The Daily Shot: 06-Jan-22

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates.

• Global Developments

• Food for Thought

The United States

1. The FOMC minutes revealed an even more hawkish Federal Reserve than the markets were expecting.

• Inflation concerns:

Participants remarked that inflation readings had been higher and were more persistent and widespread than previously anticipated. Some participants noted that trimmed mean measures of inflation had reached decade-high levels and that the percentage of product categories with substantial price increases continued to climb.

• Faster rate hikes:

Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

• Balance sheet runoff (not just stopping securities purchases but allowing the central bank’s balance sheet to shrink):

Participants had an initial discussion about the appropriate conditions and timing for starting balance sheet runoff relative to raising the federal funds rate from the ELB. They also discussed how this relative timing might differ from the previous experience, in which balance sheet runoff commenced almost two years after policy rate liftoff when the normalization of the federal funds rate was judged to be well under way. Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate.

– Starting balance sheet runoff sooner:

Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.

– And moving faster:

Many participants judged that the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode. Many participants also judged that monthly caps on the runoff of securities could help ensure that the pace of runoff would be measured and predictable, particularly given the shorter weighted average maturity of the Federal Reserve’s Treasury security holdings.

——————–

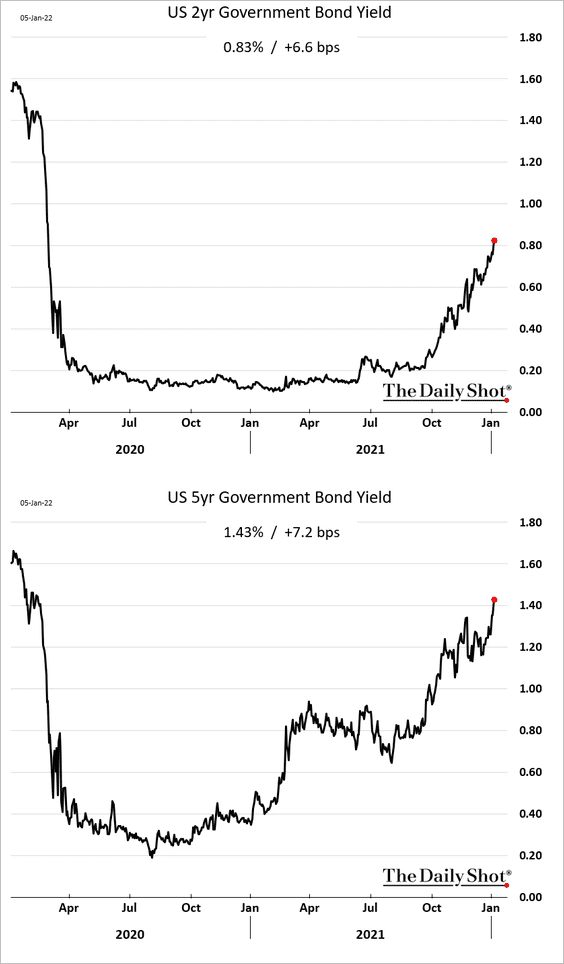

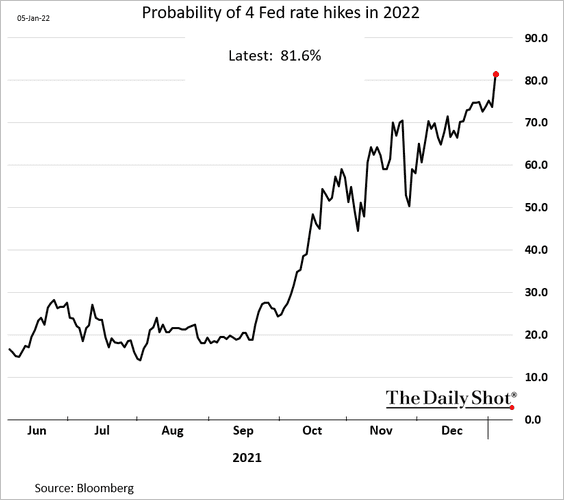

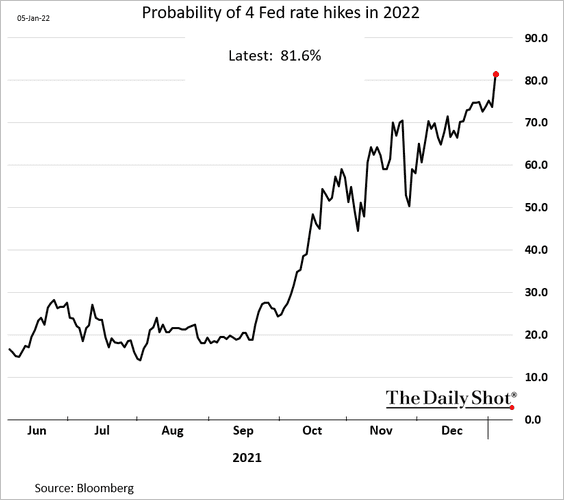

2. Bonds around the world sold off in response to the hawkish FOMC minutes.

• The probability of liftoff in March breached 75%.

And the odds of a 100 bps rate increase over the course of this year is now above 80%.

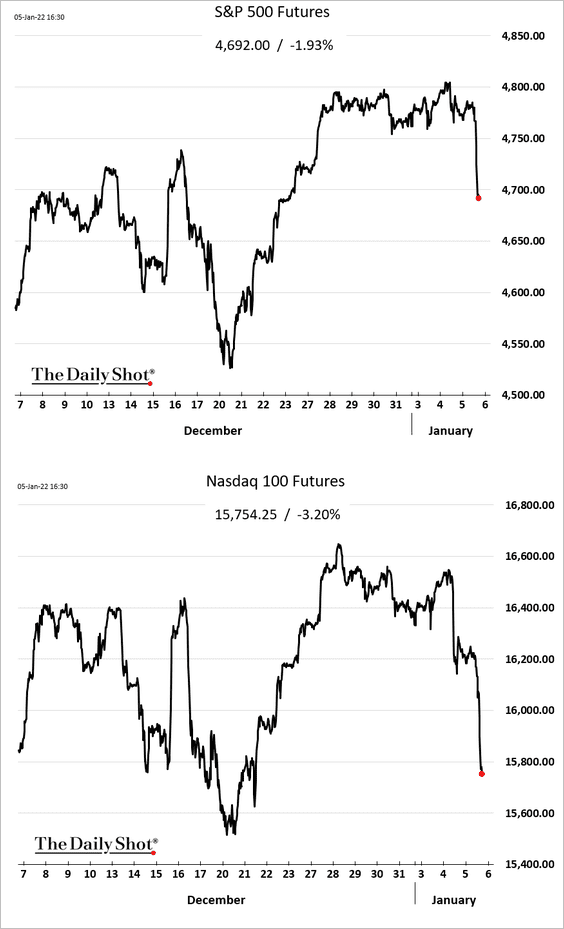

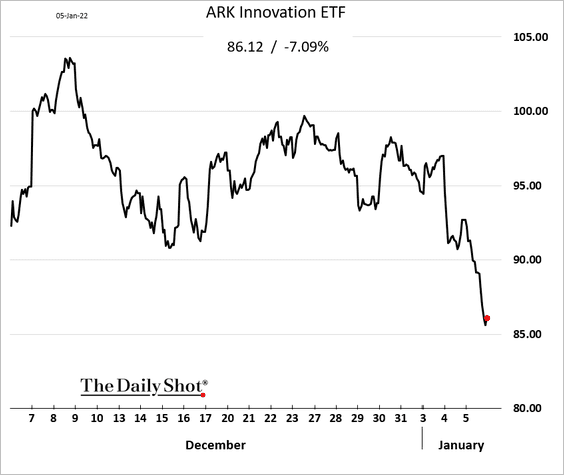

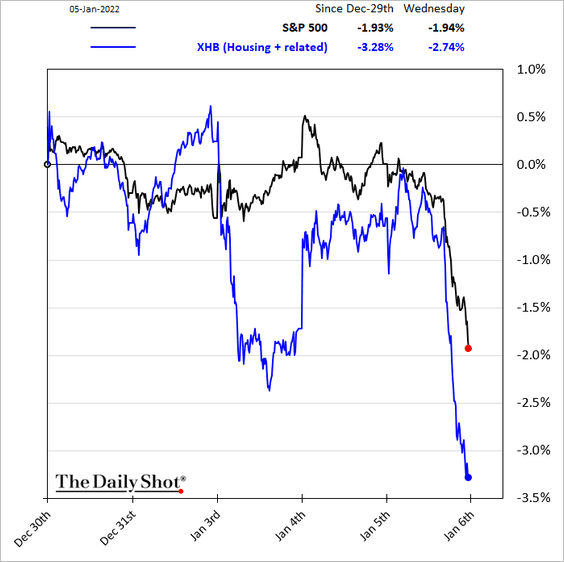

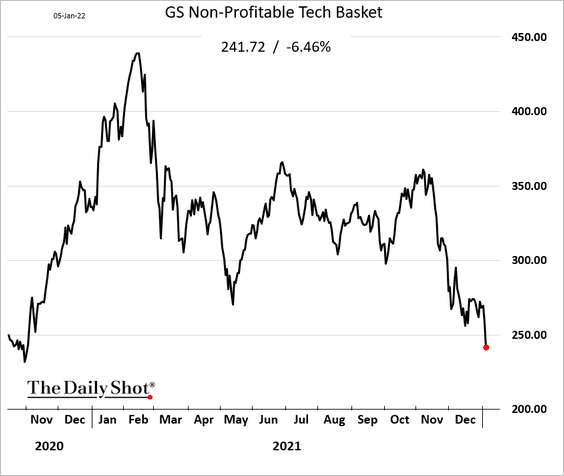

• Shares sold off sharply, especially companies trading with high multiples (or what some refer to as high-duration stocks).

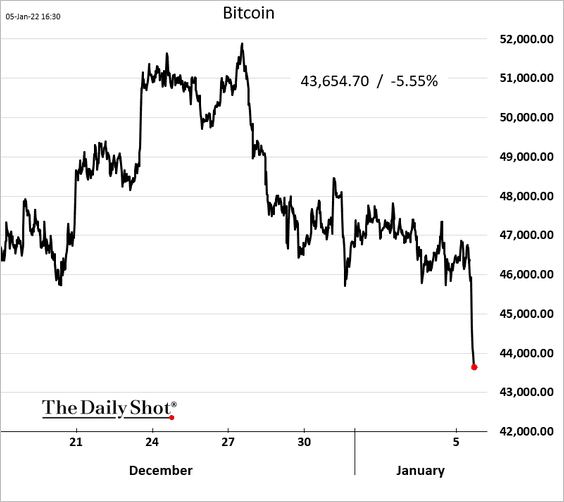

• Speculative assets were hit particularly hard.

