The Daily Shot: 18-Nov-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

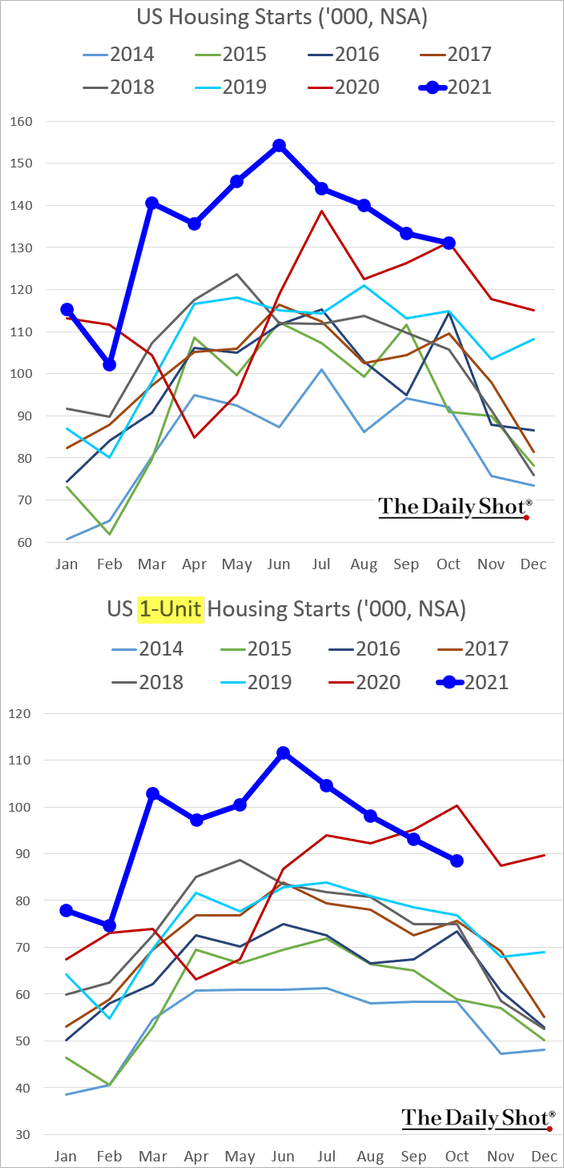

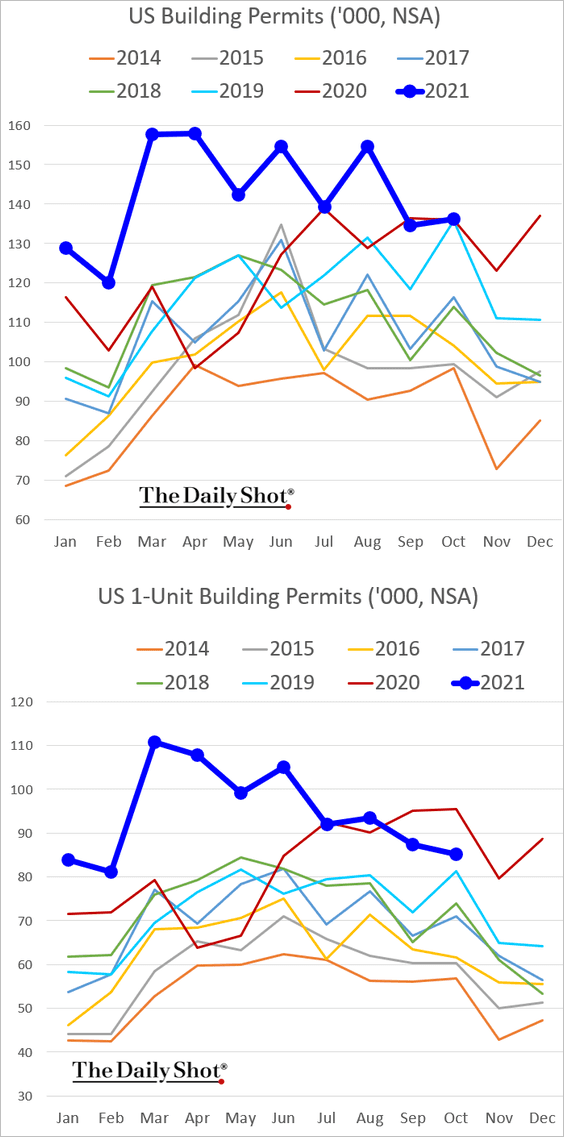

1. Let’s begin with the housing market.

• Residential construction activity is moderating, especially in single-family housing.

– Starts:

– Permits:

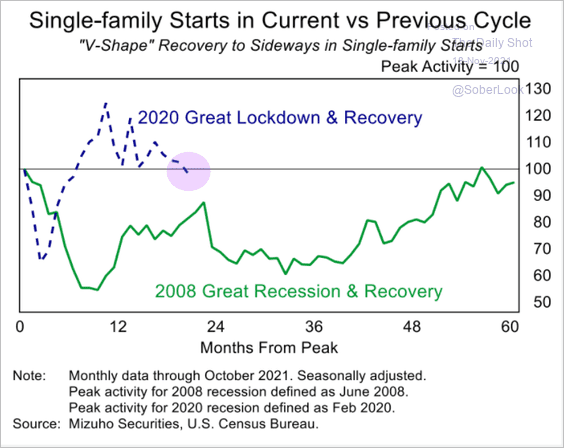

On a seasonally-adjusted basis, single-family starts are now below pre-covid levels.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

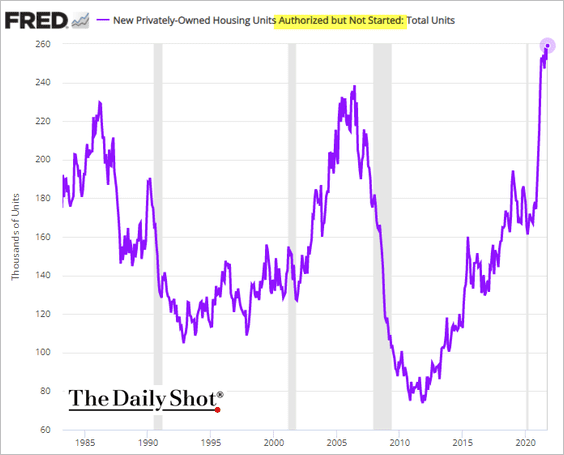

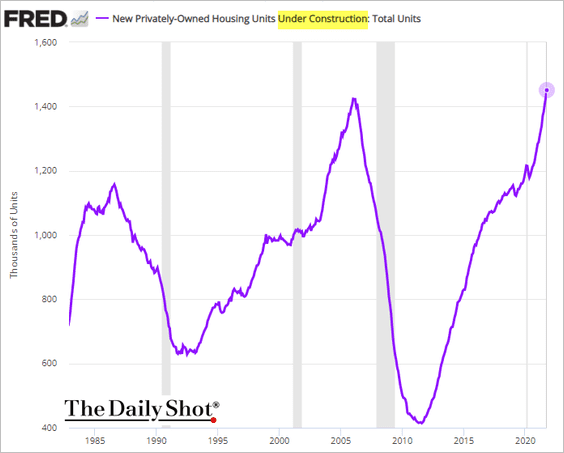

Shortages are creating a substantial construction backlog.

Source: Reuters Read full article

Source: Reuters Read full article

Here is the number of residential construction projects that have been authorized but not started.

• The number of units currently under construction has exceeded the housing bubble peak.

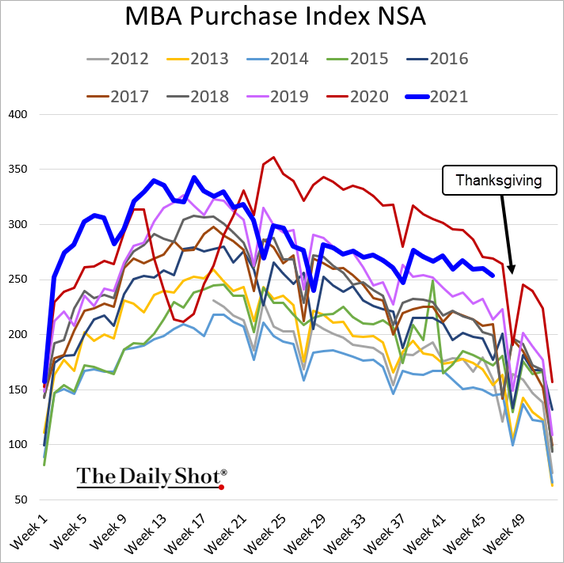

• Loan applications to purchase a house remain elevated for this time of the year.

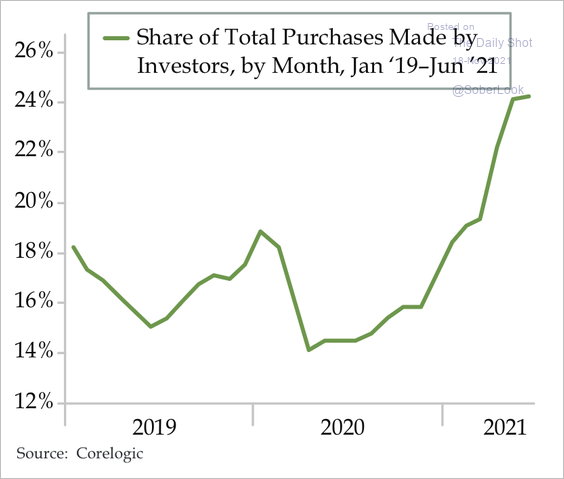

• Investors accounted for a larger share of home buyers over the past year.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

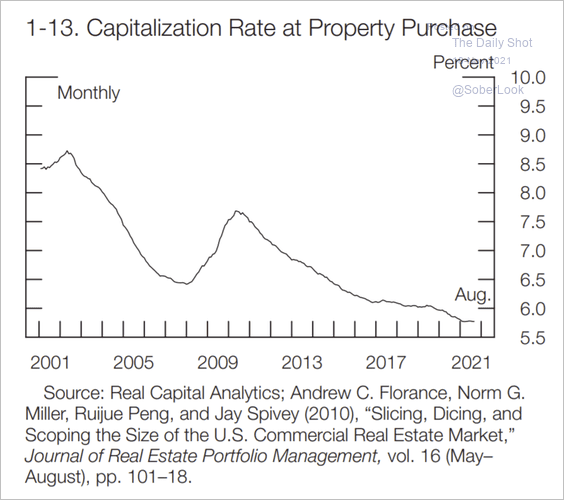

2. Cap rates on commercial properties are at multi-decade lows. At these levels, prices are more vulnerable to rising bond yields.

Source: @Callum_Thomas

Source: @Callum_Thomas

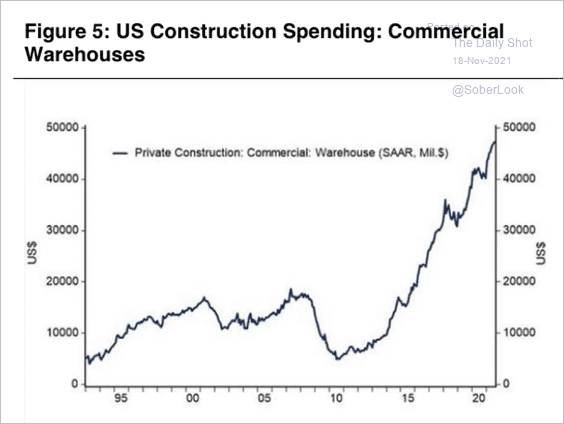

3. Commercial warehouse construction spending has risen to all-time highs.

Source: Citi Private Bank

Source: Citi Private Bank

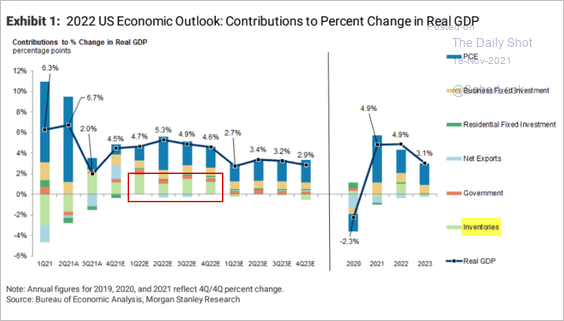

4. Inventory rebuilding will support economic growth next year, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

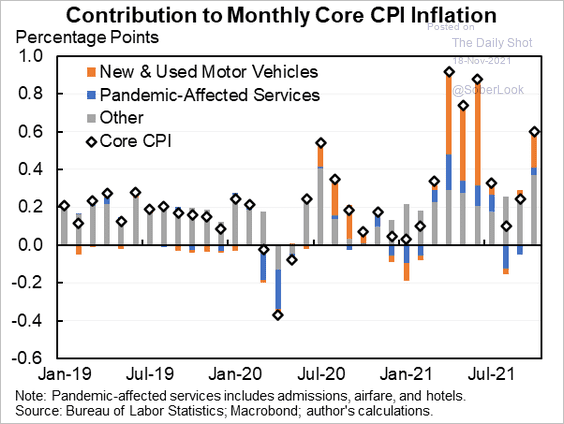

5. Next, we have some updates on inflation.

• As we saw earlier, the latest inflation increase was not just about “ships and chips.”

