The Daily Shot: 04-Jan-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

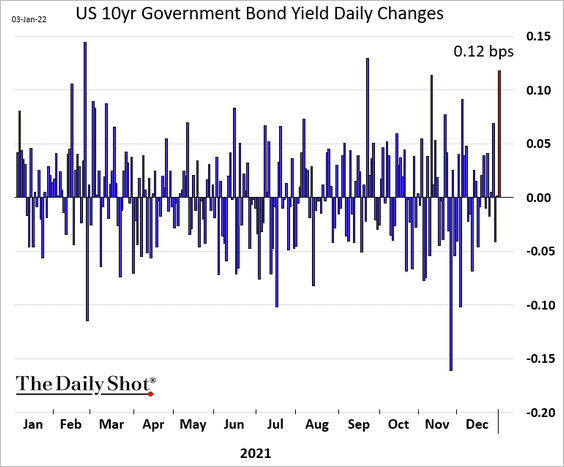

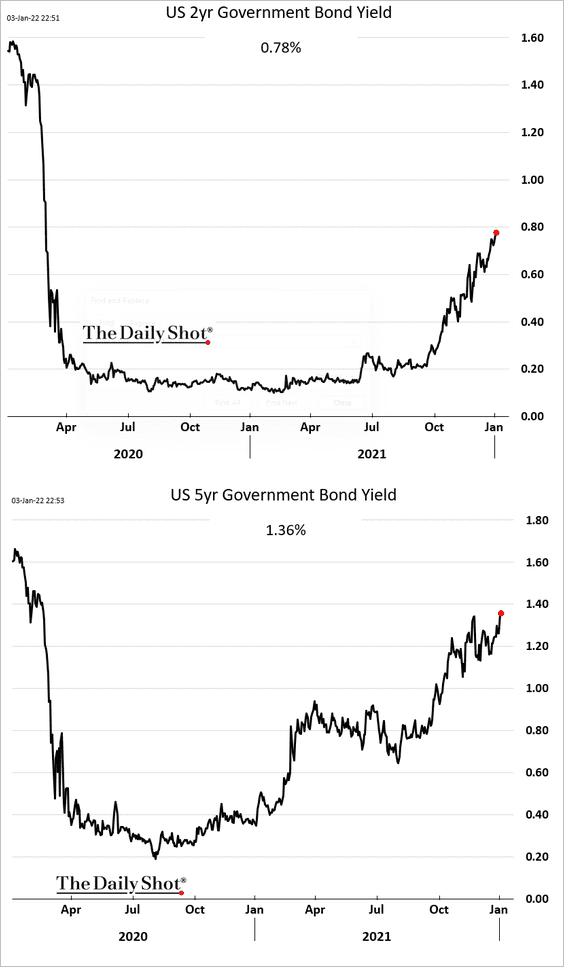

1. Treasury yields rose sharply on Monday, …

… with short-term yields hitting cycle highs.

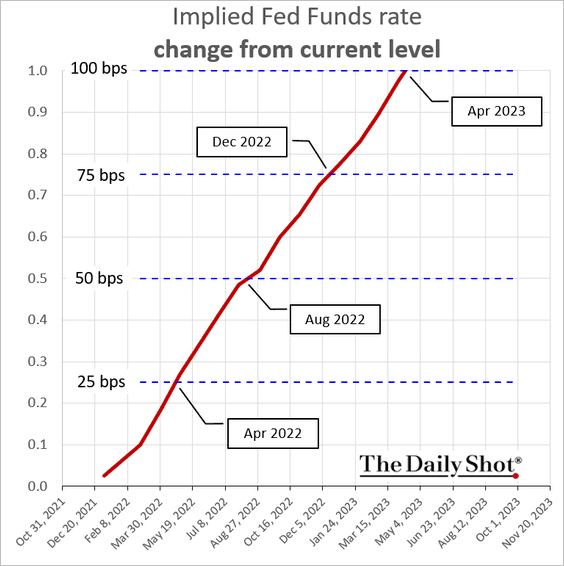

The market is now fully pricing in three rate hikes this year.

Could the Fed boost rates by a full percentage point in 2022? There is a 76% chance of such an outcome, according to fed fund futures.

——————–

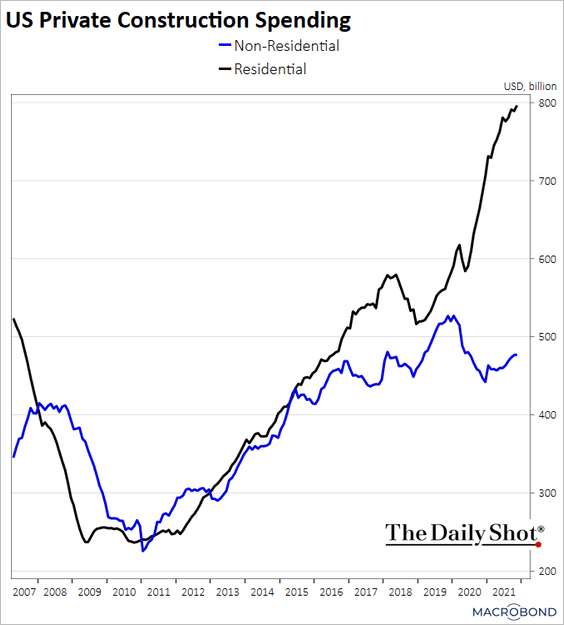

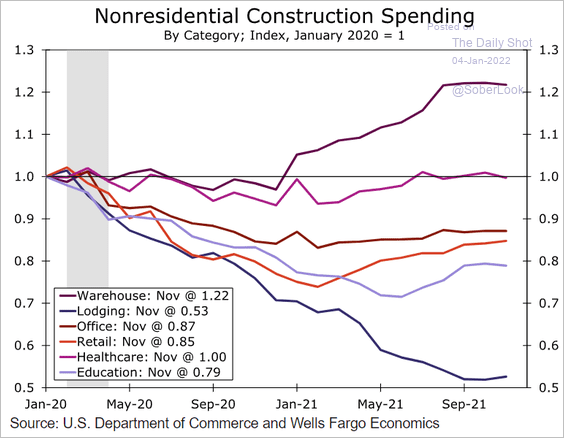

2. The gap between residential and non-residential construction spending continues to widen.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

This chart shows the trajectories of nonresidential construction spending by sector.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

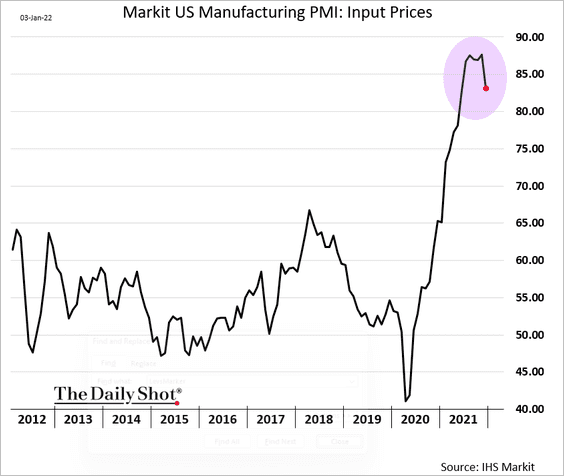

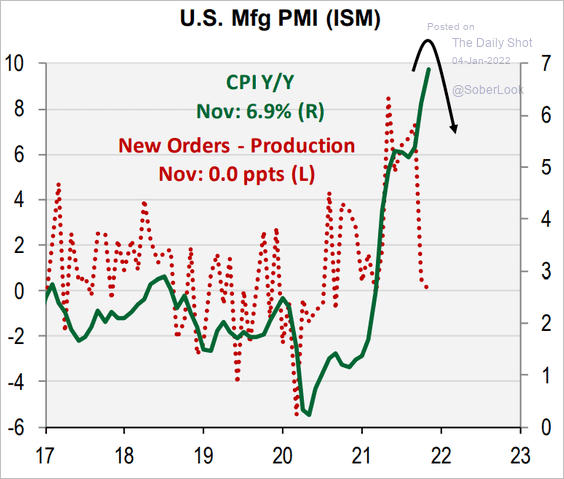

3. Manufacturers haven’t had this much pricing power since the mid-90s.

Source: Evercore ISI Research

Source: Evercore ISI Research

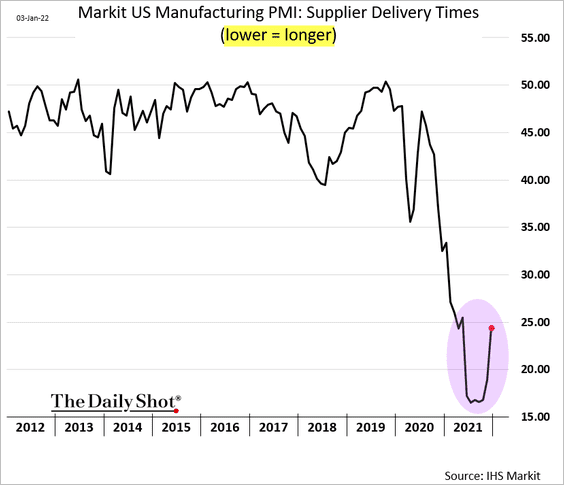

4. The Markit Manufacturing PMI report showed some easing in supply bottlenecks in December (2 charts).

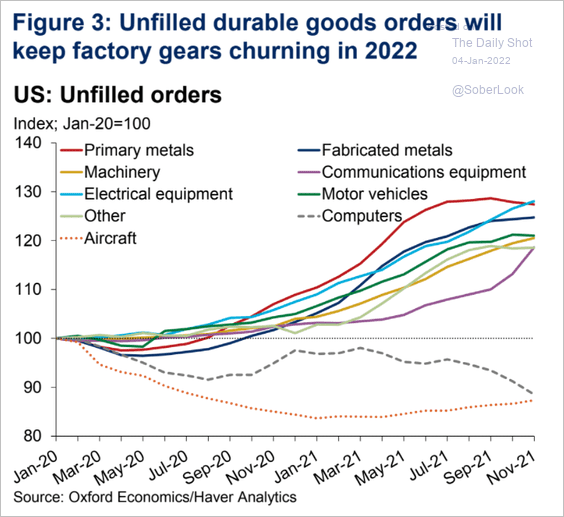

But factory backlogs should keep production strong this year.

