The Daily Shot: 23-Dec-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

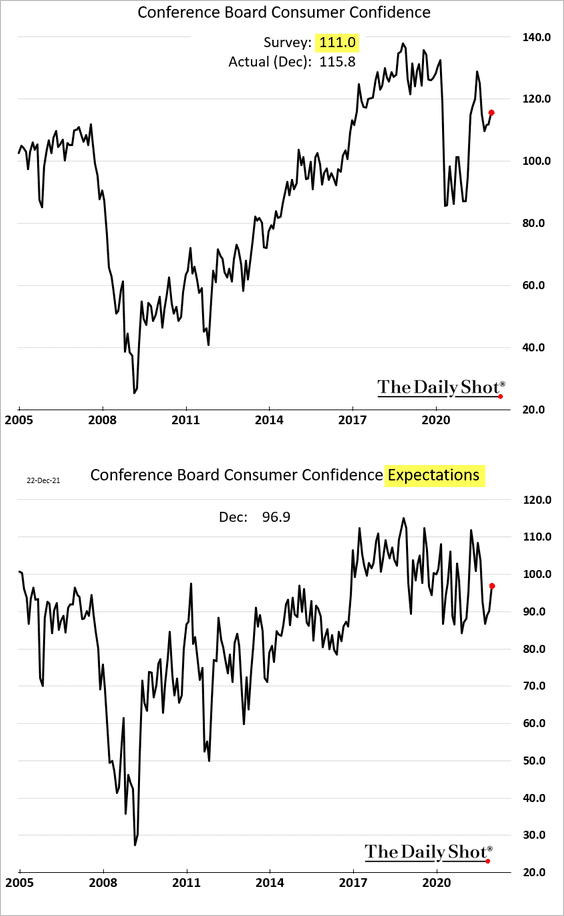

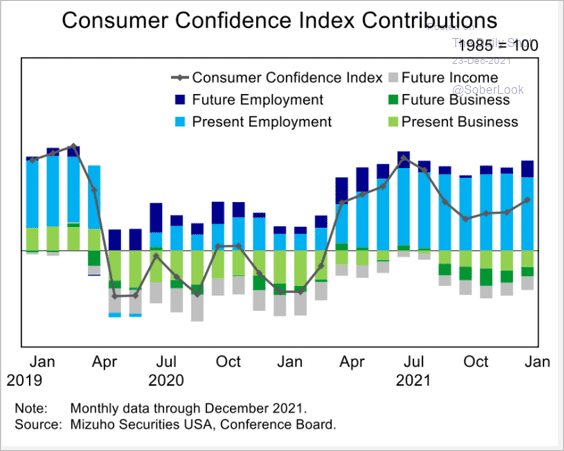

1. The Conference Board’s consumer confidence indicator ticked higher despite the omicron concerns.

• The labor market’s strength remains a tailwind for household sentiment.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

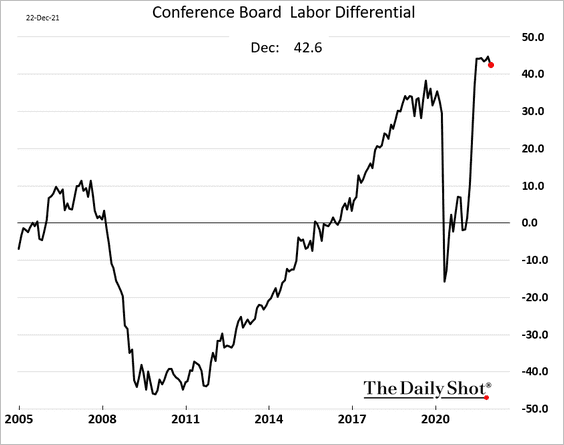

Here is the labor differential (“jobs plentiful” less “jobs hard to get”).

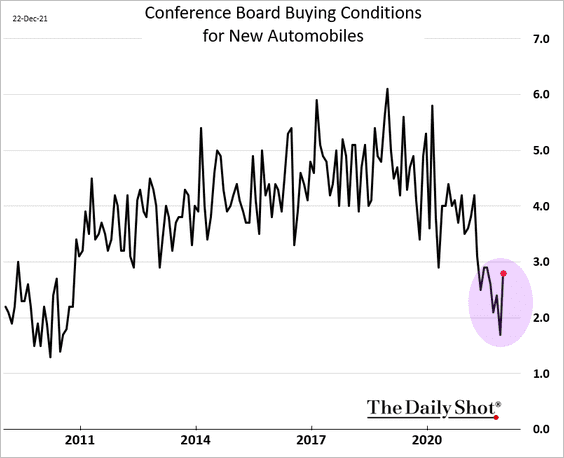

• Buying conditions indicators appear to have bottomed.

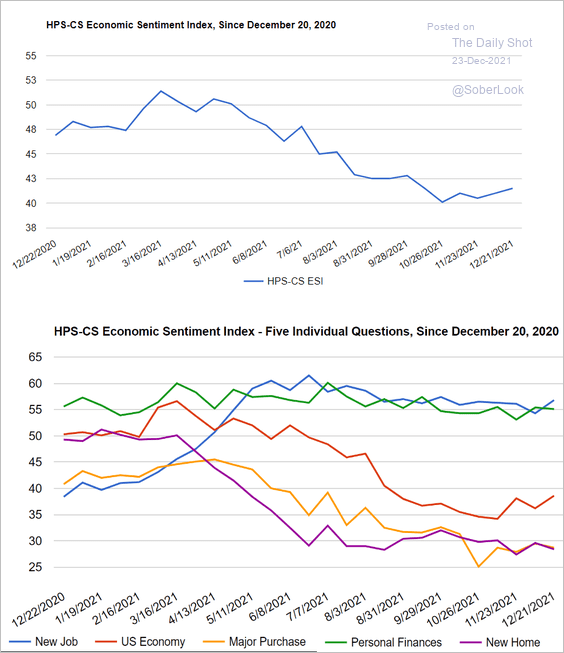

• A separate report from Hamilton Place Strategies and CivicScience also showed an uptick in sentiment this month.

Source: @HPS_CS

Source: @HPS_CS

——————–

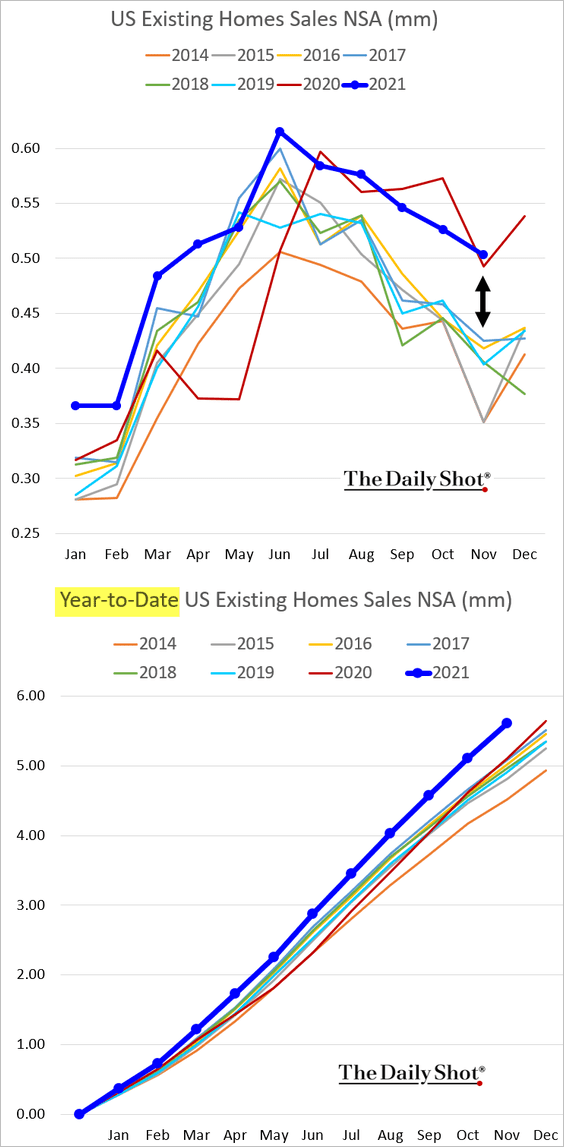

2. Next, we have some updates on the housing market.

• Existing home sales were strong in November, well above 2019 levels.

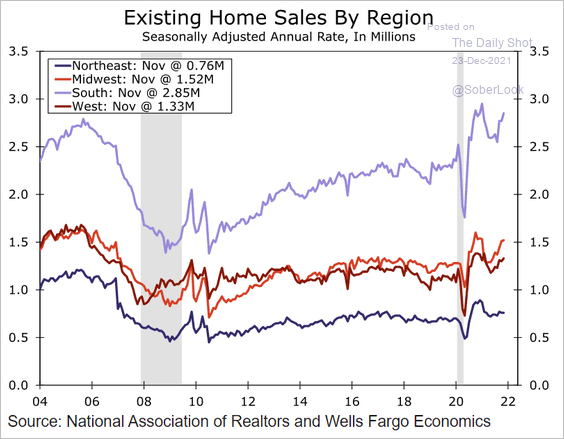

Here are the seasonally-adjusted trends by region.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