Source: @jasonfurman

Source: @jasonfurman

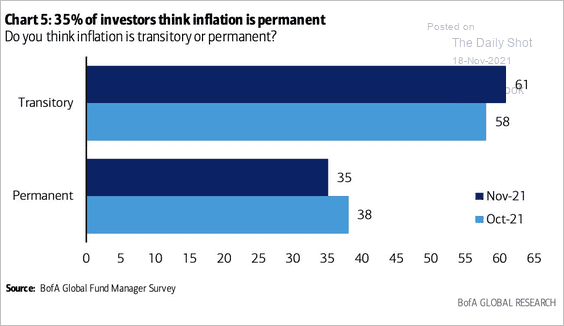

• Many fund managers still view inflation as “transitory.”

Source: BofA Global Research

Source: BofA Global Research

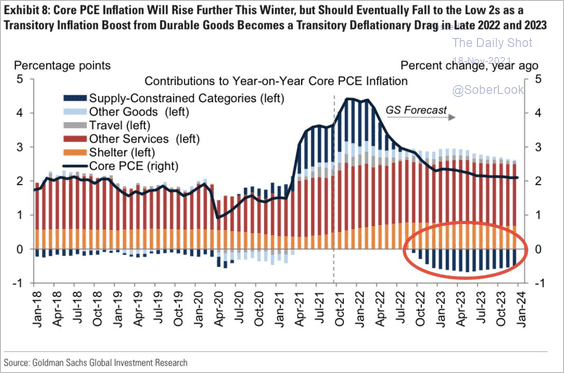

• Durable goods prices surged this year, but they will become a significant drag on the CPI in 2023.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

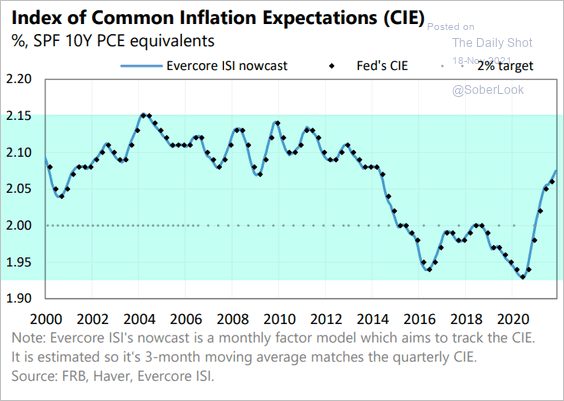

• This chat shows the Philly Fed’s Survey of Professional Forecasters long-term (10-year average) PCE inflation projection. It’s one of the indicators supporting some economists’ views that inflation expectations are “well-anchored.”

Source: Evercore ISI

Source: Evercore ISI

——————–

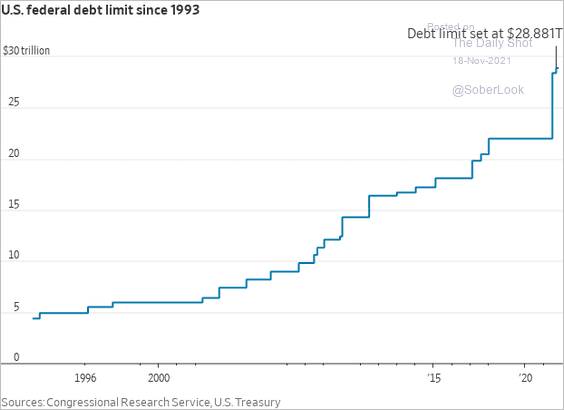

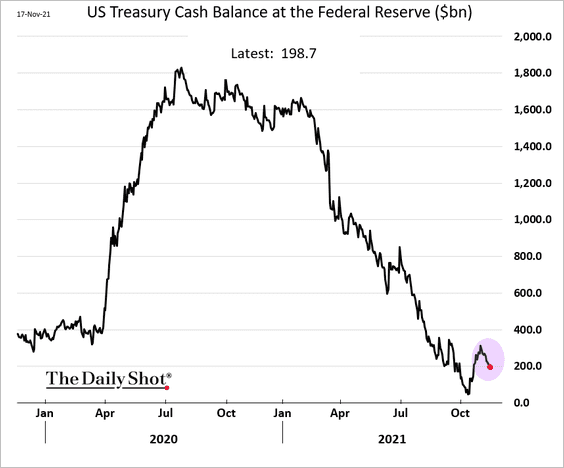

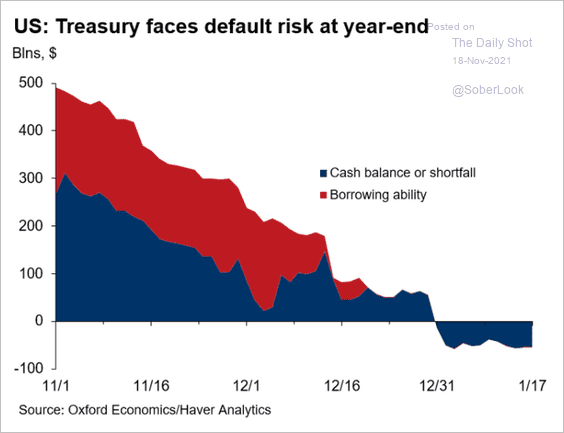

6. The debt ceiling jitters will return next month.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The US Treasury’s cash balances dipped below $200 billion again.

• The Treasury faces default risk at the end of the year.

