The Daily Shot: 29-Nov-21

• Equities

• Energy

• Rates

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• The United Kingdom

• The United States

• Food for Thought

Equities

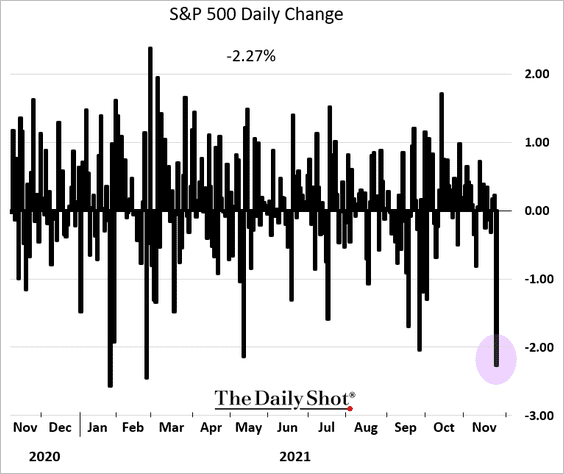

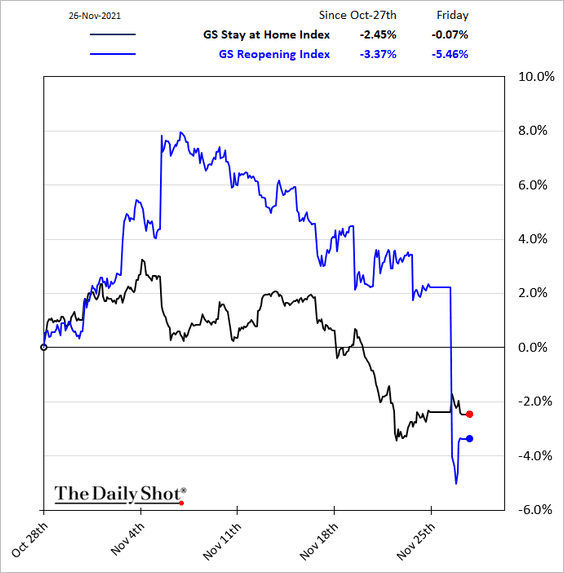

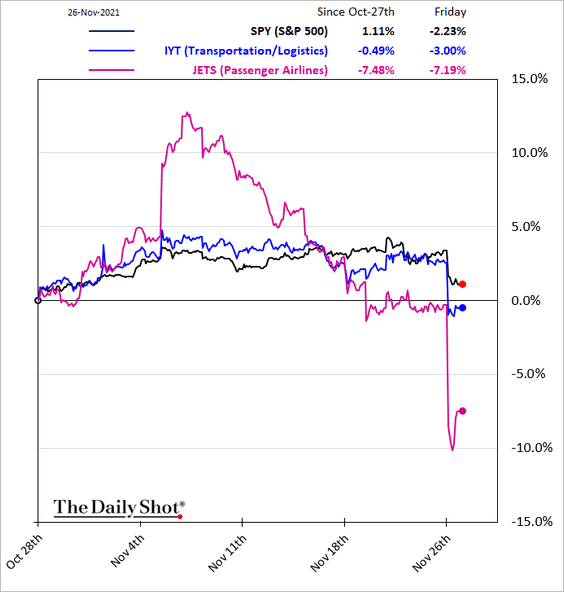

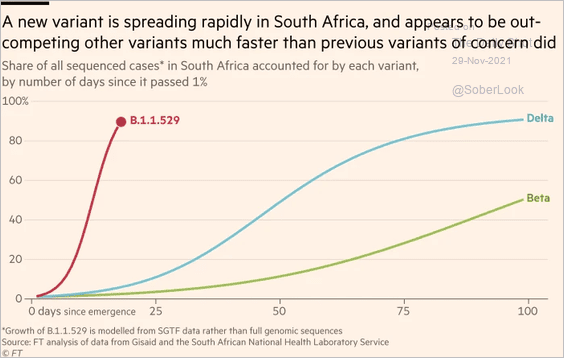

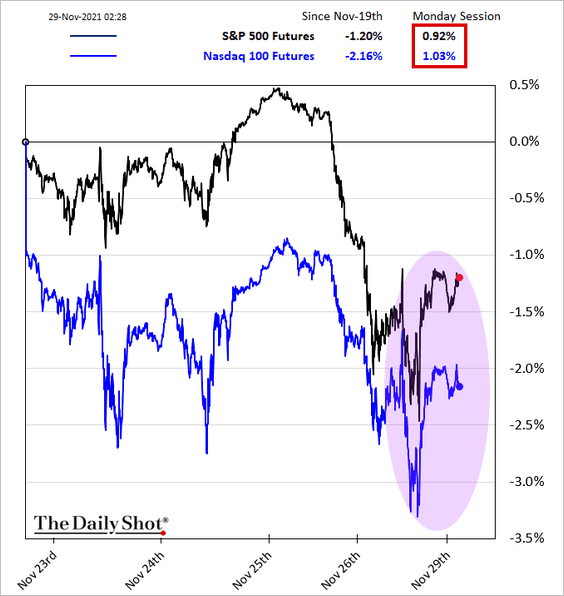

1. The news of a COVID variant called omicron spreading in South Africa and elsewhere spooked investors around the world.

Reopening stocks tumbled, …

… with airlines getting hit particularly hard.

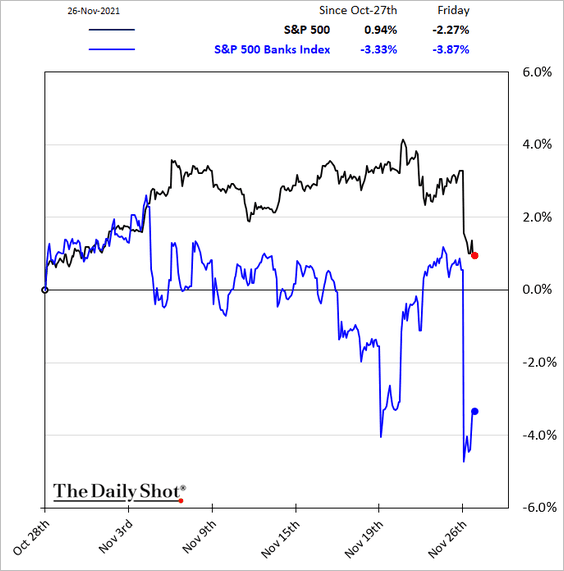

Bank shares also underperformed as Treasury yields dropped.

2. There are two key concerns.

• Given a large number of mutations on omicron’s spike proteins, will the current vaccines be effective (will the vaccine-induced antibodies recognize the new variant)? We should know within a couple of weeks.

Source: NBC News Read full article

Source: NBC News Read full article

• Is the new variant spreading faster than other COVID-19 mutations? Once again, it’s not clear at this point.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Anecdotal evidence suggests that the virus is indeed spreading quickly, but symptoms seem to be mild.

Source: Haaretz Daily Read full article

Source: Haaretz Daily Read full article

If omicron is no worse than the Delta variant in terms of vaccine effectiveness, the stock market could resume its rally, hitting new highs within weeks. Futures moved higher this morning.

——————–

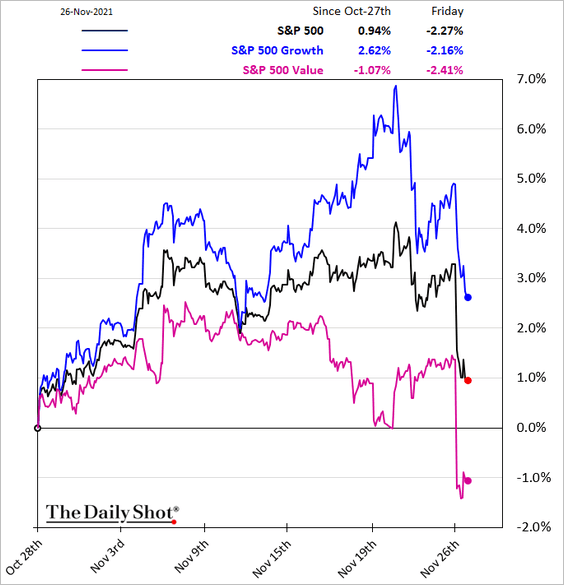

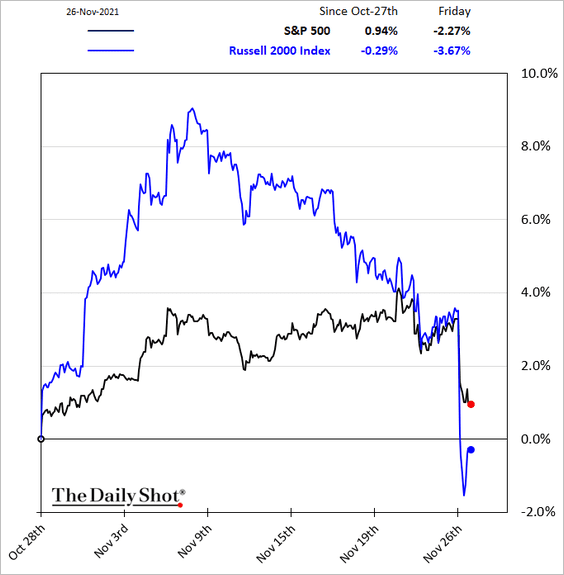

3. Value stocks extended their underperformance on Friday.

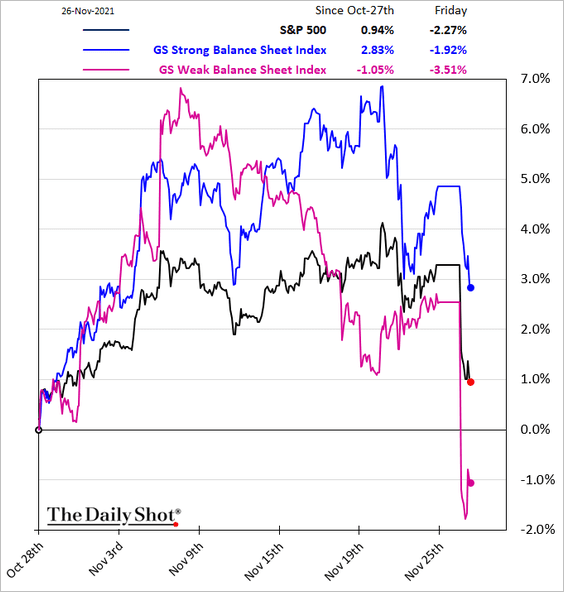

• Related to the above, companies with weak balance sheets dropped sharply.

• Small caps declined almost 3.7% on Friday.

——————–

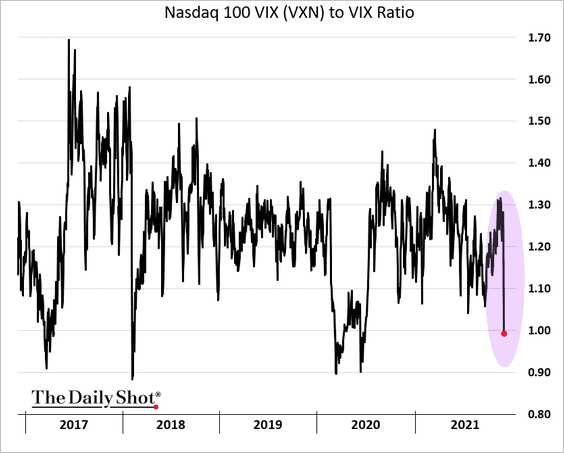

4. The ratio of the Nasdaq 100 VIX-equivalent (VXN) to VIX dipped below one again. Tech, especially tech mega-caps, is viewed as a “safe haven” in a lockdown scenario.

