The Daily Shot: 09-Dec-21

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

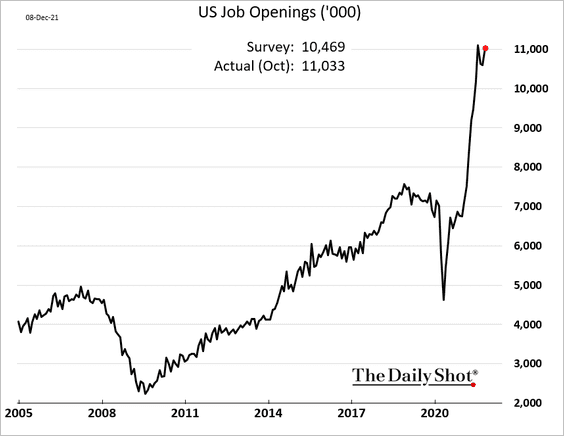

1. The October job openings report topped forecasts, pointing to persistently tight labor markets.

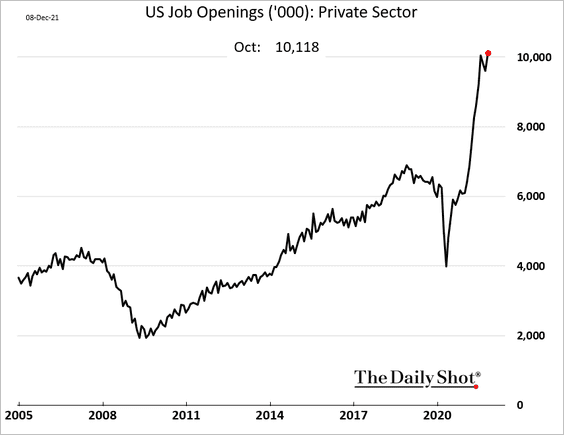

• Private-sector job openings hit a record high.

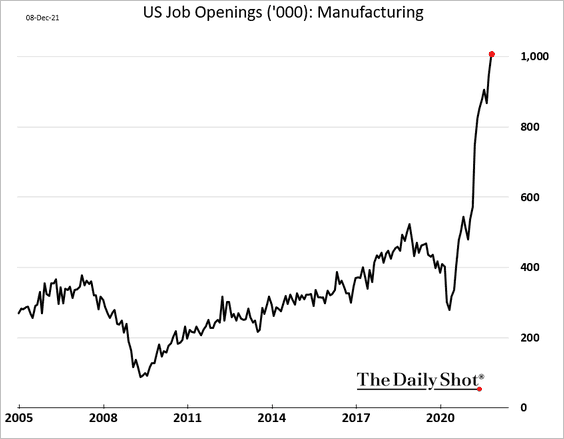

• Job vacancies in manufacturing are surging.

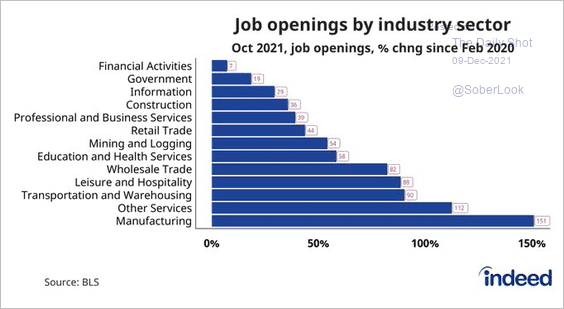

• Below are the changes by sector.

Source: @nick_bunker

Source: @nick_bunker

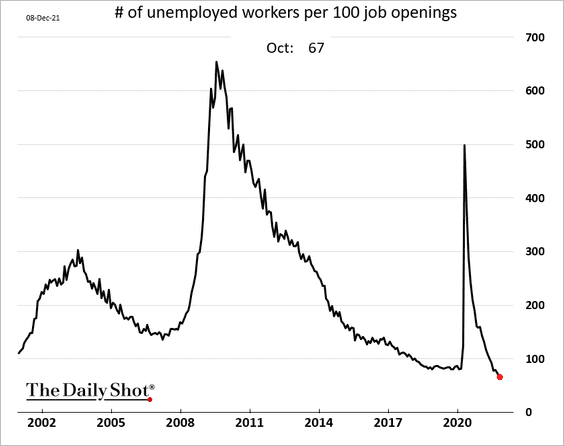

• The number of unemployed workers per job opening hit a record low.

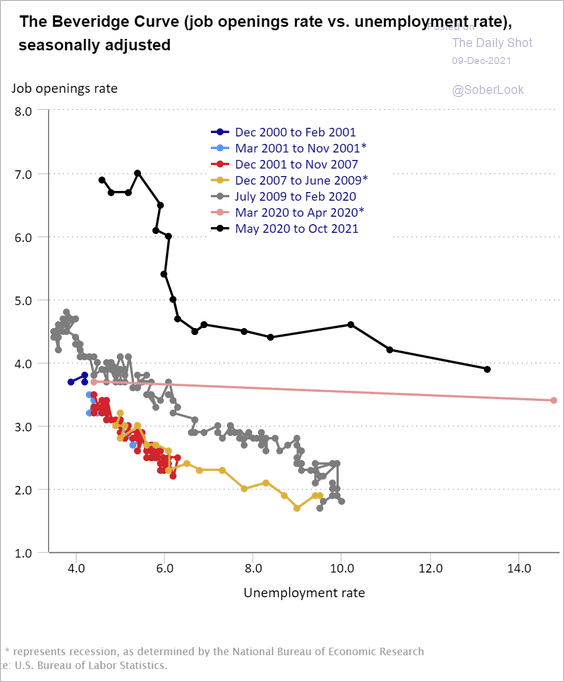

• Here is the Beveridge curve.

Source: BLS

Source: BLS

——————–

2. Next, we have a couple of additional updates on the labor market.

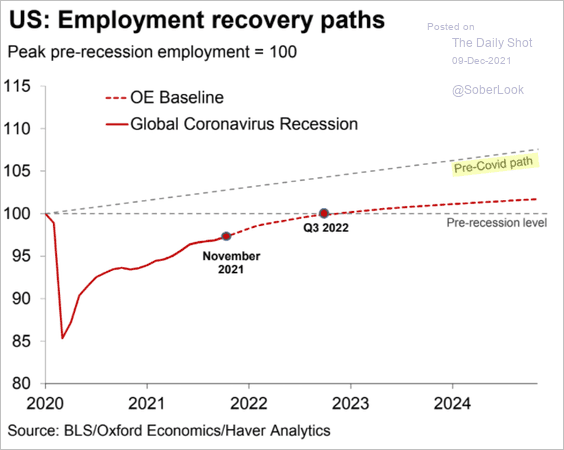

• Returning to the pre-COVID employment growth path will be challenging. Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

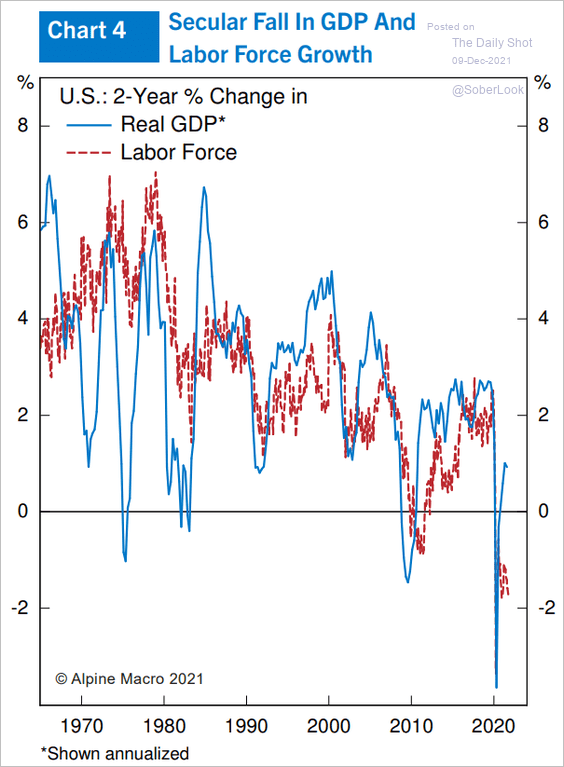

• Stalled labor force growth will cap US economic expansion.

Source: Alpine Macro

Source: Alpine Macro

——————–

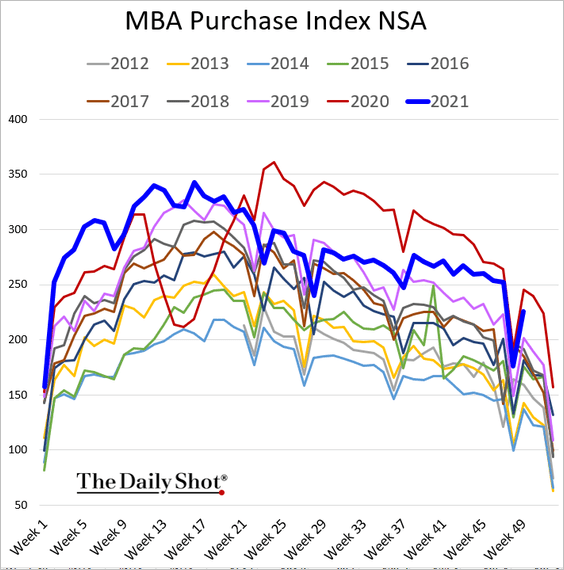

3. Loan applications to purchase a home remained strong after the Thanksgiving-week lull.

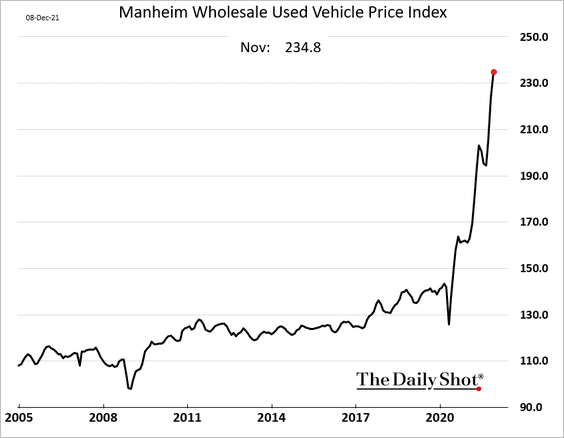

4. Wholesale used car prices climbed another 5% in November.

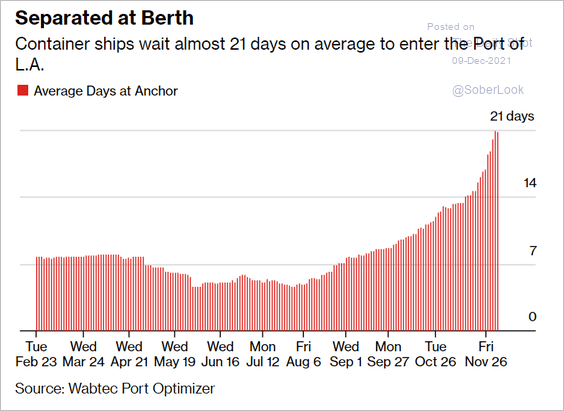

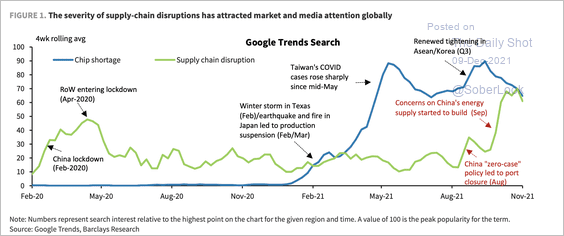

5. Next, we have some updates on supply-chain challenges.

• Port of LA container ships’ waiting time:

Source: @business Read full article

Source: @business Read full article

• Searches for items related to supply chain disruptions on Google:

Source: Barclays Research

Source: Barclays Research

• Lead times to deliver semiconductors:

![]() Source: Bloomberg Read full article

Source: Bloomberg Read full article

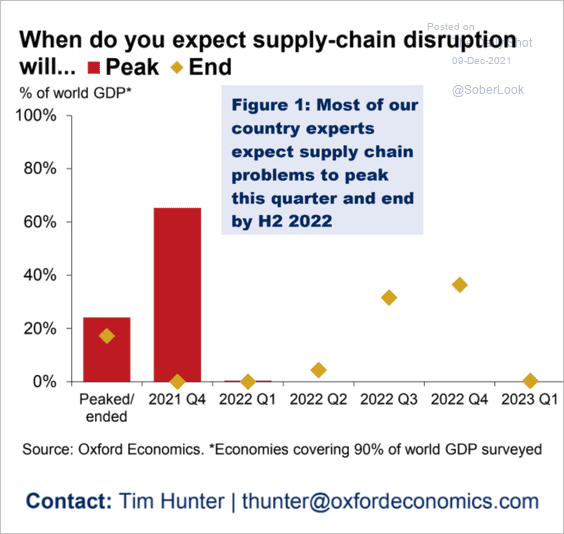

• When do economists see supply-chain disruptions easing?

Source: Oxford Economics

Source: Oxford Economics

——————–

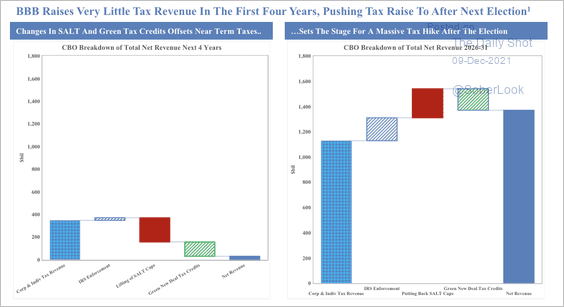

6. The Build Back Better (BBB) plan could push tax hikes off until after the 2024 election.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

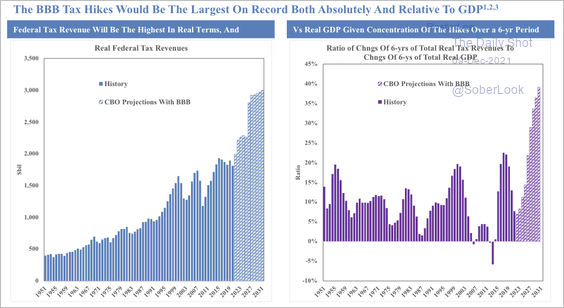

Still, BBB tax hikes could be the largest in both absolute terms and relative to GDP.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

——————–

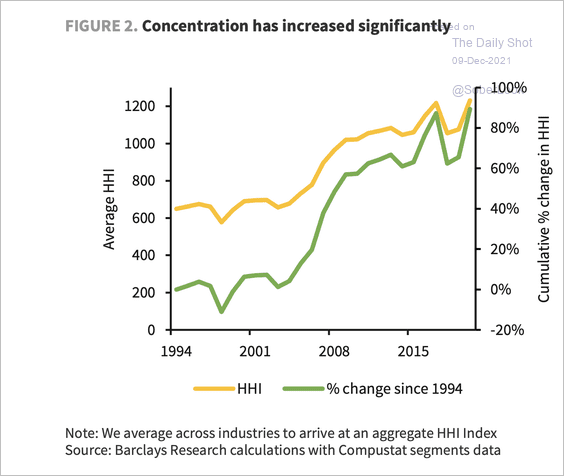

7. US industries have become much more concentrated in recent decades. The average Herfindahl-Hirschmann Index (HHI) has risen 90% since the start of the 2000s.

Source: Barclays Research

Source: Barclays Research

Back to Index

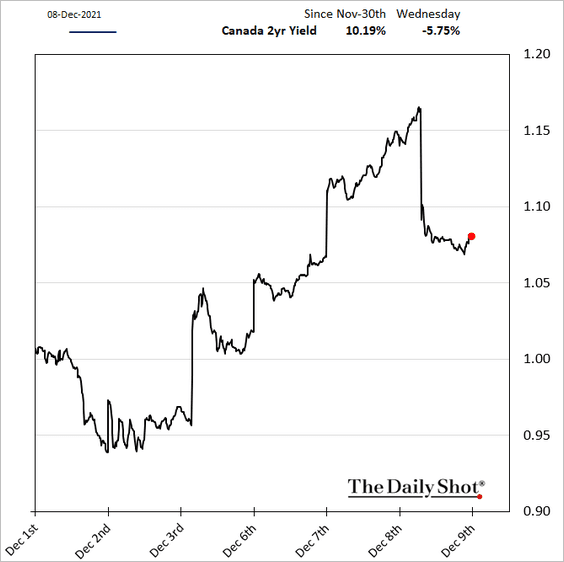

Canada

As expected, the BoC left rates unchanged. But the tone seemed a bit more dovish.

Source: Reuters Read full article

Source: Reuters Read full article

Bond yields declined.

Back to Index

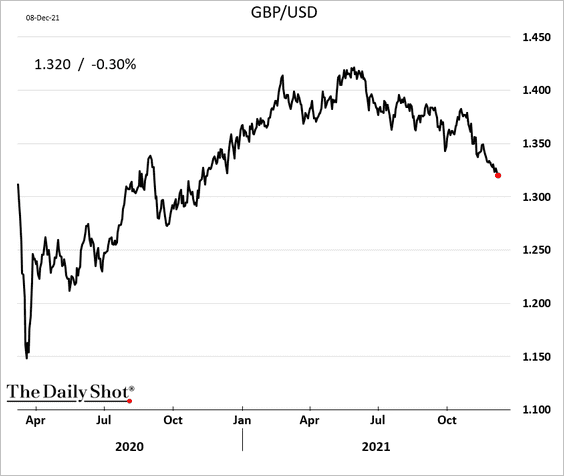

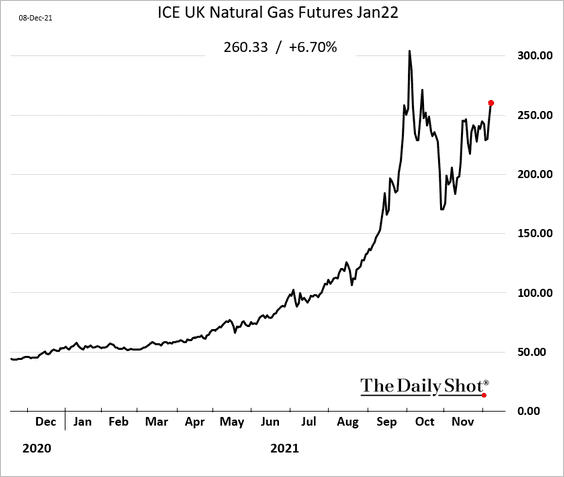

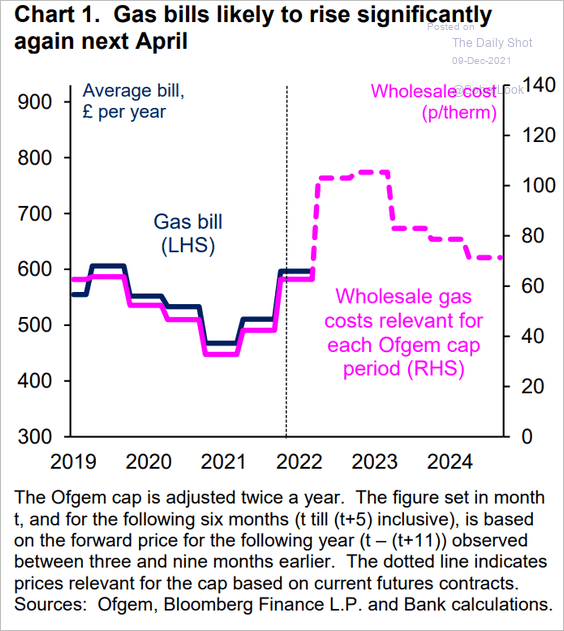

The United Kingdom

1. The pound continues to drift lower vs. USD.

2. Natural gas prices are surging again.

This is going to feed into much higher prices at the consumer level.