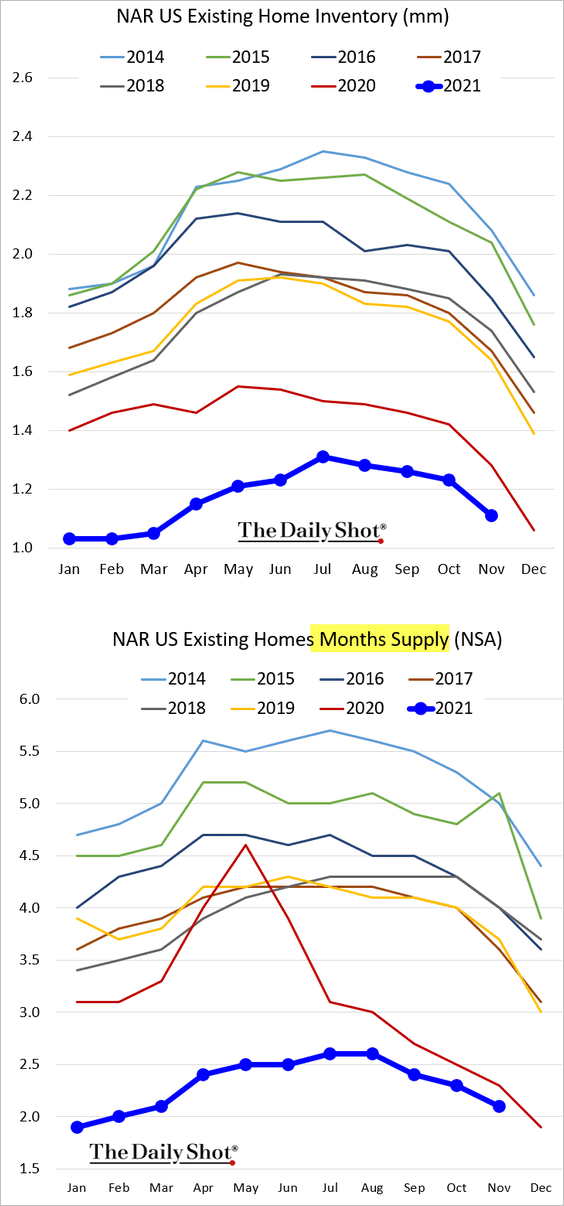

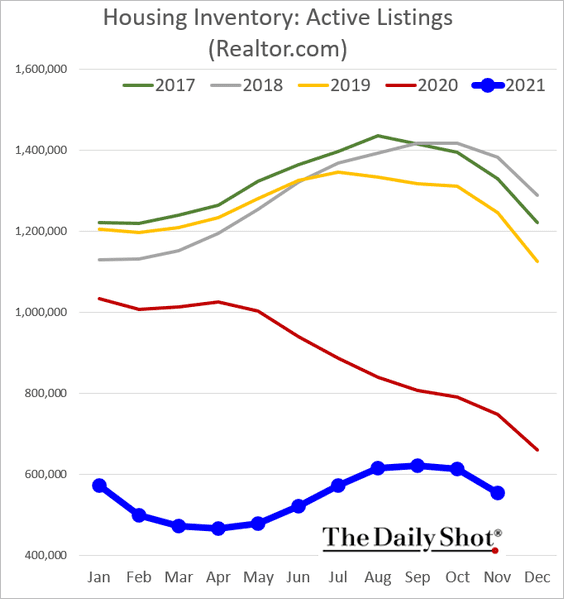

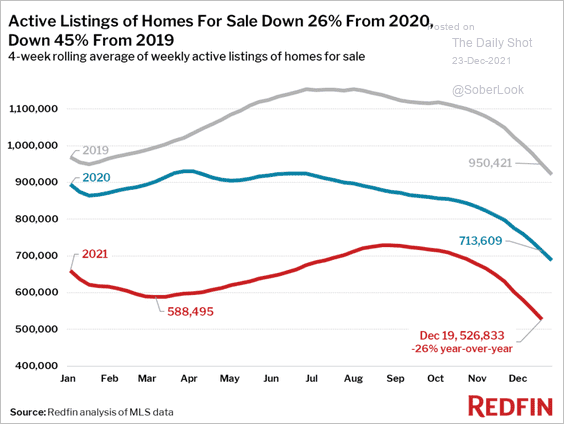

• Inventories remain exceptionally tight.

– NAR:

– Realtor.com:

– Redfin (through December):

Source: Redfin

Source: Redfin

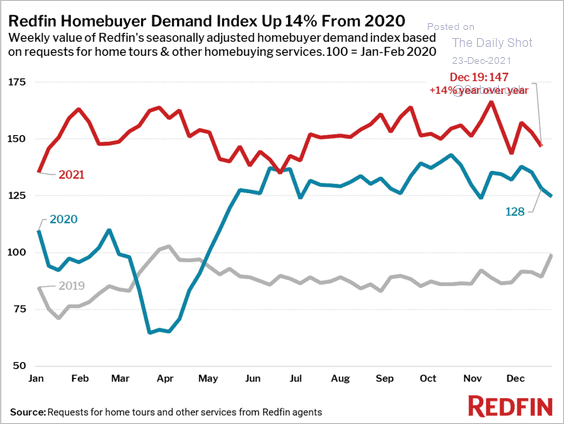

• Homebuyer demand is holding above last year’s levels.

Source: Redfin

Source: Redfin

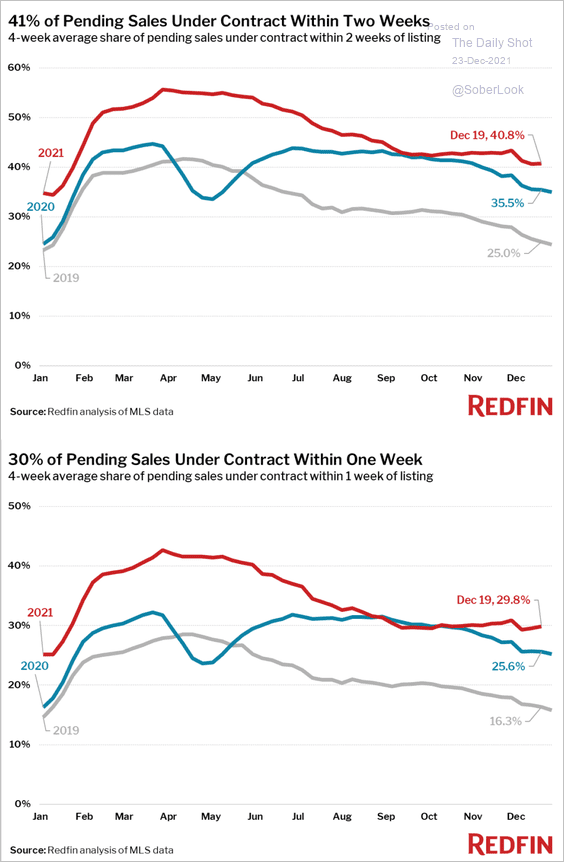

• Homes are selling quickly.

Source: Redfin

Source: Redfin

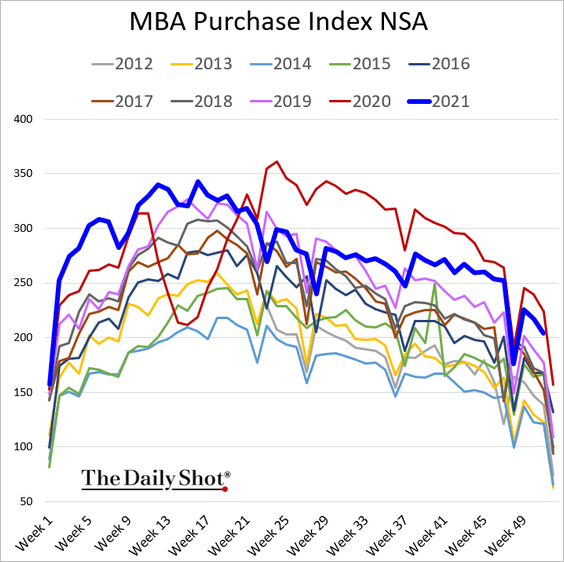

• Mortgage applications remain strong for this time of the year.

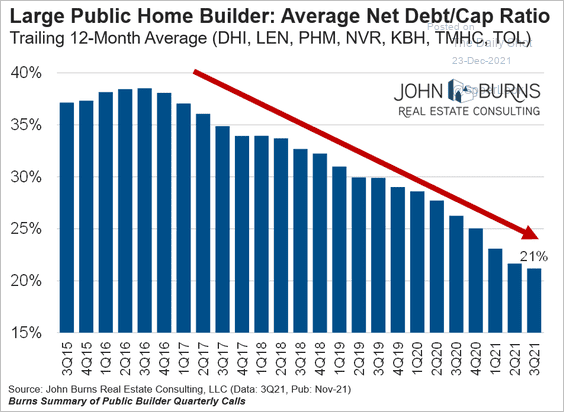

• Homebuilder leverage continues to moderate.

Source: @RickPalaciosJr

Source: @RickPalaciosJr

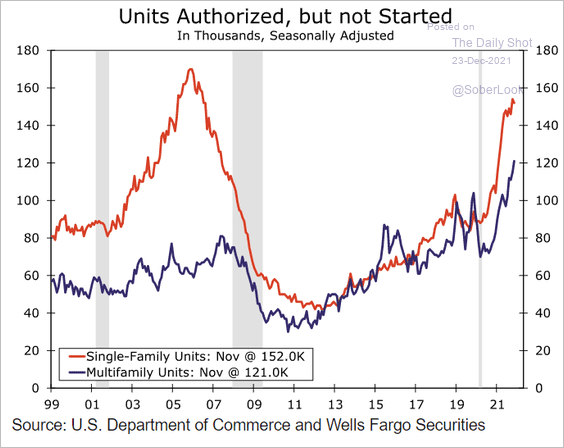

• Here is the number of residential housing projects that have been authorized but not started.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

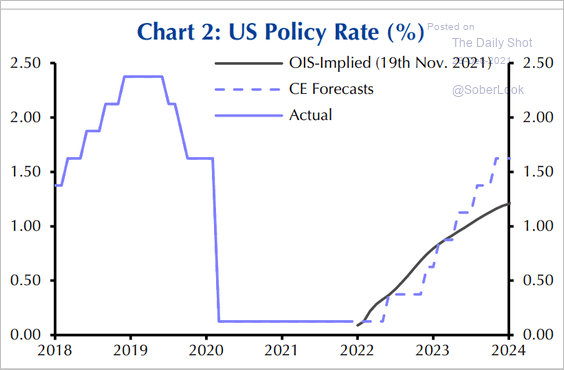

3. Capital Economics does not see the Fed slowing rate hikes in 2023. This forecast diverges from market expectations.

Source: Capital Economics

Source: Capital Economics

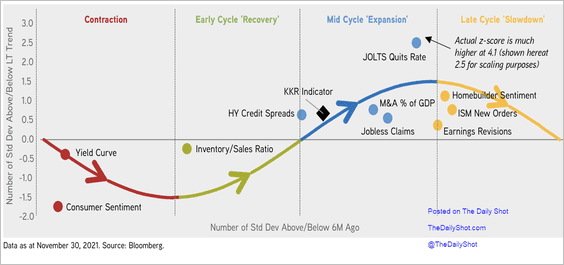

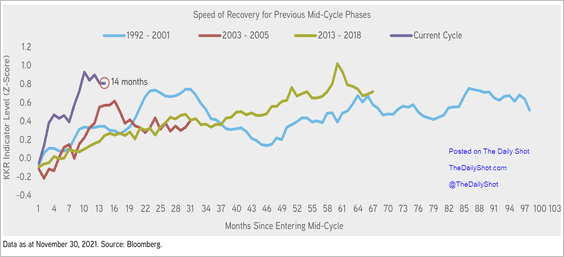

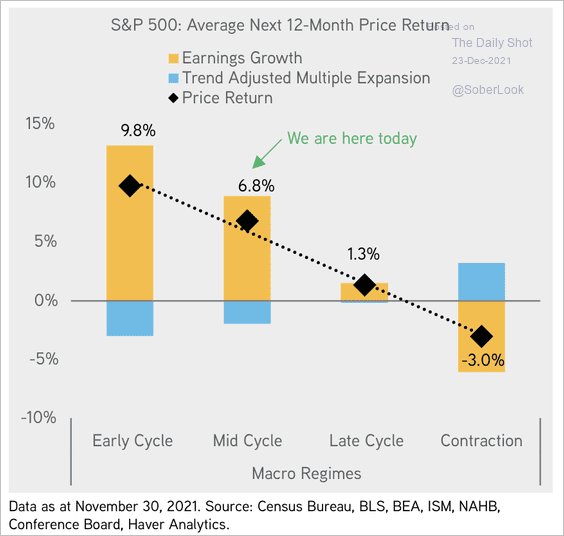

4. The economy is in a mid-cycle phase of the business cycle.

Source: KKR Global Institute

Source: KKR Global Institute

This mid-cycle phase has been much faster/stronger than previous cycles.

