The Daily Shot: 22-Nov-21

• Administrative Update

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

1. As a reminder, The Daily Shot will not be published on November 24th, 25th, and 26th.

2. If you encounter a technical issue with The Daily Shot, please refer to one of the sections on this page.

Back to Index

The United States

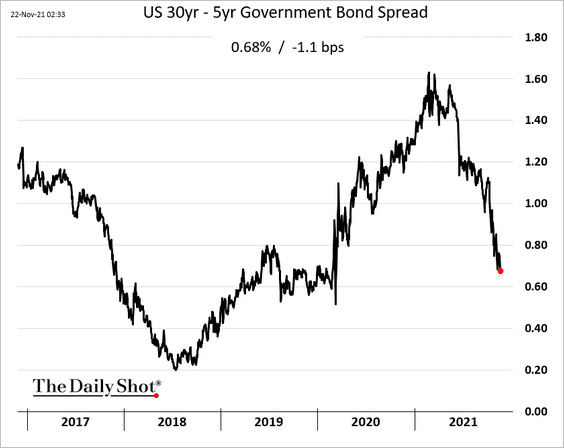

1. The recent surge in inflation and robust labor markets are forcing the Federal Reserve to take a more hawkish stance. Last week, several Fed officials indicated that the withdrawal of monetary accommodation (taper and rate hikes) should be accelerated.

– Clarida:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

– Waller:

Source: Reuters Read full article

Source: Reuters Read full article

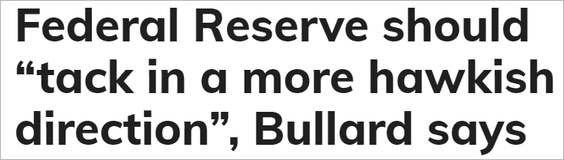

– Bullard:

Source: MarketWatch Read full article

Source: MarketWatch Read full article

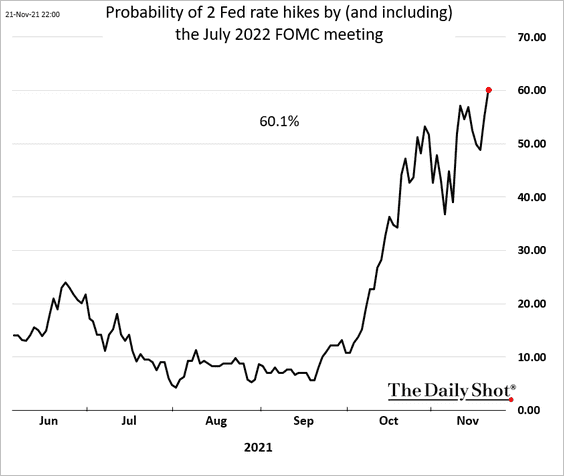

• The probability of two rate hikes by next July climbed to 60%.

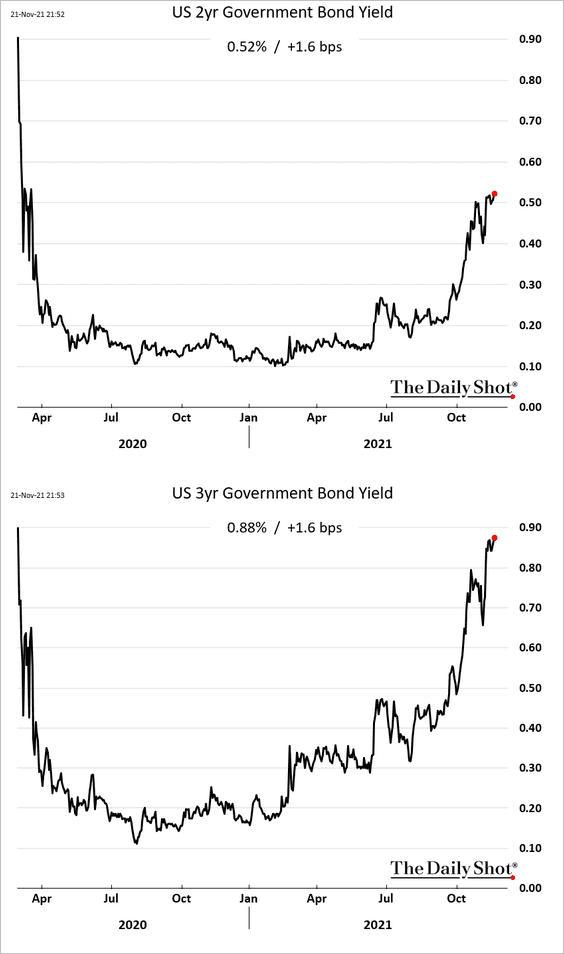

• Short-term yields increased further, …

… as the yield curve continues to flatten.

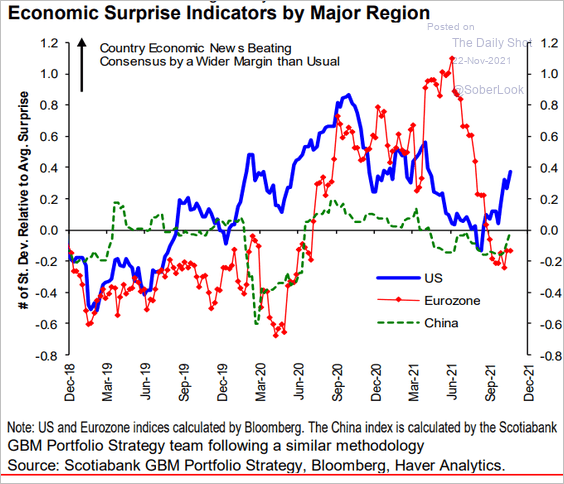

• Rising expectations for a more hawkish Fed and stronger US economic data …

Source: Scotiabank Economics

Source: Scotiabank Economics

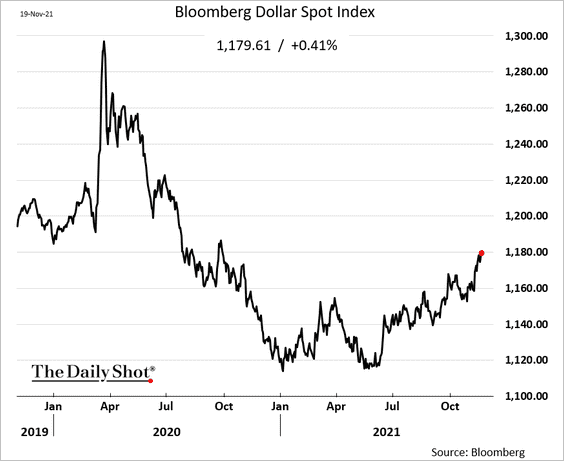

… are supporting the US dollar.

——————–

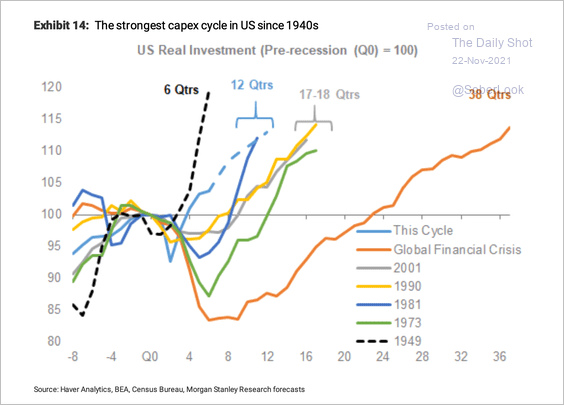

2. This is the strongest Capex cycle the US has seen since the 1940s.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

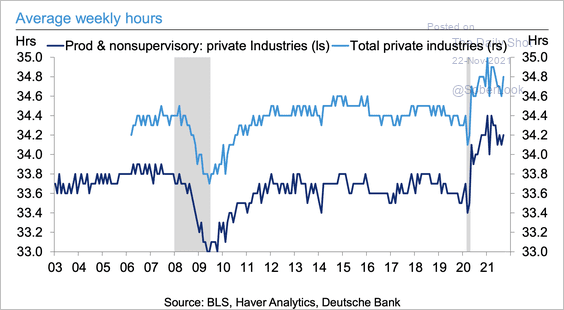

3. Hours worked have been elevated during the pandemic recovery – a sign of robust labor demand.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

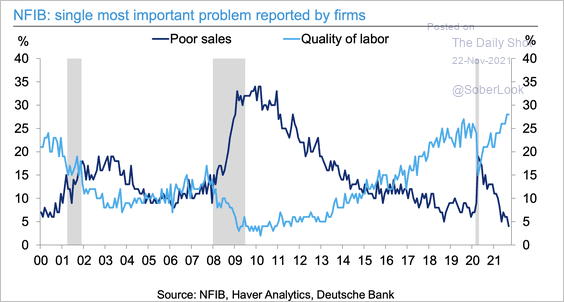

Among small businesses, there is far more concern about hiring than sales.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

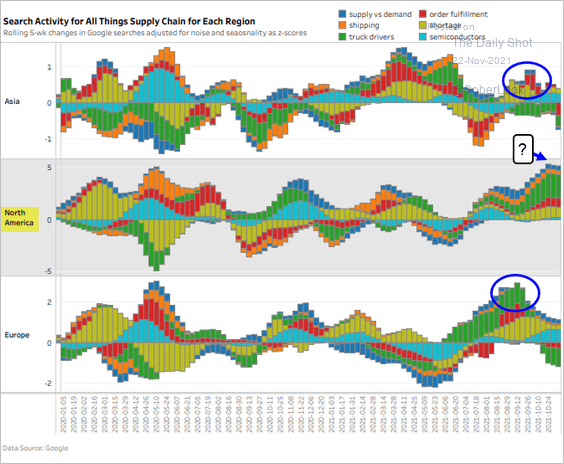

4. Based on Google search activity, supply chain concerns have peaked in Asia and Europe. Is North America next?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

