The Daily Shot: 03-Dec-21

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the labor market.

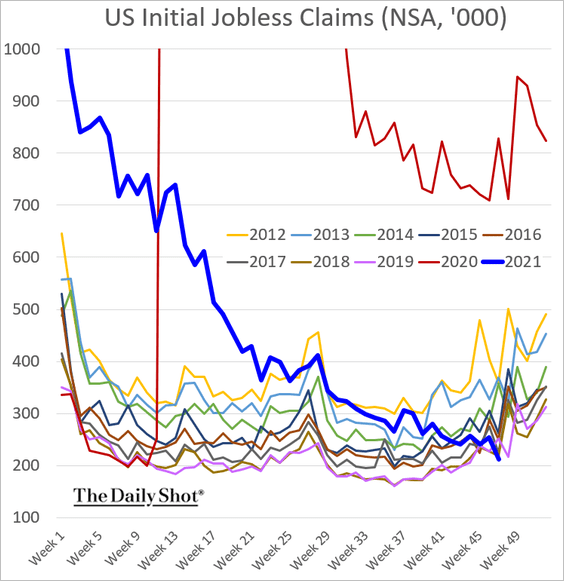

• Initial jobless claims hit a multi-year low for this time of the year.

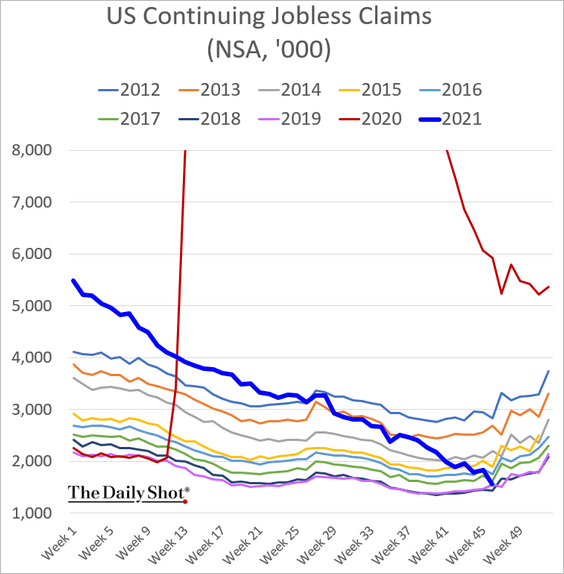

• Continuing claims, which are reported on a one-week lag to initial claims, are nearing 2018/19 levels.

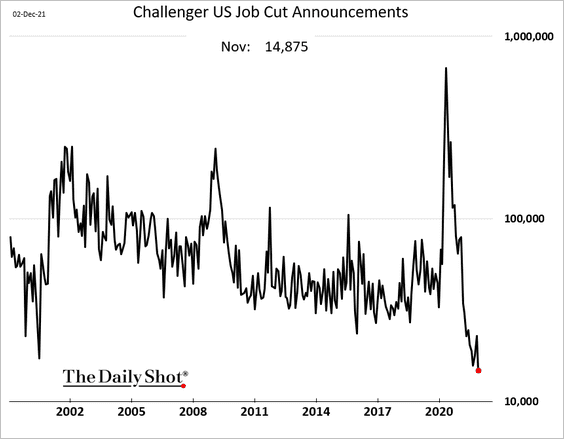

• Announced job cuts are now the lowest in decades (y-axis shown in log scale).

• These rapid improvements in the labor market are allowing the Fed to accelerate QE taper.

Source: Reuters Read full article

Source: Reuters Read full article

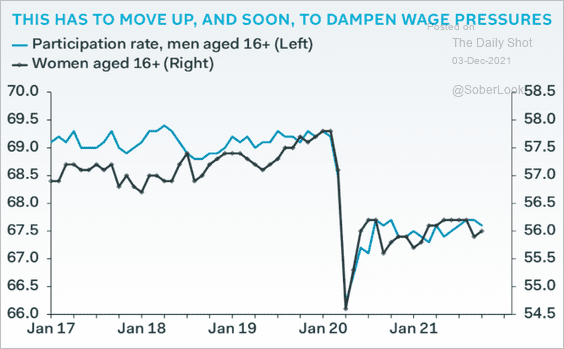

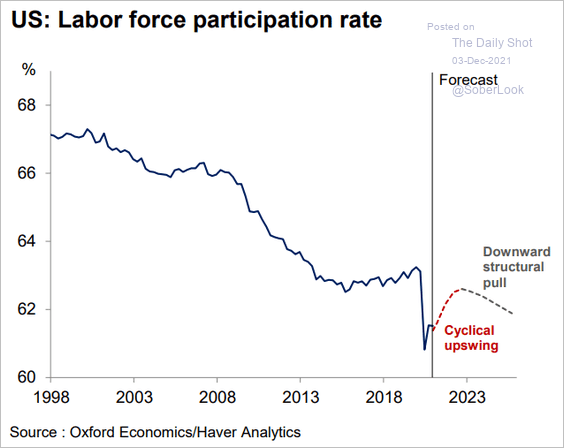

• Economists are increasingly focused on labor force participation. It needs to rise in order to ease wage pressures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

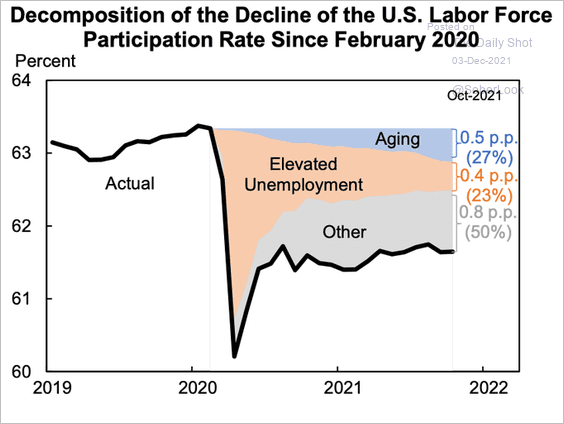

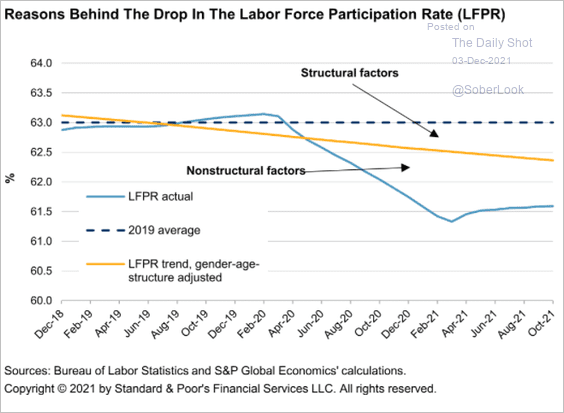

– The decline in labor force participation has been due to cyclical as well as structural trends (2 charts).

Source: @jasonfurman

Source: @jasonfurman

Source: S&P Global Ratings

Source: S&P Global Ratings

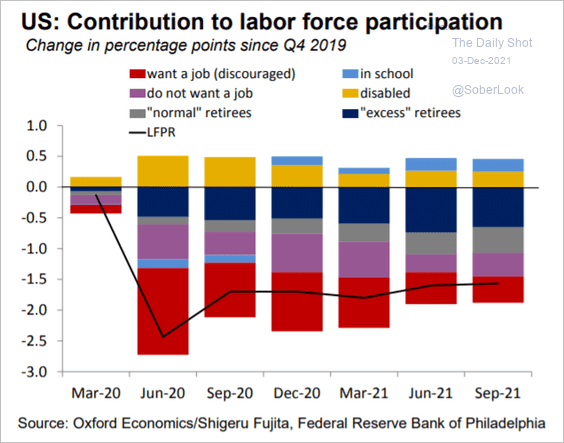

– This chart provides more detail on the drivers of the decline.

Source: @GregDaco

Source: @GregDaco

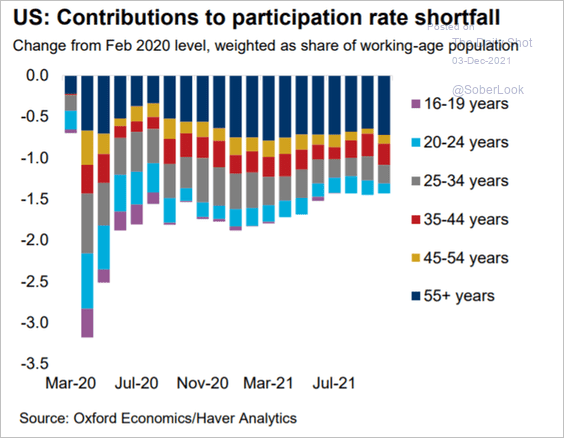

– Here is the breakdown by age group.

Source: @GregDaco

Source: @GregDaco

– While participation is expected to rebound next year, it will likely peak in early 2023 due to structural factors (according to Oxford Economics).

Source: @GregDaco

Source: @GregDaco

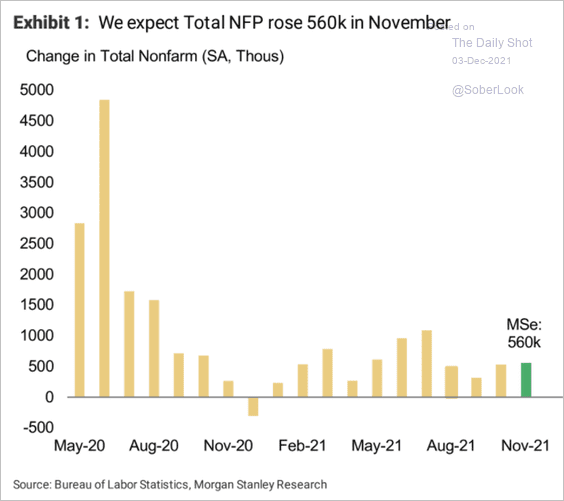

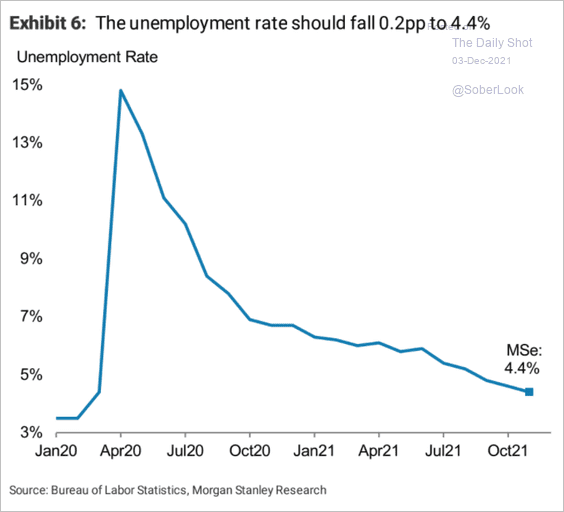

• Morgan Stanley is estimating 560k jobs created in November, roughly in line with consensus, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

… with the unemployment rate going down to 4.4%.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

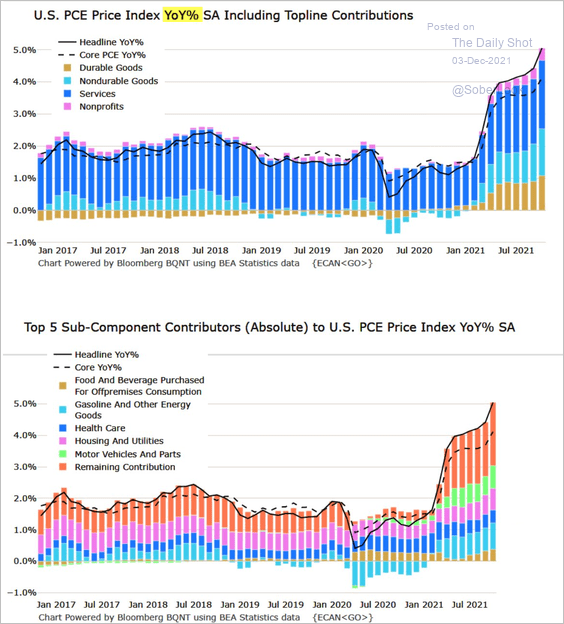

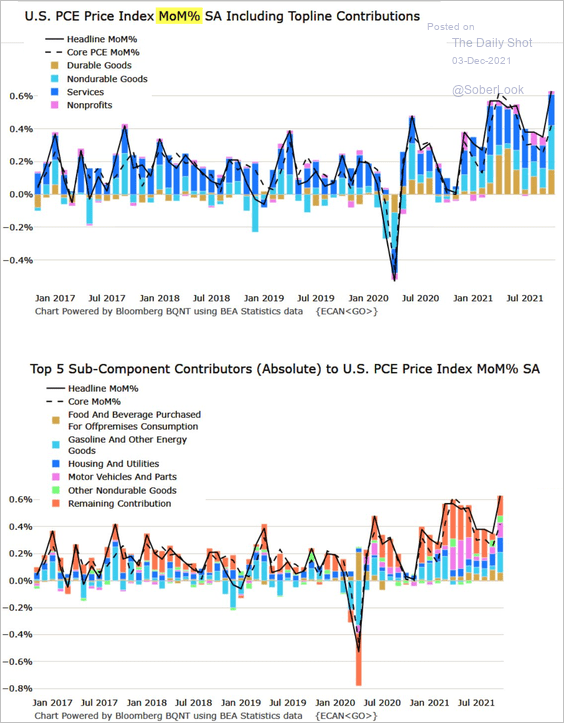

2. Next, we have some updates on inflation and supply-chain bottlenecks.

• These charts show the components of the PCE inflation index.