Source: Oxford Economics

Source: Oxford Economics

——————–

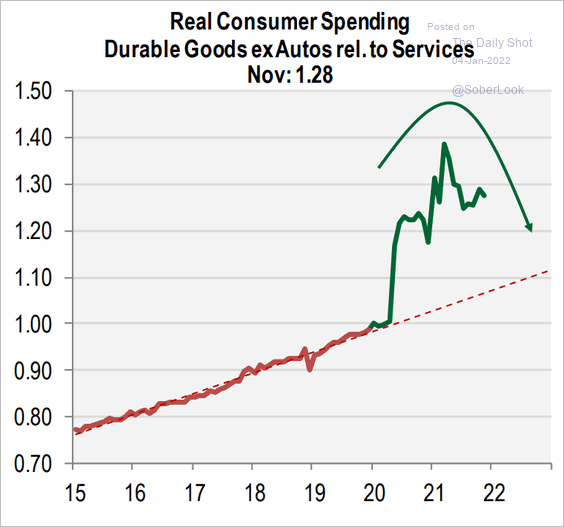

5. Consumer spending on durable goods relative to services will likely be returning to its pre-COVID trend.

Source: Cornerstone Macro

Source: Cornerstone Macro

That should ease some of the price pressures.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

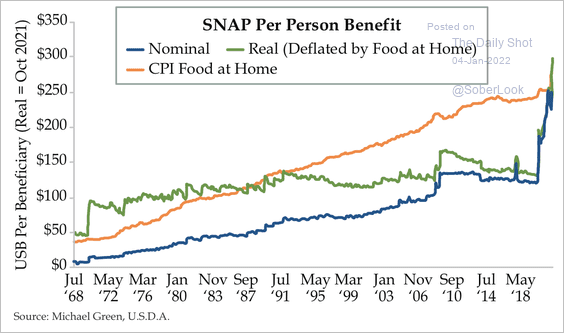

6. The distribution of SNAP benefits spiked since the start of the pandemic (exceeding food inflation) after the government extended eligibility.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

The United Kingdom

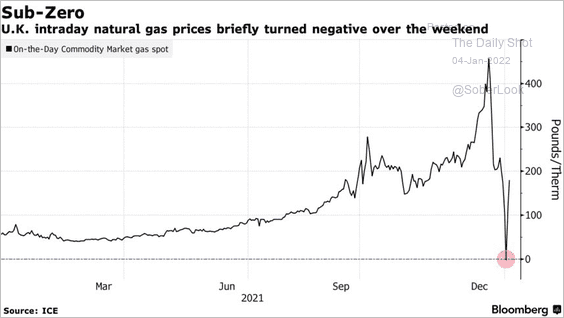

1. UK spot natural gas prices briefly dipped below zero, pointing to extraordinary volatility in the market.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

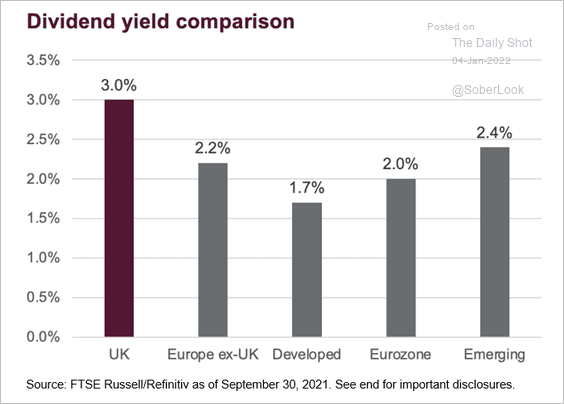

2. UK stock dividend yields are well above the levels we see in other markets.

Source: FTSE Russell Read full article

Source: FTSE Russell Read full article

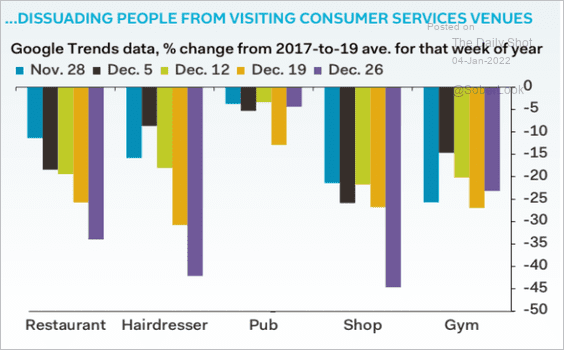

3. Consumers are shying away from service venues as omicron surges.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

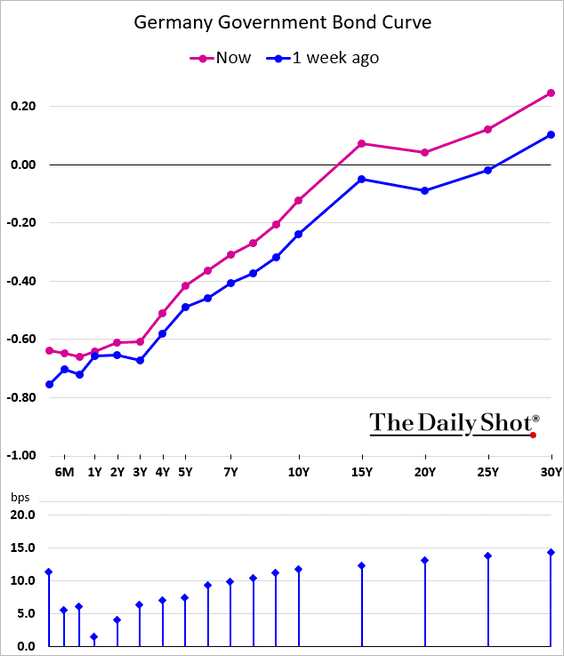

1. Euro-area bond yields are climbing. Here is the Bund curve.

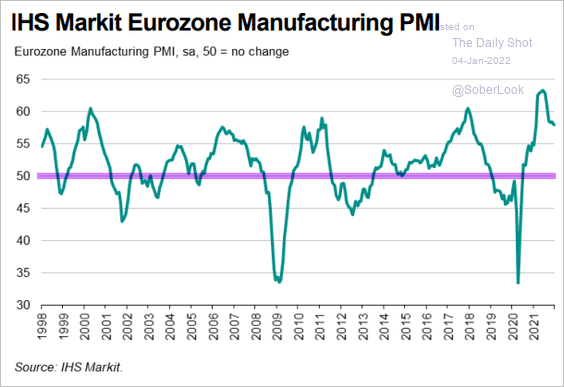

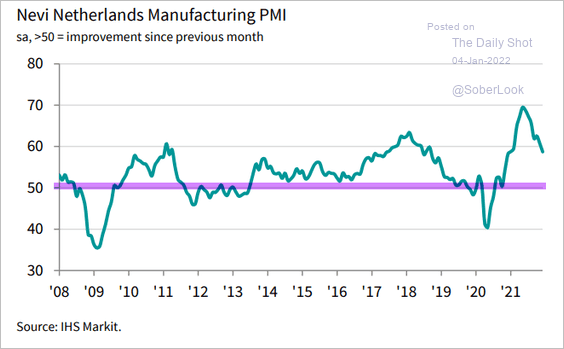

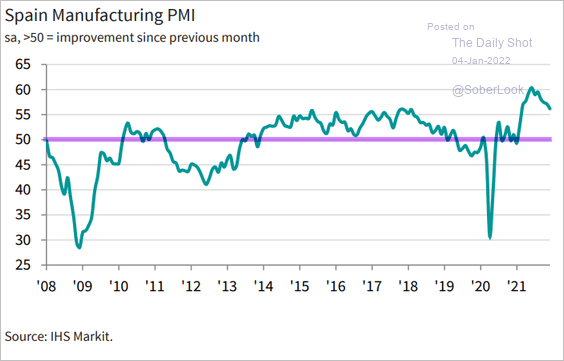

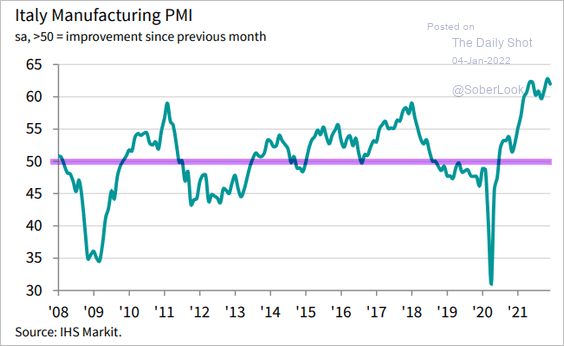

2. The Eurozone manufacturing PMI is off the highs but remains well in growth territory.

Source: IHS Markit

Source: IHS Markit

• The Netherlands:

Source: IHS Markit

Source: IHS Markit

• Spain:

Source: IHS Markit

Source: IHS Markit

• Italy:

Source: IHS Markit

Source: IHS Markit

——————–

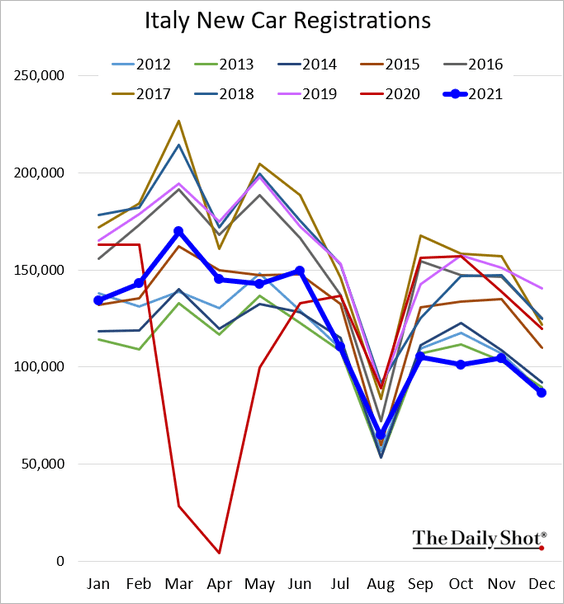

3. Italian car registrations remained depressed going into the year-end.

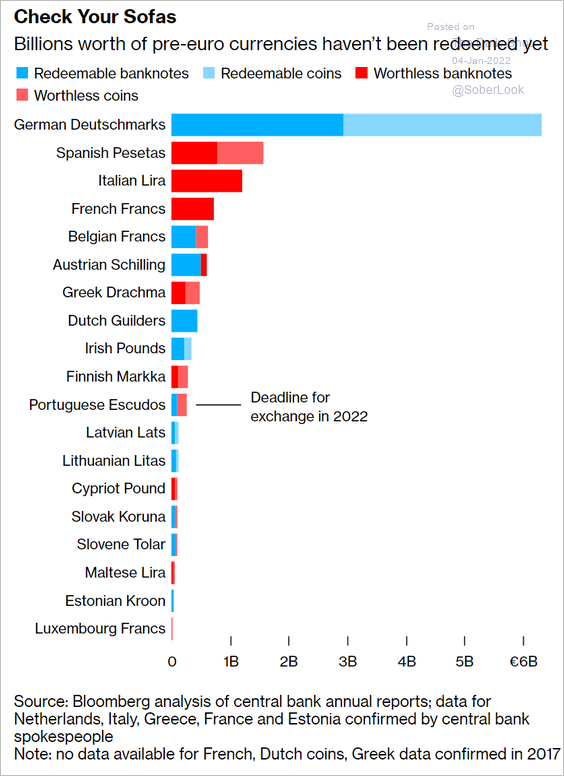

4. Somone has been collecting pre-euro notes.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Europe

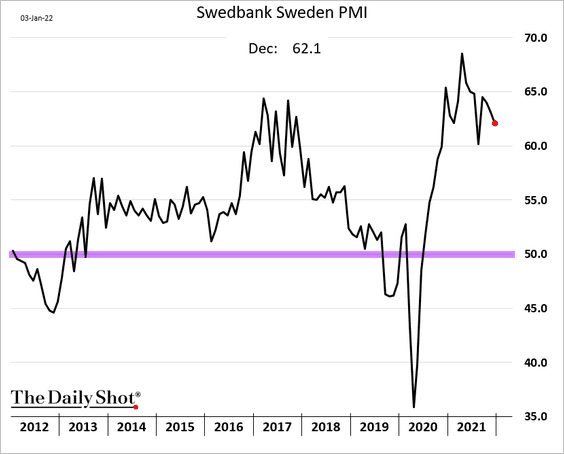

1. Sweden’s manufacturing growth remains very strong.

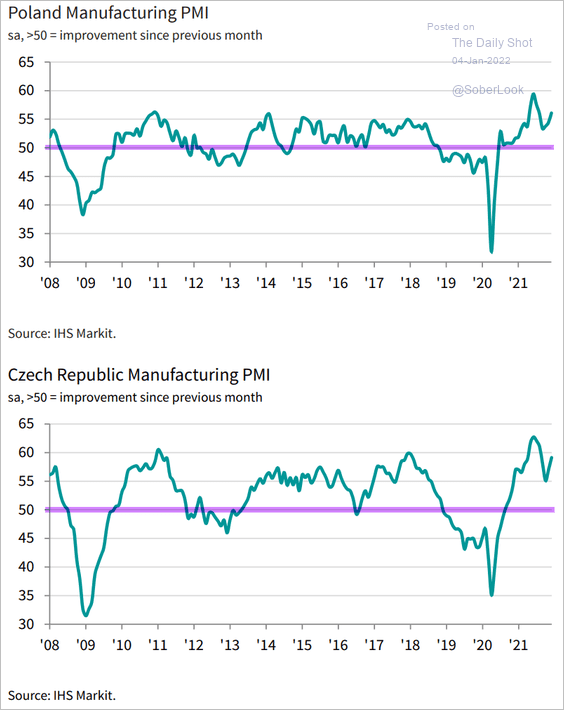

2. Manufacturing accelerated in central Europe last month.

Source: IHS Markit

Source: IHS Markit

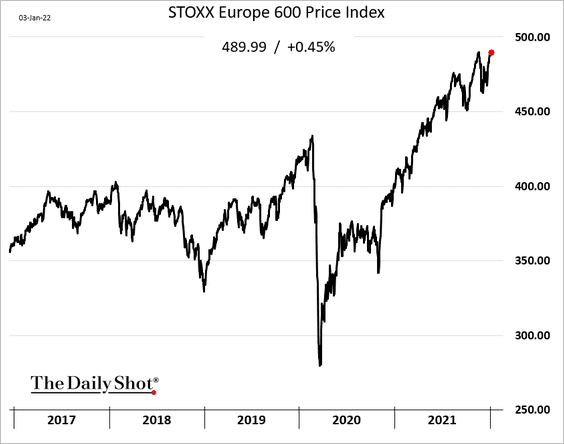

3. The STOXX 600 hit a record high.

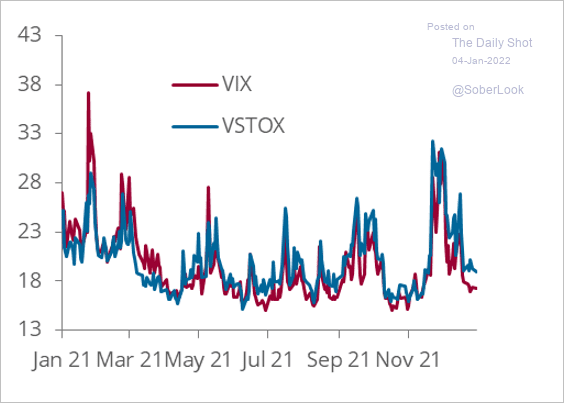

European implied volatility (VSTOX) is elevated relative to the US (VIX).

Source: @Marcomadness2

Source: @Marcomadness2

Back to Index

Asia – Pacific

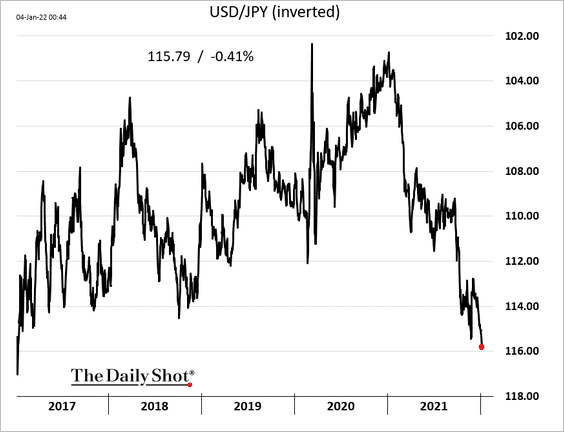

1. The yen hit a multi-year low as global risk appetite returns and traders press their carry bets. This trend should help Japanese exporters.

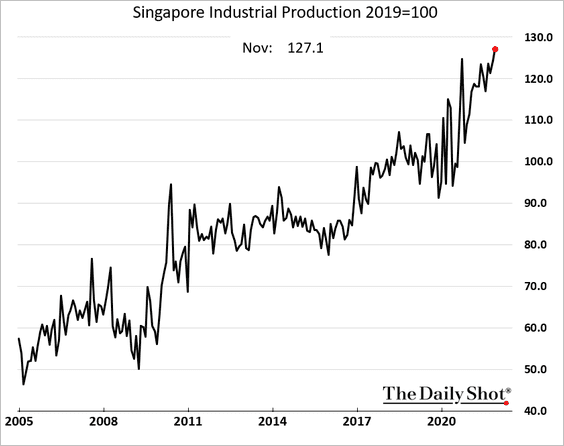

2. Singapore’s industrial production hit a record in November.

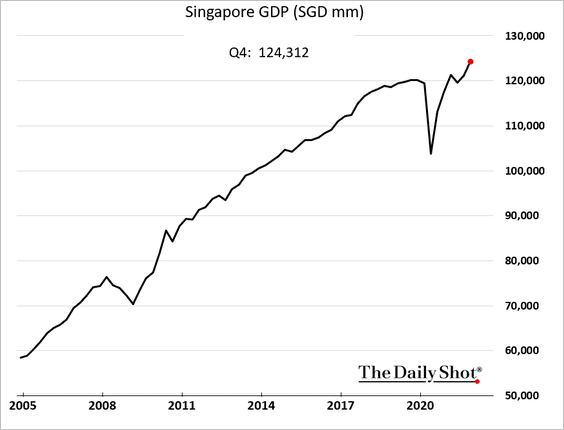

The GDP climbed further in Q4.

——————–

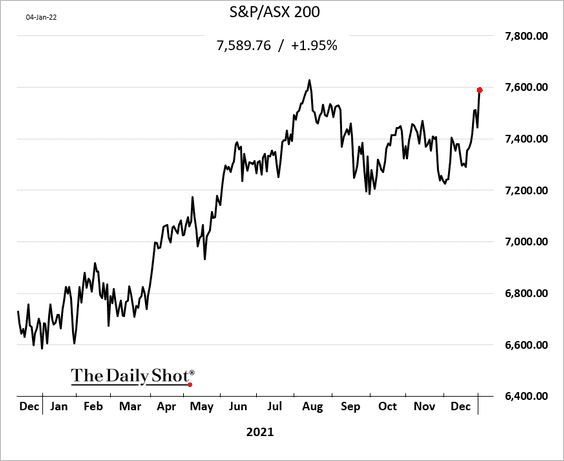

3. Australian stocks are approaching record highs.

Back to Index

China

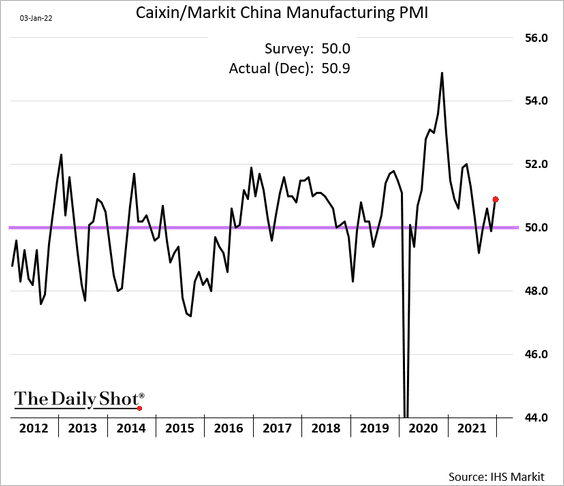

1. The Markit manufacturing PMI showed factory activity swinging into modest growth last month.

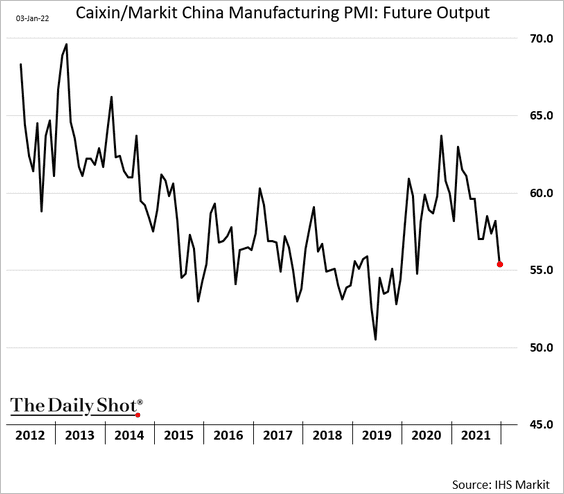

But businesses are less upbeat about their output going forward.

