The Daily Shot: 16-Feb-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Global Developments

• Food for Thought

The United States

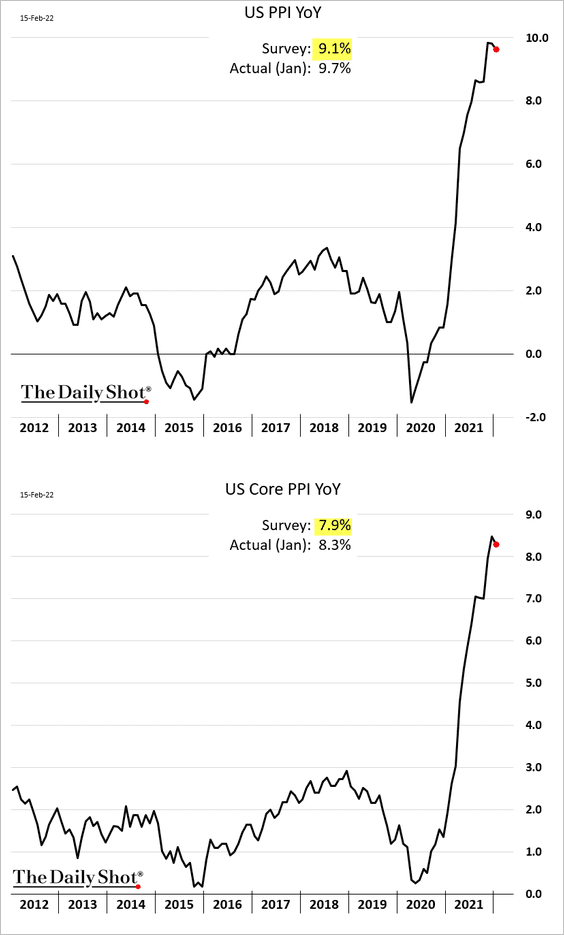

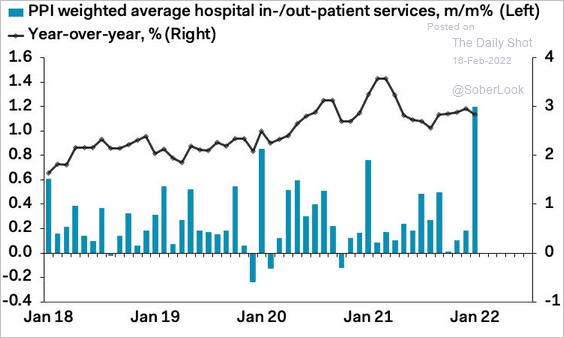

1. The PPI report topped forecasts, with both the headline and core indices holding near the highs.

Here is the core PPI excluding trade services (business markups).

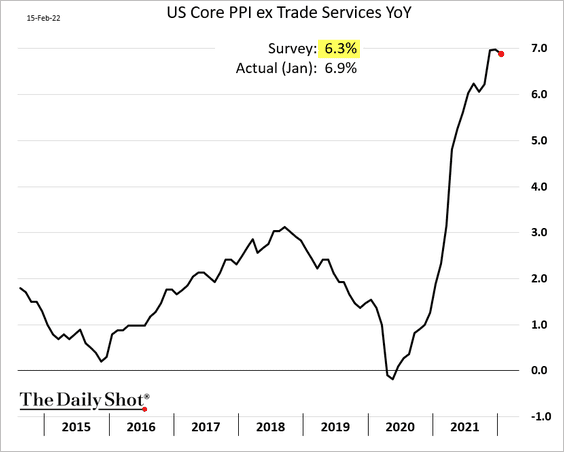

Goods inflation got a boost from capital equipment prices, which rose by most in decades last month.

Source: @WSJ Read full article

Source: @WSJ Read full article

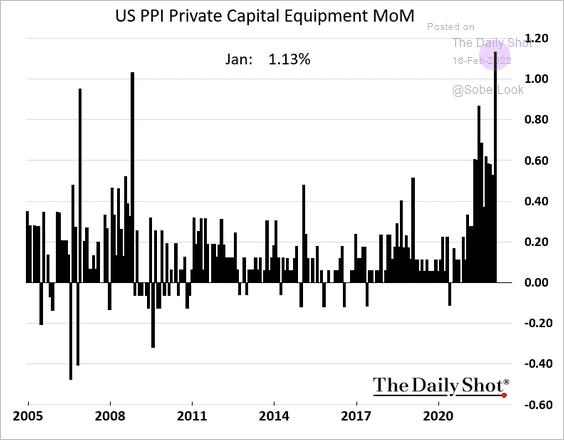

And hospital costs pushed the services component of the PPI higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

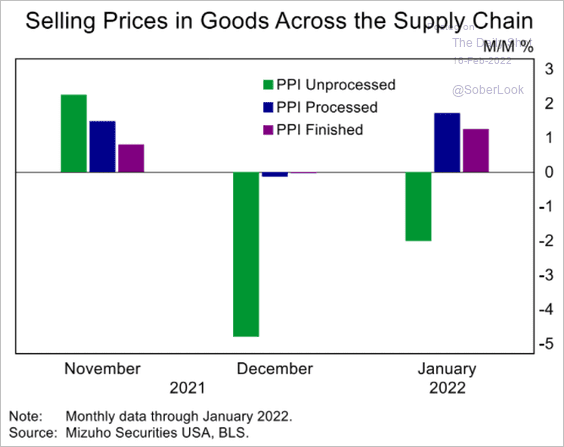

The good news is that upstream prices are starting to cool.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

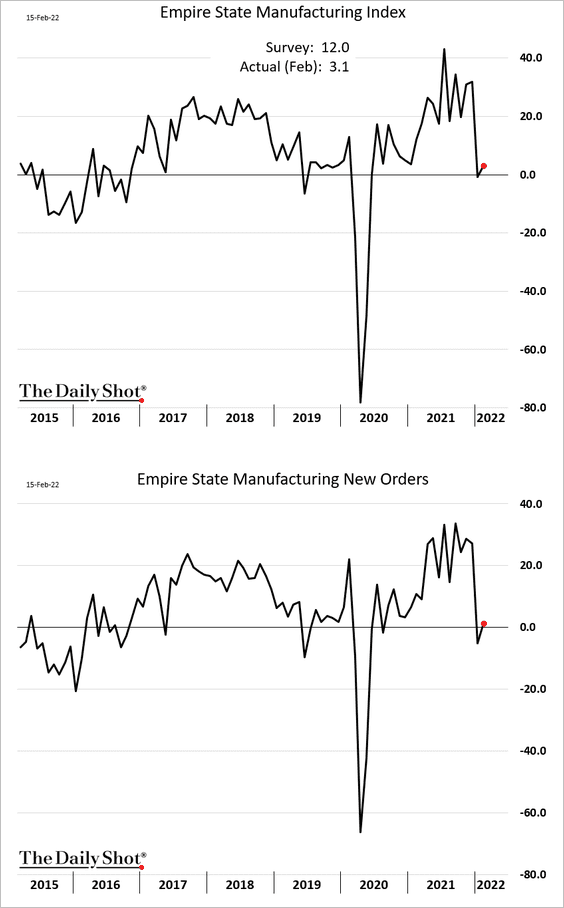

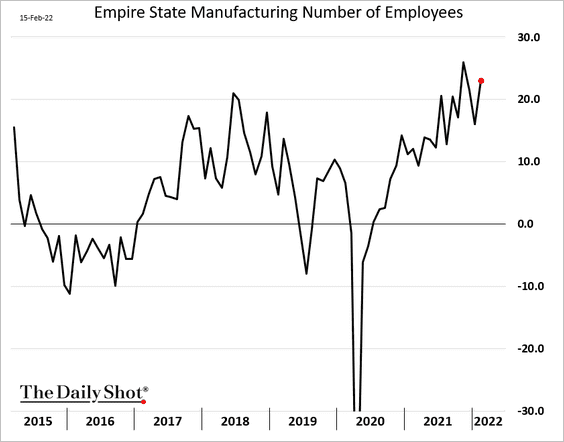

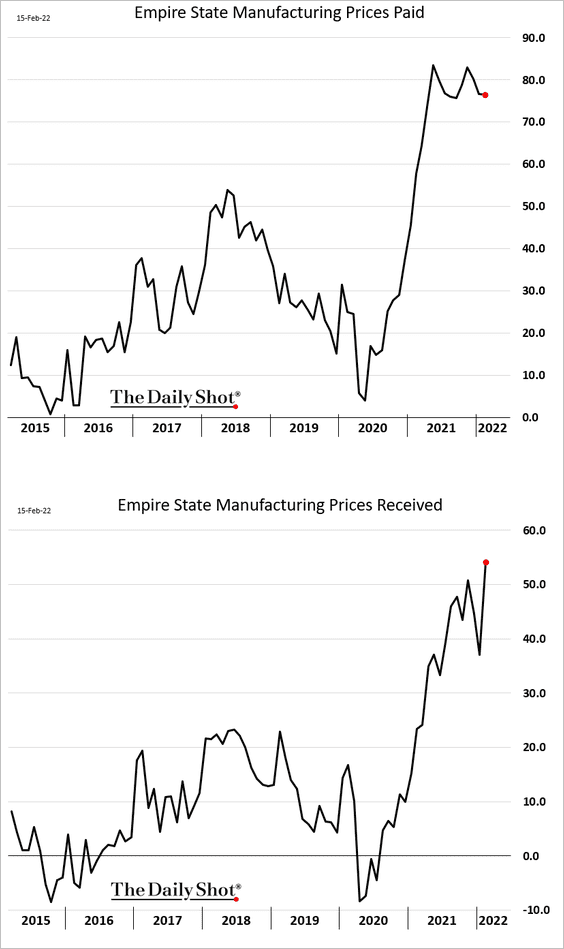

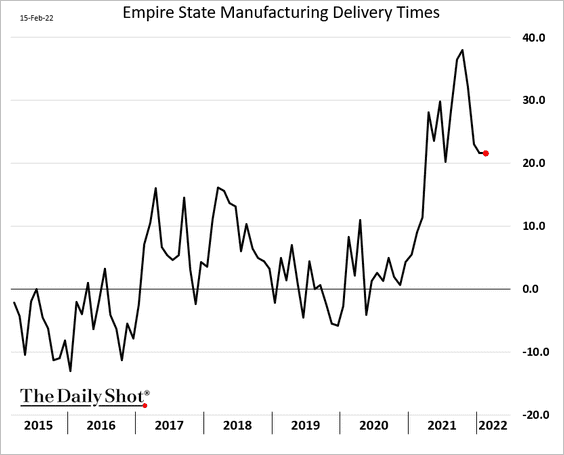

2. The NY Fed’s manufacturing report, the first regional factory activity signal of the month, didn’t see much of a rebound from the January drop.

