The Daily Shot: 12-Nov-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some data on inflation.

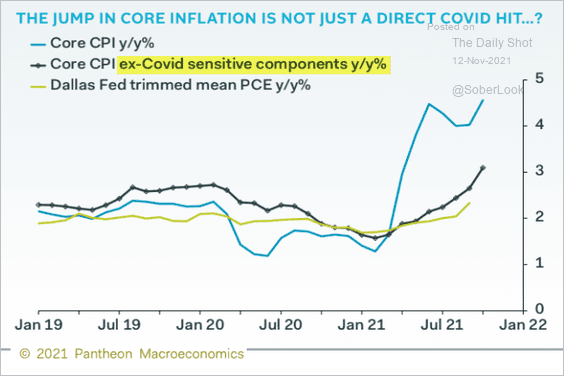

• In previous months, the biggest price gains were driven by the recovery in services hit by the lockdowns (e.g. car rentals and hotels) as well as semiconductor shortages and supply-chain constraints. Inflation, however, is no longer just about “chips and ships.”

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

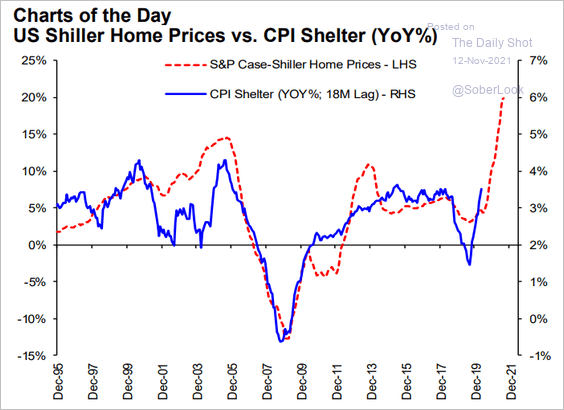

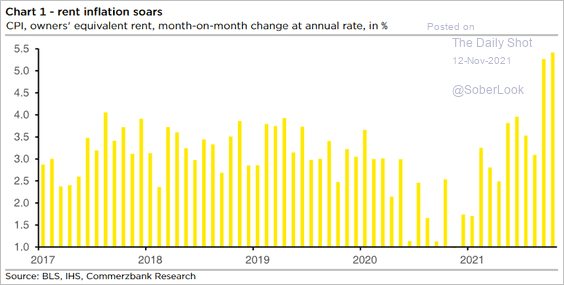

The sector to watch is shelter, …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Commerzbank Research

Source: Commerzbank Research

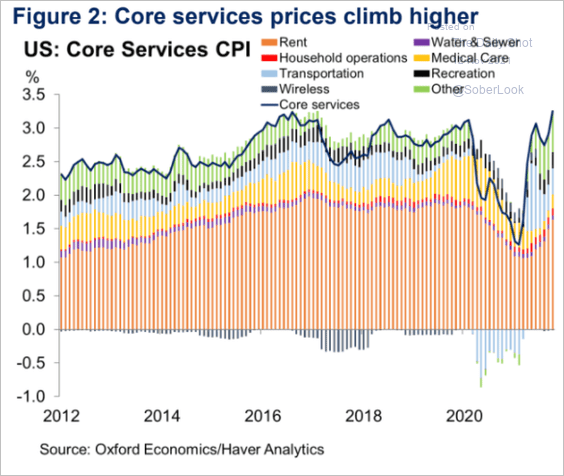

… which will drive up the core services CPI.

Source: Oxford Economics Read full article

Source: Oxford Economics Read full article

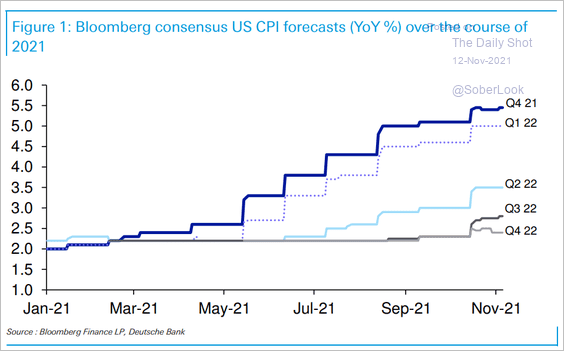

• Economists have been boosting longer-dated inflation projections.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

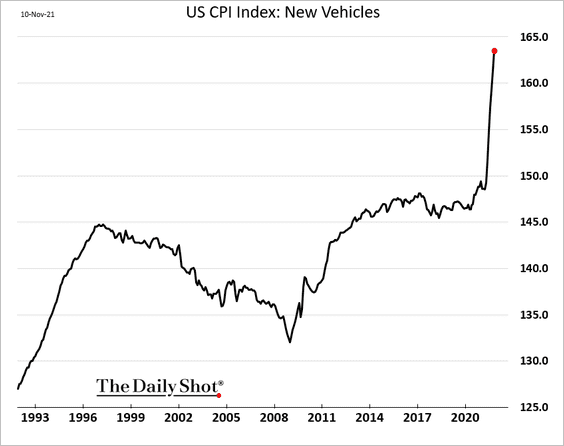

• New vehicle prices have surged at the fastest pace on record. However, this is the US. As inventories get rebuilt, which may take a while, dealers will start offering incentives to sell more cars. Car prices will begin to moderate, and the reversal of the trend below will become deflationary.

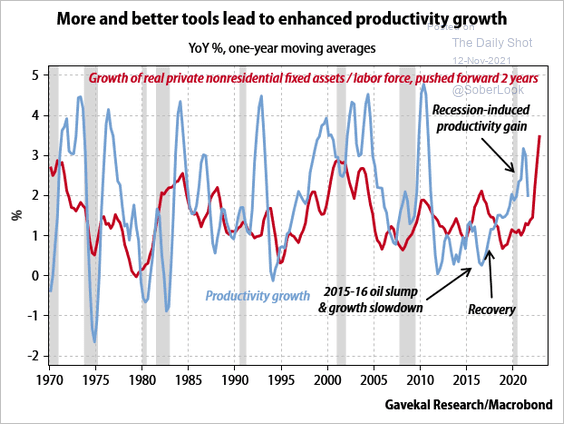

• Over a longer time frame, productivity improvements should curtail inflation.

Source: Gavekal Research

Source: Gavekal Research

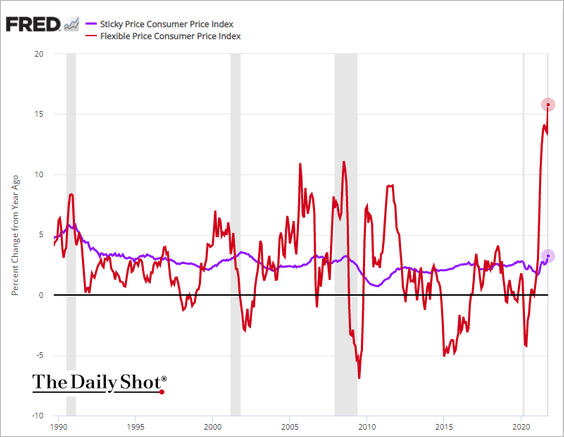

• Below are some additional inflation trends.

– Flexible vs. sticky CPI:

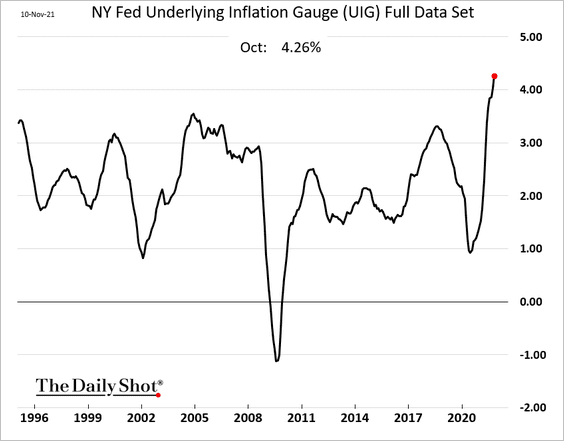

– The NY Fed’s UIG inflation measure:

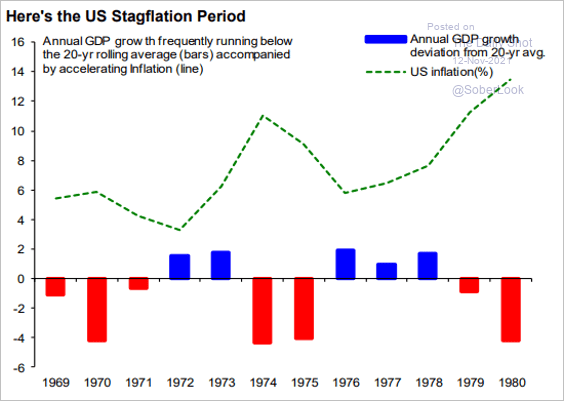

– Periods of stagflation in the US:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

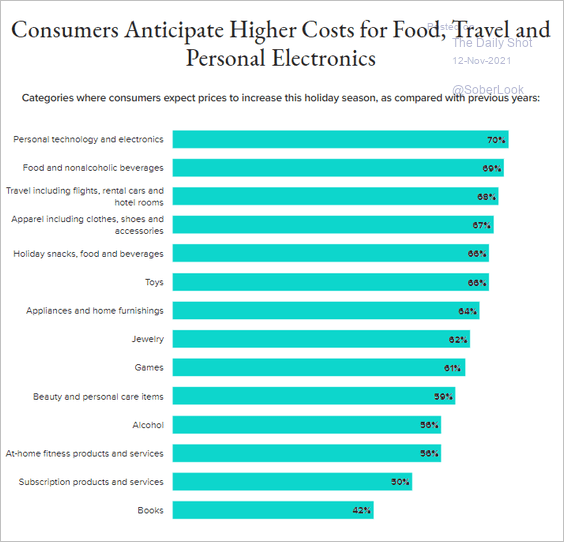

– Where do consumers expect the biggest price gains this holiday season?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

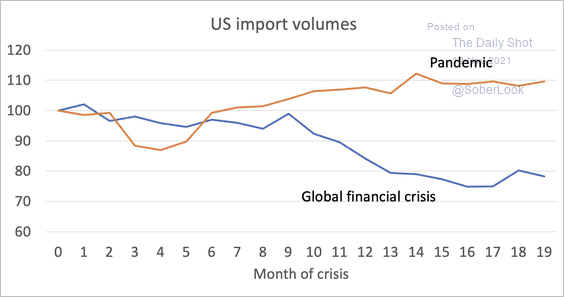

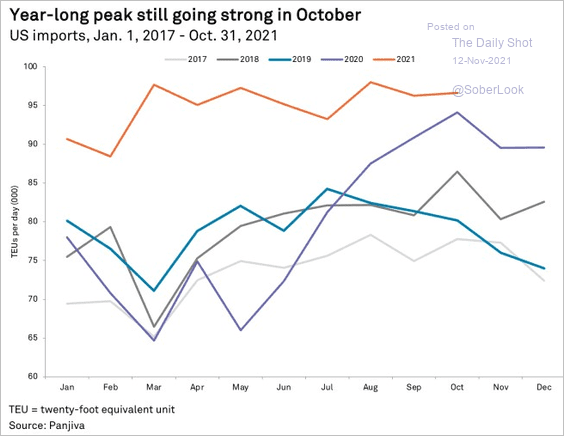

2. Import volumes remain elevated (2 charts).

Source: @paulkrugman

Source: @paulkrugman

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

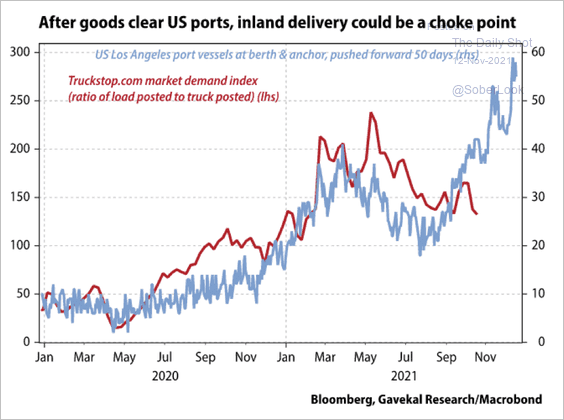

• Inland delivery issues could become the next bottleneck once the port situation begins to ease. For now, however, the West Coast ports remain clogged.

Source: Gavekal Research

Source: Gavekal Research

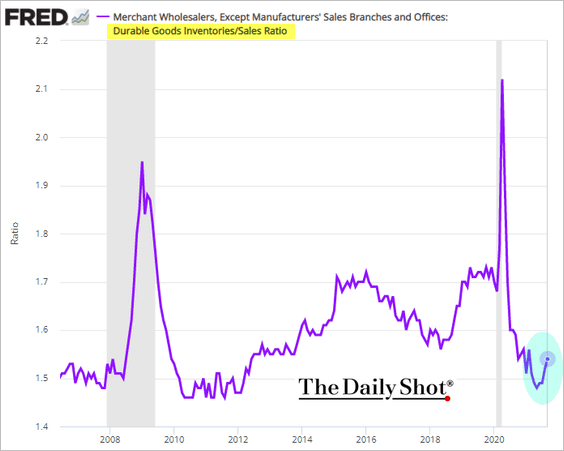

• The durable goods inventories-to-sales ratio appears to be rebounding.

——————–

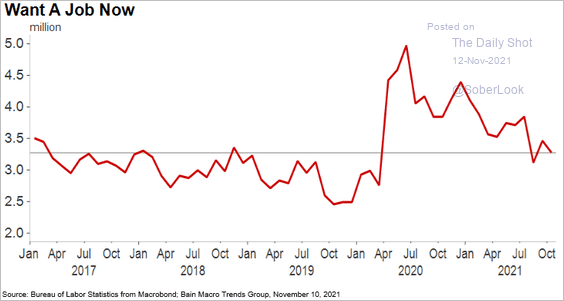

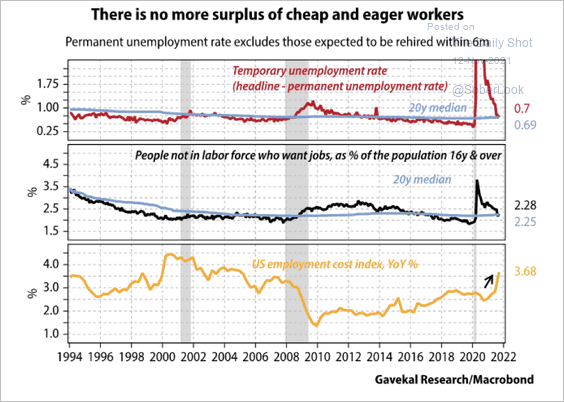

3. Next, we have some updates on the labor market.

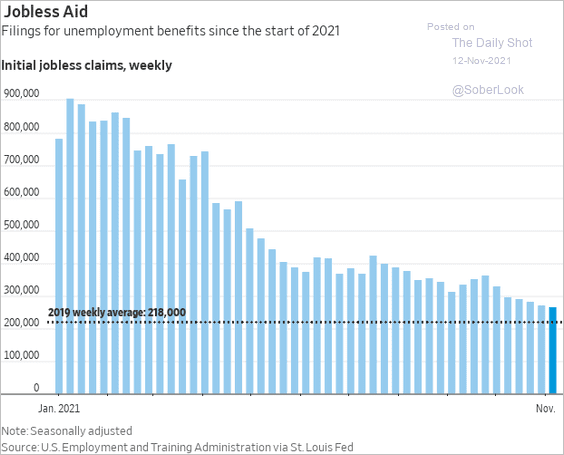

• Jobless claims are approaching pre-COVID levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Most of the “labor slack” is gone (2 charts).