Source: BoE Read full article

Source: BoE Read full article

——————–

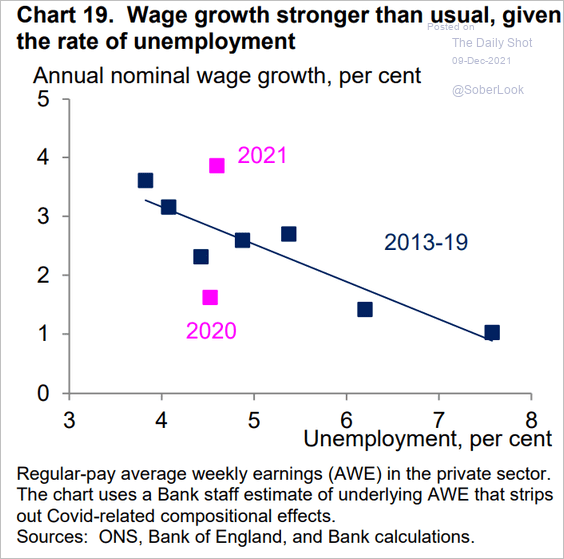

3. Wage growth is elevated relative to the current unemployment rate.

Source: BoE Read full article

Source: BoE Read full article

Back to Index

Europe

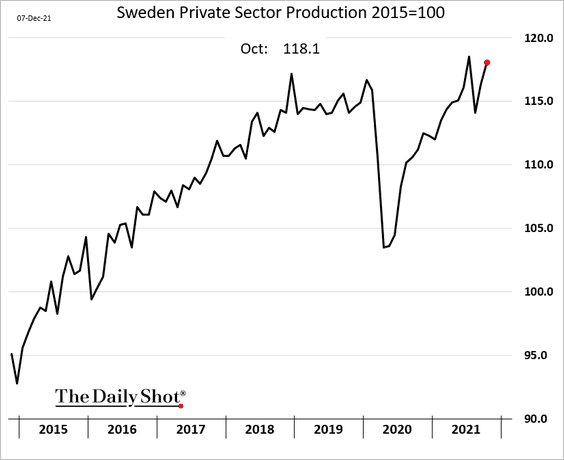

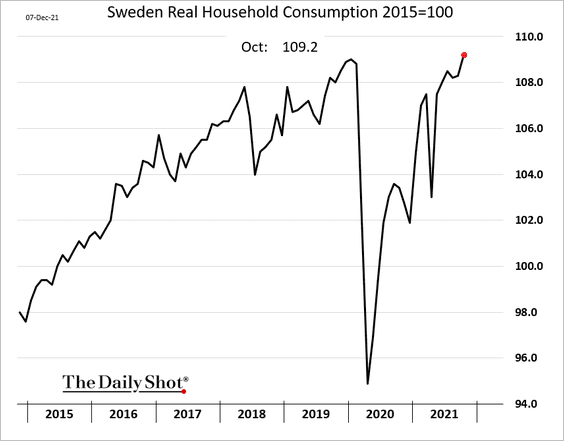

1. Sweden’s economic growth remains robust.

• Private sector output:

• Consumer spending:

——————–

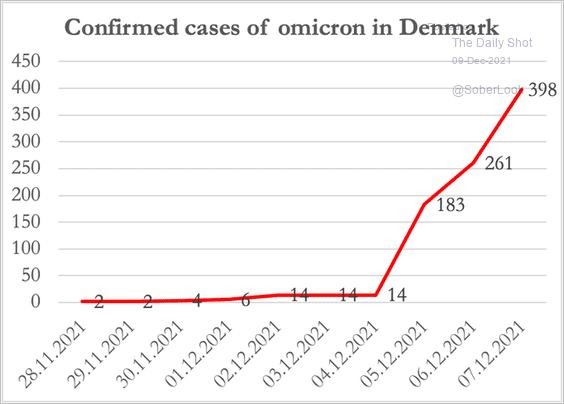

2. Denmark’s omicron cases are surging. Why Denmark? Because the country has a highly effective program of sequencing infections to identify variants. This trend is probably taking place in your country as well.

Source: @M_B_Petersen

Source: @M_B_Petersen

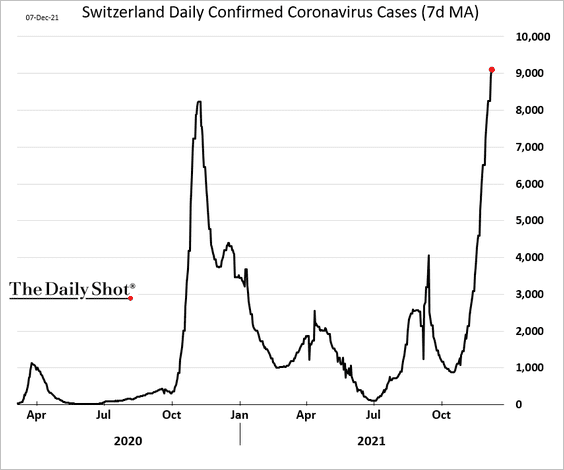

3. Swiss COVID cases hit a record high.

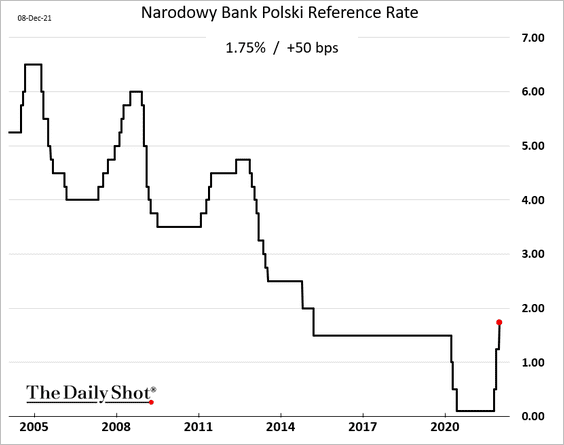

4. Poland’s central bank hiked rates again as inflation surges.

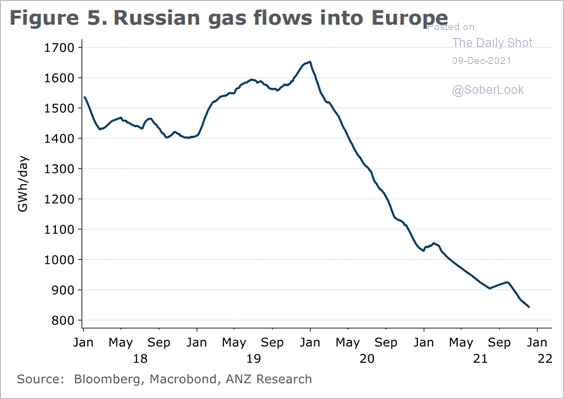

5. Russian gas flows to Europe remain weak, …

Source: ANZ Research

Source: ANZ Research

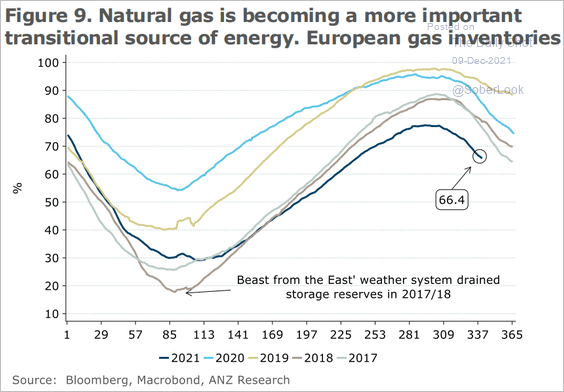

… depressing inventories …

Source: ANZ Research

Source: ANZ Research

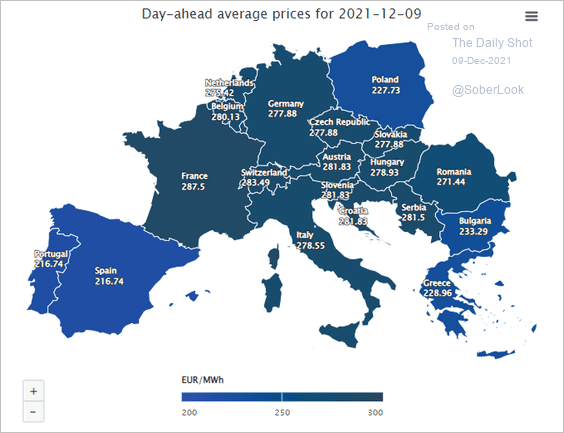

… and boosting electricity prices.

Source: @MikeZaccardi

Source: @MikeZaccardi

——————–

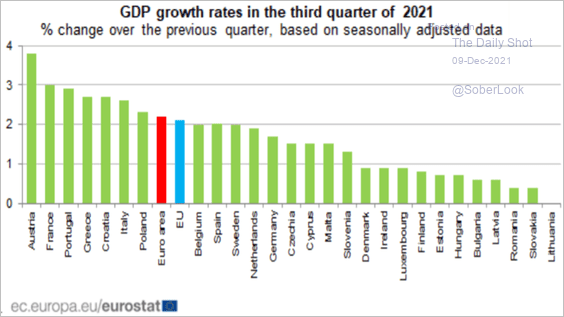

6. This chart shows Q3 GDP growth by country across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

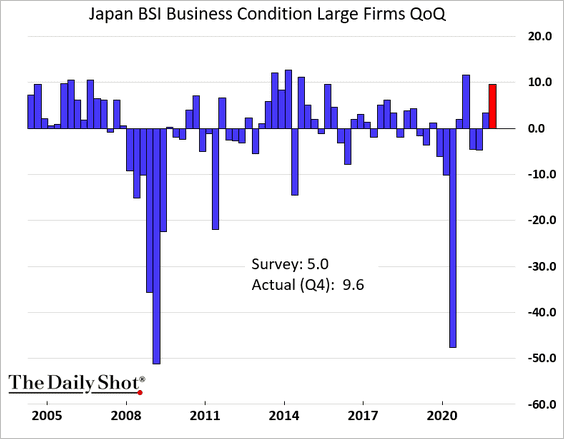

1. Business conditions in Japan improved this quarter.

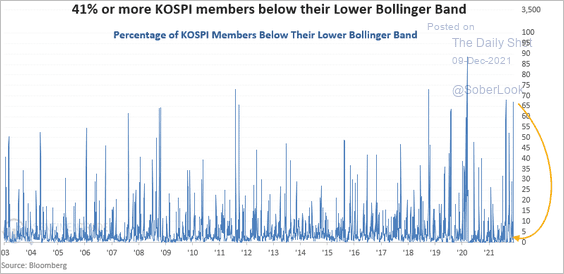

2. The percentage of stocks in South Korea’s KOSPI index trading below their lower Bollinger Band increased to the seventh-highest level in history, which typically precedes a price bounce.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

China

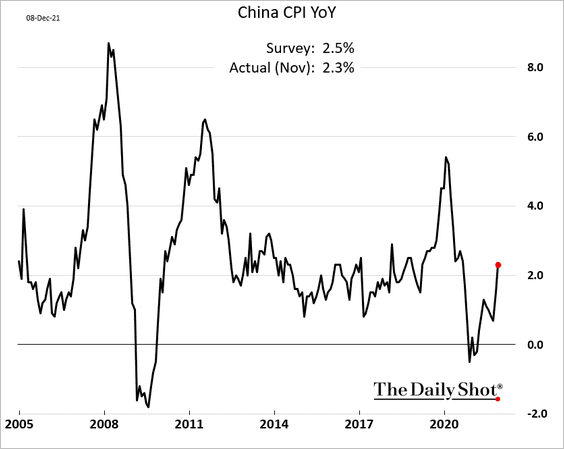

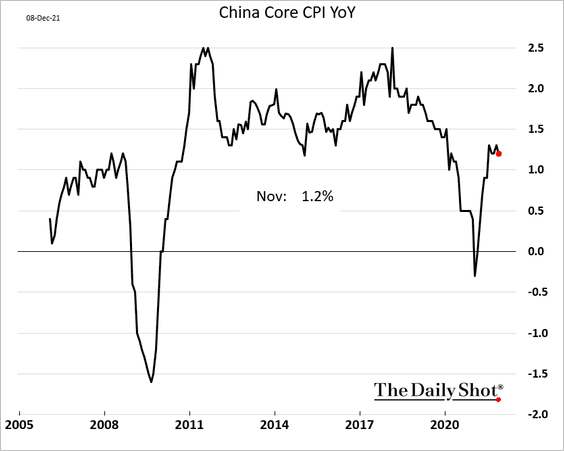

1. The November CPI report was softer than expected.

• The core CPI declined, …

… pulled lower by phone prices.

