The Daily Shot: 15-Nov-21

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

Administrative Update

The Daily Shot will not be published on November 24th, 25th, and 26th.

Back to Index

The United States

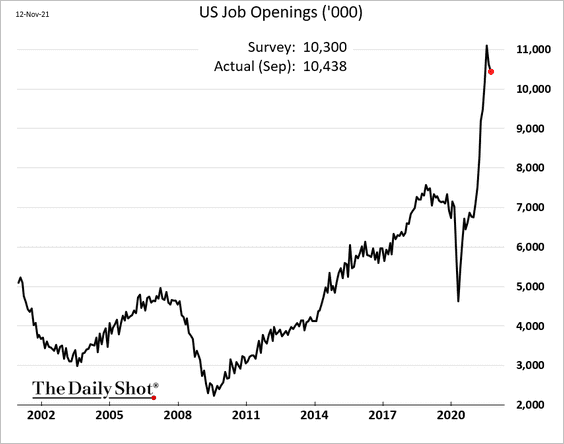

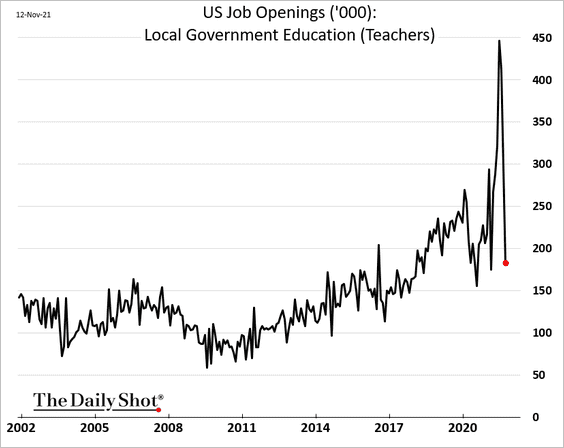

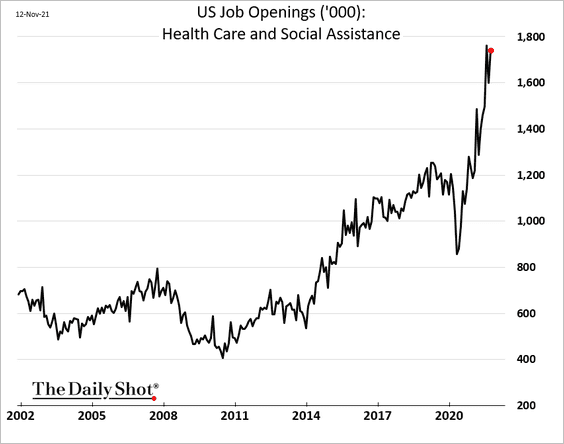

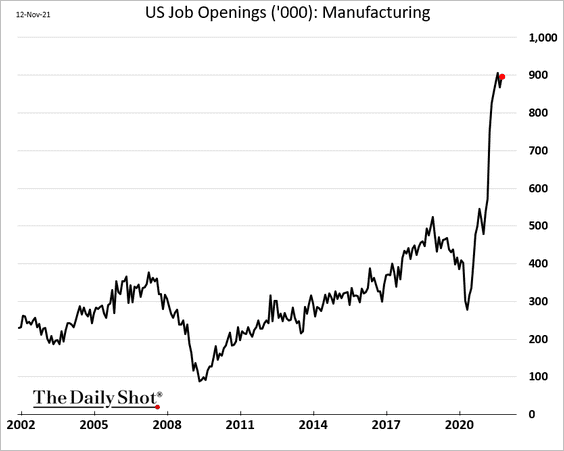

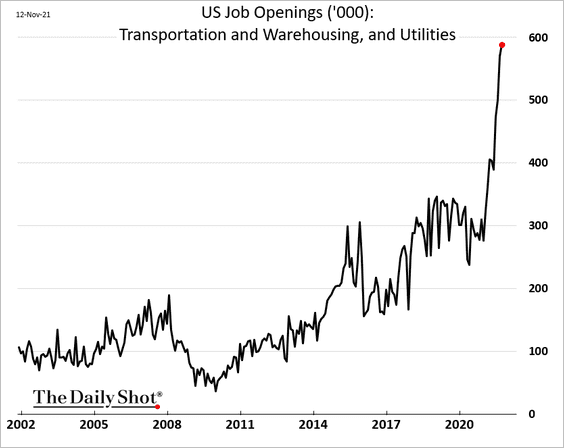

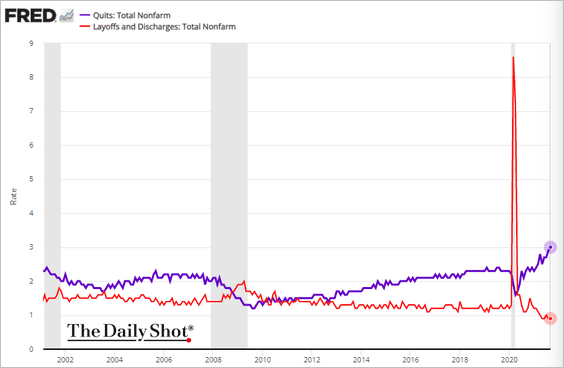

1. The job openings report continues to point to a tight labor market in the US.

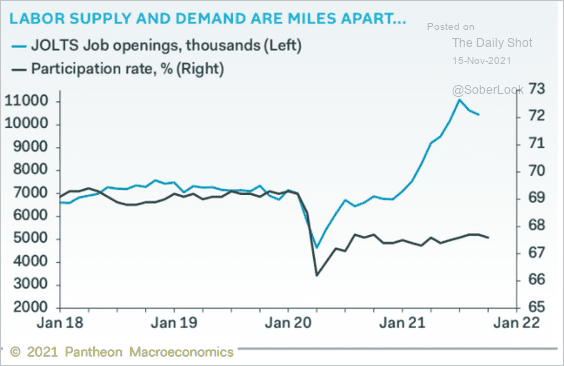

• The labor supply/demand gap remains unusually wide.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

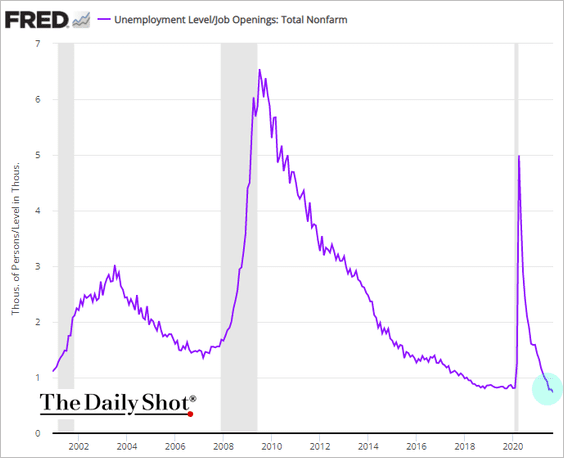

• The number of unemployed Americans per job opening hit a record low.

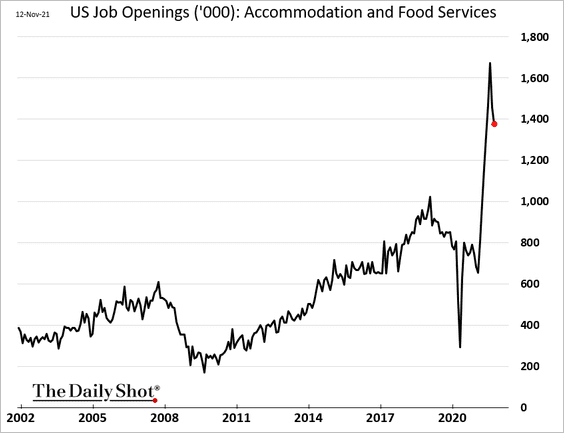

• Some sectors saw a pullback in vacancies from record highs.

– Hotels and restaurants:

– Local school teachers (distorted by seasonal adjustments):

Yet other sectors posted gains.

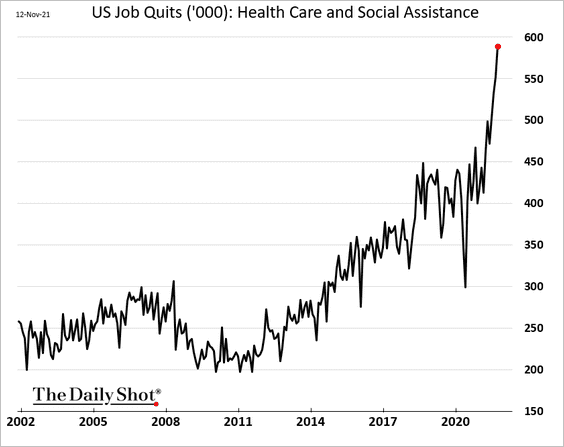

– Healthcare:

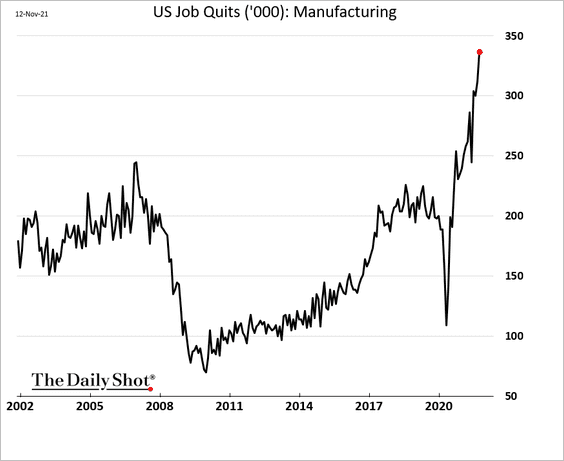

– Manufacturing:

– Logistics (record high):

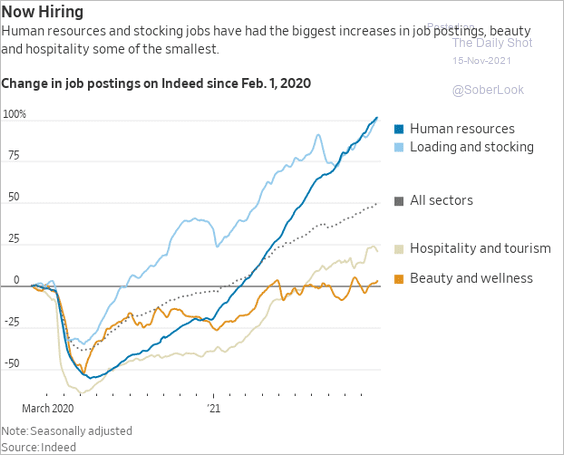

By the way, here are some trends for job postings on Indeed.

Source: @WSJ Read full article

Source: @WSJ Read full article

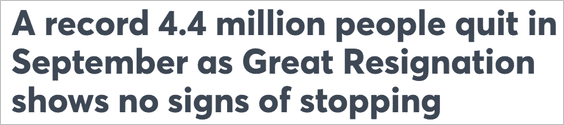

• Americans are quitting their jobs in record numbers.

Source: CNBC Read full article

Source: CNBC Read full article

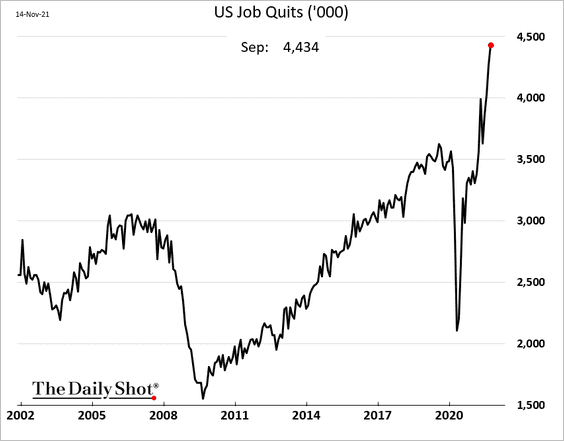

Here is the quits rate vs. layoffs.

Resignations have been surging in a number of sectors. Below are a couple of examples.

——————–

2. Next, we have some additional updates on the labor market.

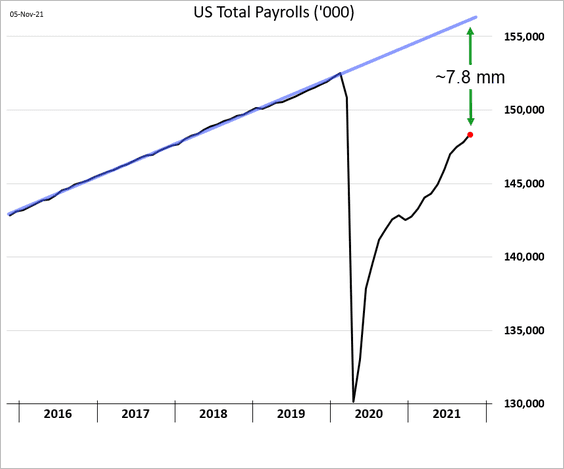

• Getting back to the pre-COVID employment trend will take a while.

• Upward revisions to the official payrolls figures have surged.

