The Daily Shot: 04-Nov-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

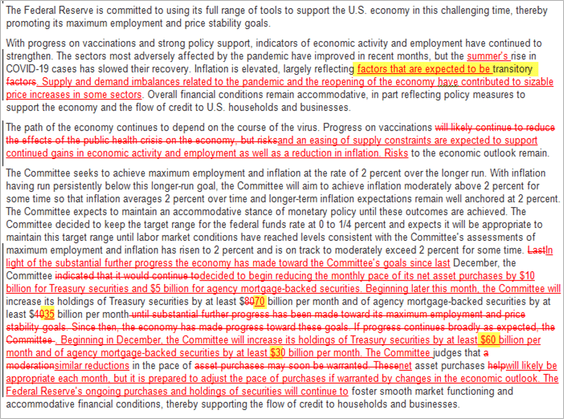

1. The Federal Reserve will start tapering securities purchases this month. The initial reductions will be $10 billion in Treasuries and $5 billion in MBS per month, targeting completion for next June. The central bank left itself the option to adjust the pace of tapering.

• The central bank still sees inflation as transitory. However, there was a subtle change in the language from “largely reflecting transitory factors” to “reflecting factors that are expected to be transitory.”

Source: @johnjhardy

Source: @johnjhardy

• Will we see liftoff right after tapering is complete? Much will depend on the labor market recovery, but the Fed could be shifting its views on “maximum employment.” There is a realization that some of the workers who left the labor force are not returning, and the labor market could keep tightening.

Source: Anna Wong, @economics Read full article

Source: Anna Wong, @economics Read full article

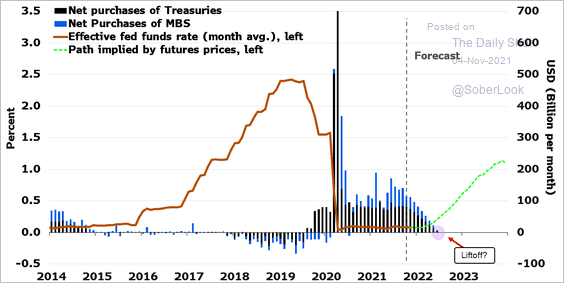

• The market didn’t see any major surprises in the FOMC’s decision (taper was well telegraphed). Longer-dated Treasury yields climbed, and the curve steepened somewhat.

——————–

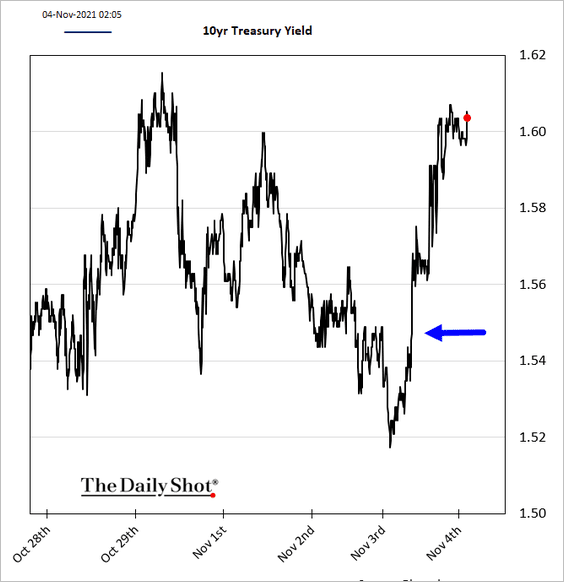

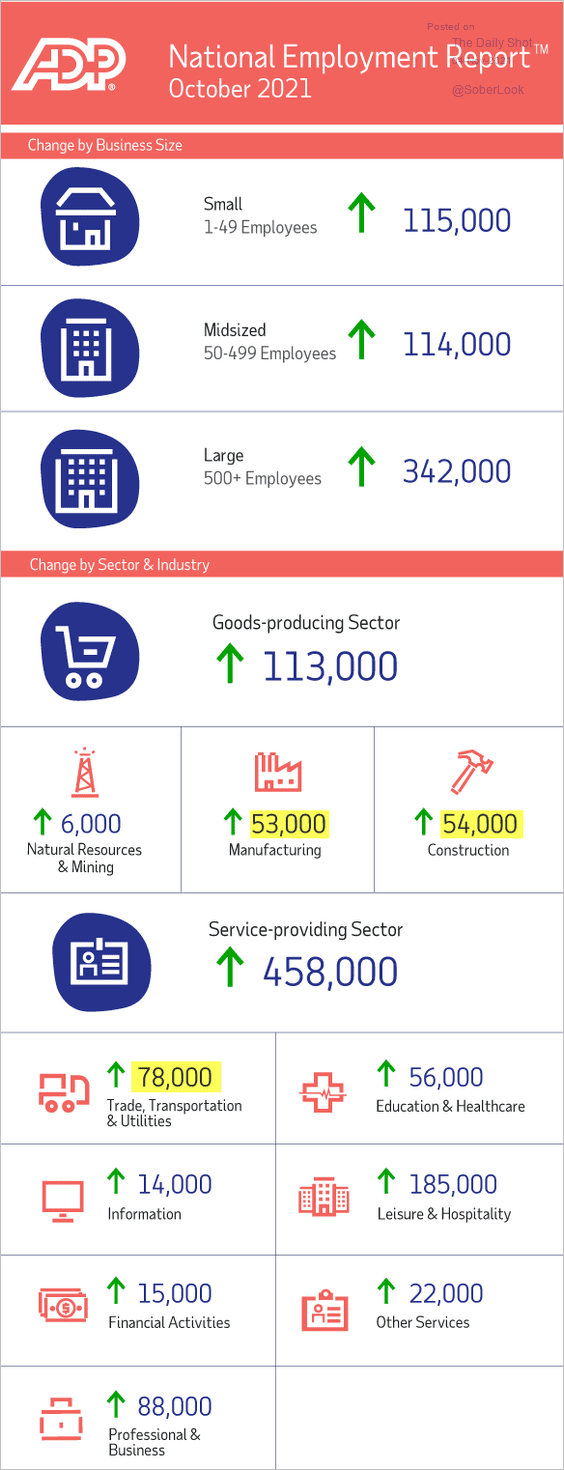

2. The ADP private payrolls report surprised to the upside.

Source: ADP Research Institute

Source: ADP Research Institute

• Job gains were broad, with every major sector seeing an increase in employment.

Source: ADP Research Institute

Source: ADP Research Institute

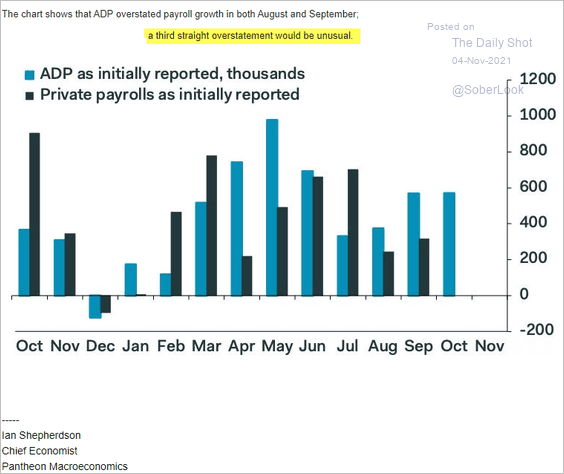

• The ADP report overshot the official payroll figures in August and September. Will it happen again?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

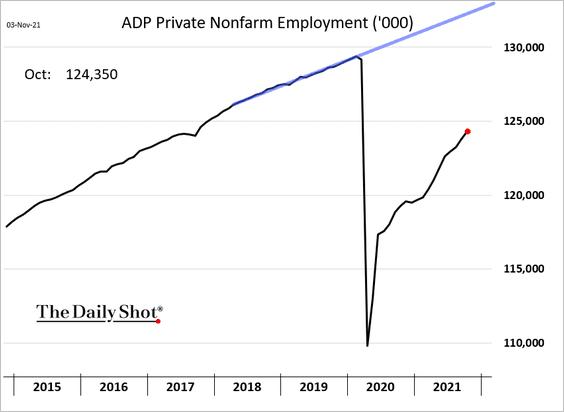

• Here is the absolute level of private employment.

——————–

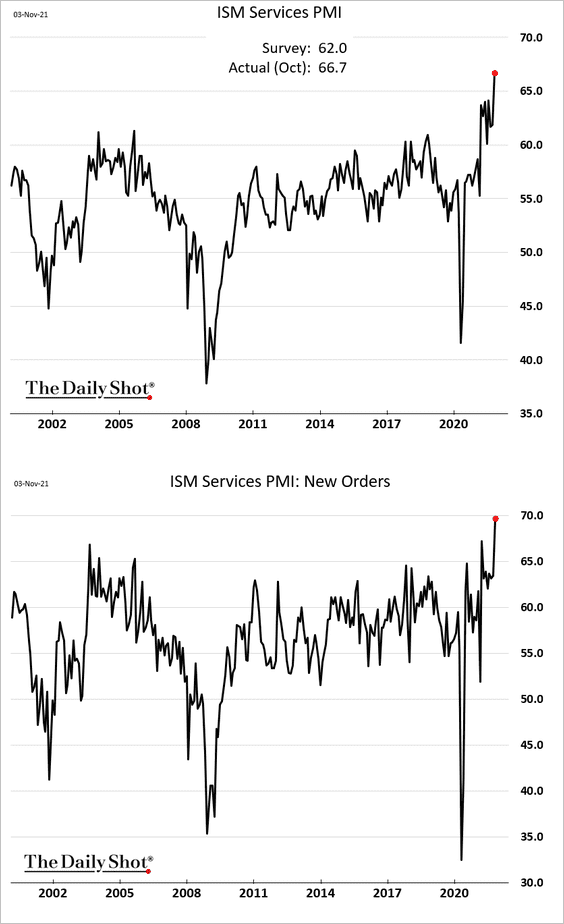

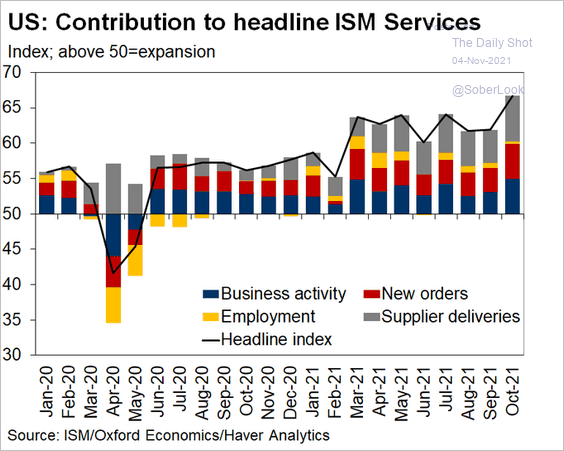

3. The ISM Services PMI hit a record high, pointing to accelerating growth in service industries last month.

Source: @GregDaco

Source: @GregDaco

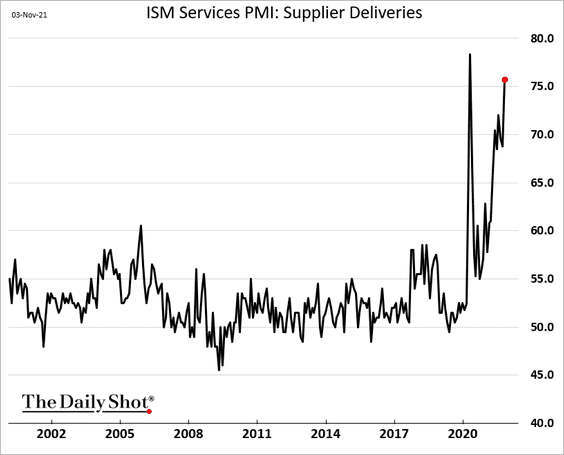

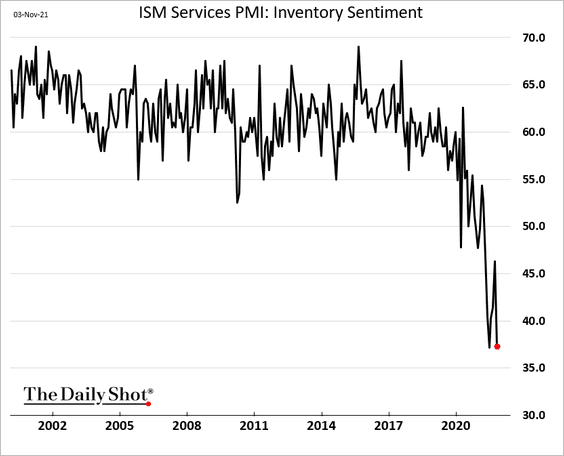

Supply chain issues are becoming more extreme.

