The Daily Shot: 09-Feb-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

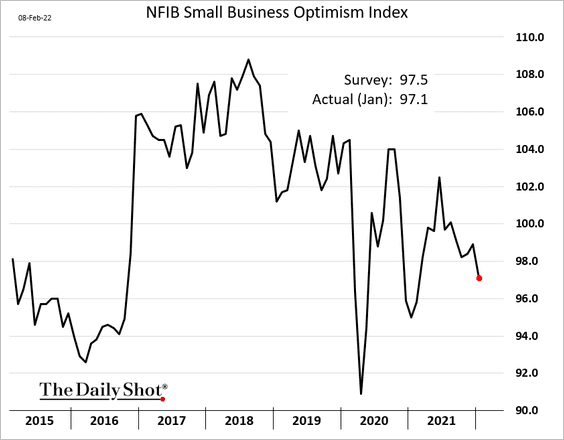

1. Small business sentiment continues to move lower.

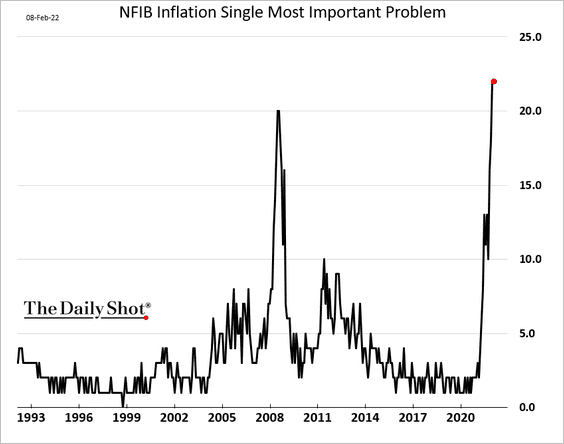

• Inflation remains a key concern.

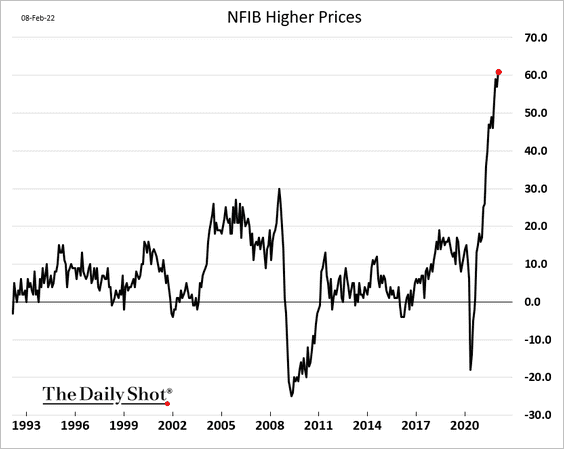

• The share of companies raising selling prices hit a multi-decade high.

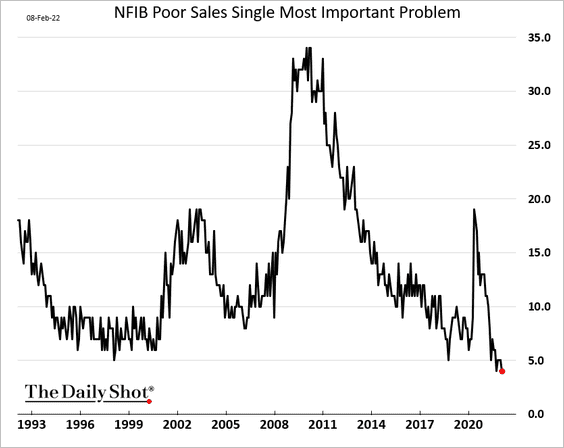

• Very few small firms are complaining about poor sales.

——————–

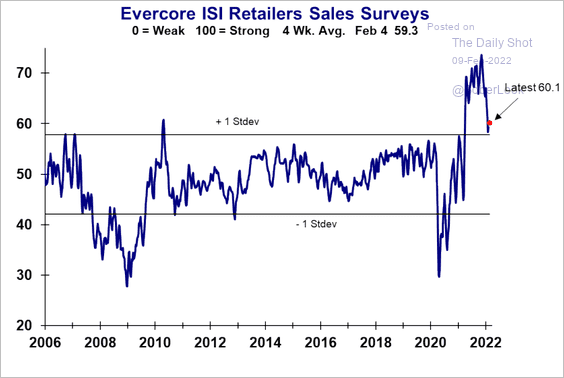

2. The Evercore ISI survey showed retailers’ sales weakening as omicron hit. But there has been some stabilization in recent weeks.

Source: Evercore ISI Research

Source: Evercore ISI Research

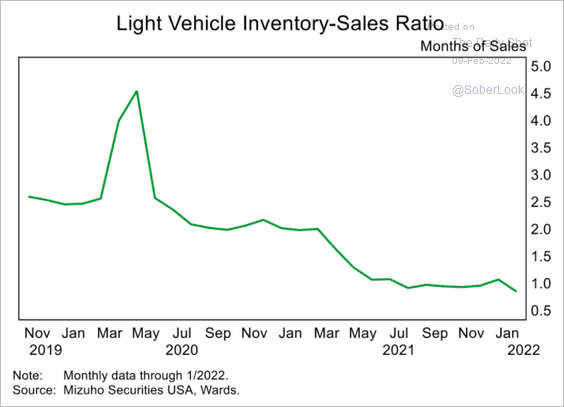

3. Vehicle inventories remain tight.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

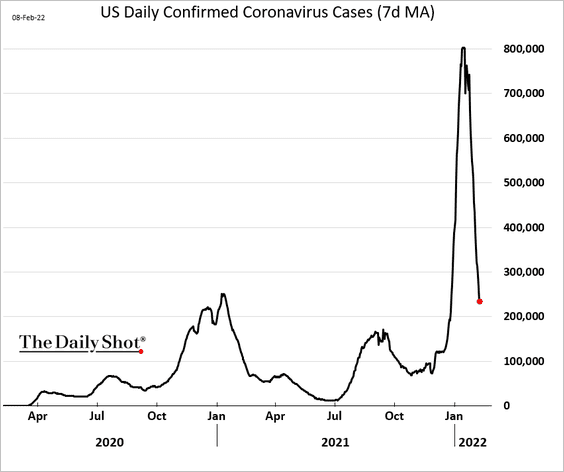

4. COVID cases are falling quickly.

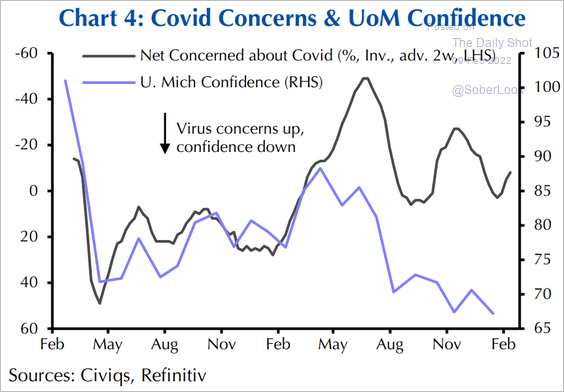

5. COVID has not been the reason for the recent weakness in the U. Michigan consumer sentiment indicator. Instead, it’s been about inflation.

Source: Capital Economics

Source: Capital Economics

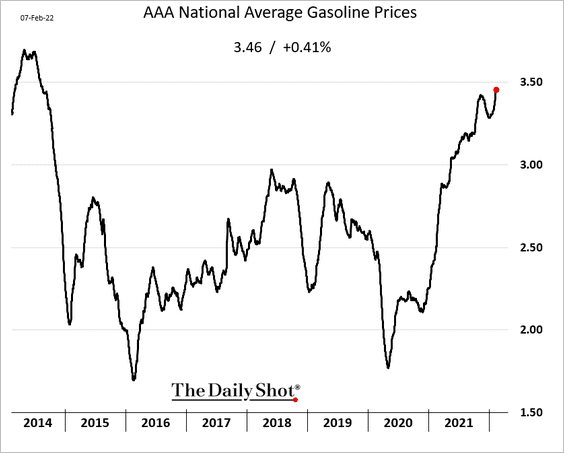

Multi-year highs in gasoline prices will continue to weigh on household confidence.

——————–

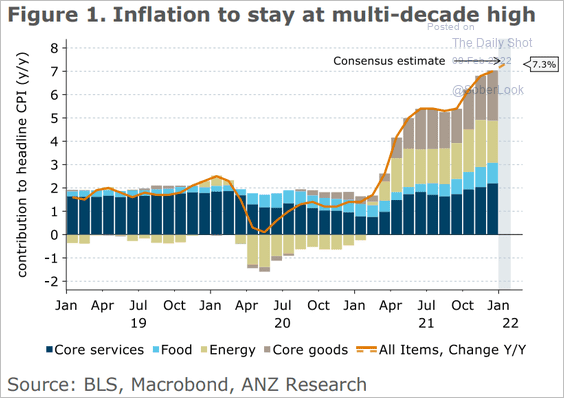

6. The January CPI is expected to hit 7.3% on a year-over-year basis. But we are nearing the peak.

Source: ANZ Research

Source: ANZ Research

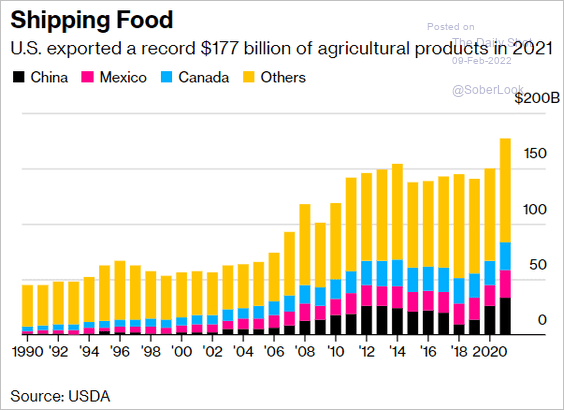

7. US exports hit a record high in 2021, driven by agricultural sales.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

8. Semiconductor companies are boosting CapEx amid strong demand.

![]() Source: @WSJ Read full article

Source: @WSJ Read full article

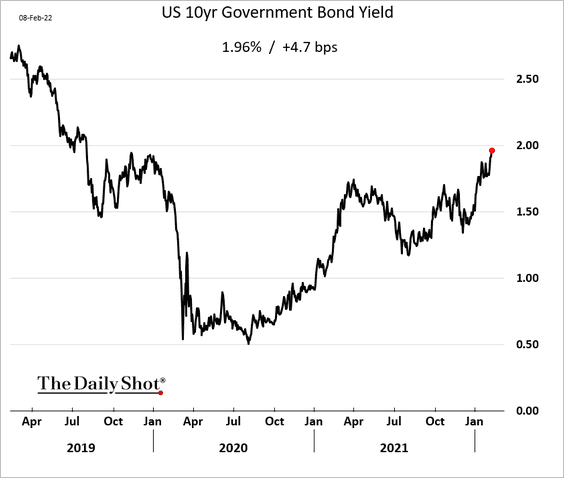

9. The 10yr Treasury yield is approaching 2% for the first time since mid-2019, pushing the 30yr mortgage rate toward 4%.