Source: KKR Global Institute

Source: KKR Global Institute

——————–

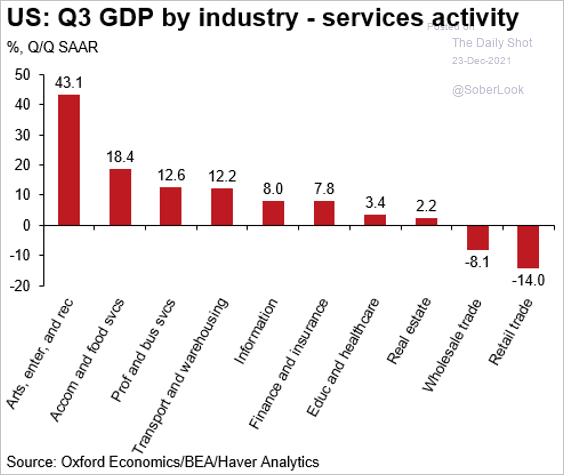

5. This chart shows how various sectors in the service industry performed in the third quarter.

Source: @OrenKlachkin

Source: @OrenKlachkin

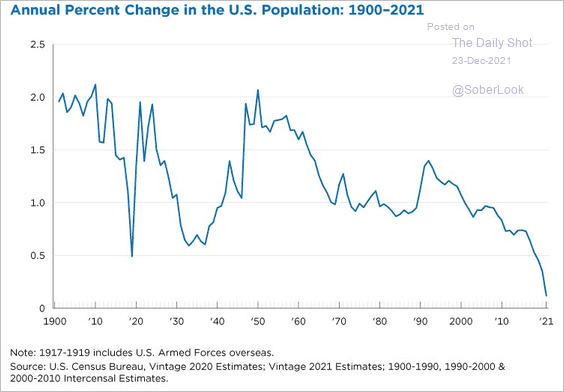

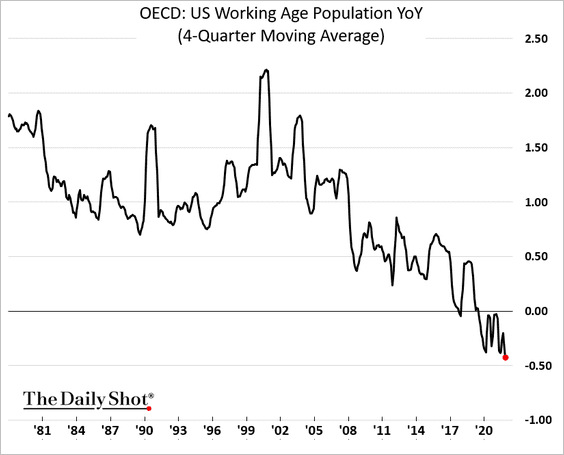

6. US population growth dropped to a record low this year. A lesson from Japan is that it’s challenging to maintain economic expansion when your population growth stalls.

Source: U.S. Census Bureau

Source: U.S. Census Bureau

And it will be especially difficult as the US working-age population declines.

Back to Index

Canada

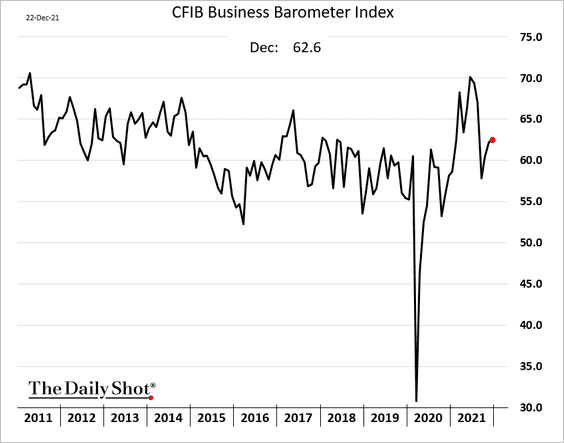

The CFIB small/medium-size business index ticked higher this month.

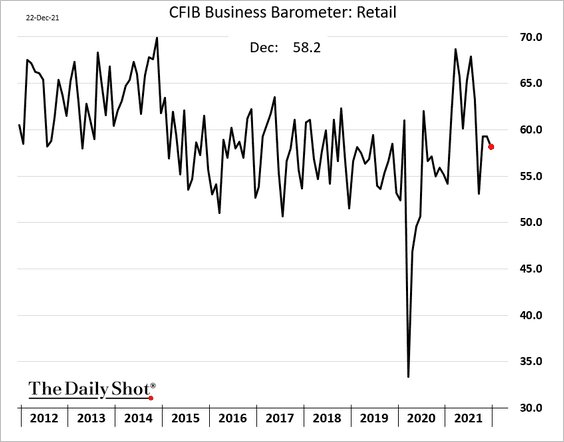

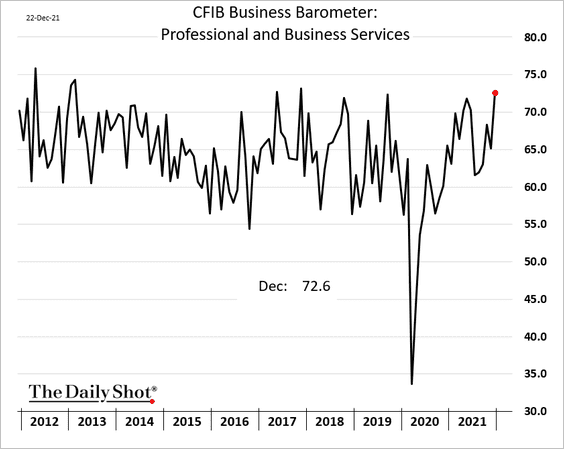

The recovery has been uneven,

• Retail:

• Business services:

Back to Index

The United Kingdom

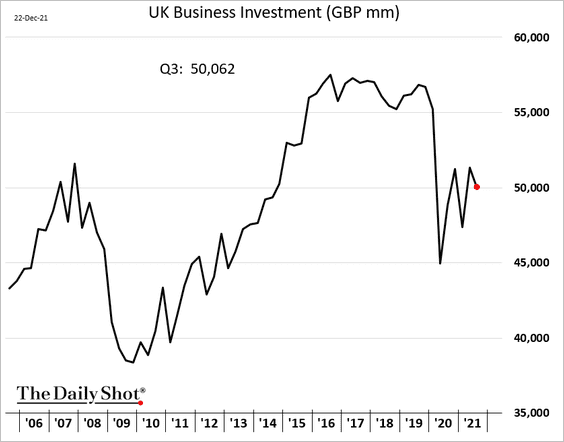

1. The updated GDP report showed soft business investment in Q3. Exports remained depressed.

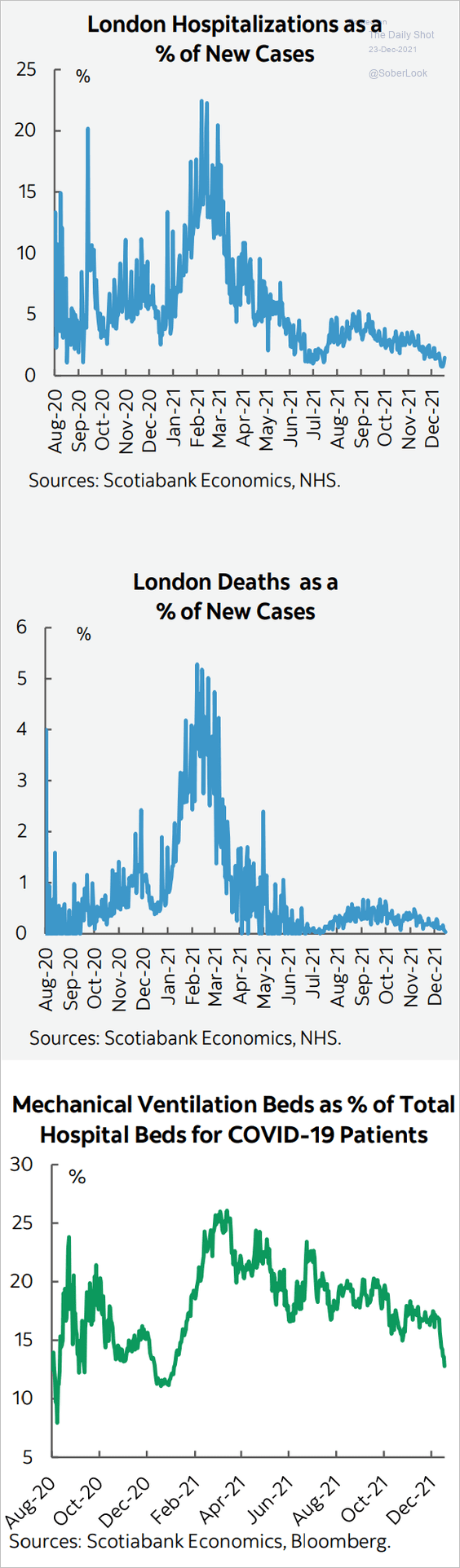

2. UK hospitalization data suggest that omicron may be less dangerous than previous COVID variants.

Source: Scotiabank Economics

Source: Scotiabank Economics

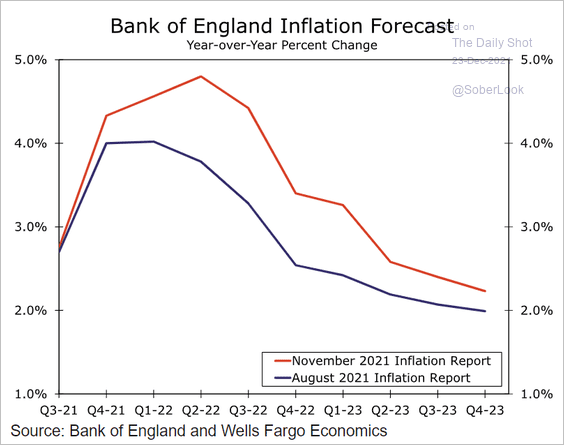

3. The BoE now sees inflation peaking by the middle of 2022.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

The Eurozone

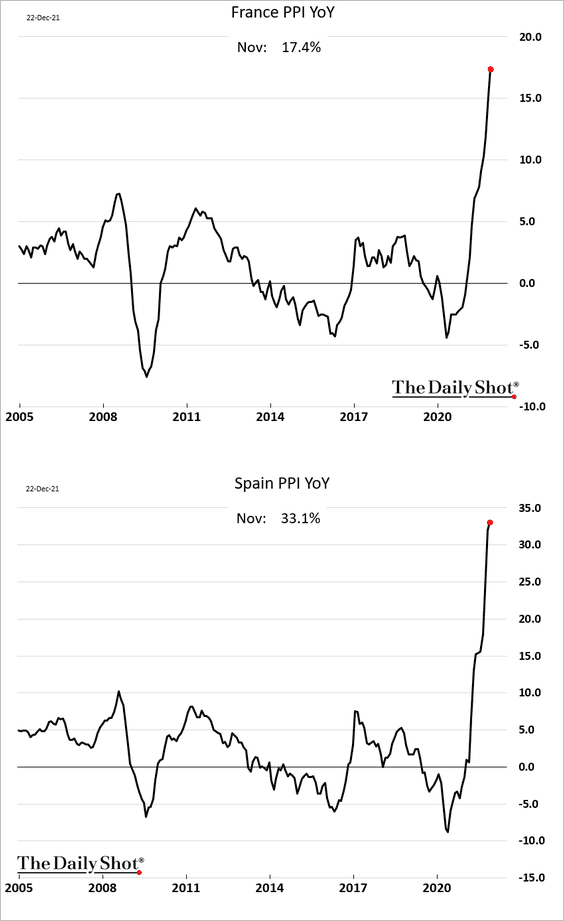

1. Producer prices continued to surge in November.

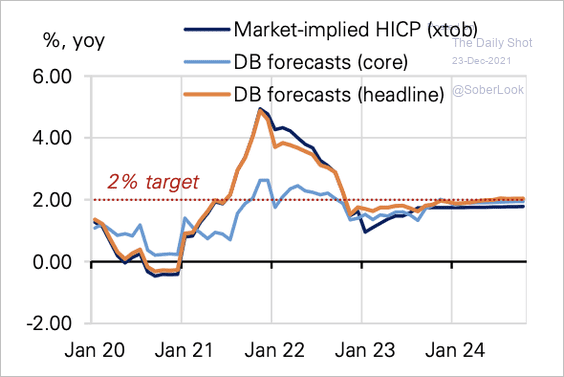

2. Deutsche Bank expects consumer inflation to settle around the 2% target within the next two years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

