The Daily Shot: 10-Jan-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

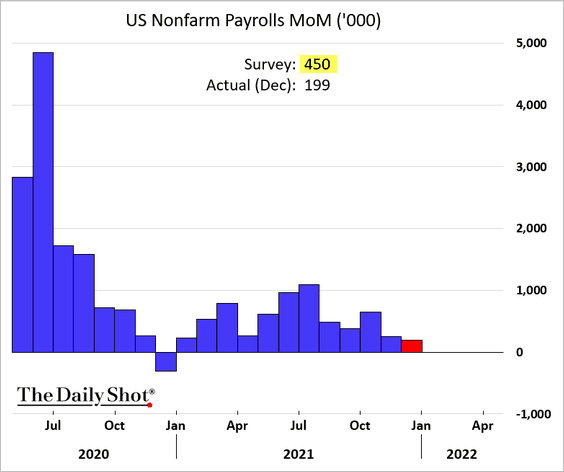

1. The December payrolls increase surprised to the downside again.

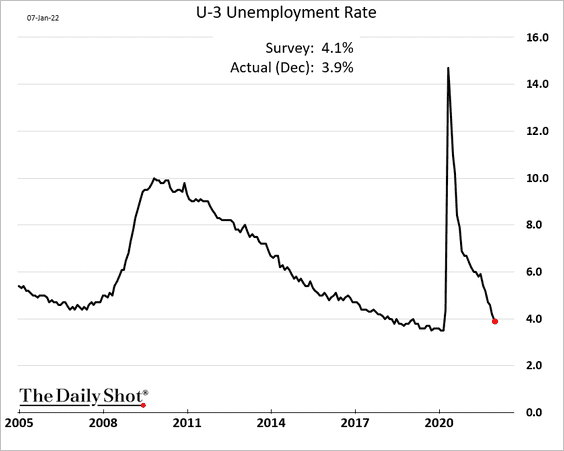

At the same time, the unemployment rate dipped below 4% for the first time in this cycle. The divergence points to further tightening in the labor market.

Below are some of the trends from the payrolls report.

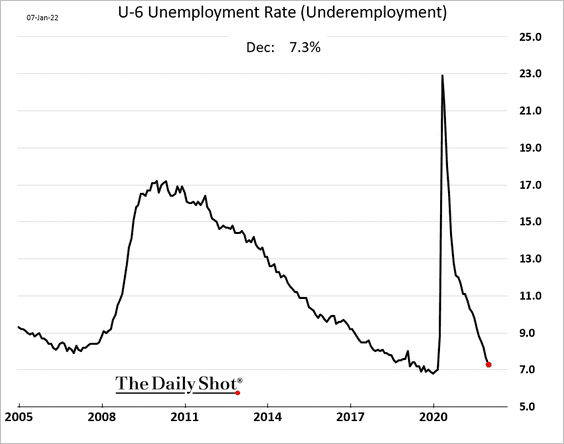

• Underemployment (U-6) is nearly back to pre-COVID levels.

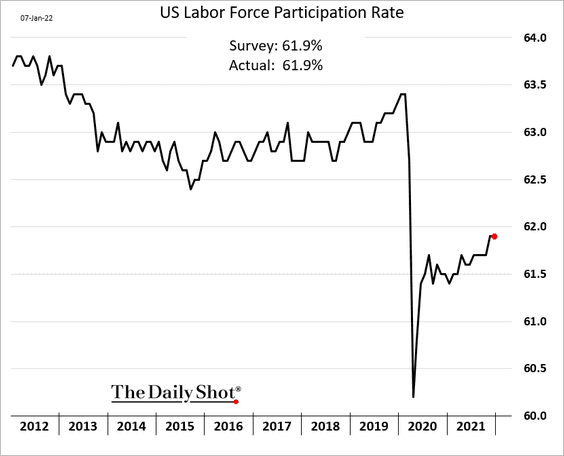

• The overall labor force participation rate held steady.

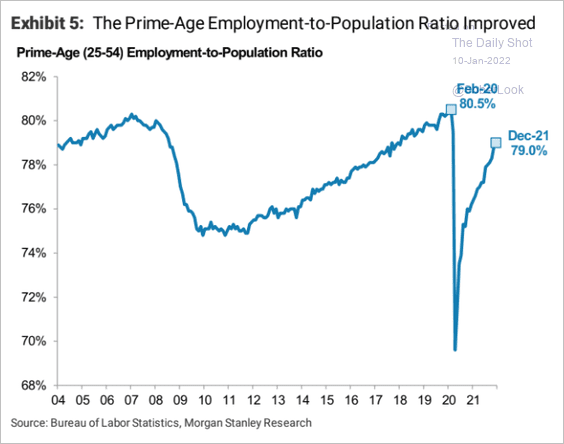

– Prime-age participation:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

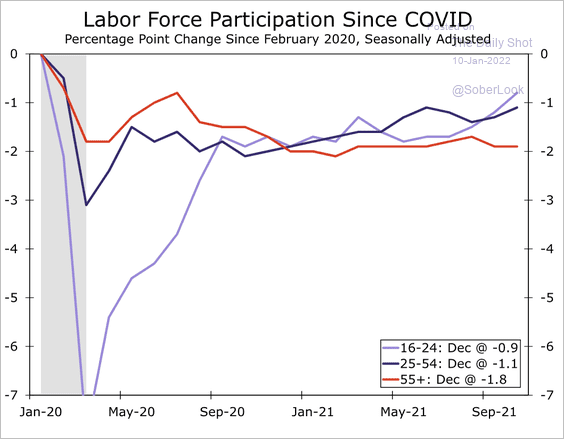

– Participation by age group:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

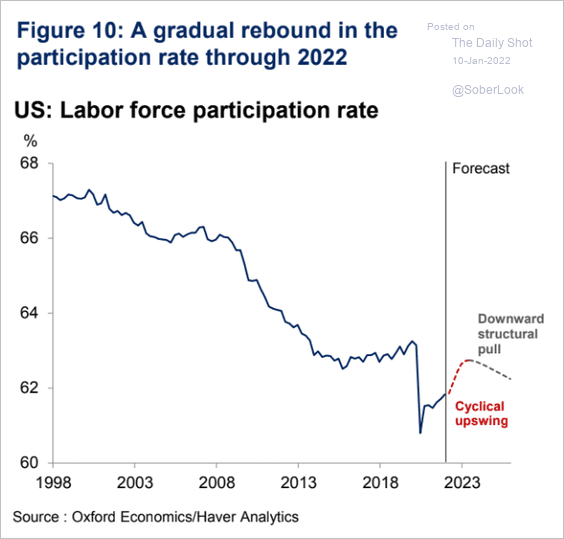

– A forecast from Oxford Economics:

Source: Oxford Economics

Source: Oxford Economics

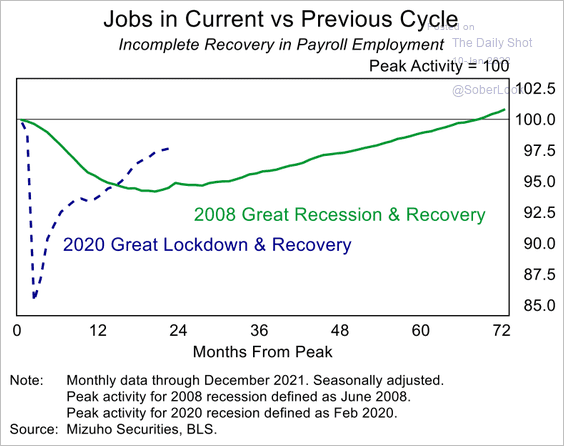

• Here are the total payrolls vs. the post-2008 recovery.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

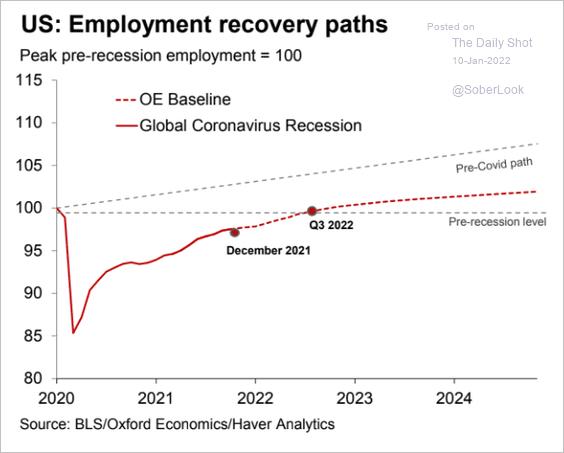

• We should be at pre-COVID levels later this year, but getting to the pre-pandemic trajectory will not happen any time soon.

Source: Oxford Economics

Source: Oxford Economics

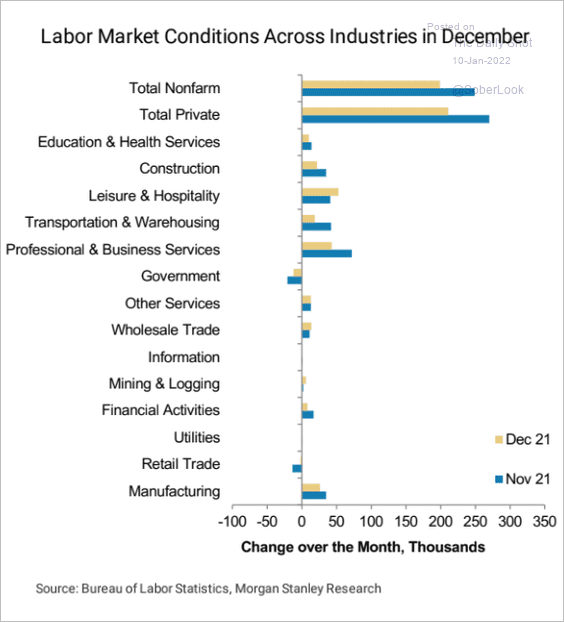

• This chart shows the employment changes by sector.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

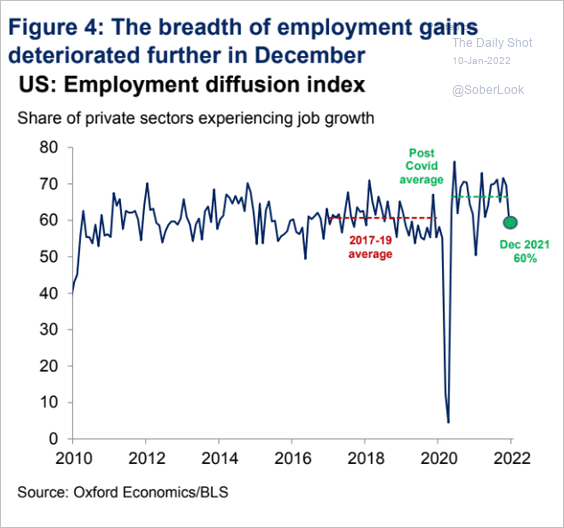

The breadth of job gains across industries deteriorated.

Source: Oxford Economics

Source: Oxford Economics

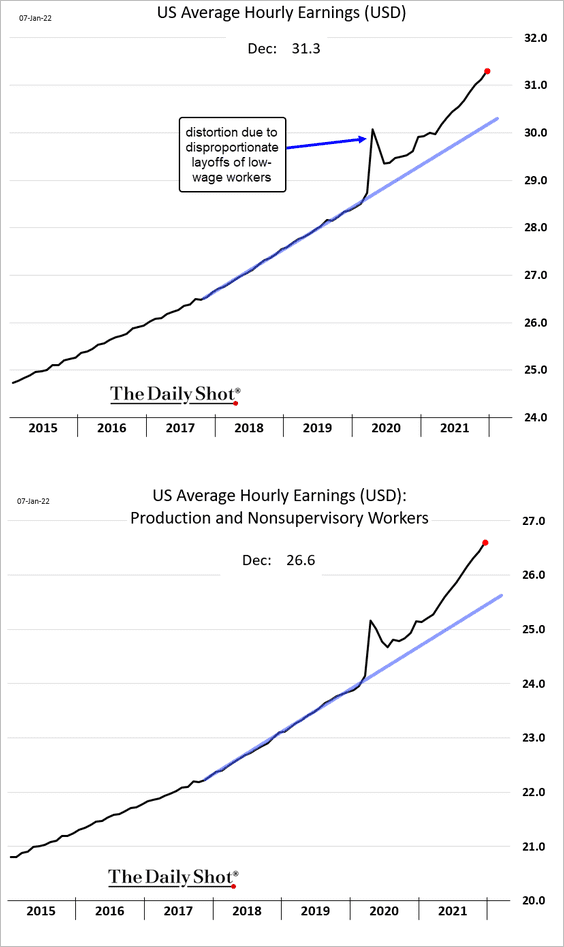

• Wage growth continues to run faster than the pre-COVID trend, outpacing productivity gains (a signal for the Fed).

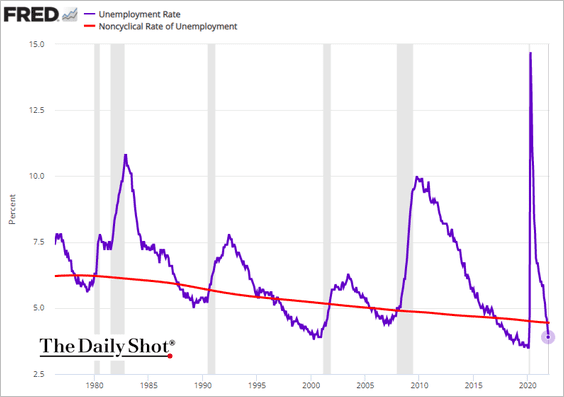

• The headline unemployment rate is now firmly below the natural rate of unemployment.

