The Daily Shot: 07-Jan-22

• The United States

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

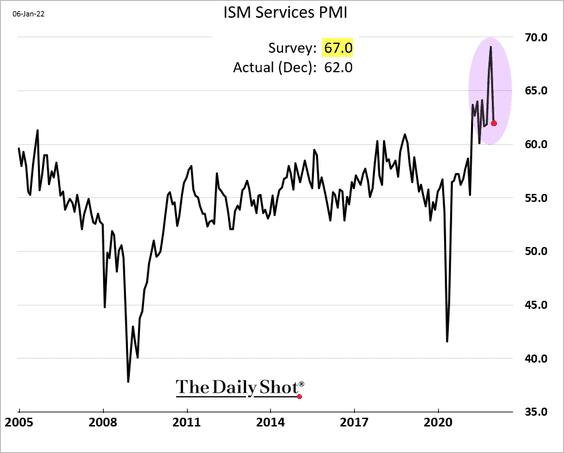

1. The ISM Services PMI declined sharply in December.

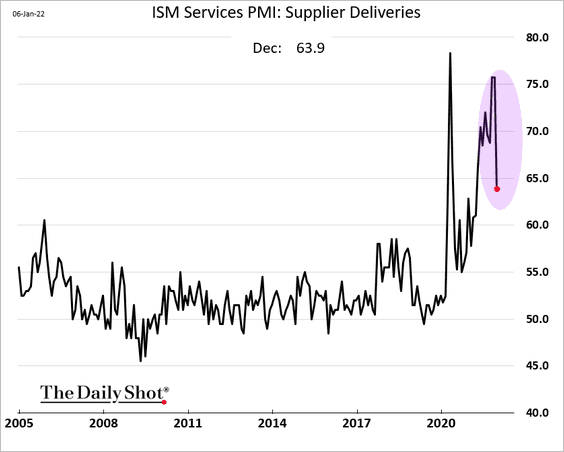

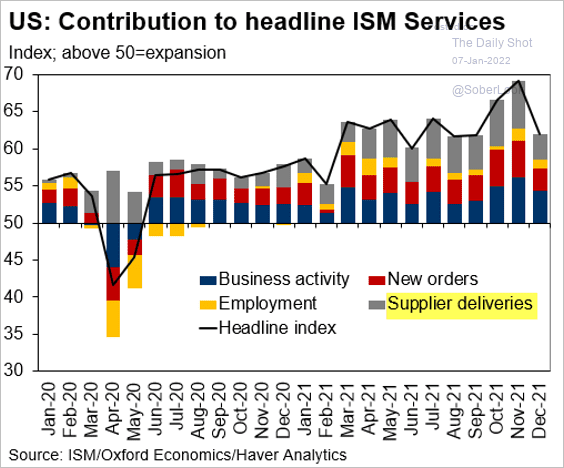

While service-sector growth slowed somewhat, a good portion of the decline came from moderating supplier delivery delays (2 charts).

Source: @GregDaco

Source: @GregDaco

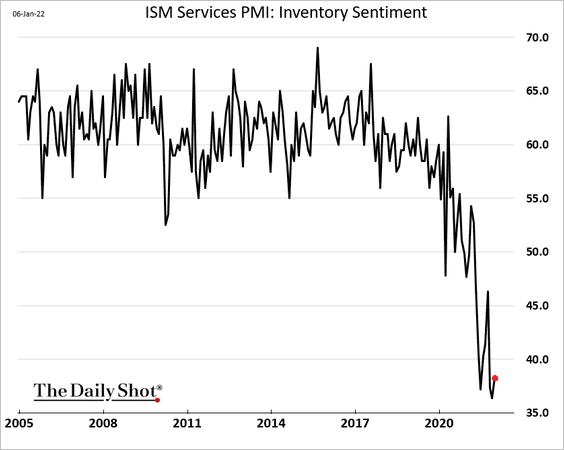

However, inventories remain extraordinarily tight.

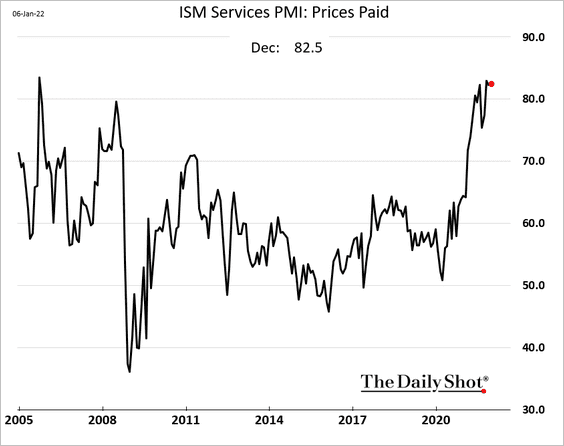

And prices paid by service firms continue to surge (PMI > 80 indicates rapid increases).

——————–

2. Next, we have some updates on inflation.

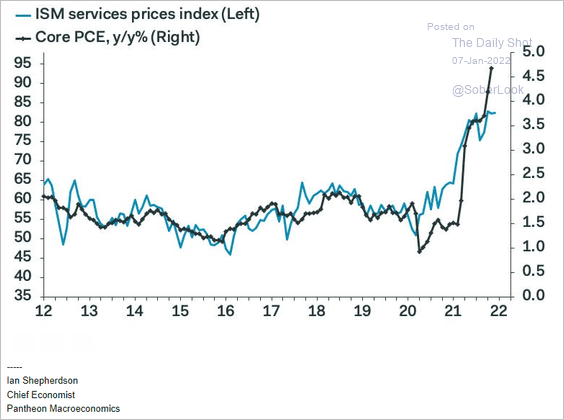

• The ISM services price index (above) points to further gains in the core PCE inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

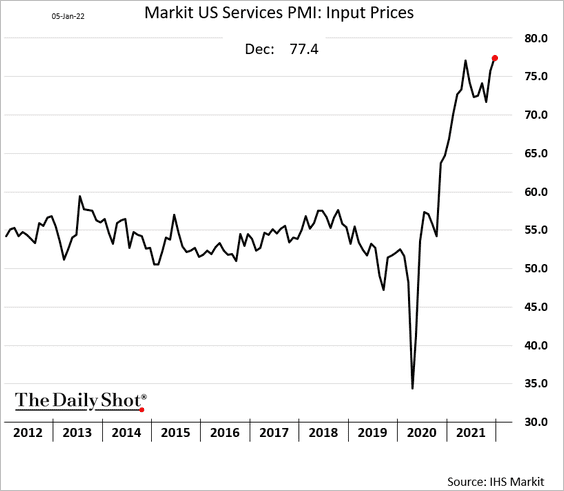

• Prices in the manufacturing sector are also surging, according to Markit PMI.

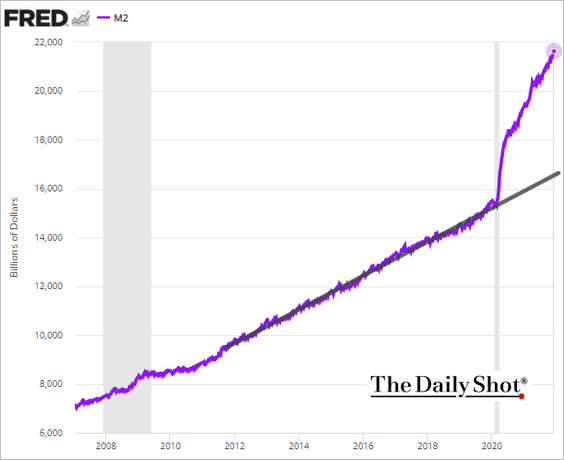

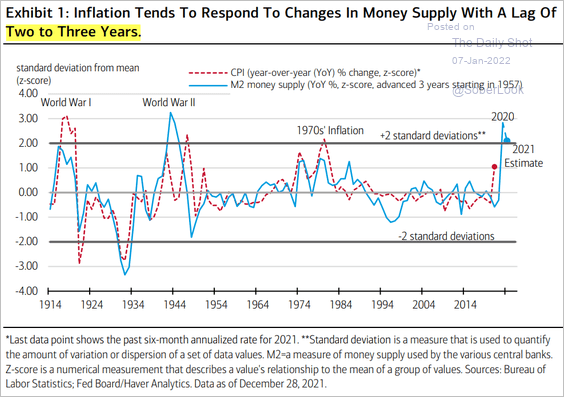

• The pandemic-era spike in the money supply …

,,, may fuel inflation over the next 2-3 years.

Source: BofA Global Research

Source: BofA Global Research

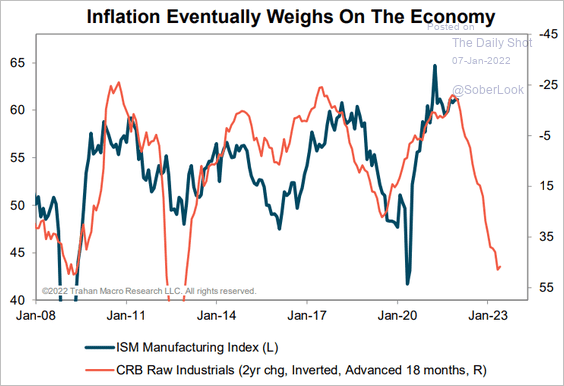

• How much will inflation weigh on growth this year?

Source: Trahan Macro Research

Source: Trahan Macro Research

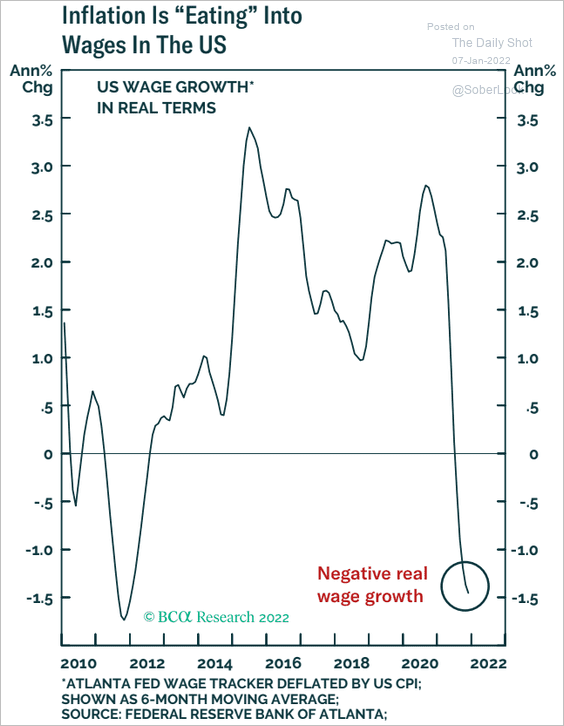

• Inflation has been eating into wages.

Source: BCA Research

Source: BCA Research

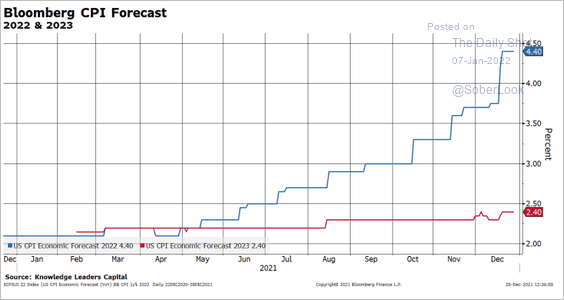

• Economists have been rapidly boosting their CPI forecasts for 2022 but much less so for 2023.