– Year-over-year:

Source: @M_McDonough

Source: @M_McDonough

– Month-over-month:

Source: @M_McDonough

Source: @M_McDonough

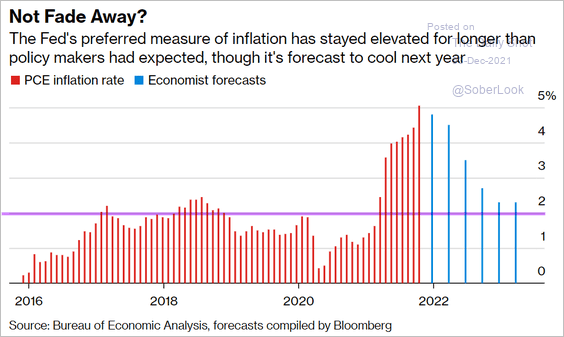

• Economists expect inflation to moderate but hold above 2%.

Source: @markets Read full article

Source: @markets Read full article

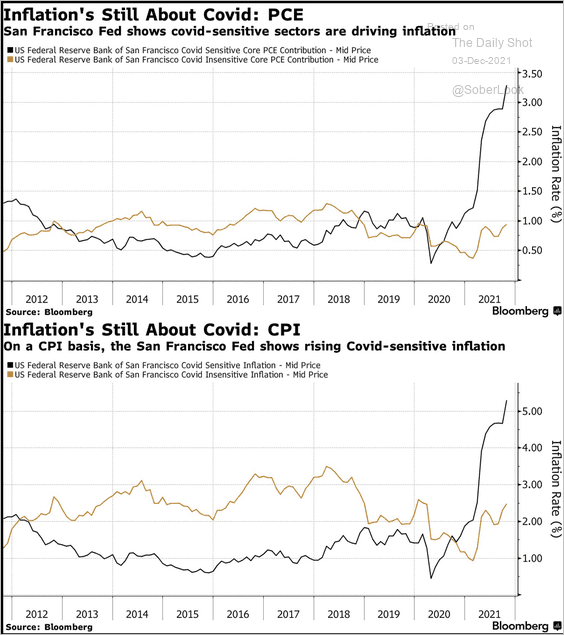

• A large portion of the inflation spike is still driven by COVID-related trends.

Source: @acemaxx, @sffed, @JohnAuthers Read full article

Source: @acemaxx, @sffed, @JohnAuthers Read full article

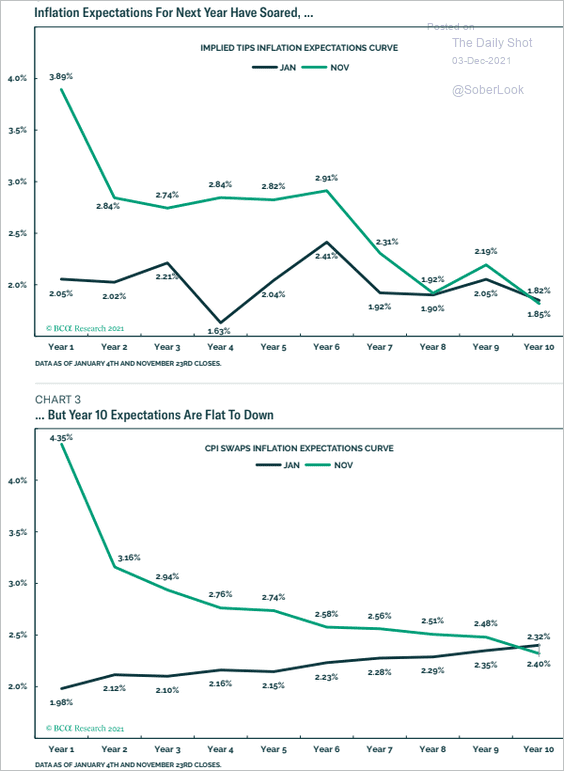

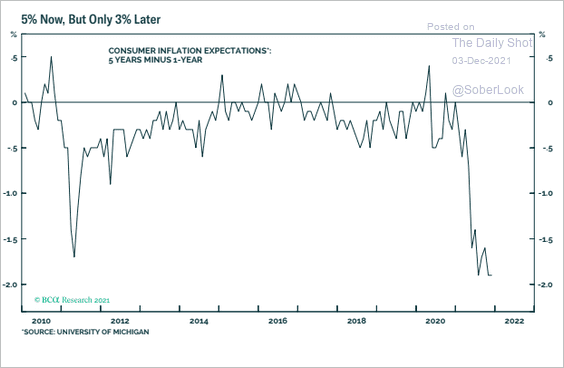

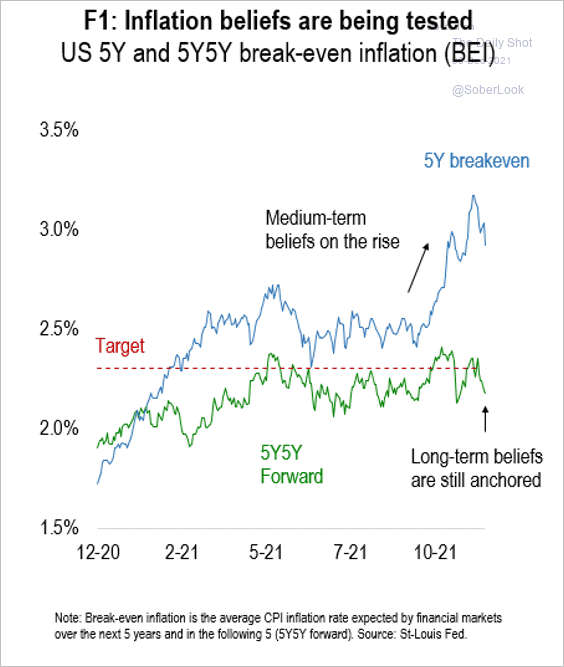

• Longer-term inflation expectations remain subdued (3 charts).

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: Numera Analytics

Source: Numera Analytics

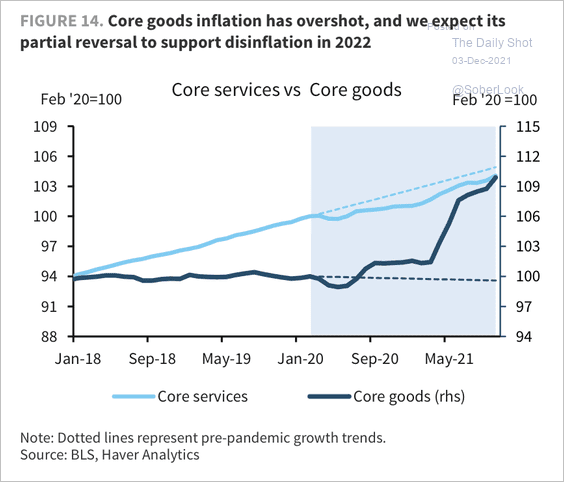

• Core goods inflation has risen significantly above pre-pandemic growth trends, which can lead to disinflation next year, according to Barclays.

Source: Barclays Research

Source: Barclays Research

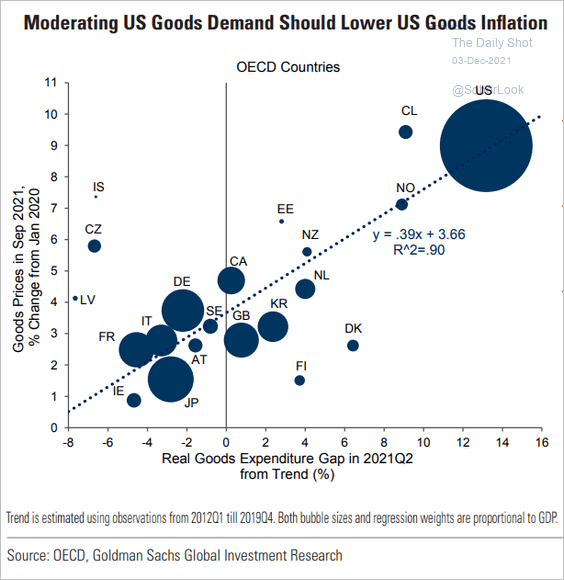

• Easing goods demand should dampen goods inflation (as services CPI ramps up).

Source: Goldman Sachs

Source: Goldman Sachs

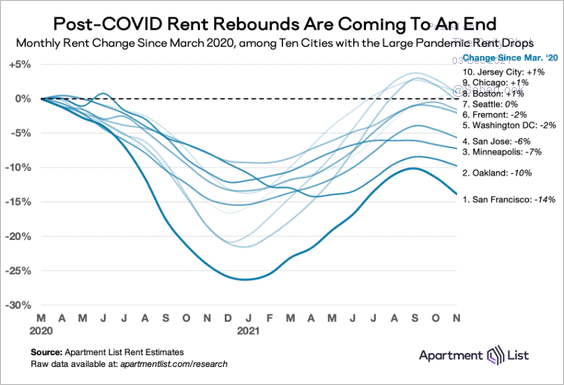

• The post-COVID rent rebound appears to have peaked.

Source: Apartment List Read full article

Source: Apartment List Read full article

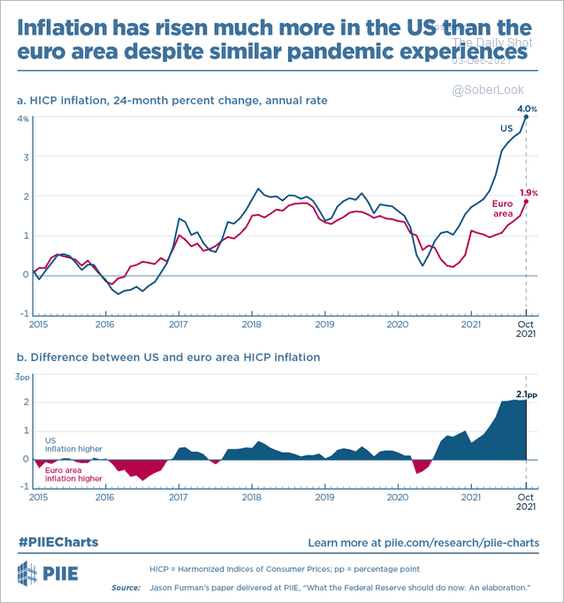

• The US and the Eurozone had similar monetary expansionary policies. Why did inflation trends diverge so much? One possibility is that the US fiscal response was much more aggressive.

Source: @PIIE

Source: @PIIE

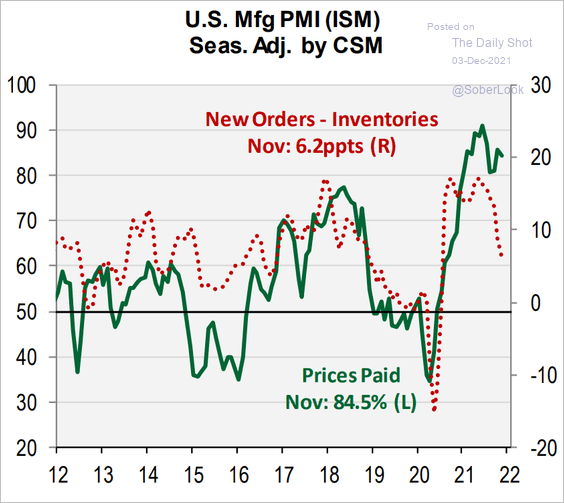

• The spread between new orders and inventories points to moderation in price pressures.

Source: Cornerstone Macro

Source: Cornerstone Macro

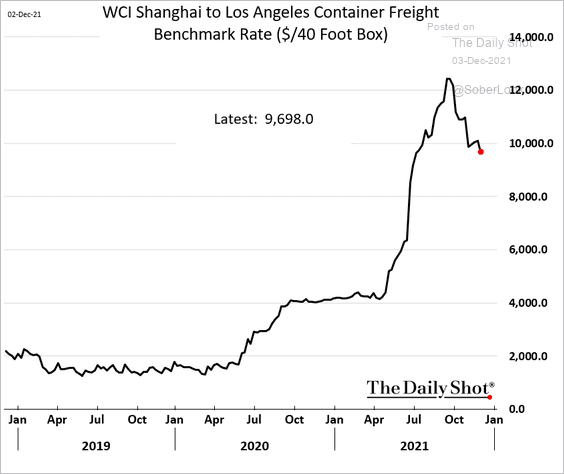

• Container shipping rates are easing.

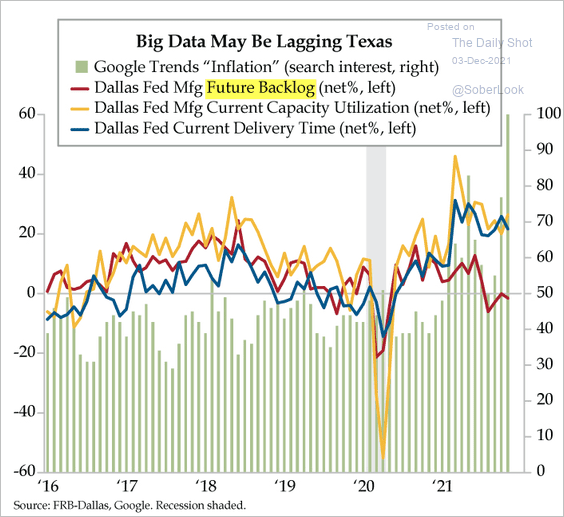

• Manufacturers are not concerned about backlogs persisting for too long, according to the Dallas Fed’s regional survey.