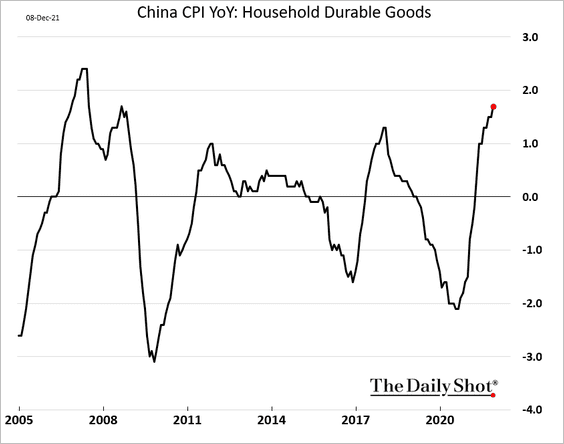

• Household durables inflation continues to climb.

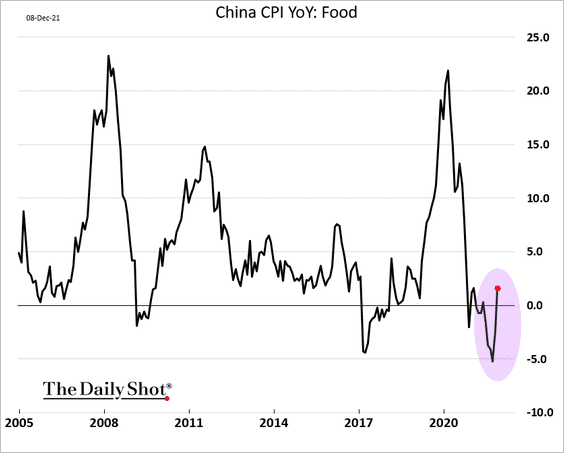

• Food inflation is in positive territory as pork prices stabilize.

——————–

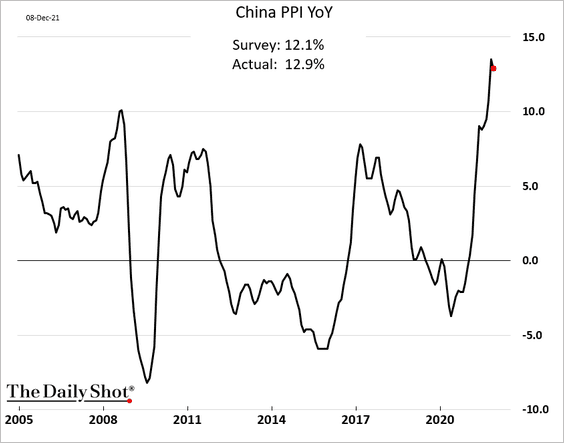

2. The PPI was off the highs but above forecasts.

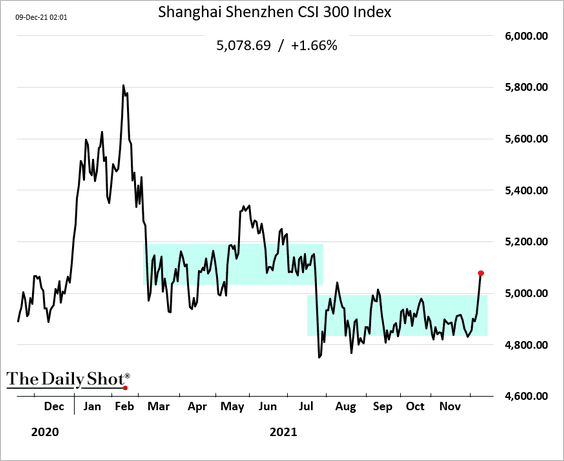

3. Shares broke out of their trading range.

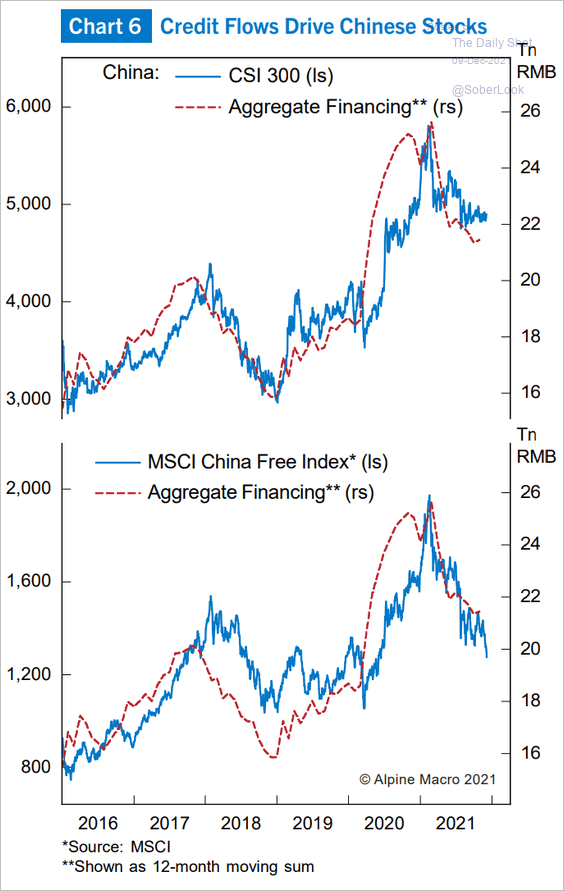

China’s stocks are tied to credit flows.

Source: Alpine Macro

Source: Alpine Macro

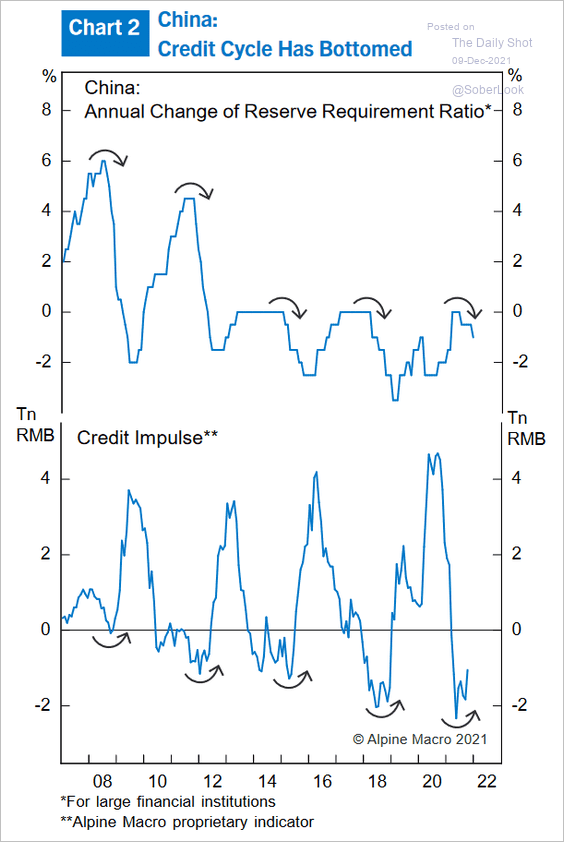

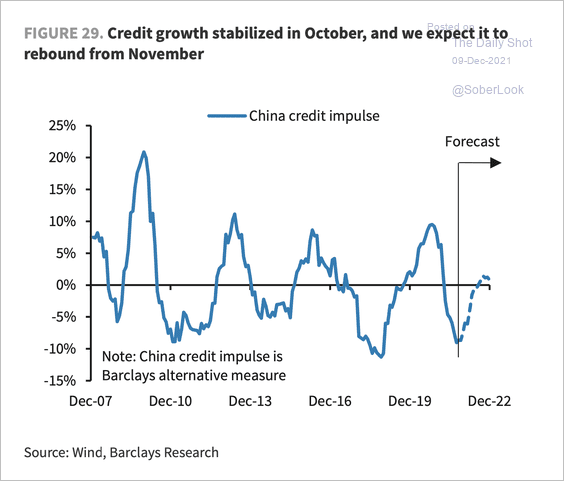

And as Beijing eases, the credit cycle bottoms (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Barclays Research

Source: Barclays Research

——————–

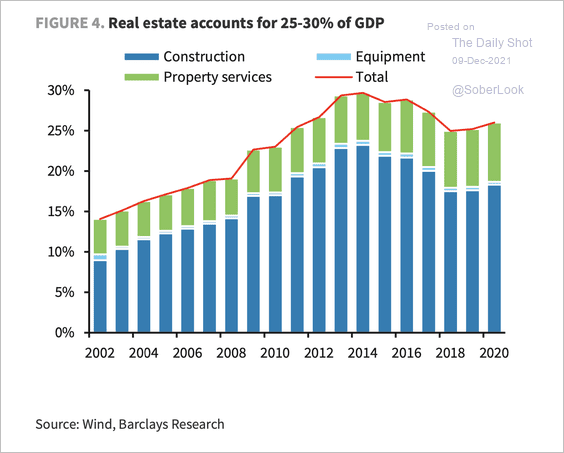

4. Real estate has been a huge part of the Chinese economy.

Source: Barclays Research

Source: Barclays Research

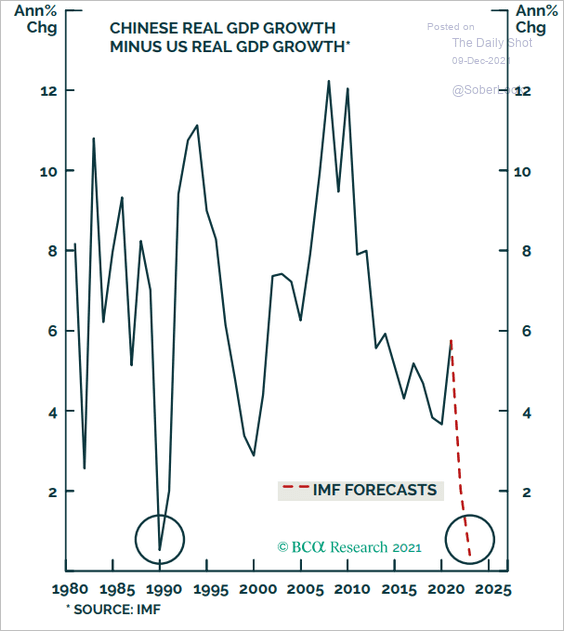

5. The GDP growth spread between China and the US is expected to narrow sharply.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

