The Daily Shot: 23-Nov-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The next Daily Shot will be out on Monday, November 29th.

The United States

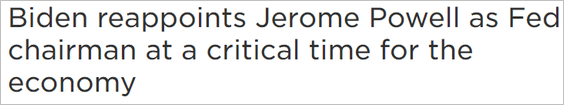

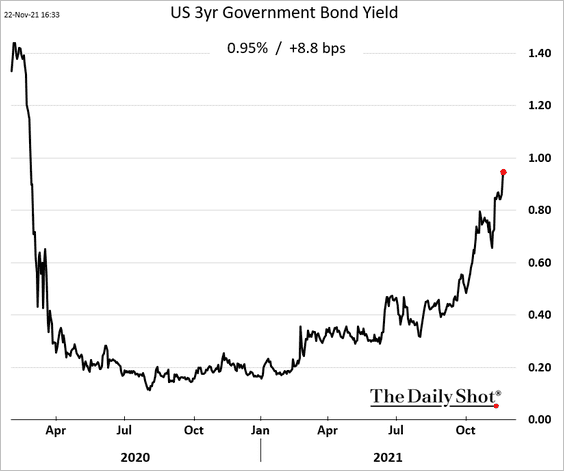

1. The stock market initially cheered Jerome Powell’s reappointment.

Source: NPR Read full article

Source: NPR Read full article

But then the realization set in that the Fed is now on course to accelerate monetary tightening.

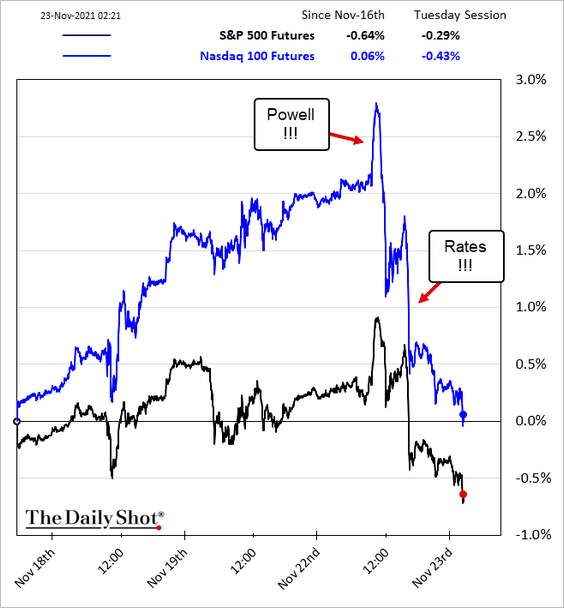

• The probability of three rate hikes next year blasted past 90%, …

… with the third hike now fully priced in by January 2023.

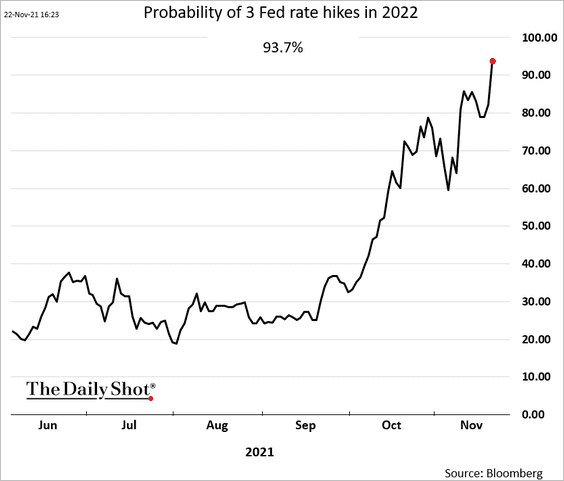

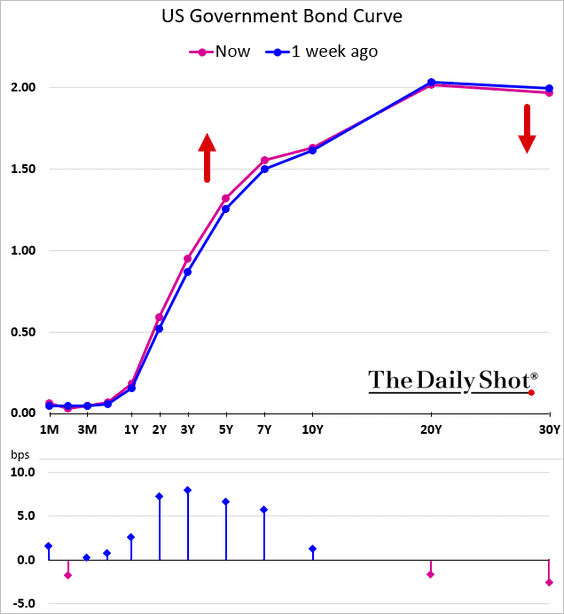

• Short-term Treasury yields jumped …

… and the curve flattened further.

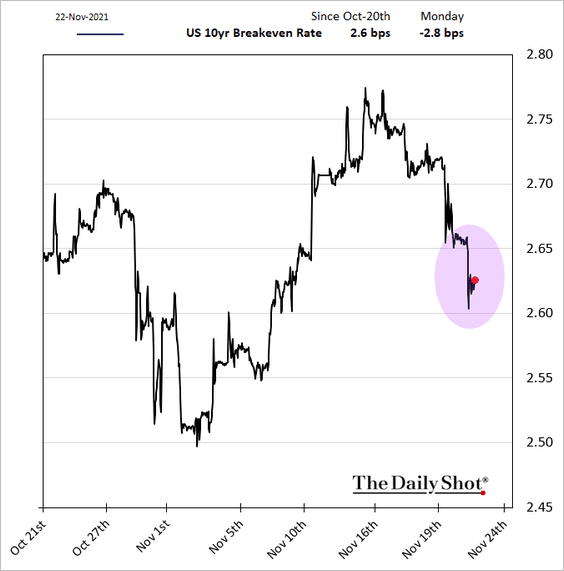

• Inflation expectations declined.

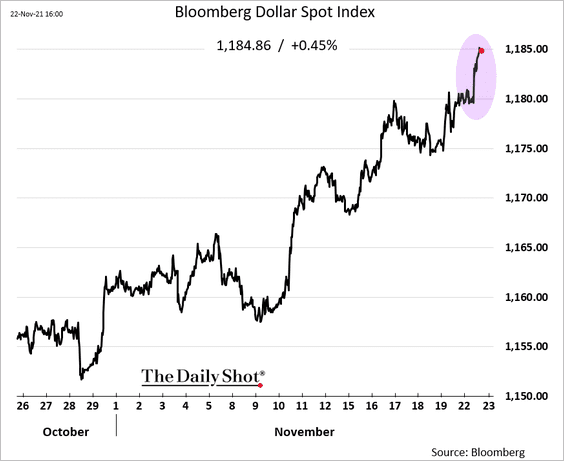

• And the US dollar rally resumed.

——————–

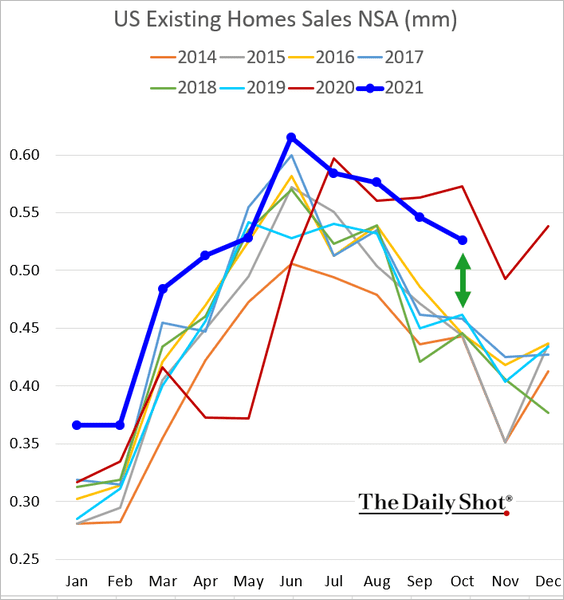

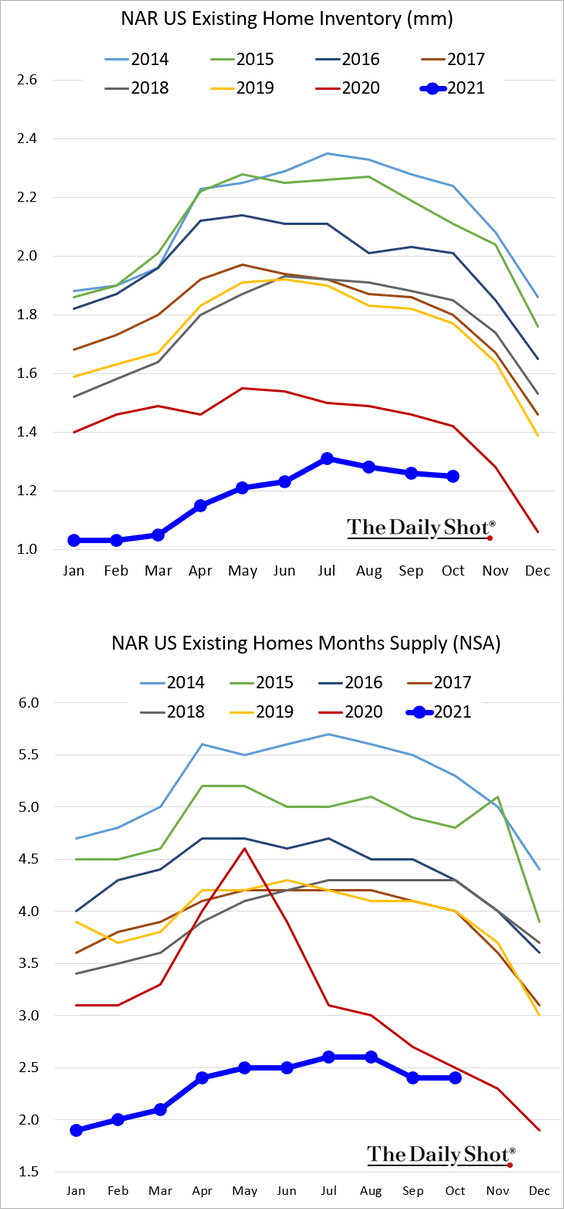

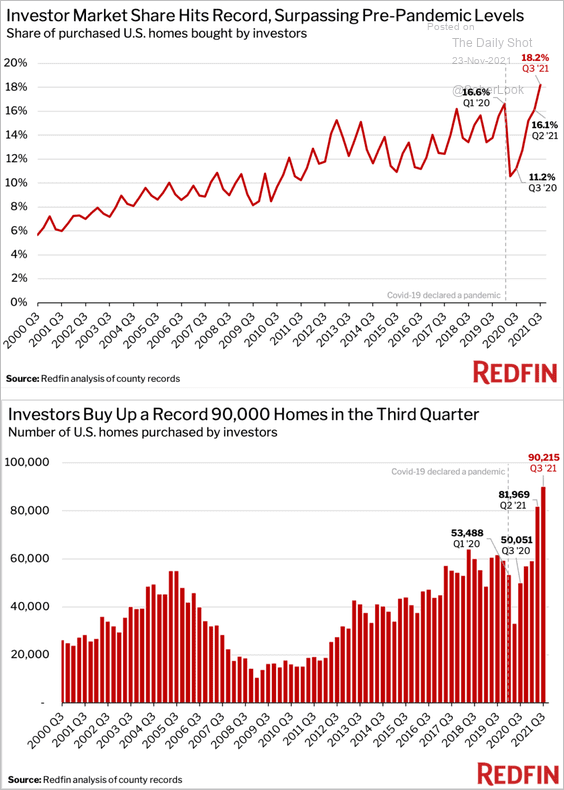

2. Next, we have some updates on the housing market.

• Existing home sales were below last year’s torrid activity but firmly above 2019 levels, topping forecasts.

• Inventories remain depressed.

• Investors have been moving into the housing market as rents surge.

