The Daily Shot: 26-Oct-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

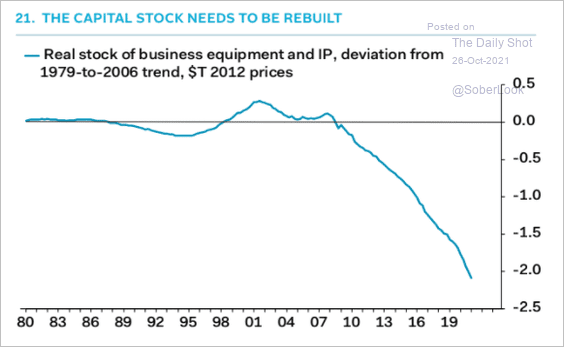

1. The nation’s capital expenditures have been relatively slow since the pre-financial-crisis trend.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

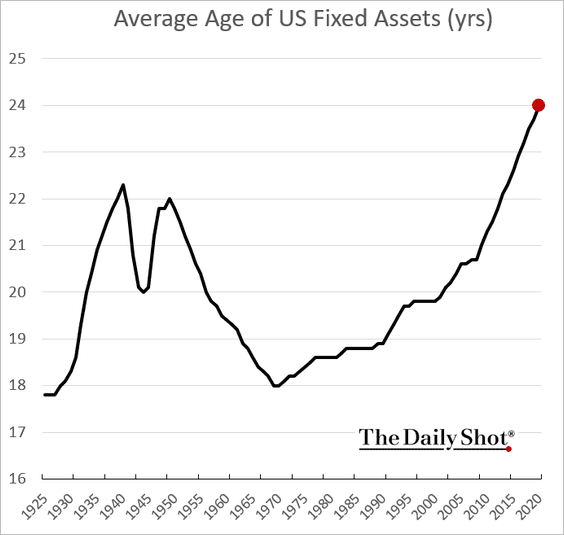

US fixed assets are rapidly aging. Combined with labor shortages, these trends point to robust business investment ahead.

Source: BEA, h/t @TheOneDave

Source: BEA, h/t @TheOneDave

——————–

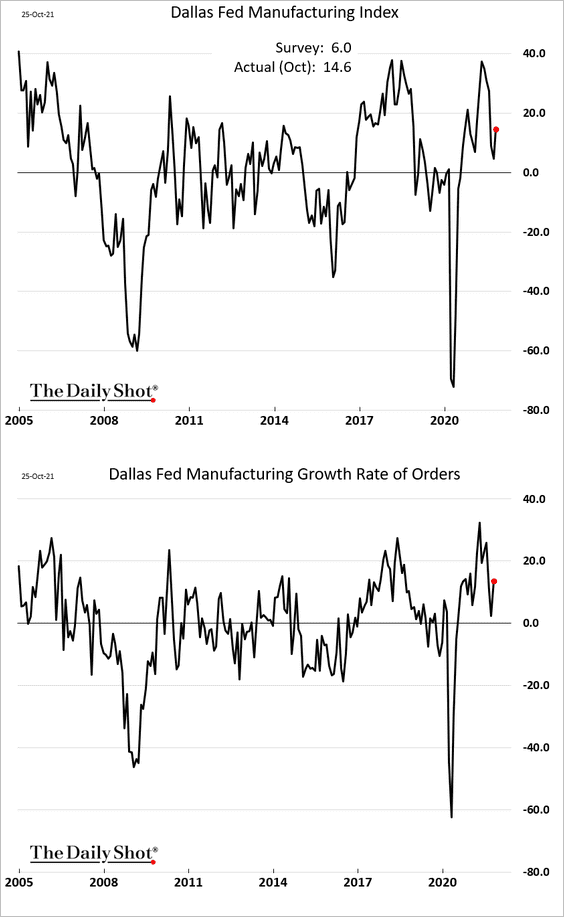

2. The Dallas Fed’s manufacturing index rebounded this month as order growth picked up.

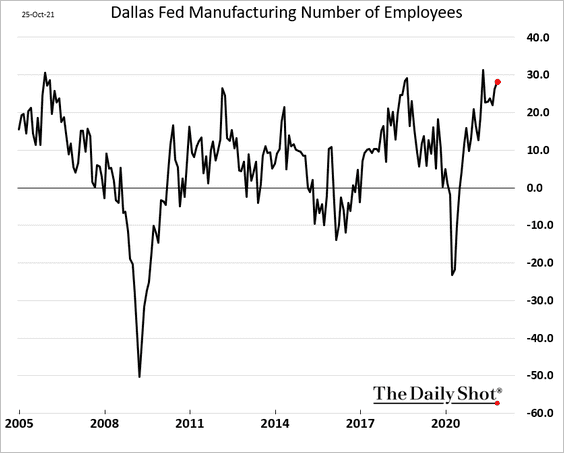

• Hiring in the region remains robust.

• Supply issues continue to plague manufacturers.

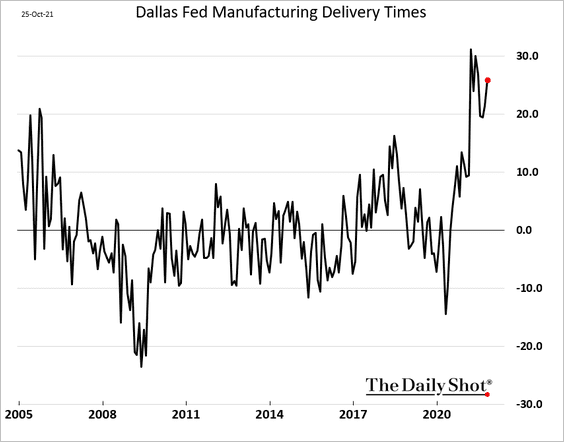

– Delivery times:

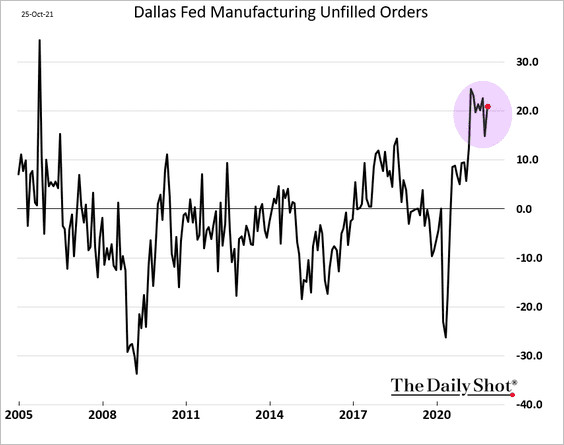

– Unfilled orders:

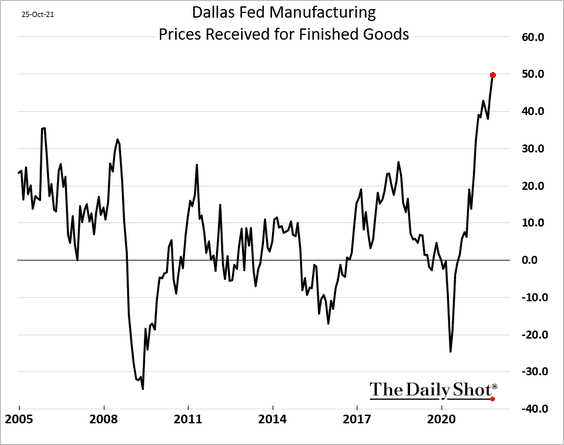

• Manufacturers are boosting prices at unprecedented rates.

——————–

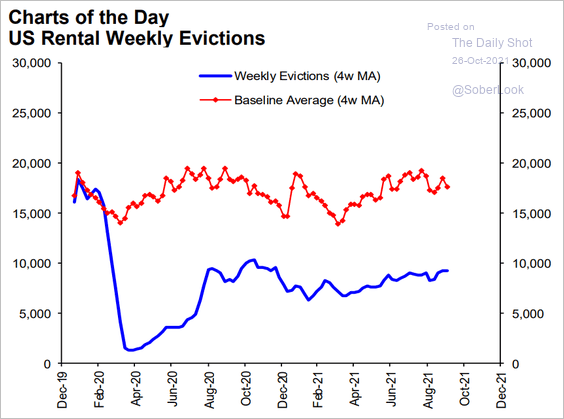

3. The eviction “Armageddon” some analysts have been expecting hasn’t materialized yet.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

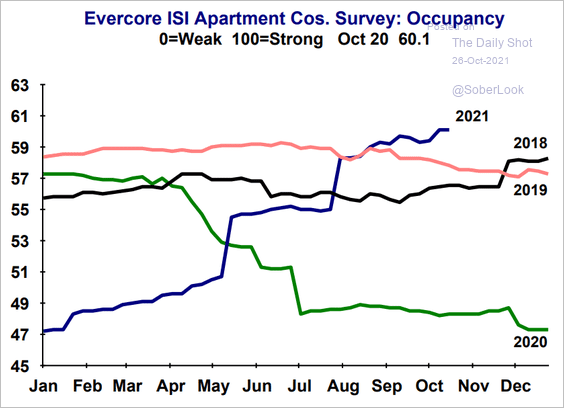

According to a survey from Evercore ISI, apartment occupancy rates are now higher than in 2019.

Source: Evercore ISI

Source: Evercore ISI

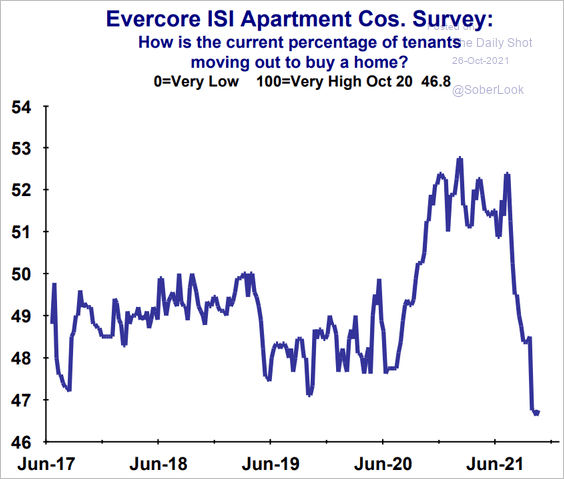

And the wave of tenants leaving to buy a home has faded.

Source: Evercore ISI

Source: Evercore ISI

——————–

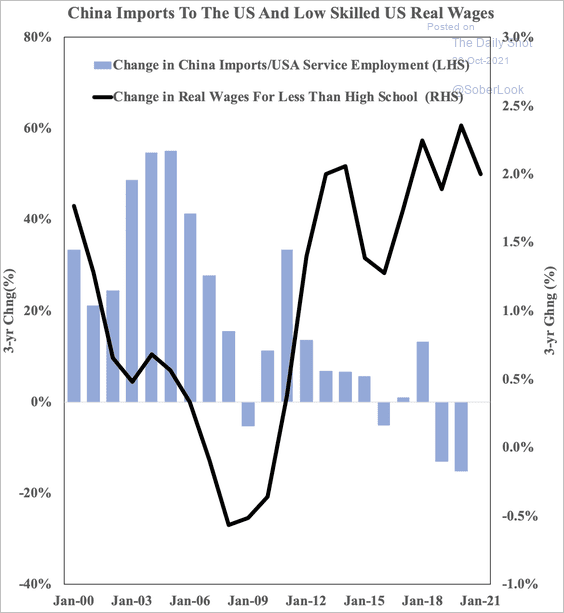

4. China’s cheap export wave has ebbed and resulted in an improvement in real wages for low-skilled Americans.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

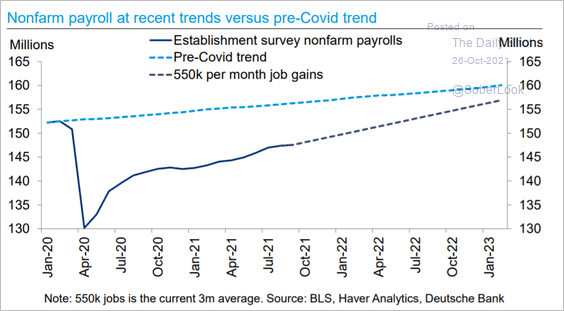

5. Next, we have some updates on the labor market.

• It will be some time before payrolls return to their pre-COVID trend (around mid-2023).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

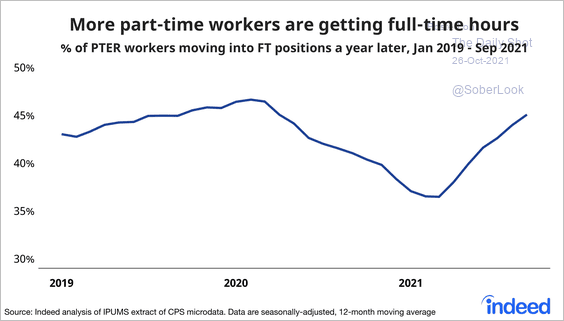

• Part-time workers are increasingly getting full-time hours.

Source: @nick_bunker

Source: @nick_bunker

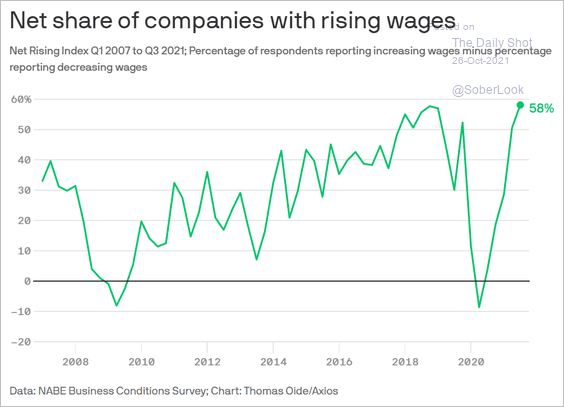

• The share of companies with rising wages hit a multi-year high.

Source: @axios Read full article

Source: @axios Read full article

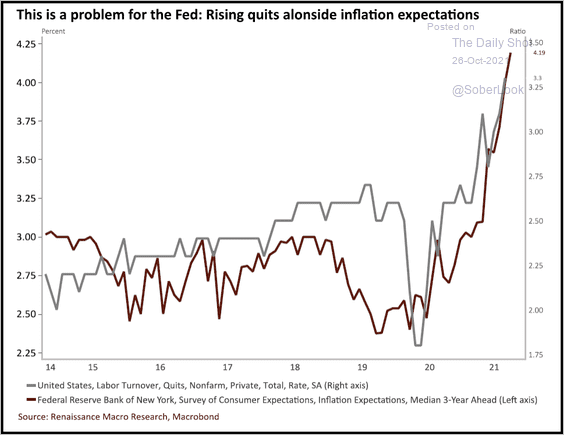

• Labor turnover is rising alongside inflation expectations.