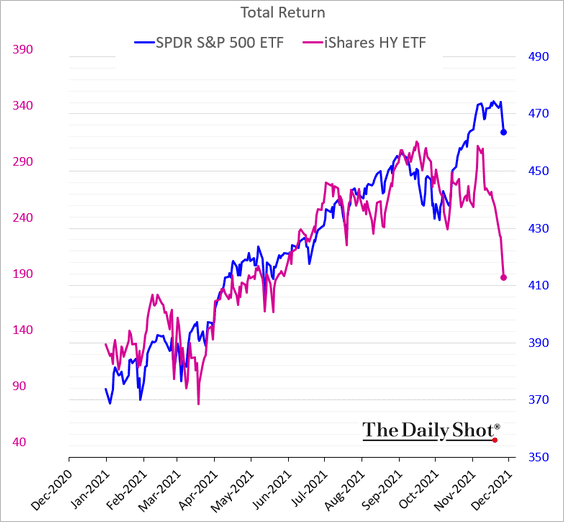

5. Equities have diverged from credit this month.

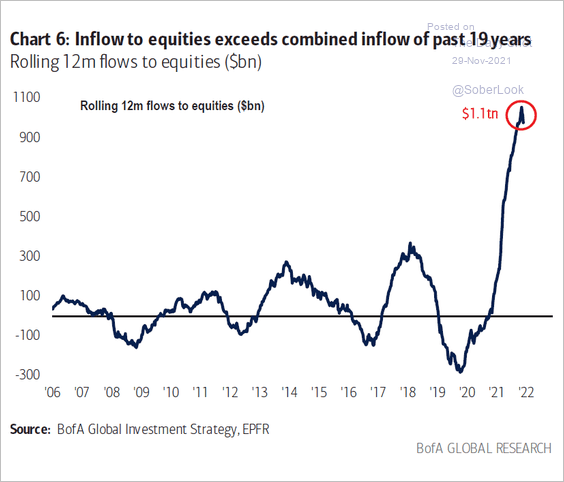

6. Flows into stock funds have been unprecedented this year.

Source: BofA Global Research, Bloomberg Read full article

Source: BofA Global Research, Bloomberg Read full article

7. Is corporate pricing power reaching its limits?

Source: BCA Research

Source: BCA Research

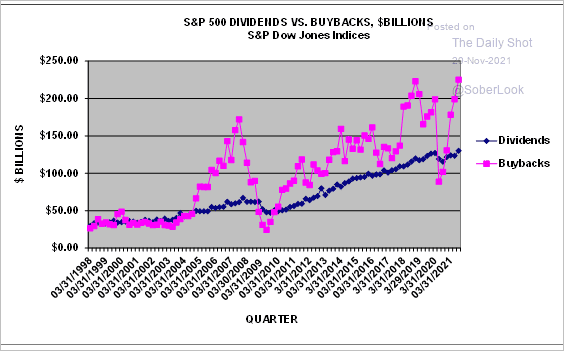

8. Q3 share buyback activity hit a quarterly record.

Source: @hsilverb, h/t @Callum_Thomas

Source: @hsilverb, h/t @Callum_Thomas

9. About half of this year’s $1bn+ global IPOs are trading below their listing price.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Energy

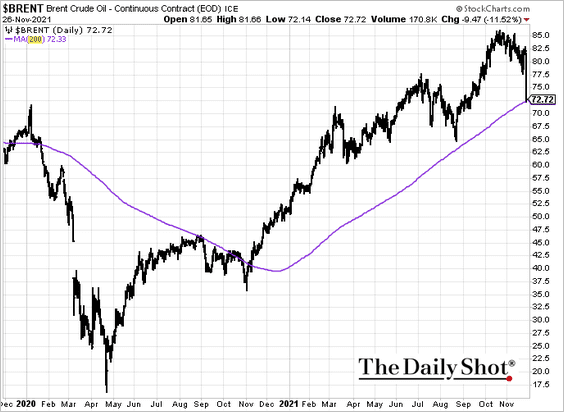

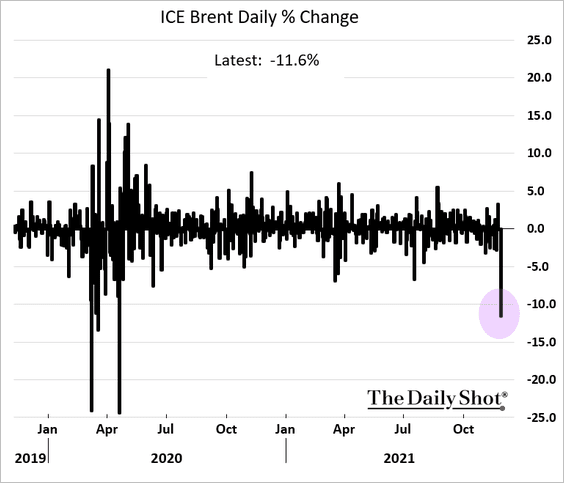

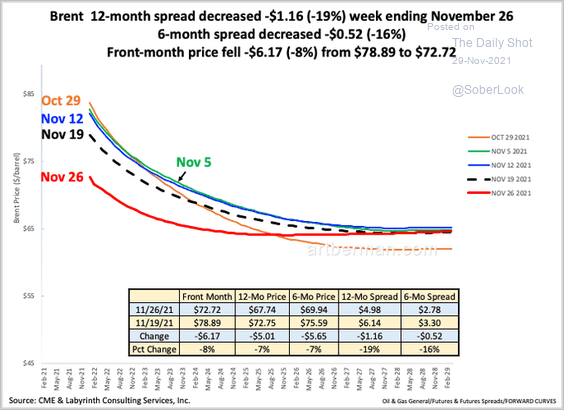

1. Crude oil tumbled on Friday, with Brent stopping at the 200-day moving average.

The curve flattened (lower backwardation).

Source: @aeberman12

Source: @aeberman12

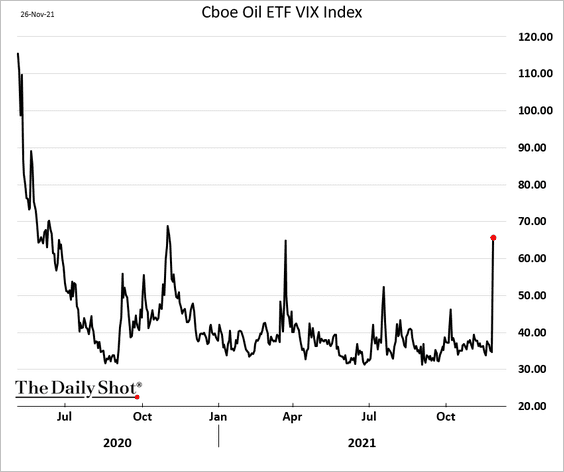

Implied vol spiked.

——————–

2. Inventories of crude oil and products in the US continue to trend lower.

Source: @HFI_Research

Source: @HFI_Research

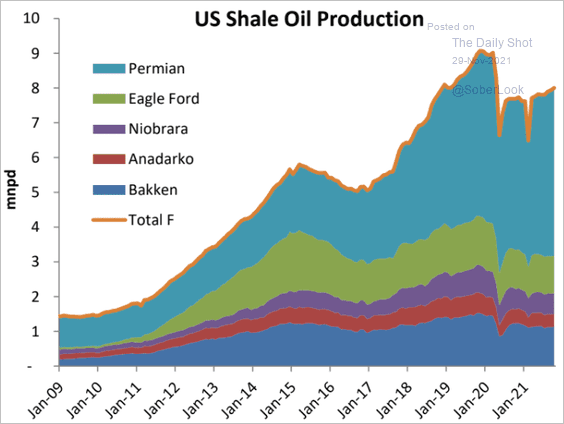

3. This chart shows the components of US shale production.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

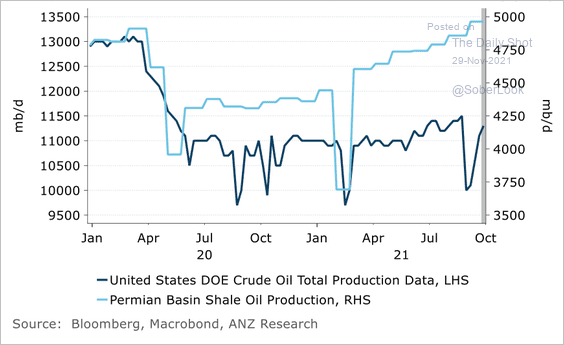

• US Permian Basin oil production is back to pre-pandemic levels, but total production is lagging.

Source: ANZ Research

Source: ANZ Research

• DUC inventories are now visibly below the recent averages.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