Source: The Daily Feather

Source: The Daily Feather

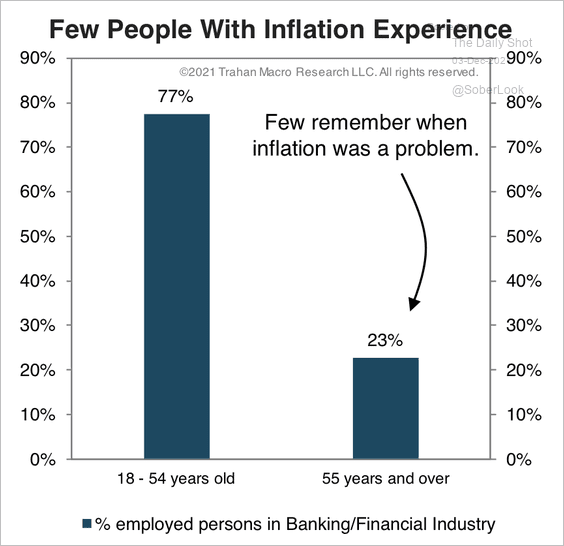

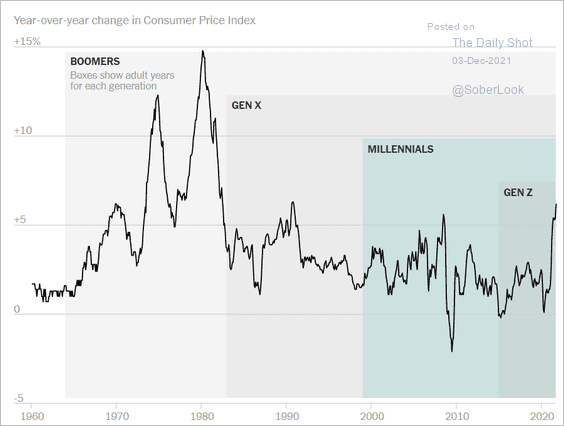

• Most Millennial/GenXers have no experience with high inflation (2 charts).

Source: Trahan Macro Research

Source: Trahan Macro Research

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

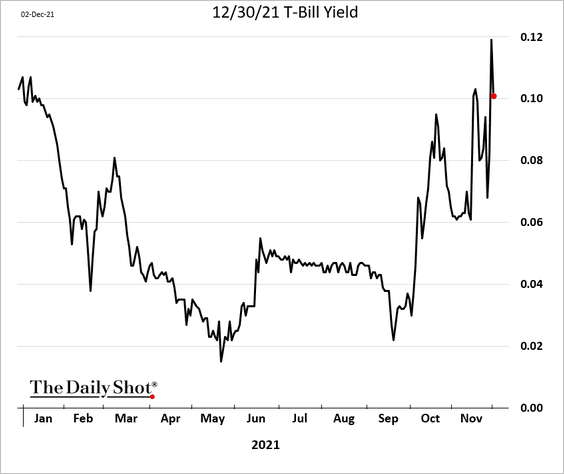

3. The Treasury market is still jittery about the debt ceiling. Here is the yield on a T-Bill maturing at the end of the month.

Back to Index

The Eurozone

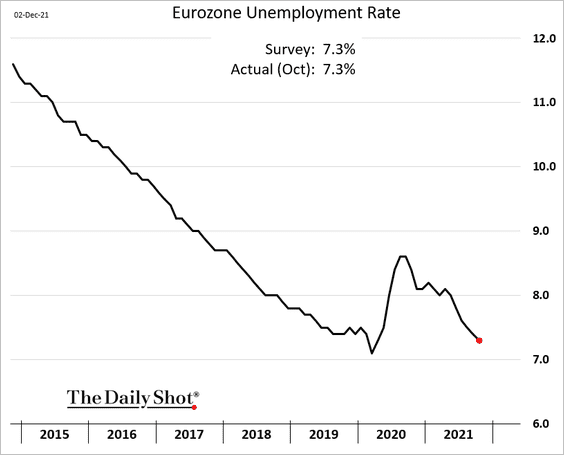

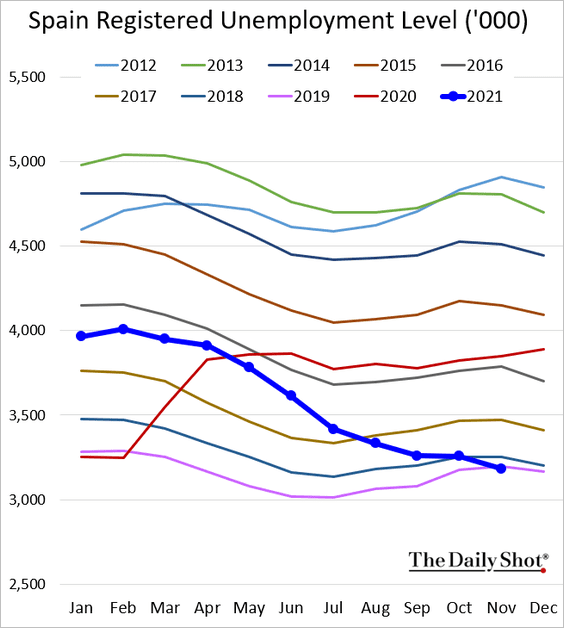

1. The unemployment rate is approaching pre-COVID levels.

Spain’s unemployment is already there.

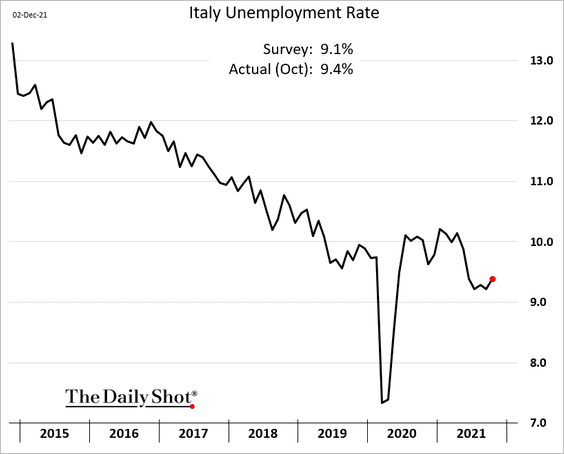

However, Italian unemployment ticked higher.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

2. Suppliers to Germany’s automotive industry are gloomy.

Source: @CESifoGroup, @ifo_Institut Read full article

Source: @CESifoGroup, @ifo_Institut Read full article

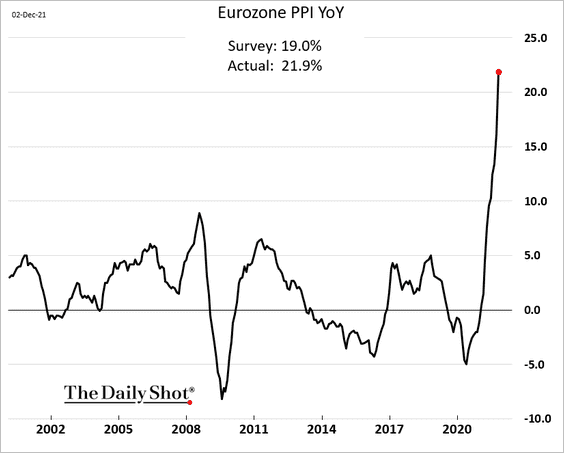

3. The Euro-area PPI shot past 20%, topping expectations.

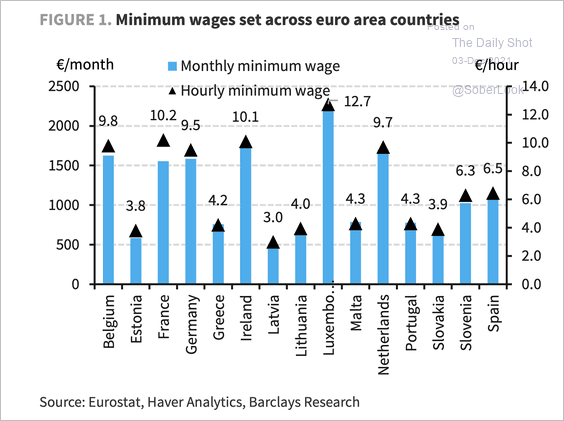

4. Here is the minimum wage across the Eurozone.

Source: Barclays Research

Source: Barclays Research

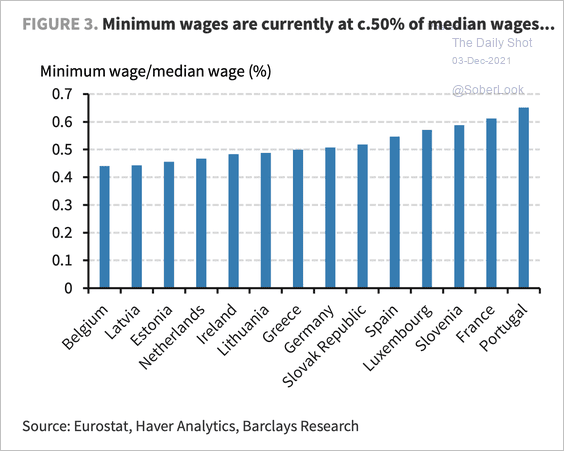

And this chart shows the minimum wage as a percentage of median wages in each country.

Source: Barclays Research

Source: Barclays Research

——————–

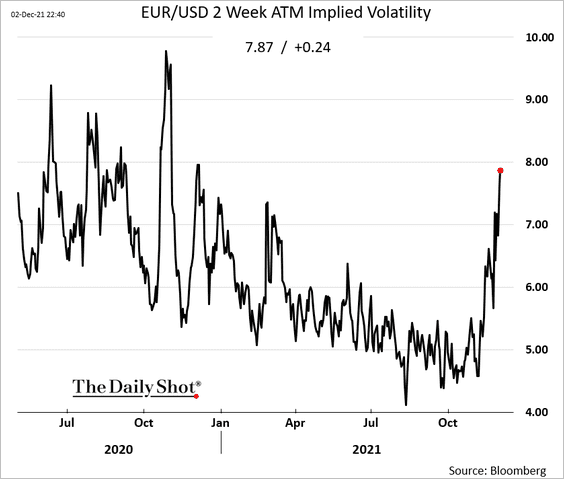

5. The EUR/USD 2-week implied vol jumped ahead of the Fed and ECB decisions.

h/t @vkaramanis_fx

h/t @vkaramanis_fx

Back to Index

Europe

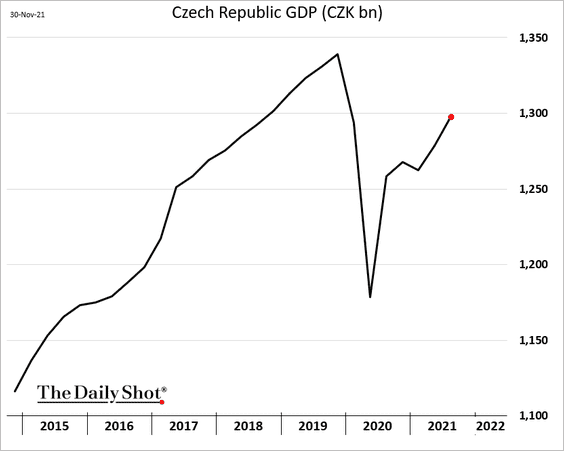

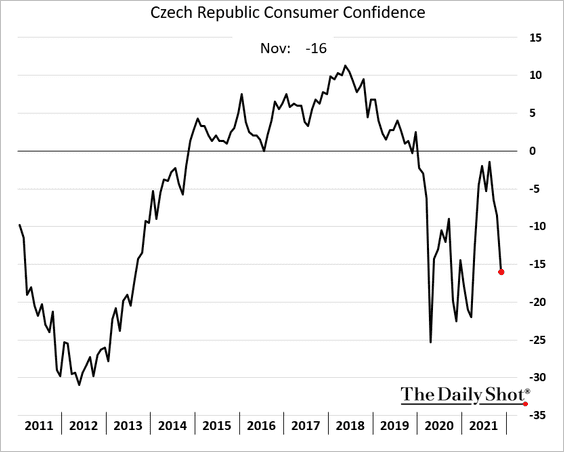

1. Czech GDP continues to rebound but remains well below pre-COVID levels.

Consumer confidence has deteriorated last month as the pandemic surged.

