The Daily Shot: 05-Nov-21

• The United Kingdom

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United Kingdom

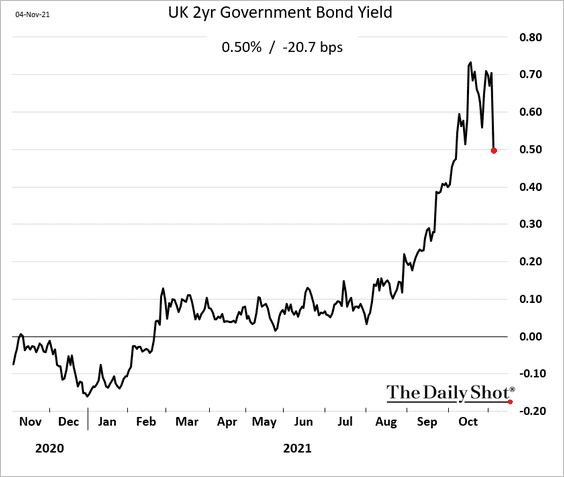

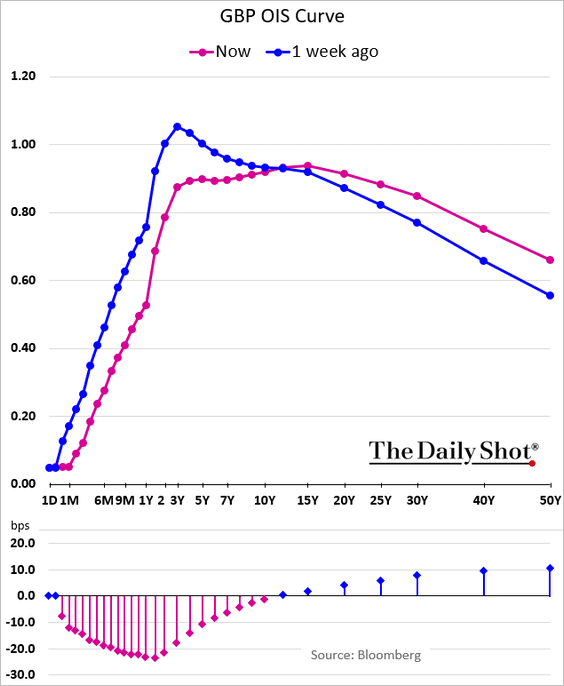

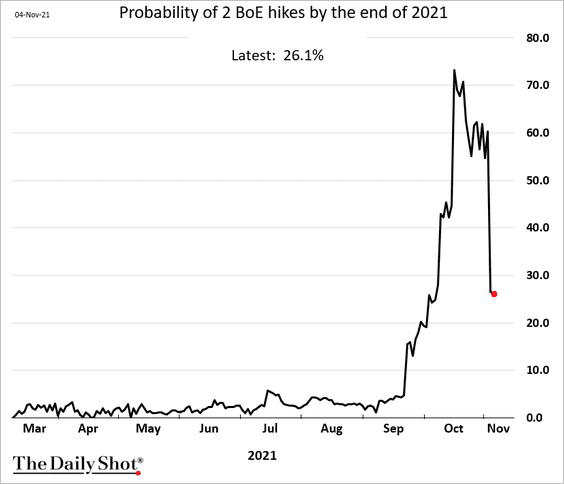

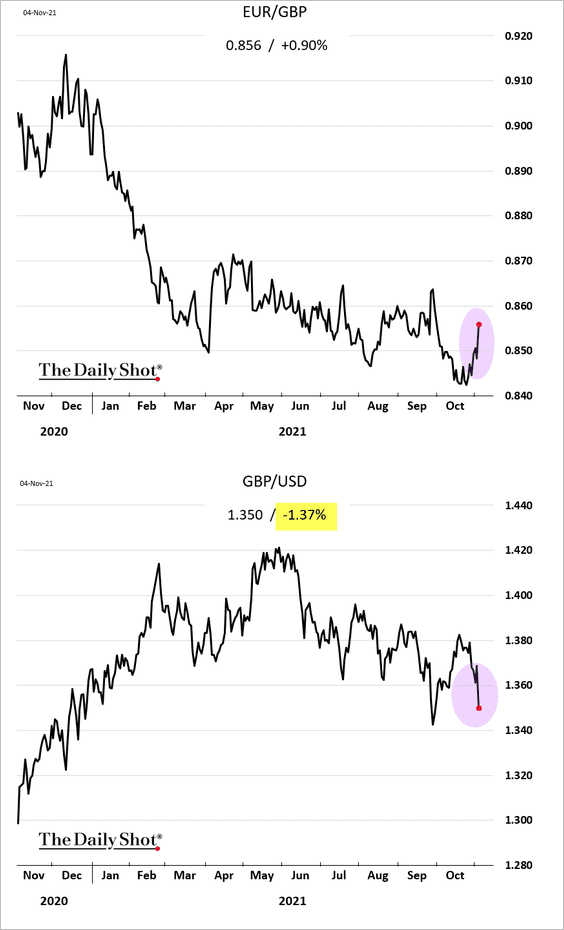

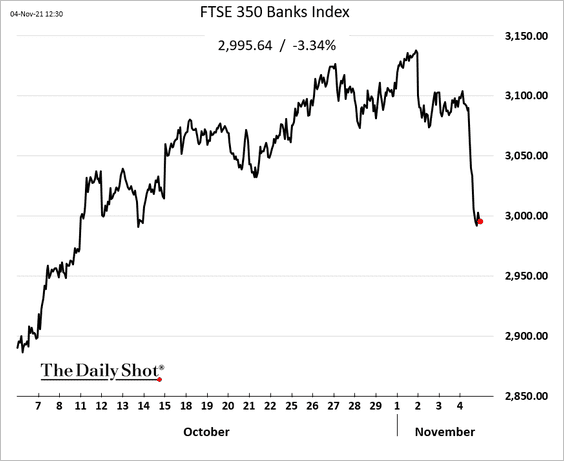

1. Despite a surge in inflation this year, major central banks are not as eager to hike rates as the markets feared. In recent days, that has been the lesson from the ECB, the Fed, the RBA, and now the BoE. The UK’s central bank surprised the markets by holding rates unchanged. To be sure, the BoE will probably hike in December, but there doesn’t seem to be the urgency that was priced into the markets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Gilt yields tumbled.

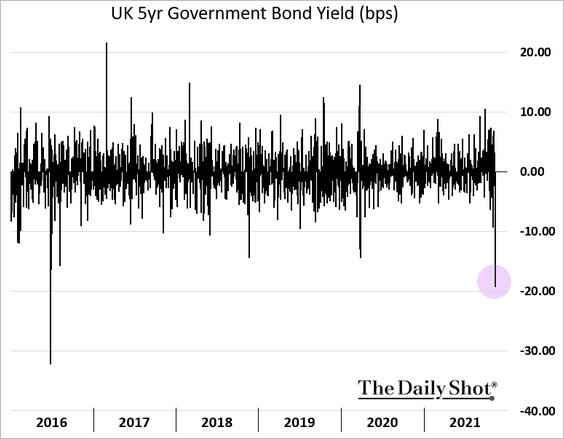

Below are the daily changes in the 5yr yield.

h/t James Hirai

h/t James Hirai

• The yield curve steepened.

• Here is the probability of two rate hikes this year.

• The pound slumped.

• Bank shares came under pressure.