– ARK Innovation ETF:

– Bitcoin:

——————–

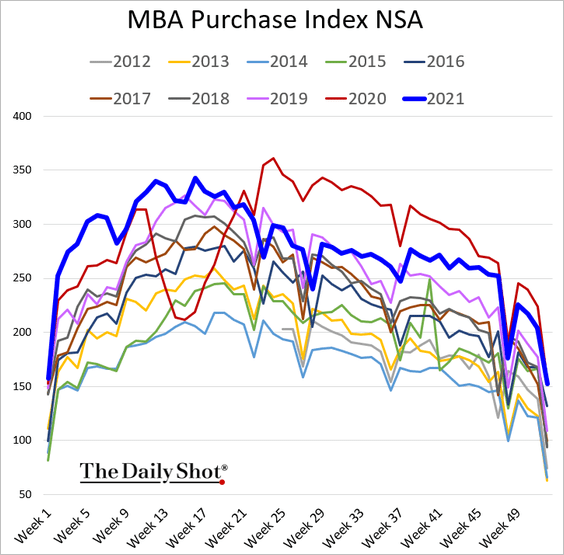

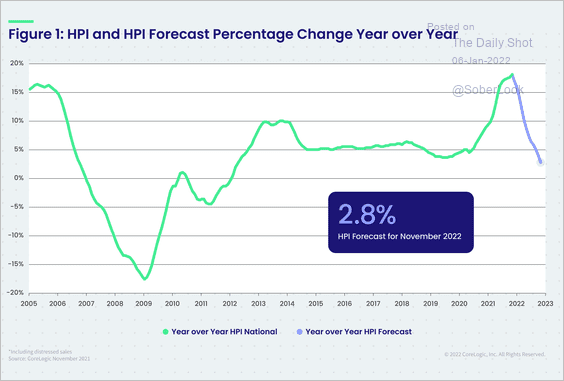

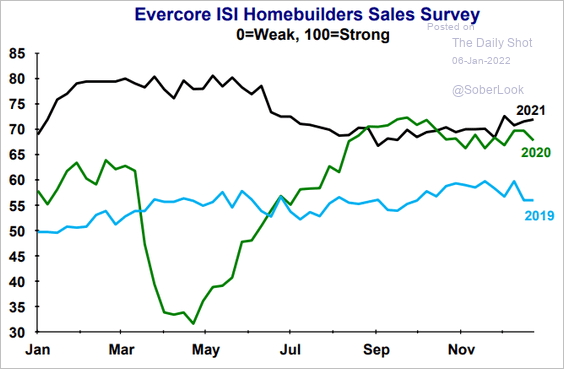

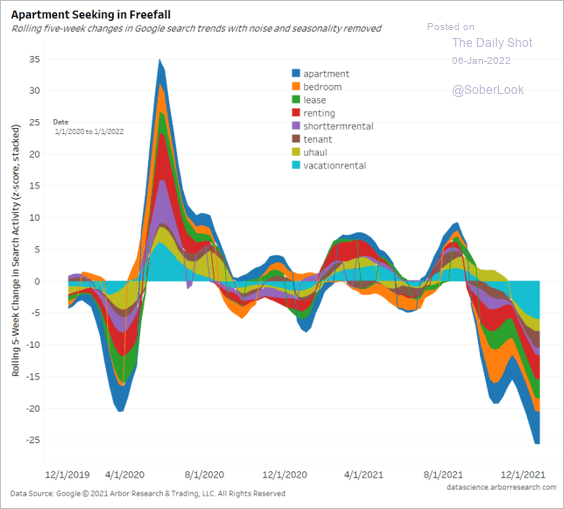

3. Next, we have some updates on the housing market.

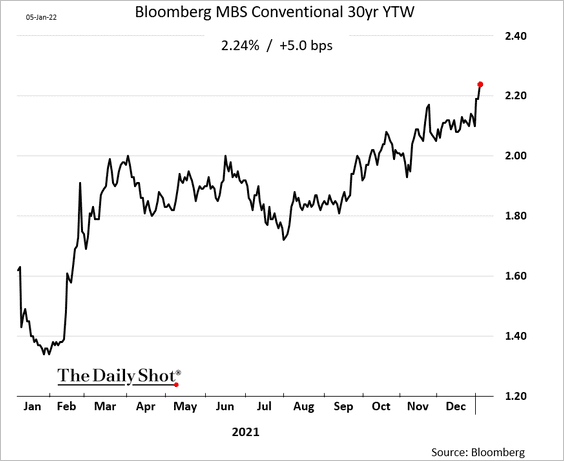

• Mortgage-backed bonds were under pressure amid talk of faster Fed balance sheet runoff.

As a result, we should see higher mortgage rates. Housing stocks underperformed on Wednesday.

• Mortgage applications finished the year on a strong note. But repeating 2021 will be challenging.

• Home price appreciation is expected to slow sharply this year, according to CoreLogic,

Source: CoreLogic

Source: CoreLogic

• Homebuilders were upbeat in December, according to a survey by Evercore ISI Research.

Source: Evercore ISI Research

Source: Evercore ISI Research

• Apartment search activity has collapsed going into the year-end.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

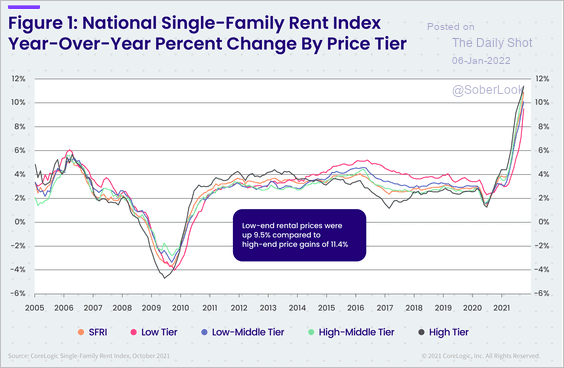

• Single-family housing rents continue to surge.

Source: CoreLogic

Source: CoreLogic

Source: CNBC Read full article

Source: CNBC Read full article

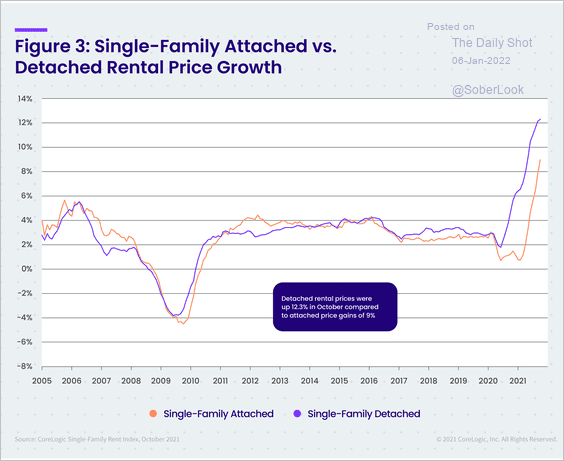

Attached-housing rents have been lagging standalone homes but have recently accelerated.

Source: CoreLogic

Source: CoreLogic

——————–

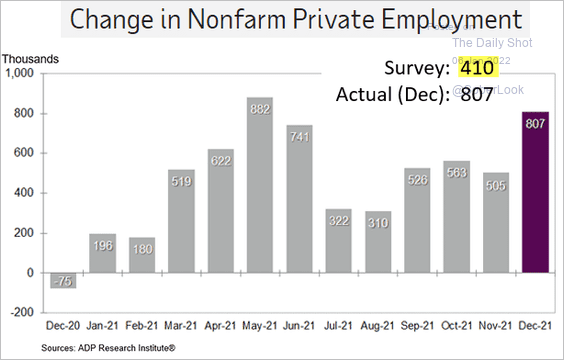

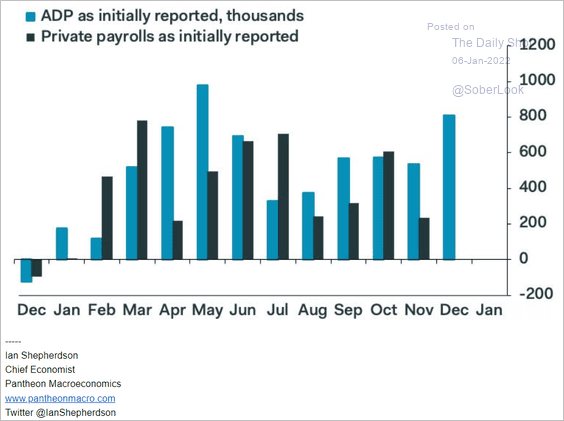

4. Turning to the labor market, the ADP report showed over 800k private payrolls created in December. The labor market has been exceptionally strong.

Source: ADP Research Institute

Source: ADP Research Institute

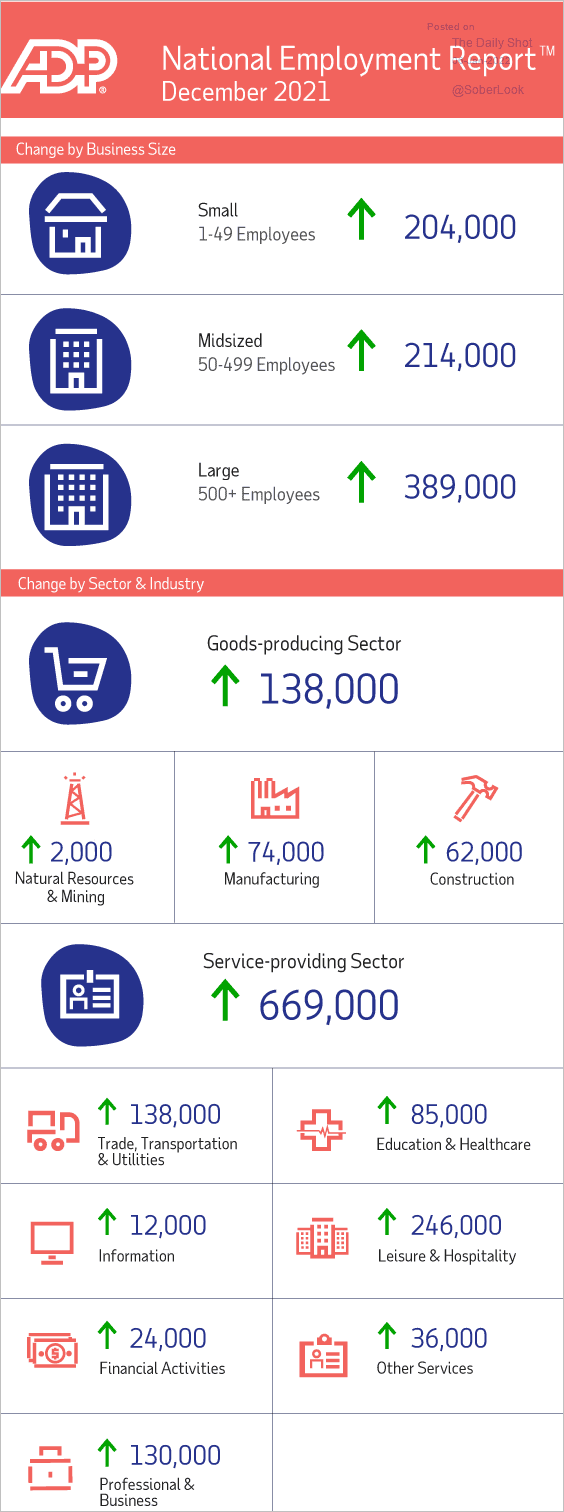

Gains were broad, with all major sectors showing increases.

Source: ADP Research Institute

Source: ADP Research Institute

This chart compares the ADP figures with the official payrolls report (as initially reported).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

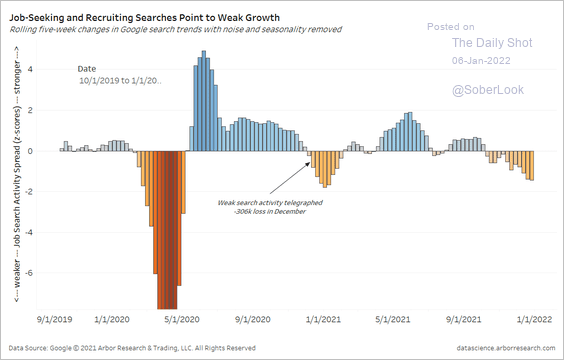

Separately, data from Arbor Data Science shows that job-seeking activity slowed going into the year-end (note that this is seasonally adjusted data).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