• Hiring remains robust.

• Price pressures are still at extreme levels.

• Supply chain bottlenecks are off the highs but remain elevated.

——————–

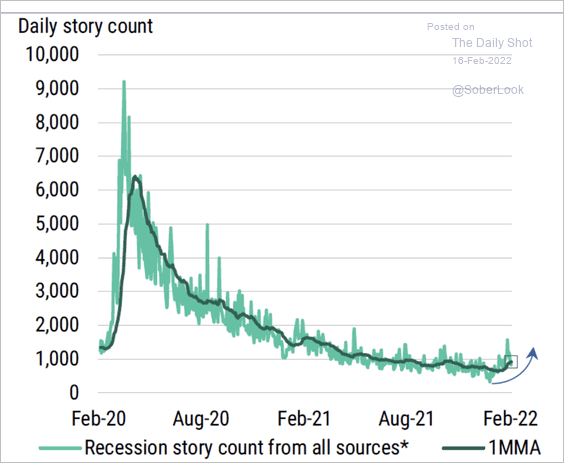

3. News services are starting to talk about recession again.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

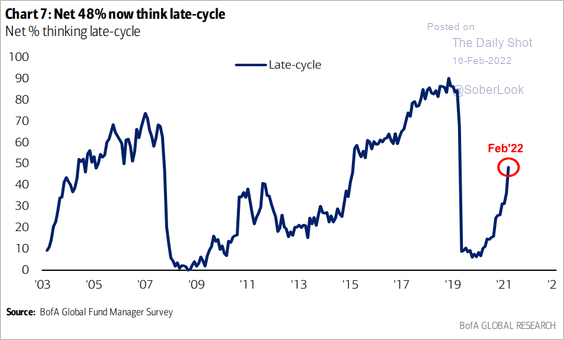

Asset managers increasingly think that the economy is in the late phase of the cycle.

Source: BofA Global Research

Source: BofA Global Research

——————–

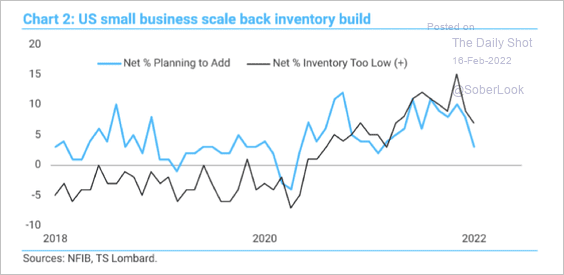

4. Small businesses have been scaling back their inventory build.

Source: TS Lombard

Source: TS Lombard

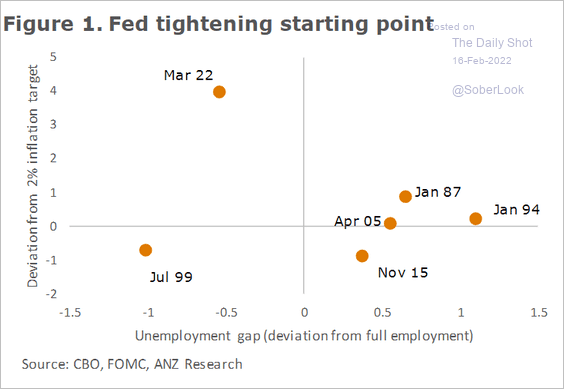

5. The Fed’s tightening is starting at a different point than in previous cycles.

Source: ANZ Research

Source: ANZ Research

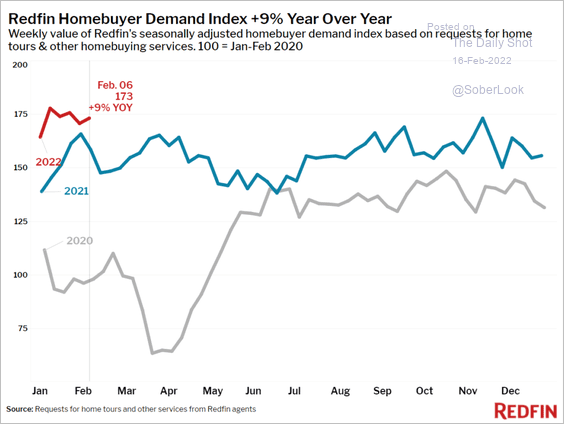

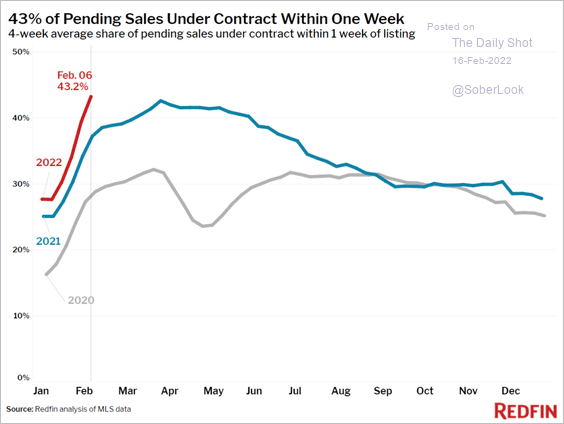

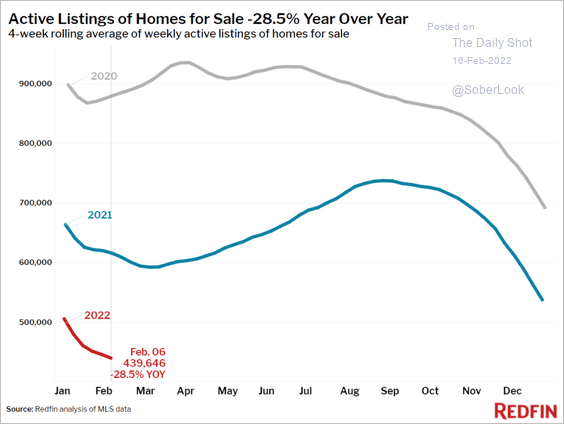

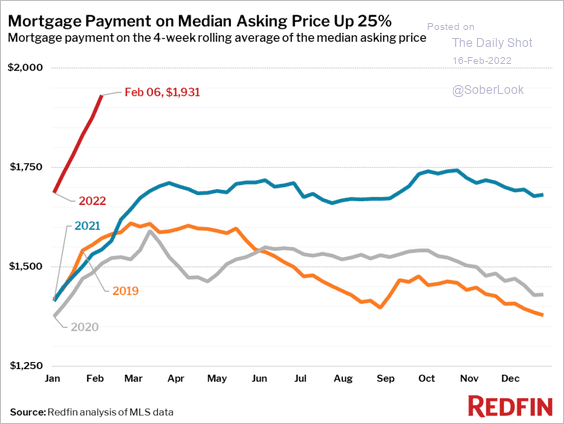

6. Next, we have some updates on the housing market.

• Housing demand has been strong (2 charts), …

Source: Redfin Read full article

Source: Redfin Read full article

Source: Redfin Read full article

Source: Redfin Read full article

… while inventories are exceptionally tight.

Source: Redfin Read full article

Source: Redfin Read full article

• But deteriorating affordability will increasingly become a drag on the market.

Source: Redfin Read full article

Source: Redfin Read full article

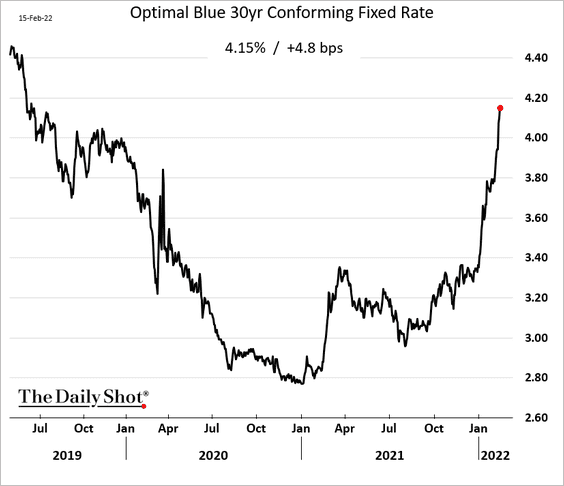

The 30-year mortgage rate is now well above 4%, …

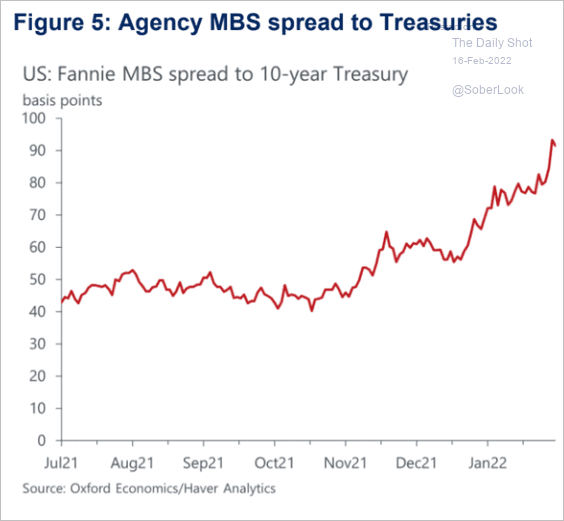

… driven by higher Treasury yields and wider MBS spreads.