Source: Bain & Company Read full article

Source: Bain & Company Read full article

Source: Gavekal Research

Source: Gavekal Research

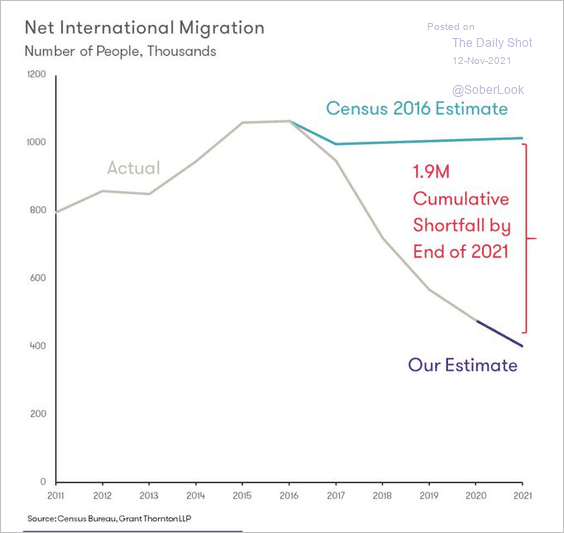

• Here is part of the reason for US labor shortages.

Source: @DianeSwonk

Source: @DianeSwonk

——————–

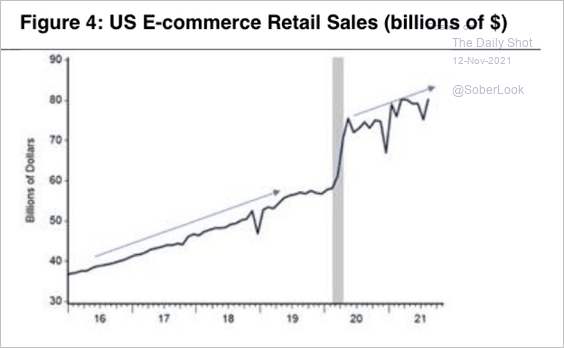

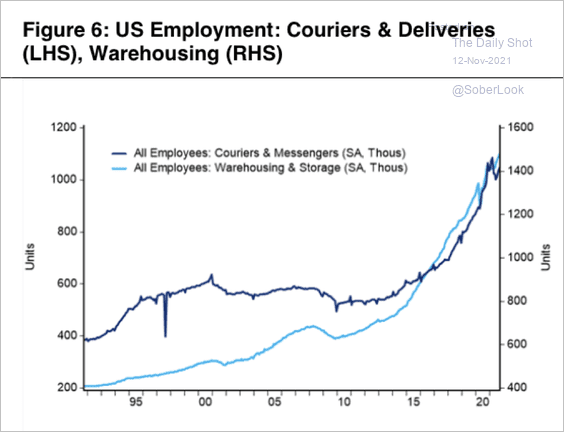

4. E-commerce retail sales continue to grow, …

Source: Citi Private Bank

Source: Citi Private Bank

… contributing to rising demand for warehouse workers and couriers.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

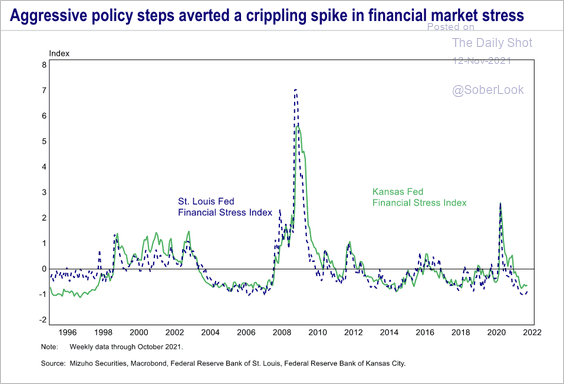

5. Financial stress is at the lowest levels in nearly 30 years.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

6. The Oxford Economics Recovery Tracker is at pre-COVID levels.

![]() Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

Back to Index

The United Kingdom

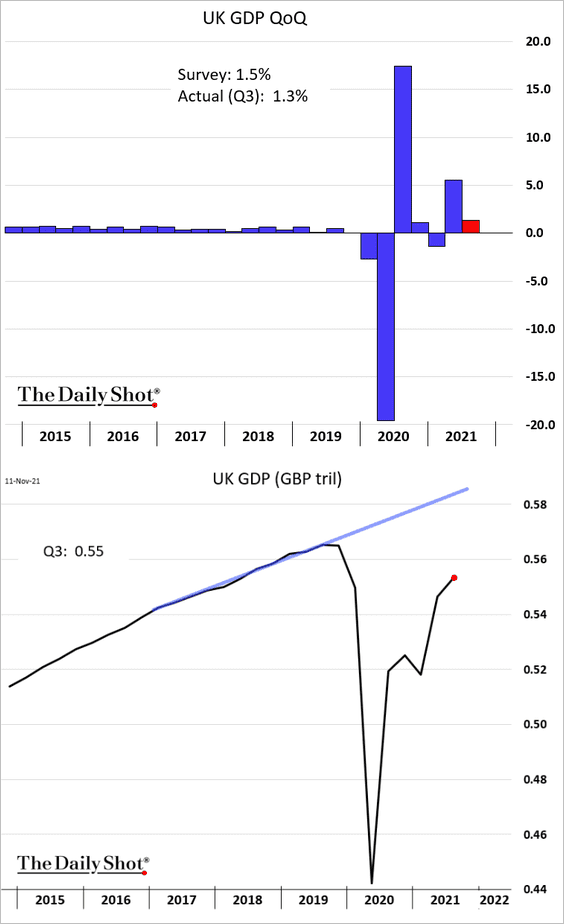

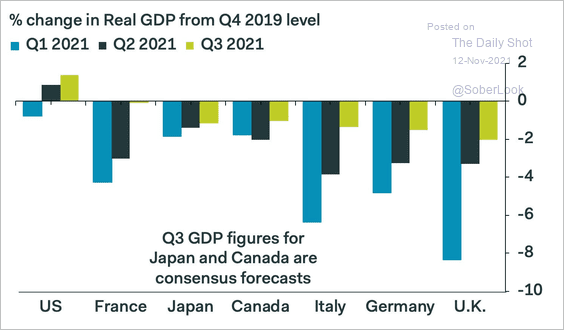

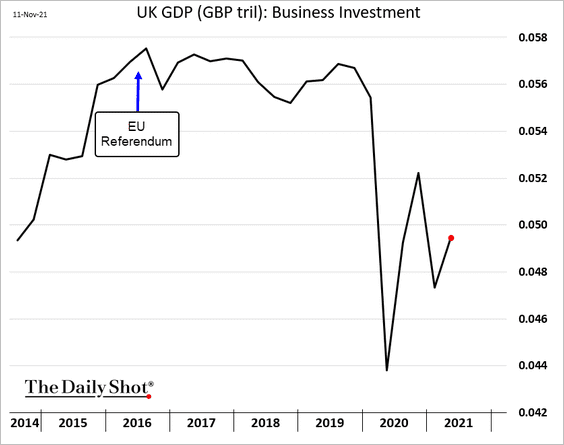

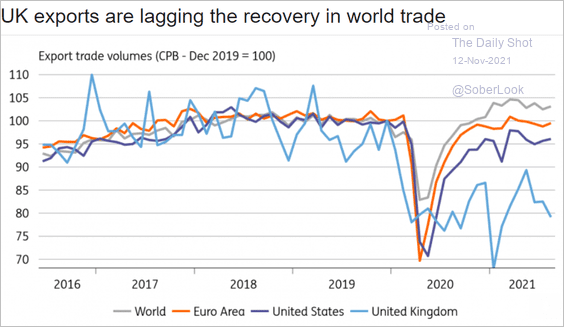

1. The Q3 GDP report underwhelmed, …

… underperforming other economies.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Business investment remains soft.

• And exports are not recovering.

Source: ING

Source: ING

——————–

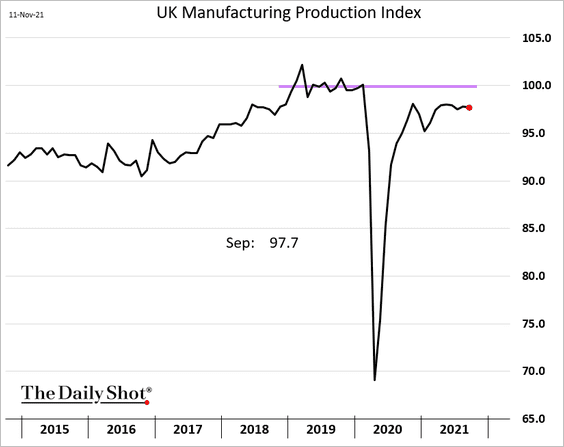

2. Manufacturing production remains below pre-covid levels.

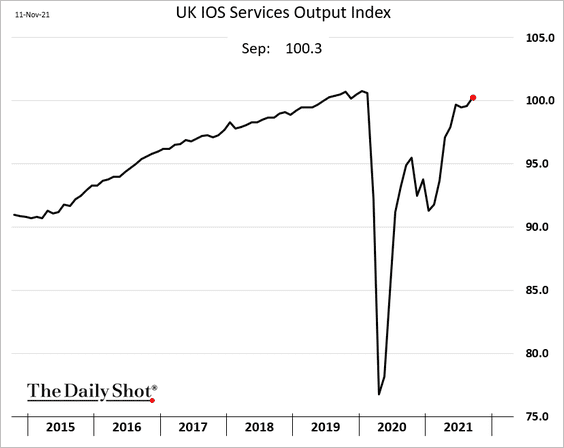

But services output has recovered.

——————–

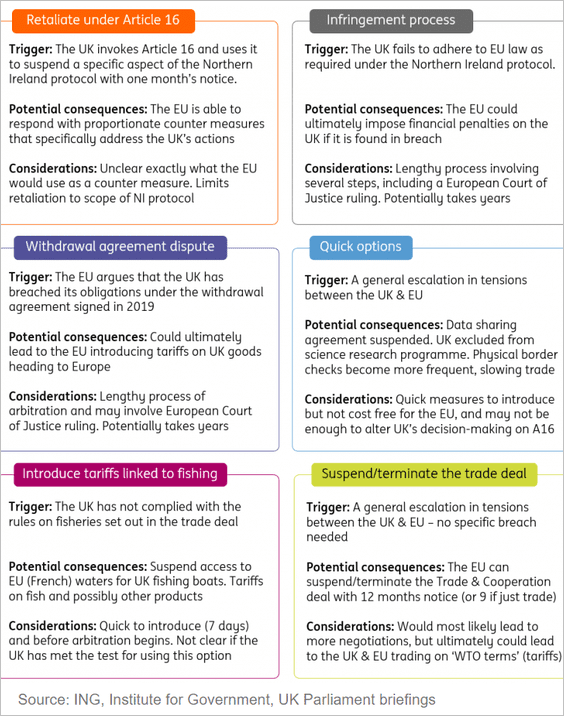

3. The table below shows the EU’s options for retaliation if the UK triggers Article 16.

Source: ING

Source: ING

Back to Index

The Eurozone

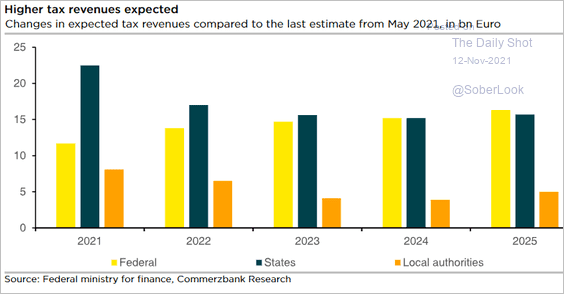

1. Germany’s federal tax revenue is expected to improve.

Source: Commerzbank Research

Source: Commerzbank Research

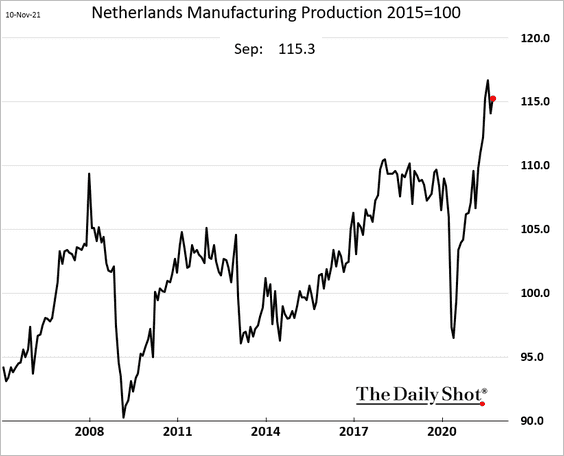

2. Dutch factory output has been impressive.

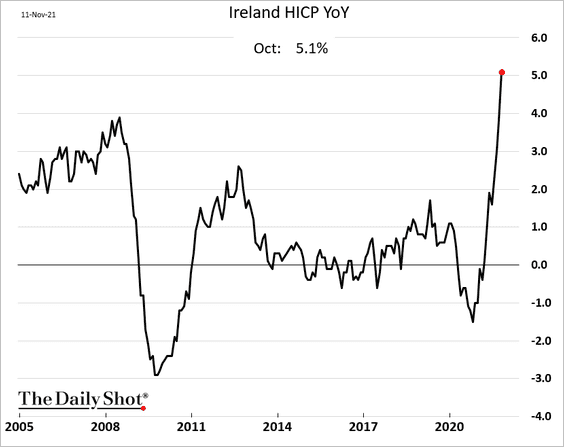

3. Ireland’s CPI blew past 5% for the first time in years.

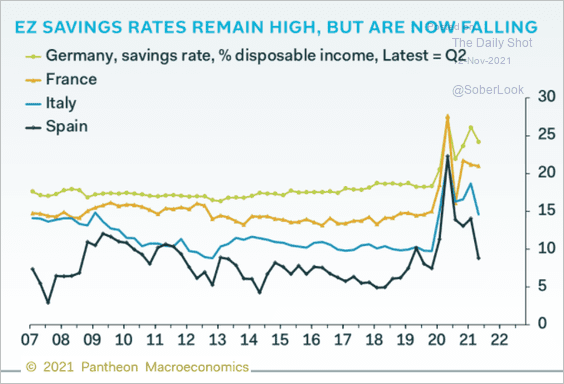

4. Savings rates are starting to moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

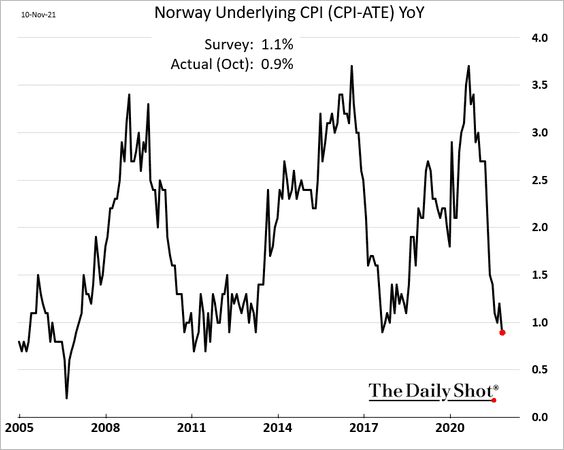

1. Norway’s core inflation is back below 1%.

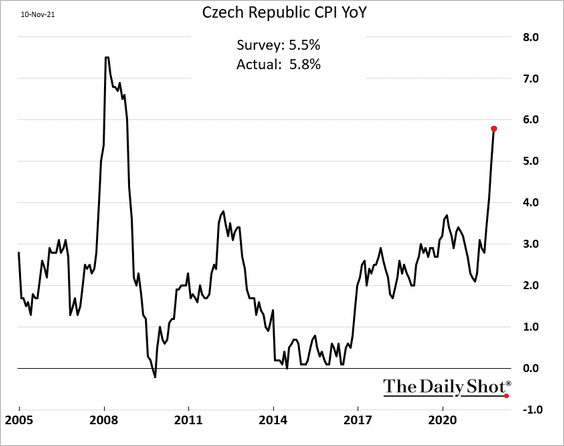

2. Czech inflation, on the other hand, is nearing 6% (well above consensus). More rate hikes are coming.

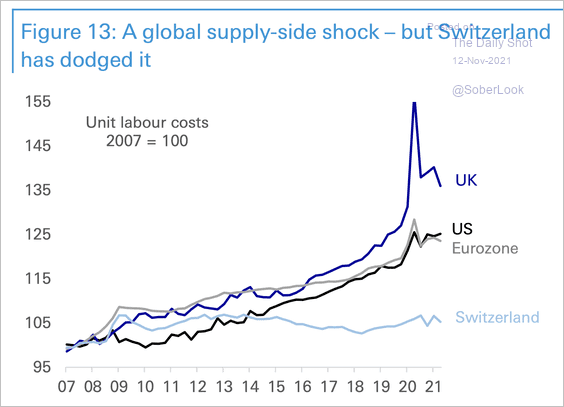

3. Switzerland has managed to dodge the global supply-side shock, showing no growth at all in unit labor costs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

