The Daily Shot: 03-Nov-21

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

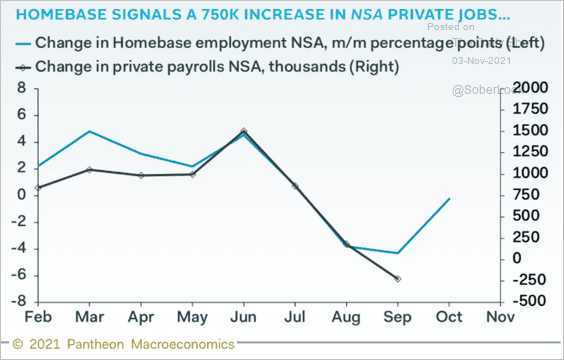

1. Let’s begin with the labor market.

• Homebase small business employment data point to substantial job gains in October.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

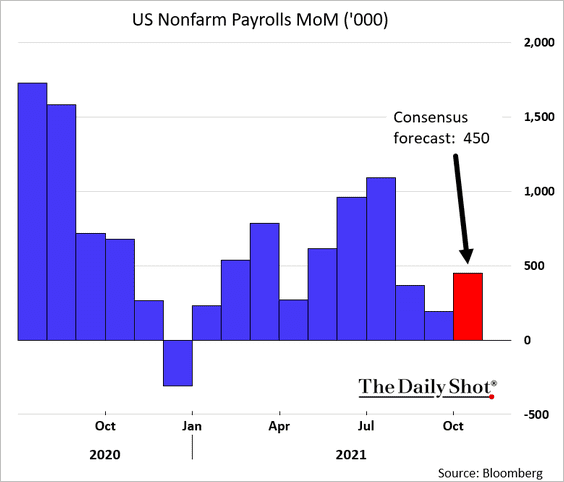

– The market consensus is a gain of 450k, according to Bloomberg.

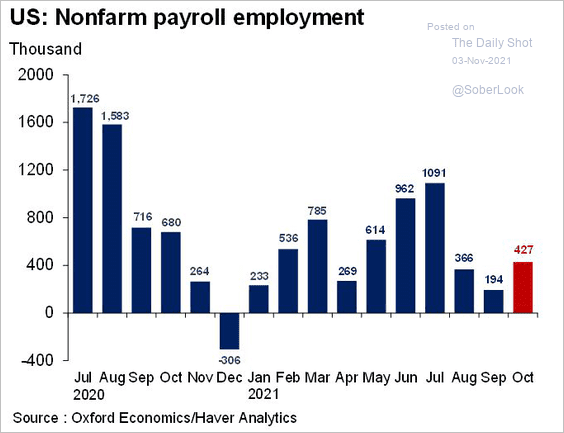

– Here is a forecast from Oxford Economics.

Source: @GregDaco

Source: @GregDaco

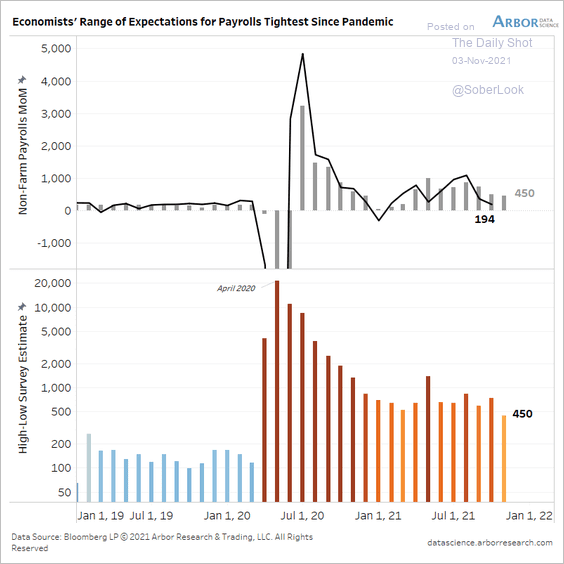

– The range of expectations for October is the tightest since the start of the pandemic.

Source: @benbreitholtz

Source: @benbreitholtz

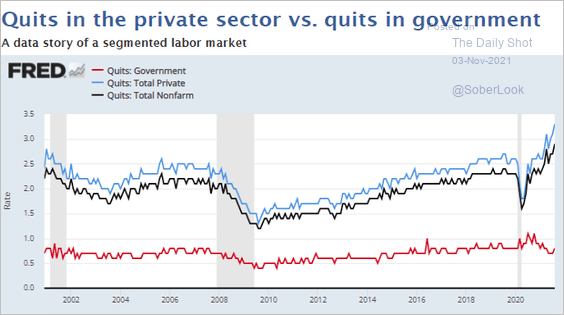

• This chart shows the quit rate (voluntary departures) for government vs. private workers.

Source: FRED

Source: FRED

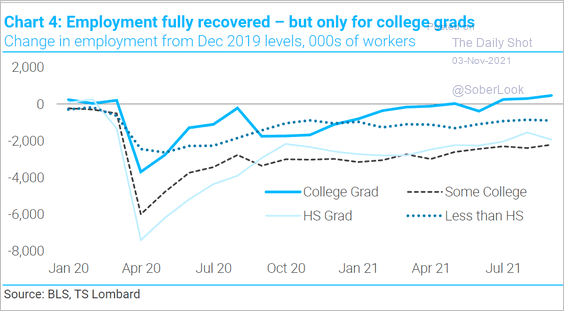

• Employment for college grads has fully recovered.

Source: TS Lombard

Source: TS Lombard

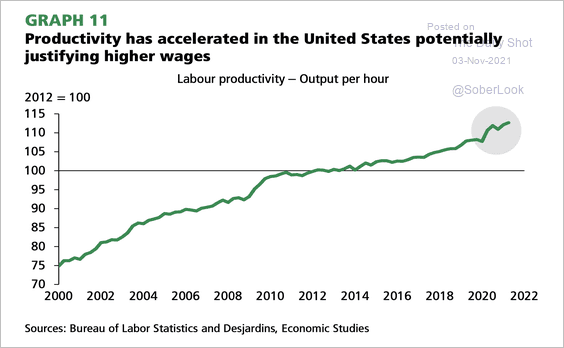

• Labor productivity picked up momentum since the start of the pandemic.

Source: Desjardins

Source: Desjardins

——————–

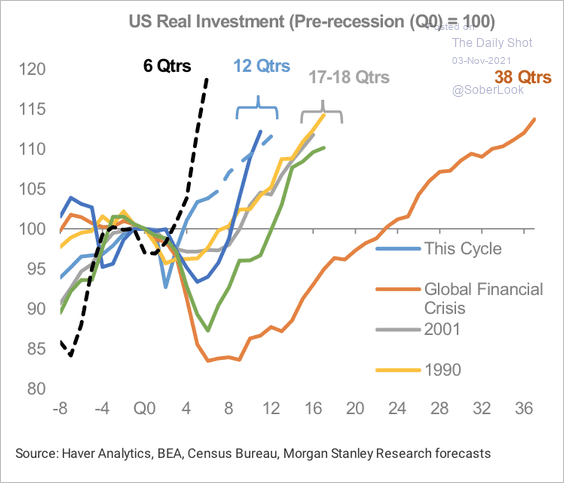

2. The latest capital expenditure recovery has been the strongest since the 1940s (boosting productivity).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

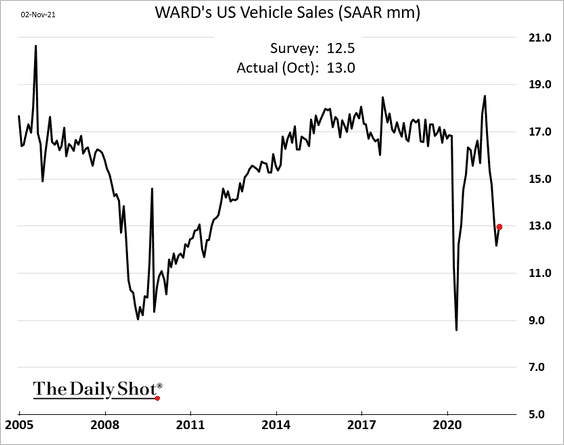

3. US vehicle sales appear to have stabilized.

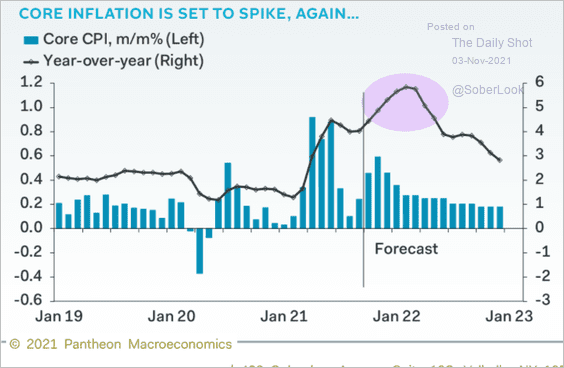

4. According to Pantheon Macroeconomics, the core CPI is set to accelerate next year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

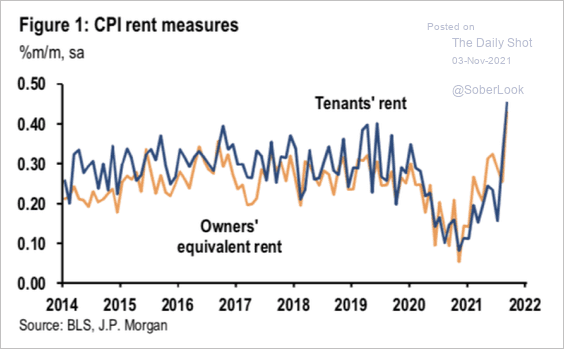

Rent and owners’ equivalent rent …

Source: JP Morgan Research

Source: JP Morgan Research

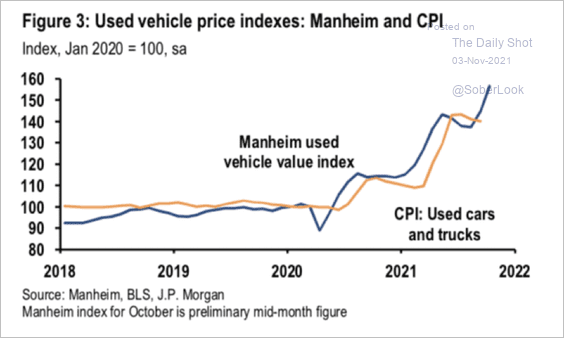

… as well as used vehicle prices are expected to strongly contribute to the core CPI gains.

Source: JP Morgan Research

Source: JP Morgan Research

Back to Index

Canada

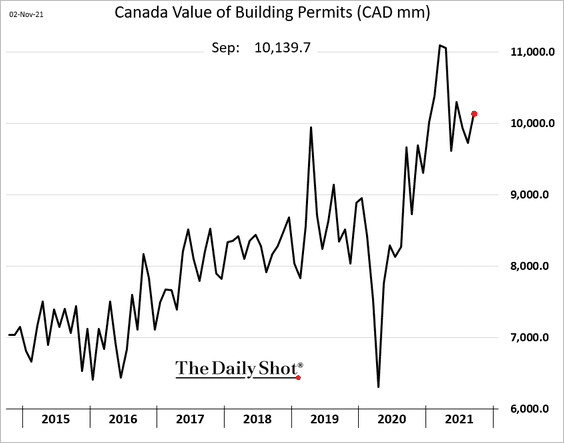

1. Building permits jumped in September.

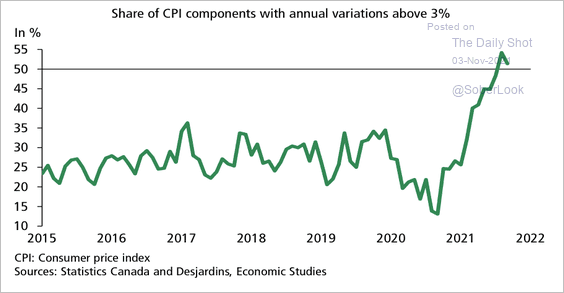

2. Over half of the CPI basket components have annual variations above 3%.

Source: Desjardins

Source: Desjardins

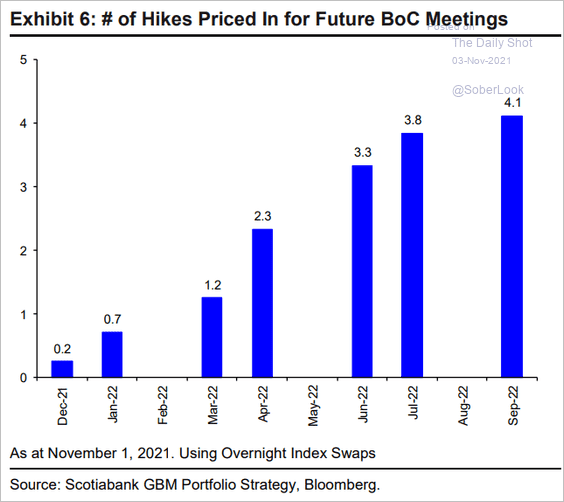

3. Here is the number of BoC hikes priced into the market.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

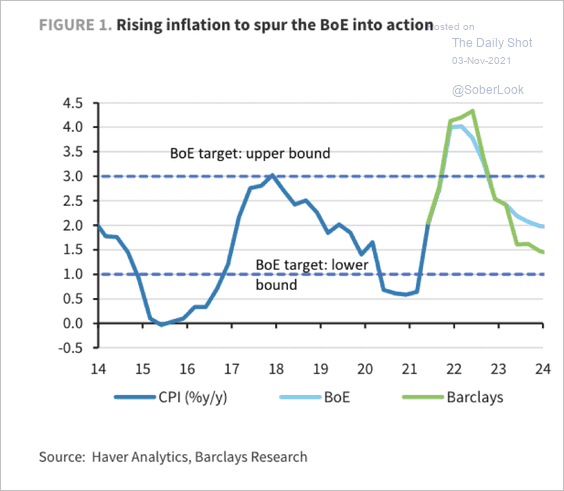

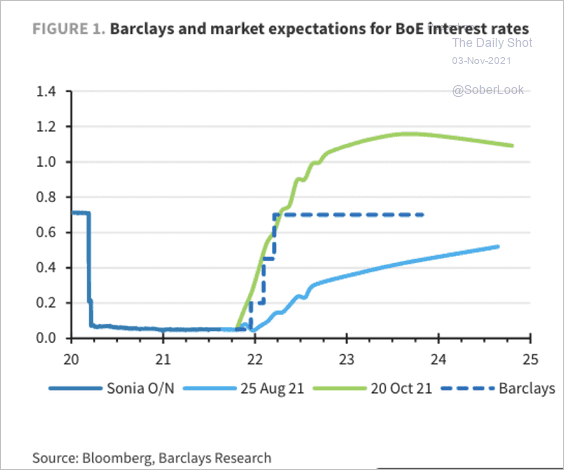

Both Barclays and the BoE forecast inflation to surpass the 4% upper-bound set by the central bank by the end of the year …

Source: Barclays Research

Source: Barclays Research

…which could signal the beginning of rate hikes.