Source: Oxford Economics

Source: Oxford Economics

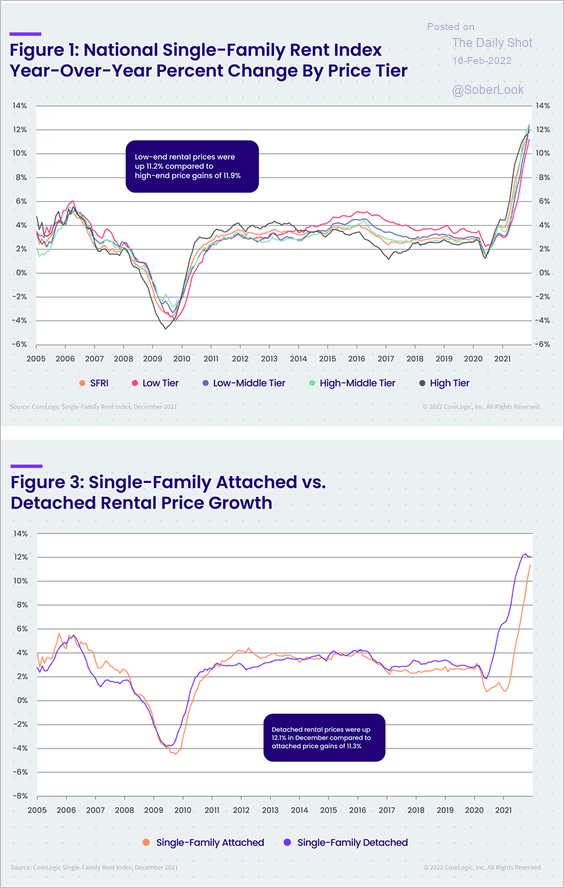

• Gains in single-family attached housing rental costs are catching up with detached units (2nd panel).

Source: CoreLogic

Source: CoreLogic

Back to Index

Canada

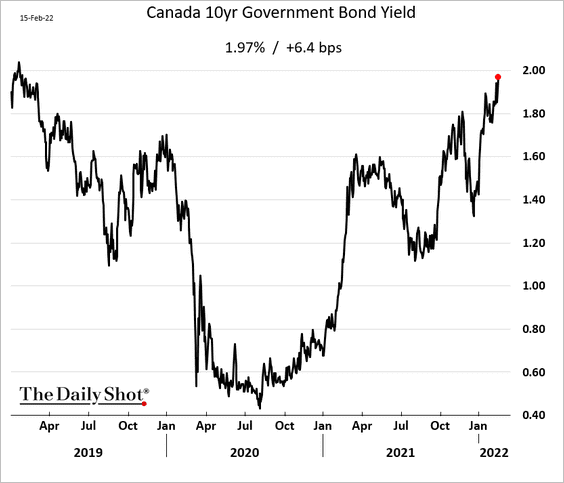

1. The 10yr yield is approaching 2%.

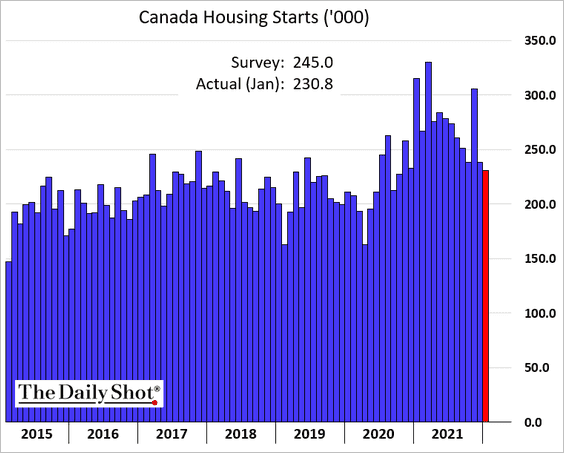

2. Housing starts were softer last month.

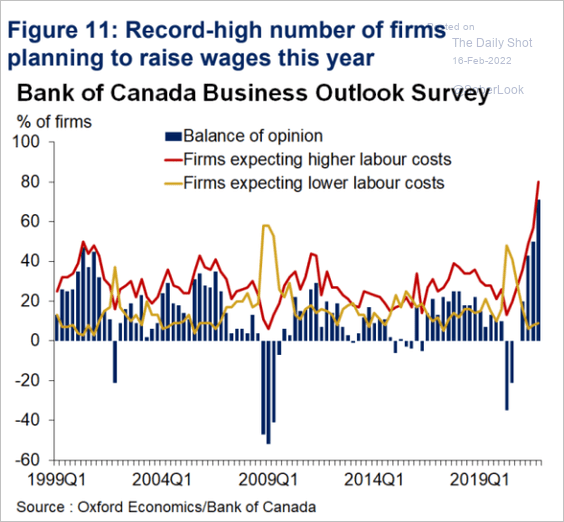

3. Companies are rapidly boosting wages.

Source: Oxford Economics

Source: Oxford Economics

4. The Oxford Economics Recovery Tracker is starting to rebound.

![]() Source: Oxford Economics

Source: Oxford Economics

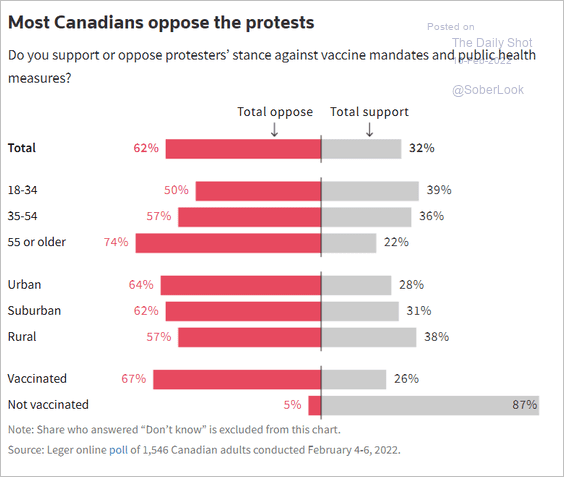

5. How do Canadians view the recent protests?

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

The United Kingdom

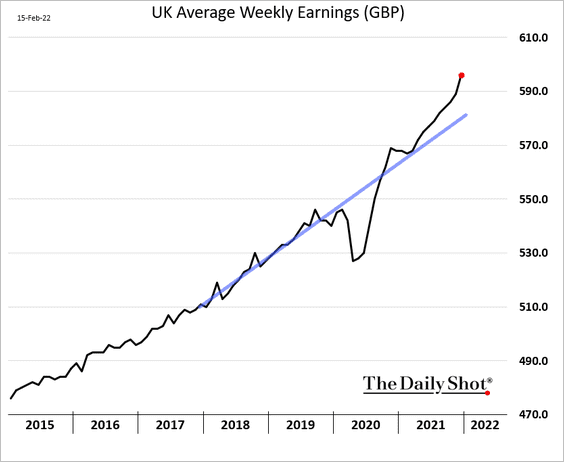

1. The recent acceleration in wage growth is a warning signal for the BoE.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

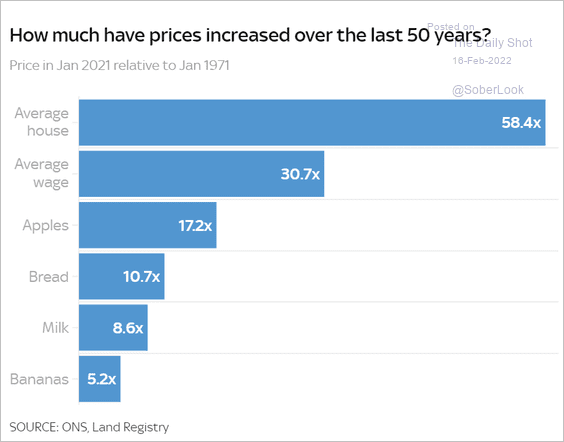

2. This chart shows price increases on select items over the past 50 years.

Source: Sky News Read full article

Source: Sky News Read full article

Back to Index

The Eurozone

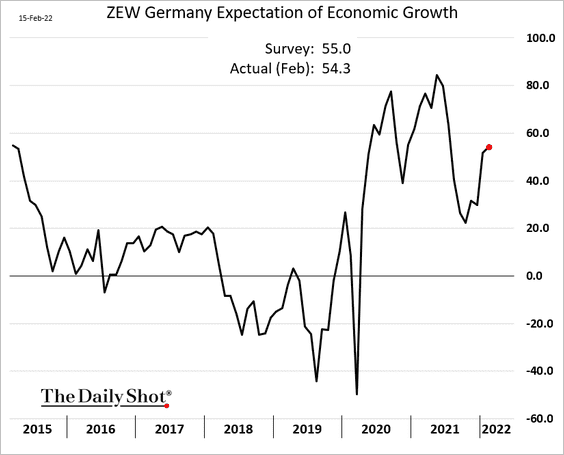

1. Germany’s ZEW index ticked higher this month.

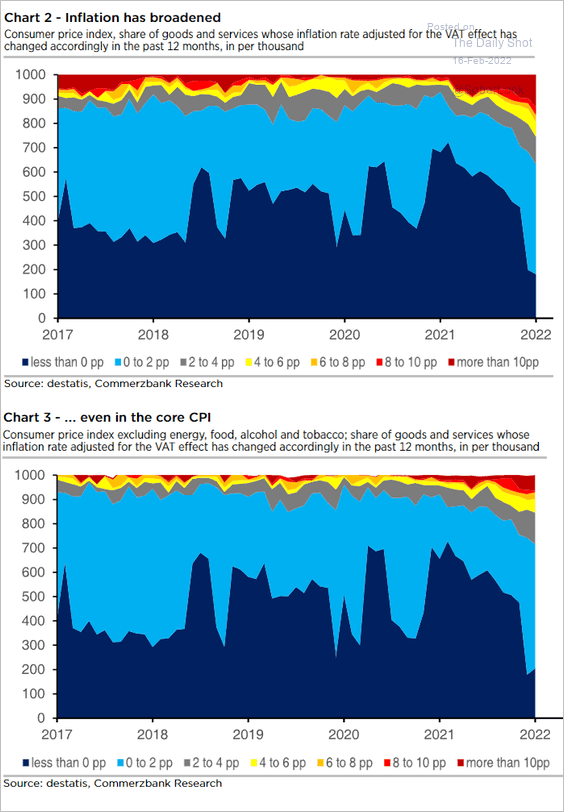

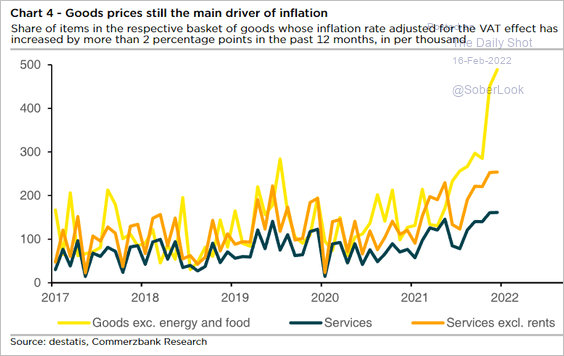

2. Germany’s inflation is broadening, …

Source: Commerzbank Research

Source: Commerzbank Research

… with goods driving the biggest gains.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