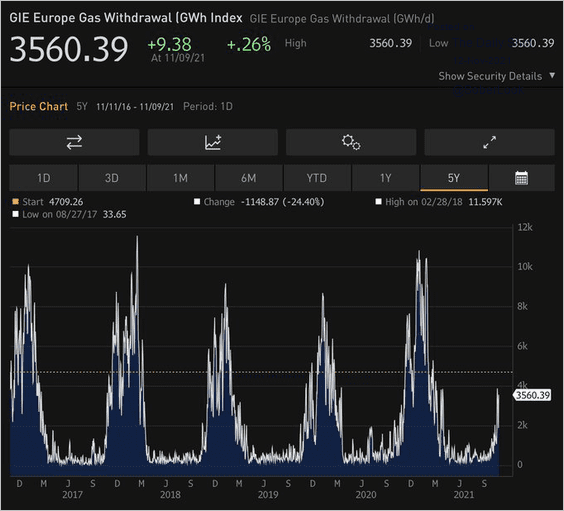

4. Natural gas withdrawals are starting. A cold snap could be trouble.

Source: @BurggrabenH

Source: @BurggrabenH

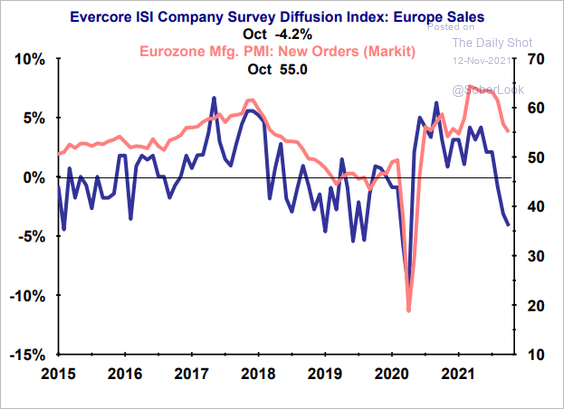

5. Global companies’ European sales have been slowing, according to a survey from Evercore ISI.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

China

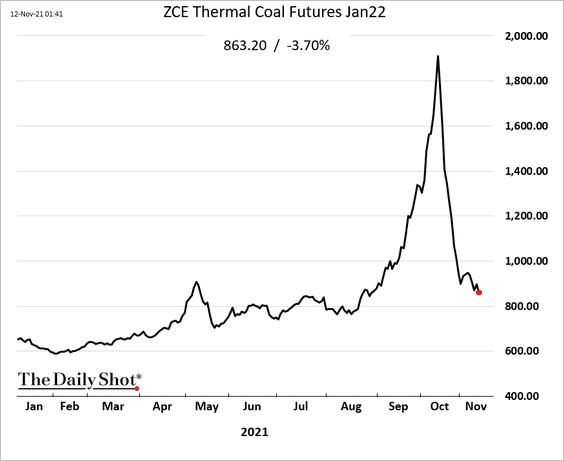

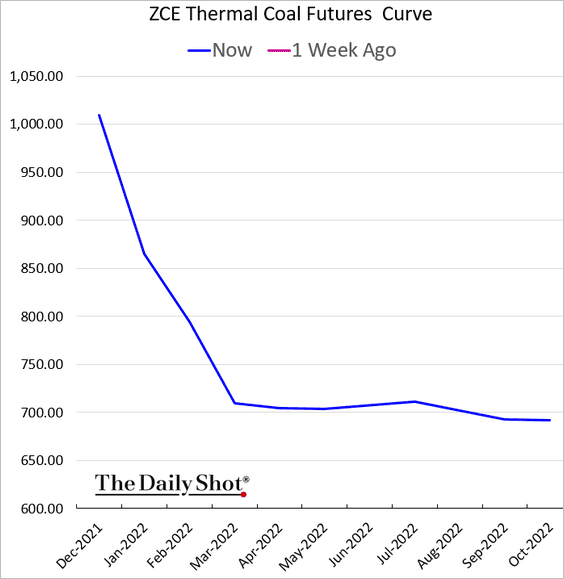

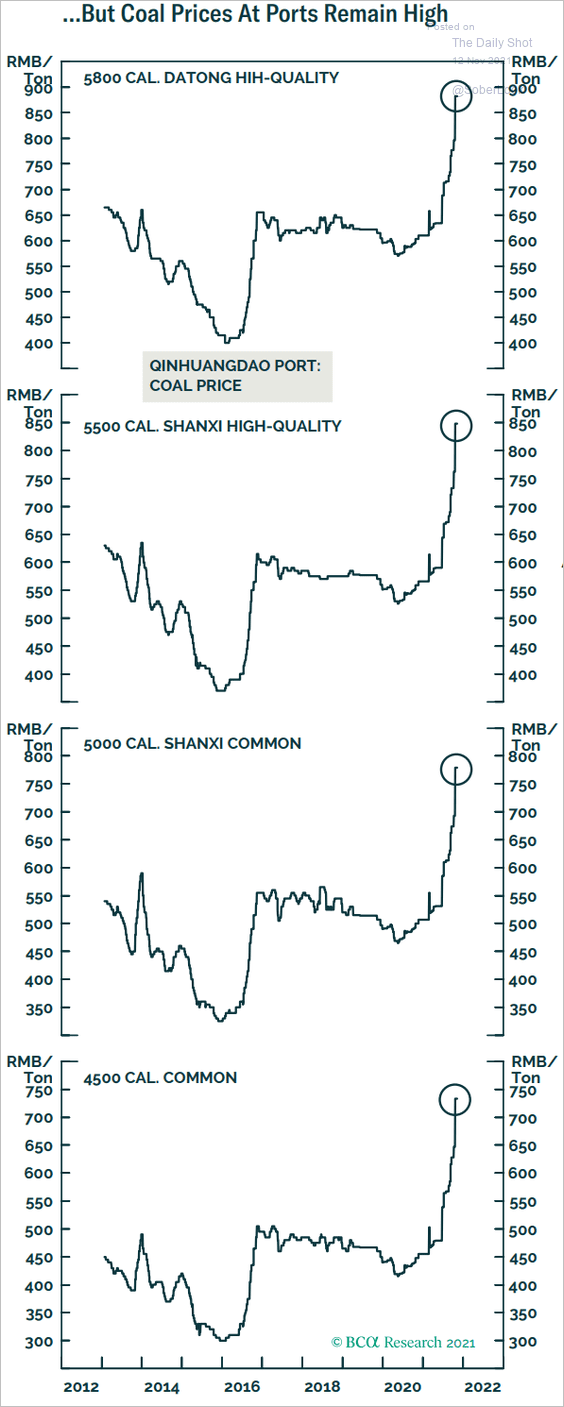

1. Coal futures prices continue to fall as Beijing forces out “speculators.”

However, China hasn’t fixed its coal supply shortages. The futures curve is in deep backwardation – an indication of tight markets.

Moreover, coal prices at China’s ports remain near the highs.

Source: BCA Research

Source: BCA Research

——————–

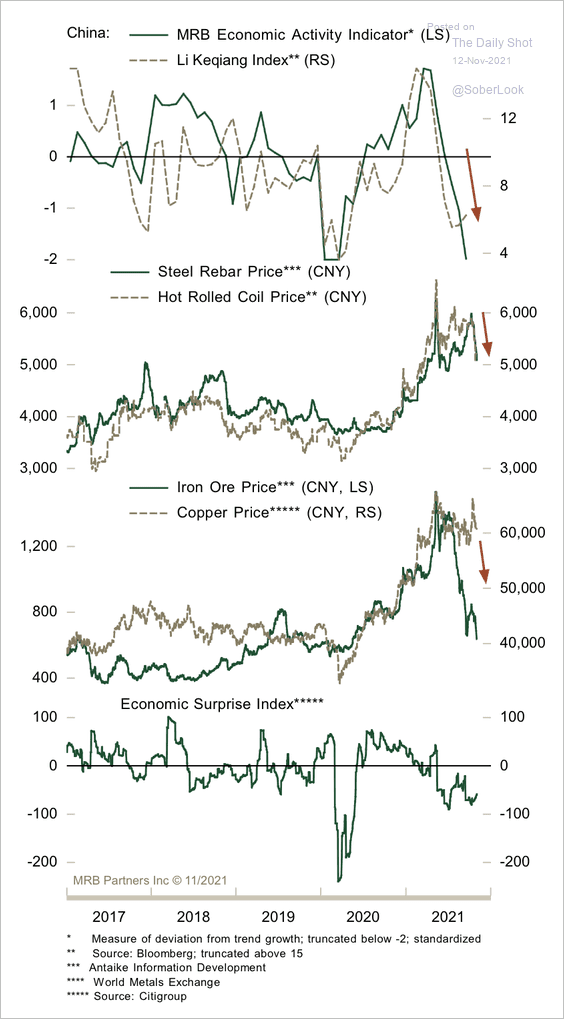

2. The broad economy has decelerated from peak growth, which has weighed on industrial metal prices recently.

Source: MRB Partners

Source: MRB Partners

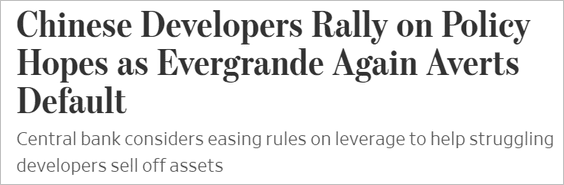

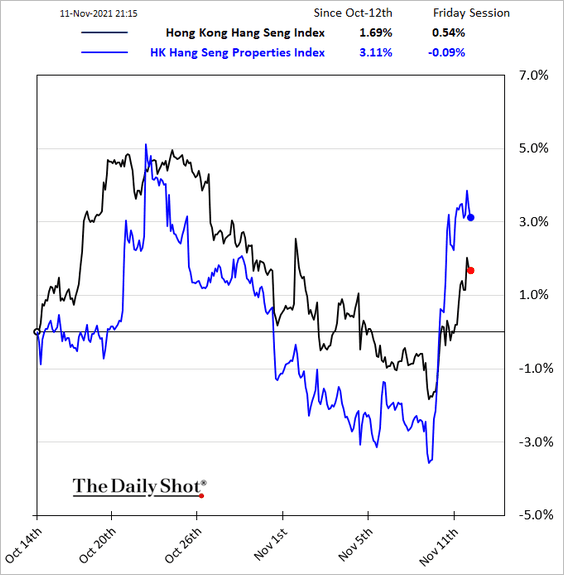

3. Next, we have some updates on the property credit crisis.

• Beijing is signaling some easing in credit/leverage rules.

Source: @WSJ Read full article

Source: @WSJ Read full article

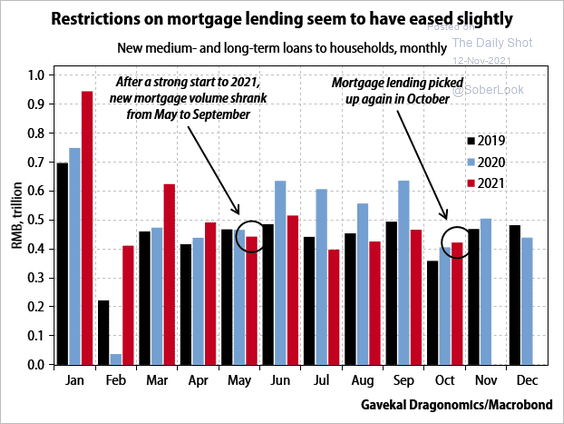

Mortgage lending seems to be improving.

Source: Gavekal Research

Source: Gavekal Research

Developers’ shares jumped.

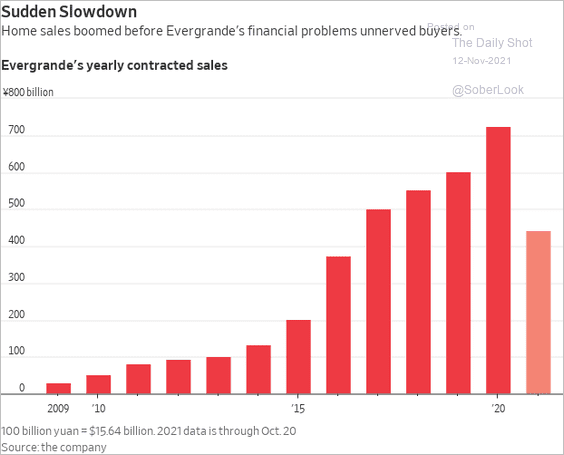

• Evergrande’s sales tumbled this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

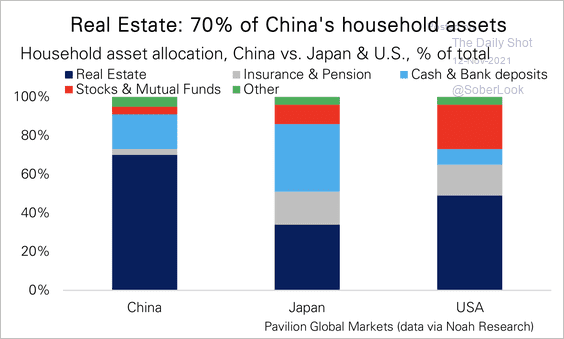

• Chinese household assets are dominated by real estate.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

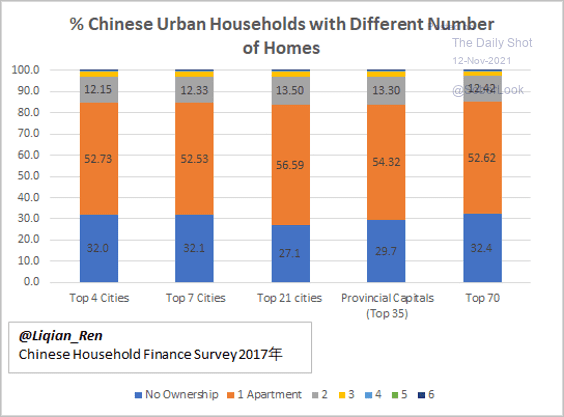

Many households own several properties.

