The Daily Shot: 22-Oct-21

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• The United States

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

China

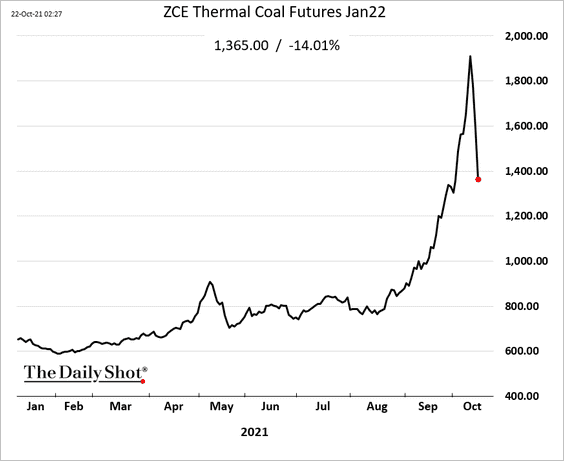

1. Beijing’s intervention in the coal market sent futures plummeting.

Source: Reuters Read full article

Source: Reuters Read full article

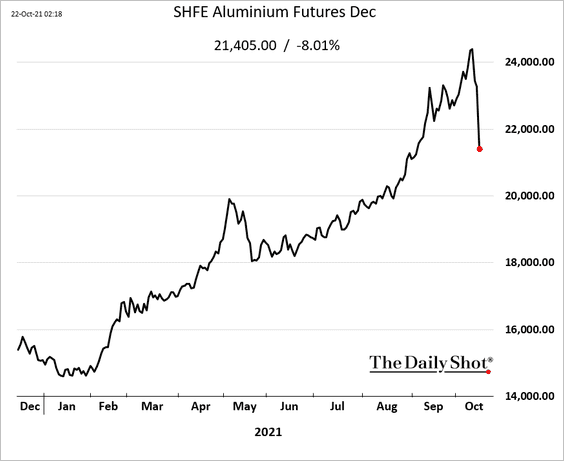

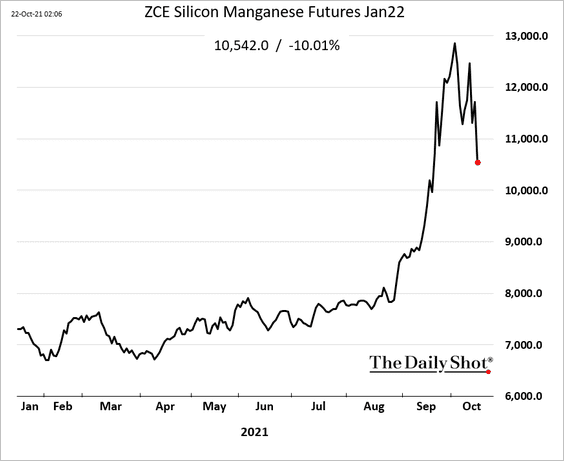

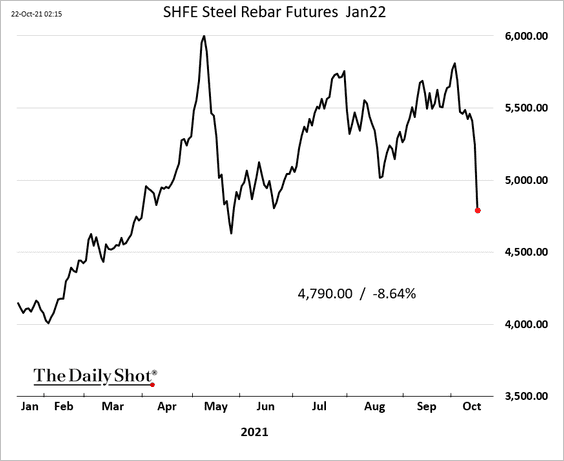

And with it, other industrial commodities came under pressure.

• Aluminum:

• Silicon manganese:

• Steel rebar:

——————–

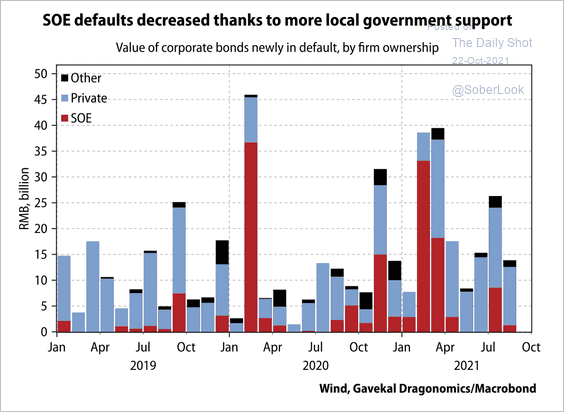

2. Next, we have some updates on China’s credit markets.

• After a wave of state-owned enterprise (SOE) defaults earlier this year, several provincial governments recently pledged to ensure that no SOE will default, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

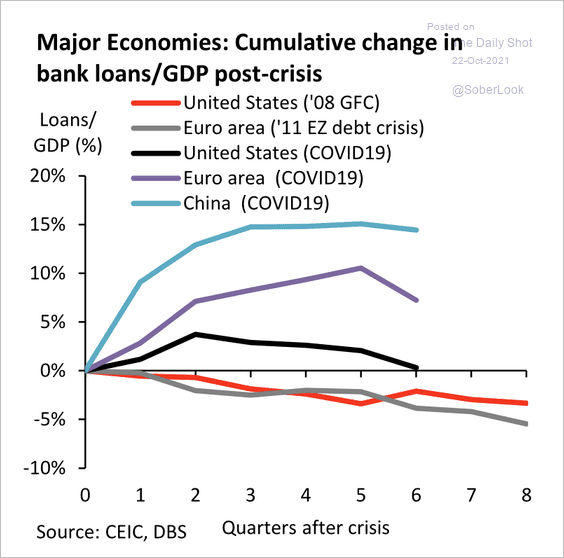

• Bank loans as a share of GDP remain elevated after the pandemic shock, especially relative to other countries.

Source: DBS Group Research

Source: DBS Group Research

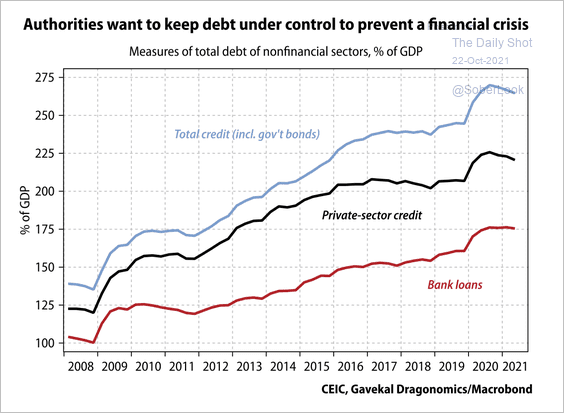

• Nonfinancial credit growth slowed over the past year.

Source: Gavekal Research

Source: Gavekal Research

——————–

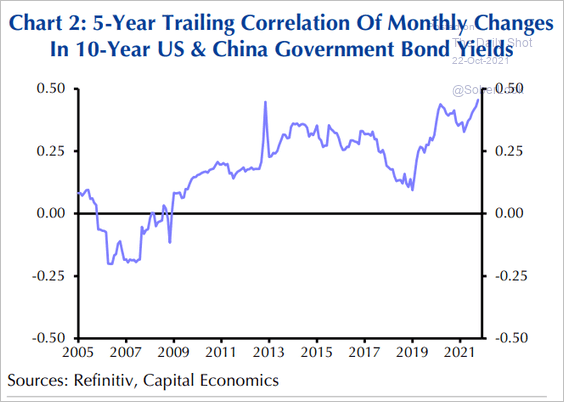

3. Long-term correlation between China’s government bonds and Treasuries has been climbing since the financial crisis.

Source: Capital Economics

Source: Capital Economics

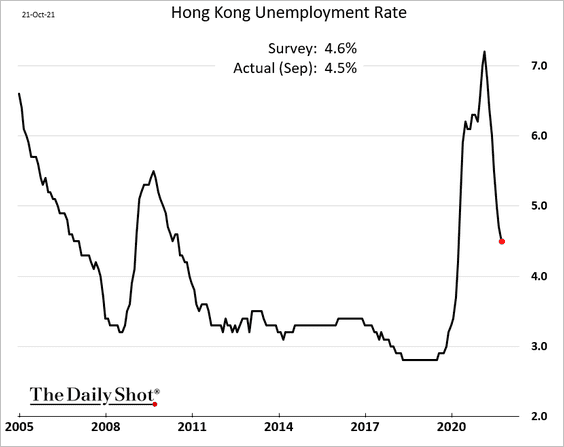

4. Hong Kong’s unemployment rate continues to moderate.

Back to Index

Asia – Pacific

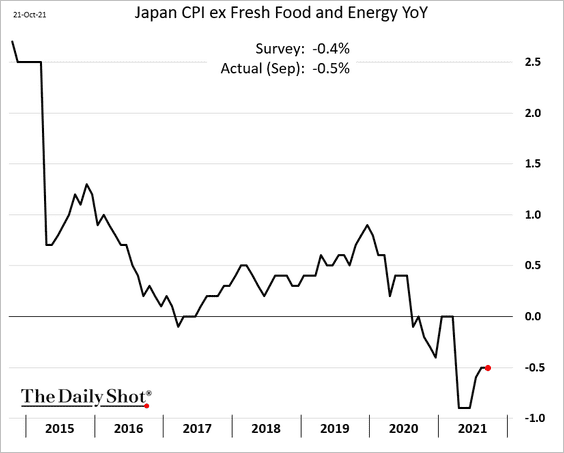

1. Japan’s core inflation remains stuck in negative territory.

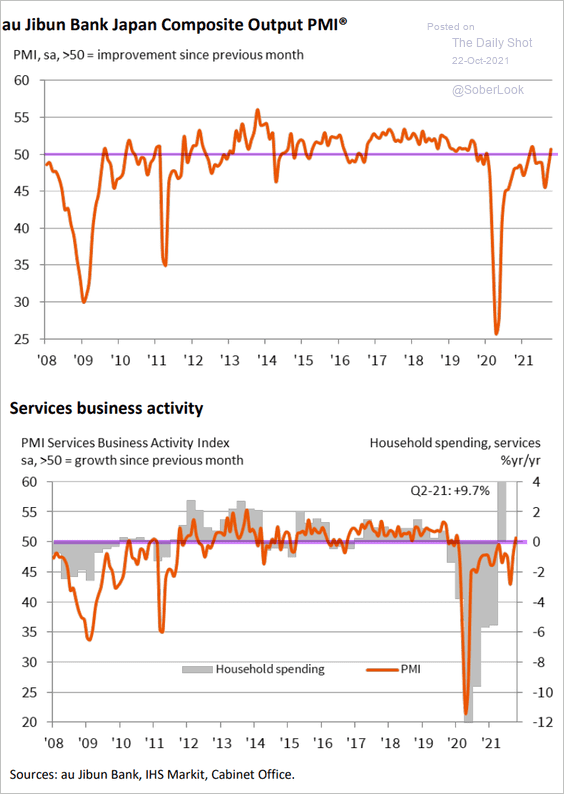

Business activity stabilized this month, as service-sector PMI moved above 50.

