The Daily Shot: 13-Dec-21

• The United States

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

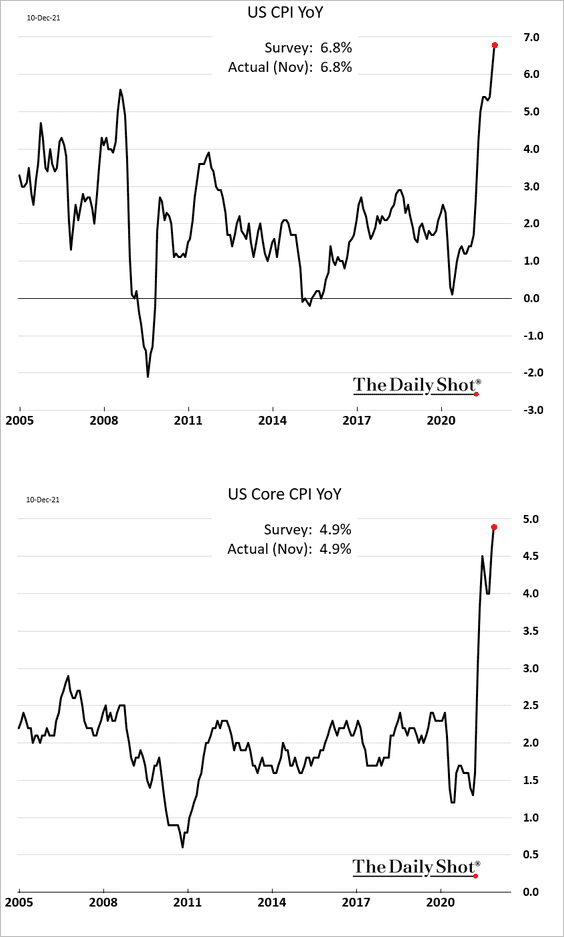

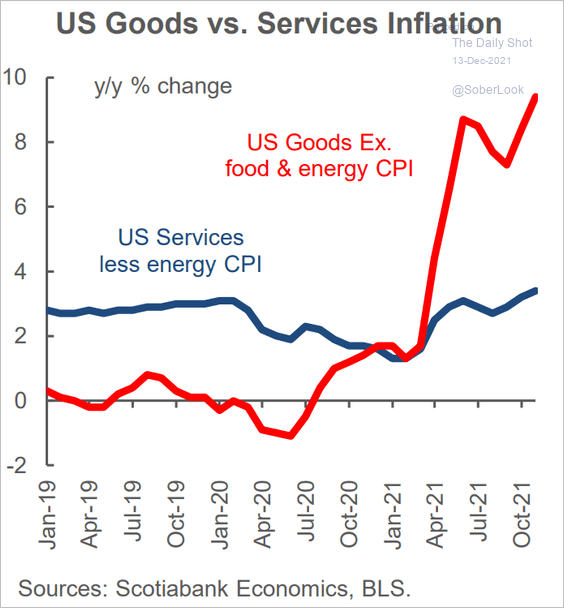

1. Traders were concerned about another upside inflation surprise, but the November CPI report was roughly in line with expectations. That’s why stocks and bonds rallied despite a multi-decade high CPI print.

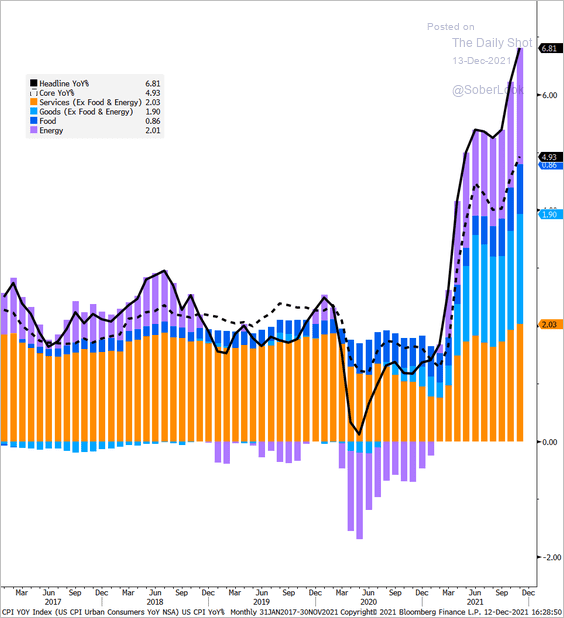

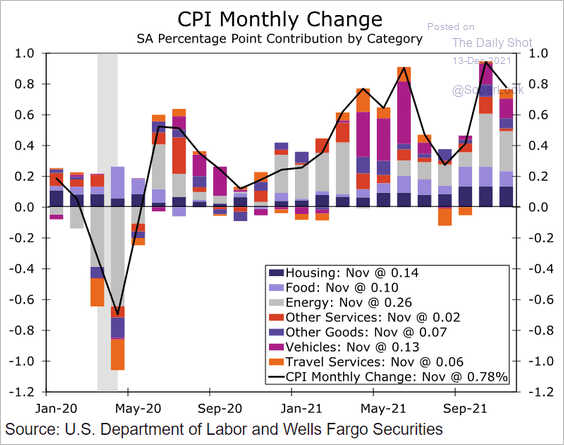

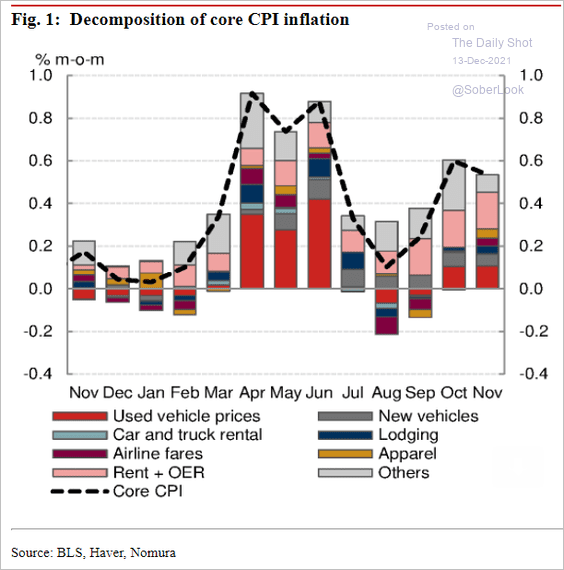

• Let’s take a look at the contributions to the CPI surge.

– Goods vs. services:

Source: Scotiabank Economics

Source: Scotiabank Economics

– Year-over-year key components:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Month-over-month contributions (2 charts):

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: Nomura Securities

Source: Nomura Securities

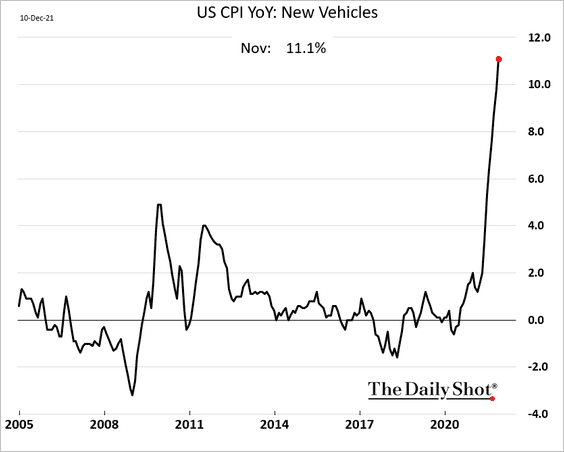

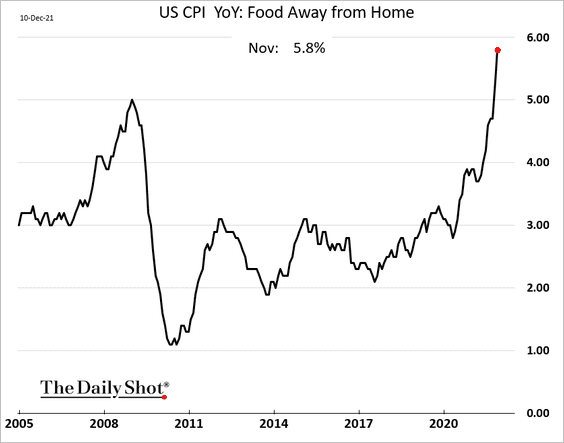

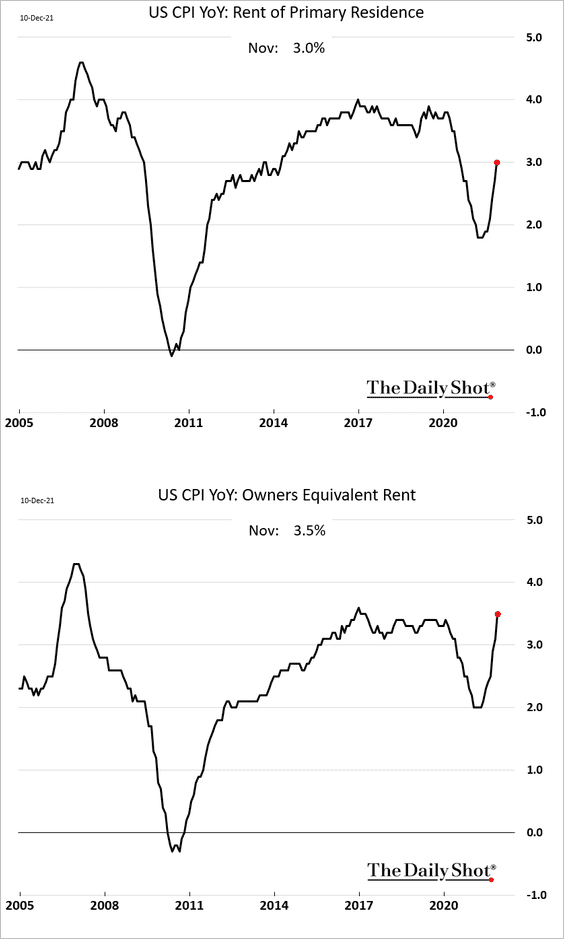

• Here are some of the CPI components (year-over-year).

– New vehicles:

– Food away from home (restaurants are rapidly boosting prices to cope with higher wages):

– Shelter (plenty of room to rise further):

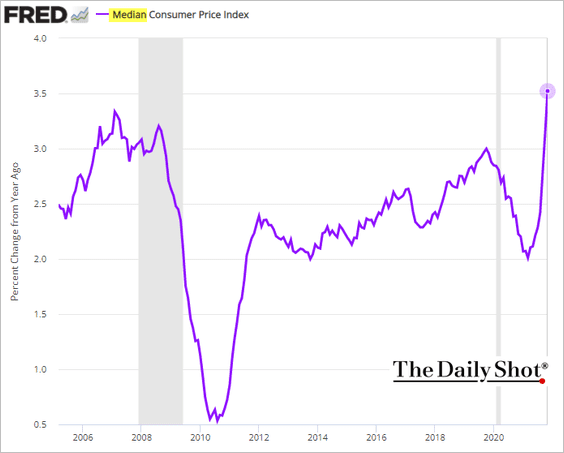

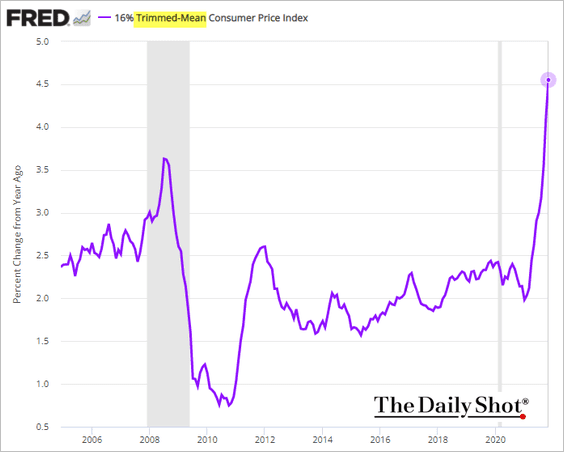

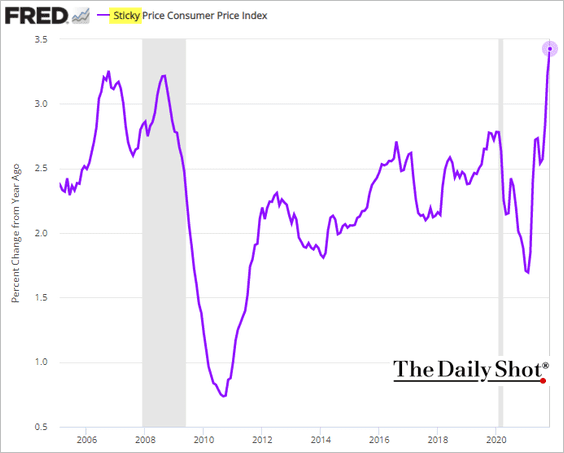

• Alternative core inflation indicators are all surging.

