The Daily Shot: 30-Nov-21

• Equities

• Credit

• Rates

• Energy

• Commodities

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• Europe

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

*

Equities

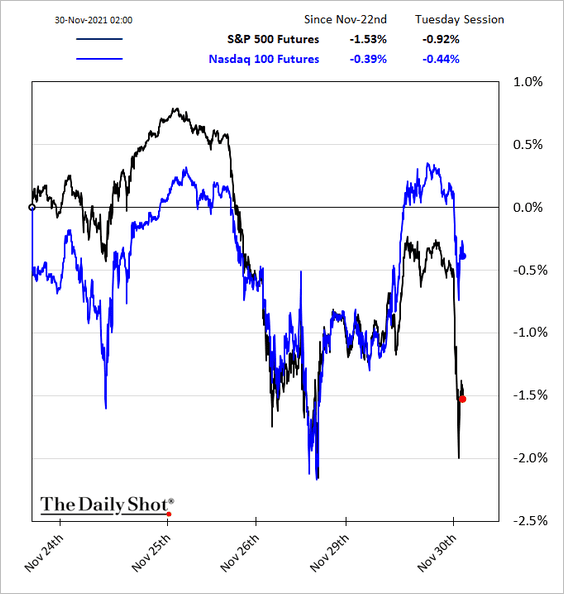

1. After a sharp rebound on Monday, global shares and US futures are lower this morning as the omicron jitters resurface.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

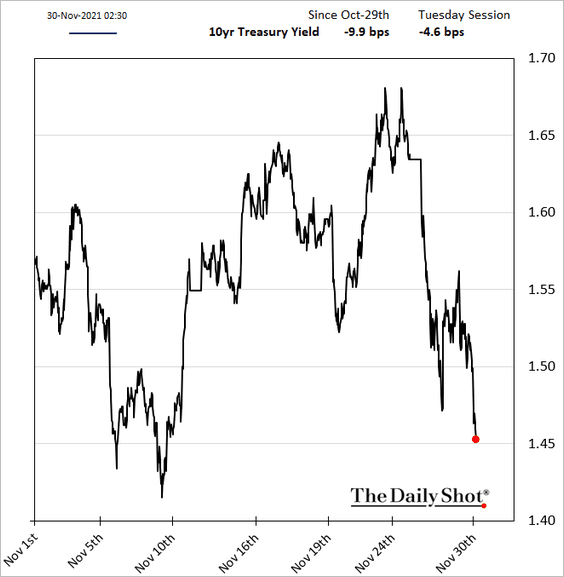

Treasury yields continue to slide.

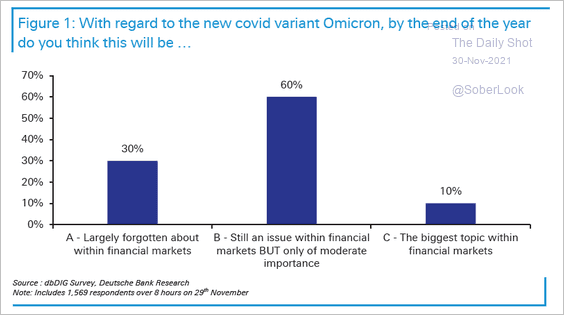

By the way, a Deutsche Bank survey of investors points to limited concerns about the new variant.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

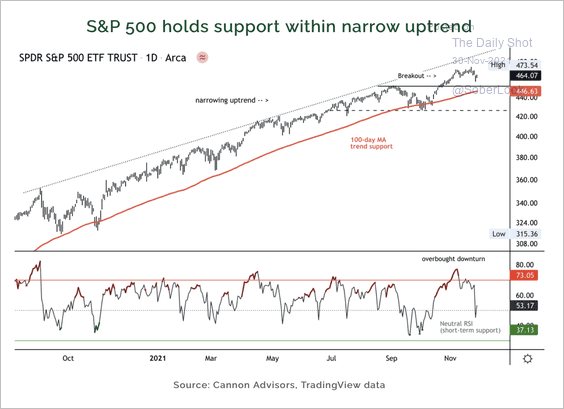

2. The SPDR S&P 500 ETF (SPY) is holding support above its 100-day moving average, although the broader uptrend is starting to narrow.

Source: Cannon Advisors

Source: Cannon Advisors

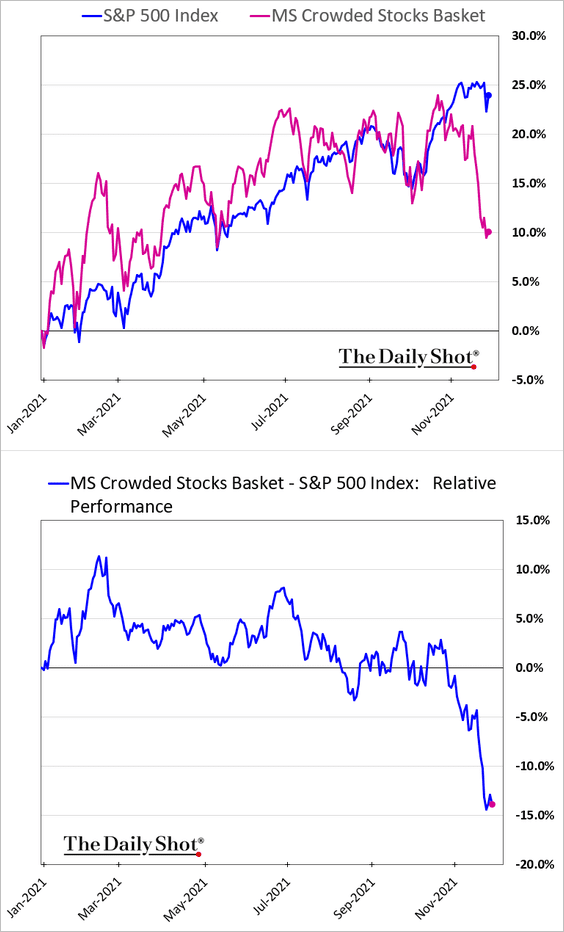

3. Morgan Stanley’s basket of the most crowded stocks has underperformed massively in recent days as investors cut back on the biggest bets.

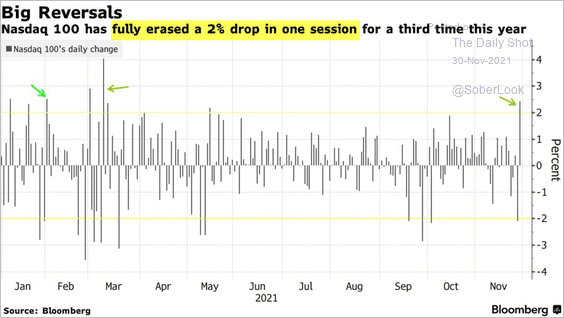

4. How long does it take dip buyers to reverse a 2% drop in the Nasdaq 100? Sometimes, just one session.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

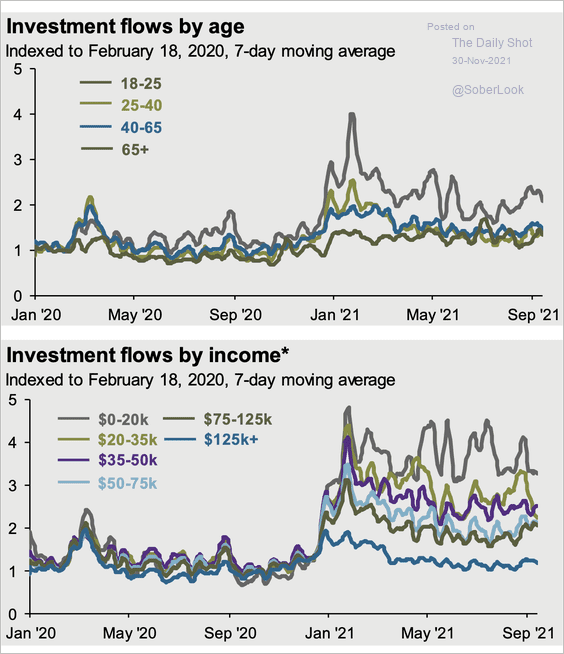

Who are the dip buyers? Often it’s the younger and the less well-off individual investors.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

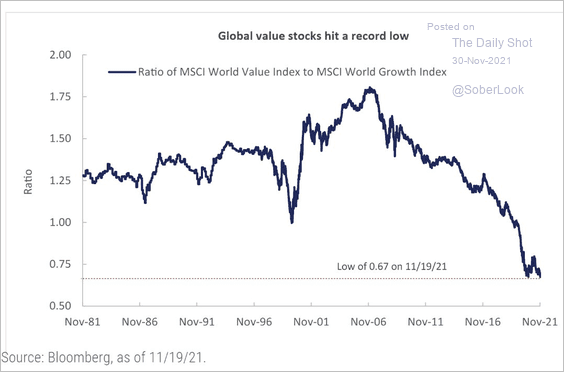

5. Some analysts have been predicting that value stocks finally bottomed relative to growth. So far, they have been proven wrong.

Source: @Callum_Thomas

Source: @Callum_Thomas

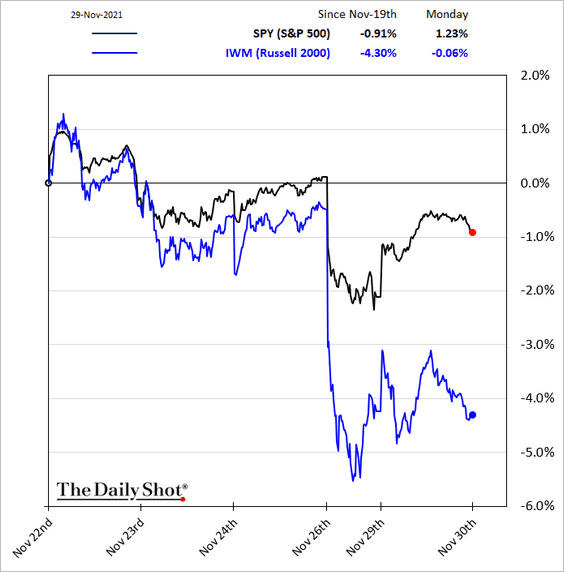

6. Small caps continue to underperform.

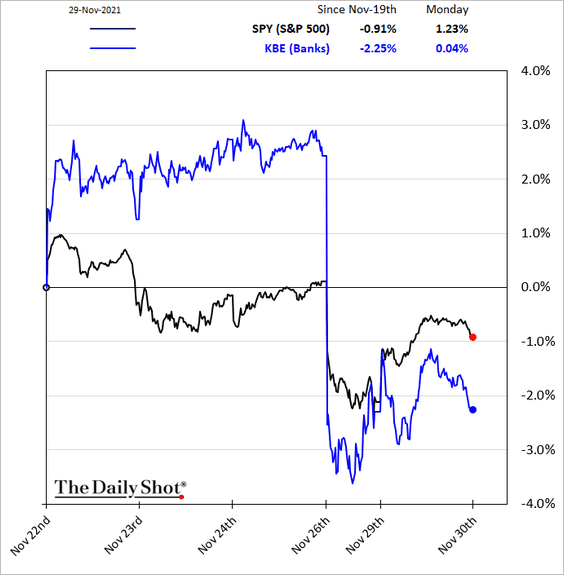

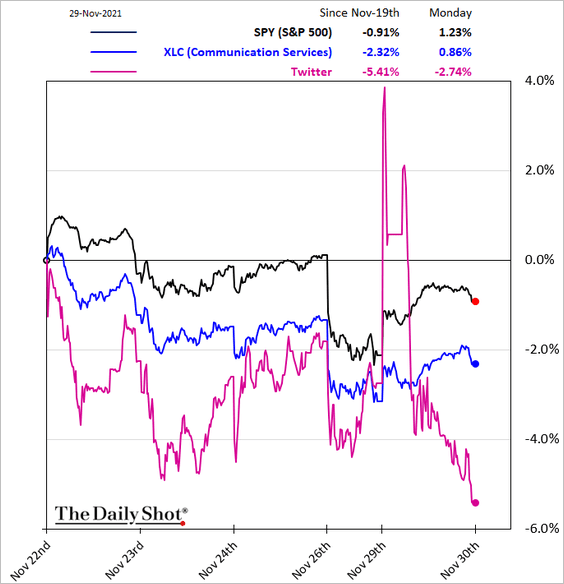

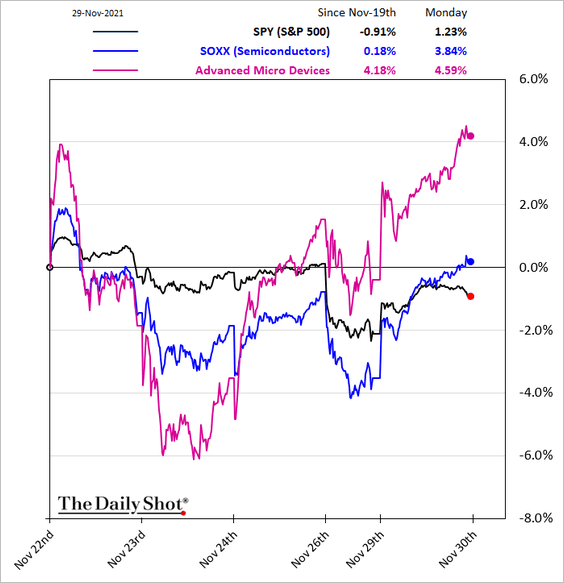

7. Next, we have some sector trends over the past five business days.

• Banks:

• Communication Services:

• Semiconductors:

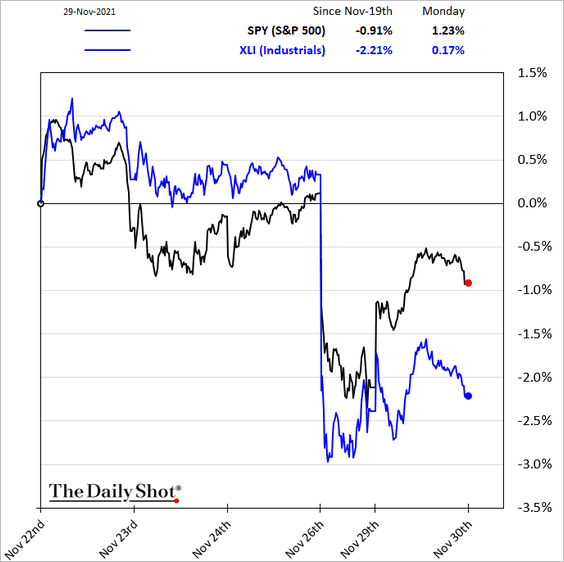

• Industrials:

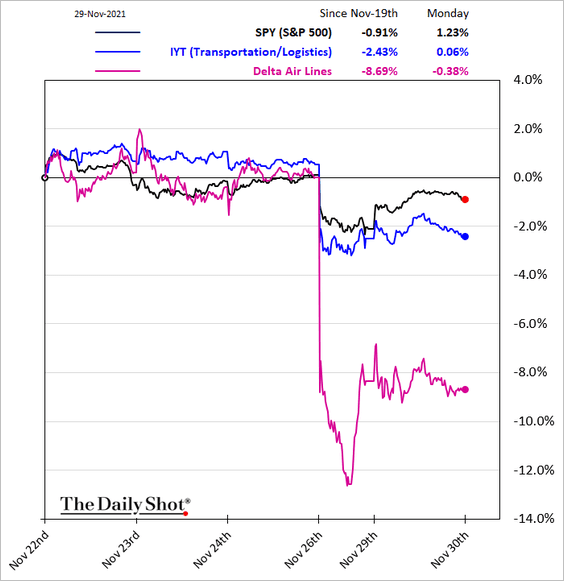

• Transportation:

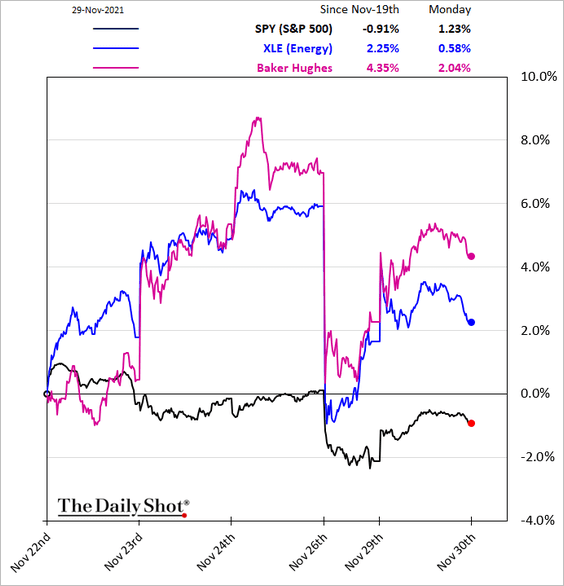

• Energy:

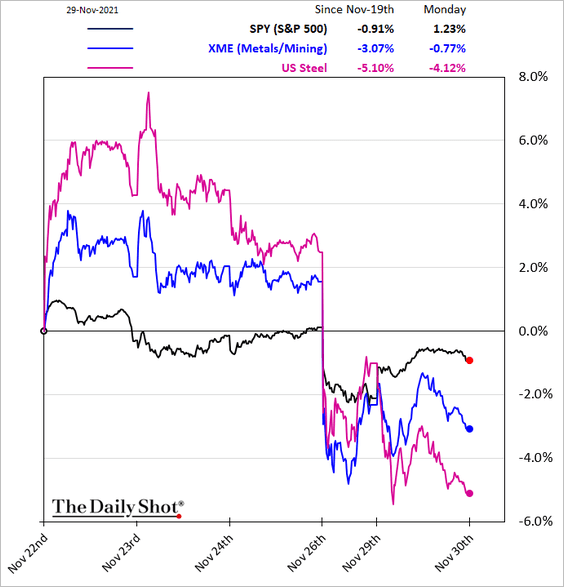

• Metals & Mining:

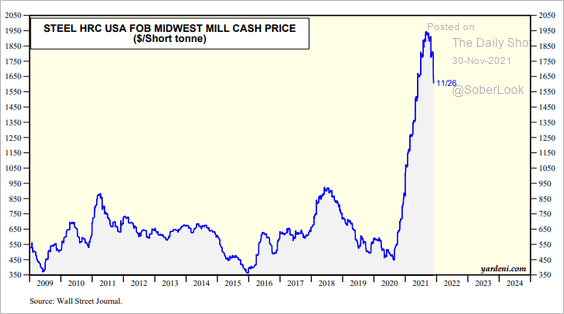

By the way, this chart shows US steel prices.