Source: CNBC Read full article

Source: CNBC Read full article

Source: Redfin

Source: Redfin

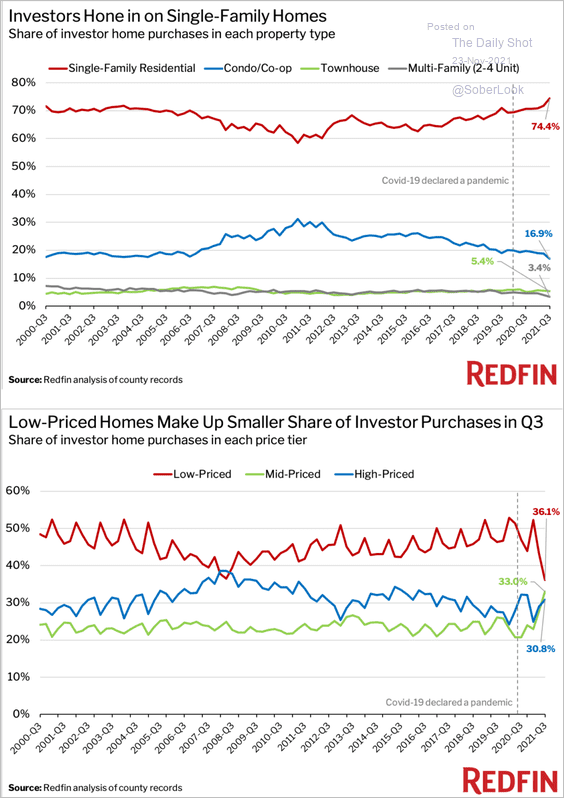

Investors increasingly focused on single-family mid- and higher-end homes.

Source: Redfin

Source: Redfin

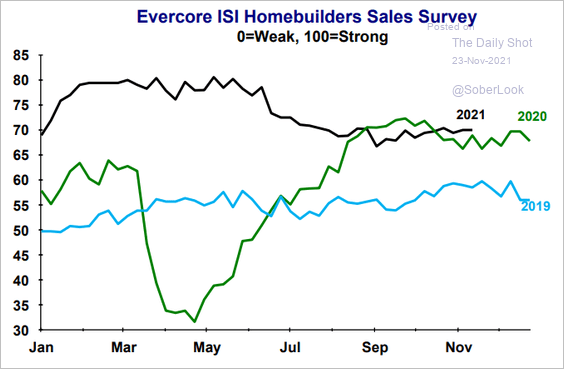

• Here is the Evercore ISI Homebuilder Sales Survey.

Source: Evercore ISI

Source: Evercore ISI

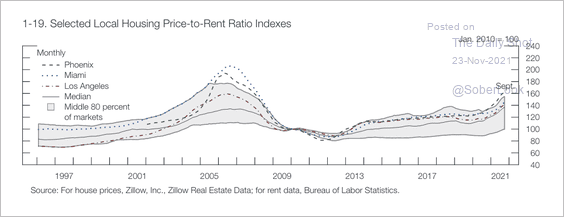

• Home price-to-rent ratios are rising, albeit still below 2007 record highs.

Source: Federal Reserve Read full article

Source: Federal Reserve Read full article

——————–

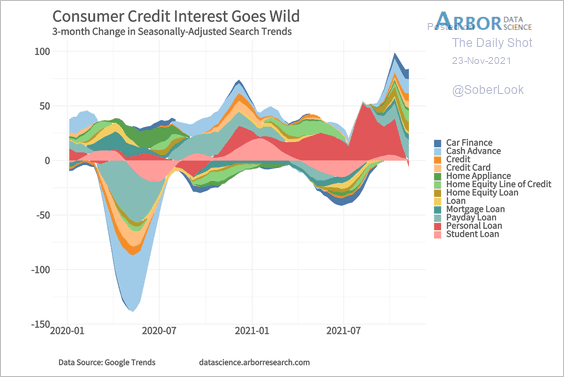

3. Online search activity for items related to consumer credit has risen sharply in recent months.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

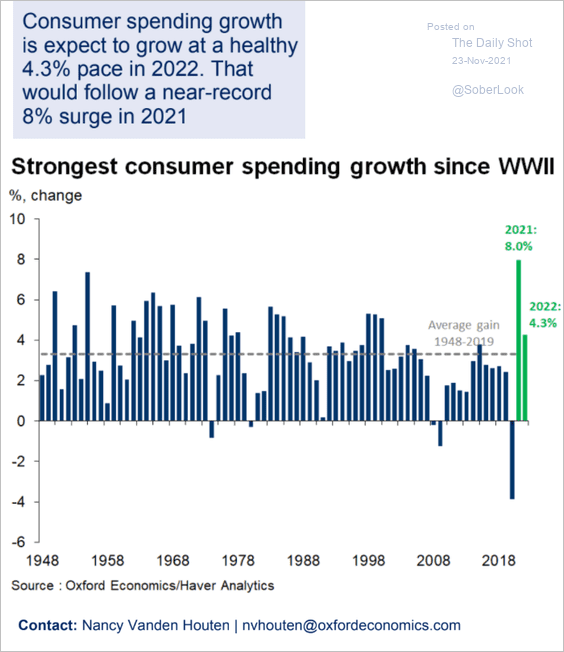

4. The US is experiencing the strongest consumer spending growth since WW II, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

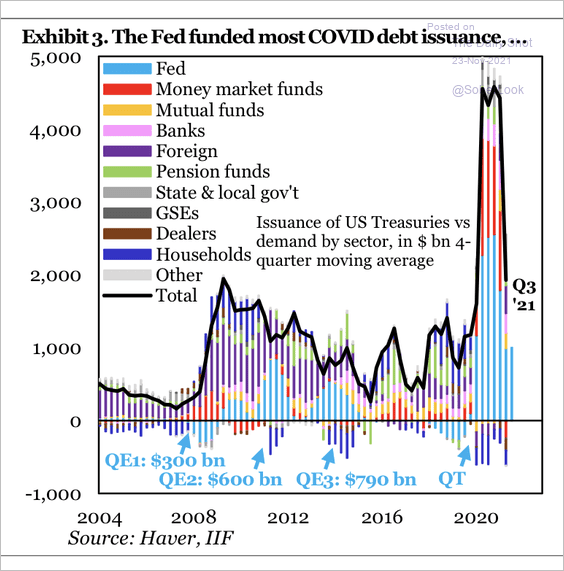

5. Aggressive fiscal stimulus was mainly funded via the Fed’s QE and affiliated balance sheets, notably money market funds, and depository banks, according to IIF.

Source: IIF

Source: IIF

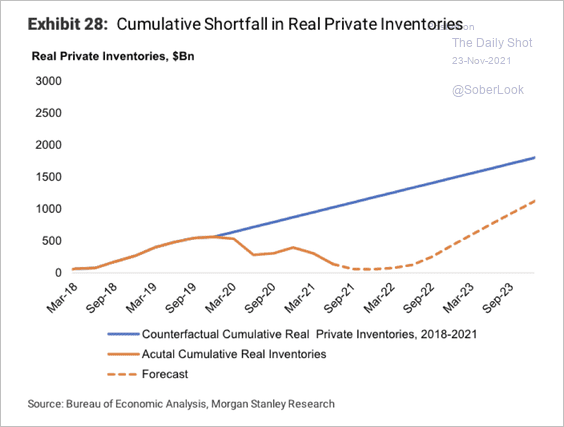

6. Real private inventories are unlikely to return to the pre-pandemic trend until at least 2024.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

The United Kingdom

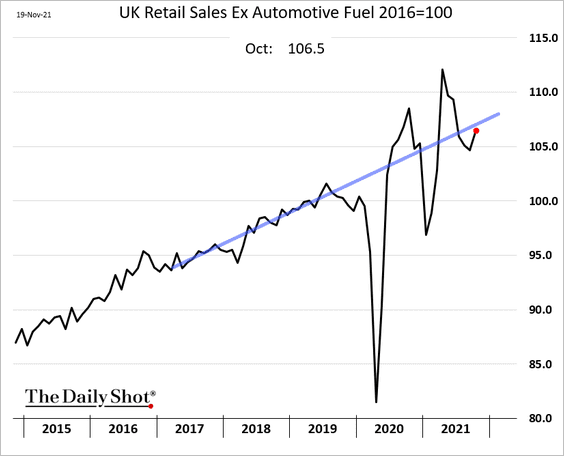

1. UK retail sales are back on the pre-COVID trend.

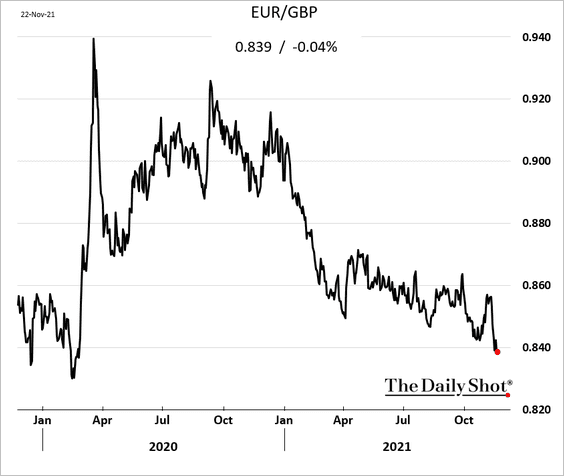

2. The pound continues to strengthen against the euro, which may put further pressure on UK exporters.

Back to Index

The Eurozone

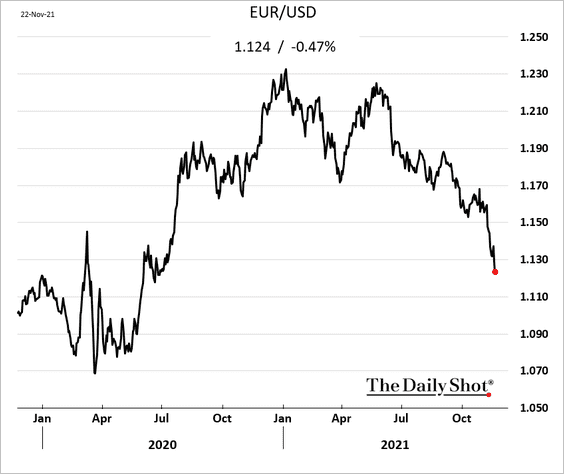

1. The euro continues to slide.

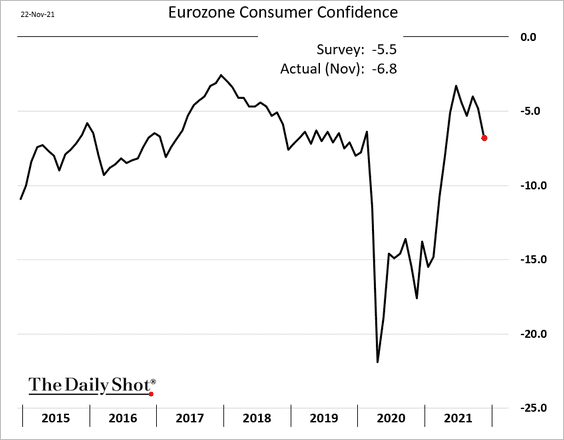

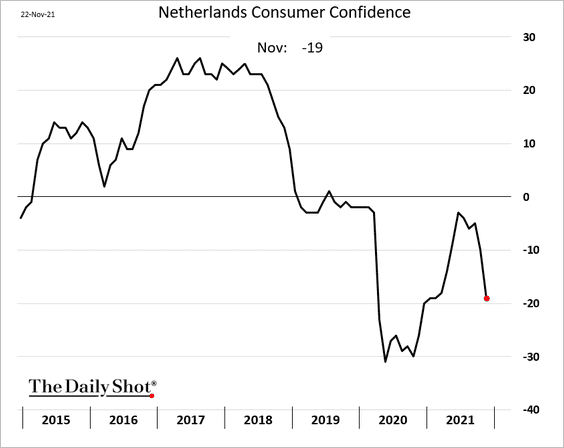

2. Consumer confidence eased this month amid the latest COVID wave.

——————–

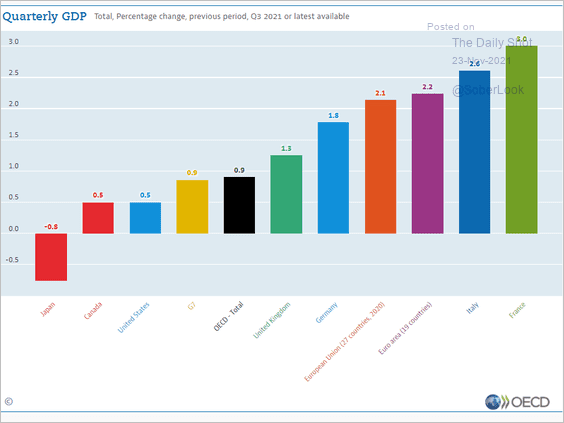

3. French and Italian GDP growth outperformed last quarter.

Source: OECD Read full article

Source: OECD Read full article

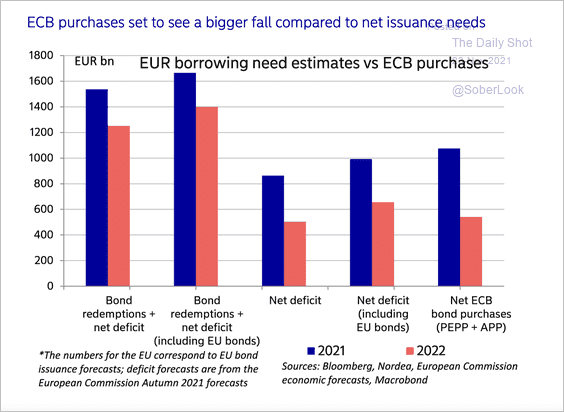

4. On the surface, issuance pressure is decreasing next year, but if lower ECB purchases are included, net issuance will actually increase, pushing yields higher.