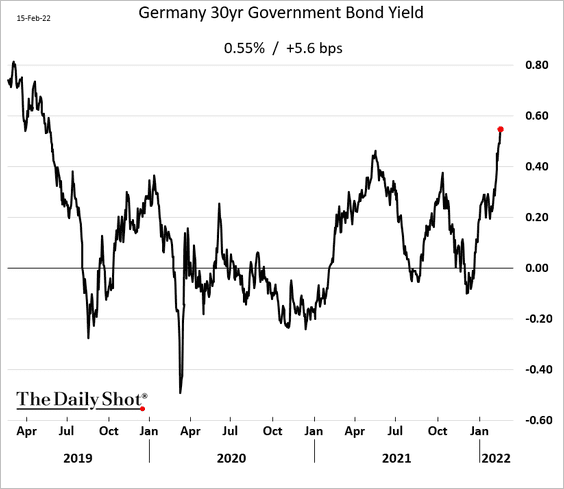

3. Bund yields continue to climb.

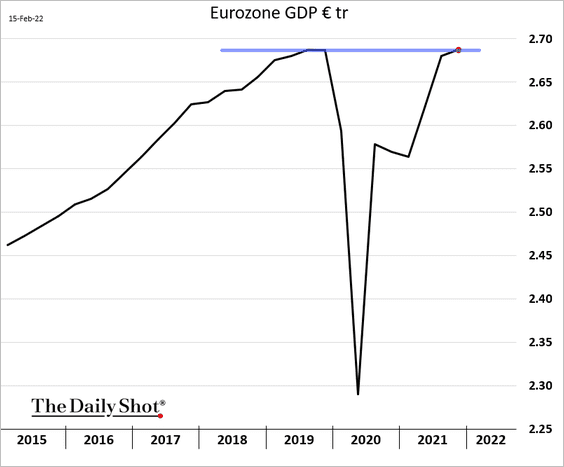

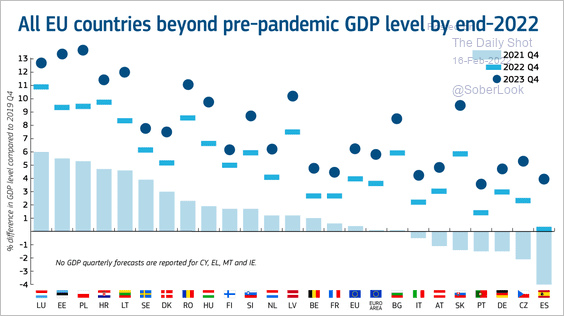

4. The euro-area GDP is back at pre-COVID levels.

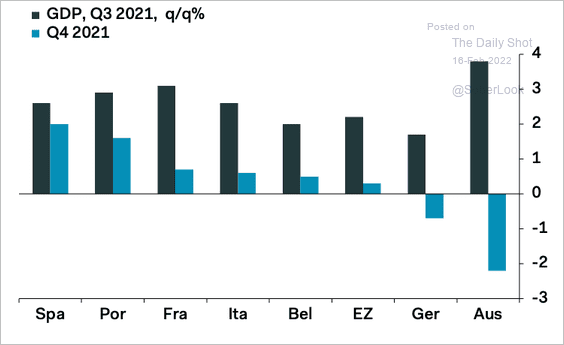

Here is a summary by country.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

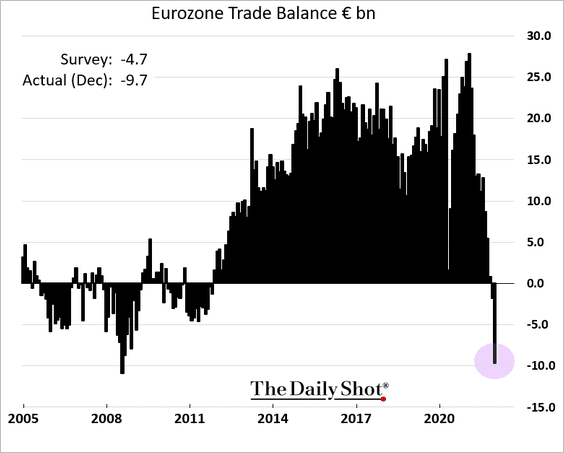

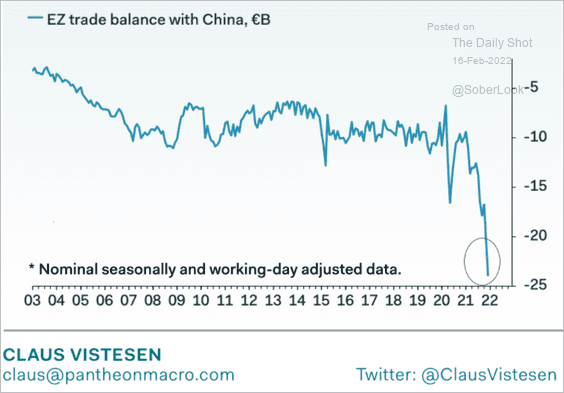

5. The Eurozone trade balance swung into deficit – the worst since 2008.

The deficit is driven by the recent spike in energy prices and a worsening imbalance with China.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