Source: Yardeni Research

Source: Yardeni Research

——————–

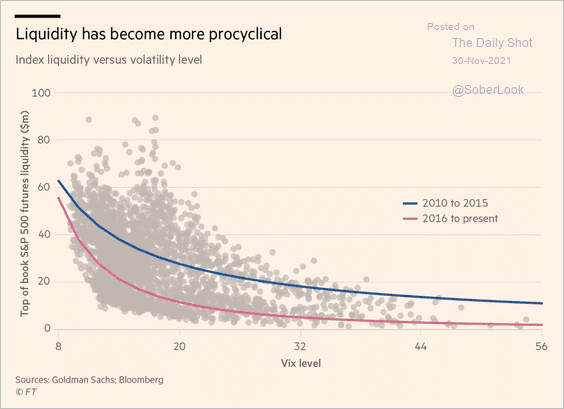

8. The S&P 500 futures liquidity dries up quickly when volatility jumps. This trend has become more extreme in recent years.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

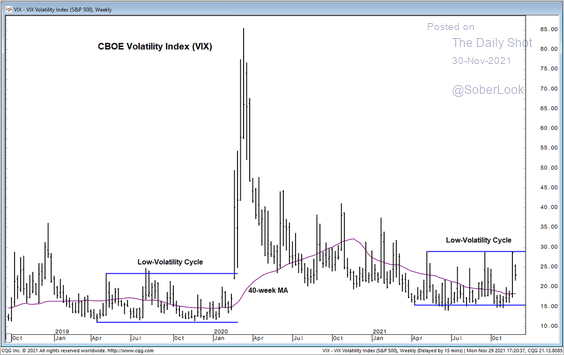

9. Are we nearing the end of a low-volatility cycle?

Source: @StocktonKatie

Source: @StocktonKatie

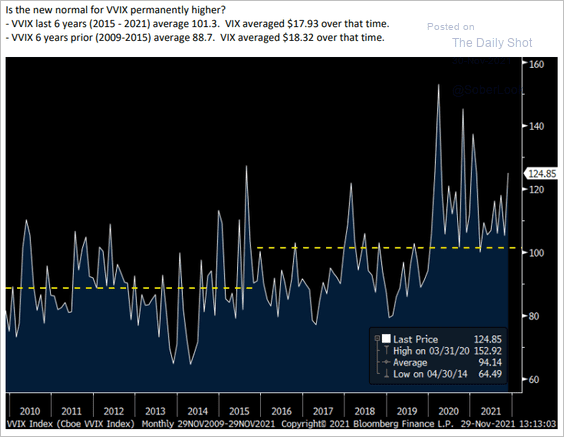

It appears that vol of vol (VVIX) has shifted higher.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

——————–

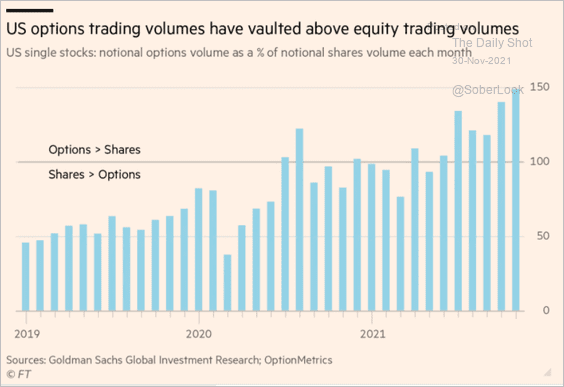

10. Options have been exceeding stocks in trading volume, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

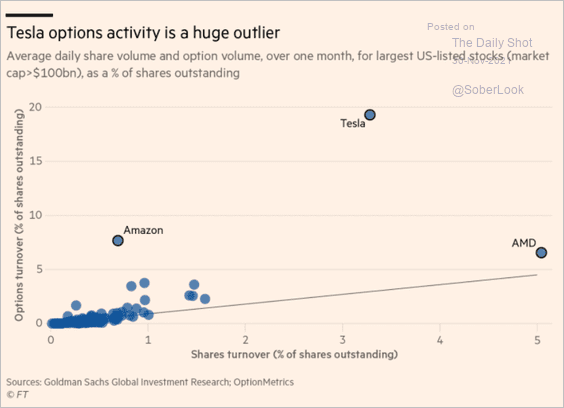

… often boosted by Tesla.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

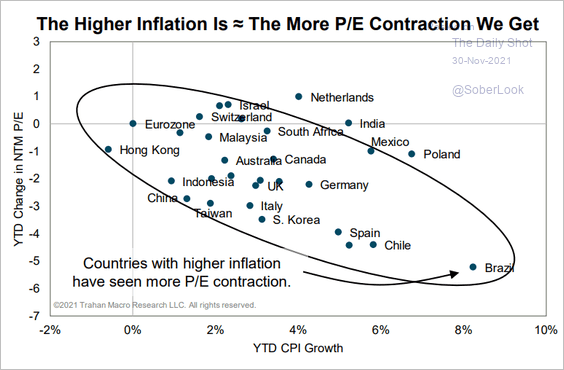

11. Higher inflation can put downward pressure on stock valuations (P/E ratios).

Source: Trahan Macro Research

Source: Trahan Macro Research

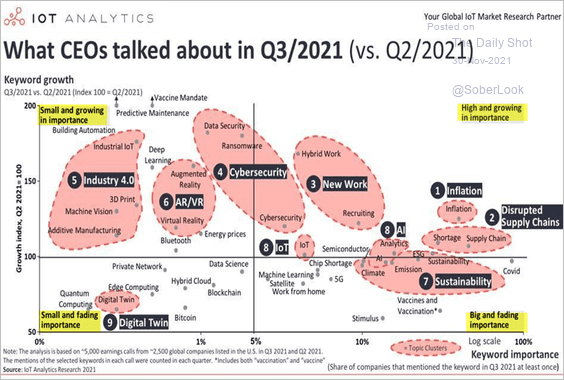

12. What did CEOs talk about on Q3 earnings calls?

Source: IoT Analytics, h/t Gustavo Fuhr Read full article

Source: IoT Analytics, h/t Gustavo Fuhr Read full article

Back to Index

Credit

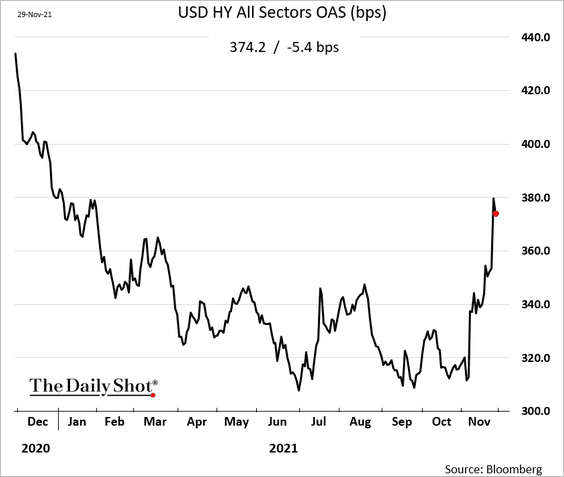

1. The stock rally on Monday didn’t reduce high-yield spreads very much as a bit of risk aversion returns to credit markets.

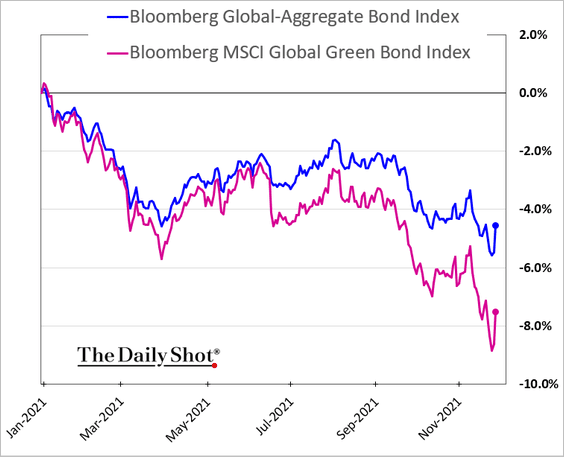

2. Green bonds have been underperforming.

Source: Bloomberg

Source: Bloomberg

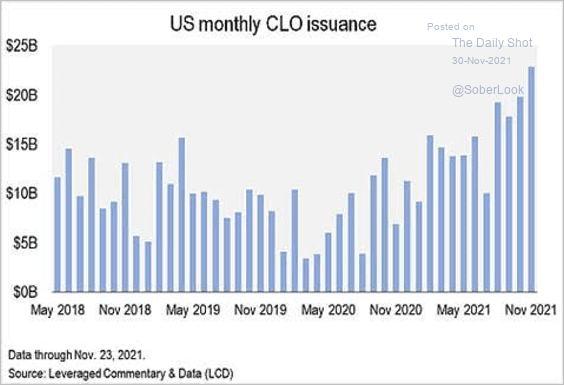

3. US CLO issuance hit a new monthly record in November.

Source: LCD, S&P Global Market Intelligence

Source: LCD, S&P Global Market Intelligence

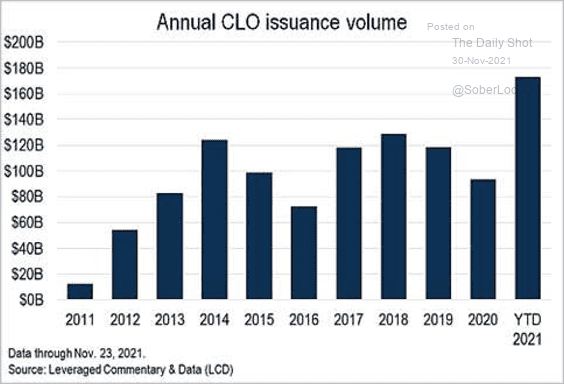

Below is the year-to-date volume.

Source: LCD, S&P Global Market Intelligence

Source: LCD, S&P Global Market Intelligence

——————–

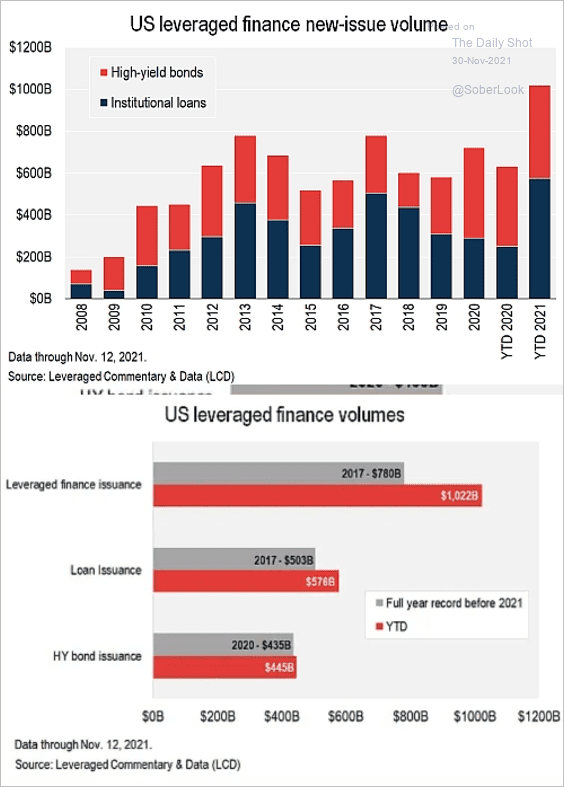

4. Here is the overall leveraged finance issuance, …

Source: @lcdnews

Source: @lcdnews

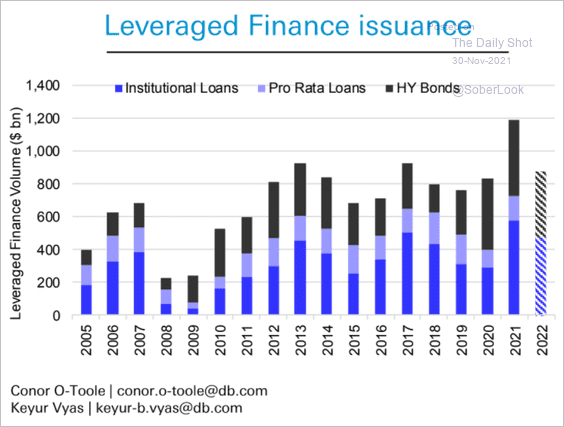

… with Deutsche Bank’s forecast for 2022.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

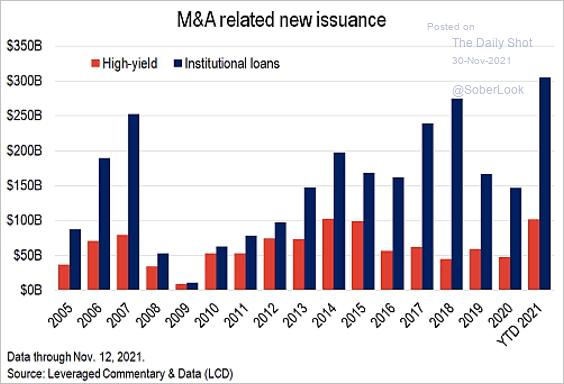

This chart shows the issuance related to M&A activity.