Source: IHS Markit

Source: IHS Markit

——————–

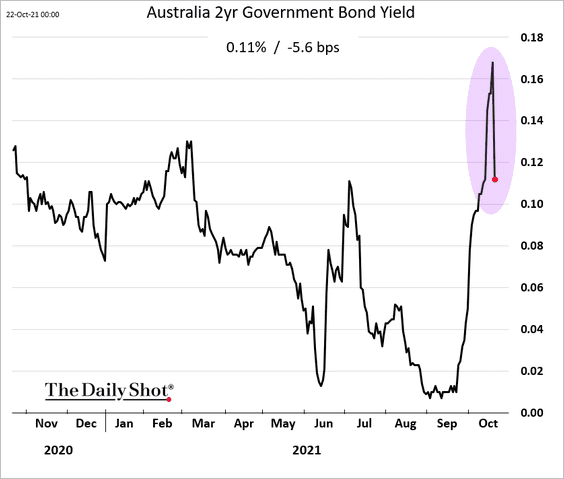

2. The RBA intervened in the market after the 2yr yield surged.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Separately, Australia’s service sector is back in growth mode (PMI > 50).

Source: IHS Markit

Source: IHS Markit

Back to Index

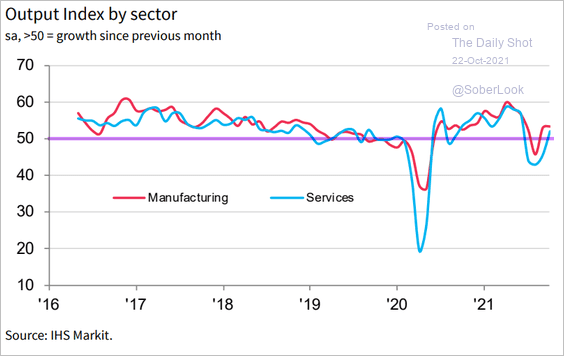

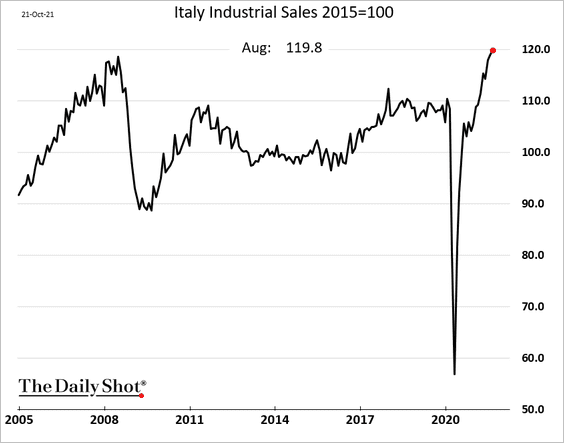

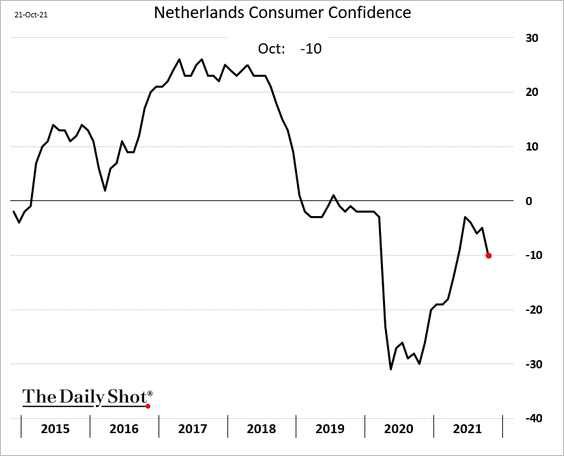

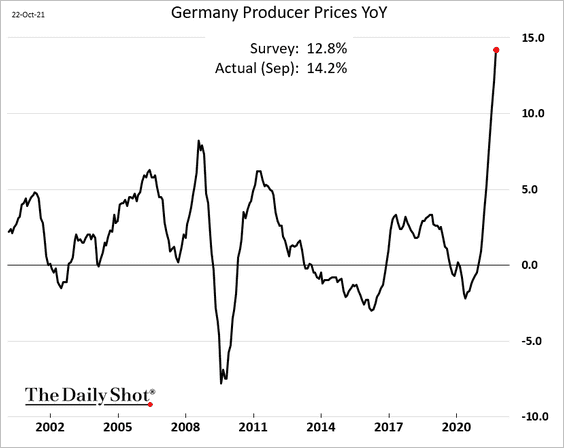

The Eurozone

1. Italian industrial sales hit a record high in August.

2. Dutch consumer sentiment worsened this month.

3. Germany’s PPI exceeded 14% last month (on a year-over-year basis).

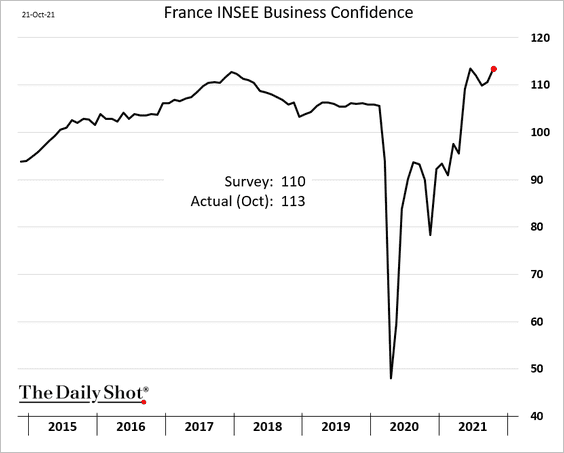

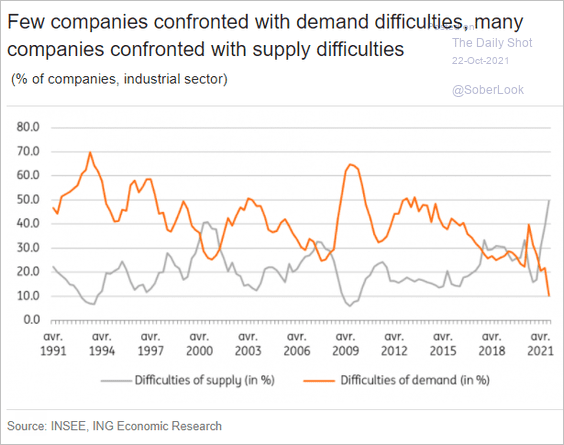

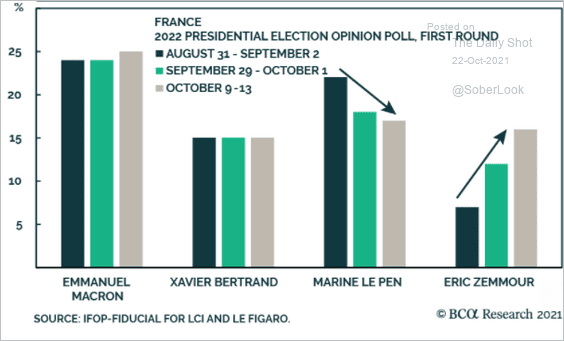

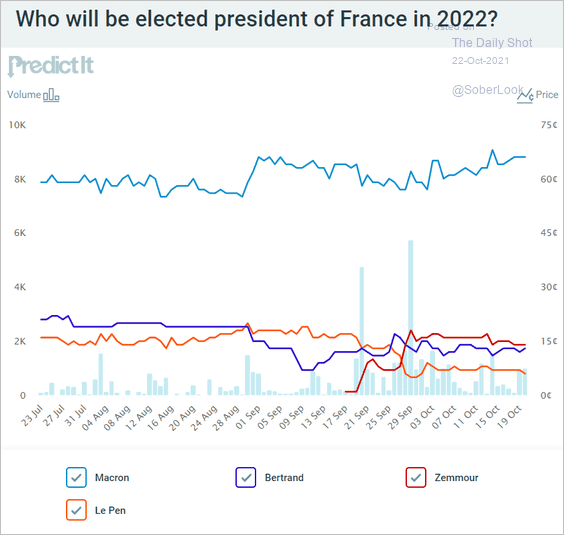

4. Next, we have some updates on France.

• Business confidence surprised to the upside this month.

• There are no issues with demand. Instead, companies face supply difficulties.

Source: ING

Source: ING

• What are the polls and the betting markets telling us about the presidential election?

– Polls:

Source: BCA Research

Source: BCA Research

– Betting markets:

Source: @PredictIt

Source: @PredictIt

Back to Index

The United Kingdom

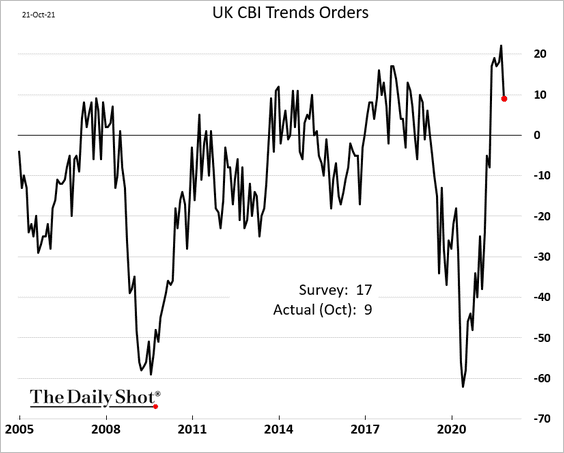

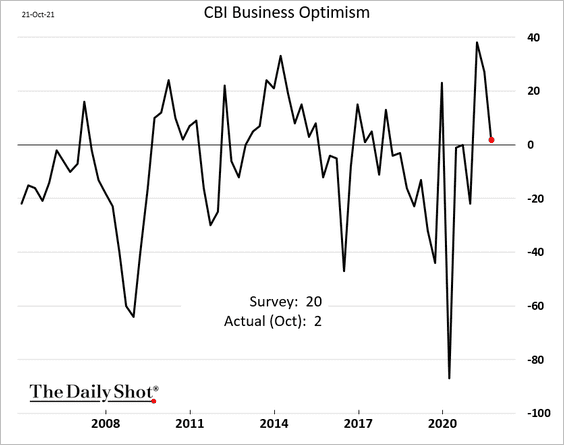

1. The CBI report showed softer orders this month.

• Business optimism deteriorated amid supply shortages.

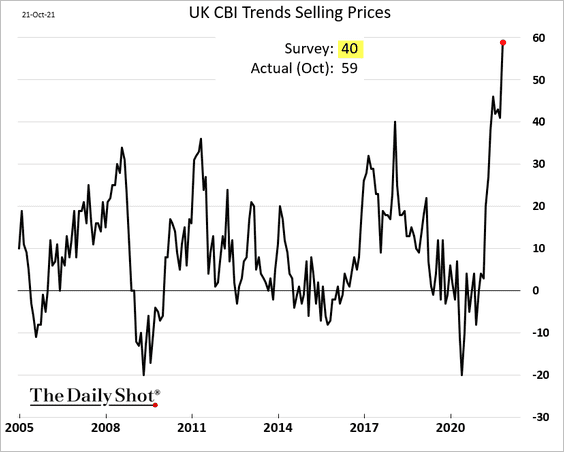

• Prices are surging:

Source: Reuters Read full article

Source: Reuters Read full article

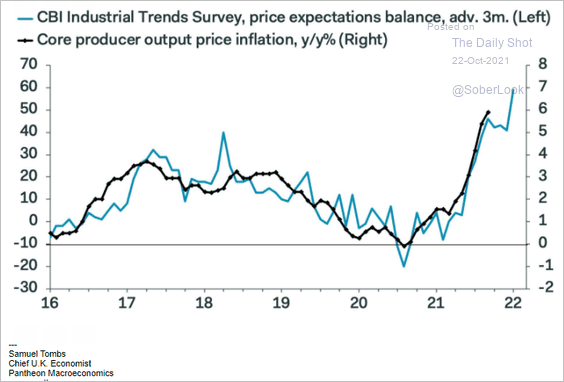

What does it mean for the PPI?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