Source: Renaissance Macro Research

Source: Renaissance Macro Research

——————–

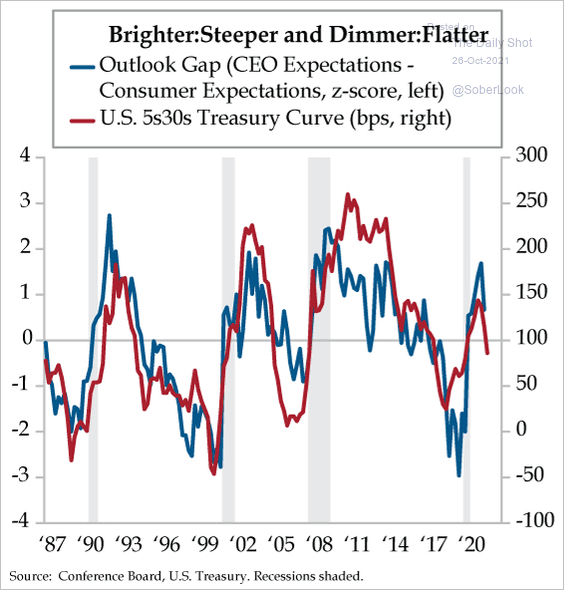

6. The spread between CEO expectations and consumer expectations is highly correlated with the Treasury curve (an indicator of economic growth).

Source: The Daily Feather

Source: The Daily Feather

Back to Index

The United Kingdom

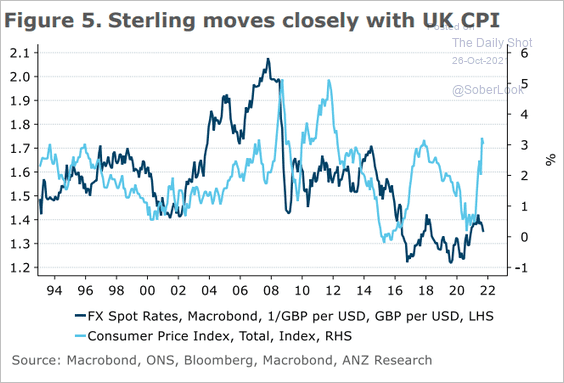

1. Rising inflation in the UK bodes well for the pound.

Source: ANZ Research

Source: ANZ Research

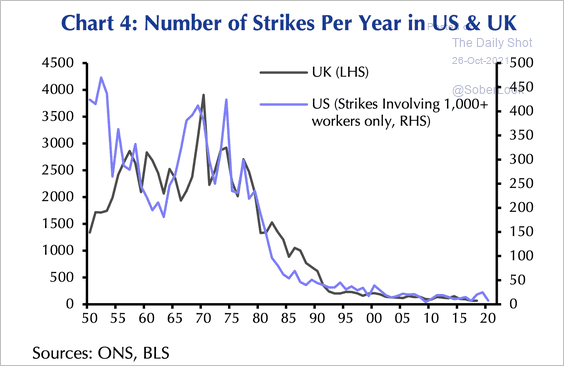

2. There has been a staggering decline in the number of labor actions since the 1970s.

Source: Capital Economics

Source: Capital Economics

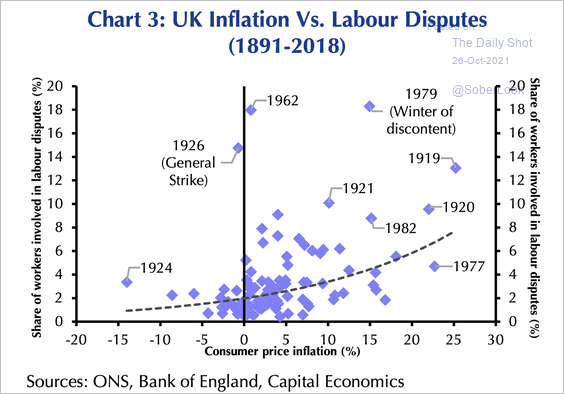

Labor disputes correlate positively with inflation, especially in the 1970s and after the First World War.

Source: Capital Economics

Source: Capital Economics

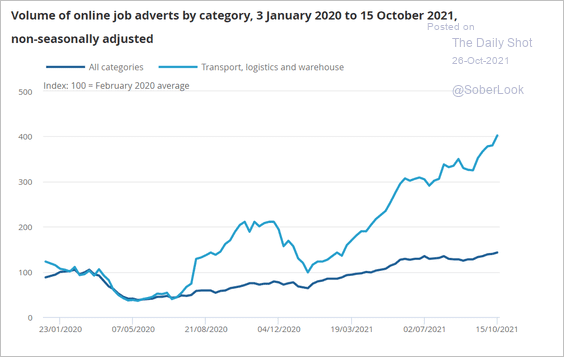

3. Labor shortages have been acute in the transportation/logistics sectors.

Source: ONS Read full article

Source: ONS Read full article

Back to Index

The Eurozone

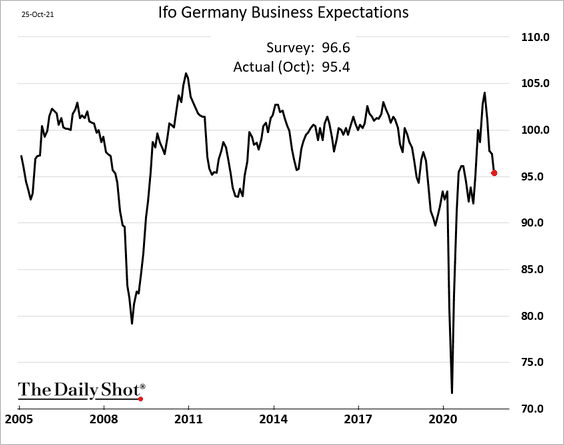

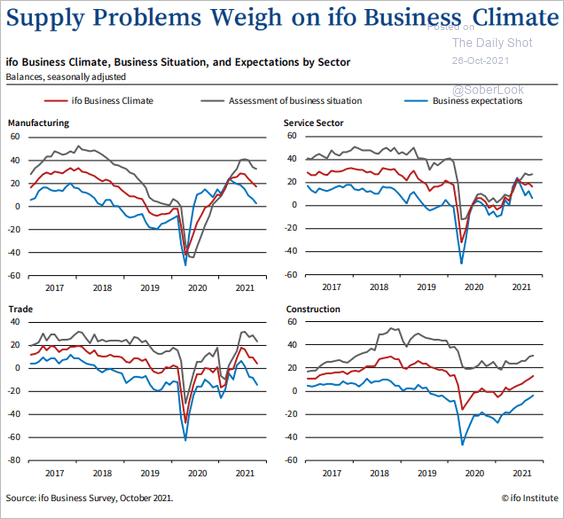

1. Germany’s Ifo business expectations index deteriorated further this month, undershooting forecasts.

Analysts attribute the decline to supply challenges, which have increasingly become a drag on growth.

Source: ifo Institute

Source: ifo Institute

——————–

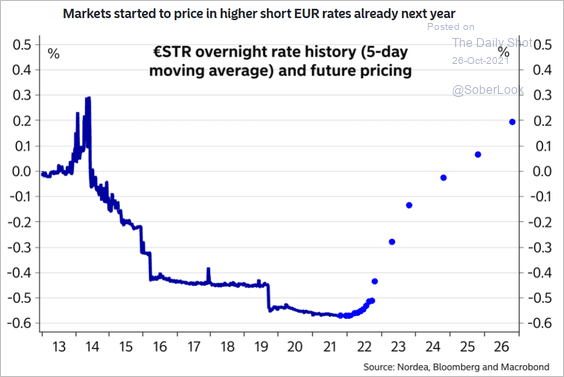

2. The market is pricing in higher short-term rates in the euro area starting next year.

Source: Nordea Markets

Source: Nordea Markets

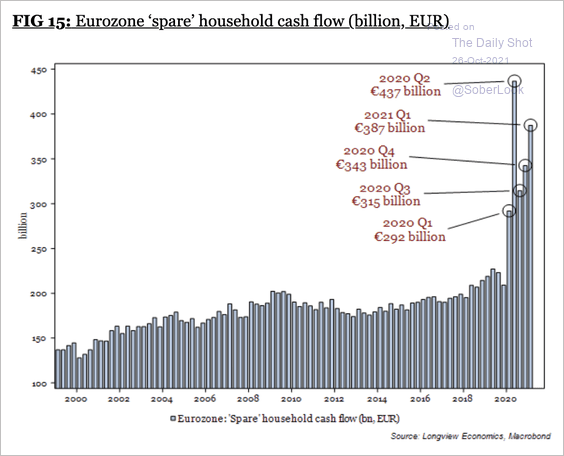

3. Eurozone households have built up a significant amount of spare cash flow.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