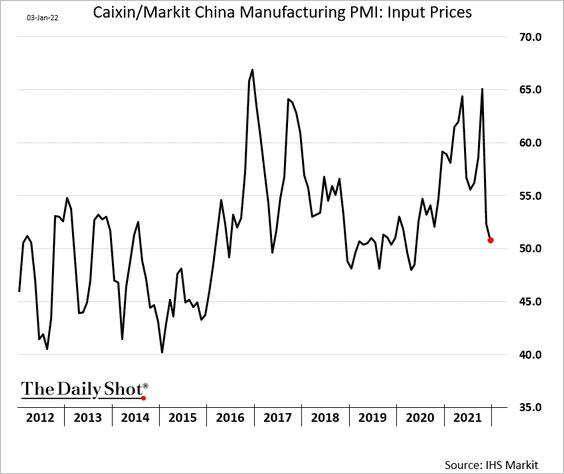

Price pressures are moderating, which should give the PBoC room to ease further.

——————–

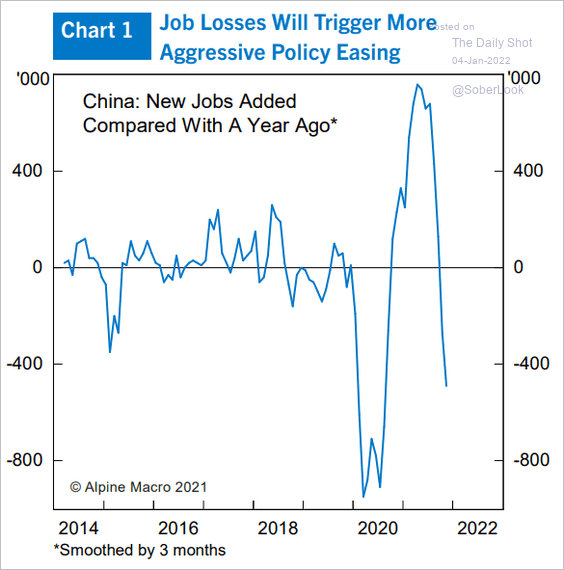

2. Softer labor market trends could also prompt Beijing to ease policy.

Source: Alpine Macro

Source: Alpine Macro

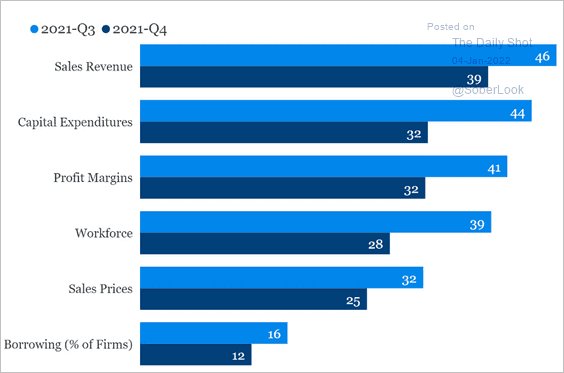

3. The service sector weakened over the past quarter as China maintains its “zero-COVID” policy.

Source: China Beige Book

Source: China Beige Book

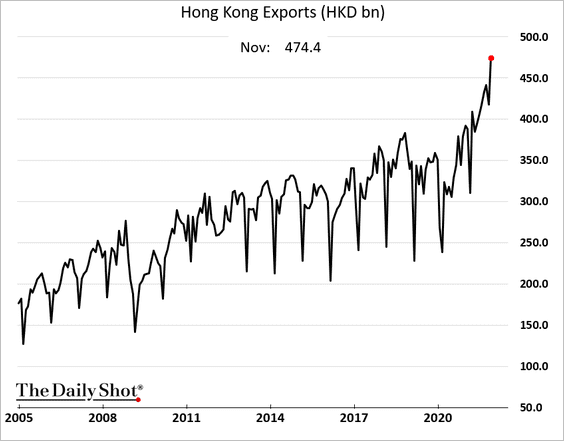

4. Hong Kong’s exports soared in November.

Back to Index

Emerging Markets

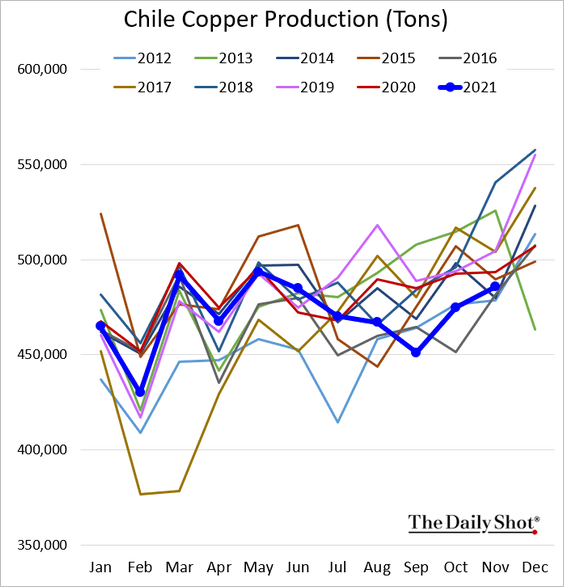

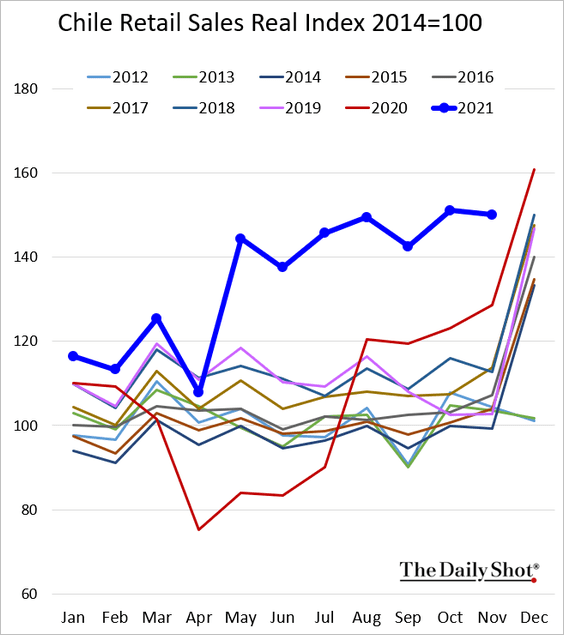

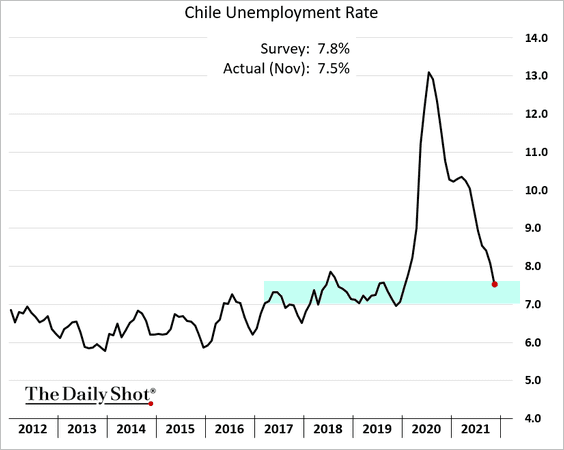

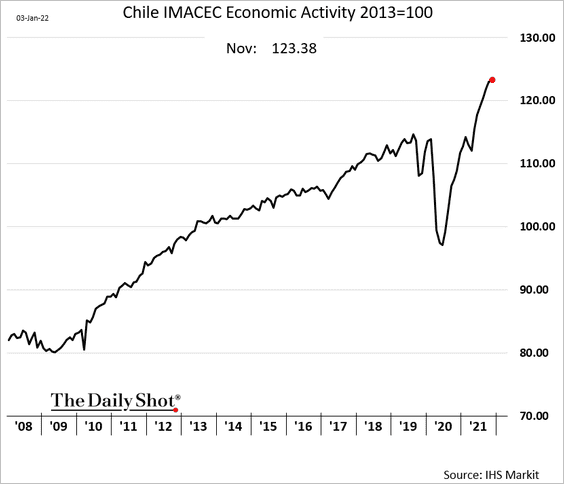

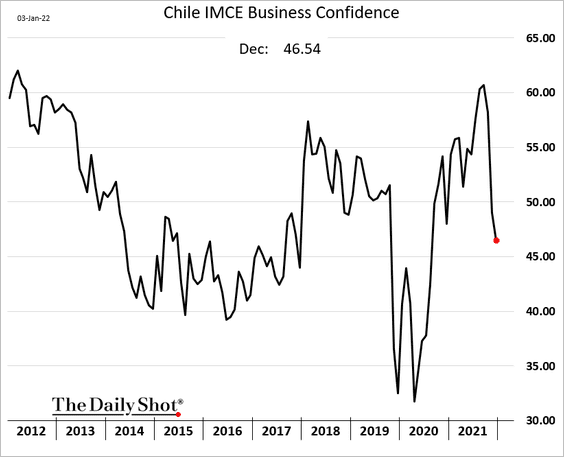

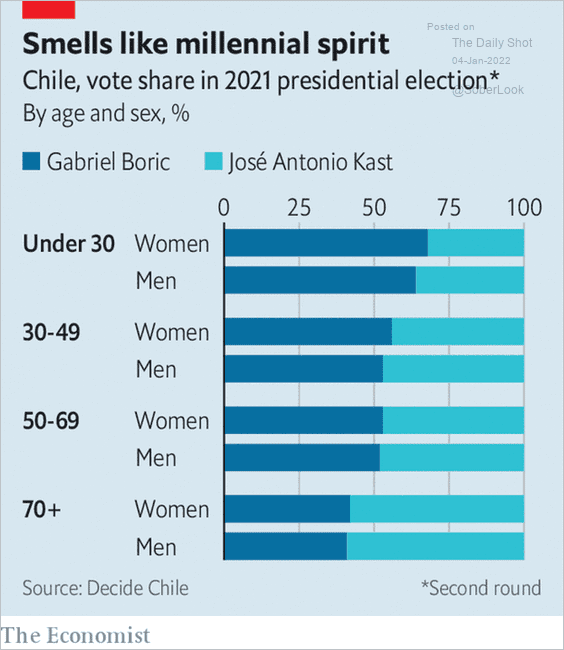

1. Let’s begin with Chile.

• Factory output (exceptionally strong):