We will have more data on the employment report tomorrow.

——————–

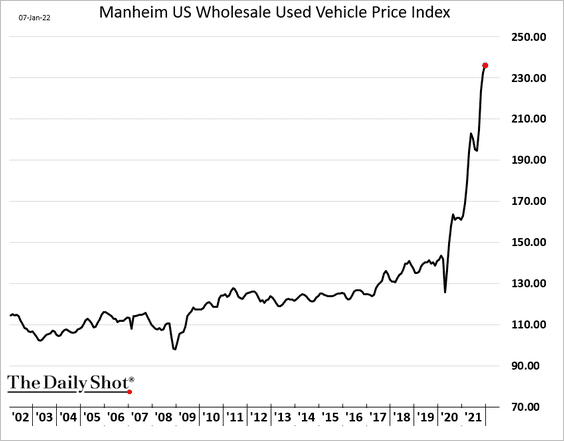

2. Used vehicle prices continue to surge.

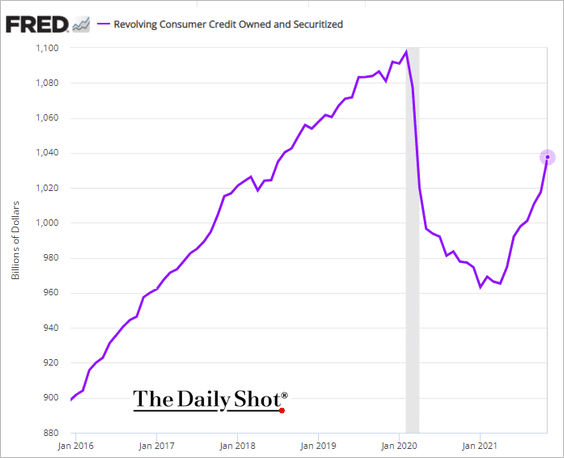

3. US consumers are tapping their credit cards again.

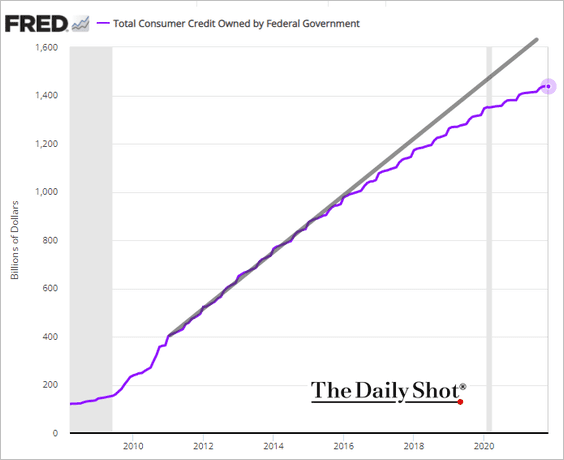

Student debt growth continues to slow.

——————–

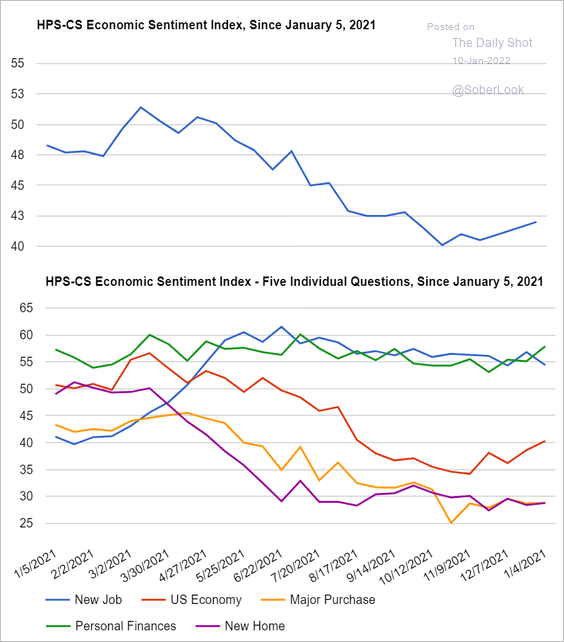

4. The HPS-CS consumer sentiment indicator showed some improvement in recent weeks, despite the surge in COVID cases.

Source: @HPSInsight, @CivicScience Read full article

Source: @HPSInsight, @CivicScience Read full article

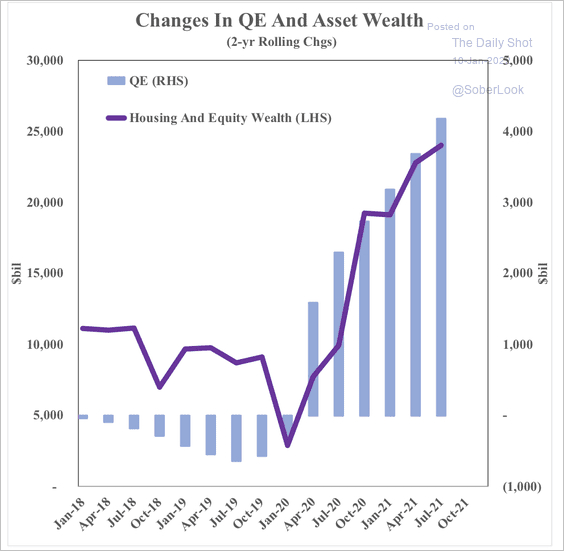

5. Household wealth has risen along with QE in this economic cycle.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

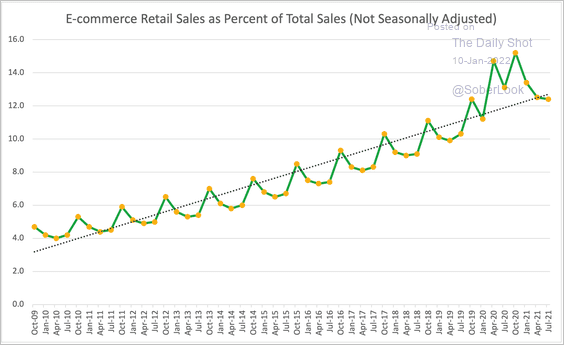

6. Counter to the existing narrative, the pandemic didn’t actually lead to a step-change in e-commerce sales as a percentage of total sales.

Source: Snippet Finance Read full article

Source: Snippet Finance Read full article

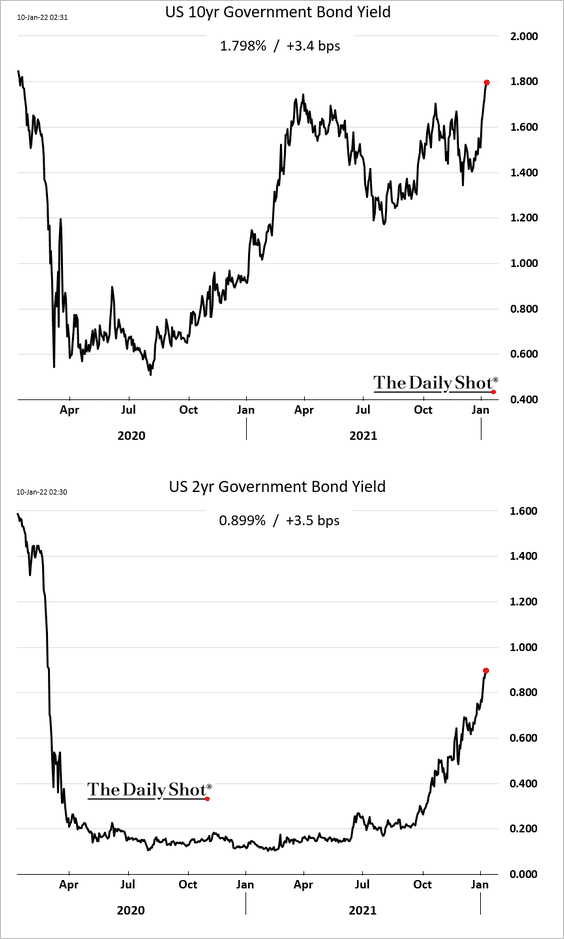

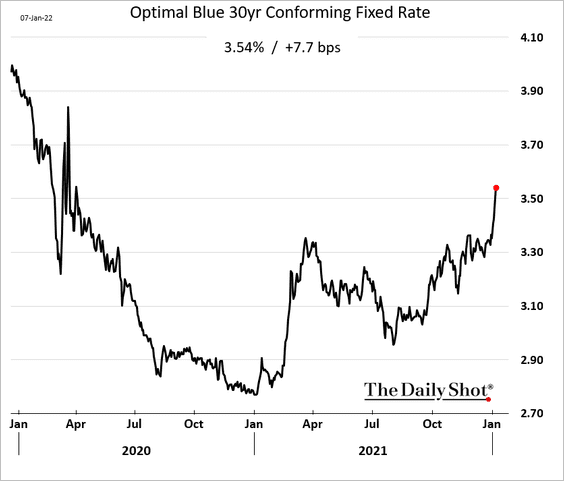

7. Treasury yields keep rising, with the 10yr hitting a cycle high, …

… pushing up mortgage rates.

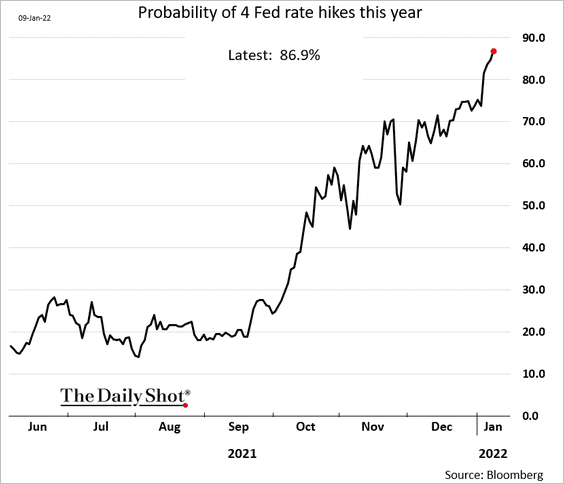

The probability of a full 100 bps Fed rate increase this year is nearing 90%, according to the futures market.

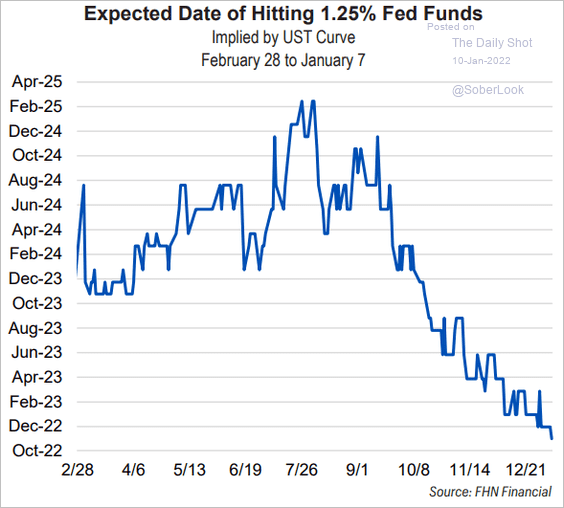

Here is a calculation based on the Treasury curve.

Source: FHN Financial

Source: FHN Financial

——————–

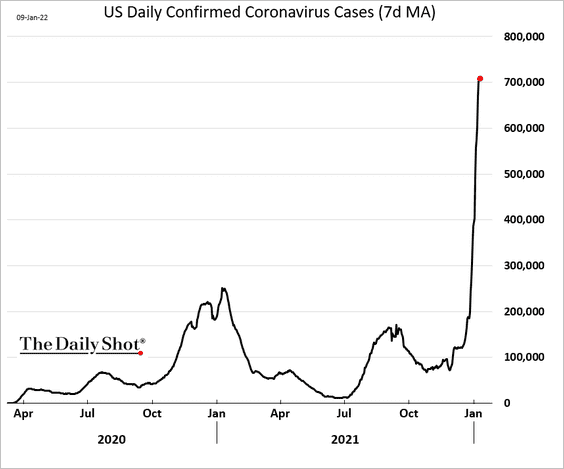

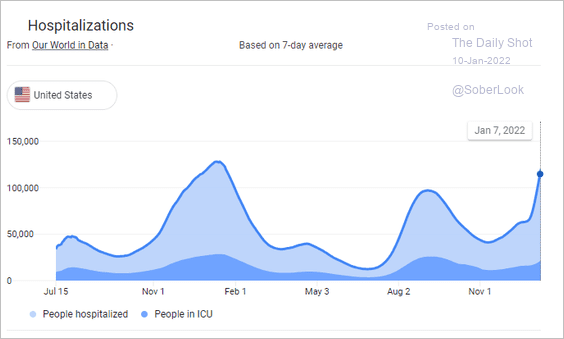

8. COVID cases continue to climb, …

… with some five million Americans now forced to stay at home due to exposure.

Source: @WSJ Read full article

Source: @WSJ Read full article

Hospitalizations may also hit a new high.

