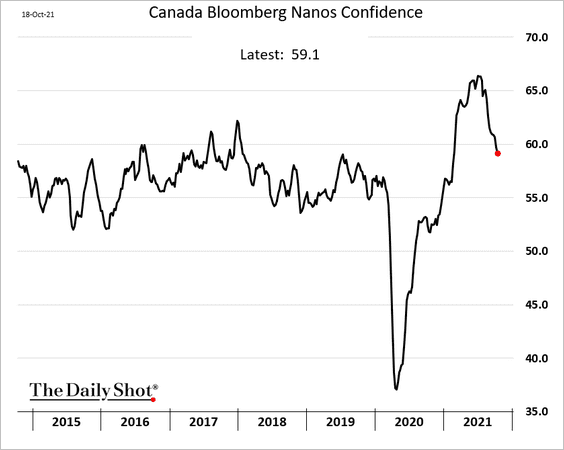

2. Consumer confidence continues to ease.

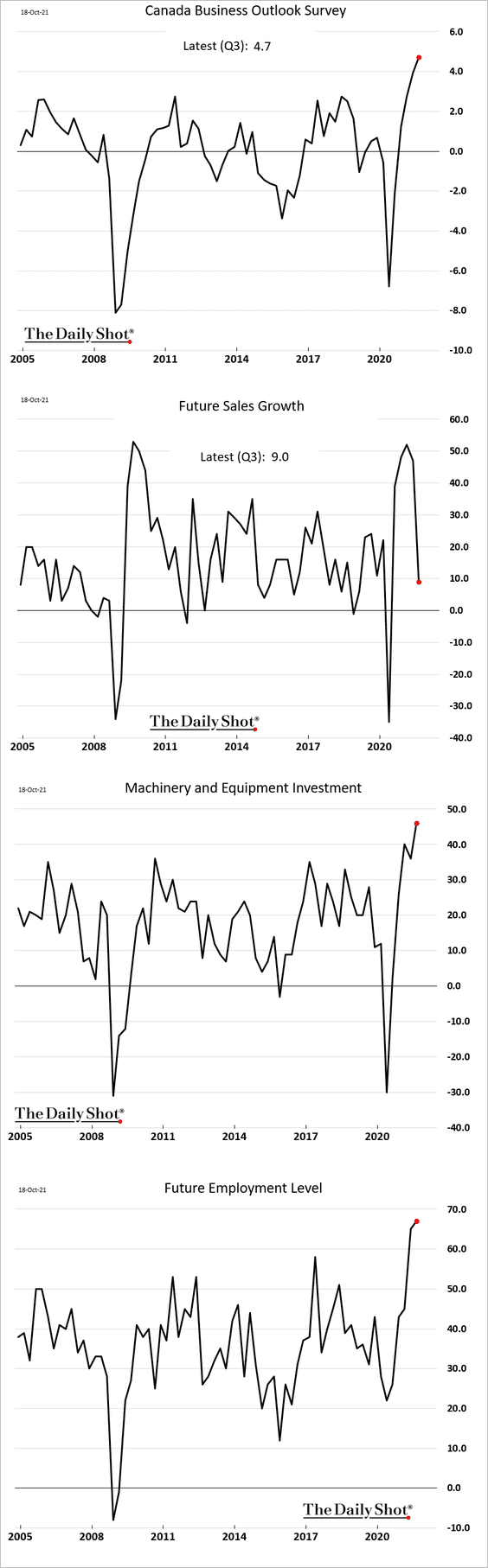

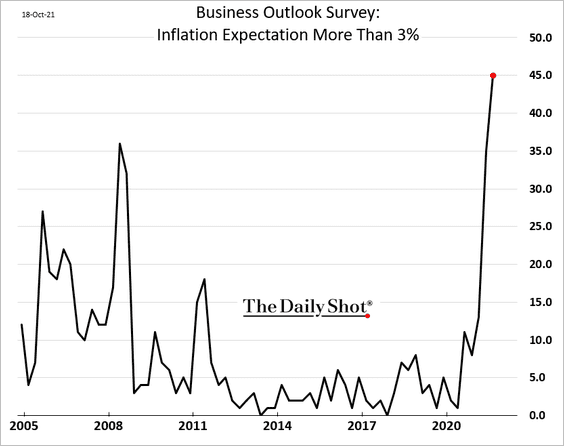

3. Business sentiment surged to a record high, according to a BoC survey. Businesses see sales growth moderating, but CapEx and hiring expectations hit new highs.

Source: Reuters Read full article

Source: Reuters Read full article

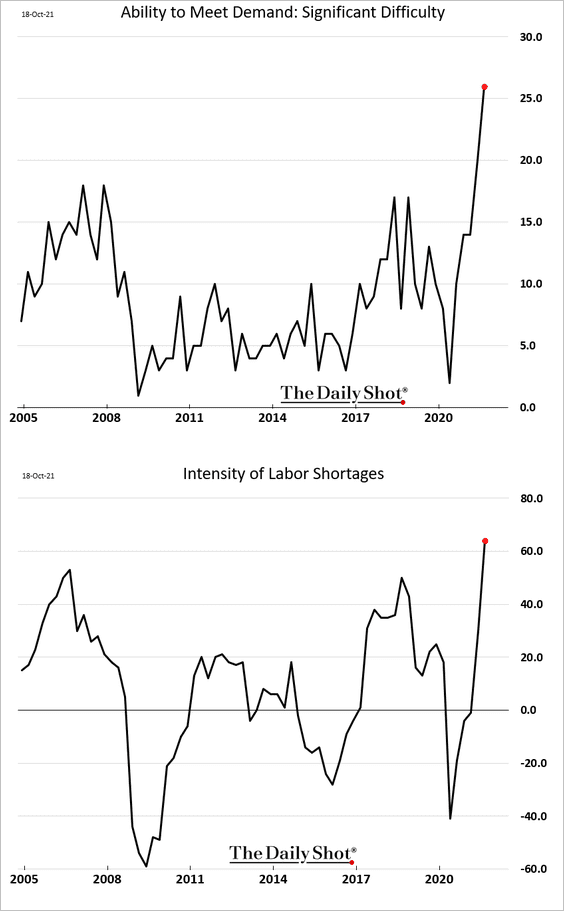

• Production bottlenecks and labor shortages have become acute in some sectors.

• Companies see much higher inflation ahead.

——————–

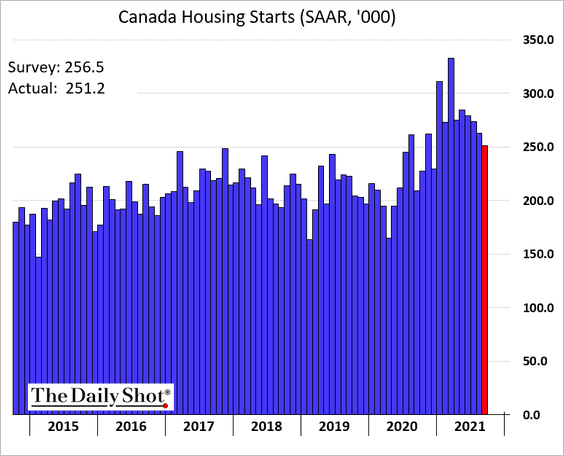

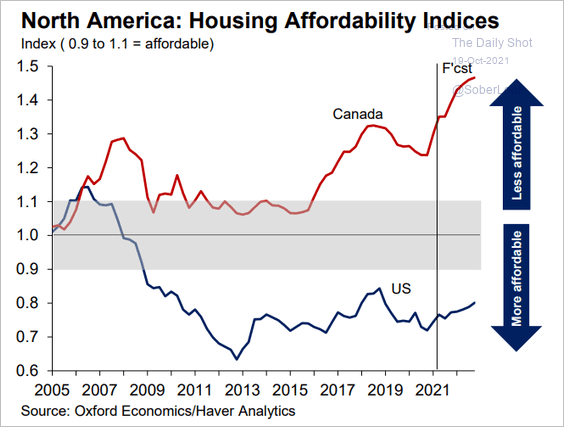

3. Housing starts are moderating, …

… as affordability increasingly becomes an issue.

Source: @GregDaco

Source: @GregDaco

——————–

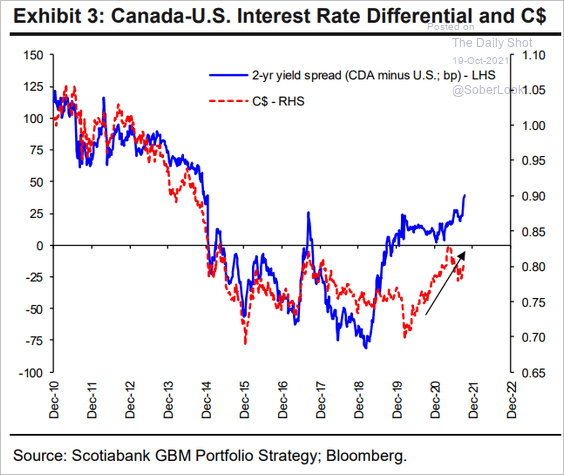

4. The rate differential with the US should be a tailwind for the loonie.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