– Median CPI (rising inflation breadth):

– Trimmed-mean CPI:

– Sticky CPI:

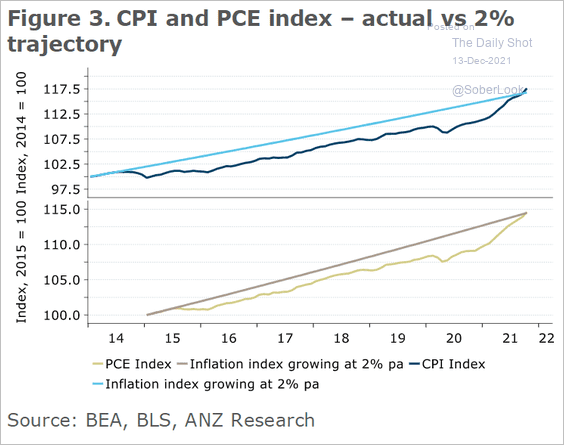

• The disinflationary trend that started after oil prices crashed in 2014 has been reversed. Since the Fed is targeting price levels, the central bank should see this as “mission accomplished.”

Source: ANZ Research

Source: ANZ Research

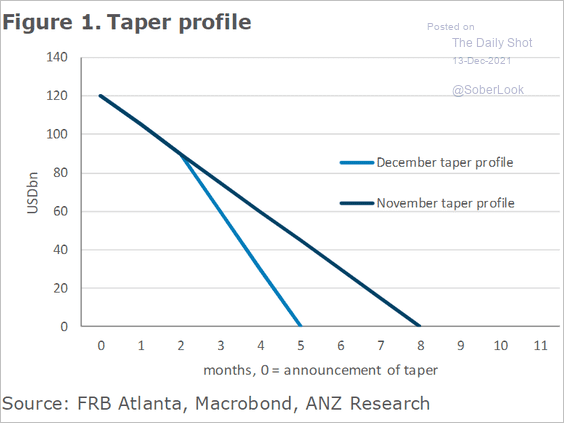

As a result, the Fed is expected to accelerate its QE taper. Here is a projection from ANZ.

Source: ANZ Research

Source: ANZ Research

Tomorrow, we’ll take a look at some inflation forecasts.

——————–

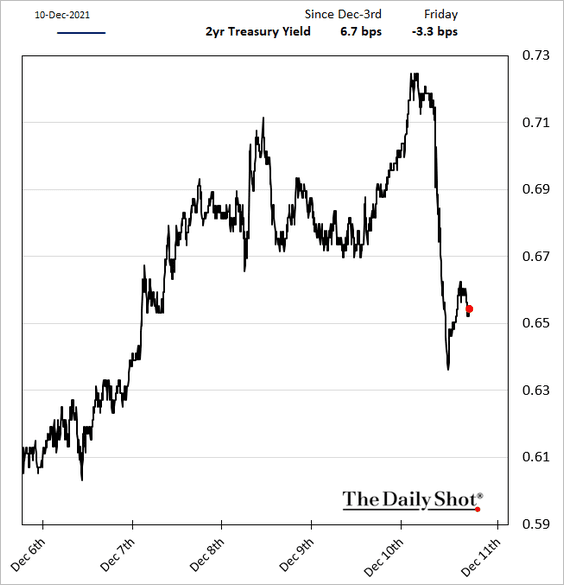

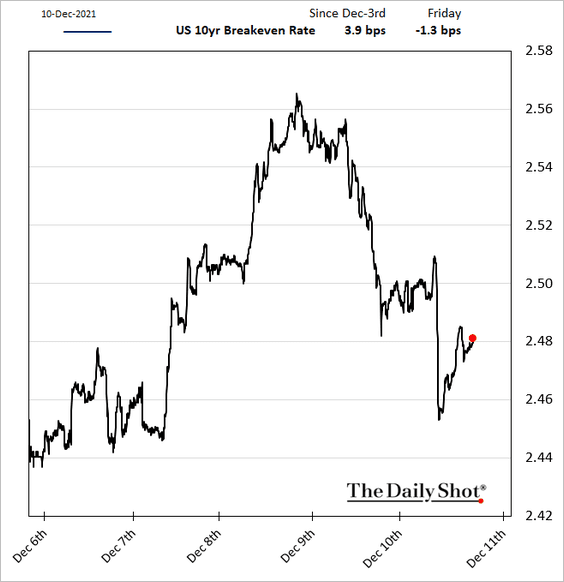

2. Since the market feared an upside inflation surprise, Treasuries rallied when the CPI report came in line with expectations.

And inflation expectations ticked lower.

——————–

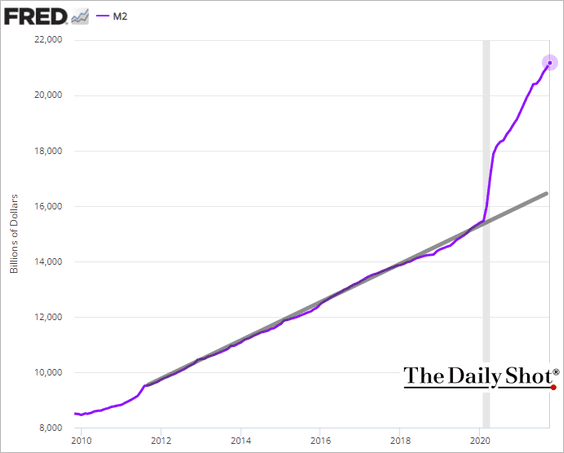

3. One driver of US inflation has been a rapid growth in the money supply. Eliminating QE should slow this trend.

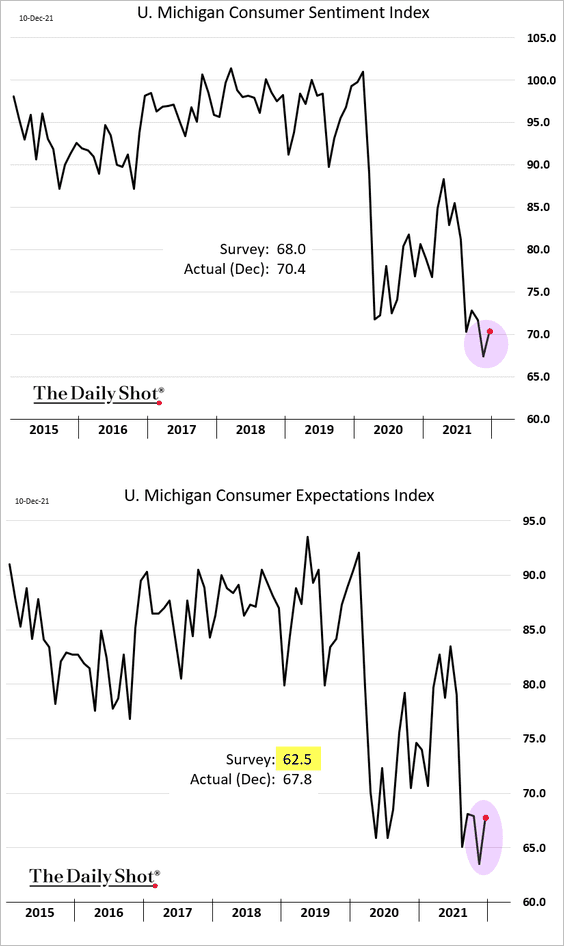

4. The U. Michigan consumer sentiment index ticked higher this month, …

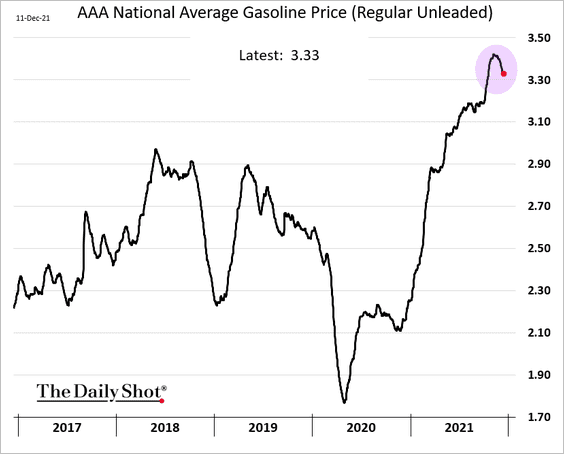

… boosted by a pullback in gasoline prices.

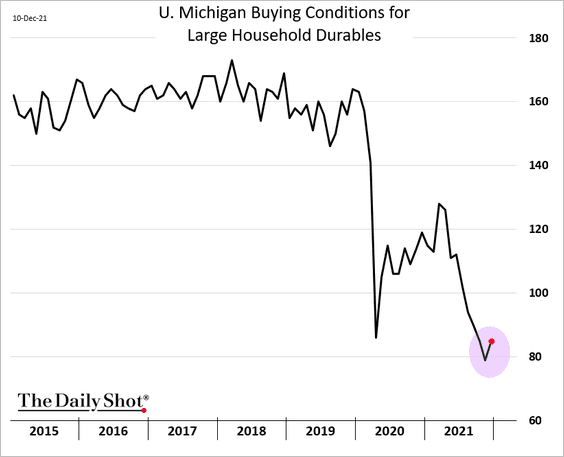

This chart shows the U. Michigan buying conditions for household durables.

——————–

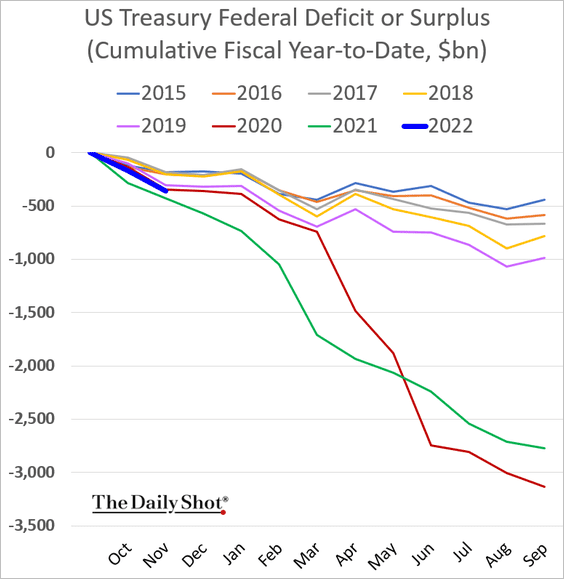

5. Finally, the US budget deficit is following the 2020 (pre-COVID) path.

Back to Index

The United Kingdom

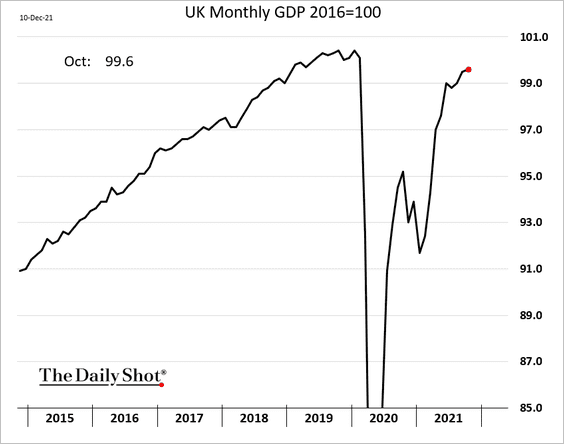

1. The October monthly GDP estimate was below forecasts as the economy approaches full recovery.

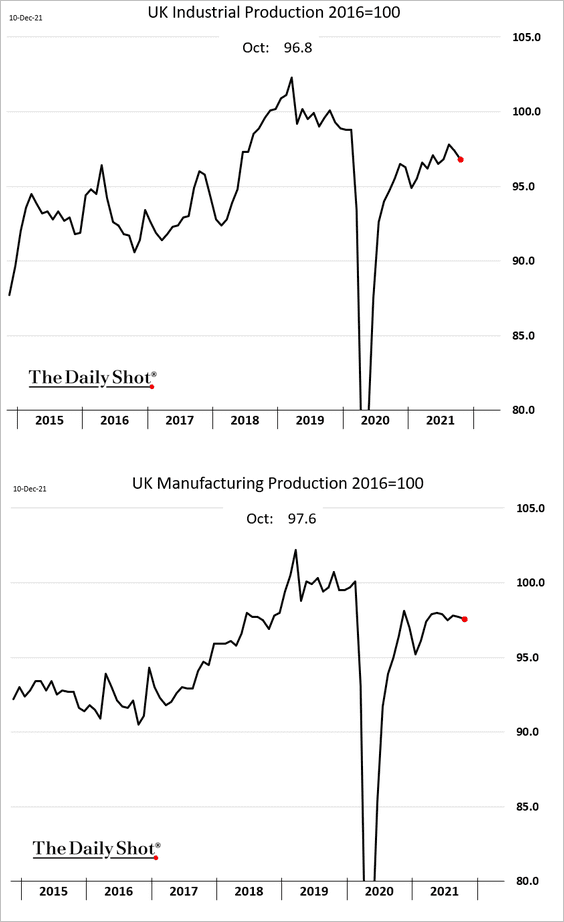

• Industrial production was soft.