Source: Nordea Markets

Source: Nordea Markets

5. Euro-area flash PMI indicators surprised to the upside, especially in France. The region’s economic growth remains robust, despite the COVID surge.

Back to Index

Europe

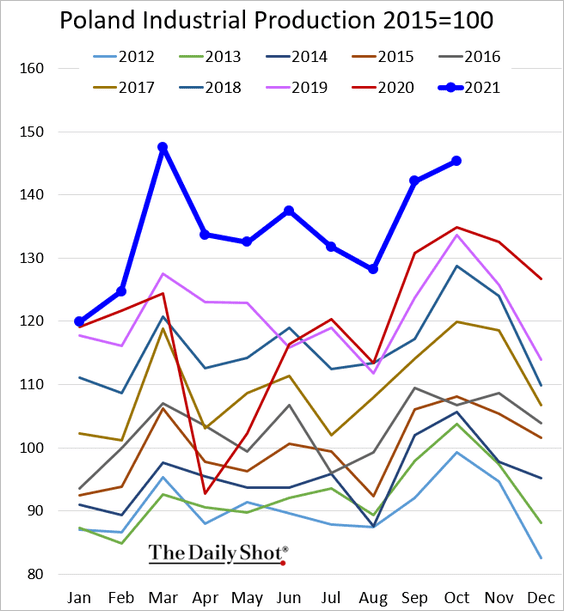

1. Poland’s industrial production remains near record highs.

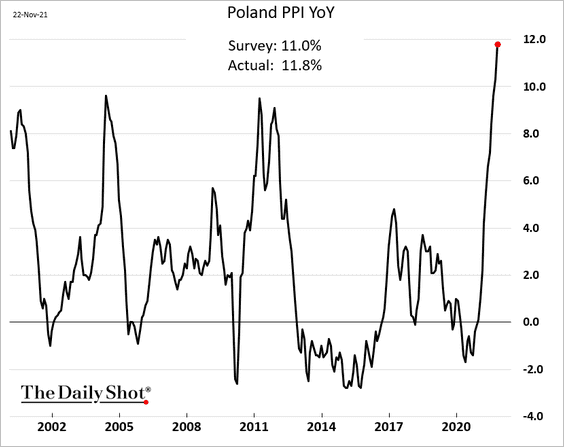

Producer prices are soaring.

——————–

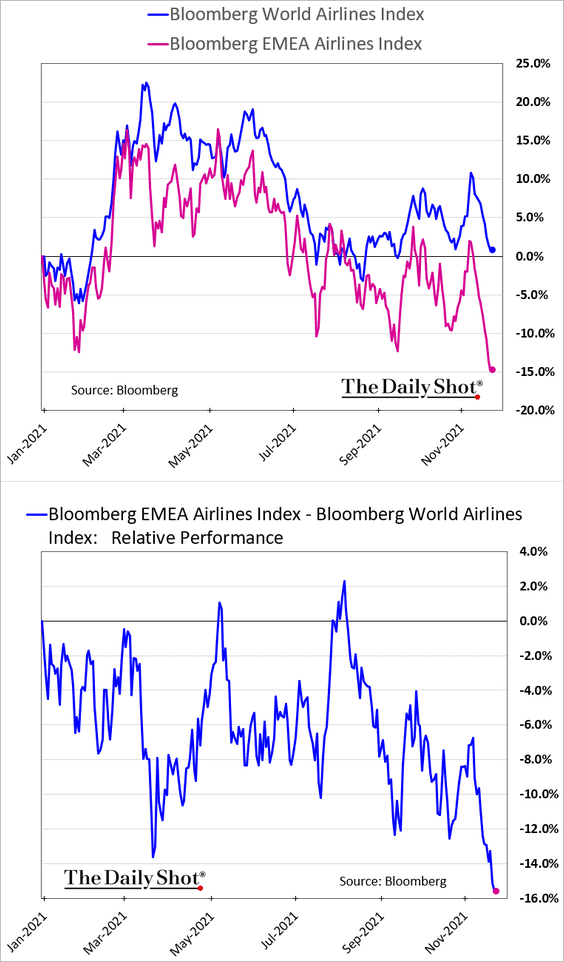

2. European airline shares are underperforming due to the COVID wave.

h/t @mikamsika

h/t @mikamsika

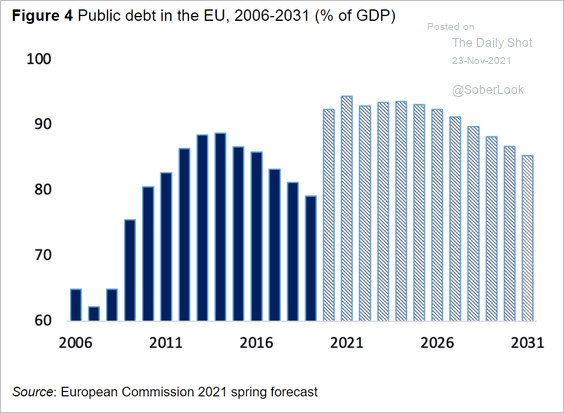

3. Here is the evolution of public debt in the EU (as % of GDP).

Source: VOX EU Read full article

Source: VOX EU Read full article

Back to Index

Asia – Pacific

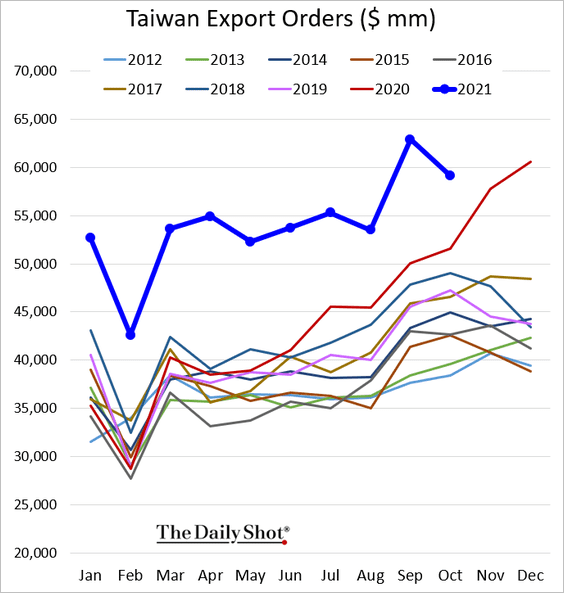

1. Taiwan’s export orders were weaker than expected in October but still well above 2020 levels.

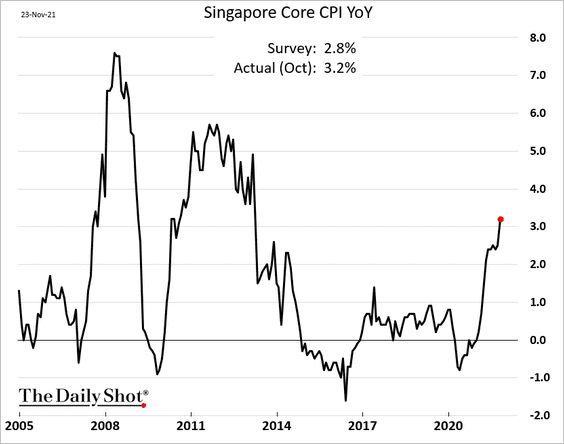

2. Singapore’s inflation is accelerating.

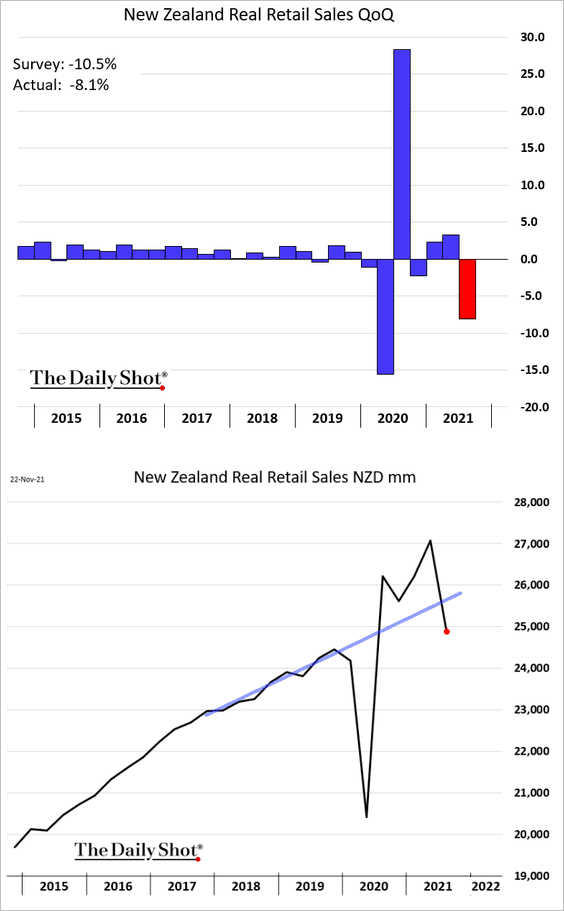

3. New Zealand’s retail sales declined less than expected in Q3.

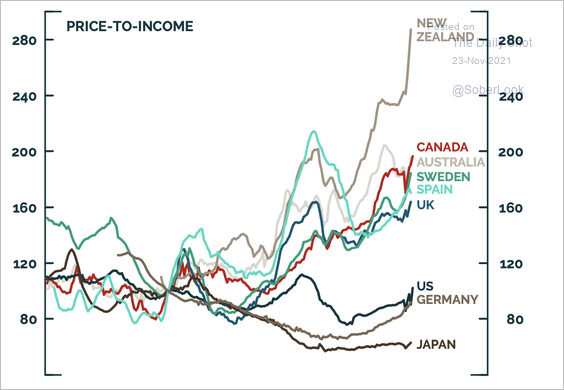

The nation’s housing price-to-income ratio has left other bubble-like markets in the dust.

Source: BCA Research

Source: BCA Research

——————–

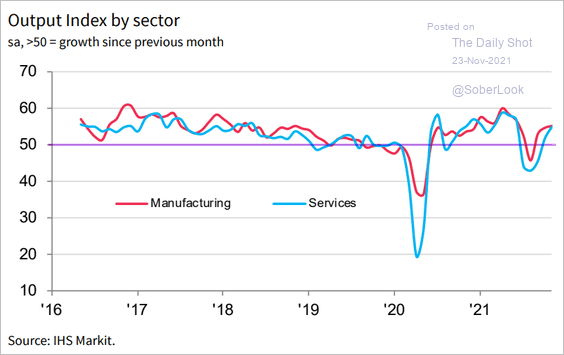

4. Australia’s business activity picked up momentum this month. Here is the Markit PMI.

Source: IHS Markit

Source: IHS Markit

Back to Index

China

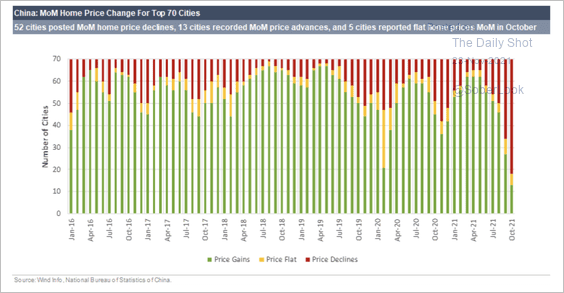

1. More cities experienced home price declines last month.

Source: CreditSights

Source: CreditSights

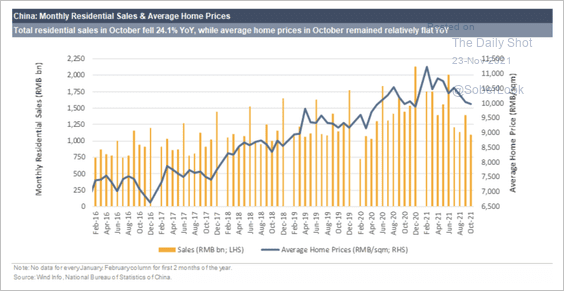

Residential sales continue to slow.