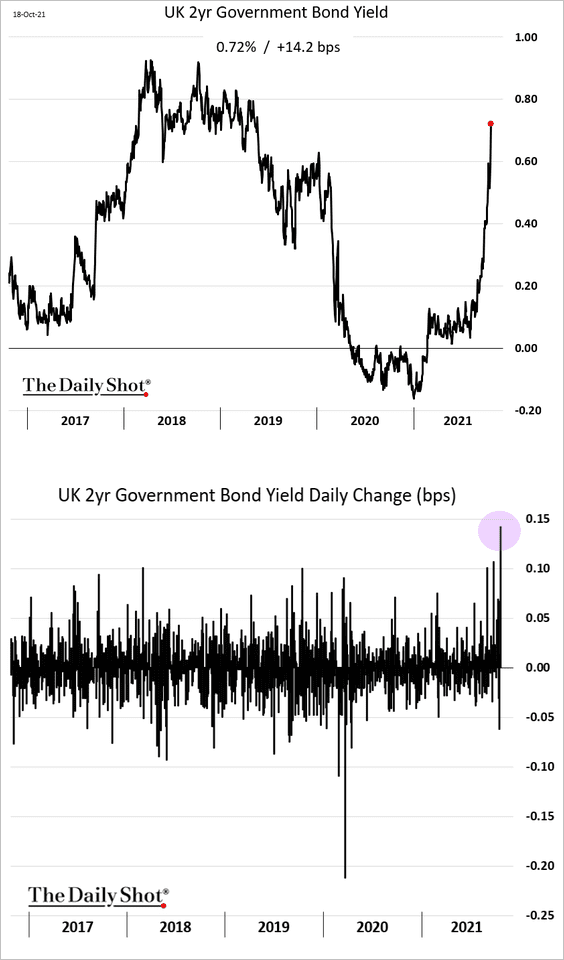

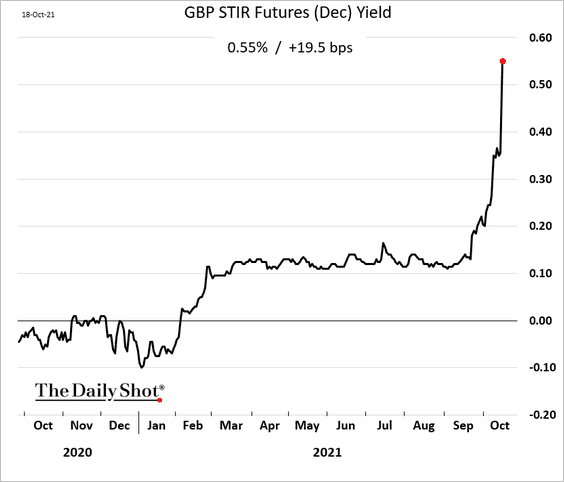

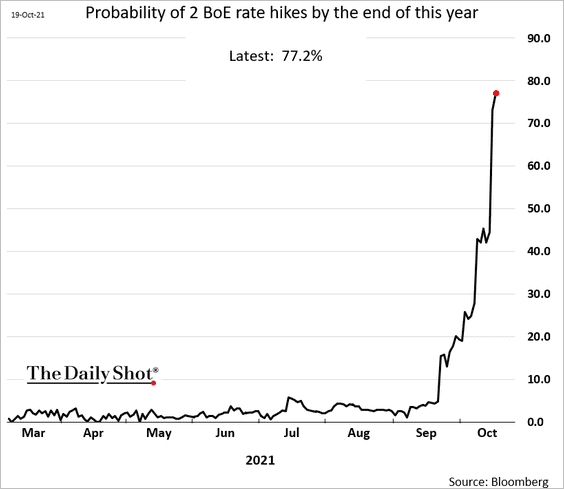

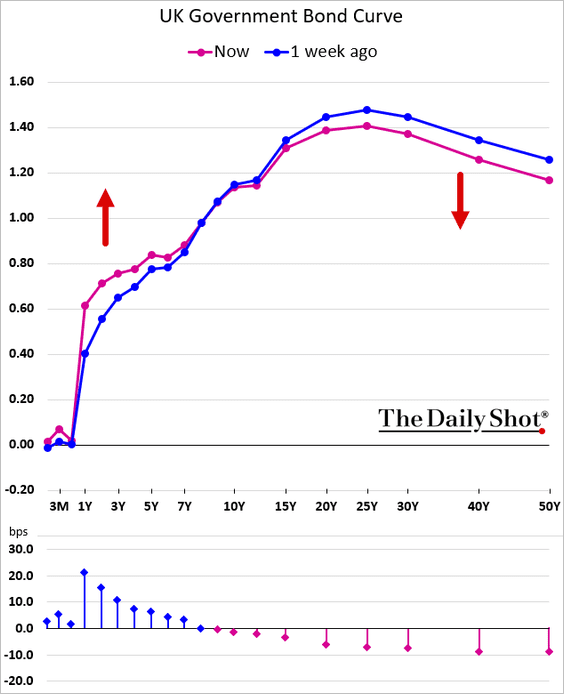

The United Kingdom

1. A historic rate dislocation took place on Monday as the market repriced BoE rate hike expectations.

Source: Reuters Read full article

Source: Reuters Read full article

• The 2yr gilt:

• Short-term rate futures (yield):

• The probability of 2 rate hikes before the end of the year:

Similar to the US, the market expects the BoE to hike more aggressively to tame inflation – slowing economic growth in the process. The curve has flattened.

Source: @TheStalwart Read full article

Source: @TheStalwart Read full article

——————–

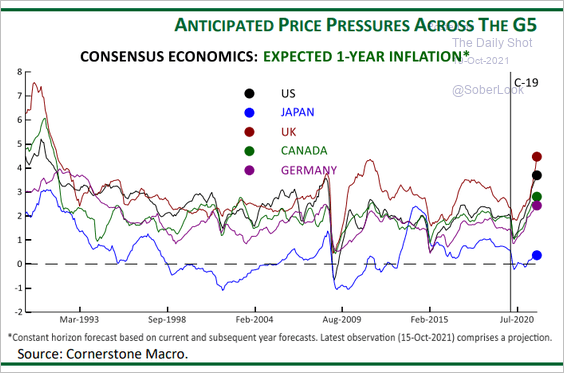

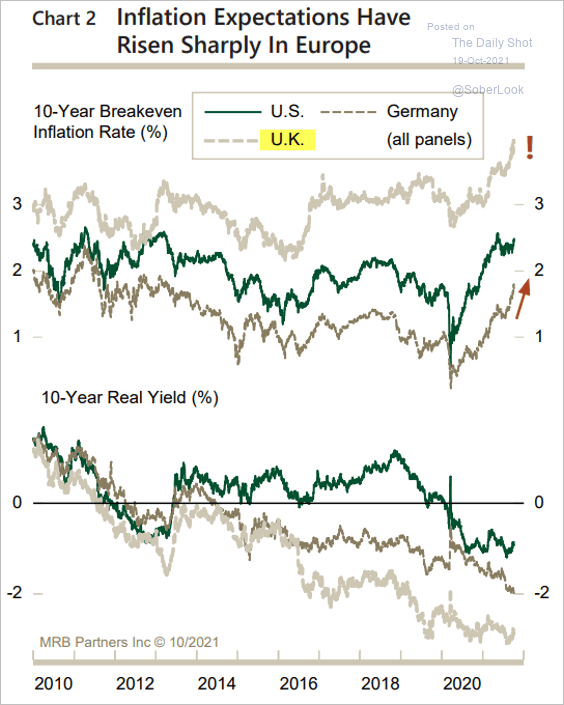

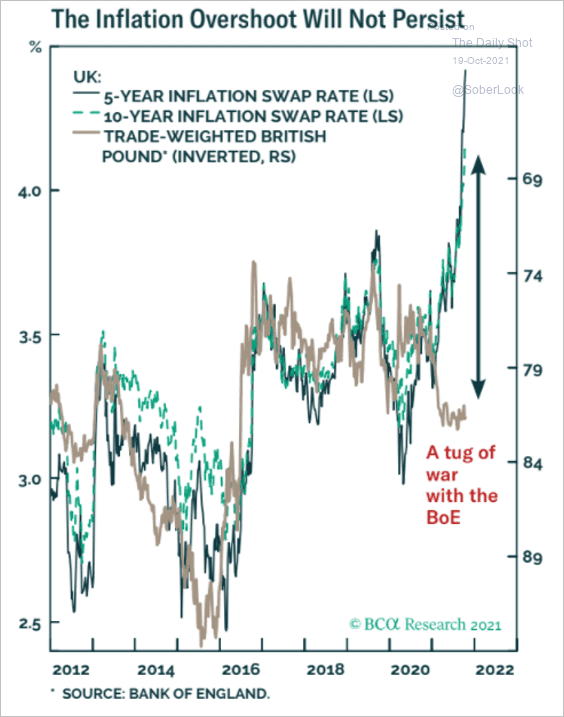

2. UK inflation expectations are outpacing other economies (2 charts).

Source: Cornerstone Macro

Source: Cornerstone Macro

Source: MRB Partners

Source: MRB Partners

Will the recent rally in the pound dampen inflation expectations?