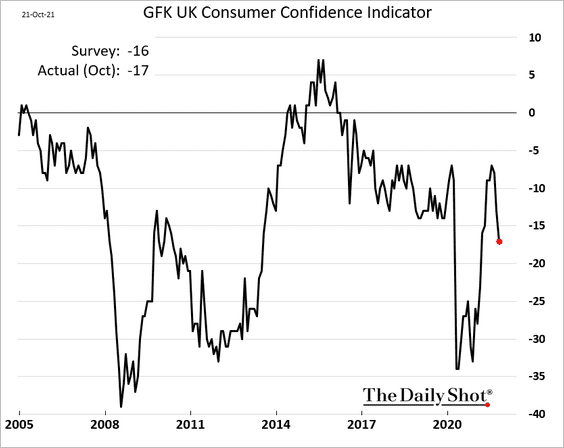

2. UK consumer confidence softened further this month.

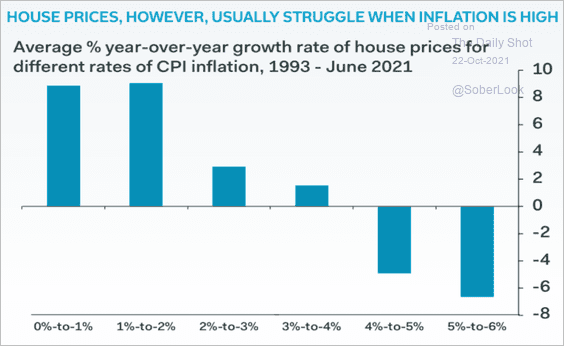

3. How does the housing market perform in different inflation scenarios?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The United States

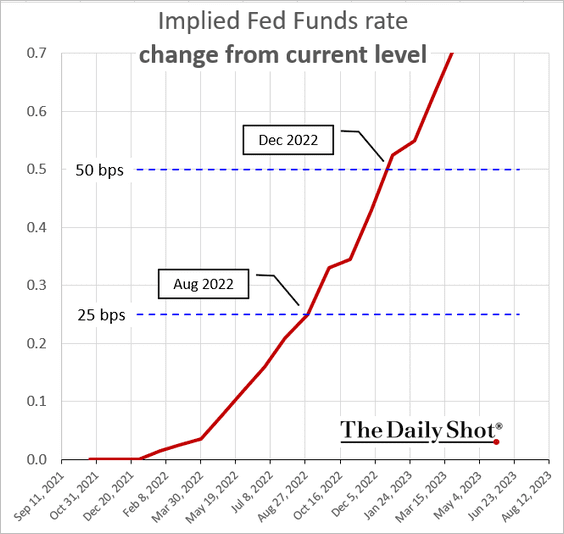

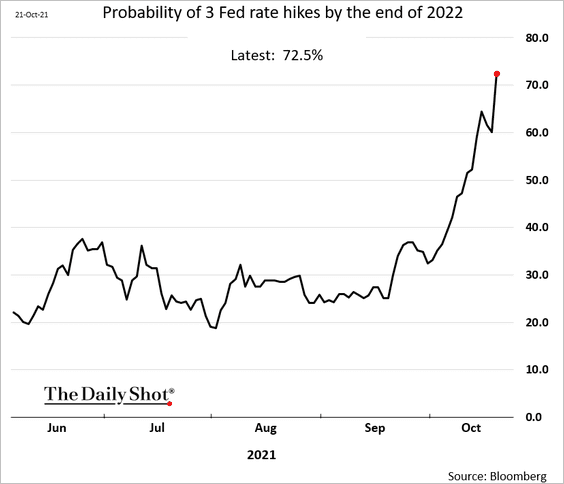

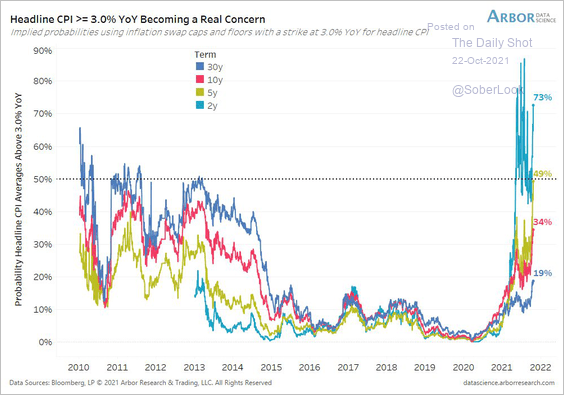

1. The markets are now expecting a much more hawkish Federal Reserve than most analysts have been forecasting.

• Two rate hikes next year are now fully priced in.

And the probability of three hikes is over 70%.

Has the market overshot on its Fed tightening expectations? If not, the trends above don’t bode well for risk assets such as stocks.

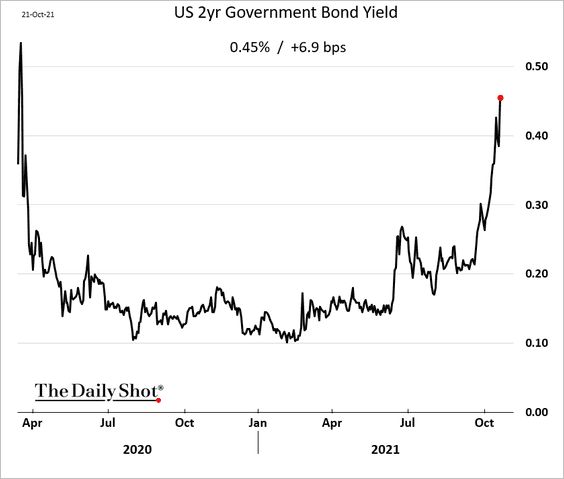

• The 2yr Treasury yield continues to climb.

• Options markets are pricing in a higher probability of inflation exceeding 3% over a longer period.

Source: @benbreitholtz

Source: @benbreitholtz

——————–

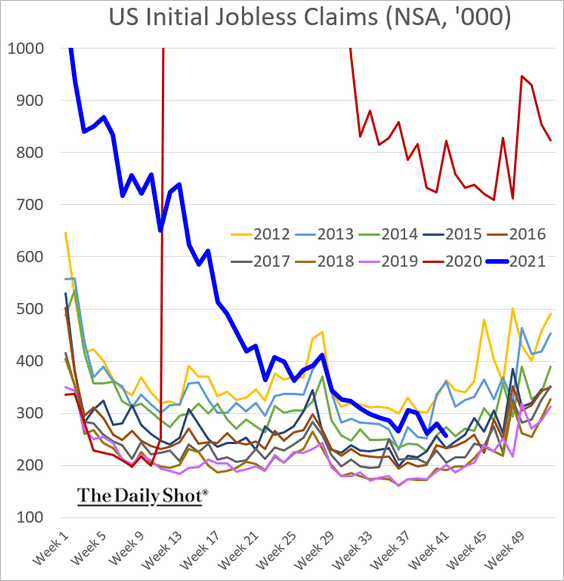

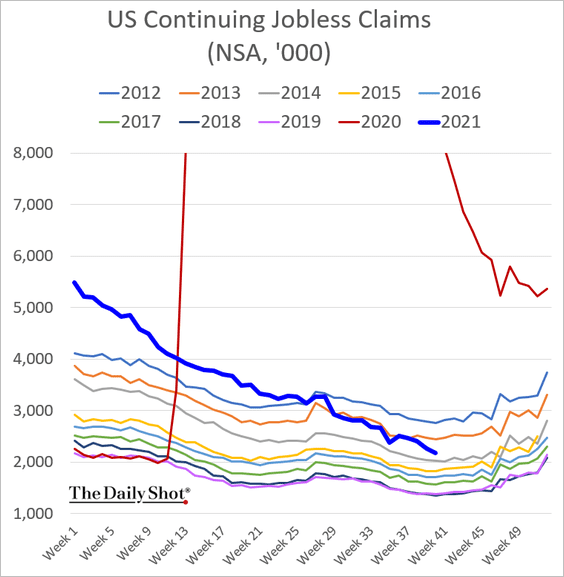

2. Jobless claims continue to trend lower.

——————–

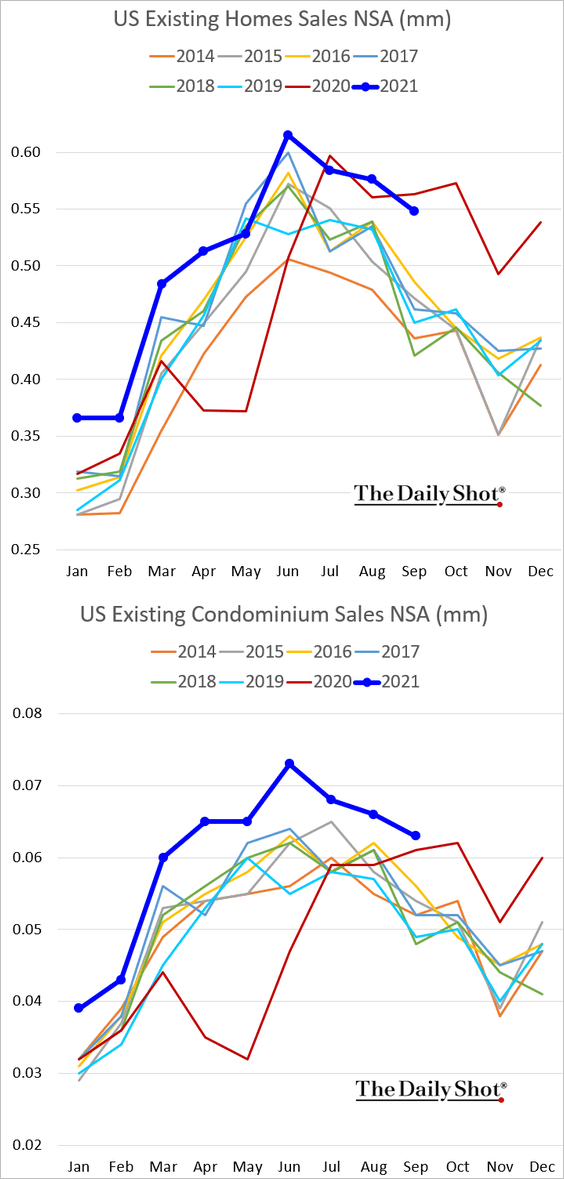

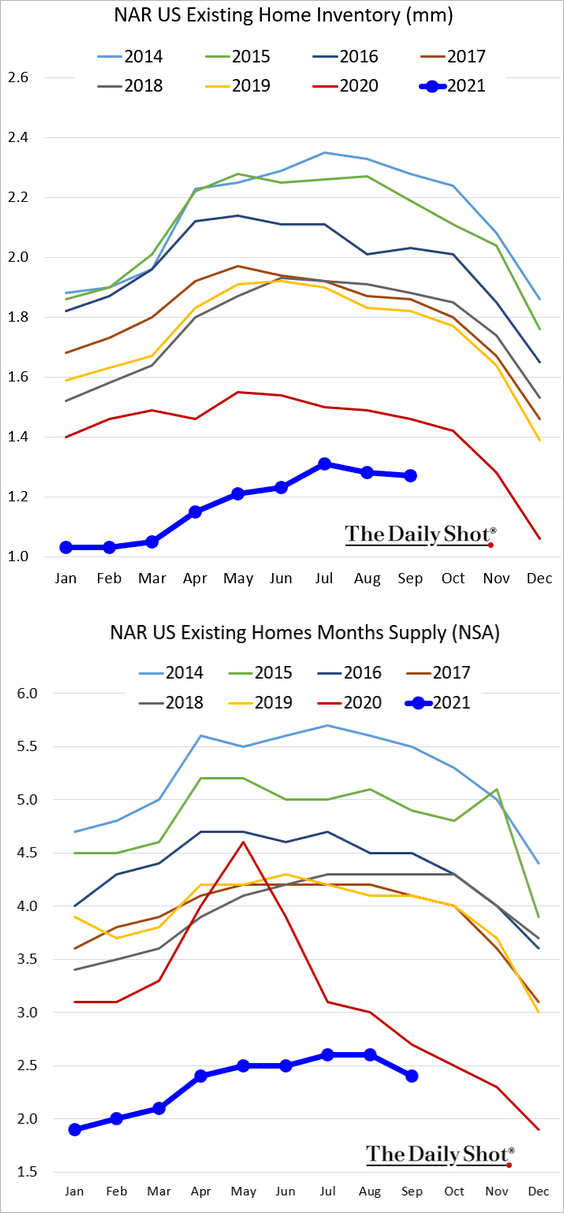

3. Existing home sales were robust last month.

• Inventories remain exceptionally tight.

