The Daily Shot: 03-Feb-22

• The United States

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

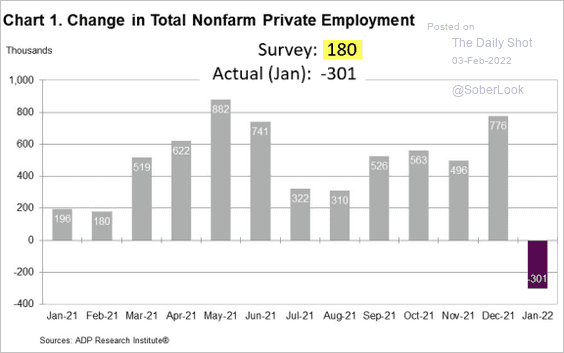

1. The January ADP report was ugly, showing a loss of 300k private-sector payrolls. What happened? At least 20 million Americans were infected with omicron in January. Many couldn’t come to work, with some not getting paid – which reduced the number of people counted as employed.

Source: ADP Research Institute

Source: ADP Research Institute

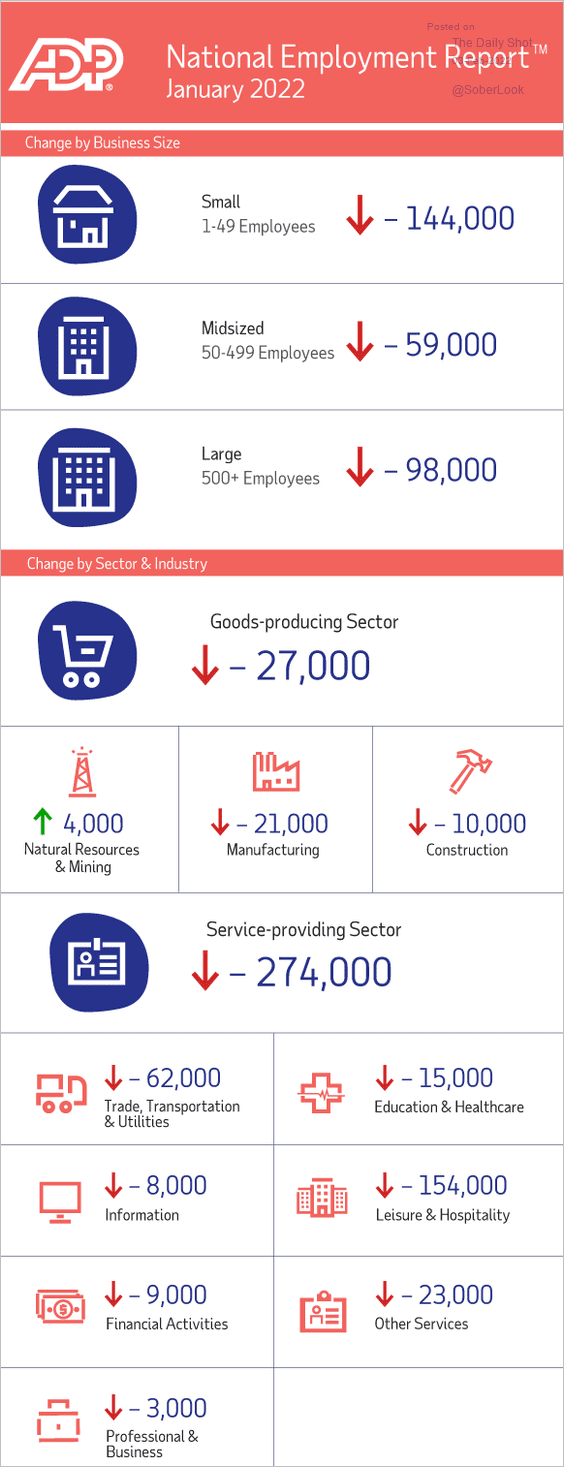

Job losses were broad.

Source: ADP Research Institute

Source: ADP Research Institute

The market expects the official figures to show a gain of 100k in private payrolls this Friday, but there is quite a bit of uncertainty around that figure.

——————–

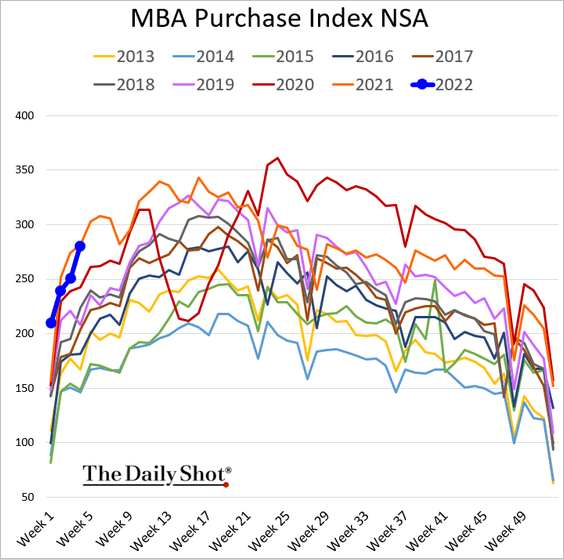

2. Mortgage applications remain very strong despite higher rates.

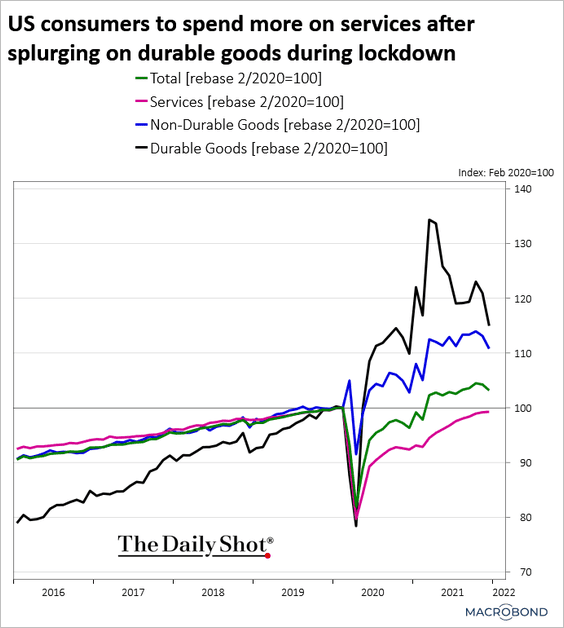

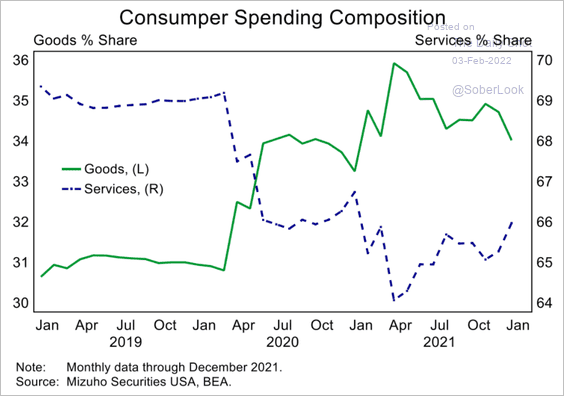

3. Is consumer spending shifting toward services?

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

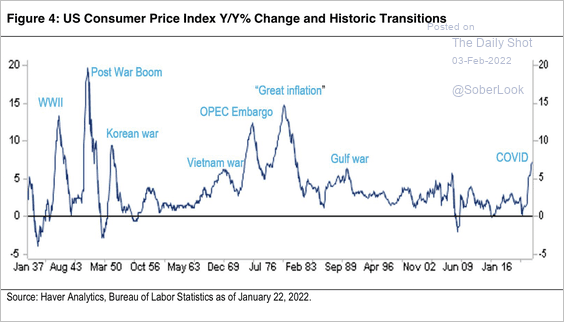

4. Next, we have some inflation trends.

• Here is a look at inflation spikes across historical events.

Source: Citi Private Bank

Source: Citi Private Bank

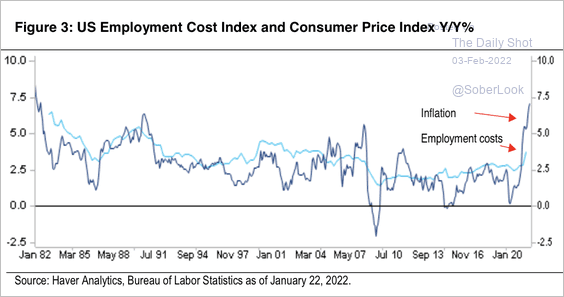

• Inflation has been outpacing the employment cost index.

Source: Citi Private Bank

Source: Citi Private Bank

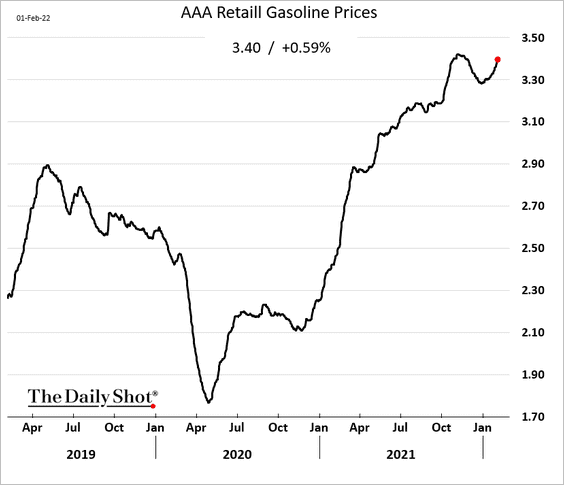

• Gasoline prices are nearing multi-year highs again, which is pressuring consumer sentiment.

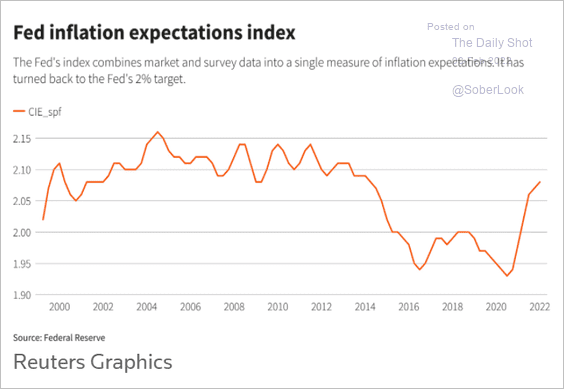

• Below is the Fed’s measure of inflation expectations, which will influence the central bank’s policy decisions as tightening takes shape.

Source: Reuters Read full article

Source: Reuters Read full article

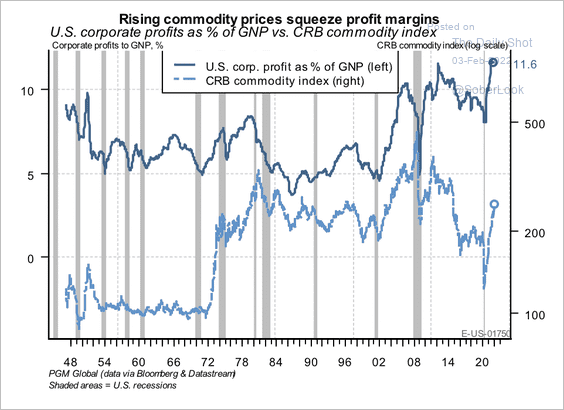

• The rise in corporate profits suggests input costs pressures are being passed through to consumers.

