The Daily Shot: 15-Feb-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

1. Let’s begin with the labor market.

• US nominal wage growth is now the highest in over two decades.

![]() Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

Wage gains among hourly workers have been particularly strong.

![]() Source: Federal Reserve Bank of Atlanta

Source: Federal Reserve Bank of Atlanta

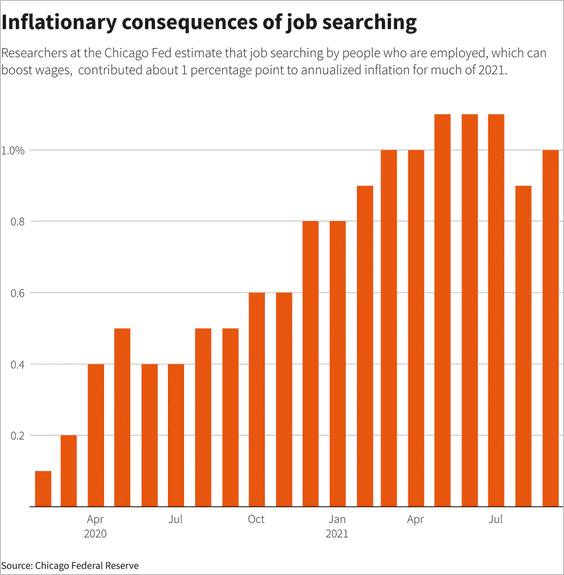

• Record job-switching is boosting US inflation:

Source: Reuters Read full article

Source: Reuters Read full article

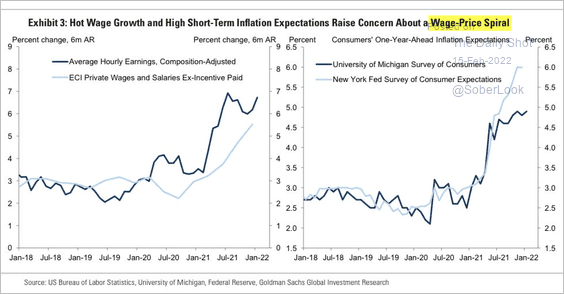

• Some economists and Fed officials are becoming concerned about the wage-price spiral.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

Source: @WSJ Read full article

Source: @WSJ Read full article

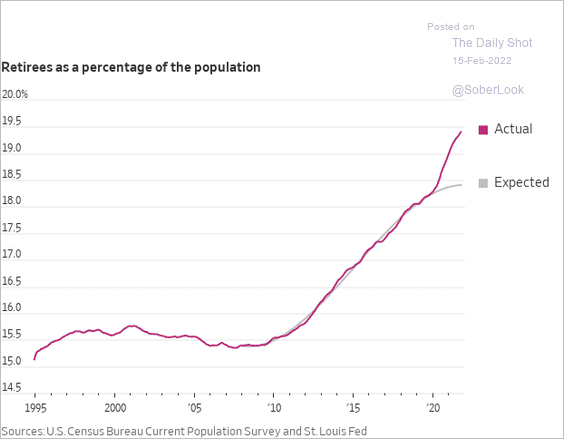

• 2.6 million people retired earlier than expected since the start of the pandemic.

Source: @WSJ Read full article

Source: @WSJ Read full article

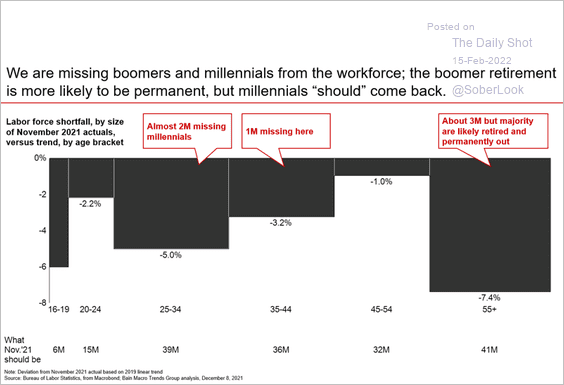

• Here is an overview of the labor force shortfall.

Source: Bain & Company

Source: Bain & Company

——————–

2. Next, we have some updates on supply chain issues.

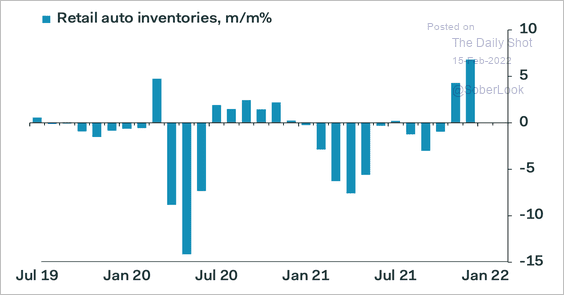

• Automobile inventories have been rising.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

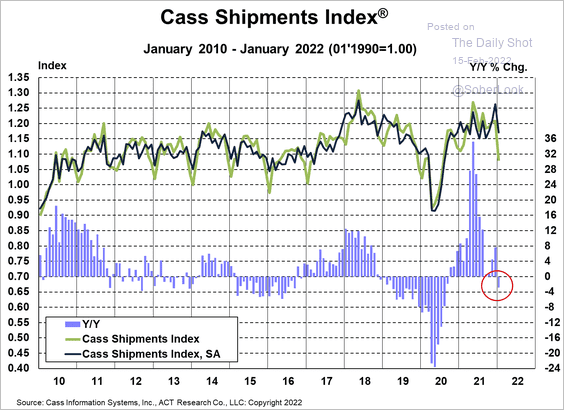

• Domestic shipping activity slowed a bit last month.

Source: Cass Information Systems

Source: Cass Information Systems

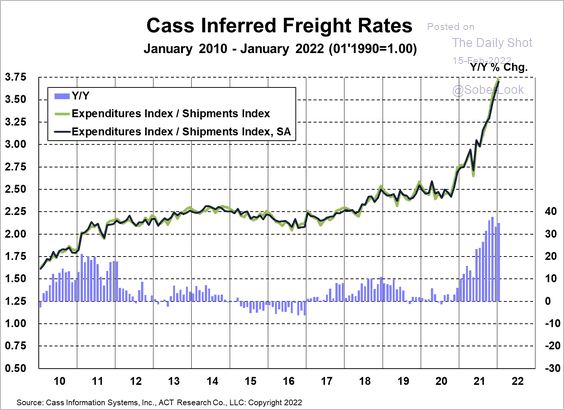

But freight rates continue to surge.

Source: Cass Information Systems

Source: Cass Information Systems

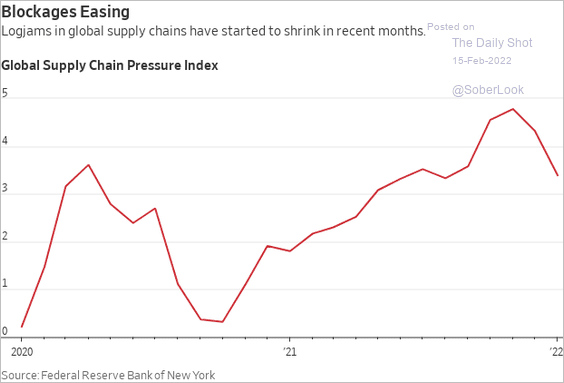

• Here is the NY Fed’s supply pressures index.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

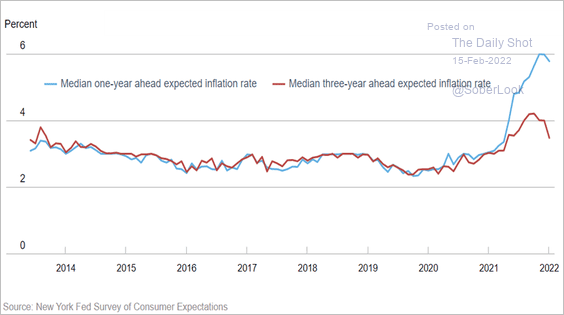

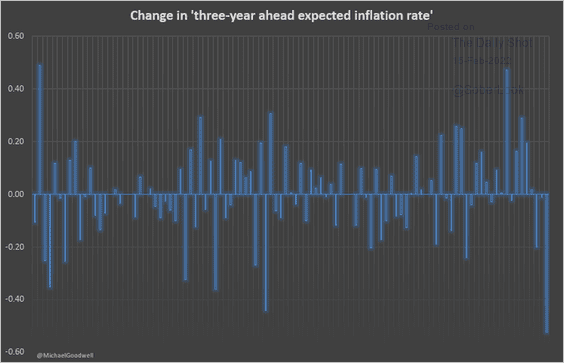

3. Consumer inflation expectations appear to have peaked, with the 3-year indicator dropping sharply.

Source: NY Fed

Source: NY Fed

Source: @MichaelGoodwellLargest

Source: @MichaelGoodwellLargest

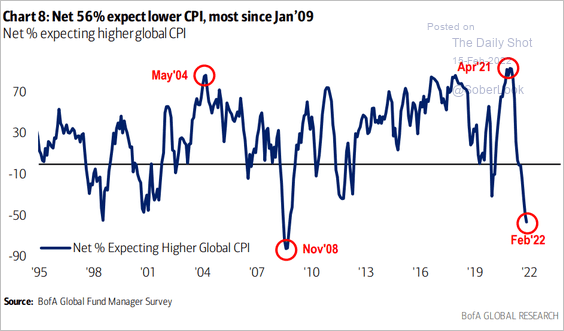

Fund managers also see inflation moving lower from here.