——————–

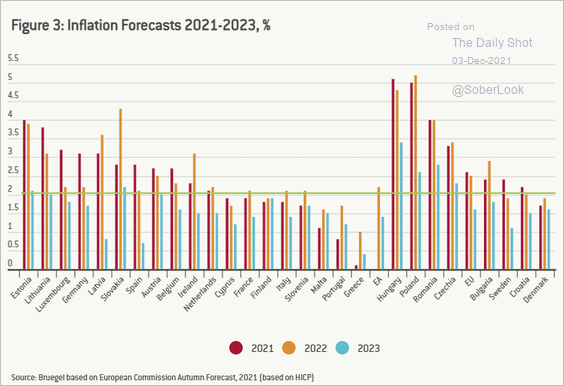

2. This chart shows consumer inflation forecasts by country.

Source: Bruegel Read full article

Source: Bruegel Read full article

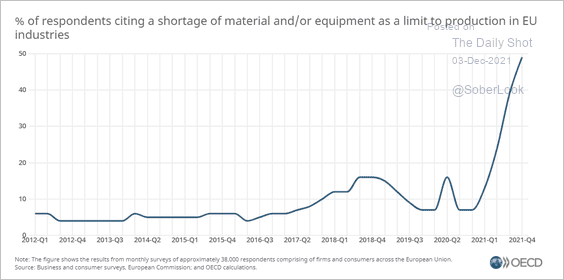

3. EU firms have not been this concerned about shortages of material and equipment in recent history.

Source: OECD Read full article

Source: OECD Read full article

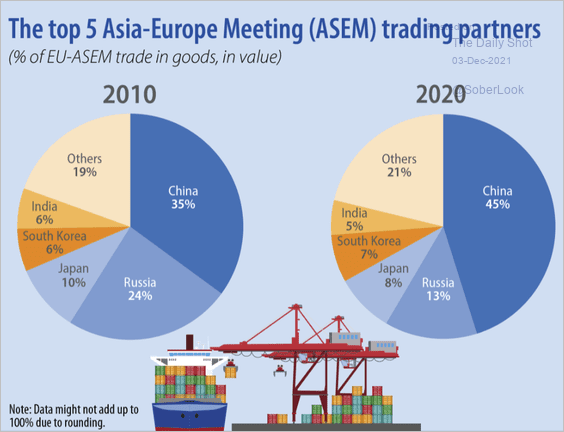

4. Next, we have the EU’s distribution of trade with Asian economies.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

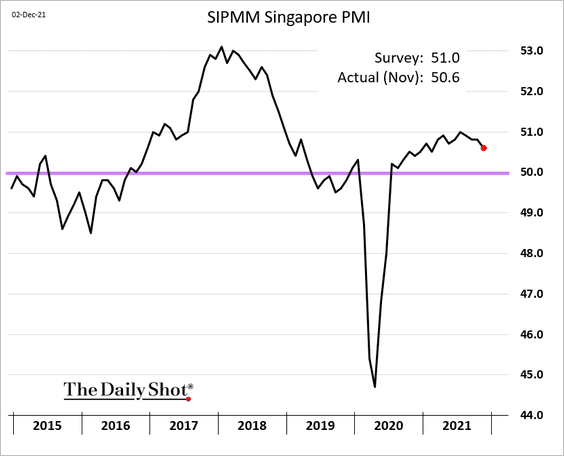

1. Growth in Singapore’s factory activity is moderating.

Source: The Straits Times Read full article

Source: The Straits Times Read full article

——————–

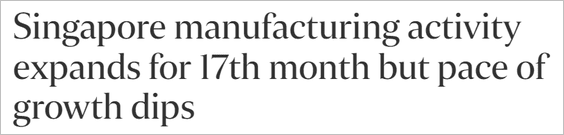

2. South Korea’s domestic demand is highly sensitive to policy rate changes.

Source: Gavekal Research

Source: Gavekal Research

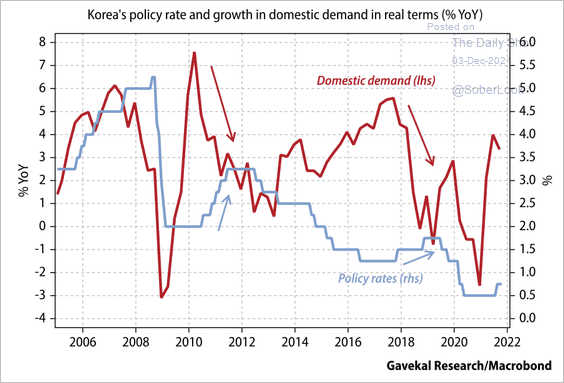

3. Next, we have some updates on Australia.

• There have been tentative signs of a rebound in Australia’s economic activity amid rising inflation expectations.

Source: BCA Research

Source: BCA Research

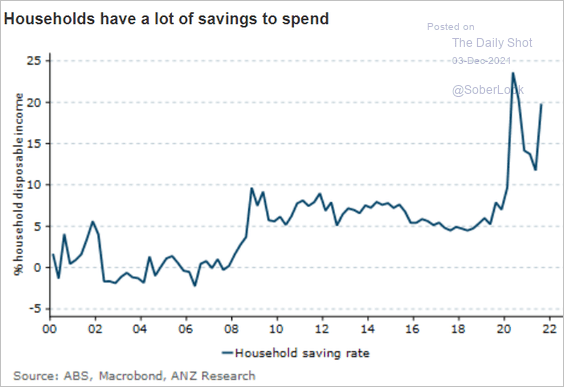

• Households are sitting on quite a bit of cash. This chart shows savings as a percentage of disposable income.

Source: ANZ Research

Source: ANZ Research

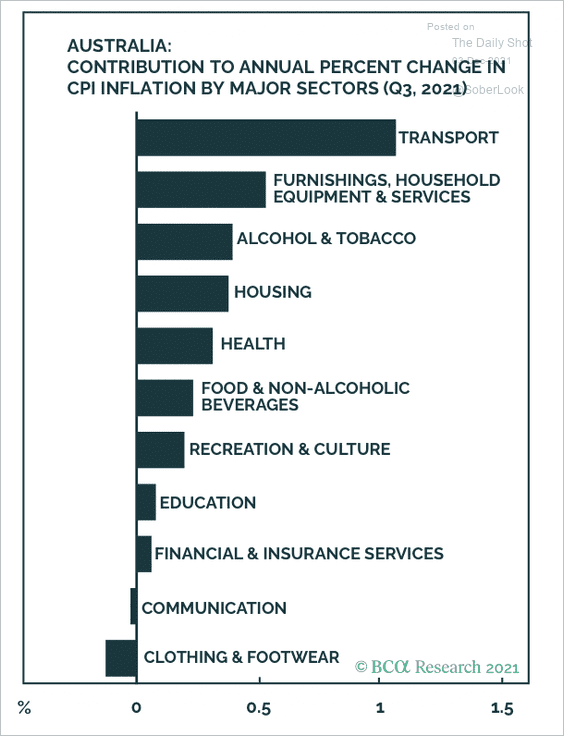

• Here are the contributions to the Q3 CPI.

Source: BCA Research

Source: BCA Research

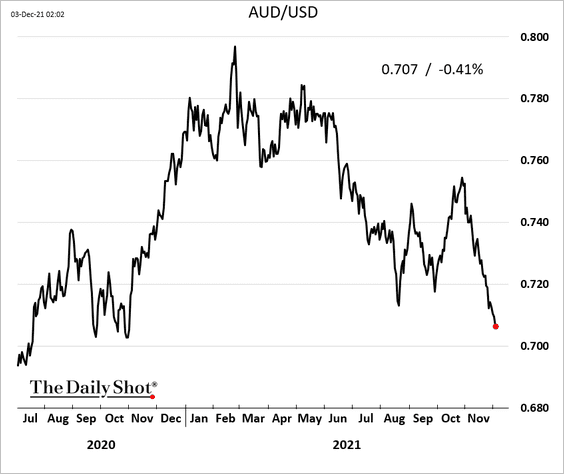

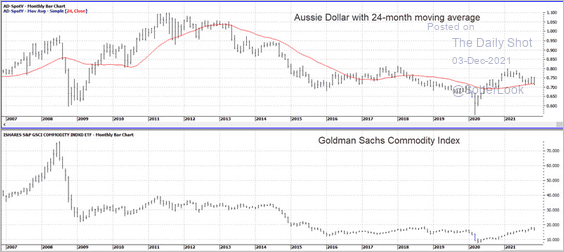

• The Aussie dollar has been under pressure.

– AUD/USD is testing long-term support as the Goldman Sachs Commodity Index appears to have bottomed.

Source: SentimenTrader

Source: SentimenTrader

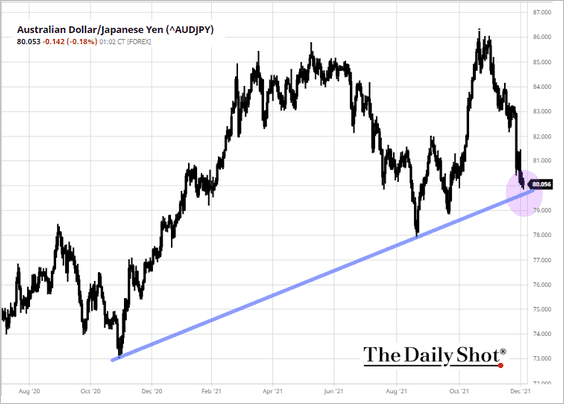

– AUD/JPY is also at support.

Source: barchart.com

Source: barchart.com

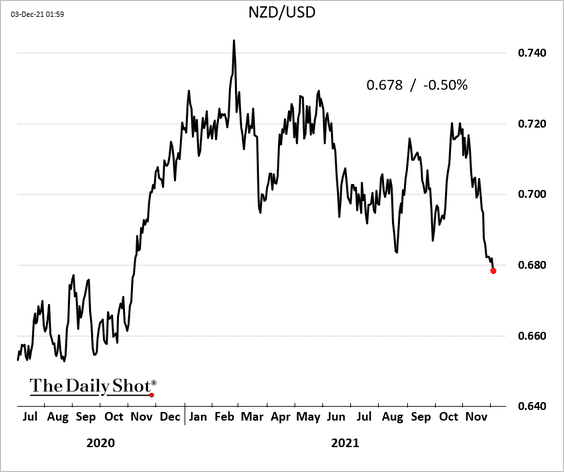

3. The Kiwi dollar hit the lowest level in a year vs. USD.

Back to Index

China

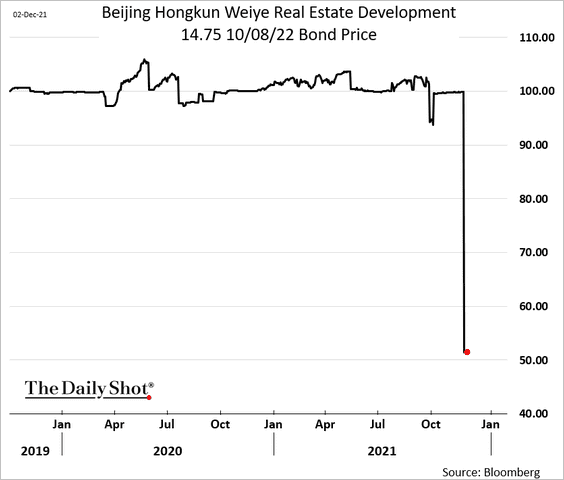

1. Beijing gave leveraged developers some breathing room, but the credit crisis in the space is by no means over.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

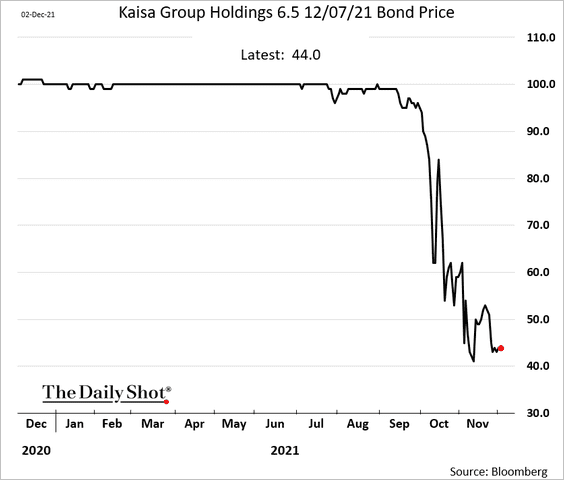

• Kaisa:

Source: Reuters Read full article

Source: Reuters Read full article

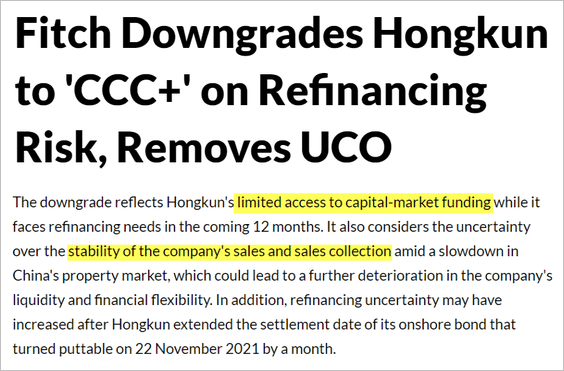

• Hongkun:

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

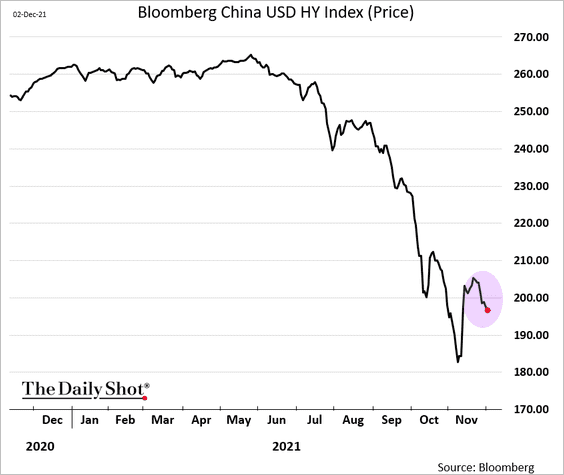

• The rebound in China’s USD high-yield index is fading.