– Supplier delivery times:

– Backlog of orders:

– Inventory sentiment:

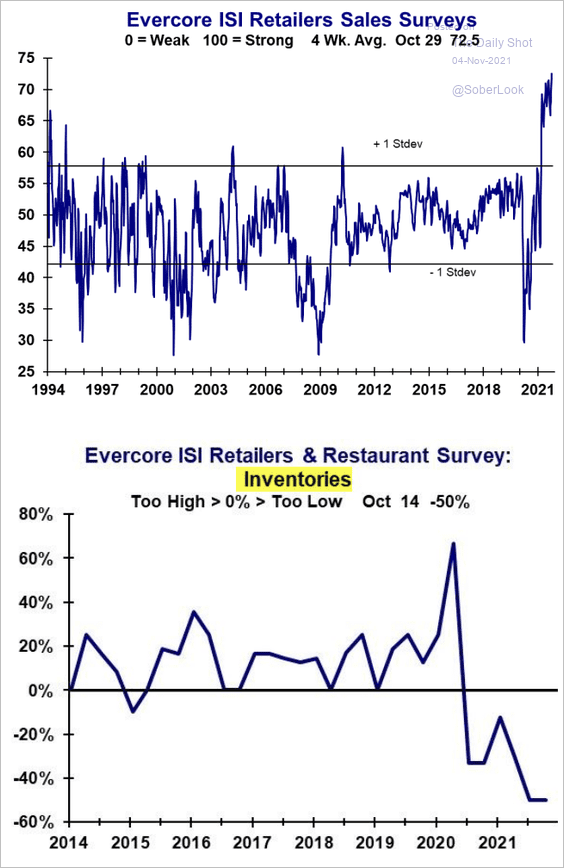

By the way, the Evercore ISI Retailers Survey supports the data we see from ISM.

Source: Evercore ISI

Source: Evercore ISI

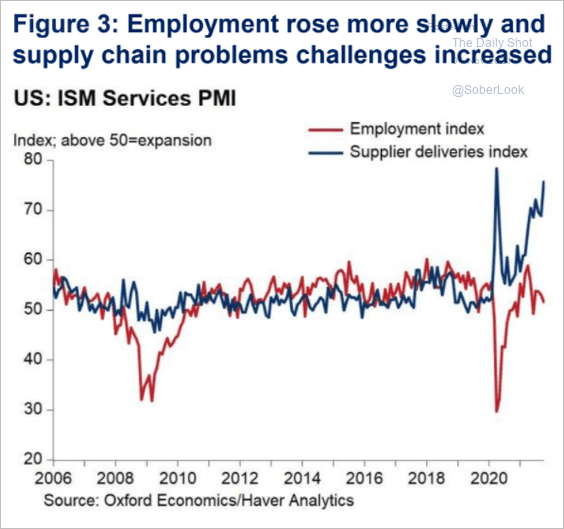

• Supply issues and tight labor markets held back hiring.

Source: Oxford Economics

Source: Oxford Economics

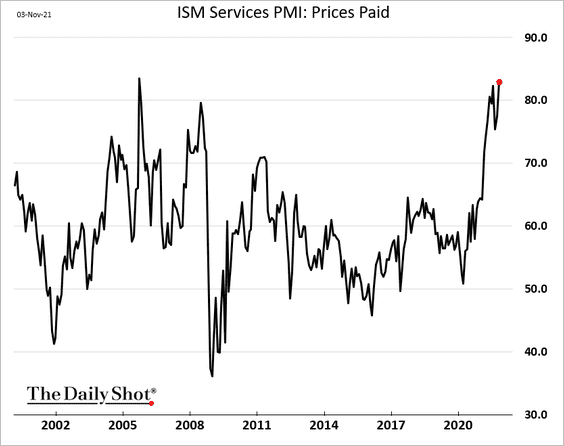

• Costs continue to surge.

——————–

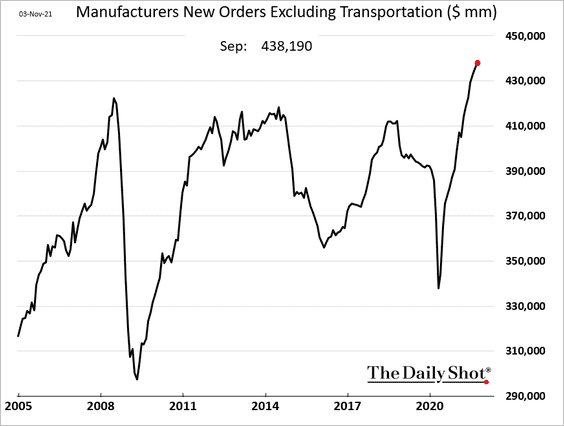

4. Factory orders keep rising.

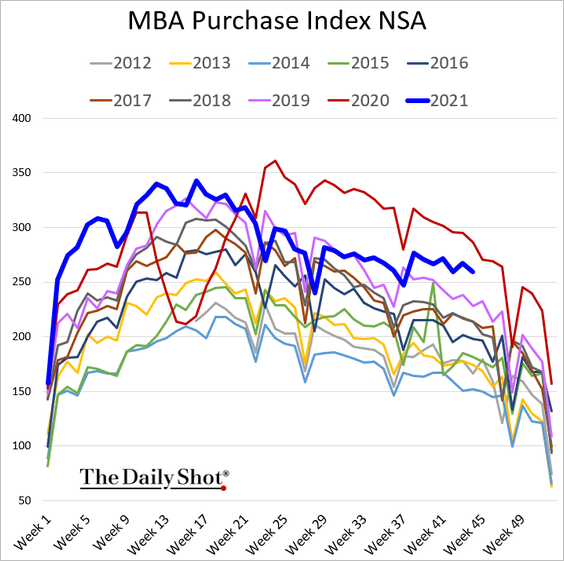

5. Mortgage applications to purchase a house remain healthy.

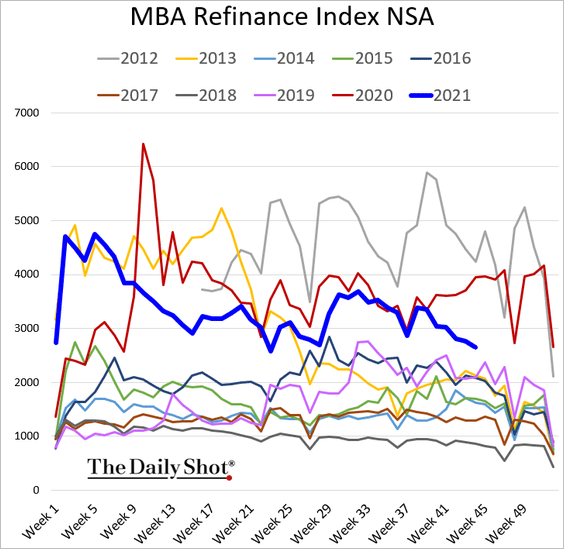

But refinancing activity has been easing.

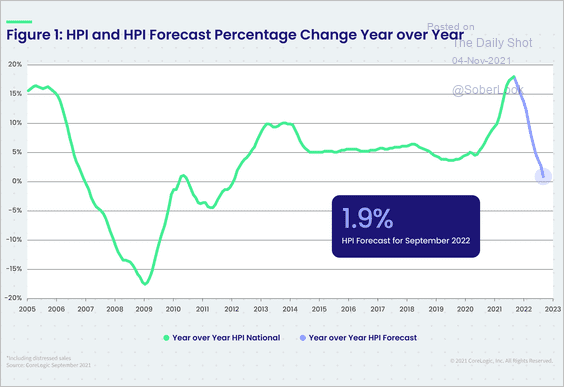

6. CoreLogic sees home price appreciation slowing sharply next year.

Source: CoreLogic

Source: CoreLogic

Back to Index

The United Kingdom

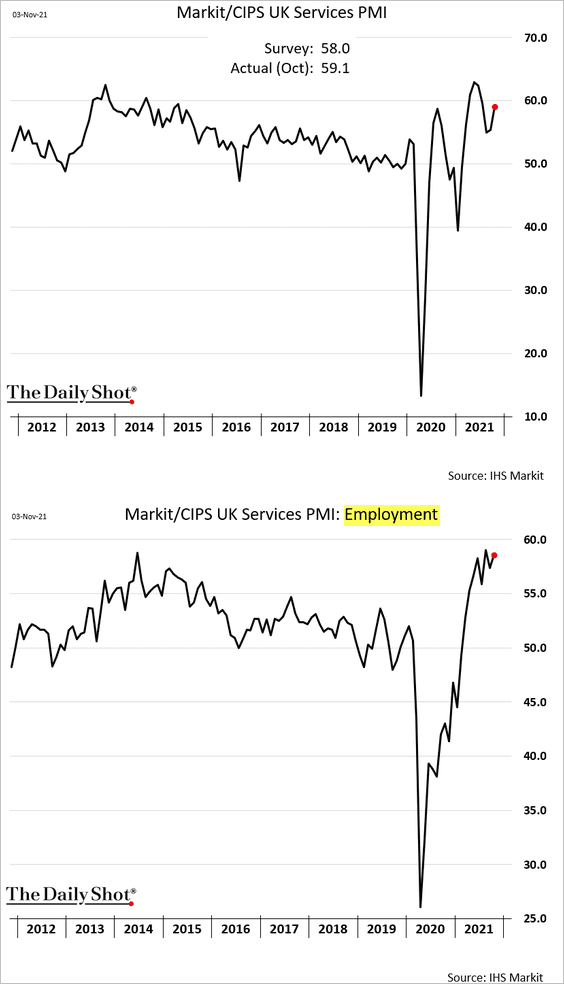

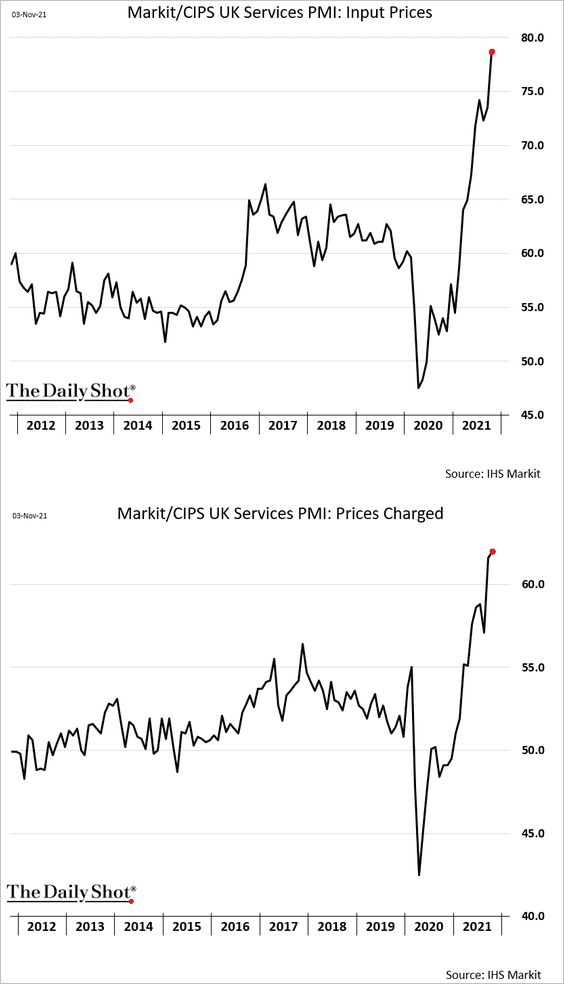

1. The updated services PMI figure was even stronger than the flash report. Hiring remains robust.

Service firms are experiencing extreme price pressures and are passing higher costs to their customers.