Source: @liqian_ren

Source: @liqian_ren

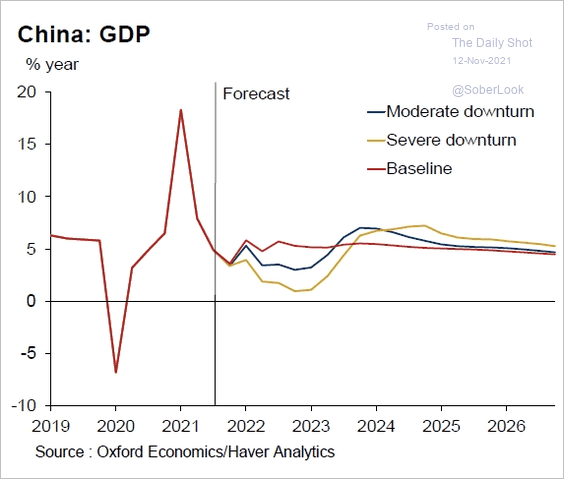

• How much will the property crisis impact the GDP growth? Here are some scenarios from Oxford Economics.

Source: @OxfordEconomics Read full article

Source: @OxfordEconomics Read full article

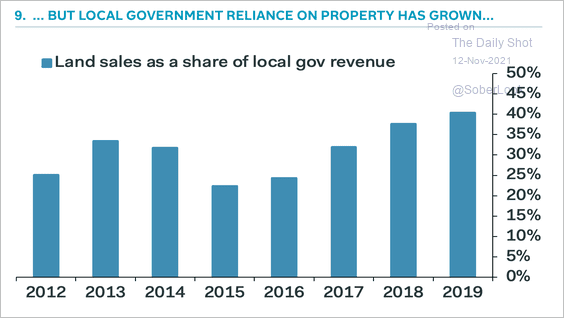

• Chinese local governments have increasingly relied on the property sector.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

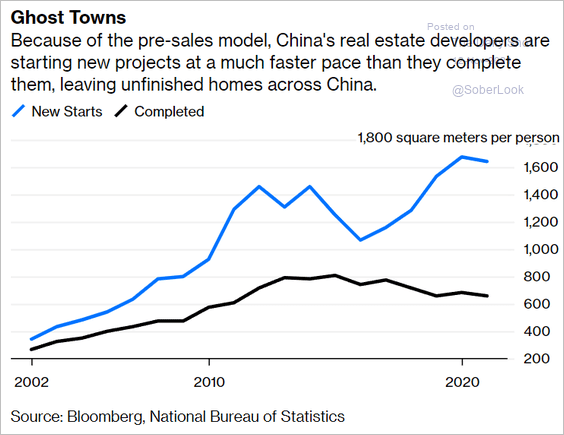

• There are a lot of unfinished housing construction projects.

Source: @shuli_ren, @bopinion Read full article

Source: @shuli_ren, @bopinion Read full article

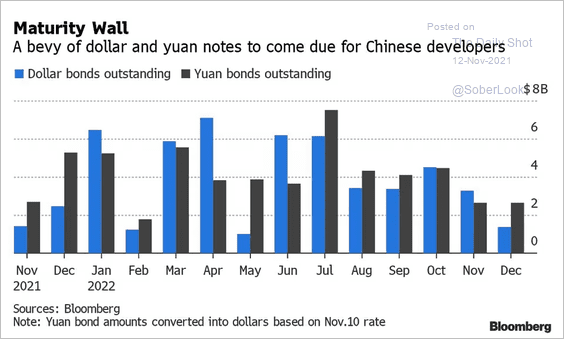

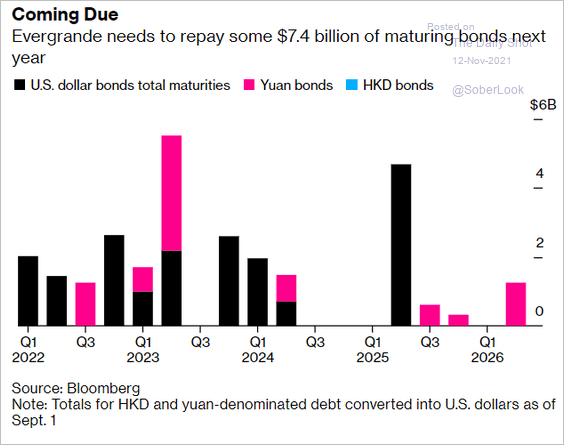

• Property developers are facing a substantial maturity wall.

Source: Yahoo Finance/Bloomberg Read full article

Source: Yahoo Finance/Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

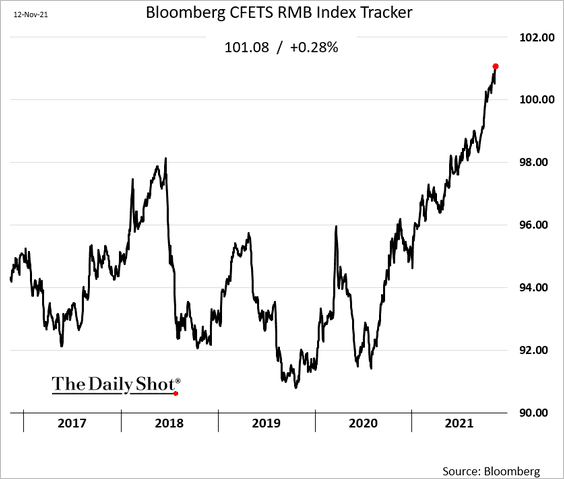

4. The renminbi continues to climb against a basket of currencies (boosted by US dollar gains). This trend results in tighter financial conditions in China, dampening economic growth.

Back to Index

Emerging Markets

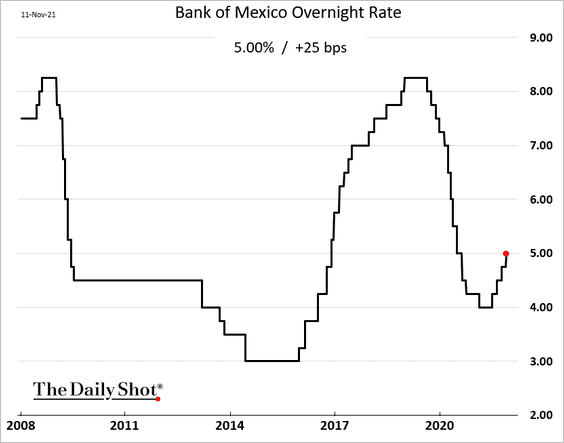

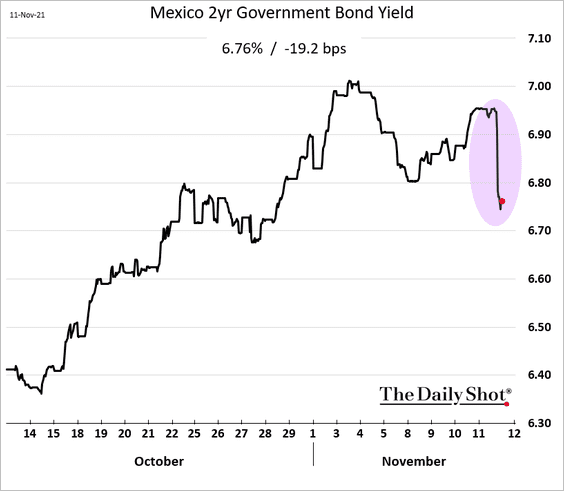

1. Banxico hiked rates.

However, the market expected a more aggressive action from Mexico’s central bank amid surging inflation. Bond yields declined.

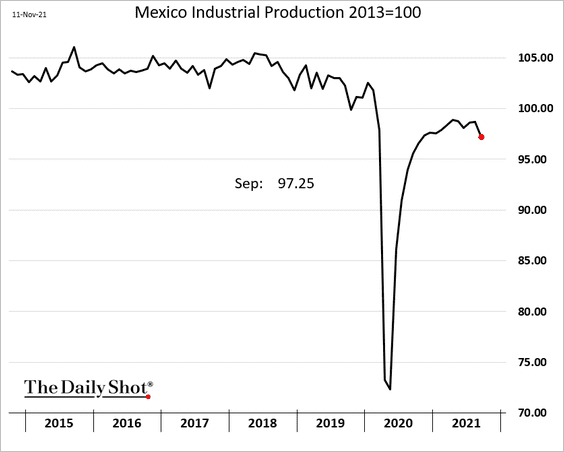

Banxico remains cautious due to the nation’s weak economy.

——————–

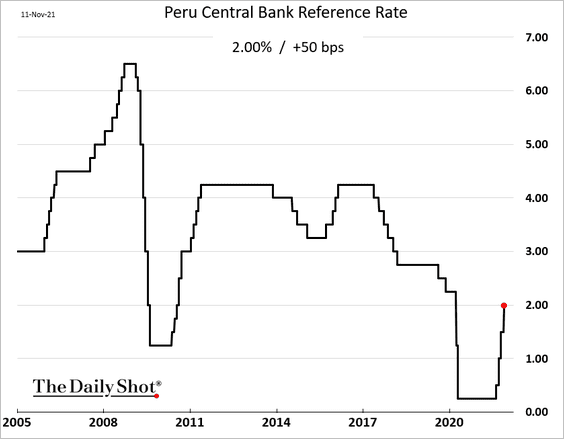

2. Peru’s central bank also hiked rates.

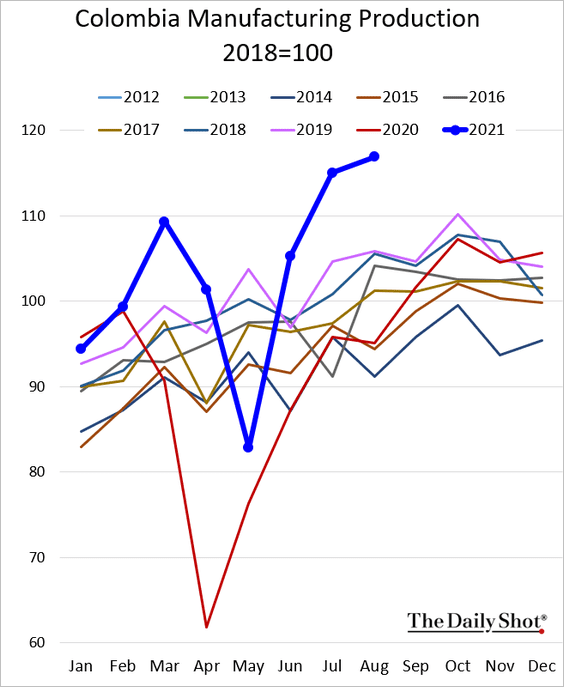

3. Colombia’s manufacturing output hit a record high.

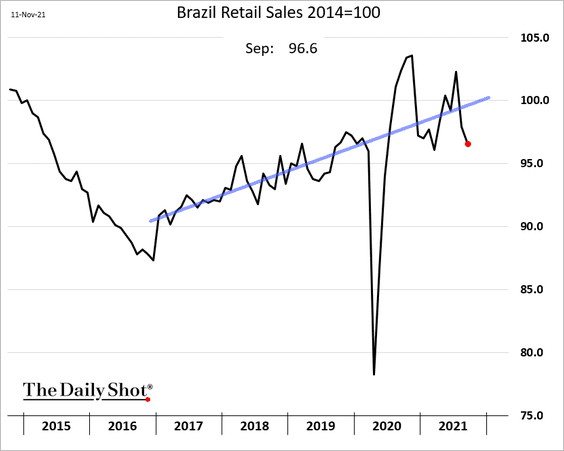

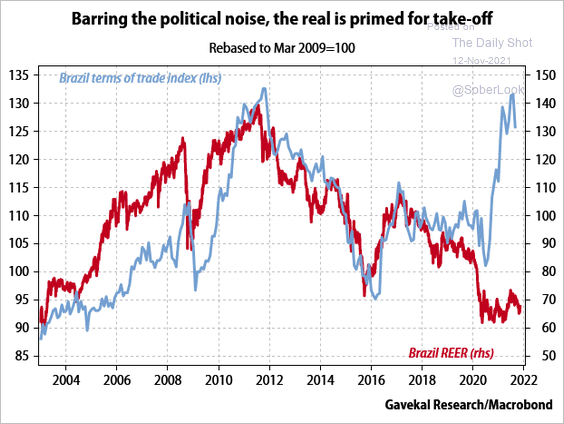

4. Brazil’s retail sales declined again in September.

Separately, the real has plenty of room to rally.

Source: Gavekal Research

Source: Gavekal Research

——————–

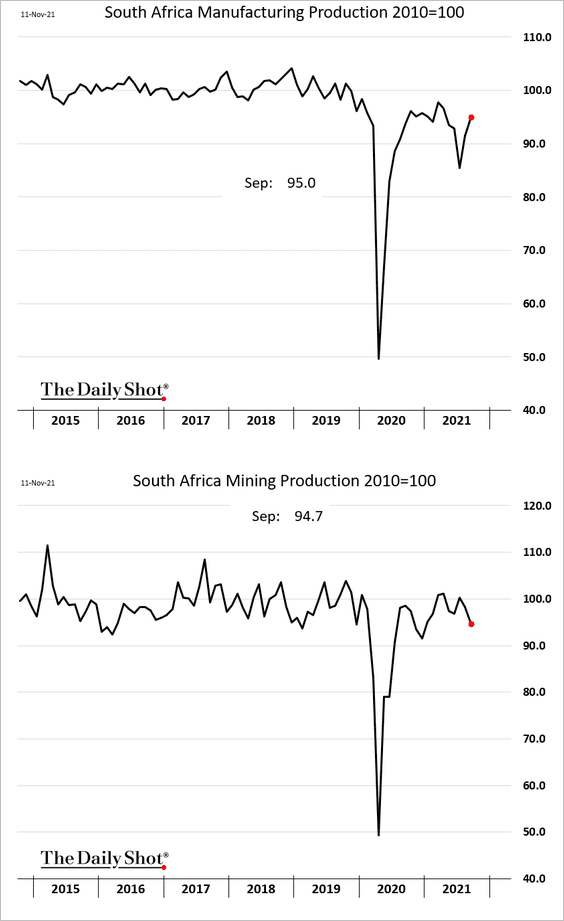

5. South Africa’s industrial production is rebounding, but mining output has been soft.

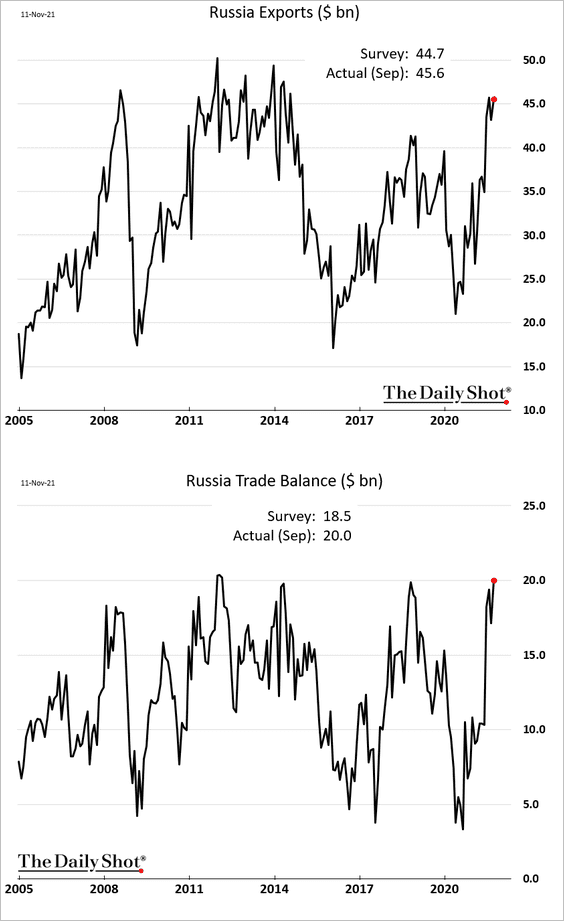

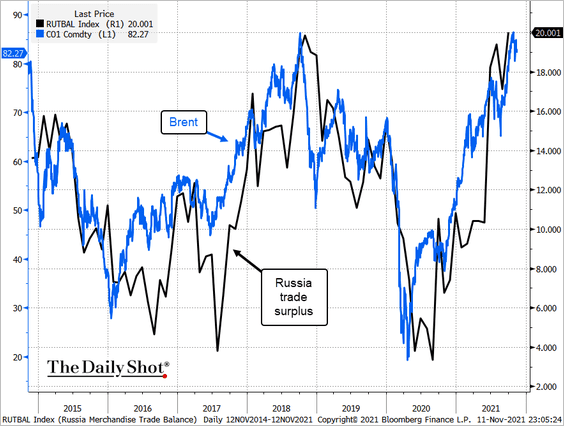

6. Russia’s exports and trade surplus are following energy prices higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