Source: CreditSights

Source: CreditSights

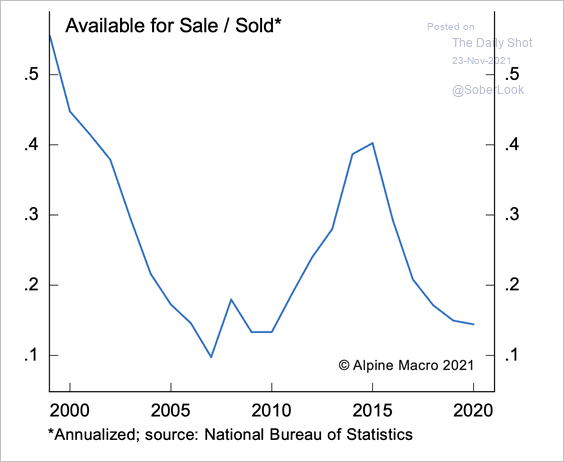

However, housing inventories have normalized – a good setup for an eventual rebound.

Source: Alpine Macro

Source: Alpine Macro

——————–

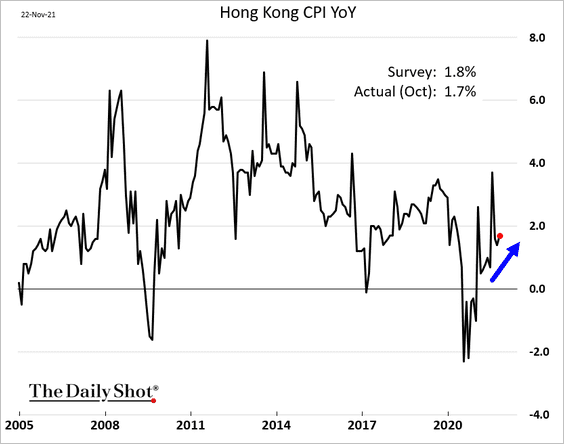

2. Hong Kong’s inflation is gradually recovering but remains below 2%.

Back to Index

Emerging Markets

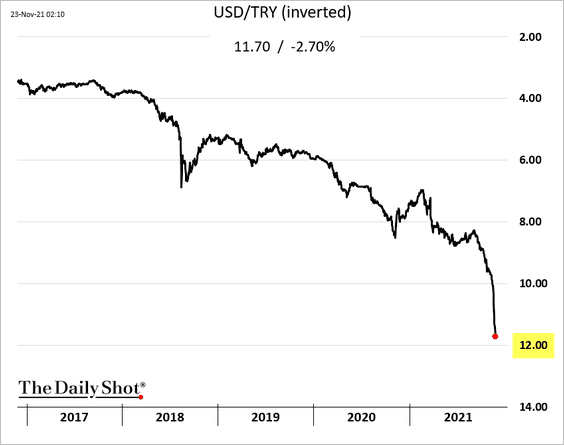

1. The Turkish lira continues to tumble, with 12.0 in sight.

Source: Reuters Read full article

Source: Reuters Read full article

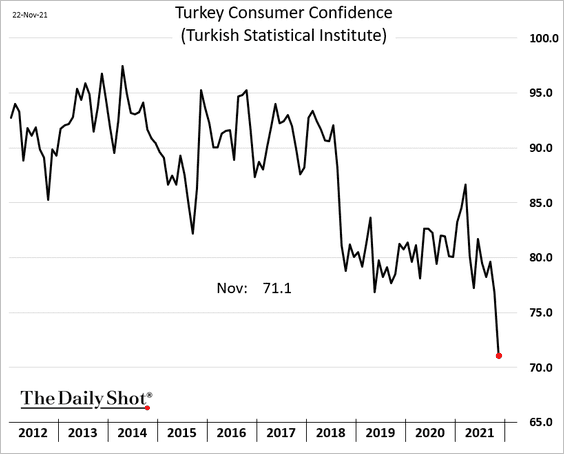

The currency weakness is hitting consumer confidence.

——————–

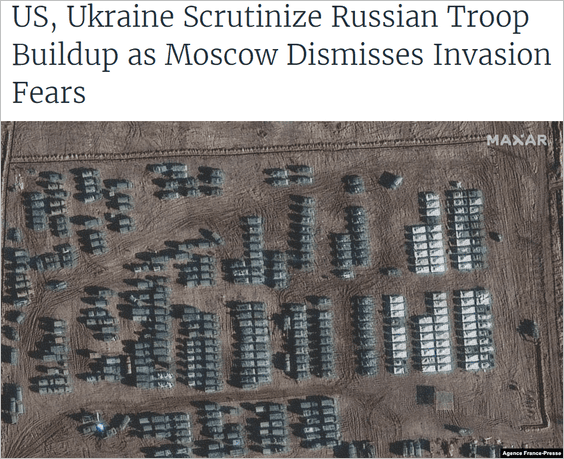

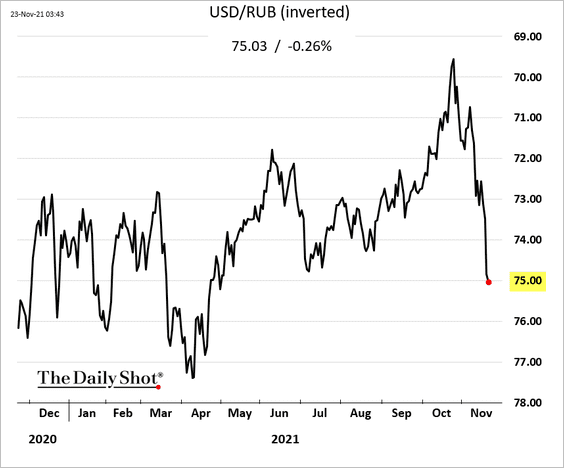

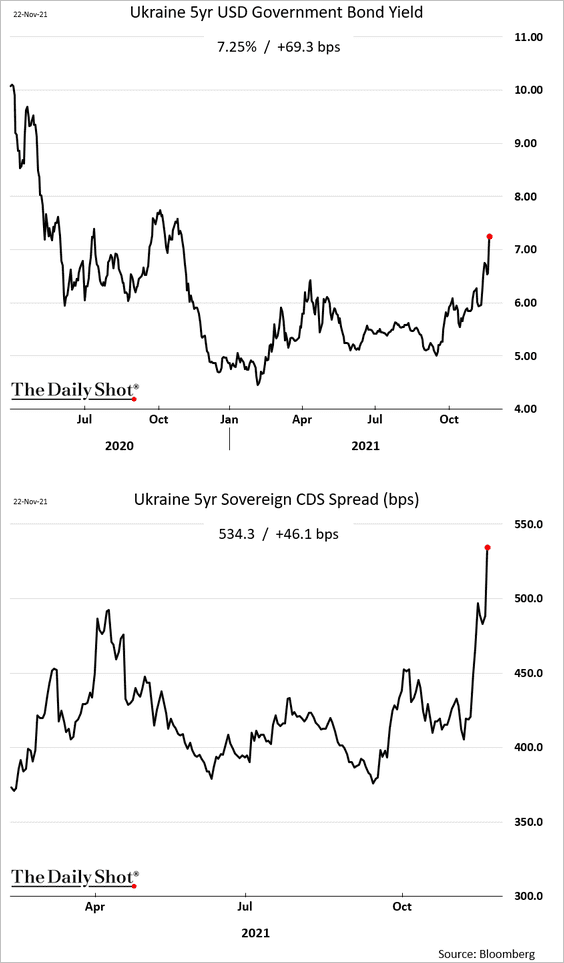

2. Worries about Russia invading Ukraine persist.

Source: VOA Read full article

Source: VOA Read full article

The ruble took a hit, passing 75.0 to the dollar.

Ukrainian bond yields and sovereign CDS spread increased.

——————–

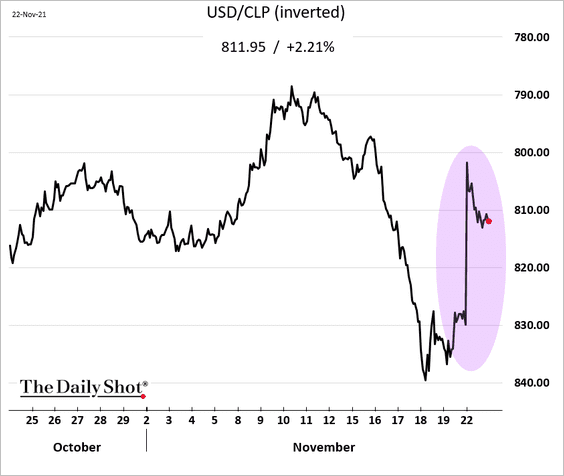

3. The Chilean peso jumped in response to the election outcome.

Source: The Guardian Read full article

Source: The Guardian Read full article

——————–

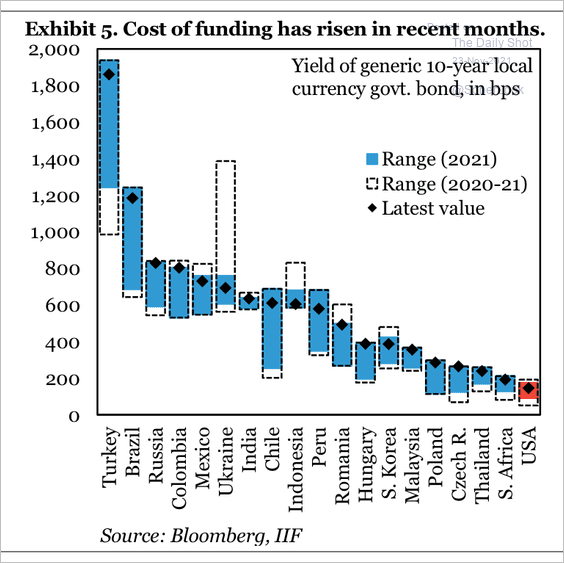

4. Funding costs have risen for governments issuing debt in local currency.

Source: IIF

Source: IIF

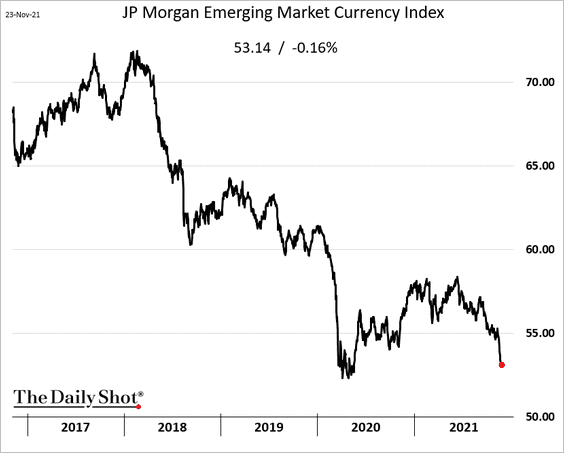

5. With the Fed expected to accelerate policy tightening, the JP Morgan EM Currency Index is under pressure.

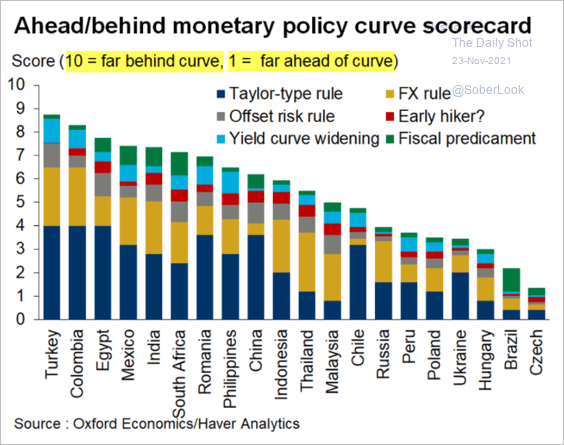

6. Which central banks are behind the curve?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

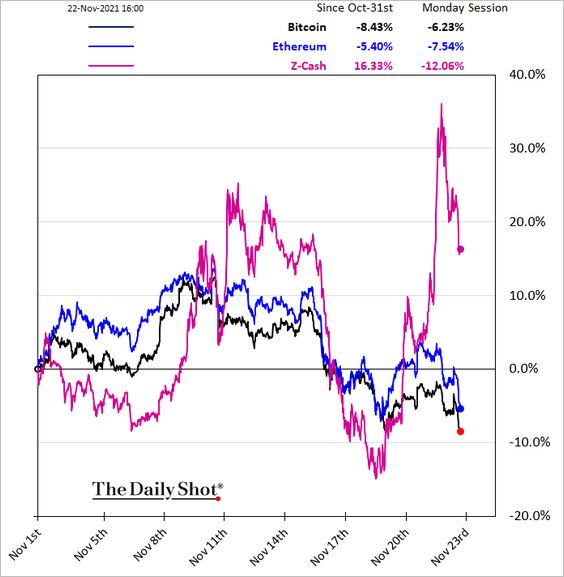

1. Some altcoins such as Z-Cash have outperformed the leading cryptocurrencies.

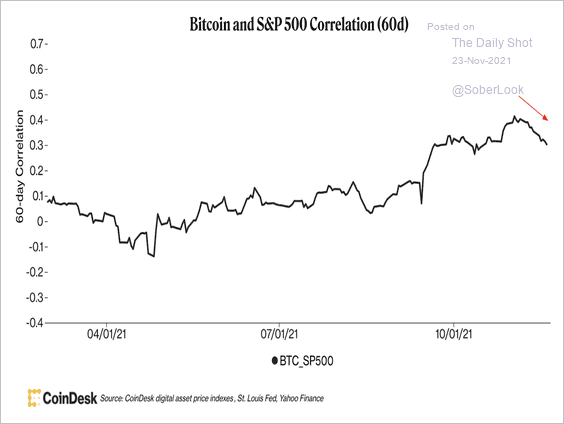

2. Bitcoin’s correlation with the S&P 500 started to decline as cryptos sold off last week.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