Source: PGM Global

Source: PGM Global

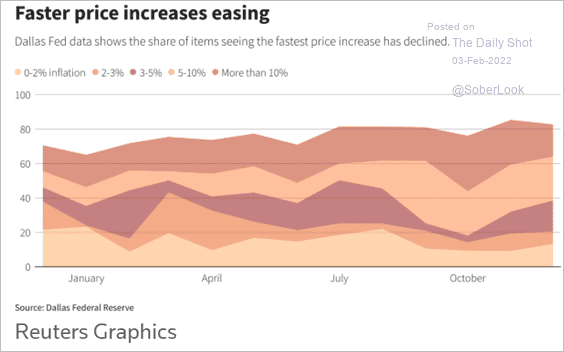

• This chart shows the number of CPI items for each range of price increases.

Source: Reuters Read full article

Source: Reuters Read full article

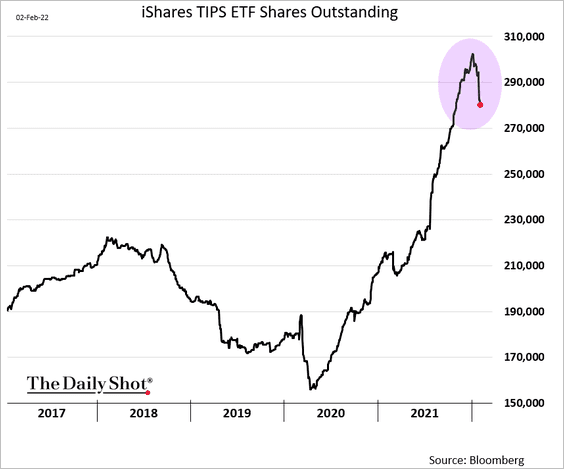

• The reversal in fund flows to Treasury Inflation-Protected Securities (TIPS) suggests that inflation is peaking.

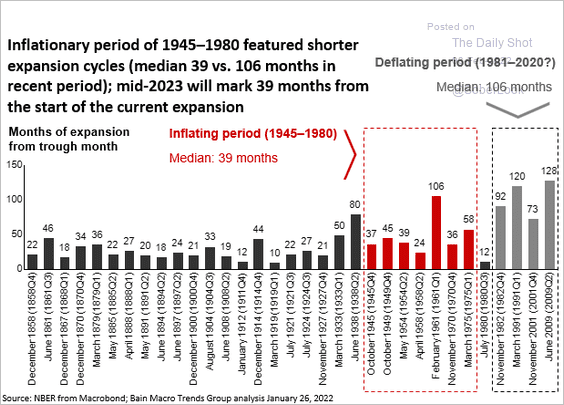

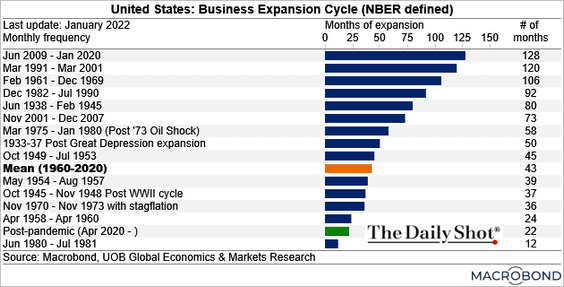

5. Does higher inflation mean a shorter expansion cycle this time?

Source: Bain & Company

Source: Bain & Company

• Most economists see the current cycle continuing for a while.

Source: Chart and data provided by Macrobond Read full article

Source: Chart and data provided by Macrobond Read full article

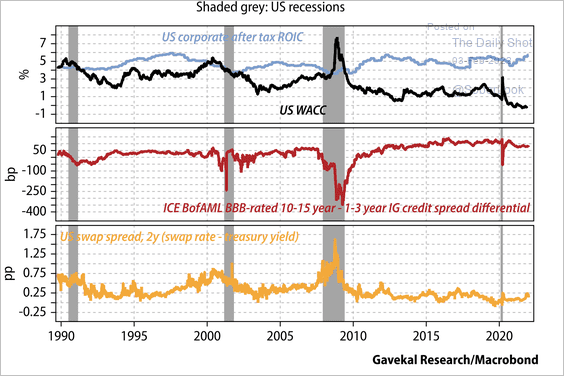

• The risk of recession remains low based on these measures.

Source: Gavekal Research

Source: Gavekal Research

——————–

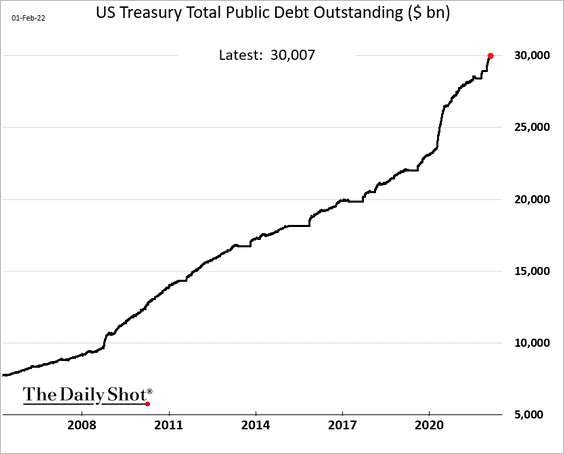

6. The federal debt has exceeded $30 trillion.

Back to Index

The Eurozone

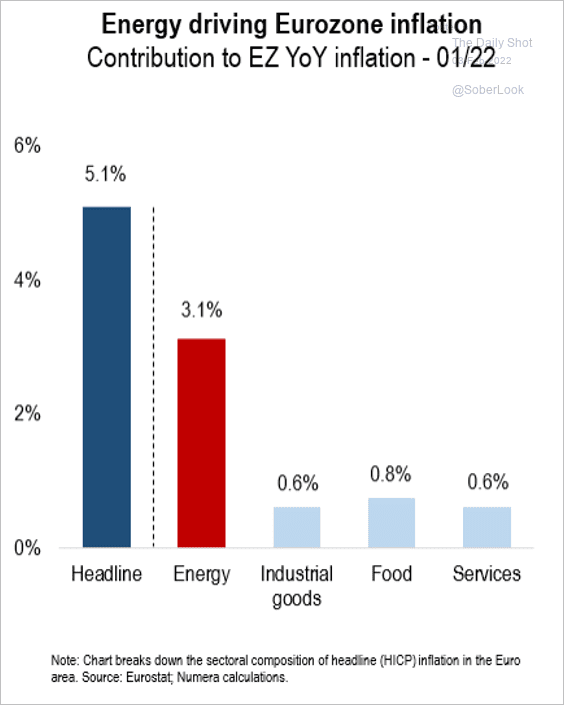

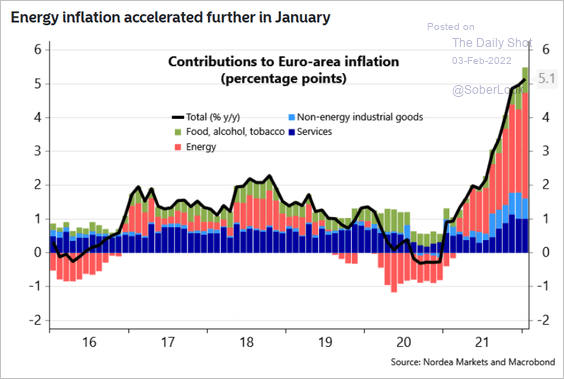

1. The euro-area inflation report was a shocker, with the CPI climbing above 5% for the first time. Energy was the biggest driver of inflation, but the core CPI (2nd panel) surprised to the upside as well.

Source: Numera Analytics

Source: Numera Analytics

Source: Nordea Markets

Source: Nordea Markets

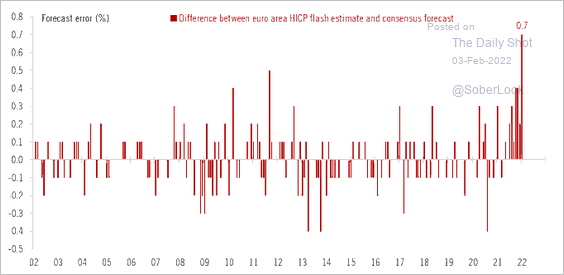

This was the highest upside CPI surprise on record.

Source: @fwred

Source: @fwred

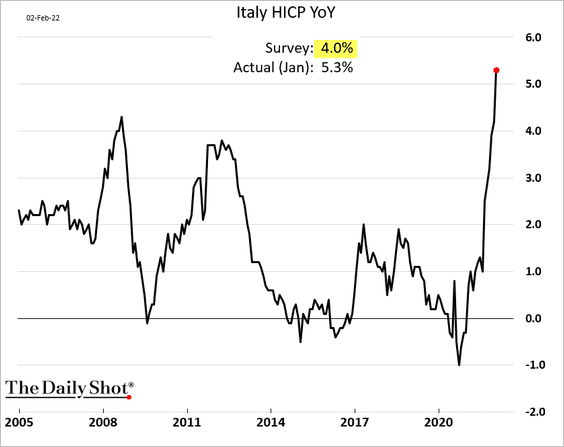

Italy’s inflation hit the highest level in decades.

——————–

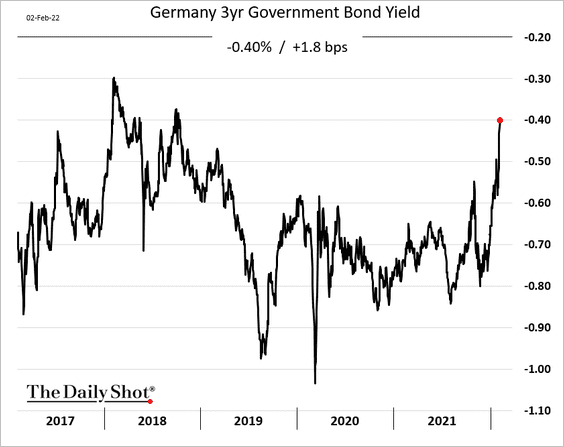

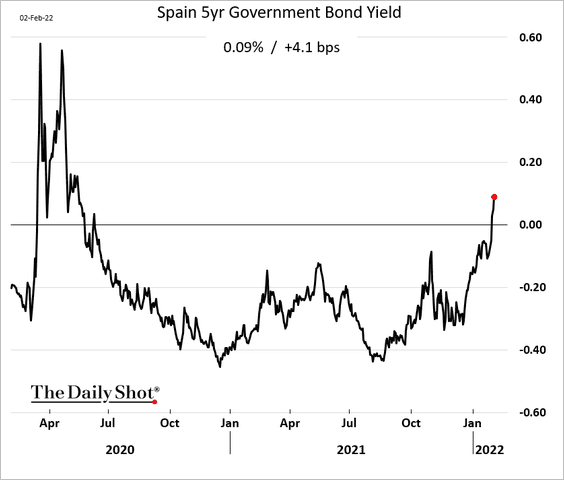

2. Bond yields continue to rise as the market prepares for the ECB to shift to a less dovish posture.

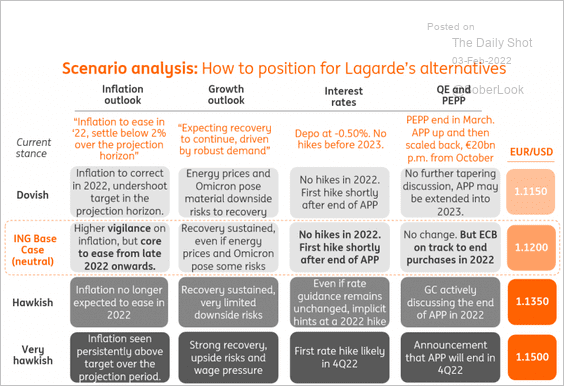

• Here are some potential scenarios for the ECB’s direction and their impact on the euro.