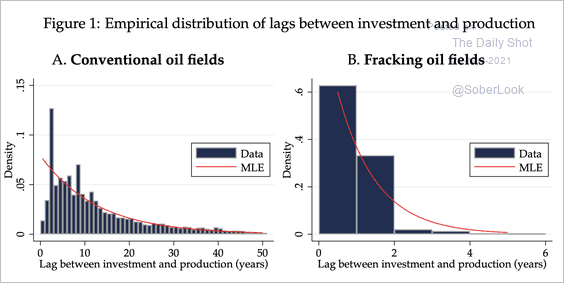

4. Conventional oil fields take much longer to get production going.

Source: Wharton Read full article

Source: Wharton Read full article

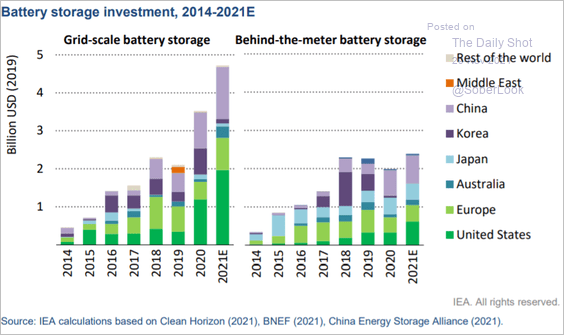

5. Finally, this chart shows the global trends in battery storage investment.

Source: IEA Read full article

Source: IEA Read full article

Back to Index

Rates

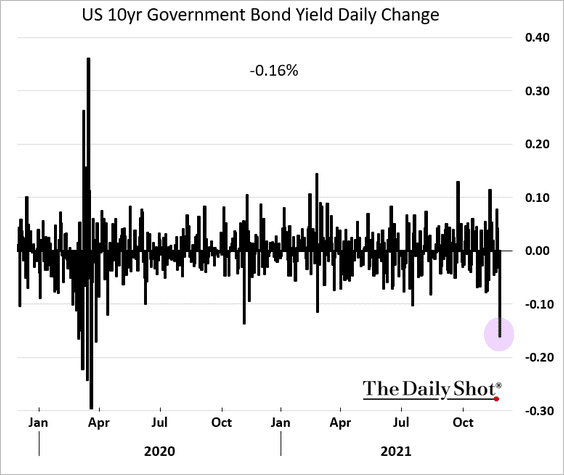

1. Treasury yields declined sharply on Friday due to omicron fears.

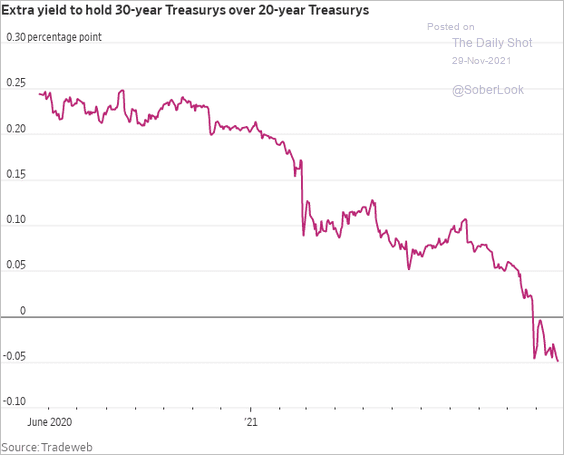

2. The 20yr Treasury isn’t getting much love.

Source: Numera Analytics Read full article

Source: Numera Analytics Read full article

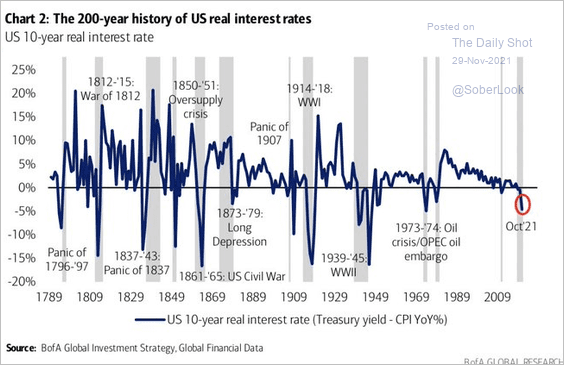

3. This chart shows the 200-year history of US real rates.

Source: BofA Global Research; @carlquintanilla

Source: BofA Global Research; @carlquintanilla

Back to Index

Cryptocurrency

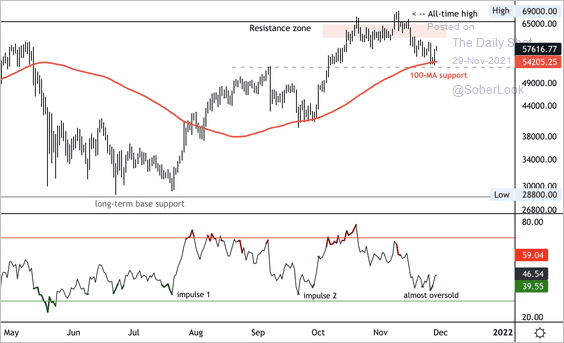

1. Bitcoin is holding support around its 100-day moving average after last week’s sell-off.

Source: Dantes Outlook

Source: Dantes Outlook

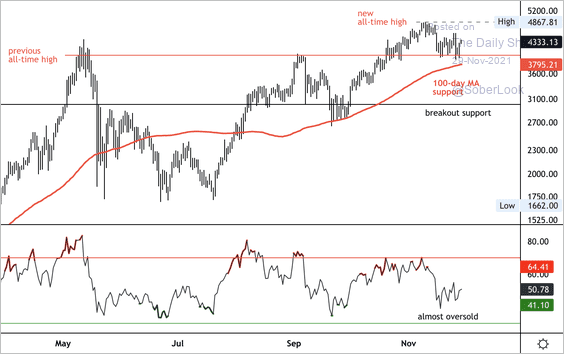

Ether is also holding support at its 100-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

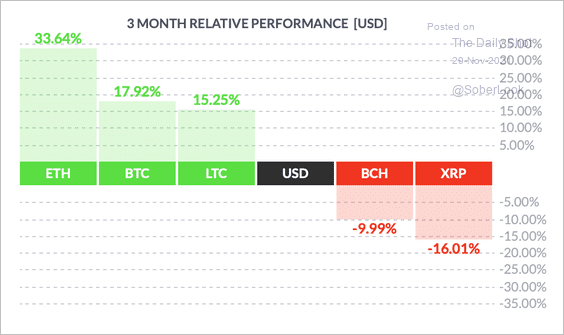

2. Ether (ETH) has outperformed other large cryptocurrencies over the past three months.

Source: FinViz

Source: FinViz

3. Bitcoin’s correlation with stocks remains positive.

Source: @technology Read full article

Source: @technology Read full article

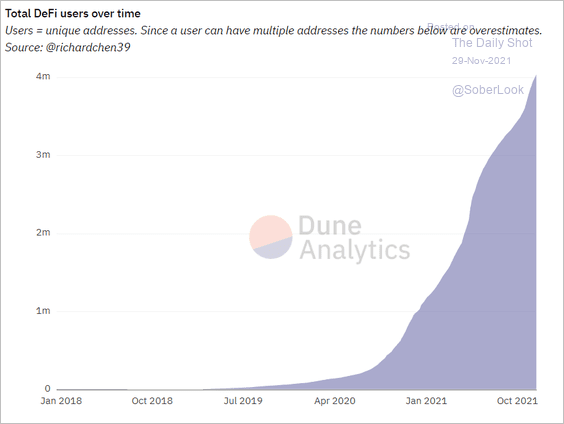

4. The total number of decentralized finance (DeFi) users in Ethereum has exceeded 4 million.

Source: @DuneAnalytics

Source: @DuneAnalytics

Back to Index

Emerging Markets

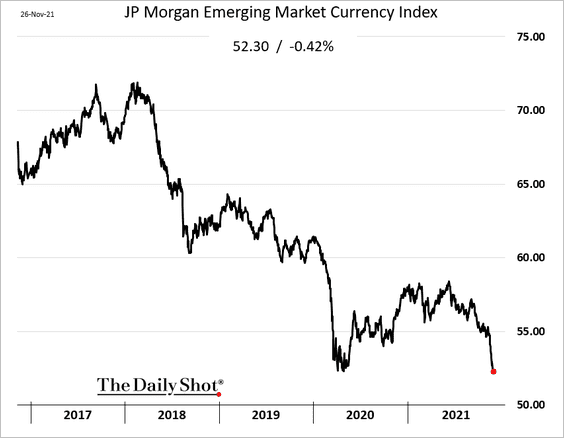

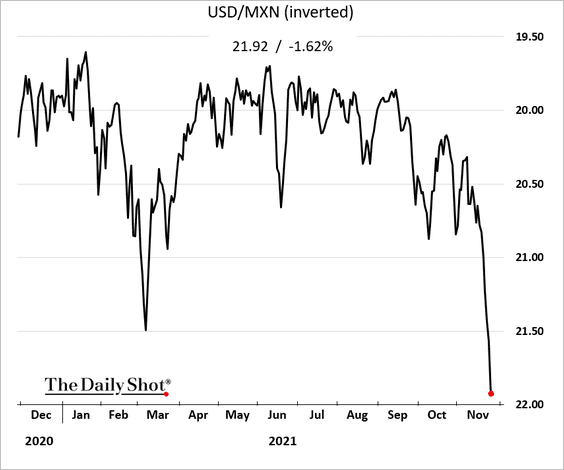

1. The JP Morgan EM Currency Index is nearing multi-year lows.

A number of EM currencies came under pressure this month.

• The ruble:

• The Mexican peso:

——————–

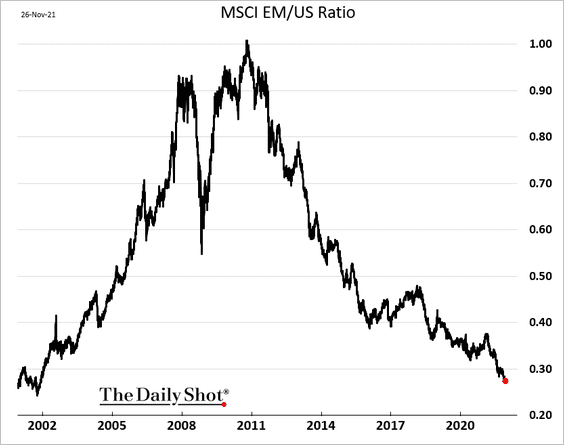

2. EM shares continue to widen their underperformance vs. US equities.

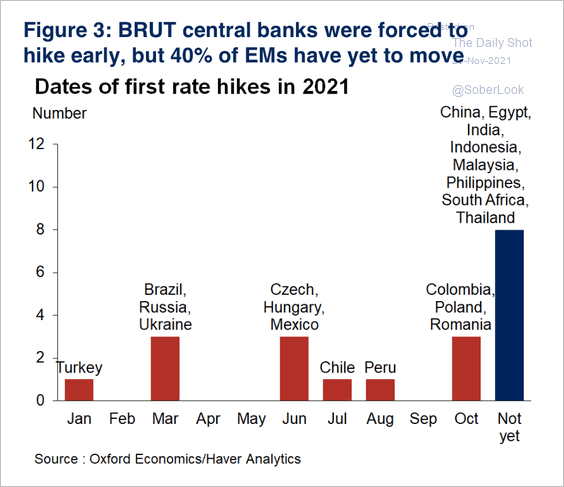

3. Which EM countries have not yet hiked rates?

Source: Oxford Economics

Source: Oxford Economics

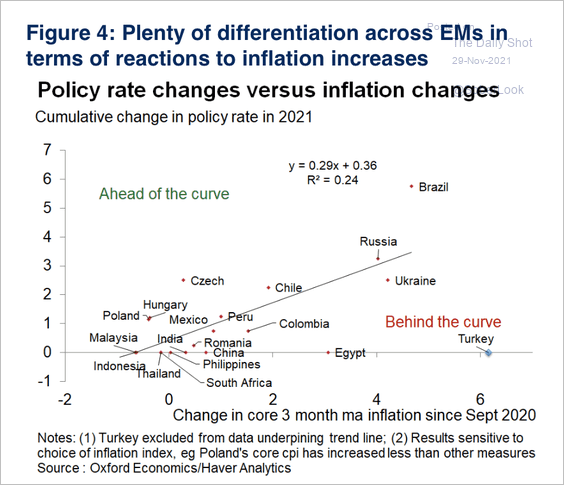

• Policy rate changes and inflation vary across EM countries.

Source: Oxford Economics

Source: Oxford Economics

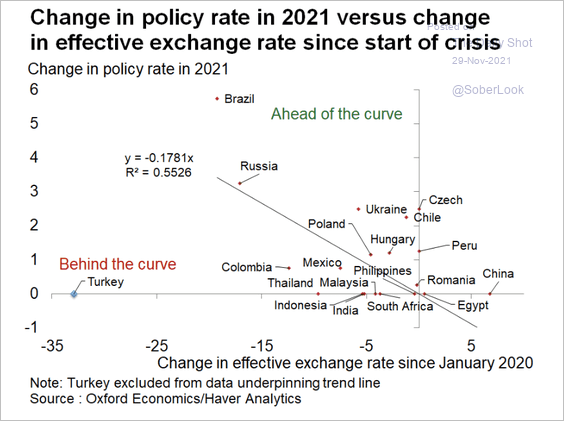

• There is a correlation between currency weakness and rate increases.

Source: Oxford Economics

Source: Oxford Economics

——————–

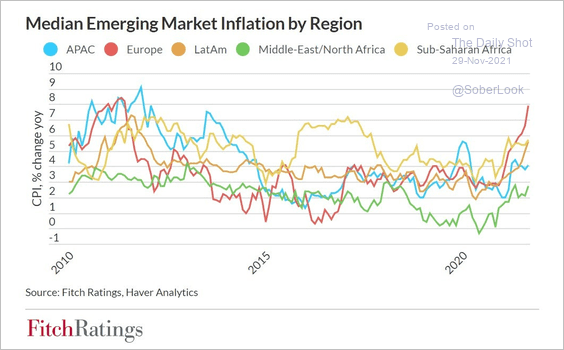

4. This chart shows median inflation by region.

Source: Fitch Ratings

Source: Fitch Ratings

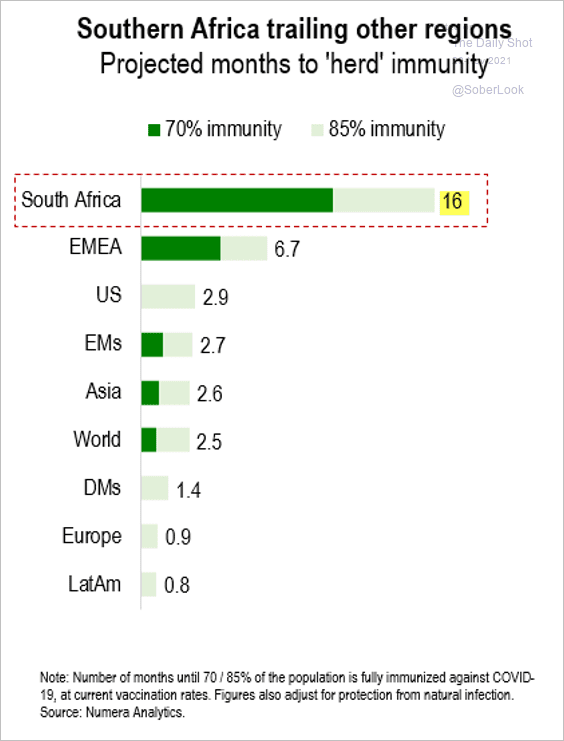

5. Will we see more COVID mutations coming out of Southern African countries? There is an urgent need to boost vaccinations in the region.