Source: Barclays Research

Source: Barclays Research

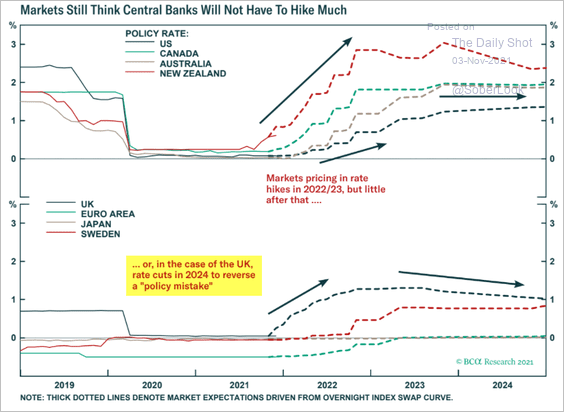

But markets see the BoE overshooting on rate hikes, having to backtrack later.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

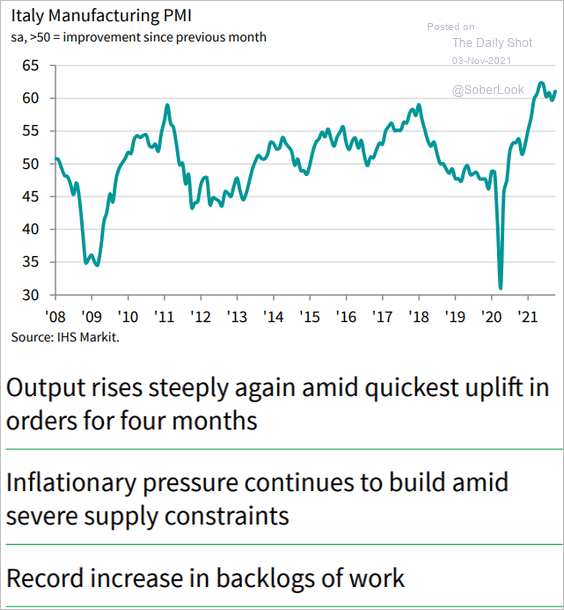

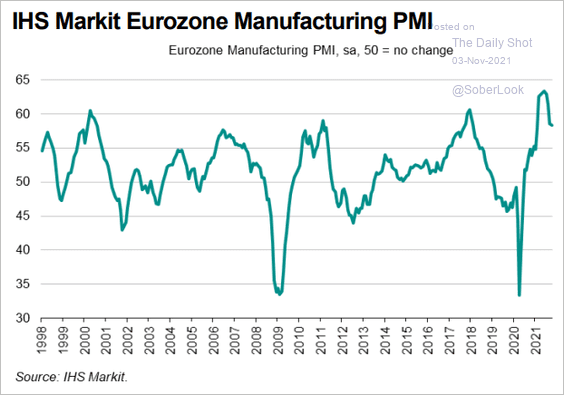

1. Italian manufacturing growth accelerated in October, bucking the trend we see at the Eurozone level.

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

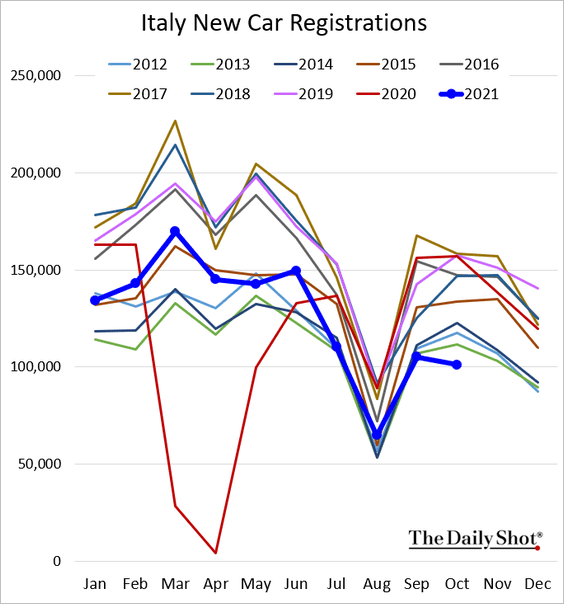

Separately, Italian car registrations are at multi-year lows (for this time of the year).

——————–

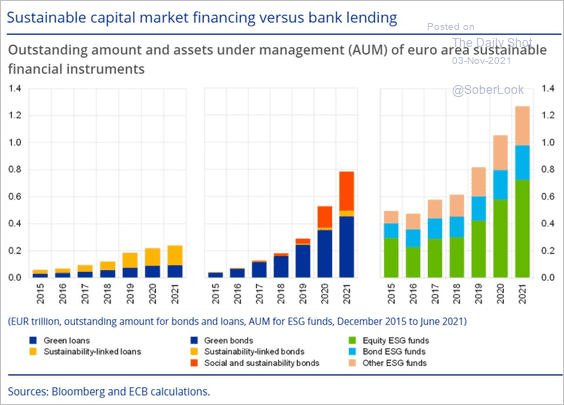

2. Sustainable financial products make up less than 10% of their respective markets in the euro area, but green capital markets are growing rapidly.

Source: ECB Read full article

Source: ECB Read full article

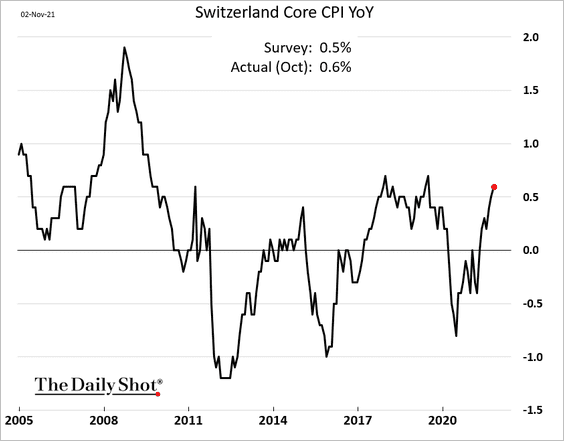

3. Swiss inflation continues to rebound.

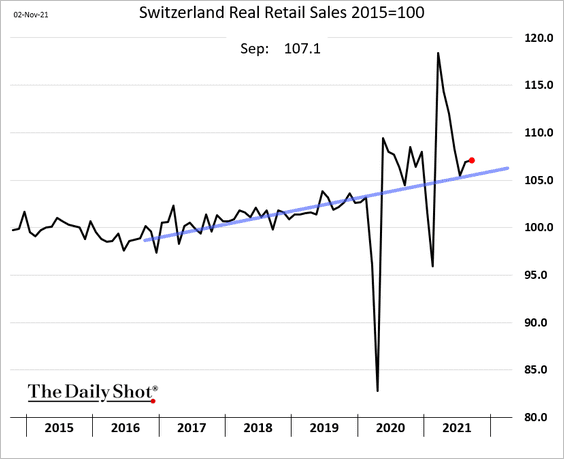

Swiss retail sales are back above the pre-COVID trend.

Back to Index

Asia – Pacific

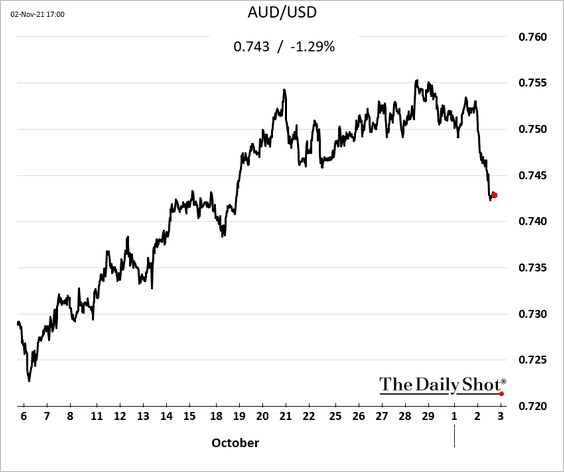

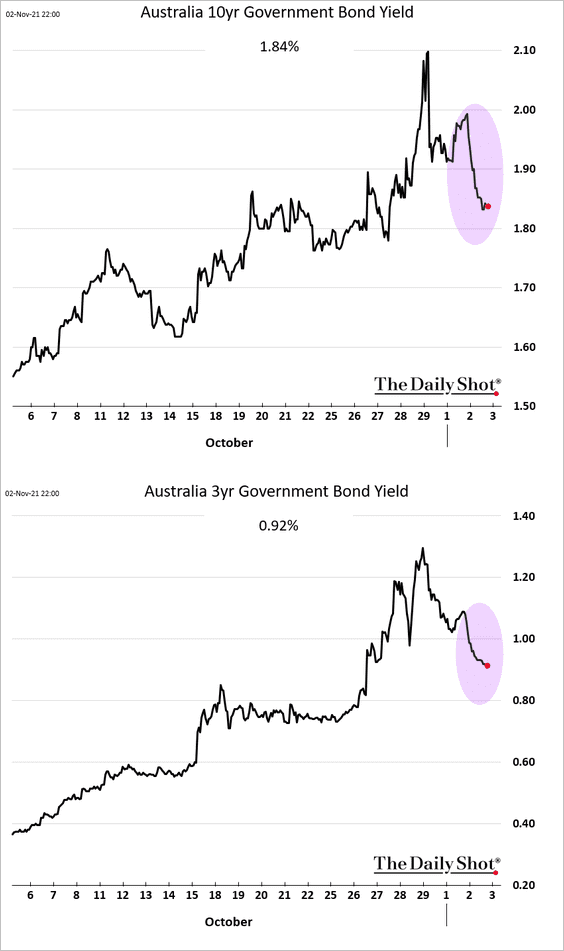

1. Let’s begin with Australia.

• The RBA bowed to market pressure, giving up yield targeting. But the central bank struck a dovish tone, indicating that it will be patient on rate hikes.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

The Aussie dollar and bond yields fell.

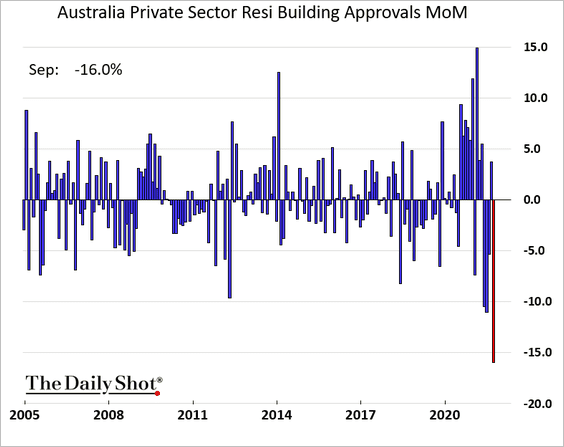

• Private-sector residential building approvals tumbled in September.

Source: The Bull Read full article

Source: The Bull Read full article

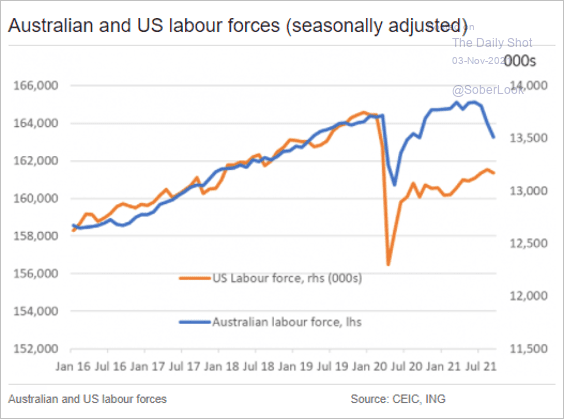

• This chart shows the trajectory of Australia’s labor force vs. the US.