Source: ING

Source: ING

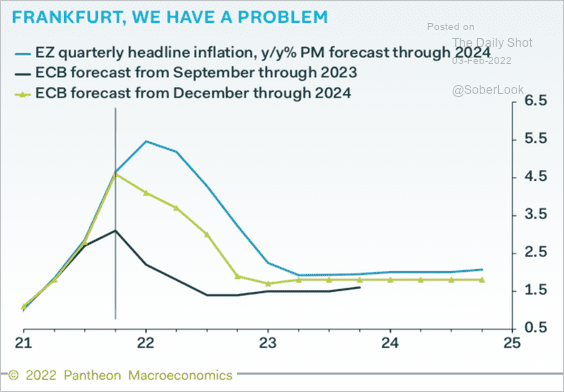

• The ECB will be forced to adjust its inflation projections much higher. Here is a forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

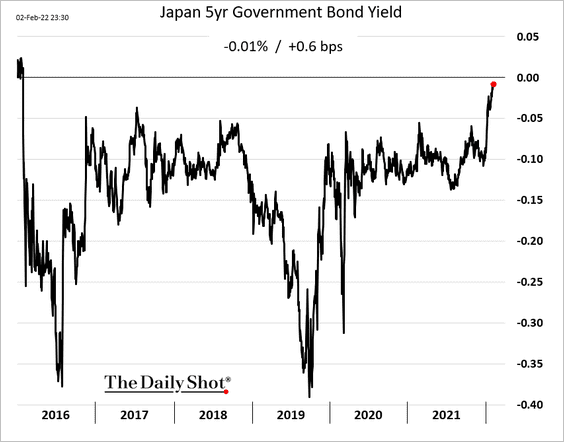

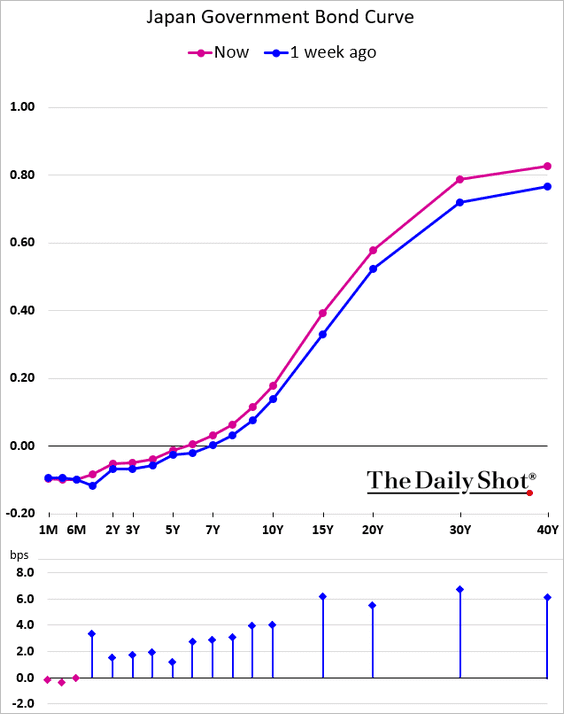

1. The 5yr JGB is approaching zero for the first time in seven years.

The curve has been steepening.

——————–

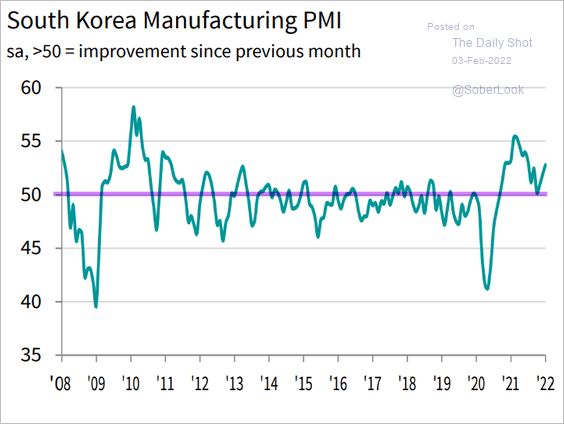

2. South Korean manufacturing shifted back into growth mode last month.

Source: IHS Markit

Source: IHS Markit

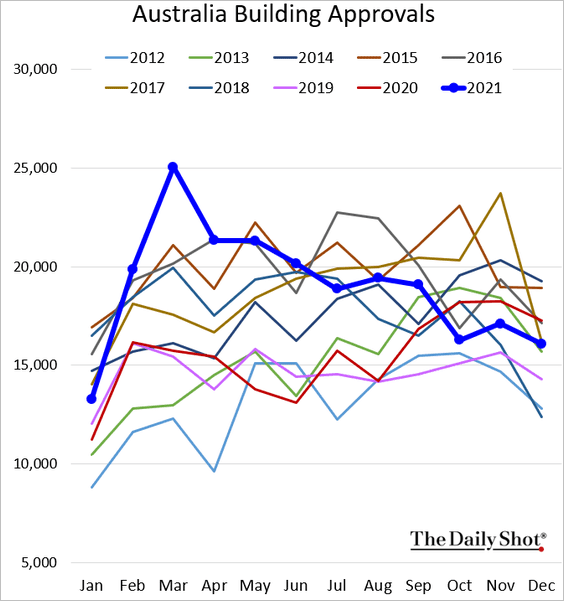

3. Australian building approvals were better than expected in December.

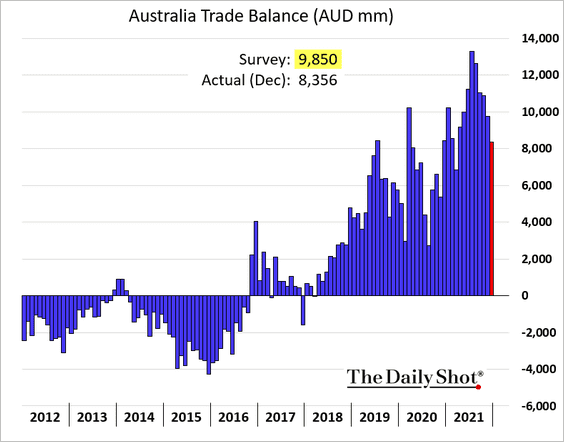

The nation’s trade surplus declined again at the end of the year.

Back to Index

China

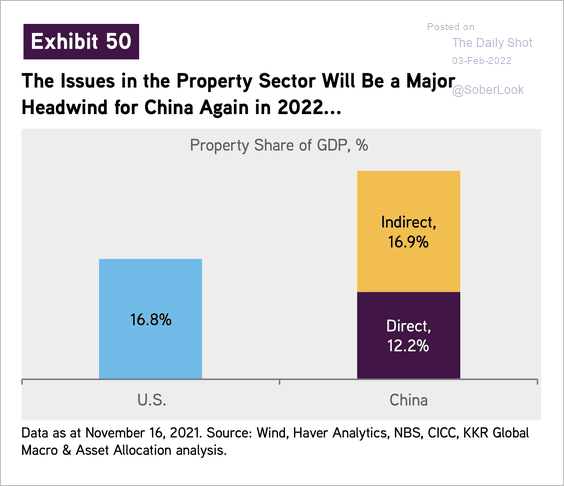

1. China is very dependent on its property sector – both directly and indirectly.

Source: KKR

Source: KKR

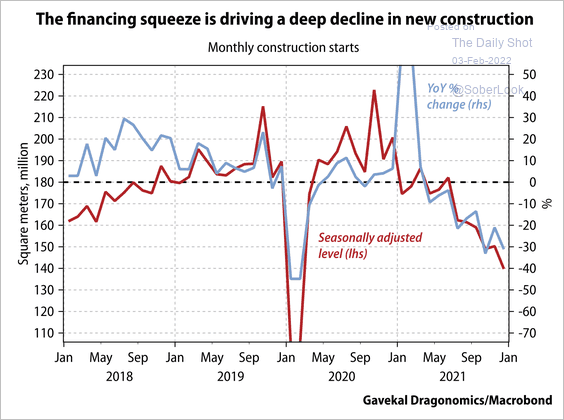

Construction activity has been soft.

Source: Gavekal Research

Source: Gavekal Research

——————–

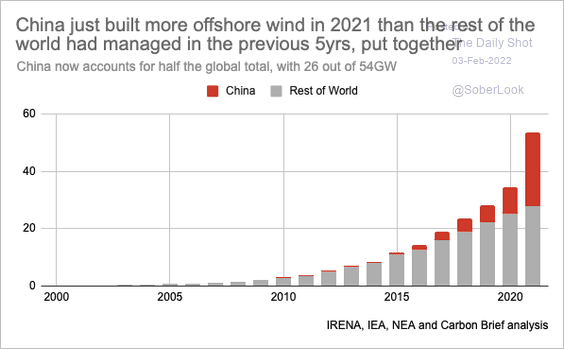

2. China accelerated the construction of offshore wind turbines last year.

Source: @DrSimEvans

Source: @DrSimEvans

Back to Index

Emerging Markets

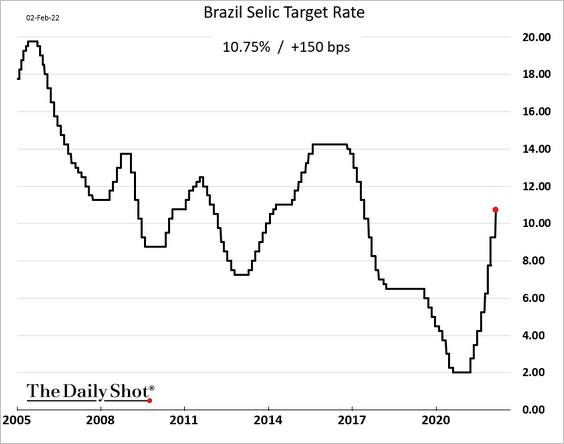

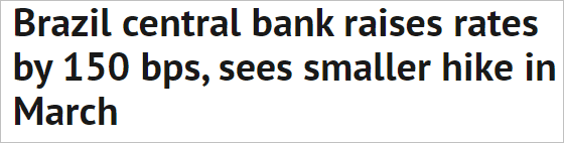

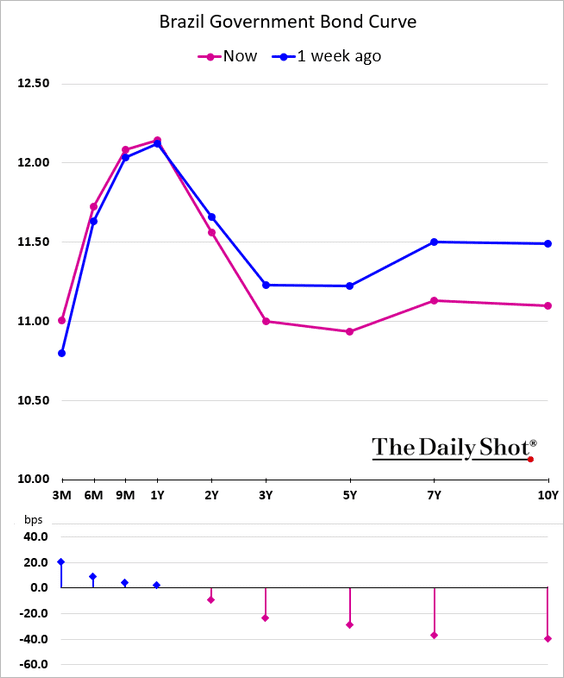

1. Let’s begin with Brazil.

• The central bank hiked rates by 150 bps again but going forward, the increases are likely to be smaller.