Back to Index

Canada

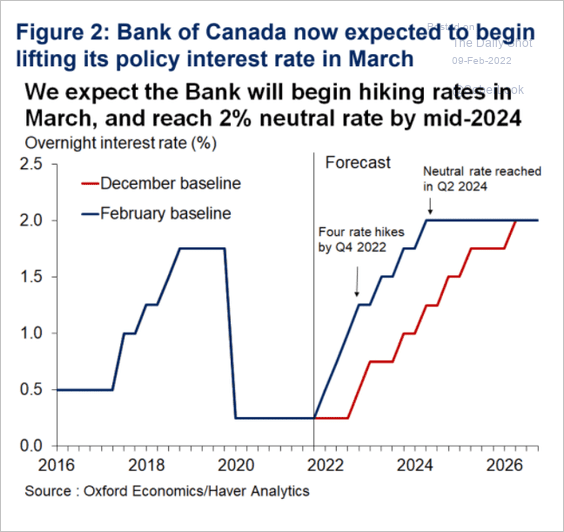

1. Oxford Economics expects the BoC rate hikes to start in March.

Source: Oxford Economics

Source: Oxford Economics

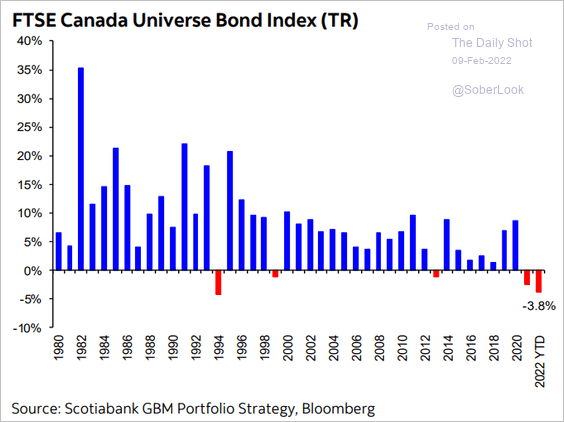

2. Canadian bonds have been under pressure.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

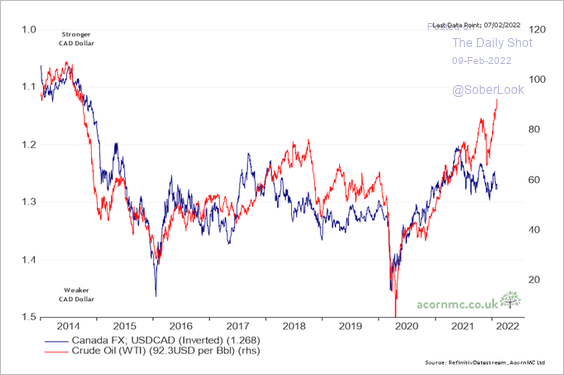

3. The loonie has diverged from oil prices.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

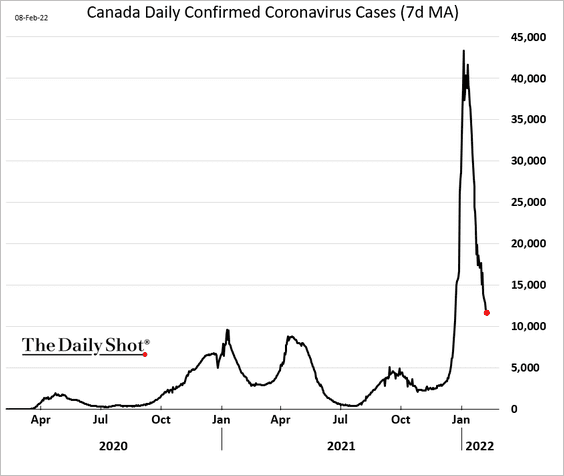

4. COVID cases are falling.

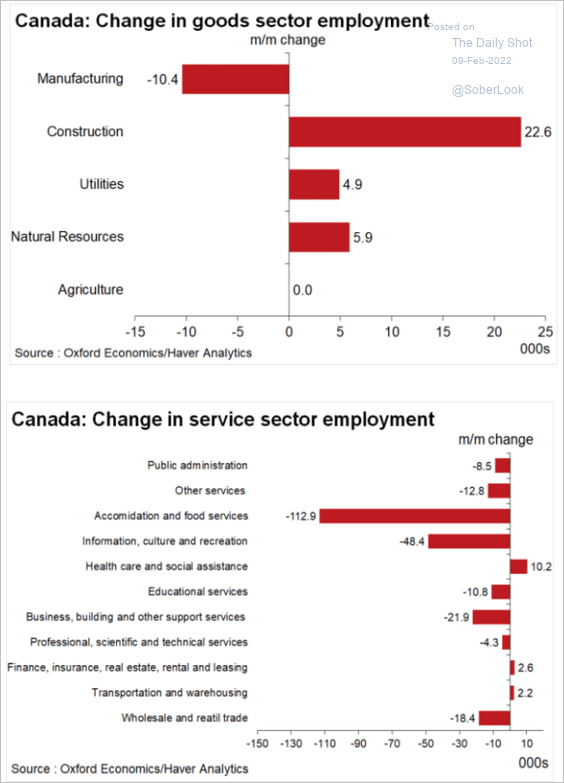

5. Here are the January employment changes by sector.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

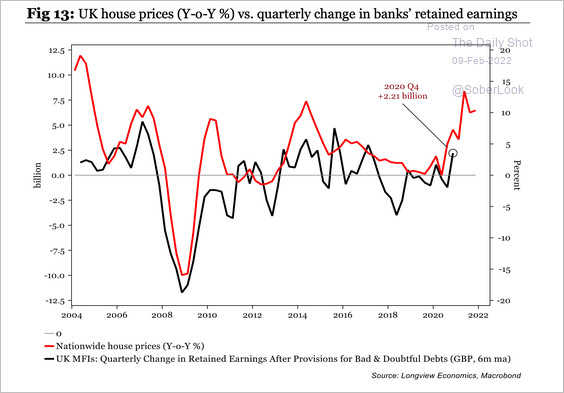

The United Kingdom

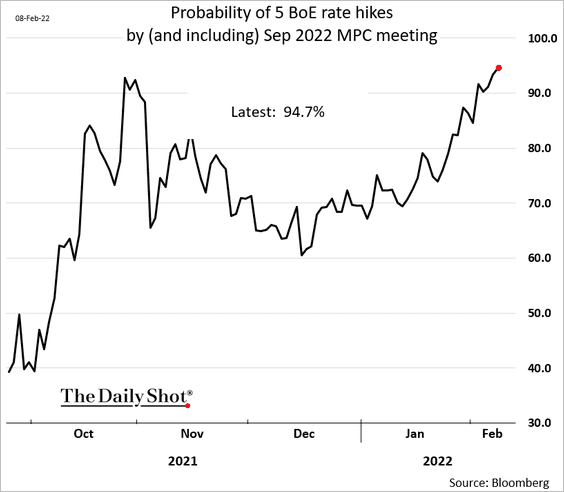

1. Five rate hikes by September?

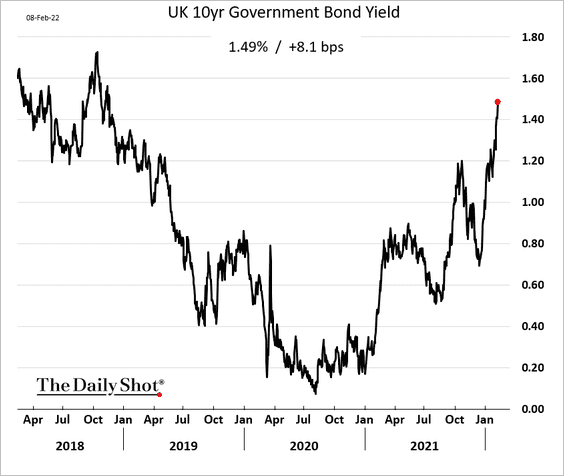

2. The 10yr gilt yield hasn’t been this high since 2018.

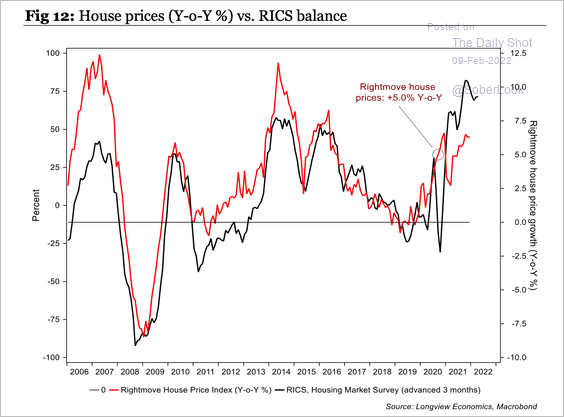

3. Surveyor data suggests that UK house prices should continue to grow.

Source: Longview Economics

Source: Longview Economics

Retained earnings at UK banks are a positive lead indicator of future house prices.

Source: Longview Economics

Source: Longview Economics

——————–

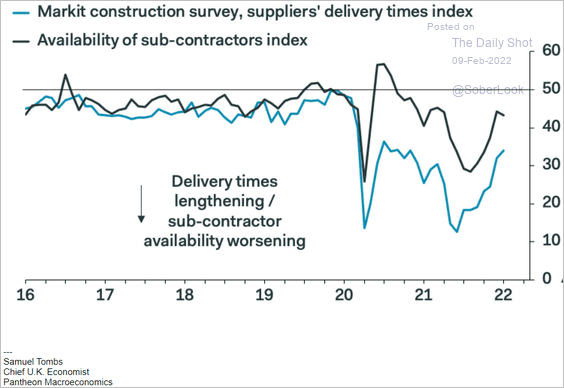

4. Construction supply strains are improving.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

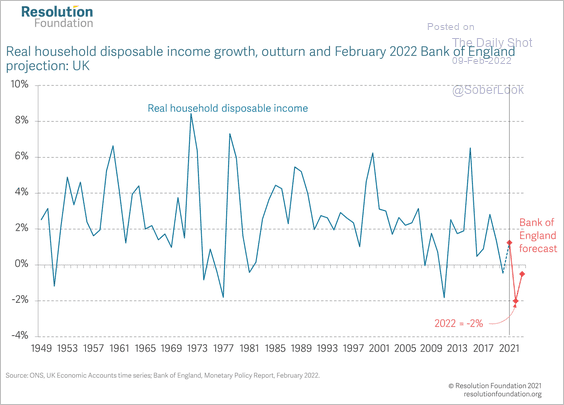

5. Real household disposable income has deteriorated.

Source: @resfoundation, @bankofengland Read full article

Source: @resfoundation, @bankofengland Read full article

Back to Index

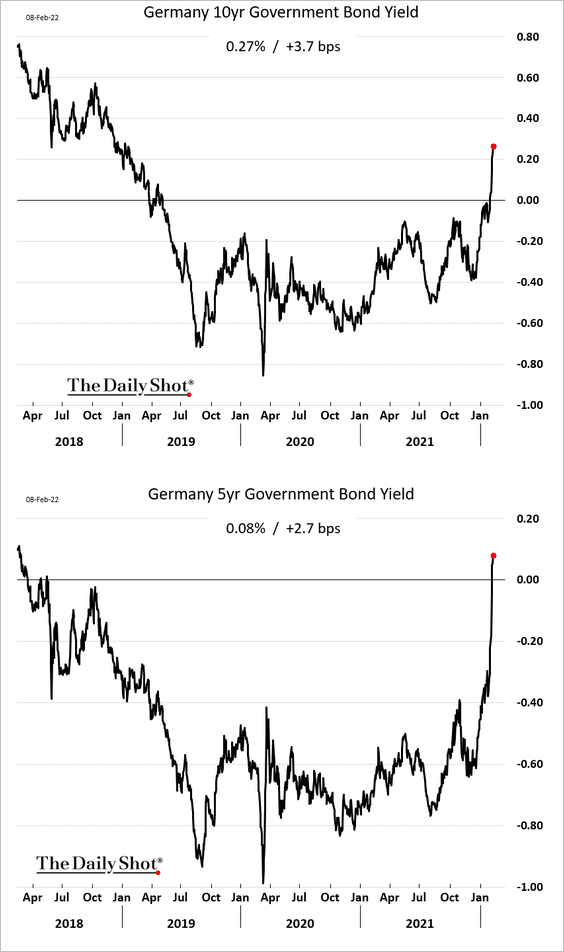

The Eurozone

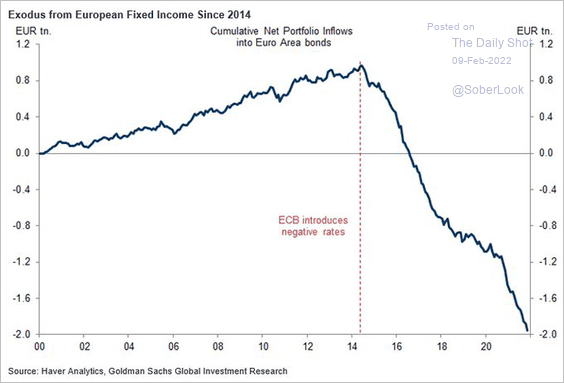

1. Eurozone bond yields continue to surge.

By the way, investors have consistently been pulling capital out of euro-area bonds since 2014.