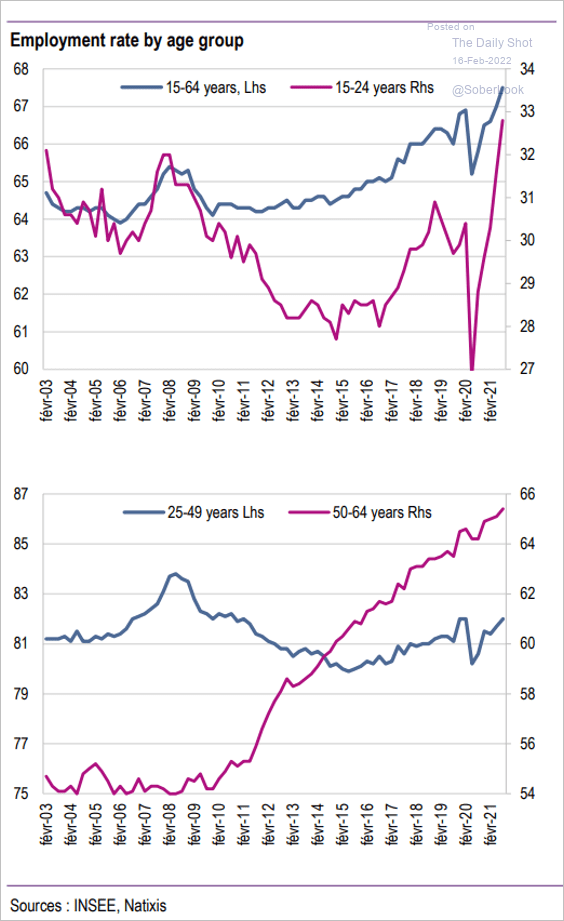

6. Finally, we have French employment trends by age group.

Source: Natixis

Source: Natixis

Back to Index

Europe

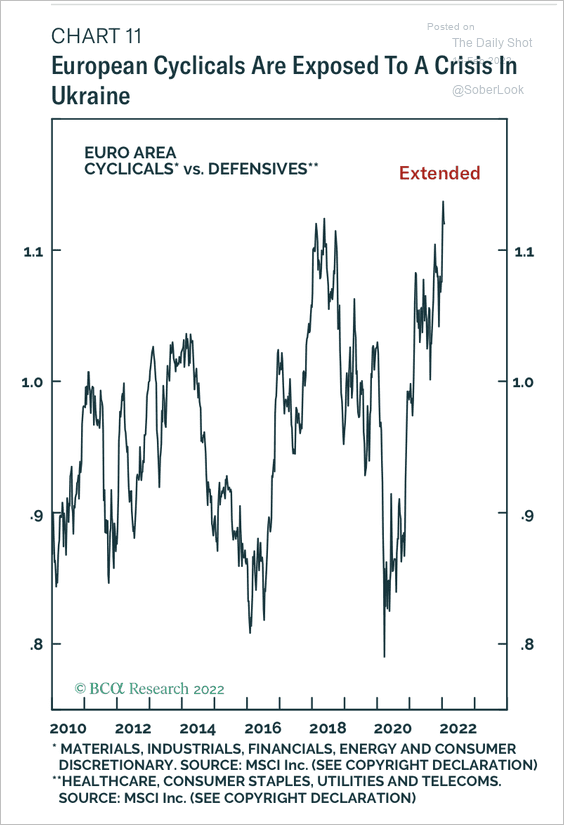

1. European cyclicals appear stretched relative to defensives.

Source: BCA Research

Source: BCA Research

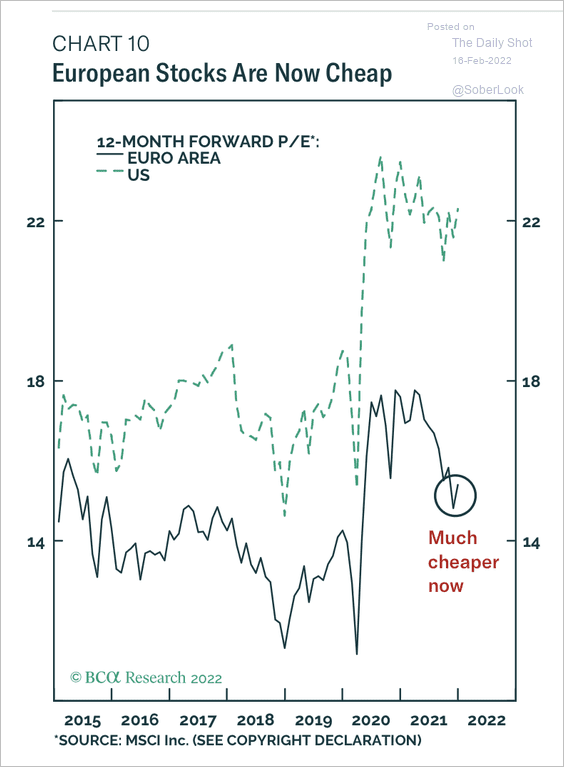

2. European stocks appear cheap relative to the US.

Source: BCA Research

Source: BCA Research

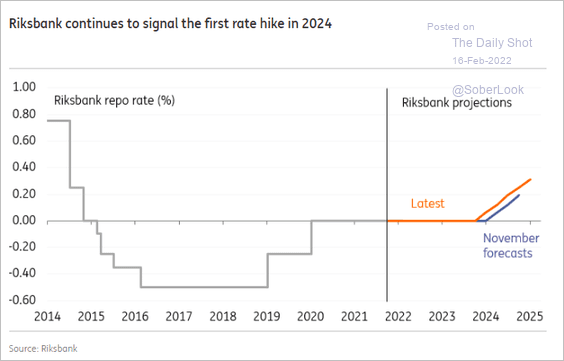

3. Will Sweden’s Riksbank wait until 2024 to hike rates?

Source: ING

Source: ING

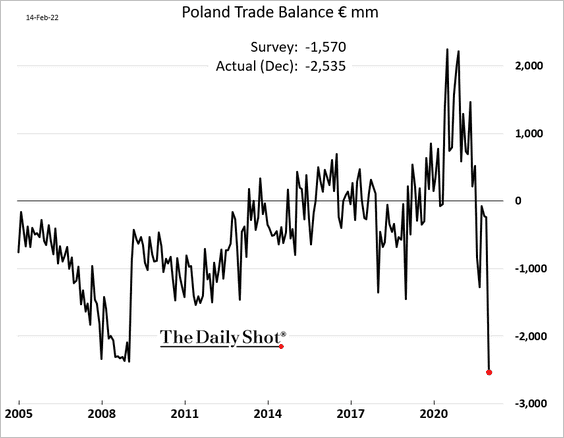

4. Poland’s trade deficit hit a record as energy prices surge.

5. Here is an overview of the GDP recovery across the EU.

Source: EC Read full article

Source: EC Read full article

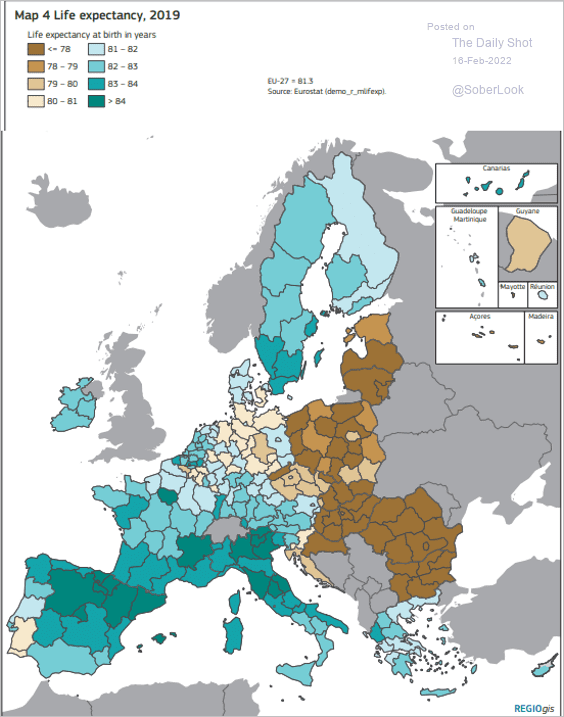

6. This map shows the life expectancy in select parts of Europe.

Source: EC Read full article

Source: EC Read full article

Back to Index

Asia – Pacific

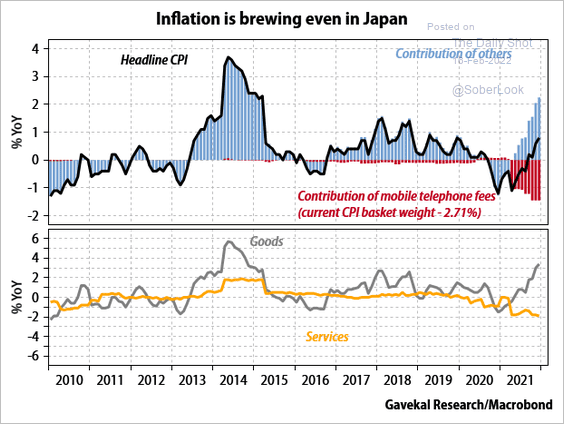

1. Will Japan’s CPI accelerate once the drag from mobile services ebbs?

Source: Gavekal Research

Source: Gavekal Research

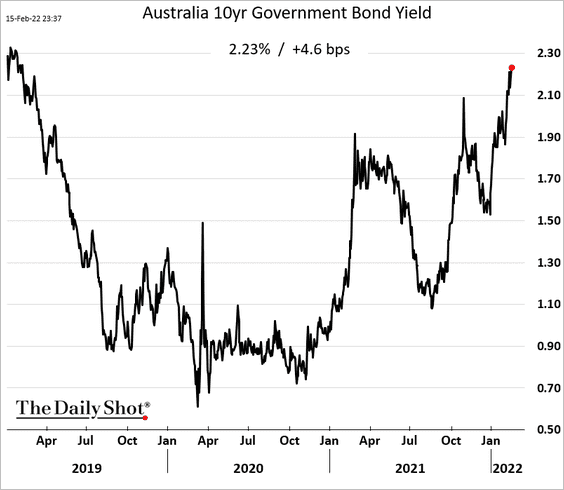

2. Australia’s bond yields are near three-year highs.

Back to Index

China

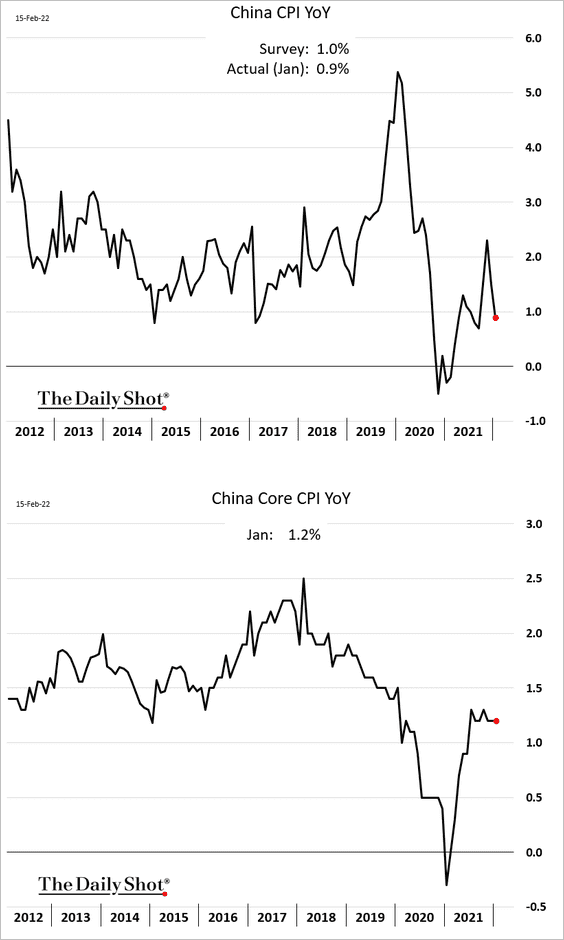

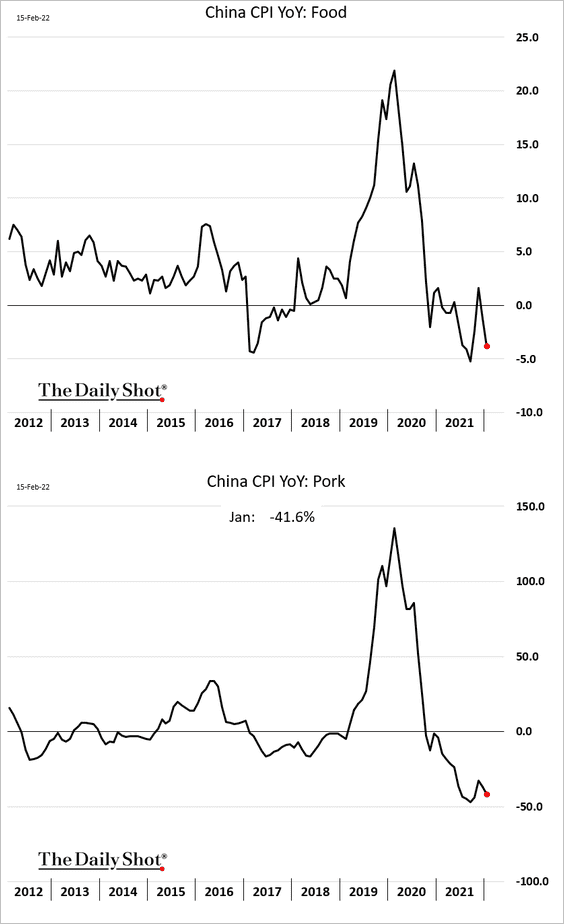

1. The CPI declined last month, driven by pork deflation. Core inflation is holding steady.

——————–

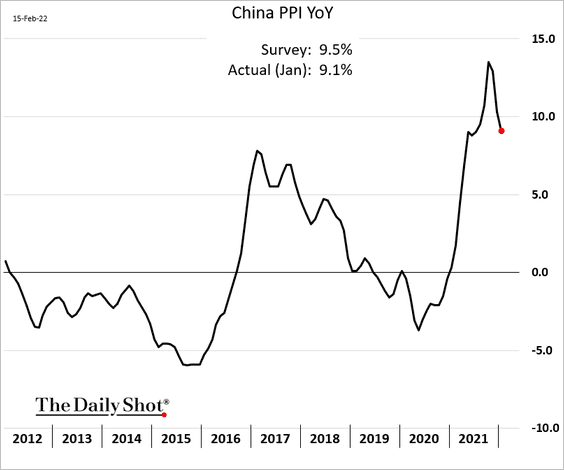

2. Producer price gains are moderating.

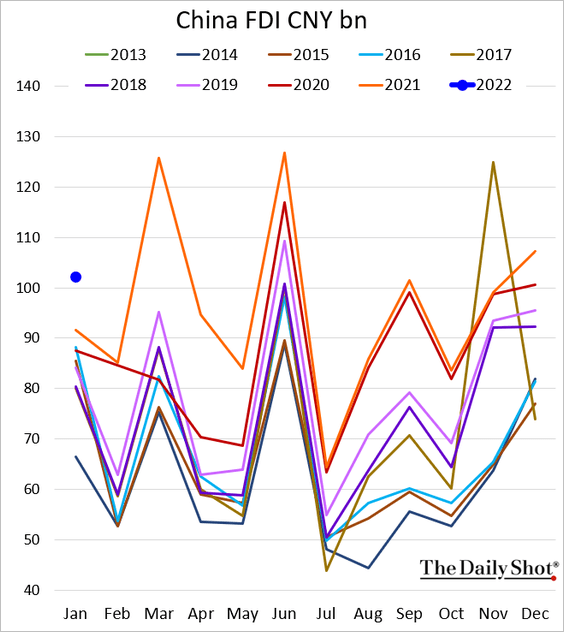

3. Foreign direct investment was robust last month.

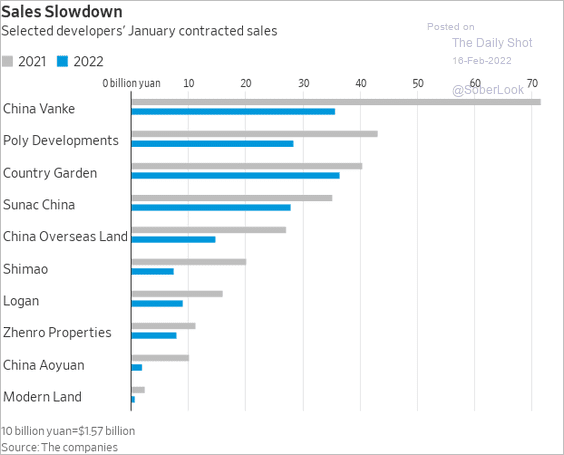