Source: Google.com

Source: Google.com

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Canada

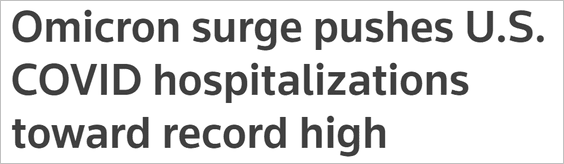

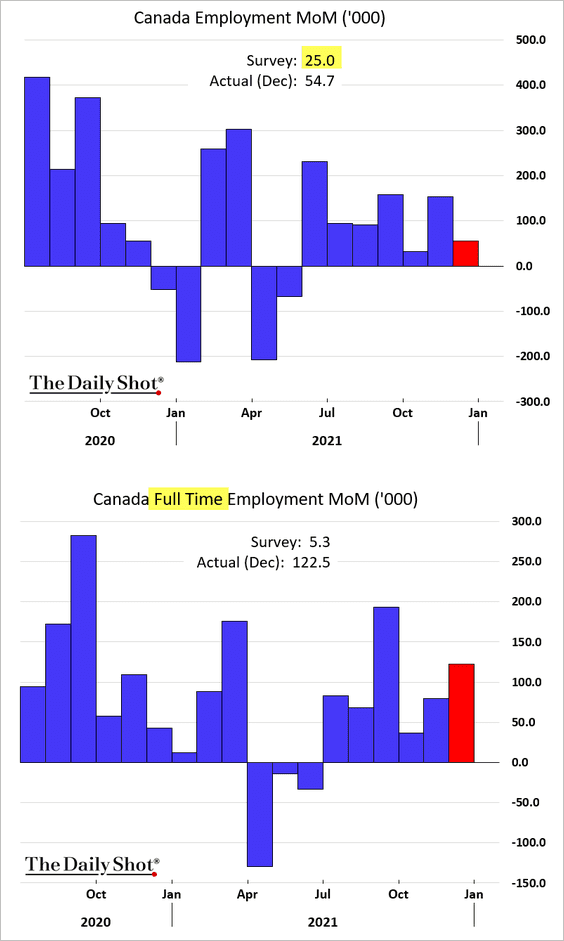

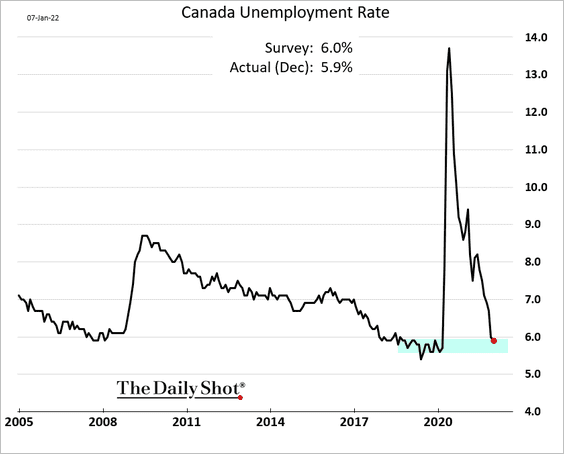

1. The employment report topped forecasts again, with job gains driven by full-time positions.

• The unemployment rate is back below 6%.

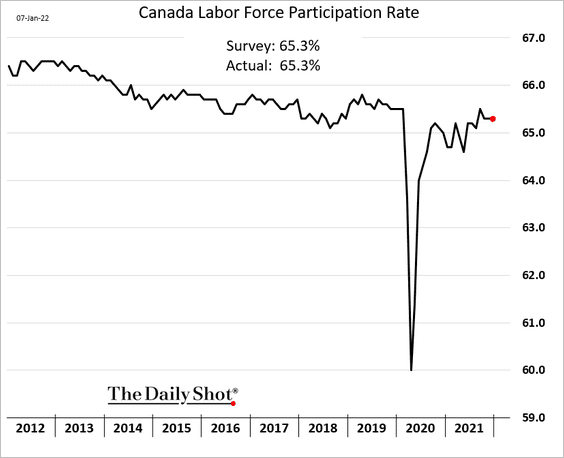

• The participation rate held steady.

——————–

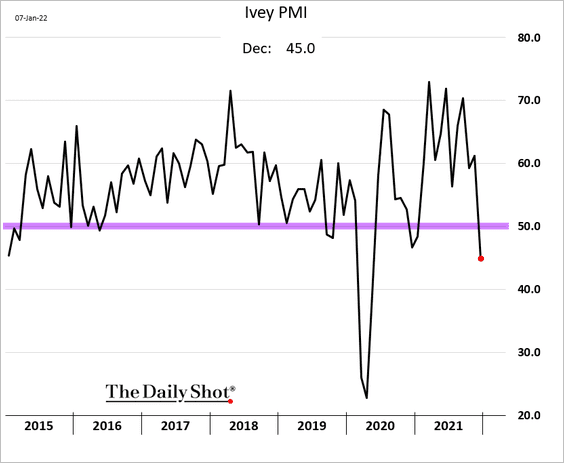

2. According to Ivey PMI, business activity was in contraction territory last month, as omicron cases exploded.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

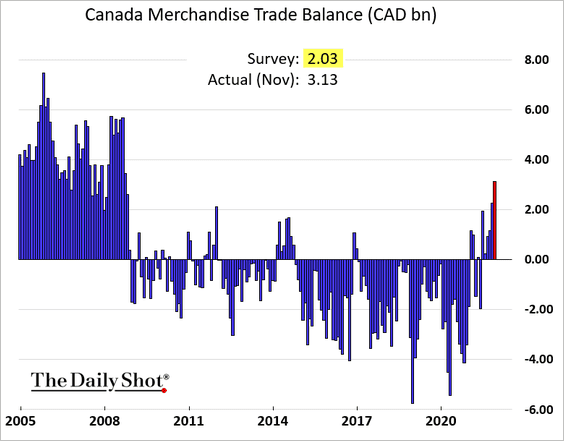

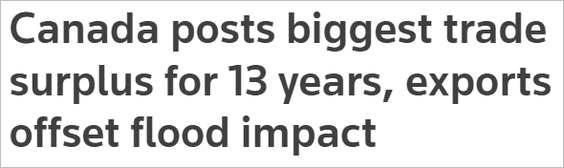

3. The trade surplus hit the highest level since 2008 amid high commodity prices and strong US demand.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The United Kingdom

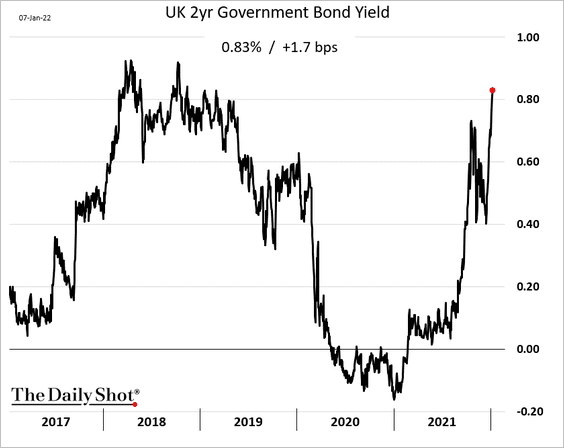

1. The 2yr gilt yield hit the highest level since early 2019.

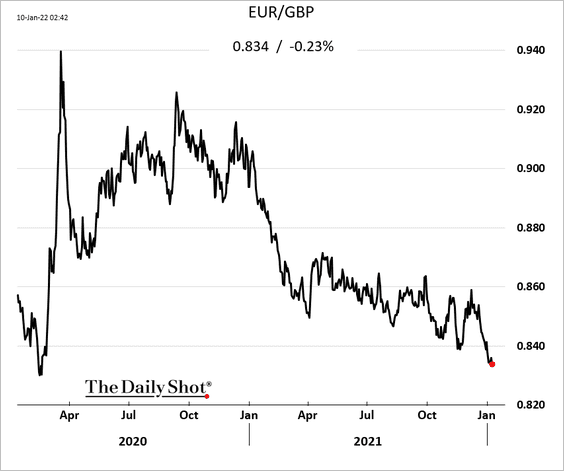

2. The pound is at a cycle-high against the euro.

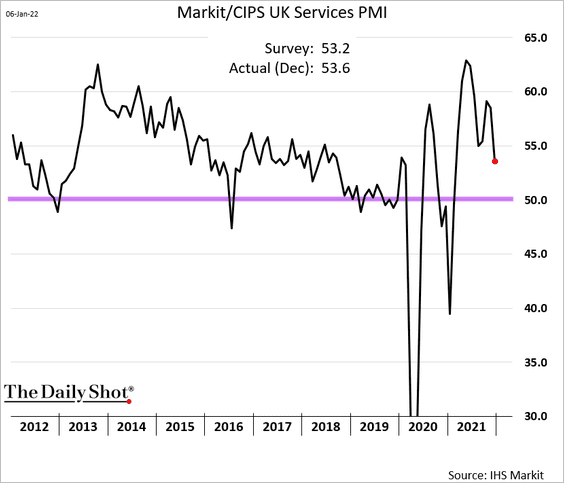

3. Service-sector growth slowed in December but remained in expansion territory.

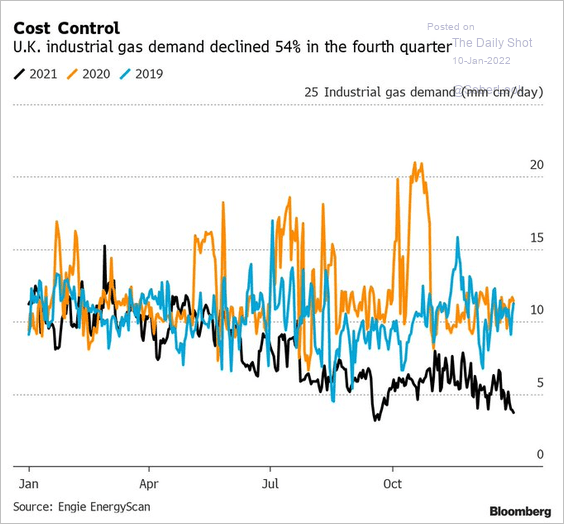

4. Record-high natural gas prices have been a drag on output, with many firms simply unable to pay the exorbitant costs.

Source: @SStapczynski Read full article

Source: @SStapczynski Read full article

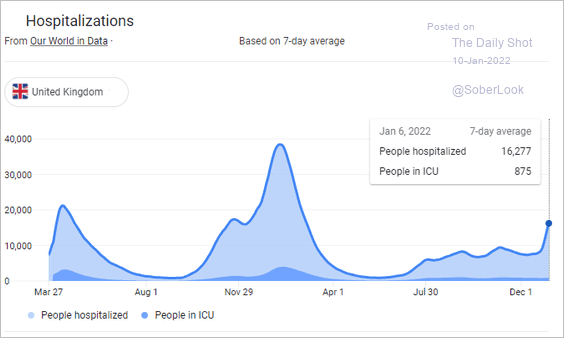

5. COVID hospitalizations remain below the previous peaks but are rising.

Source: Google.com

Source: Google.com

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The Eurozone

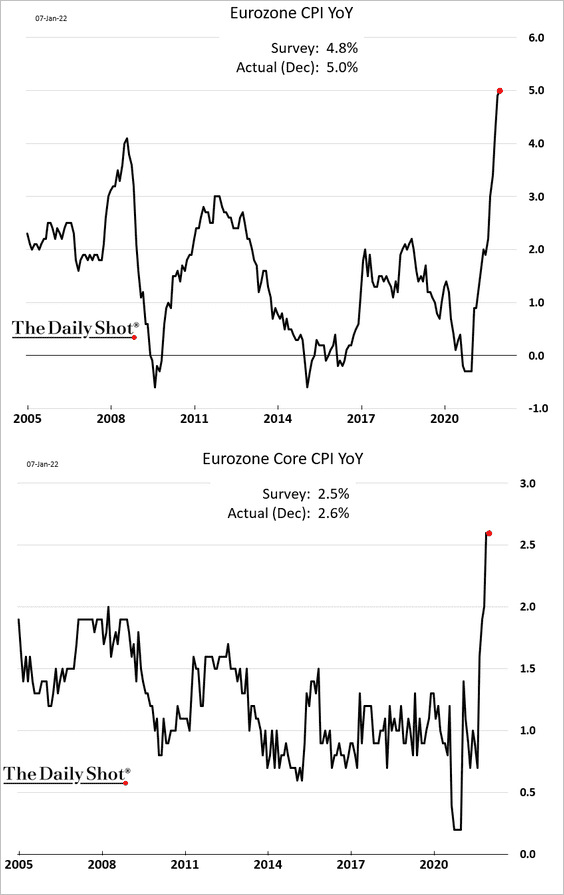

1. The headline CPI hit a record high, surprising to the upside.

Source: CNBC Read full article

Source: CNBC Read full article

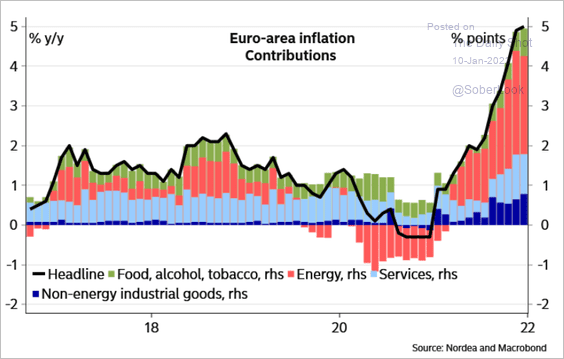

Here is the attribution.

Source: Nordea Markets

Source: Nordea Markets

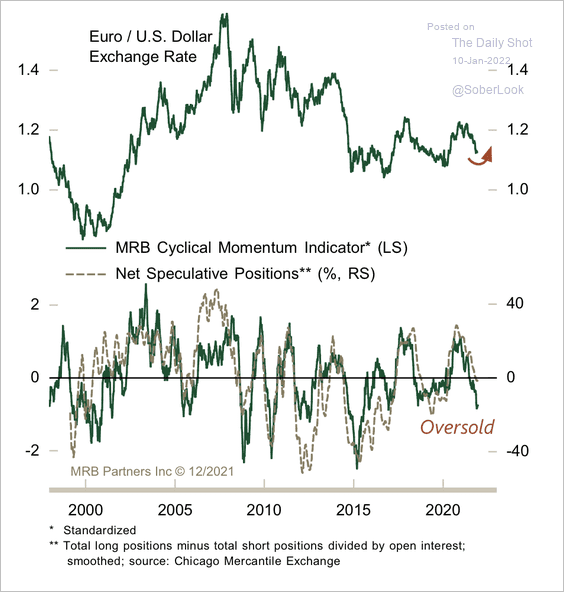

The ongoing upside CPI surprises have become a conundrum for the ECB.