Source: Knowledge Leaders Capital

Source: Knowledge Leaders Capital

——————–

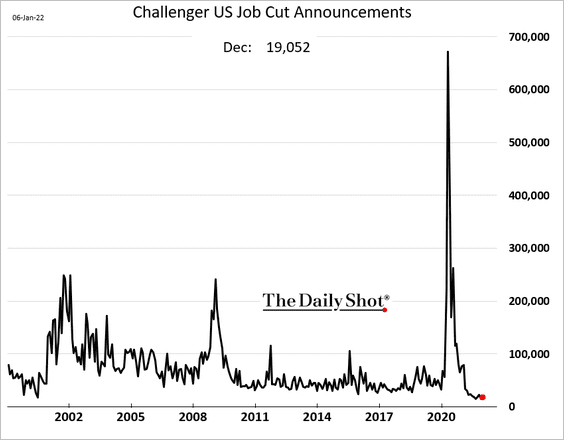

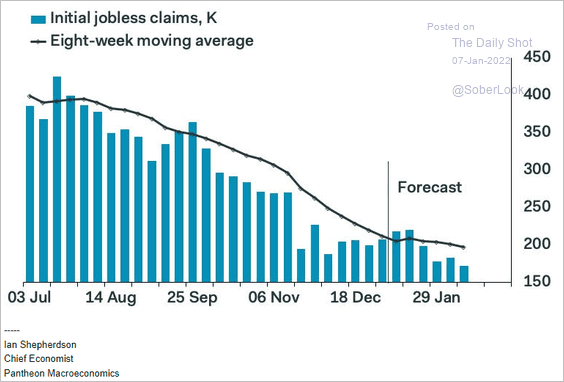

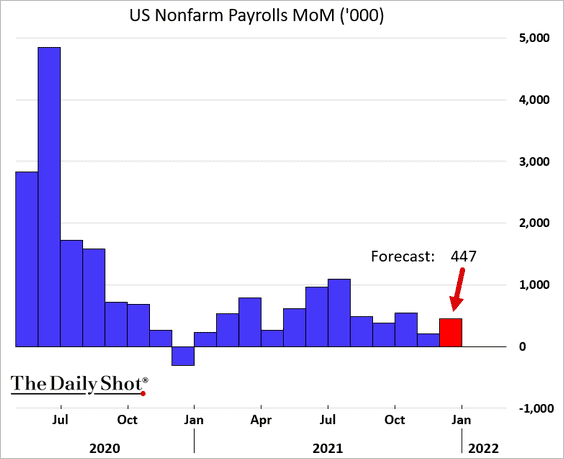

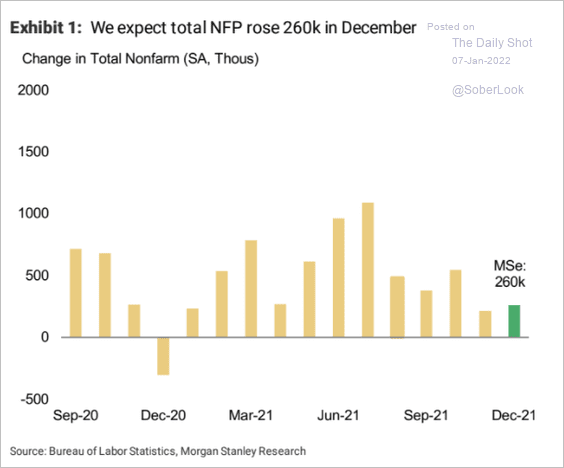

3. Now let’s take a look at the labor market.

• Layoffs remain near multi-decade lows.

• Pantheon Macroeconomics expects jobless claims to decline further.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The median forecast for today’s payrolls report is 447k new jobs.

Morgan Stanley is less optimistic.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

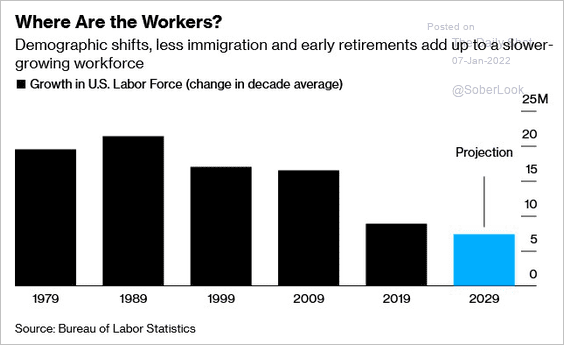

• Worker shortages are expected to persist for years to come.

Source: @jessefelder, @business Read full article

Source: @jessefelder, @business Read full article

——————–

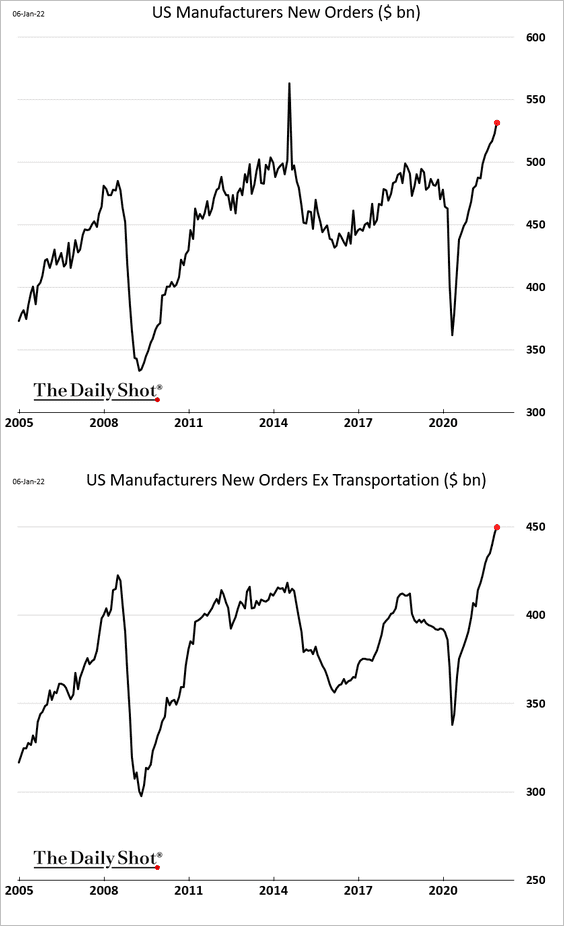

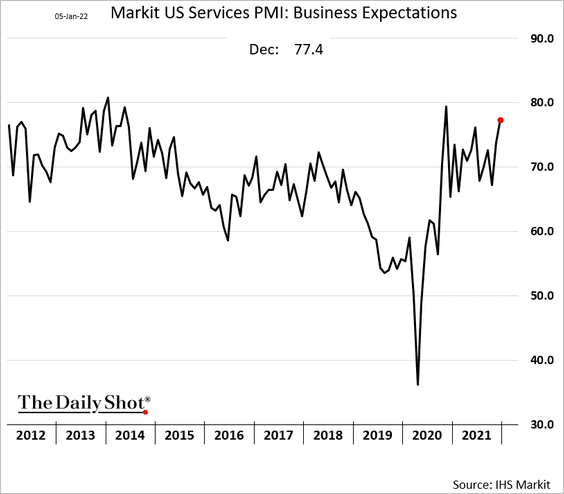

4. Factory orders continued to climb in November.

According to Markit, manufacturers were very upbeat last month.

——————–

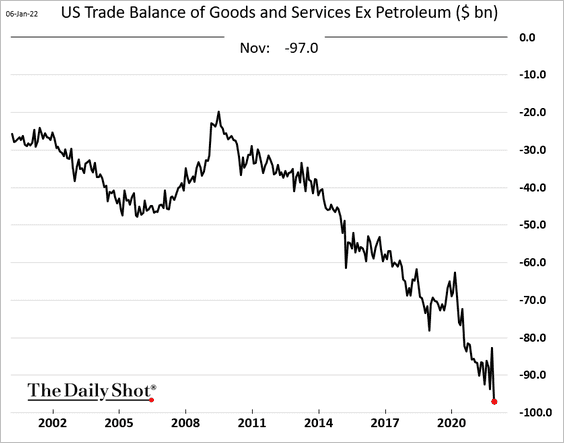

5. The US trade deficit, excluding petroleum products, is nearing $100 billion per month.

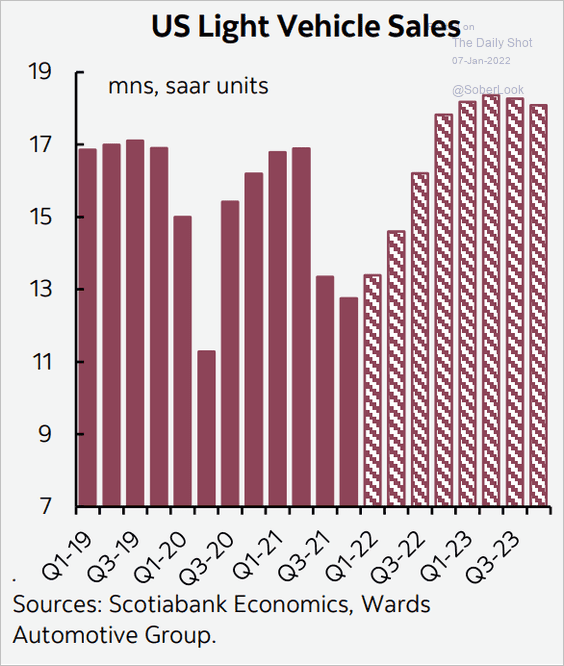

6. Have vehicle sales bottomed? Here is a forecast from Scotiabank Economics.

Source: Scotiabank Economics

Source: Scotiabank Economics

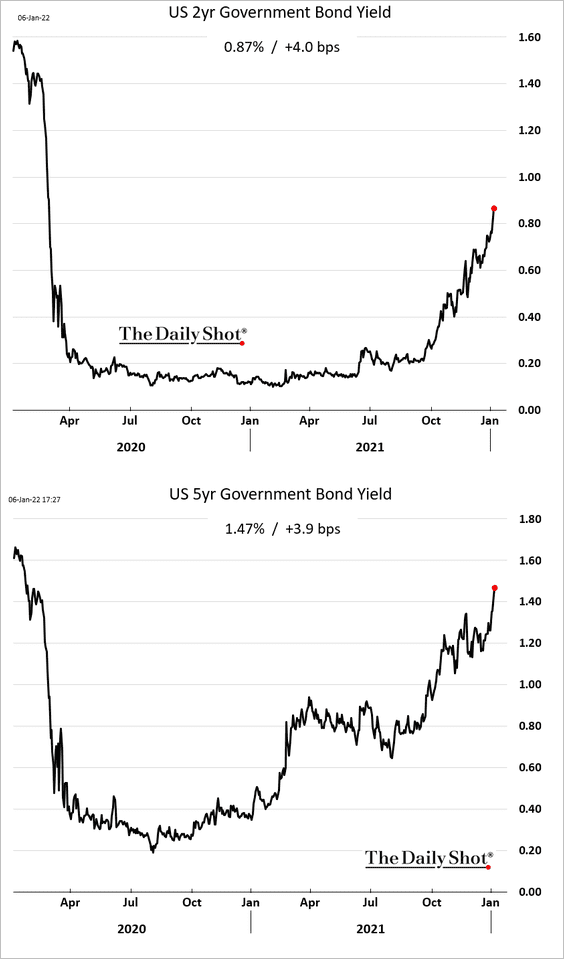

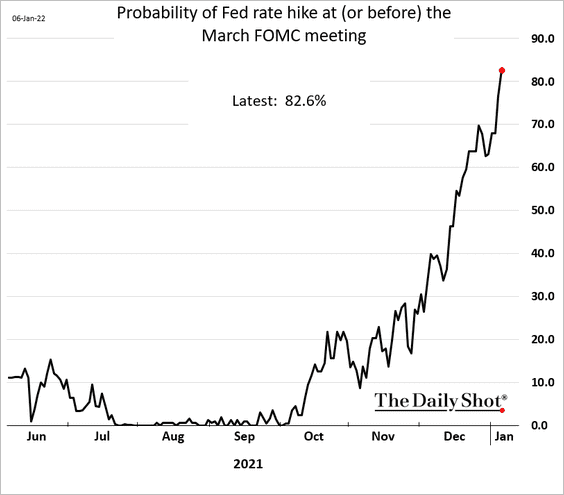

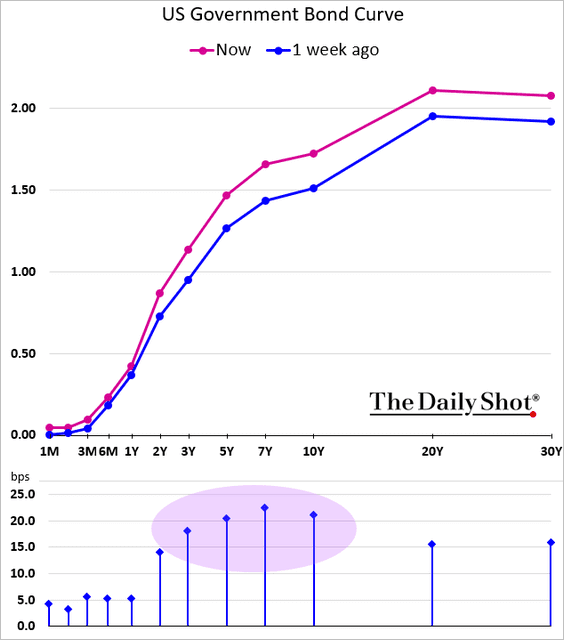

7. Treasury yields continue to surge amid bets on faster rate hikes by the Federal Reserve.

• The futures-based probability of liftoff in March is now above 80%.