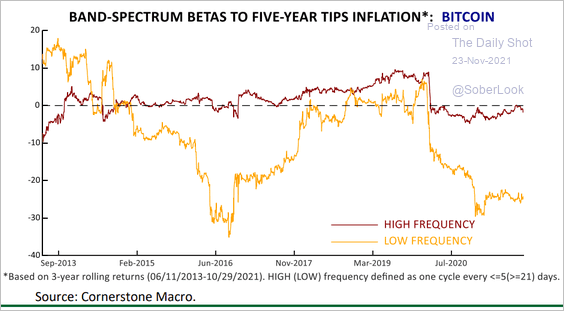

Bitcoin’s inverse correlation with inflation expectations only works within short periods. For longer-term investors, bitcoin is not a good inflation hedge.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

3. El Salvador’s new bitcoin-linked bond might turn out to be riskier than the country’s outstanding government bonds, which are already categorized as junk-grade.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

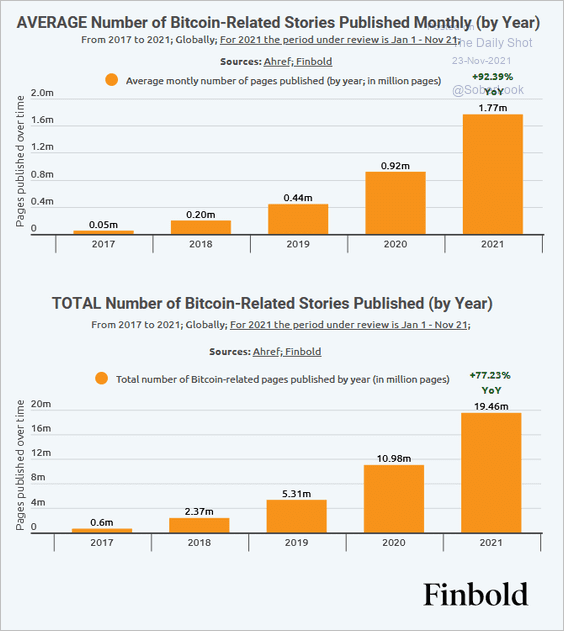

4. Bitcoin-related news coverage continues to grow.

Source: Finbold Read full article

Source: Finbold Read full article

Back to Index

Commodities

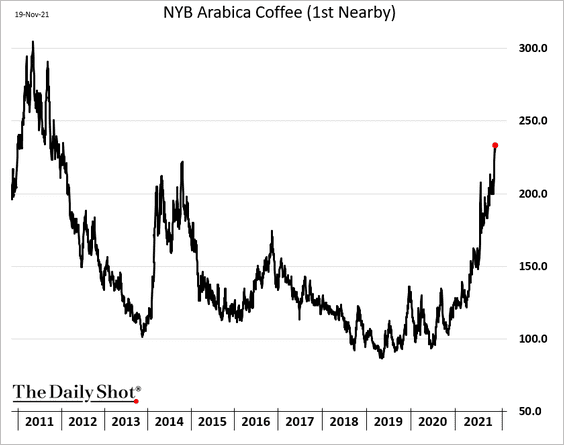

1. Coffee futures have been surging amid supply shortages that logistics bottlenecks have exacerbated.

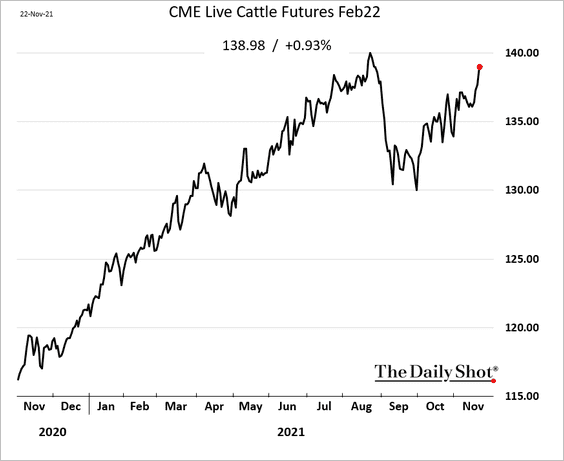

2. US cattle futures have rebounded from the late-summer selloff.

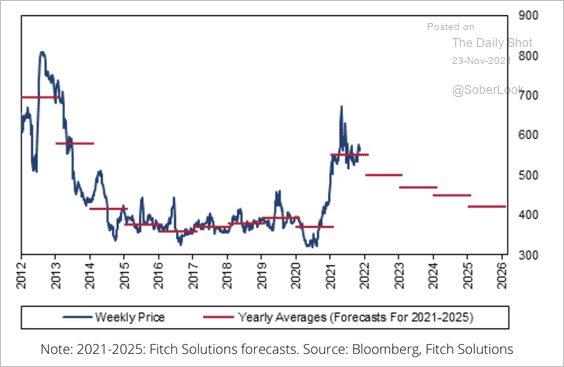

3. Fitch Solutions expects the average CBOT corn price to fall next year as the market shifts to a surplus.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

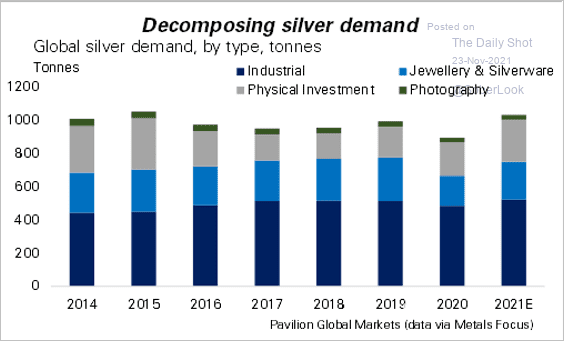

4. This chart shows the decomposition of silver demand.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

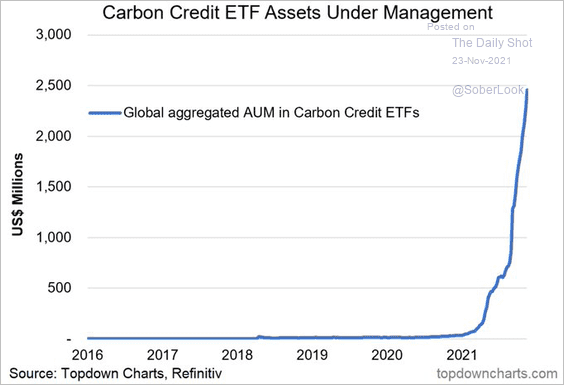

5. The AUM of carbon credit ETFs has been surging.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

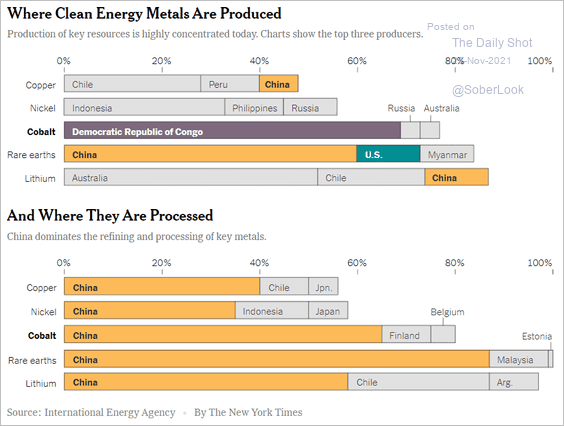

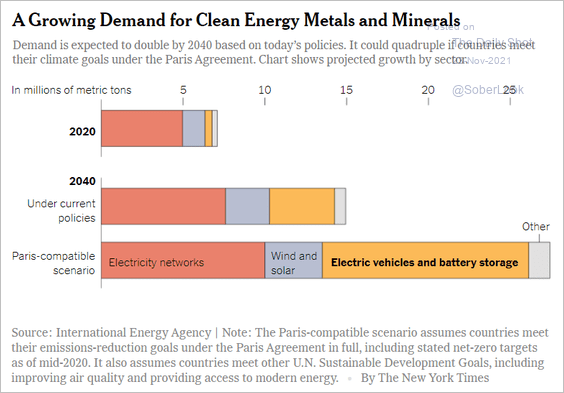

6. Finally, we have the sources of “clean energy” metals. China controls much of this market.

Source: The New York Times Read full article

Source: The New York Times Read full article

Demand is expected to swell over the next couple of decades.

Source: The New York Times Read full article

Source: The New York Times Read full article

Back to Index

Energy

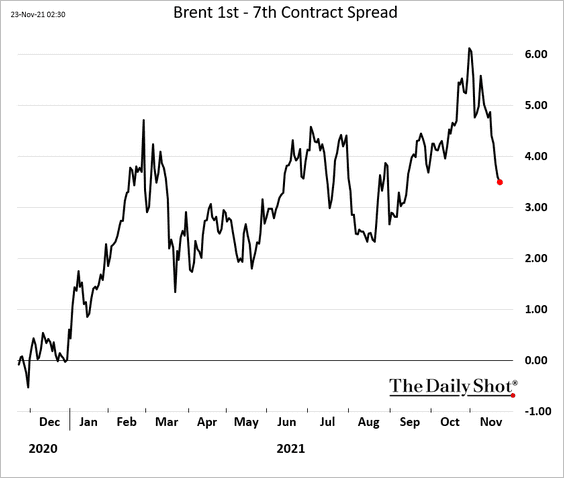

1. Brent’s backwardation is easing (the curve is flatter).

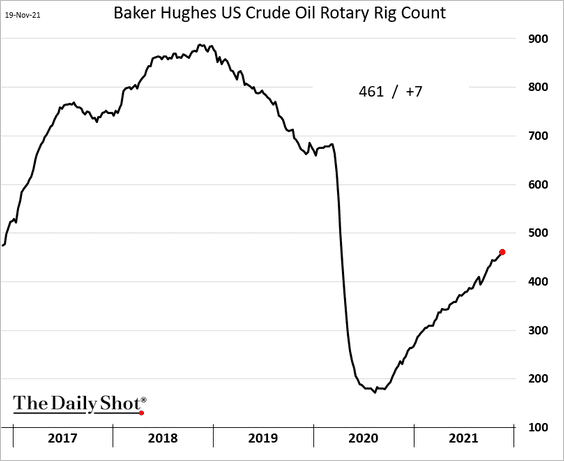

2. The US rig count continues to recover.

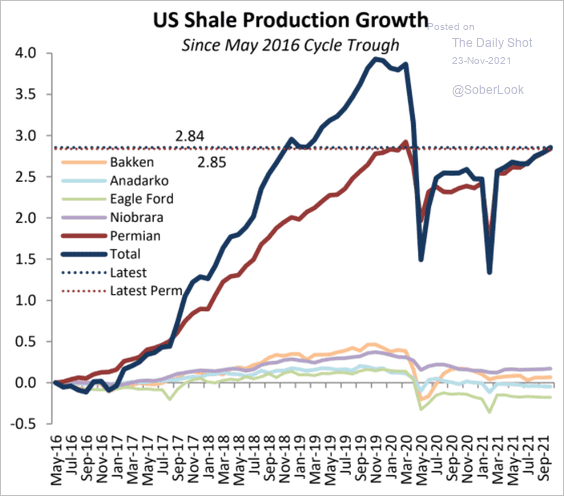

3. Shale production in the Permian Basin is nearing the pre-COVID peak.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