——————–

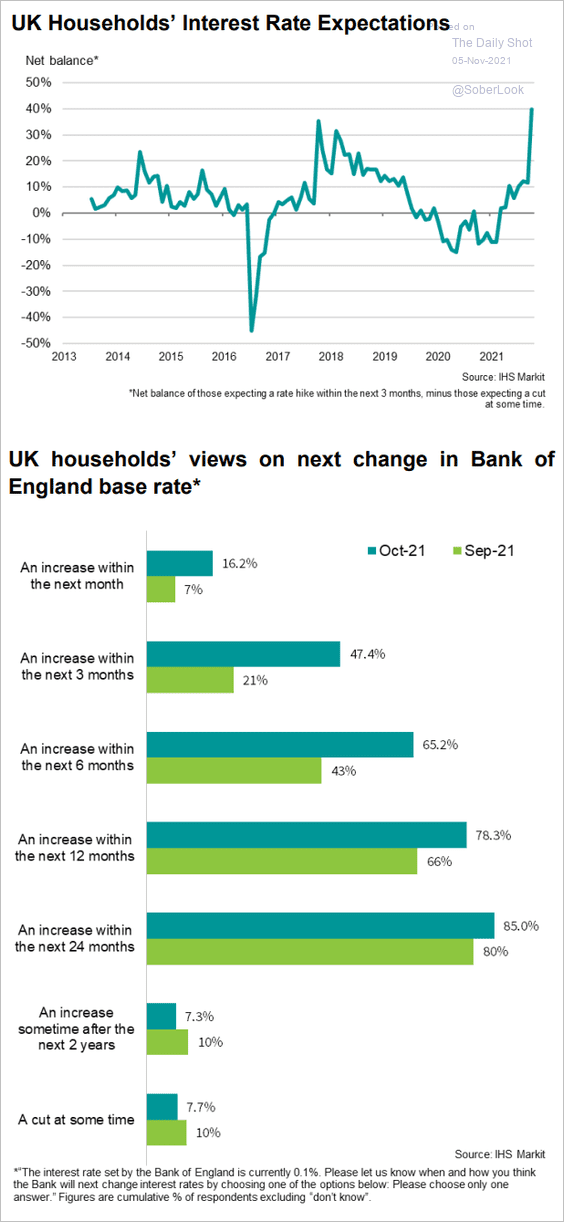

2. UK households expect rate hikes.

Source: IHS Markit

Source: IHS Markit

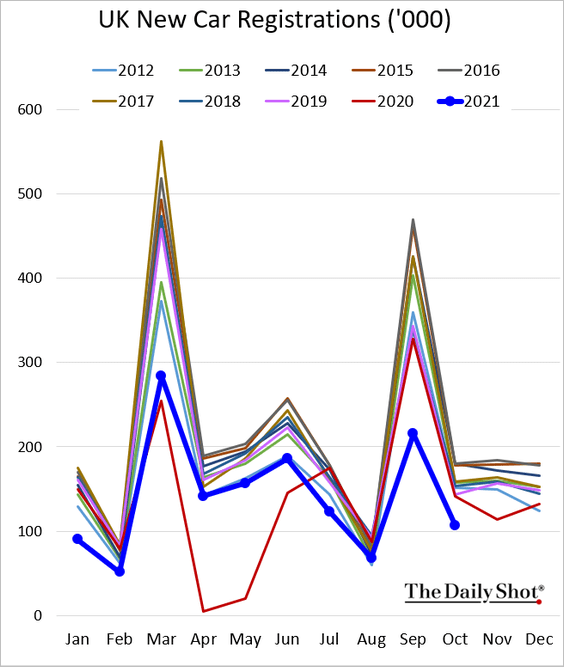

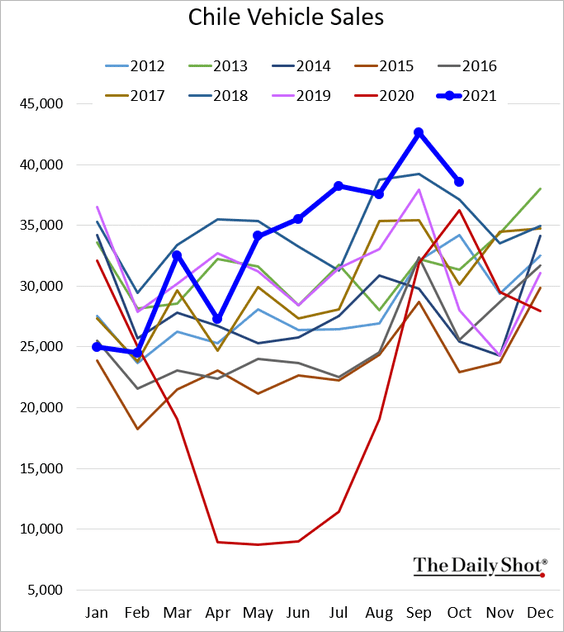

3. UK car registrations remain depressed, which has been a global trend (except in Chile).

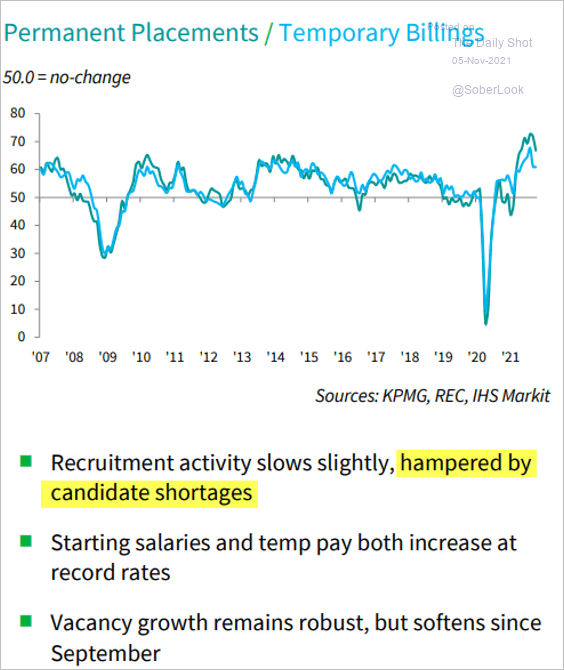

4. Job placements eased from the highs due to labor shortages.

Source: IHS Markit

Source: IHS Markit

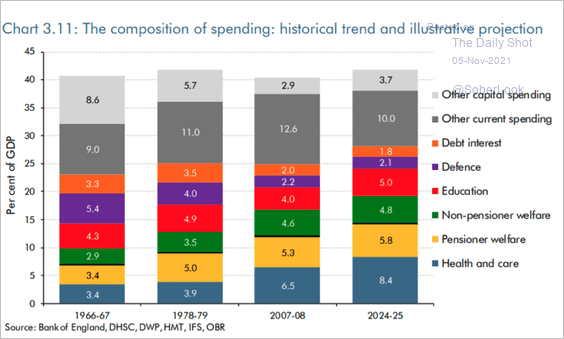

5. Finally, we have the composition of government spending over time.

Source: @rcolvile, @DuncanWeldon

Source: @rcolvile, @DuncanWeldon

Back to Index

The United States

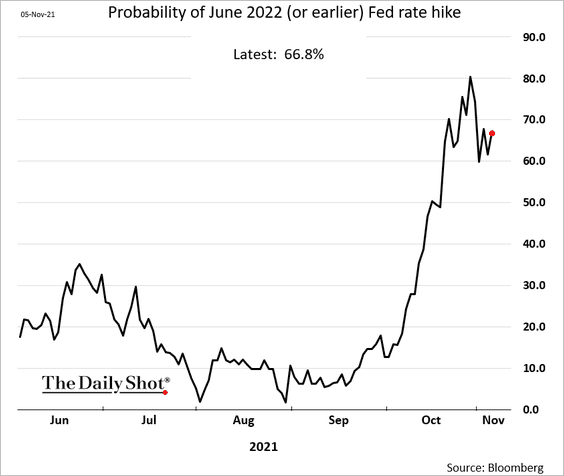

1. The market is still pricing 2 : 3 odds that the Fed will hike rates immediately after QE ends.

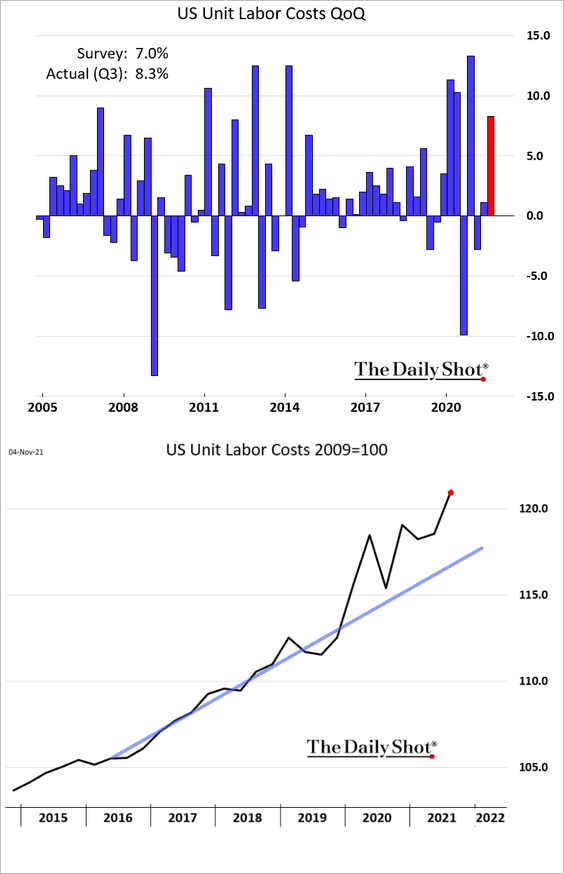

2. Gains in US unit labor costs have been running well above the pre-COVID trend.

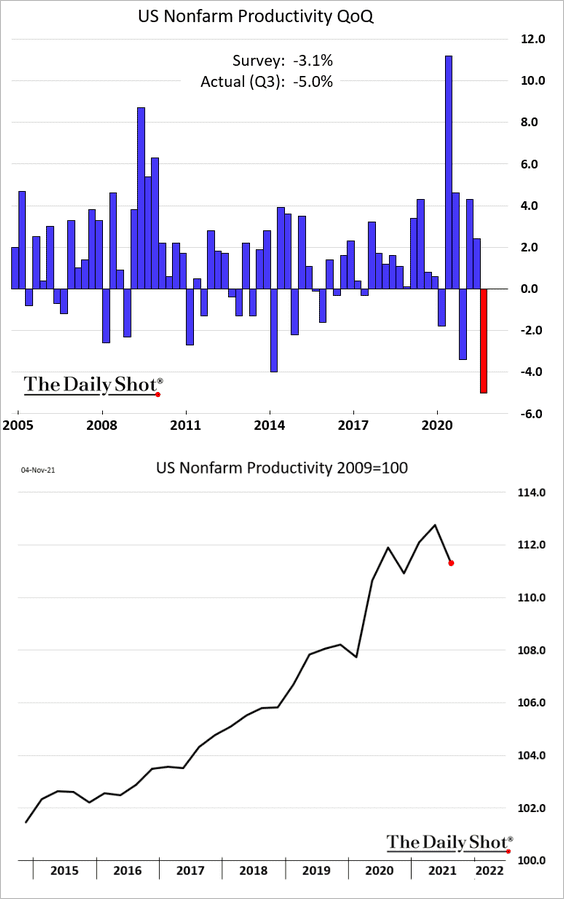

3. Productivity was dragged down by slower growth in Q3.

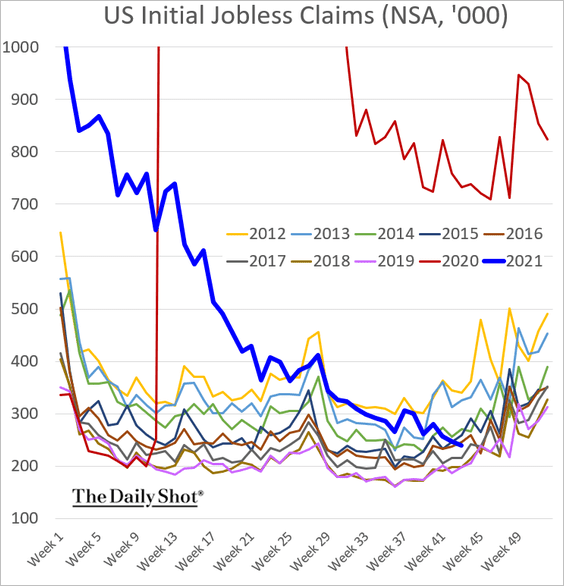

4. Initial jobless claims continue to fall and are now within the range seen in recent years.

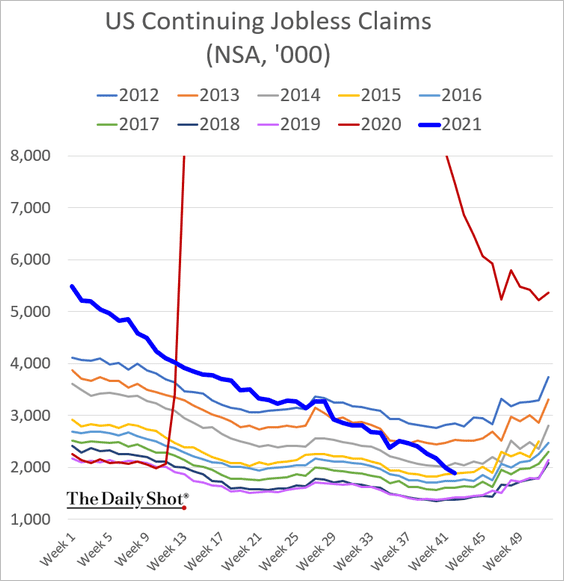

Continuing claims are also declining.

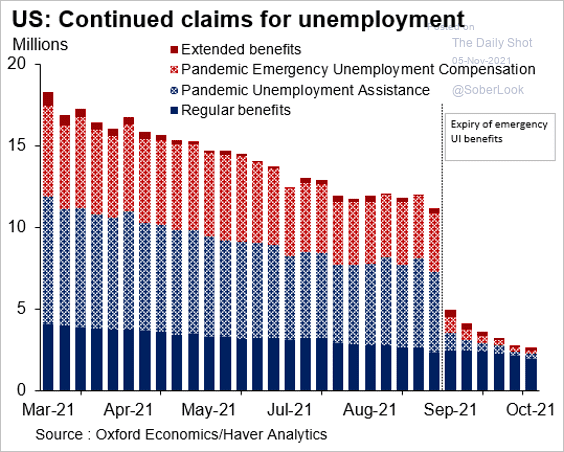

This chart includes the emergency unemployment benefits.

Source: @GregDaco

Source: @GregDaco

——————–

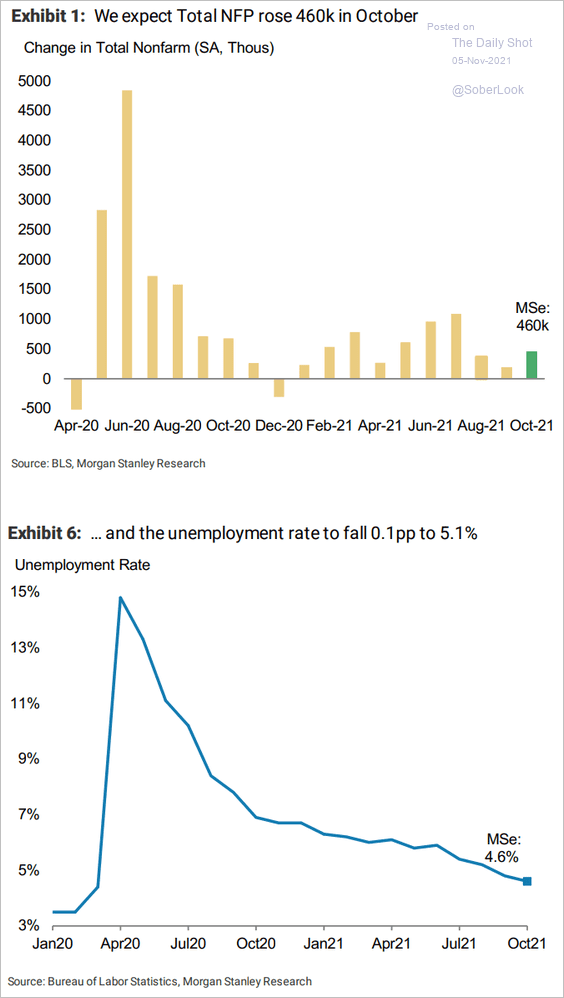

5. Morgan Stanley sees 460k jobs created in October (in line with consensus), with the unemployment rate dipping to 4.6%.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

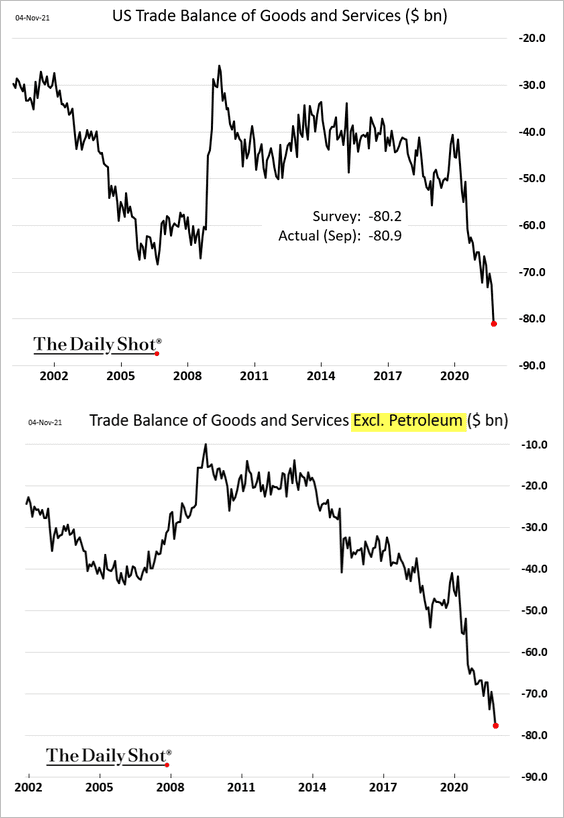

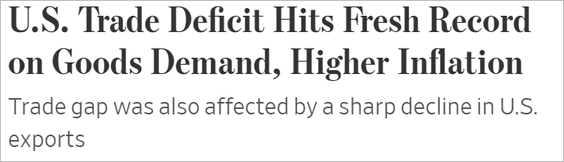

6. The trade deficit hit a record high, with imports surging and exports moderating.

Source: @WSJ Read full article

Source: @WSJ Read full article

This chart shows the divergence in the paths of imports and exports.