Source: @GregDaco, @OxfordEconomics, @nanc455

Source: @GregDaco, @OxfordEconomics, @nanc455

Back to Index

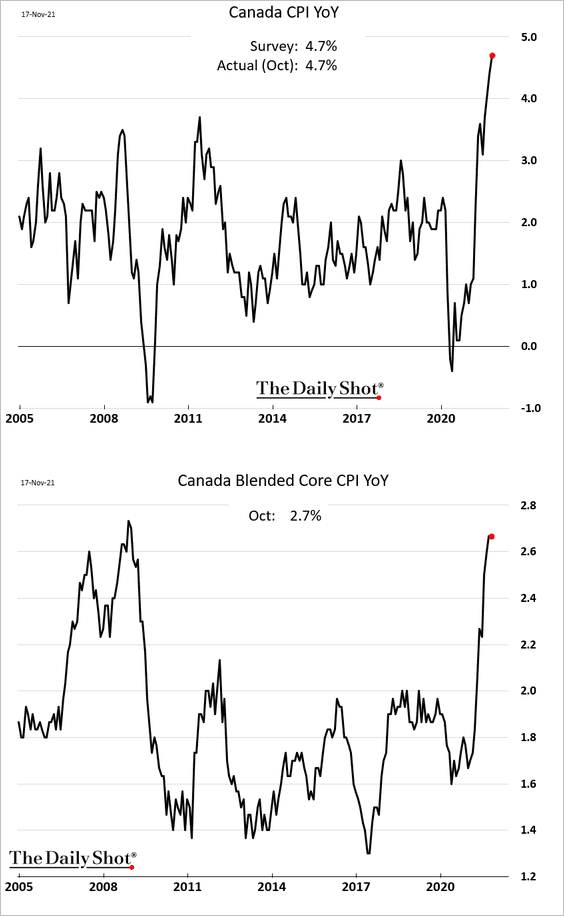

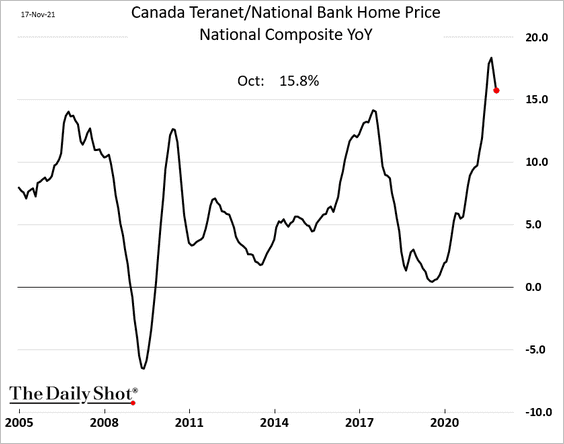

Canada

1. Inflation continues to surge. However, core inflation indicators seem to have leveled off.

2. Housing price appreciation has peaked.

3. The Oxford Economics Recovery Tracker is now firmly above pre-COVID levels.

![]() Source: Oxford Economics

Source: Oxford Economics

Back to Index

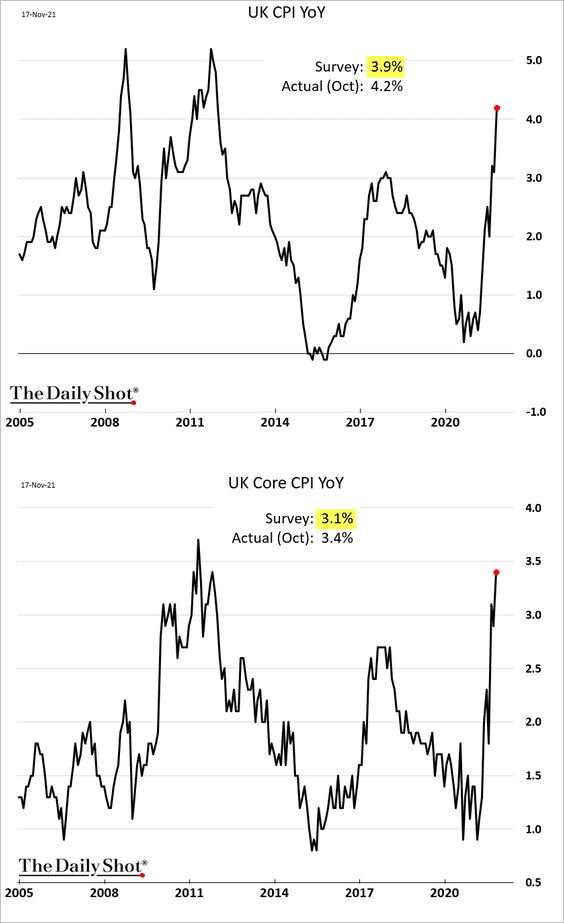

The United Kingdom

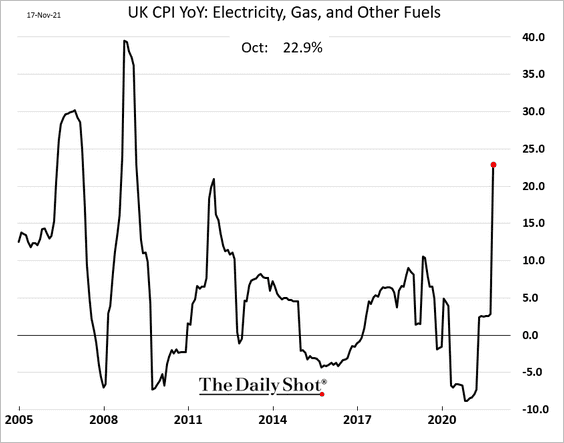

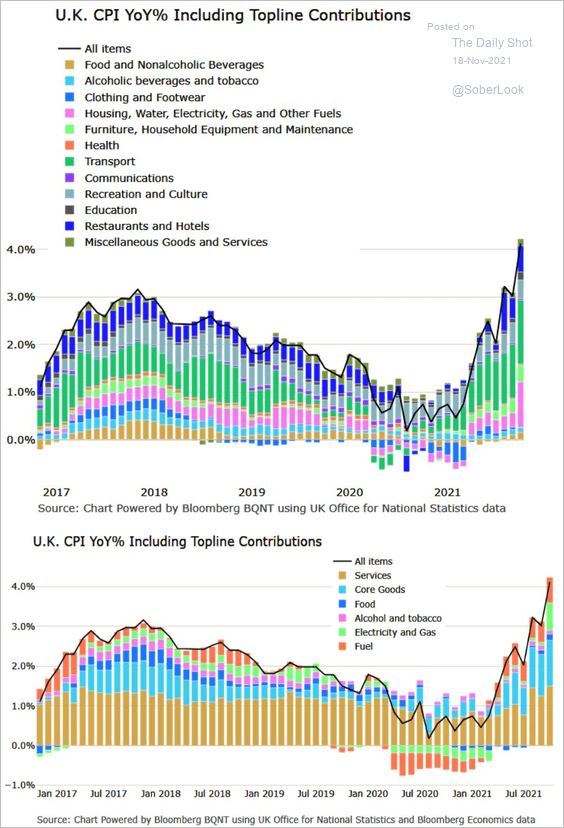

1. Inflation surprised to the upside, adding to the BoE’s concerns about being behind the curve.

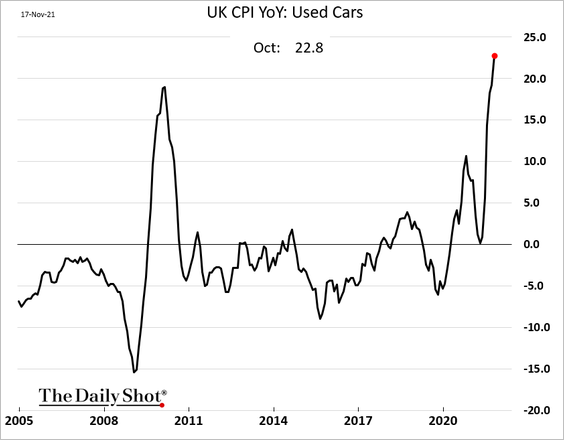

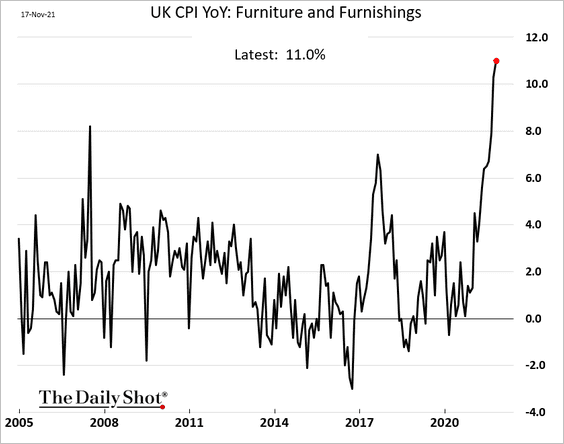

And it wasn’t just about the natural gas price spike, which, by the way, is yet to fully propagate through the economy.

Below are a couple of examples.

– Used cars:

– Furniture:

Here are the contributions to the CPI.

Source: @M_McDonoug

Source: @M_McDonoug

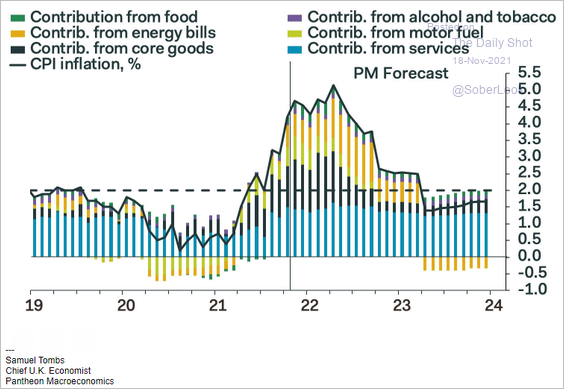

• Consumer inflation is yet to peak.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

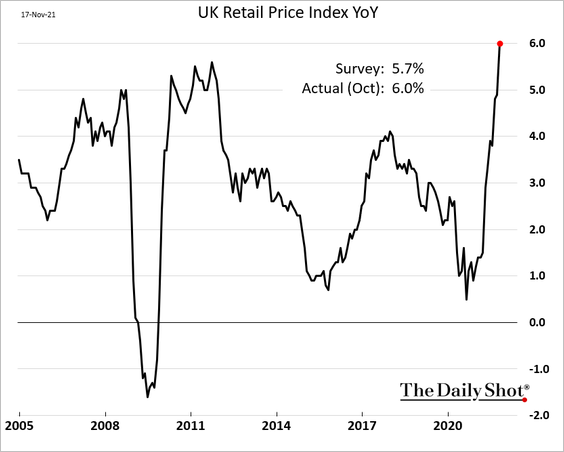

• The Retail Price Index hit 6% year-over-year.

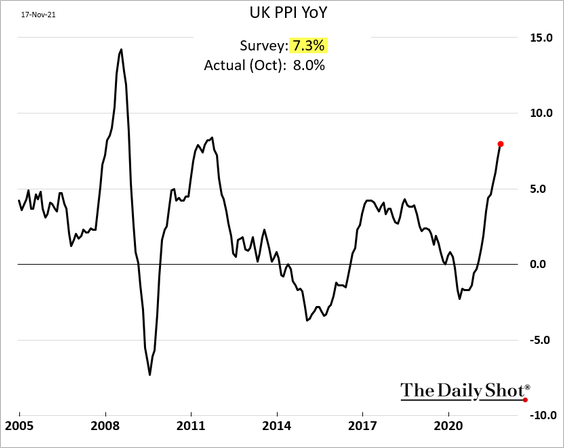

• Producer prices also topped forecasts.

——————–

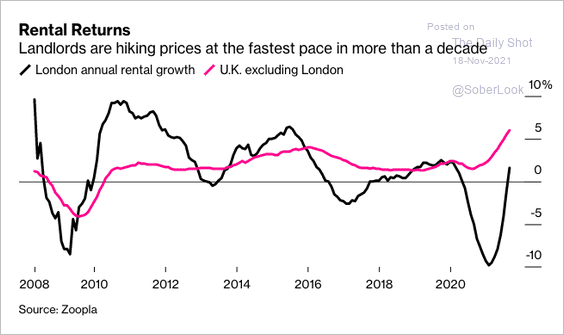

2. Rent costs are rising.

Source: @Quicktake Read full article

Source: @Quicktake Read full article

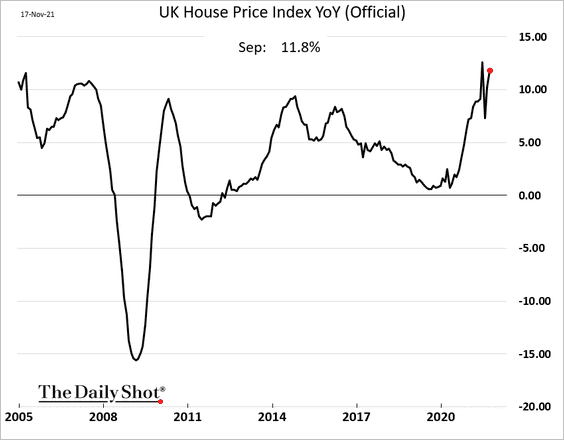

3. Home price appreciation is nearing 12% again.

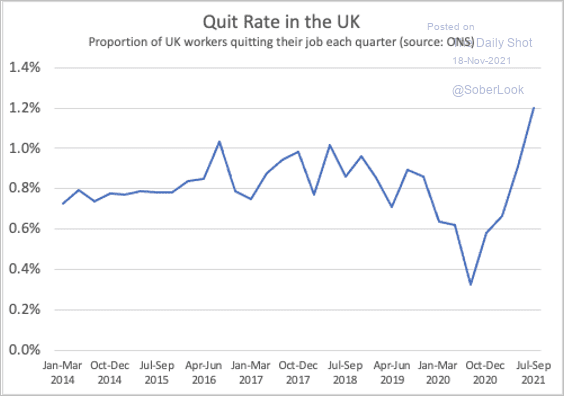

4. The quit rate in the UK is surging (similar to the US).

Source: @mmamertino

Source: @mmamertino

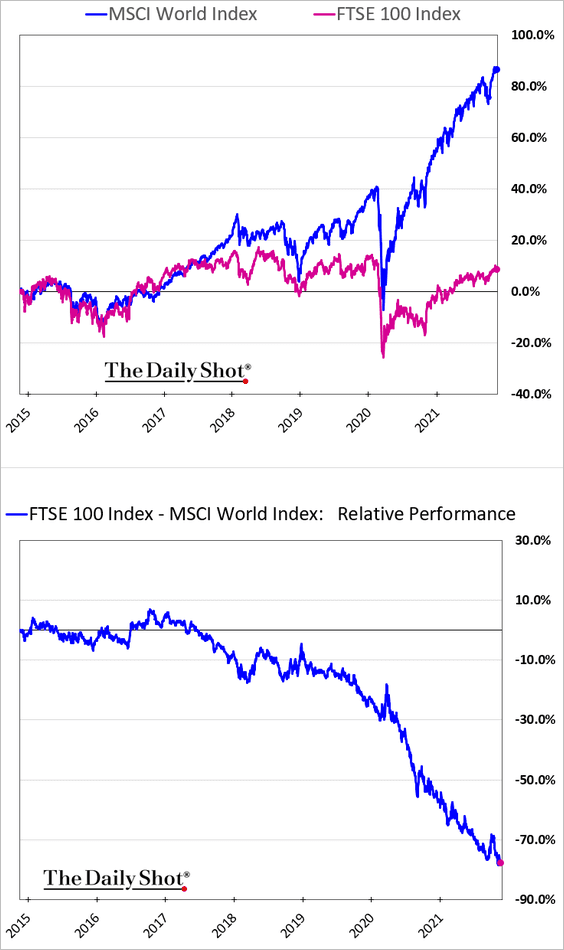

5. UK equity underperformance continues to widen.

Back to Index

The Eurozone

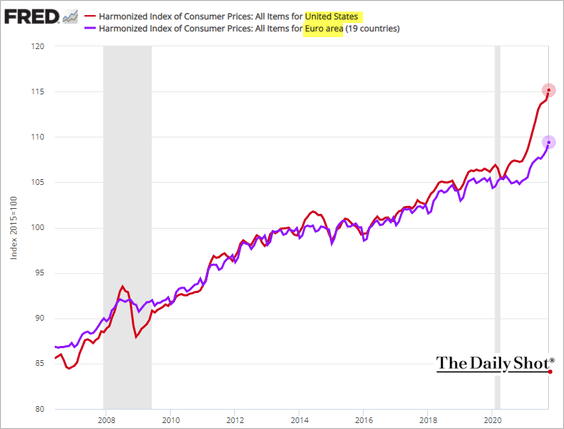

1. The Eurozone-US inflation divergence has been a drag on the euro.

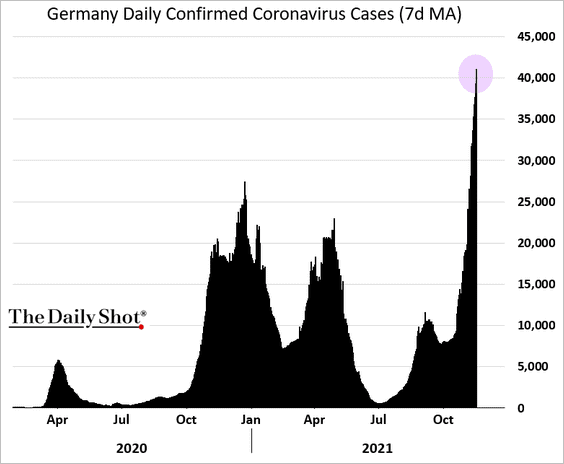

2. COVID cases in Germany continue to surge.

Source: CNBC Read full article

Source: CNBC Read full article

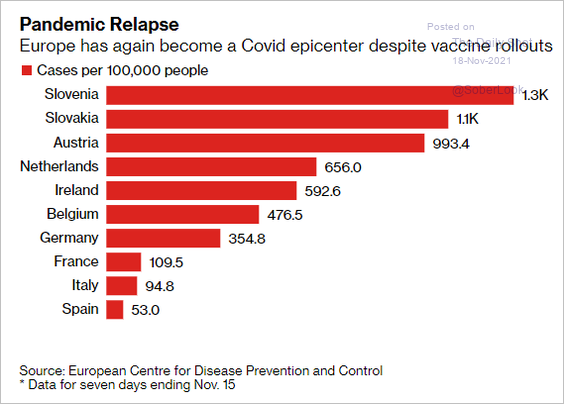

Here is the situation in other euro-area economies.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