Source: Reuters Read full article

Source: Reuters Read full article

But economists expect inflation to moderate in the months ahead.

——————–

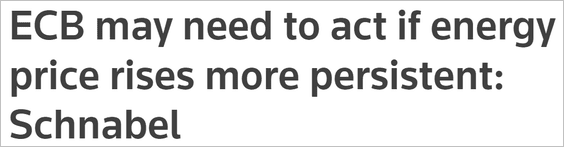

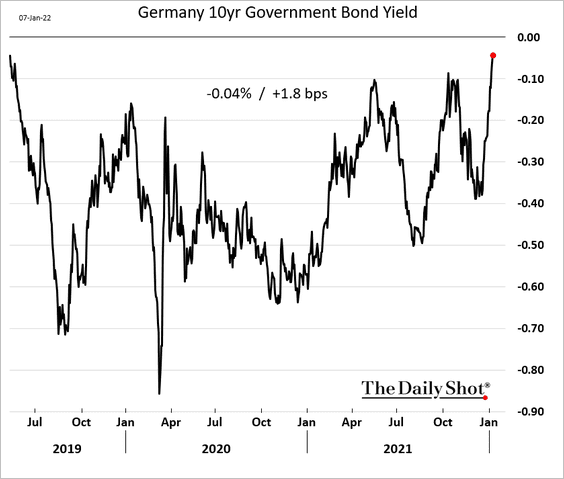

2. Bund yields continue to climb, with the 10yr approaching zero for the first time since mid-2019.

Goldman attributes the recent yield gains to economic growth.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

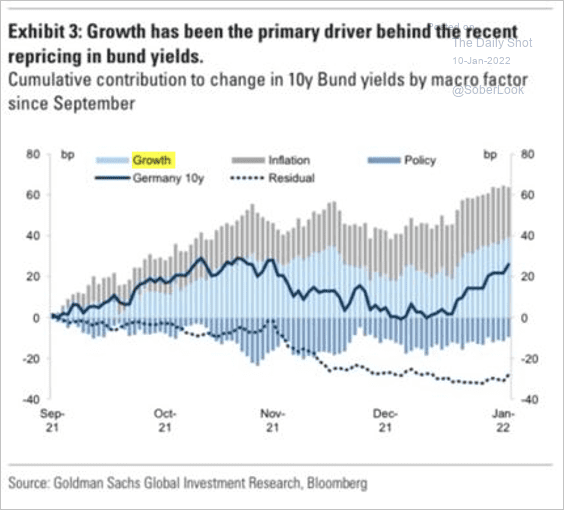

3. The euro appears to be oversold.

Source: MRB Partners

Source: MRB Partners

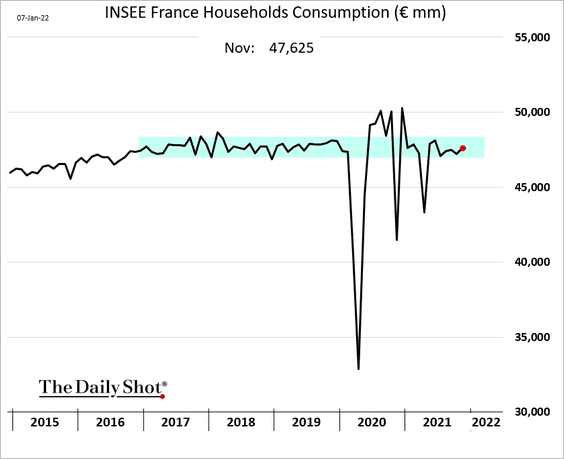

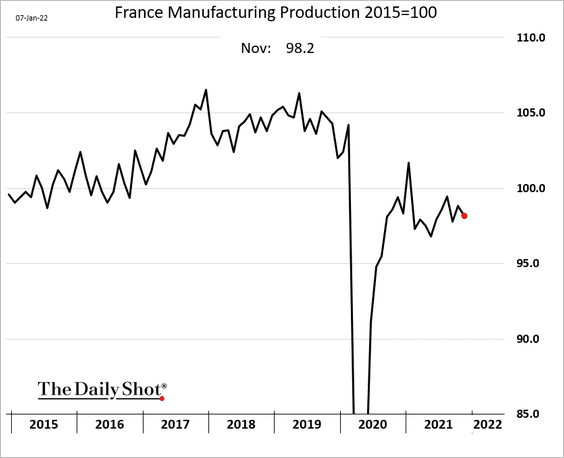

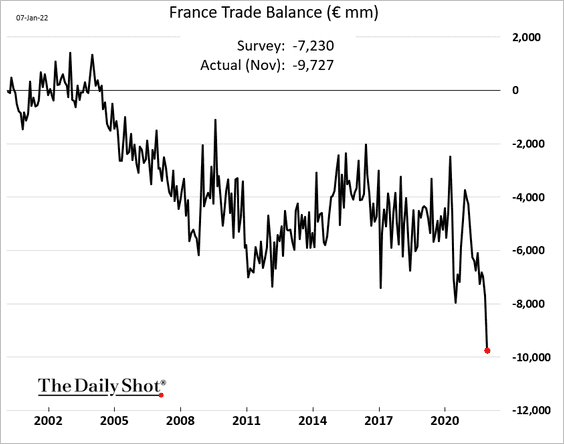

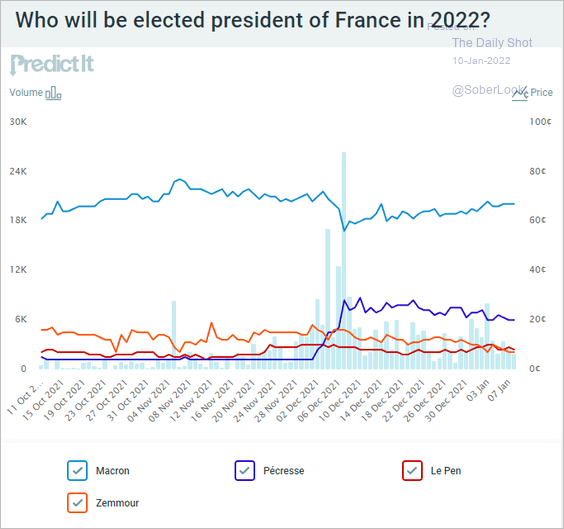

4. Next, we have some updates on France.

• Household consumption (an uptick in November):

• Industrial production:

• The trade balance (record deficit):

Source: Reuters Read full article

Source: Reuters Read full article

• Betting markets’ election odds:

Source: @PredictIt

Source: @PredictIt

——————–

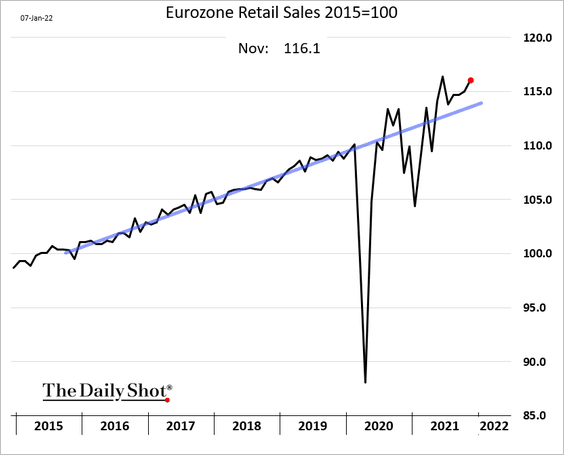

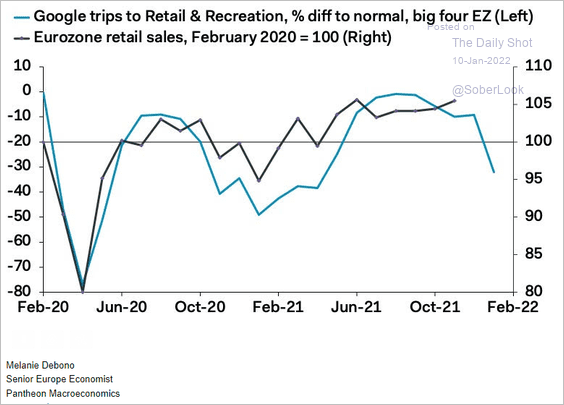

5. Euro-area retail sales climbed further in November.

But omicron poses downside risks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

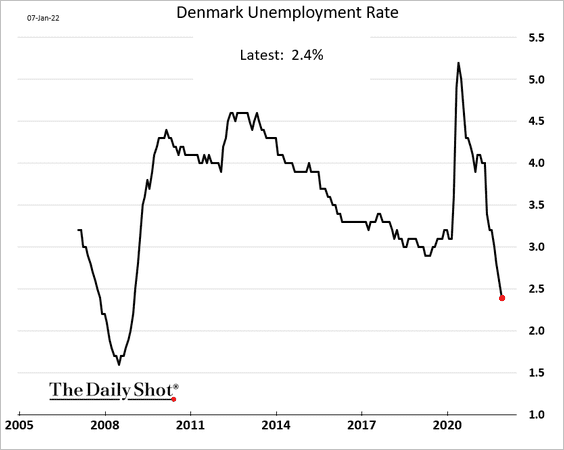

1. Denmark’s unemployment rate hit a multi-year low.

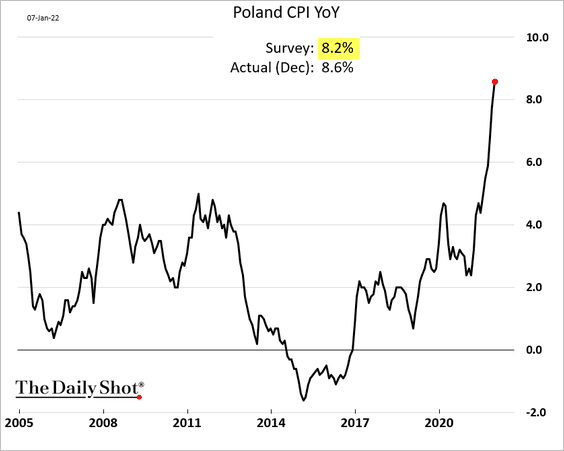

2. Poland’s inflation continues to surprise to the upside.

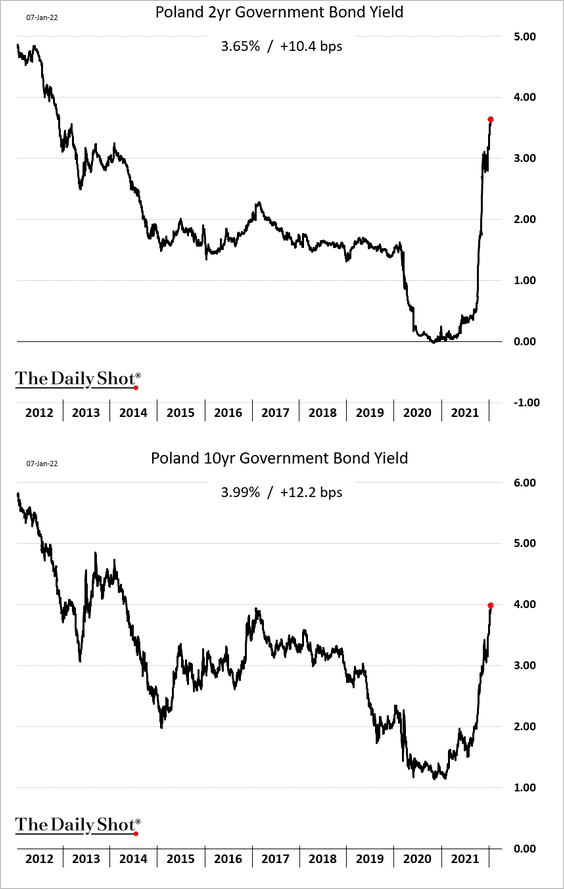

Bond yields are surging.