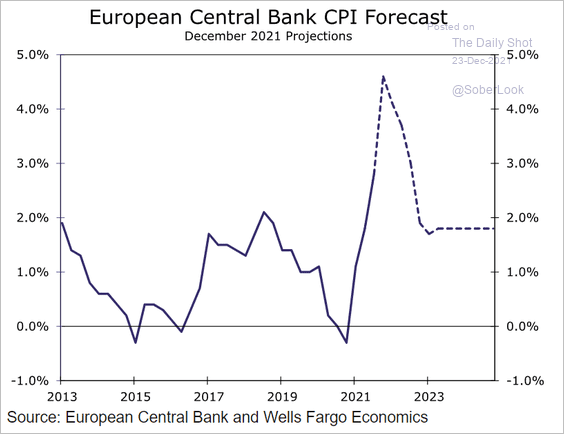

Here is the ECB’s forecast.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

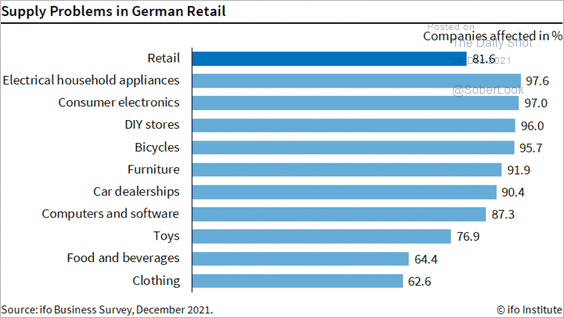

3. Germany’s retail-sector supply challenges are acute.

Source: @KlausWohlrabe, @ifo_institut

Source: @KlausWohlrabe, @ifo_institut

Back to Index

Europe

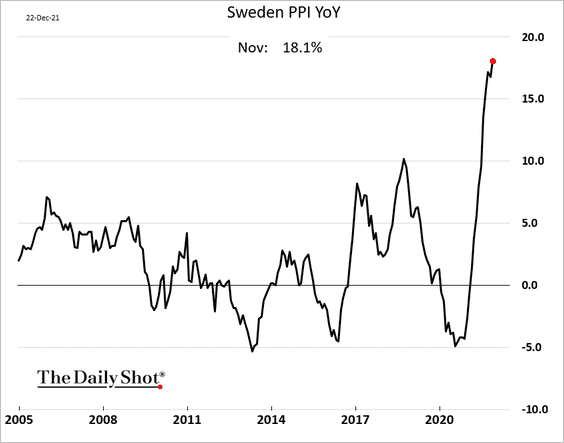

1. Sweden’s producer price gains hit a new high.

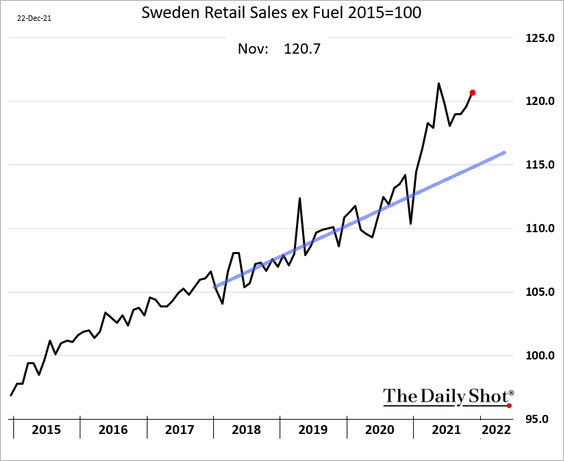

Retail sales remain well above the pre-COVID trend.

——————–

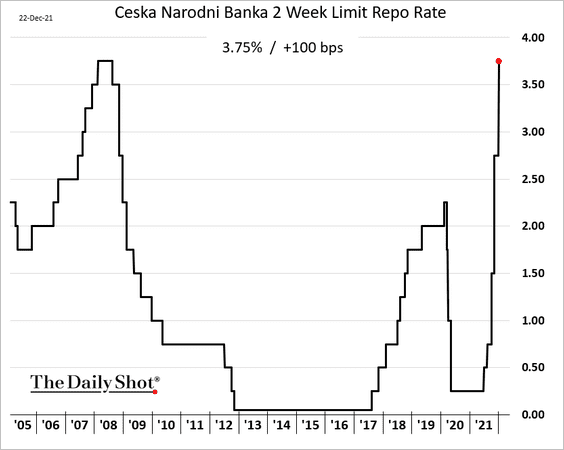

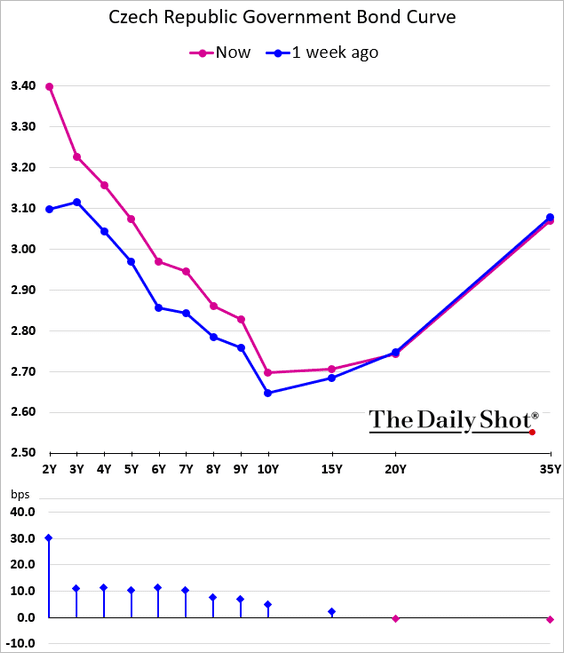

2. The Czech central bank hiked rates by 100 bps (the market expected 75bps).

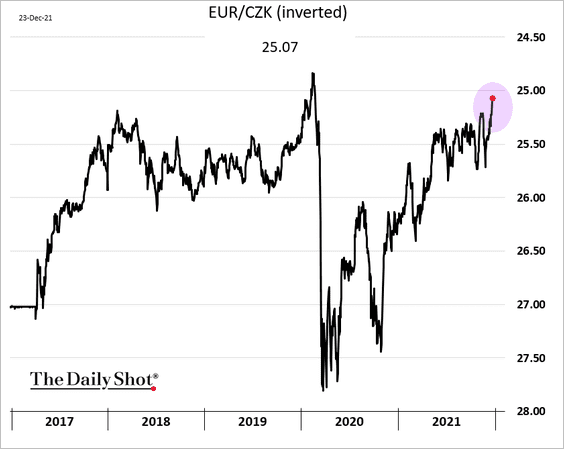

• The Czech koruna jumped.

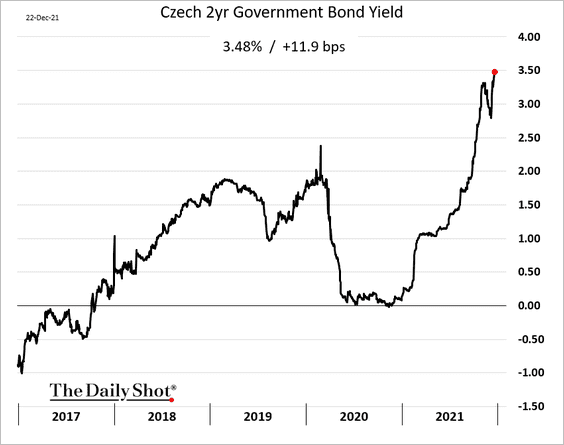

• Bond yields continue to hit multi-year highs.

• The market sees the central bank’s aggressive inflation-fighting posture as a policy mistake. The yield curve has inverted sharply, indicating a substantial economic slowdown ahead.

