The Daily Shot: 02-Nov-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

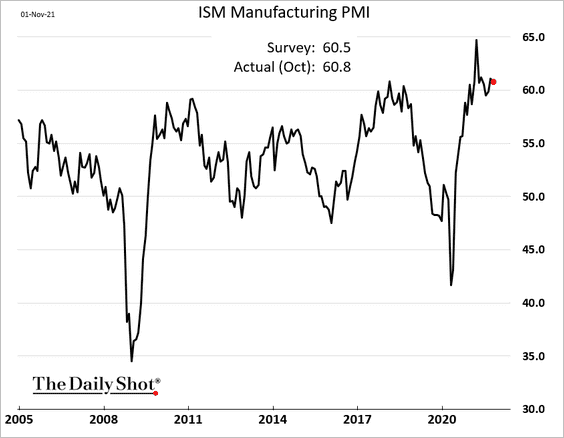

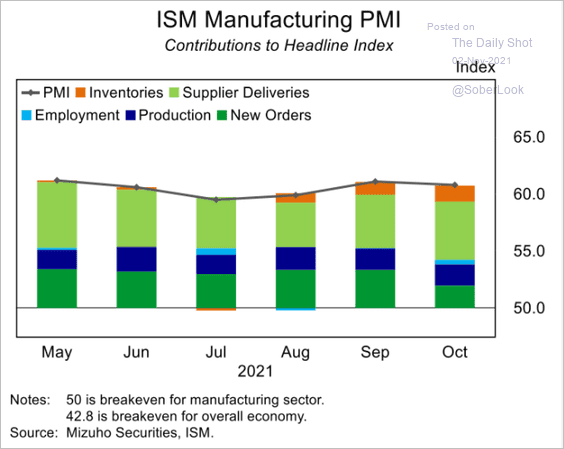

1. The ISM Manufacturing PMI was roughly in line with expectations, indicating brisk factory activity in October.

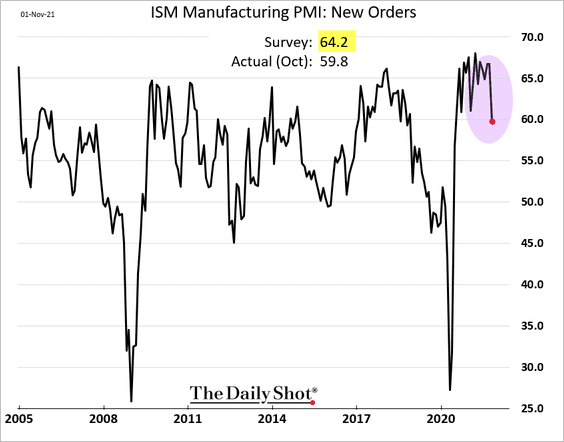

However, growth in new orders slowed sharply, with some customers frustrated by shortages and delays.

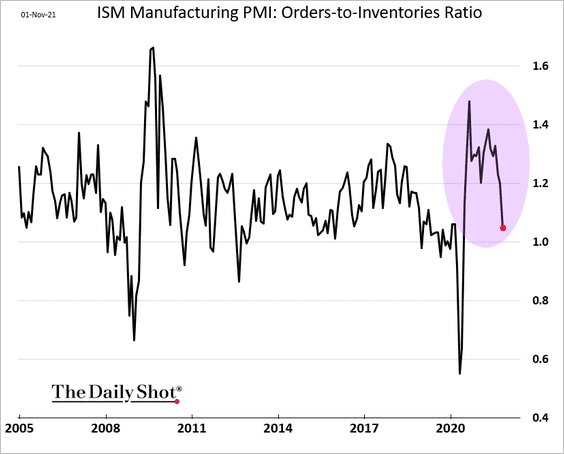

Here is the orders-to-inventories ratio.

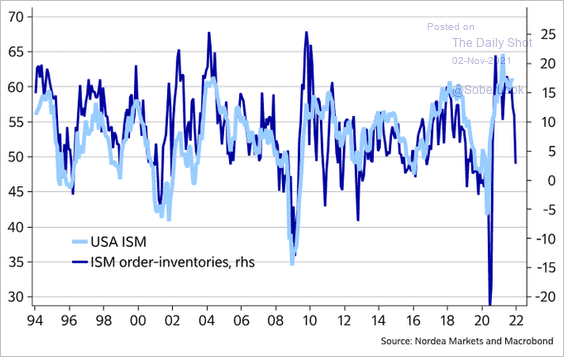

This slowdown in orders points to softer production ahead.

Source: @MikaelSarwe

Source: @MikaelSarwe

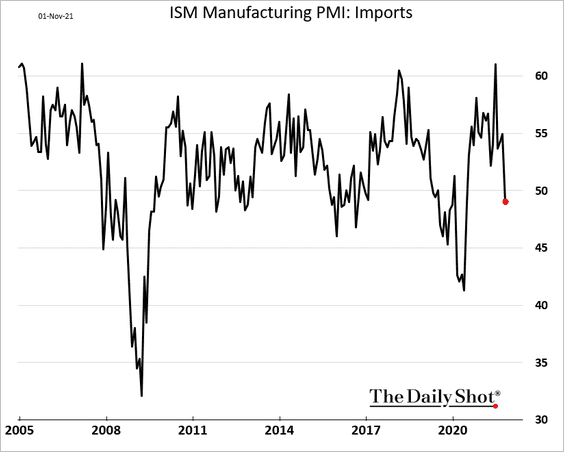

• Imports declined due to shipping delays.

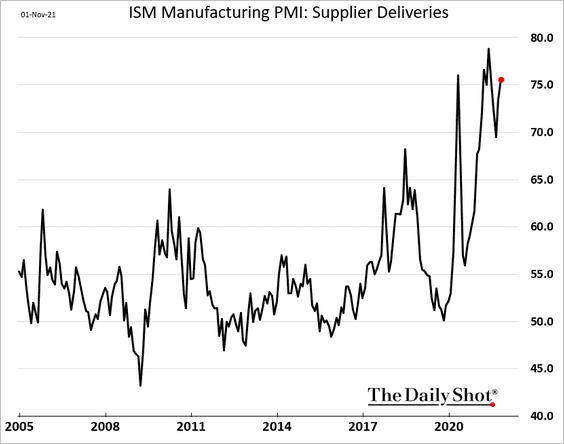

• Supplier delivery times remain near extremes.

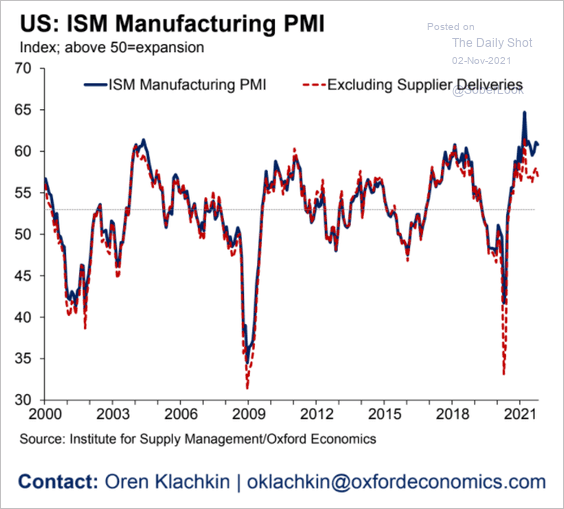

By the way, supplier issues have been distorting the ISM index to the upside.

Source: Oxford Economics

Source: Oxford Economics

Source: Mizuho Securities USA

Source: Mizuho Securities USA

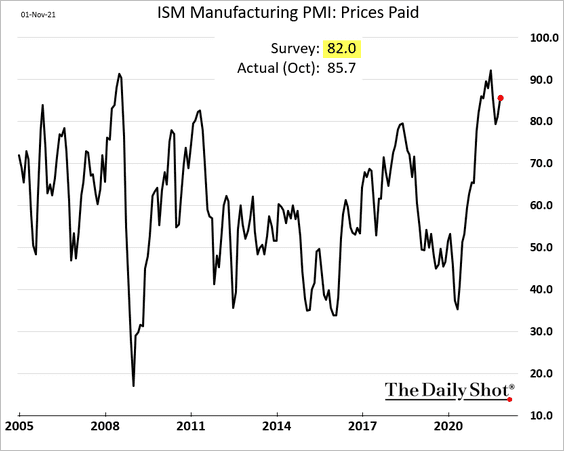

• The ‘prices paid’ index topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

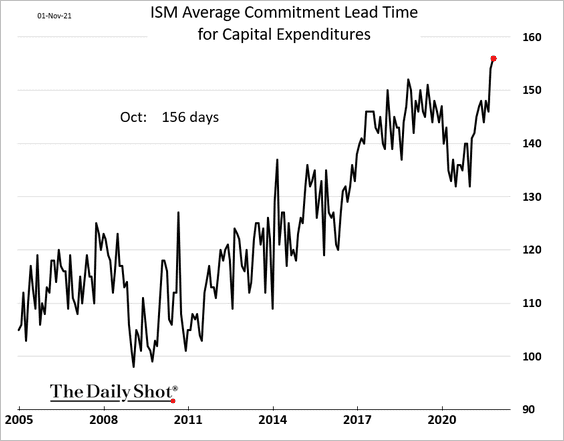

• CapEx commitment lead times hit a record high.

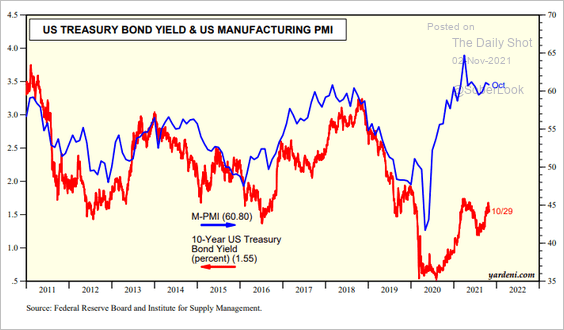

• The ISM index has diverged from Treasury yields.

Source: Yardeni Research

Source: Yardeni Research

——————–

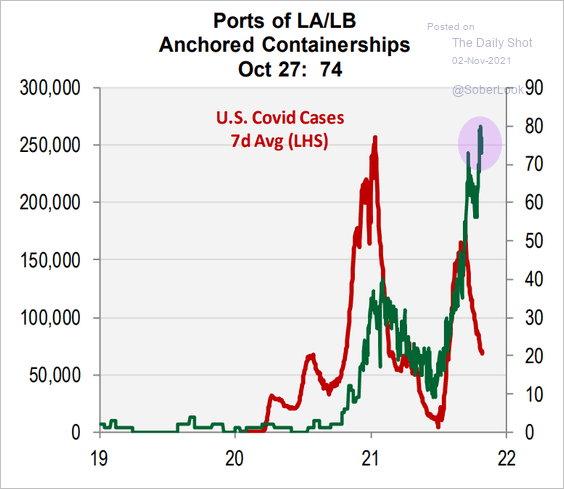

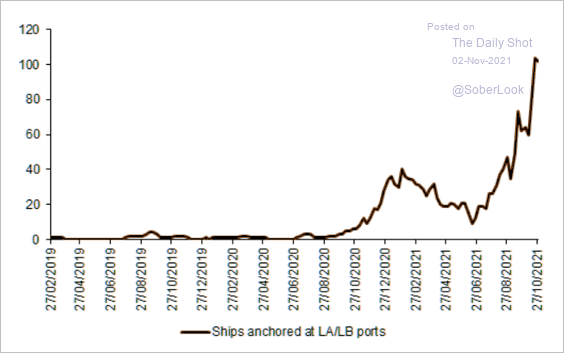

2. West Coast port metrics continue to show clogged supply chains.

Source: Cornerstone Macro

Source: Cornerstone Macro

Source: @themarketear

Source: @themarketear

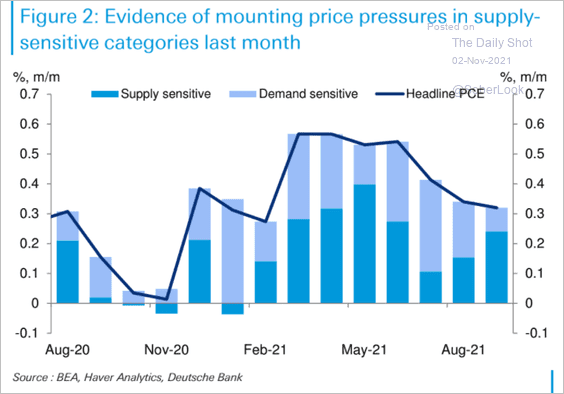

Supply-sensitive products have been a significant contributor to inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

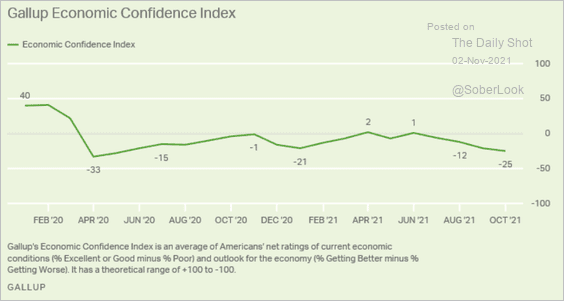

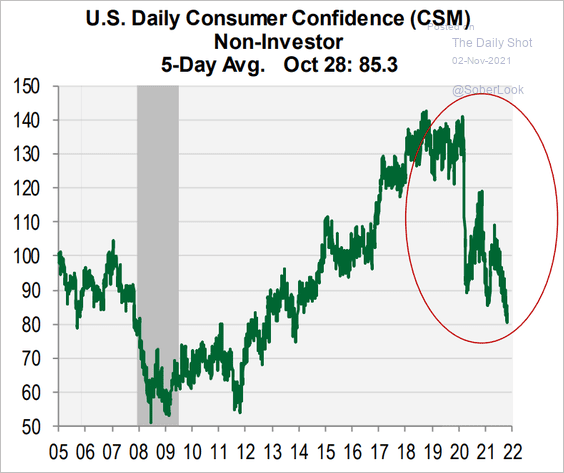

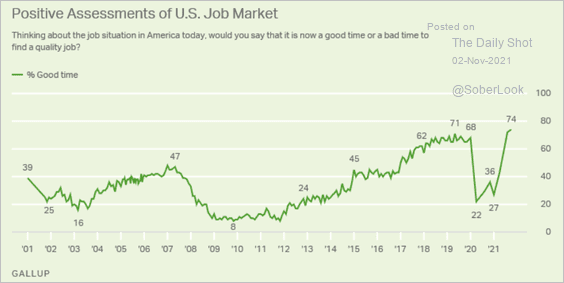

3. Consumer confidence has been deteriorating.

Source: Gallup Read full article

Source: Gallup Read full article

Source: Cornerstone Macro

Source: Cornerstone Macro

But households are concerned about inflation, not jobs.