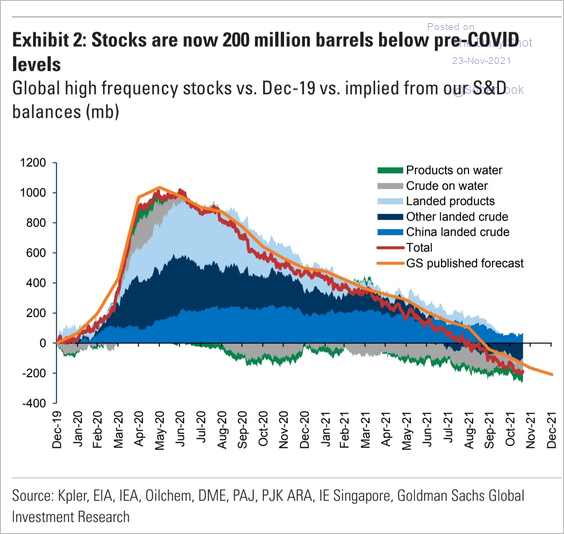

4. Here is Goldman’s estimate of total petroleum inventories relative to pre-COVID levels.

Source: Goldman Sachs; @Scutty

Source: Goldman Sachs; @Scutty

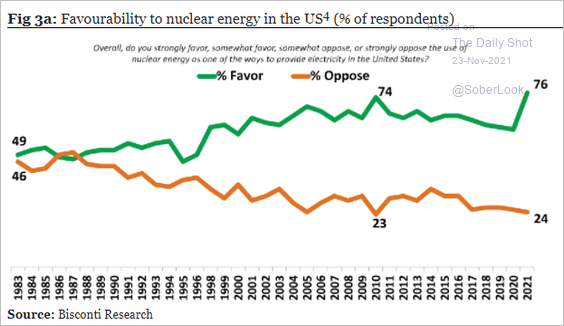

5. Americans increasingly support nuclear energy.

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

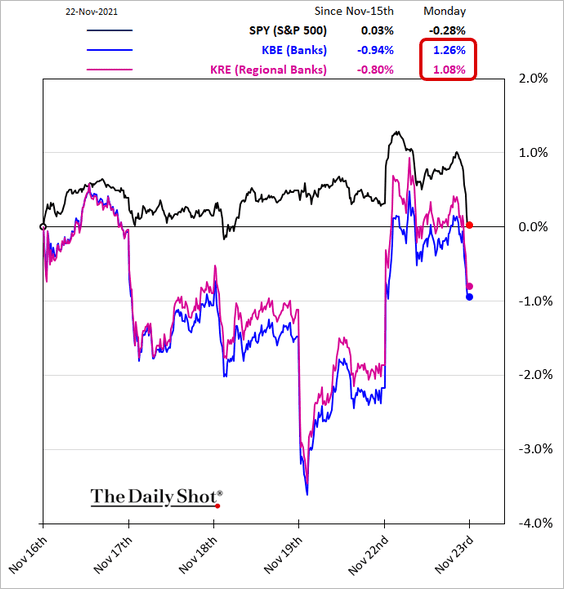

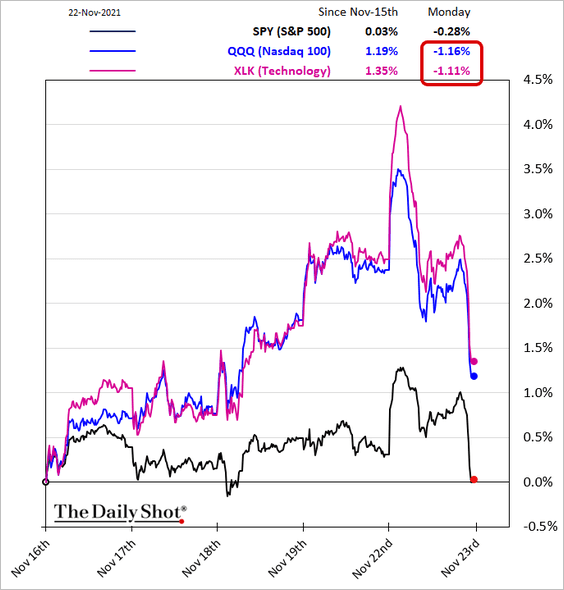

1. Higher rates sent banks and tech shares in opposite directions.

——————–

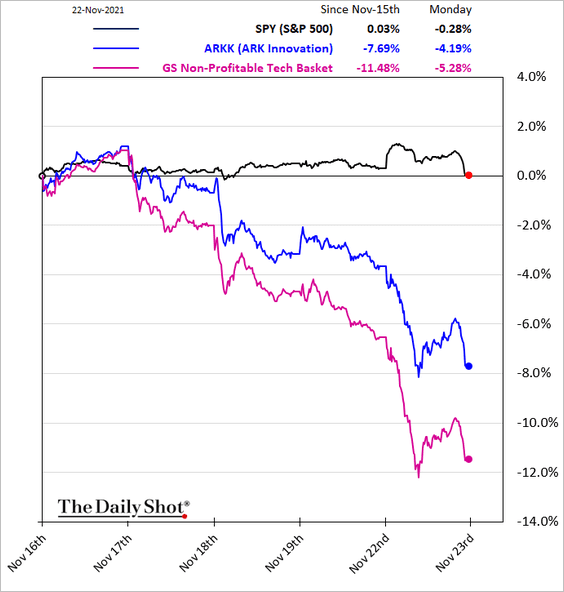

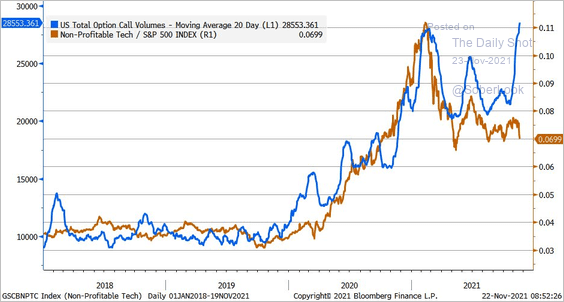

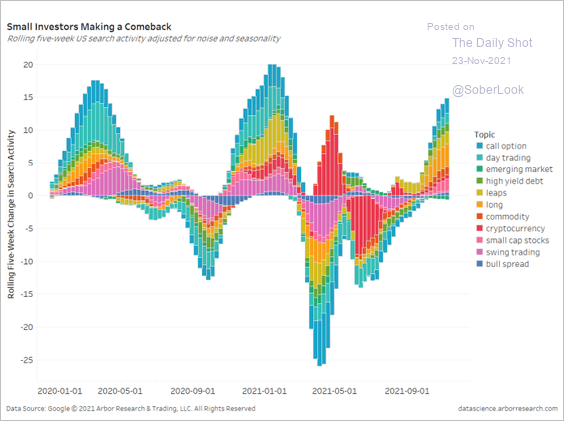

2. Speculative growth stocks have underperformed sharply in recent days, …

… despite record call option volume (indicating elevated retail activity).

Source: @LizAnnSonders

Source: @LizAnnSonders

Online search activity also points to increased retail investor involvement.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

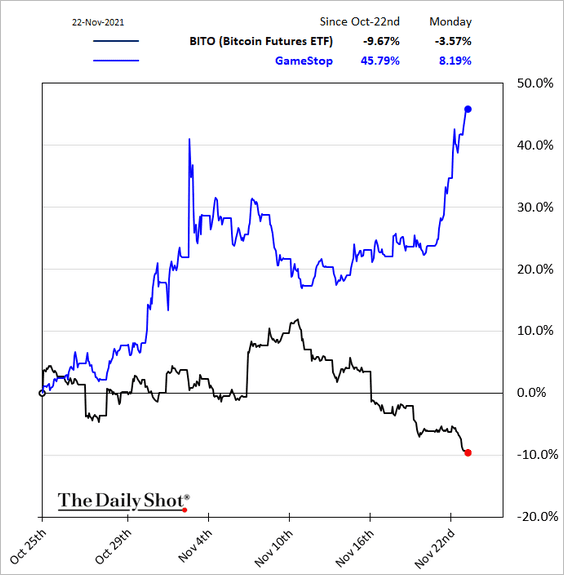

3. When cryptos are down, the Reddit crowd returns to its tried and true meme stocks.

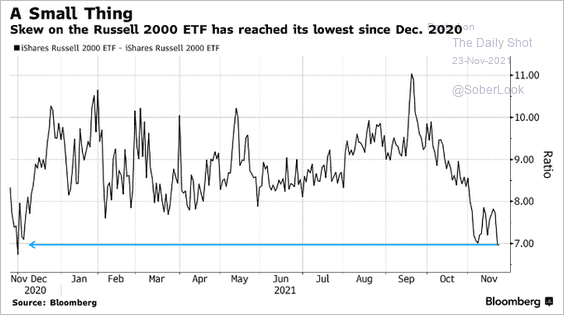

4. The Russell 2000 (small-cap) skew hit the lowest level in a year, pointing to limited concerns about downside risks.

Source: @TheOneDave

Source: @TheOneDave

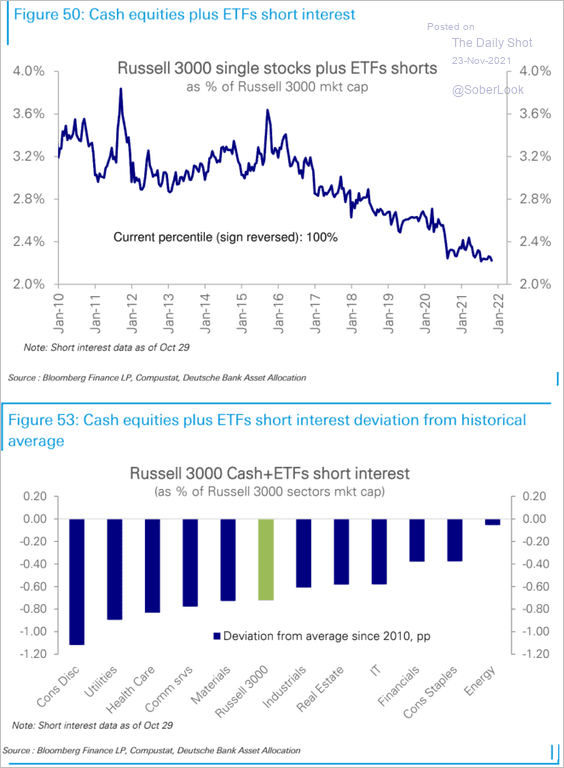

5. Short interest continues to trend lower. The second chart shows short interest deviation from historical averages by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

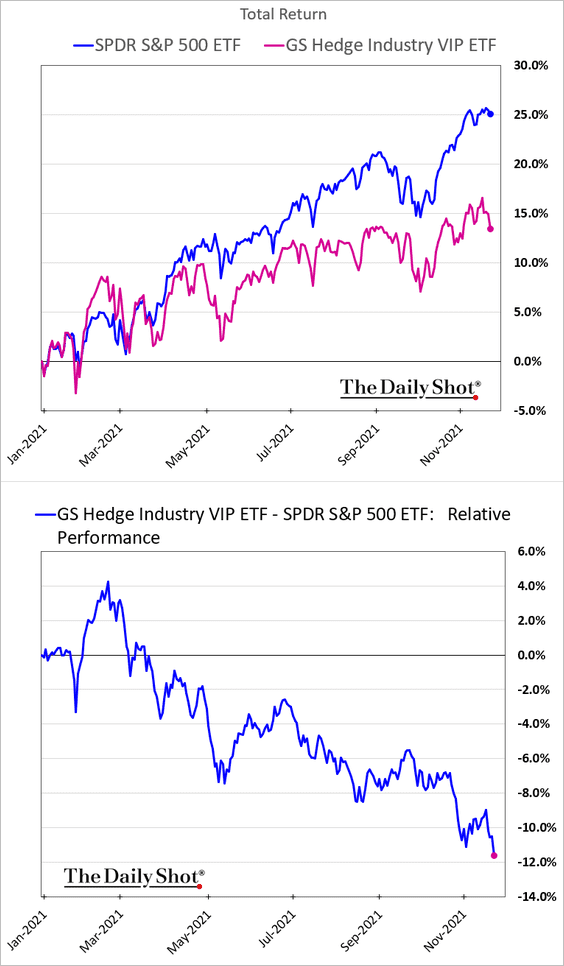

6. Hedge funds’ favorite stocks continue to lag, which has been a drag on performance.

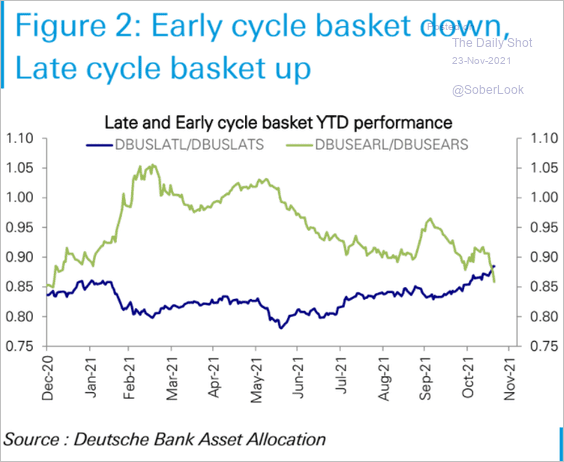

7. The stock market is signaling a shift into the later phase of the economic cycle.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