——————–

7. The Oxford Economics supply chain stress tracker shows no signs of easing.

![]() Source: Oxford Economics

Source: Oxford Economics

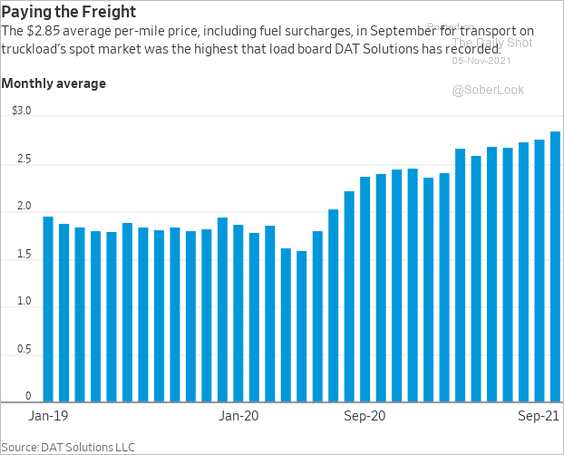

• Truckload per-mile shipping costs hit a new high.

Source: @WSJ Read full article

Source: @WSJ Read full article

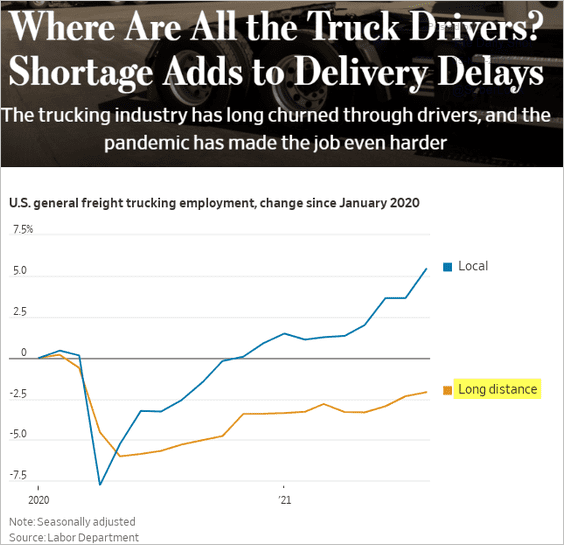

• Recruiting long-distance drivers has been challenging.

Source: @WSJ Read full article

Source: @WSJ Read full article

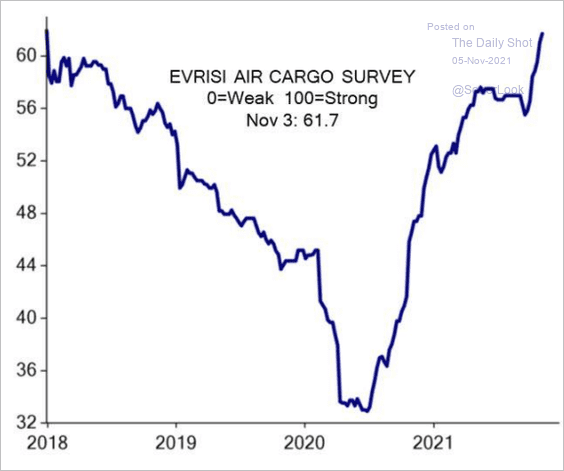

• To avoid these bottlenecks, some businesses have been shifting to air freight, despite much higher costs. Here is the Evercore ISI survey of air cargo firms.

Source: Evercore ISI

Source: Evercore ISI

——————–

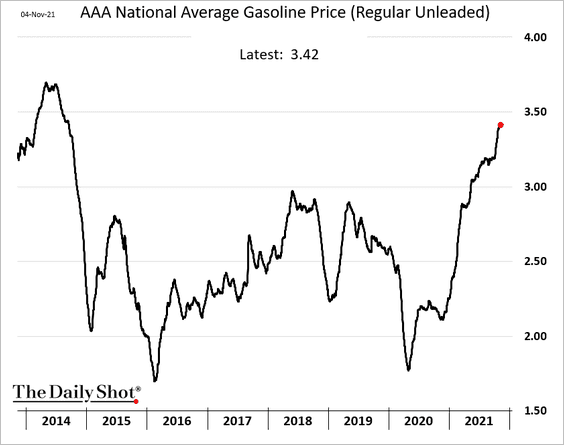

8. US retail gasoline prices continue to climb, which will weigh on consumer sentiment.

Back to Index

The Eurozone

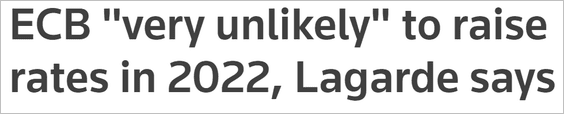

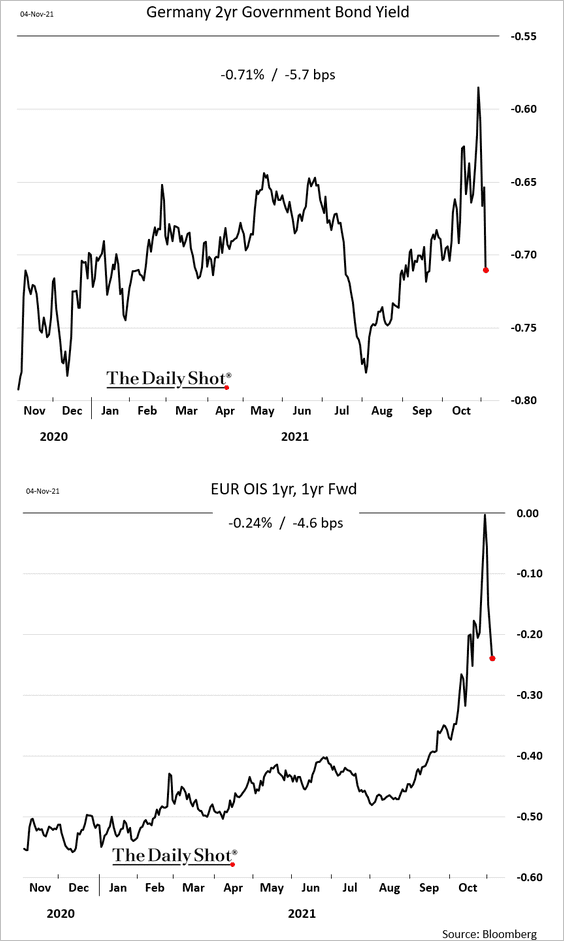

1. Christine Lagarde continues to insist that the ECB is not planning to raise rates next year. The combination of her comments and the BoE’s inaction sent short-term rates tumbling.

Source: Reuters Read full article

Source: Reuters Read full article

Here is the Bund curve.

——————–

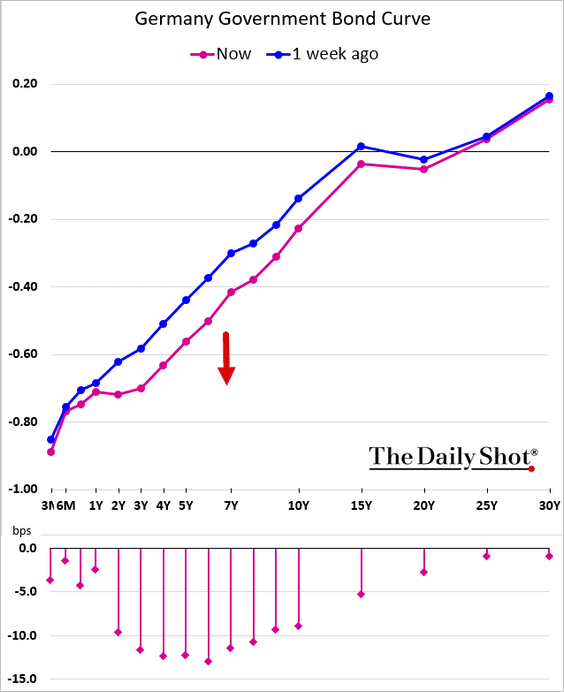

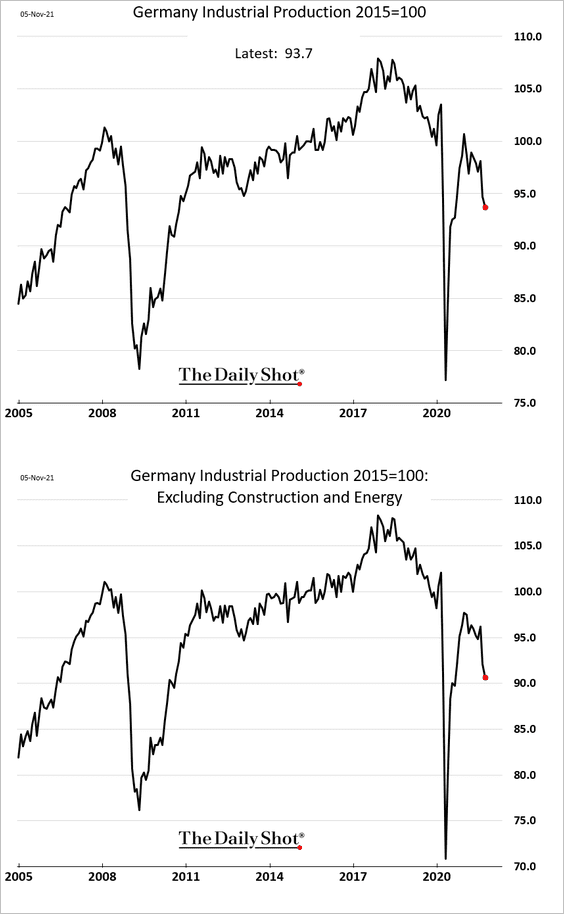

2. German factory orders ticked higher in September.

But industrial production continues to sink.

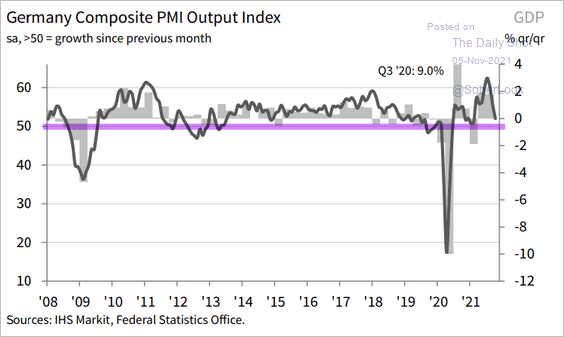

Germany’s composite PMI shows slowing business growth.

Source: IHS Markit

Source: IHS Markit

——————–

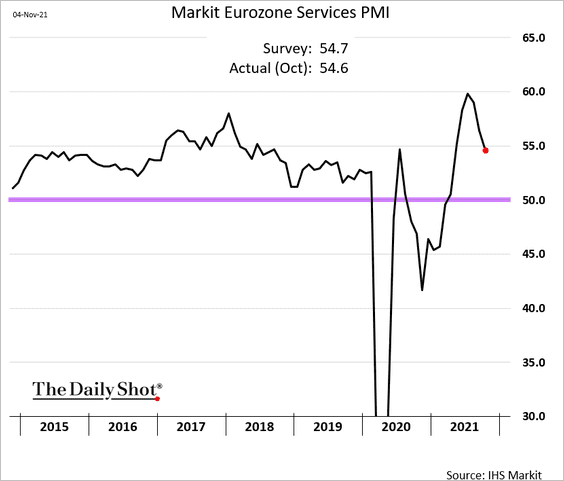

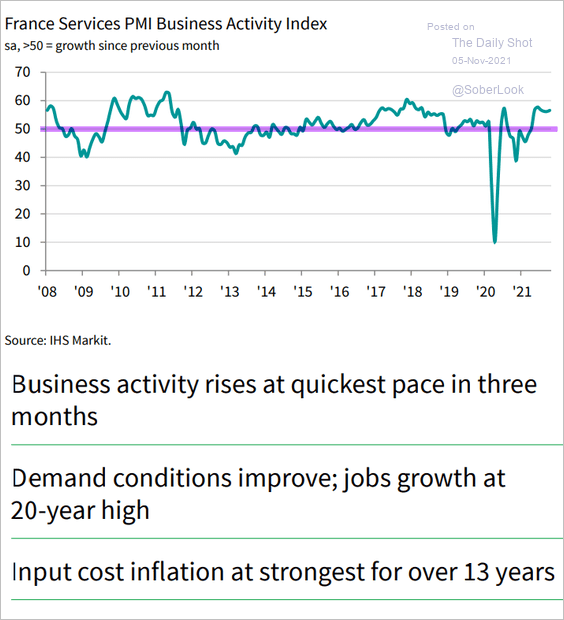

3. Services PMI eased further at the Eurozone level.

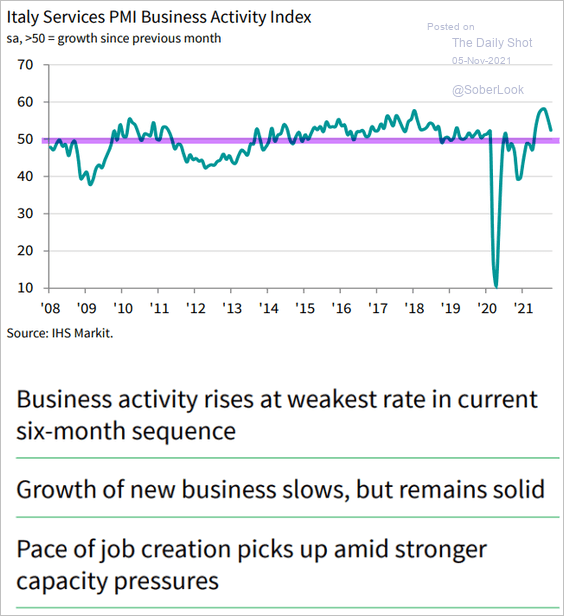

Italy’s service sector expansion is also slowing.