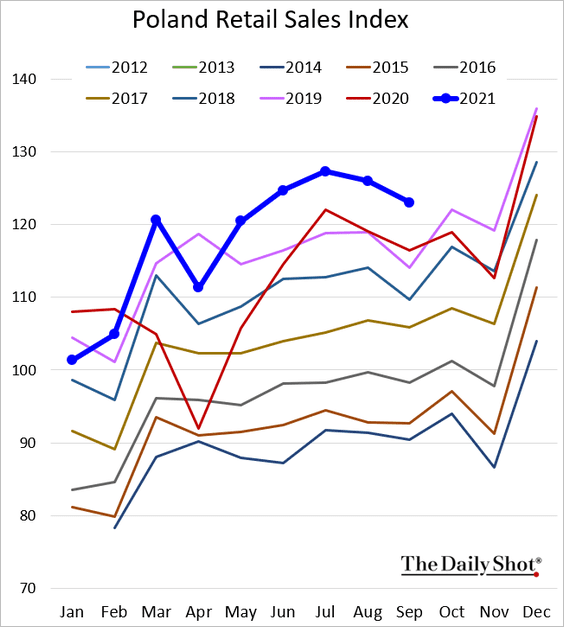

1. Poland’s retail sales have been holding up well.

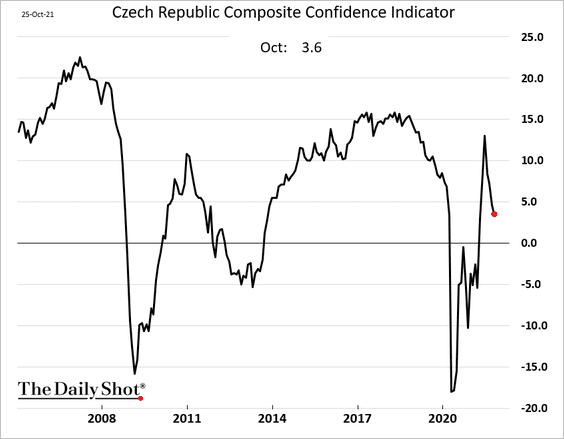

2. Czech consumer and business confidence continues to sink.

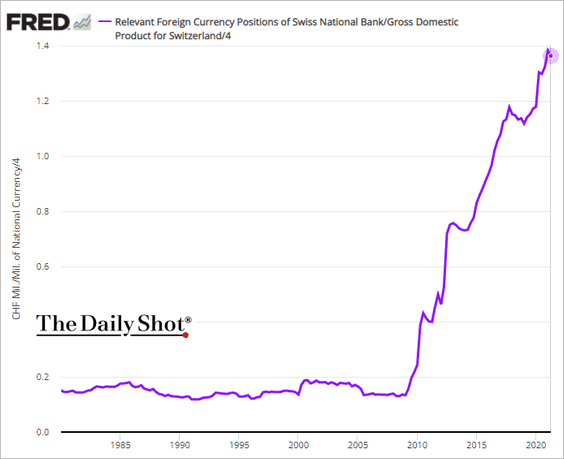

3. The SNB’s foreign currency holdings (mostly EUR and USD) are now close to 140% of Switzerland’s annual GDP.

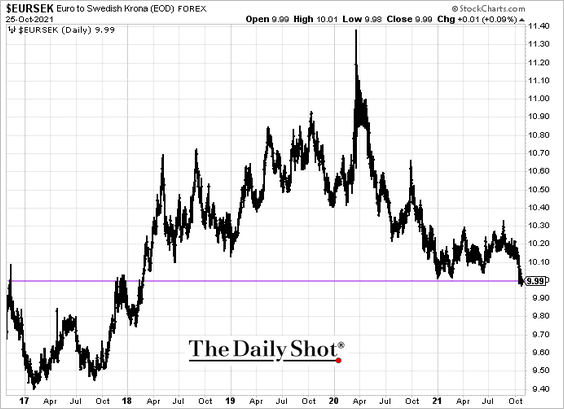

4. EUR/SEK is testing support at 10. Will the Swedish krona rally accelerate?

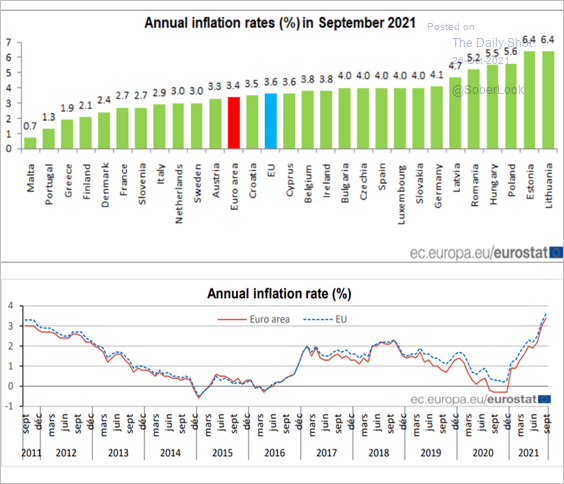

5. Next, we have some inflation data for the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

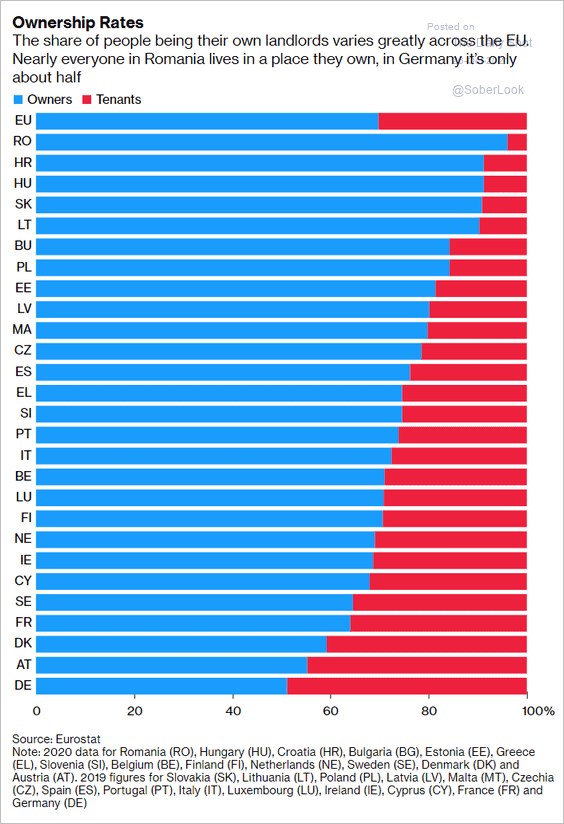

6. Finally, this chart shows homeownership rates in the EU.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Japan

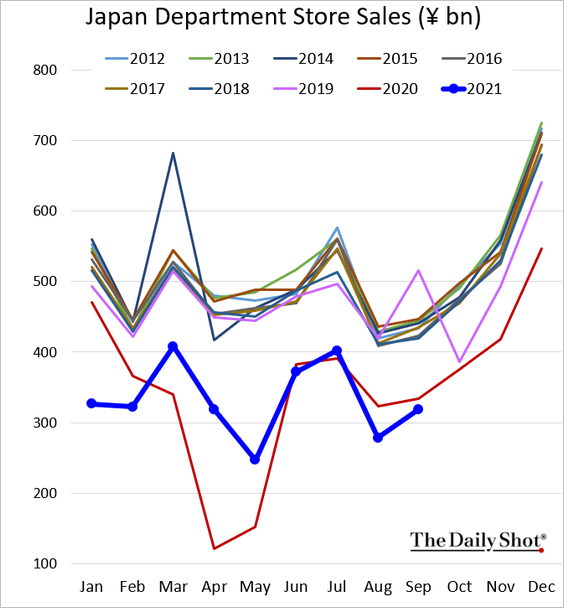

1. Department store sales remain depressed (below 2020 levels).

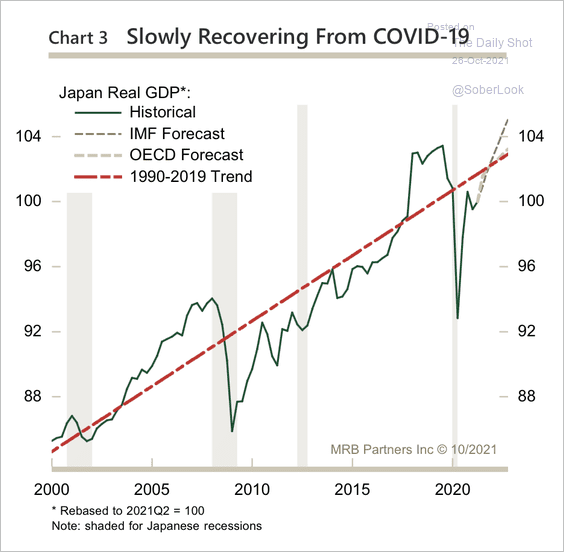

2. The economy is expected to return to its trend growth next year.

Source: MRB Partners

Source: MRB Partners

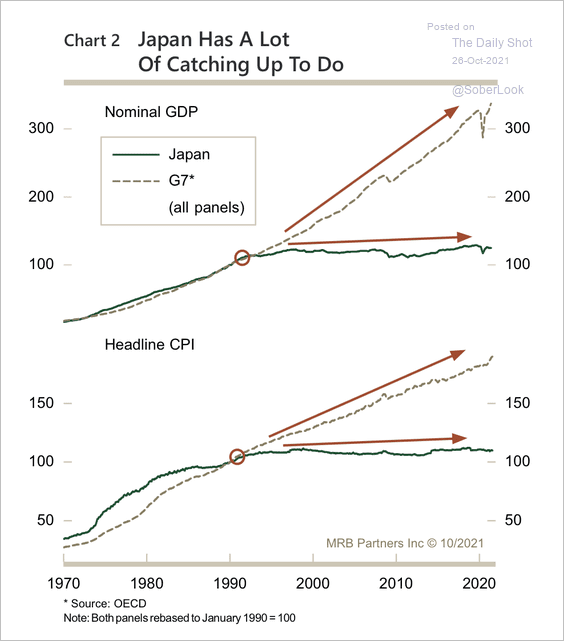

3. Japan’s growth and inflation have lagged the rest of the G7.

Source: MRB Partners

Source: MRB Partners

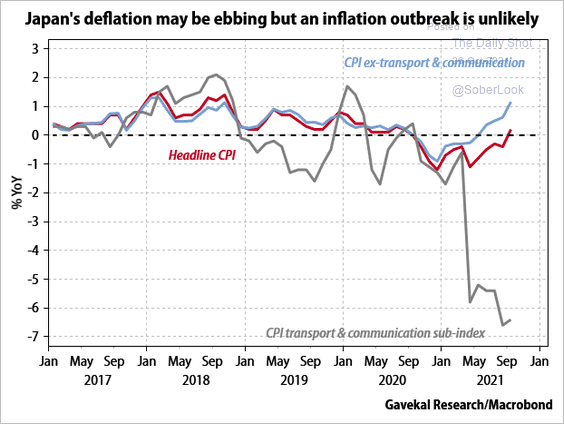

4. Is deflation finally ebbing?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Asia – Pacific

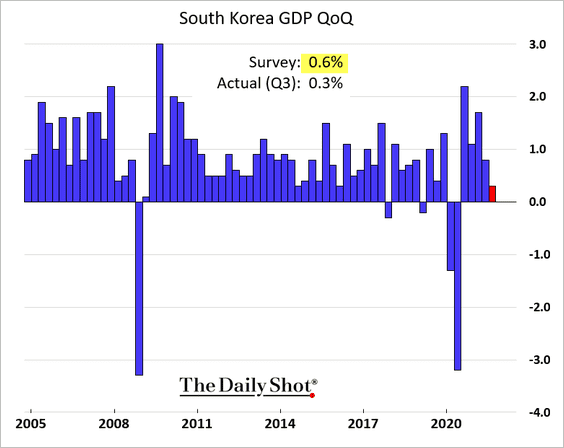

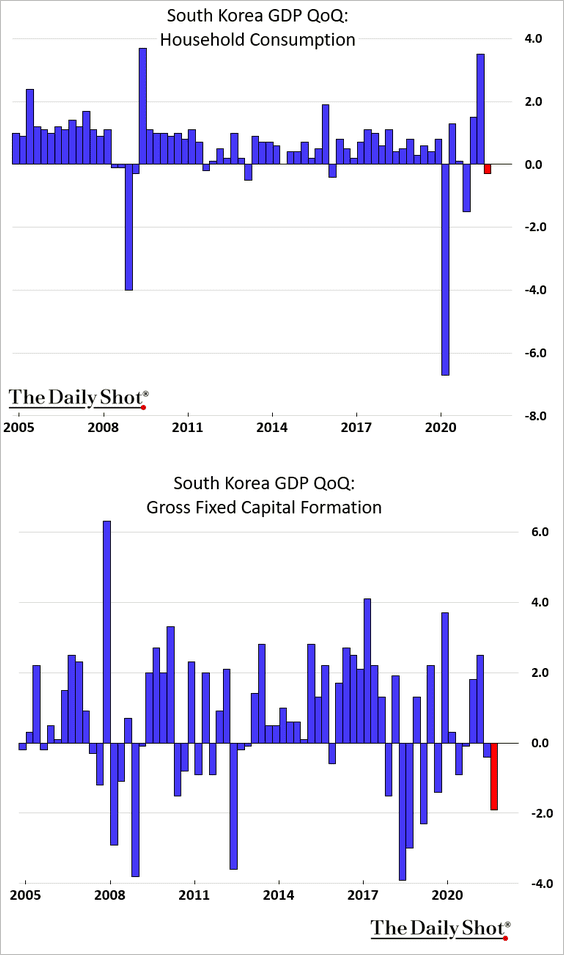

1. South Korea’s Q3 GDP growth disappointed.

Household consumption and business investment shrunk.

——————–

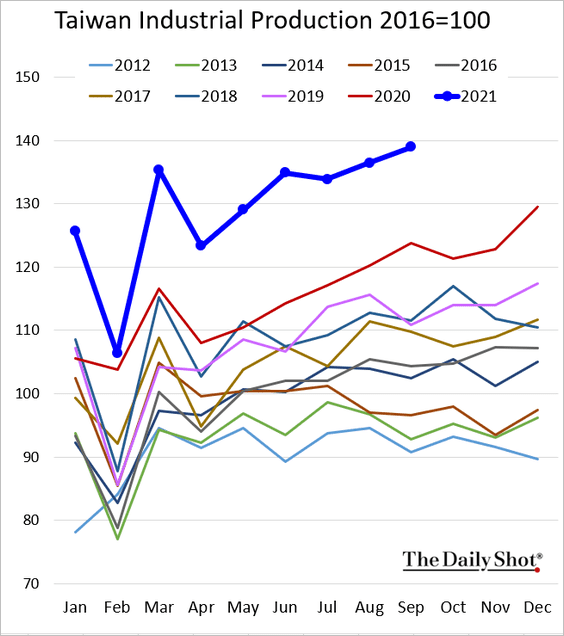

2. Taiwan’s industrial production hit another record high.

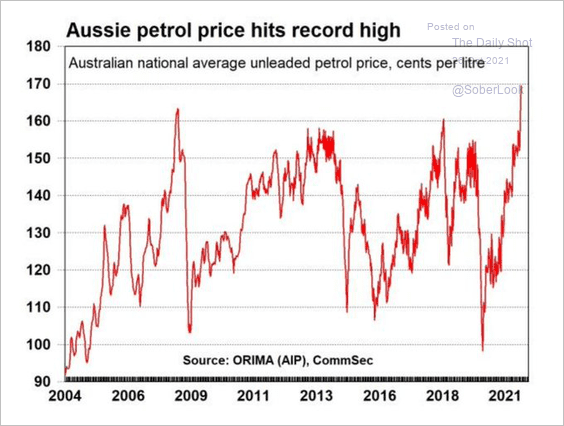

3. Fuel prices in Australia are surging.

Source: @Scutty

Source: @Scutty

Back to Index

China

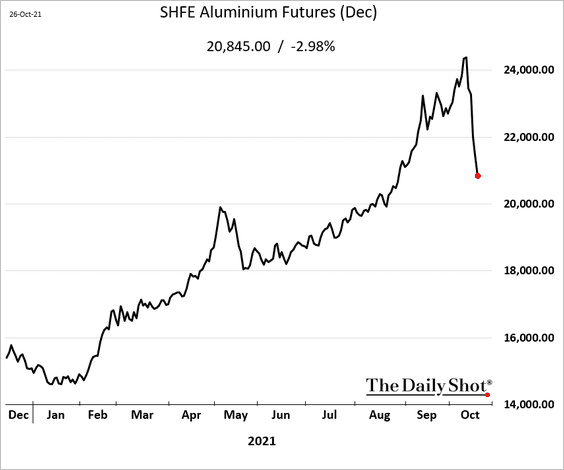

1. China’s coal prices keep dragging other industrial commodities lower, impacting global markets.

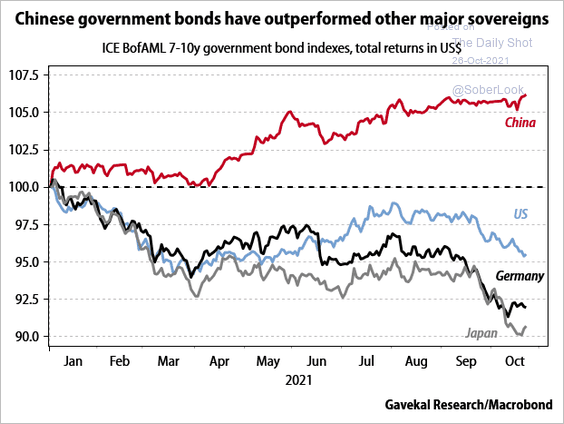

2. Government bonds continue to outperform.

Source: Gavekal Research

Source: Gavekal Research

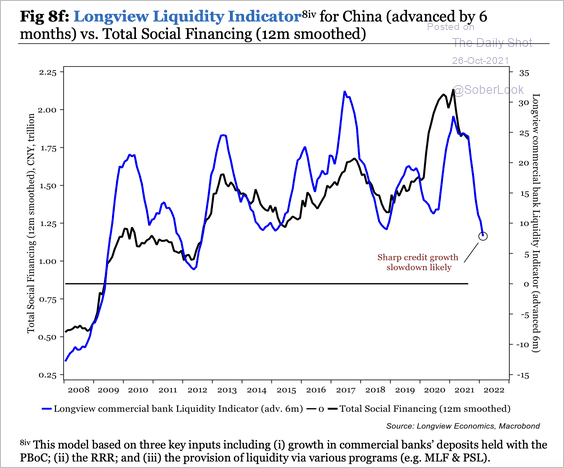

3. Longview Economics liquidity indicator points to continued weakness in Chinese credit.

Source: Longview Economics

Source: Longview Economics

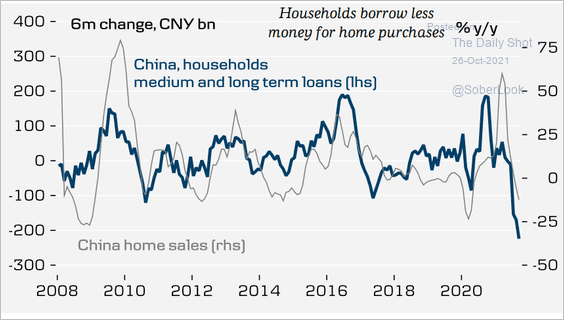

• Lending to households:

Source: Danske Bank

Source: Danske Bank

• Lending to developers:

Source: Danske Bank

Source: Danske Bank

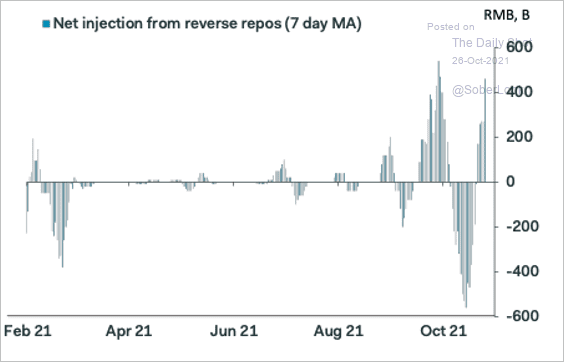

In response to tighter credit conditions, the PBoC has been injecting liquidity into the banking system.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

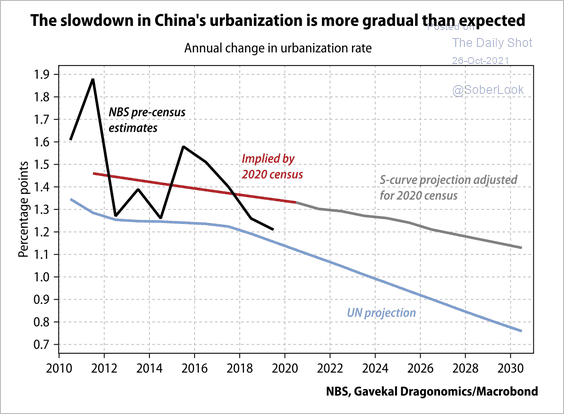

4. China’s urbanization rate is increasing but at a slowing pace. The latest census data found that the urban population was higher than previously estimated, suggesting this pace is more gradual.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

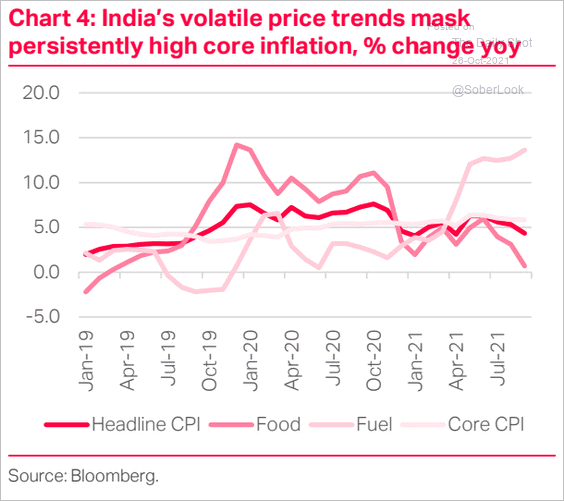

1. India’s core CPI has been running above 5%.

Source: TS Lombard

Source: TS Lombard

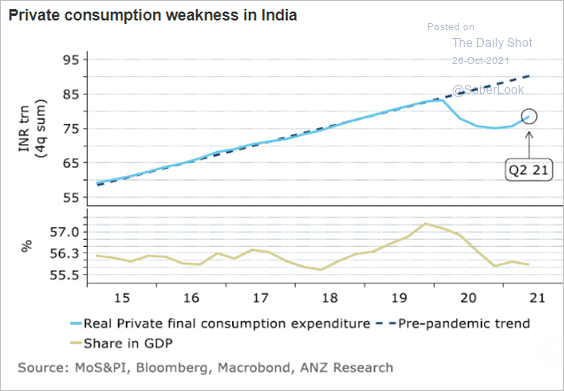

The nation’s private consumption remains well below pre-COVID levels.