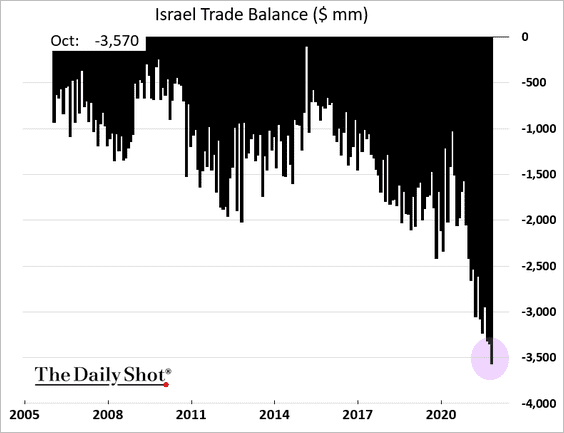

7. Israel’s trade deficit hits another record.

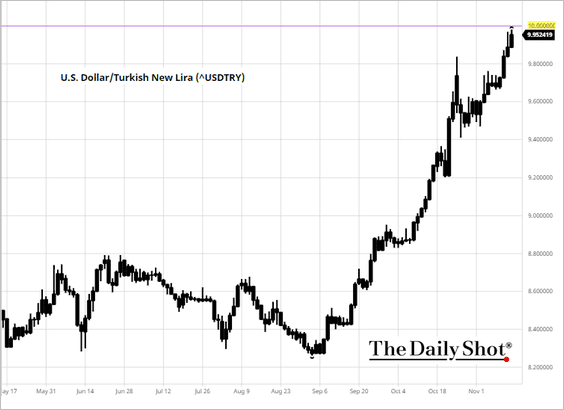

8. USD/TRY is testing 10.0 as the Turkish lira continues to weaken.

Source: brchart.com

Source: brchart.com

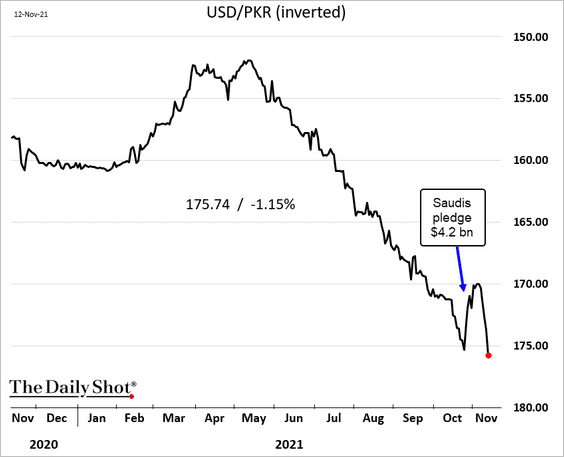

9. The Pakistani rupee hit a record low despite a pledge of support from Saudi Arabia.

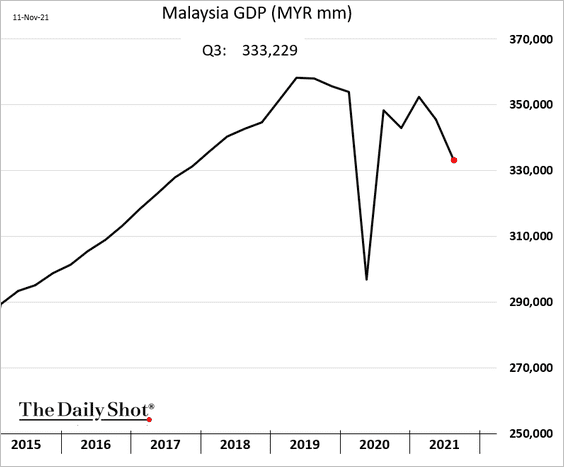

10. Malaysia’s GDP deteriorated last quarter due to lockdowns.

Back to Index

Cryptocurrency

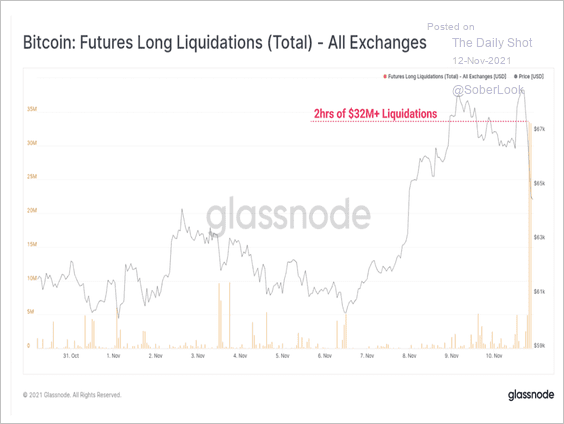

1. Approximately $64 million BTC long positions were liquidated within two hours of bitcoin’s all-time price high near $69K on Wednesday. The sell-off appeared to be fueled by a reduction in leveraged positions.

Source: @glassnode

Source: @glassnode

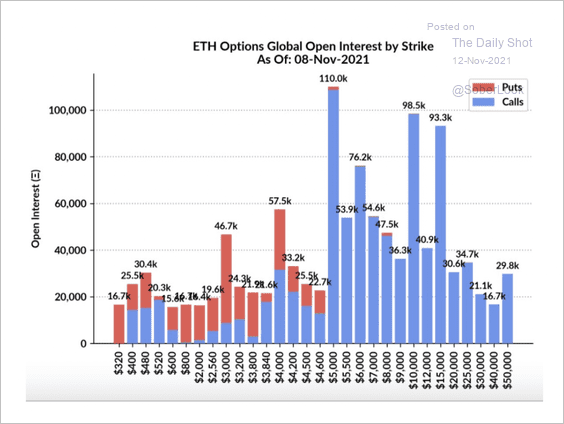

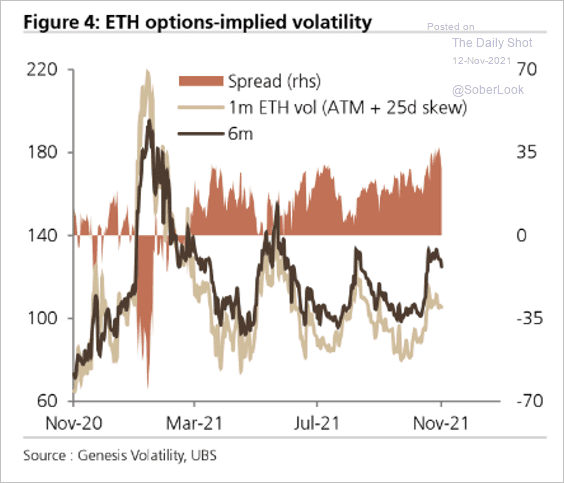

2. The largest amount of open interest in ether options is at the $5K strike price, where calls outweigh puts.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

The ETH vol curve has been moving deeper into contango.

Source: UBS Research

Source: UBS Research

——————–

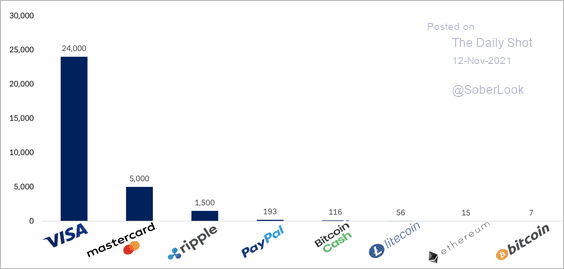

3. Bitcoin’s transaction capacity per second is still very low compared to major payment networks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

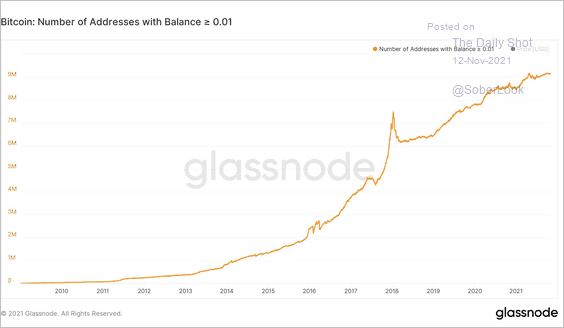

4. This chart shows the number of bitcoin addresses with a nonzero balance.

Source: @APompliano

Source: @APompliano

Back to Index

Commodities

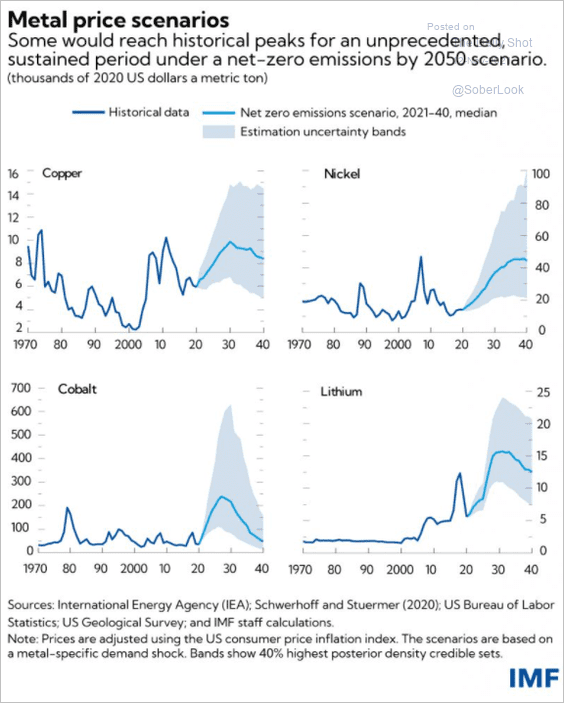

1. Key metal prices could keep surging. Here are some price scenarios under net-zero emission targets.

Source: IMF Read full article

Source: IMF Read full article

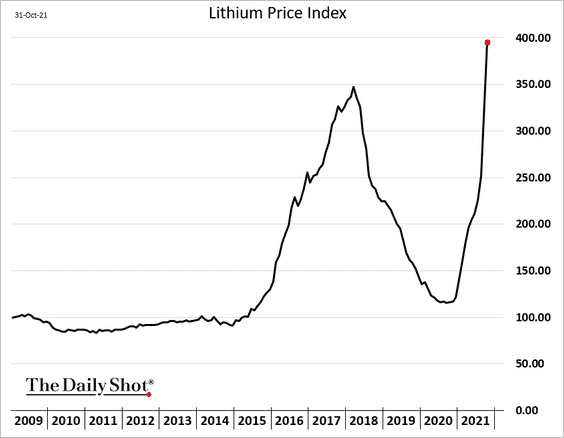

Lithium prices continue to climb.

Source: Benchmark Mineral Intelligence

Source: Benchmark Mineral Intelligence

——————–

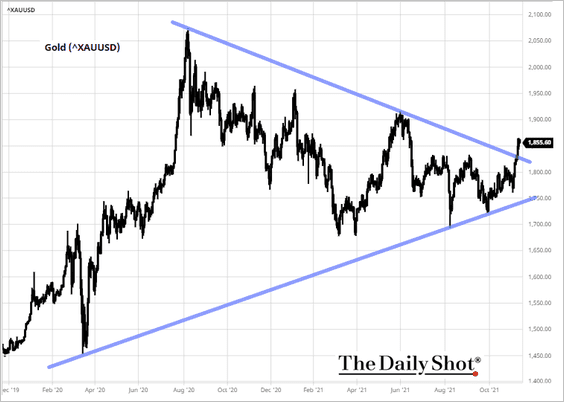

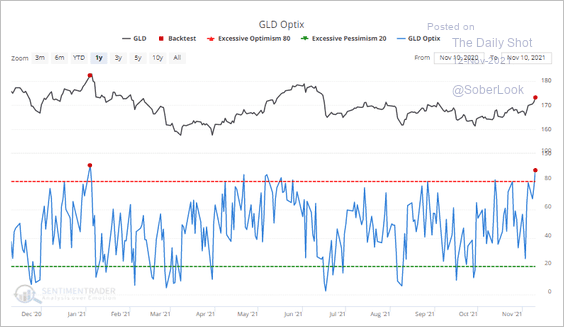

2. Gold broke through short-term resistance, …

Source: barchart.com

Source: barchart.com

… but it is showing signs of excessive optimism, which typically precede pullbacks.