Source: IHS Markit

Source: IHS Markit

But France has been bucking the trend.

Source: IHS Markit

Source: IHS Markit

——————–

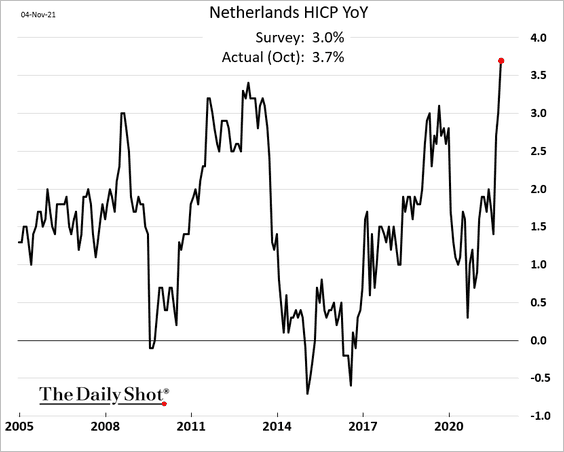

4. The Dutch CPI surprised to the upside (strongest in almost 20 years).

Back to Index

Europe

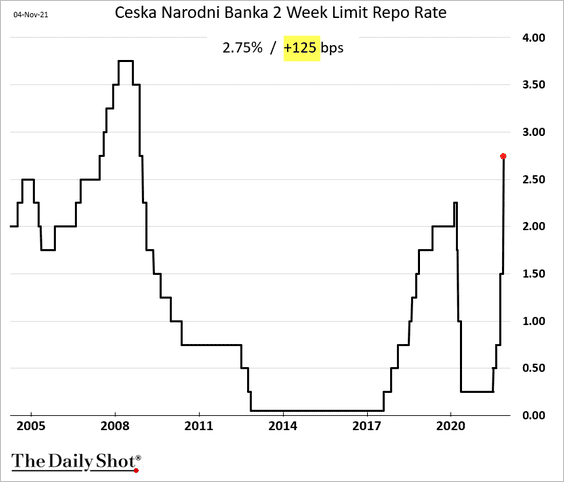

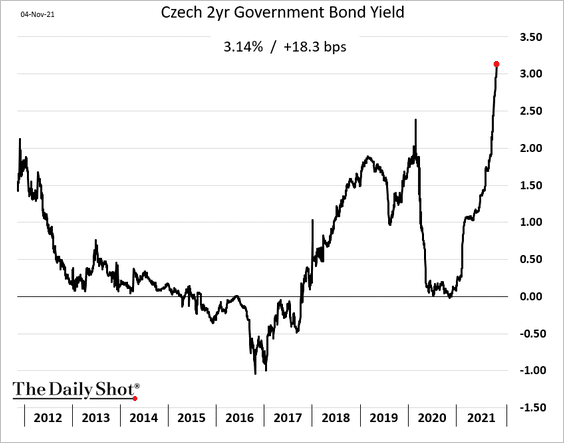

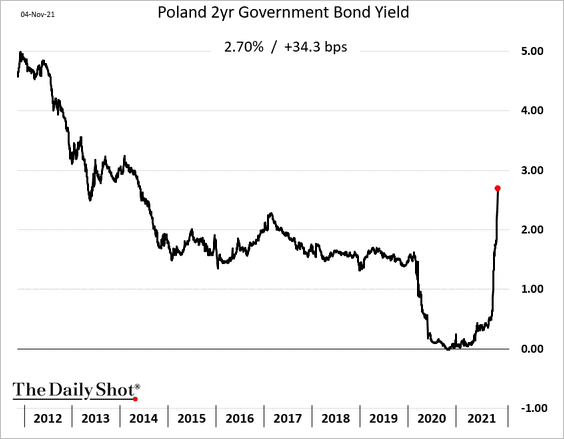

1. Similar to Poland, the Czech central bank surprised the markets with an aggressive rate hike.

Czech short-term bond yields surged.

Polish yields climbed sharply as well.

——————–

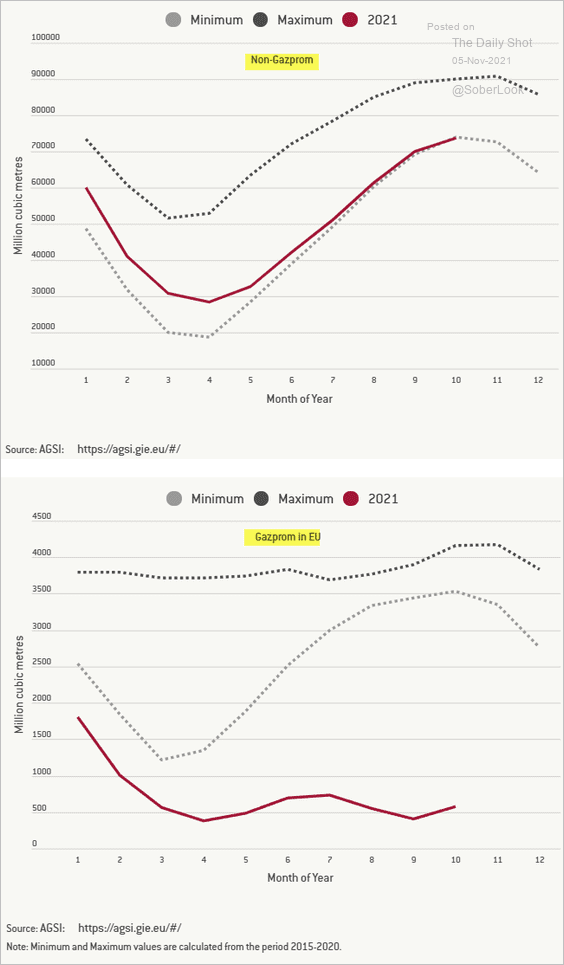

2. The charts below show European natural gas in storage at Gazprom and non-Gazprom facilities.

Source: Bruegel Read full article

Source: Bruegel Read full article

Back to Index

Asia – Pacific

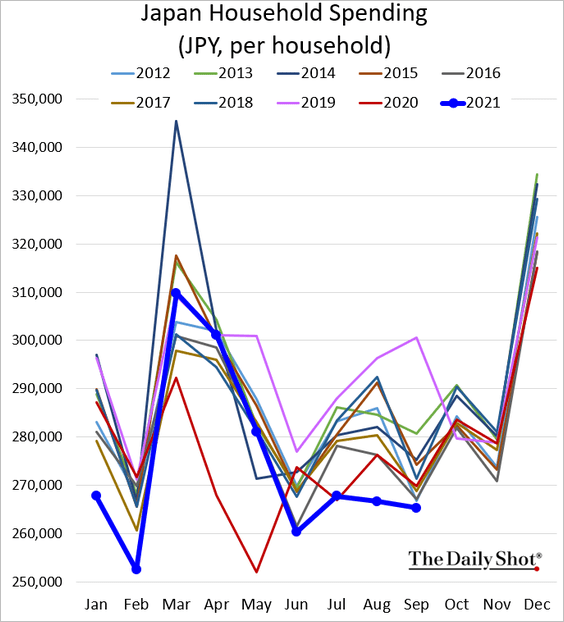

1. Japan’s household spending remains depressed.

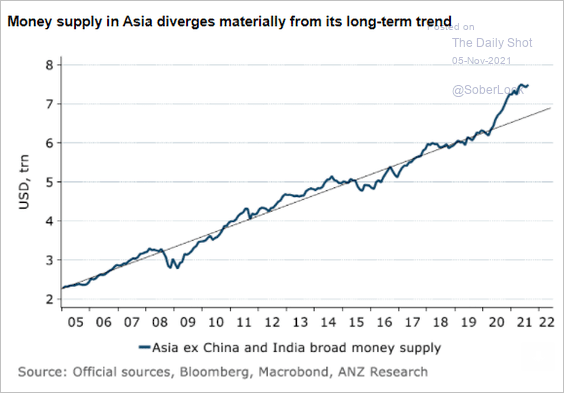

2. Asia’s money supply has risen well above the long-term trend.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

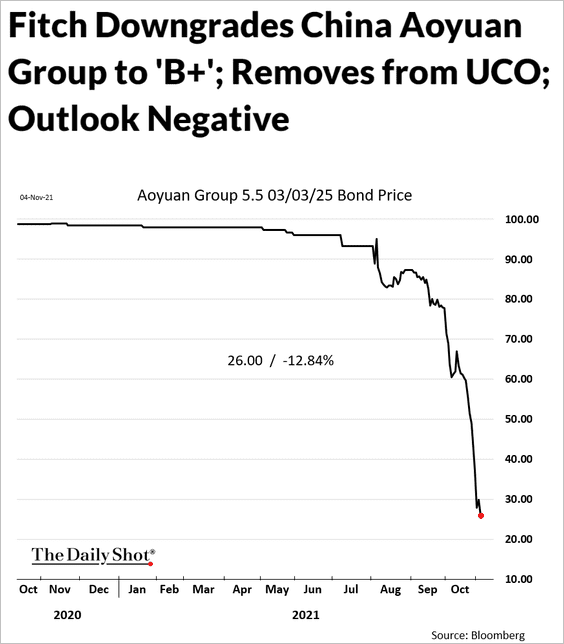

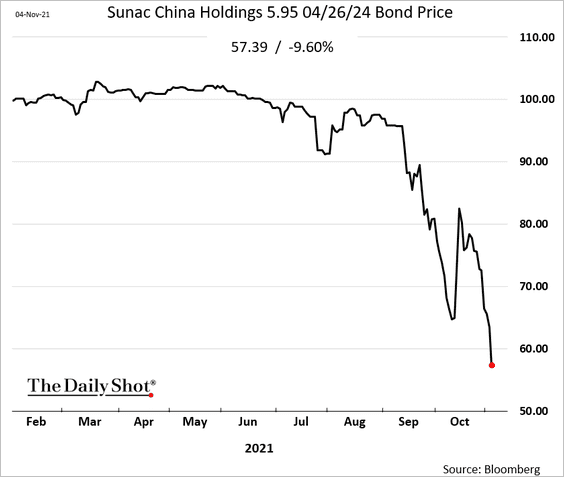

1. We continue to get more bad news about China’s leveraged developers’ debt.

– Aoyuan:

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

– Sunac:

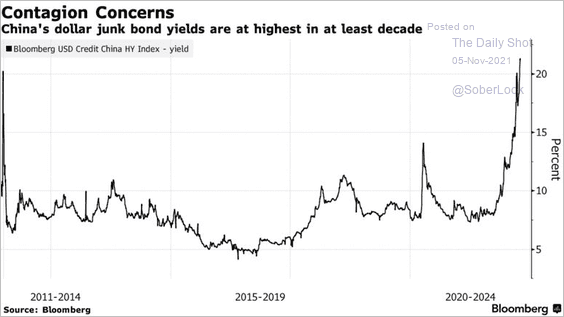

• Dollar-denominated junk bond yields keep surging.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

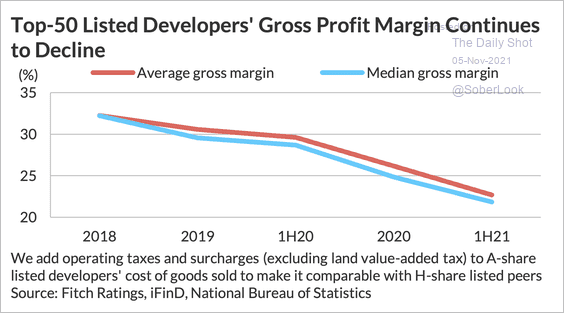

• Chinese developers’ gross margins have been squeezed over the past couple of years.

