The Daily Shot: 03-Jan-22

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

Administrative Update

Happy New Year!

Please note that information on scheduling, technical issues, account management, and the image search tool is available here.

Back to Index

The United States

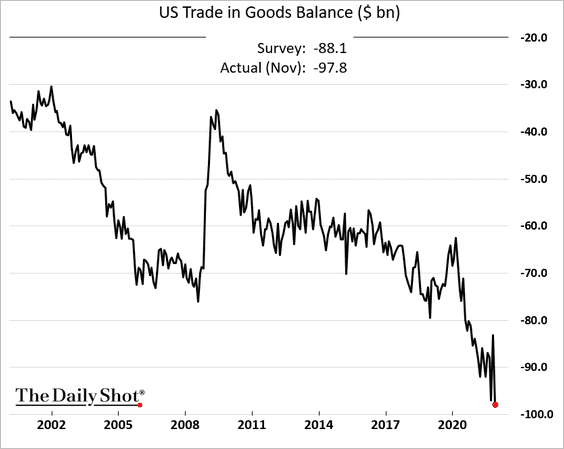

1. The trade deficit in goods hit a new record in November, …

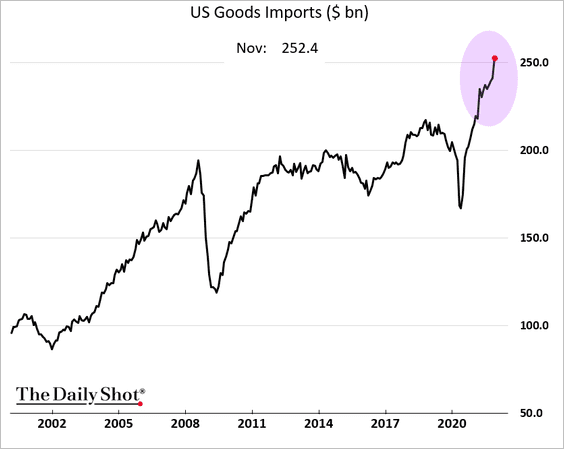

… as imports surged. This is why supply chain bottlenecks have been so extreme.

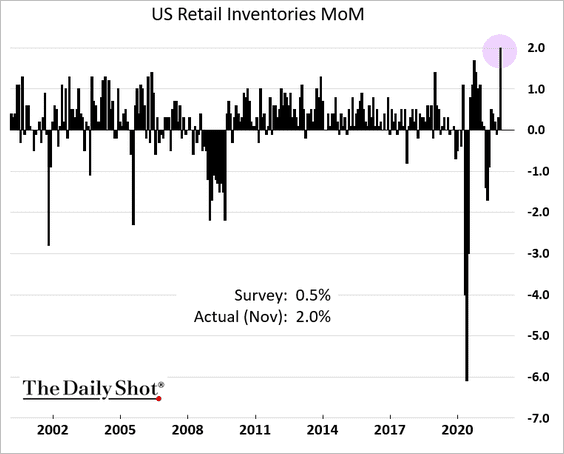

The surge in demand for imports has been driven by the US consumer. Retailers boosted inventories by most in decades to get ready for holiday shopping.

——————–

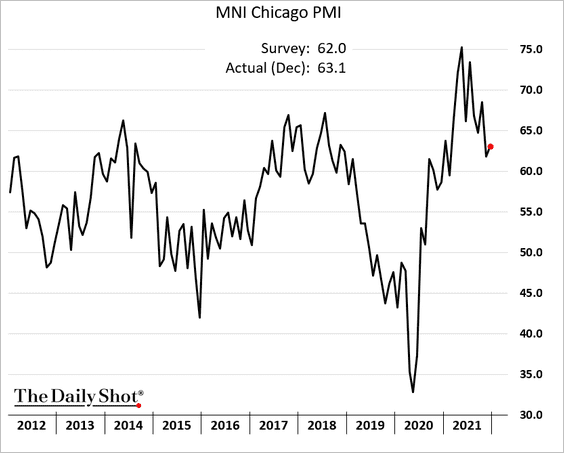

2. Next, let’s take a look at the December regional business activity surveys reported last week.

• The Chicago PMI ticked higher. This index is sensitive to Boeing’s production, which sent the index lower in November.

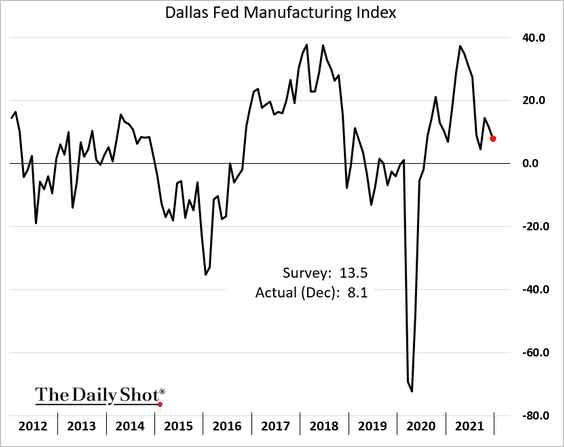

• The Dallas Fed manufacturing index was softer than expected.

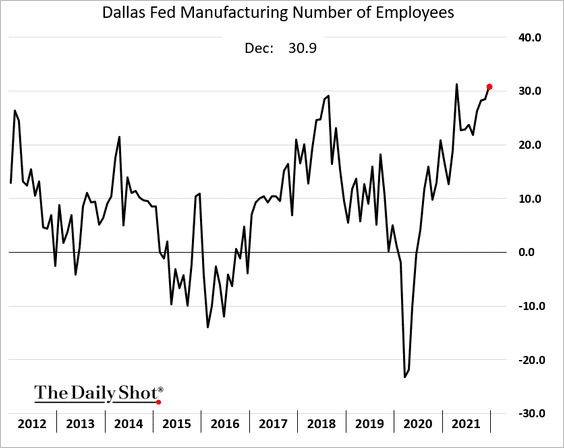

– Texas-area factory hiring remains robust.

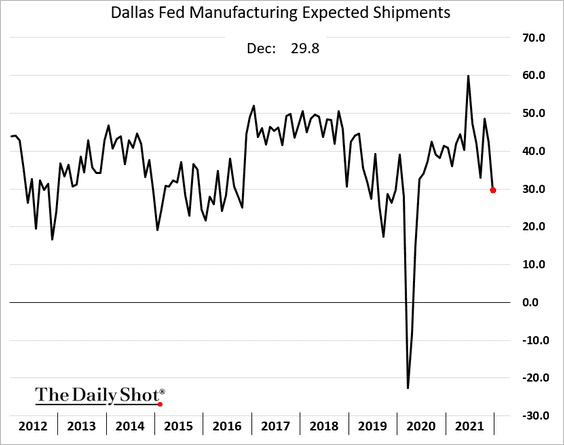

– But the region’s manufacturers are less upbeat about the future, with the expected shipments index declining sharply.

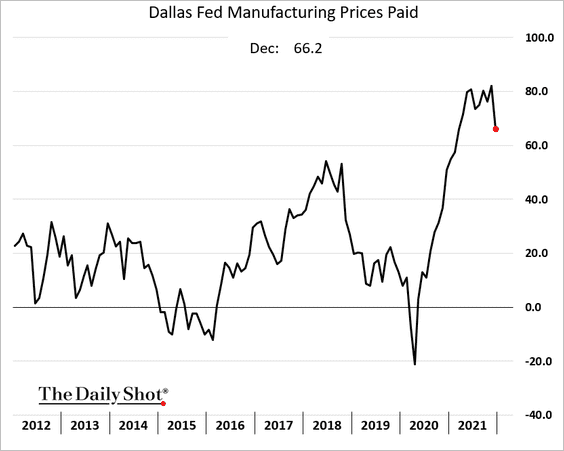

– Price pressures remain extreme but appear to be peaking.

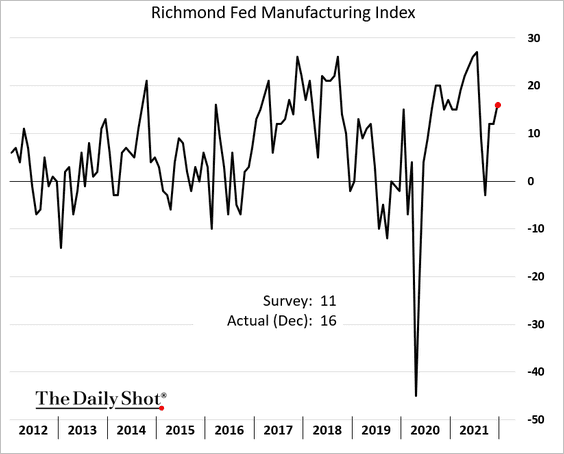

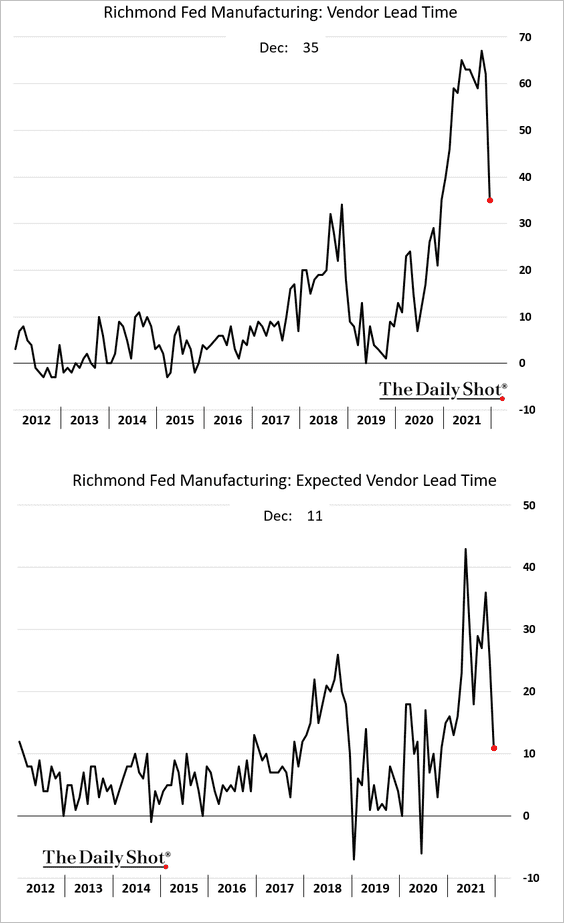

• The Richmond Fed’s manufacturing index topped forecasts.

Supply issues remained near extremes in December.

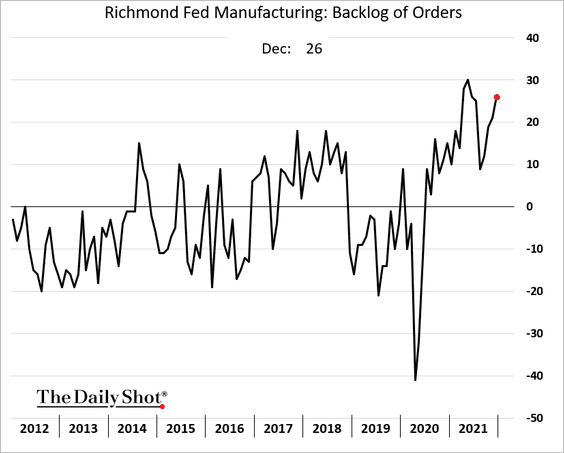

– Backlog of orders:

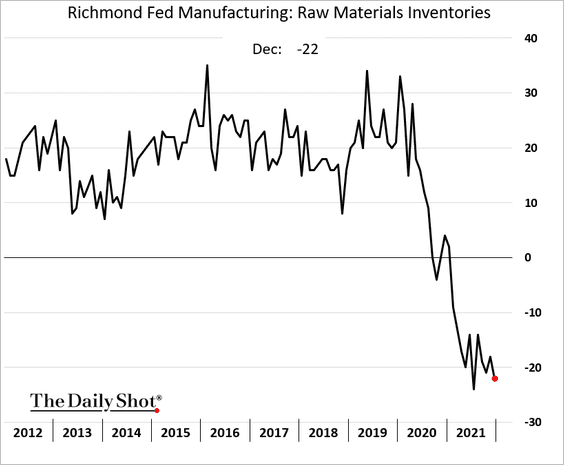

– Raw materials inventories:

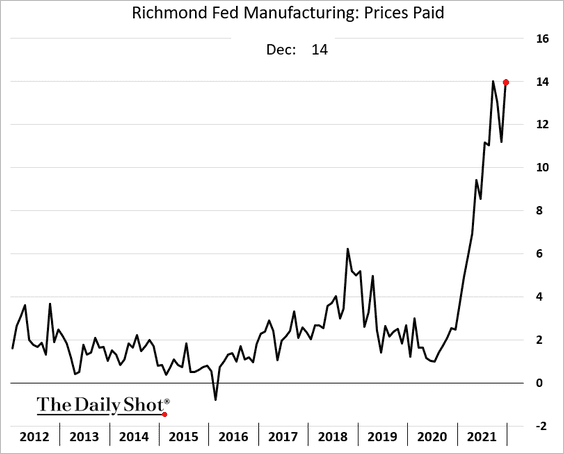

– Input prices:

But there were hopeful signs in the vendor lead time indices.

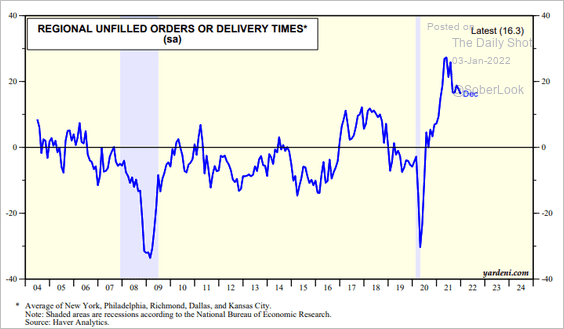

• This index summarizes the supply issues across the regional Fed surveys.