• Copper production:

• Retail sales (weaker than expected but still robust):

• The unemployment rate (back in pre-COVID range):

• The overall economic activity:

• Business confidence (pulled lower by Boric’s victory):

• Election demographics:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

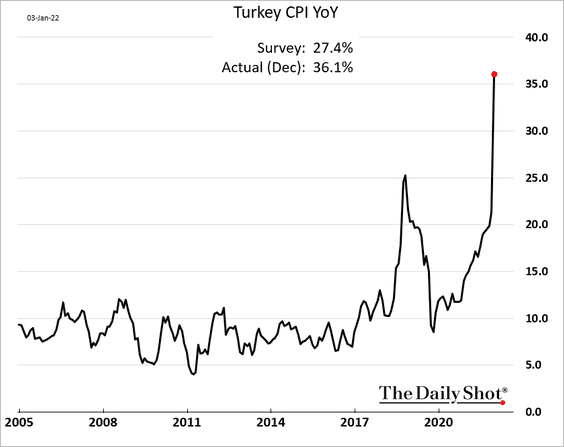

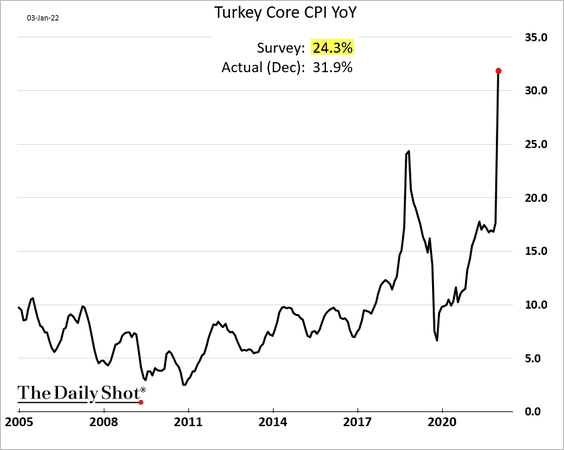

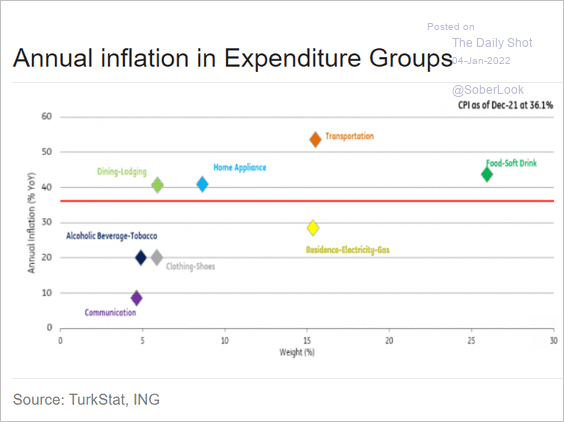

2. Turkey’s inflation surged far above expectations as the devaluation and high energy prices take a toll.

• Headline CPI:

• Core CPI:

• CPI by sector:

Source: ING

Source: ING

• The PPI:

——————–

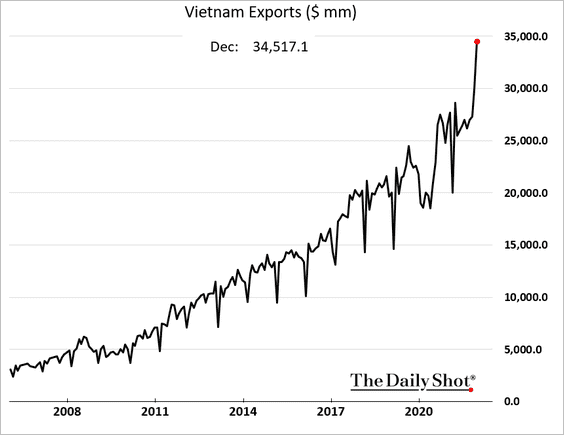

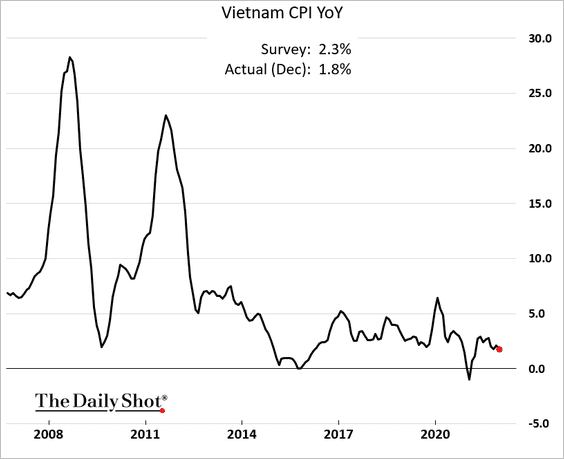

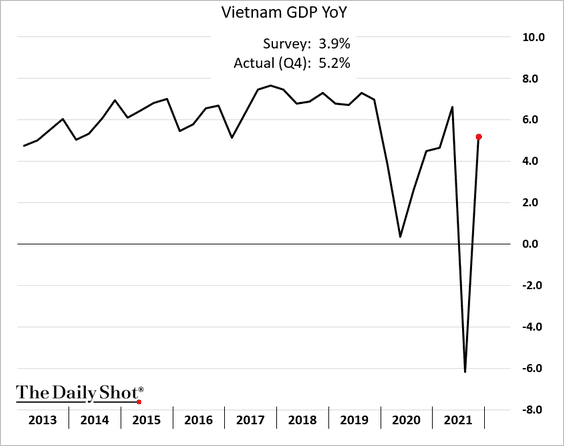

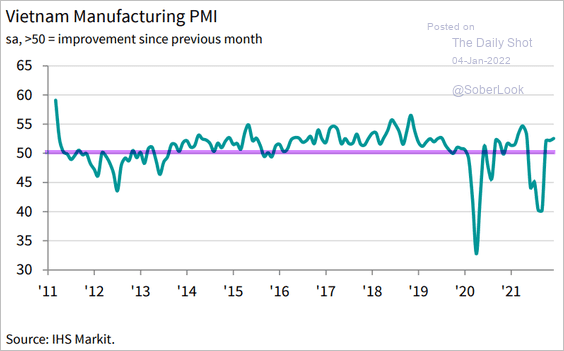

3. Next, we have some updates on Vietnam.

• The stock market:

• Exports (meeting the surge in US consumer demand):

• The CPI:

• The GDP rebound:

• Manufacturing PMI (steady growth):

Source: IHS Markit

Source: IHS Markit

——————–

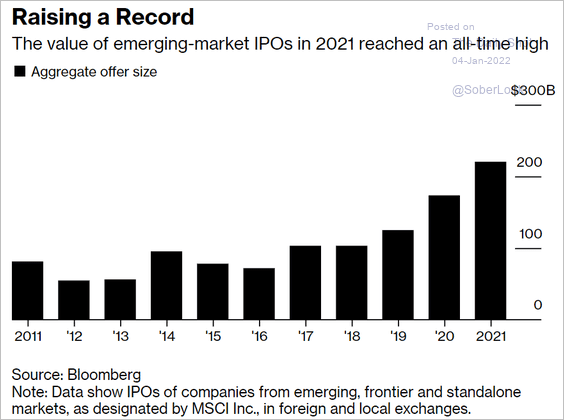

4. EM IPO volume hit a record high in 2021.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Cryptocurrency

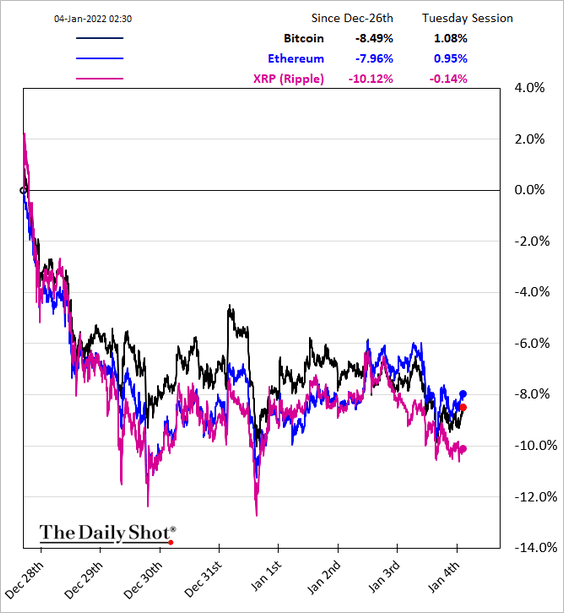

1. Let’s start with the relative performance over the past week.

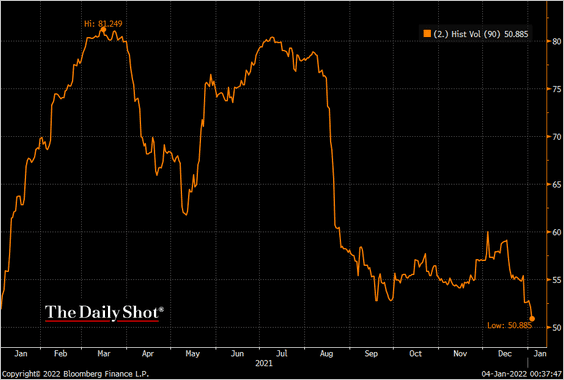

2. Bitcoin’s realized vol has been declining.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

3. Bitcoin’s spot trading volume remains below its recent peak, which occurred during the Dec. 5 flash crash.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

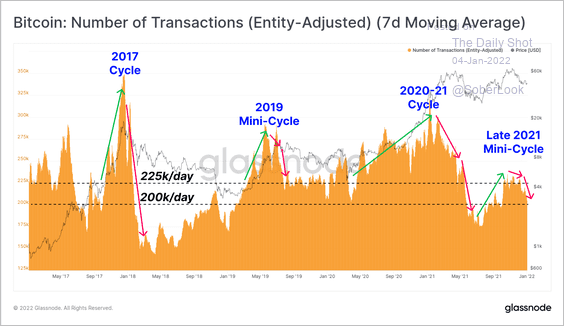

4. The number of transactions on Bitcoin’s blockchain is starting to decline, which suggests lower demand for the cryptocurrency.