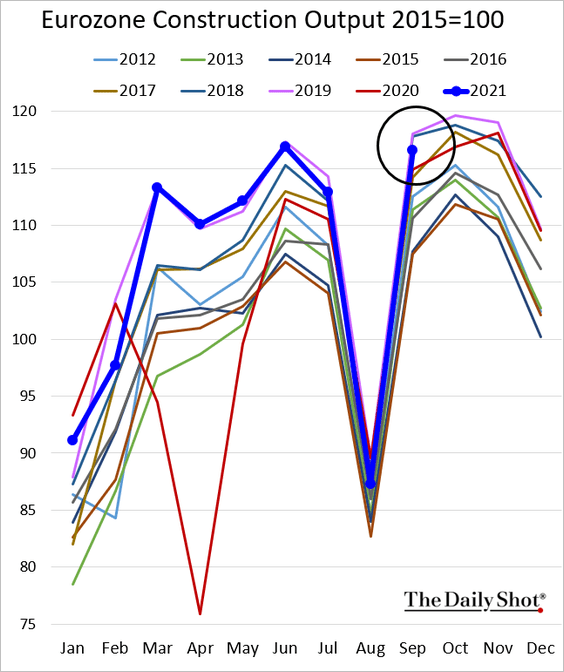

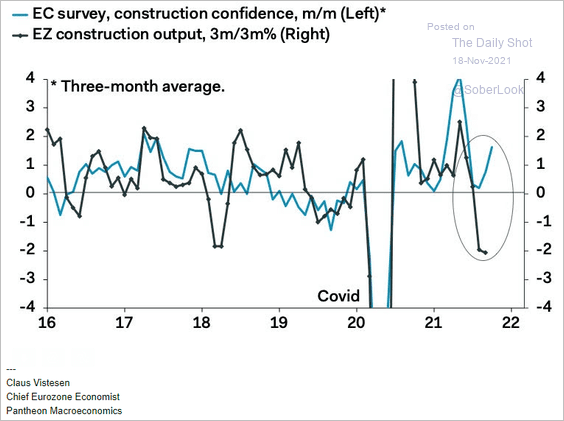

3. Construction output is running below 2018/19 levels.

But improved sentiment points to a rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

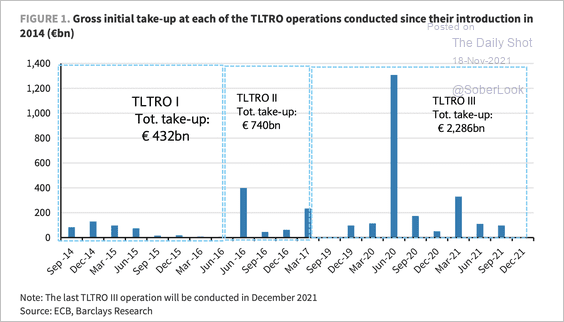

4. TLTRO III was much larger than previous iterations as the ECB sought to reduce rates and restrictions to encourage take-up during the pandemic crisis.

Source: Barclays Research

Source: Barclays Research

Back to Index

Europe

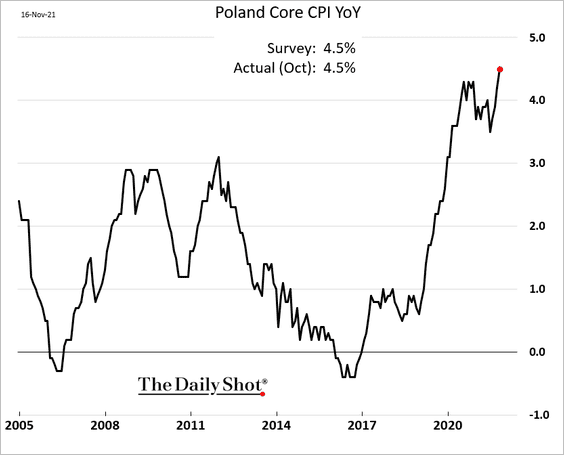

1. Poland’s core inflation hit 4.5% for the first time in years.

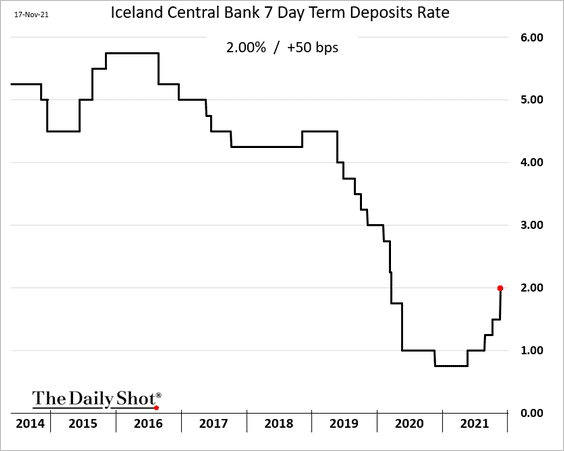

2. Iceland hiked rates by 50 bps amid inflation concerns.

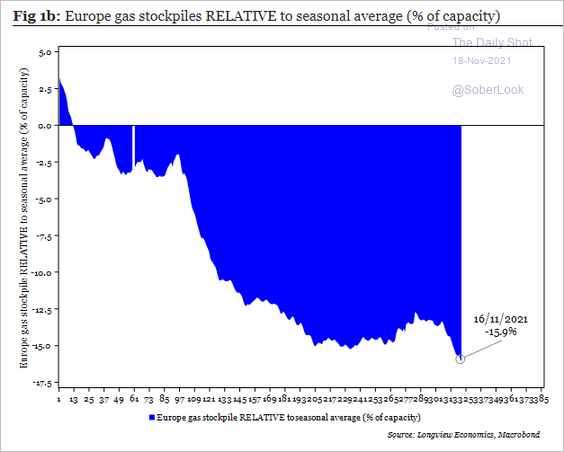

3. Natural gas inventories continue to sink relative to their seasonal average. A cold snap this winter could be trouble.

Source: Longview Economics

Source: Longview Economics

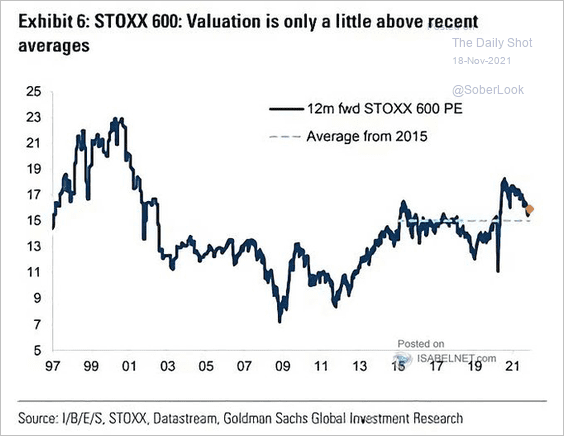

4. European stocks are not overpriced.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

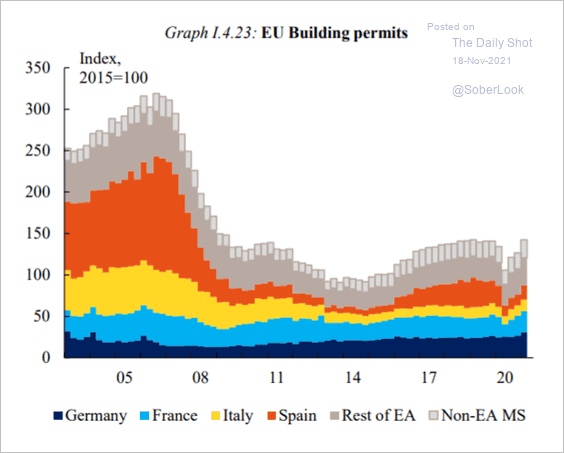

5. Next, we have the evolution of building permits in the EU.

Source: EC Read full article

Source: EC Read full article

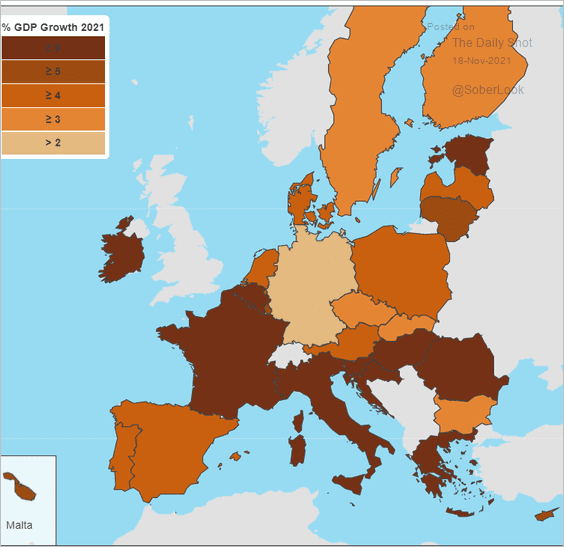

6. Finally, this map shows the 2021 GDP growth across the EU.

Source: EC Read full article

Source: EC Read full article

Back to Index

China

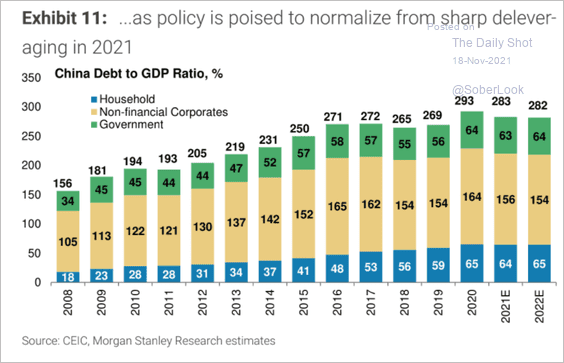

1. The total debt-to-GDP ratio appears to have stabilized.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

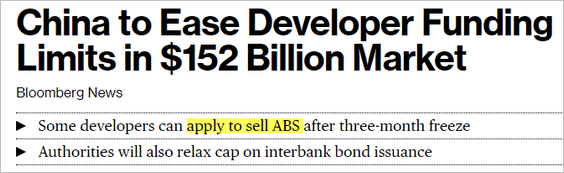

2. Developers are getting regulatory relief to access credit.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

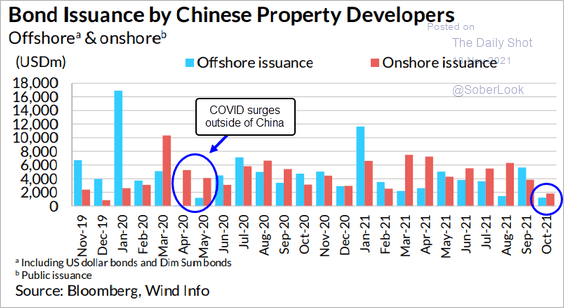

Issuance, especially offshore, has dwindled last month, …

Source: Fitch Ratings

Source: Fitch Ratings

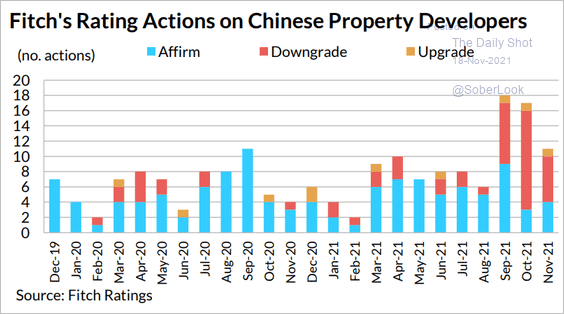

… and ratings downgrades spiked.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

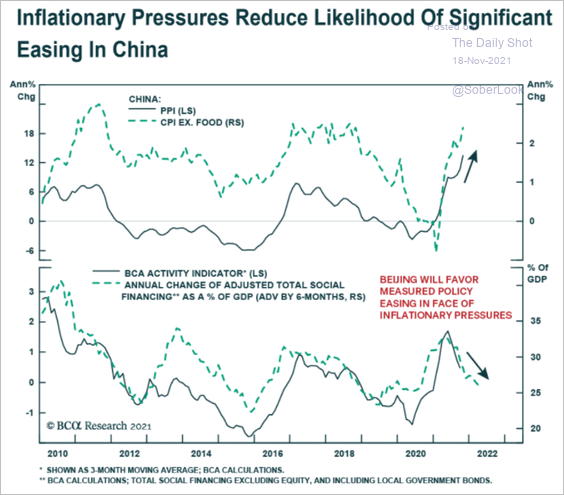

3. Hog prices have stabilized and are no longer a drag on the CPI.

Source: @JCIChina Read full article

Source: @JCIChina Read full article

Higher inflation reduces the probability of monetary easing.