——————–

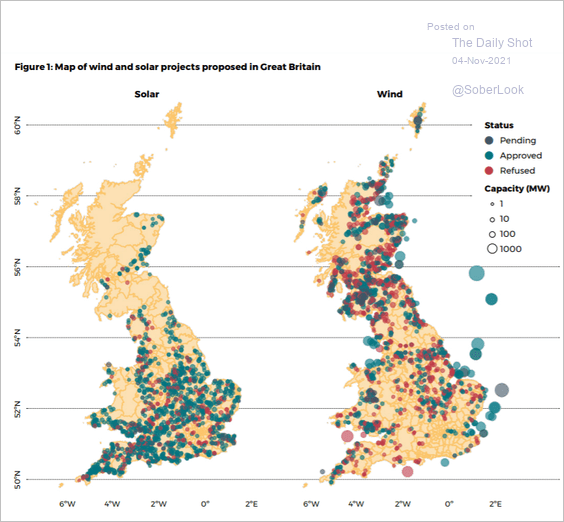

2. This map shows the UK’s pipeline of solar and wind projects.

Source: CAGE Research Centre, University of Warwick Read full article

Source: CAGE Research Centre, University of Warwick Read full article

Back to Index

The Eurozone

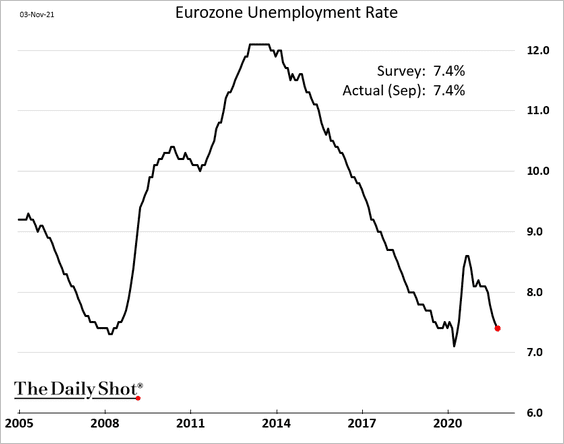

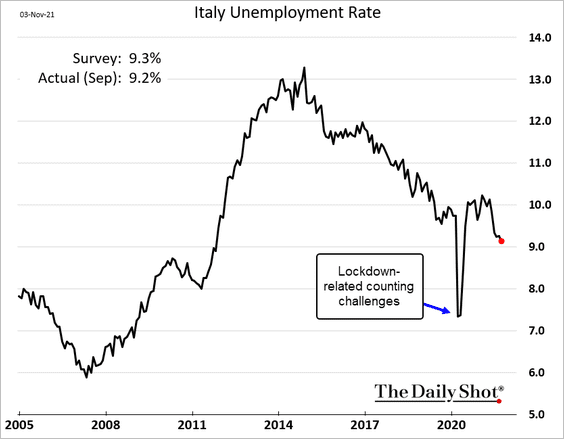

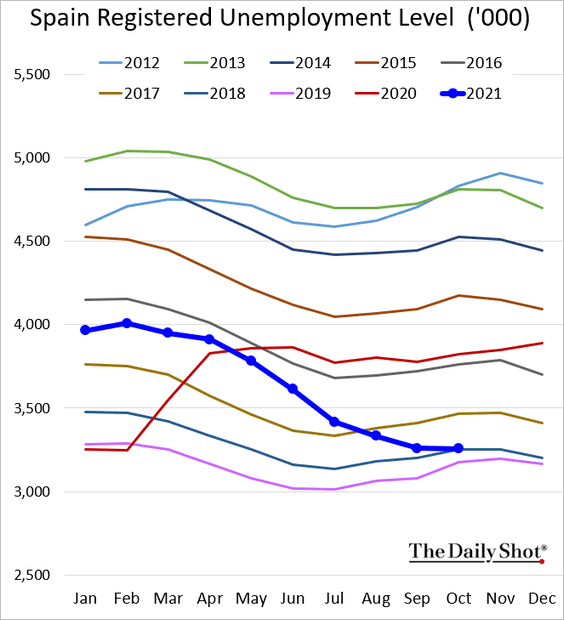

1. The unemployment rate continues to move lower, and economists expect the trend to continue.

• Italy’s unemployment rate:

• Spain’s unemployment level:

——————–

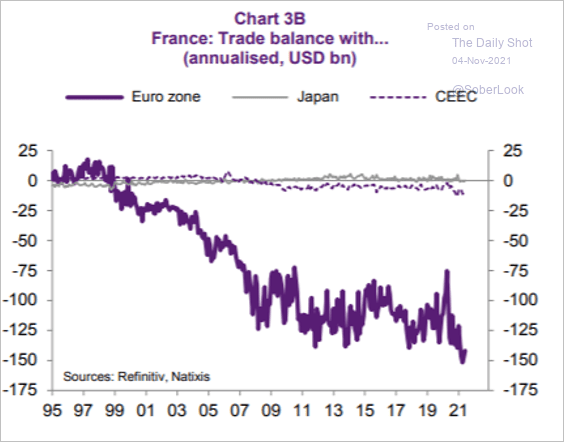

2. France is running a substantial trade deficit with the rest of the Eurozone.

Source: Natixis

Source: Natixis

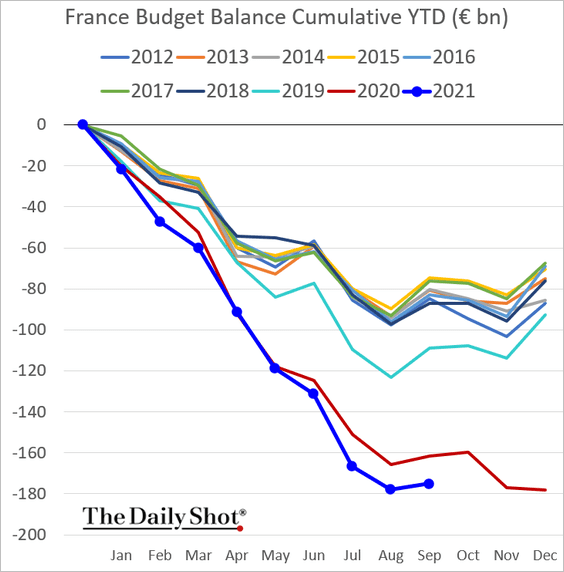

Separately, the budget deficit is now higher than it was in 2020.

——————–

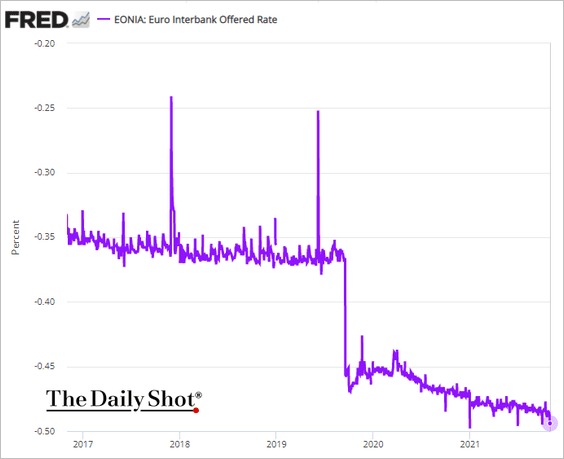

3. Interbank rates have been moving deeper into negative territory, driven by ample liquidity.

Back to Index

Europe

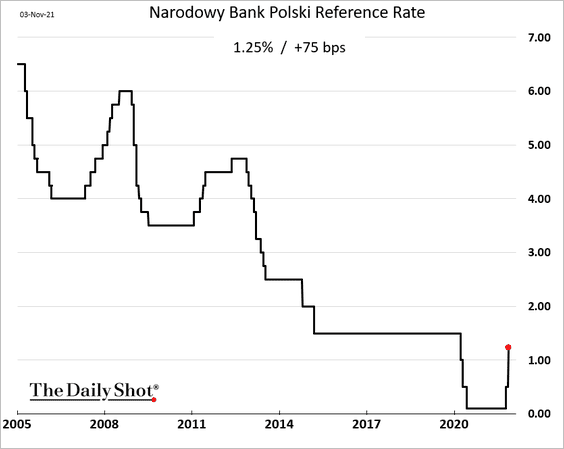

1. Poland’s central bank hiked rates by 75 bps (more than expected) as inflation surges.

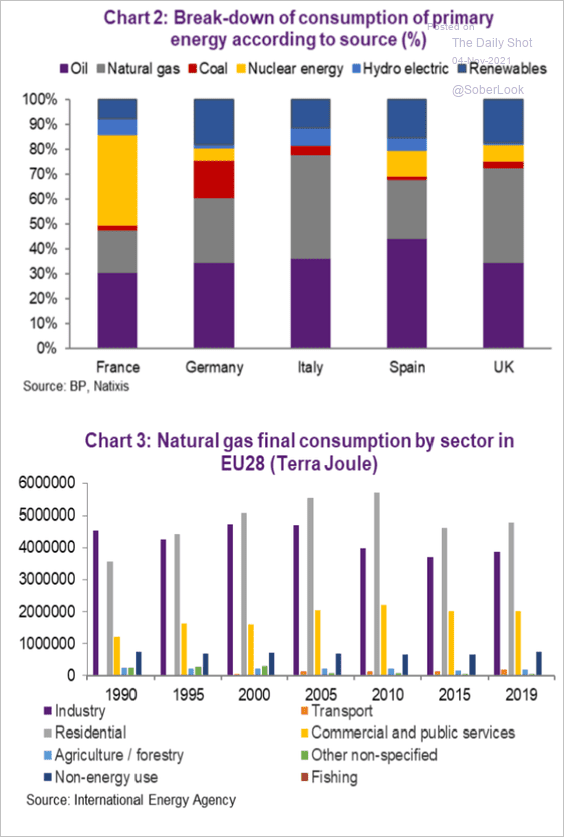

2. Next, we have some data on energy consumption.

Source: Natixis

Source: Natixis

Back to Index

Asia – Pacific

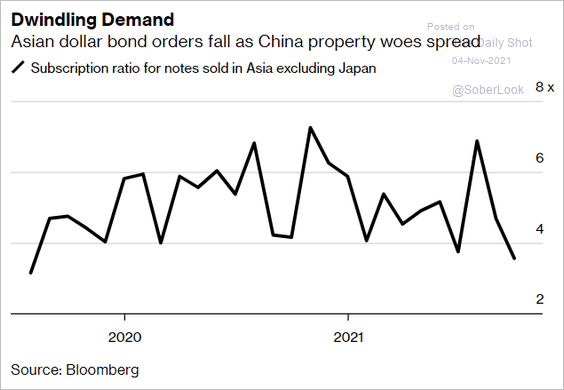

1. China’s property credit crunch has made it challenging for other Asian companies to sell USD-denominated bonds.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