Source: BCA Research

Source: BCA Research

Back to Index

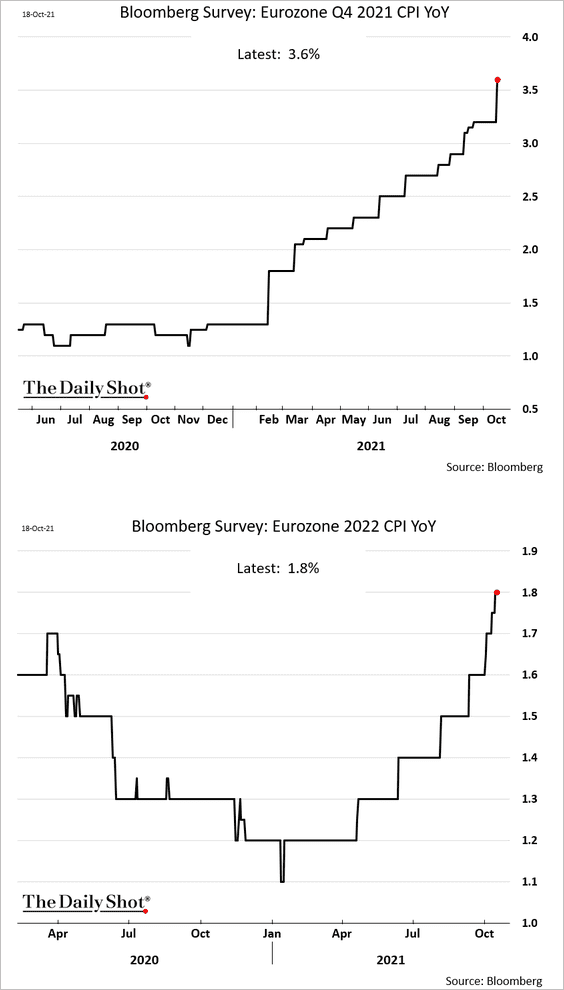

The Eurozone

1. Economists are boosting inflation forecasts.

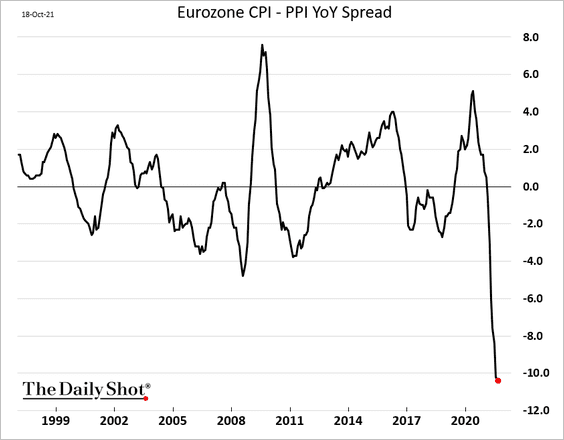

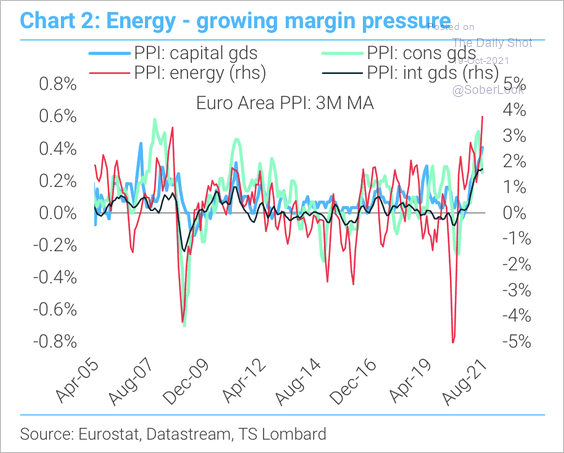

2. The CPI – PPI spread has blown out, which could squeeze corporate profit margins in some sectors.

Source: TS Lombard

Source: TS Lombard

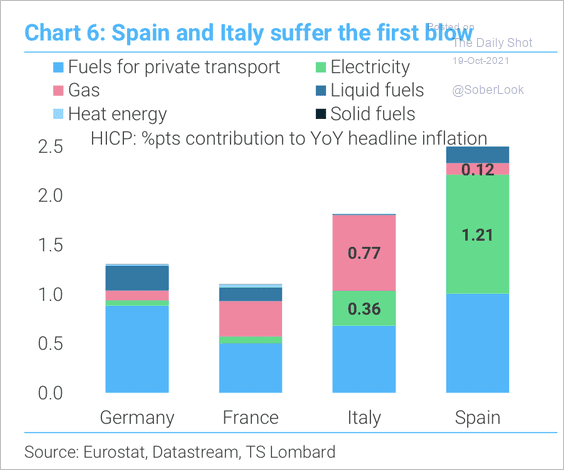

Gas and electricity prices have a higher contribution to Italy and Spain’s headline inflation versus Germany and France.

Source: TS Lombard

Source: TS Lombard

Back to Index

Europe

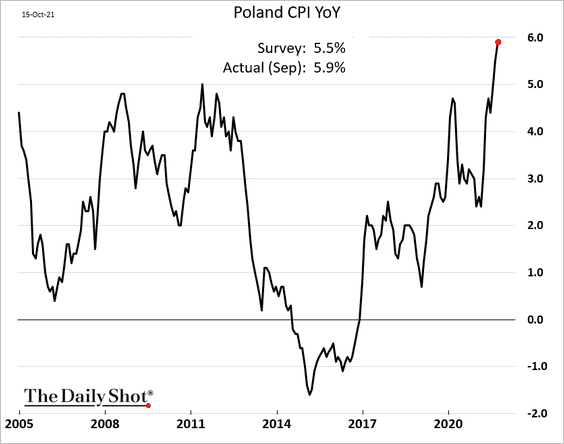

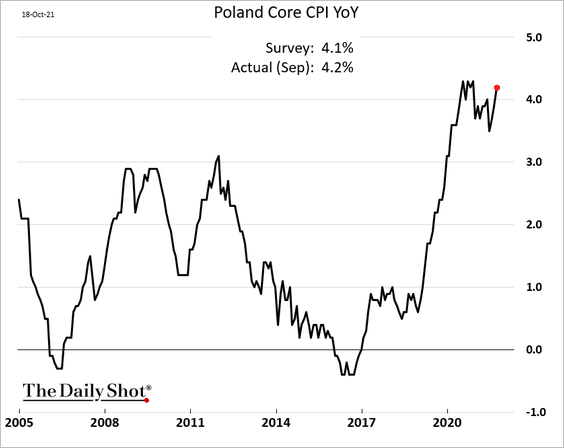

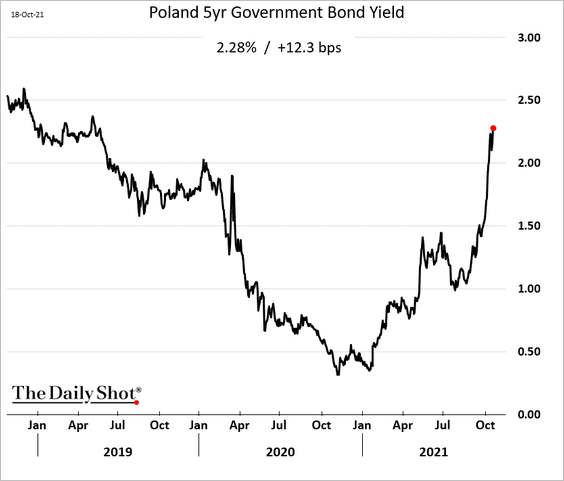

1. Poland’s inflation was revised higher.

Bond yields continue to surge.

——————–

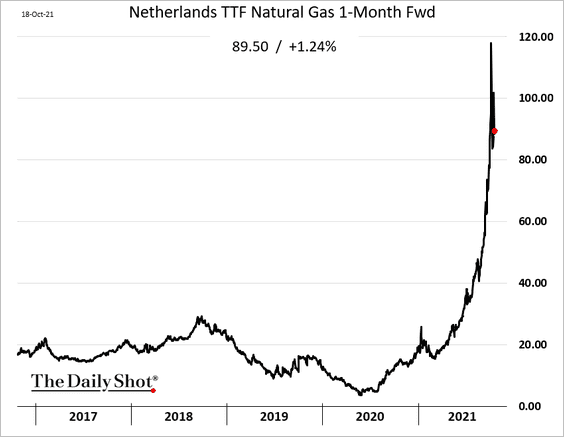

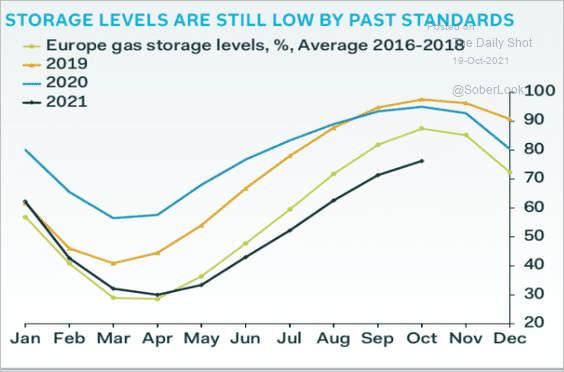

2. Gas prices remain elevated amid tight inventories.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

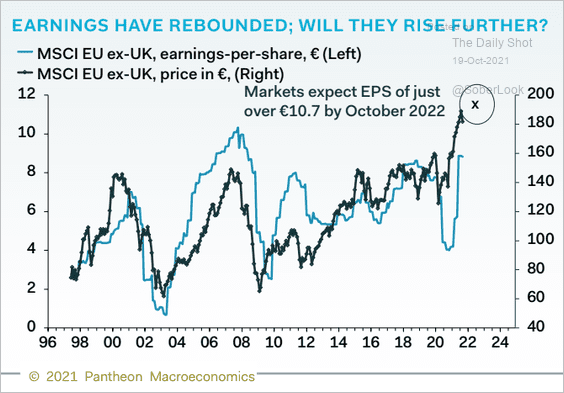

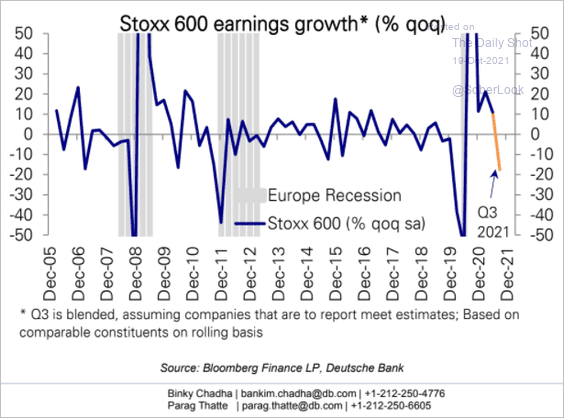

3. Earnings have rebounded.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

But autos and financials are expected to drag Q3 earnings growth lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia – Pacific