Source: Numera Analytics

Source: Numera Analytics

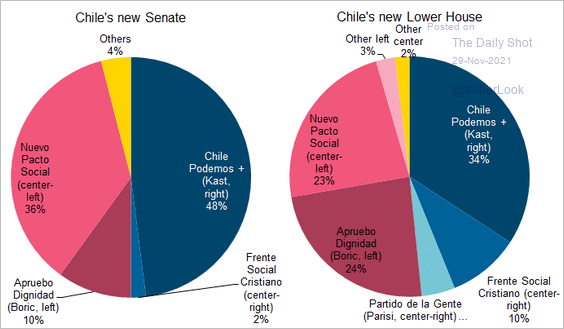

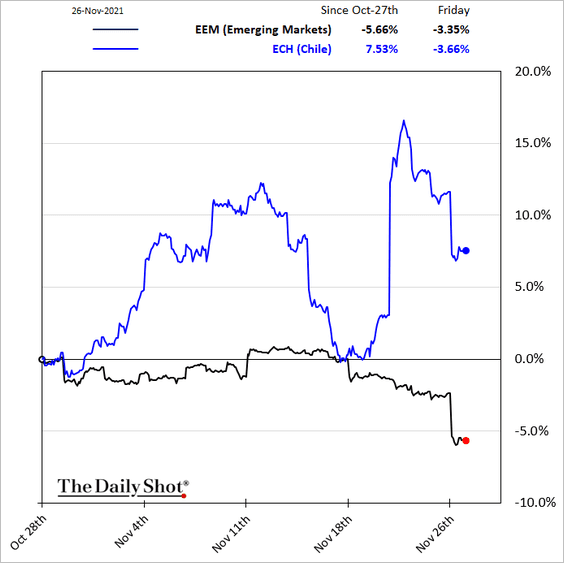

6. Chile’s new legislature appears to be relatively well balanced, which is making markets less jittery about the polarized presidential election runoff next month.

Source: @desousacarlos

Source: @desousacarlos

——————–

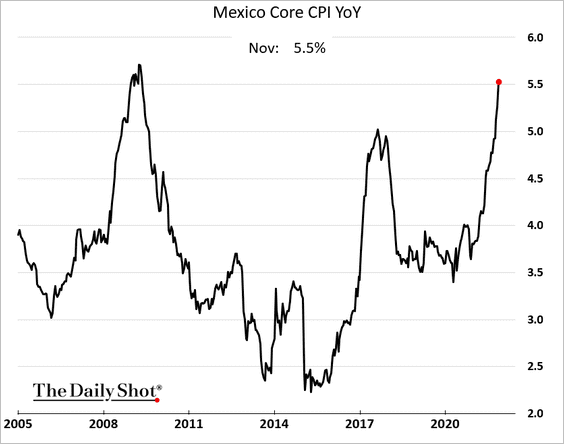

7. Mexico’s core CPI climbed above 5.5% for the first time since 2009.

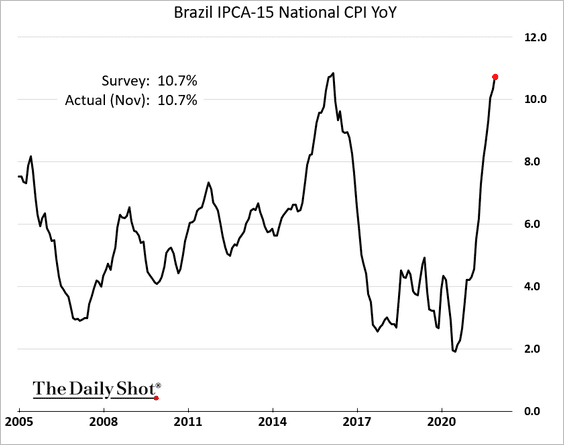

8. Brazil’s inflation continues to surge.

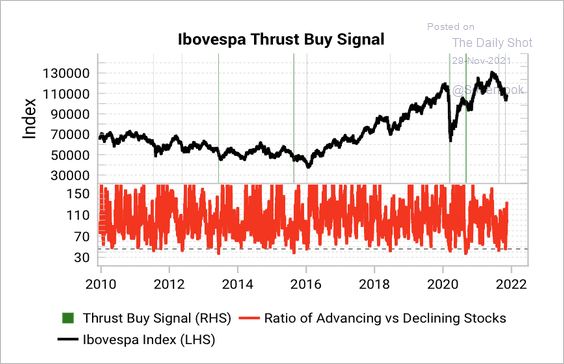

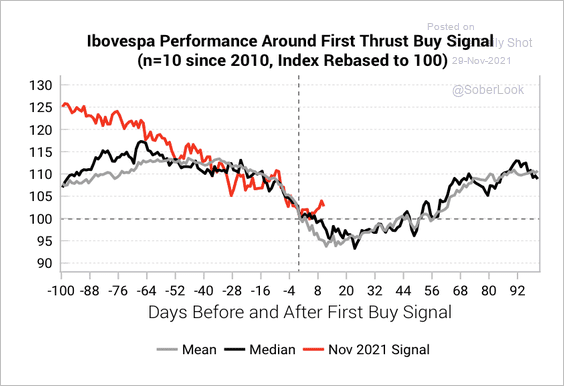

Separately, Brazilian equities appear oversold, according to Variant Perception (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