Source: Bloomberg

Source: Bloomberg

• The “belly” of the Treasury curve sold off the most over the past week.

Back to Index

The Eurozone

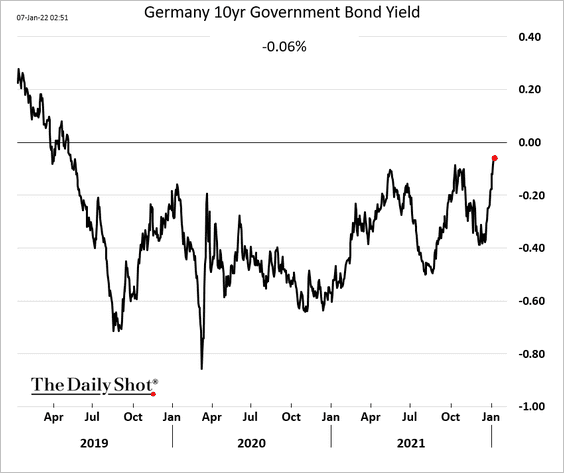

1. The 10yr Bund yield is approaching zero for the first time since mid-2019.

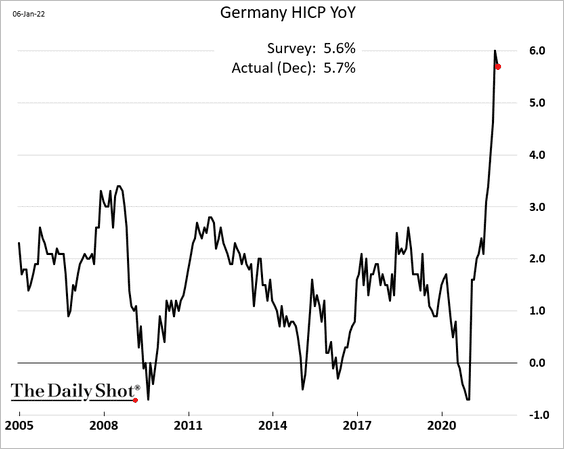

2. German inflation appears to have peaked, and economists expect further moderation in the months ahead.

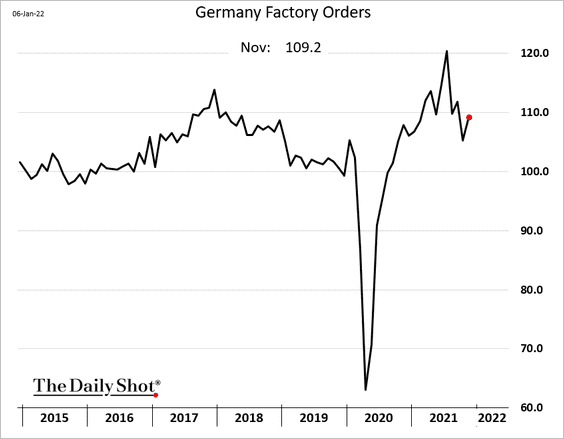

3. German factory orders jumped in November.

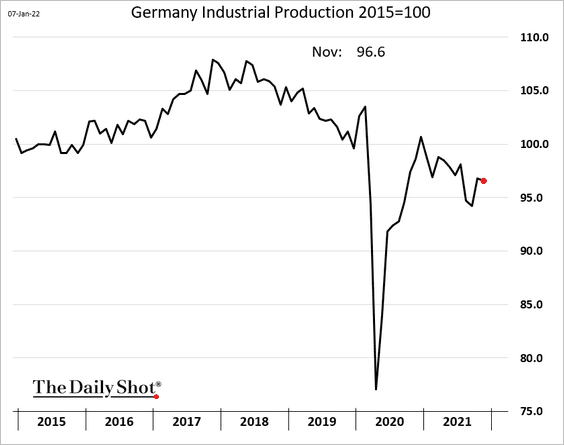

But surprisingly, industrial production declined.

——————–

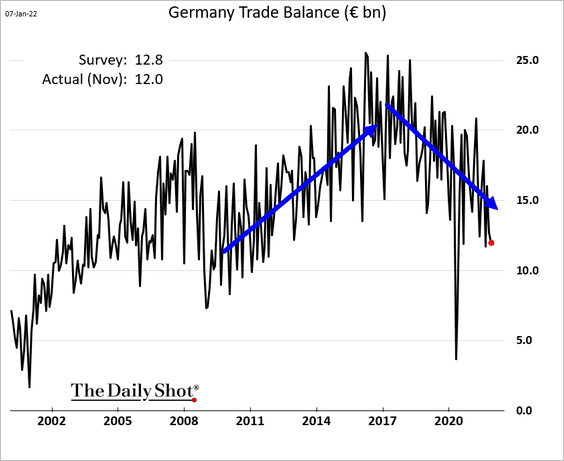

4. German trade surplus continues to trend lower.

Back to Index

Japan

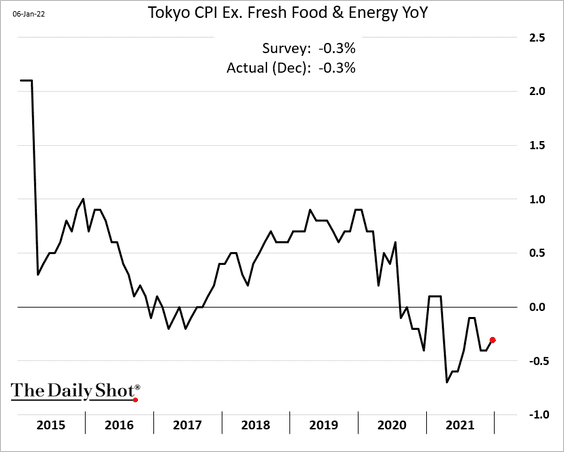

1. The December Tokyo core CPI, which is released well before the national figures, remains in negative territory.

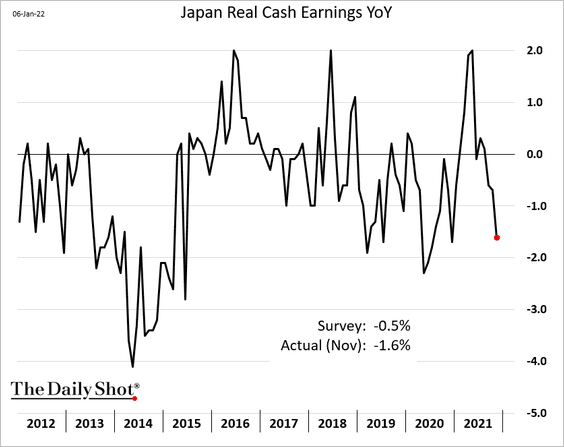

2. Real wages deteriorated more than expected in November.

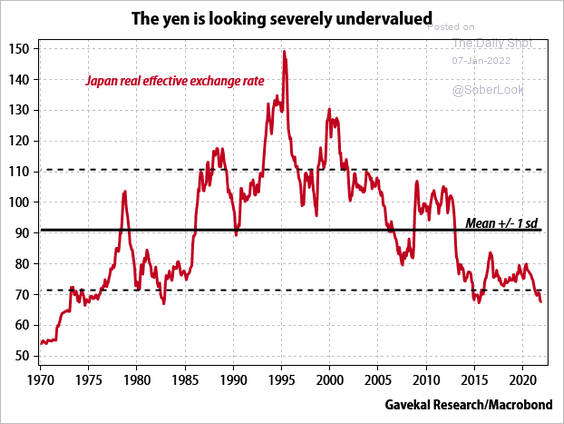

3. The yen looks undervalued.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Asia – Pacific

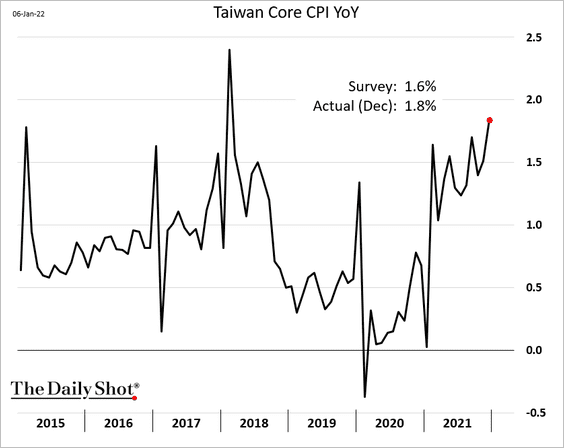

1. Taiwan’s core CPI continues to rebound (topping forecasts).

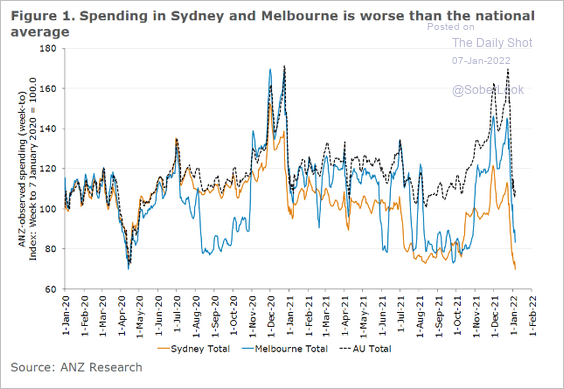

2. Omicron is pressuring Australia’s consumer spending.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

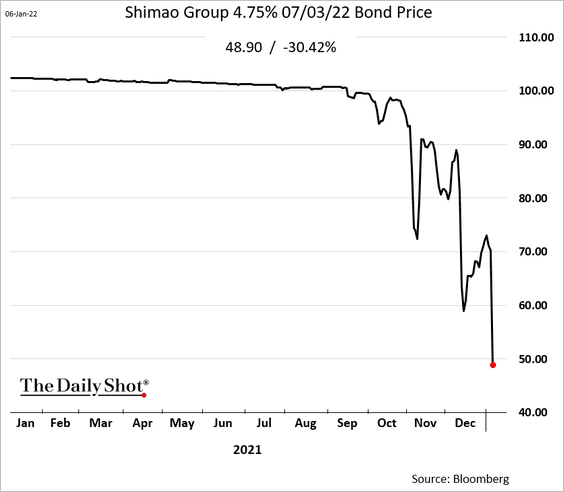

1. Chinese developer Shimao defaulted on its trust loan, sending bond prices plummeting.

Source: Reuters Read full article

Source: Reuters Read full article

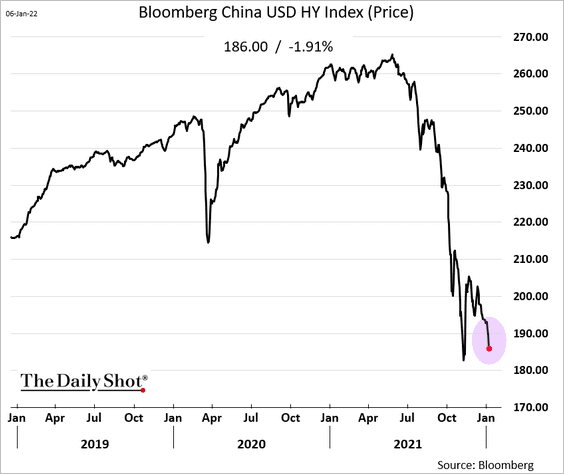

China’s USD high-yield index is nearing last year’s lows.