Source: Goldman Sachs; @ReutersJamie

Source: Goldman Sachs; @ReutersJamie

——————–

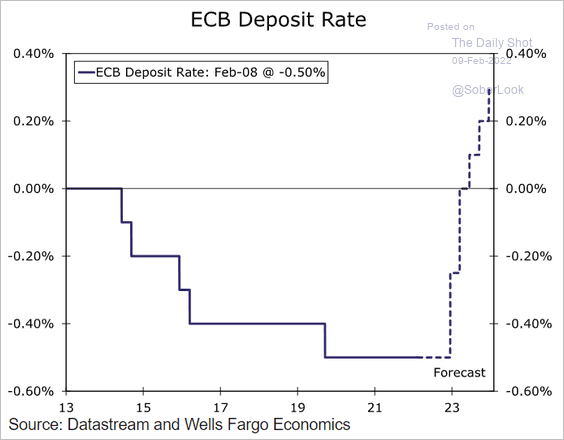

2. Wells Fargo expects the ECB to announce its first rate hike in December.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

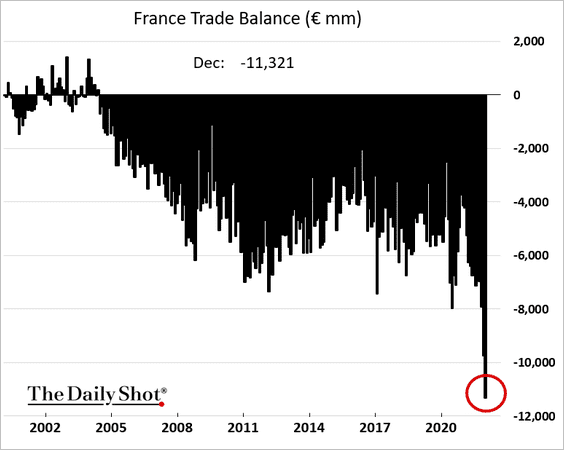

3. The French trade deficit hit a record at the end of the year as imports surged.

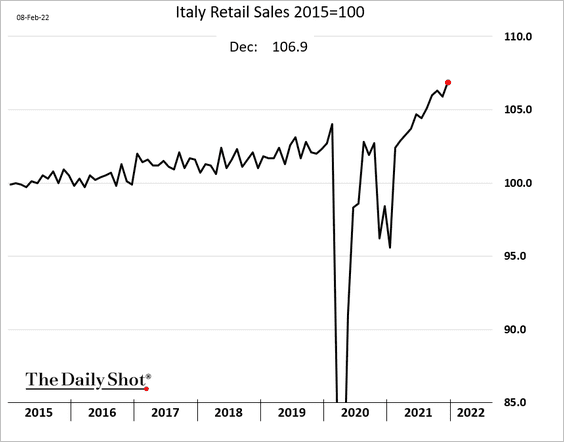

4. Italian retail sales continued to grow going into the year-end.

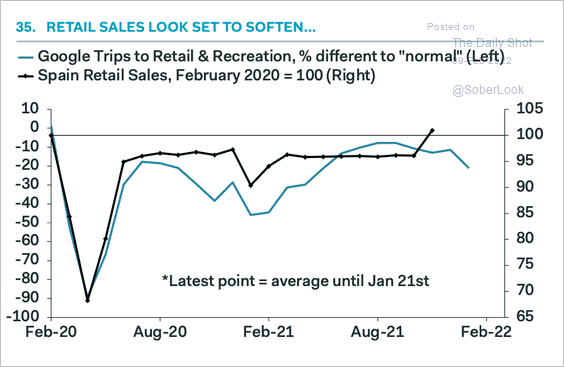

Spanish retail sales likely softened in January.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

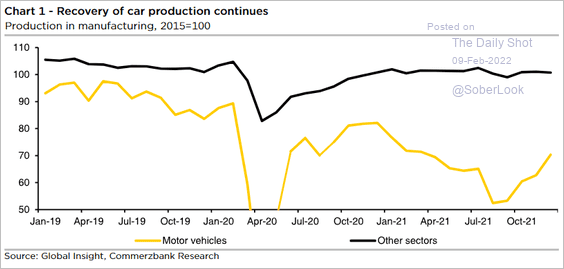

5. German car production is rebounding.

Source: Commerzbank Research

Source: Commerzbank Research

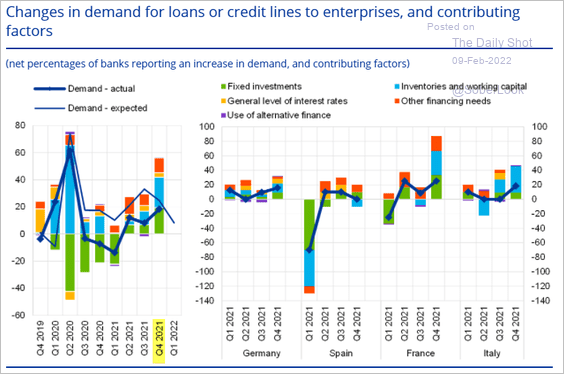

6. Loan demand in the Eurozone has picked up.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

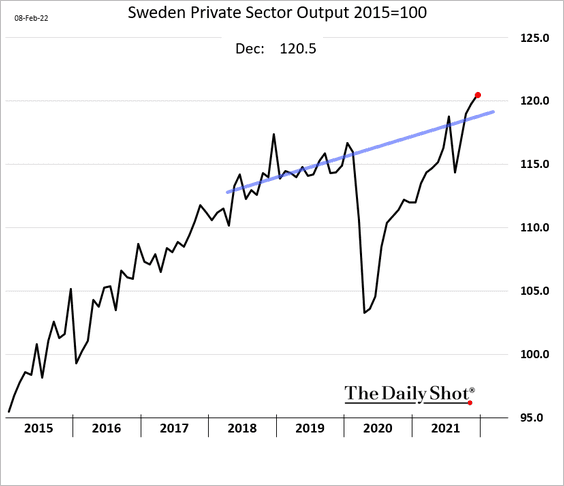

1. Sweden’s private sector output kept climbing in December, driven by services.

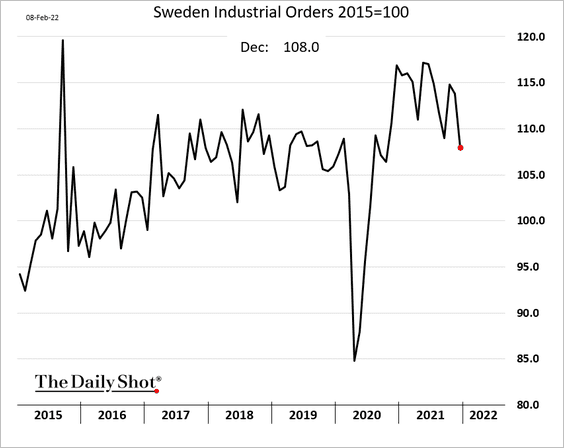

But industrial orders softened, …

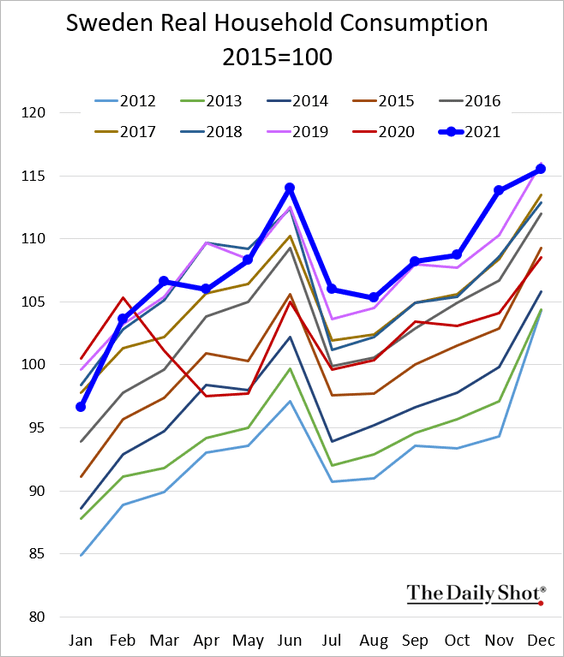

… and consumer spending was weak for that time of the year.

——————–

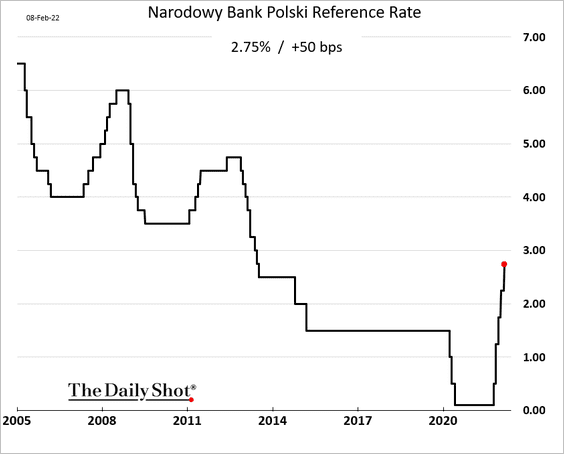

2. Poland’s central bank hiked rates again, as expected.

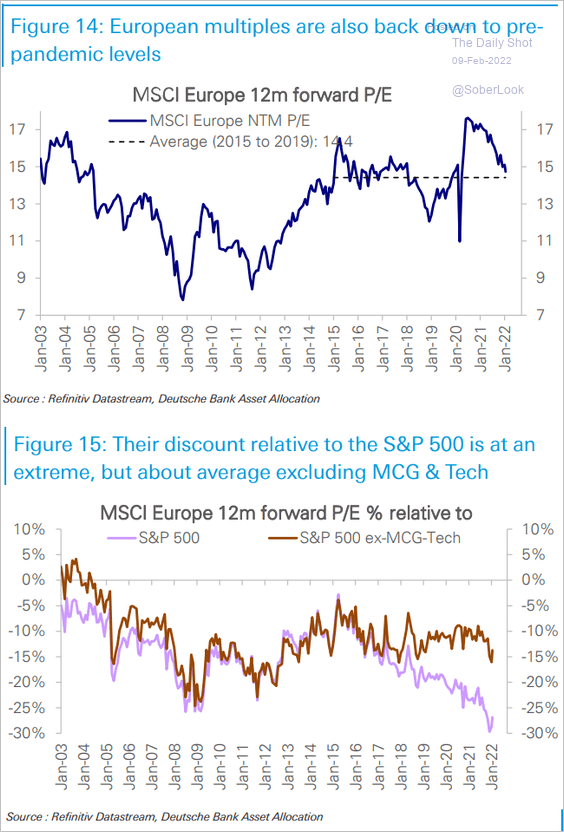

3. European stock valuations are back at pre-COVID levels. The second panel shows valuations relative to the S&P 500, with and without the mega-caps/tech.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

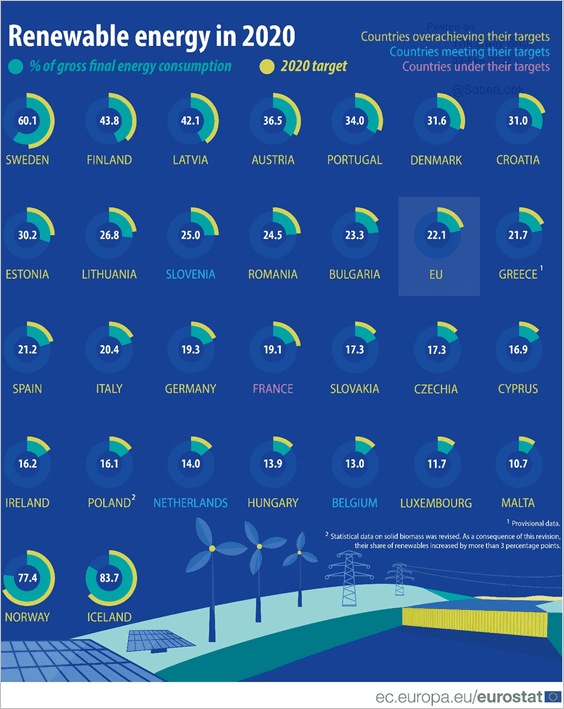

4. Next, we have a couple of charts on renewable energy.

• Renewables use by country:

Source: Eurostat Read full article

Source: Eurostat Read full article

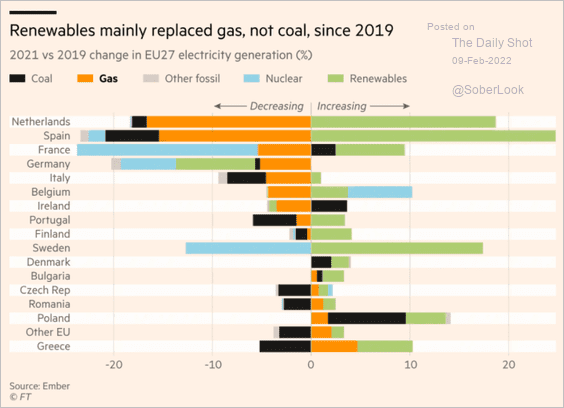

• Renewables replacing natural gas:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