Source: BofA Global Research

Source: BofA Global Research

——————–

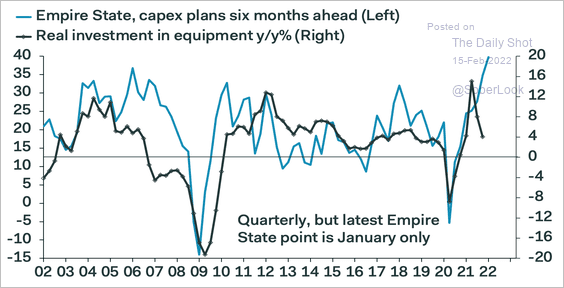

4. Business investment should remain robust.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The United Kingdom

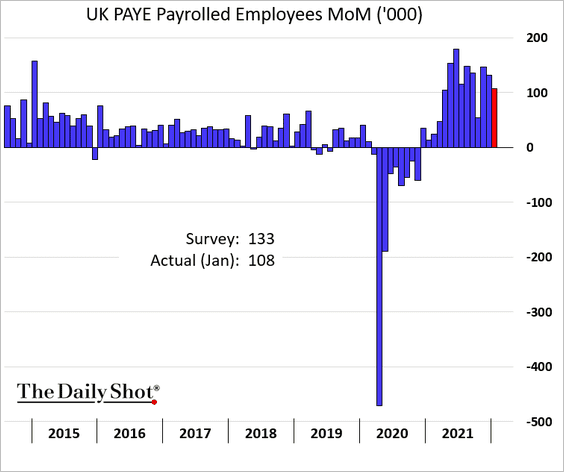

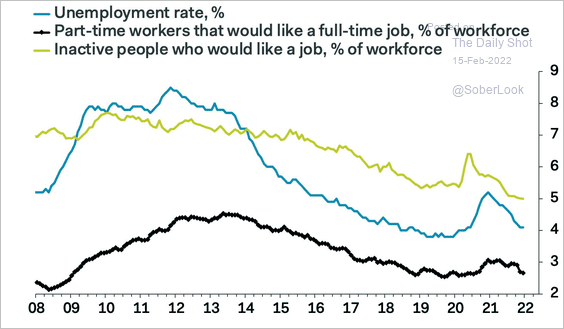

1. Payrolls gains were a bit softer than expected in January, …

… as the labor market tightens further.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

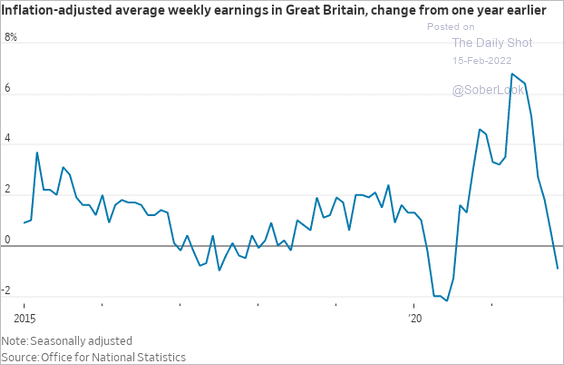

2. Real wage growth has turned negative as inflation surges.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

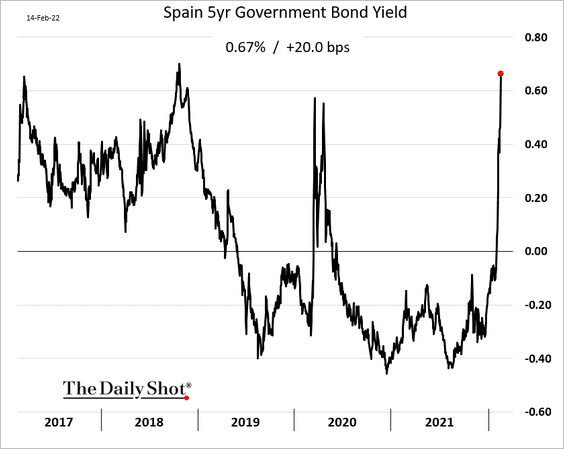

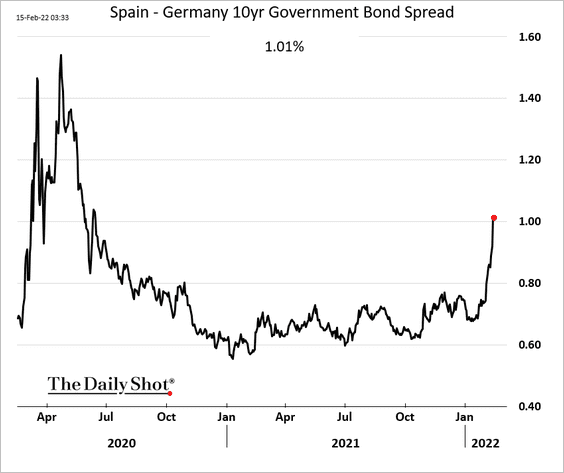

1. Spain’s bond yields are soaring.

The 10yr spread to Germany broke above 100 bps.

——————–

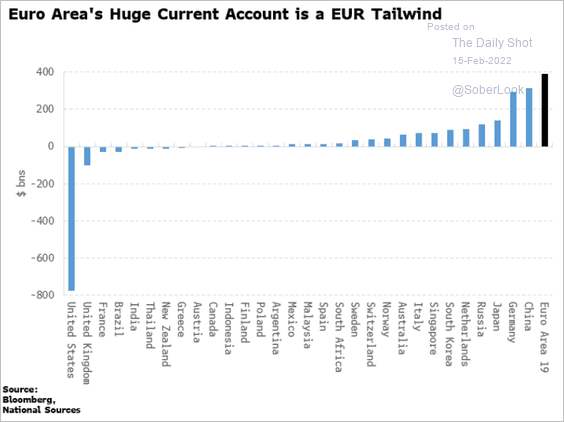

2. The euro-area current account surplus should be a tailwind for the euro.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

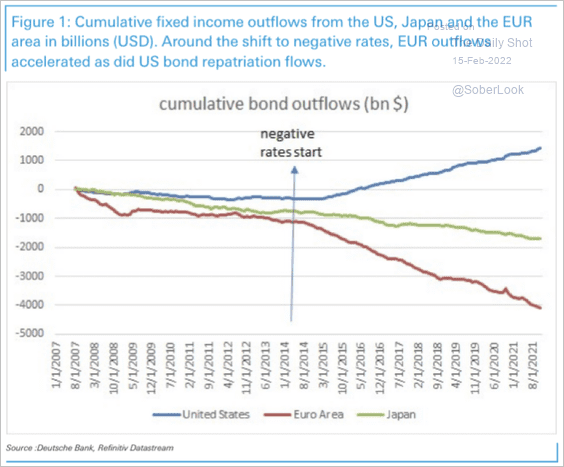

3. Euro-area bond outflows have accelerated since negative rates became the norm in 2014.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

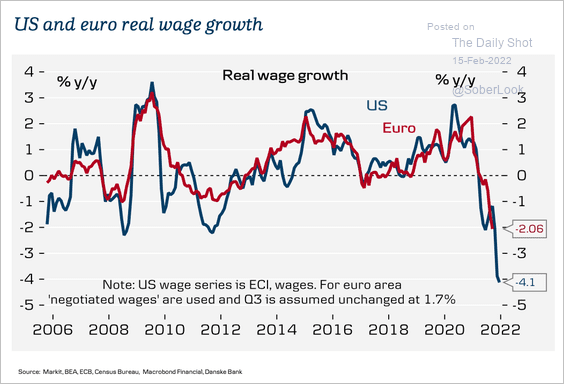

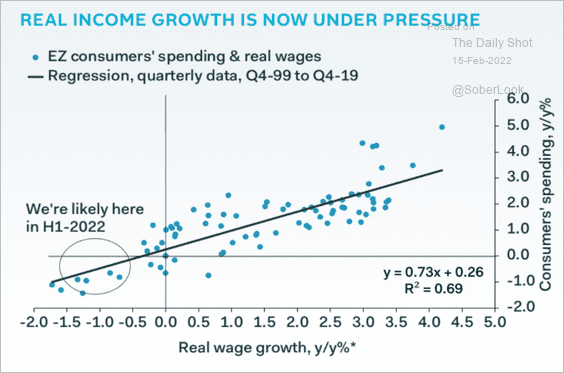

4. Real wages continue to fall further into negative territory.

Source: Danske Bank

Source: Danske Bank

Will this trend put pressure on consumer spending?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

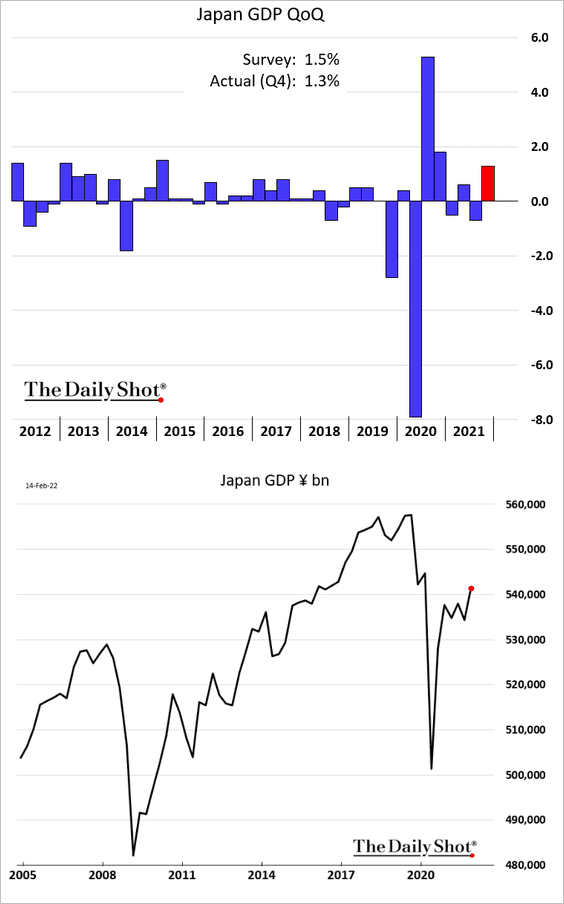

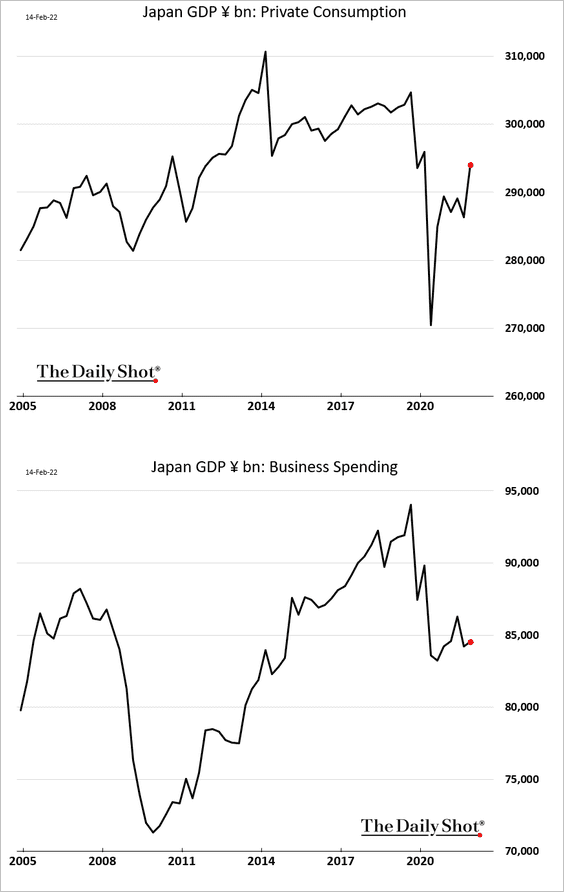

1. Japan’s GDP jumped in Q4, although the gain missed consensus. The GDP remains well below pre-COVID levels.

Private consumption rose sharply, but business investment remains weak.