——————–

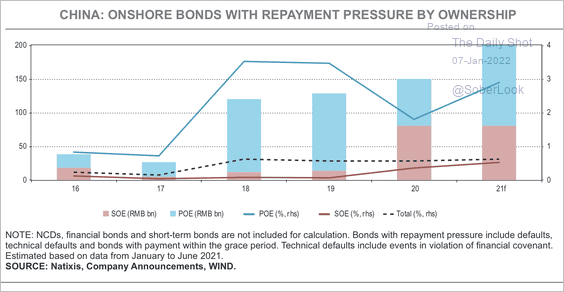

2. Offshore and onshore defaults have continued to climb with higher pressure for both state-owned enterprises (SOEs) and privately-owned enterprises (POEs).

Source: Natixis

Source: Natixis

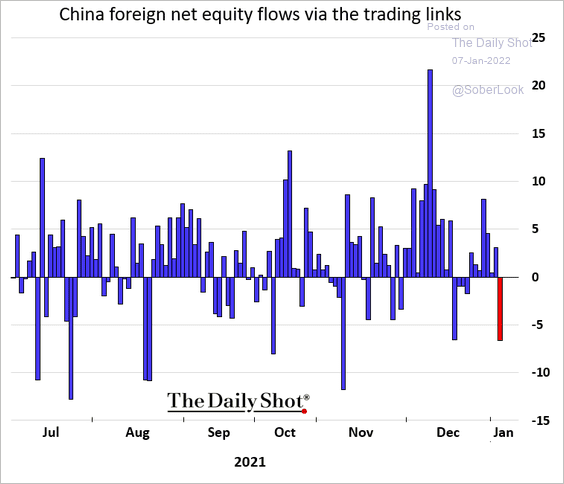

3. Foreign investors pulled capital out of mainland shares.

h/t @johnchenghc

h/t @johnchenghc

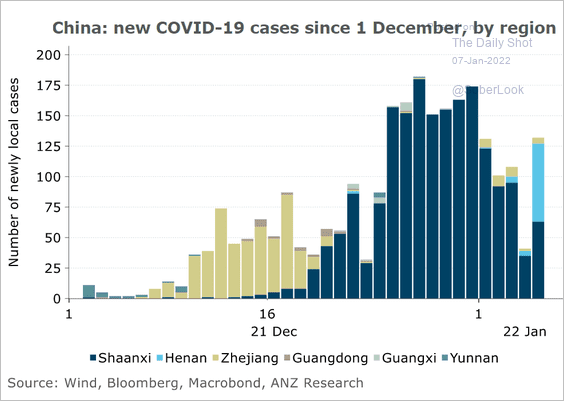

4. Will China be able to contain the spread of omicron?

Source: ANZ Research

Source: ANZ Research

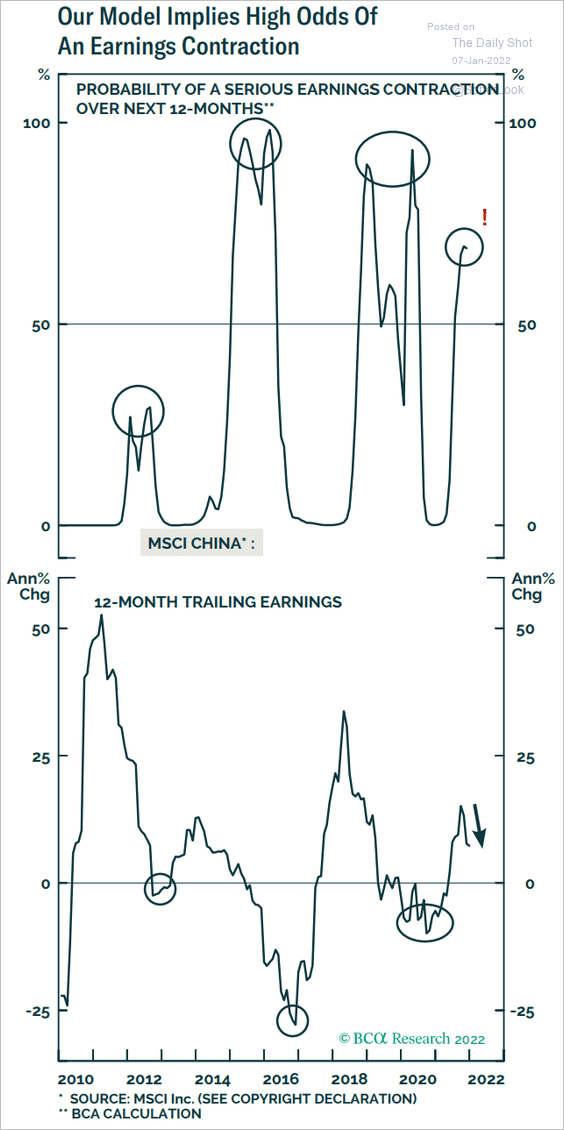

5. BCA Research sees an increased risk of an earnings contraction this year.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

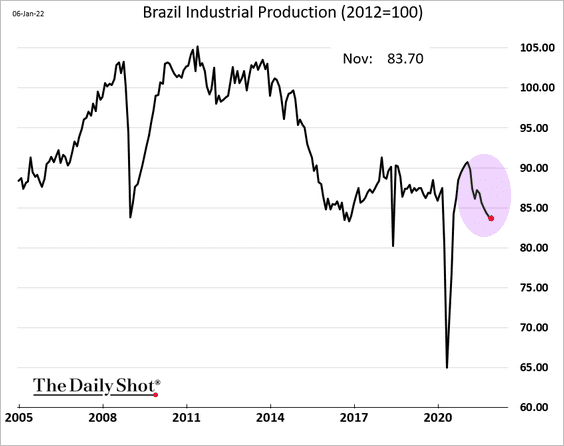

1. Brazil’s industrial production continued to weaken in November.

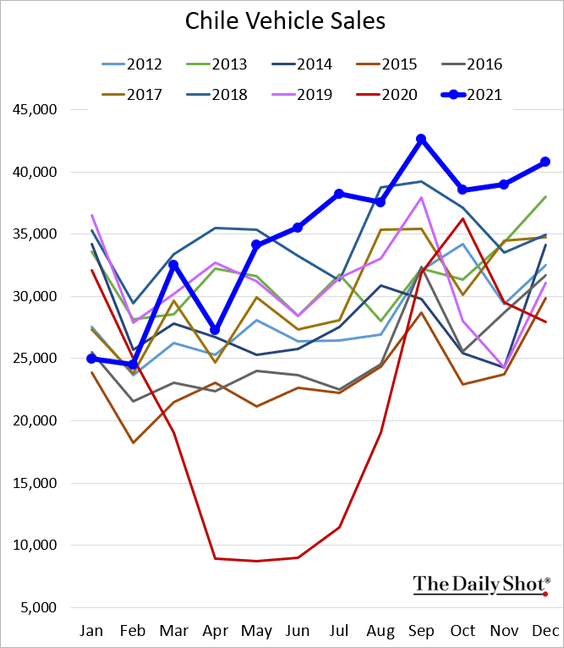

2. Chile’s vehicle sales have been remarkably strong, something we don’t see in most other economies.

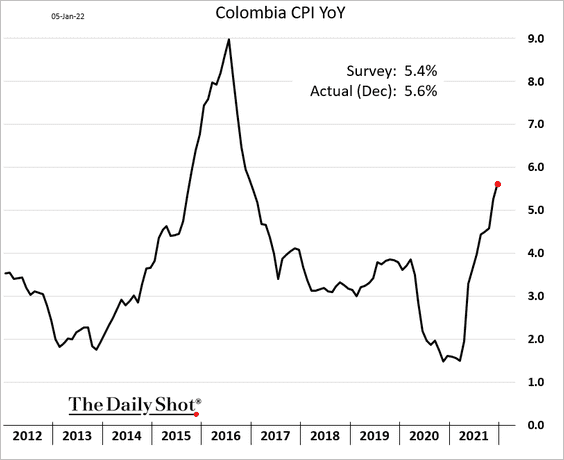

3. Colombia’s CPI continues to climb.

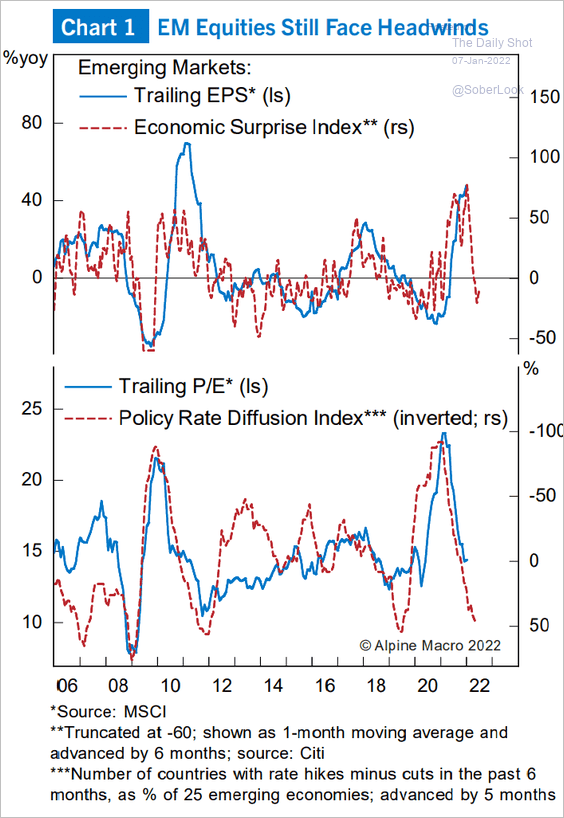

4. Softer economic data and rate hikes point to headwinds for EM shares.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

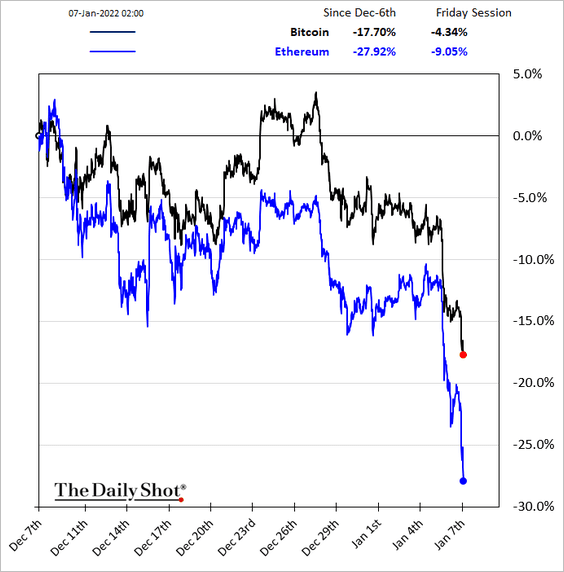

1. Bitcoin dipped below $42k and is now in oversold territory. Will the uptrend support hold?

Ether is down nearly 30% over the past 30 days.