Source: Yardeni Research

Source: Yardeni Research

——————–

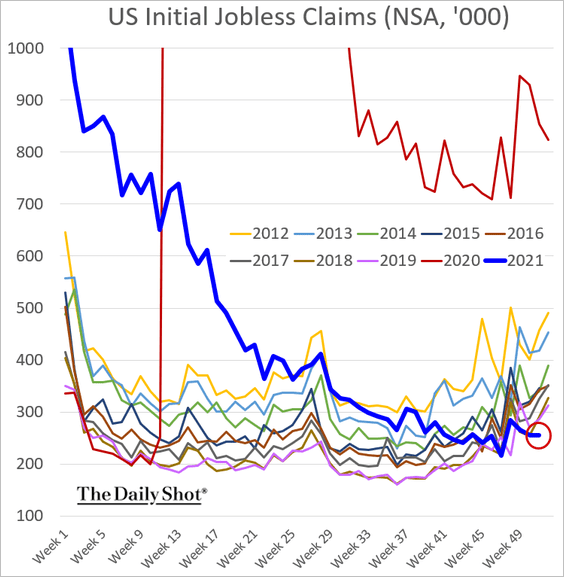

3. Initial jobless claims hit a multi-year low for this time of the year as the labor market continues to strengthen.

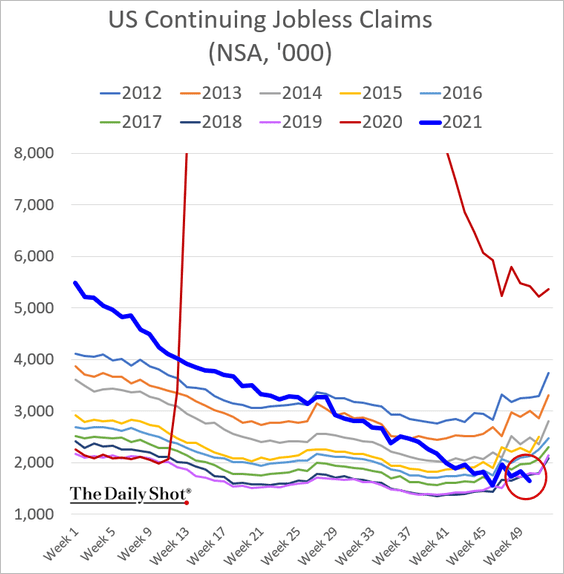

Continuing claims are also at extreme lows, suggesting that the unemployment rate fell further in December.

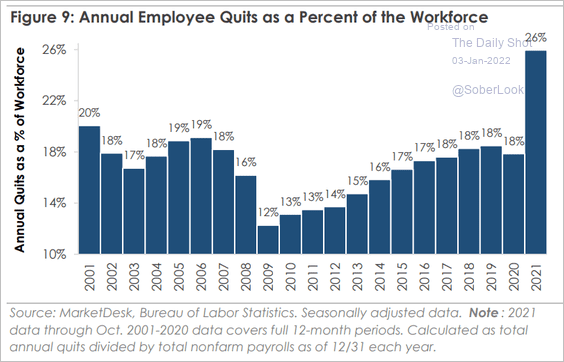

Here is another indicator of the tightening labor market.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

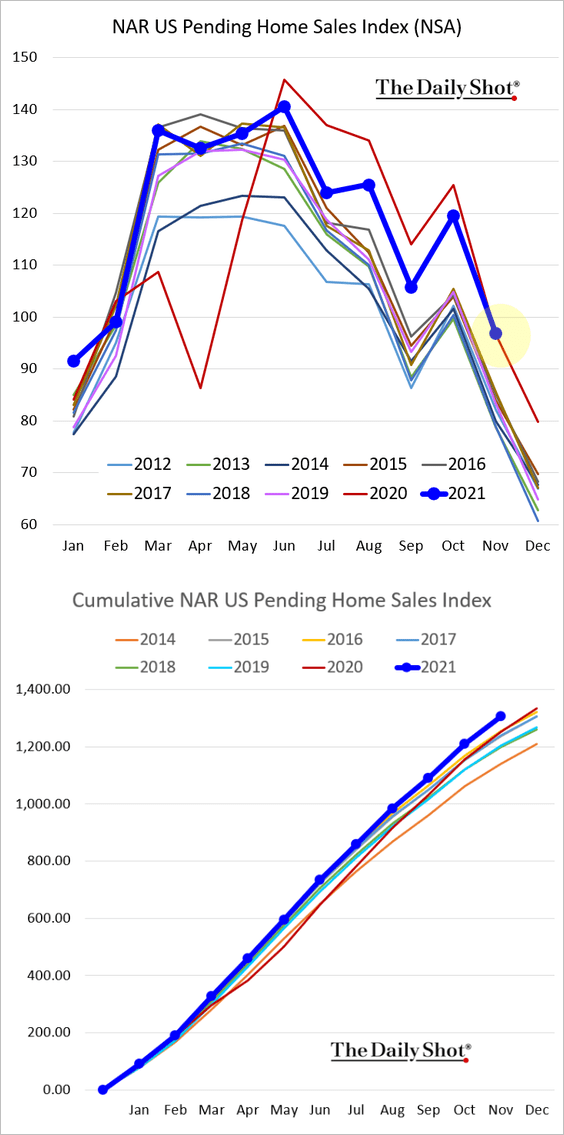

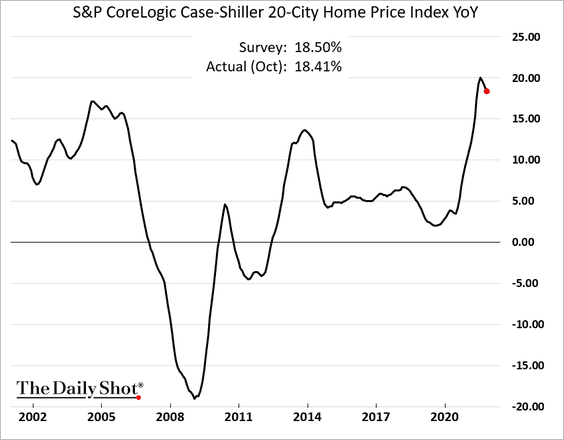

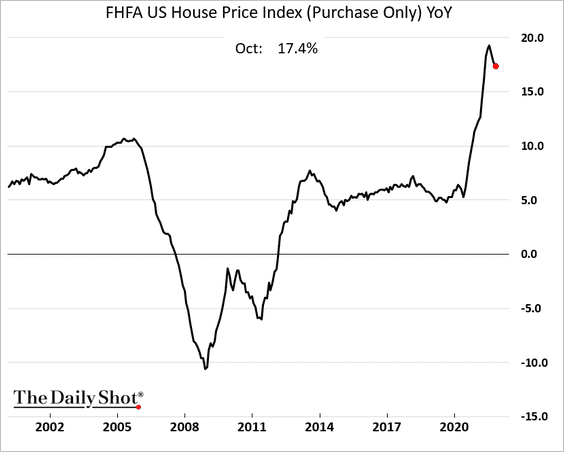

4. Next, we have some updates on the housing market.

• Pending home sales are at the levels we saw in 2020. The media has been quoting the seasonally-adjusted figure of -2.2%. But seasonal adjustments for this time of the year can be misleading, especially in the current environment. Pending home sales are at record highs on a year-to-date basis (second panel).

• Home price appreciation slowed further in October (2 charts). However, we are likely to see faster price gains in November and December.

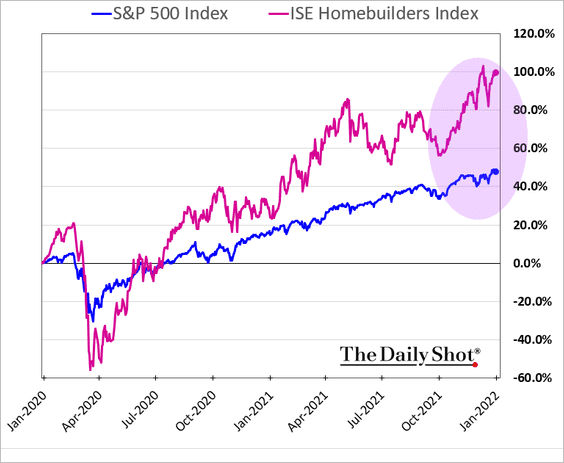

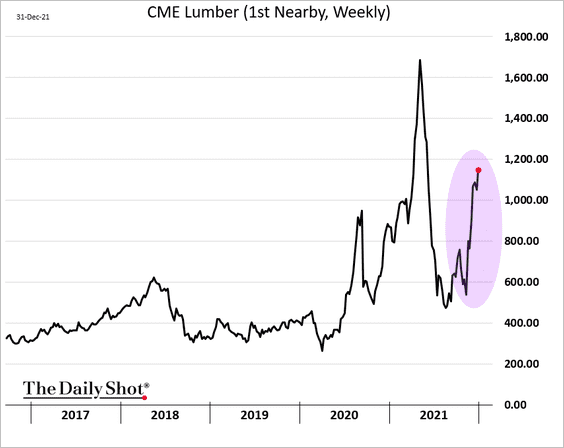

• The markets continue to signal robust demand for residential construction.

– Homebuilder share prices:

– Lumber prices:

——————–

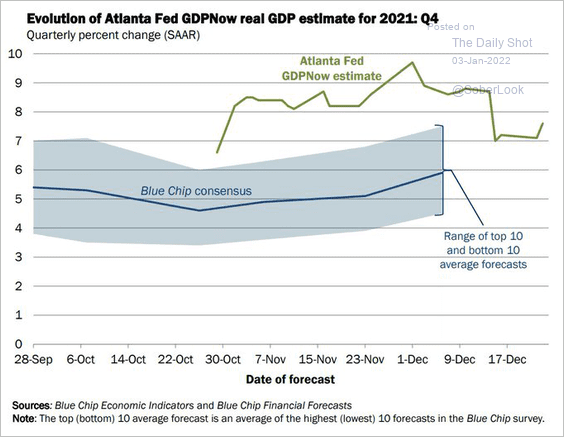

5. The Atlanta Fed’s GDP tracker says that the economy grew by 7.6% (annualized) in Q4.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

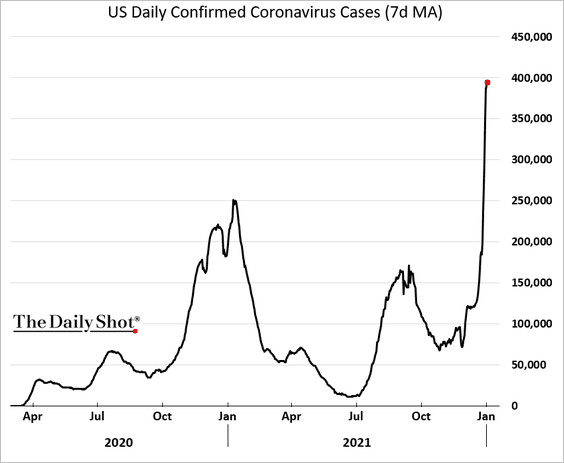

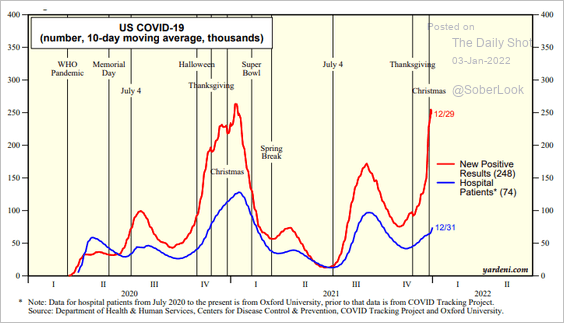

6. Omicron, which is more contagious than the previous coronavirus strains, sent US cases to a new record (some 400,000 new confirmed cases per day).

But hospitalizations remain well below previous peaks.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

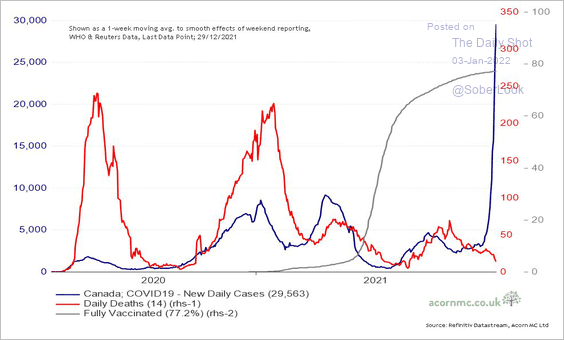

Canada

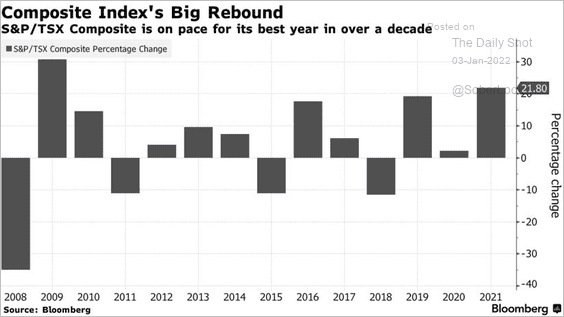

1. It was a good year for Canadian shares, with energy, financials, and housing boosting the benchmark index.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

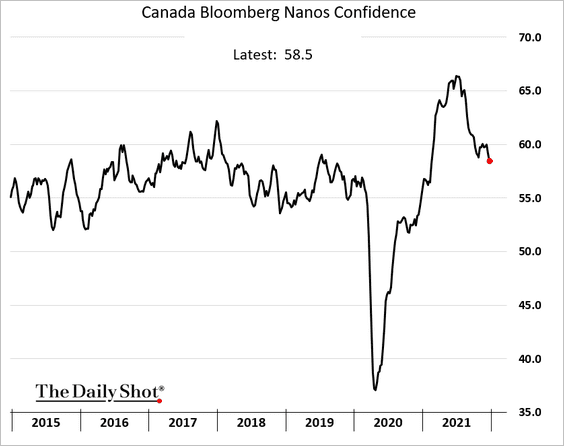

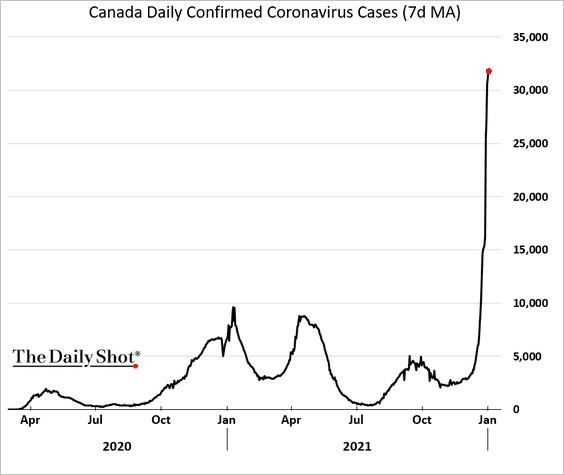

2. Consumer confidence deteriorated further in recent days, …

… as COVID cases surge.