Source: Cornerstone Macro

Source: Cornerstone Macro

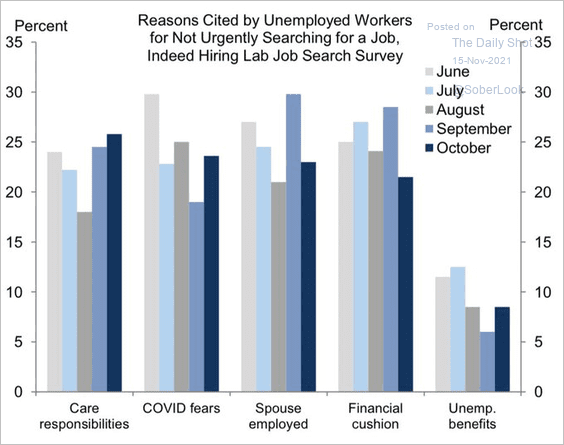

• What are the reasons many Americans are not urgently searching for a job?

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

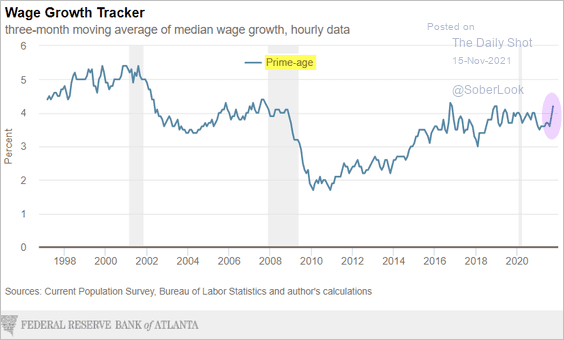

• Wage growth among prime-age workers continues to climb.

Source: @AtlantaFed

Source: @AtlantaFed

——————–

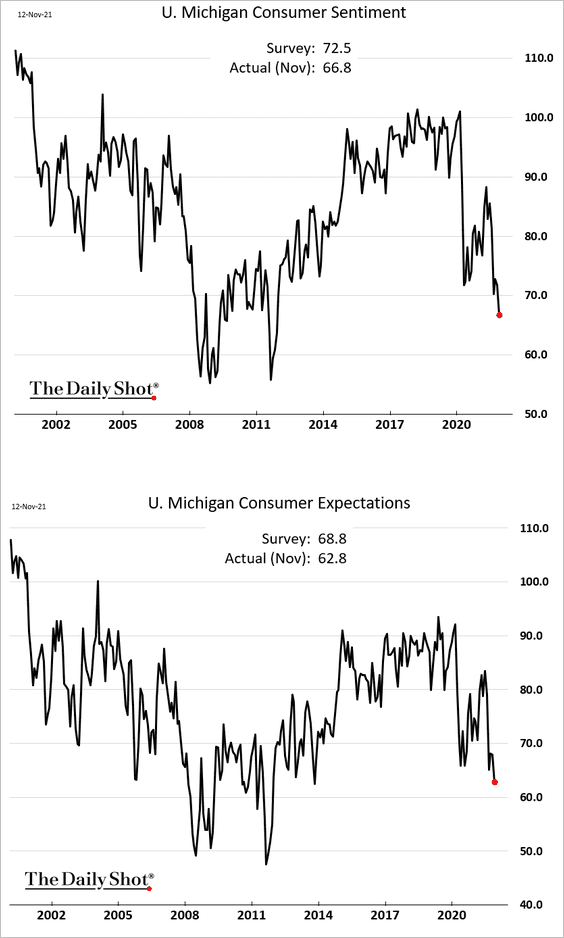

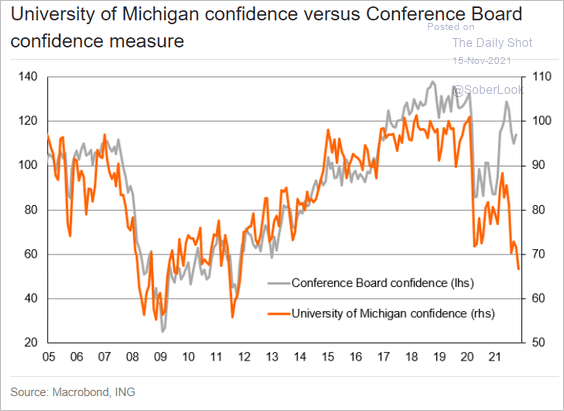

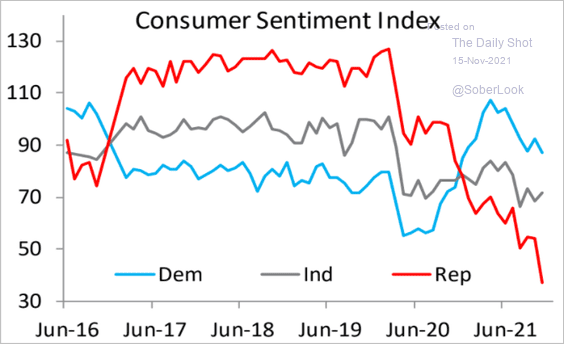

3. The U. Michigan consumer sentiment index deteriorated further, driven by inflation concerns.

One should be cautious with these results because the U. Michigan survey has diverged sharply from the Conference Board’s indicator.

Source: ING

Source: ING

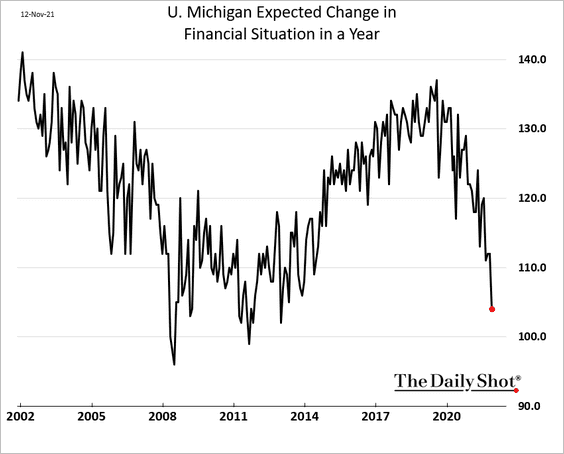

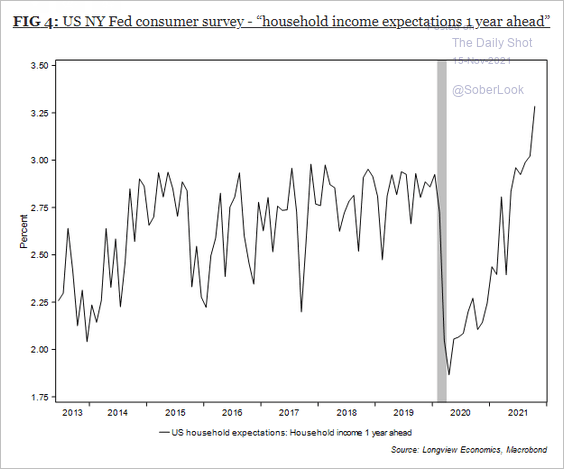

• Households’ expected financial situation index has deteriorated sharply.

But this indicator conflicts with the NY Fed’s household survey.

Source: Longview Economics

Source: Longview Economics

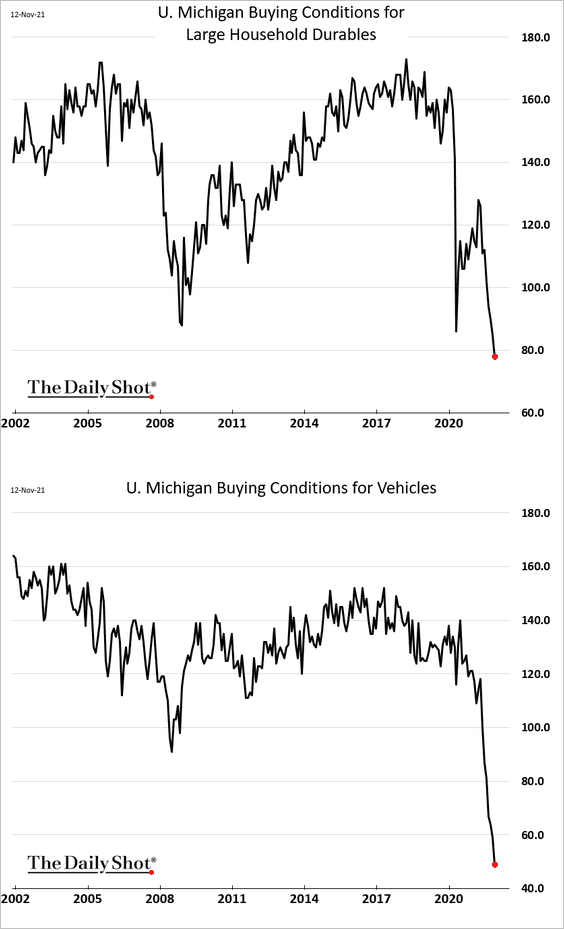

• Buying conditions for durables and vehicles have deteriorated further, driven by price concerns.

• Here is the partisan divergence.