——————–

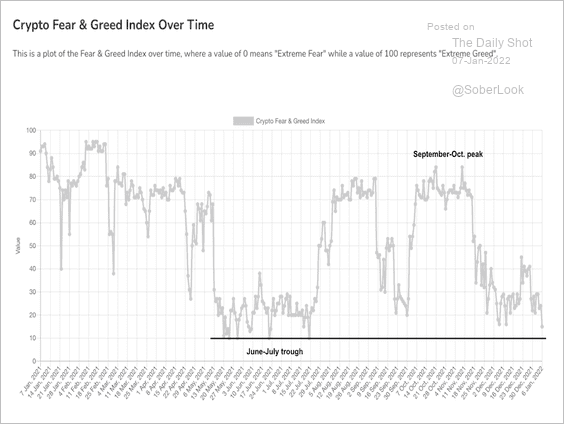

2. The crypto Fear & Greed Index is at the lowest level since July, indicating “extreme fear.”

Source: Alternative.me Read full article

Source: Alternative.me Read full article

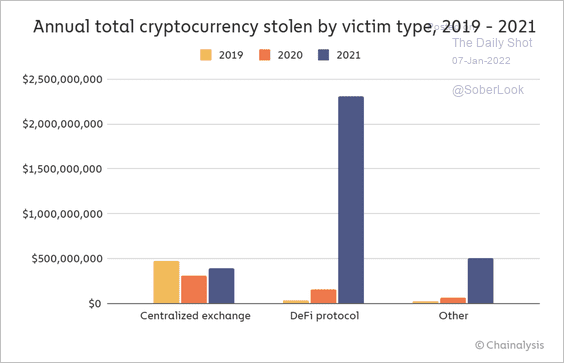

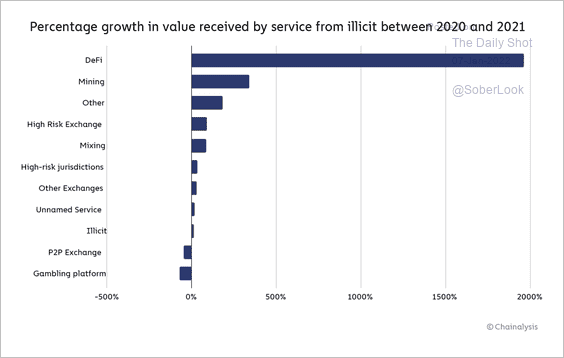

3. Crypto crime is increasing, mostly via stolen funds in the decentralized finance (DeFi) space (2 charts).

Source: Chainalysis Read full article

Source: Chainalysis Read full article

Source: Chainalysis Read full article

Source: Chainalysis Read full article

——————–

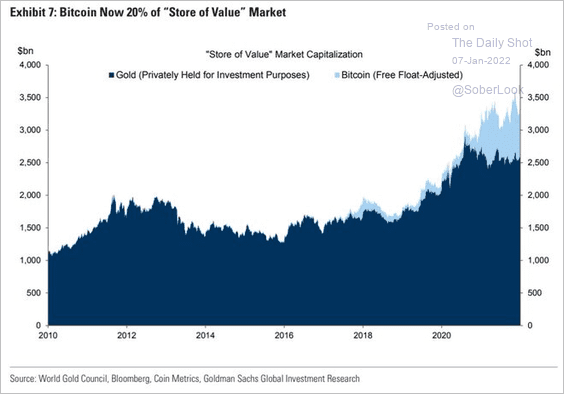

4. Crypto’s share of “store of value” market has been climbing (taking market share from gold).

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

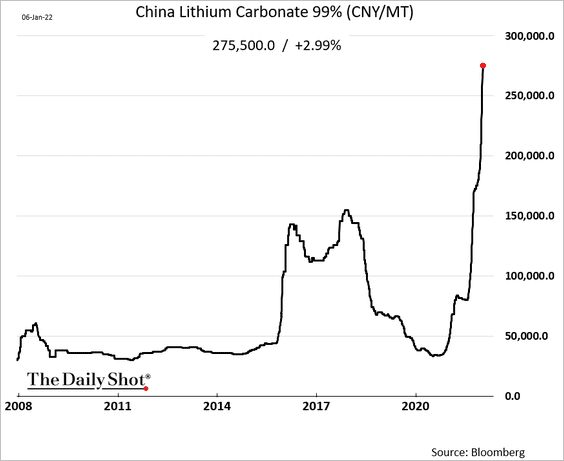

Commodities

1. Electric car battery prices are on the way up as lithium carbonate surges to record highs.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

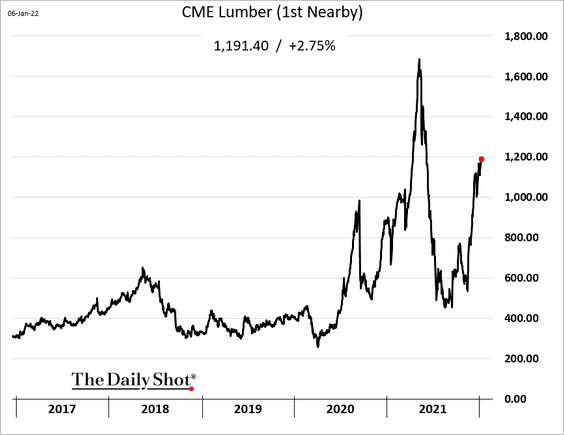

2. US lumber futures continue to climb.

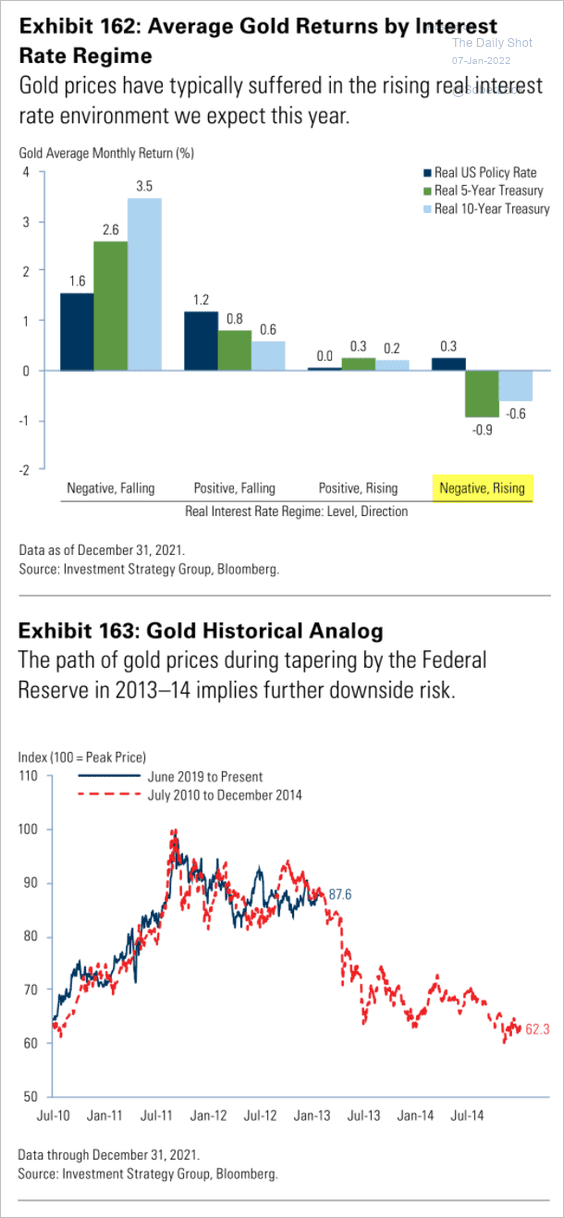

3. Gold faces downside risks as the Fed tightens.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Energy

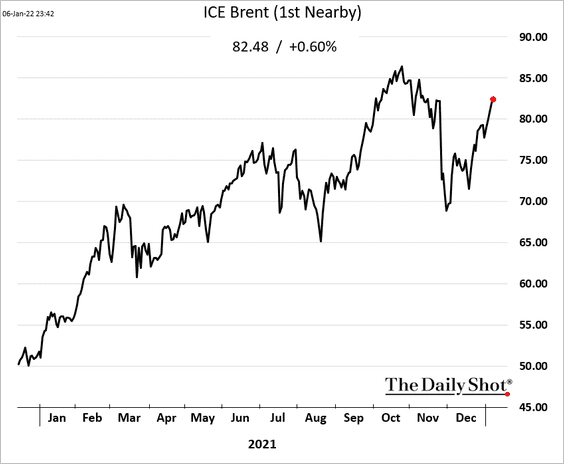

1. Crude oil prices continue to climb.

Source: Reuters Read full article

Source: Reuters Read full article

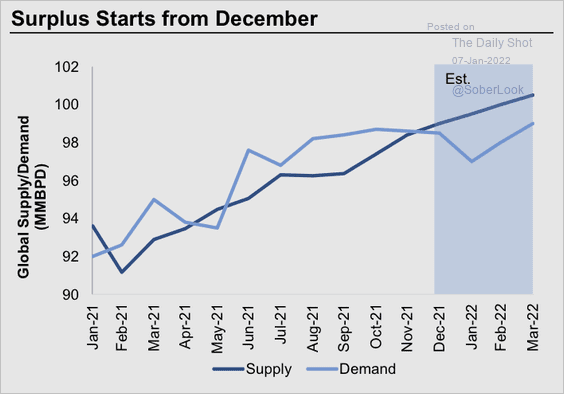

2. Will this year’s crude oil surplus end up being lower than expected? Here is a forecast from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

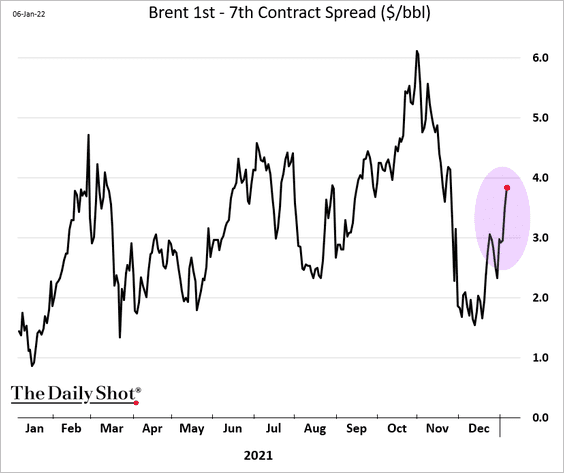

For now, the market sees tight supplies as backwardation deepens.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

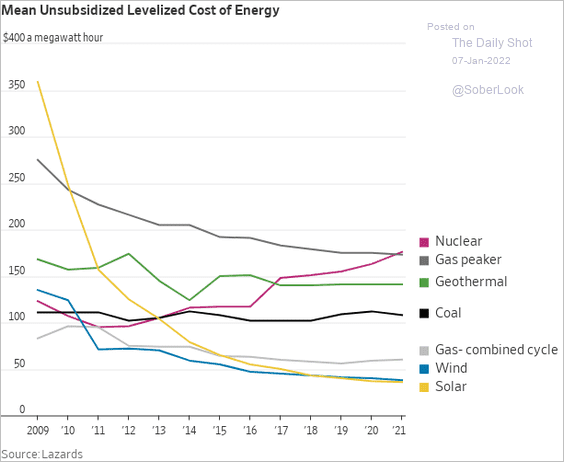

3. Nuclear energy could be made cheaper.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

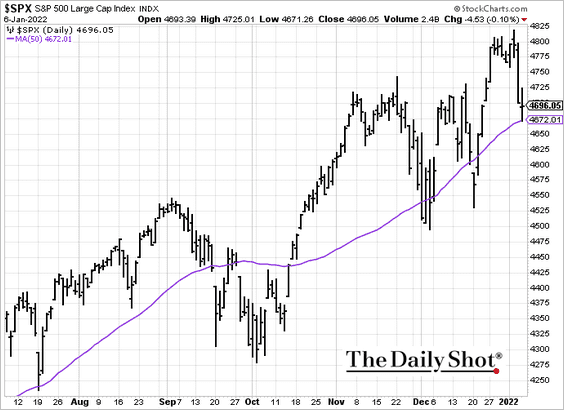

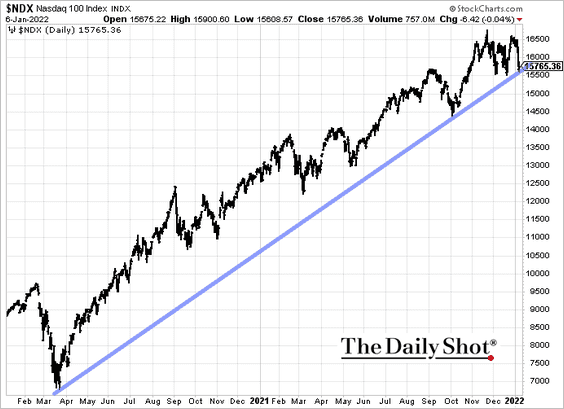

1. The S&P 500 held support at the 50-day moving average.

The Nasdaq 100 is also at support.

