The Daily Shot: 10-Nov-21

• The United States

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

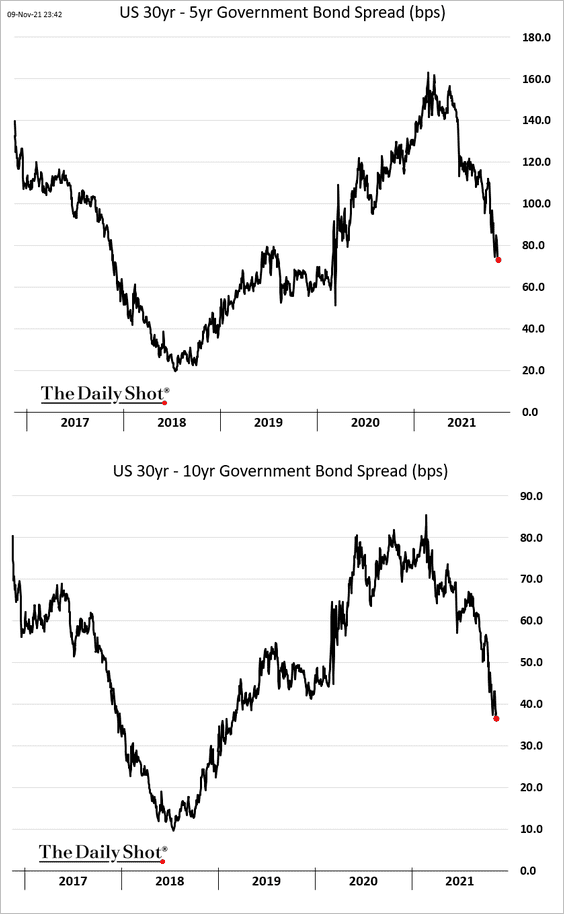

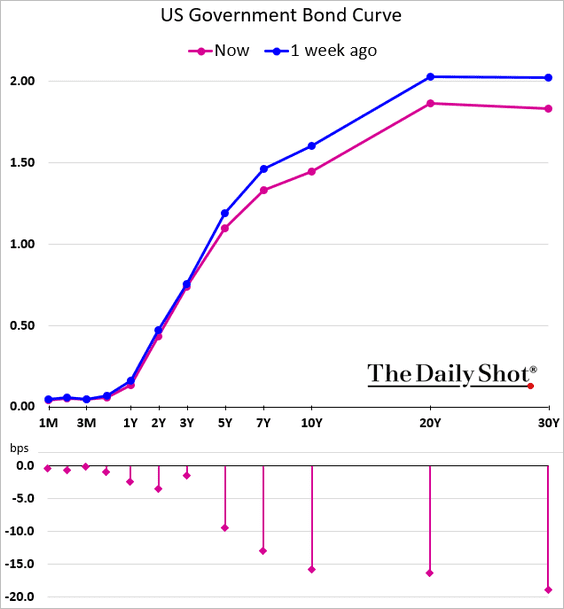

1. Let’s begin with some updates on the rates markets.

• The Treasury curve continues to flatten. The markets are less upbeat about economic growth as the Fed begins tapering.

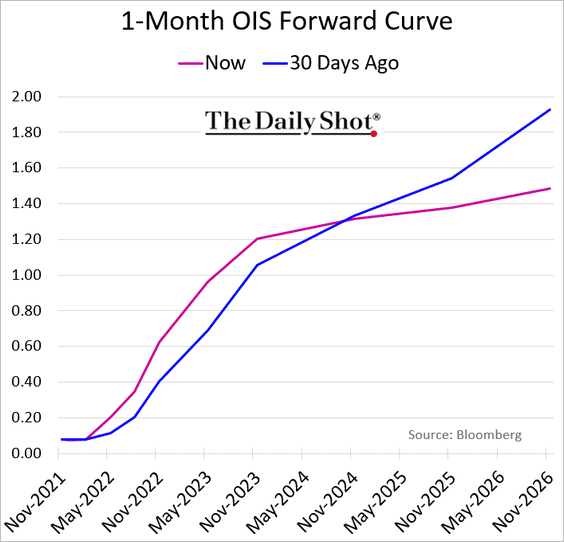

• The market now expects the Fed to start hiking sooner, but it also sees the central bank slowing/pausing rate increases in 2024.

Source: TS Lombard

Source: TS Lombard

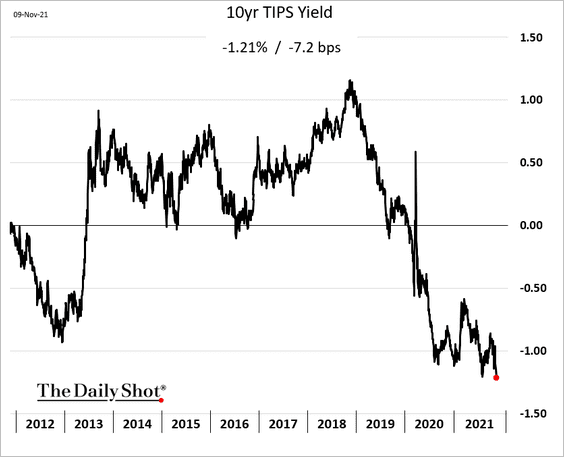

• Real rates continued to drop on Tuesday as investors bid up inflation-linked Treasuries (amid heightened concerns about rising prices).

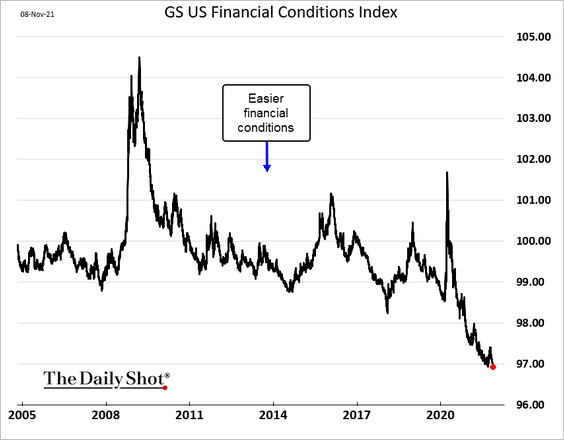

• With real rates deep in negative territory and stocks at record highs, Goldman’s indicator shows extraordinarily accommodative financial conditions in the US.

——————–

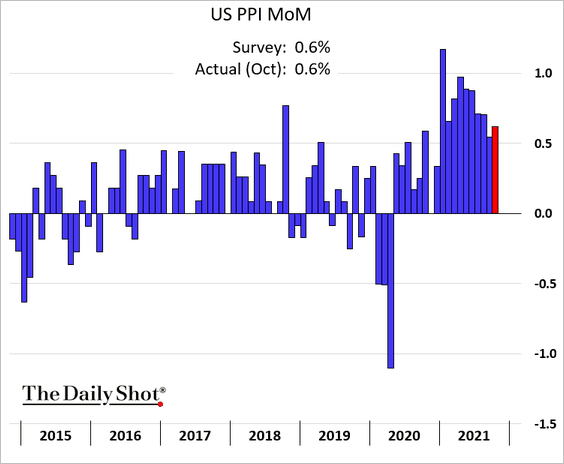

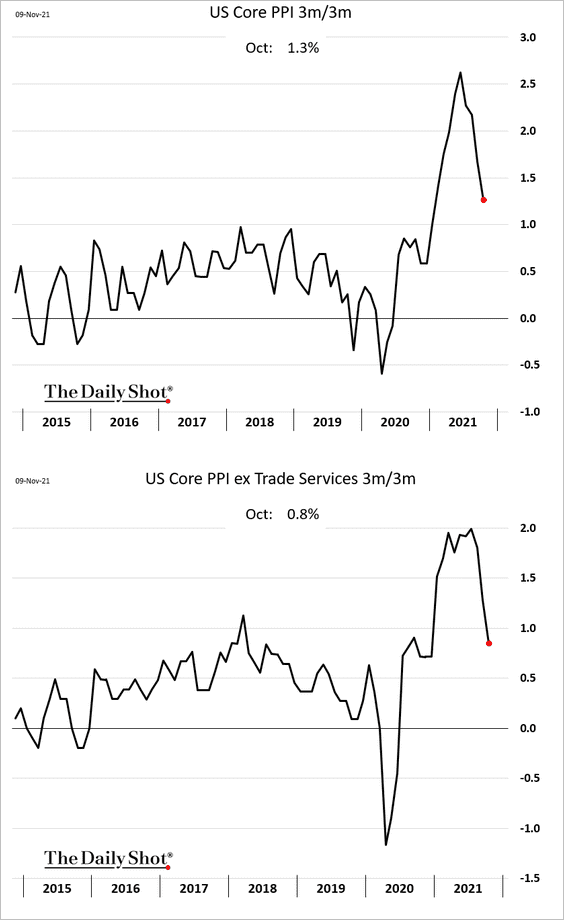

2. Producer prices continue to surge, with the PPI report coming in roughly as expected.

However, the pace of price increases has been moderating. Here are the 3-month changes.

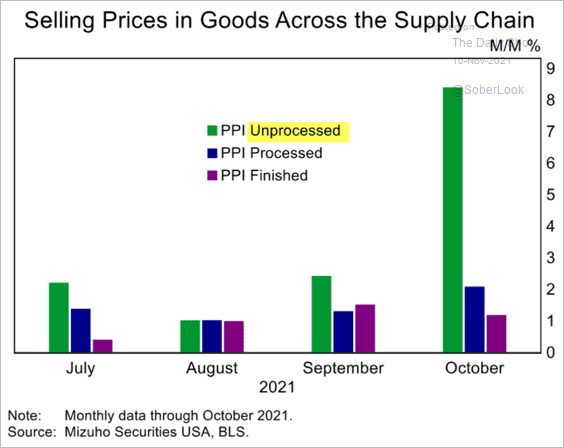

Bottlenecks are clearly visible in the PPI across the supply chain.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

3. Next, we have some additional updates on inflation.

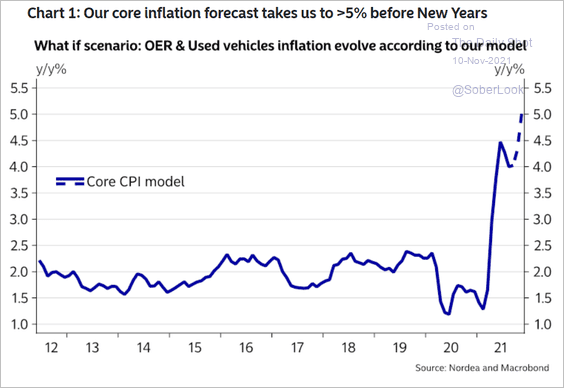

• Will the core CPI hit 5% by year-end?

Source: Nordea Markets

Source: Nordea Markets

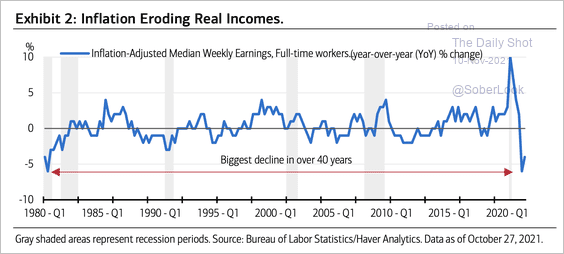

• Inflation might be transient, but it is putting a squeeze on real incomes in the US. The drop has been similar to the inflation-plagued 1970s.

Source: BofA Global Research

Source: BofA Global Research

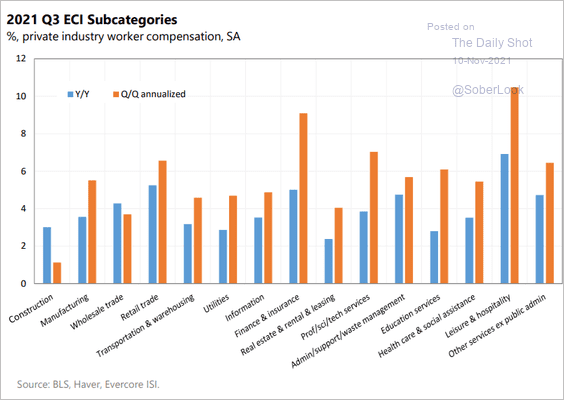

• This chart shows the Employment Cost Index (ECI) by industry.