Source: Fitch Ratings

Source: Fitch Ratings

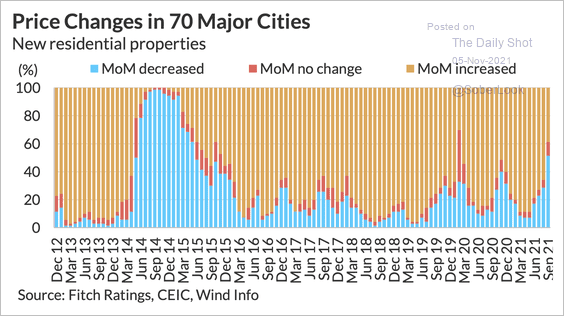

• More major Chinese cities are seeing home price decreases than increases.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

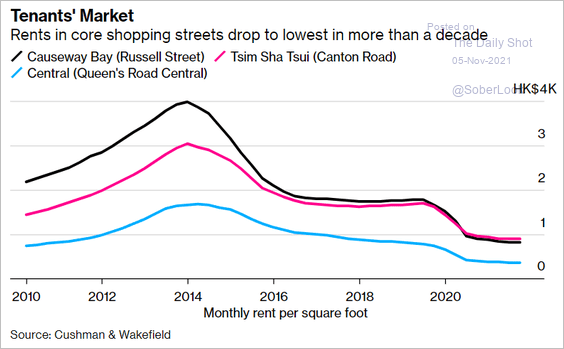

2. Rents are getting cheaper in Hong Kong (still unaffordable for many).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

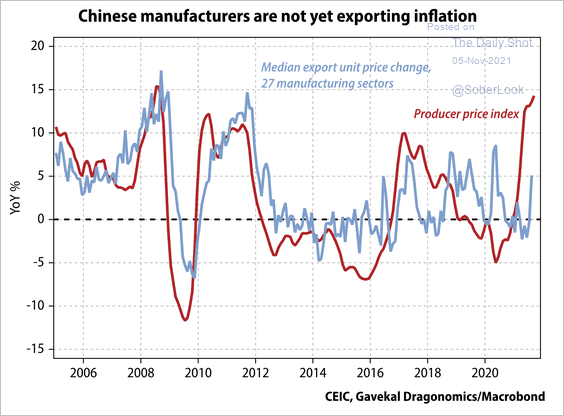

3. China continues to be a disinflationary force by not passing through rising materials prices into exports. Is this trend sustainable?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

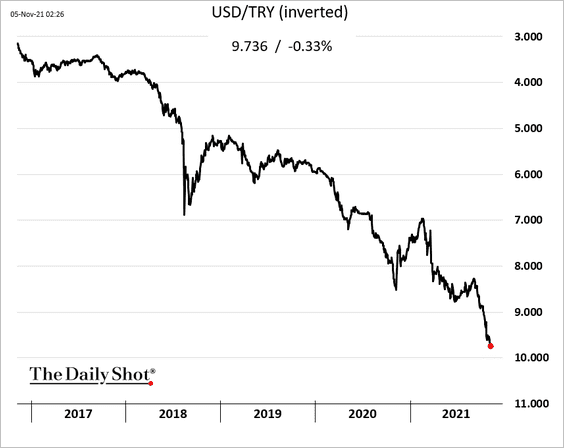

1. The Turkish lira continues to sink.

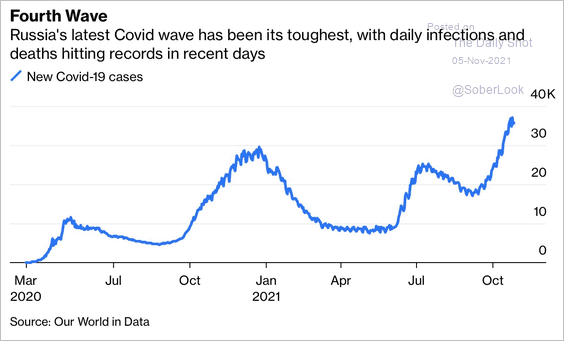

2. Russia is struggling with rising COVID cases.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

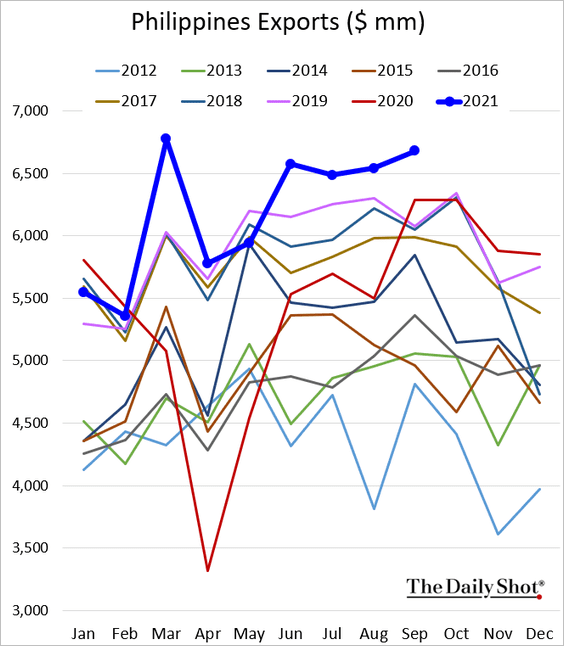

3. Philippine exports remain robust, …

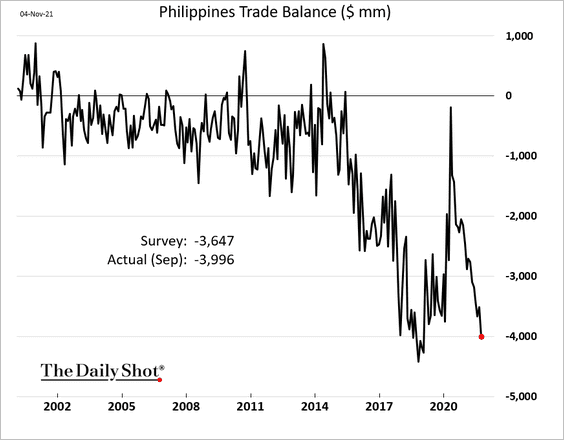

… but imports have been surging. The trade deficit has accelerated.

——————–

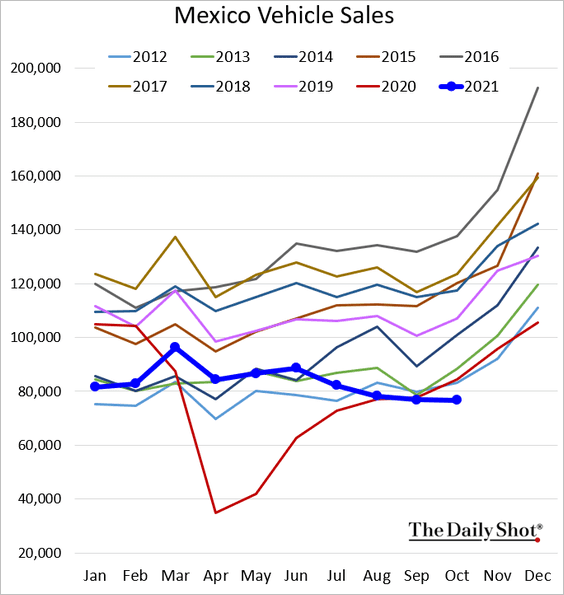

4. Mexico’s vehicle sales hit a multi-year low.

5. Chile’s car sales are bucking the trend.

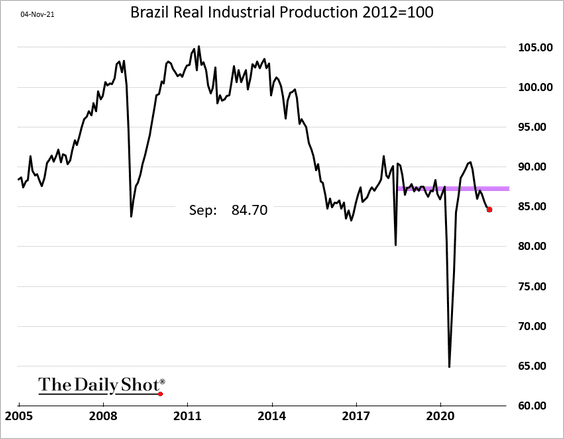

6. Brazil’s industrial production is now well below pre-COVID levels.

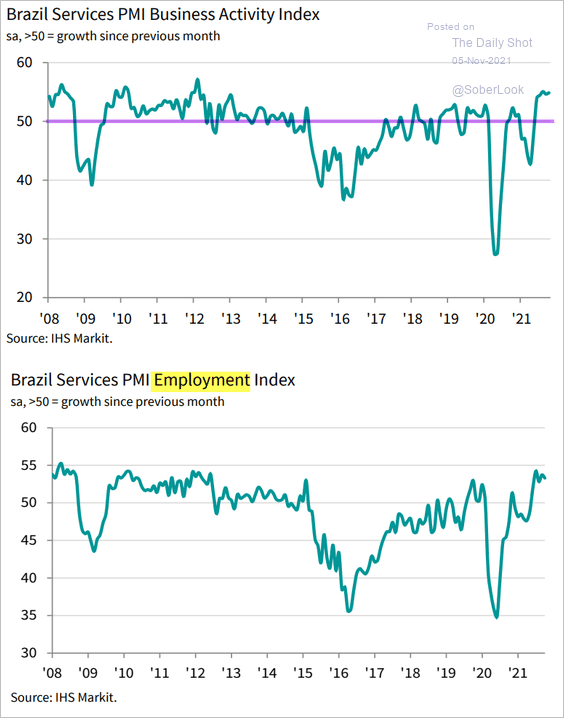

However, Brazil’s service sector is in good shape.

Source: IHS Markit

Source: IHS Markit

Back to Index

Cryptocurrency

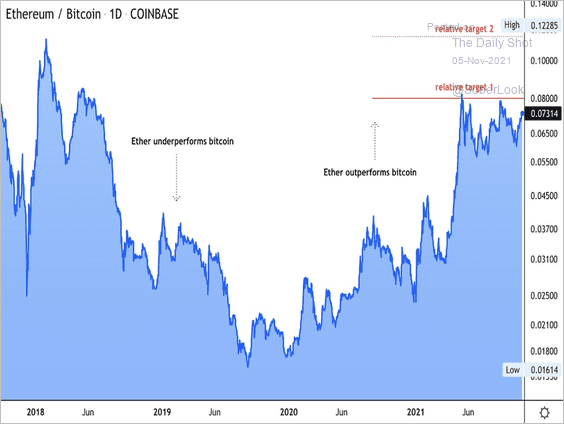

1. Will the ETH/BTC ratio see a breakout above 0.08 resistance? Ether has significantly outperformed bitcoin during the current crypto bull market.

Source: CoinDesk

Source: CoinDesk

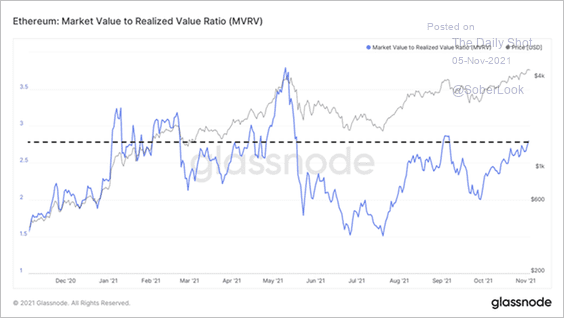

2. Ether’s market-value-to-realized-value (MVRV) is significantly lower than peak levels in May, suggesting the cryptocurrency is not yet overvalued.

Source: @fundstrat

Source: @fundstrat

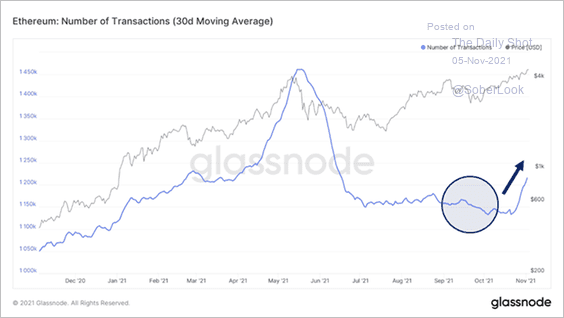

3. The number of transactions on the Ethereum blockchain have increased as decentralized exchange volumes started to pick up.