But COVID-related deaths remain relatively low.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The United Kingdom

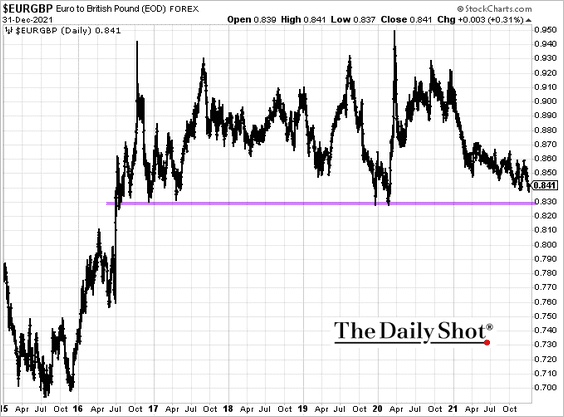

1. EUR/GBP is approaching support as the pound strengthens.

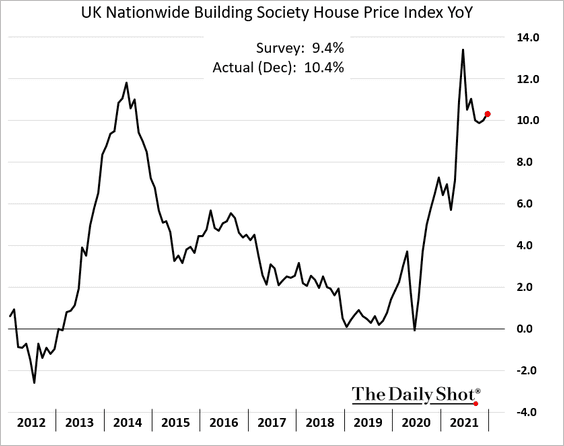

2. Home-price appreciation has moved back above 10% in December, topping expectations.

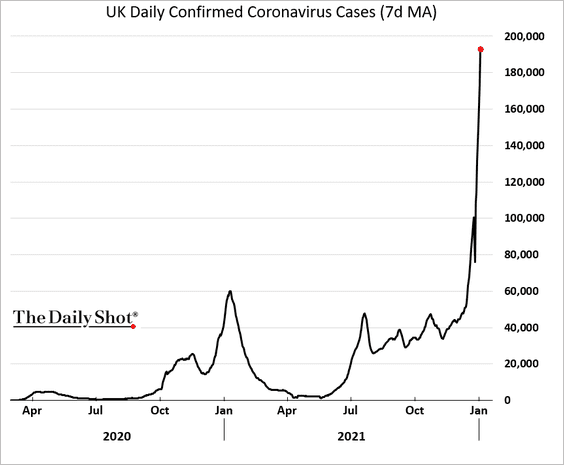

3. COVID cases have exploded as omicron sweeps the country. But fatalities remain subdued.

Back to Index

The Eurozone

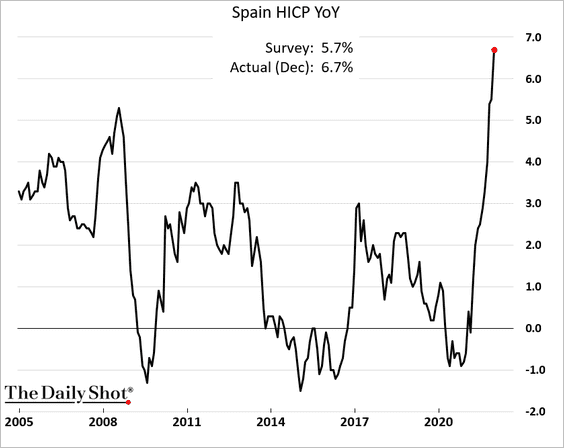

1. Spain’s December CPI was much stronger than expected. Will we see a similar inflation shock in Germany?

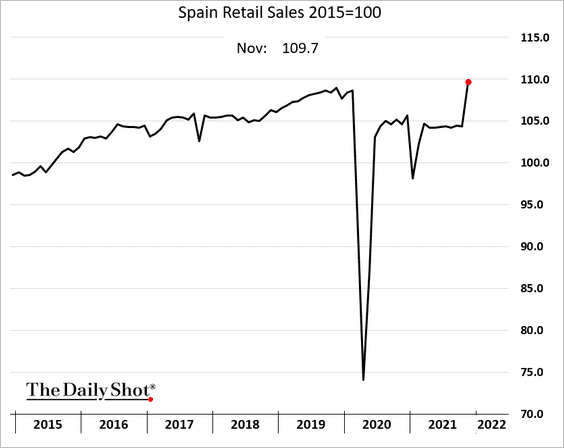

Separately, Spain’s retail sales were above pre-COVID levels in November (partially due to early holiday shopping in 2021).

——————–

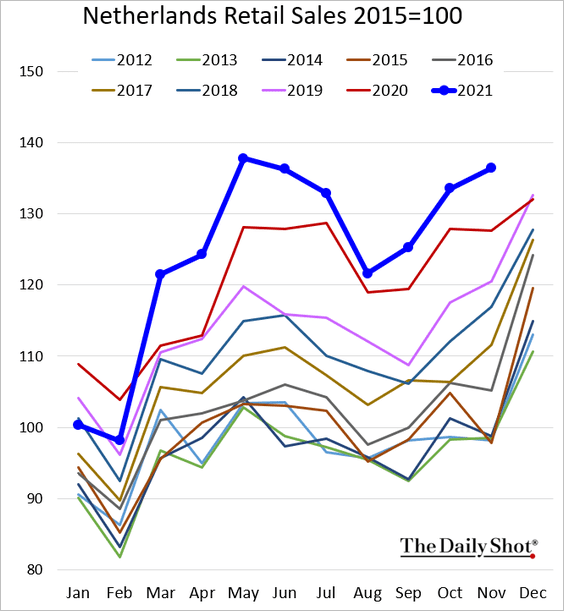

2. Dutch retail sales hit multi-year highs for this time of the year.

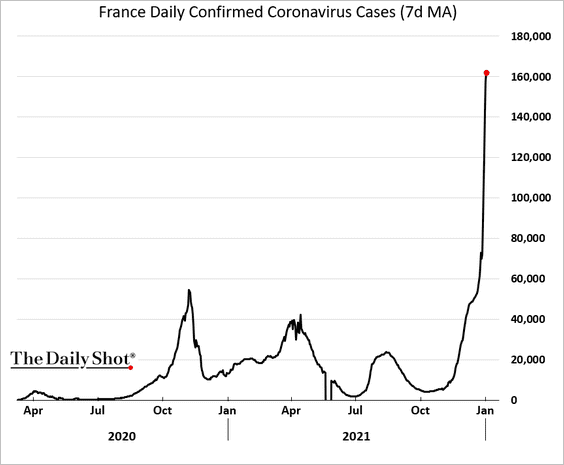

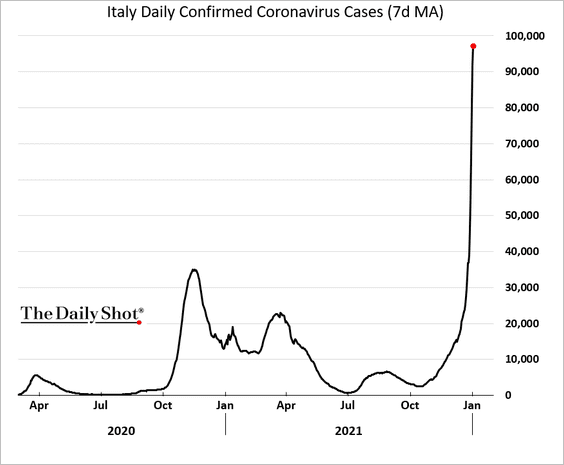

3. COVID cases are surging across parts of Europe.

• France:

• Italy:

——————–

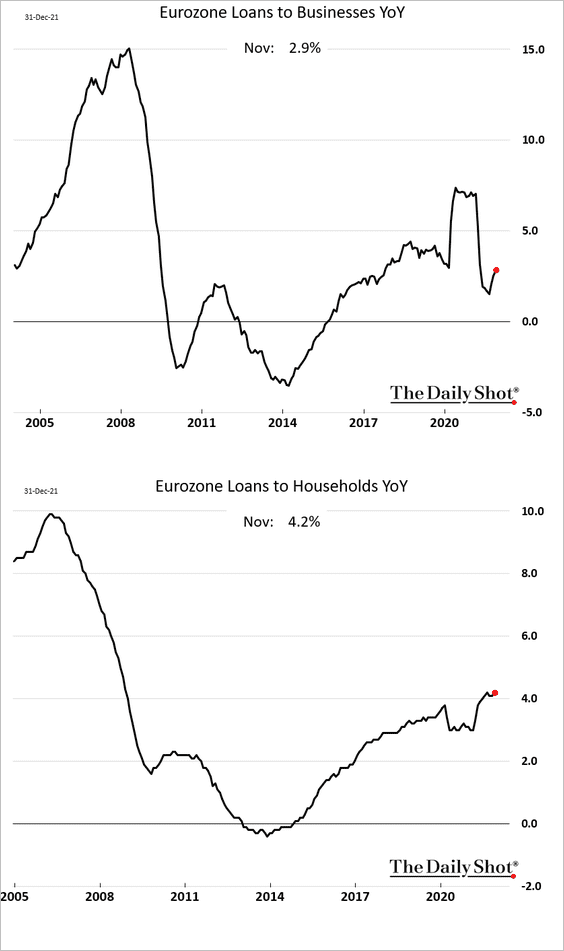

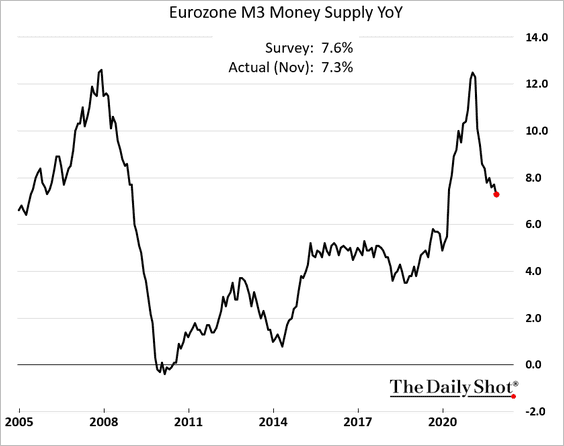

4. Euro-area loan growth improved in November.

But money supply growth surprised to the downside.

Back to Index

Europe

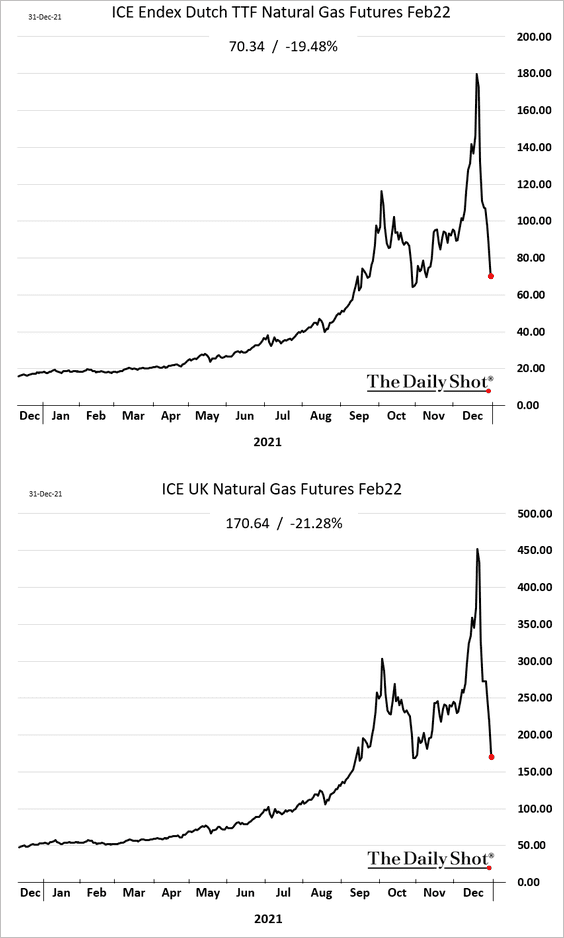

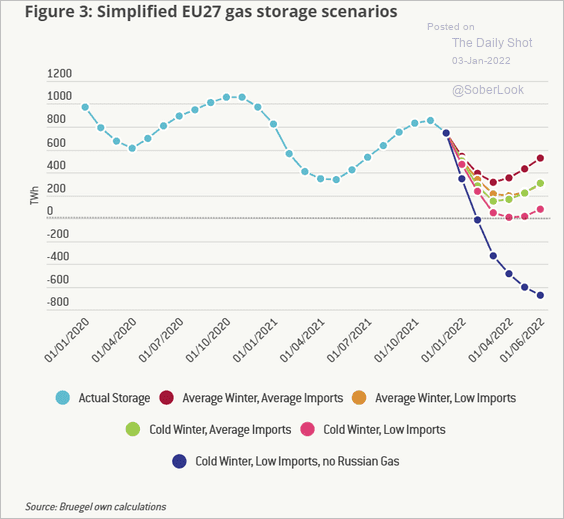

Next, we have some updates on the energy situation.

• Natural gas prices plummeted last week as LNG cargoes rushed to supply Europe.

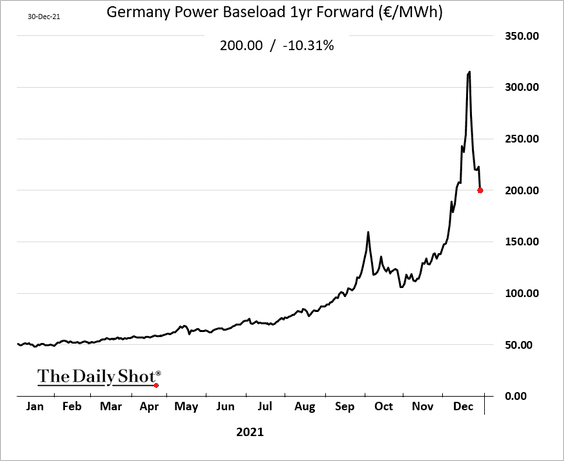

• German long-term power prices have been coming off the peak but remain extremely high.