Source: Evercore ISI

Source: Evercore ISI

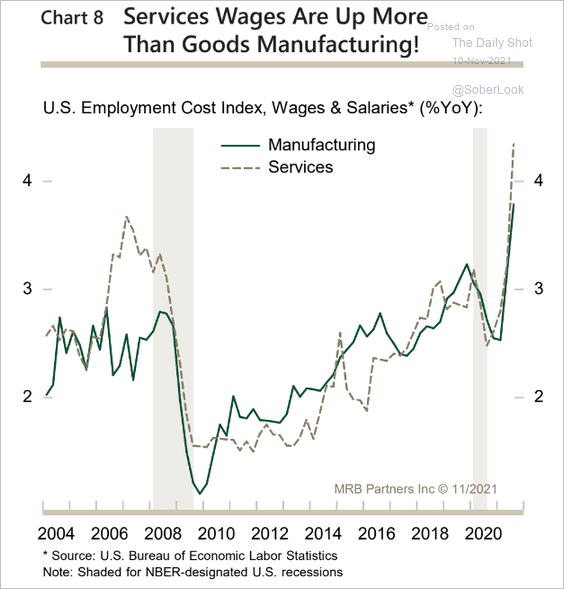

And here is the ECI (just the wage component) for manufacturing and services.

Source: MRB Partners

Source: MRB Partners

——————–

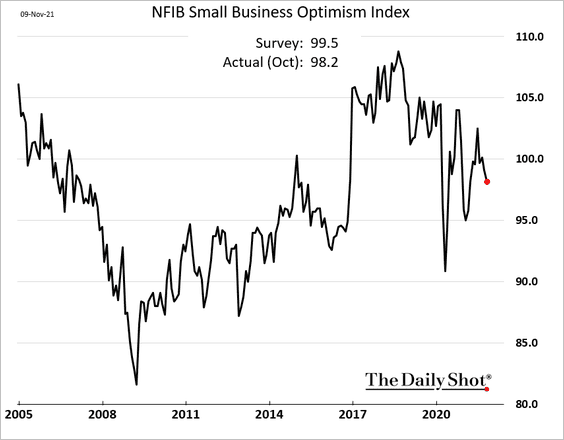

4. The NFIB small business sentiment ticked lower, …

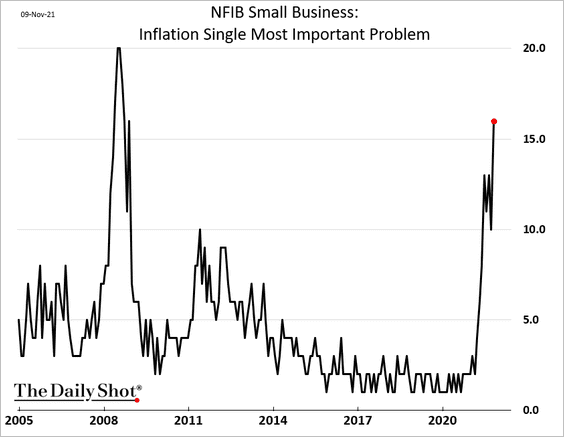

… driven by concerns about inflation.

——————–

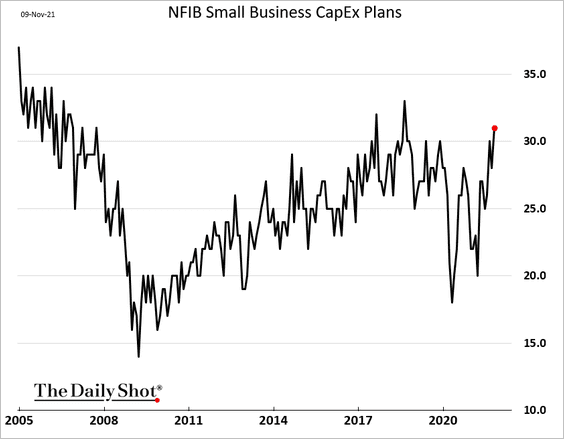

• CapEx plans continue to improve (which should be expected in a tight labor market).

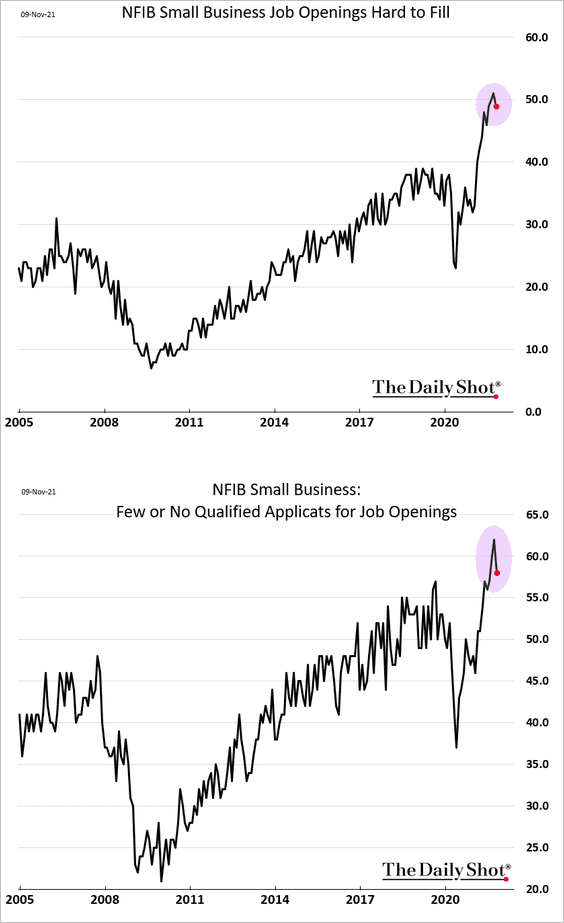

• Are labor shortages peaking?

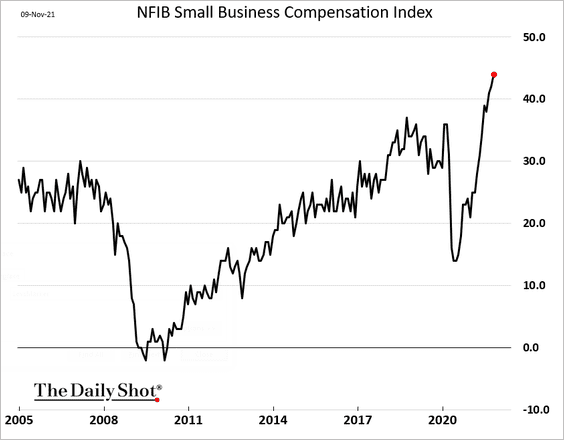

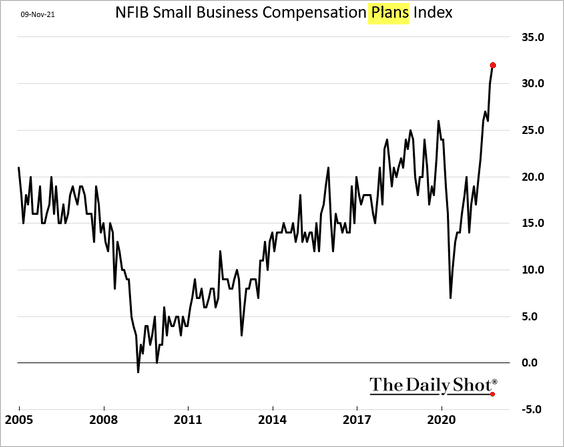

• Companies are boosting wages and plan to keep doing so in the months ahead.

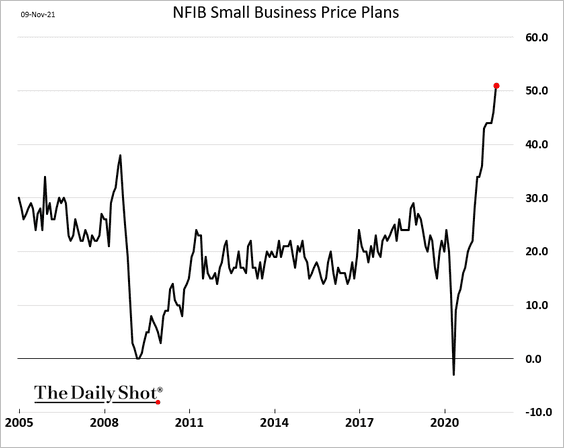

• Companies also increasingly plan to boost prices.

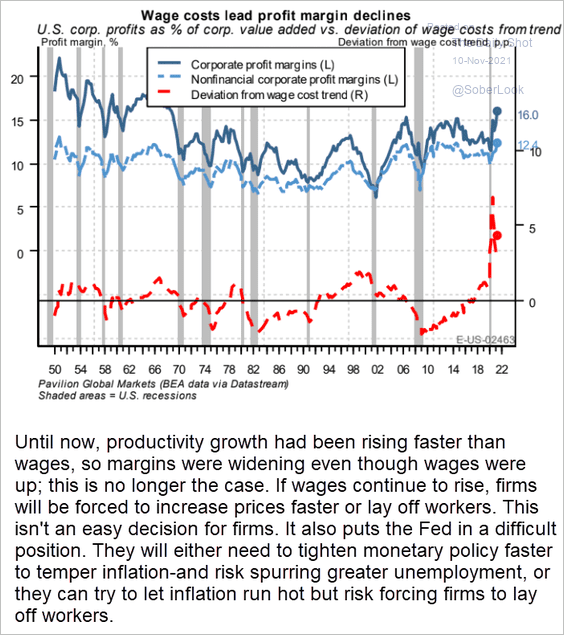

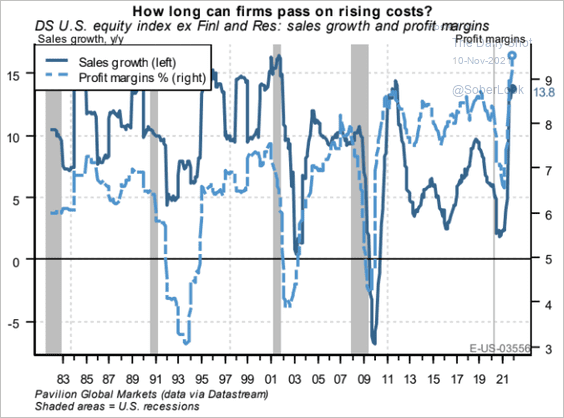

Will rapid wage growth put downward pressure on corporate margins? Below is a comment from Pavilion Global Markets.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

• Business outlook has deteriorated further.

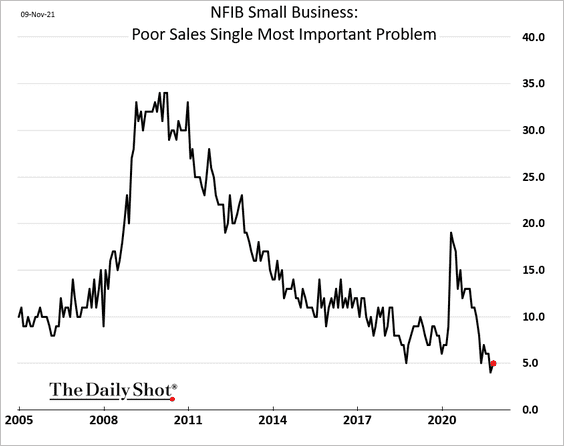

And yet, very few companies complain about poor sales.