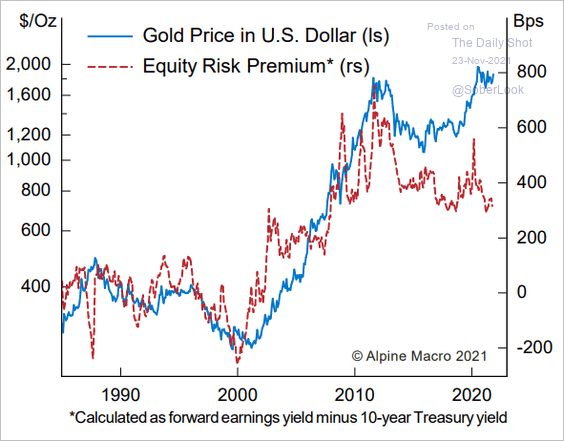

8. Gold price suggests that the equity risk premium should be higher.

Source: Alpine Macro

Source: Alpine Macro

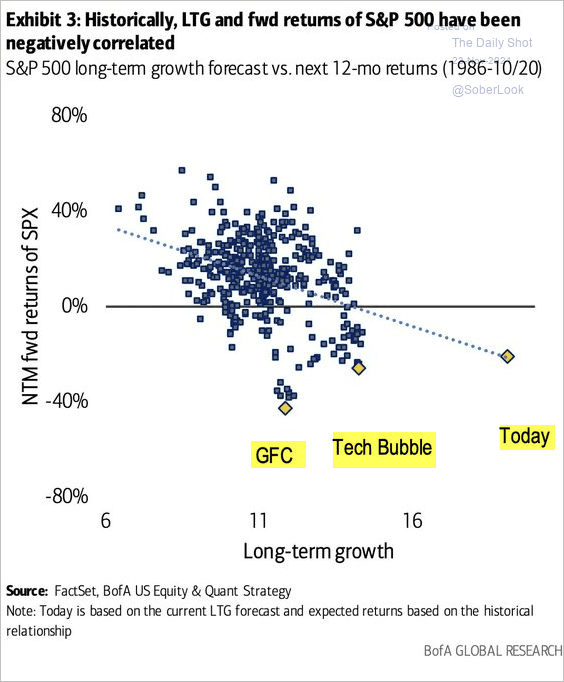

9. This scatterplot shows 12-month forward returns vs. the S&P 500 long-term growth estimates.

Source: @jessefelder; BofA Global Research Read full article

Source: @jessefelder; BofA Global Research Read full article

Back to Index

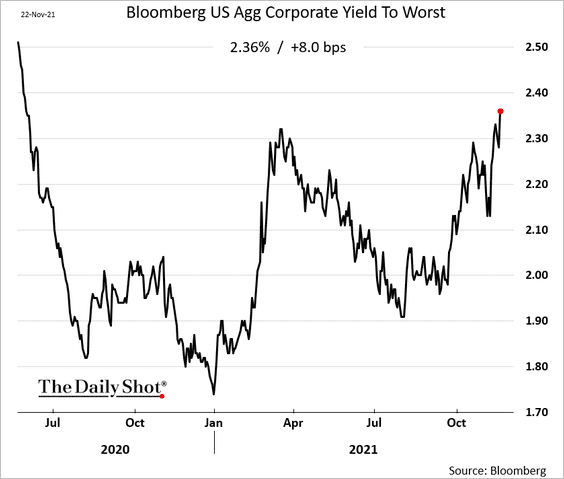

Credit

1. Investment-grade bond yields continue to grind higher.

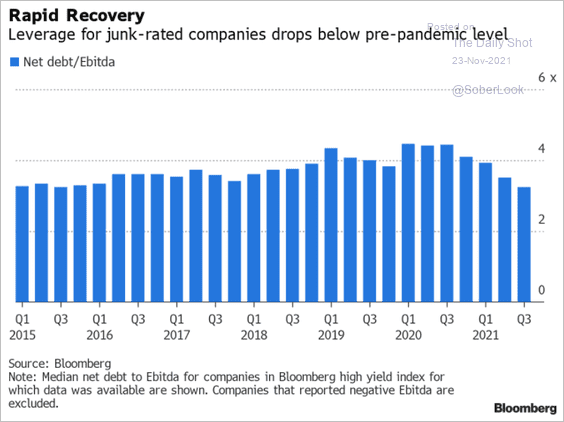

2. High-yield companies’ leverage is now below pre-COVID levels as earnings surge.

Source: @jackpitcher20 Read full article

Source: @jackpitcher20 Read full article

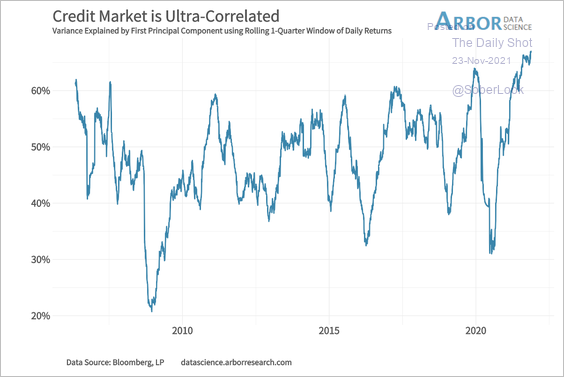

3. Credit market movements have become more correlated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

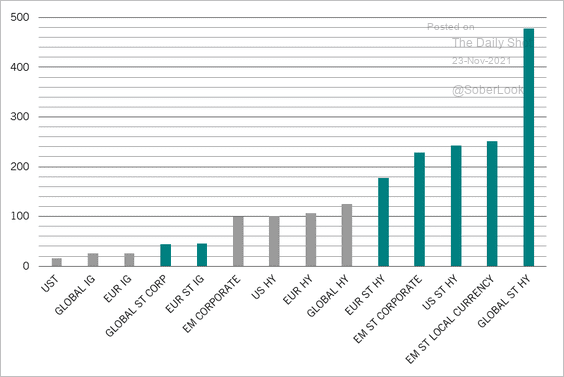

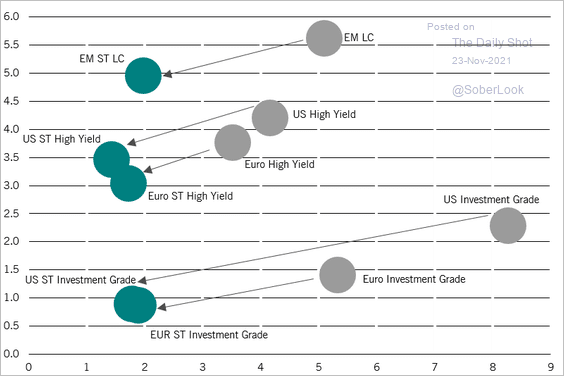

4. Based on current yields and duration, short-term bonds have a much greater cushion against rising yields than their longer-maturity counterparts, according to Pictet Asset Management.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

And reducing bond duration does not necessarily mean a significant sacrifice of yield.

Source: Pictet Wealth Management

Source: Pictet Wealth Management

Back to Index

Rates

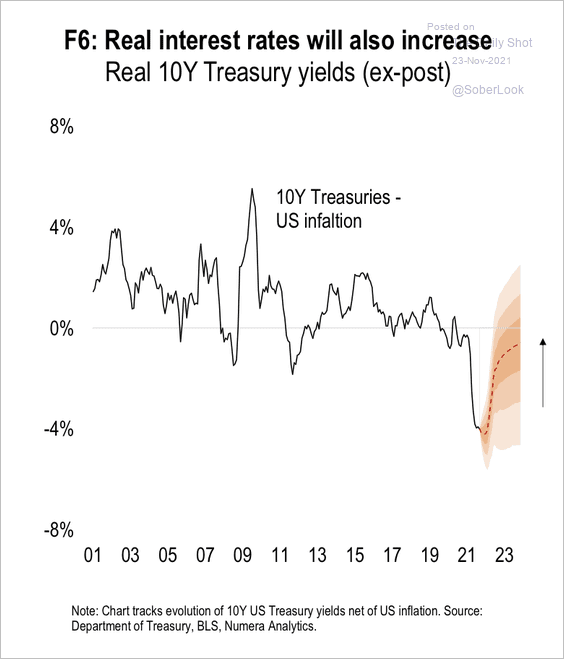

1. Numera Analytics expects real yields to increase substantially next year.

Source: Numera Analytics

Source: Numera Analytics

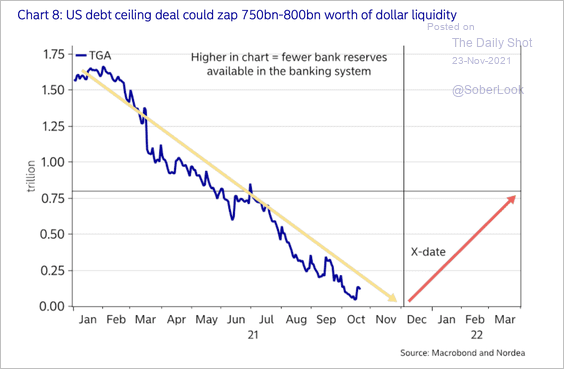

2. Once the debt ceiling is lifted, which has to happen in early December, the Treasury will start to rebuild its cash account at the Fed. According to Nordea, this amounts to nearly $800bn of effective quantitative tightening (reducing reserves).

Source: Nordea Markets

Source: Nordea Markets

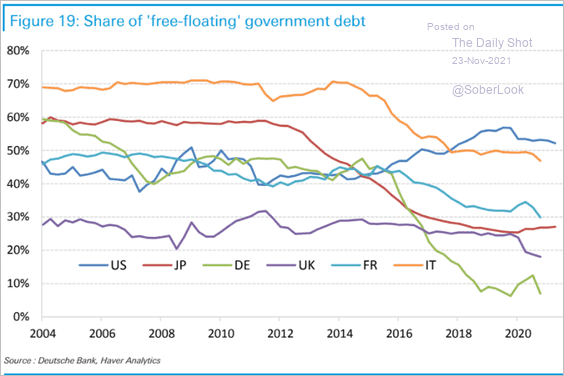

3. This chart shows the share of “free-floating” government debt over time.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

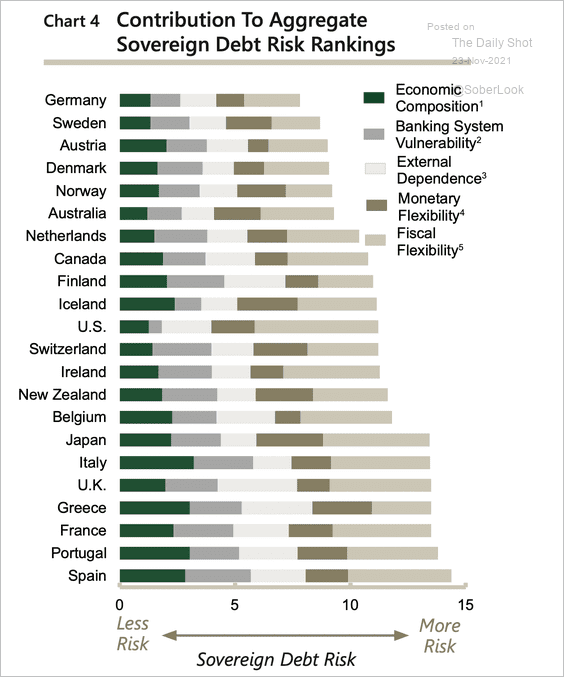

1. Here is a look at MRB’ breakdown of key factors that make up sovereign debt risk.

Source: MRB Partners

Source: MRB Partners

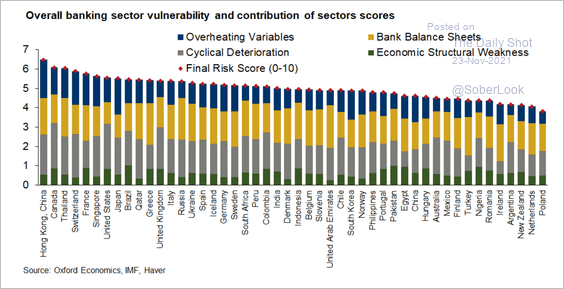

2. This chart shows the Oxford Economics banking sector vulnerability measure by country.

Source: Oxford Economics

Source: Oxford Economics

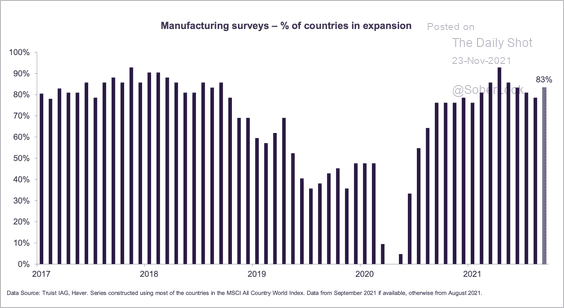

3. 83% of the economies making up the MSCI All Country World index are in expansion mode.