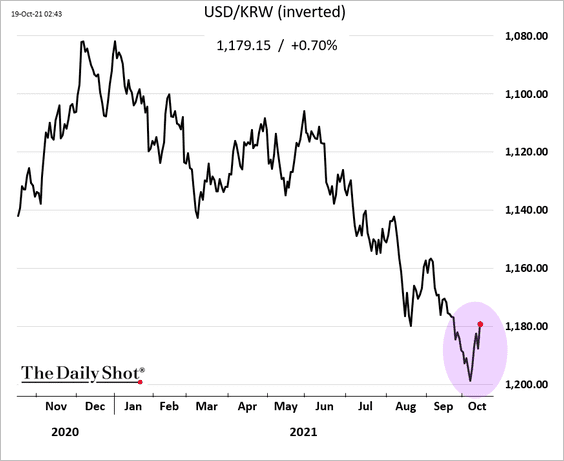

1. The won is rebounding.

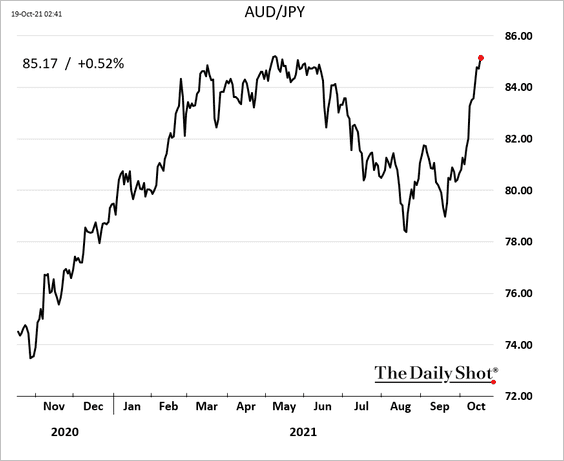

2. Aussie-yen is rallying as global risk appetite returns.

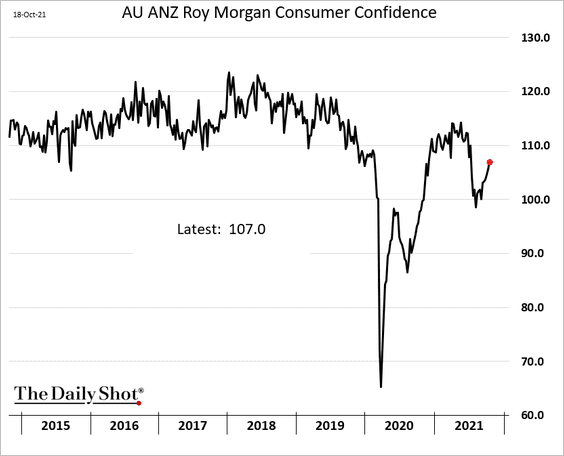

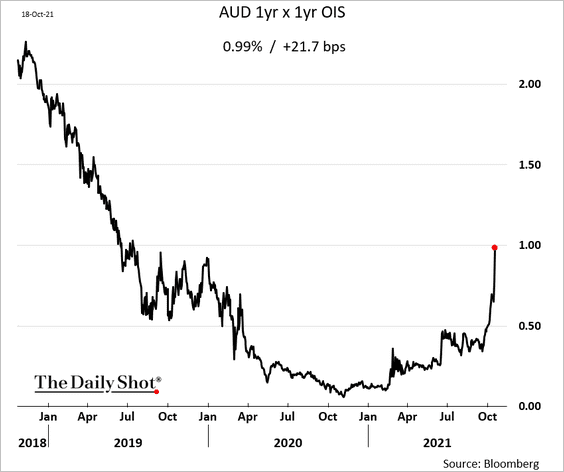

3. Australia’s consumer confidence continues to recover.

The market expects a series of RBA rate hikes in the months ahead.

Back to Index

China

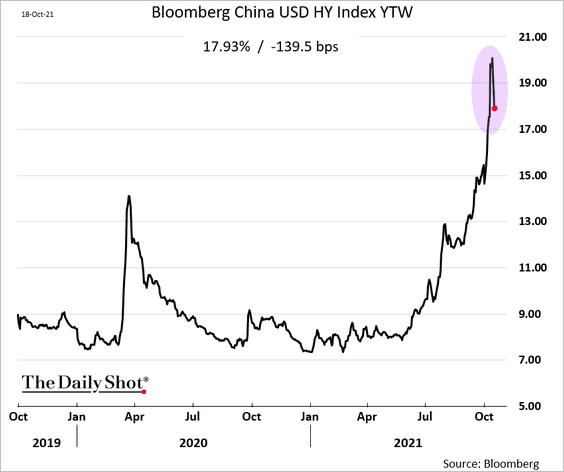

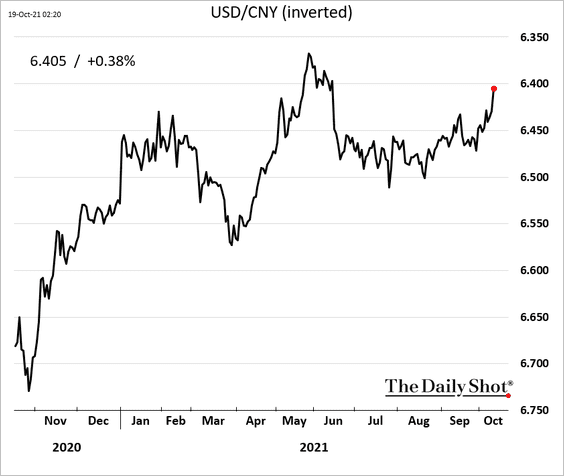

1. The PBoC says that the property developers’ credit risk is manageable. After a couple of developers paid their coupon, risk aversion eased somewhat, and yields on some leveraged firms’ debt declined.

The renminbi rallied.

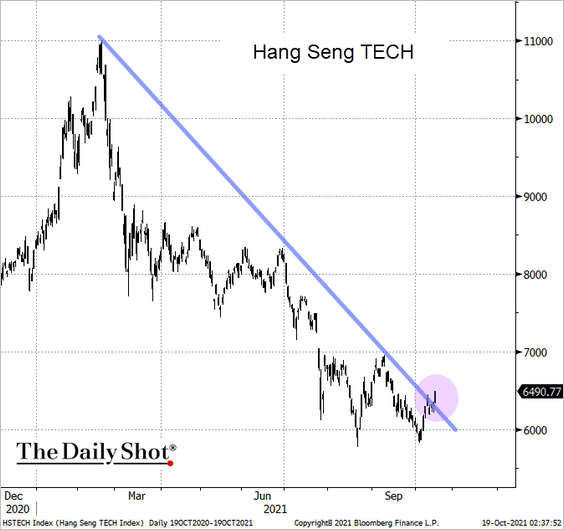

Tech stocks in Hong Kong are testing resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

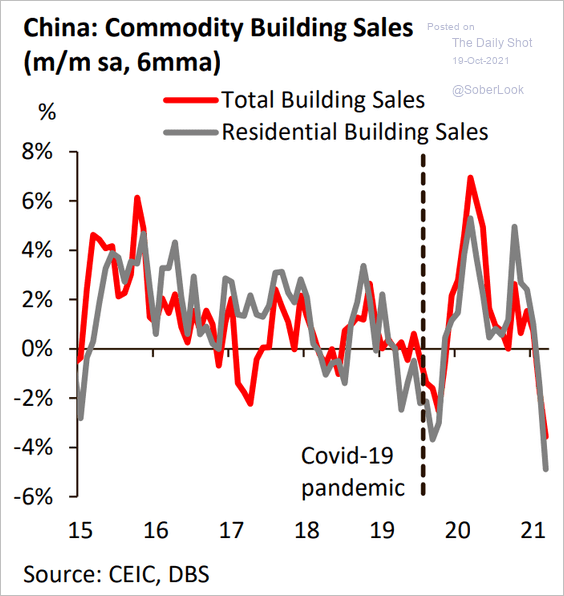

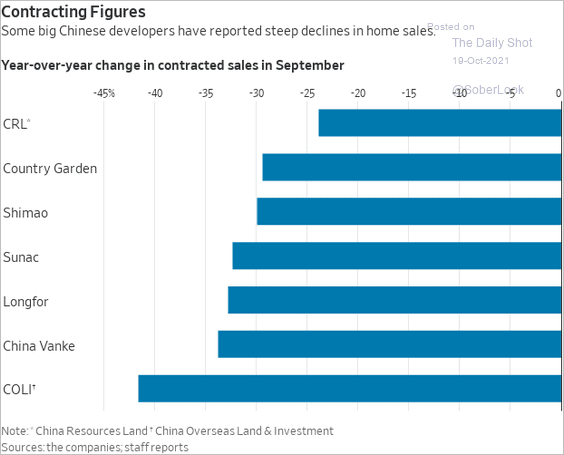

2. Here are some additional trends in China’s real estate markets.

• Housing sales have been soft.

Source: DBS

Source: DBS

Source: @WSJ Read full article

Source: @WSJ Read full article

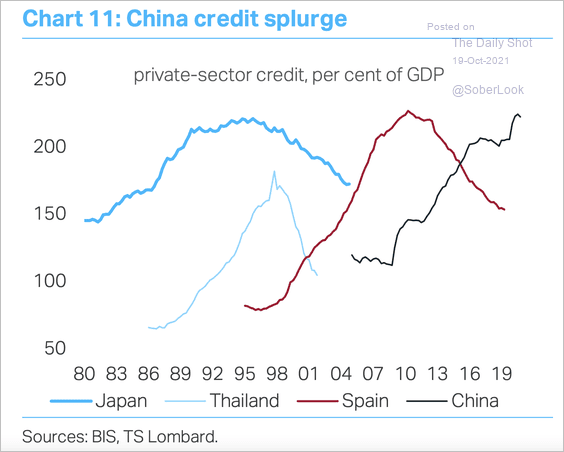

• Historically, residential credit cycles don’t have happy endings. Will China be different?

Source: TS Lombard

Source: TS Lombard

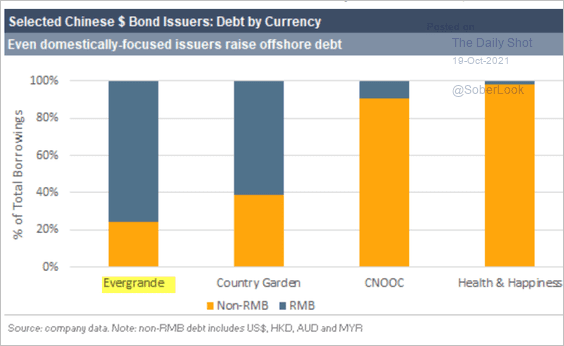

• Will US-dollar Evergrande debt investors get a lower recovery in favor of domestic bondholders?

Source: CreditSights

Source: CreditSights

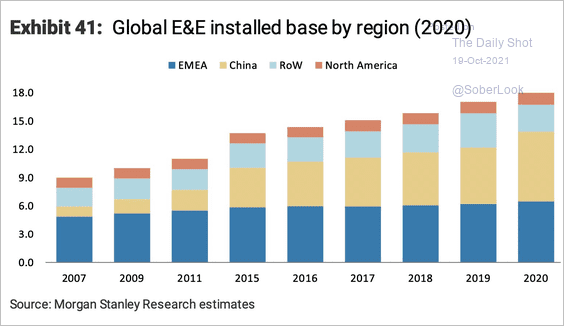

• This chart shows the elevator and escalator (E&E) market over time.

Source: Morgan Stanley Research; @benedictevans

Source: Morgan Stanley Research; @benedictevans

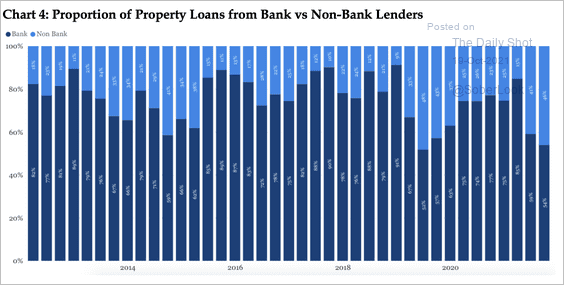

• Near-record share of property loans in China has been outside the formal banking system.