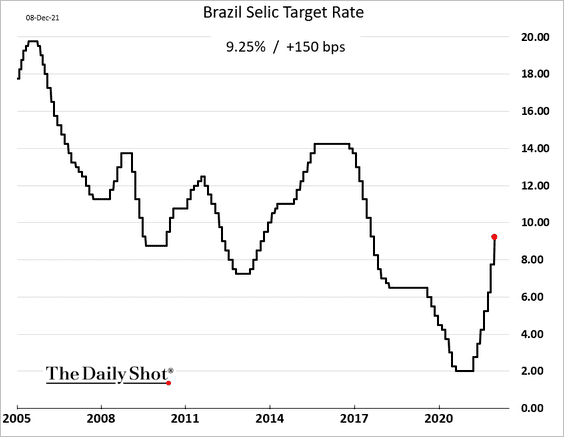

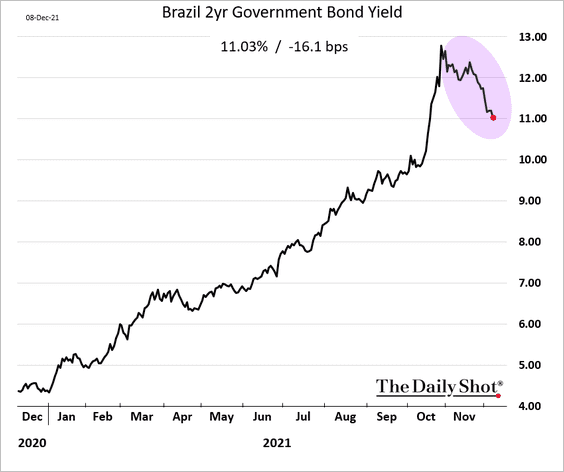

1. Brazil’s central bank announced another aggressive rate hike and indicated there is at least one more to come.

Source: Reuters Read full article

Source: Reuters Read full article

Beyond that point, the central bank might pause. Here is the two-year bond yield.

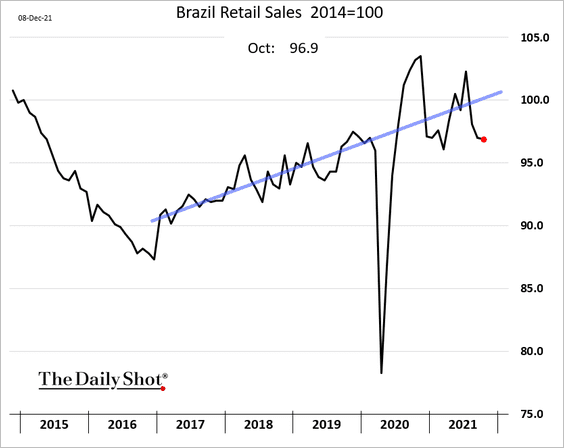

• Brazil’s retail sales remain below the pre-COVID trend.

——————–

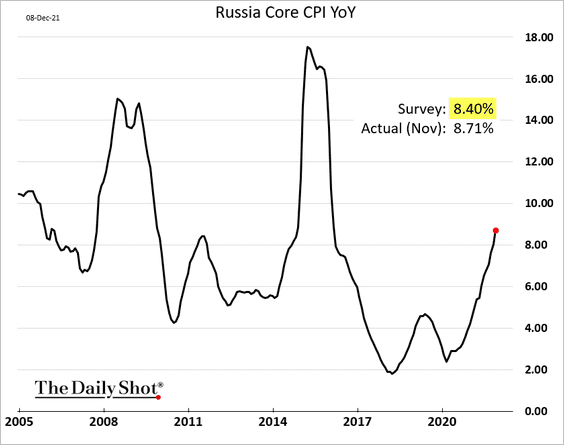

2. Russia’s CPI surprised to the upside.

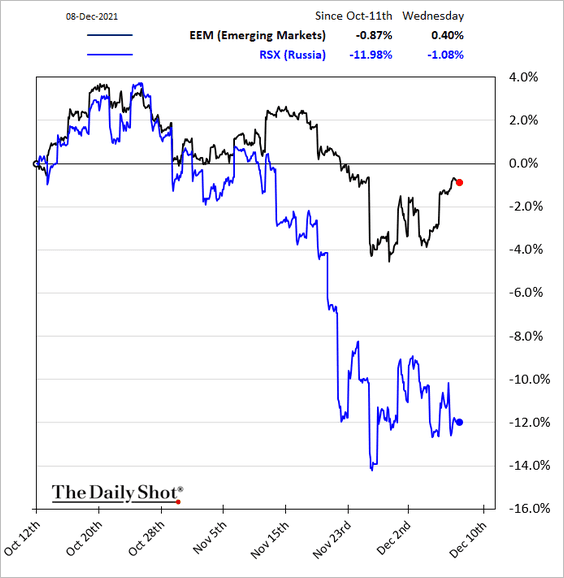

Russian stocks have been underperforming amid elevated geopolitical risk.

——————–

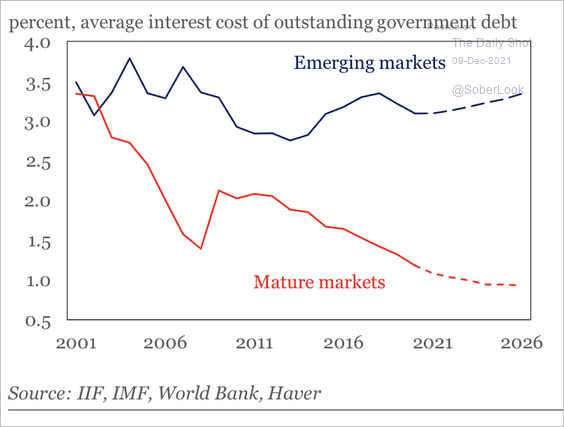

3. The interest burden on EM government debt is rising.

Source: IIF

Source: IIF

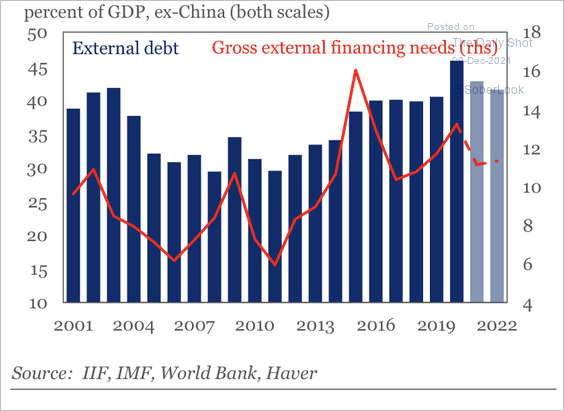

EM external financing needs are back near pre-pandemic levels.

Source: IIF

Source: IIF

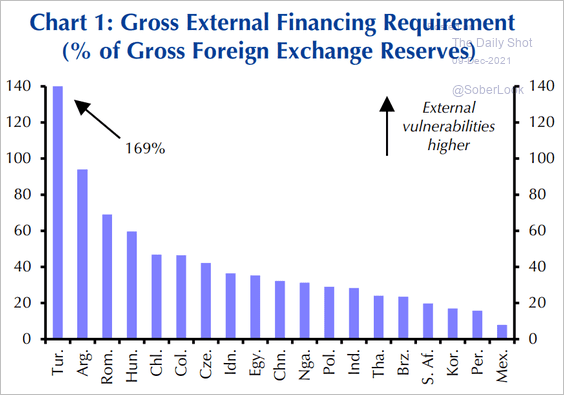

Here are the financing requirements by country.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

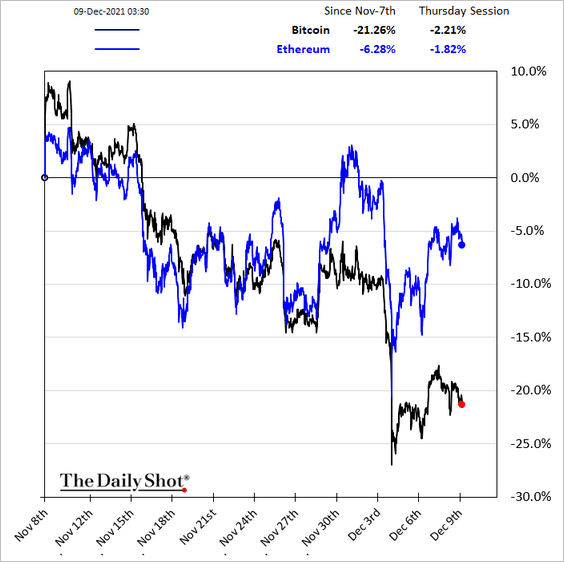

1. Ether has widened its outperformance over bitcoin.

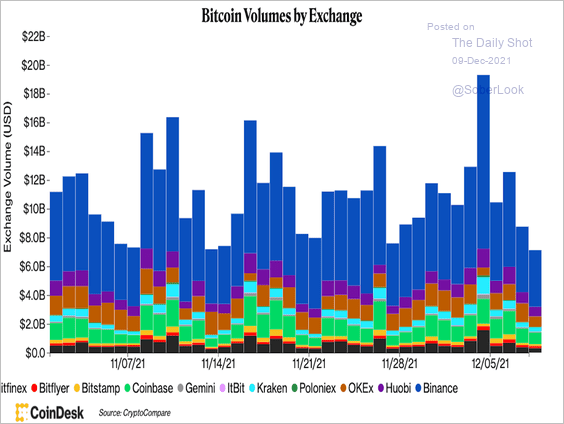

2. Bitcoin’s trading volume continued to decline over the past few days.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

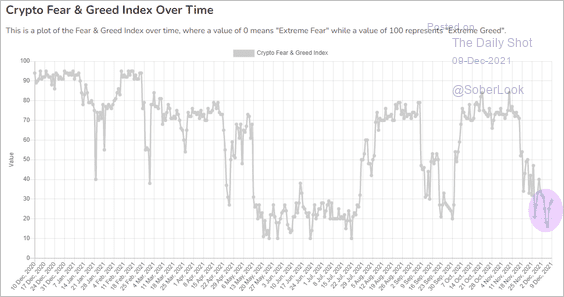

Risk appetite for bitcoin remains depressed.