——————–

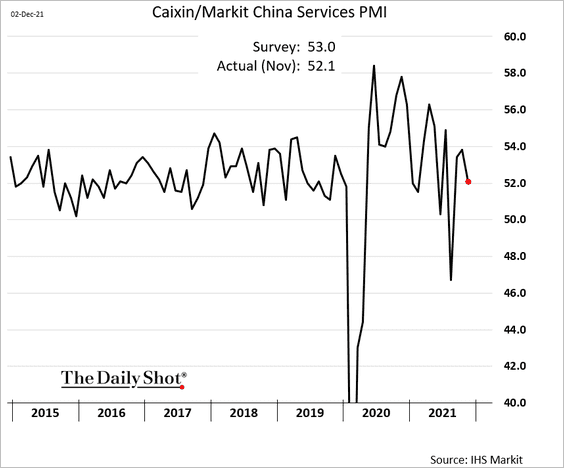

2. Service sector growth keeps moderating, according to Markit.

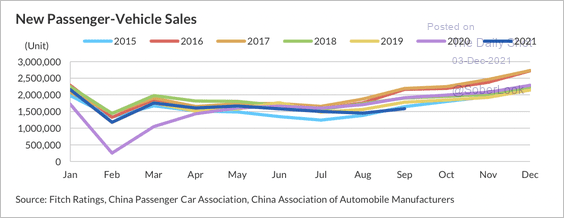

3. New passenger vehicle sales continue to slow and remain below historical levels.

Source: Fitch Ratings

Source: Fitch Ratings

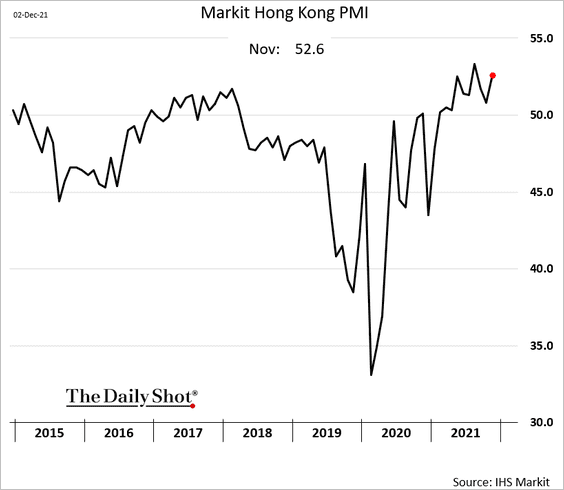

4. Hong Kong’s business activity strengthened last month.

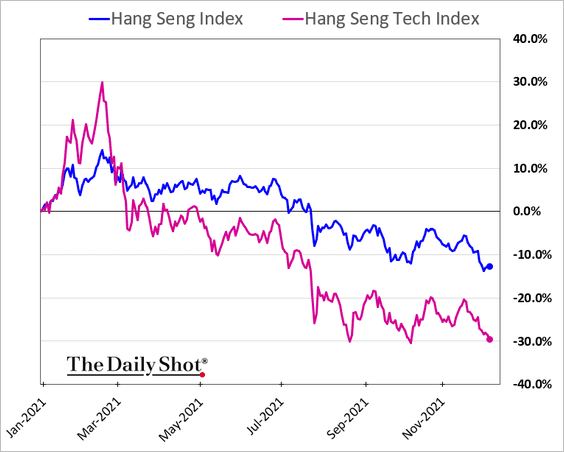

5. China’s tech shares trading in Hong Kong continue to underperform.

Back to Index

Emerging Markets

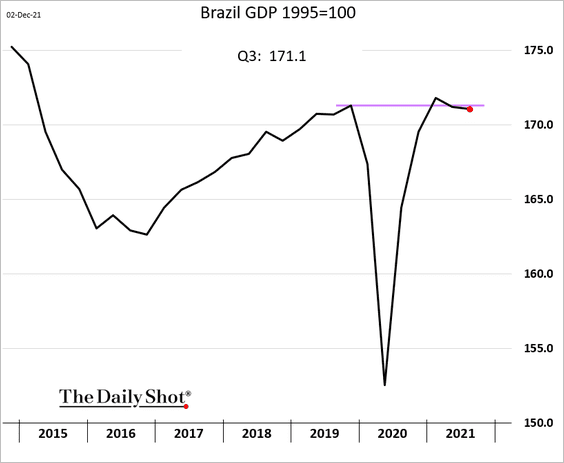

1. Brazil’s GDP dipped below its pre-COVID level.

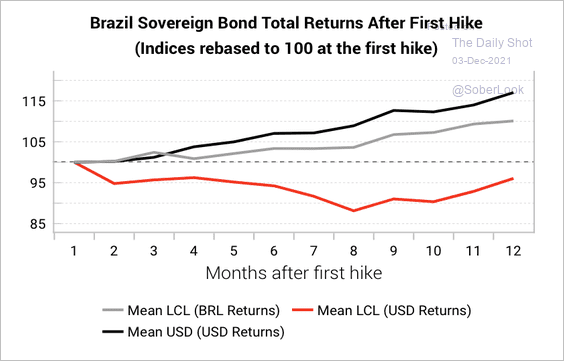

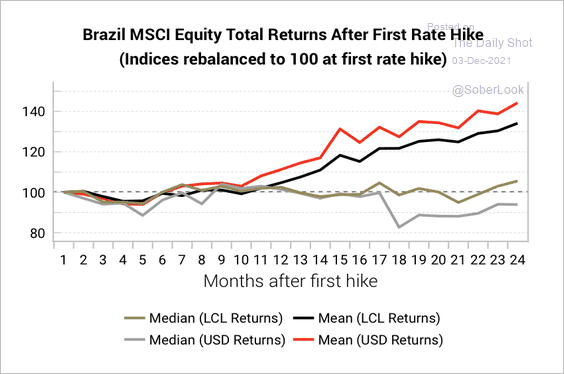

• Generally, the risk/reward for buying EM debt (particularly Brazil) is much better toward the end of a rate hike cycle, whereas equity returns vary around rate hikes (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

——————–

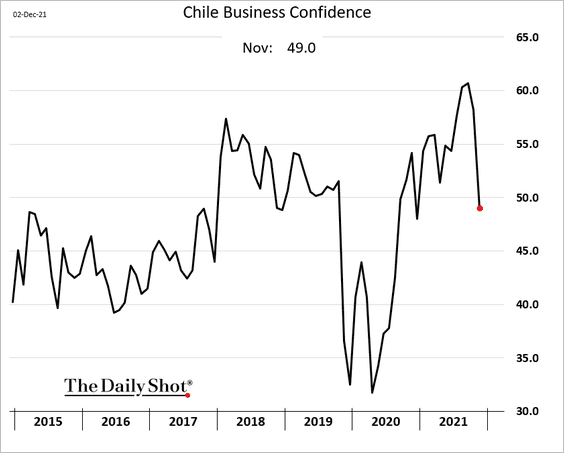

2. Chile’s business confidence slipped last month as political uncertainty takes a toll.

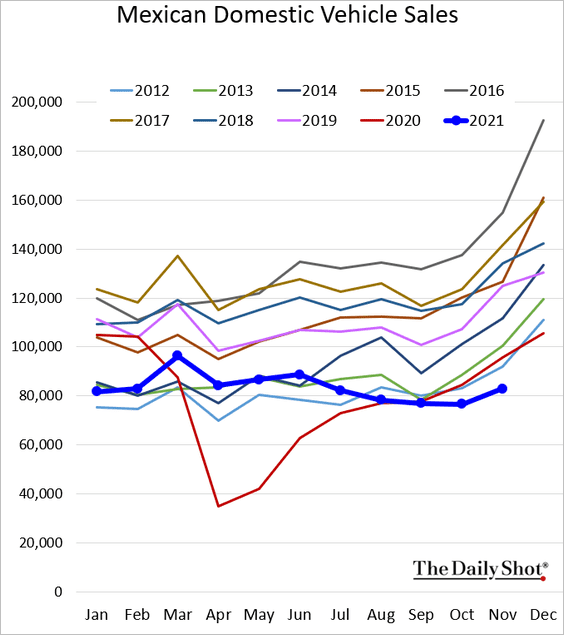

3. Mexican vehicle sales remain depressed.

——————–

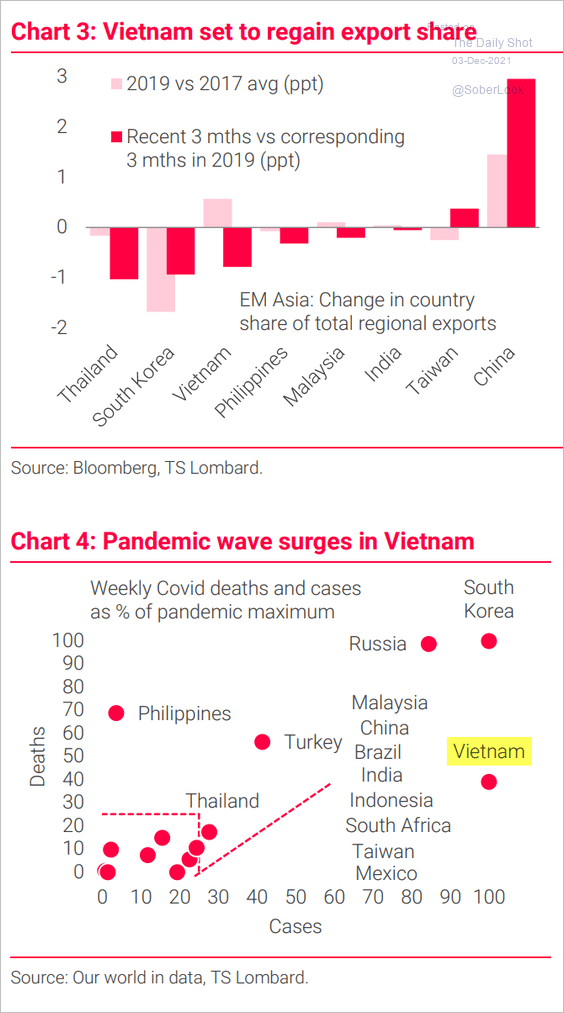

4. Vietnam is expected to regain its export market share.

Source: TS Lombard

Source: TS Lombard

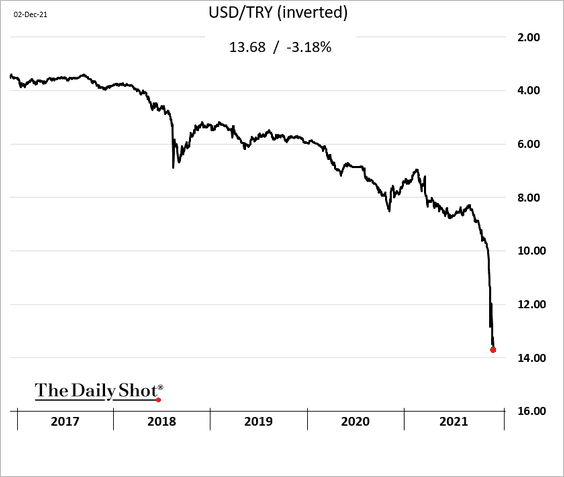

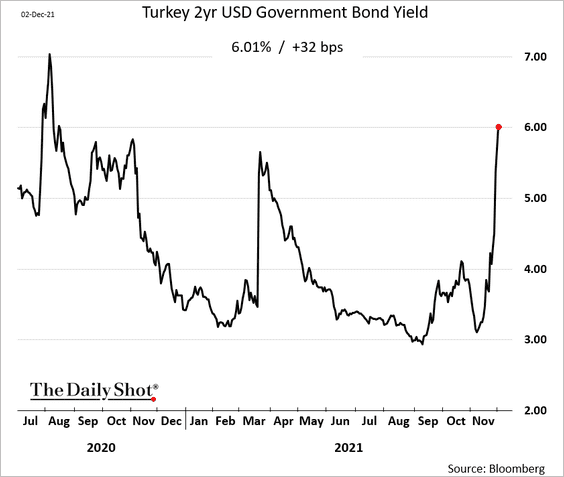

5. Erdogan wants to push rates lower, …

Source: @bpolitics Read full article

Source: @bpolitics Read full article

… sending the lira to new lows.

Investors have been dumping Turkey’s dollar bonds.

——————–

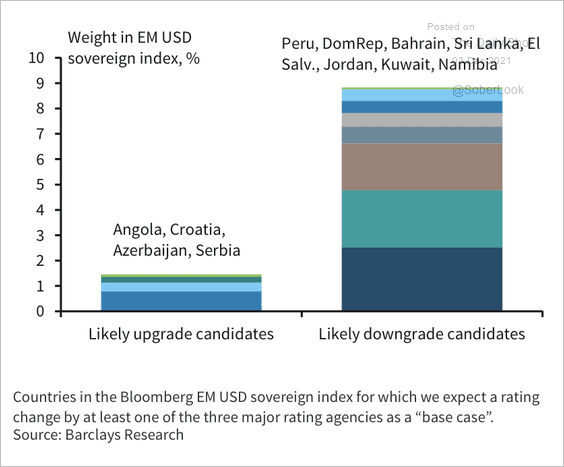

6. Barclays’ 2022 EM sovereign debt downgrade candidates continue to outweigh potential upgrade candidates.

Source: Barclays Research

Source: Barclays Research

Back to Index

Cryptocurrency

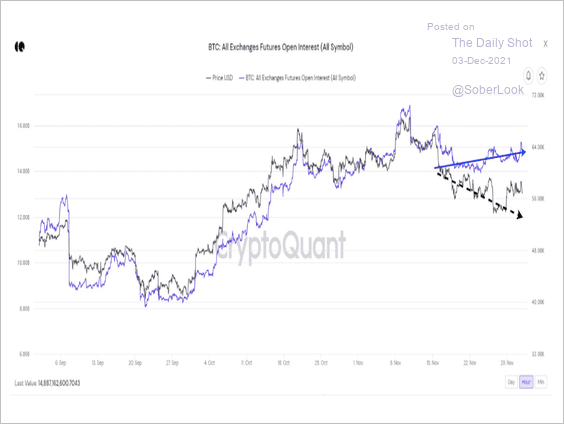

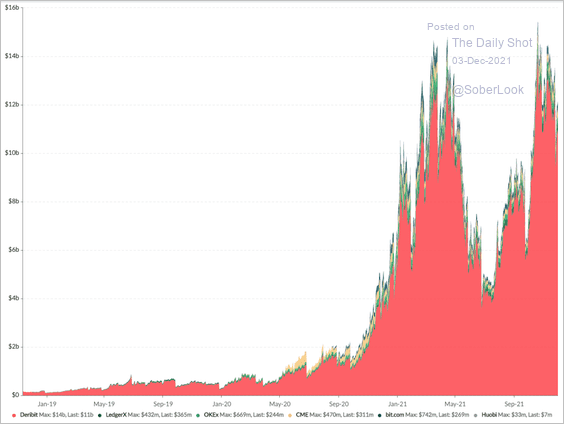

1. The rise in BTC futures open interest could suggest the market is oversaturated with leverage. This may lead to liquidations (broad-based selling) if BTC continues to decline.