Source: ING

Source: ING

——————–

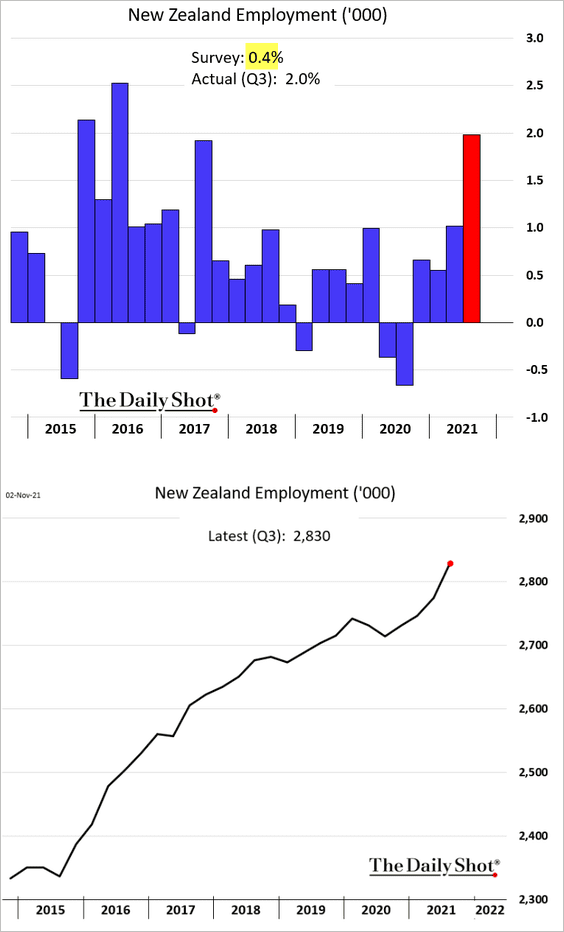

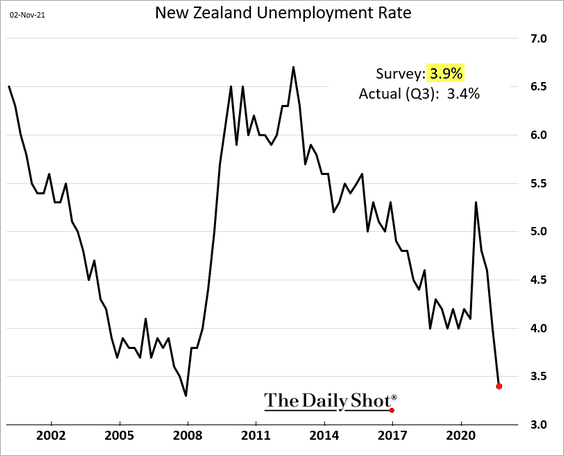

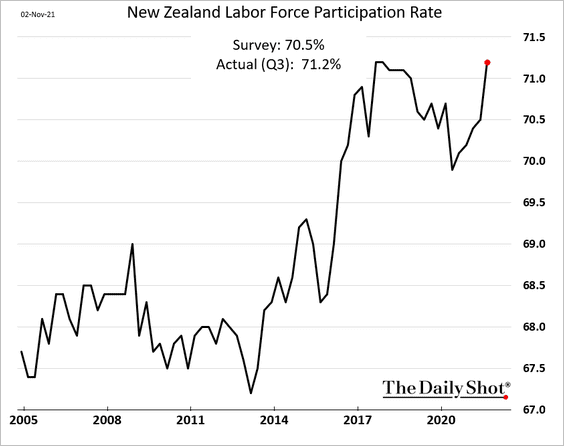

2. New Zealand’s Q3 employment report was remarkably strong.

• Employment gains:

• The unemployment rate:

• Labor force participation:

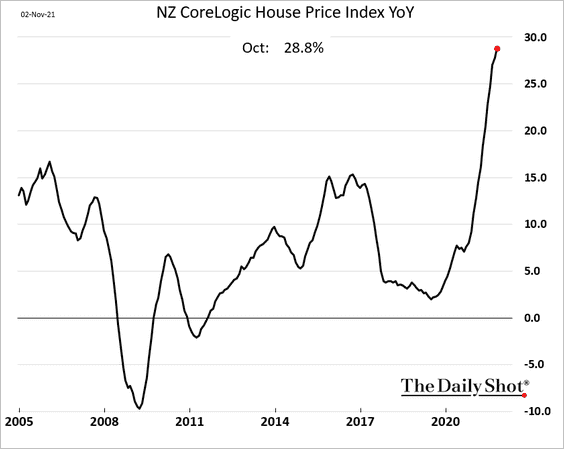

Separately, New Zealand’s home price gains are approaching 30%.

——————–

3. Next, we have semiconductor output as a share of GDP for select economies.

![]() Source: Deloitte Read full article

Source: Deloitte Read full article

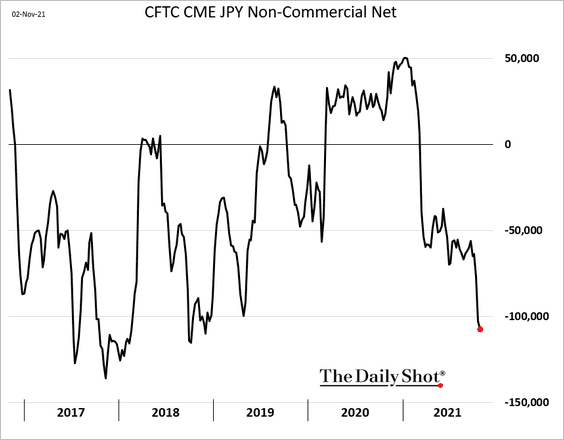

4. Speculative accounts continue to boost their bets against the yen (often as part of a carry trade).

Back to Index

China

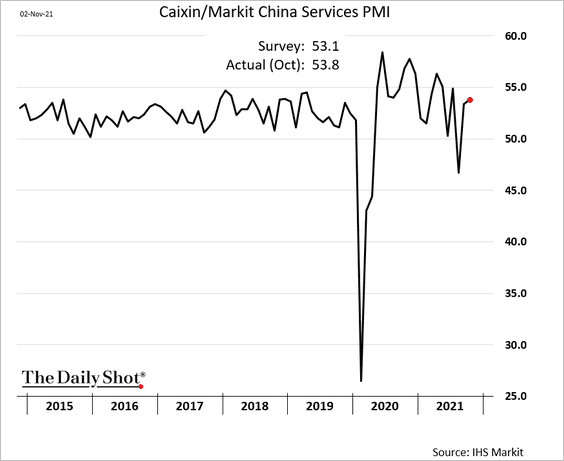

1. Markit’s PMI index showed further improvement in service-sector growth.

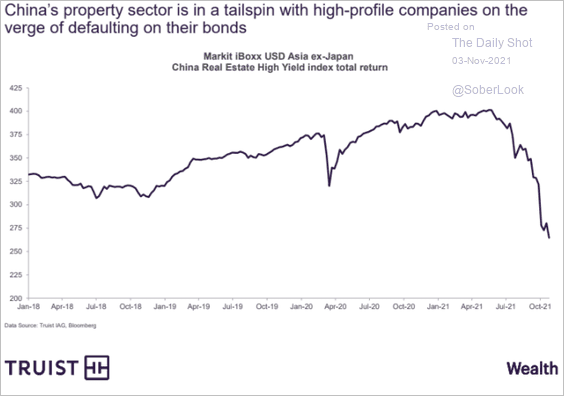

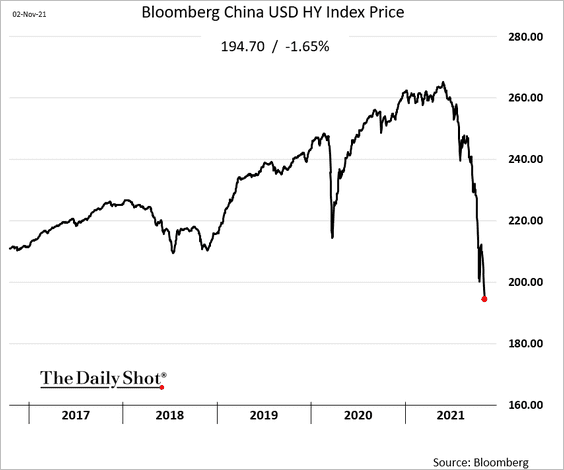

2. The selloff in developers’ bonds continues.

• Property developer debt total return:

Source: Truist Advisory Services

Source: Truist Advisory Services

• The overall HY index:

——————–

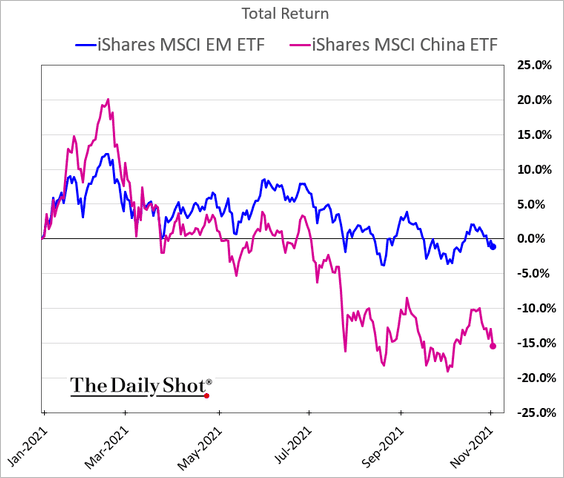

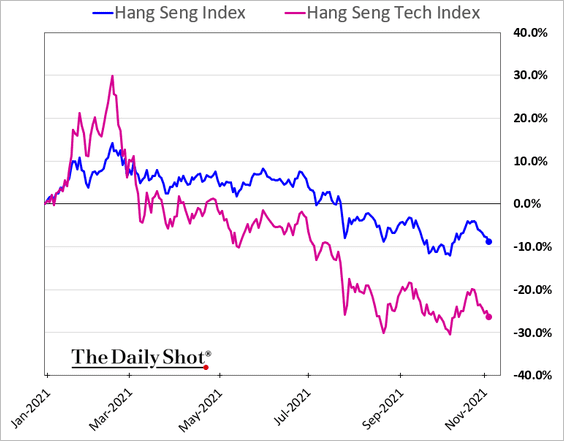

3. China’s stocks continue to underperform.

Tech shares in Hong Kong are struggling.

——————–

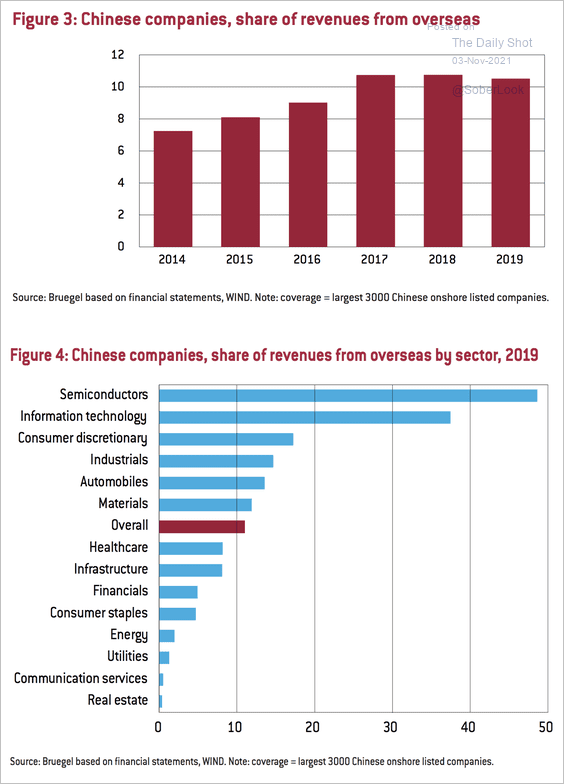

4. What share of China’s corporate revenues comes from abroad?

Source: Bruegel Read full article

Source: Bruegel Read full article

5. Bloomberg’s renminbi index continues to grind higher (vs. a basket of currencies).

![]()

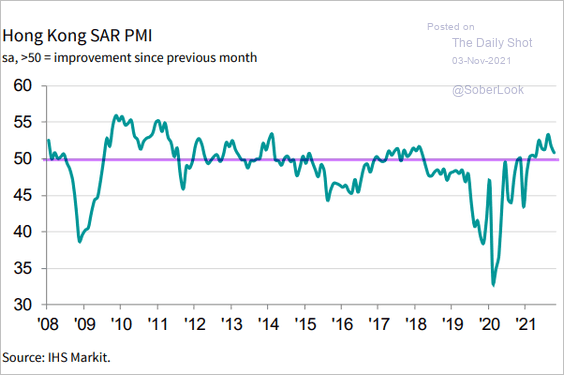

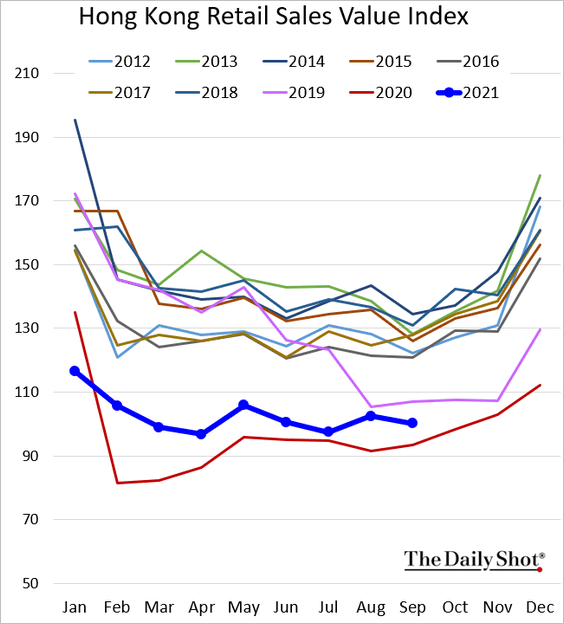

6. Next, we have a couple of updates from Hong Kong.

• Business growth moderated further in October.

Source: IHS Markit

Source: IHS Markit

• Retail sales remain soft.