4. Property developers’ sales have slowed.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

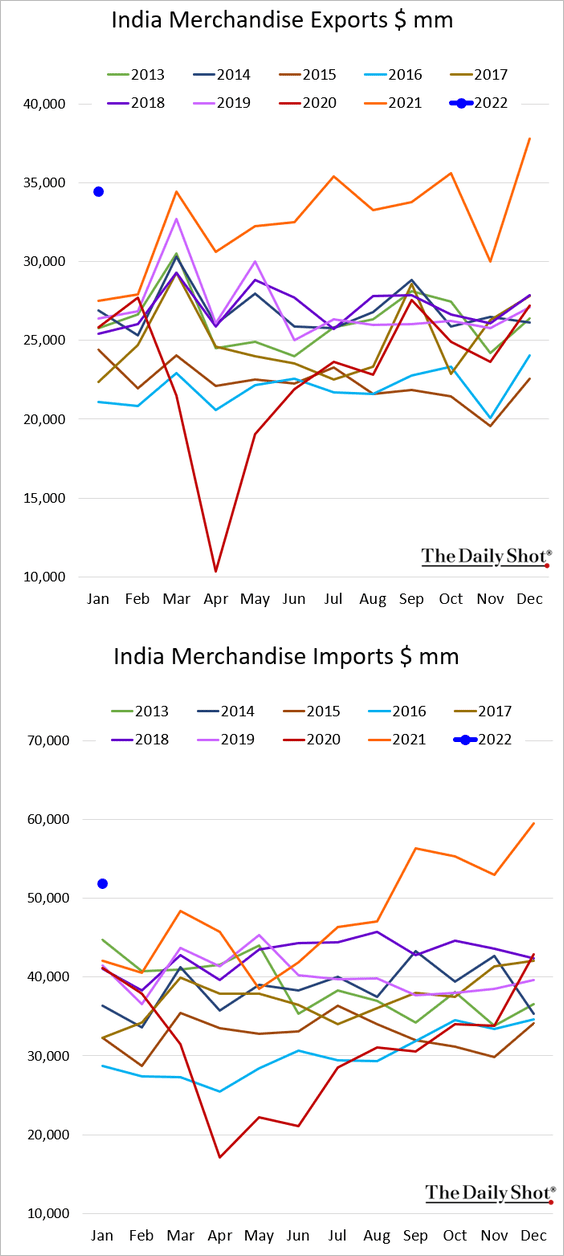

1. India’s exports and imports were quite strong last month.

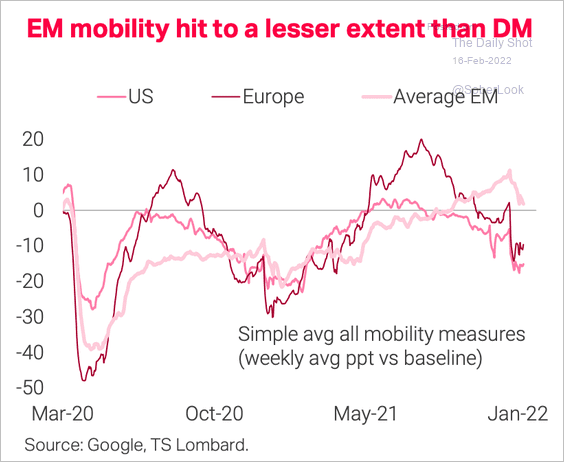

2. Omicron has hit emerging market mobility on average much less than it did in Europe or the US.

Source: TS Lombard

Source: TS Lombard

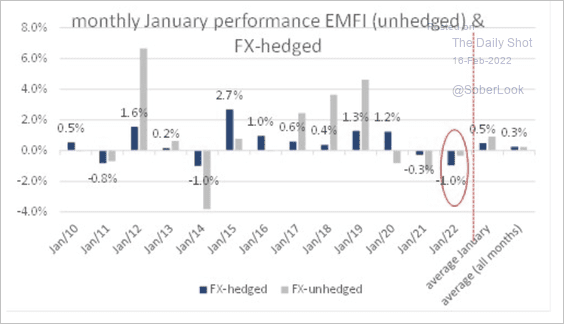

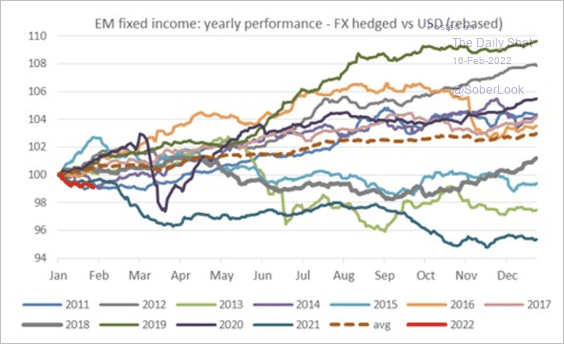

3. January was the worst start to the year for EM fixed income since 2010.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The 2022 start for EM fixed income was similar to 2014 before an aggressive rally.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• EM fixed income (FX hedged) is strongly correlated to changes in Treasury yields.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

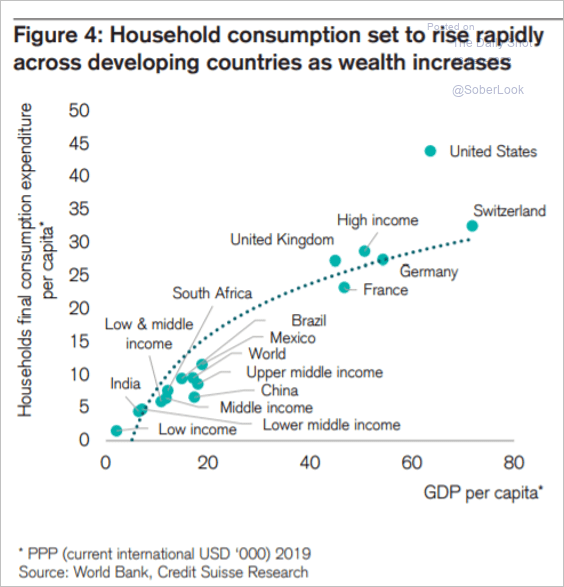

4. EM household consumption is set to rise rapidly in the years ahead.

Source: Credit Suisse

Source: Credit Suisse

Back to Index

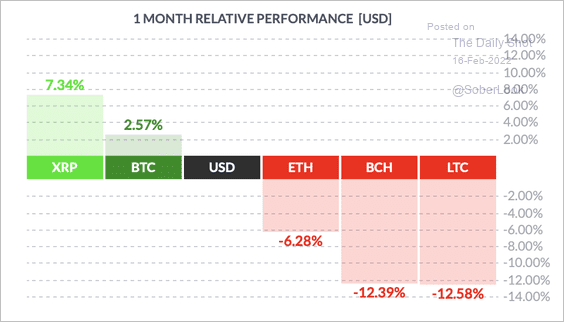

Cryptocurrency

1. XRP and BTC are in the lead among the largest cryptos so far this month.

Source: FinViz

Source: FinViz

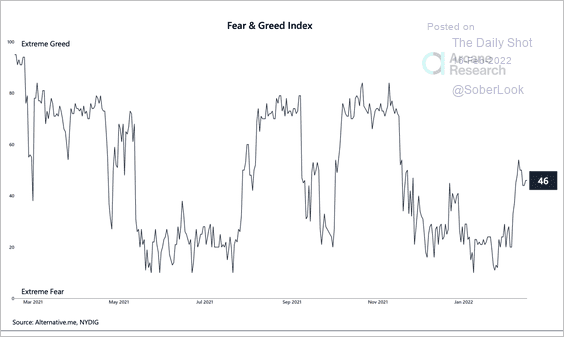

2. Bitcoin’s Fear & Greed Index dipped back into “fear” territory as traders reacted to macro and geopolitical risks.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

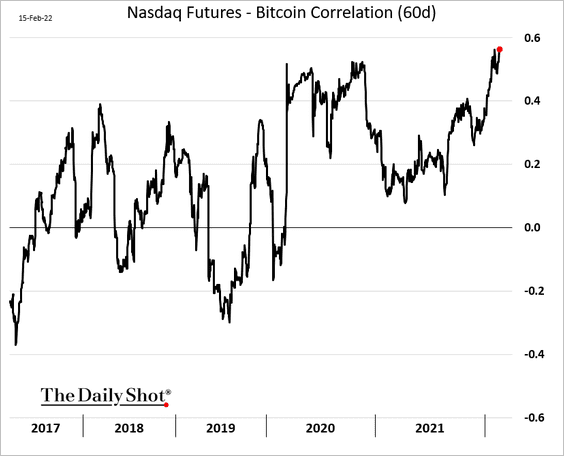

3. Bitcoin is increasingly trading in tandem with stocks.

Back to Index

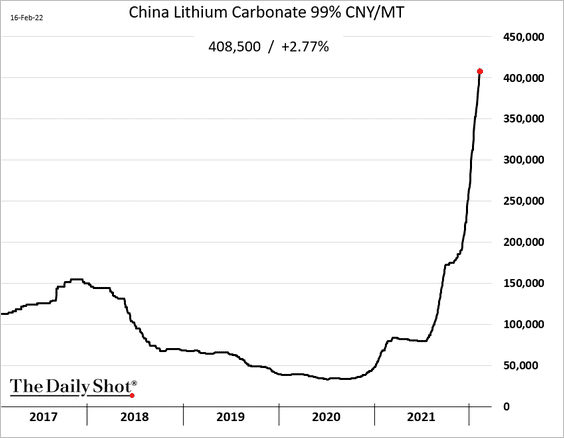

Commodities

Lithium carbonate prices continue to surge, which will boost EV battery costs.