——————–

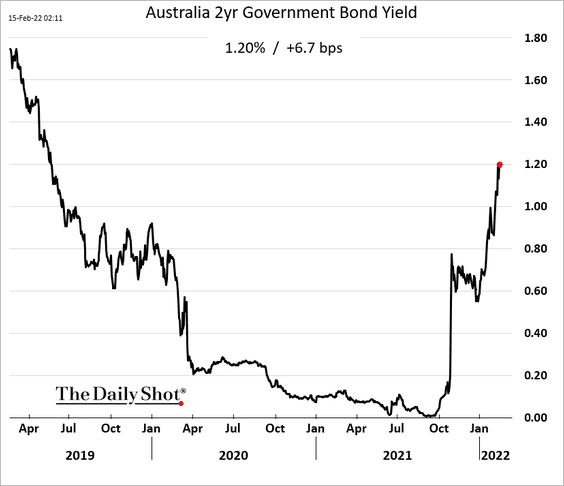

2. Australia’s 2yr yield hit 1.2% for the first time since early 2019.

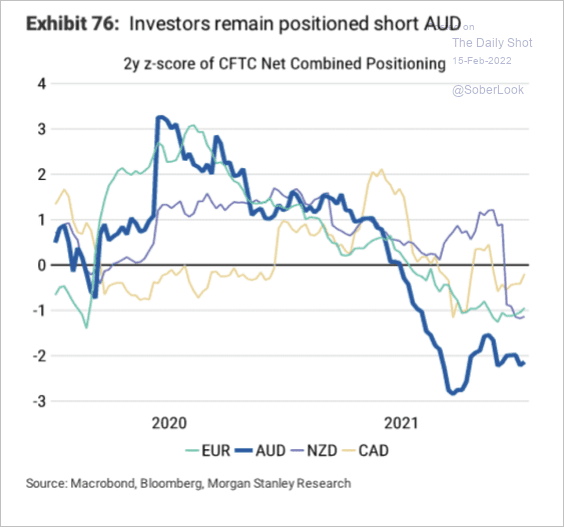

Separately, investors remain net-short the Aussie dollar.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

China

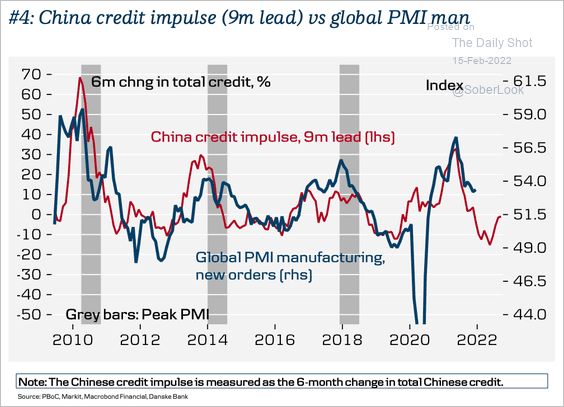

1. China’s credit impulse continues to perk up. Given historic leads (6-9 months), it suggests a bottom in global PMIs by mid-2022.

Source: Danske Bank

Source: Danske Bank

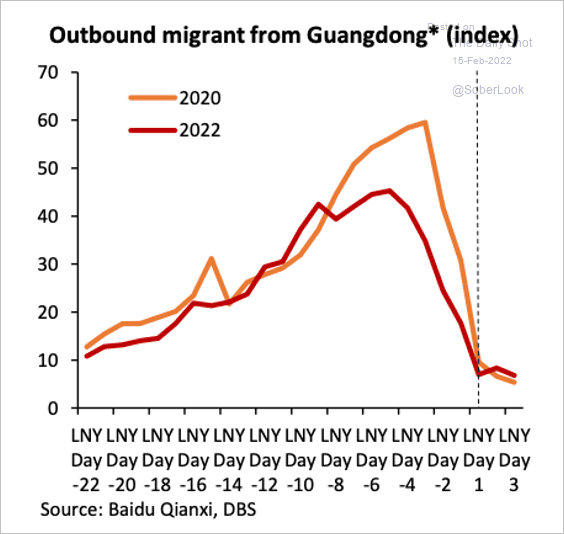

2. Chinese manufacturing hubs have been offering incentives for migrant workers not to go home for the holidays.

Source: DBS

Source: DBS

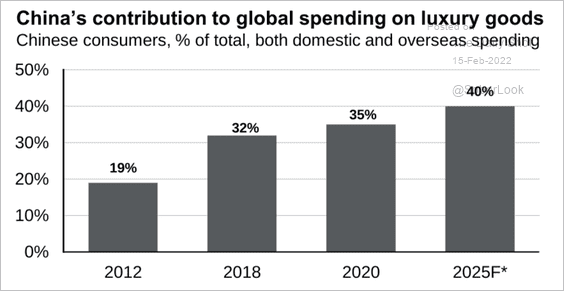

3. China’s contribution to global spending on luxury goods is expected to increase over the next few years.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

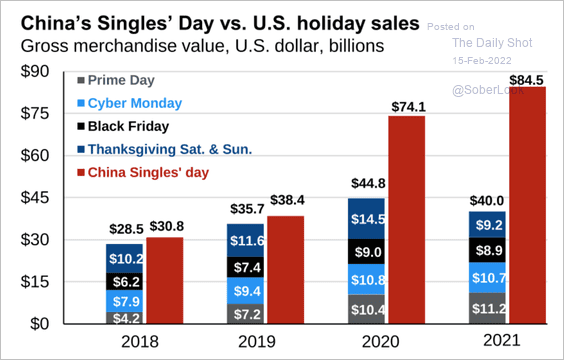

• Single’s Day has the highest gross merchandise value relative to other major spending holidays.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Emerging Markets

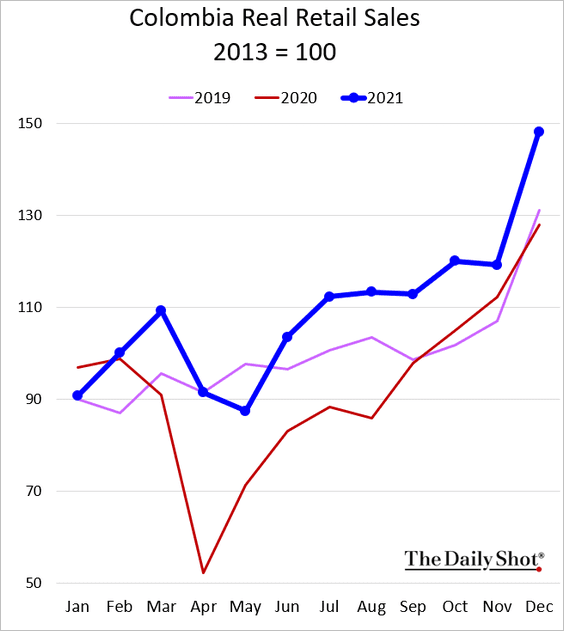

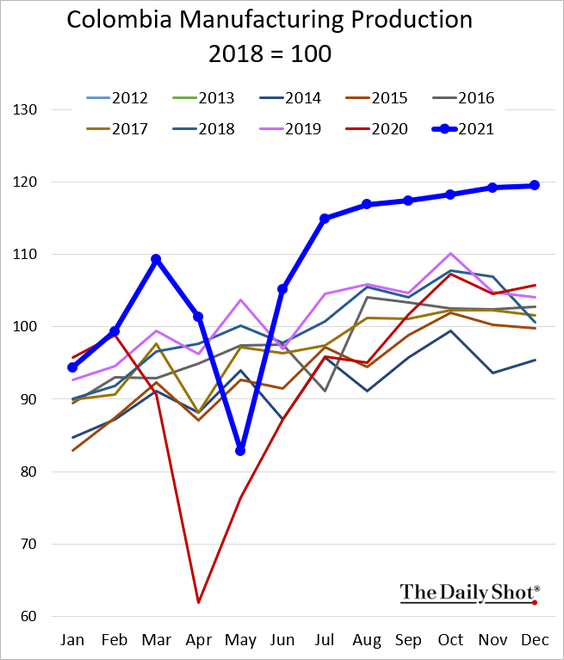

1. Colombia’s economy finished last year on a strong note.

• Retail sales:

• Manufacturing:

——————–

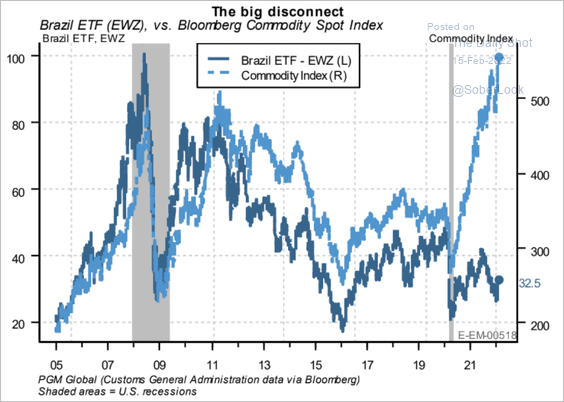

2. Brazil’s stocks should benefit from higher commodity prices.

Source: PGM Global

Source: PGM Global

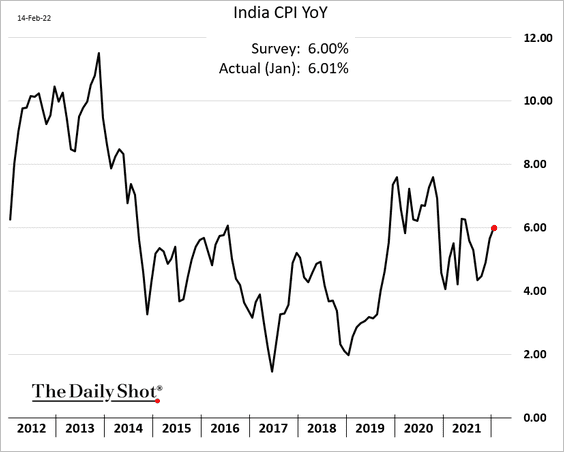

3. India’s CPI is back above 6%.

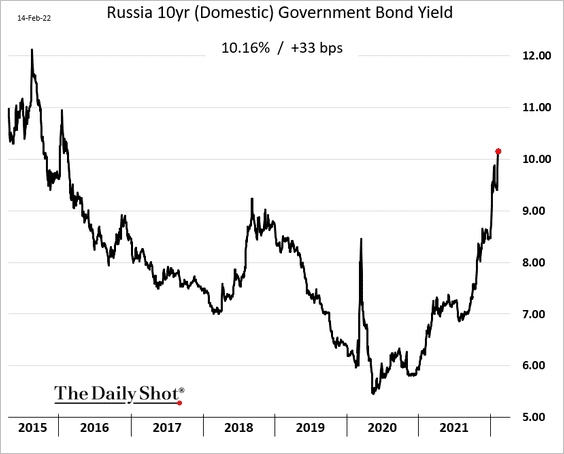

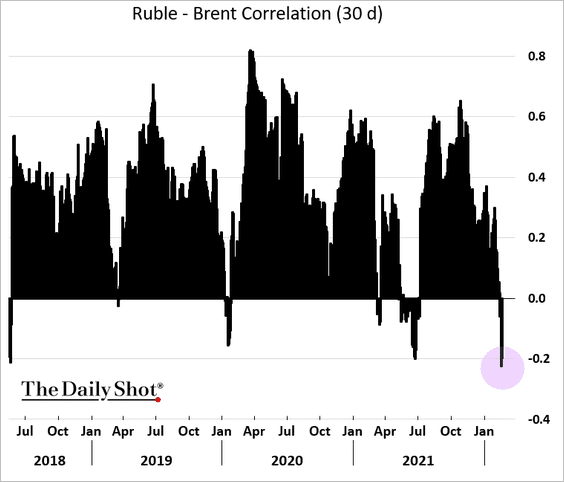

4. Russia’s 10yr bond yield is above 10% for the first time in six years.

The ruble-oil correlation has broken down.