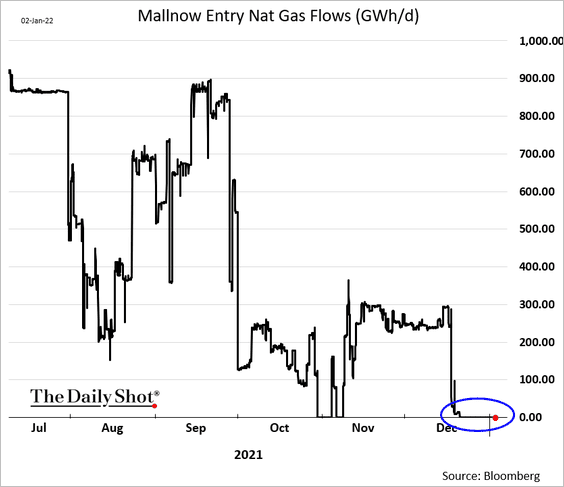

• Russian natural gas flows into Western Europe remain depressed.

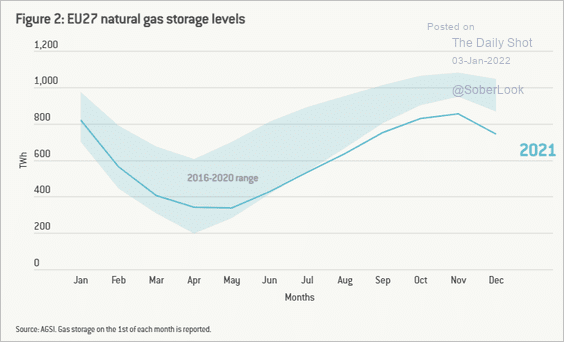

• Natual gas in storage is at multi-year lows for this time of the year.

Source: Bruegel Read full article

Source: Bruegel Read full article

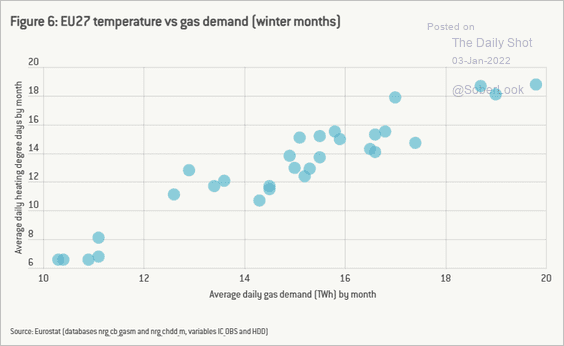

– Inventory draws will depend on the temperature.

Source: Bruegel Read full article

Source: Bruegel Read full article

– Here are some possible scenarios.

Source: Bruegel Read full article

Source: Bruegel Read full article

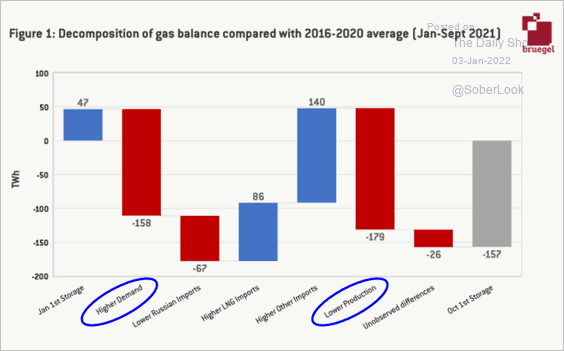

– Europe has experienced the perfect storm of much higher demand and lower production.

Source: Bruegel Read full article

Source: Bruegel Read full article

Back to Index

Japan

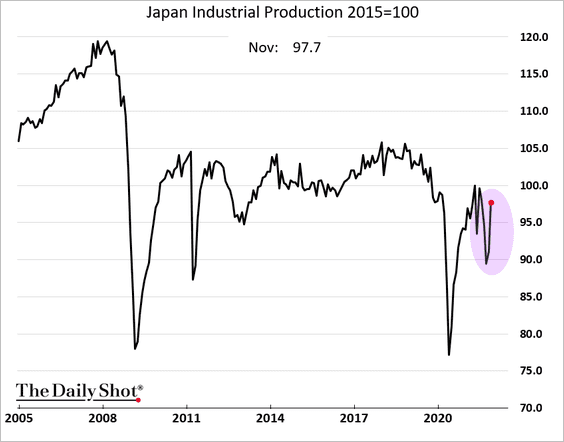

1. Industrial production rebounded in November.

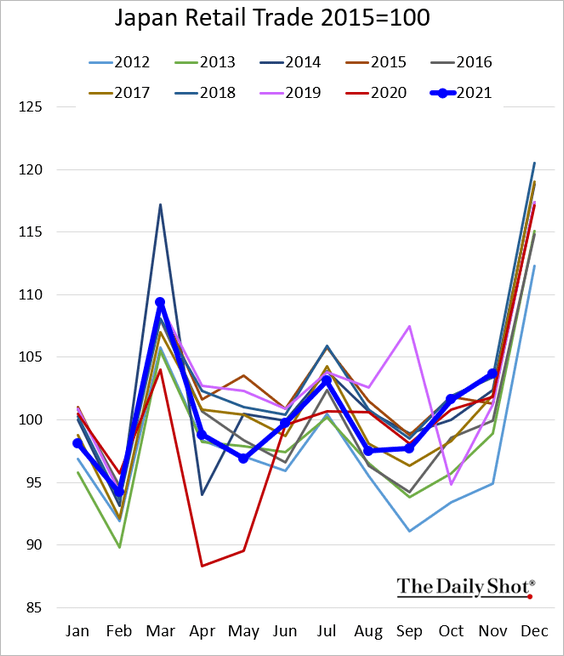

2. Retail sales strengthened.

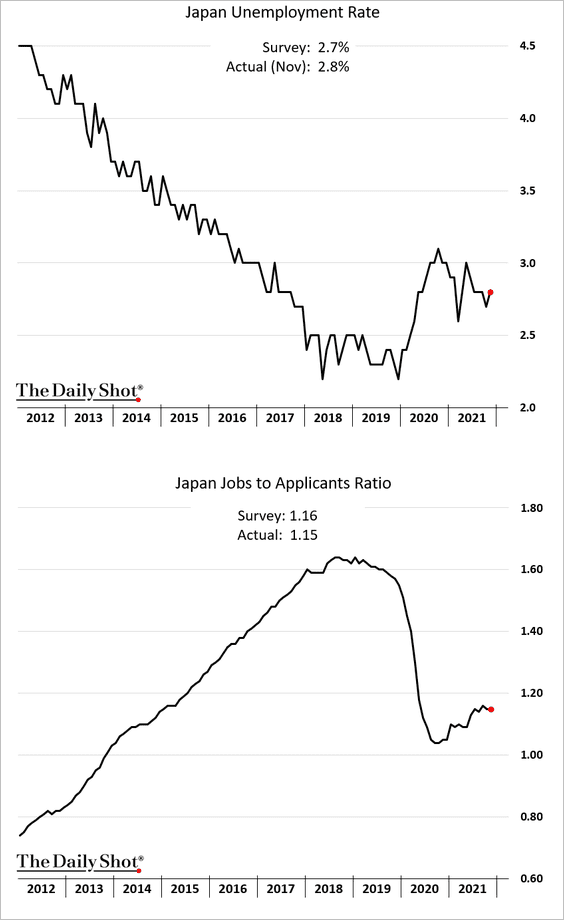

3. The labor market may take a while to return to pre-COVID levels.

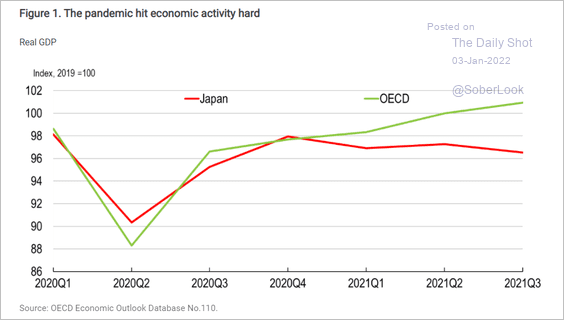

4. Japan’s GDP recovery has been lagging behind the rest of the OECD.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Asia – Pacific

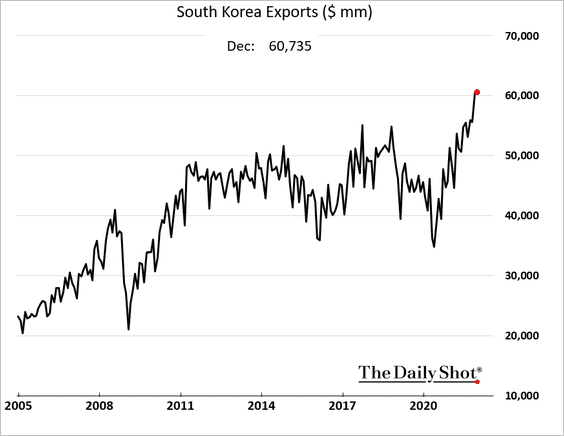

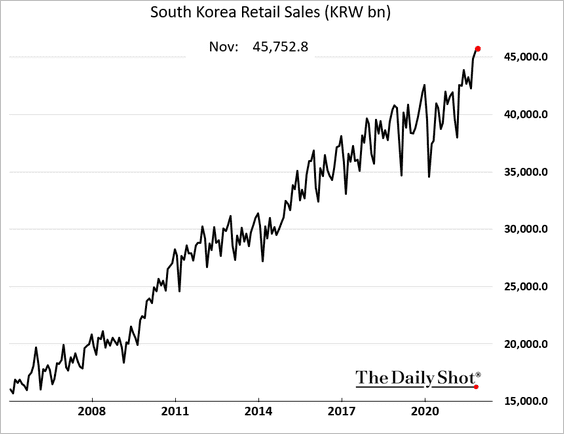

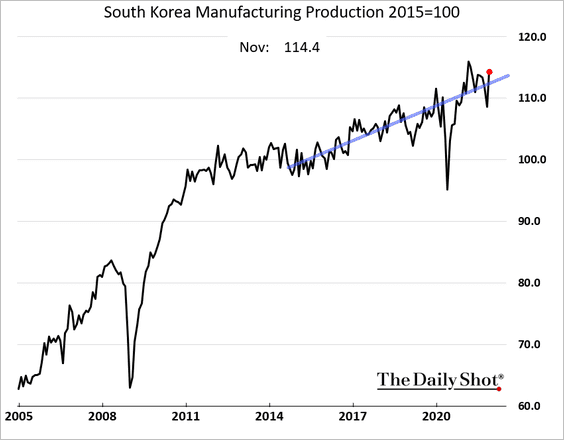

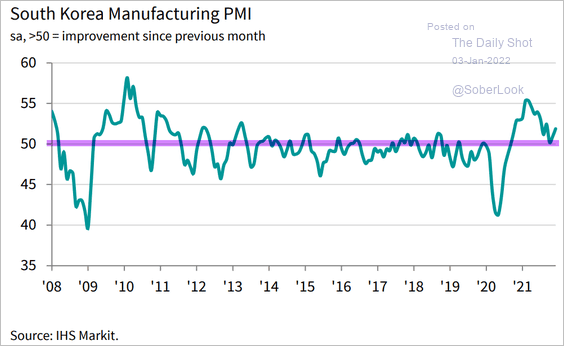

1. Let’s begin with South Korea.

• Exports have been surging.

• Retail sales hit a record high.

• Industrial production jumped in November, following the pre-COVD trend.

• Factory activity returned to growth in December.

Source: IHS Markit

Source: IHS Markit

——————–

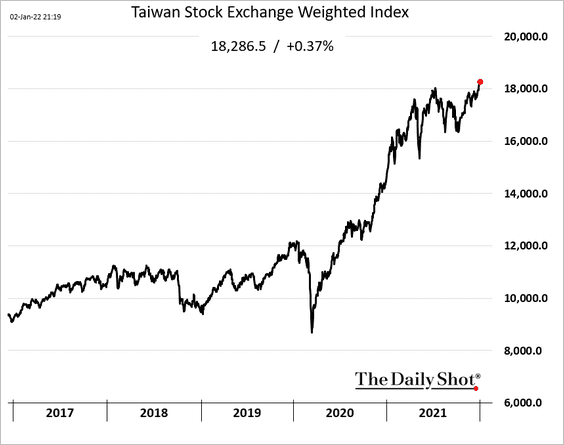

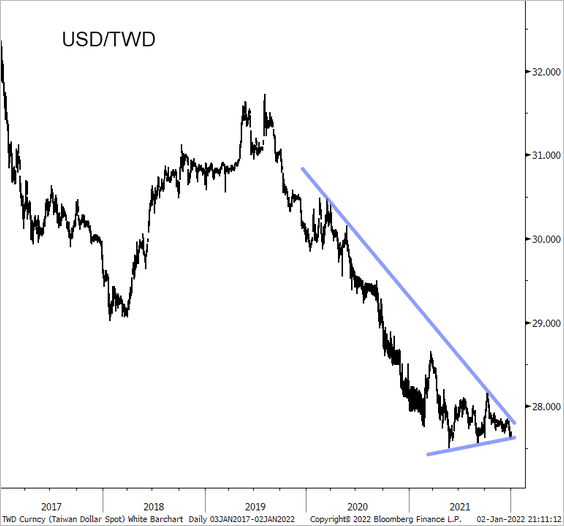

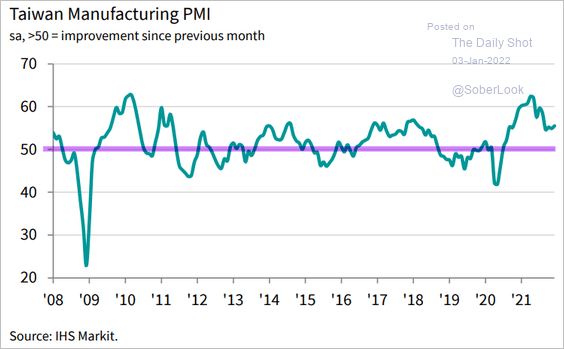

2. Next, we have some updates on Taiwan.

• The stock market is hitting record highs.

• Will USD/TWD break to the downside as the Taiwan dollar strengthens further (boosted by foreign capital inflows)?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Manufacturing growth held up well in December.