Source: Gallup Read full article

Source: Gallup Read full article

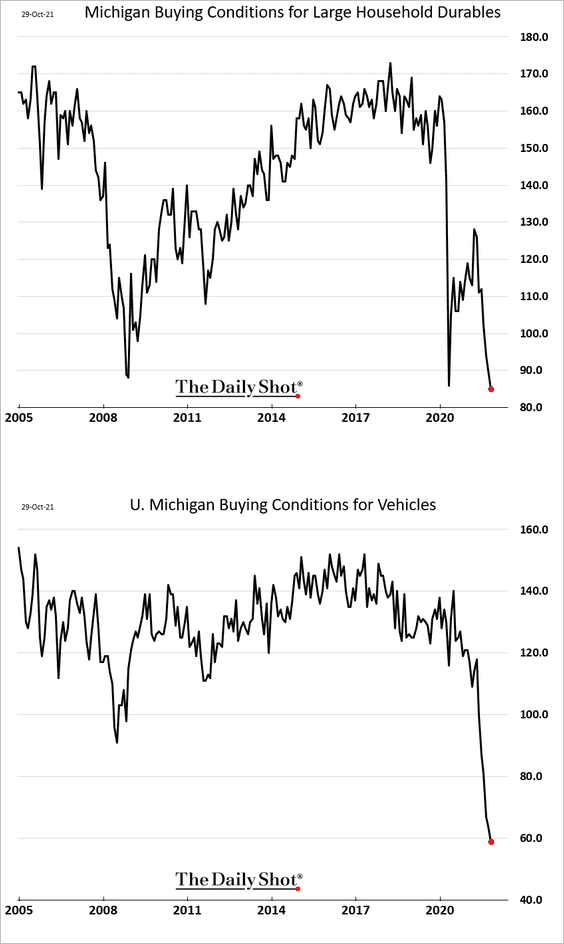

Buying conditions for durables and vehicles have deteriorated further in October due to prices gains.

——————–

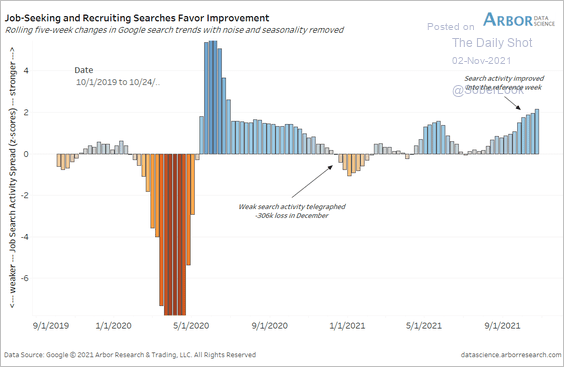

4. Online job-seeking activity has improved.

Source: @benbreitholtz

Source: @benbreitholtz

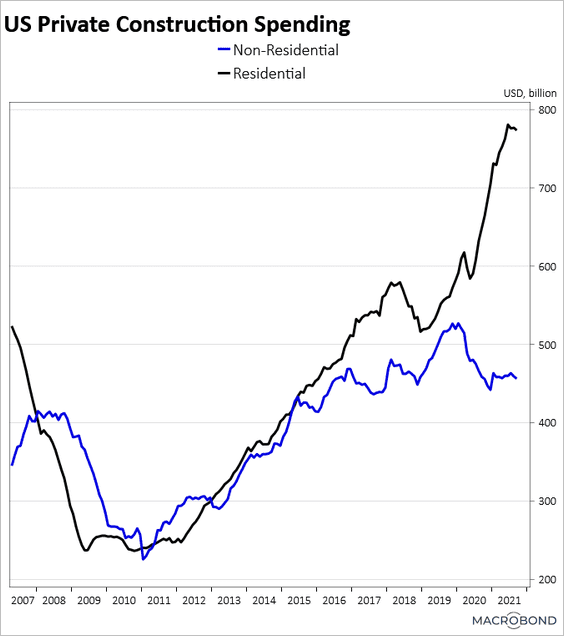

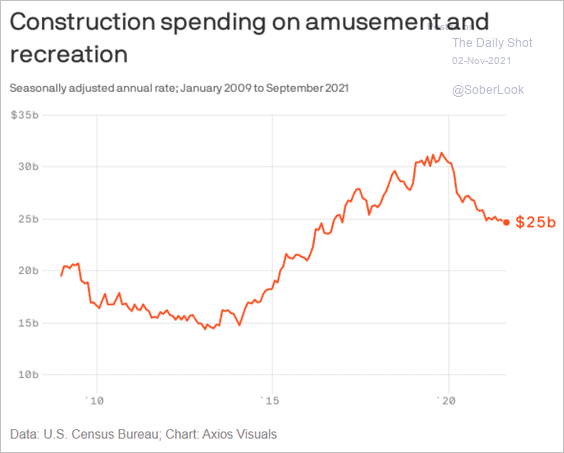

5. Residential and non-residential construction spending trends have diverged sharply.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Here is an example.

Source: @axios

Source: @axios

——————–

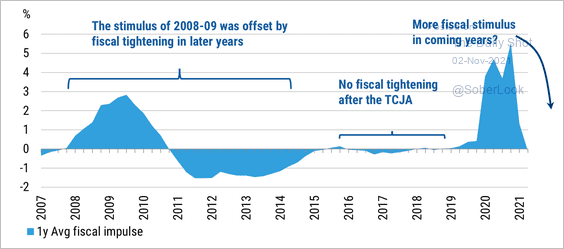

6. Below is a look at the fiscal impulse over the past 15 years. Will more stimulus come in the form of infrastructure packages?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

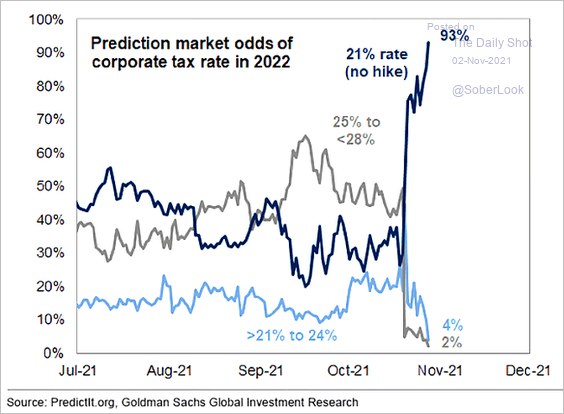

7. What are the betting markets telling us about a potential hike in corporate taxes?

Source: @ISABELNET_SA, @GoldmanSachs Read full article

Source: @ISABELNET_SA, @GoldmanSachs Read full article

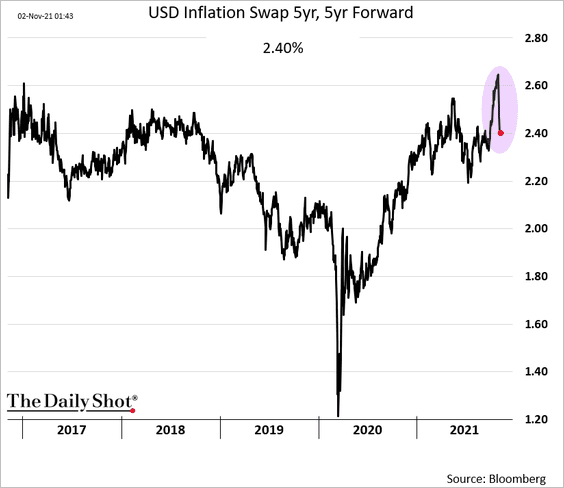

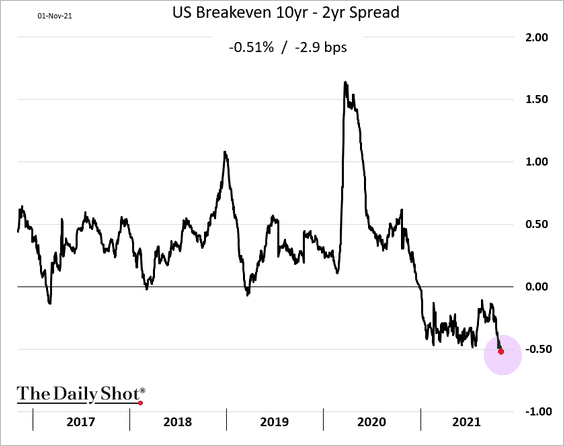

8. Long-term market-based inflation expectations tumbled. The market expects the Fed to be more aggressive in taming inflation.

Back to Index

Canada

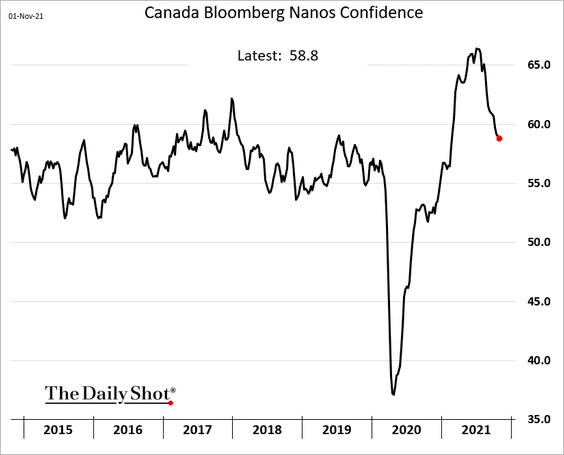

1. Consumer confidence continues to ease. Similar to the US, this trend is driven by price gains.

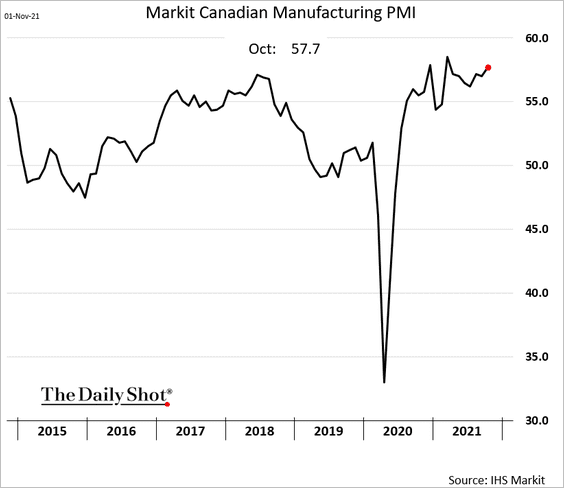

2. Canada’s manufacturing growth remains robust.

Back to Index

The United Kingdom

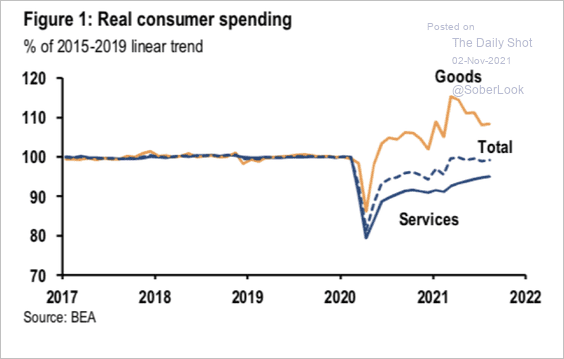

1. Real consumer spending is now back in line with the pre-pandemic average. Still, it will be a while before the service sector fully recovers.

Source: JP Morgan Research

Source: JP Morgan Research

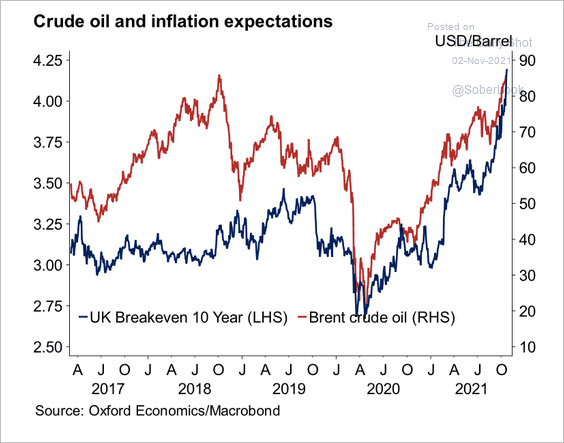

2. Commodity prices contributed to higher inflation expectations, but Oxford Economics expects this trend to weaken next year.

Source: Oxford Economics

Source: Oxford Economics

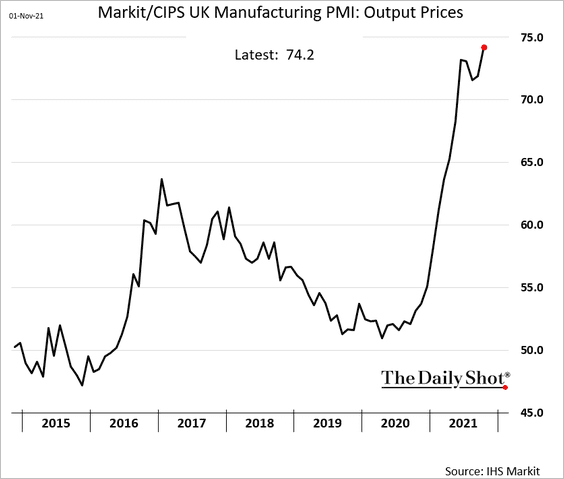

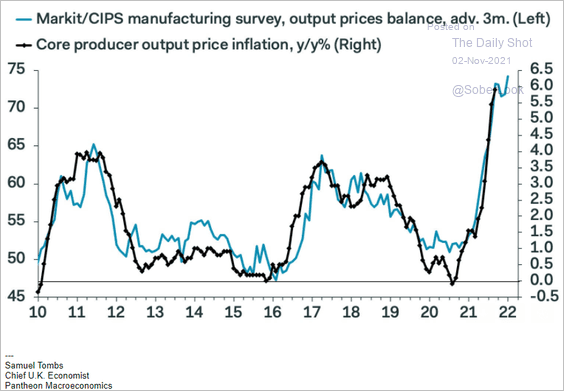

3. Factories are boosting prices at rates not seen before.

As a result, we could see further gains in the PPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