h/t @JPBarnert

h/t @JPBarnert

——————–

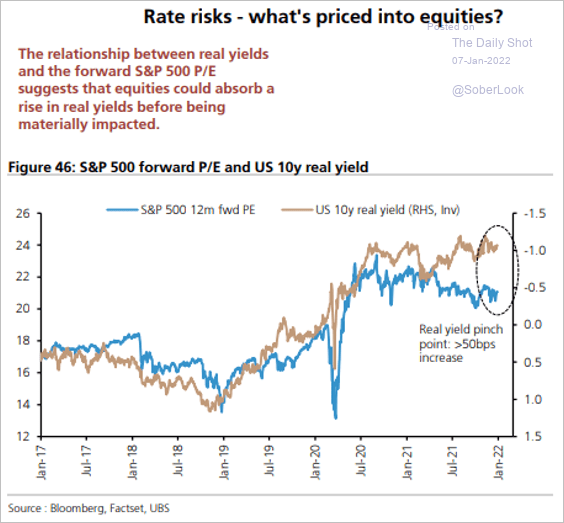

2. Stock valuations have decoupled from real yields.

Source: UBS; @WallStJesus

Source: UBS; @WallStJesus

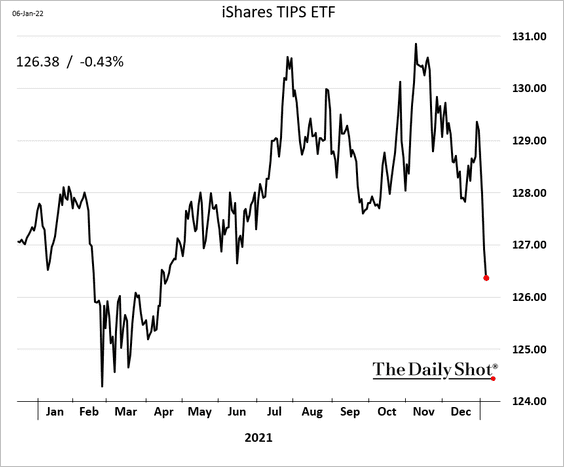

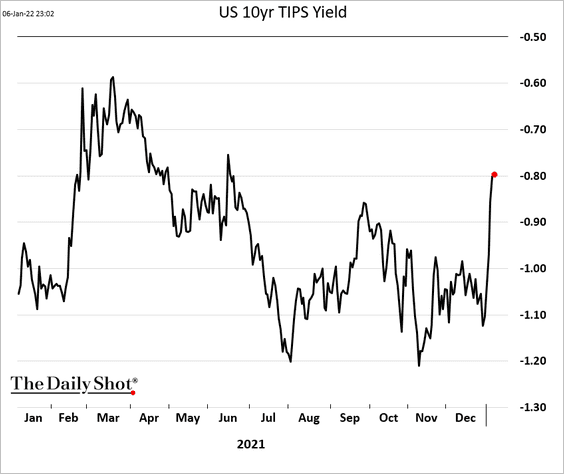

• Inflation-linked Treasuries (TIPS) have sold off sharply in recent days.

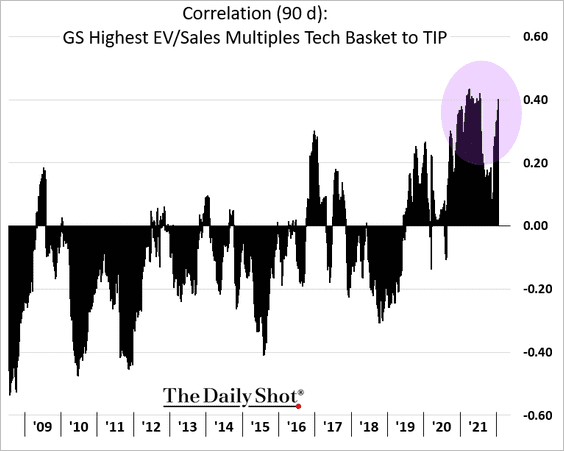

The spike in real yields is pressuring parts of the market. Here is the correlation between high-multiple tech stocks and TIPS.

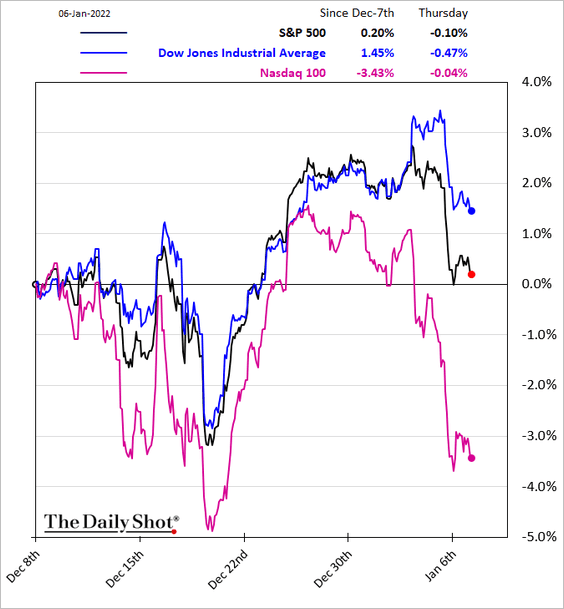

That’s partially why the Nasdaq 100 has underperformed over the past week, …

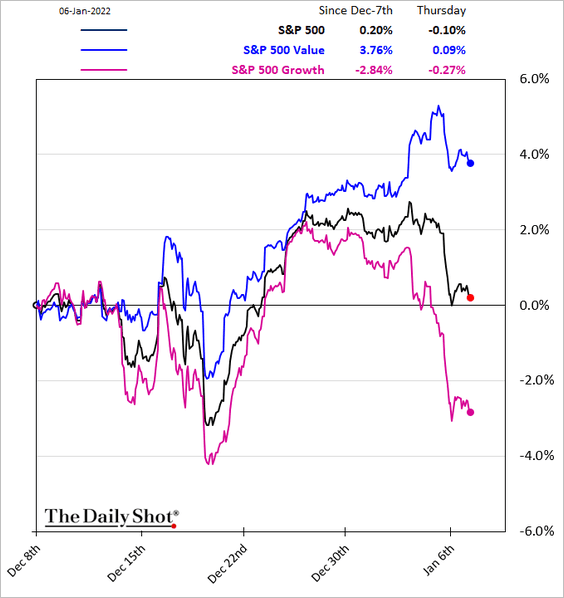

… and value is outperforming growth.

——————–

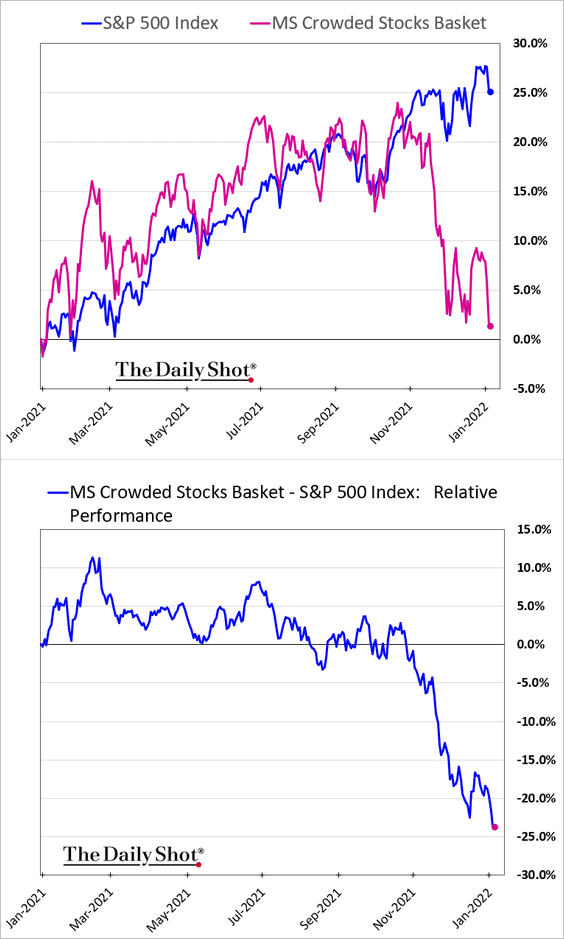

3. Crowded stocks have been squeezed out.

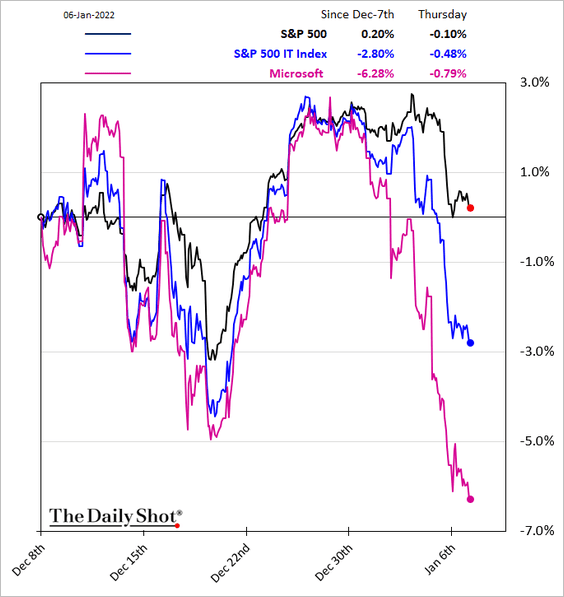

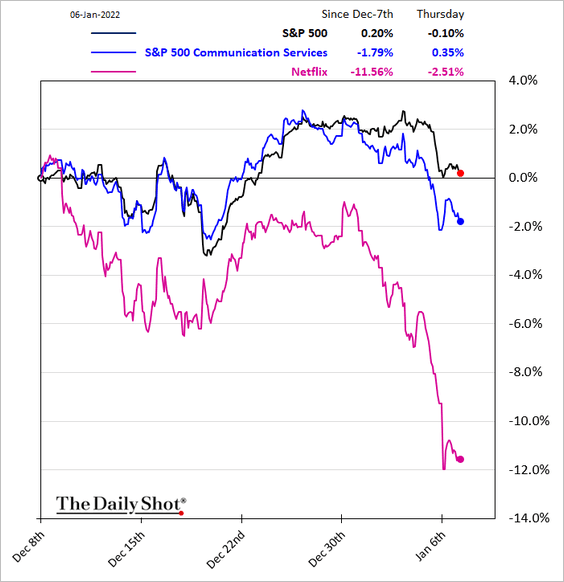

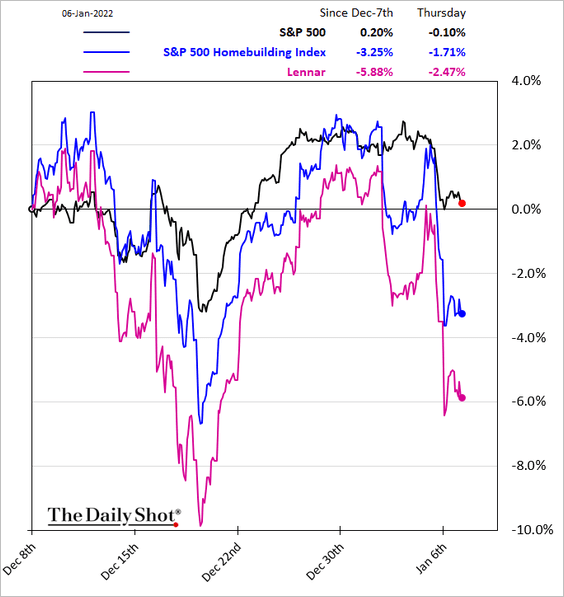

4. Next, we have some sector trends over the past month.

• Tech:

• Communication Services:

• Homebuilders (mortgage rates are rising):