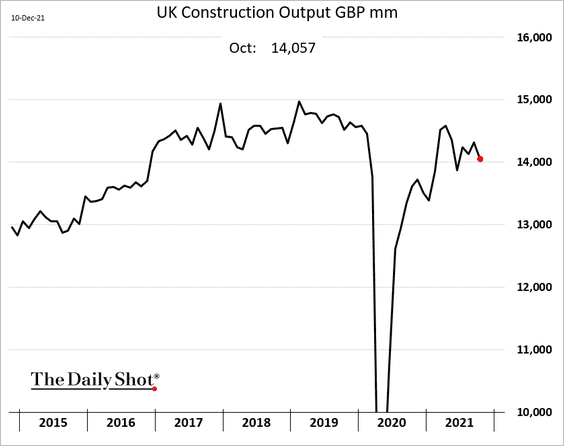

• Construction output weakened:

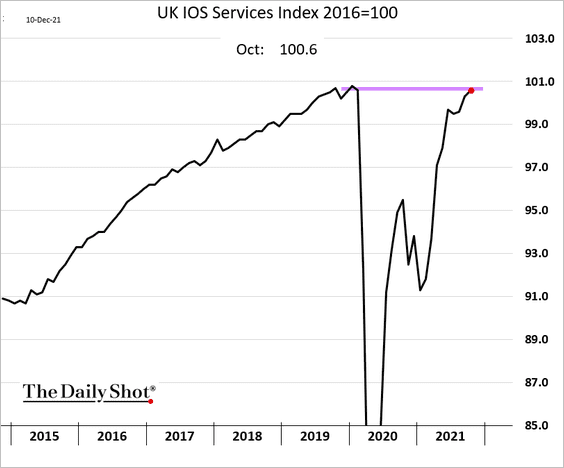

• Services have made a full recovery.

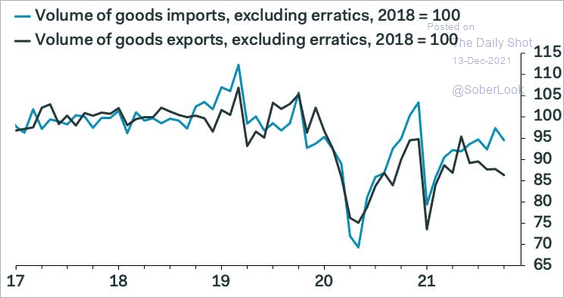

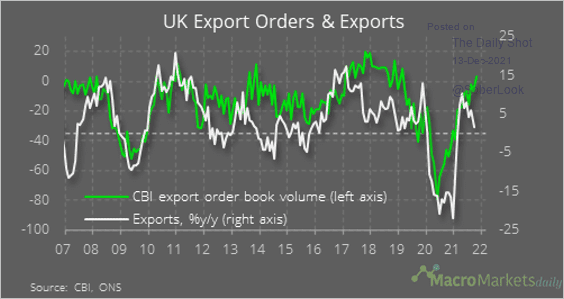

• Exports have been trending lower, …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

… but export orders point to improvements ahead.

Source: @macro_daily

Source: @macro_daily

——————–

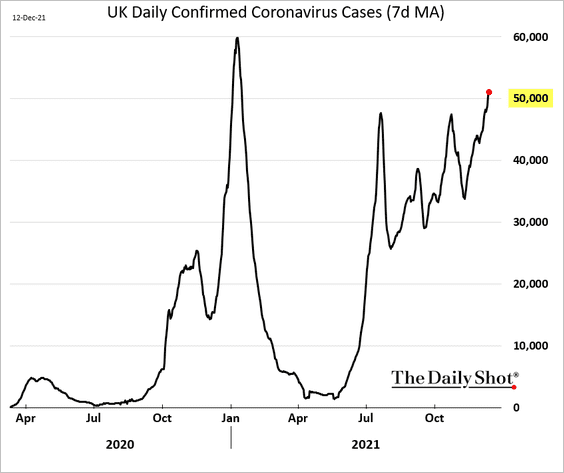

2. The 7-day average of COVID cases exceeded 50k per day.

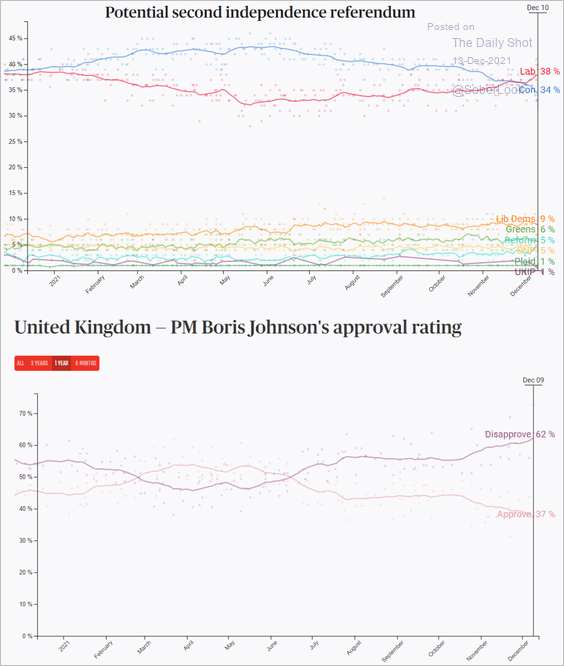

3. Finally, we have some political polls.

Source: POLITICO

Source: POLITICO

Back to Index

Europe

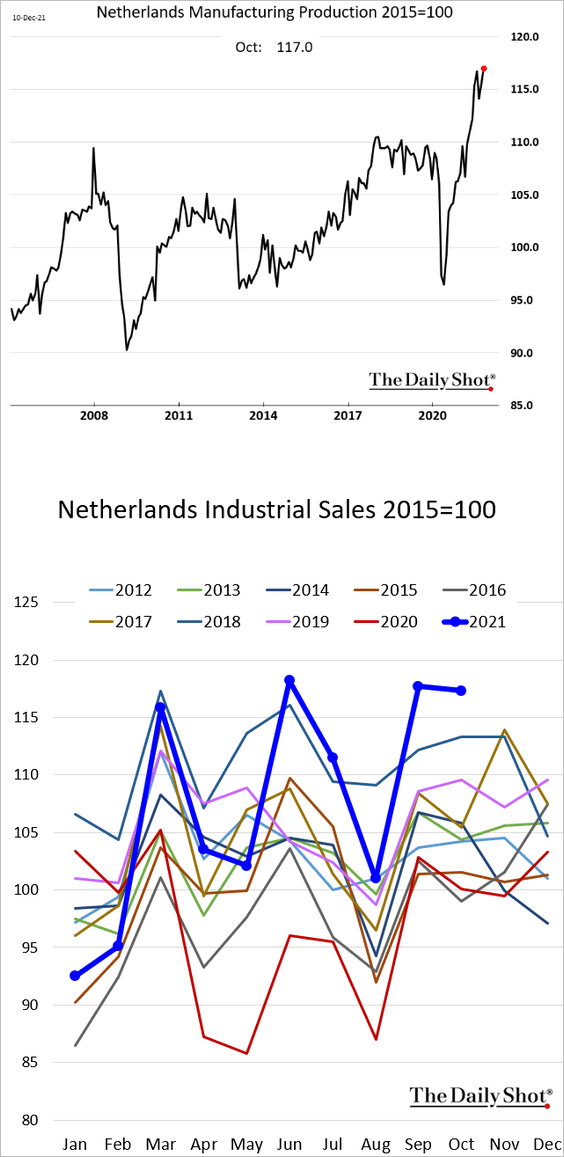

1. Dutch factory output hit a new high in October, with industrial sales holding at multi-year highs for this time of the year.

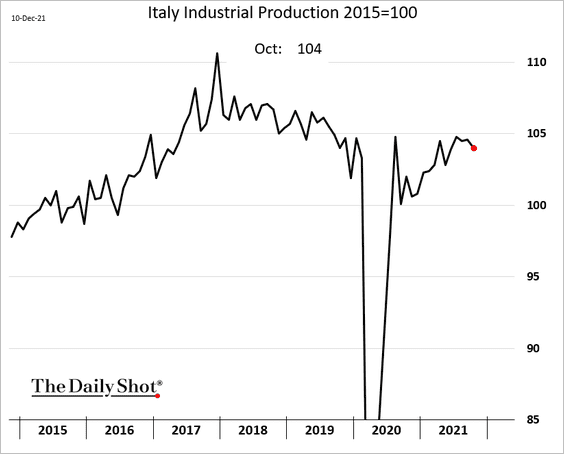

2. Italian industrial production has been rolling over.

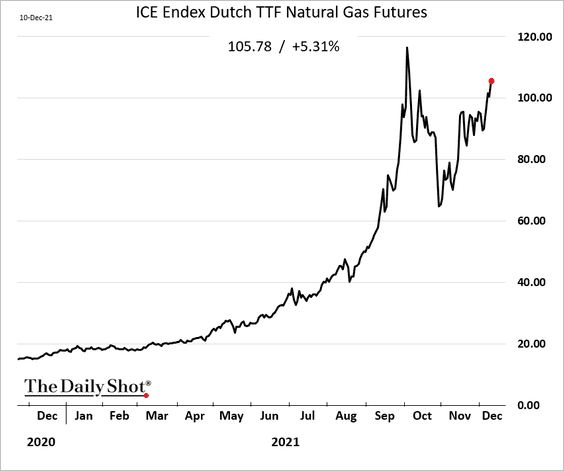

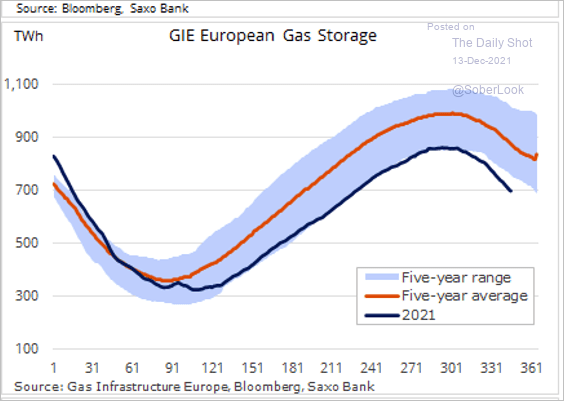

3. European natural gas prices are surging again, …

… amid declining inventories (now well below the 5yr range). Power prices will stay elevated.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

——————–

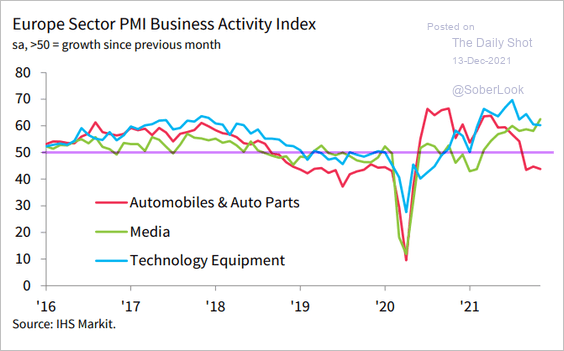

4. The automobile sector remains in contraction mode (PMI < 50).

Source: IHS Markit

Source: IHS Markit

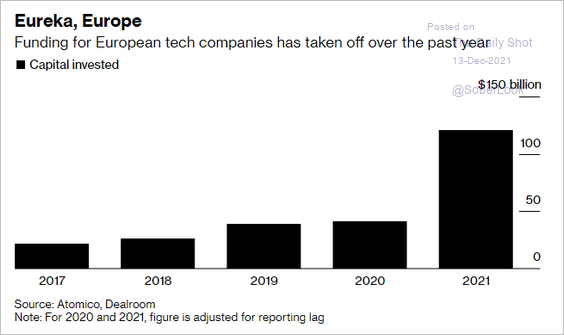

5. Tech sector investment surged this year.

Source: @StuartLWallace, @IvanLevingston Read full article

Source: @StuartLWallace, @IvanLevingston Read full article

Back to Index

Asia – Pacific

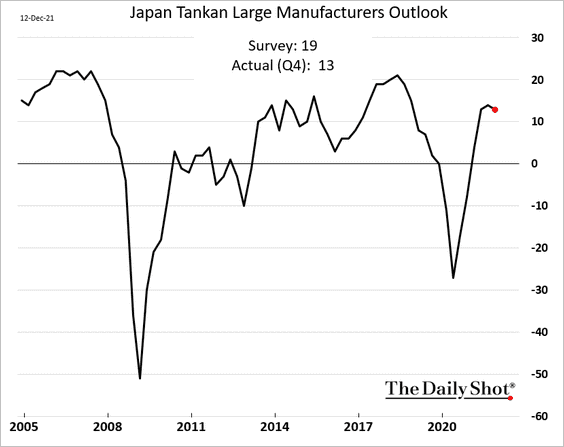

1. Japan’s Tankan manufacturing survey showed a pullback in business confidence this quarter.

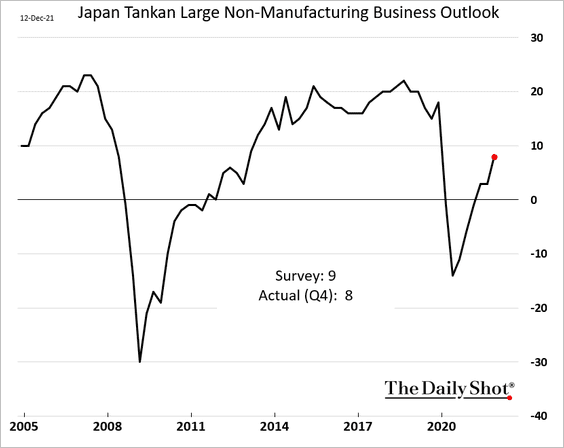

Service sector outlook continues to recover.