——————–

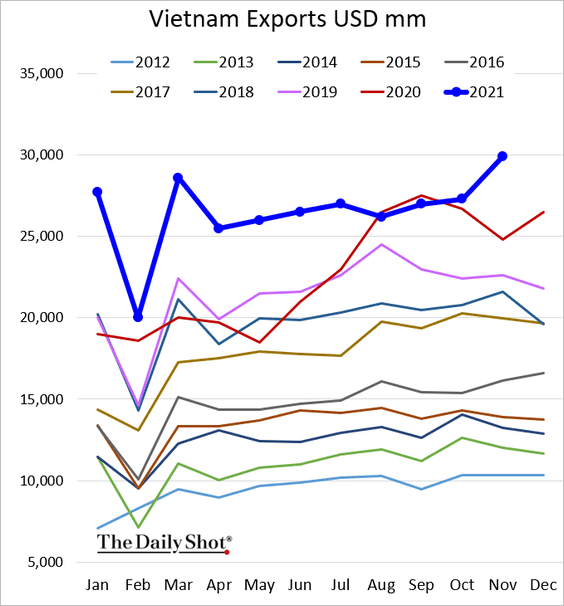

9. Vietnam’s exports hit a record high.

Back to Index

China

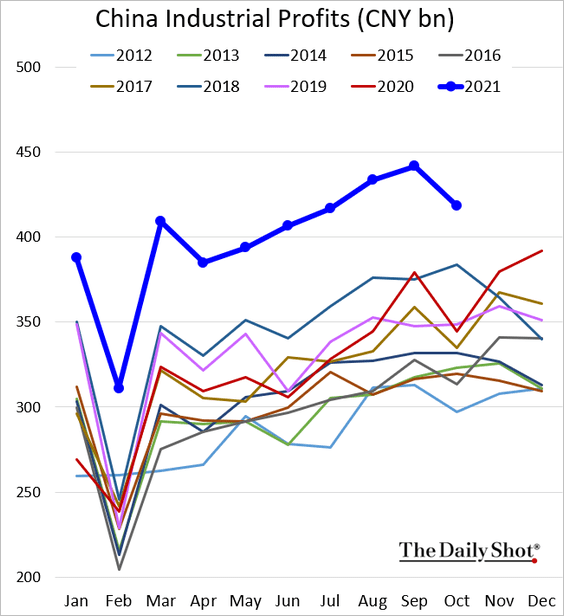

1. Industrial profits remain at multi-year highs for this time of the year.

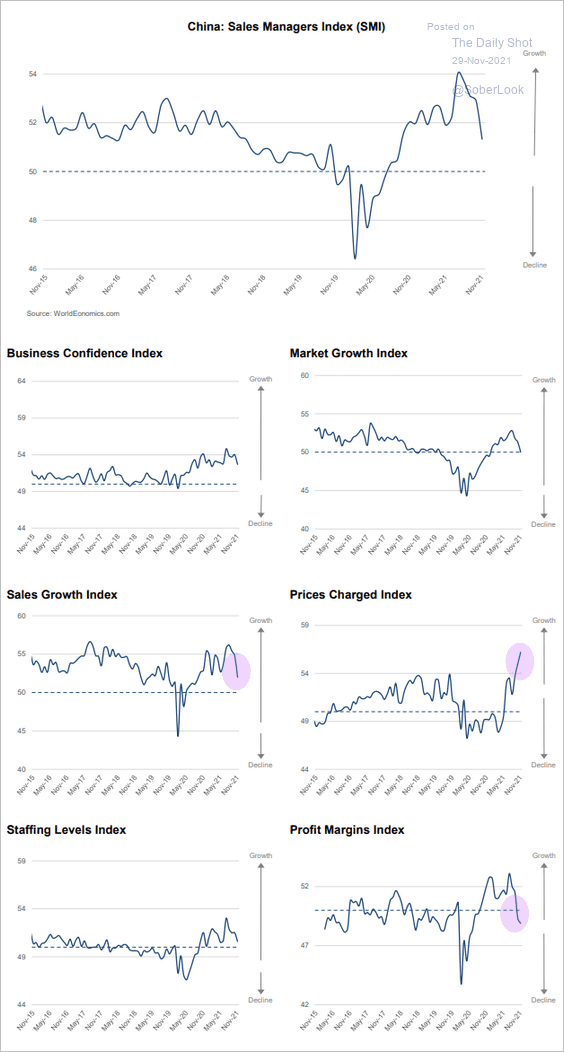

2. The World Economics SMI report shows business activity moderating this month as companies are forced to boost prices.

Source: World Economics

Source: World Economics

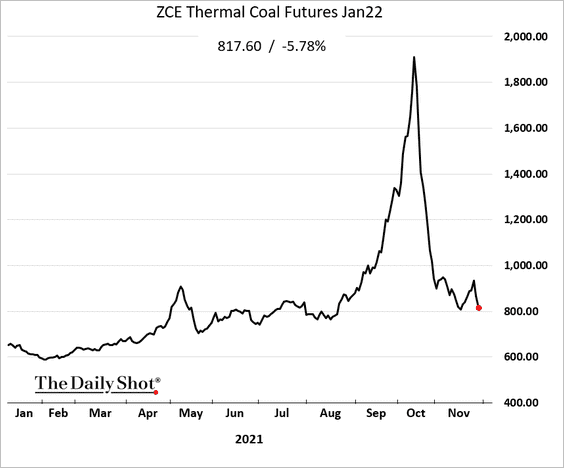

3. Thermal coal futures saw a “dead-cat” bounce.

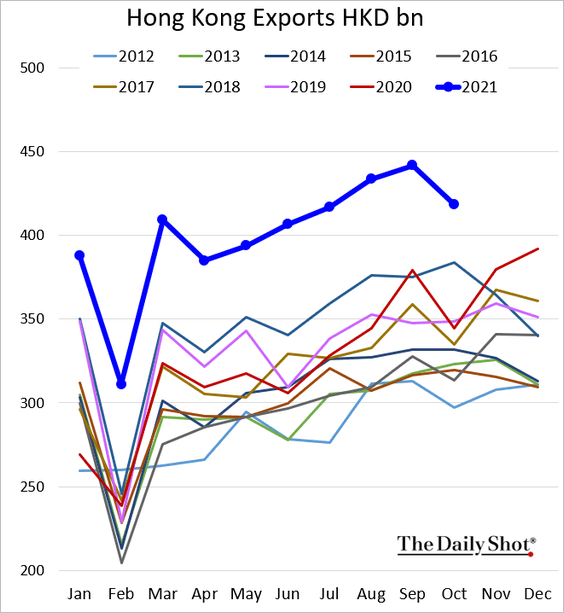

4. Hong Kong’s exports remain robust.

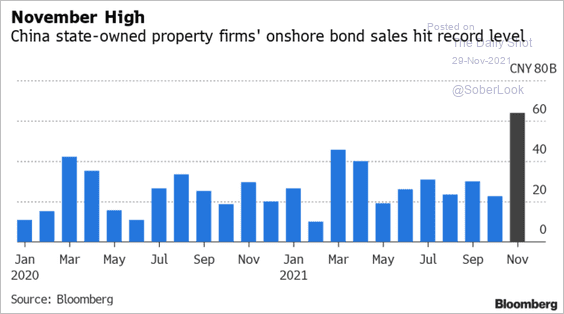

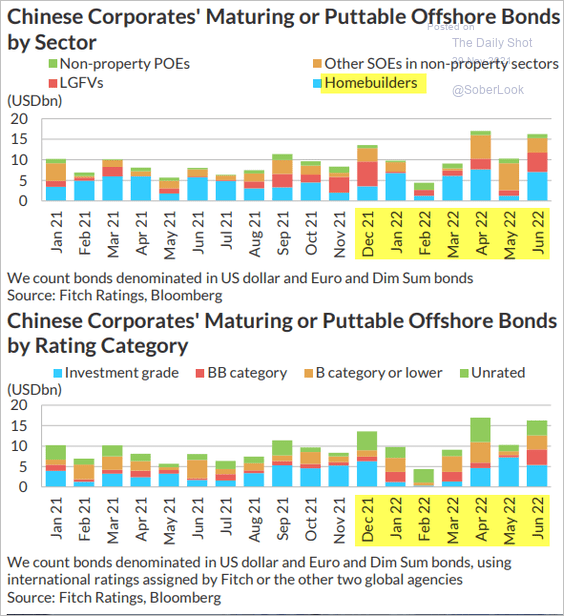

5. State-owned property firms issued a record amount of onshore debt in November to boost liquidity (as the dollar market froze).

Source: Bloomberg Read full article Further reading

Source: Bloomberg Read full article Further reading

Here are the offshore bond maturities.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Asia – Pacific

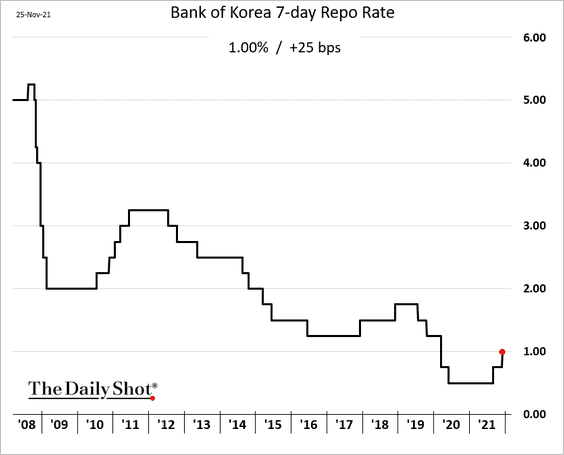

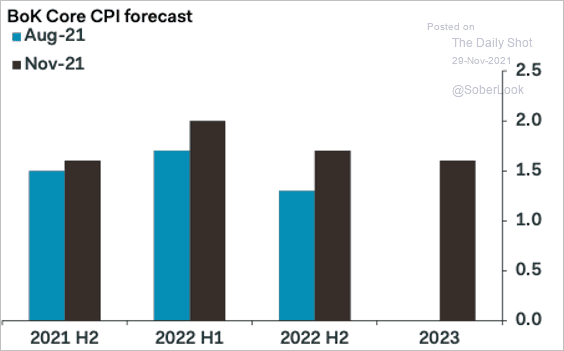

1. South Korea’s central bank hiked rates again (as expected).

The central bank boosted its inflation forecasts.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

2. Taiwan’s industrial production remains exceptionally strong.

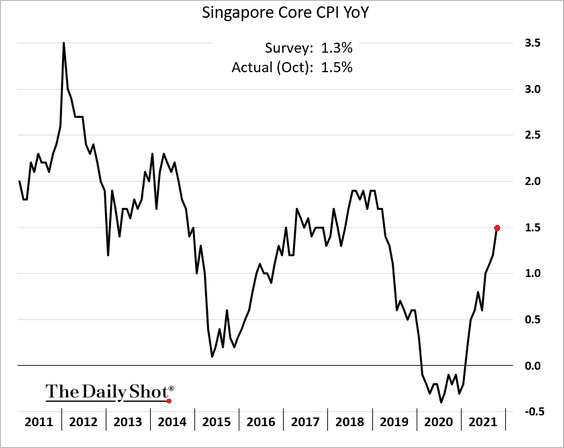

3. Singapore’s inflation continues to rebound.

4. Next, we have some updates on Australia.

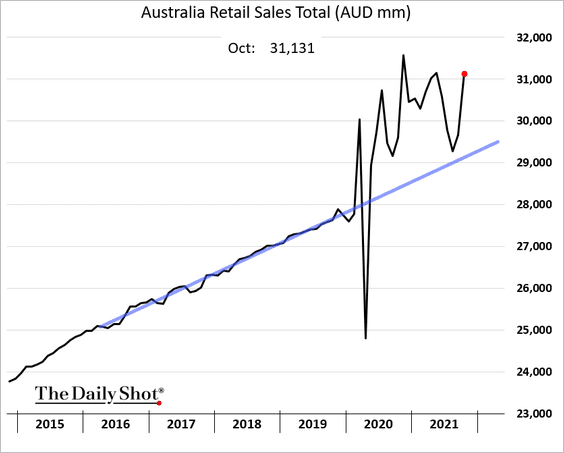

• Retail sales rebounded in October.

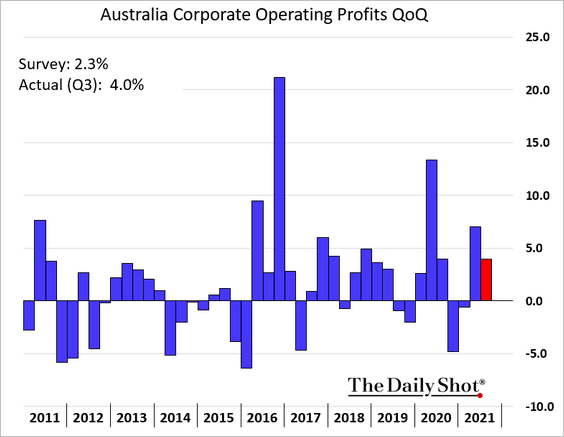

• Corporate profits surprised to the upside again last quarter.

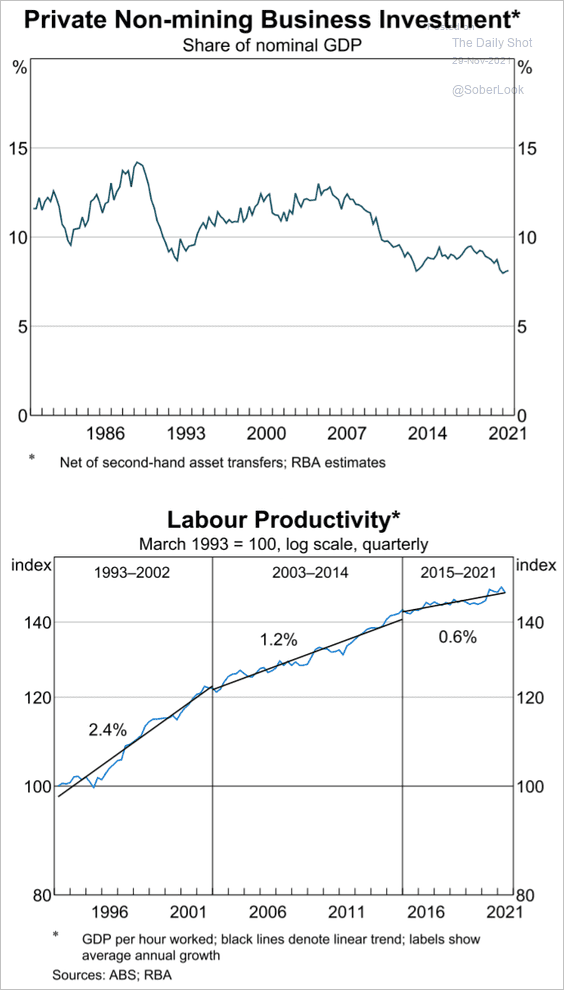

• Softer business investment slowed productivity growth in recent years.

Source: BIS Read full article

Source: BIS Read full article

——————–

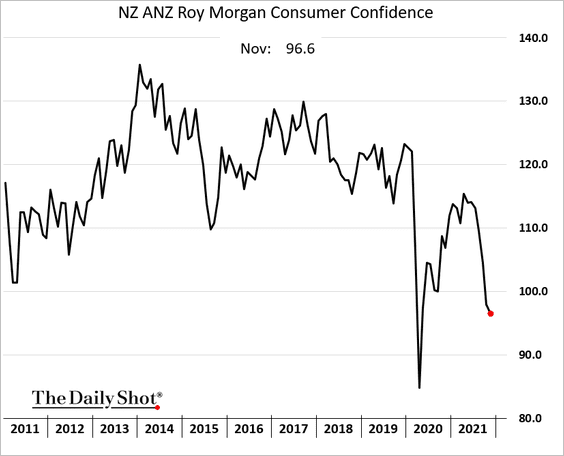

5. Finally, here are some updates on New Zealand.

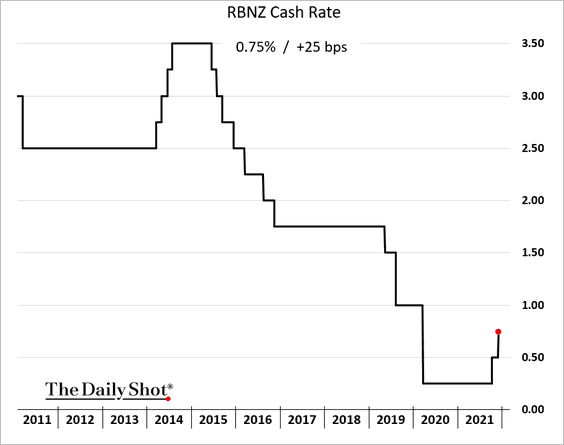

• The RBNZ hiked rates as expected. The 25 bps increase was a bit more cautious than some analysts were expecting.

• Consumer confidence continued to deteriorate this month.

• The trade deficit is moderating.