Source: ANZ Research

Source: ANZ Research

——————–

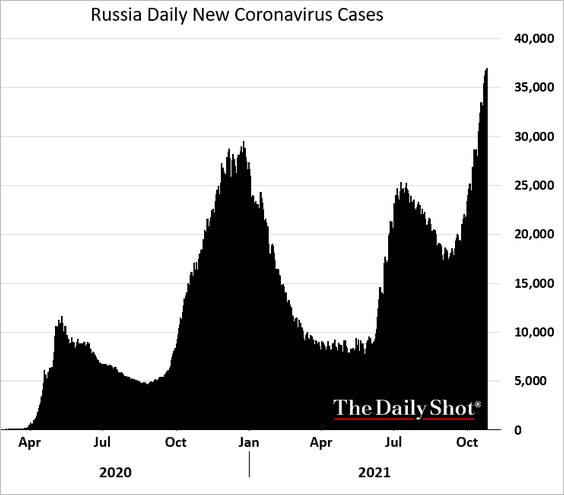

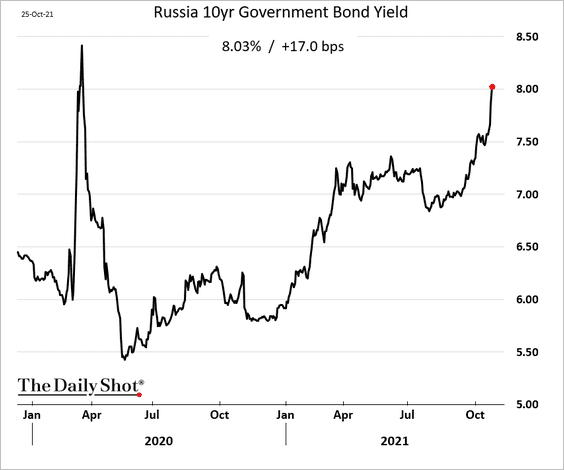

2. Russia’s COVID cases hit a record high.

Source: Reuters Read full article

Source: Reuters Read full article

The 10yr bond yield is now above 8%.

——————–

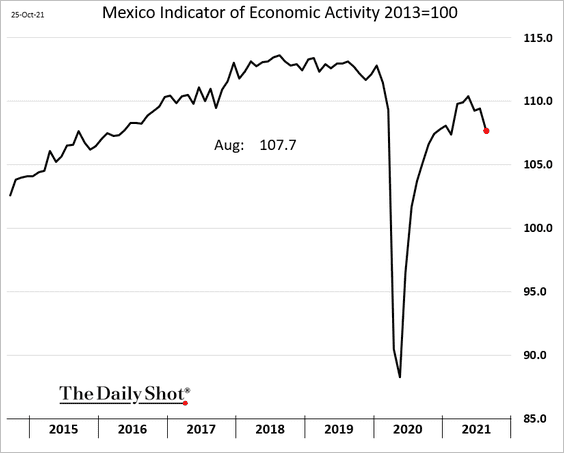

3. Mexico’s economic activity deteriorated in August.

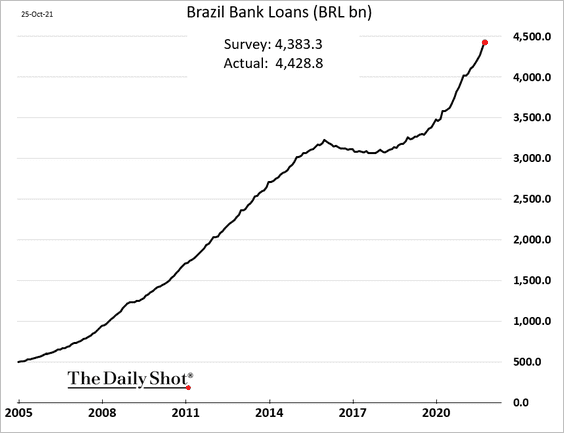

4. Brazil’s loan growth remains robust.

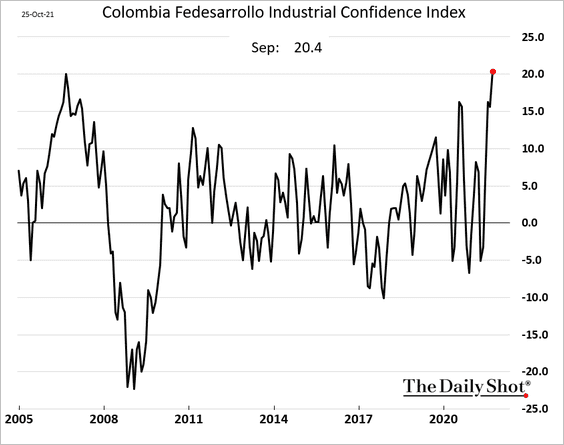

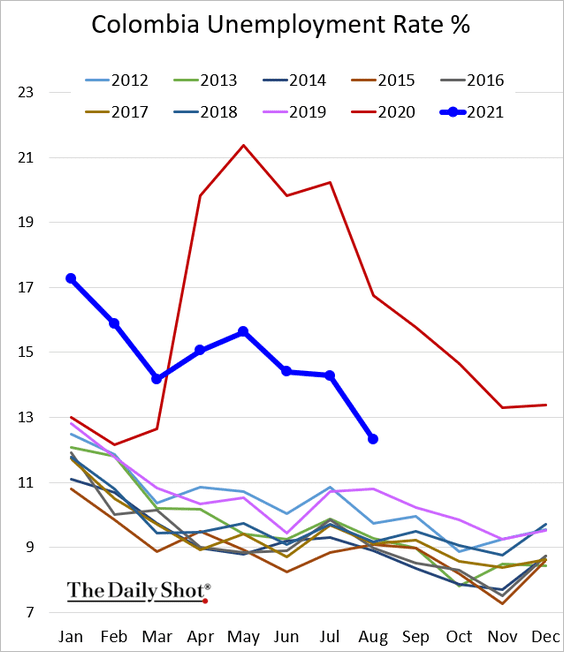

5. Colombia’s industrial confidence is surging.

The nation’s unemployment rate is still elevated.

——————–

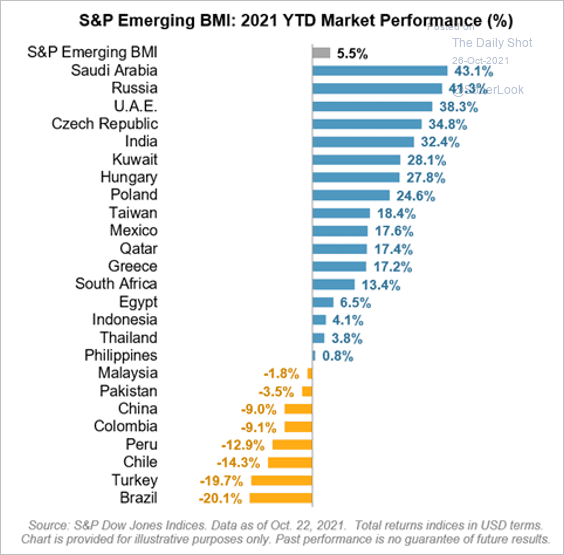

6. This chart shows year-to-date equity performance across emerging markets.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

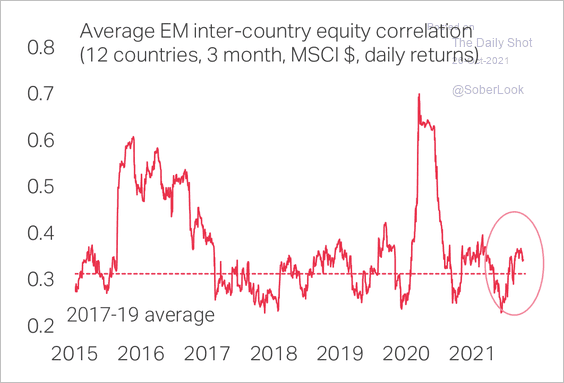

• Correlations among EM equities are starting to rise.

Source: TS Lombard

Source: TS Lombard

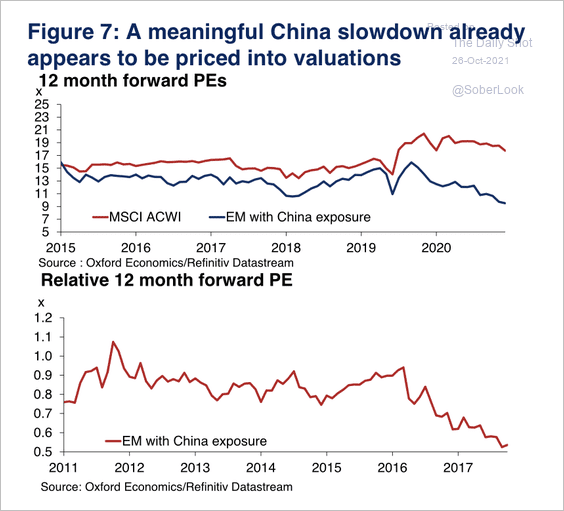

• Valuation multiples of China-exposed EM companies have deteriorated sharply.

Source: Oxford Economics

Source: Oxford Economics

——————–

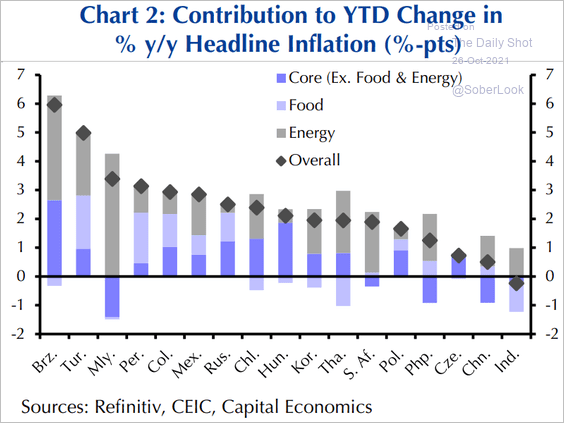

7. What are the drivers of inflation in emerging markets?

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

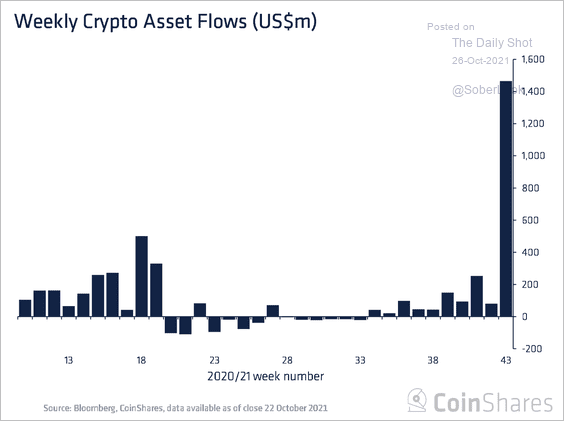

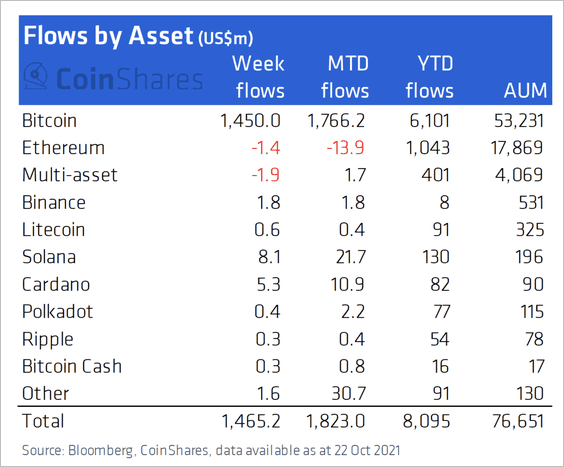

1. Crypto funds saw a record $1.5 billion in inflows last week, fueled by the crypto rally and the launch of the ProShares Bitcoin Strategy ETF.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin-focused funds accounted for most of the inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

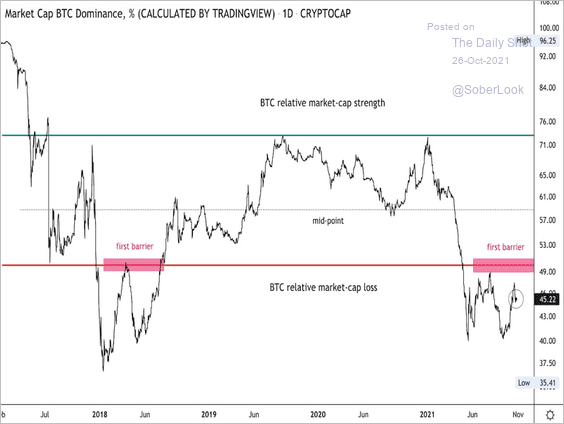

2. Bitcoin’s market share relative to the total crypto market declined to 45% last week as altcoins outperformed. A similar situation occurred in the “bear trap” of 2018.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