——————–

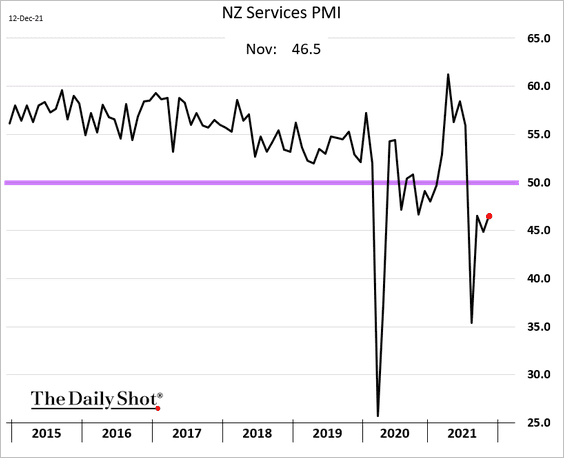

2. New Zealand’s service sector activity remains in contraction mode.

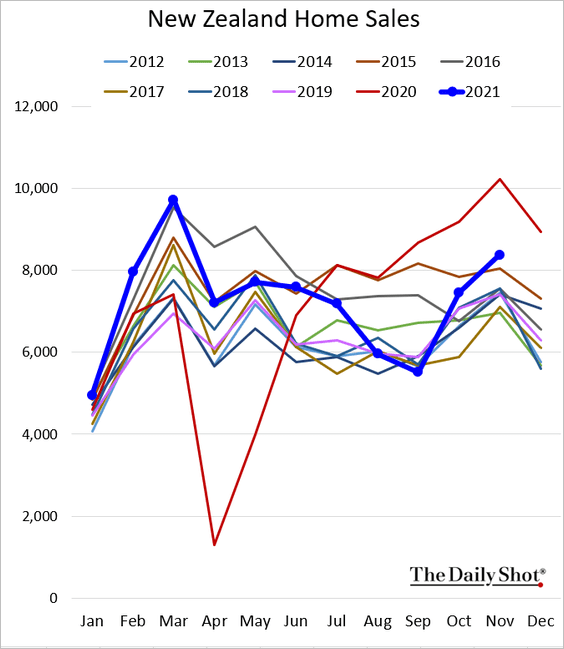

Home sales are rebounding.

Back to Index

China

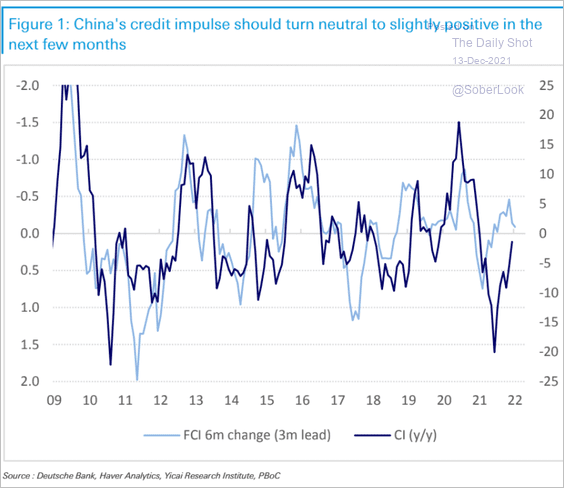

1. Indicators point to a rebound in China’s credit impulse.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

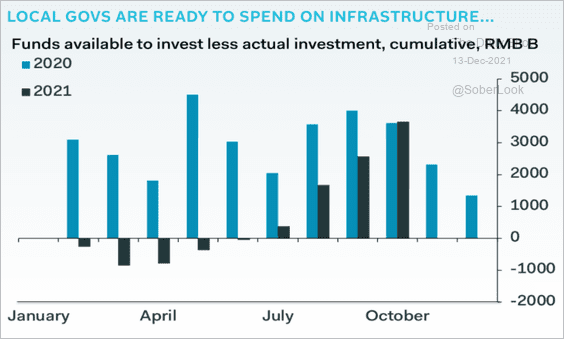

2. A boost in infrastructure spending is coming.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

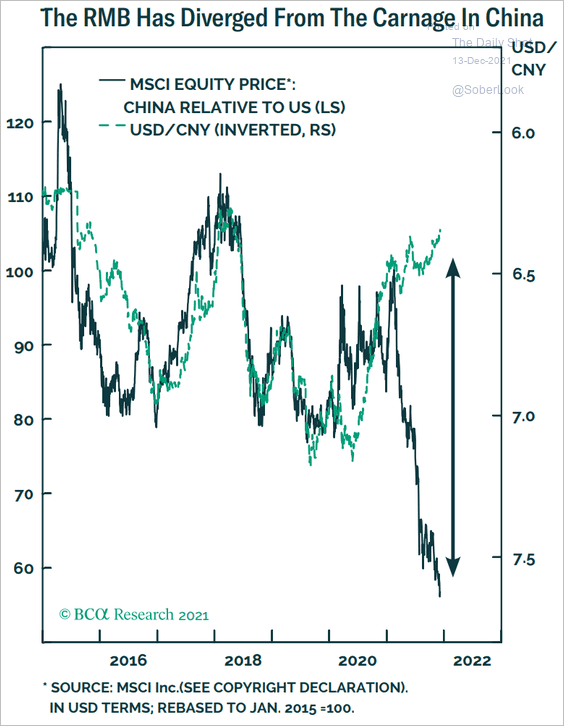

3. The renminbi has diverged from equity prices.

Source: BCA Research

Source: BCA Research

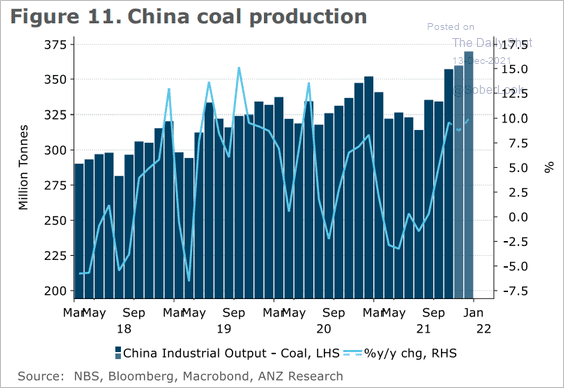

4. Coal output is growing.

Source: ANZ Research

Source: ANZ Research

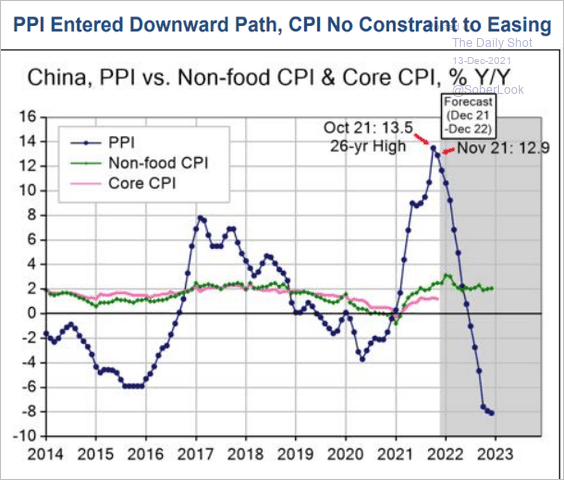

5. The PPI has peaked, according to Evercore ISI. However, the CPI is expected to stay elevated, which will constrain further PBoC easing.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Emerging Markets

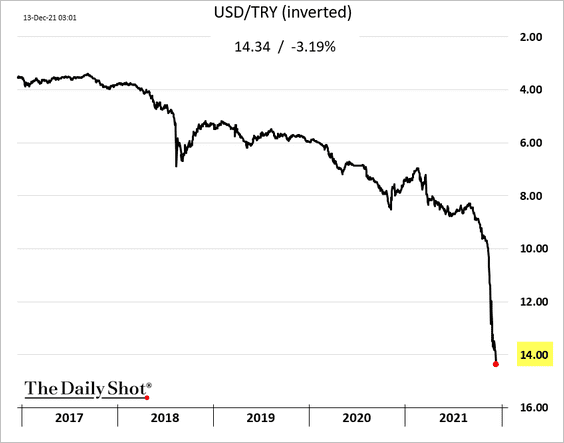

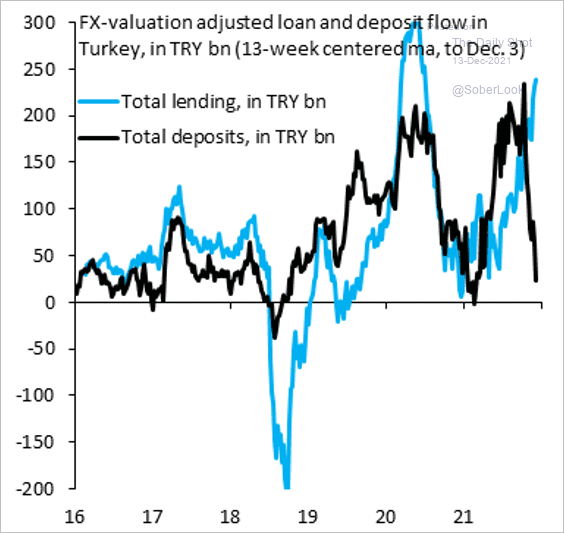

1. The Turkish lira resumed its descent, breaching 14 to the dollar.

Separately, increased lending in Turkey isn’t generating higher deposits. Something is off.