Source: Alternative.me

Source: Alternative.me

——————–

3. Several crypto CEOs testified during a U.S. House Financial Services Committee hearing on Wednesday. Regulation is clear, but enforcement is not.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

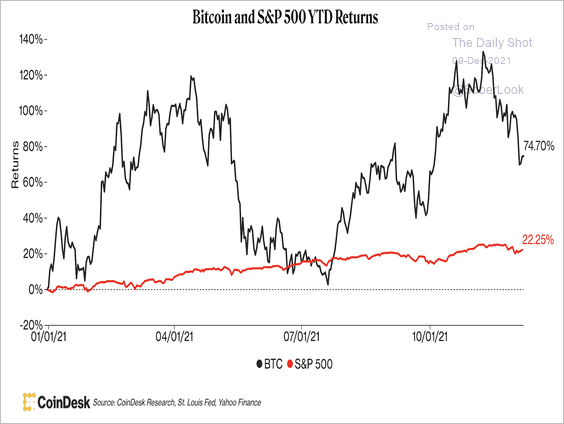

4. Bitcoin’s year-to-date return has narrowed relative to the S&P 500 over the past month.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

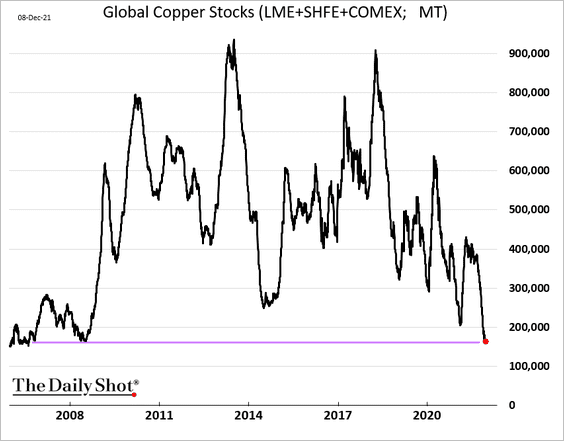

1. Copper inventories hit the lowest level since 2006.

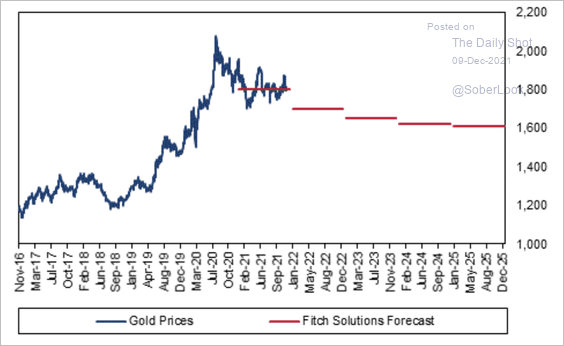

2. Fitch Solutions expects lower gold prices next year as the dollar strengthens and bond yields start to recover.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

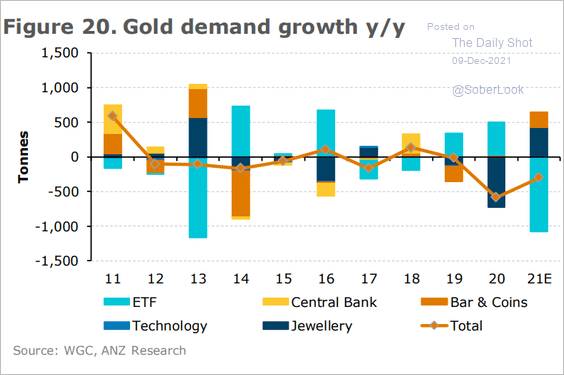

Here are the drivers of gold demand growth.

Source: ANZ Research

Source: ANZ Research

——————–

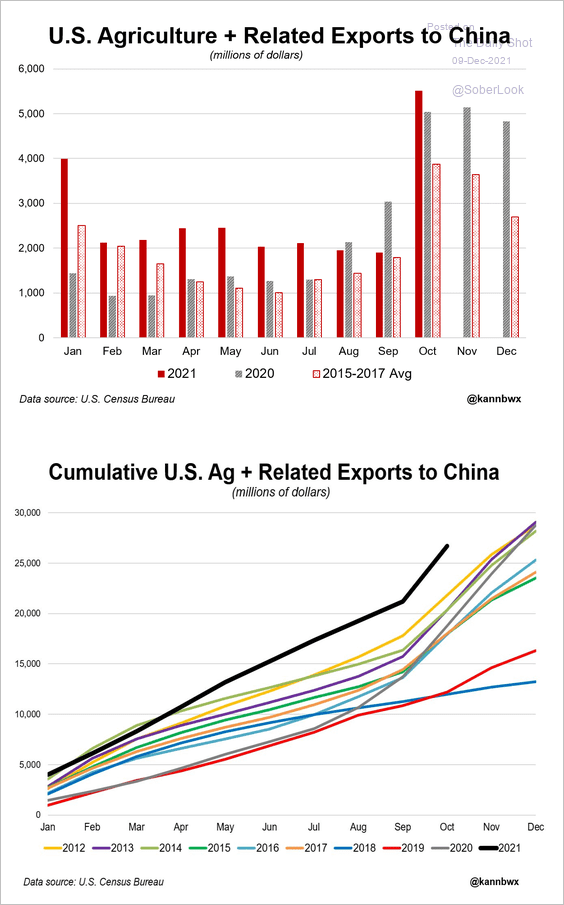

3. US agricultural exports to China are running well ahead of 2020.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

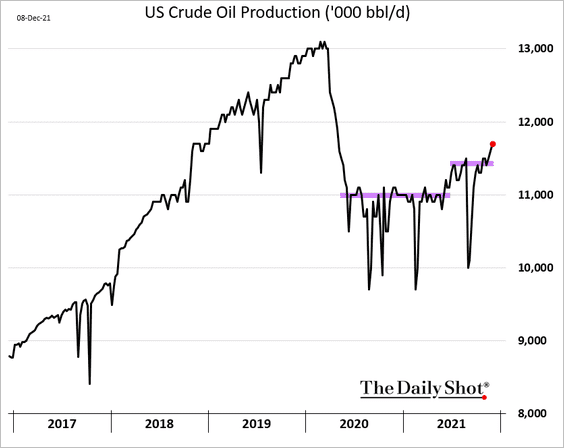

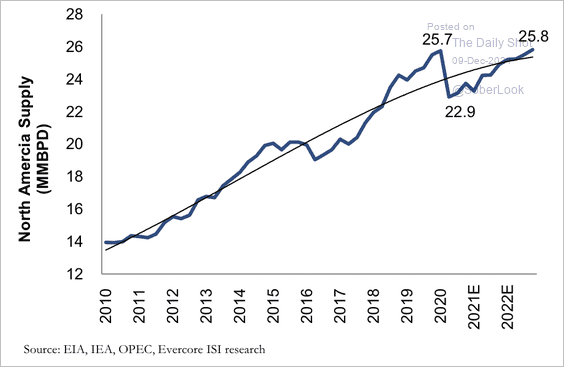

1. US crude oil production is breaking out.

North American oil supply should reach previous highs by the end of next year.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

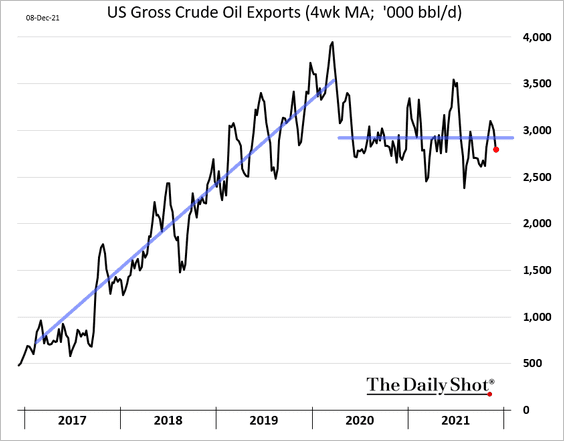

2. US gross crude oil exports have been flat since the start of the pandemic.

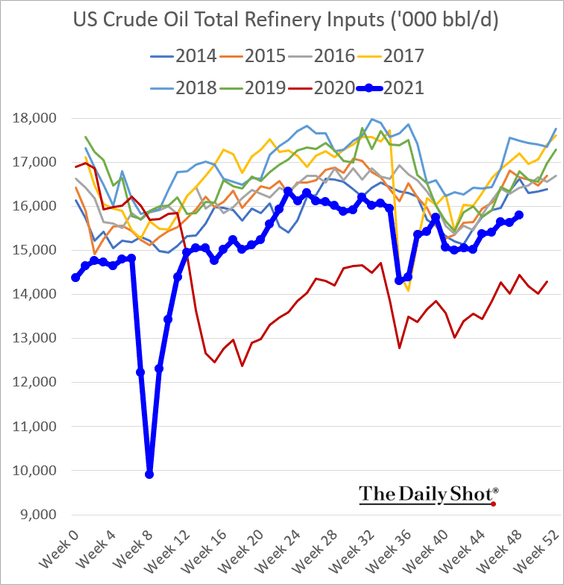

3. US refinery runs remain soft.

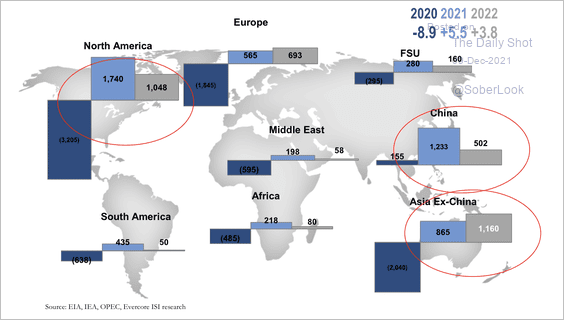

4. This map shows the recovery in global oil demand by region.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Equities

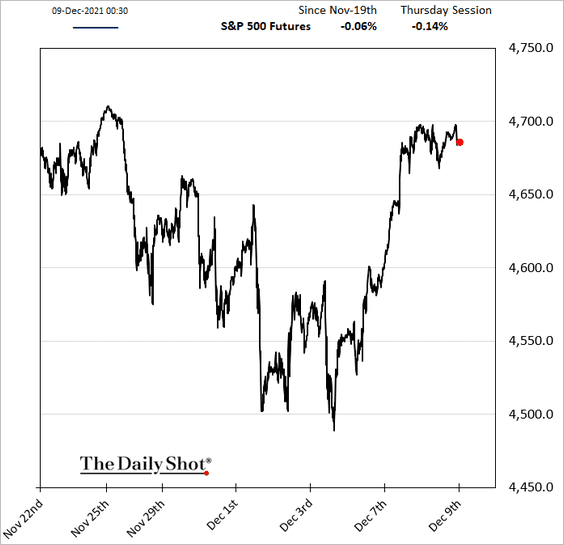

1. The omicron/Fed scare didn’t last very long.

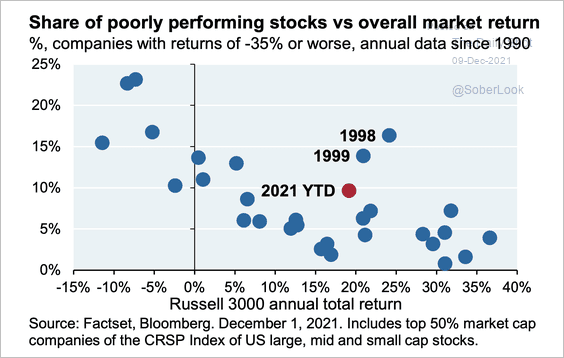

2. In a year with such high index returns, a substantial percentage of stocks dropped more than 35%.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