——————–

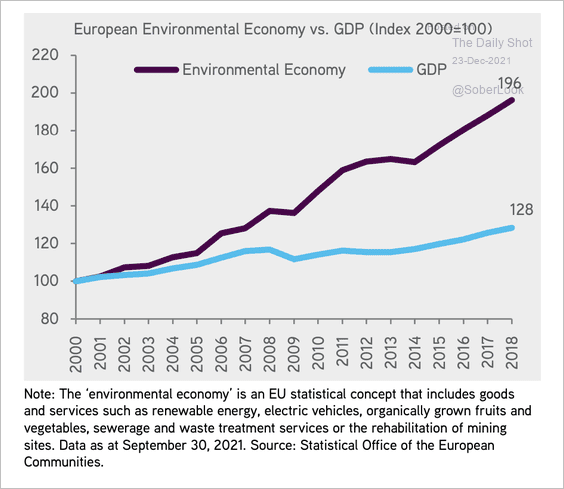

3. The environmental economy (see definition below) has outpaced the overall European economy for some years now.

Source: KKR

Source: KKR

Back to Index

Asia – Pacific

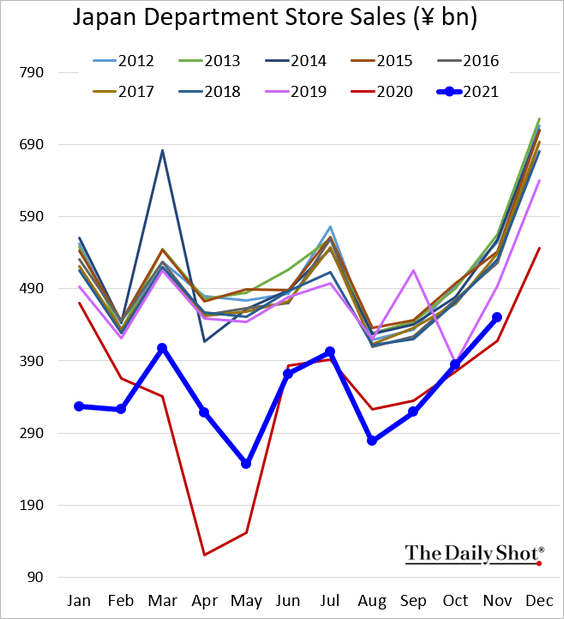

1. Japan’s department store sales are recovering but remain below 2019 levels.

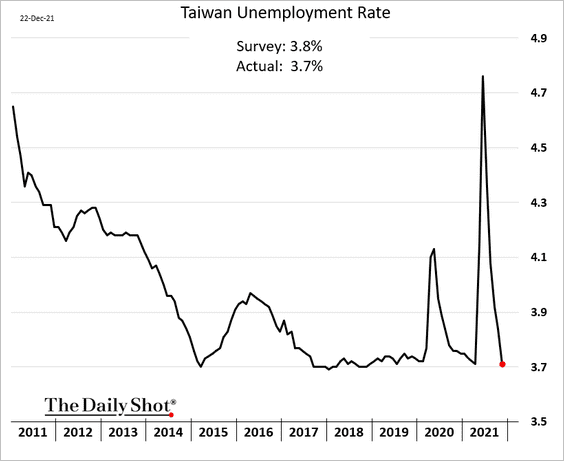

2. Taiwan’s unemployment rate is back at the 3.7% “floor.”

Back to Index

China

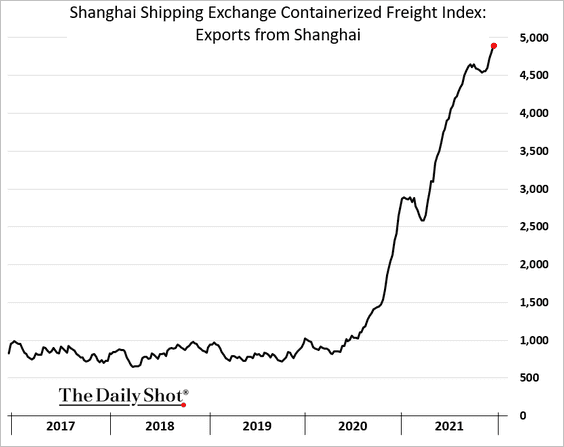

1. As of last week, container freight rates out of Shanghai continued to climb.

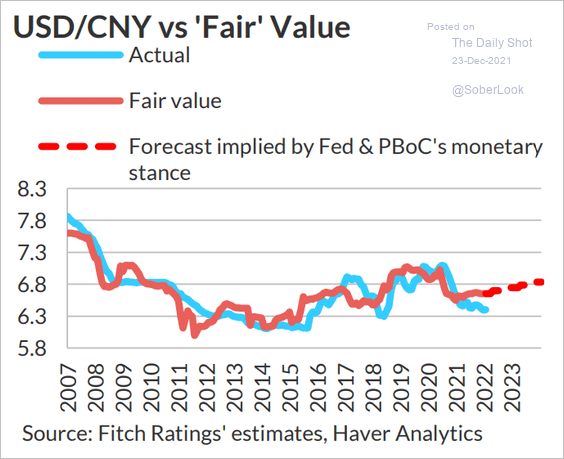

2. The renminbi has been boosted by portfolio inflows, but easier monetary policy points to China’s currency weakening over the next couple of years (chart shows USD strengthening against CNY).

Source: Fitch Ratings

Source: Fitch Ratings

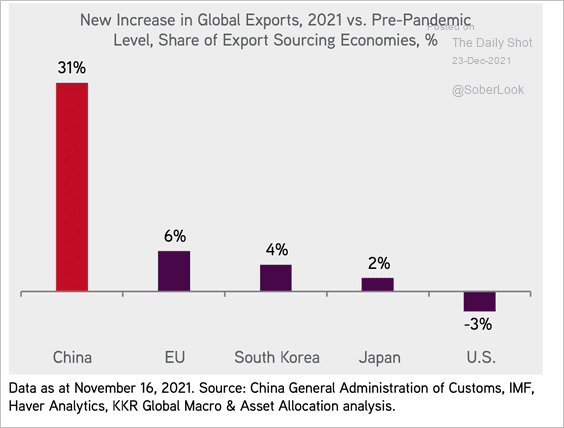

3. China has captured the vast majority of the post-pandemic increase in global trade.

Source: KKR

Source: KKR

Back to Index

Emerging Markets

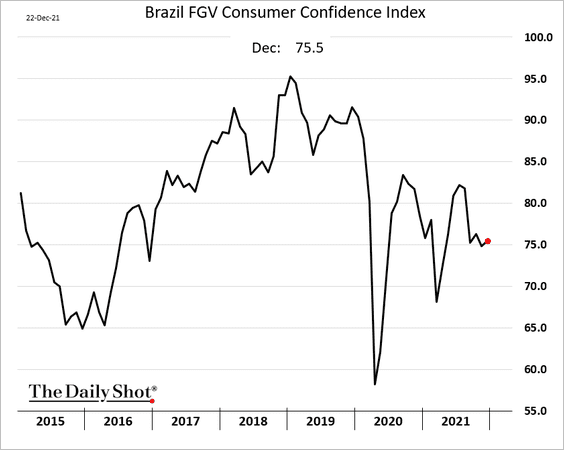

1. Brazil’s consumer confidence ticked up but remains depressed.

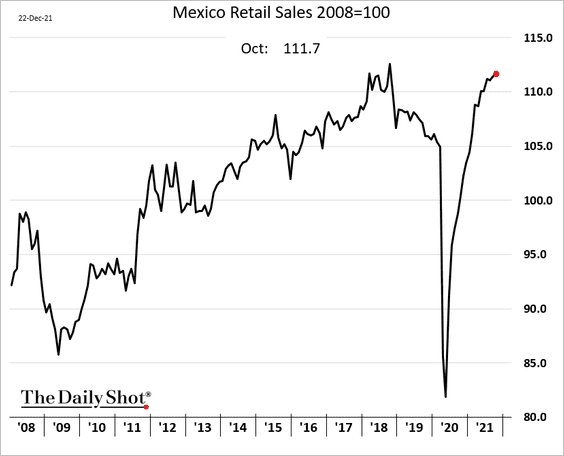

2. Mexico’s retail sales continued to grind higher in October.

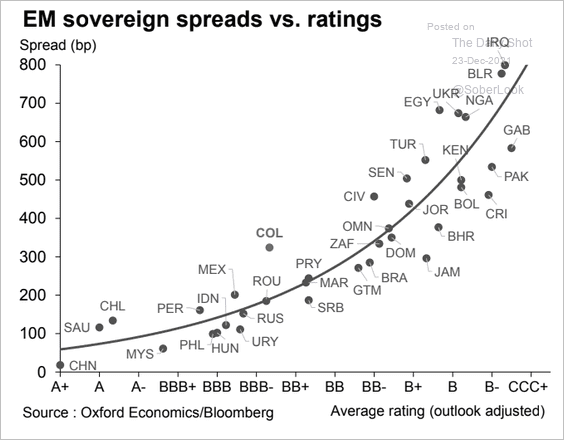

3. Next, we have sovereign spreads vs. ratings across EM economies. Colombia’s bonds look attractive on a relative basis.

Source: Oxford Economics

Source: Oxford Economics

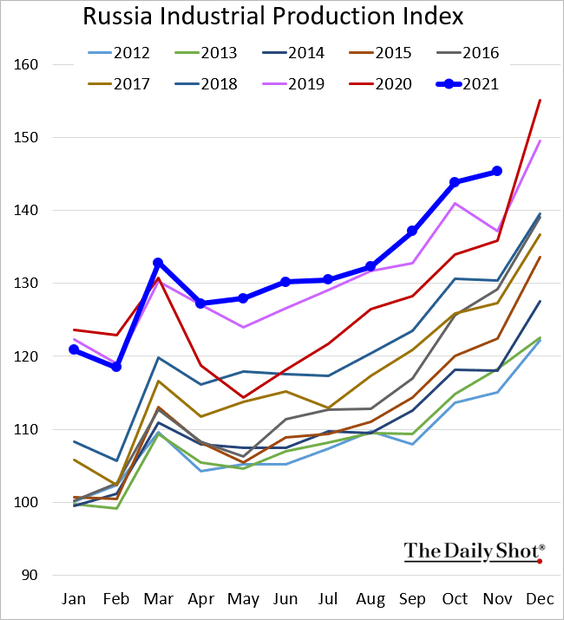

4. Russia’s industrial production has been strong for this time of the year.

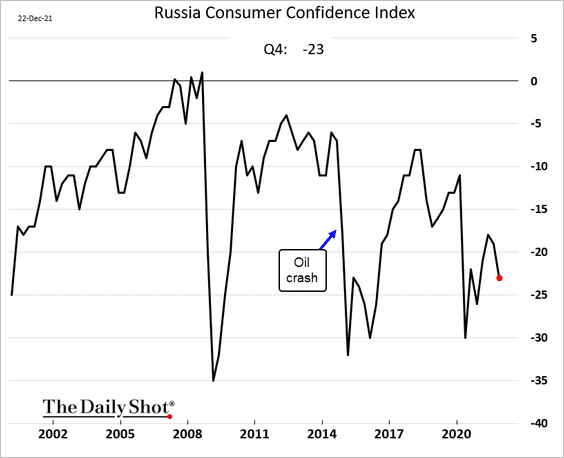

But consumer confidence deteriorated this quarter.

——————–

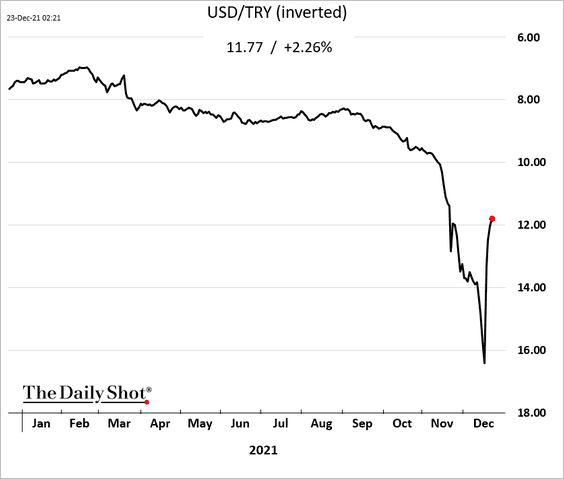

4. The Turkish lira continues to rebound. Guaranteed principal on a juicy carry trade brings in quite a few takers.

Back to Index

Cryptocurrency

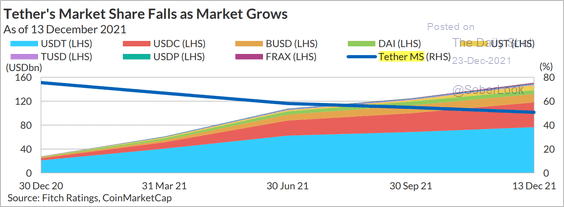

1. Tether’s market share continues to decline.

Source: Fitch Ratings

Source: Fitch Ratings

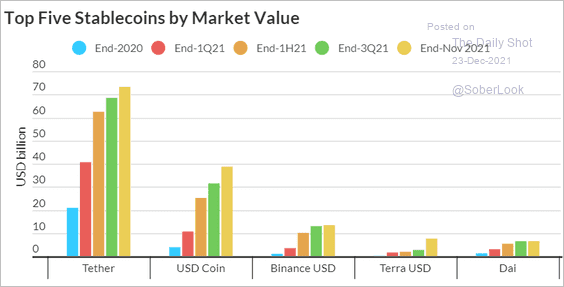

Here are the top five stablecoins by market value.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

2. This graphic illustrates the changes in market capitalization rankings by year (see this link if you are not familiar with crypto symbols).