Source: Piper Sandler

Source: Piper Sandler

——————–

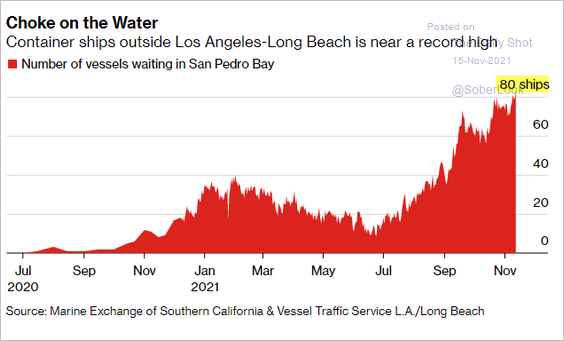

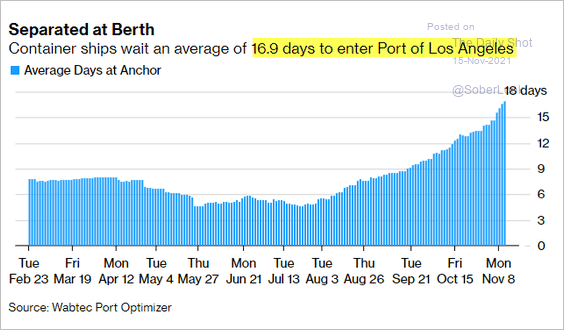

4. US West Coast ports remain massively backed up.

Source: @C_Barraud, @business Read full article

Source: @C_Barraud, @business Read full article

Source: @C_Barraud, @business Read full article

Source: @C_Barraud, @business Read full article

——————–

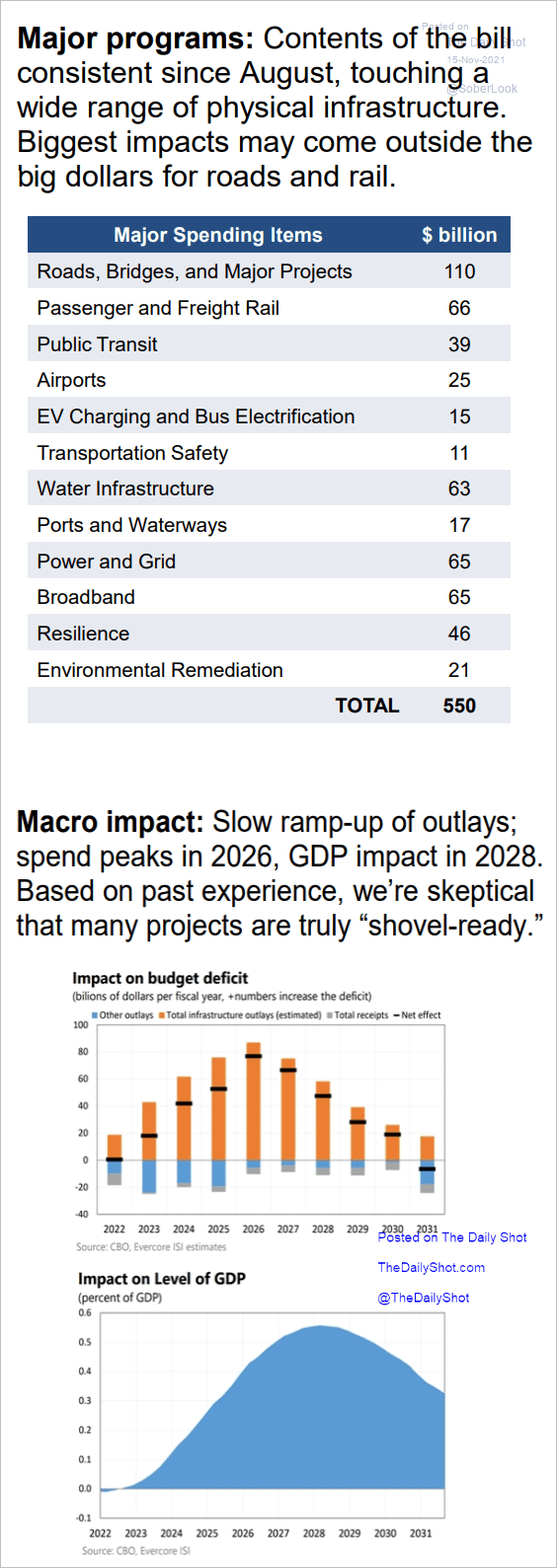

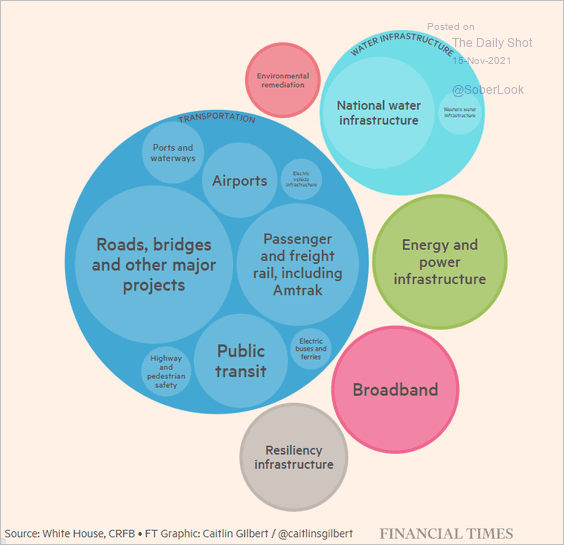

5. Finally, we have some data on the infrastructure bill.

Source: Evercore ISI

Source: Evercore ISI

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Canada

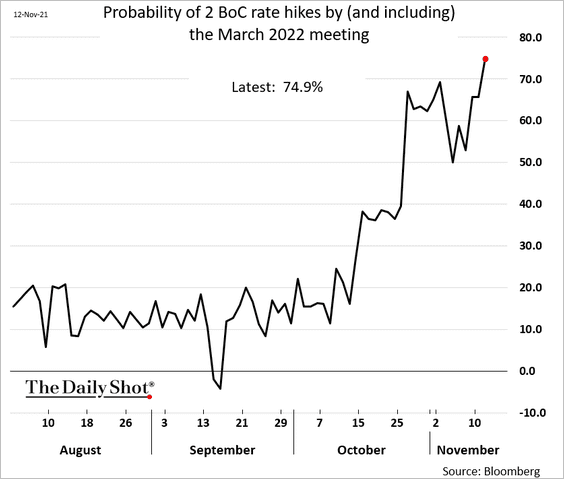

1. Two rate hikes by March?

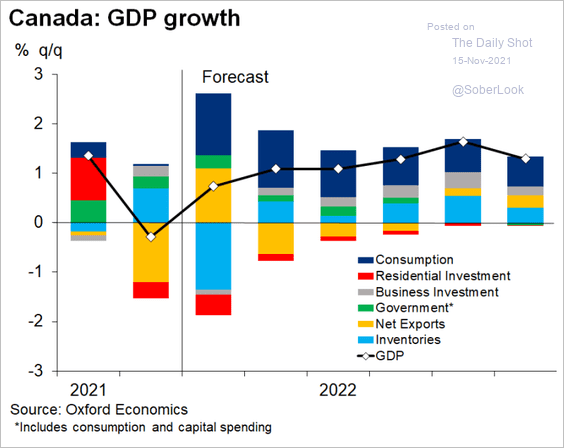

2. This chart shows the GDP growth forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

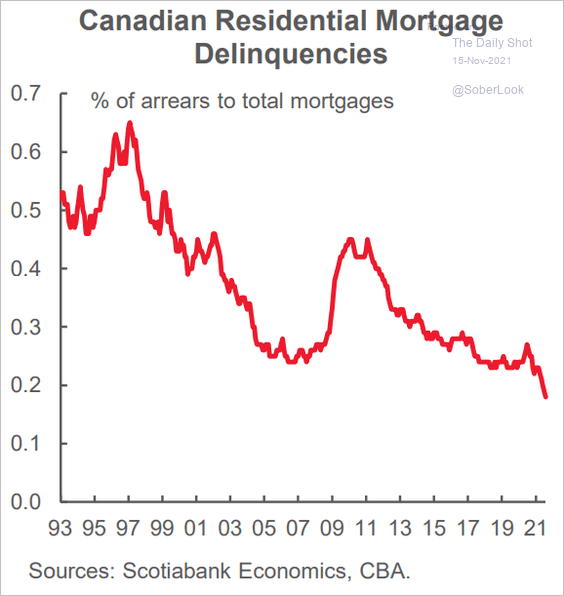

3. Mortgage delinquencies are at a three-decade low.

Source: Scotiabank Economics

Source: Scotiabank Economics

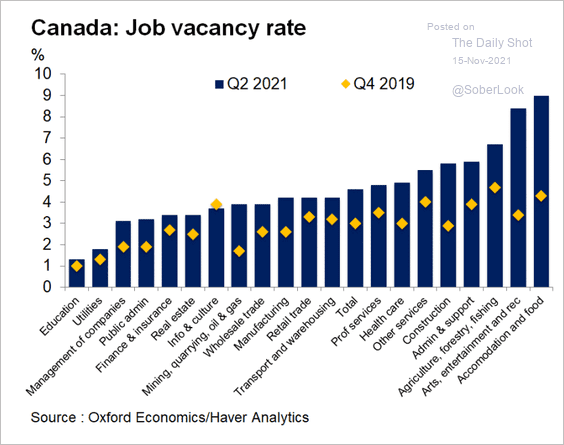

4. The labor market is tight.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

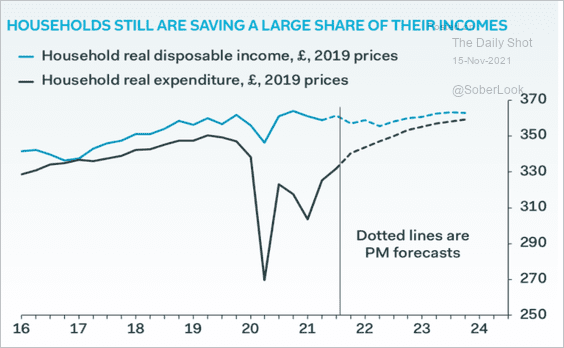

The United Kingdom

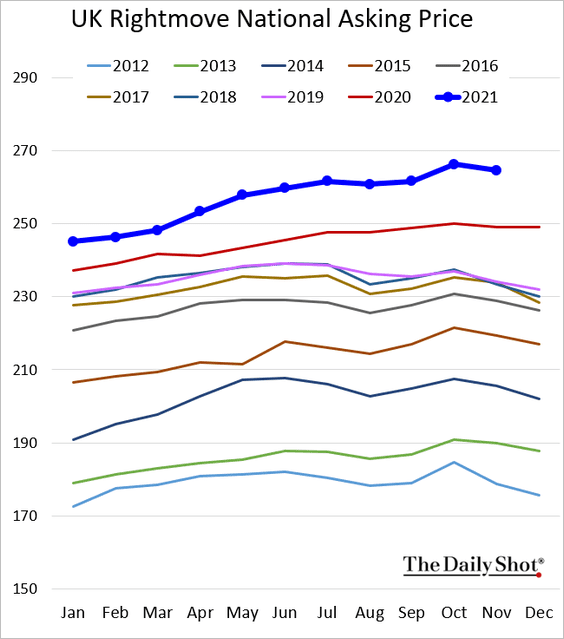

1. The index of home asking prices continues to signal a robust housing market.

2. Households remain cautious.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

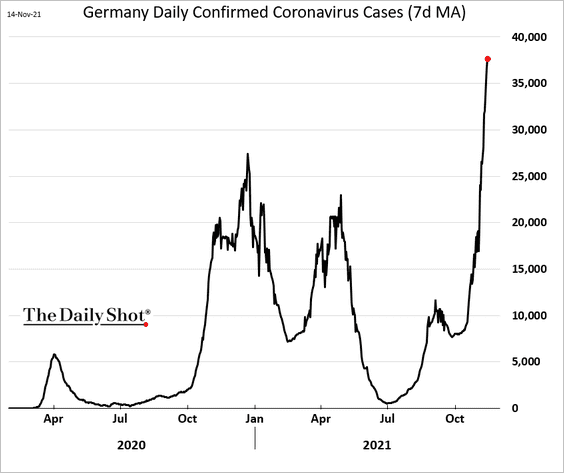

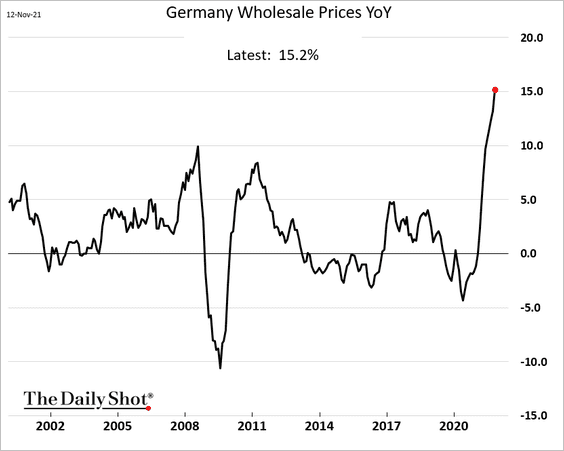

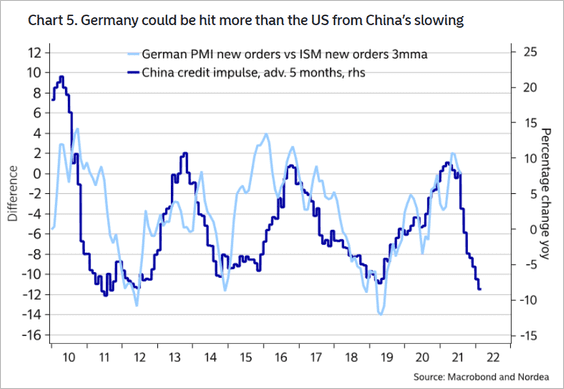

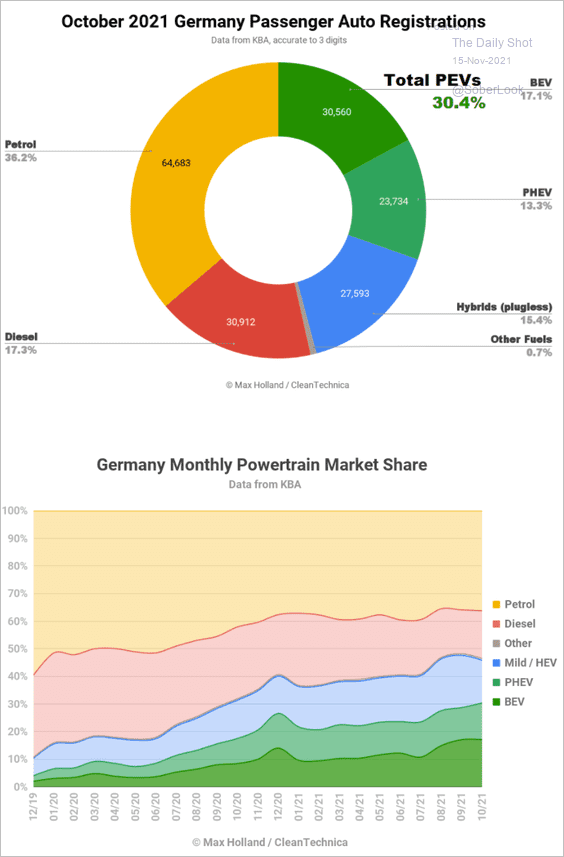

1. Let’s begin with Germany.

• COVID cases continue to surge.

• Wholesale price inflation exceeded 15%.

• China’s slowdown could be a greater drag on Germany’s economy than on the US.

• Here is the distribution of new car registrations.