Back to Index

Emerging Markets

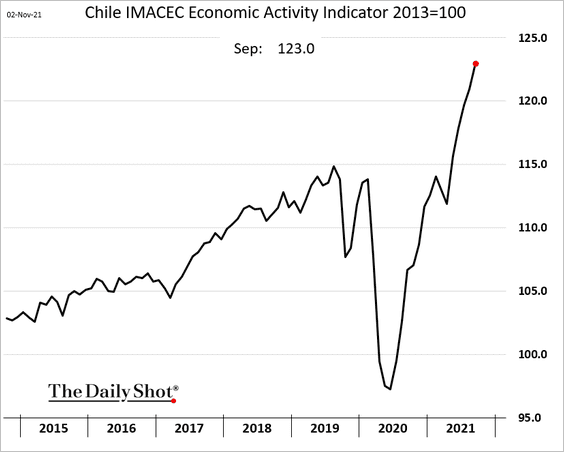

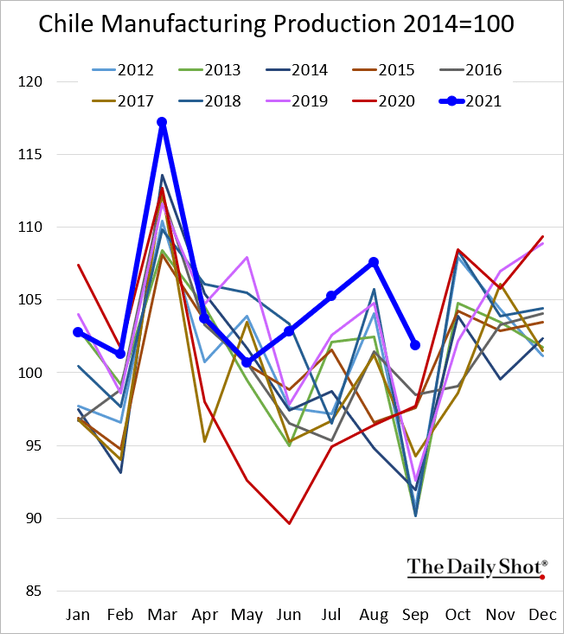

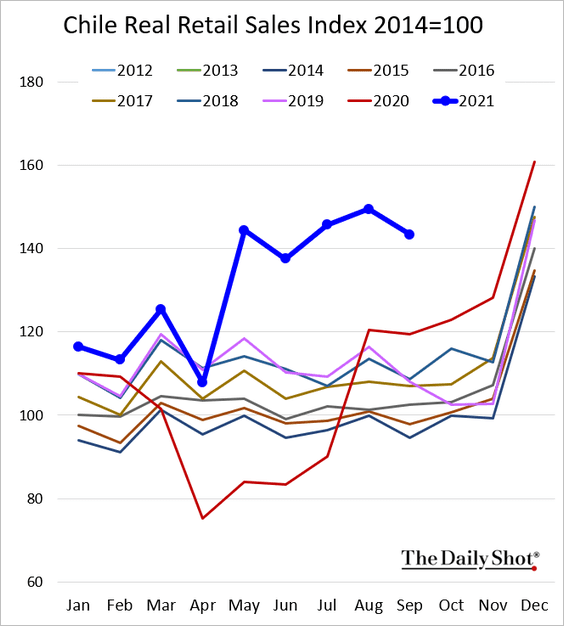

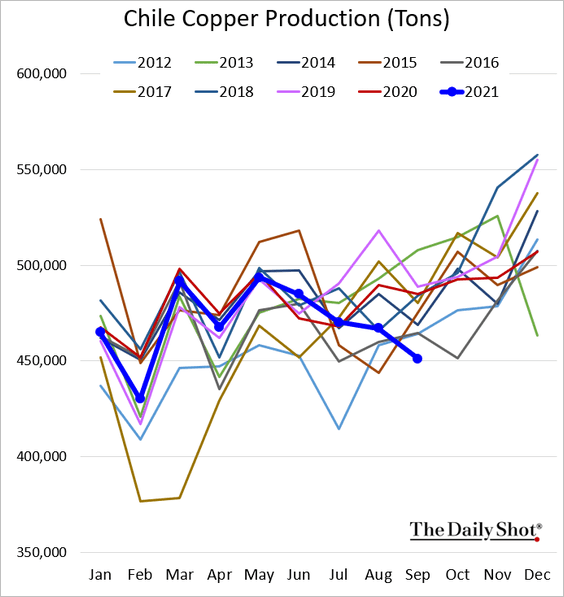

1. Let’s begin with Chile.

• Economic growth has been surging.

• Industrial production remains at multi-year highs (for this time of the year).

• Retail sales have been exceptional.

• Copper production deteriorated in September due to labor strikes.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

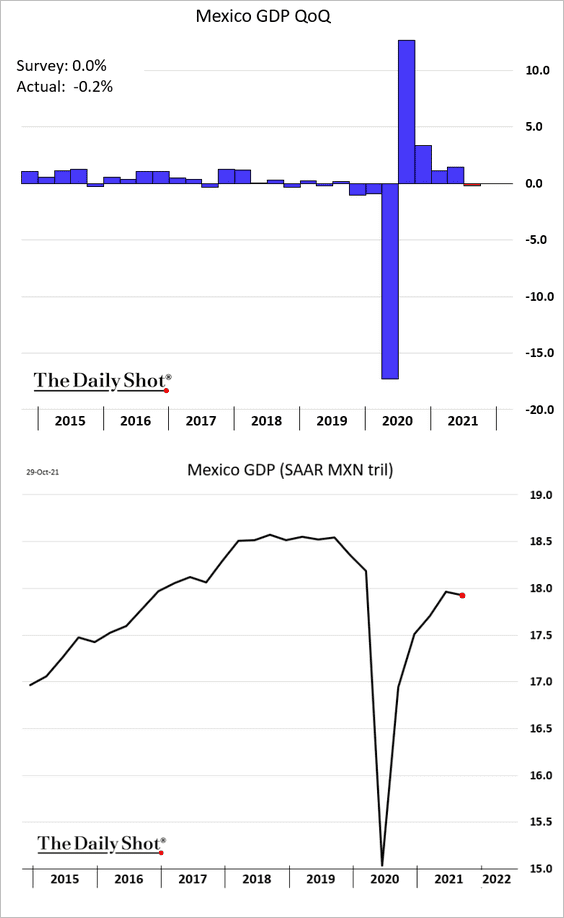

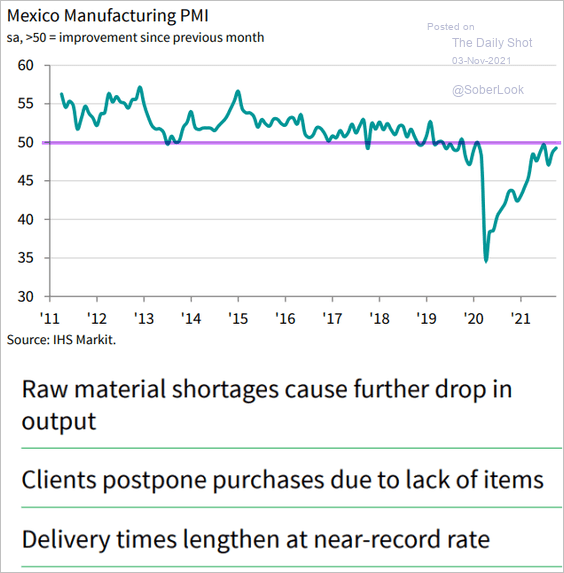

2. Mexico’s GDP declined in Q3.

• Manufacturing activity is struggling to return to growth.

Source: IHS Markit

Source: IHS Markit

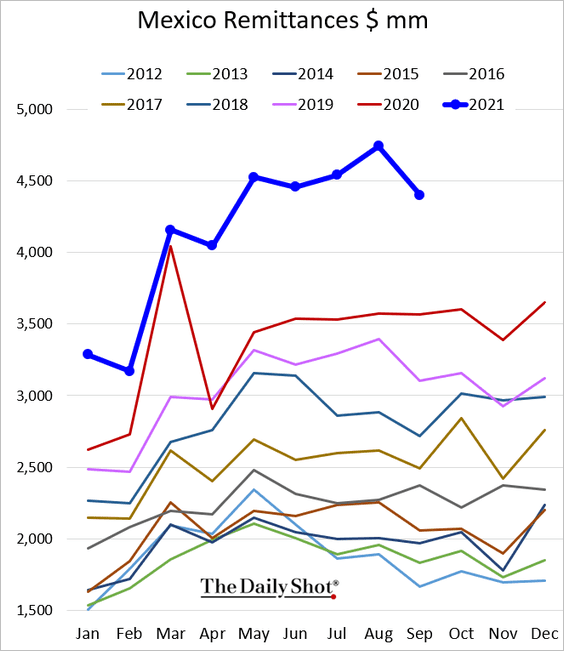

• Remittances remain robust.

——————–

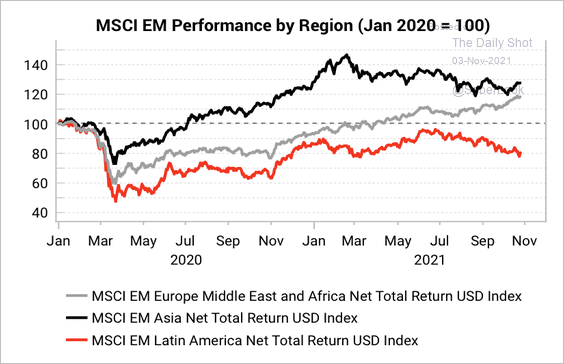

3. Latin American equities have lagged the broader EM basket over the past year.

Source: Variant Perception

Source: Variant Perception

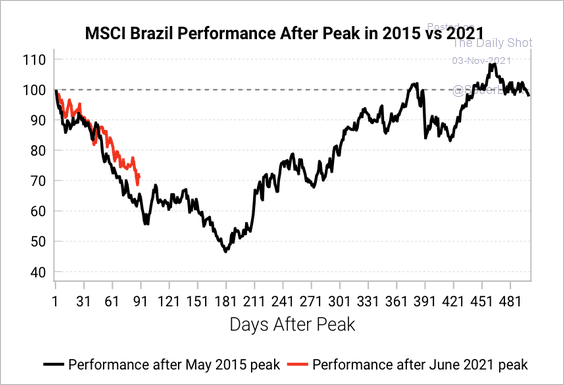

Brazil’s equity market could see further downside before stabilizing, according to the 2015 analog.

Source: Variant Perception

Source: Variant Perception

——————–

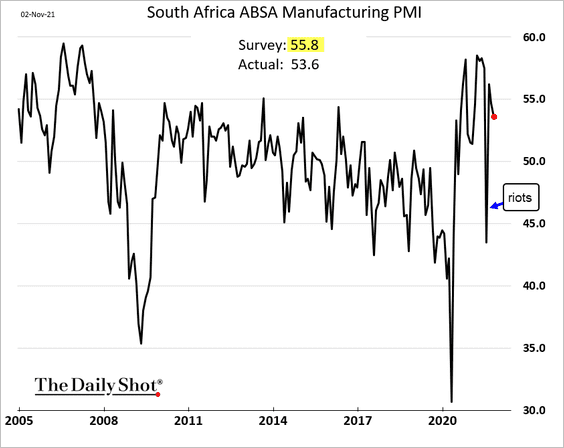

4. South Africa’s manufacturing growth slowed in October.

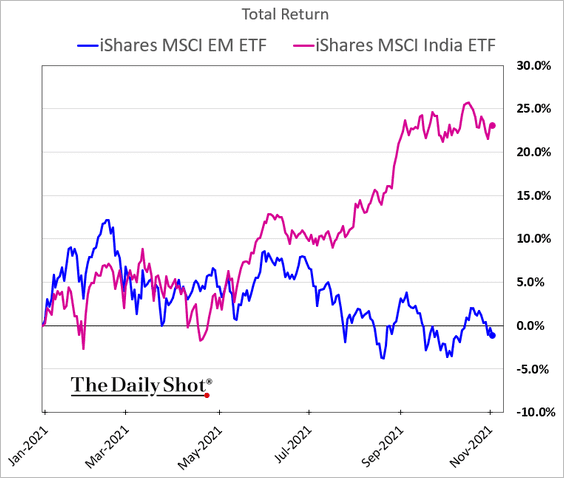

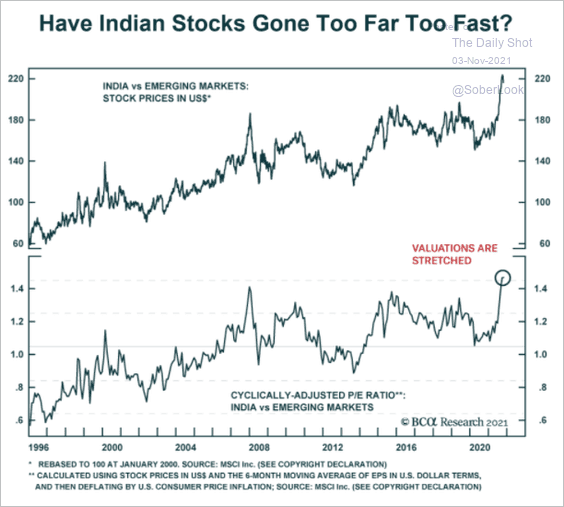

5. India’s stocks have massively outperformed peers since July.

Has the market overshot?