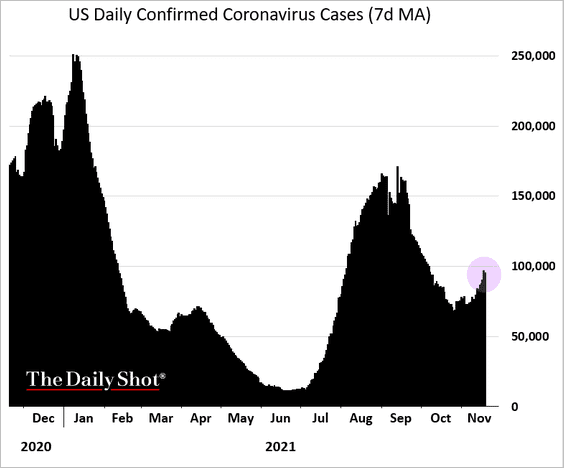

5. US COVID cases are rising again.

Back to Index

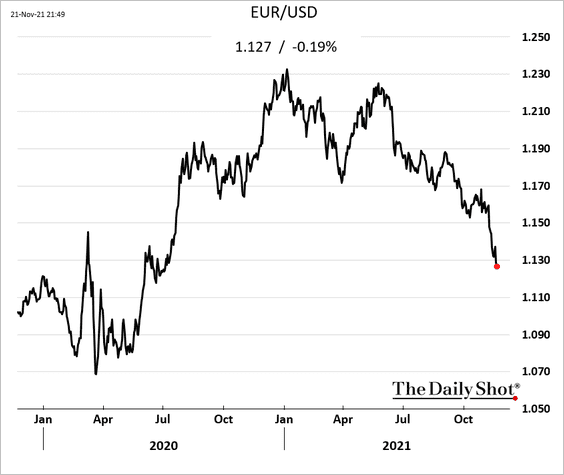

The Eurozone

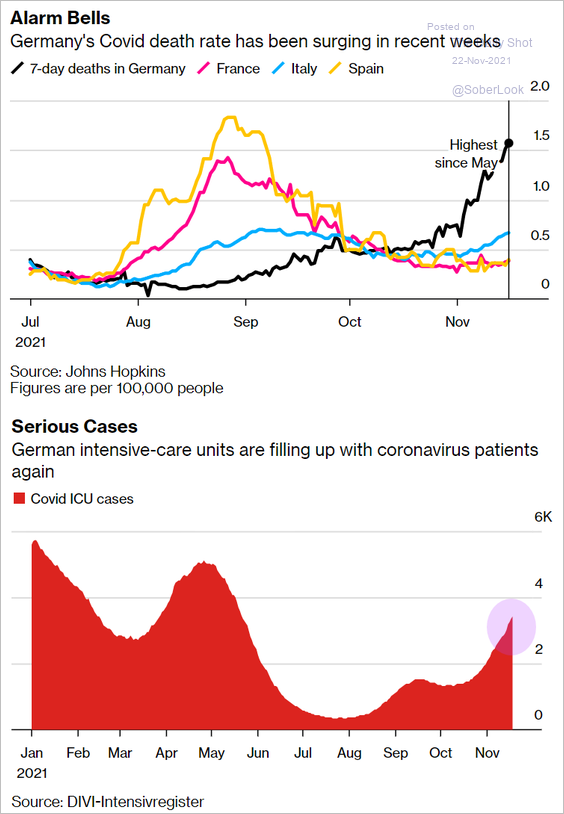

1. COVID cases and hospitalizations in Germany continue to climb, …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

… which, in combination with a more hawkish Fed, is pressuring the euro.

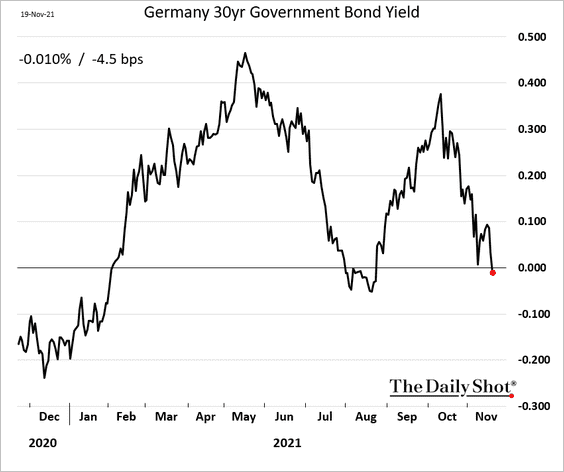

The whole German yield curve is now back in negative territory.

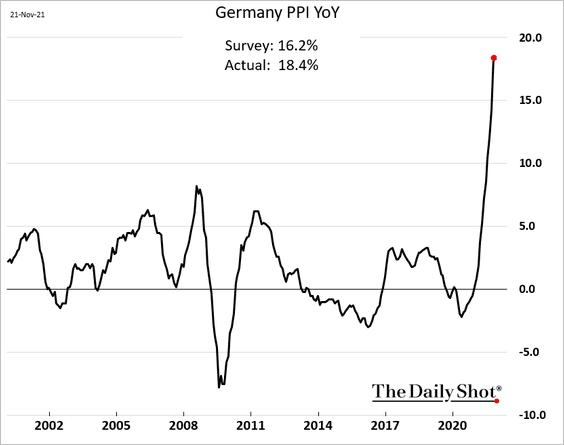

Separately, Germany’s producer prices continue to surge.

——————–

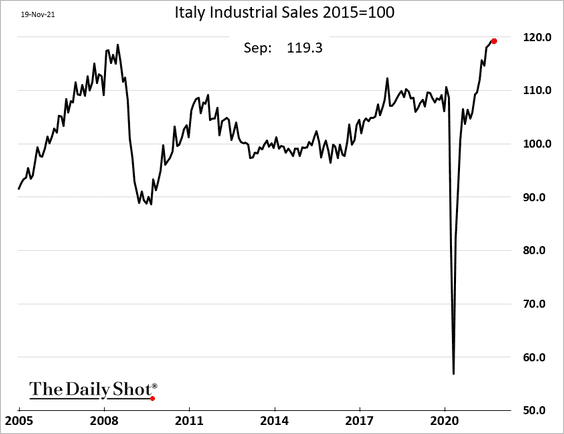

2. Have Italian industrial sales peaked?

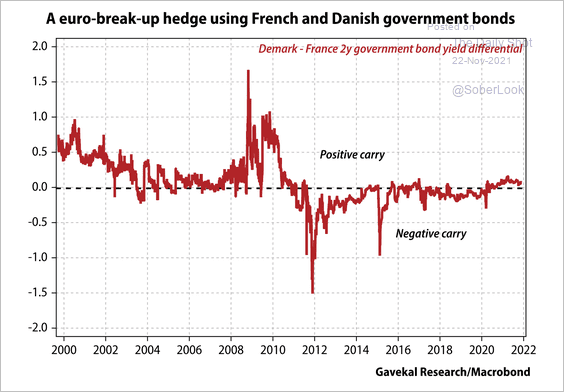

3. Looking for a positive-carry hedge against the euro breakup? The Danish-French bond spread fits the profile.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Europe

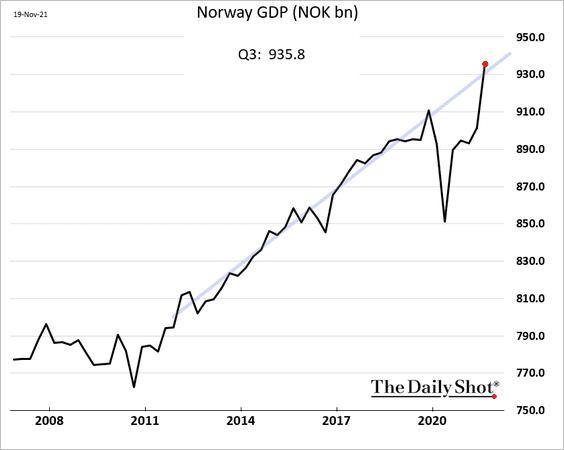

1. Norway’s GDP is now above the pre-COVID trend.

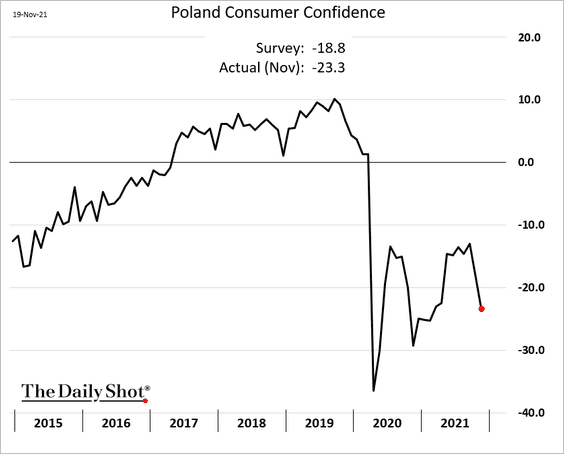

2. Poland’s consumer sentiment has deteriorated as the pandemic takes a toll.

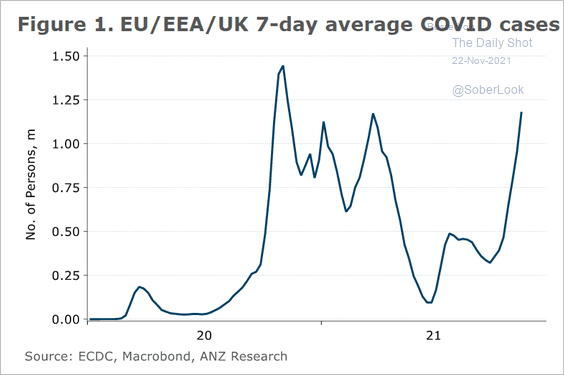

3. Here is the COVID trend across Europe.

Source: ANZ Research

Source: ANZ Research

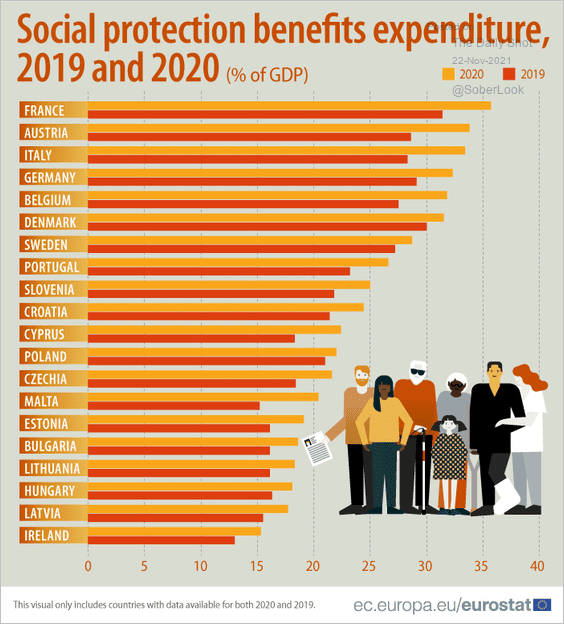

4. Next, let’s take a look at social protection benefits in the EU.

Source: @EU_Eurostat Read full article

Source: @EU_Eurostat Read full article

Back to Index

Asia – Pacific

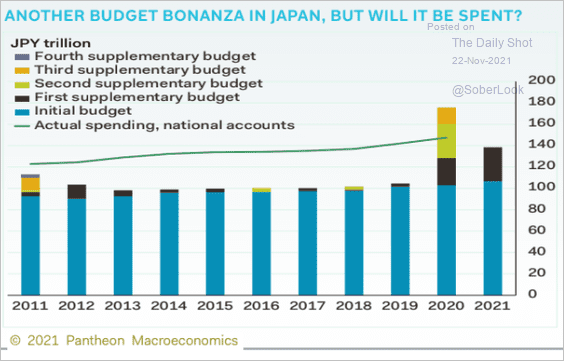

1. Japan’s government budget has blown out again, but it’s not clear how much of it will be spent.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

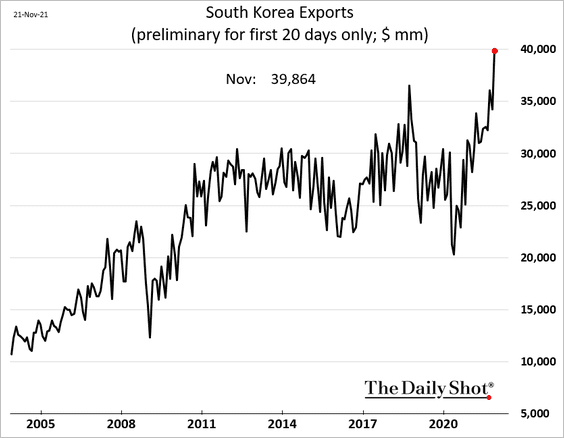

2. South Korea’s exports surged this month, hitting a record high.

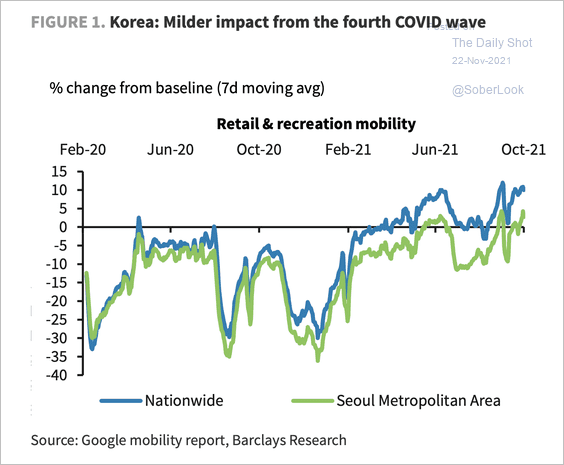

The fourth COVID wave has had a smaller impact in South Korea.