Source: CleanTechnica Read full article

Source: CleanTechnica Read full article

——————–

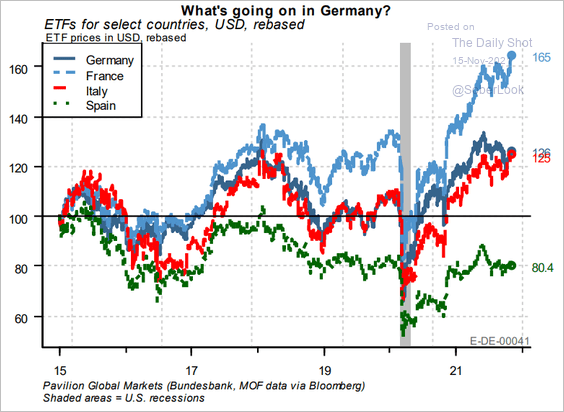

2. French stocks have been outperforming.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

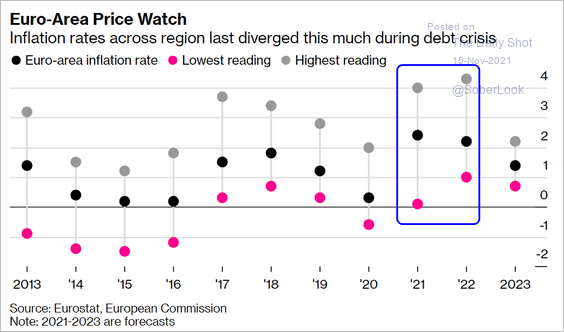

3. Euro-area CPI dispersion has widened substantially.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

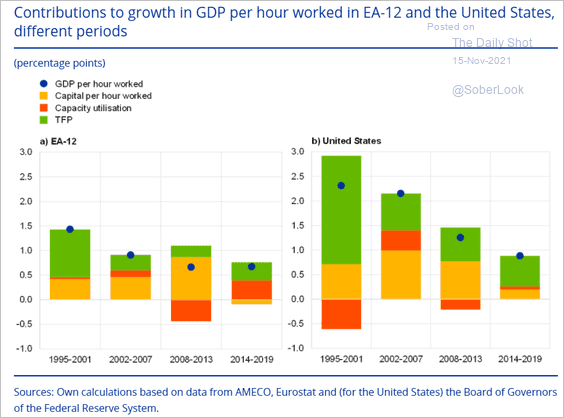

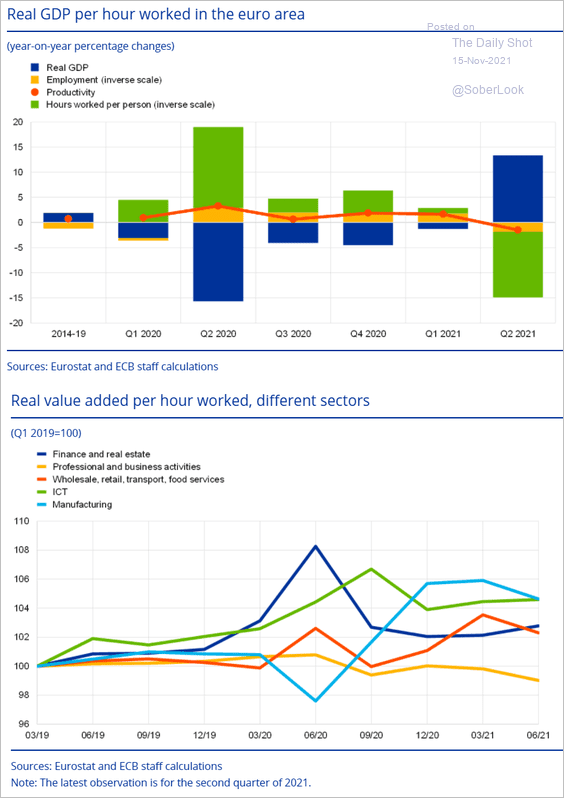

4. The next set of charts provides an overview of productivity growth (TFP = total factor productivity).

Source: ECB Read full article

Source: ECB Read full article

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

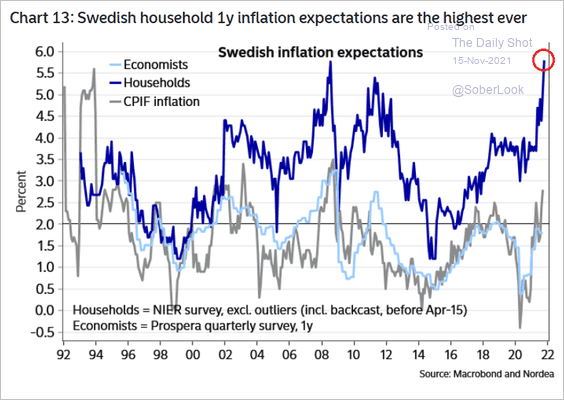

1. Household inflation expectations in Sweden have been surging.

Source: Nordea Markets

Source: Nordea Markets

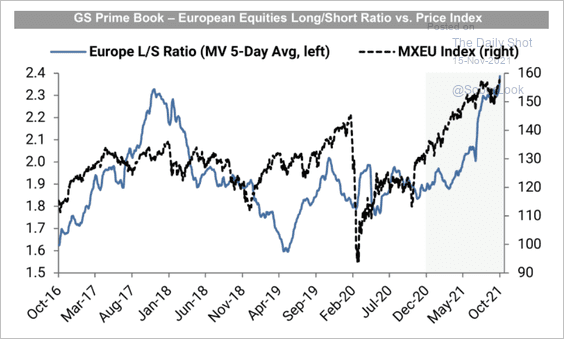

2. European equities’ long/short ratio has risen to multi-year highs.

Source: Goldman Sachs, {h/t} @ZoetropeFinance

Source: Goldman Sachs, {h/t} @ZoetropeFinance

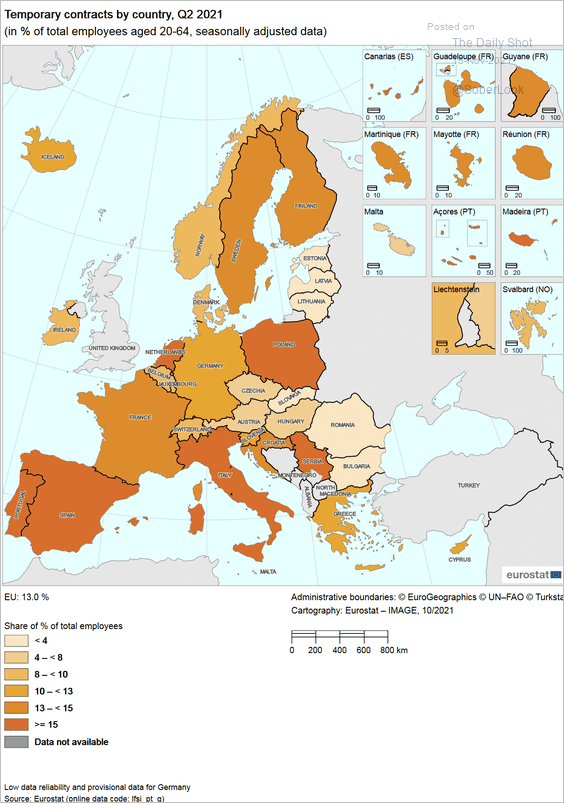

3. How prevalent is temp work in the EU?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

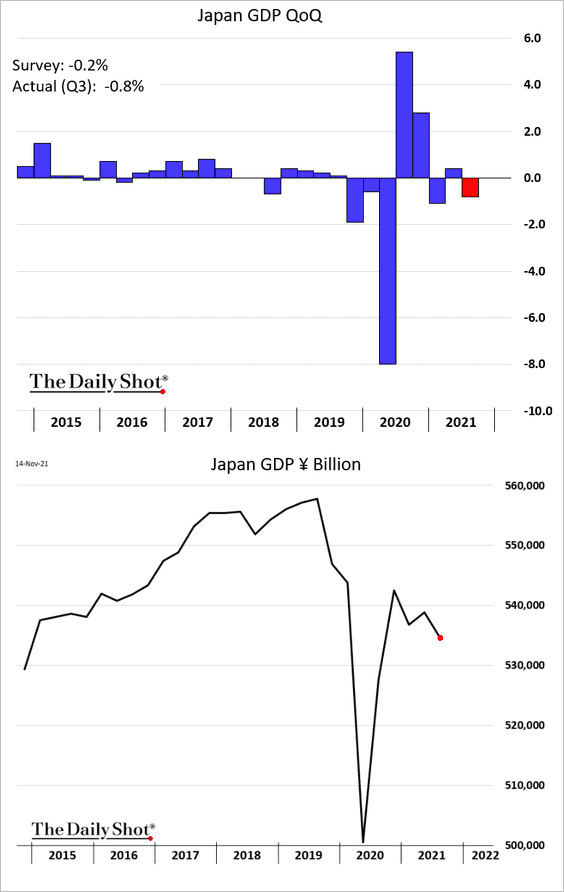

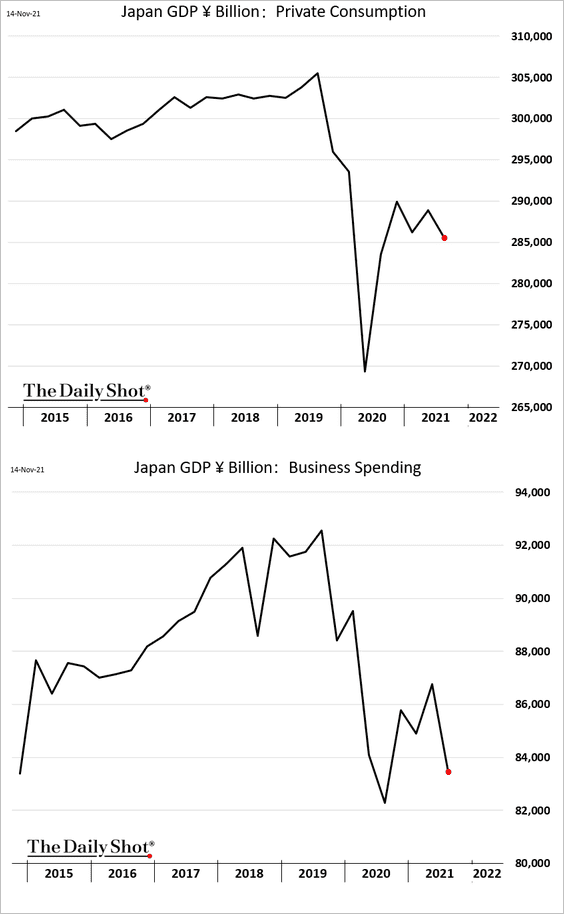

1. Japan’s Q3 GDP report was disappointing, with the economy contracting meaningfully this year.

Private consumption and business investment deteriorated.

——————–

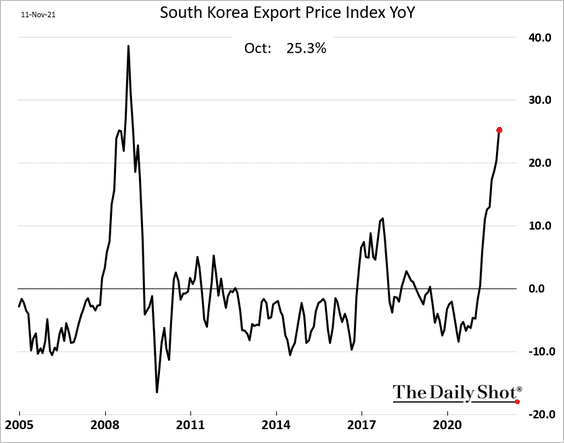

2. South Korea’s export prices are up 25% vs. last year.

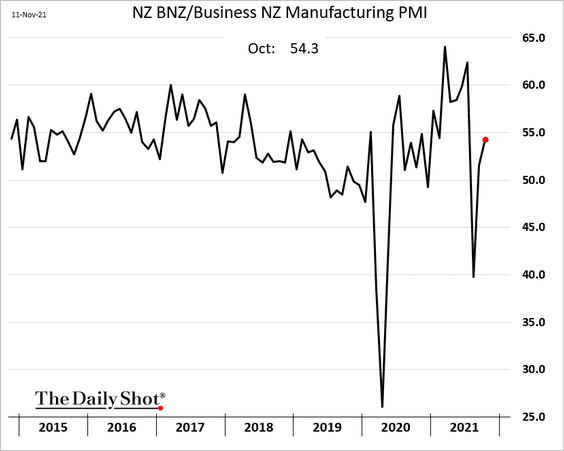

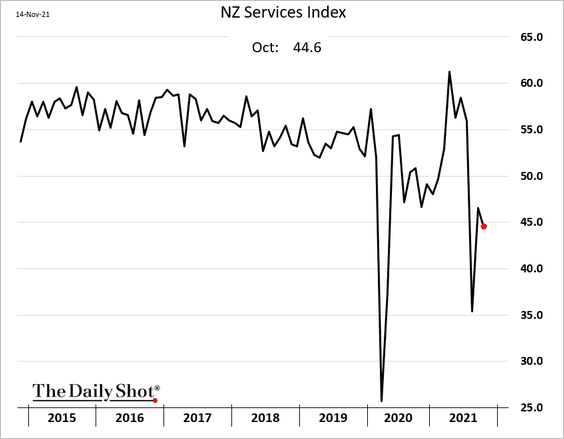

3. New Zealand’s manufacturing activity is back in growth mode.

But services are struggling.