Back to Index

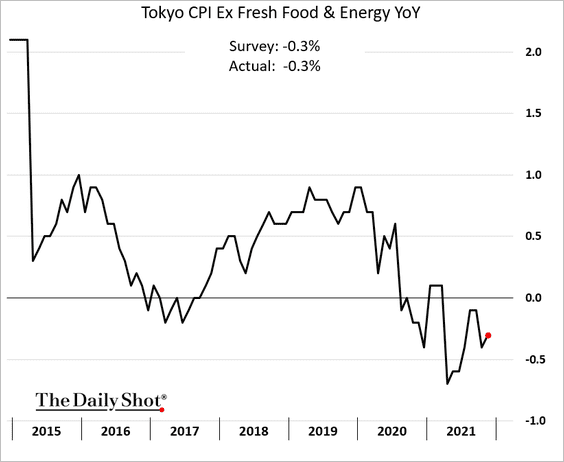

Japan

1. The November Tokyo CPI showed that Japan remained firmly in deflation this month.

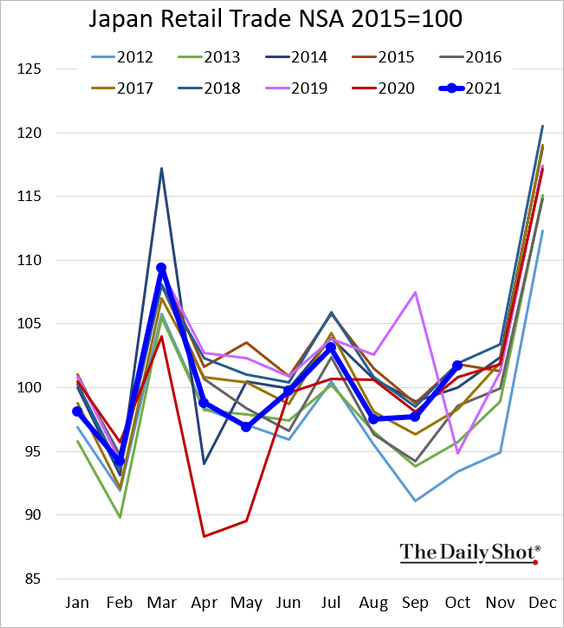

3. Retail sales have been firming, …

… although department store sales remain soft.

——————–

4. Here is the evolution of business lending since 1970.

Source: @bopinion Read full article

Source: @bopinion Read full article

Back to Index

The Eurozone

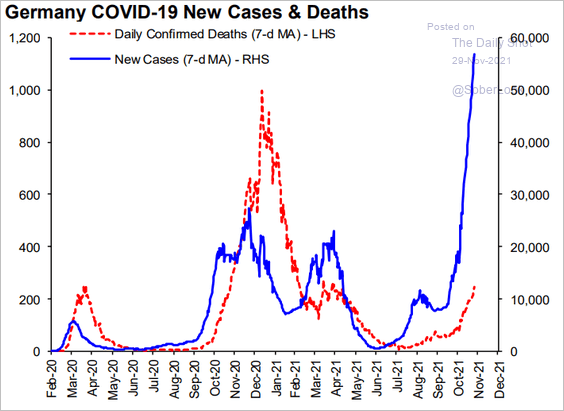

1. Let’s begin with Germany.

• German stocks sold off sharply on Friday and continue to underperform global peers.

• COVID cases have surged, but fatalities remain relatively low.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

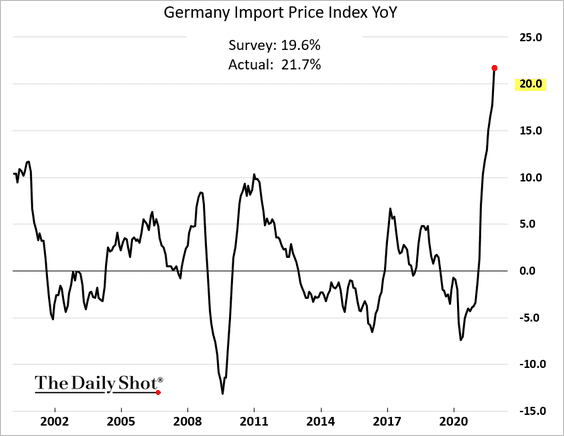

• Germany is importing inflation as import prices rise by nearly 22% vs. last year.

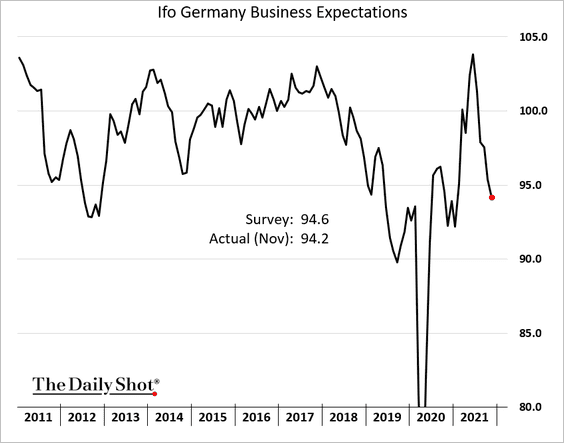

• The Ifo business expectations index deteriorated further amid rising costs and the COVID wave.

Source: ifo Institute

Source: ifo Institute

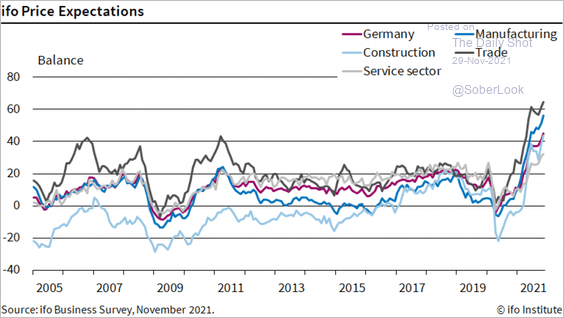

This chart shows price expectations by sector.

Source: ifo Institute

Source: ifo Institute

• Consumer confidence eased as well.

——————–

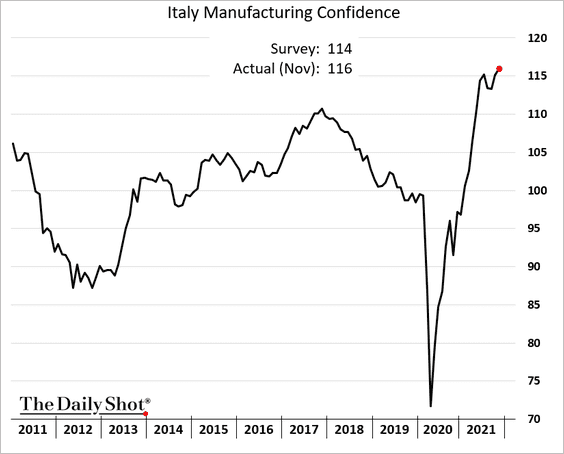

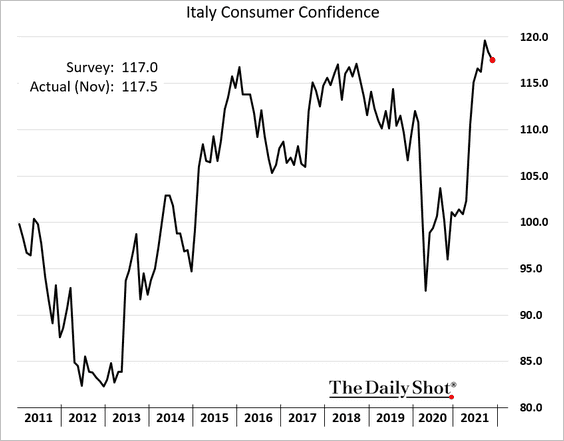

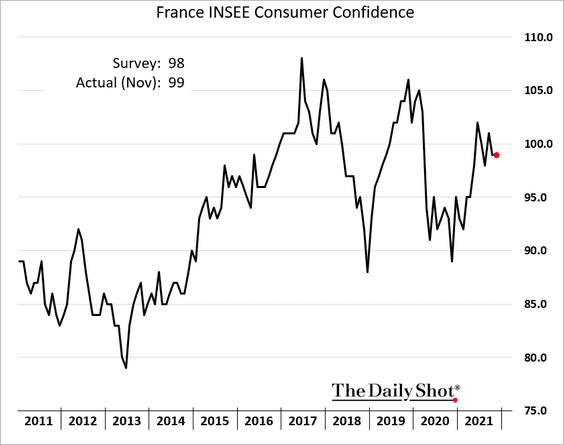

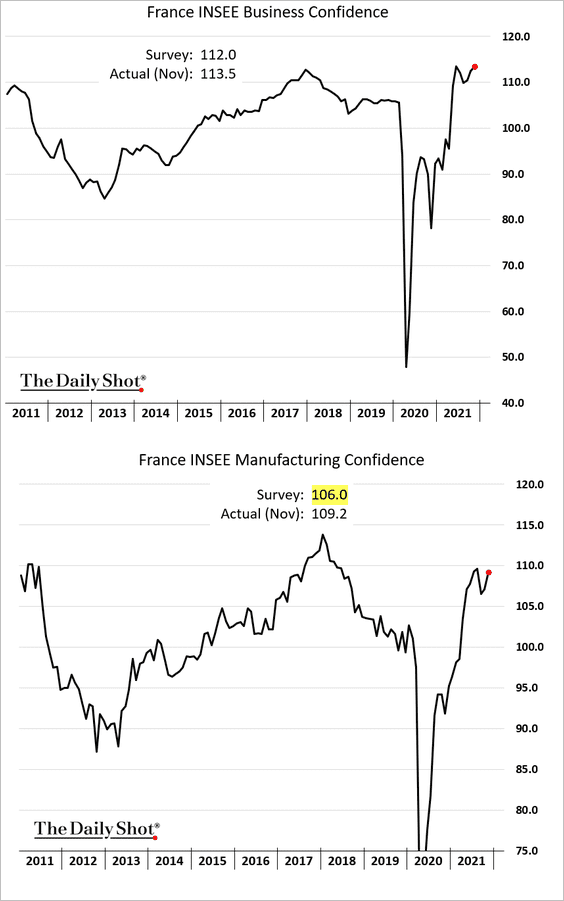

2. French and Italian sentiment indicators have been resilient.

• Italian manufacturing confidence:

• Italian consumer confidence:

• French consumer confidence:

• French business confidence:

——————–

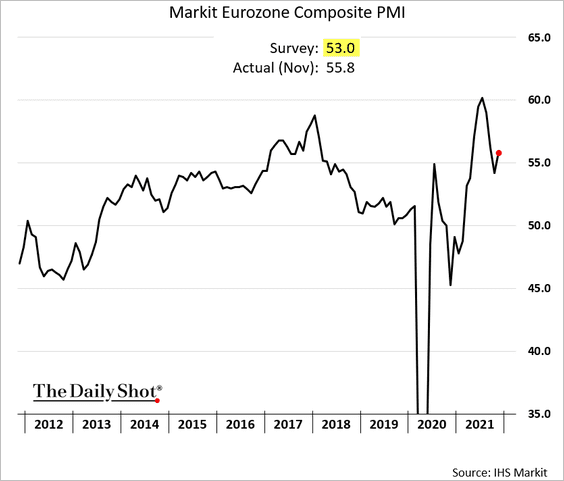

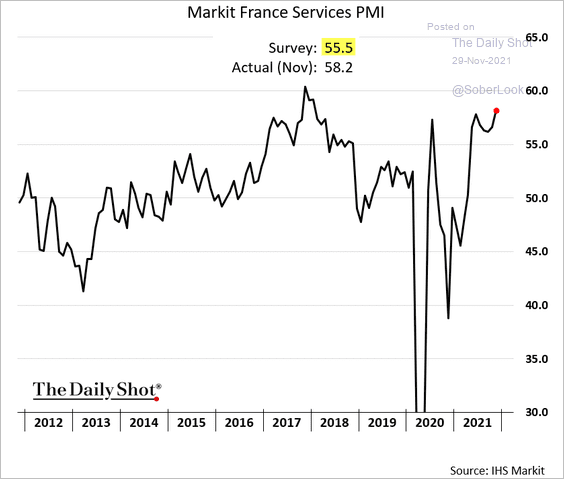

3. The flash PMI report from Markit surprised to the upside.

The figures from France were especially strong.