Source: CryptoQuan Read full article

Source: CryptoQuan Read full article

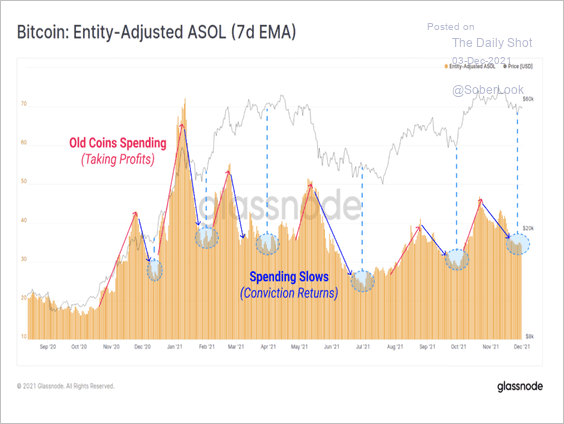

2. The chart below shows the recent decline in the average lifespan of all spent transactions on the Bitcoin blockchain network. Stability in spending activity suggests less profit-taking from long-term BTC holders.

Source: @glassnode

Source: @glassnode

3. Open interest in bitcoin’s options market saw a significant rise this year and is currently near $12 billion.

Source: Skew

Source: Skew

More professional traders are flocking to crypto options markets.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

4. China’s crypto industry continues to phase out.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Energy

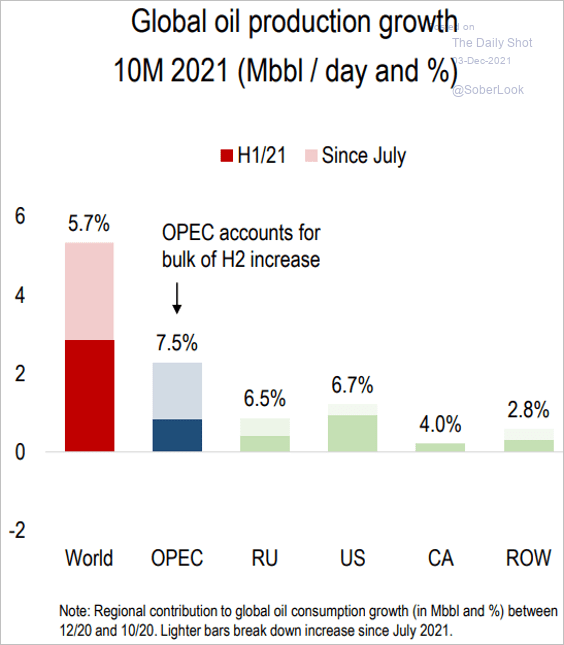

1. Let’s start with the drivers of global oil production growth this year.

Source: Numera Analytics

Source: Numera Analytics

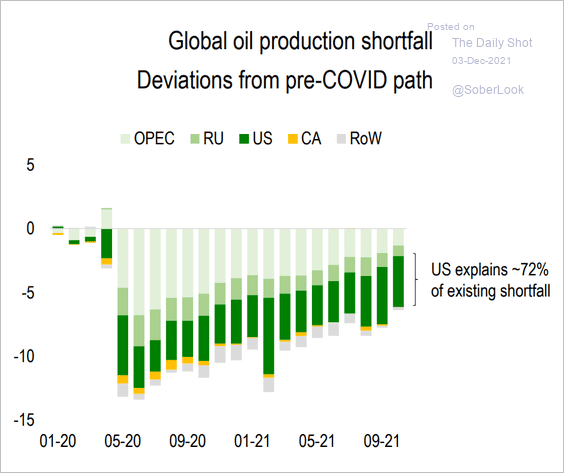

And here are the contributions to production shortfalls vs. the pre-COVID trend. At this point, much of it is the US.

Source: Numera Analytics

Source: Numera Analytics

——————–

2. OPEC+ will proceed with its planned output increase.

Source: Reuters Read full article

Source: Reuters Read full article

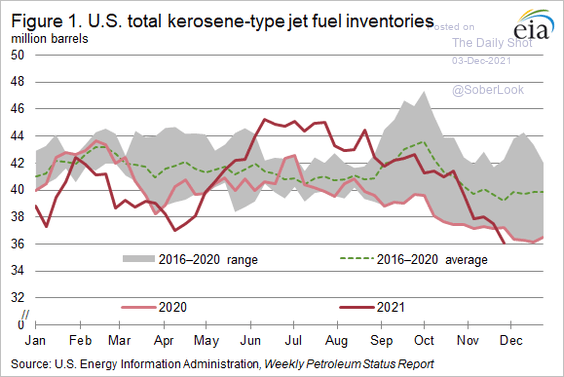

3. US jet fuel inventory is back below the 5-year range.

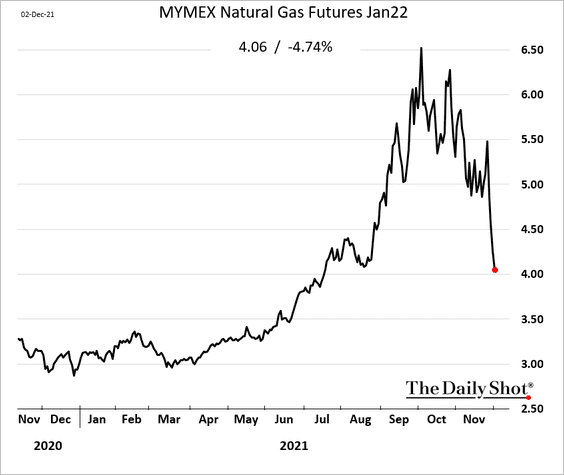

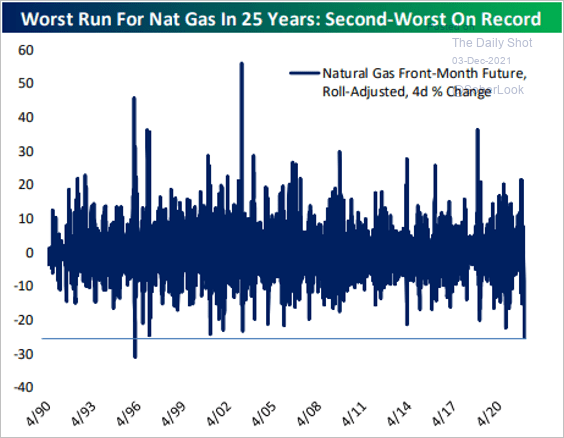

4. It’s been a while since US natural gas saw such a sharp price decline.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Source: NGI Read full article

Source: NGI Read full article

——————–

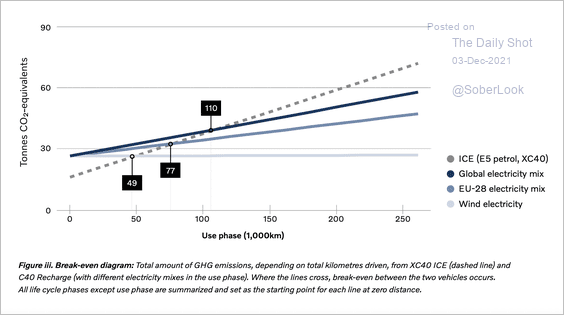

5. How environmentally friendly are EVs? Even if one assumes a 100% renewable energy mix, an electric Volvo XC40 takes 49,000 km to hit breakeven in CO2 terms (vs. one with an internal combustion engine). This figure rises to 110,000 km if the current global electricity mix is used.

Source: @SnippetFinance Read full article

Source: @SnippetFinance Read full article

Back to Index

Equities

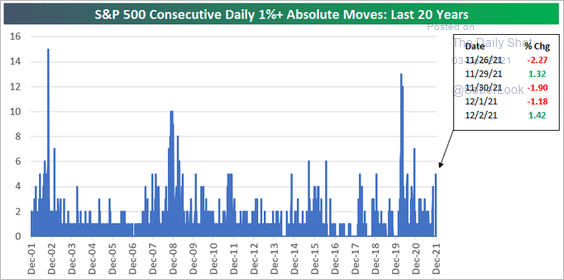

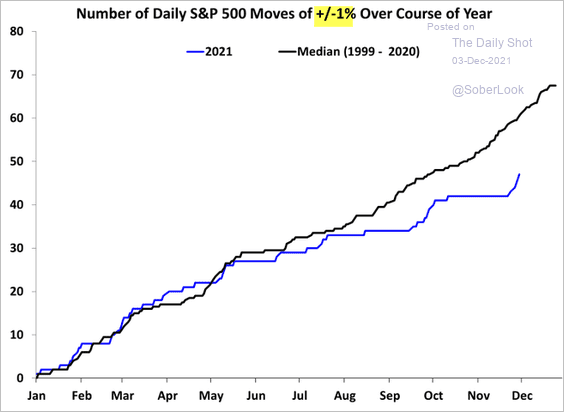

1. It’s been a volatile week, with five consecutive days of 1%+ moves.

Source: @bespokeinvest

Source: @bespokeinvest

But year-to-date, we are still below the median.

Source: @WillieDelwiche

Source: @WillieDelwiche

——————–

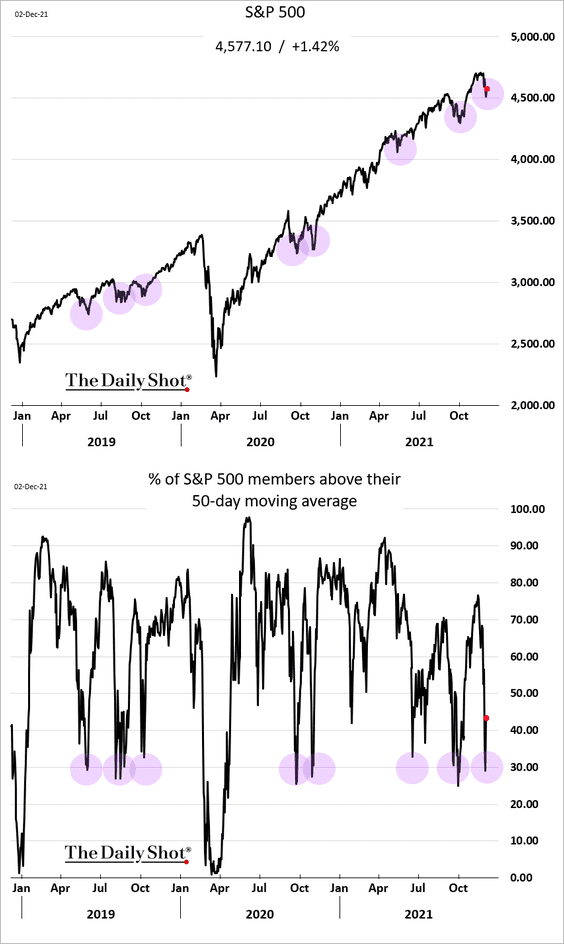

2. Dip buyers tend to come in when the share of S&P 500 members above their 50-day moving average is near 30%.

h/t Akshay Chinchalkar

h/t Akshay Chinchalkar

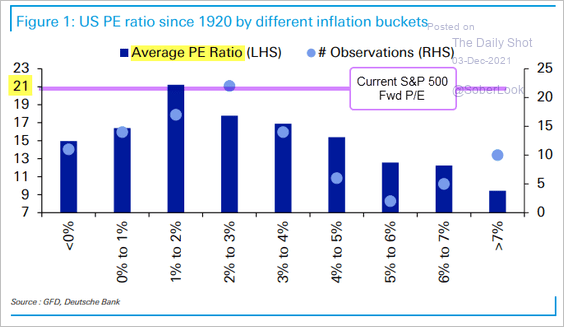

3. With the S&P 500 forward P/E ratio hovering around 21, the market is betting on transitory inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

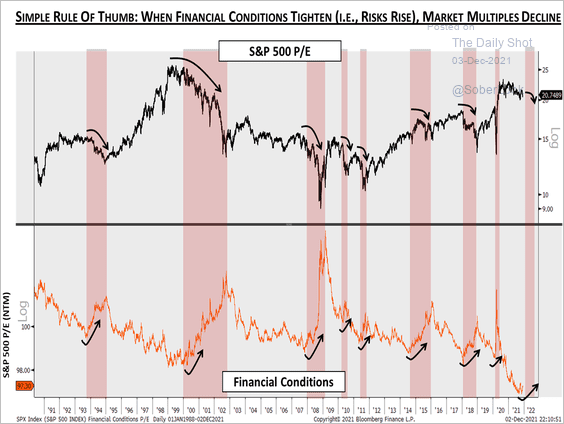

• If inflation doesn’t send the P/E ratio lower, will tighter financial conditions do the job?