Source: IHS Markit

Source: IHS Markit

——————–

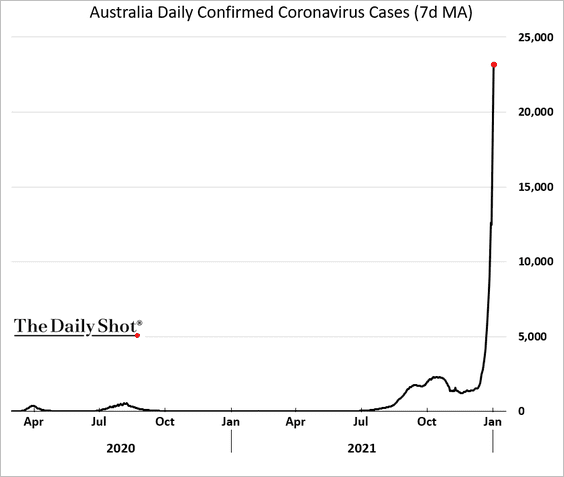

3 Australia’s COVID cases have gone vertical.

Back to Index

China

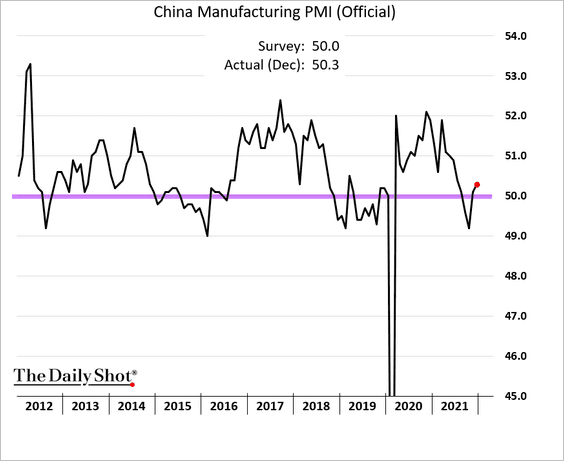

1. The official PMI indicators point to modest growth in manufacturing, …

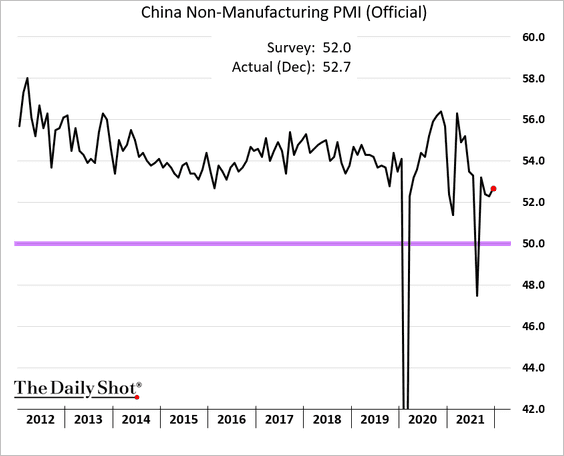

… and steady expansion in non-manufacturing sectors.

——————–

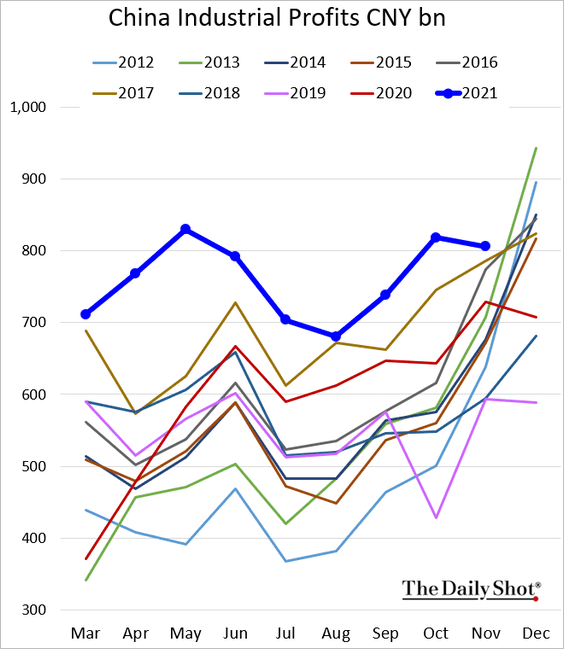

2. Industrial profits softened in November.

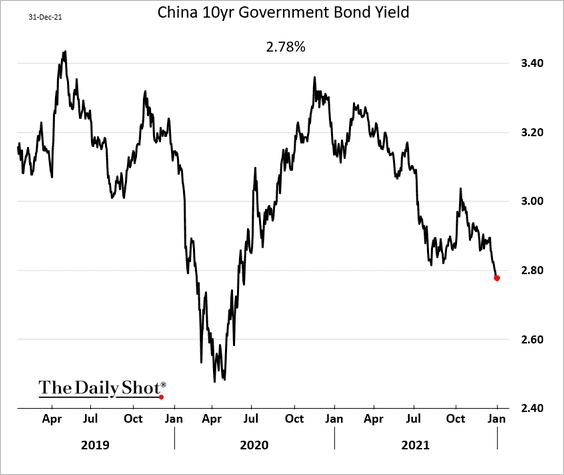

3. Bond yields continue to decline.

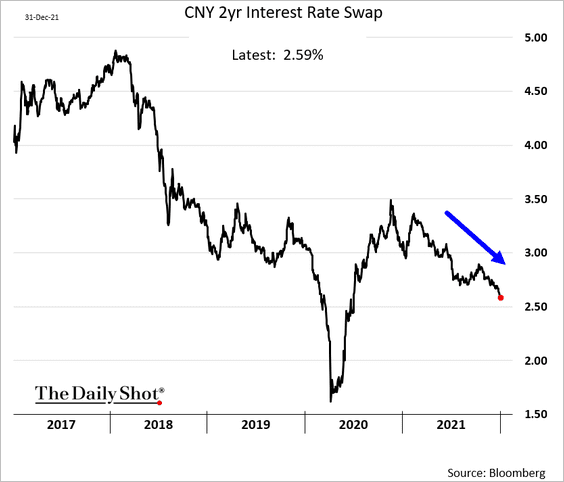

Short-term rates are lower as well as the market prices in more policy easing.

——————–

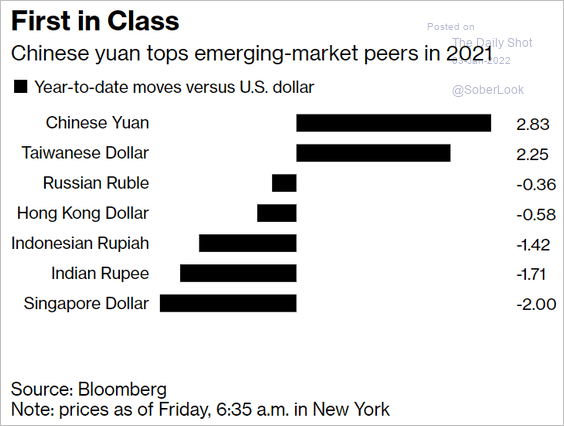

4. The renminbi has outperformed other EM currencies.

Source: @markets Read full article

Source: @markets Read full article

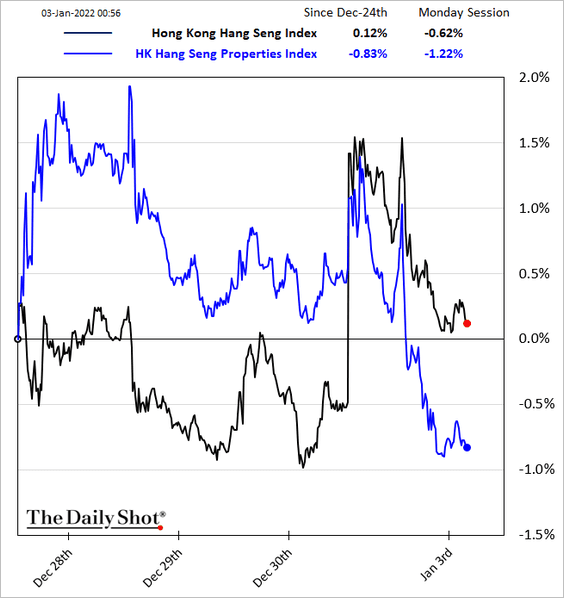

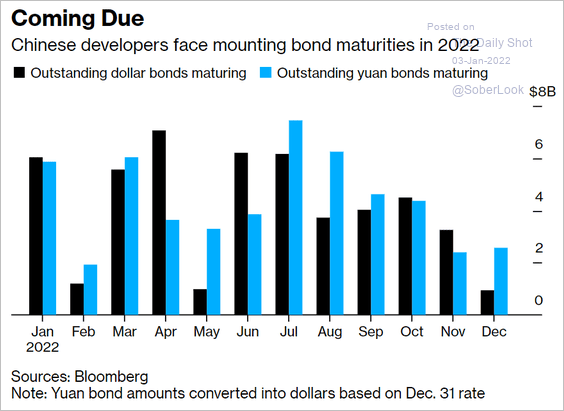

5. Property developers’ shares are underperforming again, …

… amid concerns about debt repayment.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Emerging Markets