——————–

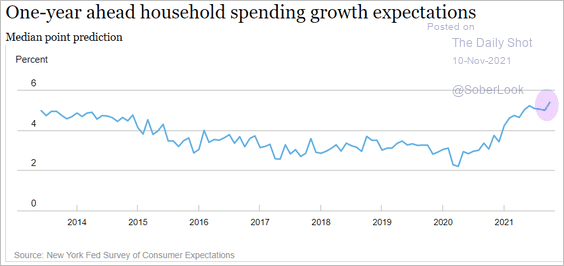

5. US consumers expect to boost spending at the highest pace in years.

Source: NY Fed

Source: NY Fed

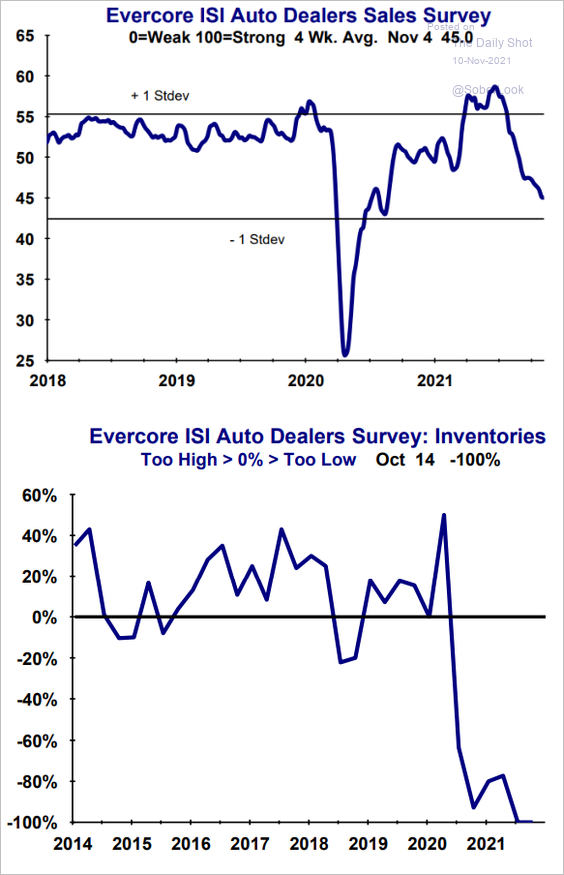

6. Auto dealers continue to struggle with supply constraints.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

The Eurozone

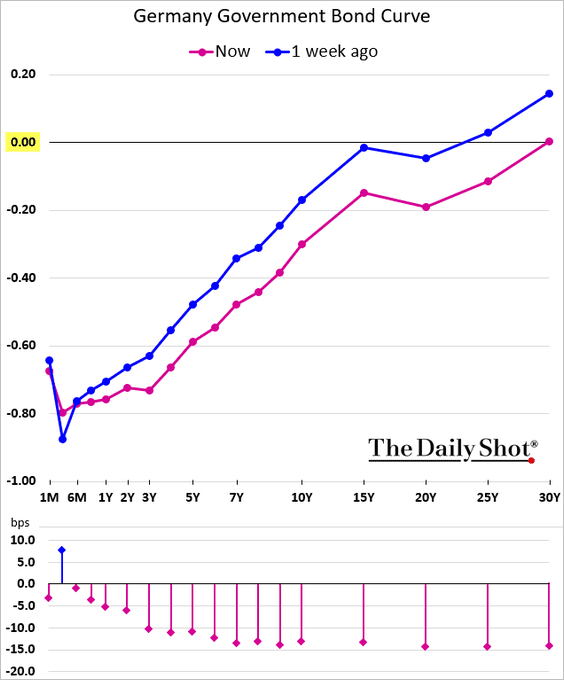

1. Let’s begin with Germany.

• The 30yr Bund yield is back near zero, …

… as the whole curve is about to go negative.

——————–

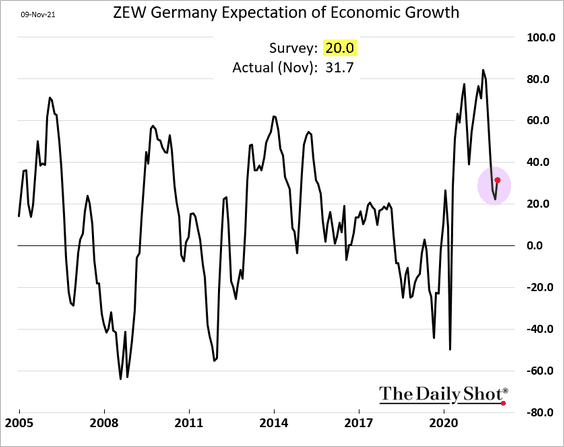

• Similar to the Sentix index, the ZEW measure topped forecasts.

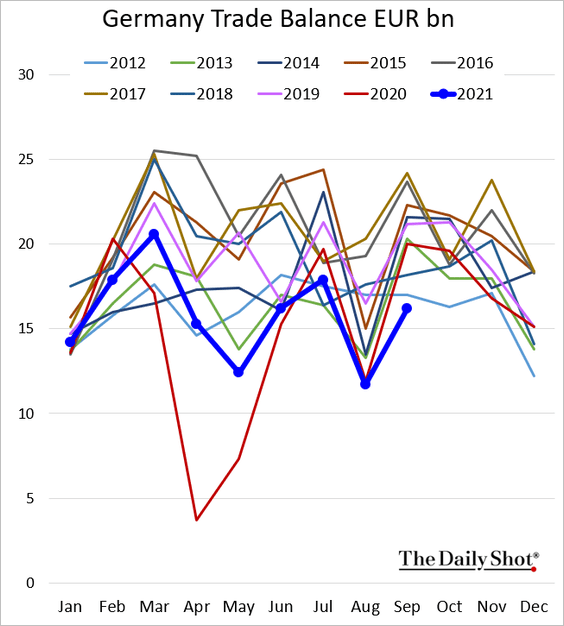

• Germany’s trade surplus remains depressed for this time of the year.

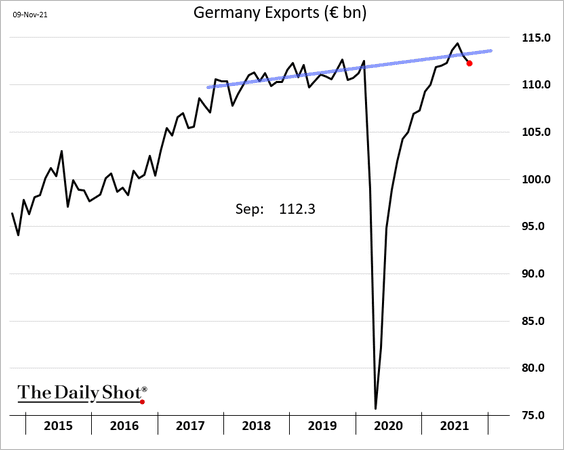

Exports have been trending lower, pressured by the automotive sector.

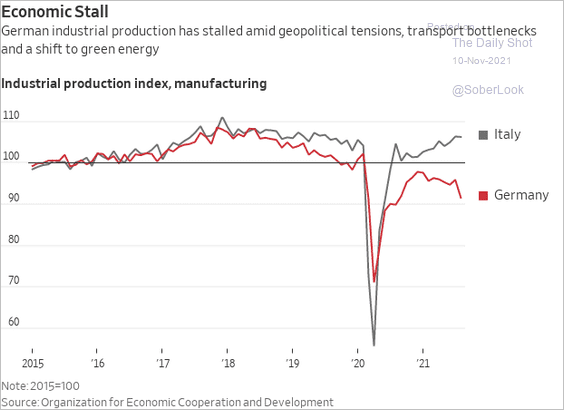

• As we saw earlier, industrial production has deteriorated. Here is a comparison with Italy.

Source: @WSJ Read full article

Source: @WSJ Read full article

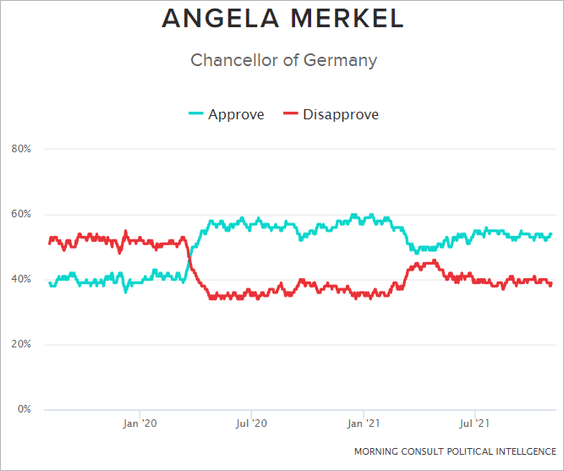

• Angela Merkel remains popular.