——————–

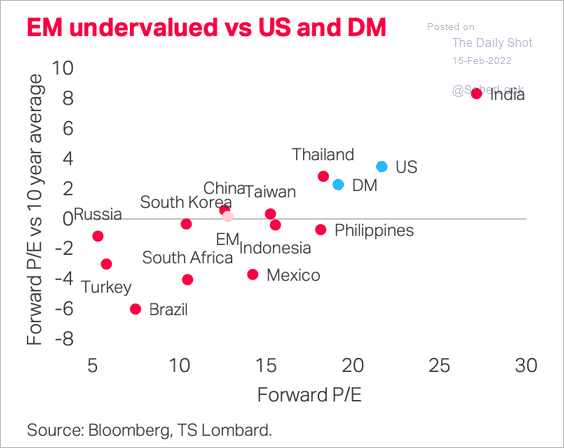

5. Some emerging market equity valuations are very attractive vs. their developed market peers.

Source: TS Lombard

Source: TS Lombard

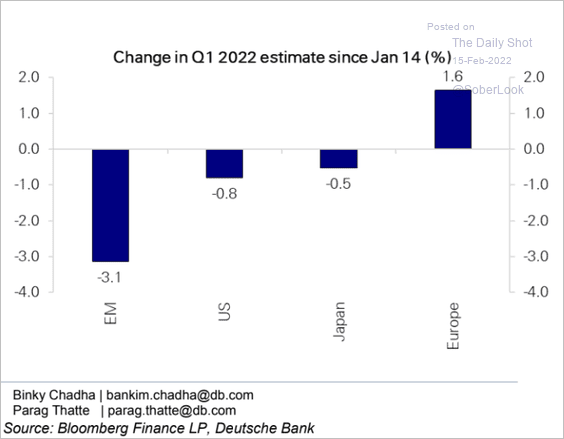

• Q1 earnings estimates for EM companies have deteriorated over the past month.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

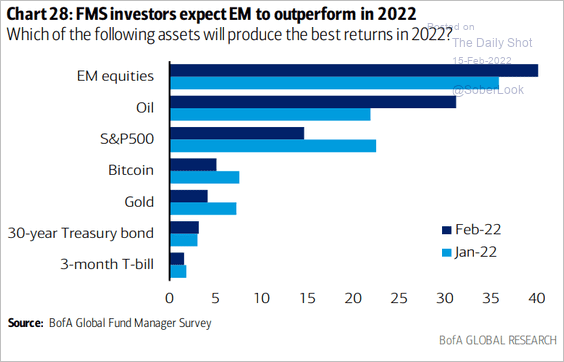

• Fund managers expect EM stocks to outperform

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

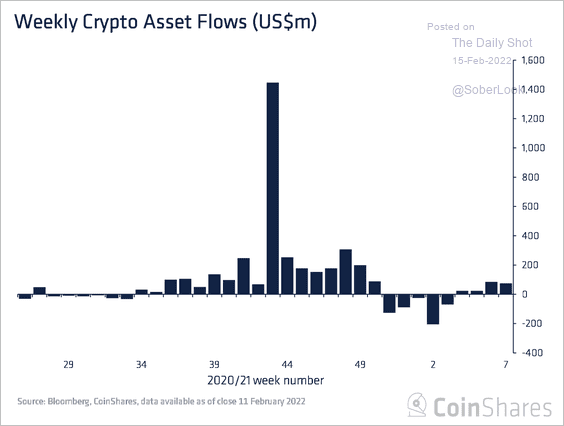

1. Crypto funds saw inflows last week, albeit relatively minor compared to Q4.

Source: CoinShares Read full article

Source: CoinShares Read full article

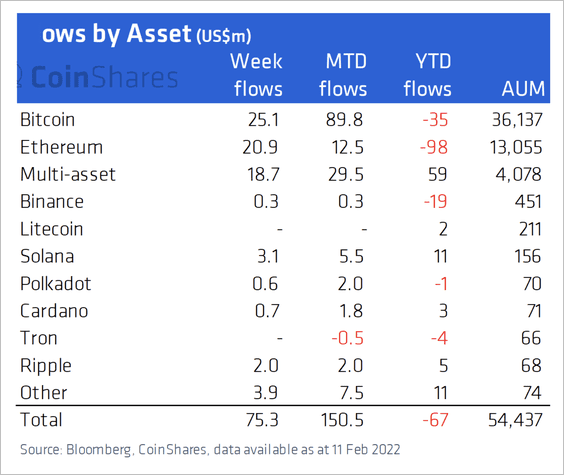

Bitcoin funds accounted for a majority of inflows last week, while Ethereum funds finally broke above a nine-week spell of outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

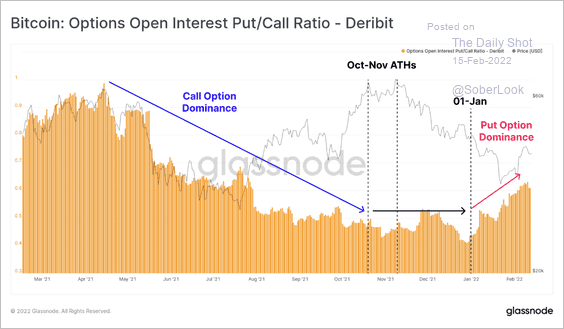

2. This chart shows the recent increase in puts versus call options, indicating greater demand for downside protection among bitcoin traders.