Back to Index

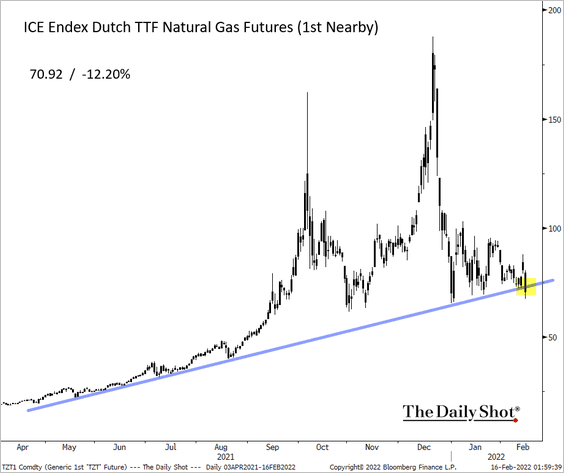

Energy

1. European natural gas hit support on the news of Russia’s “de-escalation.”

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

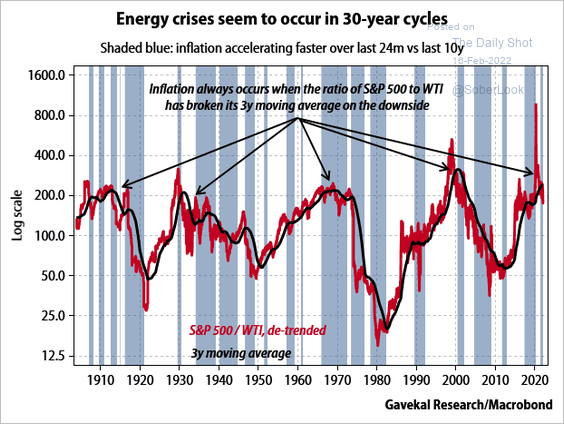

2. There is an energy crisis about every 30 years.

Source: Gavekal Research

Source: Gavekal Research

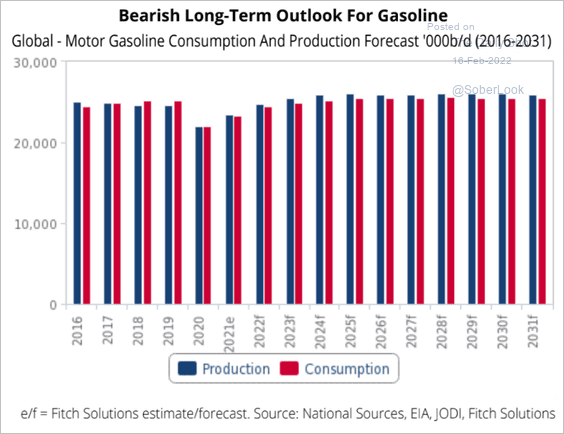

3. US gasoline supply/demand fundamentals look bearish over the log run.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