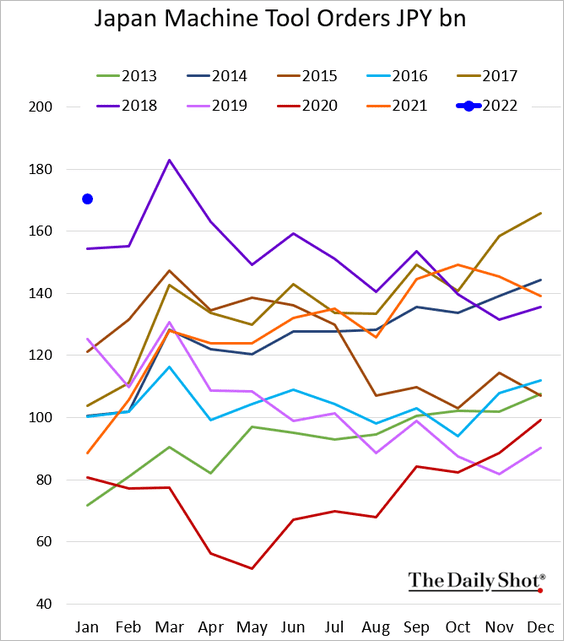

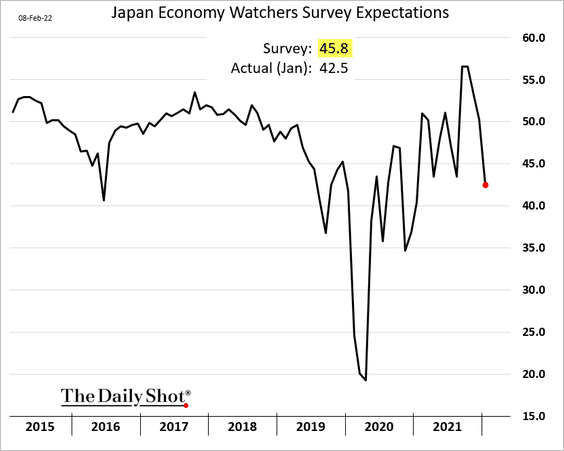

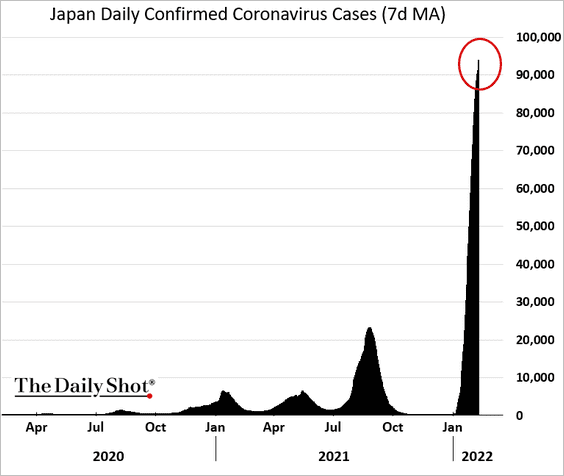

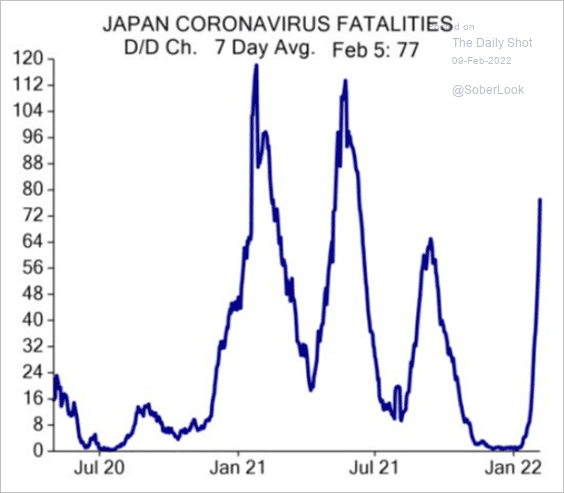

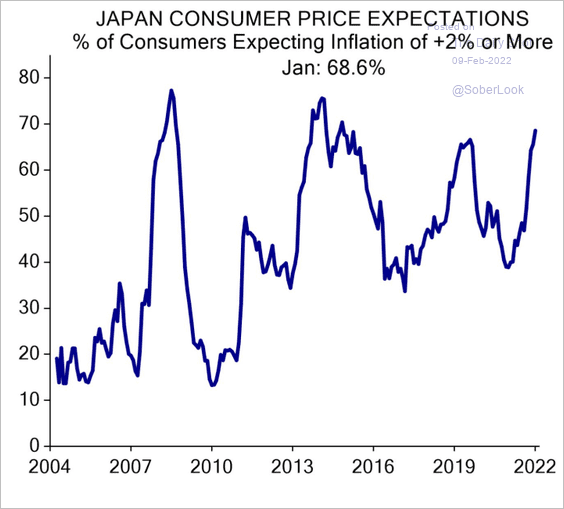

Japan

1. Machine tool orders remained strong in January.

2. The Economy Watchers index surprised to the downside, …

… as COVID cases and fatalities surge.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

3. Inflation expectations are moving higher.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

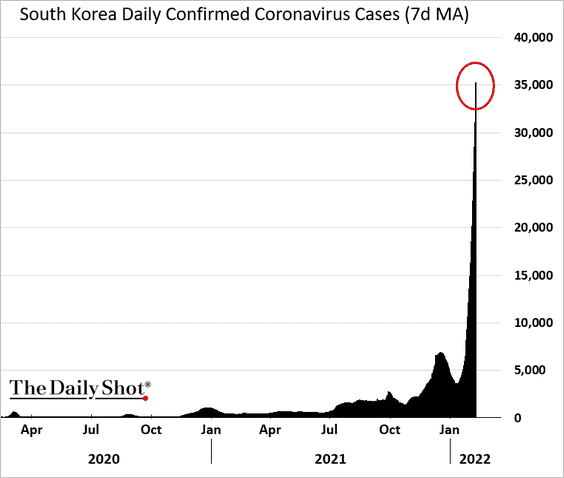

Asia – Pacific

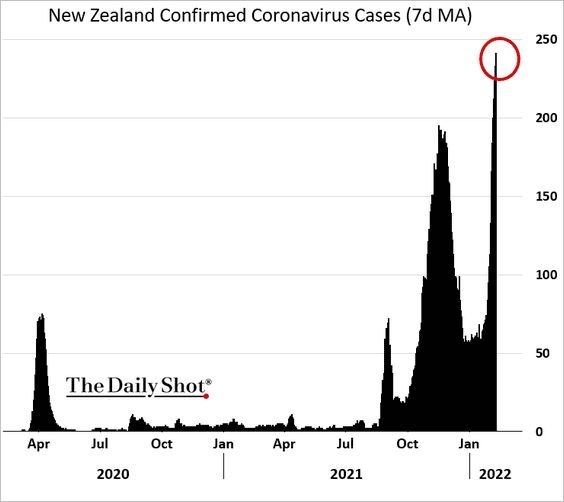

1. COVID cases surge across Asia/Pacific.

——————–

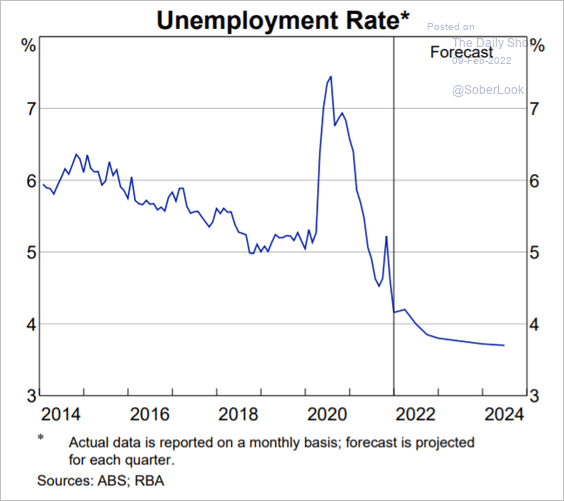

2. Australia’s labor market is expected to tighten further.

Source: BIS Read full article

Source: BIS Read full article

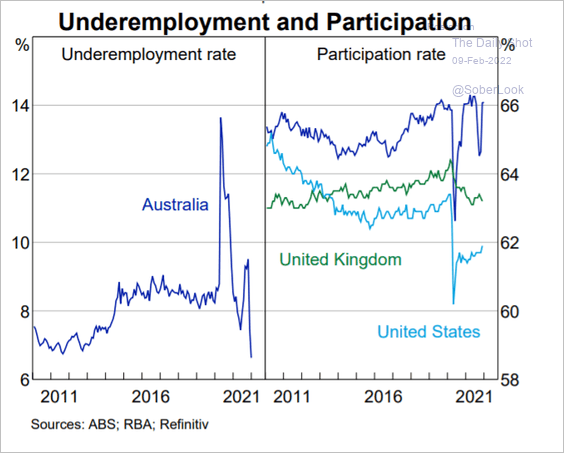

Labor force participation is high relative to the US and the UK.

Source: BIS Read full article

Source: BIS Read full article

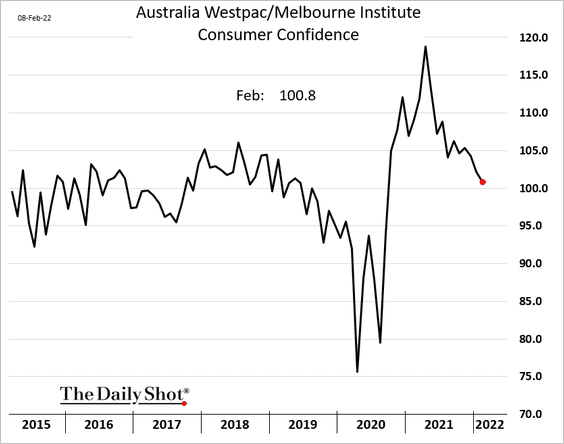

Separately, the Westpac consumer confidence index continues to fall.