Source: Financial Post Read full article

Source: Financial Post Read full article

• The yield curve inverted further.

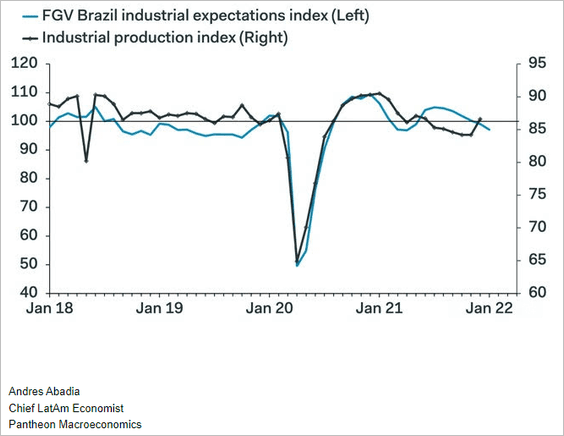

• Industrial production jumped in December, but indicators (including the PMI report) suggest that activity deteriorated in January.

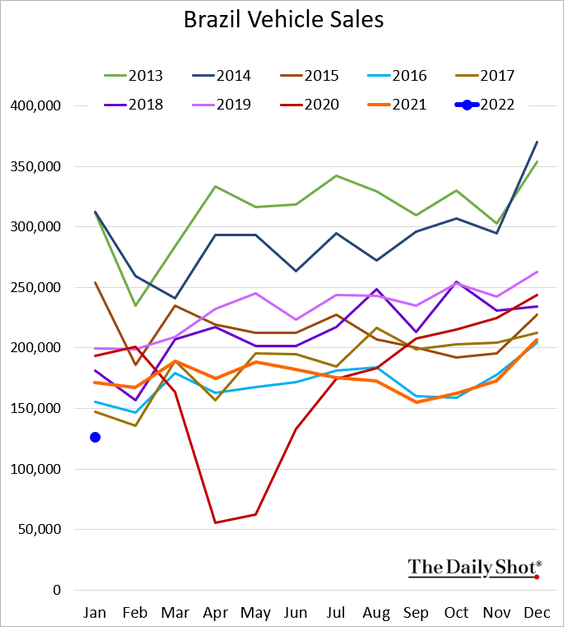

• Vehicle sales were terrible in January.

——————–

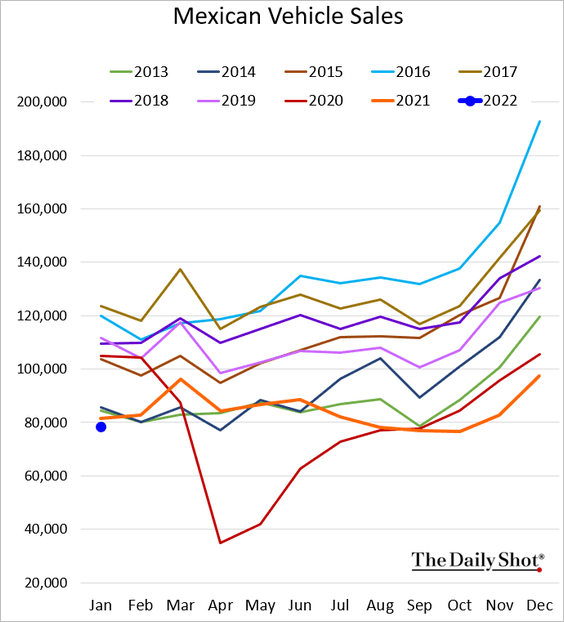

3. Mexican auto sales were soft as well.

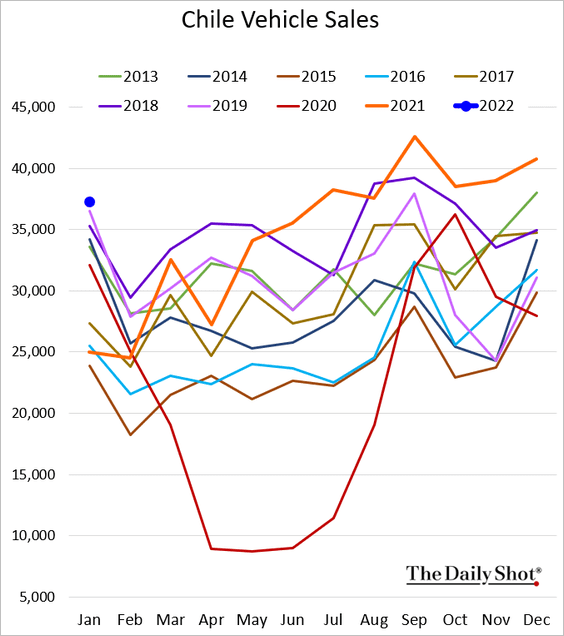

But Chile continues to surprise to the upside.

——————–

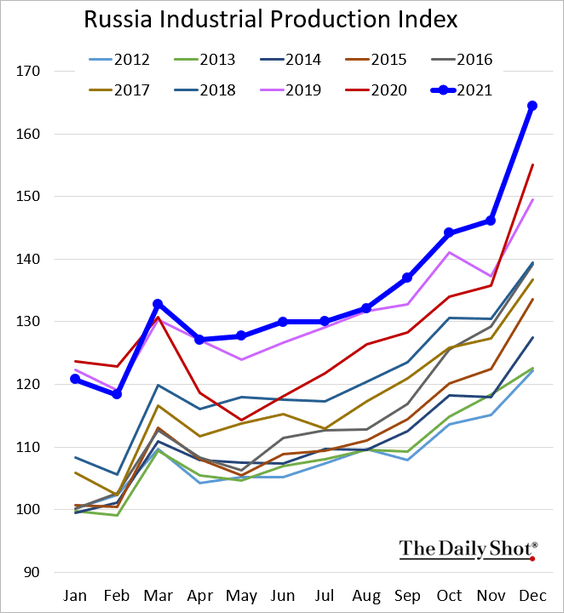

4. Russia’s industrial production finished the year on a strong note.

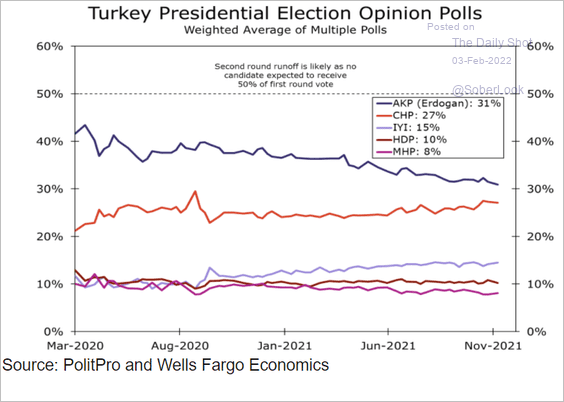

5. Erdogan’s party continues to lose popularity as inflation surges.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Cryptocurrency

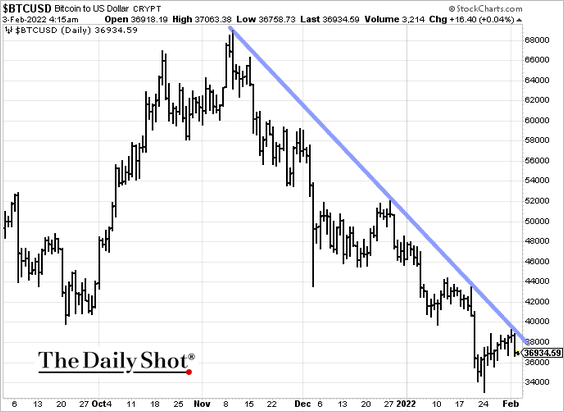

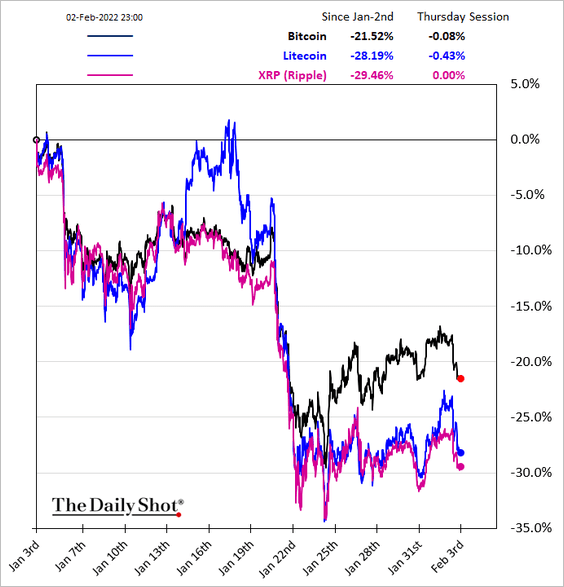

1. The bitcoin downtrend resistance is holding.

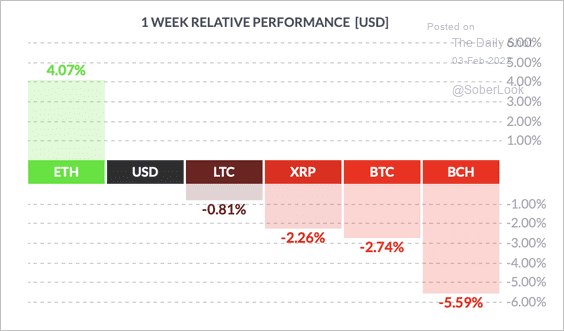

2. Ether is starting to outperform major cryptos, …

Source: FinViz

Source: FinViz

… but bitcoin is still ahead of other tokens over the past month.