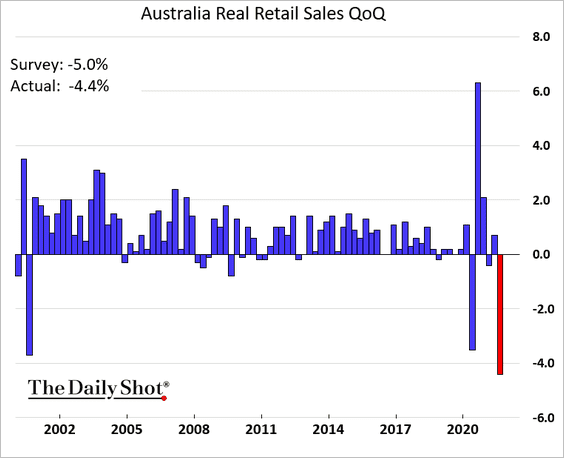

2. Australian retail sales tumbled last quarter (as expected).

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

China

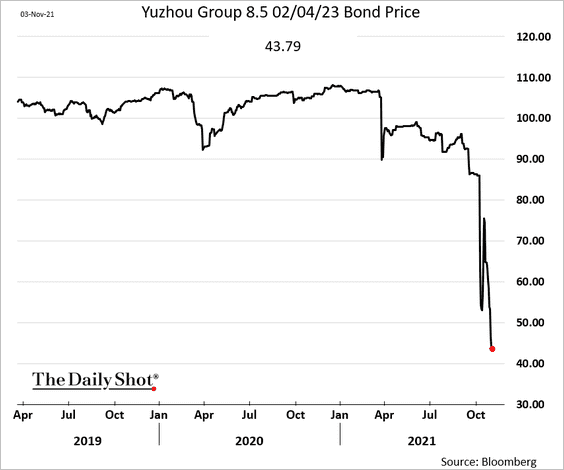

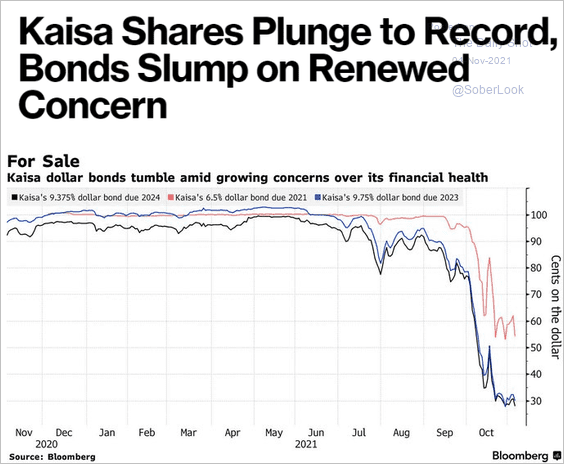

1. The carnage in China’s property credit markets continues.

• Yuzhou:

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

• Kaisa:

Source: @markets Read full article

Source: @markets Read full article

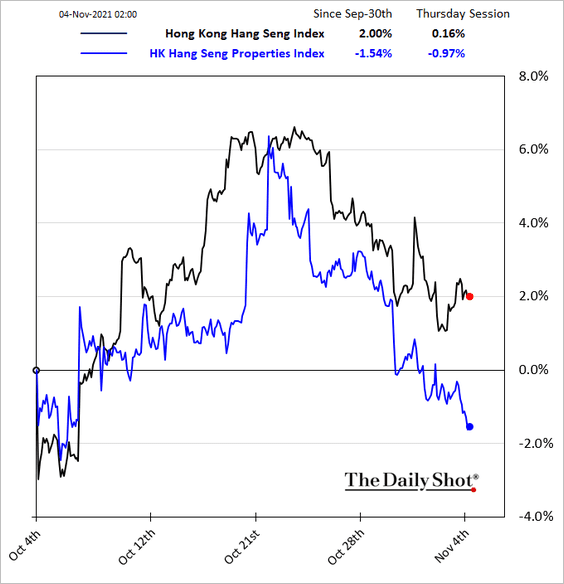

After attempting to rebound, property stocks in Hong Kong are tumbling again.

——————–

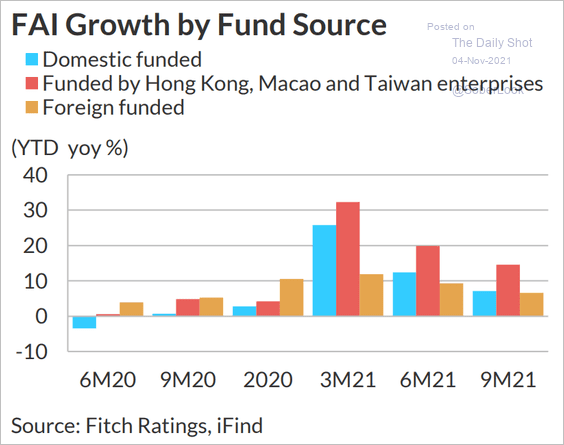

2. What are the sources of China’s fixed-asset investment?

Source: Fitch Ratings

Source: Fitch Ratings

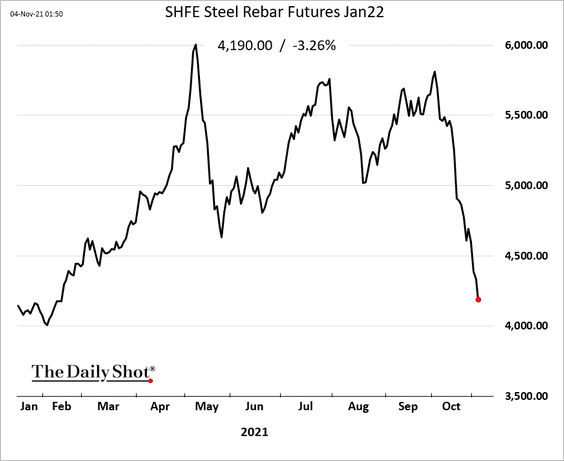

3. Steel prices continue to tumble.

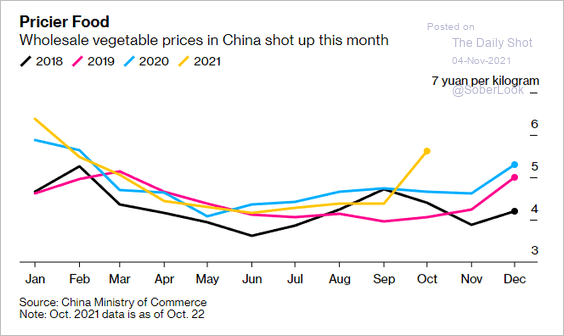

4. Vegetable prices are surging, which will boost consumer inflation.

Source: @StuartLWallace Read full article

Source: @StuartLWallace Read full article

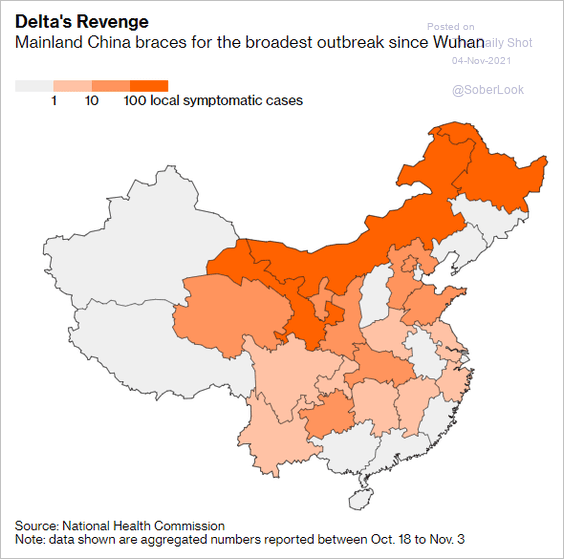

5. COVID is spreading again.

Source: @StuartLWallace Read full article

Source: @StuartLWallace Read full article

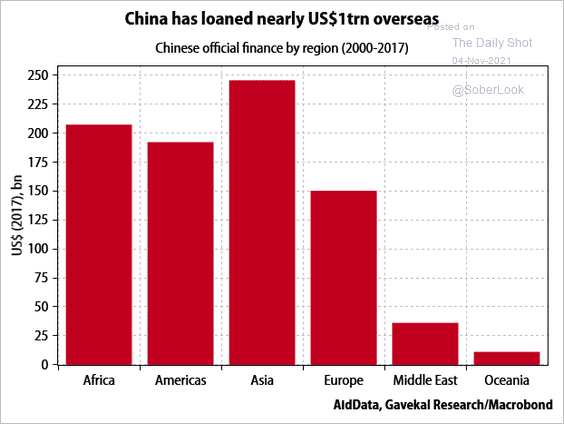

6. According to Gavekal Research, China has loaned nearly $1 trillion abroad.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

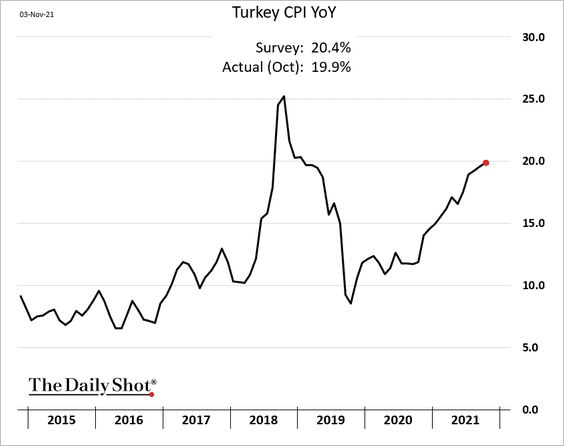

1. Turkey’s consumer inflation is nearing 20%.

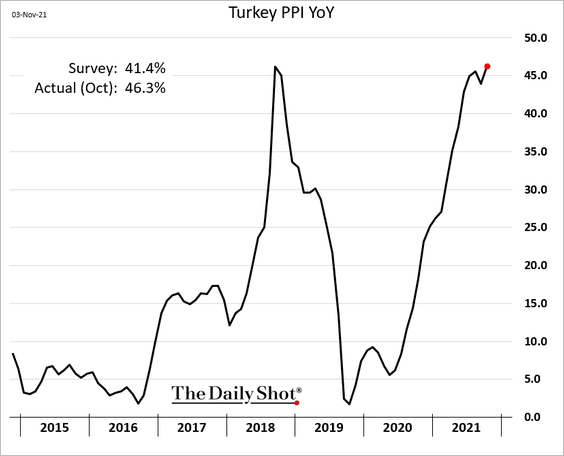

The PPI hit 46%, driven by the lira’s weakness. Let’s cut rates some more and see what happens.