Back to Index

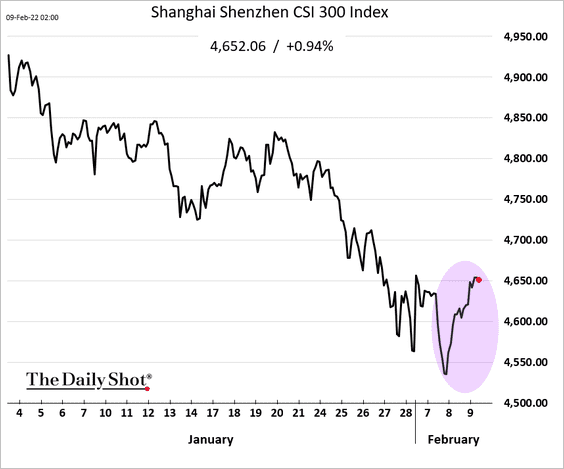

China

1. You can’t have the stock market slump spoil the Olympics.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

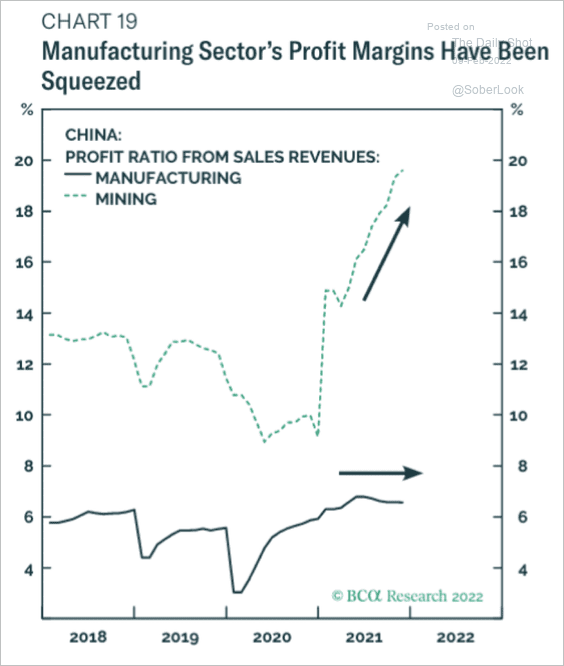

2. Manufacturing profit margins have been squeezed, while mining profitability has risen along with commodity prices.

Source: BCA Research

Source: BCA Research

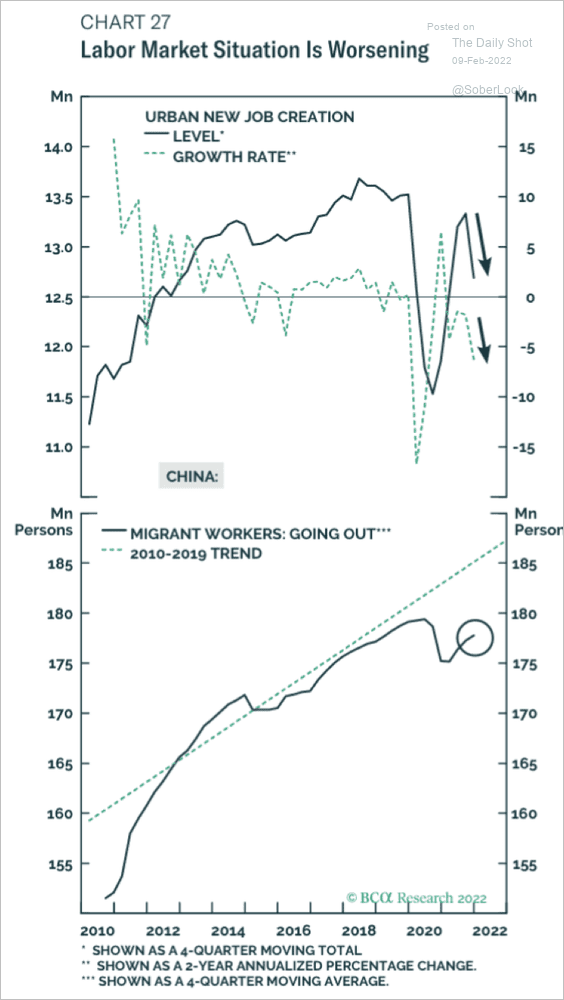

3. Labor market conditions have weakened over the past year.

Source: BCA Research

Source: BCA Research

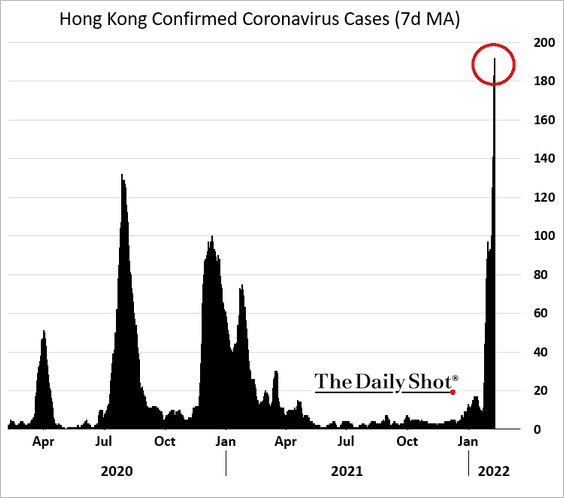

4. COVID cases are rising in Hong Kong.

Back to Index

Emerging Markets

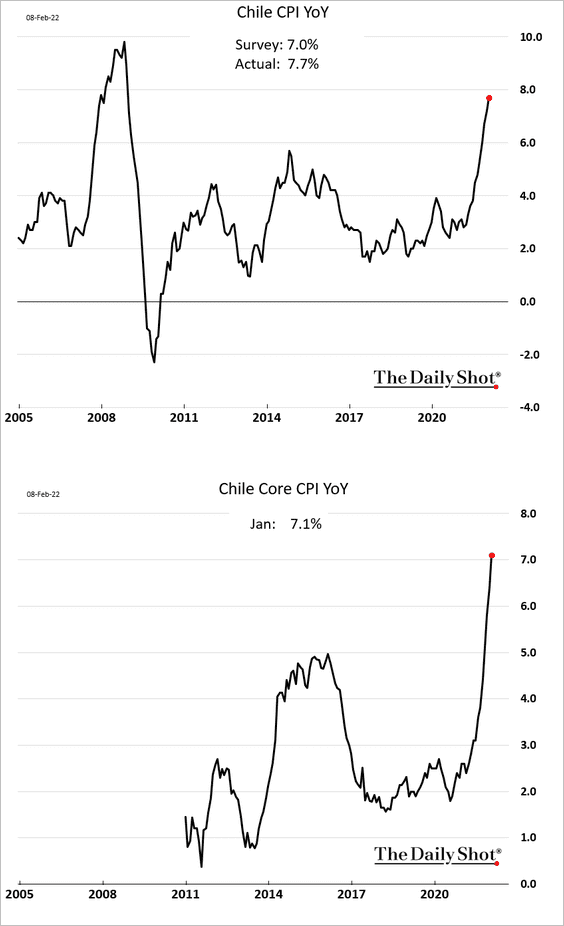

1. Chile’s inflation continues to surge.

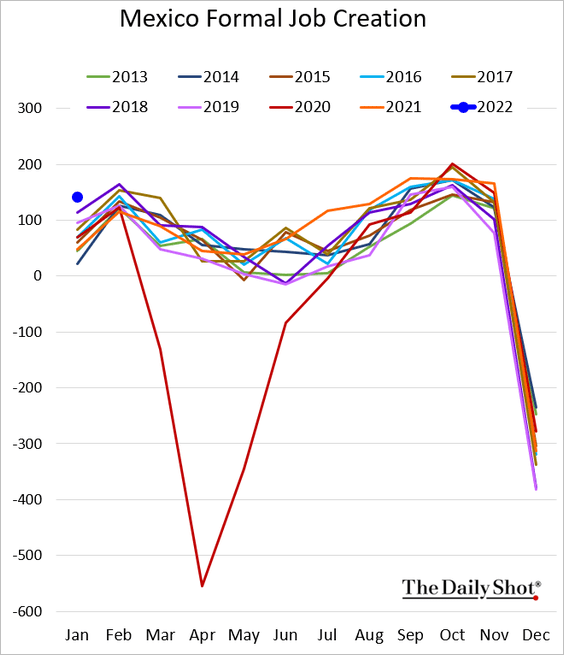

2. Mexican formal job creation was off to a strong start in January.

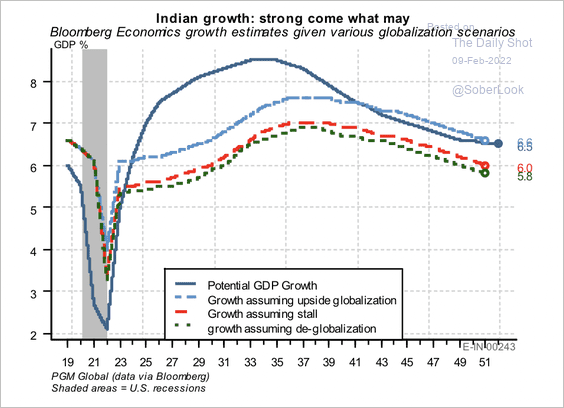

3. Over the long term, India could experience higher economic growth rates.

Source: PGM Global

Source: PGM Global

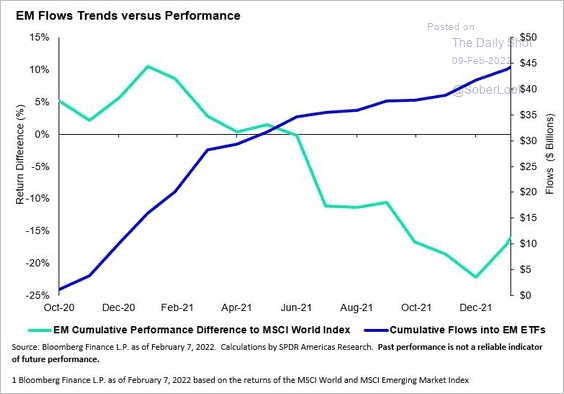

4. Cumulative flows into EM ETFs increased over the past year, but performance lagged the broader MSCI World Index.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

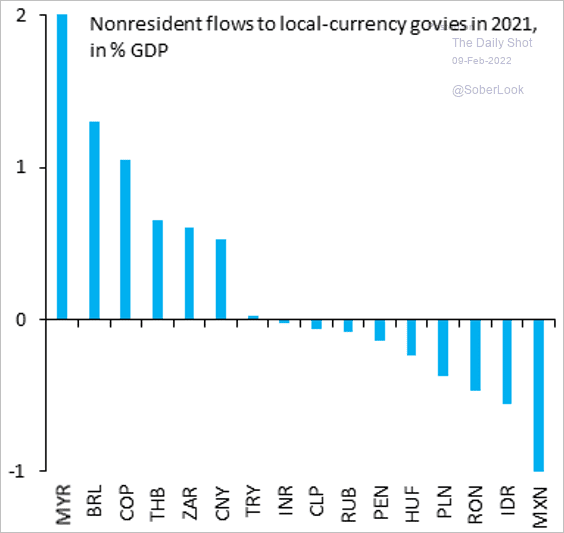

Here are the net foreign flows into local-currency government bonds.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

——————–

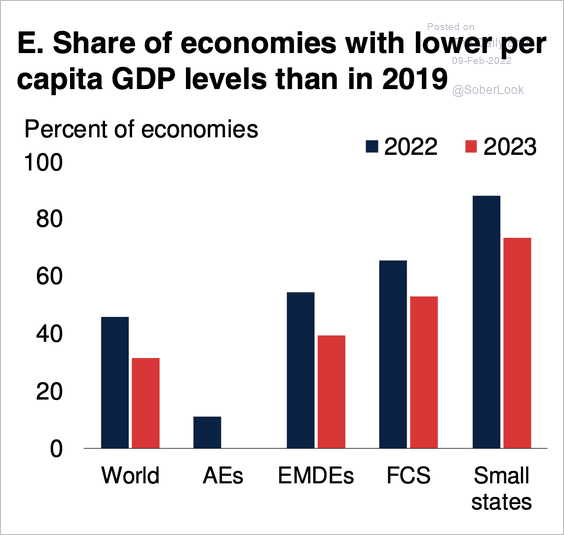

5. In 2023, 40% of emerging and developing economies (EMDEs) will still have per-capita incomes below 2019 levels.

Source: World Bank

Source: World Bank

Back to Index

Cryptocurrency

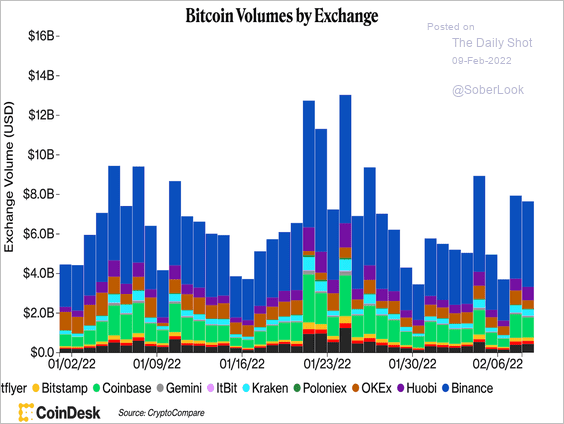

1. Bitcoin spot trading volume has ticked higher over the past two days.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

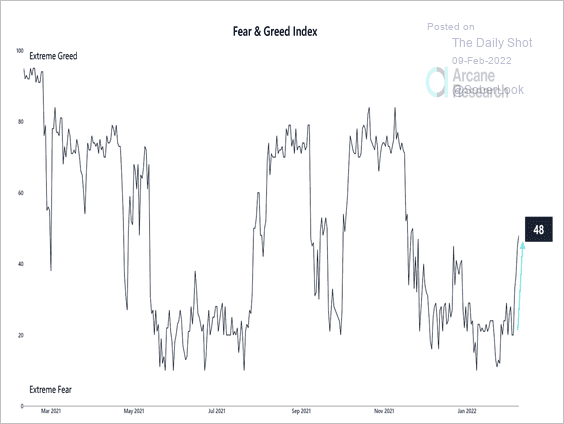

2. The bitcoin Fear & Greed Index continues to rise from extreme lows, signaling improving investor sentiment.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

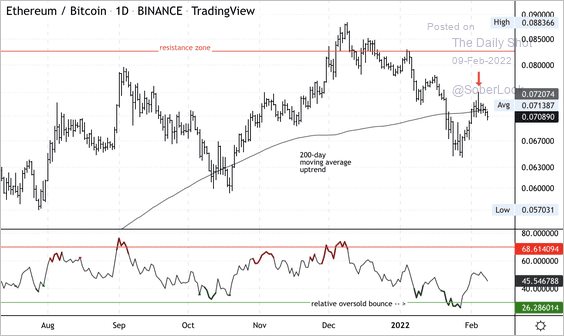

3. Ether is starting to underperform bitcoin.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

4. Roughly 12,000 stolen BTC was seized on Tuesday, representing one-sixth of the total trading volume at the time of the hack in 2016.

Source: @WSJ Read full article

Source: @WSJ Read full article

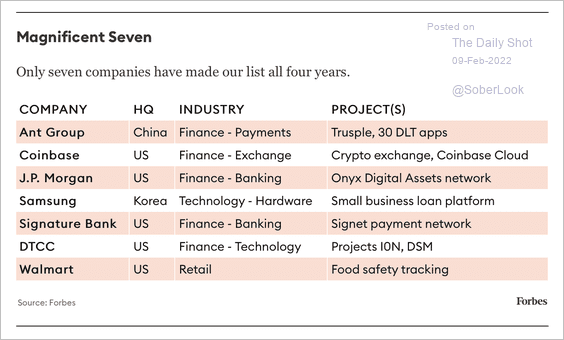

5. Here is a look at some corporate blockchain projects, compiled by Forbes.

Source: Forbes Read full article

Source: Forbes Read full article

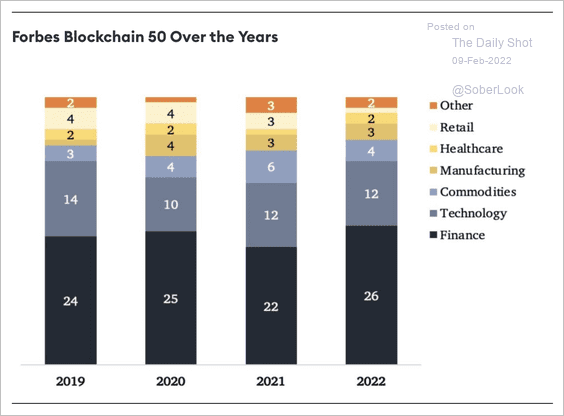

Most companies that made the Forbes “Blockchain 50” list are in finance and tech.