Source: Glassnode Read full article

Source: Glassnode Read full article

Back to Index

Commodities

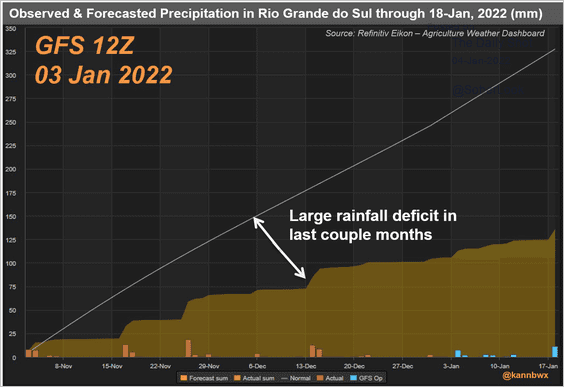

1. Low precipitation levels in parts of South America have been boosting soybean futures.

• Argentina rainfall deficit:

Source: @kannbwx

Source: @kannbwx

• Southern Brazil rainfall deficit:

Source: @kannbwx

Source: @kannbwx

——————–

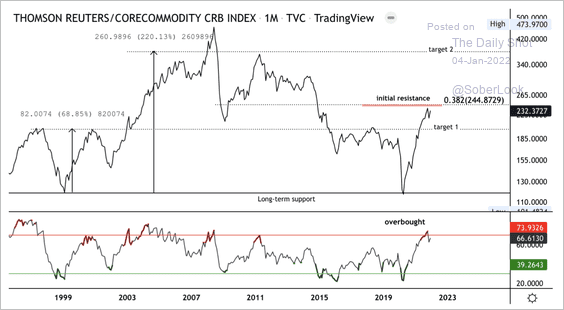

2. The Thomson Reuters Core Commodity CRB Index is approaching resistance and is the most overbought in a decade.

Source: Dantes Outlook

Source: Dantes Outlook

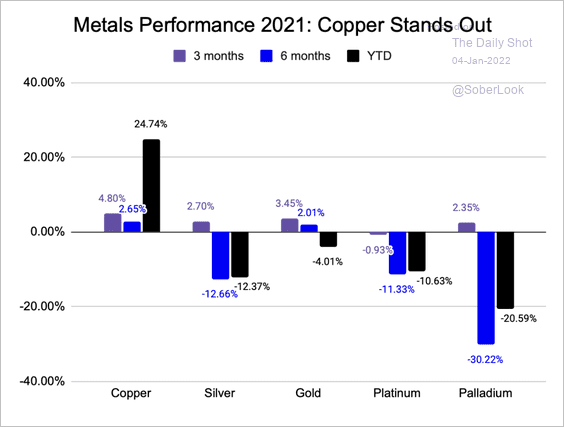

3. Copper has been resilient despite weakness in other metals last year.

Source: Dantes Outlook

Source: Dantes Outlook

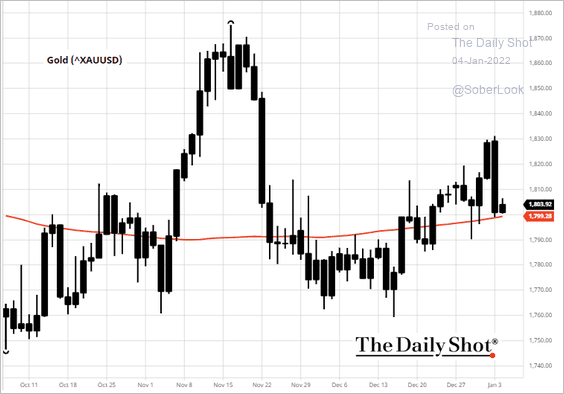

4. Gold is back near its 200-day moving average.

Source: barchart.com

Source: barchart.com

Back to Index

Energy

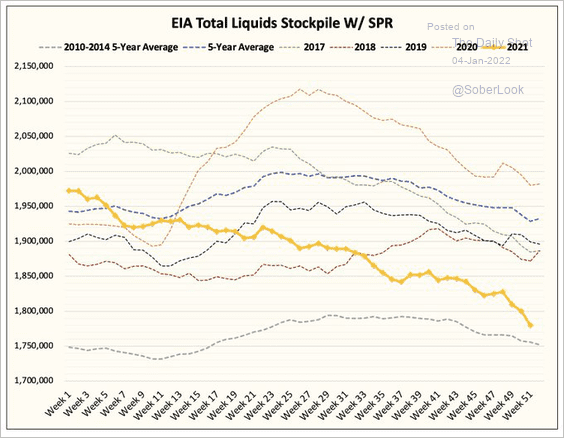

1. US crude oil inventory is at multi-year lows.

Source: @HFI_Research

Source: @HFI_Research

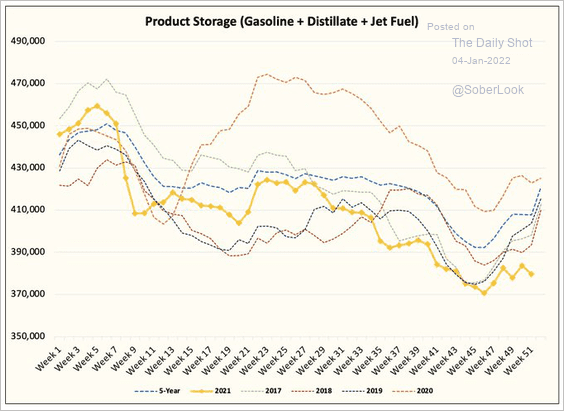

Refined product inventories are also extremely low.

Source: @HFI_Research

Source: @HFI_Research

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

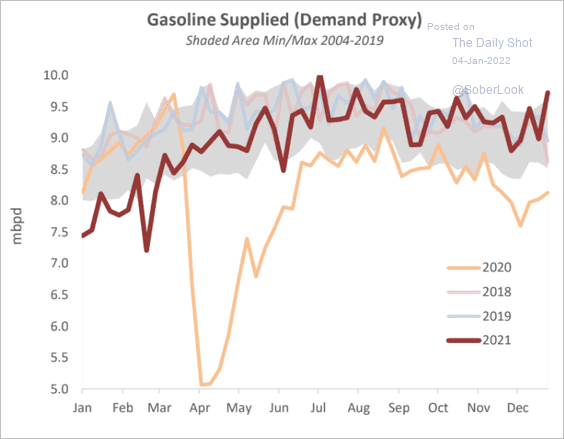

2. US gasoline demand hit a record high for this time of the year.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

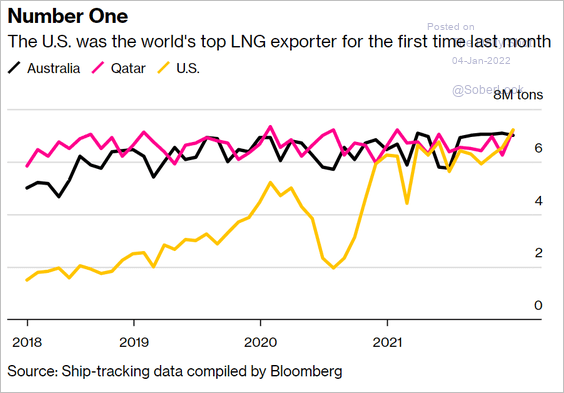

3. The US is now the largest LNG exporter.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

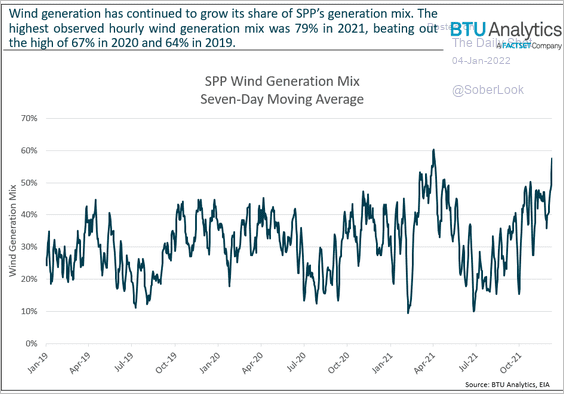

4. Wind generation has risen as a share of the Southwest Power Pool energy mix.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