Source: Truist Advisory Services

Source: Truist Advisory Services

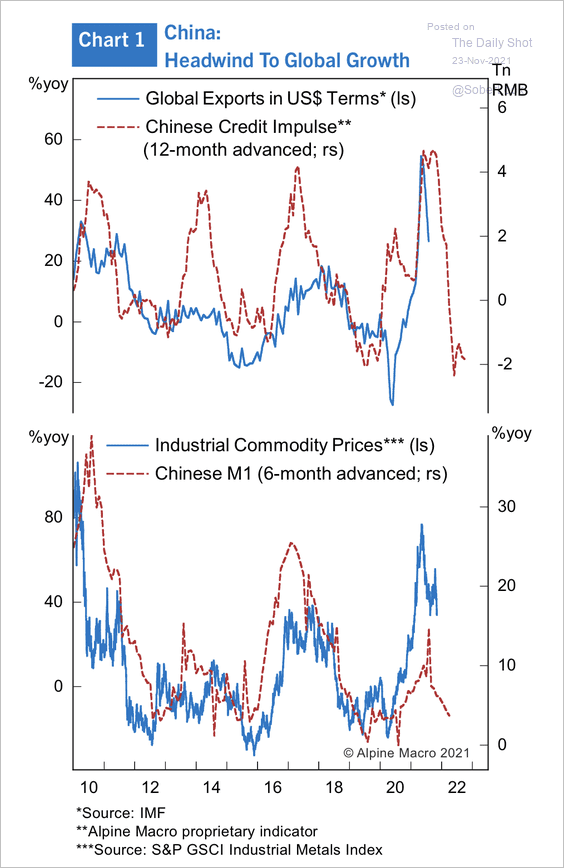

4. The decline in China’s credit impulse remains a headwind to global growth.

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

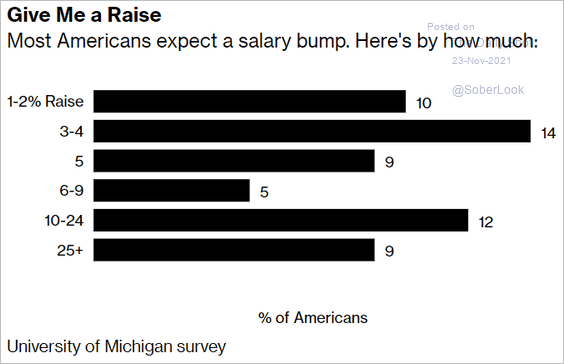

1. Expecting a salary bump:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

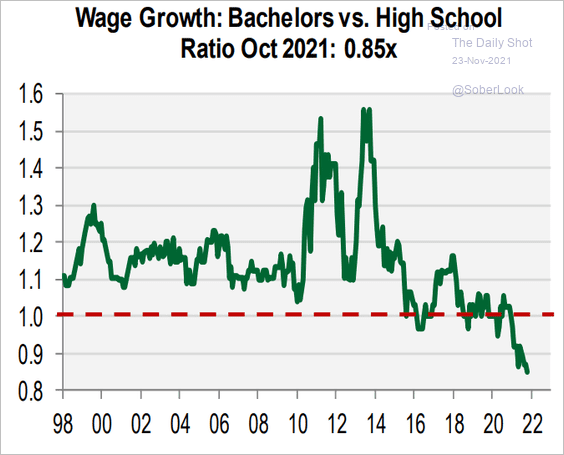

2. Bachelors vs. high school degree – wage growth ratio:

Source: Cornerstone Macro

Source: Cornerstone Macro

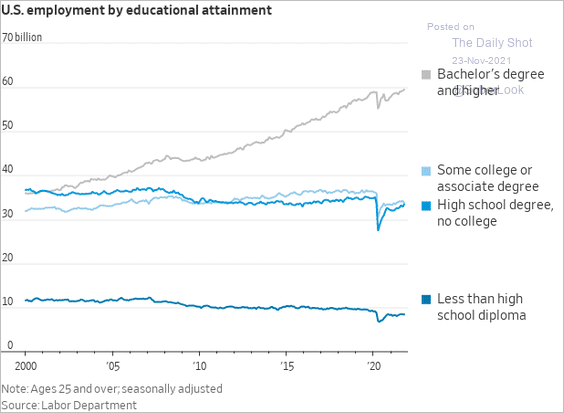

3. Employment by educational attainment:

Source: @WSJ Read full article

Source: @WSJ Read full article

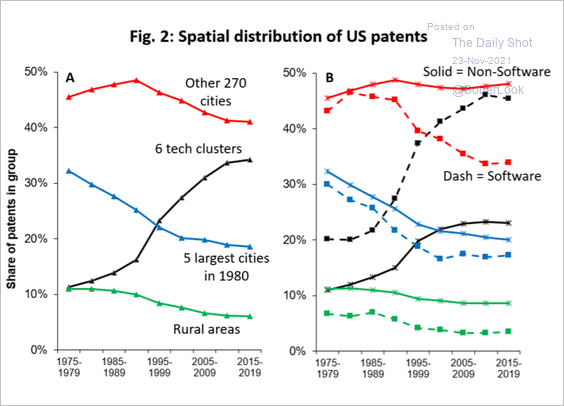

4. US patents by community type:

Source: NBER Read full article

Source: NBER Read full article

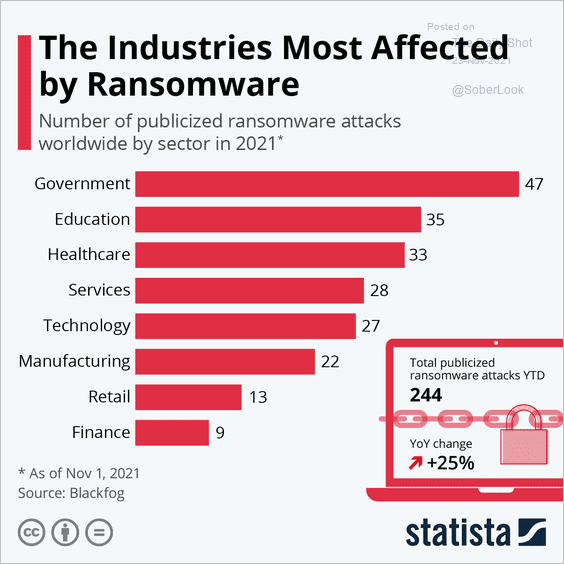

5. Ransomware attacks by sector:

Source: Statista

Source: Statista

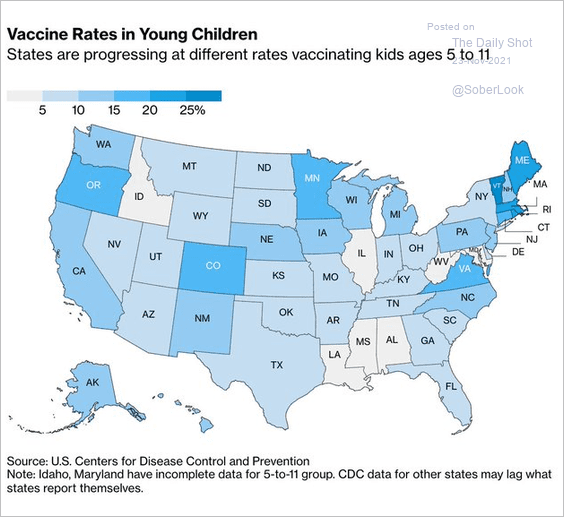

6. Vaccination rates in young children:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

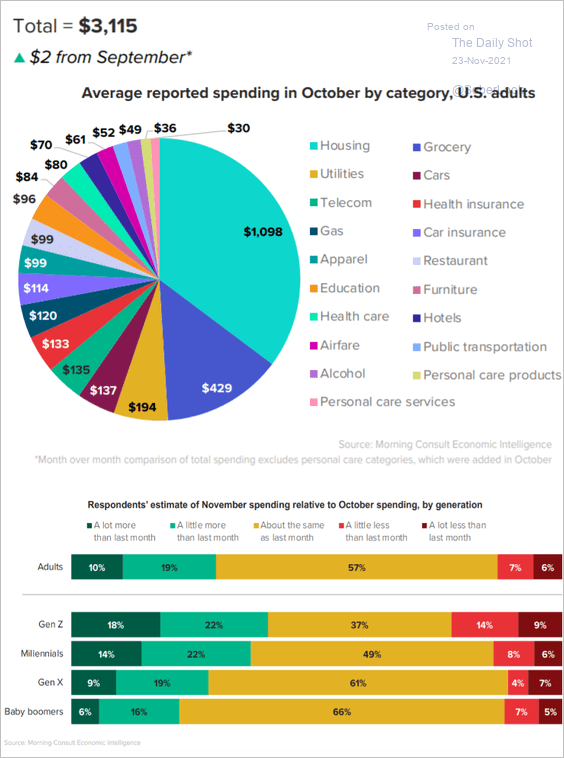

7. US consumer spending in November:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

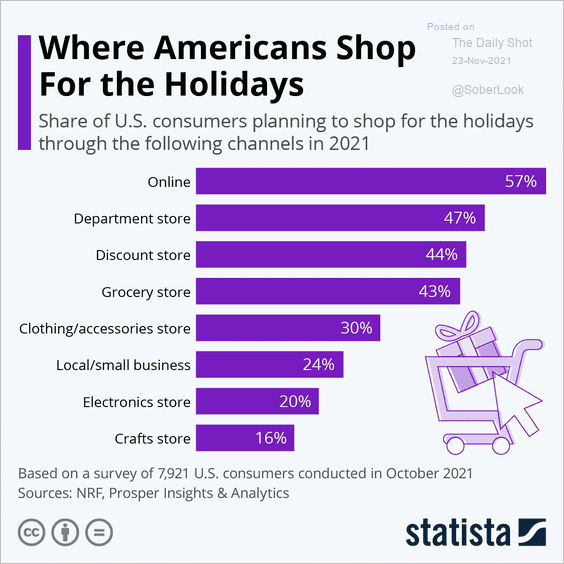

8. Holiday shopping:

Source: Statista

Source: Statista

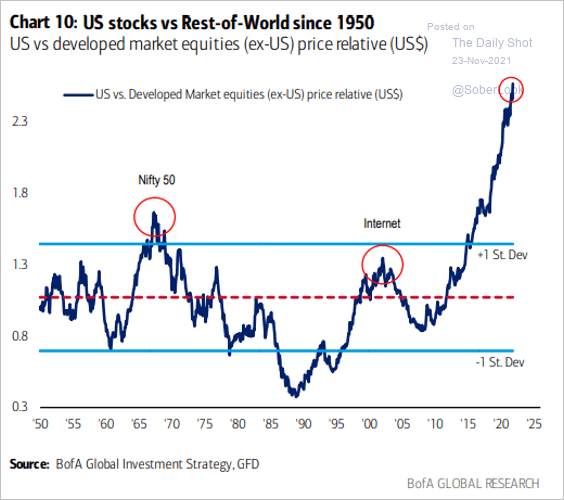

9. US stocks’ outperformance vs. the rest of the world:

Source: BofA Global Research

Source: BofA Global Research

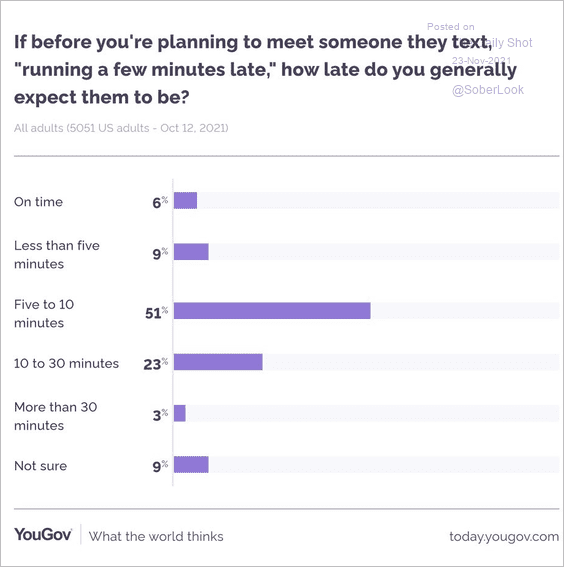

10. Running a few minutes late:

Source: @YouGovAmerica

Source: @YouGovAmerica

——————–

The next Daily Shot will be out on Monday, November 29th.

Tomorrow, we will publish the Thanksgiving Food for Thought Special.

——————–

Back to Index