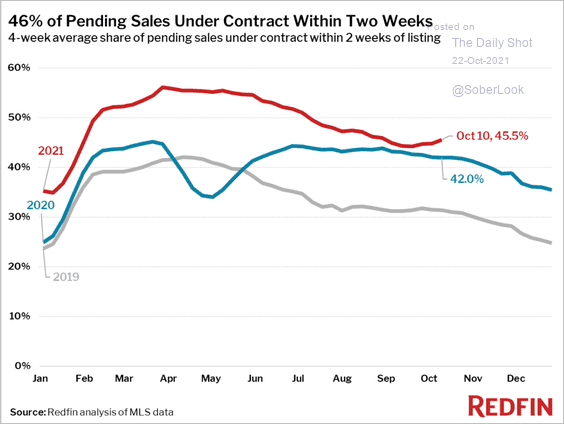

• Homes are selling quickly.

Source: @tayloramarr

Source: @tayloramarr

——————–

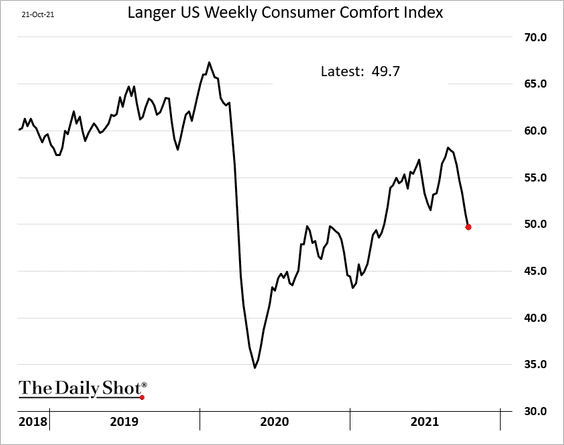

4. As we saw with other sentiment indicators, the Langer Consumer Comfort index shows deterioration in consumer confidence amid product shortages/delays and rising prices.

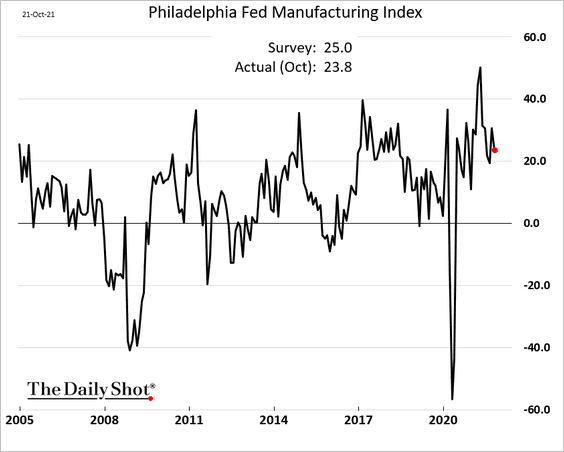

5. The Philly Fed’s regional manufacturing indicator ticked lower this month.

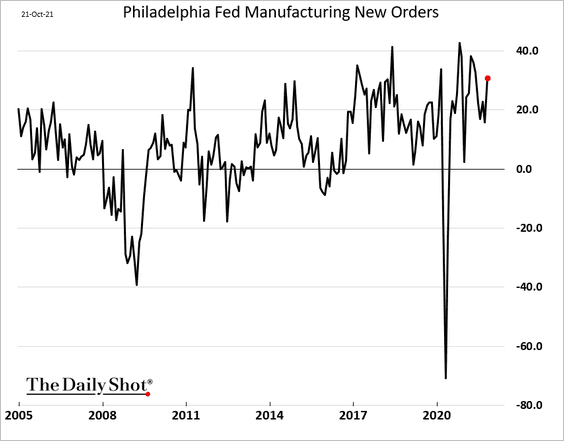

• New orders remain robust.

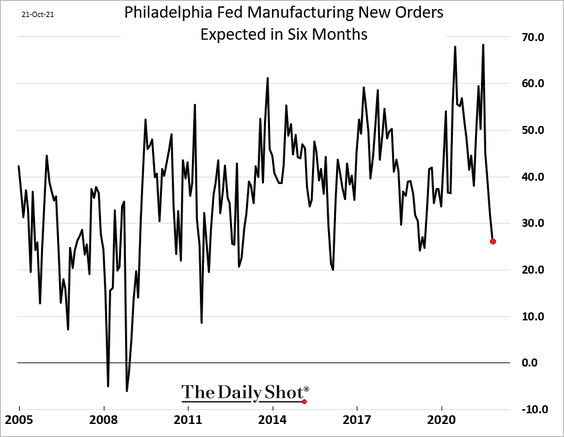

But manufacturers expect a slowdown ahead.

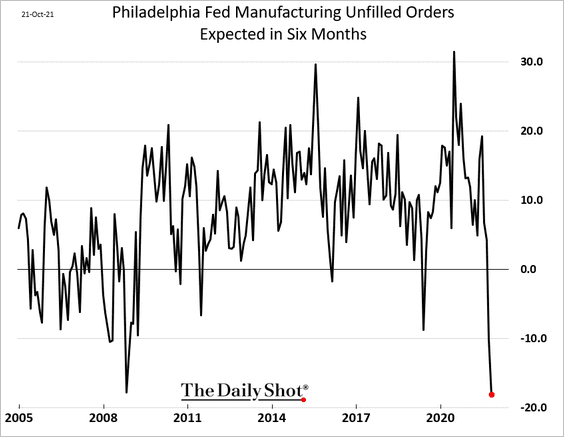

They see unfilled orders disappearing quickly.

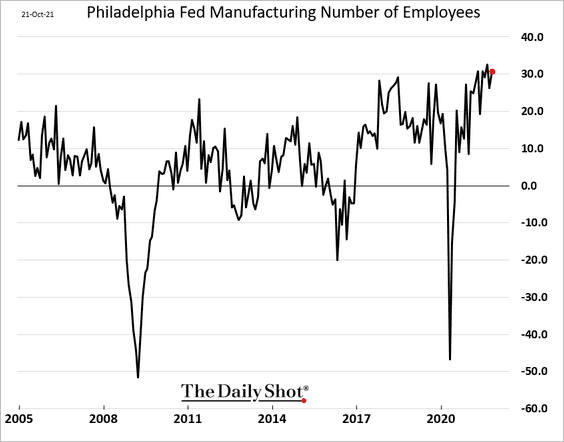

• Hiring remains exceptionally strong.

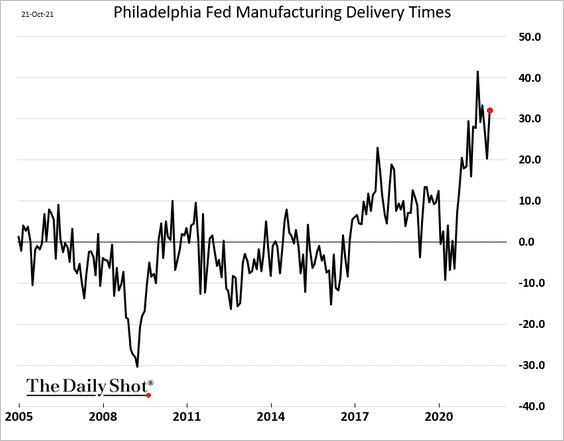

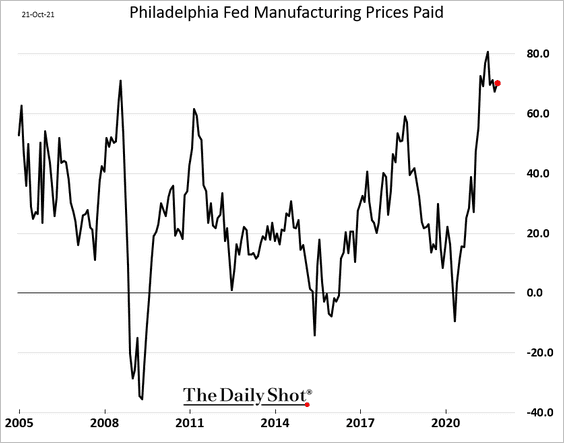

• Supply chain issues and price pressures persist.

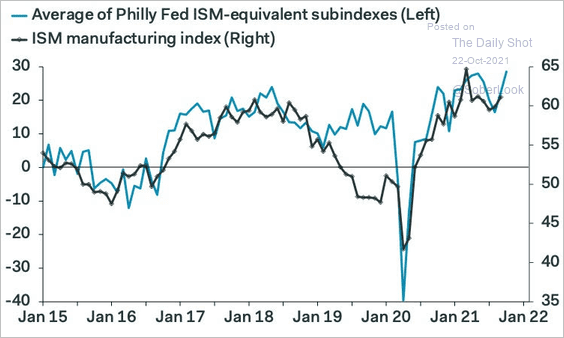

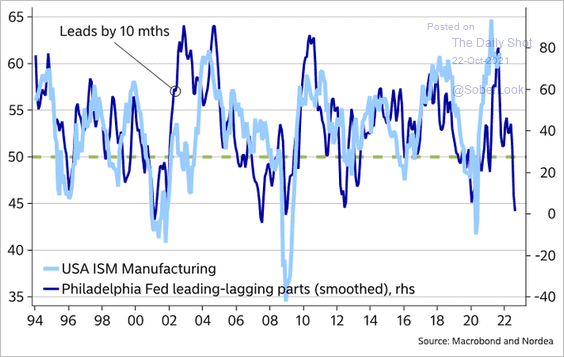

For October, the Philly Fed’s index points to a stronger ISM PMI (at the national level).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

However, forward-looking indicators spell trouble ahead.