Source: BCA Research

Source: BCA Research

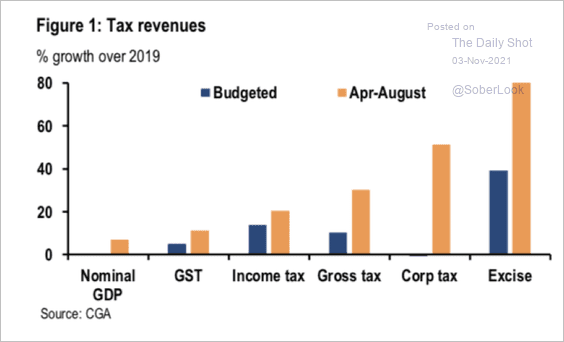

Separately, India’s tax revenues have surpassed budget expectations.

Source: JP Morgan Research

Source: JP Morgan Research

——————–

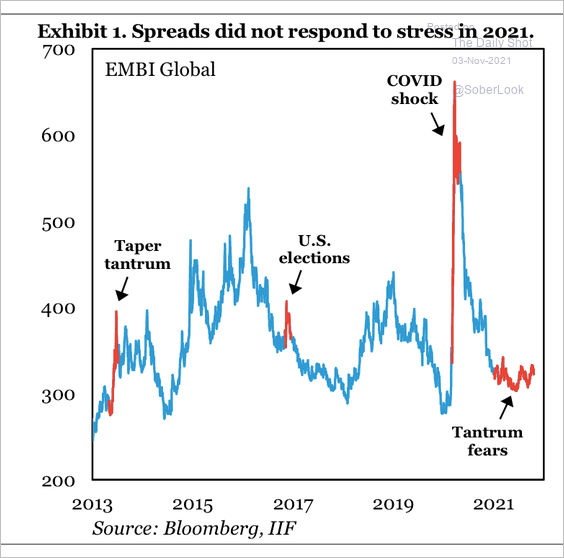

6. Unlike previous occasions, EM spreads did not respond to central bank taper talks this year.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

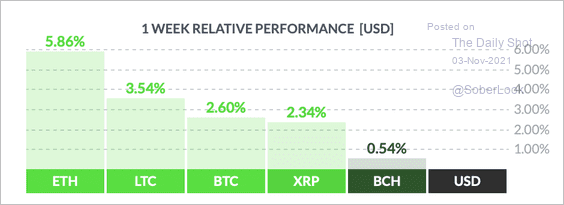

1. Ether has outperformed other large cryptocurrencies over the past week.

Source: FinViz

Source: FinViz

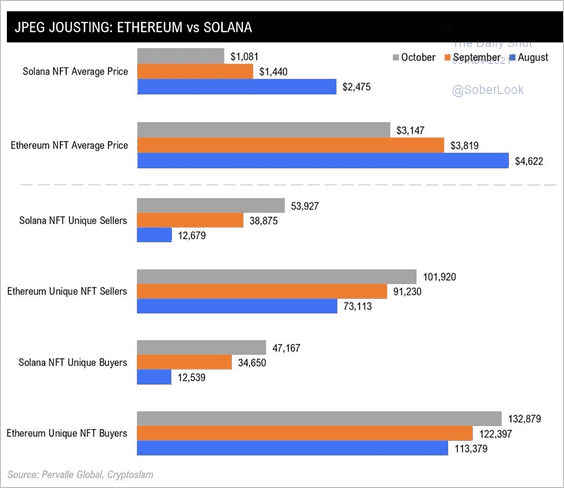

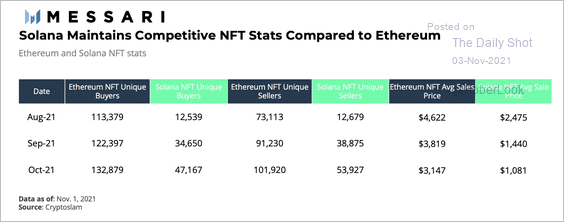

2. How does Ethereum compare to Solana in the NFT market?

Source: @MichaelRinko

Source: @MichaelRinko

Source: @MessariCrypto

Source: @MessariCrypto

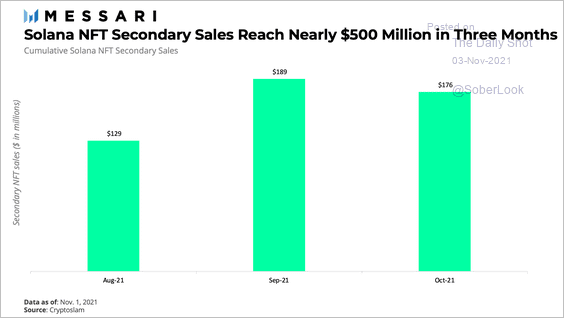

Secondary NFT sales on Solana, a decentralized blockchain, reached $500 million over the past few months.

Source: @MessariCrypto

Source: @MessariCrypto

——————–

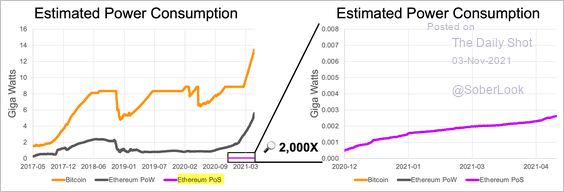

3. Ethereum’s proof-of-stake (PoS) blockchain consensus mechanism is far more energy-efficient than mining.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

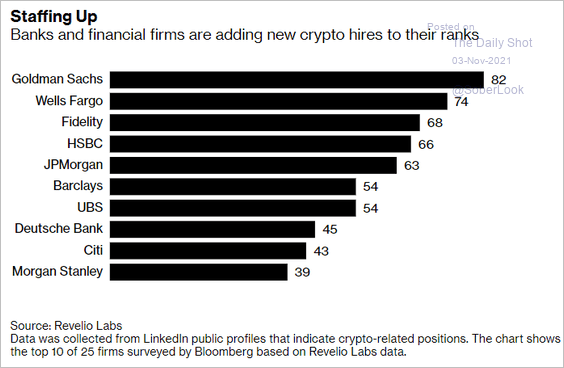

4. Banks have been hiring workers with crypto experience.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

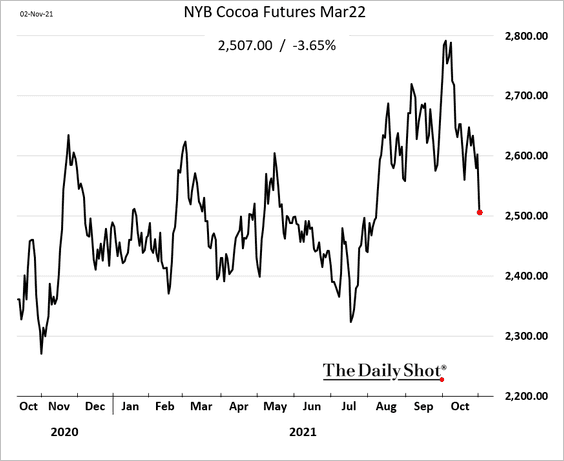

1. Cocoa prices tumbled on Tuesday. Favorable weather conditions in West Africa and ample cocoa supplies at US ports put pressure on the commodity. There won’t be any shortages of chocolate for the holidays.

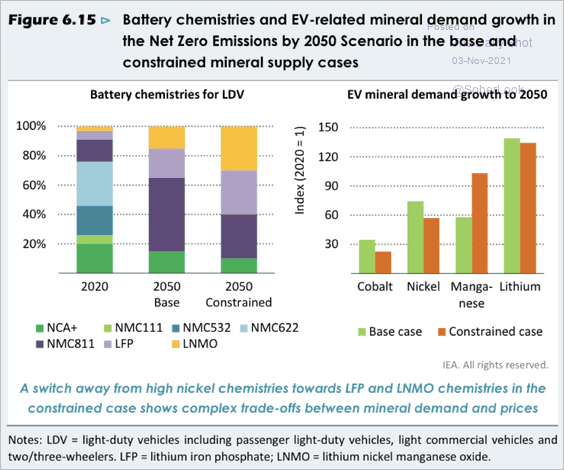

2. Demand for minerals related to electric vehicle production is expected to accelerate over the next 30 years.

Source: IEA

Source: IEA

Back to Index

Energy

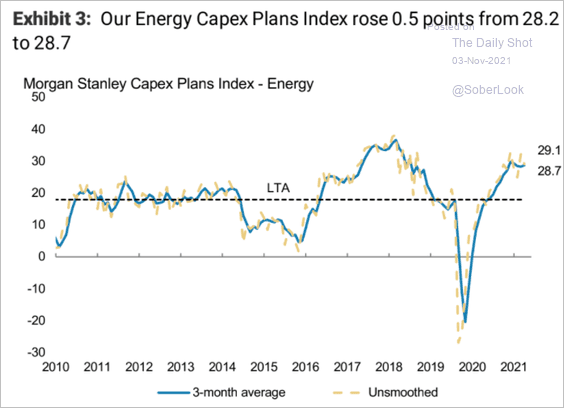

1. Morgan Stanley’s CapEx plans index points to robust investment in the energy space.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

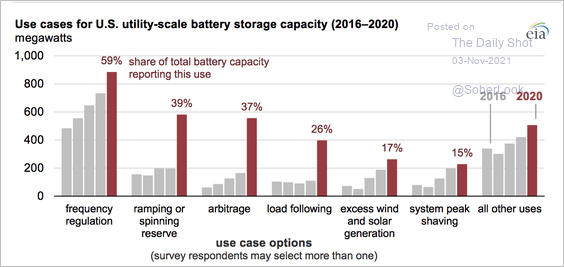

2. According to EIA, US “battery storage applications have shifted as more batteries are added to the grid.”

Source: EIA Read full article

Source: EIA Read full article

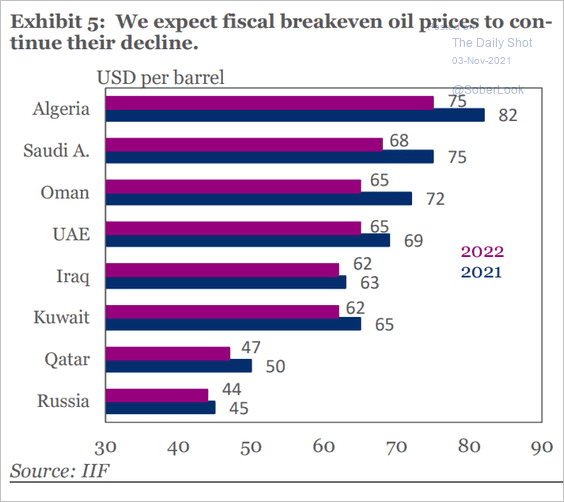

3. Most major exporters’ governments are “in the money” on oil prices.

Source: IIF

Source: IIF

Back to Index

Equities

1. Let’s start with the year-to-date and month-to-date sector returns.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

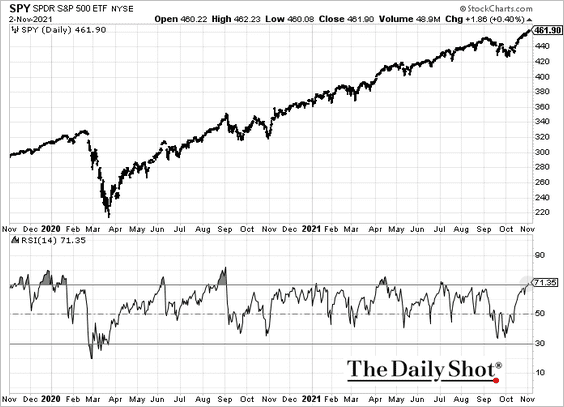

2. Technicals show the S&P 500 in overbought territory as US indices hit record highs.

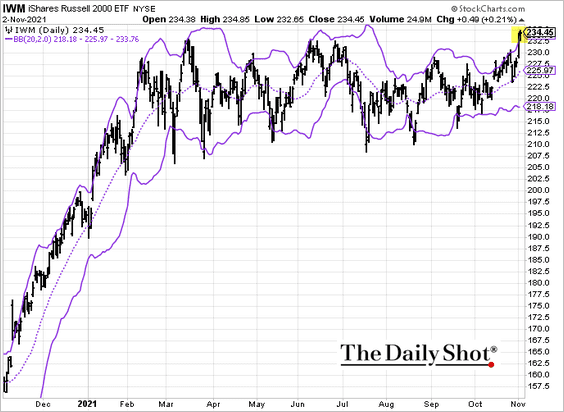

The Russell 2000 is above the upper Bollinger band.