Source: Glassnode Read full article

Source: Glassnode Read full article

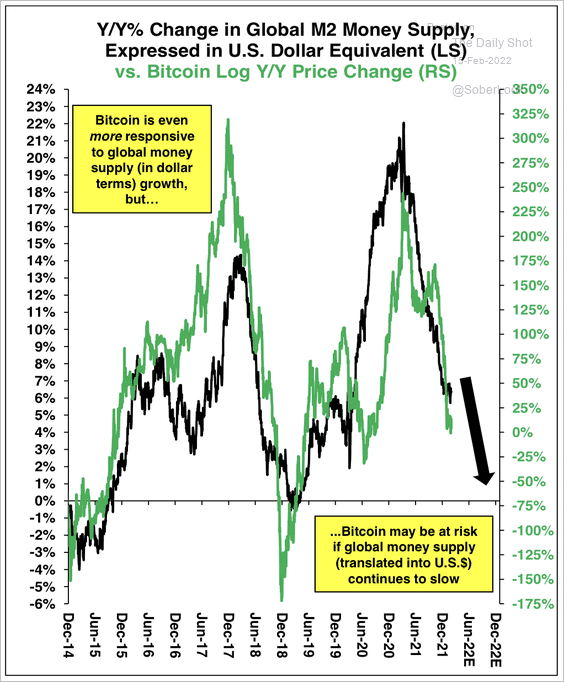

3. Bitcoin has been very responsive to changes in global money supply.

Source: Stifel

Source: Stifel

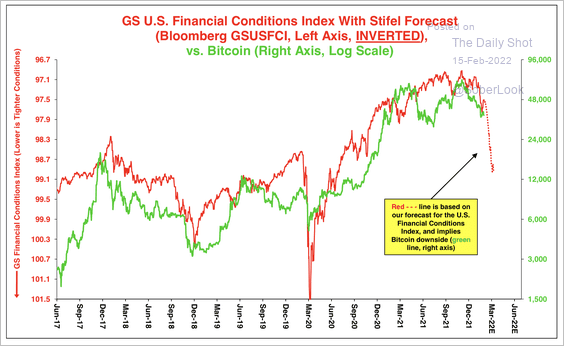

4. Tighter financial conditions could be a headwind for bitcoin.

Source: Stifel

Source: Stifel

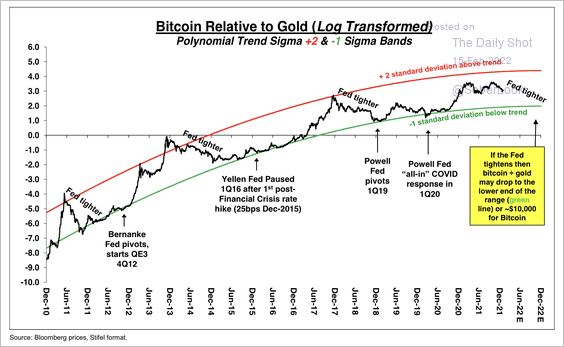

5. Bitcoin tends to underperform gold when the Fed tightens policy.

Source: Stifel

Source: Stifel

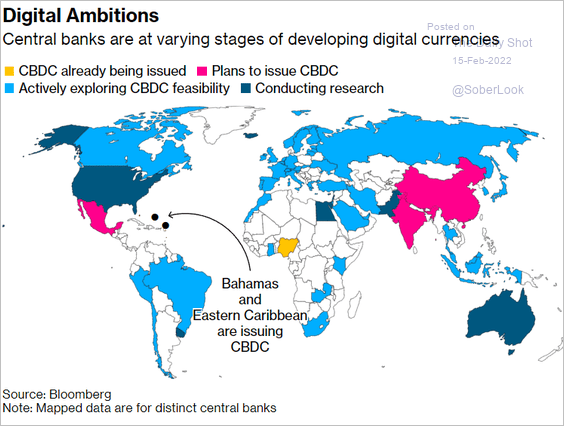

6. Here is a look at central banks’ digital currency status.

Source: @carolynnlook, @markets Read full article

Source: @carolynnlook, @markets Read full article

Back to Index

Commodities

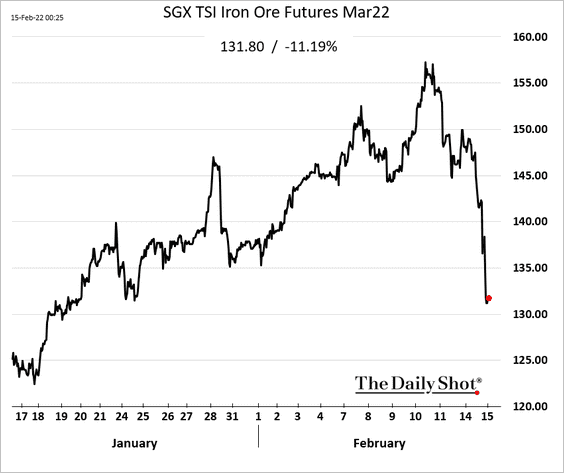

1. Beijing is waging war on iron ore prices.

Source: @annieLee23, @markets Read full article

Source: @annieLee23, @markets Read full article

——————–

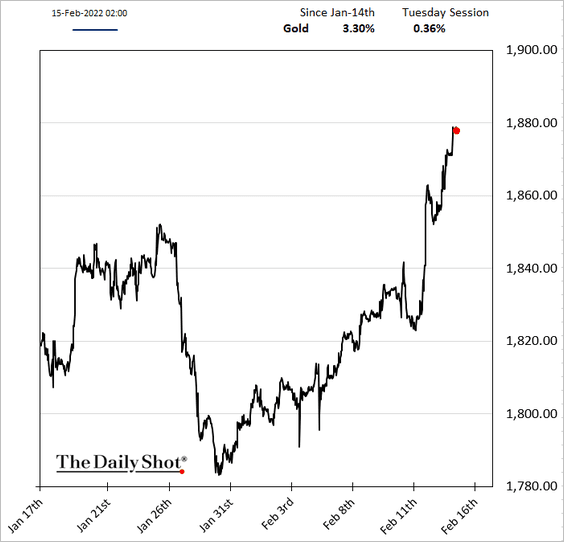

2. Gold has been rallying on the Ukraine/Russia uncertainty.

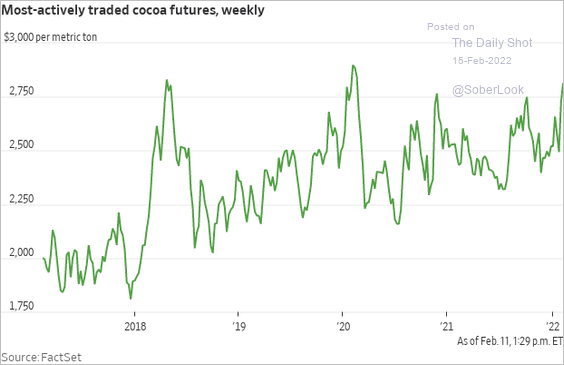

3. Dry weather in West Africa has been boosting cocoa futures.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

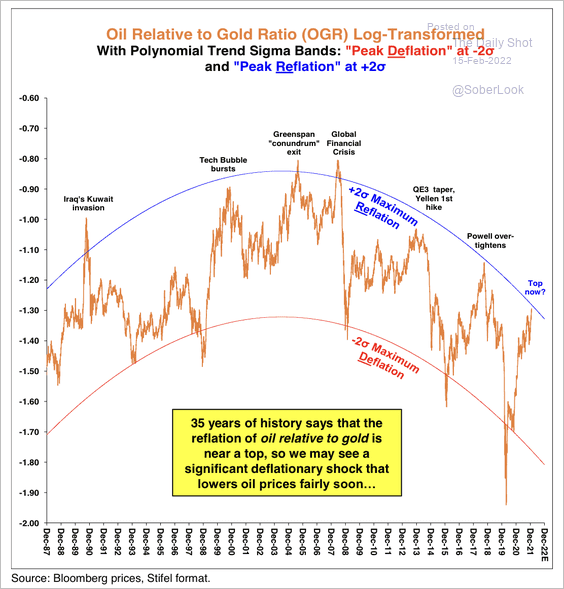

1. Oil appears stretched relative to gold.

Source: Stifel

Source: Stifel

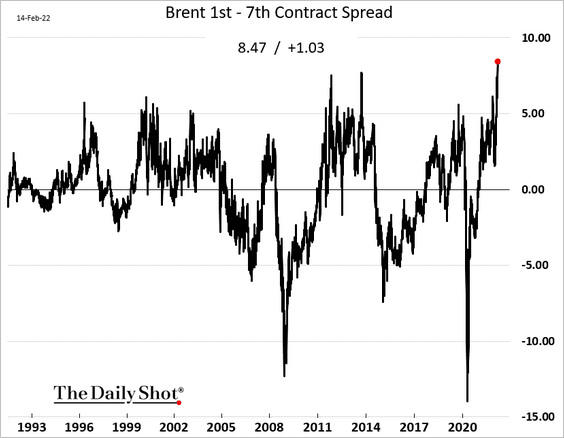

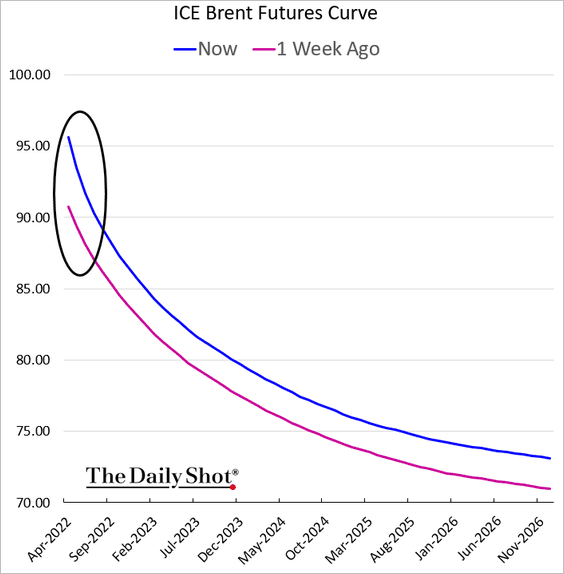

2. The Brent crude backwardation hit the highest level in decades amid tighter supplies.

——————–

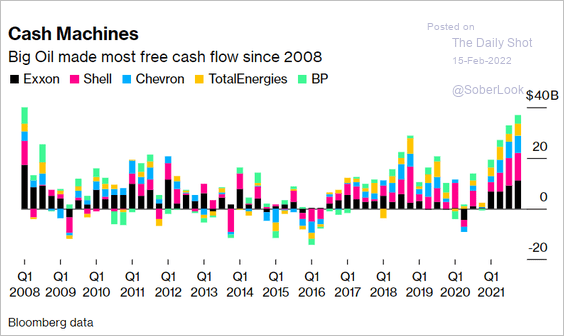

3. Energy firms’ free cash flow has been increasing rapidly.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

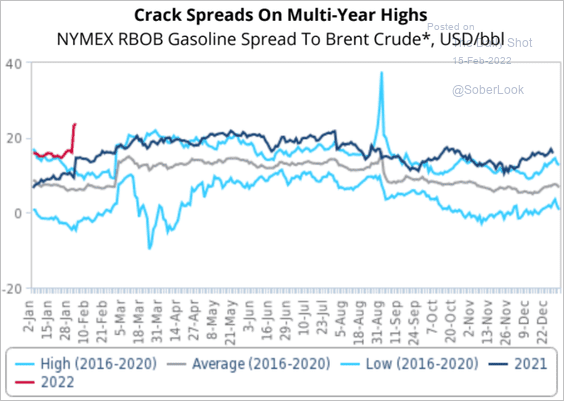

4. Crack spreads are elevated.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

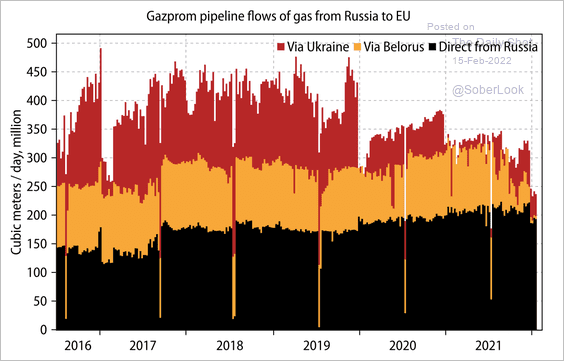

5. Russian gas flows to the EU have been falling.

Source: Gavekal Research

Source: Gavekal Research

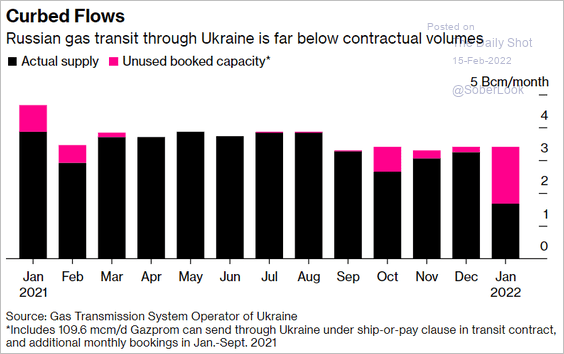

Last month’s flows were well below contractual volumes.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

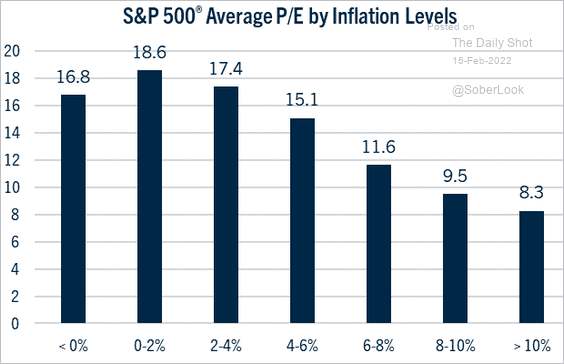

1. Higher inflation means lower stock valuations.

Source: John Lynch, Comerica Wealth Management

Source: John Lynch, Comerica Wealth Management

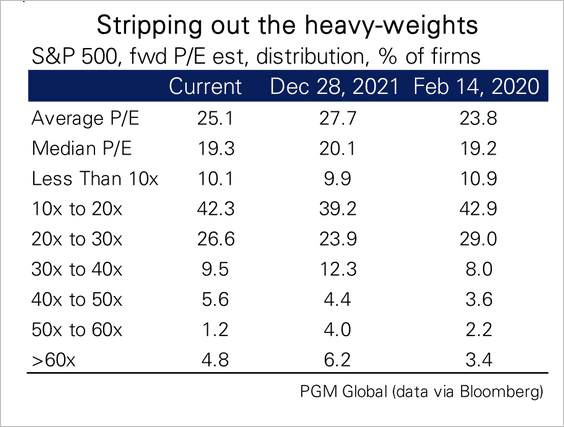

• Median S&P 500 valuations have fallen back to pre-pandemic levels, but the distribution of multiples shows that many stocks still trade at rich valuations.