——————–

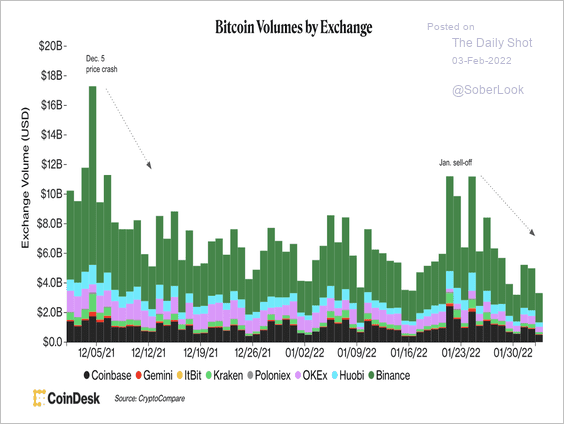

3. Bitcoin’s trading volume across exchanges continues to decline, which is typical after a sell-off.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

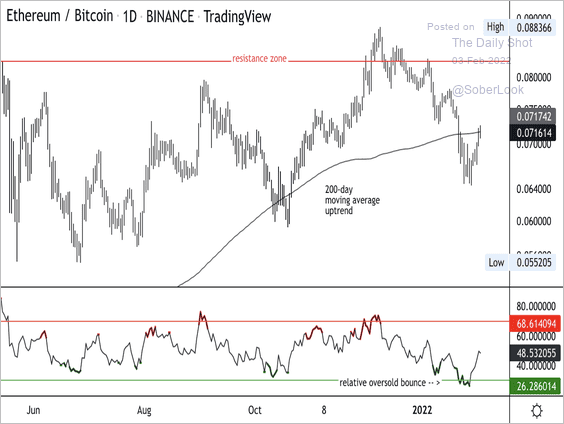

4. The ETH/BTC price ratio is holding short-term support.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

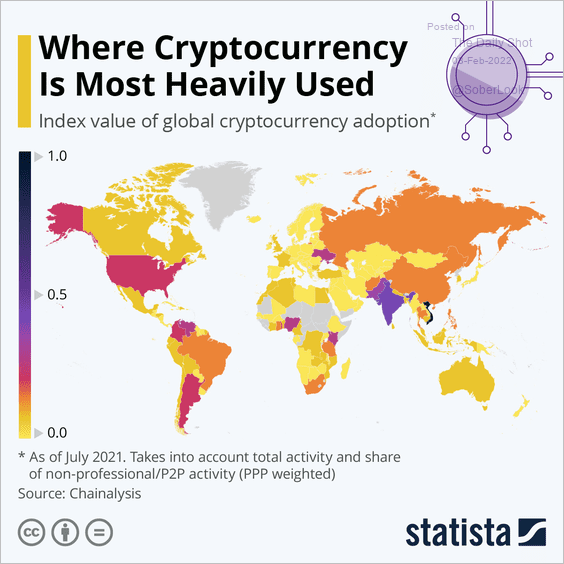

5. Here is the index of global cryptocurrency adoption.

Source: Statista

Source: Statista

Back to Index

Commodities

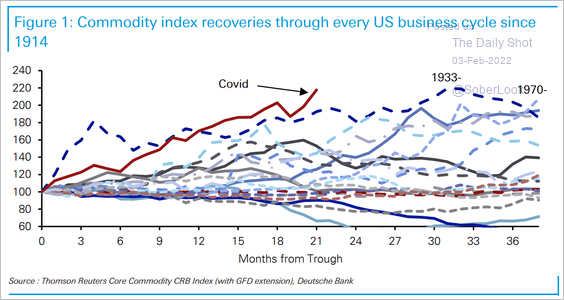

1. This commodity rally has been impressive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

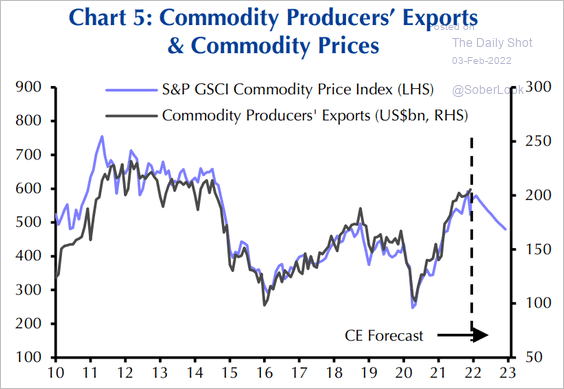

Are commodity prices peaking? What does it mean for commodity exporters? Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

——————–

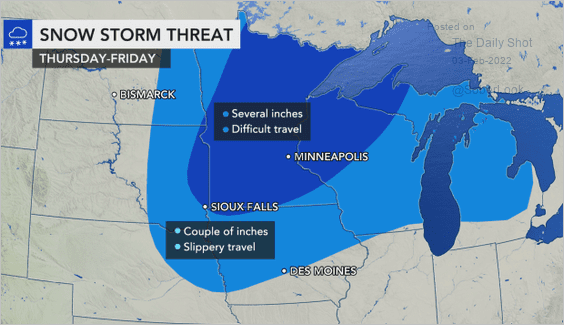

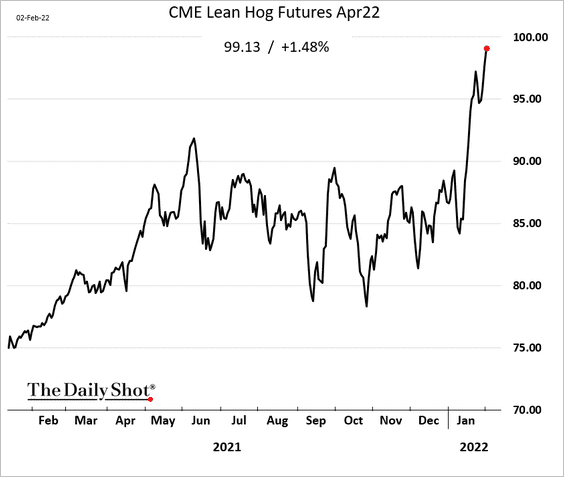

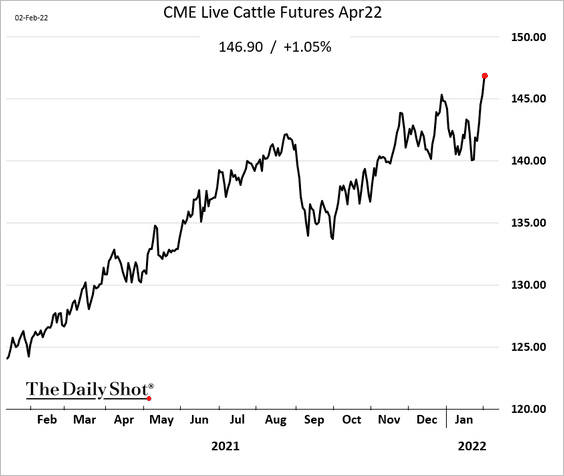

2. US hogs and cattle futures surged this week as traders watch a major storm in the Midwest.

Source: Reuters Read full article

Source: Reuters Read full article

Source: AccuWeather

Source: AccuWeather

Back to Index

Energy

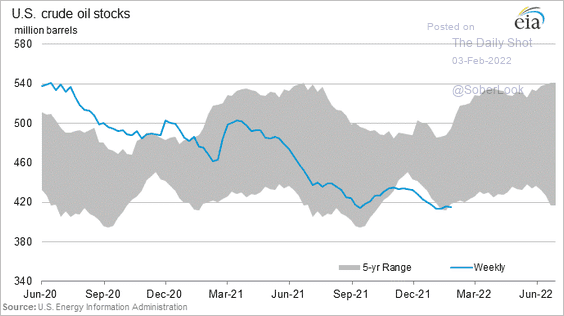

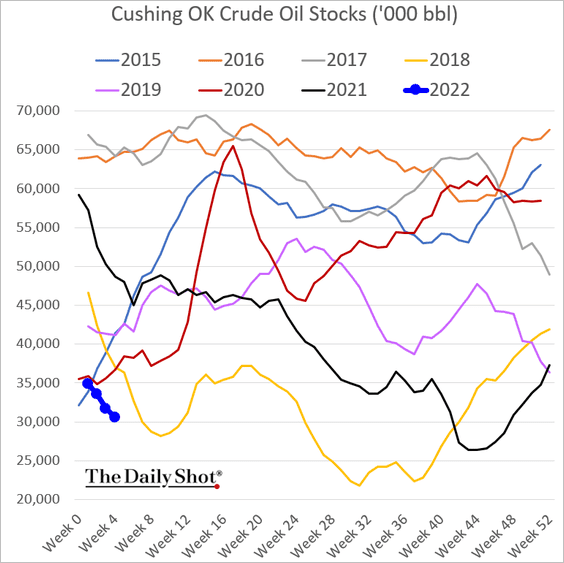

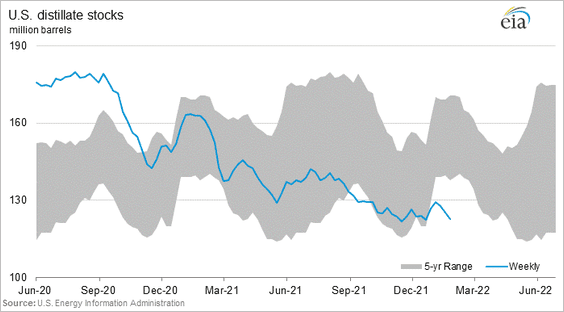

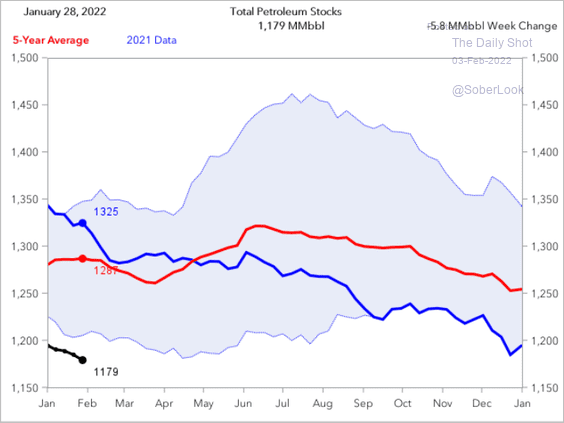

1. US petroleum inventories remain tight.

• Crude oil:

• Crude oil at Cushing, OK.