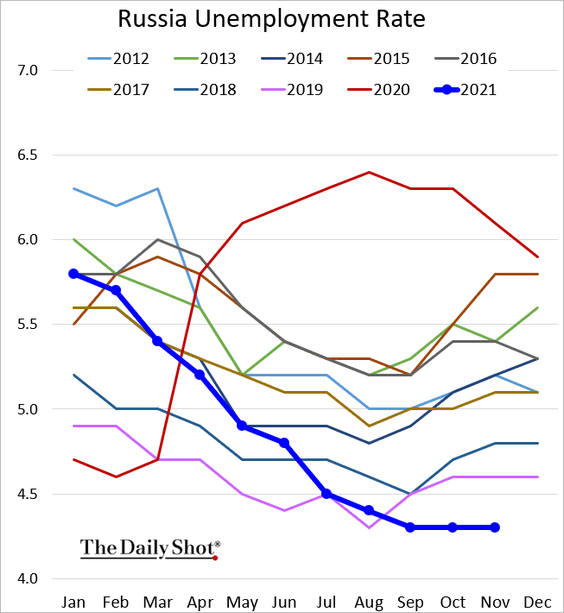

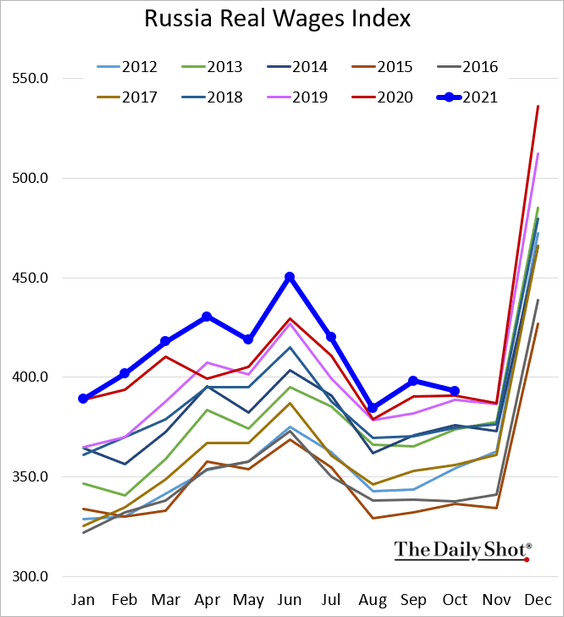

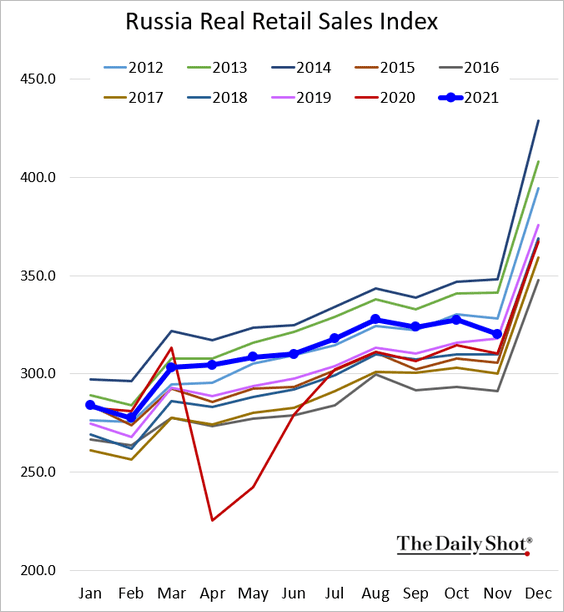

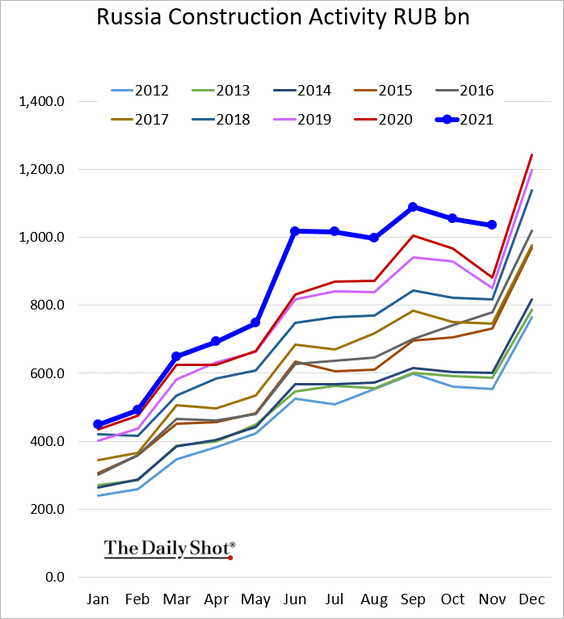

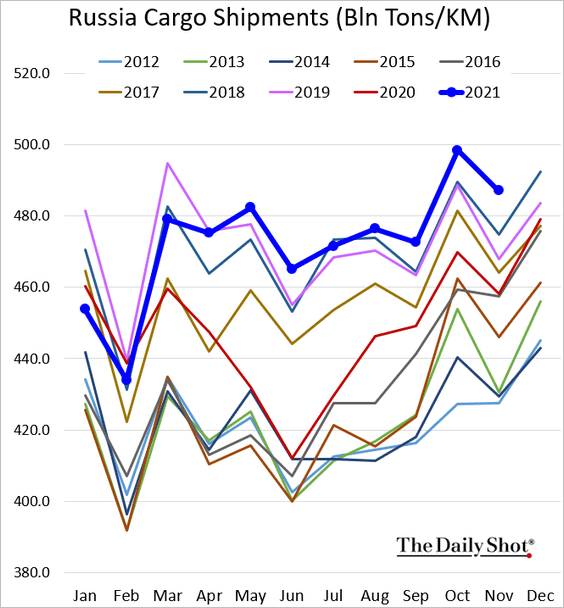

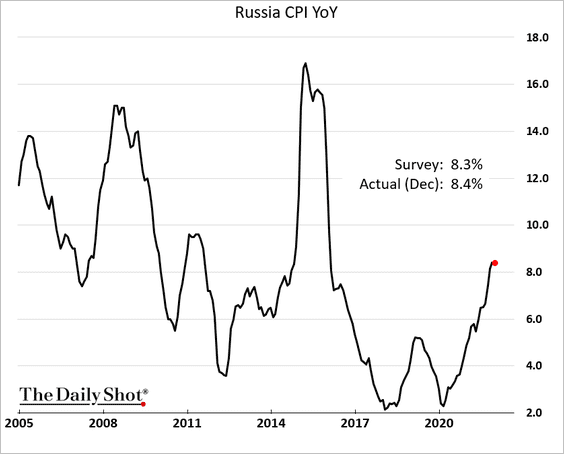

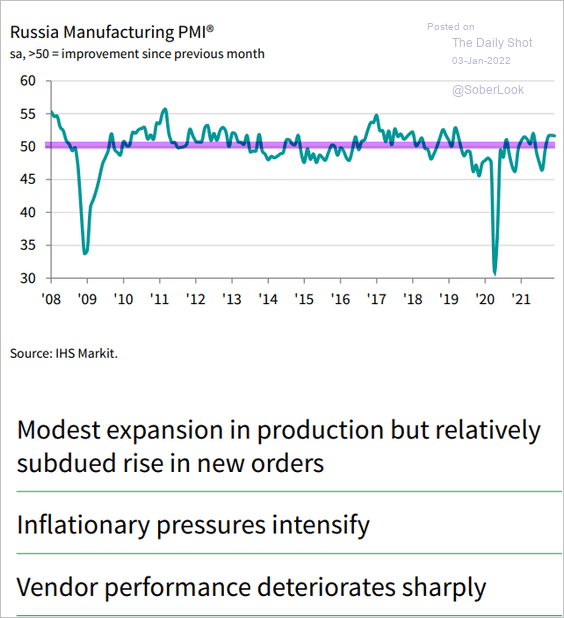

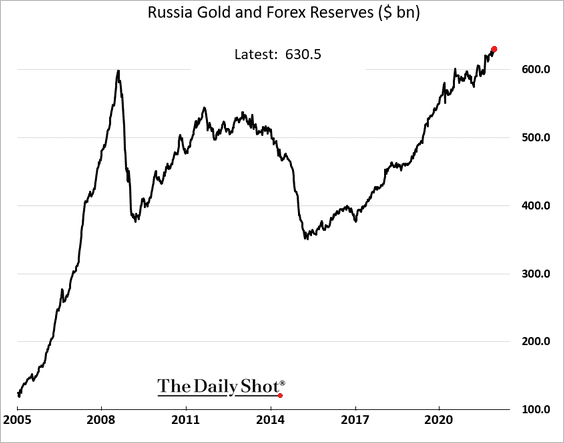

1. Let’s begin with some updates on Russia.

• The unemployment rate remains at multi-year lows.

• Real wages softened in October.

• Retail sales deteriorated in November.

• Construction activity has been very strong.

• Cargo shipments are also robust.

• The December CPI was a bit higher than expected.

• Manufacturing growth remains modest but stable.

Source: IHS Markit

Source: IHS Markit

• F/X reserves hit a record high.

——————–

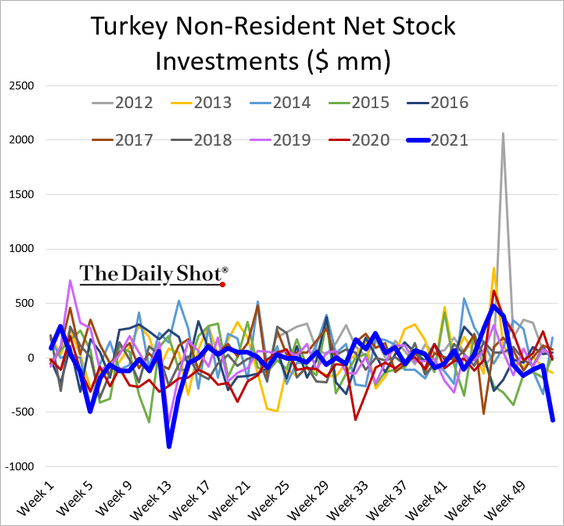

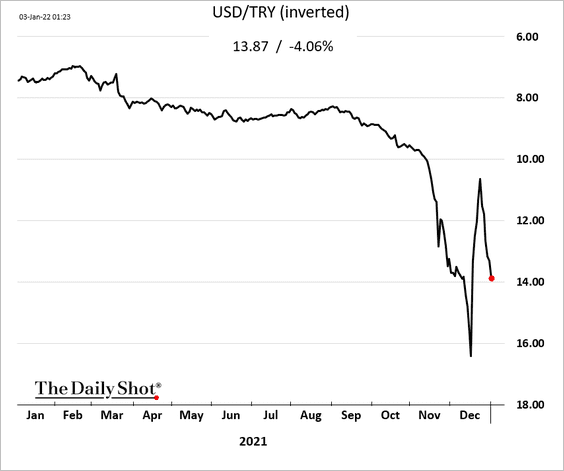

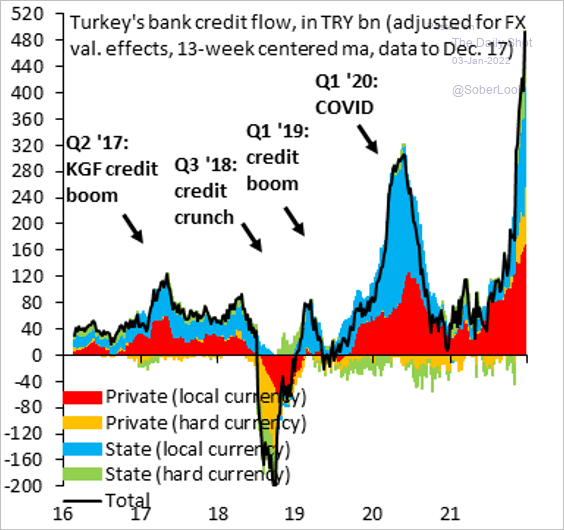

2. Next, we have some updates on Turkey.

• Foreign investors pulled capital out of Turkish stocks going into the year-end.

• The lira’s rebound is fading.

• The surge in lending has been weighing on the lira.

Source: @RobinBrooksIIF, @UgrasUlkuIIF

Source: @RobinBrooksIIF, @UgrasUlkuIIF

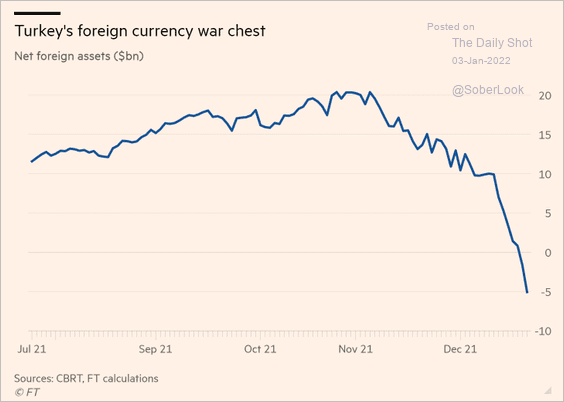

• Foreign reserves have turned negative.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Inflation is surging.

Source: Reuters Read full article

Source: Reuters Read full article

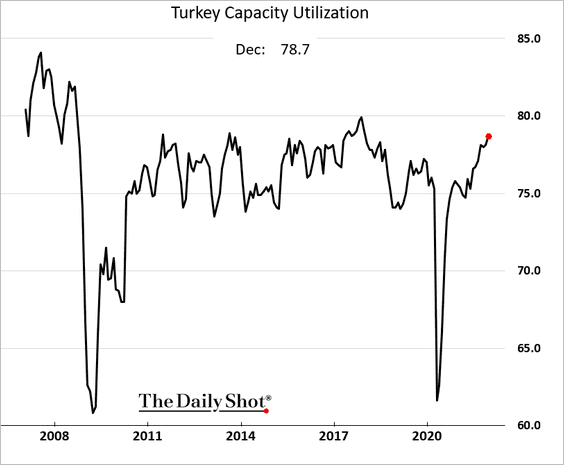

• But capacity utilization continues to climb.

——————–

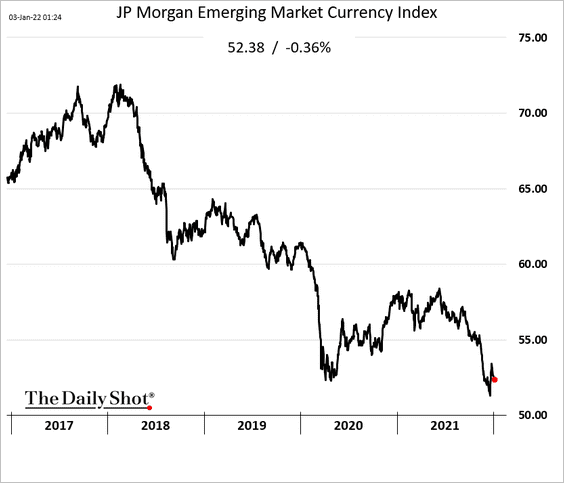

3. The Turkish lira has been pressuring the JP Morgan EM Currency Index.

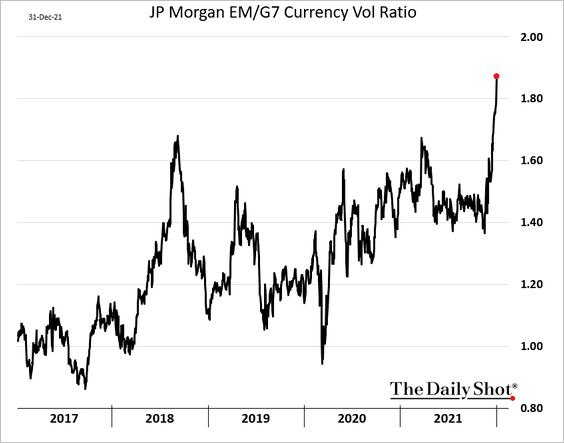

The lira also sent the EM/DM currency vol ratio to multi-year highs.

Back to Index

Cryptocurrency

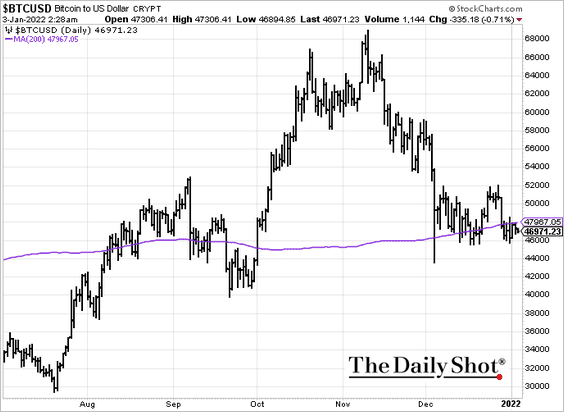

1. Bitcoin is trading below its 200-day moving average.

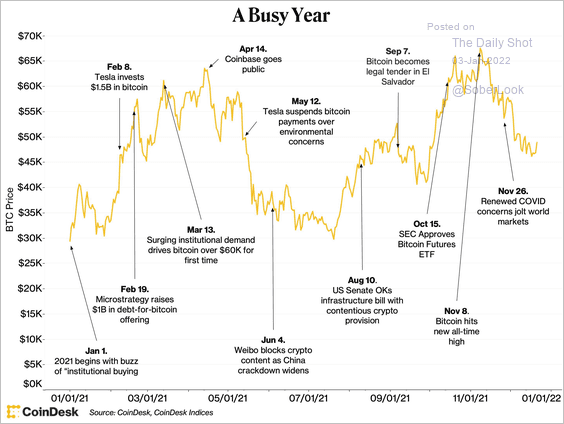

2. It’s been a busy year for the crypto market.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

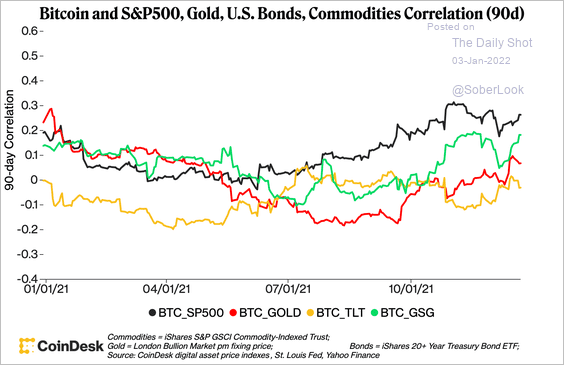

3. Bitcoin’s correlation with traditional assets has risen over the past few months.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

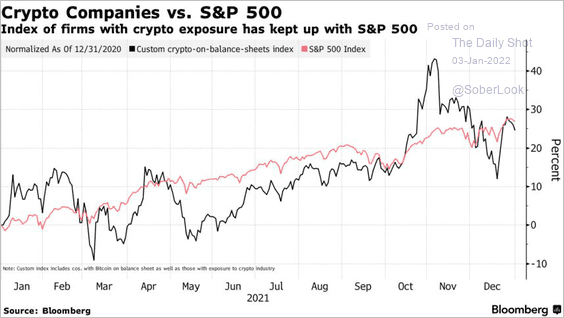

4. Companies with exposure to bitcoin have performed in-line with the S&P 500 last year, but lagged BTC.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