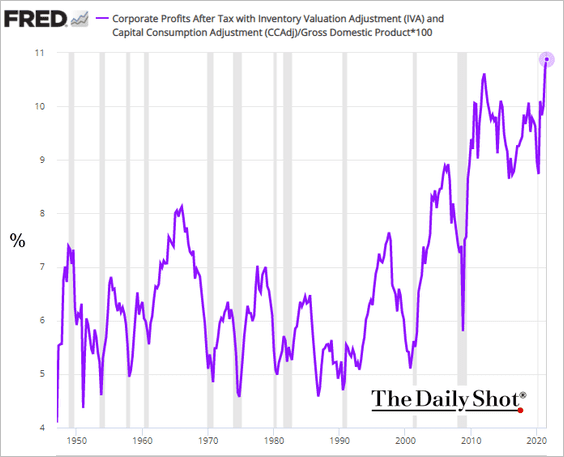

5. Finally, this chart shows after-tax corporate profits as a percentage of US GDP.

Back to Index

Canada

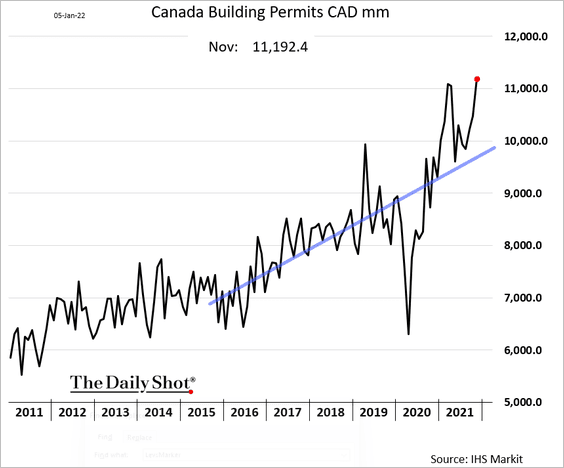

1. Building permits are running well above the pre-COVID trend.

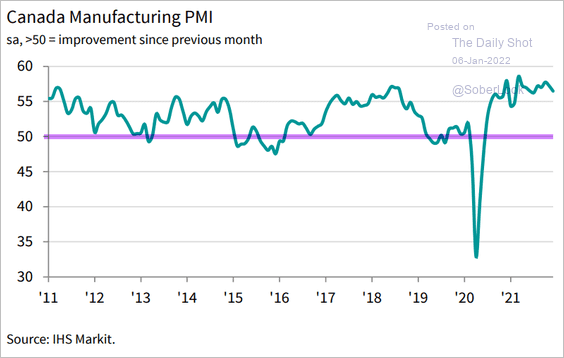

2. Growth in manufacturing activity has been holding up well.

Source: IHS Markit

Source: IHS Markit

3. The Oxford Economics recovery tracker is back below pre-pandemic levels as COVID cases surge.

![]() Source: Oxford Economics

Source: Oxford Economics

Back to Index

The Eurozone

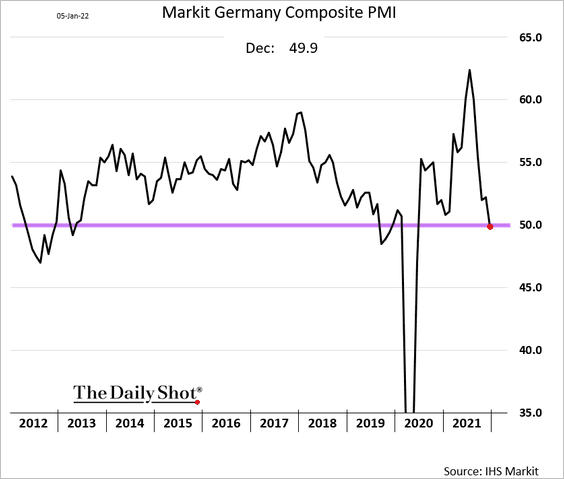

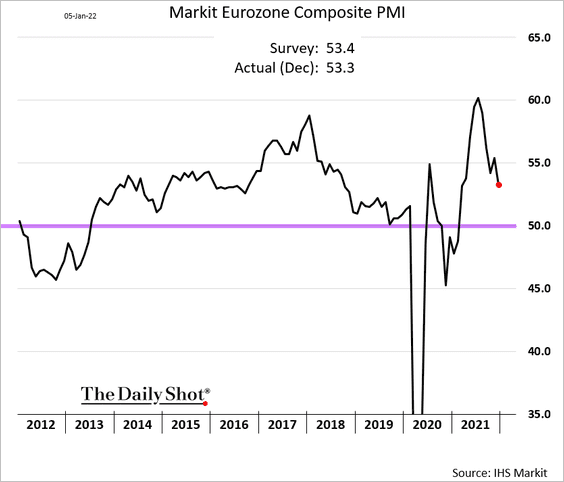

1. Weakness in Germany’s service sector put the composite PMI (total business activity) into contraction territory (PMI < 50).

Here is the composite PMI at the Eurozone level.

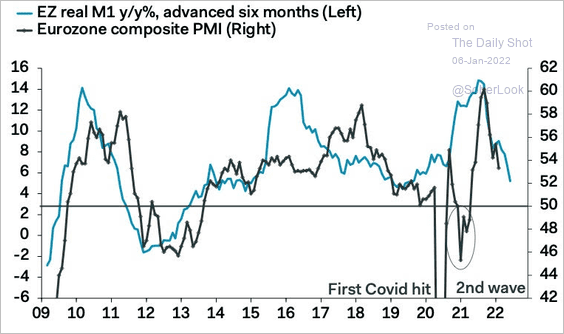

Slower money supply growth points to downside risks for the composite PMI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

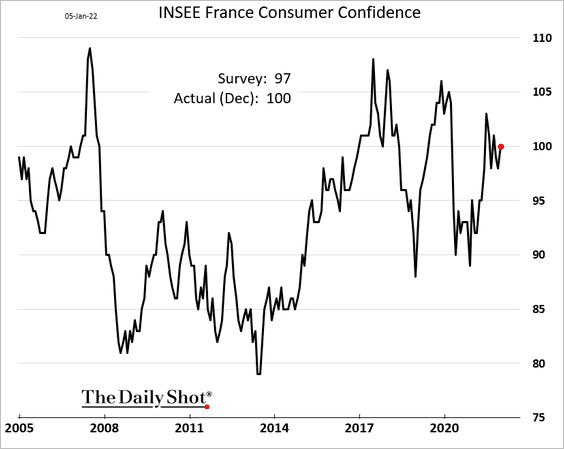

2. French consumer sentiment has been resilient.

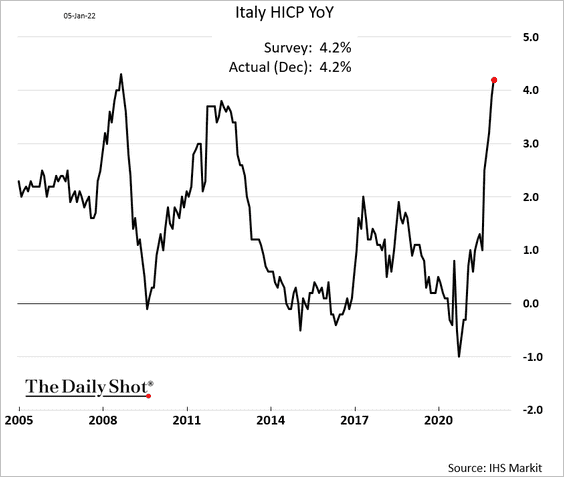

3. Italian consumer inflation climbed above 4% (as expected).

Back to Index

Asia – Pacific

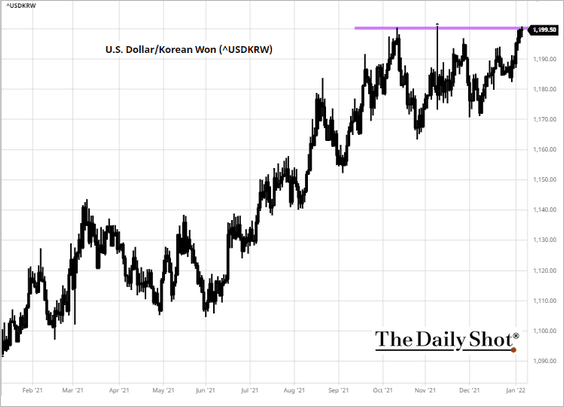

1. USD/KRW is testing resistance as the won weakens due to the hawkish FOMC minutes and North Korea’s latest missile test.

Source: barchart.com

Source: barchart.com

Source: Reuters Read full article

Source: Reuters Read full article

——————–

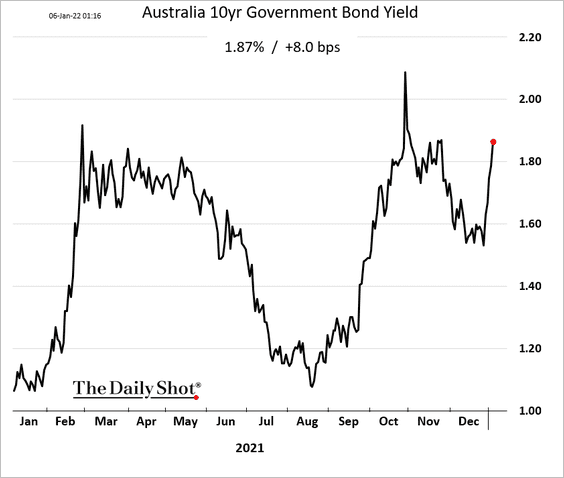

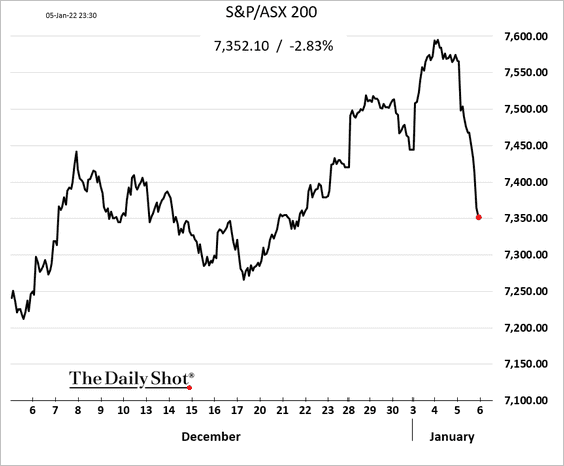

2. The Fed’s hawkish stance is also pressuring Australia’s stocks and bonds.

Back to Index

China

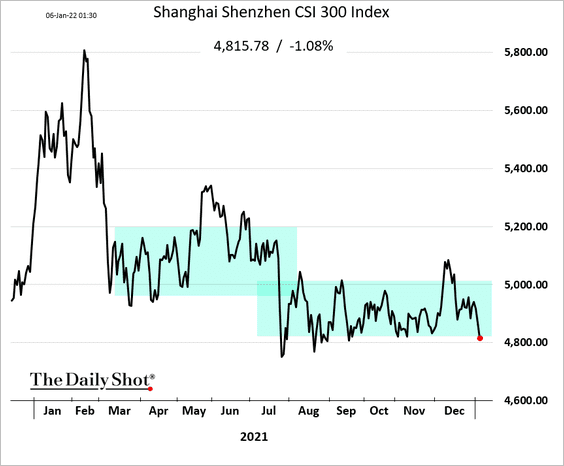

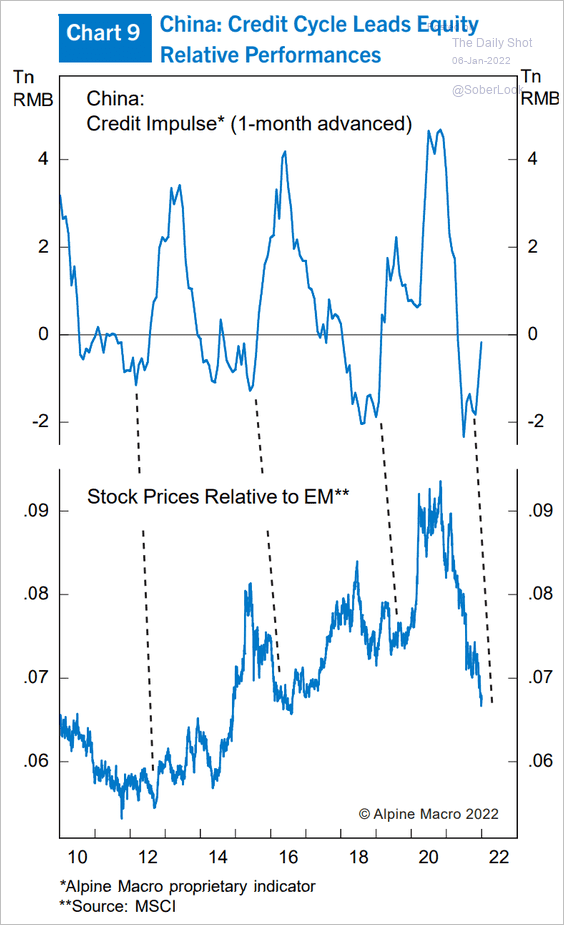

1. The key equity index (mainland) is at the lower end of its trading range.

China’s stocks could rebound as the credit cycle bottoms.

Source: Alpine Macro

Source: Alpine Macro

——————–

2. The shares of Huarong (a large troubled asset manager) dropped 60% as trading reopened after a nine-month suspension and a $6.6 billion state bailout.