Source: PGM Global

Source: PGM Global

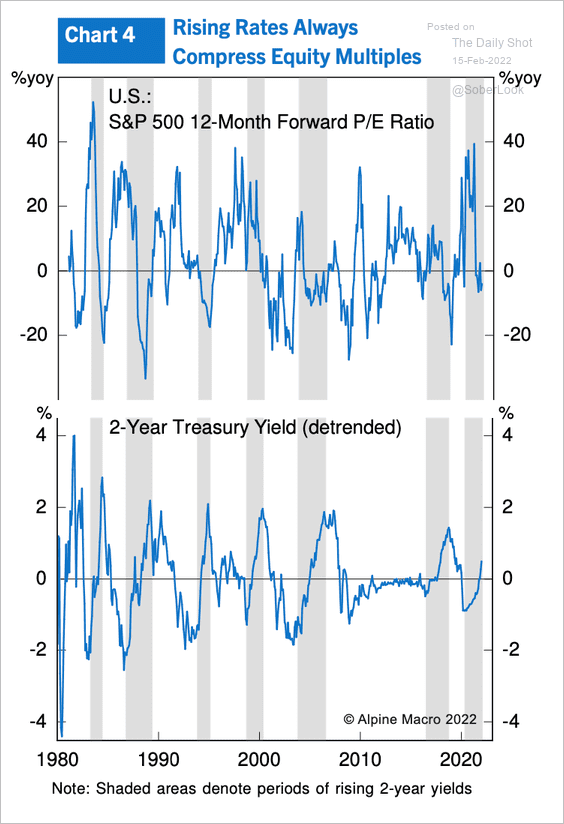

• Rising rates tend to compress equity multiples.

Source: Alpine Macro

Source: Alpine Macro

——————–

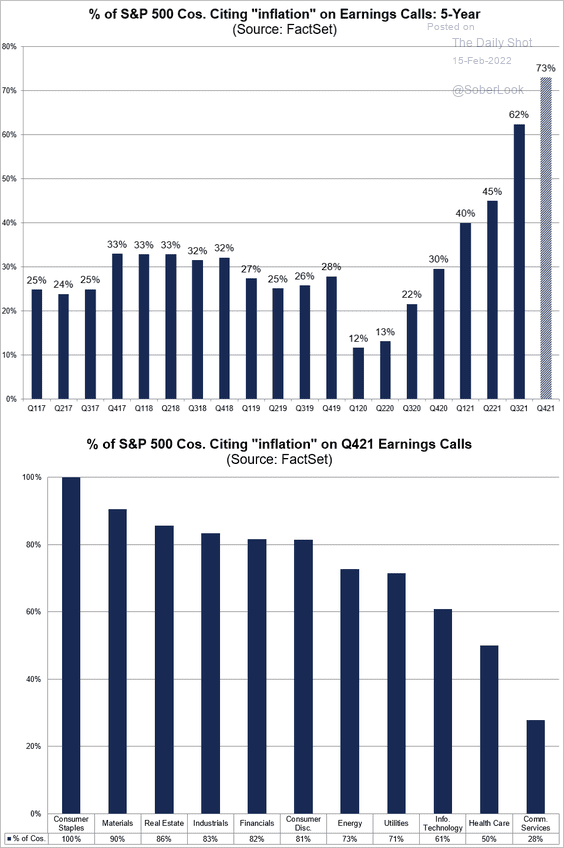

2. Most companies are now worried about inflation. Which sectors are impacted the most?

Source: @FactSetThe Read full article

Source: @FactSetThe Read full article

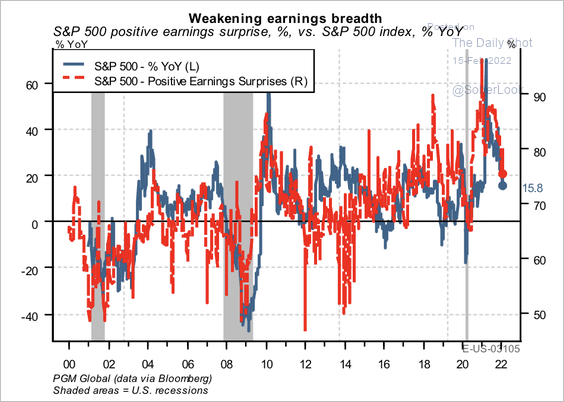

3. This chart shows positive earnings surprises vs. the S&P 500 (year-over-year).

Source: PGM Global

Source: PGM Global

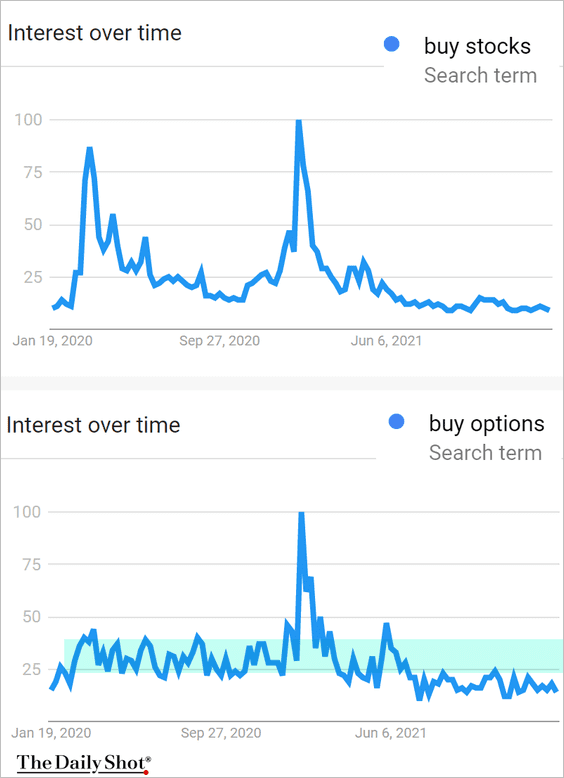

4. Google search activity suggests that retail investors have lost interest in the stock market. Nothing seems to be “going to the moon” these days.

Source: Google Trends

Source: Google Trends

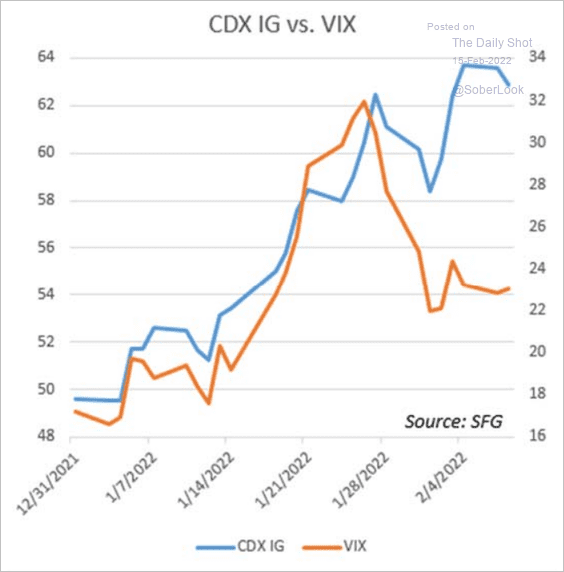

5. Equity implied volatility (VIX) has diverged from credit spreads.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

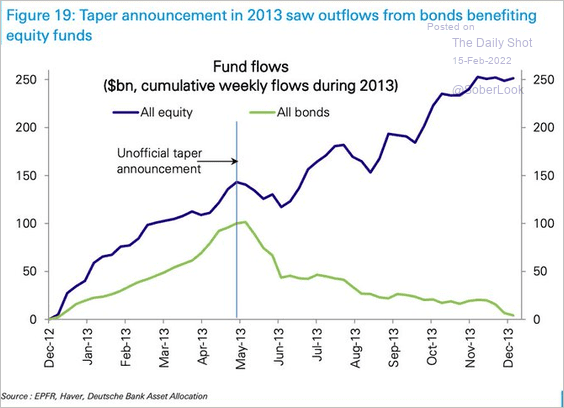

6. During the 2013 taper tantrum, investors dumped bonds, but equity inflows remained robust.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