Back to Index

China

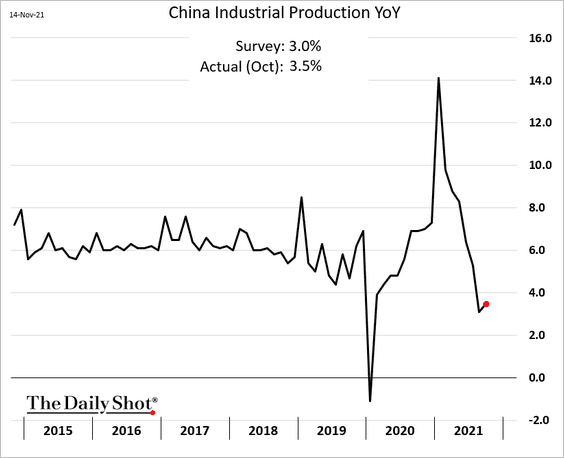

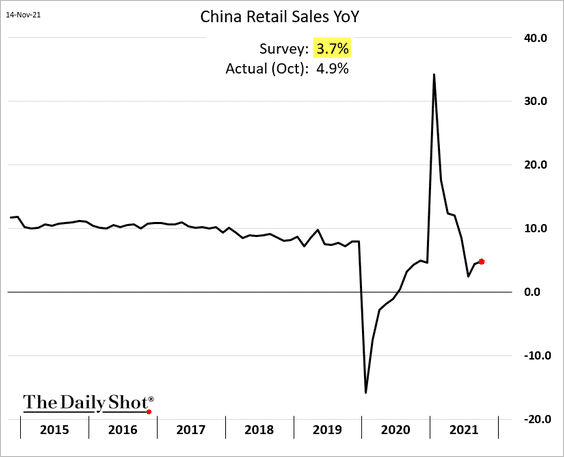

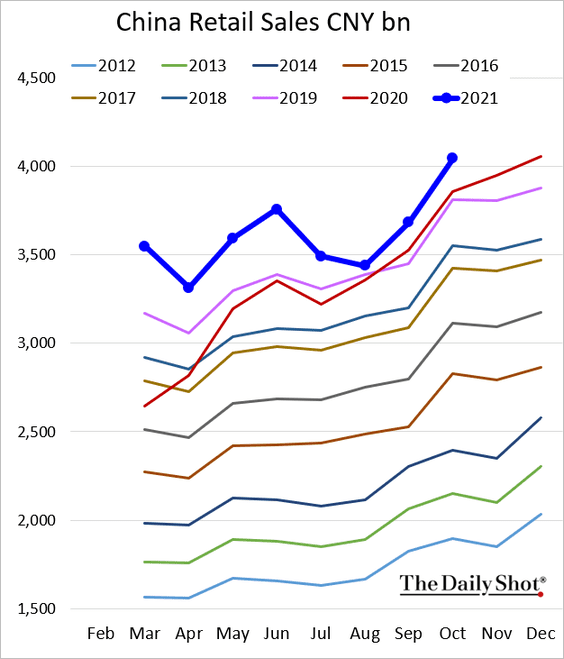

1. Retail sales and industrial production reports showed an improvement last month, topping forecasts.

——————–

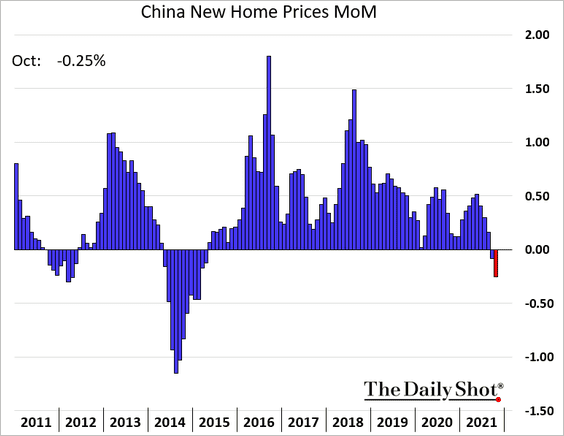

2. Home prices continue to decline.

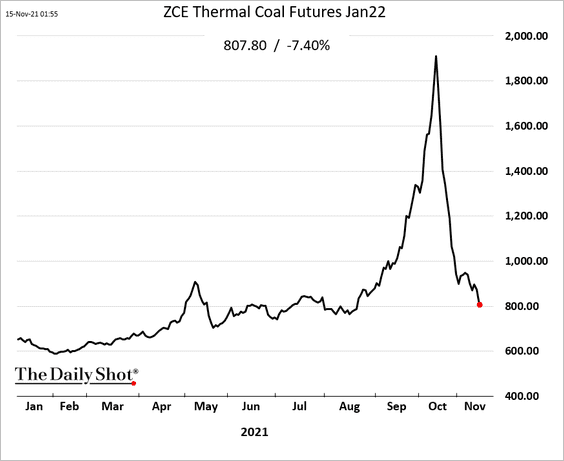

3. Pressured by Beijing, coal futures continue to tumble.

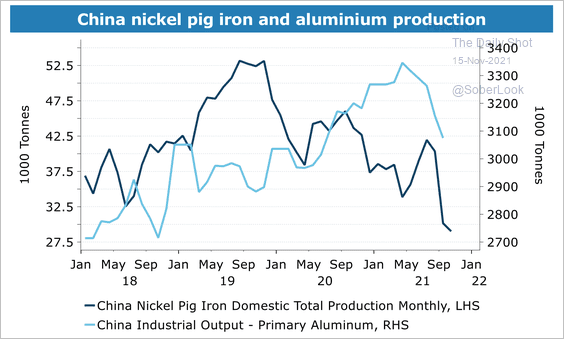

Energy-intensive metals output has fallen over the past year.

Source: ANZ Research

Source: ANZ Research

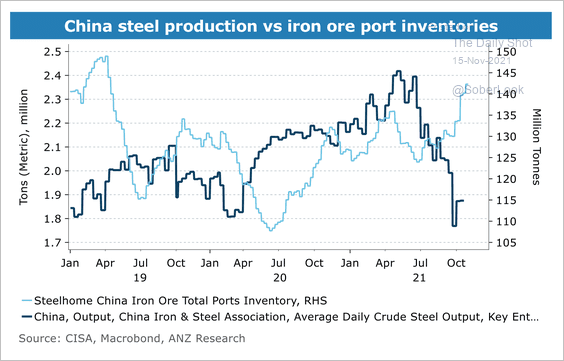

And iron ore inventories are building up.

Source: ANZ Research

Source: ANZ Research

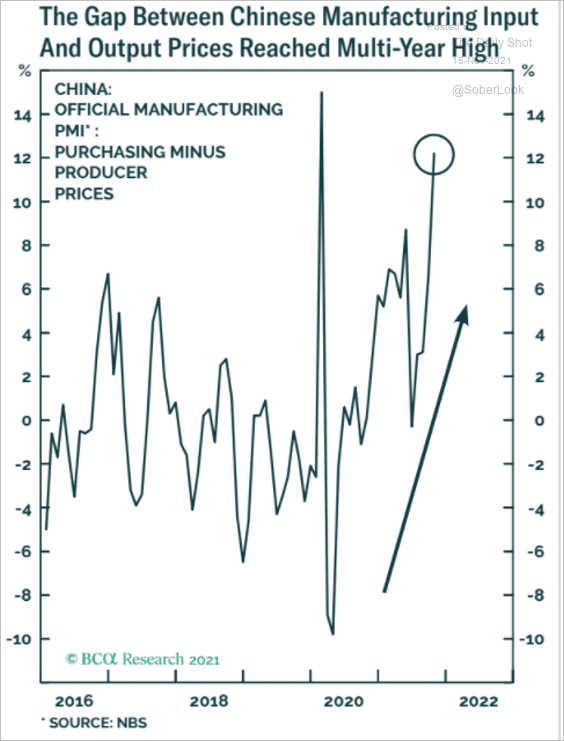

4. China’s companies are facing margin pressures.

Source: BCA Research

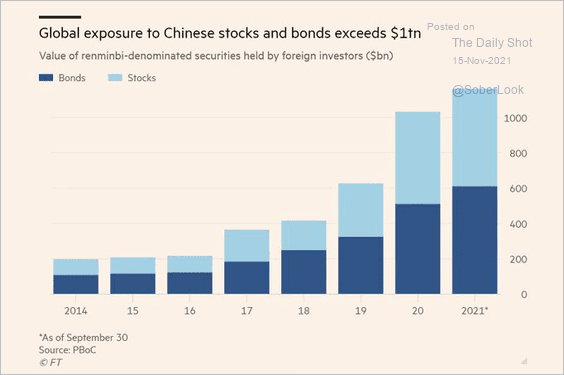

Source: BCA Research 5. The world is increasingly exposed to China’s capital markets.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

Back to Index

Emerging Markets

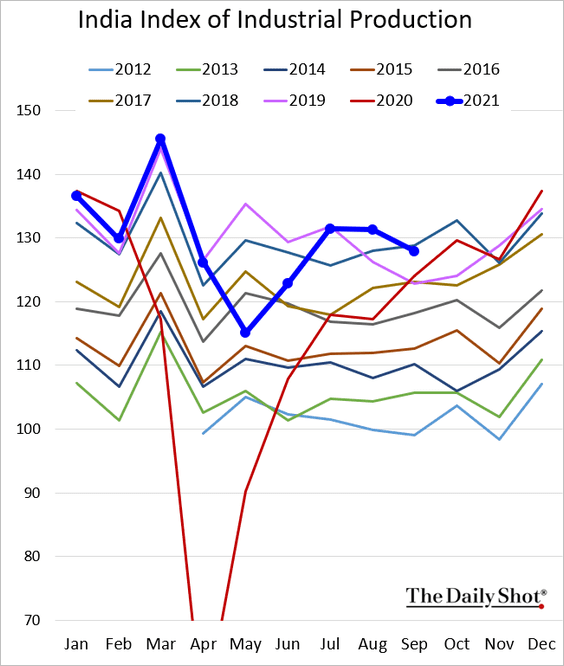

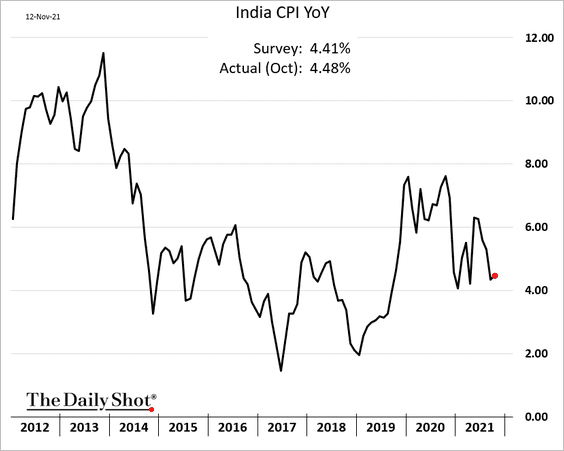

1. India’s industrial production has lost momentum.

Inflation ticked higher last month.

——————–

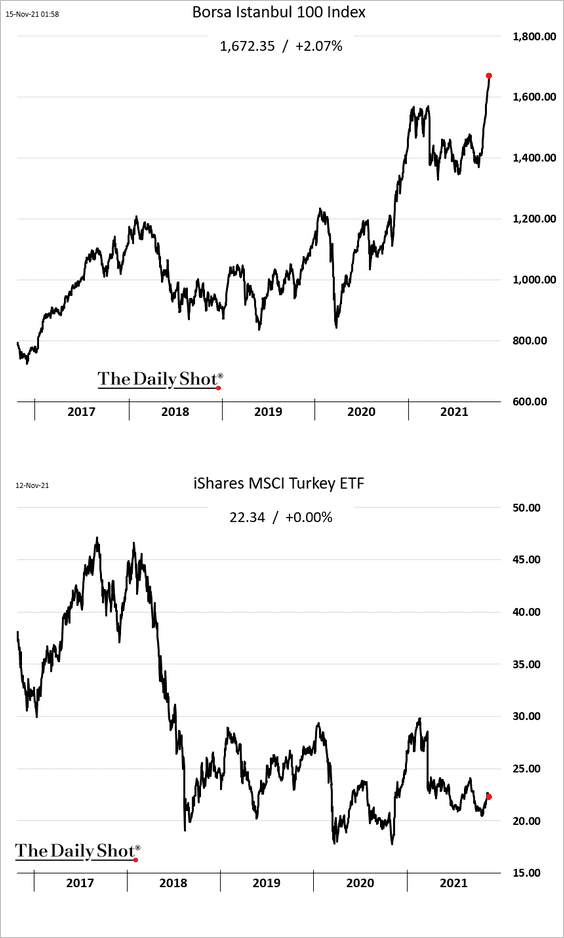

2. Turkey’s stock market is surging in lira terms (a “safe haven” against inflation). In dollar terms (2nd panel), it’s a different story.

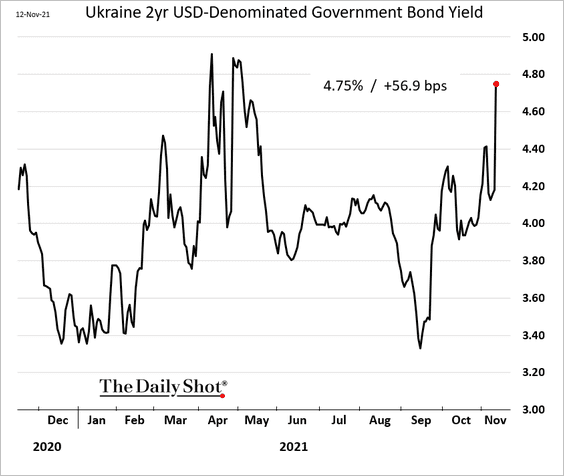

3. There is some unease about Ukraine as Russia’s troops amass near the border (could just be Putin’s harassment maneuver).

Source: The Independent Read full article

Source: The Independent Read full article

Bond yields are higher.

——————–

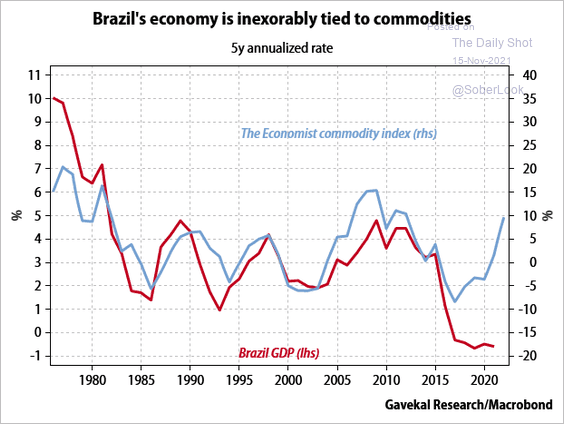

4. Brazil’s economy should benefit from the recent commodities rally.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Cryptocurrency

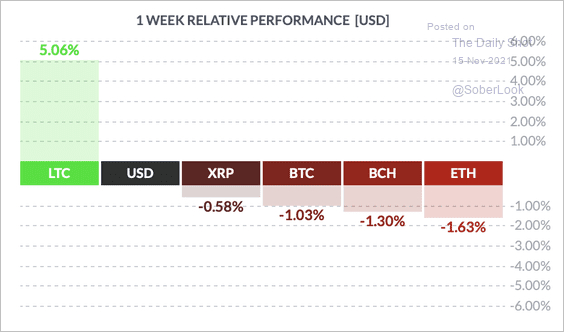

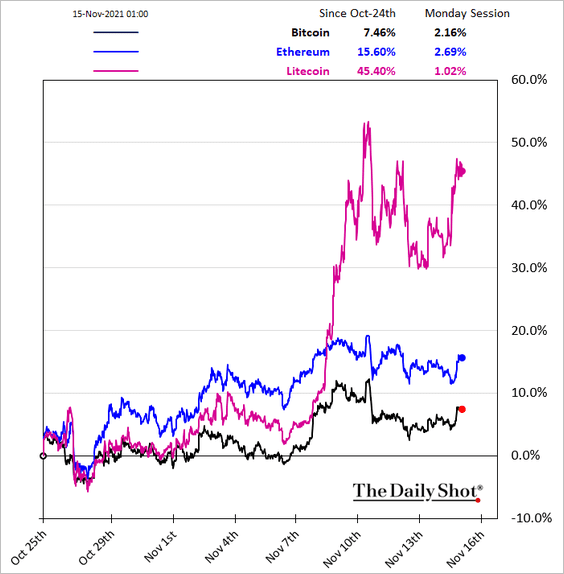

1. Litecoin (LTC) continued to outperform major cryptocurrencies over the past week, while bitcoin (BTC) and ether (ETH) lagged.