Source: @lcdnews

Source: @lcdnews

Back to Index

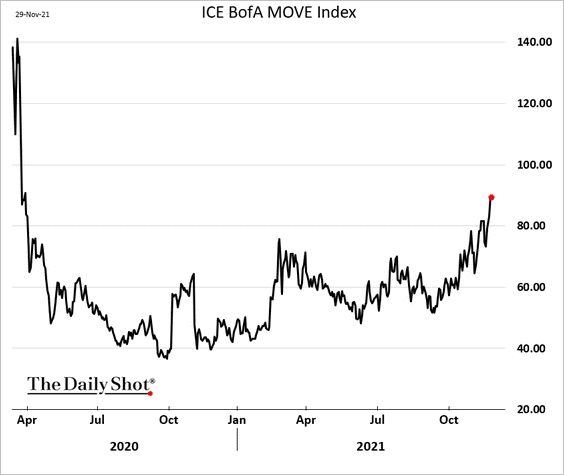

Rates

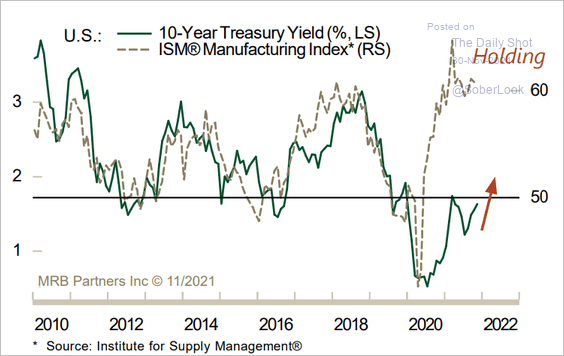

1. Treasury market implied volatility continues to grind higher.

2. Analysts still expect strong US growth to push Treasury yields higher next year.

Source: MRB Partners

Source: MRB Partners

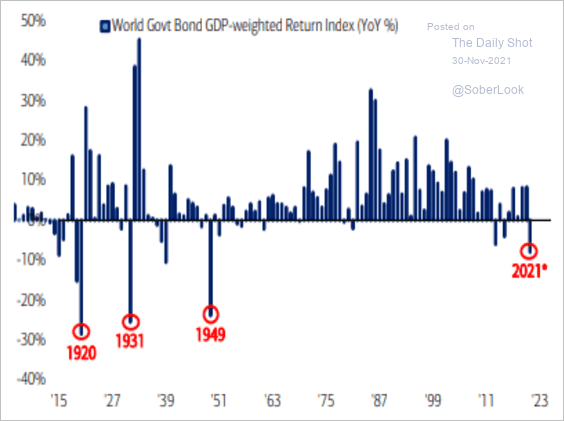

3. 2021 has not been a good year for bonds.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Energy

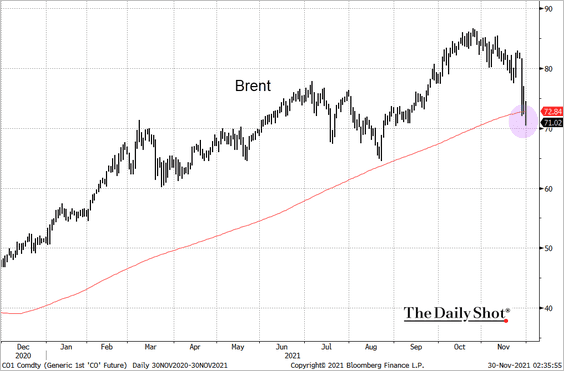

1. Brent dipped below the 200-day moving average in response to the vaccine news (see the equities section).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

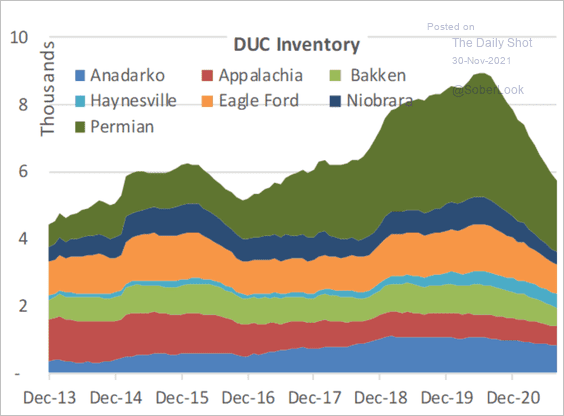

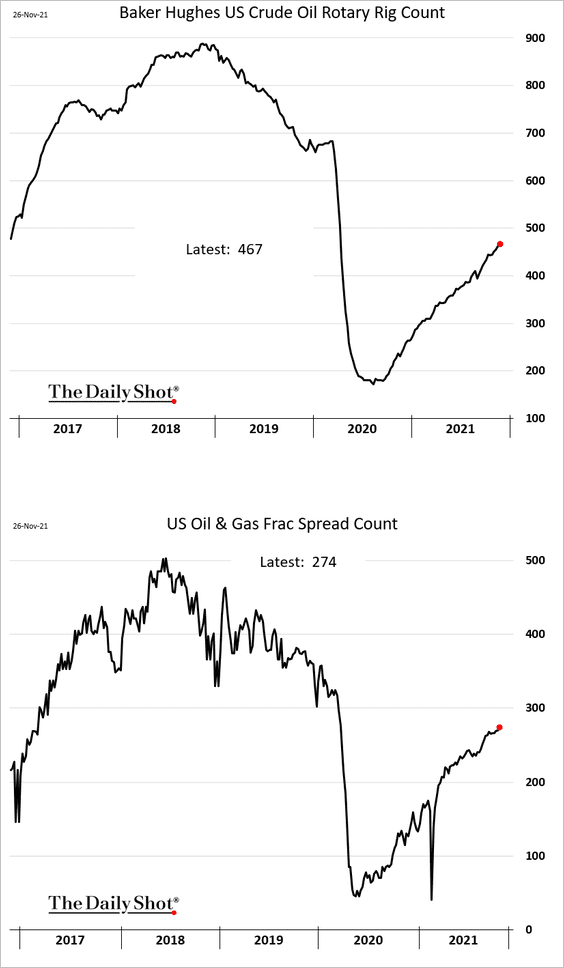

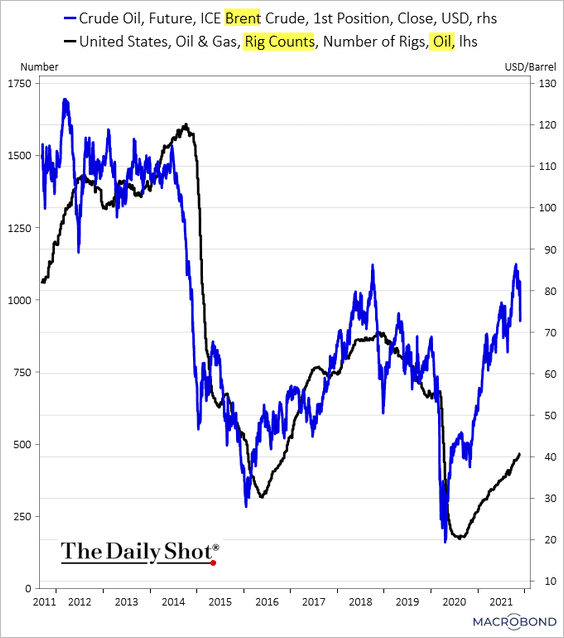

2. US onshore oil and gas producers have been leaning hard on their drilled but uncompleted (DUC) inventory of wells. As this inventory has depleted, drilling activity should pick up more meaningfully.

Source: Cornerstone Macro

Source: Cornerstone Macro

For now, US fracking activity continues to recover gradually.

And there is plenty of room for growth at current prices.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

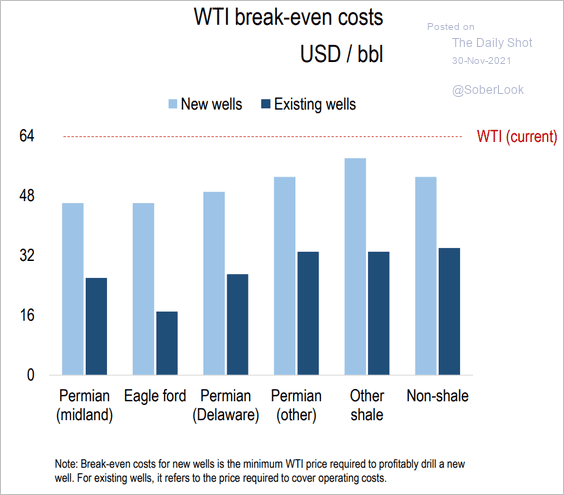

Here are the breakeven costs for US producers.

Source: Numera Analytics

Source: Numera Analytics

——————–

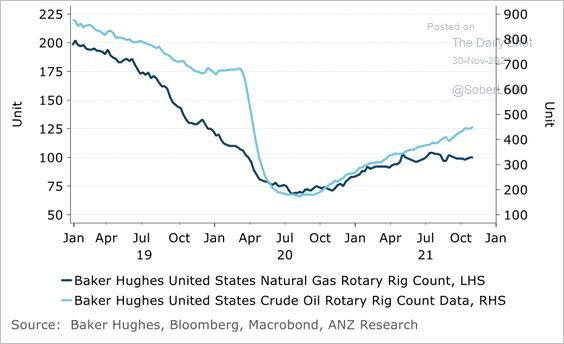

3. US gas rig count is moderating despite the rise in gas prices.

Source: ANZ Research

Source: ANZ Research

Back to Index

Commodities

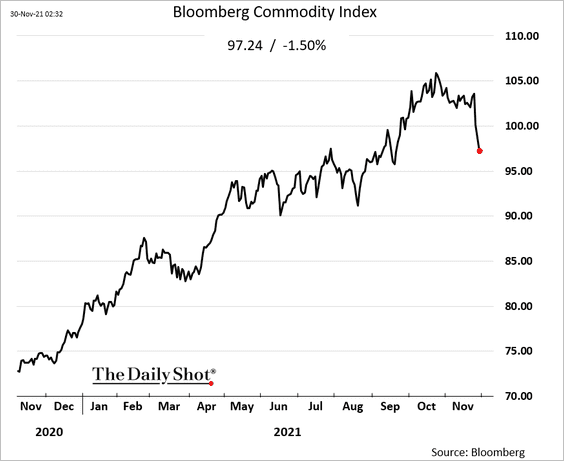

1. The rally in commodities has faded for now.

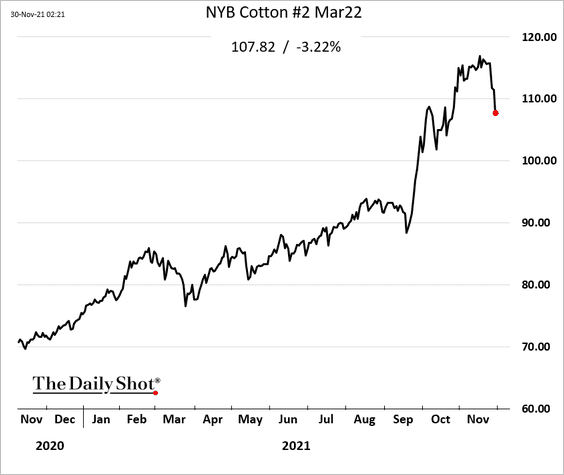

Here is US cotton, for example.

——————–

2. Below is an illustration of the growing demand for copper from clean energy projects. The image shows an underwater cable structure for offshore wind turbines.

Source: @NatalieBiggs_C6, h/t @Ole_S_Hansen

Source: @NatalieBiggs_C6, h/t @Ole_S_Hansen

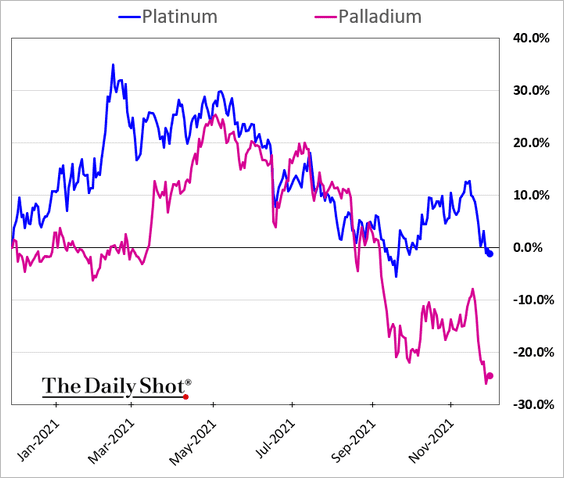

3. Palladium has been underperforming amid softer vehicle production globally.

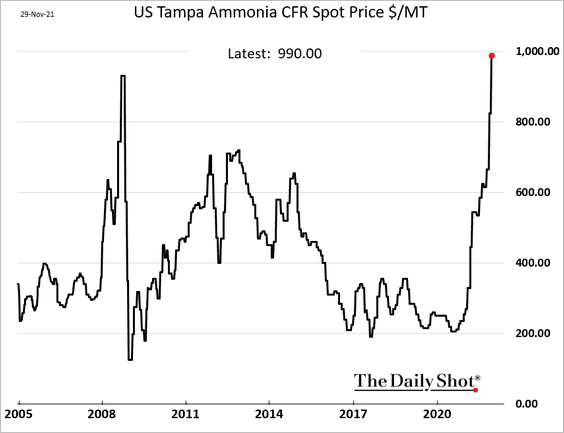

4. Fertilizer prices continue to surge.

h/t @TaviCosta

h/t @TaviCosta

Back to Index

Cryptocurrency

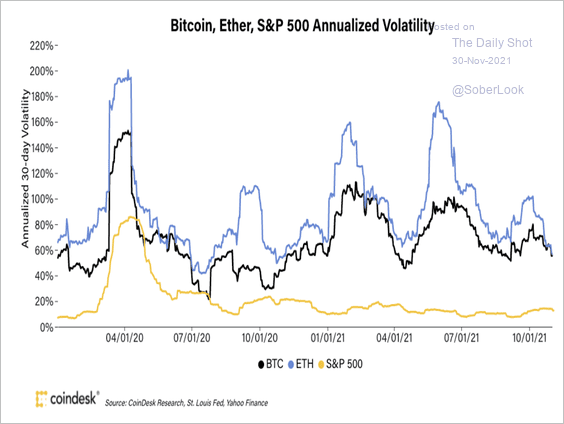

1. Ethereum continues to outperform bitcoin.

2. Bitcoin and ether’s annualized 30-day volatility remains relatively low.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

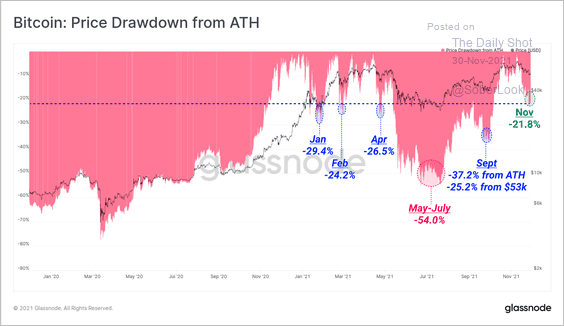

3. Bitcoin’s drawdown deepened during last week’s sell-off.

Source: Glassnode Read full article

Source: Glassnode Read full article

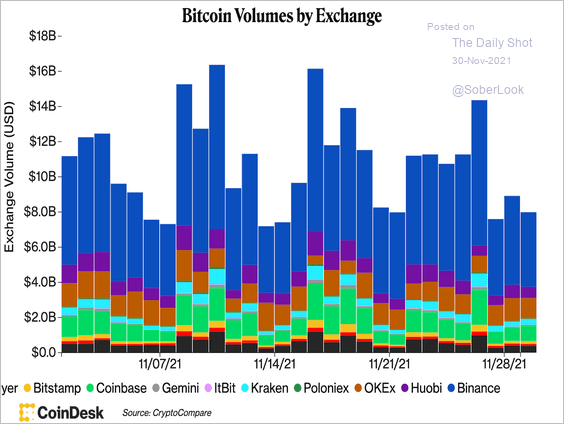

4. Bitcoin’s trading volume was much lower compared to last Monday across major exchanges.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

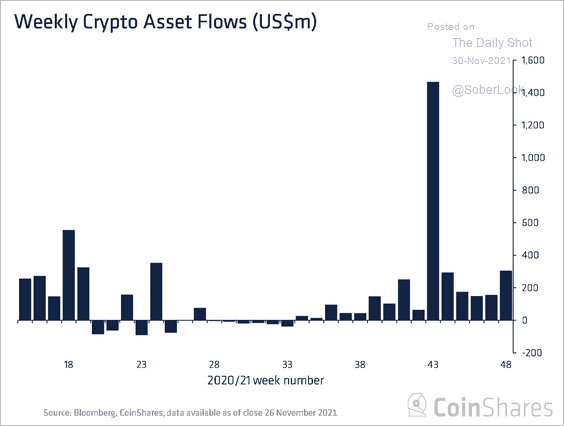

5. Crypto investment funds saw inflows totaling $306 million last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Emerging Markets

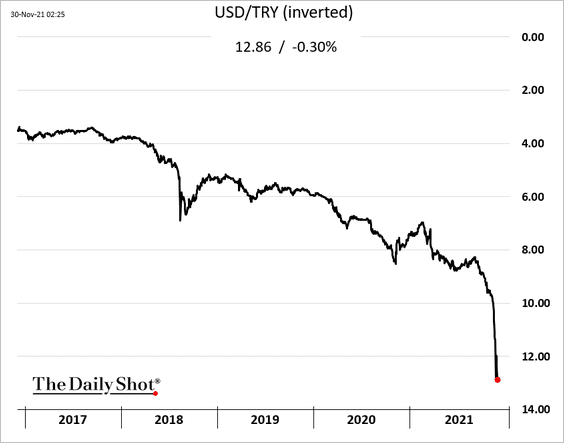

1. So far, there are no signs of a rebound in the Turkish lira.

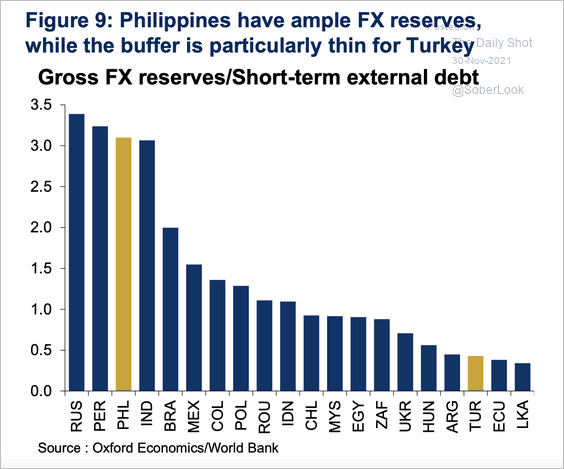

• Turkey has a very low FX reserve buffer.