——————–

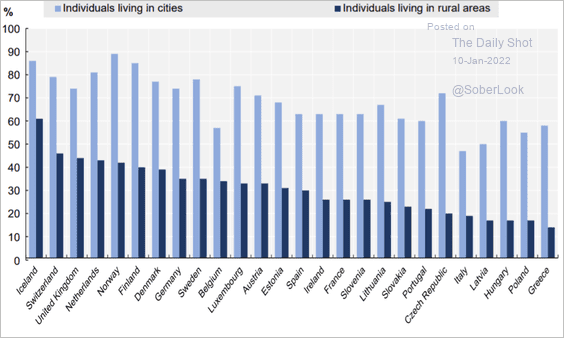

3. Here is the share of individuals living in rural areas vs. cities with “basic” or “above basic” digital skills.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Asia – Pacific

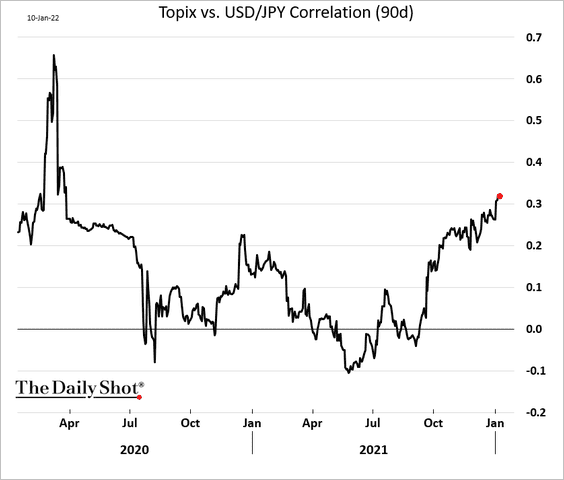

1. Japan’s stock market is once again correlated to dollar-yen (inversely correlated to the yen).

h/t Naoto Hosoda

h/t Naoto Hosoda

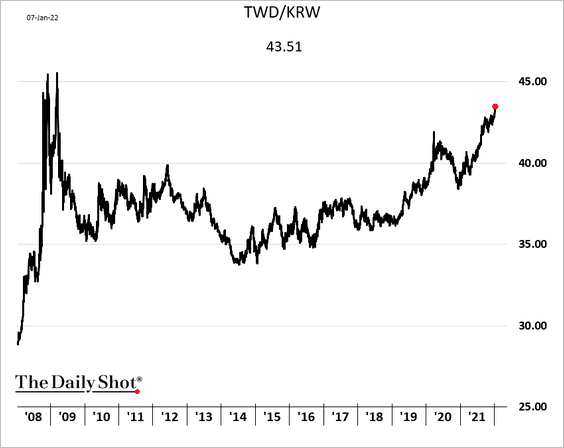

2. The Taiwan dollar hit a multi-year high vs. the South Korean won.

h/t Chester Yung

h/t Chester Yung

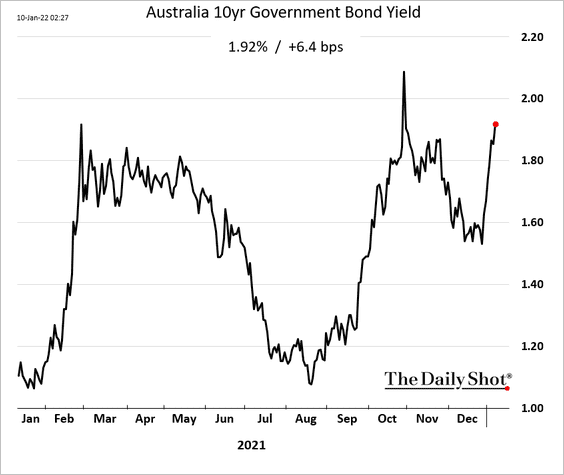

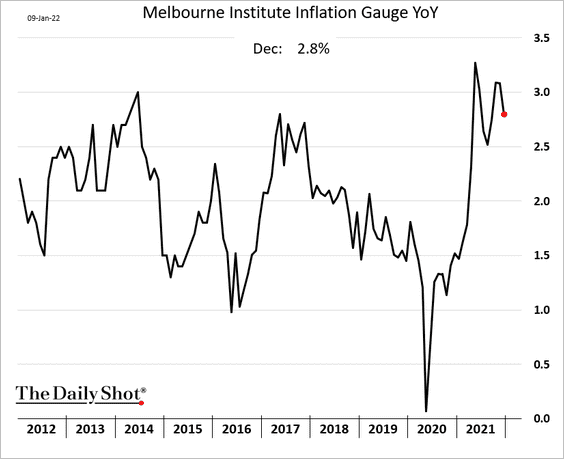

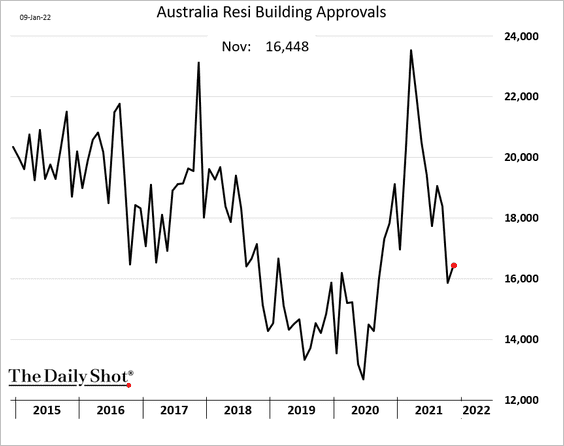

3. Next, we have some updates on Australia.

• The 10yr bond yield:

• Monthly inflation estimate (back below 3%):

• Residential building approvals (an uptick in November):

Back to Index

China

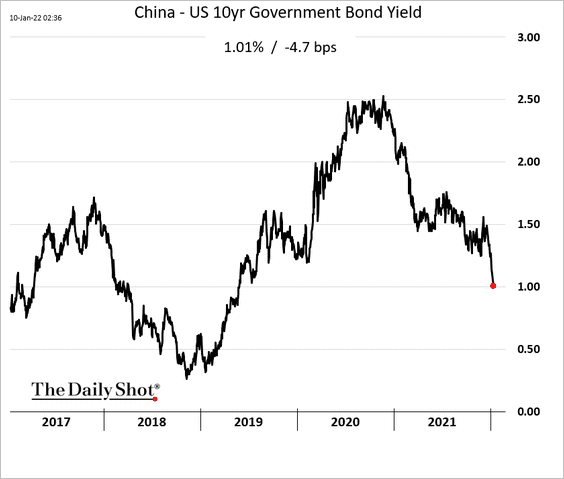

1. The China-US 10yr bond spread continues to tighten, which could become a headwind for the renminbi.

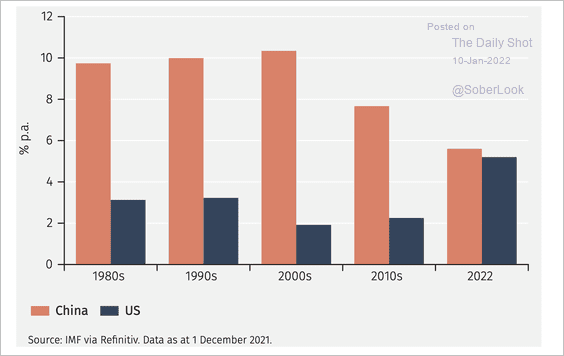

2. For the first time in decades US and China might grow at a similar rate.

Source: EFG International

Source: EFG International

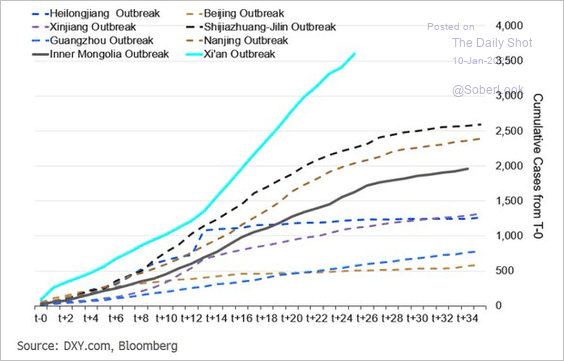

3. Will the omicron spike hit consumption?

Source: @TomOrlik

Source: @TomOrlik

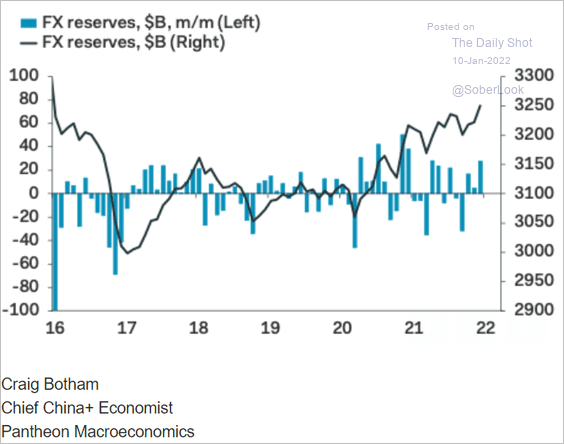

4. FX reserves continue to climb.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

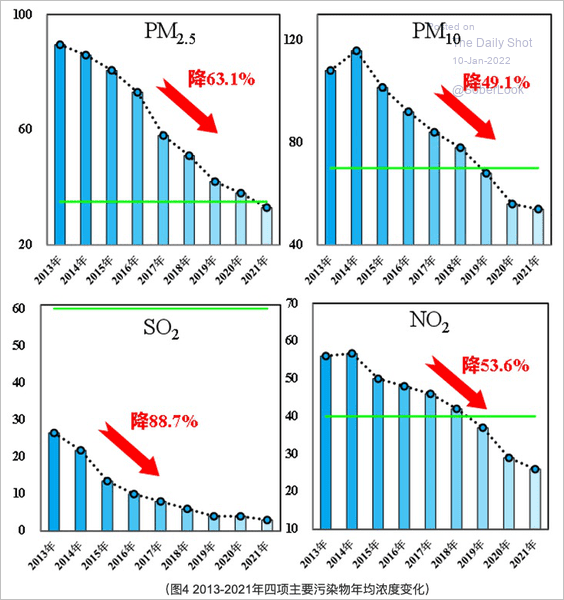

5. Assuming these figures are correct, Beijing has made tremendous progress fighting pollution.

Source: @vancewagner Read full article

Source: @vancewagner Read full article

Back to Index

Emerging Markets

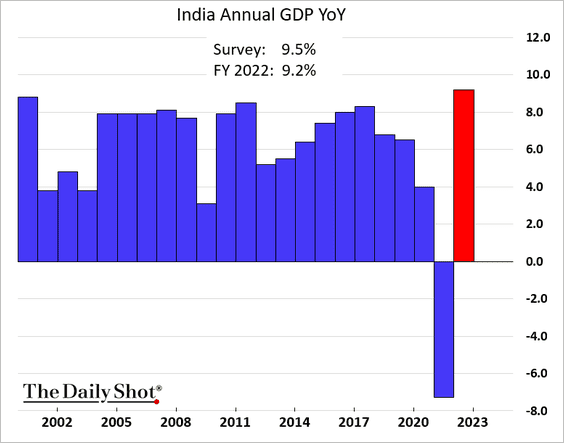

1. India’s GDP rebound came in a bit below forecasts.

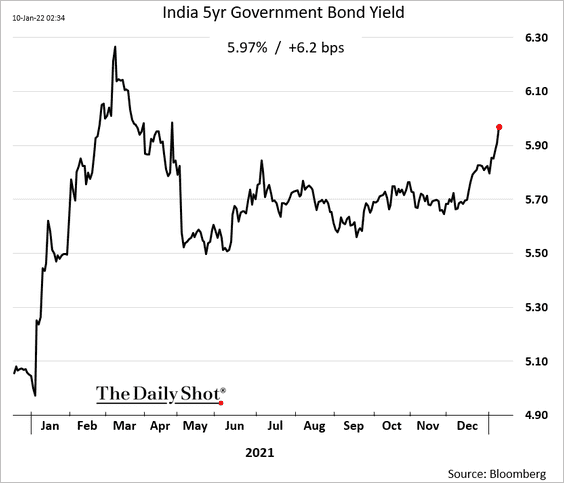

Bond yields are climbing amid lackluster demand (and a failed auction).

——————–

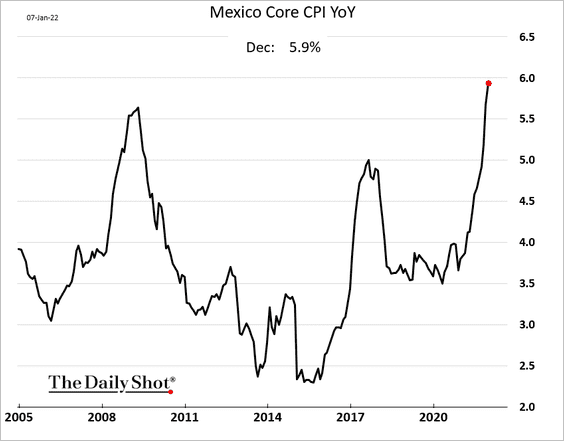

2. Mexican core inflation is nearing 6%.

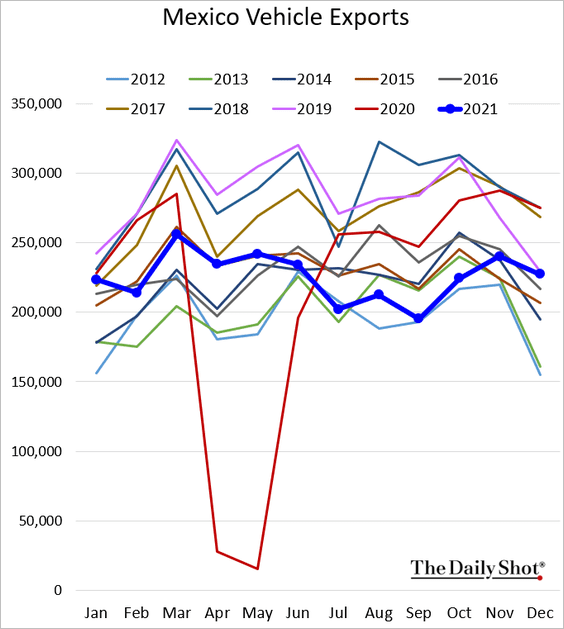

The nation’s vehicle exports seem to be recovering.