Source: FinViz

Source: FinViz

Cryptos are stronger this morning.

——————–

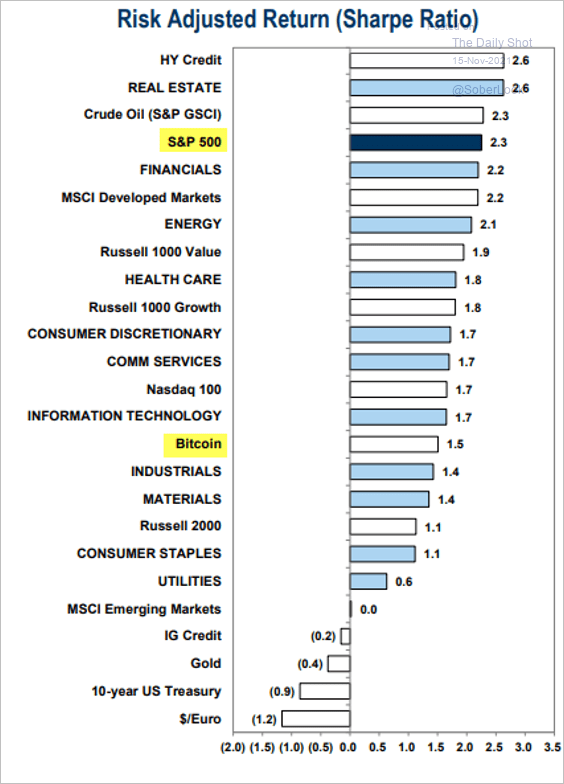

2. The S&P 500 has outperformed bitcoin this year on a risk-adjusted basis.

Source: Goldman Sachs; @TheStalwart

Source: Goldman Sachs; @TheStalwart

3. Bitcoin’s Taproot upgrade has been activated, which could help improve the blockchain’s scalability.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

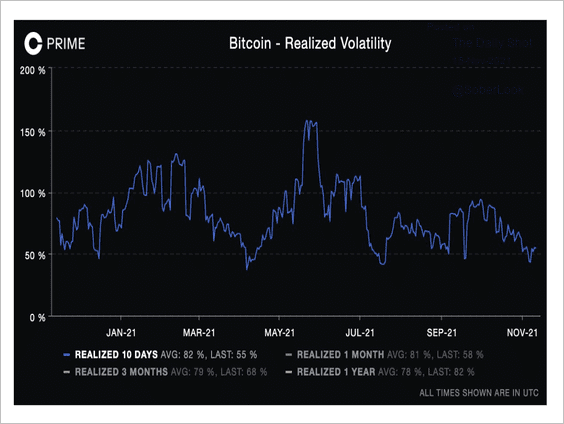

4. Bitcoin’s realized volatility is slowly drifting back toward a one-year low.

Source: Skew Read full article

Source: Skew Read full article

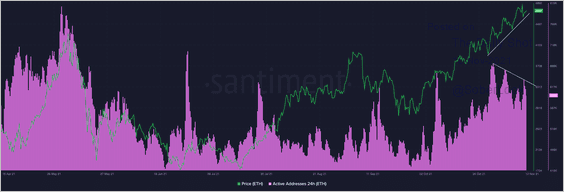

5. Blockchain data shows ether’s active addresses and trading volumes have decoupled from rising prices, which could indicate scope for a pullback in ETH.

Source: @santimentfeed

Source: @santimentfeed

6. Could we see an ether futures-based ETF before a bitcoin spot-based ETF?

Source: @markets Read full article

Source: @markets Read full article

7. VanEck will launch a bitcoin futures-based ETF this week after the SEC rejected its spot-based ETF.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

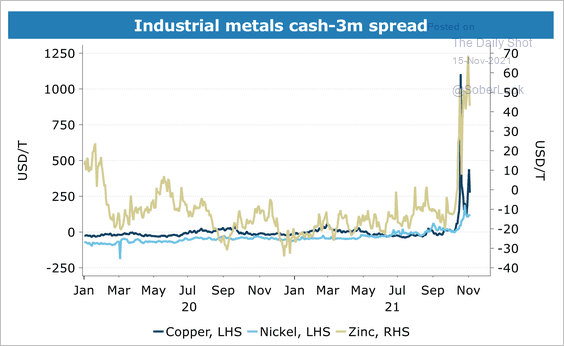

1. The cash/three-month spreads for LME industrial metals spiked in recent weeks (backwardation). This is mainly due to the reduction in exchange inventories in the absence of strong supply growth.

Source: ANZ Research

Source: ANZ Research

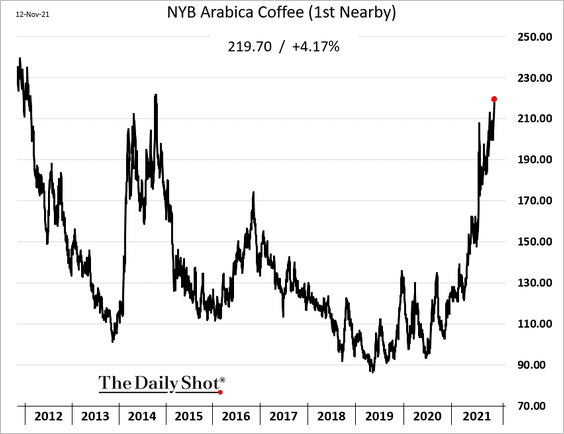

2. Lingering concerns about Brazil’s crop recovery from the weather damage sent coffee futures to multi-year highs.

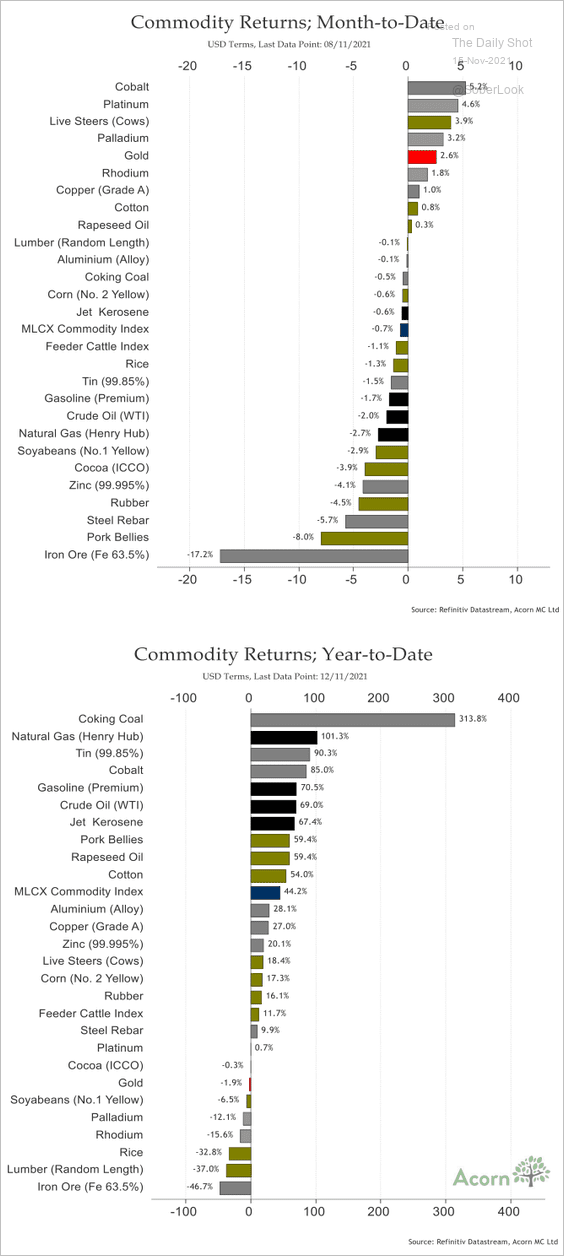

3. Next, we have month-to-date and year-to-date returns.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

Back to Index

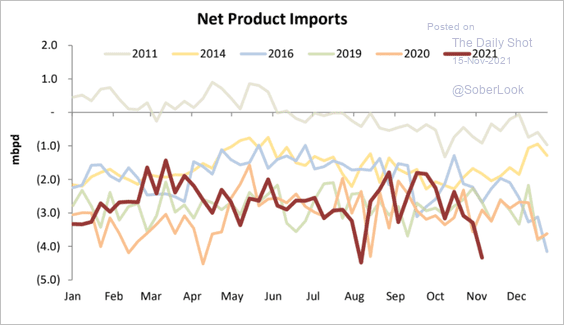

Energy

1. US refined product exports accelerated this month.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

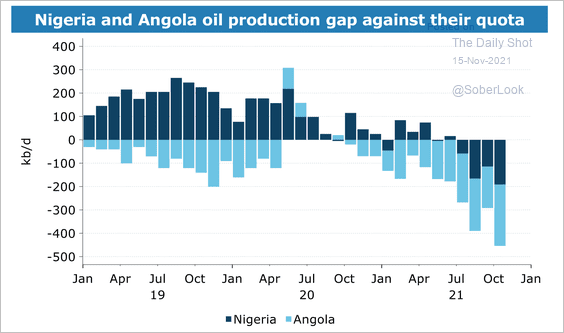

2. Oil output in Nigeria and Angola continues to lag against their permitted quotas.

Source: ANZ Research

Source: ANZ Research

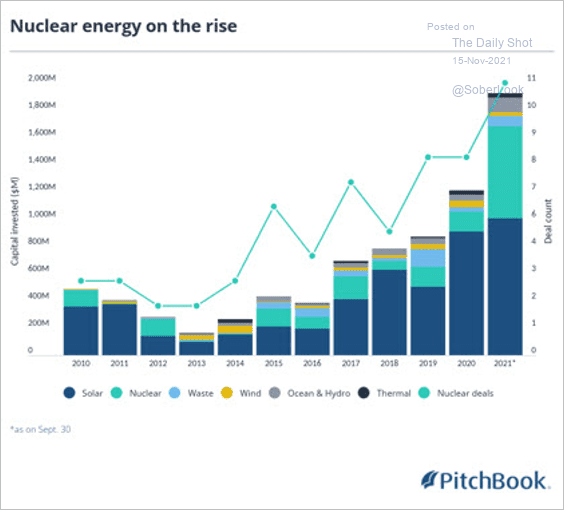

3. Nuclear energy startups have raised $676 million in VC funding through the third quarter of this year, according to PitchBook data.