Source: Oxford Economics

Source: Oxford Economics

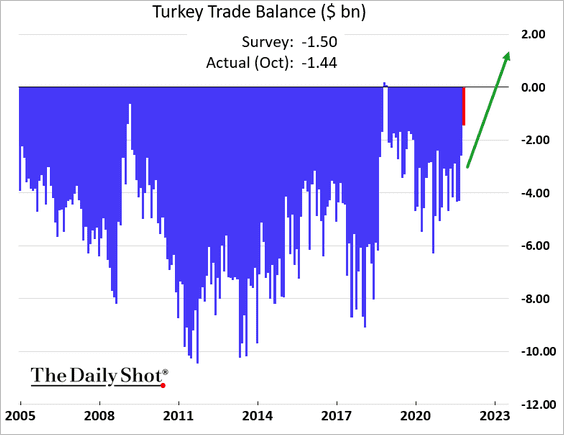

• The trade deficit is rapidly shrinking as imports collapse. We are likely to see a surplus soon.

——————–

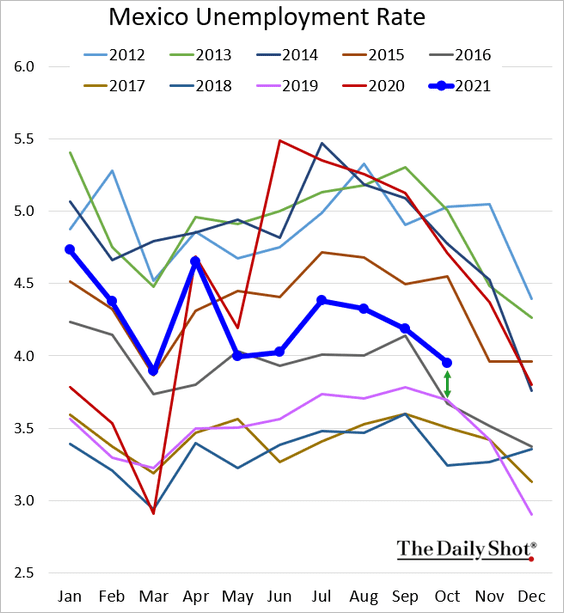

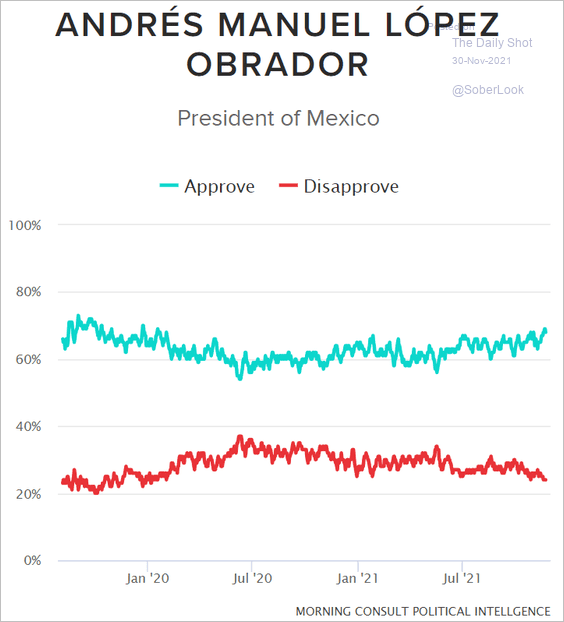

2. Mexico’s unemployment rate is nearing 2019 levels.

Separately, AMLO remains popular, …

Source: Morning Consult

Source: Morning Consult

… and is pressing the limits of his power.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

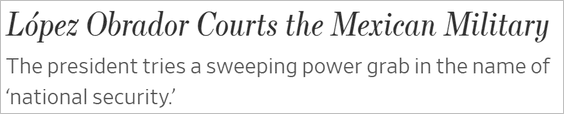

3. Financial conditions in Brazil have tightened sharply as the central bank reacted to a large inflation overshoot.

Source: Goldman Sachs

Source: Goldman Sachs

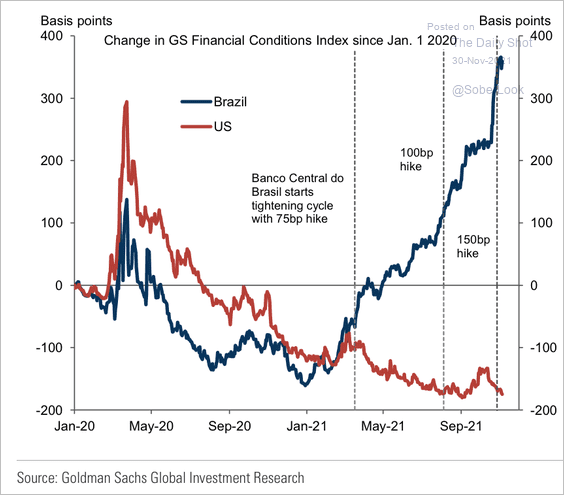

4. LatAm economic surprises have underperformed other EMs.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

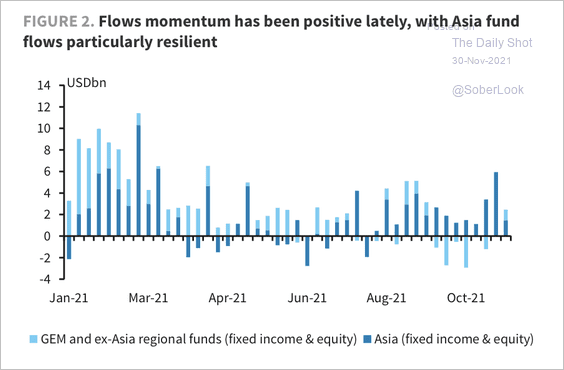

5. EM Asia-focused fund flows have been particularly strong over the past month.

Source: Barclays Research

Source: Barclays Research

Back to Index

China

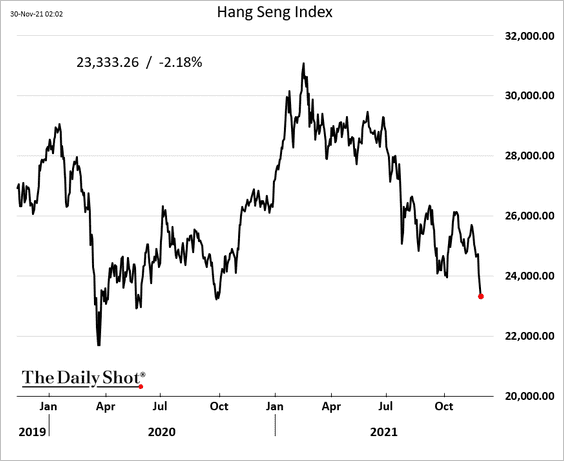

1. Stocks in Hong Kong remain under pressure.

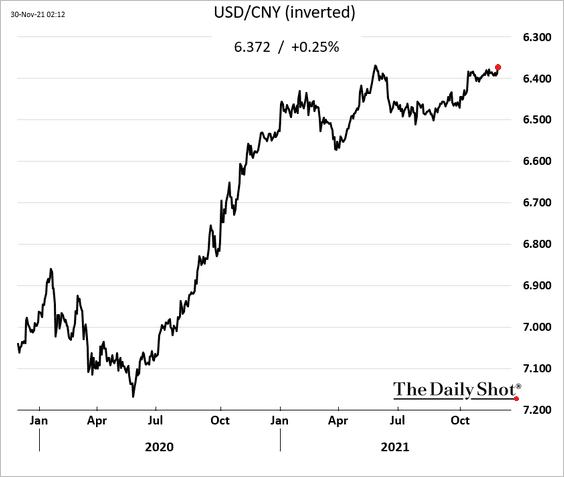

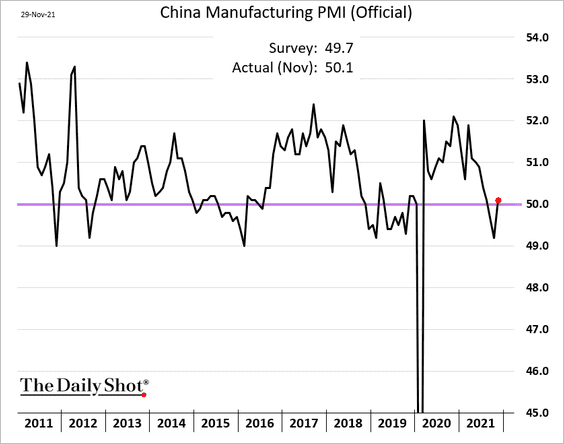

2. The renminbi is nearing a multi-year high against the dollar.

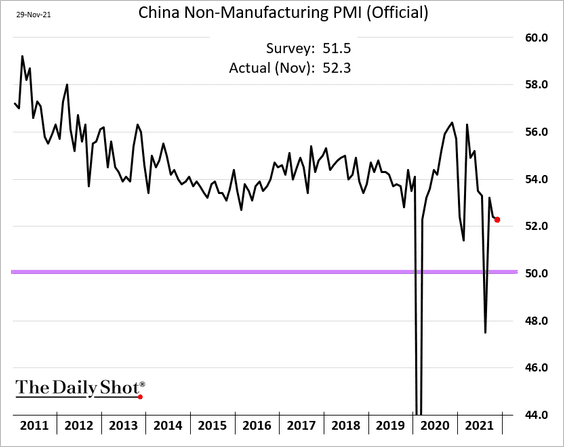

3. The official PMI report showed a rebound in business activity this month, topping expectations.

Source: Reuters Read full article

Source: Reuters Read full article

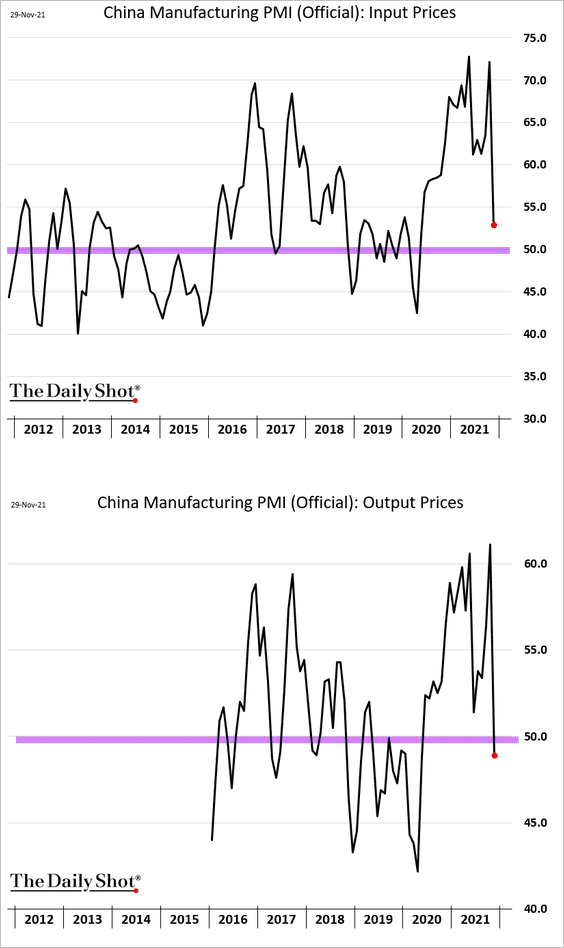

According to the report, price pressures have eased sharply as Beijing forces commodity prices lower.

——————–

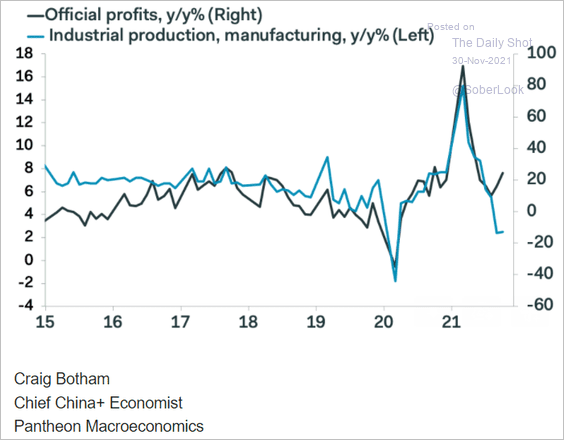

4. Industrial profits have diverged from industrial production.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

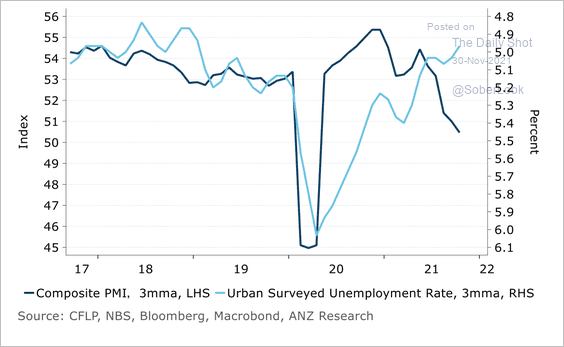

5. The unemployment rate has decoupled from growth over the past few months.

Source: ANZ Research

Source: ANZ Research

Back to Index

Asia – Pacific

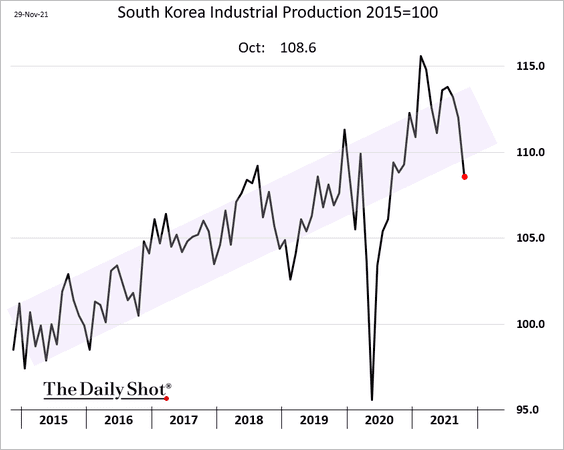

1. South Korea’s industrial production slowed in October.

2. The Taiwan Strait tensions continue to simmer.

Source: Firstpost Read full article

Source: Firstpost Read full article

3. Next, we have some updates on Australia.

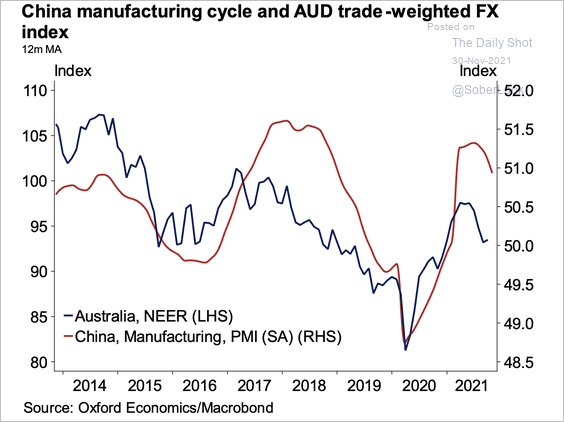

• The Australian dollar follows the Chinese manufacturing cycle.

Source: Oxford Economics

Source: Oxford Economics

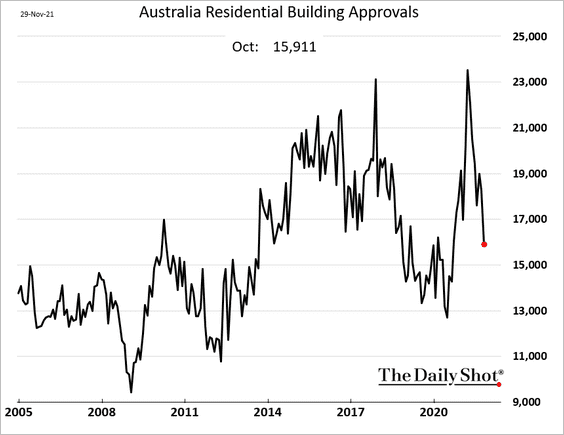

• Building approvals are moving back toward pre-COVID lows.