Source: @RobinBrooksIIF, @UgrasUlkuIIF

Source: @RobinBrooksIIF, @UgrasUlkuIIF

——————–

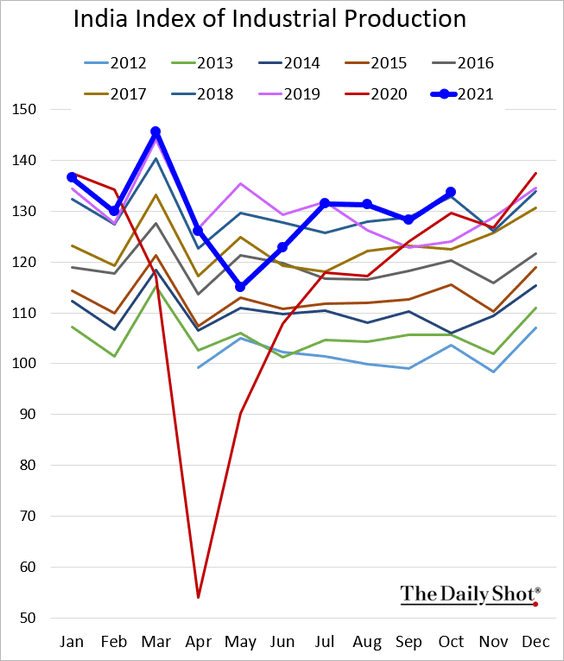

2. India’s industrial production was below forecasts but remains robust.

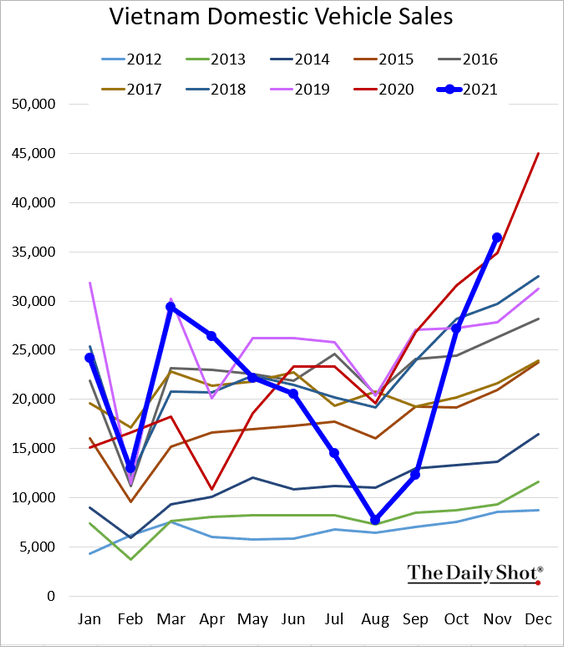

3. Vietnam’s car sales surged over the past couple of months.

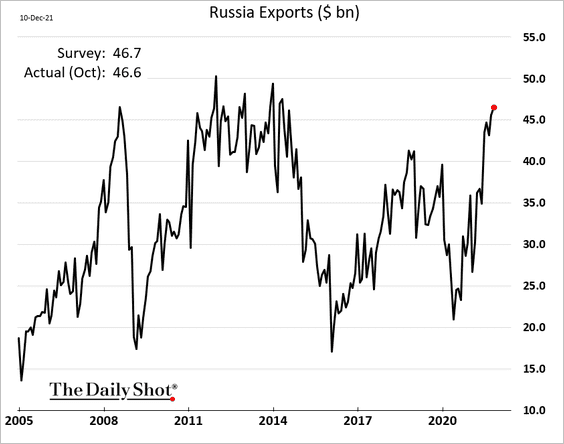

4. Russian exports continue to climb, boosted by higher energy prices.

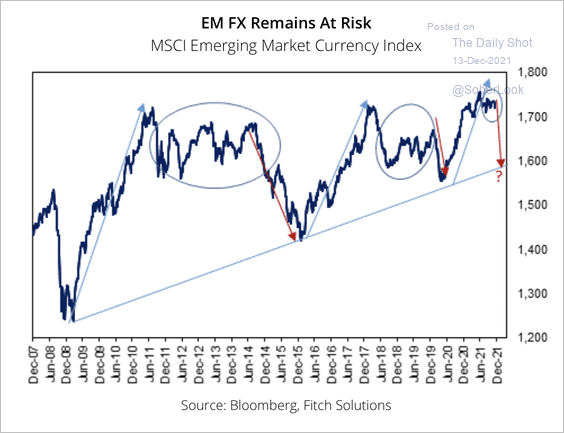

5. Will EM currencies retest long-term resistance as the Fed pulls stimulus?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

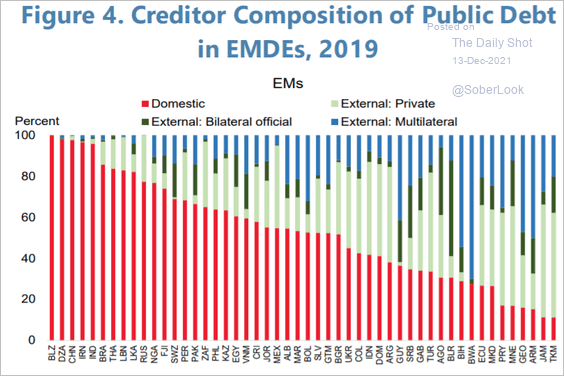

6. Finally, we have the creditor composition of public debt (multilateral = syndicated debt).

Source: IMF Read full article

Source: IMF Read full article

Back to Index

Cryptocurrency

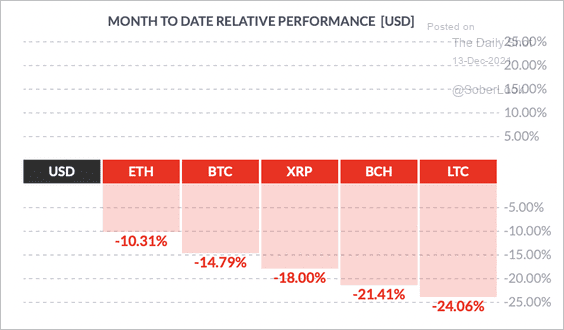

1. Most major cryptocurrencies are still in the red this month.

Source: FinViz

Source: FinViz

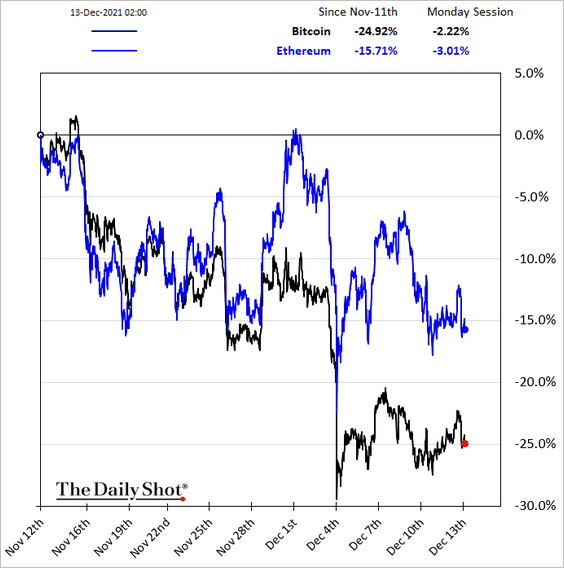

Ether continues to outperform bitcoin.

——————–

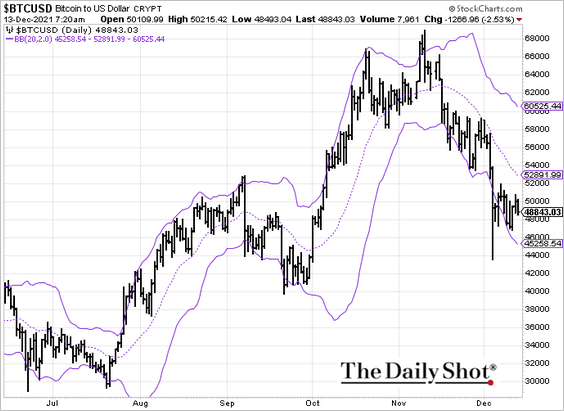

2. Bitcoin is holding support at the lower Bollinger Band.

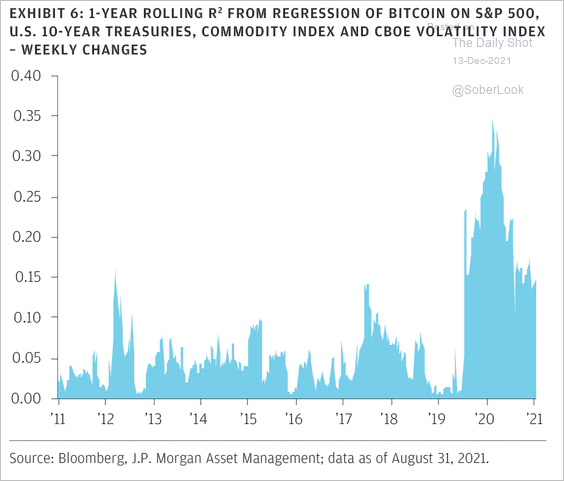

3. Bitcoin has exhibited high idiosyncratic risk since its inception.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

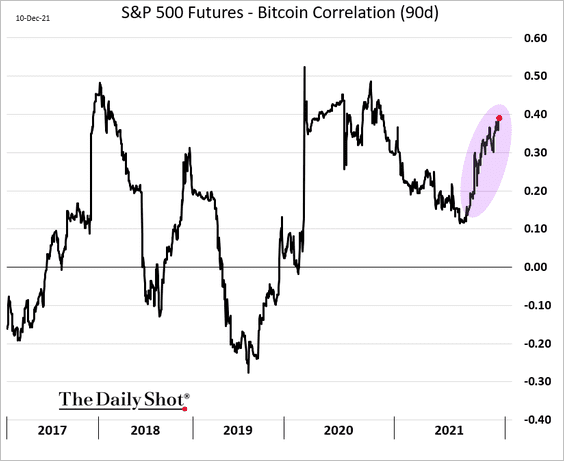

4. Bitcoin’s correlation with stocks remains elevated.

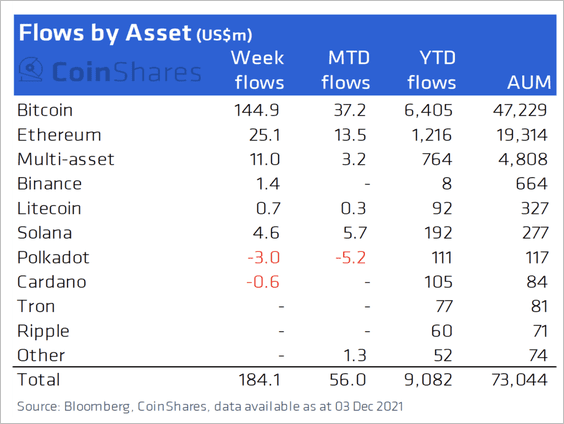

5. Bitcoin investment products saw inflows totaling $145 million last week, although the recent crypto sell-off triggered $42 million in outflows during the latter half of the week.