Source: BCA Research

Source: BCA Research

——————–

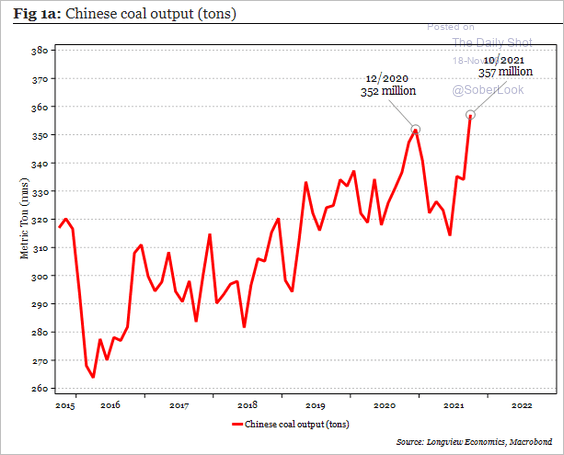

4. China’s coal production hit a new high.

Source: Longview Economics

Source: Longview Economics

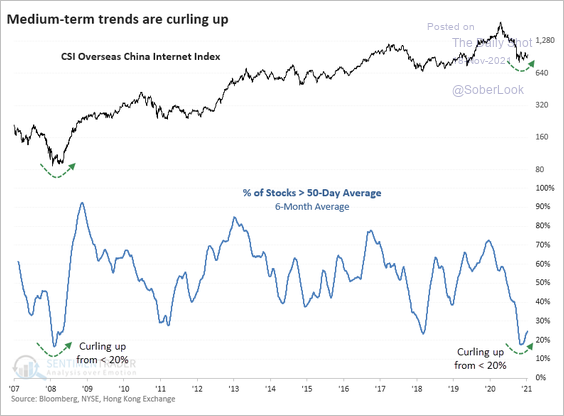

5. Fewer than 20% of stocks in the Overseas China Internet Index are trading above their 50-day moving averages, which typically precedes a price recovery.

Source: SentimenTrader

Source: SentimenTrader

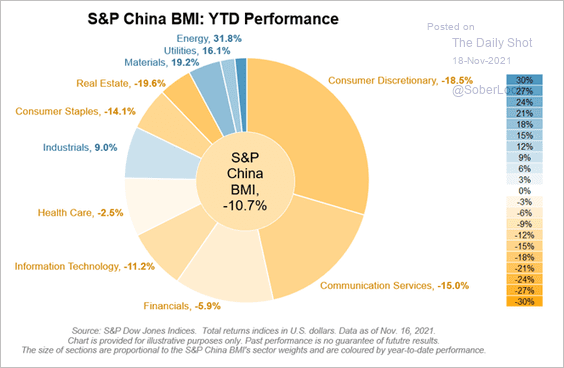

6. Here is the stock market performance by sector year-to-date.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Emerging Markets

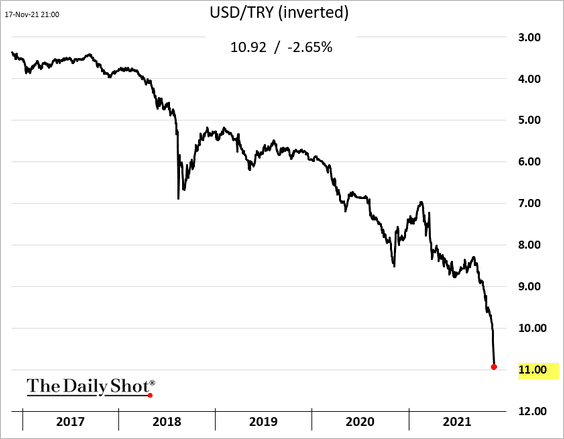

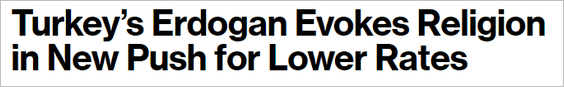

1. The Turkish lira continues to slide as Erdogan presses for rate cuts.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Will the central bank oblige?

Source: Numera Analytics

Source: Numera Analytics

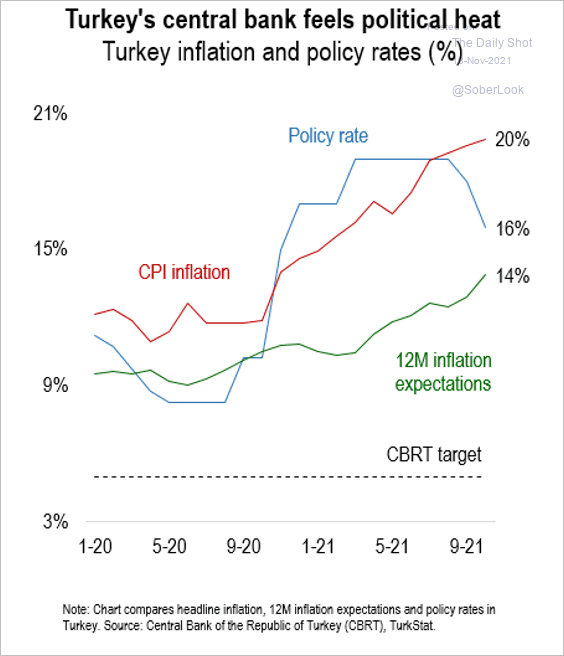

Options traders are betting on it.

——————–

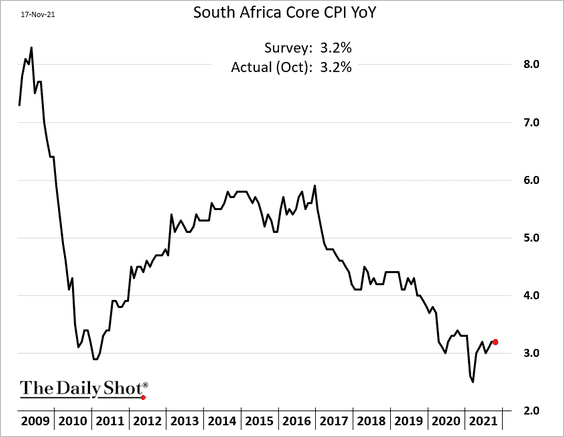

2. South Africa’s CPI remains “well behaved.”

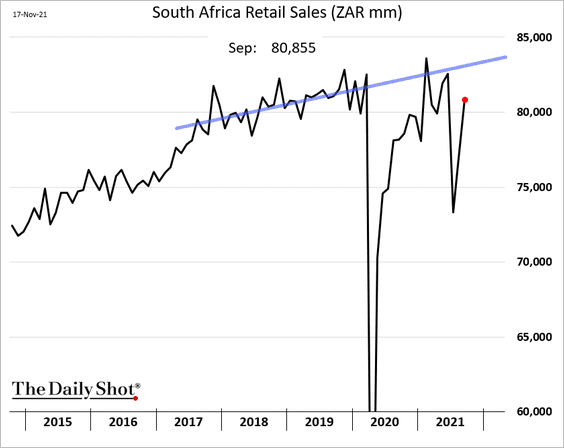

Retail sales rebounded in September.

——————–

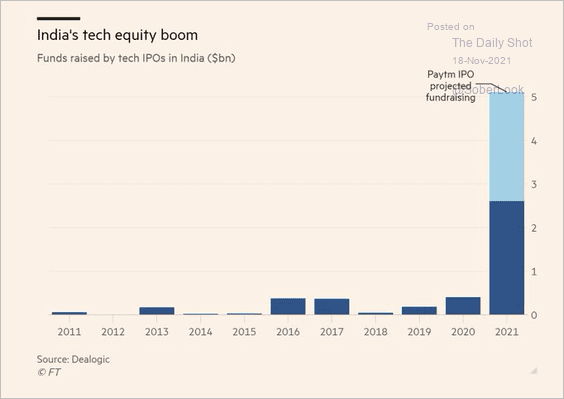

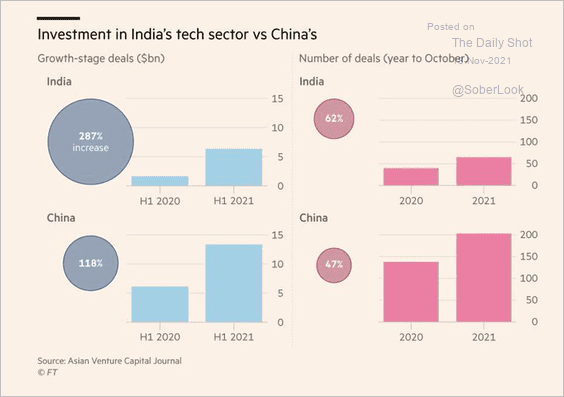

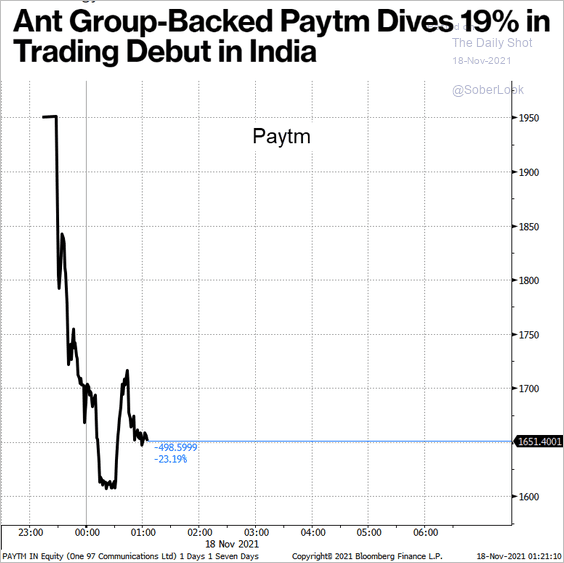

3. India’s tech IPO market has been hot.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

Perhaps too hot?

Source: @technology Read full article

Source: @technology Read full article

——————–

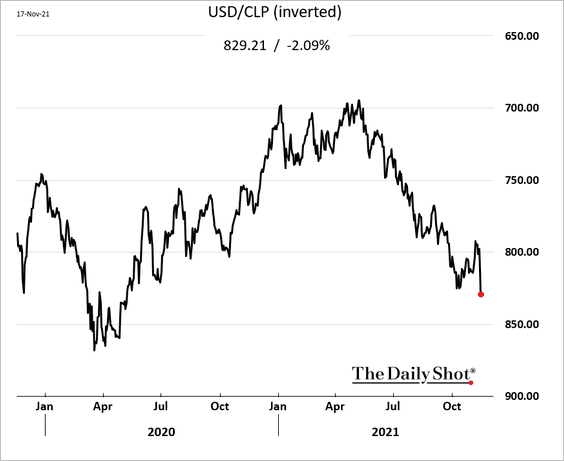

4. The Chilean peso is under pressure ahead of the vote on November 21st.

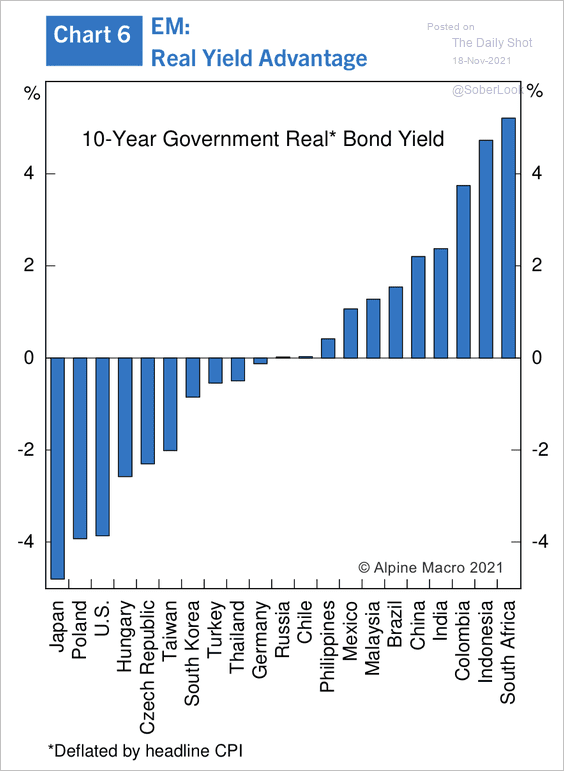

5. A majority of EM local-currency bonds have positive real yields, unlike their developed market peers.

Source: Alpine Macro

Source: Alpine Macro

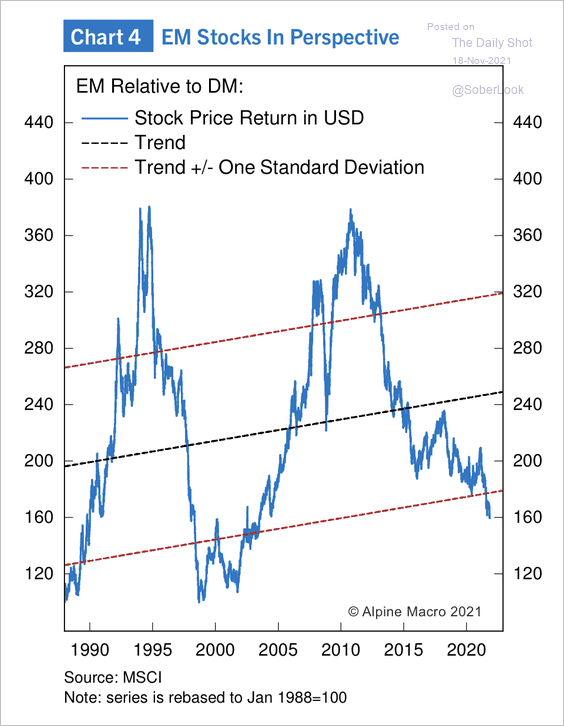

6. EM equities are below their long-term trend relative to developed market equities.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