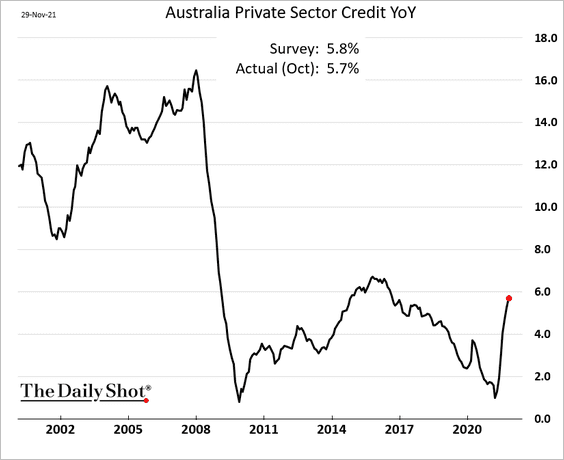

• Private credit growth has been recovering.

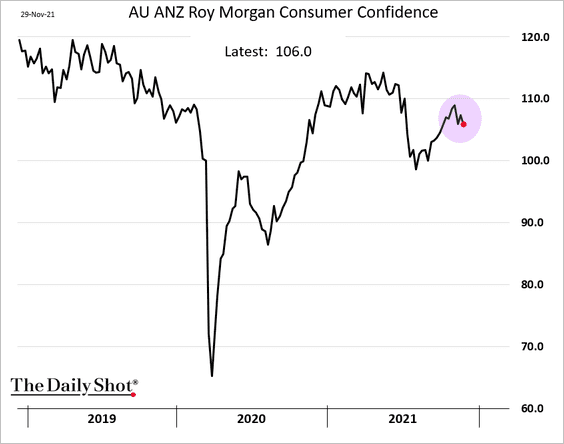

• Consumer sentiment is weakening again.

Back to Index

Japan

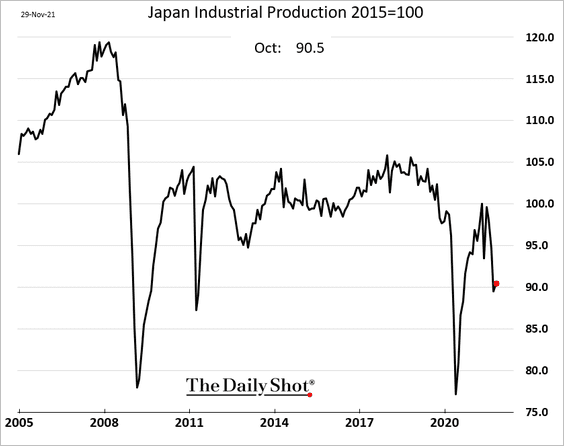

1. Industrial production ticked higher in October but remains depressed.

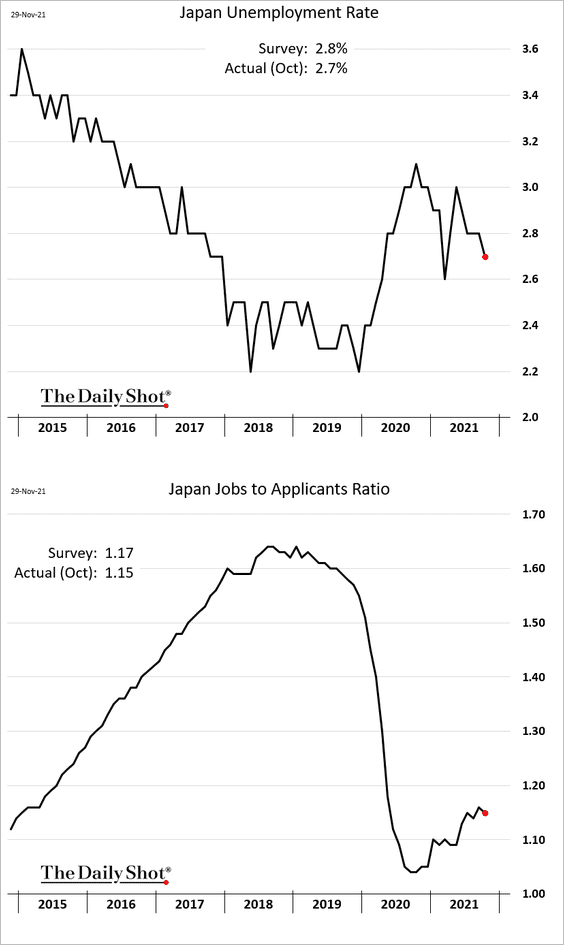

2. The unemployment rate is moving lower, but the jobs-to-applicants ratio has stalled.

Back to Index

The Eurozone

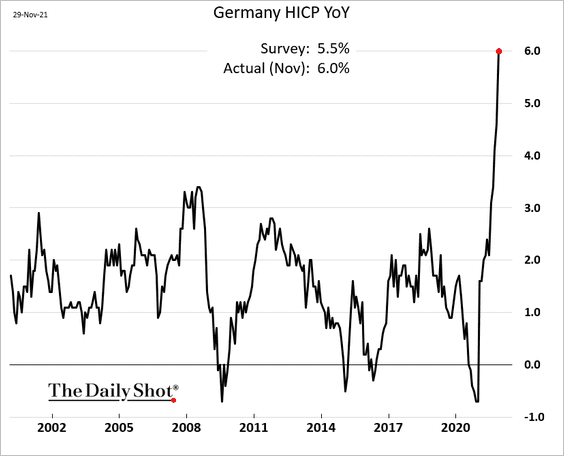

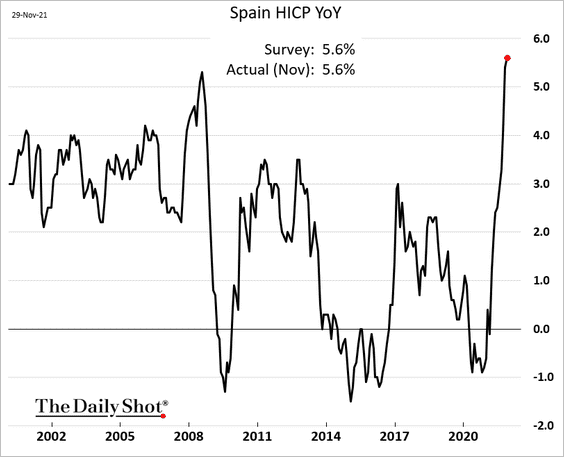

1. German inflation hit 6% in November.

Spain’s CPI is surging as well.

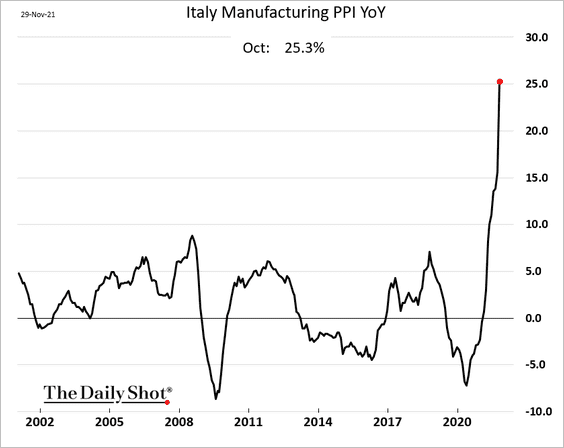

And Italian PPI exceeded 25%.

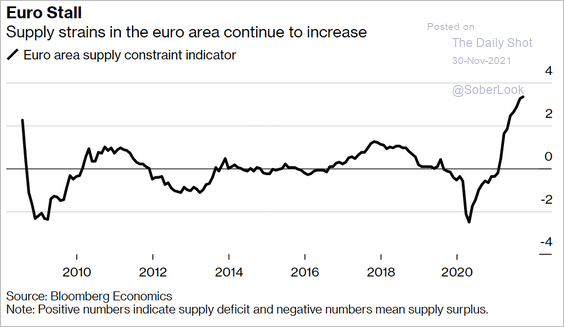

Supply constraints remain severe.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

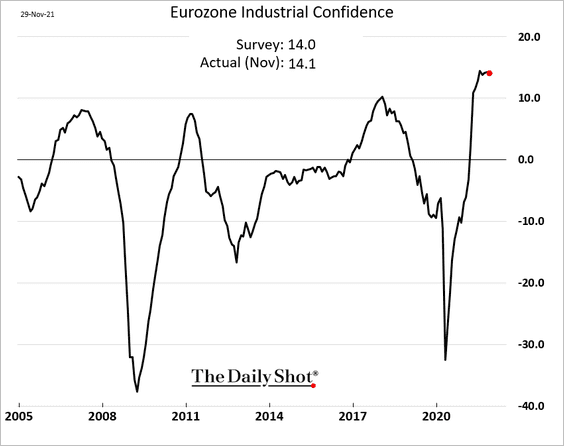

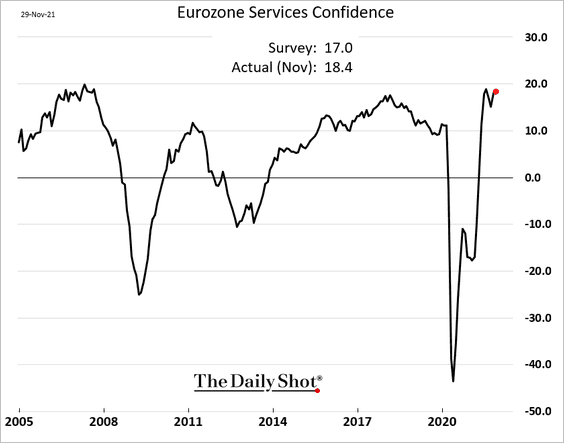

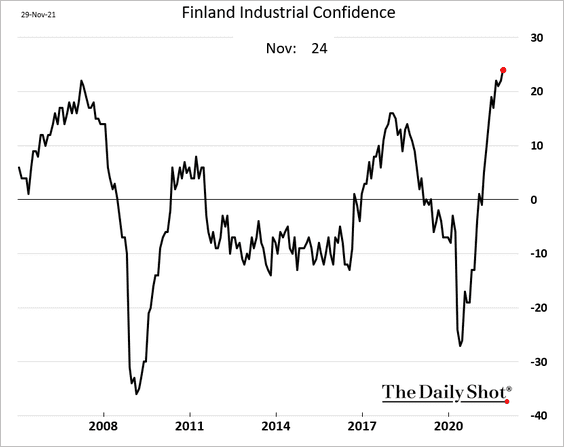

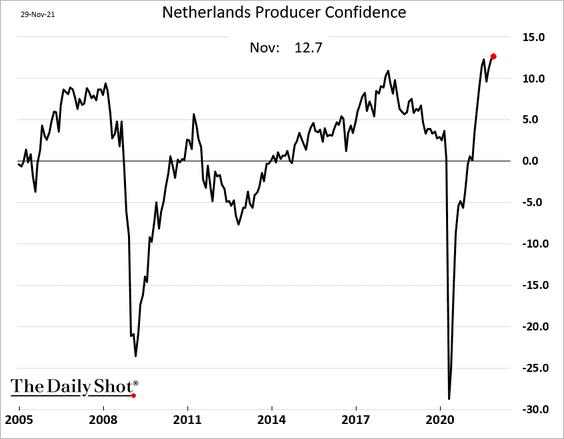

2. As we saw yesterday, euro-area business sentiment has been strong.

• Industrial confidence:

• Services:

Here are a couple of examples.

• Finland:

• The Netherlands:

——————–

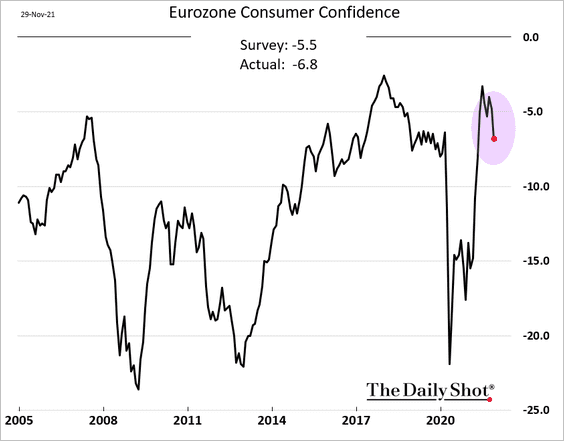

3. Consumer sentiment has been easing as COVID surges.

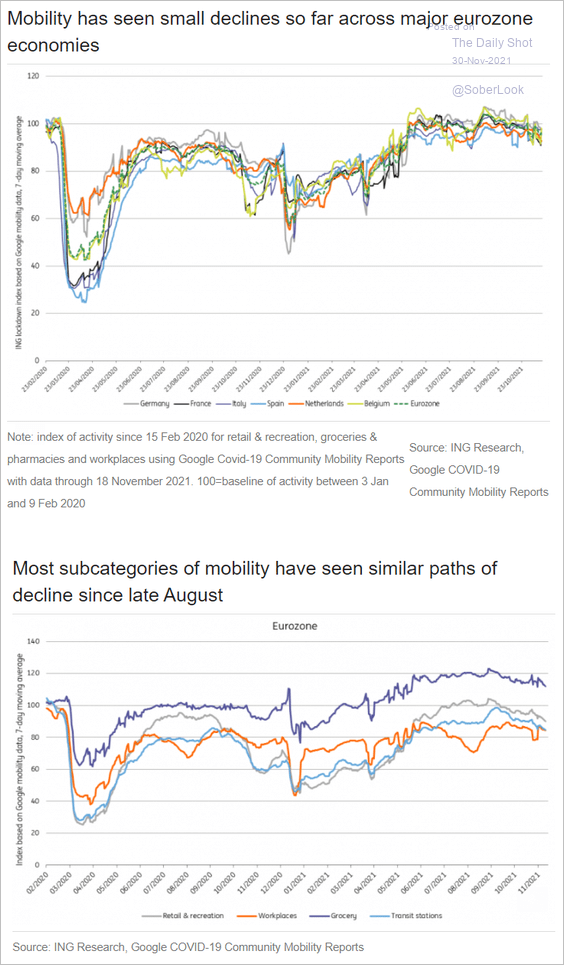

Mobility indicators have slowed modestly even before the omicron scare.

Source: ING

Source: ING

Back to Index

Europe

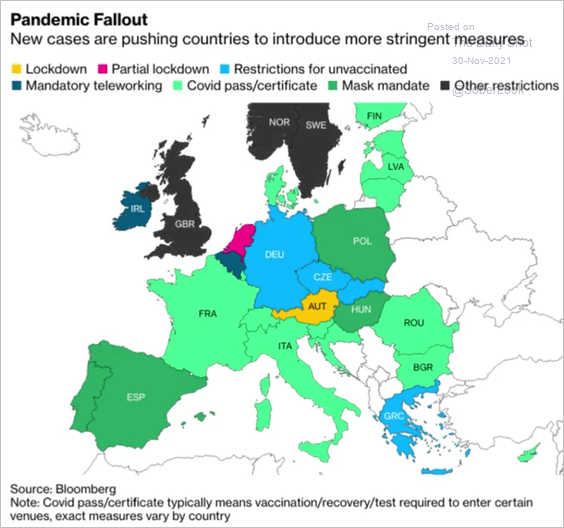

1. Let’s start with COVID restrictions (before countries respond to the new variant).

Source: @Quicktake Read full article

Source: @Quicktake Read full article

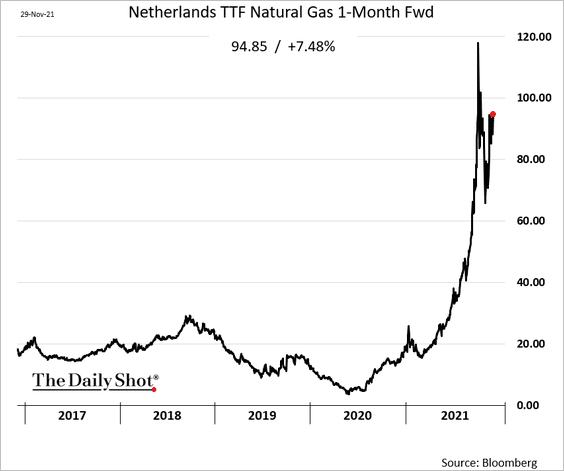

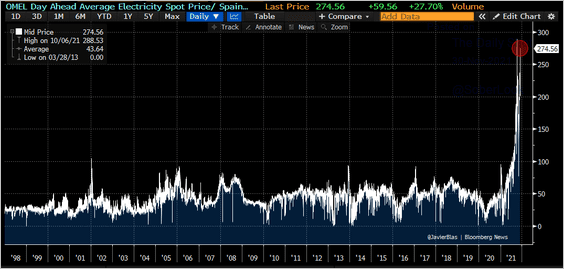

2. Natural gas prices remain near extremes.

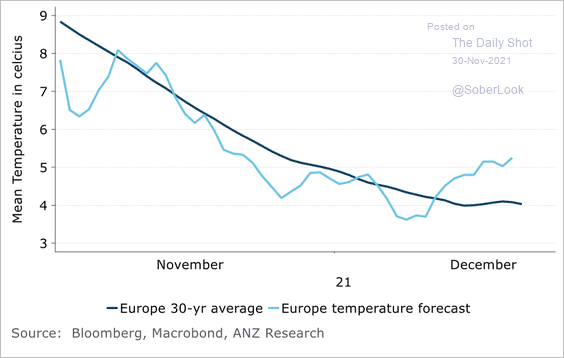

European winter is projected to be colder than normal, which could keep gas prices elevated.