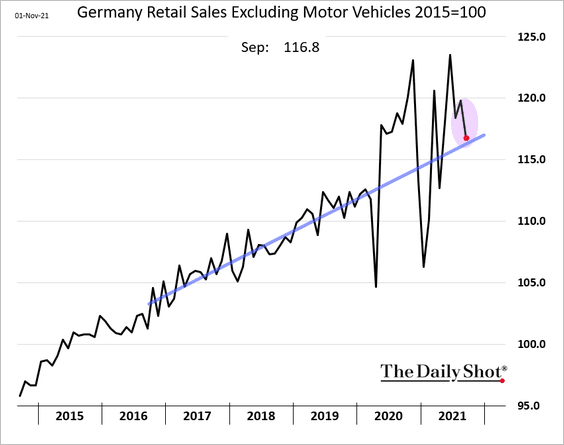

1. German retail sales declined sharply in September and are now back on the pre-COVID trend.

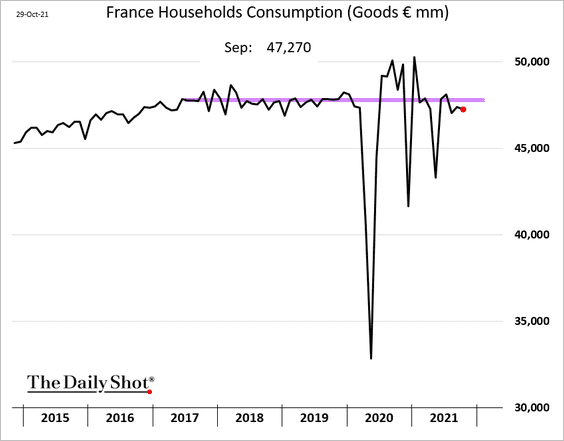

2. French household consumption remains below pre-pandemic levels.

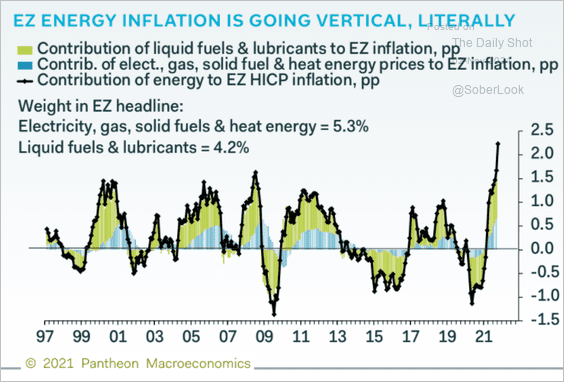

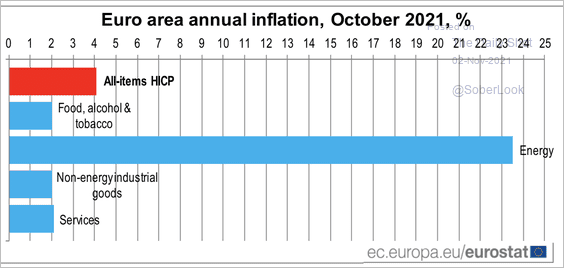

3. Energy inflation has been surging.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Eurostat Read full article

Source: Eurostat Read full article

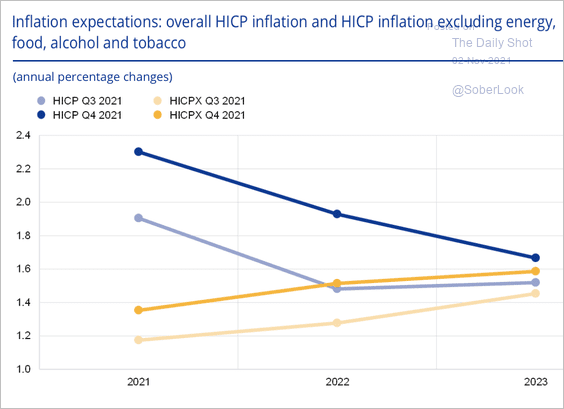

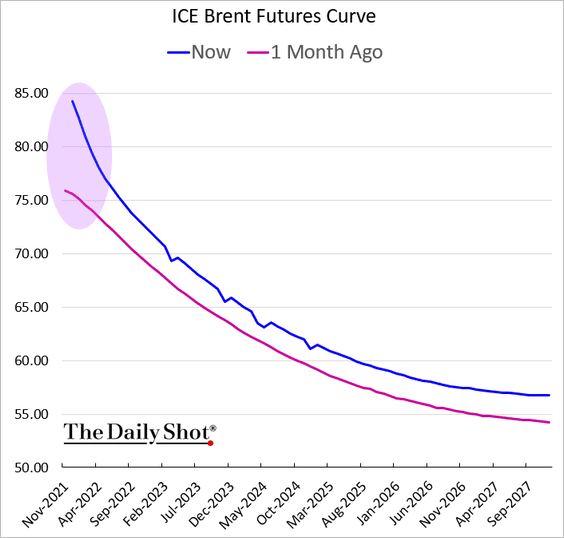

Forecasters expect the headline inflation to moderate (following the crude oil backwardation), but they see the CPI excluding energy climbing over the next couple of years.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

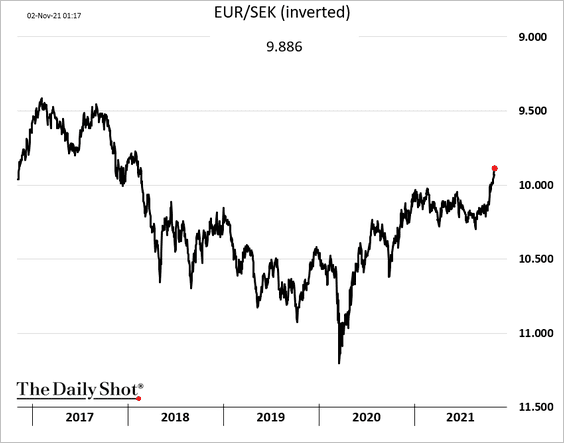

1. The Swedish krona continues to hit multi-year highs.

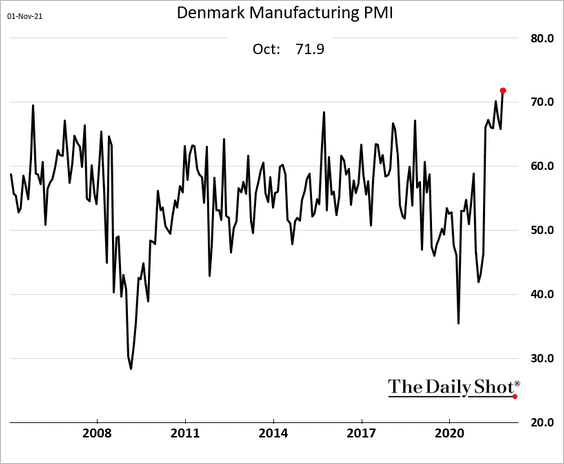

2. Denmark’s manufacturing PMI (growth in business activity) hit a record high in October.

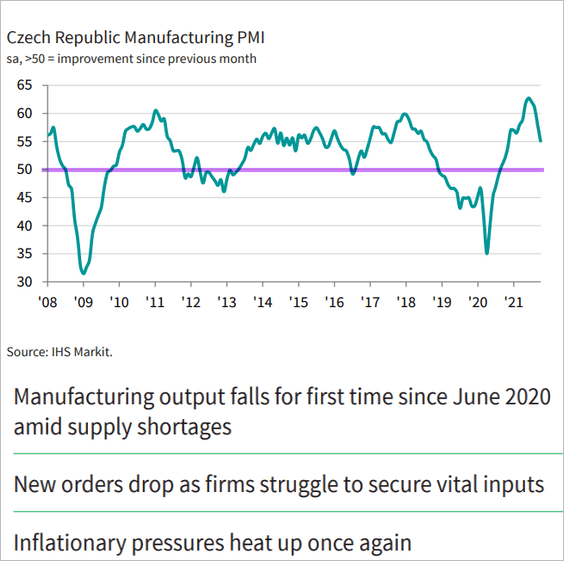

3. Czech manufacturing growth is slowing.

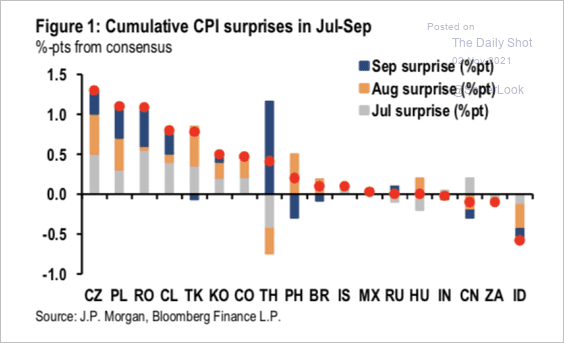

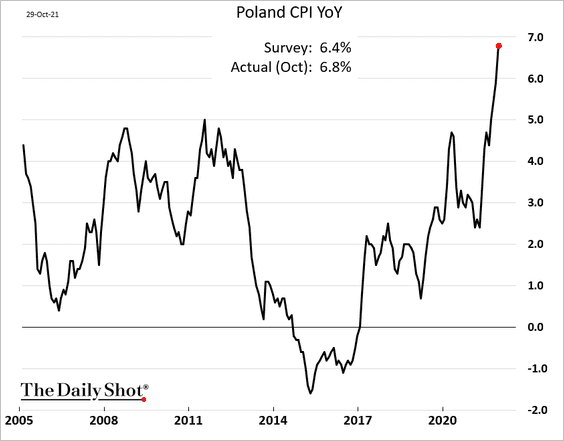

4. Central European economies have seen mostly positive inflation surprises over the past quarter.

Source: JP Morgan Research

Source: JP Morgan Research

Back to Index

Japan

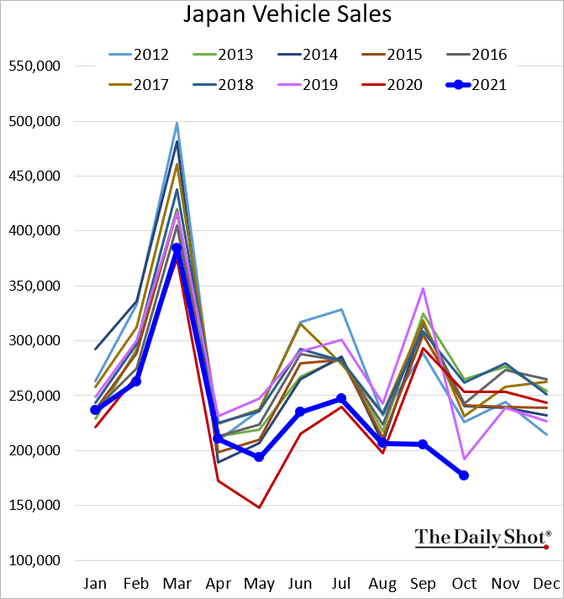

1. Vehicle sales deteriorated further in October.

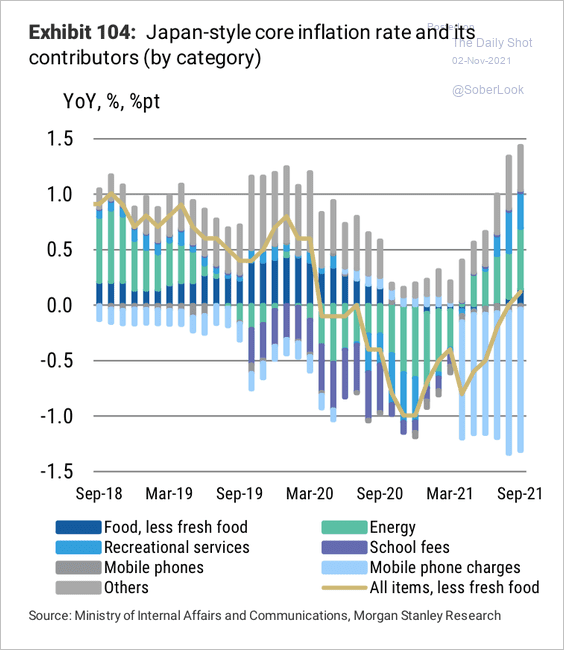

2. The decline in mobile phone charges has been a drag on core inflation this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

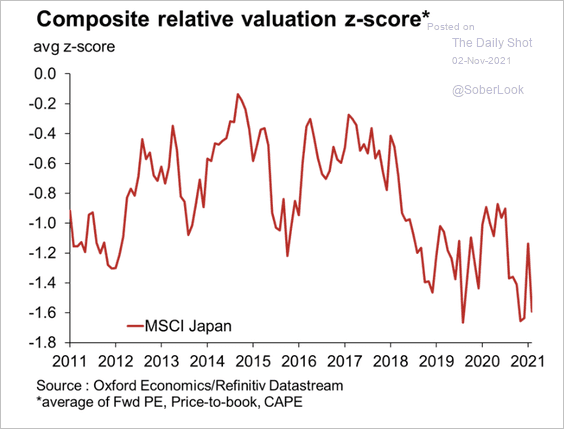

3. Japanese equities have given back recent gains and remain attractively valued.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Asia – Pacific

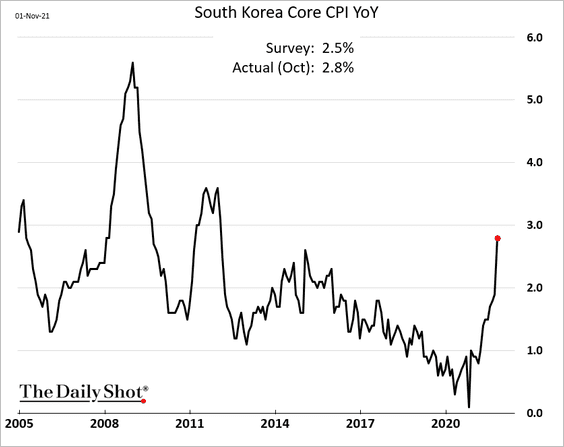

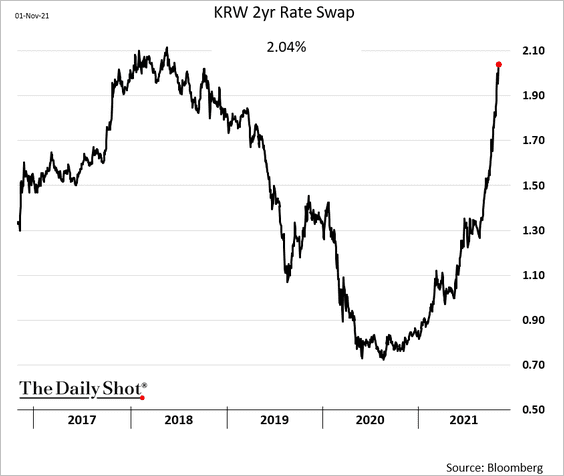

1. South Korean CPI surprised to the upside.

Source: Reuters Read full article

Source: Reuters Read full article

Rate hikes are coming.

——————–

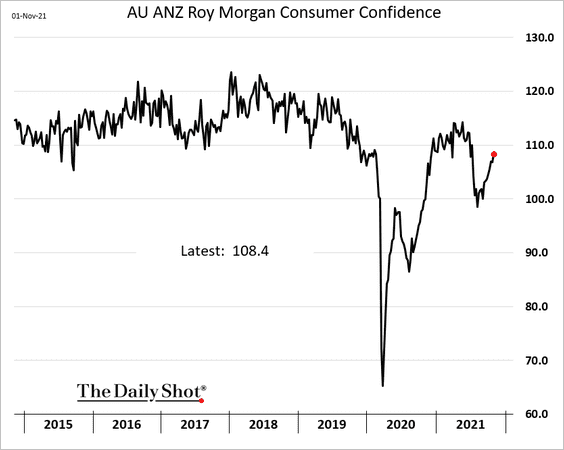

2. Next, we have some updates on Australia.

• Consumer confidence continues to recover.

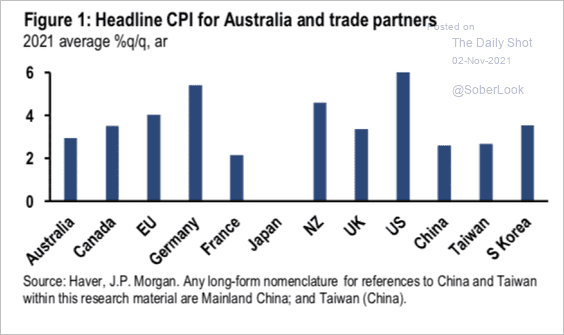

• Inflation has not been intense relative to other developed economies.

Source: JP Morgan Research

Source: JP Morgan Research

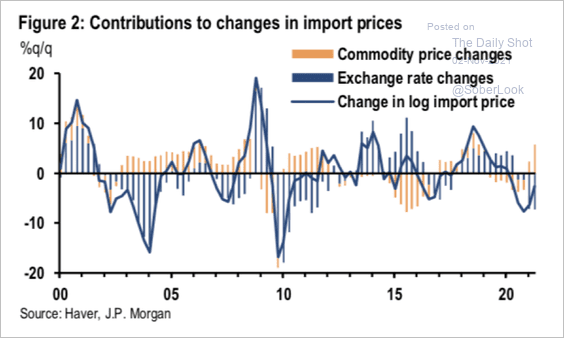

A stronger Australian dollar helped restrain import prices.

Source: JP Morgan Research

Source: JP Morgan Research

Back to Index

China

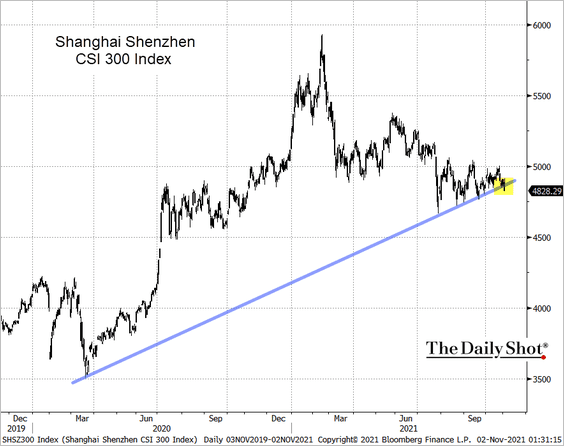

1. The Shanghai Shenzhen CSI 300 equity index is testing support.

Backed by Beijing, semiconductor stocks continue to outperform.