• Distillates:

• Total petroleum inventories:

Source: Fundamental Analytics

Source: Fundamental Analytics

——————–

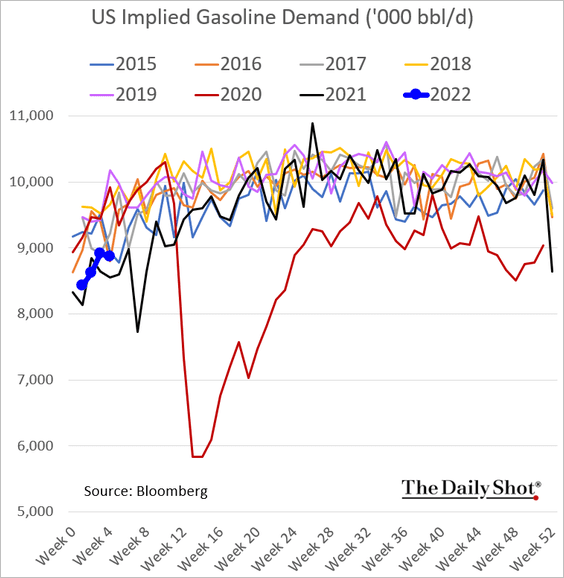

2. Gasoline demand has been relatively soft.

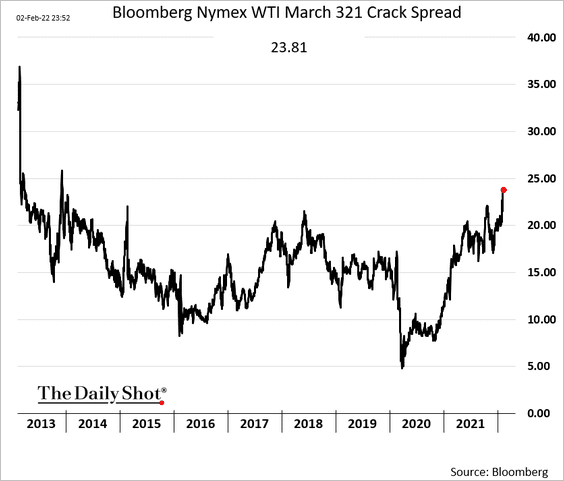

3. Crack spreads continue to widen.

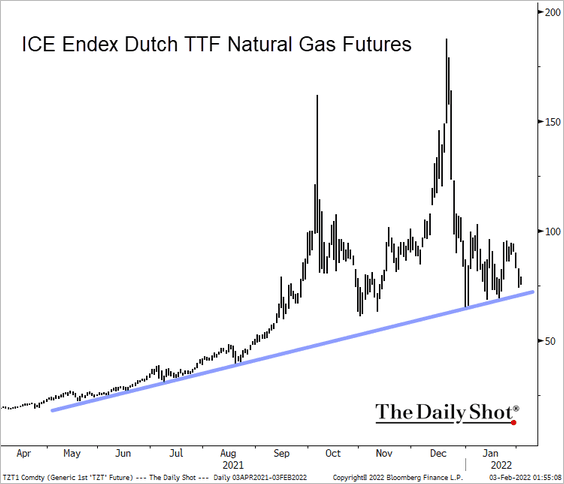

4. European natural gas prices are well off the highs, but the uptrend support is holding.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Equities

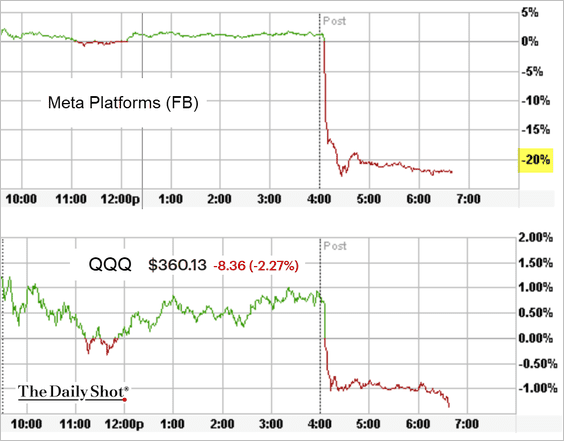

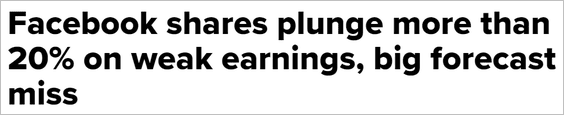

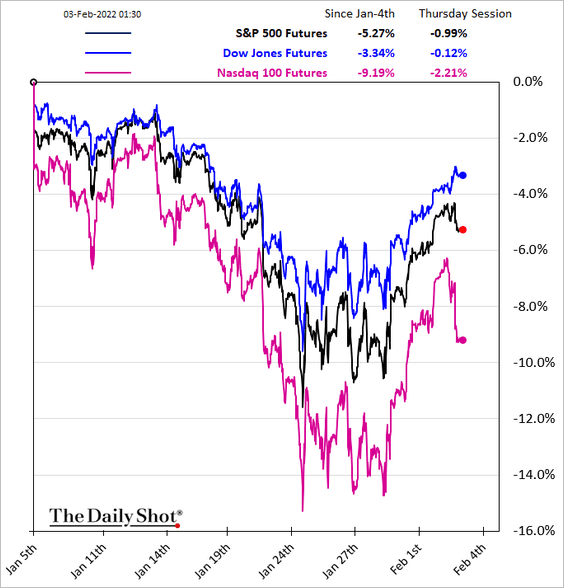

1. Some bad news from Meta on Wednesday sent the share price sharply lower after the close, pulling the Nasdaq 100 down by 2%.

Source: CNBC Read full article

Source: CNBC Read full article

Here are the index futures.

——————–

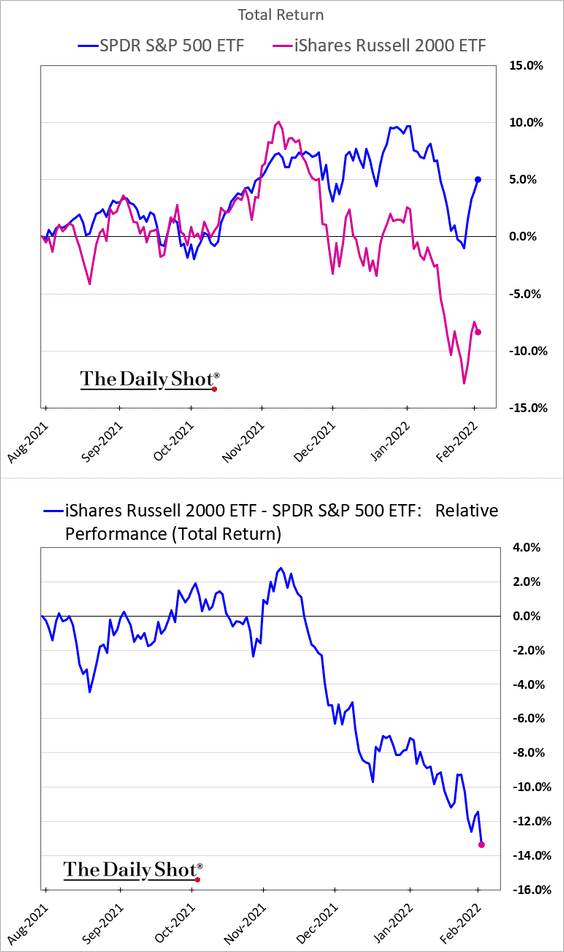

2. Small-cap underperformance continues to widen.

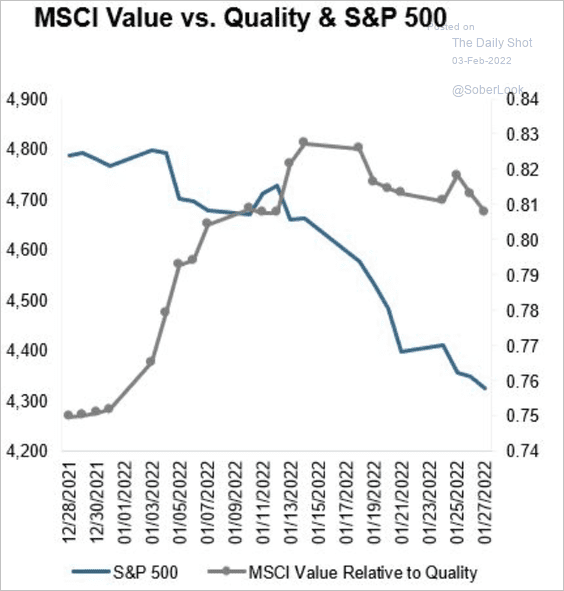

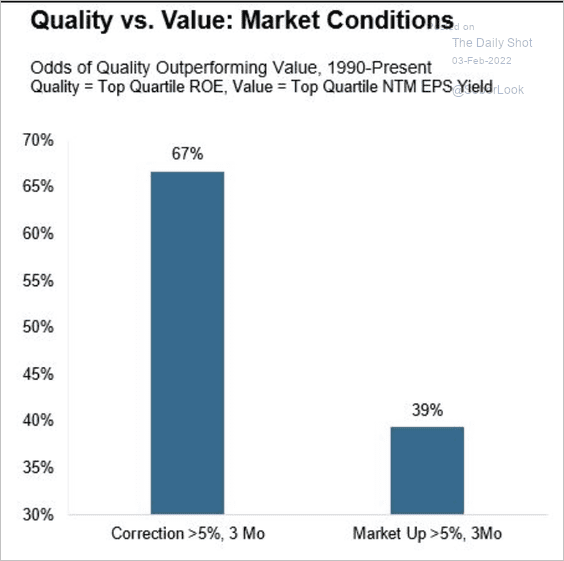

3. Value typically lags quality after leading in a down market. However, value stocks have been consistently cheaper this cycle, which historically matters more for performance, according to Fidelity (2 charts).

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

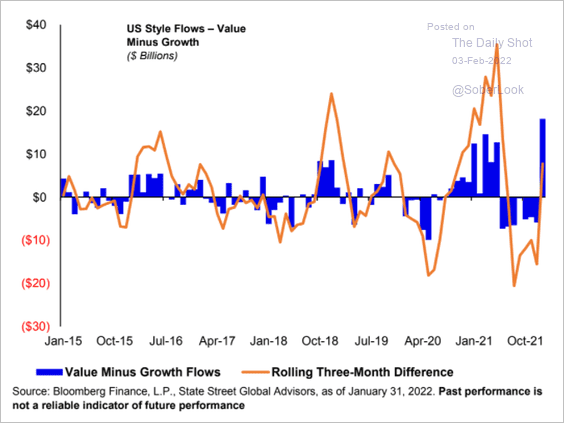

• Fund flows shifted sharply toward value last month.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

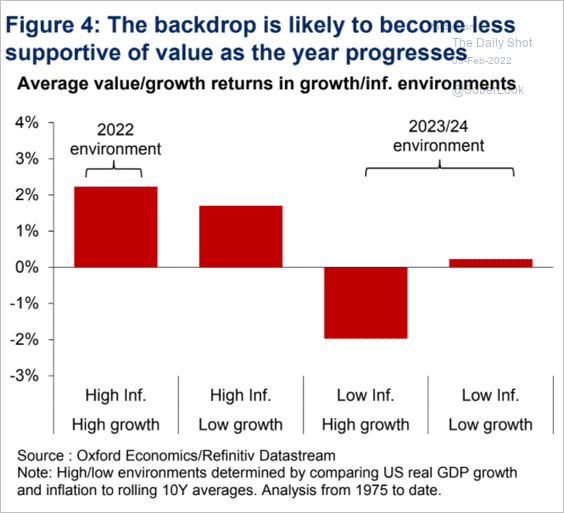

• But the economic backdrop is becoming less supportive for the value factor.