Source: ANZ Research

Source: ANZ Research

Here is Spain’s electricity price.

Source: @JavierBlas

Source: @JavierBlas

——————–

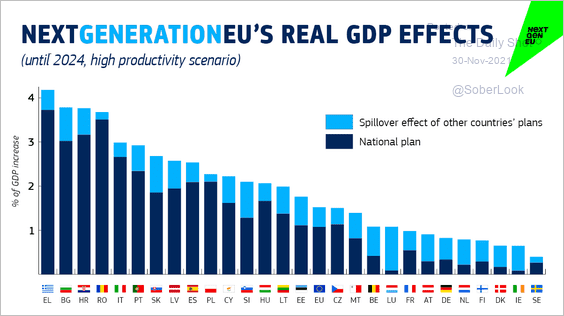

3. Who will benefit the most from the EU’s COVID stimulus program?

Source: @ecfin

Source: @ecfin

Back to Index

The United Kingdom

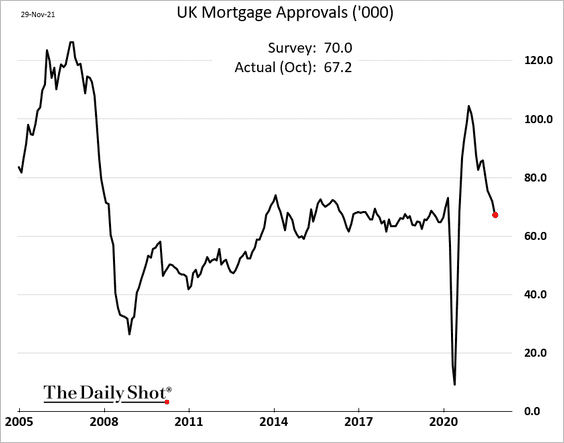

1. Mortgage approvals continue to tumble.

Source: Reuters Read full article

Source: Reuters Read full article

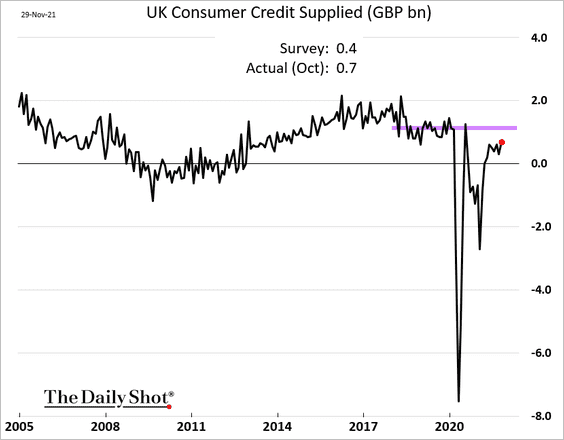

But consumer credit surprised to the upside.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

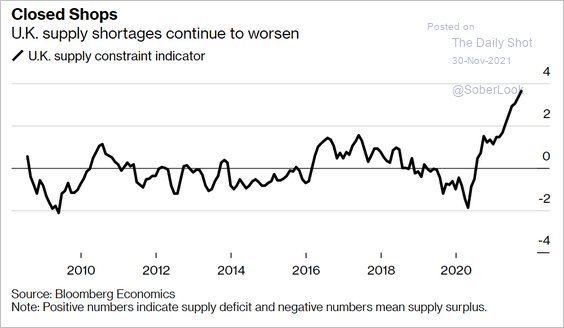

2. Supply constraints remain extreme.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

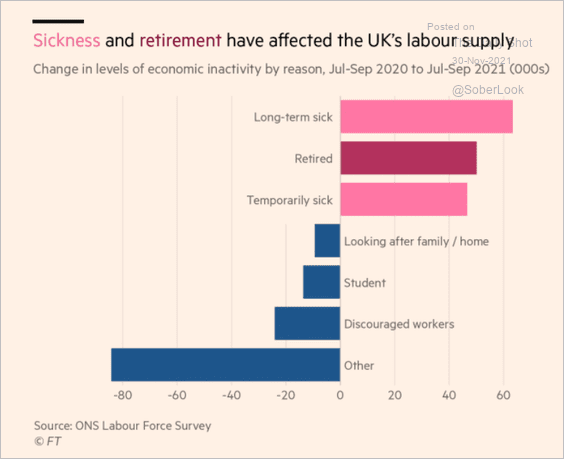

3. What factors are driving the COVID-era changes in the UK’s labor supply?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

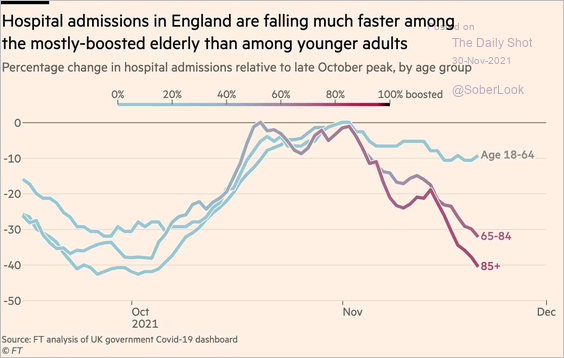

4. Booster shots help reduce hospital admissions.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

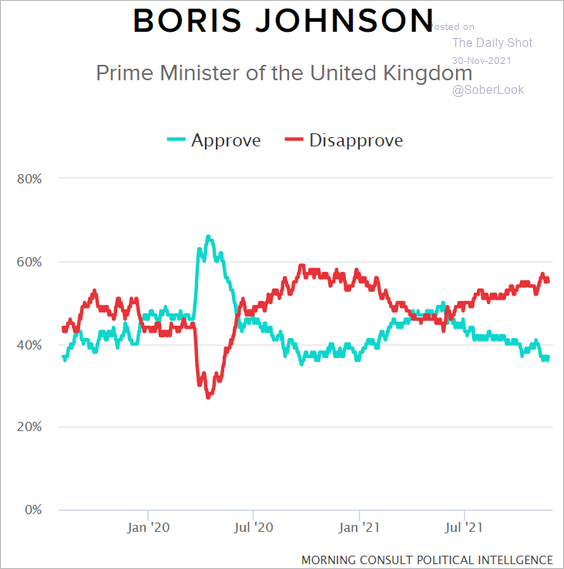

5. This chart shows the Prime Minister’s approval ratings.

Source: Morning Consult

Source: Morning Consult

Back to Index

Canada

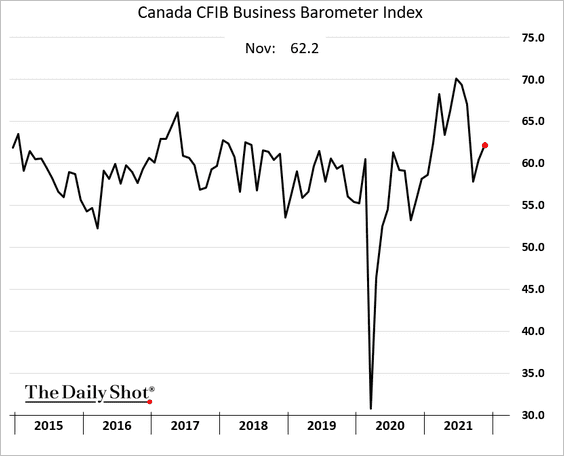

1. The CFIB small/medium-size business indicator improved again this month.

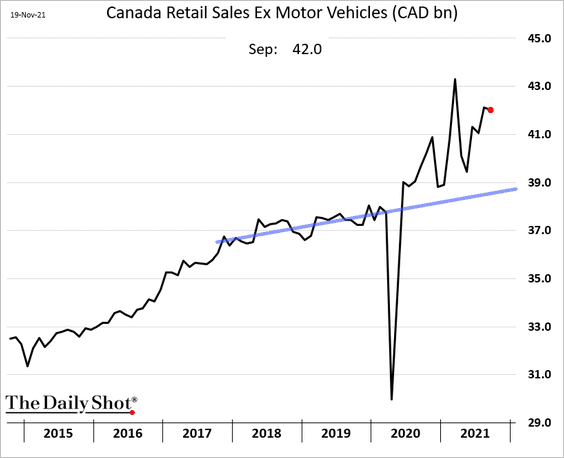

2. Retail sales remain well above the pre-COVID trend.

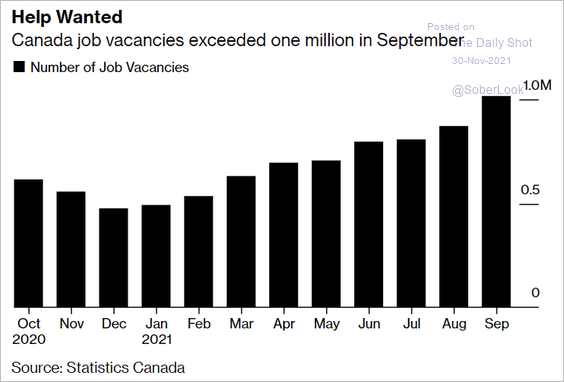

3. Job vacancies are surging.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

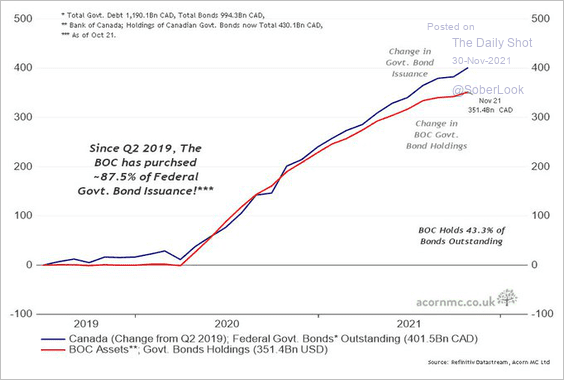

4. The BoC has purchased some 90% of the pandemic-era federal government bond issuance.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The United States

1. Let’s begin with the housing market.

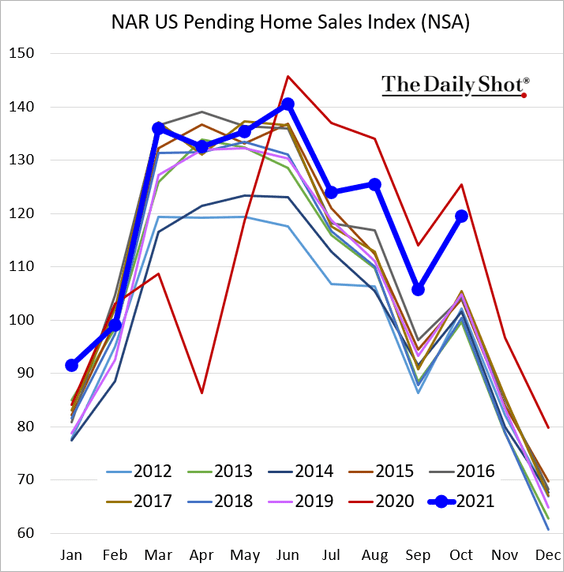

• Pending home sales have been very strong, running well above 2019 levels.

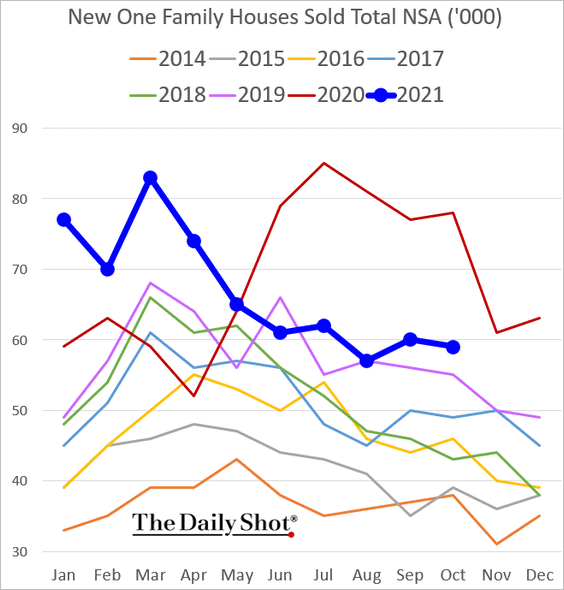

• New home sales have also been higher than in 2019.

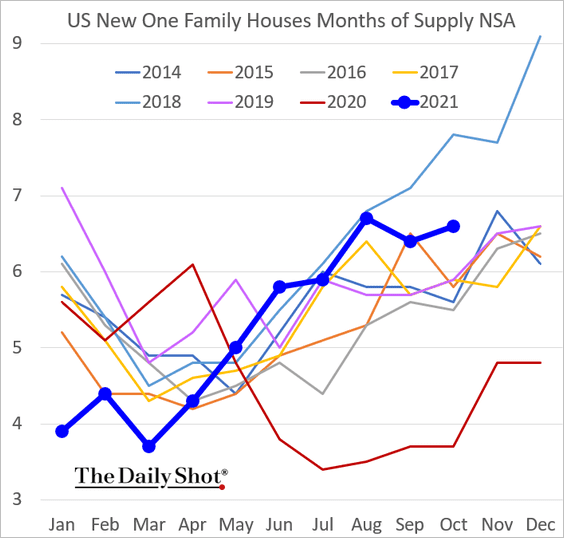

But inventories of new homes are not low.

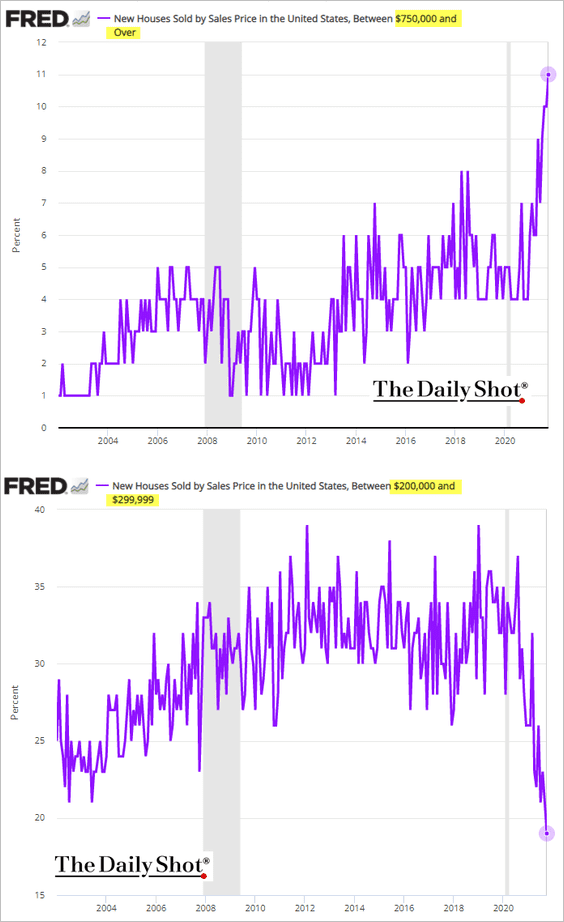

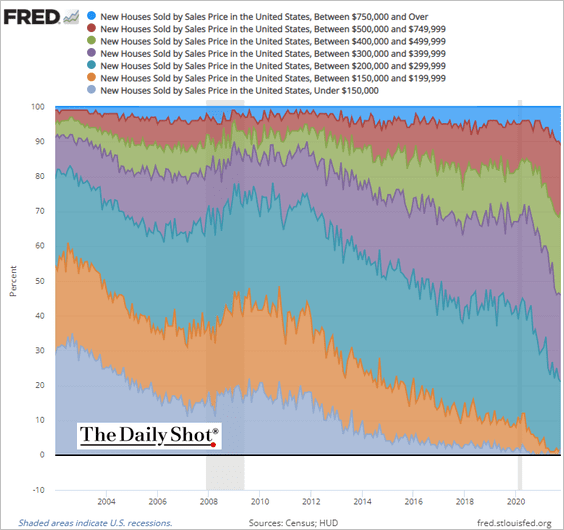

• New home sales are increasingly dominated by higher-priced properties.