——————–

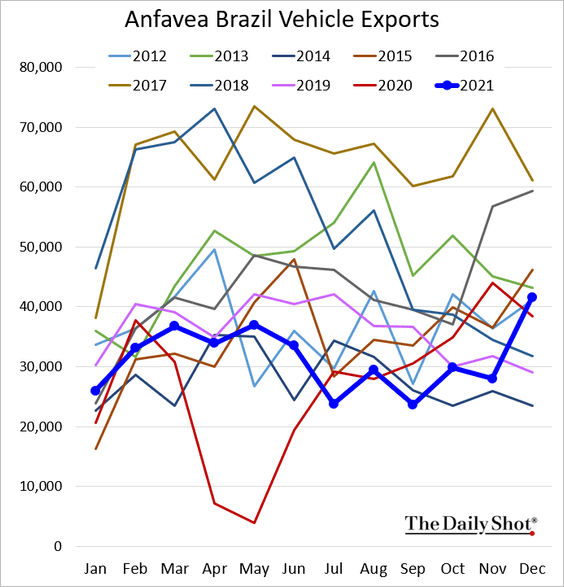

3. Brazil’s car exports are rebounding.

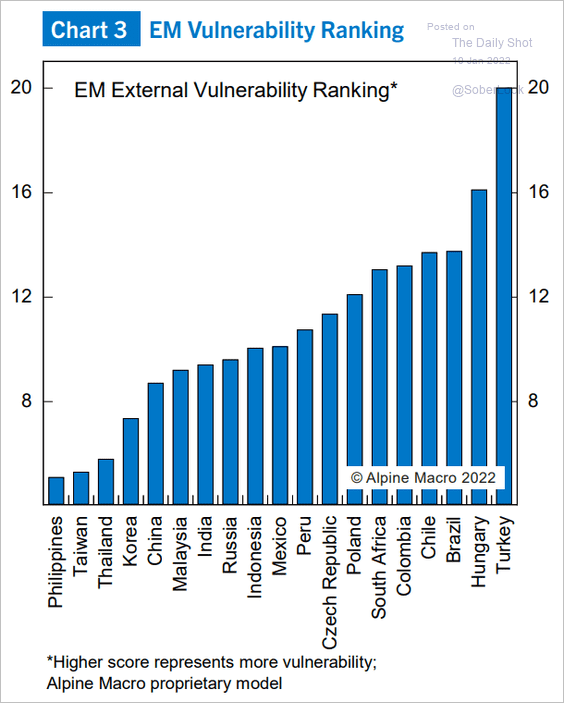

4. This chart shows EM external vulnerability rankings from Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

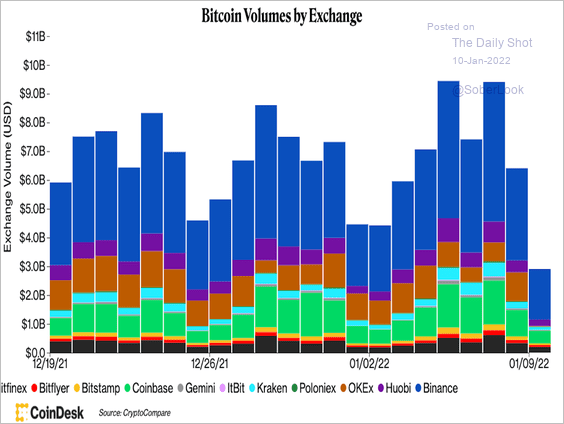

Cryptocurrency

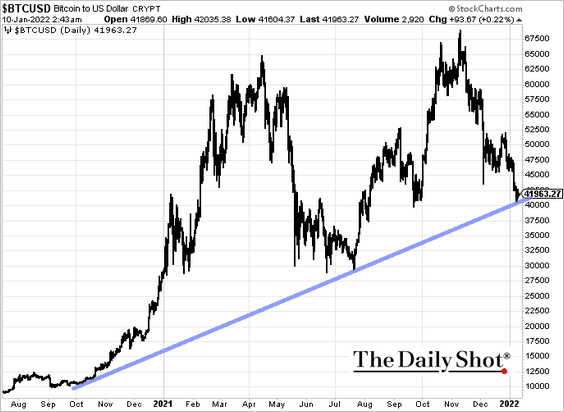

1. Bitcoin is holding support.

Bitcoin’s spot trading volume on Sunday was very low as the sell-off stabilized around the $40K support level.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

2. Leverage in the bitcoin and ether futures market is starting to decline.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

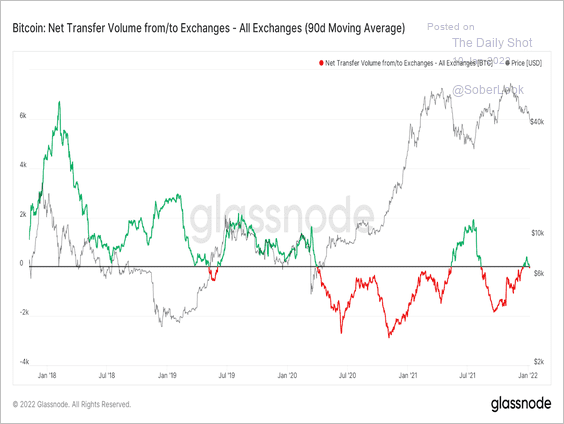

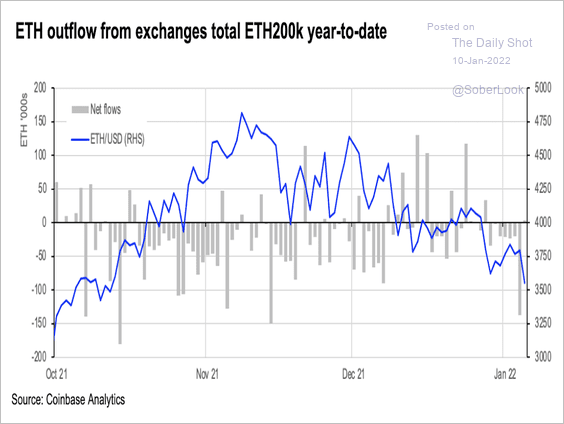

3. The net flow of bitcoin and ether to and from exchanges has trended lower over the past year. Inflows imply investor intention to sell their coins, while consistent outflows could represent strong holding sentiment (2 charts).

Source: @glassnode

Source: @glassnode

Source: @CoinbaseInsto

Source: @CoinbaseInsto

——————–

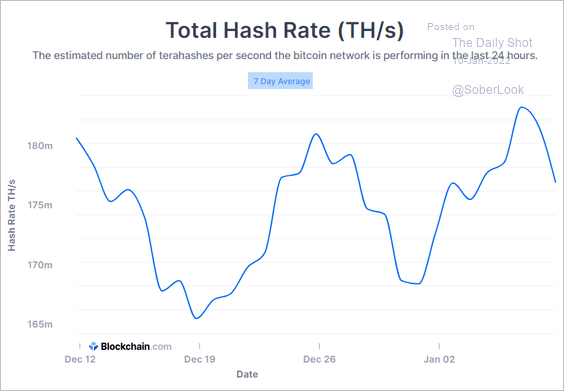

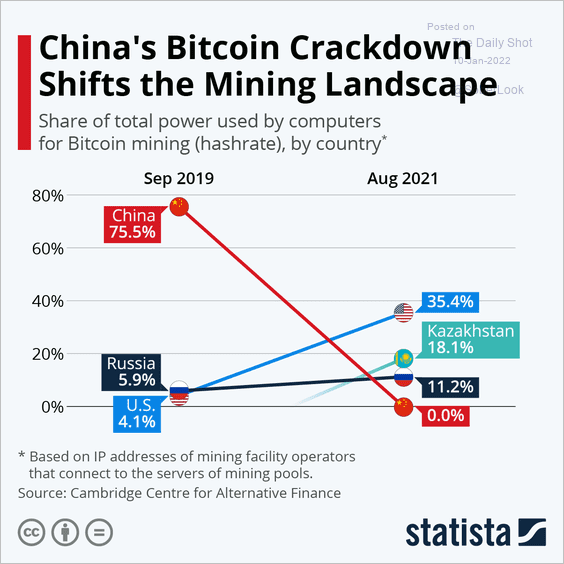

4. The Kazakhstan unrest impacted the bitcoin hashrate.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Blockchain.com

Source: Blockchain.com

Source: Statista

Source: Statista

——————–

5. A PayPal stablecoin?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

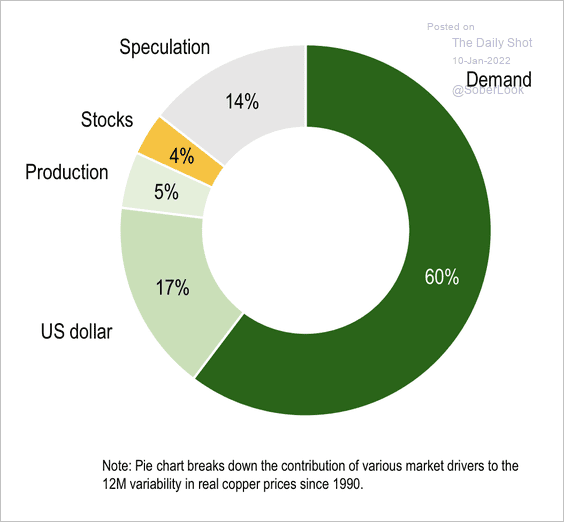

1. Demand factors dominate copper’s pricing outlook.

Source: Numera Analytics

Source: Numera Analytics

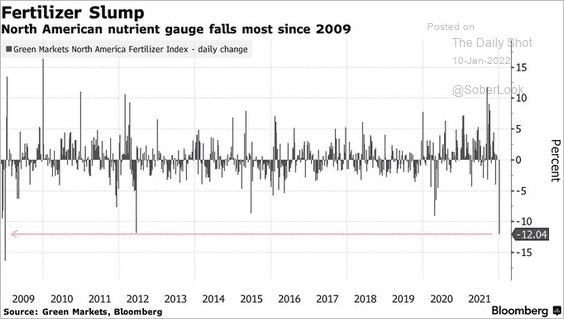

2. Fertilizer prices saw a sharp pullback.

Source: @C_Barraud Read full article

Source: @C_Barraud Read full article

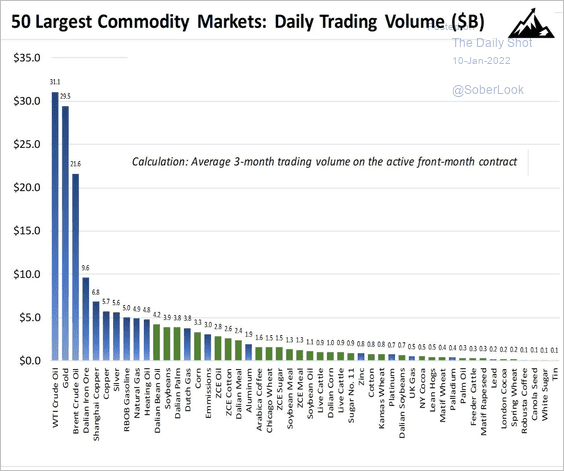

3. This chart shows trading volumes across major commodity markets.

Source: Peak Trading Research

Source: Peak Trading Research

Back to Index

Energy

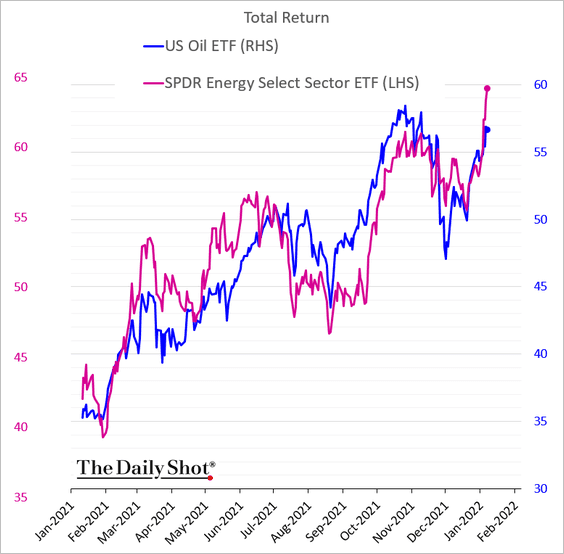

1. Energy shares have been outpacing oil prices recently.

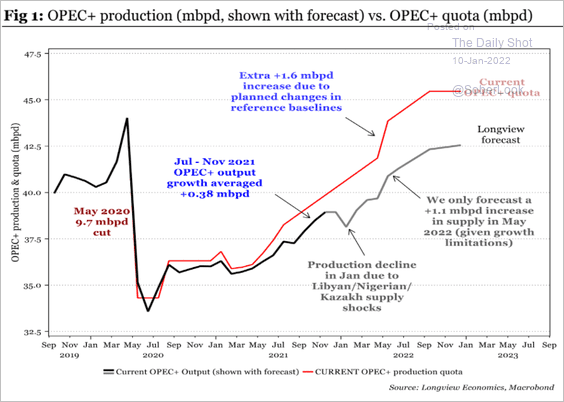

2. OPEC’s output is unlikely to keep up with its quota increases.

Source: Longview Economics

Source: Longview Economics

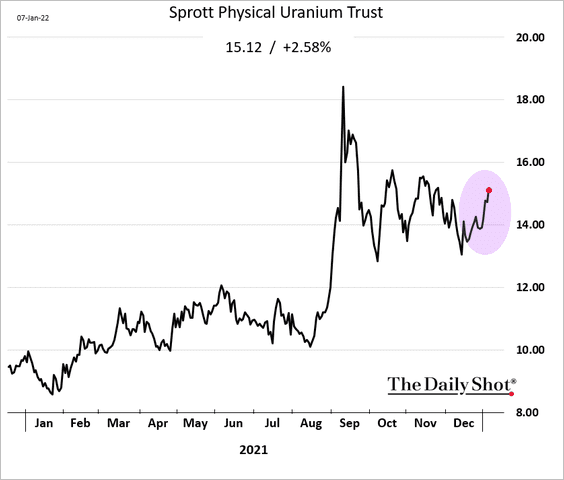

3. Uranium prices are higher amid the Kazakhstan uncertainty.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

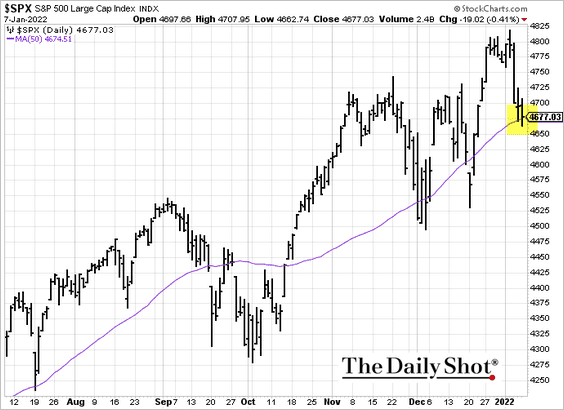

1. The S&P 500 is holding support at the 50-day moving average.

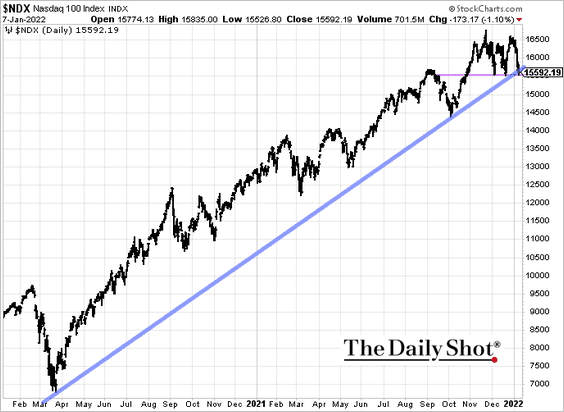

The Nasdaq 100 is also at support.