Source: SentimenTrader

Source: SentimenTrader

——————–

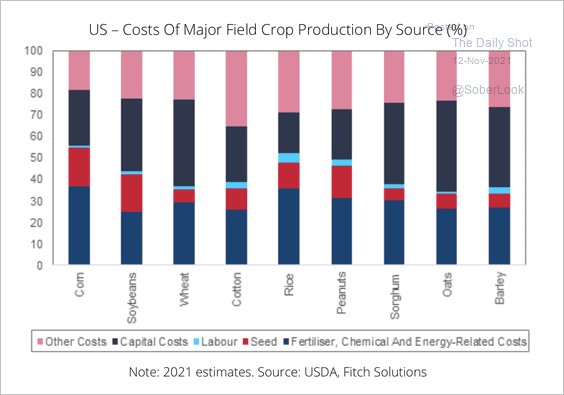

3. Fertilizer is a key input of agricultural production, particularly rice. Fitch is warning that increased protectionist policies from China could create difficulties for fertilizer exporters.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

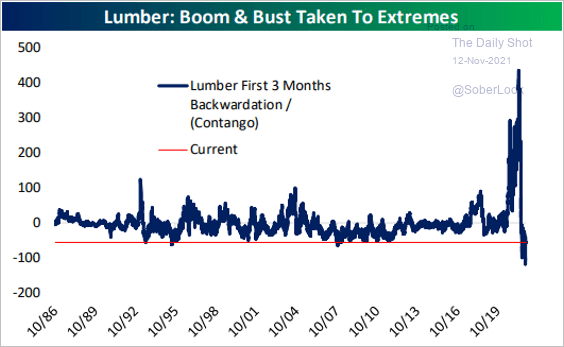

4. Lumber is in contango as mills step up output.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Back to Index

Energy

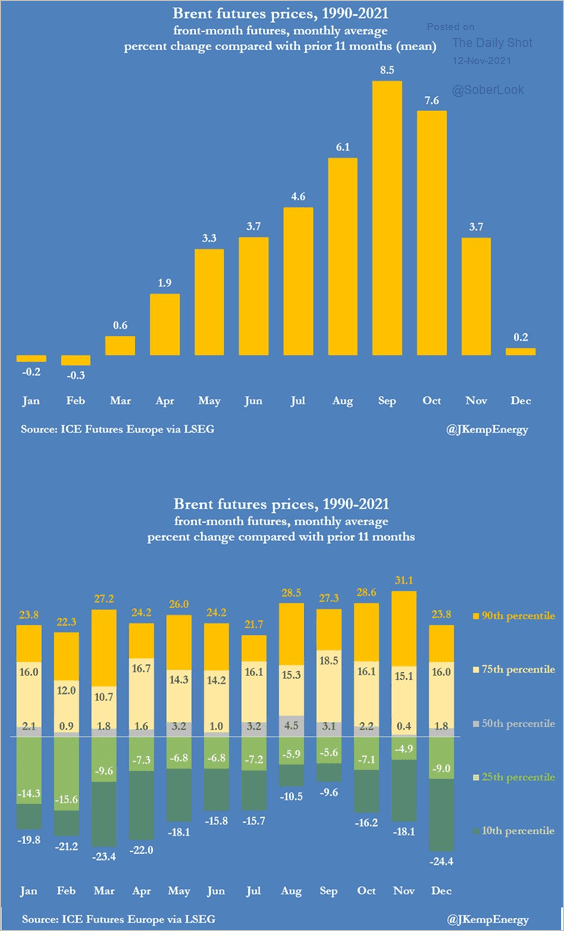

1. We are in a seasonally soft period for oil.

Source: @JKempEnergy Read full article

Source: @JKempEnergy Read full article

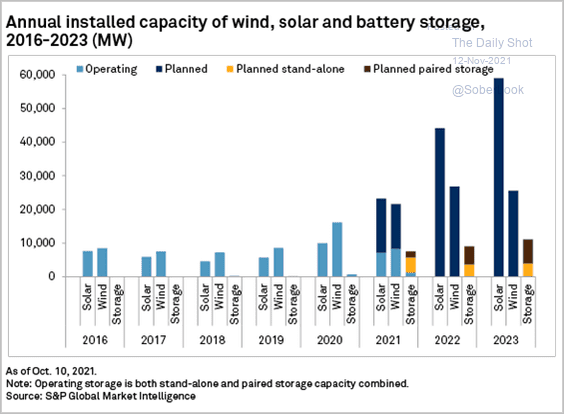

2. This chart shows US installed capacity for wind, solar, and battery usage.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

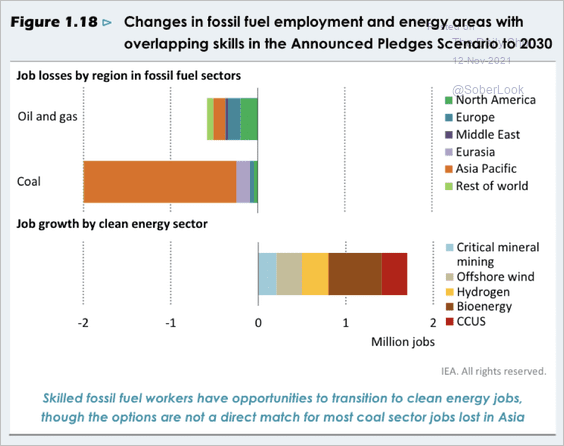

3. Job gains in clean energy will not fully offset job losses associated with traditional energy.

Source: IEA

Source: IEA

Back to Index

Equities

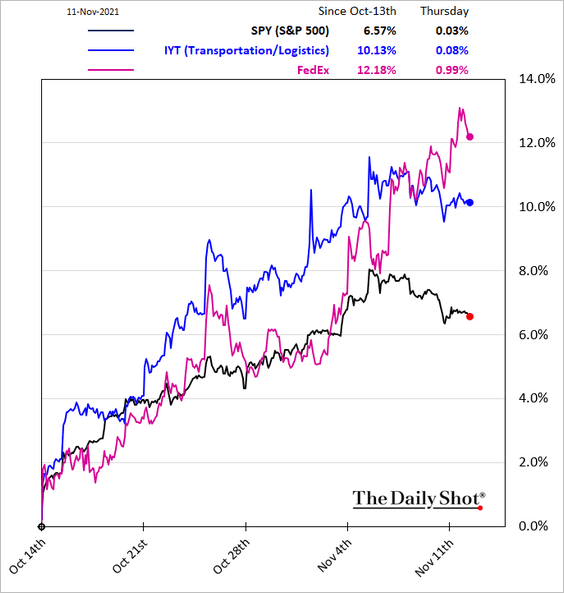

1. The transportation sector’s outperformance could be a bullish sign for stocks.

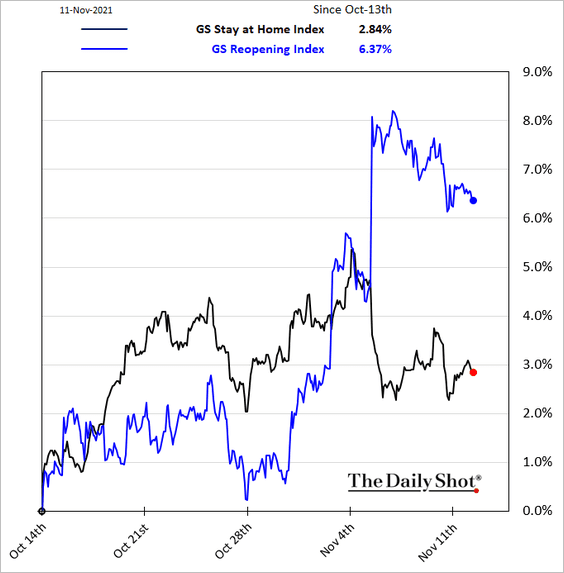

2. “Reopening” stocks are outperforming “stay at home” this month.

3. Next, we have some updates on the options market.

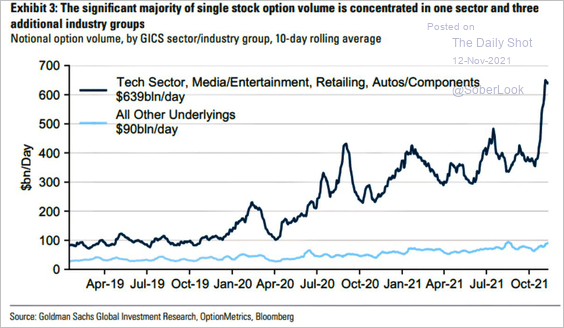

• The surge in options volume has been concentrated in four sectors.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

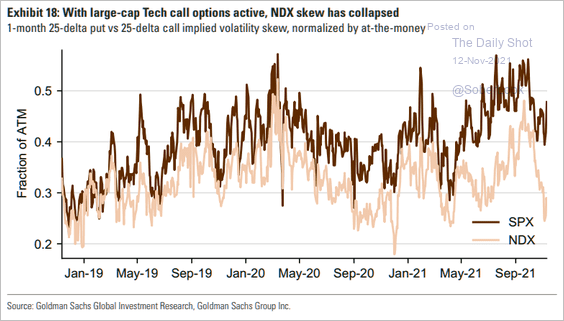

• The demand for mega-cap call options sent the Nasdaq 100 skew sharply lower.

Source: Goldman Sachs; @themarketear

Source: Goldman Sachs; @themarketear

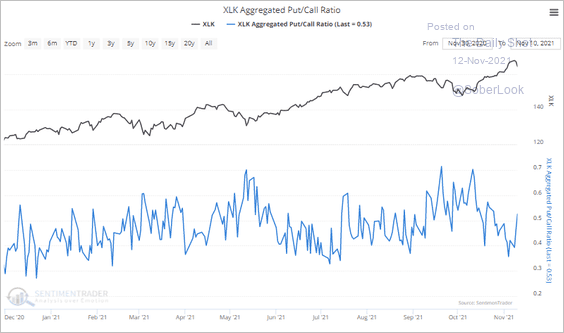

• However, put options in the SPDR Tech ETF (XLK) are starting to rise relative to calls.

Source: SentimenTrader

Source: SentimenTrader

——————–

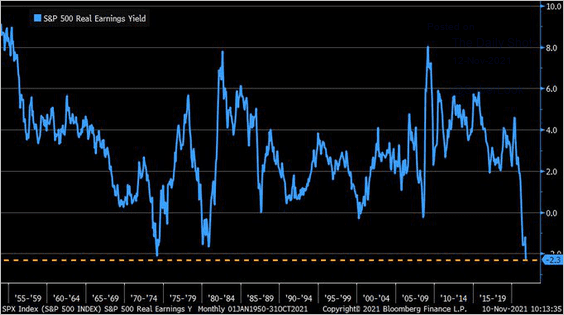

4. The S&P 500 real earnings yield hit a record low.

Source: @LizAnnSonders

Source: @LizAnnSonders

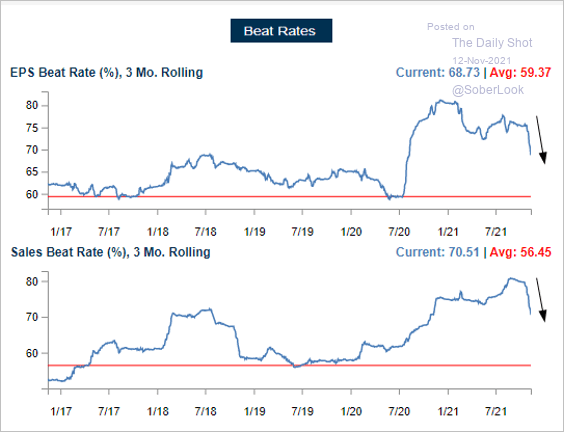

5. The share of companies beating earnings and sales estimates has moderated in the Q3 reporting season.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

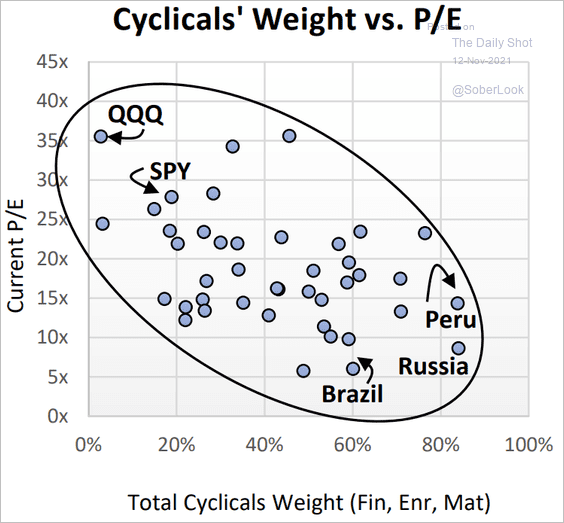

6. Higher concentrations of cyclical shares tend to reduce P/E ratios of markets/sectors.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Alternatives

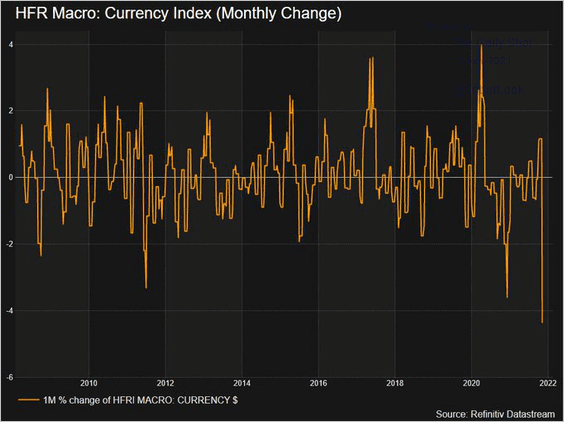

1. Currency hedge funds struggled last month.

Source: @ReutersJamie Read full article

Source: @ReutersJamie Read full article

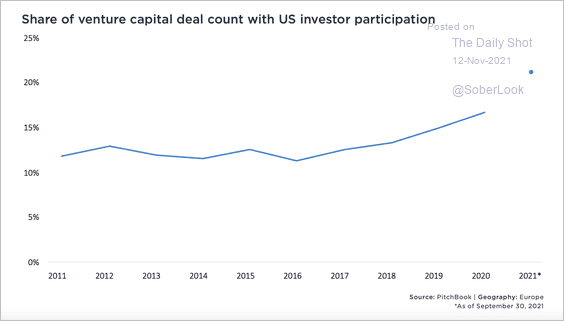

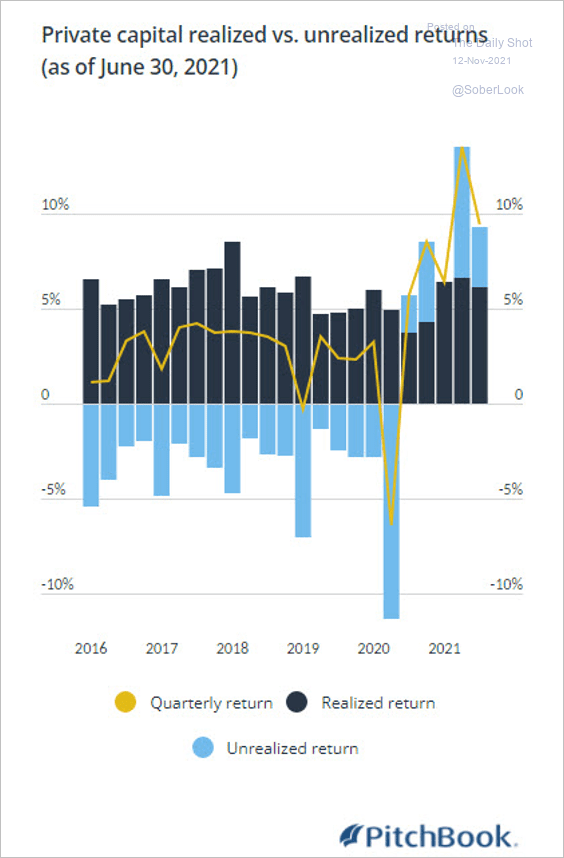

2. Barbarians at the gate? A record 21.2% of all venture deals in Europe had a US-based investor on board.

Source: PitchBook

Source: PitchBook

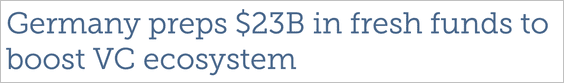

3. The German government is dedicating billions to boost VC investments in the country.

Source: PitchBook Read full article

Source: PitchBook Read full article

Berlin and Munich accounted for the bulk of VC investment last year.