Source: Barclays Research

Source: Barclays Research

——————–

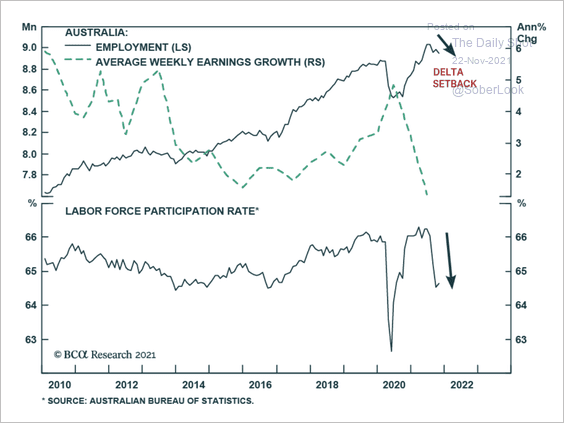

3. Weaker employment conditions highlight the case for a dovish RBA.

Source: BCA Research

Source: BCA Research

Back to Index

China

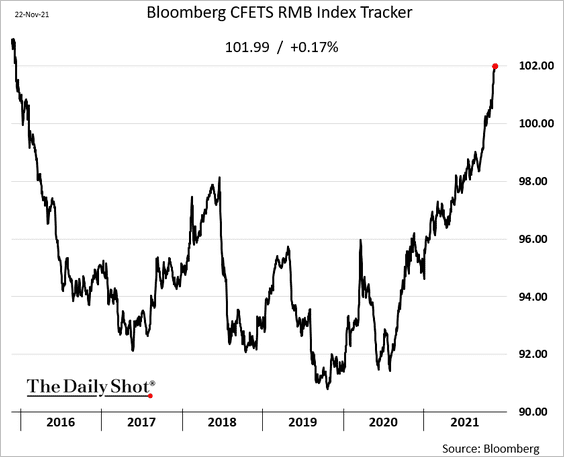

1. The renminbi continues to surge against a basket of currencies.

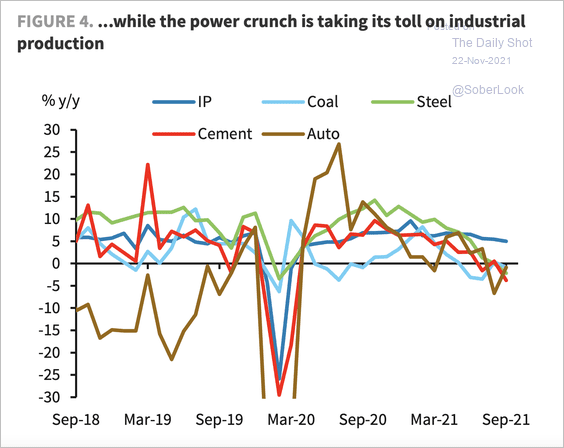

2. The power price spike in China has taken a toll on various energy-intensive industries.

Source: Barclays Research

Source: Barclays Research

Back to Index

Emerging Markets

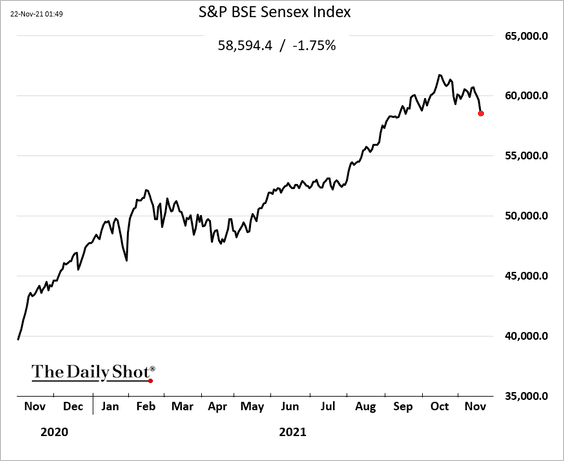

1. India’s equity market is rolling over.

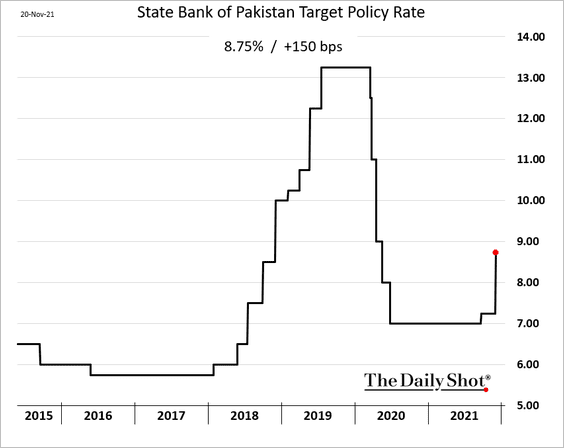

2. Pakistan’s central bank hiked rates more than expected to defend the currency.

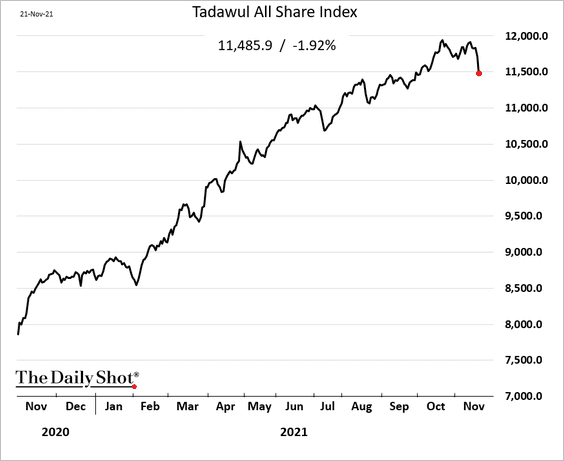

3. Saudi stocks took a hit in response to weaker oil prices.

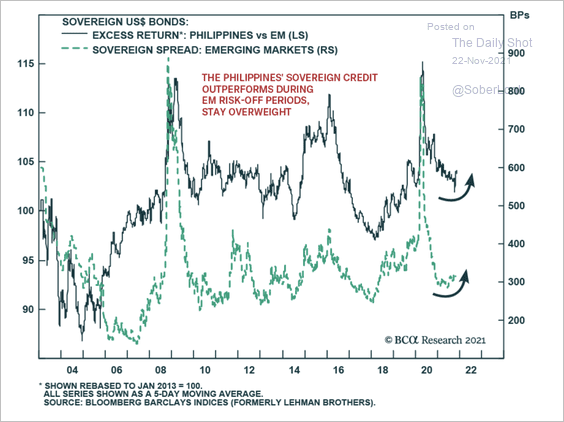

4. Philippine sovereign credit spreads tend to widen much less than EM peers during risk-off periods.

Source: BCA Research

Source: BCA Research

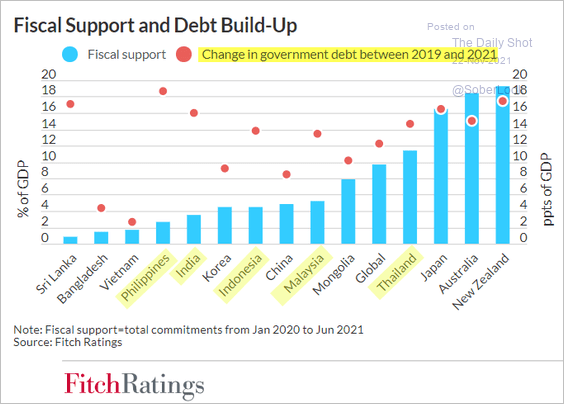

5. Government debt increased sharply in some EM Asia economies.

Source: Fitch Ratings

Source: Fitch Ratings

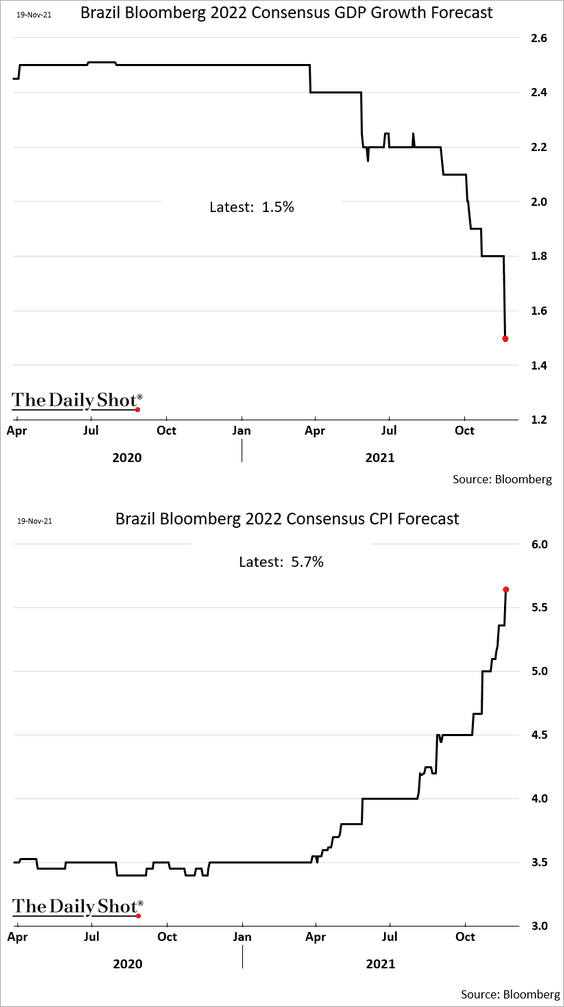

6. Brazil is headed for stagflation as economists downgrade the GDP forecasts while pushing inflation projections sharply higher.