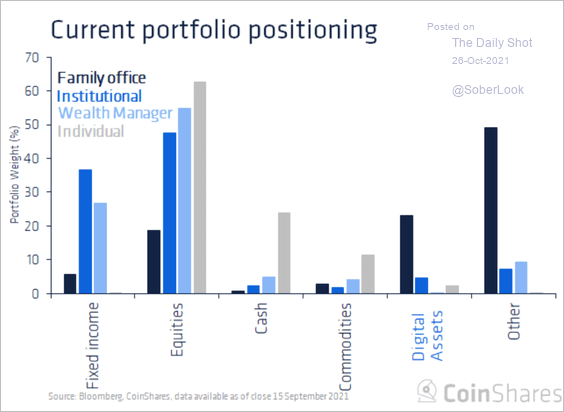

3. Family offices like digital assets.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

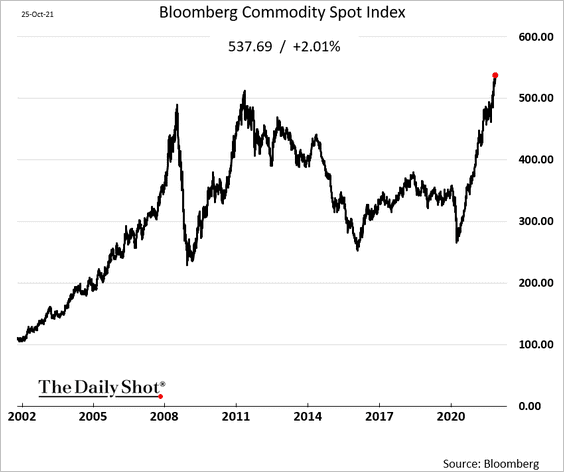

Commodities

1. Bloomberg’s broad commodity index hit a record high.

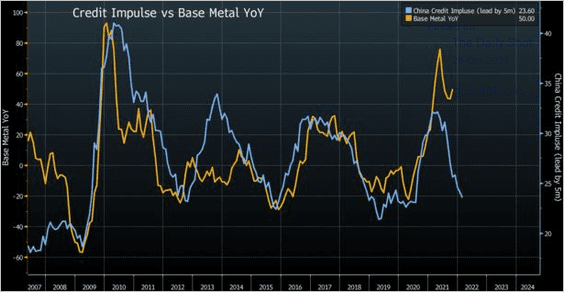

2. China’s slowing economy could put downward pressure on industrial metals.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

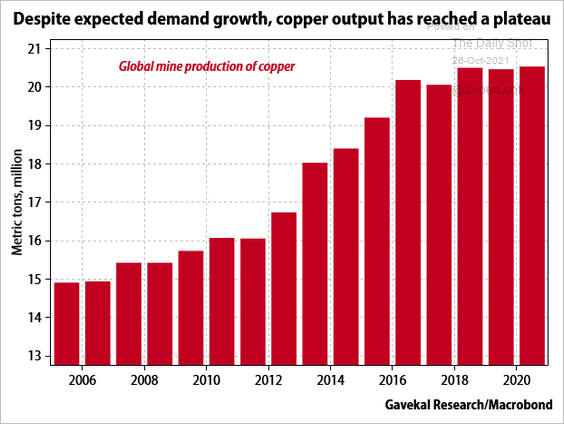

3. Copper output has been flat in recent years.

Source: Gavekal Research

Source: Gavekal Research

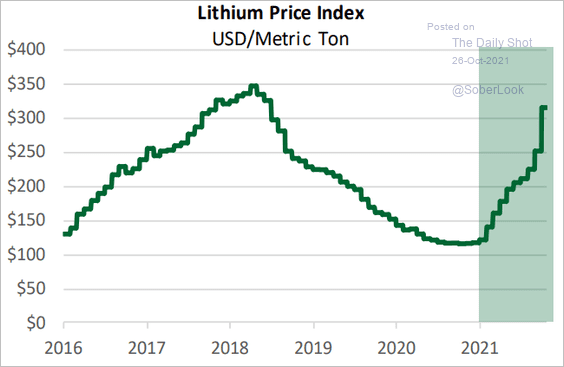

4. Lithium prices surged this year.

Source: Cornerstone Macro

Source: Cornerstone Macro

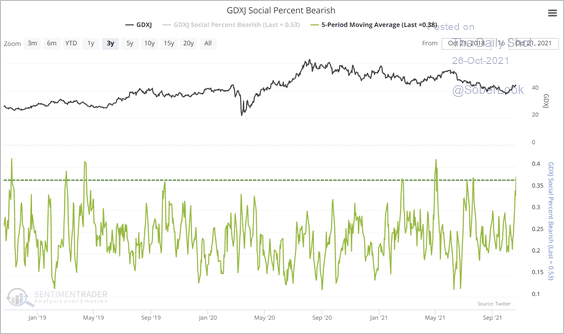

5. 38% of tweets about small-cap gold mining stocks had a negative tone over the past week, among the highest levels in three years.

Source: SentimenTrader

Source: SentimenTrader

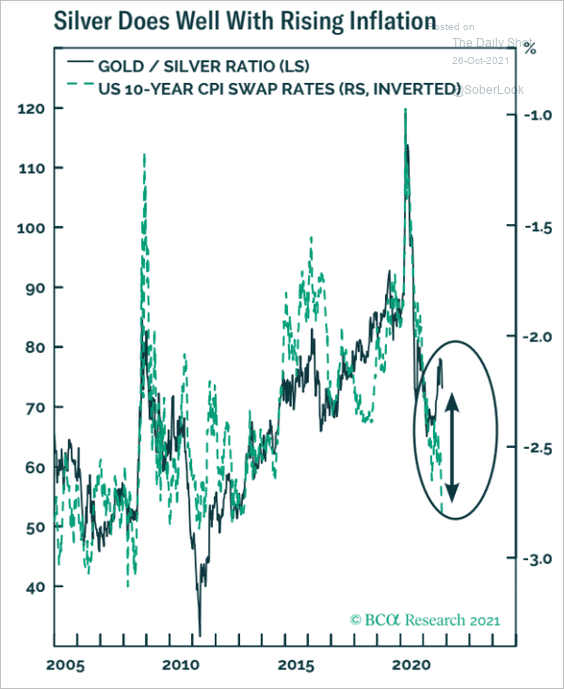

6. Will strong inflation result in silver outperforming in the months ahead?

Source: BCA Research

Source: BCA Research

Back to Index

Energy

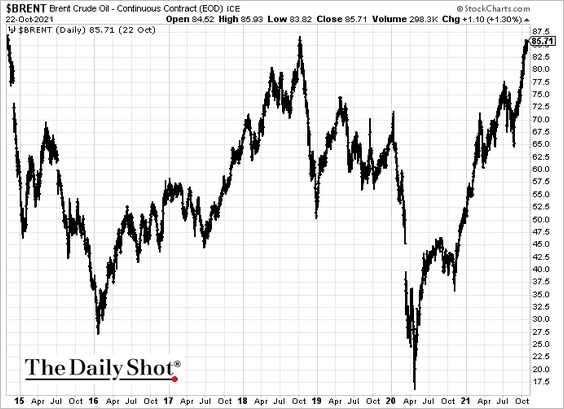

1. Brent crude is nearing the 2018 highs.

2. Backwardation in WTI is surging.

Source: @HFI_Research

Source: @HFI_Research

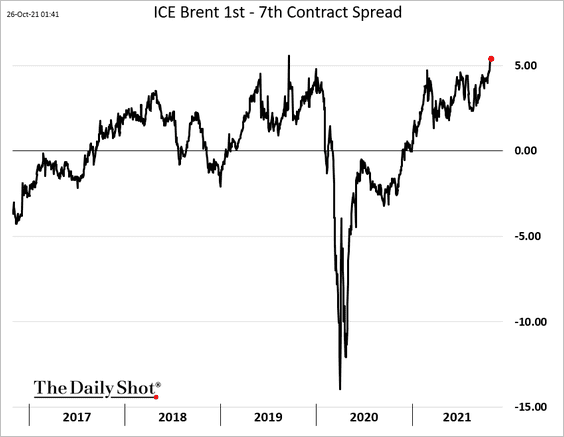

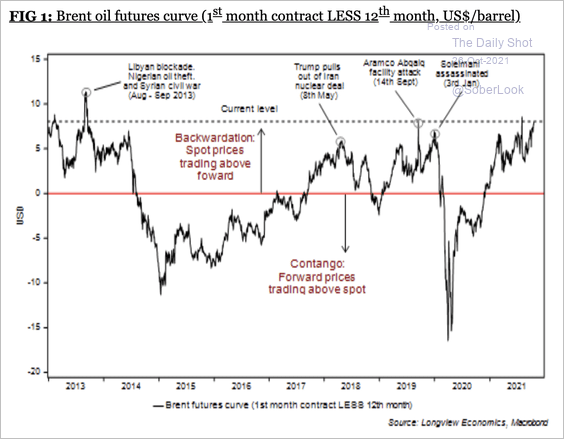

The backwardation in the Brent futures curve has returned to previous highs.

Moments of marked backwardation do not last long.

Source: Longview Economics

Source: Longview Economics

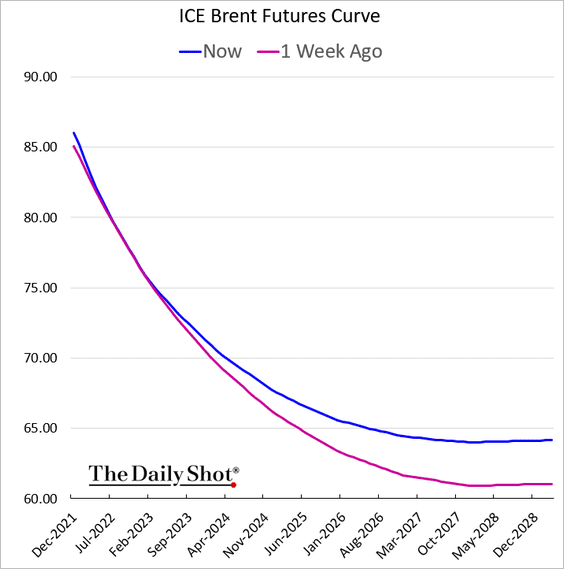

The long end of the curve has risen sharply in recent days.

——————–

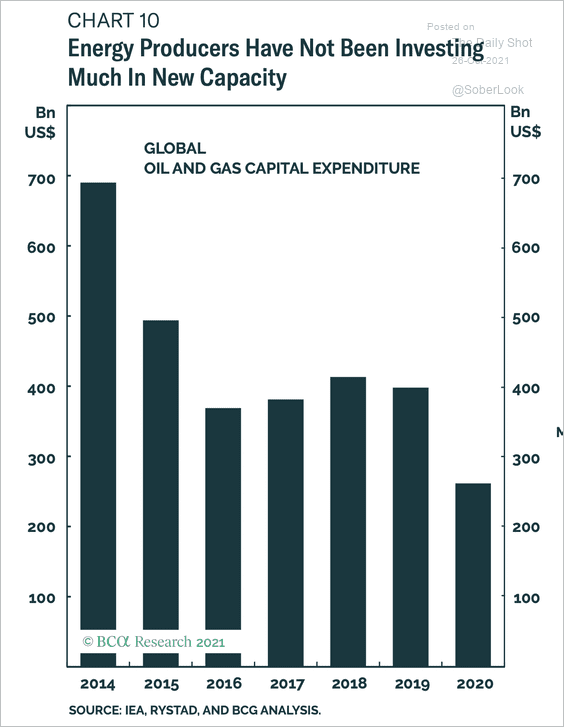

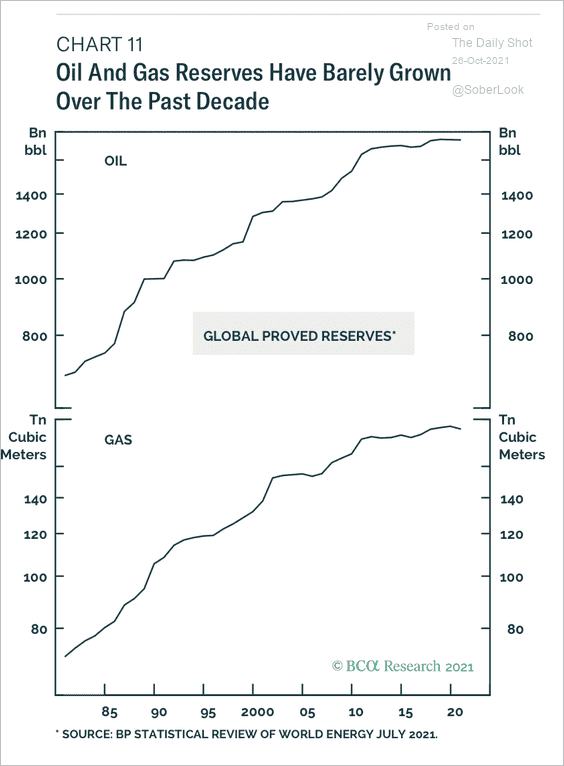

3. Global energy producers have cut back capital expenditure drastically since 2014.

Source: BCA Research

Source: BCA Research

Growth in reserves has slowed.