——————–

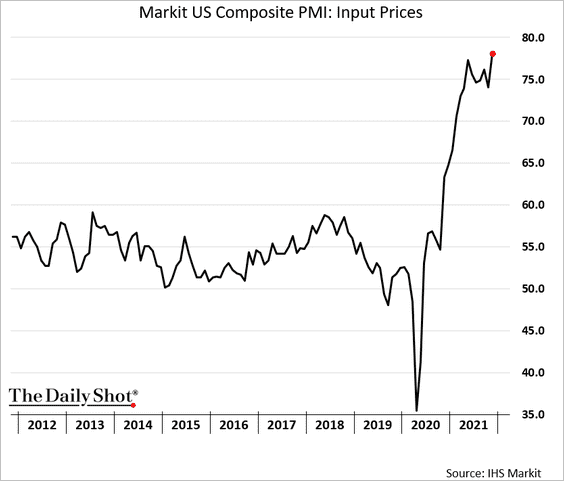

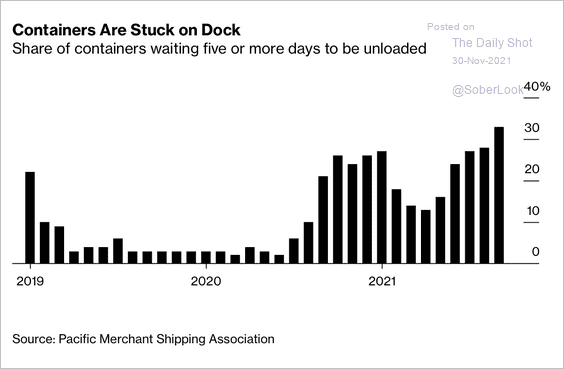

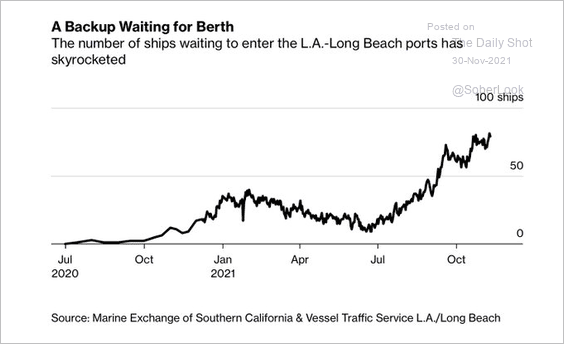

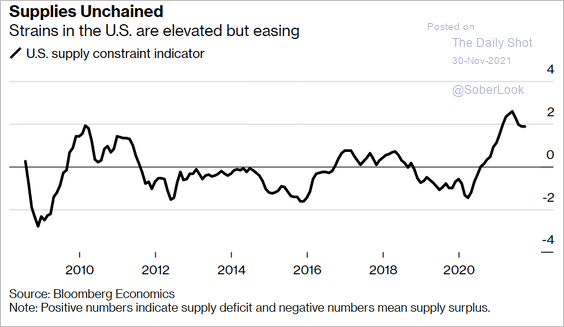

2. Next, let’s take a look at US supply constraints.

• According to the Markit PMI report, US businesses continue to face rising input costs.

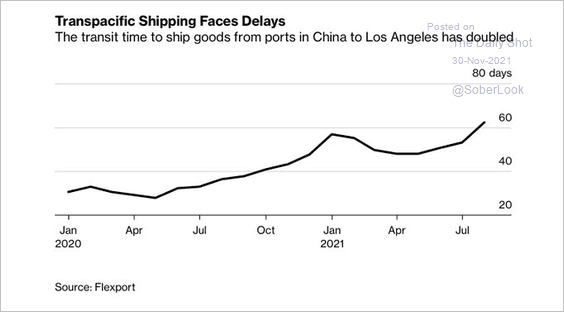

• Container backlogs are still at extreme levels (3 charts).

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

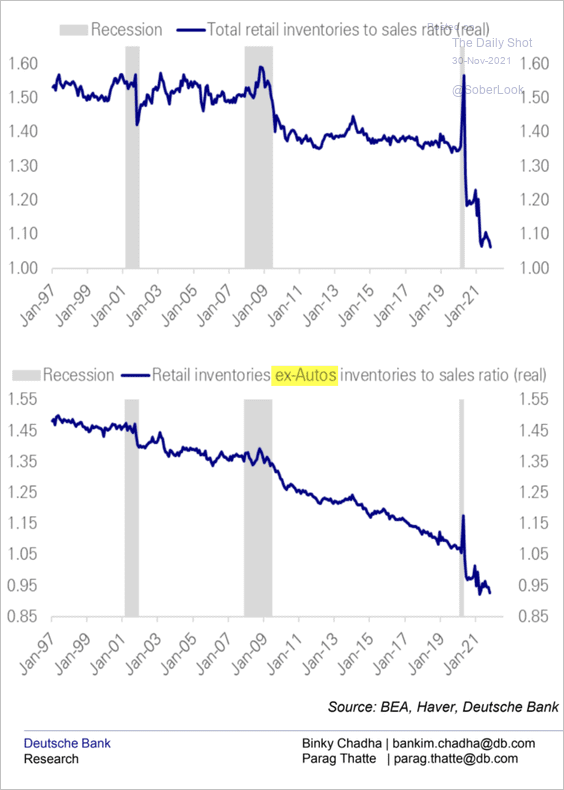

• Inventory-to-sales ratios are remarkably low even outside the automobile industry.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

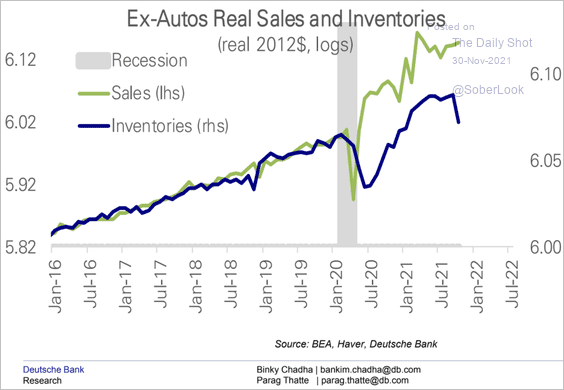

Inventories are above pre-COVID levels, but demand has been massive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

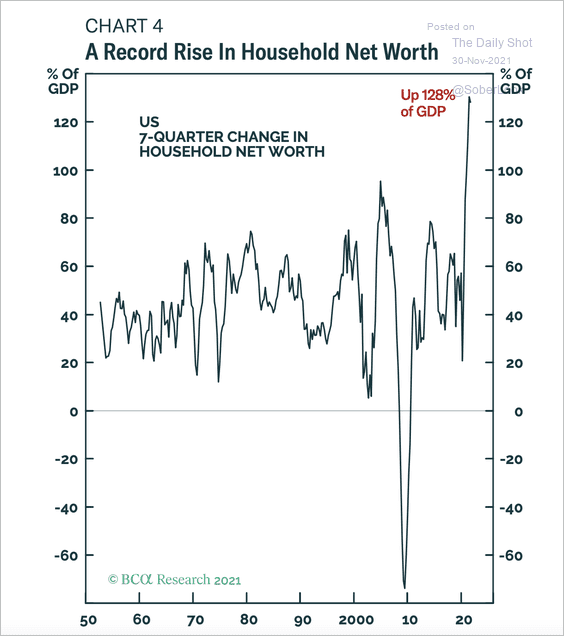

What’s driving the demand? Here is a clue.

Source: BCA Research

Source: BCA Research

• Nonetheless, Bloomberg’s supply constraint indicator points to bottlenecks beginning to ease.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

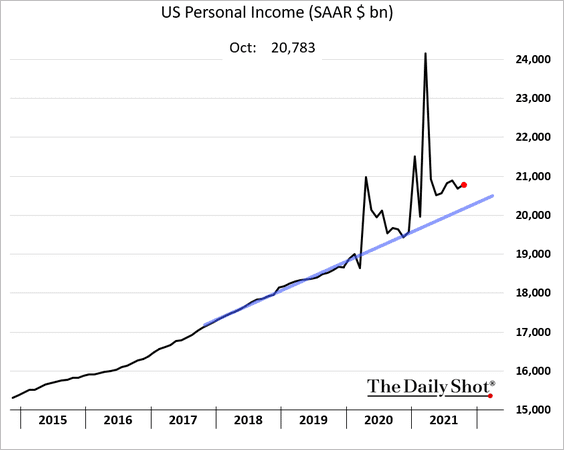

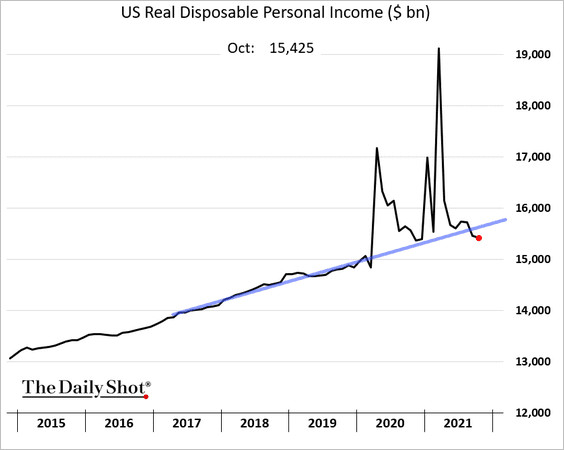

3. Personal incomes are running above the pre-COVID trend.

But inflation is eating into disposable incomes.

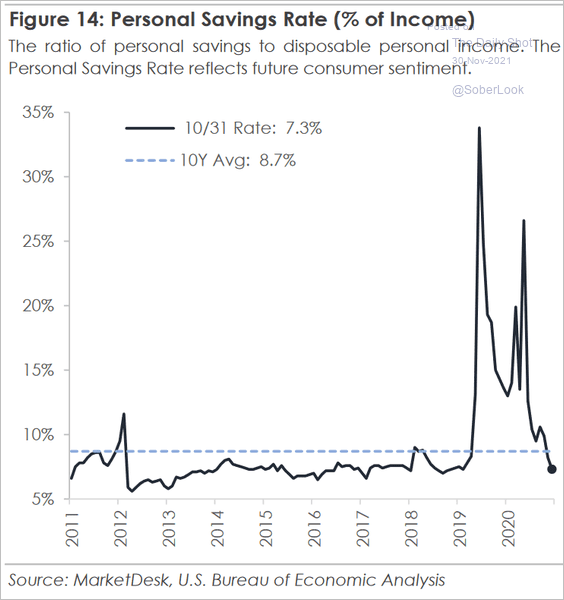

• The personal savings rate is moderating.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

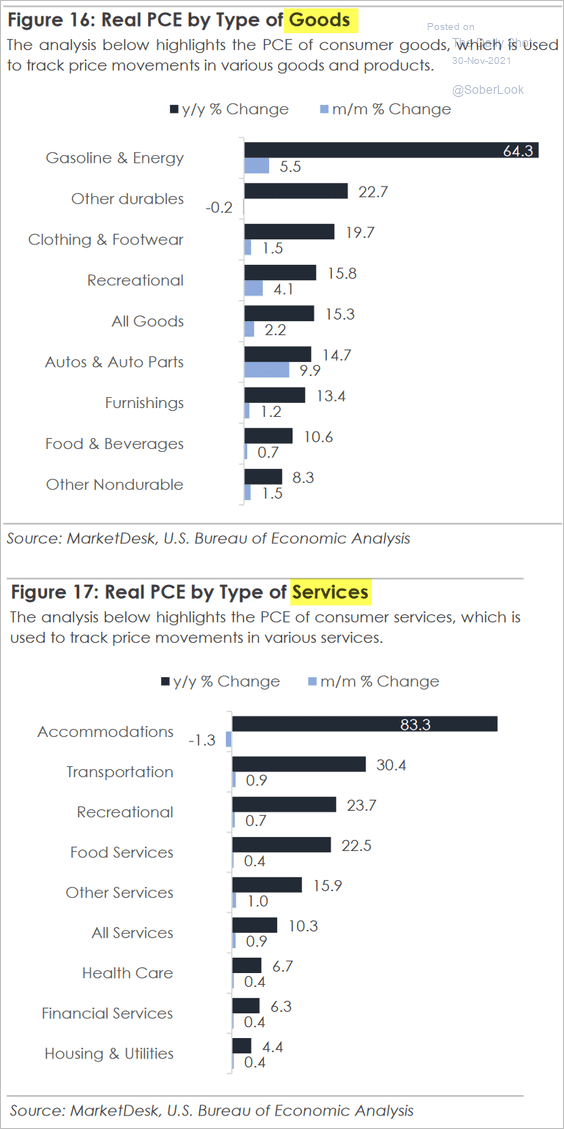

4. Here is the breakdown of consumer spending by sector.

Source: MarketDesk Research

Source: MarketDesk Research

5. Next, we have some high-frequency indicators.

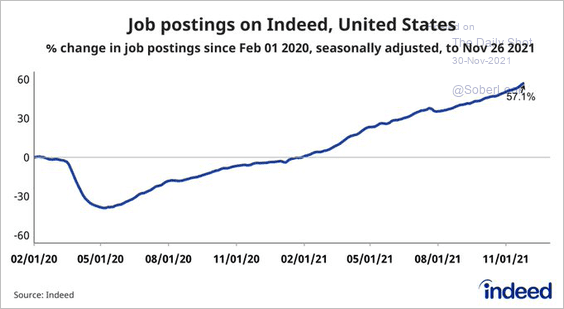

• Job postings on Indeed continue to climb.

Source: @AE_Konkel, @indeed

Source: @AE_Konkel, @indeed

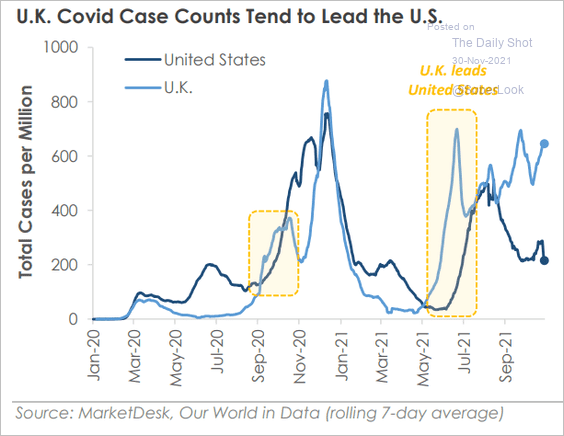

• Does the COVID situation in the UK point to a US rebound in cases?