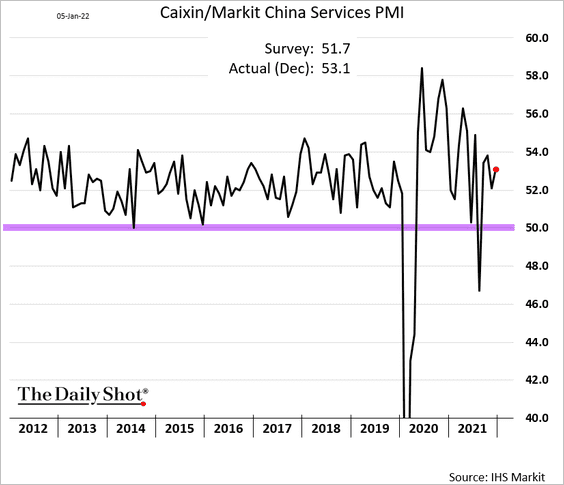

3. The service-sector PMI from Markit showed robust improvement in activity in December.

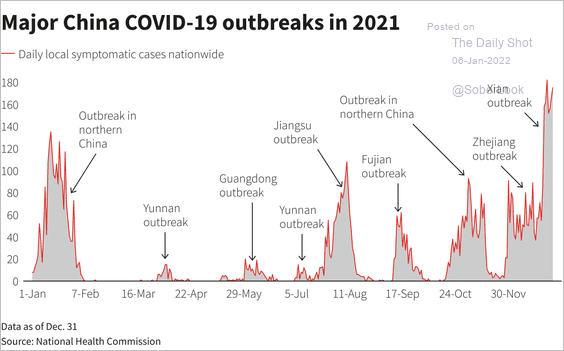

4. Omicron could be a drag on China’s economy this year.

Source: @MichaelKantro, @csm_research

Source: @MichaelKantro, @csm_research

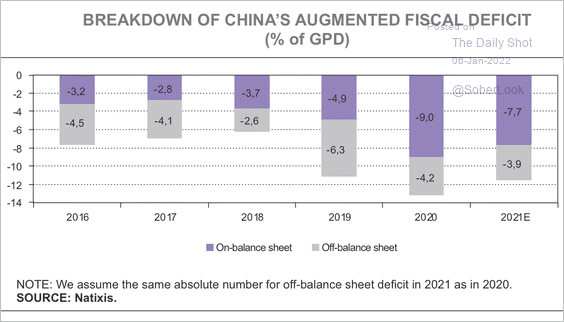

5. An increase in local government bond issuance and other financing vehicles (off-balance sheet) has pushed China’s augmented fiscal deficit to 13.2% of GDP, according to Natixis.

Source: Natixis

Source: Natixis

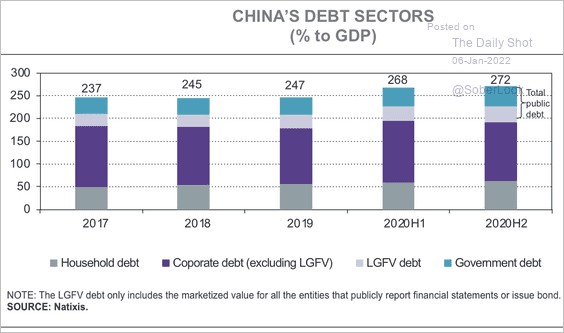

Overall, expansionary fiscal policy and slower economic growth contributed to higher government debt in 2020.

Source: Natixis

Source: Natixis

Back to Index

Emerging Markets

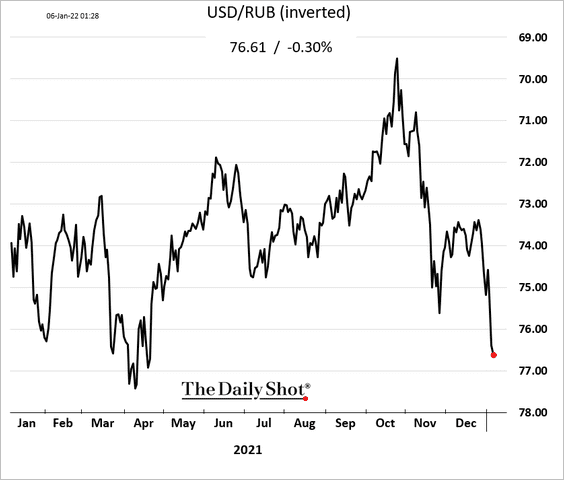

1. The Russian ruble has been selling off.

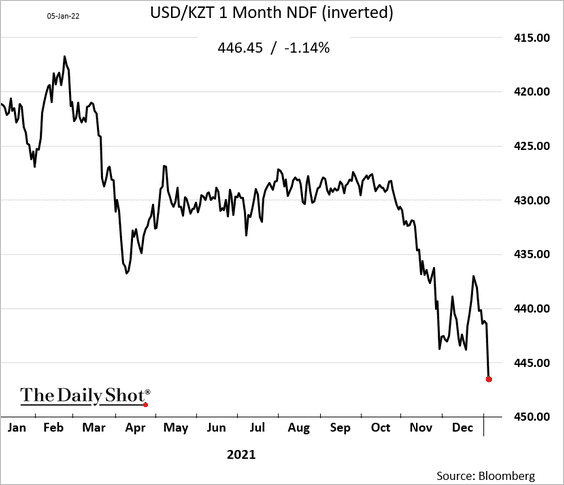

2. The Kazakh tenge is also weaker amid widening social unrest.

Source: AP Read full article

Source: AP Read full article

——————–

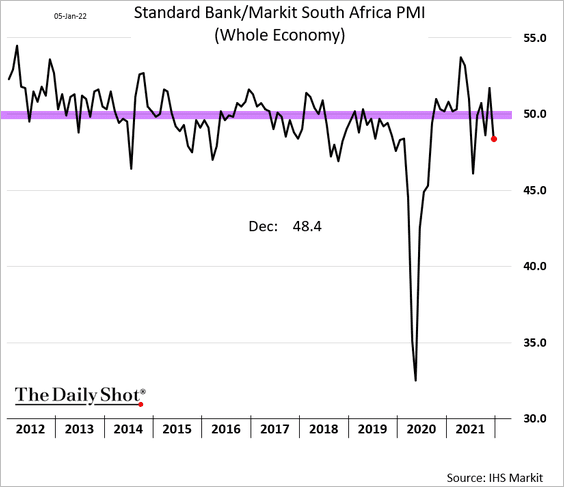

3. South Africa’s business activity is back in contraction (PMI < 50).

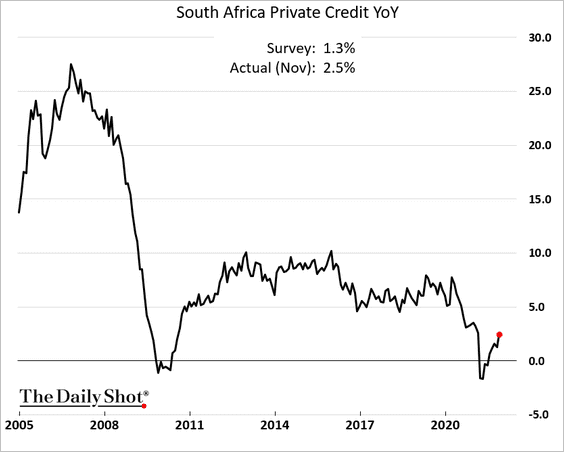

• Credit growth has been rebounding.

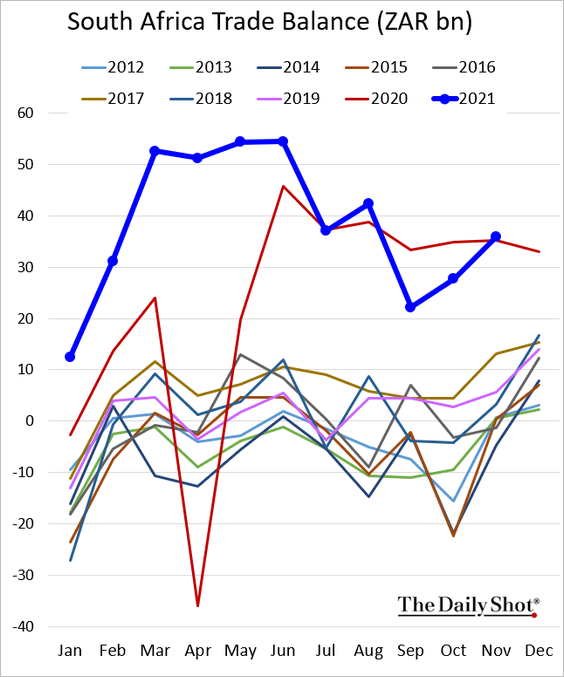

• South Africa’s trade surplus is at record highs for this time of the year.

——————–

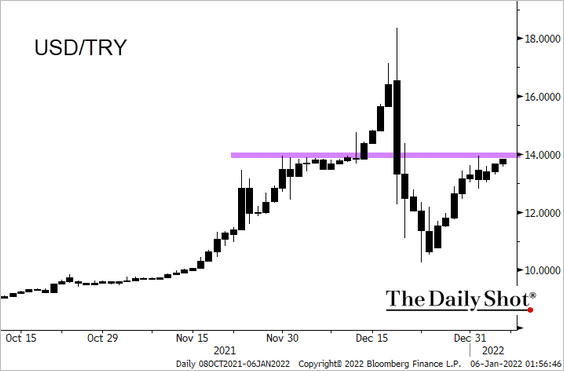

4. USD/TRY is testing resistance at 14.0 to the dollar as the lira weakens further.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

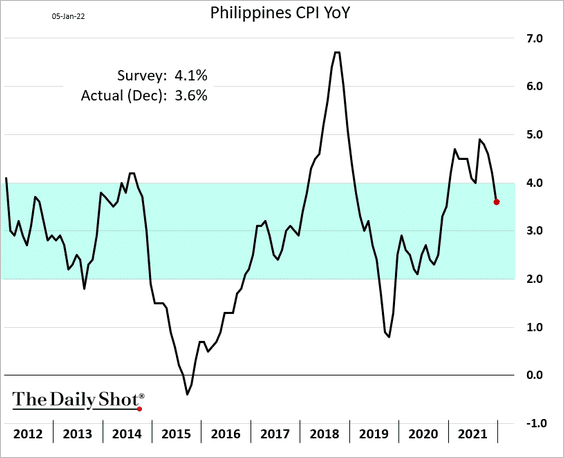

5. The Philippine CPI is back in the central bank’s target range.

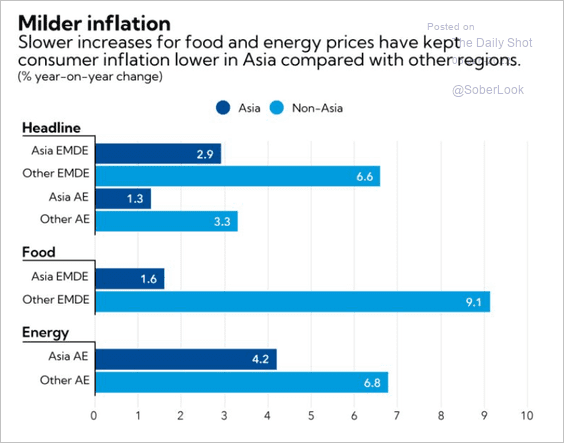

Inflation in Asia has been lower than in other regions.

Source: IMF Read full article

Source: IMF Read full article

——————–

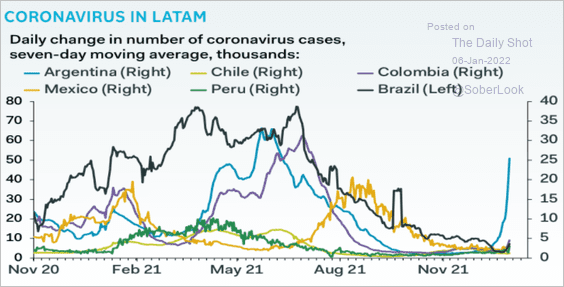

6. LatAm COVID cases have been subdued except in Argentina.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Cryptocurrency

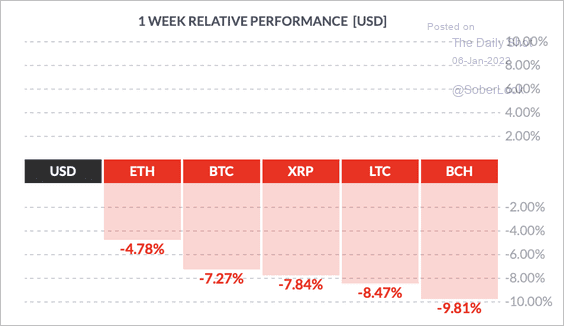

1. It’s been a rough week for cryptocurrencies.

Source: FinViz

Source: FinViz

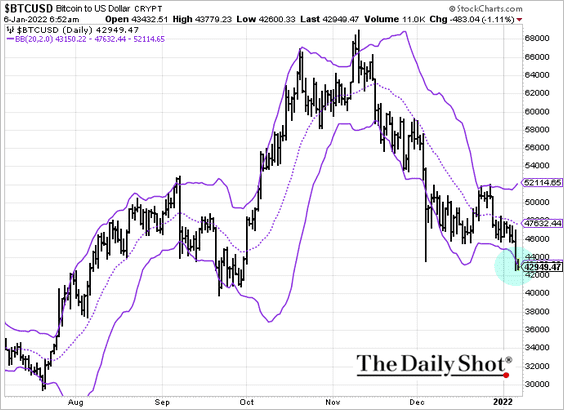

• Bitcoin is at the lower Bollinger Band (which tends to act as a support level), as the FOMC minutes show the US central bank ready to remove stimulus quickly.