Source: BCA Research

Source: BCA Research

——————–

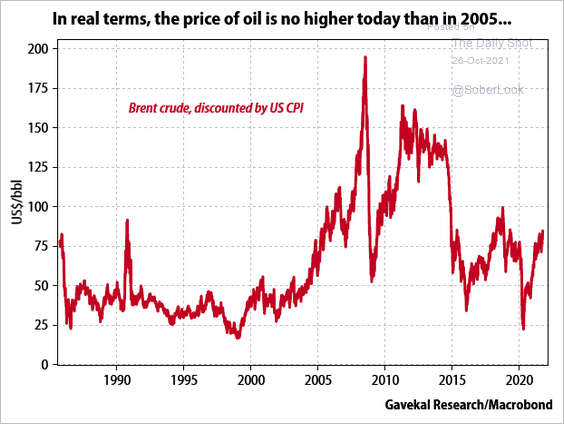

4. Oil prices are below 2005 levels in real terms.

Source: Gavekal Research

Source: Gavekal Research

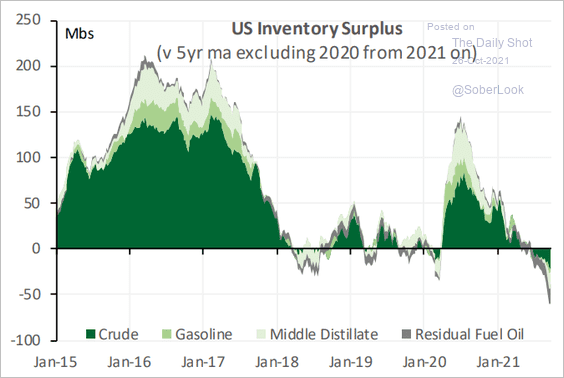

5. US inventories of crude oil and refined products are now well below the 5yr moving average.

Source: Cornerstone Macro

Source: Cornerstone Macro

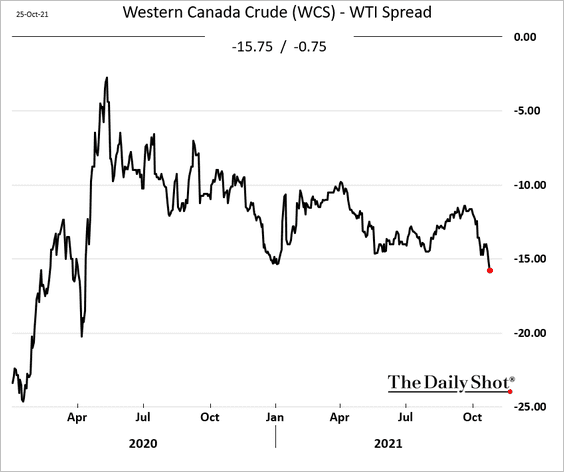

6. Western Canada’s heavy crude discount to WTI is widening again.

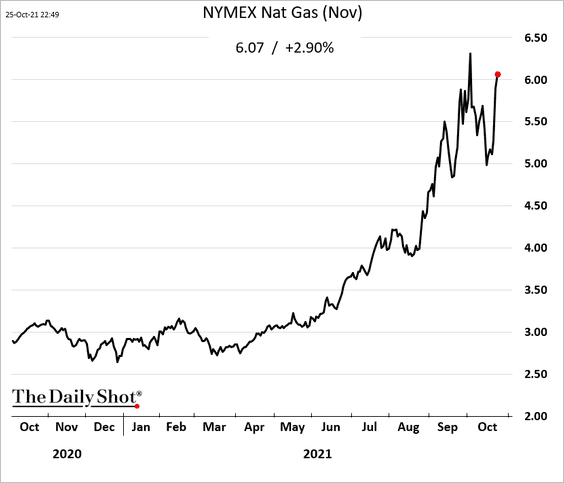

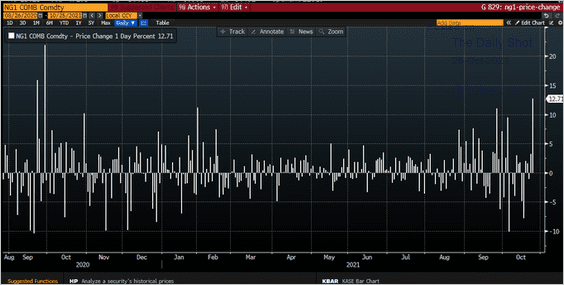

7. US natural gas prices jumped 12% on Monday.

Source: @sjcasey, @gersonjr Read full article

Source: @sjcasey, @gersonjr Read full article

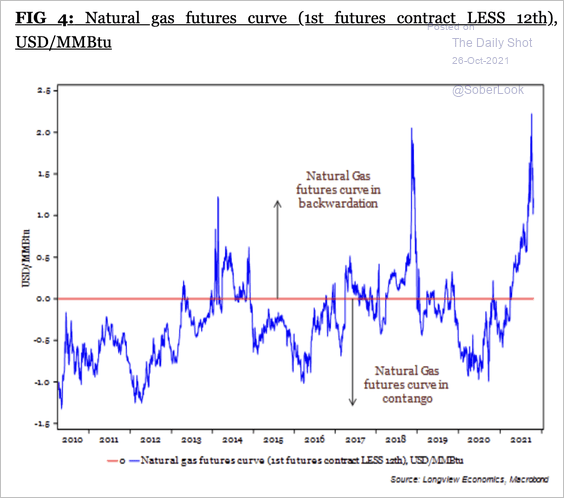

• The natural gas futures curve backwardation reached a prior extreme.

Source: Longview Economics

Source: Longview Economics

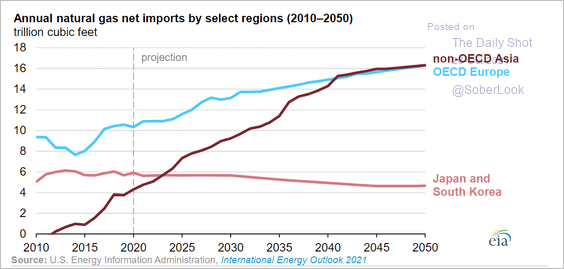

• This chart shows natural gas imports by region.

Source: EIA Read full article

Source: EIA Read full article

Back to Index

Equities

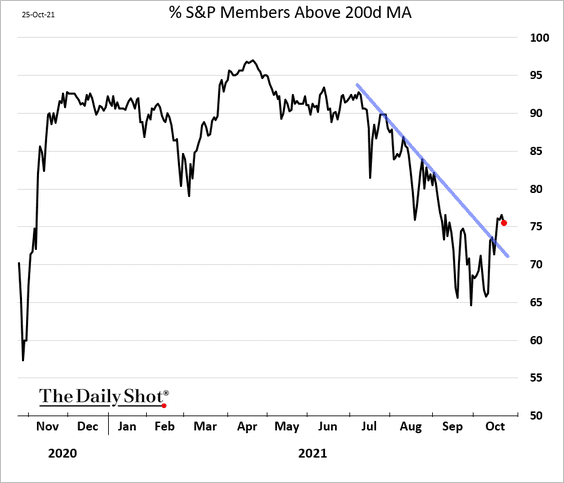

1. Stock market breadth has been improving as the S&P 500 hits record highs.

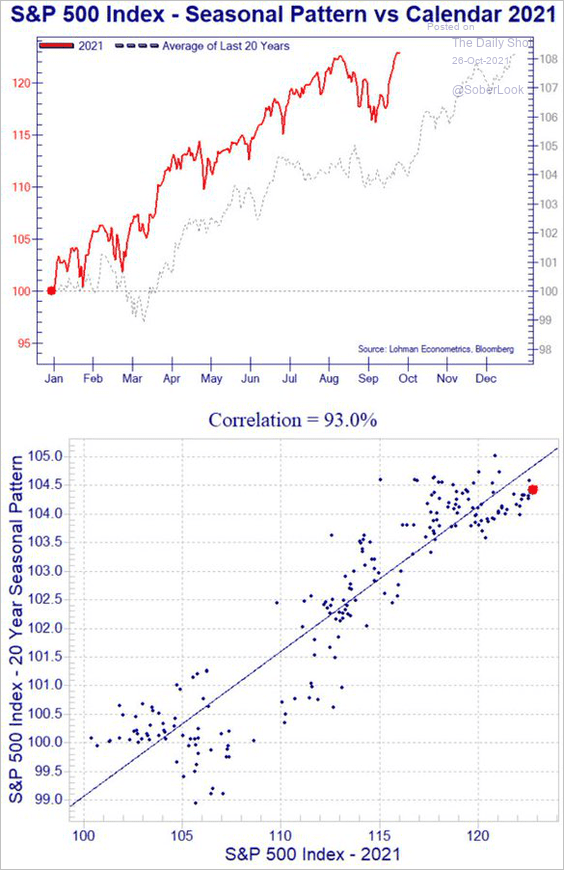

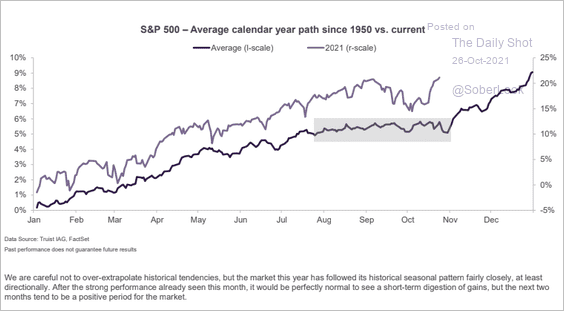

2. The market has been following its seasonal pattern this year.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

Source: Truist Advisory Services

Source: Truist Advisory Services

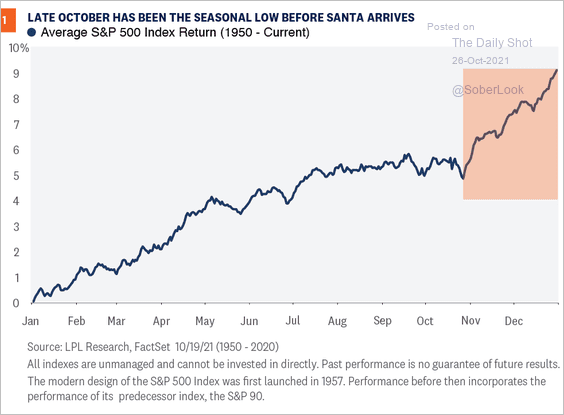

If the trend continues, we should see a Santa rally. Of course, Santa could bring the 2018 bag of coal if the debt ceiling impasse is not resolved next month.

Source: LPL Research

Source: LPL Research

——————–

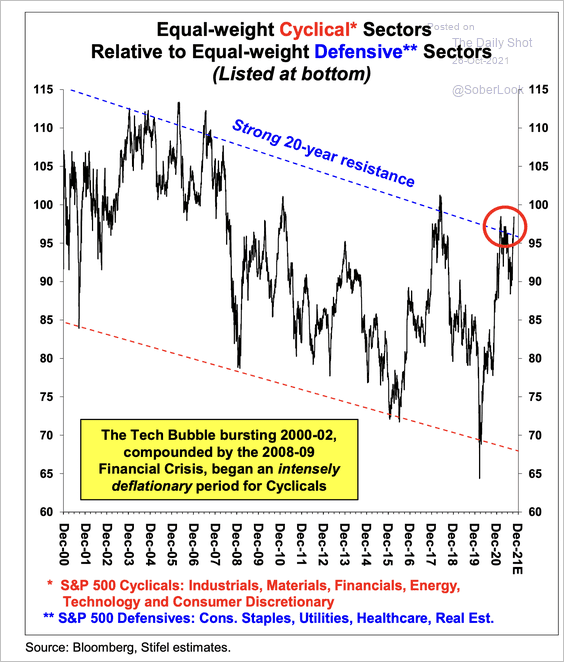

3. Equal weighted cyclicals vs. defensives ratio is hitting a 20-year resistance.

Source: Stifel

Source: Stifel

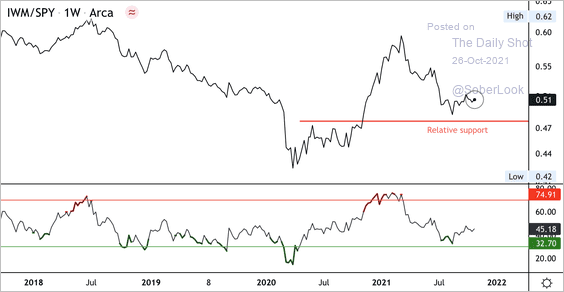

4. The Russell 2,000 small-cap ETF (IWM) is holding support relative to the S&P 500.

Source: Dantes Outlook

Source: Dantes Outlook

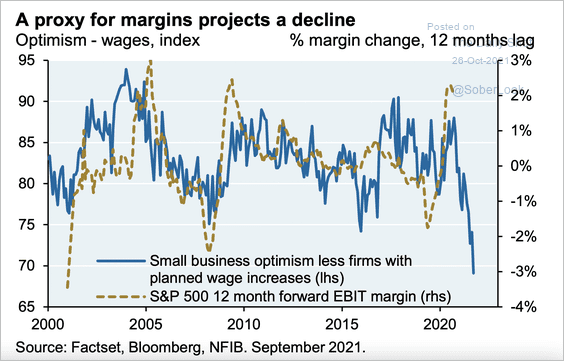

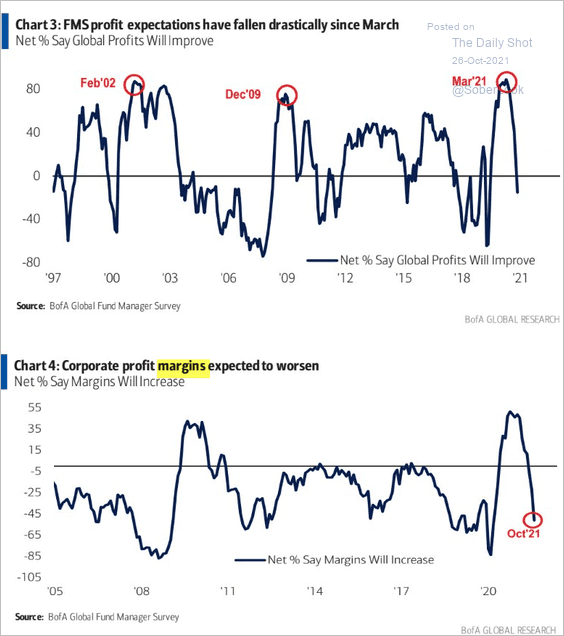

5. Small business survey data that compares optimism to wage increases is, most of the time, a good guide to where S&P 500 margins are heading.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Fund managers agree.

Source: BofA Global Research

Source: BofA Global Research

——————–

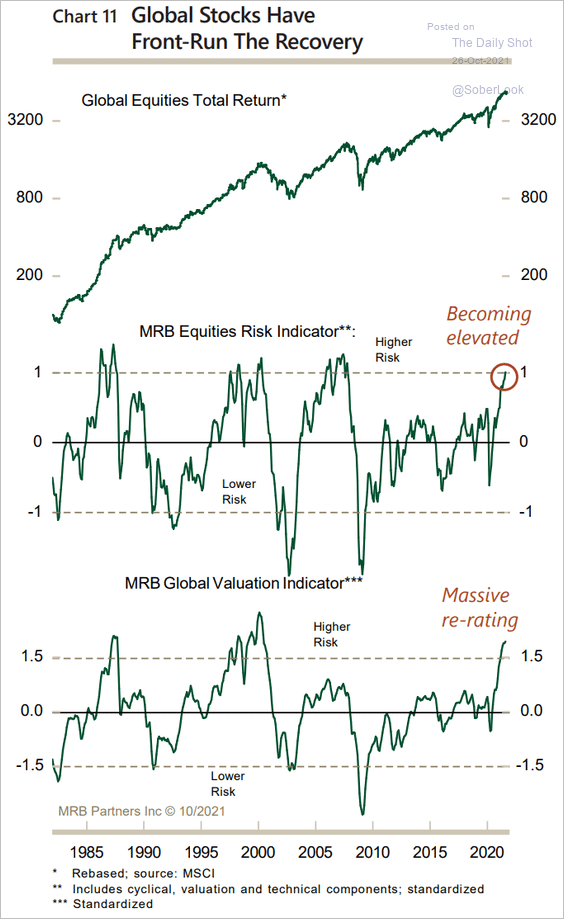

6. MRB’s risk and valuation indicators point to rising risks for global stocks.

Source: MRB Partners

Source: MRB Partners

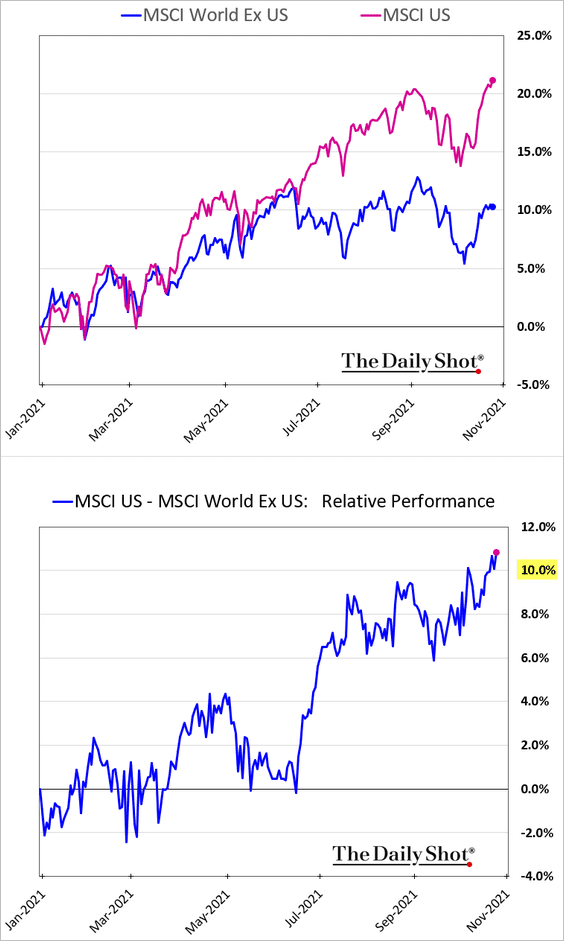

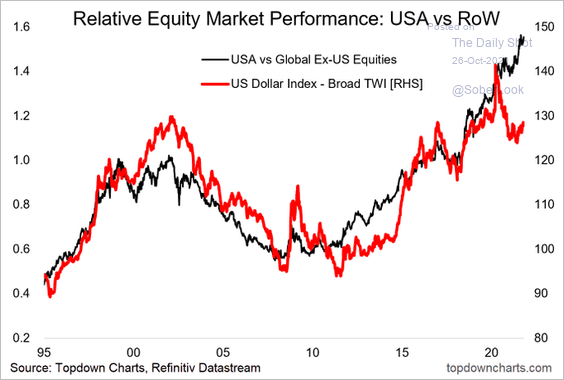

7. US stocks continue to widen their outperformance vs. the rest of the world.

The US relative performance has diverged from the dollar.