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

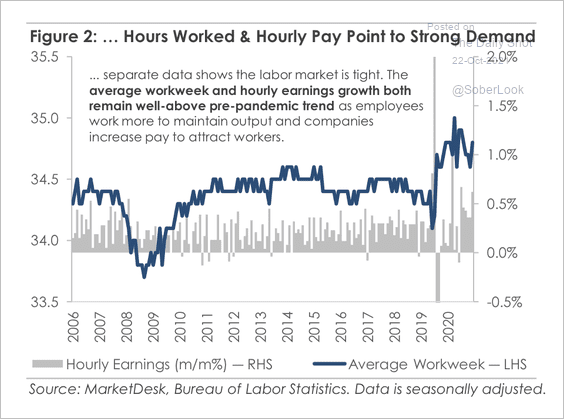

6. Hours worked and hourly pay remain above pre-pandemic levels.

Source: MarketDesk Research

Source: MarketDesk Research

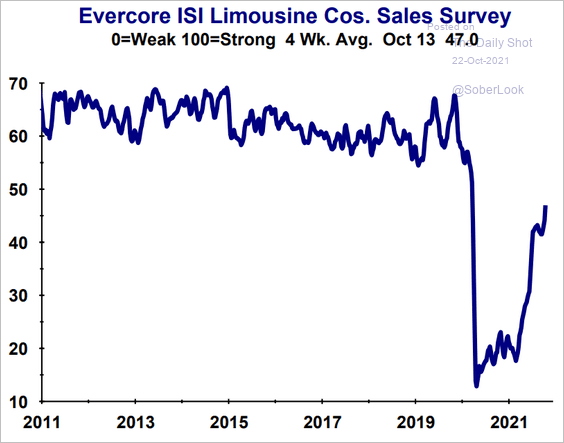

7. The Evercore ISI limo service company index continues to rebound. It points to improving back-to-the-office activity.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Emerging Markets

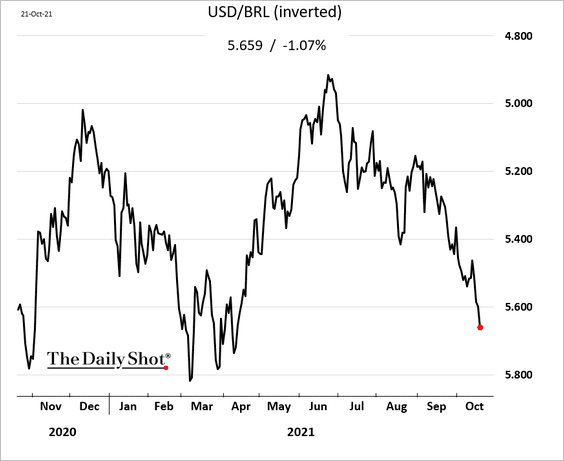

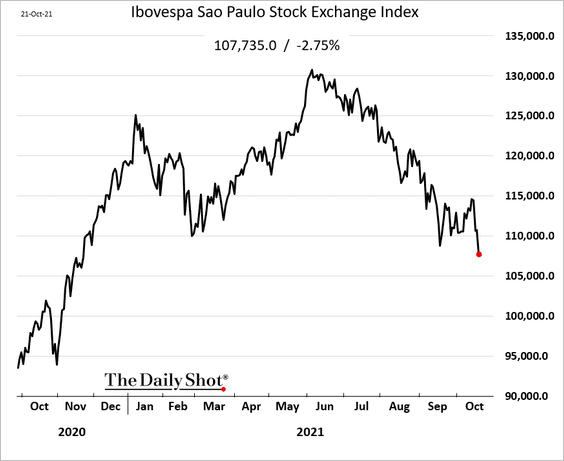

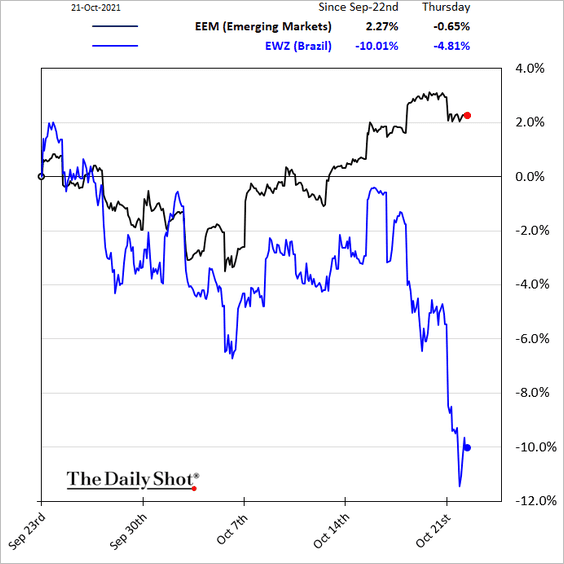

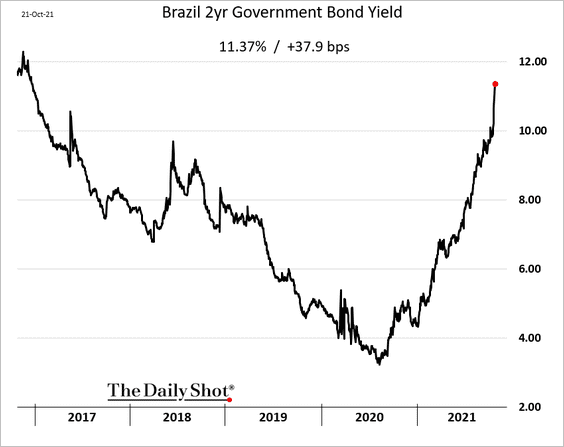

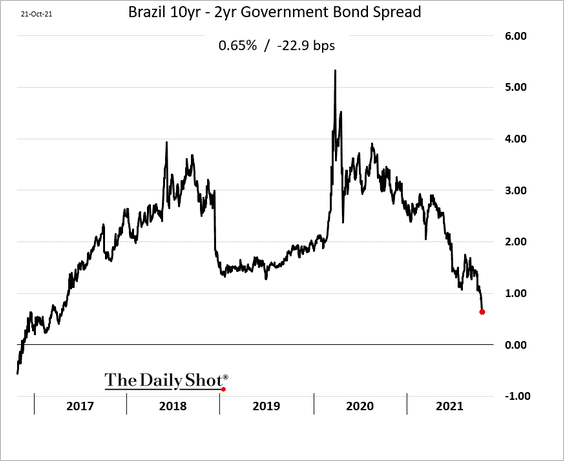

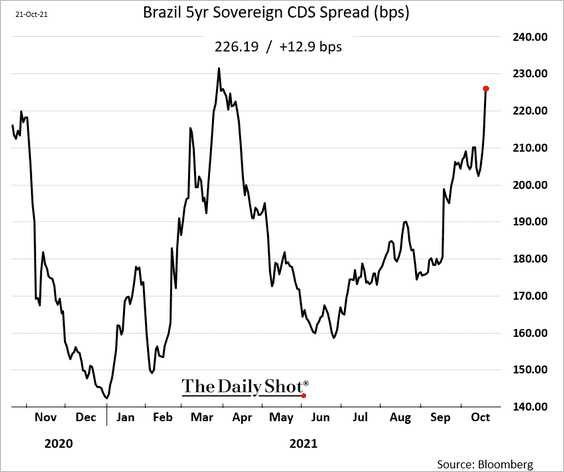

1. Investors remain concerned about Brazil.

Source: Reuters Read full article

Source: Reuters Read full article

• The Brazilian real:

• Equities:

• Rising yields …

… and a flattening curve (will it invert?):

• Sovereign CDS spread:

——————–

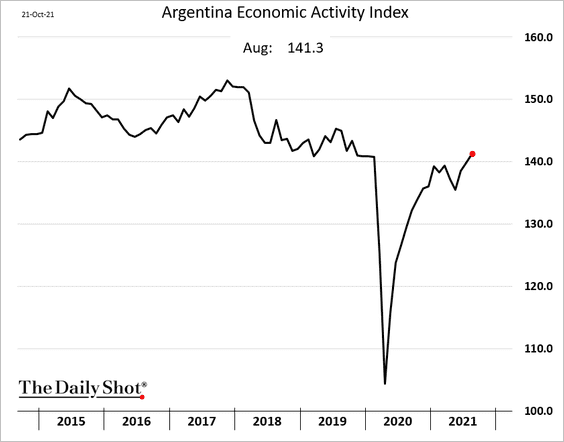

2. Argentina’s economic activity is now above pre-COVID levels, …

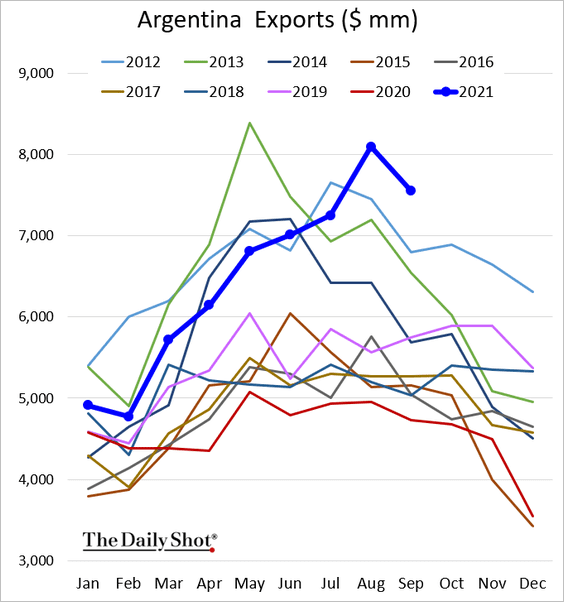

… as exports surge.

——————–

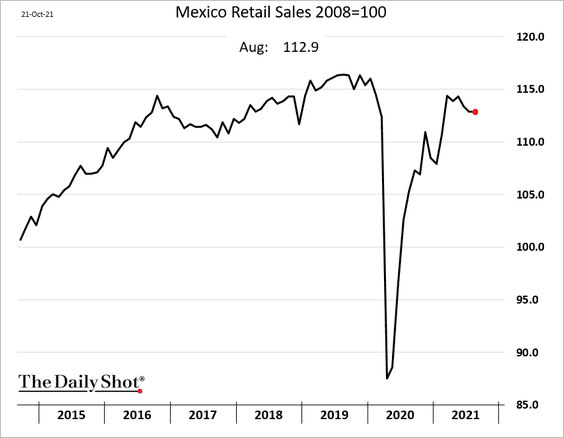

3. Mexico’s retail sales remained flat in August.

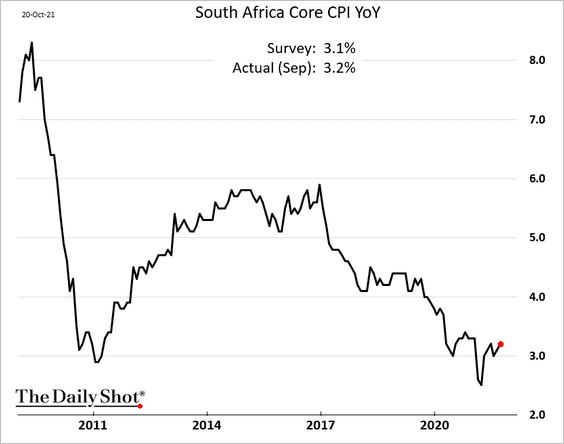

4. South Africa’s CPI is rebounding.

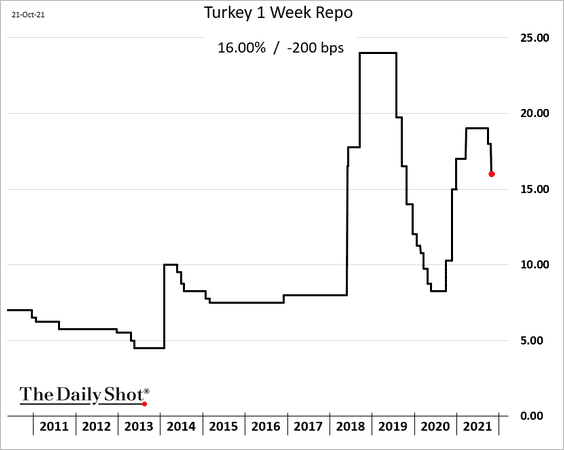

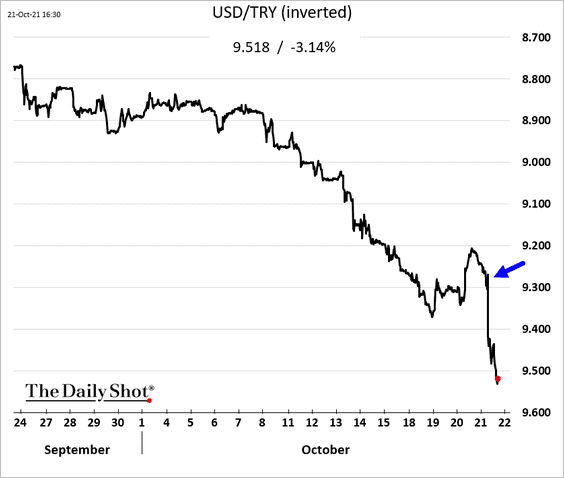

5. Under Erdogan’s pressure, Turkey’s central bank (or what’s left of it) cut rates by 200 bps.

The lira plummeted. Could this carnage trigger hyperinflation?