Source: China Beige Book

Source: China Beige Book

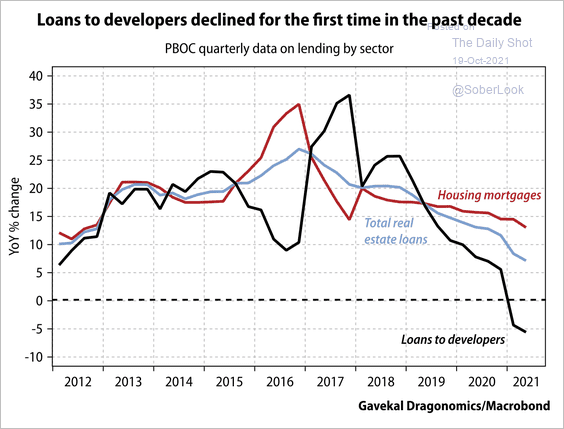

• For the first time in a decade, loans to developers in China declined.

Source: Gavekal Research

Source: Gavekal Research

——————–

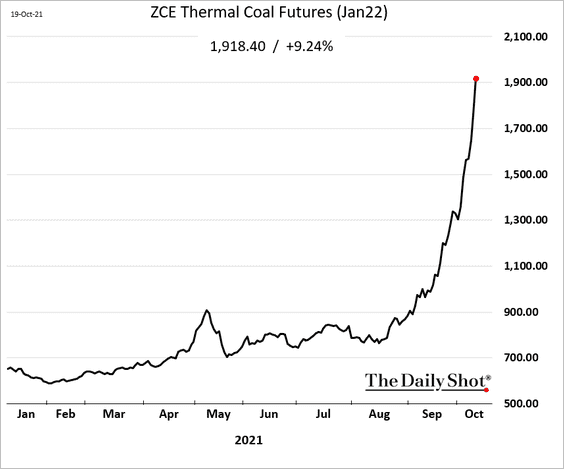

3. Thermal coal prices continue to surge.

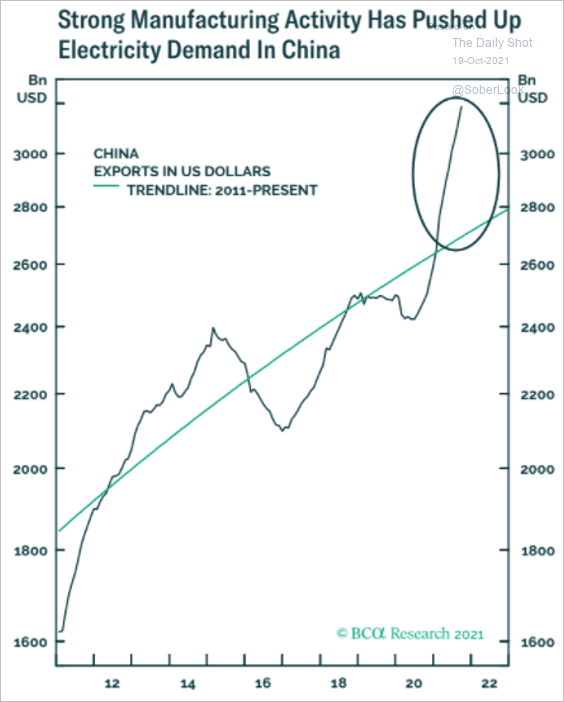

• China doesn’t have enough energy to support the latest surge in exports.

Source: BCA Research

Source: BCA Research

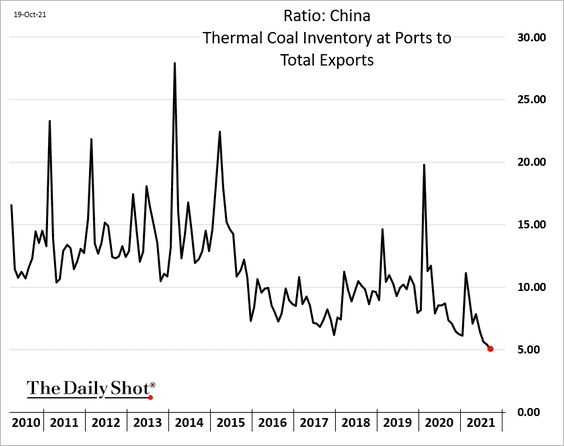

• This chart shows the ratio of coal inventories to total exports.

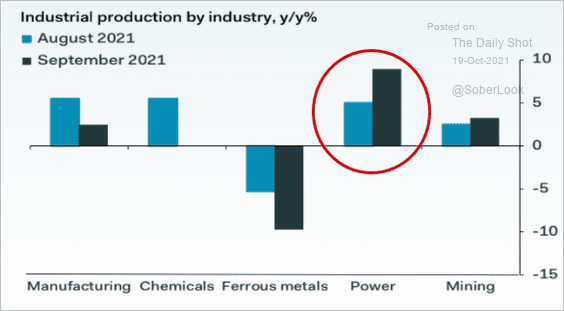

• Power production surged in September.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

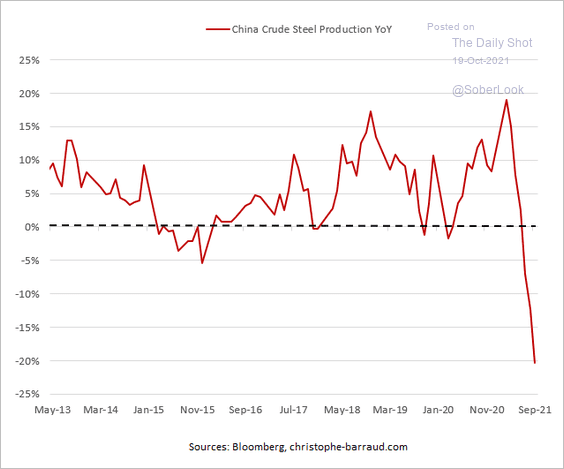

4. Steel production has slowed sharply.

Source: @C_Barraud

Source: @C_Barraud

Back to Index

Emerging Markets

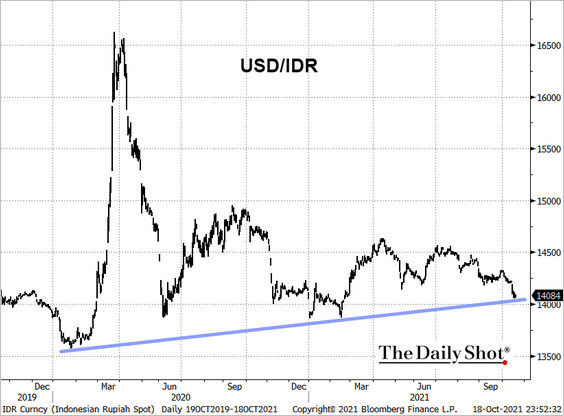

1. USD/IDR is at support (the Indonesian rupiah is strengthening).

h/t Michael G Wilson, @TheTerminal, Bloomberg Finance L.P.

h/t Michael G Wilson, @TheTerminal, Bloomberg Finance L.P.

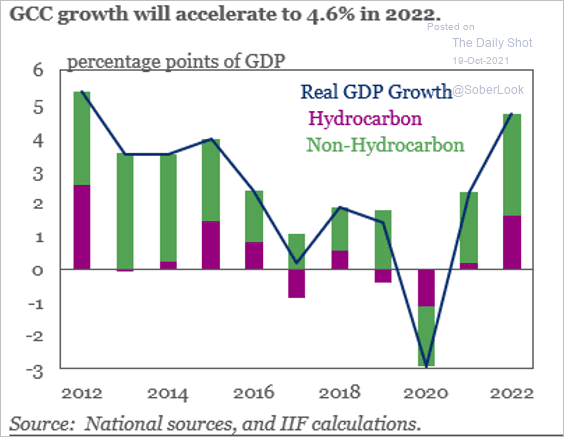

2. Gulf countries are recovering as energy prices surge.

Source: @IIF Read full article

Source: @IIF Read full article

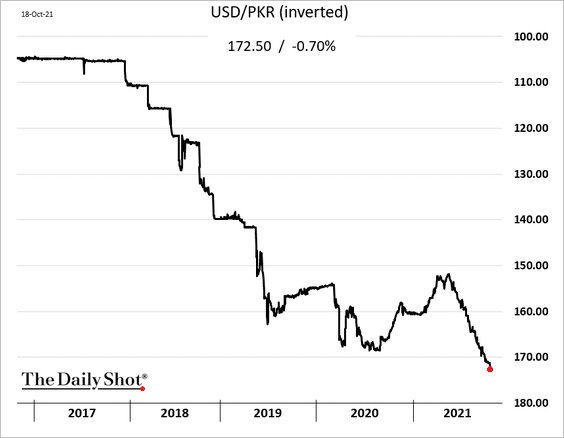

3. The Pakistani rupee depreciation continues.

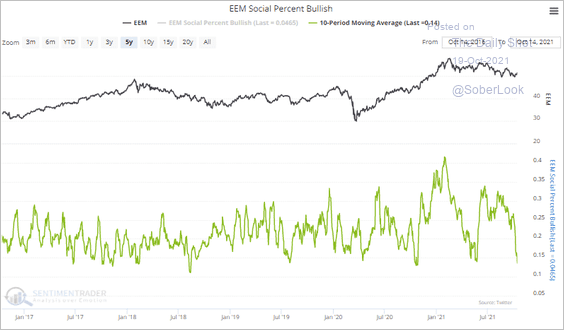

4. Social media users are less upbeat on EM equities.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Cryptocurrencies

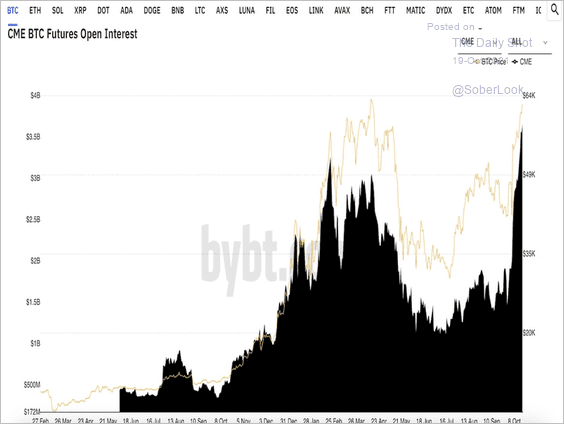

1. CME bitcoin futures open interest surged to record highs last week.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