Source: @topdowncharts

Source: @topdowncharts

——————–

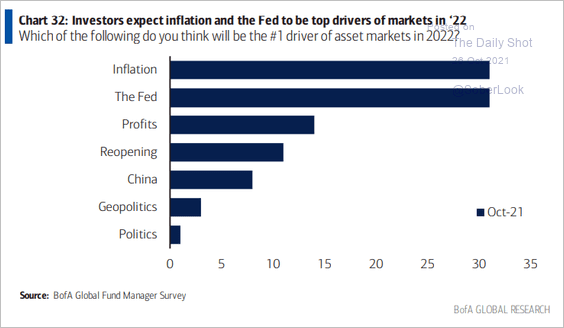

8. What will be the drivers of market performance next year?

Source: BofA Global Research; @MaverickBogdan

Source: BofA Global Research; @MaverickBogdan

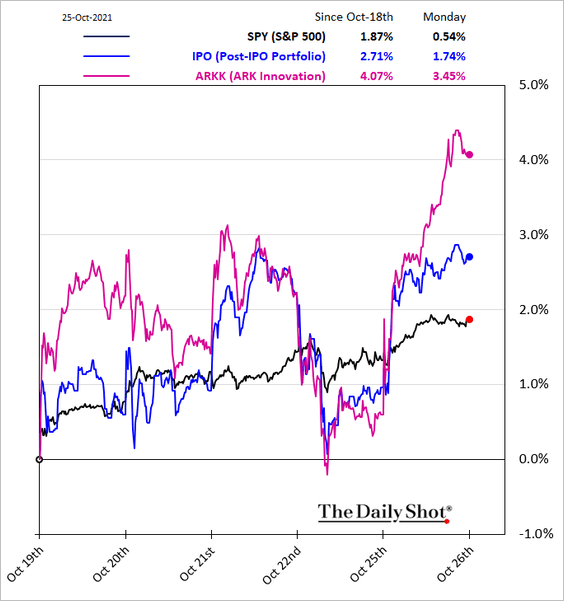

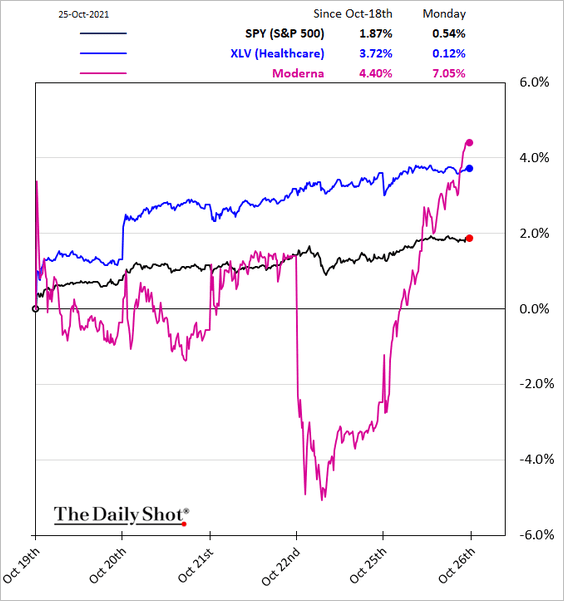

9. Speculative growth stocks surged on Monday.

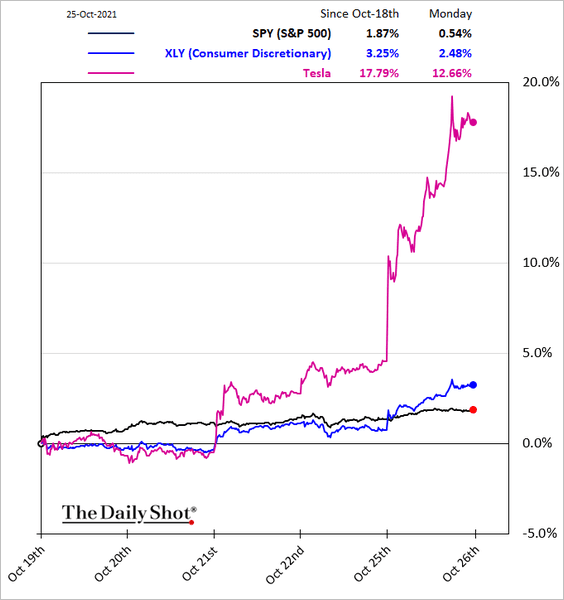

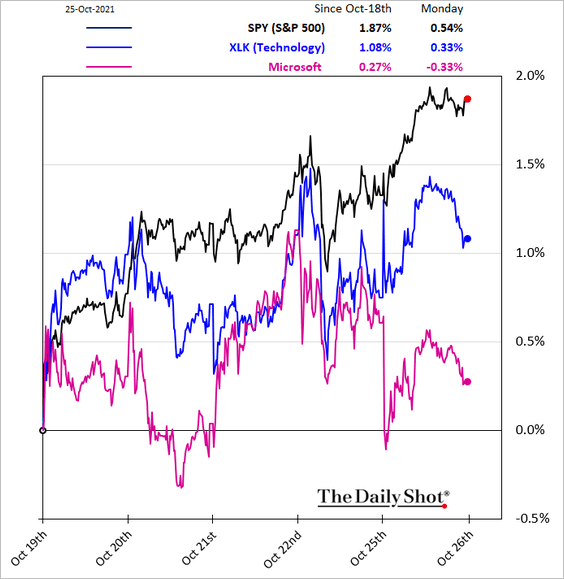

10. Next, we have some sector updates.

• Consumer Discretionary:

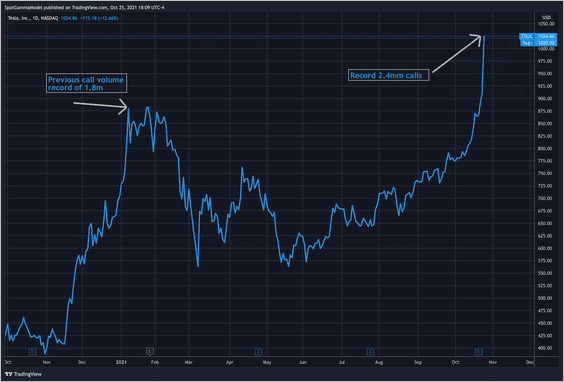

By the way, here is Tesla’s call option volume.

Source: @spotgamma, @elonmusk

Source: @spotgamma, @elonmusk

• Tech:

• Healthcare:

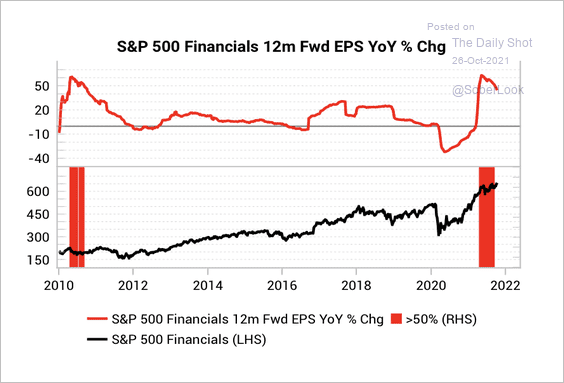

• S&P 500 financial sector forward earnings have grown extremely fast, which suggests a lot of good news is now priced in.

Source: Variant Perception

Source: Variant Perception

Back to Index

Credit

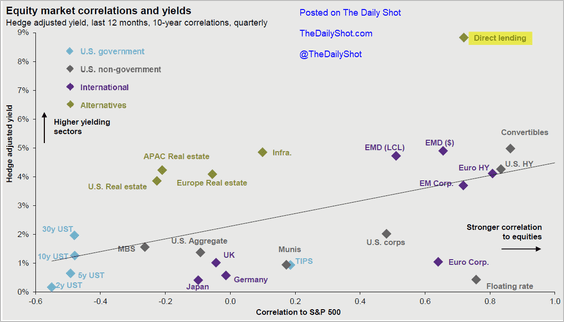

1. Direct lending risk/return profile remains attractive, attracting a great deal of capital.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

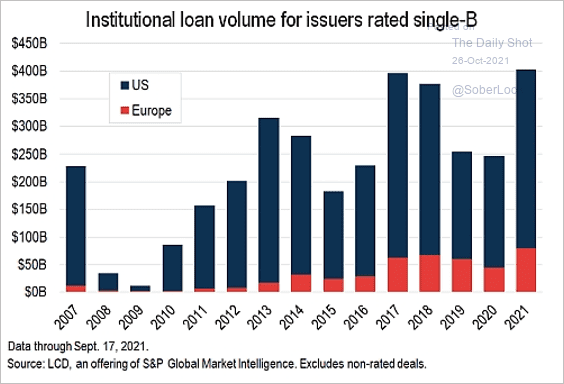

2. Single-B loan issuance hit a new high this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

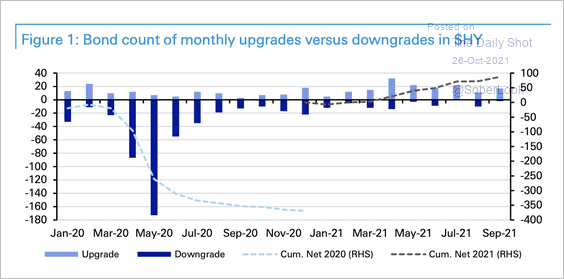

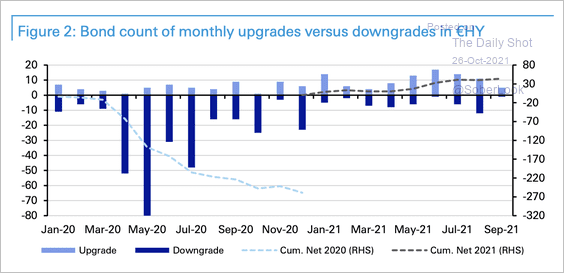

3. US and European high-yield upgrades have outnumbered downgrades this year (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

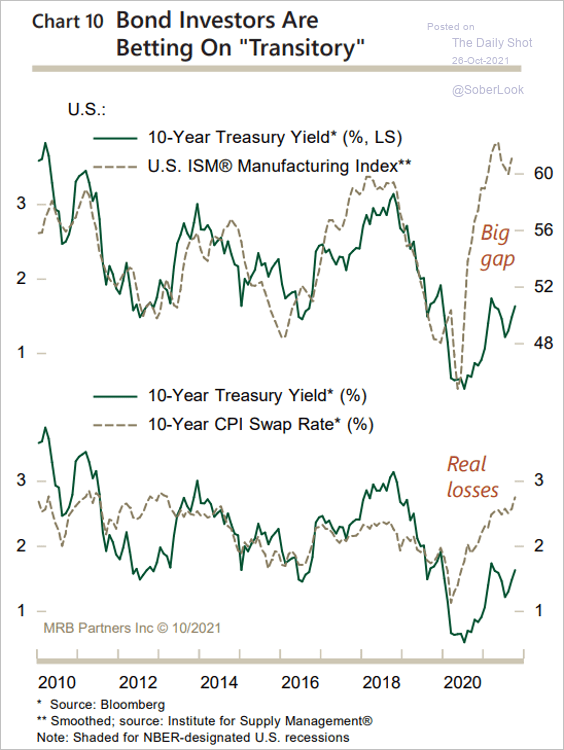

1. More losses ahead for Treasuries?

Source: MRB Partners

Source: MRB Partners

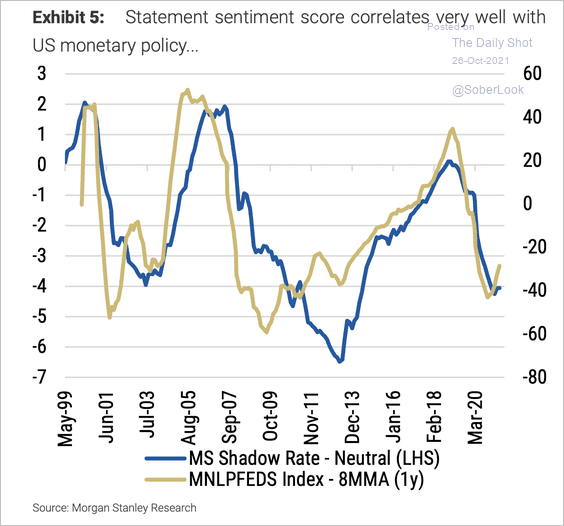

2. Morgan Stanley used machine learning to parse Fed statements and compile a composite score that correlates very well with monetary policy with a one-year lead.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

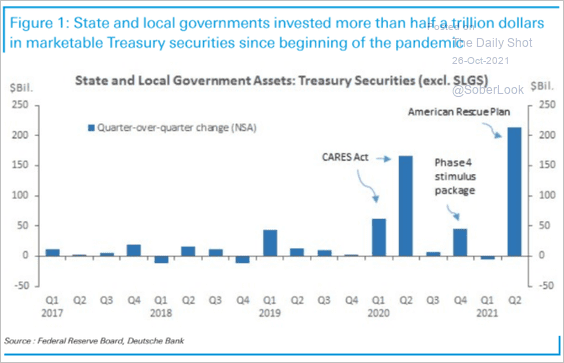

3. State governments have been buying massive amounts of Treasury debt.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