——————–

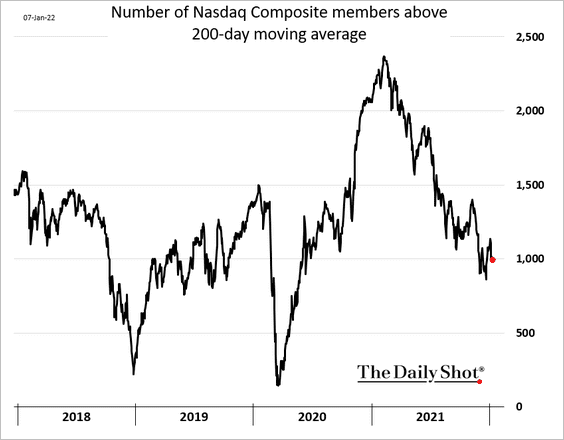

2. The Nasdaq Composite breadth has been deteriorating.

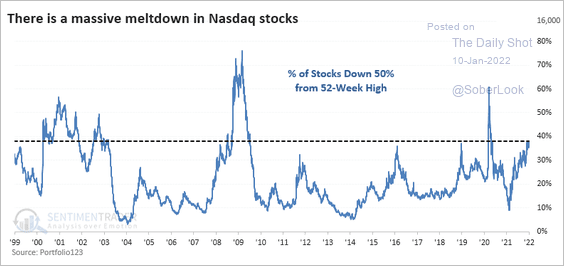

After last week’s sell-off, more than 38% of Nasdaq stocks were down 50% from their 52-week highs.

Source: SentimenTrader

Source: SentimenTrader

——————–

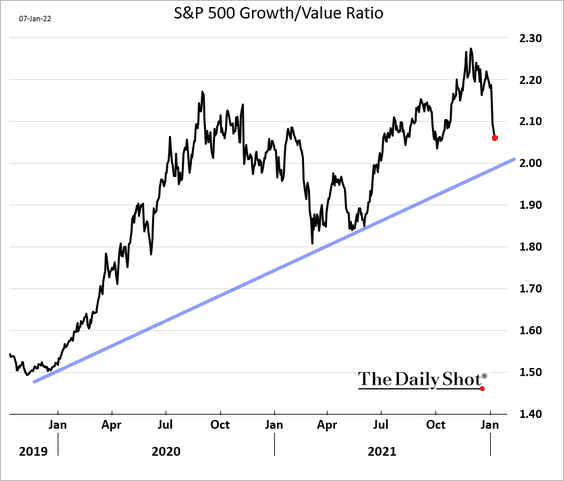

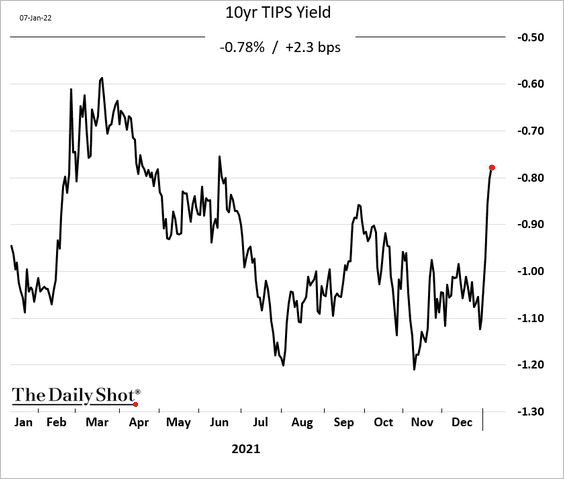

3. The growth-value rotation has more room to run, …

… especially if real yields climb further (2 charts).