Source: PitchBook

Source: PitchBook

Back to Index

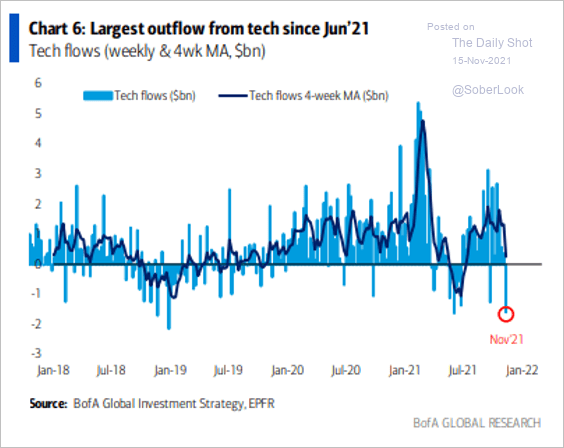

Equities

1. Tech stocks saw some outflows.

Source: BofA Global Research

Source: BofA Global Research

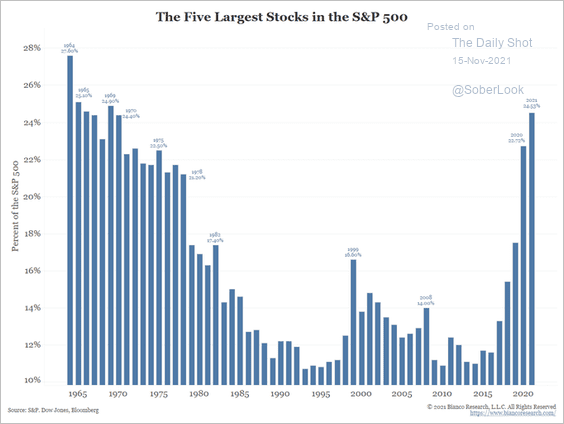

2. The S&P 500 has become much more concentrated in recent years.

Source: @biancoresearch

Source: @biancoresearch

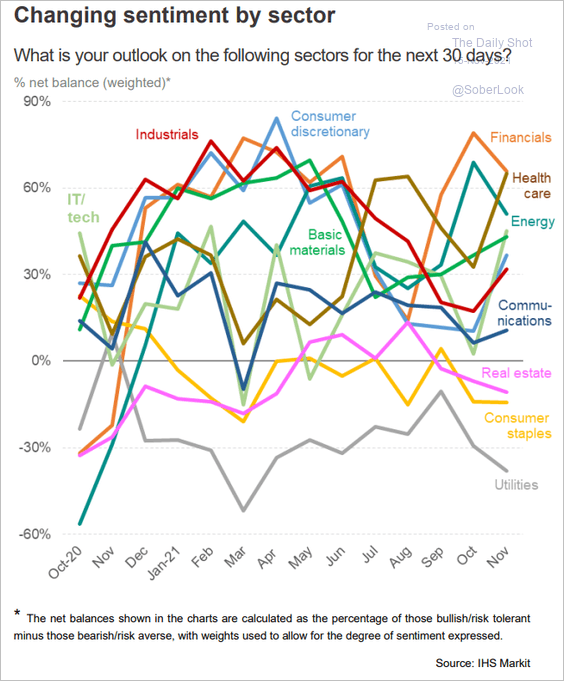

3. How do investment managers see sector performance over the next 30 days?

Source: IHS Markit

Source: IHS Markit

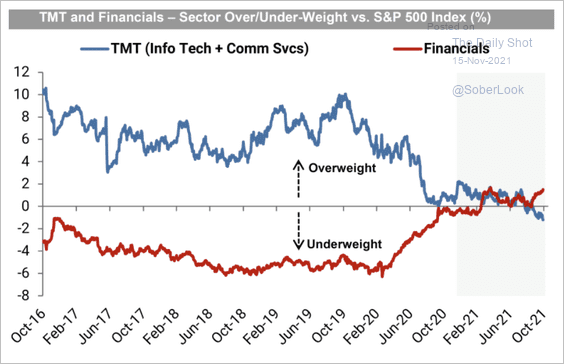

4. Hedge funds have moved into financials and further out of tech/communication stocks amid a flatter yield curve.

Source: Goldman Sachs, {h/t} @ZoetropeFinance

Source: Goldman Sachs, {h/t} @ZoetropeFinance

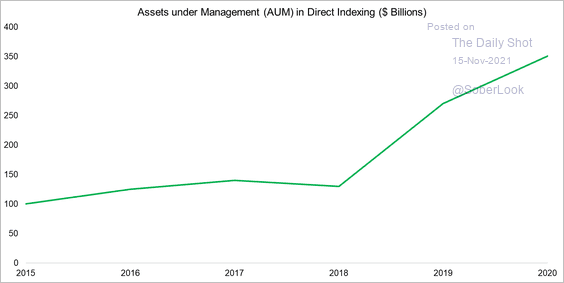

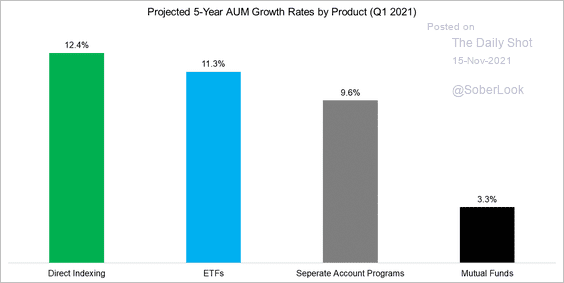

5. Total assets under management of direct index products have risen in recent years and are expected to grow faster than ETFs over the next five years (2 charts).

Source: FactorResearch Read full article

Source: FactorResearch Read full article

Source: FactorResearch Read full article

Source: FactorResearch Read full article

——————–

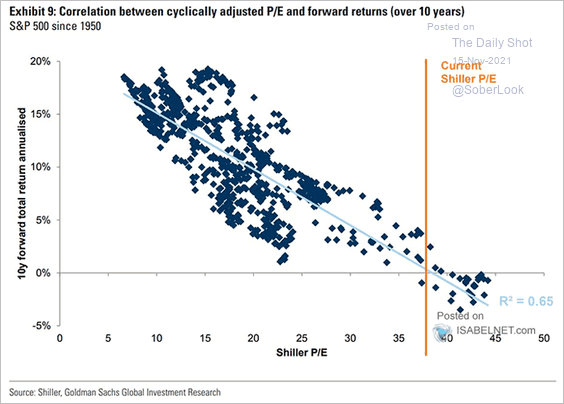

6. Valuations point to a “lost decade” in stocks.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

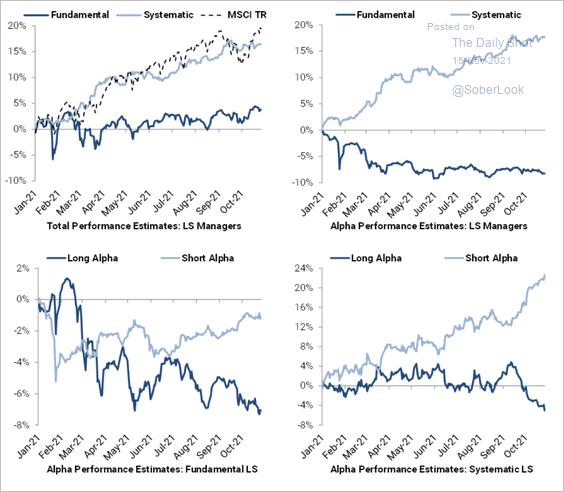

8. Fundamental and systematic funds experienced positive returns but trailed the overall market in October.

Source: Goldman Sachs, {h/t} @ZoetropeFinance

Source: Goldman Sachs, {h/t} @ZoetropeFinance

9. Next, we have some updates on the options market.

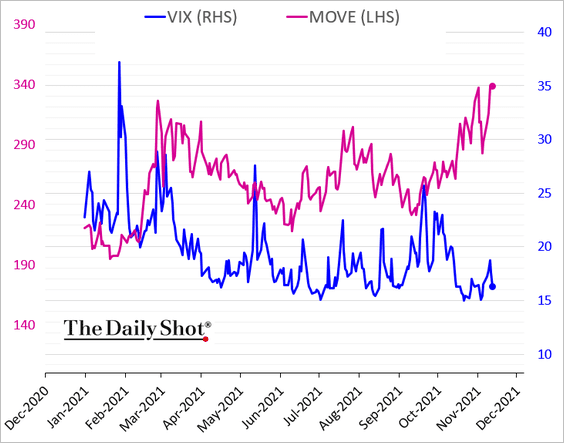

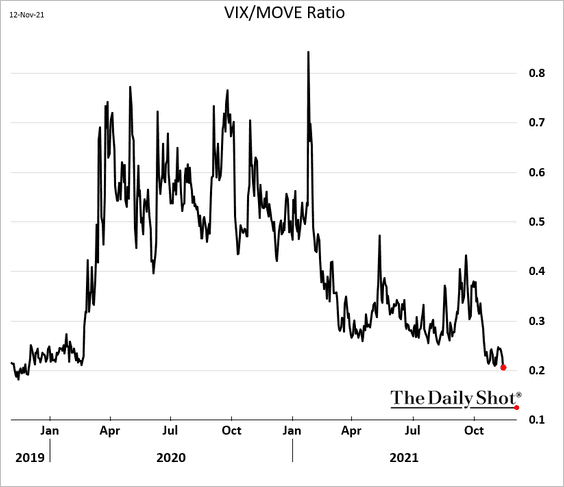

• VIX has further diverged from the Treasury market implied vol (MOVE).

Here is the VIX/MOVE ratio.

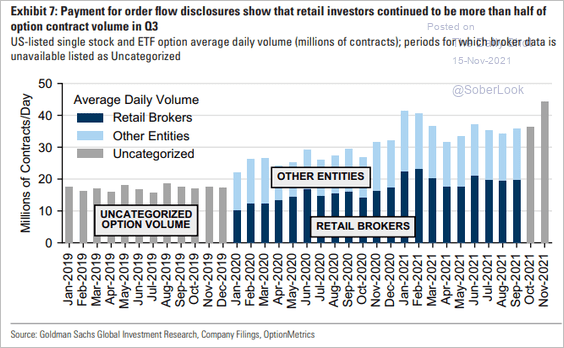

• Retail investors are still dominating options order flow.

Source: Goldman Sachs

Source: Goldman Sachs

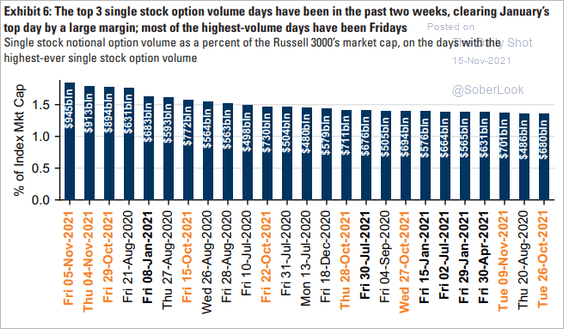

• Single-stock options volume in recent weeks has been impressive.

Source: Goldman Sachs

Source: Goldman Sachs

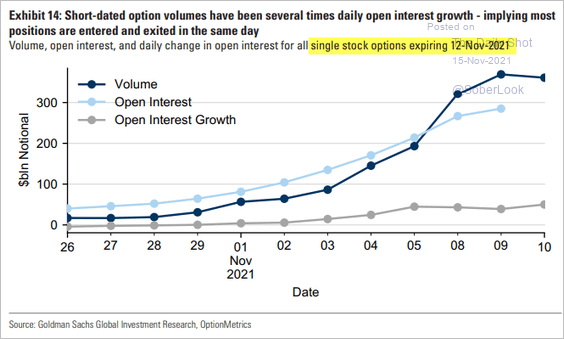

• There is a great deal of demand for short-dated options.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Rates