Source: CoinShares

Source: CoinShares

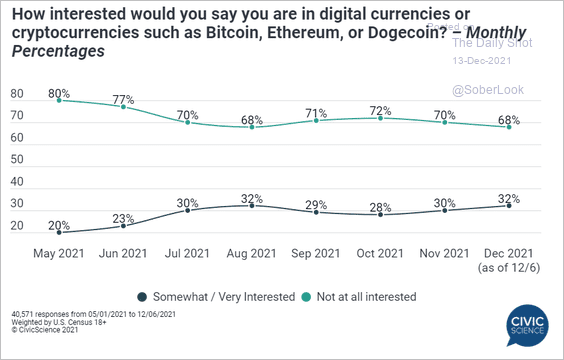

6. The public’s interest in crypto has been moving higher again.

Source: @CivicScience Read full article

Source: @CivicScience Read full article

Back to Index

Commodities

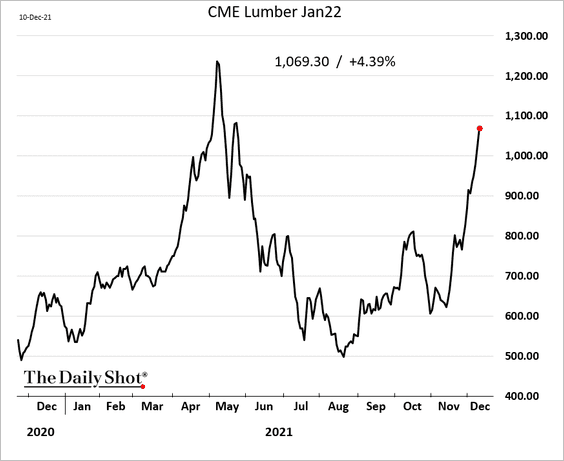

1. US lumber prices are surging again as residential construction accelerates.

Source: Markets Insider Read full article

Source: Markets Insider Read full article

——————–

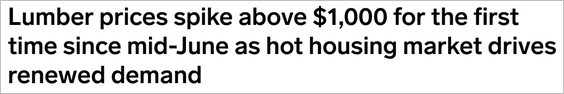

2. The euro and copper have diverged.

Source: BCA Research

Source: BCA Research

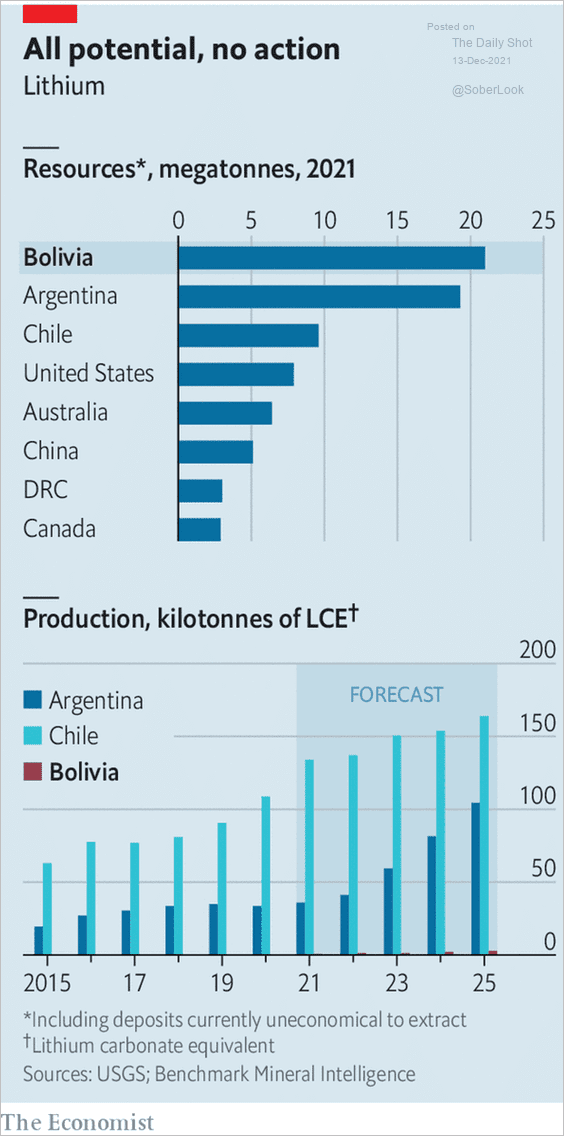

3. Next, we have some data on global lithium supplies.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Energy

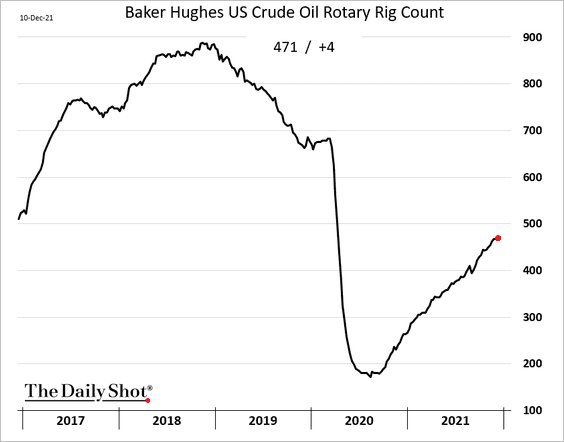

1. US rig count is grinding higher.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

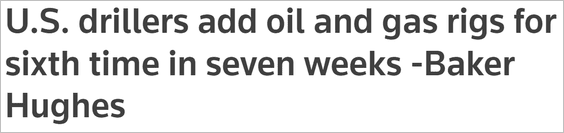

2. Have crude oil prices peaked for now?

Source: @EIAgov

Source: @EIAgov

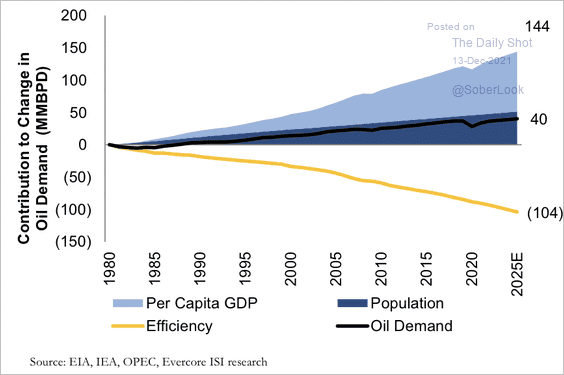

3. Efficiency gains have been a drag on oil demand over many years.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Equities

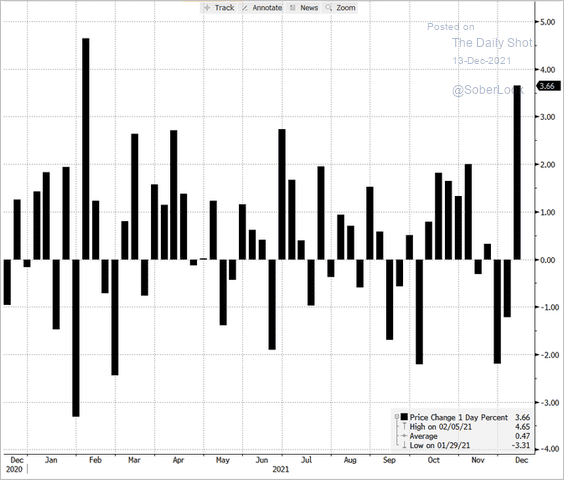

1. It was a good week for US stocks as the S&P 500 hit a record high.

Source: @kgreifeld

Source: @kgreifeld

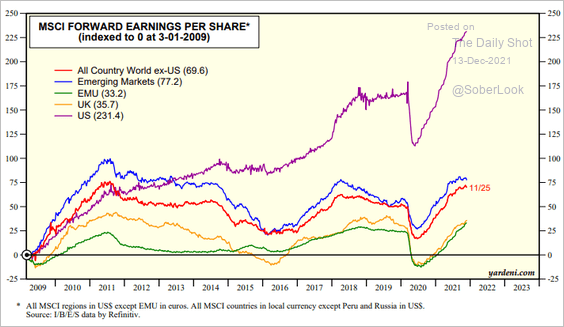

2. The valuation gap between US stocks and the rest of the world continues to widen.

Source: Yardeni Research

Source: Yardeni Research

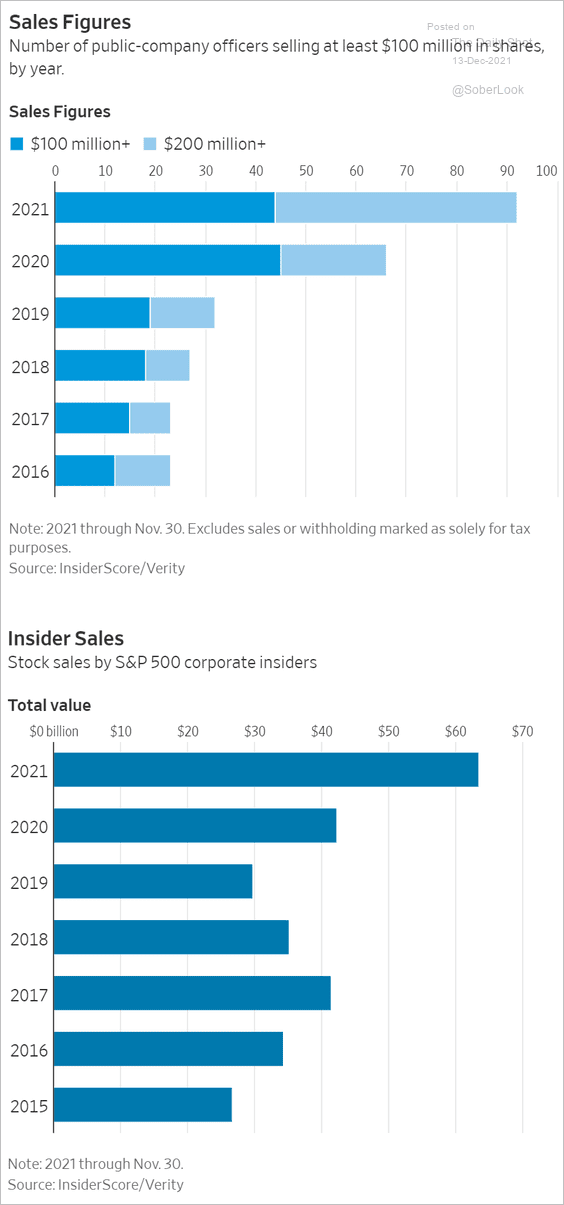

3. Insiders have sold quite a bit of stock this year. Note that these are dollar amounts, partly reflecting elevated share prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

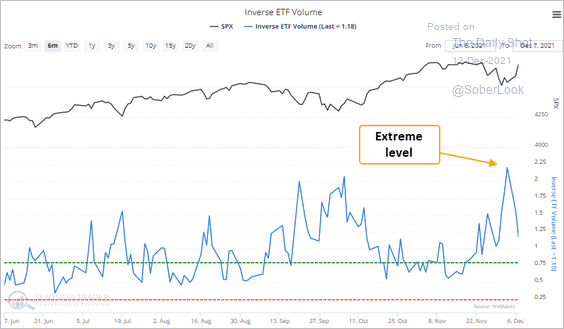

4. Inverse ETF volume is declining from extreme levels, suggesting that investors are less concerned about a stock market sell-off.

Source: SentimenTrader

Source: SentimenTrader

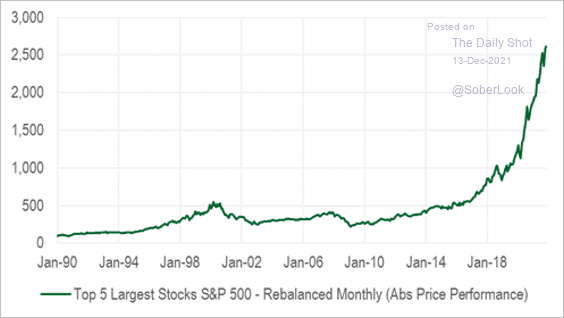

5. Sticking with the top five stocks (rebalanced monthly) produced impressive returns recently.

Source: @MichaelKantro

Source: @MichaelKantro

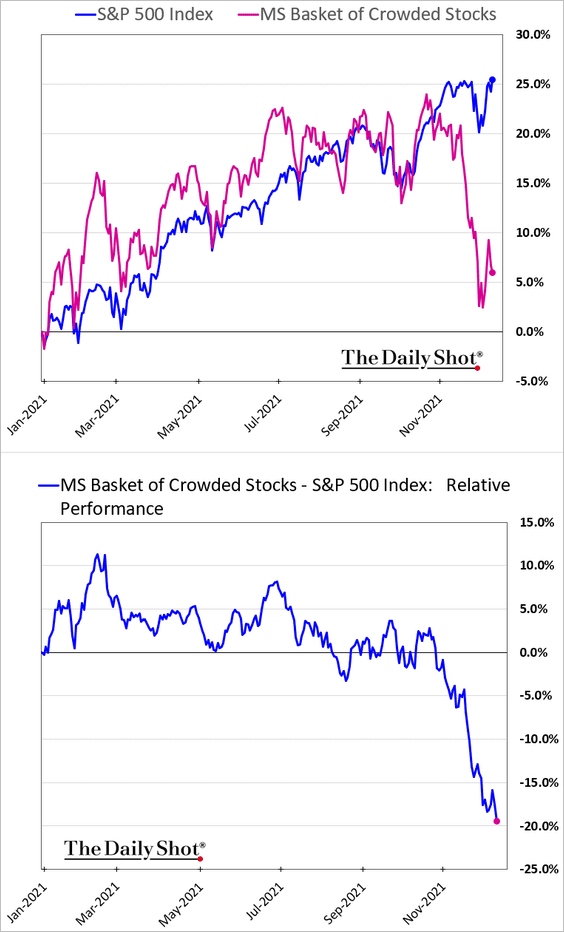

6. Crowded stocks continue to struggle.

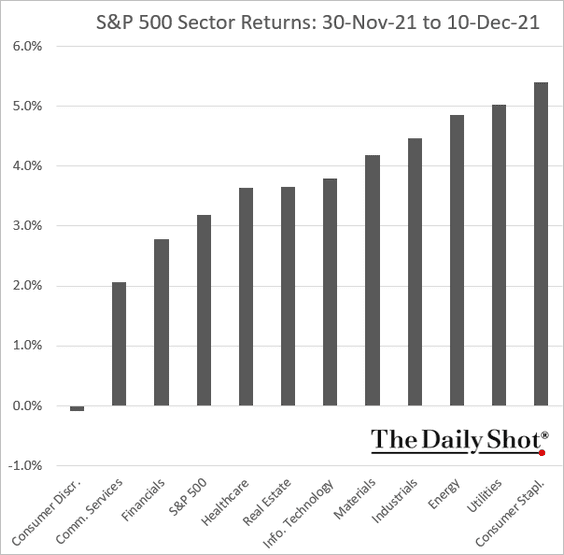

7. Next, we have some sector trends.

• Month-to-date returns:

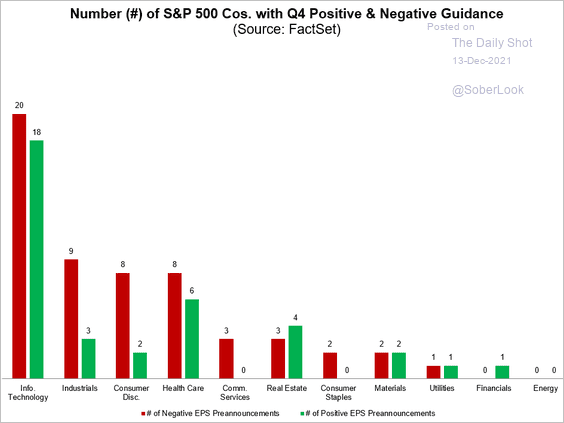

• Positive vs. negative guidance for Q4:

Source: @FactSet Read full article

Source: @FactSet Read full article

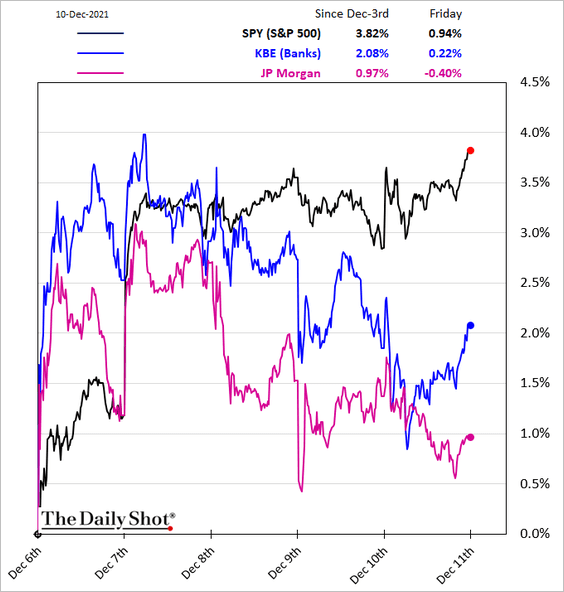

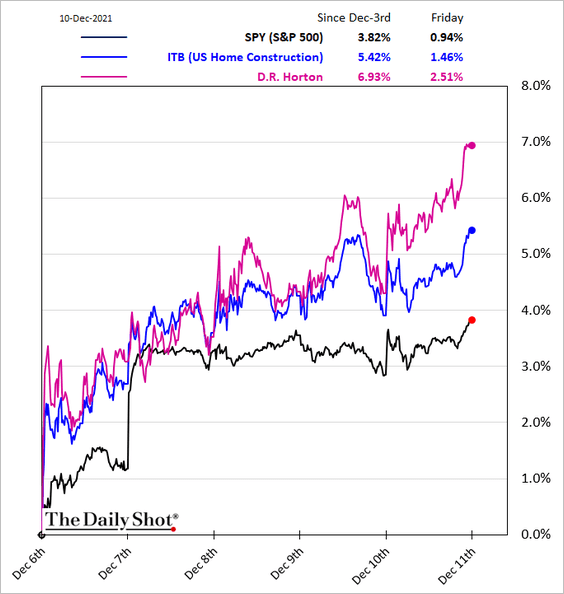

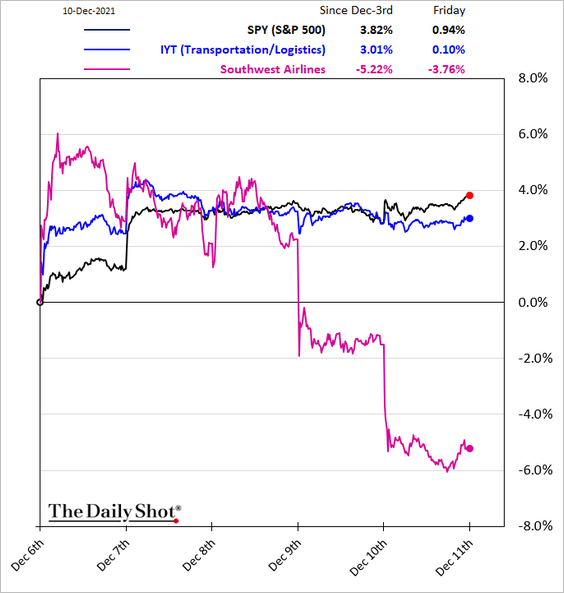

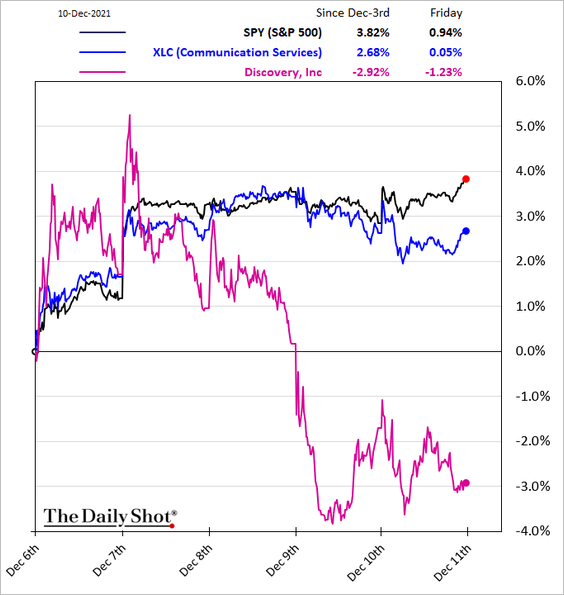

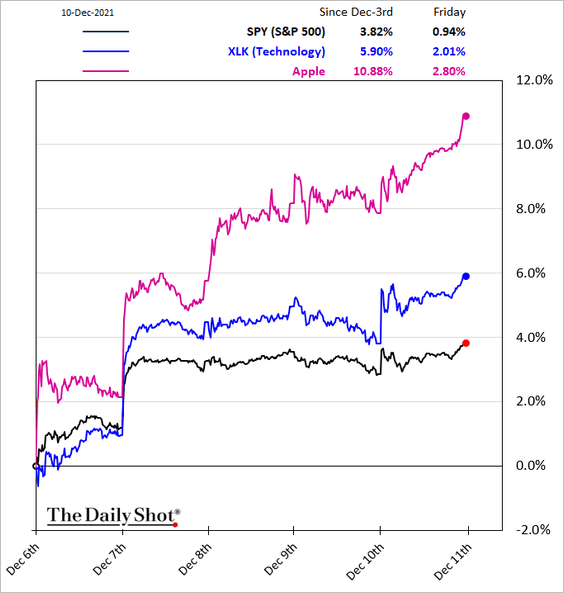

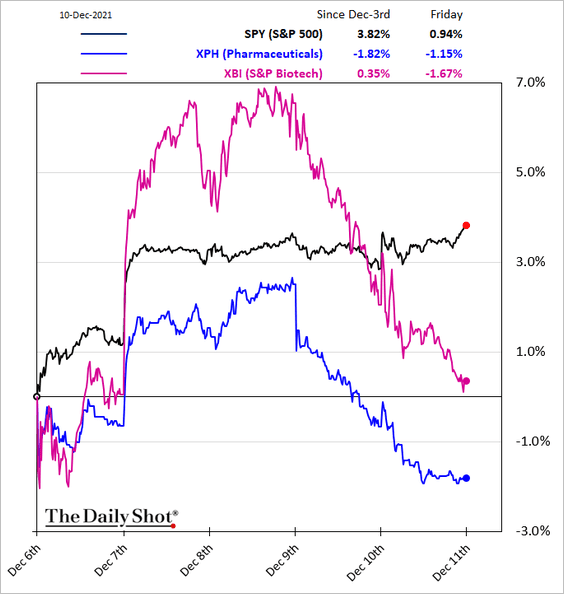

• Last week’s performance:

– Banks:

– Housing:

– Transportation:

– Communication Services:

– Tech:

– Pharma and biotech:

Back to Index

Credit

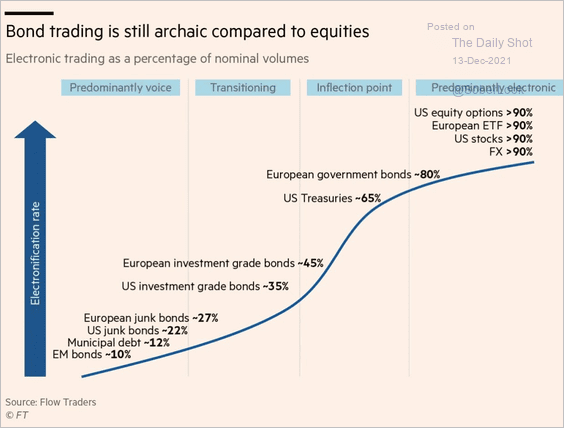

1. A great deal of bond trading is still done over the phone.

Source: @LizAnnSonders, @FT Read full article

Source: @LizAnnSonders, @FT Read full article

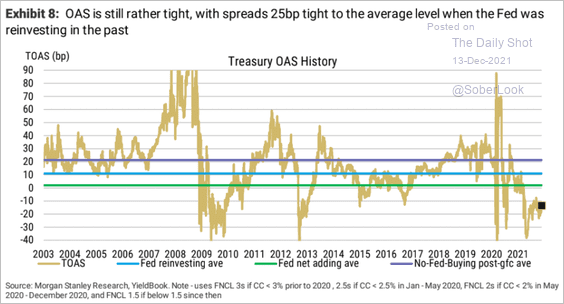

2. MBS bond spreads remain tight.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Rates

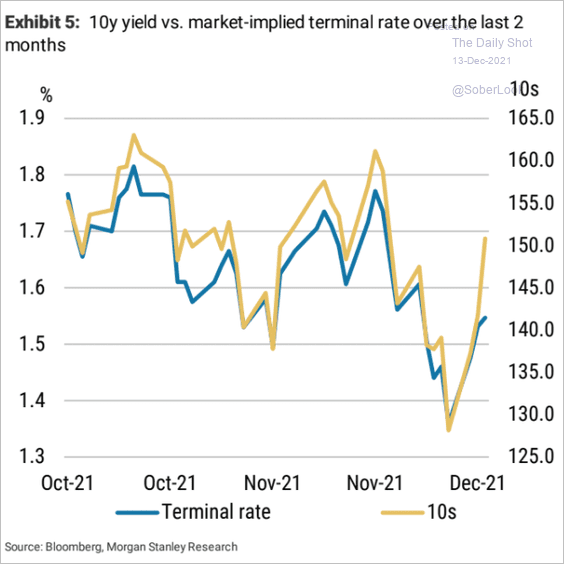

The 10yr Treasury yield has diverged from the market expectation of the terminal rate (long-term fed funds rate).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Global Developments

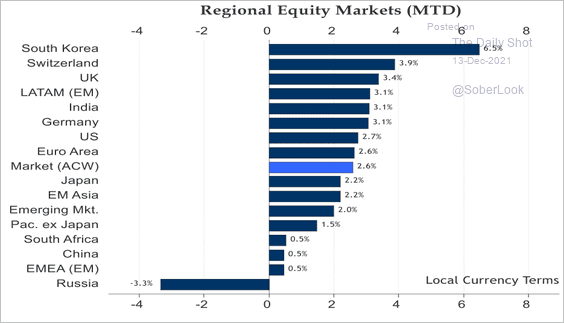

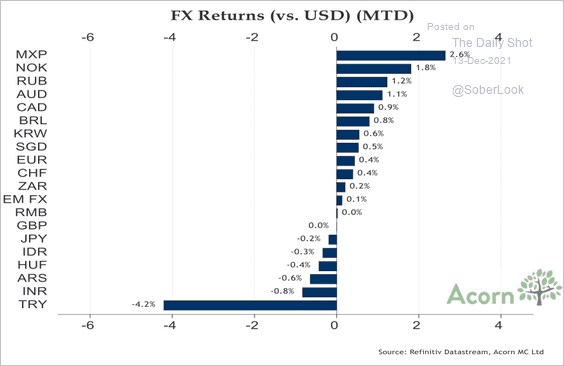

1. Let’s begin with some month-to-date returns data from Acorn Macro.

• Equities:

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

• Currencies:

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

——————–

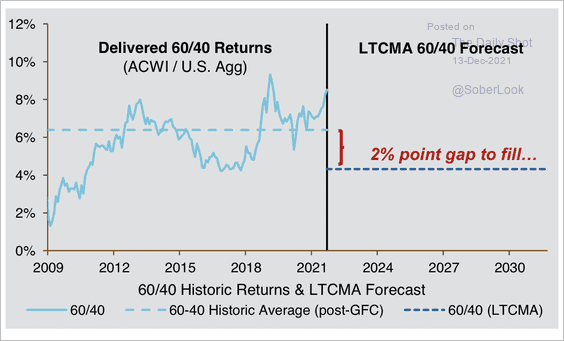

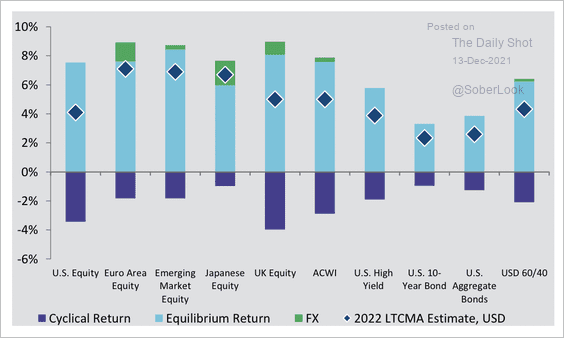

2. There is a 2% gap between the historic 60/40 (equities/bonds) returns and JP Morgan’s forecasts.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

The gap is mainly due to a difficult starting point of low yields and high valuations.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