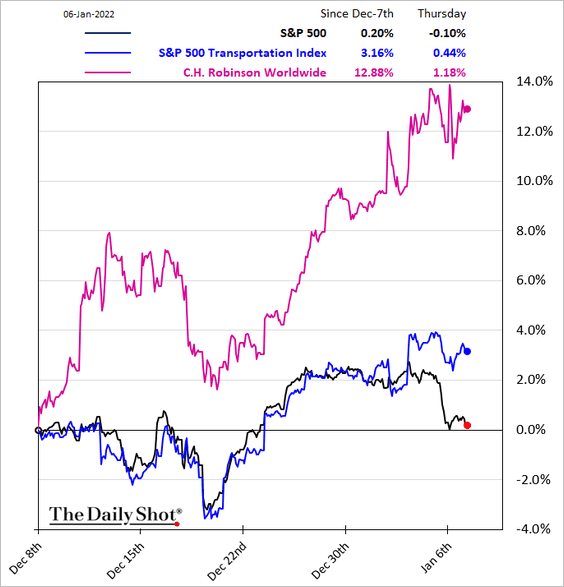

• Transportation/logistics:

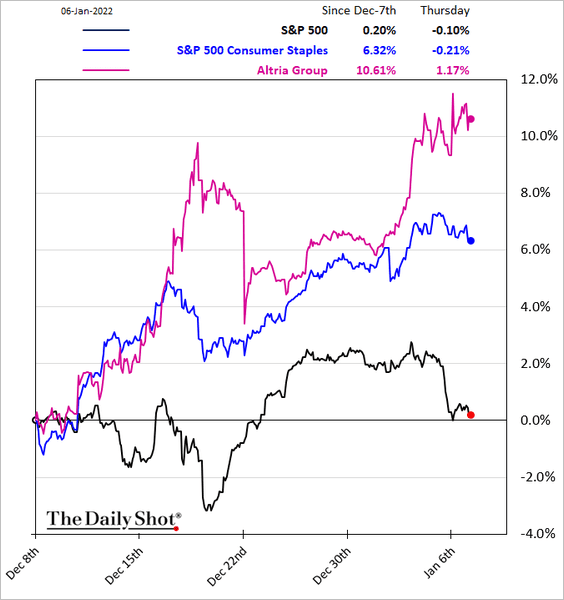

• Consumer staples:

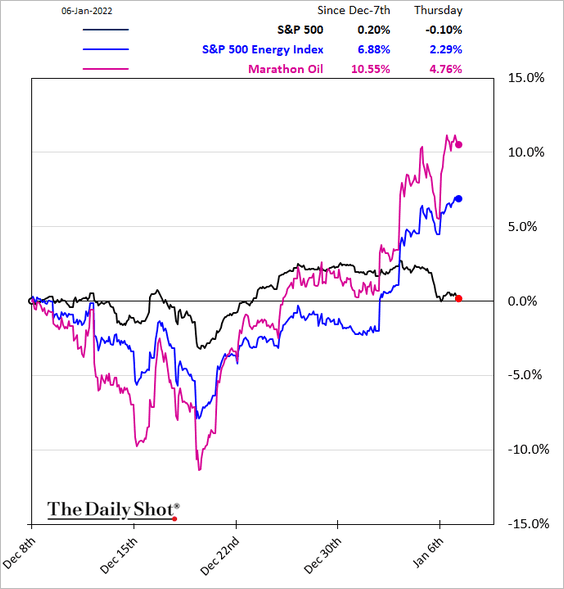

• Energy:

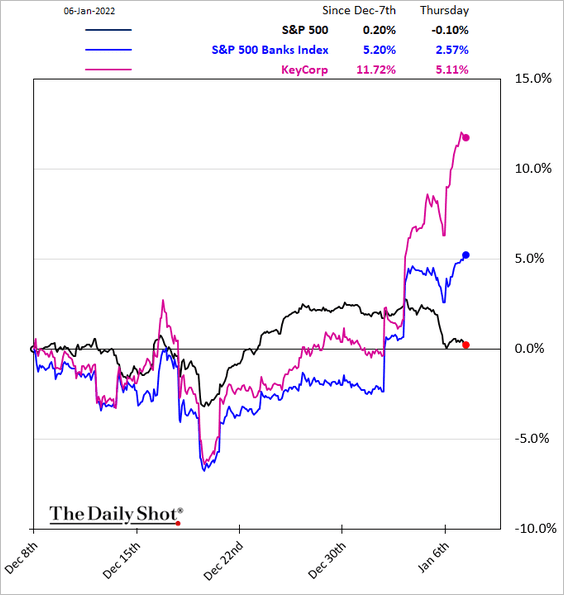

• Banks:

——————–

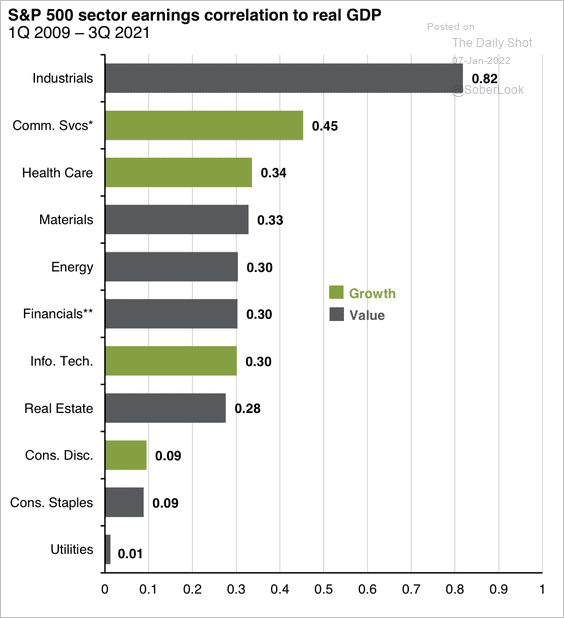

5. Here is a look at the correlation between sector earnings and real GDP.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

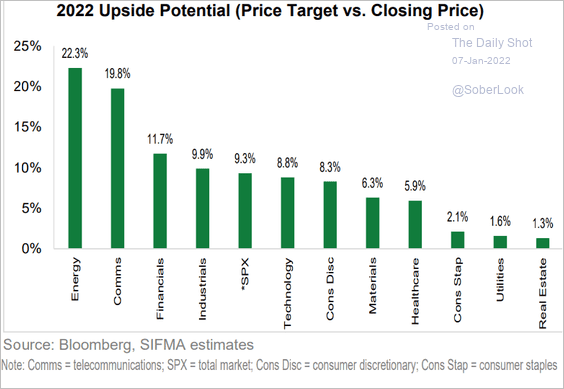

6. Which sectors have the most upside potential based on analysts’ price targets?

Source: SIFMA

Source: SIFMA

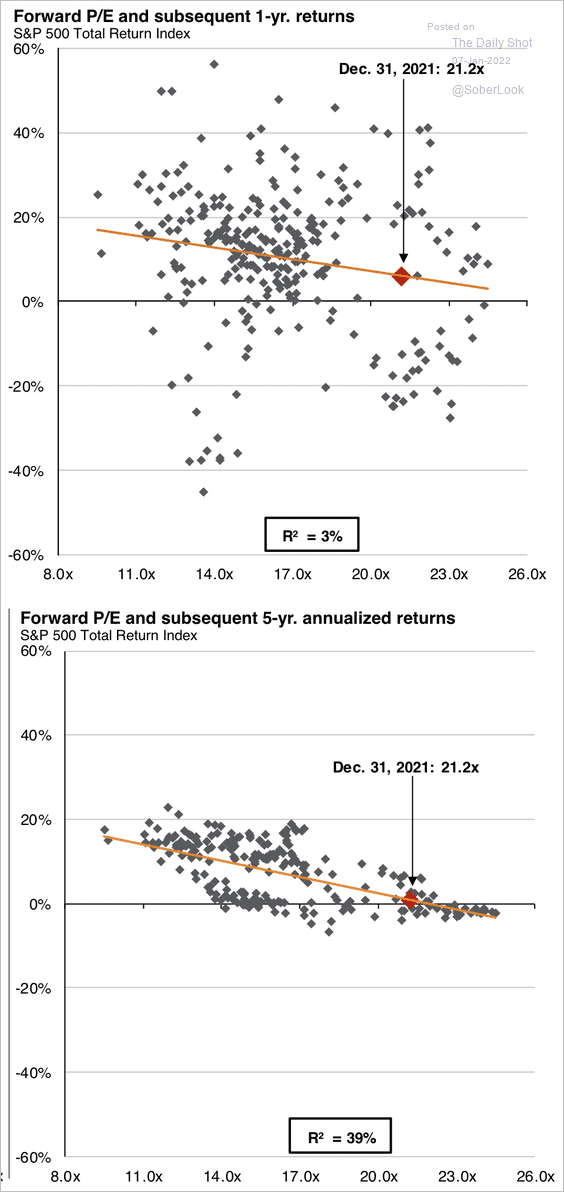

7. Current valuation levels suggest lower equity returns over the next few years.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

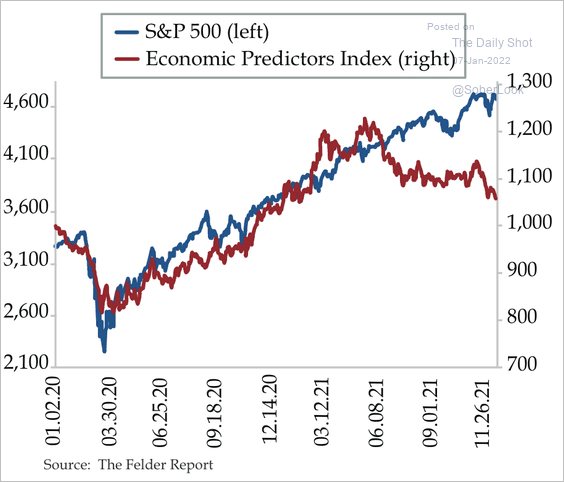

8. The S&P 500 has diverged from economic growth expectations over the past year.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Global Developments

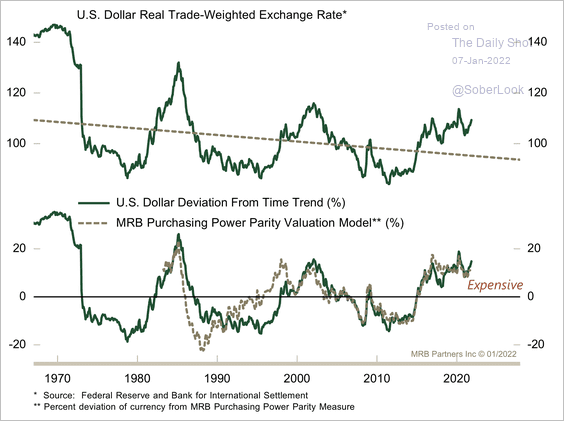

1. The dollar appears overvalued, similar to 2001.

Source: MRB Partners

Source: MRB Partners

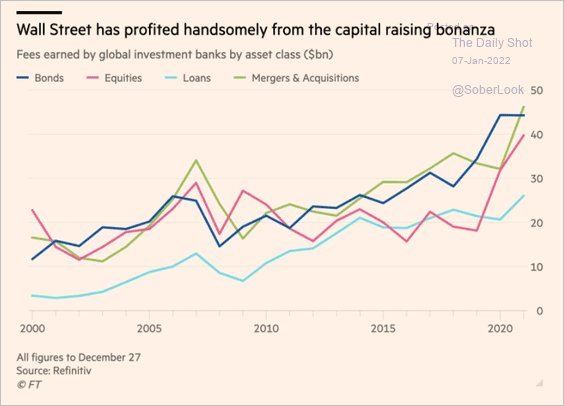

2. Companies raised a record amount of cash in the capital markets in 2021, …

Source: @GregDaco, @FT Read full article

Source: @GregDaco, @FT Read full article

… supporting investment banking revenues.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