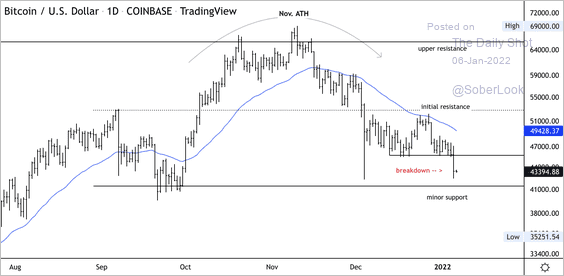

• Bitcoin broke below a month-long trading range, although the pullback could stabilize at lower support. There is strong resistance ahead given the downtrend since November.

Source: Dantes Outlook

Source: Dantes Outlook

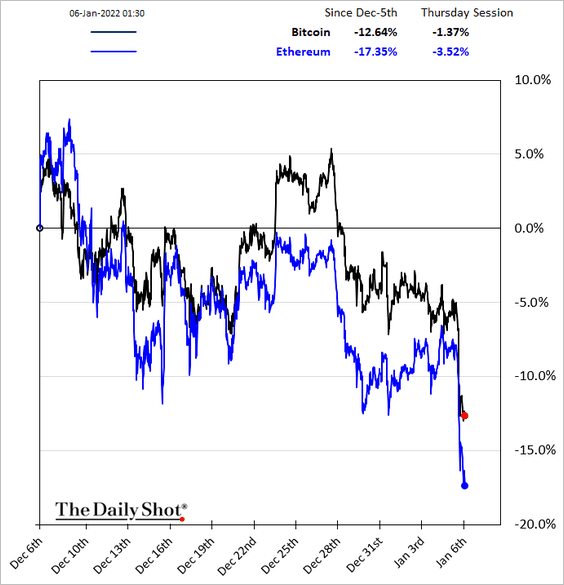

• Ether is underperforming.

——————–

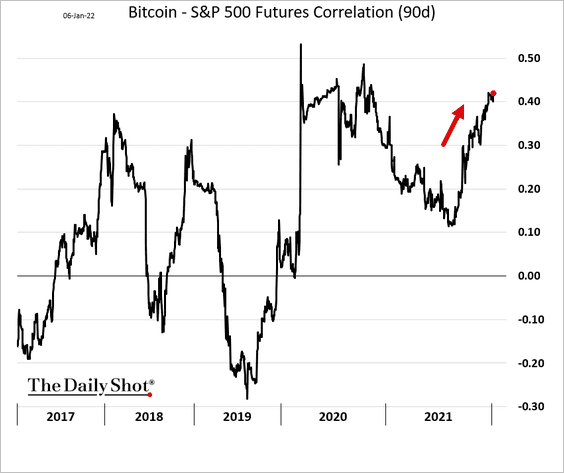

2. Bitcoin’s correlation with stocks continues to climb.

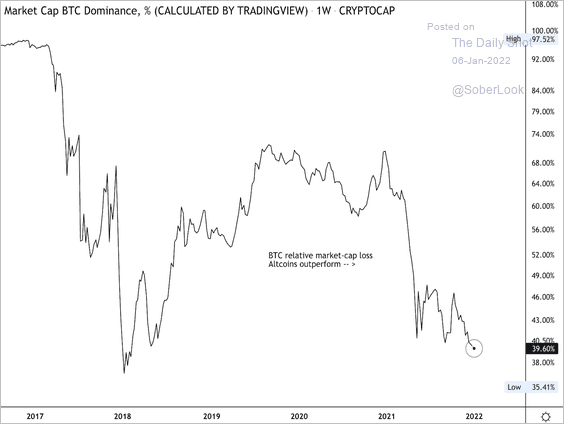

3. The bitcoin dominance ratio, or the measure of bitcoin’s market cap relative to the total crypto market cap, continues to decline. This reflects the outperformance of altcoins relative to BTC.

Source: CoinDesk

Source: CoinDesk

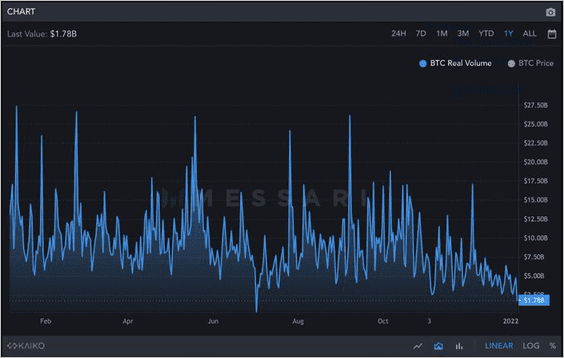

4. Bitcoin trading volume has been low.

Source: @crypto Read full article

Source: @crypto Read full article

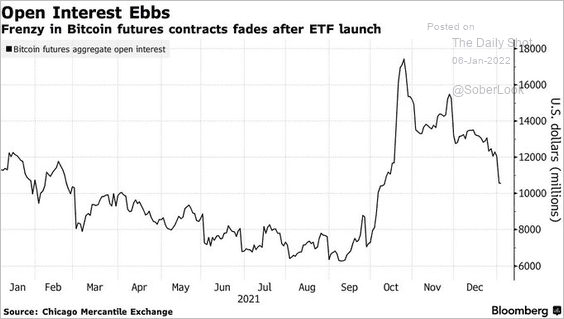

Bitcoin futures open interest is down sharply.

Source: @crypto Read full article

Source: @crypto Read full article

——————–

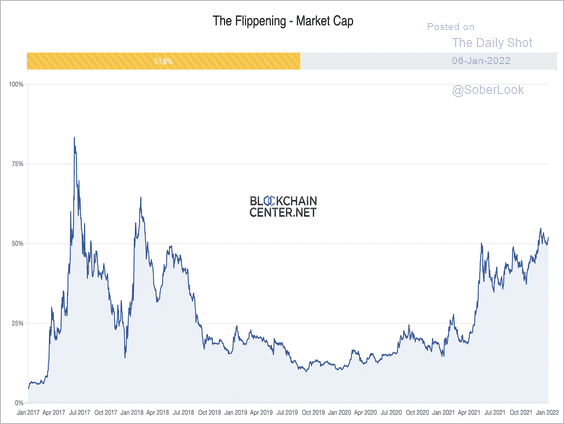

5. Ethereum is roughly 50% away from overtaking bitcoin as the largest cryptocurrency by market cap.

Source: Blockchain Center

Source: Blockchain Center

Back to Index

Commodities

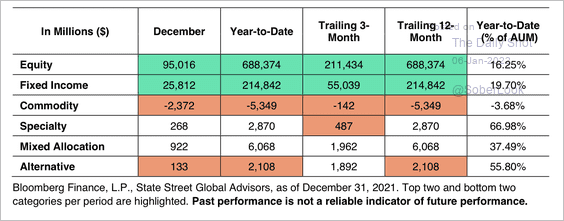

Commodity ETFs saw outflows last year, dragged lower by gold exposures.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Back to Index

Energy

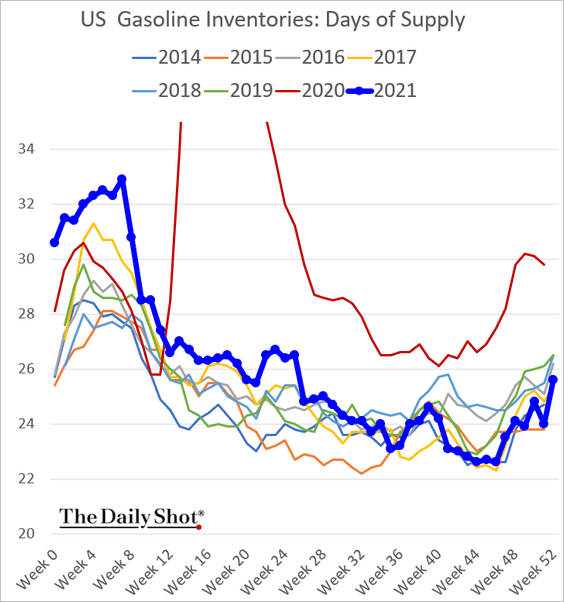

1. US gasoline inventories jumped more than usual last week as driving conditions in the Northeast worsened due to bad weather.