Source: MarketDesk Research

Source: MarketDesk Research

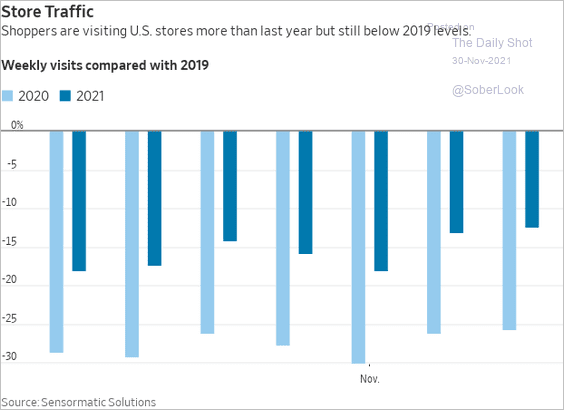

• Store traffic relative to 2019:

Source: @WSJ Read full article

Source: @WSJ Read full article

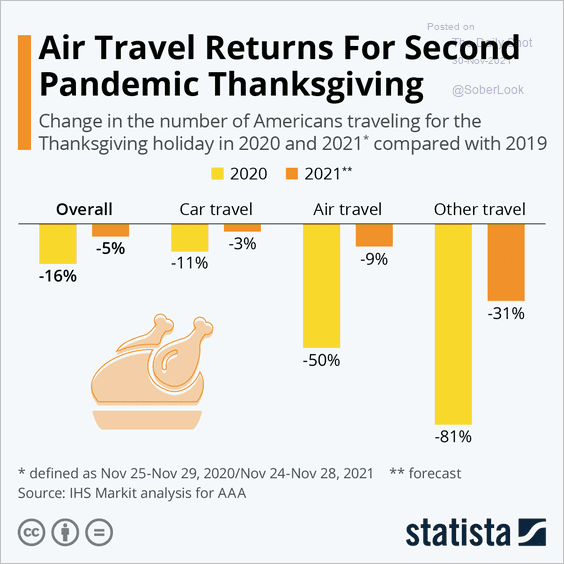

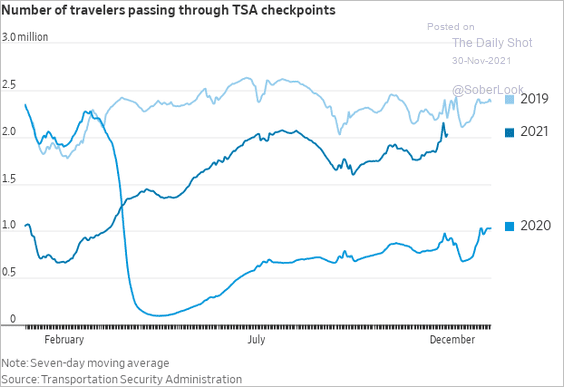

• Thanksgiving travel vs. 2019:

Source: Statista

Source: Statista

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

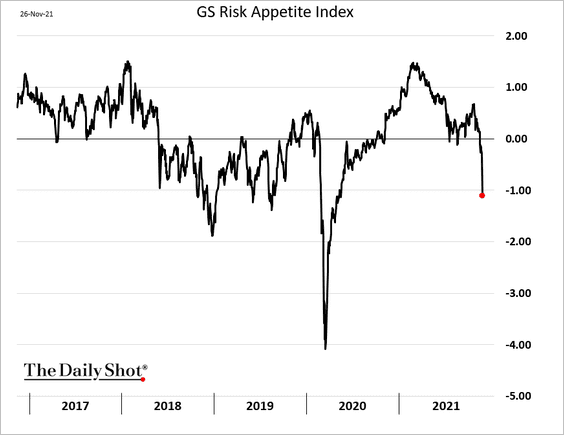

1. Goldman’s risk appetite index has deteriorated.

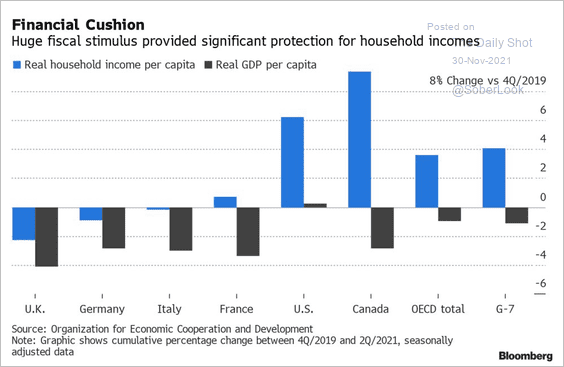

2. Household incomes have been boosted by stimulus measures, cushioning the impact of lower GDP per capita.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

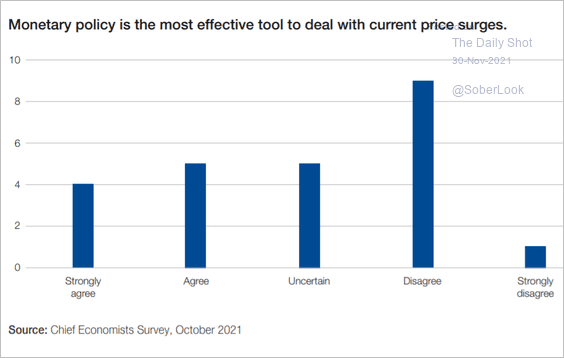

3. Is monetary policy the most effective way to deal with price surges (a survey of economists)?

Source: WEF Read full article

Source: WEF Read full article

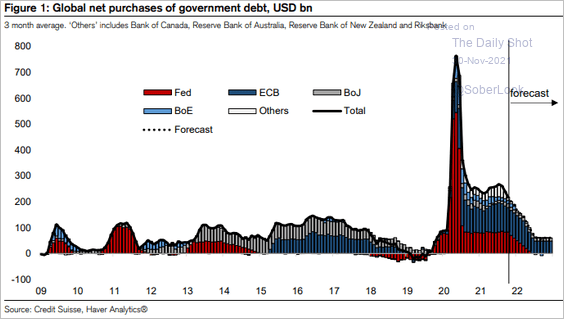

4. This chart shows a projection for government debt purchases by central banks (from Credit Suisse).

Source: Credit Suisse; @johnauthers, @bopinion Read full article

Source: Credit Suisse; @johnauthers, @bopinion Read full article

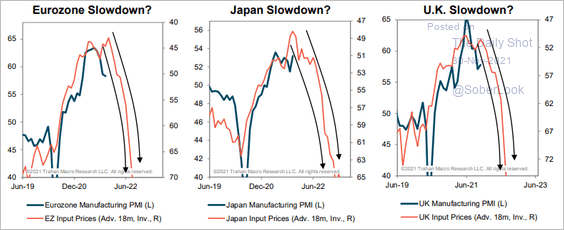

5. Higher input costs are expected to pressure factory activity,

Source: Trahan Macro Research

Source: Trahan Macro Research

——————–

Food for Thought

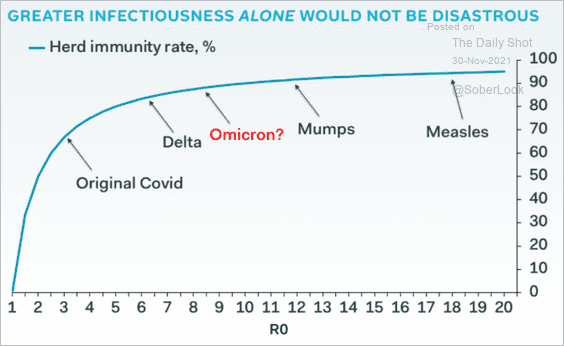

1. How contagious is omicron?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

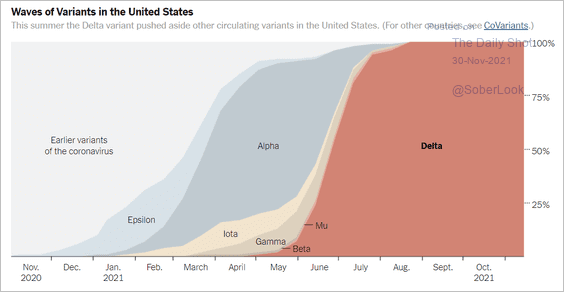

2. Dominant COVID variants over time:

Source: The New York Times Read full article

Source: The New York Times Read full article

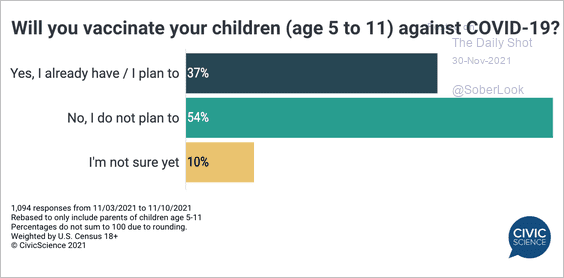

3. Vaccinating children:

Source: @CivicScience

Source: @CivicScience

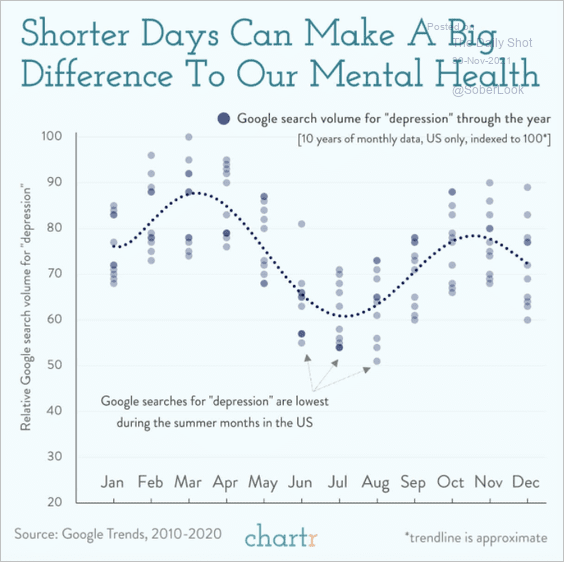

4. Shorter days impacting mental health:

Source: @chartrdaily

Source: @chartrdaily

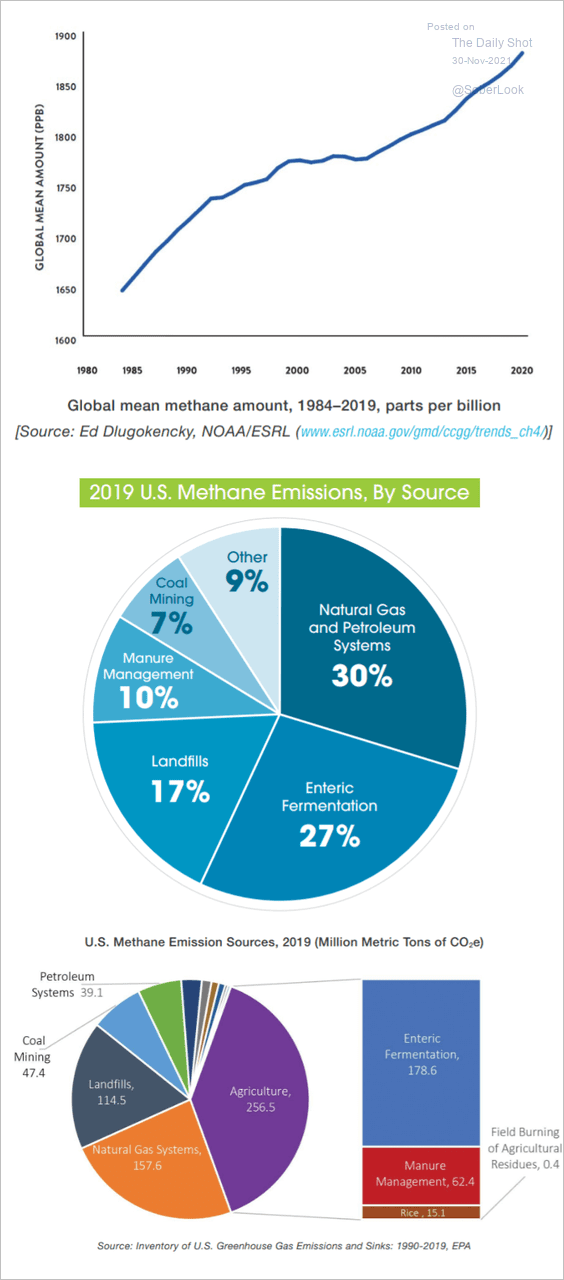

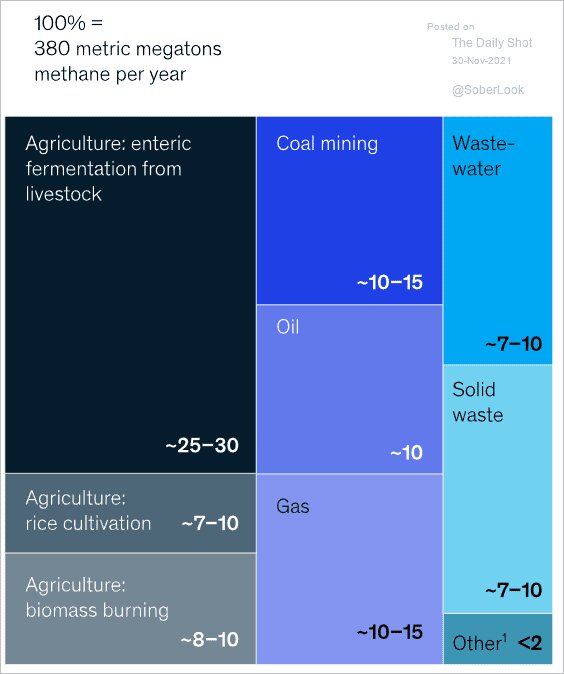

5. Data on methane emissions:

Source: The White House Read full article

Source: The White House Read full article

Source: McKinsey Read full article

Source: McKinsey Read full article

——————–

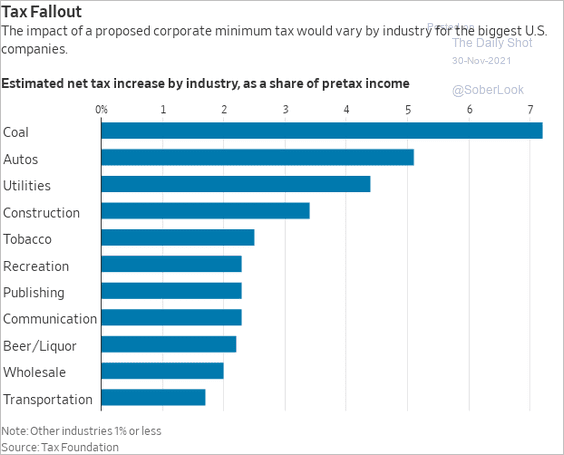

6. The impact of the proposed corporate minimum tax:

Source: @WSJ Read full article

Source: @WSJ Read full article

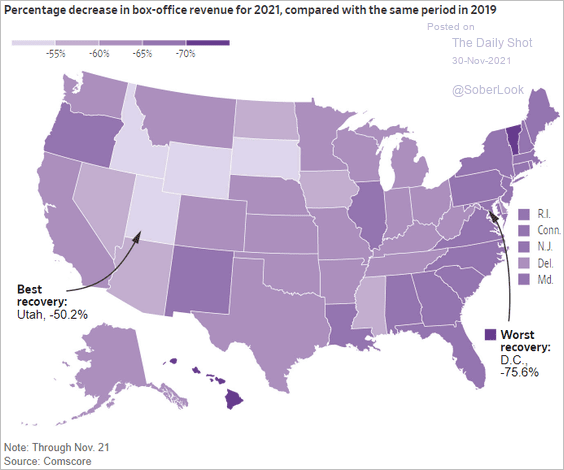

7. Box-office revenue in 2021 vs. 2019:

Source: @WSJ Read full article

Source: @WSJ Read full article

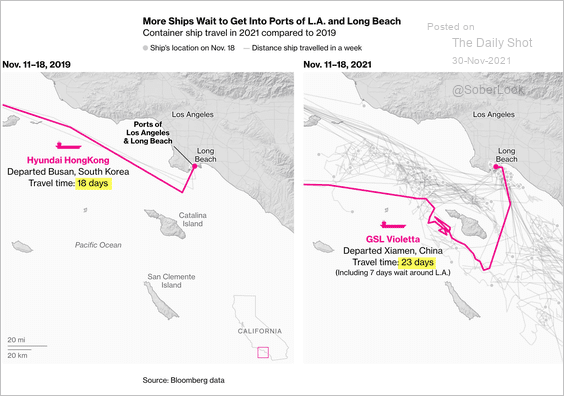

8. Container ship travel time in 2019 vs. now:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

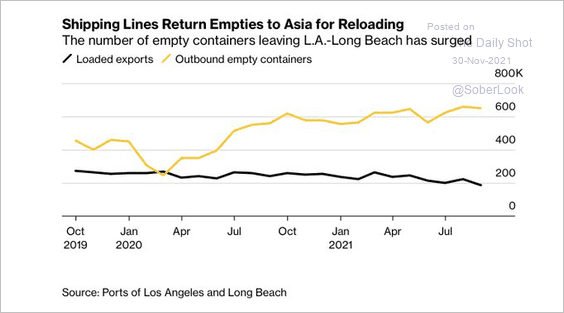

• US inbound vs. outbound containers:

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

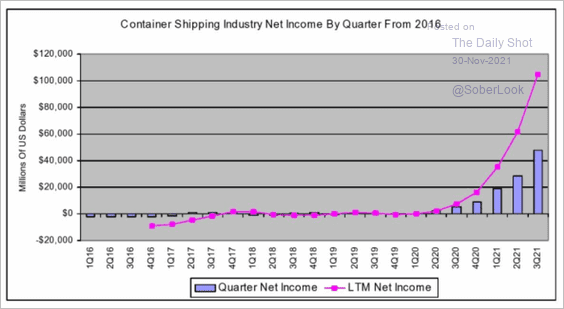

• Container shipping industry net income:

Source: @tracyalloway, @mccown_john Read full article

Source: @tracyalloway, @mccown_john Read full article

——————–

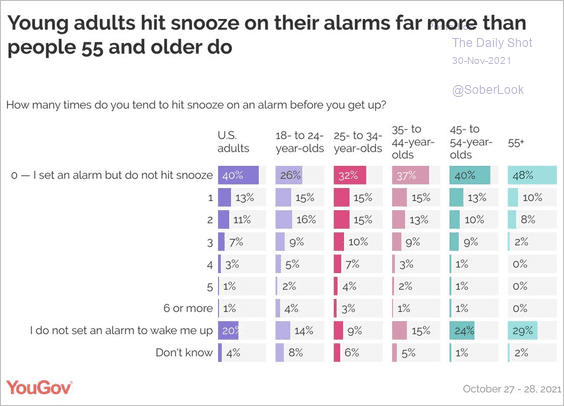

9. Hitting the snooze button:

Source: YouGov America

Source: YouGov America

——————–

Back to Index