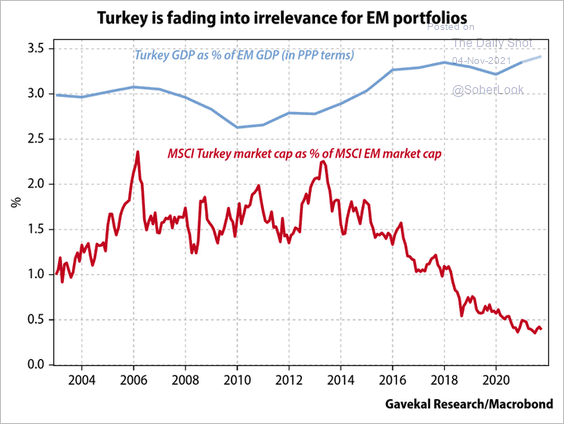

Separately, Turkish stocks are becoming less relevant for EM investors.

Source: @Gavekal

Source: @Gavekal

——————–

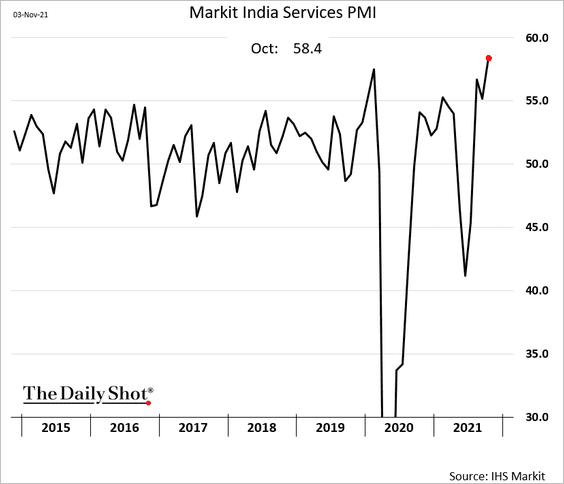

2. India’s service-sector PMI surged last month, pointing to a strong recovery after the lockdowns.

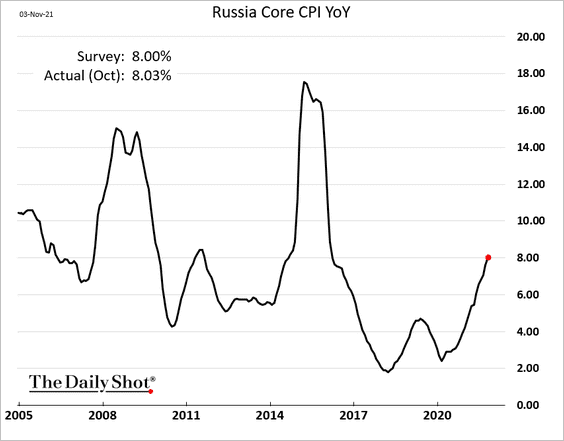

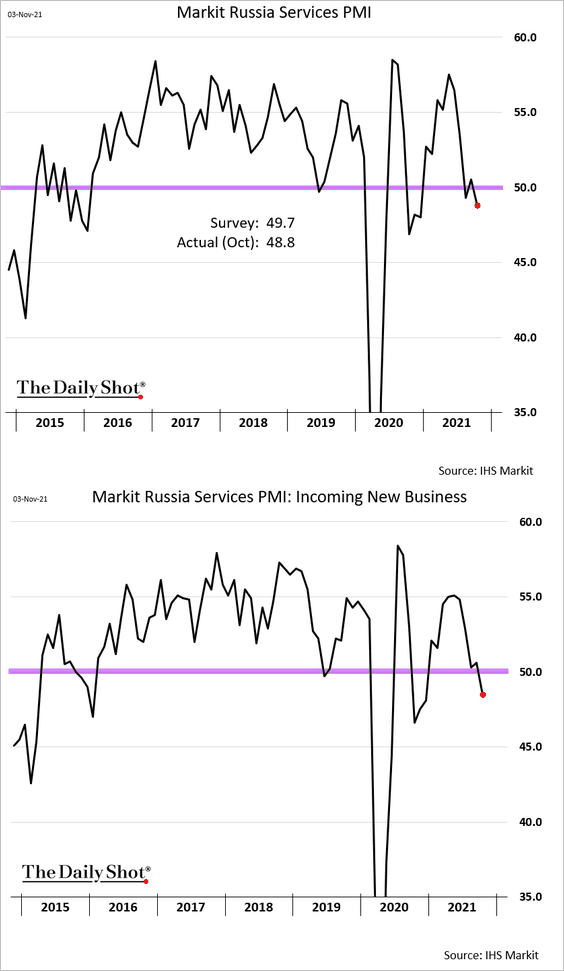

3. Russia’s CPI continues to climb.

The nation’s service industries are back in contraction.

——————–

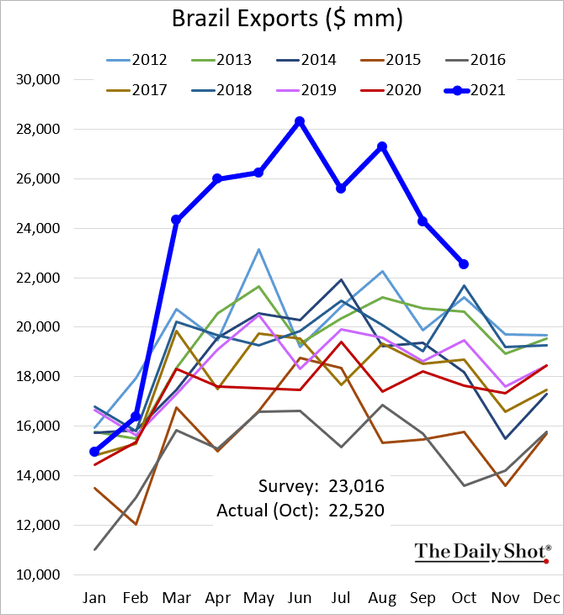

4. Brazil’s exports have been slowing.

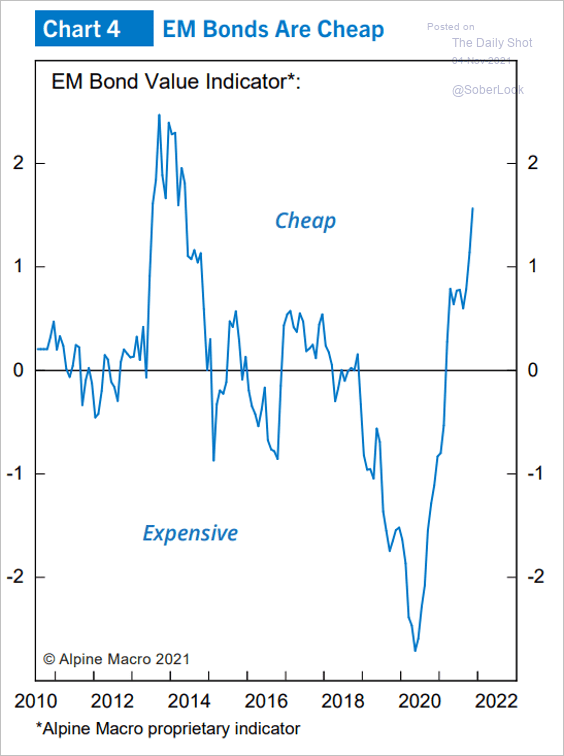

5. Are EM bonds oversold?

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

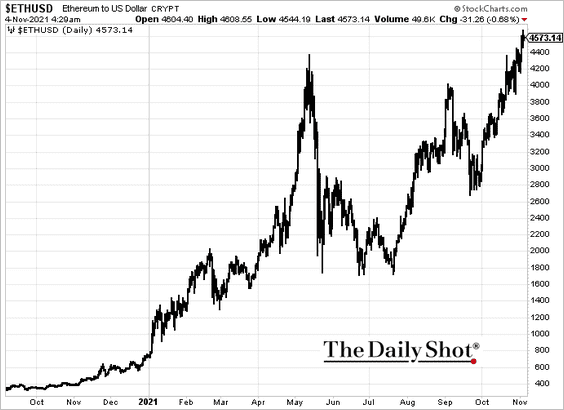

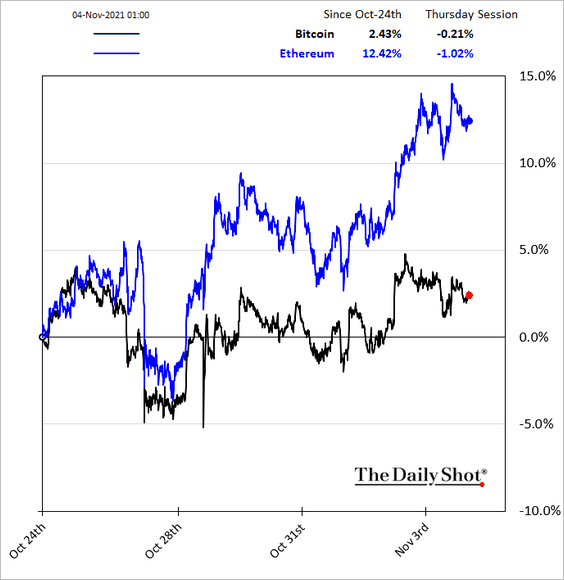

1. Ether is on track for eight consecutive positive quarters after reaching an all-time high of around $4.6K.

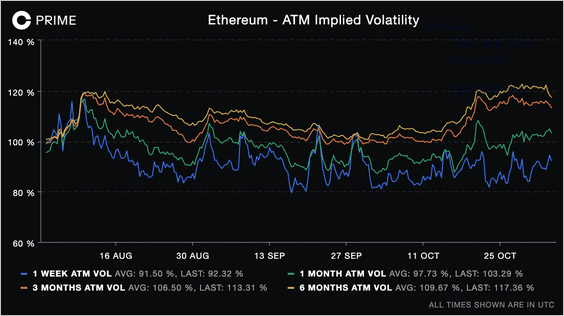

2. Long-dated implied volatility in the ETH options market is well supported. It appears that investors are starting to position for the ETH2 launch (network upgrade) next year.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