Source: Oxford Economics

Source: Oxford Economics

——————–

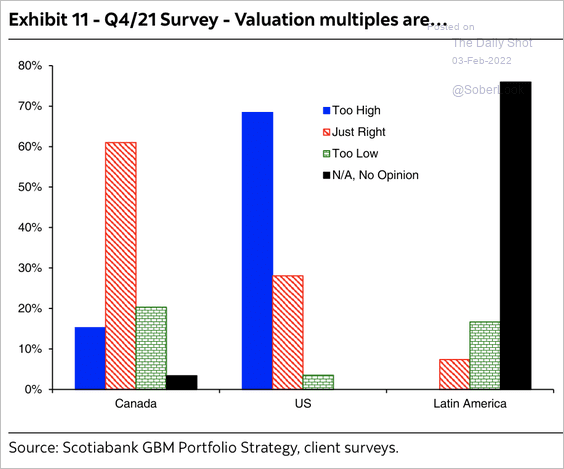

4. Despite high valuation multiples, …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

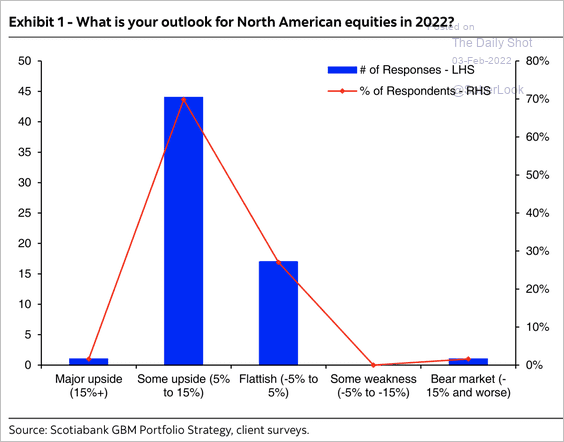

… a majority of institutional investors surveyed by Scotiabank expect a 5%-15% upside in North American equities this year.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

5. Short interest levels remain depressed.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

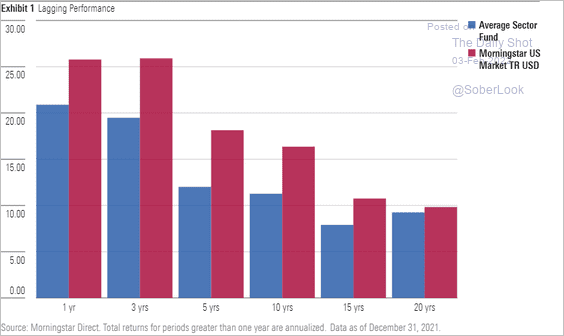

6. Sector funds’ annualized total returns have lagged broad market benchmarks by a wide margin over most trailing periods.

Source: Amy C. Arnott, Morningstar Read full article

Source: Amy C. Arnott, Morningstar Read full article

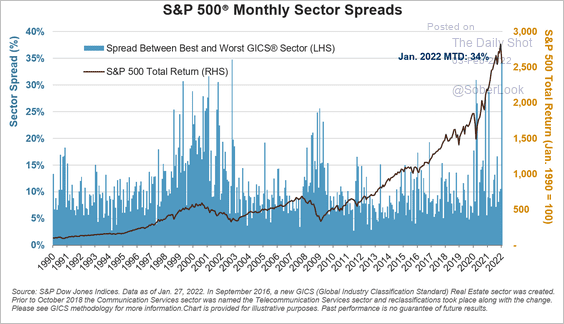

7. The dispersion in sector returns has blown out as energy outperforms.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Here is the spread between the best- and worst-performing sectors across major indices.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

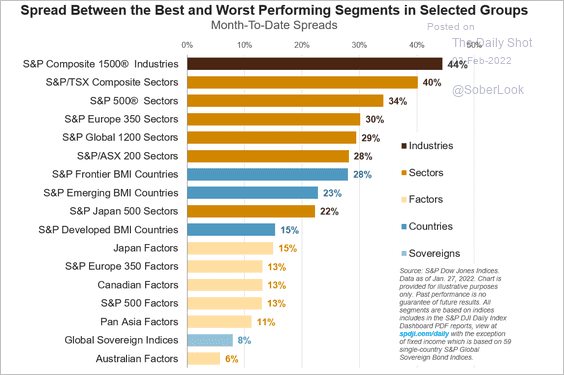

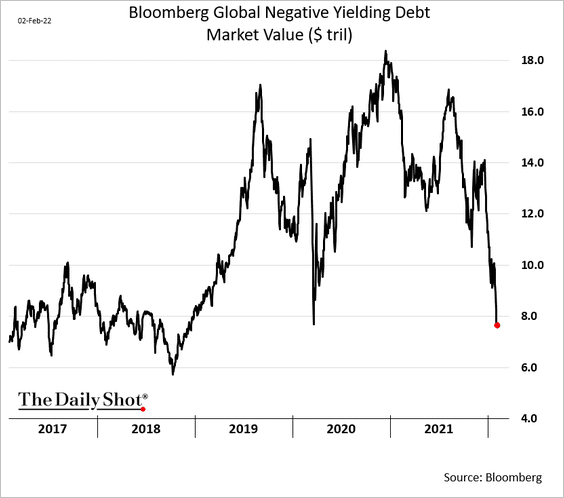

8. Finally, we have some data from LPL Research showing the massive growth in sustainable-investing funds.

Source: LPL Research

Source: LPL Research

Back to Index

Rates

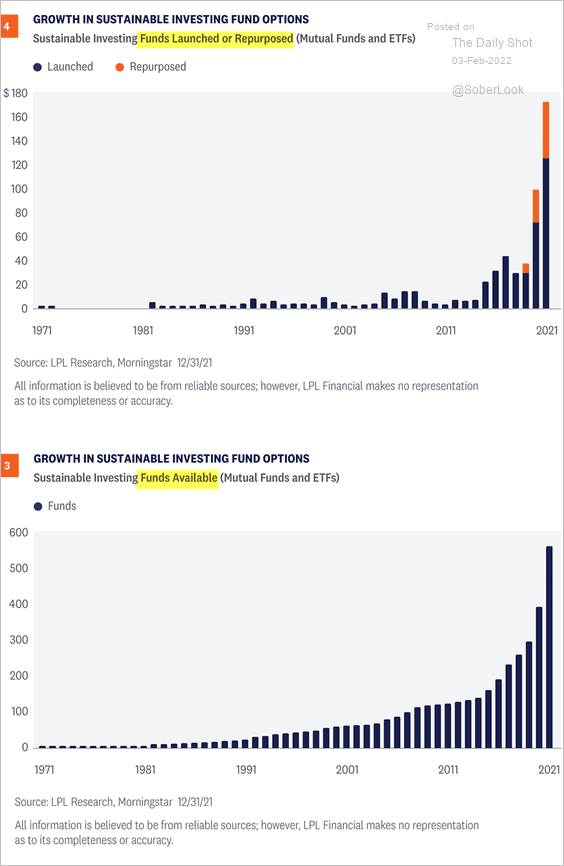

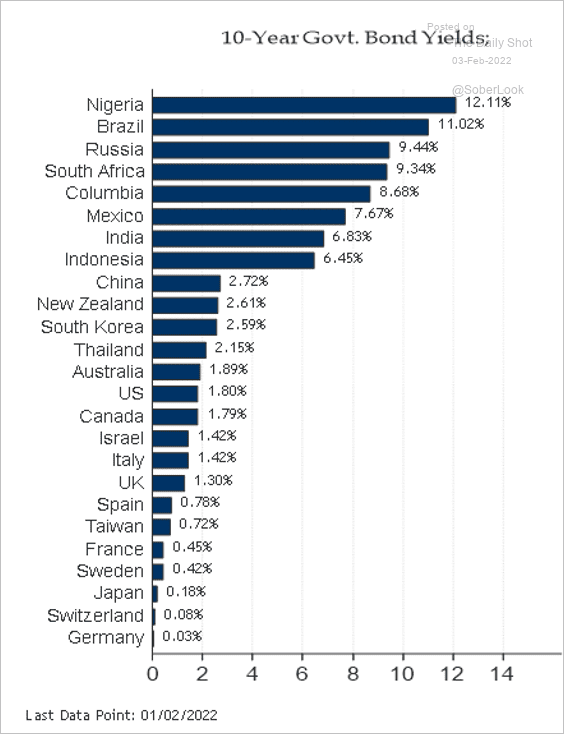

1. The value of negative-yielding global debt continues to tumble as the euro-area inflation surges and JGBs sell off.

All 10-year yields are now positive.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

——————–

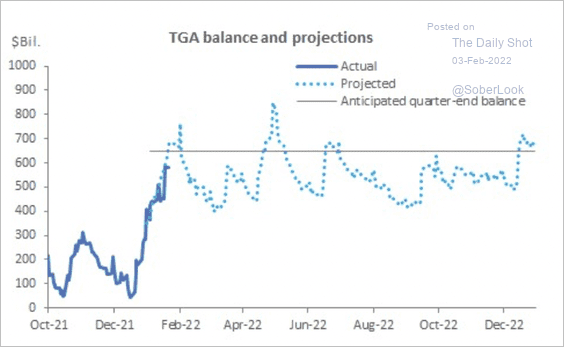

2. Treasury General Account (TGA) balances (at the Fed) are close to the anticipated seasonal peak.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

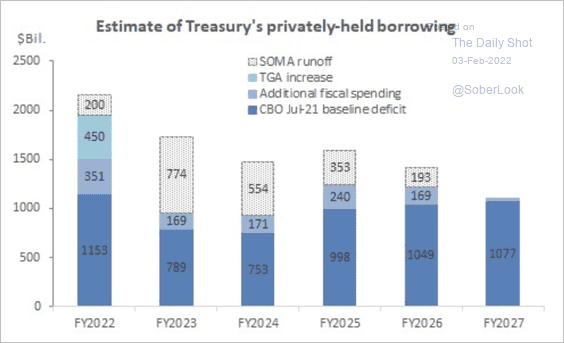

3. The SOMA runoff will significantly increase the Treasury’s privately-held borrowing amount, particularly next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

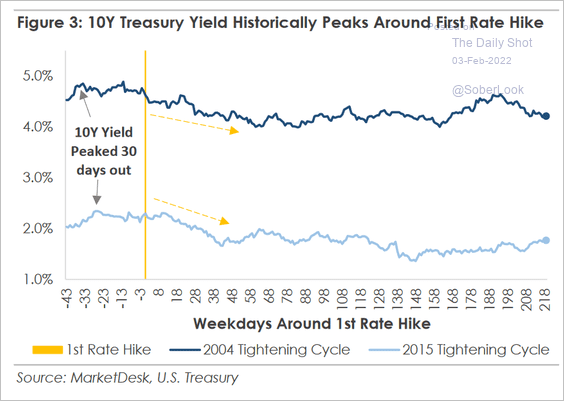

4. Treasury yields tend to peak around the first rate hike.

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Global Developments

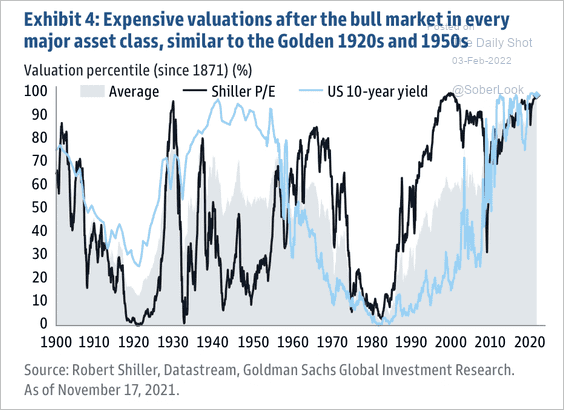

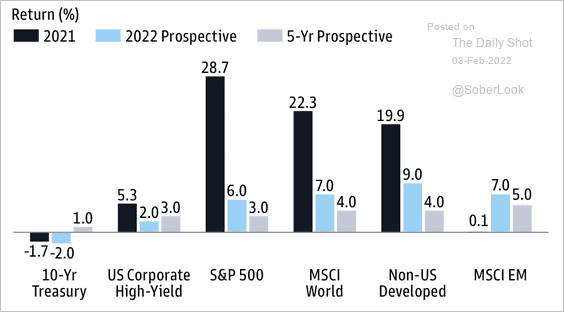

1. Valuations across all asset classes have been near record highs.

Source: Goldman Sachs Asset Management

Source: Goldman Sachs Asset Management

Goldman expects returns across major asset classes to be lower this year and beyond.