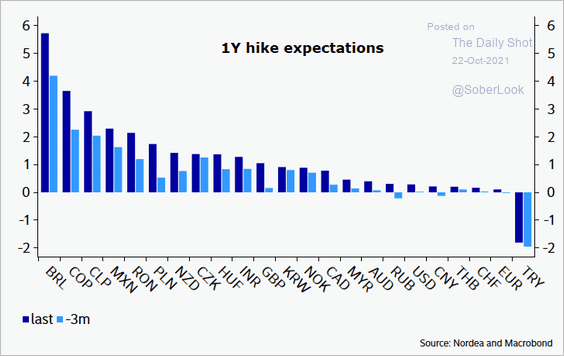

One of these countries is not like the others.

Source: Goldman Sachs; @AndreasSteno

Source: Goldman Sachs; @AndreasSteno

——————–

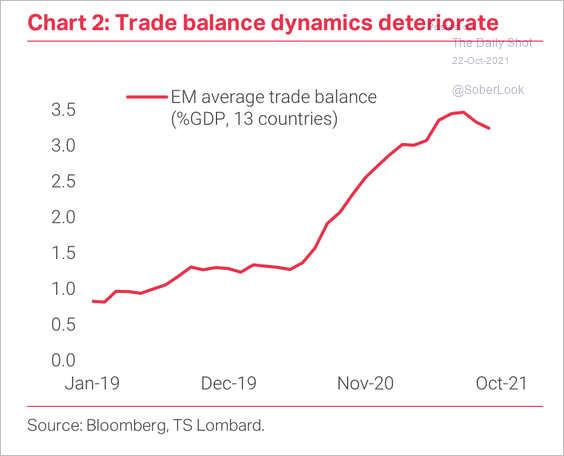

6. EM trade balances have been under pressure due to rising imports.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

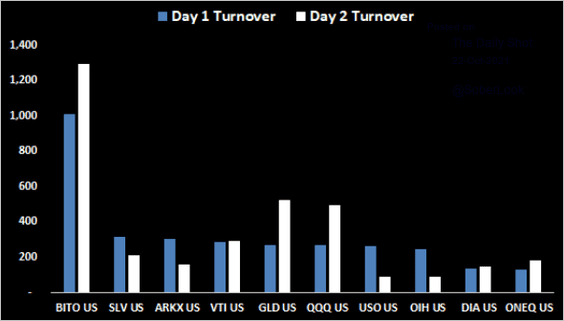

1. Here is a look at the ProShares Bitcoin Strategy ETF (BITO) first two days of trading activity versus other large ETFs.

Source: @EricBalchunas

Source: @EricBalchunas

Valkyrie Investments’ bitcoin futures ETF will debut on Friday under the ticker BTF (not BTFD as originally planned).

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

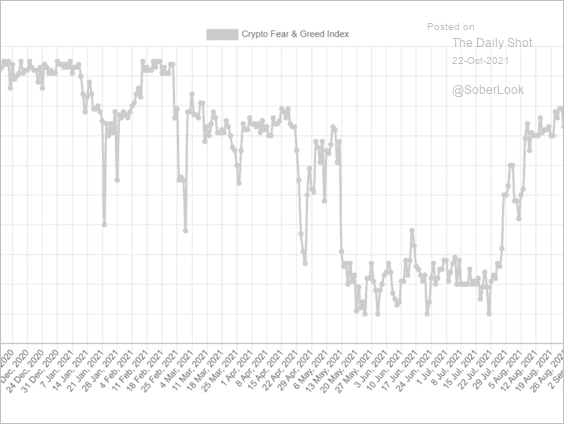

2. The crypto Fear & Greed Index is in “extreme greed” territory.

Source: Alternative.me Read full article

Source: Alternative.me Read full article

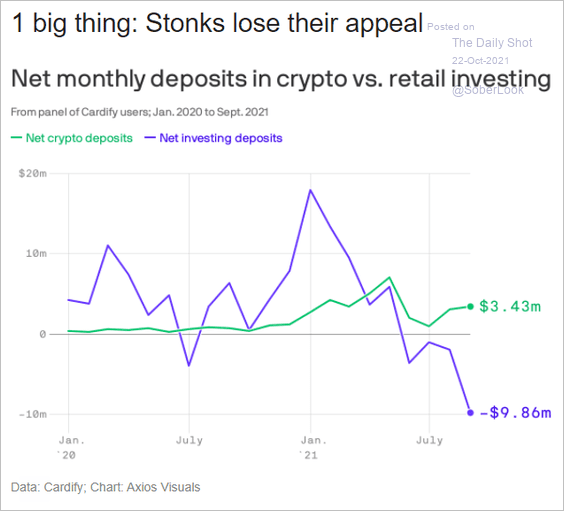

3. Retail investors are ditching stocks and moving into crypto.

Source: @axios

Source: @axios

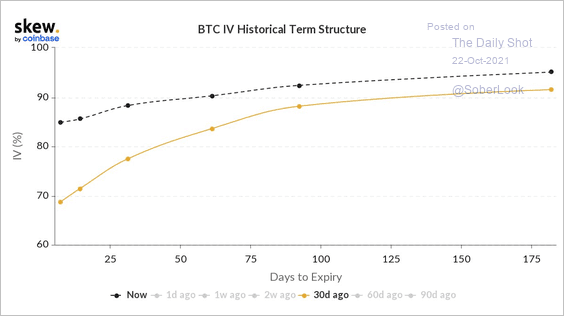

4. Bitcoin’s option implied volatility increased over the past month, particularly in the short-end of the vol curve.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

Back to Index

Commodities

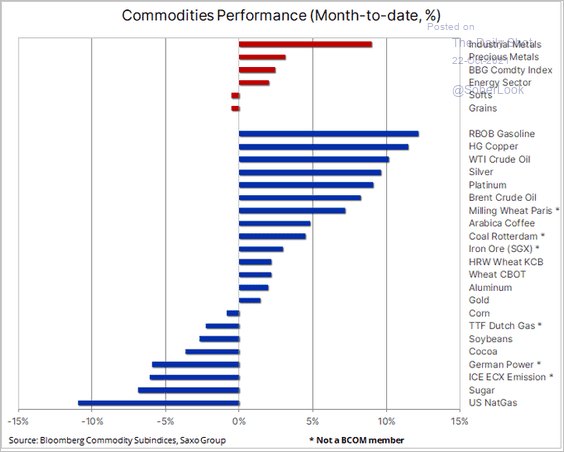

1. Let’s start with the month-to-date performance summary.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

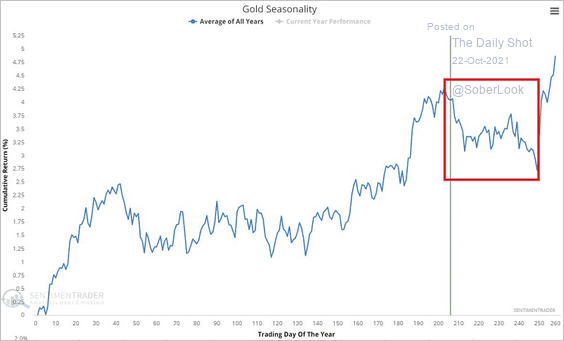

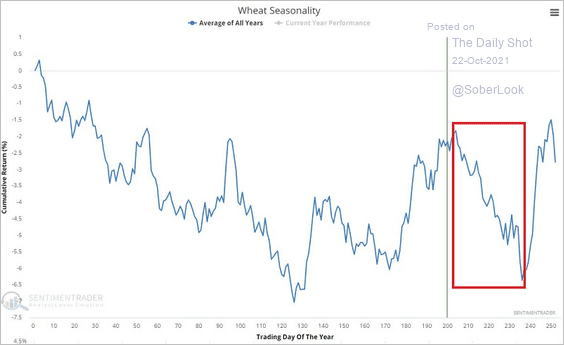

2. Several commodities, including gold and wheat, tend to experience seasonal downturns during this time of year (2 charts).

Source: SentimenTrader

Source: SentimenTrader

Source: SentimenTrader

Source: SentimenTrader

——————–

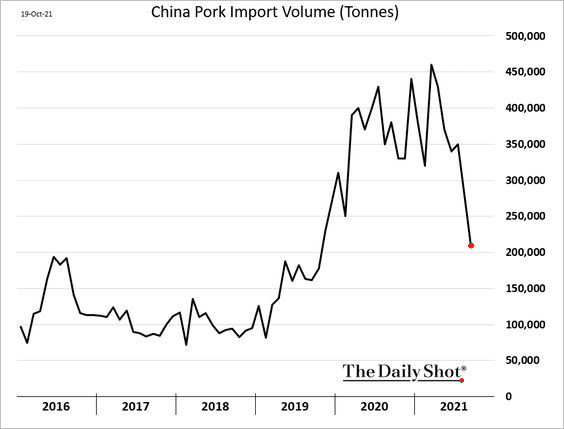

3. China’s pork imports are tumbling as the herd recovers.

h/t James W.

h/t James W.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

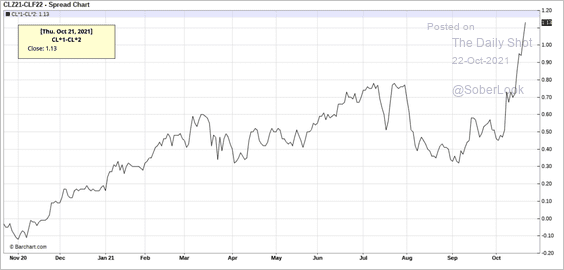

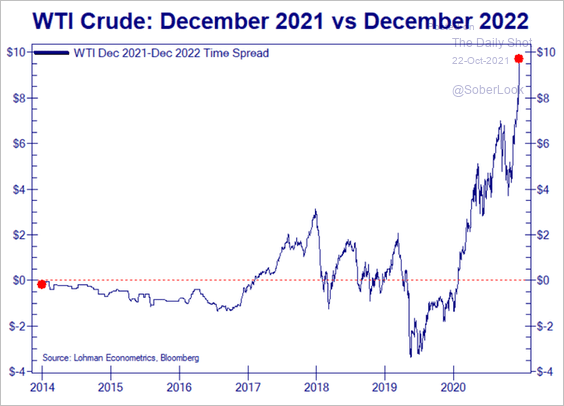

1. The WTI crude oil curve is moving deeper into backwardation as the market tightens.

• 1st – 2nd contract:

Source: @HFI_Research

Source: @HFI_Research

• Dec-red-Dec:

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

——————–

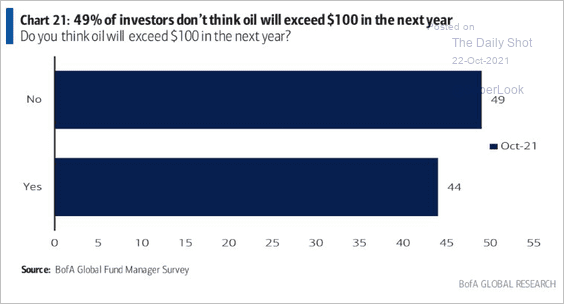

2. $100/bbl oil next year?

Source: BofA Global Research

Source: BofA Global Research

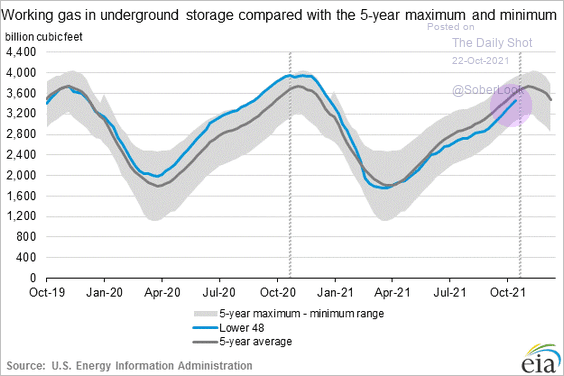

3. US natural in storage is approaching the 5yr average. Unlike Europe and Asia, the US is not facing natural gas shortages.