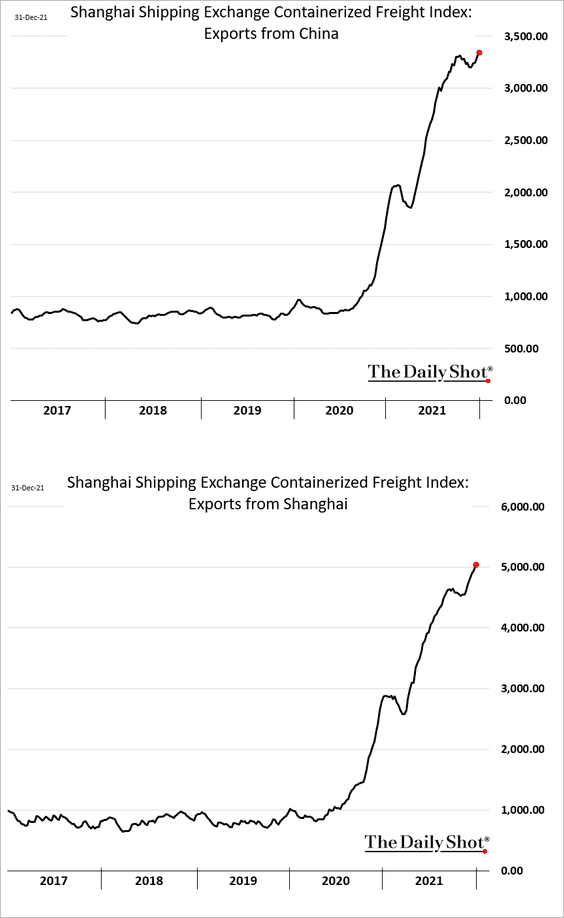

3. Container shipping costs out of China have not peaked.

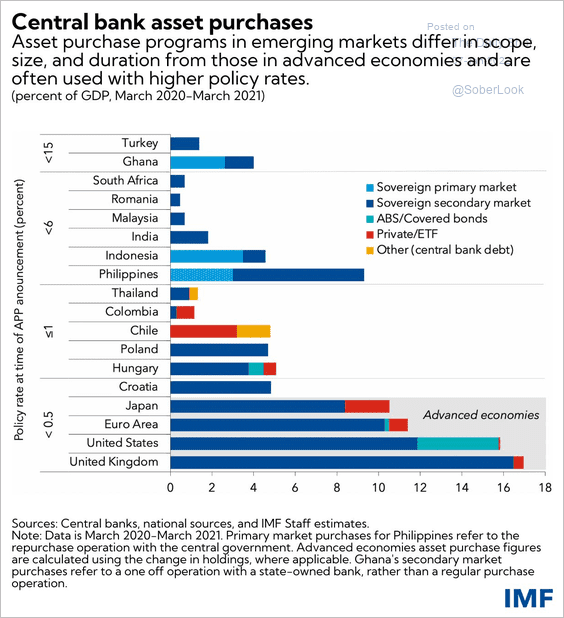

4. Finally, we have a summary of central banks’ pandemic-era asset purchases.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

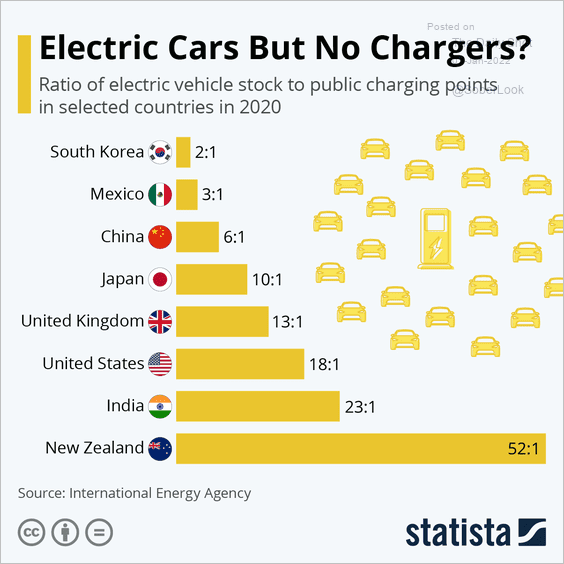

1. Electric vehicles per charging station:

Source: Statista

Source: Statista

2. Increasing concentration in the semiconductor industry:

![]() Source: McKinsey Read full article

Source: McKinsey Read full article

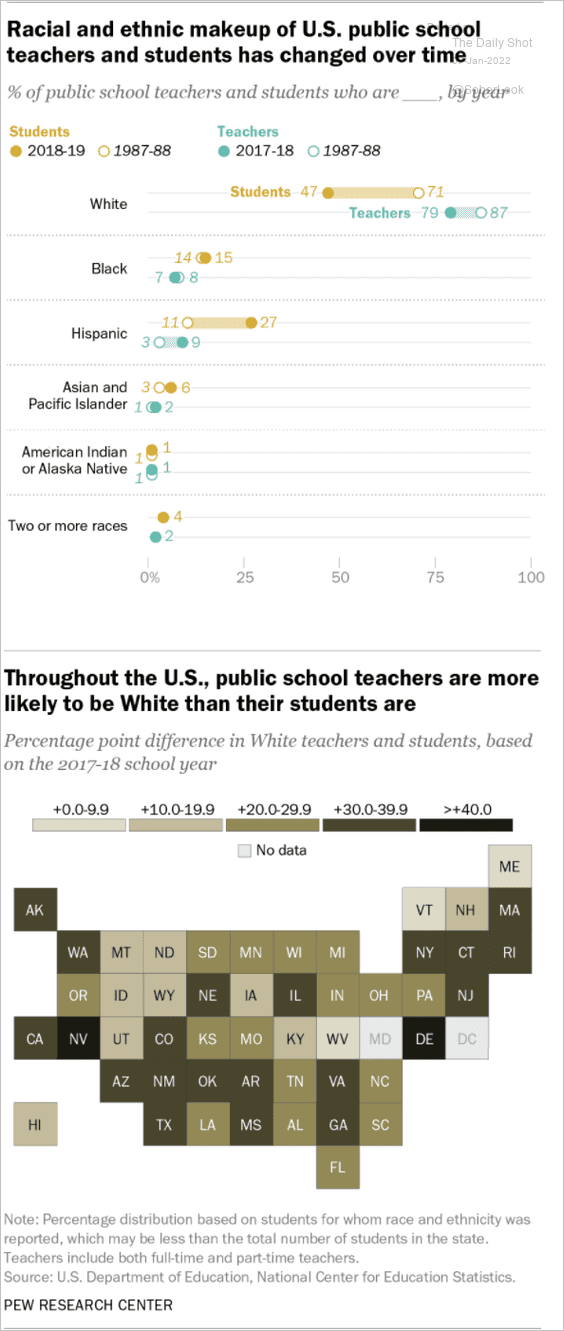

3. Racial and ethnic makeup of US public school teachers and students:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

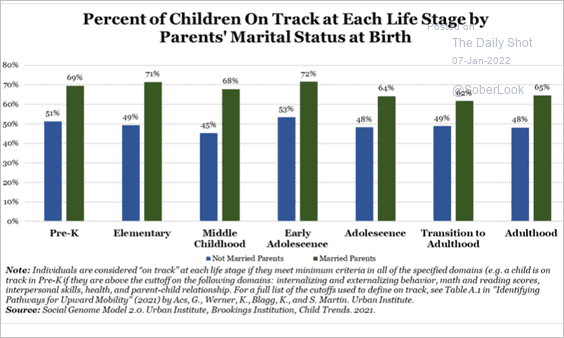

4. Parents’ marital status and children’s progress at different stages:

Source: Brookings

Source: Brookings

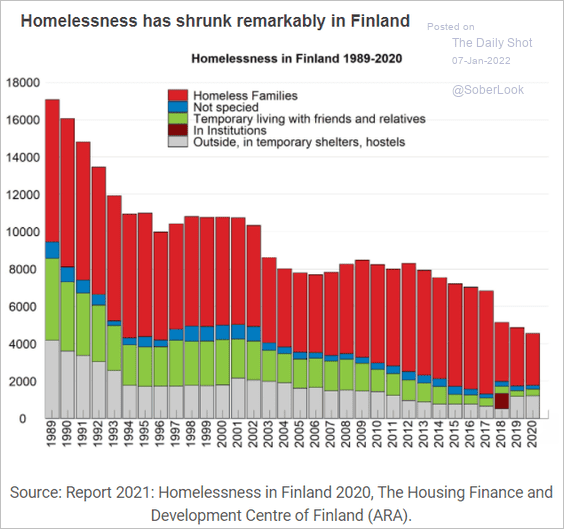

6. Homelessness in Finland:

Source: OECD Read full article

Source: OECD Read full article

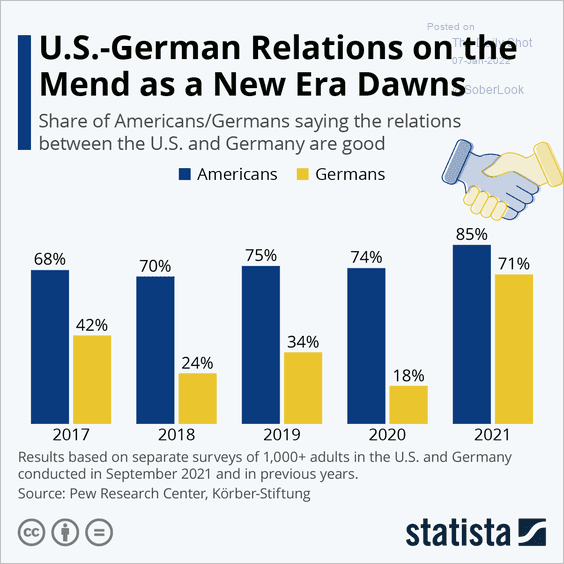

7. US-German relations:

Source: Statista

Source: Statista

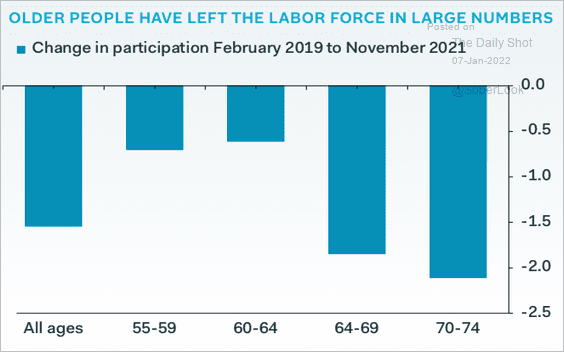

8. Changes in US labor force participation:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

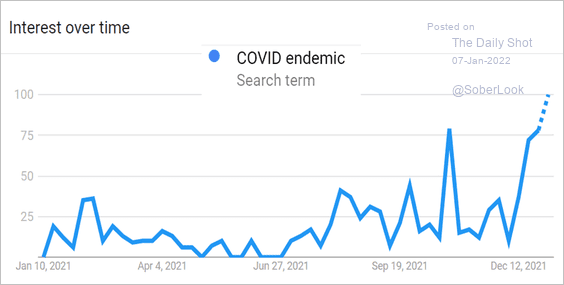

9. Living with COVID (from “pandemic” to “endemic”):

h/t @Peter_Atwater, Google Trends

h/t @Peter_Atwater, Google Trends

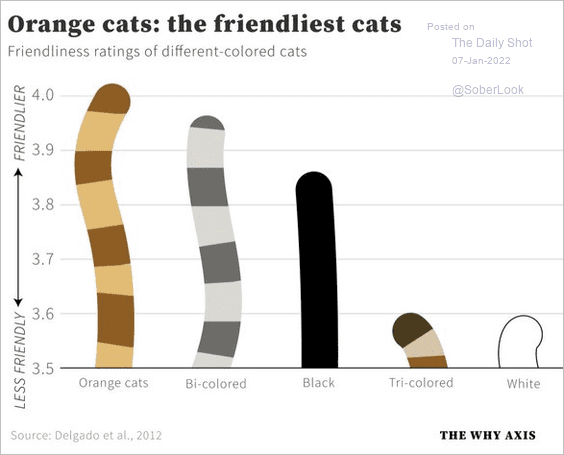

10. Cats’ friendliness ratings by color:

Source: @WaltHickey, @_cingraham Read full article

Source: @WaltHickey, @_cingraham Read full article

——————–

Have a great weekend!

Back to Index