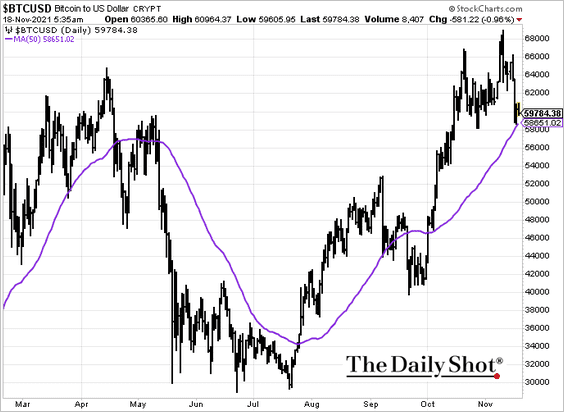

1. Bitcoin held support at the 50-day moving average.

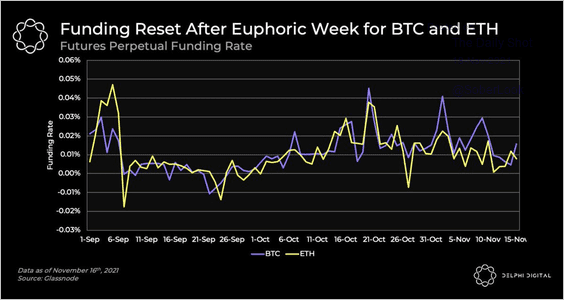

2. Elevated funding rates (the cost of holding long positions in the perpetual futures market) in bitcoin and ether have reset near neutral territory.

Source: Delphi Digital Read full article

Source: Delphi Digital Read full article

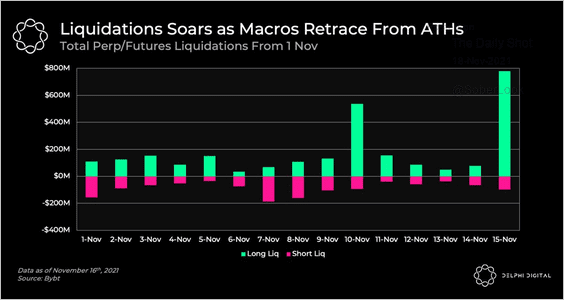

3. Some leveraged traders faced liquidations during the recent sell-off.

Source: Delphi Digital Read full article

Source: Delphi Digital Read full article

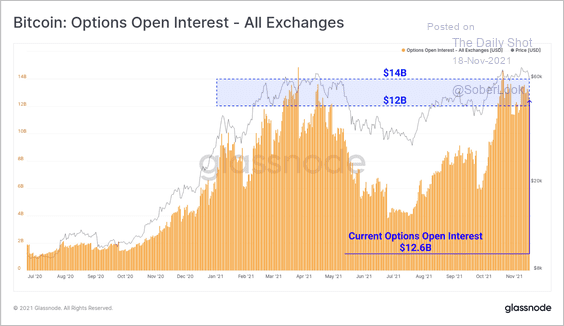

4. In the bitcoin options market, open interest is near all-time highs seen in March and April, which preceded a significant price drop.

Source: @glassnode

Source: @glassnode

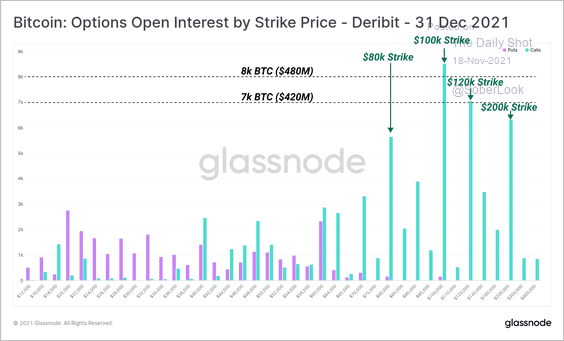

5. There is a large dominance of BTC call options expiring Dec. 31.

Source: @glassnode

Source: @glassnode

6. Is crypto facing the “stadium curse?”

Source: CoinDesk Read full article

Source: CoinDesk Read full article

7. Fidelity is launching bitcoin custody services in Canada.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

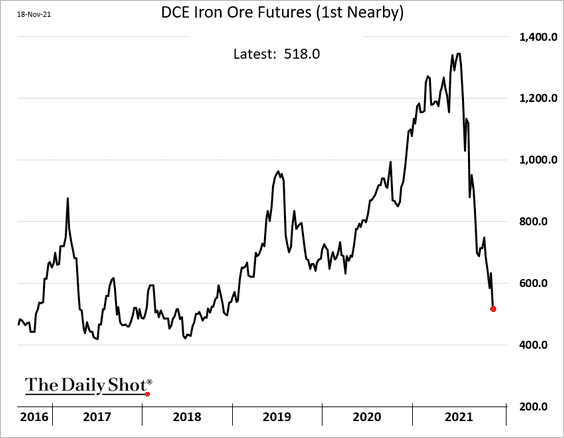

1. Iron ore futures in China continue to tumble.

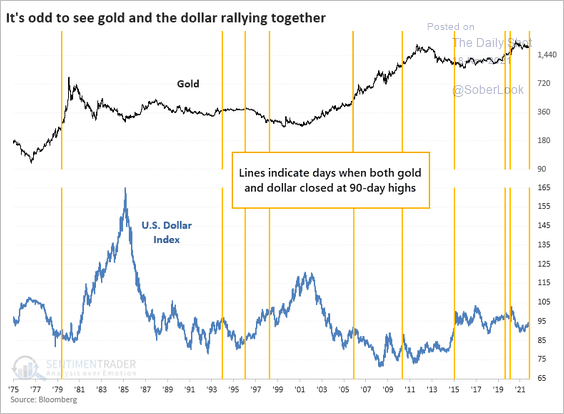

2. There have only been nine other times when both gold and the dollar hit a 90-day high at the same time. And while gold’s returns over the next 6-12 months were positive, it struggled to hold gains during the next 1-3 months.

Source: SentimenTrader

Source: SentimenTrader

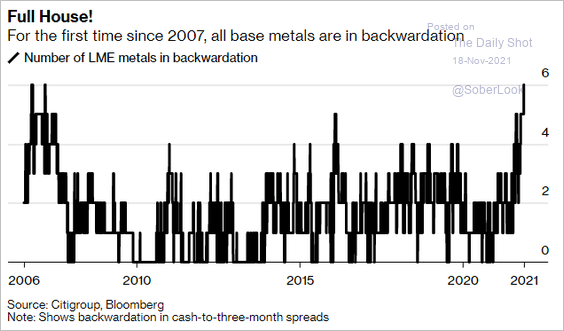

3. All the LME base metals are in backwardation (inverted curve), pointing to tight inventories.

Source: @markets Read full article

Source: @markets Read full article

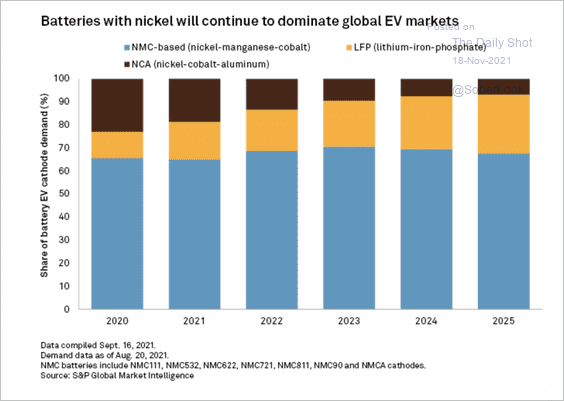

4. Lithium batteries are going to take a bigger share of global electric vehicle markets.

Source: S&P Global Research Read full article

Source: S&P Global Research Read full article

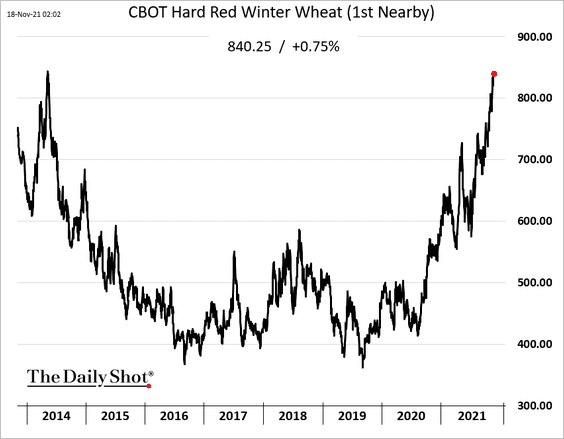

5. Wheat prices in the US continue to climb.

Back to Index

Energy

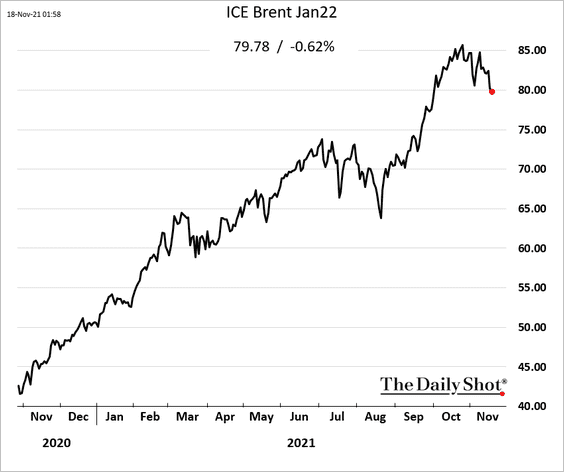

1. The rally in crude oil is fading.

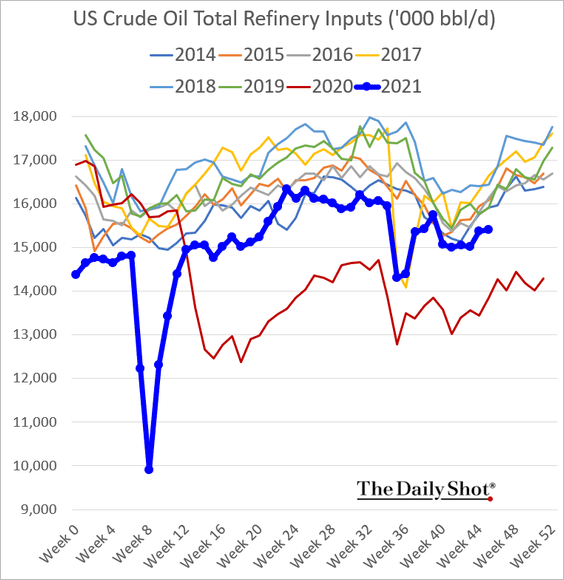

2. US refinery inputs are very weak for this time of the year.

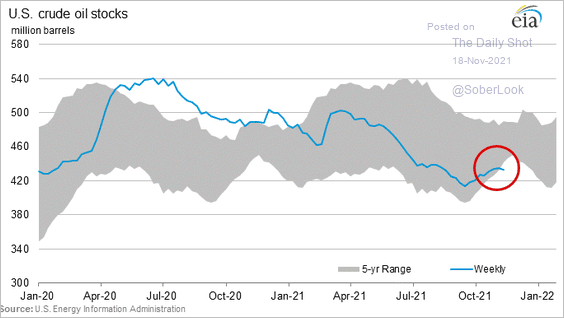

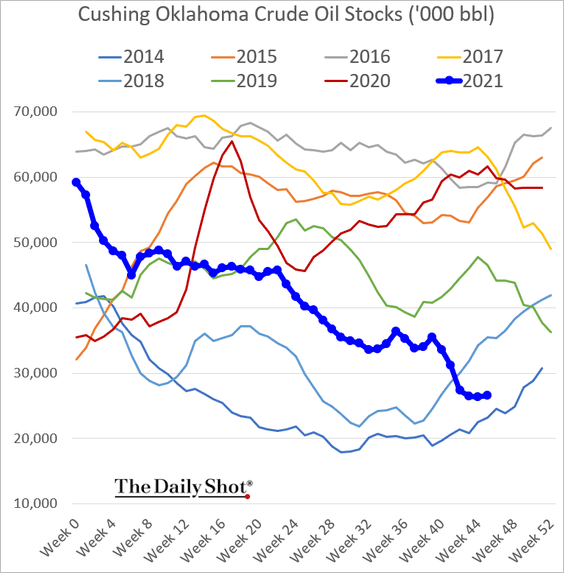

3. US crude oil inventories are at multi-year lows.

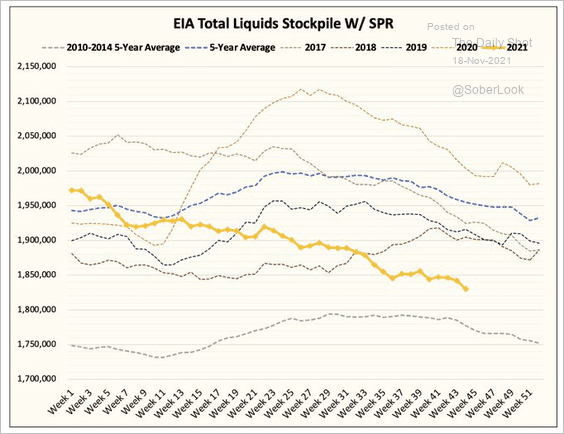

This chart shows the total liquids inventory.