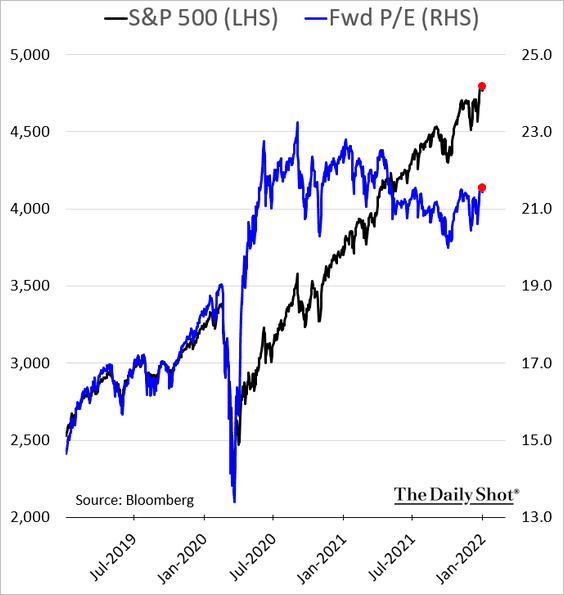

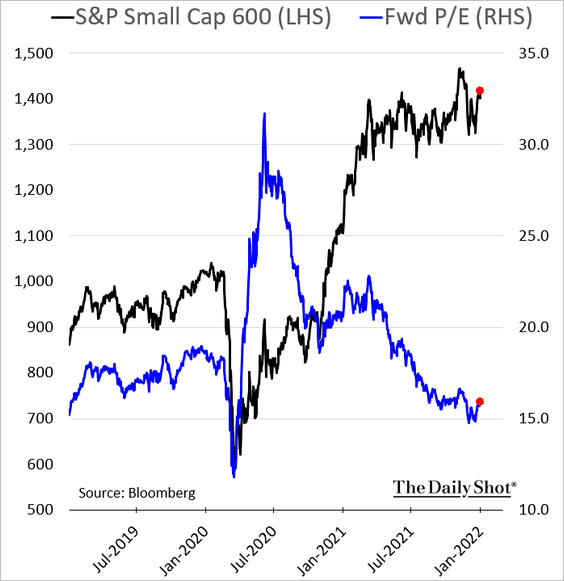

Equities

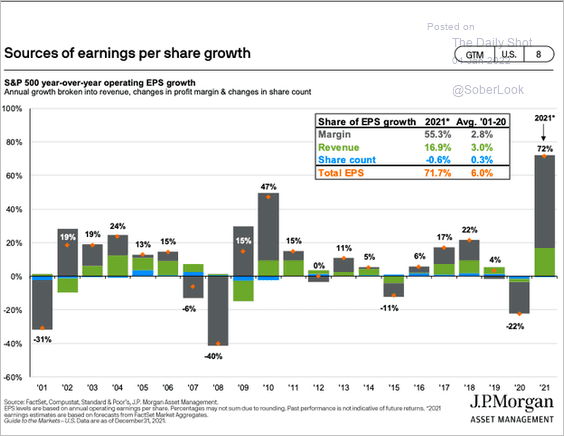

1. Let’s start with some earnings per share (EPS) trends.

• The S&P 500 forward EPS:

• Small caps EPS (below pre-COVID levels):

• Sources of operating EPS growth:

Source: J.P. Morgan Asset Management; @SamRo

Source: J.P. Morgan Asset Management; @SamRo

——————–

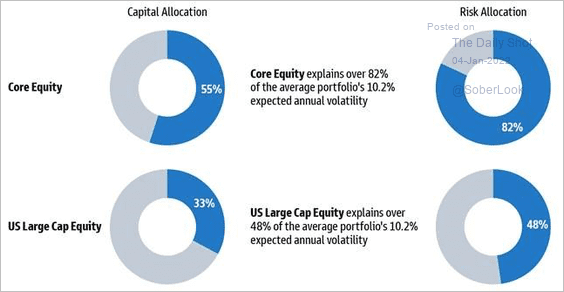

2. The average US equity portfolio reviewed by Goldman Sachs remains under-allocated to small caps.

Source: Goldman Sachs Asset Management Read full article

Source: Goldman Sachs Asset Management Read full article

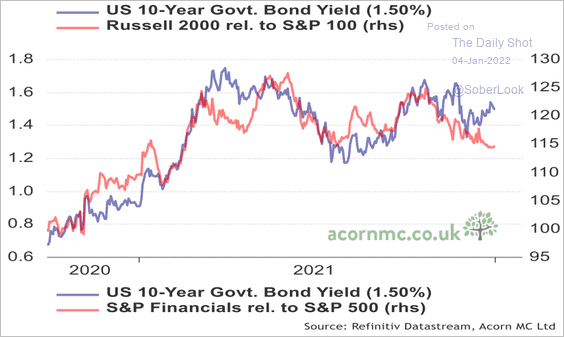

3. The Russell 2000 relative performance has diverged from Treasury yields.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

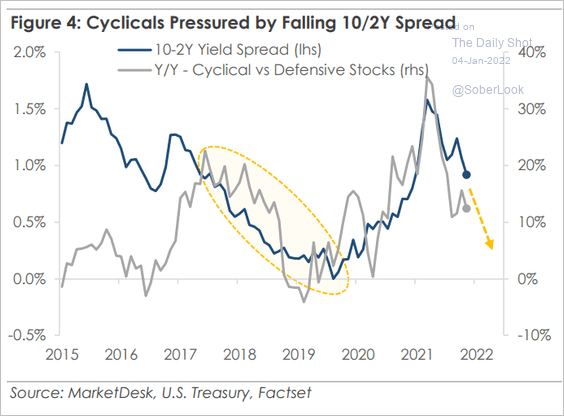

4. A flatter yield curve has been pressuring cyclicals.

Source: MarketDesk Research

Source: MarketDesk Research

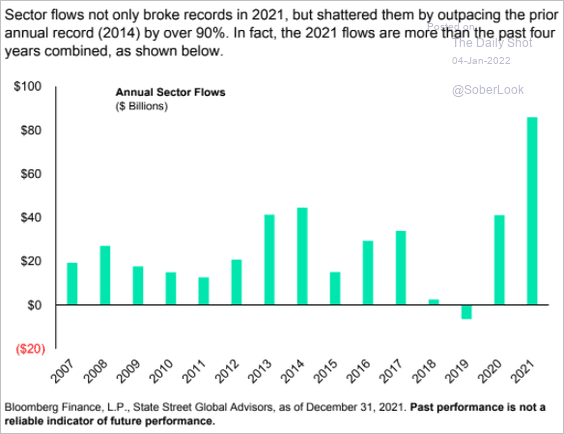

5. Sector ETF inflows hit a record last year.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

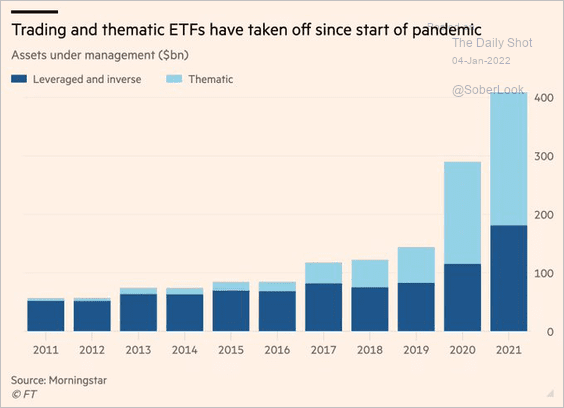

Trading and thematic ETFs’ AUM exploded.

Source: @jessefelder, @RobinWigg Read full article

Source: @jessefelder, @RobinWigg Read full article

——————–

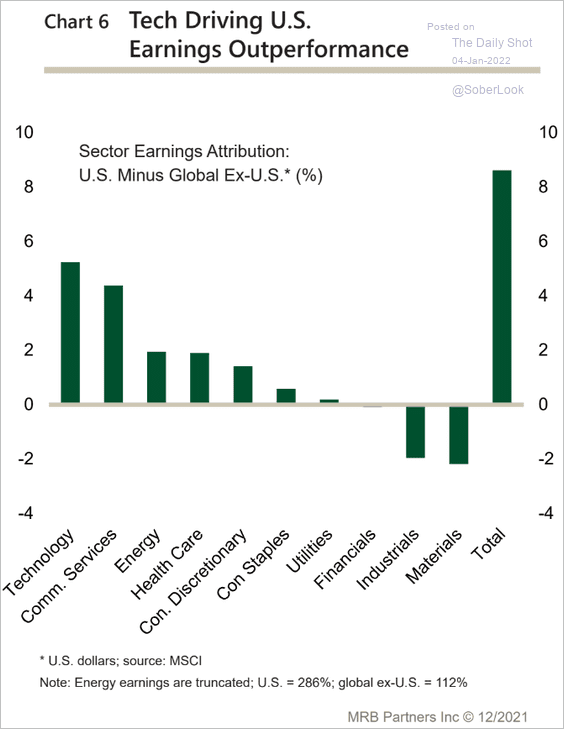

6. Tech has been driving US earnings outperformance vs. the rest of the world.

Source: MRB Partners

Source: MRB Partners

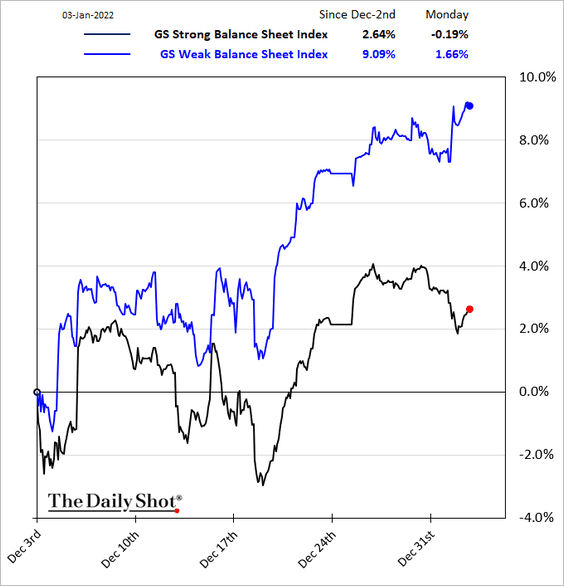

7. Companies with weak balance sheets have been outperforming.

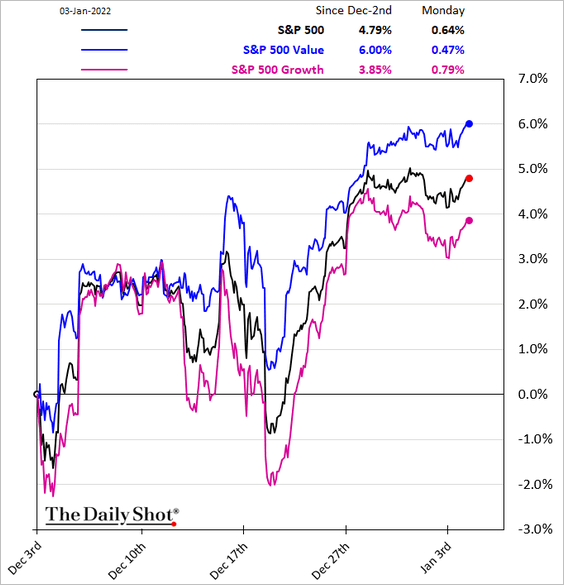

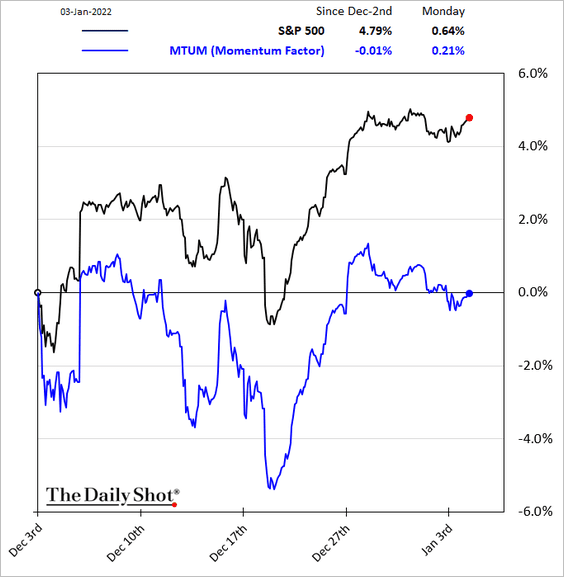

8. Value stocks have outperformed growth over the past month.

Momentum stocks continue to lag.