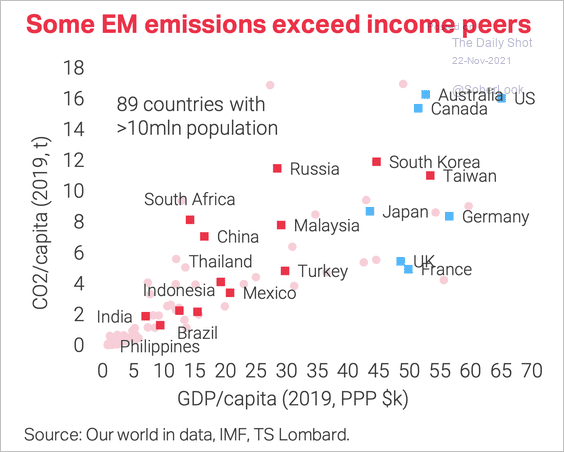

7. Some emerging market economies will have to contend with emission reduction as a growth dampener.

Source: TS Lombard

Source: TS Lombard

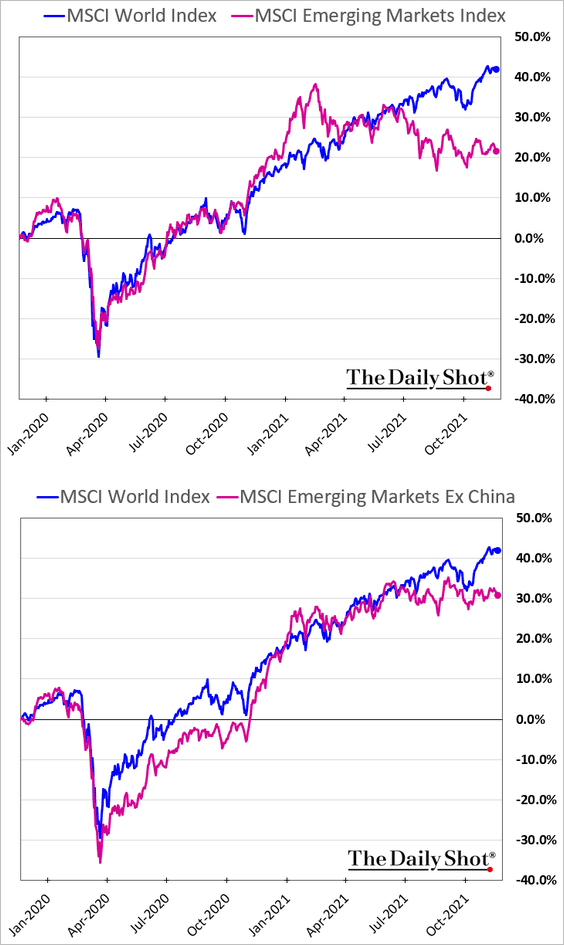

8. EM shares continue to underperform.

Back to Index

Cryptocurrency

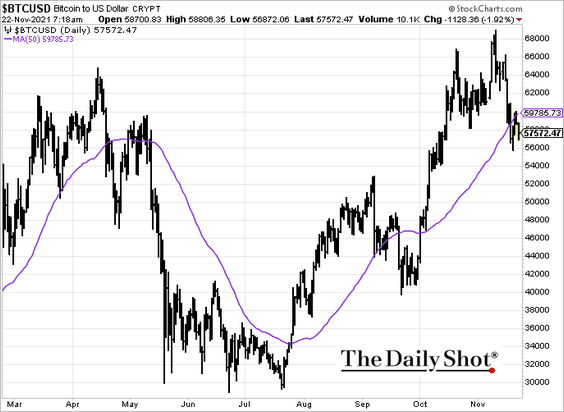

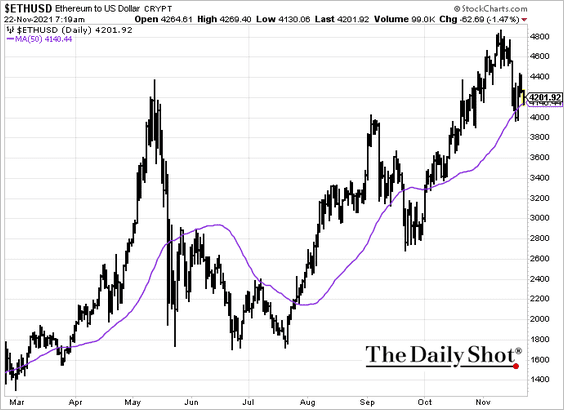

1. The 50-day moving average represents resistance for bitcoin …

… and support for ether.

——————–

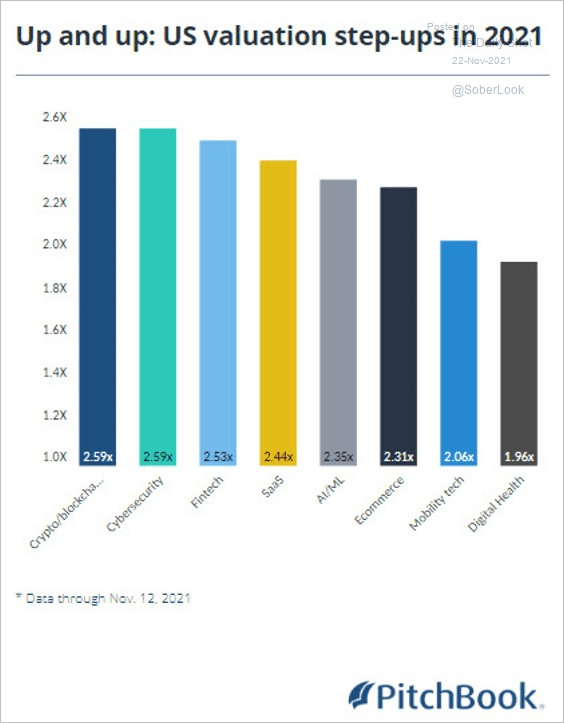

2. Crypto/blockchain contributed to the rise in VC mega-deals this year.

Source: PitchBook

Source: PitchBook

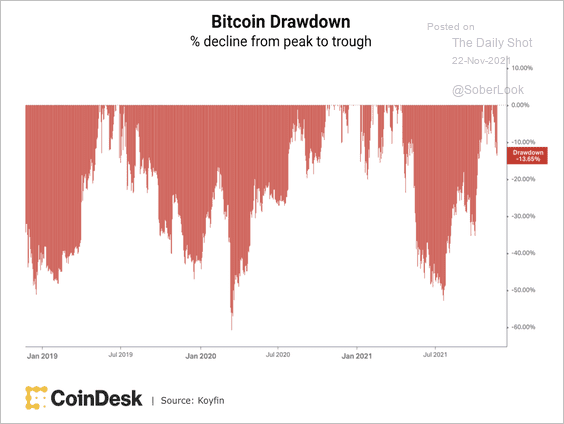

3. Bitcoin can experience severe drawdowns.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

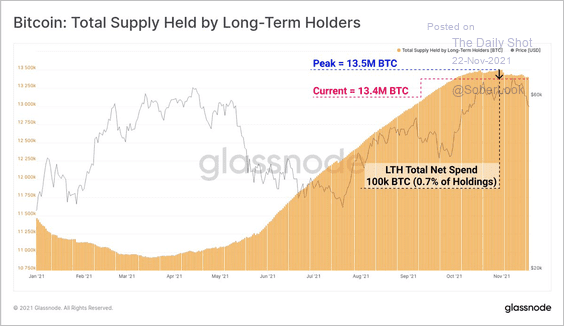

4. Long-term bitcoin holders do not appear to be selling their coins in a panic yet, according to blockchain data compiled by Glassnode.

Source: @glassnode

Source: @glassnode

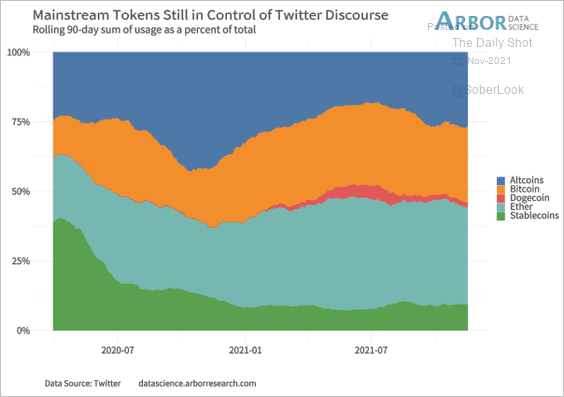

5. Altcoins are once again becoming a larger component of Twitter discourse.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Commodities

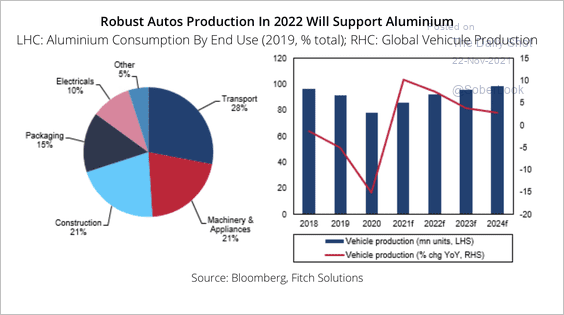

1. Demand for aluminum in auto production is expected to remain strong next year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

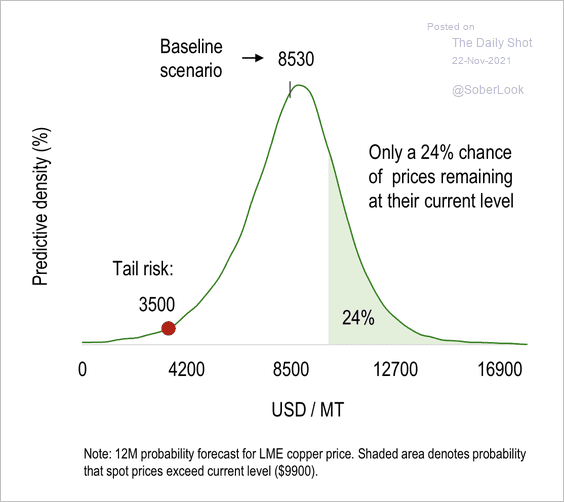

2. The LME copper price has a low chance of remaining at current levels over the next 12 months, according to Numera Analytics.