——————–

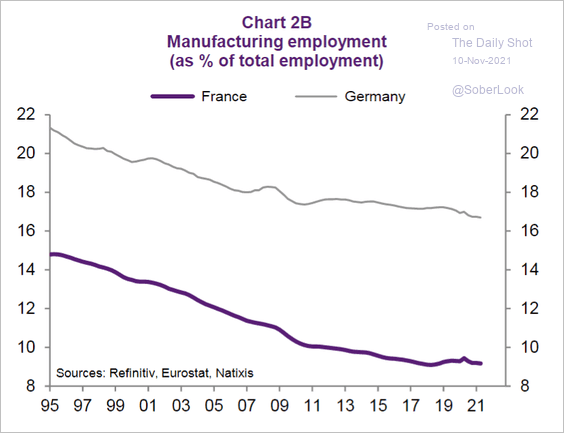

2. This chart compares German and French manufacturing employment.

Source: Natixis

Source: Natixis

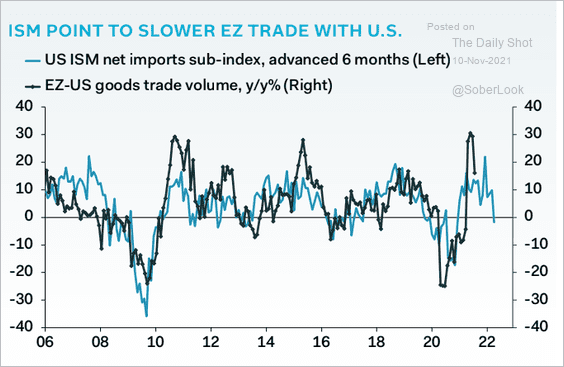

3. The US ISM index points to slower Eurozone trade with the US.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

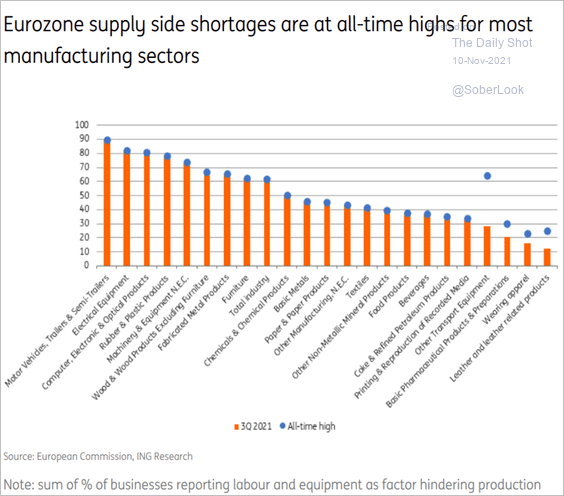

4. Supply shortages are at extreme levels across most sectors.

Source: ING

Source: ING

Back to Index

Asia – Pacific

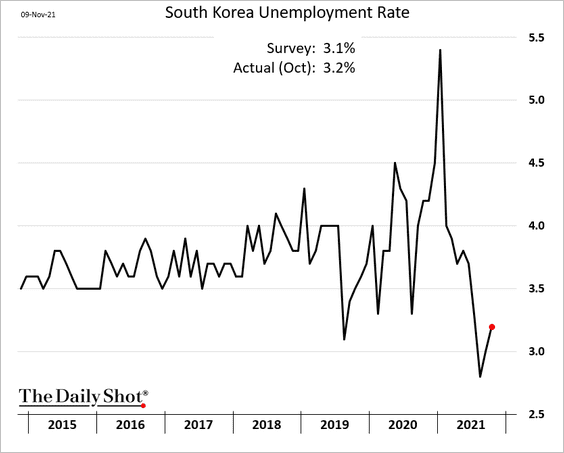

1. South Koran unemployment rate increased last month as more people entered the labor force.

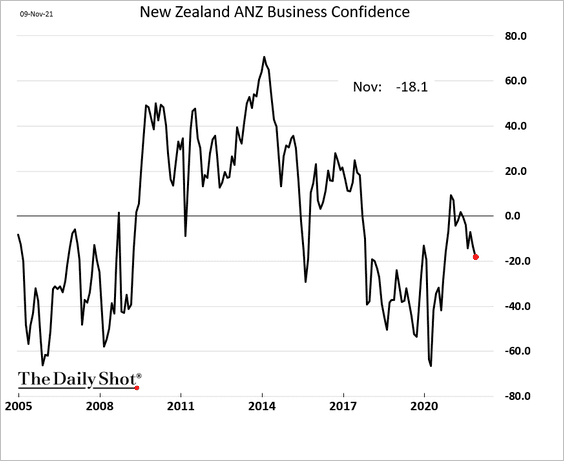

2. New Zealand’s business confidence continues to deteriorate.

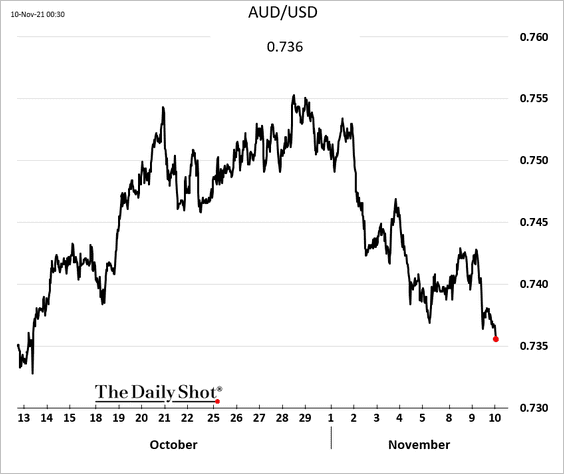

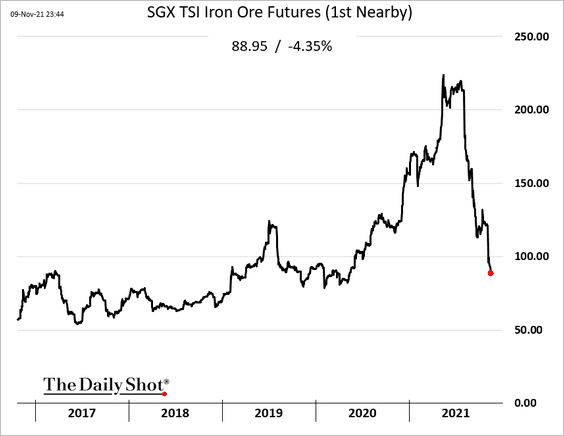

3. The Aussie dollar is weaker as iron ore prices continue to slide (see the commodities section).

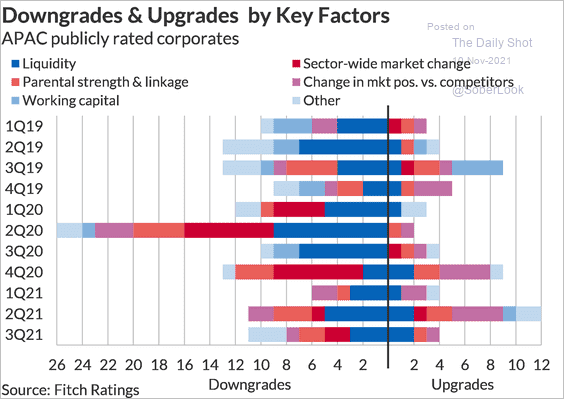

4. Here are the reasons for downgrades and upgrades of APAC corporate debt (according to Fitch).

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

China

1. Let’s begin with the property debt crisis.

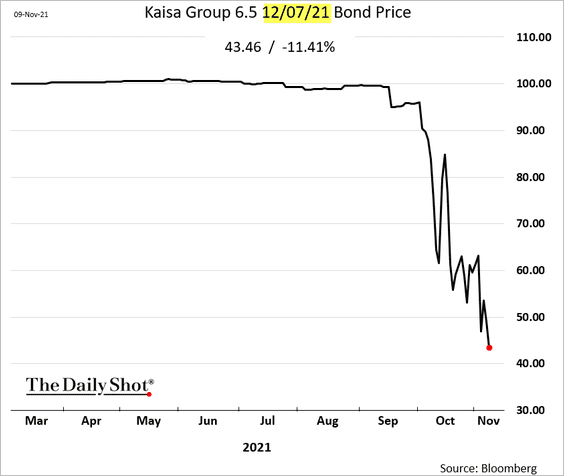

• Kaisa’s bonds continue to plummet.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

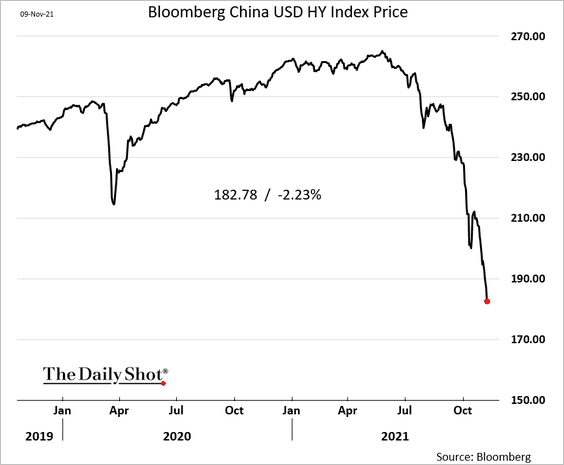

• The USD-based HY index keeps sinking.

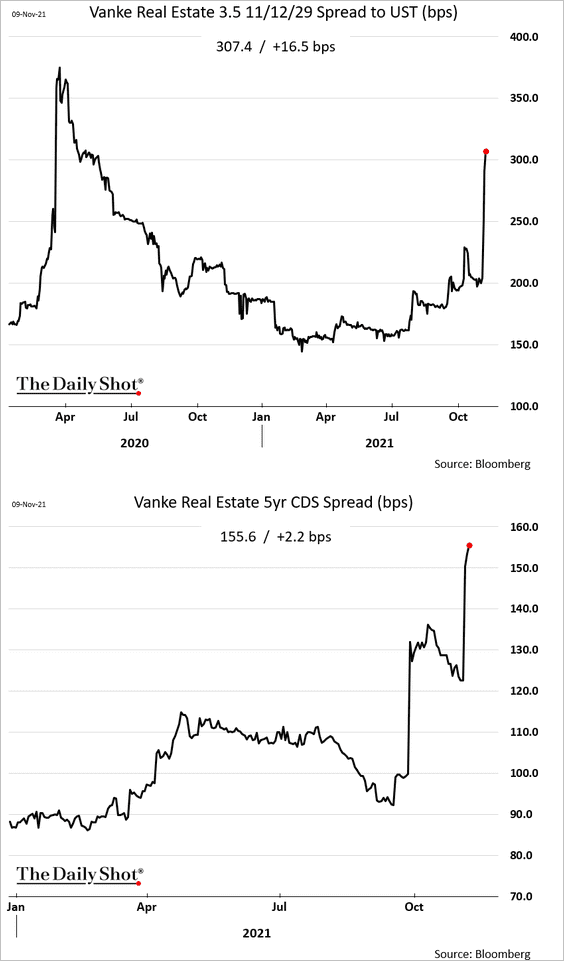

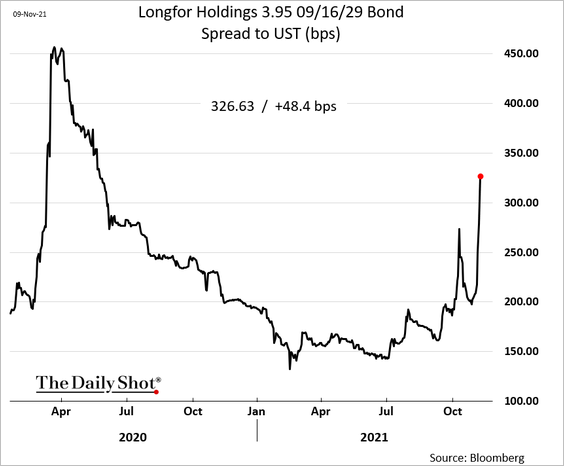

• We now see a spillover into investment-grade debt.

– Vanke (spread):

– Longfor (spread):

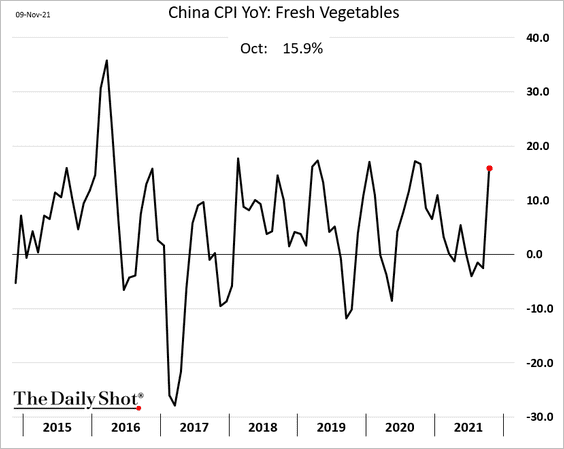

• The Fed is looking into a potential impact on the US. That concern is probably overblown.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

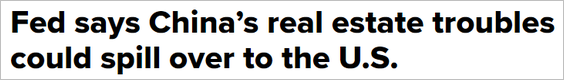

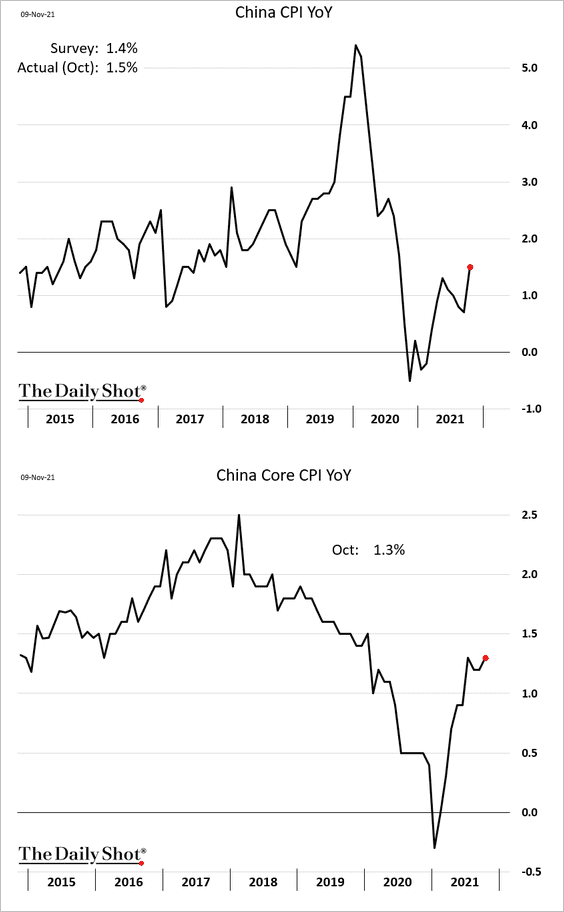

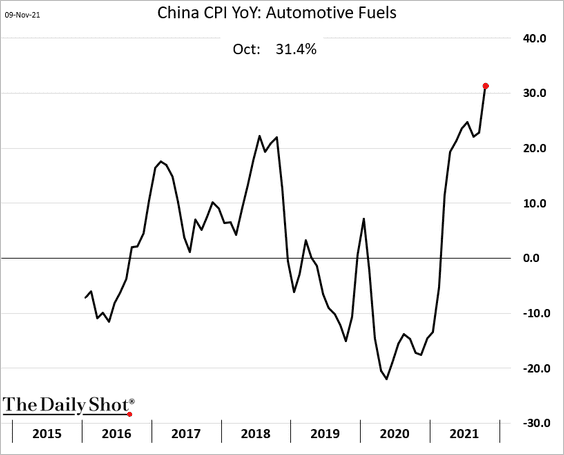

2. Consumer inflation climbed last month but remained below 2%.

Here are a couple of the drivers of this increase.

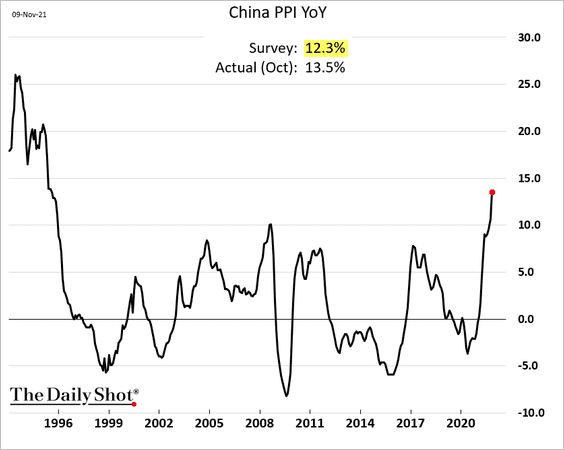

3. Producer prices are surging. Will China export some of these price gains to the rest of the world?

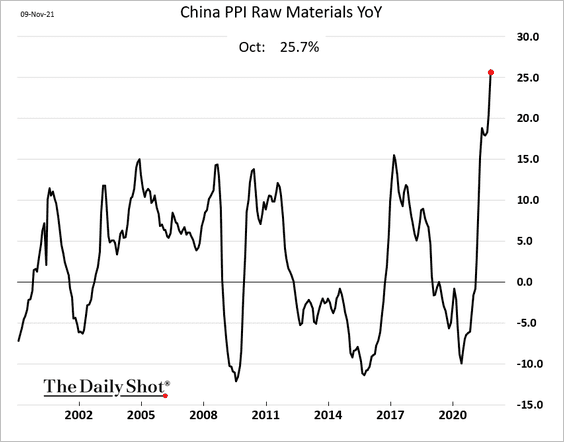

• Raw materials and energy drove the PPI gains.