Source: Forbes Read full article

Source: Forbes Read full article

Back to Index

Commodities

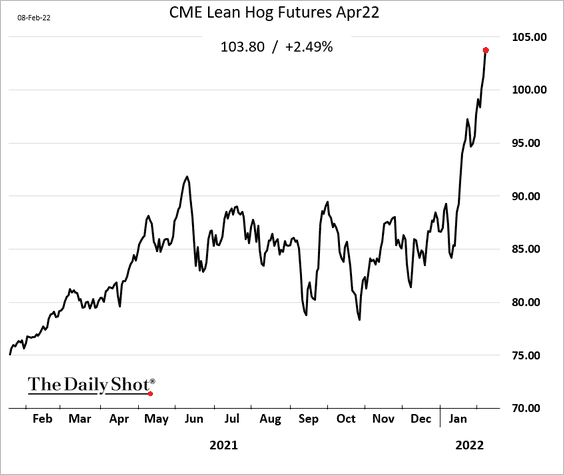

1. US hog futures are surging.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Xinhua Read full article

Source: Xinhua Read full article

——————–

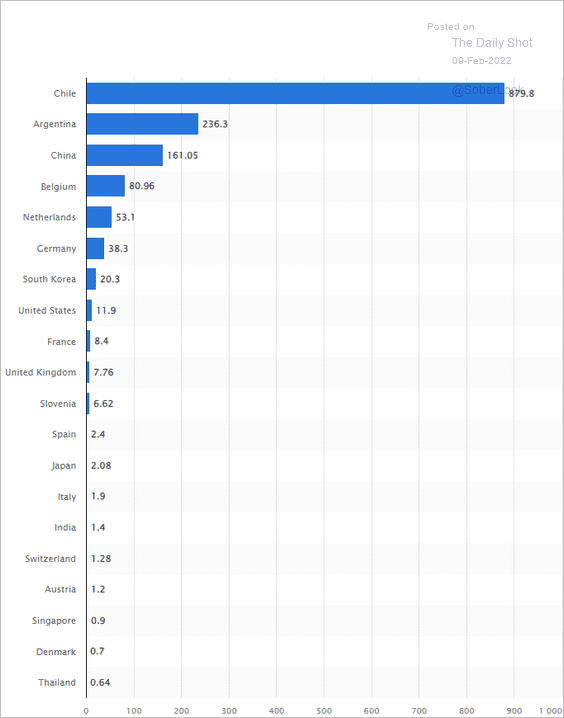

2. Next, we have the leading exporting countries of lithium carbonate worldwide.

Source: Statista

Source: Statista

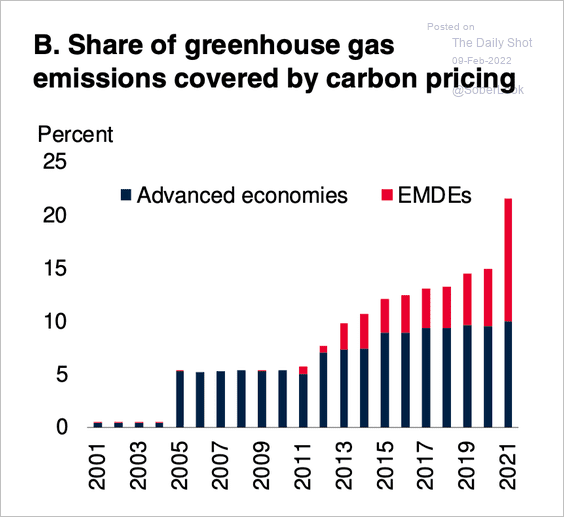

3. Emerging economies are catching up to advanced ones in terms of carbon pricing mechanisms being implemented.

Source: World Bank

Source: World Bank

Back to Index

Energy

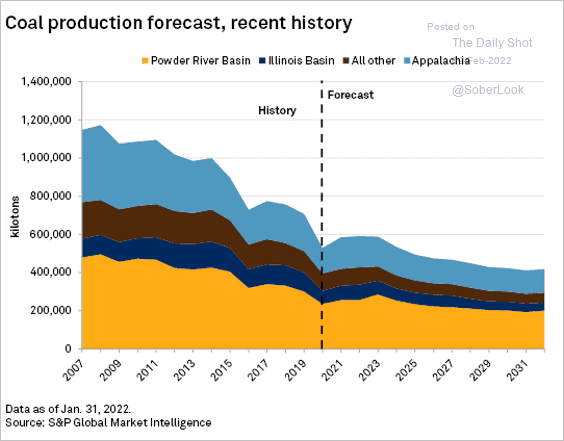

1. US coal production is expected to keep slowing in the years ahead.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

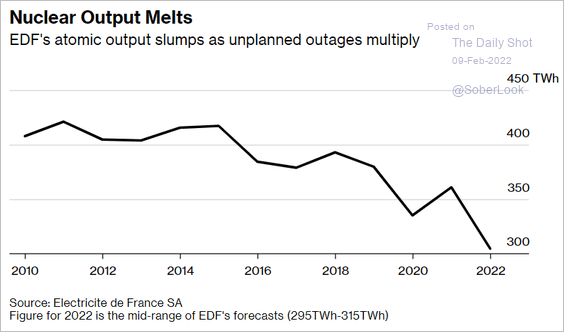

2. French electricity output from nuclear energy continues to shrink.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

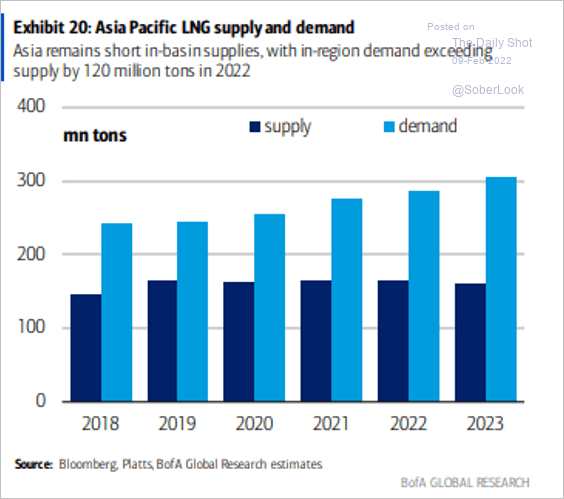

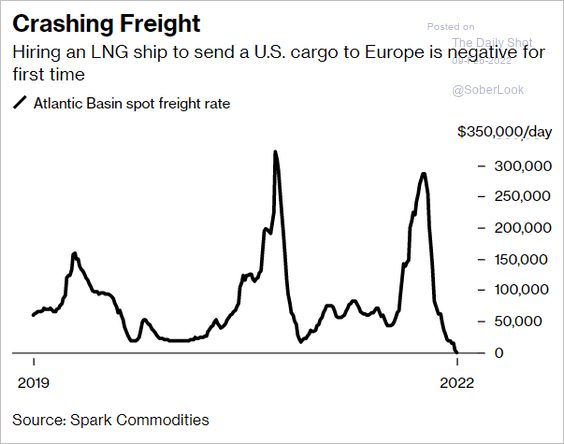

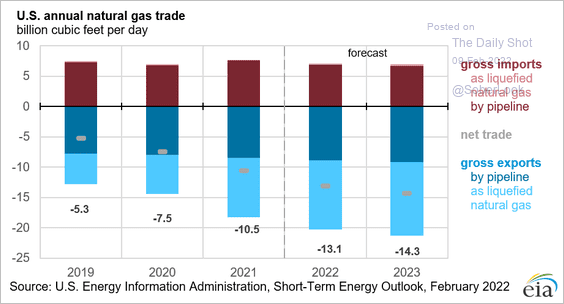

3. Next, we have some updates on natural gas markets.

• Asia’s demand for LNG:

Source: BofA Global Research; @chigrl

Source: BofA Global Research; @chigrl

• LNG freight costs between the US and Europe (as the US floods Europe with LNG):

Source: @markets Read full article

Source: @markets Read full article

• US gas export projections:

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

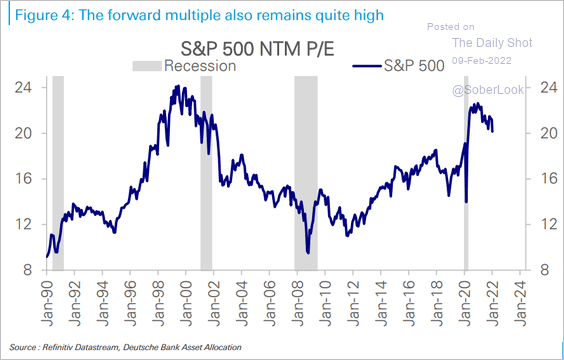

Equities

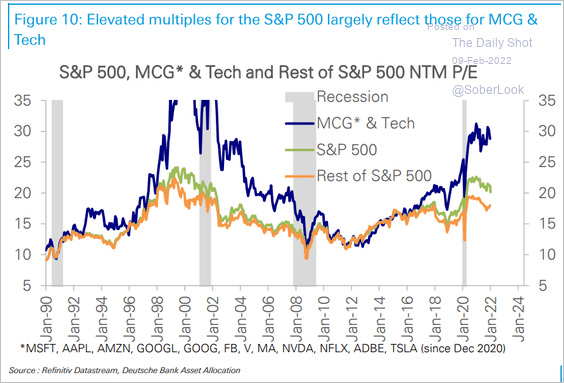

1. The S&P 500 valuations remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• This chart shows the S&P 500 forward P/E ratio (valuation) without the mega-caps/tech.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

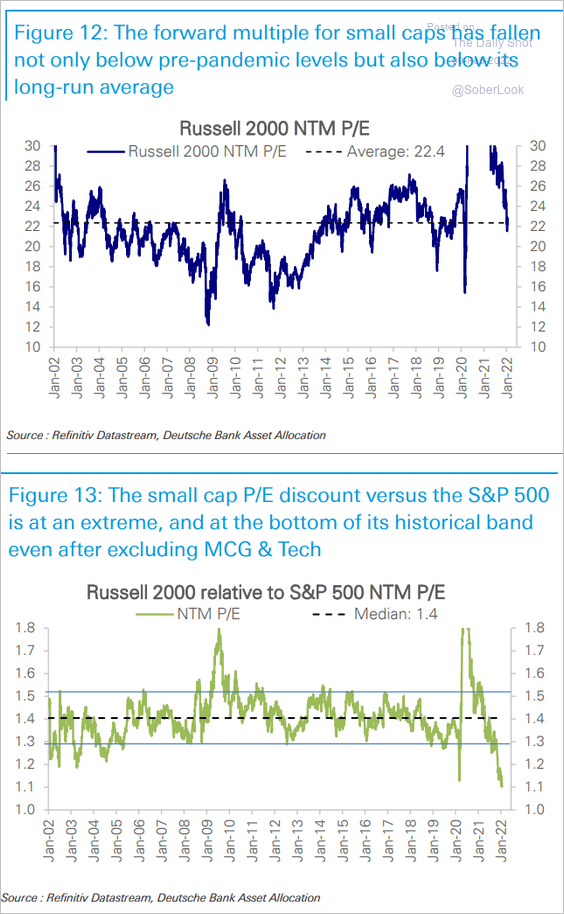

• Small-cap valuations are below the long-run average and massively lagging S&P 500 valuations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