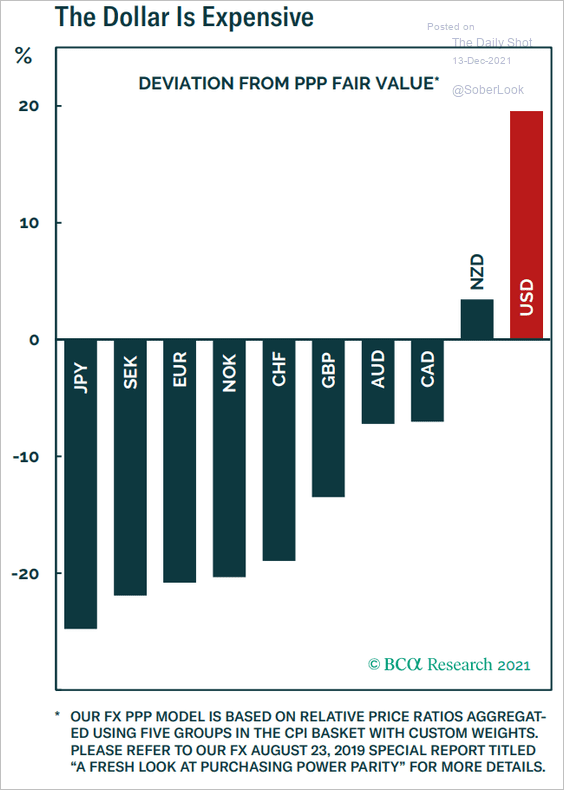

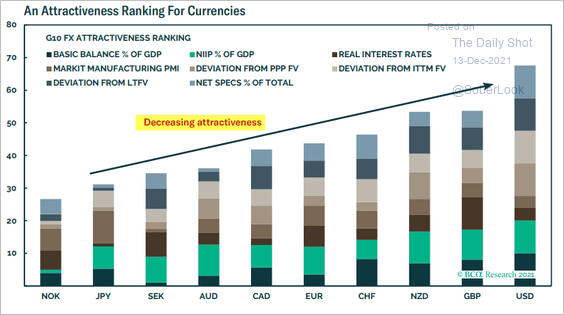

3. Is the US dollar overvalued (2 charts)?

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

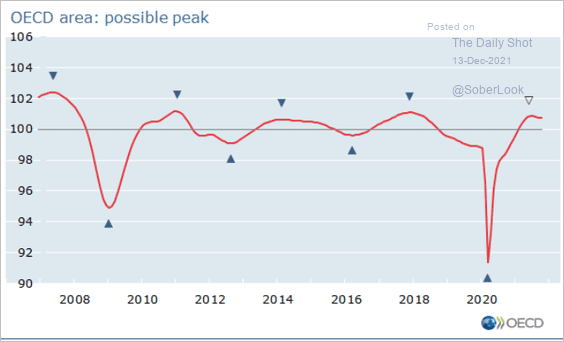

4. Has growth peaked across OECD economies?

Source: OECD Read full article

Source: OECD Read full article

——————–

Food for Thought

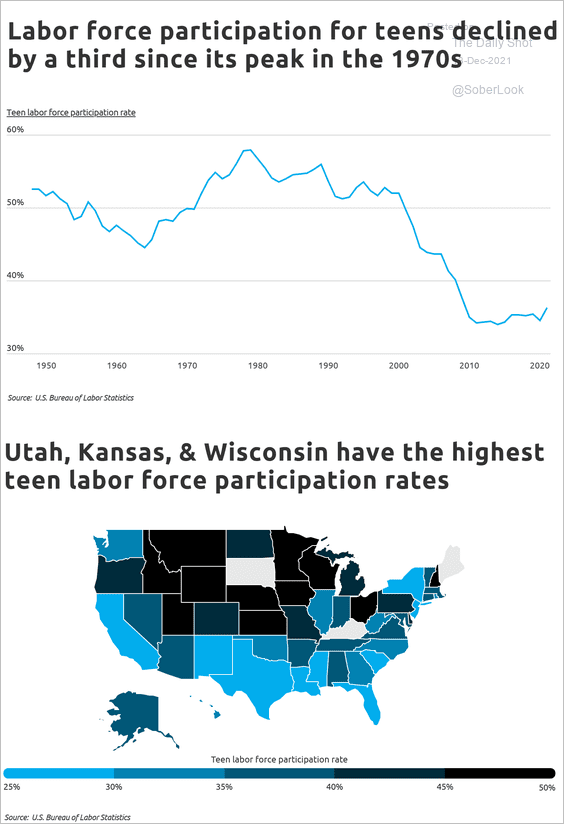

1. US teen labor force participation rate:

Source: Self Read full article

Source: Self Read full article

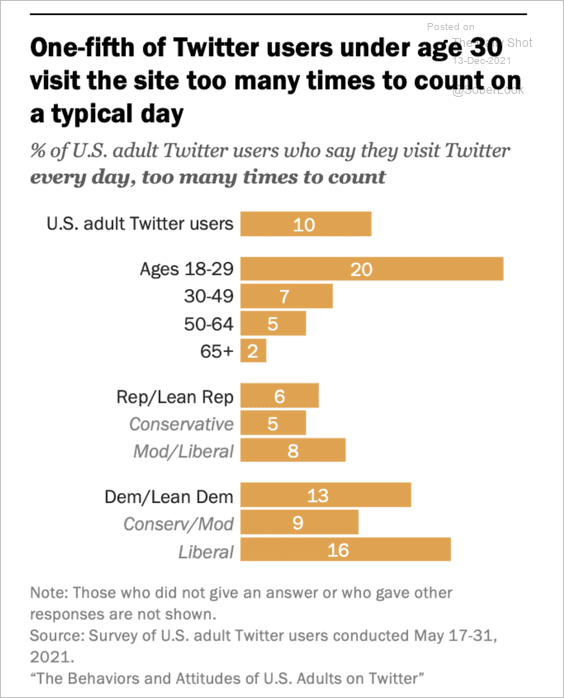

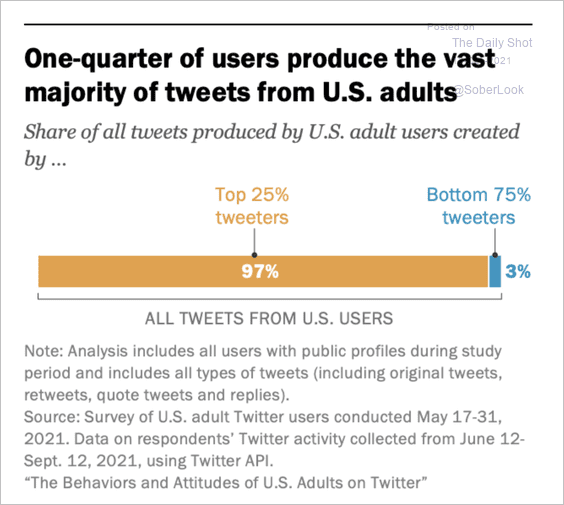

2. Twitter power users:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

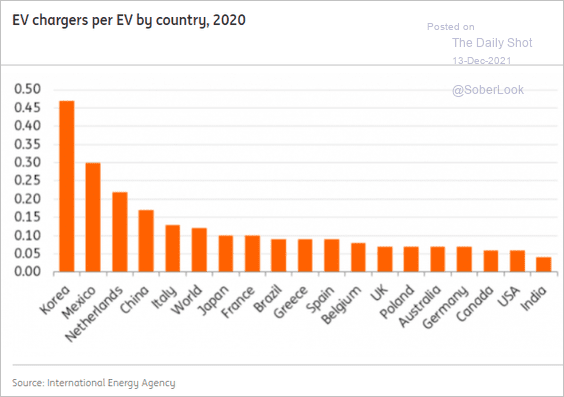

3. Charging stations per EV:

Source: ING

Source: ING

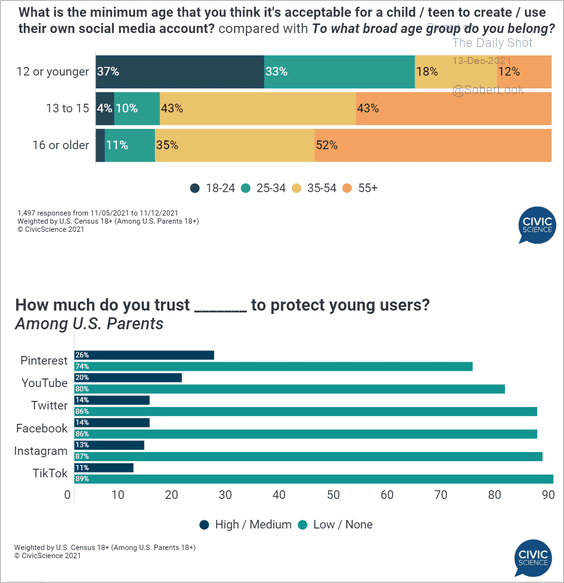

4. Age appropriateness of social media:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

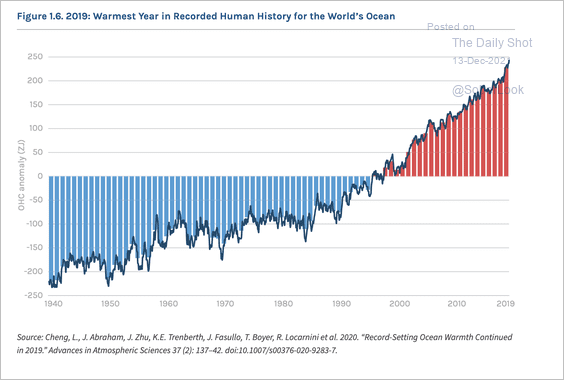

5. Warmer oceans:

Source: Oceanpanel.org

Source: Oceanpanel.org

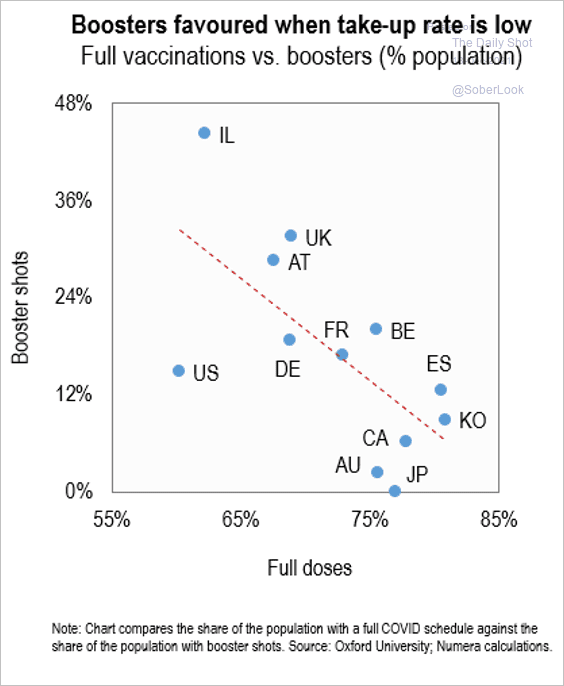

6. Booster shots vs. total vaccination rates:

Source: Numera Analytics

Source: Numera Analytics

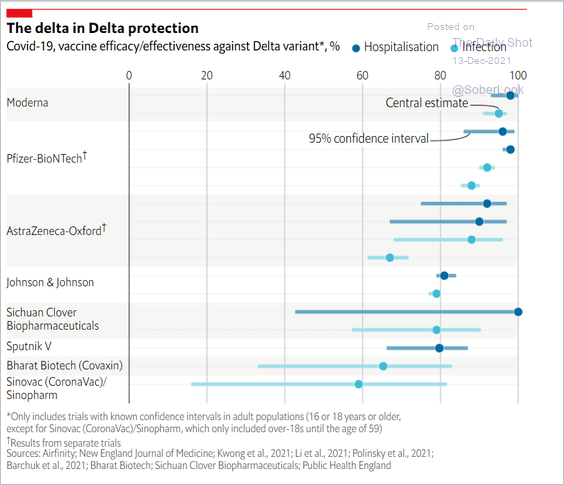

7. Vaccine effectiveness against the Delta variant:

Source: The Economist Read full article

Source: The Economist Read full article

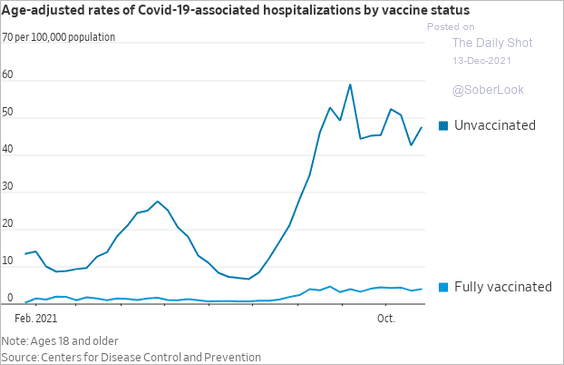

8. US COVID hospitalizations:

Source: @WSJ Read full article

Source: @WSJ Read full article

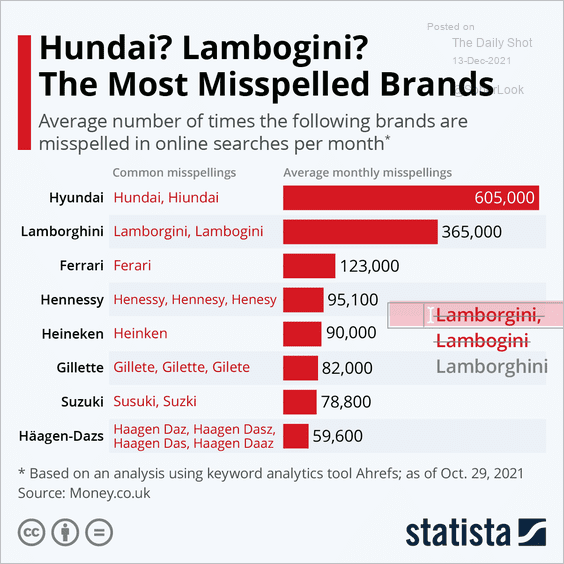

9. The most misspelled brands:

Source: Statista

Source: Statista

——————–

Back to Index