Source: @gaborgurbacs

Source: @gaborgurbacs

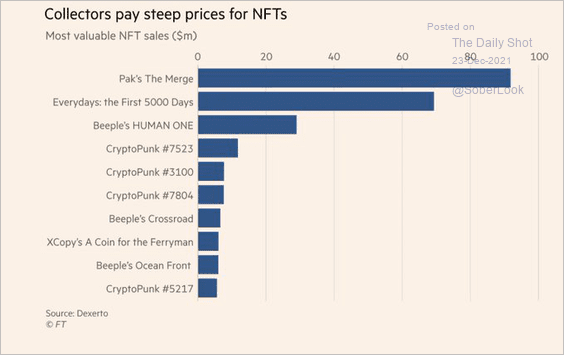

3. There have been some sizeable NFT transactions recently.

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

Back to Index

Energy

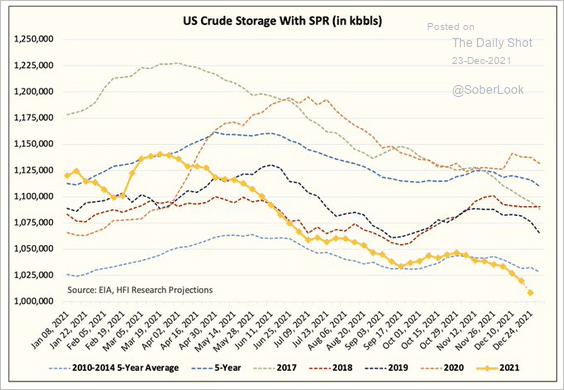

1. US crude stockpiles declined sharply last week as firms draw down inventories going into the year-end to reduce their royalty taxes.

Source: @HFI_Research

Source: @HFI_Research

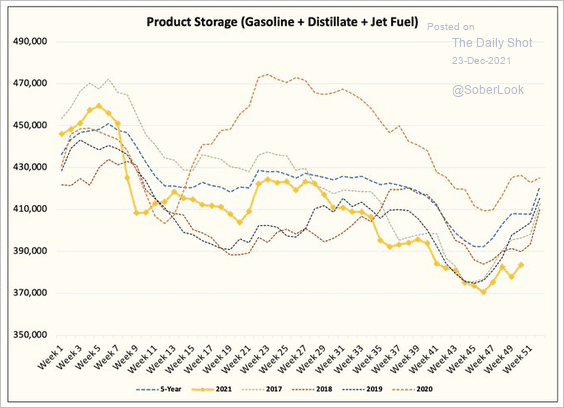

Product inventories climbed more than expected (2 charts).

Source: @HFI_Research

Source: @HFI_Research

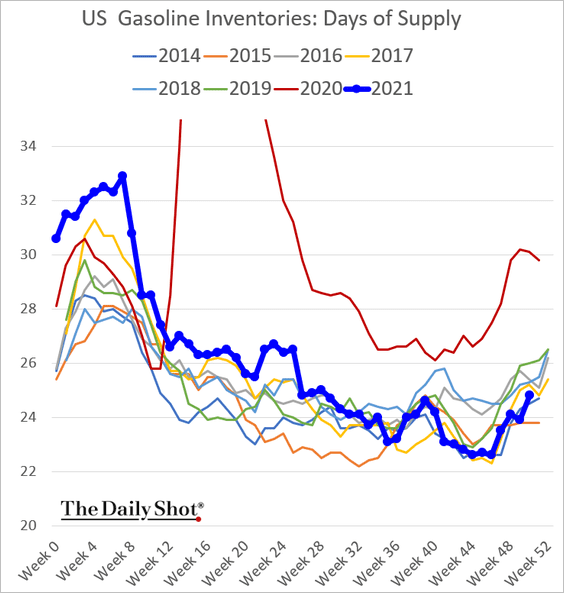

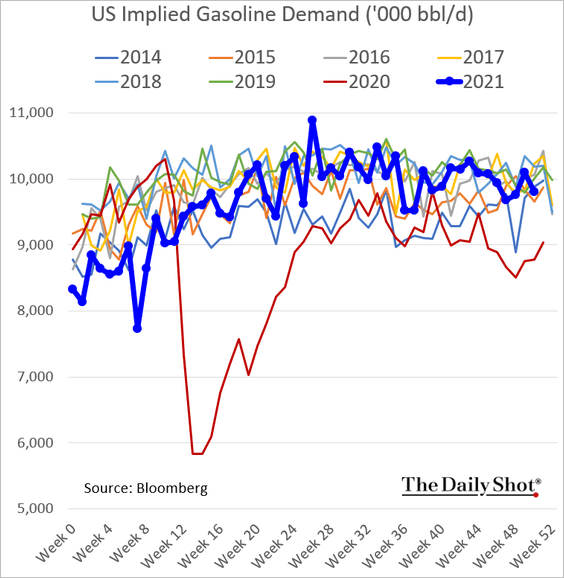

And gasoline demand dropped, suggesting that omicron concerns are impacting mobility.

——————–

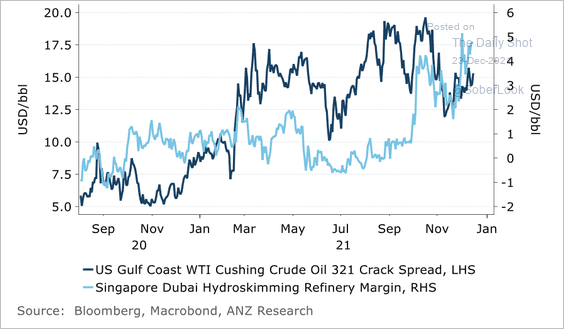

2. Global refinery margins remain strong.

Source: ANZ Research

Source: ANZ Research

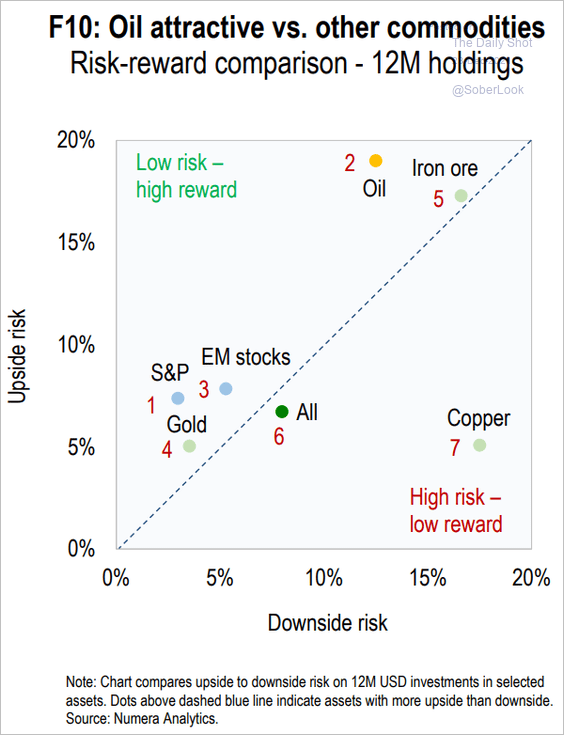

3. Crude oil is attractive relative to other commodities.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

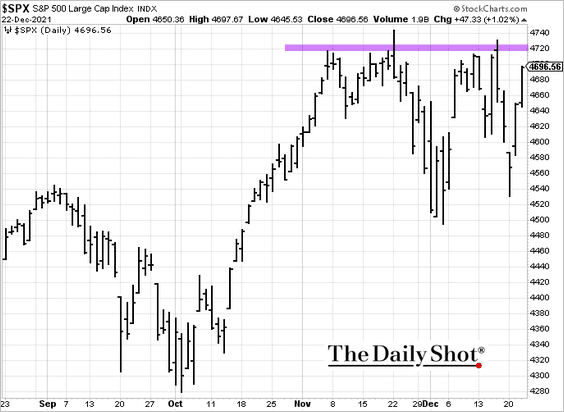

Equities

1. The market rebound has been rapid, with the S&P 500 approaching resistance.

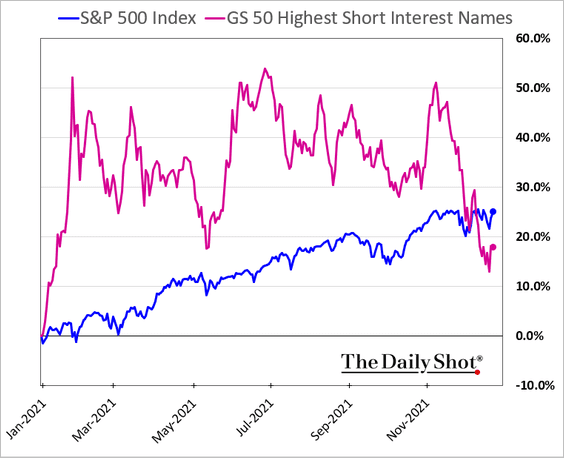

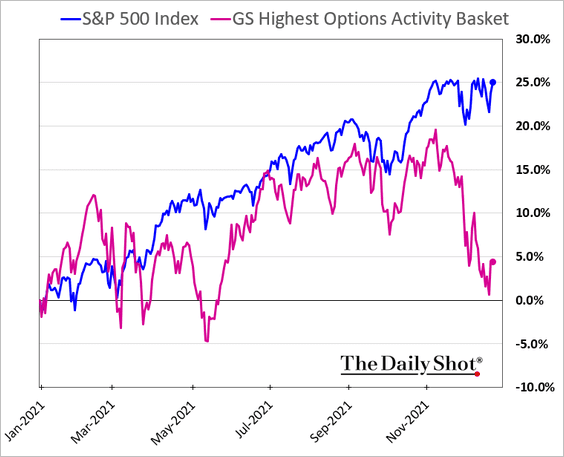

2. Most-shorted shares have been underperforming this month as the Reddit crowd pulls back.

• We can see the retail investor retreat from the underperformance of stocks with the highest options volumes.

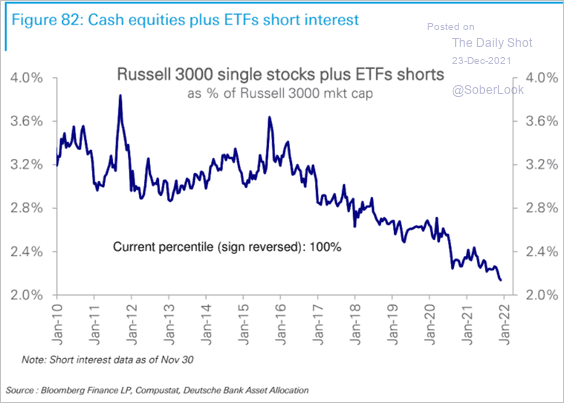

• Short interest across the US stock market continues to drop (Russell 3000 = broad market index).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

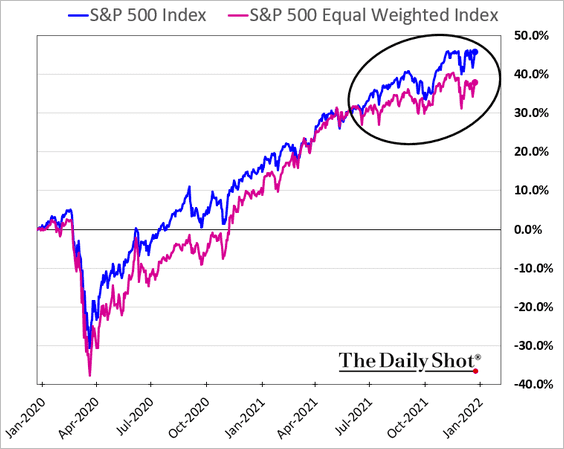

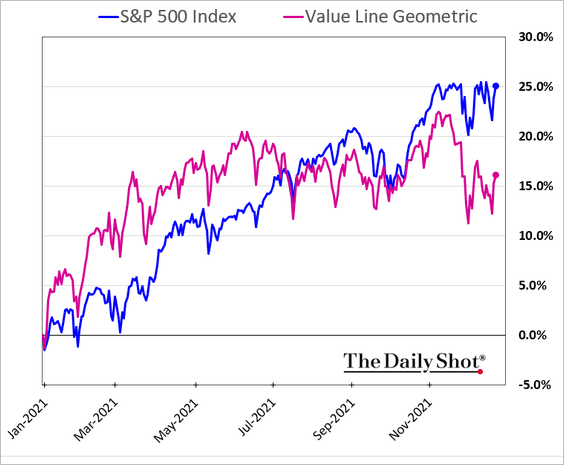

3. The S&P 500 equal-weight index is underperforming.

Further reading

Further reading

We see a similar trend in the Value Line index.