![]() Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

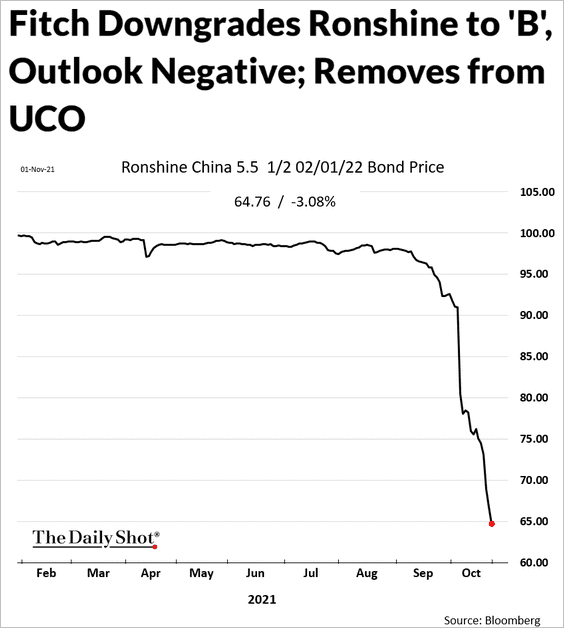

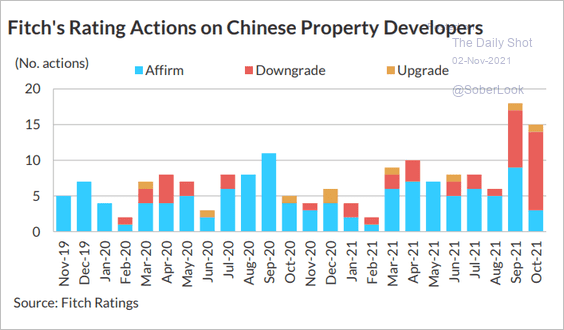

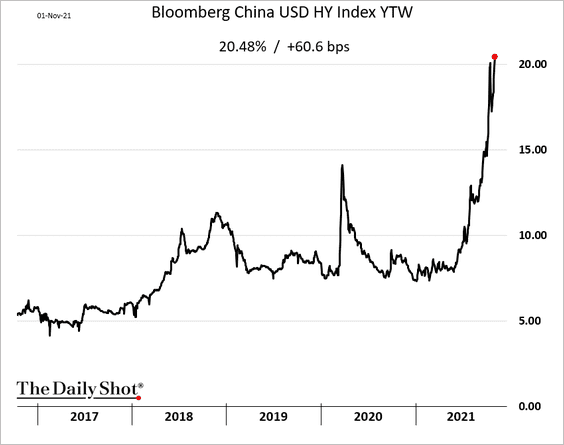

2. Rating agencies continue to clobber developers’ debt.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

Source: Fitch Ratings

Source: Fitch Ratings

The yield on Bloomberg’s USD-denominated HY debt index hit a new high.

——————–

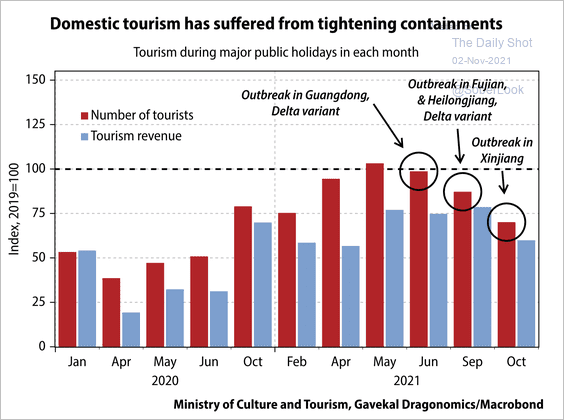

3. Domestic tourism in China is struggling under the weight of COVID restrictions.

Source: Gavekal Research

Source: Gavekal Research

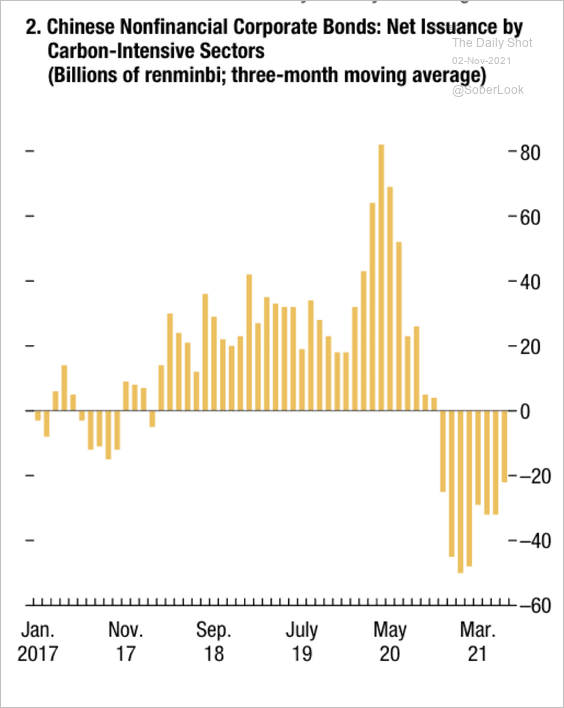

4. Following new regulations, China’s issuance of carbon-intensive bonds has decreased.

Source: IMF

Source: IMF

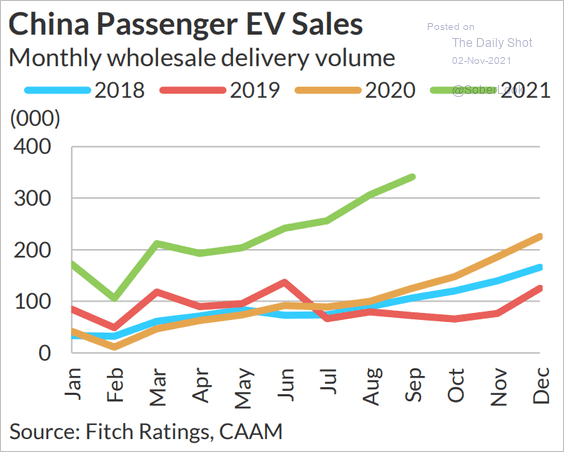

5. China’s EV sales have been surging …

Source: Fitch Ratings

Source: Fitch Ratings

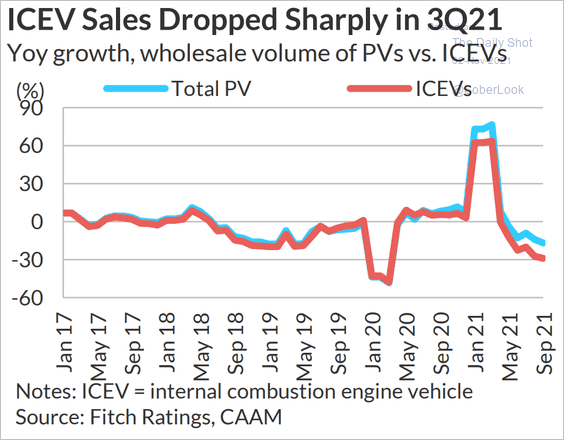

… at the expense of cars with internal combustion engines.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

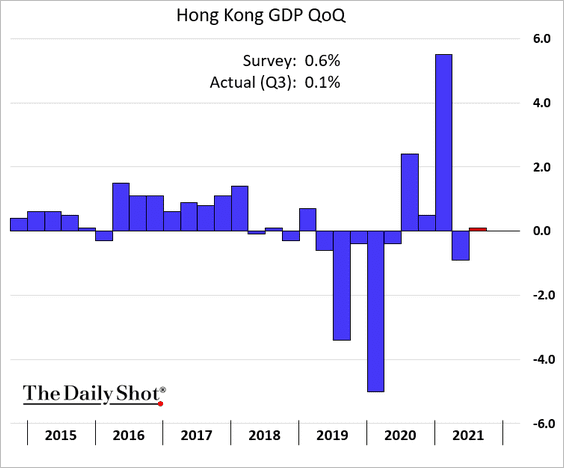

6. Hong Kong’s Q3 GDP growth surprised to the downside.

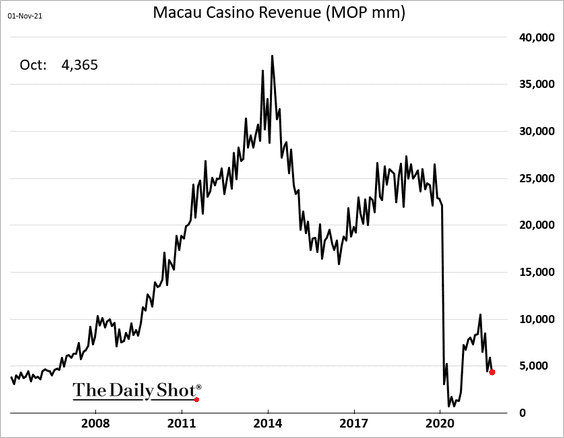

7. Macau casino revenue is deteriorating again.

Back to Index

Emerging Markets

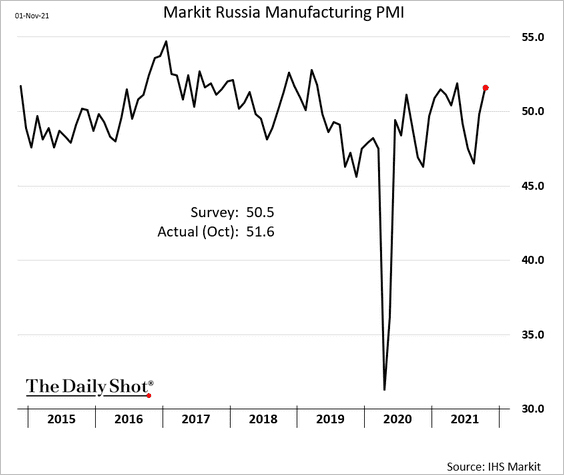

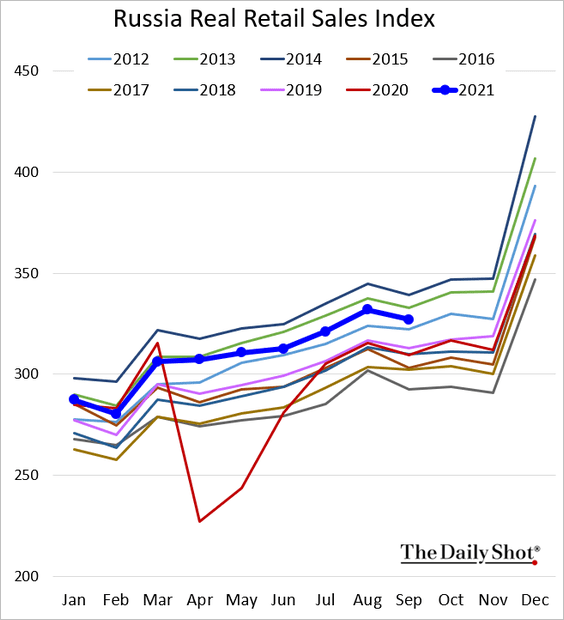

1. Let’s begin with Russia.

• Manufacturing PMI (back in growth mode):

• Retail sales:

• The unemployment rate:

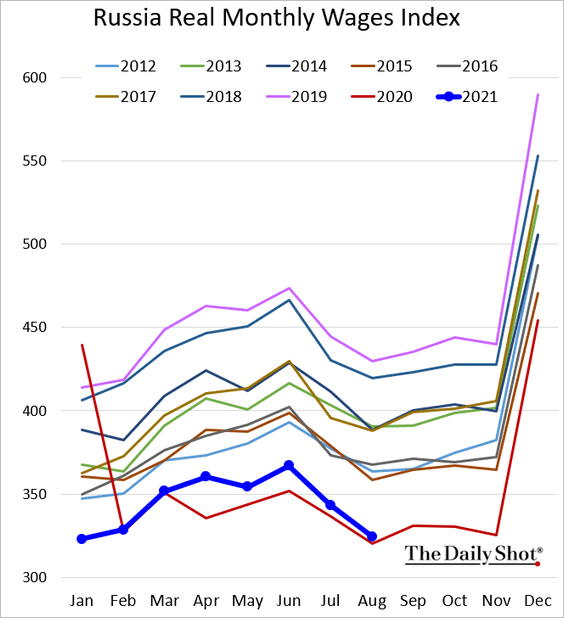

• Real wages (squeezed by rising inflation):

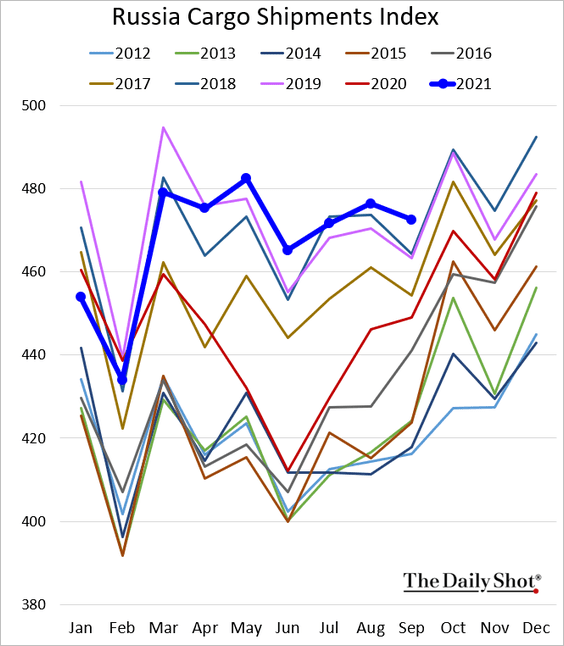

• Cargo shipments (very strong):

——————–

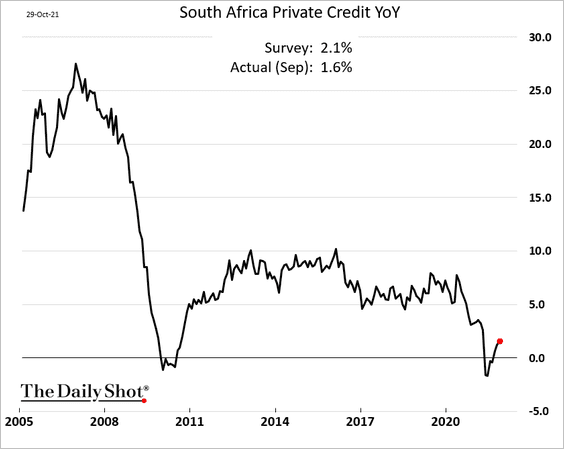

2. South Africa’s private sector credit growth remains tepid.

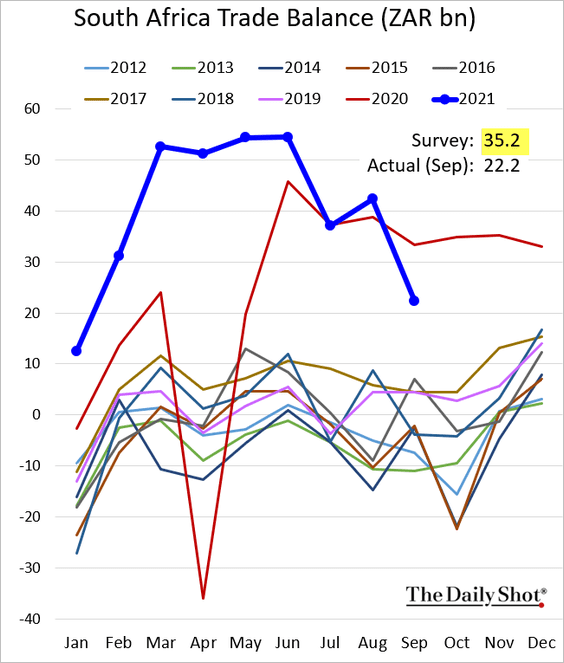

The trade balance surprised to the downside.