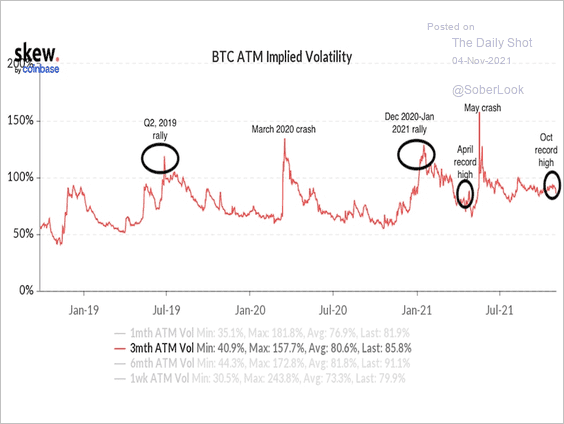

3. Bitcoin’s implied volatility has been low relative to previous major market events.

Source: Skew Read full article

Source: Skew Read full article

Back to Index

Energy

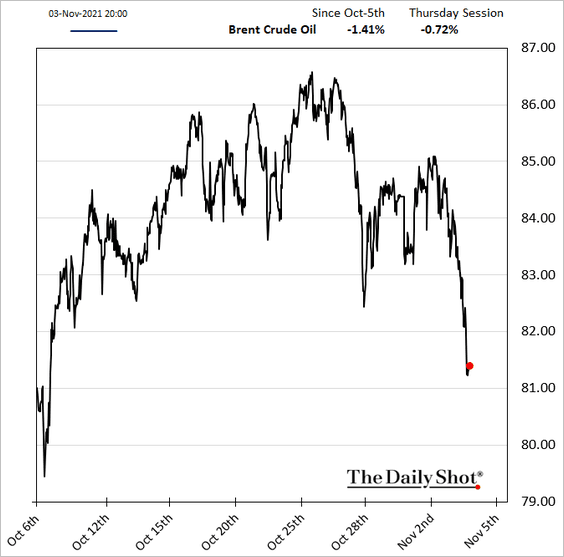

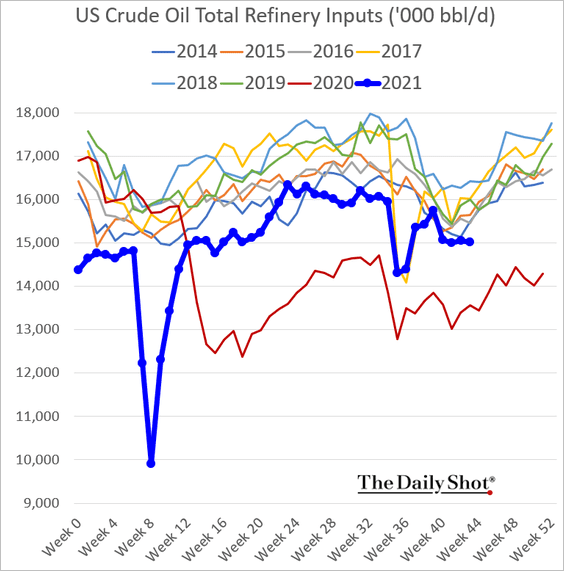

1. Crude oil sold off, with traders spooked by bearish geopolitics.

Source: ABC News Read full article

Source: ABC News Read full article

Source: World Oil Read full article

Source: World Oil Read full article

——————–

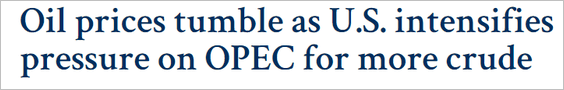

2. US gasoline demand is holding near multi-year highs.

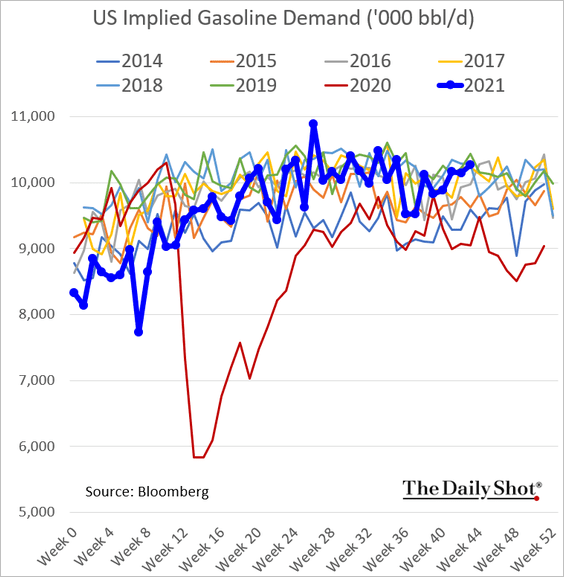

Gasoline inventories remain near the lows.

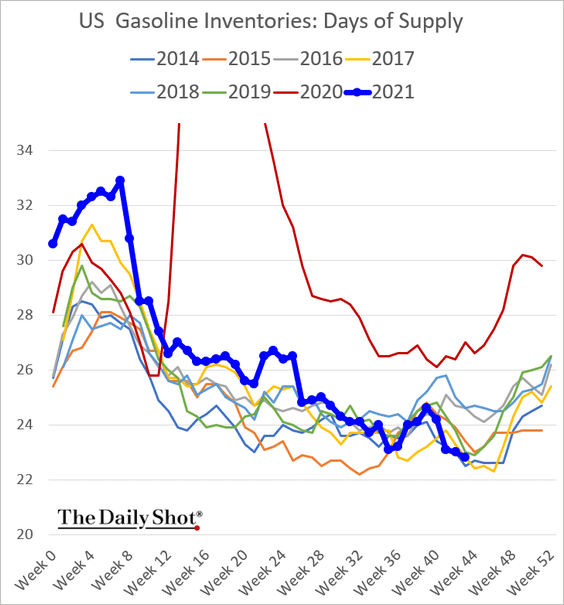

And refinery runs are stalling.

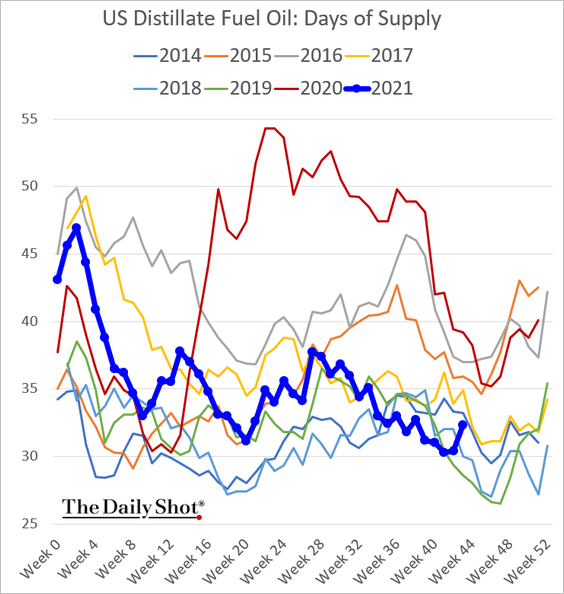

3. Distillates inventories jumped last week.

——————–

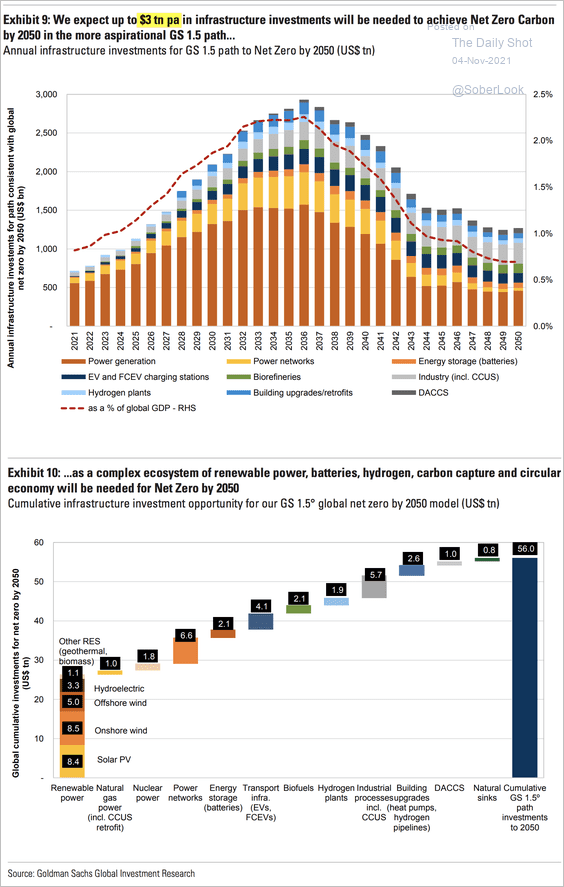

4. Infrastructure investment requirements make current carbon reduction goals challenging ($3 trillion of investment needed for net-zero by 2050).

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Equities

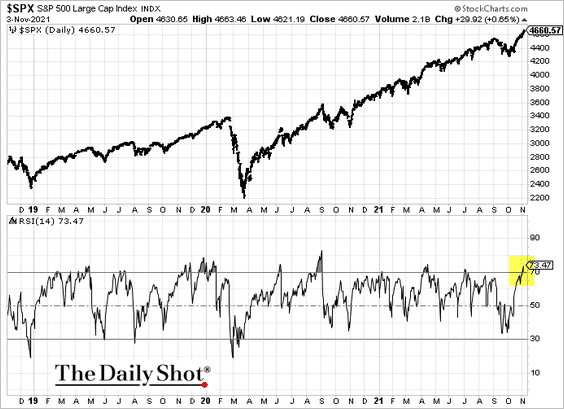

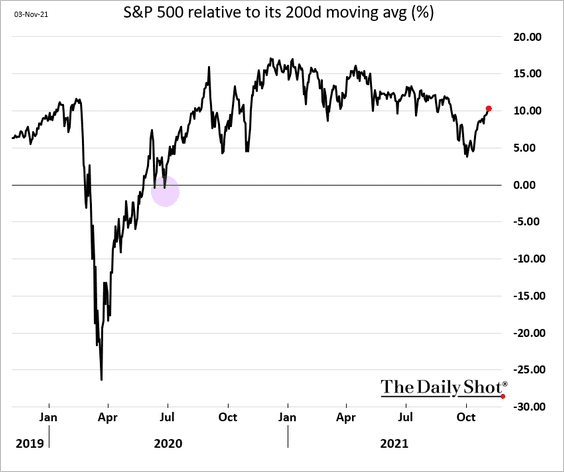

1. Indices continue to hit record highs, as market technicals look increasingly stretched.

By the way, it’s been nearly 500 days since the S&P 500 dipped below its 200-day moving average.

——————–

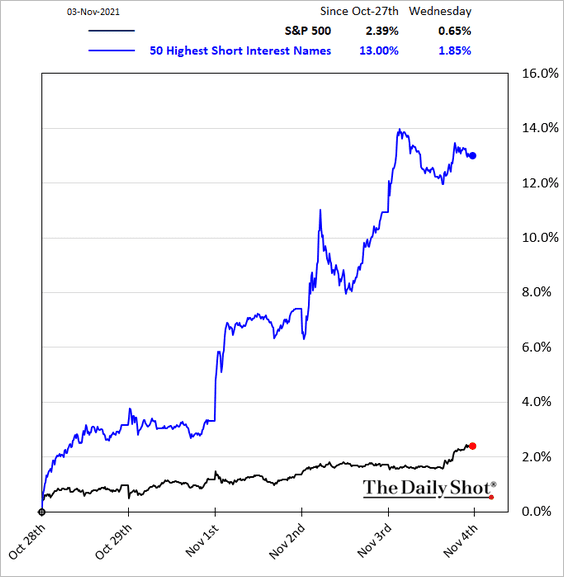

2. A short squeeze has accelerated market gains in recent weeks.

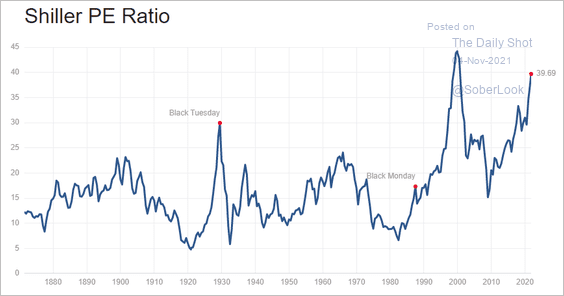

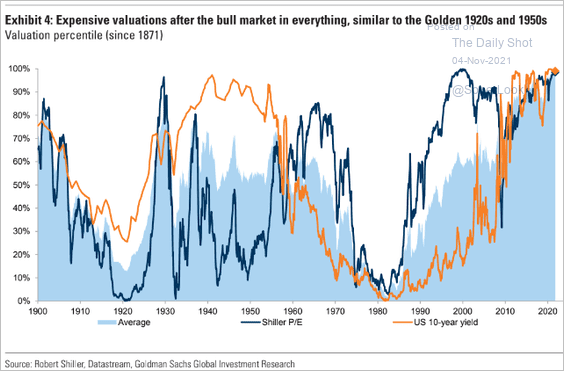

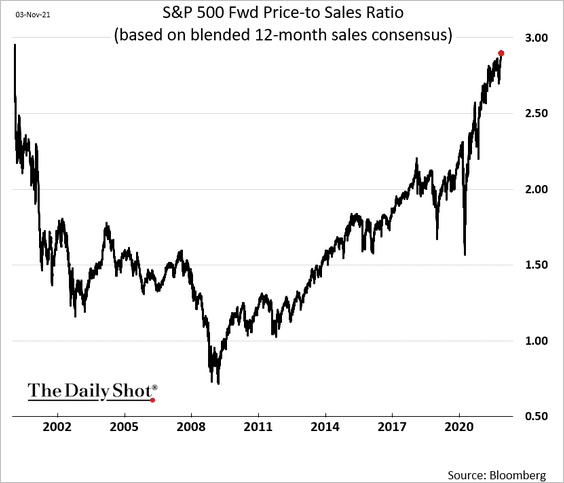

3. Some analysts are increasingly nervous about valuations.

• Shiller PE Ratio (2 charts):