Source: @fundstrat

Source: @fundstrat

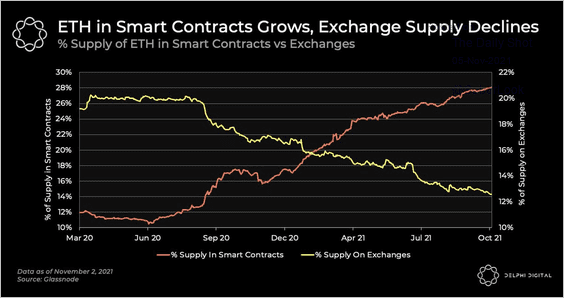

4. More ETH is being used in smart contracts instead of being deployed on exchanges to trade.

Source: @Delphi_Digital

Source: @Delphi_Digital

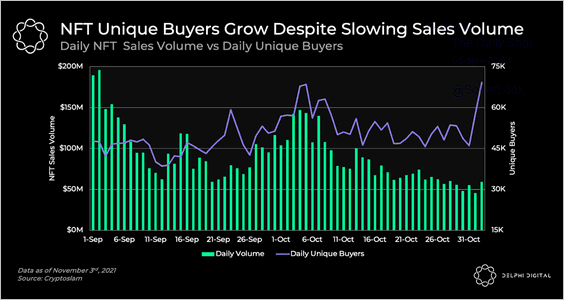

5. NFTs are seeing new buyers despite lower sales volume.

Source: @Delphi_Digital

Source: @Delphi_Digital

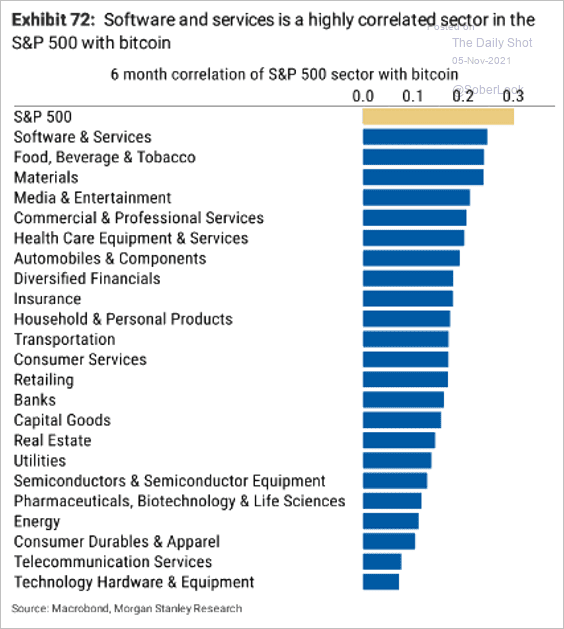

6. How correlated are US equity sectors with bitcoin?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

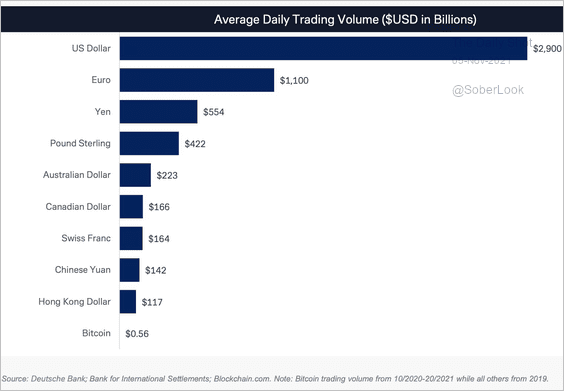

7. This chart compares bitcoin’s trading volume with major currencies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

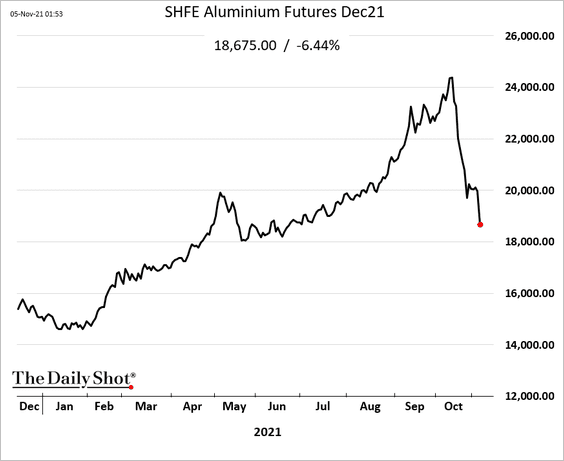

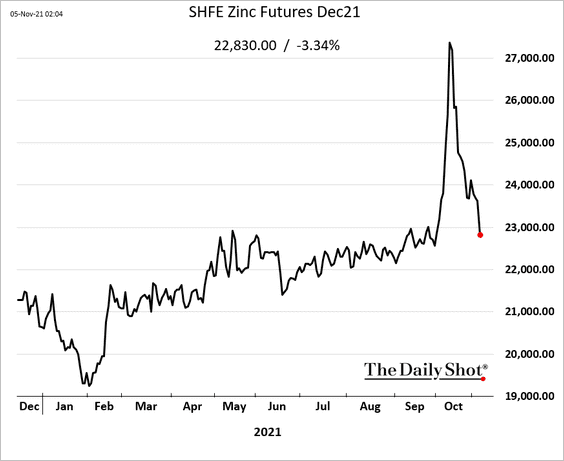

1. China’s industrial commodity markets remain under pressure, which is being felt globally.

• Aluminum:

• Zinc:

——————–

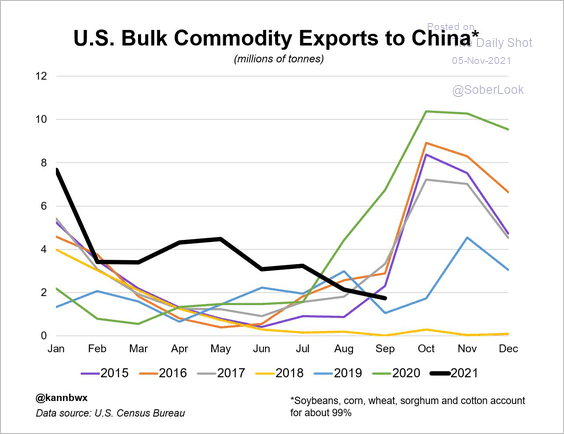

2. After a surge earlier this year, US agricultural commodity exports to China have been slowing.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

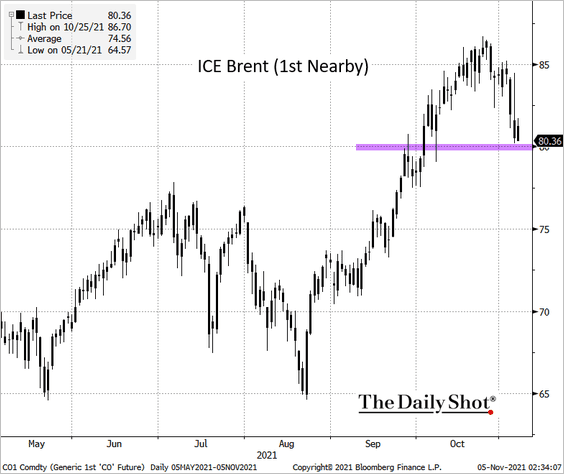

1. Brent is testing support at $80/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

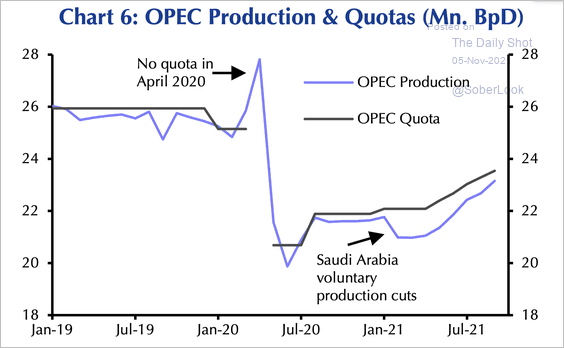

2. A bullish trend in the market has been OPEC+’s inability to meet even its own conservative quotas.

Source: Capital Economics

Source: Capital Economics

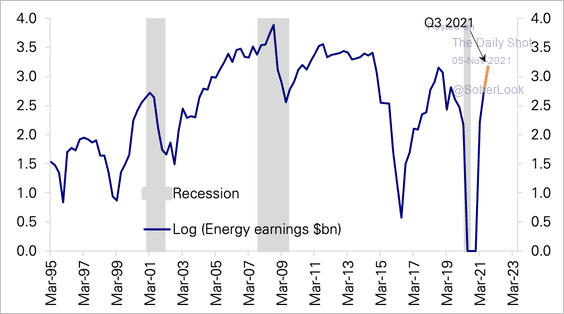

3. S&P 500 energy company earnings have risen strongly on the back of higher oil prices.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

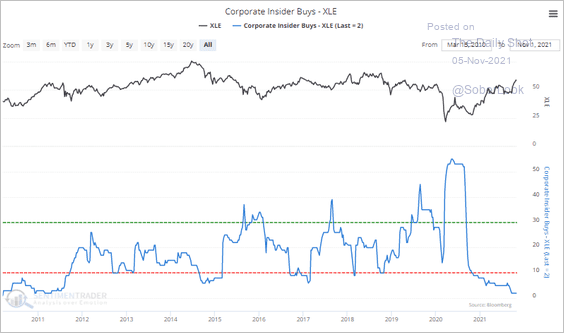

4. Corporate insiders in energy companies have significantly pulled back their buying activity after last year’s surge.

Source: SentimenTrader

Source: SentimenTrader

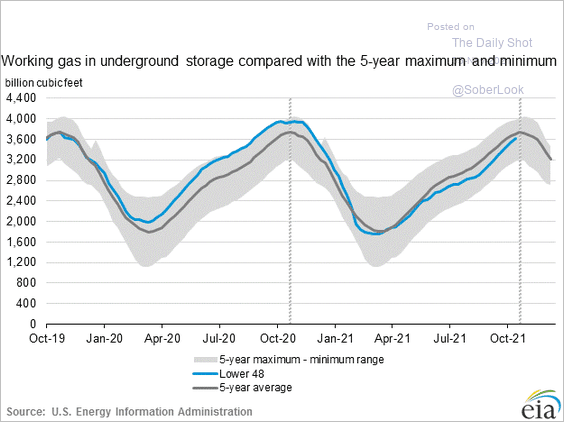

5. US natural gas in storage is nearing the 5-year average.

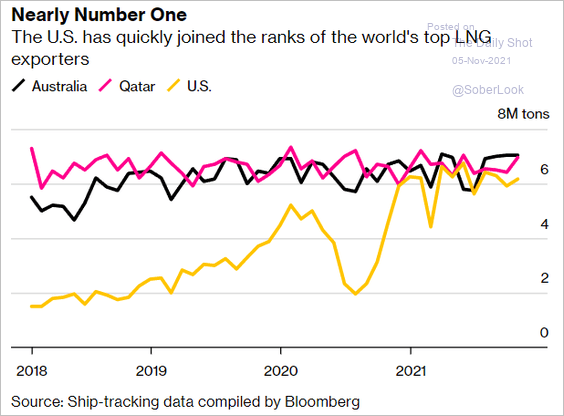

US LNG exports have been rising.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

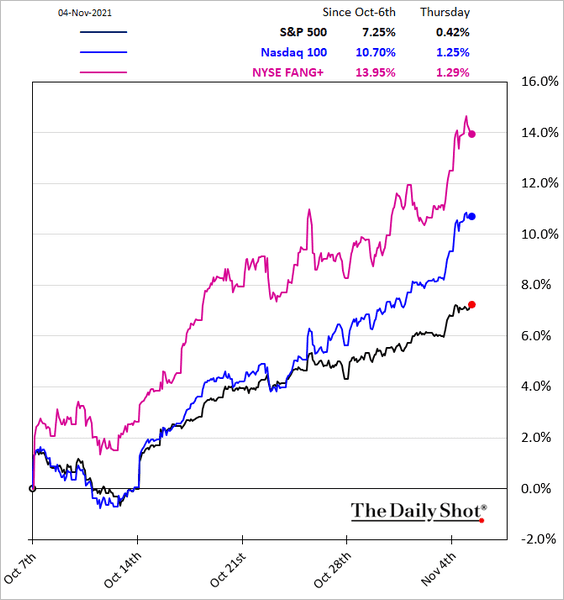

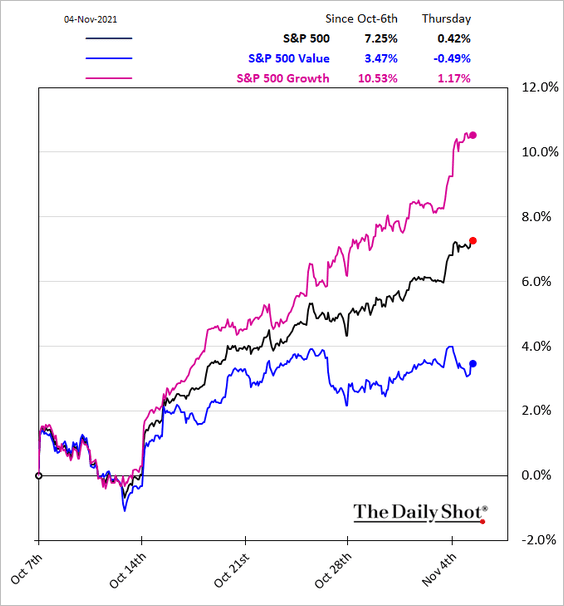

1. Large growth stocks have outperformed sharply in recent weeks.

• Here are the S&P 500 growth and value indices.