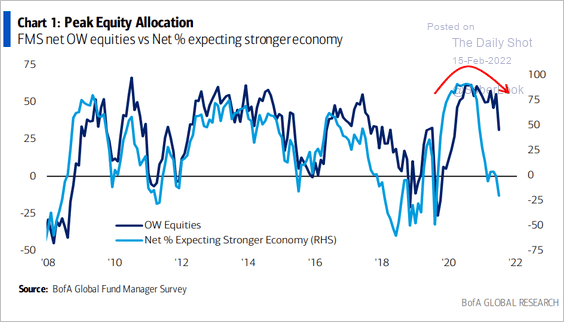

7. Fund managers have been reducing their allocations to stocks amid expectations of slower economic growth.

Source: BofA Global Research

Source: BofA Global Research

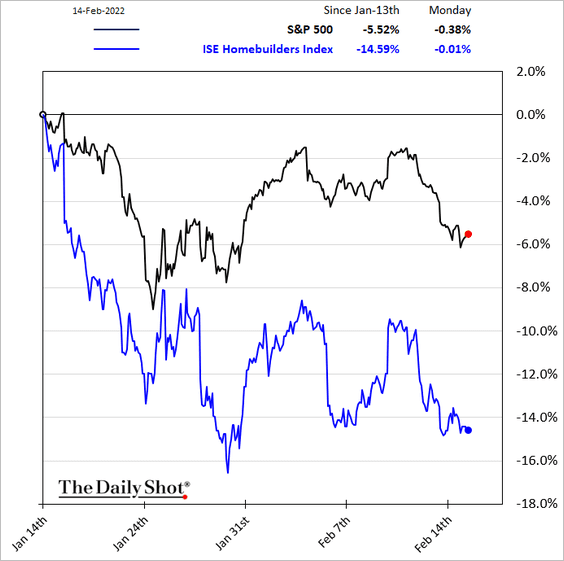

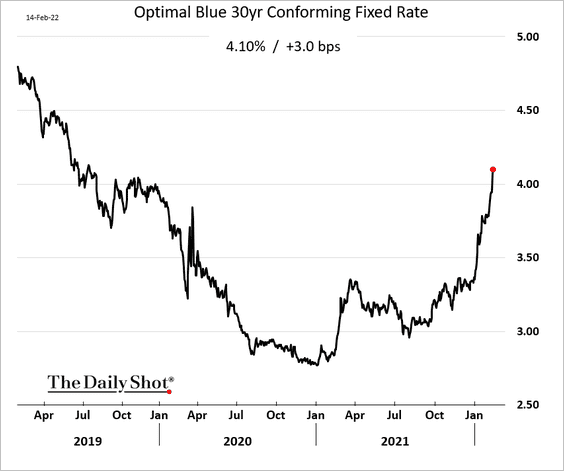

8. Homebuilder shares continue to lag as US mortgage rates rise above 4% (2nd chart).

Back to Index

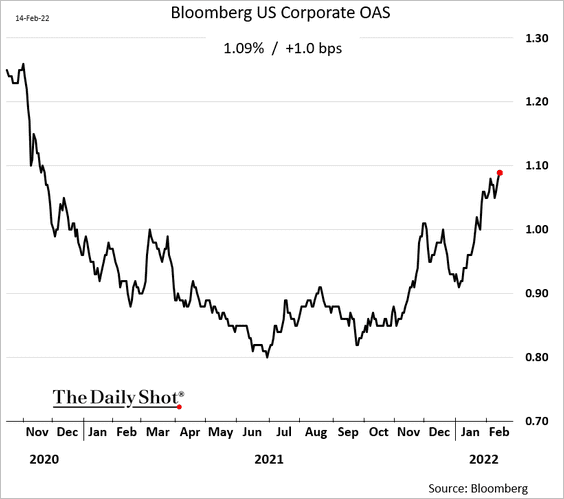

Credit

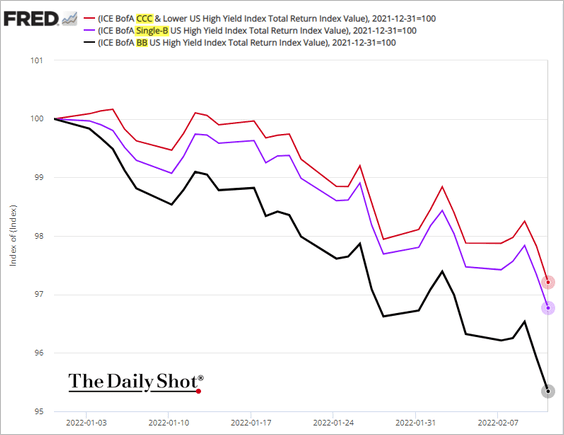

1. CCC-rated corporate bonds keep outperforming.

2. Investment-grade bond spreads continue to widen.

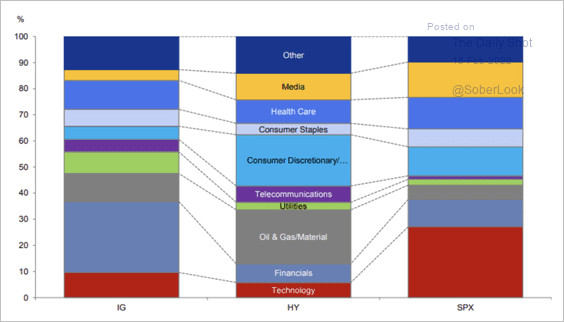

3. The rate-sensitive tech sector accounts for 27% of the S&P 500, versus 10% and 6% of investment-grade and high-yield indices.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

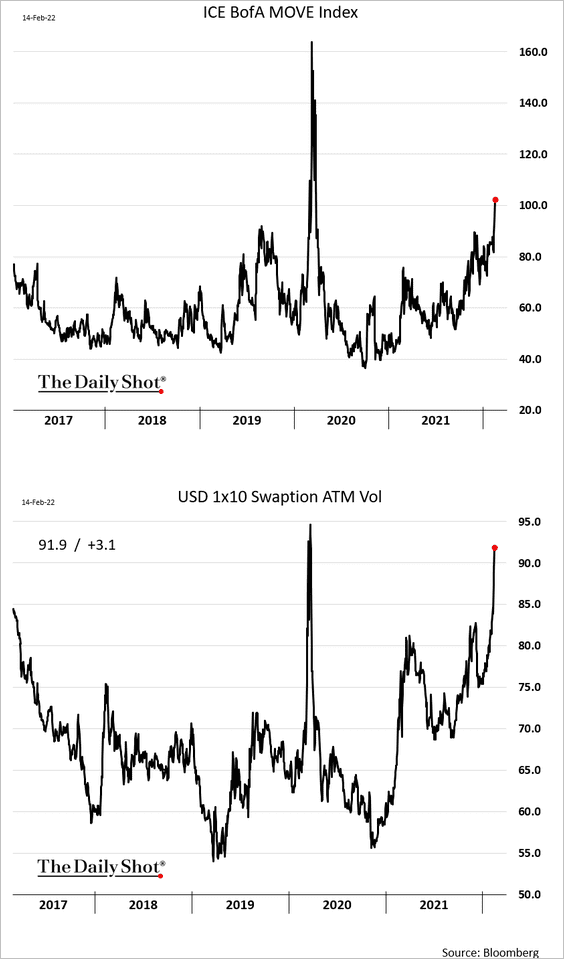

Rates

1. Rates implied volatility is surging.

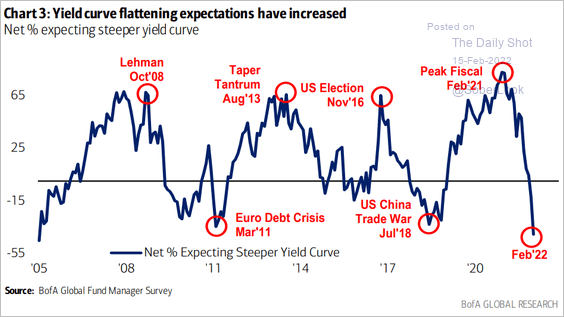

2. Fund managers have boosted their expectations for a flatter yield curve.

Source: BofA Global Research

Source: BofA Global Research

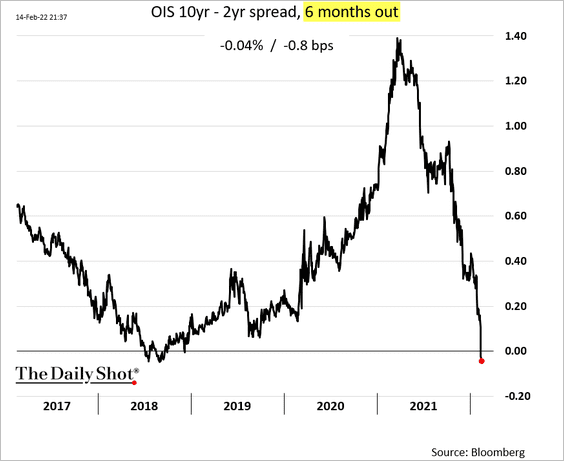

• The market now expects the yield curve to be inverted in six months.

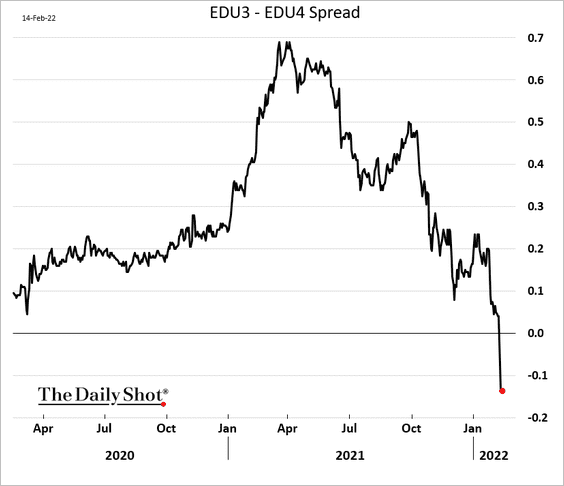

• And short-term interest rate futures point to Fed rate cuts between 2023 and 2024 (chart shows September 2023 vs. September 2024 Eurodollar futures).

——————–

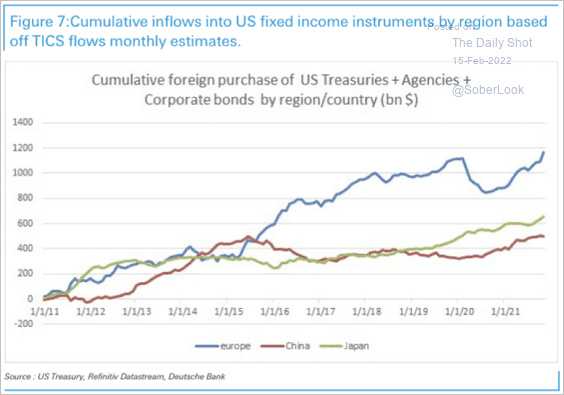

3. Europe has been the largest buyer of Treasuries, agency debt, and corporate bonds over the past decade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

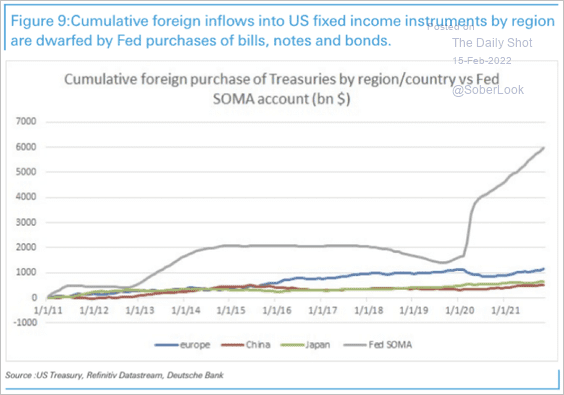

Still, foreign purchases of Treasuries are small compared to the Fed’s buying spree.