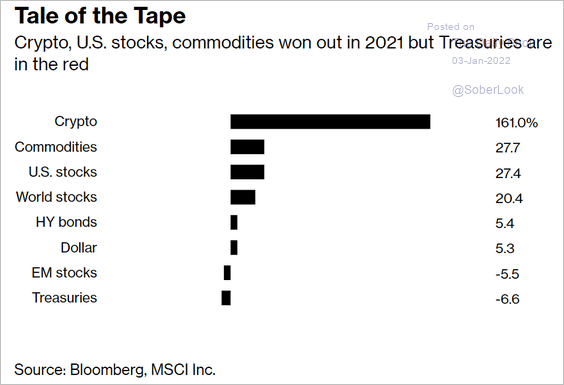

5. Cryptos outperformed traditional assets in 2021.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

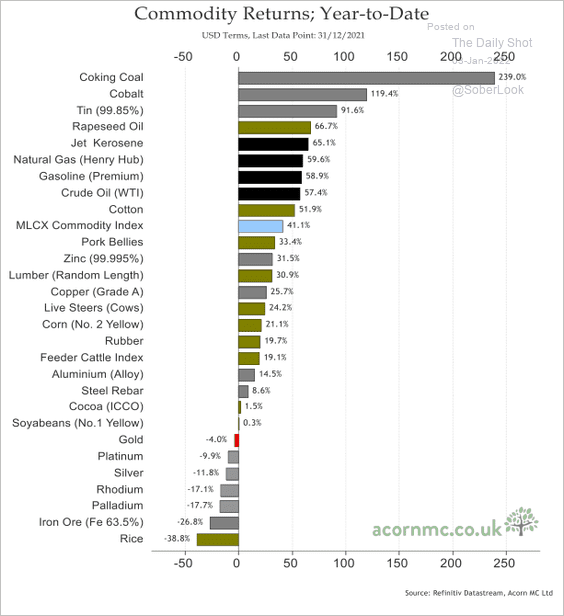

1. This chart shows the 2021 performance across commodity markets.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

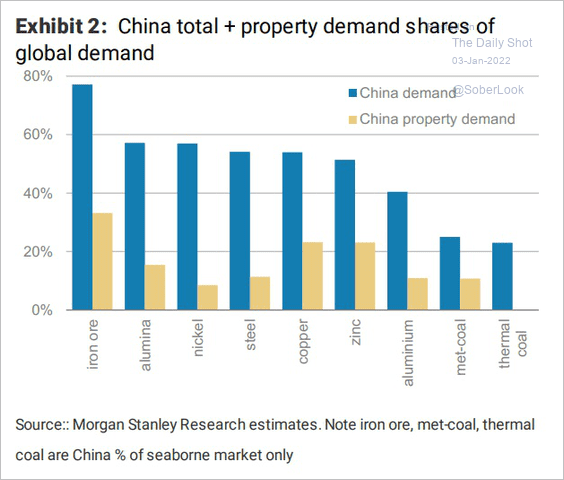

2. China’s property market drives industrial commodity demand.

Source: Morgan Stanley Research; @Scutty

Source: Morgan Stanley Research; @Scutty

Back to Index

Energy

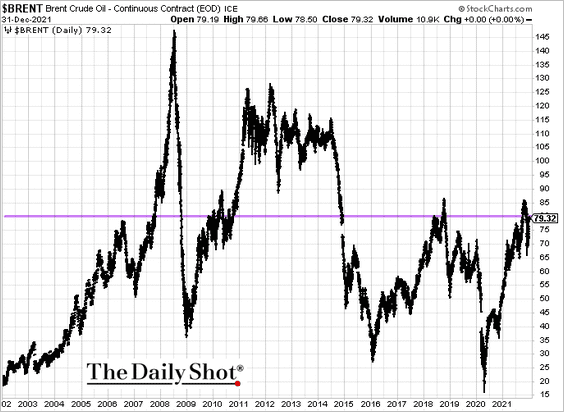

1. Brent is back near $80/bbl.

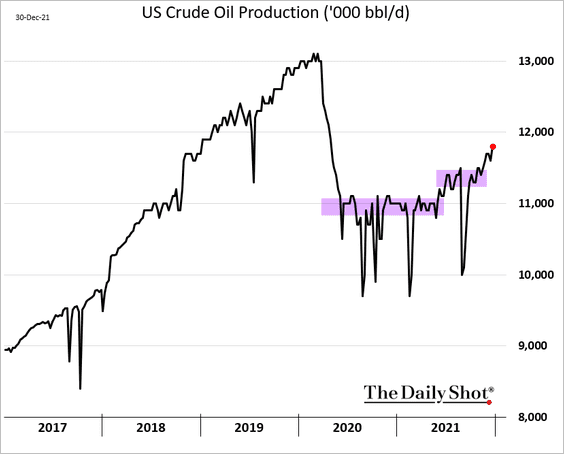

2. US oil production is accelerating.

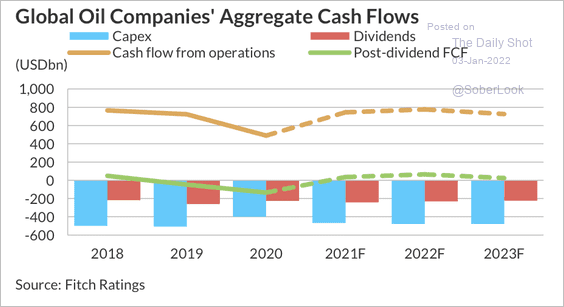

3. Healthy cash flow has improved the liquidity positions of oil companies monitored by Fitch.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Equities

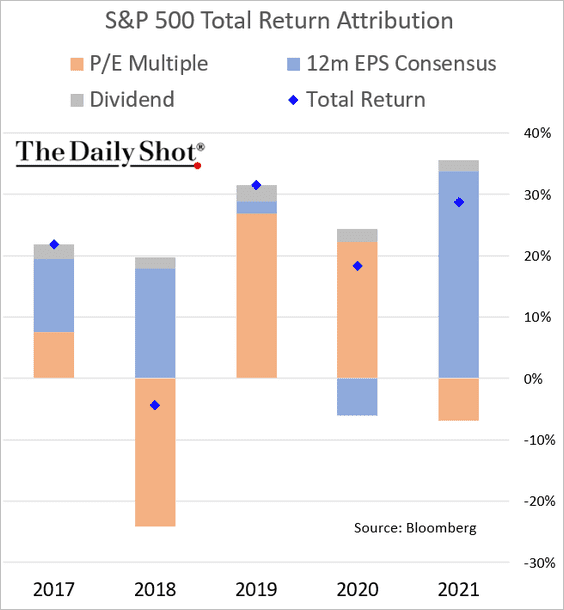

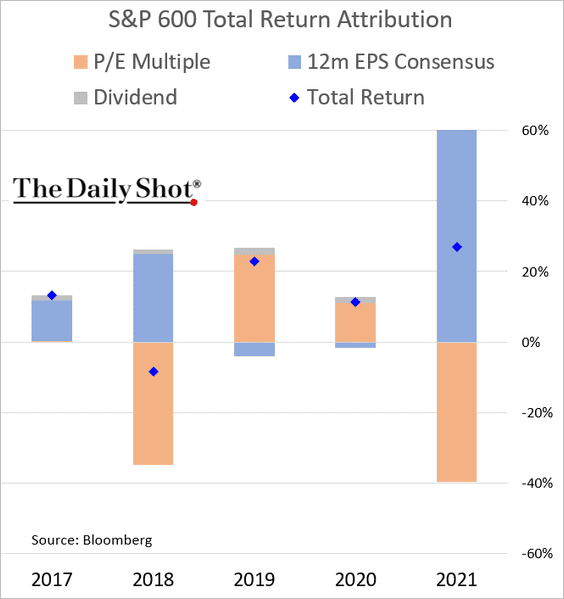

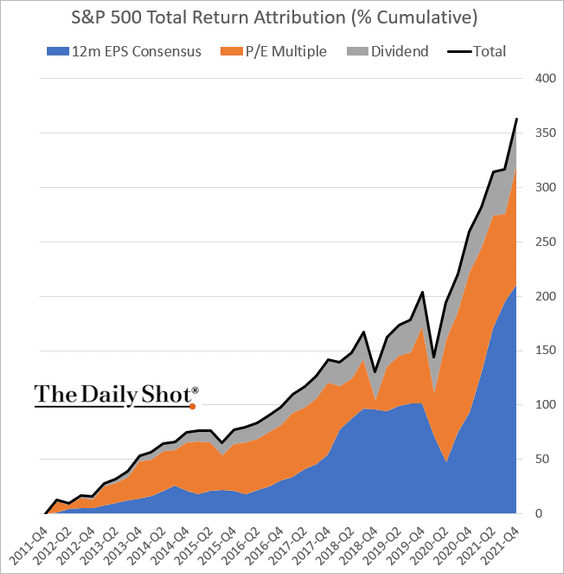

1. Let’s begin with some performance attribution data.

• S&P 500:

• S&P 600 (small caps):

• S&P 500 cumulative attribution over the past decade:

——————–

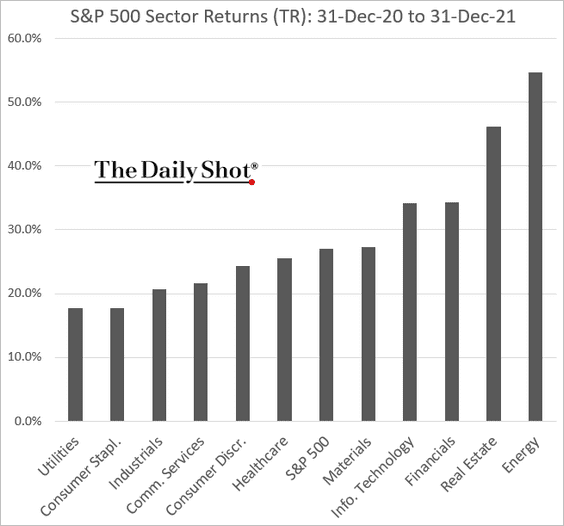

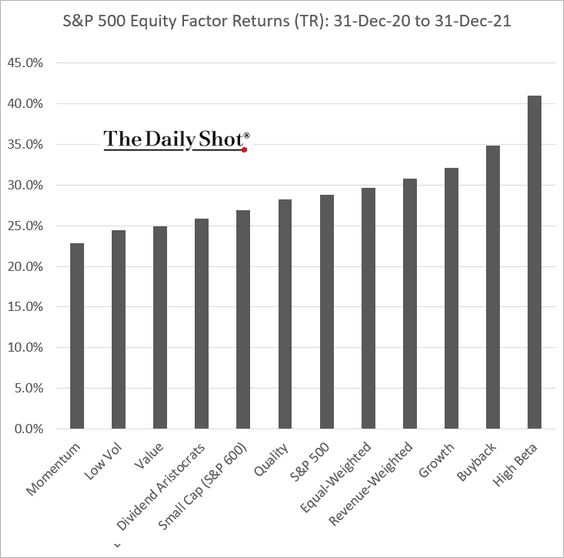

2. Next, we have the 2021 performance across sectors and equity factors (double-digit gains across the board).

——————–

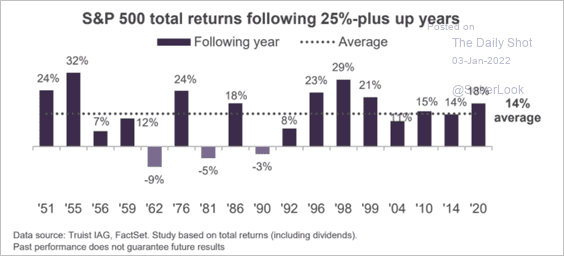

3. On average, the S&P 500 has produced annual gains of 14% after rising more than 25% in 2021.

Source: Truist Advisory Services

Source: Truist Advisory Services

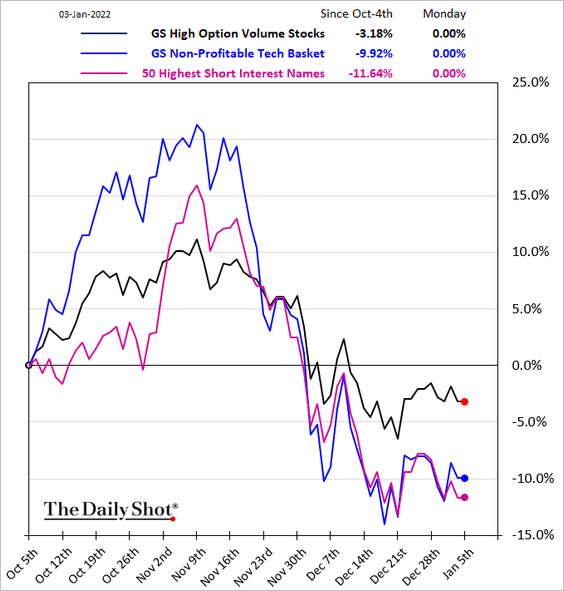

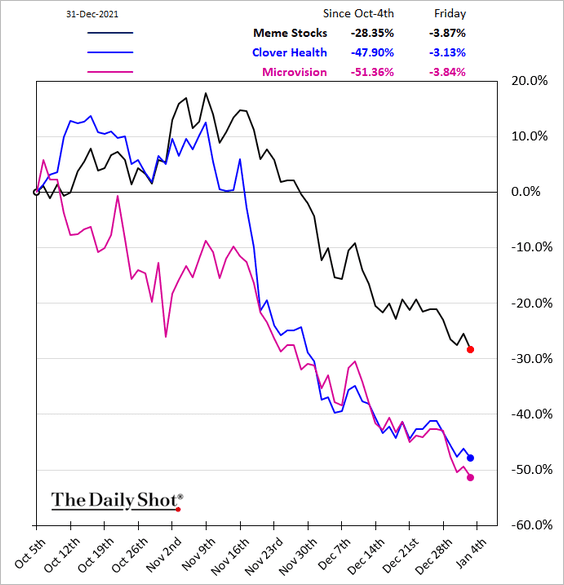

4. Speculative stocks favored by the Reddit crowd have underperformed sharply in recent weeks (2 charts).

——————–

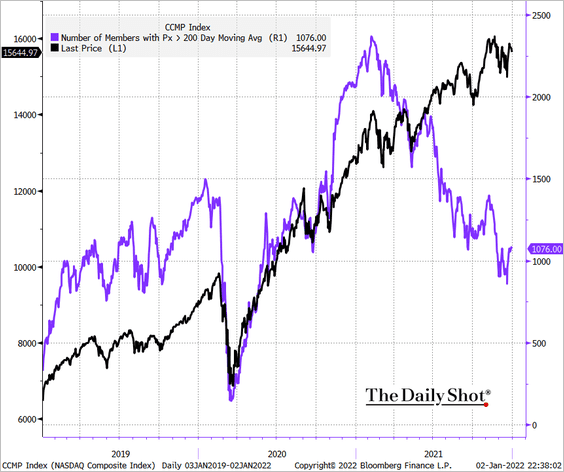

5. The Nasdaq Composite breadth remains soft.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

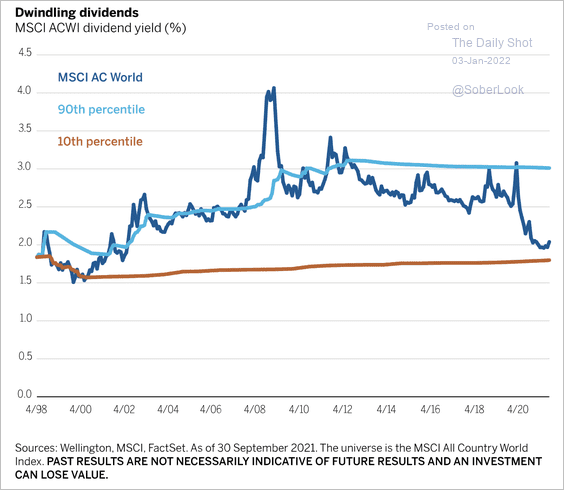

6. Global dividend levels have reached lows last seen in the late 1990s.

Source: Wellington Management Read full article

Source: Wellington Management Read full article

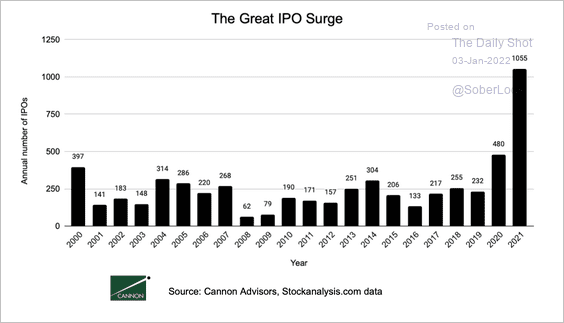

7. 2021 was a banner year for IPOs, as new listings rose to record highs.