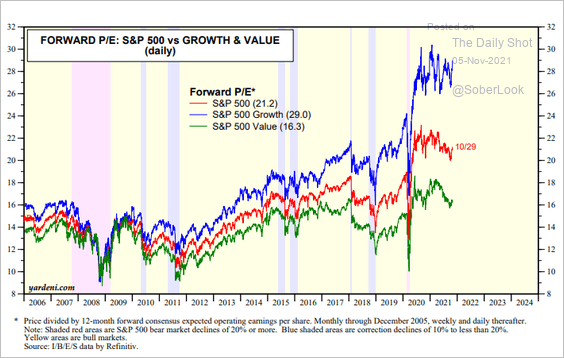

And this chart shows relative valuations.

Source: Yardeni Research

Source: Yardeni Research

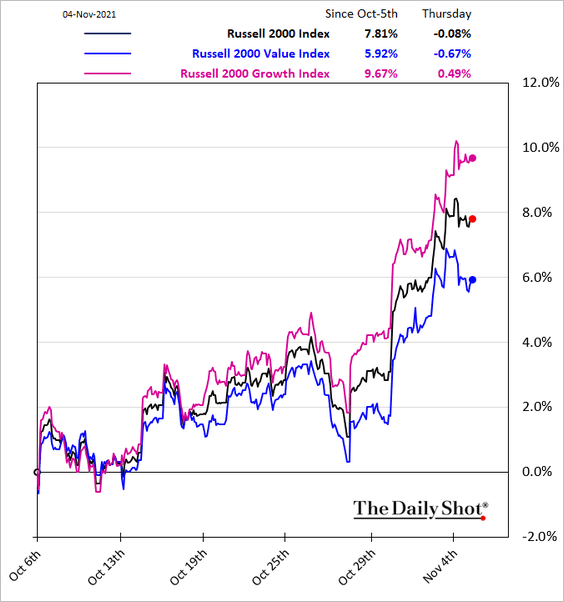

• Small-cap growth shares have also outperformed.

——————–

2. Next, we have some sector/subsector trends.

• Semiconductor stocks are surging, …

![]()

… amid record sales.

![]() Source: Yardeni Research

Source: Yardeni Research

Will sales peak soon?

![]() Source: MRB Partners

Source: MRB Partners

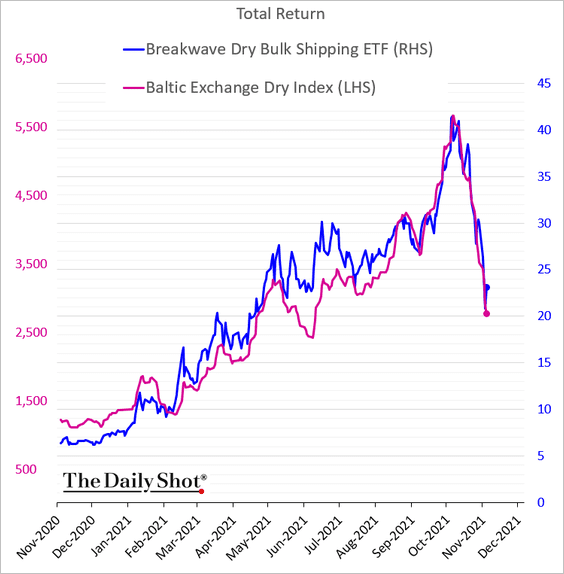

• Dry bulk shipping stocks have been following shipping costs down as demand for vessels ebbs.

Source: Hellenic Shipping News, h/t Walter Read full article

Source: Hellenic Shipping News, h/t Walter Read full article

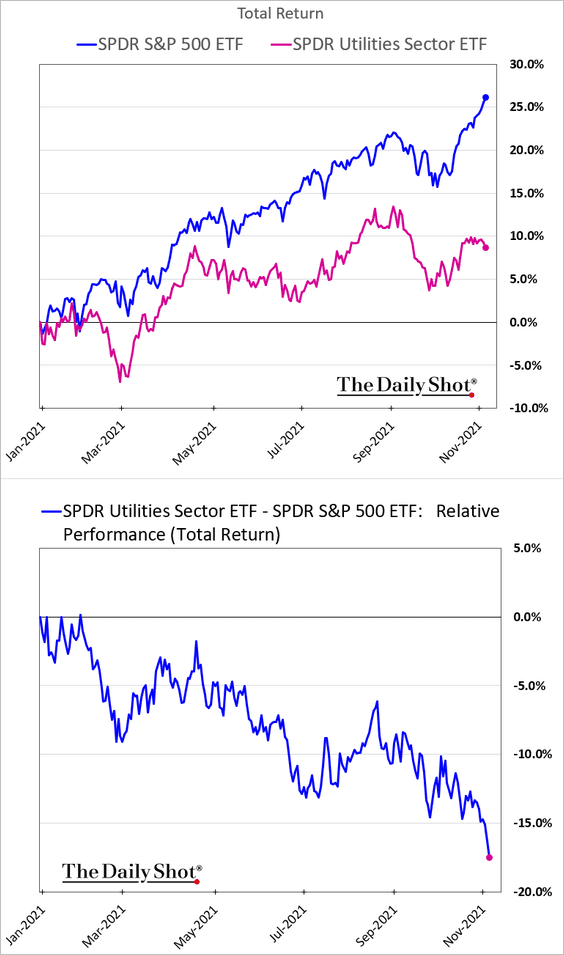

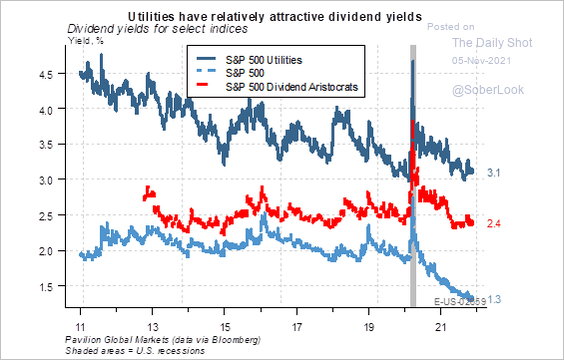

• Utilities have been underperforming, …

… despite attractive dividend yields.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

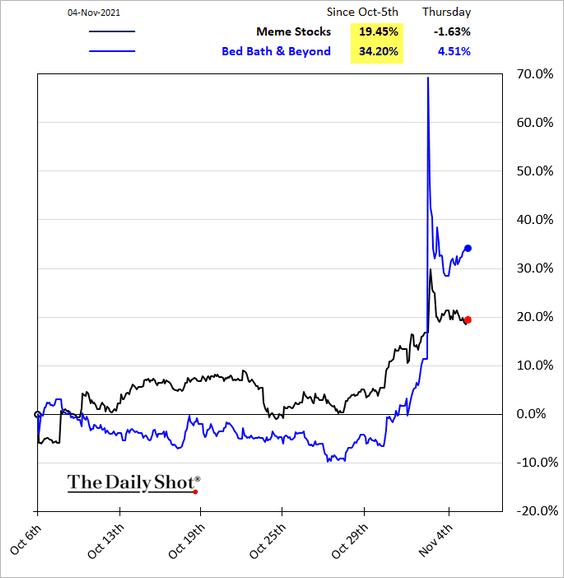

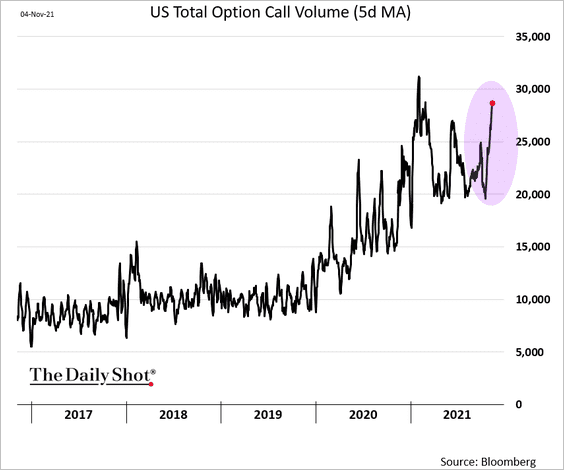

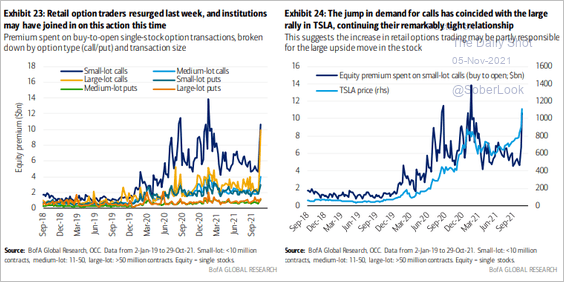

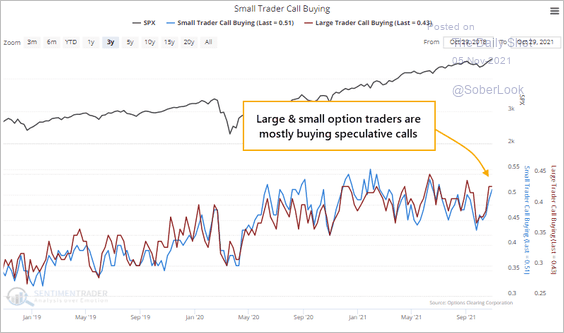

3. The Reddit crowd is back in the game.

• Meme stocks:

• Speculative call option volumes (3 charts):

Source: BofA Global Research

Source: BofA Global Research

Source: SentimenTrader

Source: SentimenTrader

——————–

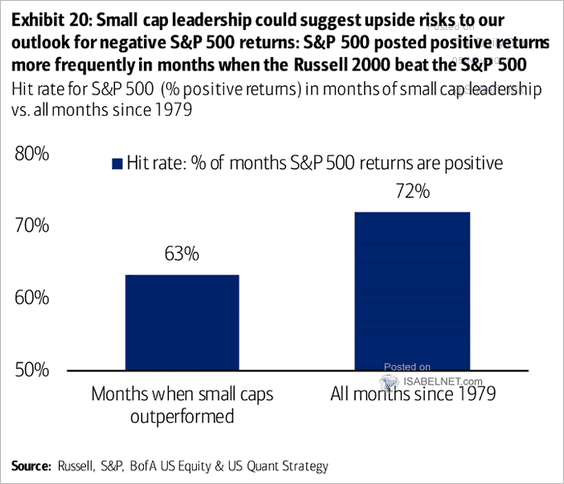

4. Small-caps’ recent outperformance bodes well for the S&P 500.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

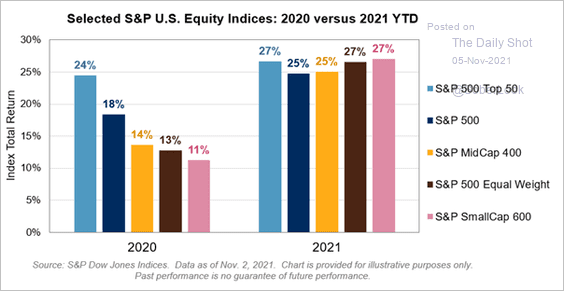

5. The 2021 rally has been broader than what we saw last year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

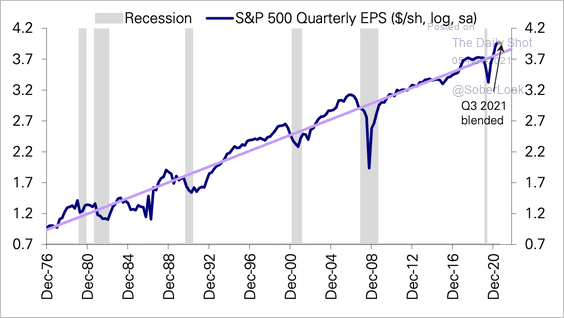

6. S&P 500 earnings have been well above the long-run trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

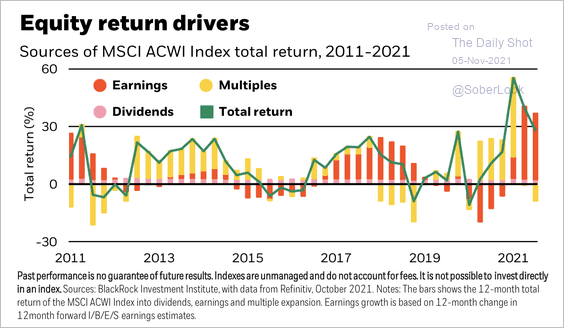

7. BlackRock expects earnings growth to normalize as economic activity settles.

Source: BlackRock

Source: BlackRock

Back to Index

Credit

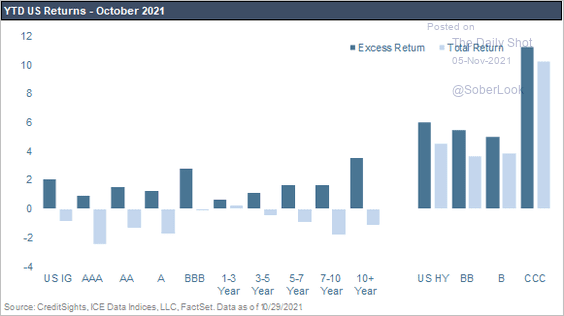

1. CCC-rated corporate bonds outperformed this year.

Source: CreditSights

Source: CreditSights

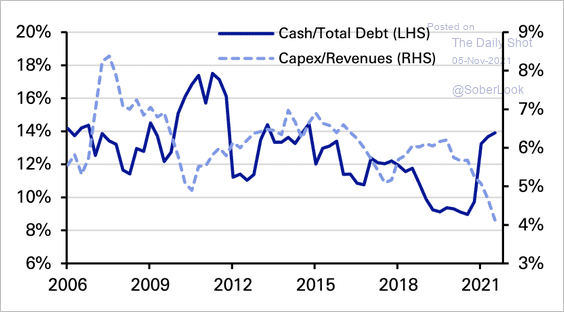

2. US high-yield corporates have been more conservative in managing cash flow as capital expenditures declined.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