Source: Numera Analytics

Source: Numera Analytics

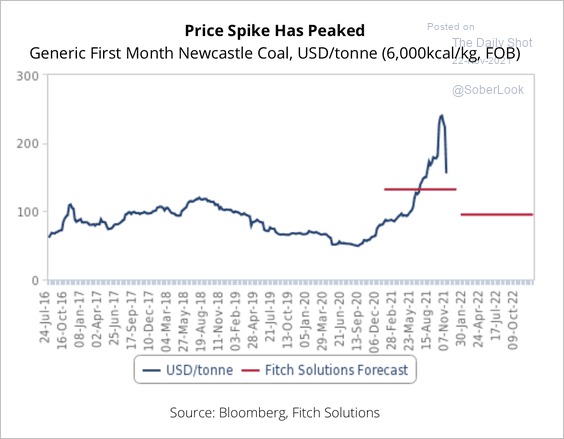

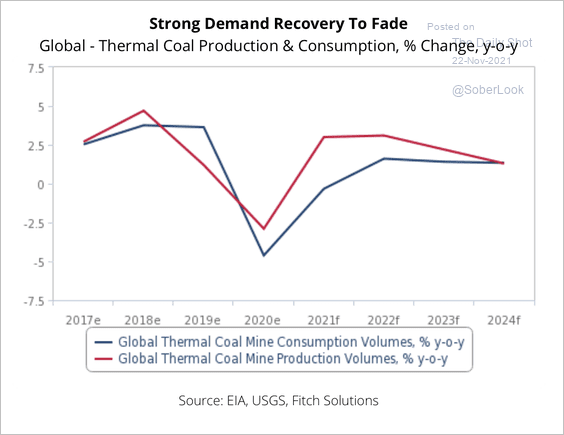

3. Fitch Solutions expects China’s government to continue boosting domestic availability of coal over the coming months, which should reduce import demand and depress seaborne coal prices (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

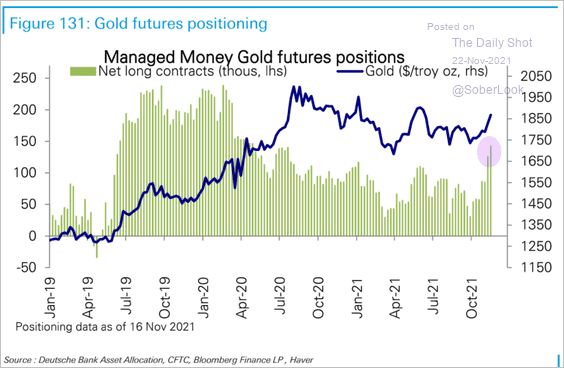

4. Funds have been boosting their exposure to gold.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

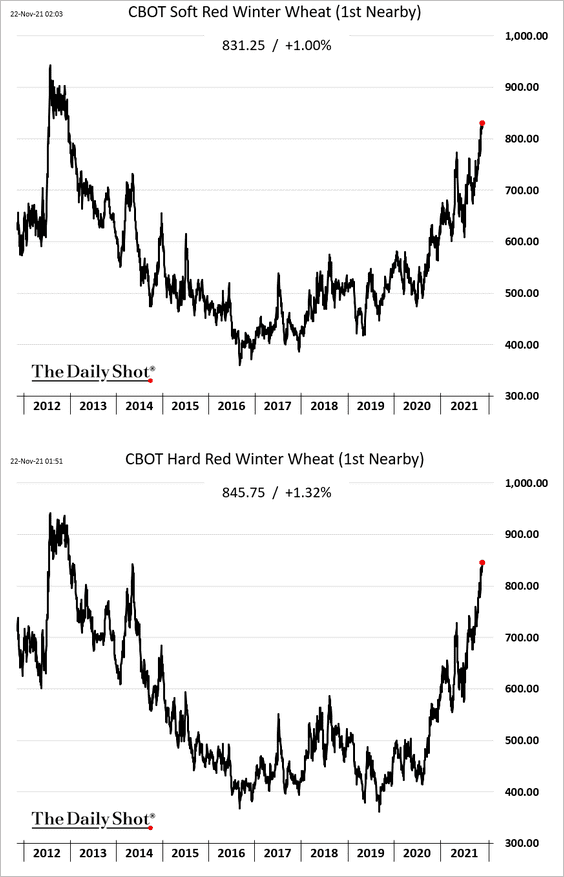

5. US wheat prices are surging.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

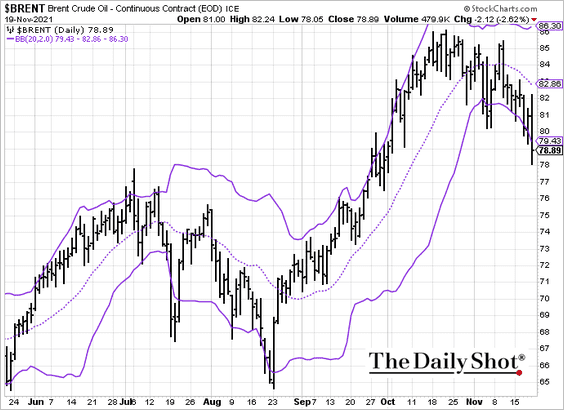

1. Crude oil futures have been rolling over, with Brent dipping below the Bollinger Band.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

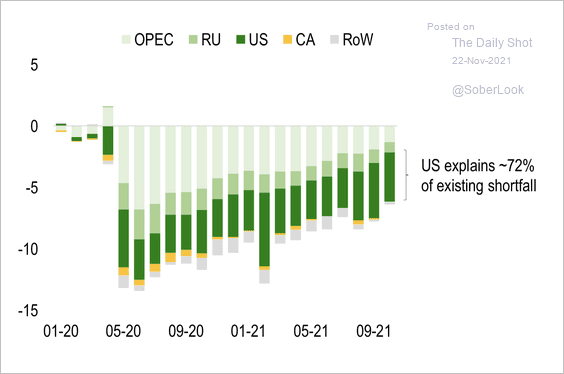

2. The US accounts for the bulk of the existing oil shortfall (chart shows global oil production deviation from the pre-pandemic path).

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Equities

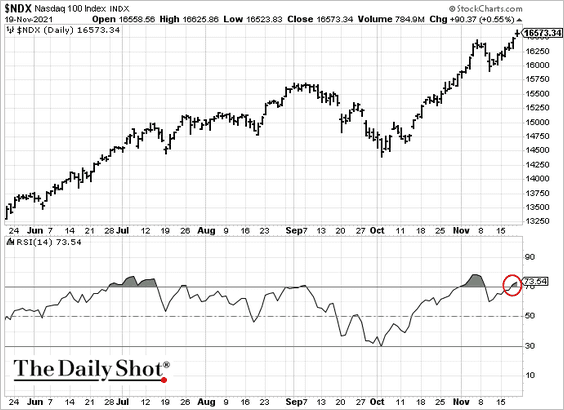

1. The Nasdaq 100 looks overbought as it hits another record high.

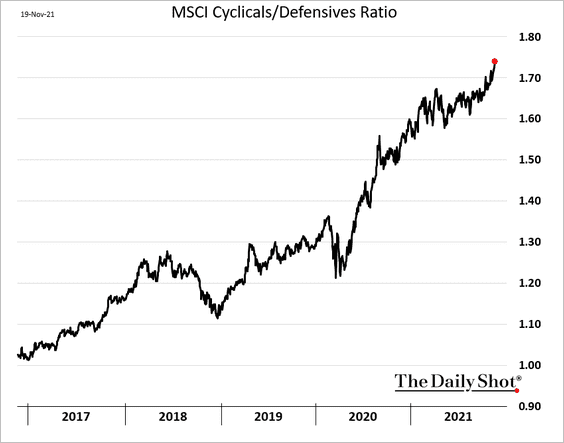

2. Cyclical sectors continue to outperform defensives.

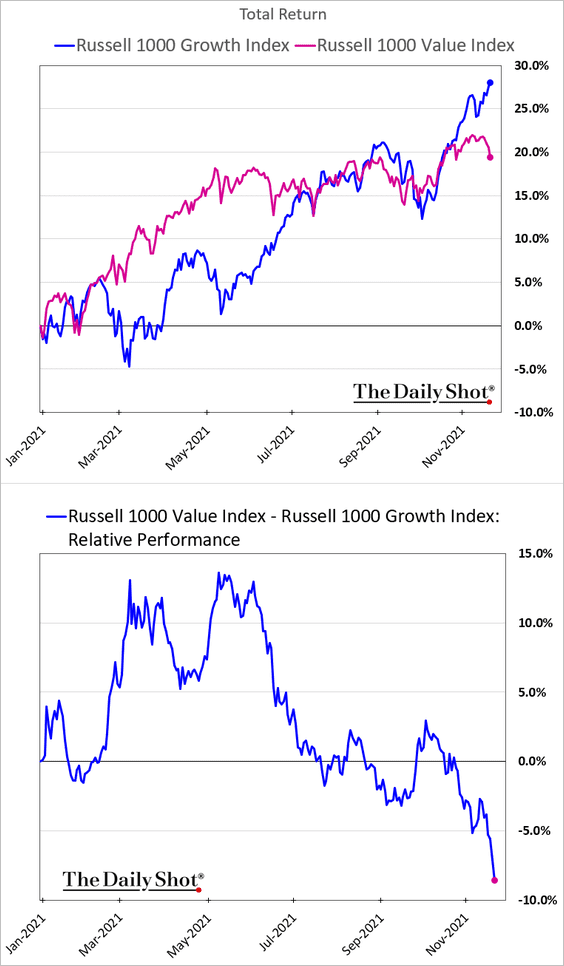

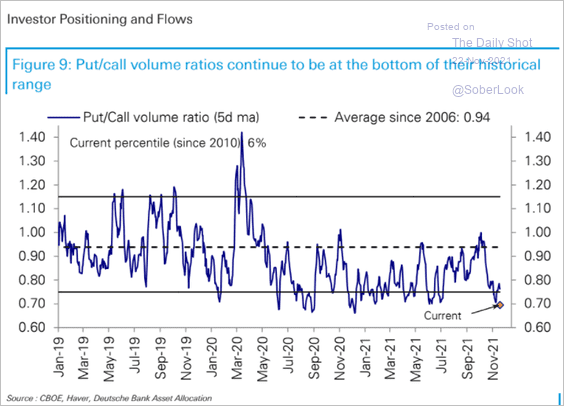

3. Large-cap value stocks are widening their underperformance vs. growth.

However, small-cap value stocks are well ahead of growth year-to-date (partially driven by demand from retail investors).