Source: @HFI_Research

Source: @HFI_Research

——————–

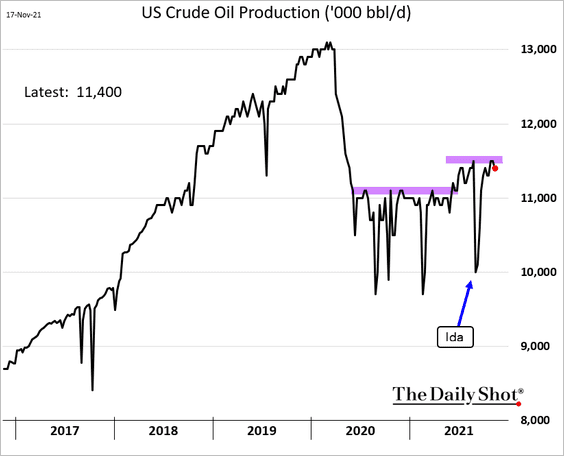

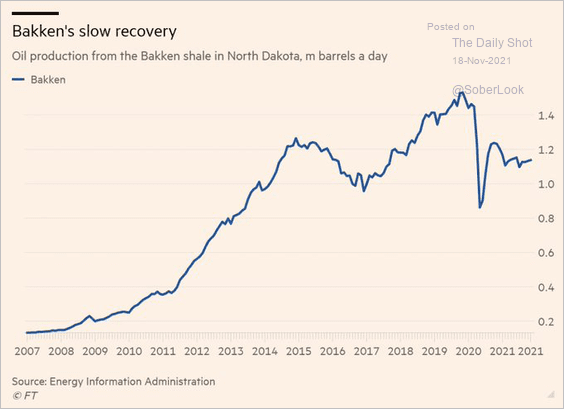

4. US crude oil production has stalled again.

Bakken’s output remains weak (“most of the best wells have been drilled”).

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

——————–

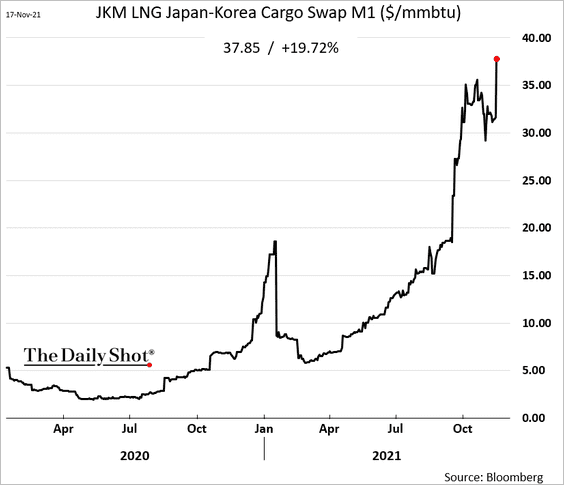

5. LNG prices continue to surge.

Back to Index

Equities

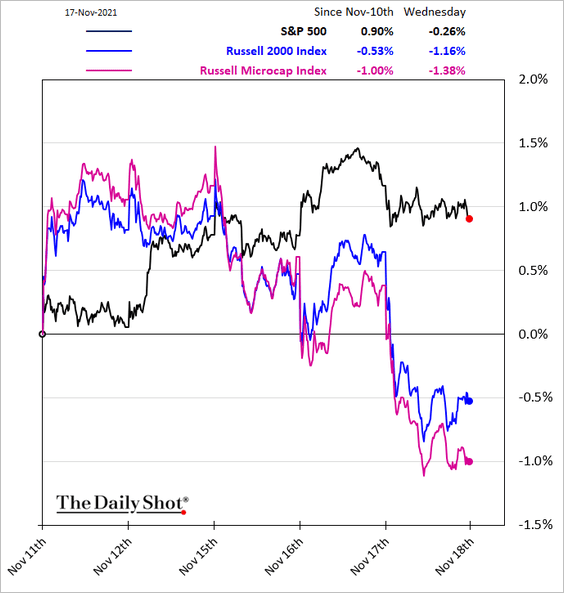

1. US small caps have underperformed sharply in recent days.

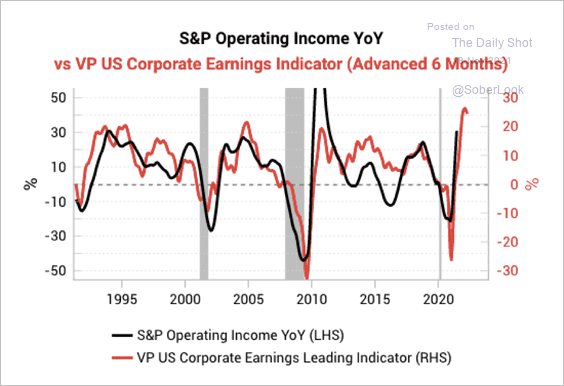

2. When will the S&P 500 operating income growth peak?

Source: Variant Perception

Source: Variant Perception

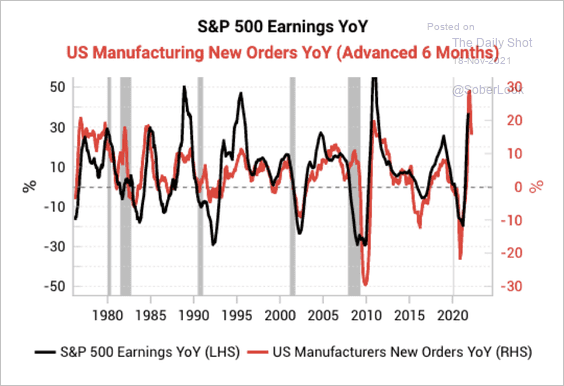

3. Manufacturing order growth points to a turning point in S&P 500 earnings.

Source: Variant Perception

Source: Variant Perception

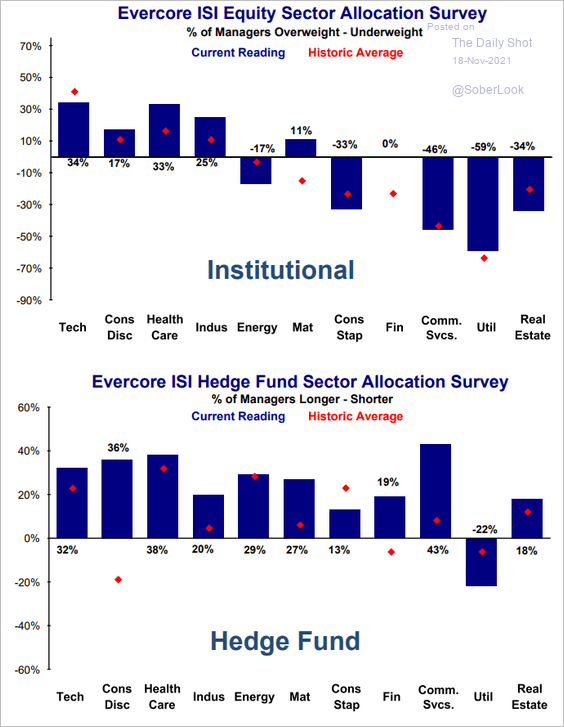

4. Here is the Evercore ISI sector allocation survey of institutional investors and hedge funds (shown against historical averages).

Source: Evercore ISI

Source: Evercore ISI

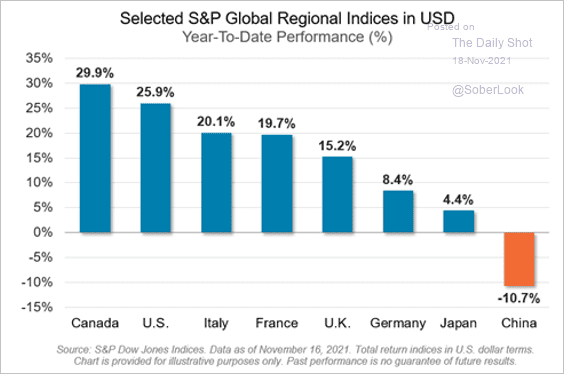

5. This chart shows the year-to-date stock market performance in select economies.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

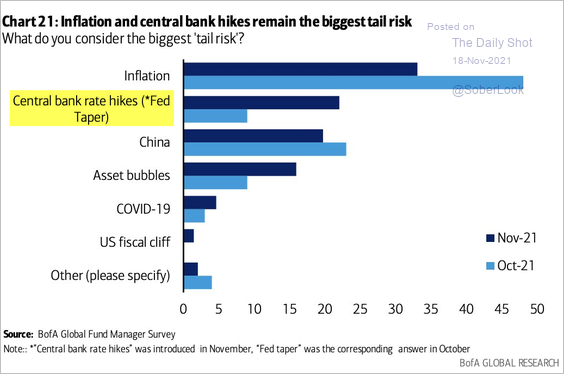

6. Fund managers are increasingly concerned about early rate hikes derailing the rally.

Source: BofA Global Research

Source: BofA Global Research

7. “Reopening” stocks have been outperforming.

Source: DealBook Read full article

Source: DealBook Read full article

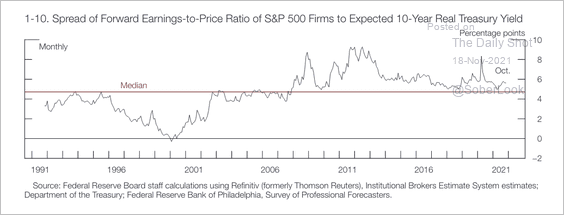

8. Equity risk premium has remained above the historical median over the past decade.

Source: Federal Reserve

Source: Federal Reserve

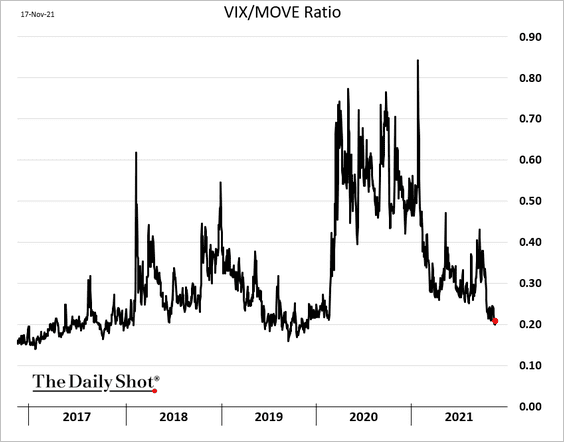

9. Equity implied volatility (VIX) continues to decline relative to rate vol (MOVE).

Back to Index

Credit

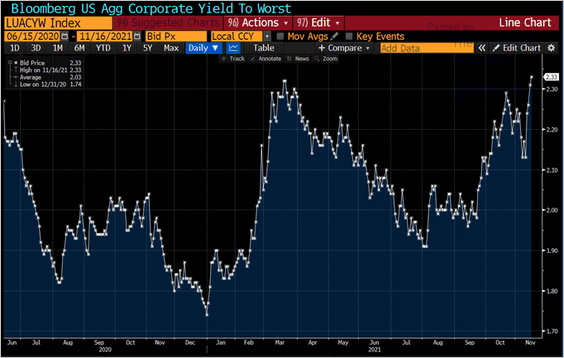

1. Investment-grade yields have been rising.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

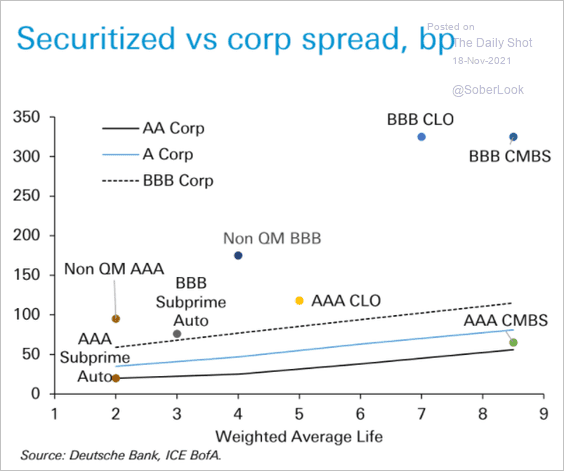

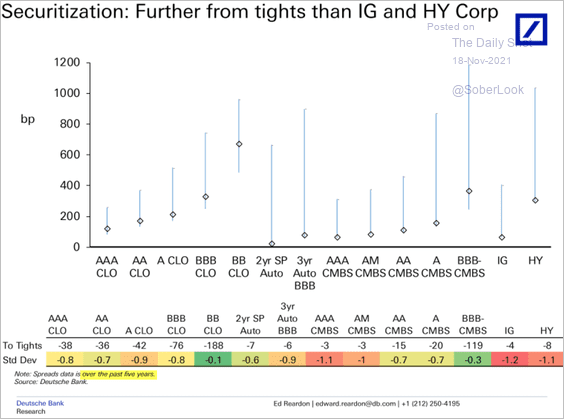

2. Next, we have some data on securitized debt spreads (from Deutsche Bank).

– Term structure:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

– Current spreads vs. the past five years:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