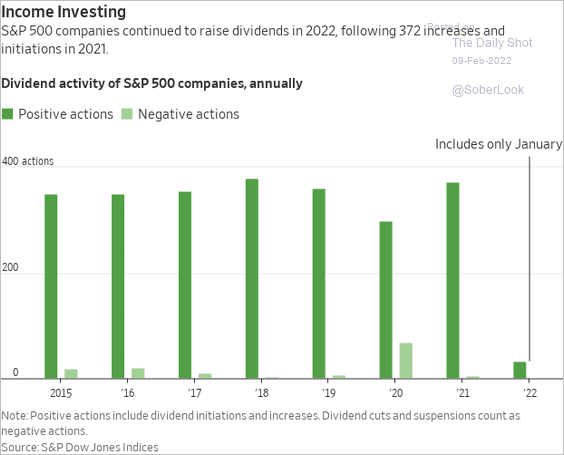

2. Many S&P 500 companies continue to boost dividends.

Source: @WSJ Read full article

Source: @WSJ Read full article

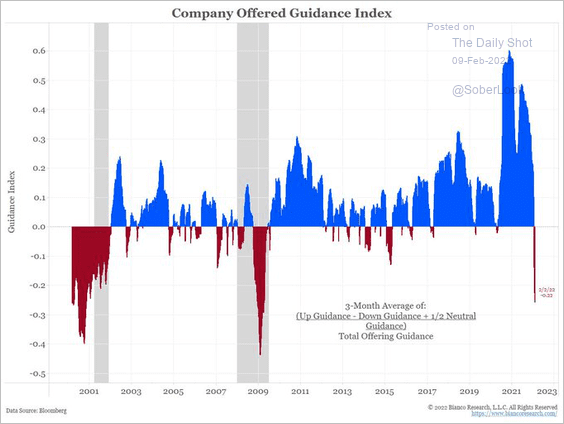

3. Company guidance has been deteriorating lately.

Source: @LizAnnSonders, @biancoresearch

Source: @LizAnnSonders, @biancoresearch

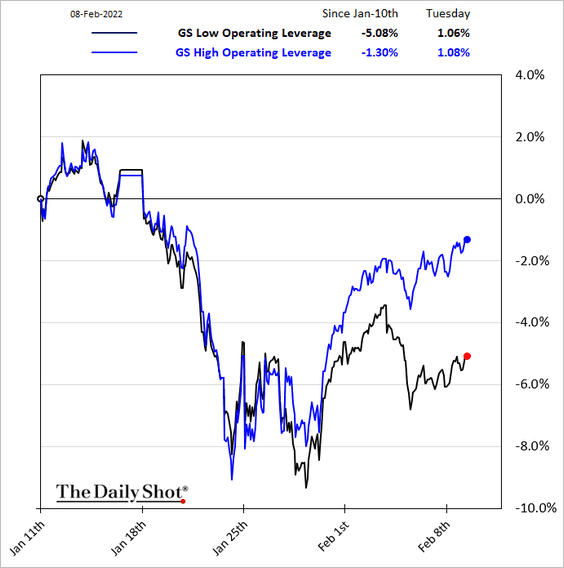

4. Companies with high operating leverage are outperforming (suggesting optimism about economic growth).

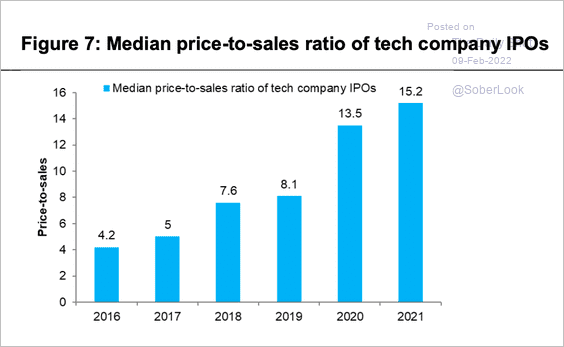

5. The median price to sales multiple of tech companies at IPO hit a new high in 2021.

Source: Citi Private Bank

Source: Citi Private Bank

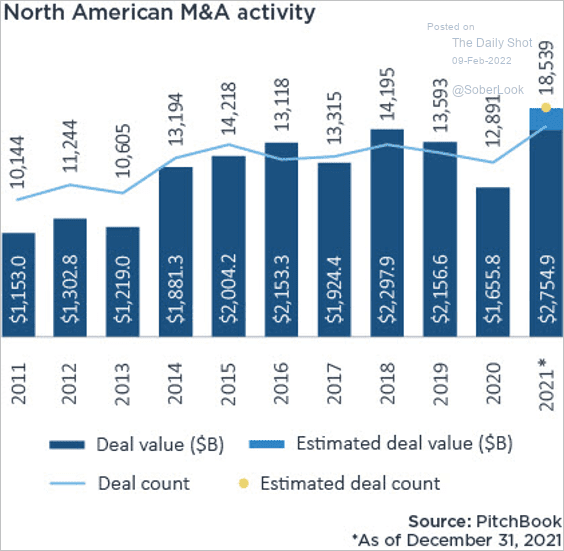

6. North American M&A activity rebounded from the pandemic-induced slowdown last year, mainly driven by tech deals.

Source: PitchBook

Source: PitchBook

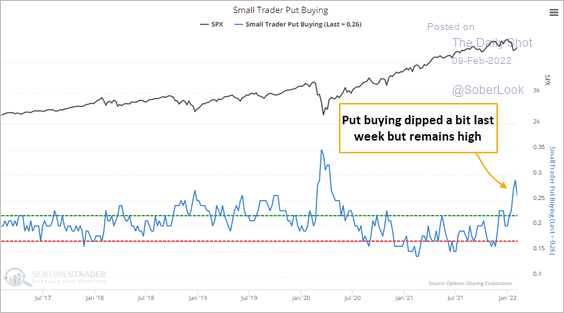

7. Put option buying among small traders remains elevated.

Source: SentimenTrader

Source: SentimenTrader

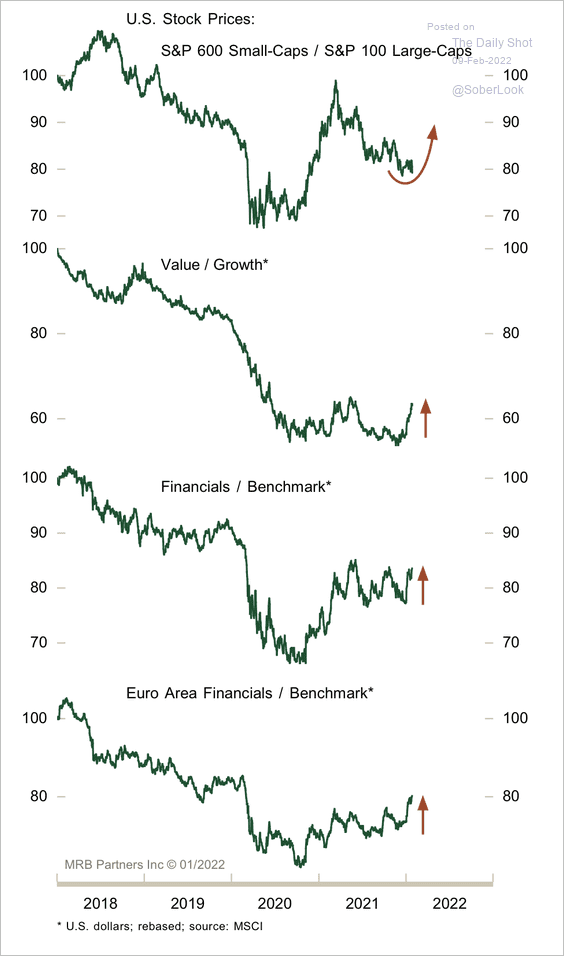

8. Small-cap, value, and financial stocks are gaining strength on a relative basis.

Source: MRB Partners

Source: MRB Partners

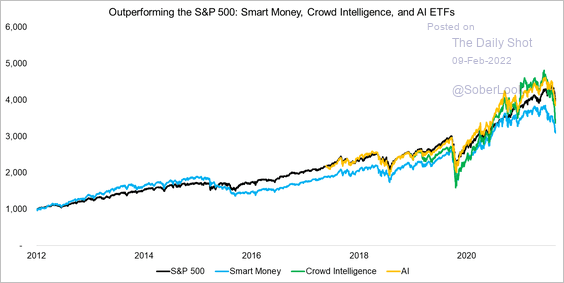

9. Smart money, crowd intelligence, and artificial intelligence ETFs have generally performed in line with the S&P 500.

Source: FactorResearch Read full article

Source: FactorResearch Read full article

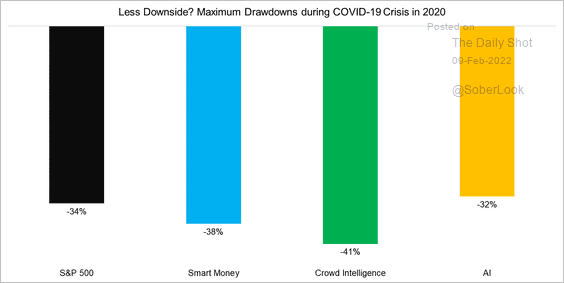

Smart money and crowd intelligence ETFs fell further than the S&P 500 during the March 2020 sell-off, while AI did marginally better.

Source: FactorResearch Read full article

Source: FactorResearch Read full article

Back to Index

Credit

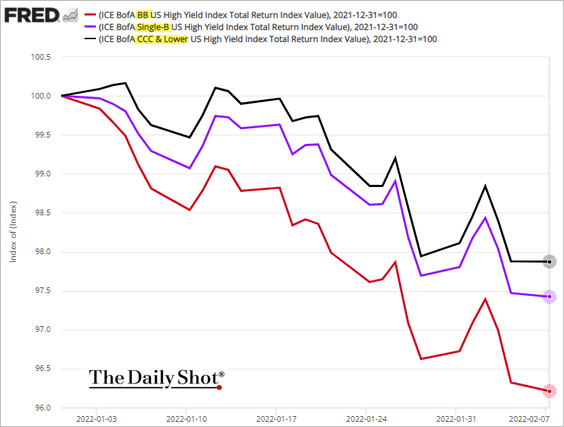

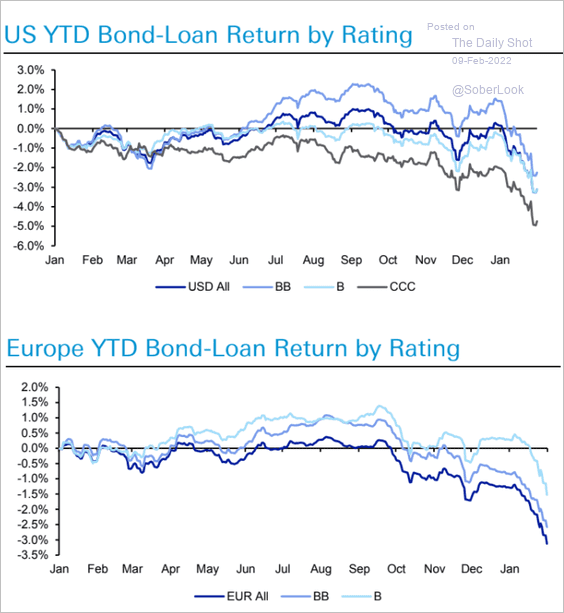

1. CCC–rated bonds have outperformed year-to-date.

2. HY bonds have been lagging leveraged loans both in the US and Europe.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