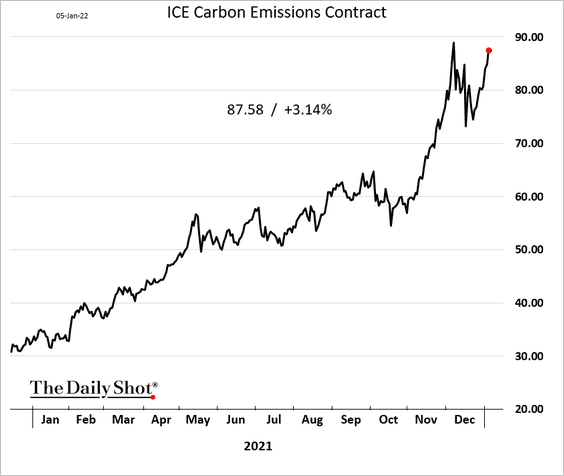

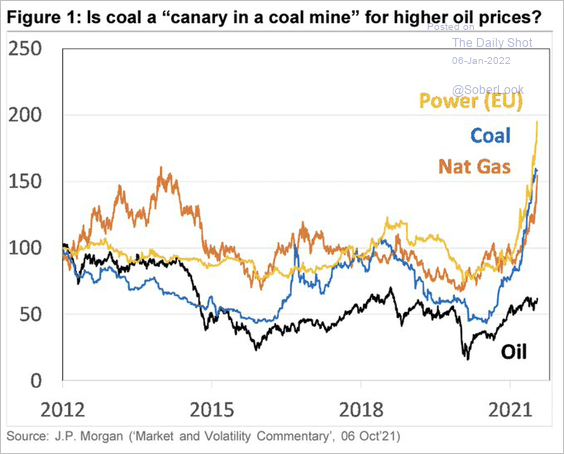

2. European emissions futures are nearing record highs again as utilities try to offset their coal-burning activities.

3. Oil is cheap relative to other energy commodities.

Source: @UrbanKaoboy

Source: @UrbanKaoboy

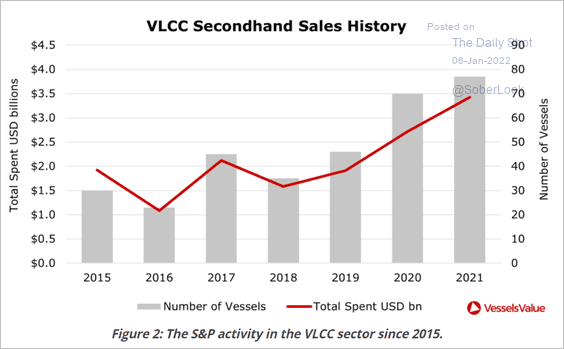

4. Used crude oil tanker sales have been rising quickly over the past couple of years.

Source: VesselsValue Read full article

Source: VesselsValue Read full article

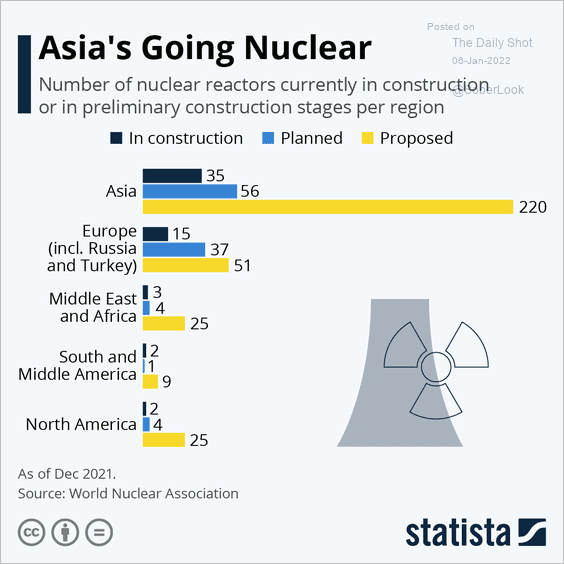

5. Asia is embracing nuclear power.

Source: Statista

Source: Statista

Back to Index

Equities

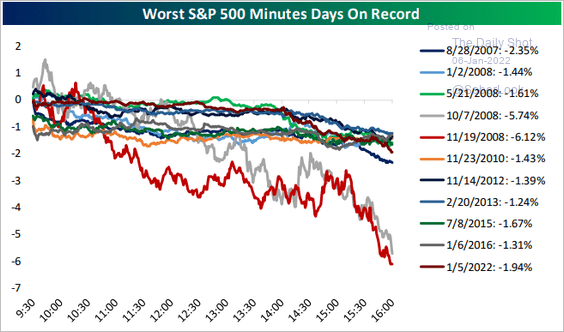

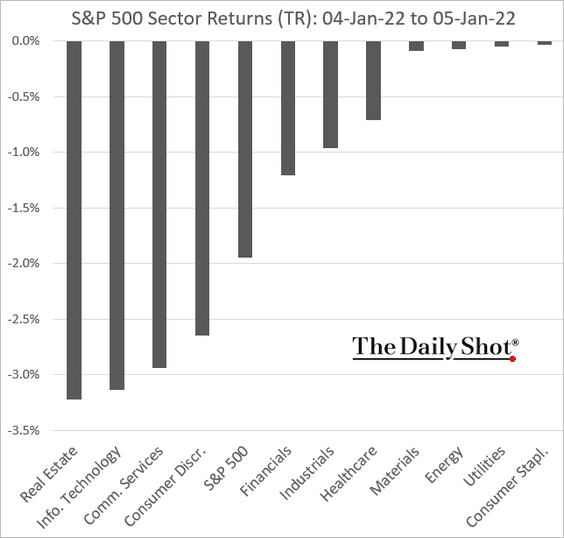

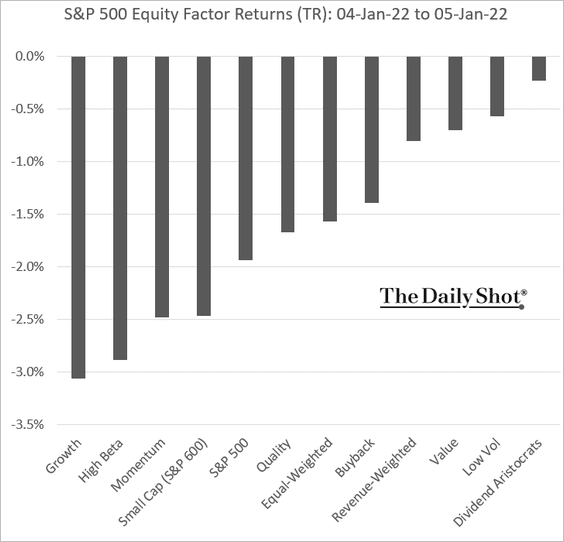

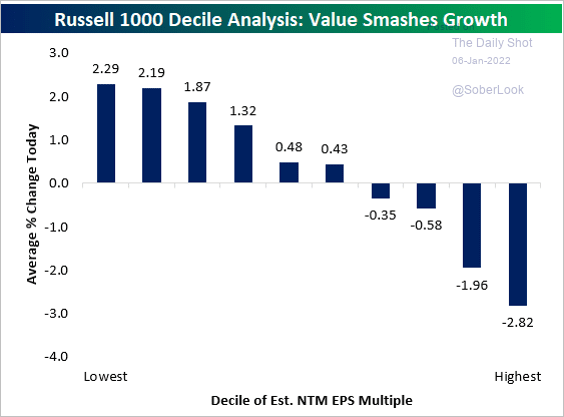

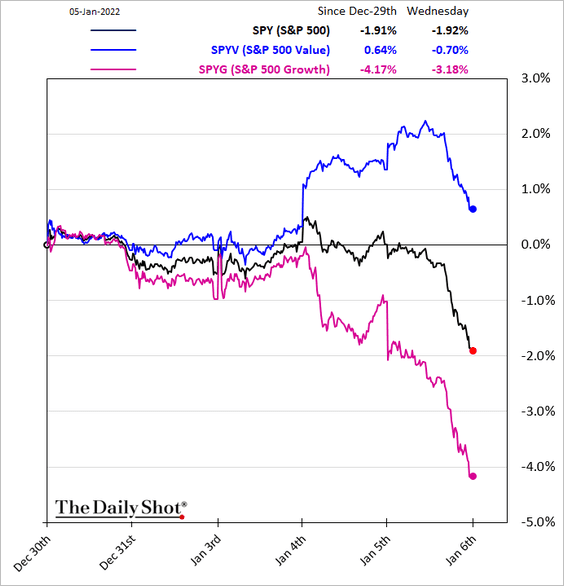

1. This was the worst equity market reaction to FOMC minutes on record.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

• Wednesday’s performance by sector:

• By equity factor:

Large-cap stocks with the highest earnings multiples sharply underperformed those with lower multiples (2 charts).

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

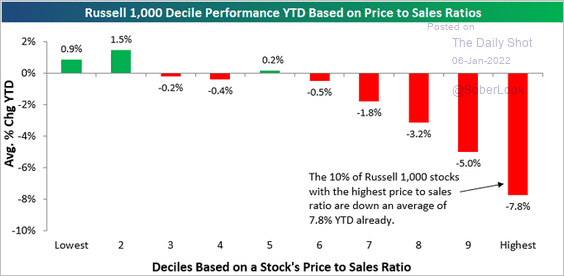

Here is the year-to-date performance by price-to-sales ratio.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

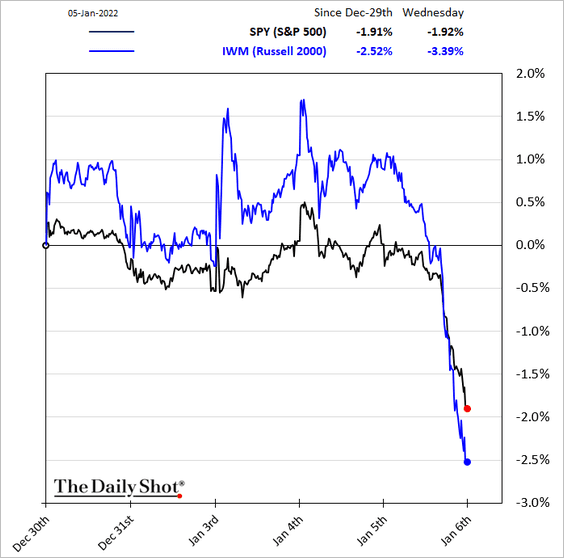

2. Small caps gave up their outperformance over the past few days.

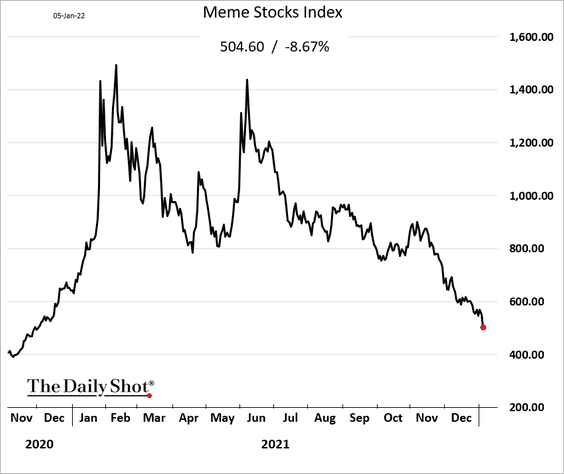

3. Stocks favored by the Reddit crowd have given up all their gains in 2021.

——————–

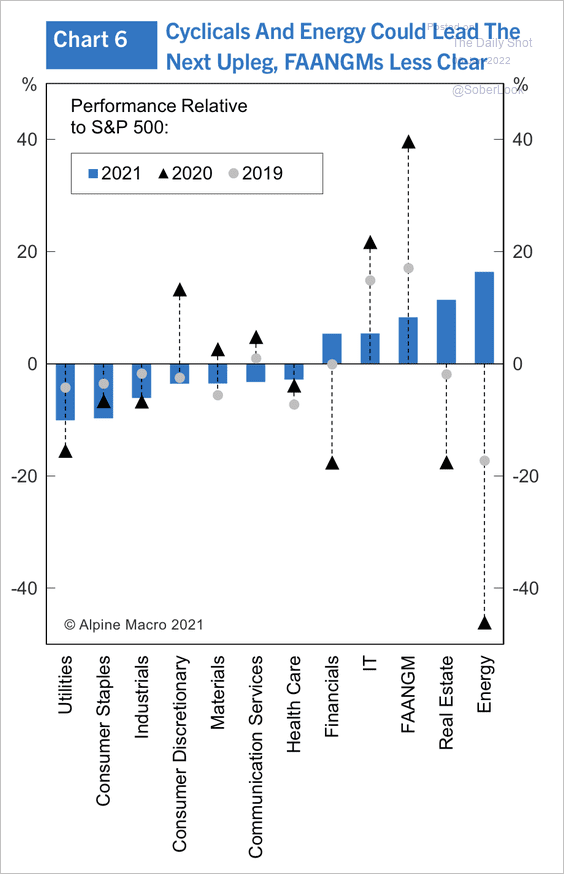

4. Here is a look at relative performance across S&P 500 sectors over the past three years.

Source: Alpine Macro

Source: Alpine Macro

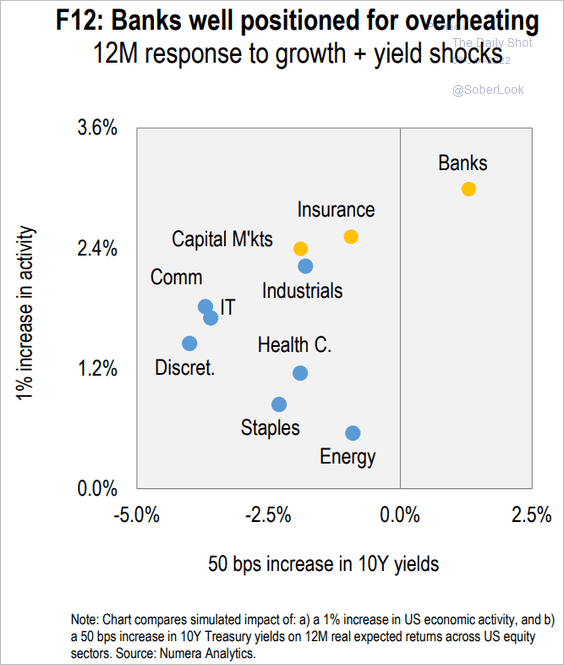

This scatterplot shows sector response to increases in economic activity vs. Treasury yield changes.