——————–

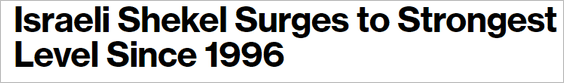

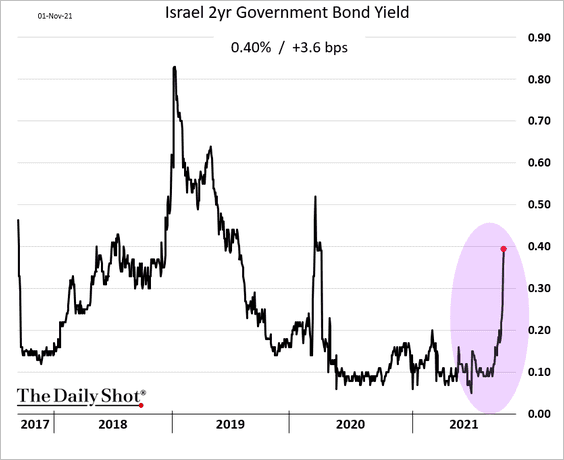

3. The Israeli shekel, bond yields are surging on rate hike expectations.

Source: @markets Read full article

Source: @markets Read full article

——————–

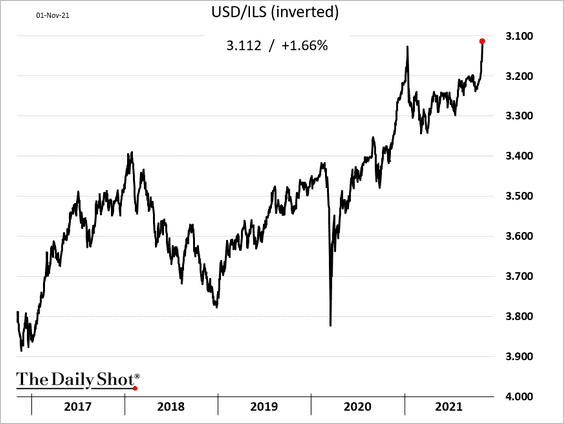

4. Indonesia’s core CPI remains near the lows. Overall, EM Asia’s inflation rates have been modest relative to the rest of the world.

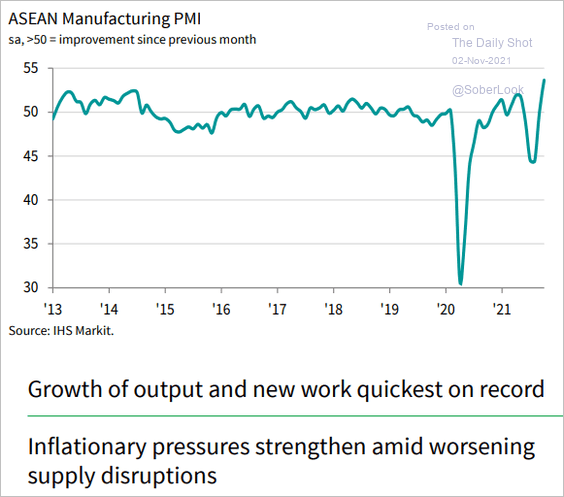

5. As we saw yesterday, EM Asia’s factory activity has rebounded sharply. Here is the ASEAN PMI.

Source: IHS Markit

Source: IHS Markit

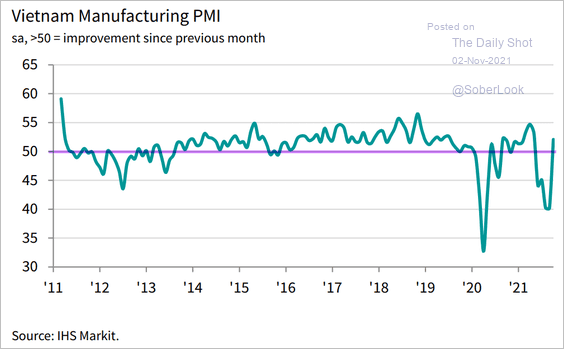

Even Vietnam, which was hit hard by pandemic lockdowns, is back in growth territory.

Source: IHS Markit

Source: IHS Markit

——————–

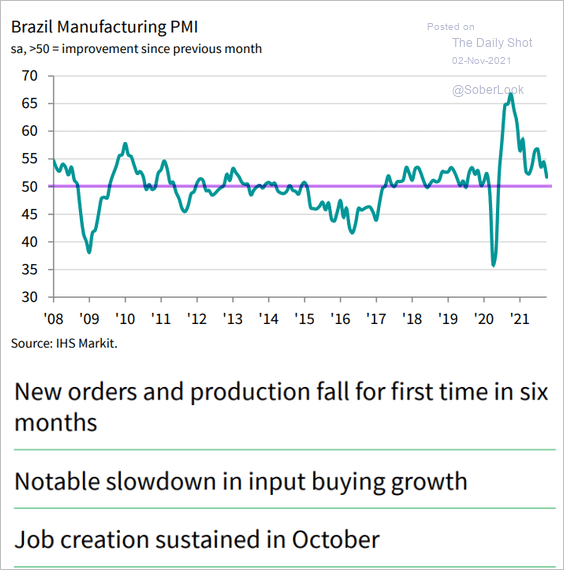

6. Brazil’s manufacturing growth is stalling.

Source: IHS Markit

Source: IHS Markit

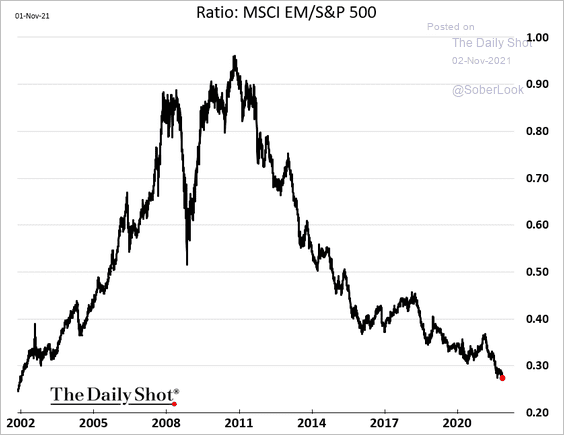

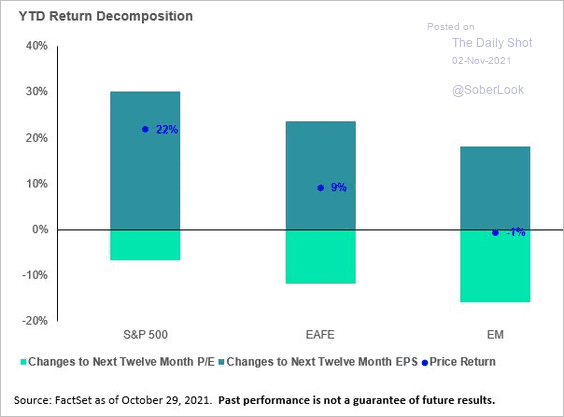

7. EM stocks continue to underperform relative to the S&P 500.

h/t @SriniSivabalan

h/t @SriniSivabalan

Here is the attribution of year-to-date returns.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

——————–

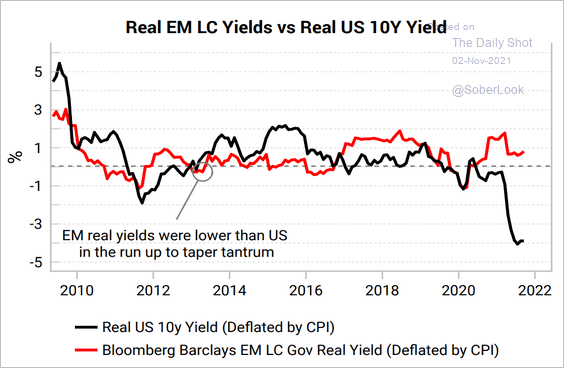

8. EM monetary conditions are tight relative to the US.

Source: Variant Perception

Source: Variant Perception

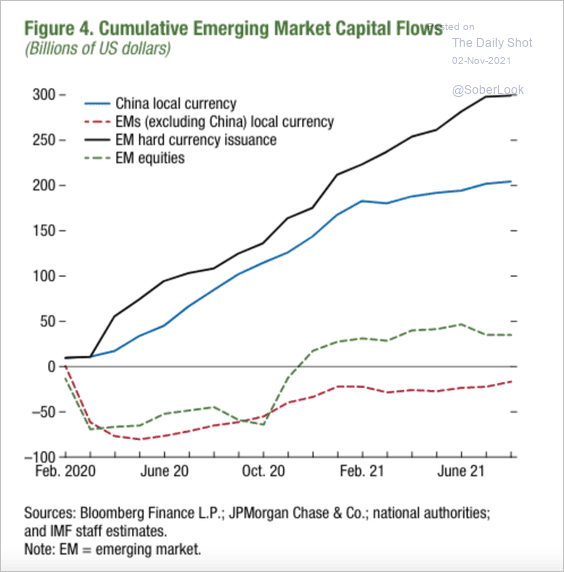

9. Since the start of the pandemic, over $500 billion has poured into EM assets, with about 40% of the total going to China.

Source: IMF

Source: IMF

Back to Index

Cryptocurrency

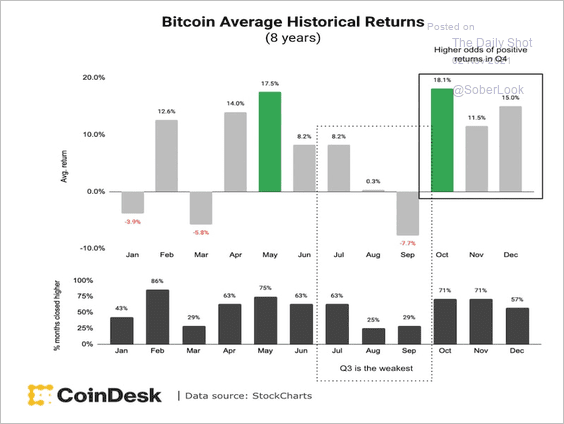

1. Bitcoin tends to produce positive returns in Q4.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

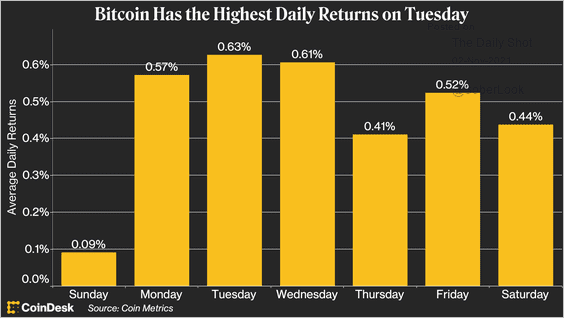

Tuesday tends to be the best day of the week for bitcoin, followed by Wednesday.

Source: @CoinDeskData

Source: @CoinDeskData

——————–

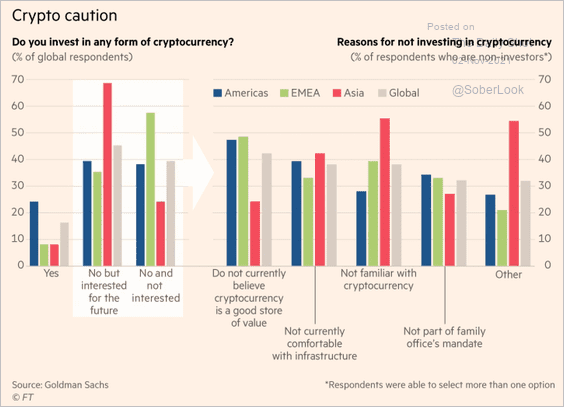

2. How do family offices view crypto?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. US regulators are urging lawmakers to subject stablecoins to the same strict federal oversight as banks.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

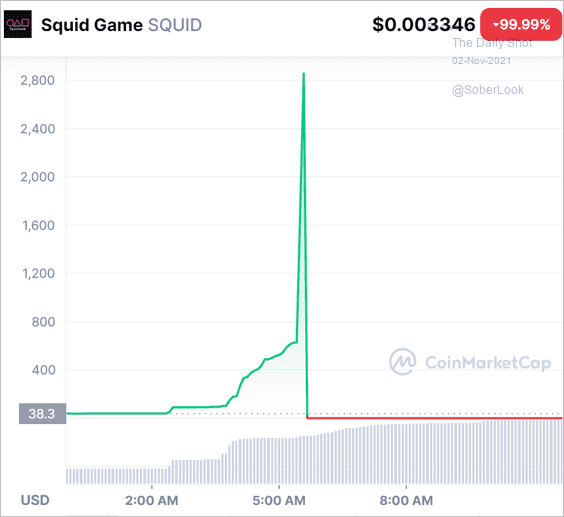

4. Squid Game pump and dump?

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinMarketCap

Source: CoinMarketCap

Back to Index

Commodities

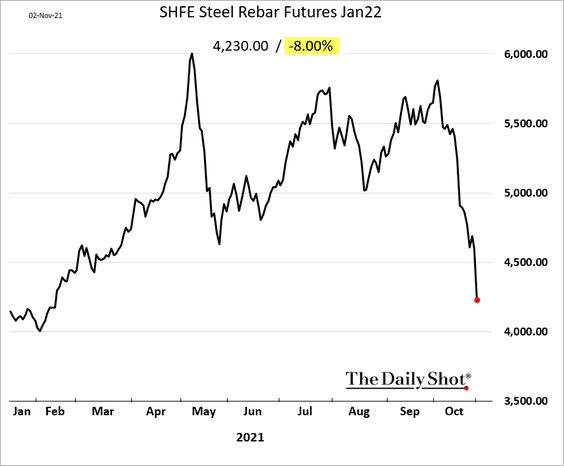

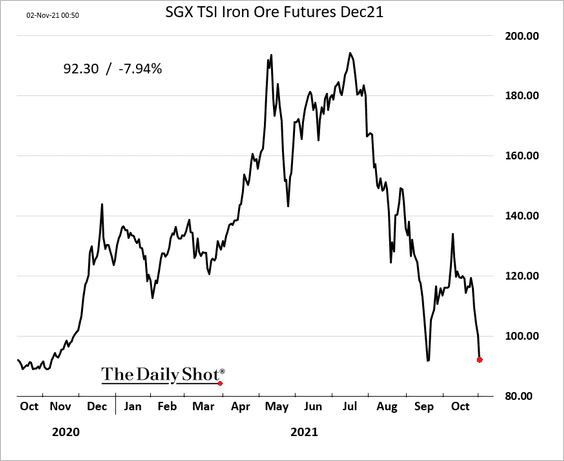

1. China’s coal price collapse keeps pressuring industrial commodities.

• Steel rebar in Shanghai:

• Iron ore in Singapore:

——————–

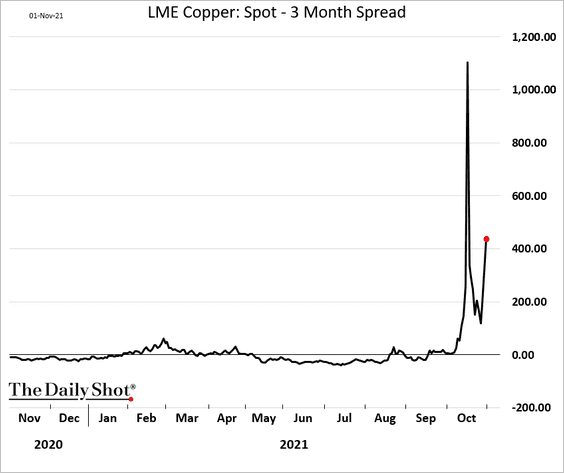

2. Copper backwardation is climbing again.

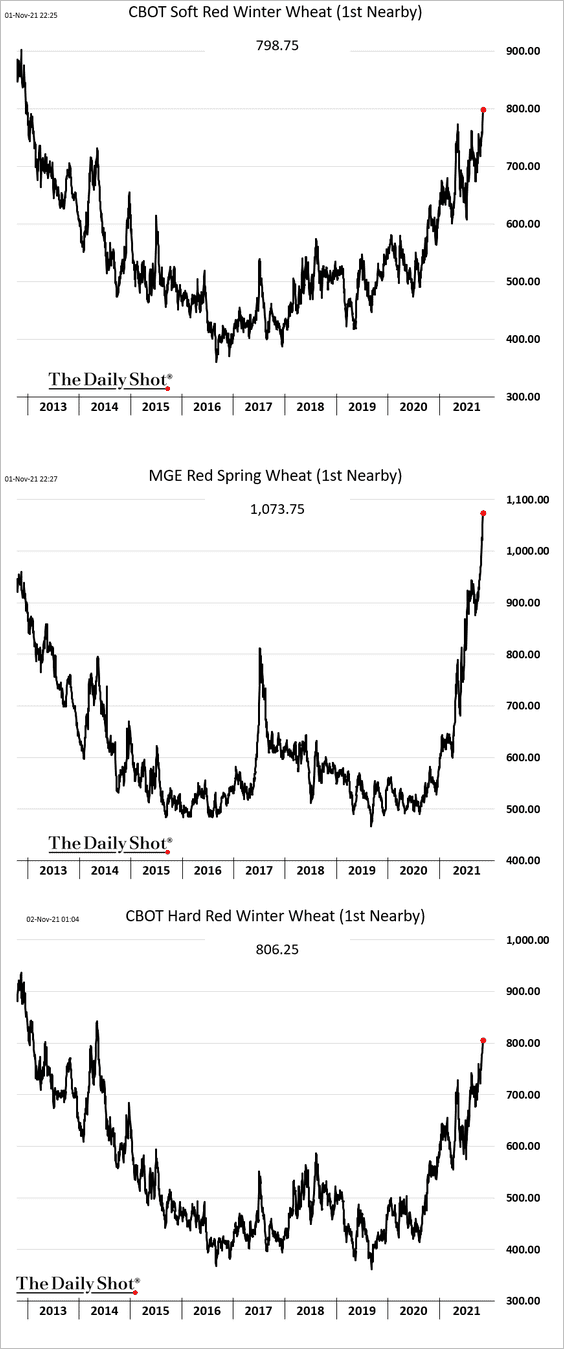

3. US wheat prices hit multi-year highs.

Source: @markets Read full article

Source: @markets Read full article

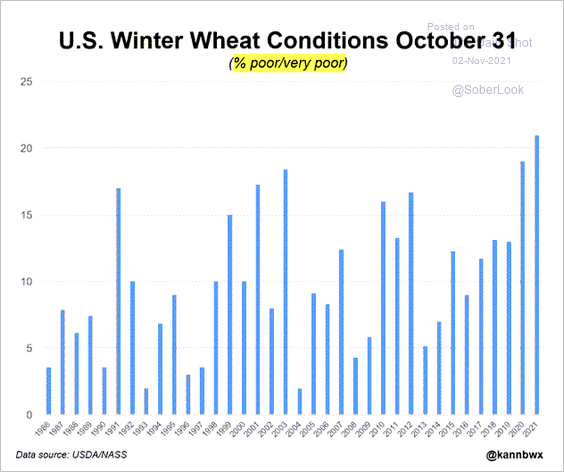

The US winter wheat crop is not in great shape.

Source: @kannbwx

Source: @kannbwx

——————–

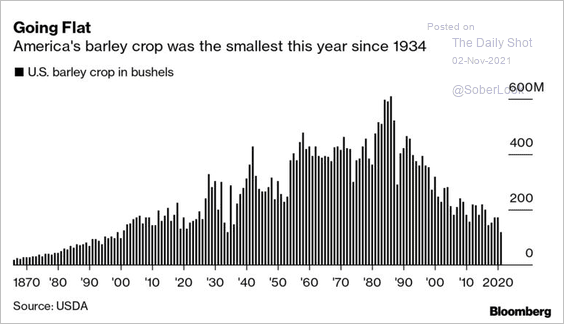

4. The US barley crop continues to shrink.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

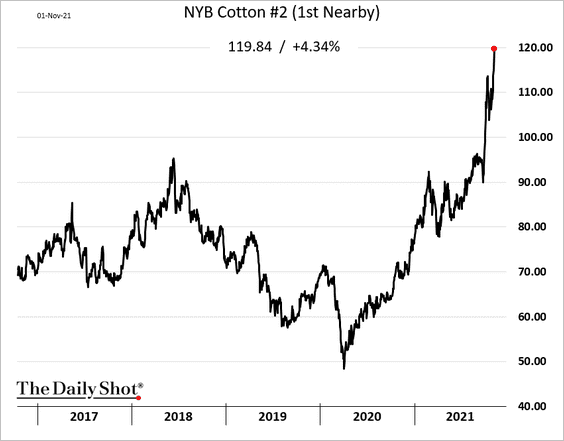

5. Cotton futures hit a multi-year high in New York amid strong demand from China.

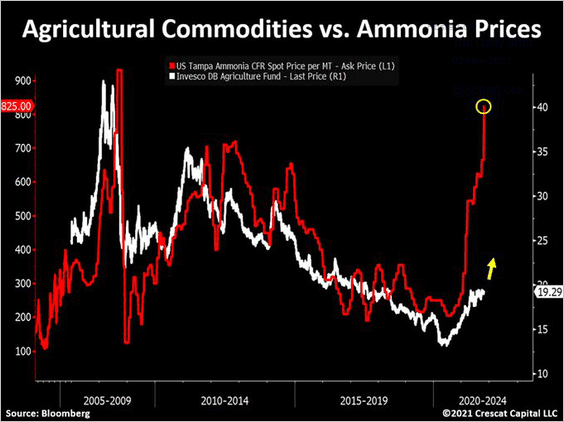

6. Surging fertilizer prices point to higher agricultural commodity prices ahead.

Source: @TaviCosta

Source: @TaviCosta

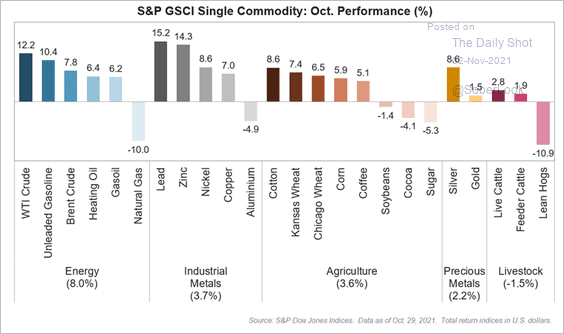

7. Here is a look at commodity returns in October.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Energy

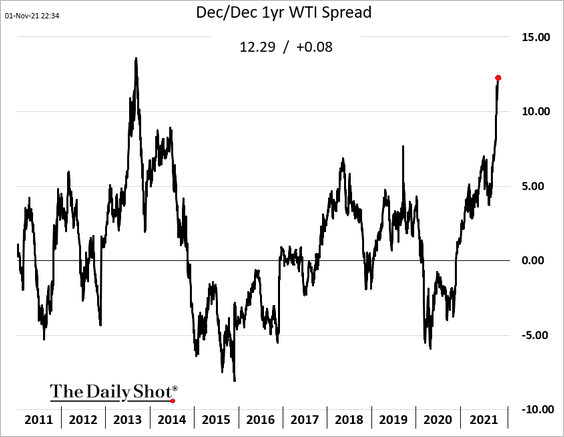

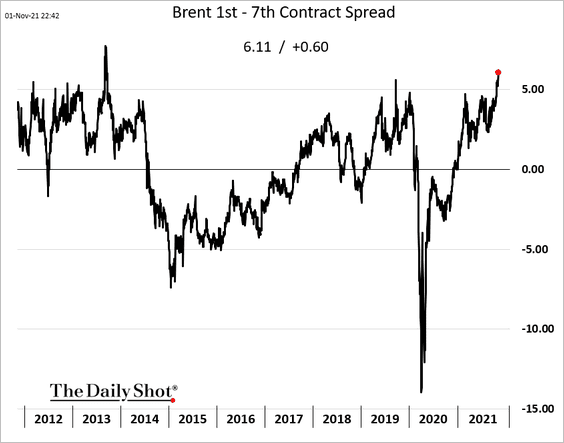

1. Crude oil continues to move deeper into backwardation.

• WTI Dec-Red-Dec (one-year) spread:

• Brent 1st – 7th contract spread:

The US inflation expectations curve has not been this inverted in years due to the steep backwardation in oil.

——————–

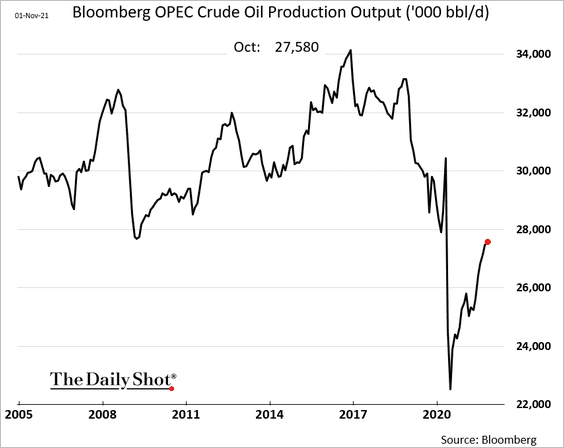

2. OPEC’s production increase was smaller than expected.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

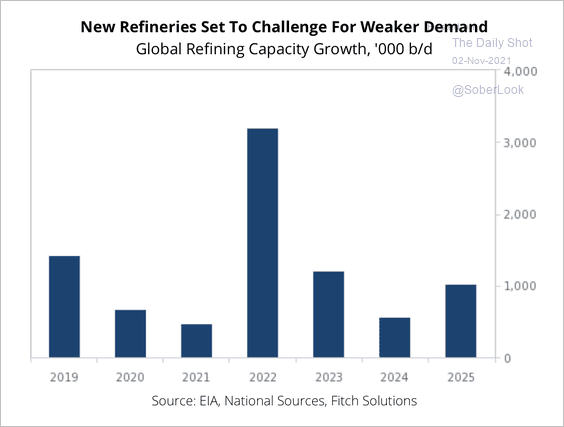

3. Fitch expects a wave of refinery closures over the next few years, although sufficient margins should keep the bulk of existing refiners in operation.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

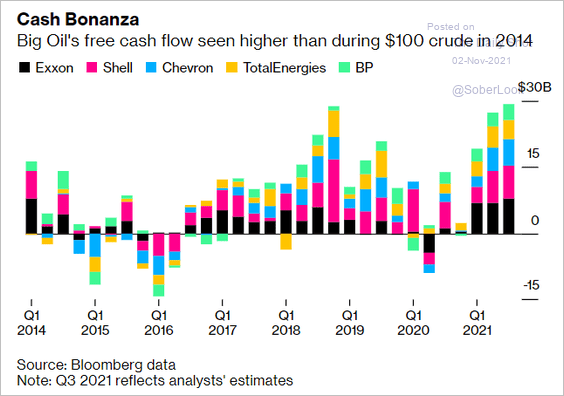

4. Big oil’s free cash flow surge has been impressive.

Source: @markets Read full article

Source: @markets Read full article

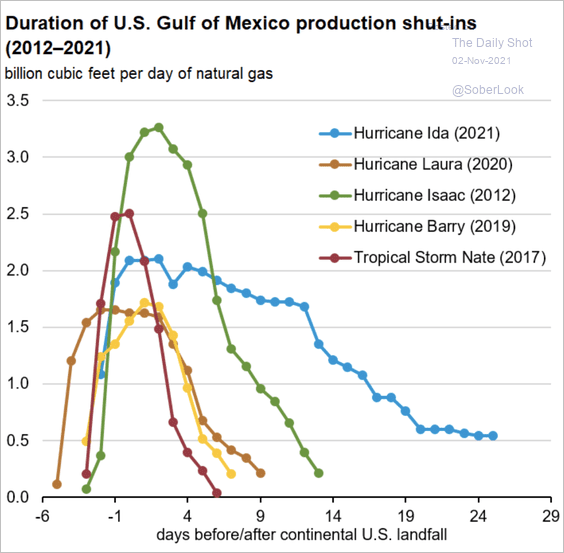

5. Hurricane Ida curbed US natural gas production more than any other hurricane in recent years.

Source: EIA

Source: EIA

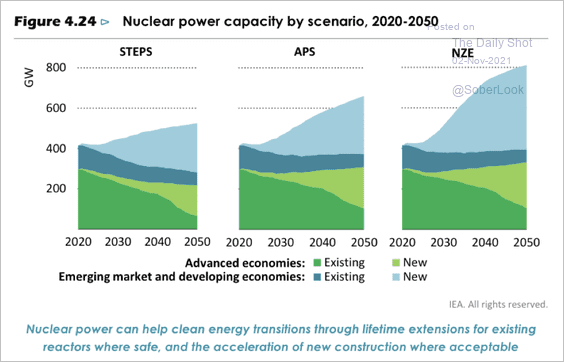

6. Nuclear power capacity is expected to increase, especially in emerging economies.

Source: IEA

Source: IEA

Back to Index

Equities

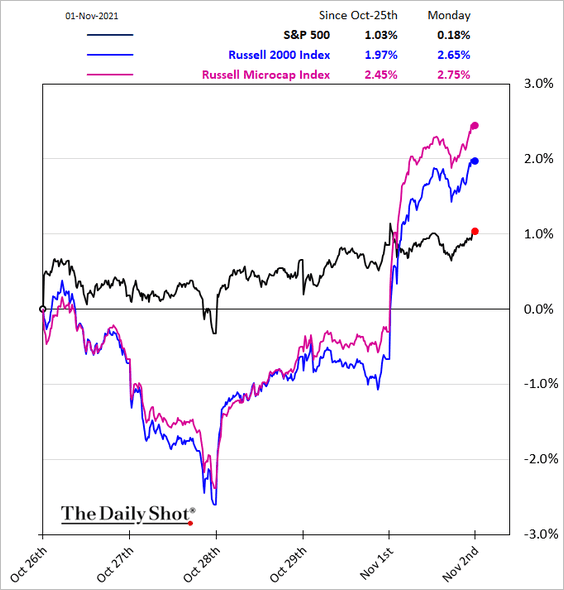

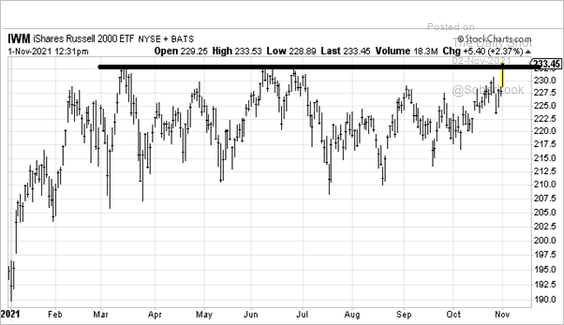

1. US small caps and microcaps surged on Monday.

• The iShares Russell 2000 ETF (IWM) is testing resistance.