——————–

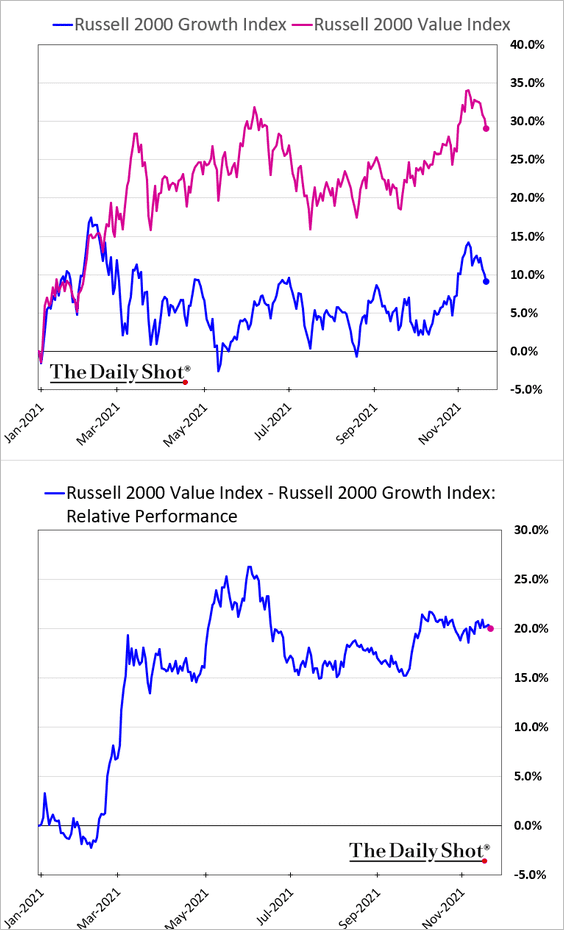

4. This chart shows the divergence between small- and large-cap earnings-per-share expectations.

Source: Yardeni Research

Source: Yardeni Research

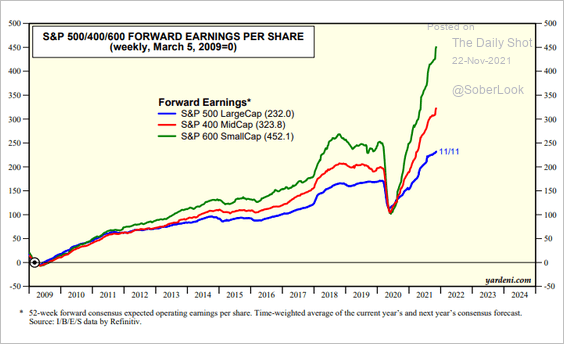

5. The put-call ratio remains depressed, pointing to investor complacency.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

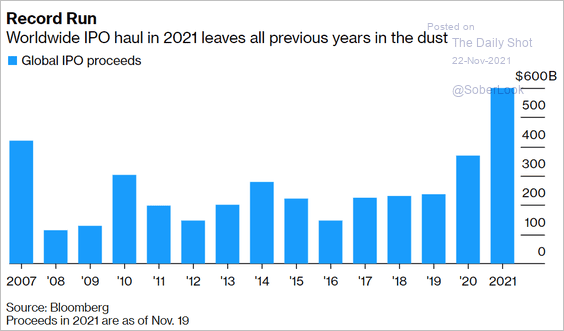

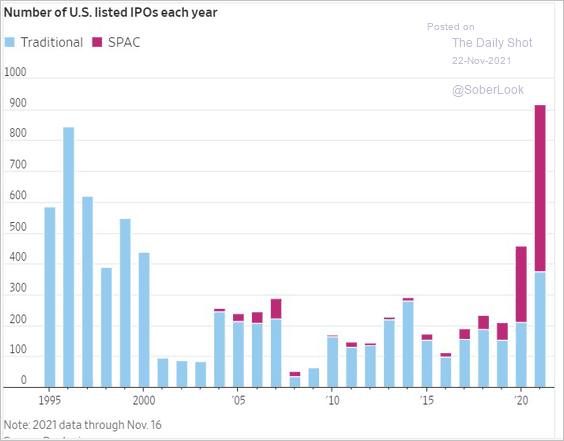

6. IPO activity is hitting record highs.

• Global:

Source: @markets Read full article

Source: @markets Read full article

• US:

Source: @WSJmarkets Read full article

Source: @WSJmarkets Read full article

——————–

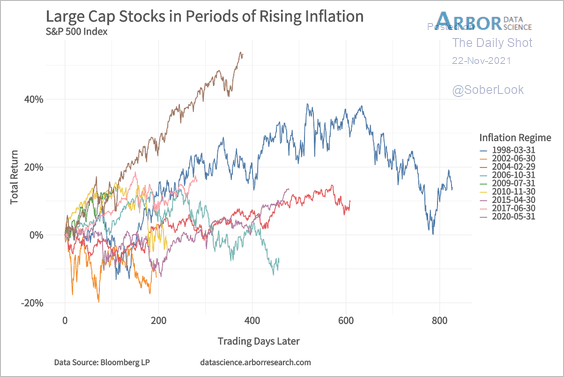

7. How does the S&P 500 perform during periods of high inflation.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

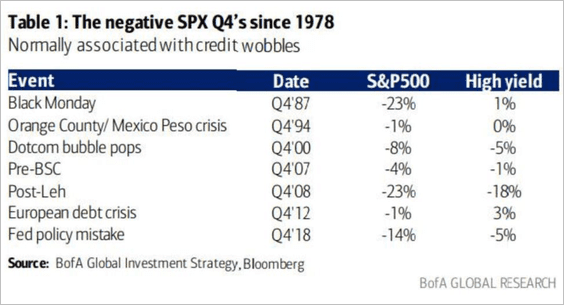

8. Since 1978, a negative outcome in Q4 for the S&P 500 was always associated with a credit event.

Source: BofA Global Research

Source: BofA Global Research

9. Next, we have some sector updates.

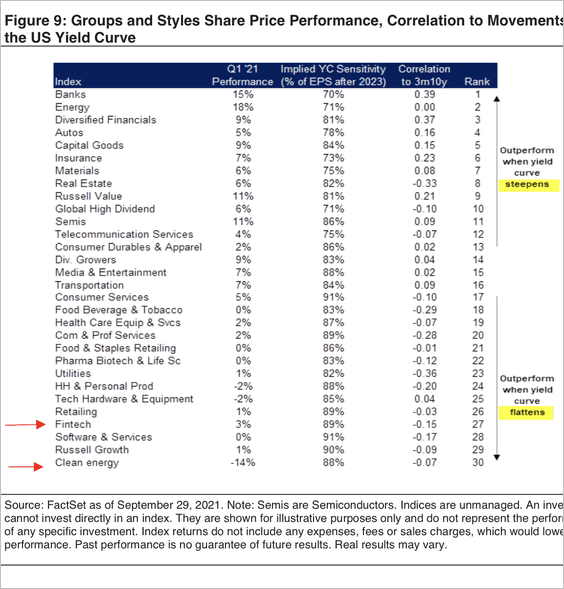

• Sector sensitivities to movements in the Treasury yield curve:

Source: Citi Private Bank

Source: Citi Private Bank

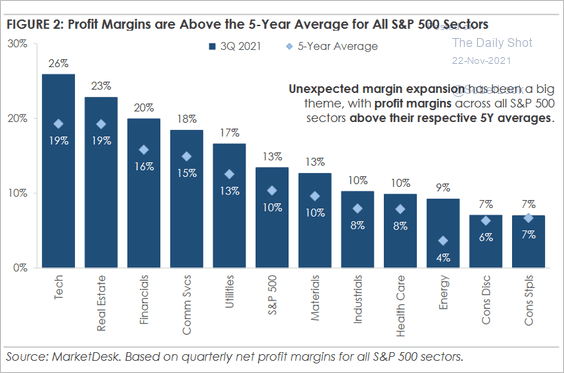

• Strong profit margins across most sectors:

Source: MarketDesk Research

Source: MarketDesk Research

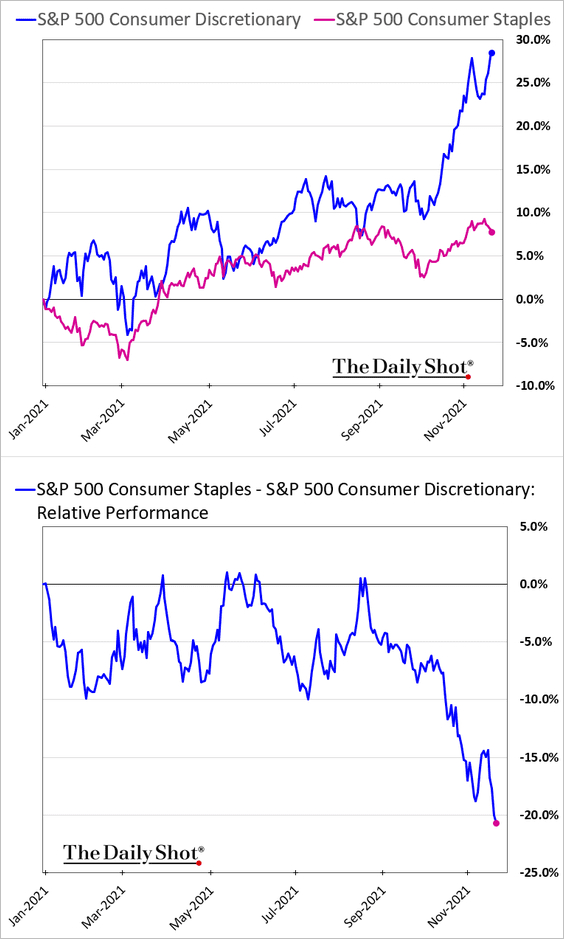

• Consumer discretionary vs. consumer staples:

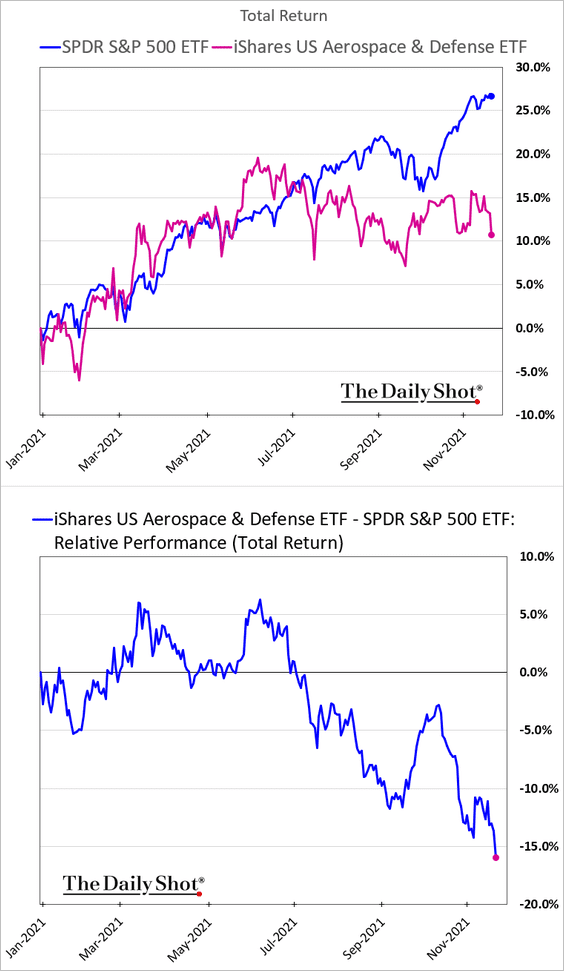

• Aerospace and Defense:

Back to Index

Credit

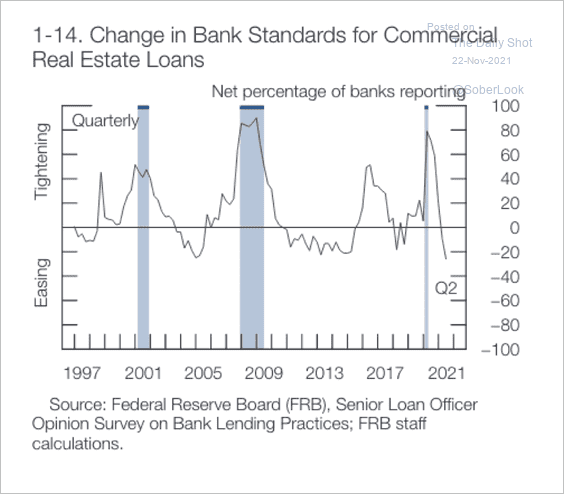

1. Bank lending standards on US commercial real estate continue to ease.

Source: Federal Reserve Read full article

Source: Federal Reserve Read full article

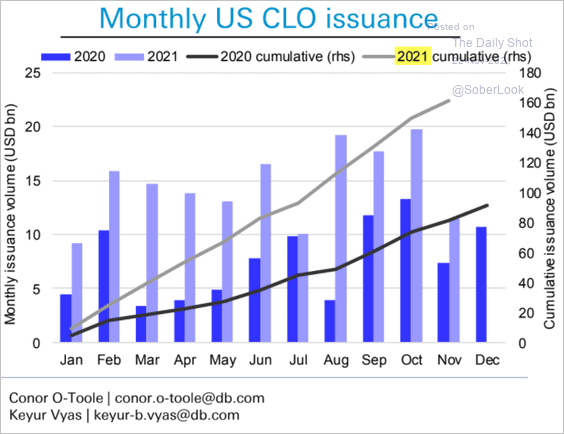

2. Next, we have a couple of updates on the CLO market.

• Issuance:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

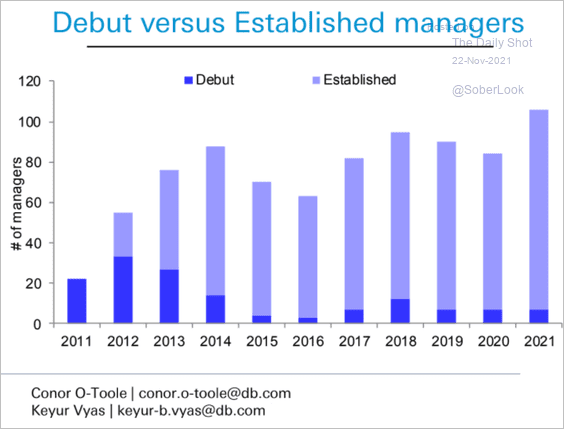

• New vs. established managers:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

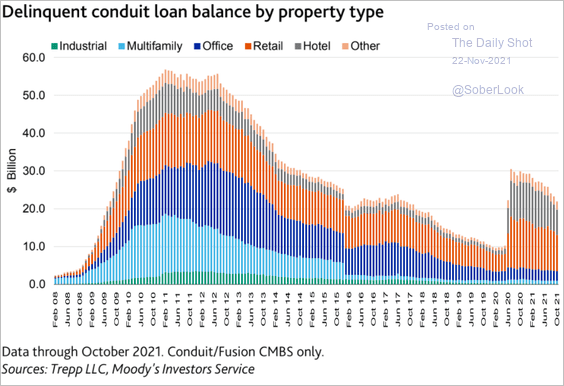

3. Commercial real estate delinquent loan balances continue to moderate.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

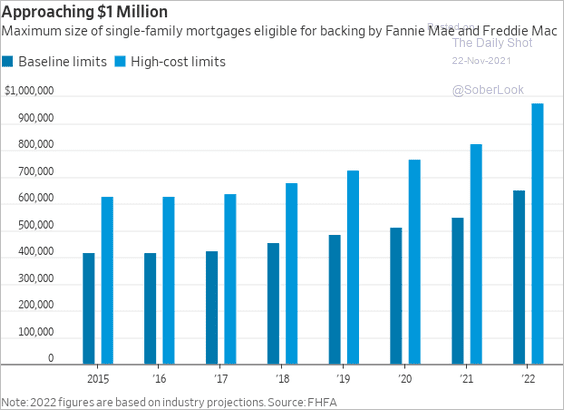

4. The maximum size of resi mortgages eligible for backing by Fannie Mae and Freddie Mac keeps climbing with property prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

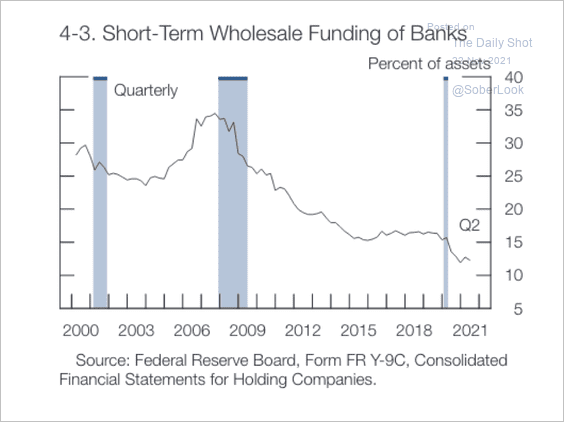

1. As US banks increased their liquid assets, mainly in the form of Treasuries and mortgage-backed securities, their need for short-term funding has declined.

Source: Federal Reserve Read full article

Source: Federal Reserve Read full article

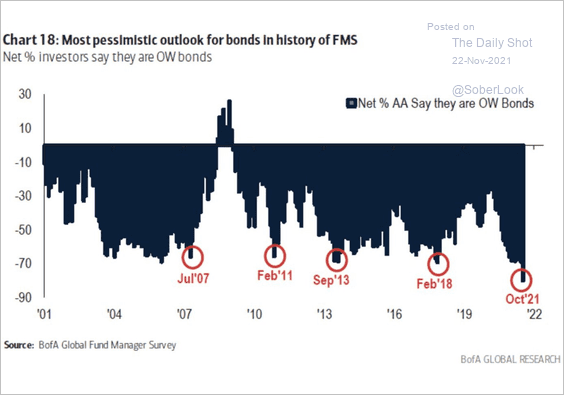

2. Fund managers are pessimistic about bonds.

Source: BofA Global Research

Source: BofA Global Research

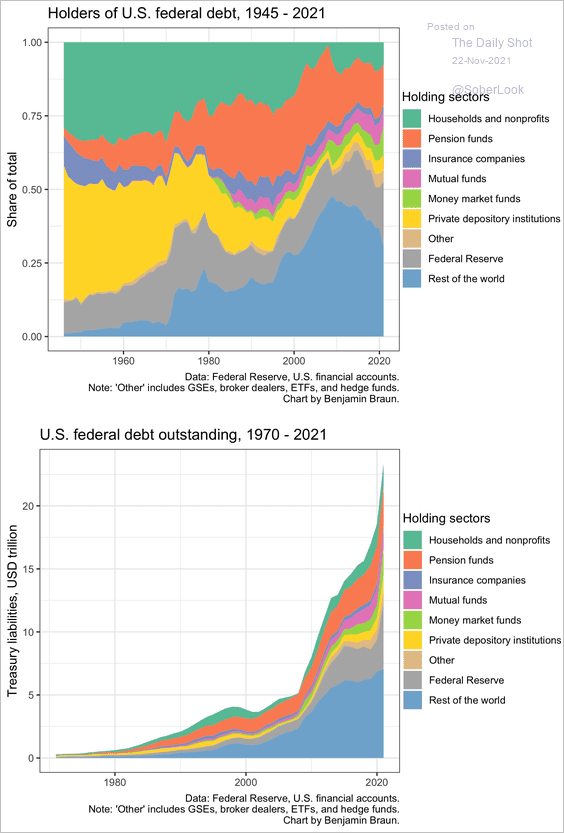

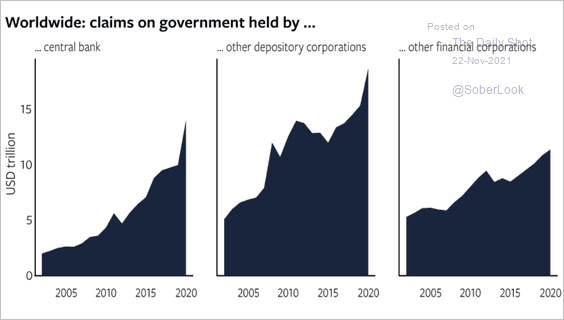

3. Who owns Treasury securities?

Source: @BJMbraun

Source: @BJMbraun

Who holds global government debt?

Source: ODI Read full article

Source: ODI Read full article

——————–

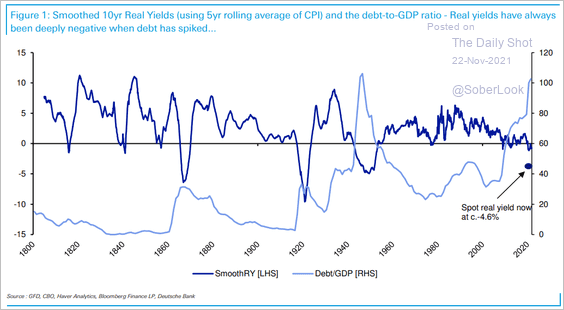

4. Real yields tend to be negative when debt spikes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

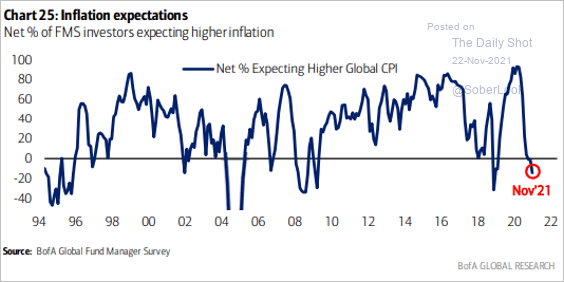

1. Fund managers believe that inflation has peaked.

Source: BofA Global Research

Source: BofA Global Research

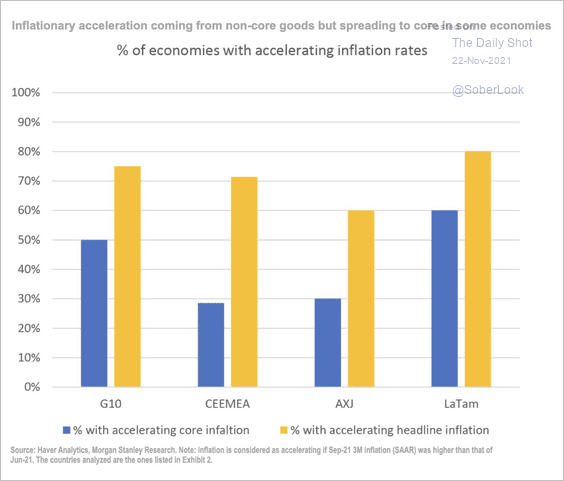

2. Here is the share of economies with accelerating headline and core CPI.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

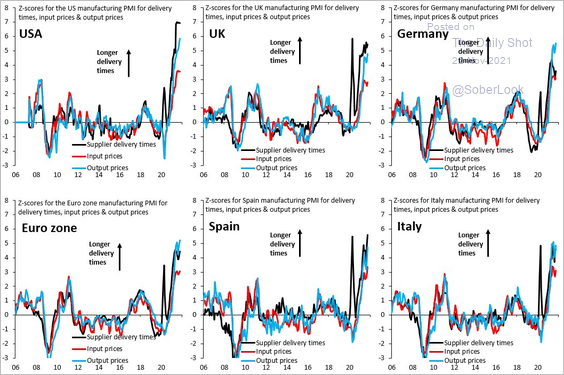

3. Below is a look at supply-chain disruptions boosting input and output prices.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