——————–

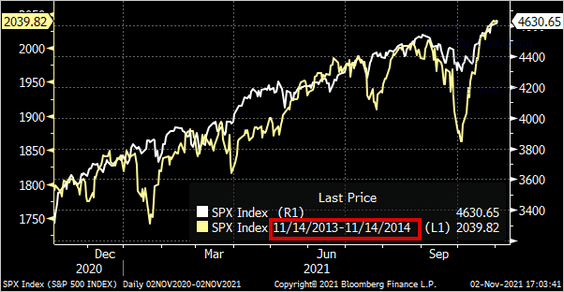

3. Will the Fed’s taper bring back some of the volatility we saw during the 2013/14 period?

Source: @Marcomadness2

Source: @Marcomadness2

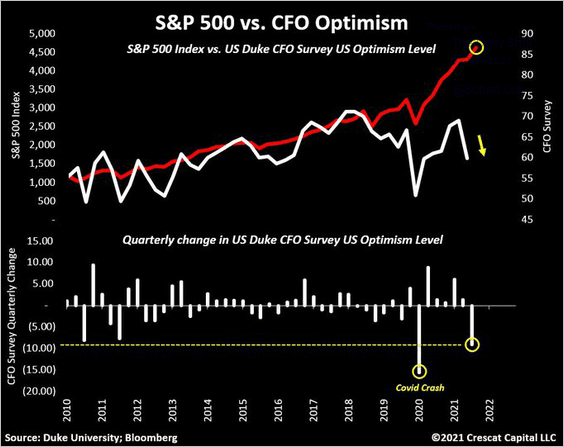

4. CFO optimism and stock prices have decoupled.

Source: @TaviCosta

Source: @TaviCosta

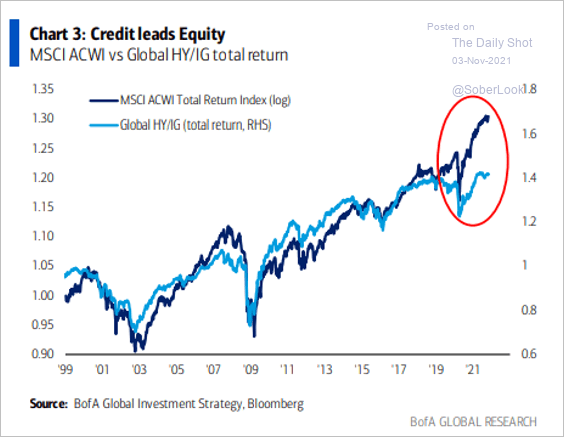

5. Stocks have also decoupled from the credit markets.

Source: BofA Global Research

Source: BofA Global Research

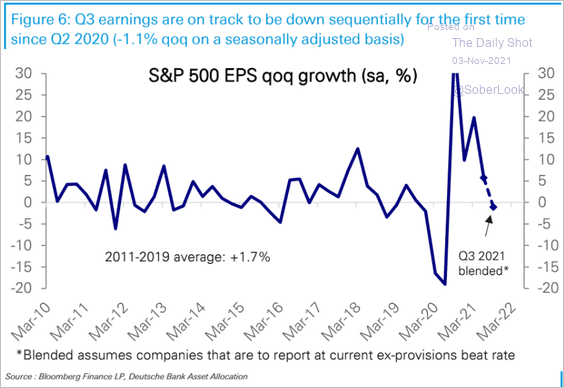

6. Earnings are down quarter-over-quarter for the first time since Q2 of 2020.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

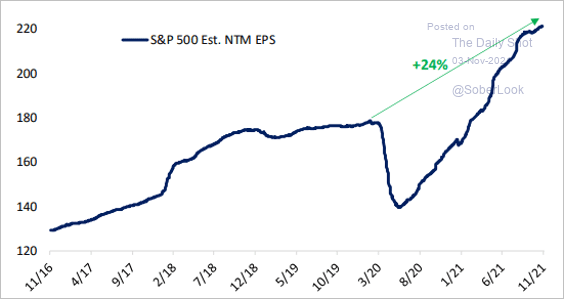

By the way, the pandemic has done wonders for corporate earnings.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

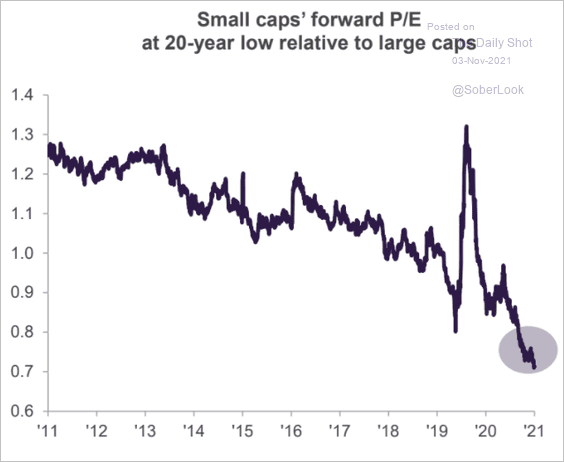

7. Small caps haven’t been this cheap relative to large caps in a long time.

Source: Truist Advisory Services

Source: Truist Advisory Services

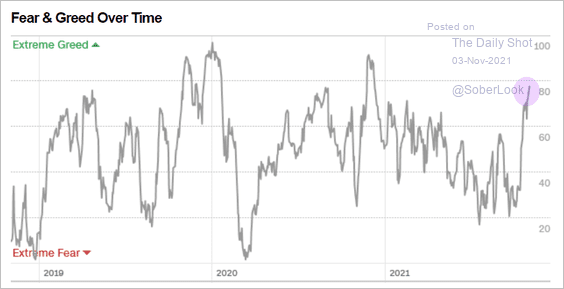

8. CNN’s Fear & Greed index is moving deeper into greed territory.

Source: CNN Business

Source: CNN Business

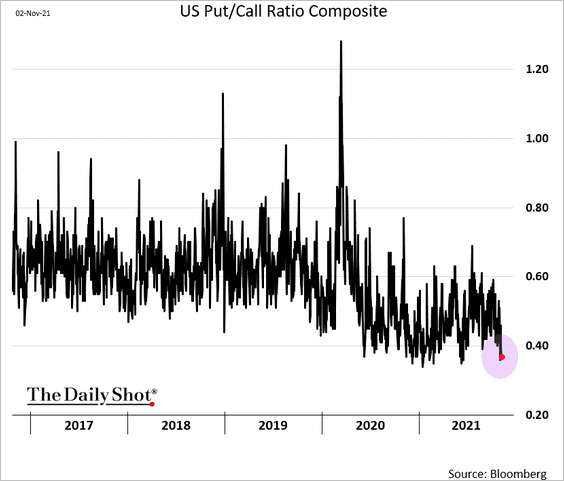

The put/call ratio is back near the lows.

——————–

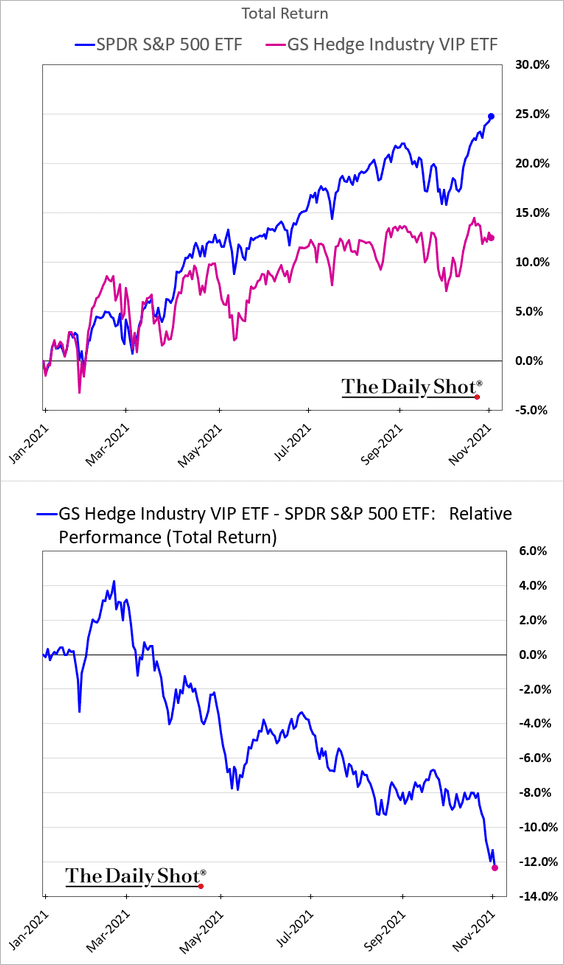

9. Stocks favored by hedge funds continue to widen their underperformance.

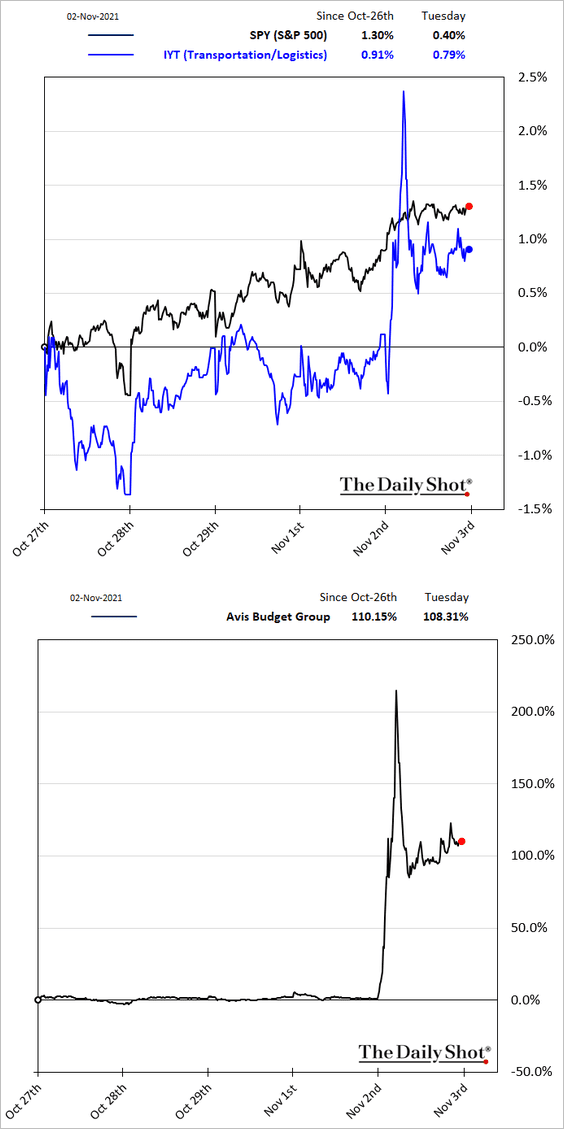

10. It was an interesting day for the transportation sector.

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

Alternatives

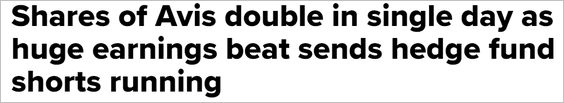

1. Let’s start with some data on fintech fundraising activity.

Source: BIS Read full article

Source: BIS Read full article

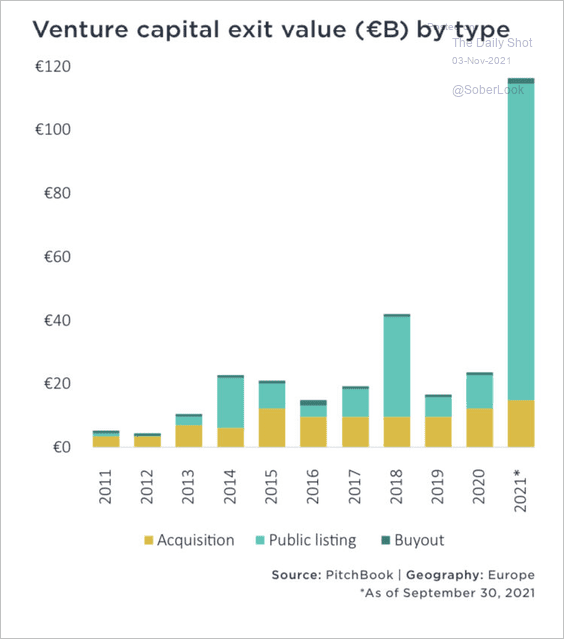

2. VC exits surged in Europe.

Source: PitchBook; h/t Emmanuel Ferry

Source: PitchBook; h/t Emmanuel Ferry

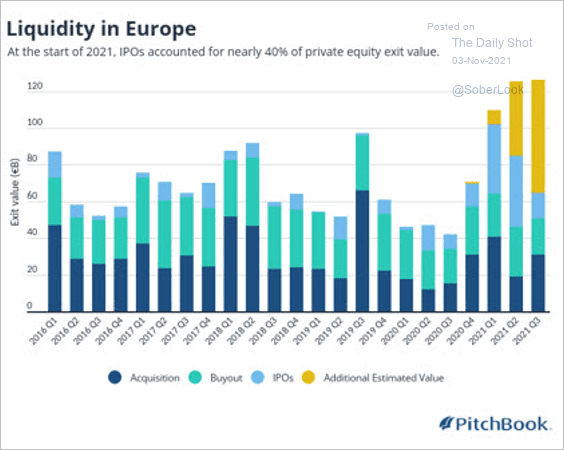

3. Public listings across Europe account for 21% of Q3’s private equity exit value, down from nearly 40% in the first quarter.