Source: Goldman Sachs Asset Management

Source: Goldman Sachs Asset Management

——————–

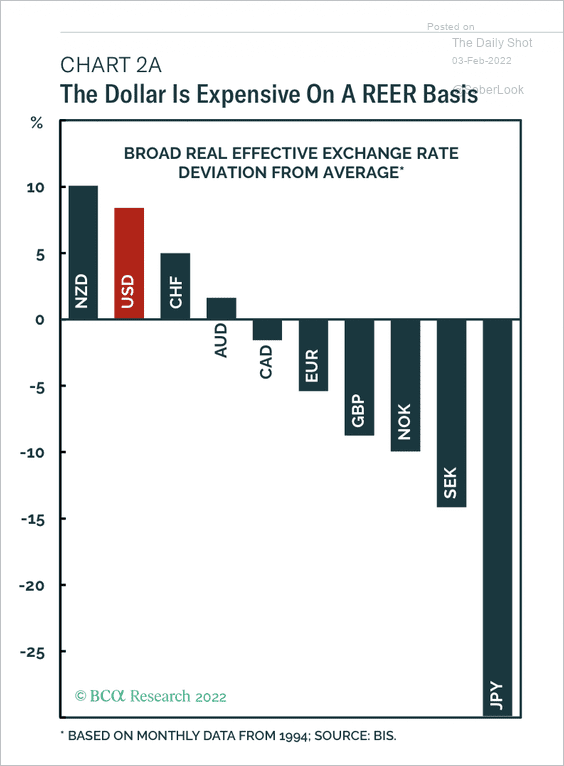

2. The dollar appears overvalued on a real effective exchange rate (REER) basis.

Source: BCA Research

Source: BCA Research

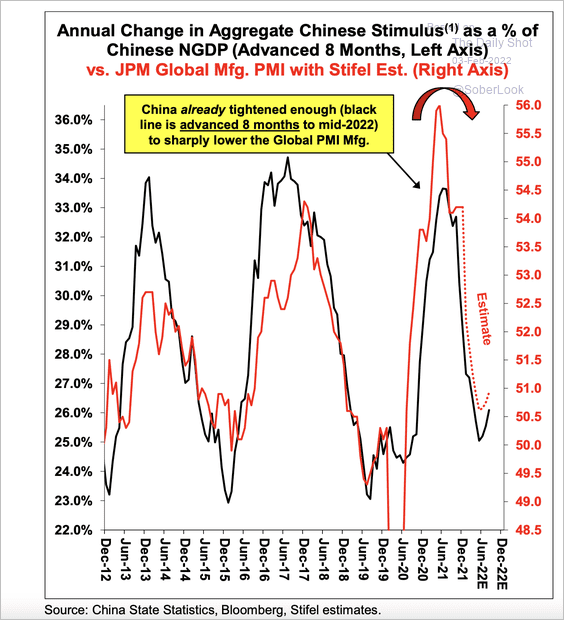

3. Weaker aggregate stimulus in China will hit global manufacturing activity this year.

Source: Stifel

Source: Stifel

——————–

Food for Thought

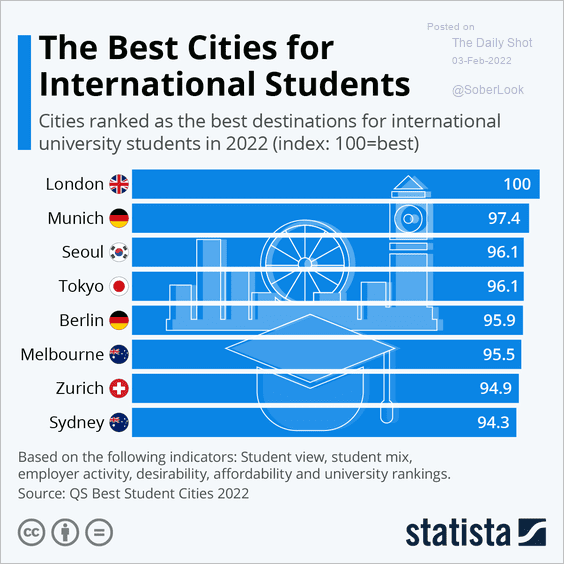

1. Best cities for international students:

Source: Statista

Source: Statista

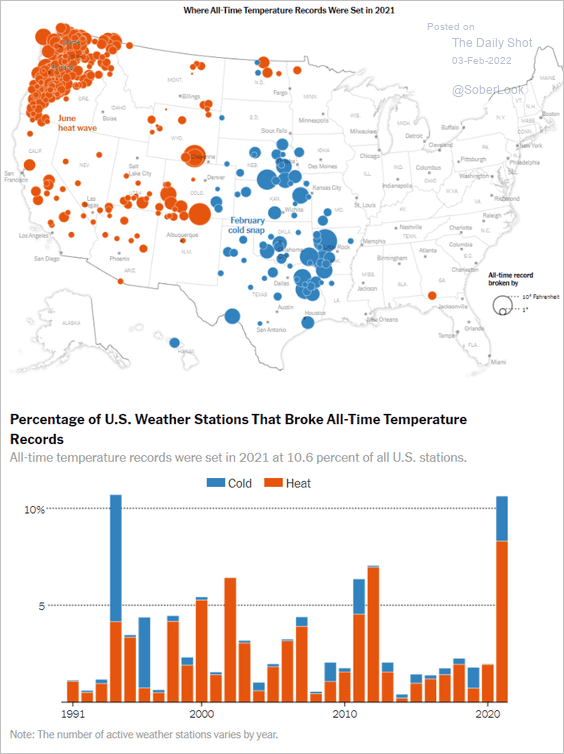

2. All-time temperature records:

Source: The New York Times Read full article

Source: The New York Times Read full article

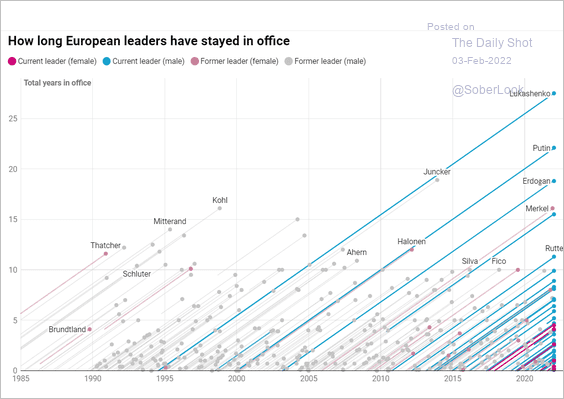

3. How long European leaders have stayed in office:

Source: Datawrapper Read full article

Source: Datawrapper Read full article

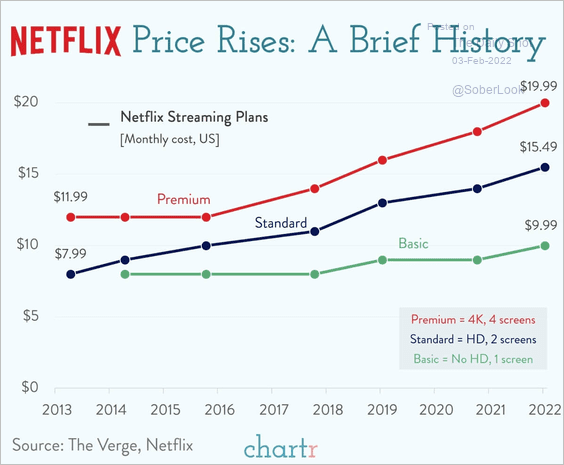

4. Netflix streaming inflation:

Source: @chartrdaily

Source: @chartrdaily

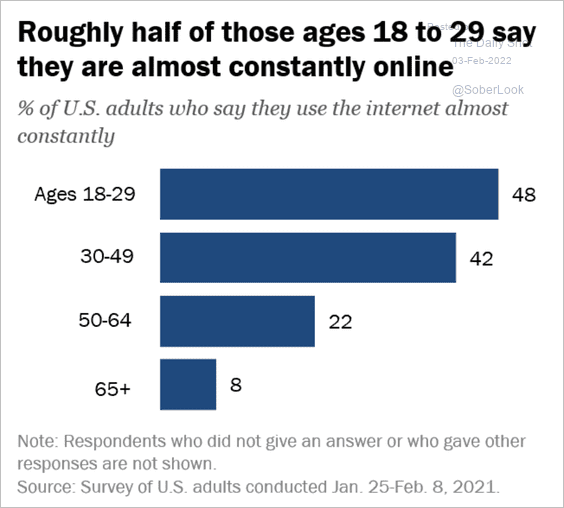

5. Spending time online:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

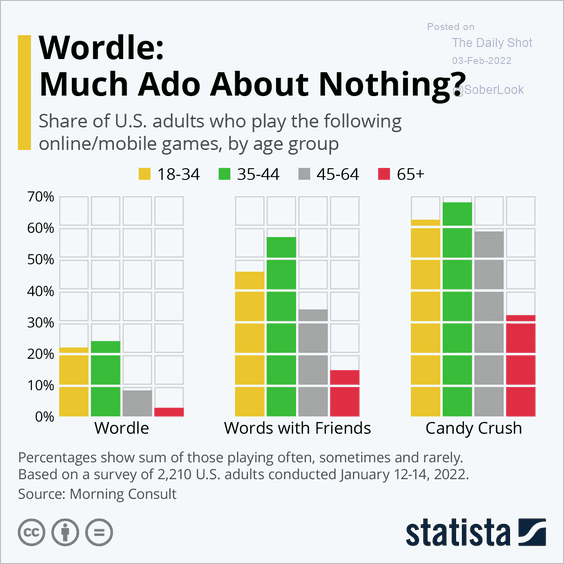

6. Popular online games:

Source: Statista

Source: Statista

——————–

Back to Index