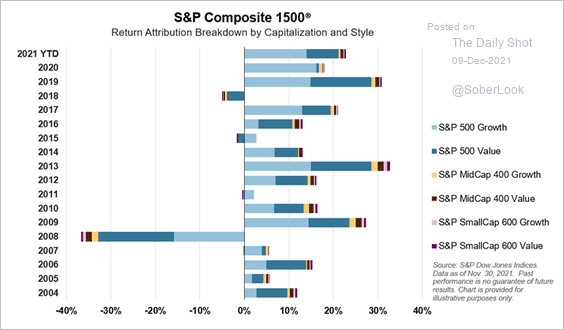

3. Next, we have equity factor return attribution by year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

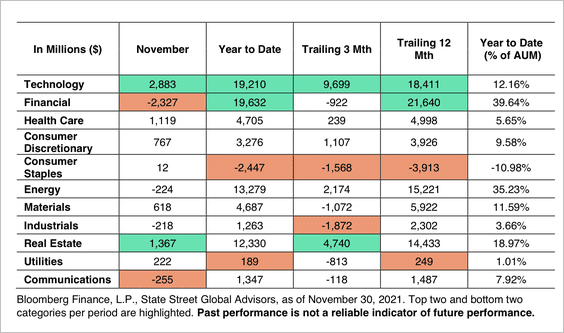

4. Investors rotated out of financials and into tech and real estate ETFs last month.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

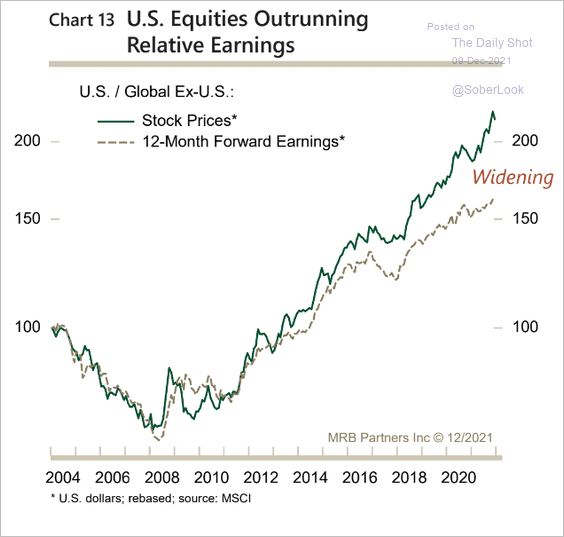

5. This chart shows US share price outperformance relative to the rest of the world vs. US earnings outperformance.

Source: MRB Partners

Source: MRB Partners

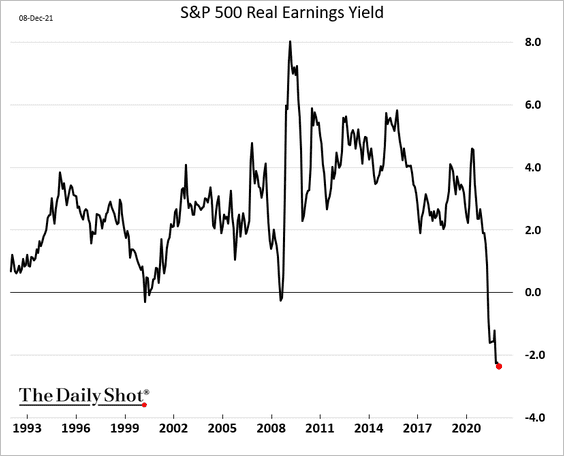

6. The S&P 500 real earnings yield hit a new low.

h/t @nchrysoloras

h/t @nchrysoloras

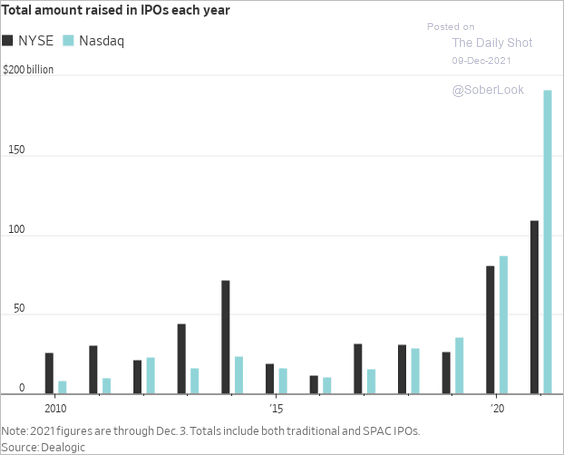

7. Nasdaq pulls ahead of NYSE in IPO volume.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

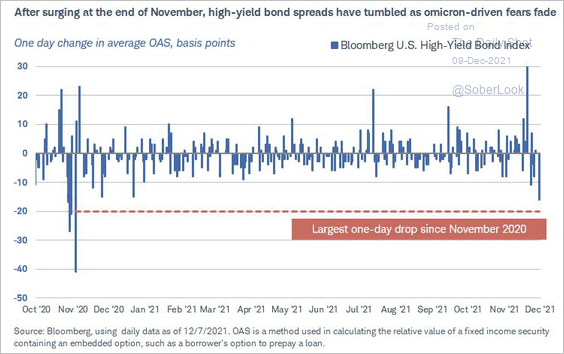

1. High-yield spreads tightened sharply as risk aversion faded.

Source: Kathy Jones, Charles Schwab

Source: Kathy Jones, Charles Schwab

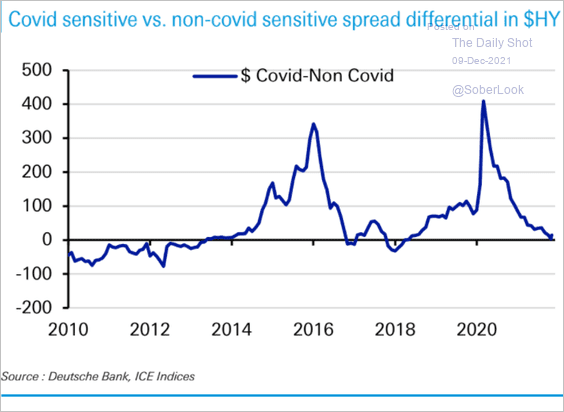

2. The spread between COVID-sensitive and non-sensitive HY bonds is back near zero.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

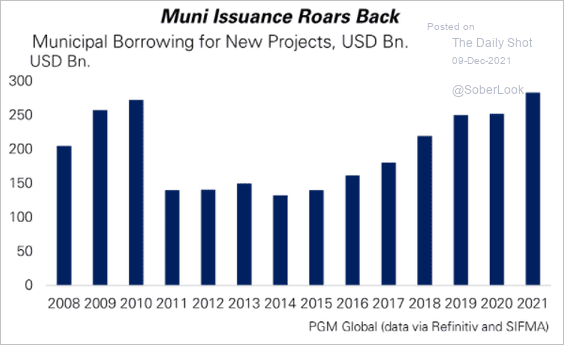

3. Muni issuance has been surging.

Source: PGM Global

Source: PGM Global

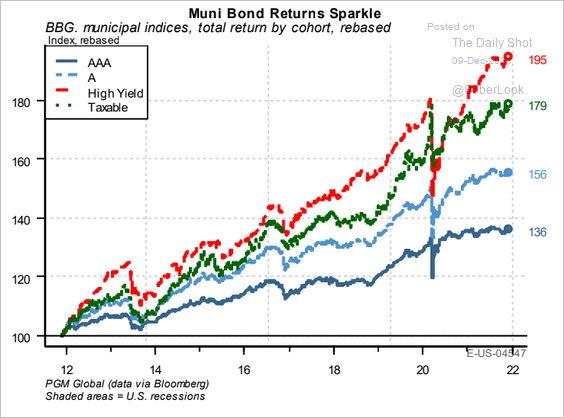

Returns remain healthy.

Source: PGM Global

Source: PGM Global

Back to Index

Global Developments

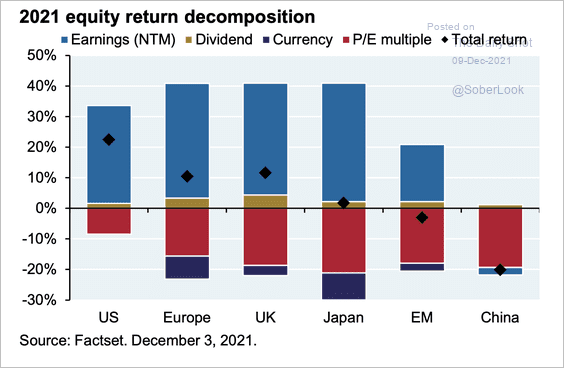

1. This chart shows 2021 equity return attribution for select markets.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

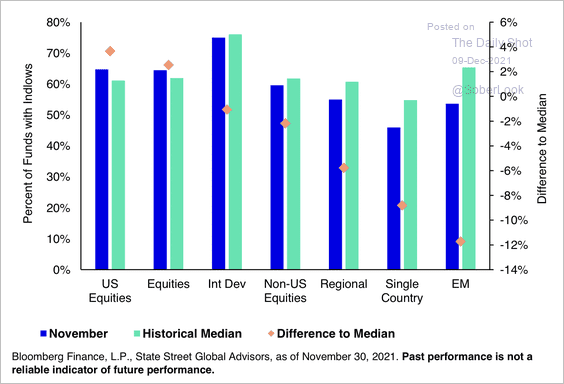

2. Outside of the US, most equity ETFs have seen recent inflows below their historical median. EM had the steepest drop-off.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