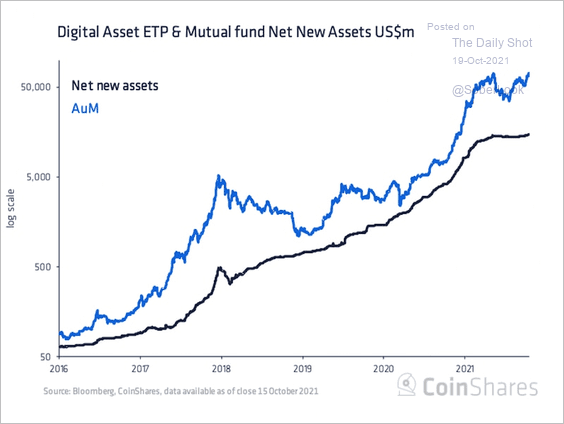

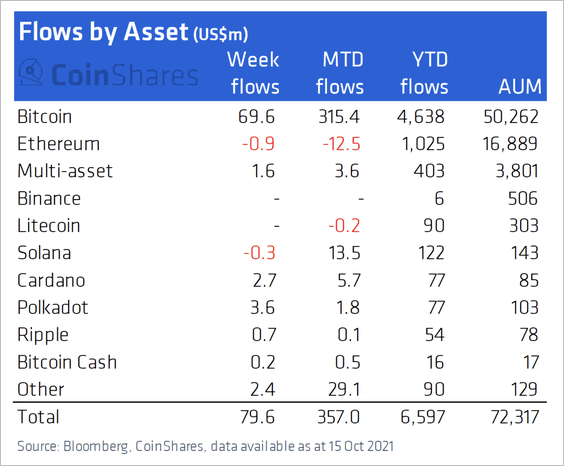

2. Crypto fund assets under management reached an all-time high of around $72.3 billion.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin funds dominated inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

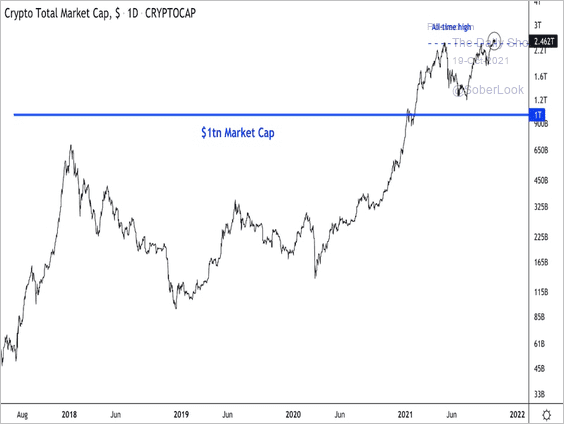

3. The total cryptocurrency market cap reached an all-time high near $2.5 trillion.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

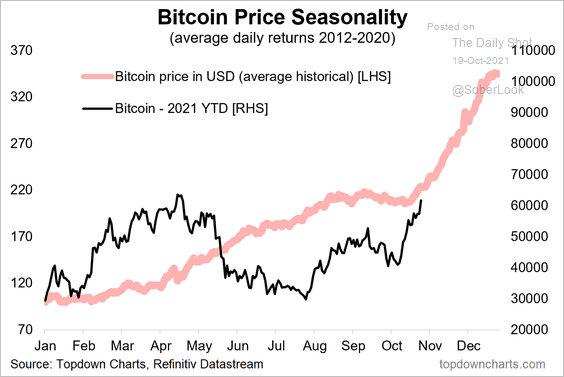

4. Similar to equities, bitcoin is entering a seasonally strong period.

Source: @topdowncharts

Source: @topdowncharts

Back to Index

Energy

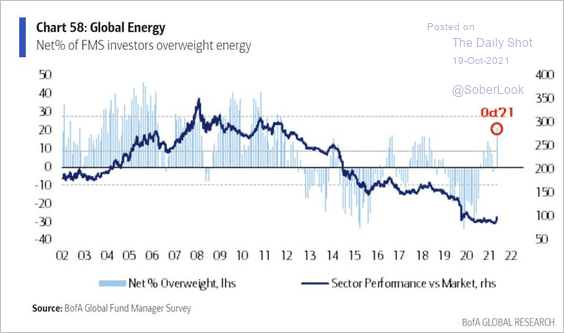

1. Fund managers are overweight energy.

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

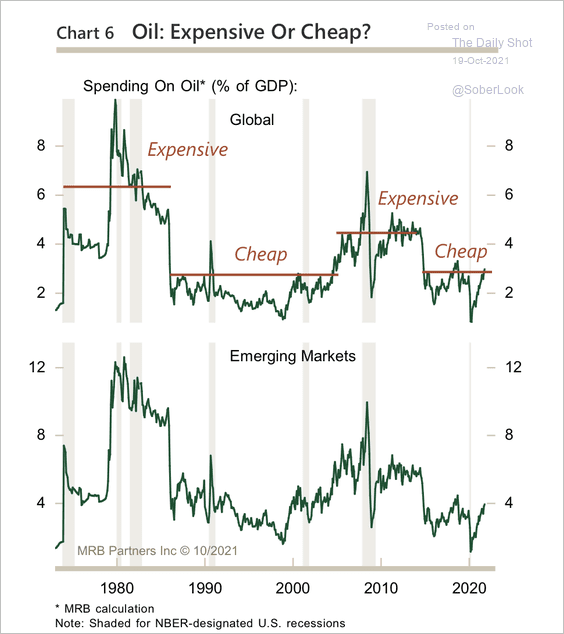

2. Spending on oil has been relatively low in recent years.

Source: MRB Partners

Source: MRB Partners

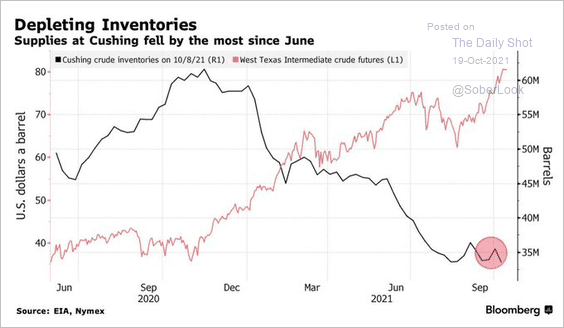

3. Inventories at Cushing, OK (NYMEX WTI settlement hub) are near the recent lows.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

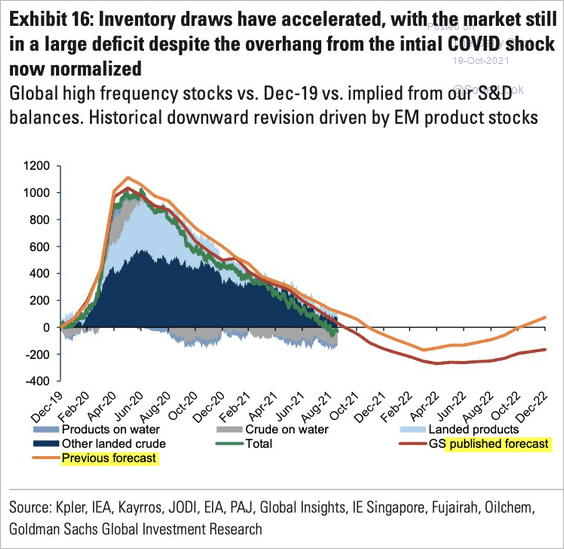

Goldman sees the energy market (oil and refined products) moving deeper into deficit in the months ahead.

Source: Goldman Sachs; @HFI_Research

Source: Goldman Sachs; @HFI_Research

Back to Index

Equities

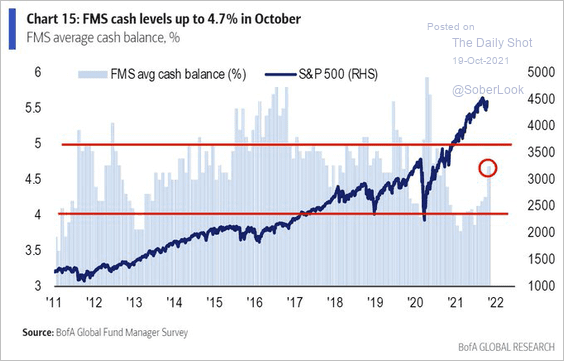

1. Fund managers boosted cash holdings this month, …

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

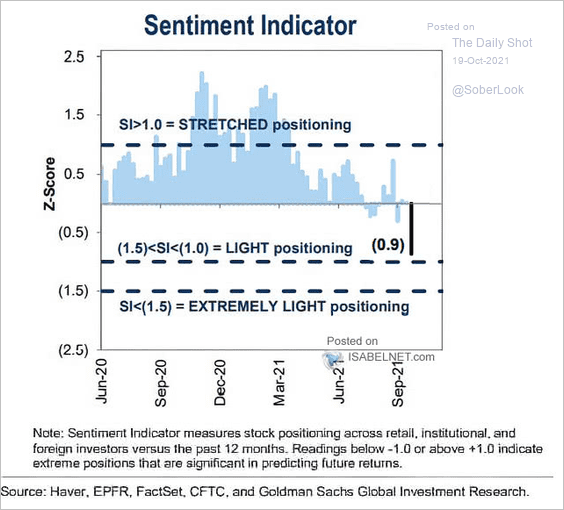

… as sentiment deteriorated. It’s a bullish sign for stocks.