Business input costs continue to surge.

Back to Index

The United Kingdom

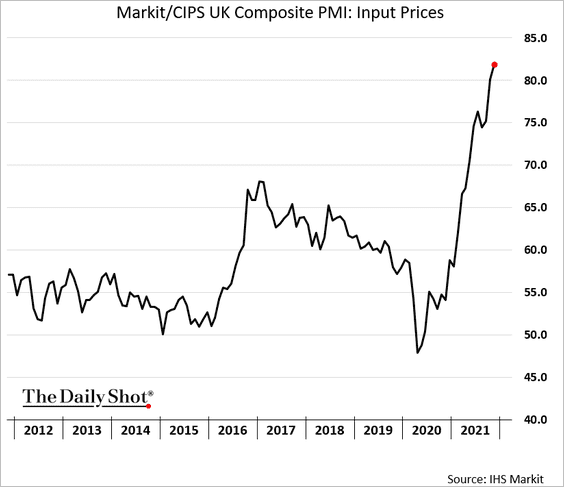

1. The flash PMI report showed manufacturing still lagging services this month.

Source: IHS Markit

Source: IHS Markit

Input prices are soaring.

——————–

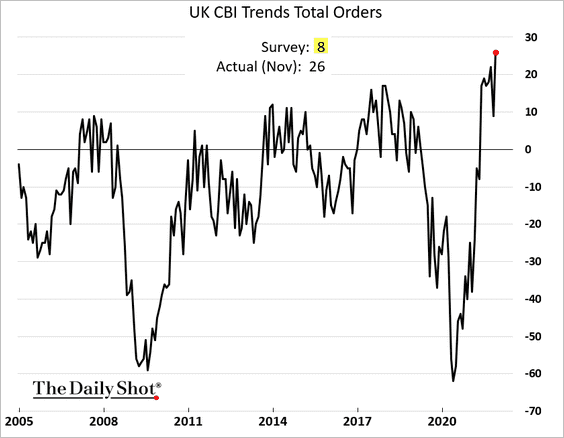

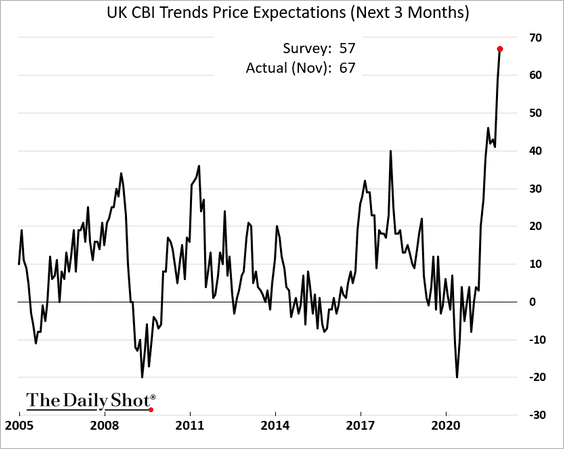

2. On the other hand, the CBI industrial orders index hit a record high.

Price expectations have gone vertical.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

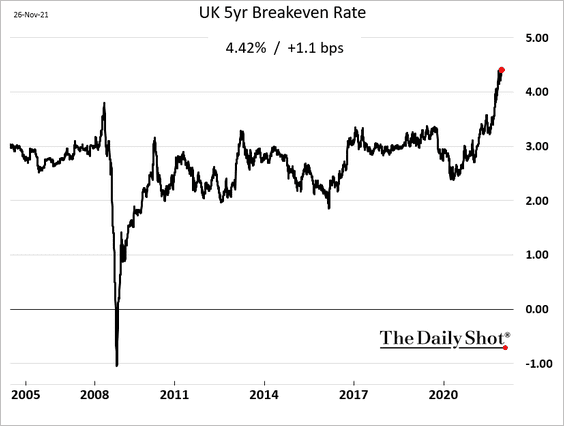

3. Market-based inflation expectations continue to grind higher.

Back to Index

The United States

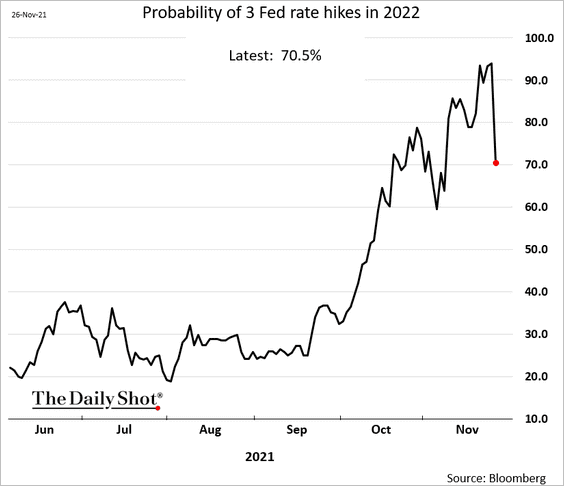

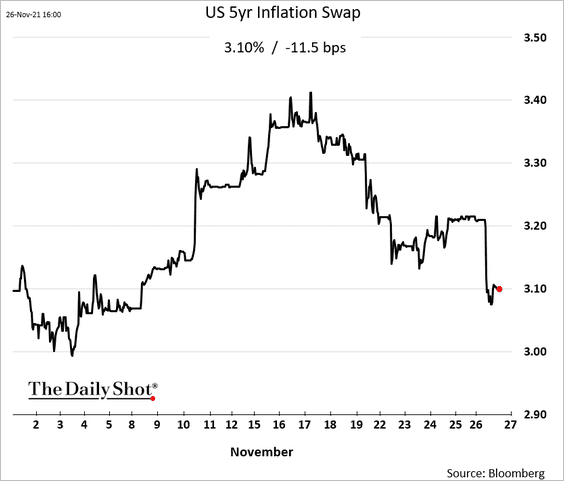

1. The omicron scare sent rate hike probabilities sharply lower. Nonetheless, the odds of three Fed hikes next year are still above 70%.

Inflation expectations dropped.

——————–

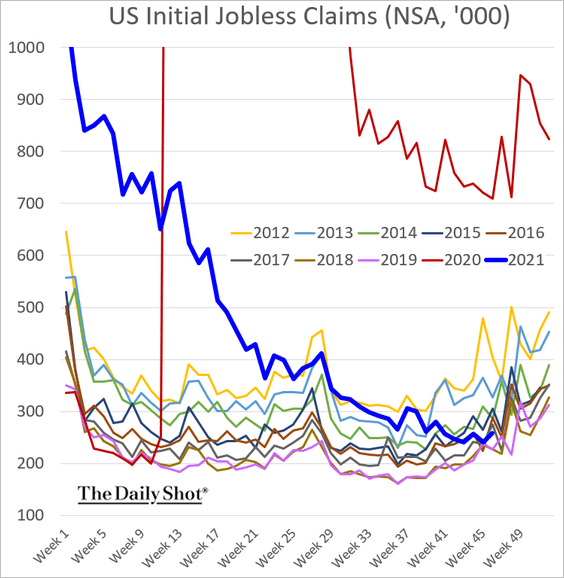

2. Jobless claims remain very low for this time of the year.

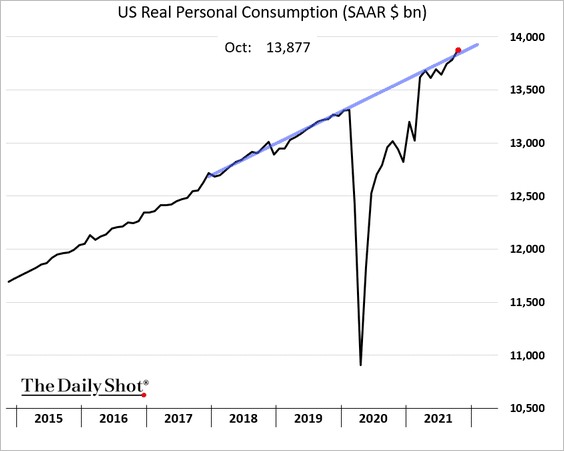

3. Consumer spending continued to climb in October, rising well above the pre-COVID trend.

The trend doesn’t look as impressive when adjusted for inflation.

——————–

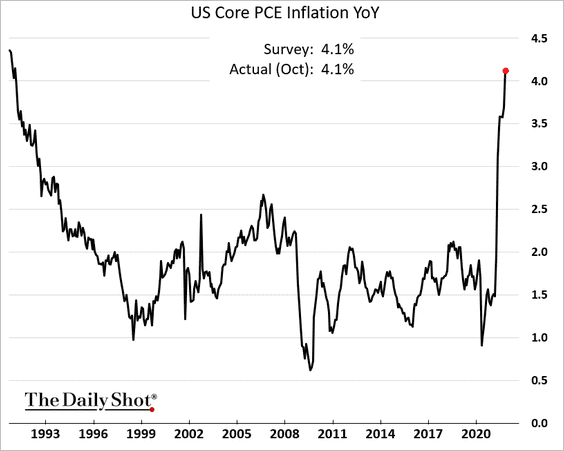

4. The core PCE inflation, the Fed’s preferred measure, climbed above 4% for the first time in decades.

5. Mortgage applications remain exceptionally strong.

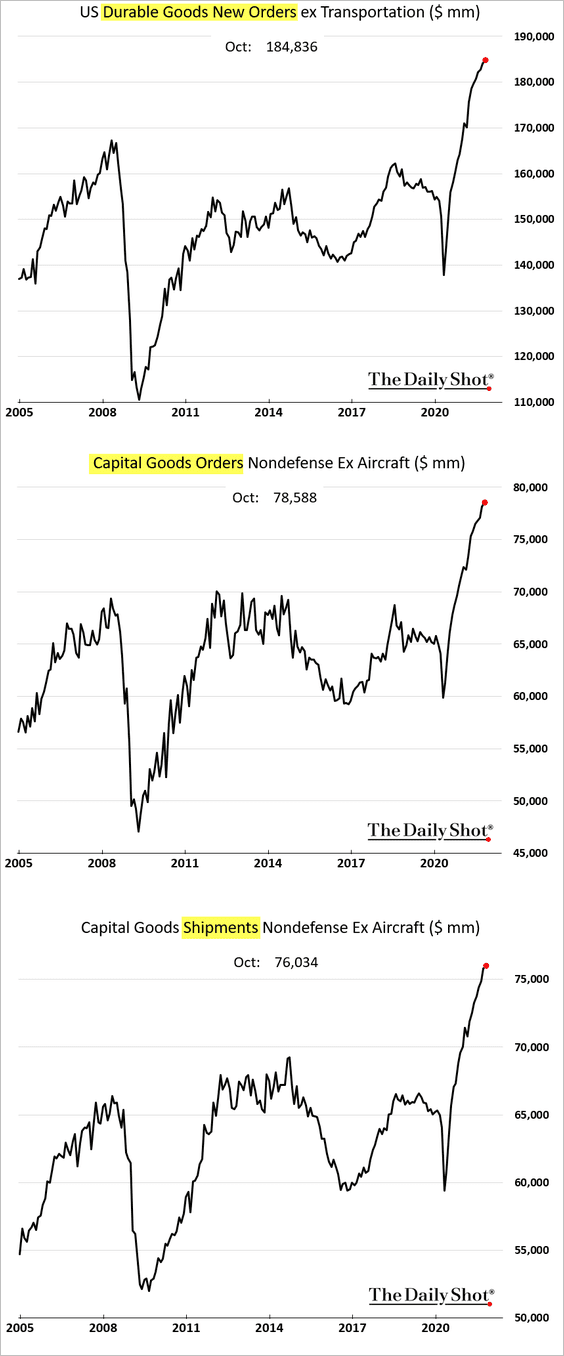

6. US durable goods orders keep climbing. The persistent strength in capital goods orders points to robust business investment.