——————–

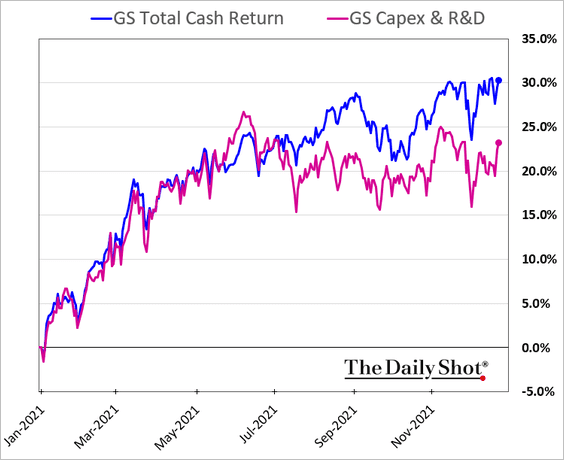

4. The market has been rewarding companies focused on buybacks and dividends rather than CapEx.

5. A mid-cycle economic expansion is consistent with above-average equity market performance over the next 12 months. During this phase, returns are driven by earnings growth rather than multiple expansion.

Source: KKR Global Institute

Source: KKR Global Institute

Back to Index

Rates

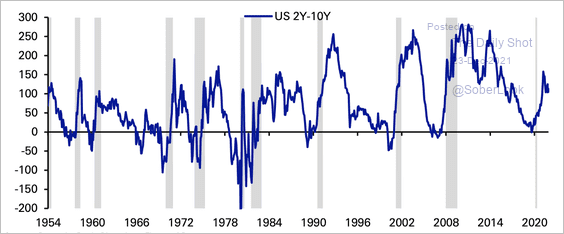

1. While the recent flattening of the 2s10s Treasury curve is a concern, there is typically a 12-18 month gap between inversions and recessions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

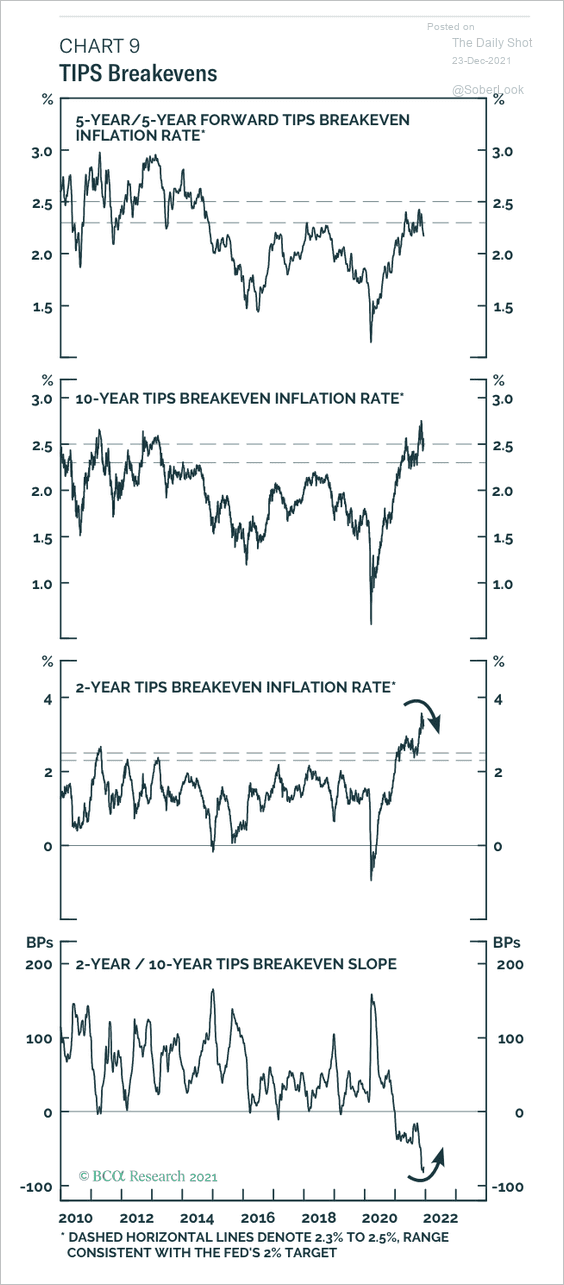

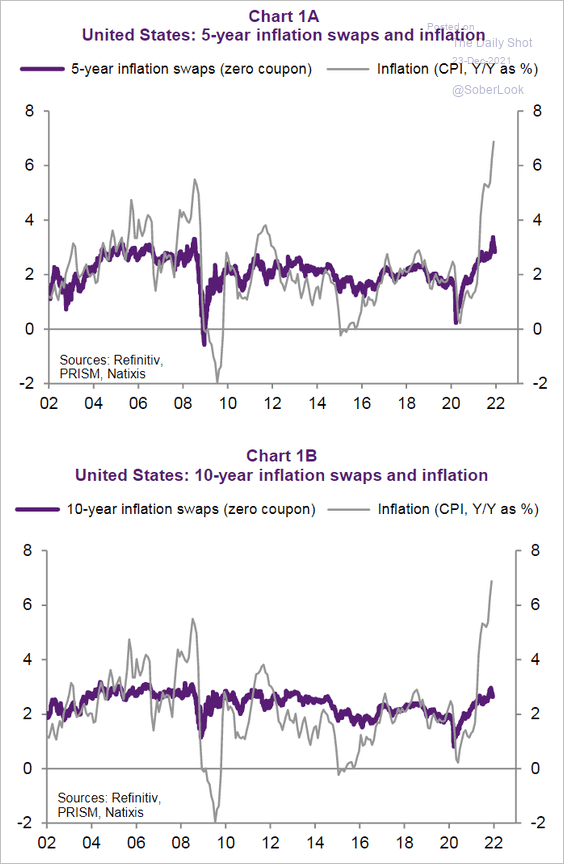

2. BCA Research expects short-term inflation expectations to fall next year.

Source: BCA Research

Source: BCA Research

This chart shows US market-based inflation expectations vs. the CPI over the past couple of decades.

Source: Natixis

Source: Natixis

Back to Index

Global Developments

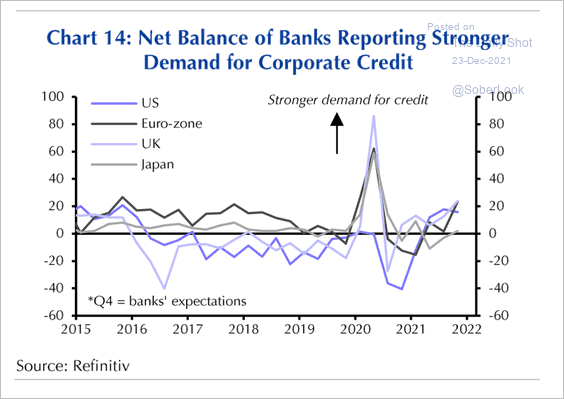

1. Demand for corporate borrowing is picking up.

Source: Capital Economics

Source: Capital Economics

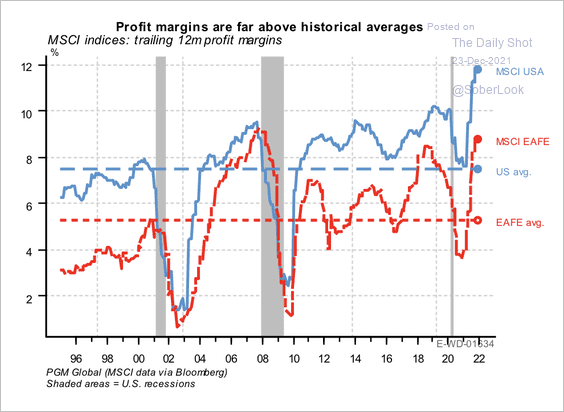

2. Profit margins are well above historical averages in almost every region.

Source: PGM Global

Source: PGM Global

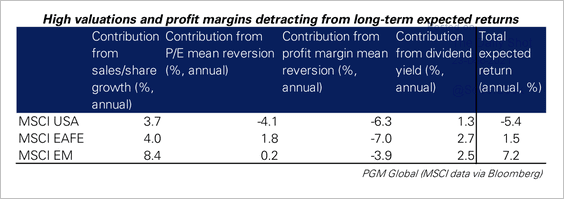

But PGM Global expects difficulties ahead for US and global equity markets as corporate margins and valuations contract.