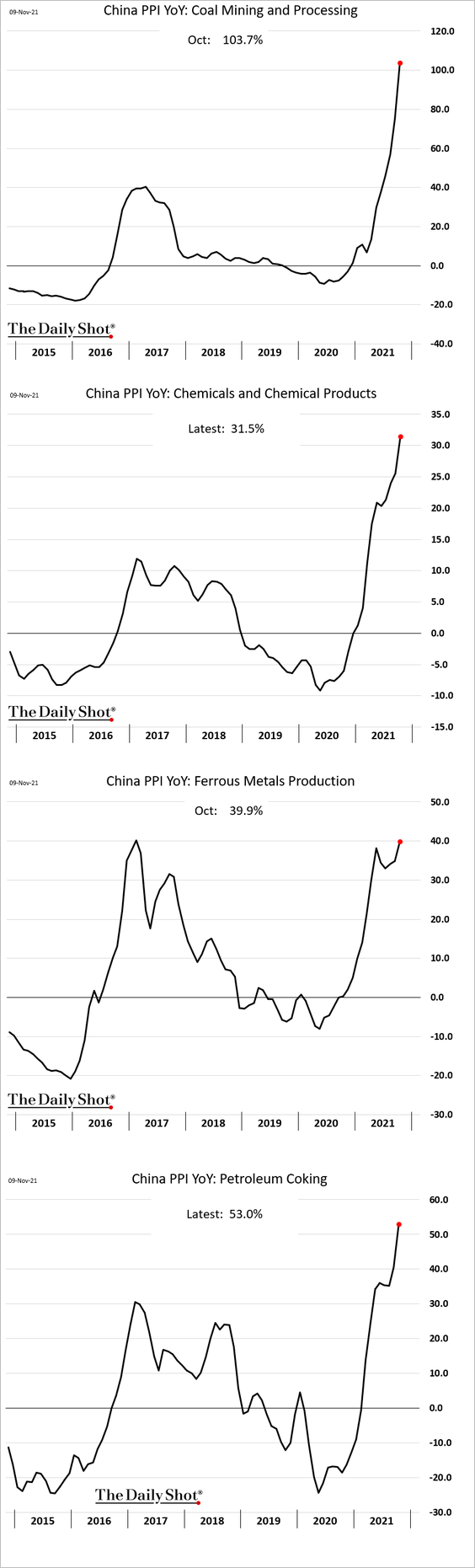

• Coal inflation exceeded 100%. Below are some additional PPI components.

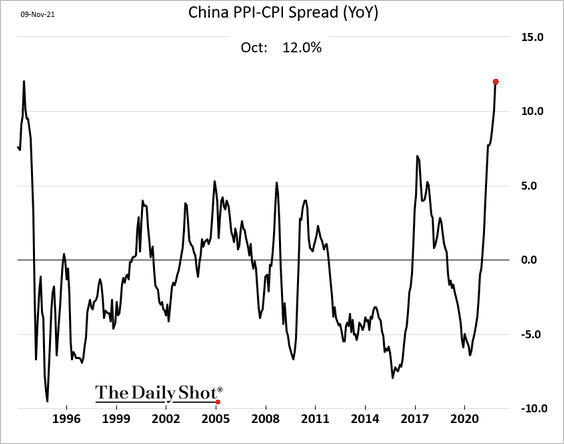

• The PPI – CPI spread hit 12%, which will pressure corporate margins.

——————–

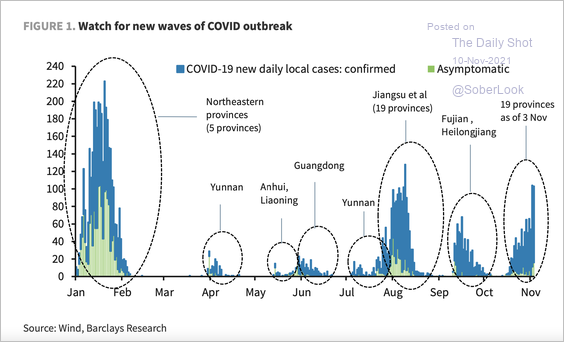

4. COVID remains a concern.

Source: Barclays Research

Source: Barclays Research

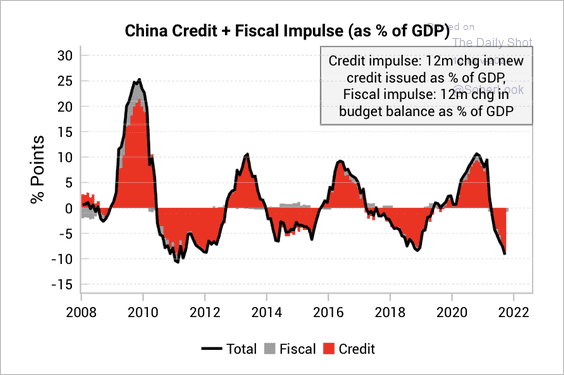

5. The credit and fiscal impulse remains deeply negative.

Source: Variant Perception

Source: Variant Perception

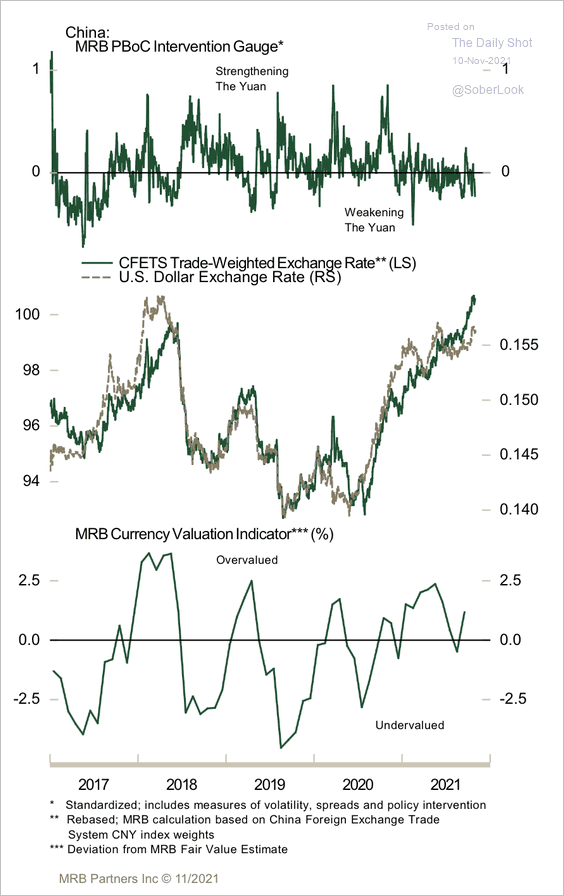

6. The yuan is still at fair value despite recent appreciation, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

Back to Index

Emerging Markets

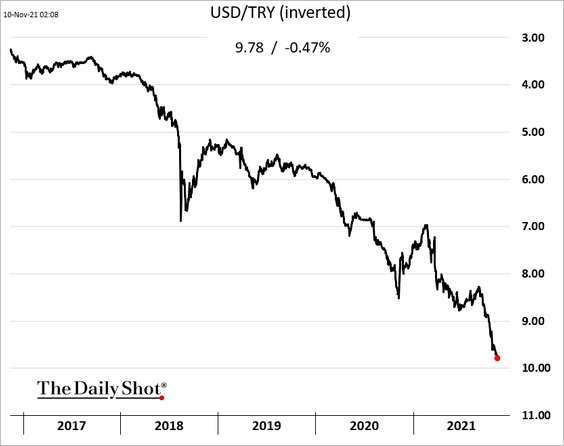

1. The Turkish lira keeps sinking, approaching 10 to the dollar.

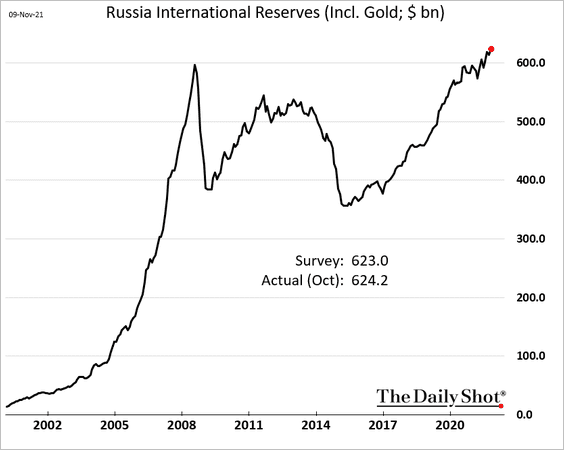

2. Russia’s F/X reserves (including gold) hit a record high.

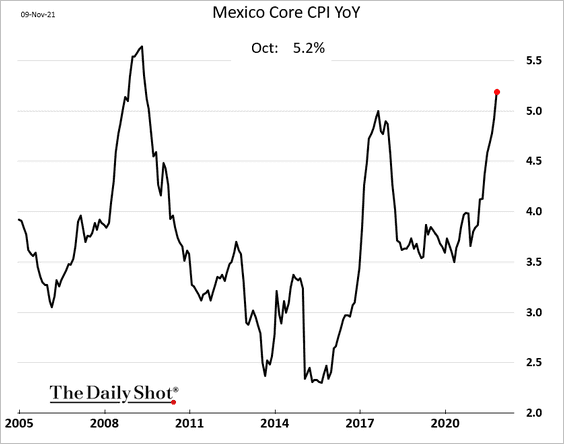

3. Mexico’s core CPI is above 5% for the first time in over a decade.

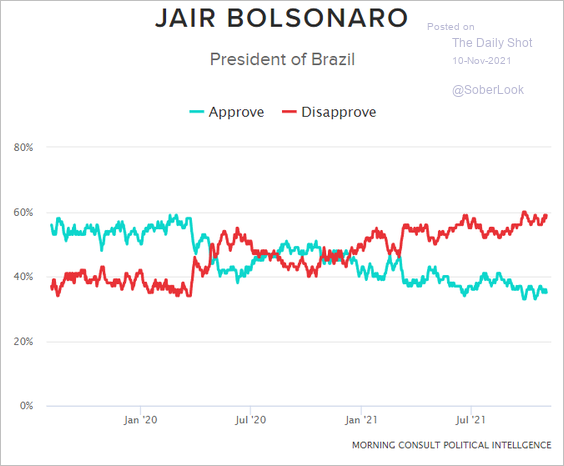

4. Bolsonaro’s approval ratings have been deteriorating.

Source: Morning Consult

Source: Morning Consult

Back to Index

Cryptocurrency

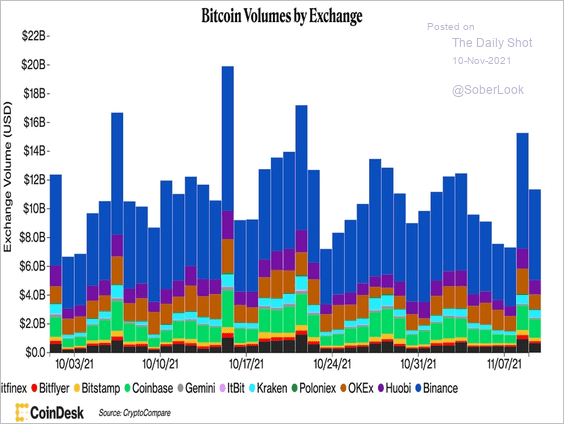

1. Bitcoin’s spot trading volume has risen over the past two days, but it is still far below mid-October highs.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

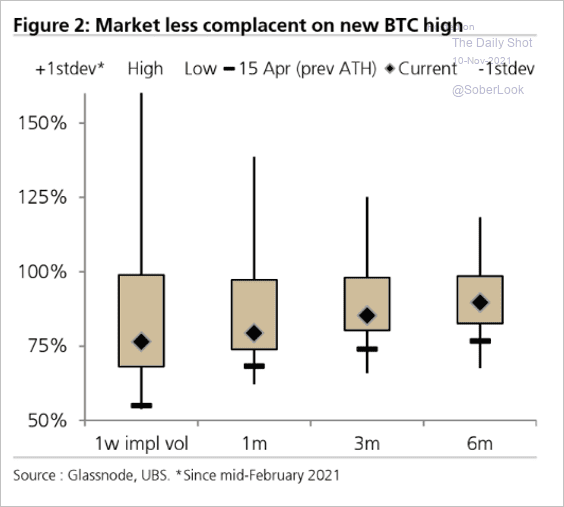

2. There is a bit more caution (higher implied vol) this time around as bitcoin hit a record high .

Source: UBS

Source: UBS

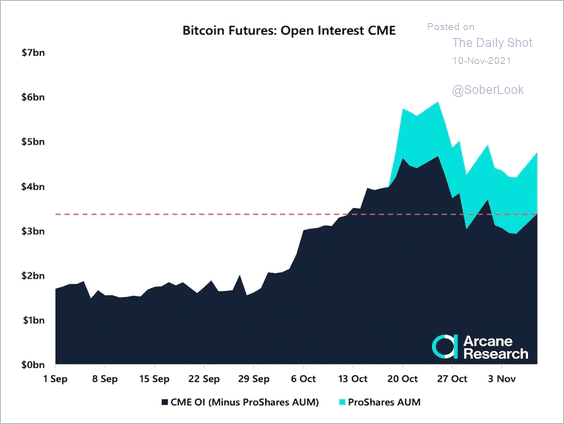

3. CME’s bitcoin futures open interest is down about 32% from its October 25th peak. The bitcoin-futures ETF hype is starting to fade.