Source: multpl

Source: multpl

Source: Goldman Sachs

Source: Goldman Sachs

• Price-to-sales:

——————–

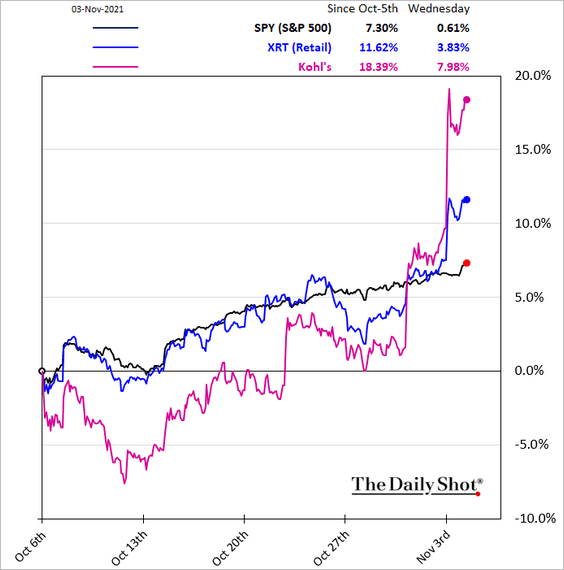

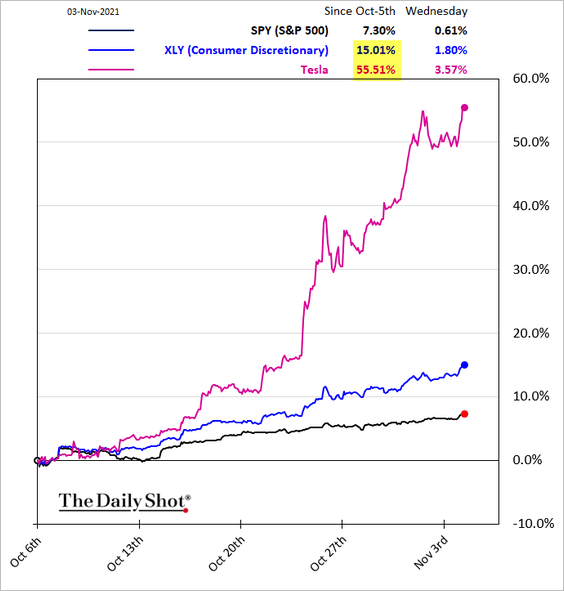

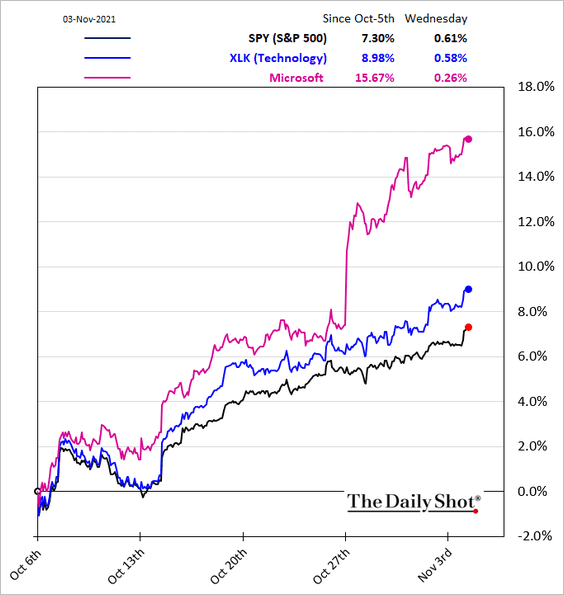

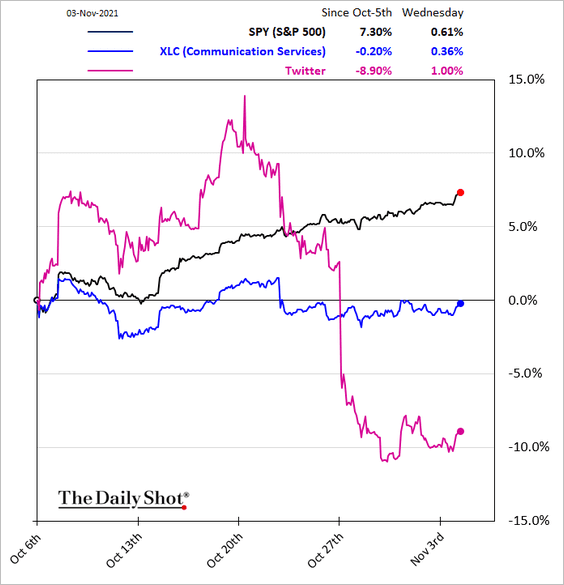

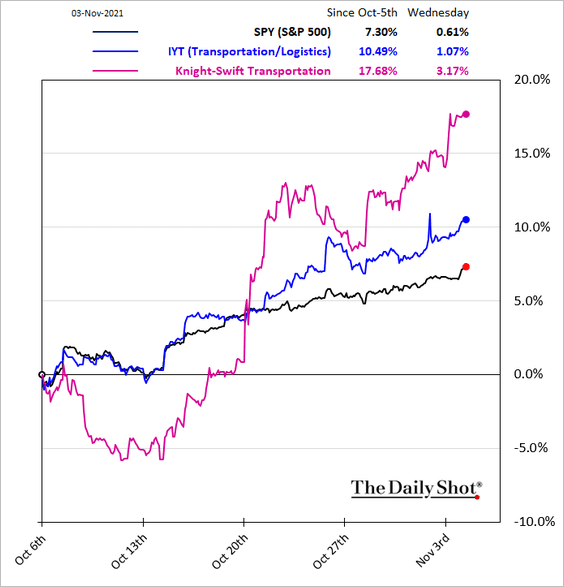

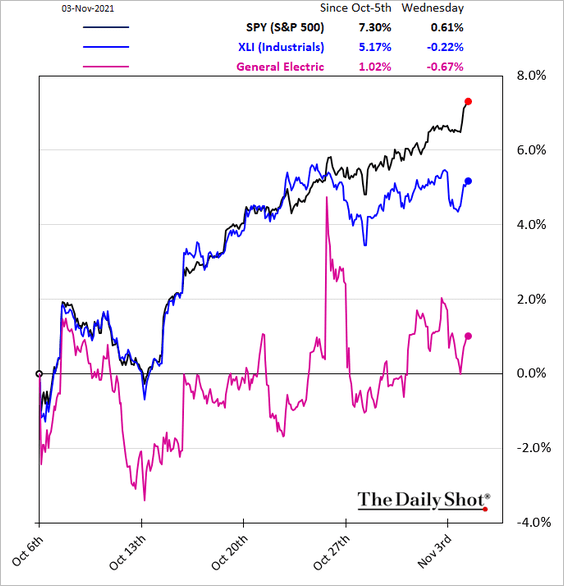

4. Next, we have some sector updates (over the past 30 days).

• Retail (boosted by a short squeeze):

• Consumer discretionary:

• Tech:

• Communication services:

• Transportation (supported by supply-chain issues):

• Industrials:

——————–

5. Tech and financial ETFs saw inflows last month while investors rotated out of materials and industrials.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

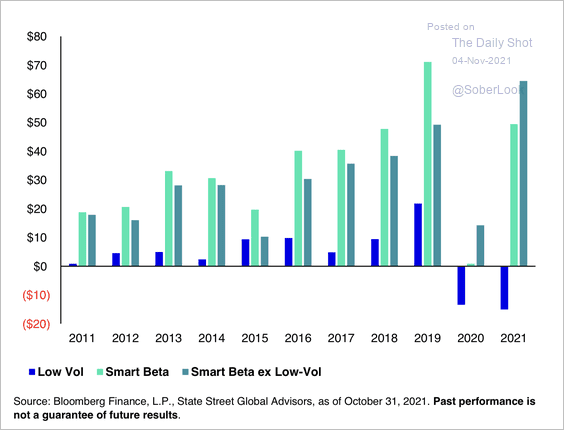

So far, this is the second-highest inflow in a calendar year for smart-beta funds (chart in billions).

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

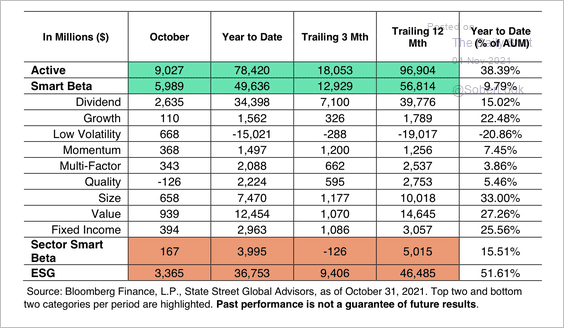

Here is a look at flows by active strategies.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