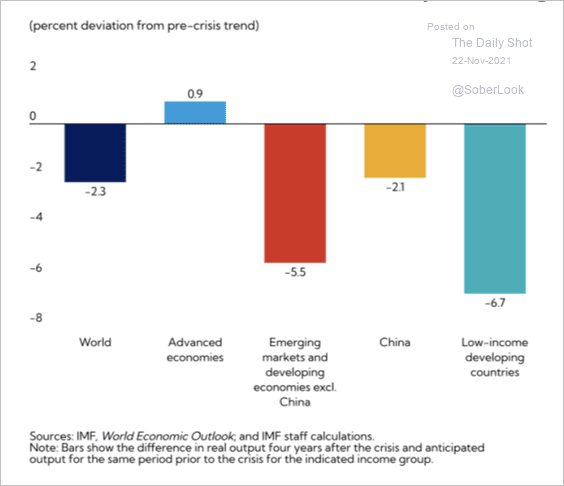

4. The IMF expects only advanced economies to return to pre-pandemic growth trends next year.

Source: IMF

Source: IMF

5. China’s weak credit impulse points to downside risks for global semiconductor sales.

![]() Source: @BittelJulien

Source: @BittelJulien

——————–

Food for Thought

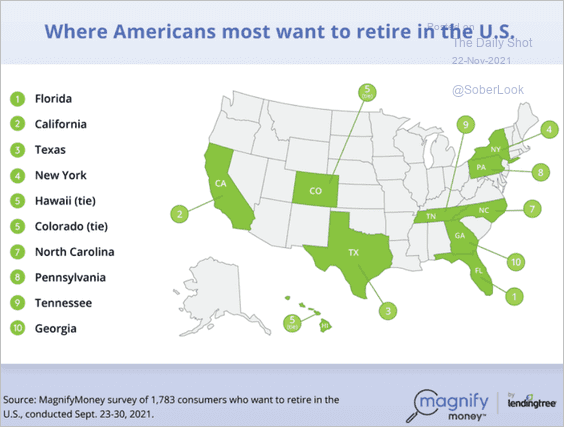

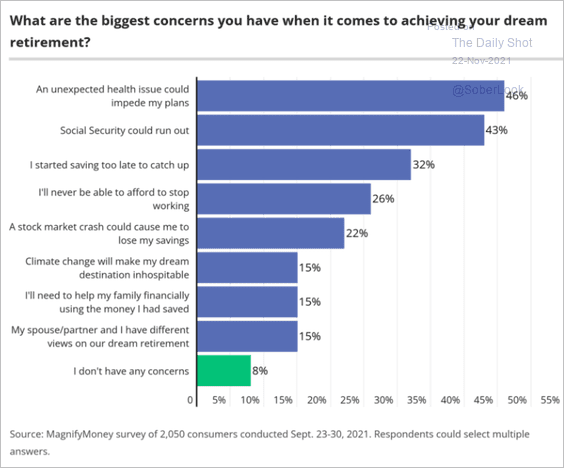

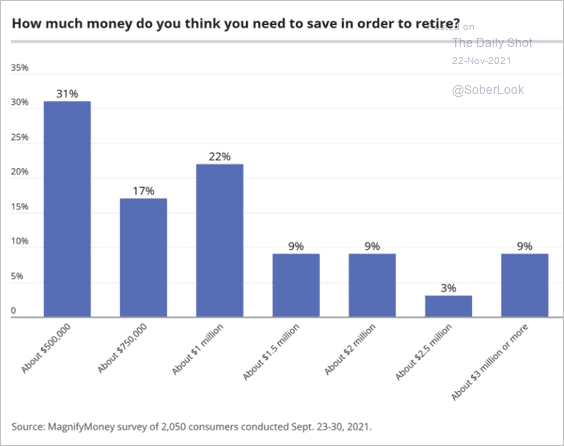

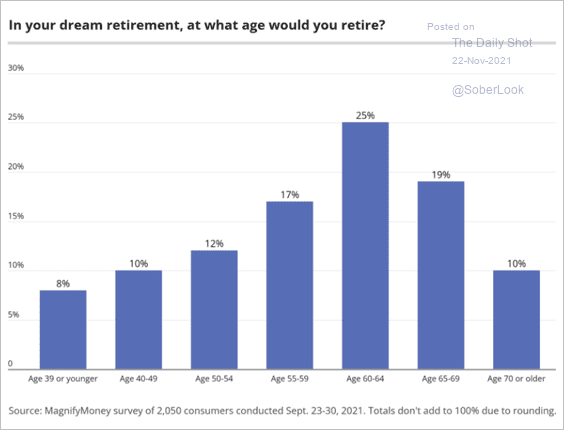

1. Thinking about retirement:

• Preferred retirement locations:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

• Concerns about retirement:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

• Saving for retirement:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

• Preferred retirement age:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

——————–

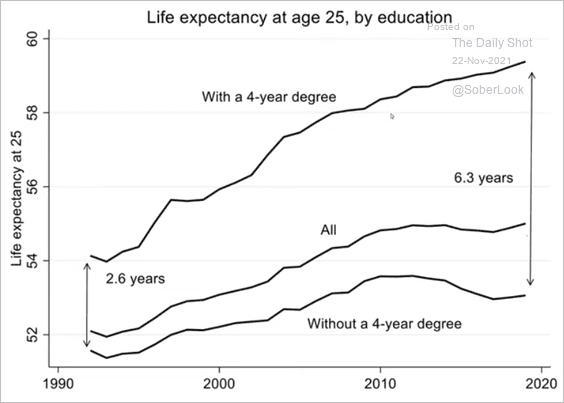

2. Life expectancy by education in the US:

Source: NBER Read full article

Source: NBER Read full article

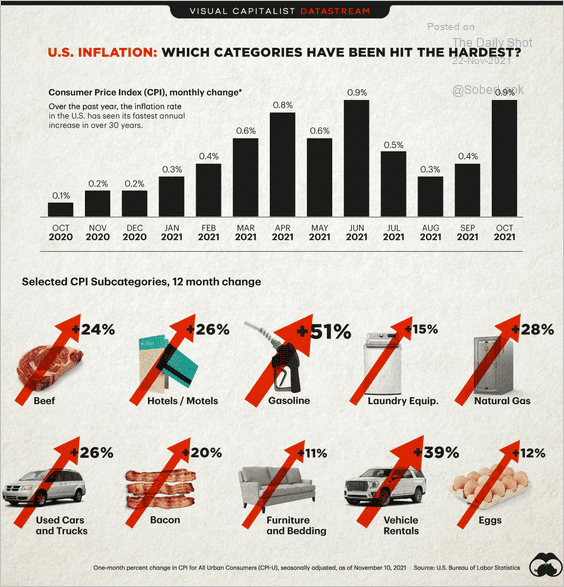

3. Goods inflation:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

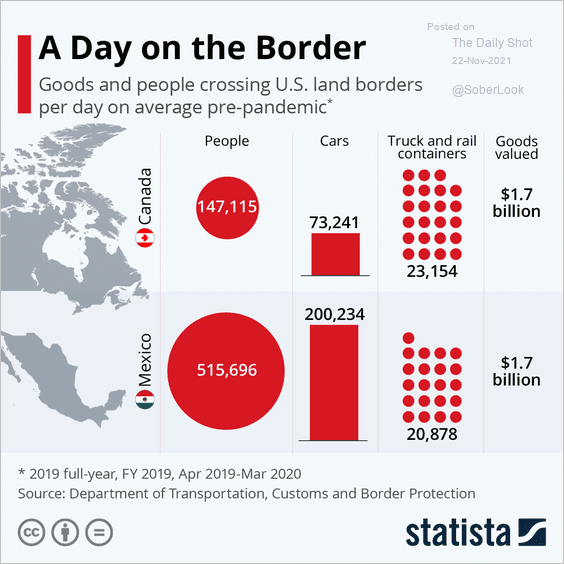

4. Land border activity in the US:

Source: Statista

Source: Statista

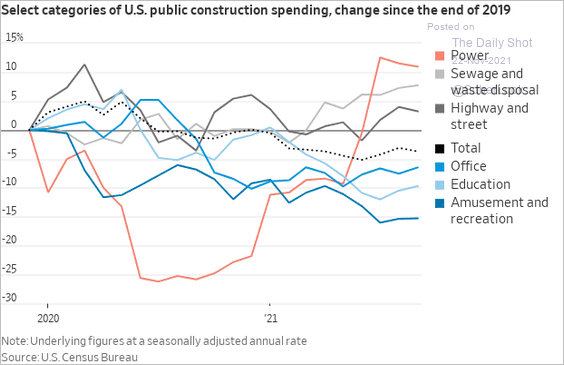

5. US public construction spending:

Source: @WSJ Read full article

Source: @WSJ Read full article

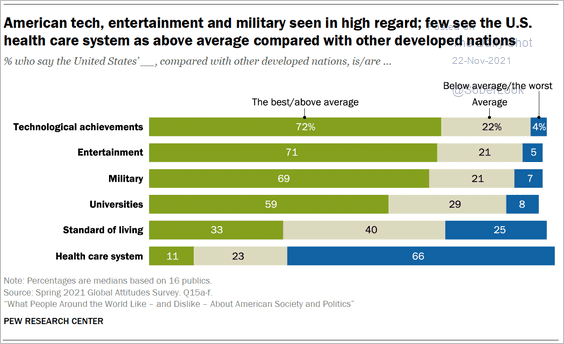

6. How other advanced economies view aspects of US society:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

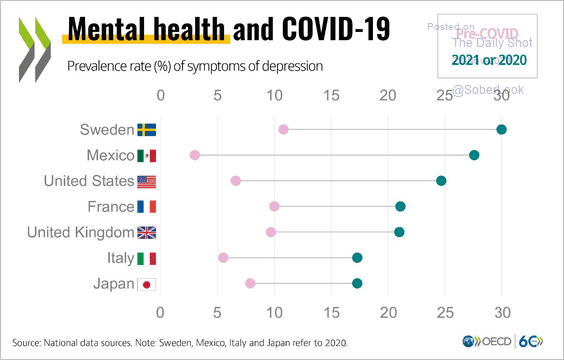

7. Deterioration in mental health during the COVID era:

Source: @stescarpetta Read full article

Source: @stescarpetta Read full article

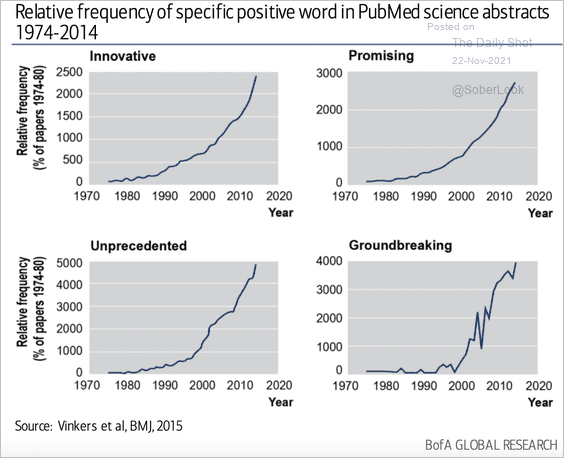

9. Is science getting more “exciting” (“innovative”, “promising”, “unprecedented,” and “groundbreaking”)?

Source: BofA Global Research Further reading

Source: BofA Global Research Further reading

——————–

Back to Index