Back to Index

Equities

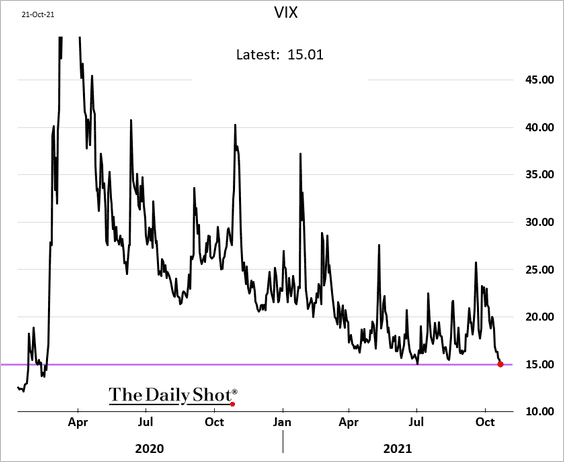

1. VIX closed at the lowest level since March 2020.

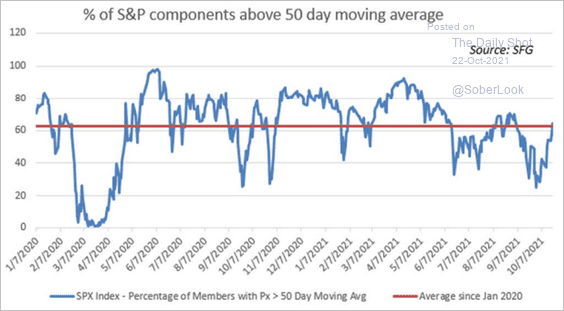

2. Despite the S&P 500 hitting a record high, only 60% of its members are above their 50-day moving average.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

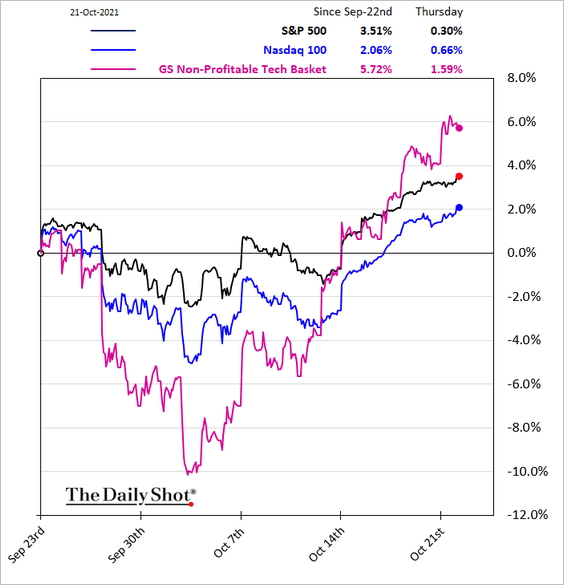

3. Speculative activity is back, as non-profitable tech shares outperform.

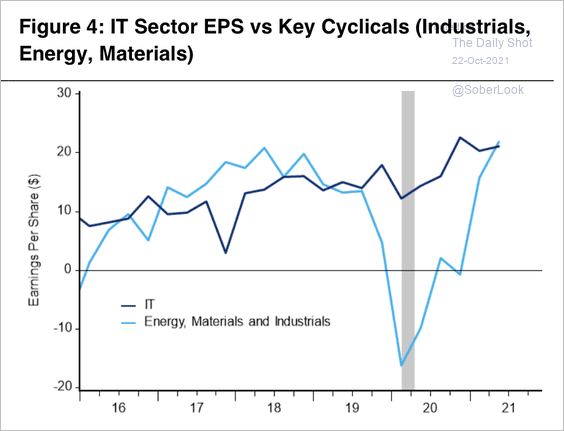

4. The sharp rebound in cyclical stock earnings has caught up to tech.

Source: Citi Private Bank

Source: Citi Private Bank

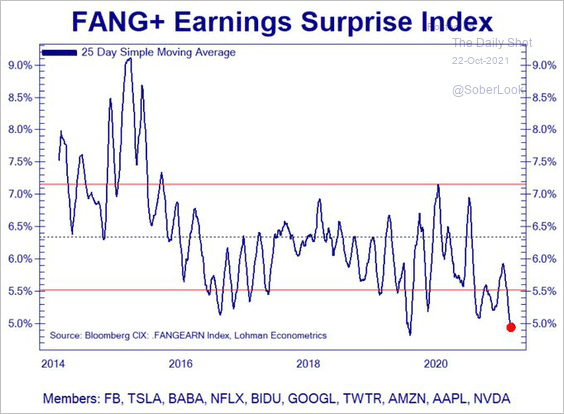

5. The tech mega-caps earnings surprises have been more subdued lately.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

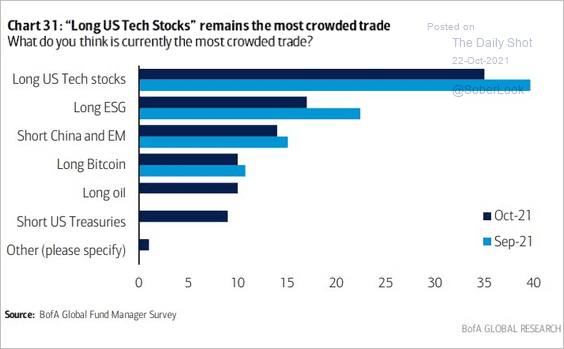

6. What do fund managers see as the most crowded trade?

Source: BofA Global Research; @MaverickBogdan

Source: BofA Global Research; @MaverickBogdan

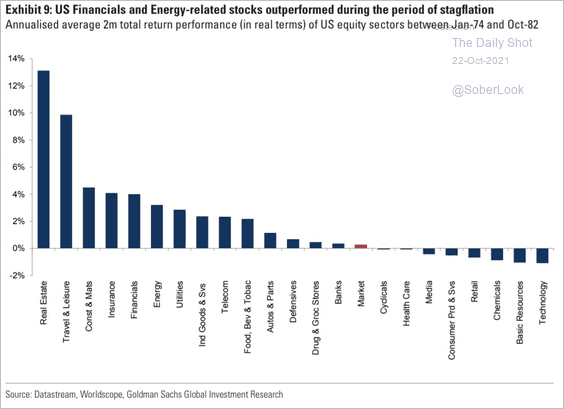

7. How do different sectors perform during stagflation?

Source: @HFI_Research

Source: @HFI_Research

Back to Index

Credit

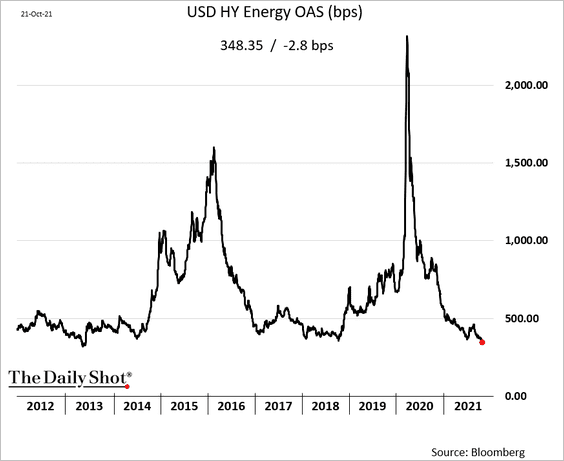

1. HY energy sector bond spreads tightened to the lowest level since 2013 as energy prices surge.

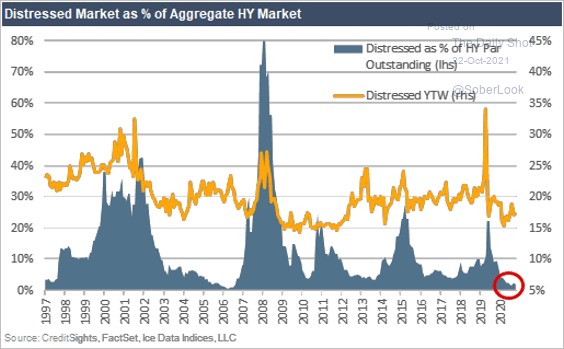

2. The share of US high-yield debt trading at distressed levels is near multi-year lows.

Source: CreditSights

Source: CreditSights

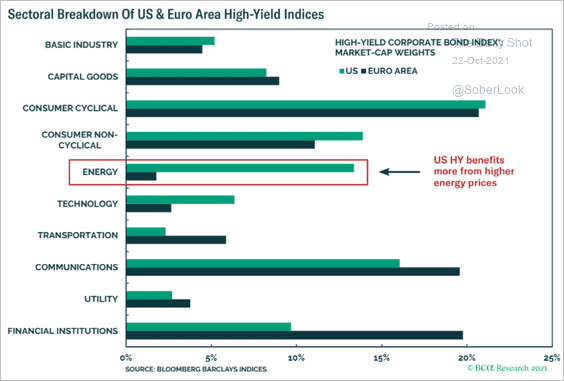

3. How does the US HY market compare to Europe in terms of sector weights?

Source: BCA Research

Source: BCA Research

Back to Index

Rates

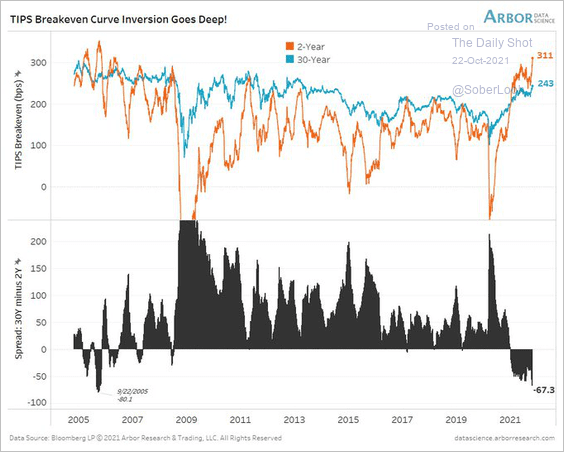

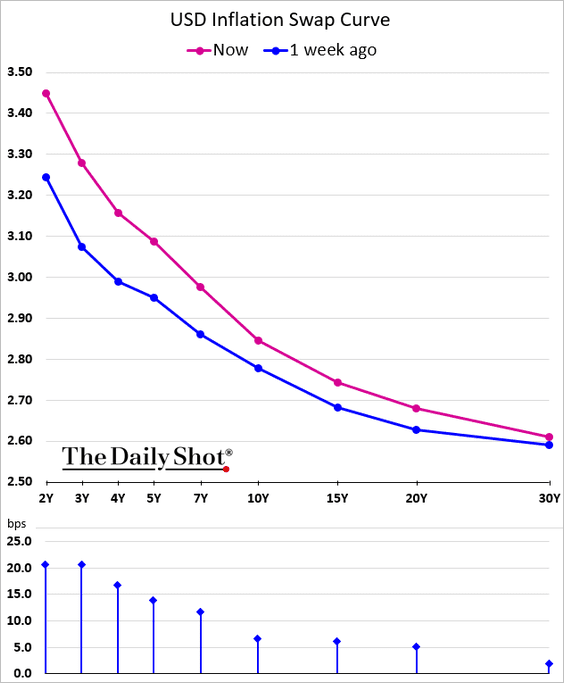

1. The inflation expectations curve inverted further, driven in part by the backwardation in oil (see the energy section).