Source: Arcane Research

Source: Arcane Research

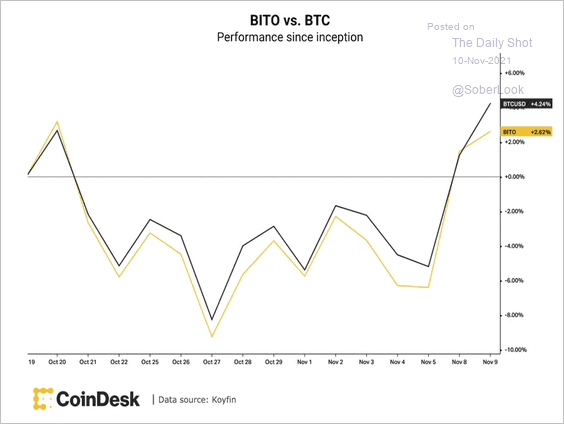

4. The ProShares Bitcoin Strategy ETF (BITO) continues to lag BTC’s performance (welcome to contango).

Source: CoinDesk Read full article

Source: CoinDesk Read full article

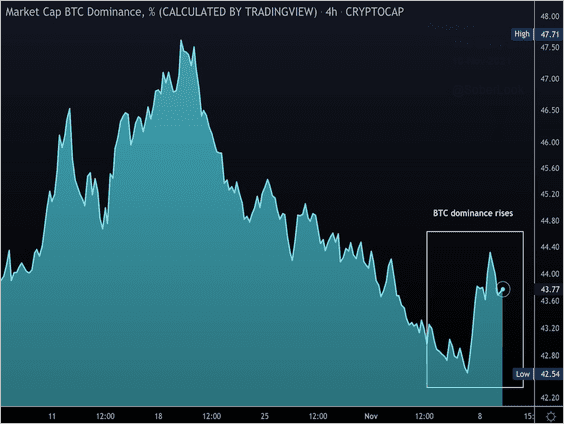

6. Bitcoin’s market dominance has risen over the past few days as altcoins lag.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

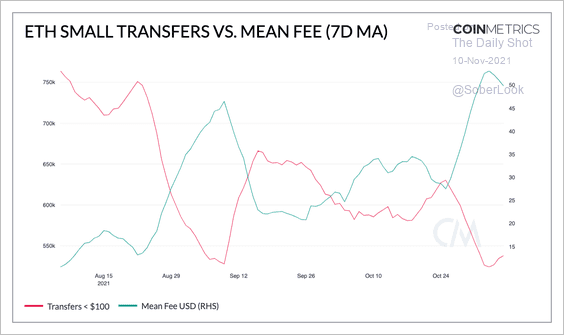

7. ETH’s gas fees are back on the rise as network activity picks up.

Source: @coinmetrics

Source: @coinmetrics

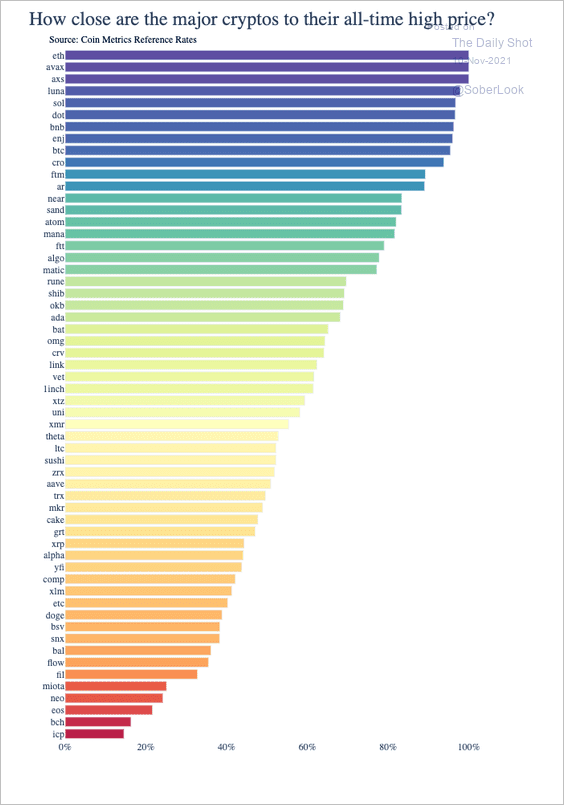

8. This chart shows how close major cryptocurrencies are to their all-time price high.

Source: @coinmetrics

Source: @coinmetrics

9. Coinbase sales surprised to the downside, sending shares down 13% after the close.

Source: Google

Source: Google

Back to Index

Commodities

1. Iron ore prices continue to tumble, giving up much of their COVID-era gains.

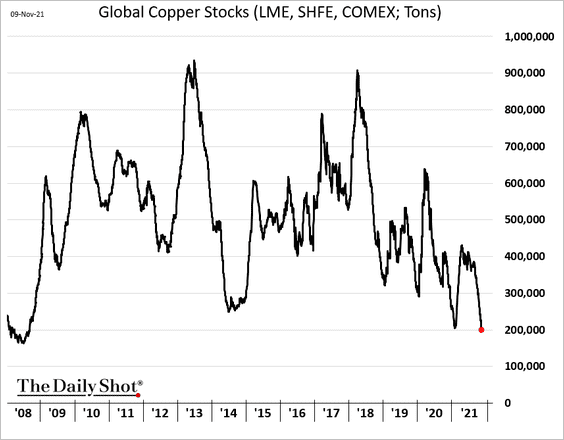

2. Copper inventories hit the lowest level since 2008.

Back to Index

Energy

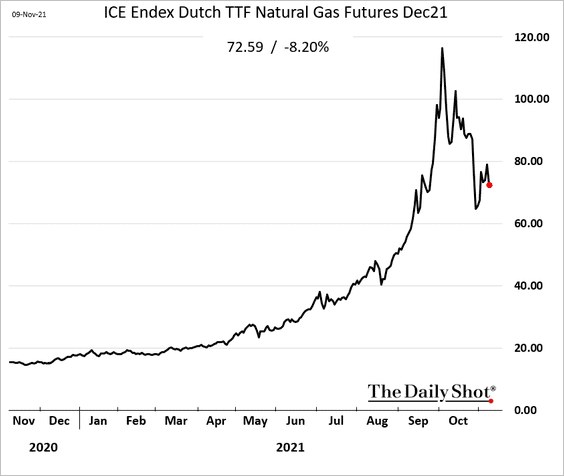

1. European natural gas prices declined as Russia resumes flows into EU-based storage facilities.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

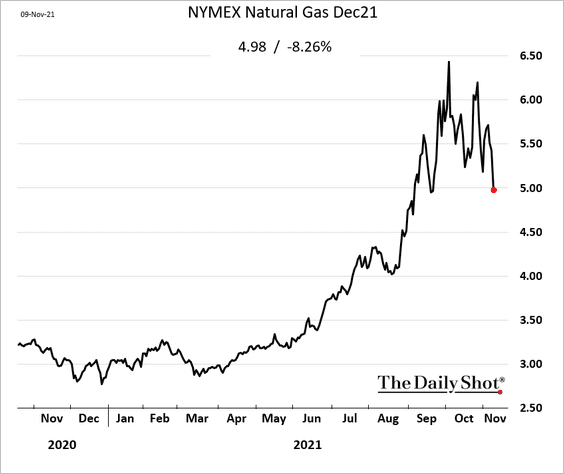

2. US natural gas was down sharply as well.

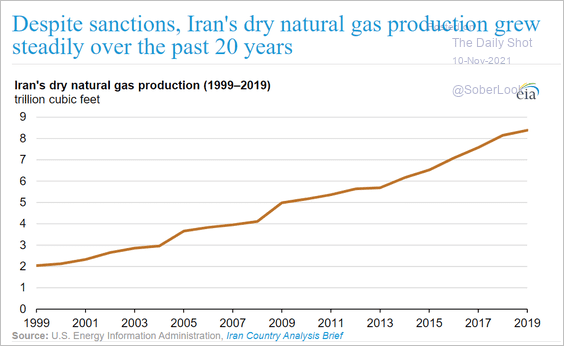

3. Iran’s natural gas production has been growing steadily despite sanctions.

Source: EIA

Source: EIA

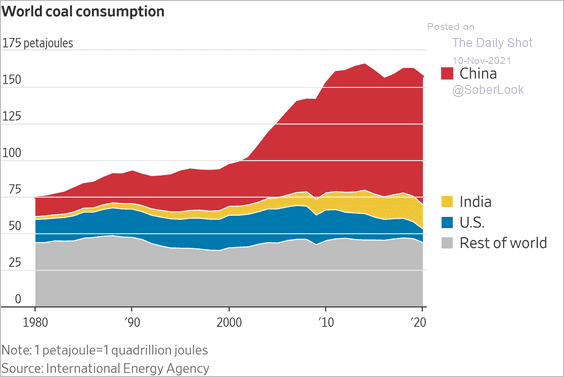

4. This chart shows the world’s coal consumption.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

1. Let’s begin with some updates on corporate margins.

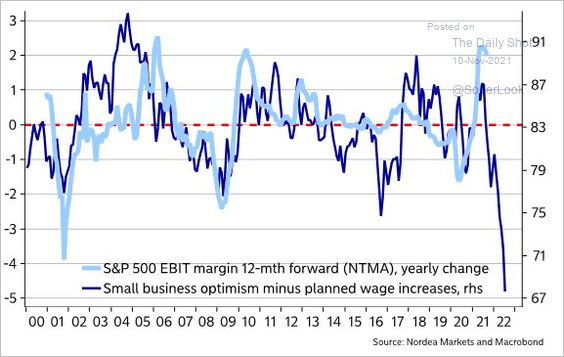

• Analysts have been concerned about wage gains and higher input costs pressuring margins.

Source: @MikaelSarwe

Source: @MikaelSarwe

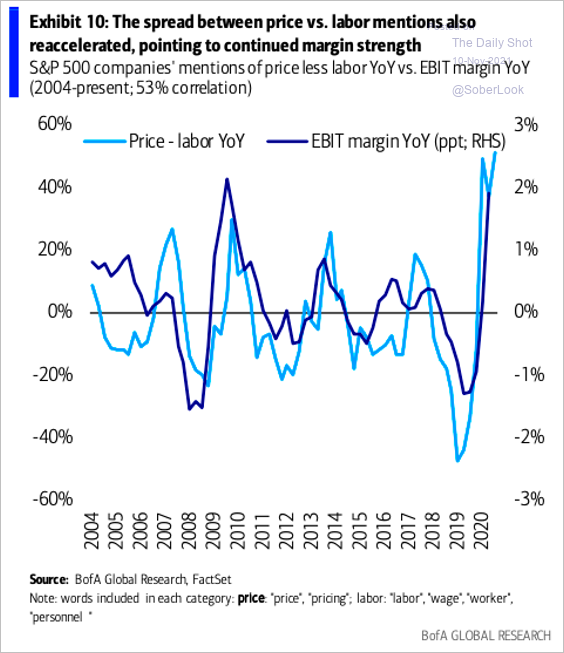

• But companies have been able to pass on higher costs to their customers.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

• How long can they keep doing so?