Source: PGM Global

Source: PGM Global

——————–

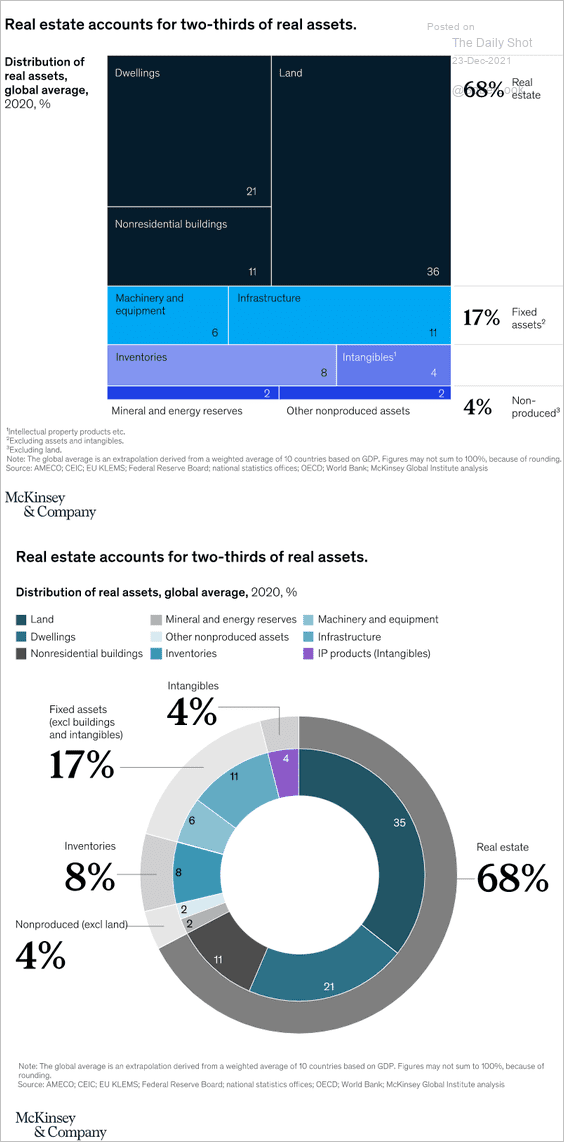

3. What makes up the world’s real assets?

Source: McKinsey Read full article

Source: McKinsey Read full article

——————–

Food for Thought

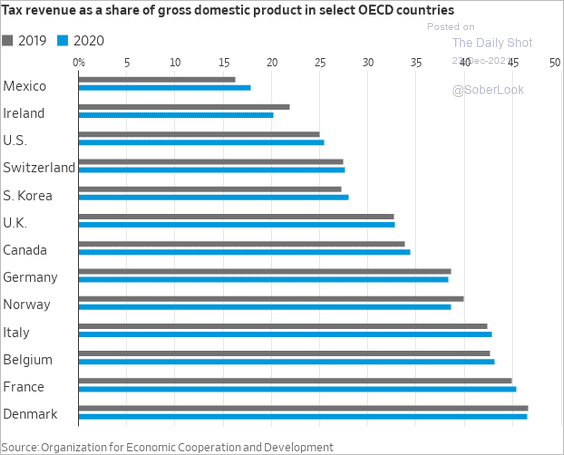

1. Tax revenue as a share of GDP:

Source: @WSJ Read full article

Source: @WSJ Read full article

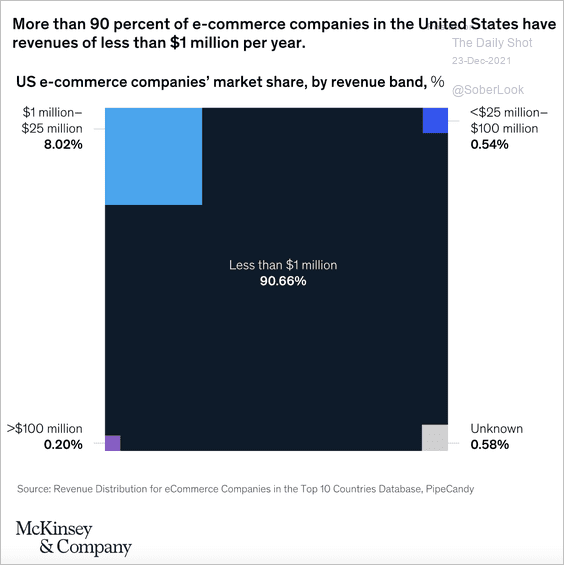

2. More than 90% of e-commerce firms in the US have revenues less than $1 million.

Source: McKinsey

Source: McKinsey

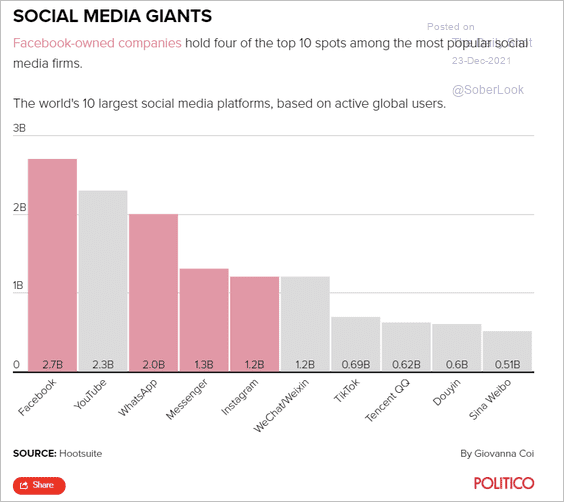

3. Largest social media platforms, based on active global users:

Source: Politico Read full article

Source: Politico Read full article

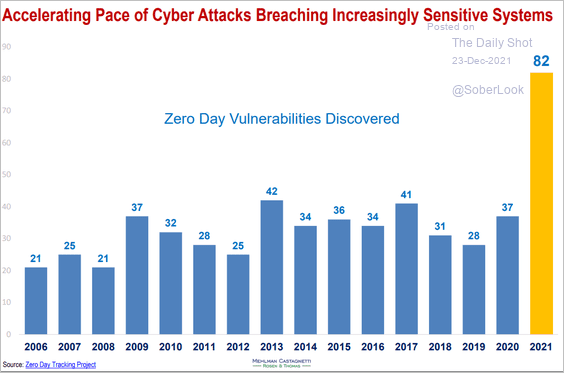

4. Cyberthreat:

Source: Mehlman Castagnetti Rosen & Thomas Read full article

Source: Mehlman Castagnetti Rosen & Thomas Read full article

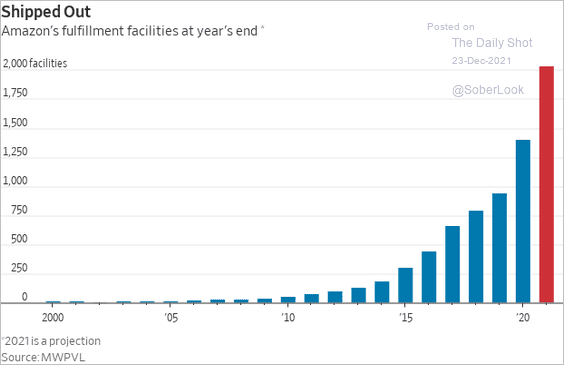

5. Amazon fulfillment facilities:

Source: @WSJ Read full article

Source: @WSJ Read full article

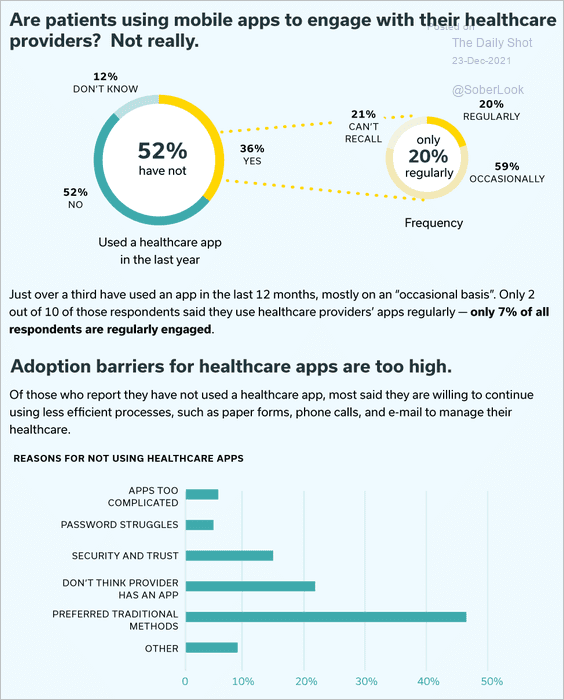

6. Using mobile apps for healthcare:

Source: Lifelink Systems

Source: Lifelink Systems

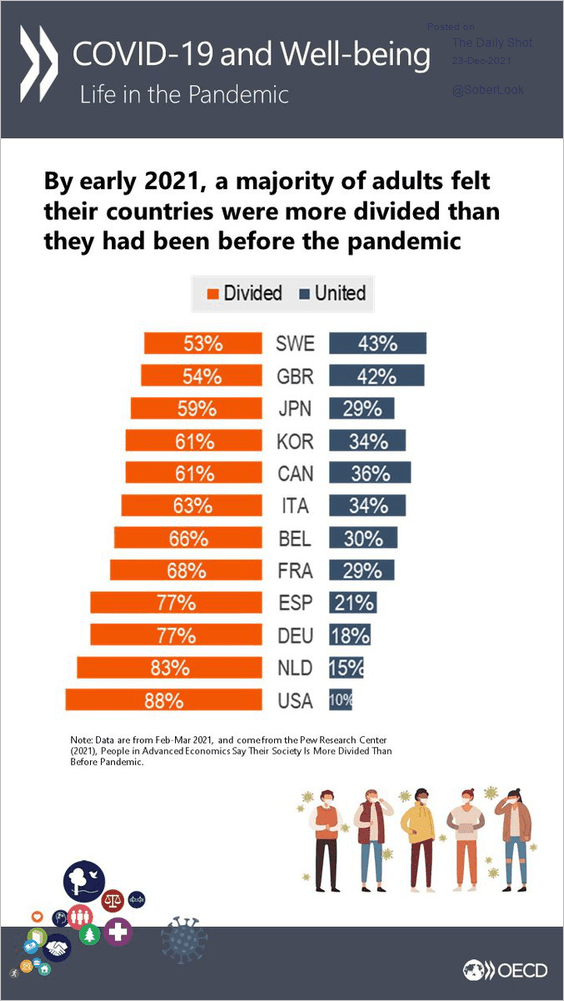

7. Growing divisions around the world:

Source: @OECD_Stat Read full article

Source: @OECD_Stat Read full article

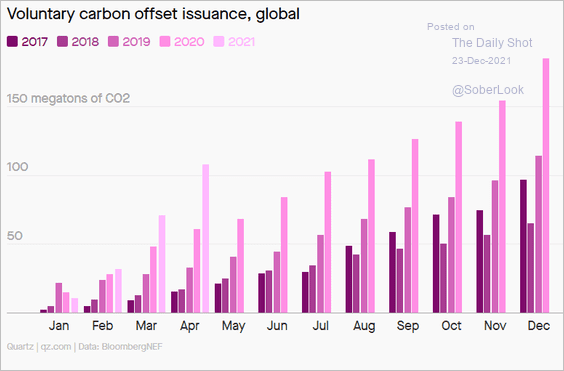

8. Carbon offset issuance:

Source: Quartz Read full article

Source: Quartz Read full article

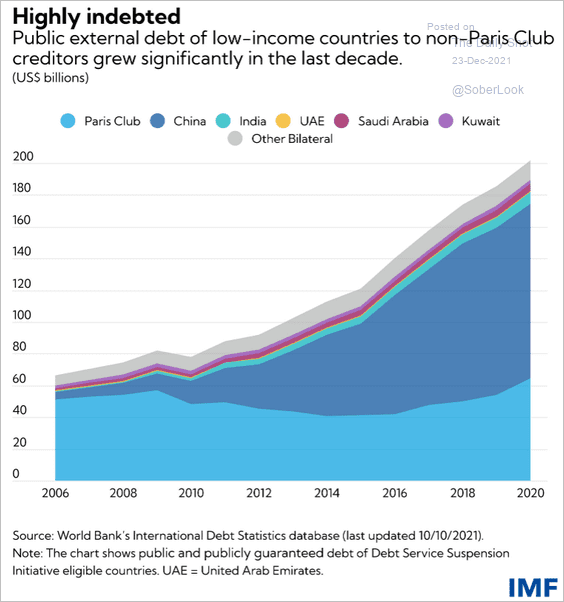

9. Public external debt of low-income countries:

Source: IMF Read full article

Source: IMF Read full article

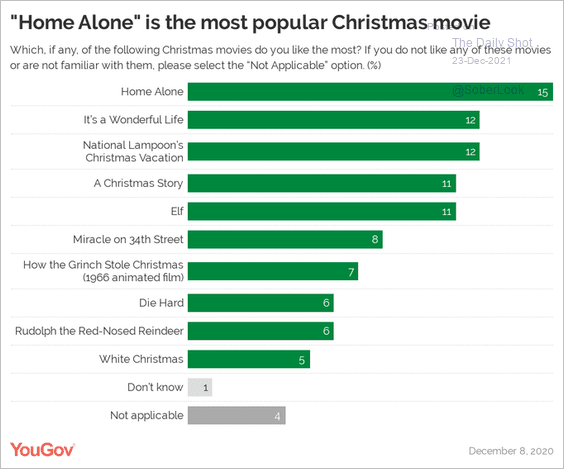

10. Most popular Christmas movies:

Source: YouGov

Source: YouGov

——————–

Back to Index