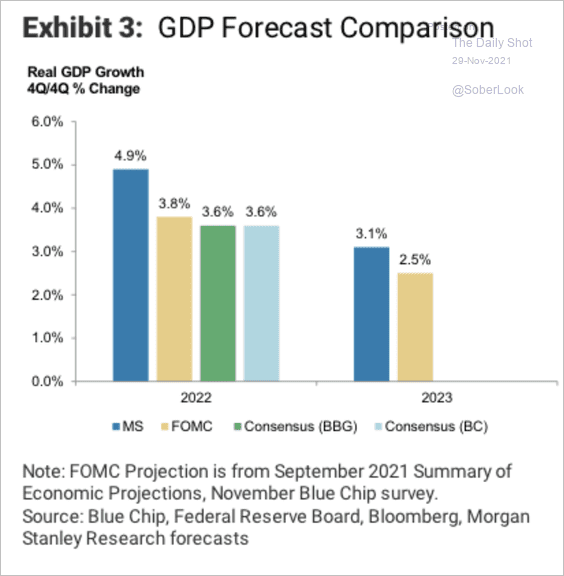

7. Morgan Stanley’s GDP forecast for next year is far more bullish than consensus.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

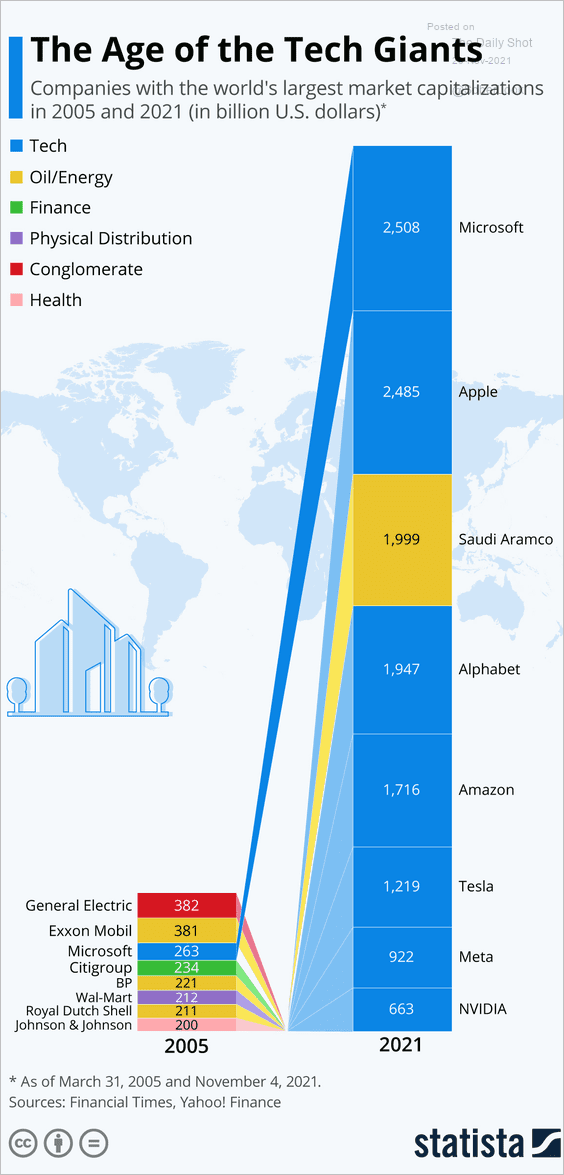

1. Companies with the largest market capitalizations in 2005 and 2021:

Source: Statista

Source: Statista

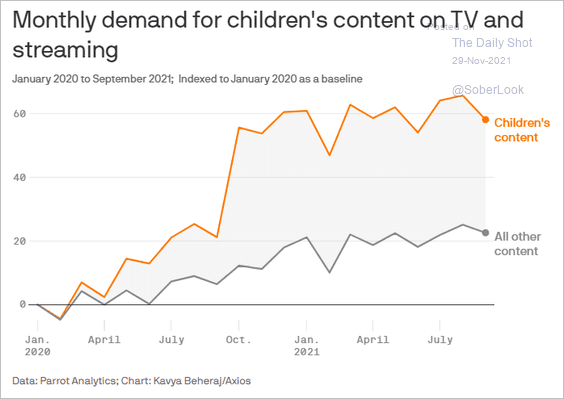

2. Demand for children’s video content:

Source: @axios Read full article

Source: @axios Read full article

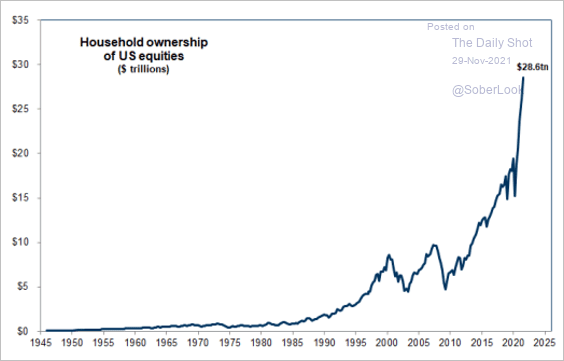

3. Deposits and currency held by US households:

Source: @LizAnnSonders, @biancoresearch

Source: @LizAnnSonders, @biancoresearch

• Households’ ownership of US stocks:

Source: Goldman Sachs

Source: Goldman Sachs

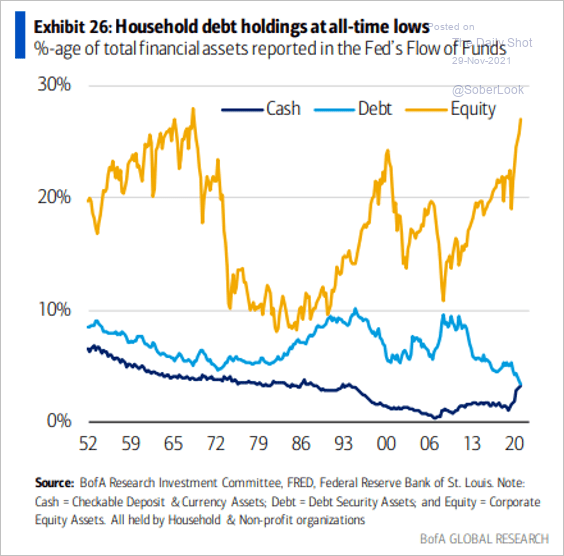

• US households don’t like bonds:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

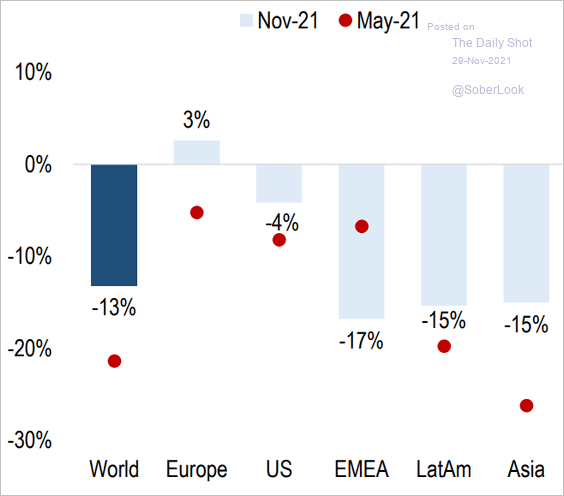

4. Road traffic congestion vs. pre-COVID levels:

Source: Numera Analytics

Source: Numera Analytics

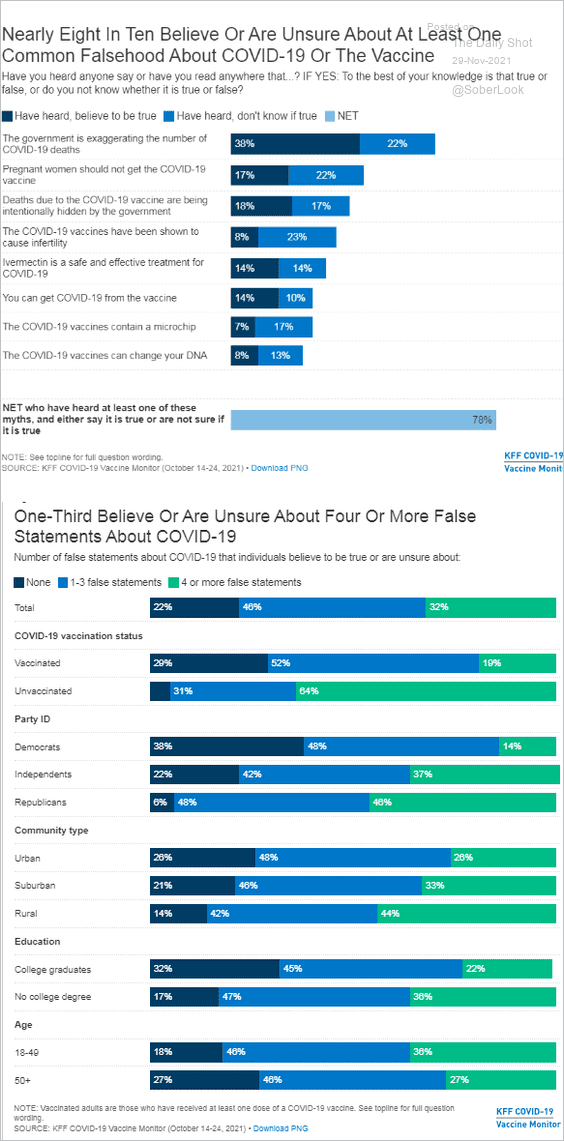

5. Vaccine myths:

Source: KFF Read full article

Source: KFF Read full article

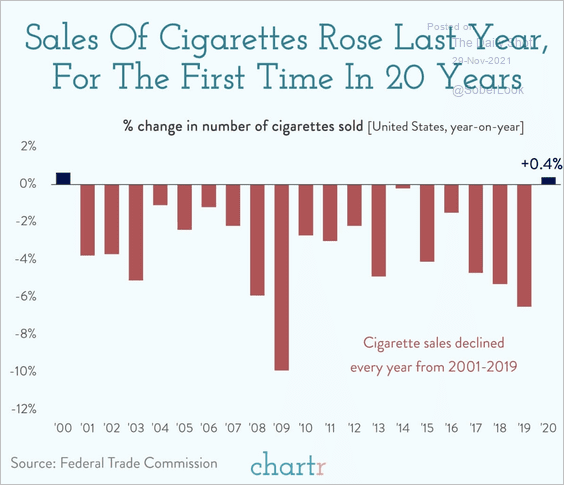

6. Year-over-year changes in cigarette sales:

Source: @chartrdaily

Source: @chartrdaily

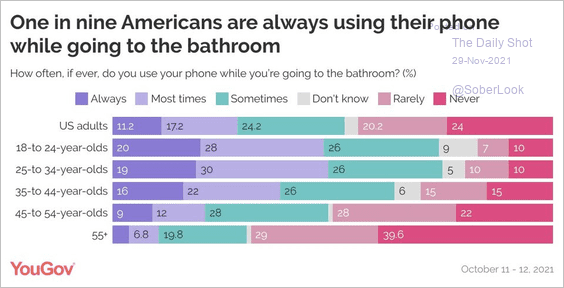

7. Using a phone in the bathroom:

——————–

Back to Index