Source: Pavilion Global Markets

Source: Pavilion Global Markets

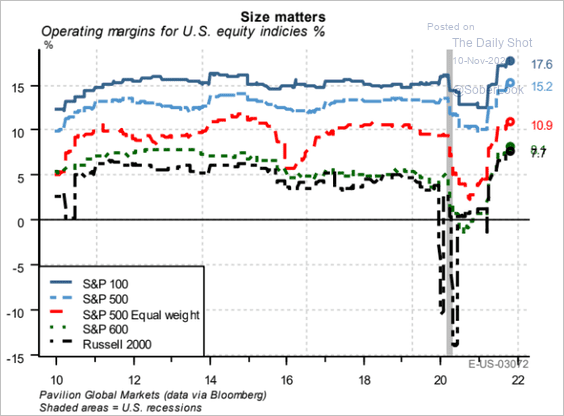

• Larger firms tend to have the widest margins and can better withstand higher costs.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

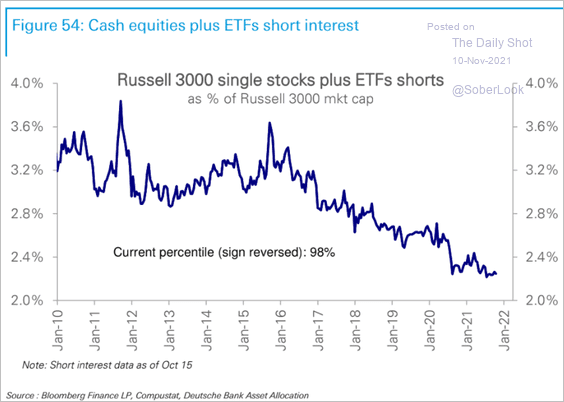

2. Shorting stocks has become increasingly challenging.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

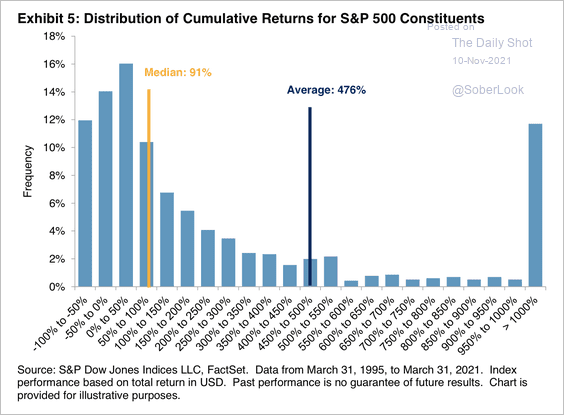

3. A relatively small number of stocks perform exceedingly well and raise the average index return above the median.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

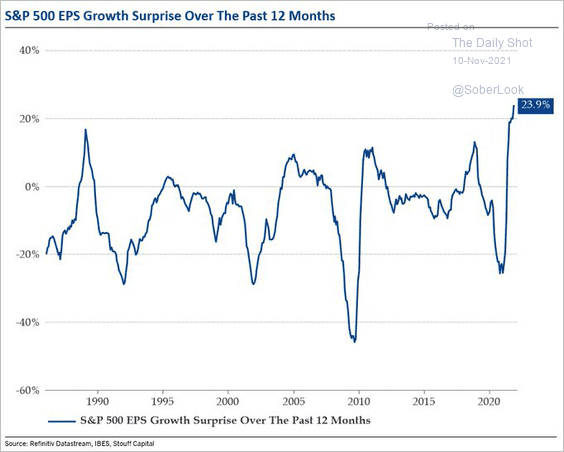

4. Positive earnings surprises have been remarkable over the past 12 months.

Source: @Callum_Thomas, @BittelJulien

Source: @Callum_Thomas, @BittelJulien

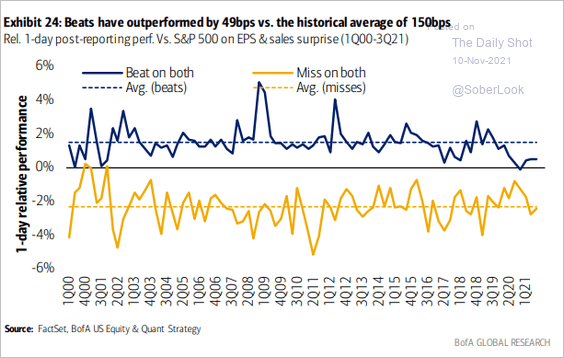

But the outperformance of companies that beat earnings estimates has narrowed.

Source: BofA Global Research

Source: BofA Global Research

——————–

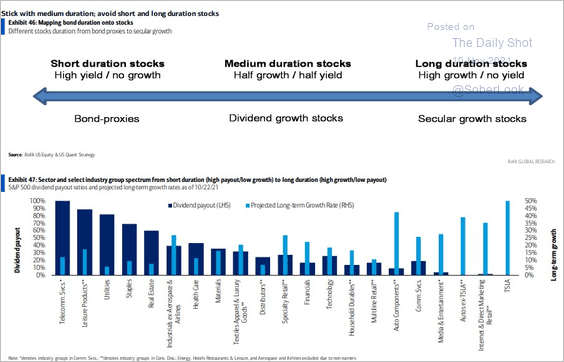

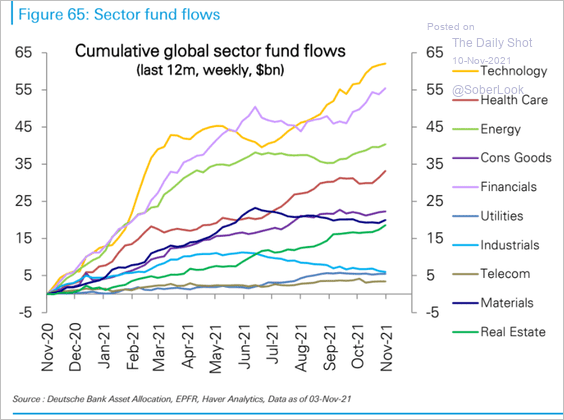

5. Next, we have a couple of sector updates.

• The effective duration of different sectors:

Source: BofA Global Research

Source: BofA Global Research

• Fund flows:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

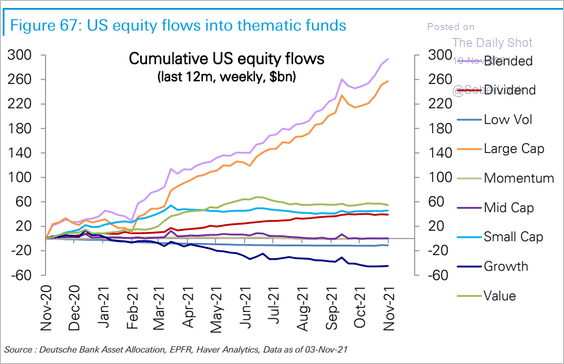

6. This chart shows fund flows by equity factor.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

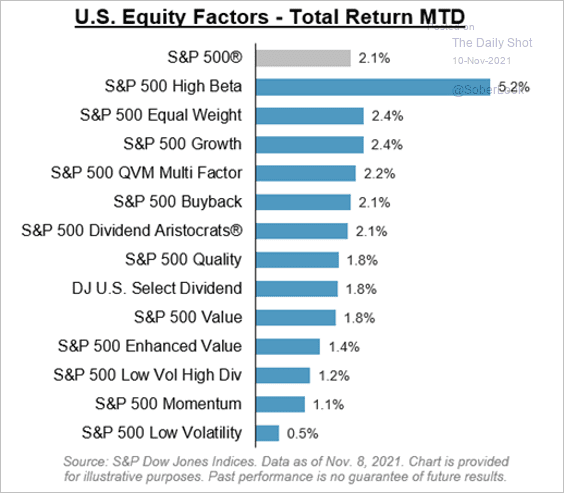

And here are the month-to-date factor returns.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

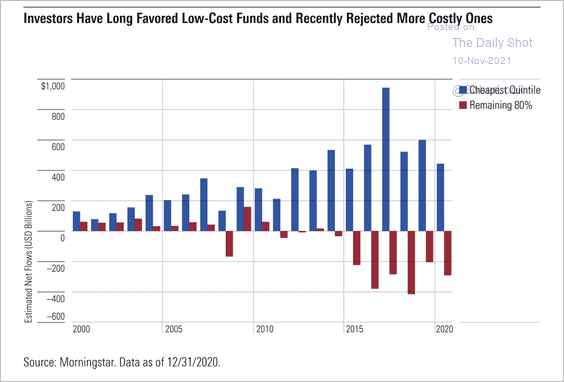

7. Investors have always been buying the cheapest-fee funds, but only recently have they started to shun expensive ones.

Source: Morningstar Read full article

Source: Morningstar Read full article

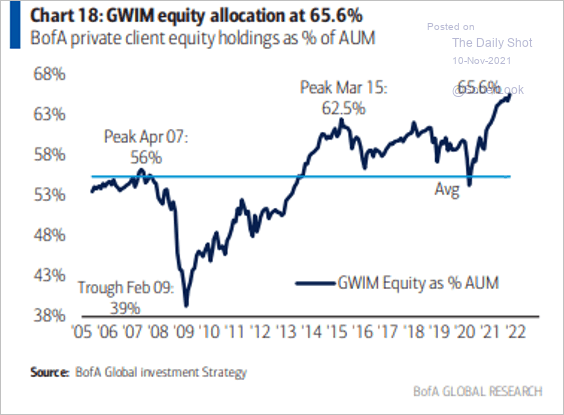

8. Merrill Lynch’s private client exposure to stocks hit a record high.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Credit

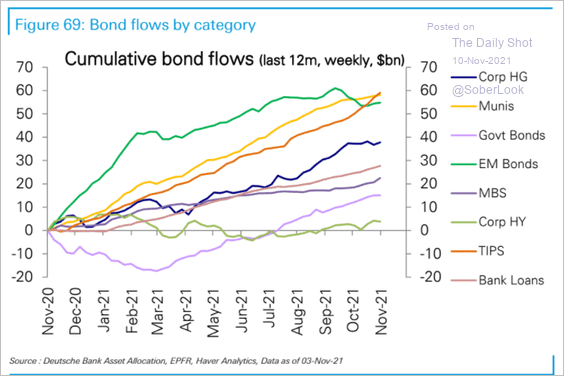

1. Fixed-income fund flows have been robust, but corporate high-yield has lagged.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