Back to Index

Rates

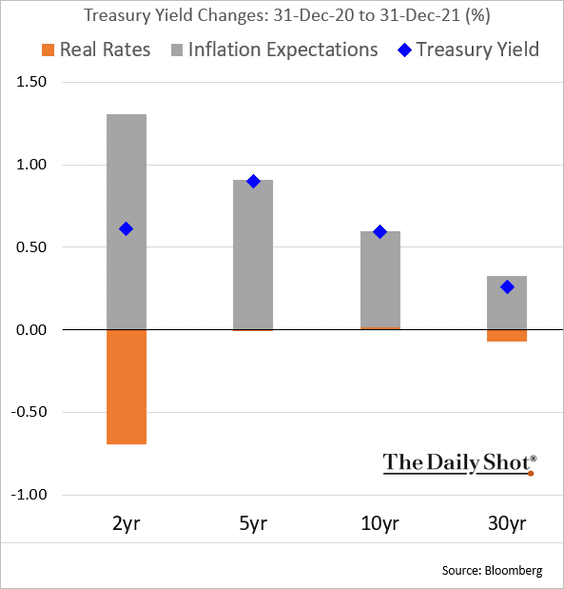

1. Inflation expectations drove most of the Treasury yield gains in 2021.

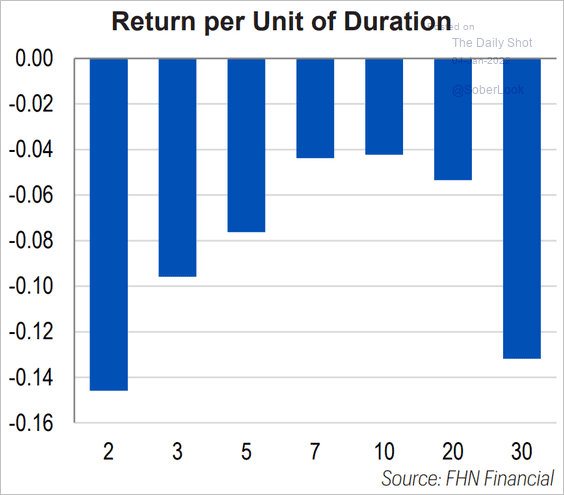

2. The 2-yr and the 30yr Treasury saw the worst losses on a duration-adjusted basis last year.

Source: FHN Financial

Source: FHN Financial

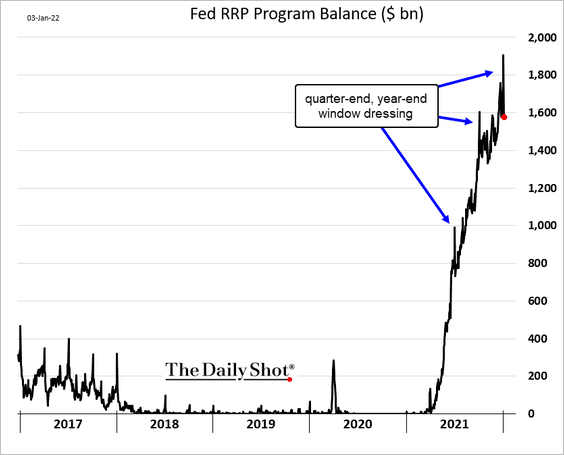

3. The Fed’s RRP balances came off the record high reached at the end of the year.

——————–

Food for Thought

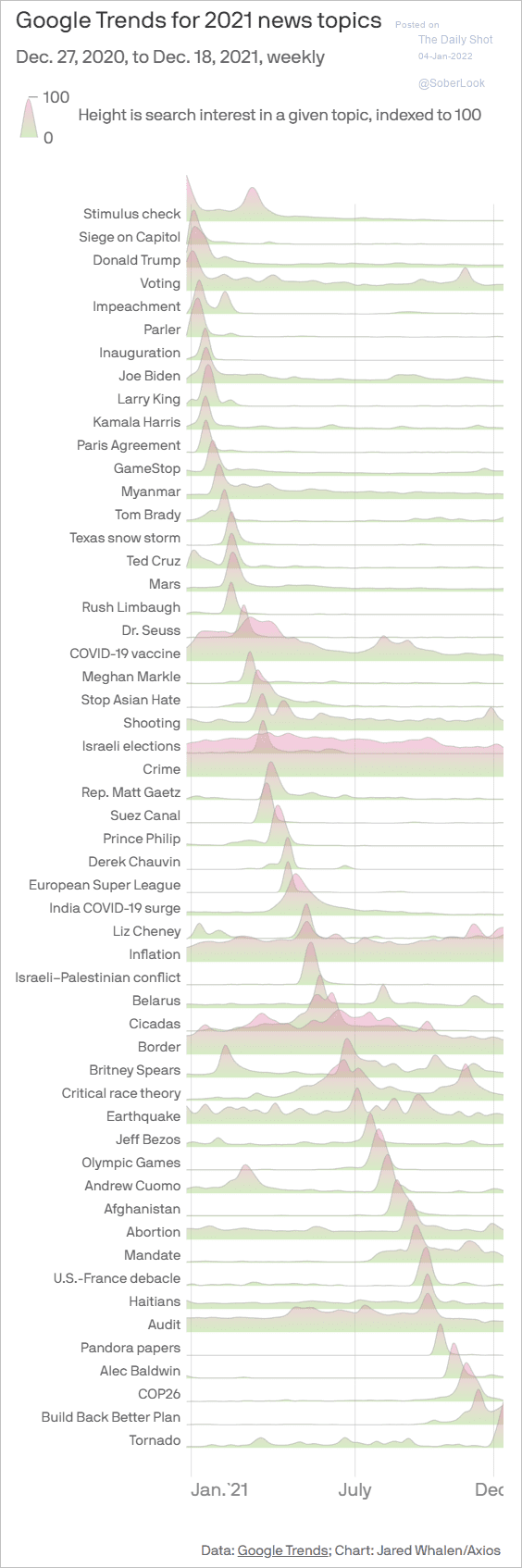

1. The 2021 news cycle:

Source: @axios Read full article

Source: @axios Read full article

2. US COVID relief programs as a share of total disposable income:

Source: @AE_Konkel

Source: @AE_Konkel

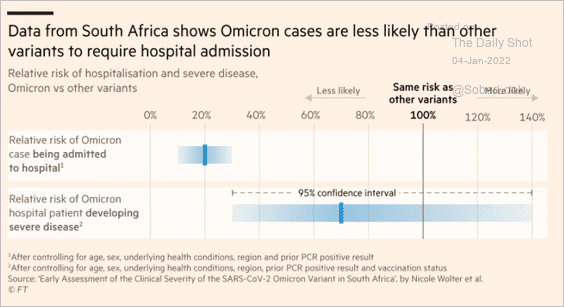

3. Risk of hospitalization and severe illness for omicron vs. other variants:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

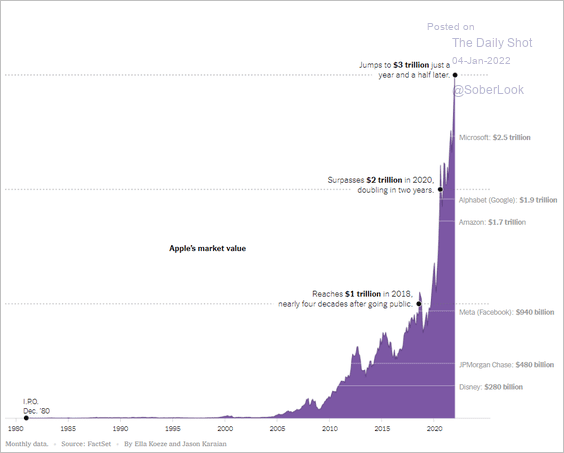

4. Apple’s market value:

Source: The New York Times Read full article

Source: The New York Times Read full article

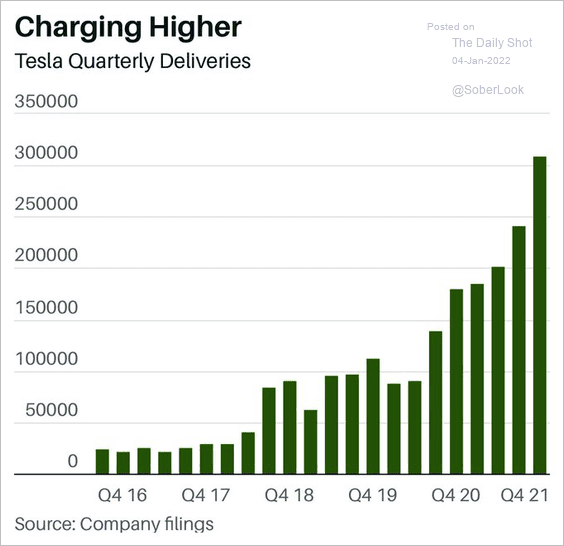

5. Tesla’s car sales:

Source: @WallStJesus, Barron’s Read full article

Source: @WallStJesus, Barron’s Read full article

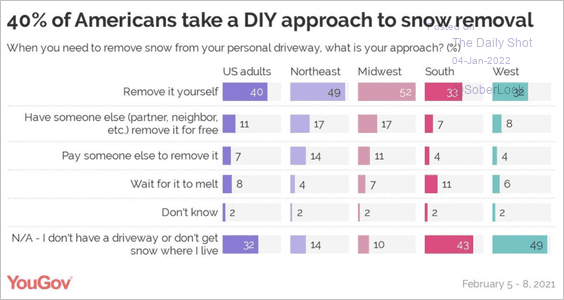

6. Approach to snow removal:

——————–

Back to Index