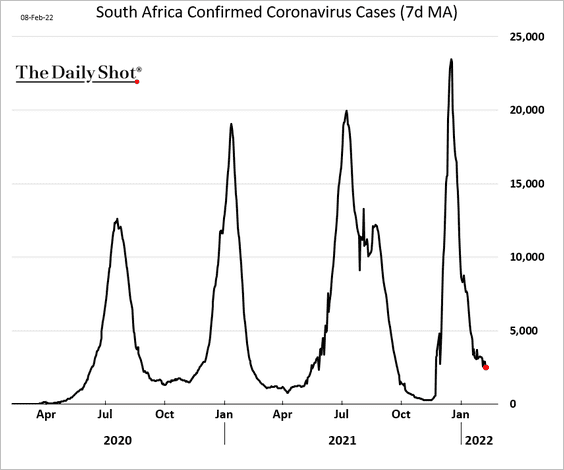

1. Based on South Africa’s COVID waves, we should expect the next major global coronavirus spike in May.

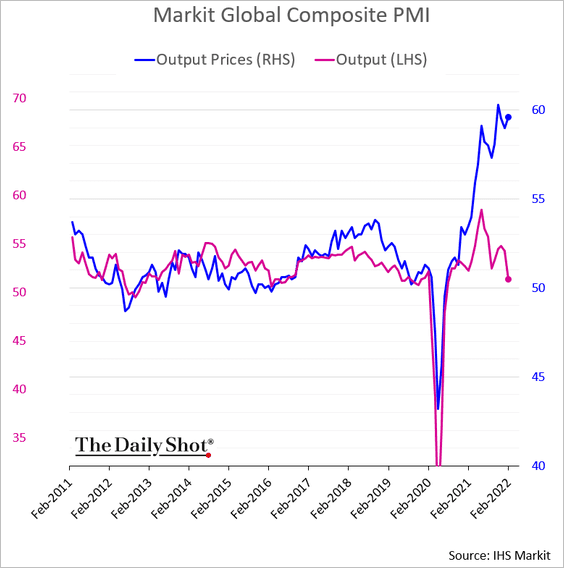

2. Business selling prices have been surging while output growth has rolled over (a stagflationary trend).

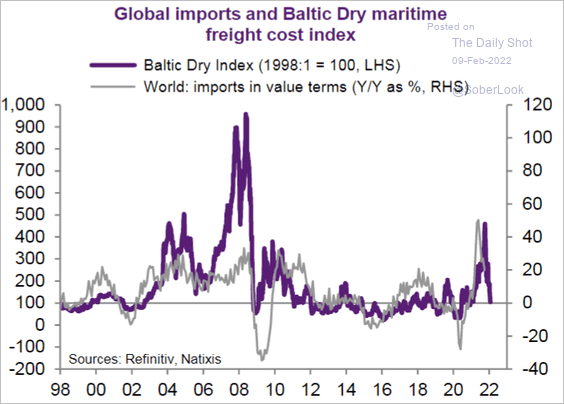

3. The decline in dry bulk shipping costs points to slower global trade.

Source: Natixis

Source: Natixis

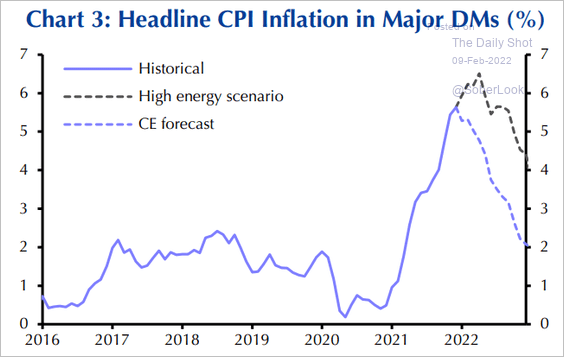

4. What happens to inflation in an energy shock scenario, such as a Russia/Ukraine conflict?

Source: Capital Economics

Source: Capital Economics

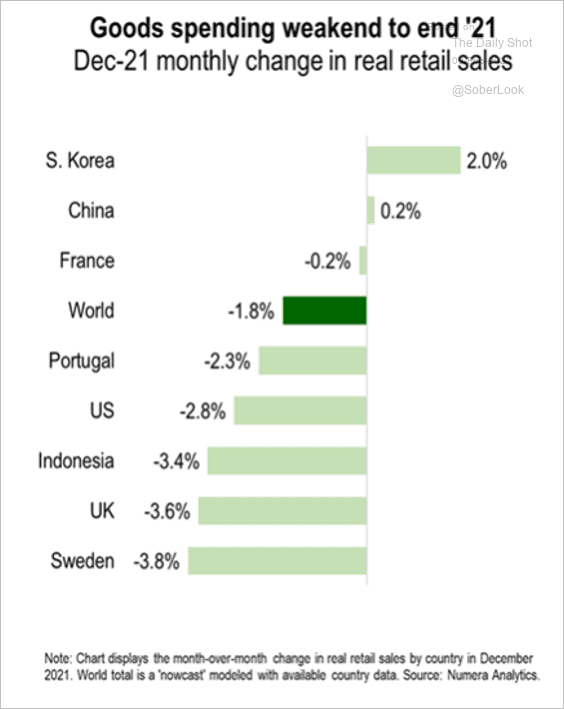

5. Goods spending slowed at the end of last year.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Food for Thought

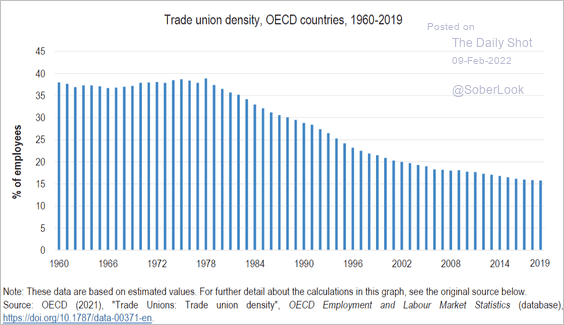

1. Trade unions in OECD countries:

Source: OECD Read full article

Source: OECD Read full article

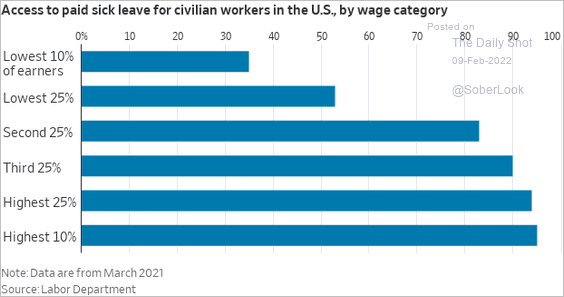

2. Access to paid sick leave:

Source: @WSJ Read full article

Source: @WSJ Read full article

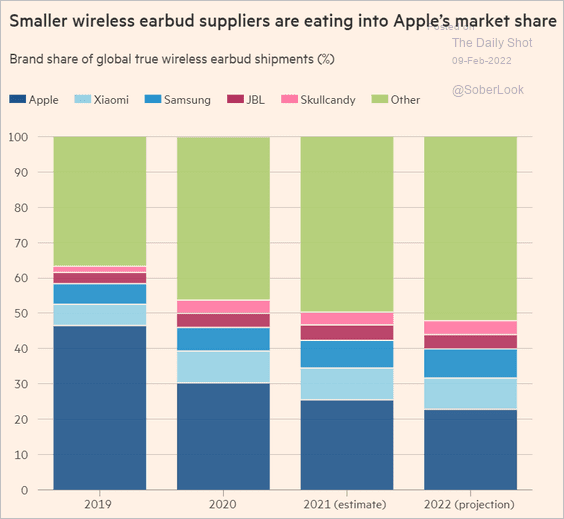

3. Wireless earbud shipments:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

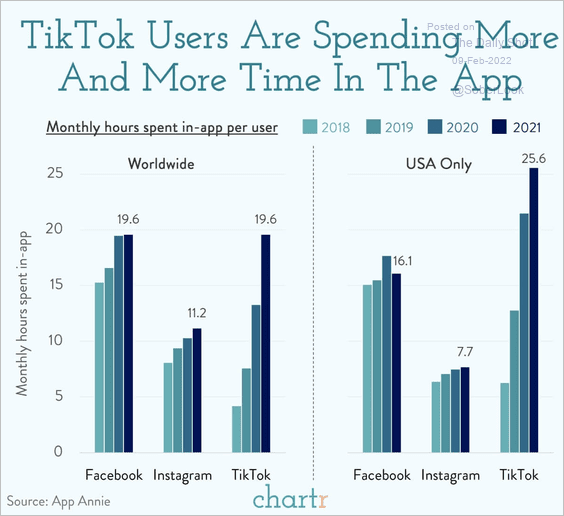

4. Time spent on social media apps:

Source: @chartrdaily

Source: @chartrdaily

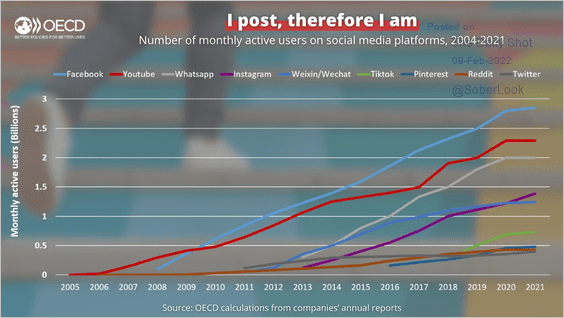

• Active users on social media across OECD economies:

Source: @OECDEduSkills Read full article

Source: @OECDEduSkills Read full article

——————–

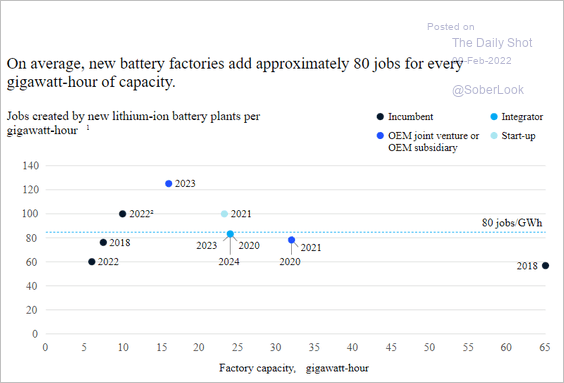

5. Jobs at battery factories:

Source: McKinsey Read full article

Source: McKinsey Read full article

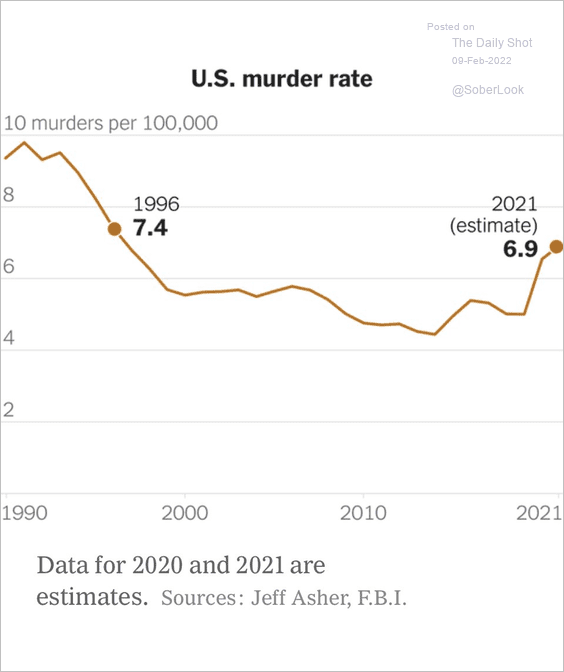

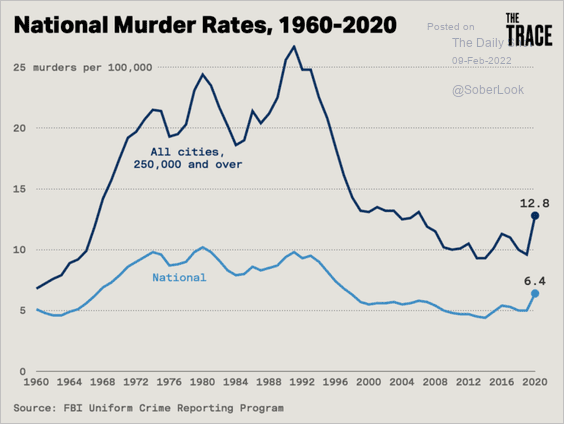

6. The US murder rate (2 charts):

Source: @DLeonhardt

Source: @DLeonhardt

Source: The Trace

Source: The Trace

——————–

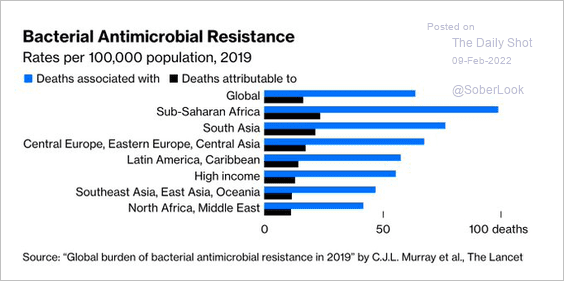

7. Deaths due to antibiotic resistance:

Source: @BBGVisualData, @bopinion, @ThereseRaphael1 Read full article

Source: @BBGVisualData, @bopinion, @ThereseRaphael1 Read full article

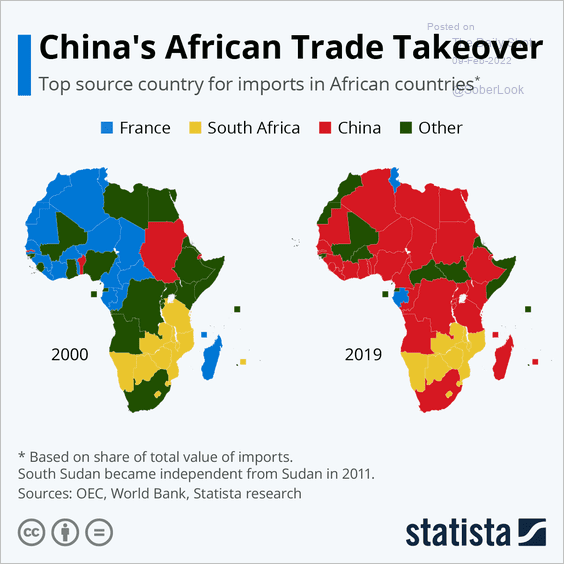

8. The top source of imports across Africa:

Source: Statista

Source: Statista

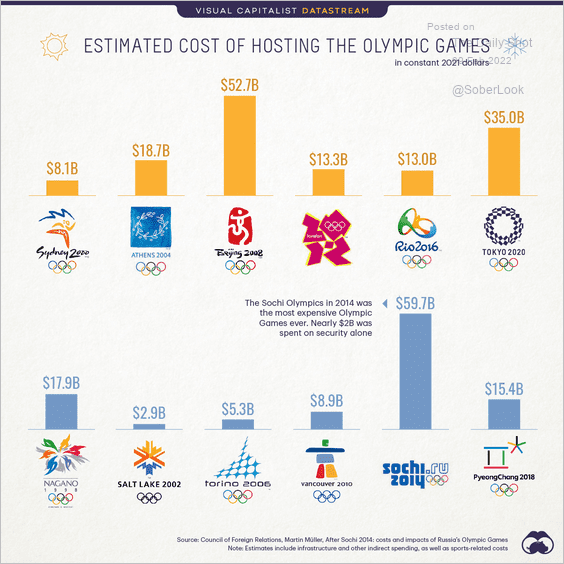

9. Estimated costs of hosting the Olympic Games:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index