Source: @MichaelKantro, @csm_research

Source: @MichaelKantro, @csm_research

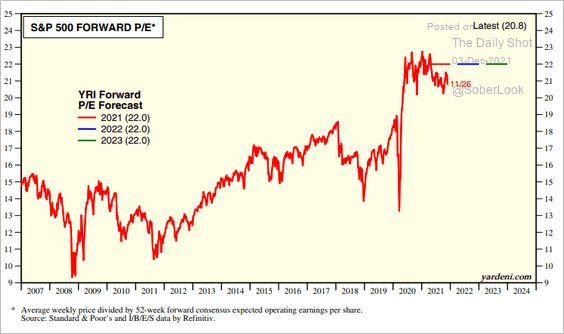

• According to Yardeni Research, the forward P/E ratio will hold near 22x over the next couple of years.

Source: Yardeni Research

Source: Yardeni Research

——————–

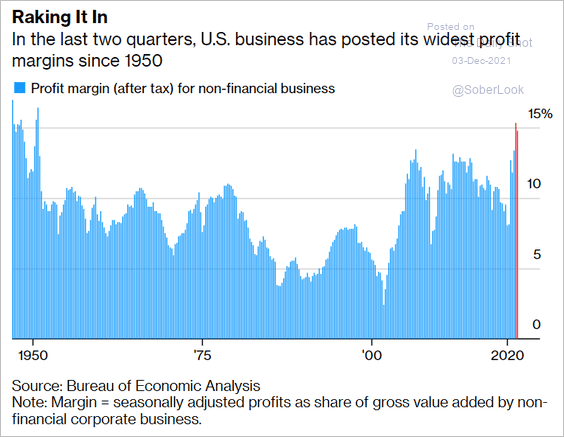

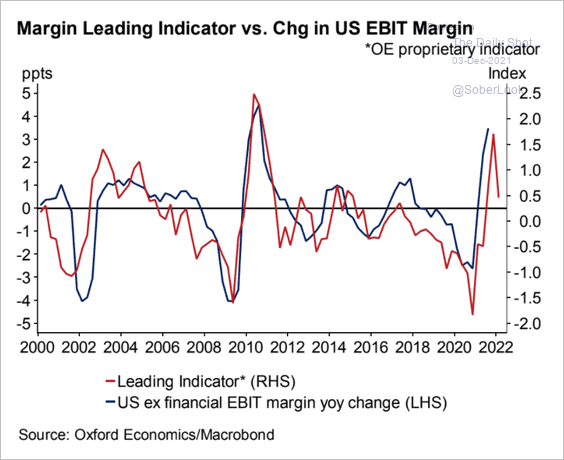

4. Profit margins hit a multi-decade high.

Source: @markets Read full article

Source: @markets Read full article

• But margins are peaking, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

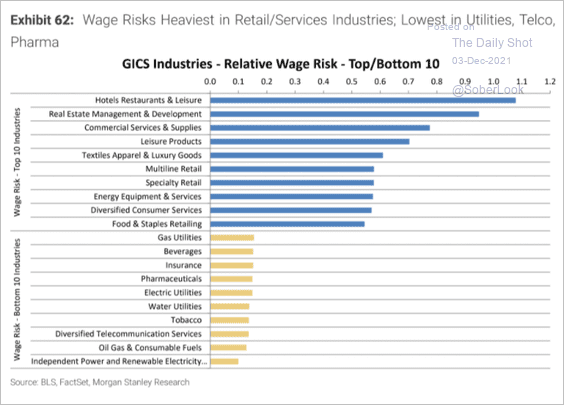

• Which sectors face margin pressures due to higher labor costs?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

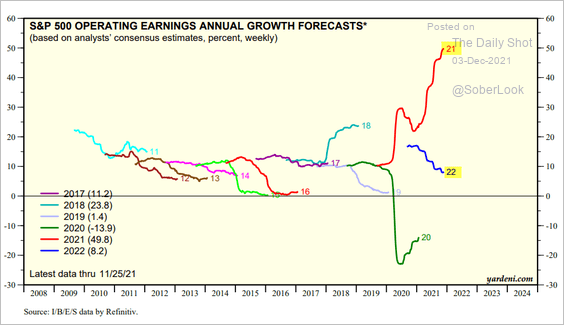

5. Earnings growth faces increasingly tougher comps next year.

Source: Yardeni Research

Source: Yardeni Research

6. Speculative growth stocks have been under pressure recently.

– Post-IPO portfolio:

Source: @LizAnnSonders

Source: @LizAnnSonders

• Non-profitable tech:

Source: @LizAnnSonders

Source: @LizAnnSonders

——————–

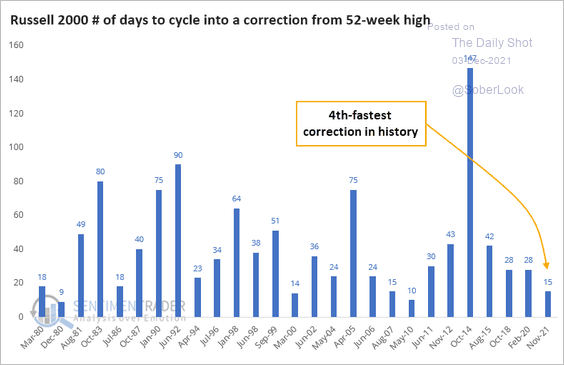

7. The Russell 2,000 Index had one of its fastest corrections in history this week.

Source: SentimenTrader

Source: SentimenTrader

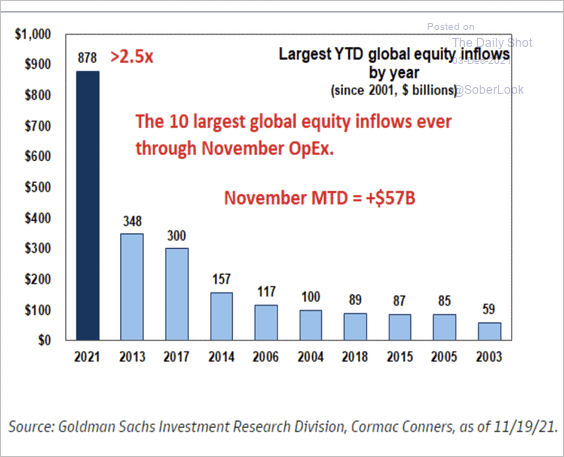

8. This has been a record year for inflows into the equity market.

Source: Goldman Sachs

Source: Goldman Sachs

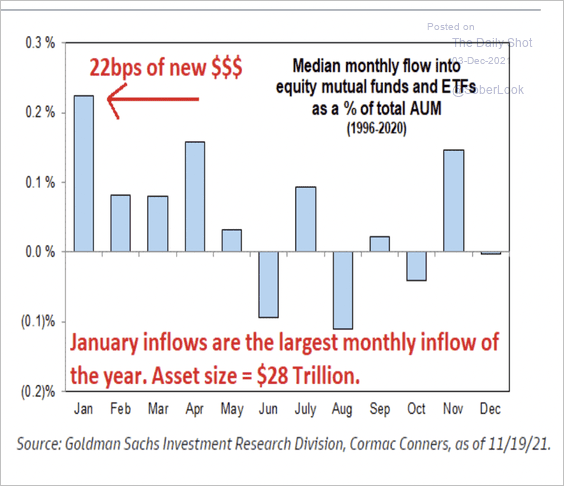

January tends to see the greatest amount of equity inflows.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Rates

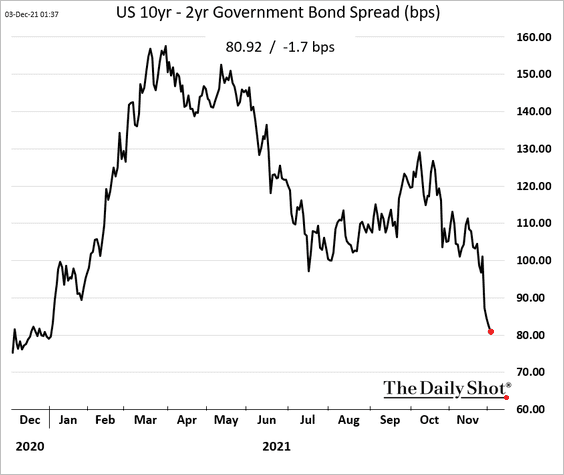

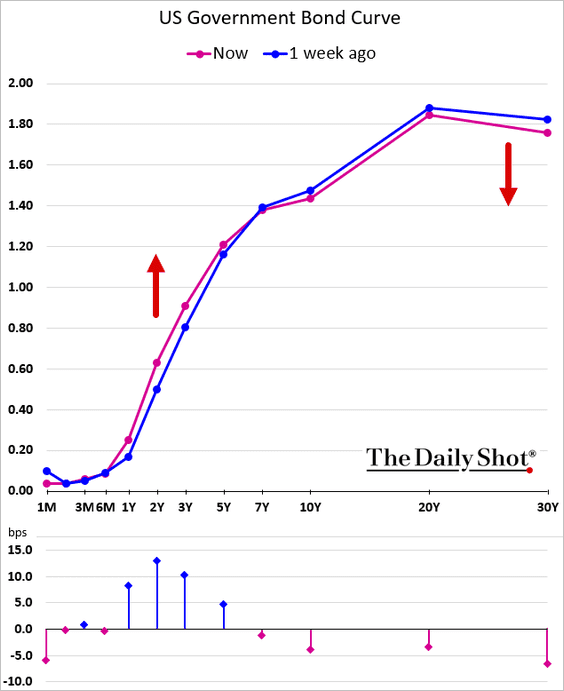

1. The Treasury curve continues to flatten.

——————–

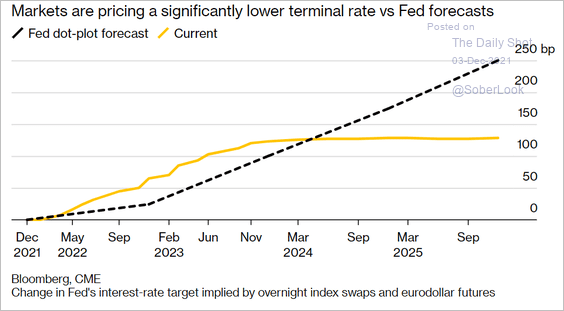

2. The market expects the Fed to end its rate hiking cycle in late 2023.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

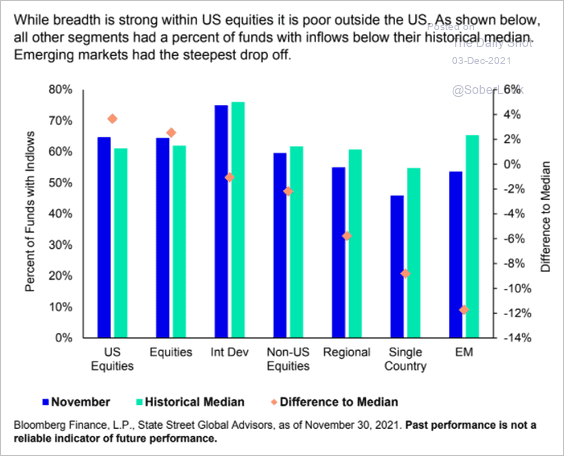

1. Let’s start with the percentage of funds that saw inflows, by asset class.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