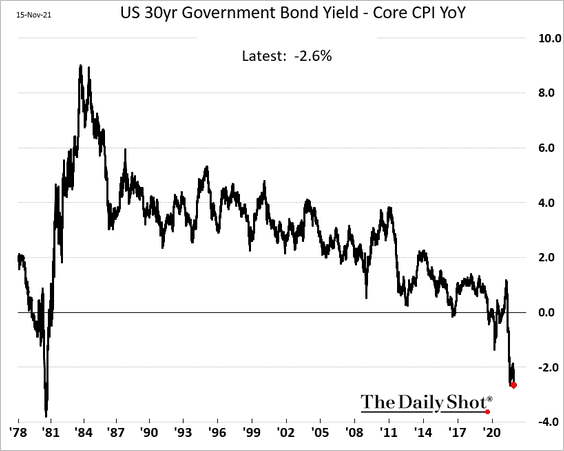

1. US real long-term rates are at multi-decade lows.

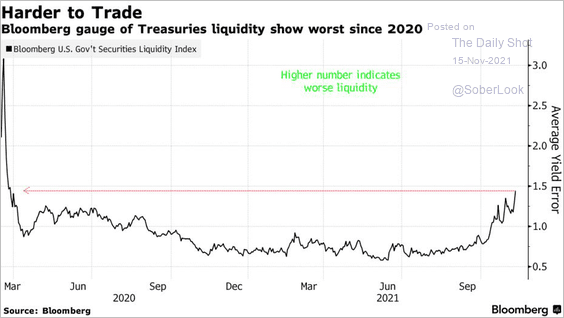

2. Treasury liquidity has deteriorated.

Source: @markets Read full article

Source: @markets Read full article

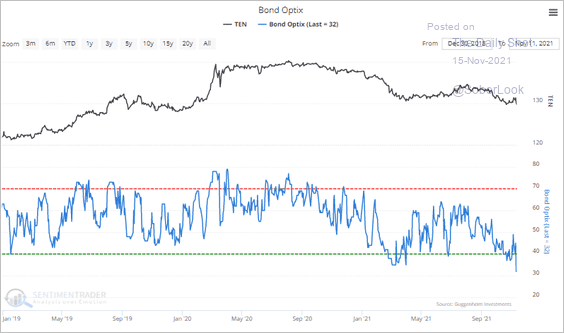

3. Investors are extremely pessimistic on Treasury notes and bonds.

Source: SentimenTrader

Source: SentimenTrader

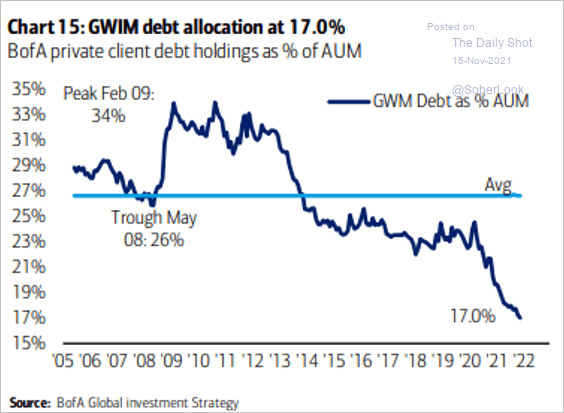

4. Merrill Lynch private clients’ allocation to bonds has never been this low.

Source: BofA Global Research

Source: BofA Global Research

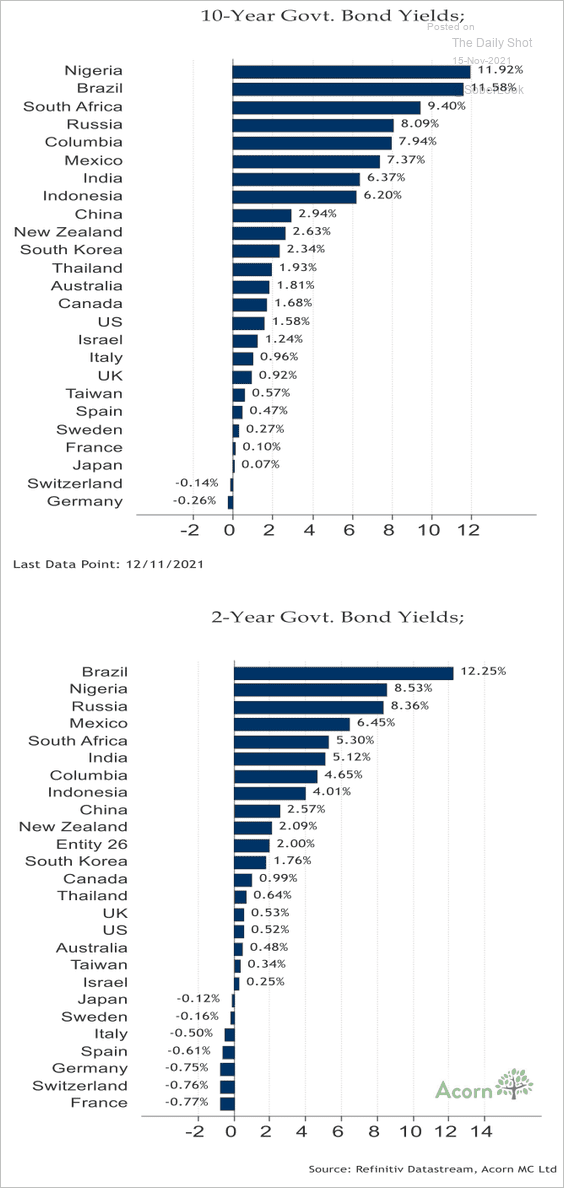

5. Negative yields are becoming less common.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

——————–

Food for Thought

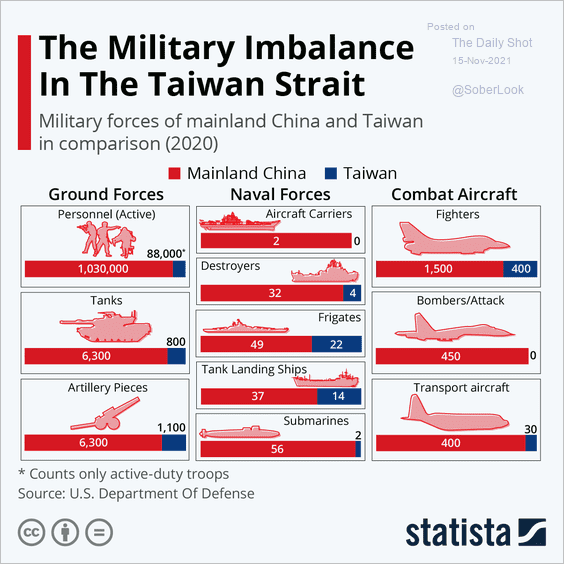

1. The military imbalance in the Taiwan Strait:

Source: Statista

Source: Statista

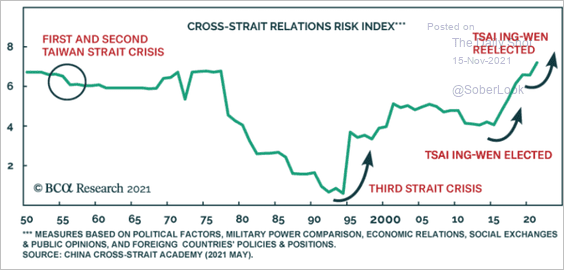

Deteriorating relations between China and Taiwan:

Source: BCA Research

Source: BCA Research

——————–

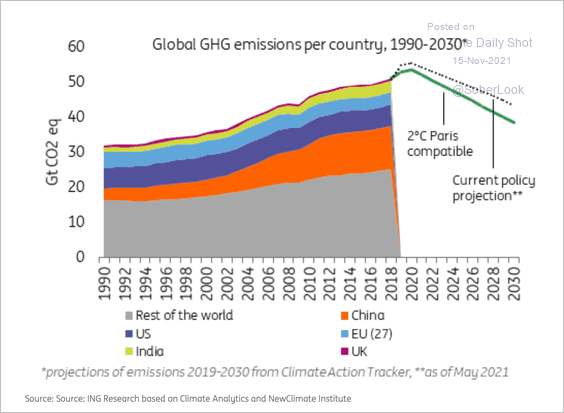

2. Challenges reaching the Paris agreement targets:

Source: ING

Source: ING

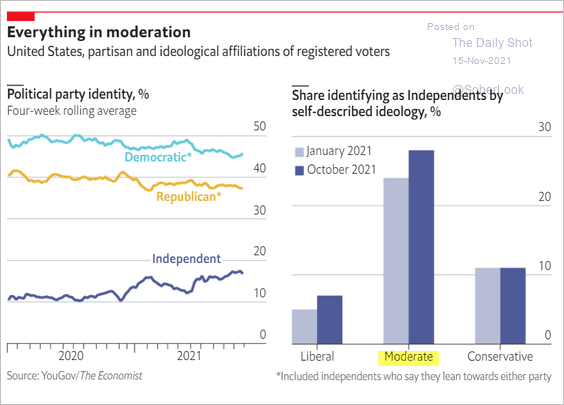

3. Independent voters in the US:

Source: The Economist Read full article

Source: The Economist Read full article

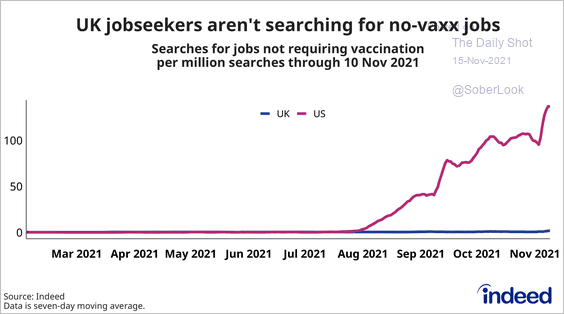

4. Searches for no-vaxx jobs:

Source: @PawelAdrjan

Source: @PawelAdrjan

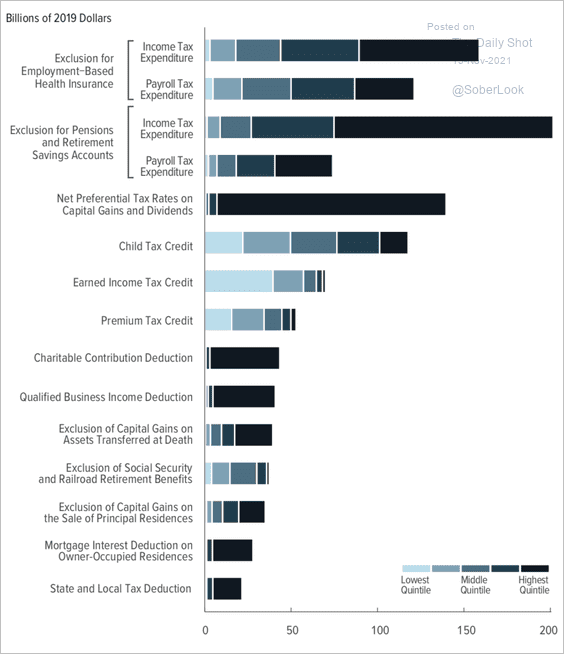

5. Total US tax benefits (dollar amounts):

Source: CBO Read full article

Source: CBO Read full article

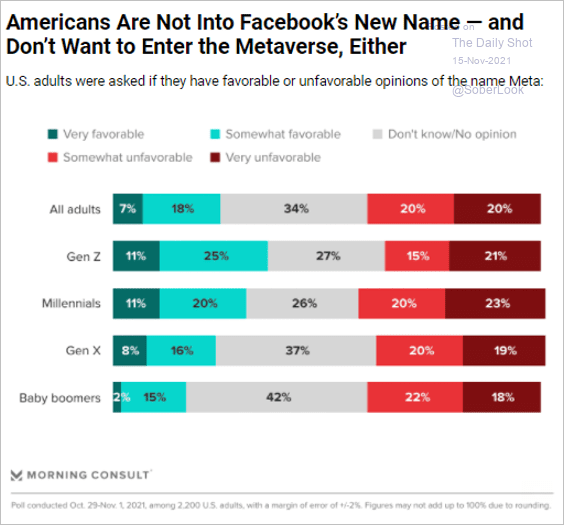

6. Views on Meta:

Source: Morning Consult

Source: Morning Consult

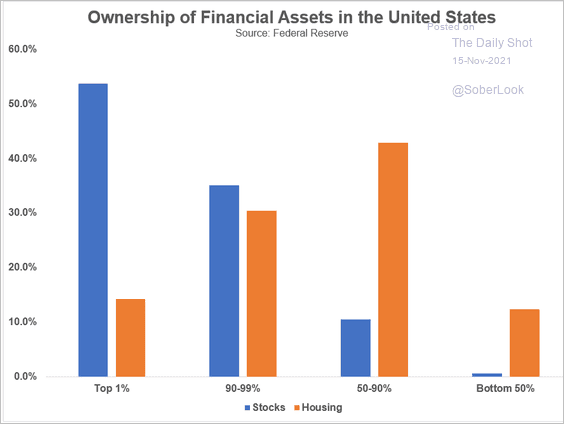

7. Ownership of equities and housing by wealth percentile:

Source: @awealthofcs Read full article

Source: @awealthofcs Read full article

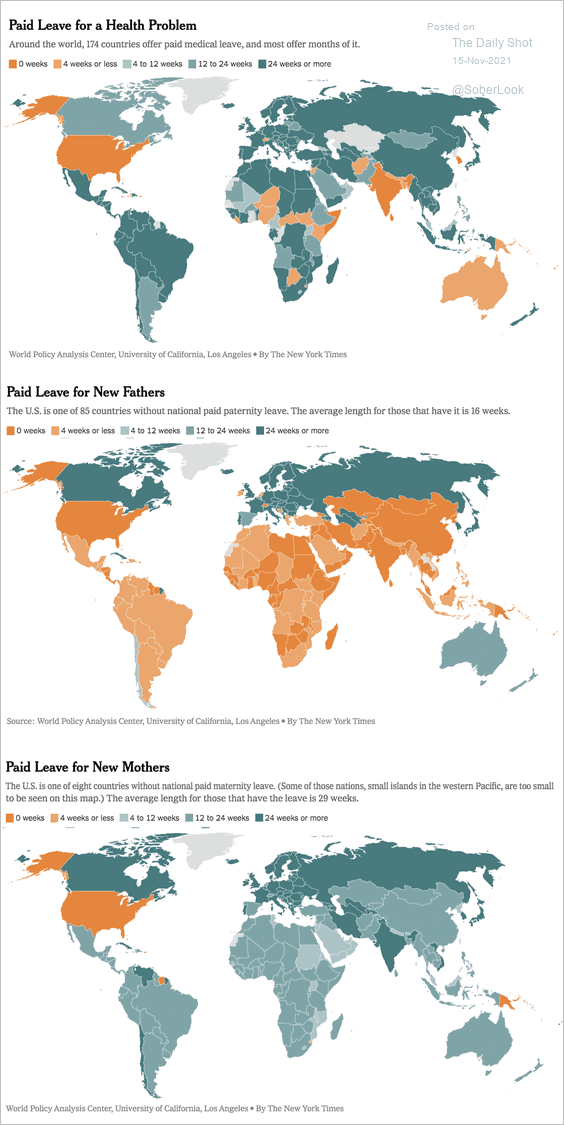

8. Paid leave globally:

Source: The New York Times Read full article

Source: The New York Times Read full article

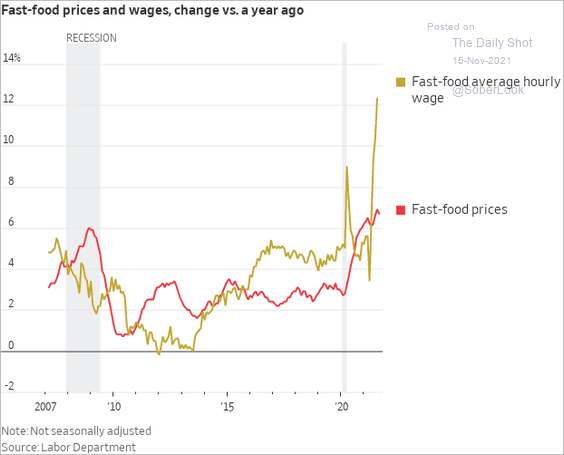

9. Fast-food industry prices and wages:

Source: @WSJ Read full article

Source: @WSJ Read full article

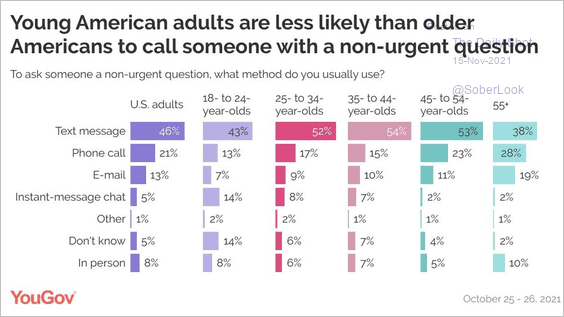

10. Asking someone a non-urgent question:

Source: YouGov

Source: YouGov

——————–

Back to Index