Source: PitchBook

Source: PitchBook

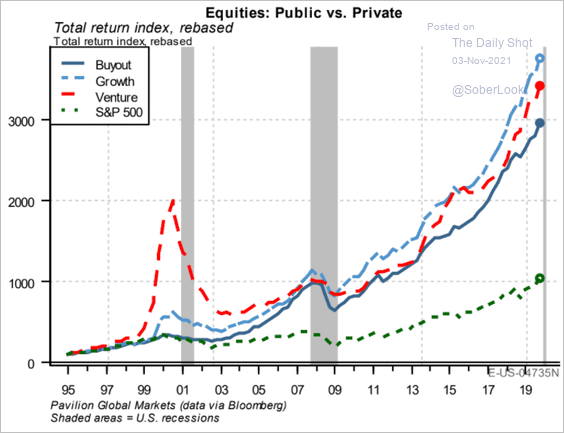

4. Here is the relative performance of buyout, growth, and VC strategies.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

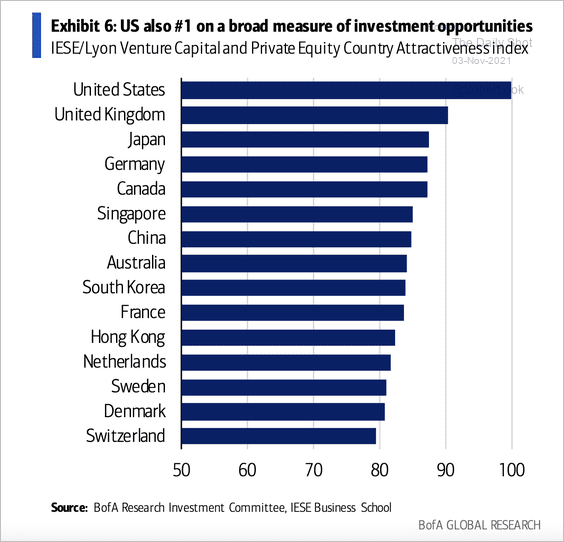

5. Below are the ranking of how broadly “investable” a country is.

Source: BofA Global Research

Source: BofA Global Research

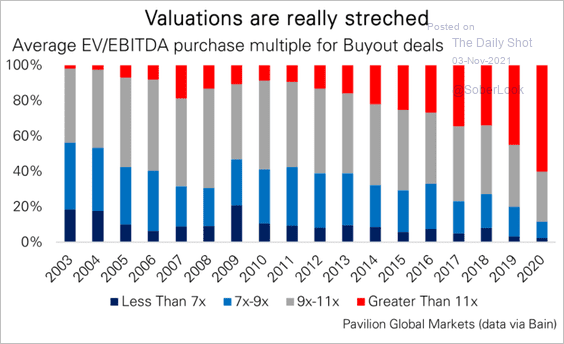

6. Buyout valuations have been stretched.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

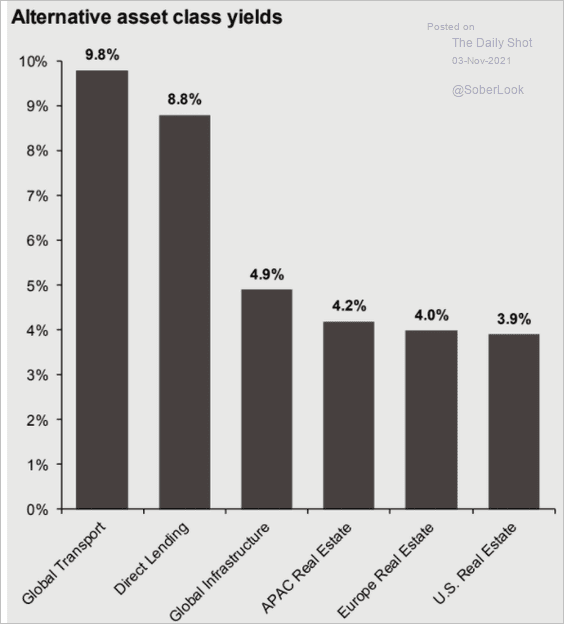

7. Next, we have the average yields on alternative asset classes.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

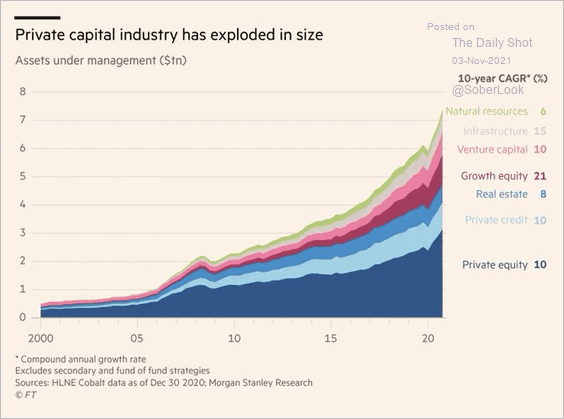

8. Private markets’ AUM has exploded, …

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

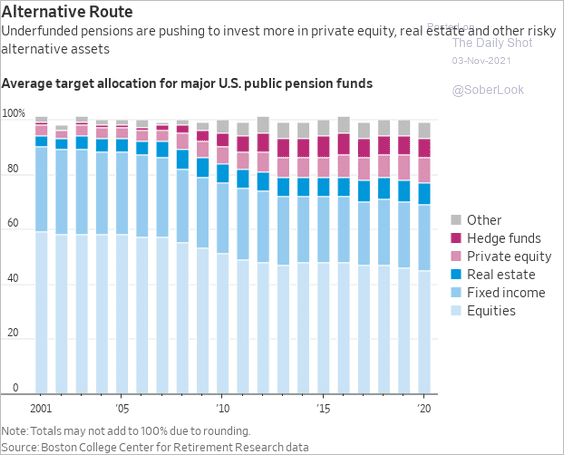

… as pensions allocate more capital to alternatives.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

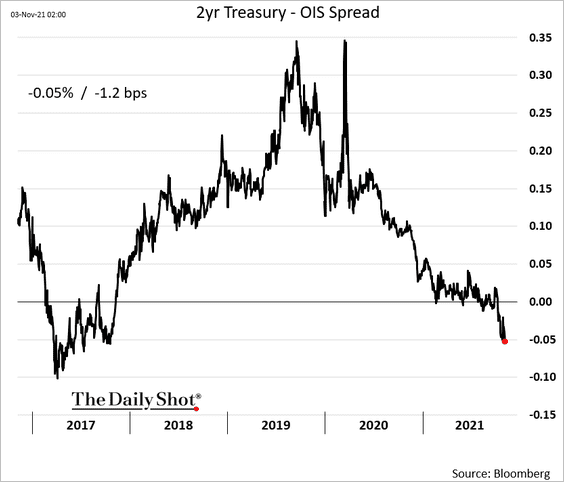

1. Despite increased rate hike expectations, short-term Treasuries are well bid.

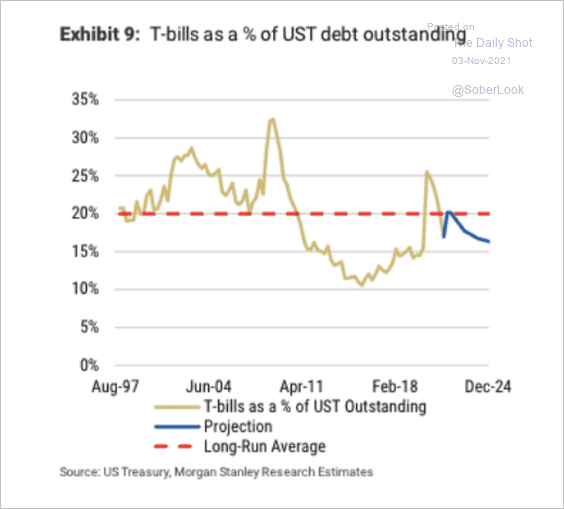

2. Morgan Stanley projects an increase in T-Bill issuance in the first quarter of 2022.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

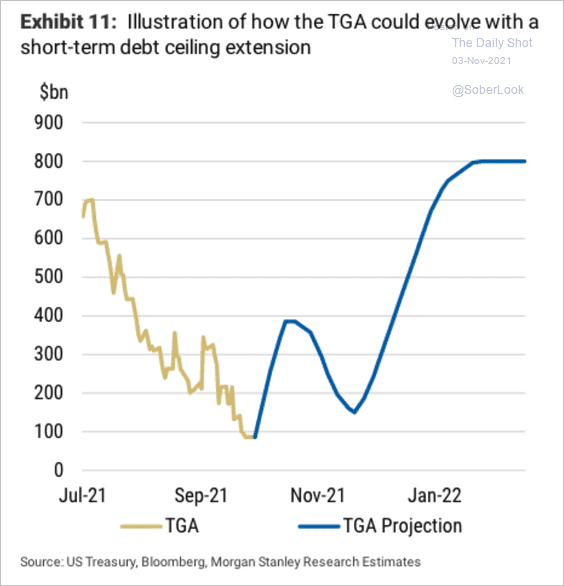

3. Here is Morgan Stanley’s projection for the Treasury general account with a debt ceiling extension.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