Source: @fundstrat

Source: @fundstrat

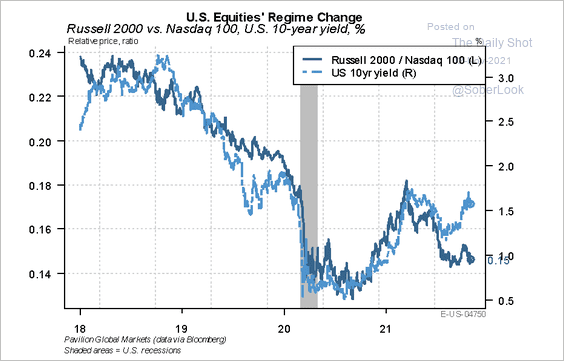

• The Russell 2000 has been underperforming the Nasdaq 100 even as Treasury yields increased.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

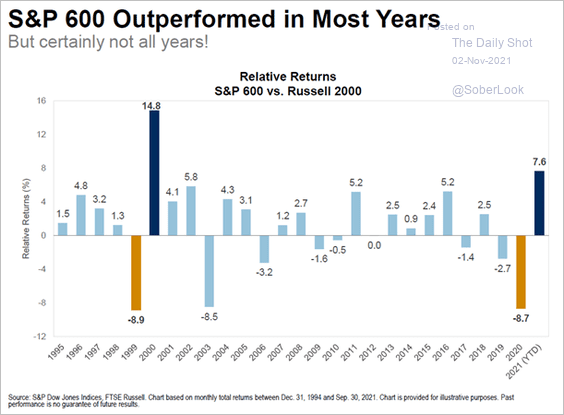

• How does the Russell 2000 perform relative to the S&P 600 small-cap index?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

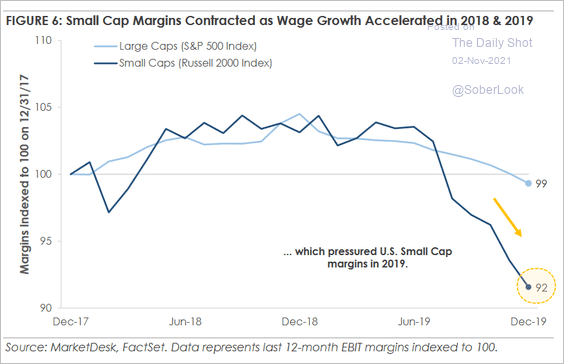

• Will small-cap margins get hit as wage growth accelerates?

Source: MarketDesk Research

Source: MarketDesk Research

——————–

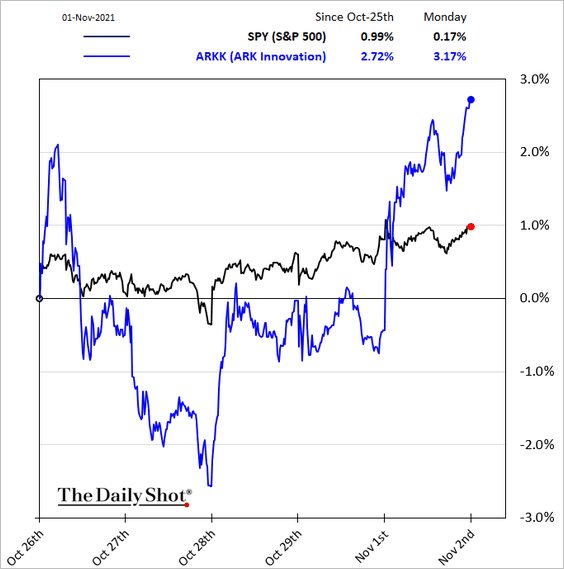

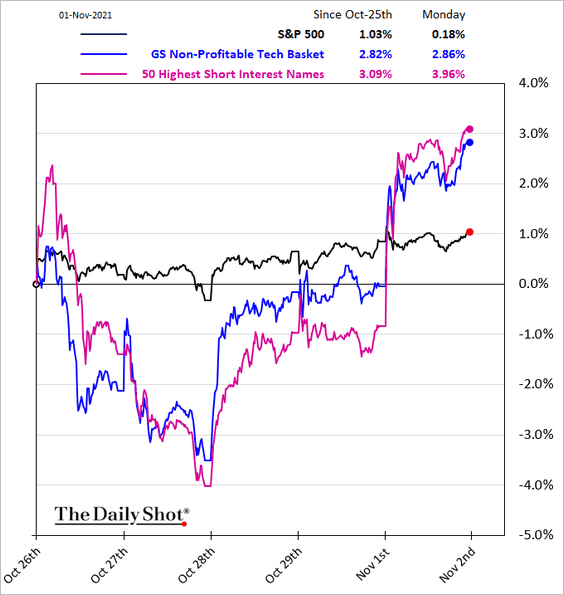

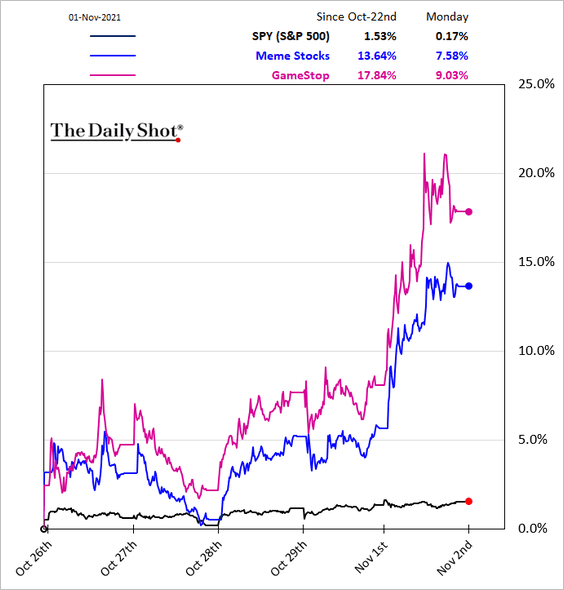

2. Speculative stocks are back in favor as the Reddit crowd returns.

• ARK Innovation:

• Non-profitable tech and stocks with the highest short interest:

• Meme stocks:

——————–

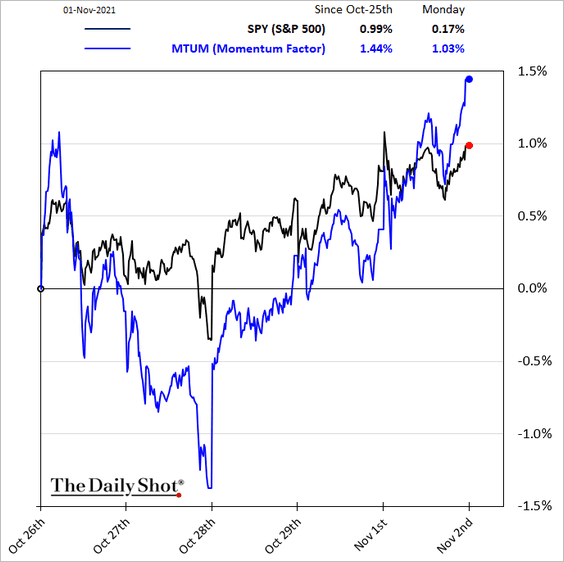

3. Momentum stocks are rebounding.

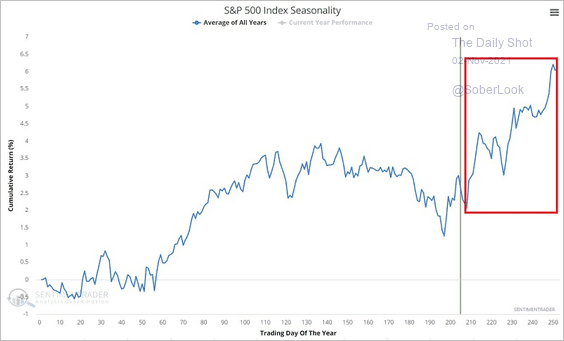

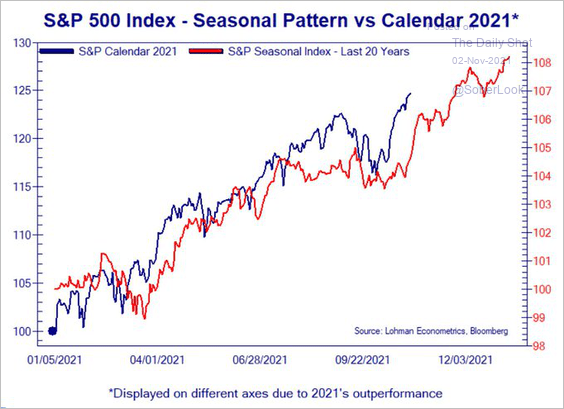

4. The S&P 500 is entering a seasonally strong period …

Source: SentimenTrader

Source: SentimenTrader

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

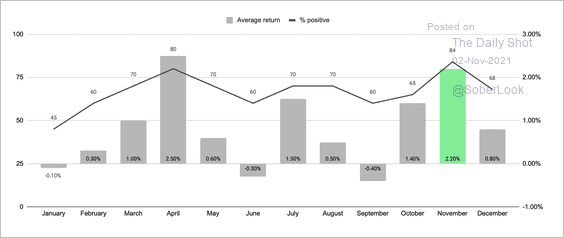

… and, on average (over the past 20 years), November is typically a good month for the S&P 500.

Source: Cannon Advisors

Source: Cannon Advisors

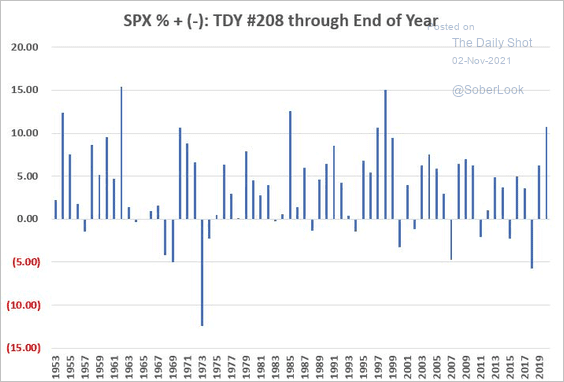

Historically, buying at the 208th trading day of the year and selling at the close of the last trading day of the year has resulted in positive returns with small drawdowns.

Source: SentimenTrader

Source: SentimenTrader

——————–

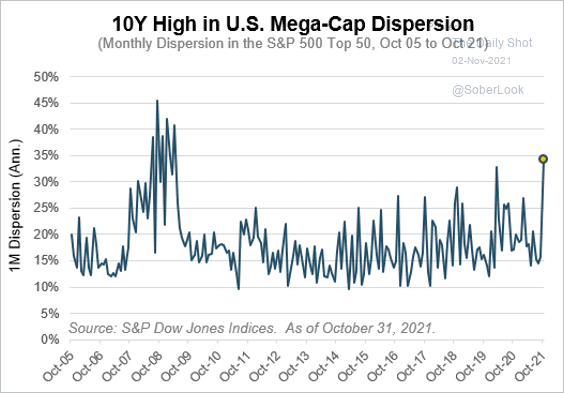

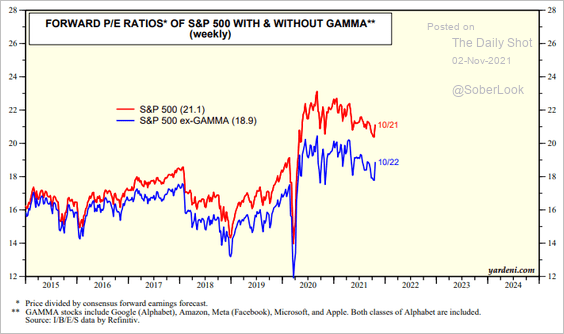

5. The return dispersion in tech mega-caps surged in October.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• How has the S&P 500 performed without the tech mega-caps?

Source: Yardeni Research

Source: Yardeni Research

——————–

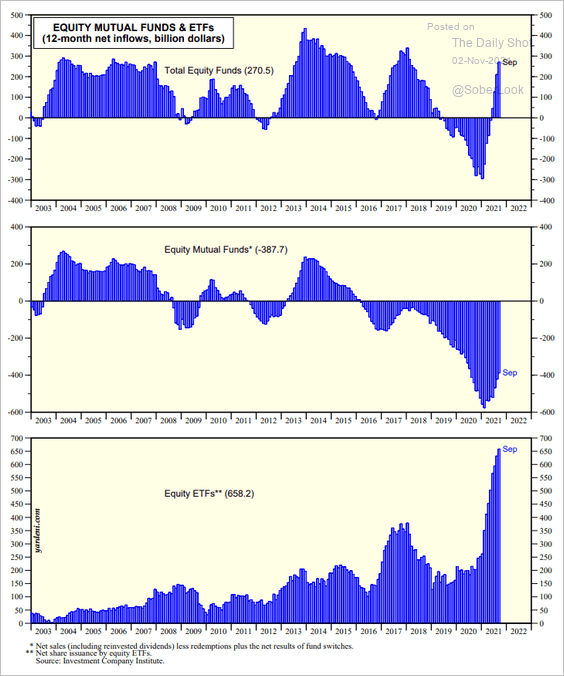

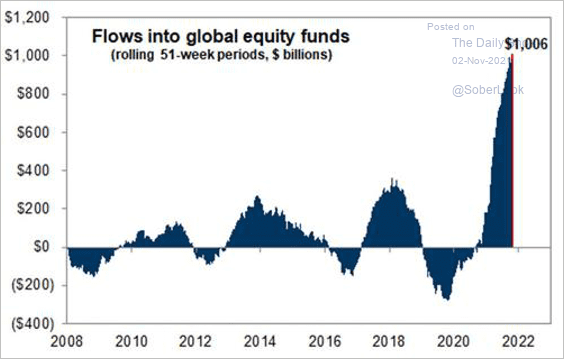

6. Equity fund inflows have been strong, driven by ETFs.

Source: Yardeni Research

Source: Yardeni Research

Source: @MichaelGoodwell, h/t @Callum_Thomas

Source: @MichaelGoodwell, h/t @Callum_Thomas

——————–

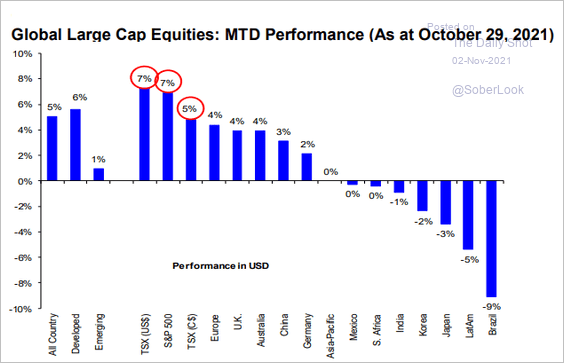

7. Here is a look at market performance around the world.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

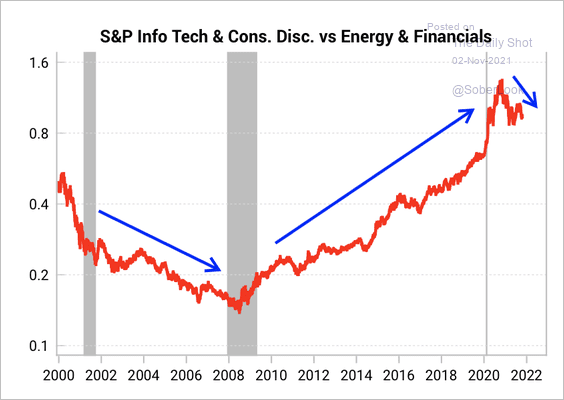

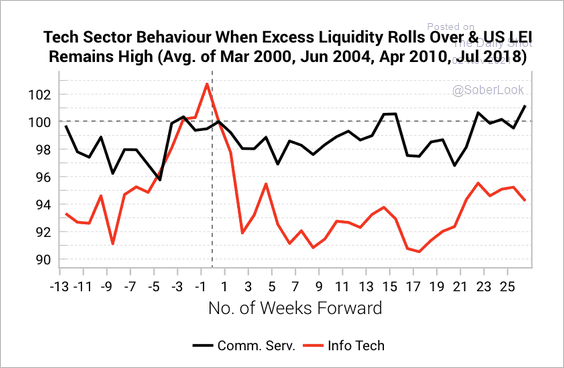

8. Tech and consumer discretionary sectors are losing relative strength versus energy and financials. This is consistent with the rotation from growth to value.