——————–

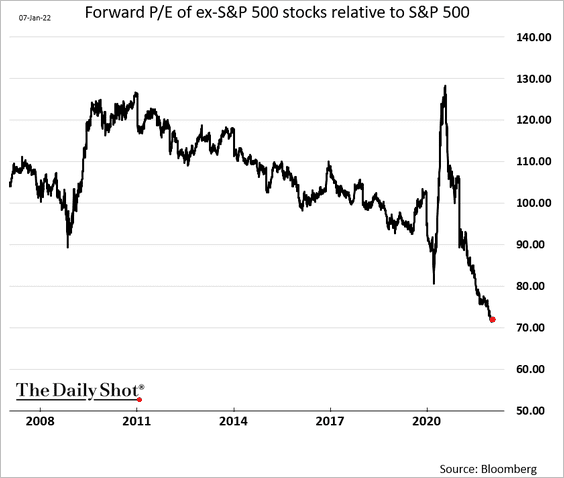

4. US stocks outside of the S&P 500 look exceptionally cheap relative to the S&P 500.

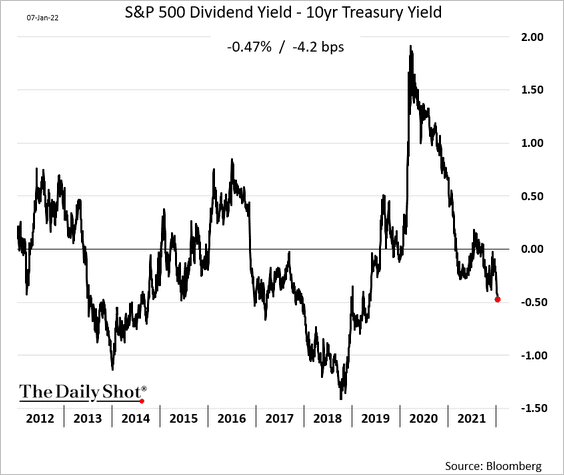

5. The S&P 500 dividend yield spread to the 10yr Treasury is now firmly in negative territory.

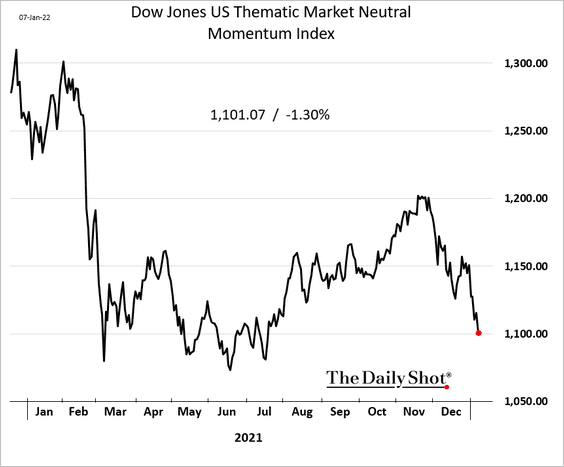

6. Momentum stocks continue to underperform.

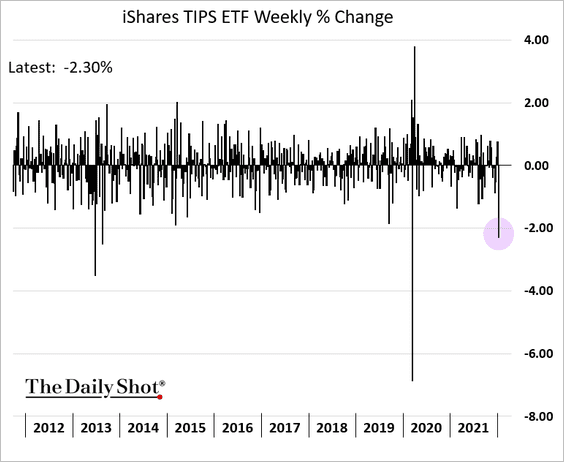

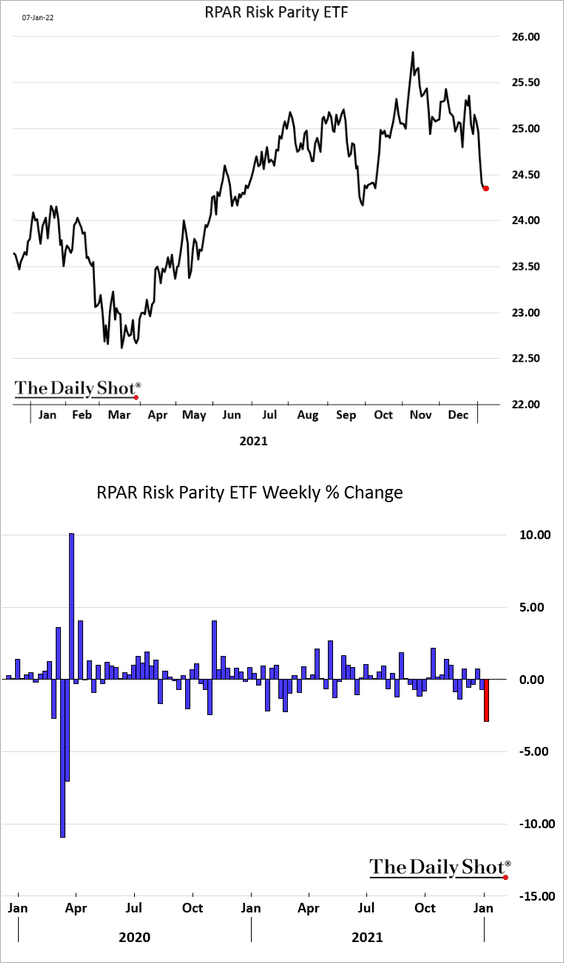

7. It was a tough week for risk parity strategies.

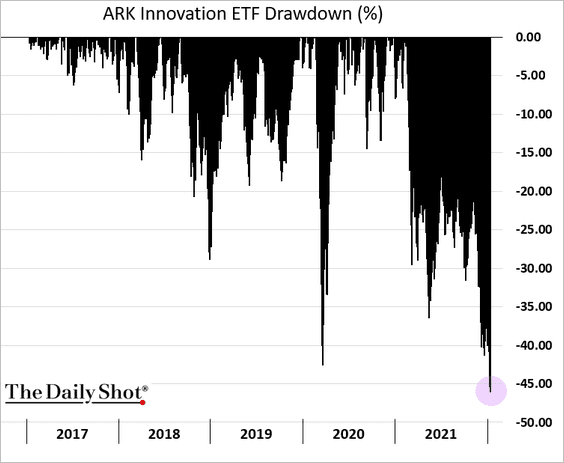

8. The ARK Innovation ETF drawdown exceeded 45%.

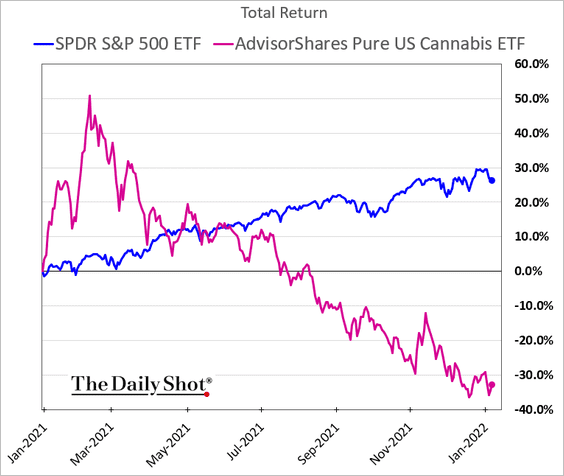

9. It’s been a rough year for cannabis stocks.

h/t MarketDesk Research

h/t MarketDesk Research

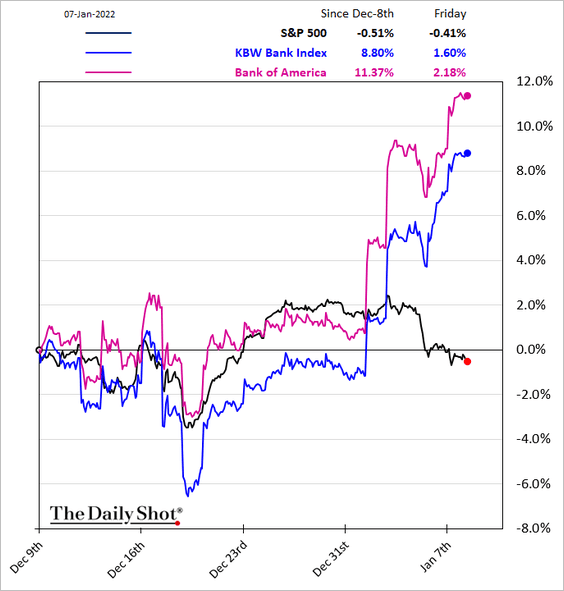

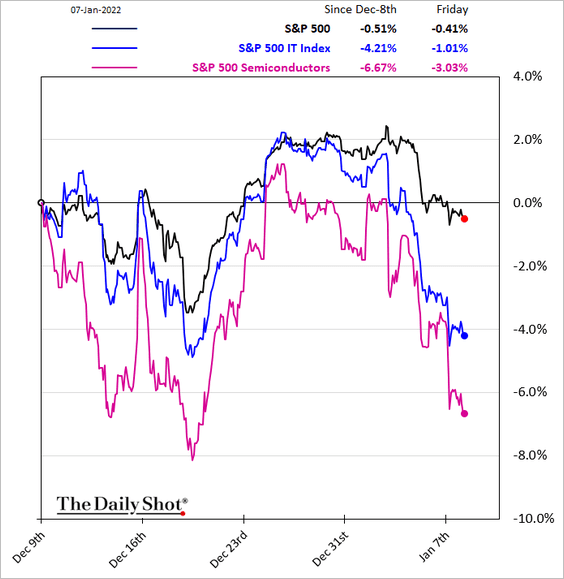

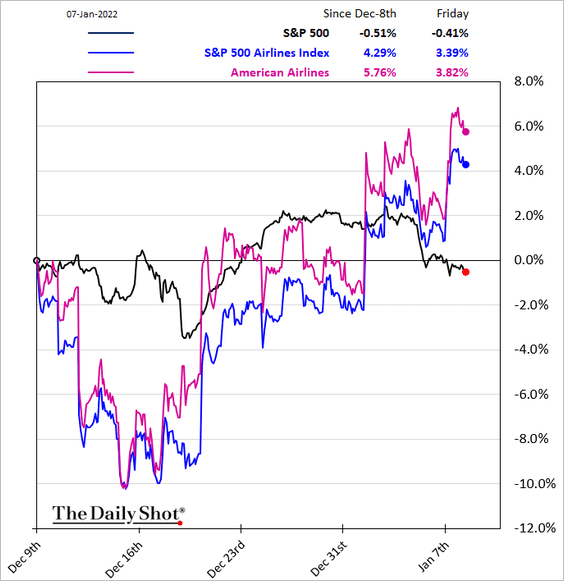

10. Finally, we have three sector trends over the past month.

• Banks:

• Tech and semiconductors:

• Airlines:

Back to Index

Rates

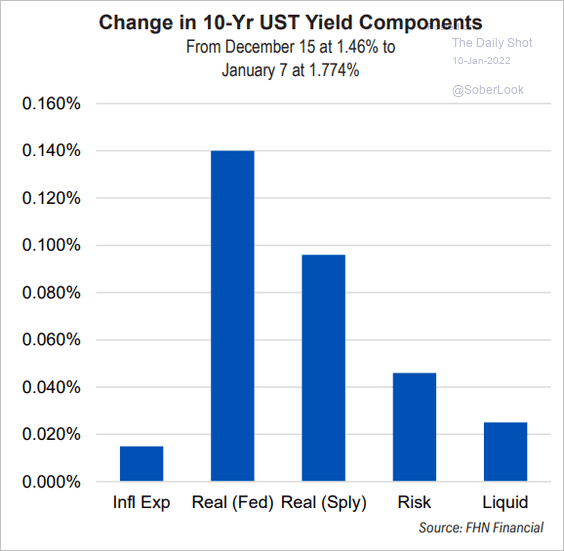

1. What factors drove the recent gains in the 10yr Treasury yield?

Source: FHN Financial

Source: FHN Financial

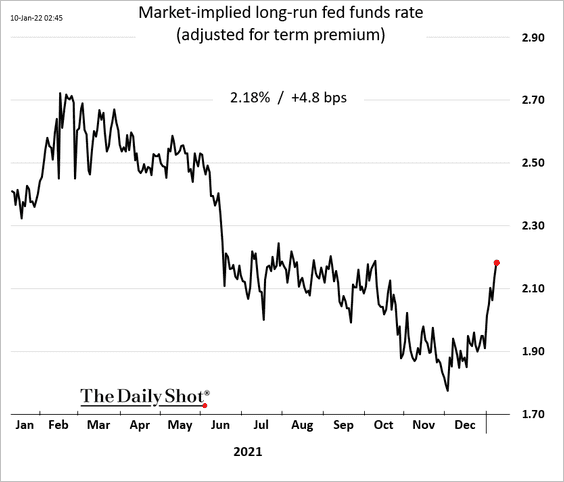

2. The market expectations for the fed funds rate over the long run have rebounded.

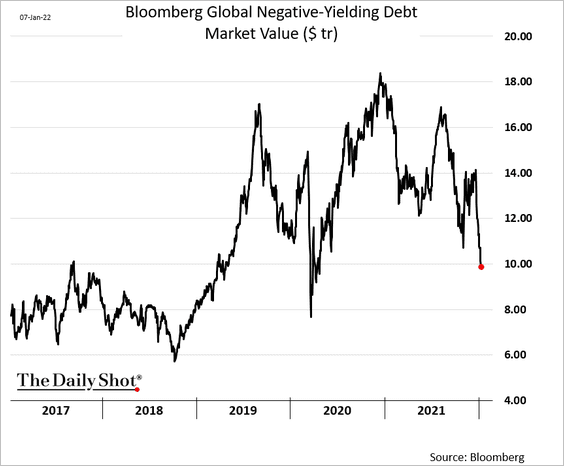

3. Global negative-yielding debt levels are falling.

——————–

Food for Thought

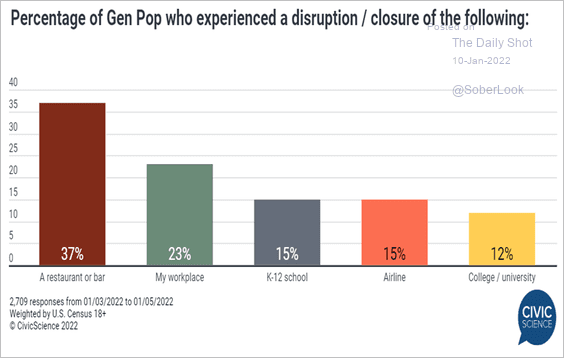

1. Omicron-related disruptions:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

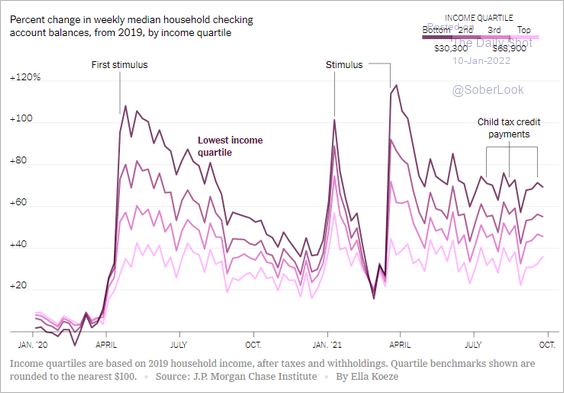

2. US checking account balances since the start of the pandemic, by income quartile:

Source: The New York Times Read full article

Source: The New York Times Read full article

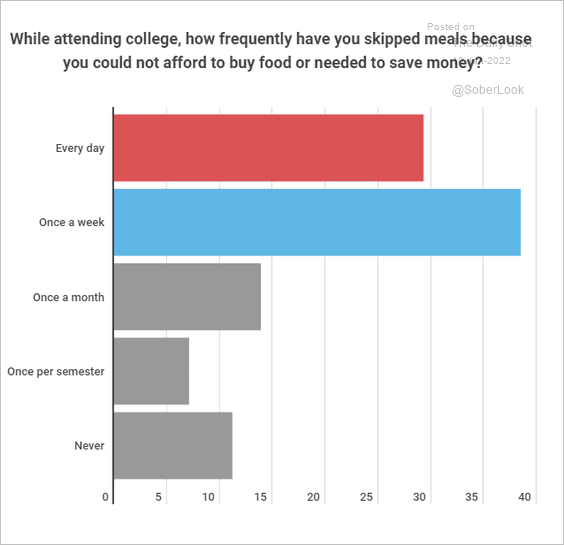

3. Skipping meals while in college:

Source: Intelligent.com Read full article

Source: Intelligent.com Read full article

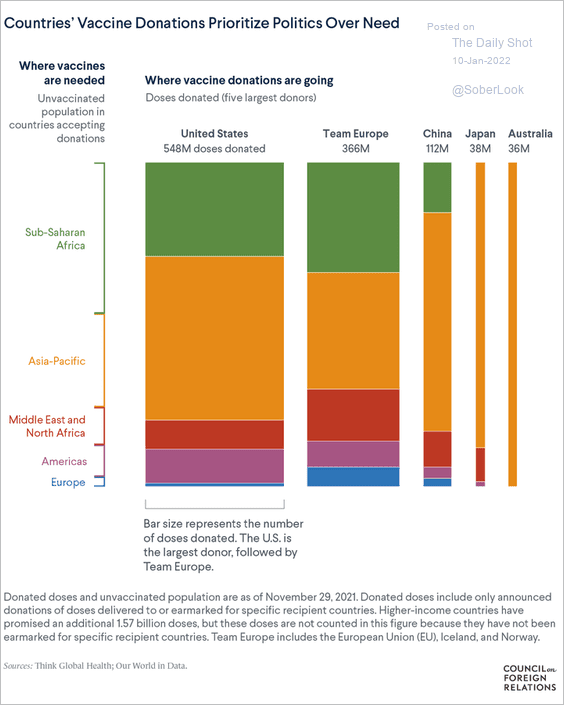

4. Vaccine donations:

Source: @TomBollyky Read full article

Source: @TomBollyky Read full article

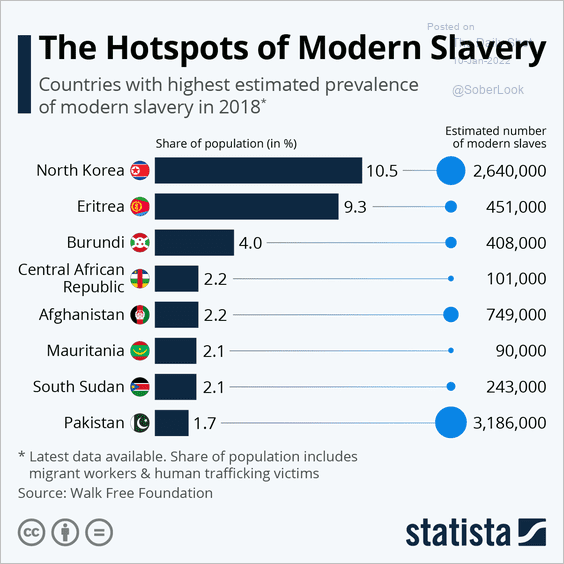

5. Prevalence of modern slavery:

Source: Statista

Source: Statista

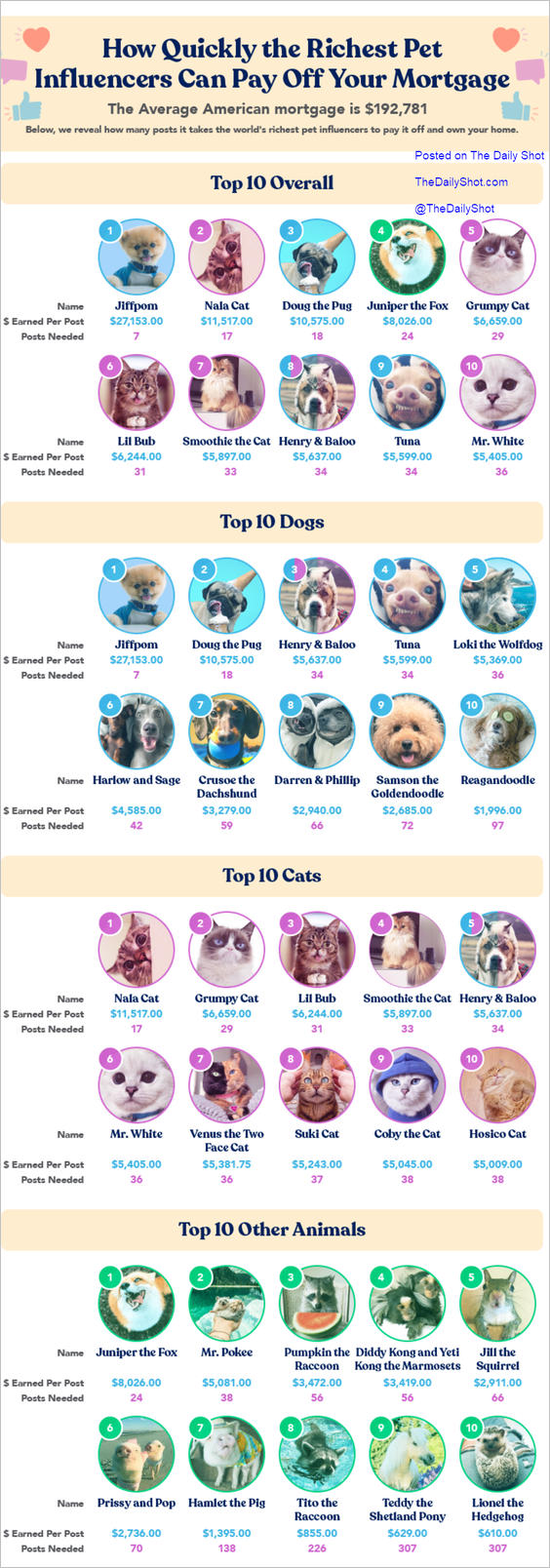

6. Richest pet influencers:

——————–

Back to Index