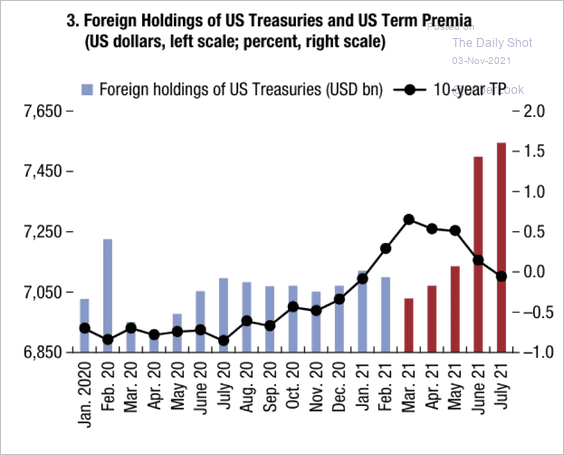

4. Despite a falling term premium, foreign investors continue to pile money into the Treasury market.

Source: IMF

Source: IMF

Back to Index

Global Developments

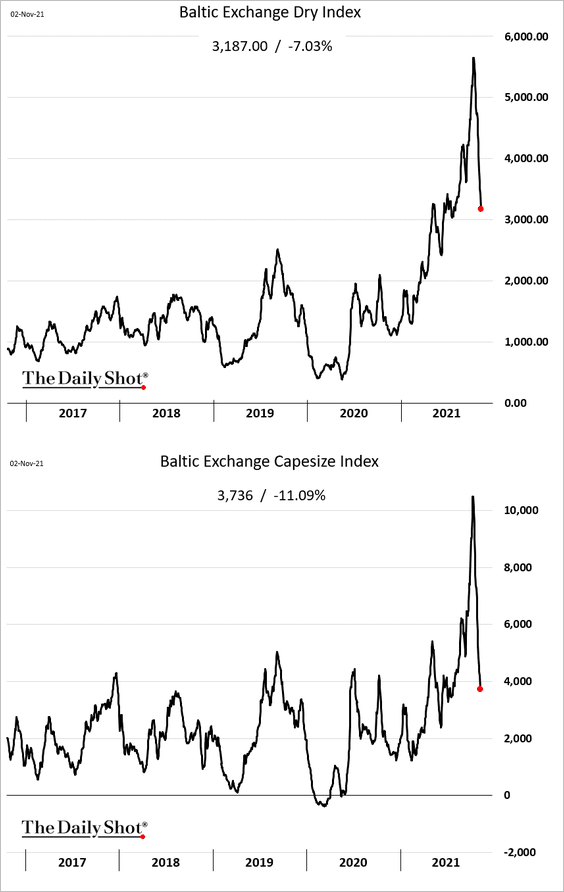

1. Dry bulk shipping costs continue to tumble amid softer demand for vessels.

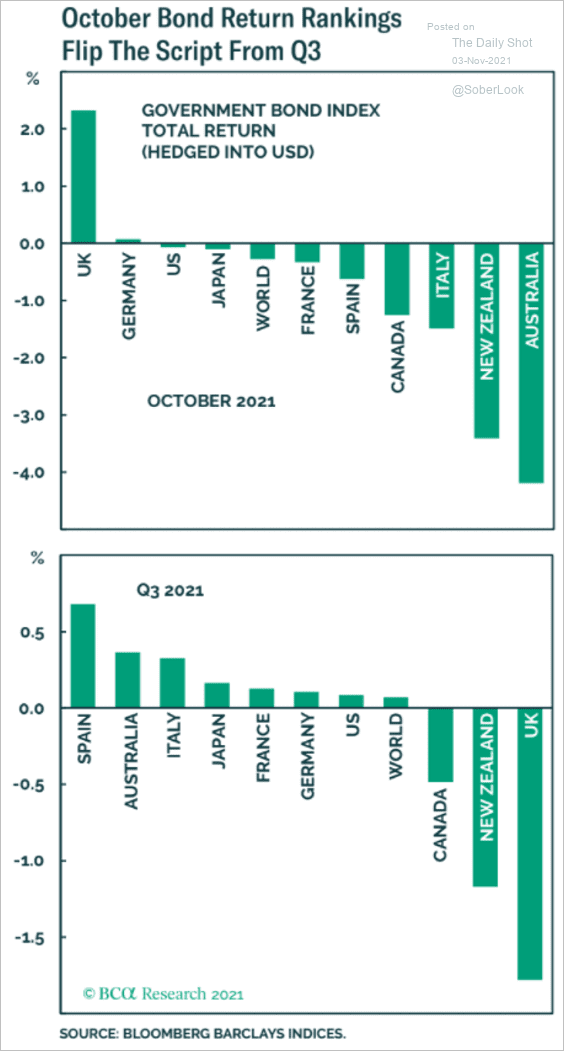

2. This chart shows government bond returns in October vs. Q3.

Source: BCA Research

Source: BCA Research

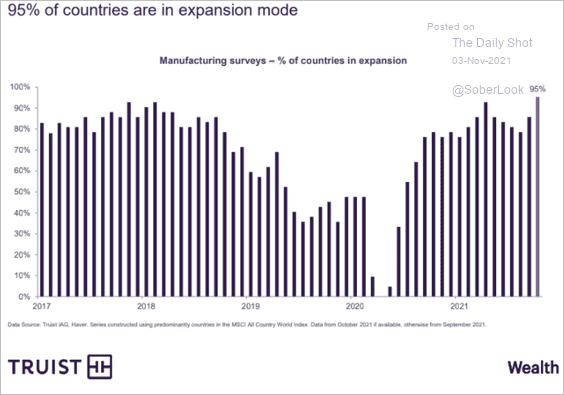

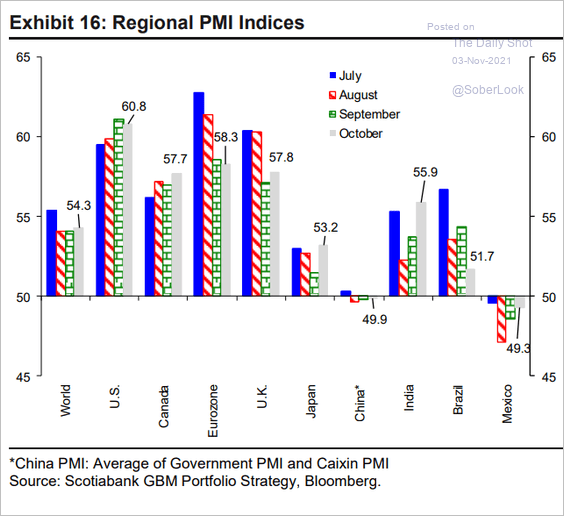

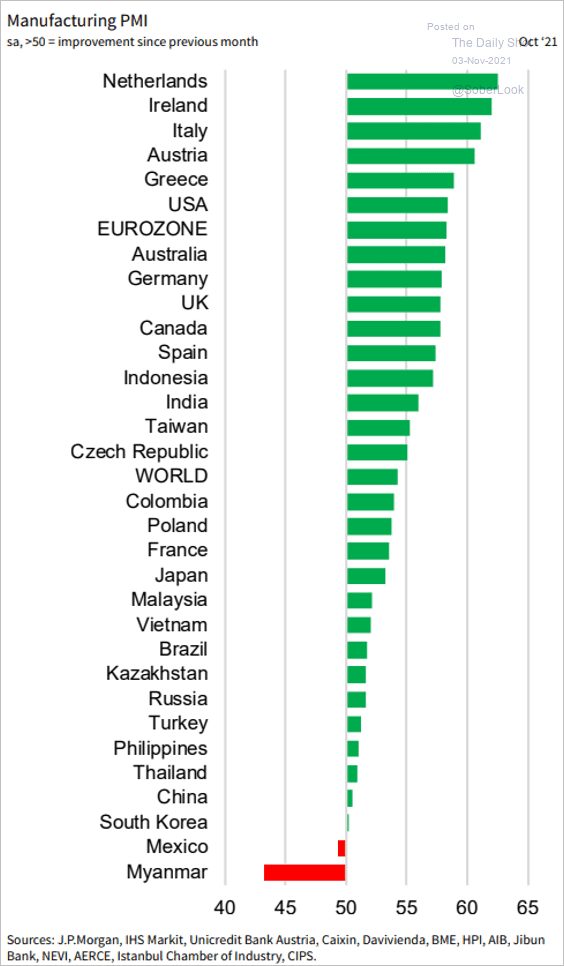

3. Next, we have some data on manufacturing PMIs.

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: IHS Markit

Source: IHS Markit

——————–

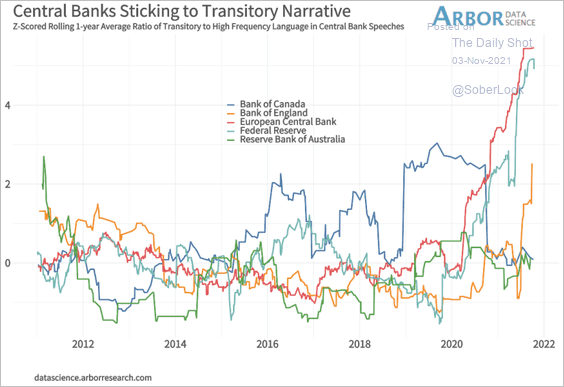

4. Central banks continue to stick to the “transitory” narrative on inflation.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

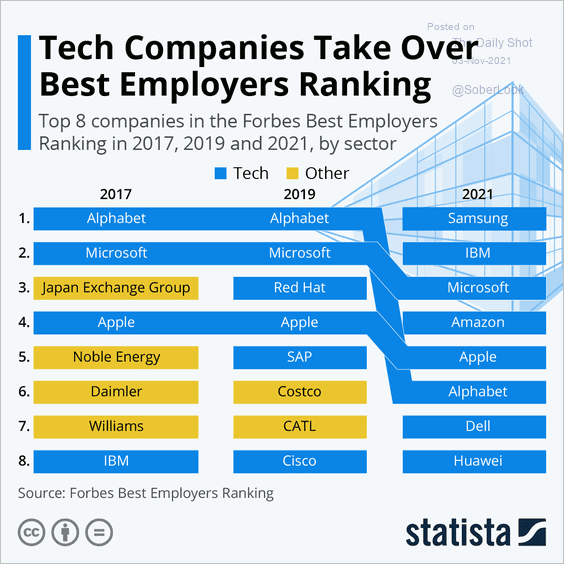

1. Best-ranked employers:

Source: Statista

Source: Statista

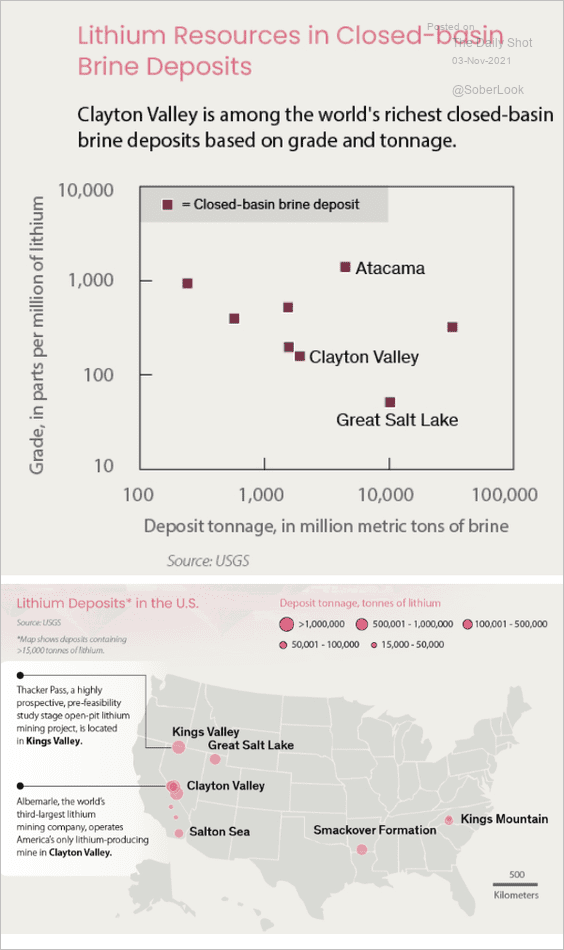

2. Lithium resources in the US:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

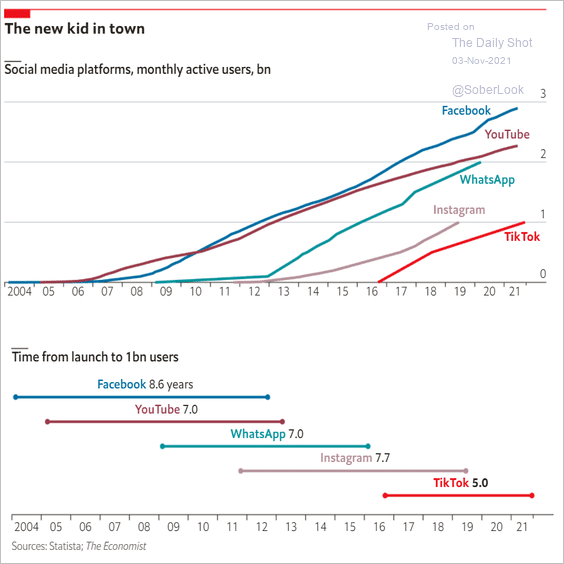

3. Active users on social media platforms:

Source: The Economist Read full article

Source: The Economist Read full article

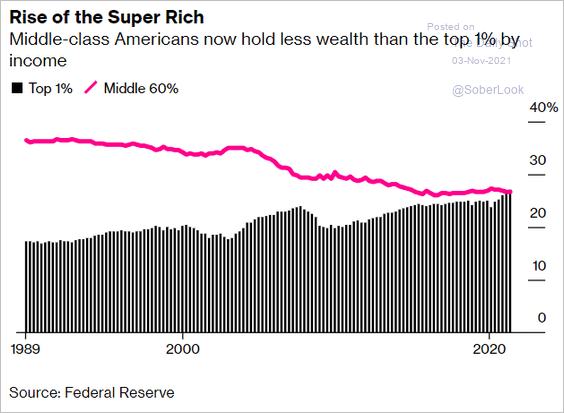

4. Wealth held by the middle-class:

Source: @wealth Read full article

Source: @wealth Read full article

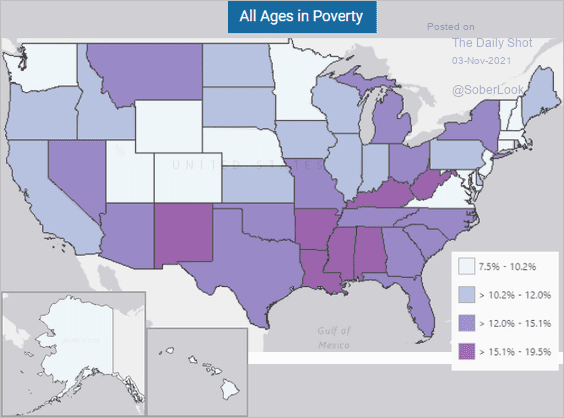

5. Poverty rates by state:

Source: @uscensusbureau

Source: @uscensusbureau

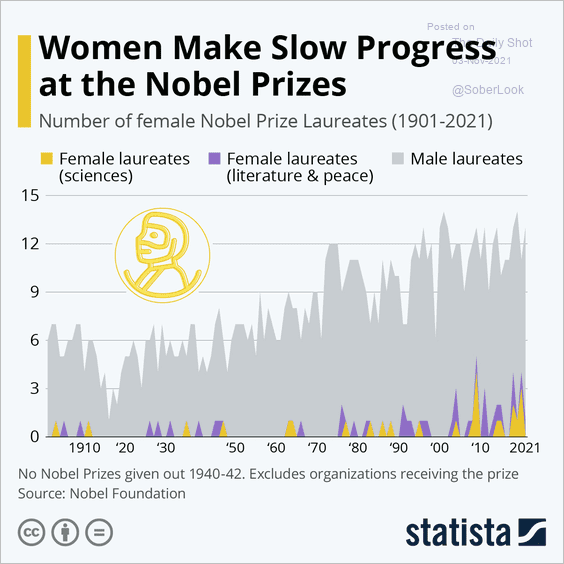

6. Female Nobel Prize laureates:

Source: Statista

Source: Statista

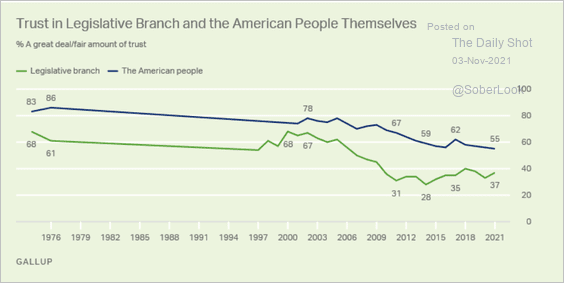

7. Americans’ trust in themselves:

Source: Gallup Read full article

Source: Gallup Read full article

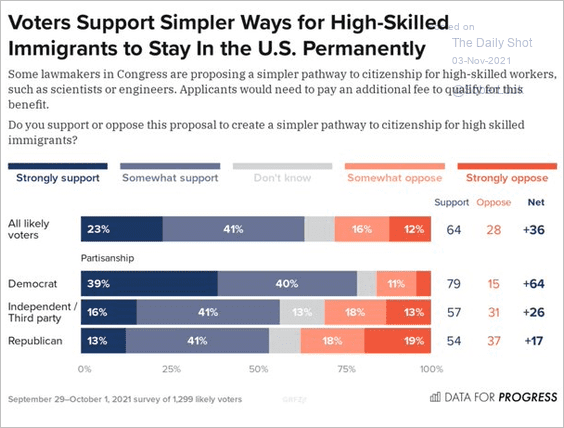

8. Pathway to US citizenship for high-skilled immigrants:

Source: @calebwatney, @DataProgress

Source: @calebwatney, @DataProgress

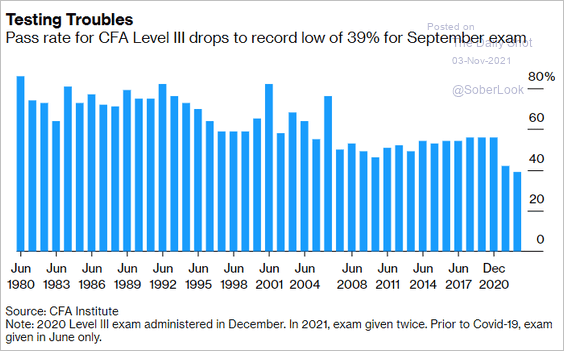

9. CFA Level III pass rate at record lows:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

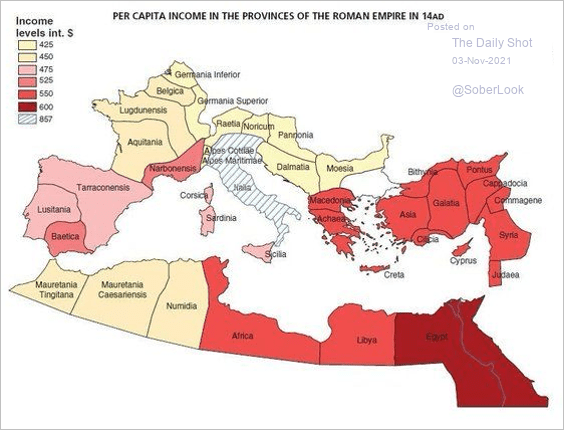

10. Per-capita income in the Roman Empire provinces (14 AD):

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

——————–

Back to Index