——————–

Food for Thought

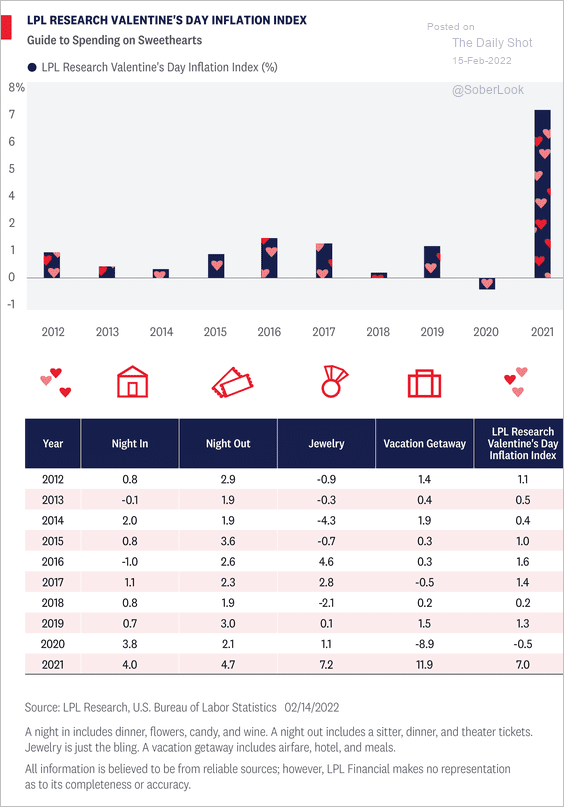

1. Valentine’s Day inflation index:

Source: LPL Research

Source: LPL Research

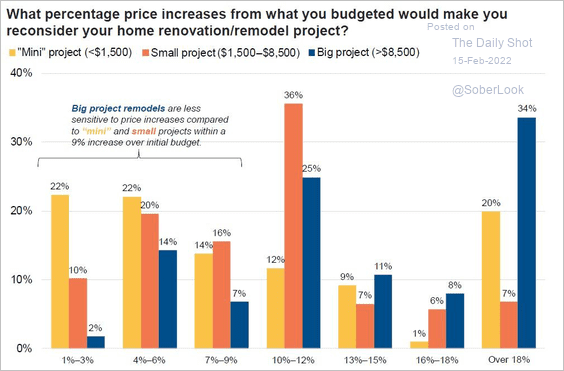

2. Reconsidering a home renovation project due to higher costs:

Source: Todd Tomalak

Source: Todd Tomalak

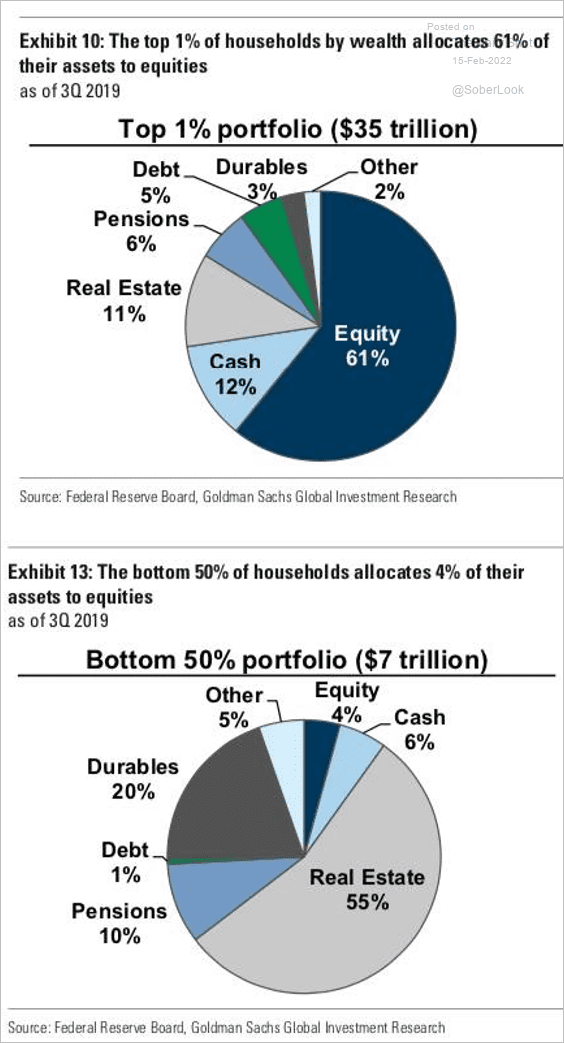

3. Portfolio allocations of the top 1% vs. the bottom 50%:

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

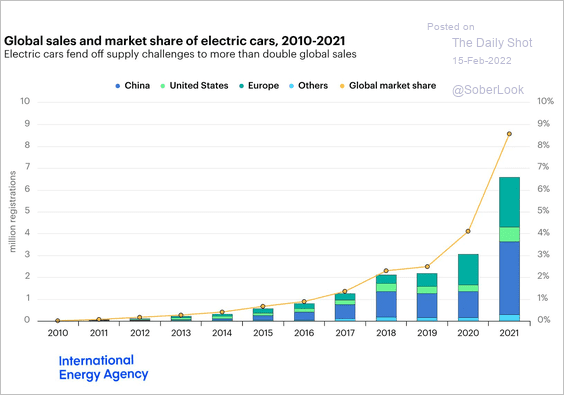

4. EV sales (updated):

Source: @fbirol Read full article

Source: @fbirol Read full article

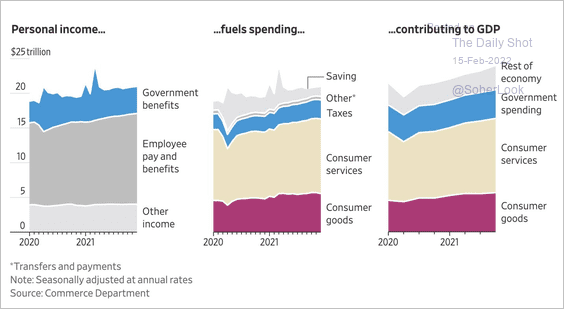

5. Personal income driving spending and GDP growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

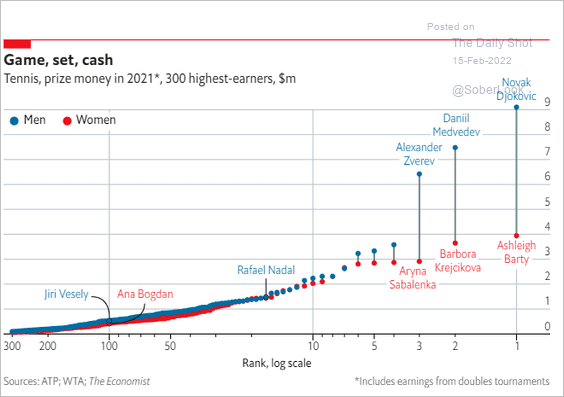

6. Tennis prize money:

Source: The Economist Read full article

Source: The Economist Read full article

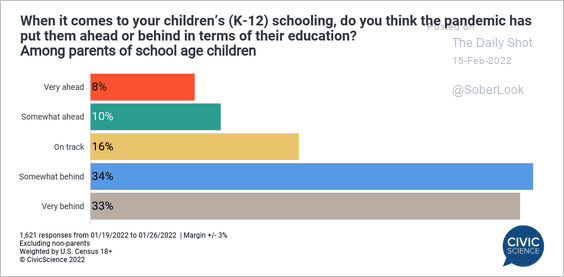

7. Kids falling behind in terms of their education:

Source: @CivicScience

Source: @CivicScience

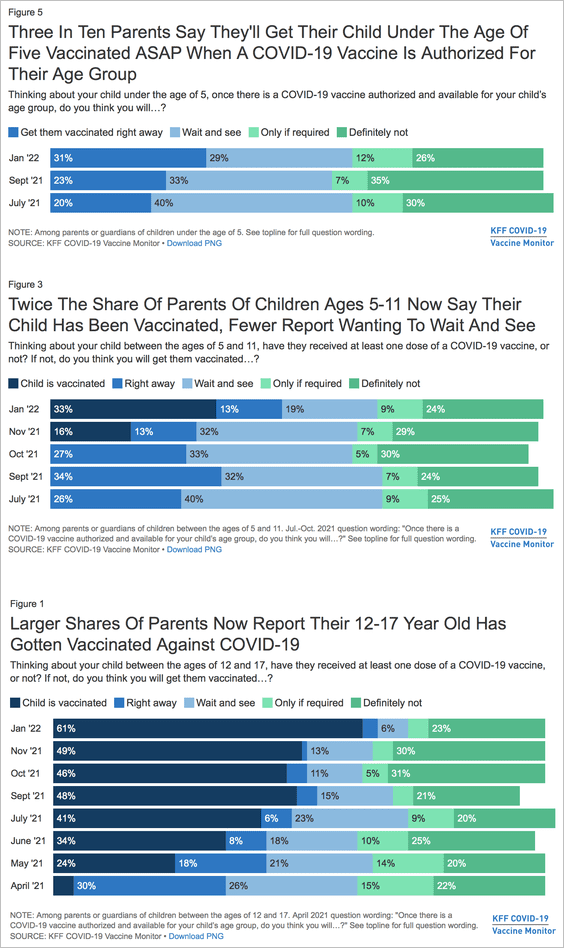

8. Vaccinating children against COVID:

Source: KFF Read full article

Source: KFF Read full article

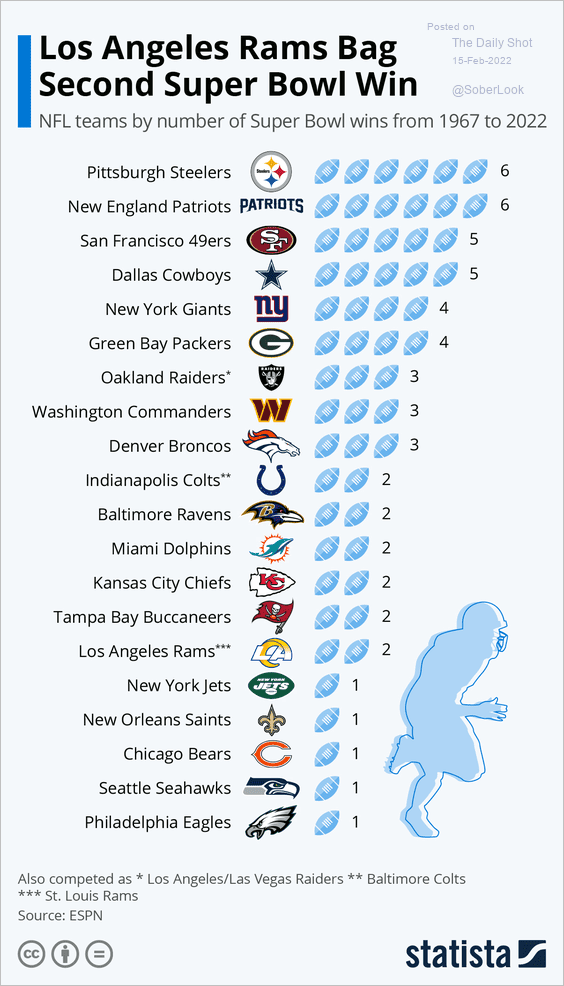

9. The number of Super Bowl wins since 1967 (by NFL team):

Source: Statista

Source: Statista

——————–

Back to Index