Source: Cannon Advisors

Source: Cannon Advisors

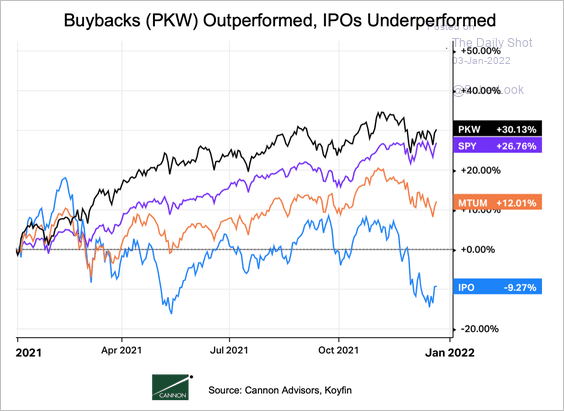

US firms that repurchased shares outperformed last year, while IPOs underperformed.

Source: Cannon Advisors

Source: Cannon Advisors

——————–

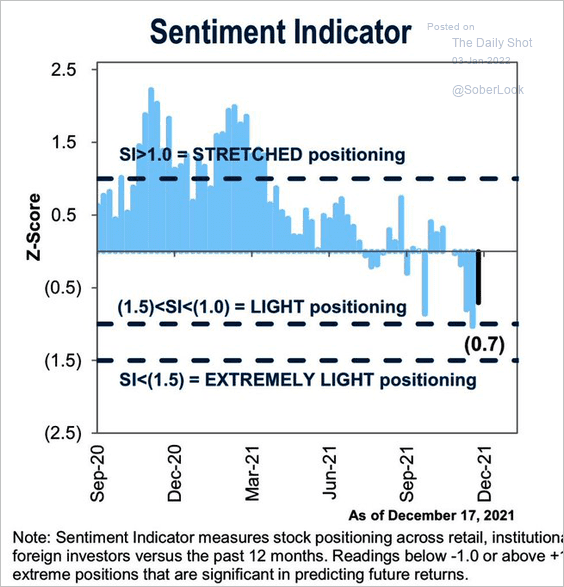

8. Goldman’s sentiment indicator suggests that investors remain cautious, which is a bullish sign going into 2022.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

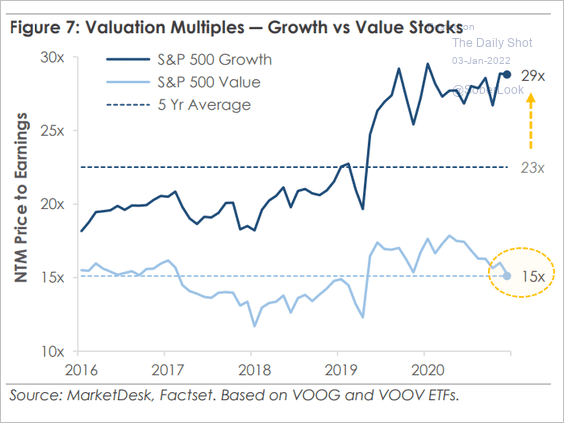

9. The valuation divergence between growth and value shares has widened further.

Source: MarketDesk Research

Source: MarketDesk Research

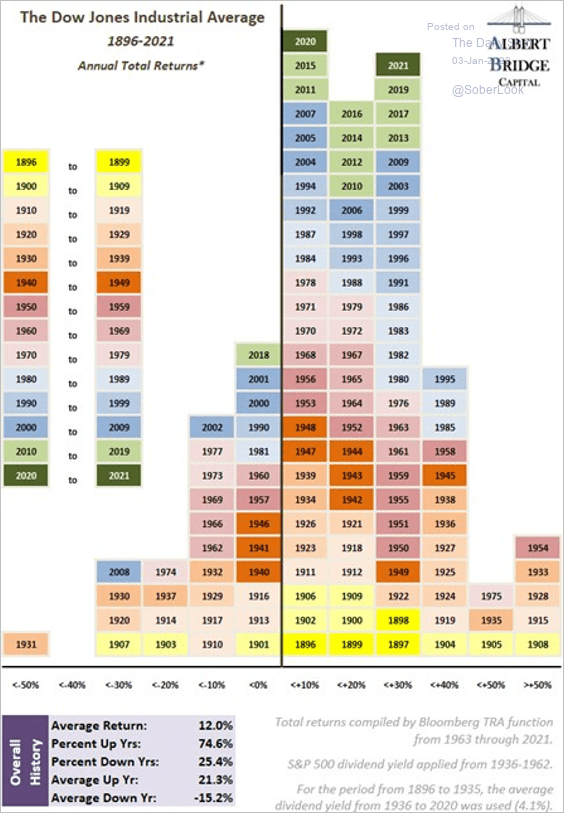

10. Finally, we have the long-term distribution of equity returns (color-coded by decade).

Source: @AlbertBridgeCap Read full article

Source: @AlbertBridgeCap Read full article

Back to Index

Global Developments

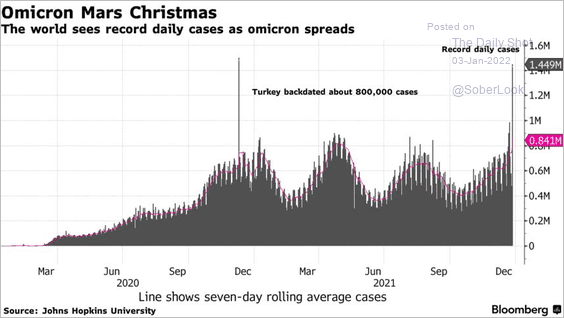

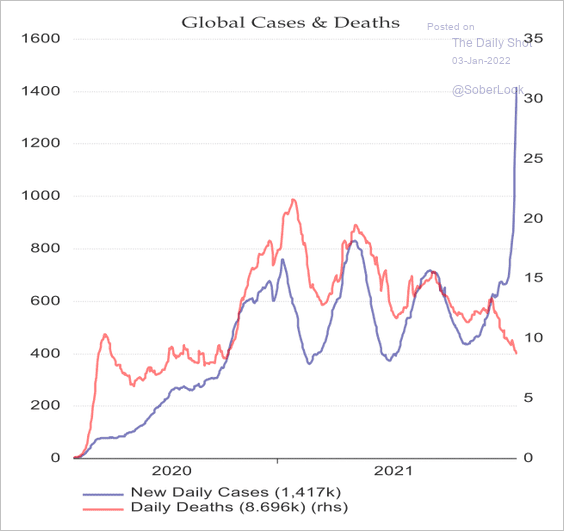

1. COVID cases are hitting record highs.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

But death rates remain subdued.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

——————–

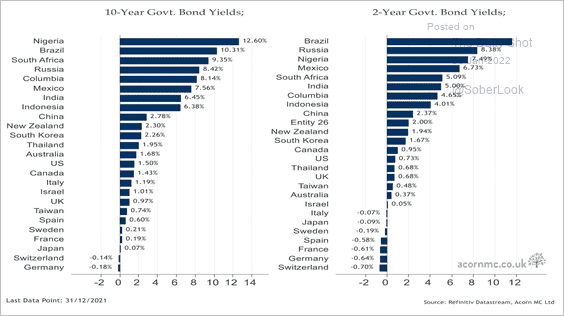

2. Negative yields are fading.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

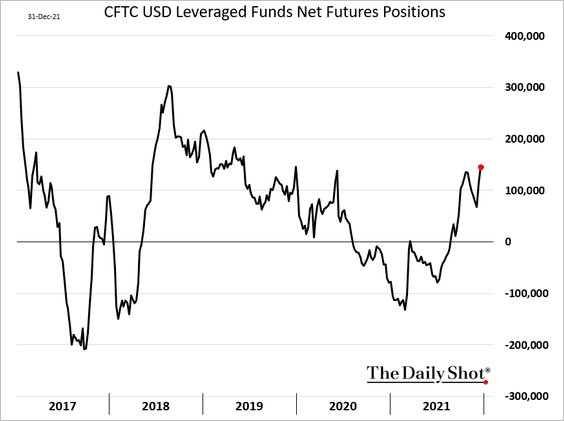

3. Hedge funds are boosting their bets on the US dollar.

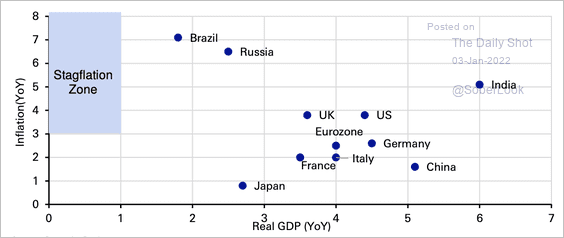

4. Here are Deutsche Bank’s growth and inflation forecasts by country.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

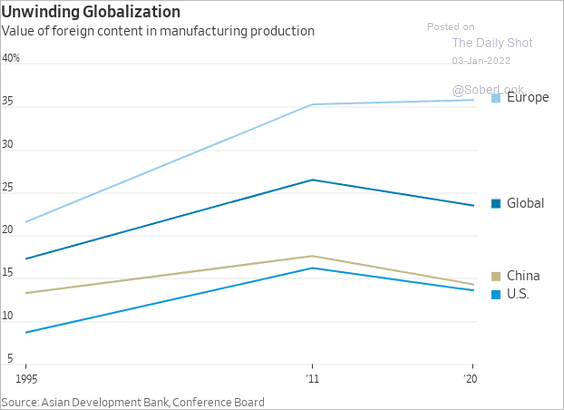

1. Reduced reliance on global supply chains:

Source: @WSJ Read full article

Source: @WSJ Read full article

2. Semiconductor industry’s profitability:

![]() Source: McKinsey Read full article

Source: McKinsey Read full article

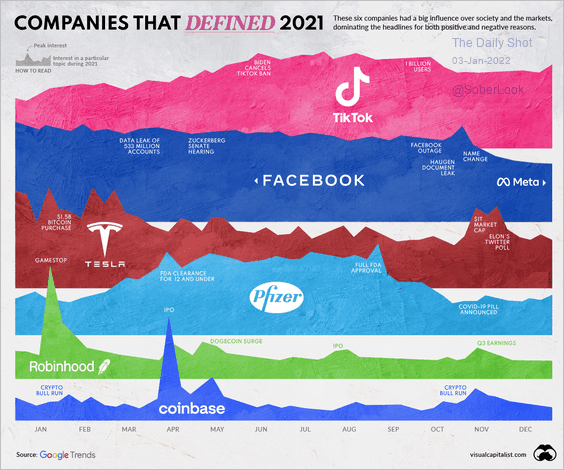

3. Public interest in select companies during 2021:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

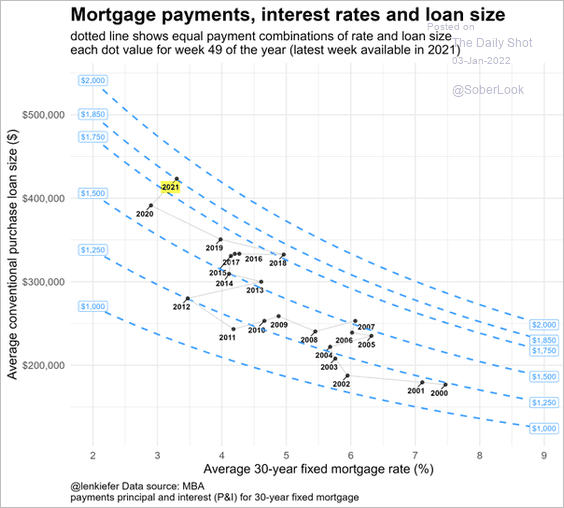

4. US mortgage payments, rates, and loan sizes:

Source: @lenkiefer

Source: @lenkiefer

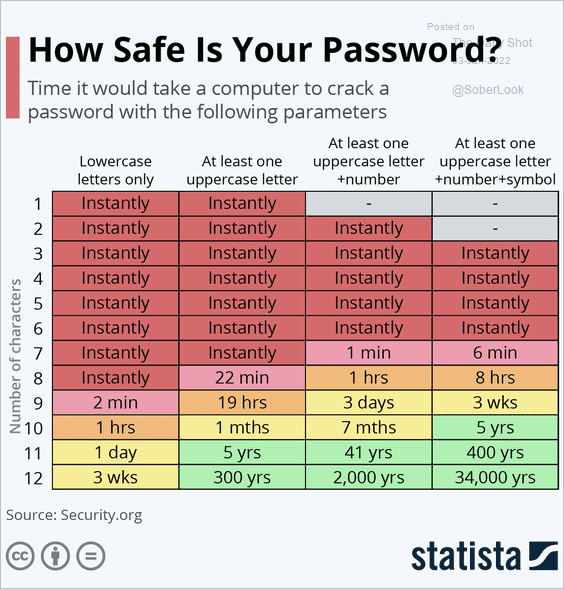

5. How safe is your password?

Source: Statista

Source: Statista

——————–

Back to Index