Source: @ISABELNET_SA

Source: @ISABELNET_SA

——————–

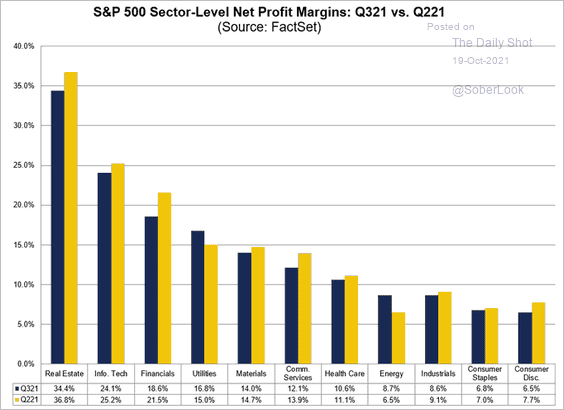

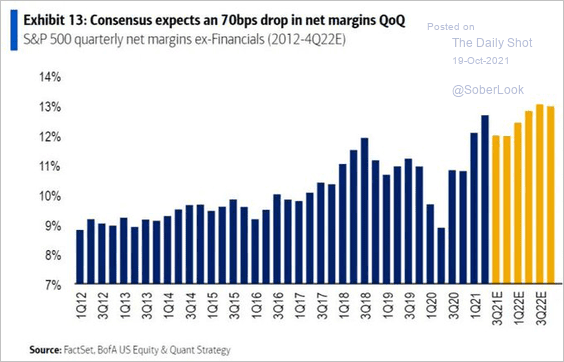

2. Profit margins will dip before rebounding next year.

Source: @FactSet Read full article

Source: @FactSet Read full article

Source: @jessefelder; BofA Global Research Read full article

Source: @jessefelder; BofA Global Research Read full article

——————–

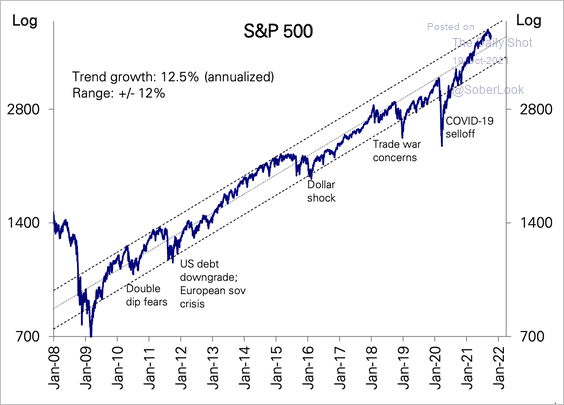

3. The S&P 500 declined from the top of its long-term trend channel, but recently held support above the midpoint.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