Source: Numera Analytics

Source: Numera Analytics

——————–

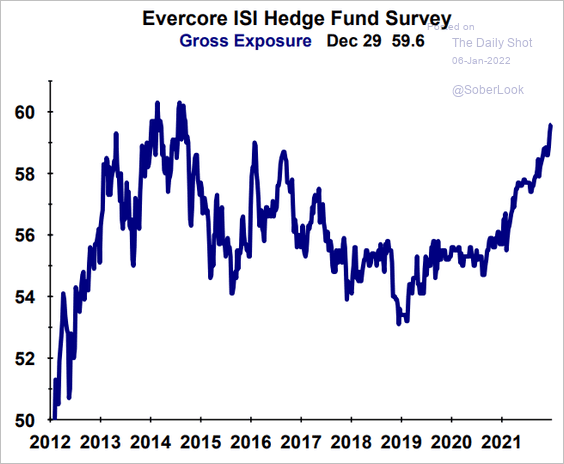

5. Hedge funds have been boosting their gross equity exposure.

Source: Evercore ISI Research

Source: Evercore ISI Research

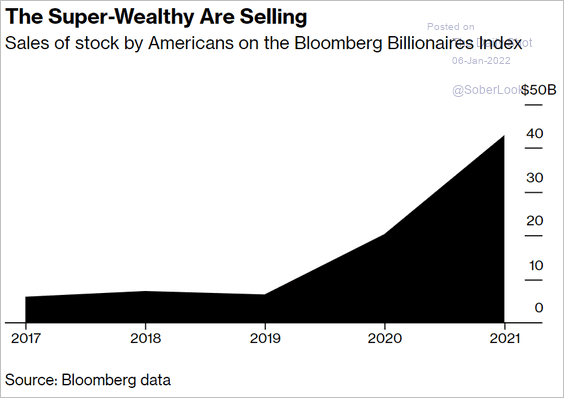

6. Super-wealthy Americans have been taking profits.

Source: @wealth Read full article

Source: @wealth Read full article

Back to Index

Credit

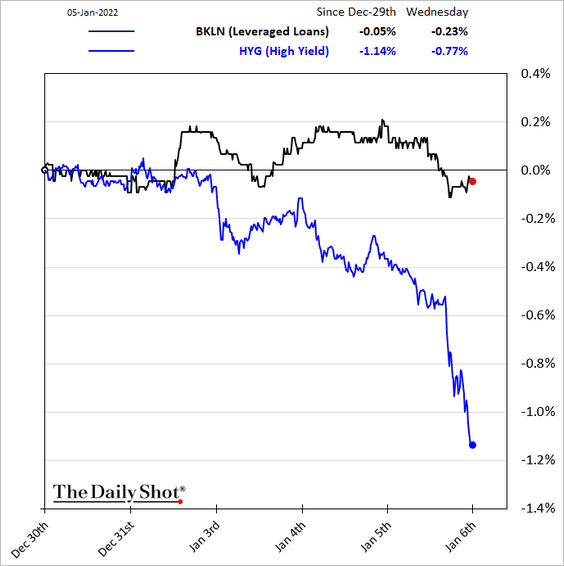

1. Leveraged loans tend to outperform high-yield bonds when rates rise.

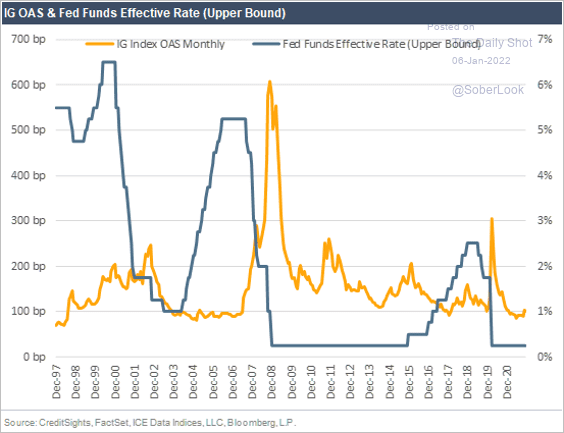

2. Investment-grade spreads are usually not sensitive to Fed rate hikes.

Source: CreditSights

Source: CreditSights

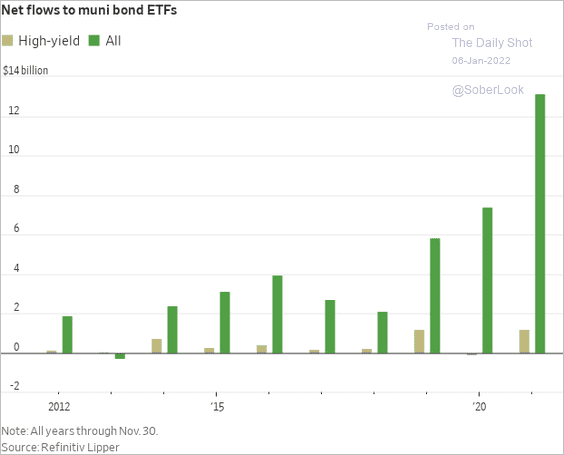

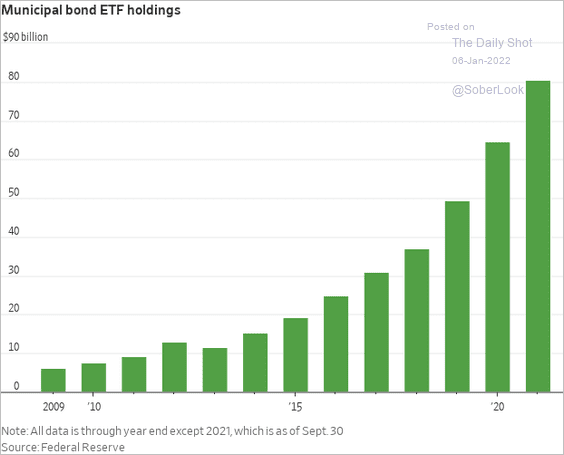

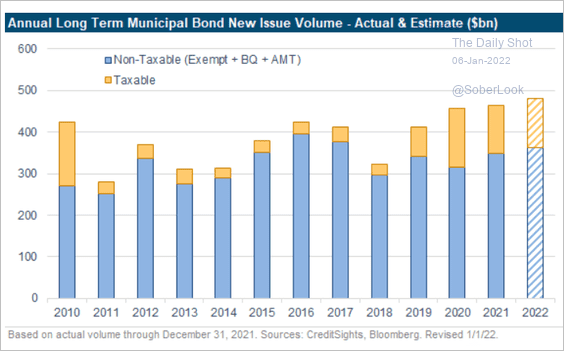

3. Next, we have some updates on the muni market.

• ETF flows:

Source: @WSJ Read full article

Source: @WSJ Read full article

• ETF holdings of munis:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Issuance and issuance forecast from CreditSights:

Source: CreditSights

Source: CreditSights

Back to Index

Rates.

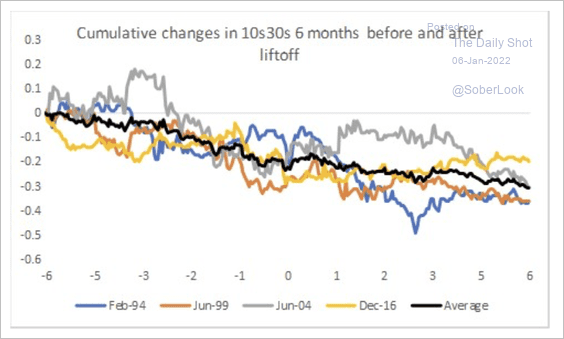

1. The longer end of the Treasury curve (10s/30s) typically flattens around the beginning of a tightening cycle.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

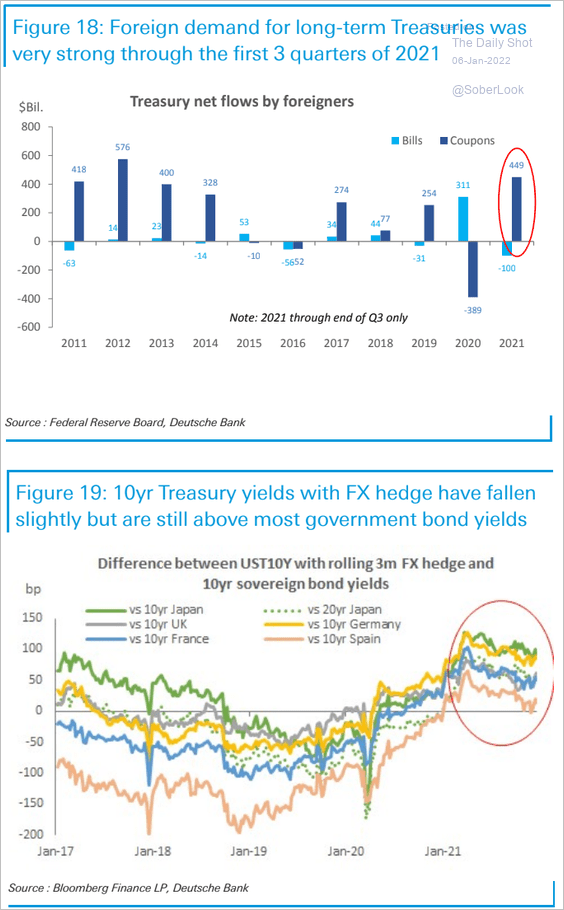

2. Foreign demand for Treasury notes and bonds has been very strong. Hedged into local currencies, Treasuries look attractive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

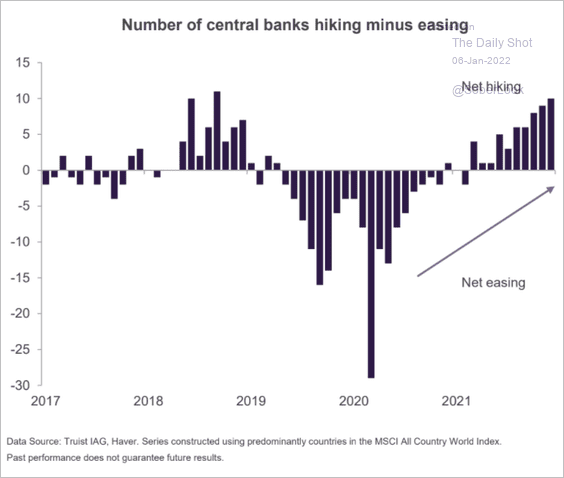

1. Central banks around the world are hiking rates.

Source: Truist Advisory Services

Source: Truist Advisory Services

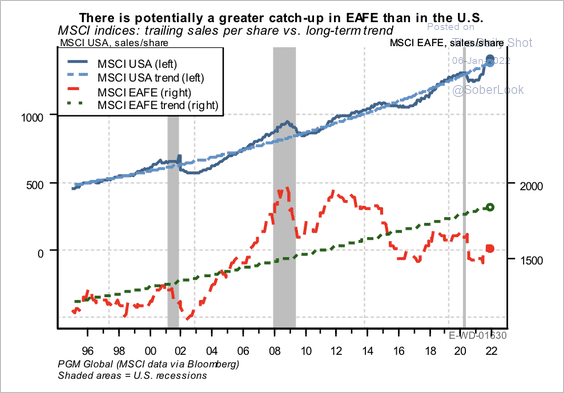

2. Sales growth in developed economies excluding the US could have more room to revert to its long-term trend relative to the US.

Source: PGM Global

Source: PGM Global

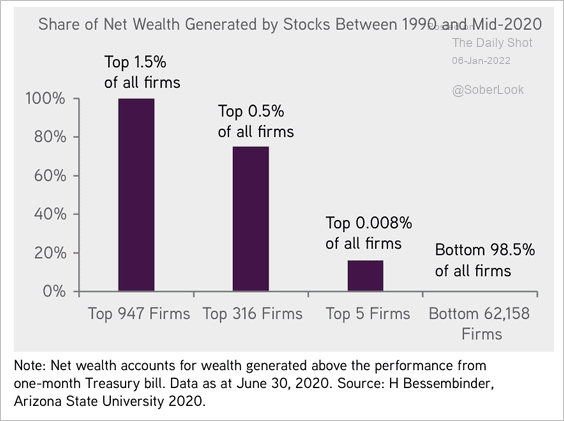

3. Just 1.5% of all stocks have generated net wealth in global markets over the past 30 years.

Source: KKR Global Institute

Source: KKR Global Institute

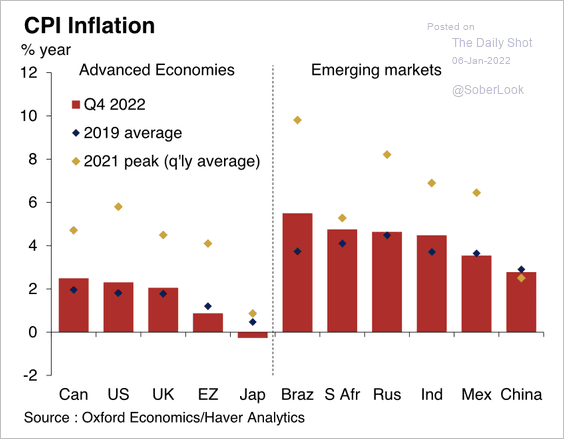

4. Oxford Economics expects lower inflation next year, especially for emerging markets.

Source: Oxford Economics

Source: Oxford Economics

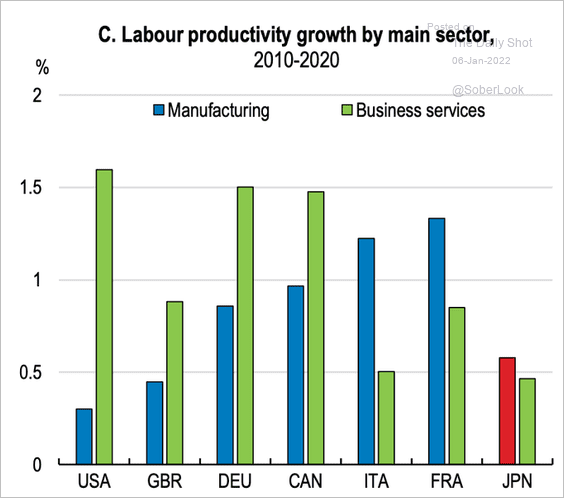

5. Finally, we have productivity growth in manufacturing and business services in select economies.

Source: @adam_tooze, OECD Read full article

Source: @adam_tooze, OECD Read full article

——————–

Food for Thought

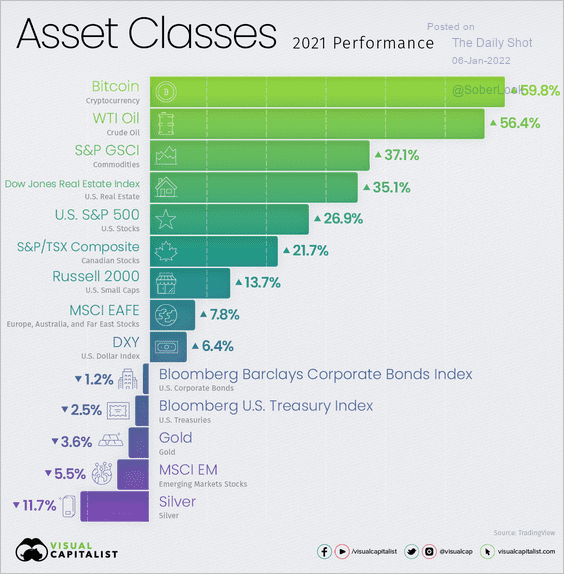

1. 2021 performance by asset class:

Source: Visual Capitalist, h/t Walter Read full article

Source: Visual Capitalist, h/t Walter Read full article

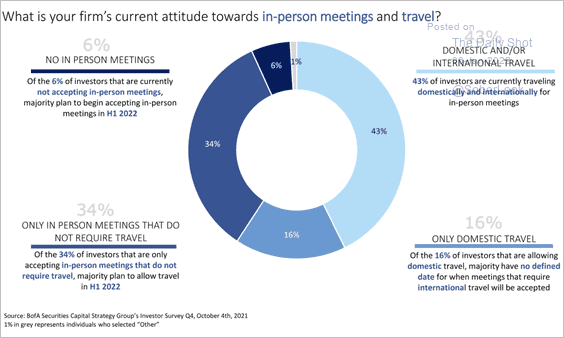

2. Institutional investors’ attitude towards in-person meetings:

Source: BofA Global Research

Source: BofA Global Research

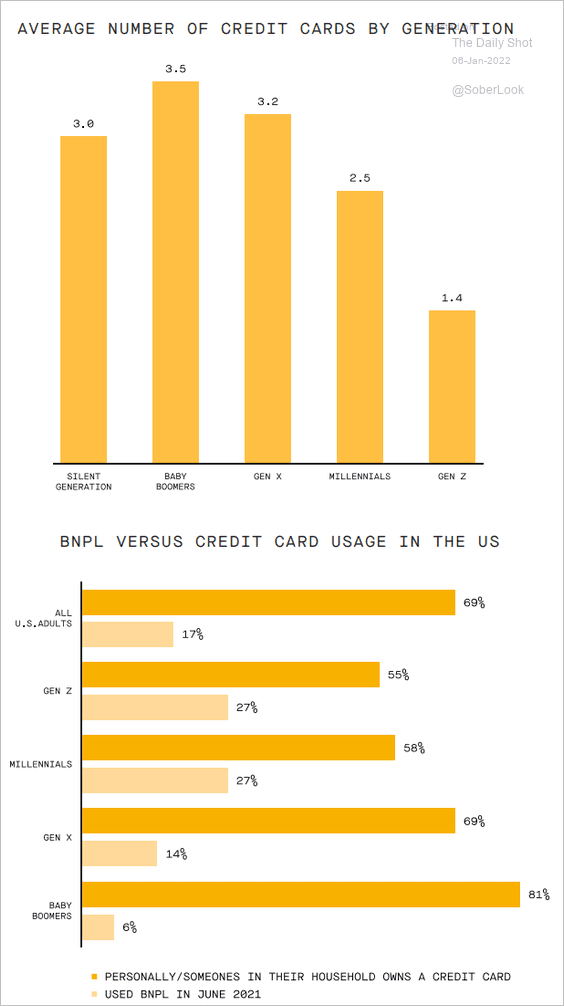

3. Credit cards vs. BNPL (buy now pay later):

Source: GP Bullhound Read full article

Source: GP Bullhound Read full article

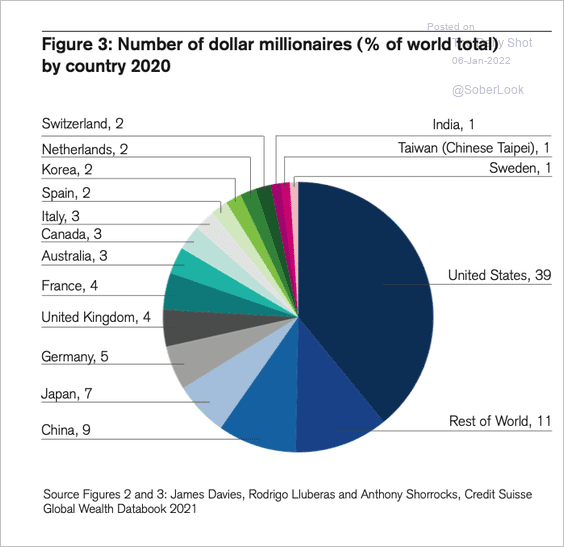

4. Millionaires by country:

Source: Credit Suisse

Source: Credit Suisse

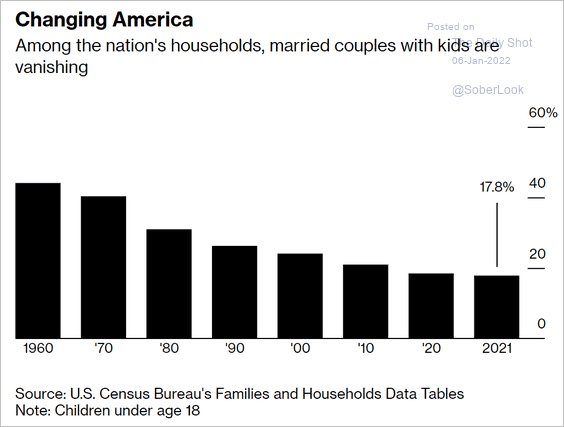

5. Married couples with kids as a share of US households:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

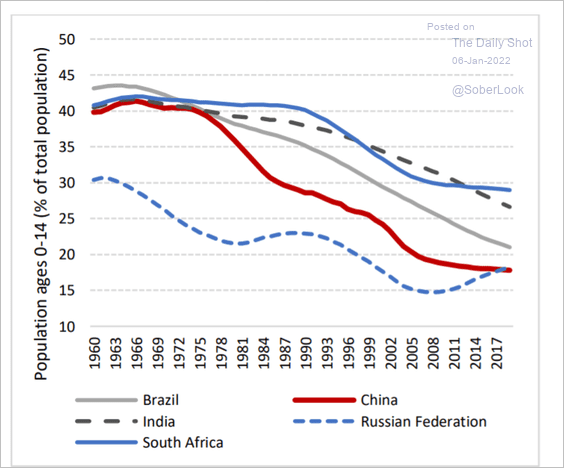

6. Population ages 0-14 as a share of total population:

Source: arXiv Read full article

Source: arXiv Read full article

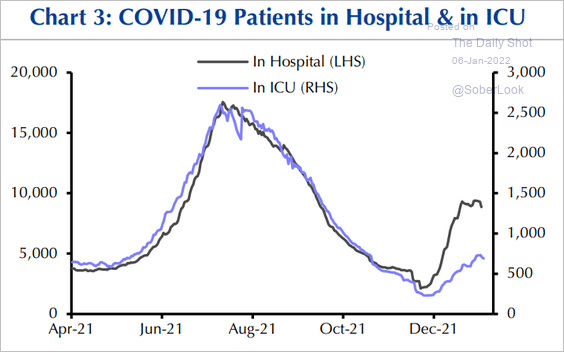

7. COVID hospitalizations vs. ICU admissions in South Africa:

Source: Capital Economics

Source: Capital Economics

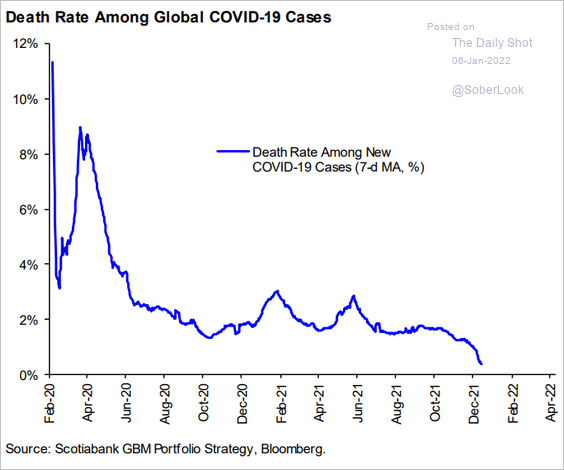

8. Death rates among COVID cases:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

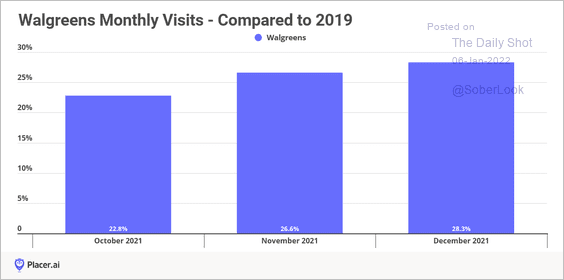

9. Walgreens visits vs. 2019:

Source: Placer.ai

Source: Placer.ai

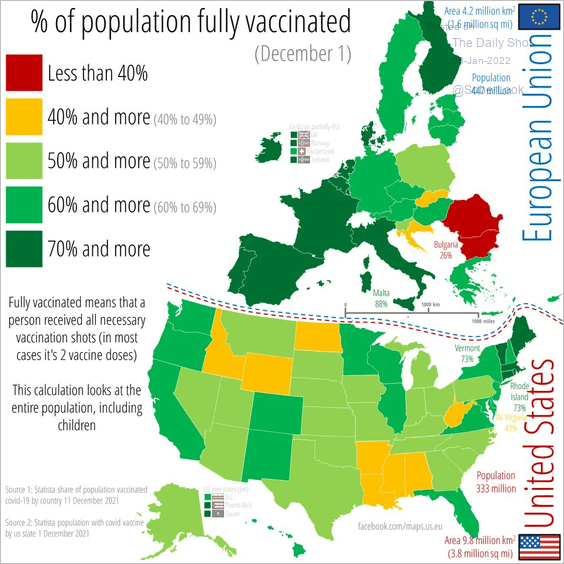

10. Fully-vaccinated population share:

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

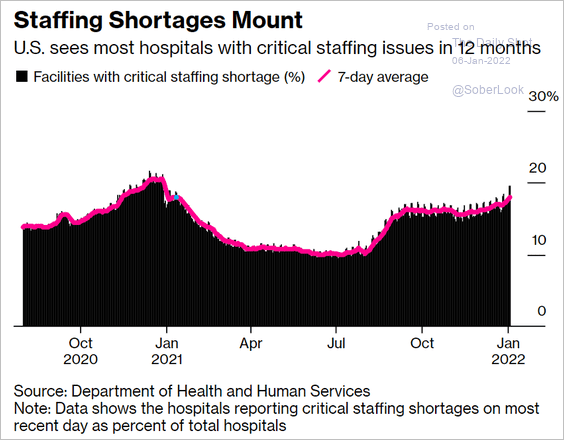

11. Staffing shortages at US hospitals:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

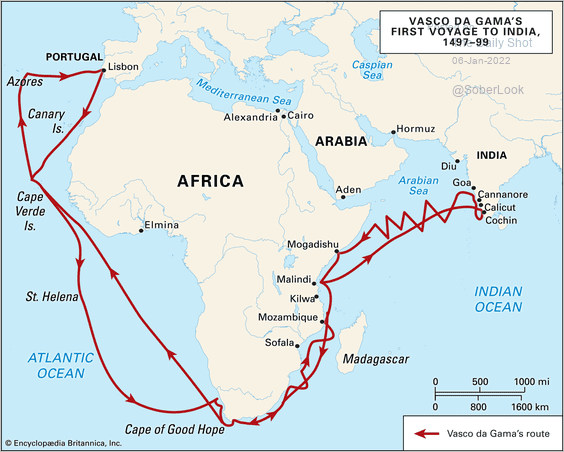

12. Vasco da Gama’s first voyage to India:

Source: Britannica Read full article

Source: Britannica Read full article

——————–

Back to Index