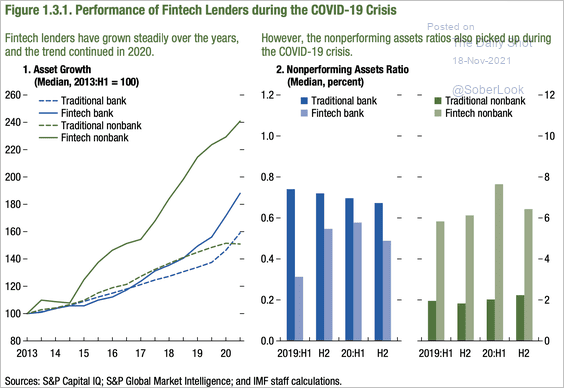

3. Covid crisis was the first real test of fintechs. Fintech lenders grew assets throughout the crisis at a rapid clip but saw an increase in non-performing assets (not seen among traditional lenders).

Source: IMF

Source: IMF

——————–

Food for Thought

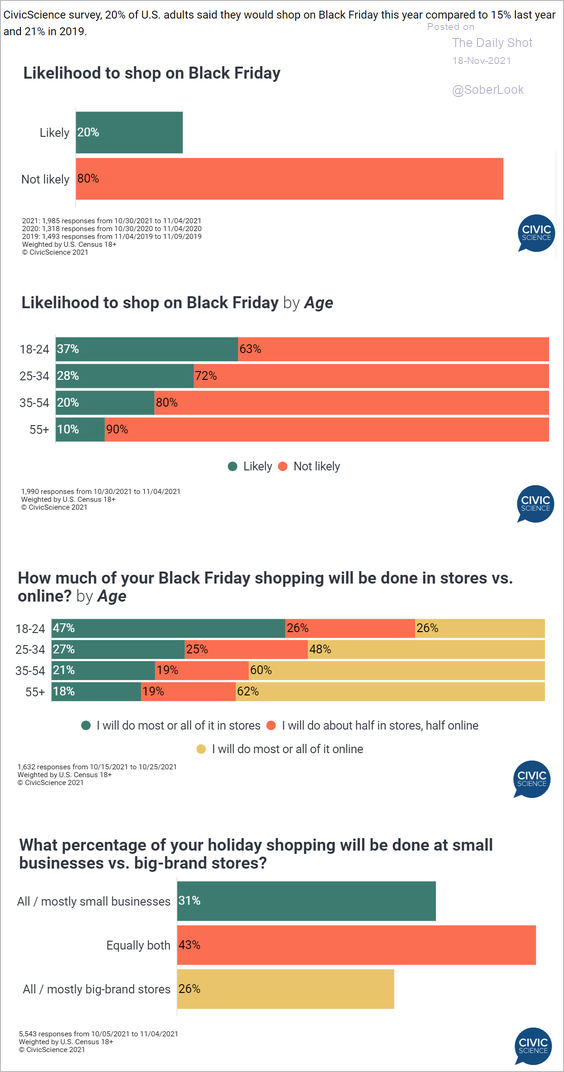

1. Shopping on Black Friday:

Source: @CivicScience

Source: @CivicScience

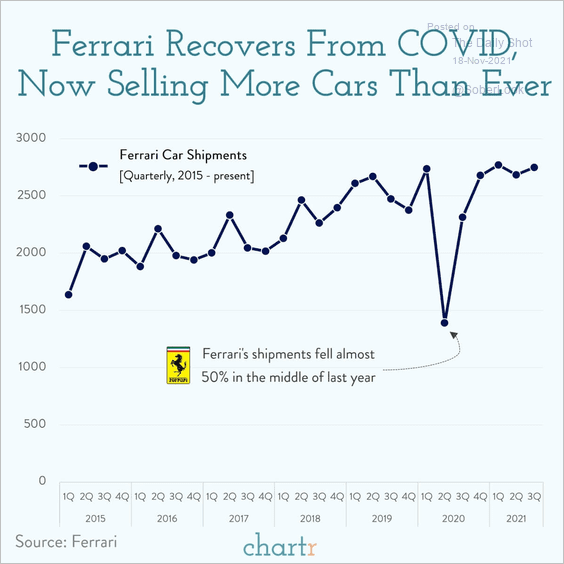

2. Ferrari sales:

Source: @chartrdaily

Source: @chartrdaily

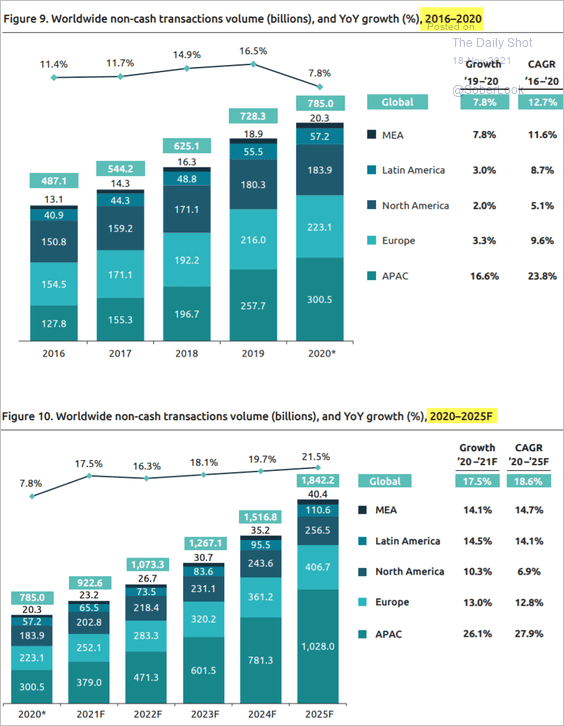

3. Global growth in non-cash transactions:

Source: Capgemini Read full article

Source: Capgemini Read full article

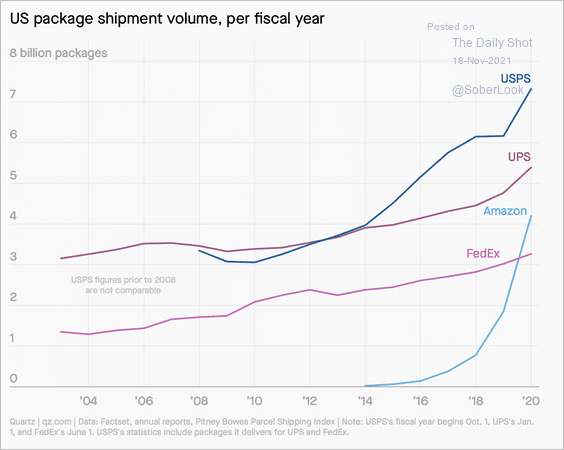

4. US package shipment market:

Source: QZ Read full article

Source: QZ Read full article

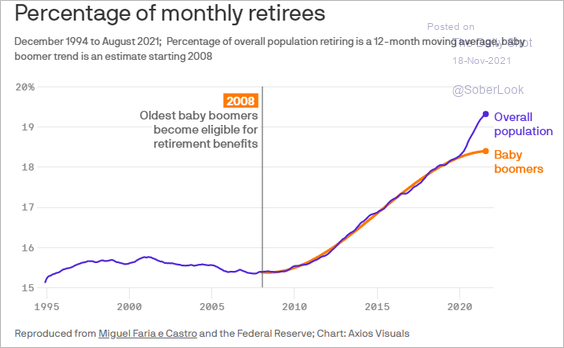

5. Baby boomer retirements:

Source: @axios Read full article

Source: @axios Read full article

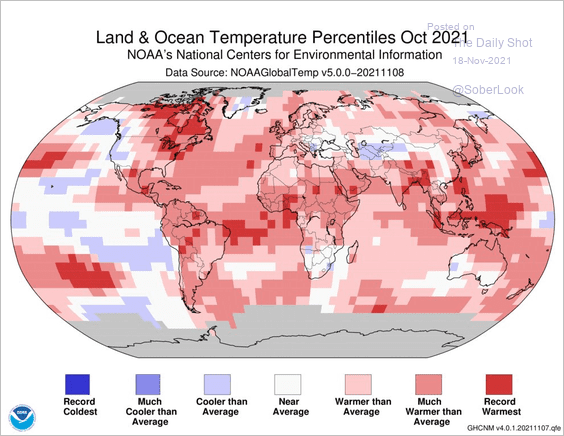

6. Warm oceans:

Source: @NOAANCEI Read full article

Source: @NOAANCEI Read full article

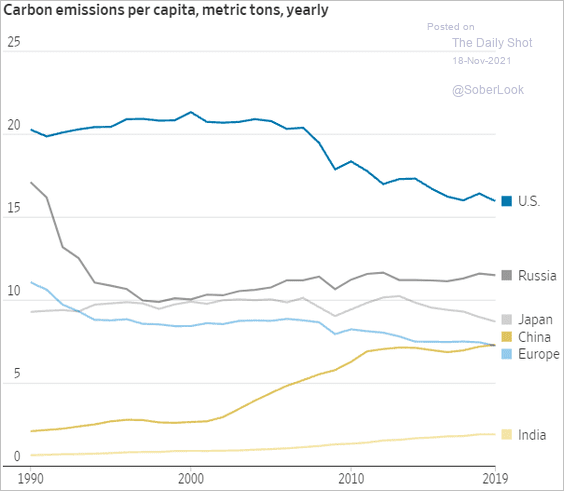

7. Carbon emissions per capita:

Source: @WSJ Read full article

Source: @WSJ Read full article

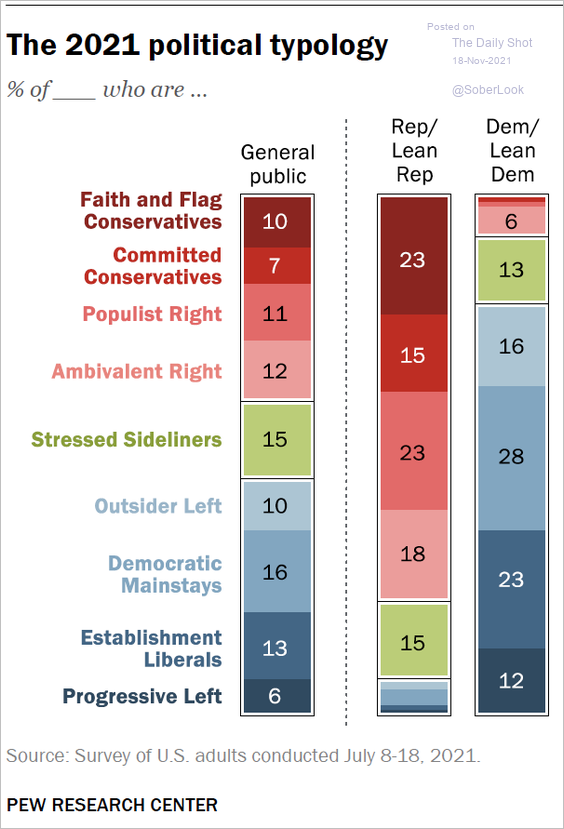

8. US 2021 political typology:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

9. Evolution of the Microsoft Windows logo:

Source: CSH

Source: CSH

——————–

Back to Index