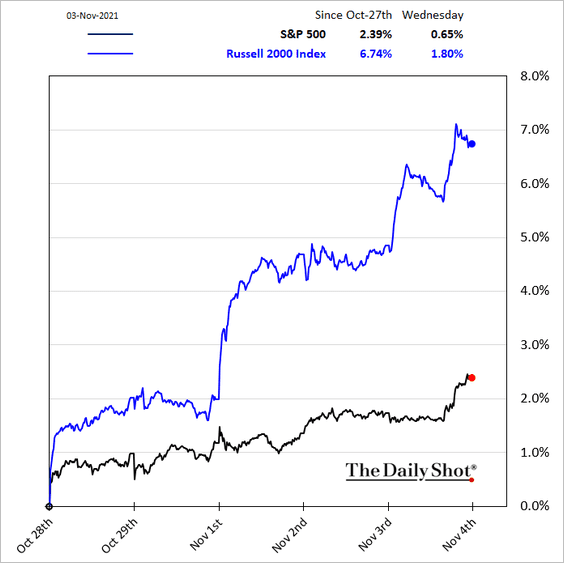

6. It’s been a great few days for small caps.

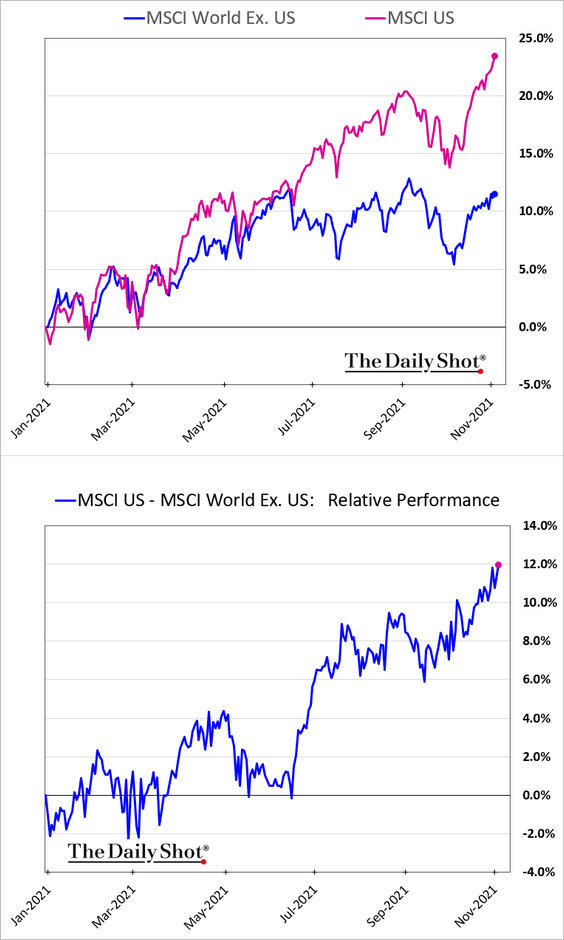

7. US stocks continue to widen their outperformance vs. the rest of the world.

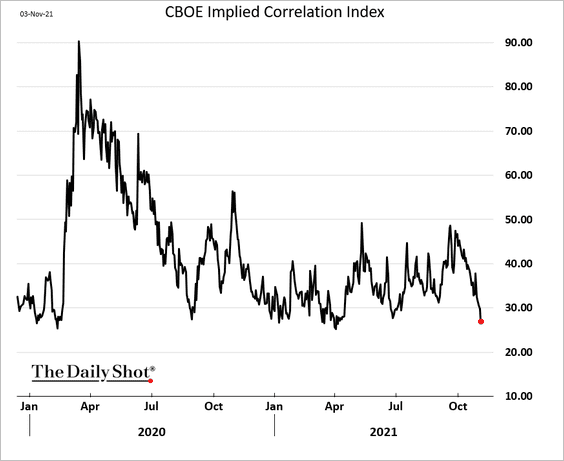

8. Implied correlation in the stock market has been tumbling in recent weeks.

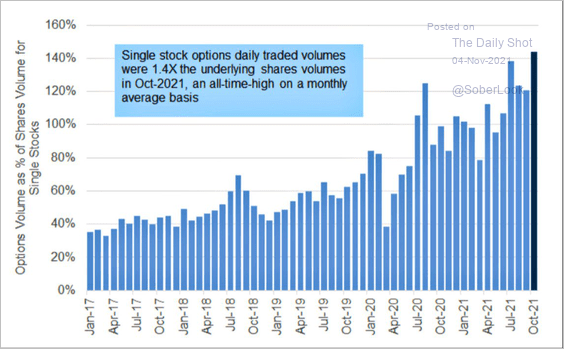

9. The volume of single stock options hit a record high in October.

Source: @WallStJesus

Source: @WallStJesus

Back to Index

Global Developments

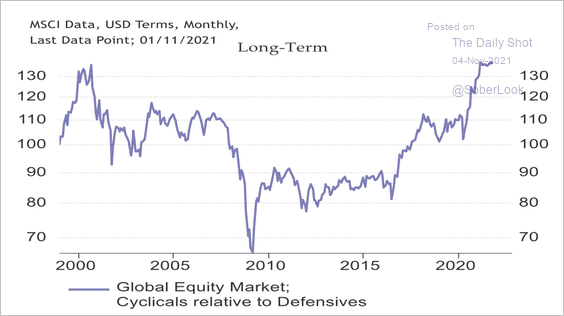

1. The global cyclical/defensive stock ratio is back near 2000 highs.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

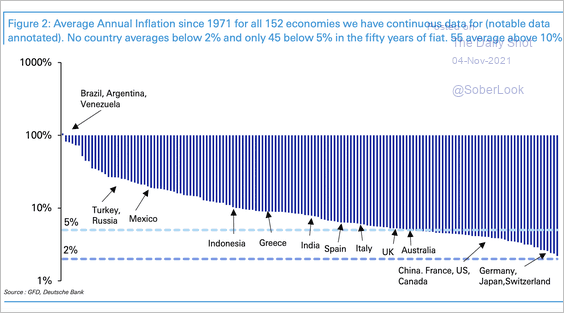

2. Since 1971, across 152 countries, not one had inflation that averaged below 2%. Only 45 had inflation averaging below 5%.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

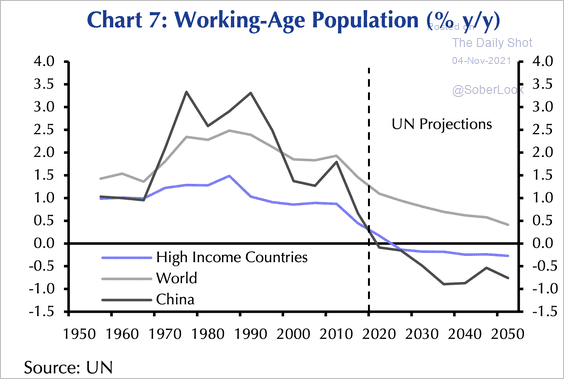

3. Working-age population growth is about to turn negative in China and the developed world.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

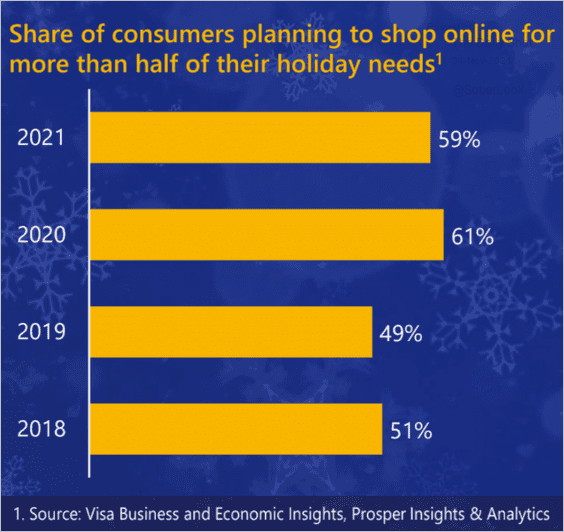

1. Shopping online:

Source: Michael Brown, Visa Business and Economic Insights

Source: Michael Brown, Visa Business and Economic Insights

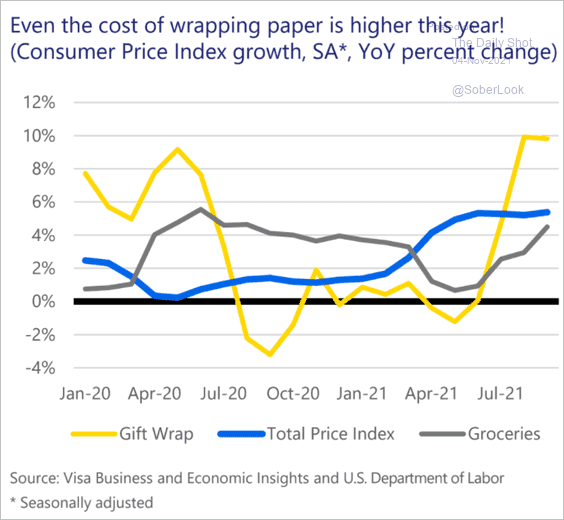

2. Gift wrap inflation:

Source: Michael Brown, Visa Business and Economic Insights

Source: Michael Brown, Visa Business and Economic Insights

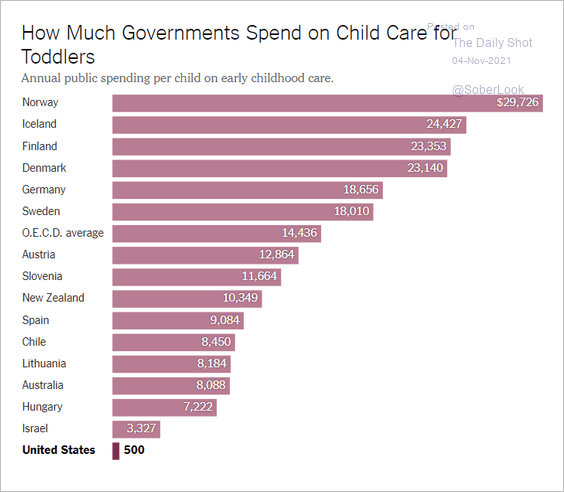

3. Social spending on child care for toddlers:

Source: The New York Times Read full article

Source: The New York Times Read full article

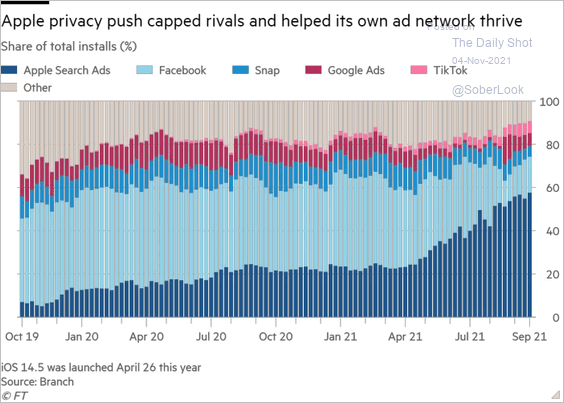

4. Apple’s advertising business growth after iPhone privacy changes:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

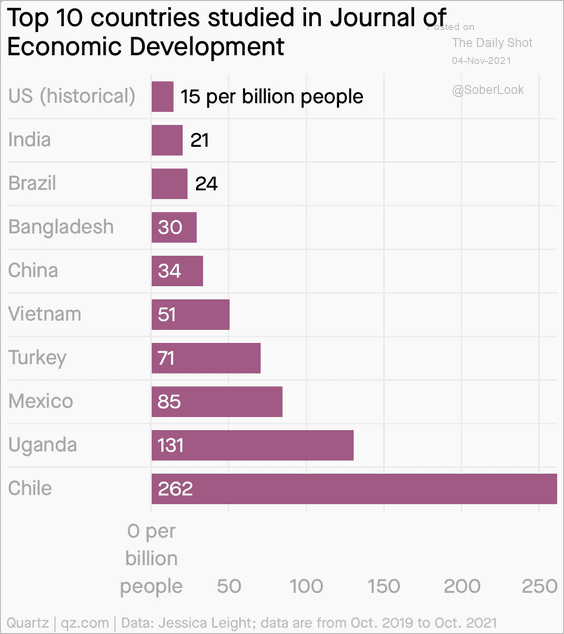

5. Top countries studied by development economists:

Source: Quartz Read full article

Source: Quartz Read full article

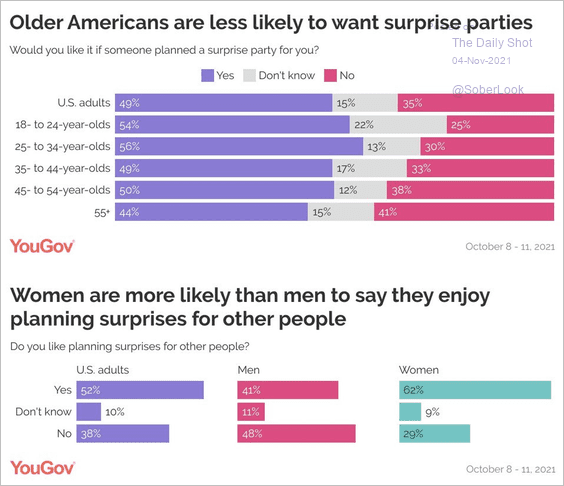

6. Would you like a surprise party?

Source: YouGov Read full article

Source: YouGov Read full article

——————–

Back to Index