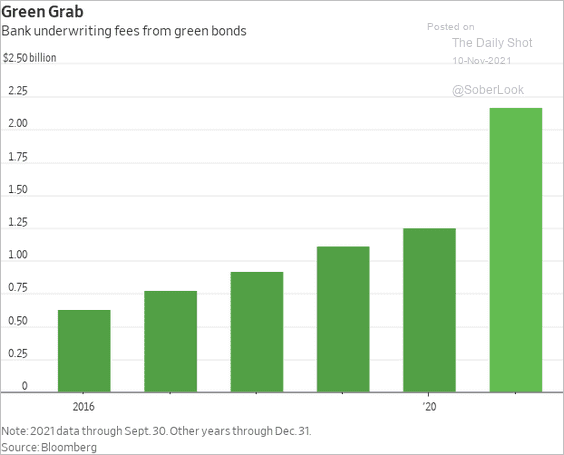

2. Banks have done well in underwriting green bonds.

Source: @WSJ Read full article

Source: @WSJ Read full article

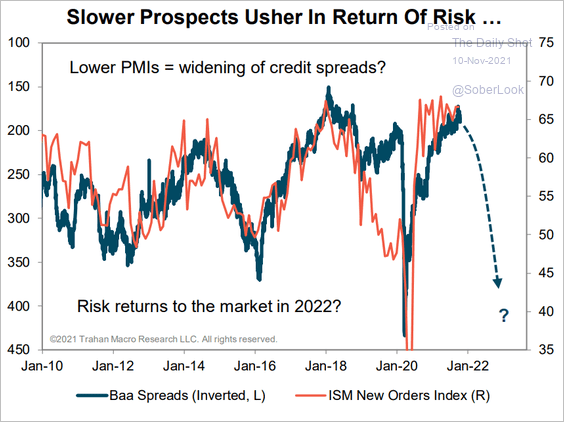

3. Will slower growth boost spreads next year?

Source: Trahan Macro Research

Source: Trahan Macro Research

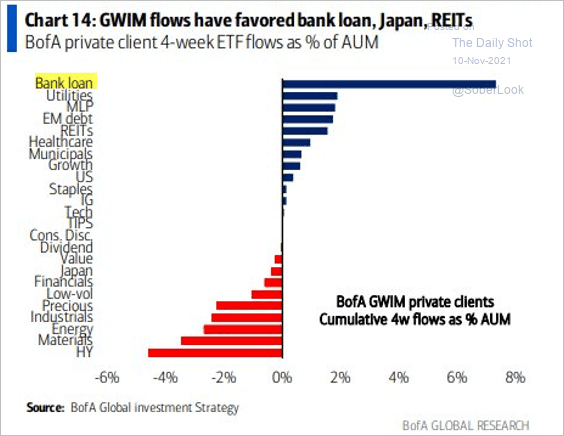

4. Merrill Lynch’s private clients love leveraged loans (ahead of Fed rate hikes).

Source: BofA Global Research

Source: BofA Global Research

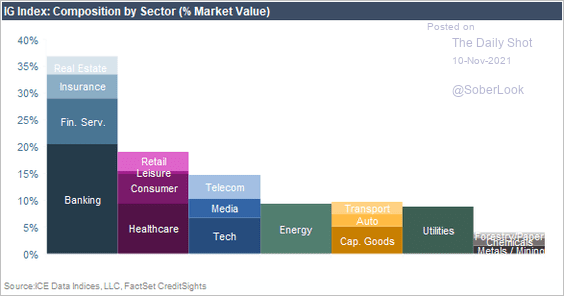

5. Here is the investment-grade index composition by sector.

Source: CreditSights

Source: CreditSights

Back to Index

Global Developments

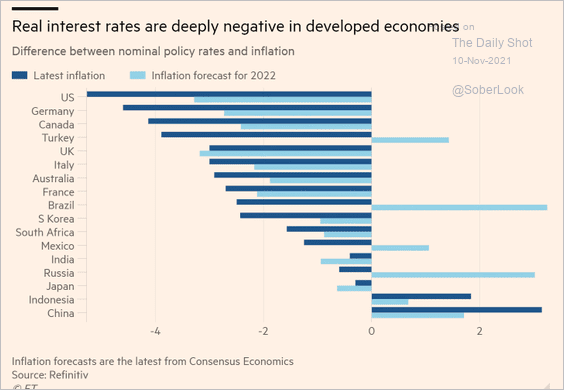

1. This chart shows real rates in select economies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

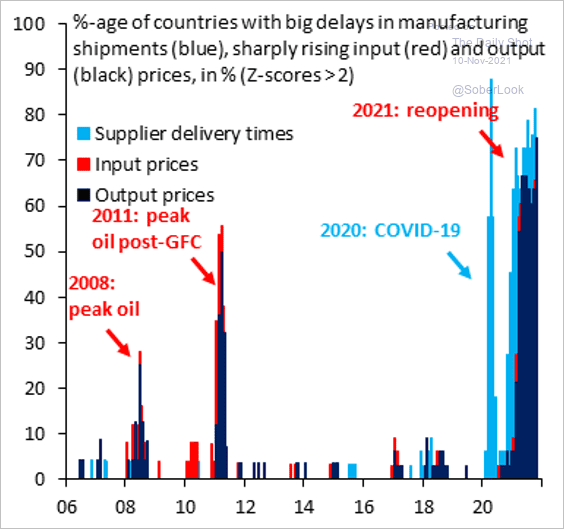

2. Inflation breadth has blown out.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

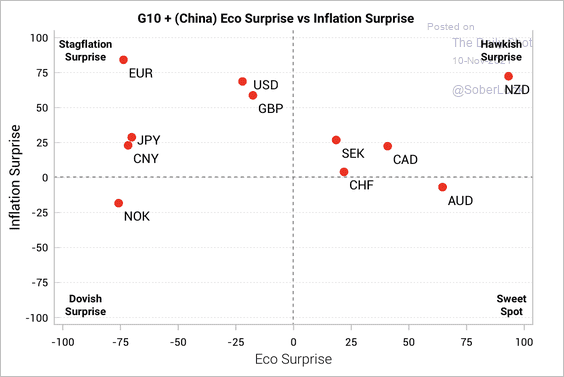

3. Here is a look at “stagflation/inflation surprises” across G10 countries.

Source: Variant Perception

Source: Variant Perception

——————–

Food for Thought

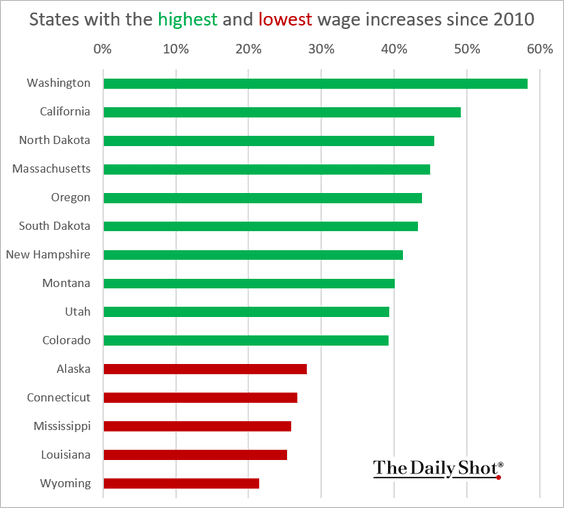

1. States with the highest and lowest wage increases since 2010:

Source: Approve.com Read full article

Source: Approve.com Read full article

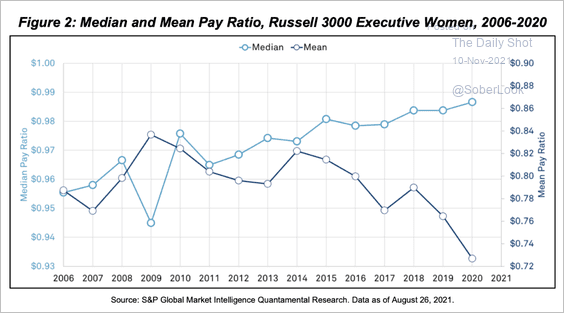

2. Median and mean pay ratio for executive women at US public firms:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

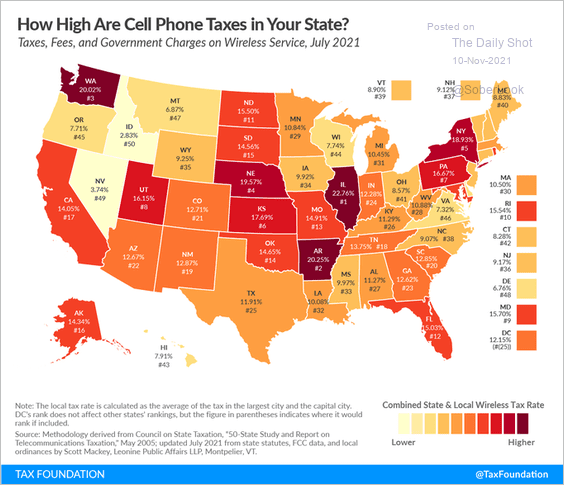

3. Cell phone taxes:

Source: @TaxFoundation Read full article

Source: @TaxFoundation Read full article

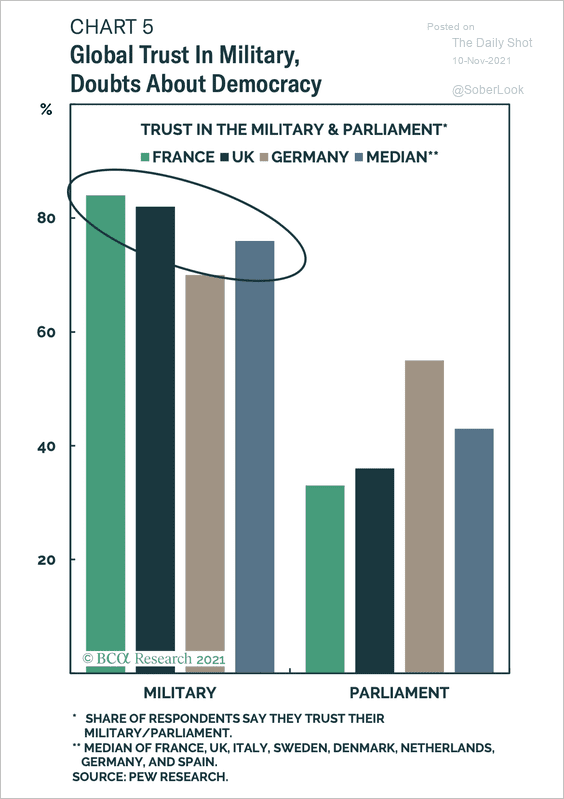

4. Trust in the military vs. parliament in France, Germany, and the UK:

Source: BCA Research

Source: BCA Research

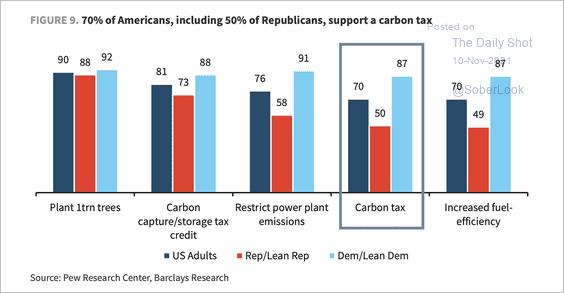

5. Support for a carbon tax:

Source: Barclays Research

Source: Barclays Research

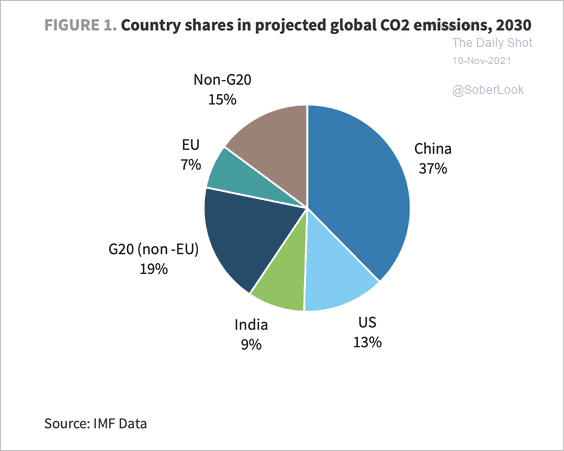

6. Projected CO2 emissions (according to the IMF):

Source: Barclays Research

Source: Barclays Research

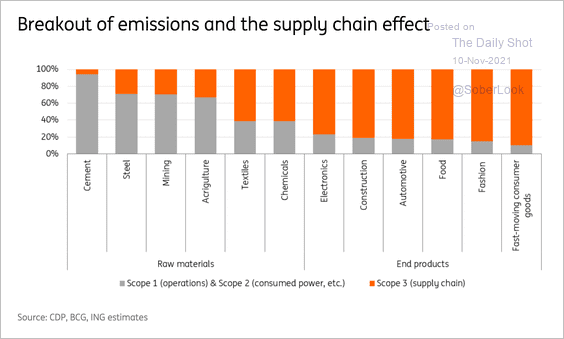

7. Emissions driven by supply chain effects:

Source: ING

Source: ING

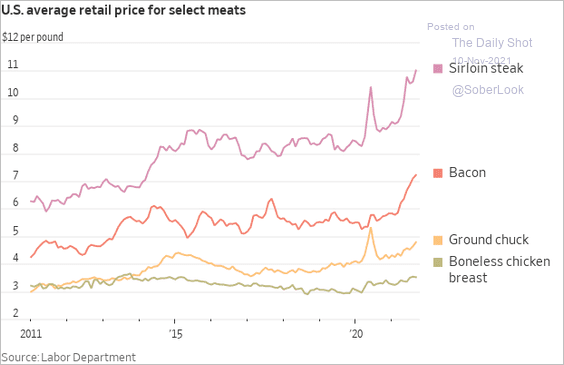

8. US meat prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

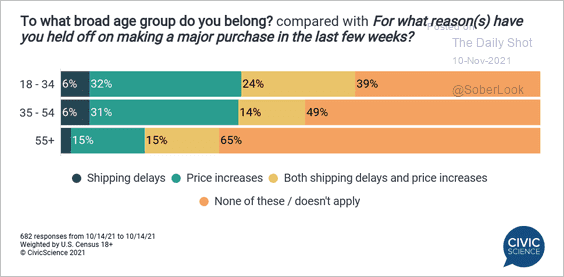

9. Delaying a major purchase:

Source: @CivicScience

Source: @CivicScience

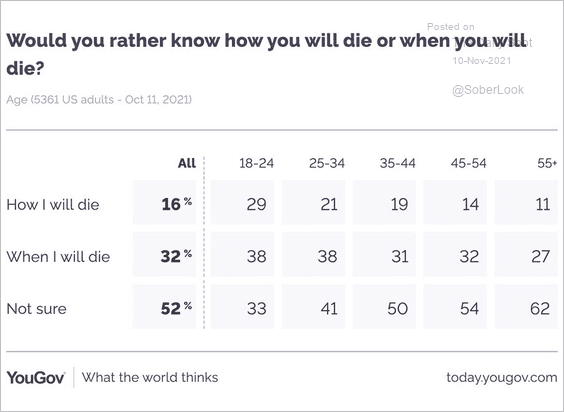

10. Would you rather know how or when you will die?

Source: @YouGovAmerica

Source: @YouGovAmerica

——————–

Back to Index