Source: PitchBook Read full article

Source: PitchBook Read full article

And as the German VC ecosystem has matured, later rounds have dominated.

Source: SentimenTrader

Source: SentimenTrader

——————–

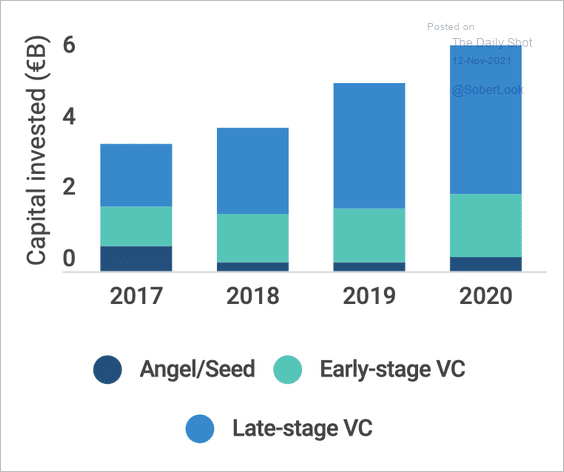

4. 14 out of the 35 global ed-tech companies valued at $1 billion or more were minted this year, according to PitchBook data.

Source: PitchBook

Source: PitchBook

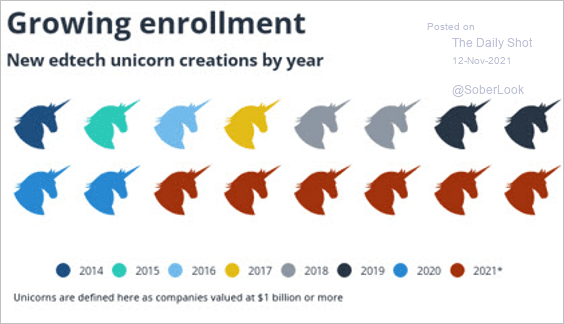

5. Private capital funds, and VC strategies, in particular, have seen higher returns in recent quarters. But much of those returns remain unrealized and are based on estimated valuations, according to PitchBook.

Source: PitchBook

Source: PitchBook

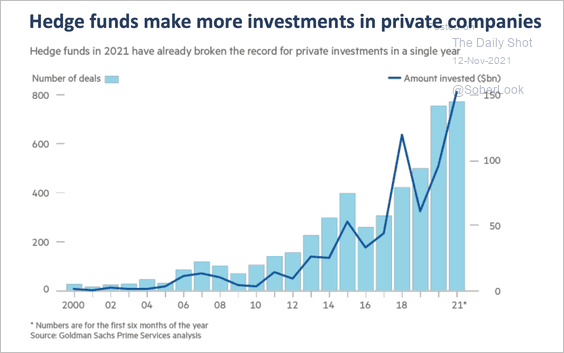

6. Hedge funds are moving into private markets in a big way.

Source: Goldman Sachs Global Markets Division; Zoetrope Finance

Source: Goldman Sachs Global Markets Division; Zoetrope Finance

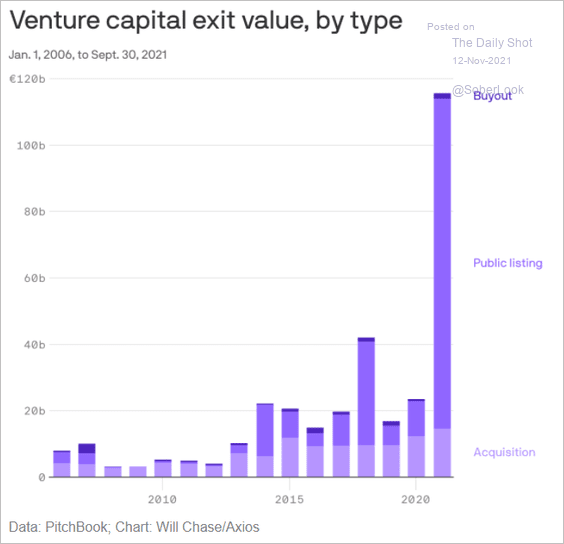

7. VC exits surged this year.

Source: @axios

Source: @axios

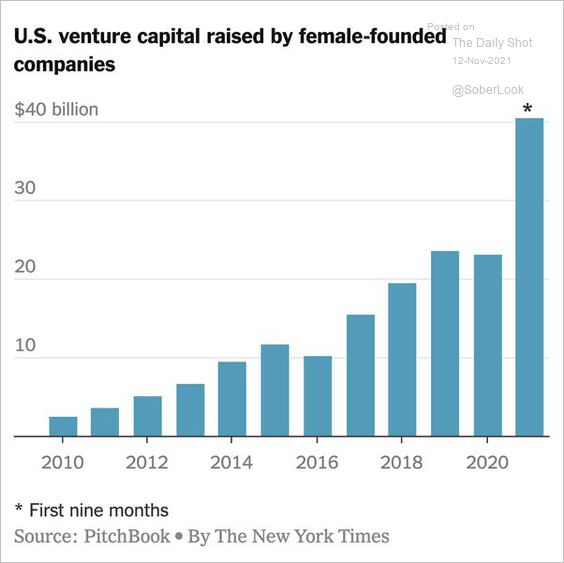

8. This chart shows VC capital raised by female-founded companies.

Source: @Alisha__g, @dealbook, @PitchBook Read full article

Source: @Alisha__g, @dealbook, @PitchBook Read full article

Back to Index

Credit

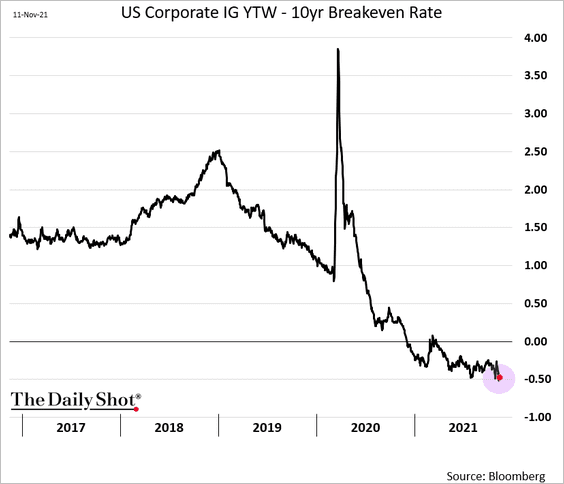

1. Implied real investment-grade yields have moved deeper into negative territory.

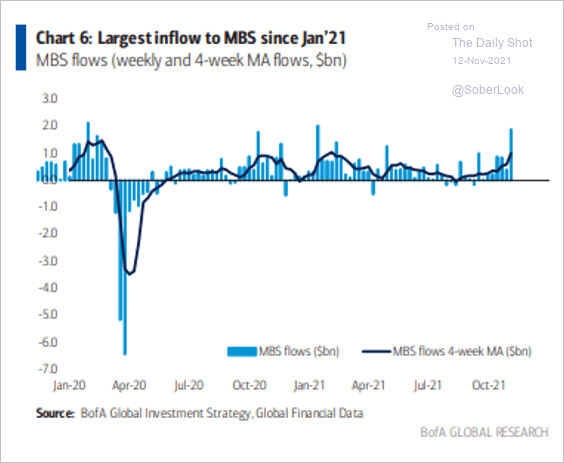

2. Inflows into MBS funds have accelerated recently.

Source: BofA Global Research

Source: BofA Global Research

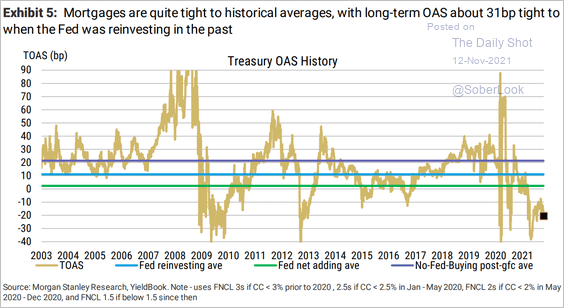

• MBS spreads have been relatively tight.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

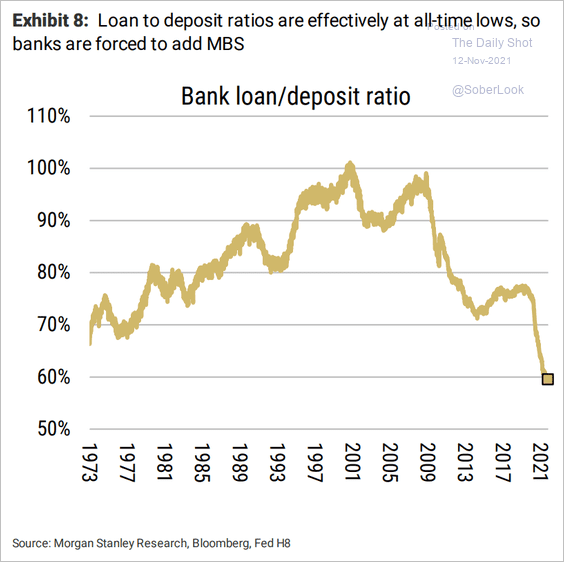

• Banks have been forced to buy MBS as the loan-to-deposit ratio hit a record low.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

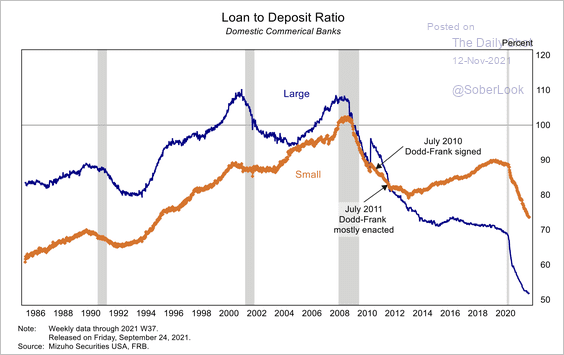

3. The loan-to-deposit ratio of small vs. large lenders continues to diverge – partly due to regulation.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

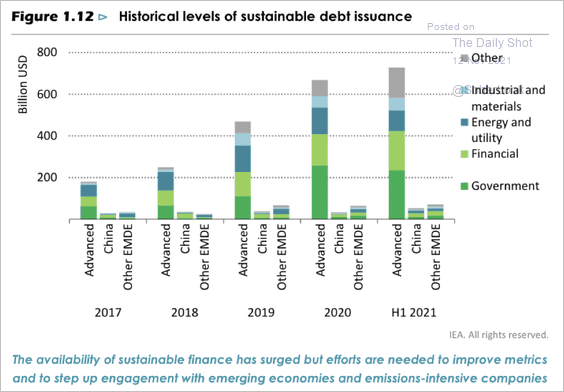

4. Sustainable finance is surging in advanced economies, but less so in emerging economies (possibly due to high debt and limited fiscal space).

Source: IEA

Source: IEA

Back to Index

Rates

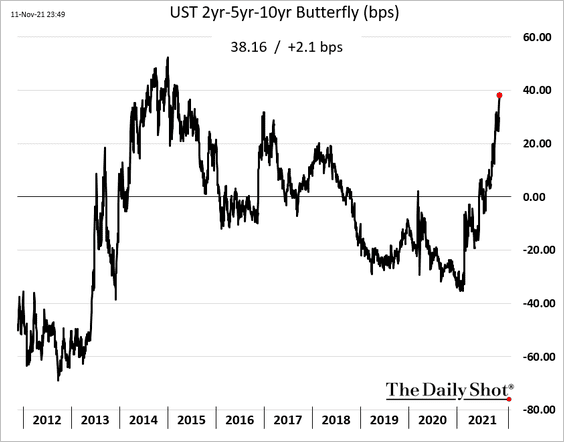

1. The 2-5-10 Treasury butterfly spread has blown out, as the belly of the curve takes a hit. Investors expect the Fed to be more aggressive in fighting surging inflation.

2. What happened in the Treasury market in early 2020 when the pandemic first struck?

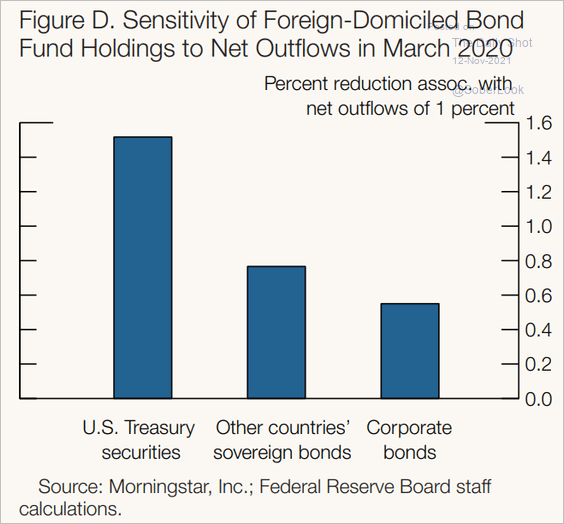

• Fund outflows forced managers to sell Treasuries.

Source: Federal Reserve Board Read full article

Source: Federal Reserve Board Read full article

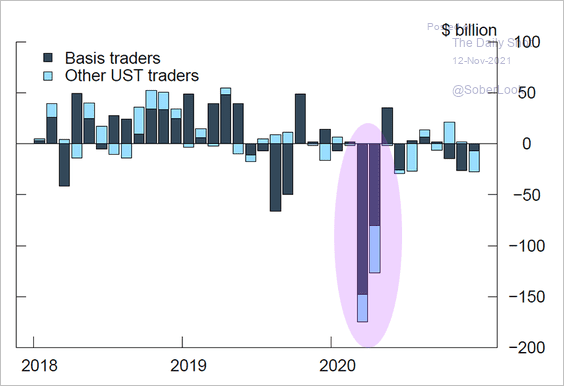

• Futures/cash (basis) arbitrage trades got unwound.