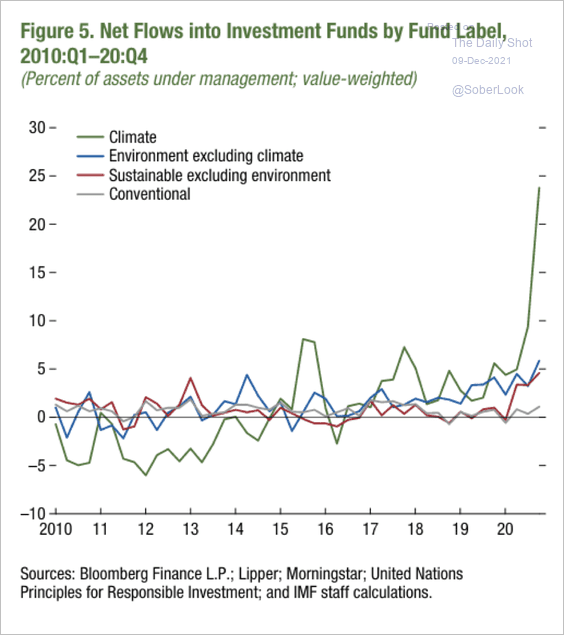

3. Climate funds have seen exceptional inflows compared to other ESG funds over the past year.

Source: IMF

Source: IMF

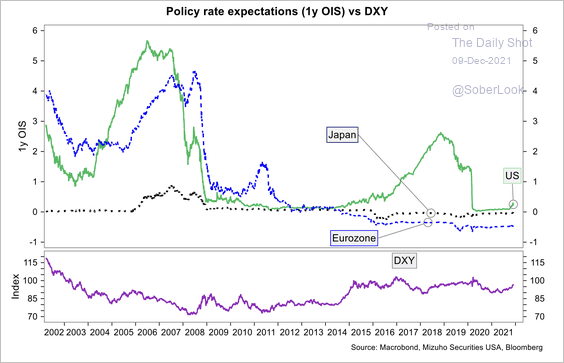

4. Expectations of higher policy rates in the US relative to other developed countries have supported the dollar.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

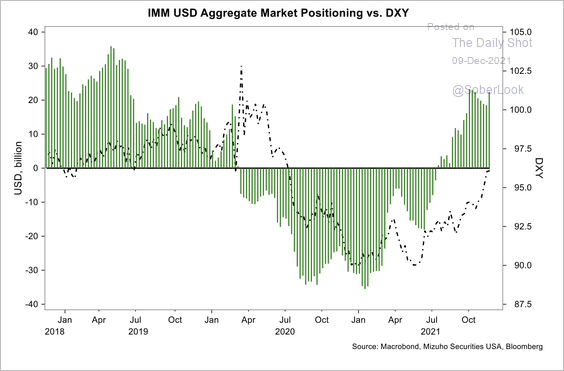

Long dollar positioning continues to rise.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

Food for Thought

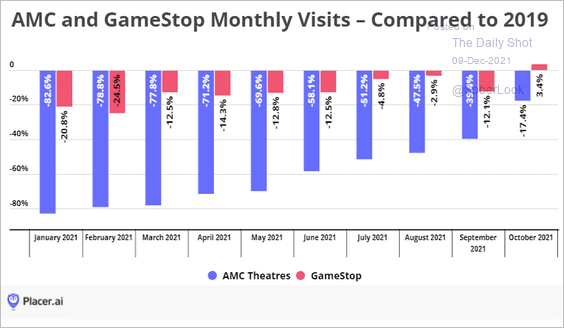

1. AMC and GameStop visits vs. 2019:

Source: Placer.ai

Source: Placer.ai

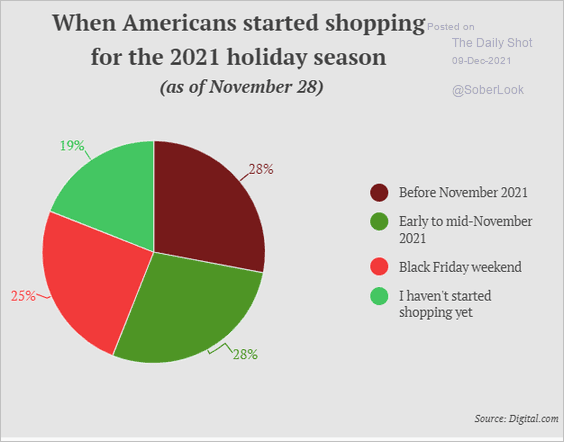

2. When Americans started shopping this year:

Source: Digital.com

Source: Digital.com

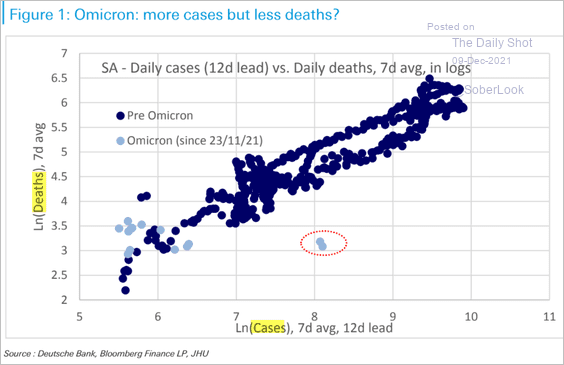

3. A data point on omicron from South Africa:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

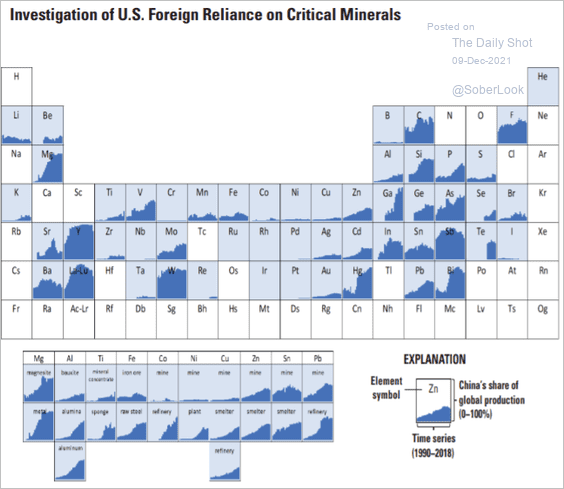

4. China’s share of global commodity production for the elements of the periodic table:

Source: U.S. Department of the Interior

Source: U.S. Department of the Interior

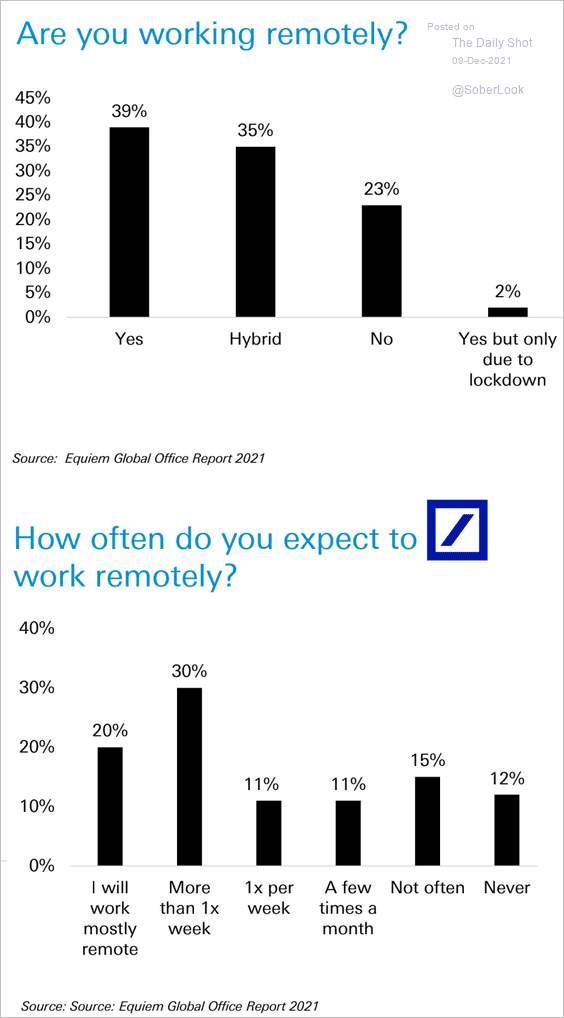

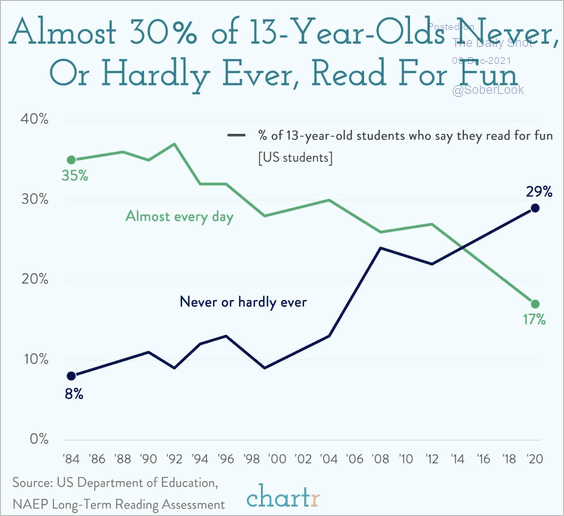

5. Working remotely:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

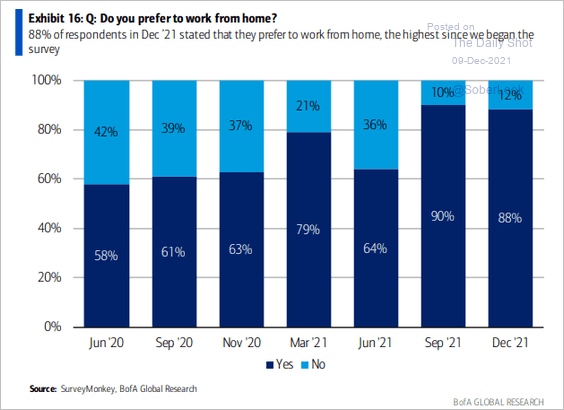

6. The largest sovereign wealth funds:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

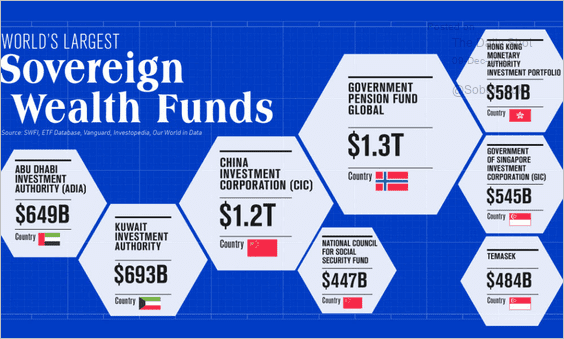

7. 13-year-olds reading for fun:

——————–

Back to Index