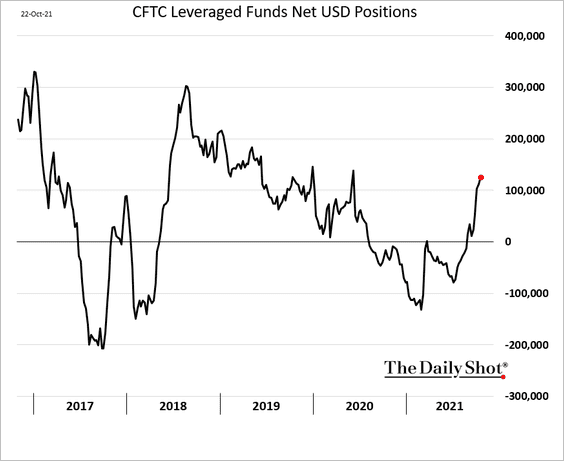

1. Hedge funds remain long the US dollar.

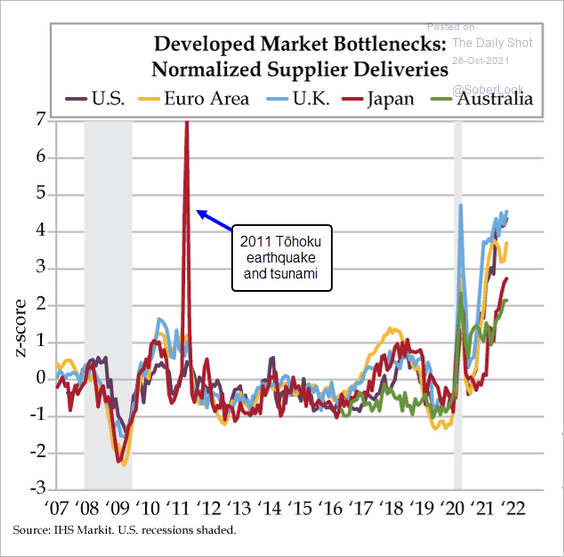

2. Supply bottlenecks remain a global challenge.

Source: The Daily Feather

Source: The Daily Feather

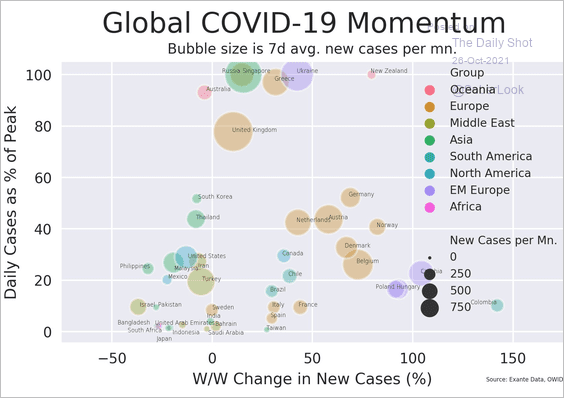

3. Here is a look at COVID “momentum.”

Source: @jnordvig, @Exa

Source: @jnordvig, @Exa

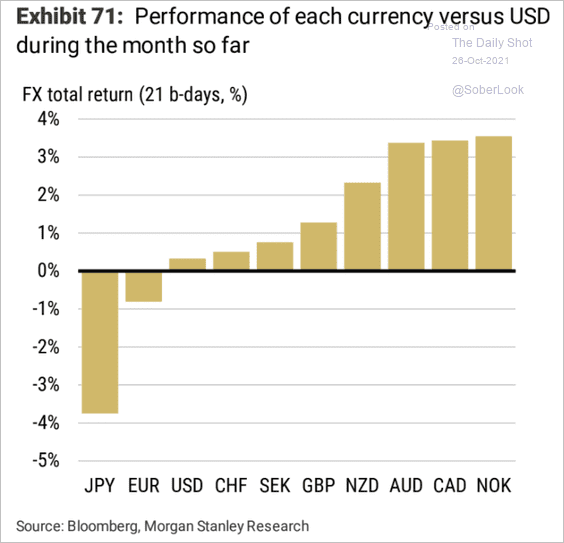

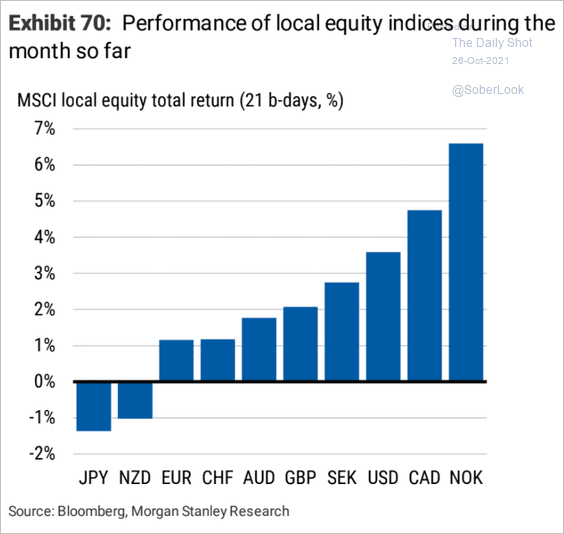

4. Next, we have month-to-date currency and equity performance for advanced economies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

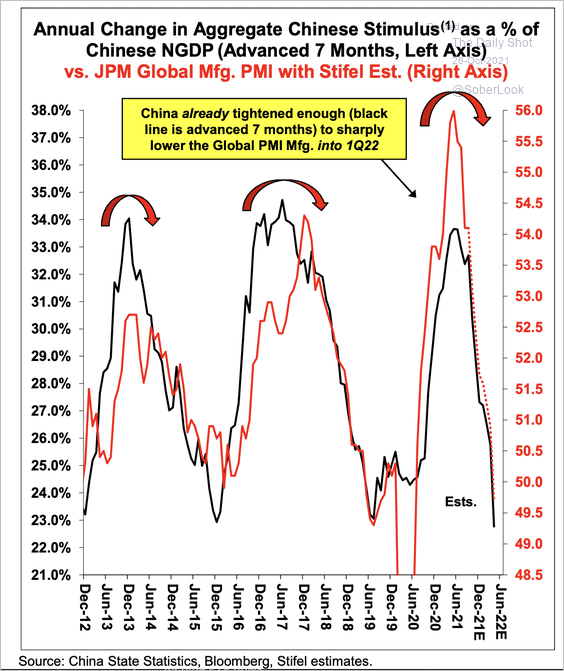

5. Chinese stimulus is fading and is likely to take down global PMIs with it. Stifel estimates this dynamic could take PMI below 50 by the first half of next year.

Source: Stifel

Source: Stifel

——————–

Food for Thought

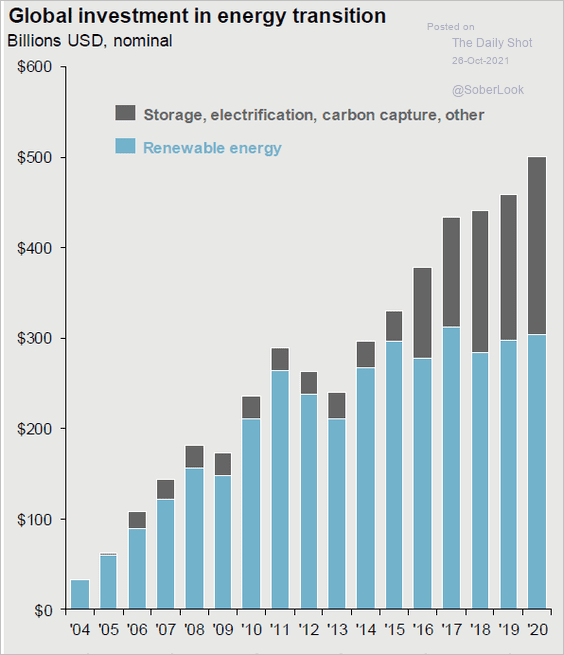

1. Investments in energy transition:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

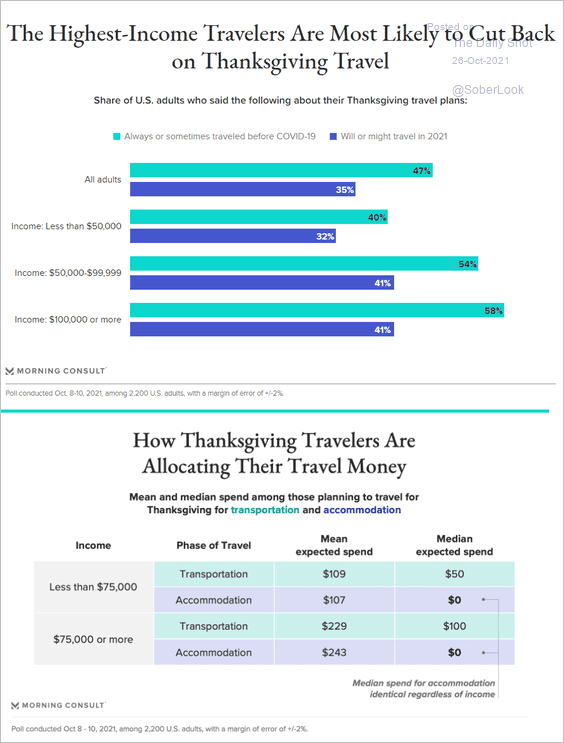

2. Cutting back on Thanksgiving travel:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

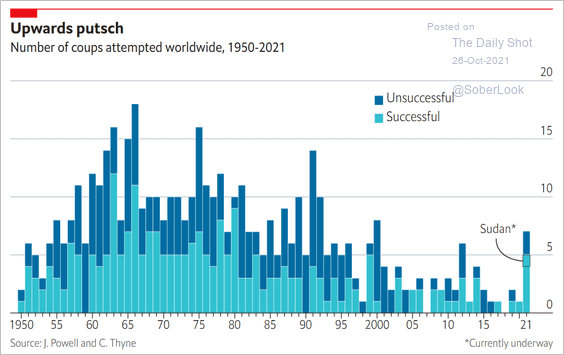

3. Coups attempted since 1950:

Source: The Economist Read full article

Source: The Economist Read full article

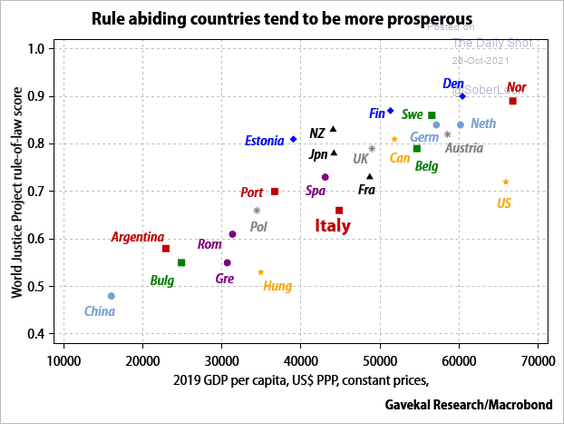

4. Rule-of-law score vs. GDP per capita:

Source: Gavekal Research

Source: Gavekal Research

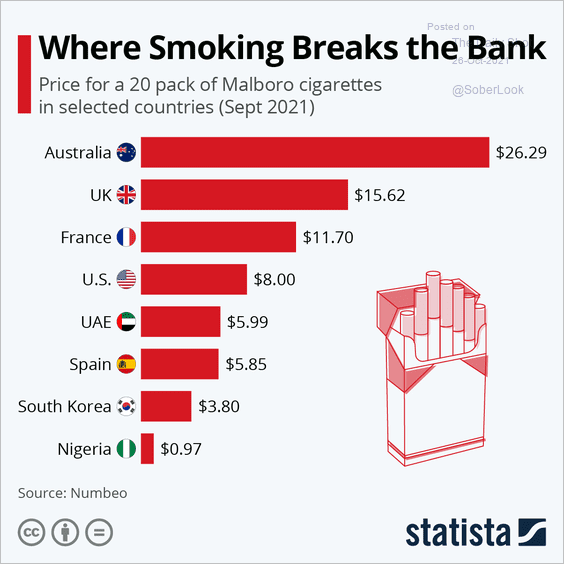

5. Cigarette costs around the world:

Source: Statista

Source: Statista

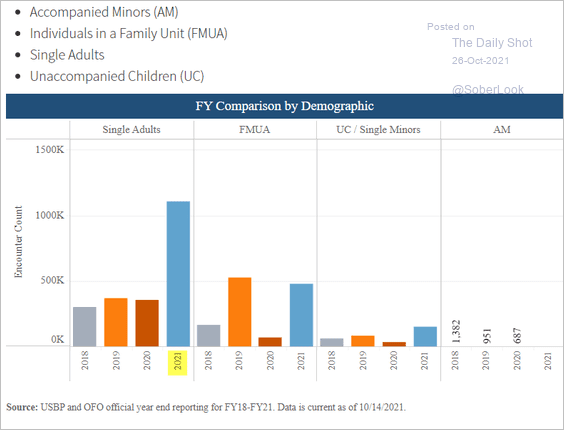

6. Southwest land border encounters:

Source: CBP

Source: CBP

7. Semiconductor sales by end market type:

![]() Source: CreditSights

Source: CreditSights

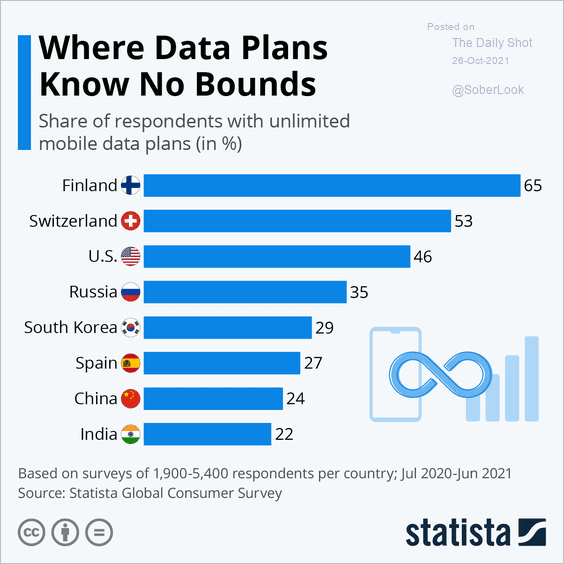

8. Unlimited mobile data plans:

Source: Statista

Source: Statista

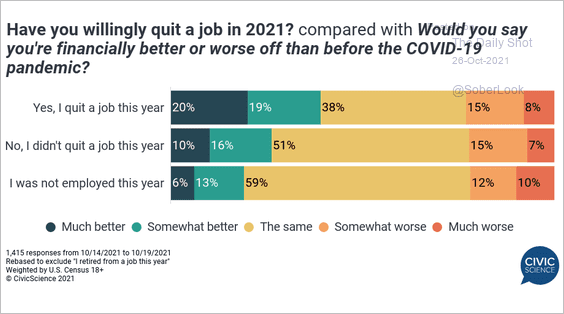

9. Are you financially better off?

Source: @CivicScience

Source: @CivicScience

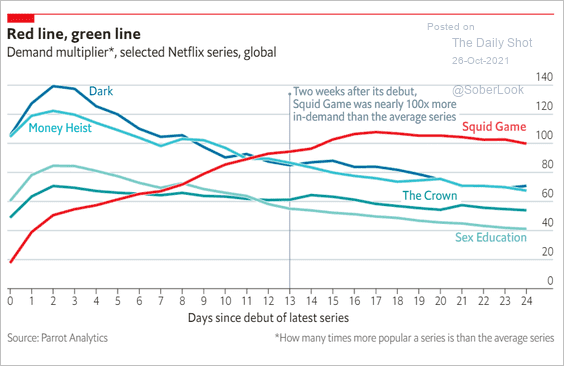

10. Popularity of select Netflix series:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index