Source: Board Of Governors of the Federal Reserve System Read full article

Source: Board Of Governors of the Federal Reserve System Read full article

Back to Index

Global Developments

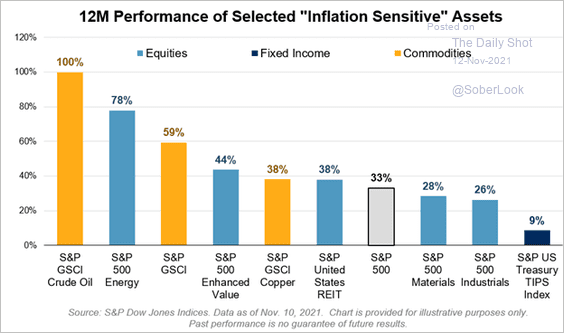

1. How have inflation-sensitive assets performed over the past 12 months?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

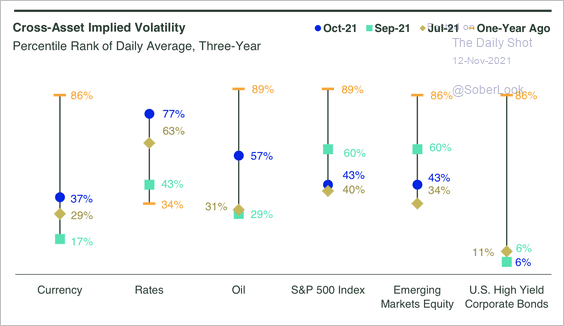

2. In October, equity implied volatility fell below the historical median, while rates implied vol jumped to the highest level since March.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

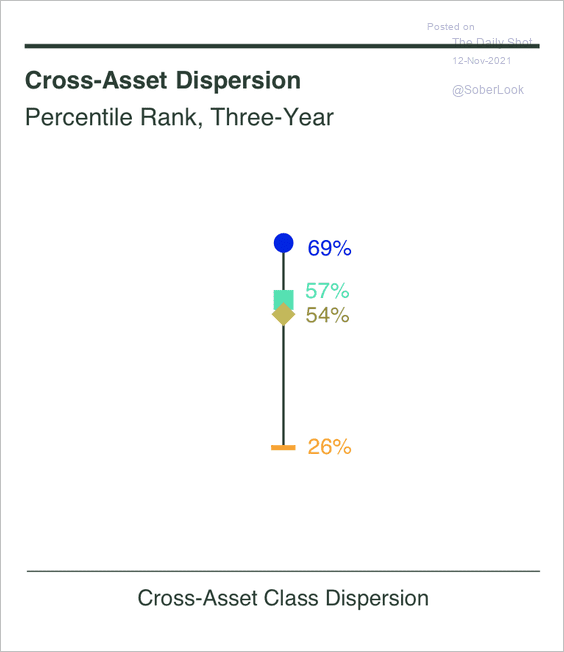

Cross-asset dispersion has also been trending higher.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

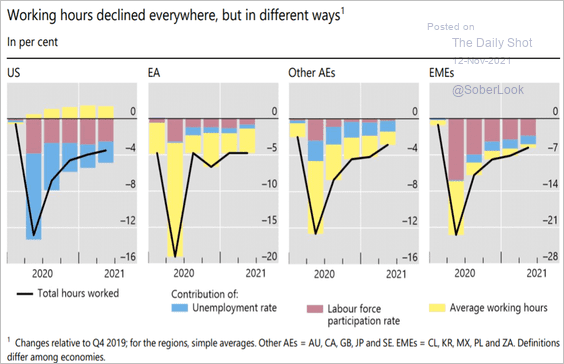

3. What were the drivers of reduced working hours since the start of the pandemic?

Source: BIS

Source: BIS

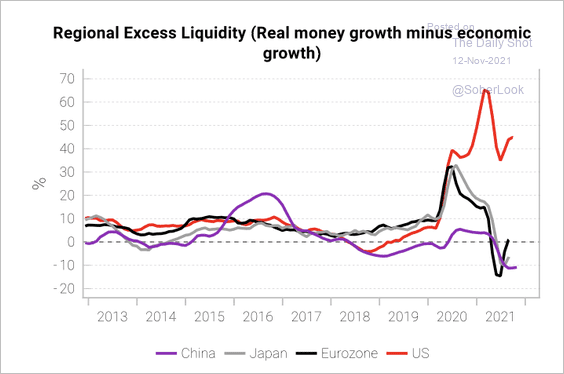

4. Excess liquidity growth remains weak outside of the US.

Source: Variant Perception

Source: Variant Perception

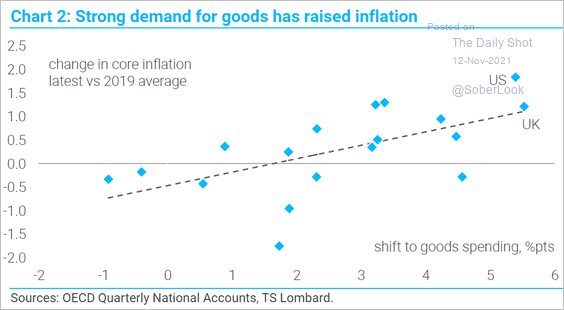

5. Demand for goods boosted inflation in many economies.

Source: TS Lombard

Source: TS Lombard

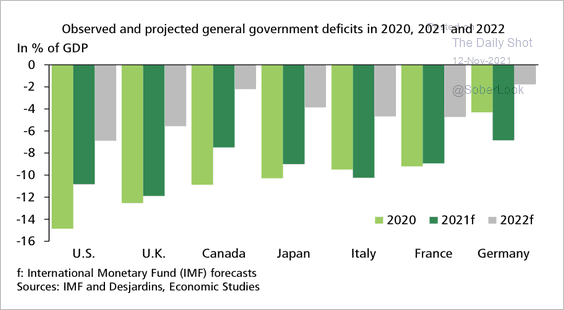

6. Government deficits are expected to fall in most G7 countries.

Source: Desjardins

Source: Desjardins

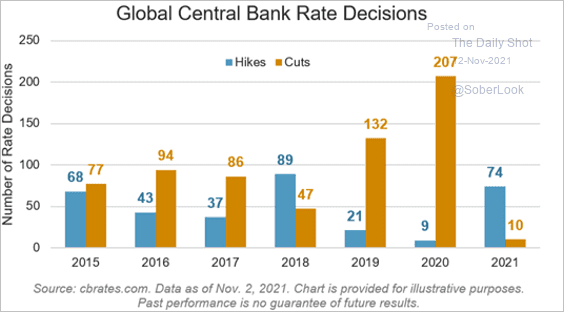

7. Finally, we have rate hikes vs. rate cuts, by year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

Food for Thought

1. Black Friday shopping plans:

Source: @CivicScience

Source: @CivicScience

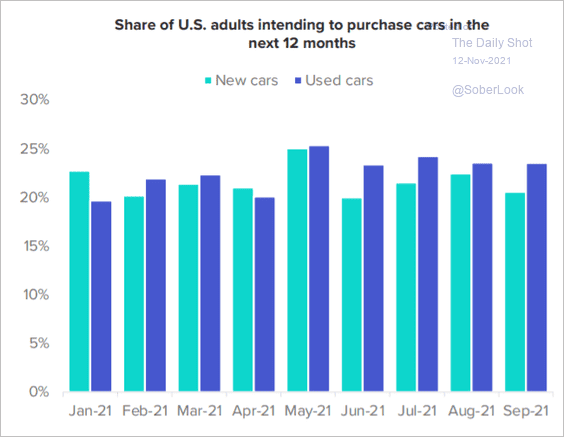

2. Buying used cars:

Source: Morning Consult

Source: Morning Consult

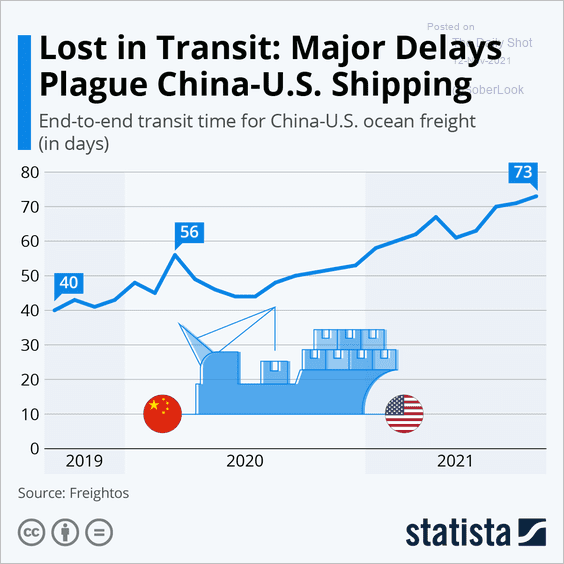

3. China-US shipping freight delays:

Source: Statista

Source: Statista

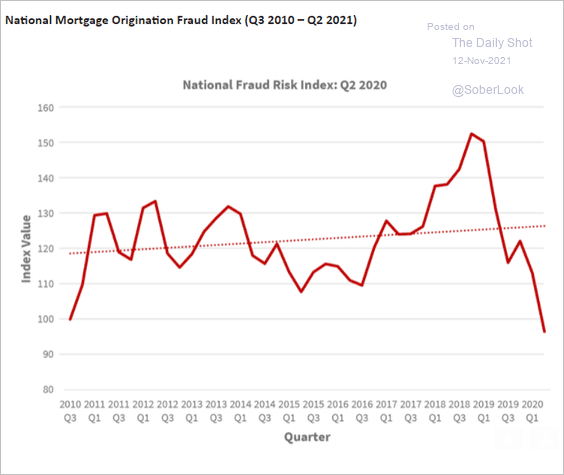

4. The US mortgage origination fraud index:

Source: CoreLogic

Source: CoreLogic

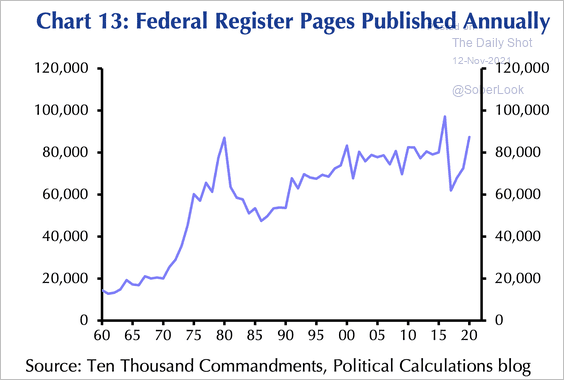

5. Federal regulations:

Source: Capital Economics

Source: Capital Economics

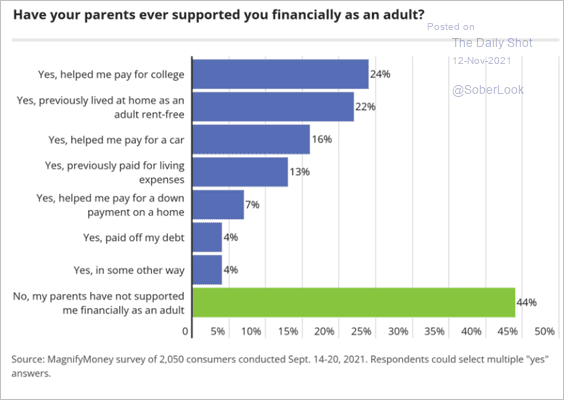

6. Have your parents ever supported you financially as an adult?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

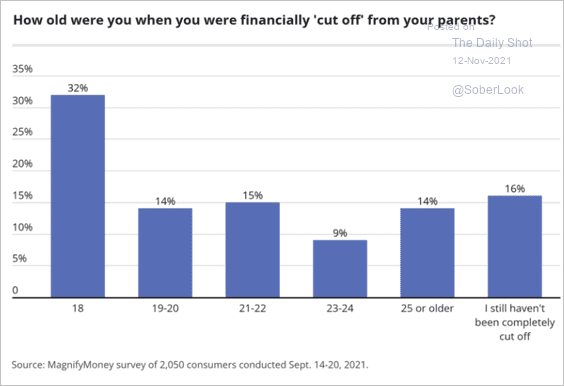

How old were you when your parents cut you off financially?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

——————–

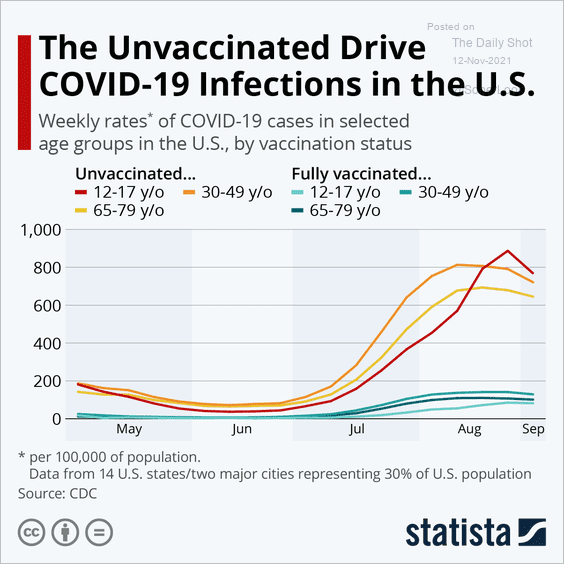

7. Covid cases by vaccination status:

Source: Statista

Source: Statista

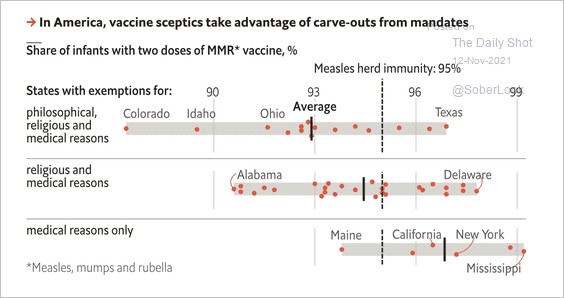

8. Americans avoiding the MMR vaccine:

Source: The Economist Read full article

Source: The Economist Read full article

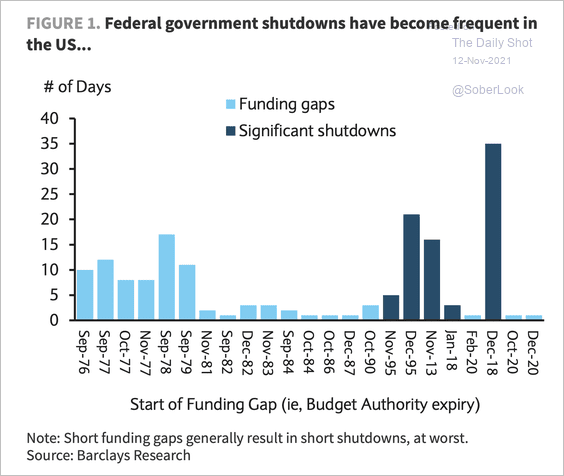

9. Government shutdowns:

Source: Barclays Research

Source: Barclays Research

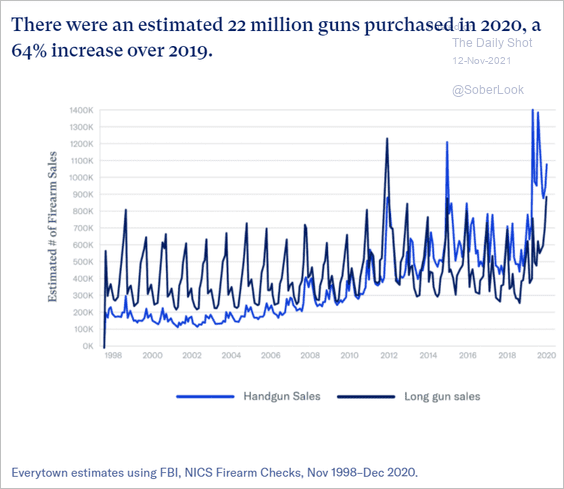

10. US gun sales:

Source: Everytown

Source: Everytown

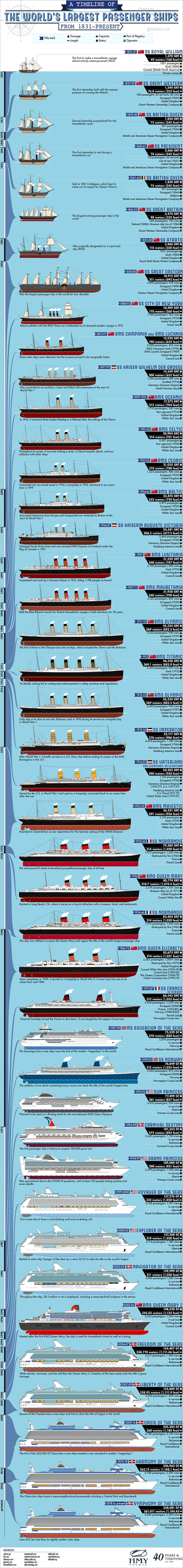

11. The world’s largest passenger ships:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Have a great weekend!

Back to Index