Source: Variant Perception

Source: Variant Perception

Tech has struggled during prior episodes of tightening liquidity.

Source: Variant Perception

Source: Variant Perception

Back to Index

Rates

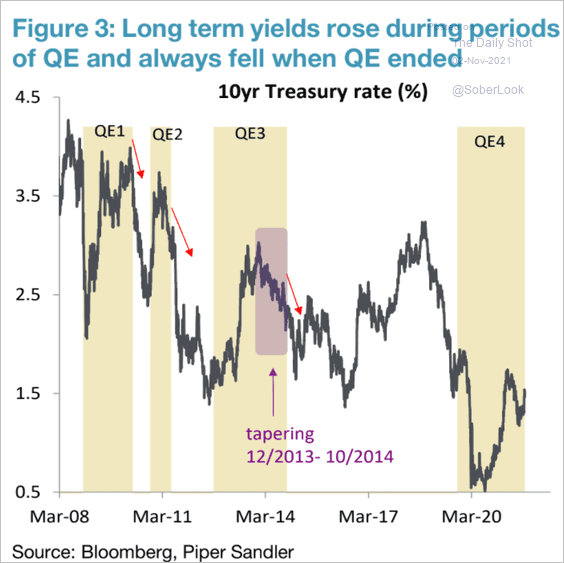

1. End of QE tends to be good for long-term Treasuries.

Source: Piper Sandler

Source: Piper Sandler

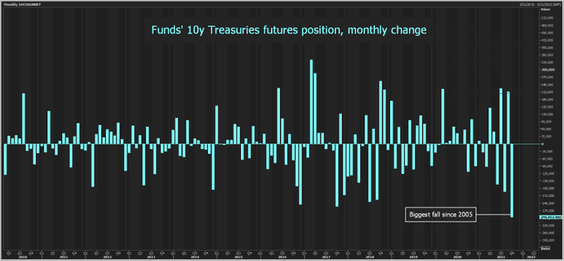

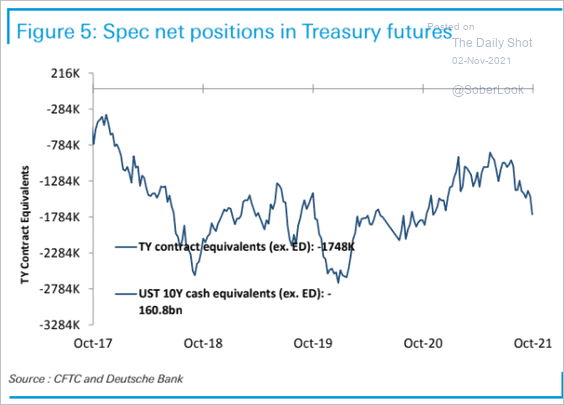

2. Speculative accounts sharply increased their bets against Treasury futures.

Source: @ReutersJamie Read full article

Source: @ReutersJamie Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

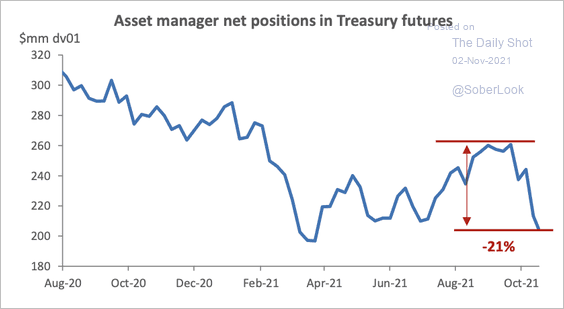

Asset managers reduced their exposure to Treasuries, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

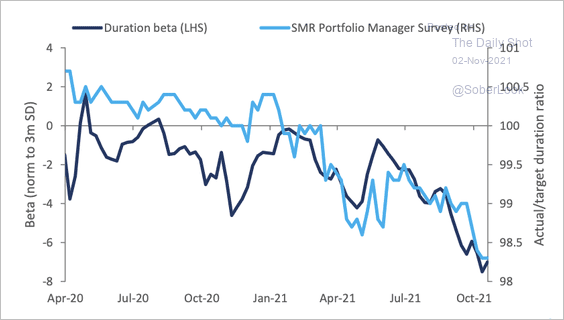

… and they are increasingly bearish on duration.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

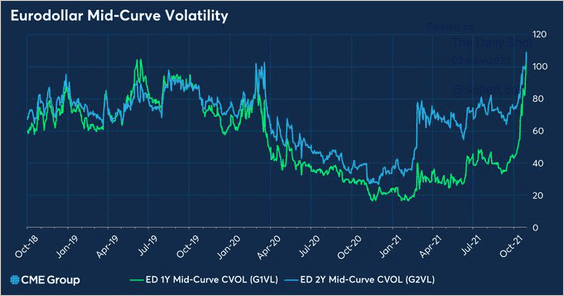

3. Short-term rate volatility has been surging.

Source: @CMEGroup

Source: @CMEGroup

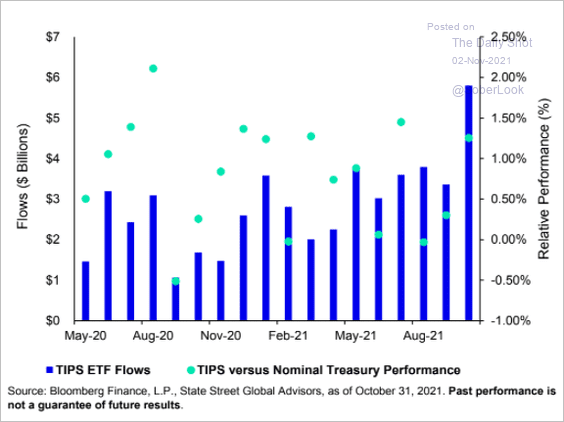

4. TIPS fund inflows have been impressive as inflation jitters spread.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

Food for Thought

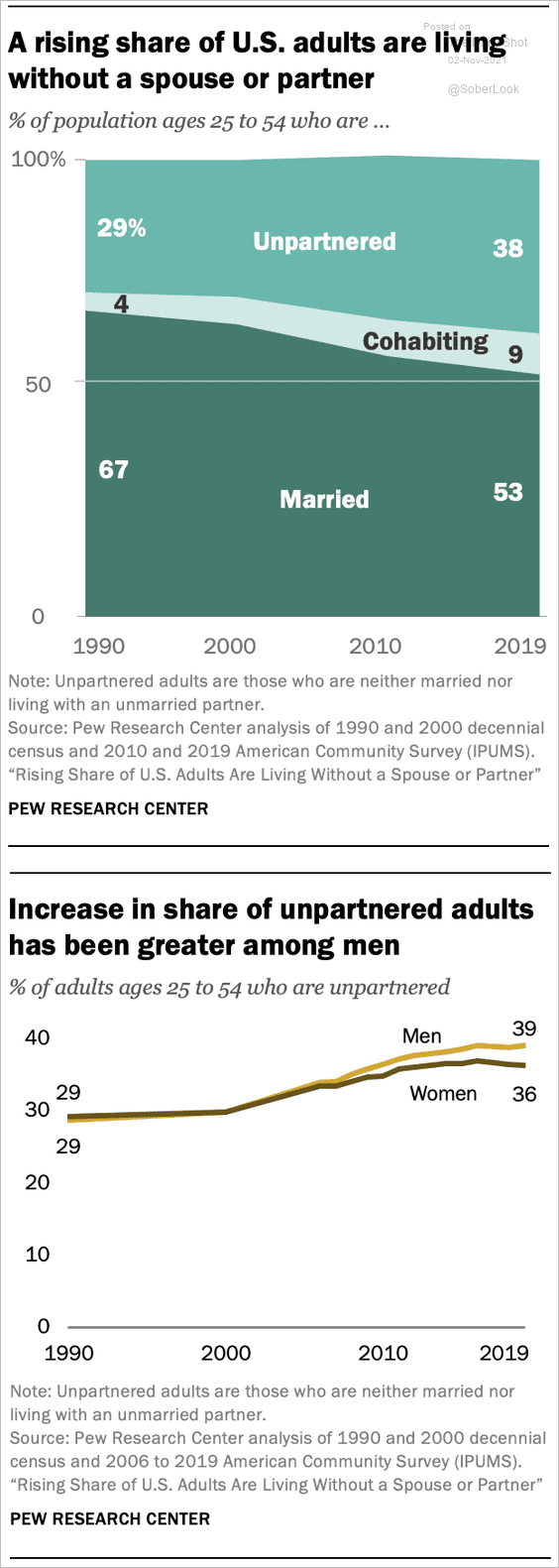

1. US adults living without a spouse or partner:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

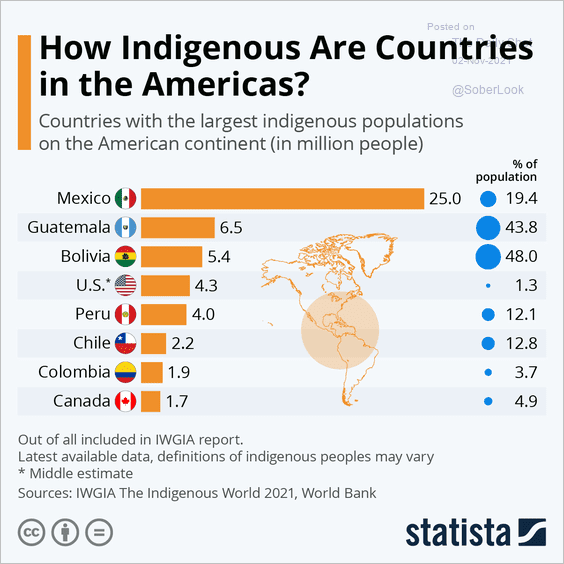

2. Indigenous populations in the Americas:

Source: Statista

Source: Statista

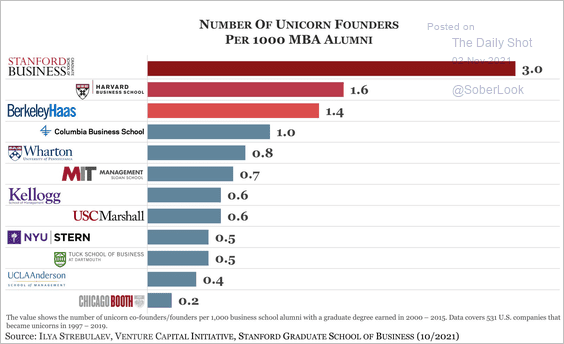

3. MBA programs with the highest number of unicorn founders:

Source: Ilya Strebulaev, Stanford University Graduate School of Business

Source: Ilya Strebulaev, Stanford University Graduate School of Business

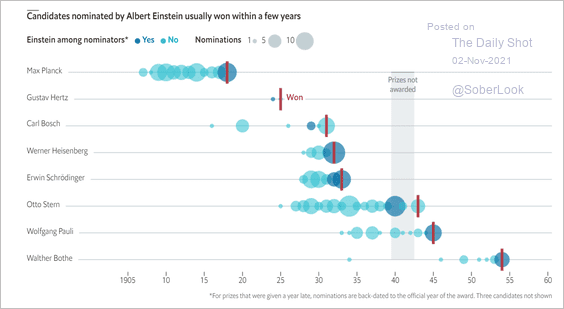

4. The best way to win a Nobel Prize is to get nominated by another laureate.

Source: The Economist Read full article

Source: The Economist Read full article

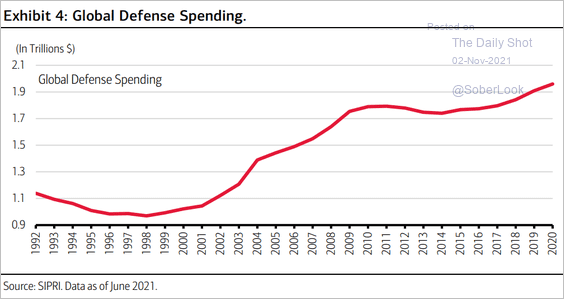

5. Global defense spending:

Source: Merrill Lynch, BofA Global Research

Source: Merrill Lynch, BofA Global Research

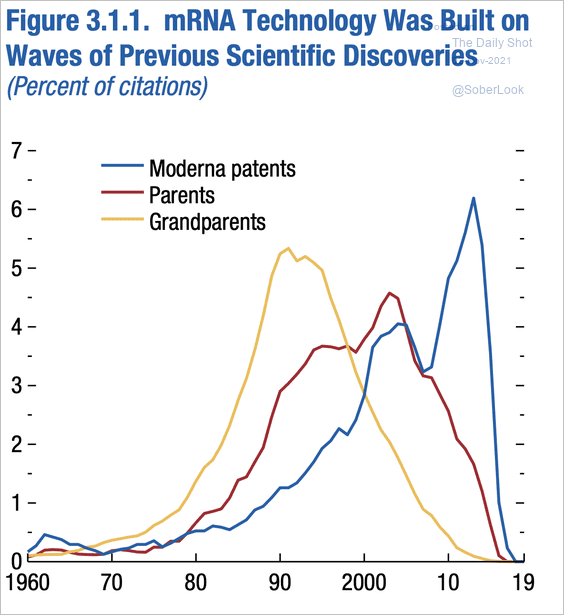

6. History of RNA vaccine patents:

Source: IMF

Source: IMF

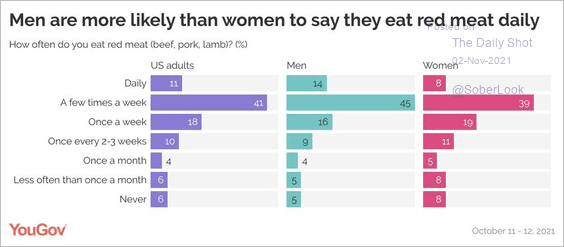

7. Eating red meat:

Source: @YouGovAmerica

Source: @YouGovAmerica

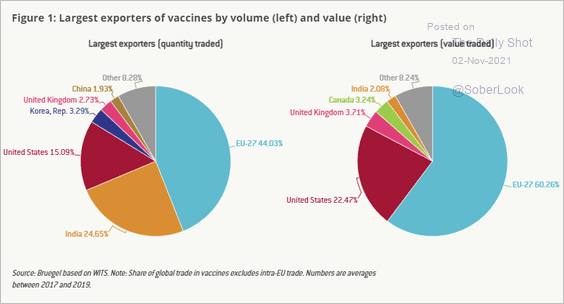

8. Vaccine exporters:

Source: Bruegel Read full article

Source: Bruegel Read full article

9. A GPS-tracked falcon flew from South Africa to Finland (over 6,000 miles in 42 days).

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

——————–

Back to Index