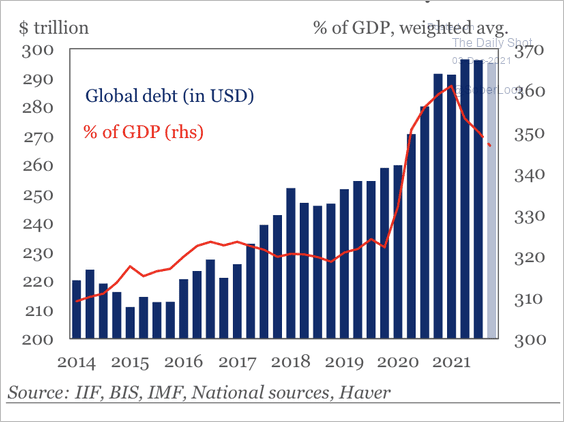

2. Global debt is starting to decline as the economic recovery takes hold.

Source: IIF

Source: IIF

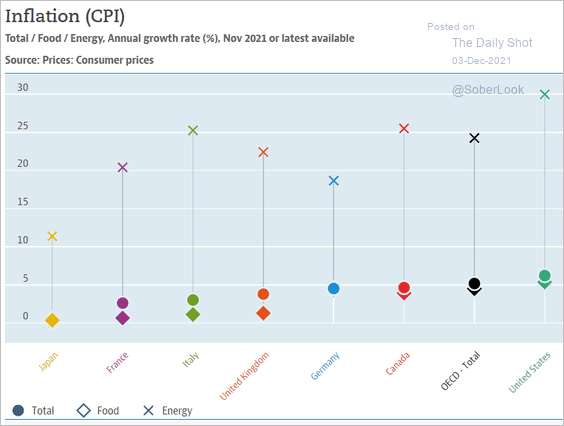

3. Energy inflation surged across OECD economies:

Source: OECD

Source: OECD

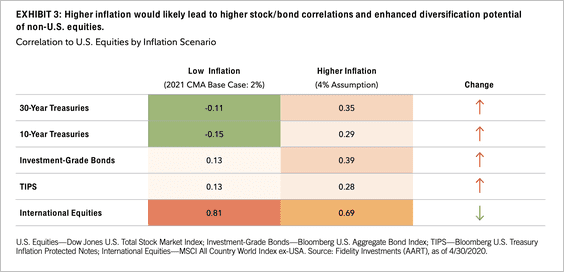

4. Here is a look at Fidelity’s capital market assumptions in a low/high inflation scenario.

Source: Fidelity Investments Read full article

Source: Fidelity Investments Read full article

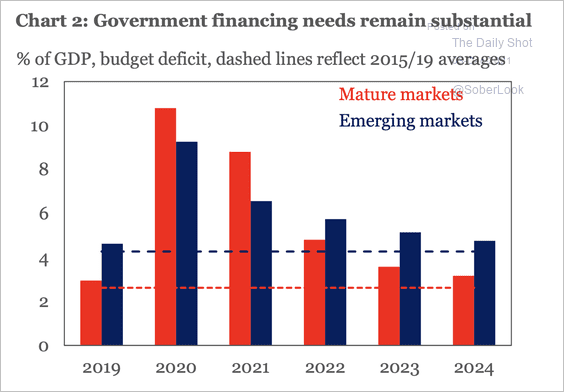

5. Financing needs by governments remain a vulnerability around the world.

Source: IIF

Source: IIF

——————–

Food for Thought

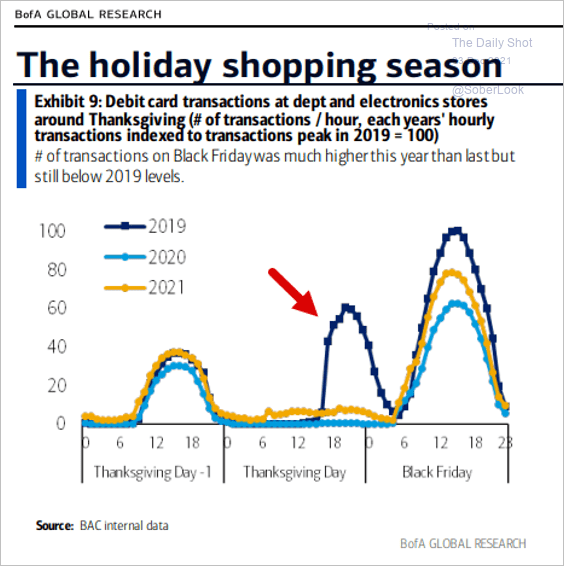

1. No more shopping on Thanksgiving day?

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

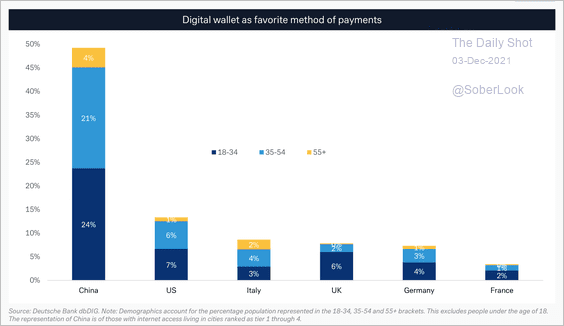

2. Digital payments penetration:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

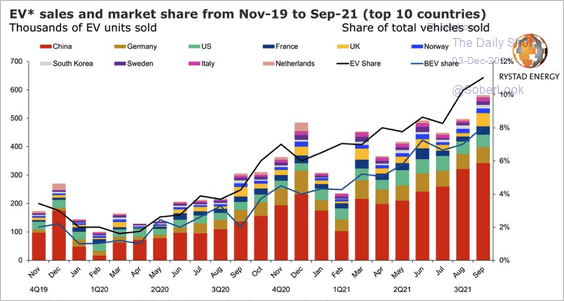

3. EV sales hit 10% of total vehicles sold.

Source: @aeberman12 Read full article

Source: @aeberman12 Read full article

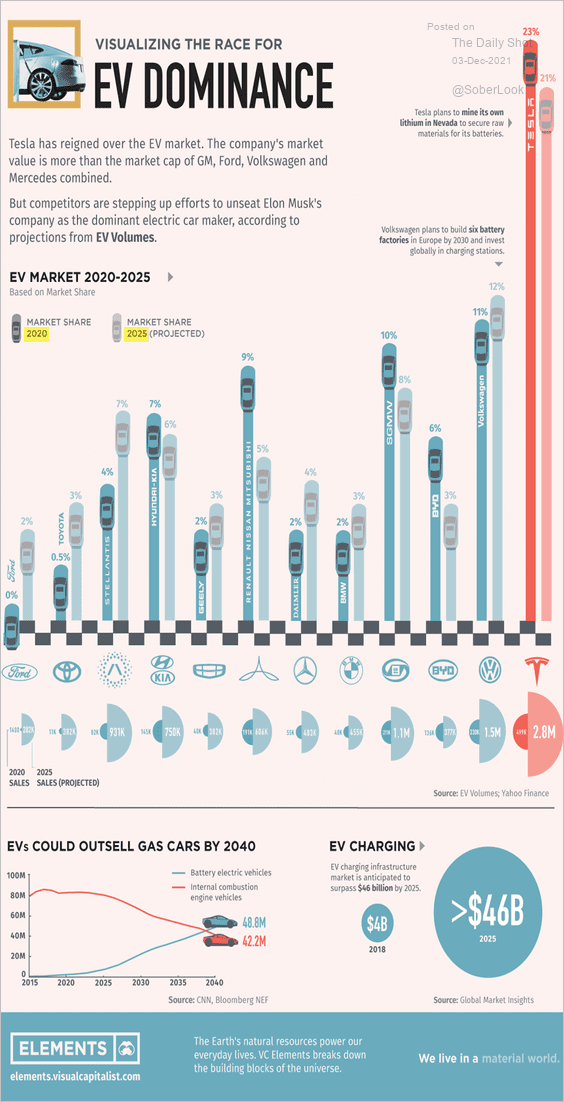

The EV market:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

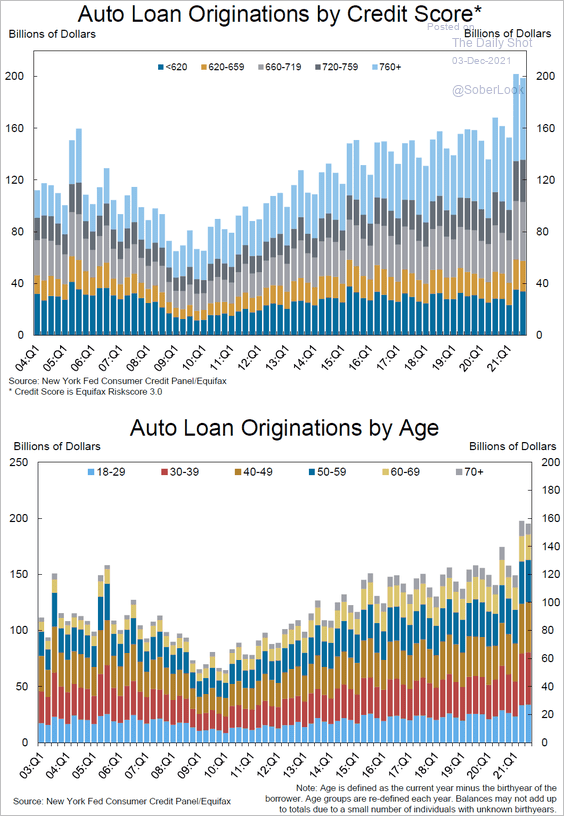

4. Auto loan originations in the US:

Source: NY Fed

Source: NY Fed

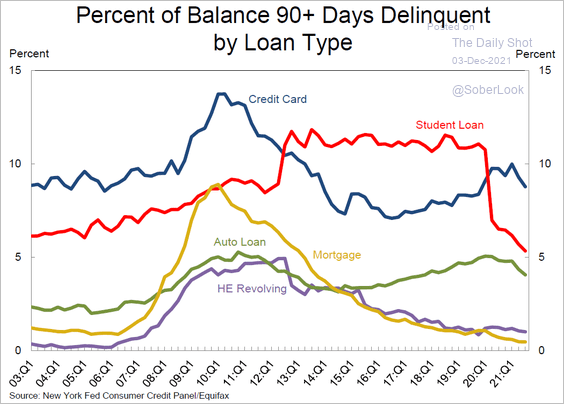

5. Delinquent household loans in the US:

Source: NY Fed

Source: NY Fed

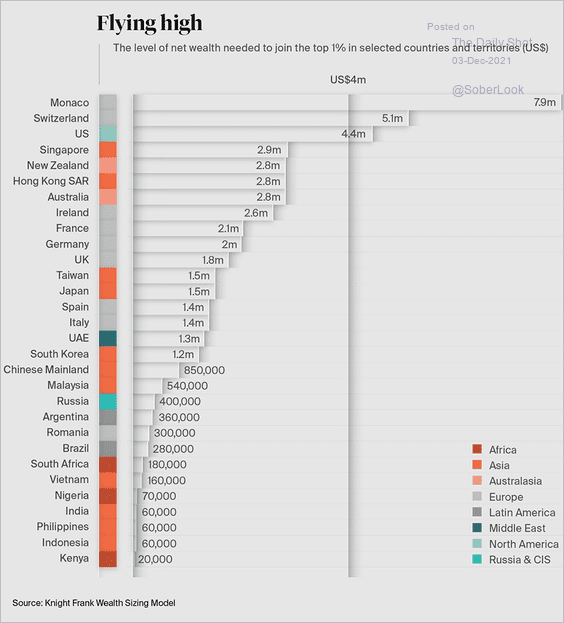

6. Joining the top 1%:

Source: Knight Frank Read full article

Source: Knight Frank Read full article

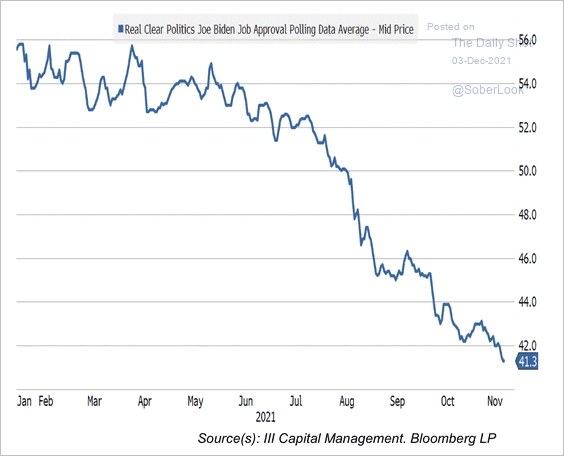

7. President Biden’s approval rating:

Source: III Capital Management

Source: III Capital Management

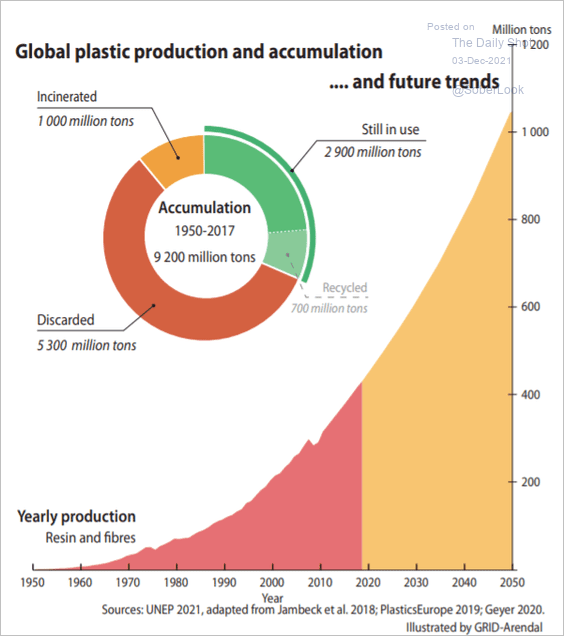

8. Production and accumulation of plastics:

Source: UN Read full article

Source: UN Read full article

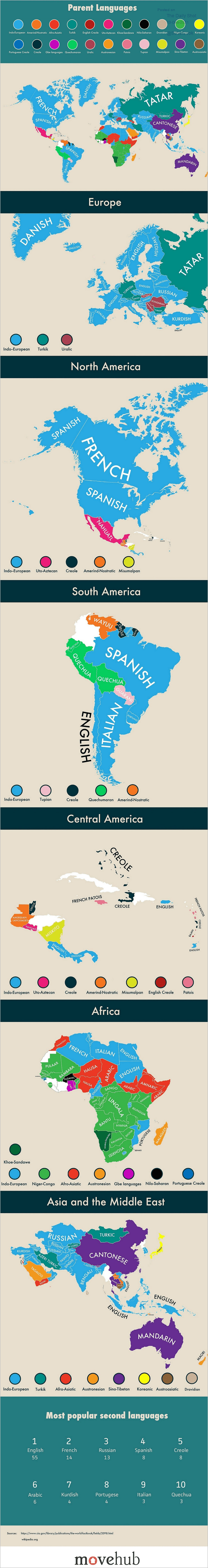

9. Second languages:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Have a great weekend!

Back to Index