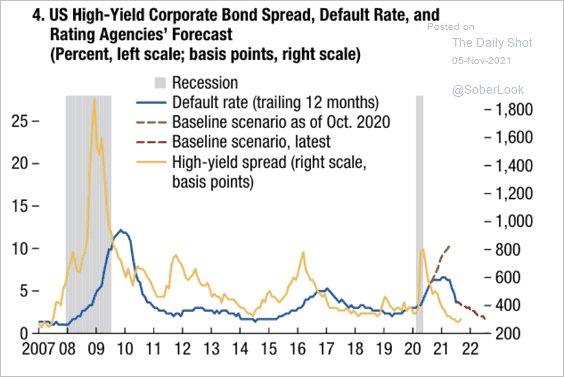

3. Based on the high-yield spread and rating agency projections, default rates for risky bonds are expected to continue lower over the next year.

Source: IMF

Source: IMF

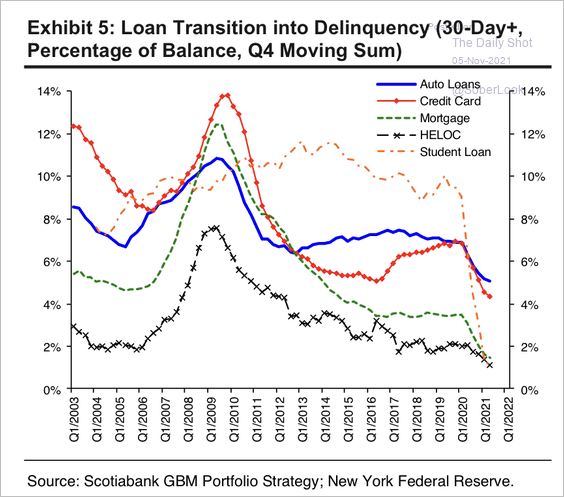

4. US loan transitions to delinquency are at historically low levels.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

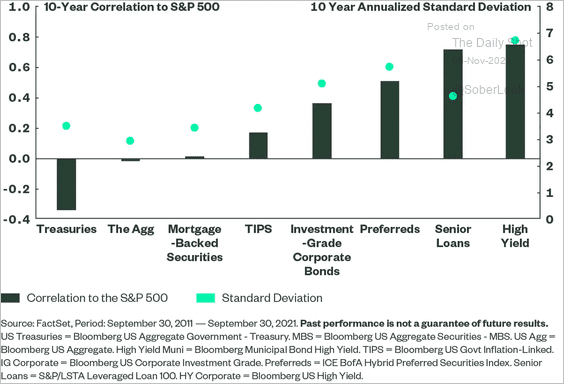

5. This chart shows fixed-income correlations to the S&P 500.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

Back to Index

Food for Thought

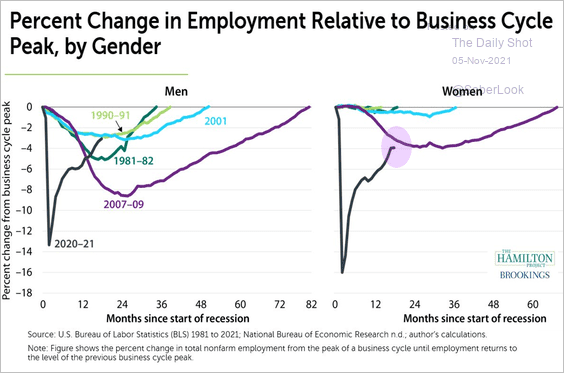

1. US employment recovery vs. previous economic downturns:

Source: @laurenlbauer

Source: @laurenlbauer

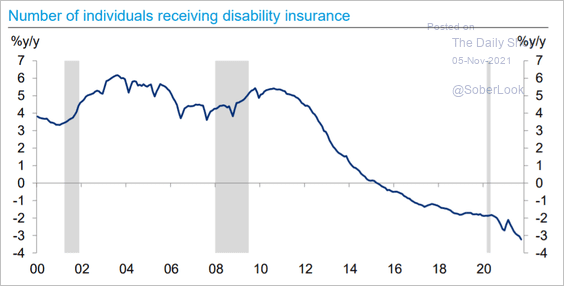

2. Number of Americans on disability insurance:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

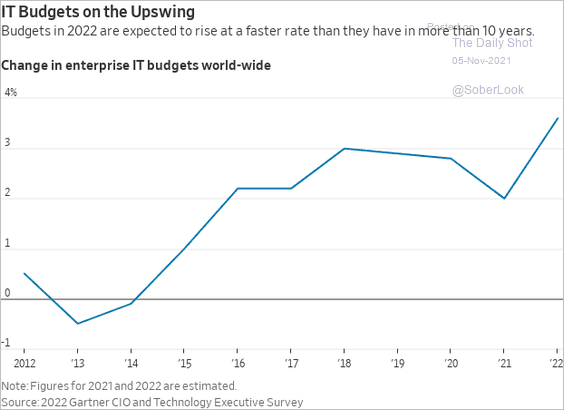

3. Enterprise IT budgets:

Source: @WSJ Read full article

Source: @WSJ Read full article

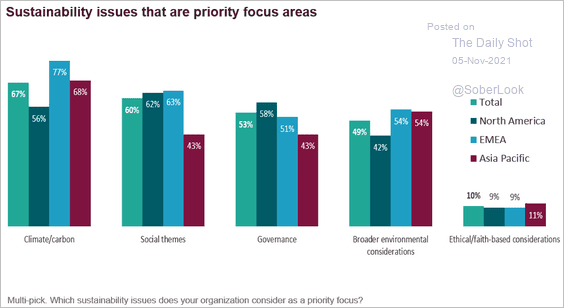

4. Global investors’ prioritization of sustainability issues:

Source: FTSE Russell Read full article

Source: FTSE Russell Read full article

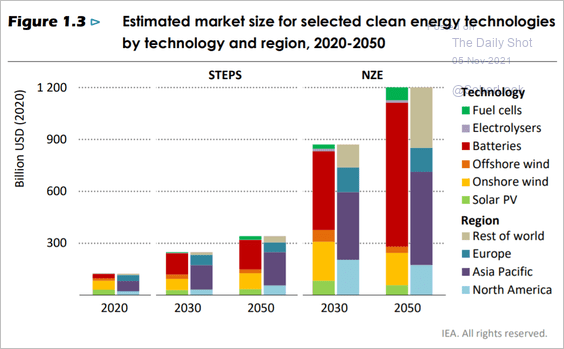

5. Market size for clean energy technologies:

Source: EIA

Source: EIA

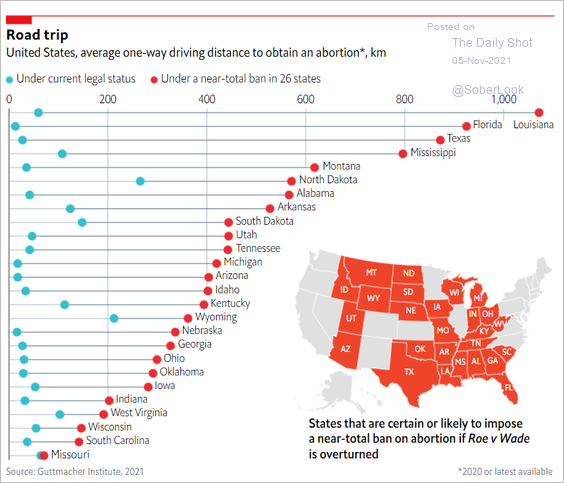

6. Driving distance to obtain an abortion:

Source: The Economist Read full article

Source: The Economist Read full article

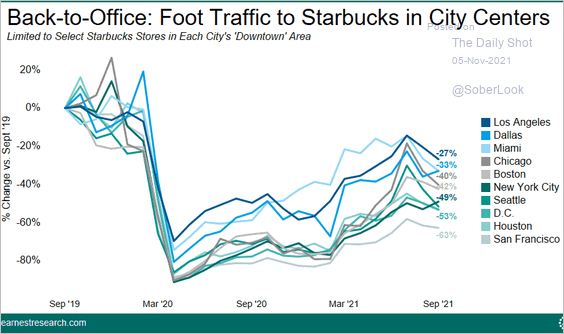

7. Starbucks foot traffic in city centers:

Source: Earnest Research

Source: Earnest Research

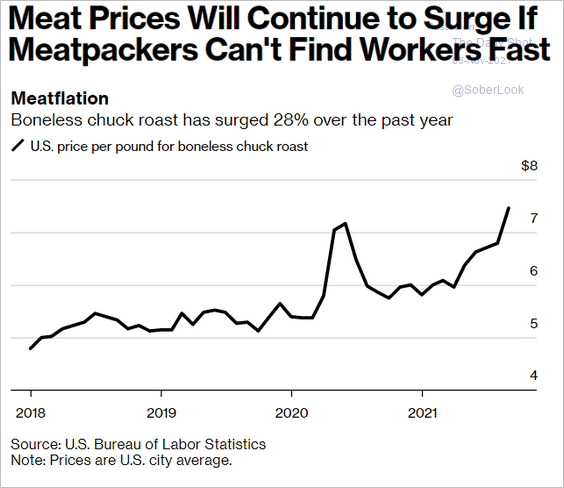

8. US meat prices:

Source: @business Read full article

Source: @business Read full article

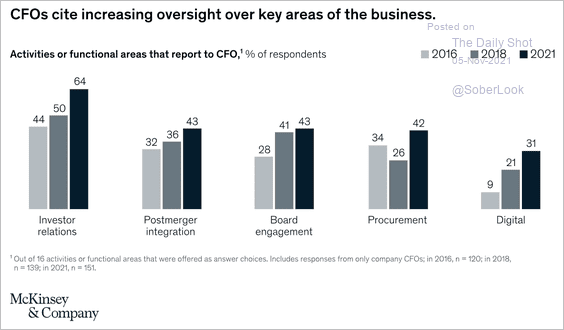

9. Increased CFO oversight:

Source: McKinsey Read full article

Source: McKinsey Read full article

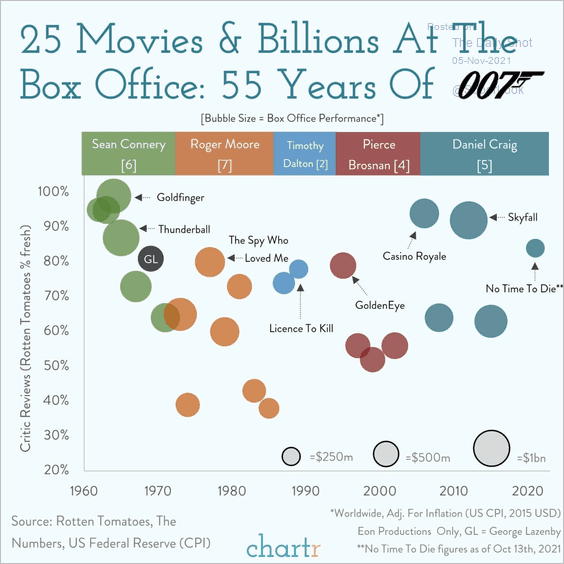

10. James Bond movies:

Source: @chartrdaily

Source: @chartrdaily

——————–

Have a great weekend!

Back to Index