4. US residential electricity prices are expected to grow this year at a similar rate to 2021.

Source: EIA

Source: EIA

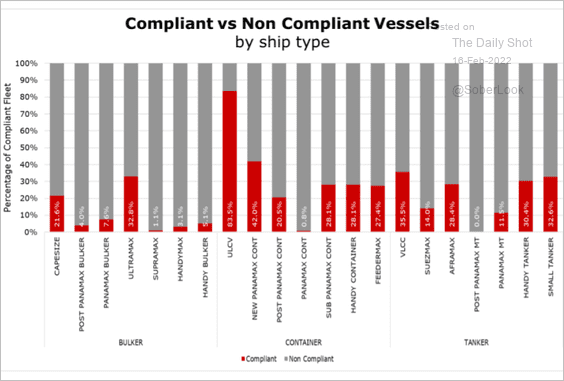

5. Less than 22% of the global cargo fleet currently complies with EEDI/EEXI regulations.

Source: VesselsValue Read full article

Source: VesselsValue Read full article

Back to Index

Equities

1. The Russia “de-escalation” news sent stocks higher, but uncertainty remains.

Source: ABC News Read full article

Source: ABC News Read full article

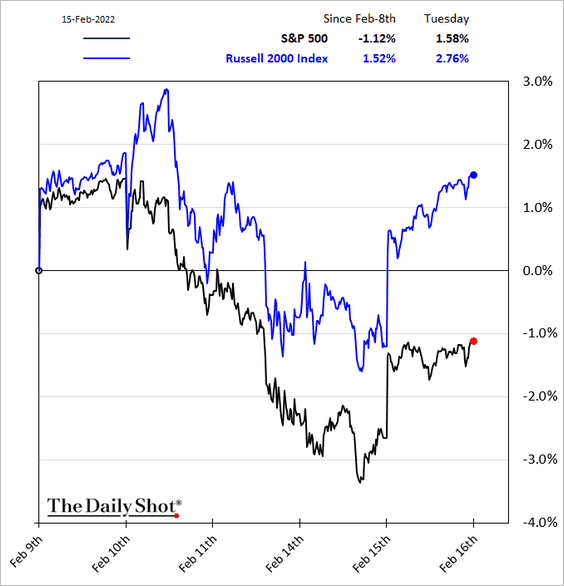

2. Small caps have been outperforming in recent days.

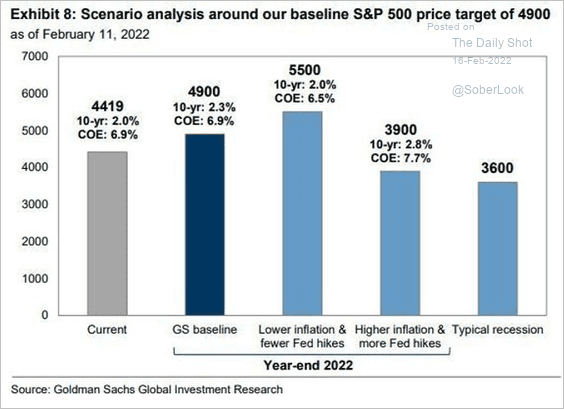

3. Here are some 2022 scenarios for the S&P 500 from Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

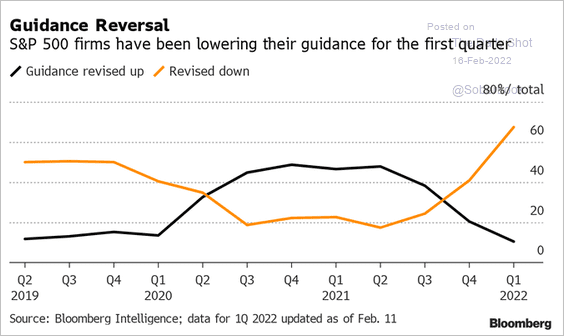

4. Corporate guidance has been deteriorating.

Source: @lisaabramowicz1, @GinaMartinAdams, @cw_soong

Source: @lisaabramowicz1, @GinaMartinAdams, @cw_soong

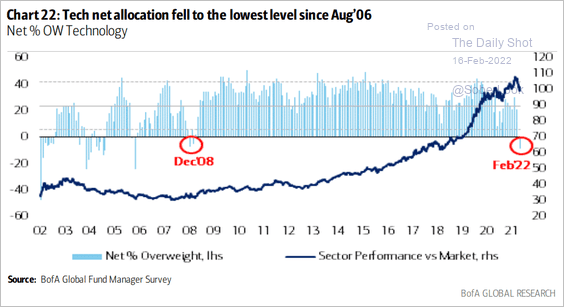

5. Fund managers have soured on tech stocks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Alternatives

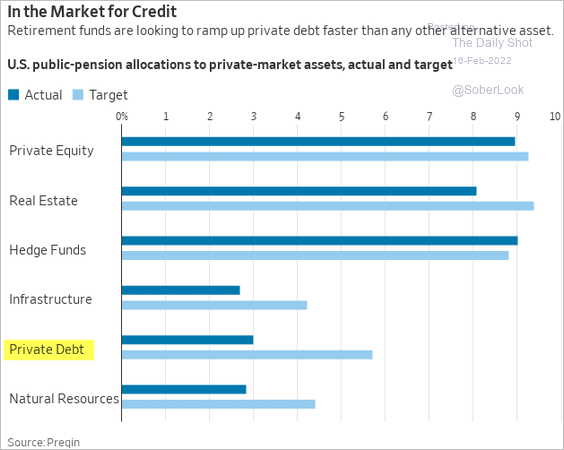

1. Public pensions are in the market for private credit.

Source: @WSJ Read full article

Source: @WSJ Read full article

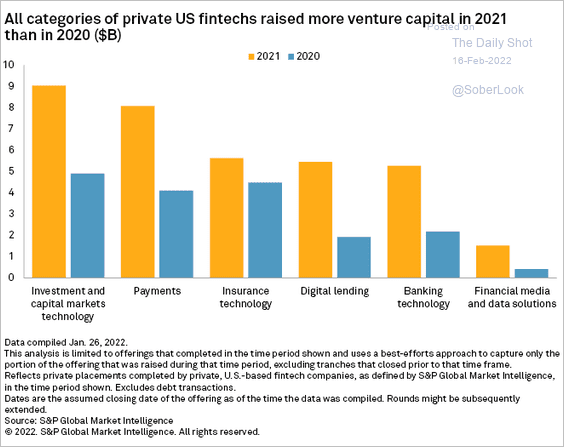

2. Fintechs raised quite a bit of VC capital last year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

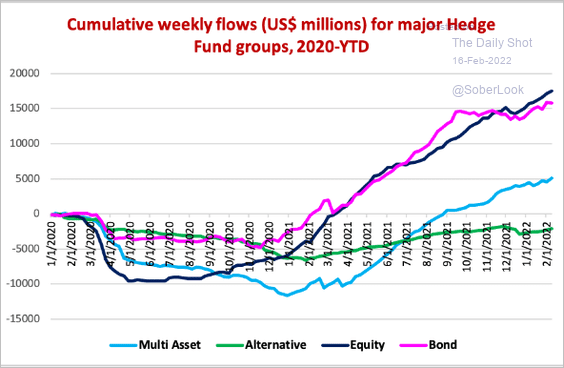

3. Hedge funds continue to see inflows.

Source: EPFR

Source: EPFR

Back to Index

Global Developments

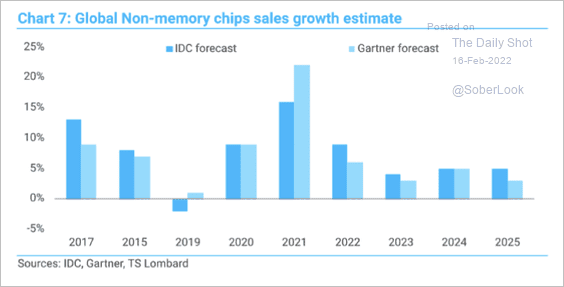

1. Growth in chip sales is expected to slow over the coming years.

Source: TS Lombard

Source: TS Lombard

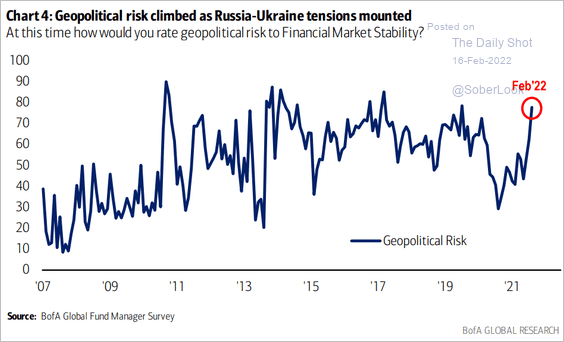

2. Investors are increasingly concerned about geopolitical risks.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

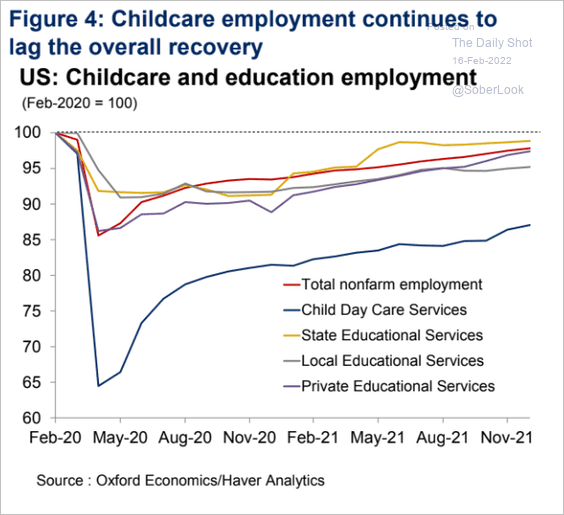

1. Lagging childcare employment recovery:

Source: Oxford Economics

Source: Oxford Economics

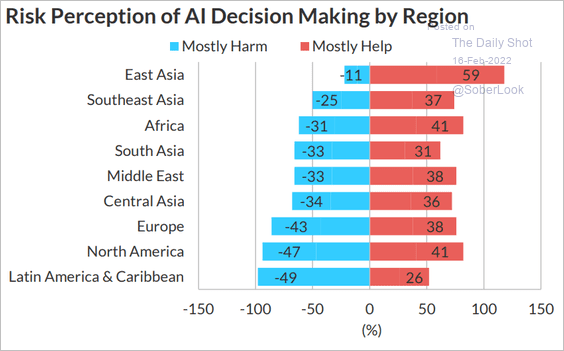

2. Views on AI decision-making:

Source: Fitch Ratings

Source: Fitch Ratings

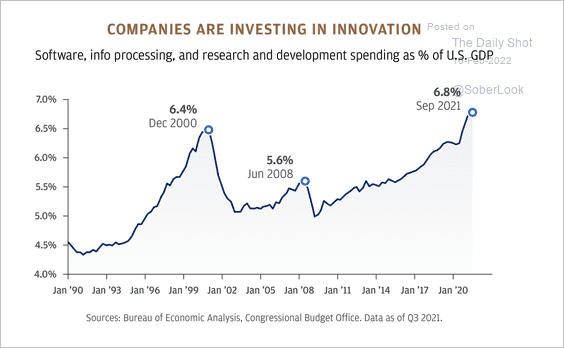

3. Tech investment as a share of US GDP:

Source: JP Morgan Private Bank

Source: JP Morgan Private Bank

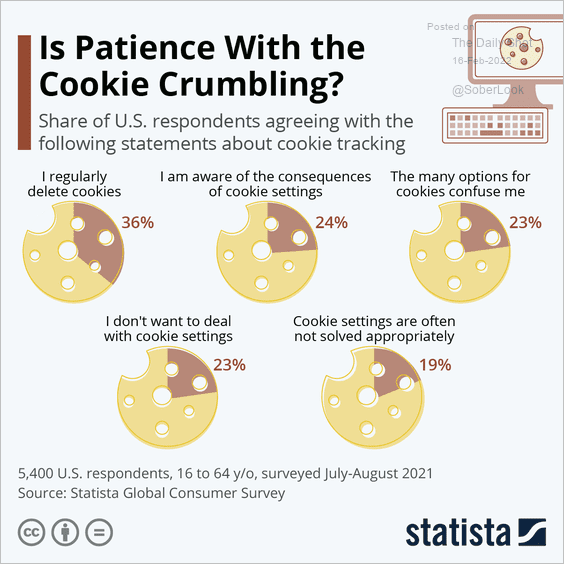

4. Dealing with cookie settings:

Source: Statista

Source: Statista

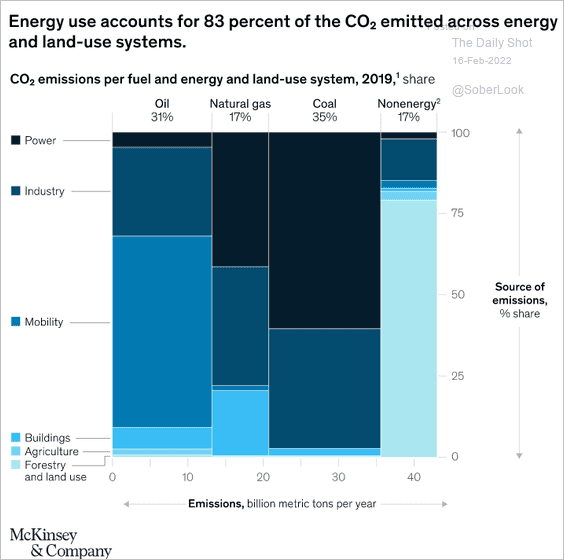

5. CO2 emissions per fuel and land-use systems:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

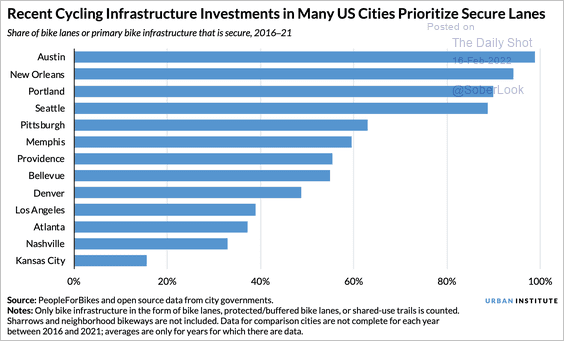

6. Bike lanes:

Source: @urbaninstitute, @livfiol, @yfreemark Read full article

Source: @urbaninstitute, @livfiol, @yfreemark Read full article

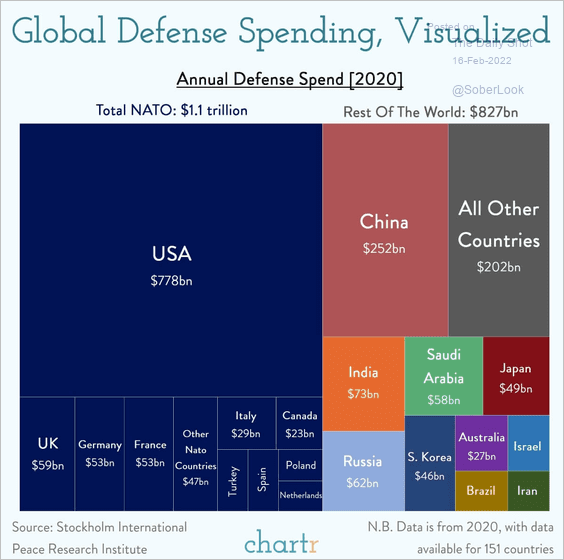

7. Global defense spending:

Source: @PredictIt

Source: @PredictIt

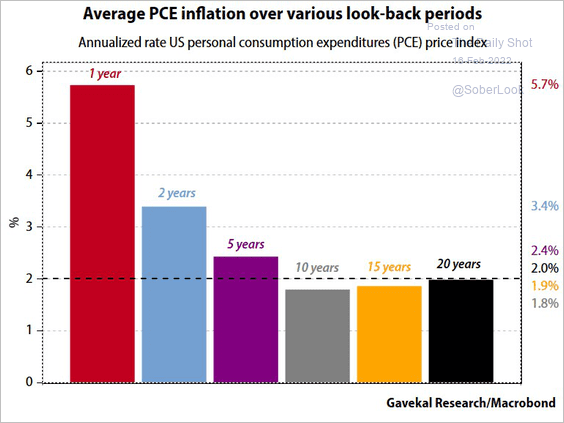

8. US consumer inflation over different periods:

Source: Gavekal Research

Source: Gavekal Research

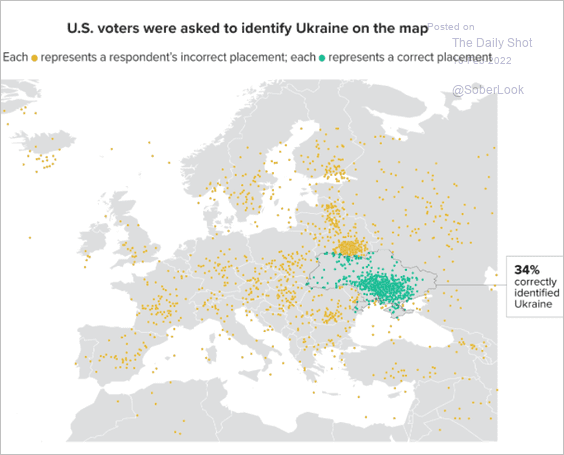

9. Correctly identifying Ukraine on the map:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Back to Index