Source: @benbreitholtz

Source: @benbreitholtz

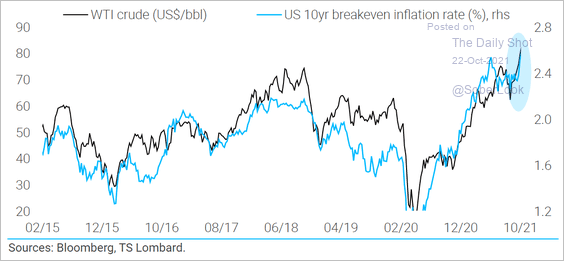

Inflation expectations have been highly correlated with oil.

Source: TS Lombard

Source: TS Lombard

——————–

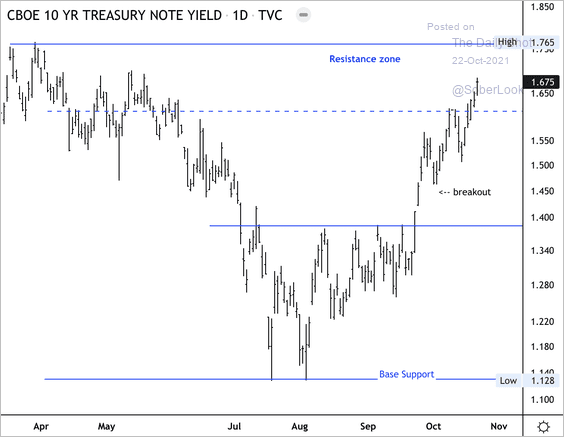

2. The 10-year Treasury yield is approaching resistance.

Source: Dantes Outlook

Source: Dantes Outlook

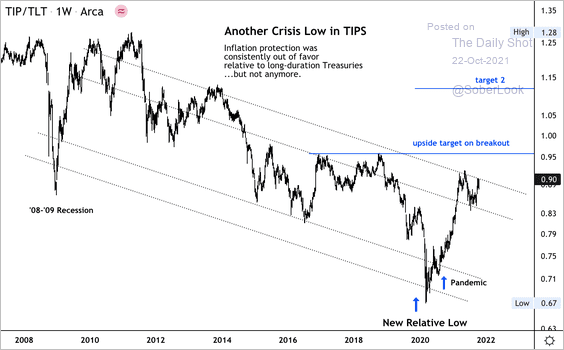

3. Will the iShares TIPS ETF (TIP) break out of a long-term downtrend relative to the iShares 20+ year Treasury bond ETF (TLT)? A sustained rise in the TIP/TLT ratio would suggest greater demand for inflation protection.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

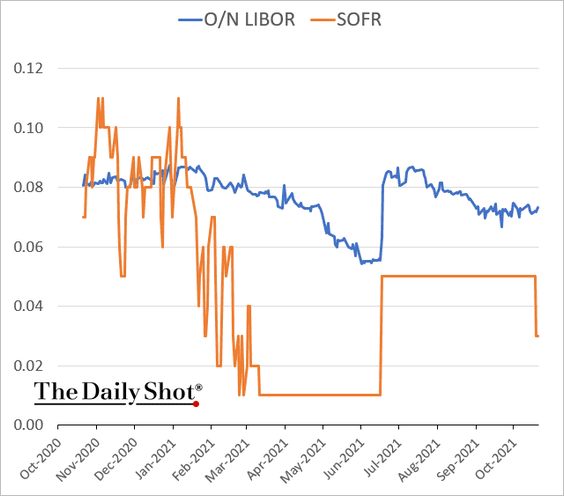

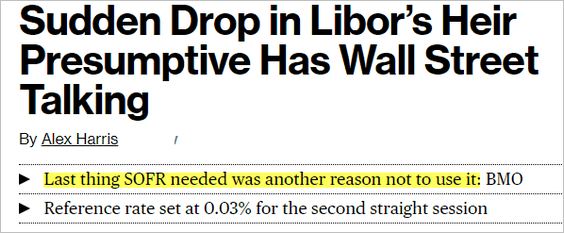

4. Which index would you trust?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

Food for Thought

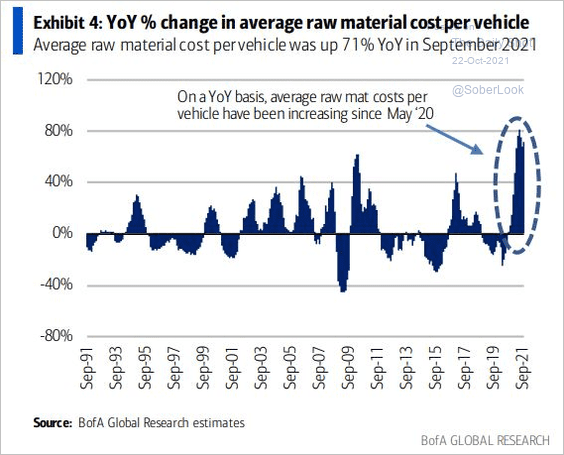

1. Year-over-year changes in raw material costs for a typical US light vehicle:

Source: BofA Global Research, Gustavo Fuhr

Source: BofA Global Research, Gustavo Fuhr

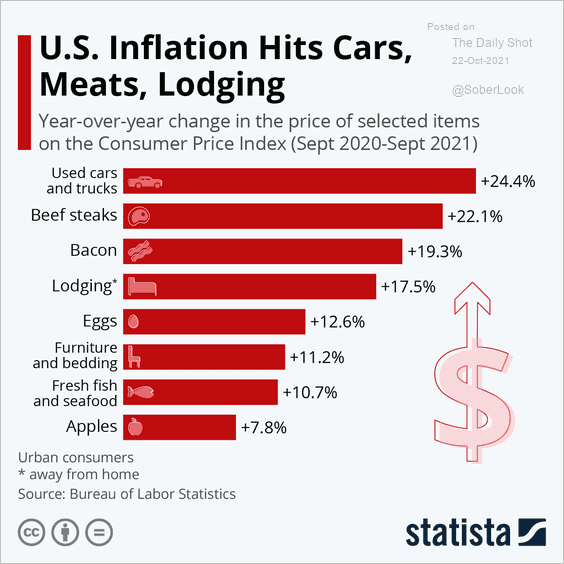

2. Some US CPI components:

Source: Statista

Source: Statista

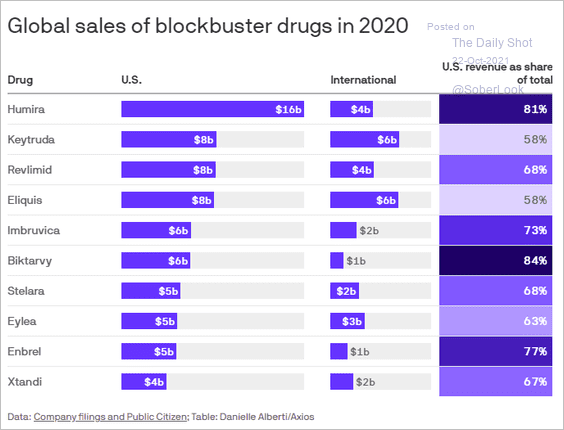

3. Blockbuster drugs:

Source: @axios Read full article

Source: @axios Read full article

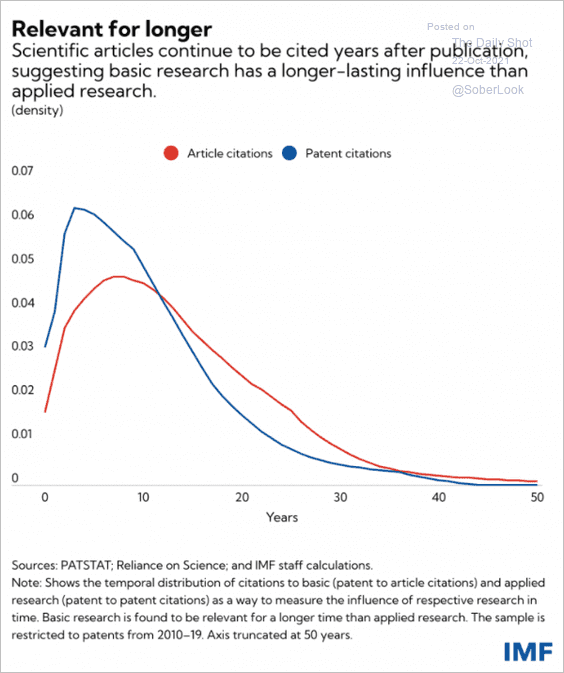

4. Citations of patents vs. research publications:

Source: IMF Read full article

Source: IMF Read full article

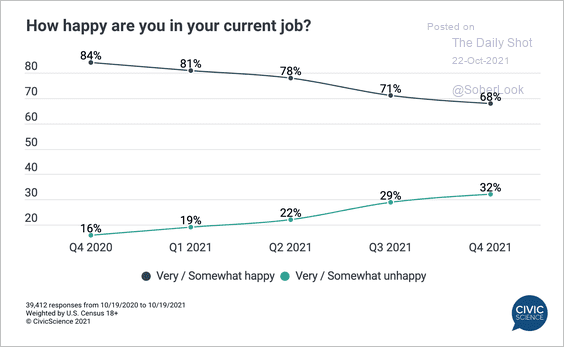

5. How happy are you with your current job?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

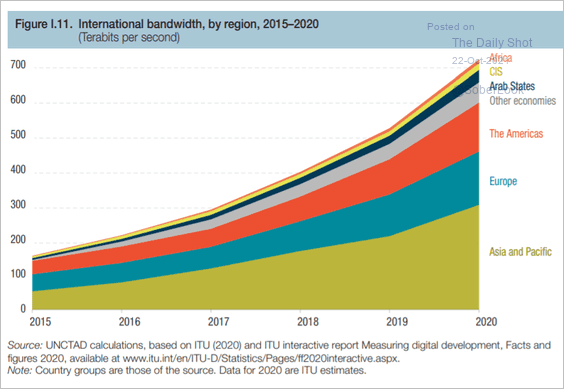

6. Global internet bandwidth usage:

Source: UNCTAD Read full article

Source: UNCTAD Read full article

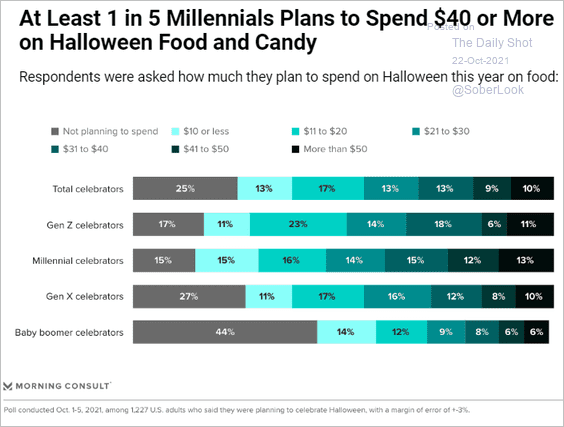

7. Halloween spending:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

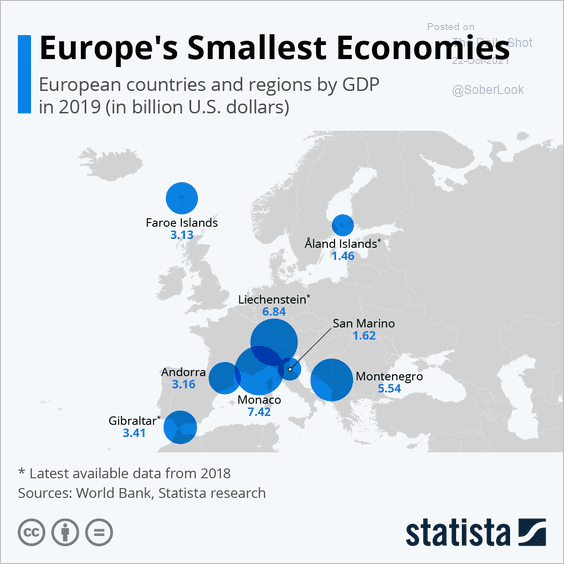

8. Europe’s smallest economies:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index