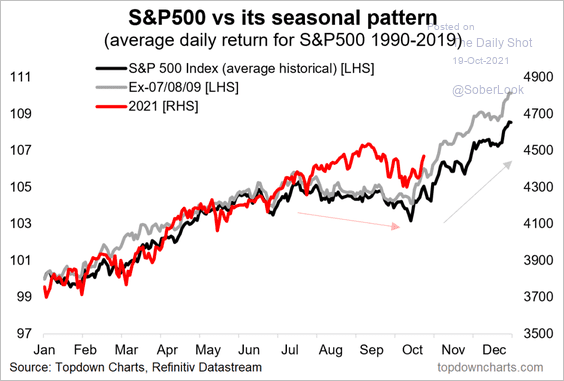

4. The S&P 500 is entering a seasonally strong period.

Source: @topdowncharts

Source: @topdowncharts

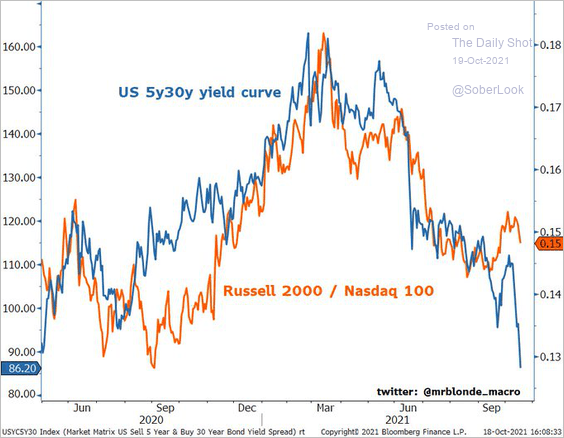

5. Will a flatter yield curve drive small-cap underperformance?

Source: @MrBlonde_macro

Source: @MrBlonde_macro

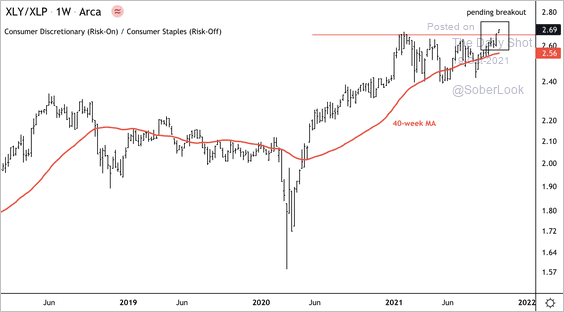

6. The SPDR consumer discretionary ETF (XLY) is breaking out relative to the SPDR consumer staples ETF (XLP).

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

Global Developments

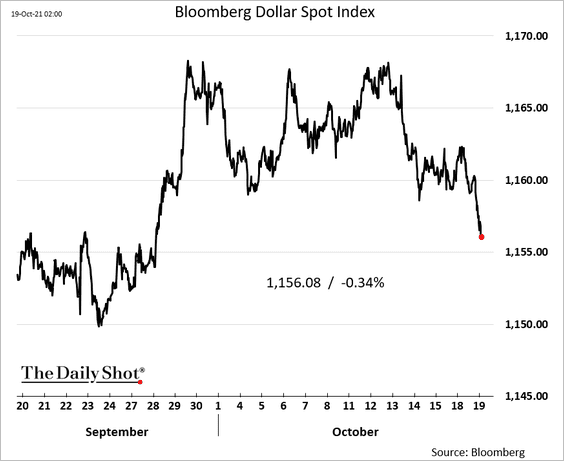

1. The US dollar is down as risk aversion moderates.

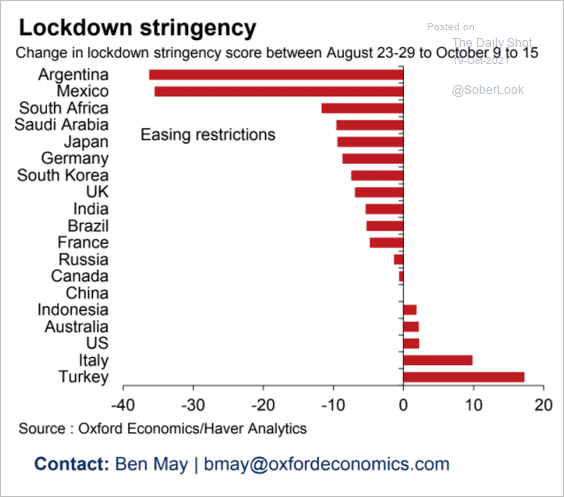

2. Lockdowns are easing globally.

Source: Oxford Economics

Source: Oxford Economics

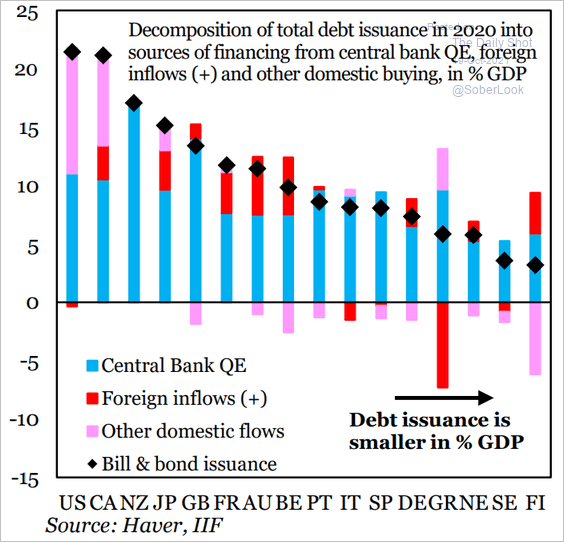

3. What were the sources of government debt financing in 2020?

Source: IIF

Source: IIF

——————–

Food for Thought

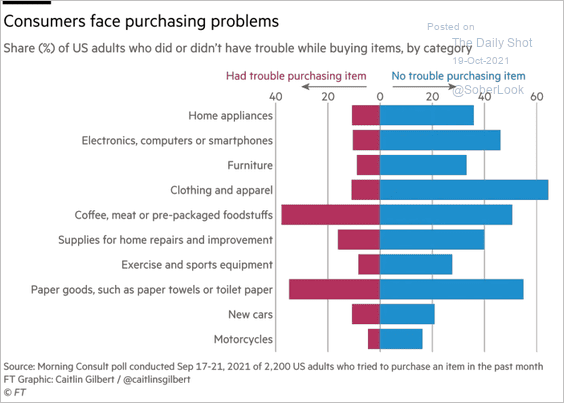

1. Consumers having trouble purchasing items:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

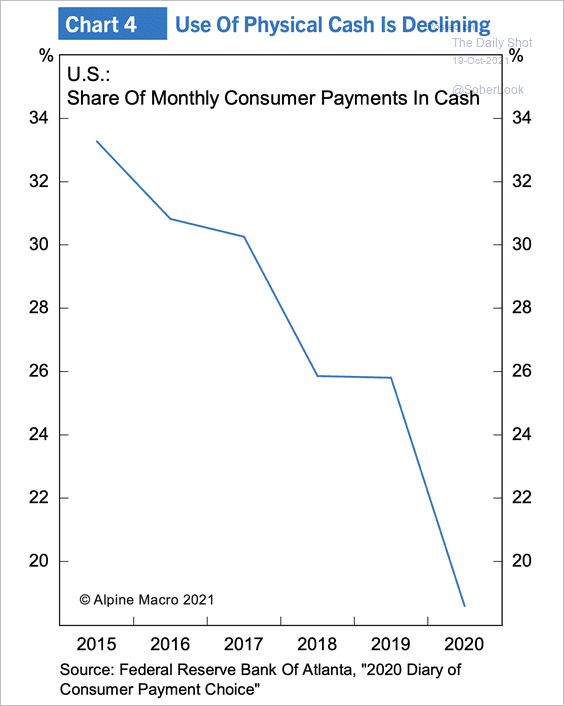

2. Physical cash as a payment method:

Source: Alpine Macro

Source: Alpine Macro

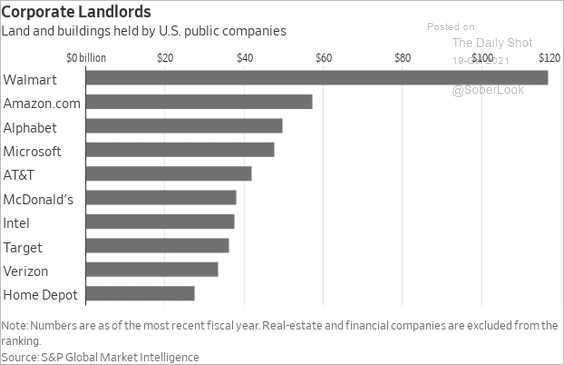

3. Land and buildings owned by US public companies:

Source: @WSJ Read full article

Source: @WSJ Read full article

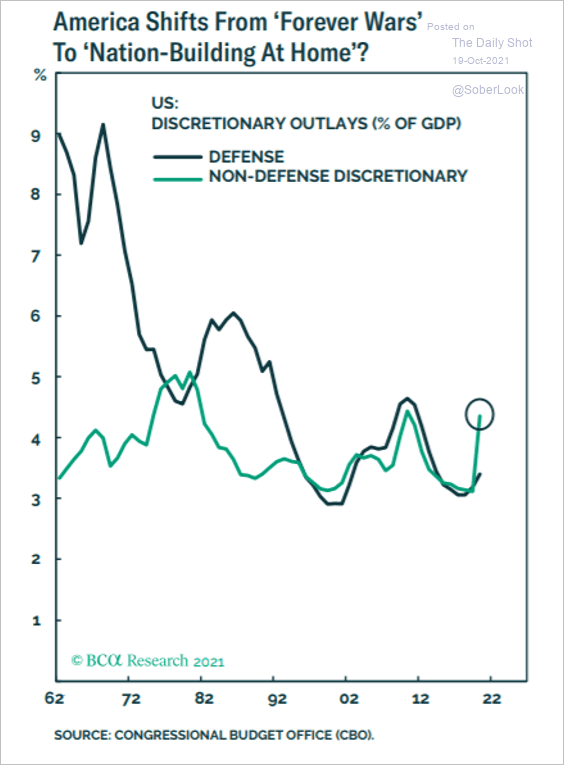

4. US defense vs. non-defense discretionary spending:

Source: BCA Research

Source: BCA Research

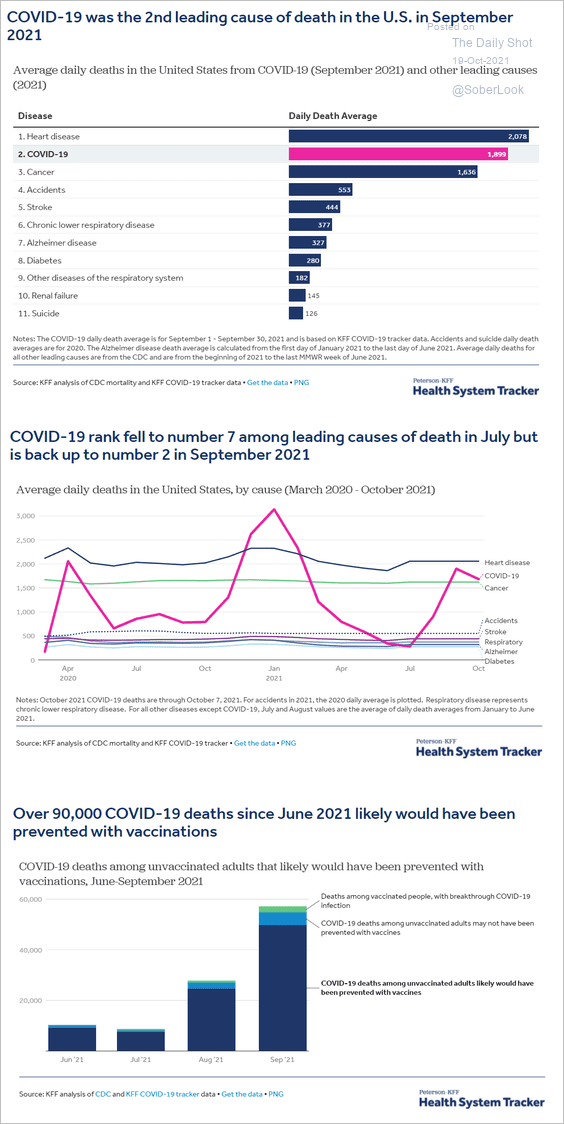

5. COVID vs. other causes of death in the US:

Source: Peterson-KFF Health System Tracker Read full article

Source: Peterson-KFF Health System Tracker Read full article

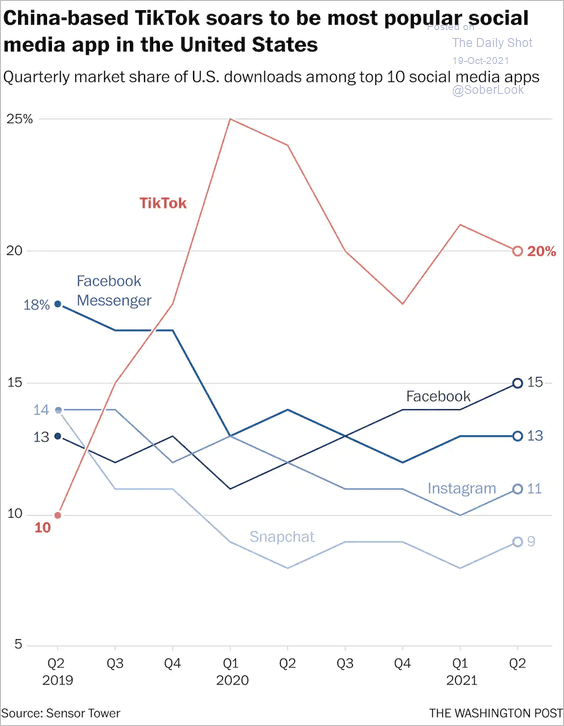

6. Downloads among top ten social media apps:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

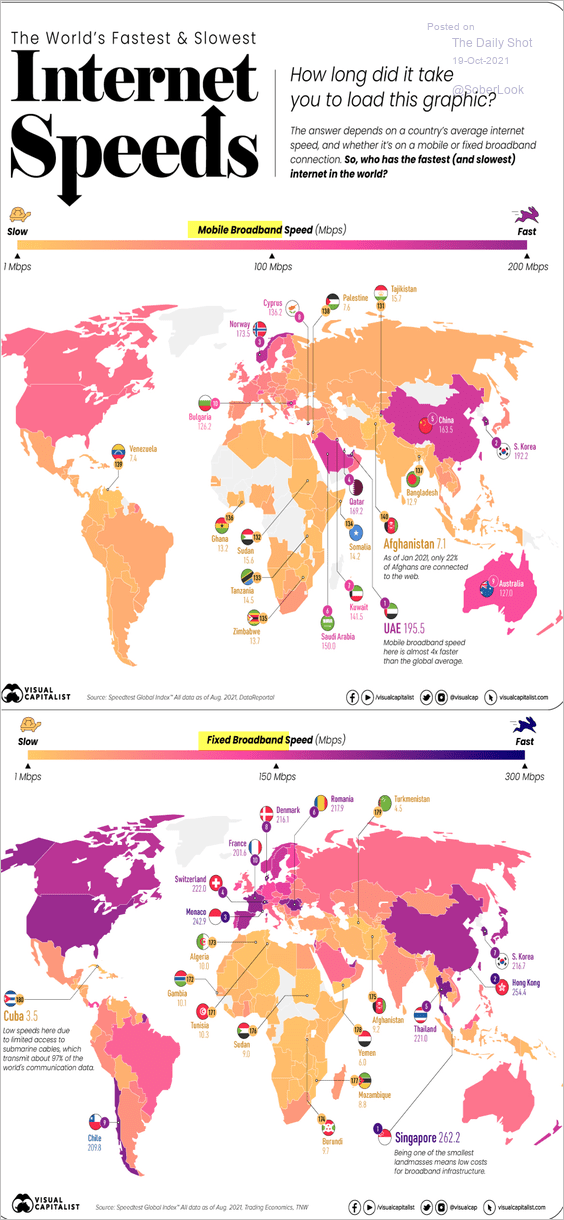

7. Internet speeds:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

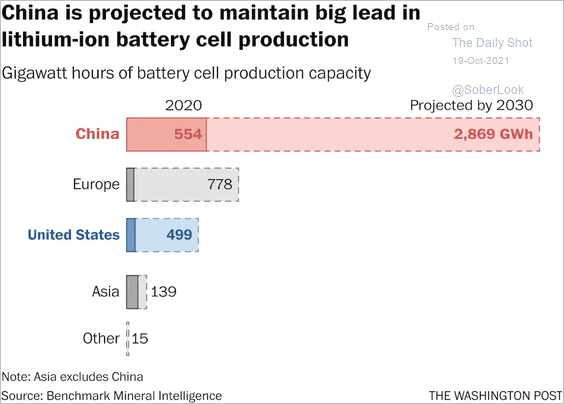

8. Lithium-ion battery production expectations:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

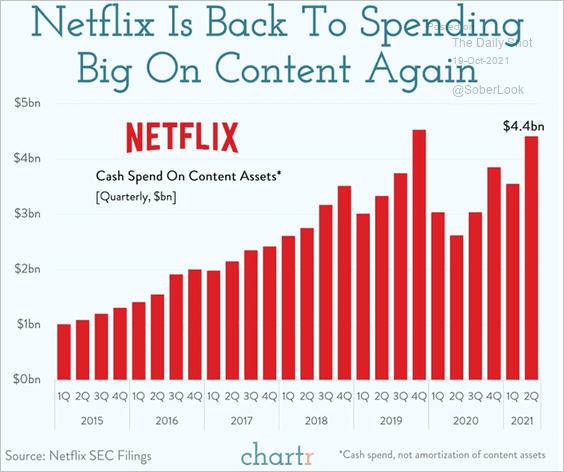

9. Netflix content spending:

Source: @chartrdaily

Source: @chartrdaily

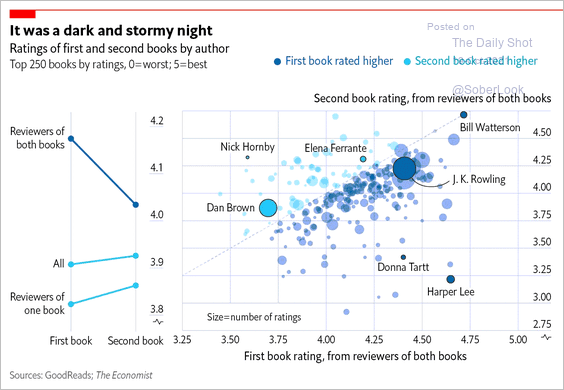

10. Each author’s second book vs. first book ratings:

Source: @_rospearce Read full article

Source: @_rospearce Read full article

——————–

Back to Index